UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06686

JPMorgan China Region Fund, Inc.

(Exact name of registrant as specified in charter)

One Beacon Street, 18th Floor

Boston, MA 02108

(Address of principal executive offices) (Zip code)

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 441-9800

Date of fiscal year end: December 31

Date of reporting period: January 1, 2017 through June 30, 2017

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

At the annual stockholders’ meeting on May 11, 2017 stockholders approved the proposal for the liquidation and dissolution of JPMorgan China Region Fund, Inc. (the ‘Fund’) as set out in the Fund’s proxy statement dated April 12, 2017. The Fund’s Board of Directors subsequently approved the specific terms of the implementation of the liquidation on June 30, 2017. The Fund is following the plan of liquidation and dissolution. The Fund closed its stock register books at the close of business on July 10, 2017 and trading of the Fund’s stock on the New York Stock Exchange (‘NYSE’) was suspended before the market opened on July 11, 2017. On July 14, 2017, the Fund made a liquidating distribution pursuant to the plan of liquidation and dissolution in exchange for and redemption of all of the Fund’s issued and outstanding common stock. The Fund was de-listed from the NYSE on July 21, 2017. Certain portions of this report speak as of the Fund’s operations prior to its liquidation.

This report, including the financial statements herein, is sent to the stockholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

Semi-Annual Report

June 30, 2017 (Unaudited)

CONTENTS

LIQUIDATION (Unaudited)

At the annual stockholders’ meeting on May 11, 2017 stockholders approved the proposal for the liquidation and dissolution of JPMorgan China Region Fund, Inc. (the ‘Fund’) as set out in the Fund’s proxy statement dated April 12, 2017. The Fund’s Board of Directors subsequently approved the specific terms of the implementation of the liquidation on June 30, 2017. The Fund is following the plan of liquidation and dissolution. The Fund closed its stock register books at the close of business on July 10, 2017 and trading of the Fund’s stock on the New York Stock Exchange (‘NYSE’) was suspended before the market opened on July 11, 2017. On July 14, 2017, the Fund made a liquidating distribution pursuant to the plan of liquidation and dissolution in exchange for and redemption of all of the Fund’s issued and outstanding common stock. The Fund was de-listed from the NYSE on July 21, 2017.

OBJECTIVES (Unaudited)

The Fund seeks to achieve long-term capital appreciation through investments primarily in equity securities of companies with substantial assets in, or revenues derived from, the People’s Republic of China (‘China’), Hong Kong, Taiwan and Macau — collectively, the ‘China Region’.

STRATEGY

The Fund provides investors with an opportunity to participate in the economic growth of the China Region where the economies of China, Hong Kong, Taiwan and Macau have become increasingly linked over recent years. Hong Kong enterprises have made substantial investments in China, particularly where

labor and land prices are lower than in Hong Kong. Similarly, many Chinese companies have Hong Kong based subsidiaries with securities listed on the Hong Kong Stock Exchange (H-shares). The Fund may directly invest up to an aggregate of $20m, as measured at the time of the original investment, to acquire Renminbi denominated China A-shares. In addition, the Fund can make indirect China A-share investments up to 10% of the Fund’s total assets through exposure to China A-share investment companies. Further details on China A-shares are provided in note 7(iii) of the Notes to Financial Statements on page 13.

The Fund invests to take advantage of the many opportunities that result from this linkage among the markets of the China Region.

MANAGEMENT (Unaudited)

JF International Management Inc. (‘JFIMI’) is the investment management company appointed to advise and manage the Fund’s portfolio (the ‘Investment Advisor’). JFIMI is part of JPMorgan Chase & Co. (‘JPMC’), one of the world’s premier financial services institutions. In asset management, JPMC operates globally under the name of J.P. Morgan Asset Management (‘JPMAM’). Funds under management for the global asset management business of JPMAM were US$1.9 trillion as of June 30, 2017.

The Fund’s lead portfolio manager is Emerson Yip, a Senior Portfolio Manager within JPMAM’s Greater China investment team in Hong Kong.

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 1 | |

FORWARD-LOOKING STATEMENTS (Unaudited)

This report contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of the Fund and JFIMI and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as ‘anticipate,’ ‘estimate,’ ‘intend,’ ‘expect,’ ‘believe,’ ‘plan,’ ‘may,’ ‘should,’ ‘would,’ or other words that convey uncertainty of future events or outcomes. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Fund to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could materially and negatively affect the results, performance or achievements of the Fund include changes in economic, political, legal and regulatory conditions in the China Region and elsewhere, changes in interest and exchange rates and related policies and other risks. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Fund, JFIMI or its respective representatives only as of the date hereof. The Fund, JFIMI and their respective representatives undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

|

| MARKET INFORMATION |

The Fund is listed on the New York Stock Exchange (symbol JFC). The share price is published in • The Wall Street Journal (daily online at www.WSJ.com/Free) |

The estimated net asset value is published in • The Wall Street Journal under “Closed-End Funds” (every Saturday) • www.jpmchinaregionfund.com |

| Wilmington Trust, N.A. will serve as the liquidation trustee to JPMorgan China Region Fund, Inc. Liquidation Trust (the ‘Liquidation Trust’). |

| | | | | | |

| | | |

| 2 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

HIGHLIGHTS (unaudited)

| | | | | | | | |

| | | JUNE 30, 2017

US$ (Unaudited) | | | DECEMBER 31, 2016

US$ (Audited) | |

Net Assets | | | $130.2 million | | | | $108.9 million | |

Net Asset Value Per Share | | | $20.19 | | | | $16.89 | |

| | |

Market Data | | | | | | | | |

Share Price on the New York Stock Exchange | | | $20.07 | | | | $15.58 | |

Discount to Net Asset Value | | | 0.6% | | | | 7.8% | |

| | |

Total Return for the Six Months Ended June 30, 2017 | | | | | | | | |

Net Asset Value | | | | | | | 19.6% | |

Share Price | | | | | | | 28.8% | |

| | |

JFC Benchmark Index* | | | | | | | 21.6% | |

MSCI Hong Kong | | | | | | | 21.6% | |

MSCI China | | | | | | | 25.0% | |

MSCI Taiwan | | | | | | | 21.8% | |

China Securities Index (‘CSI’) 300 | | | | | | | 14.4% | |

| | |

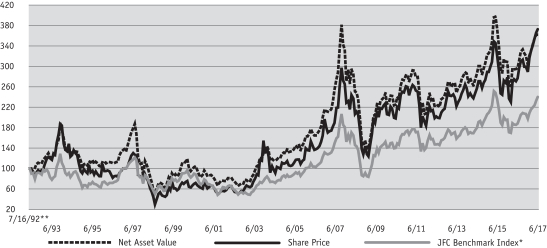

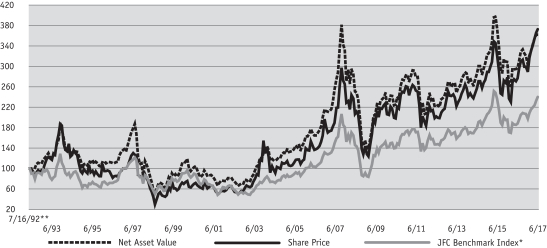

Net Asset Value and Share Price vs. Benchmark Index | | | | | | | | |

| * | | JFC Benchmark Index: 80% MSCI Golden Dragon Index (Net) 20% CSI 300 Index (Net). Prior to October 1, 2013, 80% MSCI Golden Dragon Index (GDR) +20% CSI 300 Index (Total). Prior to April 13, 2012, the MSCI Golden Dragon Index (Total). At December 31, 2011 the MSCI Golden Dragon Index (Total) comprised 24.1% of the MSCI Hong Kong Index (Total), 42.7% of the MSCI China Index (Total) and 33.2% of the MSCI Taiwan Index (Total). Prior to March 2001, 25% Taiwan Weighted Index, 20% BNP Paribas China Index, 50% MSCI Hong Kong, 5% HSBC; Prior to March 1999, 60% Hong Kong All Ordinaries, 30% Credit Lyonnais Securities Asia All China B Index, 10% Taiwan Weighted Index. Prior to January 1997, Peregrine Greater China Index. |

| ** | | Commencement of operations. |

Source: J.P. Morgan Asset Management.

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 3 | |

CHAIRMAN’S STATEMENT

JUNE 30, 2017 (Unaudited)

Dear Fellow Stockholder

As you are aware, the Fund’s stockholders approved a proposal to liquidate and dissolve the Fund pursuant to a Plan of Liquidation and Dissolution at the 2017 Annual Meeting of Stockholders. The Board subsequently approved the specific terms of the implementation of the liquidation on June 30, 2017. Pursuant to this plan the Fund closed its stock register books at the close of business on July 10, 2017 (the ‘Determination Date’) and the trading of the Fund’s stock on the New York Stock Exchange (‘NYSE’) was suspended before the market opened on July 11, 2017. The Fund was de-listed from the NYSE on July 21, 2017.

The Board announced on July 14, 2017 that the Fund made a liquidating distribution (the “Liquidating Distribution”) in exchange for and redemption of all of the Fund’s issued and outstanding common stock. The gross proceeds of the Liquidating Distribution were $20.0022 per share of the Fund’s common stock, comprised of cash in the amount of $14.8840 per share and an equity interest in the JPMorgan China Region Fund, Inc. Liquidating Trust (the “Liquidating Trust”) with a fair market value of $5.1182 per share. This Liquidating Distribution represents all of the Fund’s net assets,

except for amounts set aside for reasonably ascertainable liabilities and obligations of the Fund and the Liquidating Trust.

As described in the proxy statement and numerous press releases, the Fund’s assets held through the Qualified Foreign Institutional Investor (‘QFII’) program will only be repatriated once approved by Chinese regulators, the timing of which is not known. These assets will be held in both Reminbi and US Dollars until such time that approval is granted. As a result, we were unable to distribute to stockholders, in cash, the net asset value, less liquidation costs, for these assets in the liquidating distribution, and instead established the Liquidating Trust to safe-guard the assets through the repatriation process. Wilmington Trust, National Association will serve as the liquidation trustee to the Liquidating Trust. The Liquidating Trust will provide stockholders with periodic reports during the Trust’s operations.

Respectfully submitted

The Rt. Hon. The Earl of Cromer Chairman

August 25, 2017

For more information please refer to the Fund’s website at www.jpmchinaregionfund.com

| | | | | | |

| | | |

| 4 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

STATEMENT OF ASSETS AND LIABILITIES

AS OF JUNE 30, 2017 (Unaudited)

| | | | |

| | | (in US$) | |

ASSETS: | | | | |

Cash | | | 117,177,554 | |

Foreign currency, at value (cost $13,047,072) | | | 13,262,273 | |

Deposits at broker (See Note 7.iii.) | | | 26,017 | |

| | | | |

Total Assets | | | 130,465,844 | |

| | | | |

| |

LIABILITIES: | | | | |

Accrued Liabilities | | | | |

Investment advisory fees | | | 155,578 | |

Directors’ fees and expenses | | | 32,334 | |

Custodian and accounting fees | | | 20,052 | |

Administration fees | | | 14,583 | |

Deferred China capital gains tax | | | 3,941 | |

Other | | | 41,705 | |

| | | | |

Total Liabilities | | | 268,193 | |

| | | | |

Net Assets | | | 130,197,651 | |

| | | | |

| |

| Net assets consist of: | | | | |

Common stock, $0.01 par value

(100,000,000 shares authorized; 6,447,637 shares issued and outstanding) | | | 64,476 | |

Paid-in capital | | | 98,741,472 | |

Accumulated undistributed (distributions in excess of) net investment income | | | (978,394 | ) |

Accumulated realized income on investments and foreign currency transactions | | | 32,156,593 | |

Accumulated net unrealized appreciation on investments, foreign currency holdings, and other

assets and liabilities denominated in foreign currencies | | | 213,504 | |

| | | | |

Net Assets | | | 130,197,651 | |

| | | | |

Net Asset Value Per Share ($130,197,651 ÷ 6,447,637) | | | 20.19 | |

| | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 5 | |

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2017 (Unaudited)

| | | | |

| | | (in US$) | |

INVESTMENT INCOME: | | | | |

Dividends from non-affiliates (net of foreign withholding tax of $6,112) | | | 322,054 | |

Interest income from non-affiliates | | | 1 | |

Interest income from affiliates | | | 4,909 | |

| | | | |

Total Investment Income | | | 326,964 | |

| | | | |

| |

EXPENSES: | | | | |

Investment advisory fees | | | 673,435 | |

Legal fees | | | 232,792 | |

Directors’ fees and expenses | | | 136,798 | |

Interest expense to non-affiliates (See Note 6) | | | 111,682 | |

Audit fees | | | 81,326 | |

Custodian and accounting fees | | | 57,752 | |

Administration fees | | | 43,750 | |

Shareholder service fees | | | 12,806 | |

Interest expense to affiliates | | | 71 | |

Shareholder report fees | | | (16,374 | ) |

NYSE listing fees | | | (25,000 | ) |

Other expenses | | | 1,778 | |

| | | | |

Total Expenses | | | 1,310,816 | |

| | | | |

Less amounts waived (See Note 4) | | | (19,508 | ) |

| | | | |

Net expenses | | | 1,291,308 | |

| | | | |

Net Investment Loss | | | (964,344 | ) |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY

HOLDINGS AND OTHER ASSETS AND LIABILITIES DENOMINATED IN FOREIGN CURRENCIES: | | | | |

Net realized gain (loss) | | | | |

Investments in non-affiliates | | | 37,231,404 | |

Foreign currency transactions | | | 237,423 | |

| | | | |

Net realized gain (loss) | | | 37,468,827 | |

| | | | |

Net change in unrealized appreciation/depreciation | | | | |

Investments in non-affiliates | | | (15,404,683 | ) |

Foreign currency translations | | | 224,690 | |

| | | | |

Change in net unrealized appreciation/depreciation | | | (15,179,993 | ) |

| | | | |

Net realized and unrealized gain (loss) on investments, foreign currency holdings and other assets

and liabilities denominated in foreign currencies | | | 22,288,834 | |

| | | | |

Net increase in net assets resulting from operations | | | 21,324,490 | |

| | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| | | | | | | | |

| | | Six Months Ended

June 30, 2017

(Unaudited)

(in US$) | | | Year Ended

December 31, 2016

(in US$) | |

INCREASE IN NET ASSETS: | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | | (964,344 | ) | | | (137,658 | ) |

Net realized gain (loss) on investment transactions | | | 37,468,827 | | | | (3,659,391 | ) |

Net change in unrealized appreciation (depreciation) on investments, foreign currency holdings and other assets and liabilities denominated in foreign currencies | | | (15,179,993 | ) | | | 1,704,697 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 21,324,490 | | | | (2,092,352 | ) |

| | | | | | | | |

| | |

DISTRIBUTIONS TO STOCKHOLDERS: | | | | | | | | |

Net realized gain (loss) | | | — | | | | (2,221,856 | ) |

| | | | | | | | |

Total distributions to shareholders | | | — | | | | (2,221,856 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | 21,324,490 | | | | (4,314,208 | ) |

| | | | | | | | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 108,873,161 | | | | 113,187,369 | |

| | | | | | | | |

End of period (including undistributed (distributions in excess of) net investment income of $(978,394) and $(14,050), respectively) | | | 130,197,651 | | | | 108,873,161 | |

| | | | | | | | |

| | |

SHARE TRANSACTIONS | | | | | | | | |

Opening number of shares | | | 6,447,637 | | | | 6,447,637 | |

| | | | | | | | |

Closing number of shares | | | 6,447,637 | | | | 6,447,637 | |

| | | | | | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 7 | |

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2017 (Unaudited)

| | | | |

| | | (in US$) | |

INCREASE (DECREASE) IN CASH | | | | |

Cash flows provided (used) by operating activities: | | | | |

Increase in net assets resulting from operations | | $ | 21,324,490 | |

Adjustments to reconcile net increase / decrease in net assets resulting

from operations to net cash provided (used) by operating activities: | | | | |

Purchase of investment securities | | | (20,065,942 | ) |

Proceeds from disposition of investment securities | | | 160,340,238 | |

Change in unrealized (appreciation)/depreciation on investments in non-affiliates | | | 15,404,683 | |

Net realized (gain)/loss on investments | | | (37,231,404 | ) |

Increase in deposits at broker | | | (636 | ) |

Decrease in dividends receivable | | | 16,133 | |

Decrease in accrued expenses and other liabilities | | | (237,176 | ) |

| | | | |

Net cash provided (used) by operating activities | | | 139,550,386 | |

| | | | |

| |

Cash flows provided (used) by financing activities: | | | | |

Repayment of borrowings | | | (15,000,000 | ) |

| | | | |

Net cash provided (used) by financing activities | | | (15,000,000 | ) |

| | | | |

Net increase in cash | | | 124,550,386 | |

| | | | |

| |

Cash: | | | | |

Beginning of period (including foreign currency of $2,612,398) | | | 5,889,441 | |

| | | | |

End of period (including foreign currency of $13,262,273) | | $ | 130,439,827 | |

| | | | |

Supplemental disclosure of cash flow information:

During 2017, the Fund paid $111,682 in interest expense.

For purposes of reporting the Statement of Cash Flows, the Fund considers all cash accounts that are not subject to withdrawal restrictions or penalties to be cash.

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

FINANCIAL HIGHLIGHTS

FOR THE PERIODS INDICATED

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Six Months Ended June 30, 2017

(Unaudited) (in US$) | | | For the Year Ended

December 31,

2016 (in US$) | | | For the Year Ended December 31, 2015 (in US$) | | | For the Year Ended December 31, 2014 (in US$) | | | For the Year Ended December 31, 2013 (in US$) | | | For the Year Ended December 31, 2012 (in US$) | |

For a share outstanding throughout each year: | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | 16.89 | | | | 17.55 | | | | 19.39 | | | | 17.28 | | | | 15.47 | | | | 12.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.15 | ) | | | (0.02 | ) | | | 0.10 | | | | 0.14 | | | | 0.10 | | | | 0.08 | |

Net realized and unrealized gain (loss) | | | 3.45 | | | | (0.30 | ) | | | (0.97 | ) | | | 2.10 | | | | 1.84 | | | | 2.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.30 | | | | (0.32 | ) | | | (0.87 | ) | | | 2.24 | | | | 1.94 | | | | 2.82 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | — | | | | (0.34 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from net realized gains | | | — | | | | (0.34 | ) | | | (0.63 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions | | | — | | | | (0.34 | ) | | | (0.97 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | 20.19 | | | | 16.89 | | | | 17.55 | | | | 19.39 | | | | 17.28 | | | | 15.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Market value, end of period | | | 20.07 | | | | 15.58 | | | | 15.32 | | | | 16.91 | | | | 15.16 | | | | 14.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Investment Return | | | | | | | | | | | | | | | | | | | | | | | | |

Per share market value * | | | 28.8 | % | | | 3.8 | % | | | (3.6 | %) | | | 12.5 | % | | | 9.2 | % | | | 28.2 | % |

| | | | | | |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | | 130,197,651 | | | | 108,873,161 | | | | 113,187,369 | | | | 125,022,307 | | | | 111,435,597 | | | | 99,728,043 | |

Ratio of net expenses to average net assets | | | 2.12 | % | | | 2.49 | % | | | 2.00 | % | | | 2.14 | % | | | 2.26 | % | | | 2.11 | % |

Ratio of net expenses to average net assets, excluding interest expense | | | 1.94 | % | | | 2.29 | % | | | 1.86 | % | | | 1.94 | % | | | 2.05 | % | | | 2.04 | % |

Ratios of total expenses to average net assets, without waivers and reimbursements | | | 2.15 | % | | | 2.57 | % | | | 2.05 | % | | | 2.16 | % | | | 2.28 | % | | | 2.12 | % |

Ratios of total expenses to average net assets, without waivers and reimbursements, excluding interest expense | | | 1.97 | % | | | 2.37 | % | | | 1.91 | % | | | 1.96 | % | | | 2.07 | % | | | 2.04 | % |

Ratios of net investment income (loss) to average net assets | | | (1.58 | %) | | | (0.12 | %) | | | 0.51 | % | | | 0.82 | % | | | 0.61 | % | | | 0.54 | % |

Portfolio turnover rate | | | 21.6 | % | | | 29.0 | % | | | 106.0 | % | | | 86.7 | % | | | 66.6 | % | | | 85.8 | % |

Number of shares outstanding at end of period (In thousands) | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | |

| * | The total investment return excludes the effect of commissions. Dividends and distributions, if any, are assumed for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan or if specified in accordance with the terms of the distribution. |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 9 | |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2017 (Unaudited)

1. Organization and Capital

JPMorgan China Region Fund, Inc. (the ‘Fund’) was incorporated in the State of Maryland on May 22, 1992, and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940 (‘1940 Act’). The Fund commenced operations on July 16, 1992.

The Fund seeks to achieve long-term capital appreciation through investments primarily in equity securities of companies with substantial assets in, or revenues derived from, the People’s Republic of China (‘China’), Hong Kong, Taiwan and Macau — collectively, the ‘China Region’.

At the Fund’s 2017 Annual Meeting of Stockholders held on May 11, 2017 stockholders approved the proposal to liquidate and dissolve the Fund pursuant to a Plan of Liquidation and Dissolution (the “Plan”). The Final Results of the Annual Meeting were announced on May 15, 2017. The Fund’s Board of Directors subsequently approved the specific terms of the implementation of the liquidation on June 30, 2017. Pursuant to the Plan, the Fund closed its stock register books at the close of business on July 10, 2017 and the trading of the Fund’s stock on the New York Stock Exchange (‘NYSE’) was suspended before the market opened on July 11, 2017.

On July 14, 2017, the Fund made a liquidating distribution (the ‘Liquidating Distribution’) in exchange for and redemption of all of the Fund’s issued and outstanding common stock. The Fund was de-listed from the NYSE on July 21, 2017. The gross proceeds of the Liquidating Distribution were $20.0022 per share of the Fund’s common stock, comprised of cash in the amount of $14.8840 per share and an equity interest in the JPMorgan China Region Fund, Inc. Liquidating Trust (the ‘Liquidating Trust’) with a fair market value of $5.1182 per share. This Liquidating Distribution represents all of the Fund’s net assets, except for amounts set aside for reasonably ascertainable liabilities and obligations of the Fund and the Liquidating Trust.

As described in the proxy statement and numerous press releases, the Fund’s assets held through the Qualified Foreign Institutional Investor (‘QFII’) program will only be repatriated once approved by Chinese regulators, the timing of which is not known. These assets will be held in both Renminbi and US Dollars until such time that approval is granted. As a result, the Fund was unable to distribute to stockholders, in cash, the net asset value, less liquidation costs, for these assets in the liquidating distribution, and instead established the Liquidating Trust to safe-guard the assets through the repatriation process. Wilmington Trust, National Association will serve as the liquidation trustee to the Liquidating Trust. The Liquidating Trust will provide stockholders with periodic reports during the Trust’s operations.

2. Significant Accounting Policies

The following significant accounting policies, which are in conformity with U.S. generally accepted accounting principles (‘GAAP’), are consistently followed by the Fund in the preparation of its financial statements.

The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of GAAP.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reported period. Actual results could differ from these estimates.

i) Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the mid-market price of such currencies against U.S. dollars as follows:

| • | | investments, other assets, and liabilities at the prevailing rates of exchange on the valuation date; |

| • | | investment transactions and investment income at the prevailing rates of exchange on the dates of such transactions. |

| | | | | | |

| | | |

| 10 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2017 (Unaudited) (continued)

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of the securities held. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of securities sold during the period. Accordingly, realized and unrealized foreign currency gains (losses) are included in the reported net unrealized appreciation/depreciation on investments. The Fund does isolate the effect of changes in foreign exchange rates from fluctuations when determining realized gain or loss for sales of fixed income securities.

Unrealized currency gains (losses) resulting from valuing foreign currency denominated assets and liabilities at period-end exchange rates are reflected as a component of accumulated net unrealized gain (loss) on investments, foreign currency holdings, and other assets and liabilities denominated in foreign currencies.

ii) Distribution of Income and Gains — The Fund intends to distribute to stockholders, at least annually, substantially all of its net investment income and expects to distribute annually any net long-term capital gains in excess of net short-term capital losses.

Income and capital gain distributions are determined in accordance with Federal income tax regulations and may differ from those determined in accordance with GAAP.

iii) Other — Security transactions are accounted for on trade date. Realized gains and losses on the sale of investment securities are determined on the identified cost basis. Interest income is recognized on the accrual basis. Dividend income, net of foreign taxes withheld, if any, is recorded on the ex-dividend date or when the Fund first learns of the dividend.

iv) Foreign Taxes — The Fund may be subject to foreign taxes on income, gains on investments or currency purchases/repatriation, a part of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

As described in Note 7.iii, the Fund invests in China A-shares and can also invest in China B-shares, both of which are separately identified in the Investment Portfolio. Following the announcements made on November 14, 2014 by the People’s Republic of China (‘PRC’) Ministry of Finance, State Administration of Taxation and China Securities Regulatory Commission the Fund no longer provides for 10% capital gains tax (CGT) on realized and unrealized gains made in respect of transactions in China A-shares and China B-shares made on or after November 17, 2014.

3. Investment Transactions

During the six months ended June 30, 2017, the Fund made purchases of $19,679,421 and sales of $159,455,655 of investment securities other than short-term investments. There were no purchases or sales of U.S. Government securities.

4. Related party, Other Service Provider Transactions and Directors

i) JF International Management Inc. (the Investment ‘Advisor’), an indirect wholly-owned subsidiary of JPMorgan Chase & Co. (‘JPMorgan’) provides investment advisory services to the Fund under the terms of an investment advisory agreement. The Advisor is paid a fee, computed daily and payable monthly, at the annual rate of 1.00% of the Fund’s weekly managed gross assets. Investments in funds on which the Advisor or its affiliates charge a management fee are excluded from the calculation. Additionally, the Advisor has voluntarily agreed to waive its Investment Advisory fee on any cash held when borrowings are drawn under a borrowing facility. For the six months ended June 30, 2017, the Advisor waived Investment Advisory fees of $25,508, related to such holdings of cash.

ii) On June 1, 2015, the Fund entered into an agreement with Pristine Advisers (“Pristine”), an entity unaffiliated with the Fund. Under this agreement, Pristine provides certain investor relations and public relations services for the Fund. This

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 11 | |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2017 (Unaudited) (continued)

agreement was in effect for one year, and was subsequently agreed that from June 1, 2016 the agreement be automatically renewed until either the Fund or Pristine advises the other of its intent to cancel and that the Fund continue to pay Pristine a monthly retainer fee equal to $2,000 plus certain customary out-of-pocket expenses billed periodically.

The Advisor has agreed to voluntarily reimburse the Fund for one half of the Pristine monthly retainer fees through a waiver of the Investment Advisory fees owed by the Fund to the Advisor. In the six months ended June 30, 2017, an adjustment was made to the Advisor’s Investment Advisory fees to correct an over-waiver of $6,000 made during the prior period. The Fund cancelled the agreement with Pristine at the end of January 2017.

iii) During the six months ended June 30, 2017, the Fund did not pay any brokerage commissions to JPMorgan companies or affiliated brokers/dealers.

iv) Other Service Providers — Pursuant to an Administration Agreement, JPMorgan Chase Bank, N.A. (‘JPMCB’), an indirect, wholly-owned subsidiary of JPMorgan (the ‘Administrator’), provides certain services to the Fund. The Fund pays a flat annual fee of $87,500 per the Administration Agreement. Such amounts are included in Administration fees on the Statement of Operations.

JPMCB also provides portfolio custody and accounting services for the Fund. In consideration of the accounting services, JPMCB receives a fee accrued daily and paid monthly at the annual rate of 0.0025% of the first $75.0 billion of the average daily net assets of all funds in the JPMorgan Mutual Fund Complex (non-Money Market Funds), 0.002% of the average daily assets of all such funds between $75.0 billion and $150.0 billion and 0.0015% of the average daily net assets of all such funds in excess of $150.0 billion, subject to a minimum annual fee of $20,000 per fund. The Fund bears its pro rata portion of the total accounting services fee and also pays certain transaction-based charges. The custodian fees are split between safekeeping and transaction charges and vary by market. The amounts paid directly to JPMCB by the Fund for custody and accounting services are included in Custodian and accounting fees on the Statement of Operations.

v) Directors — The Fund pays each of its Directors who is not a director, officer or employee of the Advisor, Administrator or any affiliate thereof, an annual fee of $24,100, the Audit Committee Chairman $28,500 and the Chairman $35,000 plus a $3,300 attendance fee for each Board meeting, Management Engagement Committee meeting and Audit Committee meeting attended. A per diem allowance of $2,000 per day, or $1,000 per half day, is paid to Directors in respect of time spent by Directors on Fund business outside normal Board and Committee meetings. The per diem allowance is subject to Board approval in advance. In addition, the Fund reimburses all Directors for travel and out-of-pocket expenses incurred in connection with Board of Directors meetings. Under normal circumstances, in order to minimize expenses, the Board expects to hold two meetings a year by telephone.

vi) As of June 30, 2017, the Fund had two shareholders, each holding more than 5% of the Fund’s outstanding shares, who held in aggregate approximately 20.3% of the Fund’s outstanding shares.

5. Capital Share Transactions

The Fund offered an optional Distribution Reinvestment and Cash Purchase Plan (the “Plan”) to its shareholders. Pursuant to the Plan, when the Fund declares income or capital gains distributions, the Fund will either issue new shares, or buy existing shares, to reinvest such distributions for shareholders that elect to participate in the Plan. During the six months ended June 30, 2017 and the year ended December 31, 2016, the Fund did not issue shares under the Plan.

On September 12, 2016, the Board of Directors renewed an authority for the Fund to repurchase up to 644,764 shares (10% of its then issued and outstanding shares) of its common stock in the open market through September 11, 2017. Repurchases can be made only when the Fund’s shares are trading at less than NAV and at such times and amounts as it is believed to be in the best interest of the Fund’s stockholders. When shares trade at a discount to NAV, any purchase of shares by the Fund has the effect of increasing the NAV of the Fund’s remaining shares outstanding. All shares purchased by the Fund are thereafter considered authorized and unissued.

| | | | | | |

| | | |

| 12 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2017 (Unaudited) (continued)

During the six months ended June 30, 2017 and the year ended December 31, 2016, the Fund did not repurchase any shares under the share repurchase program.

6. Borrowings

On February 25, 2015, the Fund renewed its financing arrangement with Scotiabank (Ireland) Ltd (the ‘Lender’) which was originally entered into on February 27, 2012 and renewed and amended on February 25, 2013. Under this arrangement, the Lender provided a secured, committed credit facility in the aggregate amount of $17.5 million to the Fund. No compensating balances were required. The Fund had a flat commitment fee of 0.25% on the aggregate amount, as required under this agreement.

On July 10, 2015, the Fund increased its financing arrangement with the Lender to an amount of $22 million which, subject to the Lender’s approval, allowed future increases up to $32 million. The agreement was in place until February 24, 2017.

On February 24, 2017, the Fund extended its $22 million secured, committed credit facility with the Lender. Interest on borrowings, if any, were payable at 0.90% plus the London Interbank Offered Rate (‘‘LIBOR’’). The Fund paid an upfront loan arrangement fee of $4,400, as required under this agreement. Interest on unutilized amounts was payable at a flat commitment fee of 0.25%, irrespective of the amount of the utilized commitment. Under the terms of the financing agreement with the Lender, the adjusted asset coverage ratio (as defined in the agreement) may not be less than 4.50 to 1.00 at any time and the net asset value of the Fund may not be less than $50,000,000 at any time.

The Fund made an early repayment of the borrowings on May 19, 2017.

Borrowings outstanding from the secured, committed credit facility and average borrowings from the credit facility for the six months ended June 30, 2017, were as follows:

| | | | | | | | | | | | | | | | |

Outstanding

Borrowings at

June 30,

2017 | | Weighted

Average

Borrowings For Days Drawn Upon | | | Average

Interest

Rate on

Borrowings | | | Number of

Days

Outstanding | | | Interest

Expense on

Borrowings | |

$— | | $ | 14,833,333 | | | | 1.76 | % | | | 138 | | | $ | 111,682 | |

The maximum borrowings during the six months ended June 30, 2017 were $15,000,000. Interest expense to non-affiliates on the Statement of Operations includes interest expense on borrowings during the six months ended June 30, 2017.

7. Risks and Uncertainties

i) China Region — Investing in securities of ‘China Region companies’ may include certain risks and considerations not typically associated with investing in U.S. securities. In general, China Region companies are companies organized in the People’s Republic of China, the Hong Kong Special Administrative Region, the Macau Special Administrative Region or Taiwan (the ‘China Region’) or for which the principal securities trading market is in the China Region; or companies, regardless of where organized, which have 50% or more of their assets in, or derive 50% or more of their revenues or profits from, the China Region. Such risks include fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, these securities may not be as liquid as U.S. securities.

ii) Foreign Transactions — Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

iii) Direct Investments in China A-share securities — The China Securities Regulatory Commission (‘CSRC’) may grant qualified foreign institutional investor (‘QFII’) licenses, which allow foreign investments in A-shares on the Shanghai and

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 13 | |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2017 (Unaudited) (continued)

Shenzhen Stock Exchanges and certain other securities historically not eligible for investment by non-Chinese investors. Each QFII is authorized to invest in China A-shares only up to a specified quota established by the Chinese State Administration of Foreign Exchange (‘SAFE’). JF Asset Management Limited has a QFII license permitting it to invest a specific portion of the assets of certain funds (which may include the Fund) in local Chinese securities. Although the laws of China permit the use of nominee accounts for clients of QFIIs, the Chinese regulators require the general securities trading and settlement accounts to be maintained in the name of the QFII. As the Fund is permitted to invest in China A-shares, the Fund’s local custodian bank maintains a specific sub-account for the A-share investments in the name of the Fund. This amount is included in Deposits at broker on the Statement of Assets and Liabilities. However, there is a risk that creditors of the QFII and its affiliates (each, a ‘JP Morgan Affiliate’) may assert that a JP Morgan Affiliate, and not the Fund, has recourse against the securities and other assets in the account and/or sub-accounts. If a court upholds such an assertion, creditors of a JP Morgan Affiliate could seek payment from the Fund’s A-share investments. There were no such assertions during any of the periods presented.

Additional risks for the Fund’s A-share investments include a potential lack of liquidity, greater price volatility, and restrictions on the repatriation of invested capital. Because of low trading volume and various restrictions on the free flow of capital into the A-share market, the China A-share market could be less liquid and trading prices of A-shares could be more volatile than other local securities markets. In addition, and with reference to the proposed liquidation vote at the stockholders meeting in May 2017, the total proceeds arising from the sale of the Fund’s investments in A-shares can be repatriated under certain conditions. These include receiving clearance from the People’s Republic of China tax authorities in respect of the tax reporting package that will need to be filed once the liquidation is confirmed. SAFE will also need to approve the repatriation of these proceeds. The timing of the receipt of this clearance and SAFE approval is uncertain. Rules regarding taxation of investments in mainland China may be subject to change and such changes in the taxation of A-shares could materially affect the Fund’s performance.

iv) Other — In the normal course of business, the Fund may enter into contracts that provide general indemnifications. The maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of any loss from such claims is considered remote.

8. Tax Status

U.S. Federal Income Taxes — No provision for federal income taxes is required since the Fund intends to continue to qualify as a regulated investment company under subchapter M of the Internal Revenue Code and distribute substantially all of its taxable income. Management has reviewed the Fund’s tax positions for all open tax years and has determined that as of June 30, 2017, no liability for income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund’s Federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

Under the Regulated Investment Company Modernization Act of 2010 (the ‘Act’), net capital losses recognized by the Fund after December 31, 2010, are carried forward indefinitely, and retain their character as short-term and/or long-term losses. Prior to the Act, pre-enactment net capital losses incurred by the Fund were carried forward for eight years and treated as short-term losses. The Act requires that post-enactment net capital losses be used before pre-enactment net capital losses.

At December 31, 2016, the Fund had post-enactment net capital loss carryforwards which are available to offset future realized gains:

| | | | | | | | |

| | | Capital Loss Carryforward Character | |

| | | Short-Term | | | Long-Term | |

| | $ | 3,303,510 | | | $ | 104,850 | |

| | | | | | |

| | | |

| 14 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2017 (Unaudited) (continued)

9. Subsequent Event

At the annual stockholders’ meeting on May 11, 2017 stockholders approved the proposal for the liquidation and dissolution of the Fund as set out in the Fund’s proxy statement dated April 12, 2017. The Fund’s Board of Directors subsequently approved the specific terms of the implementation of the liquidation on June 30, 2017. The Fund is following the plan of liquidation and dissolution. The Fund closed its stock register books at the close of business on July 10, 2017 and trading of the Fund’s stock on the NYSE was suspended before the market opened on July 11, 2017. On July 14, 2017, the Fund made a liquidating distribution pursuant to the plan of liquidation and dissolution in exchange for and redemption of all of the Fund’s issued and outstanding common stock. The Fund was de-listed from the NYSE on July 21, 2017.

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 15 | |

RESULTS OF THE ANNUAL STOCKHOLDERS’ MEETING (Unaudited)

The Fund held its annual stockholders’ meeting on May 11, 2017. At this meeting, stockholders elected Mr. Julian M.I. Reid to the Fund’s Board of Directors, the results of which are set out below. Also below are the results of the vote on the proposal to liquidate and dissolve the Fund.

I) Election of Directors

| | | | | | | | | | | | | | | | | | | | |

| Nominee | | Votes For | | | Votes Against | | | Votes Withheld | | | Shares Not

Voted | | | Total Voting Shares | |

| Mr. Julian M.I. Reid | | | 5,465,208 | | | | 325,263 | | | | — | | | | — | | | | 5,790,471 | |

| | | |

| II) Proposal to Liquidate and Dissolve the Fund | | | | | | | | | | | | | |

| | | Votes For | | | Votes Against | | | Votes Withheld | | | Shares Not

Voted | | | Total Voting Shares | |

| | | 3,453,617 | | | | 1,128,117 | | | | 25,666 | | | | 1,183,071 | | | | 5,790,471 | |

OTHER INFORMATION

Liquidation

At the annual stockholders’ meeting on May 11, 2017 stockholders approved the proposal for the liquidation and dissolution of the Fund as set out in the Fund’s proxy statement dated April 12, 2017. The Fund’s Board of Directors subsequently approved the specific terms of the implementation of the liquidation on June 30, 2017. The Fund is following the plan of liquidation and dissolution. The Fund closed its stock register books at the close of business on July 10, 2017 and trading of the Fund’s stock on the NYSE was suspended before the market opened on July 11, 2017. On July 14, 2017, the Fund made a liquidating distribution pursuant to the plan of liquidation and dissolution in exchange for and redemption of all of the Fund’s issued and outstanding common stock. The Fund was de-listed from the NYSE on July 21, 2017.

Fundamental Investment Restriction on Borrowing

On May 12, 2011, shareholders of the Fund approved a change to the Fund’s fundamental investment restrictions to permit, inter alia, the Fund to borrow up to 20% of its net assets for investment purposes.

This gives the Investment Advisor flexibility to take advantage of additional investment opportunities when it believes that the return from the additional investment would exceed the cost of borrowing. If the Fund borrows money, it may be exposed to additional risks. If the return on securities purchased with borrowed funds is less than the borrowing costs of those funds, then the use of borrowing will detract from Fund performance. In particular,

borrowing will magnify losses in times of negative performance. Nonetheless, the Investment Advisor may maintain leverage if it expects that the long-term benefits to investors of maintaining leverage outweigh any current reduced return. Borrowing may also increase the Fund’s interest and other expenses. Finally, the use of borrowing would subject the Fund to additional restrictions imposed by lenders and the Investment Company Act of 1940 on the Fund’s investments.

The Investment Advisor will utilize borrowed monies at its discretion and under the supervision of the Board. The Investment Advisor has agreed to waive any entitlement to a management fee on any cash held when borrowings are drawn under a borrowing facility.

The entire text of the Fund’s fundamental investment restriction on borrowing is as follows:

“Under its fundamental investment restrictions, the Fund may not: Issue senior securities, borrow or pledge its assets, except that the Fund may (i) borrow from a bank for the purpose of obtaining amounts necessary to make distributions for qualification as a registered investment company to avoid imposition of an excise tax under United States tax law; and (ii) borrow money (including through reverse repurchase agreements) up to the maximum amount permitted under the Investment Company Act of 1940 (a) for temporary or emergency purposes, (b) for such short-term credits as may be necessary for the clearance or settlement of transactions, (c) for repurchases of its Common Stock and (d) for investment purposes, provided that

| | | | | | |

| | | |

| 16 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

amounts borrowed under this clause shall not exceed 20% on the net assets of the Fund. The Fund may also pledge its assets to secure such borrowings. Notwithstanding the above, initial and variation margin in respect of futures contracts and options thereon and any collateral arrangement in respect of options on securities or indexes will not be prohibited by this paragraph 3 or any other investment restrictions.”

Information About Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the ‘Commission’) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The Fund’s Forms N-Q are also available on the Fund’s website at www.jpmchinaregionfund.com.

Proxy Voting Policies and Procedures and Proxy Voting Record

A description of the policies and procedures that are used by the Fund’s investment advisor to vote proxies relating

to the Fund’s portfolio securities is available (1) without charge, upon request, by calling +44 20 7742 3735; and (2) as an exhibit to the Fund’s annual report on Form N-CSR which is available on the website of the Securities and Exchange Commission (the ‘Commission’) at http://www.sec.gov. Information regarding how the investment advisor votes these proxies is now available by

calling the same number and on the Commission’s website. The Fund has filed its report on Form N-PX covering the Fund’s proxy voting record for the 12 month period ended June 30, 2017.

Certifications

Simon J. Crinage, as the Fund’s President, has certified to the New York Stock Exchange that, as of August 22, 2017, he was not aware of any violation by the Fund of applicable NYSE corporate governance listing standards. The Fund’s reports to the Commission on Forms N-CSR and N-CSRS contain certifications by the Fund’s principal executive officer and principal financial officer that relate to the Fund’s disclosure in such reports and that are required by Rule 30a-2(a) under the 1940 Act.

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 17 | |

FUND MANAGEMENT

Information pertaining to the Directors and officers of the Fund is set forth below.

| | | | | | | | | | |

Name, (YOB), Address and

Position(s) with Fund | | Term of

Office and

Length of

Time Served | | Principal Occupation(s) During

Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director* | | | Other Trusteeships/

Directorships Held by Director |

Independent Directors | | | | | | |

| | | | |

The Rt. Hon. The Earl of Cromer (1946) 60 Victoria Embankment London EC4Y 0JP United Kingdom Chairman and Class I Director | | Three year term ends in 2018; Chairman and Director since 1994. | | Chairman of the Board of the Fund; Chairman of the Board, Western Provident Association (insurance), LG India Plus Fund Ltd (financial), Pedder Street Asia Absolute Return Fund Limited (financial); LG Asia Plus Fund Limited (financial); Director, Cheetah Korea Value Fund Ltd (financial) and Chief Executive Officer, Cromer Associates Limited (family business). | | | 1 | | | See Principal Occupation. |

| | | | |

John R. Hass (1961) 1 Beacon Street Boston, MA 02108 USA Class II Director | | Three year term ends in 2019; Director since July 20, 2016 | | Partner at RRE Ventures (financial); Director of the Cheetah Korea Value Fund (financial); and Board member of the Tory Burch Foundation. | | | 1 | | | See Principal Occupation. |

| | | | |

Alistair E.M. Laband (1952) Flat 41, 20th floor Po Shan Mansions Block B 10-12 Po Shan Road Mid-levels Hong Kong Class II Director | | Three year term ends in 2019; Director since July 20, 2016 | | Director of Tom Lee Music Company (retail) and China Nepstar Chain Drugstore Limited (retail) (retired August 2016) | | | 1 | | | Director of the trustee of Rosebud Charitable Trust (charity). |

| | | | |

Julian M. I. Reid (1944) 60 Victoria Embankment London EC4Y 0JP United Kingdom Class III Director | | Three year term ends in 2020; Director since 1998. | | Director and Chairman of The Korea Fund, Inc. (financial). | | | 1 | | | See Principal Occupation. |

| | | | | | |

| | | |

| 18 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

| | | | | | | | | | |

Name, (YOB), Address and

Position(s) with Fund | | Term of

Office and

Length of

Time Served | | Principal Occupation(s) During

Past 5 Years | | Number of

Portfolios in

Fund Complex

Overseen by

Director* | | | Other Trusteeships/

Directorships Held by Director |

Interested Director & President of the Fund | | | | | | |

| | | | |

Simon J. Crinage (1965) 60 Victoria Embankment London, EC4Y 0JP United Kingdom Class I Director and President | | Three year term ends in 2018; Director since 2009 & President since 2003** | | Managing Director, J.P. Morgan. | | | 1 | | | Director of The Association of Investment Companies Limited and JF International Management Inc. |

| * | | The Fund is the only fund in the Fund Complex. |

| ** | | The officers of the Fund serve at the discretion of the Board of Directors. |

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 19 | |

FUND MANAGEMENT

(continued)

Information pertaining to the officers of the Fund is set forth below.

| | | | |

Name, (YOB), Address and

Position(s) with Fund | | Term of Office and

Length of Time Served | | Principal Occupation(s) During Past 5 Years |

Officers who are not Directors |

| | |

Neil S. Martin

(1971)

60 Victoria Embankment

London EC4Y 0JP

United Kingdom | | Since 2014** | | Chief Operating Officer and Treasurer of the Fund; Executive Director, J.P. Morgan. |

| | |

Lucy J. Dina

(1977)

60 Victoria Embankment

London EC4Y 0JP

United Kingdom

Secretary | | Since 2013** | | Secretary of the Fund; Vice President, J.P. Morgan. |

| | |

Steve M. Ungerman

(1953)

270 Park Avenue

New York

Chief Compliance Officer | | Since 2014** | | Chief Compliance Officer of the Fund;

Managing Director, J.P. Morgan Chase Bank NA. |

| ** | | The officers of the Fund serve at the discretion of the Board of Directors. |

| | | | | | |

| | | |

| 20 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2017 |

DIRECTORS AND ADMINISTRATION

(Unaudited)

| | |

| Officers and Directors | | The Rt. Hon. The Earl of Cromer — Director and Chairman of the Board and Management Engagement Committee Simon J. Crinage — Director and President John R. Hass — Director Alistair E.M. Laband — Director and Chairman of the Audit Committee Julian M. I. Reid — Director Neil S. Martin — Chief Operating Officer and Treasurer Lucy J. Dina — Secretary Steve M. Ungerman — Chief Compliance Officer |

| |

| Investment Advisor | | JF International Management Inc. P.O. Box 3151 Road Town, Tortola British Virgin Islands |

| |

| Administrator | | JPMorgan Chase Bank, N.A. 1 Beacon Street, 18th Floor Boston, Massachusetts 02108 U.S.A. |

| |

| Custodian | | JPMorgan Chase Bank N.A. 1 Beacon Street, 18th Floor Boston, Massachusetts 02108 U.S.A. |

| |

Independent Registered Public Accounting Firm | | PricewaterhouseCoopers LLP 300 Madison Avenue New York, New York 10017 U.S.A. |

| |

| Legal Counsel | | Dechert LLP New York: 1095 Avenue of the Americas New York, New York 10036 U.S.A. |

| |

| | Hong Kong: 27/F Henley Building 5 Queens Road Central Hong Kong |

| |

| Registrar, Transfer Agent, and Dividend Paying Agent | | Computershare Trust Company, N.A. P. O. Box 30170 College Station, TX 77842-3170 U.S.A. |

| |

| Liquidation Trustee to the Liquidation Trust | | Wilmington Trust, N.A. 246 Goose Lane — Suite 105 Guilford, CT 06437 U.S.A. |

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that from time to time the Fund may purchase shares of its common stock in the open market.

www.jpmchinaregionfund.com

| | | | | | | | |

| | | |

| JUNE 30, 2017 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 21 | |

This report, including the financial statements herein, is sent to the stockholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

© JPMorgan Chase & Co., 2017 All rights reserved. June 30.

ITEM 2. CODE OF ETHICS.

Not required for this filing.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not required for this filing.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not required for this filing.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not required for this filing.

ITEM 6. SCHEDULE OF INVESTMENTS

| (a) | Schedule of Investments is included as part of Item 1. |

| (b) | Not applicable to the Fund. |

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not required for this filing.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

| | (a) | Not applicable to a semiannual report. |

| | (b) | There has been no change, as of the date of this filing, in any of the portfolio managers identified in response to paragraph (a)(1) of this Item in the registrant’s most recently filed annual report on Form N-CSR. |

ITEM 9. PURCHASE OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable to the Fund.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the Fund’s board of directors since the Fund filed its last form N-CSR.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The Fund’s principal executive and principal financial officers have concluded that the Fund’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of this Form N-CSR based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the 1934 Act (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the Fund’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d))) that occurred during the Fund’s second fiscal quarter that has materially affected, or is reasonably likely to materially affect, the Fund’s internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Not required for this filing.

(a)(2) Certifications pursuant to Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not required for this filing.

(a)(4) Not required for this filing.

(b) The certifications required by Rule 30a-2(b) of the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| JPMorgan China Region Fund, Inc. |

| |

| By: | | /s/ Simon Crinage |

| | Simon Crinage President and Principal Executive Officer September 1, 2017 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | |

| By: | | /s/ Simon Crinage |

| | Simon Crinage President and Principal Executive Officer September 1, 2017 |

| | |

| By: | | /s/ Neil S. Martin |

| | Neil S. Martin Treasurer and Chief Operating Officer September 1, 2017 |