UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06686

JPMorgan China Region Fund, Inc.

(Exact name of registrant as specified in charter)

One Beacon Street, 18th Floor

Boston, MA 02108

(Address of principal executive offices) (Zip code)

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 441-9800

Date of fiscal year end: December 31

Date of reporting period: January 1, 2015 through June 30, 2015

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

This report, including the financial statements herein, is sent to the stockholders of the Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

Semi-Annual Report

June 30, 2015 (Unaudited)

CONTENTS

OBJECTIVES

JPMorgan China Region Fund, Inc. (the ‘Fund’) seeks to achieve long-term capital appreciation through investments primarily in equity securities of companies with substantial assets in, or revenues derived from, the People’s Republic of China (‘China’), Hong Kong, Taiwan and Macau — collectively, the ‘China Region’.

The Fund provides investors with an opportunity to participate in the growing economies of the China Region where the economies of China, Hong Kong, Taiwan and Macau have become increasingly linked over recent years. Hong Kong enterprises have made substantial investments in China, particularly where labor and land prices are lower than in Hong Kong. Similarly, many Chinese companies have Hong Kong based subsidiaries with securities listed on the Hong Kong Stock Exchange (H-shares). Renminbi denominated China A-shares, which are listed in China, are available for acquisition by the Fund by direct investment up to $20m at the time of original investment (in April 2012). The current value of these holdings reflects any capital appreciation or depreciation since the initial investment. In addition, the Fund can make indirect China A-share investments up to 10% of the Fund’s total assets through exposure to China A-share investment companies. Further details on China A-shares are provided in note 7(iii) of the Notes to Financial Statements on page 26.

The Fund invests to take advantage of the many opportunities that result from this linkage among the markets of the China Region.

MANAGEMENT

JF International Management Inc. (‘JFIMI’) is the investment management company appointed to advise and manage the Fund’s portfolio (the ‘Investment Advisor’). JFIMI is part of JPMorgan Chase & Co. (‘JPMC’), one of the world’s premier financial services institutions. In asset management, JPMC operates globally under the name of J.P. Morgan Asset Management (‘JPMAM’). Funds under management for the global asset management business of JPMAM were US$1.8 trillion as of June 30, 2015.

The Fund’s lead portfolio manager is Emerson Yip, a Senior Portfolio Manager within JPMAM’s Greater China investment team in Hong Kong.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 1 | |

FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of the Fund and JFIMI and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as ‘anticipate,’ ‘estimate,’ ‘intend,’ ‘expect,’ ‘believe,’ ‘plan,’ ‘may,’ ‘should,’ ‘would,’ or other words that convey uncertainty of future events or outcomes. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Fund to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could materially and negatively affect the results, performance or achievements of the Fund include changes in economic, political, legal and regulatory conditions in the China Region and elsewhere, changes in interest and exchange rates and related policies and other risks. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Fund, JFIMI or its respective representatives only as of the date hereof. The Fund, JFIMI and their respective representatives undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

|

| MARKET INFORMATION |

The Fund is listed on the New York Stock Exchange (symbol JFC). The share price is published in • The Wall Street Journal (daily online at www.WSJ.com/Free) |

The estimated net asset value is published in • The Wall Street Journal under “Closed-End Funds” (every Saturday) • www.jpmchinaregionfund.com |

| | | | | | |

| | | |

| 2 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

HIGHLIGHTS (unaudited)

| | | | | | | | |

| | | JUNE 30, 2015

US$ (Unaudited) | | | DECEMBER 31, 2014

US$ (Audited) | |

Net Assets | | | $144.9 million | | | | $125.0 million | |

Net Asset Value Per Share | | | $22.47 | | | | $19.39 | |

| | |

Market Data | | | | | | | | |

Share Price on the New York Stock Exchange | | | $18.83 | | | | $16.91 | |

Discount to Net Asset Value | | | 16.2% | | | | 12.8% | |

| | |

Total Return for the Six Months Ended June 30, 2015 | | | | | | | | |

Net Asset Value | | | | | | | +15.9% | |

Share Price | | | | | | | +11.4% | |

| | |

JFC Benchmark Index* | | | | | | | +14.5% | |

MSCI Hong Kong Index | | | | | | | +11.9% | |

MSCI China Index | | | | | | | +14.8% | |

MSCI Taiwan Index | | | | | | | +5.2% | |

CSI 300 Index | | | | | | | +27.4% | |

|

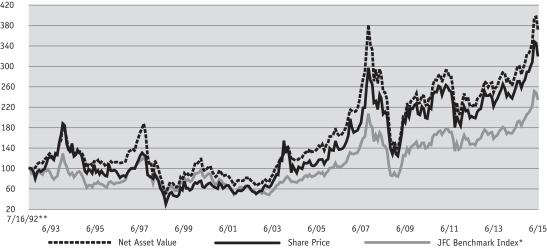

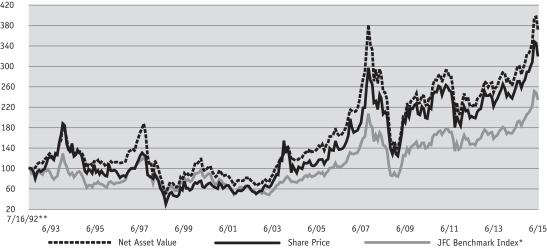

Net Asset Value and Share Price vs. Benchmark Index | |

| * | | JFC Benchmark Index: 80% MSCI Golden Dragon Index (Net) 20% CSI 300 Index (Net). Prior to October 1, 2013, 80% MSCI Golden Dragon Index (GDR) +20% CSI 300 Index (Total). Prior to April 13, 2012, the MSCI Golden Dragon Index (Total). At December 31, 2011 the MSCI Golden Dragon Index (Total) comprised 24.1% of the MSCI Hong Kong Index (Total), 42.7% of the MSCI China Index (Total) and 33.2% of the MSCI Taiwan Index (Total). Prior to March 2001, 25% Taiwan Weighted Index, 20% BNP Paribas China Index, 50% MSCI Hong Kong, 5% HSBC; Prior to March 1999, 60% Hong Kong All Ordinaries, 30% Credit Lyonnais Securities Asia All China B Index, 10% Taiwan Weighted Index. Prior to January 1997, Peregrine Greater China Index. |

| ** | | Commencement of operations. |

Source: J.P. Morgan Asset Management.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 3 | |

CHAIRMAN’S STATEMENT

JUNE 30, 2015 (Unaudited)

Dear fellow Stockholder,

Performance

The Greater China markets ended the six months to June 30, 2015 in positive territories, despite periods of volatility. China A-shares led gains, rising over 27% during the period, overcoming a few sharp corrections driven by regulatory crackdowns on margin financing. The onshore sell-offs spilled over to the offshore-listed equities and domestic Hong Kong equities, compounded by concerns over Greece, whilst further relaxation of monetary policy and fiscal stimulus helped support market performance. Additional capital market liberalization measures encouraged cross-borders flows buoying Hong Kong equities. Taiwan also advanced, although tech weakness offset some of the gains.

Against this backdrop, I am pleased to report that the Fund achieved a positive net asset value (‘NAV’) return of +15.9% in the six months to June 30, 2015. This was ahead of the return of +14.5% from the Fund’s benchmark1 representing an outperformance of 1.4% over the same period. The outperformance relative to the benchmark was largely attributable to positive allocation decisions and stock selection in Hong Kong and Taiwan, further details of which are provided in the Investment Advisor’s Report on pages 5 to 9 of this report. Over the same period, the Fund’s share price rose by 11.4%, which when compared against the Fund’s NAV return resulted in a widening of the discount from 12.8% to 16.2%. This was not surprising given the volatility and uncertainty in the China A-share market during the period.

Leverage

On February 25, 2015, your Board renewed the Fund’s US$17.5m credit facility with Scotiabank (Ireland) Ltd (‘Scotiabank’) for a further two year period. Under this arrangement, Scotiabank provides a secured, committed credit facility which can be utilized at any time. On July 10, 2015, given the growth in your fund’s net assets, this facility was increased to US$22m. This financing arrangement gives the Investment Advisor the flexibility to manage tactically borrowed monies at his discretion under the supervision of the Board. Since the beginning of the reporting period and up to

June 30, 2015 the Fund’s equity exposure ranged from 109.4% to 112.1%, and at the time of writing is 107.8%.

Outlook

Your Board believes the macro environment in the Greater China region will further stabilise from very low levels, underpinned by easing monetary and fiscal policies in China. The three interest rate cuts since last November have effectively boosted property sales, which should drive an eventual rebound in fixed asset investment. We also continue to see progress on the structural reform front with additional commitments to help local governments deleverage. The recent market corrections are expected to be temporary as the Chinese government has taken a series of measures to boost market confidence, including cutting interest rates, the Reserve Requirement Ratio (‘RRR’), transaction fees and rationalisation of brokers’ margin financing requirements. Despite possible near term pressure from the domestic China market, Hong Kong equities remain attractively valued and should benefit from more capital market liberalization measures such as mutual fund recognition and the further growth of Shanghai-Hong Kong Stock Connect. Your Investment Advisor remains positive on the Taiwan market given its muted performance to date and moderate valuations.

With its recent easing moves, China’s government continues to show that it is targeting the equity market as an instrument of both stimulus and economic reform. After the recent market correction, valuations for certain secular growth names have become attractive; your Investment Advisor is selectively buying while being mindful of extremely high volatility given the interplay between government liquidity support, profit-taking and perceived loss avoidance. From a bottom-up stock selection basis, your Investment Advisor continues to demonstrate interesting ideas that are leveraged to both the region’s secular growth and the Chinese government’s reform agenda.

Respectfully submitted

The Rt. Hon. The Earl of Cromer

Chairman

August 27, 2015

| 1. | | 80% MSCI Golden Dragon Index (net) and 20% CSI 300 Index (net). |

For more information please refer to the Fund’s website at www.jpmchinaregionfund.com

| | | | | | |

| | | |

| 4 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

INVESTMENT ADVISOR’S REPORT

In the first half of 2015, the Fund achieved a total return on net assets of 15.9% (in USD terms), outperforming the benchmark return of 14.5% by 1.3%.

During the review period, country allocation contributed to outperformance, driven by our overweight position in China, including A-shares. Positive stock selection in Taiwan and Hong Kong was somewhat offset by weaker stock choices in China.

At the stock level, in China, the Fund benefited from an overweight position in a basket of A-share names, such as Hangzhou Hikvision and media names of China South Publishing and Zhejiang Huace Film. We feel these names have fundamental support and believe in the long-term outlook of the media holdings as proxies to consumption in China. Another key contributor to performance was an overweight position in CAR INC, an auto rental company in China that rose by almost 60% in the first half of the year on strong structural demand growth. We were also correctly underweight in China Shenhua Energy and Petrochina, which both fell early in the year in line with weak energy prices. Our overweight position in financials such as China Merchants Bank and Ping An Insurance also helped performance as they continued to benefit from a favorable liquidity environment. In Taiwan, we continued to see strength in stocks geared to the Apple i-Phone food-chain, as overweight positions in lens maker Largan Precision and casing supplier Catcher Technology helped as the stocks rose on a positive earnings outlook. Underweight positions in several other technology stocks which we felt had limited growth prospects, such as Inotera Memories and flat panel producers also contributed to performance.

Meanwhile, an overweight position in Alibaba Group was a key detractor to performance over the first half of the year. The stock, which is not in the benchmark, fell early in the year after missing elevated earnings expectations. China Minsheng Bank hurt performance as well as the stock corrected after the President resigned to cooperate in an

anti-corruption investigation. Our underweight position in China Mobile was another notable detractor, as the stock rose due to stronger-than-expected 4G subscriber additions. Several of our Taiwan technology overweight positions, such as memory chip producer Nanya Technology and power component supplier Delta Electronics, disappointed over the quarter on releasing poorer than expected earnings. In Hong Kong, one of the largest detractors from performance was an underweight position in Hong Kong Exchanges, which fared well over the quarter given strong trading activity in Hong Kong as the Southbound leg of Shanghai-Hong Kong Stock Connect saw increased participation. Shipping company Orient Overseas International also hurt performance as the stock fell due to concerns over weak shipping rates.

China

Market Performance

Chinese equities rallied in the first quarter of 2015, with offshore-listed equities up 8%, continuing the rally of the final quarter of 2014. The key catalysts were accommodative policy in terms of both cyclical stimulus (easing monetary/fiscal policies) and structural reforms (pertaining to Local Government Finance Vehicle (‘LGFV’) debt swaps and deposit insurance, for example), despite the macroeconomic backdrop remaining weak. The gains have been led by both cyclical names (beneficiaries of policy easing) as well as growth sectors. On the macro front, concurrent indicators remain weak. January-February industrial production (up 6.8% year on year) and fixed-asset investment (up 13.9% year on year) both reached new post 2008-09 global financial crisis lows, due to still very high real interest rates as well as muted infrastructure spending (affected by anti-corruption campaigns). January’s consumer price inflation falling below 1% (posing a potential deflection risk) has prompted more monetary easing. The People’s Bank of China (‘PBOC’) implemented one more rate cut (since November 2014) as well as a

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 5 | |

INVESTMENT ADVISOR’S REPORT (continued)

first reduction in reserve ratio requirements, both in February. M2 (money supply) growth in February at 12.5% year on year marked an improvement from January’s 10.8% year-on-year levels. Earnings revisions continued to be negative, led by energy (due to the global oil price declines), materials, and staples, as a result of demand headwinds. Sectors seeing positive earnings revisions included non-bank financials (benefiting from underlying equity market strength) and transportation (also a beneficiary of oil price weakness).

Despite a rollercoaster second quarter, Chinese equities ended the period with offshore-listed equities up 4.2%. The offshore market was dragged down in June by A-shares and renewed concerns over Greece. On the macro front, concurrent indicators showed some signs of stabilisation from a very low base, thanks to monetary easing. May M2 money supply accelerated to 10.8% year on year vs. April’s 10.1%. May’s industrial production (6.1%) was higher than April (5.9%) and March (5.6%, post global financial crisis low). Fixed asset investment rebounded slightly to 9.9% after April’s sharp slowdown to 9.6% from March 13.2%. Retail sales stabilised at 10.1% in May vs. 10% in April. Earnings revisions remained negative, in line with weak economic conditions, with industrials and materials representing the main detractors. Sectors with positive revisions were led by brokers and insurance as underlying fundamentals continued to strengthen.

A-shares

In the first quarter of 2015, the domestic A-share market (CSI 300 Index) rallied, up 15% over the period. Despite a correction in January after regulators suspended new margin account openings, A-shares rebounded in February and continued their strength in March. Expectations of further relaxation of monetary policies and additional fiscal stimulus including domestic infrastructure investment and increasing external demand from the new “One Belt One Road” initiative pushed the market higher.

In the second quarter of 2015, onshore A-shares finished up 10.4%. The market surged in April and May as the Chinese government continued its monetary easing and fiscal stimulus measures. The progress on mutual recognition to sell mutual funds cross-border between Hong Kong and China also encouraged liquidity provisions that buoyed mainland stock markets. The gains were somewhat offset by sharp corrections that came in the second half of June after touching new highs in the middle of the month as regulators increased scrutiny on margin financing. The government stepped in to support the market but market sentiment took a hit. Valuations, however, for certain secular growth names have become more attractive.

Market Outlook

We expect the macro environment to further stabilise from very low levels, underpinned by easing monetary and fiscal policies. The three interest rate cuts since last November have effectively boosted property sales. Twenty-five out of thirty-one cities surveyed reported median volume up 71% year on year through end of June. We anticipate further room for monetary easing. After three cuts to the RRR in this easing cycle, 18.5% is still at very high levels compared to the 16% low of 2009 and the 6% level of the 1999 cycle. Recovering property sales should eventually lead new property construction to turn positive, driving a rebound in fixed asset investment.

On the structural reform front, we have also seen good progress. A second trillion debt swap has been announced, demonstrating the government’s commitment to help local governments deleverage. Another major milestone we expect would be an IPO registration system to be launched late this year or early next year, making equity market access much easier for the more productive private sector.

Market valuations at 11X forward one-year price — earnings are undemanding (vs. mid cycle 12X). We

| | | | | | |

| | | |

| 6 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

believe the recent sharp A-share market sell-off has been caused by the government crackdown on grey market margin financing. The sell-off should be temporary as the government has taken a series of measures to boost market confidence, including cutting interest rates and RRR recently, reducing transaction fees, and the rationalisation of brokers‘ margin financing business.

Hong Kong

Market Performance

Most of the gains in Hong Kong equities during the first quarter occurred during January, driven by proposed corporate restructuring. The market witnessed explosive growth in turnover towards the end of the quarter, spurred by rule clarifications regarding easier participation from mainland-based mutual funds in the Stock Connect programme. However, the primary beneficiaries of the ensuing stock rally were China-related stocks rather than Hong Kong equities. The surprise announcement of the re-organisation of Cheung Kong and Hutchison Whampoa led to a share price appreciation due to the elimination of a holding company discount and the enhanced ability to undertake corporate actions following the restructure. Moreover, companies with similar restructuring potential also benefited from market speculation. As largely expected, the Hong Kong Monetary Authority announced further tightening measures at the end of February, primarily targeting mortgages on homes selling for under HKD 7 million. However, new property launches following the announcement of these measures were positively received as developers were able to take on additional financing while secondary property volumes were reduced. Retail sales in Hong Kong appear to be in structural decline as December sales fell 4% year over year, while in January and February combined, sales fell 2%, reflecting weakness in overnight visitor growth and per capita spending. Hong Kong appears to be losing its share of mainland tourists to Japan, Korea, and Taiwan, owing in part

to relative currency strength. Gaming revenues continued on their recent downward spiral, with declines worse than expected for each of the three months. Broker downgrades have generally lagged the weakness of the underlying results.

Hong Kong equities began the second quarter with a sharp rally sparked ostensibly by the clarification of the rules on domestic mainland China funds investing in Hong Kong equities under the Stock Connect programme. Market turnover set record highs on multiple fronts, including full utilisation of the southbound quota for the first time. However, at quarter end, the market sold off on concerns over Greece’s potential exit from the eurozone, coupled with a substantial market correction in the domestic China equity market. The de-listing of Hutchison Whampoa as part of the group reorganisation was positively received by the market. BOC Hong Kong also announced a sweeping re-focus — officially announcing its intention to sell its China operation in order to deploy more resources into growing its ASEAN business in conjunction with China’s “One Belt, One Road” initiative. The failure to pass the electoral reform package proposed by Beijing had little immediate impact on the market, with popular reaction rather muted. The retail sector in Hong Kong took another hit with the announcement of once-a-week restriction on visitors with Shenzhen resident visas. While this is targeted at parallel traders and should help to improve relations between local residents and mainland tourists, the change will nonetheless affect near-term tourist sales. In Macau, Galaxy Entertainment opened two new gaming properties in late May. These were generally well received, but failed to spark much new demand as June gaming revenue fell 36% year on year. However, the Macau government surprised the market with a relaxation of transit visa restrictions, exactly a year after they were first tightened. While the near-term impact will be modest, this represents the first positive policy to be introduced over the past year or so.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 7 | |

INVESTMENT ADVISOR’S REPORT (continued)

Market Outlook

The Greek crisis and the correction in the China A-share market will continue to exert near-term pressure on Hong Kong equities. However, they remain attractive on a relative valuation basis and should also benefit from the enhanced cross-border flows from mutual fund recognition, which began on 1 July. Moreover, progress on the Shenzhen Connect programme remains on track, although the timing of the launch itself has become more uncertain. The office sector remains the brightest segment in the property space, as rental rates are set to increase given central office vacancy rates have already fallen to 2.3%, as long as the stock market correction does not detract from office demand. In Macau, the policy change on transit visas is a positive first step and largely removes the risk of a sustained long-term slide in gaming revenues. However, negative policy changes continue to affect the sector, including the proposed full smoking ban. Moreover, share valuations are not cheap, especially given likely earnings pressures in the first half.

Taiwan

Market Performance

The Taiex Index gained 3% in the first quarter. The Taiwanese market saw profit taking in the technology sector at the start of the year, particularly in stocks that are part of the Apple supply chain, following a very strong iPhone 6 launch late in the third quarter of last year, as well as concerns that the consumer technology product cycle will be much more moderate in 2015. However, the selling reversed quickly, with qualified foreign institutional investors (‘QFIIs’) becoming strong net buyers of Taiwanese stocks again. This trend reversal started in mid January as the Taiwanese market continued to deliver the best earnings revisions in the region (+5% vs. –2%), while still being seen as one of the most defensive of emerging markets, with a high dividend yield and a high current account surplus-

to-GDP ratio of 12-13%. However, there was a shift in technology sentiment again in the final two weeks of the quarter after softer guidance from Taiwan Semiconductor Manufacturing Company as well as concerns about Mediatek’s margins. Foreign investors led the selling in upstream technology stocks in late March. Domestically, the government decided to postpone the implementation of the big player tax until 2018. The tax was seen as an impediment to trading volume as high net worth investors had been avoiding the market ahead of the implementation of the tax. The Government policy on capital markets has remained supportive, with more proposals to enhance retail participation and market turnover, which provided some support for the over the counter (‘OTC’) market and domestic sectors. Most notably, Taiwan’s Financial Supervisory Commission (‘FSC’) allows more stocks for day trading and stock borrowing/lending (‘SBL’) while removing the current cap on retail margin trading. At the same time, the FSC announced that it would widen the daily stock up/down limit from 7% to 10% on 3 February 2015. The margin maintenance ratio was raised to 130% from 120%, along with higher price limits. The new daily limit is the first major revision to the stock limit in the past 25 years. The Central Bank of the Republic of China (‘CBC’) kept the policy rate unchanged at 1.875%, marking the fourteenth consecutive quarter that the CBC has kept the rate unchanged — one of the longest periods of an unchanged policy rate in history. On the exchange rate, the CBC said that it would keep the currency dynamically stable. It would not intentionally support either the appreciation or the depreciation of the currency.

During the second quarter, the Taiex Index trended higher in April, but failed to sustain this momentum in later sessions. The TWSE Index finished down 2.7% quarter on quarter. The strength in April was boosted by speculation over the establishment of a stock trading link between Taipei and Shanghai. Not surprisingly, financials were one of the strongest

| | | | | | |

| | | |

| 8 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

performers for the quarter. Besides being the biggest beneficiaries of a stock connect, financials reported stronger-than-expected first-quarter 2015 results. The market turned weak in May and June, with investors locking in profits ahead of the summer. Technology wrapped up the quarter with 4.5% quarter-on-quarter decline, with weakness in most sub-sectors on concerns over slower-than-expected first-half momentum. Besides weak sales of PCs and notebooks, sluggish smartphone demand from China and the emerging markets meant inventory digestion was taking longer than expected. Non-technology fared better in comparison, with gains in energy, textile, financials and food. The textile sub-sector was helped by the fast-growing leisurewear market in the US, while the China Securities Finance Corporation’s new Renminbi Qualified Foreign Institutional Investor measure is expected to benefit Taiwan.

Market Outlook

Market sentiment remains fragile, weighed down by the generally sluggish second quarter for technology and concerns over the second half of 2015. The only visibly positive area has been Apple iPhone’s supply chain, where sales of its current model surpassed expectations, and expectations for the replacement model remain high. As a whole, however, technology continues to suffer from weakness across the end markets for PCs, notebooks, TVs and smartphones.

For the financial sector, strong results so far have been driven largely by trading gains and low credit costs. However, the sustainability of these earnings will need to be closely monitored. Despite the shaky outlook, we maintain a constructive view given Taiwan’s muted performance within the region. The sluggish second quarter and concerns over the second half of 2015 should already have been partly priced in. Valuations are not stretched and, at the margin, domestic interest could shift back to Taiwan given the volatility of the China market.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 9 | |

TOP TEN HOLDINGS

AT JUNE 30, 2015 (Unaudited)

| | | | |

| | | % OF

NET ASSETS | |

Tencent Holdings Ltd. | | | 5.7 | |

| Provides internet, mobile, and telecommunication value-added services in China. The company has an instant messaging community in China. Tencent also provides online advertising services. | | | | |

| |

Taiwan Semiconductor Manufacturing Co., Ltd. (‘TSMC’) | | | 5.3 | |

| Manufactures and markets integrated circuits. The company provides the following services: wafer manufacturing, wafer probing, assembly and testing, mask production and design services. The company’s integrated circuits are used in computer, communication, consumer electronics, automotive and industrial equipment industries. | | | | |

| |

China Construction Bank Corp. ‘A’ ‘H’ | | | 4.8 | |

| Provides a complete range of banking services and other financial services to individual and corporate customers. The bank’s services include retail banking, international settlement, project finance and credit card services. | | | | |

| |

Ping An Insurance Group Co. Ltd. ‘A’ ‘H’ | | | 4.0 | |

| Provides a variety of insurance service in China. The Company writes property, casualty, and life insurance. Ping An Insurance also offers financial services. | | | | |

| |

AIA Group Ltd. | | | 3.9 | |

| Offers insurance and financial services. The company writes life insurance for individuals and businesses, accident and health insurance, retirement planning, and wealth management services. | | | | |

| |

China Merchants Bank Co., Ltd. ‘A’ ‘H’ | | | 2.7 | |

| Provides a wide range of commercial banking services including deposits, loan, bill discount, government bonds underwriting and trading, interbank lending, letter of credit, bank guarantee, and other related services. | | | | |

| |

China Petroleum & Chemical Corp. | | | 2.0 | |

| Refines, produces and trades petroleum and petrochemical products such as gasoline, diesel, jet fuel, kerosene, ethylene, synthetic fibers, synthetic rubber, synthetic resins and chemical fertilizers. Also, the Company explores for and produces oil and natural gas in China. | | | | |

| |

CK Hutchison Holdings Ltd. | | | 1.9 | |

| Holds all of the non-property businesses of the Cheung Kong Group and the Hutchison Group, including ports and related services, telecommunications, retail, infrastructure, energy and movable assets leasing operations. | | | | |

| |

China Pacific Insurance Group Co., Ltd. ‘A’ ‘H’ | | | 1.8 | |

| Provides integrated insurance services. The Company offers life and property insurance products through its subsidiaries. | | | | |

| |

Fubon Financial Holding Co., Ltd. | | | 1.8 | |

| Provides financial holding services. The Company was formed through the merger of Fubon Insurance, Fubon Securities, Fubon Commercial Bank, and Fubon Life Assurance. | | | | |

| | | | | | |

| | | |

| 10 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

INVESTMENT PORTFOLIO

AT JUNE 30, 2015 (Unaudited)

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK (unless otherwise noted) | |

CHINA (61.5%) | |

Aerospace & Defense (0.4%) | |

AVIC Aircraft Co., Ltd., ‘A’ | | | 52,400 | | | | 368,262 | |

China Avionics Systems Co., Ltd., ‘A’ | | | 33,006 | | | | 185,921 | |

| | | | | | | | |

| | | | | | | 554,183 | |

| | | | | | | | |

Airlines (0.6%) | |

China Southern Airlines Co., Ltd., ‘A’ | | | 163,000 | | | | 382,199 | |

Spring Airlines Co., Ltd., ‘A’ | | | 21,400 | | | | 435,144 | |

| | | | | | | | |

| | | | | | | 817,343 | |

| | | | | | | | |

Auto Components (0.7%) | |

Fuyao Glass Industry Group Co., Ltd. (a) (e) | | | 257,200 | | | | 629,765 | |

Fuyao Glass Industry Group Co., Ltd., ‘A’ | | | 81,978 | | | | 188,784 | |

Huayu Automotive Systems Co., Ltd., ‘A’ | | | 65,900 | | | | 226,893 | |

| | | | | | | | |

| | | | | | | 1,045,442 | |

| | | | | | | | |

Automobiles (0.9%) | |

Chongqing Changan Automobile Co., Ltd., ‘A’ | | | 91,502 | | | | 312,090 | |

Chongqing Changan Automobile Co., Ltd., ‘B’ | | | 217,778 | | | | 557,119 | |

FAW CAR Co., Ltd., ‘A’ | | | 37,000 | | | | 148,453 | |

SAIC Motor Corp., Ltd., ‘A’ | | | 66,200 | | | | 241,271 | |

| | | | | | | | |

| | | | | | | 1,258,933 | |

| | | | | | | | |

Banks (14.0%) | |

Agricultural Bank of China Ltd. (a) | | | 3,031,000 | | | | 1,630,547 | |

Agricultural Bank of China Ltd., ‘A’ | | | 727,700 | | | | 435,376 | |

Bank of Communications Co., Ltd., ‘A’ | | | 699,800 | | | | 929,907 | |

China CITIC Bank Corp., Ltd. (a) | | | 1,564,000 | | | | 1,246,914 | |

China Construction Bank Corp. | | | 7,333,000 | | | | 6,697,711 | |

China Construction Bank Corp., ‘A’ | | | 270,000 | | | | 310,450 | |

China Merchants Bank Co., Ltd. | | | 856,000 | | | | 2,495,707 | |

China Merchants Bank Co., Ltd., ‘A’ | | | 445,981 | | | | 1,346,358 | |

China Minsheng Banking Corp., Ltd. | | | 1,307,900 | | | | 1,714,272 | |

China Minsheng Banking Corp., Ltd., ‘A’ | | | 408,900 | | | | 655,453 | |

Huaxia Bank Co., Ltd., ‘A’ | | | 100,000 | | | | 245,283 | |

Industrial Bank Co., Ltd., ‘A’ | | | 336,300 | | | | 935,523 | |

Ping An Bank Co., Ltd., ‘A’ | | | 315,202 | | | | 739,080 | |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

Banks — continued | |

Shanghai Pudong Development Bank Co., Ltd., ‘A’ | | | 318,800 | | | | 871,932 | |

| | | | | | | | |

| | | | | | | 20,254,513 | |

| | | | | | | | |

Beverages (0.7%) | |

Kweichow Moutai Co., Ltd., ‘A’ (a) | | | 14,800 | | | | 614,936 | |

Luzhou Laojiao Co., Ltd., ‘A’ | | | 88,500 | | | | 465,407 | |

| | | | | | | | |

| | | | | | | 1,080,343 | |

| | | | | | | | |

Biotechnology (0.2%) | |

Hualan Biological Engineering, Inc., ‘A’ | | | 35,200 | | | | 251,412 | |

| | | | | | | | |

Capital Markets (2.9%) | |

China Cinda Asset Management Co., Ltd. (a) | | | 1,152,000 | | | | 642,019 | |

China Merchants Securities Co., Ltd., ‘A’ | | | 67,400 | | | | 287,599 | |

CITIC Securities Co., Ltd., ‘A’ | | | 235,737 | | | | 1,023,010 | |

GF Securities Co., Ltd., ‘A’ | | | 93,200 | | | | 340,426 | |

Haitong Securities Co., Ltd., ‘A’ (a) | | | 312,000 | | | | 1,096,855 | |

Huatai Securities Co., Ltd. (a) (e) | | | 168,400 | | | | 475,771 | |

Huatai Securities Co., Ltd., ‘A’ | | | 97,500 | | | | 363,679 | |

| | | | | | | | |

| | | | | | | 4,229,359 | |

| | | | | | | | |

Chemicals (0.3%) | |

Kingfa Sci & Tech Co., Ltd., ‘A’ | | | 86,000 | | | | 165,315 | |

Qinghai Salt Lake Industry Co., Ltd., ‘A’ | | | 62,249 | | | | 284,894 | |

| | | | | | | | |

| | | | | | | 450,209 | |

| | | | | | | | |

Commercial Services & Supplies (0.2%) | |

Beijing Originwater Technology Co., Ltd., ‘A’ | | | 37,000 | | | | 291,119 | |

| | | | | | | | |

Communications Equipment (0.3%) | |

Guangzhou Haige Communications Group, Inc. Co., ‘A’ | | | 55,300 | | | | 287,068 | |

ZTE Corp., ‘A’ | | | 48,800 | | | | 187,377 | |

| | | | | | | | |

| | | | | | | 474,445 | |

| | | | | | | | |

Construction & Engineering (1.6%) | |

China Communications Construction Co., Ltd., ‘A’ | | | 120,700 | | | | 341,799 | |

China Machinery Engineering Corp. | | | 498,000 | | | | 537,090 | |

China Railway Construction Corp., Ltd., ‘A’ | | | 152,700 | | | | 384,890 | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 11 | |

INVESTMENT PORTFOLIO

AT JUNE 30, 2015 (Unaudited) (continued)

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK — continued | |

Construction & Engineering — continued | |

China State Construction Engineering Corp., Ltd., ‘A’ | | | 378,000 | | | | 506,560 | |

Suzhou Gold Mantis Construction Decoration Co., Ltd., ‘A’ | | | 106,500 | | | | 484,153 | |

| | | | | | | | |

| | | | | | | 2,254,492 | |

| | | | | | | | |

Construction Materials (0.6%) | |

Anhui Conch Cement Co., Ltd., ‘A’ | | | 70,000 | | | | 242,138 | |

BBMG Corp. | | | 550,000 | | | | 556,986 | |

| | | | | | | | |

| | | | | | | 799,124 | |

| | | | | | | | |

Diversified Consumer Services (0.3%) | |

China Maple Leaf Educational Systems Ltd. | | | 1,264,000 | | | | 391,354 | |

| | | | | | | | |

Diversified Financial Services (0.1%) | |

Avic Capital Co., Ltd., ‘A’ | | | 50,000 | | | | 186,663 | |

| | | | | | | | |

Diversified Telecommunication Services (1.0%) | |

China Telecom Corp., Ltd. | | | 2,502,000 | | | | 1,468,622 | |

| | | | | | | | |

Electrical Equipment (0.1%) | |

Henan Pinggao Electric Co., Ltd., ‘A’ | | | 54,600 | | | | 198,818 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components (1.2%) | |

AAC Technologies Holdings, Inc. | | | 118,500 | | | | 669,582 | |

Hangzhou Hikvision Digital Technology Co., Ltd., ‘A’ | | | 97,680 | | | | 705,703 | |

Shenzhen Deren Electronic Co., Ltd., ‘A’ | | | 26,500 | | | | 247,351 | |

Shenzhen O-film Tech Co., Ltd., ‘A’ (a) | | | 34,100 | | | | 185,540 | |

| | | | | | | | |

| | | | | | | 1,808,176 | |

| | | | | | | | |

Food & Staples Retailing (0.2%) | |

Yonghui Superstores Co., Ltd., ‘A’ (a) | | | 156,500 | | | | 292,507 | |

| | | | | | | | |

Food Products (1.5%) | |

China Mengniu Dairy Co., Ltd. | | | 233,000 | | | | 1,161,761 | |

Heilongjiang Agriculture Co., Ltd., ‘A’ | | | 69,000 | | | | 188,718 | |

Inner Mongolia Yili Industrial Group Co., Ltd., ‘A’ | | | 292,508 | | | | 891,534 | |

| | | | | | | | |

| | | | | | | 2,242,013 | |

| | | | | | | | |

Health Care Equipment & Supplies (0.1%) | |

Shinva Medical Instrument Co., Ltd., ‘A’ | | | 22,800 | | | | 215,572 | |

| | | | | | | | |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

Health Care Providers & Services (1.5%) | |

Aier Eye Hospital Group Co., Ltd., ‘A’ | | | 36,466 | | | | 189,710 | |

iKang Healthcare Group, Inc. ADR (a) | | | 35,028 | | | | 677,441 | |

Phoenix Healthcare Group Co., Ltd. | | | 597,000 | | | | 1,136,769 | |

Searainbow Holding Corp., ‘A’ (a) | | | 20,500 | | | | 161,990 | |

| | | | | | | | |

| | | | | | | 2,165,910 | |

| | | | | | | | |

Hotels, Restaurants & Leisure (0.3%) | |

China International Travel Service Corp., Ltd., ‘A’ (a) | | | 25,050 | | | | 267,830 | |

Shenzhen Tempus Global Travel Holdings Ltd., ‘A’ | | | 30,740 | | | | 179,007 | |

| | | | | | | | |

| | | | | | | 446,837 | |

| | | | | | | | |

Household Durables (1.3%) | |

Gree Electric Appliances, Inc. of Zhuhai, ‘A’ (a) | | | 46,001 | | | | 474,031 | |

JANUS Dongguan Precision Components Co., Ltd., ‘A’ | | | 48,901 | | | | 295,567 | |

Midea Group Co., Ltd., ‘A’ | | | 70,500 | | | | 423,841 | |

Qingdao Haier Co., Ltd., ‘A’ (a) | | | 79,800 | | | | 390,313 | |

TCL Corp., ‘A’ | | | 375,000 | | | | 341,679 | |

| | | | | | | | |

| | | | | | | 1,925,431 | |

| | | | | | | | |

Independent Power & Renewable Electricity Producers (1.6%) | |

China Longyuan Power Group Corp., Ltd. | | | 1,134,000 | | | | 1,261,049 | |

China Yangtze Power Co., Ltd., ‘A’ | | | 209,000 | | | | 483,686 | |

GD Power Development Co., Ltd., ‘A’ (a) | | | 347,000 | | | | 390,032 | |

SDIC Power Holdings Co., Ltd., ‘A’ | | | 58,100 | | | | 139,333 | |

| | | | | | | | |

| | | | | | | 2,274,100 | |

| | | | | | | | |

Insurance (5.8%) | |

China Pacific Insurance Group Co., Ltd. | | | 459,600 | | | | 2,205,639 | |

China Pacific Insurance Group Co., Ltd., ‘A’ | | | 84,000 | | | | 408,825 | |

Ping An Insurance Group Co. of China Ltd. | | | 285,000 | | | | 3,849,488 | |

Ping An Insurance Group Co. of China Ltd., ‘A’ | | | 145,176 | | | | 1,918,355 | |

| | | | | | | | |

| | | | | | | 8,382,307 | |

| | | | | | | | |

Internet & Catalog Retail (0.3%) | |

Vipshop Holdings Ltd. ADR (a) | | | 16,200 | | | | 360,450 | |

| | | | | | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK — continued | |

Internet Software & Services (6.2%) | |

Beijing Tensyn Digital Marketing Technology JSC, ‘A’ | | | 8,500 | | | | 183,324 | |

Tencent Holdings Ltd. | | | 414,800 | | | | 8,278,288 | |

Wangsu Science & Technology Co., Ltd., ‘A’ | | | 60,200 | | | | 450,650 | |

| | | | | | | | |

| | | | | | | 8,912,262 | |

| | | | | | | | |

IT Services (0.6%) | |

Beijing eGOVA Co., Ltd., ‘A’ | | | 48,600 | | | | 295,393 | |

Hand Enterprise Solutions Co., Ltd., ‘A’ (a) | | | 84,750 | | | | 331,975 | |

Wonders Information Co., Ltd., ‘A’ | | | 35,000 | | | | 277,246 | |

| | | | | | | | |

| | | | | | | 904,614 | |

| | | | | | | | |

Machinery (1.5%) | |

China Conch Venture Holdings Ltd. | | | 350,500 | | | | 804,858 | |

China Shipbuilding Industry Co., Ltd., ‘A’ (a) | | | 271,600 | | | | 648,231 | |

CRRC Corp., Ltd., ‘A’ | | | 95,490 | | | | 282,728 | |

Shanghai Mechanical and Electrical Industry Co., Ltd., ‘A’ | | | 25,000 | | | | 132,801 | |

Zhengzhou Yutong Bus Co., Ltd., ‘A’ | | | 75,000 | | | | 248,549 | |

| | | | | | | | |

| | | | | | | 2,117,167 | |

| | | | | | | | |

Media (0.7%) | |

Beijing Gehua CATV Network Co., Ltd., ‘A’ | | | 36,400 | | | | 184,906 | |

China South Publishing & Media Group Co., Ltd., ‘A’ | | | 73,500 | | | | 271,550 | |

Guangdong Advertising Co., Ltd., ‘A’ | | | 42,546 | | | | 173,313 | |

Zhejiang Huace Film & TV Co., Ltd., ‘A’ | | | 71,350 | | | | 310,668 | |

| | | | | | | | |

| | | | | | | 940,437 | |

| | | | | | | | |

Metals & Mining (1.4%) | |

Angang Steel Co., Ltd. | | | 950,000 | | | | 655,675 | |

Baoshan Iron & Steel Co., Ltd., ‘A’ | | | 227,000 | | | | 319,945 | |

Hebei Iron & Steel Co., Ltd., ‘A’ | | | 229,600 | | | | 259,184 | |

Jiangxi Copper Co., Ltd. | | | 361,000 | | | | 602,633 | |

Shenzhen Zhongjin Lingnan Nonfemet Co., Ltd., ‘A’ | | | 72,500 | | | | 217,348 | |

| | | | | | | | |

| | | | | | | 2,054,785 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels (3.1%) | |

China Petroleum & Chemical Corp. | | | 3,407,400 | | | | 2,940,768 | |

China Shenhua Energy Co., Ltd., ‘A’ | | | 66,400 | | | | 223,261 | |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

Oil, Gas & Consumable Fuels — continued | |

CNOOC Ltd. | | | 934,000 | | | | 1,325,412 | |

| | | | | | | | |

| | | | | | | 4,489,441 | |

| | | | | | | | |

Personal Products (0.2%) | |

Hengan International Group Co., Ltd. | | | 22,000 | | | | 261,393 | |

| | | | | | | | |

Pharmaceuticals (1.9%) | |

CSPC Pharmaceutical Group Ltd. | | | 986,000 | | | | 974,355 | |

Humanwell Healthcare Group Co., Ltd., ‘A’ | | | 34,900 | | | | 208,522 | |

Inner Mongolia Furui Medical Science Co., Ltd., ‘A’ (a) | | | 11,000 | | | | 159,634 | |

Jiangsu Hengrui Medicine Co., Ltd., ‘A’ | | | 70,094 | | | | 503,465 | |

Kangmei Pharmaceutical Co., Ltd., ‘A’ | | | 101,200 | | | | 289,352 | |

Tasly Pharmaceutical Group Co., Ltd., ‘A’ | | | 54,447 | | | | 436,911 | |

Zhejiang Huahai Pharmaceutical Co., Ltd., ‘A’ | | | 34,500 | | | | 173,863 | |

| | | | | | | | |

| | | | | | | 2,746,102 | |

| | | | | | | | |

Real Estate Management & Development (3.5%) | |

Beijing Capital Development Co., Ltd., ‘A’ | | | 75,000 | | | | 233,309 | |

China Fortune Land Development Co., Ltd., ‘A’ | | | 55,000 | | | | 270,077 | |

China Vanke Co., Ltd. | | | 825,100 | | | | 2,030,937 | |

China Vanke Co., Ltd., ‘A’ (a) | | | 200,500 | | | | 469,482 | |

Financial Street Holdings Co., Ltd.,‘A’ | | | 123,000 | | | | 280,276 | |

Poly Real Estate Group Co., Ltd., ‘A’ | | | 260,450 | | | | 479,655 | |

Sunac China Holdings Ltd. | | | 1,172,000 | | | | 1,283,650 | |

| | | | | | | | |

| | | | | | | 5,047,386 | |

| | | | | | | | |

Road & Rail (1.2%) | | | | | | | | |

CAR, Inc. (a) | | | 519,000 | | | | 1,104,747 | |

Daqin Railway Co., Ltd., ‘A’ | | | 141,980 | | | | 321,464 | |

Guangshen Railway Co., Ltd., ‘A’ | | | 195,800 | | | | 259,551 | |

| | | | | | | | |

| | | | | | | 1,685,762 | |

| | | | | | | | |

Software (0.6%) | |

Aisino Co., Ltd., ‘A’ | | | 46,500 | | | | 485,247 | |

Beijing Thunisoft Corp., Ltd., ‘A’ | | | 43,704 | | | | 308,768 | |

Hundsun Technologies, Inc., ‘A’ | | | 6,800 | | | | 122,874 | |

| | | | | | | | |

| | | | | | | 916,889 | |

| | | | | | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 13 | |

INVESTMENT PORTFOLIO

AT JUNE 30, 2015 (Unaudited) (continued)

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK — continued | |

Specialty Retail (0.7%) | |

China Harmony New Energy Auto Holding Ltd. | | | 578,000 | | | | 644,994 | |

Suning Commerce Group Co., Ltd., ‘A’ | | | 165,200 | | | | 407,605 | |

| | | | | | | | |

| | | | | | | 1,052,599 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals (0.1%) | |

BOE Technology Group Co., Ltd., ‘A’ (a) | | | 200,000 | | | | 167,392 | |

| | | | | | | | |

Trading Companies & Distributors (0.1%) | |

Xiamen C & D, Inc., ‘A’ | | | 73,208 | | | | 206,720 | |

| | | | | | | | |

Transportation Infrastructure (0.5%) | |

Shanghai International Airport Co., Ltd., ‘A’ | | | 72,000 | | | | 368,070 | |

Shenzhen Airport Co., ‘A’ (a) | | | 103,000 | | | | 187,363 | |

Sichuan Haite High-tech Co., Ltd., ‘A’ | | | 37,800 | | | | 138,070 | |

| | | | | | | | |

| | | | | | | 693,503 | |

| | | | | | | | |

Water Utilities (0.3%) | |

SIIC Environment Holdings Ltd. (a) | | | 3,131,300 | | | | 453,357 | |

| | | | | | | | |

Wireless Telecommunication Services (0.2%) | |

China United Network Communications Ltd., ‘A’ (a) | | | 218,000 | | | | 257,691 | |

| | | | | | | | |

TOTAL CHINA | | | | | | | 89,027,177 | |

| | | | | | | | |

HONG KONG (29.8%) | | | | | | | | |

Auto Components (0.4%) | | | | | | | | |

Xinyi Glass Holdings Ltd. | | | 1,104,000 | | | | 586,783 | |

| | | | | | | | |

Banks (2.7%) | |

BOC Hong Kong Holdings Ltd. | | | 423,500 | | | | 1,764,686 | |

Dah Sing Financial Holdings Ltd. | | | 120,169 | | | | 788,306 | |

Hang Seng Bank Ltd. | | | 50,100 | | | | 979,178 | |

HSBC Holdings plc | | | 34,947 | | | | 316,264 | |

| | | | | | | | |

| | | | | | | 3,848,434 | |

| | | | | | | | |

Commercial Services & Supplies (1.2%) | |

China Everbright International Ltd. | | | 925,000 | | | | 1,658,700 | |

| | | | | | | | |

Communications Equipment (0.2%) | |

VTech Holdings Ltd. | | | 24,400 | | | | 323,904 | |

| | | | | | | | |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

Diversified Financial Services (1.5%) | |

Hong Kong Exchanges and Clearing Ltd. | | | 62,812 | | | | 2,217,023 | |

| | | | | | | | |

Diversified Telecommunication Services (1.9%) | |

China Unicom Hong Kong Ltd. | | | 1,072,000 | | | | 1,687,198 | |

CITIC Telecom International Holdings Ltd. | | | 913,000 | | | | 424,018 | |

HKBN Ltd. (a) | | | 218,000 | | | | 226,675 | |

HKT Trust & HKT Ltd. | | | 373,000 | | | | 438,849 | |

| | | | | | | | |

| | | | | | | 2,776,740 | |

| | | | | | | | |

Electric Utilities (0.7%) | |

Cheung Kong Infrastructure Holdings Ltd. | | | 121,000 | | | | 939,709 | |

| | | | | | | | |

Gas Utilities (0.9%) | |

China Resources Gas Group Ltd. | | | 442,000 | | | | 1,311,480 | |

| | | | | | | | |

Hotels, Restaurants & Leisure (0.7%) | |

Melco Crown Entertainment Ltd. ADR | | | 35,908 | | | | 704,874 | |

Sands China Ltd. | | | 91,200 | | | | 307,077 | |

| | | | | | | | |

| | | | | | | 1,011,951 | |

| | | | | | | | |

Household Durables (0.8%) | |

Man Wah Holdings Ltd. | | | 472,800 | | | | 464,166 | |

Techtronic Industries Co., Ltd. | | | 226,000 | | | | 740,549 | |

| | | | | | | | |

| | | | | | | 1,204,715 | |

| | | | | | | | |

Industrial Conglomerates (2.5%) | |

CK Hutchison Holdings Ltd. | | | 192,000 | | | | 2,821,216 | |

Shun Tak Holdings Ltd. | | | 1,468,000 | | | | 812,447 | |

| | | | | | | | |

| | | | | | | 3,633,663 | |

| | | | | | | | |

Insurance (4.5%) | |

AIA Group Ltd. | | | 870,400 | | | | 5,698,577 | |

China Taiping Insurance Holdings Co., Ltd. (a) | | | 235,400 | | | | 845,752 | |

| | | | | | | | |

| | | | | | | 6,544,329 | |

| | | | | | | | |

Marine (0.7%) | |

Orient Overseas International Ltd. | | | 187,000 | | | | 956,525 | |

| | | | | | | | |

Multiline Retail (0.4%) | |

Lifestyle International Holdings Ltd. | | | 297,000 | | | | 550,968 | |

| | | | | | | | |

Pharmaceuticals (1.0%) | |

Sino Biopharmaceutical Ltd. | | | 1,272,000 | | | | 1,476,866 | |

| | | | | | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

COMMON STOCK — continued | |

Real Estate Investment Trusts (REITs) (1.4%) | |

Champion REIT | | | 872,000 | | | | 479,223 | |

Link REIT (The) | | | 170,000 | | | | 995,672 | |

Yuexiu Real Estate Investment Trust | | | 1,114,000 | | | | 613,655 | |

| | | | | | | | |

| | | | | | | 2,088,550 | |

| | | | | | | | |

Real Estate Management & Development (5.0%) | |

Cheung Kong Property Holdings Ltd. (a) | | | 204,000 | | | | 1,692,203 | |

Great Eagle Holdings Ltd. | | | 118,170 | | | | 440,572 | |

Hongkong Land Holdings Ltd. | | | 218,000 | | | | 1,787,600 | |

Kerry Properties Ltd. | | | 224,000 | | | | 878,482 | |

New World Development Co., Ltd. | | | 490,094 | | | | 641,104 | |

Sun Hung Kai Properties Ltd. | | | 69,000 | | | | 1,118,022 | |

Wheelock & Co., Ltd. | | | 120,000 | | | | 613,039 | |

| | | | | | | | |

| | | | | | | 7,171,022 | |

| | | | | | | | |

Specialty Retail (0.7%) | |

Chow Tai Fook Jewellery Group Ltd. | | | 863,600 | | | | 931,387 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods (0.7%) | |

Pacific Textiles Holdings Ltd. | | | 161,000 | | | | 257,133 | |

Samsonite International S.A. | | | 227,700 | | | | 787,244 | |

| | | | | | | | |

| | | | | | | 1,044,377 | |

| | | | | | | | |

Water Utilities (0.8%) | |

Beijing Enterprises Water Group Ltd. (a) | | | 1,480,000 | | | | 1,214,312 | |

| | | | | | | | |

Wireless Telecommunication Services (1.1%) | |

China Mobile Ltd. | | | 128,500 | | | | 1,645,300 | |

| | | | | | | | |

TOTAL HONG KONG | | | | | | | 43,136,738 | |

| | | | | | | | |

TAIWAN (17.5%) | | | | | | | | |

Banks (0.9%) | | | | | | | | |

E.Sun Financial Holding Co., Ltd. | | | 1,907,044 | | | | 1,273,238 | |

| | | | | | | | |

Chemicals (0.4%) | |

China Steel Chemical Corp. | | | 134,000 | | | | 603,672 | |

| | | | | | | | |

Diversified Financial Services (2.5%) | |

Chailease Holding Co., Ltd. | | | 457,000 | | | | 1,101,972 | |

Fubon Financial Holding Co., Ltd. | | | 1,308,989 | | | | 2,604,869 | |

| | | | | | | | |

| | | | | | | 3,706,841 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components (2.5%) | |

Delta Electronics, Inc. | | | 279,000 | | | | 1,428,706 | |

Largan Precision Co., Ltd. | | | 19,000 | | | | 2,170,672 | |

| | | | | | | | |

| | | | | | | 3,599,378 | |

| | | | | | | | |

| | | | | | | | |

| DESCRIPTION | | HOLDINGS

(IN SHARES) | | | VALUE

(IN US$) | |

Food & Staples Retailing (0.7%) | |

President Chain Store Corp. | | | 146,000 | | | | 1,026,819 | |

| | | | | | | | |

Internet Software & Services (0.6%) | |

PChome Online, Inc. | | | 49,917 | | | | 825,088 | |

| | | | | | | | |

Leisure Products (0.3%) | |

Johnson Health Tech Co., Ltd. | | | 180,288 | | | | 418,955 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment (8.5%) | |

Advanced Semiconductor Engineering, Inc. | | | 1,432,802 | | | | 1,941,082 | |

Chipbond Technology Corp. | | | 418,000 | | | | 903,616 | |

Nanya Technology Corp. (a) | | | 335,000 | | | | 561,328 | |

Powertech Technology, Inc. | | | 232,000 | | | | 502,280 | |

Silicon Motion Technology Corp. ADR | | | 19,805 | | | | 685,451 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 1,691,057 | | | | 7,700,449 | |

| | | | | | | | |

| | | | | | | 12,294,206 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals (1.1%) | |

Catcher Technology Co., Ltd. | | | 131,000 | | | | 1,638,853 | |

| | | | | | | | |

TOTAL TAIWAN | | | | | | | 25,387,050 | |

| | | | | | | | |

TOTAL INVESTMENTS

(108.8% of Net Assets)

(Cost $121,436,255) | | | | | | | 157,550,965 | |

| | | | | | | | |

Liabilities in excess of other assets

(-8.8% of Net Assets) | | | | (12,689,535 | ) |

| | | | | | | | |

NET ASSETS (100.0%) | | | | | | | 144,861,430 | |

| | | | | | | | |

| | | | |

As of June 30, 2015, aggregate cost for Federal income tax purposes was $121,436,255. The aggregate unrealized gain for all securities is as follows: | |

Excess of value over cost | | | 39,453,954 | |

Excess of cost over value | | | (3,339,244 | ) |

| | | | |

Net unrealized gain | | | 36,114,710 | |

| | | | |

NOTES TO SCHEDULE OF PORTFOLIO INVESTMENTS:

| ADR – | American Depositary Receipt |

| (a) | Non-income producing security. |

| (e) | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. Unless otherwise indicated, this security has been determined to be liquid under procedures established by the Board of Directors and may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| A | China A shares (See Note 7.iii on page 26) |

| B | China B shares (See Note 7.iii on page 26) |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 15 | |

STATEMENT OF ASSETS AND LIABILITIES

AS OF JUNE 30, 2015

| | | | |

| | | (in US$) | |

ASSETS: | | | | |

Investments in non-affiliates, at value (cost $121,436,255) | | | 157,550,965 | |

Cash | | | 629,952 | |

Foreign currency, at value (cost $1,863,959) | | | 1,863,043 | |

Deposits at broker (See Note 7.iii.) | | | 28,444 | |

Receivable for securities sold | | | 2,262,807 | |

Dividends receivable | | | 1,116,499 | |

| | | | |

Total Assets | | | 163,451,710 | |

| | | | |

| |

LIABILITIES: | | | | |

Loan payable to bank (See Note 6) | | | 17,500,000 | |

Payables | | | | |

Payable for securities purchased | | | 379,090 | |

Accrued Liabilities | | | | |

Deferred China capital gains tax | | | 514,259 | |

Investment advisory fees | | | 34,100 | |

Administration fees | | | 30,103 | |

Custodian and accounting fees | | | 24,377 | |

Directors’ fees and expenses | | | 5,645 | |

Interest on loan | | | 3,025 | |

Other | | | 99,681 | |

| | | | |

Total Liabilities | | | 18,590,280 | |

| | | | |

Net Assets | | | 144,861,430 | |

| | | | |

| |

| Net assets consist of: | | | | |

Common stock, $0.01 par value

(100,000,000 shares authorized; 6,447,637 shares issued and outstanding) | | | 64,476 | |

Paid-in capital | | | 98,994,144 | |

Undistributed net investment income | | | 2,184,738 | |

Accumulated realized gain on investments and foreign currency transactions | | | 7,518,152 | |

Accumulated net unrealized appreciation on investments, foreign currency holdings, and other

assets and liabilities denominated in foreign currencies | | | 36,099,920 | |

| | | | |

Net Assets | | | 144,861,430 | |

| | | | |

Net Asset Value Per Share ($144,861,430 ÷ 6,447,637) | | | 22.47 | |

| | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 16 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2015 (Unaudited)

| | | | |

| | | (in US$) | |

INVESTMENT INCOME: | | | | |

Dividends from non-affiliates (net of foreign withholding tax of $204,183) | | | 2,016,526 | |

Interest income from non-affiliates | | | 718 | |

Interest income from affiliates | | | 594 | |

| | | | |

Total Investment Income | | | 2,017,838 | |

| | | | |

| |

EXPENSES: | | | | |

Investment advisory fees | | | 764,039 | |

Directors’ fees and expenses | | | 153,181 | |

Custodian and accounting fees | | | 107,201 | |

Interest expense to non-affiliates (See Note 6) | | | 92,456 | |

Legal fees | | | 57,905 | |

Administration fees | | | 43,820 | |

Audit fees | | | 35,675 | |

Insurance fees | | | 25,040 | |

Shareholder report fees | | | 17,833 | |

NYSE listing fees | | | 12,610 | |

Shareholder service fees | | | 8,296 | |

Interest expense to affiliates | | | 70 | |

Other expenses | | | 15,273 | |

| | | | |

Total Expenses | | | 1,333,399 | |

Less amounts waived | | | (8,712 | ) |

| | | | |

Net Expenses | | | 1,324,687 | |

| | | | |

Net Investment Income | | | 693,151 | |

| | | | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY

HOLDINGS AND OTHER ASSETS AND LIABILITIES DENOMINATED IN FOREIGN CURRENCIES: | | | | |

Net realized gain (loss) | | | | |

Investments in non-affiliates (net of China tax of $1,963 on realized loss) | | | 10,907,954 | |

Foreign currency transactions | | | 3,996 | |

| | | | |

Net realized gain (loss) | | | 10,911,950 | |

| | | | |

Net change in unrealized appreciation/depreciation | | | | |

Investments in non-affiliates (net of China tax of $15,874 on unrealized depreciation) | | | 8,234,549 | |

Foreign currency translations | | | (527 | ) |

| | | | |

Change in net unrealized appreciation/depreciation | | | 8,234,022 | |

| | | | |

Net realized and unrealized gain (loss) on investments, foreign currency holdings and other assets

and liabilities denominated in foreign currencies | | | 19,145,972 | |

| | | | |

Net increase in net assets resulting from operations | | | 19,839,123 | |

| | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 17 | |

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| | | | | | | | |

| | | Six Months Ended

June 30, 2015

(Unaudited)

(in US$) | | | Year Ended

December 31, 2014

(in US$) | |

INCREASE IN NET ASSETS: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | | 693,151 | | | | 907,437 | |

Net realized gain (loss) on investment transactions | | | 10,911,950 | | | | 8,321,030 | |

Net change in unrealized appreciation (depreciation) on investments, foreign currency holdings and other assets and liabilities denominated in foreign currencies | | | 8,234,022 | | | | 5,177,093 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 19,839,123 | | | | 14,405,560 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO STOCKHOLDERS: | | | | | | | | |

Net investment income | | | — | | | | (818,850 | ) |

| | | | | | | | |

Total distributions to shareholders | | | — | | | | (818,850 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | 19,839,123 | | | | 13,586,710 | |

| | | | | | | | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 125,022,307 | | | | 111,435,597 | |

| | | | | | | | |

End of period (including undistributed net investment income of $2,184,738 and $1,491,587, respectively) | | | 144,861,430 | | | | 125,022,307 | |

| | | | | | | | |

| | |

SHARE TRANSACTIONS | | | | | | | | |

Opening number of shares | | | 6,447,637 | | | | 6,447,637 | |

| | | | | | | | |

Closing number of shares | | | 6,447,637 | | | | 6,447,637 | |

| | | | | | | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 18 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2015 (Unaudited)

| | | | |

| | | (in US$) | |

INCREASE (DECREASE) IN CASH | | | | |

Cash flows provided (used) by operating activities: | | | | |

Net increase/decrease in net assets from operations | | | 19,839,123 | |

Adjustments to reconcile net increase/decrease in net assets

from operations to net cash provided (used) by operating activities: | | | | |

Purchase of investment securities | | | (78,459,859 | ) |

Proceeds from disposition of investment securities | | | 76,700,443 | |

Change in unrealized (appreciation)/depreciation on investments in non-affiliates | | | (8,250,423 | ) |

Net realized (gain)/loss on investments | | | (10,909,918 | ) |

Increase in deposits at broker | | | (13 | ) |

Increase in dividends receivable | | | (1,067,271 | ) |

Increase in Deferred China capital gains tax | | | 17,838 | |

Decrease in accrued expenses and other liabilities | | | (145,962 | ) |

| | | | |

Net cash provided (used) by operating activities | | | (2,276,042 | ) |

| | | | |

| |

Cash flows provided (used) by financing activities: | | | | |

Proceeds from borrowings | | | 2,500,000 | |

| | | | |

Net cash provided (used) by financing activities | | | 2,500,000 | |

| | | | |

Net increase/decrease in cash | | | 223,958 | |

| | | | |

| |

Cash: | | | | |

Beginning of period (including foreign currency of $1,162,989) | | | 2,269,037 | |

| | | | |

End of period (including foreign currency of $1,863,043) | | | 2,492,995 | |

| | | | |

Supplemental disclosure of cash flow information:

For the six month period, the Fund paid $102,910 in interest expense, including $70 to affiliates.

For purposes of reporting the Statement of Cash Flows, the Fund considers all cash accounts that are not subject to withdrawal restrictions or penalties to be cash equivalents.

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 19 | |

FINANCIAL HIGHLIGHTS

FOR THE PERIODS INDICATED

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

Six Months

Ended

June 30,

2015

(Unaudited)

(in US$) | | | For the

Year Ended

December 31,

2014

(in US$) | | | For the

Year Ended

December 31,

2013

(in US$) | | | For the

Year Ended

December 31,

2012

(in US$) | | | For the

Year Ended

December 31,

2011

(in US$) | | | For the

Year Ended

December 31,

2010

(in US$) | |

For a share outstanding throughout each year: | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | 19.39 | | | | 17.28 | | | | 15.47 | | | | 12.75 | | | | 17.41 | | | | 15.27 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.11 | | | | 0.14 | | | | 0.10 | | | | 0.08 | | | | 0.14 | | | | 0.05 | |

Net realized and unrealized gain (loss) | | | 2.97 | | | | 2.10 | | | | 1.84 | | | | 2.74 | | | | (4.70 | ) | | | 2.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 3.08 | | | | 2.24 | | | | 1.94 | | | | 2.82 | | | | (4.56 | ) | | | 2.16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | — | | | | (0.13 | ) | | | (0.13 | ) | | | (0.10 | ) | | | (0.10 | ) | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | 22.47 | | | | 19.39 | | | | 17.28 | | | | 15.47 | | | | 12.75 | | | | 17.41 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Market value, end of period | | | 18.83 | | | | 16.91 | | | | 15.16 | | | | 14.00 | | | | 11.02 | | | | 15.79 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Investment Return | | | | | | | | | | | | | | | | | | | | | | | | |

Per share market value | | | 11.4 | % | | | 12.5 | % | | | 9.2 | % | | | 28.2 | % | | | (29.6 | %) | | | 14.7 | % |

| | | | | | |

RATIOS/SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period | | | 144,861,430 | | | | 125,022,307 | | | | 111,435,597 | | | | 99,728,043 | | | | 82,226,478 | | | | 112,248,790 | |

Ratio of net expenses to average net assets | | | 1.92 | % | | | 2.14 | % | | | 2.26 | % | | | 2.11 | % | | | 1.89 | % | | | 1.99 | % |

Ratio of net expenses to average net assets, excluding interest expense | | | 1.79 | % | | | 1.94 | % | | | 2.05 | % | | | 2.04 | % | | | 1.89 | % | | | 1.99 | % |

Ratios of net investment income to average net assets | | | 1.01 | % | | | 0.82 | % | | | 0.61 | % | | | 0.54 | % | | | 0.87 | % | | | 0.32 | % |

Portfolio turnover rate | | | 50.9 | % | | | 86.7 | % | | | 66.6 | % | | | 85.8 | % | | | 66.8 | % | | | 76.1 | % |

Number of shares outstanding at end of period (in thousands) | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | | | | 6,448 | |

| * | The total investment return excludes the effect of commissions. Dividends and distributions, if any, are assumed for the purpose of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan or if specified in accordance with the terms of the distribution. |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 20 | | | | JPMORGAN CHINA REGION FUND, INC. | | JUNE 30, 2015 |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2015

1. Organization and Capital

JPMorgan China Region Fund, Inc. (the ‘Fund’) was incorporated in the State of Maryland on May 22, 1992, and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940 (‘1940 Act’). The Fund commenced operations on July 16, 1992.

The Fund seeks to achieve long-term capital appreciation through investments primarily in equity securities of companies with substantial assets in, or revenues derived from, the People’s Republic of China (‘China’), Hong Kong, Taiwan and Macau — collectively, the ‘China Region’.

2. Significant Accounting Policies

The following significant accounting policies, which are in conformity with U.S. generally accepted accounting principles (‘GAAP’), are consistently followed by the Fund in the preparation of its financial statements.

The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of GAAP.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reported period. Actual results could differ from these estimates.

i) Security Valuation — All securities for which market quotations are readily available are valued at the last sales price prior to the time of determination or, if no sales price is available at that time, at the mean between the last current bid and ask prices. Securities that are traded over-the-counter are valued, if bid and ask quotations are available, at the mean between the current bid and ask prices. Certain investments of the Fund may, depending upon market conditions, trade in relatively thin markets and/or in markets that experience significant volatility. As a result of these conditions, the prices used by the Fund to value securities may differ from the value that would be realized if these securities were sold and the differences could be material. All other securities and assets are valued at fair value as determined in good faith by the Board of Directors. It is possible that the estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and such differences could be material. In valuing the Fund’s assets, quotations of foreign securities in a foreign currency are translated to United States (‘U.S.’) dollar equivalents at the prevailing exchange rate in effect on the valuation date. Investments in open ended mutual funds are valued at current day’s closing net asset value per share (‘NAV’).

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the fair value of the Fund’s investments are summarized into the three broad levels listed below.

| • | | Level 1 — quoted prices in active markets for identical securities |

| • | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | | | | | | | |

| | | |

| JUNE 30, 2015 | | JPMORGAN CHINA REGION FUND, INC. | | | | | 21 | |

NOTES TO FINANCIAL STATEMENTS

AT JUNE 30, 2015 (continued)

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table represents each valuation input as presented on the Investment Portfolio:

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted prices | | | Level 2

Other significant

observable inputs | | | Level 3

Significant

unobservable inputs | | | Total | |

Total Investments in Securities (a) | | $ | 157,550,965 | | | $ | — | | | $ | — | | | $ | 157,550,965 | |

| | | | | | | | | | | | | | | | |

| (a) | All portfolio holdings are designated as Level 1 are disclosed individually on the SOI. Please refer to the Investment Portfolio for industry specifics of portfolio holdings. |

ii) Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the mid-market price of such currencies against U.S. dollars as follows:

| • | | investments, other assets, and liabilities at the prevailing rates of exchange on the valuation date; |

| • | | investment transactions and investment income at the prevailing rates of exchange on the dates of such transactions. |

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of the securities held. Similarly, the Fund does not isolate the effect of changes in foreign exchange rates from the fluctuations arising from changes in the market prices of securities sold during the period. Accordingly, realized and unrealized foreign currency gains (losses) are included in the reported net unrealized appreciation/depreciation on investments. The Fund does isolate the effect of changes in foreign exchange rates from fluctuations when determining realized gain or loss for sales of fixed income securities.

Unrealized currency gains (losses) resulting from valuing foreign currency denominated assets and liabilities at period-end exchange rates are reflected as a component of accumulated net unrealized gain (loss) on investments, foreign currency holdings, and other assets and liabilities denominated in foreign currencies.

iii) Restricted and Illiquid Securities — Certain securities held by the Fund may be subject to legal or contractual restrictions on resale or are illiquid. Restricted securities generally may be resold in transactions exempt from registration under the Securities Act of 1933 (the ‘Securities Act’). Illiquid securities are securities which cannot be disposed of promptly (within seven days) and in the usual course of business at approximately its fair value and include, but are not limited to, repurchase agreements maturing in excess of seven days, time deposits with a withdrawal penalty, non-negotiable instruments and instruments for which no market exists. Disposal of these securities may involve time-consuming negotiations and expense. Prompt sale at the current valuation may be difficult and could adversely affect the net assets of the Fund.

iv) Distribution of Income and Gains — The Fund intends to distribute to stockholders, at least annually, substantially all of its net investment income and expects to distribute annually any net long-term capital gains in excess of net short-term capital losses.

Income and capital gain distributions are determined in accordance with Federal income tax regulations and may differ from those determined in accordance with GAAP.