QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

Tularik Inc. |

(Name of Registrant as Specified in its Charter) |

|

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant) |

| | | |

| Payment of Filing Fee (Check the appropriate box) |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | | Title of each class of securities to which transaction applies:

|

| 2. | | Aggregate number of securities to which transaction applies:

|

| 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| 4. | | Proposed maximum aggregate value of transaction:

|

| 5. | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1. | | Amount Previously Paid:

|

| 2. | | Form, Schedule or Registration Statement No.:

|

| 3. | | Filing Party:

|

| 4. | | Date Filed:

|

TULARIK INC.

Two Corporate Drive

South San Francisco, CA 94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on April 18, 2002

To the Stockholders of Tularik Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Tularik Inc., a Delaware corporation (the "Company"), will be held on Thursday, April 18, 2002 at 8:00 a.m. local time in the auditorium of its offices at Two Corporate Drive, South San Francisco, California for the following purposes:

- (1)

- To elect directors to serve for the ensuing year and until their successors are elected.

- (2)

- To approve the Company's 1997 Non-Employee Directors' Stock Option Plan, as amended, to increase (i) the aggregate number of shares of common stock authorized for issuance under such plan by 400,000 shares and (ii) the size of the annual grant to each director by 2,000 shares.

- (3)

- To ratify the selection of PricewaterhouseCoopers LLP as independent auditors of the Company for its fiscal year ending December 31, 2002.

- (4)

- To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors of the Company has fixed the close of business on March 4, 2002 as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof. A list of the stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose germane to the meeting during ordinary business hours in the office of the Secretary of the Company during the ten days prior to the Annual Meeting.

South San Francisco, California

March 19, 2002

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE OR SUBMIT A PROXY BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. THE ENCLOSED RETURN ENVELOPE IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

TULARIK INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors (the "Board") of Tularik Inc., a Delaware corporation ("Tularik" or the "Company"), for use at the Annual Meeting of Stockholders to be held on April 18, 2002 at 8:00 a.m. local time (the "Annual Meeting"), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held in the auditorium of the Company's offices at Two Corporate Drive, South San Francisco, California. The Company intends to mail this Proxy Statement and accompanying proxy card on or about March 19, 2002 to all stockholders entitled to vote at the Annual Meeting.

Voting Rights and Outstanding Shares

Only holders of record of Common Stock at the close of business on March 4, 2002 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on March 4, 2002, the Company had outstanding and entitled to vote 50,229,252 shares of Common Stock.

Each holder of record of Common Stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes will be counted in determining whether a quorum is present. Abstentions will have the same effect as votes against a proposal. Broker non-votes are not counted for any purpose in determining whether a matter has been approved.

Voting Via the Internet or by Telephone

Stockholders may grant a proxy to vote their shares by means of the telephone or on the Internet. The laws of the State of Delaware, under which the Company is incorporated, specifically permit electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that such proxy was authorized by the stockholder.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in street name receive instructions for voting their stock from their banks, brokers or other agents. A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers telephone and Internet voting options. If your shares are held in an account with a broker or bank participating in the ADP Investor Communication Services program, you may vote those shares telephonically by calling the telephone number shown on the voting form received from your broker or bank, or via the Internet at ADP Investor Communication Services' voting Web site (www.proxyvote.com).

For Shares Registered in Your Name

Stockholders of record may go to http://www.eproxy.com/tlrk to grant a proxy to vote their shares by means of the Internet. They will be required to provide the company number and control number contained on their proxy cards. The stockholder will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen, and the

stockholder will be prompted to submit or revise them as desired. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-240-6326 and following the recorded instructions.

General Information for All Shares Voted Via the Internet or by Telephone

Votes submitted via the Internet must be received by 12:00 noon, Central Time, on April 17, 2002. Votes submitted by telephone must be received by 12:00 noon, Eastern Time, on April 17, 2002. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

THE TELEPHONE AND INTERNET VOTING PROCEDURES DESCRIBED ABOVE ARE DESIGNED TO AUTHENTICATE STOCKHOLDERS' IDENTITIES, TO ALLOW STOCKHOLDERS TO GRANT A PROXY AND VOTE THEIR SHARES AND TO CONFIRM THAT STOCKHOLDERS' INSTRUCTIONS HAVE BEEN RECORDED PROPERLY. STOCKHOLDERS VOTING VIA THE INTERNET SHOULD UNDERSTAND THAT THERE MAY BE COSTS ASSOCIATED WITH ELECTRONIC ACCESS, SUCH AS USAGE CHARGES FROM INTERNET ACCESS PROVIDERS AND TELEPHONE COMPANIES, THAT MUST BE BORNE BY THE STOCKHOLDER.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. A proxy may be revoked by filing with the Secretary of the Company at the Company's principal executive office, Two Corporate Drive, South San Francisco, California, 94080, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Stockholder Proposals

The deadline for submitting a stockholder proposal for inclusion in the Company's proxy statement and form of proxy for the Company's 2003 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission ("SEC") is November 19, 2002. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must do so between December 19, 2002 and January 17, 2003. Stockholders are also advised to review the Company's Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

2

PROPOSAL 1

ELECTION OF DIRECTORS

There are five nominees for positions on the Board. Each director to be elected will hold office until the next annual meeting of stockholders and until his successor is elected and has been qualified, or until such director's earlier death, resignation or removal. Each nominee listed below is currently a director of the Company and, other than Craig A.P.D. Saxton, was elected by the stockholders. Paul A. Marks, who has served as a member of the Board since 1993, has decided to resign from his position as director of the Company, effective as of the date of the Annual Meeting. Currently, there are six Board positions authorized in the Company's Bylaws; however, the Board intends to amend the Company's Bylaws, effective as of the date of the Annual Meeting, to reduce the authorized size of the Board to five directors.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the five nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Any proxy granted pursuant to this solicitation will not be voted for more than five nominees. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

Nominees

The names of the nominees for director and certain information about them are set forth below:

Name

| | Age

| | Principal Occupation/

Position Held With the Company

|

|---|

| David V. Goeddel, Ph.D. | | 50 | | Chief Executive Officer of the Company |

| A. Grant Heidrich, III | | 49 | | General Partner, Mayfield Fund/Chairman of the Board of the Company |

| Edward R. McCracken | | 58 | | Chairman of The PRASAD Project |

| Steven L. McKnight, Ph.D. | | 52 | | Professor, University of Texas Southwestern Medical Center |

| Craig A. P. D. Saxton, M.D. | | 59 | | Former Executive Vice President, Pfizer Central Research |

David V. Goeddel, Ph.D. co-founded Tularik in November 1991 and has served as a member of the Board since the Company's inception and as Chief Executive Officer since April 1996. From March 1996 to December 1997, Dr. Goeddel served as President of the Company, and from January 1993 to March 1996, Dr. Goeddel served as Vice President, Research of the Company. Dr. Goeddel was the first scientist hired by Genentech, Inc., a biotechnology company, and from 1978 to 1993 served in various positions, including Genentech Fellow, Staff Scientist and Director of Molecular Biology. Dr. Goeddel's pioneering work in the field of gene cloning and expression of human proteins has been the basis for five significant marketed therapeutics developed by Genentech, including human insulin, human growth hormone, interferon-alpha, interferon-gamma and tissue plasminogen activator. Based on his contributions in gene cloning and expression of human proteins, Dr. Goeddel was elected to the National Academy of Sciences and the American Academy of Arts and Sciences. Since 1998, Dr. Goeddel has served on the board of directors of Pharma Vision AG, a stockholder of the Company. Dr. Goeddel holds a Ph.D. in Biochemistry from the University of Colorado and has performed postdoctoral research at Stanford Research Institute.

A. Grant Heidrich, III has served as a member of the Board since November 1991 and as Chairman since February 2000. Mr. Heidrich joined Mayfield Fund, a venture capital fund, in 1982 and is currently a general partner of Mayfield Fund. Mr. Heidrich is a member of the board of directors of

3

Millennium Pharmaceuticals, Inc. Mr. Heidrich holds an M.B.A. from Columbia University Graduate School of Business.

Edward R. McCracken has served as a member of the Board since August 1993. From 1984 to 1998, Mr. McCracken served as Chief Executive Officer of Silicon Graphics, Inc., a computer products and services company. Prior to joining Silicon Graphics, Mr. McCracken spent 16 years with Hewlett-Packard Company, a computer company, where he worked in a variety of senior management positions. Mr. McCracken serves as chairman of The PRASAD Project, a charitable foundation, and serves on the board of National Semiconductor Corporation. Mr. McCracken holds an M.B.A. from Stanford University.

Steven L. McKnight, Ph.D. co-founded Tularik in November 1991 and has served as a member of the Board since the Company's inception. From September 1992 to September 1995, Dr. McKnight served as Director, Biology of the Company. Dr. McKnight has been a part-time employee of, or a consultant to, the Company since January 1996. He is currently Professor and Chairman of the Department of Biochemistry at the University of Texas Southwestern Medical Center, where he has served since 1995. Previously, Dr. McKnight was an investigator at the Howard Hughes Medical Institute at the Carnegie Institution of Washington. Dr. McKnight is recognized as one of the world leaders in gene regulation based in part on his discovery of leucine zipper proteins. Dr. McKnight is a member of the National Academy of Sciences and the American Association of Arts and Sciences.

Craig A. P. D. Saxton, M.D. has served as a member of the Board since September 2001. From 1976 to 2001, Dr. Saxton served in a variety of positions with Pfizer Inc, a pharmaceutical company, most recently as Executive Vice President, Central Research and Vice President of Pfizer Inc. Dr. Saxton joined the Central Research Division of Pfizer in Sandwich, U.K. as a Medical Advisor in 1976. After several positions of increasing responsibility within the Clinical Research Division at Sandwich, he relocated to New York, where he was appointed Senior Associate Medical Director of International Pharmaceuticals in 1981. He was named Vice President, Medical Director of the International Division in 1982. In 1988, Dr. Saxton moved to the Central Research Division in Groton, where he was appointed Senior Vice President of Clinical Research and Development, becoming Executive Vice President of the division in 1993. Dr. Saxton serves as a director of Neurogen Corporation. Dr. Saxton earned his M.D. in 1965 from Leed's University.

Board Committees and Meetings

During the fiscal year ended December 31, 2001, the Board held seven meetings and acted by unanimous written consent two times. During 2001, all directors attended at least 75% of the meetings of the Board and of the committees on which they served that were held during the period for which they were a director or committee member. The Board has an Audit Committee and a Compensation Committee. In 2001, the Audit Committee met five times and the Compensation Committee met four times.

The Compensation Committee makes recommendations concerning salaries and incentive compensation, awards stock options to employees and consultants under the Company's 1997 Equity Incentive Plan (the "1997 Plan") and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. See "Report of the Compensation Committee of the Board" below. The Compensation Committee is currently composed of three non-employee directors: Messrs. Heidrich and McCracken and Dr. Marks.

The Audit Committee's functions include meeting with the Company's independent auditors at least annually to review the results of the annual audit and discuss the Company's financial statements; recommending to the Board the independent auditors to be retained; and receiving and considering the accountants' comments as to controls, adequacy of staff and management performance and procedures

4

in connection with audit and financial controls. See "Report of the Audit Committee of the Board" below. The Audit Committee is currently composed of three non-employee directors: Messrs. Heidrich and McCracken and Dr. Marks.

There are no family relationships among any directors or executive officers of the Company.

The Board of Directors Recommends

a Vote in Favor of Each Named Nominee.

5

PROPOSAL 2

APPROVAL OF AMENDMENTS TO THE COMPANY'S

1997 NON-EMPLOYEE DIRECTORS' STOCK OPTION PLAN

In January 1997, the Board adopted, and the stockholders subsequently approved, the Company's 1997 Non-Employee Directors' Stock Option Plan (the "Directors' Plan"). As of December 31, 2001, there were 47,000 shares of Common Stock reserved for issuance under the Directors' Plan.

On February 14, 2002, the Board amended the Directors' Plan, subject to stockholder approval, to increase the number of shares of Common Stock authorized for issuance under the Directors' Plan from a total of 300,000 shares to a total of 700,000 shares. The Board adopted this amendment in order to ensure that the Company can continue to grant stock options at levels determined appropriate by the Board.

On February 14, 2002, the Board amended the Directors' Plan, subject to stockholder approval, to increase the size of annual grants made to non-employee directors under the Directors' Plan from 8,000 shares to 10,000 shares. The Board adopted this amendment in order to maintain a competitive compensation package to continue to attract and retain qualified directors. In increasing the size of annual awards, the Board gave significant weight to the fact that members of the Board receive no cash remuneration (other than reimbursement for meeting expenses) for their service to the Company.

As of December 31, 2001, options (net of canceled or expired options) covering an aggregate of 253,000 shares of the Company's Common Stock had been granted under the Directors' Plan. Only 47,000 shares of Common Stock (plus any shares that might in the future be returned to the Directors' Plan as a result of cancellations or expiration of options) remained available for future grant under the Directors' Plan.

The essential features of the Directors' Plan are outlined below:

General

The Directors' Plan provides for the automatic grant of nonstatutory stock options to non-employee directors of the Company. Options granted under the Directors' Plan are not intended to qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"). See "Federal Income Tax Information" for a discussion of the tax treatment of nonstatutory stock options.

Purpose

The Board adopted the Directors' Plan to provide a means by which non-employee directors of the Company may be given an opportunity to purchase stock in the Company, to assist in retaining the services of such persons, to secure and retain the services of persons capable of filling such positions and to provide incentives for such persons to exert maximum efforts for the success of the Company. Five of the current directors of the Company are eligible to participate in the Directors' Plan.

Administration

The Board administers the Directors' Plan. The Board has the power to construe and interpret the Directors' Plan but not to determine the persons to whom or the dates on which options will be granted, the number of shares to be subject to each option, the time or times during the term of each option within which all or a portion of such option may be exercised, the exercise price, the type of consideration or the other terms of the option.

The Board has the power, which it has not yet exercised, to delegate administration of the Directors' Plan to a committee composed of not fewer than two members of the Board. As used herein

6

with respect to the Directors' Plan, the "Board" refers to any committee the Board appoints as well as to the Board itself.

Stock Subject to the Directors' Plan

Subject to this Proposal, an aggregate of 700,000 shares of Common Stock is reserved for issuance under the Directors' Plan. If options granted under the Directors' Plan expire or otherwise terminate without being exercised, the shares of Common Stock not acquired pursuant to such options again become available for issuance under the Directors' Plan. If the Company reacquires unvested stock issued under the Directors' Plan, the reacquired stock will not again become available for reissuance under the Directors' Plan.

Eligibility

The Directors' Plan provides that options may be granted only to non-employee directors of the Company. A "non-employee director" is defined in the Directors' Plan as a director of the Company who is not otherwise an employee of the Company or any affiliate.

Terms of Options

The following is a description of the terms of options under the Directors' Plan. Individual option grants generally are not more restrictive than the terms described below.

Automatic Grants. The Directors' Plan provides for the automatic grant of an option to purchase 25,000 shares of Common Stock to each Non-Employee Director upon his or her initial election to the Board. In addition, the Directors' Plan currently provides for the automatic grant of an option to purchase 8,000 shares of Common Stock each year to each Non-Employee Director. Under this Proposal 2, shares subject to an option granted to each Non-Employee Director on an annual basis would increase to 10,000.

Exercise Price; Payment. The exercise price of options may not be less than 100% of the fair market value of the stock subject to the option on the date of the grant. At December 31, 2001, the closing price of the Company's Common Stock as reported on the Nasdaq National Market System was $24.02 per share. The exercise price of options granted under the Directors' Plan must be paid (i) in cash at the time the option is exercised, (ii) by delivery of other Common Stock of the Company, (iii) by a combination of the methods of payment specified in (i) and (ii) or (iv) pursuant to a program developed under Regulation T.

Option Exercise. Options granted under the Directors' Plan become exercisable in cumulative increments ("vest") as set out in the Directors' Plan during the optionholder's service as a director of the Company and during any subsequent employment of the optionholder by and/or service by the optionholder as a consultant to the Company or an affiliate (collectively, "service"). The Board has the power to accelerate the time during which an option may vest or be exercised. Options granted under the Directors' Plan permit exercise prior to vesting, subject to a right of repurchase in favor of the Company. An optionholder may satisfy any federal, state or local tax withholding obligation relating to the exercise of such option by a cash payment upon exercise, by authorizing the Company to withhold a portion of the stock otherwise issuable to the optionholder, by delivering already-owned Common Stock of the Company or by a combination of these means.

Term. The term of options under the Directors' Plan is ten years. Options under the Directors' Plan terminate three months after termination of the optionholder's service unless (i) such termination is due to the optionholder's permanent and total disability (as defined in the Code), in which case the option may be exercised (to the extent the option was exercisable at the time of the termination of service) at any time within six months of such termination; or (ii) the optionholder dies before the

7

optionholder's service has terminated, in which case the option may be exercised (to the extent the option was exercisable at the time of the optionholder's death) within six months of the optionholder's death by the person or persons to whom the rights to such option pass by will or by the laws of descent and distribution. An optionholder may designate a beneficiary who may exercise the option following the optionholder's death. The option term is not extended in the event that exercise of the option within these periods is prohibited, except that if the exercise of the option following the termination of the optionholder's service would result in liability under Section 16(b) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), then the option will terminate on the earlier of (i) the expiration of the term of the option or (ii) the 10th day after the last date on which such exercise would result in such liability under Section 16(b) of the Exchange Act.

Other Provisions. The option agreement may contain such other terms, provisions and conditions not inconsistent with the Directors' Plan as determined by the Board.

Restrictions on Transfer

The Board may grant options that are transferable to the extent permitted in the stock option agreement.

Adjustment Provisions

Transactions not involving receipt of consideration by the Company, such as a merger, consolidation, reorganization, stock dividend or stock split, may change the type(s), class(es) and number of shares of Common Stock subject to the Directors' Plan and outstanding options. In that event, the Directors' Plan will be appropriately adjusted as to the type(s), class(es) and the maximum number of shares of Common Stock subject to the Directors' Plan, and outstanding options will be adjusted as to the type(s), class(es), number of shares and price per share of Common Stock subject to such options.

Effect of Certain Corporate Events

The Directors' Plan provides that, in the event of a dissolution, liquidation or sale of substantially all of the assets of the Company, specified types of merger or other corporate reorganization, any surviving corporation will be required to either assume options outstanding under the Directors' Plan or substitute similar options for those outstanding under the Directors' Plan. If any surviving corporation does not assume options outstanding under the Directors' Plan, or to substitute similar options, then the vesting and the time during which such options may be exercised will be accelerated. An outstanding option will terminate if the optionholder does not exercise it before a change in control.

Duration, Amendment and Termination

The Board may suspend or terminate the Directors' Plan without stockholder approval or ratification at any time or from time to time. Unless sooner terminated, the Directors' Plan will terminate at the time that all options granted under the Directors' Plan are fully vested and either have been fully exercised or have expired.

The Board may also amend the Directors' Plan at any time or from time to time. However, no amendment will be effective unless approved by the stockholders of the Company within 12 months before or after its adoption by the Board if the amendment would (i) increase the number of shares reserved for issuance upon exercise of options; or (ii) change any other provision of the Directors' Plan in any other way if such modification requires stockholder approval in order to comply with Rule 16b-3 of the Exchange Act. The Board may submit any other amendment to the Directors' Plan for stockholder approval.

8

Federal Income Tax Information

Nonstatutory stock options granted under the Directors' Plan generally have the following federal income tax consequences.

There are no tax consequences to the optionholder or the Company by reason of the grant of a nonstatutory stock option. Upon exercise of a nonstatutory stock option, the optionholder normally will recognize taxable ordinary income equal to the excess of the stock's fair market value on the date of exercise over the option exercise price. If the optionholder becomes an employee, the Company is required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized. Subject to the requirement of reasonableness and the satisfaction of a tax reporting obligation, the Company will generally be entitled to a business expense deduction equal to the taxable ordinary income realized by the optionholder.

Upon disposition of the stock, the optionholder will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid for such stock plus any amount recognized as ordinary income upon exercise of the option (or vesting of the stock). Such gain or loss will be long-term or short-term depending on whether the stock was held for more than one year. Slightly different rules may apply to optionholders who acquire stock and are subject to Section 16(b) of the Exchange Act.

New Plan Benefits

The following table presents certain information with respect to options granted under the Directors' Plan as of December 31, 2001 to each non-employee director and to all non-employee directors as a group.

1997 NON-EMPLOYEE DIRECTORS' STOCK OPTION PLAN

Name and Position

| | Number of Shares

Underlying Options Granted

|

|---|

| A. Grant Heidrich, Chairman of the Board of Directors | | 40,000 |

| Edward R. McCracken, Director | | 40,000 |

| Steven L. McKnight, Director | | 40,000 |

| Paul A. Marks, Director | | 40,000 |

| Craig A.P.D. Saxton, Director | | 25,000 |

| All Non-Employee Directors as a Group | | 281,000 |

Stockholders are requested in this Proposal 2 to approve the Directors' Plan, as amended. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to approve the amendments to the Directors' Plan. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The Board of Directors Recommends

a Vote in Favor of Proposal 2.

9

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board has selected PricewaterhouseCoopers LLP as the Company's independent auditors for the fiscal year ending December 31, 2002 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent auditors is not required by the Company's Bylaws or otherwise. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of PricewaterhouseCoopers LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

On March 15, 2002, the Company dismissed Ernst & Young LLP as the independent auditors of the Company. On March 15, 2002, the Company appointed PricewaterhouseCoopers LLP as its independent auditors. The decision to change independent auditors has been approved by the Audit Committee under authority granted by the Board of Directors of the Company.

Ernst & Young LLP's reports on the Company's financial statements for each of the fiscal years ended December 31, 2001 and 2000 did not contain an adverse opinion or disclaimer of opinion, nor were the reports qualified or modified as to uncertainty, audit scope or accounting principles, except for Ernst & Young's reports dated February 4, 2002 and February 8, 2001 on the Company's consolidated financial statements for the years ended December 31, 2001 and 2000 which refer to Note 1 to the Company's consolidated financial statements, and noted that during the year ended December 31, 2000, the Company changed its method of revenue recognition for non-refundable technology access fees received in connection with collaboration agreements.

In connection with the Company's audits for the fiscal years ended December 31, 2001 and 2000, and through March 14, 2002, there were no disagreements between the Company and Ernst & Young LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Ernst & Young LLP, would have caused Ernst & Young LLP to make reference thereto in their reports on the Company's financial statements for such years. Ernst & Young LLP's letter to the SEC stating its agreement with the statements made herein is filed as an exhibit to the Company's Current Report on Form 8-K filed with the SEC on March 19, 2002.

During the fiscal years ended December 31, 2001 and 2000, and through March 14, 2002, the Company did not consult with PricewaterhouseCoopers LLP regarding either (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements or (ii) any matter that was either the subject of a disagreement or a reportable event.

10

The following are the aggregate fees billed by Ernst & Young LLP to the Company for:

- (i)

- Audit Fees. The fees billed for the audit of the Company's financial statements for the fiscal year ended December 31, 2001 and the review of the Company's interim financial statements for such fiscal year were $156,627;

- (ii)

- Financial Information Systems Design and Implementation Fees. The fees billed for information technology consulting for such fiscal year were zero; and

- (iii)

- All Other Fees. The fees billed for professional services other than audit and information consulting fees during the fiscal year ended December 31, 2001 were $84,899.

The Audit Committee has determined that the rendering of all other non-audit services by Ernst & Young is compatible with maintaining the auditors' independence.

The Board of Directors Recommends

a Vote in Favor of Proposal 3.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD1

The Audit Committee of the Company is currently composed of three directors, Messrs. Heidrich and McCracken and Dr. Marks, and operates under the Audit Committee charter adopted by the Board. The members of the Audit Committee are independent as defined in Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards. The Audit Committee provides assistance and guidance to the Board in fulfilling its oversight responsibilities to the Company's stockholders with respect to the Company's corporate accounting and reporting practices as well as the quality and integrity of the Company's financial statements and reports.

1 The material in this report is not "soliciting material," is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

The Company's management team has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The Company's independent auditors are responsible for auditing the Company's financial statements and expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles. The Audit Committee's responsibility is to monitor and oversee these processes.

To this end, the Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2001 with management and Ernst & Young LLP, the Company's independent auditors. The Audit Committee has discussed with Ernst & Young certain matters related to the conduct of the audit as required by Statement on Auditing Standards 61. In addition, the Audit Committee has received from Ernst & Young the written disclosures and the letter regarding the auditor's independence required by Independence Standards Board Discussion No.1 and has discussed with Ernst & Young its independence, including the compatibility of non-audit services provided by Ernst & Young with its independence.

Based on the review and discussions described above, the Audit Committee recommended to the Board that the Company's audited financial statements for the fiscal year ended December 31, 2001 be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2001 for filing with the SEC. Based on the Audit Committee's recommendation, the Board has also selected, subject to stockholder approval, PricewaterhouseCoopers as the Company's independent auditors for the fiscal year ending December 31, 2002.

AUDIT COMMITTEE

A. Grant Heidrich, III

Edward R. McCracken

Paul A. Marks, M.D.

11

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company's Common Stock and Common Stock, Series A Preferred Stock and Series B Preferred Stock of Cumbre Inc., a subsidiary of the Company, as of February 28, 2002, except as otherwise noted, by: (i) each director (including each nominee for director); (ii) each of the executive officers named in the "Summary Compensation Table" below; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of the Company's Common Stock and the Common and Preferred Stock of Cumbre. Unless otherwise indicated in the footnotes to the table, and subject to community property laws where applicable, the Company believes that each of the stockholders named in the table has sole voting and dispositive power with respect to the shares indicated as beneficially owned.

| | Tularik Inc.

| | Cumbre Inc.

| |

|---|

Beneficial Owner

| | Number of

Tularik

Shares

Beneficially

Owned(1)

| | Tularik Shares

Issuable

Pursuant to Options

Exercisable

within 60 Days

of February 28,

2002

| | Percent

of

Total(2)

| | Number of

Cumbre

Shares

Beneficially

Owned(3)

| | Cumbre Shares

Issuable

Pursuant to Options

Exercisable

within 60 Days

of February 28,

2002

| | Percent

of

Total(4)

| |

|---|

BZ Group Holding Limited(5)

Egglirain 24

8832 Wilen

Switzerland | | 12,158,238 | | — | | 24.2 | % | 6,000,000 | | — | | 23.9 | % |

Pharma Vision AG(5)

Spielhof 3

8750 Glarus

Switzerland |

|

10,158,238 |

|

— |

|

20.2 |

% |

6,000,000 |

|

— |

|

23.9 |

% |

Vulcan Ventures Inc.

505 Fifth Avenue South, Suite 900

Seattle, WA 98104 |

|

— |

|

— |

|

— |

|

4,000,000 |

|

— |

|

16.0 |

% |

David V. Goeddel, Ph.D.(6) |

|

2,033,919 |

|

391,666 |

|

4.8 |

% |

100,000 |

|

— |

|

* |

|

Michael D. Levy, M.D. (7) |

|

52 |

|

175,000 |

|

* |

|

— |

|

— |

|

— |

|

Andrew J. Perlman, M.D., Ph.D.(8) |

|

326,696 |

|

225,416 |

|

1.1 |

% |

25,000 |

|

— |

|

* |

|

William J. Rieflin(9) |

|

205,945 |

|

194,999 |

|

* |

|

10,000 |

|

— |

|

* |

|

Terry J. Rosen, Ph.D.(10) |

|

176,278 |

|

309,666 |

|

* |

|

— |

|

— |

|

— |

|

A. Grant Heidrich, III(11) |

|

718,976 |

|

16,000 |

|

1.5 |

% |

80,000 |

|

— |

|

* |

|

Edward R. McCracken |

|

21,512 |

|

55,000 |

|

* |

|

— |

|

— |

|

— |

|

Steven L. McKnight, Ph.D.(12) |

|

813,620 |

|

44,000 |

|

1.7 |

% |

465,733 |

|

124,267 |

|

2.4 |

% |

Paul A. Marks, M.D.(13) |

|

87,000 |

|

18,000 |

|

* |

|

— |

|

— |

|

— |

|

Craig A.P.D. Saxton, M.D. |

|

— |

|

25,000 |

|

* |

|

— |

|

— |

|

— |

|

All executive officers and directors as a group (13 persons)(14) |

|

4,560,604 |

|

2,014,745 |

|

13.1 |

% |

680,733 |

|

124,267 |

|

3.2 |

% |

- (1)

- Includes shares of Tularik Common Stock obtained upon exercise of unvested options that are subject to a right of repurchase by the Company, at the original option exercise price of $3.00 per share, in the event the holder ceases to provide services to the Company and its affiliates, as follows: 48,611 shares beneficially owned by Dr. Goeddel; 6,945 shares beneficially owned by Mr. Rieflin; 6,000 shares beneficially owned by Mr. Heidrich; 4,000 shares beneficially owned by Dr. Marks; and 16,416 shares beneficially owned by Dr. McKnight.

- (2)

- Applicable percentages are based on 50,229,052 shares of Tularik Common Stock outstanding on February 28, 2002, adjusted as required by rules promulgated by the SEC.

- (3)

- Includes shares of Cumbre Series A and Series B Preferred Stock on an as-converted basis. Also includes shares of Cumbre Common Stock obtained upon exercise of unvested options which are subject to a right of repurchase by Cumbre, at the original option exercise price of $.10 per share, in the event the holder ceases to provide services to Cumbre, as follows: 18,750 shares beneficially owned by Dr. Perlman; and 206,799 shares beneficially owned by Dr. McKnight.

12

- (4)

- Applicable percentages are based on 25,085,533 shares of Cumbre Common Stock and Preferred Stock on an as-converted basis outstanding on February 28, 2002, adjusted as required by rules promulgated by the SEC.

- (5)

- Information is as provided by BZ Group Holding Limited ("BZ Group Holding"), Spezialitäten Vision AG, a company in which 51 percent of the voting stock is owned by BZ Group Holding, and Pharma Vision AG ("Pharma Vision"), a company in which 51 percent of the voting stock is owned by BZ Group Holding, in a questionnaire provided to Tularik Inc. on January 31, 2002. As to such shares of Tularik Common Stock, BZ Group Holding has sole voting and dispositive power with respect to 800,000 shares and shared voting and dispositive power with respect to 11,358,238 shares. Pharma Vision has shared voting and dispositive power with respect to all shares of Tularik Common Stock that it beneficially owns. Dr. Goeddel, a member of the Company's Board, is a director of Pharma Vision.

- (6)

- Includes 585 shares of Tularik Common Stock issued pursuant to the Company's 401(k) plan. Does not include 160,000 shares of Tularik Common Stock held in trust for Dr. Goeddel's minor children, for which Dr. Goeddel is not the trustee and disclaims beneficial ownership.

- (7)

- Represents 52 shares of Tularik Common Stock issued pursuant to the Company's 401(k) plan.

- (8)

- Includes 307,386 shares of Tularik Common Stock held in a revocable trust of which Dr. Perlman and his wife, Dr. Phyllis Gardner, are sole trustees. Drs. Perlman and Gardner, each acting alone, have the power to vote and dispose of such shares. Includes 585 shares of Tularik Common Stock issued pursuant to the Company's 401(k) plan. Does not include 42,000 shares of Tularik Common Stock held in trust for Dr. Perlman's minor children, for which Dr. Perlman is not the trustee and disclaims beneficial ownership. Dr. Perlman resigned his position with the Company on February 1, 2002.

- (9)

- Includes 200,003 shares of Tularik Common Stock held in a revocable trust of which Mr. Rieflin and his wife are sole trustees. Mr. and Mrs. Rieflin, each acting alone, have the power to vote and dispose of such shares. Includes 585 shares of Tularik Common Stock issued pursuant to the Company's 401(k) plan. Does not include 19,998 shares of Tularik Common Stock held in trust for Mr. Rieflin's minor children, for which Mr. Rieflin is not the trustee and disclaims beneficial ownership. Includes 10,000 shares of Cumbre Series B Preferred Stock held in a revocable trust of which Mr. Rieflin and his wife are sole trustees. Mr. and Mrs. Rieflin, each acting alone, have the power to vote and dispose of such Cumbre shares. Does not include 25,000 shares of Common Stock of Cumbre held in trust for Mr. Rieflin's minor children, for which Mr. Rieflin is not the trustee and disclaims beneficial ownership.

- (10)

- Includes 70,336 shares of Tularik Common Stock held in a revocable trust of which Dr. Rosen and his wife are sole trustees. Dr. and Mrs. Rosen, each acting alone, have the power to vote and dispose of such shares. Includes 585 shares of Tularik Common Stock issued pursuant to the Company's 401(k) plan. Does not include 49,998 shares of Tularik Common Stock held in trust for Dr. Rosen's minor children, for which Dr. Rosen is not the trustee and disclaims beneficial ownership.

- (11)

- Includes 26,443 shares of Tularik Common Stock held by Mayfield Associates, 6,000 shares of Tularik Common Stock held by Mayfield VI Management Partners and 554,666 shares of Tularik Common Stock held by Mayfield VI. Mr. Heidrich is a general partner of Mayfield Associates and of Mayfield VI Management Partners. Mayfield VI Management Partners is the general partner of Mayfield VI. Mr. Heidrich disclaims beneficial ownership of these shares except to the extent of his proportionate partnership interest in these shares. Includes 104,848 shares of Tularik Common Stock held in a revocable trust of which Mr. Heidrich and his wife are sole trustees. Includes 80,000 shares of Cumbre Series B Preferred Stock held in a revocable trust of which Mr. Heidrich and his wife are sole trustees. Mr. and Mrs. Heidrich, each acting alone, have the power to vote and dispose of such Tularik and Cumbre shares.

- (12)

- Includes 206,000 shares of Tularik Common Stock held in the Steven L. McKnight Exempt Family Trust. Dr. and Mrs. McKnight, each acting alone, have the power to vote and dispose of such shares. Does not include 200,000 shares of Tularik Common Stock held in trust for Dr. McKnight's minor children, for which Dr. McKnight is not the trustee and disclaims beneficial ownership.

- (13)

- Includes 51,467 shares of Tularik Common Stock held in the Paul A. Marks 1999 Grantor Annuity Trust. Dr. and Mrs. Marks, each acting alone, have the power to vote and dispose of such shares.

- (14)

- Includes shares of Tularik Common Stock and Cumbre Common and Preferred Stock described in the notes above, as applicable.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Executive officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2001, the Company's executive officers, directors and greater than ten percent beneficial owners complied with all Section 16(a) filing requirements on a timely basis.

13

EXECUTIVE COMPENSATION

Compensation of Directors

The Company does not provide cash compensation to members of its Board for serving on its Board or for attendance at committee meetings. The members of the Board are eligible for reimbursement for some expenses incurred in connection with attendance at Board meetings in accordance with Company policy.

Each non-employee director of the Company receives stock option grants under the Company's 1997 Non-Employee Directors' Stock Option Plan (the "Directors' Plan"). Only non-employee directors of the Company or an affiliate of such directors (as defined in the Internal Revenue Code of 1986, as amended (the "Code")) are eligible to receive options under the Directors' Plan. Options granted under the Directors' Plan are intended by the Company not to qualify as incentive stock options under the Code.

Option grants under the Directors' Plan are non-discretionary. On the date of the annual meeting of stockholders each year, each member of the Board who is not an employee of the Company and who was a director on December 31 of the prior year or, where specified by the non-employee director, an affiliate of such director, is automatically granted under the Directors' Plan, without further action by the Company, the Board or the stockholders of the Company, an option to purchase 8,000 shares of Common Stock of the Company. No other options may be granted at any time under the Directors' Plan. As described above, the Company is proposing that the number of shares subject to options to purchase Common Stock of the Company granted annually to each non-employee director be increased from 8,000 to 10,000. The exercise price of options granted under the Directors' Plan is equal to the fair market value of the Common Stock subject to the option at the close of the market on the date of the option grant. These options vest on an annual basis. Options granted under the Directors' Plan may not be exercised after the expiration of ten years from the date of grant. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change-in-control transaction involving the Company, each option either will continue in effect, if the Company is the surviving entity, or will be assumed or an equivalent option will be substituted by the acquiring company, if the Company is not the surviving entity. If the acquiring company does not assume the options or substitute similar options, the options will fully vest upon a change of control, as defined and as described in the Directors' Plan.

During the last fiscal year, the Company granted options covering 8,000 shares to each non-employee director of the Company, except Dr. Saxton, at an exercise price per share of $20.93, the fair market value of such Common Stock on the date of the 2001 annual meeting of stockholders. The Company granted options covering 25,000 shares to Dr. Saxton, upon his joining the Board on September 9, 2001, at an exercise price per share of $22.62, the fair market value of such Common Stock on the date of the grant. As of February 28, 2002, options to purchase 116,000 shares had been exercised under the Directors' Plan.

In consideration for consulting services provided to the Company in addition to his responsibilities as a director of the Company, the Company granted Dr. McKnight additional options to purchase an aggregate of 18,000 shares of Common Stock at an exercise price of $18.36 per share. The $18.36 per share exercise price for these options was equal to the fair market value of the Common Stock at the close of the market on the date of the option grants. These options vest monthly over a 48-month period beginning October 2001. In consideration for consulting services provided to Cumbre, Dr. McKnight was granted options to purchase (i) 275,733 shares of Cumbre Common Stock at an exercise price of $0.10 per share and (ii) 124,267 shares of Cumbre Common Stock at an exercise price of $0.25 per share. The exercise prices for these options were equal to the fair market value of Cumbre Common Stock on the respective dates of the option grants. The options vest annually over a four-year period. In addition to the options described above, the Company and Cumbre paid Dr. McKnight

14

approximately $89,000 in 2001 for consulting services provided to the Company and Cumbre. Dr. McKnight spent approximately 20% of his time providing consulting services to the Company and Cumbre in 2001. In 2002, the Company and Cumbre will pay Dr. McKnight approximately $100,000 for these consulting services. Dr. McKnight will spend approximately 20% of his time providing consulting services to the Company and Cumbre in 2002.

Compensation of Executive Officers

Summary Compensation Table

The following table shows for the fiscal years ended December 31, 2001, 2000 and 1999, compensation awarded or paid to, or earned by, the Company's Chief Executive Officer and its other four most highly compensated executive officers at December 31, 2001 (the "Named Executive Officers"):

| |

| |

| |

| | Long-Term

Compensation Awards

| |

| |

|---|

| |

| | Annual Compensation

| |

| |

|---|

Name and Principal Position

| |

| | Securities

Underlying Options

| | All Other

Compensation(1)

| |

|---|

| | Year

| | Salary

| | Bonus

| |

|---|

Dr. David V. Goeddel

Chief Executive Officer | | 2001

2000

1999 | | $

$

$ | 435,385

398,077

349,135 | | | —

—

— | | 150,000

175,000

150,000 | | $

$

$ | 2,213

1,620

1,535 | |

Dr. Terry Rosen

Executive Vice President, Operations |

|

2001

2000

1999 |

|

$

$

$ |

312,577

273,654

239,135 |

|

$

$

$ |

25,971

25,971

20,000 |

(2)

(2)

(2) |

75,000

100,000

75,000 |

|

$

$

$ |

2,775

1,265

1,936 |

|

Dr. Andrew J. Perlman

Executive Vice President(3) |

|

2001

2000

1999 |

|

$

$

$ |

300,615

275,000

249,481 |

|

|

—

—

— |

|

40,000

60,000

50,000 |

|

$

$

$ |

2,474

1,915

2,777 |

|

Mr. William J. Rieflin

Executive Vice President, Administration, General Counsel & Secretary |

|

2001

2000

1999 |

|

$

$

$ |

298,000

259,038

234,308 |

|

$

$

$ |

23,533

23,533

23,533 |

(4)

(4)

(4) |

60,000

60,000

50,000 |

|

$

$

$ |

2,173

1,248

970 |

|

Dr. Michael D. Levy(5)

Vice President, Development and

Chief Medical Officer |

|

2001

2000

1999 |

|

$

|

285,000

—

— |

|

$

|

115,296

—

— |

(6)

|

175,000

—

— |

|

$

|

322,804

—

— |

(7)

|

- (1)

- Includes term life insurance premiums paid by the Company on behalf of the Named Executive Officers, wellness benefits, taxable travel reimbursement amounts and the Company's matching payments in stock under its 401(k) plan. The value of the stock awarded under this plan to each of Drs. Goeddel, Levy, Perlman and Rosen and Mr. Rieflin in 2001 was $1,000.

- (2)

- Amounts reflect forgiveness of a loan given in connection with relocation to the San Francisco Bay area. See "Certain Transactions."

- (3)

- Dr. Perlman resigned his position on February 1, 2002.

- (4)

- Amounts reflect forgiveness of a loan given in connection with relocation to the San Francisco Bay area.

- (5)

- Dr. Levy joined the Company in January 2001.

- (6)

- Amount reflects a signing bonus plus a gross up tax amount.

- (7)

- Amount reflects costs reimbursed by the Company in connection with relocation to the San Francisco Bay area.

15

Stock Option Grants and Exercises

The Company grants options to its executive officers under the 1997 Plan. As of December 31, 2001, options to purchase 5,357,728 shares were outstanding under the 1997 Plan and options to purchase 349,560 shares were available for grant under such plan. The following tables show, for the fiscal year ended December 31, 2001, certain information regarding options granted to, exercised by and held at year end by, the Company's Named Executive Officers.

2001 Option Grants

| |

| |

| |

| |

| | Potential Realizable

Value at Assumed

Annual Rates of

Stock Price

Appreciation for

Option Term(4)

|

|---|

| | Individual Grants

|

|---|

| |

| | Percent of Total

Options Granted to

Employees

in Fiscal Year(2)

| |

| |

|

|---|

Name

| | Number of Securities

Underlying

Options Granted(1)

| | Exercise

Price

(Per Share)(3)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Dr. Goeddel | | 150,000 | | 7.9 | % | $ | 22.25 | | 4/19/11 | | $ | 2,098,936 | | $ | 5,319,115 |

| Dr. Perlman | | 40,000 | | 2.1 | % | $ | 22.25 | | 4/19/11 | | $ | 559,600 | | $ | 1,418,400 |

| Dr. Rosen | | 75,000 | | 3.95 | % | $ | 22.25 | | 4/19/11 | | $ | 1,049,250 | | $ | 2,659,500 |

| Mr. Rieflin | | 60,000 | | 3.16 | % | $ | 22.25 | | 4/19/11 | | $ | 839,400 | | $ | 2,127,600 |

| Dr. Levy | | 125,000 | | 6.59 | % | $ | 27.875 | | 1/1/11 | | $ | 2,191,305 | | $ | 5,553,196 |

| | | 50,000 | | 1.31 | % | $ | 22.25 | | 4/19/11 | | $ | 699,500 | | $ | 1,773,000 |

- (1)

- All options were granted for a term of ten years. The options granted to Dr. Levy that expire on January 1, 2011 vest as follows: 25% beginning January 1, 2002 and 75% in equal installments monthly over a three-year period beginning February 1, 2002. Options that expire on April 19, 2011 vest in equal installments monthly from the date of grant over a four-year period. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change-in-control transaction involving the Company, each option either will continue in effect, if the Company is the surviving entity, or will be assumed or an equivalent option will be substituted by the acquiring company, if the Company is not the surviving entity. If the acquiring company does not assume the options or substitute similar options, the options will fully vest upon a change of control, as defined and as described in the 1997 Plan. Under the terms of the 1997 Plan, the Board retains the discretion, subject to plan limits, to amend the terms (including the exercise price and vesting dates) of outstanding options, but not in a manner that would impair the rights of the holder of any outstanding option.

- (2)

- Based on options to purchase 1,897,035 shares granted to employees in 2001.

- (3)

- The exercise price of the options granted under the 1997 Plan is equal to the fair market value of the Common Stock subject to the option at the close of the market on the date of the option grant.

- (4)

- The potential realizable value is based on the term of the option at its time of grant. It is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounded annually for the entire term of the option, and that the option is exercised and sold on the last day of its term for the appreciated stock price. These amounts represent certain assumed rates of appreciation only, in accordance with the rules of the SEC, and do not reflect the Company's estimate or projection of future stock price performance. Actual gains, if any, are dependent on the actual future performance of the Company's Common Stock. No gain to the optionee is possible unless the stock price increases over the option term, which will benefit all stockholders.

16

2001 Aggregated Option Exercises and Fiscal Year End Option Values

None of the Named Executive Officers exercised options during fiscal 2001.

| | Number of Securities

Underlying Unexercised Options at December 31, 2001

| | Value of Unexercised

In-the-Money Options

at December 31, 2001(1)

|

|---|

Name

|

|---|

| | Vested

| | Unvested

| | Exercisable

| | Unexercisable

|

|---|

| Dr. Goeddel | | 110,001 | | 281,665 | | $ | 1,823,444 | | $ | — |

| Dr. Perlman | | 124,919 | | 108,414 | | $ | 2,927,160 | | $ | — |

| Dr. Rosen | | 142,416 | | 167,250 | | $ | 2,589,236 | | $ | — |

| Mr. Rieflin | | 105,334 | | 114,665 | | $ | 2,261,878 | | $ | — |

| Dr. Levy | | 8,333 | | 166,667 | | $ | 88,500 | | $ | — |

- (1)

- All options, vested or unvested, are immediately exercisable, but are subject to the Company's right to repurchase unvested shares on termination of employment. Value is calculated based on the fair market value of the Company's Common Stock at December 31, 2001 ($24.02) minus the exercise price of the options.

Employment Agreements

Each executive officer has entered into a standard form proprietary information and inventions assignment agreement that provides that the employee will not disclose any confidential information of the Company received during the course of employment and that, with some exceptions, the employee will assign to the Company any and all inventions conceived or developed during the course of employment.

Compensation Committee Interlocks and Insider Participation

None of the Company's executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Company's compensation committee. No interlocking relationship exists between the Board or the Compensation Committee of the Company and the board of directors or compensation committee of any other company, nor has such interlocking relationship existed in the past.

17

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD1

The Compensation Committee of the Company is currently composed of three non-employee directors, Messrs. Heidrich and McCracken and Dr. Marks. The Compensation Committee:

- •

- approves the Company's rewards strategy and programs;

- •

- makes recommendations concerning salaries and incentive compensation for employees of, and consultants to, the Company;

- •

- establishes and approves salaries and incentive compensation for certain senior officers and employees; and

- •

- administers and grants stock options pursuant to the Company's stock option plans.

1 The material in this report is not "soliciting material," is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

The Company's executive compensation program is designed to provide incentives to the Company's executive officers and, thereby, to promote achievement of the Company's business goals and stockholder returns. Executive compensation consists of a combination of base salary, stock incentives and employee benefits. The Compensation Committee considers stock incentives to be a critical component of an executive's compensation package in order to help align executive interests with stockholder interests.

Compensation Philosophy

The objectives of the executive compensation program are to align compensation with business objectives and individual performance, and to enable the Company to attract, retain and motivate executive officers who are expected to contribute to the long-term success of the Company. The Company's executive compensation philosophy is based on the principles of competitive and fair compensation and sustained performance.

Competitive and Fair Compensation

The Company is committed to providing an executive compensation program that helps attract and retain highly qualified executives. To ensure that compensation is competitive, the Compensation Committee compares the Company's compensation practices with those of other companies in the industry and sets the Company's compensation guidelines based on this review. The Compensation Committee believes compensation for the Company's executive officers is within the range of compensation paid to executives with comparable qualifications, experience and responsibilities who are with companies that are in the same or similar business and of comparable size and success as the Company. The Compensation Committee also strives to achieve equitable relationships both among the compensation of individual officers and between the compensation of officers and other employees throughout the Company.

Sustained Performance

Executive officers are rewarded based upon corporate performance and individual performance. Corporate performance is evaluated by reviewing the extent to which strategic, scientific and business goals are met, including such factors as timely achievement of clinical and preclinical results, identification of validated drug discovery targets, effective development of new assays for high throughput screening, identification of lead compounds, formation of new business alliances and

18

meeting stated financial objectives. Individual performance is evaluated by reviewing attainment of specified individual objectives and the degree to which teamwork and Company values are fostered.

In evaluating each executive officer's performance, the Compensation Committee generally conforms to the following process:

- •

- Company and individual goals and objectives are generally set at the beginning of the performance cycle;

- •

- At the end of the performance cycle, the accomplishment of the executive's goals and objectives and his or her contributions to the Company are evaluated;

- •

- The executive's performance is then compared with peers within the Company and the results are communicated to the executive; and

- •

- The comparative results, combined with comparative compensation practices of other companies in the industry, are then used to determine salary and stock compensation levels.

Elements of Annual Compensation

Annual compensation for the Company's executives generally consists of two elements—salary and stock options.

The salary for executives is generally set by reviewing compensation for competitive positions in the market and the historical compensation levels of the executives. Increases in annual salaries are based on actual corporate and individual performance against targeted performance and various subjective performance criteria. Targeted performance criteria vary for each executive based on his or her area of responsibility. Subjective performance criteria include an executive's ability to motivate others, develop the skills necessary to mature with the Company and recognize and pursue new business opportunities to enhance the Company's growth and success. The Compensation Committee does not use a specific formula based on these targeted performance and subjective criteria, but instead makes an evaluation of each executive officer's contributions in light of all such criteria.

Compensation at the executive officer level also includes the long-term incentives afforded by stock options. The Company's stock option program is designed to promote the identity of long-term interests between the Company's employees and its stockholders and assist in the retention of executives. The Compensation Committee of the Board believes that the award of stock options by the Company will, among other things, create incentives for executive officers of the Company to contribute to the success of the entire organization through the ownership of equity.

The size of option grants is generally intended to reflect the executive's position with the Company and his or her contributions to the Company, including his or her success in achieving the individual performance criteria described above. The Company's option program generally uses a four-year vesting period to encourage key employees to continue in the employ of the Company. During 2001, options granted to most executives vested in equal installments monthly from the date of grant over a four-year period. All stock options granted to executive officers in 2001 were granted at fair market value on the date of grant. During 2001, the current executive officers received options to purchase an aggregate of 530,000 shares of Common Stock of the Company, at a weighted average exercise price of $23.58 per share.

All executive officers of the Company other than Dr. Goeddel are eligible to participate in the Company's 1999 Employee Stock Purchase Plan (the "Purchase Plan"). The Purchase Plan is available to all other employees of the Company and generally permits participants to purchase shares at a discount of approximately 15% from the fair market value at the beginning or end of the applicable purchase period.

19

Compliance With Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for compensation over $1.0 million paid to the corporation's Chief Executive Officer and the four other most highly compensated executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. The Company generally intends to structure the stock options granted to its executive officers in a manner that complies with the statute to mitigate any disallowance of deductions under Section 162(m). However, the Compensation Committee reserves the right to use its judgment to authorize compensation payments that may be in excess of the limit when the Compensation Committee believes such payment is appropriate, after taking into consideration changing business conditions or the officer's performance, and is in the best interests of the stockholders.

Dr. Goeddel's 2001 Compensation

Dr. Goeddel is eligible to participate in the same executive compensation plans available to the other executive officers of the Company, except the Purchase Plan. The Compensation Committee believes that Dr. Goeddel's annual compensation, including the portion of his compensation based upon the Company's merit-based stock option program, has been set at a level competitive with other companies in the industry.

Dr. Goeddel's salary for 2001 increased to $420,000 from $400,000 in 2000. In April 2001, Dr. Goeddel was granted a stock option to purchase 150,000 shares of the Company's Common Stock at an exercise price of $22.25 per share (the fair market value of a share of the Company's Common Stock on the date of grant) for services performed during the prior year.

In determining Dr. Goeddel's 2001 compensation, including whether to grant stock options to Dr. Goeddel, the Compensation Committee considered Dr. Goeddel's overall compensation package as compared with other chief executives in the Company's industry and past option grants, as well as the effectiveness of Dr. Goeddel's leadership of the Company and the resulting success of the Company in the attainment of its goals.

COMPENSATION COMMITTEE

A. Grant Heidrich, III

Edward R. McCracken

Paul A. Marks, M.D.

20

PERFORMANCE MEASUREMENT COMPARISON1

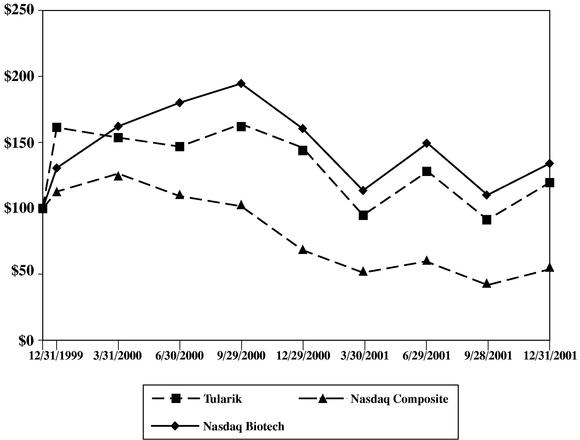

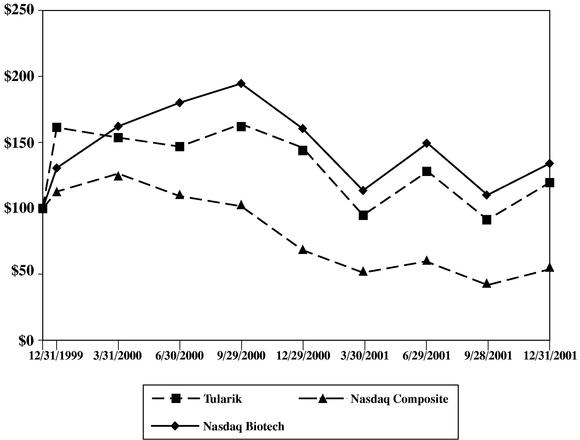

The rules of the SEC require that the Company include in its Proxy Statement a line-graph presentation comparing cumulative stockholder returns on the Company's Common Stock with the Nasdaq Composite Index (which tracks the aggregate price performance of equity securities of companies traded on the Nasdaq) and either a published industry or line-of-business standard index or an index of peer companies selected by the Company. The Company has elected to use the Nasdaq Biotechnology Index (consisting of a group of approximately 75 companies in the biotechnology sector, including the Company) for purposes of the performance comparison that appears below.

The graph shows the cumulative total stockholder return assuming the investment of $100 and the reinvestment of dividends and is based on the returns of the component companies weighted according to their market capitalizations as of the end of each period for which returns are indicated. No dividends have been declared on the Company's Common Stock. The graph commences as of December 10, 1999, the date the Common Stock of the Company first started trading on the Nasdaq National Market.

The stockholder return shown on the graph below is not necessarily indicative of future performance and the Company does not make or endorse any predictions as to future stockholder returns.

1 The material in this section is not "soliciting material," is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in such filing.

21

CERTAIN TRANSACTIONS