SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | |

¨ Confidential,for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x DefinitiveProxy Statement | | |

| ¨ Definitive Additional Materials | | |

| ¨ Soliciting Material under Rule 14a-12 | | |

Tularik Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials:

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1. | | Amount previously paid: |

| | 2. | | Form, Schedule or Registration Statement No.: |

TULARIK INC.

1120 Veterans Boulevard

South San Francisco, CA 94080

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on April 20, 2004

To the Stockholders of Tularik Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders of Tularik Inc., a Delaware corporation (the “Company”), which will be held on Tuesday, April 20, 2004 at 8:00 a.m. local time in the auditorium of its principal offices at 1120 Veterans Boulevard, South San Francisco, California for the following purposes:

| | (1) | | To elect directors to serve for the ensuing year and until their successors are elected. |

| | (2) | | To approve the terms of future private placements of shares of our common stock to Amgen Inc. pursuant to the Stock Purchase Agreement dated as of May 21, 2003 between the Company and Amgen Inc. |

| | (3) | | To ratify the selection by the Audit Committee of the Board of Directors of PricewaterhouseCoopers LLP as independent auditors of the Company for its fiscal year ending December 31, 2004. |

| | (4) | | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Annual Meeting is March 4, 2004. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or at any adjournment or postponement thereof. A list of the stockholders entitled to vote at the meeting will be available for examination by any stockholder for any purpose reasonably related to the meeting during ordinary business hours in the office of the Secretary of the Company during the ten days prior to the Annual Meeting.

By Order of the Board of Directors,

William J. Rieflin

Secretary

South San Francisco, California

March 18, 2004

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED ENVELOPE OR SUBMIT A PROXY BY TELEPHONE OR THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. THE ENCLOSED RETURN ENVELOPE IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES. IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE, YOU MAY BE ABLE TO VOTE ON THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS PROVIDED WITH YOUR VOTING FORM. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THAT RECORD HOLDER.

TULARIK INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

APRIL 20, 2004

INFORMATION CONCERNING VOTING AND SOLICITATION

General

The Board of Directors (the “Board”) of Tularik Inc., a Delaware corporation (“Tularik” or the “Company”), is soliciting your proxy to vote at the Annual Meeting of Stockholders to be held on April 20, 2004 at 8:00 a.m. local time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the proposals set forth in this proxy statement and in the accompanying Notice of Annual Meeting. You are invited to attend the Annual Meeting, which will be held in the auditorium of the Company’s principal offices at 1120 Veterans Boulevard, South San Francisco, California 94080, and to vote on the proposals set forth in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy telephonically or via the Internet.

The Company intends to mail this proxy statement and accompanying proxy card on or about March 18, 2004 to all stockholders entitled to vote at the Annual Meeting.

Voting Rights and Outstanding Shares

Only holders of record of shares of Tularik common stock (the “Common Stock”) at the close of business on March 4, 2004 will be entitled to notice of and to vote at the Annual Meeting. Each holder of record of Common Stock on March 4, 2004 will be entitled to one vote for each share held on such date on all matters to be voted upon at the Annual Meeting.

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by stockholders present at the Annual Meeting or by proxy. At the close of business on March 4, 2004, 67,024,669 shares of Common Stock were outstanding and entitled to vote. If there is no quorum present, the chairman of the meeting or a majority of the votes present at the meeting may adjourn the meeting to another date.

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and, with respect to proposals other than the election of directors, “Against” votes, abstentions and broker non-votes. A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner (despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions). Abstentions and broker non-votes will be counted in determining whether a quorum is present. Abstentions will be counted towards the vote total for Proposals 1 and 3. For Proposal 3, abstentions will have the same effect as “Against” votes. Abstentions are not counted for any purpose in determining whether Proposal 2 has been approved. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

Voting via the Internet or by Telephone

Stockholders may grant a proxy to vote their shares via the Internet or by telephone. The laws of the State of Delaware, under which the Company is incorporated, specifically permit electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the inspector of election can determine that such proxy was authorized by the stockholder.

For Shares Registered in the Name of a Broker or Bank

Most beneficial owners whose stock is held in street name receive a proxy card and voting instructions from their banks, brokers or other agents rather than from the Company. A number of brokers and banks are participating in a program provided through ADP Investor Communication Services that offers telephone and Internet voting options. If your shares are held in an account with a broker or bank participating in the ADP Investor Communication Services program, you may vote those shares telephonically by calling the telephone number shown on the voting form received from your broker or bank, or via the Internet at ADP Investor Communication Services’ voting website (www.proxyvote.com).

For Shares Registered in Your Name

Stockholders of record may go to http://www.eproxy.com/tlrk/ to grant a proxy to vote their shares via the Internet. Each such stockholder will be required to provide the company number and control number stated on his or her proxy card. Each stockholder electing to do so will then be asked to complete an electronic proxy card. The votes represented by such proxy will be generated on the computer screen, and the stockholder will be prompted to submit or revise them as desired. Any stockholder using a touch-tone telephone may also grant a proxy to vote shares by calling 1-800-560-1965 and following the recorded instructions.

General Information for All Shares Voted via the Internet or by Telephone

Votes submitted via the Internet or by telephone must be received by 12:00 p.m., Central Time, on April 19, 2004. Submitting your proxy via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting.

WE PROVIDE INTERNET AND TELEPHONE VOTING TO ALLOW YOU TO VOTE YOUR SHARES CONVENIENTLY, WITH PROCEDURES DESIGNED TO ENSURE THE AUTHENTICITY AND CORRECTNESS OF YOUR PROXY VOTING INSTRUCTIONS. HOWEVER, EACH STOCKHOLDER VOTING VIA THE INTERNET SHOULD UNDERSTAND THAT THERE MAY BE COSTS ASSOCIATED WITH ELECTRONIC ACCESS, SUCH AS USAGE CHARGES FROM INTERNET ACCESS PROVIDERS AND TELEPHONE COMPANIES, THAT MUST BE BORNE BY THE STOCKHOLDER.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this Proxy Statement, the proxy card and any additional information furnished to stockholders. In addition to these mailed proxy materials, the Company’s directors, officers and employees may also solicit proxies in person, by telephone or by other means of communication. No additional compensation will be paid to directors, officers or other employees for such services. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners.

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before the final vote at the meeting. A proxy may be revoked by submitting another properly executed proxy bearing a later date, sending a written notice of revocation to the Secretary of the Company at the Company’s principal offices, 1120 Veterans Boulevard, South San Francisco, California 94080, or by attending the meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

2

Submission of Stockholder Proposals for 2005 Annual Meeting

To be considered for inclusion in the Company’s proxy materials for the Company’s 2005 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), your proposal must be submitted in writing to the Secretary of the Company at the Company’s principal offices, 1120 Veterans Boulevard, South San Francisco, California 94080 by November 16, 2004. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy materials must do so between December 21, 2004 and January 20, 2005. Stockholders are also advised to review the Company’s bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

3

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Board consists of six directors. There are six nominees for director this year. Each director to be elected will hold office until the next annual meeting of stockholders and until his successor is elected, or until such director’s death, resignation or removal. Each nominee listed below is currently a director of the Company and was previously elected by the stockholders. It is the Company’s policy to encourage nominees for director to attend the Annual Meeting. All six of the nominees for election as a director at the 2003 annual meeting of stockholders attended that meeting.

Directors are elected by a plurality of the votes properly cast in person or by proxy. The six nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the six nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of a substitute nominee proposed by the Company’s management. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve.

Nominees for Director

The names of the nominees for director and a brief biography of each of them are set forth below:

| | | | |

Name

| | Age

| | Principal Occupation/Position Held With the Company

|

David V. Goeddel, Ph.D. | | 52 | | Chief Executive Officer of the Company |

A. Grant Heidrich, III | | 51 | | Partner Emeritus, Mayfield/Chairman of the Board of the Company |

Edward W. Holmes, M.D. | | 63 | | Vice Chancellor for Health Sciences and Dean of the School of Medicine, University of California, San Diego |

Edward R. McCracken | | 60 | | Former Chief Executive Officer, Silicon Graphics, Inc. |

Steven L. McKnight, Ph.D. | | 54 | | Professor, University of Texas Southwestern Medical Center |

Craig A. P. D. Saxton, M.D. | | 61 | | Former Executive Vice President, Pfizer Central Research |

David V. Goeddel, Ph.D. co-founded Tularik in November 1991 and has served as a member of the Board since the Company’s inception and as Chief Executive Officer since April 1996. From March 1996 to December 1997, Dr. Goeddel served as President of the Company, and from January 1993 to March 1996, Dr. Goeddel served as Vice President, Research of the Company. Dr. Goeddel was the first scientist hired by Genentech, Inc., a biotechnology company, and from 1978 to 1993 served in various positions, including Genentech Fellow, Staff Scientist and Director of Molecular Biology. Dr. Goeddel’s pioneering work in the field of gene cloning and expression of human proteins has been the basis for five significant marketed therapeutics developed by Genentech, including human insulin, human growth hormone, interferon-alpha, interferon-gamma and tissue plasminogen activator. Based on his contributions in gene cloning and expression of human proteins, Dr. Goeddel was elected to the National Academy of Sciences and the American Academy of Arts and Sciences. Dr. Goeddel holds a Ph.D. in Biochemistry from the University of Colorado.

A. Grant Heidrich, III has served as a member of the Board since November 1991 and as Chairman since February 2000. Mr. Heidrich joined Mayfield, a venture capital fund, in 1982 and is currently a partner emeritus of Mayfield. Mr. Heidrich is a member of the board of directors of Millennium Pharmaceuticals, Inc. Mr. Heidrich holds an M.B.A. from Columbia University Graduate School of Business.

Edward W. Holmes, M.D. has served as a member of the Board since September 2002. Dr. Holmes has been the Vice Chancellor for Health Sciences and Dean of the School of Medicine of the University of California, San Diego (UCSD) since September 2000. Prior to joining UCSD, Dr. Holmes was the Dean of the School of Medicine, Vice Chancellor for Academic Affairs and the Walter Kempner Professor of Medicine and Genetics at Duke University from January 1999 to September 2000. Before that, Dr. Holmes served at Stanford University, where he was the Joseph Grant Professor in the School of Medicine, the Senior Associate Dean for Research,

4

Vice President for Translational Medicine and Clinical Research and Special Counselor to the President of the University on Biomedical Research. Prior to Stanford, he served as Chair of the Department of Medicine and the Frank Wister Thomas Professor of Medicine and Genetics at the University of Pennsylvania. Dr. Holmes began his career in academia in 1974 as a Howard Hughes Medical Investigator and an Assistant Professor of Medicine and Biochemistry at Duke University, rising through the ranks to become the Chief of the Division of Endocrinology, Metabolism and Genetics and the James B. Wyngaarden Professor of Medicine. Dr. Holmes is currently active on the NIH Scientific Boundaries Panel, the Scientific Advisory Board of GlaxoSmithKline and the National Diabetes and Digestive and Kidney Diseases Advisory Council of the National Institute of Health. He has been elected to membership in the American Society for Clinical Investigation and the Association of American Physicians, and he is a Fellow of the American Association for the Advancement of Science and a member of the Institute of Medicine of the National Academy of Sciences. He holds a Doctor of Medicine degree from the University of Pennsylvania.

Edward R. McCracken has served as a member of the Board since August 1993. From 1984 to 1998, Mr. McCracken served as Chief Executive Officer of Silicon Graphics, Inc., a computer products and services company. Prior to joining Silicon Graphics, Mr. McCracken spent 16 years with Hewlett-Packard Company, a computer company, where he worked in a variety of senior management positions. Mr. McCracken serves on the board of National Semiconductor Corporation. Mr. McCracken holds an M.B.A. from Stanford University.

Steven L. McKnight, Ph.D. co-founded Tularik in November 1991 and has served as a member of the Board since the Company’s inception. From September 1992 to September 1995, Dr. McKnight served as Director, Biology of the Company. Dr. McKnight has been a part-time employee of, or a consultant to, the Company since January 1996. He is currently Professor and Chairman of the Department of Biochemistry at the University of Texas Southwestern Medical Center, where he has served since 1995. Previously, Dr. McKnight was an investigator at the Howard Hughes Medical Institute at the Carnegie Institution of Washington. Dr. McKnight is recognized as one of the world leaders in gene regulation based in part on his discovery of leucine zipper proteins. Dr. McKnight is a member of the National Academy of Sciences and the American Association of Arts and Sciences. Dr. McKnight is a founder of, consultant to and director for Cumbre Inc., a majority-owned subsidiary of the Company. Dr. McKnight holds a Ph.D. in Biology from the University of Virginia.

Craig A. P. D. Saxton, M.D. has served as a member of the Board since September 2001. From 1976 to 2001, Dr. Saxton served in a variety of positions with Pfizer Inc, a pharmaceutical company, most recently as Executive Vice President, Central Research and Vice President of Pfizer Inc. Dr. Saxton joined the Central Research Division of Pfizer in Sandwich, U.K. as a Medical Advisor in 1976. After several positions of increasing responsibility within the Clinical Research Division at Sandwich, he relocated to New York, where he was appointed Senior Associate Medical Director of International Pharmaceuticals in 1981. He was named Vice President, Medical Director of the International Division in 1982. In 1988, Dr. Saxton moved to the Central Research Division in Groton, where he was appointed Senior Vice President of Clinical Research and Development, becoming Executive Vice President of the division in 1993. Dr. Saxton serves as a director of Neurogen Corporation. Dr. Saxton earned his M.D. in 1965 from Leeds University.

Information about the Board of Directors

Independence of the Board of Directors

Rules promulgated by the National Association of Securities Dealers, Inc. (“NASD”) for companies listed on the Nasdaq National Market (“Nasdaq”) require that a majority of the members of a listed company’s board of directors qualify as “independent,” as affirmatively determined by the board of directors. After review of all relevant transactions or relationships between each director (and his family members) and the Company, its senior management and its independent auditors, the Board has affirmatively determined that four of the Company’s six directors are independent directors within the meaning of the applicable NASD rules. Dr. Goeddel, the Company’s Chief Executive Officer, and Dr. McKnight, who serves as a consultant to the Company, are not “independent” within the meaning of the NASD rules.

5

Meetings of the Board of Directors

During the fiscal year ended December 31, 2003, the Board met eleven times and acted by unanimous written consent two times. During 2003, every director except Dr. McKnight attended 75% or more of the meetings of the Board and of the committees on which he served, held during the period for which he was a director or committee member, respectively. Dr. McKnight attended 72% of the meetings of the Board in 2003.

As required under NASD rules, the Company’s independent directors meet in regularly scheduled executive sessions at which only independent directors are present, in conjunction with regularly scheduled Board meetings and otherwise as needed.

Stockholder Communications with the Board of Directors

The Company makes every effort to ensure that the views of stockholders are heard by the Board or individual directors, as applicable. As a result, the Company believes that there has not been a need to adopt a formal process for stockholder communications with the Board. However, the Nominating and Corporate Governance Committee of the Board will consider, from time to time, whether adoption of a formal process for stockholder communications with the Board has become necessary or appropriate.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics that applies to all of our directors, officers and employees. The text of our code of business conduct and ethics is posted on our website at www.tularik.com. We intend to disclose on our website any substantive amendment to our code of business conduct and ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, other executive officers and directors within five business days of such amendment. In addition, we intend to disclose the nature of any material waiver, including an implicit waiver, from a provision of our code of business conduct and ethics that is granted to any executive officer or director, the name of such person who is granted the waiver and the date of the waiver as required by applicable laws, rules and regulations.

Committees of the Board of Directors

The Board has an Audit Committee, a Compensation and Talent Committee and a Nominating and Corporate Governance Committee. Copies of the charters of all three of the Board’s standing committees are available on the Company’s website at www.tularik.com. Each committee has authority to obtain advice and assistance from consultants and advisors, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member of each committee is free of any relationship that would interfere with his individual exercise of independent judgment with regard to the Company.

Below is a description of each of these committees.

The Audit Committee

The Audit Committee is responsible for overseeing the Company’s corporate accounting, financial reporting practices, audits of financial statements and the quality and integrity of the Company’s financial statements and reports. In addition, the Audit Committee oversees the qualifications, independence and performance of the Company’s independent auditors. In furtherance of these responsibilities, the Audit Committee’s duties include the following: evaluating the performance of and assessing the qualifications of the independent auditors; determining and approving the engagement of the independent auditors to perform audit, review and attest services and to perform any proposed permissible non-audit services; monitoring the rotation of partners on the audit engagement team as required by law; discussing with management and the independent auditors the results of the annual audit; reviewing the financial statements proposed to be included in the Company’s annual report on Form 10-K; discussing with management and the independent auditors the results of the auditors’ review of

6

the Company’s quarterly financial statements; conferring with management and the independent auditors regarding the scope, adequacy and effectiveness of internal auditing and financial reporting controls and procedures; and establishing procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting control and auditing matters and the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee is currently composed of three directors: Messrs. Heidrich and McCracken and Dr. Saxton. The Board has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in Rule 4350(d)(2)(A) of the NASD rules and Rule 10A-3(b)(1) of the Exchange Act). The Board has also determined that Mr. Heidrich qualifies as an “audit committee financial expert” as defined in applicable rules of the Securities and Exchange Commission (“SEC”). In making such a determination, the Board considered a number of factors, including Mr. Heidrich’s formal education and experience as a venture capitalist for over 20 years.

In 2003, the Audit Committee met five times. The Audit Committee has adopted a written charter that is attached as Appendix A to this Proxy Statement.See “Report of the Audit Committee of the Board” below.

The Compensation and Talent Committee

The Compensation and Talent Committee is charged with overseeing the Company’s compensation policies, plans and programs. In connection therewith, the Compensation and Talent Committee is responsible for reviewing, modifying (as needed) and approving the Company’s overall compensation strategy; evaluating the Chief Executive Officer’s performance in light of corporate performance goals and objectives and recommending the compensation and other terms of employment of the Chief Executive Officer to the Board; nominating other executive officers for election by the Board and determining the compensation to be paid to such executive officers; administering the Company’s stock option and other benefit plans; reviewing the Company’s organization concepts and staffing; developing succession plans for the Company’s senior management, especially the Chief Executive Officer; and related matters.

The Compensation and Talent Committee is currently composed of three directors: Messrs. Heidrich and McCracken and Dr. Saxton. All members of the Company’s Compensation and Talent Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the NASD rules). The Compensation and Talent Committee has adopted a written charter that is available on the Company’s website at www.tularik.com.

In 2003, the Compensation and Talent Committee met three times. See “Report of the Compensation and Talent Committee of the Board” below.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee’s role is to oversee all aspects of the Company’s corporate governance functions on behalf of the Board, including monitoring compliance of the Company’s directors and executive officers with the Company’s code of business conduct and ethics; identifying, reviewing and evaluating candidates to serve as directors of the Company; reviewing and evaluating incumbent directors; and making other recommendations to the Board regarding affairs related to directors of the Company, including director compensation.

The Nominating and Corporate Governance Committee has not established any specific minimum qualifications that must be met for recommendation for a position on the Company’s Board. Instead, in considering candidates for director, the Nominating and Corporate Governance Committee will generally consider all relevant factors, including among others the candidate’s applicable expertise and demonstrated excellence in his or her field, the usefulness of such expertise to the Company, the availability of the candidate to devote sufficient time and attention to the affairs of the Company, the candidate’s reputation for personal

7

integrity and ethics and the candidate’s ability to exercise sound business judgment. Other relevant factors, including diversity, age and skills, will also be considered. Candidates for director are reviewed in the context of the existing membership of the Board (including the qualities and skills of the existing directors), the operating requirements of the Company and the long-term interests of its stockholders.

The Nominating and Corporate Governance Committee uses its network of contacts (and those of other members of the Board) when compiling a list of potential director candidates and may also engage outside consultants (such as professional search firms). However, the Nominating and Corporate Governance Committee also has a policy of considering potential director candidates recommended by stockholders, outside advisors and others. The Company has retained a professional search firm that is currently engaged in conducting searches to identify potential candidates for the Board’s consideration. All potential director candidates are evaluated based on the factors set forth above, and the Nominating and Corporate Governance Committee makes no distinction in its evaluation of candidates based on whether such candidates are recommended by stockholders or others. No special procedure has been established for the consideration of director candidates recommended by stockholders.

The Nominating and Corporate Governance Committee is currently composed of three directors: Messrs. Heidrich and McCracken and Dr. Holmes. All members of the Company’s Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 4200(a)(15) of the NASD rules). The Nominating and Corporate Governance Committee has adopted a written charter that is available on the Company’s website at www.tularik.com.

In 2003, the Nominating and Corporate Governance Committee met two times.

The Board of Directors Recommends

a Vote in Favor of Each Named Nominee for Director.

8

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS1

The Audit Committee of the Company is currently composed of three directors, Messrs. Heidrich and McCracken and Dr. Saxton, and operates under the written Audit Committee charter adopted by the Board. The members of the Audit Committee are independent as defined in Rule 4350(d)(2)(A) of the NASD rules. The Audit Committee provides assistance and guidance to the Board in fulfilling its oversight responsibilities to the Company’s stockholders with respect to the Company’s corporate accounting and reporting practices as well as the quality and integrity of the Company’s financial statements and reports.

The Company’s management team has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The Company’s independent auditors are responsible for auditing the Company’s financial statements and expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles. The Audit Committee’s responsibility is to monitor and oversee these processes.

To this end, the Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2003 with management and PricewaterhouseCoopers LLP, the Company’s independent auditors. The Audit Committee has discussed with PricewaterhouseCoopers LLP certain matters related to the conduct of the audit as required by Statement on Auditing Standards 61. In addition, the Audit Committee has received from PricewaterhouseCoopers LLP the written disclosures and the letter regarding the auditor’s independence required by Independence Standards Board Standard No.1 and has discussed with PricewaterhouseCoopers LLP its independence, including the compatibility of non-audit services provided by PricewaterhouseCoopers LLP with its independence.

Based on the review and discussions described above, the Audit Committee recommended to the Board that the Company’s audited financial statements for the fiscal year ended December 31, 2003 be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003 for filing with the Securities and Exchange Commission. Based on the Audit Committee’s recommendation, the Board has also selected, subject to stockholder approval, PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending December 31, 2004.

AUDIT COMMITTEE

A. Grant Heidrich, III

Edward R. McCracken

Craig A. P. D. Saxton, M.D.

| 1 | | The material in this report is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in such filing. |

9

PROPOSAL 2

APPROVAL OF PRIVATE PLACEMENTS TO AMGEN INC.

Background

On May 21, 2003, the Company entered into a collaboration agreement with Amgen Inc. (the “Collaboration Agreement”) to collaborate on the discovery, development and commercialization of therapeutics aimed at oncology targets. Under the Collaboration Agreement, Amgen will select oncology targets identified by the Company, and the companies will jointly embark on multiple drug discovery and development programs over a five-year period. The terms of the collaboration include milestones payable to the Company of up to $21.0 million per target, $50.0 million in committed research funding over a five-year period and royalties on net commercial sales of Amgen products resulting from the collaboration. Through December 31, 2003, Amgen has made payments of $10.4 million to the Company for research funding and milestones. Amgen has exclusive worldwide commercialization rights to Amgen products resulting from the collaboration, with the Company retaining an option to certain co-promotion rights in the United States on a product-by-product basis.

Concurrently with the Collaboration Agreement, the Company and Amgen entered into a stock purchase agreement (the “Stock Purchase Agreement”). Under the terms of the Stock Purchase Agreement, on June 27, 2003 Amgen purchased 3,500,000 shares of newly issued Common Stock at a price of $10.00 per share. Subject to certain conditions of closing being met, the Stock Purchase Agreement further obligates Amgen to purchase additional newly issued Common Stock at then market prices as follows: $10.0 million in Common Stock on May 31, 2004 and $15.0 million in Common Stock on each of May 31, 2005 and May 31, 2006 (collectively, the “Private Placements”). One of the conditions to closing of the Private Placements is that the Company obtain stockholder approval of the Private Placements as further described below.

Subsequent to the purchase from the Company of 3,500,000 shares of Common Stock in June 2003, Amgen acquired 9,000,000 shares of Common Stock from ZKB Pharma Vision AG in separate transactions negotiated between those parties in 2003. Amgen next purchased 1,452,885 shares of Common Stock from the underwriters of the Company’s public offering of Common Stock in November 2003 (the “Public Offering”), which purchase enabled Amgen to approximately maintain its pre-Public Offering percentage ownership of the outstanding Common Stock after the completion of the Public Offering. As a result of these purchases, as of December 31, 2003, Amgen beneficially owned approximately 21.0% of the Company’s outstanding shares of Common Stock. Pursuant to a registration rights agreement between the Company and Amgen, dated as of June 27, 2003 and amended on November 10, 2003 (as amended, the “Registration Rights Agreement”), Amgen may require the Company to register for resale with the SEC all of these shares, including shares to be purchased in the Private Placements. The percentage of the outstanding shares of Common Stock beneficially owned by Amgen would increase as a result of the completion of the Private Placements, with the amount of the percentage increase dependent upon the actual price paid by Amgen for such shares.

Stockholder Approval Requirements

The Company is subject to the rules of the NASD applicable to companies whose securities are traded on Nasdaq. Rule 4350(i)(1)(B) of the NASD rules (the “Change of Control Rule”) requires companies that are listed on Nasdaq to obtain stockholder approval prior to issuing common stock if such issuance will result in a change of control of the issuer. Under the existing Change of Control Rule, Nasdaq considers a number of factors in determining whether a change of control will occur as a result of a particular transaction, the most significant of which is the investor’s post-transaction ownership and/or voting level. If an investor acquires, or obtains the right to acquire, between 20% and 30% of the common stock or voting power of an issuer on a post-transaction basis, Nasdaq will consider certain factors in determining whether a change of control has occurred, such as whether the investor has a right to representation on the issuer’s board or to participate in management. Ownership of more than 30% of the common stock or voting power gives rise to a presumption that a change of control has occurred. A pending proposal to amend the NASD rules would provide that a change of control will be deemed

10

to have occurred if an investor acquires, or obtains the right to acquire, 20% or more of the common stock or the voting power of an issuer on a post-transaction basis (subject to certain exceptions).

At this time, Amgen beneficially owns approximately 21.0% of the outstanding shares of Common Stock, with an obligation, subject to certain closing conditions described in the Stock Purchase Agreement, to acquire additional shares of Common Stock in the Private Placements. Because any of the Private Placements could be viewed by Nasdaq under the Change of Control Rule as an issuance that results in a change of control, thereby requiring stockholder approval, the Company is seeking such stockholder approval at this time.

In addition, Rule 4350(i)(1)(D) of the NASD Rules requires each company that is listed on Nasdaq to obtain stockholder approval prior to issuing common stock in a private placement at a price less than the greater of the market value and the book value of the common stock, where the amount of common stock to be issued is or will be greater than 20% of the common stock or voting power of the company outstanding prior to the issuance. Because it is possible that the issuance of Common Stock in any of the Private Placements could be effected at a per share price less than the greater of the market value and the book value of the Common Stock at that time, and in amount equal to or greater than 20% of the Common Stock outstanding prior to such Private Placement, thereby requiring stockholder approval, the Company is seeking such stockholder approval at this time.

Finally, one of the conditions of closing the Private Placements is that the Company obtain stockholder approval of the Private Placements. In the Stock Purchase Agreement, the Company had agreed to use commercially reasonable efforts to obtain such approval. As a result, the Company is seeking stockholder approval at this time.

Vote Required

The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and voting at the Annual Meeting, excluding the shares previously purchased by Amgen pursuant to the Stock Purchase Agreement, will be required to approve the Private Placements to Amgen. Abstentions and broker non-votes are not counted for any purpose in determining whether this proposal has been approved. The Stock Purchase Agreement was filed as an exhibit to the Company’s current report on Form 8-K filed with the SEC on May 21, 2003, the Collaboration Agreement was filed as an exhibit to the Company’s quarterly report on Form 10-Q for the quarter ended June 30, 2003 and the Registration Rights Agreement was filed as an exhibit to Amgen’s 13D/A filed on July 1, 2003 and November 13, 2003, and you are encouraged to review the full text of each agreement. The foregoing summary of the terms of these agreements is qualified in its entirety by reference to the Stock Purchase Agreement, the Collaboration Agreement and the Registration Rights Agreement.

If Proposal 2 does not receive stockholder approval, Amgen will not be obligated to purchase and the Company will not be obligated to sell shares of Common Stock in the Private Placements. In such event, the Company may request from Nasdaq a written interpretation of the Change of Control Rule confirming that the Private Placements would not constitute a change of control of the Company. If Nasdaq confirms that there would be no change of control, Amgen and Tularik will each independently decide whether or not to proceed with the Private Placements in the absence of stockholder approval.

The Board of Directors Recommends

a Vote in Favor of Proposal 2.

11

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board has selected PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending December 31, 2004 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited the Company’s financial statements since March 15, 2002. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s bylaws nor other governing documents or laws require stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors. However, the Audit Committee of the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of PricewaterhouseCoopers LLP. Abstentions will have the same effect as negative votes. Broker non-votes are not counted for any purpose in determining whether this matter has been approved.

Independent Auditors’ Fees

The following presents aggregate fees billed to the Company for the fiscal years ended December 31, 2003 and December 31, 2002 by PricewaterhouseCoopers LLP, the Company’s principal accountant. Certain amounts from fiscal 2002 have been reclassified to conform to new presentation requirements.

Audit Fees. Audit fees were $247,950 and $196,600 for the years ended December 31, 2003 and December 31, 2002, respectively. The fees were for professional services rendered for the audits of our consolidated financial statements, reviews of the financial statements included in our quarterly reports, reviews of SEC registration statements and issuance of comfort letters.

Audit-Related Fees. There were no audit-related fees for the years ended December 31, 2003 and December 31, 2002, respectively.

Tax Fees. There were no tax fees for the year ended December 31, 2003. Tax fees were $38,535 for the year ended December 31, 2002. The tax fees were for professional services related to tax compliance, including the preparation of tax returns and claims for refund.

All Other Fees. All other fees were $5,000 and $4,800 for the years ended December 31, 2003 and December 31, 2002, respectively. The fees were for the performance of agreed-upon procedures associated with one of the Company’s collaboration agreements and for access to an online database of accounting pronouncements and interpretations maintained by PricewaterhouseCoopers LLP.

All fees described above were approved by the Audit Committee, other than the annual $1,400 subscription fee paid for access to the database that will be ratified by the Audit Committee at its next scheduled meeting. The Audit Committee has determined that the rendering of all non-audit services by PricewaterhouseCoopers LLP is compatible with maintaining the auditors’ independence.

12

Pre-Approval Policies and Procedures

The Audit Committee has adopted policies and procedures for the pre-approval of audit and non-audit services rendered by the Company’s independent auditors. The policy requires pre-approval of all services rendered by the Company’s independent auditors either as part of the Audit Committee’s approval of the scope of the engagement of the independent auditors or on a case-by-case basis before the independent auditors are engaged to provide each service. The pre-approval of any individual expenditure on non-audit services up to $50,000 has been delegated to Mr. Heidrich, the Chairman of the Audit Committee, but any pre-approval decision must be reported to the full Audit Committee at the next regularly scheduled meeting.

Change in Independent Auditors

On March 15, 2002, the Company dismissed Ernst & Young LLP as the independent auditors of the Company and appointed PricewaterhouseCoopers LLP as its independent auditors. The decision to change independent auditors was approved by the Audit Committee under authority granted by the Board.

Ernst & Young LLP’s reports on the Company’s financial statements for each of the fiscal years ended December 31, 2001 and 2000 did not contain an adverse opinion or disclaimer of opinion, nor were the reports qualified or modified as to uncertainty, audit scope or accounting principles, except for Ernst & Young LLP’s reports dated February 4, 2002 and February 8, 2001 on the Company’s consolidated financial statements for the years ended December 31, 2001 and 2000, which refer to Note 1 to the Company’s consolidated financial statements, and noted that during the year ended December 31, 2000, the Company changed its method of revenue recognition for non-refundable technology access fees received in connection with collaboration agreements.

In connection with the Company’s audits for the fiscal year ended December 31, 2001, and through March 14, 2002, there were no disagreements between the Company and Ernst & Young LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Ernst & Young LLP, would have caused Ernst & Young LLP to make reference thereto in their reports on the Company’s financial statements for such years. Ernst & Young LLP’s letter to the SEC stating its agreement with the statements made herein is filed as an exhibit to the Company’s current report on Form 8-K filed with the SEC on March 19, 2002.

During the fiscal year ended December 31, 2001, and through March 14, 2002, the Company did not consult with PricewaterhouseCoopers LLP regarding either (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements or (ii) any matter that was either the subject of a disagreement or a reportable event.

The Board of Directors Recommends

a Vote in Favor of Proposal 3.

13

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of the Company’s Common Stock and the Common Stock, Series A Preferred Stock and Series B Preferred Stock of Cumbre Inc., a majority-owned subsidiary of the Company, as of February 29, 2004, except as otherwise noted, by: (i) each director (all of whom are nominees for director); (ii) each of the executive officers named in the “Summary Compensation Table” below; (iii) all current executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of the Company’s Common Stock and the Common and Preferred Stock of Cumbre. Unless otherwise indicated in the footnotes to the table, and subject to community property laws where applicable, the Company believes that each of the stockholders named in the table has sole voting and dispositive power with respect to the shares indicated as beneficially owned.

| | | | | | | | | | | | | | |

| | | Tularik Inc.

| | | Cumbre Inc.

| |

Beneficial Owner

| | Number of

Tularik Shares

Beneficially

Owned

| | Tularik Shares

Issuable

Pursuant to

Options

Exercisable

Within

60 Days of

February 29,

2004

| | Percent of

Total(1)

| | | Number of

Cumbre Shares

Beneficially

Owned(2)

| | Cumbre Shares

Issuable

Pursuant to

Options

Exercisable

Within

60 Days of

February 29,

2004

| | Percent of

Total(3)

| |

Amgen Inc.(4) One Amgen Center Drive Thousand Oaks, CA 91320-1799 | | 13,952,885 | | — | | 20.8 | % | | — | | — | | — | |

ZKB Pharma Vision AG(5)(6) | | 1,653,238 | | — | | 2.5 | % | | 3,000,000 | | — | | 12.0 | % |

c/o Zurich Cantonalbank Postfach 8010 Zurich, Switzerland | | | | | | | | | | | | | | |

Vulcan Ventures Inc.(6) 505 Fifth Avenue South Suite 900 Seattle, WA 98104 | | — | | — | | — | | | 4,000,000 | | — | | 15.9 | % |

Big Bend V(6) 3401 Armstrong Avenue Dallas, TX 75205-3949 | | — | | — | | — | | | 3,000,000 | | — | | 12.0 | % |

David V. Goeddel, Ph.D.(7) | | 2,086,629 | | 582,291 | | 4.0 | % | | 100,000 | | — | | * | |

Michael D. Levy, M.D.(8) | | 10,178 | | 256,563 | | * | | | — | | — | | — | |

Andrew J. Perlman, M.D. (9) | | 352,588 | | 264,450 | | * | | | 25,000 | | — | | * | |

William J. Rieflin(10) | | 221,052 | | 271,874 | | * | | | 10,000 | | — | | * | |

Terry J. Rosen, Ph.D.(11) | | 138,993 | | 403,104 | | * | | | — | | — | | — | |

A. Grant Heidrich, III(12) | | 153,245 | | 36,000 | | * | | | 80,000 | | — | | * | |

Edward W. Holmes, M.D. | | — | | 35,000 | | * | | | — | | — | | — | |

Edward R. McCracken(13) | | 70,512 | | 26,000 | | * | | | — | | — | | — | |

Steven L. McKnight, Ph.D.(14) | | 310,016 | | 109,666 | | * | | | 465,733 | | 174,267 | | 2.6 | % |

Craig A. P. D. Saxton, M.D. | | 25,000 | | 45,000 | | * | | | — | | — | | — | |

All executive officers and directors as a group (11 persons)(13)(15) | | 3,385,705 | | 2,071,406 | | 8.1 | % | | 680,733 | | 174,267 | | 3.4 | % |

| (1) | | Applicable percentages are based on 67,008,103 shares of Tularik Common Stock outstanding on February 29, 2004, adjusted as required by rules promulgated by the SEC. |

| (2) | | Includes shares of Cumbre Series A and Series B Preferred Stock on an as-converted basis. Also includes shares of Cumbre Common Stock obtained upon exercise of unvested options that are subject to a right of |

14

| | repurchase by Cumbre, at the original option exercise price of $0.10 per share, in the event the holder ceases to provide services to Cumbre, as follows: 6,250 shares beneficially owned by Dr. Perlman and 68,933 shares beneficially owned by Dr. McKnight. |

| (3) | | Applicable percentages are based on 25,080,177 shares of Cumbre Common Stock and Preferred Stock on an as-converted basis outstanding on February 29, 2004, adjusted as required by rules promulgated by the SEC. |

| (4) | | Information is as provided by Amgen Inc. on a Form 4 Statement of Changes in Beneficial Ownership and a Form 13D/A filed with the SEC on November 17, 2003. Amgen Inc. has sole voting and dispositive power with respect to all shares that it beneficially owns. |

| (5) | | Information regarding shares of Tularik Common Stock is as provided by Zurich Cantonalbank, a company which holds approximately 70% of the voting rights and approximately 50% of the capital stock of ZKB Pharma Vision AG (“Pharma Vision”), on a Form 144 Notice of Proposed Sale of Securities filed with the SEC on July 31, 2003. Zurich Cantonalbank and Pharma Vision have shared voting and dispositive power with respect to all shares that they beneficially own. |

| (6) | | Information regarding shares of Cumbre Common Stock is as provided in the stock records of Cumbre. |

| (7) | | Includes 973 shares of Tularik Common Stock issued pursuant to the Company’s 401(k) plan and 127 shares owned by Dr. Goeddel’s minor child. Does not include 170,000 shares of Tularik Common Stock held in trust for Dr. Goeddel’s minor children, for which Dr. Goeddel is not the trustee and disclaims beneficial ownership. |

| (8) | | Includes 440 shares of Tularik Common Stock issued pursuant to the Company’s 401(k) plan. |

| (9) | | Includes 327,386 shares of Tularik Common Stock held in a revocable trust of which Dr. Perlman and his wife, Dr. Phyllis Gardner, are sole trustees. Drs. Perlman and Gardner, each acting alone, have the power to vote and dispose of such shares. Includes 882 shares of Tularik Common Stock issued pursuant to the Company’s 401(k) plan. Does not include 42,000 shares of Tularik Common Stock held in trust for Dr. Perlman’s minor children, for which Dr. Perlman is not the trustee and disclaims beneficial ownership. |

| (10) | | Includes 205,503 shares of Tularik Common Stock held in a revocable trust of which Mr. Rieflin and his wife are sole trustees. Mr. and Mrs. Rieflin, each acting alone, have the power to vote and dispose of such shares. Includes 945 shares of Tularik Common Stock issued pursuant to the Company’s 401(k) plan. Does not include 39,498 shares of Tularik Common Stock held in trust for Mr. Rieflin’s minor children, for which Mr. Rieflin is not the trustee and disclaims beneficial ownership. Includes 10,000 shares of Cumbre Series B Preferred Stock held in a revocable trust of which Mr. Rieflin and his wife are sole trustees. Mr. and Mrs. Rieflin, each acting alone, have the power to vote and dispose of such Cumbre shares. Does not include 25,000 shares of Cumbre Common Stock held in trust for Mr. Rieflin’s minor children, for which Mr. Rieflin is not the trustee and disclaims beneficial ownership. |

| (11) | | Includes 50,626 shares of Tularik Common Stock held in a revocable trust of which Dr. Rosen and his wife are sole trustees. Dr. and Mrs. Rosen, each acting alone, have the power to vote and dispose of such shares. Includes 973 shares of Tularik Common Stock issued pursuant to the Company’s 401(k) plan. Does not include 49,998 shares of Tularik Common Stock held in trust for Dr. Rosen’s minor children, for which Dr. Rosen is not the trustee and disclaims beneficial ownership. |

| (12) | | Includes 125,961 shares of Tularik Common Stock held in a revocable trust of which Mr. Heidrich and his wife are sole trustees. Includes 80,000 shares of Cumbre Series B Preferred Stock held in a revocable trust of which Mr. Heidrich and his wife are sole trustees. Mr. and Mrs. Heidrich, each acting alone, have the power to vote and dispose of such Tularik and Cumbre shares. |

| (13) | | Includes 10,000 shares of Tularik Common Stock beneficially owned by Mr. McCracken that were obtained upon exercise of unvested options and are subject to a right of repurchase by the Company, at the original option exercise price of $5.17 per share, in the event the holder ceases to provide services to the Company and its affiliates. |

15

| (14) | | Includes 71,540 shares of Tularik Common Stock held in the Steven L. McKnight Exempt Family Trust. Dr. and Mrs. McKnight, each acting alone, have the power to vote and dispose of such shares. Does not include 120,000 shares of Tularik Common Stock held in trust for Dr. McKnight’s minor children, for which Dr. McKnight is not the trustee and disclaims beneficial ownership. |

| (15) | | Includes shares of Tularik Common Stock and Cumbre Common and Preferred Stock described in the notes above, as applicable. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Executive officers, directors and greater than ten percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended December 31, 2003, the Company’s executive officers, directors and greater than ten percent beneficial owners complied with all Section 16(a) filing requirements on a timely basis except that one report on Form 4 for Mr. Jack M. Anthony, covering one option grant, was filed late, and one report on Form 4 for Mr. Rieflin, covering a gift of shares to trusts created for the benefit of his minor children, was filed late.

EXECUTIVE COMPENSATION

Compensation of Directors

Prior to 2003, the Company did not provide cash compensation to members of its Board for serving on its Board or for participation on committees of the Board. Beginning in 2003, directors who are not employees of the Company receive the following annual cash compensation: $7,500 for service to the Company as a member of the Board; $10,000 for service to the Company as a member of the Audit Committee; $4,000 for service to the Company as a member of the Compensation and Talent Committee; and $2,000 for service to the Company as a member of the Nominating and Corporate Governance Committee. The members of the Board are also eligible for reimbursement of some expenses incurred in connection with attendance at Board meetings in accordance with Company policy.

Each non-employee director of the Company receives stock option grants under the Company’s 1997 Non-Employee Directors’ Stock Option Plan (the “Directors’ Plan”). Options granted under the Directors’ Plan are intended by the Company not to qualify as incentive stock options under the Internal Revenue Code of 1986, as amended.

Option grants under the Directors’ Plan are non-discretionary. Upon election to the Board, each new non-employee director is automatically granted an option to purchase 25,000 shares of Common Stock of the Company. On the date of the annual meeting of stockholders each year, each member of the Board who is not an employee of the Company and who was a director on December 31 of the prior year is automatically granted an option to purchase 10,000 shares of Common Stock of the Company. No other options may be granted at any time under the Directors’ Plan. The exercise price of options granted under the Directors’ Plan is equal to the fair market value of the Common Stock subject to the option at the close of the market on the date of the option grant. These options vest on an annual basis over four years. Options granted under the Directors’ Plan may not be exercised after the expiration of ten years from the date of grant. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change of control transaction involving the Company, each option either will continue in effect, if the Company is the surviving entity, or will

16

be assumed or an equivalent option will be substituted by the acquiring company, if the Company is not the surviving entity. If the acquiring company does not assume the options or substitute similar options, the options will fully vest upon a change of control, as defined and as described in the Directors’ Plan.

During the last fiscal year, the Company granted options covering 10,000 shares to each non-employee director of the Company at an exercise price per share of $5.17, which was the fair market value of such Common Stock on the date of the 2003 annual meeting of stockholders. As of February 29, 2004, options to purchase an aggregate of 150,000 shares had been exercised under the Directors’ Plan.

In consideration for consulting services provided to the Company in addition to his responsibilities as a director of the Company, the Company granted Dr. McKnight options to purchase 100,000 shares of Common Stock at an exercise price of $4.88 per share. The exercise price for these options was equal to the fair market value of the Common Stock at the close of the market on March 21, 2003, the date of grant. The option shares vest monthly over a 48-month period beginning as of the grant date. In consideration for consulting services provided to Cumbre, on February 1, 2004, Dr. McKnight was granted options to purchase 50,000 shares of Cumbre Common Stock at an exercise price of $0.25 per share. The exercise price for these options was equal to the fair market value of Cumbre Common Stock on the date of the option grant. The option shares vest monthly over a 48-month period beginning as of the grant date. In addition to the options described above, the Company paid Dr. McKnight approximately $22,500 in 2003 for consulting services provided to the Company. In addition, on May 6, 2002, the Company loaned Dr. McKnight $200,000. The loan represents a cash advance on consulting fees that will be earned by Dr. McKnight over a three-year period beginning on the date of the loan. The loan bears interest at a rate of 3.21% per annum. In 2003, the Company forgave $60,000 of the loan for his consulting services. In 2004, the Company will forgive an additional $70,000 of the loan for his consulting services. Also, in 2003, Cumbre paid Dr. McKnight $50,000 for consulting services provided to Cumbre. In 2004, Cumbre will pay Dr. McKnight $50,000 for his consulting services. Dr. McKnight spent approximately 20% of his working time providing consulting services to the Company and Cumbre in 2003 and has agreed to spend approximately 20% of his working time providing consulting services to the Company and Cumbre in 2004.

17

Compensation of Executive Officers

Summary Compensation Table

The following table shows for the fiscal years ended December 31, 2003, 2002 and 2001, compensation awarded or paid to, or earned by, the Company’s Chief Executive Officer and its other four most highly compensated executive officers at December 31, 2003 (the “Named Executive Officers”):

| | | | | | | | | | | | | | | | |

| | | Year

| | | Annual Compensation

| | | Long-Term

Compensation

Awards

| | All Other

Compensation(1)

| |

Name and Principal Position

| | | Salary

| | Bonus

| | | Securities

Underlying

Options

| |

Dr. David V. Goeddel Chief Executive Officer | | 2003

2002

2001 |

| | $

$

$ | 445,000

445,000

420,000 | |

| —

—

— |

| | 350,000

200,000

150,000 | | $

$

$ | 2,590

2,582

2,213 |

|

| | | | | |

Dr. Terry Rosen Executive Vice President, Operations | | 2003

2002

2001 |

| | $

$

$ | 324,000

324,000

302,000 | | $

$

$ | 40,971

25,971

25,971 | (2)

(3)

(3) | | 225,000

110,000

75,000 | | $

$

$ | 1,989

1,826

2,775 |

|

| | | | | |

William J. Rieflin Executive Vice President, Administration, General Counsel and Secretary | | 2003

2002

2001 |

| | $

$

$ | 309,000

309,000

288,000 | | $

$ | 65,000

—

23,533 |

(3) | | 200,000

100,000

60,000 | | $

$

$ | 1,811

2,408

2,173 |

|

| | | | | |

Dr. Michael D. Levy Vice President, Development and Chief Medical Officer | | 2003

2002

2001 |

| | $

$

$ | 306,000

306,000

285,000 | | $

$

$ | 70,000

145,000

115,296 | (3)

(2)

(4) | | 125,000

100,000

175,000 | | $

$

$ | 2,107

2,104

322,804 |

(5)

|

| | | | | |

Dr. Andrew J. Perlman Executive Vice President | | 2003

2002

2001 |

(6)

| | $

$

$ | 300,000

81,458

290,000 | |

| —

—

— |

| | 125,000

50,000

40,000 | | $

$

$ | 2,790

1,581

2,474 |

|

| (1) | | Includes term life insurance premiums paid by the Company on behalf of the Named Executive Officers, wellness benefits, amounts paid upon voluntary waiver of medical benefits, taxable travel reimbursement amounts and the Company’s matching payments in Common Stock under its 401(k) plan. The value of the Common Stock awarded under this plan to each of Drs. Goeddel, Levy, Rosen and Perlman and Mr. Rieflin in 2003 was $1,500. |

| (2) | | A portion of this amount reflects forgiveness of a loan given in connection with relocation to the San Francisco Bay area. |

| (3) | | Amount reflects forgiveness of a loan given in connection with relocation to the San Francisco Bay area. |

| (4) | | Amount reflects a signing bonus plus a gross-up tax amount. |

| (5) | | Amount reflects costs reimbursed by the Company in connection with relocation to the San Francisco Bay area. |

| (6) | | In 2002, Dr. Perlman was only employed by the Company for approximately three months. |

18

Stock Option Grants and Exercises

The Company grants options to its executive officers under the 1997 Plan. As of February 29, 2004, options to purchase a total of 8,342,829 shares were outstanding under the 1997 Plan and options to purchase 2,594,047 shares remained available for grant under such plan. The following tables show, for the fiscal year ended December 31, 2003, certain information regarding options granted to, and held at year end by, the Company’s Named Executive Officers.

2003 Option Grants

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (4)

|

Name

| | Number of

Securities

Underlying

Options

Granted(1)

| | Percent of Total

Options Granted to

Employees in Fiscal Year(2)

| | | Exercise

Price

(Per

Share)(3)

| | Expiration

Date

| |

| | | | | | 5%

| | 10%

|

Dr. Goeddel | | 350,000 | | 7.7 | % | | $ | 4.88 | | 3/20/13 | | $ | 1,074,152 | | $ | 2,722,112 |

Dr. Rosen | | 225,000 | | 5.0 | % | | $ | 4.88 | | 3/20/13 | | $ | 690,526 | | $ | 1,749,929 |

Mr. Rieflin | | 200,000 | | 4.4 | % | | $ | 4.88 | | 3/20/13 | | $ | 613,801 | | $ | 1,555,493 |

Dr. Levy | | 125,000 | | 2.8 | % | | $ | 4.88 | | 3/20/13 | | $ | 383,626 | | $ | 972,183 |

Dr. Perlman | | 125,000 | | 2.8 | % | | $ | 4.88 | | 3/20/13 | | $ | 383,626 | | $ | 972,183 |

| (1) | | All options were granted for a term of ten years and vest in equal installments monthly from the date of grant over a four-year period. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change of control transaction involving the Company, each option either will continue in effect, if the Company is the surviving entity, or will be assumed or an equivalent option will be substituted by the acquiring company, if the Company is not the surviving entity. If the acquiring company does not assume the options or substitute similar options, the options will fully vest upon a change of control, as defined and as described in the 1997 Plan. Under the terms of the 1997 Plan, the Board retains the discretion, subject to plan limits, to amend the terms (including the exercise price and vesting dates) of outstanding options, but not in a manner that would impair the rights of the holder of any outstanding option. |

| (2) | | Based on options to purchase 4,507,433 shares granted to employees in 2003. |

| (3) | | The exercise price of the options granted under the 1997 Plan is equal to the fair market value of the Common Stock subject to the option at the close of the market on the date of the option grant. |

| (4) | | The potential realizable value is based on the term of the option at its time of grant. It is calculated by assuming that the stock price on the date of grant appreciates at the indicated annual rate, compounded annually for the entire term of the option, and that the option is exercised and sold on the last day of its term for the appreciated stock price. These amounts represent certain assumed rates of appreciation only, in accordance with the rules of the SEC, and do not reflect the Company’s estimate or projection of future stock price performance. Actual gains, if any, are dependent on the actual future performance of the Company’s Common Stock. No gain to the optionee is possible unless the stock price increases over the option term. |

19

2003 Fiscal Year End Option Values

Option grants under the 1997 Plan and the Company’s 1991 Stock Plan, under which options were granted until the 1997 Plan was adopted (collectively, the “Plans”), are discretionary. The exercise price of options granted under the Plans is equal to the fair market value of the Common Stock subject to the option at the close of the market on the date of the option grant. Options granted to employees under the Plans typically vest on a monthly basis over a four-year period, except that options granted to new employees typically vest one-quarter after one year’s service to the Company and then monthly thereafter. Options granted under the Plans may not be exercised after the expiration of ten years from the date of grant. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of assets or other change of control transaction involving the Company, each option either will continue in effect, if the Company is the surviving entity, or will be assumed or an equivalent option will be substituted by the successor corporation, if the Company is not the surviving entity. If the acquiring company does not assume the options or substitute similar options, the options will fully vest upon a change of control, as defined and as described in the Plans. The following table shows, for the fiscal year ended December 31, 2003, certain information regarding options held at year end by the Named Executive Officers. No options were exercised in 2003 by the Named Executive Officers.

| | | | | | | | | | | | | | |

| | | Number of Securities Underlying Unexercised Options at December 31, 2003

| | Value of Unexercised In-the-Money Options at December 31, 2003(1)

|

Name

| | Vested

| | Unvested

| | Exercisable

| | Unexercisable

|

Dr. Goeddel | | 451,459 | | 490,207 | | | | $ | 2,014,256 | | | | $ | 3,832,395 |

Dr. Rosen | | 334,937 | | 289,729 | | | | $ | 1,886,320 | | | | $ | 2,430,695 |

Mr. Rieflin | | 214,875 | | 255,124 | | | | $ | 1,293,099 | | | | $ | 2,170,588 |

Dr. Levy | | 187,293 | | 212,707 | | | | $ | 479,056 | | | | $ | 1,770,500 |

Dr. Perlman | | 198,069 | | 190,219 | | | | $ | 1,817,350 | | | | $ | 1,444,079 |

| (1) | | All options, vested or unvested, granted prior to June 14, 2001 are immediately exercisable, but are subject to the Company’s right to repurchase unvested shares on termination of employment. Value is calculated based on the fair market value of the Common Stock at December 31, 2003 ($16.12) minus the exercise price of the options. |

Employment Agreements

Each executive officer of the Company has entered into a standard form proprietary information and inventions assignment agreement that provides that the employee will not disclose any confidential information of the Company received during the course of employment and that, with some exceptions, the employee will assign to the Company any and all inventions conceived or developed during the course of employment.

Compensation Committee Interlocks and Insider Participation

As noted above, the Compensation and Talent Committee is currently composed of three independent directors: Messrs. Heidrich and McCracken and Dr. Saxton. None of the Company’s executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on the Company’s Compensation and Talent Committee. No interlocking relationship exists between the Board or the Compensation and Talent Committee of the Company and the board of directors or compensation committee of any other company, nor has such interlocking relationship existed in the past.

20

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides certain information with respect to all of our equity compensation plans in effect as of December 31, 2003:

Equity Compensation Plan Information

| | | | | | | | | |

Plan Category

| | Number of Securities

to be Issued upon

Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted-Average

Exercise Price of

Outstanding

Options,

Warrants and

Rights

| | Number of Securities

Remaining Available for

Future Issuance under

Equity Compensation

Plans (excluding

Securities Reflected in Column(a))

|

| | | (a) | | (b) | | (c) |

Equity compensation plans approved by security holders: | | | | | | | | | |

1997 Equity Incentive Plan | | 8,551,296 | | | | $ | 10.2948 | | 238,744 |

1997 Non-Employee Directors’ Plan | | 200,000 | | | | $ | 15.1266 | | 350,000 |

1991 Stock Plan(1) | | 152,193 | | | | $ | 1.2670 | | 0 |

1999 Employee Stock Purchase Plan | | N/A | | | | | N/A | | 966,619 |

Equity compensation plans not approved by security holders: | | | | | | | | | |

Out of Plan Options(2) | | 24,000 | | | | $ | 2.5833 | | 0 |

Out of Plan Warrants(3) | | 353,985 | | | | $ | 10.6569 | | 0 |

Total | | 9,281,474 | | | | $ | 10.2448 | | 1,555,363 |

| | |

| |

| |

|

| |

|

| (1) | | The Company’s 1991 Stock Plan was terminated for purposes of new option grants in 1997, but the plan remains in effect as to outstanding stock options granted under that plan. |

| (2) | | This number includes non-plan options granted to Dr. Perlman and to Brigham & Women’s Hospital, as described more fully below in “Other Non-Stockholder Approved Equity Arrangements.” |

| (3) | | This number includes warrants issued to a placement agent in connection with the sale of the Company’s Series F preferred stock, warrants issued pursuant to build-to-suit lease agreements and warrants issued in connection with the acquisition of the Company’s wholly owned subsidiary, Amplicon Corporation, all as described more fully below in “Other Non-Stockholder Approved Equity Arrangements.” |

Other Non-Stockholder Approved Equity Arrangements

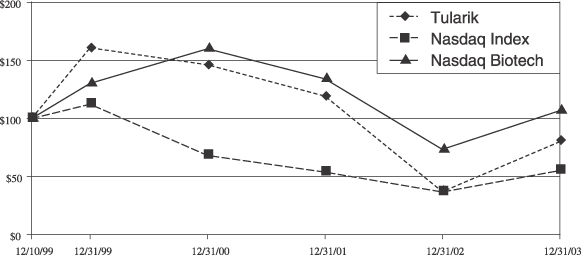

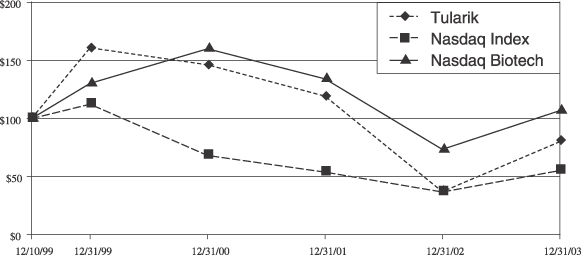

On November 18, 1994, the Company granted to Brigham & Women’s Hospital an option to purchase 4,000 shares of the Company’s common stock with an exercise price equal to the fair market value on the date of grant ($0.50). As of February 29, 2004, all shares were vested and exercisable. This option expires on November 18, 2004, ten years from the grant date.