UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06722

FORWARD FUNDS

(Exact name of registrant as specified in charter)

433 California Street, 11th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

J. Alan Reid, Jr., President

Forward Funds

433 California Street, 11th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: (800) 999-6809

Date of fiscal year end: December 31

Date of reporting period: January 1, 2006 – June 30, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

|

| Item 1 - Reports to Stockholders |

|

| The following is a copy of the report transmitted to shareholders of the Forward Legato Fund, the Forward Emerald Growth Fund, the Forward Emerald Banking and Finance Fund, the Forward Emerald Opportunities Fund, the Forward Uniplan Real Estate Investment Fund, the Forward Hoover Small Cap Equity Fund, the Forward Hoover Mini-Cap Fund, the Forward International Equity Fund, the Forward Global Emerging Markets Fund, the Forward International Small Companies Fund, the Sierra Club Equity Income Fund and the Sierra Club Stock Fund, each a series of the registrant, pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

| |

FORWARD FUNDS.

Semi-Annual Report

June 30, 2006

Semi-Annual Report | June 30, 2006

FORWARD THINKING: Paying Attention to Correlation

Many have observed a trend that we feel deserves our investors’ attention: high correlation among major global markets. Traditionally, U.S. and overseas markets often moved in separate directions. Adding one or more international funds to a portfolio centered on U.S. equities provided a meaningful measure of diversification. In recent years, however, U.S. and international markets have increasingly moved in lockstep as performance of large-cap stocks around the world has converged.

Markets have become globalized—companies now offer the same goods and services almost everywhere. For example, technology stocks have become major players in markets worldwide as technology is a critical component of economic growth. Investors who believe that their portfolios are reasonably diversified because they hold both domestic and international funds may need to look further to manage risk, especially during periods of volatility.

New Opportunities for Risk Reduction

We have long been committed to meeting investor needs as market conditions change. That’s why we offer a family of products in a range of asset classes, including long/short strategies, like the Forward Emerald Opportunities Fund. The Fund integrates a traditional long portfolio with the ability to short or hedge within the fund, investing in undervalued stocks and selling short over-valued issues. These strategies typically result in a low correlation to major markets, offering investors another risk management tool.

We encourage you to review your portfolio and its level of diversification and to speak with your financial advisor about strategies to manage high correlation and reduce risk. And we will continue to develop innovative products that can help our investors diversify with funds that provide investment exposure via a wide range of asset classes.

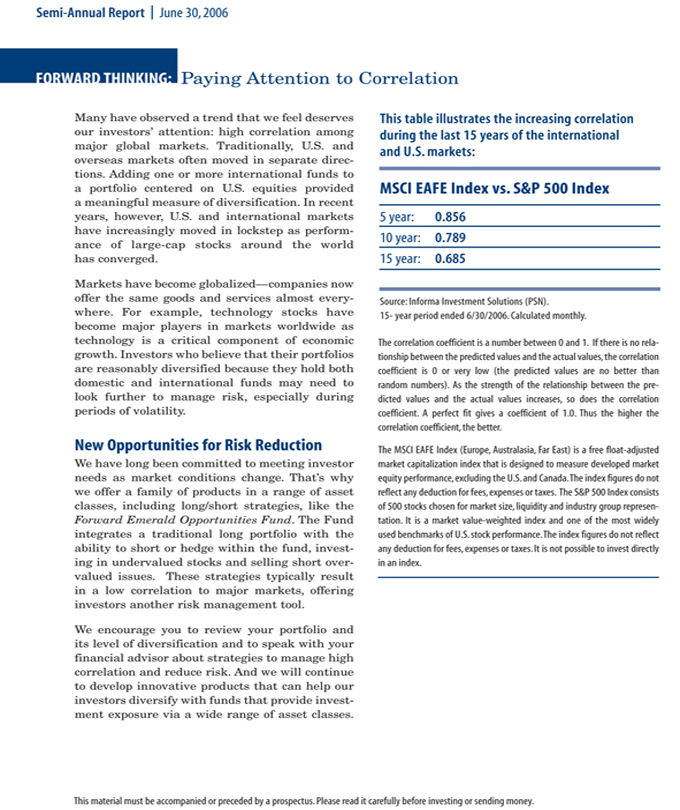

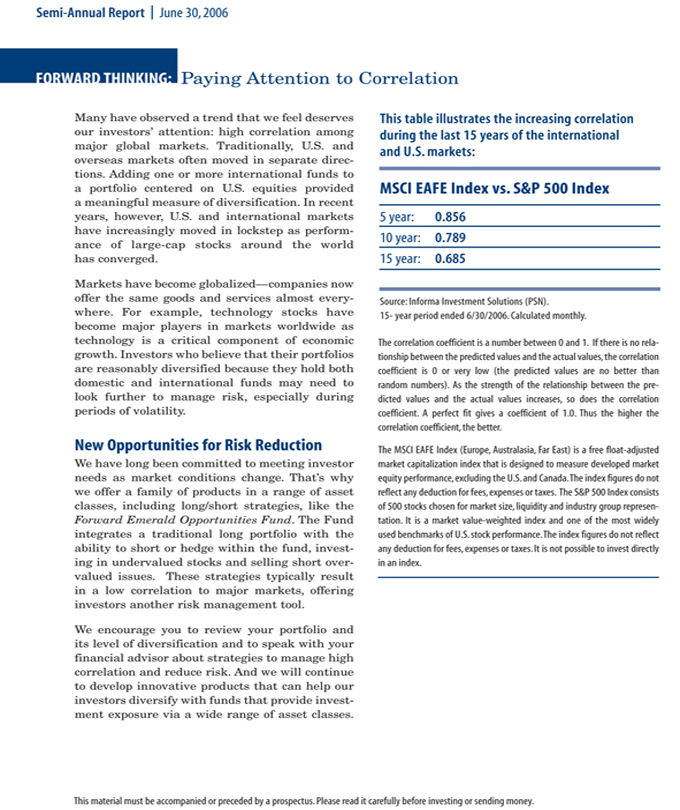

This table illustrates the increasing correlation during the last 15 years of the international and U.S. markets:

MSCI EAFE Index vs. S&P 500 Index

5 year:

0.856

10 year:

0.789

15 year:

0.685

Source: Informa Investment Solutions (PSN).

15- year period ended 6/30/2006. Calculated monthly.

The correlation coefficient is a number between 0 and 1. If there is no relationship between the predicted values and the actual values, the correlation coefficient is 0 or very low (the predicted values are no better than random numbers). As the strength of the relationship between the predicted values and the actual values increases, so does the correlation coefficient. A perfect fit gives a coefficient of 1.0. Thus the higher the correlation coefficient, the better.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the U.S. and Canada.The index figures do not reflect any deduction for fees, expenses or taxes. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation. It is a market value-weighted index and one of the most widely used benchmarks of U.S. stock performance.The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

This material must be accompanied or preceded by a prospectus. Please read it carefully before investing or sending money.

A MESSAGE FROM: J. Alan Reid Jr., President

Dear Shareholder:

Following several highly bullish years, the markets experienced considerable volatility during the first half of 2006. I am pleased to report that throughout this extraordinary period, Forward Funds has produced solid results for shareholders.

Our record reflects our agile, forward-thinking investment philosophy. We seek out and offer our investors innovative investment products. We identify portfolio managers who focus on delivering alpha.1 And we maintain our pro-shareholder position, which has created transparent, clear and ethical investment practices. This forward thinking permeates everything we do. Here are some examples:

Strong Results from Small Caps. Forward Funds has five small-cap funds—four domestic and one international. Our small-cap managers have done a great job of uncovering opportunities in this segment of the market. While conventional wisdom has it that large caps may return to favor and outperform small caps, our managers feel otherwise. Irene Hoover of the Forward Hoover Small Cap Equity Fund and the Forward Hoover Mini-Cap Fund states, “From the thousands of small-cap companies, there are always companies to discover for new investment—like emerging companies, smaller companies with accelerated growth, turnarounds or out-of-favor industries with niche-leading companies.”

International Opportunities Continue. Despite the dramatic volatility of international and emerging markets in the first half of the year, Forward’s international funds delivered solid results. Forward Funds works with Pictet Asset Management, a leader in international investing in both emerging and mature markets worldwide. During the spring volatility returned to international markets due to central banks’ more restrictive monetary policies, a halt in the uptrend of bond yields and the stalling of Asian currencies’ reevaluation processes. Pictet continues to identify opportunities thanks to attractive price/earnings ratios and continuing progress in many emerging markets.

Cutting Costs with ReFlow. Forward Funds’ portfolio managers now reduce costs by utilizing ReFlow, a service that purchases and sells shares of mutual funds to counterbalance daily shareholder flow. ReFlow benefits shareholders by reducing fund trading and transaction costs, stabilizing a fund’s cash position and improving tax efficiency and shareholder performance. ReFlow enabled the portfolio management teams at Pictet to keep from selling under pressure or holding cash, resulting in cost savings for the three Forward international funds during the first half of 2006.

New Large-Cap Fund. Forward Funds is adding a new U.S. large-cap equity fund to our family of funds in the fall of 2006. The Forward Large Cap Equity Fund will be sub-advised by Affinity Investment Advisors. A registration statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective.

Forward Funds remains deeply committed to helping our shareholders attain true portfolio diversification and achieve their long-term goals. We also believe that open, transparent practices give our investors access to the information they need to make important investment choices. I invite you to review the information in this report and the performance of the Forward Funds year to date.

Best regards,

J. Alan Reid Jr.

President

Forward Management, LLC

1 Alpha is a coefficient measuring the portion of an investment’s risk arising for specific (non-market) risk.

Small company stocks are generally riskier than large company stocks due to greater volatility and less liquidity. Investing in foreign securities may involve certain additional risks, including exchange rate fluctuation, less liquidity, greater volatility and less regulation. Real estate funds may be subject to a higher degree of market risk due to concentration in a specific industry or in geographic regions. Investments in real estate and REITS have various risks including vacancies and devaluation based upon adverse economic or regulatory changes.

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results.

A Carefully Selected Team of

FORWARD FUNDS: Portfolio Managers Around the Globe

Forward Funds has assembled a team of investment managers who meet our demanding standards for discipline, performance and the ability to find opportunities others overlook.

San Francisco, California

1. Forward Management, LLC

Funds co-managed: Sierra Club Stock Fund

Firm’s assets under management: $1.2 billion (12/31/05)

Overview: Established in 1998, Forward Management is the investment advisor to the Forward Funds. Since 2005, Forward Management has been co–portfolio manager with New York Life Investment Management of the Sierra Club Stock Fund. Forward employs an index-like approach to investing in the top 100 stocks (by market cap) that meet both Forward Management’s and the Sierra Club’s stringent criteria for investing.

San Francisco, California

2. Hoover Investment Management Co., LLC

Funds managed: Forward Hoover Small Cap Equity Fund

Forward Hoover Mini-Cap Fund

Firm’s assets under management: $1.348 billion (12/31/05)

Overview: Hoover is a registered investment advisor founded in 1997 by Irene G. Hoover, CFA.1 The firm focuses on the small-capitalization sector using a combination of macro/top-down as well as company-specific/bottom-up investment research.

Irvine, California

3. Affinity Investment Advisors, LLC

Fund managed (as of Q3 2006): Forward Large Cap Equity Fund2

Firm’s assets under management: $281 million (3/31/06)

Overview: An independent equity management firm, Affinity was founded in 1992. The firm uses both quantitative and qualitative analysis to identify undervalued stocks with strong earnings momentum, earnings estimate revisions and relative strength.

Union Grove (Milwaukee), Wisconsin

4. Forward Uniplan Advisors, Inc.

Funds managed: Forward Uniplan Real Estate Investment Fund Sierra Club Equity Income Fund (co-manage)

Firm’s assets under management: $302.5 million (12/31/05)

Overview: President Richard Imperiale founded the firm in 1984. Uniplan uses a value-oriented quantitative approach to investing in equities, fixed-income and REIT securities. Forward Management owns 20% of the company.

Mequon (Milwaukee), Wisconsin

5. Netols Asset Management, Inc.

Fund co-managed: Forward Legato Fund

Firm’s assets under management: $221 million (12/31/05)

Overview: Founded in 2000, Netols specializes in small-cap value stock portfolio management utilizing a value approach to investing with a bottom-up process and a focus on the inefficient and under-followed areas of the stock market.

1 Irene Hoover has earned the right to use the Chartered Financial Analyst designation.

2 A registration statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective.

Minneapolis, Minnesota

6. Riverbridge Partners, LLC

Fund co-managed: Forward Legato Fund

Firm’s assets under management: $823 million (12/31/05)

Overview: Founded in 1987, Riverbridge Partners specializes in small-cap growth stock portfolio management. Riverbridge believes that earnings power determines the value of a franchise. They focus on companies that are building earnings power and the intrinsic value of the company over the long term.

Lancaster, Pennsylvania

7. Emerald Mutual Fund Advisers Trust

Funds managed: Forward Emerald Banking and Finance Fund

Forward Emerald Growth Fund

Forward Emerald Opportunities Fund

Firm’s assets under management: $2.36 billion (12/31/05)

Overview: The four principal officers of the parent company, Emerald Advisers, Inc., combine more than 70 years of experience in the mutual fund, investment advisory, pension funds management and securities brokerage industries. Emerald’s research staff conducts extensive fundamental research to identify companies whose earnings growth exceeds that of their peer group.

Radnor (Philadelphia), Pennsylvania

8. Conestoga Capital Advisors, LLC

Fund co-managed: Forward Legato Fund

Firm’s assets under management: $212 million (12/31/05)

Overview: Founded in 2001, Conestoga specializes in small-cap core stock portfolio management. Conestoga uses a core investment strategy based on investing in well-managed companies that are growing at reasonable valuations and are poised to deliver superior long-term performance.

Parsippany, New Jersey (New York City)

9. New York Life Investment Management LLC (NYLIM)

Funds co-managed: Sierra Club Equity Income Fund

Sierra Club Stock Fund

Firm’s assets under management (including affiliates):

more than $200 billion (12/31/05)

Overview: Founded in 2000, NYLIM is an independently managed, wholly-owned subsidiary of New York Life Insurance Company. NYLIM uses a quantitative approach, typically investing in value stocks.

London, England; Geneva, Switzerland

10. Pictet Asset Management Limited

Funds managed: Forward International Equity Fund

Forward Global Emerging Markets Fund

Forward International Small Companies Fund

Firm’s assets under management: $25.2 billion (12/31/05)

Overview: Pictet Asset Management is the institutional business division of Pictet & Cie, a Swiss private bank that was founded in 1805, which manages a range of products, including a variety of equity portfolios for U.S. and international institutional clients. The firm has offices in Geneva, Zurich, Singapore and Tokyo in addition to London, investing in emerging and developing markets worldwide.

| | |

| |

| FORWARD FUNDS: | | Table of Contents |

Forward Funds are distributed by ALPS Distributors, Inc., P.O. Box 1345, Denver, CO 80201

The report has been prepared for the general information of Forward Funds’ shareholders. It is not authorized for distribution to prospective investors unless accompanied or proceeded by a current Forward Funds Prospectus, which contains more complete information about Forward Funds’ investment policies, management fees and expenses. Investors are reminded to read the prospectus before investing or sending money.

June 30, 2006

Fund Performance

Performance Results for Periods Ended June 30, 2006

The performance quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance quoted does not reflect the non-recurring redemption fee of 2% that may be charged if shares are sold or exchanged within 180 days (60 days for the Sierra Club Equity Income Fund and the Sierra Club Stock Fund) of purchase. If these fees were reflected, the performance quoted would be lower. Investment performance reflects fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For performance data current to the most recent month end, please visit our web site at www.forwardfunds.com.

Real Estate Funds may be subject to a higher degree of market risk because of concentration in a specific industry or geographic sector. Risks include declines in value of real estate, general and economic conditions, changes in the value of the underlying property and defaults by borrowers.

Investing in foreign securities may involve certain additional risks, including exchange rate fluctuations, less liquidity, greater volatility and less regulation.

Small company stocks are generally riskier than large company stocks due to greater volatility and less liquidity.

Forward International Equity Fund(a)

| | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | |

Investor Class | | 31.46% | | 9.65% | | 7.15% | | 10/01/98 |

Forward International Small Companies Fund(b)

| | | | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | 10 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | | | |

Investor Class | | 33.46% | | N/A | | N/A | | 23.97% | | 03/05/02 |

| | | | | |

Institutional Class | | 33.91% | | 17.52% | | 13.01% | | 13.19% | | 02/07/96 |

| | | | | |

Class A (load adjusted)(c) | | 26.99% | | N/A | | N/A | | 26.05% | | 05/02/05 |

| | | | | |

Class A (without load)(d) | | 33.28% | | N/A | | N/A | | 31.40% | | 05/02/05 |

Forward Global Emerging Markets Fund(e)

| | | | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | 10 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | | | |

Investor Class | | 30.96% | | N/A | | N/A | | 39.12% | | 04/09/03 |

| | | | | |

Institutional Class | | 31.25% | | 24.37% | | 7.10% | | 7.32% | | 10/04/95 |

Fund Performance

Performance Results for Periods Ended June 30, 2006

See page 2 for important performance disclosure information about the Forward Funds.

Sierra Club Equity Income Fund(f)

| | | | | | |

| | | 1 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | |

Investor Class | | 6.44% | | 8.13% | | 01/02/03 |

Sierra Club Stock Fund(g)

| | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | |

Investor Class | | 5.62% | | 2.18% | | 4.48% | | 10/01/98 |

| | | | |

Class A (load adjusted)(c) | | 0.57% | | N/A | | 5.13% | | 05/02/05 |

| | | | |

Class A (without load)(d) | | 5.62% | | N/A | | 9.65% | | 05/02/05 |

Forward Emerald Banking and Finance Fund(h)

| | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | |

Class A (load adjusted)(c) | | 4.29% | | 15.32% | | 13.81% | | 02/18/97 |

| | | | |

Class A (without load)(d) | | 9.50% | | 16.46% | | 14.41% | | 02/18/97 |

| | | | |

Class C (with CDSC)(i) | | 7.82% | | 15.70% | | 19.43% | | 07/01/00 |

| | | | |

Class C (without CDSC)(j) | | 8.82% | | 15.70% | | 19.43% | | 07/01/00 |

Forward Emerald Opportunities Fund(k)

| | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | |

Class A (load adjusted)(c) | | 20.46% | | -6.16% | | 0.70% | | 10/31/97 |

| | | | |

Class A (without load)(d) | | 26.46% | | -5.24% | | 1.27% | | 10/31/97 |

| | | | |

Class C (with CDSC)(i) | | 24.62% | | -5.72% | | -15.74% | | 07/01/00 |

| | | | |

Class C (without CDSC)(j) | | 25.62% | | -5.72% | | -15.74% | | 07/01/00 |

Forward Uniplan Real Estate Investment Fund

| | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | |

Investor Class | | 17.92% | | 17.07% | | 15.34% | | 05/10/99 |

Fund Performance

Performance Results for Periods Ended June 30, 2006

See page 2 for important performance disclosure information about the Forward Funds.

Forward Emerald Growth Fund(l)

| | | | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | 10 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | | | |

Class A (load adjusted)(c) | | 16.78% | | 4.52% | | 8.85% | | 12.83% | | 10/01/92 |

| | | | | |

Class A (without load)(d) | | 22.63% | | 5.53% | | 9.38% | | 13.23% | | 10/01/92 |

| | | | | |

Class C (with CDSC)(i) | | 20.85% | | 4.84% | | N/A | | 2.19% | | 07/01/00 |

| | | | | |

Class C (without CDSC)(j) | | 21.85% | | 4.84% | | N/A | | 2.19% | | 07/01/00 |

Forward Hoover Small Cap Equity Fund

| | | | | | | | |

| | | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | | | |

Investor Class | | 11.97% | | 9.78% | | 11.68% | | 10/01/98 |

| | | | |

Institutional Class | | 12.36% | | N/A | | 13.49% | | 06/06/02 |

| | | | |

Class A (load adjusted)(c) | | 6.72% | | N/A | | 15.22% | | 05/02/05 |

| | | | |

Class A (without load)(d) | | 12.03% | | N/A | | 20.12% | | 05/02/05 |

Forward Hoover Mini-Cap Fund

| | | | | | |

| | | 1 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | |

Investor Class | | 18.78% | | 21.65% | | 01/02/03 |

| | | |

Institutional Class | | 19.44% | | 16.40% | | 08/15/03 |

Forward Legato Fund

| | | | | | |

| | | 1 YEAR | | SINCE

INCEPTION | | INCEPTION

DATE |

| Average Annual Total Return | | | | | | |

Class A (load adjusted)(c) | | 4.80% | | 8.88% | | 04/01/05 |

| | | |

Class A (without load)(d) | | 10.04% | | 13.23% | | 04/01/05 |

(a) Pictet Asset Management Limited has been the Fund’s sub-advisor since September 1, 2005. From March 6, 2000 through August 31, 2005, Hansberger Global Investors, Inc. was the Fund’s sub-advisor and the Fund’s investment strategy was different. Prior to March 6, 2000, the Fund was managed by a different sub-advisor. Accordingly, performance figures for periods before September 1, 2005 do not reflect the current strategy or the current sub-advisor’s performance.

(b) The Retail Class and Institutional Class of the Pictet International Small Companies Fund were reorganized into the Investor and Institutional classes, respectively, of the Forward International Small Companies Fund on December 23, 2003. Performance figures for periods prior to December 23, 2003 represent performance of the respective class of shares of the Pictet International Small Companies Fund.

(c) Includes the effect of the maximum 4.75% sales charge.

(d) Excludes sales charge.

(e) The Retail Class and Institutional Class of the Pictet Global Emerging Markets Fund were reorganized into the Investor and Institutional Class, respectively, of the Forward Global Emerging Markets Fund on September 16, 2004. Performance figures shown for periods prior to September 16, 2004 represent performance of the Retail Class and Institutional Class of the Pictet Global Emerging Markets Fund.

Fund Performance

Performance Results for Periods Ended June 30, 2006

See page 2 for important performance disclosure information about the Forward Funds.

(f) On April 1, 2005, the Fund changed its name, certain investment policies and restrictions, and one of its sub-advisors. Prior to that time, the Fund operated as the Sierra Club Balanced Fund and the portion of the Fund that is currently managed by Forward Uniplan Advisors, Inc. was managed by a different sub-advisor. Performance figures for periods prior to that date do not reflect the current strategy or allocation of the Fund’s assets among different investment advisors.

(g) Forward Management, LLC (Forward Management or the Advisor) and New York Life Investment Management, LLC (NYLIM) have been managing the Fund’s portfolio since January 1, 2006. Between January 1, 2003 and December 31, 2005, NYLIM and MDTA LLC (formerly known as Harris Bretall Sullivan & Smith L.L.C.) were the Fund’s sub-advisors and the strategy for the portion of the Fund that Forward Management manages was different. Prior to January 1, 2003, the Fund was managed by a different sub-advisor and was not subject to the Sierra Club’s environmental and social evaluation process. Accordingly, performance figures for periods prior to January 1, 2006 do not reflect current management or strategy.

(h) As of May 1, 2005, Forward Management became the investment advisor and Emerald Mutual Fund Advisers Trust (Emerald) became the sub-advisor to the Fund. Prior to May 1, 2005, Emerald was the investment advisor. Prior to October 20, 1998, the Fund was named the HomeState Select Opportunities Fund and pursued a different objective.

(i) Includes the 1.00% contingent deferred sales charge.

(j) Excludes the 1.00% contingent deferred sales charge.

(k) As of May 1, 2005, Forward Management became the investment advisor and Emerald became the sub-advisor to the Fund. Prior to May 1, 2005, Emerald was the investment advisor. Prior to September 29, 2005, the Fund was named the Forward Emerald Technology Fund and invested a minimum 80% of its net assets, plus borrowing for investment purposes, if any, in a non-diversified portfolio of equity securities of public companies in the technology sector. Accordingly, performance figures for periods prior to September 29, 2005 do not reflect the current strategy. Prior to February 29, 2000, the Fund was named the HomeState Year 2000 Fund and its investment objective focused on a specific industry within the technology sector. The Fund has invested in a variety of initial public offerings (IPOs). The performance of the IPOs may have greater impact on the performance results of a small fund and may lessen as the Fund’s assets grow.

(l) As of May 1, 2005, Forward Management became the investment advisor and Emerald became the sub-advisor to the Fund. Prior to May 1, 2005, Emerald was the investment advisor. Prior to July 1, 2001, the Fund was named the HomeState Pennsylvania Growth Fund and focused on a specific geographic region within the U.S.

Disclosure of Fund Expenses

For the Six Months Ended June 30, 2006 (Unaudited)

As a shareholder of the Forward Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads) on purchase payments, reinvested dividends or other distributions, and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder services fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period January 1, 2006 through June 30, 2006.

Actual Expenses

The first line for each share class of each Fund in the table provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During the

Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example For Comparison Purposes

The second line for each share class of each Fund in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line for each share class of each Fund in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | BEGINNING ACCOUNT VALUE 01/01/06 | | ENDING ACCOUNT VALUE 06/30/06 | | EXPENSE RATIO(a) | | | EXPENSES PAID DURING PERIOD(b) 01/01/06–06/30/06 |

| | |

| FORWARD INTERNATIONAL EQUITY FUND | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,117.90 | | 1.54 | % | | $ | 8.07 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.17 | | 1.54 | % | | $ | 7.69 |

| | |

| FORWARD INTERNATIONAL SMALL COMPANIES FUND | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,108.50 | | 1.53 | % | | $ | 7.98 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.22 | | 1.53 | % | | $ | 7.64 |

Disclosure of Fund Expenses

For the Six Months Ended June 30, 2006 (Unaudited)

| | | | | | | | | | | | |

| | | BEGINNING ACCOUNT VALUE 01/01/06 | | ENDING ACCOUNT VALUE 06/30/06 | | EXPENSE RATIO(a) | | | EXPENSES PAID DURING PERIOD(b) 01/01/06–06/30/06 |

| | |

| FORWARD INTERNATIONAL SMALL COMPANIES FUND | | | | | | |

| Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,110.20 | | 1.18 | % | | $ | 6.18 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,018.94 | | 1.18 | % | | $ | 5.91 |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,110.20 | | 1.43 | % | | $ | 7.50 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.69 | | 1.43 | % | | $ | 7.17 |

| | | |

| FORWARD GLOBAL EMERGING MARKETS FUND | | | | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,035.10 | | 1.83 | % | | $ | 9.25 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,015.70 | | 1.83 | % | | $ | 9.17 |

| Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,036.00 | | 1.54 | % | | $ | 7.76 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.17 | | 1.54 | % | | $ | 7.69 |

| | | | |

| SIERRA CLUB EQUITY INCOME FUND | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,009.50 | | 1.57 | % | | $ | 7.83 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.00 | | 1.57 | % | | $ | 7.86 |

| | | | |

| SIERRA CLUB STOCK FUND | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 981.50 | | 1.48 | % | | $ | 7.29 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.44 | | 1.48 | % | | $ | 7.42 |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 981.50 | | 1.48 | % | | $ | 7.29 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.44 | | 1.48 | % | | $ | 7.42 |

| | |

| FORWARD EMERALD BANKING AND FINANCE FUND | | | | | | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,039.80 | | 1.62 | % | | $ | 8.20 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,016.76 | | 1.62 | % | | $ | 8.10 |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,036.30 | | 2.27 | % | | $ | 11.48 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,013.52 | | 2.27 | % | | $ | 11.35 |

| | |

| FORWARD EMERALD OPPORTUNITIES FUND | | | | | | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,112.70 | | 2.51 | % | | $ | 13.17 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,012.33 | | 2.51 | % | | $ | 12.54 |

Disclosure of Fund Expenses

For the Six Months Ended June 30, 2006 (Unaudited)

| | | | | | | | | | | | |

| | | BEGINNING ACCOUNT VALUE 01/01/06 | | ENDING ACCOUNT VALUE 06/30/06 | | EXPENSE RATIO(a) | | | EXPENSES PAID DURING PERIOD(b) 01/01/06–06/30/06 |

| | |

| FORWARD EMERALD OPPORTUNITIES FUND | | | | | | |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,109.50 | | 3.18 | % | | $ | 16.64 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,009.01 | | 3.18 | % | | $ | 15.85 |

| | |

| FORWARD UNIPLAN REAL ESTATE INVESTMENT FUND | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,116.20 | | 1.46 | % | | $ | 7.64 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.57 | | 1.46 | % | | $ | 7.29 |

| | |

| FORWARD EMERALD GROWTH FUND | | | | | | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,059.60 | | 1.41 | % | | $ | 7.21 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.79 | | 1.41 | % | | $ | 7.06 |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,055.00 | | 2.07 | % | | $ | 10.52 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,014.55 | | 2.07 | % | | $ | 10.32 |

| | |

| FORWARD HOOVER SMALL CAP EQUITY FUND | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,047.40 | | 1.65 | % | | $ | 8.38 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,016.55 | | 1.65 | % | | $ | 8.25 |

| Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,049.10 | | 1.29 | % | | $ | 6.55 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,018.82 | | 1.29 | % | | $ | 6.46 |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,047.50 | | 1.56 | % | | $ | 7.94 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,017.04 | | 1.56 | % | | $ | 7.82 |

| | |

| FORWARD HOOVER MINI-CAP FUND | | | | | | |

| Investor Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,061.80 | | 1.79 | % | | $ | 9.15 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,016.57 | | 1.79 | % | | $ | 8.95 |

| Institutional Class | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,064.80 | | 1.23 | % | | $ | 6.30 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,018.46 | | 1.23 | % | | $ | 6.16 |

| | |

| FORWARD LEGATO FUND | | | | | | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,030.10 | | 1.63 | % | | $ | 8.22 |

| | | | |

Hypothetical | | $ | 1,000.00 | | $ | 1,016.69 | | 1.63 | % | | $ | 8.17 |

Disclosure of Fund Expenses

For the Six Months Ended June 30, 2006 (Unaudited)

(a) Annualized, based on the Portfolio’s most recent fiscal half-year expenses.

(b) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), then divided by 365.

Summary of Portfolio Holdings (Note 10) (Unaudited)

Under SEC rules, all funds are required to include in their annual and semi-annual shareholder reports a presentation of portfolio holdings in a table, chart or graph by reasonably identifiable categories. The following tables, which present portfolio holdings as a percent of total net assets, are provided in compliance with such requirements.

| | | |

|

| FORWARD INTERNATIONAL EQUITY FUND | |

Financials | | 34.64% | (a) |

| |

Industrials | | 13.16% | |

| |

Consumer Discretionary | | 12.63% | |

| |

Energy | | 10.23% | |

| |

Materials | | 7.33% | |

| |

Consumer Staples | | 6.25% | |

| |

Information Technology | | 5.32% | |

| |

Telecommunication Services | | 4.72% | |

| |

Health Care | | 4.14% | |

| |

Utilities | | 1.19% | |

| |

Net Other Assets and Liabilities | | 0.39% | |

| | 100.00% | |

|

| FORWARD INTERNATIONAL SMALL COMPANIES FUND | |

Industrials | | 25.57% | (a) |

| |

Consumer Discretionary | | 16.96% | |

| |

Financials | | 15.14% | |

| |

Information Technology | | 12.68% | |

| |

Health Care | | 6.11% | |

| |

Consumer Staples | | 5.86% | |

| |

Materials | | 5.11% | |

| |

Utilities | | 4.28% | |

| |

Energy | | 3.68% | |

| |

Short-Term Bank Debt Instruments | | 4.33% | |

| |

Net Other Assets and Liabilities | | 0.28% | |

| | 100.00% | |

|

| FORWARD GLOBAL EMERGING MARKETS FUND | |

Financials | | 27.29% | (a) |

| |

Energy | | 14.74% | |

| |

Information Technology | | 14.10% | |

| |

Telecommunication Services | | 11.62% | |

| |

Materials | | 7.38% | |

| |

Consumer Discretionary | | 5.73% | |

| |

Industrials | | 4.39% | |

| | | |

| |

Consumer Staples | | 3.82% | |

| |

Industrials | | 2.32% | |

| |

Health Care | | 2.30% | |

| |

Utilities | | 2.22% | |

| |

Short-Term Bank Debt Instruments | | 2.89% | |

| |

Net Other Assets and Liabilities | | 1.20% | |

| | 100.00% | |

| | | |

|

| SIERRA CLUB EQUITY INCOME FUND | |

Commercial Services & Supplies | | 11.00% | |

| |

Corporate Notes & Bonds | | 8.28% | |

| |

Banks | | 8.21% | |

| |

U.S. Government & Agency Obligations | | 6.91% | |

| |

Software | | 6.65% | |

| |

Hotels, Restaurants & Leisure | | 6.51% | |

| |

Diversified Financials | | 5.89% | |

| |

Real Estate | | 4.77% | |

| |

Media | | 4.32% | |

| |

Biotechnology | | 4.07% | |

| |

Health Care Providers & Services | | 3.83% | |

| |

Health Care Equipment & Supplies | | 2.70% | |

| |

Pharmaceuticals | | 2.66% | |

| |

Computers & Peripherals | | 2.39% | |

| |

Insurance | | 2.39% | |

| |

Semiconductors & Semiconductor Equipment | | 2.37% | |

| |

Food & Drug Retailing | | 1.89% | |

| |

Specialty Retail | | 1.67% | |

| |

Mutual Funds | | 1.64% | |

| |

Diversified Telecommunication Services | | 1.49% | |

| |

Communications Equipment | | 1.33% | |

| |

Cosmetics/Personal Care | | 1.07% | |

| |

Food | | 0.89% | |

| |

Semiconductors | | 0.74% | |

| |

Office Furnishings | | 0.62% | |

| |

Air Freight & Logistics | | 0.56% | |

Summary of Portfolio Holdings (Note 10) (Unaudited)

| | |

|

| SIERRA CLUB EQUITY INCOME FUND |

Internet Software & Services | | 0.40% |

| |

Internet | | 0.26% |

| |

Household Durables | | 0.16% |

| |

Short-Term Bank Debt Instruments | | 4.07% |

| |

Net Other Assets and Liabilities | | 0.26% |

| | 100.00% |

|

| SIERRA CLUB STOCK FUND |

Banks | | 14.08% |

| |

Commercial Services & Supplies | | 10.45% |

| |

Diversified Financials | | 10.16% |

| |

Hotels, Restaurants & Leisure | | 8.15% |

| |

Software | | 8.02% |

| |

Health Care Providers & Services | | 7.08% |

| |

Health Care Equipment & Supplies | | 5.41% |

| |

Computers & Peripherals | | 4.76% |

| |

Media | | 4.45% |

| |

Biotechnology | | 3.51% |

| |

Semiconductors & Semiconductor Equipment | | 2.66% |

| |

Diversified Telecommunication Services | | 2.50% |

| |

Communications Equipment | | 2.27% |

| |

Insurance | | 2.25% |

| |

Food & Drug Retailing | | 1.95% |

| |

Internet Software & Services | | 1.55% |

| |

Property & Casualty Insurance | | 1.42% |

| |

Multi-Line Insurance | | 0.96% |

| |

Specialty Retail | | 0.96% |

| |

Food Products | | 0.94% |

| |

Real Estate | | 0.78% |

| |

Pharmaceuticals | | 0.53% |

| |

Internet & Catalog Retail | | 0.49% |

| |

Leisure Equipment & Products | | 0.48% |

| |

Airlines | | 0.47% |

| |

IT Consulting Services | | 0.47% |

| |

Multi-Line Retail | | 0.47% |

| |

Telecommunications | | 0.47% |

| |

Mutual Funds | | 0.47% |

| |

Household Durables | | 0.19% |

| | |

| |

Short-Term Bank Debt instruments | | 1.30% |

| |

Net Other Assets and Liabilities | | 0.35% |

| | 100.00% |

|

| FORWARD EMERALD BANKING AND FINANCE FUND |

Financial Services | | 96.43% |

| |

Banks Regional | | 68.94% |

| |

Insurance Carriers: Property & Casualty | | 8.27% |

| |

Investment Management Companies | | 4.60% |

| |

Diversified Financial Services | | 3.79% |

| |

Financial Miscellaneous | | 3.13% |

| |

Financial Data Processing Services | | 2.89% |

| |

Savings & Loans | | 1.79% |

| |

Financial Information Services | | 0.98% |

| |

Real Estate Investment Trusts | | 0.73% |

| |

Insurance: Multi-Line | | 0.62% |

| |

Securities Brokerage & Service | | 0.44% |

| |

Property Casualty | | 0.25% |

| |

Short-Term Bank Debt Instruments | | 4.43% |

| |

Net Other Assets and Liabilities | | -0.86% |

| | 100.00% |

|

| FORWARD EMERALD OPPORTUNITIES FUND |

Technology | | 18.67% |

| |

Consumer Discretionary | | 15.03% |

| |

Health Care | | 12.39% |

| |

Biotechnology | | 7.61% |

| |

Medical & Dental Instruments | | 3.01% |

| |

Drugs & Pharmaceuticals | | 1.48% |

| |

Miscellaneous Health Care | | 0.29% |

| |

Consumer Staples | | 6.75% |

| |

Financial Services | | 6.67% |

| |

Energy | | 4.47% |

| |

Producer Durables | | 3.74% |

| |

Materials & Processing | | 3.17% |

| |

Utilities | | 2.10% |

| |

Auto & Transportation | | 0.46% |

| |

Options Purchased | | 2.98% |

| |

Short-Term Bank Debt Instruments | | 38.90% |

| |

Net Other Assets and Liabilities | | -15.33% |

| | 100.00% |

Summary of Portfolio Holdings (Note 10) (Unaudited)

| | | |

|

| FORWARD UNIPLAN REAL ESTATE INVESTMENT FUND | |

Retail | | 34.99% | |

| |

Residential | | 13.98% | |

| |

Office | | 13.52% | |

| |

Industrial | | 12.49% | |

| |

Specialty | | 9.12% | |

| |

Hotels | | 7.03% | |

| |

Health Care | | 6.28% | |

| |

Preferred Stocks | | 1.49% | |

| |

Short-Term Bank Debt Instruments | | 0.00% | (b) |

| |

Net Other Assets and Liabilities | | 1.10% | |

| | 100.00% | |

|

| FORWARD EMERALD GROWTH FUND | |

Technology | | 22.74% | |

| |

Consumer Discretionary | | 20.05% | |

| |

Health Care | | 16.35% | |

| |

Producer Durables | | 15.30% | |

| |

Financial Services | | 6.07% | |

| |

Energy | | 5.92% | |

| |

Materials & Processing | | 4.76% | |

| |

Auto & Transportation | | 4.39% | |

| |

Consumer Staples | | 0.74% | |

| |

Utilities | | 0.18% | |

| |

Warrants | | 0.00% | (a) |

| |

Short-Term Bank Debt Instruments | | 3.86% | |

| |

Net Other Assets and Liabilities | | -0.36% | |

| | 100.00% | |

|

| FORWARD HOOVER SMALL CAP EQUITY FUND | |

Consumer Discretionary | | 27.06% | (a) |

| |

Financial Services | | 23.61% | |

| |

Producer Durables | | 10.10% | |

| |

Health Care | | 7.95% | |

| |

Technology | | 6.85% | |

| |

Energy | | 6.63% | |

| |

Materials & Processing | | 6.22% | |

| |

Consumer Staples | | 4.20% | |

| |

Auto & Transportation | | 3.68% | |

| |

Utilities | | 1.04% | |

| | | |

| |

Short-Term Bank Debt Instruments | | 3.93% | |

| |

Net Other Assets and Liabilities | | -1.27% | |

| | 100.00% | |

|

| FORWARD HOOVER MINI-CAP FUND | |

Consumer Discretionary | | 23.89% | |

| |

Financial Services | | 15.30% | |

| |

Health Care | | 15.15% | |

| |

Materials & Processing | | 11.99% | |

| |

Auto & Transportation | | 10.58% | |

| |

Consumer Staples | | 5.49% | |

| |

Producer Durables | | 4.78% | |

| |

Technology | | 4.18% | |

| |

Energy | | 3.29% | |

| |

Utilities | | 1.09% | |

| |

Short-Term Bank Debt Instruments | | 6.30% | |

| |

Net Other Assets and Liabilities | | -2.04% | |

| | 100.00% | |

|

| FORWARD LEGATO FUND | |

Health Care | | 19.04% | |

| |

Information Technology | | 18.52% | |

| |

Consumer Discretionary | | 14.62% | |

| |

Financial Services | | 10.41% | |

| |

Producer Durables | | 8.01% | |

| |

Materials Processing | | 6.70% | |

| |

Energy | | 6.03% | |

| |

Auto & Transportation | | 4.88% | |

| |

Industrials | | 4.82% | |

| |

Consumer Staples | | 3.58% | |

| |

Other | | 1.05% | |

| |

Utilities | | 0.60% | |

| |

Short-Term Bank Debt Instruments | | 2.08% | |

| |

Net Other Assets and Liabilities | | -0.34% | |

| | 100.00% | |

(a) When sector categorization is broken down by industry, no industry exceeds the 25% maximum specified in the Statement of Additional Information.

(b) Amount represents less than 0.01%.

The Funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ form N-Q was filed for the quarter ended March 31, 2006. The Funds’ Form N-Q is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the Funds’ proxy voting policies and procedures and how the Funds’ voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2006 are available (i) without charge, upon request, by calling 1-800-999-6809 and (ii) on the Securities and Exchange Commission’s website at www.sec.gov.

Portfolio of Investments (Note 10) (Unaudited)

Forward International Equity Fund

| | | | | |

| SHARES | | | | VALUE (NOTE 3) |

| |

| COMMON STOCKS: 99.45% | | | |

| Australia: 3.36% | | | |

| 33,500 | | AMP, Ltd. | | $ | 227,234 |

| | |

| 49,200 | | AWB Ltd. | | | 158,274 |

| | |

| 102,300 | | Pacific Brands, Ltd. | | | 163,408 |

| | |

| 82,100 | | Telestra Corp., Ltd. | | | 224,465 |

| | |

| 7,400 | | Wesfarmers Ltd. | | | 194,238 |

| | |

| | | | | 967,619 |

| | | | | |

| Austria: 1.54% | | | |

| 5,100 | | Raiffeisen International Bank-Holding AG | | | 442,786 |

| | | | | |

| Belgium: 1.89% | | | |

| 11,000 | | Agfa-Gevaert NV | | | 266,396 |

| | |

| 4,000 | | Delhaize Group | | | 277,213 |

| | |

| | | | | 543,609 |

| | | | | |

| Brazil: 1.93% | | | |

| 5,300 | | Banco Nossa Caixa SA | | | 110,934 |

| | |

| 4,627 | | Companhia de Bebidas das Americas, ADR(b) | | | 190,864 |

| | |

| 2,500 | | Petroleo Brasileiro SA, ADR(b) | | | 199,600 |

| | |

| 21,700 | | Vivo Participacoes SA, ADR(b)(d) | | | 53,382 |

| | |

| | | | | 554,780 |

| | | | | |

| Canada: 3.90% | | | |

| 32,100 | | iShares MSCI Canada Index Fund | | | 762,375 |

| | |

| 4,454 | | Suncor Energy, Inc. | | | 360,819 |

| | |

| | | | | 1,123,194 |

| | | | | |

| China: 0.51% | | | |

| 138,000 | | PetroChina Co., Ltd. | | | 147,470 |

| | | | | |

| Czechoslovakia: 1.19% | | | |

| 10,200 | | CEZ AS | | | 343,634 |

| | | | | |

| Egypt: 0.41% | | | |

| 2,900 | | Orascom Telecom Holding SAE, GDR(c) | | | 118,320 |

| | | | | |

| France: 6.40% | | | |

| 10,900 | | Air France-KLM | | | 256,169 |

| | |

| 19,780 | | Bull SA(a) | | | 132,276 |

| | |

| 5,740 | | Gemalto NV(a) | | | 154,350 |

| | |

| 2,160 | | Pernod Recard SA | | | 428,095 |

| | | | | |

| SHARES | | | | VALUE (NOTE 3) |

|

|

| | | |

| 4,500 | | Total SA, ADR(b) | | $ | 294,840 |

| | |

| 8,800 | | Total SA | | | 578,925 |

| | |

| | | | | 1,844,655 |

| | | | | |

| Germany: 8.19% | | | |

| 2,440 | | Allianz AG | | | 385,155 |

| | |

| 8,800 | | Bayer AG | | | 404,854 |

| | |

| 11,300 | | Deutsche Post AG | | | 303,570 |

| | |

| 1,500 | | Fresenius Medical Care AG & Co. KGaA | | | 171,468 |

| | |

| 27,500 | | GEA Group AG | | | 469,076 |

| | |

| 10,300 | | Hypo Real Estate Holding AG | | | 624,266 |

| | |

| | | | | 2,358,389 |

| | | | | |

| Greece: 6.39% | | | |

| 39,600 | | Chipita International SA | | | 181,273 |

| | |

| 34,900 | | Hellenic Exchanges SA | | | 561,384 |

| | |

| 17,700 | | National Bank of Greece SA | | | 698,884 |

| | |

| 11,000 | | Opap SA | | | 398,046 |

| | |

| | | | | 1,839,587 |

| | | | | |

| Hong Kong: 0.98% | | | |

| 26,000 | | Cheung Kong (Holdings), Ltd. | | | 281,692 |

| | | | | |

| Hungary: 1.14% | | | |

| 3,200 | | MOL Magyar Olaj-es Gazipari Rt., GDR(c) | | | 328,000 |

| | | | | |

| Italy: 6.78% | | | |

| 58,400 | | Danieli SpA | | | 415,186 |

| | |

| 19,700 | | Fondiaria-Sai SpA | | | 588,176 |

| | |

| 38,700 | | Mediaset SpA | | | 456,243 |

| | |

| 63,100 | | UniCredito Italiano SpA | | | 493,782 |

| | |

| | | | | 1,953,387 |

| | | | | |

| Japan: 17.30% | | | |

| 6,300 | | Aeon Credit Service Co., Ltd. | | | 153,208 |

| | |

| 4,000 | | Aoyama Trading Co., Ltd. | | | 125,268 |

| | |

| 5,600 | | Arnest One Corp. | | | 158,719 |

| | |

| 16,000 | | Asahi Glass Co., Ltd. | | | 203,088 |

| | |

| 81 | | Astellas Pharma, Inc. | | | 2,976 |

| | |

| 21,000 | | Bank of Fukuoka, Ltd. | | | 159,822 |

| | |

| 8,400 | | Century Leasing System, Inc. | | | 132,560 |

| | | | |

| June 30, 2006 | | 14 | | See Notes to Financial Statements |

Portfolio of Investments (Note 10) (Unaudited)

Forward International Equity Fund

| | | | | |

| SHARES | | | | VALUE (NOTE 3) |

| Japan: 17.30% | | | |

| | |

| 13,000 | | Daiwa Securities Group, Inc. | | $ | 155,115 |

| | |

| 22,000 | | The Eighteenth Bank, Ltd. | | | 124,708 |

| | |

| 24,000 | | Fujitsu, Ltd. | | | 186,222 |

| | |

| 9,100 | | GLORY, Ltd. | | | 175,130 |

| | |

| 7,200 | | Hitachi Chemical Co., Ltd. | | | 188,952 |

| | |

| 21,000 | | ITOCHU Corp. | | | 184,622 |

| | |

| 13,000 | | JGC Corp. | | | 223,916 |

| | |

| 18,000 | | Kyowa Exeo Corp. | | | 232,725 |

| | |

| 26,000 | | Mitsubishi Electric Corp. | | | 208,564 |

| | |

| 22 | | Mitsubishi UFJ Financial Group, Inc. | | | 307,921 |

| | |

| 34,000 | | Mitsui Mining & Smelting Co., Ltd. | | | 200,761 |

| | |

| 2,400 | | Nidec Corp. | | | 172,156 |

| | |

| 8,000 | | Ricoh Co., Ltd. | | | 157,110 |

| | |

| 19,000 | | Sekisui Chemical Co., Ltd. | | | 164,213 |

| | |

| 1,000 | | SMC Corp. | | | 141,626 |

| | |

| 13,000 | | Sompo Japan Insurance, Inc. | | | 181,953 |

| | |

| 19,000 | | Sumitomo Heavy Industries, Ltd. | | | 175,848 |

| | |

| 18 | | Sumitomo Mitsui Financial Group, Inc. | | | 190,526 |

| | |

| 10,000 | | Sumitomo Realty & Development Co., Ltd. | | | 246,687 |

| | |

| 5,600 | | Toyota Motor Corp. | | | 293,435 |

| | |

| 33 | | West Japan Railway Co. | | | 137,121 |

| | |

| | | | | 4,984,952 |

| | | | | |

| Luxembourg: 2.21% | | | |

| 13,200 | | Arcelor | | | 636,986 |

| | | | | |

| Mexico 0.64% | | | |

| 3,100 | | Coca-Cola Femsa, SA de CV, ADR(b) | | | 91,512 |

| | |

| 4,800 | | Grupo Televisa SA, ADR(b) | | | 92,688 |

| | |

| | | | | 184,200 |

| | | | | |

| Netherlands: 2.80% | | | |

| 24,000 | | Royal Dutch Shell Plc, Class A | | | 807,089 |

| | | | | |

| Norway: 4.16% | | | |

| 435,700 | | Pan Fish ASA(a) | | | 471,928 |

| | |

| 29,900 | | Tandberg ASA | | | 247,461 |

| | |

| 39,700 | | Telenor ASA | | | 480,092 |

| | |

| | | | | 1,199,481 |

| | | | | |

| SHARES | | | | VALUE (NOTE 3) |

| Philippines: 0.57% | | | |

| 753,200 | | Ayala Land, Inc. | | $ | 163,038 |

| | | | | |

| Russia: 0.80% | | | |

| 5,500 | | OAO Gazprom, GDR(c) | | | 231,275 |

| | | | | |

| South Korea: 1.89% | | | |

| 2,900 | | Kookmin Bank, ADR(b) | | | 240,874 |

| | |

| 480 | | Samsung Electronics Co., Ltd. | | | 305,091 |

| | |

| | | | | 545,965 |

| | | | | |

| Spain: 6.29% | | | |

| 19,900 | | Banco Bilbao Vizcaya Argentaria SA | | | 409,160 |

| | |

| 20,900 | | Corporacion Dermoestetica(a) | | | 179,852 |

| | |

| 6,100 | | Fadesa Inmobiliaria SA | | | 209,191 |

| | |

| 4,200 | | Fomento de Construcciones y Contratas SA | | | 319,268 |

| | |

| 9,280 | | Tecnicas Reunidas SA(a) | | | 210,621 |

| | |

| 29,000 | | Telefonica SA | | | 482,796 |

| | |

| | | | | 1,810,888 |

| | | | | |

| Sweden: 2.54% | | | |

| 7,400 | | Modern Times Group AB, Class B(a) | | | 388,827 |

| | |

| 13,300 | | Svenska Handelsbanken AB | | | 342,496 |

| | |

| | | | | 731,323 |

| | | | | |

| Switzerland: 4.37% | | | |

| 5,590 | | Julius Baer Holding, Ltd. | | | 484,619 |

| | |

| 9,100 | | Novartis AG | | | 491,771 |

| | |

| 1,300 | | Valora Holding AG | | | 281,225 |

| | |

| | | | | 1,257,615 |

| | | | | |

| Taiwan: 1.85% | | | |

| 84,000 | | Cathay Financial Holding Co., Ltd. | | | 183,686 |

| | |

| 18,200 | | Hon Hai Precision Industry Co., Ltd.(c) | | | 220,220 |

| | |

| 14,214 | | Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR(b) | | | 130,483 |

| | |

| | | | | 534,389 |

| | | | | |

| Thailand: 0.63% | | | |

| 65,400 | | Bangkok Bank Public Co., Ltd. | | | 181,690 |

| | | | | |

| Turkey: 1.12% | | | |

| 117,600 | | Aksigorta AS | | | 324,261 |

| | | | | |

| | | | |

| See Notes to Financial Statements | | 15 | | June 30, 2006 |

Portfolio of Investments (Note 10) (Unaudited)

Forward International Equity Fund

| | | | | |

| SHARES | | | | VALUE (NOTE 3) |

| United Kingdom: 7.67% | | | |

| 7,200 | | Carnival Plc | | $ | 293,369 |

| | |

| 12,400 | | GlaxoSmithKline Plc | | | 346,540 |

| | |

| 83,800 | | IG Group Holdings Plc | | | 329,360 |

| | |

| 139,100 | | Old Mutual Plc | | | 419,999 |

| | |

| 8,500 | | Standard Chartered Plc | | | 207,520 |

| | |

| 28,500 | | William Hill Plc | | | 330,243 |

| | |

| 29,800 | | Yell Group Plc | | | 281,923 |

| | |

| | | | | 2,208,954 |

| | |

| | Total Common Stocks (Cost $25,151,131) | | | 28,649,228 |

| |

| RIGHTS: 0.16% | | | |

| Greece: 0.16% | | | |

| 14,400 | | National Bank of Greece SA, Rights(a) | | | 45,479 |

| | |

| | Total Rights

(Cost $0) | | | 45,479 |

| | |

| | Total Investments: 99.61%

(Cost $25,151,131) | | | 28,694,707 |

| | |

| | Net Other Assets and Liabilities: 0.39% | | | 111,175 |

| | |

| | Net Assets: 100.00% | | $ | 28,805,882 |

(a) Non-income producing security.

(b) ADR — American Depositary Receipt

(c) GDR — Global Depositary Receipt

(d) Security, or portion of security, is currently on loan.

Percentages are stated as a percent of net assets.

| | | | |

| June 30, 2006 | | 16 | | See Notes to Financial Statements |

Portfolio of Investments (Note 10) (Unaudited)

Forward International Small Companies Fund

| | | | | |

| Shares | | | | Value (Note 3) |

| |

| COMMON STOCKS: 95.39% | | | |

| Australia: 4.32% | | | |

| 720,000 | | A.B.C. Learning Centres, Ltd.(c) | | $ | 3,423,502 |

| | |

| 528,000 | | ABB Grain, Ltd., Class B(d) | | | 2,667,479 |

| | |

| 1,300,000 | | Bendigo Mining, Ltd.(a) | | | 1,661,231 |

| | |

| 375,000 | | McGuigan Simeon Wines, Ltd. | | | 696,513 |

| | |

| 2,192,276 | | Sigma Pharmaceuticals, Ltd.(c) | | | 4,234,740 |

| | |

| 1,400,000 | | Timbercorp, Ltd.(c) | | | 4,181,309 |

| | |

| 193,000 | | Toll Holdings, Ltd. | | | 2,014,614 |

| | |

| | | | | 18,879,388 |

| | | | | |

| Austria: 4.22% | | | |

| 24,500 | | Andritz AG | | | 4,048,717 |

| | |

| 29,749 | | austriamicrosystems AG(a) | | | 1,536,020 |

| | |

| 49,480 | | Boehler-Uddeholm AG | | | 2,704,707 |

| | |

| 203,750 | | Century Casinos, Inc., ADC(a)(b)(d) | | | 2,292,634 |

| | |

| 138,460 | | Conwert Immobilien Invest AG(a) | | | 2,637,940 |

| | |

| 35,500 | | EVN AG | | | 3,613,685 |

| | |

| 395,046 | | SkyEurope Holding AG(a)(d) | | | 1,601,258 |

| | |

| | | | | 18,434,961 |

| | | | | |

| Belgium: 2.39% | | | |

| 45,000 | | Bekaert NV | | | 4,321,224 |

| | |

| 70,644 | | ICOS Vision Systems NV(a)(c)(d) | | | 3,233,797 |

| | |

| 120,000 | | Option NV(a)(c) | | | 2,876,980 |

| | |

| | | | | 10,432,001 |

| | | | | |

| Denmark: 0.56% | | | |

| 22,000 | | Bang & Olufsen AS, Class B(c) | | | 2,432,398 |

| | | | | |

| Finland: 0.84% | | | |

| 100,800 | | Metso Corp. | | | 3,656,573 |

| | | | | |

| France: 6.94% | | | |

| 49,070 | | April Group | | | 2,633,355 |

| | |

| 88,170 | | Archos(a)(c)(d) | | | 3,117,241 |

| | |

| 95,772 | | bioMerieux(d) | | | 5,657,635 |

| | |

| 26,160 | | Cegedim SA(a)(d) | | | 2,231,094 |

| | |

| 74,240 | | CS Communication & Systemes(a)(d) | | | 2,671,262 |

| | |

| 55,000 | | Groupe Steria SCA | | | 2,900,955 |

| | |

| 57,280 | | Ipsen, Ltd. | | | 2,314,432 |

| | | | | |

| Shares | | | | Value (Note 3) |

|

|

| | | |

| 29,000 | | Seche Environnement(d) | | $ | 3,986,216 |

| | |

| 120,000 | | SR Teleperformance(a) | | | 4,799,570 |

| | |

| | | | | 30,311,760 |

| | | | | |

| Germany: 5.54% | | | |

| 11,630 | | Bijou Brigitte Modische Accessoires AG(c)(d) | | | 3,109,482 |

| | |

| 135,000 | | Gerry Weber International AG(c)(d) | | | 2,965,591 |

| | |

| 125,000 | | IVG Immobilien AG | | | 3,835,974 |

| | |

| 152,500 | | Pfleiderer AG | | | 4,274,298 |

| | |

| 19,500 | | Rational AG | | | 3,155,875 |

| | |

| 46,000 | | Rheinmetall AG | | | 3,200,890 |

| | |

| 29,000 | | Wincor Nixdorf AG | | | 3,680,297 |

| | |

| | | | | 24,222,407 |

| | | | | |

| Greece: 0.68% | | | |

| 125,000 | | Piraeus Bank SA | | | 2,972,880 |

| | | | | |

| Hong Kong: 3.73% | | | |

| 2,000,000 | | China Shineway Pharmaceuticals Group, Ltd.(e) | | | 1,519,248 |

| | |

| 1,500,000 | | Hysan Development Co., Ltd. | | | 4,229,432 |

| | |

| 2,182,000 | | Kowloon Development Co., Ltd. | | | 3,652,118 |

| | |

| 1,000,000 | | Moulin Global Eyecare Holdings, Ltd.(a) | | | 0 |

| | |

| 6,200,000 | | Pacific Basin Shipping, Ltd. | | | 2,813,828 |

| | |

| 6,500,000 | | Prime Success International Group, Ltd. | | | 4,079,760 |

| | |

| | | | | 16,294,386 |

| | | | | |

| Indonesia: 0.12% | | | |

| 80,000,000 | | PT Bank Century Tbk(a)(d) | | | 518,191 |

| | | | | |

| Ireland: 2.11% | | | |

| 105,000 | | FBD Holdings Plc | | | 4,954,160 |

| | |

| 245,000 | | Kingspan Group Plc | | | 4,276,152 |

| | |

| | | | | 9,230,312 |

| | | | | |

| Italy: 4.98% | | | |

| 380,809 | | Astaldi SpA | | | 2,282,458 |

| | |

| 320,304 | | Biesse SpA | | | 4,595,255 |

| | |

| 350,900 | | Credito Emiliano SpA | | | 4,332,016 |

| | |

| 701,140 | | Hera SpA | | | 2,330,947 |

| | | | |

| See Notes to Financial Statements | | 17 | | June 30, 2006 |

Portfolio of Investments (Note 10) (Unaudited)

Forward International Small Companies Fund

| | | | | |

| Shares | | | | Value (Note 3) |

| Italy: 4.98% | | | |

| 200,900 | | Recordati SpA | | $ | 1,466,798 |

| | |

| 28,000 | | Tod’s SpA | | | 2,098,738 |

| | |

| 160,000 | | Valentino Fashion Group SpA | | | 4,656,361 |

| | |

| | | | | 21,762,573 |

| | | | | |

| Japan: 20.57% | | | |

| 175,000 | | CKD Corp.(c) | | | 2,718,803 |

| | |

| 230,000 | | Daimei Telecom Engineering Corp. | | | 3,199,055 |

| | |

| 679,000 | | DAISO Co., Ltd.(c)(d) | | | 2,179,880 |

| | |

| 196,700 | | Espec Corp. | | | 2,821,922 |

| | |

| 140,100 | | Fujimi, Inc.(c)(d) | | | 3,284,503 |

| | |

| 120,000 | | Hamamatsu Photonics K.K.(c) | | | 4,146,438 |

| | |

| 600,000 | | Haseko Corp.(a)(c) | | | 2,041,727 |

| | |

| 268,100 | | Heiwa Corp.(c) | | | 3,724,295 |

| | |

| 280,000 | | Hitachi Koki Co., Ltd. | | | 4,274,155 |

| | |

| 125,000 | | Izumi Co., Ltd.(c) | | | 4,559,769 |

| | |

| 210,800 | | Japan General Estate Co., Ltd. | | | 4,342,685 |

| | |

| 660,000 | | Keiyo Bank, Ltd. | | | 3,741,241 |

| | |

| 420,000 | | Kitz Corp. | | | 3,189,083 |

| | |

| 390,000 | | Nabtesco Corp. | | | 4,370,293 |

| | |

| 358,000 | | Nippon Koei Co., Ltd. | | | 1,030,328 |

| | |

| 210,600 | | Nippon Seiki Co., Ltd. | | | 4,172,760 |

| | |

| 287,000 | | Nittetsu Mining Corp. Co., Ltd. | | | 2,046,144 |

| | |

| 55,000 | | Okinawa Electric Power Co., Inc. | | | 3,290,907 |

| | |

| 1,140 | | Pasona, Inc.(c) | | | 2,183,965 |

| | |

| 630,000 | | Ryobi, Ltd.(c) | | | 4,138,827 |

| | |

| 166,000 | | Ryowa Life Create Co., Ltd.(c) | | | 842,234 |

| | |

| 104,400 | | Seijo Corp.(d) | | | 2,931,584 |

| | |

| 384,000 | | Shizuoka Gas Co., Ltd. | | | 3,120,640 |

| | |

| 260,000 | | SMBC Friend Securities Co., Ltd. | | | 2,183,441 |

| | |

| 73,000 | | Sysmex Corp. | | | 3,371,736 |

| | |

| 375,000 | | The Tokushima Bank, Ltd.(d) | | | 2,791,628 |

| | |

| 410,000 | | Tokyo Tatemono Co., Ltd.(c) | | | 4,397,148 |

| | |

| 195,000 | | Toyo Suisan Kaisha, Ltd. | | | 3,056,817 |

| | |

| 220 | | Village Vanguard Co., Ltd.(a) | | | 1,693,566 |

| | |

| | | | | 89,845,574 |

| | | | | |

| | | | | |

| Shares | | | | Value (Note 3) |

| Netherlands: 3.10% | | | |

| 45,000 | | Fugro NV | | $ | 1,940,235 |

| | |

| 200,300 | | Koninklijke BAM Groep NV | | | 3,980,030 |

| | |

| 53,000 | | Koninklijke Boskalis Westminster NV | | | 3,595,139 |

| | |

| 62,960 | | Nutreco Holding NV(c) | | | 4,033,266 |

| | |

| | | | | 13,548,670 |

| | | | | |

| Norway: 3.61% | | | |

| 666,740 | | Acta Holding ASA | | | 2,121,533 |

| | |

| 65,000 | | Aker Yards AS | | | 4,575,258 |

| | |

| 508,820 | | Bergesen Worldwide Gas ASA(a) | | | 1,798,933 |

| | |

| 3,179,320 | | Pan Fish ASA(a) | | | 3,443,676 |

| | |

| 240,000 | | Subsea 7, Inc.(a)(c) | | | 3,818,339 |

| | |

| | | | | 15,757,739 |

| | | | | |

| Singapore: 3.75% | | | |

| 6,000,000 | | Gallant Venture Ltd.(a) | | | 2,010,940 |

| | |

| 10,500,000 | | Global Testing Corp., Ltd.(a) | | | 1,892,370 |

| | |

| 2,500,000 | | KS Energy Services, Ltd. | | | 3,225,093 |

| | |

| 2,500,000 | | Parkway Holdings, Ltd.(d) | | | 3,904,891 |

| | |

| 3,400,000 | | Petra Foods, Ltd.(e) | | | 2,988,586 |

| | |

| 4,600,000 | | United Test and Assembly Center, Ltd.(a) | | | 2,341,670 |

| | |

| | | | | 16,363,550 |

| | | | | |

| Spain: 1.48% | | | |

| 160,000 | | Banco Pastor SA | | | 2,096,999 |

| | |

| 272,000 | | Sol Melia SA(a) | | | 4,385,694 |

| | |

| | | | | 6,482,693 |

| | | | | |

| Sweden: 4.05% | | | |

| 200,000 | | Bergman & Beving AB, Class B(d) | | | 4,123,024 |

| | |

| 83,670 | | Brostrom AB, Class B(c) | | | 1,649,368 |

| | |

| 125,000 | | Hexagon AB, Class B | | | 4,546,433 |

| | |

| 230,000 | | Kungsleden AB | | | 2,698,013 |

| | |

| 140,000 | | Oriflame Cosmetics SA | | | 4,654,714 |

| | |

| | | | | 17,671,552 |

| | | | | |

| Switzerland: 4.54% | | | |

| 8,600 | | Advanced Digital Broadcast Holdings SA(a) | | | 308,898 |

| | |

| 2,710 | | Barry Callebaut AG(a) | | | 1,141,518 |

| | | | |

| June 30, 2006 | | 18 | | See Notes to Financial Statements |

Portfolio of Investments (Note 10) (Unaudited)

Forward International Small Companies Fund

| | | | | |

| Shares | | | | Value (Note 3) |

| Switzerland: 4.54% | | | |

| 29,500 | | BKW FMB Energie AG | | $ | 2,571,918 |

| | |

| 40,000 | | Dufry Group(a)(d) | | | 3,213,061 |

| | |

| 4,400 | | Geberit AG | | | 5,078,857 |

| | |

| 64,400 | | Logitech International SA, Registered Shares(a) | | | 2,481,372 |

| | |

| 14,000 | | SIG Holding AG(a) | | | 3,074,286 |

| | |

| 16,330 | | Ypsomed Holding AG(a) | | | 1,972,931 |

| | |

| | | | | 19,842,841 |

| | | | | |

| United Kingdom: 17.86% | | | |

| 470,000 | | Amlin Plc | | | 2,051,529 |

| | |

| 720,890 | | Avocet Mining Plc(a)(d) | | | 2,226,656 |

| | |

| 170,000 | | AWG Plc | | | 3,766,808 |

| | |

| 452,600 | | Balfour Beatty Plc | | | 2,875,471 |

| | |

| 640,000 | | Bodycote International Plc | | | 2,997,762 |

| | |

| 175,000 | | BowLeven Plc(a)(d) | | | 734,736 |

| | |

| 266,180 | | Charter Plc(a) | | | 3,970,521 |

| | |

| 3,613,000 | | European Nickel Plc(a)(d) | | | 2,305,445 |

| | |

| 1,100,000 | | FKI Plc | | | 2,176,929 |

| | |

| 146,000 | | Forth Ports Plc | | | 4,952,448 |

| | |

| 300,000 | | Hunting Plc | | | 2,157,046 |

| | |

| 420,000 | | Inchcape Plc | | | 3,670,446 |

| | |

| 1,281,660 | | Indago Petroleum, Ltd.(a)(d) | | | 1,230,291 |

| | |

| 533,400 | | Informa Plc | | | 4,254,513 |

| | |

| 307,690 | | Inspired Gaming Group Plc(a) | | | 1,072,735 |

| | |

| 520,000 | | Laird Group Plc | | | 3,750,902 |

| | |

| 400,000 | | Lancashire Holdings, Ltd.-W/I(a) | | | 2,258,309 |

| | |

| 14,590 | | Lonmin Plc | | | 759,089 |

| | |

| 210,000 | | Premier Oil Plc(a) | | | 3,738,417 |

| | |

| 2,100,000 | | Regus Group Plc(a) | | | 4,253,056 |

| | |

| 619,980 | | SCI Entertainment Group Plc(a) | | | 5,928,379 |

| | |

| 400,000 | | Shaftesbury Plc | | | 3,802,689 |

| | |

| 670,000 | | St. James's Place Capital Plc | | | 4,067,685 |

| | |

| 323,000 | | Stanley Leisure Plc | | | 3,847,301 |

| | |

| 400,000 | | Tullow Oil Plc | | | 2,826,123 |

| | |

| 283,670 | | Wolfson Microelectronics Plc(a) | | | 2,347,871 |

| | |

| | | | | 78,023,157 |

| | | | | |

| Shares | | | | Value (Note 3) |

| | | |

| | Total Common Stocks (Cost $378,869,275) | | $ | 416,683,606 |

| | |

| Par Value | | | | |

|

| SHORT-TERM BANK DEBT INSTRUMENTS: 4.33% |

| $18,903,000 | | Wells Fargo & Co. — Grand Cayman 4.350%, 07/03/06 | | | 18,903,000 |

| | |

| | Total Short-Term Bank Debt Instruments (Cost $18,903,000) | | | 18,903,000 |

| | |

| | Total Investments: 99.72%

(Cost $397,772,275) | | | 435,586,606 |

| | |

| | Net Other Assets and Liabilities: 0.28% | | | 1,210,762 |

| | |

| | Net Assets: 100.00% | | $ | 436,797,368 |

(a) Non-income producing security.

(b) ADC— Austrian Depositary Certificates

(c) Security, or portion of security, is currently on loan.

(d) Securities determined to be illiquid under procedures approved by the Fund's Board of Trustees.

(e) Fair Valued security.

Percentages are stated as a percent of net assets.

| | | | |

| See Notes to Financial Statements | | 19 | | June 30, 2006 |

Portfolio of Investments (Note 10) (Unaudited)

Forward International Small Companies Fund

Information related to these illiquid securities is as follows:

| | | | | | | | | | |

| Date(s) of Purchase | | Security | | | Cost | | | Market Value | | % of Net Assets |

| 12/14/04 - 06/09/06 | | bioMerieux | | $ | 4,995,940 | | $ | 5,657,635 | | 1.30% |

| 01/11/06 - 02/10/06 | | Bergman & Beving AB, Class B | | $ | 2,889,036 | | $ | 4,123,024 | | 0.94% |

| 06/17/05 - 05/26/06 | | Seche Environnement | | $ | 2,969,764 | | $ | 3,986,216 | | 0.91% |

| 03/23/05 - 06/06/06 | | Parkway Holdings, Ltd. | | $ | 3,190,283 | | $ | 3,904,891 | | 0.89% |

| 11/25/05 - 06/30/06 | | Fujimi, Inc. | | $ | 2,829,671 | | $ | 3,284,503 | | 0.75% |

| 12/10/04 - 04/27/06 | | ICOS Vision Systems NV | | $ | 2,466,027 | | $ | 3,233,797 | | 0.74% |

| 12/06/05 - 03/31/06 | | Dufry Group | | $ | 2,577,041 | | $ | 3,213,061 | | 0.74% |

| 05/24/06 - 06/14/06 | | Archos | | $ | 4,024,226 | | $ | 3,117,241 | | 0.71% |

| 12/20/04 - 03/31/06 | | Bijou Brigitte Modische Accessoires AG | | $ | 2,169,407 | | $ | 3,109,482 | | 0.71% |

| 04/29/05 - 05/22/06 | | Petra Foods, Ltd. | | $ | 2,486,973 | | $ | 2,988,586 | | 0.68% |

| 03/23/06 - 03/28/06 | | Gerry Weber International AG | | $ | 2,693,742 | | $ | 2,965,591 | | 0.68% |

| 01/11/06 - 06/30/06 | | Seijo Corp. | | $ | 2,827,197 | | $ | 2,931,584 | | 0.67% |

| 01/12/06 - 06/30/06 | | The Tokushima Bank, Ltd. | | $ | 3,250,158 | | $ | 2,791,628 | | 0.64% |

| 03/29/06 | | CS Communication & Systemes | | $ | 3,329,362 | | $ | 2,671,262 | | 0.61% |

| 02/23/06 - 05/25/06 | | ABB Grain, Ltd., Class B | | $ | 3,043,523 | | $ | 2,667,479 | | 0.61% |

| 05/12/06 - 06/22/06 | | European Nickel Plc | | $ | 2,324,488 | | $ | 2,305,445 | | 0.53% |

| 10/11/05 - 02/02/06 | | Century Casinos, Inc., ADC | | $ | 1,475,034 | | $ | 2,292,634 | | 0.52% |

| 07/06/04 - 03/28/06 | | Cegedim SA | | $ | 2,252,053 | | $ | 2,231,094 | | 0.51% |

| 05/04/06 - 06/30/06 | | Avocet Mining Plc | | $ | 2,689,174 | | $ | 2,226,656 | | 0.51% |

| 01/30/06 - 06/30/06 | | DAISO Co., Ltd. | | $ | 2,992,392 | | $ | 2,179,880 | | 0.50% |

| 09/22/05 - 04/20/06 | | SkyEurope Holding AG | | $ | 2,690,185 | | $ | 1,601,258 | | 0.37% |

| 03/31/06 - 05/02/06 | | China Shineway Pharmaceuticals Group, Ltd. | | $ | 1,699,420 | | $ | 1,519,248 | | 0.35% |

| 12/12/05 - 02/09/06 | | Indago Petroleum, Ltd. | | $ | 1,609,974 | | $ | 1,230,291 | | 0.28% |

| 09/16/05 - 02/16/06 | | BowLeven Plc | | $ | 1,605,751 | | $ | 734,736 | | 0.17% |

| 02/25/05 | | PT Bank Century Tbk | | $ | 907,358 | | $ | 518,191 | | 0.12% |

| | | | |

| June 30, 2006 | | 20 | | See Notes to Financial Statements |

Portfolio of Investments (Note 10) (Unaudited)

Forward Global Emerging Markets Fund

| | | | | |

| Shares | | | | Value (Note 3) |

| |

| COMMON STOCKS: 93.59% | | | |

| Brazil: 9.20% | | | |

| 15,200 | | Bradespar SA | | $ | 516,756 |

| | |

| 5,800 | | Cia Brasileira de Distribuicao Grupo Pao de Acucar, ADR(c)(f) | | | 180,612 |

| | |

| 19,974 | | Cia Vale do Rio Doce | | | 477,778 |

| | |

| 5,000 | | Lojas Renner SA | | | 265,675 |

| | |

| 22,484 | | Petroleo Brasileiro SA, ADR(c) | | | 1,795,123 |

| | |

| 11,170 | | Tim Participacoes SA, ADR(c) | | | 307,733 |

| | |

| 11,618 | | Unibanco-Uniao de Bancos Brasileiros SA, ADR(c) | | | 771,319 |

| | |

| | | | | 4,314,996 |

| | | | | |

| China: 8.31% | | | |

| 924,000 | | Air China, Ltd. | | | 386,636 |

| | |

| 385,000 | | China Life Insurance Co., Class H | | | 607,216 |

| | |

| 152,000 | | China Mobile (Hong Kong), Ltd. | | | 868,907 |

| | |

| 513,579 | | China Unicom, Ltd. | | | 459,556 |

| | |

| 640,000 | | CNOOC, Ltd. | | | 510,879 |

| | |

| 586,000 | | PetroChina Co., Ltd. | | | 626,214 |

| | |

| 16,900 | | Sohu.com, Inc.(a) | | | 435,851 |

| | |

| | | | | 3,895,259 |

| | | | | |

| Egypt: 0.50% | | | |

| 5,700 | | Orascom Telecom Holding SAE | | | 236,389 |

| | | | | |

| Hong Kong: 4.69% | | | |

| 170,000 | | China Overseas Land & Investment, Ltd. | | | 103,418 |

| | |

| 108,000 | | China Resources Enterprise, Ltd. | | | 220,394 |

| | |

| 45,800 | | Esprit Holdings, Ltd. | | | 373,854 |

| | |

| 48,000 | | Hutchison Whampoa, Ltd. | | | 438,161 |

| | |

| 225,000 | | Kowloon Development Co., Ltd. | | | 376,593 |

| | |

| 184,000 | | Shangri-LA Asia, Ltd. | | | 354,165 |

| | |

| 94,000 | | Wharf (Holdings), Ltd. | | | 334,029 |

| | |

| | | | | 2,200,614 |

| | | | | |

| India: 3.91% | | | |

| 11,400 | | Dr. Reddy’s Laboratories, Ltd., ADR(c)(f) | | | 315,780 |

| | |

| 12,300 | | ICICI Bank, Ltd.(c) | | | 290,895 |

| | |

| 17,000 | | Patni Computer Systems, Ltd.(c) | | | 242,760 |

| | |

| 8,177 | | Satyam Computer Services, Ltd., ADR(c)(f) | | | 270,986 |

| | | | | |