UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06722

Forward Funds

(Exact name of registrant as specified in charter)

345 California Street, Suite 1600

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

| | |

John A. Blaisdell, Principal Executive Officer Forward Funds 345 California Street, Suite 1600 San Francisco, CA 94104 (Name and address of agent for service) | | With a Copy To: George J. Zornada K&L Gates LLP State Street Financial Center One Lincoln St. |

| | Boston, MA 02111-2950 |

| | (617) 261-3231 |

Registrant’s telephone number, including area code: (800) 999-6809

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1 Reports to Stockholders.

The following are copies of the reports transmitted to shareholders of the Salient Adaptive Balanced Fund, Salient Adaptive Income Fund, Salient Adaptive US Equity Fund, Salient EM Infrastructure Fund, Salient International Dividend Signal Fund, Salient International Real Estate Fund, Salient International Small Cap Fund, Salient Real Estate Fund, Salient Select Income Fund, Salient Select Opportunity Fund, Salient Tactical Growth Fund, Salient Tactical Muni & Credit Fund, Salient Tactical Real Estate Fund and Salient US Dividend Signal Fund (collectively, the “Funds”), each a series of the registrant, pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

Table of Contents

The series of funds under the Forward Funds Trust (“Salient Funds”) are distributed by:

Forward Securities, LLC

San Francisco, California

The report has been prepared for the general information of the Funds’ shareholders. It is not authorized for distribution to prospective investors unless accompanied or proceeded by a current Funds’ Prospectus, which contains more complete information about Funds’ investment policies, management fees and expenses, experience of the management teams and other information. Investors are reminded to read the Prospectus before investing or sending money.

Shareholder Update | December 31, 2017

| | |

| A MESSAGE FROM: | | Rusty Guinn |

| | Executive Vice President of Asset Management |

Dear Shareholder:

We enter 2018 with gratitude for the trust that you, the shareholders of the Salient Funds, have placed in us. It is our aim to build strategies that enable you to act as good stewards of wealth, and it is our hope that you have found value in your partnership with us over the past year. Thank you.

The past year has been profitable for most investors, including those in most financial markets in which the Salient Funds invest. It has also been a year of widening disconnects between those markets and the economies, businesses and political systems that underlie them. We have observed continued political upheaval in the Middle East and North Asia but precious little volatility in most financial markets as a result. We have observed divergences in central banking policies but near-universal appetite for ownership of risky assets across the globe. We have observed investors unwilling to sell, despite high valuations, lower going-forward return expectations, challenging demographics, historically low yields and spreads, and early signs of inflation. We have observed speculative behaviors around cryptocurrencies, venture capital and growing segments of the technology sector.

It has been an unusual year, to say the least.

Still, there is reason to be optimistic about the world and the markets and companies in which we invest. While we enter the year eagerly and optimistically, we also do so with a redoubled commitment to the integrity and consistency of our investment processes. Risk has not disappeared from investments in financial markets, and we see it as our charge to ensure that those risks are still taken prudently and with the expectation of appropriate compensation—the returns to our investors.

We hope that 2018 proves a prosperous one for you, our shareholders. Thank you for your trust.

Sincerely,

Rusty Guinn

Executive Vice President of Asset Management

Salient

RISKS

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

Inflation is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

Spread is the difference between the bid and the ask price of a security or asset.

Valuation is the process of determining the value of an asset or company based on earnings and the market value of assets.

1

Salient is the trade name for Salient Partners, L.P., which together with its subsidiaries provides asset management and advisory services. This information is being provided solely for educational purposes and is not an offer to sell or solicitation of an offer to buy an interest in any investment fund. Any such offer or solicitation may only be made by means of a confidential private offering memorandum or prospectus relating to a particular fund and only in a manner consistent with federal and applicable state securities laws.

The Salient Funds offered under the Forward Funds Trust are distributed by Forward Securities, LLC.

Not FDIC Insured | No Bank Guarantee | May Lose Value

©2018 Salient. All rights reserved.

The discussions concerning the Funds included in this shareholder report may contain certain forward-looking statements about the factors that may affect performance of the Funds in the future, including the portfolio managers’ outlook regarding economic, financial, market, petroleum, political and other factors relevant to investment performance in the U.S. and abroad. These statements are based on the portfolio managers’ expectations concerning certain future events and their expected impact on the Funds and are current only through the date on the cover of this report. Forward-looking statements are inherently uncertain and are not intended to predict the future performance of the Funds. Actual events may cause adjustments in the portfolio managers’ strategies from those currently expected to be employed, and the outlook of the portfolio managers is subject to change.

2

Fund Commentary and Performance (Unaudited)

Salient International Real Estate Fund

As of December 31, 2017

For the year ended December 31, 2017, Salient International Real Estate Fund’s Class A shares (without sales load) returned 21.30%, outperforming the Fund’s benchmark, the FTSE EPRA/NAREIT Developed ex-U.S. Index, which returned 20.82%.

2017 proved to be a beneficial year for international real estate investment trust (REIT) equities. The asset class, as represented by the FTSE EPRA/NAREIT Developed ex-U.S. Index, generated strong returns in U.S. dollar terms and outperformed its domestic counterpart, as represented by the FTSE NAREIT Equity REITs Index, which returned 5.23% for the year. While most markets performed strongly, Europe and Asia Pacific (together comprising approximately 93% of the index) generated most of the return for the benchmark, with each region up over 15% at year-end. From a country perspective, Hong Kong and Singapore were up 38% and 42% for the year, respectively, while every European country was up over 14% for 2017. Notably, the United Kingdom, which made up 10% of the index on average throughout the year, was up 24% as fears surrounding Brexit—the United Kingdom’s planned exit from the European Union—subsided throughout the year.

During 2017, the Fund benefited from its investments in the United Kingdom, Hong Kong and Italy. In the U.K., the office and industrial real estate sectors benefited from resurging business sentiment and supportive monetary policy, as fears surrounding the eventual impact of Brexit receded from pre-2017 levels. The Fund’s investments in Hong Kong provided a strong total return of over 35% at year-end, as growth in gross domestic product and a stable rise in inflation supported real estate prices. In Italy, both the office and retail sectors, the primary constituents of the country’s real estate universe, contributed to the Fund’s return during the reporting period. In addition to stable growth and inflation within Italy, the Fund benefited from a strengthening in the euro, which began the year at an exchange rate of 1.05 EUR per USD and ended the year at a rate of 1.20 EUR per USD—a change of 14%.

The only detractor to the Fund’s performance in 2017 was an investment in the SPDR Dow Jones International Real Estate ETF. In order to maintain exposure to the market while managing the Fund’s cash position, the Fund’s investment team invested a small portion of its assets in the international real estate ETF for a brief part of the year. During that period of time, the market slumped slightly and the position detracted from the Fund’s performance.

Finally, from an allocation perspective, the Fund experienced meaningful positive attribution from its overweight positions in the United Kingdom and Italy. It also benefited from individual security selection within Japan, a country which was down -1.58% for the year in the benchmark index while the Fund’s investments were up 9.14%. On the downside, an underweight exposure to Hong Kong hurt the Fund in a year of strong performance, as did security selection within Germany, where the Fund’s individual investments were up less than the country at large.

3

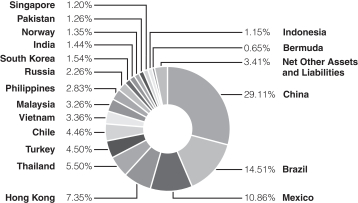

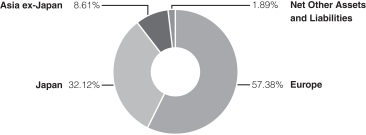

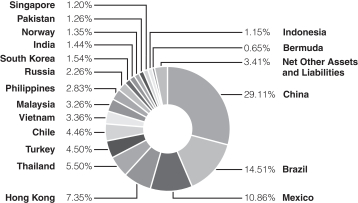

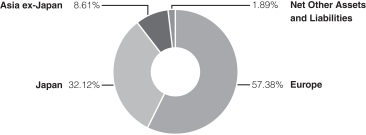

Salient International Real Estate Fund

Weightings by Country as a Percentage of Net Assets

as of December 31, 2017

These allocations may not reflect the current or future position of the portfolio.

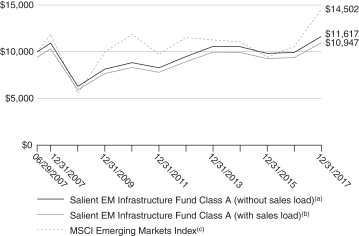

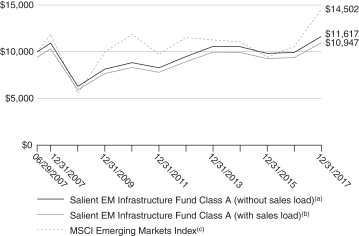

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

4

Salient International Real Estate Fund(d)

| | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception | | | Inception

Date | |

| Average Annual Total Return for the period ended December 31, 2017 | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | 21.44% | | | | 2.78% | | | | N/A | | | | 4.87% | | | | 05/02/11 | |

| | | | | |

Institutional Class(e) | | | 21.88% | | | | 3.11% | | | | 1.92% | | | | 3.18% | | | | 04/28/06 | |

| | | | | |

Class A (with sales load)(b) | | | 14.35% | | | | 1.48% | | | | 0.98% | | | | 2.33% | | | | 04/28/06 | |

| | | | | |

Class A (without sales load)(a) | | | 21.30% | | | | 2.69% | | | | 1.58% | | | | 2.85% | | | | 04/28/06 | |

| | | | | |

Class C (with CDSC)(f) | | | 19.73% | | | | 2.13% | | | | 0.93% | | | | 2.18% | | | | 04/28/06 | |

| | | | | |

Class C (without CDSC)(g) | | | 20.73% | | | | 2.13% | | | | 0.93% | | | | 2.18% | | | | 04/28/06 | |

(a) Excludes sales charge.

(b) Includes the effect of the maximum 5.75% sales charge.

(c) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(d) Prior to May 1, 2016, Salient International Real Estate Fund was known as Forward International Real Estate Fund. Prior to June 12, 2009, Forward International

Real Estate Fund was known as Kensington International Real Estate Fund.

(e) Prior to June 13, 2009, Institutional Class was known as Class Y.

(f) Includes the 1.00% contingent deferred sales charge.

(g) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5

Fund Commentary and Performance (Unaudited)

Salient Real Estate Fund

As of December 31, 2017

For the year ended December 31, 2017, Salient Real Estate Fund’s Investor Class shares returned -3.92%, underperforming the Fund’s primary benchmark, the FTSE NAREIT Equity REITs Index, which returned 5.23%. The Fund’s secondary benchmark, the S&P 500 Index, returned 21.83%.

The market environment for Salient Real Estate Fund was generally supportive in 2017. The real estate investment trust (REIT) common equity market, as measured by the FTSE NAREIT Equity REITs Index, returned more than 5.2% for the year. This return was generated in approximately equal parts throughout both halves of the year (2.7% in the first and 2.5% in the second), and every property type had at least one half of solid positive performance. Examining these market returns uncovers wide dispersion between property types. Top-performing sectors included infrastructure, data center and industrial REITs, which were aided by growing demand for fiber optic transmission and data storage capacity along with the buildout required to provide “last mile,” or final delivery of products, to retail stores. In particular, much of the strong performance for industrial REITs can be attributed to expectations that e-commerce will continue to win market share from traditional bricks-and-mortar retail stores. On the flip side of this debate, retail REITs, notably shopping centers and regional malls, were the worst-performing sectors for the year, as worries regarding tenant strength and occupancy levels mounted, mainly during the first half of the year.

During the reporting period, the Fund benefited from its investments in the data centers, industrials and timber sectors. Global demand for outsourced IT solutions and growth in cloud computing drove demand toward data center properties in 2017. As investors’ expectations for data center operators rose, they purchased REITs that own them, driving down capitalization rates—the ratio of a property’s net operating income to its market value. This compression of rates, coupled with market-leading cash flow growth, created positive results for the data center sector.

The industrials sector also benefited Fund returns during the reporting period. The global demand for “last mile” delivery and the required buildout to meet such a demand was very positive for industrial real estate operating fundamentals. The strong operating fundamentals led to further compression in both market capitalization rates and vacancy levels.

The timber sector also experienced strong performance in 2017. Increased lumber demand both domestically and abroad led to a steady rise in the price of the resource. The Fund’s investments in the sector also benefited from realized merger and acquisitions synergies as well as strong operating performance.

Not all REIT sectors performed well in 2017. The shopping centers, regional malls and healthcare sectors detracted from the Fund’s performance results. 2017 presented a highly volatile market environment for most shopping center REITs, as headwinds posed by e-commerce and changing consumer preferences increased. Amazon and other web-based retailers continued to take market share from bricks-and-mortar stores.

Similar to the headwinds faced by owners of shopping centers, regional mall landlords also weathered a highly volatile market environment in 2017. Slack in department store profitability and store closures, coupled with the acceleration in e-commerce growth, caused investors to question the viability of much of America’s retail property.

Alongside the retail sector, healthcare facility owners and operators, in particular, faced mounting headwinds in 2017 amidst potential shifts in government policy. Investors feared that government reimbursements might be at risk, calling into question operators’ future profitability. Additionally, reductions in occupancy rates and skilled mix (the proportion of people not dependent on Medicaid coverage) combined for a slowdown in operating performance in the healthcare sector.

Lastly, other factors that impacted performance in 2017 included an overweight position to retail REITs, along with some volatility surrounding the Fund’s largest healthcare holding, both of which detracted from the Fund’s performance for the year. However, the Fund benefited from individual security selection within the data center and self-storage sectors, as well as from its overweight position to timber REITs.

6

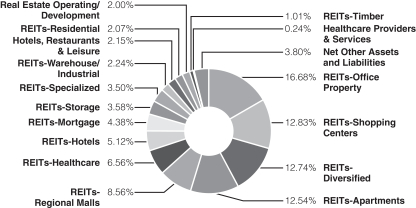

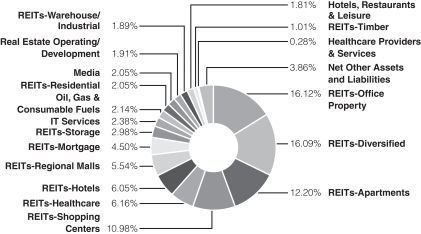

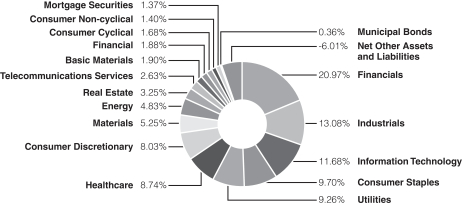

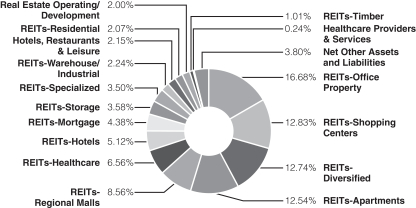

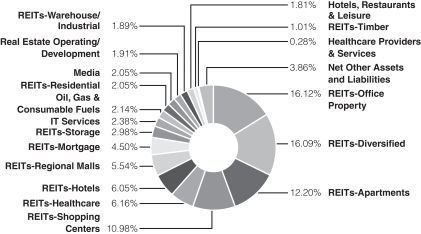

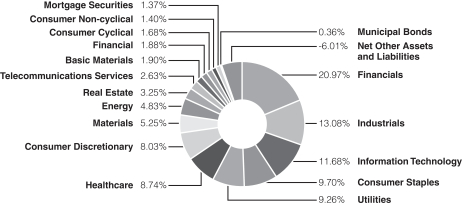

Salient Real Estate Fund

Weightings by Sector as a Percentage of Net Assets

as of December 31, 2017

These allocations may not reflect the current or future position of the portfolio.

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

7

Salient Real Estate Fund(b)

| | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception | | | Inception

Date | |

| Average Annual Total Return for the period ended December 31, 2017 | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | -3.92% | | | | 7.39% | | | | 4.97% | | | | 8.39% | | | | 05/10/99 | |

| | | | | |

Institutional Class | | | -3.63% | | | | 7.78% | | | | N/A | | | | 4.58% | | | | 05/01/08 | |

| | | | | |

Class A (with sales load)(c) | | | -9.55% | | | | 6.07% | | | | N/A | | | | 12.93% | | | | 06/12/09 | |

| | | | | |

Class A (without sales load)(d) | | | -4.02% | | | | 7.34% | | | | N/A | | | | 13.72% | | | | 06/12/09 | |

| | | | | |

Class C (with CDSC)(e) | | | -5.36% | | | | 6.75% | | | | N/A | | | | 13.01% | | | | 06/12/09 | |

| | | | | |

Class C (without CDSC)(f) | | | -4.46% | | | | 6.75% | | | | N/A | | | | 13.01% | | | | 06/12/09 | |

(a) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(b) Prior to May 1, 2016, Salient Real Estate Fund was known as Forward Real Estate Fund. Prior to January 20, 2009, Forward Real Estate Fund was known as Forward Progressive Real Estate Fund. Prior to October 30, 2006, Forward Progressive Real Estate Fund was known as Forward Uniplan Real Estate Investment Fund.

(c) Includes the effect of the maximum 5.75% sales charge.

(d) Excludes sales charge.

(e) Includes the 1.00% contingent deferred sales charge.

(f) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

8

Fund Commentary and Performance (Unaudited)

Salient Select Income Fund

As of December 31, 2017

For the year ended December 31, 2017, Salient Select Income Fund’s Class A shares (without sales load) returned 1.46%, underperforming the Fund’s benchmark, the ICE BofAML Fixed Rate Preferred Securities Index, which returned 10.58%.

The market environment for Salient Select Income Fund was generally supportive in 2017, as both the real estate investment trust (REIT) common and preferred equity markets rose consistently throughout the year. The REIT preferred market, as measured by the Wells Fargo Hybrid and Preferred Securities REIT Index, rose 11.53% for the year, while the REIT common equity market, as measured by the FTSE NAREIT Equity REITs Index, provided a total return of 5.23% for the year. Notably, almost half of the REIT preferred market’s return came in the first quarter of the year, and both markets made positive gains in every quarter. High-level returns show that wide dispersion persisted in 2017 as investor capital moved across and between property sectors. The top-performing sectors for the year included infrastructure, data centers and industrial REITs, aided by growing demand for fiber optic transmission and data storage capacity along with the buildout needed to provide “last mile,” or final delivery of products, to retail stores. On the bottom end of the return spectrum were the shopping center and regional mall REIT sectors, both of which lagged due to concerns regarding the long-term viability of retailers and their need for bricks-and-mortar spaces amidst the rise in e-commerce demand.

During 2017, the lodging/resorts, commercial financing and industrials sectors all contributed to the Fund’s performance. The Fund had several investments, both preferred and common equity, across the lodging sector, which benefited from healthy business and leisure travel environments. Merger and acquisition activity within the space was also positive for the Fund’s investments.

2017 was also a supportive year for mortgage REITs in the commercial financing sector, as volatility in interest rates remained relatively subdued. Additionally, the Fund’s holdings in the sector, which were predominately focused on the preferred equity portion of the capital stack, benefited from improvement in issuer credit quality.

The global demand for “last mile” delivery and the required buildout to meet such a demand was also very positive for real estate operating fundamentals in the industrial sector. Strong operating fundamentals led to further compression in both market capitalization rates and vacancy levels, making a positive contribution to the Fund’s performance during the reporting period.

The sectors that detracted from the Fund’s performance in 2017 included department stores, shopping centers and regional malls. The Fund’s investments in department store companies were the largest detractors in 2017, as many of the country’s largest retailers faced headwinds brought on by e-commerce and changes in consumer buying patterns. 2017 also presented a highly volatile market environment for most shopping center REITs, as those same headwinds posed by e-commerce and changing consumer preferences impacted the sector. Amazon and other web-based retailers continued to take market share from bricks-and-mortar stores. Similar to the struggles that shopping center REITs encountered, regional malls also faced opposition from e-commerce businesses as well as pronounced volatility within the sector.

Lastly, the Fund maintained a short position on the broad real estate market throughout much of 2017, typically rotating between the iShares U.S. Real Estate ETF and the Vanguard REIT ETF but occasionally holding both. These short positions detracted slightly from the Fund’s performance. Additionally, in order to maintain market exposure in a tax efficient manner, the Fund owned call options on particular REITs for part of the year. These securities provided a slight positive contribution to the Fund’s performance in 2017.

9

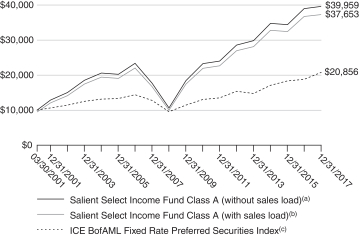

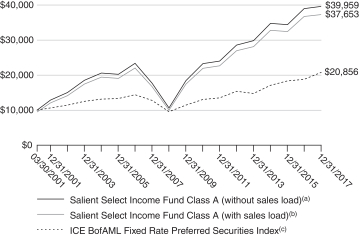

Salient Select Income Fund

Weightings by Sector as a Percentage of Net Assets

as of December 31, 2017*

*Weightings by Sector reflects long positions and excludes securities sold short.

These allocations may not reflect the current or future position of the portfolio.

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

10

Salient Select Income Fund(d)

| | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception | | | Inception

Date | |

| Average Annual Total Return for the period ended December 31, 2017 | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | 1.44% | | | | 6.80% | | | | N/A | | | | 9.08% | | | | 10/26/11 | |

| | | | | |

Institutional Class | | | 1.84% | | | | 7.19% | | | | 8.80% | | | | 6.03% | | | | 04/28/06 | |

| | | | | |

Class A (with sales load)(b) | | | -4.39% | | | | 5.49% | | | | 7.77% | | | | 8.23% | | | | 03/30/01 | |

| | | | | |

Class A (without sales load)(a) | | | 1.46% | | | | 6.75% | | | | 8.41% | | | | 8.62% | | | | 03/30/01 | |

| | | | | |

Class C (with CDSC)(e)(f) | | | -0.06% | | | | 6.16% | | | | 7.70% | | | | 7.86% | | | | 03/30/01 | |

| | | | | |

Class C (without CDSC)(e)(g) | | | 0.87% | | | | 6.16% | | | | 7.70% | | | | 7.86% | | | | 03/30/01 | |

(a) Excludes sales charge.

(b) Includes the effect of the maximum 5.75% sales charge.

(c) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(d) Prior to May 1, 2016, Salient Select Income Fund was known as Forward Select Income Fund. Prior to June 12, 2009, Forward Select Income Fund was known as Kensington Select Income Fund.

(e) While Class C shares were initially offered for purchase effective March 30, 2001, no shareholder activity occurred until April 13, 2001.

(f) Includes the 1.00% contingent deferred sales charge.

(g) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

11

Fund Commentary and Performance (Unaudited)

Salient Select Opportunity Fund

As of December 31, 2017

For the year ended December 31, 2017, Salient Select Opportunity Fund’s Institutional Class shares returned 6.04%, underperforming the Fund’s benchmarks, the ICE BofAML Fixed Rate Preferred Securities Index, which returned 10.58%, and the MSCI World Index, which returned 23.07%.

Domestic and international equity markets generated strong positive total returns for 2017, with the S&P 500 Index rising 21.83% alongside the MSCI World Index, which rose more than 23%. Similarly, preferred securities, as measured by the ICE BofAML Fixed Rate Preferred Securities Index, saw a meaningful rise of more than 10% for the year. Global growth expectations generally rose through much of year while concerns regarding potential destabilization in Europe driven by the United Kingdom’s plans to exit the European Union largely subsided from beginning-of-year levels. This environment was supportive for many eurozone stocks. Financials stocks, in particular, rose as a result of rising expectations for global growth, with the MSCI World Financials Index gaining 23.48% and the MSCI Europe Financials Index gaining 28.16% for the year. Domestically, preferred equities also benefited from the uptick in investor confidence, which, coupled with improving capitalization ratios and credit quality in the financials sector, led to solid performance for many financial institutions in the U.S. This landscape was a positive for the Fund, as financial institutions comprise a large portion of the Fund’s issuer base.

From a sector perspective, the diversified, regional banks, office and data centers sectors all made positive contributions to the Fund’s return in 2017. The Fund’s investments in Europeans financials, as well as its positions in domestic regional banks, performed well over 2017, as the domestic interest rate landscape witnessed a gradual and predicted rise and concerns regarding the solvency of Europe’s largest banks continued to lessen.

The Fund’s singular office holding performed well given that 2017 represented a rather lackluster year for office REITs, as the company’s primary cities of investment (San Francisco, Los Angeles and Washington, D.C.) witnessed moderate supply growth amidst a healthy business operating environment.

Additionally, global demand for outsourced IT solutions and growth in cloud computing continued to drive demand toward properties in the data center sector. As investors’ expectations for data center operators rose, they bought up REITs that own them, driving down capitalization rates—the ratio of a property’s net operating income to its market value. This compression of rates, coupled with market-leading cash flow growth, created positive results for the data center sector.

Detractors to the Fund’s performance in 2017 included the healthcare, restaurants and department stores sectors. Alongside the retail sector, healthcare facility owners and operators, in particular, faced mounting headwinds in 2017 amidst shifts in policy surrounding government reimbursement that caused concerns over future profit growth for operators. Additionally, reductions in occupancy rates and skilled mix (the proportion of guests not dependent on Medicaid coverage) combined for a slowdown in operating performance in the healthcare sector.

Investments in the restaurant industry also detracted from the Fund’s performance during the reporting period. Specifically, the Fund’s investment in Chipotle Mexican Grill, Inc. detracted from returns, as growth expectations faded, profits softened and the company failed to deliver on a major product rollout.

2017 also presented a highly volatile market environment for department store operators, as headwinds posed by e-commerce and changing consumer preferences increased. Amazon and other web-based retailers continued to take market share from bricks-and-mortar stores.

Other factors that impacted the Fund’s performance during the year included security selection. The Fund benefited from its individual holdings within the financials sector as well as from being invested in the common equity portion of those companies’ capital stack. Additionally, the Fund’s exposure to foreign markets was beneficial during a year of broad depreciation of the U.S. dollar. Lastly, the Fund’s investments in the lodging industry detracted from overall performance results.

12

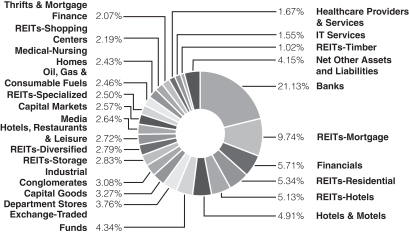

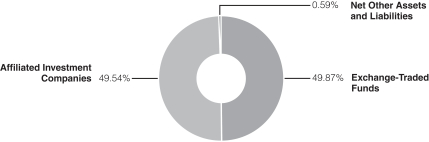

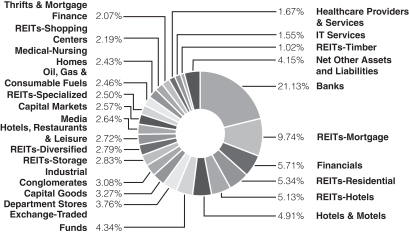

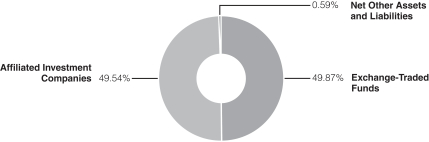

Salient Select Opportunity Fund

Weightings by Sector as a Percentage of Net Assets

as of December 31, 2017

These allocations may not reflect the current or future position of the portfolio.

Hypothetical Growth of $100,000 Investment in the Fund

The chart above shows how a hypothetical investment of $100,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $100,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

13

Salient Select Opportunity Fund(b)

| | | | | | | | | | | | |

| | | 1 Year | | | Since

Inception | | | Inception

Date | |

| Average Annual Total Return for the period ended December 31, 2017 | | | | | | | | | | | | |

Investor Class | | | 5.66% | | | | 1.38% | | | | 06/02/14 | |

| | | |

Institutional Class | | | 6.04% | | | | 5.07% | | | | 07/31/13 | |

| | | |

Class A (with sales load)(c) | | | -0.58% | | | | 3.15% | | | | 07/31/13 | |

| | | |

Class A (without sales load)(d) | | | 5.51% | | | | 4.54% | | | | 07/31/13 | |

| | | |

Class C (with CDSC)(e) | | | 4.02% | | | | 2.36% | | | | 02/18/14 | |

| | | |

Class C (without CDSC)(f) | | | 5.02% | | | | 2.36% | | | | 02/18/14 | |

(a) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(b) Prior to May 1, 2016, Salient Select Opportunity Fund was known as Forward Select Opportunity Fund. Prior to December 23, 2013, Forward Select Opportunity Fund was known as Forward Select Income Opportunity Fund.

(c) Includes the effect of the maximum 5.75% sales charge.

(d) Excludes sales charge.

(e) Includes the 1.00% contingent deferred sales charge.

(f) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

14

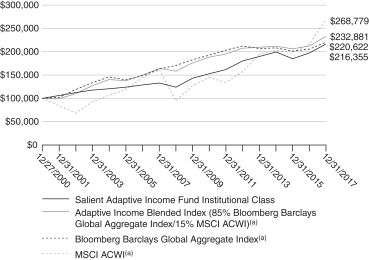

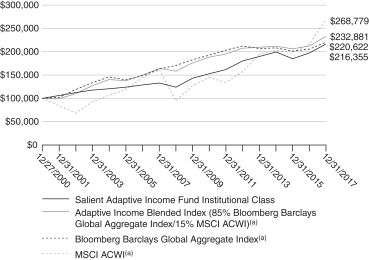

Fund Commentary and Performance (Unaudited)

Salient Tactical Real Estate Fund

As of December 31, 2017

For the year ended December 31, 2017, Salient Tactical Real Estate Fund’s Class A shares (without sales load) returned -5.24%, underperforming the Fund’s primary benchmark, the FTSE NAREIT Composite Index, which returned 9.29%. The Fund’s secondary benchmark, the FTSE NAREIT Equity REITs Index, returned 5.23%.

The market environment for Salient Tactical Real Estate Fund was generally supportive in 2017. The real estate trust (REIT) common equity market, as measured by the FTSE NAREIT Equity REITs Index, returned more than 5.2% for the year. This return was generated in approximately equal parts throughout both halves of the year (2.7% in the first and 2.5% in the second), and every property type had at least one half of solid positive performance. Examining these market returns uncovers wide dispersion between property types. Top-performing sectors included infrastructure, data center and industrial REITs, which were aided by growing demand for fiber optic transmission and data storage capacity along with the buildout needed to provide “last mile,” or final delivery of products, to retail stores. In particular, much of the strong performance for industrial REITs can be attributed to expectations that e-commerce will continue to win market share from traditional bricks-and-mortar retail. On the flip side of this debate, retail REITs, notably shopping centers and regional malls, were the worst-performing sectors for the year, as worries regarding tenant strength and occupancy levels mounted, mainly during the first half of the year.

During the reporting period, the Fund benefited from its investments in the data centers, industrials and timber sectors. Global demand for outsourced IT solutions and growth in cloud computing drove demand toward data center properties in 2017. As investors’ expectations for data center operators rose, they purchased REITs that own them, driving down capitalization rates—the ratio of a property’s net operating income to its market value. This compression of rates, coupled with market-leading cash flow growth, created positive results for the data center sector.

The industrials sector also benefited Fund returns during the reporting period. The global demand for “last mile” delivery and the required buildout to meet such a demand was very positive for industrial real estate operating fundamentals. Strong operating fundamentals led to further compression in both market capitalization rates and vacancy levels.

The timber sector also experienced strong performance in 2017. Increased lumber demand both domestically and abroad led to a steady rise in the price of the resource. The Fund’s investments in the sector benefited from realized merger and acquisitions synergies as well as strong operating performance.

Not all REIT sectors performed well in 2017. The shopping center, healthcare and lodging/resorts sectors detracted from the Fund’s performance results. 2017 presented a highly volatile market environment for most shopping center REITs, as headwinds posed by e-commerce and changing consumer preferences increased. Amazon and other web-based retailers continued to take market share from bricks-and-mortar stores.

Alongside the shopping center sector, healthcare facility owners and operators, in particular, faced mounting headwinds in 2017 amidst potential shifts in government policy. Investors feared that government reimbursements might be at risk, calling into question operators’ future profitability. Additionally, reductions in occupancy rates and skilled mix (the proportion of guests not dependent on Medicaid coverage) combined for a slowdown in operating performance in the healthcare sector.

Within the lodging sector, the Fund benefited from strong performance in select service hotel company investments, but investments in luxury resorts detracted from 2017 performance results. Much of the poor performance was a result of a dilutive transaction in the first quarter, taken on by a company in the portfolio to further expand and upgrade its portfolio asset base.

Other factors that contributed to the Fund’s performance in 2017 included individual security selection and sector weightings. For example, the Fund benefited from careful security selection within the self-storage sector and an overweight exposure to data centers, which outperformed most other sectors by a wide margin in 2017. However, the Fund’s overweight position in shopping center REITs, along with its underweight exposure to infrastructure REITs, both detracted from the Fund’s return for the year.

Lastly, the Fund maintained a short position on the broad real estate market throughout much of 2017, typically rotating between the iShares U.S. Real Estate ETF and the Vanguard REIT ETF but occasionally holding both. These short positions detracted slightly from the Fund’s performance, as the market experienced an uplift during the year.

15

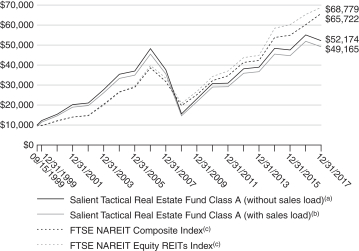

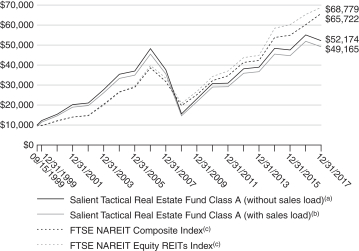

Salient Tactical Real Estate Fund

Weightings by Sector as a Percentage of Net Assets

as of December 31, 2017*

*Weightings by Sector reflects long positions and excludes securities sold short.

These allocations may not reflect the current or future position of the portfolio.

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

16

Salient Tactical Real Estate Fund(d)

| | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Since

Inception | | | Inception

Date | |

| Average Annual Total Return for the period ended December 31, 2017 | | | | | | | | | | | | | | | | | |

Investor Class | | | -5.23% | | | | 6.53% | | | | N/A | | | | 6.98% | | | | 05/02/11 | |

| | | | | |

Institutional Class | | | -4.88% | | | | 6.90% | | | | 3.89% | | | | 2.80% | | | | 04/28/06 | |

| | | | | |

Class A (with sales load)(b) | | | -10.69% | | | | 5.22% | | | | 2.68% | | | | 9.10% | | | | 09/15/99 | |

| | | | | |

Class A (without sales load)(a) | | | -5.24% | | | | 6.47% | | | | 3.29% | | | | 9.45% | | | | 09/15/99 | |

| | | | | |

Class C (with CDSC)(e) | | | -6.68% | | | | 5.88% | | | | 2.63% | | | | 8.70% | | | | 09/15/99 | |

| | | | | |

Class C (without CDSC)(f) | | | -5.76% | | | | 5.88% | | | | 2.63% | | | | 8.70% | | | | 09/15/99 | |

(a) Excludes sales charge.

(b) Includes the effect of the maximum 5.75% sales charge.

(c) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(d) Prior to May 1, 2016, Salient Tactical Real Estate Fund was known as Forward Real Estate Long/Short Fund. Prior to May 1, 2011, Forward Real Estate Long/ Short Fund was known as Forward Strategic Realty Fund. Prior to to June 12, 2009, Forward Strategic Realty Fund was known as Kensington Strategic Realty Fund.

(e) Includes the 1.00% contingent deferred sales charge.

(f) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

17

Investment Disclosures (Unaudited)

Fund Risk Disclosures

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

Asset allocation does not assure profit or protect against risk.

Diversification does not assure profit or protect against risk.

Salient International Real Estate Fund

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Foreign securities, especially emerging or frontier markets, will involve additional risks including exchange rate fluctuations, social and political instability, less liquidity, greater volatility and less regulation.

Mortgage and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Investing in a non-diversified fund involves the risk of greater price fluctuation than a more diversified portfolio.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Salient Real Estate Fund

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Investing in lower-rated (“high yield”) debt securities involves special risks in addition to those associated with investments in higher-rated debt securities, including a high degree of credit risk.

Mortgage and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

18

Investment Disclosures (Unaudited)

Salient Select Income Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Investing in lower-rated (“high yield”) debt securities involves special risks in addition to those associated with investments in higher-rated debt securities, including a high degree of credit risk.

Mortgage and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Short selling involves additional investment risks and transaction costs, and creates leverage, which can increase the risk and volatility of a fund.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

Salient Select Opportunity Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Foreign securities, especially emerging or frontier markets, will involve additional risks including exchange rate fluctuations, social and political instability, less liquidity, greater volatility and less regulation.

Investing in lower-rated (“high yield”) debt securities involves special risks in addition to those associated with investments in higher-rated debt securities, including a high degree of credit risk.

Mortgage and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Investing in a non-diversified fund involves the risk of greater price fluctuation than a more diversified portfolio.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

19

Investment Disclosures (Unaudited)

Salient Tactical Real Estate Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Foreign securities, especially emerging or frontier markets, will involve additional risks including exchange rate fluctuations, social and political instability, less liquidity, greater volatility and less regulation.

Investing in lower-rated (“high yield”) debt securities involves special risks in addition to those associated with investments in higher-rated debt securities, including a high degree of credit risk.

Mortgage and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Short selling involves additional investment risks and transaction costs, and creates leverage, which can increase the risk and volatility of a fund.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

Alternative strategies typically are subject to increased risk and loss of principal. Consequently, investments such as mutual funds that focus on alternative strategies are not suitable for all investors.

Fund Benchmark Definitions

FTSE EPRA/NAREIT Developed ex-U.S. Index is designed to track the performance of listed real estate companies and REITs worldwide, excluding U.S. companies.

FTSE NAREIT Composite Index is an unmanaged index consisting of approximately 200 real estate investment trust stocks.

FTSE NAREIT Equity REITs Index is representative of the tax-qualified REITs listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market.

ICE BofAML Fixed Rate Preferred Securities Index is a capitalization-weighted index of preferred stock issues that is generally representative of the market for preferred securities. Prior to October 2017, the ICE BofAML Fixed Rate Preferred Securities Index was known as the BofA Merrill Lynch Preferred Index.

MSCI World Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed markets.

S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries in the U.S. economy.

One cannot invest directly in an index.

20

Investment Disclosures (Unaudited)

Definition of Terms

Call option is an agreement that gives an investor the right (but not the obligation) to buy a stock, bond, commodity or other instrument at a specified price within a specific time period.

Capitalization (cap) rate is the rate of return on a real estate investment property based on the income that the property is expected to generate. The cap rate is used to estimate the investor’s potential return on his or her investment.

Cash flow is a revenue or expense stream that changes a cash account over a given period.

Credit quality informs investors of a bond or bond portfolio’s credit worthiness, or risk of default.

Inflation is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

MSCI Europe Financials Index represents large- and mid-cap companies within the financials sector across 15 developed market countries in Europe.

MSCI World Financials Index represents large- and mid-cap companies within the financials sector across 23 developed market countries.

Real estate investment trust (REIT) is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages.

Short is a borrowed security, commodity or currency that is sold on the open market with the expectation that the asset will fall in value.

Volatility is a statistical measure of the dispersion of returns for a given security or market index.

Wells Fargo Hybrid and Preferred Securities REIT Index is a modified market capitalization-weighted index that tracks the performance of preferred securities issued in the U.S. market by real estate investment trusts.

21

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2017

As a shareholder of the Salient Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder services fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period July 1, 2017 through December 31, 2017.

Actual Expenses

The first line for each share class of each Fund in the table provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example For Comparison Purposes

The second line for each share class of each Fund in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| Salient International Real Estate Fund | | Beginning

Account Value

07/01/17 | | | Ending

Account Value

12/31/17 | | | Expense

Ratios(a) | | | Expenses Paid

During Period(b)

07/01/17-12/31/17 | |

| Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,100.90 | | | | 2.33% | | | $ | 12.34 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,013.46 | | | | 2.33% | | | $ | 11.82 | |

| Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,102.00 | | | | 1.98% | | | $ | 10.49 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,015.22 | | | | 1.98% | | | $ | 10.06 | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,099.50 | | | | 2.38% | | | $ | 12.59 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,013.21 | | | | 2.38% | | | $ | 12.08 | |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,096.50 | | | | 2.93% | | | $ | 15.48 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,010.44 | | | | 2.93% | | | $ | 14.85 | |

| Salient Real Estate Fund | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 974.60 | | | | 1.98% | | | $ | 9.85 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,015.22 | | | | 1.98% | | | $ | 10.06 | |

22

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2017

| | | | | | | | | | | | | | | | |

| Salient Real Estate Fund (continued) | | Beginning

Account Value

07/01/17 | | | Ending

Account Value

12/31/17 | | | Expense

Ratios(a) | | | Expenses Paid

During Period(b)

07/01/17-12/31/17 | |

| Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 976.70 | | | | 1.63% | | | $ | 8.12 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,016.99 | | | | 1.63% | | | $ | 8.29 | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 974.00 | | | | 2.03% | | | $ | 10.10 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,014.97 | | | | 2.03% | | | $ | 10.31 | |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 972.20 | | | | 2.58% | | | $ | 12.83 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,012.20 | | | | 2.58% | | | $ | 13.09 | |

| Salient Select Income Fund | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 995.80 | | | | 2.06% | | | $ | 10.36 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,014.82 | | | | 2.06% | | | $ | 10.46 | |

| Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 997.70 | | | | 1.75% | | | $ | 8.81 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,016.38 | | | | 1.75% | | | $ | 8.89 | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 995.60 | | | | 2.12% | | | $ | 10.66 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,014.52 | | | | 2.12% | | | $ | 10.76 | |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 992.80 | | | | 2.69% | | | $ | 13.51 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,011.64 | | | | 2.69% | | | $ | 13.64 | |

| Salient Select Opportunity Fund | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 994.90 | | | | 1.74% | | | $ | 8.75 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,016.43 | | | | 1.74% | | | $ | 8.84 | |

| Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 997.00 | | | | 1.38% | | | $ | 6.95 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,018.25 | | | | 1.38% | | | $ | 7.02 | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 994.30 | | | | 1.89% | | | $ | 9.50 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,015.68 | | | | 1.89% | | | $ | 9.60 | |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 991.80 | | | | 2.33% | | | $ | 11.70 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,013.46 | | | | 2.33% | | | $ | 11.82 | |

23

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2017

| | | | | | | | | | | | | | | | |

| Salient Tactical Real Estate Fund | | Beginning

Account Value

07/01/17 | | | Ending

Account Value

12/31/17 | | | Expense

Ratios(a) | | | Expenses Paid

During Period(b)

07/01/17-12/31/17 | |

| Investor Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 967.70 | | | | 2.44% | | | $ | 12.10 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,012.91 | | | | 2.44% | | | $ | 12.38 | |

| Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 969.40 | | | | 2.11% | | | $ | 10.47 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,014.57 | | | | 2.11% | | | $ | 10.71 | |

| Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 967.50 | | | | 2.50% | | | $ | 12.40 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,012.60 | | | | 2.50% | | | $ | 12.68 | |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 965.10 | | | | 3.06% | | | $ | 15.16 | |

| | | | |

Hypothetical | | $ | 1,000.00 | | | $ | 1,009.78 | | | | 3.06% | | | $ | 15.50 | |

(a) Annualized, based on the Fund’s most recent fiscal half year expenses.

(b) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account values over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365.

24

Schedule of Investments (See Note 11)

Salient International Real Estate Fund

December 31, 2017

| | | | | | | | |

| | | Shares | | | Value

(See Note 2) | |

| | |

| Common Stocks: 98.39% | | | | | | | | |

| Australia: 7.30% | | | | | | | | |

| | |

Garda Diversified Property Fund | | | 535,600 | | | $ | 493,124 | |

| | |

Mirvac Group | | | 259,600 | | | | 475,999 | |

| | |

Scentre Group | | | 139,000 | | | | 454,426 | |

| | |

Westfield Corp. | | | 22,554 | | | | 167,003 | |

| | |

| | | | | | | 1,590,552 | |

| | | | | | | | |

| Austria: 2.16% | | | | | | | | |

| | |

BUWOG AG | | | 13,625 | | | | 470,004 | |

| | | | | | | | |

| France: 5.75% | | | | | | | | |

| | |

Gecina SA | | | 4,571 | | | | 844,067 | |

| | |

Klepierre | | | 9,300 | | | | 409,131 | |

| | |

| | | | | | | 1,253,198 | |

| | | | | | | | |

| Germany: 4.98% | | | | | | | | |

| | |

ADO Properties SA(a) | | | 7,200 | | | | 365,254 | |

| | |

alstria office REIT AG | | | 19,000 | | | | 294,083 | |

| | |

Vonovia SE | | | 8,600 | | | | 427,092 | |

| | |

| | | | | | | 1,086,429 | |

| | | | | | | | |

| Hong Kong: 11.26% | | | | | | | | |

| | |

Henderson Land Development Co., Ltd. | | | 121,660 | | | | 801,947 | |

| | |

Hongkong Land Holdings, Ltd. | | | 43,000 | | | | 302,720 | |

| | |

Link REIT | | | 74,000 | | | | 686,216 | |

| | |

Swire Properties, Ltd. | | | 205,400 | | | | 662,508 | |

| | |

| | | | | | | 2,453,391 | |

| | | | | | | | |

| Italy: 6.29% | | | | | | | | |

| | |

Beni Stabili SpA | | | 900,000 | | | | 832,576 | |

| | |

COIMA RES SpA(a) | | | 50,000 | | | | 539,033 | |

| | |

| | | | | | | 1,371,609 | |

| | | | | | | | |

| Japan: 21.49% | | | | | | | | |

| | |

Mitsubishi Estate Co., Ltd. | | | 51,000 | | | | 887,153 | |

| | |

Mitsui Fudosan Co., Ltd. | | | 43,000 | | | | 963,612 | |

| | |

NIPPON REIT Investment Corp. | | | 160 | | | | 459,374 | |

| | |

Nomura Real Estate Holdings, Inc. | | | 10,700 | | | | 239,878 | |

| | |

NTT Urban Development Corp. | | | 51,100 | | | | 591,386 | |

| | |

Sumitomo Realty & Development Co., Ltd. | | | 29,000 | | | | 953,069 | |

| | | | | | | | |

| | | Shares | | | Value

(See Note 2) | |

| | |

| | | | | | | | |

| | | | | | | | | |

| | |

Tokyo Tatemono Co., Ltd. | | | 43,600 | | | $ | 588,943 | |

| | |

| | | | | | | 4,683,415 | |

| | | | | | | | |

| Netherlands: 1.65% | | | | | | | | |

| | |

InterXion Holding NV(b) | | | 6,100 | | | | 359,473 | |

| | | | | | | | |

| Singapore: 6.72% | | | | | | | | |

| | |

CapitaLand, Ltd. | | | 172,600 | | | | 455,552 | |

| | |

Keppel REIT | | | 514,700 | | | | 484,894 | |

| | |

UOL Group, Ltd. | | | 78,900 | | | | 523,267 | |

| | |

| | | | | | | 1,463,713 | |

| | | | | | | | |

| Spain: 6.48% | | | | | | | | |

| | |

Inmobiliaria Colonial SA | | | 59,300 | | | | 589,345 | |

| | |

Lar Espana Real Estate Socimi SA | | | 30,200 | | | | 322,133 | |

| | |

Merlin Properties Socimi SA | | | 36,900 | | | | 500,302 | |

| | |

| | | | | | | 1,411,780 | |

| | | | | | | | |

| Sweden: 3.26% | | | | | | | | |

| | |

Fabege AB | | | 18,400 | | | | 391,637 | |

| | |

Hufvudstaden AB, Class A | | | 19,900 | | | | 318,765 | |

| | |

| | | | | | | 710,402 | |

| | | | | | | | |

| United Kingdom: 21.05% | | | | | | | | |

| | |

Belmond, Ltd., Class A(b) | | | 25,300 | | | | 309,925 | |

| | |

Capital & Counties Properties Plc | | | 159,500 | | | | 688,471 | |

| | |

Derwent London Plc | | | 15,100 | | | | 635,675 | |

| | |

Great Portland Estates Plc | | | 67,250 | | | | 625,142 | |

| | |

Hammerson Plc | | | 46,900 | | | | 346,372 | |

| | |

Helical Plc | | | 121,200 | | | | 556,370 | |

| | |

Land Securities Group Plc | | | 17,675 | | | | 240,548 | |

| | |

Segro Plc | | | 74,140 | | | | 587,588 | |

| | |

Workspace Group Plc | | | 44,100 | | | | 596,608 | |

| | |

| | | | | | | 4,586,699 | |

| | |

Total Common Stocks

(Cost $17,874,913) | | | | | | | 21,440,665 | |

| | |

Total Investments: 98.39%

(Cost $17,874,913) | | | | | | | 21,440,665 | |

| | |

| Net Other Assets and Liabilities: 1.61% | | | | | | | 350,642 | |

| | |

| Net Assets: 100.00% | | | | | | $ | 21,791,307 | |

| | | | |

| See accompanying Notes to Financial Statements. | | 25 | | |

Schedule of Investments (See Note 11)

Salient International Real Estate Fund

December 31, 2017

Percentages are stated as a percent of net assets.

(a) Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Trustees, unless otherwise noted below. At period end, the aggregate value of those securities was $904,287, representing 4.15% of net assets.

(b) Non-income producing security.

Investment Abbreviations:

REIT — Real Estate Investment Trust

| | | | |

| See accompanying Notes to Financial Statements. | | 26 | | |

Schedule of Investments (See Note 11)

Salient Real Estate Fund

December 31, 2017

| | | | | | | | |

| | | Shares | | | Value

(See Note 2) | |

| |

| Common Stocks: 96.20% | | | | | |

| Healthcare Providers & Services: 0.24% | | | | | | | | |

| | |

Genesis Healthcare, Inc.(a) | | | 91,700 | | | $ | 69,958 | |

| | | | | | | | |

| Hotels, Restaurants & Leisure: 2.15% | | | | | | | | |

| | |

Belmond, Ltd., Class A(a) | | | 51,800 | | | | 634,550 | |

| | | | | | | | |

| Real Estate Operating/Development: 2.00% | | | | | | | | |

| | |

Forest City Realty Trust, Inc., Class A | | | 24,500 | | | | 590,450 | |

| | | | | | | | |

| REITs-Apartments: 12.54% | | | | | | | | |

| | |

American Campus Communities, Inc. | | | 5,000 | | | | 205,150 | |

| | |

Apartment Investment & Management Co., Class A | | | 16,000 | | | | 699,360 | |

| | |

AvalonBay Communities, Inc. | | | 5,100 | | | | 909,891 | |

| | |

Clipper Realty, Inc. | | | 31,400 | | | | 313,686 | |

| | |

Equity Residential | | | 12,700 | | | | 809,879 | |

| | |

Essex Property Trust, Inc. | | | 3,200 | | | | 772,384 | |

| | |

| | | | | | | 3,710,350 | |

| | | | | | | | |

| REITs-Diversified: 12.74% | | | | | | | | |

| | |

Alexander & Baldwin, Inc. | | | 12,200 | | | | 338,428 | |

| | |

American Assets Trust, Inc. | | | 24,300 | | | | 929,232 | |

| | |

Farmland Partners, Inc. | | | 28,900 | | | | 250,852 | |

| | |

Howard Hughes Corp.(a) | | | 3,500 | | | | 459,445 | |

| | |

Resource Capital Corp. | | | 38,038 | | | | 356,416 | |

| | |

Urstadt Biddle Properties, Inc., Class A | | | 31,500 | | | | 684,810 | |

| | |

Vornado Realty Trust | | | 9,600 | | | | 750,528 | |

| | |

| | | | | | | 3,769,711 | |

| | | | | | | | |

| REITs-Healthcare: 6.56% | | | | | | | | |

| | |

Brookdale Senior Living, Inc.(a) | | | 63,700 | | | | 617,890 | |

| | |

MedEquities Realty Trust, Inc. | | | 1,800 | | | | 20,196 | |

| | |

Sabra Health Care REIT, Inc. | | | 45,000 | | | | 844,650 | |

| | |

Welltower, Inc. | | | 7,200 | | | | 459,144 | |

| | |

| | | | | | | 1,941,880 | |

| | | | | | | | |

| REITs-Hotels: 5.12% | | | | | | | | |

| | |

Ashford Hospitality Prime, Inc. | | | 85,423 | | | | 831,166 | |

| | |

Chatham Lodging Trust | | | 30,100 | | | | 685,076 | |

| | |

| | | | | | | 1,516,242 | |

| | | | | | | | |

| | | Shares | | | Value

(See Note 2) | |

| | |

| | | | | | | | |

| REITs-Mortgage: 4.38% | | | | | | | | |

| | |

Colony NorthStar, Inc., Class A | | | 113,500 | | | $ | 1,295,035 | |

| | | | | | | | |

| REITs-Office Property: 16.68% | | | | | | | | |

| | |

Alexandria Real Estate Equities, Inc. | | | 5,700 | | | | 744,363 | |

| | |

Digital Realty Trust, Inc. | | | 7,200 | | | | 820,080 | |

| | |

Government Properties Income Trust | | | 36,300 | | | | 673,002 | |

| | |

HCP, Inc. | | | 17,800 | | | | 464,224 | |

| | |

Mack-Cali Realty Corp. | | | 27,900 | | | | 601,524 | |

| | |

Paramount Group, Inc. | | | 59,700 | | | | 946,245 | |

| | |

SL Green Realty Corp. | | | 6,800 | | | | 686,324 | |

| | |

| | | | | | | 4,935,762 | |

| | | | | | | | |

| REITs-Regional Malls: 8.56% | | | | | | | | |

| | |

GGP, Inc. | | | 24,600 | | | | 575,394 | |

| | |

Macerich Co. | | | 7,600 | | | | 499,168 | |

| | |

Simon Property Group, Inc. | | | 4,000 | | | | 686,960 | |

| | |

Taubman Centers, Inc. | | | 11,800 | | | | 772,074 | |

| | |

| | | | | | | 2,533,596 | |

| | | | | | | | |

| REITs-Residential: 2.07% | | | | | | | | |

| | |

American Homes 4 Rent, Class A | | | 28,041 | | | | 612,415 | |

| | | | | | | | |

| REITs-Shopping Centers: 12.83% | | | | | | | | |

| | |

Acadia Realty Trust | | | 19,100 | | | | 522,576 | |

| | |

Brixmor Property Group, Inc. | | | 22,700 | | | | 423,582 | |

| | |

DDR Corp. | | | 66,400 | | | | 594,944 | |

| | |

Kimco Realty Corp. | | | 14,800 | | | | 268,620 | |

| | |

Kite Realty Group Trust | | | 30,900 | | | | 605,640 | |

| | |

Retail Opportunity Investments Corp. | | | 32,700 | | | | 652,365 | |

| | |

Tanger Factory Outlet Centers, Inc. | | | 27,500 | | | | 729,025 | |

| | |

| | | | | | | 3,796,752 | |

| | | | | | | | |

| REITs-Specialized: 3.50% | | | | | | | | |

| | |

CoreSite Realty Corp. | | | 9,100 | | | | 1,036,490 | |

| | | | | | | | |

| REITs-Storage: 3.58% | | | | | | | | |

| | |

Jernigan Capital, Inc. | | | 44,900 | | | | 853,549 | |

| | |

National Storage Affiliates Trust | | | 7,503 | | | | 204,532 | |

| | |

| | | | | | | 1,058,081 | |

| | | | |

| See accompanying Notes to Financial Statements. | | 27 | | |

Schedule of Investments (See Note 11)

Salient Real Estate Fund

December 31, 2017

| | | | | | | | |

| | | Shares | | | Value

(See Note 2) | |

| | |

| | | | | | | | |

| REITs-Timber: 1.01% | | | | | | | | |

| | |

Weyerhaeuser Co. | | | 8,500 | | | $ | 299,710 | |

| | | | | | | | |

| REITs-Warehouse/Industrial: 2.24% | | | | | | | | |

| | |

STAG Industrial, Inc. | | | 24,200 | | | | 661,386 | |

| | |

Total Common Stocks

(Cost $25,966,132) | | | | | | | 28,462,368 | |

| | |

Total Investments: 96.20%

(Cost $25,966,132) | | | | | | | 28,462,368 | |

| | |

| Net Other Assets and Liabilities: 3.80% | | | | | | | 1,124,633 | |

| | |

| Net Assets: 100.00% | | | | | | $ | 29,587,001 | |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

Investment Abbreviations:

REIT — Real Estate Investment Trust

| | | | |

| See accompanying Notes to Financial Statements. | | 28 | | |

Schedule of Investments (See Note 11)

Salient Select Income Fund

December 31, 2017

| | | | | | | | |

| | | Shares | | | Value

(See Note 2) | |

| |

| Common Stocks: 23.95% | | | | | |

| REITs-Apartments: 3.60% | | | | | | | | |

| | |

Apartment Investment & Management Co., Class A(a) | | | 458,800 | | | $ | 20,054,148 | |

| | |

Clipper Realty, Inc.(a)(b) | | | 940,796 | | | | 9,398,552 | |

| | |

| | | | | | | 29,452,700 | |

| | | | | | | | |