UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06722

Forward Funds

(Exact name of registrant as specified in charter)

244 California St., Suite 200

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

| | |

Gregory A. Reid, Principal Executive Officer Forward Funds 244 California St., Suite 200 San Francisco, CA 94111 | | With a Copy To: George J. Zornada K&L Gates LLP State Street Financial Center One Lincoln St. Boston, MA 02111-2950 (617) 261-3231 |

| (Name and address of agent for service) | | |

Registrant’s telephone number, including area code: (800) 999-6809

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a) The following is a copy of the report transmitted to shareholders of the Salient Global Real Estate Fund, Salient Select Income Fund and Salient Tactical Growth Fund (collectively, the “Funds”), each a series of the registrant, pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

Table of Contents

The series of funds under the Forward Funds Trust (“Salient Funds”) are distributed by:

Forward Securities, LLC

San Francisco, California

The report has been prepared for the general information of the Funds’ shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Funds’ Prospectus, which contains more complete information about Funds’ investment policies, management fees and expenses, experience of the management teams and other information. Investors are reminded to read the Prospectus before investing or sending money.

Shareholder Update | December 31, 2020

| | |

A MESSAGE FROM: | | William Enszer |

| | Chief Executive Officer |

Dear Shareholder:

We enter 2021 with gratitude for the trust that you, the shareholders of the Salient Funds, have placed in us. It is our aim to build strategies that enable you to act as good stewards of wealth, and it is our hope that you have found value in your partnership with us over the past year. Thank you.

To say that 2020 was unique would be an understatement. We started the year optimistically, but this optimism did not last long as the global economy experienced an unprecedented shutdown to try and curb the spread of the coronavirus. By mid-March, Salient had successfully transitioned the majority of our staff to a work-from-home format, which continues to this day. We implemented new collaboration tools, introduced weekly all-staff calls and streamlined our reporting structure. These efforts ensured that we could continue to be effective stewards of the capital entrusted to us.

The past year has been profitable for many investors, including those in most financial markets in which the Salient Funds invest. It has also been a year of further disconnects between those markets and the economies, businesses and political systems that underlie them. We have been on what seems like a political roller coaster with close elections and subsequent political turbulence in our Capitol. Economies worldwide basically shut down for parts of the year due to the pandemic and many businesses folded as a result. In response to these issues, both foreign and domestic central banks have kept interest rates at zero and governments around the world have implemented substantial stimulus programs in an effort to bridge the slack in the economy.

We believe we are well-positioned to take advantage of new opportunities created in the wake of COVID-19 while managing the risk associated with the gap between financial markets and what we observe in the “real” economy. We enter the new year hopeful on the back of approved COVID-19 vaccines. We wish you a healthy and prosperous 2021.

Sincerely,

William Enszer

Chief Executive Officer

Salient Partners, L.P.

RISKS

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

COVID-19 is an infectious disease caused by a new strain of coronavirus. The virus was first identified in late 2019 in Wuhan, the capital of China’s Hubei province, and has since spread globally, resulting in the ongoing 2019–2021 coronavirus pandemic.

Salient is the trade name for Salient Partners, L.P., which together with its subsidiaries provides asset management and advisory services. This information is being provided solely for educational purposes and is not an offer to sell or solicitation of an offer to buy an interest in any investment fund. Any such offer or solicitation may only be made by means of a confidential private offering memorandum or prospectus relating to a particular fund and only in a manner consistent with federal and applicable state securities laws.

1

The Salient Funds offered under the Forward Funds Trust are distributed by Forward Securities, LLC.

Not FDIC Insured | No Bank Guarantee | May Lose Value

©2021 Salient. All rights reserved.

The discussions concerning the Funds included in this shareholder report may contain certain forward-looking statements about the factors that may affect performance of the Funds in the future, including the portfolio managers’ outlook regarding economic, financial, market, petroleum, political and other factors relevant to investment performance in the U.S. and abroad. These statements are based on the portfolio managers’ expectations concerning certain future events and their expected impact on the Funds and are current only through the date on the cover of this report. Forward-looking statements are inherently uncertain and are not intended to predict the future performance of the Funds. Actual events may cause adjustments in the portfolio managers’ strategies from those currently expected to be employed, and the outlook of the portfolio managers is subject to change.

2

Fund Commentary and Performance (Unaudited)

Salient Global Real Estate Fund

As of December 31, 2020

For the year ended December 31, 2020, Salient Global Real Estate Fund’s Class A shares (without sales load) returned -10.36%, underperforming the Fund’s benchmark, the FTSE EPRA/NAREIT Developed Index, which returned -9.04%.

2020 was a very challenging year for real estate, both for the Fund and the various global property markets in which it invests. Following rather sanguine markets over the first seven weeks of 2020, global property markets shifted dramatically at the end of February with the onset of the global coronavirus pandemic. Investors rapidly shifted to a risk-off posture, sending both equity and bond markets around the world reeling. Correspondingly, global real estate markets experienced historic volatility and significant negative performance. By March 23, 2020, the global real estate market, as measured by the FTSE EPRA/NAREIT Developed Index, had declined -40.67% for the year. Following the immediate rollout of large monetary and fiscal stimulus programs around the world, as well as later positive news related to the development of COVID-19 vaccines, the broader property markets began a sustained rally for the remainder of the year, erasing much of the pandemic-related declines. As a result, global real estate investment trust (REIT) equities ended the year down -9.04%

Most property sector returns ended the year in negative territory with the notable exceptions of the data center, self-storage and industrial REIT property sectors. By region, Germany produced the best performance in 2020, generating a total return of 24.60%, followed by Finland with 11.30% and Sweden with 8.30%, as represented by the subindices of the FTSE EPRA/NAREIT Developed Index. Aided by a dovish U.S. Federal Reserve monetary policy, North America, which constitutes slightly more than 50% of the global real estate market, ended 2020 with a loss of -10.82% while Asia Pacific, which constitutes approximately 25% of the global real estate market, posted a similar return of -10.77%.

During 2020, the Fund’s investments in the retail and office REIT sectors as well as investments in Asia detracted the most from the Fund’s performance. The Fund’s holdings in retail assets, both domestic and foreign, were hit hard in 2020 as COVID-19 imperiled the operating environment for brick-and-mortar retail stores. During the height of the pandemic, many tenants requested rent reduction or forgiveness and several retailers sought bankruptcy protection, which negatively impacted the Fund’s retail REIT investments.

The fallout from Hong Kong’s anti-government political protests aimed at China, coupled with the devastating effects of COVID-19, hindered the Fund’s Asian investments during the year. Despite the setback in 2020, we continue to believe that the Fund’s core Asian investments, which are generally large, blue-chip diversified real estate companies based in major global cities, will continue to take advantage of long-term demographic, migration and leasing demand trends.

The Fund’s investments in office REITs also detracted from the Fund’s performance in 2020. Similar to many other property types, office assets were heavily impacted by the pandemic, as many businesses switched to remote working formats, which substantially limited the demand for new office leases. We anticipate that the Fund’s office investments will rebound once COVID-19 vaccines have been widely distributed.

On the upside, the Fund benefited from its investments in Germany, Canada and the healthcare sector during 2020. The Fund’s German apartment holdings performed very strongly, bolstered by their relatively defensive and predictable cash flows. In addition to strong stock price performance, the Fund also benefited from the strengthening of the euro, as it appreciated against the U.S. dollar from a low of $1.06 in late March to $1.22 at the end of December.

The Fund’s Canadian industrial investments remained strong performers in 2020 and generated attractive current income. While Canada remains a smaller exposure in both the Fund and its benchmark, we continue to believe that the defensive nature of these Canadian industrial property assets offer investors strong fundamentals and the ability to participate in the long-term trend of e-commerce replacing brick-and-mortar retail sales.

The healthcare sector also contributed to performance, as the Fund’s two U.S. healthcare holdings also generated strong returns throughout the pandemic, largely due to the more defensive net lease structure most healthcare property owners employ. Both of the Fund’s healthcare investments remain well-positioned to drive rent and occupancy growth going forward.

Despite the tremendous volatility experienced during 2020, we remain optimistic that the global economy as well as real estate operating fundamentals will continue to recover with the broad rollout of several COVID-19 vaccines. Across most property types and most geographies, we have witnessed encouraging signs of recovery for occupancy, tenant renewals, re-leasing spreads and operating margins from the depths of the public health crisis. Importantly, financing for real estate (whether public or private) remains extremely deep, resulting in the real estate sector exhibiting generally sound credit metrics. Given this recovery backdrop, we believe that in 2021 real estate companies will offer investors the potential continuation of the strong performance generated in the second half of 2020.

3

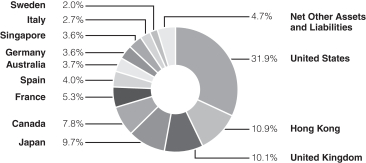

Salient Global Real Estate Fund

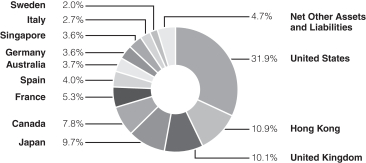

Weightings by Country as a Percentage of Net Assets

as of December 31, 2020

These allocations may not reflect the current or future position of the portfolio.

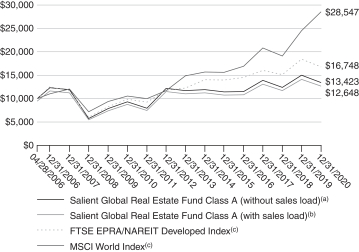

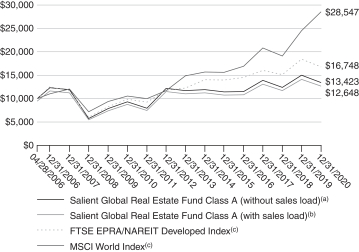

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

4

Salient Global Real Estate Fund(d)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Inception

Date |

| Average Annual Total Return for the period ended December 31, 2020 | | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | -10.34% | | | | | 3.42% | | | | | N/A | | | | | 2.98% | | | | | 05/02/11 | |

| | | | | |

Institutional Class | | | | -9.98% | | | | | 3.76% | | | | | 4.18% | | | | | 2.37% | | | | | 04/28/06 | |

| | | | | |

Class A (with sales load)(b) | | | | -15.49% | | | | | 2.14% | | | | | 3.16% | | | | | 1.61% | | | | | 04/28/06 | |

| | | | | |

Class A (without sales load)(a) | | | | -10.36% | | | | | 3.36% | | | | | 3.78% | | | | | 2.03% | | | | | 04/28/06 | |

| | | | | |

Class C (with CDSC)(e) | | | | -11.69% | | | | | 2.75% | | | | | 3.16% | | | | | 1.37% | | | | | 04/28/06 | |

| | | | | |

Class C (without CDSC)(f) | | | | -10.81% | | | | | 2.75% | | | | | 3.16% | | | | | 1.37% | | | | | 04/28/06 | |

(a) Excludes sales charge.

(b) Includes the effect of the maximum 5.75% sales charge.

(c) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(d) Prior to August 14, 2018, Salient Global Real Estate Fund was known as Salient International Real Estate Fund. Prior to May 1, 2016, Salient International Real Estate Fund was known as Forward International Real Estate Fund.

(e) Includes the 1.00% contingent deferred sales charge.

(f) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5

Fund Commentary and Performance (Unaudited)

Salient Select Income Fund

As of December 31, 2020

For the year ended December 31, 2020, Salient Select Income Fund’s Class A shares (without sales load) returned -3.17%, underperforming the Fund’s benchmark, the ICE BofAML Fixed Rate Preferred Securities Index, which returned 6.95%.

Following rather sanguine markets over the first seven weeks of 2020, the market environment for the Fund changed dramatically at the end of February 2020 with the onset of the global coronavirus pandemic. Investors rapidly shifted to a risk-off posture, sending both equity and bond markets reeling. Correspondingly, both real estate investment trust (REIT) common and preferred equity markets experienced historic volatility and significant negative performance during the year. By March 23, 2020, the REIT preferred equity market, as measured by the Wells Fargo Hybrid and Preferred Securities REIT Index, had declined -37.12%, and the REIT common equity market, as measured by the FTSE NAREIT Equity REITs Index, fell -40.69%. Following large and rapid monetary and fiscal stimulus from the U.S. government, as well as later positive news related to the development of COVID-19 vaccines, the broader markets began a sustained rally for the remainder of the year, erasing much of the pandemic-related declines. REIT common equities ended the year down -8.00% and REIT preferred stocks finished the year with a positive return of 2.82%. Most property sectors finished the year in negative territory, with the notable exceptions of data center, self-storage and industrial REITs.

During 2020, the commercial mortgage, hotel and shopping center sectors detracted from the Fund’s return. The Fund held an individual equity investment within the commercial mortgage sector that generated substantial negative performance for the Fund. During the height of the pandemic in mid-March, the company received a margin call given certain impairments across its securitized mortgage portfolio, which resulted in the company recording significant permanent losses on its balance sheet.

Several of the Fund’s preferred and common equity investments within the hotel REIT sector also detracted from the Fund’s return during the year. The impact of COVID-19 put tremendous stress on the hospitality industry, as travel dramatically decreased for several months of the year. As a result of this difficult operating environment, the Fund’s hotel investments suffered significant negative price performance.

The Fund also held several preferred equity investments within the shopping center sector that detracted from the Fund’s return in 2020. The pandemic dramatically slowed foot traffic at most retail properties across the country and as a result these companies faced higher vacancy rates and increased rent delinquencies.

On the upside, the diversified, data center and industrial REIT sectors contributed to the Fund’s performance for the reporting period. Several of the Fund’s preferred equity investments within the diversified sector performed very well during the year. These positions benefited from being part of broad, diverse real estate portfolios that improved as the economy stabilized in the second half of the year.

Within the data center sector, the Fund held several preferred equity investments that performed strongly in 2020. In the wake of pandemic-related business closures, online demand surged, boosting the resilience of data centers. As one of the most defensive sectors, data centers generated strong positive performance with far less volatility than other real estate property sectors.

The Fund also held several preferred equity investments within the industrials sector that contributed to the Fund’s performance in 2020. These positions performed solidly throughout the year, benefiting from the continued trend of brick-and-mortar retail sales shifting to e-commerce.

Despite the dramatic volatility experienced in 2020 due to the COVID-19 pandemic, we maintain a positive outlook for real estate investment as we head into 2021. While the most acute pandemic-related challenges remain for the retail, office and lodging sectors, most other property sectors have witnessed encouraging signs of recovery for occupancy, tenant renewals, re-leasing spreads and operating margins from the depths of the public health crisis. REIT balance sheets remain sound with high coverage ratios and limited near-term maturities, and new building supply generally has ticked down in most markets. Importantly, real estate transaction volumes in both the public and private market are robust while capital markets both domestically and abroad remain accommodative to real estate investment. With this recovery thesis in place, we are optimistic about the current investing landscape. We intend to continue to express our value orientation and benchmark-agnostic style of investing across the capital stack, which we’ve done consistently since the Fund’s inception in 2001.

6

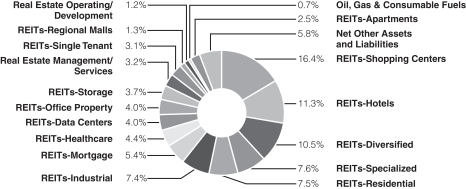

Salient Select Income Fund

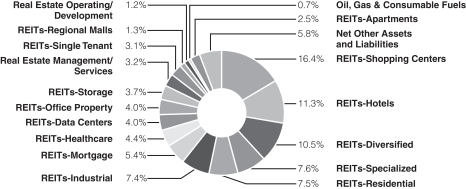

Weightings by Sector as a Percentage of Net Assets

as of December 31, 2020

These allocations may not reflect the current or future position of the portfolio.

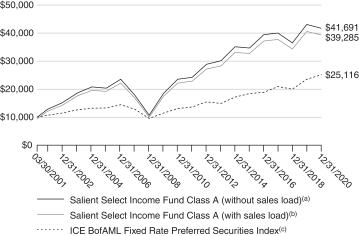

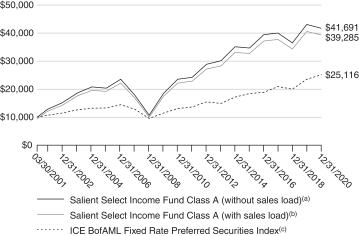

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

7

Salient Select Income Fund(d)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Inception

Date |

| Average Annual Total Return for the period ended December 31, 2020 | | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | -3.09% | | | | | 3.80% | | | | | N/A | | | | | 6.53% | | | | | 10/26/11 | |

| | | | | |

Institutional Class | | | | -2.75% | | | | | 4.16% | | | | | 6.32% | | | | | 5.15% | | | | | 04/28/06 | |

| | | | | |

Class A (with sales load)(b) | | | | -8.73% | | | | | 2.53% | | | | | 5.30% | | | | | 7.17% | | | | | 03/30/01 | |

| | | | | |

Class A (without sales load)(a) | | | | -3.17% | | | | | 3.75% | | | | | 5.92% | | | | | 7.49% | | | | | 03/30/01 | |

| | | | | |

Class C (with CDSC)(e) | | | | -4.61% | | | | | 3.14% | | | | | 5.28% | | | | | 6.76% | | | | | 03/30/01 | |

| | | | | |

Class C (without CDSC)(f) | | | | -3.69% | | | | | 3.14% | | | | | 5.28% | | | | | 6.76% | | | | | 03/30/01 | |

(a) Excludes sales charge.

(b) Includes the effect of the maximum 5.75% sales charge.

(c) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(d) Prior to May 1, 2016, Salient Select Income Fund was known as Forward Select Income Fund.

(e) Includes the 1.00% contingent deferred sales charge.

(f) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

8

Fund Commentary and Performance (Unaudited)

Salient Tactical Growth Fund

As of December 31, 2020

For the year ended December 31, 2020, Salient Tactical Growth Fund’s Institutional Class shares returned 8.40%, outperforming the Fund’s benchmark, the HFRX Equity Hedge Index, which returned 4.60%.

The stock market environment in 2020 was one of unprecedented volatility as the result of the global coronavirus pandemic. The S&P 500 Index rose to a new high in the first six weeks of the year. However, as it became evident that the virus was rapidly spreading throughout the United States, the S&P 500 experienced one of its steepest drops ever, falling nearly -34% in the next six weeks. U.S. gross domestic product (GDP) declined at an annualized rate of -31.4% during the second quarter, the largest such decline in U.S. history.

The stock market reached a low point in March and then turned strongly upward. While experiencing several steep and quick setbacks along the way, the major stock market averages rose steadily into the end of the year. Most major stock market indices set new all-time highs. The catalyst for the rapid recovery included Congress’s passage of a massive government stimulus program and the U.S. Federal Reserve’s (Fed’s) accommodative zero interest rate policy. These factors produced one of the strongest economic rebounds in U.S. history with GDP increasing at an annual rate of 33.4% in the third quarter of 2020.

The coronavirus continued to spread throughout the year and infections accelerated into year-end. At the end of 2020, there were 20 million coronavirus cases in the United States and over 350,000 deaths. The first vaccine was successfully developed in record time, however, and it was quickly authorized for use by the U.S. Food and Drug Administration. Distribution of the vaccine had begun by the end of the year, which was an encouraging development for investors. Investors were also relieved that Congress passed another stimulus program in December 2020.

During the year, equity valuations rose to levels not seen since the dot-com bubble of 2000 and the financial crisis of 2008. However, with interest rates so low, stocks remained attractive relative to the low yield on bonds. Almost two-thirds of all stocks in the S&P 500 had a higher yield than the 10-year U.S. Treasury Note at year-end. The Fed indicated that it would keep interest rates low into 2023, providing a positive monetary and credit environment.

Stock market momentum, as measured by the Fund’s volume and breadth measures, remained positive. While technology and communication services stocks led the way up in the first six months of the recovery, small cap stocks and other previously lagging sectors of the market joined in the rally in the second half of 2020. By year-end, small cap stocks and several other previously lagging indices registered all-time highs.

The investment team’s concerns at year-end were that absolute equity valuations were elevated and could be adversely affected if interest rates were to rise. In addition, investor sentiment had climbed to very optimistic levels, which is negative from a contrary point of view. The investment team believes that some correction is therefore likely in early 2021 prior to a resumption of the uptrend.

The Fund employed derivative instruments during the year primarily to cushion the portfolio from market corrections. Futures contracts were used to help offset risk due to elevated market volatility and uncertainty concerning the coronavirus and its impact on the economy and stock prices. Hedging can detract from performance, however, and as a result, the use of futures to hedge long positions detracted -0.89% from the Fund’s return for the year.

The Fund’s investment strategy strives to capture a portion of the market’s growth while aiming to preserve capital during market corrections. The tactical investment approach has had its greatest success in volatile markets that involved market corrections of 10% or more. For instance, in early 2020, the strategy largely sidestepped the steep February–March stock market decline. The Fund declined only -0.41% for the first quarter of 2020 versus a loss of -13.33% for the HFRX Equity Hedge Index and a loss of -19.60% for the S&P 500 for that same time period. During these volatile periods, the Fund’s flexible and responsive risk management process can be a powerful tool toward the goal of producing positive risk-adjusted returns.

As the Fund’s investment team looks ahead to 2021, there are several factors within its “Four Pillar Process” that the team will be watching:

1. Valuation: Equity valuations are high by any absolute measure. Any significant rise in interest rates in 2021 would be a potentially negative factor for equity valuations.

2. Monetary factors and credit conditions: The Fed continues to maintain an accommodative low interest rate policy. Intermediate- to long-term interest rates declined in 2020, which provided a positive environment for the capital markets. Credit spreads also remained narrow, indicating no immediate dislocations in the economy or the credit markets. Any significant increase in interest rates accompanied by a widening of credit spreads would be a negative for the markets in 2021.

9

Fund Commentary and Performance (Unaudited)

Salient Tactical Growth Fund

As of December 31, 2020

3. Sentiment: Investor sentiment has risen to high levels of optimism. This is negative from a contrary point of view and suggests that a stock market pullback may be necessary in early 2021 to recycle investor sentiment back to more normal levels.

4. Momentum: The severity of the stock market’s decline for the first quarter of 2020 set the stage for the market’s subsequent strength for the remainder of the year. Salient Tactical Growth Fund’s volume and breadth momentum models turned positive in late March and early April and remained so into the end of the year. Upside volume remained strong while downside volume abated. The rising relative strength of some of the lagging sectors during the second half of the year contributed to the market’s improved breadth, which was also a positive.

At the end of 2020, however, the market’s strong rise had become extended and both volume and breadth momentum measures showed an overbought condition. Some type of normal pullback would be expected in early 2021 to bring these indicators back into more neutral territory. Nonetheless, the Fund’s momentum models continue to point to potential further gains after a normal market correction.

10

Salient Tactical Growth Fund

Asset Allocation as a Percentage of Net Assets

as of December 31, 2020

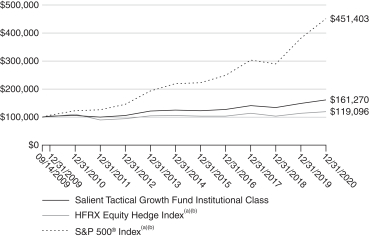

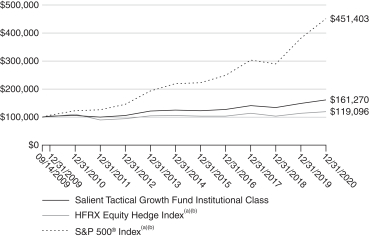

Hypothetical Growth of $100,000 Investment in the Fund

The chart above shows how a hypothetical investment of $100,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $100,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

11

Salient Tactical Growth Fund(c)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Inception

Date |

| Average Annual Total Return for the period ended December 31, 2020 | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | 7.99% | | | | | 5.24% | | | | | 3.98% | | | | | 3.97% | | | | | 09/14/09 | |

| | | | | |

Institutional Class | | | | 8.40% | | | | | 5.60% | | | | | 4.34% | | | | | 4.32% | | | | | 09/14/09 | |

| | | | | |

Class A (with sales load)(d) | | | | 1.75% | | | | | 3.89% | | | | | 3.23% | | | | | 2.99% | | | | | 03/12/10 | |

| | | | | |

Class A (without sales load)(e) | | | | 7.95% | | | | | 5.12% | | | | | 3.85% | | | | | 3.55% | | | | | 03/12/10 | |

| | | | | |

Class C (with CDSC)(f) | | | | 6.33% | | | | | 4.55% | | | | | 3.33% | | | | | 3.32% | | | | | 09/14/09 | |

| | | | | |

Class C (without CDSC)(g) | | | | 7.33% | | | | | 4.55% | | | | | 3.33% | | | | | 3.32% | | | | | 09/14/09 | |

(a) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(b) Effective January 1, 2019, the HFRX Equity Hedge Index replaced the S&P 500 Index as the Fund’s primary benchmark index.

(c) Prior to May 1, 2016, Salient Tactical Growth Fund was known as Forward Tactical Growth Fund.

(d) Includes the effect of the maximum 5.75% sales charge.

(e) Excludes sales charge.

(f) Includes the 1.00% contingent deferred sales charge.

(g) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientfunds.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

12

Investment Disclosures

Fund Risk Disclosures

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

Asset allocation does not assure profit or protect against risk.

Diversification does not assure profit or protect against risk.

This document does not constitute an offering of any security, product, service or fund, including the Funds, for which an offer can be made only by the Funds’ prospectuses.

No fund is a complete investment program and you may lose money investing in a fund. The Funds may engage in other investment practices that may involve additional risks and you should review the Funds’ prospectuses for a complete description.

Salient Global Real Estate Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Equity securities are subject to the financial and operational risks faced by individual companies, the risk that stock markets, sectors and industries may experience periods of turbulence and instability and the general risk that domestic and global economies may go through periods of decline and cyclical change.

Investing in exchange-traded funds (ETFs) will subject a fund to substantially the same risks as those associated with the direct ownership of the securities or other property held by the ETFs.

Foreign securities, especially emerging or frontier markets, will involve additional risks including exchange rate fluctuations, social and political instability, less liquidity, greater volatility and less regulation.

Manager risk is the risk that a fund’s portfolio managers may make poor investment decisions, which would negatively affect a fund’s investment performance.

Market events in the U.S. and global financial markets may result in unusually high market volatility, which could negatively impact a fund’s performance and cause a fund to experience illiquidity, shareholder redemptions or other potentially adverse effects.

Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Overseas stock exchange transactions may pose increased risk and result in delays in obtaining accurate information on the value of securities.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

13

Investment Disclosures, continued

Salient Global Real Estate Fund (continued)

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

Salient Select Income Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Equity securities are subject to the financial and operational risks faced by individual companies, the risk that stock markets, sectors and industries may experience periods of turbulence and instability and the general risk that domestic and global economies may go through periods of decline and cyclical change.

Investing in exchange-traded funds (ETFs) will subject a fund to substantially the same risks as those associated with the direct ownership of the securities or other property held by the ETFs.

Liquidity refers to how easy it is to buy and sell shares of a security without affecting its price. Investing in securities that are less actively traded or over time experience decreased trading volume may restrict a fund’s ability to take advantage of other market opportunities or to dispose of securities.

Investing in lower-rated (“high yield”) debt securities involves special risks in addition to those associated with investments in higher-rated debt securities, including a high degree of credit risk.

Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Short selling involves additional investment risks and transaction costs, and creates leverage, which can increase the risk and volatility of a fund.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

Salient Tactical Growth Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

14

Investment Disclosures, continued

Salient Tactical Growth Fund (continued)

Investing in exchange-traded funds (ETFs) will subject a fund to substantially the same risks as those associated with the direct ownership of the securities or other property held by the ETFs.

Foreign securities, especially emerging or frontier markets, will involve additional risks including exchange rate fluctuations, social and political instability, less liquidity, greater volatility and less regulation.

Manager risk is the risk that a fund’s portfolio managers may make poor investment decisions, which would negatively affect a fund’s investment performance.

Market events in the U.S. and global financial markets may result in unusually high market volatility, which could negatively impact a fund’s performance and cause a fund to experience illiquidity, shareholder redemptions or other potentially adverse effects.

Market risk is the risk that the markets on which a fund’s investments trade will lose value in response to company, market or economic news.

Relying on proprietary or third-party quantitative models and information and data supplied by third-party vendors that later prove to be inaccurate or incorrect exposes a fund to additional investment risks.

Short selling involves additional investment risks and transaction costs, and creates leverage, which can increase the risk and volatility of a fund.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

Alternative strategies typically are subject to increased risk and loss of principal. Consequently, investments such as mutual funds that focus on alternative strategies are not suitable for all investors.

Fund Benchmark Definitions

FTSE EPRA/NAREIT Developed Index is designed to track the performance of listed real estate companies and REITs worldwide.

HFRX Equity Hedge Index is comprised of private funds with strategies that maintain both long and short positions primarily in equity securities and equity derivatives.

ICE BofAML Fixed Rate Preferred Securities Index is a capitalization-weighted index of preferred stock issues that is generally representative of the market for preferred securities.

One cannot invest directly in an index.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, its affiliates and their respective third-party suppliers disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the indices, index data and any data included in, related to, or derived therefrom. Neither ICE DATA, its affiliates nor their respective third-party providers shall be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the indices or the index data or any component thereof, and the indices and index data and all components thereof are provided on an “as is” basis and your use is at your own risk. ICE DATA, its affiliates and their respective third-party suppliers do not sponsor, endorse, or recommend Salient, or any of its products or services.

Definition of Terms

10-year U.S. Treasury Note is a debt obligation issued by the U.S. Treasury that has a term of 10 years.

Breadth is a technique used in technical analysis that attempts to gauge the direction of the overall market by analyzing the number of companies advancing relative to the number declining.

15

Investment Disclosures, continued

Cash flow is a revenue or expense stream that changes a cash account over a given period.

Coverage ratio is a metric intended to measure a company’s ability to service its debt and meet its financial obligations, such as interest payments or dividends.

Credit spread is the spread between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating.

Derivative is a security whose price is dependent upon or derived from one or more underlying assets.

Federal Reserve (Fed) is the central bank of the United States that is responsible for regulating the U.S. monetary and financial systems.

FTSE NAREIT Equity REITs Index is representative of the tax-qualified REITs listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market, excluding timber and infrastructure REITs.

Futures are financial contracts that obligate the buyer to purchase an asset (or the seller to sell an asset), such as a physical commodity or a financial instrument, at a predetermined future date and price.

Gross domestic product (GDP) is the monetary value of all the finished goods and services produced in a country in a given year. GDP is one way of measuring the size of a country’s economy.

Hedging is an investment strategy intended to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting or opposite position in a related security.

A margin call occurs when the value of an investor’s margin account, which contains securities bought with borrowed money, falls below the broker’s required amount. When a margin call occurs, the investor must choose to either deposit more money in the account or sell some of the assets held in the account.

Momentum is the rate of acceleration of a security’s price or volume.

Monetary policy refers to the actions of a central bank, currency board or other regulatory committee that determine the size and rate of growth of the money supply, including a change in interest rates or the amount of money banks need to keep in bank reserves.

MSCI World Index is a free float-adjusted market capitalization index designed to measure equity market performance in the global developed markets.

Net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees and maintenance costs for a commercial real estate property in addition to rent.

Operating margin measures how much profit a company earns on sales after paying for operating expenses.

Real estate investment trust (REIT) is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages.

Re-leasing spreads measure the change in rent per square foot between new and expiring leases.

S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries in the U.S. economy.

Valuation is the process of determining the value of an asset or company based on earnings and the market value of assets.

Volatility is a statistical measure of the dispersion of returns for a given security or market index.

Volume is the number of shares or contracts traded in a security or an entire market during a given period of time.

16

Investment Disclosures, continued

Wells Fargo Hybrid and Preferred Securities REIT Index is a modified market capitalization-weighted index that tracks the performance of preferred securities issued in the U.S. market by real estate investment trusts.

Yield is the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost or on the U.S. government’s debt obligations.

17

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2020

As a shareholder of the Forward Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder services fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period July 1, 2020 through December 31, 2020.

Actual Expenses

The first line for each share class of each Fund in the table provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example For Comparison Purposes

The second line for each share class of each Fund in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| Salient Global Real Estate Fund | | Beginning

Account Value

07/01/20 | | Ending

Account Value

12/31/20 | | Expense

Ratios(a) | | Expenses Paid

During Period(b)

07/01/20-12/31/20 |

| Investor Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,186.40 | | | | | 1.50% | | | | $ | 8.24 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.60 | | | | | 1.50% | | | | $ | 7.61 | |

| Institutional Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,188.40 | | | | | 1.15% | | | | $ | 6.33 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,019.36 | | | | | 1.15% | | | | $ | 5.84 | |

| Class A | |

Actual | | | $ | 1,000.00 | | | | $ | 1,186.90 | | | | | 1.55% | | | | $ | 8.52 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.34 | | | | | 1.55% | | | | $ | 7.86 | |

| Class C | |

Actual | | | $ | 1,000.00 | | | | $ | 1,183.30 | | | | | 2.10% | | | | $ | 11.52 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,014.58 | | | | | 2.10% | | | | $ | 10.63 | |

| Salient Select Income Fund | | | | | | | | |

| Investor Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,180.70 | | | | | 1.50% | | | | $ | 8.22 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.60 | | | | | 1.50% | | | | $ | 7.61 | |

18

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2020

| | | | | | | | | | | | | | | | | | | | |

| Salient Select Income Fund (continued) | | Beginning

Account Value

07/01/20 | | Ending

Account Value

12/31/20 | | Expense

Ratios(a) | | Expenses Paid

During Period(b)

07/01/20-12/31/20 |

| Institutional Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,182.60 | | | | | 1.15% | | | | $ | 6.31 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,019.36 | | | | | 1.15% | | | | $ | 5.84 | |

| Class A | |

Actual | | | $ | 1,000.00 | | | | $ | 1,180.20 | | | | | 1.55% | | | | $ | 8.49 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.34 | | | | | 1.55% | | | | $ | 7.86 | |

| Class C | |

Actual | | | $ | 1,000.00 | | | | $ | 1,177.20 | | | | | 2.10% | | | | $ | 11.49 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,014.58 | | | | | 2.10% | | | | $ | 10.63 | |

| Salient Tactical Growth Fund | | | | | | |

| Investor Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,067.50 | | | | | 1.83% | | | | $ | 9.51 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,015.94 | | | | | 1.83% | | | | $ | 9.27 | |

| Institutional Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,069.20 | | | | | 1.48% | | | | $ | 7.70 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.70 | | | | | 1.48% | | | | $ | 7.51 | |

| Class A | |

Actual | | | $ | 1,000.00 | | | | $ | 1,066.90 | | | | | 1.89% | | | | $ | 9.82 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,015.63 | | | | | 1.89% | | | | $ | 9.58 | |

| Class C | |

Actual | | | $ | 1,000.00 | | | | $ | 1,064.00 | | | | | 2.43% | | | | $ | 12.61 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,012.92 | | | | | 2.43% | | | | $ | 12.30 | |

(a) Annualized, based on the Fund’s most recent fiscal half year expenses.

(b) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account values over the period, multiplied by the number of days in the most recent fiscal half year (182), then divided by 366.

19

Schedule of Investments (See Note 11)

Salient Global Real Estate Fund

December 31, 2020

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

|

| Common Stocks: 92.9% | |

| Australia: 3.7% | |

| | |

GPT Group | | | | 190,000 | | | | $ | 659,163 | |

| | |

Scentre Group | | | | 154,000 | | | | | 330,059 | |

| | |

| | | | | | | | | 989,222 | |

| | | | | | | | | | |

| Canada: 5.4% | |

| | |

Granite Real Estate Investment Trust | | | | 11,300 | | | | | 691,547 | |

| | |

Summit Industrial Income REIT | | | | 71,400 | | | | | 765,661 | |

| | |

| | | | | | | | | 1,457,208 | |

| | | | | | | | | | |

| France: 5.3% | |

| | |

Gecina SA | | | | 4,800 | | | | | 740,609 | |

| | |

Unibail-Rodamco-Westfield | | | | 8,800 | | | | | 692,114 | |

| | |

| | | | | | | | | 1,432,723 | |

| | | | | | | | | | |

| Germany: 3.6% | |

| | |

ADLER Group SA — 144A(a)(b) | | | | 10,000 | | | | | 354,276 | |

| | |

Vonovia SE | | | | 8,500 | | | | | 620,546 | |

| | |

| | | | | | | | | 974,822 | |

| | | | | | | | | | |

| Hong Kong: 10.9% | |

| | |

Henderson Land Development Co., Ltd. | | | | 127,628 | | | | | 498,004 | |

| | |

Hongkong Land Holdings, Ltd. | | | | 118,700 | | | | | 490,231 | |

| | |

Link REIT | | | | 83,000 | | | | | 755,864 | |

| | |

Sun Hung Kai Properties, Ltd. | | | | 60,000 | | | | | 773,949 | |

| | |

Swire Properties, Ltd. | | | | 150,200 | | | | | 436,895 | |

| | |

| | | | | | | | | 2,954,943 | |

| | | | | | | | | | |

| Italy: 2.7% | |

| | |

COIMA RES SpA — 144A(b) | | | | 89,300 | | | | | 715,648 | |

| | | | | | | | | | |

| Japan: 9.7% | |

| | |

Mitsubishi Estate Co., Ltd. | | | | 35,600 | | | | | 571,296 | |

| | |

Mitsui Fudosan Co., Ltd. | | | | 35,000 | | | | | 731,659 | |

| | |

Sumitomo Realty & Development Co., Ltd. | | | | 21,000 | | | | | 646,952 | |

| | |

Tokyo Tatemono Co., Ltd. | | | | 49,500 | | | | | 678,345 | |

| | |

| | | | | | | | | 2,628,252 | |

| | | | | | | | | | |

| Singapore: 3.6% | |

| | |

CapitaLand, Ltd. | | | | 393,000 | | | | | 975,363 | |

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

|

| | |

| Spain: 4.0% | |

| | |

Inmobiliaria Colonial SA | | | | 46,000 | | | | $ | 450,969 | |

| | |

Merlin Properties Socimi SA | | | | 65,000 | | | | | 617,785 | |

| | |

| | | | | | | | | 1,068,754 | |

| | | | | | | | | | |

| Sweden: 2.0% | |

| | |

Fabege AB | | | | 15,400 | | | | | 242,111 | |

| | |

Hufvudstaden AB, Class A | | | | 18,300 | | | | | 302,939 | |

| | |

| | | | | | | | | 545,050 | |

| | | | | | | | | | |

| United Kingdom: 10.1% | |

| | |

Capital & Counties Properties Plc | | | | 410,000 | | | | | 812,981 | |

| | |

Derwent London Plc | | | | 17,800 | | | | | 753,614 | |

| | |

Great Portland Estates Plc | | | | 83,141 | | | | | 759,486 | |

| | |

Segro Plc | | | | 30,000 | | | | | 388,754 | |

| | |

| | | | | | | | | 2,714,835 | |

| | | | | | | | | | |

| United States: 31.9% | |

| | |

Acadia Realty Trust | | | | 33,300 | | | | | 472,527 | |

| | |

Alexandria Real Estate Equities, Inc. | | | | 4,500 | | | | | 801,990 | |

| | |

American Assets Trust, Inc. | | | | 10,000 | | | | | 288,800 | |

| | |

AvalonBay Communities, Inc. | | | | 4,100 | | | | | 657,763 | |

| | |

Boston Properties, Inc. | | | | 6,500 | | | | | 614,445 | |

| | |

Chatham Lodging Trust | | | | 75,000 | | | | | 810,000 | |

| | |

Clipper Realty, Inc. | | | | 59,185 | | | | | 417,254 | |

| | |

Equinix, Inc. | | | | 840 | | | | | 599,911 | |

| | |

Farmland Partners, Inc. | | | | 90,000 | | | | | 783,000 | |

| | |

Federal Realty Investment Trust | | | | 7,200 | | | | | 612,864 | |

| | |

Mack-Cali Realty Corp. | | | | 40,000 | | | | | 498,400 | |

| | |

Retail Opportunity Investments Corp. | | | | 42,000 | | | | | 562,380 | |

| | |

Sabra Health Care REIT, Inc. | | | | 33,600 | | | | | 583,632 | |

| | |

SL Green Realty Corp. | | | | 10,600 | | | | | 631,548 | |

| | |

Ventas, Inc. | | | | 5,700 | | | | | 279,528 | |

| | |

| | | | | | | | | 8,614,042 | |

| | |

Total Common Stocks

(Cost $26,070,796) | | | | | | | | | 25,070,862 | |

| | | | |

See accompanying Notes to Financial Statements. | | 20 | | |

Schedule of Investments (See Note 11)

Salient Global Real Estate Fund

December 31, 2020

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| | |

| Limited Partnerships: 2.4% | | | | | | | | | | |

| Canada: 2.4% | |

| | |

Brookfield Property Partners LP(c) | | | | 45,000 | | | | $ | 651,150 | |

| | |

Total Limited Partnerships

(Cost $548,525) | | | | | | | | | 651,150 | |

| | |

Total Investments: 95.3%

(Cost $26,619,321) | | | | | | | | | 25,722,012 | |

| | |

| Net Other Assets and Liabilities: 4.7% | | | | | | | | | 1,262,129 | |

| | |

| Net Assets: 100.0% | | | | | | | | $ | 26,984,141 | |

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

(a) Non-income producing security.

(b) Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of those securities was $1,069,924, representing 4.0% of net assets.

(c) The Security is considered a non-income producing security as the dividends received during the last 12 months are treated as return of capital per the Generally Accepted Accounting Principles.

Investment Abbreviations:

REIT — Real Estate Investment Trust

| | | | |

See accompanying Notes to Financial Statements. | | 21 | | |

Schedule of Investments (See Note 11)

Salient Select Income Fund

December 31, 2020

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

|

| Common Stocks: 15.5% | |

| REITs-Apartments: 2.1% | |

| | |

Clipper Realty, Inc.(a) | | | | 950,000 | | | | $ | 6,697,500 | |

| | | | | | | | | | |

| REITs-Diversified: 1.0% | |

| | |

W.P. Carey & Co., Inc. | | | | 45,000 | | | | | 3,176,100 | |

| | | | | | | | | | |

| REITs-Healthcare: 2.0% | |

| | |

Sabra Health Care REIT, Inc. | | | | 375,000 | | | | | 6,513,750 | |

| | | | | | | | | | |

| REITs-Hotels: 2.4% | |

| | |

Chatham Lodging Trust | | | | 726,300 | | | | | 7,844,040 | |

| | | | | | | | | | |

| REITs-Industrial: 2.0% | |

| | |

STAG Industrial, Inc. | | | | 210,000 | | | | | 6,577,200 | |

| | | | | | | | | | |

| REITs-Office Property: 3.9% | |

| | |

Boston Properties, Inc. | | | | 45,000 | | | | | 4,253,850 | |

| | |

IQHQ, Inc. — 144A(b)(c)(d)(g) | | | | 350,000 | | | | | 5,824,000 | |

| | |

Mack-Cali Realty Corp. | | | | 207,480 | | | | | 2,585,201 | |

| | |

| | | | | | | | | 12,663,051 | |

| | | | | | | | | | |

| REITs-Single Tenant: 2.1% | |

| | |

NETSTREIT Corp.(e) | | | | 350,000 | | | | | 6,821,500 | |

| | |

Total Common Stocks

(Cost $37,269,673) | | | | | | | | | 50,293,141 | |

| | |

| Convertible Preferred Stocks: 18.6% | | | | | | | | | | |

| REITs-Data Centers: 2.8% | |

| | |

QTS Realty Trust, Inc.

Series B, 6.500% | | | | 63,500 | | | | | 9,010,650 | |

| | | | | | | | | | |

| REITs-Diversified: 4.2% | |

| | |

Lexington Realty Trust

Series C, 6.500% | | | | 230,991 | | | | | 13,725,139 | |

| | | | | | | | | | |

| REITs-Hotels: 3.9% | |

| | |

RLJ Lodging Trust

Series A, 1.950% | | | | 500,000 | | | | | 12,700,000 | |

| | | | | | | | | | |

| REITs-Shopping Centers: 3.8% | |

| | |

RPT Realty

Series D, 7.250% | | | | 245,290 | | | | | 12,225,253 | |

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

|

| | |

| REITs-Specialized: 3.9% | |

| | |

EPR Properties

Series C, 5.750% | | | | 148,700 | | | | $ | 3,420,100 | |

| | |

Series E, 9.000% | | | | 290,000 | | | | | 9,186,040 | |

| | |

| | | | | | | | | 12,606,140 | |

| | |

Total Convertible Preferred Stocks

(Cost $44,995,885) | | | | | | | | | 60,267,182 | |

| | |

| Limited Partnerships: 1.2% | | | | | | | | | | |

| Real Estate Operating/Development: 1.2% | |

| | |

Brookfield Property Partners LP(f) | | | | 275,000 | | | | | 3,979,250 | |

| | |

Total Limited Partnerships

(Cost $3,675,028) | | | | | | | | | 3,979,250 | |

| | |

| Preferred Stocks: 55.7% | | | | | | | | | | |

| Oil, Gas & Consumable Fuels: 0.7% | |

| | |

TravelCenters of America, Inc.

8.250% | | | | 90,000 | | | | | 2,401,200 | |

| | | | | | | | | | |

| REITs-Apartments: 0.4% | | | | | | | | | | |

| | |

Centerspace

6.625% | | | | 47,388 | | | | | 1,232,088 | |

| | | | | | | | | | |

| REITs-Data Centers: 1.2% | |

| | |

Digital Realty Trust, Inc.

5.200% | | | | 146,500 | | | | | 3,999,450 | |

| | | | | | | | | | |

| REITs-Diversified: 5.3% | |

| | |

Armada Hoffler Properties, Inc.

Series A, 6.750% | | | | 150,677 | | | | | 3,926,643 | |

| | |

Colony Capital, Inc.

Series H, 7.125% | | | | 250,000 | | | | | 5,940,000 | |

| | |

Series I, 7.150% | | | | 114,300 | | | | | 2,697,480 | |

| | |

Vornado Realty Trust

Series K, 5.700% | | | | 22,866 | | | | | 575,308 | |

| | |

Series M, 5.250% | | | | 150,000 | | | | | 3,954,000 | |

| | |

| | | | | | | | | 17,093,431 | |

| | | | | | | | | | |

| REITs-Healthcare: 2.4% | |

| | |

Global Medical REIT, Inc.

Series A, 7.500% | | | | 285,000 | | | | | 7,660,800 | |

| | | | | | | | | | |

| REITs-Hotels: 5.0% | |

| | |

Hersha Hospitality Trust

Series C, 6.875%(b) | | | | 260,000 | | | | | 5,057,000 | |

| | |

Series E, 6.500%(b) | | | | 205,000 | | | | | 3,871,425 | |

| | | | |

See accompanying Notes to Financial Statements. | | 22 | | |

Schedule of Investments (See Note 11)

Salient Select Income Fund

December 31, 2020

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| | |

| | | | | | | | | | |

| REITs-Hotels: 5.0% (continued) | | | | | | | | | | |

| | |

Pebblebrook Hotel Trust

Series D, 6.375%(e) | | | | 100,000 | | | | $ | 2,465,000 | |

| | |

Summit Hotel Properties, Inc.

Series E, 6.250% | | | | 212,000 | | | | | 4,776,360 | |

| | |

| | | | | | | | | 16,169,785 | |

| | | | | | | | | | |

| REITs-Industrial: 5.4% | |

| | |

Monmouth Real Estate Investment Corp.

Series C, 6.125% | | | | 400,000 | | | | | 10,040,000 | |

| | |

Plymouth Industrial REIT, Inc.

Series A, 7.500% | | | | 100,000 | | | | | 2,610,000 | |

| | |

Rexford Industrial Realty, Inc.

Series A, 5.875% | | | | 56,379 | | | | | 1,432,027 | |

| | |

Series B, 5.875% | | | | 44,613 | | | | | 1,170,645 | |

| | |

Series C, 5.625% | | | | 80,000 | | | | | 2,155,200 | |

| | |

| | | | | | | | | 17,407,872 | |

| | | | | | | | | | |

| REITs-Mortgage: 5.4% | |

| | |

iStar Financial, Inc.

Series D, 8.000% | | | | 24,300 | | | | | 625,239 | |

| | |

Series G, 7.650% | | | | 400,000 | | | | | 10,061,040 | |

| | |

Series I, 7.500% | | | | 275,200 | | | | | 6,888,256 | |

| | |

| | | | | | | | | 17,574,535 | |

| | | | | | | | | | |

| REITs-Office Property: 0.1% | |

| | |

Boston Properties, Inc.

Series B, 5.250% | | | | 11,492 | | | | | 298,217 | |

| | | | | | | | | | |

| REITs-Regional Malls: 1.3% | |

| | |

Taubman Centers, Inc.

Series K, 6.250%(d) | | | | 794 | | | | | 19,943 | |

| | |

Washington Prime Group, Inc.

Series I, 6.875% | | | | 295,000 | | | | | 4,132,950 | |

| | |

| | | | | | | | | 4,152,893 | |

| | | | | | | | | | |

| REITs-Residential: 7.5% | |

| | |

American Homes 4 Rent

Series D, 6.500% | | | | 154,141 | | | | | 3,905,933 | |

| | |

Series G, 5.875% | | | | 229,200 | | | | | 5,952,324 | |

| | |

Series H, 6.250% | | | | 71,000 | | | | | 1,894,280 | |

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| |

| | | | | | |

| | | |

UMH Properties, Inc.

Series C, 6.750% | | | | 496,899 | | | | | 12,675,893 | |

| | |

| | | | | | | | | 24,428,430 | |

| | | | | | | | | | |

| REITs-Shopping Centers: 12.6% | |

| | |

Cedar Realty Trust, Inc.

Series C, 6.500% | | | | 199,000 | | | | | 4,258,600 | |

| | |

Kimco Realty Corp.

Series L, 5.125% | | | | 187,500 | | | | | 4,925,625 | |

| | |

Saul Centers, Inc.

Series D, 6.125% | | | | 375,000 | | | | | 9,093,750 | |

| | |

Series E, 6.000% | | | | 125,000 | | | | | 2,945,000 | |

| | |

Urstadt Biddle Properties, Inc.

Series H, 6.250% | | | | 345,500 | | | | | 8,644,410 | |

| | |

Series K, 5.875% | | | | 187,469 | | | | | 4,664,229 | |

| | |

VEREIT, Inc.

Series F, 6.700% | | | | 244,533 | | | | | 6,150,005 | |

| | |

| | | | | | | | | 40,681,619 | |

| | | | | | | | | | |

| REITs-Single Tenant: 1.0% | |

| | |

Spirit Realty Capital, Inc.

Series A, 6.000% | | | | 120,000 | | | | | 3,231,600 | |

| | | | | | | | | | |

| REITs-Specialized: 3.7% | |

| | |

Farmland Partners, Inc.

Series B, 6.000% | | | | 475,000 | | | | | 12,155,250 | |

| | | | | | | | | | |

| REITs-Storage: 3.7% | |

| | |

National Storage Affiliates Trust

Series A, 6.000% | | | | 450,000 | | | | | 11,875,500 | |

| | |

Total Preferred Stocks

(Cost $174,950,586) | | | | | | | | | 180,362,670 | |

| | | | |

See accompanying Notes to Financial Statements. | | 23 | | |

Schedule of Investments (See Note 11)

Salient Select Income Fund

December 31, 2020

| | | | | | | | | | |

| | | Principal

Amount | | Value

(See Note 2) |

|

| Convertible Corporate Bonds: 3.2% | |

| Real Estate Management/Services: 3.2% | |

| | |

CTO Realty Growth, Inc. — 144A

3.875%, 04/15/25(c)(d) | | | | $10,780,000 | | | | $ | 10,358,499 | |

| | |

Total Convertible Corporate Bonds

(Cost $10,780,000) | | | | | | | | | 10,358,499 | |

| | |

Total Investments: 94.2%

(Cost $271,671,172) | | | | | | | | | 305,260,742 | |

| | |

| Net Other Assets and Liabilities: 5.8% | | | | | | | | | 18,806,366 | |

| | |

| Net Assets: 100.0% | | | | | | | | $ | 324,067,108 | |

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

(a) Affiliated company. See Note 12 in the Notes to Financial Statements for further information.

(b) Non-income producing security.

(c) Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of those securities was $16,182,498, representing 5.0% of net assets.

(d) IQHQ, Inc, CTO Realty Growth, Inc and Taubman Centers, Inc. are restricted securities exempt from the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. See Note 2(n) in the Notes to Financial Statements for further information.

(e) Security, or portion of security, is being held as collateral in a segregated account for possible future use for the line(s) of credit. At period end, the aggregate market value of those securities was $466,797, representing 0.14% of net assets.

(f) The Security is considered a non-income producing security as the dividends received during the last 12 months are treated as return of capital per the Generally Accepted Accounting Principles.

(g) This investment is classified as a Level 3 asset and such classification was a result of the unavailability of other significant observable inputs. At period end, the aggregate value of the security was $5,824,000, representing 1.80% of net assets. See Note 3 in the Notes Financial Statements for further information.

Investment Abbreviations:

REIT — Real Estate Investment Trust

| | | | |

See accompanying Notes to Financial Statements. | | 24 | | |

Schedule of Investments (See Note 11)

Salient Tactical Growth Fund

December 31, 2020

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

|

| Exchange-Traded Funds: 70.9% | |

| | | |

Consumer Discretionary Select Sector SPDR® Fund | | | | 95,469 | | | | $ | 15,349,506 | |

| | |

Health Care Select Sector SPDR® Fund | | | | 127,798 | | | | | 14,497,405 | |

| | |

Industrial Select Sector SPDR® Fund | | | | 101,738 | | | | | 9,008,900 | |

| | |

Invesco QQQ Trust Series 1™, Series 1 | | | | 51,056 | | | | | 16,018,309 | |

| | |

iShares® Russell 2000 Value ETF | | | | 73,705 | | | | | 9,710,634 | |

| | |

Materials Select Sector SPDR® Trust Fund | | | | 123,449 | | | | | 8,936,473 | |

| | |

SPDR S&P 500® ETF Trust | | | | 358,502 | | | | | 134,036,728 | |

| | |

Total Exchange-Traded Funds

(Cost $177,494,635) | | | | | | | | | 207,557,955 | |

| | |

Total Investments: 70.9%

(Cost $177,494,635) | | | | | | | | | 207,557,955 | |

| | |

| Net Other Assets and Liabilities: 29.1% | | | | | | | | | 85,366,886 | |

| | |

| Net Assets: 100.0% | | | | | | | | $ | 292,924,841 | |

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

Investment Abbreviations:

ETF — Exchange-Traded Fund

S&P — Standard & Poor’s

SPDR — Standard & Poor’s Depository Receipts

| | | | |

See accompanying Notes to Financial Statements. | | 25 | | |

Statements of Assets and Liabilities

December 31, 2020

| | | | | |

| | | Salient

Global Real

Estate Fund |

Assets: | | | | | |

Investments, at value | | | $ | 25,722,012 | |

Cash | | | | 1,358,582 | |

Interest and dividends receivable | | | | 91,200 | |

Other assets | | | | 9,264 | |

| | | | | |

Total Assets | | | | 27,181,058 | |

| | | | | |

Liabilities: | | | | | |

Payable for shares redeemed | | | | 133,945 | |

Payable to advisor | | | | 3,620 | |

Payable for distribution and service fees | | | | 10,413 | |

Payable for compliance fees | | | | 254 | |

Payable to ReFlow (See Note 2(m)) | | | | 522 | |

Payable for legal and audit fees | | | | 27,017 | |

Accrued expenses and other liabilities | | | | 21,146 | |

| | | | | |

Total Liabilities | | | | 196,917 | |

| | | | | |

Net Assets | | | $ | 26,984,141 | |

| | | | | |

Net Assets Consist of: | | | | | |

Paid-in capital | | | $ | 50,531,596 | |

Total distributable earnings | | | | (23,547,455 | ) |

| | | | | |

Total Net Assets | | | $ | 26,984,141 | |

| | | | | |

| |

Investments, At Cost | | | $ | 26,619,321 | |

Pricing of Shares | | | | | |

Investor Class: | | | | | |

Net Assets | | | $ | 698,646 | |

Shares of beneficial interest outstanding | | | | 53,853 | |

Net Asset Value, offering and redemption price per share | | | $ | 12.97 | |

Institutional Class: | | | | | |

Net Assets | | | $ | 3,359,516 | |

Shares of beneficial interest outstanding | | | | 261,247 | |

Net Asset Value, offering and redemption price per share | | | $ | 12.86 | |

Class A: | | | | | |

Net Assets | | | $ | 20,341,382 | |

Shares of beneficial interest outstanding | | | | 1,574,704 | |

Net Asset Value, offering and redemption price per share | | | $ | 12.92 | |

Maximum offering price per share (NAV/0.9425, based on maximum sales charge of 5.75% of the offering price) | | | $ | 13.71 | |

Class C: | | | | | |

Net Assets | | | $ | 2,584,597 | |

Shares of beneficial interest outstanding | | | | 200,712 | |

Net Asset Value, offering and redemption price per share | | | $ | 12.88 | |

| | | | |

See accompanying Notes to Financial Statements. | | 26 | | |

Statements of Assets and Liabilities

December 31, 2020

| | | | | | | | | | |

| | | Salient Select

Income Fund | | Salient

Tactical

Growth Fund |

Assets: | | | | | | | | | | |

Investments in affiliates, at value | | | $ | 6,697,500 | | | | $ | — | |

Investments, at value | | | | 298,563,242 | | | | | 207,557,955 | |

Cash | | | | 17,520,255 | | | | | 85,281,399 | |

Receivable for investments sold | | | | 231,615 | | | | | — | |

Receivable for shares sold | | | | 158,246 | | | | | 275,265 | |

Interest and dividends receivable | | | | 1,701,872 | | | | | 566,457 | |

Other assets | | | | 18,331 | | | | | 29,800 | |

| | | | | | | | | | |

Total Assets | | | | 324,891,061 | | | | | 293,710,876 | |

| | | | | | | | | | |

Liabilities: | | | | | | | | | | |

Payable for interest and commitment fees due on loan (See Note 2(i)) | | | | 430 | | | | | — | |

Payable for shares redeemed | | | | 394,458 | | | | | 388,178 | |

Payable to advisor | | | | 225,557 | | | | | 282,442 | |

Payable for distribution and service fees | | | | 83,780 | | | | | 30,333 | |

Payable for compliance fees | | | | 2,588 | | | | | 2,158 | |

Payable for legal and audit fees | | | | 33,210 | | | | | 32,070 | |

Accrued expenses and other liabilities | | | | 83,930 | | | | | 50,854 | |

| | | | | | | | | | |

Total Liabilities | | | | 823,953 | | | | | 786,035 | |

| | | | | | | | | | |

Net Assets | | | $ | 324,067,108 | | | | $ | 292,924,841 | |

| | | | | | | | | | |

Net Assets Consist of: | �� | | | | | | | | | |

Paid-in capital | | | $ | 314,877,957 | | | | $ | 262,692,039 | |

Total distributable earnings | | | | 9,189,151 | | | | | 30,232,802 | |

| | | | | | | | | | |

Total Net Assets | | | $ | 324,067,108 | | | | $ | 292,924,841 | |

| | | | | | | | | | |

Investment in Affiliates, At Cost | | | $ | 11,548,688 | | | | $ | — | |

| | |

Investments, At Cost | | | | 260,122,484 | | | | | 177,494,635 | |

Pricing of Shares | | | | | | | | | | |

Investor Class: | | | | | | | | | | |

Net Assets | | | $ | 9,169,873 | | | | $ | 8,049,718 | |

Shares of beneficial interest outstanding | | | | 466,201 | | | | | 298,675 | |

Net Asset Value, offering and redemption price per share | | | $ | 19.67 | | | | $ | 26.95 | |

Institutional Class: | | | | | | | | | | |

Net Assets | | | $ | 160,525,509 | | | | $ | 255,095,229 | |