UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-06722

Forward Funds

(Exact name of registrant as specified in charter)

244 California St., Suite 200

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

| | |

Gregory A. Reid, Principal Executive Officer Forward Funds 244 California St., Suite 200 San Francisco, CA 94111 (Name and address of agent for service) | | With a Copy To: George J. Zornada K&L Gates LLP State Street Financial Center One Lincoln St. Boston, MA 02111-2950 (617) 261-3231 |

Registrant’s telephone number, including area code: (800) 999-6809

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission, not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

(a) The following is a copy of the report transmitted to shareholders of the Salient Global Real Estate Fund, Salient Select Income Fund and Salient Tactical Growth Fund (collectively, the “Funds”), each a series of the registrant, pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR 270.30e-1).

[Insert Report Here]

(b) Not applicable

Table of Contents

The series of funds under the Forward Funds Trust (“Salient Funds”) are distributed by:

Forward Securities, LLC

San Francisco, California

The report has been prepared for the general information of the Funds’ shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Funds’ Prospectus, which contains more complete information about Funds’ investment policies, management fees and expenses, experience of the management teams and other information. Investors are reminded to read the Prospectus before investing or sending money.

Shareholder Update | December 31, 2021

| | |

A MESSAGE FROM: | | William Enszer |

| | Chief Executive Officer |

Dear Shareholder:

As we enter 2022, we hope this letter finds you and your families healthy and well during these challenging times. We are thankful for your partnership and we hope that our goal to build investment solutions has served the needs of your portfolios.

Due to the global impact of the COVID-19 pandemic, the last 24 months will be remembered as one of the more challenging times of this century thus far. Populations have navigated lockdowns, return to work, the global rollout of COVID-19 vaccines and an ever-mutating enemy. It is an understatement to say people have been strong, resilient and flexible over the past two years and markets have been no different. The early optimism of 2020 quickly vanished as the pandemic exploded and markets sold off in the first quarter of 2020. Since then, the markets have found a footing and been resilient through multiple waves of infection and the associated demand destruction. Companies have also been strong and flexible as they have navigated changes to their workforces, adapted to supply chain issues and found ways to grow as markets recovered.

Looking at market indices, one may think there was never a pandemic, or at a minimum, think this one is completely over. While that may be a possibility in the near future, there are changes that cannot be overlooked despite the recovery in the equity and fixed-income markets. The domestic economy is seeing spikes in inflation that have not been seen in decades and inflation levels are proving to be stubbornly sticky across goods and services. Inflation can have damaging effects on client portfolios and the impact is not limited to fixed-income investments. Inflation, for example, can negatively impact equities when companies cannot pass through cost and wage increases and where valuations look less attractive on an inflation-adjusted basis. We believe inflation presents a potential risk to investors’ portfolios. This risk has not had to be seriously considered during a decades-long secular drop in yields and inflation, and we believe, at a minimum, should be a significant input for investors as they evaluate their current portfolios.

We hope that 2022 proves a prosperous year for you, our shareholders. Thank you for your trust.

Sincerely,

William Enszer

Chief Executive Officer

Salient Partners, L.P.

RISKS

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

COVID-19 is an infectious disease caused by a new strain of coronavirus. The virus was first identified in late 2019 in Wuhan, the capital of China’s Hubei province, and has since spread globally, resulting in the ongoing coronavirus pandemic.

Inflation is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

Salient is the trade name for Salient Partners, L.P., which together with its subsidiaries provides asset management and advisory services. This information is being provided solely for educational purposes and is not an offer to sell or solicitation of an offer to buy an interest in any investment fund. Any such offer or solicitation may only be made by means of a confidential private offering memorandum or prospectus relating to a particular fund and only in a manner consistent with federal and applicable state securities laws.

1

The Salient Funds offered under the Forward Funds Trust are distributed by Forward Securities, LLC.

Not FDIC Insured | No Bank Guarantee | May Lose Value

©2022 Salient. All rights reserved.

The discussions concerning the Funds included in this shareholder report may contain certain forward-looking statements about the factors that may affect performance of the Funds in the future, including the portfolio managers’ outlook regarding economic, financial, market, petroleum, political and other factors relevant to investment performance in the U.S. and abroad. These statements are based on the portfolio managers’ expectations concerning certain future events and their expected impact on the Funds and are current only through the date on the cover of this report. Forward-looking statements are inherently uncertain and are not intended to predict the future performance of the Funds. Actual events may cause adjustments in the portfolio managers’ strategies from those currently expected to be employed, and the outlook of the portfolio managers is subject to change.

2

Fund Commentary and Performance (Unaudited)

Salient Global Real Estate Fund

As of December 31, 2021

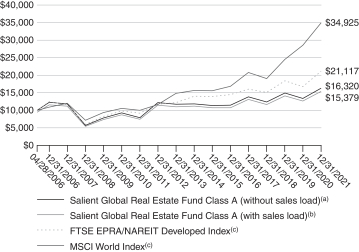

For the year ended December 31, 2021, Salient Global Real Estate Fund’s Class A shares (without sales load) returned 21.58%, underperforming the Fund’s benchmark, the FTSE EPRA/NAREIT Developed Index, which returned 26.09%.

In general, 2021 provided a very strong investing environment for real estate across most geographies following the successful rollout of COVID-19 vaccines in the first half of the year. As the most acute phase of the coronavirus pandemic began to pass, countries around the globe witnessed a recovery in economic growth. Subsequently, global real estate had one of its best years of the last decade in 2021, with most property sectors ending the year in positive territory. However, this result was somewhat lopsided with the U.S. real estate market far outpacing overseas real estate companies. Domestically, the strong performance was in large part attributable to the continued acceleration of core real estate fundamentals (occupancy, tenant renewals, re-leasing spreads and operating margins) from the depths of the COVID-19 public health crisis and optimistic investor sentiment related to real estate investment trust (REIT) valuations. By region, North America generated the best return of 2021—up 41.00%—led by the U.S. and followed closely by Canada, as represented by the subindices of the FTSE EPRA/NAREIT Developed Index. Despite strong REIT returns in the U.K. and select European countries, overseas REITs produced a much more modest 8.76% return in 2021, largely due to a less accommodative monetary policy environment and weaker growth prospects, which led to much lower sector returns.

During 2021, investments in the U.S., the U.K. and Canada contributed the most to the Fund’s performance. The U.S. was the top-performing country for 2021, registering a strong return of 43.24%, largely due to the successful COVID-19 vaccine rollout at the beginning of the year. The gains were broad as all property sectors produced positive returns. Despite a meaningful underweight position to the U.S. throughout the year, the Fund’s U.S. REIT investments contributed nearly three-quarters of the Fund’s return for the reporting period.

While not quite as strong as U.S. REIT performance, REITs based in the U.K. posted solid results due to continued improvement of operating fundamentals. The Fund’s targeted exposure to the U.K.’s industrial, retail and office sectors proved fruitful in 2021 as valuations and earnings growth accelerated throughout the year.

For the second straight year, the Fund’s Canadian industrial sector investments performed very well due to the sector’s strong fundamentals and ability to participate in the long-term trend of e-commerce replacing brick-and-mortar retail sales. We continue to believe that these industrial property assets offer investors the prospect of strong performance far into the future.

On the downside, holdings in Germany and France, as well as an investment in a large European mall operator, detracted from the Fund’s performance. Germany proved to be the weakest European real estate market in 2021 given the country’s slow economic recovery, benign monetary response to the pandemic and the political uncertainty related to the departure of Chancellor Angela Merkel. Despite possessing strong long-term fundamentals, German residential properties were the top detractor from the Fund’s performance for the reporting period.

The Fund’s investment in Unibail-Rodamco-Westfield (URW), the largest mall operator in Europe, also detracted from the Fund’s return. The market environment proved challenging as investors largely stayed away from retail in 2021. Despite having a very low valuation, URW did not produce attractive results due to the aftereffects of the pandemic that limited the recovery of retailers in the second half of 2021.

The Fund’s exposure to Paris office assets also hindered performance in 2021. Similar to 2020, the office REITs sector remained heavily impacted by the pandemic. Many businesses maintained a work-from-home posture, substantially limiting the demand for new office space. Despite lackluster demand, we continue to believe that the Fund’s office investments will rebound following the conclusion of the pandemic.

Despite numerous threats to global economic growth, including record inflation and the extension of the pandemic due to new variants of the coronavirus, we maintain an optimistic outlook for global real estate investment in 2022. We endeavor to source REIT investments in sectors that have not fully participated in the real estate recovery but could provide the foundation for the next stage of growth, most notably the retail, office and lodging sectors as well as European investment opportunities in general. In addition, we have purposefully shortened the lease duration in our portfolio as a means of defending against worldwide inflationary pressures.

Generally speaking, we believe REIT balance sheets remain sound with high coverage ratios and limited near-term maturities. Importantly, real estate transaction volumes in both the public and private markets have maintained a healthy pace, with capital markets both domestically and abroad remaining accommodative to real estate investment. At bottom, the combination of an asynchronous pandemic recovery and many potentially large macro risks indicates to us that stock and country selection will be more important than ever. As always, our value orientation and benchmark-agnostic style of investing will continue in 2022.

3

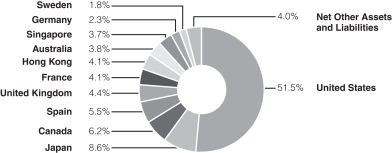

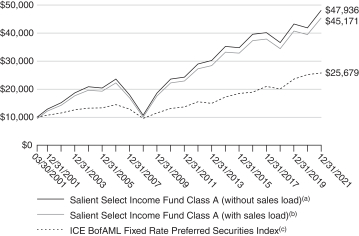

Salient Global Real Estate Fund

Weightings by Country as a Percentage of Net Assets

as of December 31, 2021

These allocations may not reflect the current or future position of the portfolio.

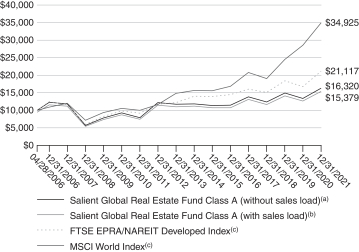

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

4

Salient Global Real Estate Fund(d)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Inception

Date |

| Average Annual Total Return for the period ended December 31, 2021 | | | | | | | | | | | | | | | | |

Investor Class | | | | 21.72% | | | | | 7.40% | | | | | 7.60% | | | | | 4.60% | | | | | 05/02/11 | |

| | | | | |

Institutional Class | | | | 22.09% | | | | | 7.78% | | | | | 7.96% | | | | | 3.52% | | | | | 04/28/06 | |

| | | | | |

Class A (with sales load)(b) | | | | 14.58% | | | | | 6.09% | | | | | 6.90% | | | | | 2.78% | | | | | 04/28/06 | |

| | | | | |

Class A (without sales load)(a) | | | | 21.58% | | | | | 7.35% | | | | | 7.53% | | | | | 3.17% | | | | | 04/28/06 | |

| | | | | |

Class C (with CDSC)(e) | | | | 19.95% | | | | | 6.73% | | | | | 6.92% | | | | | 2.51% | | | | | 04/28/06 | |

| | | | | |

Class C (without CDSC)(f) | | | | 20.95% | | | | | 6.73% | | | | | 6.92% | | | | | 2.51% | | | | | 04/28/06 | |

(a) Excludes sales charge.

(b) Includes the effect of the maximum 5.75% sales charge.

(c) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(d) Prior to August 14, 2018, Salient Global Real Estate Fund was known as Salient International Real Estate Fund. Prior to May 1, 2016, Salient International Real Estate Fund was known as Forward International Real Estate Fund.

(e) Includes the 1.00% contingent deferred sales charge.

(f) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientpartners.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5

Fund Commentary and Performance (Unaudited)

Salient Select Income Fund

As of December 31, 2021

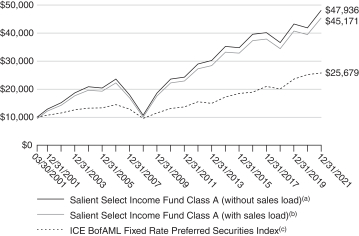

For the year ended December 31, 2021, Salient Select Income Fund’s Class A shares (without sales load) returned 14.98%, outperforming the Fund’s benchmark, the ICE BofAML Fixed Rate Preferred Securities Index, which returned 2.24%.

In general, 2021 provided a very strong investing environment as the U.S. economy produced four consecutive quarters of healthy economic recovery following the successful rollout of COVID-19 vaccines at the beginning of the year. Companies across most industries notched healthy sales growth and record profits. Against this backdrop, investors embraced risk, sending the S&P 500 Index to 70 all-time highs by the end of the year, according to CFRA Research. Correspondingly, real estate investment trust (REIT) equities posted one of their best years ever. The strong performance was in large part attributable to the acceleration of core real estate fundamentals (most notably occupancy, tenant renewals, re-leasing spreads and operating margins) throughout the year and optimistic investor sentiment related to REIT valuations. As measured by the FTSE NAREIT Equity REIT Index, REIT equities returned 43.24% for 2021, an astonishing 1,453 basis points ahead of the S&P 500.

One downside to this historically strong economic growth was a sharp increase in observed inflation. Surprisingly, despite the uptick in consumer prices, interest rates remained rather benign over the past year. The yield on the 10-year U.S. Treasury Note registered a sharp uptick during the first quarter of 2021, increasing from 0.93% to a high of 1.74%. Yet it remained rather range-bound for the final three quarters of the year ending 2021 at 1.52%, still a very low yield from a historical perspective. Of note, toward the end of 2021, the U.S. Federal Reserve began telegraphing the likelihood of multiple interest rate increases in 2022 to prevent the economy from overheating. With these concerns at the forefront of the minds of fixed-income investors, REIT preferred securities, as measured by the MSCI REIT Preferred Index, witnessed a more modest return of 4.82% in 2021.

The lodging, retail and industrial REIT sectors were the top contributors to the Fund’s performance for the reporting period. Several preferred equity investments in the lodging sector contributed meaningfully in 2021. These securities were battered particularly hard in 2020 due to the coronavirus pandemic, which raised questions surrounding the financial strength of lodging REITs. Fortunately, COVID-19 vaccines became broadly available in the first half of 2021, which, combined with general pandemic fatigue, helped drive leisure demand despite the highly infectious Delta and Omicron variants that appeared in the second half of the year.

Prolonged stimulus benefits, including one-time Economic Impact Payments and extended unemployment benefits, combined with pent-up consumer demand drove strong, consistent consumer spending growth in 2021. As with the lodging sector, this demand helped the retail sector to rebound sharply from the lows of 2020. The Fund benefited through several preferred equity positions that returned to trading near their par values.

Similar to lodging and retail REITs, industrial REITs also benefited from the ongoing economic recovery. Growth in e-commerce, record import levels and a shortage of truck drivers drove substantial demand for industrial real estate. In contrast, there were no sectors that detracted from the Fund’s performance for 2021.

Despite numerous threats to global economic growth, including record inflation and the prolonging of the pandemic due to new variants of the coronavirus, we maintain an optimistic outlook for real estate investment in 2022. We endeavor to source REIT investments in sectors that have not fully participated in this real estate recovery but could provide the foundation for the next stage of growth, most notably the retail, office and lodging sectors. In addition, we purposefully shortened the lease duration in our portfolio as a means of defending against economy-wide inflationary pressures.

Generally speaking, we believe REIT balance sheets remain sound with high coverage ratios and limited near-term maturities, providing us with a high level of confidence that the Fund’s credit investments will prove fruitful in the year to come, even in light of the prospect of higher interest rates. Importantly, real estate transaction volumes in both the public and private market have maintained a healthy pace with capital markets remaining accommodative to real estate investment. At bottom, the combination of a strong REIT market and many potentially large macro risks indicates to us that stock and credit selection will be more important than ever. As always, our value orientation and benchmark-agnostic style of investing across the capital stack, which we’ve done consistently since the Fund’s inception, will continue in 2022.

6

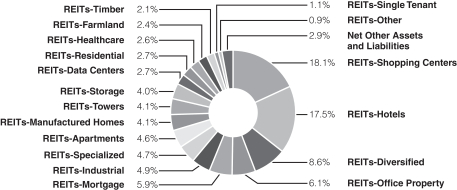

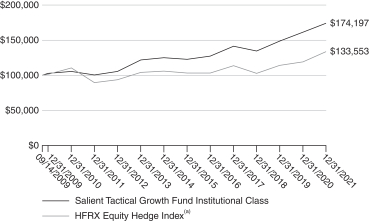

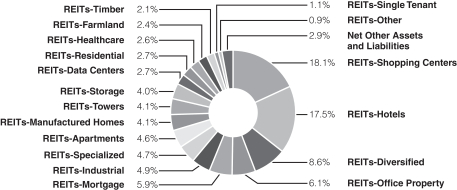

Salient Select Income Fund

Weightings by Sector as a Percentage of Net Assets

as of December 31, 2021

These allocations may not reflect the current or future position of the portfolio.

Hypothetical Growth of $10,000 Investment in the Fund

The chart above shows how a hypothetical investment of $10,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $10,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

7

Salient Select Income Fund(d)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Inception

Date |

| Average Annual Total Return for the period ended December 31, 2021 | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | 15.04% | | | | | 4.05% | | | | | 7.13% | | | | | 7.34% | | | | | 10/26/11 | |

| | | | | |

Institutional Class | | | | 15.44% | | | | | 4.41% | | | | | 7.51% | | | | | 5.78% | | | | | 04/28/06 | |

| | | | | |

Class A (with sales load)(b) | | | | 8.39% | | | | | 2.78% | | | | | 6.45% | | | | | 7.54% | | | | | 03/30/01 | |

| | | | | |

Class A (without sales load)(a) | | | | 14.98% | | | | | 4.01% | | | | | 7.09% | | | | | 7.84% | | | | | 03/30/01 | |

| | | | | |

Class C (with CDSC)(e)(f) | | | | 13.35% | | | | | 3.39% | | | | | 6.46% | | | | | 7.11% | | | | | 03/30/01 | |

| | | | | |

Class C (without CDSC)(e)(g) | | | | 14.35% | | | | | 3.39% | | | | | 6.46% | | | | | 7.11% | | | | | 03/30/01 | |

(a) Excludes sales charge.

(b) Includes the effect of the maximum 5.75% sales charge.

(c) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(d) Prior to May 1, 2016, Salient Select Income Fund was known as Forward Select Income Fund.

(e) While Class C shares were initially offered for purchase effective March 30, 2001, no shareholder activity occurred until April 13, 2001.

(f) Includes the 1.00% contingent deferred sales charge.

(g) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientpartners.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

8

Fund Commentary and Performance (Unaudited)

Salient Tactical Growth Fund

As of December 31, 2021

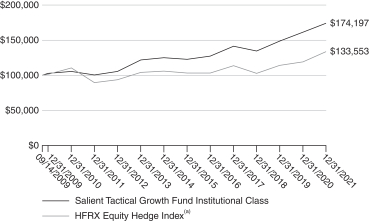

For the year ended December 31, 2021, Salient Tactical Growth Fund’s Institutional Class shares returned 8.02%, underperforming the Fund’s benchmark, the HFRX Equity Hedge Index, which returned 12.14%.

2021 was a year of growth for both the economy and the stock market. Most major market averages recorded all-time highs throughout the year. The S&P 500 Index recorded 70 new all-time highs, second only to the 77 new highs recorded in 1995, according to CFRA Research. The strength in stocks was fueled by good earnings growth, expanded price-earnings (P/E) multiples and an accommodative U.S. Federal Reserve (Fed) policy, which kept interest rates historically low and credit spreads narrow.

Volatility increased in December as the Omicron variant of the coronavirus surged in the U.S. and globally. Many businesses, which had begun to reopen in anticipation of an ebbing of the coronavirus pandemic, were forced to curtail or close operations as health officials warned that the Omicron variant could cause a surge in COVID-19 infections and hospitalizations. Additionally, the uncertainty of the Biden administration’s proposed legislation to address the ongoing pandemic and rebuild America’s infrastructure also dealt a setback to the market. And finally, significant supply chain disruptions occurred throughout the year, which resulted in dislocations and rising prices. In December, inflation surged to its highest level in over 30 years.

In 2021, equity valuations rose to levels not seen since the dot-com bubble of 2000 and the financial crisis of 2008. The median P/E multiple on the S&P 500 increased to 34x earnings in May 2021 and equity valuations remained in historically high territory. Inflationary pressures grew during the year and in November the Consumer Price Index rose 6.8% year over year, the largest 12-month increase since June 1982. As a result, the Fed announced a tapering of its asset purchases and signaled that it would begin raising interest rates in 2022. The 10-year U.S. Treasury Note ended the year at 1.52%, up from 0.93% at the beginning of the year.

Investor sentiment grew increasingly bullish during most of 2021 as stock prices rose. From a contrary point of view, this is a negative in our work because extremes in optimism usually signal caution. Stock market momentum, as measured by the Salient Tactical Growth Fund investment team’s volume and breadth measures, remained positive for most of the year but deteriorated toward year-end. The investment team lowered market exposure as these measures indicated elevated market risk.

The Fund’s investment strategy strives to capture a portion of the market’s growth while aiming to preserve capital during market corrections. The tactical investment approach has had its greatest success in volatile markets that involved market corrections of 10% or more. While the Fund occasionally employs derivative instruments, such as futures contracts, to help offset risk related to elevated market volatility, the Fund did not use derivatives during 2021.

As the Salient Tactical Growth Fund’s investment team looks ahead to 2022, there are several factors within its “Four Pillar Process” that the team will be watching:

| | 1. | Valuation: Equity valuations have been high by any absolute measure. Any significant rise in interest rates in 2022 would be a potentially negative factor for equity valuations. |

| | 2. | Monetary factors and credit conditions: The Fed has signaled that it will provide less liquidity to the markets and that it expects to hike interest rates in 2022. While this is a negative development from both an intermediate- and long-term perspective, interest rates have remained stable so far and credit spreads are still narrow, indicating no immediate dislocations in the economy or the credit markets. Nonetheless, any significant increase in interest rates in 2022, accompanied by a widening of credit spreads, would be a negative for the markets. |

| | 3. | Sentiment: Investor sentiment grew more optimistic as the market rose to new highs during 2021. This optimism is negative from a contrary point of view and suggests that a stock market pullback may be necessary in early 2022 to recycle investor sentiment back to more neutral levels. |

| | 4. | Momentum: The investment team’s volume and breadth models showed weakness as the year ended. The team also became concerned that although most major market averages climbed to new all-time highs in the fourth quarter, only about half of all stocks were able to rise above their 10- and 40-week moving averages. This divergence of leadership stocks versus the rest of the market often occurs prior to some type of market correction. The investment team believes that risks of a corrective market decline have increased going into 2022. |

9

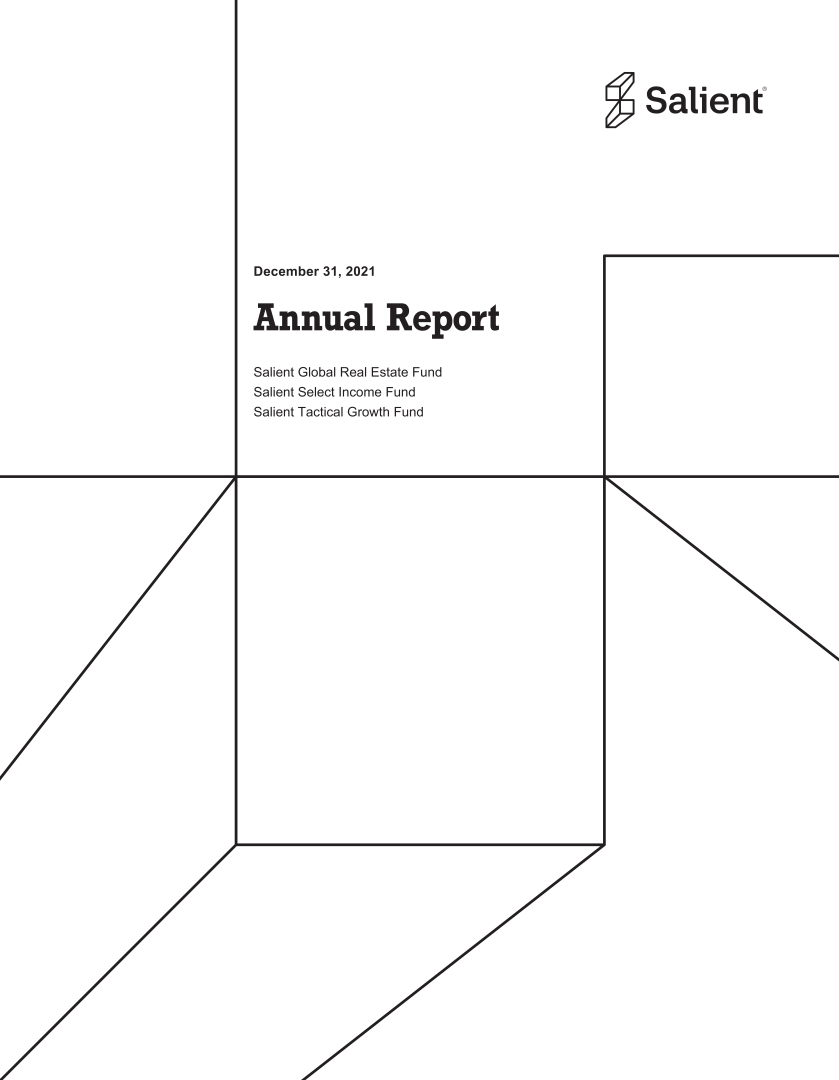

Salient Tactical Growth Fund

Asset Allocation as a Percentage of Net Assets

as of December 31, 2021

Hypothetical Growth of $100,000 Investment in the Fund

The chart above shows how a hypothetical investment of $100,000 in the Fund at its inception would have performed versus an investment in the Fund’s benchmark index. The values indicate what $100,000 would have grown to over the time period indicated. The hypothetical example does not represent the returns of any particular investment.

10

Salient Tactical Growth Fund(b)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception | | Inception

Date |

| Average Annual Total Return for the period ended December 31, 2021 | | | | | | | | | | | | | | | | |

Investor Class | | | | 7.66% | | | | | 6.13% | | | | | 5.33% | | | | | 4.26% | | | | | 09/14/09 | |

| | | | | |

Institutional Class | | | | 8.02% | | | | | 6.49% | | | | | 5.69% | | | | | 4.62% | | | | | 09/14/09 | |

| | | | | |

Class A (with sales load)(c) | | | | 1.40% | | | | | 4.78% | | | | | 4.58% | | | | | 3.37% | | | | | 03/12/10 | |

| | | | | |

Class A (without sales load)(d) | | | | 7.59% | | | | | 6.03% | | | | | 5.20% | | | | | 3.89% | | | | | 03/12/10 | |

| | | | | |

Class C (with CDSC)(e) | | | | 6.01% | | | | | 5.45% | | | | | 4.67% | | | | | 3.62% | | | | | 09/14/09 | |

| | | | | |

Class C (without CDSC)(f) | | | | 7.01% | | | | | 5.45% | | | | | 4.67% | | | | | 3.62% | | | | | 09/14/09 | |

(a) The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

(b) Prior to May 1, 2016, Salient Tactical Growth Fund was known as Forward Tactical Growth Fund.

(c) Includes the effect of the maximum 5.75% sales charge.

(d) Excludes sales charge.

(e) Includes the 1.00% contingent deferred sales charge.

(f) Excludes the 1.00% contingent deferred sales charge.

The performance quoted represents past performance, does not guarantee future results and current performance may be lower or higher than the data quoted. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance data current to the most recent month-end may be obtained at www.salientpartners.com. Investment performance may reflect fee waivers in effect. In the absence of fee waivers, total return would be lower. Total return is based on NAV, assuming reinvestment of all distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

11

Investment Disclosures

Fund Risk Disclosures

There are risks involved with investing, including loss of principal. Past performance does not guarantee future results, share prices will fluctuate and you may have a gain or loss when you redeem shares.

Asset allocation does not assure profit or protect against risk.

Diversification does not assure profit or protect against risk.

This document does not constitute an offering of any security, product, service or fund, including the Funds, for which an offer can be made only by the Funds’ prospectuses.

No fund is a complete investment program and you may lose money investing in a fund. The Funds may engage in other investment practices that may involve additional risks and you should review the Funds’ prospectuses for a complete description.

Salient Global Real Estate Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Equity securities are subject to the financial and operational risks faced by individual companies, the risk that stock markets, sectors and industries may experience periods of turbulence and instability and the general risk that domestic and global economies may go through periods of decline and cyclical change.

Investing in exchange-traded funds (ETFs) will subject a fund to substantially the same risks as those associated with the direct ownership of the securities or other property held by the ETFs.

Foreign securities, especially emerging or frontier markets, will involve additional risks including exchange rate fluctuations, social and political instability, less liquidity, greater volatility and less regulation.

Manager risk is the risk that a fund’s portfolio managers may make poor investment decisions, which would negatively affect a fund’s investment performance.

Market events in the U.S. and global financial markets may result in unusually high market volatility, which could negatively impact a fund’s performance and cause a fund to experience illiquidity, shareholder redemptions or other potentially adverse effects.

Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Overseas stock exchange transactions may pose increased risk and result in delays in obtaining accurate information on the value of securities.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

12

Investment Disclosures, continued

Salient Select Income Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Concentration in a particular industry will involve a greater degree of risk than a more diversified portfolio.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Equity securities are subject to the financial and operational risks faced by individual companies, the risk that stock markets, sectors and industries may experience periods of turbulence and instability and the general risk that domestic and global economies may go through periods of decline and cyclical change.

Investing in exchange-traded funds (ETFs) will subject a fund to substantially the same risks as those associated with the direct ownership of the securities or other property held by the ETFs.

Liquidity refers to how easy it is to buy and sell shares of a security without affecting its price. Investing in securities that are less actively traded or over time experience decreased trading volume may restrict a fund’s ability to take advantage of other market opportunities or to dispose of securities.

Investing in lower-rated (“high yield”) debt securities involves special risks in addition to those associated with investments in higher-rated debt securities, including a high degree of credit risk.

Mortgage- and asset-backed securities are debt instruments that are secured by interests in pools of mortgage loans or other financial instruments. Mortgage-backed securities are subject to, among other things, prepayment and extension risks.

Investing in the real estate industry or in real estate-related securities involves the risks associated with direct ownership of real estate which include, among other things, changes in economic conditions (e.g., interest rates), the macro real estate development market, government intervention (e.g., property taxes) or environmental disasters. These risks may also affect the value of equities that service the real estate sector.

Short selling involves additional investment risks and transaction costs, and creates leverage, which can increase the risk and volatility of a fund.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

Salient Tactical Growth Fund

Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund.

Debt securities are subject to interest rate risk. If interest rates increase, the value of debt securities generally declines. Debt securities with longer durations tend to be more sensitive to changes in interest rates and more volatile than securities with shorter durations.

Derivative instruments involve risks different from those associated with investing directly in securities and may cause, among other things, increased volatility and transaction costs or a fund to lose more than the amount invested.

Investing in exchange-traded funds (ETFs) will subject a fund to substantially the same risks as those associated with the direct ownership of the securities or other property held by the ETFs.

Foreign securities, especially emerging or frontier markets, will involve additional risks including exchange rate fluctuations, social and political instability, less liquidity, greater volatility and less regulation.

13

Investment Disclosures, continued

Salient Tactical Growth Fund, continued

Manager risk is the risk that a fund’s portfolio managers may make poor investment decisions, which would negatively affect a fund’s investment performance.

Market events in the U.S. and global financial markets may result in unusually high market volatility, which could negatively impact a fund’s performance and cause a fund to experience illiquidity, shareholder redemptions or other potentially adverse effects.

Market risk is the risk that the markets on which a fund’s investments trade will lose value in response to company, market or economic news.

Relying on proprietary or third-party quantitative models and information and data supplied by third-party vendors that later prove to be inaccurate or incorrect exposes a fund to additional investment risks.

Short selling involves additional investment risks and transaction costs, and creates leverage, which can increase the risk and volatility of a fund.

Investing in smaller companies generally will present greater investment risks, including greater price volatility, greater sensitivity to changing economic conditions and less liquidity than investing in larger, more mature companies.

Alternative strategies typically are subject to increased risk and loss of principal. Consequently, investments such as mutual funds that focus on alternative strategies are not suitable for all investors.

Fund Benchmark Definitions

FTSE EPRA/NAREIT Developed Index is designed to track the performance of listed real estate companies and REITs worldwide.

HFRX Equity Hedge Index is comprised of private funds with strategies that maintain both long and short positions primarily in equity securities and equity derivatives.

ICE BofAML Fixed Rate Preferred Securities Index is a capitalization-weighted index of preferred stock issues that is generally representative of the market for preferred securities.

One cannot invest directly in an index.

ICE Data Indices, LLC (“ICE DATA”) is used with permission. ICE DATA, its affiliates and their respective third-party suppliers disclaim any and all warranties and representations, express and/or implied, including any warranties of merchantability or fitness for a particular purpose or use, including the indices, index data and any data included in, related to, or derived therefrom. Neither ICE DATA, its affiliates nor their respective third-party providers shall be subject to any damages or liability with respect to the adequacy, accuracy, timeliness or completeness of the indices or the index data or any component thereof, and the indices and index data and all components thereof are provided on an “as is” basis and your use is at your own risk. ICE DATA, its affiliates and their respective third-party suppliers do not sponsor, endorse, or recommend Salient, or any of its products or services.

Definition of Terms

10-year U.S. Treasury Note is a debt obligation issued by the U.S. Treasury that has a term of 10 years.

Basis point is a unit of measure that is equal to 1/100th of 1% and used to denote a change in the value or rate of a financial instrument.

Breadth is a technique used in technical analysis that attempts to gauge the direction of the overall market by analyzing the number of companies advancing relative to the number declining.

Consumer Price Index (CPI) is an index number measuring the average price of consumer goods and services purchased by households. The percentage change in the CPI is a measure of inflation.

14

Investment Disclosures, continued

Coverage ratio is a metric intended to measure a company’s ability to service its debt and meet its financial obligations, such as interest payments or dividends.

COVID-19 is an infectious disease caused by a new strain of coronavirus. The virus was first identified in late 2019 in Wuhan, the capital of China’s Hubei province, and has since spread globally, resulting in the ongoing coronavirus pandemic.

Credit spread is the spread between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating.

Derivative is a security whose price is dependent upon or derived from one or more underlying assets.

Duration is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates and is expressed as a number of years.

Federal Reserve (Fed) is the central bank of the United States that is responsible for regulating the U.S. monetary and financial systems.

FTSE NAREIT Equity REITs Index is representative of the tax-qualified REITs listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market, excluding timber and infrastructure REITs.

Futures are financial contracts that obligate the buyer to purchase an asset (or the seller to sell an asset), such as a physical commodity or a financial instrument, at a predetermined future date and price.

Inflation is the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

Momentum is the rate of acceleration of a security’s price or volume.

Monetary policy refers to the actions of a central bank, currency board or other regulatory committee that determine the size and rate of growth of the money supply, including a change in interest rates or the amount of money banks need to keep in bank reserves.

MSCI REIT Preferred Index is a preferred stock market capitalization-weighted total return index of certain exchange-traded perpetual preferred securities issued by U.S. equity and U.S. hybrid REITs.

MSCI World Index is a free float-adjusted market capitalization index designed to measure equity market performance in the global developed markets.

Near-term maturity means that the agreed-upon date upon which an investment ends will occur soon, often triggering the repayment of a loan or bond, the payment of a commodity, or some other payment or settlement term.

Operating margin measures how much profit a company earns on sales after paying for operating expenses.

Par value is the face value of a bond or the stock value stated in the corporate charter.

Price-earnings (P/E) ratio is a measure of the price paid for a share of stock relative to the annual income or profit earned by the company per share. A higher P/E ratio means that investors are paying more for each unit of income.

Range-bound is when a market, or the value of a particular stock, bond, commodity or currency, moves within a relatively tight range for a certain period of time.

Real estate investment trust (REIT) is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages.

Re-leasing spreads measure the change in rent per square foot between new and expiring leases.

S&P 500 Index is an unmanaged index of 500 common stocks chosen to reflect the industries in the U.S. economy.

15

Investment Disclosures, continued

Valuation is the process of determining the value of an asset or company based on earnings and the market value of assets.

Volatility is a statistical measure of the dispersion of returns for a given security or market index.

Volume is the number of shares or contracts traded in a security or an entire market during a given period of time.

Yield is the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost or on the U.S. government’s debt obligations.

16

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2021

As a shareholder of the Forward Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder services fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the (six-month) period and held for the entire period July 1, 2021 through December 31, 2021.

Actual Expenses

The first line for each share class of each Fund in the table provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the applicable line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example For Comparison Purposes

The second line for each share class of each Fund in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| Salient Global Real Estate Fund | | Beginning

Account Value

07/01/21 | | Ending

Account Value

12/31/21 | | Expense

Ratios(a) | | Expenses Paid

During Period(b)

07/01/21-12/31/21 |

| Investor Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,059.60 | | | | | 1.50% | | | | $ | 7.79 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.64 | | | | | 1.50% | | | | $ | 7.63 | |

| Institutional Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,061.30 | | | | | 1.15% | | | | $ | 5.97 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,019.41 | | | | | 1.15% | | | | $ | 5.85 | |

| Class A | |

Actual | | | $ | 1,000.00 | | | | $ | 1,059.60 | | | | | 1.55% | | | | $ | 8.05 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.39 | | | | | 1.55% | | | | $ | 7.88 | |

| Class C | |

Actual | | | $ | 1,000.00 | | | | $ | 1,056.80 | | | | | 2.10% | | | | $ | 10.89 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,014.62 | | | | | 2.10% | | | | $ | 10.66 | |

| Salient Select Income Fund | | | | | | | | |

| Investor Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,044.00 | | | | | 1.50% | | | | $ | 7.73 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.64 | | | | | 1.50% | | | | $ | 7.63 | |

17

Disclosure of Fund Expenses (Unaudited)

For the Six Months Ended December 31, 2021

| | | | | | | | | | | | | | | | | | | | |

| Salient Select Income Fund (continued) | | Beginning

Account Value

07/01/21 | | Ending

Account Value

12/31/21 | | Expense

Ratios(a) | | Expenses Paid

During Period(b)

07/01/21-12/31/21 |

| Institutional Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,045.90 | | | | | 1.15% | | | | $ | 5.93 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,019.41 | | | | | 1.15% | | | | $ | 5.85 | |

| Class A | |

Actual | | | $ | 1,000.00 | | | | $ | 1,043.50 | | | | | 1.55% | | | | $ | 7.98 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.39 | | | | | 1.55% | | | | $ | 7.88 | |

| Class C | |

Actual | | | $ | 1,000.00 | | | | $ | 1,041.10 | | | | | 2.10% | | | | $ | 10.80 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,014.62 | | | | | 2.10% | | | | $ | 10.66 | |

| Salient Tactical Growth Fund | | | | | | | | |

| Investor Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,016.60 | | | | | 1.80% | | | | $ | 9.15 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,016.13 | | | | | 1.80% | | | | $ | 9.15 | |

| Institutional Class | |

Actual | | | $ | 1,000.00 | | | | $ | 1,018.30 | | | | | 1.45% | | | | $ | 7.38 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,017.90 | | | | | 1.45% | | | | $ | 7.38 | |

| Class A | |

Actual | | | $ | 1,000.00 | | | | $ | 1,016.20 | | | | | 1.85% | | | | $ | 9.40 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,015.88 | | | | | 1.85% | | | | $ | 9.40 | |

| Class C | |

Actual | | | $ | 1,000.00 | | | | $ | 1,013.50 | | | | | 2.40% | | | | $ | 12.18 | |

| | | | |

Hypothetical | | | $ | 1,000.00 | | | | $ | 1,013.11 | | | | | 2.40% | | | | $ | 12.18 | |

(a) Annualized, based on the Fund’s most recent fiscal half year expenses.

(b) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account values over the period, multiplied by the number of days in the most recent fiscal half year (184), then divided by 365.

18

Schedule of Investments (See Note 11)

Salient Global Real Estate Fund

December 31, 2021

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| |

| Common Stocks: 96.0% | | | | | | |

| Australia: 3.8% | | | | | | |

| | |

GPT Group | | | | 190,000 | | | | $ | 749,229 | |

| | |

Scentre Group | | | | 154,000 | | | | | 354,054 | |

| | |

| | | | | | | | | 1,103,283 | |

| | | | | | | | | | |

| Canada: 6.2% | | | | | | |

| | |

Granite Real Estate Investment Trust | | | | 11,300 | | | | | 941,555 | |

| | |

Summit Industrial Income REIT | | | | 47,500 | | | | | 882,446 | |

| | |

| | | | | | | | | 1,824,001 | |

| | | | | | | | | | |

| France: 4.1% | | | | | | |

| | |

Gecina SA | | | | 6,500 | | | | | 909,489 | |

| | |

Unibail-Rodamco-Westfield(a) | | | | 4,300 | | | | | 301,321 | |

| | |

| | | | | | | | | 1,210,810 | |

| | | | | | | | | | |

| Germany: 2.3% | | | | | | |

| | |

Vonovia SE | | | | 12,000 | | | | | 662,606 | |

| | | | | | | | | | |

| Hong Kong: 4.1% | | | | | | |

| | |

Henderson Land Development Co., Ltd. | | | | 63,000 | | | | | 268,238 | |

| | |

Link REIT | | | | 43,000 | | | | | 378,574 | |

| | |

Sun Hung Kai Properties, Ltd. | | | | 30,000 | | | | | 363,960 | |

| | |

Swire Properties, Ltd. | | | | 76,000 | | | | | 190,450 | |

| | |

| | | | | | | | | 1,201,222 | |

| | | | | | | | | | |

| Japan: 8.6% | | | | | | |

| | |

Mitsubishi Estate Co., Ltd. | | | | 35,600 | | | | | 493,473 | |

| | |

Mitsui Fudosan Co., Ltd. | | | | 35,000 | | | | | 693,276 | |

| | |

Sumitomo Realty & Development Co., Ltd. | | | | 21,000 | | | | | 617,604 | |

| | |

Tokyo Tatemono Co., Ltd. | | | | 49,500 | | | | | 722,942 | |

| | |

| | | | | | | | | 2,527,295 | |

| | | | | | | | | | |

| Singapore: 3.7% | | | | | | |

| | |

CapitaLand Integrated Commercial Trust | | | | 60,786 | | | | | 92,018 | |

| | |

CapitaLand Investment, Ltd.(a) | | | | 393,000 | | | | | 994,457 | |

| | |

| | | | | | | | | 1,086,475 | |

| | | | | | | | | | |

| Spain: 5.4% | | | | | | |

| | |

Inmobiliaria Colonial SA | | | | 95,000 | | | | | 892,298 | |

| | |

Merlin Properties Socimi SA | | | | 65,000 | | | | | 708,203 | |

| | |

| | | | | | | | | 1,600,501 | |

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| | |

| | | | | | | | | | | |

| Sweden: 1.8% | | | | | | |

| | |

Fabege AB | | | | 15,400 | | | | $ | 258,280 | |

| | |

Hufvudstaden AB, Class A | | | | 18,300 | | | | | 273,805 | |

| | |

| | | | | | | | | 532,085 | |

| | | | | | | | | | |

| United Kingdom: 4.4% | | | | | | |

| | |

Derwent London Plc | | | | 9,000 | | | | | 416,013 | |

| | |

Great Portland Estates Plc | | | | 43,500 | | | | | 428,641 | |

| | |

Segro Plc | | | | 22,300 | | | | | 433,594 | |

| | |

| | | | | | | | | 1,278,248 | |

| | | | | | | | | | |

| United States: 51.6% | | | | | | |

| | |

Alexandria Real Estate Equities, Inc. | | | | 5,700 | | | | | 1,270,872 | |

| | |

American Assets Trust, Inc. | | | | 19,000 | | | | | 713,070 | |

| | |

American Tower Corp. | | | | 4,100 | | | | | 1,199,250 | |

| | |

Americold Realty Trust | | | | 24,200 | | | | | 793,518 | |

| | |

Apple Hospitality REIT, Inc. | | | | 35,000 | | | | | 565,250 | |

| | |

AvalonBay Communities, Inc. | | | | 4,800 | | | | | 1,212,432 | |

| | |

Boston Properties, Inc. | | | | 8,500 | | | | | 979,030 | |

| | |

CatchMark Timber Trust, Inc., Class A | | | | 34,679 | | | | | 302,054 | |

| | |

Crown Castle International Corp. | | | | 3,000 | | | | | 626,220 | |

| | |

DiamondRock Hospitality Co.(a) | | | | 46,000 | | | | | 442,060 | |

| | |

Equinix, Inc. | | | | 1,000 | | | | | 845,840 | |

| | |

Farmland Partners, Inc. | | | | 45,000 | | | | | 537,750 | |

| | |

Federal Realty Investment Trust | | | | 9,000 | | | | | 1,226,880 | |

| | |

National Storage Affiliates Trust | | | | 5,800 | | | | | 401,360 | |

| | |

Potlatch Corp. | | | | 11,400 | | | | | 686,508 | |

| | |

Retail Opportunity Investments Corp. | | | | 55,000 | | | | | 1,078,000 | |

| | |

SL Green Realty Corp. | | | | 13,000 | | | | | 932,100 | |

| | |

Ventas, Inc. | | | | 7,500 | | | | | 383,400 | |

| | |

VICI Properties, Inc. | | | | 10,000 | | | | | 301,100 | |

| | |

W.P. Carey, Inc. | | | | 7,600 | | | | | 623,580 | |

| | |

| | | | | | | | | 15,120,274 | |

| | |

Total Common Stocks

(Cost $23,917,677) | | | | | | | | | 28,146,800 | |

| | |

Total Investments: 96.0%

(Cost $23,917,677) | | | | | | | | | 28,146,800 | |

| |

| Net Other Assets and Liabilities: 4.0% | | | | | 1,175,597 | |

| | |

| Net Assets: 100.0% | | | | | | | | $ | 29,322,397 | |

| | | | |

See accompanying Notes to Financial Statements. | | 19 | | |

Schedule of Investments (See Note 11)

Salient Global Real Estate Fund

December 31, 2021

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

(a) Non-income producing security.

Investment Abbreviations:

REIT — Real Estate Investment Trust

| | | | |

See accompanying Notes to Financial Statements. | | 20 | | |

Schedule of Investments (See Note 11)

Salient Select Income Fund

December 31, 2021

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| |

| Common Stocks: 25.9% | | | | | | |

| REITS-Apartments: 4.1% | | | | | | |

| | |

American Campus Communities, Inc.(a) | | | | 105,000 | | | | $ | 6,015,450 | |

| | |

UDR, Inc.(a) | | | | 100,000 | | | | | 5,999,000 | |

| | |

| | | | | | | | | 12,014,450 | |

| | | | | | | | | | |

| REITs-Diversified: 1.8% | | | | | | |

| | |

W.P. Carey & Co., Inc.(a) | | | | 65,000 | | | | | 5,333,250 | |

| | | | | | | | | | |

| REITs-Farmland: 2.4% | | | | | | |

| | |

Farmland Partners, Inc. | | | | 590,000 | | | | | 7,050,500 | |

| | | | | | | | | | |

| REITs-Hotels: 2.5% | | | | | | |

| | |

Apple Hospitality REIT, Inc.(a) | | | | 240,000 | | | | | 3,876,000 | |

| | |

DiamondRock Hospitality Co.(a)(b) | | | | 350,000 | | | | | 3,363,500 | |

| | |

| | | | | | | | | 7,239,500 | |

| | | | | | | | | | |

| REITs-Industrial: 1.4% | | | | | | |

| | |

Americold Realty Trust | | | | 119,239 | | | | | 3,909,847 | |

| | | | | | | | | | |

| REITs-Office Property: 6.1% | | | | | | |

| | |

Boston Properties, Inc.(a) | | | | 36,000 | | | | | 4,146,480 | |

| | |

IQHQ, Inc.—144A(b)(c)(d)(e) | | | | 350,000 | | | | | 6,391,000 | |

| | |

SL Green Realty Corp.(a) | | | | 50,000 | | | | | 3,585,000 | |

| | |

Vornado Realty Trust | | | | 85,000 | | | | | 3,558,100 | |

| | |

| | | | | | | | | 17,680,580 | |

| | | | | | | | | | |

| REITs-Shopping Centers: 1.4% | | | | | | |

| | |

Retail Opportunity Investments Corp.(a) | | | | 212,100 | | | | | 4,157,160 | |

| | | | | | | | | | |

| REITs-Timber: 2.1% | | | | | | |

| | |

CatchMark Timber Trust, Inc., Class A | | | | 332,006 | | | | | 2,891,772 | |

| | |

Potlatch Corp. | | | | 55,000 | | | | | 3,312,100 | |

| | |

| | | | | | | | | 6,203,872 | |

| | | | | | | | | | |

| REITs-Towers: 4.1% | | | | | | |

| | |

American Tower Corp. | | | | 21,500 | | | | | 6,288,750 | |

| | |

Crown Castle International Corp. | | | | 27,000 | | | | | 5,635,980 | |

| | |

| | | | | | | | | 11,924,730 | |

| | |

Total Common Stocks

(Cost $80,016,650) | | | | | | | | | 75,513,889 | |

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| |

| Convertible Preferred Stocks: 17.2% | | | | | | |

| REITs-Diversified: 4.6% | | | | | | |

| | |

LXP Industrial Trust

Series C, 6.500% | | | | 218,500 | | | | $ | 13,601,625 | |

| | | | | | | | | | |

| REITs-Hotels: 4.2% | | | | | | |

| | |

RLJ Lodging Trust

Series A, 1.950% | | | | 425,000 | | | | | 12,223,000 | |

| | | | | | | | | | |

| REITs-Shopping Centers: 4.7% | | | | | | |

| | |

RPT Realty

Series D, 7.250% | | | | 231,000 | | | | | 13,608,210 | |

| | | | | | | | | | |

| REITs-Specialized: 3.7% | | | | | | |

| | |

EPR Properties | | | | | | | | | | |

| | |

Series C, 5.750% | | | | 31,000 | | | | | 792,980 | |

| | |

Series E, 9.000% | | | | 280,000 | | | | | 10,010,000 | |

| | |

| | | | | | | | | 10,802,980 | |

| | |

Total Convertible Preferred Stocks

(Cost $29,391,399) | | | | | | | | | 50,235,815 | |

| |

| Preferred Stocks: 54.0% | | | | | | |

| REITS-Apartments: 0.5% | | | | | | |

| | |

Centerspace

Series C, 6.625% | | | | 56,623 | | | | | 1,476,728 | |

| | | | | | | | | | |

| REITs-Data Centers: 2.7% | | | | | | |

| | |

DigitalBridge Group, Inc.

7.125% | | | | 194,363 | | | | | 4,969,862 | |

| | |

7.150% | | | | 114,300 | | | | | 2,984,373 | |

| | |

| | | | | | | | | 7,954,235 | |

| | | | | | | | | | |

| REITs-Diversified: 2.1% | | | | | | |

| | |

Armada Hoffler Properties, Inc.

Series A, 6.750% | | | | 150,000 | | | | | 4,038,045 | |

| | |

CTO Realty Growth, Inc.

6.375% | | | | 82,800 | | | | | 2,177,640 | |

| | |

| | | | | | | | | 6,215,685 | |

| | | | | | | | | | |

| REITs-Healthcare: 2.6% | | | | | | |

| | |

Global Medical REIT, Inc.

Series A, 7.500% | | | | 285,000 | | | | | 7,552,500 | |

| | | | |

See accompanying Notes to Financial Statements. | | 21 | | |

Schedule of Investments (See Note 11)

Salient Select Income Fund

December 31, 2021

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| | |

| | | | | | | | | | |

| REITs-Hotels: 10.9% | | | | | | |

| | |

Chatham Lodging Trust

6.625% | | | | 179,421 | | | | $ | 4,756,450 | |

| | |

Hersha Hospitality Trust | | | | | | | | | | |

| | |

Series C, 6.875% | | | | 260,000 | | | | | 6,133,400 | |

| | |

Series E, 6.500%(a) | | | | 267,999 | | | | | 6,182,737 | |

| | |

Pebblebrook Hotel Trust | | | | | | | | | | |

| | |

Series F, 6.300% | | | | 2,867 | | | | | 72,478 | |

| | |

Series G, 6.375%(a) | | | | 200,000 | | | | | 5,252,000 | |

| | |

Summit Hotel Properties, Inc. | | | | | | | | | | |

| | |

Series E, 6.250% | | | | 212,000 | | | | | 5,374,200 | |

| | |

Series F, 5.875%(b) | | | | 150,000 | | | | | 3,862,500 | |

| | |

| | | | | | | | | 31,633,765 | |

| | | | | | | | | | |

| REITs-Industrial: 3.6% | | | | | | |

| | |

Monmouth Real Estate Investment Corp.

Series C, 6.125% | | | | 260,000 | | | | | 6,562,400 | |

| | |

Plymouth Industrial REIT, Inc.

Series A, 7.500% | | | | 100,000 | | | | | 2,670,000 | |

| | |

Rexford Industrial Realty, Inc.

Series B, 5.875% | | | | 45,000 | | | | | 1,170,000 | |

| | |

| | | | | | | | | 10,402,400 | |

| | | | | | | | | | |

| REITs-Manufactured Homes: 4.1% | | | | | | |

| | |

UMH Properties, Inc.

Series C, 6.750%(a) | | | | 460,000 | | | | | 11,978,400 | |

| | | | | | | | | | |

| REITs-Mortgage: 5.9% | | | | | | |

| | |

iStar Financial, Inc. | | | | | | | | | | |

| | |

Series G, 7.650% | | | | 400,000 | | | | | 10,204,000 | |

| | |

Series I, 7.500% | | | | 275,200 | | | | | 7,080,896 | |

| | |

| | | | | | | | | 17,284,896 | |

| | | | | | | | | | |

| REITs-Other: 0.9% | | | | | | |

| | |

Green Brick Partners, Inc.

5.750% | | | | 100,000 | | | | | 2,614,000 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| | |

| | | | | | | | | | |

| REITs-Residential: 2.7% | | | | | | |

| | |

American Homes 4 Rent | | | | | | | | | | |

| | |

Series G, 5.875%(a) | | | | 229,200 | | | | $ | 5,874,396 | |

| | |

Series H, 6.250% | | | | 71,000 | | | | | 1,920,550 | |

| | |

| | | | | | | | | 7,794,946 | |

| | | | | | | | | | |

| REITs-Shopping Centers: 11.9% | | | | | | |

| | |

Cedar Realty Trust, Inc.

Series C, 6.500% | | | | 200,000 | | | | | 5,054,000 | |

| | |

Kimco Realty Corp.

Series L, 5.125% | | | | 109,520 | | | | | 2,797,141 | |

| | |

Saul Centers, Inc. | | | | | | | | | | |

| | |

Series D, 6.125% | | | | 375,000 | | | | | 9,750,000 | |

| | |

Series E, 6.000% | | | | 125,000 | | | | | 3,433,750 | |

| | |

Urstadt Biddle Properties, Inc. | | | | | | | | | | |

| | |

Series H, 6.250% | | | | 346,100 | | | | | 8,939,763 | |

| | |

Series K, 5.875% | | | | 187,469 | | | | | 4,793,582 | |

| | |

| | | | | | | | | 34,768,236 | |

| | | | | | | | | | |

| REITs-Single Tenant: 1.1% | | | | | | |

| | |

Spirit Realty Capital, Inc.

Series A, 6.000% | | | | 120,000 | | | | | 3,086,400 | |

| | | | | | | | | | |

| REITs-Specialized: 1.0% | | | | | | |

| | |

CorEnergy Infrastructure Trust, Inc.

Series A, 7.375% | | | | 142,000 | | | | | 2,911,000 | |

| | | | | | | | | | |

| REITs-Storage: 4.0% | | | | | | |

| | |

National Storage Affiliates Trust

Series A, 6.000% | | | | 450,000 | | | | | 11,713,500 | |

| | |

Total Preferred Stocks

(Cost $126,003,238) | | | | | | | | | 157,386,691 | |

| | |

Total Investments: 97.1%

(Cost $235,411,287) | | | | | | | | | 283,136,395 | |

| |

| Net Other Assets and Liabilities: 2.9% | | | | | 8,439,405 | |

| | |

| Net Assets: 100.0% | | | | | | | | $ | 291,575,800 | |

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

(a) Security, or portion of security, is being held as collateral in a segregated account for possible future use for the line of credit. At period end, the aggregate market value of those securities was $53,184,230, representing 18.24% of net assets.

| | | | |

See accompanying Notes to Financial Statements. | | 22 | | |

Schedule of Investments (See Note 11)

Salient Select Income Fund

December 31, 2021

(b) The security is considered a non-income producing security as any dividends received during the period (if applicable) are treated as return of capital per the Generally Accepted Accounting Principles.

(c) This investment is classified as a Level 3 asset and such classification was a result of unavailable quoted prices from an active market or the unavailability of other significant observable inputs. At period end, the aggregate value of the security was $6,391,000, representing 2.2% of net assets. See Note 3 in the Notes to Financial Statements for further information.

(d) IQHQ, Inc. is a restricted security exempt from the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. See Note 2(n) in the Notes to Financial Statements for further information.

(e) Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of those securities was $6,391,000, representing 2.2% of net assets.

Investment Abbreviations:

REIT — Real Estate Investment Trust

| | | | |

See accompanying Notes to Financial Statements. | | 23 | | |

Schedule of Investments (See Note 11)

Salient Tactical Growth Fund

December 31, 2021

| | | | | | | | | | |

| | | Shares | | Value

(See Note 2) |

| |

| Exchange-Traded Funds: 36.1% | | | | | | |

| Exchange-Traded Funds: 36.1% | | | | | | |

| | |

SPDR S&P 500® ETF Trust | | | | 256,614 | | | | $ | 121,881,385 | |

| |

Total Exchange-Traded Funds

(Cost $81,083,475) | | | | | 121,881,385 | |

| | | | | | | | | | |

| |

| Short-Term Securities: 53.5% | | | | | | |

| | | |

Fidelity Government Portfolio - Institutional Class

0.010% | | | | $180,403,106 | | | | | 180,403,106 | |

| | |

Total Short-Term Securities

(Cost $180,403,106) | | | | | | | | | 180,403,106 | |

| | |

Total Investments: 89.6%

(Cost $261,486,581) | | | | | | | | | 302,284,491 | |

| |

| Net Other Assets and Liabilities: 10.4% | | | | | 34,970,576 | |

| | |

| Net Assets: 100.0% | | | | | | | | $ | 337,255,067 | |

All percentages disclosed are calculated by dividing the indicated amounts by net assets.

Investment Abbreviations:

ETF — Exchange-Traded Fund

S&P — Standard & Poor’s

SPDR — Standard & Poor’s Depository Receipts

| | | | |

See accompanying Notes to Financial Statements. | | 24 | | |

Statements of Assets and Liabilities

December 31, 2021

| | | | | |

| | | Salient

Global Real

Estate Fund |

Assets: | | | | | |

Investments, at value | | | $ | 28,146,800 | |

Cash | | | | 1,078,526 | |

Foreign currency, at value (Cost $16,987) | | | | 16,987 | |

Interest and dividends receivable | | | | 141,789 | |

Other assets | | | | 9,895 | |

| | | | | |

Total Assets | | | | 29,393,997 | |

| | | | | |

Liabilities: | | | | | |

Payable for shares redeemed | | | | 883 | |

Payable to advisor | | | | 10,071 | |

Payable for distribution and service fees | | | | 10,401 | |

Payable to trustees | | | | 3 | |

Payable for compliance fees | | | | 611 | |

Payable to ReFlow (See Note 2(m)) | | | | 522 | |

Payable for legal and audit fees | | | | 27,755 | |

Accrued expenses and other liabilities | | | | 21,354 | |

| | | | | |

Total Liabilities | | | | 71,600 | |

| | | | | |

Net Assets | | | $ | 29,322,397 | |

| | | | | |

Net Assets Consist of: | | | | | |

Paid-in capital | | | $ | 47,989,455 | |

Total distributable earnings | | | | (18,667,058 | ) |

| | | | | |

Total Net Assets | | | $ | 29,322,397 | |

| | | | | |

| |

Investments, At Cost | | | $ | 23,917,677 | |

Pricing of Shares | | | | | |

Investor Class: | | | | | |

Net Assets | | | $ | 734,583 | |

Shares of beneficial interest outstanding | | | | 47,822 | |

Net Asset Value, offering and redemption price per share | | | $ | 15.36 | |

Institutional Class: | | | | | |

Net Assets | | | $ | 3,684,701 | |

Shares of beneficial interest outstanding | | | | 242,047 | |

Net Asset Value, offering and redemption price per share | | | $ | 15.22 | |

Class A: | | | | | |

Net Assets | | | $ | 23,311,907 | |

Shares of beneficial interest outstanding | | | | 1,524,266 | |

Net Asset Value, offering and redemption price per share | | | $ | 15.29 | |

Maximum offering price per share (NAV/0.9425, based on maximum sales charge of 5.75% of the offering price) | | | $ | 16.22 | |

Class C: | | | | | |

Net Assets | | | $ | 1,591,206 | |

Shares of beneficial interest outstanding | | | | 104,344 | |

Net Asset Value, offering and redemption price per share | | | $ | 15.25 | |

| | | | |

See accompanying Notes to Financial Statements. | | 25 | | |

Statements of Assets and Liabilities

December 31, 2021

| | | | | | | | | | |

| | | Salient Select

Income Fund | | Salient

Tactical

Growth Fund |

Assets: | | | | | | | | | | |

Investments, at value | | | $ | 283,136,395 | | | | $ | 302,284,491 | |

Cash | | | | 12,448,648 | | | | | 35,001,552 | |

Receivable for shares sold | | | | 218,944 | | | | | 508,670 | |

Interest and dividends receivable | | | | 1,652,085 | | | | | 585,165 | |

Other assets | | | | 23,130 | | | | | 26,951 | |

| | | | | | | | | | |

Total Assets | | | | 297,479,202 | | | | | 338,406,829 | |

| | | | | | | | | | |

Liabilities: | | | | | | | | | | |

Payable on loan (See Note 2(i)) | | | | 5,000,000 | | | | | — | |

Payable for interest and commitment fees due on loan (See Note 2(i)) | | | | 17,062 | | | | | — | |

Payable for investments purchased | | | | 71,044 | | | | | — | |

Payable for shares redeemed | | | | 396,190 | | | | | 680,515 | |

Payable to advisor | | | | 190,922 | | | | | 325,069 | |

Payable for distribution and service fees | | | | 67,359 | | | | | 30,304 | |

Payable to trustees | | | | 41 | | | | | 22 | |

Payable for compliance fees | | | | 7,002 | | | | | 6,861 | |

Payable for legal and audit fees | | | | 25,752 | | | | | 26,958 | |

Accrued expenses and other liabilities | | | | 128,030 | | | | | 82,033 | |

| | | | | | | | | | |

Total Liabilities | | | | 5,903,402 | | | | | 1,151,762 | |

| | | | | | | | | | |

Net Assets | | | $ | 291,575,800 | | | | $ | 337,255,067 | |

| | | | | | | | | | |

Net Assets Consist of: | | | | | | | | | | |

Paid-in capital | | | $ | 243,930,162 | | | | $ | 296,457,157 | |

Total distributable earnings | | | | 47,645,638 | | | | | 40,797,910 | |

| | | | | | | | | | |

Total Net Assets | | | $ | 291,575,800 | | | | $ | 337,255,067 | |

| | | | | | | | | | |

| | |

Investments, At Cost | | | $ | 235,411,287 | | | | $ | 261,486,581 | |

Pricing of Shares | | | | | | | | | | |

Investor Class: | | | | | | | | | | |

Net Assets | | | $ | 10,015,773 | | | | $ | 4,943,446 | |

Shares of beneficial interest outstanding | | | | 464,799 | | | | | 176,852 | |

Net Asset Value, offering and redemption price per share | | | $ | 21.55 | | | | $ | 27.95 | |

Institutional Class: | | | | | | | | | | |

Net Assets | | | $ | 143,721,490 | | | | $ | 301,241,403 | |

Shares of beneficial interest outstanding | | | | 6,666,507 | | | | | 10,337,416 | |

Net Asset Value, offering and redemption price per share | | | $ | 21.56 | | | | $ | 29.14 | |

Class A: | | | | | | | | | | |

Net Assets | | | $ | 126,619,965 | | | | $ | 21,995,081 | |

Shares of beneficial interest outstanding | | | | 5,852,792 | | | | | 804,406 | |

Net Asset Value, offering and redemption price per share | | | $ | 21.63 | | | | $ | 27.34 | |

Maximum offering price per share (NAV/0.9425, based on maximum sales charge of 5.75% of the offering price) | | | $ | 22.95 | | | | $ | 29.01 | |

Class C: | | | | | | | | | | |

Net Assets | | | $ | 11,218,572 | | | | $ | 9,075,137 | |

Shares of beneficial interest outstanding | | | | 535,806 | | | | | 357,364 | |

Net Asset Value, offering and redemption price per share | | | $ | 20.94 | | | | $ | 25.39 | |

| | | | |

See accompanying Notes to Financial Statements. | | 26 | | |

Statements of Operations

For the Year Ended December 31, 2021

| | | | | |

| | | Salient

Global Real

Estate Fund |

Investment Income: | |

Dividends | | | $ | 725,704 | |

Foreign taxes withheld | | | | (43,552 | ) |

| | | | | |

Total Investment Income | | | | 682,152 | |

| | | | | |

Expenses: | | | | | |

Investment advisory fee | | | | 286,574 | |

Administration fees and expenses | | | | 51,282 | |

Custodian fee | | | | 4,832 | |

Legal and audit fees | | | | 50,097 | |

Transfer agent fees and expenses | | | | 34,352 | |

Trustees’ fees and expenses | | | | 8,306 | |

Registration/filing fees | | | | 51,648 | |

Reports to shareholders and printing fees | | | | 12,366 | |

Distribution and service fees | | | | | |