Exhibit 1

ANNUAL INFORMATION FORM

FALCONBRIDGE LIMITED

March 22, 2006

TABLE OF CONTENTS

| | | Page |

| GLOSSARY OF TERMS | | 3 |

| CURRENCY | | 5 |

| METRIC/IMPERIAL CONVERSION TABLE | | 5 |

| EXCHANGE RATE DATA | | 5 |

| FORWARD-LOOKING STATEMENTS | | 6 |

1. | CORPORATE STRUCTURE | | 7 |

| 1.1 | Incorporation | | 7 |

| 1.2 | Corporate Profile | | 7 |

| 1.3 | Organizational Chart | | 8 |

2. | GENERAL BUSINESS DEVELOPMENTS | | 9 |

| 2.1 | Three-Year History | | 9 |

| 2.2 | Principal Products | | 13 |

3. | DESCRIPTION OF THE BUSINESS | | 17 |

| 3.1 | Main Businesses | | 18 |

| | 3.1.1 | Nickel | | 18 |

| | 3.1.2 | Copper | | 23 |

| | 3.1.3 | Aluminum | | 29 |

| | 3.1.4 | Zinc | | 31 |

| | 3.1.5 | Exploration and Project Development | | 34 |

| 3.2 | Other Subsidiaries | | 41 |

| 3.3 | Technology | | 42 |

| 3.4 | Environment | | 42 |

| 3.5 | Labour Relations | | 43 |

| 3.6 | Legal Proceedings | | 43 |

| 3.7 | Combination of Noranda and Former Falconbridge | | 44 |

| 3.8 | Trends, Risks and Uncertainties | | 44 |

| 3.9 | Statistical Tables | | 49 |

| | 3.9.1 | Production Volumes | | | 49 |

| | 3.9.2 | Sales Volumes and Realized Prices | | | 52 |

| | 3.9.3 | Mineral Reserves and Resources | | | 54 |

| | 3.9.4 | Reconciliation of Mineral Reserves | | | 58 |

4. | DIVIDEND POLICY | | 63 |

5. | CAPITAL STRUCTURE OF THE COMPANY | | 63 |

6. | MARKET FOR SECURITIES | | 92 |

| 6.1 | Trading Price and Volume | | 92 |

| 6.2 | Prior Sales | | 93 |

| 6.3 | Ownership of Common Shares | | 93 |

7. | CREDIT RATINGS | | 94 |

8. | DIRECTORS AND EXECUTIVE OFFICERS | | 95 |

| 8.1 | Directors | | 95 |

| 8.2 | Executive Officers | | 96 |

| 8.3 | Cease Trade Orders, Bankruptcies, Penalties or Sanctions | | 99 |

9. | AUDIT COMMITTEE | | 99 |

10. | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | 101 |

11. | TRANSFER AGENTS AND REGISTRARS | | 101 |

12. | EXPERTS | | 101 |

| 12.1 | Names of Experts | | 101 |

| 12.2 | Interests of Experts | | 102 |

13. | MATERIAL CONTRACTS | | 102 |

14. | ADDITIONAL INFORMATION | | 103 |

| SCHEDULE “A” AUDIT COMMITTEE TERMS OF REFERENCE | | 104 |

2

GLOSSARY OF TERMS

anode | | a rectangular plate of metal cast in a shape suitable for refining by the electrolytic process. An anode is the finished product of the copper smelting process. |

| | |

bankable feasibility study | | a comprehensive study of a deposit in which all geological, engineering, operating, economic and other relevant factors are considered in sufficient detail that it could reasonably serve as a basis for a financial decision by a financial institution to finance the development of the deposit for mineral production. |

| | |

blister copper | | a crude form of copper (assaying about 99%) produced in a smelter, which requires further refining before being used for industrial purposes. |

| | |

capacity | | the design number of units that can be produced in a given time period based on operations with a normal number of shifts and maintenance interruptions. |

| | |

cathode | | a rectangular plate of metal, produced by electrolytic refining, which is melted into commercial shapes such as billets, ingots, etc. A cathode is typically the finished product of the copper refining process. |

| | |

COMEX | | The New York Commodity Exchange. |

| | |

concentrate | | a product containing valuable minerals from which most of the waste material in the ore has been separated. |

| | |

ferronickel | | an alloy containing nickel and iron (approximately 38% nickel and 62% iron in the case of ferronickel produced by Falcondo). The volumes produced are expressed in terms of the nickel contained. |

| | |

LME | | London Metal Exchange. |

| | |

matte | | a mixture of metal sulphides enriched with nickel, cobalt, copper, silver, gold and platinum group metals. |

| | |

mill | | a plant where ore is ground and undergoes physical or chemical treatment to extract and produce a concentrate of the valuable minerals. |

| | |

mineral resource(1) | | a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | |

inferred mineral resource(1) | | part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

| | |

indicated mineral resource(1) | | part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The |

3

| | estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| | |

measured mineral resource(1) | | part of a mineral resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| | |

mineral reserve(1) | | economical mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| | |

NI 43-101(1) | | National Instrument 43-101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators. |

| | |

probable mineral reserve(1) | | economical mineable part of an indicated, and in some circumstances a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| | |

proven mineral reserve(1) | | economical mineable part of a measured mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| | |

platinum group metals | | platinum, palladium, rhodium and related metals present in some nickel/copper ores. |

| | |

refinery | | a plant where concentrates or matte are processed into one or more refined metals. |

| | |

smelter | | a plant in which concentrates are processed into an upgraded product. |

| | |

SX-EW | | solvent extraction-electrowinning is a metallurgical technique, so far applied only to copper ores, in which metal is dissolved from the rock by organic solvents and recovered from solution by electrolysis. |

Notes:

(1) NI 43-101 definitions

4

CURRENCY

All references in this annual information form to “dollars” or “$” are to United States dollars, unless otherwise indicated.

METRIC/IMPERIAL CONVERSION TABLE

The imperial equivalents of the metric units of measurement used in this Annual Information Form are as follows:

Wherever referred to in this Annual Information

Form: | | Metric Unit | | Metric Symbol | | Imperial Equivalent |

| | | | | | |

“kg” means kilogram | | Tonne | | mt | | 1.102311 tons |

“lb” means pound | | Kilogram | | kg | | 2.20462 pounds |

“oz” means troy ounces | | Gram | | g | | 0.032151 troy ounces |

“tonne” or “mt” means 1,000 kilograms | | Metre | | m | | 3.2808 feet |

| | Cubic metre | | m3 | | 35.315 cubic feet |

| | Kilometre | | km | | 0.6214 miles |

| | Hectare | | ha | | 2.4711 acres |

EXCHANGE RATE DATA

We have historically published our consolidated financial statements in Canadian dollars. Effective July 1, 2003, we began reporting our financial results in U.S. dollars. In this Annual Information Form, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in United States dollars and references to $ or “US$” are to United States dollars and references to “Cdn$” are to Canadian dollars.

The following table sets forth, for each period indicated, information concerning the exchange rates between U.S. dollars and Canadian dollars based on the noon buying rate in the City of New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York (the “noon buying rate”). The table illustrates how many Canadian dollars it would take to buy one United States dollar.

| | Year Ended

December 31, | |

| | 2003 | | 2004 | | 2005 | |

Low | | 1.2923 | | 1.1775 | | 1.1507 | |

High | | 1.5750 | | 1.3970 | | 1.2703 | |

Average (1) | | 1.3916 | | 1.2984 | | 1.2083 | |

Period End | | 1.2923 | | 1.2034 | | 1.1656 | |

Notes

(1) The average of the daily noon buying rates on the last business day of each month during the applicable period.

5

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Information Form are forward-looking statements (as defined in applicable securities legislation). Examples of such statements include, but are not limited to, statements concerning (i) our assessment of the outlook for metal markets in 2006, (ii) Inco’s offer to acquire all of the common shares of Falconbridge Limited and the benefits of such combination, (iii) our future financial requirements and funding of those requirements, (iv) our expectations with respect to our development projects, (v) our production forecast for 2006, (vi) our capital expenditure forecasts, and (vii) our dividend schedule. Inherent in forward-looking statements are risks and uncertainties well beyond our ability to predict or control. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this Annual Information Form. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about the timing, steps to be taken and completion of Inco’s offer to acquire all of our common shares, the ability to successfully compete against global metals and mining and exploration companies by creating through such a combination an enterprise of increased scale; strong demand for nickel, copper and other metals in emerging markets such as China; approximately $350 million per annum in pre-tax operating and other synergies and cost savings, and other benefits being realized based on the achievement of operational efficiencies from restructuring, integration and other initiatives relating to the combination of Falconbridge and Inco; the approvals or clearances required to be obtained by Inco and Falconbridge from regulatory and other agencies and bodies being obtained in a timely manner; divestitures required by regulatory agencies being acceptable and completed in a timely manner; there being limited costs, difficulties or delays related to the integration of the Falconbridge’s operations with those of Inco; the timely completion of the steps required to be taken for the eventual combination of the two companies; business and economic conditions generally; exchange rates, energy and other anticipated and unanticipated costs and pension contributions and expenses; the supply and demand for, deliveries of, and the level and volatility of prices of, nickel, copper, aluminum, zinc and other primary metals products and other metal products Inco and Falconbridge produce; the timing of the receipt of remaining regulatory and governmental approvals for the development projects and other operations; the continued availability of financing on appropriate terms for development projects; Falconbridge’s costs of production and production and productivity levels, as well as those of its competitors; market competition; mining, processing, exploration and research and development activities; the accuracy of ore/mineral reserve estimates; premiums realized over LME cash and other benchmark prices; tax benefits/charges; the resolution of environmental and other proceedings and the impact on the combined company of various environmental regulations and initiatives; assumptions concerning political and economic stability in countries or locations in which Falconbridge operates or otherwise and the ability to continue to pay quarterly cash dividends in such amounts as Falconbridge’s Board of Directors may determine in light of other uses for such funds and other factors.

While Falconbridge anticipates that subsequent events and developments may cause Falconbridge’s views to change, the Company specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this Annual Information Form. Although the Company has attempted to identify important factors that could cause actual actions, events or

results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. These factors are not intended to represent a complete list of the factors that could affect Falconbridge and the combination of Inco and Falconbridge.

6

1. CORPORATE STRUCTURE

1.1 Incorporation

Falconbridge Limited is the continuing corporation resulting from the amalgamation under the Business Corporations Act (Ontario) on June 30, 2005 of Noranda Inc. (“Noranda”) and the former Falconbridge Limited (“Former Falconbridge”). Predecessors of the Company have carried on business under the Falconbridge Limited name since 1928 and under the Noranda Inc. name since 1922. The registered and head office of the Company is at BCE Place, Suite 200, 181 Bay Street, Toronto, Ontario, M5J 2T3. The principal operation’s office of the Company is at Queen’s Quay Terminal, 207 Queen’s Quay West, Suite 800, Toronto, Ontario, M5J 1A7.

In this Annual Information Form, Falconbridge Limited and its wholly-owned subsidiaries may be collectively referred to as the “Company”, and the Company, together with its other subsidiaries and joint ventures, may also be referred to as “Falconbridge”, “we”, “us” or “ours”.

1.2 Corporate Profile

We are a leading international copper and nickel company with investments in fully integrated zinc and aluminum assets. Our primary focus is the identification and development of world-class copper and nickel mining deposits.

We are one of the world’s largest producers of zinc and nickel and a significant producer of copper, primary and fabricated aluminum, cobalt, lead, molybdenum, silver, gold and sulphuric acid. We are also one of the world’s largest recyclers and processors of metal-bearing materials. We sell commodity and value-added products to customers around the world.

7

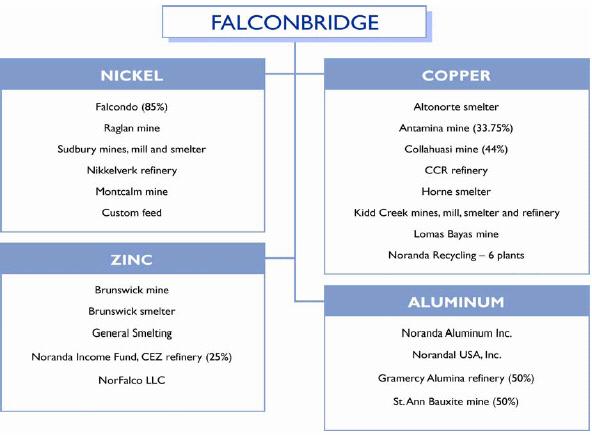

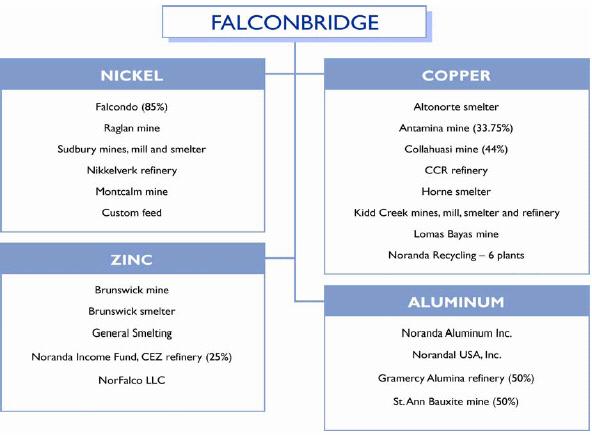

1.3 Organizational Chart

The principal direct and indirect subsidiaries of the Company and the jurisdictions in which they were incorporated or organized are set out below:

Notes:

(1). The Corporation owns 100% of the shares of Natresco Incorporated which, in turn, own 100% of the shares of Falconbridge U.S., Inc.

(2). NorFalco LLC is indirectly wholly-owned by the Corporation, through its subsidiaries Noranda Commodities, Inc. (65%) and NACID, Inc (35%).

(3). The common shares of Novicourt Inc. are listed and posted for trading on the Toronto Stock Exchange.

(4). The Corporation owns 100% of the shares of 3086143 Nova Scotia Company which, in turn, owns 100% of the shares of Noranda Finance Inc.

(5). The Corporation holds a 25% interest in the Noranda Income Fund, a trust formed under the laws of Ontario, which indirectly owns a zinc processing facility in Valleyfield, Québec.

(6). The Corporation holds 100% of the shares of Noranda Antamina Ltd. which, in turn, owns 33.75% interest in Compañia Minera Antamina S.A.

(7). Falconbridge Chile S.A., CMDIC Holdings Limited and Falconbridge Collahuasi Limited own 19.93%, 20.09% and 3.98% respectively, and 44%, collectively, of the shares of Compañia Minera Doña Inés de Collahuasi S.C.M. (“Collahuasi”), which owns 100% of Collahuasi.

(8). CMLB Holdings Limited owns 100% of the shares of Compañia Minera Falconbridge Lomas Bayas (“Lomas Bayas”), which owns 100% of Lomas Bayas.

8

2. GENERAL BUSINESS DEVELOPMENTS

2.1 Three-Year History

Recent Developments

The Company announced on March 15, 2006 that it intends to make an offer by way of a takeover bid for all of the outstanding shares of Novicourt Inc. (“Novicourt”) that it does not already own at a cash offer price of Cdn$2.30 per Novicourt share. The Company presently holds approximately 62.1% of the outstanding common shares of Novicourt. The proposed offer would be subject to a number of conditions including that not less than 50% of the shares of Novicourt not already owned by the Company are tendered.

The Company announced on March 16, 2006 that it intends to redeem a total of 20,000,000, or $500 million, of its outstanding junior preference shares. The junior preference shares will be redeemed on April 26, 2006 from holders of record on March 22, 2006. The Company intends to utilize its internal cash resources to fund the redemption.

The Company announced on March 21, 2006 that it had enacted a new shareholder rights plan, effective on that date, to replace the September 22, 2005 rights plan previously enacted by the Company. The new rights plan is designed to prevent a creeping takeover of the Company and preserve its ability to obtain the best value for all shareholders. The plan is also designed to provide the share ownership stability to protect the opportunity for shareholders to tender to the existing Inco Limited takeover offer or any other bid for the Company. The full text of the plan is available at www.sedar.com.

2005

Major developments in 2005 included:

• The continued progress on the Raglan Optimization project, which is expected to increase annual production by approximately 5,000 tonnes of nickel per year, beginning in 2007;

• The construction at the molybdenum recovery plant, with scheduled start-up in early 2006, at Compañia Minera Doña Inés de Collahuasi S.C.M. (“Collahuasi”);

• The continuation of the feasibility study on the second expansion of the copper concentrator at Collahuasi;

• The development of the new leaching pad for run-of-mine ore at Lomas Bayas;

• The Kidd Mine D shaft progress with the ramp and lateral development being at 97% of plan;

• The finalization of a joint-venture agreement between Falconbridge and Barrick Gold Corporation regarding the Kabanga nickel deposit in Tanzania and related concessions;

• The earn-in of a 70% joint venture interest in the El Morro (Chile) copper/gold property from Metallica Resources Inc.

• The completion on May 5, 2005, of Noranda’s issuer bid to exchange Noranda common shares for new Junior Preference Shares. A total of 63,377,140 Noranda common shares were repurchased as a result of this offer and a total of 50,000,000 new junior preference shares were issued as consideration;

• The completion of Noranda’s takeover bid of the Former Falconbridge whereby it offered to exchange 1.77 Noranda common shares for each outstanding Former Falconbridge common share that it did not own.

9

58,476,589 Former Falconbridge common shares were validly deposited under the offer, increasing Noranda’s ownership to 164,235,689 or 91% of the outstanding Former Falconbridge common shares;

• The issue and sale of $250 million of 12-year 5.5% and $250 million of 30-year 6.2% unsecured notes of Noranda;

• The redemption of $500 million (20,000,000 shares) of the Company’s outstanding Junior Preference Shares;

• The sale of the assets and liabilities of the Company’s Lockerby Mine in Sudbury, including all closure obligations, to First Nickel Inc.

• The approval on June 30, 2005 by Noranda and Former Falconbridge shareholders of the amalgamation of the two companies. The amalgamated company chose to continue under the operating name Falconbridge Limited and effective July 6, 2005 began trading under a new stock symbol (TSX: FAL.LV and NYSE: FAL);

• The depletion of ore reserves at the Louvicourt mine and final production on July 12, 2005. The Louvicourt mine was a major supplier of copper and zinc concentrates to the Company’s Horne smelter;

• The commencement of molybdenum production at the Company’s Altonorte Smelter following the completion of the roaster transformation;

• The sale by the Company’s subsidiary Noranda Aluminum Inc. of its aftermarket automobile wheel manufacturing and distribution operations, American Racing Equipment, to Platinum Equity for proceeds of $40.5 million;

• The acquisition by Switzerland-based Xstrata plc (“Xstrata”) of 73.1 million common shares of the Company, or approximately 19.9% of the outstanding common shares, from Brascan Corporation (now Brookfield Asset Management Inc.”) (“Brascan”) at a price of Cdn$28 per share making Xstrata the largest single Falconbridge shareholder;

• The announcement that the Board of Directors of the Company has adopted a shareholder rights plan effective September 22, 2005, designed to enhance the Company’s ability to obtain the best value for all shareholders and prevent a bidder from acquiring control of Falconbridge in a manner detrimental to shareholders. This plan expired on March 21, 2006. See “2.1 Three Year History – Recent Developments”;

• The realization of a pre-tax gain of $13 million on the sale of the Company’s stake in Canico Resources Inc. following its acquisition by another metals and mining company;

• The settlement of a Falconbridge Limited Kidd Metallurgical Division new three-year collective Agreement with Canadian Auto Workers – Local 599 which represents the facility’s production and maintenance employees;

• The announcement on October 11, 2005 of a friendly takeover bid by Inco Limited for all of the outstanding shares of Falconbridge and endorsement of the acquisition offer by both Boards of Directors and the recommendation by the Falconbridge board that the Company’s shareholders tender their shares to the offer. The offer remains outstanding as the parties seek various regulatory approvals;

10

• The announcement on December 23, 2005 that Falconbridge reached an agreement on the financing of the Koniambo nickel project with Societé Minière du Sud Pacifique S.A. (“SMSP”), its joint venture partner in the Koniambo nickel project in New Caledonia; and

• The satisfaction of the two conditions precedents under the Bercy Accord prior to December 31, 2005, allowing for the eventual transfer of the Koniambo property to Koniambo Nickel, a company owned 49% by the Company and 51% by its partners SMSP.

2004

Major developments in 2004 included:

• The achievement of increased profitability in all four business units, including zinc and aluminum;

• The advancement of new production capacity at the Collahuasi mine;

• The commencement of an underground definition program at the Nickel Rim South project with production targeted for 2009;

• The successful ramp-up at Lomas Bayas following completion of the crusher expansion project ahead of schedule and under budget;

• The achievement of planned nickel production following the three week strike at the Sudbury mines;

• The advancement of Phase One of the Raglan Optimization Program, which is expected to increase annual production by approximately 5,000 tonnes of nickel per year;

• The procurement of additional long-term zinc concentrate supply for the Kidd Creek refinery;

• The execution of an agreement to acquire a 50% interest in the Lennard Shelf zinc mine in Australia;

• The acquisition of a 50% interest in Kaiser Aluminum’s Gramercy alumina plant in Gramercy, Louisiana, and related bauxite mining assets in Jamaica;

• The completion of the removal of residual lake sediment at the Antamina copper/zinc mine enabling access to higher-grade ores;

• The advancement and near completion of the Kidd Mine D expansion project;

• The commencement of scoping studies for further expansions at Falcondo, Lomas Bayas and Collahuasi;

• The completion of the bankable feasibility study for the Koniambo project in New Caledonia;

• The renewal of collective labour agreements at the Collahuasi mine, CCR refinery, CEZ refinery, Matagami mine, Noranda Recycling – Roseville, Nikkelverk, Altonorte and American Racing;

• The completion of the Montcalm mine development, ahead of time, and under budget, with the milling of ore commencing in October;

• The continued advancement of exploration programs at Raglan and Sudbury, Canada and West Wall and El Morro, Chile; and

11

• The announcement by Noranda that it had entered into exclusive negotiations with China Minmetals Corporation regarding the acquisition of Noranda, and the subsequent announcement by Noranda in November 2004 that the period for such exclusive negotiations would not be extended.

2003

Major developments in 2003 included:

• The announcement of our plans to rationalize our magnesium business and the temporary shutdown of our Magnola magnesium plant in Danville, Québec, as a result of adverse market conditions. The plant was closed in April 2003 and is expected to remain closed until market conditions improve. A further $33 million pre-tax charge related to costs incurred to shut down the plant was recorded in 2003;

• The advancement of important development programs at Collahuasi and Kidd Creek, ensuring copper productions levels are maintained;

• The shut down of the zinc refining operations located at the Kidd Metallurgical site in Timmins, Ontario for 13 weeks during the summer for market and supply-related reasons;

• The completion by the Altonorte smelter, in Chile, of a major modernization and $170 million Phase 3 expansion project;

• The public offering by Noranda of 6,000,000 Cumulative Redeemable Series H Shares with a quarterly cumulative dividend at a rate of 6.25% per annum (the “Series H Shares”) for gross proceeds of Cdn$150 million;

• Noranda’s private placement by the Company of 6,000,000 Cumulative Preferred Shares, Series I with a quarterly cumulative dividend at a rate of 8% per annum (the “Series I Shares”) for gross proceeds of Cdn$150 million. All of the Series I Shares were purchased by Brascan pursuant to the exercise by the Company of a put option previously granted by Brascan. The Series I Shares were redeemed by Noranda in August 2003 in accordance with their terms;

• Purchase of a 3.3% net proceeds interest relating to the Antamina copper and zinc mine in Peru from Inmet Mining Corporation for $22.5 million. The purchase was completed under a put-call agreement entered into between the companies in February 2002;

• Advancement on the work at the Koniambo Project in New Caledonia including the mobilization of the project team to begin the bankable feasibility study and financing discussions progression with the French government;

• The completion of the following transactions, among others, as part of the Company’s recapitalization plan to improve the Company’s balance sheet by reducing debt:

(a) The reduction of Noranda’s quarterly dividend from Cdn$0.20 per share to Cdn$0.12 per share;

(b) The release of guarantees of Noranda in the amount of $442 million on July 1, 2003 with respect to the Antamina project loan by converting these facilities to a non-recourse basis;

12

(c) The secondary offering of Noranda’s remaining 11,984,900 Priority Units of the Noranda Income Fund in July 2003 for gross proceeds of approximately $84 million. Subsequent to the offering, we retained a 25% interest in the Noranda Income Fund through our holding of Ordinary Units of Noranda Income Limited Partnership, which are exchangeable on a one for one basis for Priority Units of Noranda Income Fund upon the occurrence of certain events;

(d) The issue and sale in August 2003 of 28.52 million common shares of Noranda to a syndicate of underwriters and of 20 million common shares to Brascan, for total net proceeds of approximately Cdn$601 million. The outstanding Series I Shares were redeemed as part of this transaction;

(e) The issue and sale in September 2003, of 12-year 6% unsecured notes of Noranda in an aggregate principal amount of $350 million;

• Our announcement that the ore reserves at the Bell Allard zinc mine in Matagami, Québec will be depleted in 2004 and that operations at the Bell Allard mine would cease in the fourth quarter of 2004;

• The retirement of Lars-Eric Johansson from his position as Executive Vice-President and Chief Financial Officer of Noranda and the appointment of Steven Douglas, previously the Executive Vice-President and Chief Financial Officer of real estate company Brookfield Properties Corporation, as his successor; and

• Our signing of new collective agreements in respect of our operations at:

• Brunswick Mine

• Brunswick Smelter

• Brunswick Smelter Bulk Handling

• General Smelting

• Horne

• Lomas Bayas

• Antamina

• Norandal Salisbury

• Noranda Recycling – Roseville

• Altonorte

2.2 Principal Products

Our principal products are copper, nickel, zinc and aluminum, with the balance of our products coming from by-products and co-products that include silver, gold, platinum group metals, lead, selenium, tellurium, cadmium, indium, cobalt, nickel sulphate and sulphuric acid.

The principal markets for our products include the steel, refinery and foundry, construction, telecommunications, automotive, agricultural and chemical industries. The United States was the principal market for our products in 2005, accounting for 36% of consolidated sales (2004 – 36%), with Canada accounting for 16% of consolidated sales (2004 – 17%), Europe 23% of consolidated sales (2004 – 26%) and other countries 25% of consolidated sales (2004– 21%).

Principal Metals

Nickel

Nickel is a metal with the characteristics of corrosion resistance, high strength over a wide range of temperatures, and high ductility. The principal uses for nickel include stainless steel, nickel-based alloys, electroplating, low-alloy steel, foundry products and copper-based alloys. Nickel is also used in batteries and catalysts.

We market and sell nickel and ferronickel to customers in 31 countries. The largest markets are Western Europe, the United States and Asia/Pacific, which in 2005 accounted for approximately 50%, 22% and 28%, respectively, of total nickel sales.

13

Copper

Copper is a metal with inherent characteristics of excellent electrical conductivity, heat transfer and resistance to corrosion. The principal use of copper is for electrical wire and cable products, a sector which consumes approximately 60% of all refined copper. Other significant end-use markets are tubing for plumbing and air-conditioning and copper alloy strips and rods used in the electrical/electronic, construction and transportation markets.

Falconbridge markets copper cathodes directly to producers of industrial products from our CCR refinery in Montreal-East, Québec, the Kidd Creek refinery in Timmins, Ontario, and the Lomas Bayas operation in Chile. Falconbridge Chile also markets cathodes made available via toll refining agreements with Altonorte anodes. Altogether, sales of copper metal cathodes in 2005 were made to more than 30 customers in ten countries. Approximately 80% of our sales of copper metal in 2005 were made in North America and the balance was made in Europe and Asia. Falconbridge Chile produces approximately 280,000 tonnes of copper anodes per year that are sold in Canada, Chile, Europe and Asia.

Copper production is dependent on mine concentrates and secondary recycled materials purchased from third parties. Mine concentrates are sourced globally while recycled materials are primarily of North American origin. In 2005, 74% of Horne, 73% of Altonorte, and 13% of Kidd Creek’s primary feedstocks came from non–related third parties. In addition, approximately 12% of Falconbridge’s Horne smelter’s feed tonnage came from recycled electronics and other copper and precious metal bearing secondary materials, which were sourced from third parties. Antamina copper concentrates are sold to customers globally.

Zinc

Zinc is a metal with many important uses in industry, as well as in health and nutrition. Its major use, accounting for approximately 49% of total World consumption, is for galvanizing steel sold to the construction and automobile industries. Galvanizing involves coating steel with zinc to protect the steel from corrosion. Zinc is also used in the production of die-cast alloys for precision machine parts, brass alloys used in a wide range of industrial parts and household wares, and zinc powders, oxides and dusts used in the manufacture of batteries, tires and pigments.

Falconbridge markets zinc metal directly from its Kidd Creek division and acts as a marketing agent for the Noranda Income Fund’s Canadian Electrolytic Zinc refinery (CEZ). Most of the production from these facilities is sold directly to the steel industry and other major consumers of zinc. CEZ and Kidd Creek are jointly a major supplier of zinc metal and zinc powders, accounting for approximately 4% of world refined production. In 2005, over 95% of Falconbridge’s consolidated sales of zinc on behalf of Kidd Creek and CEZ were in North America, with the balance sold to customers in Europe and Asia. The galvanizing sector represented approximately 55% of Falconbridge’s consolidated zinc sales on behalf of Kidd Creek and CEZ in 2005.

Zinc production is dependent on concentrates from mines. The raw material feed stream for the CEZ and Kidd Creek zinc refineries is managed through a combination of third-party purchases and the integrated mine production of Falconbridge. This allows us to take advantage of transportation, cost differentials and the treatment capabilities of our refineries. Concentrate purchases originate with both local mines and, subject to market conditions, foreign mines. Antamina zinc concentrates are sold to customers globally.

Aluminum

Aluminum is a metal with many desirable characteristics. It is ductile, malleable and an efficient conductor of heat and electricity. Although very reactive chemically, aluminum resists corrosion and has a high strength-to-weight ratio.

Alumina (aluminum oxide) is produced from bauxite, the basic aluminum-bearing ore, by a chemical process. Aluminum is, in turn, produced from alumina by an electrolytic process which uses large quantities of electrical energy to separate the aluminum from the oxygen in alumina. The smelting of one tonne of aluminum requires between 14 and

14

18.5 megawatt-hours of electric energy. Depending upon quality, between four and five tonnes of bauxite are required to produce approximately two tonnes of alumina, which yield approximately one tonne of aluminum.

Our aluminum products include primary aluminum in the form of 1,500 lb. standard ingots (sows), billet, electrical conductor rod and foundry alloy. Our aluminum fabricated products include fin stock for the air conditioning, refrigeration and automotive industries; container stock used for semi-rigid food packaging and disposable cookware; converter foil used in flexible packaging for the food, juice and pharmaceutical industries; conductor strip for transformers.

In 2005, 94% of our consolidated aluminum sales were made in North America.

Other Products

Lead Metal

Worldwide, approximately 79% of lead metal is used in the production of lead-acid batteries for end-uses such as the automotive industry and back-up power systems for the computer and telecommunications markets.

Falconbridge is engaged in the mining of lead and the refining and recycling of lead metal at our wholly-owned Brunswick Mine and Brunswick Smelter. The marketing of lead metal and its alloys is carried out from offices in Toronto, Canada, Cleveland, Ohio, USA, and Zug, Switzerland. In 2005, over 90% of our consolidated lead metal sales were made in Canada and the United States.

As is the case for copper and zinc production, lead production is dependent upon the availability of mine concentrates. In 2005, approximately 65% of the Brunswick lead smelter feed was supplied by our Brunswick Mine, with the balance sourced from lead/silver concentrates and metal-bearing residues.

Sulphuric Acid

Sulphur dioxide gas is a by-product of smelting and refining operations. Most of the sulphur dioxide gas produced at Falconbridge’s Canadian and Chilean smelters is captured before stack emission and converted into sulphuric acid or liquid sulphur dioxide in order to comply with sulphur dioxide emission limits. The Canadian sulphuric acid production is sold to NorFalco, which markets, transports and distributes sulphuric acid in North America. In 2005, NorFalco and its wholly-owned Canadian subsidiary marketed approximately 1.9 million tonnes of sulphuric acid from us and third-party suppliers. Sulphuric acid produced at Falconbridge’s Chilean smelter is sold by Falconbridge Chile Limitada locally to mining companies using this product for their copper leaching operations.

15

Magnesium

Falconbridge’s Danville Québec magnesium plant has a design capacity of 58,000 tonnes of pure and alloy magnesium products and is owned 80% by Falconbridge and 20% by Société générale de financement du Québec.

Magnesium is classified as a light metal. By volume, it is approximately two-thirds the weight of aluminum and one quarter the weight of steel. Magnesium is used in several applications, including the production of aluminum alloys typically containing between 0.5% and 3.5% magnesium (can stock for aluminum beverage containers is the largest application) and die-casting of component parts for the automotive, electronics and manufacturing industries. Magnesium die-cast alloys have excellent strength-to-weight ratios and are attractive for many applications.

Metals Marketing

Our marketing and sales strategy is to sell our production at prices that are equal to or greater than the average cash price reported on Comex, the LME or other relevant terminal markets. Premiums above the Comex or LME settlement price are negotiated based on product form and quality, packaging, delivery terms, supply commitments, delivery location and availability of product. For the intermediate copper products sold by Falconbridge Chile Limitada (blister and anodes), discounts are negotiated periodically from LME prices which largely reflect inherent third party processing charges. For products for which there is no terminal market, our objective is to obtain prices that equal or exceed benchmarks that reflect the average price realized in the marketplace.

We procure custom feed materials for processing in the metallurgical facilities. In order to minimize metal price risk exposure on purchased metals and fluctuations in inventory levels, and to obtain the average Comex/LME prices or better, the Company employs the use of derivatives in the form of forward or options contracts to hedge these risks. Generally, we do not hedge the price we realize on the sale of our own production, and accept prices based on the market price prevailing around the time of delivery of these metals. From time to time, however, we may fix the metal price associated with our own future production to lock in certain profits or cash flows.

Fluctuations in currency exchange rates, principally the Canadian/US dollar exchange rate, significantly affect our earnings and cash flows. Most of our debt is denominated in US dollars, whereas a significant portion of our Canadian operating costs are incurred in Canadian dollars.

16

3. DESCRIPTION OF THE BUSINESS

Our operations explore for, develop, mine, process and market metals and minerals. We conduct these activities through our four operating business units: Nickel, Copper, Aluminum and Zinc.

We are one of the world’s largest producers of zinc and nickel and a significant producer of copper, primary and fabricated aluminum, lead, silver, gold, sulphuric acid and cobalt. We are also a major recycler of secondary copper, nickel and precious metals.

The following table shows revenue by operating segment and the relative percentage of each operating segment’s contribution to total revenue for the past three years:

| | 2005 | | 2004 | | 2003 | |

| | ($ millions) | |

Nickel | | 2,146 | | 26 | % | 1,824 | | 27 | % | 1,288 | | 29 | % |

Copper | | 4,421 | | 55 | % | 3,592 | | 53 | % | 2,119 | | 48 | % |

Zinc | | 504 | | 6 | % | 415 | | 6 | % | 363 | | 8 | % |

Aluminum | | 1,077 | | 13 | % | 935 | | 14 | % | 686 | | 15 | % |

Other | | — | | — | | (2 | ) | — | | — | | — | |

| | | | | | | | | | | | | |

Total Revenue | | 8,148 | | 100 | % | 6,764 | | 100 | % | 4,456 | | 100 | % |

17

3.1 Main Businesses

3.1.1 Nickel

Falconbridge is the fourth largest producer of refined nickel in the world, and one of the largest recyclers and processors of nickel and cobalt-bearing materials. Our operations include mines and processing facilities in Canada, Norway and the Dominican Republic.

Falconbridge Dominicana C. por A. (“Falcondo”)

Falconbridge owns 85.26% of the outstanding shares of Falcondo. Of the balance, the Government of the Dominican Republic owns approximately 10%, Redstone Resources Inc. owns approximately 4.1% and various individuals own the remainder. Falcondo holds a mining concession and owns mining and mineral processing facilities for the production of ferronickel located near the town of Bonao, approximately 80 kilometres northwest of Santo Domingo, Dominican Republic.

Properties and Mines

Falcondo has been mining and processing nickel laterite ore in the Dominican Republic since 1971. Falcondo’s mining concession covers approximately 21,830 hectares. Falcondo owns 4,831 hectares, 4,802 of which are inside the mining concession and include the mining areas and the mineral processing facilities, and 29 of which are outside the mining concession and include the townsite at Bonao. The term of the mining concession is for an unlimited period.

Mining at Falcondo is carried out from the surface using bulldozers, hydraulic shovels and trucks. Falcondo’s total mine production for the year ended December 31, 2005, as obtained through a metallurgical balance calculation, was 3,920,220 dry tonnes (2004 – 3,736,800 dry tonnes) of ore at an average nickel grade of 1.18%.

Mineral Reserves and Resources(1)

As of December 31, 2005, proven and probable reserves totaled 54,373,000 tonnes averaging 1.19% nickel. Indicated resources in addition to mineral reserves total 13,840,000 tonnes with an average grade of 1.53% nickel. Inferred resources total 6,300,000 tonnes grading 1.4% nickel.

Mineral resources are reported using cut-off grades and minimum mining widths appropriate to the particular mining deposit and mining method. Dilution and mining extraction recovery factors are applied to the mineral resource to arrive at the mineral reserves. The assumed metal price was nickel $3.25 per lb.

The proven and probable mineral reserves at Falcondo showed a total decrease of 3.0 million tonnes after production of 3.9 million tonnes in 2005. Gains of 2.0 million tonnes in previously undrilled areas and a gain of 1.3 million tonnes due to revisions to tonnage and grade factors were mostly offset by a write-down of 2.4 million tonnes in three large reserve blocks in Caribe and Peguera deposits following an economic evaluation study.

At planned operating rates, mineral reserves at Falcondo are equal to approximately 14 years of production, not including 13.8 million tonnes of indicated resources that are in large part anticipated to be converted into reserves.

(1) For Qualified Person information with respect to the mineral reserve and mining resource estimate, see “Mineral Reserves and Resources” in Item 3.9.3 of this Annual Information Form.

18

Milling, Smelting, Refining and Marketing

The ore mined at Falcondo is milled, smelted and refined at Falcondo’s mineral processing facilities, which have a capacity of approximately 29,000 tonnes of nickel contained in ferronickel per year. The facilities include a metallurgical treatment plant, a crude oil processor and a 200-megawatt thermal power plant. In 2005, Falcondo rented back up power energy from the national grid during the period of maintenance of the three owned units and that initiative allowed the metallurgical plant to comply with the production budget. Falcondo has dock facilities and a crude oil tank farm at the port of Haina (near Santo Domingo) and a 70-kilometre crude oil pipeline from the port to its mineral processing facilities. Falcondo’s production of nickel in ferronickel for 2005 was 28,700 tonnes (2004 - 29,500 tonnes).

Marketing and sales of ferronickel produced at Falcondo are conducted through Falconbridge U.S., Inc., Falconbridge Europe S.A. and Falconbridge (Japan) Limited.

Raglan

Mining Operation

The Raglan property is located 105 kilometres south of the northern tip of the Ungava (Nunavik) Peninsula in the Province of Quebec, approximately 1,800 kilometres north of Montreal. The property comprises 1,226 map-designated claims covering 48,149 hectares and ten 20-year mining leases covering 963 hectares. The first of the leases expires in June 2016. All are renewable for three 10-year terms, provided that mining has taken place for at least two of the preceding ten years. One mining lease application covering 32 hectares remains outstanding from 2004.

Commercial production at Raglan began on April 1, 1998. Raglan’s annual production capacity is one million tonnes of ore milled per year. Net production for 2005 totaled 22,200 tonnes of nickel (26,600 tonnes in 2004), 5,800 tonnes of copper (6,900 tonnes in 2004) and 350 tonnes of cobalt (400 tonnes in 2004).

Mineral Reserves and Resources(1)

As of December 31, 2005, proven and probable reserves totaled 14,850,000 tonnes averaging 2.80% nickel and 0.77% copper. The overall Mineral Reserve was decreased by 0.8 million tonnes in 2005, resulting from production of 934,000 tonnes and minor reserve adjustment related to delineation drilling, a cut-off grade change for open pit production and incremental ore additions during underground mining. At the current mill operating rates, the Proven and Probable mineral reserves are equal to approximately 15 years of production.

As of December 31, 2005, Measured and Indicated Resources totalled 3,390,500 tonnes with an average grade of 2.42% nickel and 0.80% copper, Inferred Resources totalled 7,700,000 tonnes grading 3.0% nickel and 0.8% copper. A negative adjustment of 374,000 tonnes was realised for Indicated Resources in 2005, while Inferred Resources increased by 2,500,000 tonnes due to new discoveries and additions through exploration at Zone 5-8, Donaldson, West Boundary, East Lake, and Mine 3.

Mineral resources are reported using cut-off grades and minimum mining widths appropriate to the particular ore zone and mining method. Dilution (planned, overbreak and fill) and mining extraction recoveries are applied to the mineral resource to arrive at the mineral reserves. Assumed metal prices and exchange rate were nickel $3.25 per lb., copper $0.90 per lb. and Cdn$1.50 for US$1.00.

(1) For Qualified Person information with respect to the mineral reserve and mining resource estimate, see “Mineral Reserves and Resources” in Item 3.9.3 of this Annual Information Form.

19

Milling Operation

The ore from the Raglan mines is crushed, ground and treated at the Raglan mill to produce nickel/copper concentrate. Raglan concentrate is trucked to Deception Bay for marine shipment to Québec City and then transported by rail to the Sudbury smelter for treatment. There were six shipments from Deception Bay during 2005.

The current mill throughput is 3,000 tonnes of ore per day. Total ore milled in 2005 was 934,000 tonnes (935,000 tonnes in 2004).

Sudbury

Mining Operations

We have been mining nickel/copper ores in the Sudbury area of northern Ontario since 1929. The Sudbury Mines/Mill principal nickel/copper producing properties in the Sudbury area are located in the Townships of Falconbridge, Levack, Garson, Dowling and Blezard. The properties comprise 2,345 hectares owned by the Company and 14 hectares held under two licences of occupation of mining rights from the Province of Ontario. The licences of occupation are held in perpetuity.

Mines/Mill

Sudbury Mines/Mill operates three underground nickel/copper mines in the Sudbury area: the Craig, Fraser and Lindsley mines. In 2005, the Craig mine provided 42% of Sudbury Mines/Mill’s ore production.

Metal in concentrate produced during 2005 amounted to 19,700 tonnes of nickel (2004 – 22,600 tonnes), 23,400 tonnes of copper (2004 – 24,700 tonnes) and 525 tonnes of cobalt (2004 – 565 tonnes).

The ore from Sudbury Mines/Mill is crushed and ground and the nickel/copper bearing sulphide materials contained in the ore are separated from waste materials at the Strathcona mill to produce nickel/copper concentrate and copper concentrate. The Sudbury Mines/Mill total ore milled for 2005 was 2,248,000 tonnes (2004 – 2,259,000 tonnes). The Strathcona mill has a capacity of approximately 8,500 tonnes of ore per day. The copper concentrate from the Strathcona Mill is delivered to Kidd Creek Metallurgical’s mineral processing facilities for smelting and refining. The nickel/copper concentrate from the Strathcona mill is delivered to the Sudbury smelter for smelting.

Mineral Reserves and Resources(1)

Our exploration successes in the Sudbury basin over the course of the last few years have significantly increased the overall mineral resources available for the INO Sudbury Mines Mill Business Unit. There are 20.5 million tonnes of Measured and Indicated Mineral Resources with an average grade of 2.30% nickel and 1.02% copper and 29.0 million tonnes of Inferred Mineral Resources grading 1.8% nickel and 2.6% copper. Measured and Indicated Resources decreased by 1.2 million tonnes in 2005 and Inferred Resources by 0.7 million tonnes during the same period mainly due to the provisional sale of properties containing resources. Total mineral reserves in Sudbury consist of 8.1 million tonnes in the Proven and Probable categories averaging 1.18% nickel and 1.47% copper. After production of 2.2 million tonnes, proven and probable reserves were further decreased by 1.6 million tonnes due to new detailed drill information in the mines plus revised cut-off grades and engineering studies.

As of December 31, 2005, Nickel Rim South is estimated to contain 13.4 million tonnes grading 1.8% nickel and 3.3% copper. Drilling at Fraser Morgan Zones 8, 9, 10 and a newly discovered Zone 11 upgraded the geological confidence and

(1) For Qualified Person information with respect to the mineral reserve and mining resource estimate, see “Mineral Reserves and Resources” in Item 3.9.3 of this Annual Information Form.

20

added to the available Mineral Resources. The Fraser Morgan Mineral Resource as of December 31, 2005, consisted of 3.3 million tonnes of measured resources grading 1.85% nickel and 0.61% copper, 1.6 million tonnes of indicated resources grading 1.69% nickel, 0.46% copper and 2.4 million tonnes of inferred resources grading 1.8% nickel, 0.5% copper.

Mineral Resources are reported using short-term and long-term price forecasting, cut-off grades and minimum mining widths appropriate to the particular deposit, production forecast and mining method. Engineering design, dilution and mining recoveries are applied to the Mineral Resource to arrive at the Mineral Reserve.

Approximately 2,171,000 tonnes of Proven and Probable Mineral Reserves were milled in 2005. At planned operating rates, existing Proven and Probable Mineral Reserves, not including new Mineral Resources largely anticipated to be converted to Mineral Reserves in the future, represent approximately 4 years of production. The upgrade of mineral resources to reserves by planned future work would result in an extension of the operating life of the Sudbury mines, mill and smelter. The Nickel Rim South deposit currently under development is projected to support mining operations until approximately 2021.

Smelter

The nickel/copper concentrate from the Strathcona mill is treated at the Sudbury smelter along with Raglan and Montcalm concentrates and custom feed from other sources. The smelter produces a matte containing nickel, copper and cobalt, as well as silver, gold and platinum group metals. The Sudbury smelter has the capacity to produce approximately 130,000 tonnes of matte per year. The matte produced is shipped by rail to Québec City and by sea to the Nikkelverk refinery in Norway for further processing.

The Sudbury smelter’s output for 2005 from all sources was 63,090 tonnes of nickel (2004 – 52,600 tonnes), 20,800 tonnes of copper (2004 – 18,400 tonnes) and 2,420 tonnes of cobalt (2004 – 1,840 tonnes). Copper concentrate sent to the Kidd Creek smelter contained 18,125 tonnes of copper (2004 – 17,600 tonnes). Sulphuric acid produced as a result of smelting activity in Sudbury was 310,600 tonnes in 2005 (2004 – 244,600 tonnes).

Falconbridge Nikkelverk, AS (“Nikkelverk”)

Nikkelverk, a wholly-owned subsidiary of Falconbridge, operates a refinery and a sulphuric acid plant at Kristiansand, Norway. The refinery processes the matte produced by the Sudbury smelter as well as custom feed from other sources, which includes the treatment of the silver, gold and platinum group metals contained in the matte and custom feed. The refinery has an annual capacity of approximately 86,000 tonnes of nickel, 39,000 tonnes of copper and 5,200 tonnes of cobalt. The sulphuric acid plant has a capacity of approximately 115,000 tonnes of sulphuric acid per year. In 2005, the refinery produced 84,900 tonnes of nickel (2004 – 71,400 tonnes), 38,700 tonnes of copper (2004 – 35,600 tonnes), 5,020 tonnes of cobalt (2004 – 4,670 tonnes) and 108,800 tonnes of sulphuric acid (2004 –95,200 tonnes).

Mattes from the Sudbury smelter and from BCL Limited (“BCL”) in Botswana were the main sources of nickel/copper feed materials for the Nikkelverk refinery during the year.

In 2005 the refinery produced approximately 405,500 ounces of platinum group metals (2004 — 438,000 ounces).

Significant expansion of the nickel and cobalt capacity, based on matte or laterite intermediates, are possible if market conditions warrant such expansion.

21

Montcalm

The Montcalm nickel mine was brought into production in 2004. It is located 100 kilometres east of the Kidd Metallurgical Site in Montcalm Township in the Province of Ontario and comprises four 21 year leases covering mining and surface rights over 831 hectares.

The Montcalm project reached its designed production capacity of 750,000 tonnes annually during the fourth quarter of 2004. This included conversion of a redundant mill line at the Kidd concentrator to handle the Montcalm ores. Two concentrates are produced, a copper concentrate which is treated at the Kidd Metallurgical Complex and a nickel concentrate which is transported to Falconbridge’s smelter in Sudbury.

In 2005 a total of 750,070 tonnes of Montcalm ore were milled (2004 — 220,570 tonnes) grading 1.52% nickel and 0.79% copper. During 2005 both the mine and mill were successfully test run at an 875,000 tonne annualized rate (116% of design capacity). The current plan is to increase Montcalm mine and mill production to the 875,000 tonne a year rate starting in the second half of 2006, effectively milling 845,000 tonnes in 2006 and 875,000 tonnes a year thereafter until the mine is depleted.

Mineral Reserves and Resources(1)

As of December 31, 2005, proven and probable reserves totaled 4,507,000 tonnes averaging 1.46% nickel and 0.68% copper. Montcalm is expected to contribute approximately 9,000 tonnes of nickel annually to output from the Sudbury smelter.

Mineral resources are estimated using cut-off grades and minimum mining widths appropriate to the particular ore zone and mining method. Dilution (planned and overbreak) and mining extraction recoveries are applied to the mineral resource to arrive at the mineral reserves. Assumed metal prices and exchange rate were nickel $3.25 per lb., copper $0.90 per lb. and the Cdn$1.50 for US$1.00.

Mineral reserves decreased from 4.9 million tonnes to 4.5 million tonnes due to a 2005 production total of 0.8 million tonnes which was partly replaced by 0.4 million tonnes from upgrade drilling on the final mineral resources at the mine. No mineral resources remain. At planned operating rates, the mineral reserves are equal to approximately 5 years of production.

Falconbridge International Limited (“FIL”)

FIL, through its offices in Bridgetown, Barbados and Brussels, Belgium, is responsible for managing the INO’s custom feed business outside Canada. Custom feed, or third-party primary smelter mine production (concentrate), primary smelter production (matte) and secondary raw materials, provides a significant source of feed to the Sudbury Smelter and the Nikkelverk refinery. The availability of and profit margins associated with the custom feed processed at the Sudbury Smelter and the Nikkelverk refinery are largely a function of metal grade and the level and relationship of nickel, copper, cobalt, silver, gold and platinum group metals prices and competition for such materials.

The custom feed processed at the Sudbury Smelter consists largely of nickel/copper/cobalt secondary raw materials and nickel concentrates. Most secondary raw materials are sourced on a spot basis or under contracts of one to three years’ duration. Concentrates are sourced on a spot basis and multi-year contracts. In 2005, Sudbury Smelter’s output from all third-party feeds included 9,300 tonnes of nickel, 6,600 tonnes of copper and 1,360 tonnes of cobalt.

In 1985, FIL entered into a long-term agreement with BCL to treat complex nickel/copper matte from BCL’s smelter in Botswana. The BCL matte represented approximately 65% of the nickel and copper-bearing custom feeds processed at the

(1) For Qualified Person information with respect to the mineral reserve and mining resource estimate, see “Mineral Reserves and Resources” in Item 3.9.3 of this Annual Information Form.

22

Nikkelverk refinery in 2005. Under the agreement, which was extended in 2002 to the end of 2015, BCL has agreed to deliver approximately 10,000 tonnes of nickel in matte per year.

Custom Feed Production at the Refinery

In 2005, custom feed represented approximately 37% of the nickel (2004 – 34%), 64% of the copper (2004 – 59%) and 80% of the cobalt (2004 – 83%) output at the Nikkelverk refinery.

3.1.2 Copper

The copper business unit is a fully-integrated producer of copper metal and concentrate. The copper business unit includes the operation of the Company’s 33.75%-owned Antamina copper and zinc mine in Peru and the 100%-owned Altonorte copper smelter located near Antofagasta, Chile, Falconbridge’s 44% stake in the Collahuasi copper mine in Chile and 100% interest in the Lomas Bayas operations, as well as refining, smelting and recycling facilities in Canada and in the United States, which are referred to as Canadian Copper and Recycling (“CC&R”).

Altonorte Smelter

We own 100% of the Altonorte copper smelter located in northern Chile. The smelter recently completed a major modernization and $170 million Phase 3 expansion project, which more than doubled its capacity to a nominal 835,000 tonnes/year of copper concentrate throughput, copper anode output capacity to approximately 290,000 tonnes and sulphuric acid capacity to 790,000 tonnes.

The Altonorte custom smelter processes copper concentrate from third-party mines located mainly in Chile. Approximately 35% of the Altonorte smelter’s production is sold to Codelco and is refined at Codelco’s Chuquicamata refinery near Calama, Chile, a portion of which is returned to us in the form of cathodes. The balance of the smelter’s blister anode production is exported. The smelter’s sulphuric acid production is sold to customers located in the northern region of Chile. In 2005, Altonorte processed 894,700 tonnes of feed material (2004 – 832,800 tonnes), produced 297,600 tonnes of copper anodes (2004 – 266,400 tonnes) and produced 808,200 tonnes of sulphuric acid (2004 –751,300 tonnes).

Compañía Minera Antamina S.A. (“Antamina”)

History and Location

Located in the Andes mountains in Peru, approximately 270 kilometres north of Lima and at an elevation of 4,300 metres, the Antamina deposit is one of the largest copper/zinc orebodies in the world, with a milling rate of 100,000 tonnes per day. Antamina is expected to produce 277,000 tonnes of copper and 163,000 tonnes of zinc annually over an 18-year mine life, producing an annual average of 710 million pounds of copper and 625 million pounds of zinc in the next 10 years.

A capital investment of $2,148 million was made to bring Antamina into production. Of this amount, $1,320 million was financed using senior project debt.

Our beneficial interest in Antamina is 33.75%, with the beneficial owners comprising BHP Billiton PLC at 33.75%, Teck Cominco Limited at 22.5% and Mitsubishi Corporation with a 10% interest.

Operations

Antamina began commercial production in October 2001. In 2005, Antamina produced 1,287,257 tonnes of copper concentrate grading 29.10% copper, 343,559 tonnes of zinc concentrate grading 53.66% zinc and 12,875 tonnes of molybdenite concentrate containing 52.20% molybdenum. In 2005, payable copper contained on the concentrates sales was

23

815,703 pounds of copper, 355,711 pounds of zinc, 16,124 pounds of molybdenum and 8,797 metric ounces of Silver.

Mineral Reserves and Resources(1)

Antamina is classified as a copper-zinc-silver skarn deposit and occurs at the contact between a quartz monzonite intrusive of Tertiary Age (< 70 million years) and limestone of Cretaceous Age (70-135 million years).

Proven and probable mineral reserves total 450,000,000 tonnes with an average grade of 1.18% copper, 0.93% zinc, 0.031% molybdenum and 12.9 grams of silver per tonne. Proven and probable mineral reserves are based on the mineral resource model after applying open-pit design and cut-off criteria. Measured and indicated resources, in addition to mineral reserves in the current pit design, total 60,000,000 tonnes with an average grade of 0.49% copper, 0.33% zinc, 0.030% molybdenum and 6.7 grams of silver per tonne. Inferred mineral resources total 41,000,000 tonnes with a grade of 0.8% copper, 0.6% zinc, 0.02% molybdenum and 16 grams of silver per tonne.

Due to the polymetallic nature of the deposit, multiple ore types, and variable metallurgical recoveries, proven and probable mineral reserves are reported using a profitability economic cut-off value (US$1500/hour) and also include all measured and indicated material with a positive net value to be processed directly through the concentrator in the life-of-mine plan. Low grade ore has a value between US$1500/hour and the high grade ore value of ³US$14,000/hour. Marginal material is specified as having a value between that of material treated as waste and the low-grade cut-off value. Measured resources are specified as all in-situ pit measured marginal material. Indicated resources are specified as all in-pit indicated marginal value blocks. Inferred resources are estimated for all other inferred in-pit high grade, low grade and marginal material.

The mineral resource and mineral reserve estimates were prepared under the supervision of Dan Gurtler, Mine Manager, and Eric Lipten, Geology Superintendent who are qualified persons for the purposes of NI 43-101. Assumed metal prices were zinc $0.50 per lb., copper $0.95 per lb., molybdenum $5.00 per lb. and silver $5.00 per troy ounce.

The Antamina orebody is highly variable and is currently described by more than six different ore classifications. The current reserve estimate is the result of a three year program of diamond drilling plus significant geological, engineering and metallurgical input. The estimate includes substantive improvements in geological interpretation and modelling interpolation methodologies. The new resource model provides increased geological information and a superior reserve estimate for production purposes.

At planned operating rates, the proven and probable mineral reserves are equal to approximately 14 years of mine production. Mill operations could continue for another few years on stockpiled material. The mineral reserves decreased by 18 million tonnes in 2005 due to production. There was 30 million tonnes of production which was partly replaced by the addition of 12 million tonnes of ore resulting from a major infill drilling campaign and a new reserve estimation.

Compañia Minera Doña Inés de Collahuasi (“Collahuasi”)

Falconbridge owns a 44% interest in Compañía Minera Doña Inés de Collahuasi S.C.M., an independent company which owns the mining and water rights and other assets comprising the Collahuasi operation, together with Anglo American Plc which also holds a 44% interest, and a Japanese consortium holding the remaining 12% interest.

A capital investment of $1,792 million was required to bring Collahuasi into commercial production. The financing requirement, including working capital, was approximately $1,870 million.

The Collahuasi property covers 446 exploitation concessions over 133,803 hectares and 185 exploration concessions over 66,500 hectares. The property is located in northern Chile, about 180 kilometres southeast of the port of Iquique, at an

(1) For Qualified Person information with respect to the mineral reserve and mining resource estimate, see “Mineral Reserves and Resources” in Item 3.9.3 of this Annual Information Form.

24

elevation of 4,300 metres. It contains two separate porphyry copper deposits, known as Ujina and Rosario: the Ujina high grade secondary enrichment has been mined already but an important reserve of primary copper ore remains; Rosario has large tonnages of high grade primary ore and important secondary enrichment zones. The Huinquintipa oxide copper deposit is located downstream from the Rosario deposit. In addition, the property contains high-grade copper mineralization at the adjacent Rosario Oeste deposit.

Mining and Milling Operations

Commercial production at the Collahuasi operation began in January 1999. Production is expected to average 350,000 tonnes per year of copper in concentrates and 50,000 tonnes per year of copper cathode during the initial 10 years of mine life. The mine site is serviced under a 20-year power supply contract with Empresa Nacional de Electricidad S.A., a Chilean electric utility company.

During 2005, 161.3 million tonnes of material was mined (2004 – 165.6 million tonnes), 40.1 million tonnes of ore was milled at the concentrator (2004 – 34.8 million tonnes) and 6.5 million tonnes of ore was processed at the copper oxide leaching plant (2004 – 6.6 million tonnes). Falconbridge’s share of copper produced by Collahuasi during 2005 was 26,700 tonnes of cathode copper and 155,600 payable tonnes (161,200 contained tonnes) of copper in concentrate (2004 – 211,600 copper tonnes was produced considering cathodes and concentrates).

The Ujina pit was practically depleted during the year 2004 and ore extraction ramped-up in the Rosario Pit during the year 2004. In the last months of 2004, production at the Rosario Pit had achieved its full capacity.

Mineral Reserves and Mineral Resources(1)

As of December 31, 2005, proven and probable mineral reserves totaled 1,804,332,000 tonnes with an average grade of 0.90% copper. Measured and indicated resources are in addition to mineral reserves and totaled 478,360,000 tonnes with an average grade of 0.64% copper. Inferred mineral resources totaled 1,820,000,000 tonnes with a grade of 0.75% copper.

Proven and probable mineral reserves are based on the mineral resource model after applying open-pit design and cut-off criteria. Proven and probable mineral reserves are reported using a 0.45% copper cut-off for sulphide ore, 0.40% cut-off for oxide ore and 0.50% copper for mixed ore, and include all stockpiled material above the cut-off grade. The assumed metal price was $0.95 per lb. of copper. Mineral resources are in addition to mineral reserves and are estimated using an average 0.40% copper cut-off grade. Measured and indicated mineral resources consist of material inside an encompassing pit outline based on a copper price of $1.15 but excluding the mineral reserves contained in the interior reserve pit outline. Inferred resources were estimated for material contained in both pit designs.

At planned operating rates, the proven and probable mineral reserves are equal to more than 40 years of production not including substantial measured and indicated mineral resources of 478.4 million tonnes and 1.8 billion tonnes of inferred resources. The December 31, 2005 total mineral reserves were decreased solely by production of 45,273,000 tonnes from the reserves.

Canadian Copper and Recycling (“CC&R”)

CC&R mines and procures copper and precious metal concentrates and secondary materials for processing at our copper smelters and refineries and markets copper and related by-products.

(1) For Qualified Person information with respect to the mineral reserve and mining resource estimate, see “Mineral Reserves and Resources” in Item 3.9.3 of this Annual Information Form.

25

Mineral Reserves and Mineral Resources(1)

The Kidd Creek ore body is intersected by a number of major faults and other discontinuities. Mining and the resulting stress redistribution cause periodic ground adjustment along these faults resulting in seismic activity. Falconbridge has taken steps to minimize the impact of seismic activity on its Kidd Creek mining operations. These steps include the use of seismic monitoring equipment and the development and use of safe and cost-effective mining systems and procedures. On occasion a seismic event may occur that has the potential to cause personal injury, equipment damage or production interruption. Such events have been infrequent.

As of December 31, 2005, Kidd Creek reported reserves of 19.0 million tonnes grading 1.84% copper and 5.53% zinc. At planned operating rates (~2.4 million tonnes/year), the mineral reserves at Kidd Creek Mining Division are equal to approximately 8 years of production. Mineral resources below the 88 level in Mine D are currently undergoing evaluation to determine if they can be converted to mineral reserves and extend the life of the mine for another 5 years.

Mining Operations

Falconbridge and its predecessors in title have been mining the Kidd Creek copper/zinc deposits since 1966. The Kidd Creek mining operation’s principal copper/zinc properties in the Timmins area are located in Kidd Township, Porcupine mining division, Ontario. The property in the Timmins area of northern Ontario comprises six half lots, or 960 acres, in the Porcupine Mining Division, District of Cochrane, Ontario. The property parcel numbers are: 12757 SEC, 14980 SEC, 13574 SEC, 15114 SEC, 13571 SEC, 13569 SEC and are 100% held by the Company. The Kidd Creek deposits are mined through two separate shafts, accessing mining areas known as the upper and lower mines, which access progressively deeper levels. In 2005, the upper mine (formerly No. 1 and No. 2 mines) accounted for 23% of production, the lower mine (formerly No. 3 mine) accounted for 56%, and Mine D 21% of the Kidd Creek Mining Division’s mine ore production.

Ore production at the Kidd Creek Mining Division (“Kidd Creek Mining”) for 2005 was approximately 2.38 million tonnes (2004 Actual – 2.09 million tonnes) The 2005 milled grades as at the end of December were; copper 1.99%, and zinc 6.21% (2004 Actual – copper grade 2.09%, zinc 5.04%). Metals in concentrate produced as at the end of December 2005 totaled 42,700 tonnes of copper (2004 Actual – 41,000 tonnes); and 120,000 tonnes of zinc (2004 Actual – 87,800).

In 2000, the Company approved the development of Mine D, the depth extension of the Kidd Creek ore body beyond the limits of the No. 3 mine at 6,800 feet (2,070 metres) to a depth of 8,800 feet (2,682 metres) for Stage 1. Stage 2, going down to 10,200 feet (3,109 meters) is still under feasibility study. Production from Mine D began in the second half of 2004 and production reached 480,000 tonnes in 2005 with ramp-up continuing into 2006. Mine D, Stage 1 of the project is scheduled to be completed in 2006.

Metallurgical Operations

CC&R operates the Horne copper smelter located in Rouyn-Noranda, Québec, the Canadian Copper and Recycling refinery (“CCR refinery”) in Montreal-East, Québec, the Kidd Creek Metallurgical Division, a copper-zinc complex located in Timmins, Ontario and five recycling facilities located in the United States and Canada.

CC&R has the capacity to process approximately 1,300,000 tonnes per year of copper and precious metal-bearing feed materials at the Horne and Kidd Creek smelters. In 2005, Falconbridge processed 1,102,100 tonnes of feed at the Horne and Kidd Creek smelters (2004 - 1,058,300 tonnes). In 2005, approximately 75% of the CC&R feed was procured from North America with the balance mainly from South America.

(1) For Qualified Person information with respect to the mineral reserve and mining resource estimate, see “Mineral Reserves and Resources” in Item 3.9.3 of this Annual Information Form.

26

The ore from Kidd Creek Mining Division is transported by a company-owned railway to the Kidd Creek Metallurgical Division’s mineral processing facilities, located 27 kilometers southeast of the mine. The mill produces copper and zinc concentrates, and treats all ores from the Kidd Creek Mining Division in two of four circuits. The remaining two circuits are available to process custom feed. In 2004, one of these circuits was rehabilitated and converted to treat 750,000 tonnes per year of nickel ore from Falconbridge’s new Montcalm mine, located approximately 100 kilometers west of the metallurgical site. Nickel concentrate from the circuit is shipped to Sudbury for processing. The Kidd copper concentrate produced as well as the by-product Montcalm copper concentrate, are processed at the Kidd Creek Metallurgical Division’s copper smelter. In addition to these feeds, the smelter also treats copper concentrate from Falconbridge’s Sudbury Strathcona mill as well as other copper custom feeds. The smelter has the capacity to produce 150,000 tonnes of blister copper per year. The 119,000 tonnes (2004 – 118,200 tonnes) of blister produced at the Kidd Creek smelter in 2005 were either sent as anode for refining at its refinery, or shipped to the Company’s CCR refinery. In 2005, the Kidd Creek copper refinery produced 111,200 tonnes (2004 – 115,600 tonnes) of copper cathode.

The Kidd Creek zinc plant has the capacity to produce 147,000 tonnes of zinc per year. In October 2004 a new precious metal recovery circuit was commissioned in the zinc plant. The new circuit allows the plant to process Agnico-Eagle’s Laronde Mine precious metal bearing zinc concentrates, and to recover the gold and silver as precious metals/lead residue that is further refined at Falconbridge’s Brunswick smelter. Approximately 100,000 tonnes of Laronde zinc concentrate are received on an annual basis. The balance of the zinc plant’s feed is Kidd zinc concentrate, and any surplus Kidd zinc concentrate is available for processing at facilities such as the Noranda Income Trust’s CEZ refinery located in Valleyfield Quebec. In 2005, the Kidd Creek zinc plant produced 113,700 tonnes (2004 – 121,600 tonnes) of saleable zinc.