| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

| |

Expires: | | October 31, 2006 |

|

Estimated average burden |

hours per response | | 19.3 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06719

BB&T Funds

(Exact name of registrant as specified in charter)

| | |

| 3435 Stelzer Road Columbus, OH | | 43219 |

|

| (Address of principal executive offices) | | (Zip code) |

BISYS Fund Services, 3435 Stelzer Road, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30, 2004

Date of reporting period: September 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

BB&T FUNDS

TABLEOF CONTENTS

LETTER FROMTHE PRESIDENTANDTHE INVESTMENT ADVISOR

Dear Shareholders:

We are pleased to send you this annual report for the 12 months ended September 30, 2004, a period of challenges and opportunities in the securities markets, and one which demonstrated the benefits of active portfolio management.

In a letter such as this one, it can be instructive to look back at our last annual report. A year ago, we wrote that the markets were being driven by geopolitical events, Federal Reserve activity, conflicting economic data and investors’ appetite for risk.

As we survey the global and economic landscape this year, we see that many of the same factors are in play, and are having a significant impact on the financial markets. The situation in Iraq is far from settled, concerns over terrorism remain, the Federal Reserve (“the Fed”) has begun to tighten credit and the economic recovery has not been without some rough patches. One noteworthy difference from last year is the shifting of investor sentiment away from low-quality, high-risk securities and toward the type of higher-quality stocks and bonds favored by our funds.

However, while stocks performed particularly well during the first quarter of our period, they have been generally flat during the last nine months. Corporate earnings are up, but sharply higher energy costs have impacted businesses and consumers alike, compromising economic activity. Durable-goods orders have risen and the housing market has remained strong, but consumer confidence has waned. Buffeted by opposing forces, stock prices have merely treaded water since the beginning of 2004.

This good news/bad news cycle also has led to volatility in the bond market. Although the yield on the 10-year Treasury bond rose just 18 basis points (0.18%) for the fiscal year as a whole, there were periods of sharp volatility. Intermediate- and long-term rates were driven higher or lower as uncertainty about global events spiked or subsided. When fears of terrorist attacks escalated, for example, investors rushed to the relative safety of Treasury securities, temporarily driving bond prices higher and yields lower.

At other times, expectations that the Fed would begin to raise interest rates—the Fed did hike rates in June, August and September which pushed yields higher, and bond prices lower.

While inflation expectations moderated and longer-term rates showed little net movement, the two-year Treasury note’s yield jumped 115 basis points (1.15%). The effect of this activity was to “flatten” the yield curve, as short-term rates rose closer to the static level of long-term rates.

For the 12-month period as a whole, the S&P 500 Index1 rose 13.86%, while the Nasdaq Composite Index1 added 6.15%. Bond prices, for the most part, were modestly higher.

Looking ahead over the next year, we believe stocks offer better relative value than bonds, and based on our analysis and expectations, we have taken the following steps:

| | • | Our equity managers, who have always operated with an emphasis on quality fundamentals, have continued to focus on stocks with particularly attractive valuations. We believe that, especially in uncertain markets, high-quality portfolios could potentially perform well, although there are no guarantees. |

| | • | On a sector basis, we have pursued the stocks of companies with high earnings visibility and above-average earnings potential. This has led us to favor shares in the industrial and energy sectors, and the non-biotech portion of the health care area. Recently, we’ve also been easing into the technology sector, where some good stocks have been oversold. |

| | • | Anticipating higher interest rates all along the yield curve, we have shortened the durations and average maturities of our bond funds, and selectively boosted credit quality. |

With the securities markets far from calm and quiet, we believe the active portfolio management we provide shareholders can be especially productive. The world is a very uncertain place right now, and the members of our investment management team are keenly aware of the trust you have placed in their hands.

As always, if you have any questions or concerns about the BB&T Funds, please feel free to speak with your Investment Professional, or call us at 1-800-453-7348.

Sincerely,

|

|

|

| George O. Martinez |

| President |

BB&T Funds |

|

|

| Keith F. Karlawish, CFA |

| President |

BB&T Asset Management, Inc. |

|

|

| Jeffrey J. Schappe, CFA |

| Chief Investment Officer |

BB&T Asset Management, Inc. |

| 1 | The S&P 500 Index is an unmanaged index representative of the U.S. stock market. The S&P 500 Index® is a registered trademark of Standard & Poor’s, a division of The McGraw-Hill Companies. All rights reserved. The Nasdaq Composite Index is an unmanaged index representative of U.S. small-company stocks. Performance for the Nasdaq Composite Index is price-only (no dividend reinvestment). Source: Lipper, Inc., October 2004. Investors cannot invest directly in an index, though they can invest in the underlying securities. |

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. The BB&T Mutual Funds are distributed by BISYS Fund Services Limited Partnership d/b/a BISYS Fund Services. The BB&T Mutual Funds are NOT FDIC INSURED and are not deposits or obligations or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. Investment products involve investment risk, including the possible loss of principal.

The foregoing information and opinions are for general information only. BB&T Asset Management, Inc. does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

1

BB&T LARGE COMPANY VALUE FUND

PORTFOLIO MANAGER

Richard B. Jones, CFA

The BB&T Large Company Value Fund is managed by Richard B. Jones, CFA, Director of Value Equity Portfolio Management for BB&T Asset Management, Inc. A graduate of Miami (Ohio) University, where he earned a B.S. in Business, Mr. Jones also earned an M.B.A. from The Ohio State University, and has been managing investors’ money since 1984. He is supported by the BB&T Value Equity Portfolio Management Team, which includes Eric Farls, CFA; Robert A. Gowen; John T. Kvantas, CFA; and Buel S. Sears, CFA. The team brings to the Fund six decades of combined investment management experience, along with a broad range of equity management skills.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

PORTFOLIO MANAGERS’ PERSPECTIVE

“Our investment process is straight forward and disciplined. It relies on both quantitative and qualitative techniques. We screen roughly 2,000 large companies to find about 100 top-quality names that meet our financial quality and value criteria; from this list, we normally own about 70 stocks, each of which plays a distinct role in enabling us to build a diversified portfolio. We are long-term investors, approaching each purchase with the intent of owning it for three to five years, if all goes well. Consequently, the Fund’s turnover rate is low, 10-30%, which makes the Fund very efficient for taxable accounts.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 17.86% (Institutional Shares), compared to 20.52% for its benchmark, the Russell 1000® Value Index.

Value stocks did well last year

With the backdrop of solid economic growth, strong earnings growth and low interest rates, the stock market registered good gains over the last twelve months. The best performance was centered in the stocks of lower quality economically sensitive companies.

The Fund generated solid, absolute (double-digit total returns) and relative to peer (Lipper Large Company Value1 category median return 16.26%), performance. But our performance did lag our unmanaged index.

Our full positions in some of the better performing economically sensitive sectors, such as industrials and energy, helped performance. We also benefited, in the second half of the fiscal year, as the market began to reward higher quality financially strong companies.2

On the issue of stock quality, the BB&T Large Company Value Fund invests only in what we deem as high quality companies. We want our companies to have the financial flexibility to be able to weather challenges as well as take advantage of opportunities. This disciplined focus on quality reduces portfolio volatility. Of course, there will be periods of time when low quality stocks will show significant outperformance, such as we experienced in 2003 and the first quarter of 2004, and during these periods our portfolio will tend to generate lower relative returns.

The portfolio’s overweighting in the healthcare sector has hurt performance over the last 12 months. Near term political and industry (pipeline, patent expiration) issues have weighed on these stocks. We still believe there are a disproportionate number of opportunities in this sector, given the combination of favorable long-term demographic trends and reasonable valuations. Therefore, we continue to hold our overweighted position.2

As of September 30, 2004, the top five equity holdings in the Fund (as a percentage of net assets) were2:

| | | |

ConocoPhilips | | 3.2 | % |

Bank of America | | 2.4 | % |

Emerson Electric Co. | | 2.4 | % |

Cox Communications, Inc.-Class A | | 2.4 | % |

ChevronTexaco Corp. | | 2.3 | % |

It’s a pretty decent environment for stocks

Looking out over the next six to 12 months, we think the economy looks pretty solid, as do the prospects for stocks. We believe the manufacturing sector looks strong. Granted we haven’t seen the job growth we’ve been looking for, to confirm that the economy is in a self-sustaining mode. Still, Gross Domestic Product3 figures are good, interest rates are still historically low and corporate earnings should be higher next year. Overall, we believe it’s a pretty decent environment for stocks.

As always, we will continue to invest on a stock-by-stock, bottom-up basis. While we are aware of the external, macro conditions, we will maintain the same value driven investment approach: buy stocks of financially solid companies at reasonable levels of valuation.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | The Lipper Large Cap Value Funds Average consists of mutual funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) greater than 300% of the dollar-weighted median market capitalization of the middle 1,000 securities of the S&P SuperComposite 1500 Index. Large-cap value funds typically have a below-average price-to-earnings ratio, price-to-book ratio, and three-year sales-per-share growth value, compared to the S&P 500 Index. |

| 2 | Portfolio composition is as of September 30, 2004 and is subject to change. |

2

BB&T LARGE COMPANY VALUE FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 3 | Class B Shares were not in existence prior to 1/1/96. Performance for periods prior to that is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to the Class B Shares, but does not include the Class B Shares 12b-1 fees, which, if reflected, performance would have been lower. Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares, but does not include the Class C Shares 12b-1 fees, which, if reflected, performance would have been lower. |

The Fund is measured against the Russell 1000® Value Index an unmanaged index which consists of 1,000 of the largest capitalized U.S. domiciled companies. Companies in this index generally have low price-to-book and price-to-earnings ratios, higher dividend yields, and lower forecasted growth values. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

3

BB&T LARGE COMPANY GROWTH FUND

PORTFOLIO MANAGER

Paige C. Henderson, CFA, CPA

The BB&T Large Company Growth Fund is managed by Paige C. Henderson, CFA, CPA, Director of Core Equity for BB&T Asset Management, Inc. Ms. Henderson graduated from the University of North Carolina at Chapel Hill, where she received a B.S. in Business Administration and an M.B.A. and has been actively engaged in investment management since 1991. Ms. Henderson is supported by the BB&T Growth Equity Portfolio Management Team, which includes Brandon Carl; Raiford Garrabrant, CFA; David Nolan; Zack Schroeder; and Michele Holmes Van Dyke. The team brings to the Fund six decades of combined investment management experience, along with a broad range of growth-stock investing skills.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

PORTFOLIO MANAGERS’ PERSPECTIVE

“We use quantitative screening to target the most attractive stocks among large, established growth companies in the market’s fastest-growing sectors. Our multifactor scoring model evaluates and ranks several thousand companies with market capitalizations greater than $4 billion. We then take a closer look at the companies in the top third of our rankings, clarifying data and identify how a particular stock could enhance our portfolio, which normally is comprised of 65—75 issues. All the while, we are careful not to overpay for any particular stock. The price we are willing to pay for growth is based on our evaluation of whether a stock’s growth potential will be delivered.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 7.19% (Institutional Shares), compared to 7.51% for its benchmark, the Russell 1000® Growth Index.

Paige C. Henderson, CFA, CPA, assumed management of the Fund on July 1, 2004.

Strong returns in first fiscal quarter gave way to more challenging environment

There was a significant difference in market activity and performance between the last calendar quarter of 2003 and the first nine months of 2004. At the end of last year, the technology sector was still strong, earnings expectations were solid and small-company stocks were doing particularly well.

Things have changed, however, in the last few quarters. The market is now being driven by a number of macro factors, such as sharply higher energy prices—which is why growth is underperforming value—and we’re also seeing sharp differences among companies in the same industries and sectors. Some historically stable companies—which you’d think of as relatively safe havens in volatile times—have stumbled recently. As growth investors are often unforgiving of negative developments, this has added to pressure in key industries in the large-cap growth arena.

On a sector basis, we finished the period with a significant overweighting in industrial stocks, which was a positive factor in the Fund’s performance.1

Our health-care positions have also proven productive, as we’ve de-emphasized big pharmaceutical stocks where many companies have experienced problems, and focused on bio-tech companies such as Gilead Sciences (1.9% of the portfolio’s net assets) and Genentech, Inc. (1.28%); and health-service providers such as UnitedHealth Group, Inc. (2.1%) and Quest Diagnostics, Inc. (1.8%).1

As of September 30, 2004, the top five equity holdings in the Fund (as a percentage of net assets) were1:

| | | |

Microsoft Corp. | | 3.8 | % |

Johnson & Johnson | | 3.5 | % |

Procter & Gamble Co. | | 2.9 | % |

Intel Corp. | | 2.5 | % |

Home Depot, Inc. | | 2.5 | % |

Technology could rebound in the coming months

Looking ahead, if energy prices stabilize—maybe fall from their current $55-a-barrel level to about $40—that could help the stock market. In any case, we think we’ll see continued strength in industrial earnings, what some people might call “old-economy companies.” The consumer has been carrying the economy for years, and now it’s time for the manufacturing sector to take the lead. Corporate cash levels are at historic highs. Hopefully, uncertainty should be reduced once the U.S. elections are over and we possibly see an improvement in the global political situation. In such an improving environment, we believe there could be an upsurge in technology spending. As information technology has become an integral part of our daily lives, technology purchases have become more connected to job growth. For knowledge workers, as companies create new positions, they have to buy new computers and system licenses for each worker. This differs from the more industrially oriented cycles. If you’re pushing more steel through a mill, even if you are adding workers, you don’t necessarily need to invest in more equipment.

As we move forward, we are closely monitoring those companies that will benefit from increased spending from Corporate American and are likely to increase investments in companies with improving order trends such as semiconductor and communication equipment stocks.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2004 and is subject to change. |

4

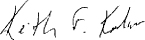

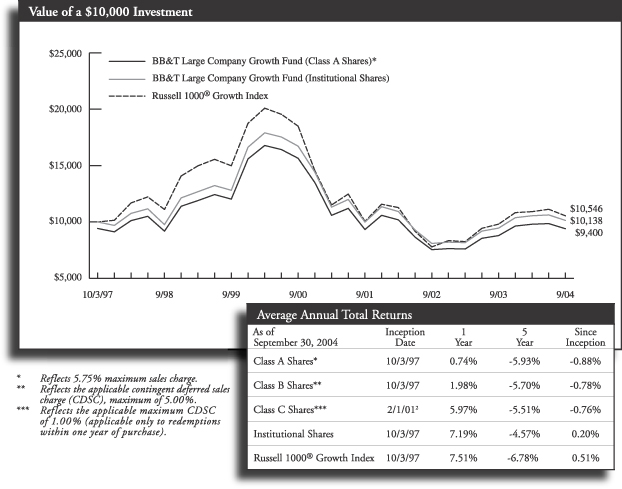

BB&T LARGE COMPANY GROWTH FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 2 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class B Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares. |

The Fund is measured against the Russell 1000® Growth Index an unmanaged index which is comprised of 1,000 of the largest capitalized U.S. domiciled companies with higher price-to-book ratios and higher forecasted growth values whose common stock is traded in the United States on the New York Stock Exchange, American Stock Exchange and NASDAQ. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total returns for the period would have been lower.

5

BB&T MID CAP VALUE FUND

PORTFOLIO MANAGER

Buel S. Sears, CFA

The BB&T Mid Cap Value Fund is managed by Buel S. Sears, CFA, who has been managing investors’ money since 1982. Mr. Sears is supported by the BB&T Value Equity Portfolio Management Team, which includes Eric Farls, CFA; Robert A. Gowen; Richard B. Jones, CFA; and John T. Kvantas, CFA. The team brings to the Fund six decades of combined investment management experience, along with a broad range of equity management skills.

INVESTMENT CONCERNS

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

PORTFOLIO MANAGERS’ PERSPECTIVE

“We seek to provide our shareholders with three important investment benefits: current income, long-term growth of capital and a commitment to controlling volatility. We diversify among economic sectors, industries and individual companies, with no more than 5% of the portfolio invested in any single security. We take a hard look at how companies in different industries can have similar risk profiles and we build our portfolio with an awareness of these correlations. We also strive to provide value to our shareholders by stressing low turnover, which may both reduce costs and improve tax efficiency.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 20.44% (Institutional Shares), compared to 25.62% for its benchmark, the Russell MidCap® Value Index.

We were in the market’s ‘sweet spot’

The Fund experienced historically strong performance partly due to judicious stock selection, but also because the mid-cap value arena was the right place to be for much of the last year.

At the start of our fiscal year, investors were enamored of the type of low-quality stocks to which we are not attracted, and we missed some of the overall market’s upsurge. But as the period unfolded, the “junk rally” began to wane, and the market rotated toward higher-quality names. Further, mid-capitalization stocks outperformed large-capitalization stocks, and the value stocks did much better than their growth cousins.

We also benefited from a number of earnings surprises from such companies as Genuine Parts Co. (1.9% of the portfolio’s net assets), C.R. Bard, Inc. (1.2%) and Compass Bancshares, Inc. (2.6%).1

As always, we kept a close watch on the stocks we owned. One of the most significant portfolio moves we made during the period was our decision to sell our stake in Caremark RX, Inc., a pharmaceutical services company whose stock price had risen to what we considered to be a fully valued level. We took our profits from Caremark and bought into AmerisourceBergen Corp. (1.3%), a drug distributor which offers a different type of access into the health care sector.1

However, in the third quarter of 2004, the Fund’s final fiscal quarter, some of our technology names came under pressure when reported earnings didn’t quite live up to investors’ expectations. Consequently, we lost some ground relative to our benchmark.

As of September 30, 2004, the top five equity holdings in the Fund (as a percentage of net assets) were:1

| | | |

First American Corp. | | 2.8 | % |

Kerr-McGee Corp. | | 2.7 | % |

Jefferson-Pilot Corp. | | 2.6 | % |

Compass Bancshares, Inc. | | 2.6 | % |

Arthur J. Gallagher & Co. | | 2.5 | % |

We are encouraged by market opportunities

Looking to the future, we are optimistic about the prospects for stocks. We acknowledge that the economy is in a state of constant change, the presidential election comes around every four years and there are significant cycles in capital spending, employment statistics and interest rates. But in the current cycle, as in all cycles, we believe there are numerous, attractive opportunities in the market. The upward trend in earnings and cash flow growth that we see in our own holdings could continue for the foreseeable future.

Over the next six to 12 months, we will remain as fully invested as is feasible and we will continue to search for fundamentally strong, well-positioned companies whose stocks are available at reasonable prices.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2004 and is subject to change. |

6

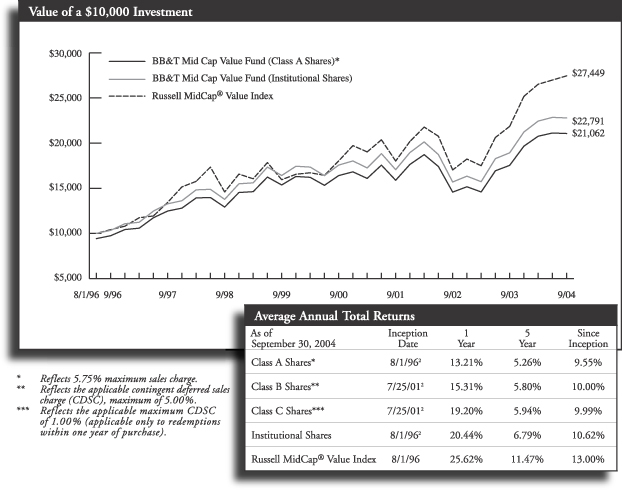

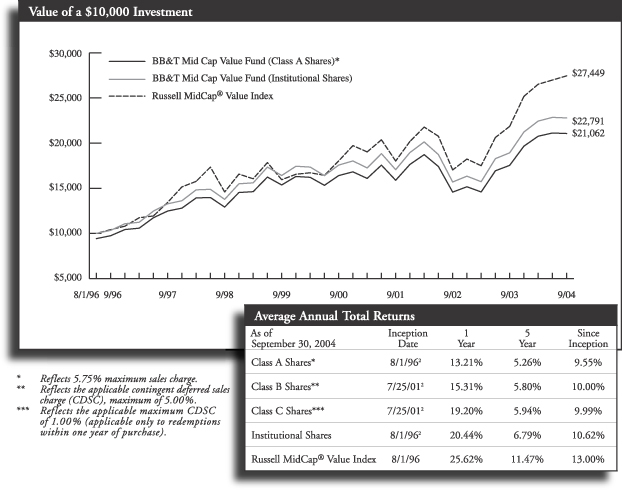

BB&T MID CAP VALUE FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 2 | Performance shown for Class A and Institutional Shares includes the performance of the OVB Equity Income Portfolio for the periods prior to its consolidation with the BB&T Mid Cap Value Fund on 7/23/01. The performance shown reflects reinvestment of all dividend and capital gains distributions. Class B and C Shares were not in existence prior to 7/25/01. Performance for periods prior to 7/25/01 is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class B and C Shares, respectively, but such performance does not reflect Class B and C Shares’ 12b-1 fees and expenses. With those adjustments, performance would be lower than that shown. |

The Fund is measured against the the Russell MidCap® Value Index which measures the performance of those securities in the Russell 1000 with lower price-to-book ratios or lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If fees had not been waived, the Fund’s total return for the period would have been lower.

7

BB&T MID CAP GROWTH FUND

PORTFOLIO MANAGER

David P. Nolan

The BB&T Mid Cap Growth Fund is managed by David P. Nolan. A graduate of Wake Forest University, where he received a B.S. in Business, Mr. Nolan managed common and collective trust funds from 1985 to 1993 and has managed the Mid Cap Growth Fund since its inception in 1993. He is supported by the BB&T Growth Equity Portfolio Management Team, which includes Brandon Carl; Raiford Garrabrant, CFA; Paige C. Henderson, CFA, CPA; Zack Schroeder; and Michele Holmes Van Dyke. The team brings to the Fund more than six decades of combined investment management experience, along with a broad range of growth-stock investing skills.

INVESTMENT CONCERNS

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

PORTFOLIO MANAGERS’ PERSPECTIVE

“We believe that companies situated in the mid-capitalization sector—which we define as between $2–10 billion in market cap—may achieve the most striking growth rates in their respective life cycles. This is the ‘sweet spot’ for many companies, which have survived the challenges of their early years and are now reaching the point where their businesses are expanding rapidly. They also may have an edge over larger companies, whose businesses have matured and who struggle to maintain double-digit growth rates. For these reasons, well-managed mid-cap companies potentially offer outstanding investment opportunities for our shareholders.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 11.55% (Institutional Shares), compared to 13.68% for its benchmark, the Russell MidCap® Growth Index.

The Fund underperformed its benchmark index for the first quarter of the year due to the Fund’s underweighting in the low-quality, low-priced stocks that outperformed in the period. The Fund did however, outperform the index in the final three quarters of the year.

Energy and telecommunications stocks were big winners

This past year, we saw the market experience a great deal of “churn”—as stocks spiked up and then fell—with investor sentiment rotating from low-quality, high-risk names to higher-quality stocks. The mid-cap growth sector was no exception, and these circumstances presented challenges throughout the period. We were gratified, nonetheless, that the Fund produced historically solid returns for the fiscal year.

On a sector basis, energy stocks represented a superior group during the year, and the Fund’s performance was enhanced in the second half of the period by our overweighting in energy stocks. Also, despite the fact that semiconductor stocks were inconsistent—this area did very well early on in the period, and then fell sharply—a number of technology companies were winners for us: AutoDesk, Inc. (2.1% of the portfolio’s net assets), a supplier of PC software; Symantec Corp. (2.0%) a provider of Internet security technology; and Research In Motion, Ltd. (1.5%), the manufacturer of the BlackBerry wireless devices; all were strong performers for us.1

In telecommunications, two names that did well for us were Russian cellular phone and service providers: Mobile Telesystems-ADR (0.6%) and VimpelCom-ADR (0.6%). These companies have done very well, as cell-phone usage in Russia has experienced explosive growth, first in Moscow, and now in outlying areas.1

As of September 30, 2004, the top five equity holdings in the Fund (as a percentage of net assets) were:1

| | | |

AutoDesk, Inc. | | 2.1 | % |

Urban Outfitters, Inc. | | 2.1 | % |

Symantec Corp. | | 2.0 | % |

Apple Computer, Inc. | | 2.0 | % |

Starwood Hotels & Resorts Worldwide, Inc. | | 2.0 | % |

We will invest in ‘individual stories’

Looking ahead, as we always do, we certainly are conscious of the overall macro picture, and how it might drive some specific sectors, such as energy. But the primary focus of our investment process remains finding the right individual stocks that meet our criteria. Especially when we’re in “range-bound” market—that is, a market whose indices bounce back and forth between fairly fixed ranges—we have found that strong performance can come from selecting individual names that meet specific investing themes. Our shareholders can rest assured that we will continue to invest the way we always have.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2004 and is subject to change. |

8

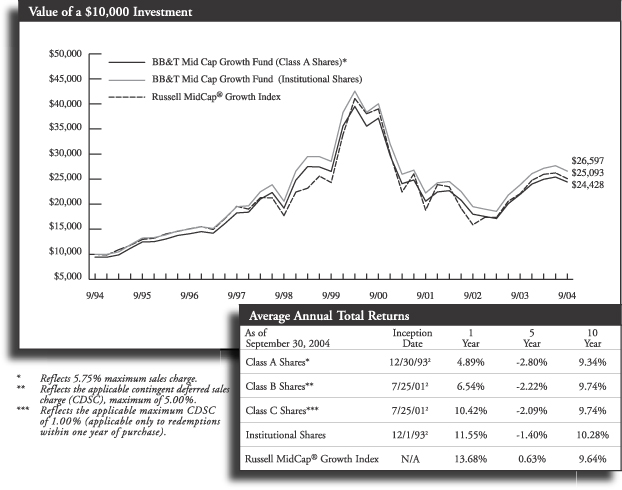

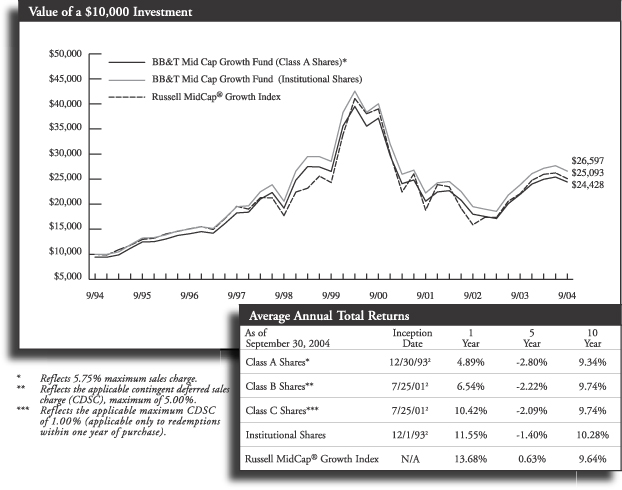

BB&T MID CAP GROWTH FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 2 | Fund performance as shown for Class A and Institutional Shares includes the performance of the OVB Capital Appreciation Portfolio for the periods prior to its consolidation with the BB&T Mid Cap Growth Fund on 7/23/01. The performance shown reflects reinvestment of all dividend and capital gains distributions. The Class B and C Shares were not in existence prior to 7/25/01. Performance for periods prior to 7/25/01 is based on the historical performance of the Class A Shares and has been adjusted for the maximum CDSC applicable to Class B and C Shares, respectively, but such performance does not reflect Class B and C Shares’ 12b-1 fees and expenses. With those adjustments, performance would be lower. |

The Fund is measured against the Russell MidCap Growth Index an unmanged index which measures the performance of those securities in the Russell 1000 Index with higher price-to-book ratios and lower forecasted growth values. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total returns for the period would have been lower.

9

BB&T SMALL COMPANY VALUE FUND

PORTFOLIO MANAGER

John T. Kvantas, CFA

The BB&T Small Company Value Fund is managed by John T. Kvantas, CFA. A graduate of the University of Illinois Champaign-Urbana, where he received a B.S. in Accountancy, Mr. Kvantas also earned an M.B.A. from the Fuqua School of Business at Duke University, and has been managing investors’ money since 1995. He is supported by the BB&T Value Equity Portfolio Management Team, which includes Robert Gowen; Eric Farls, CFA; Richard B. Jones, CFA; and Buel S. Sears, CFA. The team brings to the Fund six decades of combined investment management experience, along with a broad range of equity management skills.

INVESTMENT CONCERNS

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

PORTFOLIO MANAGERS’ PERSPECTIVE

“We use disciplined, bottom-up analysis to uncover fundamentally strong, attractively priced value stocks in a very specific universe: stocks with market capitalizations between $100 million and $3 billion. At the BB&T Funds, we believe that diversification can be a very useful tool for long-term investors, and shareholders can use our small-cap value fund to diversify their portfolios beyond the large-cap and mid-cap arenas. While small-cap stocks may be more volatile than their larger counterparts, they provide the benefit of generally not moving in tandem with the overall market. At the same time, on a year-to-year basis, value stocks may produce returns that are very dissimilar to the performance of growth stocks. Consequently, we believe that many BB&T shareholders will appreciate how our Fund can add a strong dose of diversification to their portfolios.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 25.78% (Institutional Shares), compared to 25.66% for its benchmark, the Russell 2000® Value Index.

A rotation toward quality helped the Fund’s performance

The small-cap value sector’s outperformance, relative to the overall market, continued a trend that we’ve seen over the last three or four years. When the market was soaring during the bull market in the late 1990s, small-company stocks didn’t do as well as large-company names. But the reversal since then has been truly dramatic, and during the last 12 months, small-cap value once again was the place to be for equity investors.

The Fund was also helped by a rotation away from lower-quality, riskier stocks—which dominated the market through much of 2003—and into the type of high-quality companies we like to buy. This move was driven, in part, by a perception that the Fed would start raising short-term interest rates; the Fed did, indeed, tighten credit starting in June. In such an environment, investors not surprisingly turn toward relatively more stable securities, the kind we hold in the portfolio. Small-cap stocks can be more volatile than larger stocks, and we believe our bias toward quality can be productive for our investors over time.

Another positive factor for the Fund was the performance of our energy holdings. We were overweighted in energy and when the sector took off, the stocks we owned followed suit. We also benefited from being underweighted in technology stocks, which did not do well as a group during the period.1

As of September 30, 2004, the top five equity holdings in the Fund (as a percentage of net assets) were:1

| | | |

Hilb, Rogal & Hamilton Co. | | 1.7 | % |

Imation Corp. | | 1.7 | % |

Protective Life Crop. | | 1.7 | % |

Teekay Shipping Corp. | | 1.6 | % |

CNA Surety Corp. | | 1.6 | % |

We will continue to employ our disciplined investment process

There are a lot of “macro” issues affecting the securities markets, such as global instability, high energy prices and the Fed’s decision to start raising interest rates.

But while we acknowledge the influence those factors have on short-term stock price volatility, over the long-term it is nearly impossible to predict changes in the macro factors. Going forward, we will not change our investment approach; we will continue to run our quantitative and qualitative screens, look for high-quality companies whose stock prices are significantly below our estimates of fair value, evaluate their fundamentals and buy those stocks whose prospects we like for the long-term.

We can’t know what’s going to happen in the economy or the markets over the next six to 12 months. What we do know is that we’re going to continue with the same investment approach we’ve always used.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2004 and is subject to change. |

10

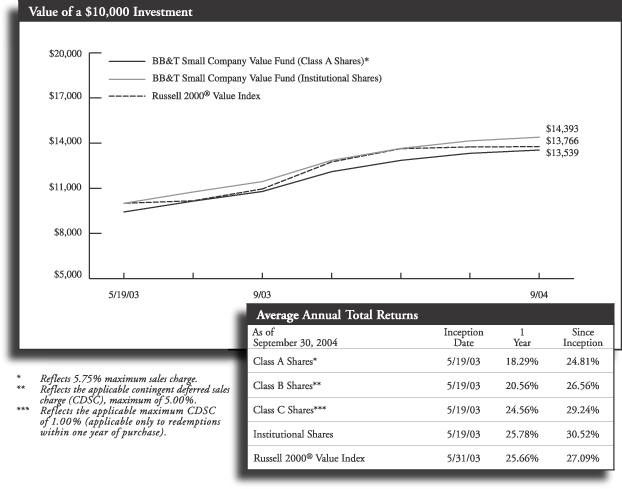

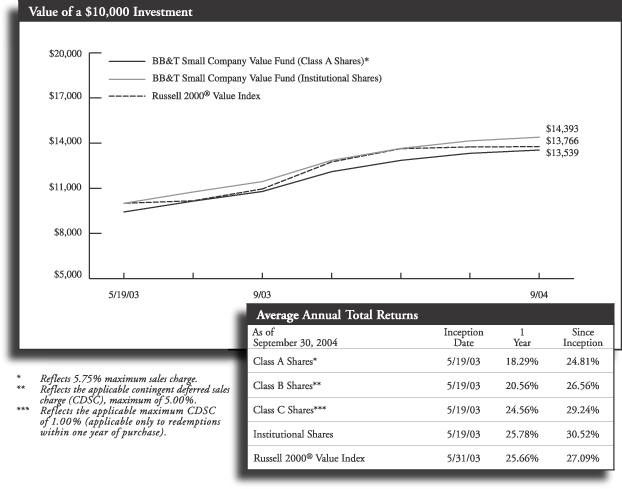

BB&T SMALL COMPANY VALUE FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Russell 2000® Value Index an unmanaged index which is comprised of the securities found in the Russell 2000® with lower price-to-book ratios and lower forecasted growth values. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been voluntarily waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

11

BB&T SMALL COMPANY GROWTH FUND

PORTFOLIO MANAGER

Raiford Garrabrant, CFA

The BB&T Small Company Growth Fund is managed by Raiford Garrabrant, CFA. Mr. Garrabrant graduated from the University of North Carolina at Chapel Hill with a B.S. in Business Administration and has been managing investors’ money since 1992. Mr. Garrabrant is supported by the BB&T Growth Equity Portfolio Management Team, which includes Brandon Carl; Paige C. Henderson, CFA, CPA; David Nolan; Zach Schroeder; and Michele Holmes Van Dyke. The team brings to the Fund six decades of combined investment management experience, along with a broad range of growth-stock investing skills.

INVESTMENT CONCERNS

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

PORTFOLIO MANAGERS’ PERSPECTIVE

“Small companies are vastly different, in many ways, from larger corporations, and successfully investing in the small-cap sector— which we define as companies having market capitalizations under $3 billion— requires special care and discipline. With small stocks, for example, the risk we confront is more company-specific than market-related; these stocks tend to move more on news about their individual company or on industry dynamics than do larger stocks. There also is less efficiency in the pricing of small-company stocks. All these factors make small-company stocks more risky, yet they are laden with enormous opportunities for long-term growth and stock-price appreciation. Investors should never forget that from small companies with promising ideas, come large companies with dominant market positions.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 4.22% (Institutional Shares), compared to 11.92% for its benchmark, the Russell 2000® Growth Index.

The Fund’s underperformance relative to its benchmark was primarily a result of two factors. First, during the first fiscal quarter, the Fund’s emphasis on owning higher quality companies had a negative impact on performance, as lower-quality, higher-beta1 shares propelled the benchmark returns. Second, in the second and third fiscal quarters, the Fund suffered from an unusually high number of companies failing to achieve their state financial goals, resulting in steep price declines for those holdings.

Multiple factors pressured our sector

As we entered our reporting period, small-company stocks had outperformed the overall market for several years; even in down markets, small caps generally did better than large-company stocks. However, in early calendar ‘04, the strength of economic recovery caused observers to turn their attention to the likelihood that the Fed would start raising interest rates (The Fed has raised short-term rates three times in recent months.)

In a rising-rate environment, investors are prone to leave higher-risk small caps and return to large- company stocks, which are perceived to be more stable. This defensive shift was a major factor in the relatively weak performance of small-cap stocks during the latter half of our fiscal year. At the same time, the growth sector underperformed the value area.

Further, the traditional growth sectors of technology, consumer discretionary and health care normally do not do well in periods of rising interest rates.

All of these factors combined to put pressure on the Fund’s performance for the full 12-month period.

Nevertheless, the Fund posted a positive return for the period. And we continued to actively manage the portfolio to respond to prevailing market conditions and to take advantage of attractive growth opportunities.

For example, last spring we began to pare back positions in the information technology and consumer discretionary sectors. We also overweighted our portfolio allocation to health care stocks, though we avoided high-risk biotech names and focused on companies in the health care services area, whose earnings we expected to hold up better in a slowing economy. In addition, we took steps to raise the Fund’s average market capitalization and lower its beta, or measure of risk relative to our benchmark, the Russell 2000® Growth Index. This more defensive posture served us well when the small-cap growth sector began to sputter this summer.1

As of September 30, 2004, the top five equity holdings in the Fund (as a percentage of net assets) were:2

| | | |

Anteon International Corp. | | 2.2 | % |

Waste Connections, Inc. | | 2.1 | % |

Forward Air Corp. | | 1.9 | % |

SFBC International, Inc. | | 1.8 | % |

UTI Worldwide, Inc. | | 1.8 | % |

We see selected buying opportunities in the near term

As we look into 2005, we are increasingly optimistic about the prospects for small-cap growth stocks.

The economy is slowing and energy costs are high, which may convince the Fed to not raise interest rates aggressively. Furthermore, if energy prices correct to more normal levels, as we believe they will, market conditions could be similar to those we saw in 1995, which was a very good year for small-cap growth stocks.

Consequently, we plan to start adding gradually to our information technology holdings. We are also looking to add some leaders in the consumer discretionary sector in the coming months.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Beta rating attempts to measure relative risk. A beta rating of higher than one indicates greater relative volatility than the market. A beta rating lower than one indicates lower volatility than the market. |

| 2 | Portfolio composition is as of September 30, 2004 and is subject to change. |

12

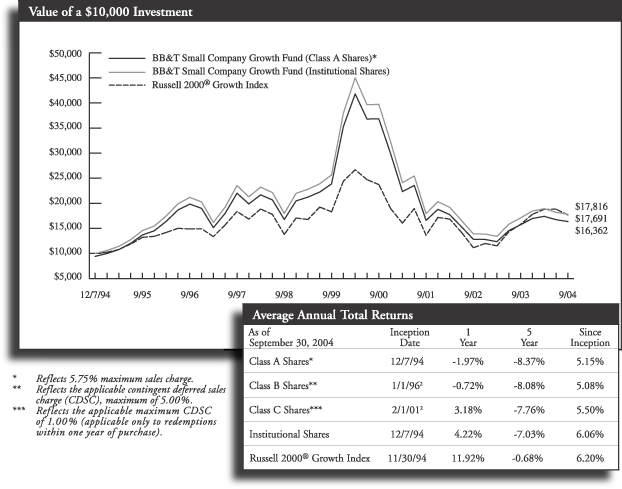

BB&T SMALL COMPANY GROWTH FUND

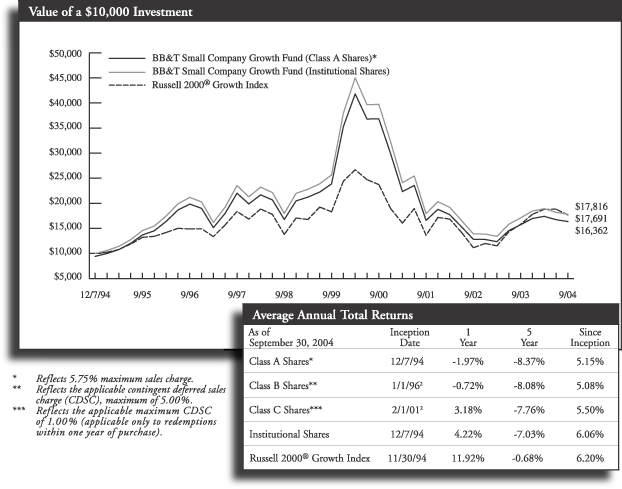

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 2 | Class B Shares were not in existence prior to 1/1/96. Performance for periods prior to that is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to the Class B Shares, but does not include the Class B Shares 12b-1 fees, which if reflected, would have lowered performance. Class C Shares were not in existence before 2/1/01. Performance for periods prior to that is based on the historical performance of the Class A Shares and has been adjusted for the maximum CDSC applicable to Class C Shares, but does not reflect the Class C Shares 12b-1 fees, which if reflected, performance would have been lower. |

The Fund is measured against the Russell 2000® Growth Index, an unmanaged index which is comprised of the securities in the Russell 2000® Index which have a greater-than-average growth orientation. Securities in this index tend to exhibit higher price-to-book and price-to-earnings ratios. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been voluntarily waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

13

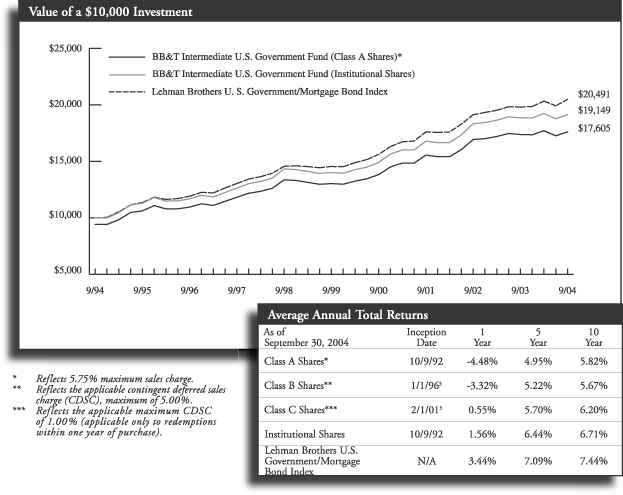

BB&T SPECIAL OPPORTUNITIES EQUITY FUND

PORTFOLIO MANAGER

George F. Shipp, CFA

The BB&T Special Opportunities Equity Fund is managed by George F. Shipp, CFA, chief investment officer of Scott & Stringfellow, Inc., subadvisor to the Fund. Mr. Shipp, who joined Scott & Stringfellow in 1982, holds a B.A. from the University of Virginia and an MBA from the Darden Graduate School of Business at the University of Virginia. Mr. Shipp is supported by an investment management team from Scott & Stringfellow, which includes Meghann A. Cohen; R. Griffith Jones, Jr.; and Farley C. Shiner, CPA. The team brings to the Fund more than three decades of combined investment management experience, along with a broad range of investing skills.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments. A concentrated portfolio may add a measure of volatility to performance, as major fluctuations in any one holding will likely affect the fund more than a fund with greater diversification.

PORTFOLIO MANAGERS’ PERSPECTIVE

“We aggressively pursue attractive opportunities wherever they can be found, limiting ourselves to neither a particular sector nor a single investing style. From a universe of 6,000 publicly traded companies, we build a concentrated portfolio that normally holds no more than 30 securities — blending relatively young growth stocks marked by above-average revenue and earnings growth, with larger, more-established value stocks that are out of favor for reasons we believe to be only temporary. This balanced approach enables us to act upon our investment team’s very best ideas and build a portfolio marked by diversification, above-average fundamentals and below-market risk characteristics.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 25.44% (Institutional Shares), compared to 13.86% for its benchmark, the S&P 500 Index. We were pleased to generate a positive return in all four quarters.

The Fund’s out-performance was due to fortunate stock selection

By that, we admit our bias against taking too seriously “top-down” forecasts of macroeconomic factors such as interest rate changes, currency fluctuations, GDP growth rates, or other imponderables. We build our portfolio one company at a time. The Fund, at its essence, is a stock-picker’s fund that attempts to assemble perceived above-average companies at below-average valuations.

Because we are not limited by investment style or market capitalization, we own both “value” and “growth” stocks; in fact, we’d assert our holdings have both characteristics. We have the flexibility to own both large and small-capitalization stocks, allowing us to search for the perceived best risk/reward opportunities, regardless of a company’s size.

We’re also relatively concentrated, with the portfolio owning between 25 and 30 names; as of September 30, 2004, the Fund held just 28 separate securities.1 That gives us the opportunity to beat the Market averages when we are more often “right” than wrong, but of course we should alert our shareholders to the alternative possibility.

Throughout the period, we had an overweighting in energy, which helped our performance. We identified a structural change in energy, fairly early in the game. Admittedly, we could not know that oil prices would climb to $50 a barrel, but looking back a year, we believed oil stocks were cheap based on then-prevailing commodity price quotes. Our domestic economy was growing, China’s rapid economic expansion pointed to its greater appetite for energy and, certainly in North America, a decades-long underinvestment in energy production was constricting supply.

We continue to own the same three energy stocks we’ve held for some time: Pioneer Natural Resources Co. (3.7% of the portfolio’s net assets), Apache Corp. (3.6%) and XTO Energy, Inc. (3.4%). We do not wish to overstay our welcome, but we believe demand for oil and natural gas continues to outstrip supply. Each of our companies has been able to expand reserves and production at well above-average rates, while materially strengthening their finances during the period of high prices.1

On the flip side, we were underweighted in technology stocks for the entire 12 months. This decision did not help our performance during the first half of the period, when tech stocks did well, but we avoided some of the sector’s broad decline in the spring and summer months. Because the economic upturn has fostered significant improvement in corporate America’s profitability and liquidity, we believe that, looking into 2005, business capital spending ought to remain relatively strong. Technology spending therefore may be poised to outgrow the consumer sector, prompting us to add storage software leader Veritas to the portfolio in July, after industry valuations became far more favorable.

As of September 30, 2004, the top five equity holdings in the Fund (as a percentage of net assets) were:1

| | | |

Veritas Software Corp. | | 3.8 | % |

Pioneer Natural Resources Co. | | 3.7 | % |

Internet Security Systems, Inc. | | 3.7 | % |

Manor Care, Inc. | | 3.7 | % |

Markel Corp. | | 3.6 | % |

We believe we are positioned to exploit future opportunities

We’ve consistently held a higher position in cash than the typical equity mutual fund. Part of this cash is due to much-appreciated inflows of new shareholder money that we tend to invest carefully, rather than automatically. We believe flexibility to take advantage of the stock market’s periodic dips is an under-appreciated asset. Shareholders should recognize that an above-average cash position can hurt our future relative performance, however, should we experience a sharply rising stock market.

We believe it is unlikely, now that the Fed is nudging short-term interest rates upward, given a backdrop of higher oil prices, that the economy accelerates over the next year. Our current portfolio positioning therefore tends to emphasize companies that may be able to prosper in a slower-growth environment.

We like to focus on themes that appear to transcend economic ups and downs. Notwithstanding negative headlines currently facing major pharmaceutical companies, healthcare continues to look like a growth business to us, driven by the aging of America. We are attempting to participate by owning a leading generic drug-maker, clinical lab, nursing and home health provider, managed care provider, and a specialty operator of cardiovascular hospitals. In a low-inflation world, we remain attuned to companies that enjoy a degree of pricing power. We believe “security” in all its forms is an investable trend. We remain at least as attracted to companies that are skilled users of ever-improving technology, as to those that make and sell it.

As always, we will go stock by stock, and build the portfolio from the bottom up—focusing on valuations, financial strength, underlying earnings growth, valuation, and dividends.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2004 and is subject to change. |

14

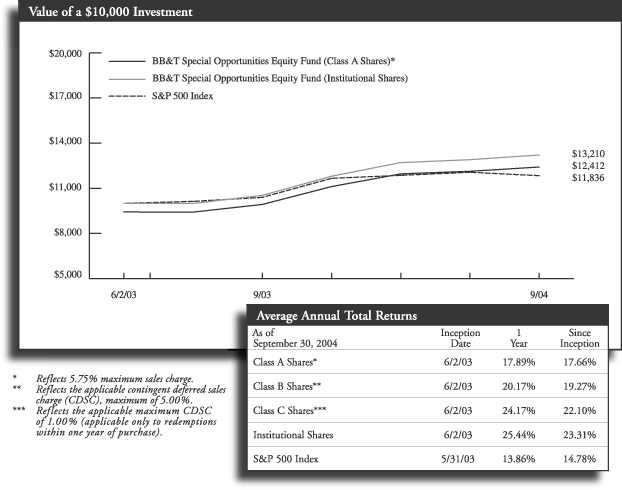

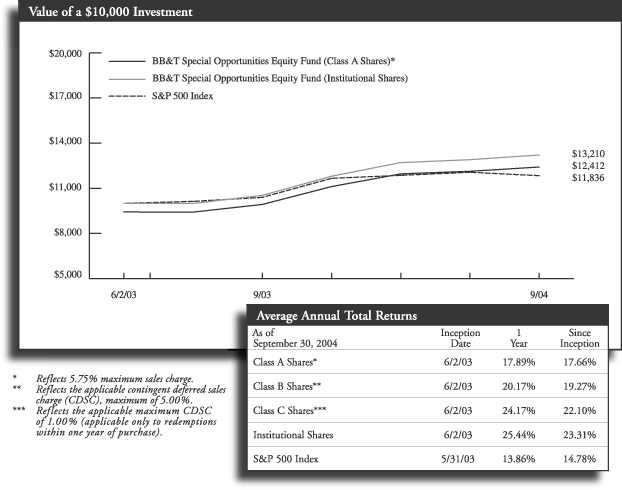

BB&T SPECIAL OPPORTUNITIES EQUITY FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

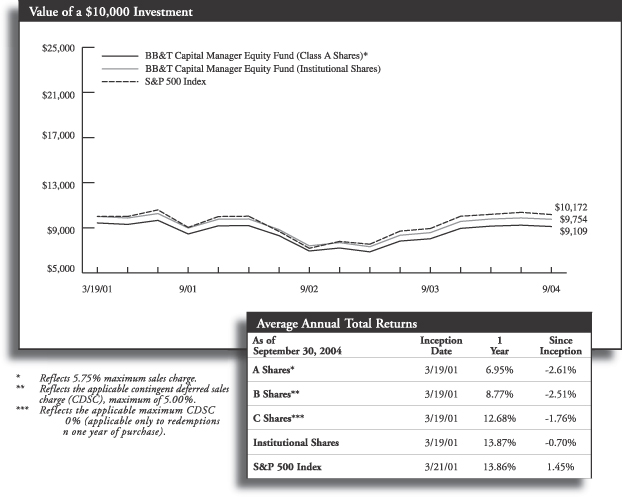

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

The Fund is measured against the S&P 500 index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been voluntarily waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

15

BB&T INTERNATIONAL EQUITY FUND

PORTFOLIO MANAGER

UBS Global Asset Management

The BB&T International Equity Fund is managed by a team of portfolio managers at UBS Global Asset Management, subadviser to the Fund. Key team members include Bruno Bertocci, executive director and global portfolio manager; Thomas P. Madsen, CFA, managing director and global head of equities; and Lydia J. Miller, managing director and global portfolio manager. Mr. Bertocci received a B.A. degree from Oberlin College and an M.B.A. from the Harvard Graduate School of Business and has 24 years of investing experience. Mr. Madsen earned B.B.A. and M.S. degrees from the University of Wisconsin and also has 24 years of investing experience. Ms. Miller earned a B.S. from the Pennsylvania State University and an M.B.A. from the University of Chicago, and brings 18 years of investing experience to the team.

INVESTMENT CONCERNS

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency and exchange rates.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

PORTFOLIO MANAGERS’ PERSPECTIVE

“Our investment philosophy focuses on a stock’s price, relative to its intrinsic (or fundamental) value. We identify discrepancies between a security’s intrinsic value and its observed market price—both across and within global equity markets. We attempt to exploit these discrepancies using a disciplined fundamental approach. Our research teams evaluate companies in their markets around the world and assign relative price /value rankings based on the present value of each company’s expected future cash flows. Our equity strategy team utilizes a global network of resources to systematically develop portfolio strategy in the context of integrated global capital markets. Currency strategies are developed separately and coordinated with country allocations. The result is a diversified portfolio of international stocks that we believe could provide solid, long-term performance while potentially managing risk.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 19.48 % (Institutional Shares), compared to 22.08% for its benchmark, the Morgan Stanley Capital International Europe, Australasia, and Far East Index (the “MSCI EAFE”).

The majority of underperformance relative to the EAFE index occurred in the consumer discretionary sector. This was driven by durables and media, where we have been underweight the auto sector and have been overweight more traditional media versus internet-reltaed media.

We have focused on selected stocks in all regions

Throughout the period, economic growth abroad was pretty strong, though parts of Continental Europe seemed to struggle. Germany, in particular, continued to have a rough time economically. China, which has been a huge economic story for some time, also is starting to show slower growth.

Our underweighting in Japan is due to that country’s dependence on China, and our feeling that Japanese companies will feel the pinch from China’s slowdown. That’s not to say we’re not investing in Japan, but we prefer companies with strong international presences, such as Honda Motor Co. Ltd (2.0% of the portfolio’s net assets), Canon, Inc. (1.7%) and Kao Corp. (1.2%); these are companies that should benefit from a global recovery.1

We are overweighted in the United Kingdom, not because of a macro view that the U.K. is a particularly productive place to be, but because we are finding some attractively valued stocks there. We like a lot of the banking stocks, particularly Royal Bank of Scotland Group PLC (2.7%) and Barclays PLC (2.1%). We’re also drawn to a lot of the consumer staple stocks, which were ignored during the bull market of 2003 and early 2004. Some of our favorites in this sector are Diageo PLC (2.2%), which produces premium alcoholic beverages; retailer Tesco, PLC (1.7%); and Kingfisher PLC (1.3%), which owns home improvement stores. These companies are fundamentally solid and they shouldn’t be too adversely affected by what we perceive to be the U.K.’s overleveraged consumers.1

As of September 30, 2004, 39.0% of the Fund’s holdings (as a percentage of net assets) was invested in Continental Europe, 33.6% in the Great Britain, 18.7% in Japan, 3.6% in other Pacific Basin countries, 3.4% in the world’s emerging markets and 1.7% in cash and cash equivalents.1

The Fund’s top five equity holdings (as a percentage of net assets) were:1

| | | |

Vodafone Group PLC | | 3.5 | % |

BP PLC | | 3.0 | % |

Total SA | | 2.8 | % |

Royal Bank of Scotland Group PLC | | 2.7 | % |

Shell Transportation & Trading Co. PLC | | 2.6 | % |

We favor telecom in the months ahead

Looking out six to 12 months, on a sector basis we like telecommunications stocks a lot — that is, companies that provide telecom services, not telecom equipment. There has been some concern about pricing pressure government regulation in the telecom sector and many good stocks have been hit pretty hard.

We think the selling has been overdone; the stocks we like appear to be selling below their intrinsic value. Some of our favorite names in this area are Vodafone Group PLC (3.5%), NTT DoCoMo, Inc. (1.7%) and France Telecom SA (1.3%).1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2004 and is subject to change. |

16

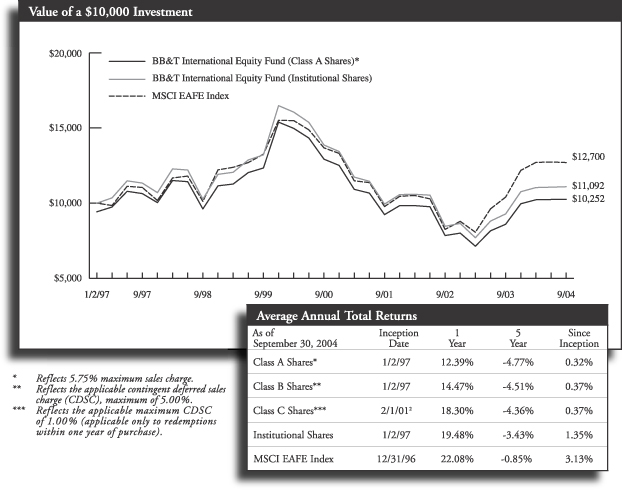

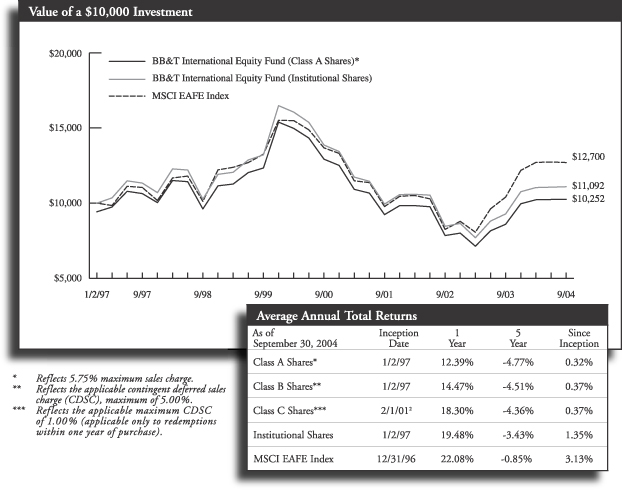

BB&T INTERNATIONAL EQUITY FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 2 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class B Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares. |

The Fund is measured against the MSCI EAFE Index, an unmanaged index which is generally representative of the performance of stock markets in that region. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

17

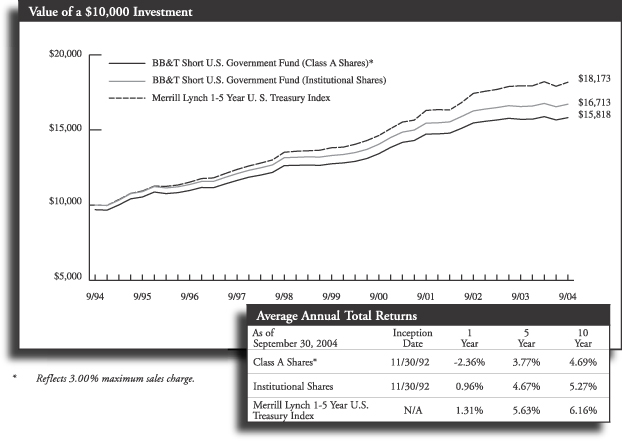

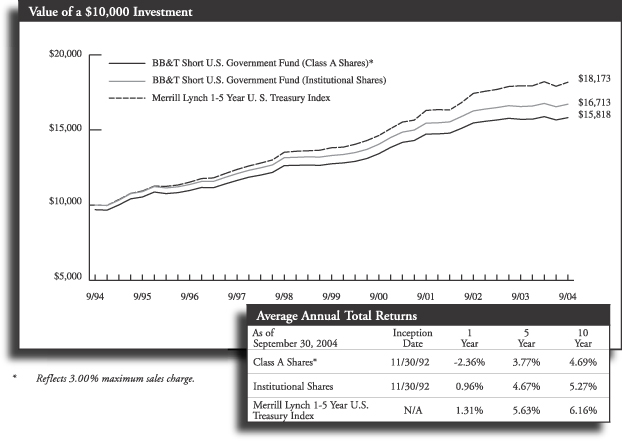

BB&T SHORT U.S. GOVERNMENT FUND

PORTFOLIO MANAGER

Kevin E. McNair, CFA

The BB&T Short U.S. Government Fund is managed by Kevin E. McNair, CFA. Mr. McNair received a B.A. in Economics from the University of North Carolina-Chapel Hill and a Master’s of Economics from North Carolina State University, and has been managing investors’ money since 1994. Mr. McNair is supported by the BB&T Fixed Income Portfolio Management Team, which includes R. Ron Elmer, CFA, CPA, CFP™; Brad D. Eppard, CFA; David T. Johnson; Robert E. Millikan, CFA; Michael D. Nichols, CFA; and Dickinson B. Phillips, CFP™. The team brings to the Fund nine decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

INVESTMENT CONCERNS

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal.

PORTFOLIO MANAGERS’ PERSPECTIVE

“This high-quality bond fund is geared toward investors looking for current income to meet their short-term needs, with limited fluctuations in principal. We seek to provide value by rotating among different sectors of the taxable, fixed-income market — Treasuries, mortgage-backed securities, agency paper and corporate debt — purchasing securities that offer the most potential for relative outperformance, and limiting movements in the portfolio’s duration within a relatively tight range.”

For the 12 months ended September 30, 2004, the Fund produced a total return of 0.96% (Institutional Shares), compared to 1.31% for its benchmark, the Merrill Lynch 1-5 Year U.S. Treasury Index.

Short-term rates climbed sharply

While yields on intermediate- and long-term bonds barely budged for the full period, short-term yields rose significantly; the two-year Treasury note’s yield was up 115 basis points (1.15%). This increase was attributable to improving economic growth and to an expectation that the Fed would begin hiking up the fed funds target rate at the front end of the yield curve. In fact, the Fed did start raising rates this past June, but the market factored in such moves earlier in the period.

The rise in short-term rates certainly impacted the Fund, which operates in the short end of the yield curve. The sharply higher rates pressured bond prices—rates and prices move in opposite directions—and presented a continuous challenge throughout the period.

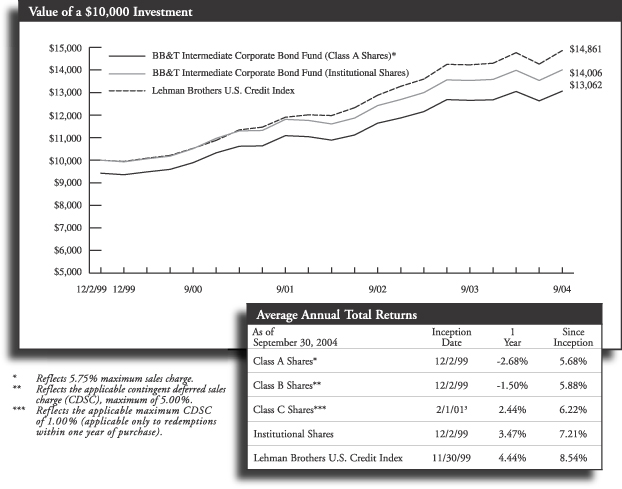

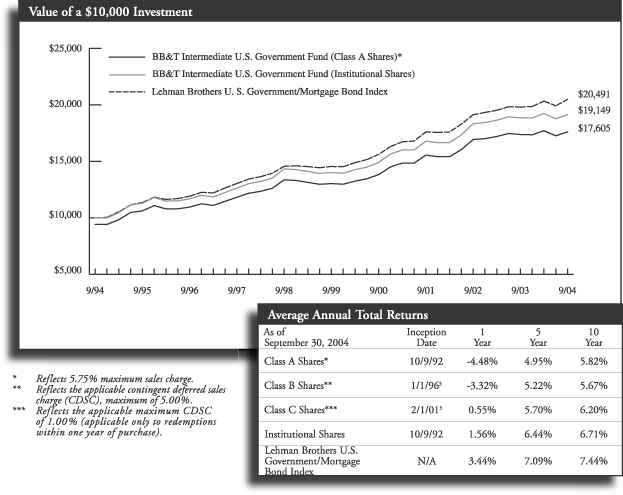

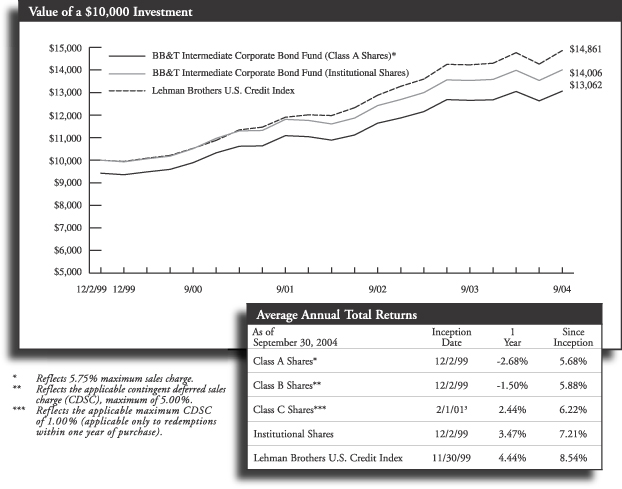

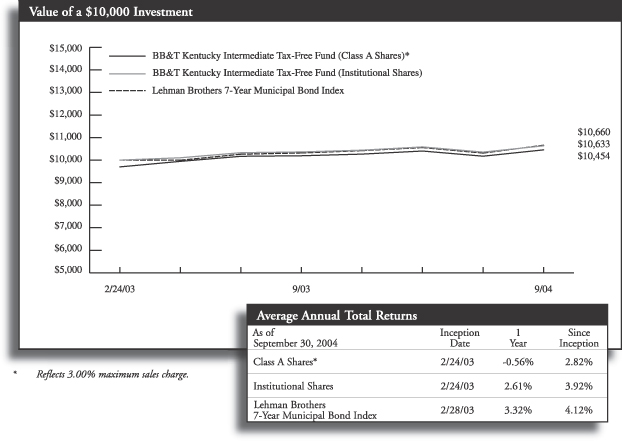

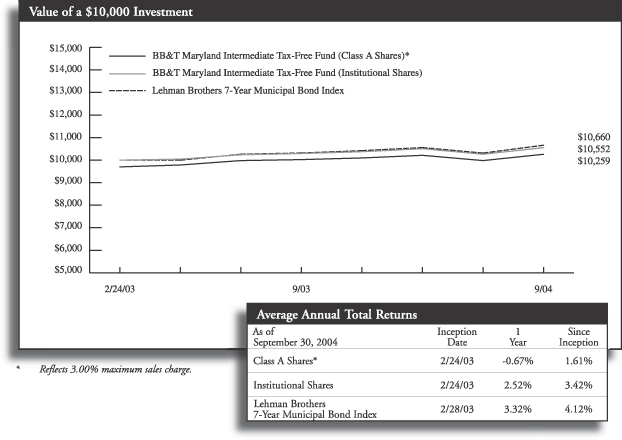

In response, we maintained a duration (interest-rate sensitivity) shorter than our benchmark’s, and therefore, more defensive. We also emphasized “spread product”: securities other than basic Treasuries that offer higher yields. For example, we were overweighted in callable agency securities. Because these securities can be “called away,” or redeemed by the issuer before maturity, they are sold with a yield premium. But in a rising-rate environment, early redemption isn’t likely, and we believe we can pick up the extra yield with little “call risk.”1