| | |

OMB APPROVAL |

OMB Number: | | 3235-0570 |

| |

Expires: | | October 31, 2006 |

|

Estimated average burden |

hours per response....... | | 19.3 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06719

BB&T Funds.

(Exact name of registrant as specified in charter)

| | |

3435 Stelzer Road Columbus, OH 43219 | | |

| (Address of principal executive offices) | | (Zip code) |

Bisys Fund Services

3435 Stelzer Road.

Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: December 31, 2004

Date of reporting period: December 31, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

ANNUAL REPORT

EQUITY INDEX FUND

| | | | |

| CLASS | | A | | SHARES |

| CLASS | | B | | SHARES |

| CLASS | | C | | SHARES |

DECEMBER 31, 2004

LETTER FROMTHE PRESIDENTANDTHE INVESTMENTADVISOR

Dear Shareholders:

We are pleased to send you this annual report for the BB&T Equity Index Fund. Buoyed by a fourth-quarter surge in most sectors, stocks posted solid gains in 2004. However, as the year began, the economic picture was murky. Unstable economic indicators and lack of job growth spurred concerns surrounding the sustainability of an economic recovery, which, in turn, dampened investor confidence. Continued geopolitical concerns also weighed on investor sentiment.

As the reporting period progressed, the economic outlook changed. In early April, employment data for March came in stronger than expected. May and June brought upward revisions to labor figures, suggesting that the “jobless recovery” might no longer be jobless. As economic indicators improved, concerns about sluggish economic growth were replaced with worries about inflation. In June, the Federal Reserve Board began raising its key, short-term interest rate for the first time in four years. (After five increases, the rate stood at 2.25% at the end of the year.)

Going forward, we believe that earnings growth rates for stocks could decelerate from the rapid pace of 2004; rising interest rates and a further decline in the dollar could also pressure stock prices. However, a number of indicators point to continuing strength in the U.S. economy, and large-capitalization stocks, as represented by the Standard & Poor’s 500® Stock Index (“S&P 500® Stock Index”)1, may continue to do moderately well by historical standards.

|

Sincerely, |

|

|

Keith F. Karlawish, CFA President BB&T Mutual Funds Group |

|

|

Jeffrey J. Schappe, CFA Chief Investment Officer BB&T Asset Management, Inc. |

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. The BB&T Mutual Funds are distributed by BISYS Fund Services. The BB&T Mutual Funds are NOT FDIC INSURED and are not deposits or obligations or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. Investment products involve investment risk, including the possible loss of principal.

The foregoing information and opinions are for general information only. BB&T Asset Management, Inc. does not assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

“S&P 500®” is a registered service mark of Standard & Poor’s Corporation, which does not sponsor and is in no way affiliated with the Fund or Master Portfolio.

1

BB&T EQUITY INDEX FUND

MASTER PORTFOLIO MANAGER

Barclays Global Fund Advisors, a subsidiary of Barclays Global Investors,

N.A. (S&P 500® Index Master Portfolio)

BB&T Asset Management, Inc. (BB&T Equity Index Fund)

Unlike many traditional, actively managed investment funds, there is no single portfolio manager who makes investment decisions for the BB&T Equity Index Fund. Instead, the Fund invests substantially all its assets in the S&P 500® Index Master Portfolio which is managed by a team of investment professionals from Barclays, who use a specially designed software program to maintain a close match to the characteristics of the S&P 500 Index.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

The performance of the Fund is expected to be lower than that of the S&P 500 Index because of Fund fees and expenses.

PORTFOLIO MANAGERS’ PERSPECTIVE

“Investing in an index fund such as ours is based on the belief that it’s very difficult to ‘beat the market’ on a consistent basis. Our approach, then, is to take advantage of the stock market’s long-term growth potential, while managing costs, to help shareholders potentially build wealth over time. We believe the Fund is an excellent diversification tool for novice and experienced investors alike, and can serve as the foundation of most equity investors’ asset allocation strategies.”

The BB&T Equity Index Fund (the “Fund”) seeks to provide investment results that correspond as closely as practicable, before fees and expenses, to the total return of the broad range of stocks represented in the S&P 500® Stock Index. The Fund employs a two-tier structure, commonly referred to as “master-feeder”. The Fund invests all of its investable assets in the S&P 500® Index Master portfolio (“Master Portfolio”). For simplicity sake, all discussion of the Fund’s investment objective, strategies, risks and holdings refer also to the Master Portfolio’s objectives, strategies, risks, and holdings unless otherwise indicated.

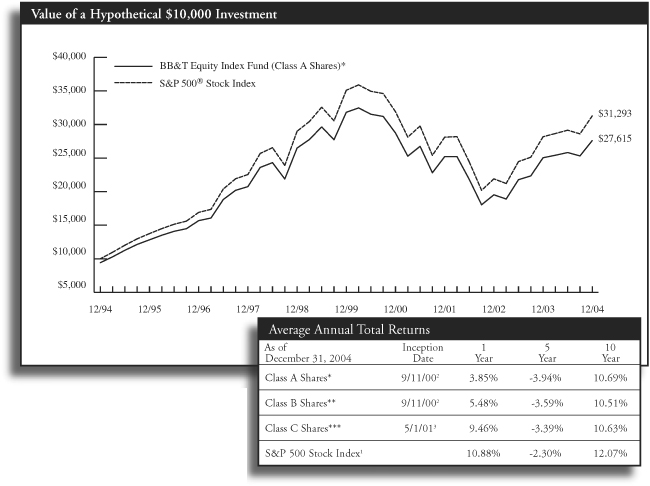

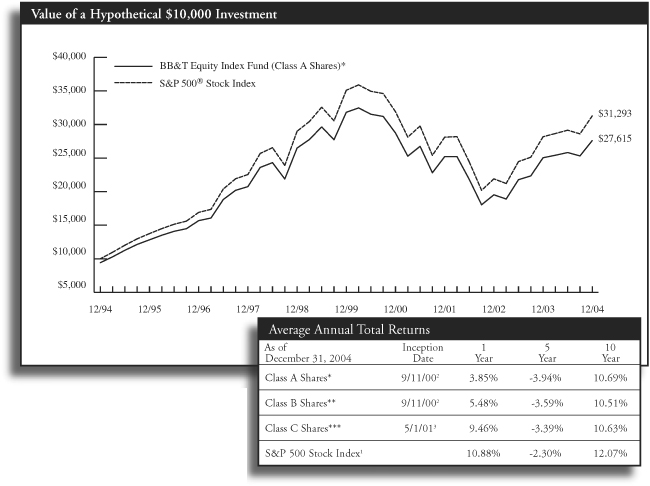

The Fund seeks to approximate as closely as practicable, before fees and expenses, the capitalization-weighted total rate of return of the S&P 500 Stock Index. For the 12 months ended December 31, 2004, the Fund returned 10.23% (Class A Shares without sales charge)2 and the Index returned 10.88%.

An index is a statistical composite that tracks a specified financial market or sector. Unlike a fund, an index does not actually hold a portfolio of securities and therefore does not incur the management, administration, distribution, transaction or other expenses incurred by a fund. These expenses negatively impact the performance of a fund, and were the basis for the Fund’s slight underperformance compared to its benchmark.

Equity markets generally posted gains during the reporting period. As the reporting period opened, unstable economic indicators and lack of job growth spurred concerns surrounding the sustainability of economic recovery, in turn dampening investor confidence. Continued geopolitical concerns also weighed on investor sentiment. As the reporting period progressed, the economic picture changed. In early April, employment data for March came in stronger than expected. May and June brought upward revisions to labor figures, suggesting that the “jobless recovery” might no longer be jobless. As economic indicators improved, concerns about sluggish economic growth were replaced with worries about inflation. Uncertainty surrounding the upcoming presidential election also appeared to compound investor pessimism, and, by mid-October, the S&P 500 Stock Index posted a loss for the year. During the last two months of the year, however, markets appeared to shrug off uncertainties to deliver positive returns for the year. During the reporting period, the Federal Reserve Board raised its federal funds interest rate for the first time in four years. The rate increased five times over the course of the reporting period, overall from 1.00% to 2.25%.

The S&P 500 Stock Index is composed of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The weightings of stocks in the S&P 500

| 2 | Please refer to page 4 for additional performance information. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

2

BB&T EQUITY INDEX FUND, CONTINUED

Stock Index are based on each stock’s relative total market capitalization. The percentage of the Fund’s assets invested in a given stock is approximately the same as the percentage such stock represents in the S&P 500 Stock Index.

During the reporting period, the best performing sector in the S&P 500 Stock Index was energy, which benefited from higher oil prices during the reporting period. Utilities and telecommunications services both posted healthy gains, as did industrials and consumer discretionary. Health care was the worst performing sector, although it did manage to finish the reporting period with a slight gain.

The Fund’s ten largest holdings as of December 31, 2004, oil giant Exxon Mobil Corp. (2.9% of the Fund’s assets) posted the strongest gains for the reporting period, thanks in part to higher oil prices. Health-care company Johnson & Johnson (1.7%) also performed well, as did the Fund’s largest holding, General Electric Co. (3.4%). Among financial stocks, Bank of America Corp. (1.7%) gained, while American International Group Inc. (1.5%) posted a slight decline. Pharmaceutical company Pfizer, Inc. (1.8%) posted the steepest decline among the Fund’s 10 largest holdings for the reporting period†

| † | The composition of the Master Portfolio is subject to change. |

3

BB&T EQUITY INDEX FUND

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase). |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | The Fund is measured against the S&P 500 Stock Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| 2 | The performance of the BB&T Equity Index Fund, prior to its commencement date, on 9/11/00, is based on the historical performance of the “master portfolio”, which commenced operations on 7/2/93. The performance shown reflects the reinvestment of all dividend and capital gains distributions but does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or redemptions. The performance has been adjusted to reflect the deduction of fees for services associated with the Fund, such as investment management and fund accounting fees. |

| 3 | Performance for Class C Shares prior to their inception date, on 5/1/01 is based on the historical performance of Class B Shares and has been adjusted for the maximum CDSC applicable to Class C Shares. |

A portion of the Fund’s fees have been voluntarily waived. If the fees had not been waived, the Fund’s total return would have been lower.

4

Portfolio Holdings Summary (Unaudited)

| | | |

Investment Type

| | % of

Investment

| |

S&P 500 Index Master Portfolio | | 100 | % |

| | |

|

|

| Total | | 100 | % |

For a summary of the S&P 500 Index Master Portfolio holdings, please see the accompanying financial statements of the Master Portfolio.

Expense Example

As a shareholder of the BB&T Equity Index Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases, and redemption fees (2) ongoing costs, including master portfolio fees; distribution fees; and other Fund expenses.

This example is intended to help you understand your ongoing costs (in dollars) of investing in the BB&T Equity Index Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2004 through December 31, 2004.

Actual Return

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | |

| | | Beginning

Account Value

7/1/04

| | Ending

Account Value

12/31/04

| | Expense Paid

During Period*

7/1/04 - 12/31/04

| | Expense Ratio

During Period

7/1/04 - 12/31/04

| |

BB&T Equity Index Fund | | | | | | | | | | | | |

A Class | | $ | 1,000.00 | | $ | 1,069.40 | | $ | 2.65 | | 0.51 | % |

B Class | | | 1,000.00 | | | 1,065.30 | | | 6.54 | | 1.26 | % |

C Class | | | 1,000.00 | | | 1,065.80 | | | 6.54 | | 1.26 | % |

Hypothetical Return for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the BB&T Equity Index Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account Value

7/1/04

| | Ending

Account Value

12/31/04

| | Expense Paid

During Period*

7/1/04 - 12/31/04

| | Expense Ratio

During Period

7/1/04 - 12/31/04

| |

BB&T Equity Index Fund | | | | | | | | | | | | |

A Class | | $ | 1,000.00 | | $ | 1,022.57 | | $ | 2.59 | | 0.51 | % |

B Class | | | 1,000.00 | | | 1,018.80 | | | 6.39 | | 1.26 | % |

C Class | | | 1,000.00 | | | 1,018.80 | | | 6.39 | | 1.26 | % |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year. |

5

BB&T FUNDS

Equity Index Fund

| | | | |

| Statement of Assets and Liabilities | | | |

| December 31, 2004 | |

Assets: | | | | |

Investment in S&P 500 Index Master Portfolio, at value (Note 1) | | $ | 155,990,287 | |

Receivable for capital shares issued | | | 408,100 | |

Prepaid expenses and other | | | 7,325 | |

| | |

|

|

|

Total Assets | | | 156,405,712 | |

| | |

|

|

|

Liabilities: | | | | |

Dividends payable | | | 59,719 | |

Payable for capital shares redeemed | | | 404,876 | |

Accrued expenses and other payables: | | | | |

Distribution fees | | | 42,520 | |

Other | | | 51,055 | |

| | |

|

|

|

Total Liabilities | | | 558,170 | |

| | |

|

|

|

Net Assets: | | | | |

Capital stock | | | 155,619,693 | |

Undistributed (distributions in excess of) net investment income | | | (546 | ) |

Undistributed realized losses from investment transactions | | | (8,291,467 | ) |

Net unrealized appreciation on investments | | | 8,519,862 | |

| | |

|

|

|

Net Assets | | $ | 155,847,542 | |

| | |

|

|

|

Net Assets | | | | |

Class A | | $ | 139,833,062 | |

Class B | | | 15,206,920 | |

Class C | | | 807,560 | |

| | |

|

|

|

Total | | $ | 155,847,542 | |

| | |

|

|

|

Outstanding Units of Beneficial Interests (Shares) | | | | |

Class A | | | 17,169,445 | |

Class B | | | 1,896,985 | |

Class C | | | 99,964 | |

| | |

|

|

|

Total | | | 19,166,394 | |

| | |

|

|

|

Net Asset Value | | | | |

Class A — redemption price per share | | $ | 8.14 | |

Class B — offering price per share* | | | 8.02 | |

Class C — offering price per share* | | | 8.08 | |

| | |

|

|

|

Maximum Sales Charge — Class A | | | 5.75 | % |

| | |

|

|

|

Maximum Offering Price (100%/(100% – Maximum Sales Charge) of net asset value adjusted to the nearest cent per share — Class A Shares | | $ | 8.64 | |

| | |

|

|

|

| * | Redemption price per share varies by length of time shares are held. |

| | | | |

| Statement of Operations | | | |

| For the Year Ended December 31, 2004 | |

Net Investment Income Allocated from Master Portfolio: | | | | |

Dividend income | | $ | 2,654,043 | |

Interest income | | | 176,008 | |

Expenses | | | (69,007 | ) |

| | |

|

|

|

Net Investment Income Allocated from Master Portfolio | | | 2,761,044 | |

| | |

|

|

|

Expenses: | | | | |

Administration and transfer agent fees (Note 3) | | | 349,503 | |

Distribution fees — Class A | | | 619,621 | |

Distribution fees — Class B | | | 141,377 | |

Distribution fees — Class C | | | 8,643 | |

Fund accounting fees | | | 30,100 | |

Printing fees | | | 33,091 | |

Professional fees | | | 80,667 | |

Custodian fees | | | 6,117 | |

Other | | | 50,719 | |

| | |

|

|

|

Gross expenses | | | 1,319,838 | |

Expenses waived by the Administrator | | | (302,563 | ) |

Expenses waived by the Distributor | | | (306,317 | ) |

| | |

|

|

|

Total Expenses | | | 710,958 | |

| | |

|

|

|

Net Investment Income | | | 2,050,086 | |

| | |

|

|

|

Realized/Unrealized Gains (Losses) Allocated

from Master Portfolio | | | | |

Net realized gains from investment transactions | | | 11,334,020 | |

Change in unrealized appreciation from investments | | | 706,798 | |

| | |

|

|

|

Net realized/unrealized gains allocated from Master Portfolio | | | 12,040,818 | |

| | |

|

|

|

Change in net assets from operations | | $ | 14,090,904 | |

| | |

|

|

|

See accompanying notes to the financial statements.

6

BB&T FUNDS

Equity Index Fund

| | | | | | | | |

| Statements of Changes in Net Assets | | | | | | |

| | | For the

Year Ended

December 31,

2004

| | | For the

Year Ended

December 31,

2003

| |

From Investment Activities: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 2,050,086 | | | $ | 1,197,756 | |

Net realized gains (losses) from investment transactions | | | 11,334,020 | | | | (327,323 | ) |

Change in unrealized appreciation from investments | | | 706,798 | | | | 26,606,785 | |

| | |

|

|

| |

|

|

|

Change in net assets from operations | | | 14,090,904 | | | | 27,477,218 | |

| | |

|

|

| |

|

|

|

Dividends to Class A Shareholders: | | | | | | | | |

Net investment income | | | (1,894,023 | ) | | | (1,150,351 | ) |

Dividends to Class B Shareholders: | | | | | | | | |

Net investment income | | | (111,354 | ) | | | (61,649 | ) |

Dividends to Class C Shareholders: | | | | | | | | |

Net investment income | | | (5,395 | ) | | | (4,698 | ) |

| | |

|

|

| |

|

|

|

Change in net assets from shareholder dividends | | | (2,010,772 | ) | | | (1,216,698 | ) |

| | |

|

|

| |

|

|

|

Capital Transactions: | | | | | | | | |

Proceeds from shares issued | | | | | | | | |

Class A | | | 34,150,250 | | | | 78,665,773 | |

Class B | | | 2,707,915 | | | | 3,158,939 | |

Class C | | | 228,965 | | | | 446,509 | |

Dividends Reinvested | | | | | | | | |

Class A | | | 2,875,377 | | | | 568,436 | |

Class B | | | 171,521 | | | | 27,337 | |

Class C | | | 10,117 | | | | 4,118 | |

Value of shares redeemed | | | | | | | | |

Class A | | | (17,293,053 | ) | | | (50,111,791 | ) |

Class B | | | (1,928,923 | ) | | | (1,368,404 | ) |

Class C | | | (305,421 | ) | | | (615,639 | ) |

| | |

|

|

| |

|

|

|

Change in net assets from capital transactions | | | 20,616,748 | | | | 30,775,278 | |

| | |

|

|

| |

|

|

|

Change in net assets | | | 32,696,880 | | | | 57,035,798 | |

Net Assets: | | | | | | | | |

Beginning of Year | | | 123,150,662 | | | | 66,114,864 | |

| | |

|

|

| |

|

|

|

End of Year | | $ | 155,847,542 | | | $ | 123,150,662 | |

| | |

|

|

| |

|

|

|

Undistributed (distributions in excess of) net investment income | | $ | (546 | ) | | $ | (28,438 | ) |

| | |

|

|

| |

|

|

|

Share Transactions: | | | | | | | | |

Issued | | | | | | | | |

Class A | | | 4,459,349 | | | | 12,756,540 | |

Class B | | | 361,065 | | | | 492,868 | |

Class C | | | 30,130 | | | | 70,088 | |

Reinvested | | | | | | | | |

Class A | | | 368,943 | | | | 96,345 | |

Class B | | | 22,255 | | | | 4,689 | |

Class C | | | 1,313 | | | | 703 | |

Redeemed | | | | | | | | |

Class A | | | (2,261,105 | ) | | | (7,846,114 | ) |

Class B | | | (256,679 | ) | | | (215,293 | ) |

Class C | | | (41,024 | ) | | | (93,669 | ) |

| | |

|

|

| |

|

|

|

Change in shares | | | 2,684,247 | | | | 5,266,157 | |

| | |

|

|

| |

|

|

|

See accompanying notes to the financial statements.

7

BB&T FUNDS

Equity Index Fund

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights, Class A Shares | | | | | | | | | | | | | | | |

| Selected data for a share of beneficial interest outstanding throughout the periods indicated. | |

| | | For the

Year Ended

December 31,

2004

| | | For the

Year Ended

December 31,

2003

| | | For the

Year Ended

December 31,

2002

| | | For the

Year Ended

December 31,

2001

| | | September 11,

2000 thru

December 31,

2000(a)

| |

Net Asset Value, Beginning of Period | | $ | 7.48 | | | $ | 5.90 | | | $ | 7.70 | | | $ | 8.83 | | | $ | 10.00 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Investment Activities | | | | | | | | | | | | | | | | | | | | |

Net investment income(e) | | | 0.11 | | | | 0.08 | | | | 0.06 | | | | 0.05 | | | | 0.02 | |

Net realized and unrealized gains (losses) from investments(e) | | | 0.66 | | | | 1.58 | | | | (1.80 | ) | | | (1.13 | ) | | | (1.17 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Activities | | | 0.77 | | | | 1.66 | | | | (1.74 | ) | | | (1.08 | ) | | | (1.15 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dividends: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.11 | ) | | | (0.08 | ) | | | (0.06 | ) | | | (0.05 | ) | | | (0.02 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Dividends | | | (0.11 | ) | | | (0.08 | ) | | | (0.06 | ) | | | (0.05 | ) | | | (0.02 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value — End of Period | | $ | 8.14 | | | $ | 7.48 | | | $ | 5.90 | | | $ | 7.70 | | | $ | 8.83 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return (excludes sales charge)(b) | | | 10.23 | % | | | 28.28 | % | | | (22.56 | )% | | | (12.24 | )% | | | (11.50 | )% |

| | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000’s) | | $ | 139,833 | | | $ | 109,282 | | | $ | 56,661 | | | $ | 39,700 | | | $ | 13,632 | |

Ratio of expenses to average net assets(c)(e) | | | 0.49 | % | | | 0.48 | % | | | 0.55 | % | | | 0.54 | % | | | 0.55 | % |

Ratio of net investment income to average net assets(c)(e) | | | 1.57 | % | | | 1.31 | % | | | 1.08 | % | | | 0.74 | % | | | 1.42 | % |

Ratio of expenses to average net assets*(c)(e) | | | 0.96 | % | | | 0.95 | % | | | 1.05 | % | | | 1.10 | % | | | 1.31 | % |

Portfolio turnover(d) | | | 14 | % | | | 8 | % | | | 12 | % | | | 9 | % | | | 10 | % |

| * | During the period certain fees were reduced. If such fee reductions had not occurred, the ratios would have been as indicated. |

| (a) | Period from the commencement of operations. |

| (b) | Not annualized for periods less than one year. |

| (c) | Annualized for periods less than one year. |

| (d) | This rate represents the portfolio turnover rate of the S&P 500 Index Master Portfolio. |

| (e) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Index Master Portfolio. |

See accompanying notes to the financial statements.

8

BB&T FUNDS

Equity Index Fund

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights, Class B Shares | |

| Selected data for a share of beneficial interest outstanding throughout the periods indicated. | | | | |

| | | For the

Year Ended

December 31,

2004

| | | For the

Year Ended

December 31,

2003

| | | For the

Year Ended

December 31,

2002

| | | For the

Year Ended

December 31,

2001

| | | September 11,

2000 thru

December 31,

2000(a)

| |

Net Asset Value, Beginning of Period | | $ | 7.37 | | | $ | 5.83 | | | $ | 7.60 | | | $ | 8.82 | | | $ | 10.00 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Investment Activities | | | | | | | | | | | | | | | | | | | | |

Net investment income(f) | | | 0.06 | | | | 0.03 | | | | 0.02 | | | | — | (b) | | | 0.02 | |

Net realized and unrealized gains (losses) from investments(f) | | | 0.65 | | | | 1.54 | | | | (1.77 | ) | | | (1.18 | ) | | | (1.18 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Activities | | | 0.71 | | | | 1.57 | | | | (1.75 | ) | | | (1.18 | ) | | | (1.16 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dividends | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.06 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.04 | ) | | | (0.02 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Dividends | | | (0.06 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.04 | ) | | | (0.02 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value — End of Period | | $ | 8.02 | | | $ | 7.37 | | | $ | 5.83 | | | $ | 7.60 | | | $ | 8.82 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return (excludes sales charge)(c) | | | 9.48 | % | | | 27.18 | % | | | (23.05 | )% | | | (13.37 | )% | | | (11.61 | )% |

| | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000’s) | | $ | 15,207 | | | $ | 13,055 | | | $ | 8,678 | | | $ | 8,067 | | | $ | 929 | |

Ratio of expenses to average net assets(d)(f) | | | 1.23 | % | | | 1.23 | % | | | 1.30 | % | | | 1.17 | % | | | 1.30 | % |

Ratio of net investment income to average net assets(d)(f) | | | 0.81 | % | | | 0.54 | % | | | 0.34 | % | | | 0.74 | % | | | 1.92 | % |

Ratio of expenses to average net assets*(d)(f) | | | 1.45 | % | | | 1.45 | % | | | 1.56 | % | | | 1.37 | % | | | 1.81 | % |

Portfolio turnover(e) | | | 14 | % | | | 8 | % | | | 12 | % | | | 9 | % | | | 10 | % |

| * | During the period certain fees were reduced. If such fee reductions had not occurred, the ratios would have been as indicated. |

| (a) | Period from commencement of operations. |

| (b) | Amount less than $0.005. |

| (c) | Not annualized for periods less than one year. |

| (d) | Annualized for periods less than one year. |

| (e) | This rate represents the portfolio turnover rate of the S&P 500 Index Master Portfolio |

| (f) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Index Master Portfolio. |

See accompanying notes to the financial statements.

9

BB&T FUNDS

Equity Index Fund

| | | | | | | | | | | | | | | | |

| Financial Highlights, Class C Shares | | | | | | | | | | | | |

| Selected data for a share of beneficial interest outstanding throughout the periods indicated. | |

| | | For the

Year Ended

December 31,

2004

| | | For the

Year Ended

December 31,

2003

| | | For the

Year Ended

December 31,

2002

| | | May 1, 2001

thru

December 31,

2001(a)

| |

Net Asset Value, Beginning of Period | | $ | 7.42 | | | $ | 5.86 | | | $ | 7.56 | | | $ | 8.34 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Investment Activities | | | | | | | | | | | | | | | | |

Net investment income(g) | | | 0.07 | | | | 0.04 | | | | 0.03 | (b) | | | — | (c) |

Net realized and unrealized gains (losses) from investments(g) | | | 0.64 | | | | 1.56 | | | | (1.70 | ) | | | (0.72 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Activities | | | 0.71 | | | | 1.60 | | | | (1.67 | ) | | | (0.72 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dividends | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.06 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Dividends | | | (0.05 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.06 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net Asset Value — End of Period | | $ | 8.08 | | | $ | 7.42 | | | $ | 5.86 | | | $ | 7.56 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Return (excludes sales charge)(d) | | | 9.46 | % | | | 27.35 | % | | | (22.08 | )% | | | (8.68 | )% |

| | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000’s) | | $ | 808 | | | $ | 813 | | | $ | 776 | | | $ | 107 | |

Ratio of expenses to average net assets(e)(g) | | | 1.23 | % | | | 1.23 | % | | | 1.30 | % | | | 1.01 | % |

Ratio of net investment income to average net assets(e)(g) | | | 0.76 | % | | | 0.52 | % | | | 0.41 | % | | | 1.09 | % |

Ratio of expenses to average net assets*(e)(g) | | | 1.45 | % | | | 1.45 | % | | | 1.56 | % | | | 1.52 | % |

Portfolio turnover(f) | | | 14 | % | | | 8 | % | | | 12 | % | | | 9 | % |

| * | During the period certain fees were reduced. If such fee reductions had not occurred, the ratios would have been as indicated. |

| (a) | Period from commencement of operations. |

| (b) | Per share net investment income has been calculated using the daily average shares method. |

| (c) | Amount less than $0.005. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | This rate represents the portfolio turnover rate of the S&P 500 Index Master Portfolio. |

| (g) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Index Master Portfolio. |

See accompanying notes to the financial statements.

10

BB&T FUNDS

Notes to Financial Statements

December 31, 2004

The BB&T Equity Index Fund (the “Fund”) commenced operations on September 11, 2000 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified open-end investment company. The Fund is a separate series of the BB&T Funds (“Trust”), a Massachusetts business trust organized in 1992. The Fund invests all of its assets in the S&P 500 Index Master Portfolio (the “Master Portfolio”) of the Master Investment Portfolio (“MIP”), a diversified open-end management investment company registered under the Investment Company Act of 1940, rather than in a portfolio of securities. The Master Portfolio has substantially the same investment objective as the Fund. Barclays Global Fund Advisors serves as Investment Advisor for the Master Portfolio. The financial statements of the Master Portfolio, including the schedule of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The Fund is authorized to issue an unlimited number of shares without par value. The Fund offers three classes of shares: Class A Shares, Class B Shares and Class C Shares.

Each class of shares has identical rights and privileges except with respect to the fees paid under the distribution plan, voting rights on matters affecting a single class of shares and the exchange privilege of each class of shares.

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with their vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

| 2. | Significant Accounting Policies: |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

| | (A) | Security Valuation—The value of the Fund’s investment in the Master Portfolio reflects the Fund’s interest of approximately 6% in the net assets of the Master Portfolio at December 31, 2004. Valuation of securities held by the Master Portfolio is discussed in Note 1 of the Master Portfolio’s Notes to Financial Statements, which are included elsewhere in this report. |

| | (B) | Distributions to Shareholders—Dividends from net investment income are declared and paid quarterly by the Fund. Distributable net realized capital gains, if any, are declared and distributed at least annually. The amount of dividends from net investment income and of distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (i.e. reclass of market discounts, gain/loss, paydowns, and distributions), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. |

| | (C) | Allocation Methodology—The investment income, expenses (other than class specific expenses) and realized and unrealized gains and losses on investments are allocated to each class of shares based on their relative net assets on the date the income is earned, expenses are accrued, or realized and unrealized gains and losses are incurred. |

| | (D) | Expenses—Expenses directly attributable to a class of shares are charged directly to that class. |

| | (E) | Securities Transactions and Income Recognition—The Fund records daily, its proportionate interest in the net investment income and realized/unrealized capital gains and losses of the Master Portfolio. The performance of the Fund is directly affected by the performance of the Master Portfolio. |

Continued

11

BB&T FUNDS

Notes to Financial Statements, Continued

December 31, 2004

| | (F) | Redemption Fees—For the Fund, certain shares purchased on or after January 1, 2004, that were redeemed or exchanged in less than 30 days were assessed a fee of 2% of the total redemption amount. The fee is applied to shares redeemed or exchanged in the order in which they were purchased and is retained by the Fund for the benefit of remaining shareholders to defray Fund portfolio transaction expenses and facilitate portfolio management. For financial statement purposes, these amounts are included in the Statement of Changes in Net Assets as “Proceeds from Shares Issued”. |

| 3. | Related Party Transactions: |

Under its Investment Advisory Agreement with respect to the Fund, BB&T Asset Management, Inc. (“BB&T” or “Adviser”) exercises general oversight over the investment performance of the Fund. BB&T will advise the Board of Trustees if investment of all of the Fund’s assets in shares of the Master Portfolio is no longer an appropriate means of achieving the Fund’s investment objective. For periods in which all the Fund’s assets are not invested in the Master Portfolio, BB&T will receive an investment advisory fee from the Fund. For the period ended December 31, 2004, all of the Fund’s assets were invested in the Master Portfolio and BB&T received no fees.

BISYS Fund Services Limited Partnership d/b/a BISYS Fund Services (“BISYS”), an Ohio Limited Partnership, and BISYS Fund Services Ohio, Inc. (“BISYS Ohio”) are subsidiaries of the BISYS Group, Inc. BISYS, with whom certain Trustees and Officers of the Fund are affiliated, serves the Fund as Administrator, Distributor and Transfer Agent. BISYS, Administrator for the Fund, and BISYS Ohio, Transfer Agent for the Fund, receives compensation at a rate of 0.22% of the average net assets of the Fund. The fee is accrued daily and payable on a monthly basis. BISYS Ohio may directly or through an affiliate, use their fee revenue, past profits, or other revenue sources to pay promotional, administrative, shareholder support, and other expenses to third parties, including broker dealers, in connection with the offer, sale and administration of shares of the Fund. For the period ended December 31, 2004, BISYS had voluntarily agreed to waive all of its fee for the Fund, the amount of such waiver was $302,563. In addition, BISYS provides an employee to serve as Chief Compliance Officer for the Fund, including providing certain related services, for which it receives an additional fee.

The Fund has adopted a Distribution and Shareholder Services Plan (the “Plan”) in accordance with Rule 12b-1 under the 1940 Act. The Plan provides for payments to the distributor of up to 0.50%, 1.00% and 1.00% for Class A Shares, Class B Shares and Class C Shares, respectively. The fees may be used by BISYS to pay banks, including the advisor, broker dealers and other institutions. As distributor, BISYS is entitled to receive commissions on sales of shares of the Fund. BISYS voluntarily waived fees totaling $306,317 for distribution for year ended December 31, 2004.

Certain Officers and Trustees of the Trust are affiliated with the Adviser or the Administrator. Such Officers and Trustees receive no compensation from the Trust for serving in their respective roles, except the Chief Compliance Officer. Each of the non-interested Trustees who served both on the Board and the Audit Committee will be compensated $7,000 per meeting for meeting and retainer fees, plus reimbursement for certain expenses. During the year ended December 31, 2004, actual Trustee compensation was $159,000 in total from the Trust, of which $5,204 was allocated to the Fund.

At December 31, 2004 the Fund had net capital loss carryforwards to offset future net capital gains, if any, to the extent provided by the Treasury regulations. To the extent that these carryforwards are used to offset future capital gains, it is probable that the gains that are offset will not be distributed to shareholders.

| | | |

Amount

| | Expires

|

| $ | 10,695 | | 2008 |

| | 740,335 | | 2009 |

| | 3,648,463 | | 2010 |

| | 715,833 | | 2011 |

| | 175,416 | | 2012 |

Continued

12

BB&T FUNDS

Notes to Financial Statements, Continued

December 31, 2004

The tax characteristics of dividends paid to shareholders during the fiscal year ended December 31, 2004, were as follows:

| | | | | | | | | | | | | | | | | | |

| | | Distributions paid from

| | Total Taxable

Distributions

| | Tax Exempt

Distributions

| | Tax

Return

of Capital

| | Total

Distributions

Paid

|

| | | Ordinary

Income

| | Net

Long-Term

Gains

| | | | |

BB&T Equity Index Fund | | $ | 3,165,550 | | $ | — | | $ | 3,165,550 | | $ | — | | $ | — | | $ | 3,165,550 |

The tax characteristics of dividends paid to shareholders during the fiscal year ended December 31, 2003, were as follows:

| | | | | | | | | | | | | | | | | | |

| | | Distributions paid from

| | Total Taxable

Distributions

| | Tax Exempt

Distributions

| | Tax

Return

of Capital

| | Total

Distributions

Paid

|

| | | Ordinary

Income

| | Net

Long-Term

Gains

| | | | |

BB&T Equity Index Fund | | $ | 635,919 | | $ | — | | $ | 635,919 | | $ | — | | $ | — | | $ | 635,919 |

Total Distributions paid differ from the Statement of Changes in Net Assets because dividends are recognized when paid for tax purposes.

As of December 31, 2004 the components of accumulated earnings (deficit) on a tax basis was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Undistributed

Ordinary

Income/Tax

Exempt Income

| | Undistributed

LongTerm

Capital

Gains (Losses)

| | Accumulated

Earnings

| | Dividends

Payable

| | | Accumulated

Capital and

Other Losses

| | | Unrealized

Appreciation

(Depreciation)

| | Total

Accumulated

Earning

(Deficit)

|

BB&T Equity Index Fund | | $ | 51,325 | | $ | — | | $ | 51,325 | | $ | (59,719 | ) | | $ | (5,415,912 | ) | | $ | 5,652,155 | | $ | 227,849 |

Under current tax law, capital losses realized after October 31 of a Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund had deferred post October capital losses of $125,170, which will be treated as arising on the first business day of the fiscal year ending December 31, 2005.

| 5. | Other Federal Tax Information (Unaudited) |

For the period ended December 31, 2004, certain dividends paid by the Funds may be subject to a maximum tax rate of 15% a provided by the Jobs an Growth Relief Reconciliation Act of 2003. The Funds intend to designate the maximum amount allowable as taxes at a maximum rate of 15%. Complete information will be reported in conjunction with your 2004 Form 1099-DIV. For the period ended December 31, 2004, the Fund paid qualified dividend income of $2,010,772.

For corporate shareholders, 100% of the total ordinary income dividends paid during the fiscal year ended December 31, 2004 qualify for the corporate dividends received deduction.

| 6. | Other Information (Unaudited) |

A description of the policies and procedures that the Fund use to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-228-1872 and (ii) on the Securities and Exchange Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2004 is available (i) without charge, upon request, by calling 1-800-228-1872 and (ii) on the Securities and Exchange Commission’s website at http://www.sec.gov.

Schedule of Portfolio Investments for quarters ending March 31 and September 30 will be available starting September 30, 2004, without charge, on the Securities and Exchange Commission’s website at http://www.sec.gov.

13

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of

BB&T Funds:

We have audited the accompanying statement of assets and liabilities of the BB&T Equity Index Fund (the “Fund”), a series of BB&T Funds, as of December 31, 2004, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the years or periods in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of the Fund’s investment at December 31, 2004 by correspondence with the underlying portfolio’s fund accounting agent. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the BB&T Equity Index Fund as of December 31, 2004, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years or periods then ended in conformity with accounting principles generally accepted in the United States of America.

Boston, Massachusetts

February 28, 2005

14

Information about Trustees and Officers (Unaudited)

Overall responsibility for the management of the Fund rests with its Board of Trustees, who are elected by the Shareholders of the Trust. The Trustees elect the Officers of the Trust to supervise actively its day-to-day operations. The names of the Trustees, their addresses, ages, length of tenure, principal occupations during the past five years, number of portfolios overseen and directorships held outside of the Trust are set below:

Independent Trustees

| | | | | | | | | | |

Name, Address and Date of Birth

| | Position(s)

Held With

the Funds

| | Term of

Office and

Length of

Time Served

| | Principal Occupation During the Last 5 Years

| | Number of

Portfolios

in Fund

Complex

Overseen

by Trustee

| | Other

Directorships Held

by Trustee

|

Thomas W. Lambeth 700 Yorkshire Road Winston-Salem, NC 27106 Birthdate: 1/35 | | Trustee | | Indefinite, 8/92 – Present | | From January 2004 to present,

Senior Fellow, Z. Smith Reynolds Foundation; from 1978 to January 2001, Executive Director, Z. Smith Reynolds Foundation. | | 25 | | None |

| | | | | |

Robert W. Stewart 201 Huntington Road Greenville, SC 29615 Birthdate: 5/32 | | Trustee | | Indefinite, 2/94 – Present | | Retired; Chairman and Chief

Executive Officer of Engineered Custom Plastics Corporation from

1969 to 1990. | | 25 | | None |

| | | | | |

Drew T. Kagan Montecito Advisors, Inc. 810 N. Jefferson St., Ste 101 Lewisburg, WV 24901 Birthdate: 2/48 | | Trustee | | Indefinite, 8/00 – Present | | From December 2003 to present, President and Director, Montecito Advisors, Inc.; from March 1996 to December 2003, President,

Investment Affiliate, Inc.; March

1992 to March 1996, President, Provident Securities & Investment

Co. | | 25 | | None |

| | | | | |

Laura C. Bingham Peace College Office of the President 15 East Peace Street Raleigh, NC 27604-1194 Birthdate: 11/56 | | Trustee | | Indefinite, 2/01 – Present | | From July 1998 to present, President

of Peace College; November 1997 to May 1998, Senior Vice President of Philanthropy and President of Fort Sanders Foundation Covenant

Health; 1992 to 1997, Vice President Hollins College. | | 25 | | None |

| | | | | |

Douglas Van Scoy 841 Middle St. Sullivans Island, SC 26481 Birthdate: 11/43 | | Trustee | | Indefinite, 5/04 – Present | | Retired: From November 1974 to

July 2001, Deputy Director of

Private Client Group and Senior Executive Vice President of Smith Barney (investment banking). | | 25 | | None |

| | | | | |

James L. Roberts 7 Kittansett Court Skillman, NJ 08558 Birthdate: 11/42 | | Trustee | | Indefinite, 11/04 – present | | Retired: From January 1999 to December 2003, President CEO and Director, Covest Bancshares, Inc. | | 25 | | None |

Interested Trustees

| | | | | | | | | | |

Name, Address and Date of Birth

| | Position(s)

Held With

the Funds

| | Term of

Office and

Length of

Time Served

| | Principal Occupation During the Last 5 Years

| | Number of

Portfolios

in Fund

Complex

Overseen

by Trustee

| | Other

Directorships Held

by Trustee

|

*Kenneth L. Miller 200 W. Second Street, 16th Floor Winston-Salem, NC 27101 Birthdate: 9/46 | | Trustee | | Indefinite, 11/02 – Present | | From August 1998 to present, Executive Vice President Branch Banking and Trust Company;

employee of Branch Banking and

Trust Company since 1989. | | 25 | | None |

| * | Mr. Miller is treated by the Funds as an “interested person” (as defined in Section 2(a)(19) of the 1940 Act) of the Fund. Mr. Miller is an “interested person” because he owns shares of BB&T Corporation and is an Executive Vice President of Branch Banking and Trust Company, the parent of the Adviser. |

15

| | | | | | |

Officers |

Name, Address and Date of Birth

| | Position(s)

Held With the

Funds

| | Term of Office and Length of Time Served

| | Principal Occupation(s) During the Past 5 Years

|

| | | |

Keith F. Karlawish1 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 8/64 | | President | | Indefinite, 2/05 – Present | | From May 2002 to present, President, BB&T Asset Management, Inc.; from 1996 to 2002, Senior Vice President and Director of Fixed Income, BB&T Asset Management, Inc. |

| | | |

E.G. Purcell, III 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 1/55 | | Vice President | | Indefinite, 11/00 – Present | | From 1995 to present, Senior Vice President, BB&T Asset Management, Inc. and its predecessors. |

| | | |

James T. Gillespie 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 11/66 | | Vice President | | Indefinite, 5/02 – Present | | From February 2005 to present, Vice President, BB&T Asset Management, Inc. from February 1992 to February 2005, Director of BISYS Fund Services; |

| | | |

George O. Martinez 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 3/59 | | Vice President President | | Indefinite, 2/05 – Present 11/03 – 1/05 | | From August 2002 to present, Senior Vice President — Client Services, BISYS Fund Services; from June 2001 to August 2002, CEO and President, Fund Watch Dog Services LLC; from June 2000 to June 2001, Senior Vice President and Senior Managing Counsel, State Street Corporation; from March 1998 to May 2000, National Director of Investment Management and Regulatory Consulting, Arthur Andersen. |

| | | |

Troy A. Sheets 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 5/71 | | Treasurer | | Indefinite, 5/02 – Present | | From April 2002 to present, Vice President of BISYS Fund Services; from September 1993 to April 2002, Senior Audit Manager of KPMG LLP. |

| | | |

Frank J. Pavlak 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 3/47 | | Chief Compliance and AML Officer | | Indefinite, 9/04 – Present | | From September 2004 to present, Senior Vice President, The BISYS Group; from 1999 to 2004, Director of Compliance, Oppenheiner Funds, Inc.; from 1981 to 1999, Branch Chief, U.S. Securities and Exchange Commission. |

| | | |

Alaina V. Metz 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 4/67 | | Assistant Secretary | | Indefinite, 9/95 – Present | | From June 1995 to present, Vice president, BISYS Fund Services. |

| | | |

Chris Sabato 3435 Stelzer Road Columbus, Ohio 43219 Birthdate: 12/68 | | Assistant Treasurer | | Indefinite 11/02 – Present | | From February 1993 to present, Director of BISYS Fund Services. |

The Fund’s Statement of Additional Information includes information about the Fund’s Trustees. To receive your free copy of the Statement of Additional Information, call toll free: 1-800-453-7348.

| 1 | Mr. Karlawish was elected President on February 1, 2005. |

16

| | |

| S&P 500 Index Master Portfolio | | Schedule of Investments December 31, 2004 |

| | | | | |

| Common Stocks (99.01)%: | | | | |

Security

| | Shares

| | Value

|

Advertising (0.19)%: | | | | | |

Interpublic Group of Companies Inc.(1)(2) | | 88,895 | | $ | 1,191,192 |

Omnicom Group Inc.(2) | | 39,270 | | | 3,311,246 |

| | | | |

|

|

| | | | | | 4,502,438 |

| | | | |

|

|

Aerospace & Defense (1.74%): | | | | | |

Boeing Co. (The) | | 177,123 | | | 9,169,658 |

General Dynamics Corp. | | 42,230 | | | 4,417,258 |

Goodrich (B.F.) Co. | | 25,452 | | | 830,753 |

L-3 Communications Holdings Inc. | | 24,375 | | | 1,785,225 |

Lockheed Martin Corp. | | 93,351 | | | 5,185,648 |

Northrop Grumman Corp. | | 77,635 | | | 4,220,239 |

Raytheon Co.(2) | | 95,294 | | | 3,700,266 |

Rockwell Collins Inc. | | 37,142 | | | 1,464,880 |

United Technologies Corp. | | 107,820 | | | 11,143,197 |

| | | | |

|

|

| | | | | | 41,917,124 |

| | | | |

|

|

Agriculture (1.40%): | | | | | |

Altria Group Inc. | | 433,160 | | | 26,466,076 |

Monsanto Co. | | 55,720 | | | 3,095,246 |

Reynolds American Inc.(2) | | 31,084 | | | 2,443,202 |

UST Inc. | | 35,067 | | | 1,687,073 |

| | | | |

|

|

| | | | | | 33,691,597 |

| | | | |

|

|

Airlines (0.12%): | | | | | |

Delta Air Lines Inc.(1)(2) | | 26,197 | | | 195,954 |

Southwest Airlines Co. | | 164,243 | | | 2,673,876 |

| | | | |

|

|

| | | | | | 2,869,830 |

| | | | |

|

|

Apparel (0.46%): | | | | | |

Coach Inc.(1) | | 39,790 | | | 2,244,156 |

Jones Apparel Group Inc. | | 25,894 | | | 946,944 |

Liz Claiborne Inc. | | 22,912 | | | 967,116 |

Nike Inc. Class B | | 55,348 | | | 5,019,510 |

Reebok International Ltd.(2) | | 12,457 | | | 548,108 |

VF Corp. | | 23,356 | | | 1,293,455 |

| | | | |

|

|

| | | | | | 11,019,289 |

| | | | |

|

|

Auto Manufacturers (0.58%): | | | | | |

Ford Motor Co. | | 385,864 | | | 5,649,049 |

General Motors Corp.(2) | | 119,097 | | | 4,771,026 |

Navistar International Corp.(1) | | 15,078 | | | 663,130 |

PACCAR Inc. | | 36,607 | | | 2,946,131 |

| | | | |

|

|

| | | | | | 14,029,336 |

| | | | |

|

|

Auto Parts & Equipment (0.22%): | | | | | |

Cooper Tire & Rubber Co.(2) | | 15,666 | | | 337,602 |

Dana Corp. | | 32,185 | | | 557,766 |

Delphi Corp.(2) | | 117,899 | | | 1,063,449 |

Goodyear Tire & Rubber Co. (The)(1)(2) | | 37,185 | | | 545,132 |

Johnson Controls Inc. | | 40,100 | | | 2,543,944 |

Visteon Corp. | | 27,718 | | | 270,805 |

| | | | |

|

|

| | | | | | 5,318,698 |

| | | | |

|

|

Banks (6.51%): | | | | | |

AmSouth Bancorp | | 75,383 | | | 1,952,420 |

Bank of America Corp. | | 852,448 | | | 40,056,532 |

Bank of New York Co. Inc. (The) | | 163,837 | | | 5,475,433 |

BB&T Corp. | | 116,474 | | | 4,897,732 |

Comerica Inc. | | 36,216 | | | 2,209,900 |

Compass Bancshares Inc. | | 25,793 | | | 1,255,345 |

Fifth Third Bancorp | | 124,816 | | | 5,901,300 |

First Horizon National Corp.(2) | | 26,102 | | | 1,125,257 |

| | | | | |

| Common Stocks, continued | | | | |

Security

| | Shares

| | Value

|

Banks, continued | | | | | |

Huntington Bancshares Inc.(2) | | 48,582 | | $ | 1,203,862 |

KeyCorp | | 85,683 | | | 2,904,654 |

M&T Bank Corp.(2) | | 24,469 | | | 2,638,737 |

Marshall & Ilsley Corp. | | 47,438 | | | 2,096,760 |

Mellon Financial Corp. | | 89,244 | | | 2,776,381 |

National City Corp.(2) | | 142,880 | | | 5,365,144 |

North Fork Bancorp Inc. | | 99,172 | | | 2,861,112 |

Northern Trust Corp. | | 46,548 | | | 2,261,302 |

PNC Financial Services Group | | 59,572 | | | 3,421,816 |

Regions Financial Corp. | | 97,967 | | | 3,486,646 |

State Street Corp.(2) | | 70,274 | | | 3,451,859 |

SunTrust Banks Inc. | | 78,194 | | | 5,776,973 |

Synovus Financial Corp. | | 65,730 | | | 1,878,563 |

U.S. Bancorp | | 393,949 | | | 12,338,483 |

Wachovia Corp. | | 338,390 | | | 17,799,314 |

Wells Fargo & Co. | | 357,026 | | | 22,189,166 |

Zions Bancorporation(2) | | 19,027 | | | 1,294,407 |

| | | | |

|

|

| | | | | | 156,619,098 |

| | | | |

|

|

Beverages (2.23%): | | | | | |

Anheuser-Busch Companies Inc. | | 166,665 | | | 8,454,915 |

Brown-Forman Corp. Class B | | 25,814 | | | 1,256,626 |

Coca-Cola Co. (The) | | 510,556 | | | 21,254,446 |

Coca-Cola Enterprises Inc.(2) | | 99,620 | | | 2,077,077 |

Coors (Adolph) Co. Class B(2) | | 8,030 | | | 607,630 |

Pepsi Bottling Group Inc.(2) | | 52,607 | | | 1,422,493 |

PepsiCo Inc. | | 355,452 | | | 18,554,594 |

| | | | |

|

|

| | | | | | 53,627,781 |

| | | | |

|

|

Biotechnology (1.17%): | | | | | |

Amgen Inc.(1) | | 268,013 | | | 17,193,034 |

Biogen Idec Inc.(1)(2) | | 70,332 | | | 4,684,815 |

Chiron Corp.(1)(2) | | 39,289 | | | 1,309,502 |

Genzyme Corp.(1) | | 52,233 | | | 3,033,170 |

MedImmune Inc.(1) | | 52,766 | | | 1,430,486 |

Millipore Corp.(1) | | 10,656 | | | 530,775 |

| | | | |

|

|

| | | | | | 28,181,782 |

| | �� | | |

|

|

Building Materials (0.27%): | | | | | |

American Standard Companies Inc.(1) | | 45,162 | | | 1,866,094 |

Masco Corp.(2) | | 94,428 | | | 3,449,455 |

Vulcan Materials Co. | | 21,527 | | | 1,175,589 |

| | | | |

|

|

| | | | | | 6,491,138 |

| | | | |

|

|

Chemicals (1.61%): | | | | | |

Air Products & Chemicals Inc. | | 47,896 | | | 2,776,531 |

Ashland Inc. | | 14,918 | | | 870,913 |

Dow Chemical Co. (The) | | 198,937 | | | 9,849,371 |

Du Pont (E.I.) de Nemours and Co.(2) | | 209,535 | | | 10,277,692 |

Eastman Chemical Co.(2) | | 16,365 | | | 944,751 |

Ecolab Inc. | | 54,705 | | | 1,921,787 |

Engelhard Corp. | | 25,890 | | | 794,046 |

Great Lakes Chemical Corp.(2) | | 10,732 | | | 305,755 |

Hercules Inc.(1)(2) | | 23,527 | | | 349,376 |

International Flavors & Fragrances Inc. | | 19,778 | | | 847,290 |

PPG Industries Inc. | | 36,211 | | | 2,468,142 |

Praxair Inc. | | 68,431 | | | 3,021,229 |

Rohm & Haas Co.(2) | | 47,349 | | | 2,094,246 |

Sherwin-Williams Co. (The) | | 29,980 | | | 1,338,007 |

Sigma-Aldrich Corp. | | 14,493 | | | 876,247 |

| | | | |

|

|

| | | | | | 38,735,383 |

| | | | |

|

|

Continued

17

| | |

| S&P 500 Index Master Portfolio | | Schedule of Investments December 31, 2004 |

| | | | | |

| Common Stocks, continued | | | | |

Security

| | Shares

| | Value

|

Commercial Services (0.89%): | | | | | |

Apollo Group Inc. Class A(1) | | 39,038 | | $ | 3,150,757 |

Block (H & R) Inc.(2) | | 34,957 | | | 1,712,893 |

Cendant Corp. | | 222,011 | | | 5,190,617 |

Convergys Corp.(1) | | 30,301 | | | 454,212 |

Donnelley (R.R.) & Sons Co.(2) | | 46,214 | | | 1,630,892 |

Equifax Inc.(2) | | 28,757 | | | 808,072 |

McKesson Corp. | | 61,882 | | | 1,946,808 |

Moody’s Corp.(2) | | 31,161 | | | 2,706,333 |

Paychex Inc. | | 79,685 | | | 2,715,665 |

Robert Half International Inc. | | 37,064 | | | 1,090,794 |

| | | | |

|

|

| | | | | | 21,407,043 |

| | | | |

|

|

Computers (4.26%): | | | | | |

Affiliated Computer Services Inc. Class A(1)(2) | | 27,278 | | | 1,641,863 |

Apple Computer Inc.(1) | | 84,787 | | | 5,460,283 |

Computer Sciences Corp.(1) | | 40,187 | | | 2,265,341 |

Dell Inc.(1) | | 524,248 | | | 22,091,811 |

Electronic Data Systems Corp.(2) | | 108,252 | | | 2,500,621 |

EMC Corp.(1) | | 505,449 | | | 7,516,027 |

Gateway Inc.(1) | | 80,466 | | | 483,601 |

Hewlett-Packard Co. | | 637,184 | | | 13,361,748 |

International Business Machines Corp. | | 351,319 | | | 34,633,027 |

Lexmark International Inc.(1) | | 27,412 | | | 2,330,020 |

NCR Corp.(1)(2) | | 19,769 | | | 1,368,608 |

Network Appliance Inc.(1) | | 76,193 | | | 2,531,131 |

Sun Microsystems Inc.(1) | | 708,949 | | | 3,814,146 |

SunGard Data Systems Inc.(1) | | 60,800 | | | 1,722,464 |

Unisys Corp.(1) | | 71,972 | | | 732,675 |

| | | | |

|

|

| | | | | | 102,453,366 |

| | | | |

|

|

Cosmetics & Personal Care (2.33%): | | | |

Alberto-Culver Co.(2) | | 19,110 | | | 928,173 |

Avon Products Inc. | | 99,702 | | | 3,858,467 |

Colgate-Palmolive Co. | | 111,831 | | | 5,721,274 |

Gillette Co. (The) | | 209,446 | | | 9,378,992 |

Kimberly-Clark Corp. | | 102,871 | | | 6,769,940 |

Procter & Gamble Co. | | 535,332 | | | 29,486,087 |

| | | | |

|

|

| | | | | | 56,142,933 |

| | | | |

|

|

Distribution & Wholesale (0.12%): | | | | | |

Genuine Parts Co.(2) | | 37,057 | | | 1,632,731 |

Grainger (W.W.) Inc. | | 19,103 | | | 1,272,642 |

| | | | |

|

|

| | | | | | 2,905,373 |

| | | | |

|

|

Diversified Financial Services (8.33%): | | | |

American Express Co. | | 264,847 | | | 14,929,425 |

Bear Stearns Companies Inc. (The) | | 21,923 | | | 2,242,942 |

Capital One Financial Corp.(2) | | 51,173 | | | 4,309,278 |

CIT Group Inc. | | 44,620 | | | 2,044,488 |

Citigroup Inc. | | 1,095,303 | | | 52,771,699 |

Countrywide Financial Corp. | | 122,378 | | | 4,529,210 |

E*TRADE Financial Corp.(1) | | 79,293 | | | 1,185,430 |

Federal Home Loan Mortgage Corp. | | 145,476 | | | 10,721,581 |

Federal National Mortgage Association | | 204,227 | | | 14,543,005 |

Federated Investors Inc. Class B | | 23,112 | | | 702,605 |

Franklin Resources Inc. | | 52,569 | | | 3,661,431 |

Goldman Sachs Group Inc. (The) | | 102,151 | | | 10,627,790 |

Janus Capital Group Inc.(2) | | 50,033 | | | 841,055 |

| | | | | |

| Common Stocks, continued | | | | |

Security

| | Shares

| | Value

|

Diversified Financial Services, continued | | | |

JP Morgan Chase & Co. | | 751,807 | | $ | 29,327,991 |

Lehman Brothers Holdings Inc. | | 56,811 | | | 4,969,826 |

MBNA Corp. | | 269,507 | | | 7,597,402 |

Merrill Lynch & Co. Inc. | | 196,513 | | | 11,745,582 |

Morgan Stanley | | 230,944 | | | 12,822,011 |

Providian Financial Corp.(1) | | 61,514 | | | 1,013,136 |

Schwab (Charles) Corp. (The) | | 283,903 | | | 3,395,480 |

SLM Corp. | | 90,634 | | | 4,838,949 |

T. Rowe Price Group Inc. | | 26,971 | | | 1,677,596 |

| | | | |

|

|

| | | | | | 200,497,912 |

| | | | |

|

|

Electric (2.74%): | | | | | |

AES Corp. (The)(1) | | 137,716 | | | 1,882,578 |

Allegheny Energy Inc.(1)(2) | | 29,089 | | | 573,344 |

Ameren Corp. | | 41,356 | | | 2,073,590 |

American Electric Power Co. Inc. | | 83,382 | | | 2,863,338 |

Calpine Corp.(1)(2) | | 113,056 | | | 445,441 |

CenterPoint Energy Inc.(2) | | 64,541 | | | 729,313 |

Cinergy Corp. | | 38,140 | | | 1,587,768 |

CMS Energy Corp.(1)(2) | | 39,938 | | | 417,352 |

Consolidated Edison Inc.(2) | | 51,390 | | | 2,248,312 |

Constellation Energy Group Inc. | | 37,317 | | | 1,631,126 |

Dominion Resources Inc. | | 69,886 | | | 4,734,078 |

DTE Energy Co.(2) | | 36,912 | | | 1,592,015 |

Duke Energy Corp.(2) | | 201,731 | | | 5,109,846 |

Edison International | | 69,181 | | �� | 2,215,867 |

Entergy Corp. | | 47,112 | | | 3,184,300 |

Exelon Corp. | | 139,736 | | | 6,158,166 |

FirstEnergy Corp. | | 69,497 | | | 2,745,826 |

FPL Group Inc.(2) | | 39,108 | | | 2,923,323 |

NiSource Inc.(2) | | 56,856 | | | 1,295,180 |

PG&E Corp.(1) | | 84,943 | | | 2,826,903 |

Pinnacle West Capital Corp.(2) | | 19,219 | | | 853,516 |

PPL Corp. | | 40,138 | | | 2,138,553 |

Progress Energy Inc.(2) | | 52,462 | | | 2,373,381 |

Public Service Enterprise Group Inc.(2) | | 50,081 | | | 2,592,693 |

Southern Co. (The)(2) | | 155,982 | | | 5,228,517 |

TECO Energy Inc. | | 42,922 | | | 658,423 |

TXU Corp.(2) | | 50,629 | | | 3,268,608 |

Xcel Energy Inc. | | 84,946 | | | 1,546,017 |

| | | | |

|

|

| | | | | | 65,897,374 |

| | | | |

|

|

Electrical Components & Equipment (0.35%): | | | |

American Power Conversion Corp. | | 40,939 | | | 876,095 |

Emerson Electric Co. | | 88,523 | | | 6,205,462 |

Molex Inc.(2) | | 40,254 | | | 1,207,620 |

Power-One Inc.(1) | | 17,671 | | | 157,625 |

| | | | |

|

|

| | | | | | 8,446,802 |

| | | | |

|

|

Electronics (0.59%): | | | | | |

Agilent Technologies Inc.(1) | | 103,128 | | | 2,485,385 |

Applera Corp. — Applied Biosystems Group(2) | | 41,513 | | | 868,037 |

Fisher Scientific International Inc.(1)(2) | | 24,678 | | | 1,539,414 |

Jabil Circuit Inc.(1) | | 42,340 | | | 1,083,057 |

Parker Hannifin Corp. | | 25,362 | | | 1,920,918 |

PerkinElmer Inc. | | 27,585 | | | 620,387 |

Sanmina-SCI Corp.(1) | | 109,404 | | | 926,652 |

Solectron Corp.(1) | | 207,543 | | | 1,106,204 |

Continued

18

| | |

| S&P 500 Index Master Portfolio | | Schedule of Investments December 31, 2004 |

| | | | | |

| Common Stocks, continued | | | | |

Security

| | Shares

| | Value

|

Electronics, continued | | | | | |

Symbol Technologies Inc. | | 51,099 | | $ | 884,013 |

Tektronix Inc. | | 19,472 | | | 588,249 |

Thermo Electron Corp.(1) | | 34,249 | | | 1,033,977 |

Waters Corp.(1) | | 25,716 | | | 1,203,252 |

| | | | |

|

|

| | | | | | 14,259,545 |

| | | | |

|

|

Engineering & Construction (0.04%): | | | | | |

Fluor Corp.(2) | | 17,942 | | | 978,018 |

| | | | |

|

|

| | | | | | 978,018 |

| | | | |

|

|

Entertainment (0.10%): | | | | | |

International Game Technology Inc. | | 72,601 | | | 2,496,022 |

| | | | |

|

|

| | | | | | 2,496,022 |

| | | | |

|

|

Environmental Control (0.18%): | | | | | |

Allied Waste Industries Inc.(1)(2) | | 67,834 | | | 629,500 |

Waste Management Inc. | | 120,598 | | | 3,610,704 |

| | | | |

|

|

| | | | | | 4,240,204 |

| | | | |

|

|

Food (1.80%): | | | | | |

Albertson’s Inc.(2) | | 78,122 | | | 1,865,553 |

Archer-Daniels-Midland Co. | | 137,932 | | | 3,077,263 |

Campbell Soup Co. | | 86,687 | | | 2,591,074 |

ConAgra Foods Inc. | | 108,388 | | | 3,192,027 |

General Mills Inc. | | 76,808 | | | 3,818,126 |

Heinz (H.J.) Co. | | 73,609 | | | 2,870,015 |

Hershey Foods Corp. | | 51,854 | | | 2,879,971 |

Kellogg Co. | | 87,045 | | | 3,887,430 |

Kroger Co.(1) | | 155,721 | | | 2,731,346 |

McCormick & Co. Inc. NVS | | 28,982 | | | 1,118,705 |

Safeway Inc.(1) | | 94,988 | | | 1,875,063 |

Sara Lee Corp. | | 165,451 | | | 3,993,987 |

SUPERVALU Inc. | | 28,446 | | | 981,956 |

Sysco Corp. | | 134,914 | | | 5,149,667 |

Wrigley (William Jr.) Co. | | 47,303 | | | 3,272,895 |

| | | | |

|

|

| | | | | | 43,305,078 |

| | | | |

|

|

Forest Products & Paper (0.53%): | | | | | |

Georgia-Pacific Corp. | | 54,791 | | | 2,053,567 |

International Paper Co.(2) | | 102,589 | | | 4,308,738 |

Louisiana-Pacific Corp. | | 23,502 | | | 628,443 |

MeadWestvaco Corp. | | 42,630 | | | 1,444,731 |

Temple-Inland Inc. | | 11,955 | | | 817,722 |

Weyerhaeuser Co.(2) | | 50,557 | | | 3,398,442 |

| | | | |

|

|

| | | | | | 12,651,643 |

| | | | |

|

|

Gas (0.16%): | | | | | |

KeySpan Corp.(2) | | 33,775 | | | 1,332,424 |

Nicor Inc.(2) | | 9,338 | | | 344,946 |

Peoples Energy Corp. | | 8,113 | | | 356,566 |

Sempra Energy | | 49,131 | | | 1,802,125 |

| | | | |

|

|

| | | | | | 3,836,061 |

| | | | |

|

|

Hand & Machine Tools (0.12%): | | | | | |

Black & Decker Corp. | | 16,987 | | | 1,500,462 |

Snap-On Inc. | | 12,351 | | | 424,380 |

Stanley Works (The) | | 17,634 | | | 863,890 |

| | | | |

|

|

| | | | | | 2,788,732 |

| | | | |

|

|

Health Care-Products (3.61%): | | | | | |

Bard (C.R.) Inc. | | 22,200 | | | 1,420,356 |

Bausch & Lomb Inc.(2) | | 11,436 | | | 737,165 |

Baxter International Inc. | | 129,974 | | | 4,489,302 |

| | | | | |

| Common Stocks, continued | | | | |

Security

| | Shares

| | Value

|

Health Care-Products, continued | | | | | |

Becton, Dickinson & Co. | | 53,376 | | $ | 3,031,757 |

Biomet Inc.(2) | | 53,756 | | | 2,332,473 |

Boston Scientific Corp.(1) | | 178,111 | | | 6,331,846 |

Guidant Corp. | | 67,172 | | | 4,843,101 |

Johnson & Johnson | | 626,323 | | | 39,721,405 |

Medtronic Inc. | | 255,028 | | | 12,667,241 |

St. Jude Medical Inc.(1) | | 75,353 | | | 3,159,551 |

Stryker Corp. | | 84,754 | | | 4,089,380 |

Zimmer Holdings Inc.(1) | | 51,717 | | | 4,143,566 |

| | | | |

|

|

| | | | | | 86,967,143 |

| | | | |

|

|

Health Care-Services (1.42%): | | | | | |

Aetna Inc.(2) | | 31,127 | | | 3,883,093 |

HCA Inc.(2) | | 88,784 | | | 3,547,809 |

Health Management Associates Inc. Class A(2) | | 51,163 | | | 1,162,423 |

Humana Inc.(1) | | 33,483 | | | 994,110 |

Laboratory Corp. of America Holdings(1)(2) | | 29,348 | | | 1,462,117 |

Manor Care Inc. | | 18,624 | | | 659,848 |

Quest Diagnostics Inc.(2) | | 21,485 | | | 2,052,892 |

Tenet Healthcare Corp.(1) | | 98,042 | | | 1,076,501 |

UnitedHealth Group Inc. | | 137,906 | | | 12,139,865 |

WellPoint Inc.(1) | | 62,258 | | | 7,159,670 |

| | | | |

|

|

| | | | | | 34,138,328 |

| | | | |

|

|

Home Builders (0.18%): | | | | | |

Centex Corp. | | 26,153 | | | 1,558,196 |

KB Home | | 9,886 | | | 1,032,098 |