UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06719

BB&T Funds

(Exact name of registrant as specified in charter)

| | |

| 434 Fayetteville Street, 5th Floor, Raleigh, NC | | 27626-0575 |

| |

|

| (Address of principal executive offices) | | (Zip code) |

BISYS Fund Services Ohio, Inc. , 3435 Stelzer Road, Columbus, OH 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2006

Item 1. Reports to Stockholders.

BB&T FUNDS

TABLEOF CONTENTS

LETTER FROMTHE PRESIDENTANDTHE INVESTMENT ADVISOR

Dear Shareholders:

We are pleased to present this annual report for the 12-month period ended September 30, 2006. The economy generated healthy growth during that time, despite a number of headwinds. Stocks overcame a spring correction to turn in solid returns, while the fixed-income markets posted small gains. The S&P 500 Index gained 10.79% during the period under review, while the Russell 2000 Index of small-cap stocks returned 9.92% and the Lehman Aggregate Bond Index gained 3.67%.

A resilient economy

Solid consumer and corporate spending helped the economy generate healthy growth during the 12-month period as a whole, despite a number of negative factors.

The destruction wreaked by Gulf Coast hurricanes during August and September of 2005 contributed to a considerable slowdown in GDP1 growth during the fourth quarter of 2005. The economy rebounded strongly in early 2006, however, due in part to a strong housing market. The housing sector subsequently slowed dramatically, weighing on the economy during the second half of the period.

High energy prices also dragged on the economy. The price of a barrel of crude oil climbed steeply to exceed $78 in July, marking an all-time high. Oil prices declined substantially during the final weeks of the period, to less than $60 per barrel.

The Federal Reserve raised the Fed funds rate six times, to 5.25%—a policy designed to forestall higher inflation by restraining economic growth.

Stocks overcome a spring swoon

Equities performed well early in the period. Energy and materials stocks led a rally, as companies in those sectors benefited from rising commodity prices. Small caps and foreign stocks also generated strong returns, as investors favored stocks that were likely to benefit from strong global economic growth.

Stocks fell significantly between May and July. The market subsequently rebounded, however, led by shares of large, high-quality firms. Energy stocks fell precipitously after oil prices declined late in the period, causing the energy sector to lag the broad market for the 12-month period as a whole. Stocks in the telecommunications, technology, utilities, health care and financials sectors posted good returns after the spring downturn.

Bond yields rise, then fall

Bonds generated slight gains during the fiscal year. Tightening by the Federal Reserve Board and concerns about higher inflation contributed to higher yields during the first three-quarters of the period. The Fed’s inaction at its August and September meetings then allowed short-term bond yields to fall, as investors began to anticipate a cut in interest rates during 2007. Meanwhile, relatively benign inflationary data pushed down yields on the long end of the yield curve.

Corporate bonds modestly outperformed Treasury issues during the fiscal year as a whole. The spread between yields on Treasury and corporate securities widened modestly late in the period, however, as investors began to anticipate slower economic growth.

Looking ahead

We saw earlier in 2006 that inflation had peaked. We continue to witness further signs of reduced inflationary pressure, due primarily to lower oil prices and a slowing housing market. As a result, we think the Federal Reserve has finished raising interest rates for this cycle. We believe weakening consumer spending will cause the economy to slow during the coming months, although we expect GDP growth to remain positive.

That backdrop appears favorable for stocks, which we believe offer greater potential returns than bonds during the coming months. High-quality large cap stocks in particular appear attractively valued, especially multi-national companies that can benefit from a declining dollar. Valuation multiples are already expanding as the markets discount receding inflationary pressures and attendant lower interest rates.

Because of the slowing economy, led by the housing correction, we favor sectors and industries less dependent upon consumer discretionary income, such as consumer staples, pharmaceuticals and healthcare equipment. Business spending should remain healthier, so we like communications equipment, data processing, and energy producers and refiners.

We believe that continued weak economic data, lower inflation and eventually a more accommodative Federal Reserve policy will lead to a decline in bond yields and further gains in the bond market. Thus, we would tend to favor portfolio durations slightly above benchmarks for all fixed-income portfolios. In addition, we expect short-term rates to decline most when the Fed eases its policy, benefiting bonds in the two-to-five year maturity range.

Meanwhile, with the Federal Reserve on hold, there may be a period of relative stability in the bond market. Sectors such as mortgage-backed securities and agency bonds, which provide an income advantage over their benchmarks, may provide superior performance in such an environment.

The dynamic nature of the financial markets makes predicting future performance difficult, however. We therefore recommend maintaining well-balanced portfolios comprised of funds that invest in various types of stocks, bonds and cash investments. The BB&T Funds offer a wide variety of investment vehicles with which you can construct such portfolios. We encourage you to use them as part of a disciplined, long-term investment strategy designed to maximize your chances of reaching your unique financial objectives.

We encourage you to call us with any questions at 1-800-228-1872, and we thank you for your trust in the BB&T Funds.

|

|

| Keith F. Karlawish, CFA |

| President |

BB&T Funds |

|

|

| Jeffrey J. Schappe, CFA |

| Chief Investment Officer |

BB&T Asset Management, Inc. |

Past performance does not guarantee future results.

| 1 | Gross Domestic Product (“GDP”) measures the monetary value of all the goods and services produced by an economy over a specified period. It includes consumption, government purchases, investments, and exports minus imports. |

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. BB&T Asset Management, Inc., a wholly owned subsidiary of BB&T Corporation, serves as investment adviser to the BB&T Funds and is paid a fee for its services. Shares of the BB&T Funds are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by BB&T Funds Distributor, Inc. The distributors are not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. BB&T Asset Management, Inc. does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

1

BB&T LARGE CAP FUND (formerly the Large Company Value Fund)

PORTFOLIO MANAGER

Ronald T. Rimkus, CFA

The BB&T Large Cap Fund is managed by Ronald T. Rimkus, a chartered financial analyst and Director of Core Equity at BB&T Asset Management, Inc. Mr. Rimkus has more than 13 years of investment experience, including hands on management of both growth and value equity portfolios. Most recently, he spent six years overseeing large-company core equity portfolios. Mr. Rimkus holds a BA from Brown University and an MBA from UCLA. He is supported by the BB&T Large Cap Core Equity Portfolio Management Team.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 14.59% (Institutional Shares). That compared to a 10.79% return for its benchmark, the S&P 500 Index.

Q. What factors affected the Fund’s performance?

A. This Fund seeks to invest in under valued shares of companies that have sustainable competitive advantages, good management and strong returns on invested capital. Those types of stocks performed well during this fiscal year, helping the Fund post strong absolute returns. In particular, the health of the global industrial economy and high commodity prices led to strong demand for industrial stocks, boosting the Fund’s gain.1

The Fund’s security-selection process helped it outperform its benchmark during this 12-month period. We held a relatively large position in health care stocks, and especially in shares of pharmaceutical companies. Shares in that industry were attractively valued following a long period of weak performance, making them compelling given the firms’ strong businesses, healthy balance sheets and good cash flows. Large drug stocks performed very well during this period, boosting returns against the index.1

An overweight stake in information technology stocks also lifted relative performance, as strength in enterprise technology spending buoyed shares of a number of large software firms. Strong stock selection in the technology sector also helped the Fund’s relative returns. For example, we bought shares of a large semiconductor maker after they posted large losses, and the Fund’s relative gains benefited from that stock’s rebound. 1

An underweight position in materials stocks weighed on returns versus the Fund’s benchmark. Few materials stocks met our selection criteria, but materials shares performed well during the period on the strength of high commodity prices. Selection among utilities stocks also dragged modestly on relative performance.1

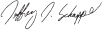

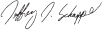

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

2

BB&T LARGE CAP FUND

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 4 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares, but does not include the Class C Shares 12b-1 fees, which, if reflected, performance would have been lower. |

Effective March 14, 2006, the standardized benchmark performance index for the Fund was changed from the Russell 1000® Value Index to the S&P 500 Index in order to better represent the Fund’s investment strategies for comparison purposes. The Fund is measured against the S&P 500 Index. The S&P 500 Index is generally considered to be representative of the performance of the stock market as a whole. The Russell 1000® Value Index consists of 1,000 of the largest capitalized U.S. domiciled companies. Companies in this index generally have low price-to-book and price-to-earnings ratios, higher dividend yields, and lower forecasted growth values. These indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

3

BB&T LARGE CAP GROWTH FUND (formerly the Large Company Growth Fund)

PORTFOLIO MANAGER

David P. Nolan

The BB&T Large Cap Growth Fund is managed by David P. Nolan. A graduate of Wake Forest University, where he received a BS in Business, Mr. Nolan managed common and collective trust funds from 1985 to 1993. Mr. Nolan is supported by the BB&T Growth Equity Portfolio Management Team, which includes Brian Baker, Brandon Carl and Michele Holmes Van Dyke. The team brings to the Fund more than six decades of combined investment management experience, along with a broad range of growth-stock investing skills.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund returned -0.10% (Institutional Shares). That compared to a 6.04% return for its benchmark, the Russell 1000® Growth Index.

Q. What factors affected the Fund’s performance?

A. This Fund invests in stocks of fast-growing firms. Such stocks posted strong gains early in the period, but performed very poorly between May and September as investors fled from relatively volatile stocks amid concerns about slower economic growth. Losses during the second half of the period offset the Fund’s earlier gains, leading to a virtually flat return for the fiscal year as a whole.1

The Fund’s emphasis on fast-growing stocks was the primary reason it lagged its benchmark for the 12-month period. Investors favored defensive shares of slow-growing firms across the 10 economic sectors. We typically invest in many of the fastest-growing stocks in each sector, so such stocks’ weak performance led to stock selection that weighed on relative returns.1

For example, the Fund had very little exposure to pharmaceutical stocks, because drug companies generally did not offer the revenue and earnings growth we seek. Many large pharmaceutical stocks performed extremely well during this period, however, causing the Fund’s small weighting in that group to drag on relative returns. The Fund’s selection within the information technology, industrials and energy sectors also weighed down performance versus the benchmark.1

We maintained an overweight position in the energy sector throughout the period. That weighting boosted relative returns during the first half of the period, as high energy prices led to strong gains by energy shares. Investor sentiment turned against the sector during the second half of the period, however, causing the Fund’s relatively large energy stake to drag on performance against the benchmark for the fiscal year as a whole.1

Certain factors did boost returns relative to the large-cap growth index, despite investors’ bias against fast-growing stocks. Selection among telecommunications services stocks helped the Fund’s performance versus its benchmark, as did selection within consumer discretionary stocks.1

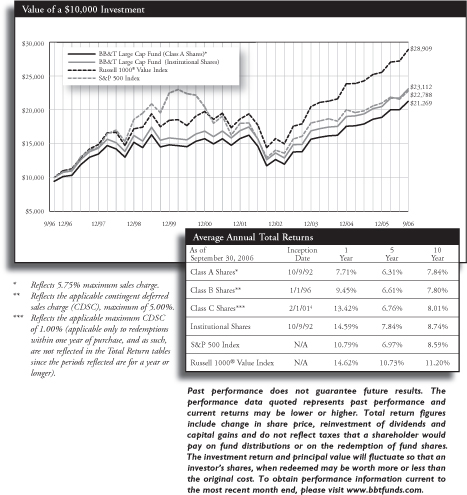

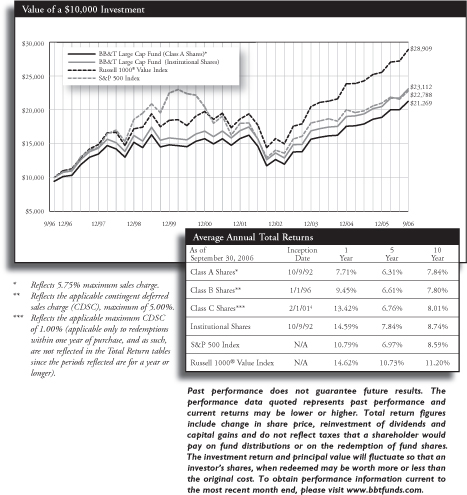

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

4

BB&T LARGE CAP GROWTH FUND

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 2 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class B Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares. |

The Fund is measured against the Russell 1000® Growth Index, an unmanaged index which is comprised of 1,000 of the largest capitalized U.S. domiciled companies with higher price-to-book ratios and higher forecasted growth values whose common stock is traded in the United States on the New York Stock Exchange, American Stock Exchange and NASDAQ. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total returns for the period would have been lower.

5

BB&T MID CAP VALUE FUND

PORTFOLIO MANAGER

Timothy P. Beyer, CFA

The BB&T Mid Cap Value Fund is managed by Timothy P. Beyer, CFA, portfolio manager for Sterling Capital Management LLC, sub-adviser to the Fund. Mr. Beyer, who joined Sterling in 2004, is a graduate of East Carolina University, where he received his BSBA in Finance, and has 16 years of investment management experience. Mr. Beyer is supported by Eduardo Brea, CFA; Robert Bridges, CFA; Lee D. Houser, CFA; Patrick W. Rau, CFA; and Brian Walton, CFA.

INVESTMENT CONCERNS

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund posted a return of 13.52% (Institutional Shares). That compared to a 12.27% return for its benchmark, the Russell Midcap® Value Index.

Q. What factors affected the Fund’s performance?

A. Both mid-cap value stocks in general and the Fund in particular generated strong performance during this period.

The Fund’s focus on quality and valuation helped it outperform its benchmark. We held a relatively large position in financial services stocks, so strong performance from that sector boosted the Fund’s returns against the index. Good stock selection in the financials sector also helped relative performance.1

The Fund maintained a significantly smaller position than the index in shares of utilities and Real Estate Investment Trusts (REITs), despite the high yields such shares offered. Those stocks sported very high valuations, in our estimation, as a result of investors’ pursuit of yield rather than fundamental strength. The underweight position in utilities stocks added to the Fund’s relative gains, but holding a smaller stake than the benchmark in REITs weighed on relative returns.1

We held a significantly underweight position in energy stocks throughout the period. We believe it is extremely difficult to create durable competitive advantages in the energy industry. Furthermore, the capital- and investment-intensive nature of the industry often results in low returns on investment and poor free cash flow. The Fund’s small stake in energy weighed on relative returns early in the period, but significantly boosted performance against the benchmark during the second half of the fiscal year. The energy under-weight had little effect on relative returns for the period as a whole. We also maintained a much smaller position than the benchmark in commodities stocks, and that under-weighting boosted relative performance as shares in that sector posted weak returns.1

Stock selection in the producer durables and technology sectors also boosted performance against the benchmark. We increased the Fund’s stakes in several technology stocks during the year, which added significantly to the funds returns. We were able to buy shares of what we consider to be high-quality technology companies with excellent free cash flow at extremely attractive prices.1

Shares of a particular auto-parts maker dragged on relative returns. The stock performed poorly as investors became concerned about a lack of liquidity and a generally difficult environment for the industry. We eliminated the Fund’s position in that stock during the period.1

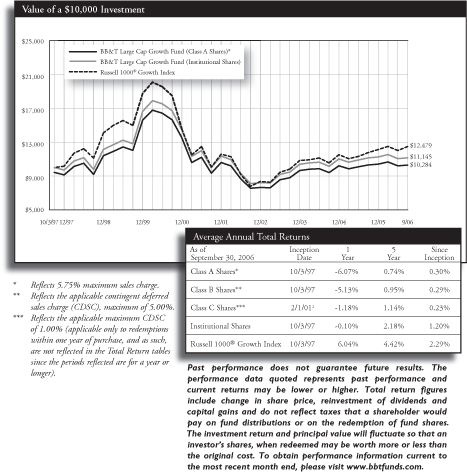

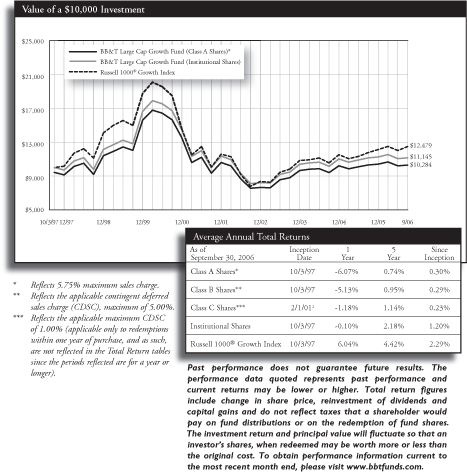

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

6

BB&T MID CAP VALUE FUND

| | The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains. |

| 3 | Performance shown for Class A and Institutional Shares includes the performance of the OVB Equity Income Portfolio for the periods prior to its consolidation with the BB&T Mid Cap Value Fund on 7/23/01. The performance shown reflects reinvestment of all dividend and capital gains distributions. Class B and C Shares were not in existence prior to 7/25/01. Performance for periods prior to 7/25/01 is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class B and C Shares, respectively, but such performance does not reflect Class B and C Shares’ 12b-1 fees and expenses. With those adjustments, performance would be lower than that shown. |

| | The Fund is measured against the Russell Midcap® Value Index, an unmanaged index which measures the performance of those securities in the Russell 1000 with lower price-to-book ratios or lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| | A portion of the Fund’s fees has been waived. If fees had not been waived, the Fund’s total return for the period would have been lower. |

7

BB&T MID CAP GROWTH FUND

PORTFOLIO MANAGER

David P. Nolan

The BB&T Mid Cap Growth Fund is managed by David P. Nolan. A graduate of Wake Forest University, where he received a BS in Business, Mr. Nolan managed common and collective trust funds from 1985 to 1993 and has managed the Mid Cap Growth Fund since its inception in 1993. He is supported by the BB&T Growth Equity Portfolio Management Team, which includes Brian Baker, Brandon Carl and Michele Holmes Van Dyke. The team brings to the Fund six decades of combined investment management experience, along with a broad range of growth-stock investing skills.

INVESTMENT CONCERNS

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund posted a return of -0.15% (Institutional Shares). That compared to a 7.03% return for its benchmark, the Russell Midcap® Growth Index.

Q. What factors affected the Fund’s performance?

A. We seek to invest in shares of firms that could potentially provide earnings growth of 20% per year or greater. Such stocks performed well early in this 12-month period, but then declined as investors concerned about slower economic growth rotated out of fast-growing stocks. That environment caused this Fund to post a loss for the period as a whole.1

During the second half of this period, stocks of firms with earnings-growth rates faster than 20% dramatically underperformed shares of companies with slower growth. In fact, stocks of medium-sized companies with the slowest earnings growth posted the best performance between April and September. The kinds of fast-growing stocks in which this Fund invests tend to experience relatively high volatility, so they typically lag their peers during periods such as this one when investors favor defensive stocks. The weak performance of stocks with rapid earnings growth was the primary reason that the Fund lagged its benchmark during this period.1

Investors’ aversion to high-growth stocks was consistent across various types of stocks, causing the Fund’s security selection to weigh on relative performance in most sectors. That dynamic was especially acute among information technology and consumer discretionary stocks. We typically hold a very small weighting in consumer staples stocks, because companies in that sector rarely produce the rapid earnings growth we seek. That underweight position also dragged on performance against the benchmark, as consumer staples stocks posted strong returns.1

The Fund’s relative returns did benefit from stock selection in the energy sector. An overweight stake in telecommunications services shares also boosted returns as did selection within that sector. Likewise, an underweight position in consumer discretionary stocks helped the Fund’s relative performance.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

8

BB&T MID CAP GROWTH FUND

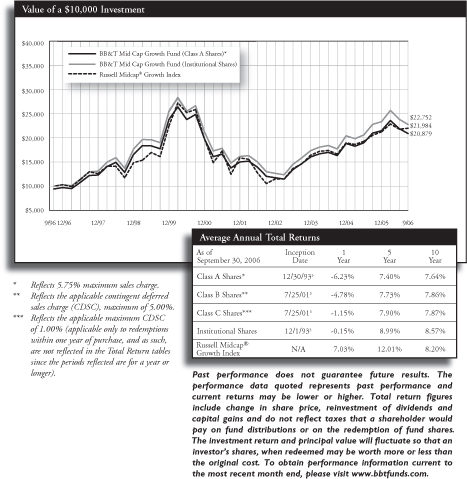

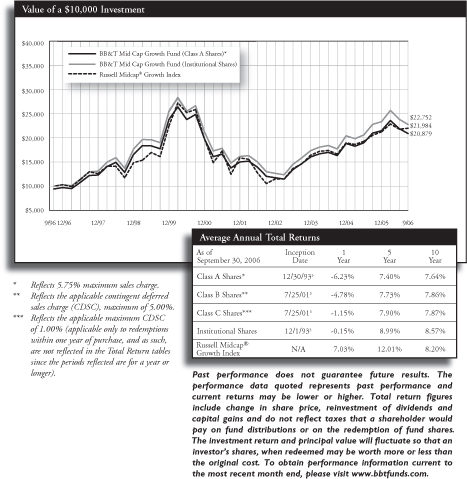

| | The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains. |

| 3 | Fund performance as shown for Class A and Institutional Shares includes the performance of the OVB Capital Appreciation Portfolio for the periods prior to its consolidation with the BB&T Mid Cap Growth Fund on 7/23/01. The performance shown reflects reinvestment of all dividend and capital gains distributions. The Class B and C Shares were not in existence prior to 7/25/01. Performance for periods prior to 7/25/01 is based on the historical performance of the Class A Shares and has been adjusted for the maximum CDSC applicable to Class B and C Shares, respectively, but such performance does not reflect Class B and C Shares’ 12b-1 fees and expenses. With those adjustments, performance would be lower. |

| | The Fund is measured against the Russell Midcap® Growth Index, an unmanaged index which measures the performance of those securities in the Russell 1000® Index with higher price-to-book ratios and lower forecasted growth values. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| | A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total returns for the period would have been lower. |

9

BB&T SMALL CAP FUND (formerly the Small Company Value Fund)

PORTFOLIO MANAGER

John T. Kvantas, CFA

The BB&T Small Cap Fund is managed by John T. Kvantas, CFA. A graduate of the University of Illinois Champaign-Urbana, where he received a BS in Accountancy, Mr. Kvantas also earned an MBA from the Fuqua School of Business at Duke University, and has been managing investors’ money since 1995. He is supported by the BB&T Small Cap Portfolio Management Team, which includes Dan Kane and Brian Baker.

INVESTMENT CONCERNS

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Diversification does not guarantee a profit nor protect against a loss.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 7.23% (Institutional Shares). That compared to a 9.92% return for its benchmark, the Russell 2000® Index of small-cap stocks.

Q. What factors affected the Fund’s performance?

A. Small-cap stocks posted solid gains during the period, as strong returns during the first and third calendar quarters of 2006 more than offset a downturn in the spring. That environment allowed this Fund and its benchmark to post healthy returns for the 12-month period.1

Strong stock selection in the industrials sector boosted returns relative to the Fund’s benchmark, as shares of particular firms in the machinery manufacturing, construction and engineering industries benefited from strong economic growth. Selection in the information technology sector lifted the Fund’s relative returns as well, in part because two of the companies represented in the Fund’s portfolio were acquired at substantial premiums to their market values. A significantly smaller weighting in health care stocks than the benchmark also contributed to relative gains, as shares of small health care firms lagged the index.1

The Fund’s sector weightings as a whole dragged on performance versus the benchmark. An overweight position in shares of savings and loan and thrift stocks weighed on relative returns, as narrowing interest margins hurt profits at those firms. That said, our stock selection within those industries partially offset the negative effects of the Fund’s overweight position. An underweight stake in telecommunications stocks also hurt relative performance. Small telecommunications companies typically do not offer the high-quality financial characteristics we seek. Shares of such firms performed well during the period, however.1

Finally, security selection within the consumer discretionary sector weighed on returns against the index, as certain of the Fund’s holdings in the restaurant and clothing industries underperformed the benchmark.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

10

BB&T SMALL CAP FUND

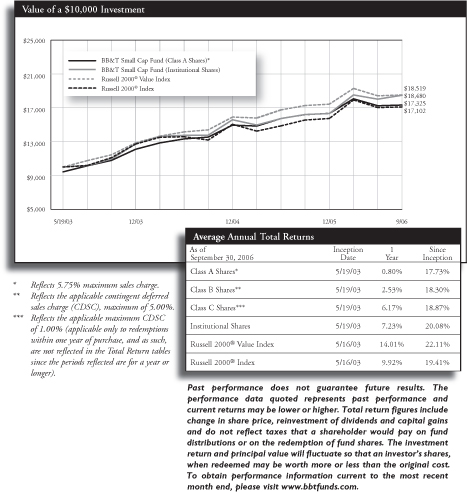

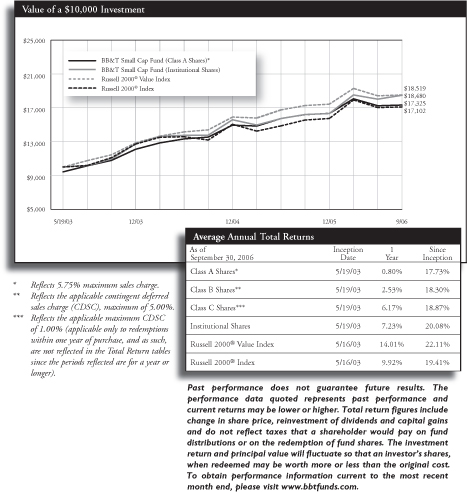

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The benchmark index for the Fund has changed from the Russell 2000® Value Index to the Russell 2000® Index in order to provide a better comparison for the Fund’s investment policies. The Russell 2000® Index is a widely recognized index of common stocks that measure the performance of small- to mid-sized companies. The Russell 2000® Value Index is comprised of the securities found in the Russell 2000® Index with lower price-to-book ratios and lower forecasted growth values. The indices are unmanaged and do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

11

BB&T INTERNATIONAL EQUITY FUND

PORTFOLIO MANAGER

UBS Global Asset Management

The BB&T International Equity Fund is managed by a team of portfolio managers at UBS Global Asset Management, subadviser to the Fund. Thomas P. Madsen, CFA, Managing Director and Global Head of Equities is the lead portfolio manager. Mr. Madsen earned BBA and MS degrees from the University of Wisconsin-Madison and has 26 years experience. Mr. Madsen has access to certain members of the International Equity investment management team, each of whom is allocated a specified portion of the portfolio over which he or she has independent responsibility for research, security selection, and portfolio construction. The team members also have access to additional portfolio managers and analysts within the various asset classes and markets in which the Fund invests. Mr. Madsen has responsibility for allocating the portfolio among the various managers and analysts, occasionally implementing trades on behalf of analysts on the team and reviewing the overall composition of the portfolio to ensure its compliance with its stated investment objectives and strategies.

INVESTMENT CONCERNS

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency and exchange rates.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 17.38% (Institutional Shares). That compared to a 19.65% return for its benchmark, the MSCI EAFE (Europe, Australasia and Far East) Index.

Q. What factors affected the Fund’s performance?

A. Stocks in markets outside of the United States posted strong returns during this 12-month period. Investors encouraged by stronger-than-expected economic growth in Europe and Japan bid foreign stocks higher, while U.S. investors also benefited from foreign currencies’ appreciation against the dollar. Those dynamics helped this Fund and its benchmark generate strong gains for the fiscal year.

We employ a bottom-up approach to stock selection for this Fund, and do not base investment decisions based on top-down, macroeconomic factors. As a result, the Fund’s geographic allocations reflect the areas where we find attractive investment opportunities.

The Fund held a larger position than the benchmark in bank stocks during this 12-month period. That relatively large allocation boosted performance against the index. Shares of banks, particularly those in Europe, had been depressed leading into this period, but they benefited during the fiscal year from better-than-expected earnings results. An overweight stake in insurance stocks also lifted the Fund’s relative returns. Like banks, insurance companies posted stronger-than-expected earnings, due to strong management and better risk management by firms in that industry.1

Selection among pharmaceuticals stocks helped the Fund’s relative performance as well. The Fund’s pharmaceuticals holdings benefited from improving sentiment in that industry. Moreover, the Fund’s returns benefited from consolidation in the industry, as one of the Fund’s holdings was acquired by a large European drug-maker.1

The Fund’s positions in Japanese consumer finance companies weighed on performance against the benchmark. Those stocks suffered after Japan enacted more stringent lending requirements. An underweight position in the metals and mining industry also weighed on relative returns, as those stocks benefited from high commodity prices. Selection among telecommunications stocks dragged on relative performance as well, as poor performance by two large telecommunications stocks more than offset strong returns among smaller holdings in that sector.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

12

BB&T INTERNATIONAL EQUITY FUND

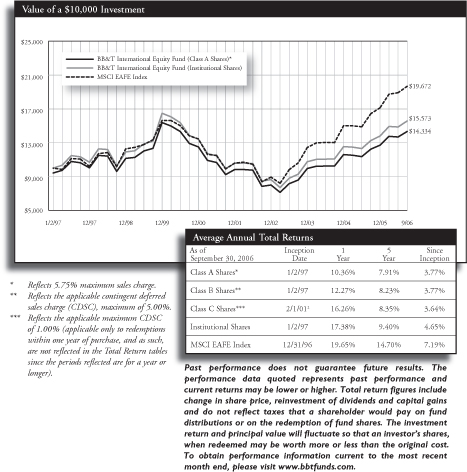

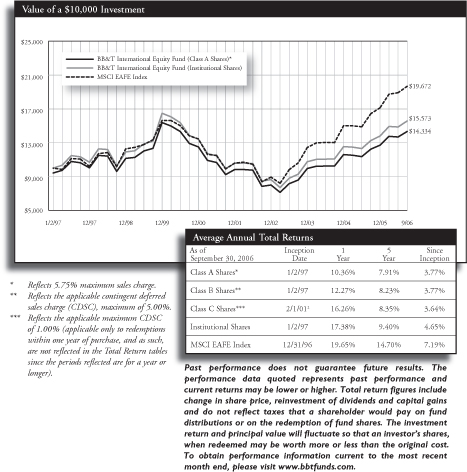

| | The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains. |

| 2 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class B Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares. |

| | The Fund is measured against the Morgan Stanley Capital International (“MSCI”) Europe, Australasia and Far East (“EAFE”) Index, an unmanaged index which is generally representative of the performance of stock markets in that region. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| | A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower. |

13

BB&T SPECIAL OPPORTUNITIES EQUITY FUND

PORTFOLIO MANAGER

George F. Shipp, CFA

The BB&T Special Opportunities Equity Fund is managed by George F. Shipp, CFA, chief investment officer of Scott & Stringfellow, Inc., subadvisor to the Fund. Mr. Shipp, who joined Scott & Stringfellow in 1982, holds a BA from the University of Virginia and an MBA from the Darden Graduate School of Business at the University of Virginia. Mr. Shipp is supported by an investment management team from Scott & Stringfellow, which includes Meghann A. Cohen; Joshua L. Haggarty, CFA; R. Griffith Jones, Jr.; and Farley C. Shiner, CPA. The team brings to the Fund more than four decades of combined investment management experience, along with a broad range of investing skills.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. A concentrated portfolio may add a measure of volatility to performance, as major fluctuations in any one holding will likely affect the fund more than a fund with greater diversification.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 11.50% (Institutional Shares). That compared to a 10.79% return for its benchmark, the S&P 500 Index.

Q. What factors affected the Fund’s performance?

A. Stocks posted solid gains during the 12-month period, helping this Fund generate a strong return. Double-digit corporate profit growth helped convince investors to buy equities despite a backdrop of global tensions, rising interest rates and uncertainty about the direction of the economy.1

The Fund held a total of 39 different stocks during the 12-month period. Of those stocks, 20 produced gains that exceeded those of the S&P 500, seven generated positive but market-lagging returns, and 12 posted losses.1

The largest contributor to the Fund’s relative gains was favorable stock selection within the health care sector. Our investments in health care stocks fared well: Four of the Fund’s six best-performing investments were health care stocks, with each posting returns of at least 30%. Those strong returns came even as the health care stocks in the benchmark lagged the broad market.1

The Fund held a larger position in energy stocks than did the benchmark index. The S&P energy sector as a whole gained only about 4% during the 12-month period, despite historically high commodity prices, so the Fund’s overweight stake weighed on returns against the benchmark. We generally maintained the Fund’s energy exposure, due to the industry’s exceptional current cash flows and reasonable valuations that we believed offered the potential for merger or share-buyback activity.1

Late in the period we modestly reduced the Fund’s exposure to sectors typically considered defensive, such as health care, financials and consumer staples, because rallies in those stocks left them with more-limited upside potential. We concurrently added positions in technology and industrials stocks, which offered valuations we found compelling. Such moves reflect the Fund’s flexible, long-term strategy.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

14

BB&T SPECIAL OPPORTUNITIES EQUITY FUND

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

The Fund is measured against the S&P 500 Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

15

BB&T EQUITY INCOME FUND

PORTFOLIO MANAGER

George F. Shipp, CFA

The BB&T Equity Income Fund is managed by George F. Shipp, CFA, Chief Investment Officer of Scott & Stringfellow, Inc., subadvisor to the Fund. Mr. Shipp, who joined Scott & Stringfellow in 1982, holds a BA from the University of Virginia and an MBA from the Darden Graduate School of Business at the University of Virginia. Mr. Shipp is supported by an investment management team from Scott & Stringfellow, which includes Meghann A. Cohen; Joshua L. Haggarty, CFA; R. Griffith Jones, Jr.; and Farley C. Shiner, CPA. The team brings to the Fund more than four decades of combined investment management experience, along with a broad range of investing skills.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. A concentrated portfolio may add a measure of volatility to performance, as major fluctuations in any one holding will likely affect the fund more than a fund with greater diversification.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

The Fund gained 16.04% (Institutional Shares). That compared to a 10.79% return for its benchmark, the S&P 500 Index.

Q. What factors affected the Fund’s performance?

Stocks posted solid gains during the 12-month period, and large-cap value stocks that pay high dividends performed particularly well. The BB&T Equity Income Fund seeks stocks with those characteristics, so strong performance by such stocks boosted the Fund’s returns. An environment characterized by global tensions, rising interest rates, high energy prices and the prospect of a slowing economy led investors to prize shares of firms that offered reliable earnings growth and dividend payments. The Fund held a total of 40 stocks during this 12-month period, of which 31 posted gains. The Fund outperformed its benchmark largely on the strength of good stock selection across a variety of sectors. The Fund’s top-five performing stocks included shares of firms in the telecommunications, health care, financial, consumer and energy sectors, highlighting the breadth of the Fund’s positive contributors.1

The Fund held a substantially underweight position in information technology stocks during most of the period, largely because the majority of companies in that sector do not pay dividends. That relatively small technology stake proved fortuitous for the Fund’s returns against its benchmark, as the S&P Technology sector gained less than 4% over the 12 months. The Fund tripled its exposure to technology stocks near the end of the period by purchasing shares of two well-established, debt-free industry leaders. We cannot know yet whether the Fund’s new positions will prove profitable, but we are pleased to increase the portfolio’s diversification while owning shares of companies that offer above-average yields, at valuations we believe to be favorable.1

The Fund also benefited from an emphasis on financial stocks, including a significant stake in Real Estate Investment Trusts. Such stocks offer relatively high dividend payments, which helped make them attractive to this income-oriented Fund. The S&P Financial sector appreciated by more than 21% during the 12-month period, so the Fund’s overweight stake in financial stocks boosted its relative returns.1

The Fund’s return exceeded that of its benchmark despite an overweight position in energy stocks, which weighed on relative performance. The S&P Energy sector gained less than 4% for the 12-month period, despite high commodity prices throughout the fiscal year.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

16

BB&T EQUITY INCOME FUND

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the S&P 500 Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

17

BB&T SHORT U.S. GOVERNMENT FUND

PORTFOLIO MANAGER

Kevin E. McNair, CFA

The BB&T Short U.S. Government Fund is managed by Kevin E. McNair, CFA. Mr. McNair received a BA in Economics from the University of North Carolina-Chapel Hill and a Master’s of Economics from North Carolina State University, and has been managing investors’ money since 1994. Mr. McNair is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; Brad D. Eppard, CFA; David T. Johnson; Robert F. Millikan, CFA; Justin B. Nicholson; and Michael D. Nichols, CFA. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

INVESTMENT CONCERNS

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 3.37% (Institutional Shares). That compared to a 3.70% return for its benchmark, the Merrill Lynch 1-5 Year U.S. Treasuries/Agencies Index.

Q. What factors affected the Fund’s performance?

A. Short-term bonds’ yields rose during the 12-month period under review, causing their prices to fall. The Federal Reserve increased its target short-term interest rate six times, for a total increase of 1.50 percentage points. That development led to higher yields on short-term bonds during the first nine months of the period. Yields on short-term bonds fell between July and September, causing prices to rise.1

The Fund maintained a duration significantly shorter than that of the benchmark throughout the 12-month period. That duration strategy helped the Fund post positive returns against the index during the first nine months of the period, because we were able to reinvest maturing bonds’ principal more rapidly as interest rates increased. We lengthened the Fund’s duration late in the period in order to capture additional yield, although we kept the duration shorter than the benchmark’s. However, the Fund’s relatively short duration weighed on relative performance during the last three months of the fiscal year.1

The Fund held an overweight position in agency bonds and mortgage-backed securities throughout the fiscal year. Low volatility in the fixed-income markets helped such issues outperform Treasury securities, so the Fund’s investments in those sectors helped returns relative to the Treasury-heavy index.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

18

BB&T SHORT U.S. GOVERNMENT FUND

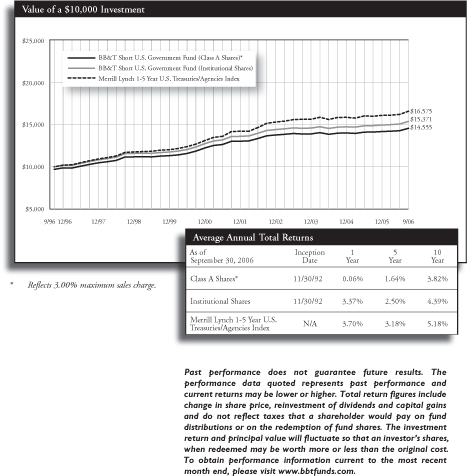

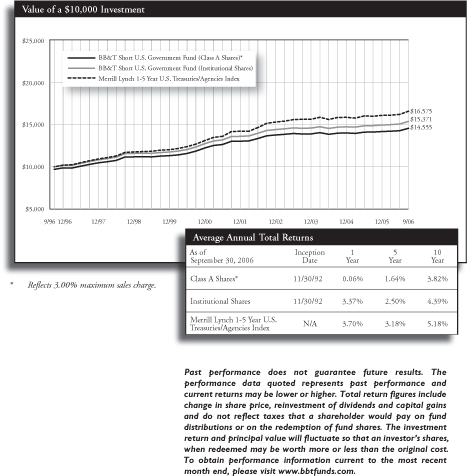

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Merrill Lynch 1-5 Year U.S. Treasuries/Agencies Index an unmanaged index which includes U.S. government and agency bonds that have a minimum issue size of $150 million and is a widely-recognized, capitalization weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of U.S. Treasury securities with maturities of 1 year or greater and no more than 5 years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

19

BB&T INTERMEDIATE U.S. GOVERNMENT FUND

PORTFOLIO MANAGER

Brad D. Eppard, CFA

The BB&T Intermediate U.S. Government Fund is managed by Brad D. Eppard, CFA. Mr. Eppard received a BS in Business Administration/ Accounting from Radford University and has been managing investors’ money since 1986. Mr. Eppard is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; David T. Johnson; Kevin E. McNair, CFA; Robert F. Millikan, CFA; Justin B. Nicholson; and Michael D. Nichols, CFA. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

INVESTMENT CONCERNS

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 3.23% (Institutional Shares). That compared to a 3.74% return for its benchmark, the Lehman Brothers U.S. Government/Mortgage Bond Index.

Q. What factors affected the Fund’s performance?

A. Investors concerned about the potential for higher inflation and further interest rate increases by the Federal Reserve demanded greater income payouts from new bonds during the first nine months of the period, causing bond yields to rise. Those rising yields pushed down prices on existing bonds. Bond yields declined during the last three months of the period, leading to higher prices on existing bonds. Bond prices fell for the period as a whole, however, causing the Fund to generate a total return that was lower than its average yield.1

The Fund held an average duration slightly longer than that of its benchmark throughout the 12-month period. That positioning weighed on returns against the benchmark while yields rose between October and June, and boosted relative returns when yields fell during the last three months of the period. The strong relative performance that duration strategy produced during the last quarter of the fiscal year offset the strategy’s negative impact during the first nine months of the period.1

The Fund began the period with relatively large stakes in short- and long-term bonds and less exposure to intermediate-term bonds—a structure known as a “barbell”. We increased the Fund’s stake in intermediate-term bonds as the period progressed. That change weighed modestly on relative returns for the period as a whole, as intermediate-term bonds lagged bonds of other durations. The Fund held larger positions than the benchmark in government agency debt and mortgage-backed securities, and an underweight stake in Treasury securities. That positioning boosted the Fund’s relative returns, because agency and mortgage issues generated greater total returns than Treasury securities during this period.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

20

BB&T INTERMEDIATE U.S. GOVERNMENT FUND

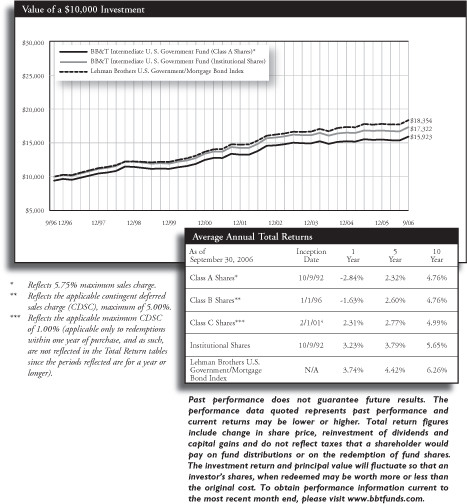

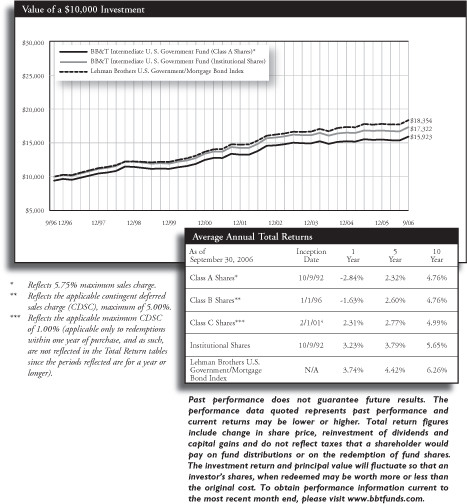

| | The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains. |

| 4 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares, but does not include the Class C Shares 12b-1 fees, which if reflected, would have lowered performance. |

| | The Fund is measured by the Lehman Brothers U.S. Government/Mortgage Bond Index, an unmanaged index which is widely used as a broad measure of the performance of U.S. Government bonds with maturities of less than 10 years, and agency mortgage backed securities. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| | A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower. |

21

BB&T TOTAL RETURN BOND FUND

PORTFOLIO MANAGER

David M. Ralston

The BB&T Total Return Bond Fund is managed by David M. Ralston, portfolio manager for Sterling Capital Management LLC, sub-adviser to the Fund. Mr. Ralston co-founded Trinity Capital Advisors in 1989, which merged into Sterling Capital Management in 1991. He is a graduate of Appalachian State University where he received his BSBA in Finance and has 25 years of investment management experience. Mr. Ralston is supported by Hung Bui, CFA; Howard Buznitsky, CFA; Neil Grant, CFA; Mitchell Kaczmarek; Mark Montgomery, CFA; and Kevin Stoll, CFA.

INVESTMENT CONCERNS

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 3.30% (Institutional Shares). That compared to a 3.67% return for its benchmark, the Lehman Brothers U.S. Aggregate Bond Index.

Q. What factors affected the Fund’s performance?

A. The Federal Reserve raised its target short-term interest rate six times during the 12-month period, boosting the federal funds rate from 3.75% to 5.25%. The increase in interest rates led to higher bond yields, with the yield on the 10-year Treasury bond increasing from 4.33% to 4.63%. Rising yields led to lower bond prices, which caused the Fund to generate a total return lower than its yield.

We kept the Fund’s duration shorter than that of its benchmark in order to help preserve shareholders’ capital. That duration strategy helped the Fund’s performance relative to the index, as yields across the yield curve rose between 25 and 50 basis points (0.25% and 0.50%) during the 12-month period. The Fund’s relative returns also benefited from an overweight stake in floating-rate notes, which increased their yield payments as short-term interest rates rose.1

The bond market exhibited low volatility during this period. That trend benefited “spread products” such as asset-backed securities, mortgage-backed securities and commercial mortgage-backed securities, which typically outperform Treasury securities during periods of low volatility. The Fund held overweight positions in those bond sectors, thereby helping the Fund’s portfolio generate a higher yield than the benchmark index. In addition, the Fund maintained an average credit quality slightly higher than that of the benchmark. This approach helped the Fund avoid problems related to leveraged transactions among a number of credit issues, and thus lifted the Fund’s performance against the index.1

The Fund held an underweight position in corporate bonds, due to our concern about the risk leveraged buyout offers posed to corporate securities. The corporate debt sector as a whole modestly outperformed Treasury and agency securities for this period. As a result, this conservative underweight position in corporate issues dragged on performance relative to the benchmark.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

22

BB&T Total Return Bond Fund

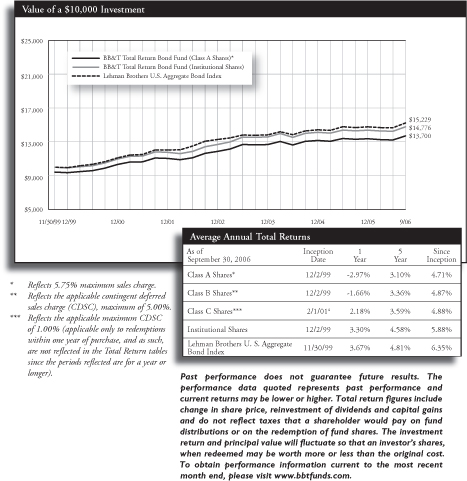

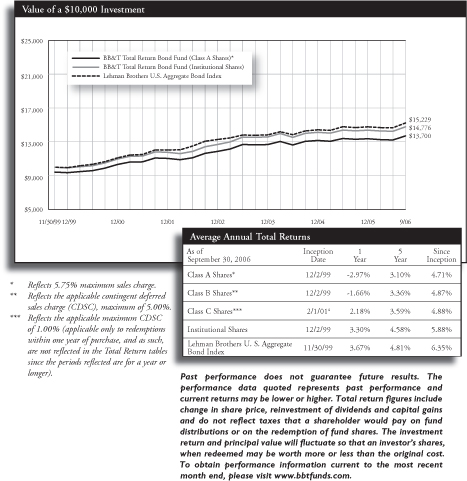

| | The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains. |

| 4 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class B Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares. |

| | The Fund is measured against the Lehman Brothers U.S. Aggregate Bond Index, an unmanaged index which is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

| | A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower. |

23

BB&T KENTUCKY INTERMEDIATE TAX-FREE FUND

PORTFOLIO MANAGER

Robert F. Millikan, CFA

The BB&T Kentucky Intermediate Tax-Free Fund is managed by Robert F. Millikan, CFA, Director of Fixed Income Management for BB&T Asset Management, Inc. Mr. Millikan received a BA in Economics from Wake Forest University, and is a past president of the North Carolina Society of Financial Analysts and chairman of the board of directors of the Carolinas Municipal Advisory Council. Mr. Millikan has been managing investors’ money since 1990. He is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; Brad D. Eppard, CFA; David T. Johnson; Kevin E. McNair, CFA; Justin B. Nicholson; and Michael D. Nichols, CFA. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

INVESTMENT CONCERNS

Because the Fund is non-diversified and invests primarily in Kentucky municipal securities, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of Kentucky municipal securities. Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return. The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal. The Fund’s income may be subject to certain state and local taxes and, depending on a investors tax status, to the Federal alternative minimum tax.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 4.04% (Institutional Shares). That compared to a 3.81% return for the Lehman Brothers 7-Year Municipal Bond Index.

Q. What factors affected the Fund’s performance?

A. The Federal Reserve Board’s interest rate increases boosted yields on short-term bonds, while expectations for low inflation depressed yields on long-term bonds. Those developments caused yields to fall for municipal securities with maturities of approximately eight years or longer, and to rise for municipal bonds with shorter maturities. Meanwhile, a combination of low supply and strong demand also pushed down municipal bond yields. Lower yields increased the prices of the longer-term securities in the Fund’s portfolio. Those gains combined with the bonds’ interest income to generate a strong total return for Fund shareholders.1

The Fund’s benchmark holds municipal bonds with an average maturity of seven years. We kept the Fund’s duration longer than that of its benchmark throughout the period in order to capture higher yield for shareholders. That strategy boosted the Fund’s returns against its benchmark, as securities with longer durations experienced greater price increases and generated more interest income than shorter-term issues.1

The benchmark index also is restricted to municipal bonds with maturities of between six- and eight-years. The Fund’s portfolio held a number of securities with maturities of longer than eight years, but also held bonds with maturities shorter than six years. Those shorter-term bonds performed poorly compared to the bonds represented in the benchmark, and weighed on relative returns as a result.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

24

BB&T KENTUCKY INTERMEDIATE TAX-FREE FUND

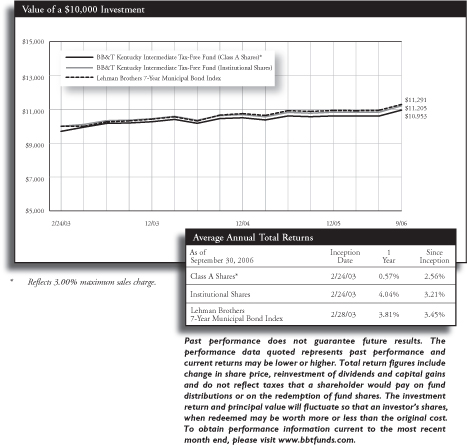

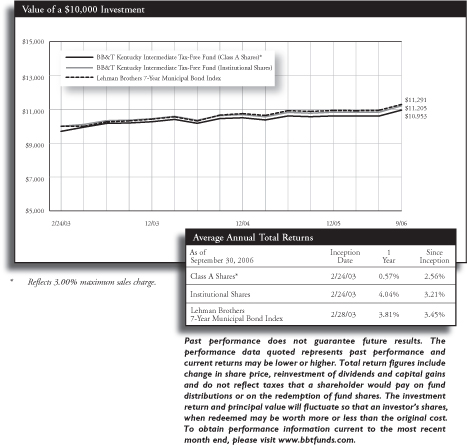

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Lehman Brothers 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of 6-8 years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

25

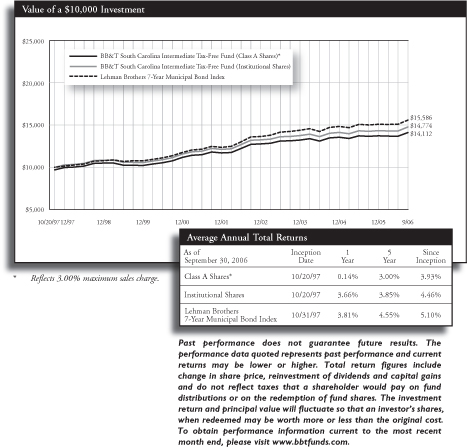

BB&T MARYLAND INTERMEDIATE TAX-FREE FUND

PORTFOLIO MANAGER

Robert F. Millikan, CFA

The BB&T Maryland Intermediate Tax-Free Fund is managed by Robert F. Millikan, CFA, Director of Fixed Income Management for BB&T Asset Management, Inc. Mr. Millikan received a BA in Economics from Wake Forest University, and is a past president of the North Carolina Society of Financial Analysts and chairman of the board of directors of the Carolinas Municipal Advisory Council. Mr. Millikan has been managing investors’ money since 1990. He is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; Brad D. Eppard, CFA; David T. Johnson; Kevin E. McNair, CFA; Justin B. Nicholson; and Michael D. Nichols, CFA. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

INVESTMENT CONCERNS

Because the Fund is non-diversified and invests primarily in Maryland municipal securities, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of Maryland municipal securities. Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return. The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal. The Fund’s income may be subject to certain state and local taxes and, depending on a investors tax status, to the Federal alternative minimum tax.

Q. How did the Fund perform during the 12-month period between October 1, 2005 and September 30, 2006?

A. The Fund gained 4.10% (Institutional Shares). That compared to a 3.81% return for the Lehman Brothers 7-Year Municipal Bond Index.

Q. What factors affected the Fund’s performance?

A. Federal Reserve interest-rate increases boosted yields on short-term municipal bonds, while investors’ expectations for low inflation depressed yields on long-term municipal bonds. Yields fell for municipal securities with maturities of longer than approximately eight years and rose for municipal bonds with shorter maturities, with the largest increases coming on securities at the short end of the yield curve. Low supply and strong demand for municipal bonds also pushed down yields.

Those developments caused prices to rise on the longer-term bonds in which this Fund invested. Rising prices and the bonds’ interest income combined to generate a strong return for Fund shareholders.

The Fund’s benchmark holds municipal bonds with maturities of between six- and eight-years, with an average maturity of seven years. We held the Fund’s duration longer than that of its benchmark throughout the period in order to capture higher yield for shareholders. That strategy boosted the Fund’s relative returns, as securities with longer durations generated more interest income and benefited more from higher prices.1

The Fund’s portfolio held a number of securities with maturities of longer than eight years, but also held bonds with maturities of less than six years. Those shorter-term bonds, which are not represented in the benchmark, performed relatively poorly. As a result, the shorter-term bonds in the Fund’s portfolio weighed on returns against the benchmark.1

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

| 1 | Portfolio composition is as of September 30, 2006 and is subject to change. |

26

BB&T MARYLAND INTERMEDIATE TAX-FREE FUND

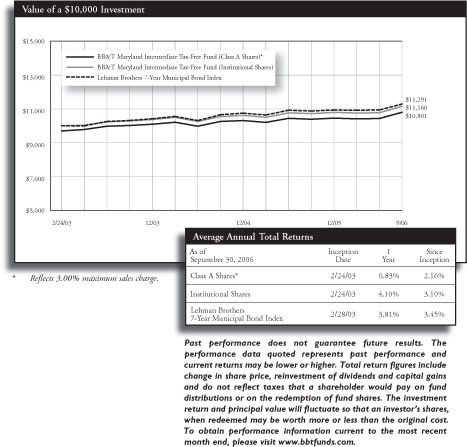

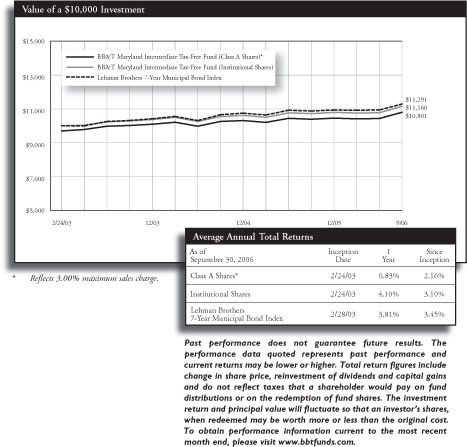

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Lehman Brothers 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of 6-8 years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the period would have been lower.

27

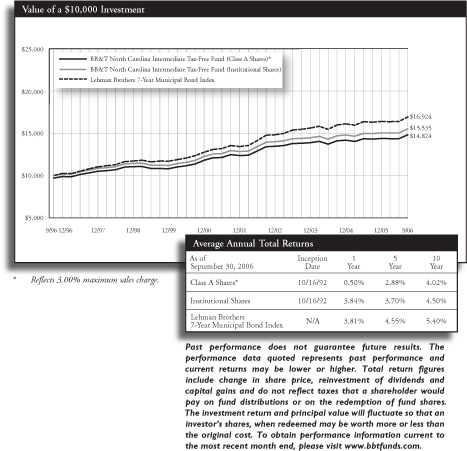

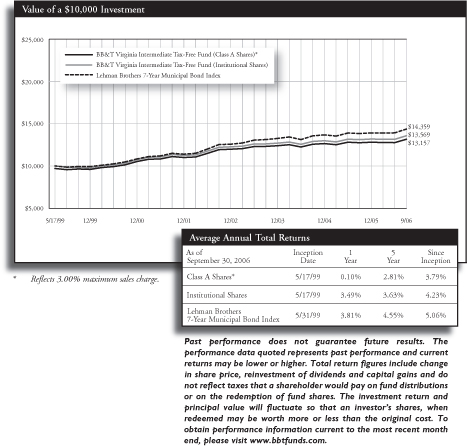

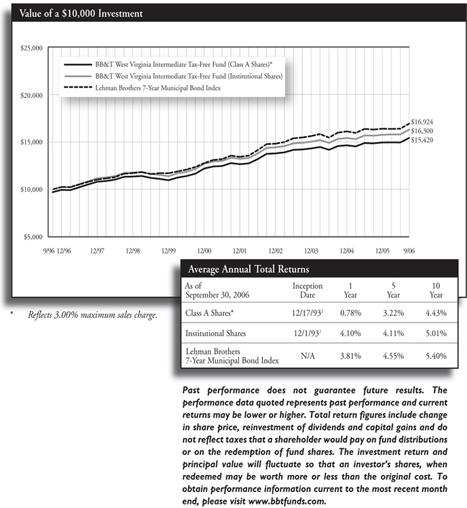

BB&T NORTH CAROLINA INTERMEDIATE TAX-FREE FUND

PORTFOLIO MANAGER

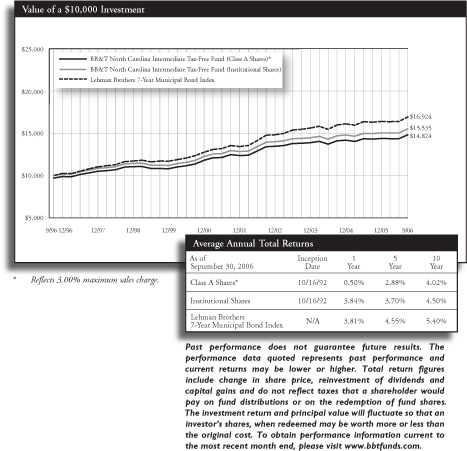

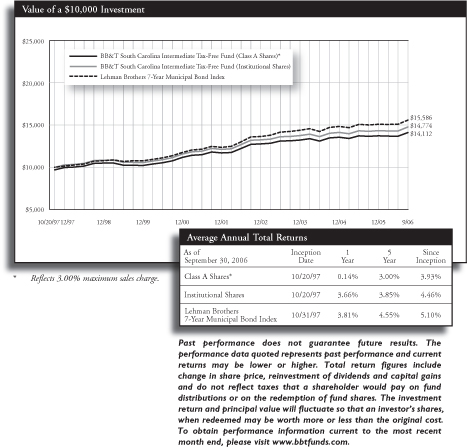

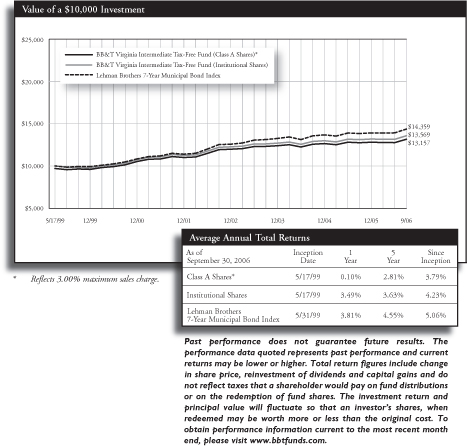

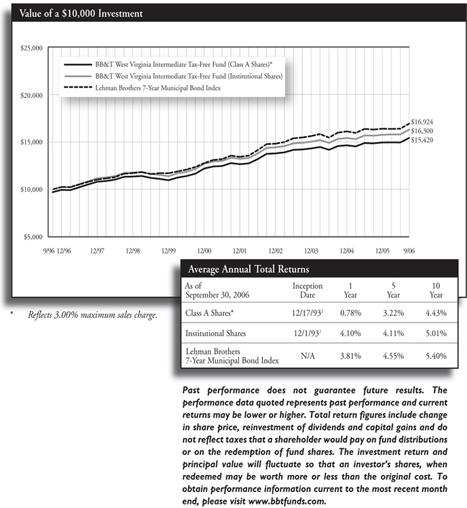

Robert F. Millikan, CFA