UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06719

|

| BB&T Funds |

| (Exact name of registrant as specified in charter) |

|

434 Fayetteville Street Mall, 5th Floor Raleigh, NC 27601-0575 |

| (Address of principal executive offices) (Zip code) |

|

Keith F. Karlawish, President BB&T Funds 434 Fayetteville Street Mall, 5th Floor Raleigh, NC 27601-0575 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

ANNUAL REPORT

EQUITY INDEX FUND

| | | | |

| CLASS | | A | | SHARES |

| CLASS | | B | | SHARES |

| CLASS | | C | | SHARES |

| INSTITUTIONAL CLASS SHARES |

DECEMBER 31, 2007

LETTER FROMTHE PRESIDENTANDTHE INVESTMENT ADVISOR

Dear Shareholders:

We are pleased to present this annual report for the BB&T Equity Index Fund, covering the 12-month period through December 31, 2007 (the “Period”). Domestic equity markets, as measured by the S&P 500® 1, posted a modest 5.49% return for the year despite high levels of volatility. The Fund gained 4.74% (Institutional Class Shares).

During the first half of the Period, equity markets benefited from global economic expansion and ongoing strong merger activity. Although corporate earnings levels slowed, they continued to exceed many analysts’ expectations, further fueling market strength. A weakening housing market and associated concerns surrounding the sub-prime mortgage market were the apparent triggers for a brief pullback in February, but equity markets quickly resumed their upward climb until late July.

Late in the Summer, however, the problems associated with the sub-prime mortgage market led to a credit crisis. Credit conditions tightened as banks, mortgage lenders, and companies that securitize sub-prime loans reported substantial losses. Tighter credit standards threatened the supply of liquidity that had fueled market growth, so the credit crunch pressured the stock market. Signs of a slowing economy also placed an additional strain on market strength.

In an effort to relieve pressure, the Federal Reserve Board (the “Fed”) in September began a series of interest rate cuts. The reductions in the Federal Funds rate represented the first change in that target short- term interest rate since June, 2006, when the Fed made the last in a series of rate increases. By the end of the reporting period, the Fed had cut the Federal Funds rate three times, from 5.25% to 4.25%. Although the Fed’s actions appeared to help alleviate concerns surrounding the economy and the markets, volatility levels remained high through the end of the year.

In this environment, larger-capitalization stocks maintained market leadership over smaller-capitalization stocks, as investors tended to seek relative safety in shares of larger companies. Growth-oriented companies outpaced value-related shares across all market capitalizations.

Thank you for selecting the BB&T Equity Index Fund (the “Fund”). We look forward to serving your investment needs during the months and years ahead.

Sincerely,

Keith F. Karlawish, CFA

President

BB&T Funds

Jeffrey J. Schappe, CFA

Chief Investment Officer

BB&T Asset Management, Inc.

1 | “S&P 500®” is a registered service mark of Standard & Poor’s Corporation, which does not sponsor and is in no way affiliated with the Fund or Master Portfolio. The S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. BB&T Asset Management, Inc., a wholly owned subsidiary of BB&T Corporation, serves as investment adviser to the BB&T Funds and is paid a fee for its services. Shares of the BB&T Funds are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds are distributed by BB&T AM Distributors, Inc. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. BB&T Asset Management, Inc. does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

1

BB&T EQUITY INDEX FUND

MASTER PORTFOLIO MANAGER

Barclays Global Fund Advisors, a subsidiary of Barclays Global Investors,

N.A. (S&P 500® Index Master Portfolio)

BB&T Asset Management, Inc. (BB&T Equity Index Fund)

Unlike many traditional, actively managed investment funds, there is no single portfolio manager who makes investment decisions for the BB&T Equity Index Fund. Instead, the Fund invests substantially all of its assets in the S&P 500® Index Master Portfolio which is managed by a team of investment professionals from Barclays, who use a specially designed software program to maintain a close match to the characteristics of the S&P 500® Index.

INVESTMENT CONCERNS

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

The performance of the Fund is expected to be lower than that of the S&P 500® Index because of Fund fees and expenses.

PORTFOLIO MANAGERS’ PERSPECTIVE

“Investing in an index fund such as ours is based on the belief that it’s very difficult to ‘beat the market’ on a consistent basis. Our approach, then, is to take advantage of the stock market’s long-term growth potential, while managing costs, to help shareholders potentially build wealth over time. We believe the Fund is an excellent diversification tool for novice and experienced investors alike, and can serve as the foundation of most equity investors’ asset allocation strategies.”

Q. How did the Fund perform during the 12-month period between January 1, 2007 and December 31, 2007?

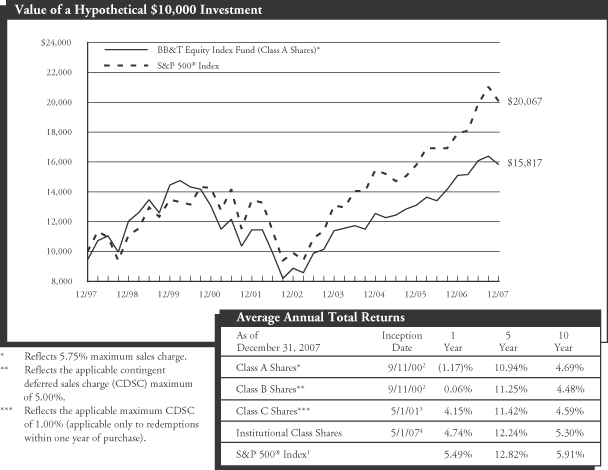

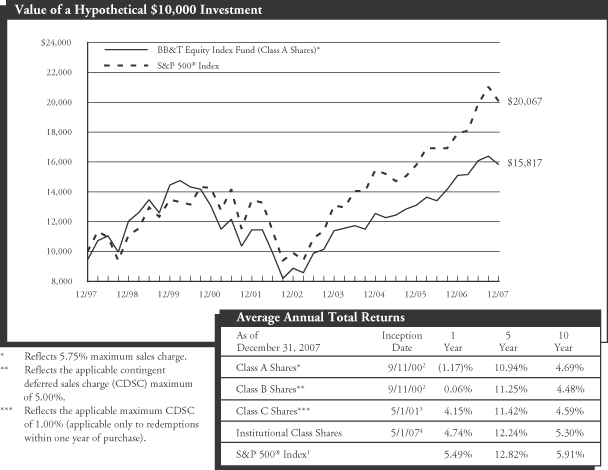

A. The Fund gained 4.74% (Institutional Class Shares) compared to a 5.49% return for S&P 500® index.

Q. What factors affected the Fund’s performance?

A. The Fund seeks to approximate as closely as practicable, before fees and expenses, the capitalization-weighted total rate of return of the S&P 500®. Domestic equity markets, as represented by the index, delivered modest gains for the reporting period despite high levels of volatility. The Fund trailed the index slightly due to the effect of management fees and expenses.†

Most sectors in the index posted positive performance during 2007. The energy sector was the strongest contributor to the performance of the Fund and its index, benefiting from oil prices that reached nearly $100 per barrel during the period. The information technology sector also delivered gains, driven in part by consumer-related technology companies that introduced popular products during the year. The consumer staples sector, which consists of companies that tend to fare relatively well in a slowing economic environment, delivered modest gains, as did the industrial sector.†

Financial services stocks declined, in the aggregate, as defaulting sub-prime loans resulted in large write-downs and a weak earnings outlook for the sector. The consumer discretionary sector also declined modestly, as consumer spending power was weakened by higher energy prices and the decline in the housing market.†

† | The composition of the Master Portfolio is subject to change. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month’s end, please visit www.bbtfunds.com.

2

BB&T EQUITY INDEX FUND

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

1 | The Fund is measured against the S&P 500® Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. Performance data for the S&P 500® Index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

2 | The performance of the BB&T Equity Index Fund prior to its commencement date on 9/11/00 is based on the historical performance of the “master portfolio,” which commenced operations on 7/2/93. The performance shown reflects the reinvestment of all dividend and capital gains distributions but does not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or redemptions. The performance has been adjusted to reflect the deduction of fees for services associated with the Fund, such as investment management and fund accounting fees. |

3 | Performance for Class C Shares prior to their inception date on 5/1/01 is based on the historical performance of Class B Shares and has been adjusted for the maximum CDSC applicable to Class C Shares. |

4 | Performance for Institutional Class Shares prior to their inception date on 5/1/07 is based on historical performance of Class A Shares. |

A portion of the Fund’s fees have been reduced. If the fees had not been reduced, the Fund’s total return would have been lower.

3

Portfolio Holdings Summary

(Unaudited)

| | | |

Investment Type | | % of

Investment | |

S&P 500 Index Master Portfolio | | 100.00 | % |

| | | |

Total | | 100.00 | % |

| | | |

For a summary of the S&P 500 Index Master Portfolio holdings, please see the accompanying financial statements of the Master Portfolio.

Expense Examples (Unaudited)

As a shareholder of the BB&T Equity Index Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and sales and (2) ongoing costs, including management fees and other Fund expenses.

These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2007 through December 31, 2007.

Actual Example

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | | | |

| | | | | Beginning

Account Value

7/1/07 | | Ending Account

Value

12/31/07 | | Expenses Paid

During Period*

7/1/07 - 12/31/07 | | Annualized

Expense Ratio

During Period

7/1/07 - 12/31/07 | |

BB&T Equity Index Fund | | Class A | | $ | 1,000.00 | | $ | 983.40 | | $ | 3.15 | | 0.63 | % |

| | Class B | | | 1,000.00 | | | 979.40 | | | 6.98 | | 1.40 | % |

| | Class C | | | 1,000.00 | | | 979.70 | | | 6.99 | | 1.40 | % |

| | Institutional Class | | | 1,000.00 | | | 984.80 | | | 2.05 | | 0.41 | % |

| * | Expenses are equal to the Fund’s annualized expense ratios during the period, multiplied by the average account value over |

the period, multiplied by the number of days in the period, then divided by 365.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchases. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| | | | | Beginning

Account Value

7/1/07 | | Ending Account

Value

12/31/07 | | Expenses Paid

During Period*

7/1/07 - 12/31/07 | | Annualized

Expense Ratio

During Period

7/1/07 - 12/31/07 | |

BB&T Equity Index Fund | | Class A | | $ | 1,000.00 | | $ | 1,022.35 | | $ | 3.21 | | 0.63 | % |

| | Class B | | | 1,000.00 | | | 1,018.50 | | | 7.12 | | 1.40 | % |

| | Class C | | | 1,000.00 | | | 1,018.50 | | | 7.12 | | 1.40 | % |

| | Institutional Class | | | 1,000.00 | | | 1,023.62 | | | 2.09 | | 0.41 | % |

| * | Expenses are equal to the Fund’s annualized expense ratios during the period, multiplied by the average account value over the period, multiplied by the number of days in the period, then divided by 365. |

4

BB&T FUNDS

Equity Index Fund

| | | | |

| Statement of Assets and Liabilities | |

| December 31, 2007 | |

Assets: | | | | |

Investment in S&P 500 Index Master Portfolio, at value ( See Note 1) | | $ | 118,383,578 | |

Receivable for capital shares issued | | | 8,927 | |

Prepaid expenses | | | 8 | |

| | | | |

Total Assets | | | 118,392,513 | |

| | | | |

Liabilities: | | | | |

Distributions payable | | | 9,503 | |

Payable for capital shares redeemed | | | 491,791 | |

Accrued expenses and other payables: | | | | |

Administration fees | | | 8,526 | |

Compliance service fees | | | 407 | |

Distribution fees | | | 18,289 | |

Professional fees | | | 29,105 | |

Other | | | 21,701 | |

| | | | |

Total Liabilities | | | 579,322 | |

| | | | |

Net Assets: | | | | |

Capital | | $ | 92,769,214 | |

Distributions in excess of net investment income | | | (4,929 | ) |

Accumulated realized loss from investment transactions | | | (8,758,868 | ) |

Net unrealized appreciation on investments | | | 33,807,774 | |

| | | | |

Net Assets | | $ | 117,813,191 | |

| | | | |

Net Assets | | | | |

Class A Shares | | $ | 30,844,557 | |

Class B Shares | | | 13,278,839 | |

Class C Shares | | | 308,181 | |

Institutional Class Shares | | | 73,381,614 | |

| | | | |

Total | | $ | 117,813,191 | |

| | | | |

Shares of Beneficial Interest Outstanding (Unlimited number of shares authorized, no par value): | | | | |

Class A Shares | | | 3,130,430 | |

Class B Shares | | | 1,372,585 | |

Class C Shares | | | 31,576 | |

Institutional Class Shares | | | 7,482,968 | |

| | | | |

Total | | | 12,017,559 | |

| | | | |

Net Asset Value | | | | |

Class A Shares — redemption price per share | | $ | 9.85 | |

Class B Shares — offering price per share* | | | 9.67 | |

Class C Shares — offering price per share* | | | 9.76 | |

Institutional Class Shares — offering and redemption price per share | | | 9.81 | |

| | | | |

Maximum Sales Charge — Class A Shares | | | 5.75 | % |

| | | | |

Maximum Offering Price (100%/(100% – Maximum Sales Charge)) of net asset value adjusted to the nearest cent per share — Class A Shares | | $ | 10.45 | |

| | | | |

| * | Redemption price per share varies by length of time shares are held. |

| | | | |

| Statement of Operations | |

| For the Year Ended December 31, 2007 | |

Net Investment Income Allocated from Master Portfolio: | | | | |

Dividend income | | $ | 2,330,447 | (a) |

Interest income | | | 148,063 | (a) |

Securities lending income | | | 25,035 | (a) |

Expenses (b) | | | (64,373 | )(a) |

| | | | |

Net Investment Income Allocated from Master Portfolio | | | 2,439,172 | |

| | | | |

Expenses: | | | | |

Distribution fees — Class A Shares | | | 417,702 | |

Distribution fees — Class B Shares | | | 143,422 | |

Distribution fees — Class C Shares | | | 3,041 | |

Administration fees | | | 122,103 | |

Printing fees | | | 79,993 | |

Professional fees | | | 71,095 | |

Transfer agent fees | | | 40,961 | |

Fund accounting fees | | | 40,821 | |

Registration fees | | | 16,311 | |

Custodian fees | | | 6,232 | |

Trustees fees | | | 5,145 | |

Compliance service fees | | | 1,583 | |

Insurance expense | | | 430 | |

Other | | | 13,827 | |

| | | | |

Gross expenses | | | 962,666 | |

Less expenses waived by the Administrator | | | (2,610 | ) |

Less expenses waived by the Distributor | | | (208,851 | ) |

| | | | |

Net Expenses | | | 751,205 | |

| | | | |

Net Investment Income | | | 1,687,967 | |

| | | | |

Realized/Unrealized Gains (Losses) Allocated

from Master Portfolio: | | | | |

Net realized gains/(losses) from: | | | | |

Investment transactions | | | 866,398 | (a) |

In-kind redemptions | | | 2,334,771 | (a) |

Futures contracts | | | 140,321 | (a) |

Change in unrealized appreciation/depreciation from: | | | | |

Investment transactions | | | 2,692,687 | (a) |

Futures contracts | | | (128,863 | )(a) |

Securities sold short | | | (8 | )(a) |

| | | | |

Net realized/unrealized gains/(losses) allocated from Master Portfolio | | | 5,905,306 | |

| | | | |

Change in net assets from operations | | $ | 7,593,273 | |

| | | | |

| (a) | Allocated from the S&P Index Master Portfolio. |

| (b) | Expenses allocated from the S&P 500 Index Master Portfolio are shown net of any fee reductions. |

See accompanying notes to the financial statements.

5

BB&T FUNDS

Equity Index Fund

| | | | | | | | |

| Statements of Changes in Net Assets | |

| | | For the

Year Ended

December 31,

2007 | | | For the

Year Ended

December 31,

2006 | |

From Investment Activities: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 1,687,967 | | | $ | 1,933,615 | |

Net realized gains (losses) from investment transactions, in-kind redemptions and futures contracts | | | 3,341,490 | | | | (884,119 | ) |

Change in unrealized appreciation/depreciation from investments, futures contracts and securities sold short | | | 2,563,816 | | | | 18,862,116 | |

| | | | | | | | |

Change in net assets from operations | | | 7,593,273 | | | | 19,911,612 | |

| | | | | | | | |

Distribution to Class A Shareholders: | | | | | | | | |

Net investment income | | | (942,024 | ) | | | (1,806,481 | ) |

Distributions to Class B Shareholders: | | | | | | | | |

Net investment income | | | (101,302 | ) | | | (112,413 | ) |

Distributions to Class C Shareholders: | | | | | | | | |

Net investment income | | | (2,237 | ) | | | (4,997 | ) |

Distributions to Institutional Class* Shareholders: | | | | | | | | |

Net investment income | | | (678,197 | ) | | | — | |

| | | | | | | | |

Change in net assets from shareholder distributions | | | (1,723,760 | ) | | | (1,923,891 | ) |

| | | | | | | | |

Capital Transactions: | | | | | | | | |

Proceeds from shares issued | | | | | | | | |

Class A Shares | | | 10,039,514 | | | | 15,573,301 | |

Class B Shares | | | 550,251 | | | | 656,553 | |

Class C Shares | | | 39,572 | | | | 21,883 | |

Institutional Class Shares | | | 78,973,053 | | | | — | |

Distributions reinvested | | | | | | | | |

Class A Shares | | | 1,300,731 | | | | 1,341,143 | |

Class B Shares | | | 129,487 | | | | 82,235 | |

Class C Shares | | | 2,176 | | | | 3,368 | |

Institutional Class Shares | | | 662,506 | | | | — | |

Value of shares redeemed | | | | | | | | |

Class A Shares | | | (92,738,401 | ) | | | (61,367,381 | ) |

Class B Shares | | | (2,859,818 | ) | | | (2,140,942 | ) |

Class C Shares | | | (28,064 | ) | | | (626,141 | ) |

Institutional Class Shares | | | (6,006,626 | ) | | | — | |

| | | | | | | | |

Change in net assets from capital transactions | | | (9,935,619 | ) | | | (46,455,981 | ) |

| | | | | | | | |

Change in net assets | | | (4,066,106 | ) | | | (28,468,260 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 121,879,297 | | | | 150,347,557 | |

| | | | | | | | |

End of year | | $ | 117,813,191 | | | $ | 121,879,297 | |

| | | | | | | | |

Accumulated distributions in excess of net investment income | | $ | (4,929 | ) | | $ | (9,444 | ) |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Issued | | | | | | | | |

Class A Shares | | | 1,024,937 | | | | 1,771,968 | |

Class B Shares | | | 56,818 | | | | 76,484 | |

Class C Shares | | | 4,006 | | | | 2,497 | |

Institutional Class Shares | | | 7,922,762 | | | | — | |

Reinvested | | | | | | | | |

Class A Shares | | | 133,468 | | | | 153,694 | |

Class B Shares | | | 13,430 | | | | 9,538 | |

Class C Shares | | | 221 | | | | 386 | |

Institutional Class Shares | | | 66,383 | | | | — | |

Redeemed | | | | | | | | |

Class A Shares | | | (9,253,835 | ) | | | (6,817,677 | ) |

Class B Shares | | | (275,566 | ) | | | (249,242 | ) |

Class C Shares | | | (2,453 | ) | | | (69,918 | ) |

Institutional Class Shares | | | (506,177 | ) | | | — | |

| | | | | | | | |

Change in shares | | | (816,006 | ) | | | (5,122,270 | ) |

| | | | | | | | |

| * | Institutional Class Shares commenced operations May 1, 2007. |

See accompanying notes to the financial statements.

6

BB&T FUNDS

Equity Index Fund

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights, Class A Shares | | | | | | | | | | | | | | | |

Selected data for a share of beneficial interest outstanding throughout the periods indicated. | | | | | | | | | |

| | | For the

Year Ended

December 31,

2007 | | | For the

Year Ended

December 31,

2006 | | | For the

Year Ended

December 31,

2005 | | | For the

Year Ended

December 31,

2004 | | | For the

Year Ended

December 31,

2003 | |

Net Asset Value, Beginning of Year | | $ | 9.52 | | | $ | 8.39 | | | $ | 8.14 | | | $ | 7.48 | | | $ | 5.90 | |

| | | | | | | | | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.13 | (b) | | | 0.12 | (b) | | | 0.11 | | | | 0.11 | | | | 0.08 | |

Net realized and unrealized gains (losses) from investments(a) | | | 0.33 | | | | 1.14 | | | | 0.25 | | | | 0.66 | | | | 1.58 | |

| | | | | | | | | | | | | | | | | | | | |

Total from Investment Activities | | | 0.46 | | | | 1.26 | | | | 0.36 | | | | 0.77 | | | | 1.66 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.13 | ) | | | (0.13 | ) | | | (0.11 | ) | | | (0.11 | ) | | | (0.08 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | (0.13 | ) | | | (0.13 | ) | | | (0.11 | ) | | | (0.11 | ) | | | (0.08 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value — End of Year | | $ | 9.85 | | | $ | 9.52 | | | $ | 8.39 | | | $ | 8.14 | | | $ | 7.48 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return (excludes sales charge) | | | 4.85 | % | | | 15.15 | % | | | 4.43 | % | | | 10.23 | % | | | 28.28 | % |

| | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (000’s) | | $ | 30,845 | | | $ | 106,833 | | | $ | 135,175 | | | $ | 139,833 | | | $ | 109,282 | |

Ratio of net expenses to average net assets(a) | | | 0.61 | % | | | 0.58 | % | | | 0.57 | % | | | 0.49 | % | | | 0.48 | % |

Ratio of net investment income to average net assets(a) | | | 1.36 | % | | | 1.40 | % | | | 1.32 | % | | | 1.57 | % | | | 1.31 | % |

Ratio of expenses to average net assets*(a) | | | 0.86 | % | | | 0.84 | % | | | 0.84 | % | | | 0.96 | % | | | 0.95 | % |

Portfolio turnover rate(c) | | | 7 | % | | | 14 | % | | | 10 | % | | | 14 | % | | | 8 | % |

| * | During the periods certain fees were reduced. If such fee reductions had not occurred, the ratios would have been as indicated. |

| (a) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Index Master Portfolio. |

| (b) | Per share net investment income has been calculated using the daily average shares method. |

| (c) | This rate represents the portfolio turnover rate of the S&P 500 Index Master Portfolio. |

See accompanying notes to the financial statements.

7

BB&T FUNDS

Equity Index Fund

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights, Class B Shares | | | | | | | | | | | | | | | |

Selected data for a share of beneficial interest outstanding throughout the periods indicated. | | | | | | | | | |

| | | For the

Year Ended

December 31,

2007 | | | For the

Year Ended

December 31,

2006 | | | For the

Year Ended

December 31,

2005 | | | For the

Year Ended

December 31,

2004 | | | For the

Year Ended

December 31,

2003 | |

Net Asset Value, Beginning of Year | | $ | 9.36 | | | $ | 8.25 | | | $ | 8.02 | | | $ | 7.37 | | | $ | 5.83 | |

| | | | | | | | | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.06 | (b) | | | 0.06 | (b) | | | 0.05 | | | | 0.06 | | | | 0.03 | |

Net realized and unrealized gains (losses) from investments(a) | | | 0.32 | | | | 1.12 | | | | 0.23 | | | | 0.65 | | | | 1.54 | |

| | | | | | | | | | | | | | | | | | | | |

Total from Investment Activities | | | 0.38 | | | | 1.18 | | | | 0.28 | | | | 0.71 | | | | 1.57 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.07 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.06 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | (0.07 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.06 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value — End of Year | | $ | 9.67 | | | $ | 9.36 | | | $ | 8.25 | | | $ | 8.02 | | | $ | 7.37 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return | | | 4.06 | % | | | 14.35 | % | | | 3.48 | % | | | 9.48 | % | | | 27.18 | % |

| | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (000’s) | | $ | 13,279 | | | $ | 14,765 | | | $ | 14,367 | | | $ | 15,207 | | | $ | 13,055 | |

Ratio of net expenses to average net assets(a) | | | 1.37 | % | | | 1.33 | % | | | 1.32 | % | | | 1.23 | % | | | 1.23 | % |

Ratio of net investment income to average net assets(a) | | | 0.65 | % | | | 0.65 | % | | | 0.57 | % | | | 0.81 | % | | | 0.54 | % |

Ratio of expenses to average net assets*(a) | | | 1.37 | % | | | 1.34 | % | | | 1.34 | % | | | 1.45 | % | | | 1.45 | % |

Portfolio turnover rate(c) | | | 7 | % | | | 14 | % | | | 10 | % | | | 14 | % | | | 8 | % |

| * | During the periods certain fees were reduced. If such fee reductions had not occurred, the ratios would have been as indicated. |

| (a) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Index Master Portfolio. |

| (b) | Per share net investment income has been calculated using the daily average shares method. |

| (c) | This rate represents the portfolio turnover rate of the S&P 500 Index Master Portfolio. |

See accompanying notes to the financial statements.

8

BB&T FUNDS

Equity Index Fund

| | | | | | | | | | | | | | | | | | | | |

| Financial Highlights, Class C Shares | | | | | | | | | | | | | | | |

Selected data for a share of beneficial interest outstanding throughout the periods indicated. | | | | | | | | | |

| | | For the

Year Ended

December 31,

2007 | | | For the

Year Ended

December 31,

2006 | | | For the

Year Ended

December 31,

2005 | | | For the

Year Ended

December 31,

2004 | | | For the

Year Ended

December 31,

2003 | |

Net Asset Value, Beginning of Year | | $ | 9.44 | | | $ | 8.32 | | | $ | 8.08 | | | $ | 7.42 | | | $ | 5.86 | |

| | | | | | | | | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | | | | | | | | |

Net investment income(a) | | | 0.06 | (b) | | | 0.06 | (b) | | | 0.03 | | | | 0.07 | | | | 0.04 | |

Net realized and unrealized gains (losses)

from investments(a) | | | 0.33 | | | | 1.12 | | | | 0.25 | | | | 0.64 | | | | 1.56 | |

| | | | | | | | | | | | | | | | | | | | |

Total from Investment Activities | | | 0.39 | | | | 1.18 | | | | 0.28 | | | | 0.71 | | | | 1.60 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.07 | ) | | | (0.06 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | (0.07 | ) | | | (0.06 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value — End of Year | | $ | 9.76 | | | $ | 9.44 | | | $ | 8.32 | | | $ | 8.08 | | | $ | 7.42 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return | | | 4.15 | % | | | 14.28 | % | | | 3.50 | % | | | 9.46 | % | | | 27.35 | % |

| | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (000’s) | | $ | 308 | | | $ | 281 | | | $ | 806 | | | $ | 808 | | | $ | 813 | |

Ratio of net expenses to average net assets(a) | | | 1.37 | % | | | 1.32 | % | | | 1.32 | % | | | 1.23 | % | | | 1.23 | % |

Ratio of net investment income to average net assets(a) | | | 0.66 | % | | | 0.64 | % | | | 0.59 | % | | | 0.76 | % | | | 0.52 | % |

Ratio of expenses to average net assets*(a) | | | 1.37 | % | | | 1.33 | % | | | 1.34 | % | | | 1.45 | % | | | 1.45 | % |

Portfolio turnover rate(c) | | | 7 | % | | | 14 | % | | | 10 | % | | | 14 | % | | | 8 | % |

| * | During the periods certain fees were reduced. If such fee reductions had not occurred, the ratios would have been as indicated. |

| (a) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Index Master Portfolio. |

| (b) | Per share net investment income has been calculated using the daily average shares method. |

| (c) | This rate represents the portfolio turnover rate of the S&P 500 Index Master Portfolio. |

See accompanying notes to the financial statements.

9

BB&T FUNDS

Equity Index Fund

| | | | |

| Financial Highlights, Institutional Class Shares | | | |

Selected data for a share of beneficial interest outstanding throughout the periods indicated. | | | | |

| | | For the Period

May 1, 2007

to

December 31,

2007(a) | |

Net Asset Value, Beginning of Period | | $ | 9.95 | |

| | | | |

Investment Activities: | | | | |

Net investment income(b) | | | 0.12 | (c) |

Net realized and unrealized gains from investments(b) | | | (0.13 | ) |

| | | | |

Total from Investment Activities | | | (0.01 | ) |

| | | | |

Distributions: | | | | |

Net investment income | | | (0.13 | ) |

| | | | |

Total Distributions | | | (0.13 | ) |

| | | | |

Net Asset Value — End of Period | | $ | 9.81 | |

| | | | |

Total Return(d) | | | (0.11 | )% |

| |

Ratios/Supplementary Data: | | | | |

Net Assets, End of Period (000’s) | | $ | 73,382 | |

Ratio of net expenses to average net assets(b)(e) | | | 0.41 | % |

Ratio of net investment income to average net assets(b)(e) | | | 1.79 | % |

Ratio of expenses to average net assets*(b)(e) | | | 0.41 | % |

Portfolio turnover rate(d)(f) | | | 7 | % |

| * | During the period certain fees were reduced. If such fee reductions had not occurred, the ratios would have been as indicated. |

| (a) | Period from commencement of operations. The Class I shares of the Equity Index Fund commenced operations on May 1, 2007 |

| (b) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Index Master Portfolio. |

| (c) | Per share net investment income has been calculated using the daily average shares method. |

| (d) | Not annualized for periods less than one year. |

| (e) | Annualized for periods less than one year. |

| (f) | This rate represents the portfolio turnover rate of the S&P 500 Index Master Portfolio. |

See accompanying notes to the financial statements.

10

BB&T FUNDS

Equity Index Fund

Notes to the Financial Statements

December 31, 2007

The BB&T Equity Index Fund (the “Fund”) commenced operations on September 11, 2000 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified open-end investment company. The Fund is a separate series of the BB&T Funds (“Trust”), a Massachusetts business trust organized in 1992. The Fund invests substantially all of its investable assets in the S&P 500® Index Master Portfolio (the “Master Portfolio”) of the Master Investment Portfolio (“MIP”), a diversified open-end management investment company registered under the of 1940 Act, rather than in a portfolio of securities. The Master Portfolio has substantially the same investment objective as the Fund. Barclays Global Fund Advisors serves as investment advisor for the Master Portfolio. The financial statements of the Master Portfolio, including the schedule of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Fund’s financial statements. The value of the Fund’s investment in the Master Portfolio reflects the Fund’s interest of 4.05% in the net assets of the Master Portfolio at December 31, 2007.

The Fund is authorized to issue an unlimited number of shares without par value. The Fund offers four classes of shares: Class A Shares, Class B Shares, Class C Shares, and Institutional Class Shares. Class A Shares of the Fund have a maximum sales charge of 5.75% as a percentage of original purchase price. Certain purchases of Class A Shares will not be subject to a front-end sales charge, but will be subject to a contingent deferred sales charge (“CDSC”). As of May 1, 2007, a CDSC of up to 1.00% of the purchase price will be charged to the shareholder if the shares are redeemed within two years after purchase. For purchases of $1 million or more prior to May 1, 2007, a CDSC of up to 1.00% of the purchase price was charged to the shareholder if the shares were redeemed in the first year after purchase. In addition, effective September 25, 2007, a CDSC of up to 1.00% of the purchase price of Class A Shares will be charged to the following shareholders who receive a sales charge waiver, and then redeem their shares within two years after purchase: (i) employees of BB&T Funds, BB&T Corporation and its affiliates, and (ii) shareholders who purchased shares with proceeds from redemptions from another mutual fund complex within 60 days or redemption if a sales charge was paid on such shares. The Class B Shares of the Funds are offered without any front-end sales charge but will be subject to a CDSC ranging from a maximum of 5.00% if redeemed less than one year after purchase to 0.00% if redeemed more than six years after purchase. The Class C Shares of the Funds are offered without any front-end sales charge but will be subject to a maximum CDSC of 1.00% if redeemed less than one year after purchase. The Institutional Class Shares commenced operations on May 1, 2007. The Institutional Class Shares of the Fund are offered without any front-end sales charge and without any CDSC.

Each class of shares has identical rights and privileges except with respect to the fees paid under the distribution plan, voting rights on matters affecting a single class of shares and the exchange privilege of each class of shares.

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts with their vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

| 2. | Significant Accounting Policies: |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

| | (A) | Recent Accounting Standards—In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement on Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current GAAP from the application of |

Continued

11

BB&T FUNDS

Equity Index Fund

Notes to the Financial Statements, Continued

December 31, 2007

| | SFAS No. 157 relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. As of December 31, 2007, the Fund does not believe the adoption of SFAS No. 157 will impact the financial statement amounts, however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements on changes in net assets for the period. |

| | (B) | Security Valuation—The Fund records its investments in the Master Portfolio at fair value. Valuation of securities held by the Master Portfolio is discussed in Note 1 of the Master Portfolio’s Notes to Financial Statements, which are included elsewhere in this report. |

| | (C) | Distributions to Shareholders—Distributions from net investment income are declared and paid quarterly by the Fund. Distributable net realized capital gains, if any, are declared and distributed at least annually. The amount of distributions from net investment income and from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g. reclass of market discounts, net operating loss, gain/loss, paydowns, and distributions), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences (e.g., wash sales) do not require reclassification. Permanent differences (e.g. reclass of redemptions-in-kind; reclass of distributions in excess of current year earnings and profits) for the fiscal year ended December 31, 2007 resulted in a decrease to distributions in excess of net investment income of $40,308, an increase in accumulated realized loss of $2,328,533 and an increase in capital of $2,288,225. Distributions to shareholders which exceed net investment income and net realized gains for tax purposes are reported as distributions of capital. |

| | (D) | Allocation Methodology—The investment income, expenses (other than class specific expenses) and realized and unrealized gains and losses on investments are allocated to each class of shares based on their relative net assets on the date the income is earned, expenses are accrued, or realized and unrealized gains and losses are incurred. |

| | (E) | Expenses—Expenses directly attributable to a class of shares are charged directly to that class. Expenses directly attributable to the Fund are charged to the Fund. Expenses not directly attributable to the Fund are allocated proportionately among all BB&T Funds in relation to the net assets of each Fund or on another reasonable basis. Expenses which are attributable to both the BB&T Funds and BB&T Variable Insurance Fund Trusts are allocated across the BB&T Funds and BB&T Variable Insurance Funds, based upon relative net assets or on another reasonable basis. BB&T Asset Management, Inc. serves as the Investment Adviser for the BB&T Funds and BB&T Variable Insurance Funds Trust. |

| | (F) | Securities Transactions and Income Recognition—The Fund records daily, its proportionate interest in the net investment income and realized/unrealized capital gains and losses of the Master Portfolio. The performance of the Fund is directly affected by the performance of the Master Portfolio. |

| | (G) | Federal Income Taxes—It is the policy of the Fund to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income tax is required. |

| 3. | Related Party Transactions: |

Under its Investment Advisory Agreement with respect to the Fund, BB&T Asset Management, Inc. (“BB&T AM” or “Adviser”) exercises general oversight over the investment performance of the Fund. BB&T AM will advise the Board of Trustees if investment of all of the Fund’s assets in shares of the Master Portfolio is no longer an appropriate means of achieving the Fund’s investment objective. For periods in which all the Fund’s assets are not invested in the Master Portfolio, BB&T AM may receive an investment advisory fee from the Fund. For the year ended December 31, 2007, all of the Fund’s investable assets were invested in the Master Portfolio and BB&T AM received no fees.

BB&T AM serves the administrator to the Trust pursuant to the Administration Agreement. The Fund pays its portion of a fee to BB&T AM for providing administration services based on the aggregate assets of the Trust and the BB&T Variable Insurance Funds at a rate of 0.11% on the first $3.5 billion of average daily net assets; 0.075% on the next $1 billion of average daily net

Continued

12

BB&T FUNDS

Equity Index Fund

Notes to the Financial Statements, Continued

December 31, 2007

assets; 0.06% on the next $1.5 billion of average daily net assets; and 0.04% of average daily net assets over $6 billion. This fee is accrued daily and payable on a monthly basis. Expenses incurred are reflected on the Statement of Operations as “Administration fees”. During the year ended December 31, 2007, BB&T AM voluntarily waived administration fees of $2,610 of the Fund, and this waiver is not subject to recoupment in subsequent fiscal periods. Effective April 23, 2007, pursuant to a sub-administration agreement with BB&T AM, PFPC Inc. (“PFPC”) serves as sub-administrator to the Trust subject to the general supervision of the Board and BB&T AM. For these services, PFPC is entitled to a fee, payable by BB&T AM. Prior to April 23, 2007, Citi Fund Services (“Citi”), formerly known as BISYS Fund Services Ohio, Inc., served as sub-administrator to the Trust.

Effective April 23, 2007, PFPC Inc. serves as the Funds’ transfer agent and receives compensation by the Fund for these services. Expenses incurred are reflected on the Statement of Operations as “Transfer agent fees”. Prior to April 23, 2007, Citi served as the Fund’s transfer agent.

On April 23, 2007, BB&T AM’s Chief Compliance Officer (“CCO”) also began to serve as the Fund’s CCO. Since April 23, 2007, the CCO’s compensation is reviewed and approved by the Fund’s Board and paid by BB&T AM. However, the Fund reimburses BB&T AM for its allocable portion of the CCO’s salary. As a result, the CCO fee paid by the Fund is only part of the total compensation received by the CCO. Prior to April 23, 2007, under a Compliance Services Agreement between the Fund and Citi (the “CCO Agreement”), Citi made an employee available to serve as the Fund’s CCO. For the services provided under the CCO Agreement, the Fund paid Citi $560 for the year ended December 31, 2007 plus certain out of pocket expenses. Expenses incurred are reflected on the Statement of Operations as “Compliance service fees”.

Effective April 23, 2007, BB&T AM Distributors, Inc. (the “Distributor”) serves as the Fund’s distributor pursuant to an Underwriting Agreement. Prior to April 23, 2007, BB&T Funds Distributor, Inc. (“BBTFDI”) served as distributor to the Fund. BBTFDI and the Distributor contractually agreed to waive 0.25% of the Class A shares distribution fees throughout the year. Distribution fees totaling $208,851 were waived for the year ended December 31, 2007. Distribution fee waivers are included in the Statement of Operations as “Less expenses waived by the Distributor”, and these waivers are not subject to recoupment in subsequent fiscal periods.

The Fund has adopted a Distribution and Shareholder Services Plan (the “Plan”) in accordance with Rule 12b-1 under the 1940 Act. The Plan provides for payments to the distributor of up to 0.50%, 1.00% and 1.00% of the average daily net assets of the Fund for Class A Shares, Class B Shares and Class C Shares, respectively. The fees may be used by the Distributors to pay banks, broker dealers and other institutions, including affiliates of the advisor. The Distributor, is entitled to receive commissions on sales of shares of the Fund. For the year ended December 31, 2007, BBTFDI and the Distributor received $13,510 and $575, respectively, from commissions earned on sold shares of the Fund. Commissions paid to affiliated broker-dealers during the year ended December 31, 2007 were $14,138.

The Adviser and/or its affiliates may pay out of their own assets compensation to broker-dealers and other persons for the sale and distribution of the shares and/or for the servicing of the shares. These are additional payments over and above the sales charge (including Rule 12b-1 fees) and service fees paid by the Fund. The payments, which may be different for different financial institutions, will not change the price an investor will pay for shares or the amount that a Fund will receive for the sale of the shares.

Certain Officers and Trustees of the Trust are affiliated with the Adviser, the administrator, or the sub-administrator. Such Officers and Trustees receive no compensation from the Trust for serving in their respective roles. Each of the five Trustees who are non-interested persons (as defined in the 1940 Act) of the Trust serve on both the Board and the Audit Committee and are compensated $6,000 per quarter and $2,400 for each regularly scheduled meeting, plus reimbursement for certain expenses. Additionally, the Chairman of the Board and Audit Committee Chairman receive an annual retainer of $6,000 and $10,000, respectively. During the year ended December 31, 2007, $5,948 of Trustee compensation was allocated to the Fund.

In September 2006, the FASB released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in

Continued

13

BB&T FUNDS

Equity Index Fund

Notes to the Financial Statements, Continued

December 31, 2007

the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required no later than the last business day of the first financial statement reporting period for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. As of December 31, 2007, management has completed their analysis and has determined that the adoption of FIN 48 will not have an impact on the financial statements.

At December 31, 2007, the Fund’s most recent fiscal year end, the Fund has net capital loss carryforwards available to offset future net capital gains, if any, to the extent provided by the Treasury regulations. To the extent that these carryforwards are used to offset future capital gains, it is probable that the gains that are offset will not be distributed to shareholders.

| | | |

| Amount | | Expires |

| $ | 197,809 | | 2009 |

| | 3,648,463 | | 2010 |

| | 715,833 | | 2011 |

| | 175,416 | | 2012 |

| | 519,736 | | 2013 |

| | 612,669 | | 2014 |

| | | | |

| $ | 5,869,926 | | |

| | | | |

Capital loss carryforwards utilized in the current fiscal year were $553,221.

Under current tax law, capital losses realized after October 31 of a Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year tax purposes. The Fund had $7,365 of deferred post-October capital losses, which will be treated as arising on the first business day of the fiscal year ending December 31, 2008.

The tax character of distributions paid to shareholders of the Fund during the most recent fiscal year ended December 31, 2007, were as follows:

| | | | | | |

Distributions paid from: | | |

Ordinary

Income | | Total Taxable

Distributions | | Total

Distributions

Paid* |

| $1,734,513 | | $ | 1,734,513 | | $ | 1,734,513 |

The tax character of distributions paid to shareholders of the Fund during the fiscal year ended December 31, 2006, were as follows:

| | | | | | |

Distributions paid from: | | |

Ordinary

Income | | Total Taxable

Distributions | | Total

Distributions

Paid* |

| $1,903,635 | | $ | 1,903,635 | | $ | 1,903,635 |

* Total Distributions paid may differ from the Statement of Changes in Net Assets due to differences in the tax rules governing the timing of recognition.

At December 31, 2007, the components of accumulated earnings (deficit) on a tax basis were as follows:

| | | | | | | | | | | | |

Distributions

Payable | | | Accumulated

Capital and

Other Losses | | | Unrealized

Appreciation | | Total

Accumulated

Earnings |

| $ | (9,503 | ) | | $ | (5,877,291 | ) | | $ | 30,930,771 | | $ | 25,043,977 |

Continued

14

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

BB&T Funds:

We have audited the accompanying statements of assets and liabilities of the BB&T Equity Index Fund (the Fund), a series of the BB&T Funds, including the schedule of portfolio investments, as of December 31, 2007, and the related statement of operations for the year then ended, the statements of changes in net assets for each period in the two-year period then ended, and the financial highlights for each period in the five-year periods then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of the fund’s investment at December 31, 2007, by correspondence with the master portfolio’s fund accounting agent. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the periods in the two-year period then ended, and the financial highlights for each of the periods in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

February 27, 2008

15

BB&T FUNDS

Equity Index Fund

Other Information

December 31, 2007

| Other | Federal Income Tax Information (Unaudited): |

For the year ended December 31, 2007, certain dividends paid by the Fund may be subject to a maximum tax rate of 15% as provided for by the Jobs and Growth Tax Reconciliation Act of 2003. The Fund intends to designate the maximum amount allowable as taxed at a maximum rate of 15%. Complete information will be reported in conjunction with your 2007 Form 1099-DIV.

For the fiscal year ended December 31, 2007, 100% of the ordinary income distributions paid by the Fund were considered qualified dividend income.

For the fiscal year ended December 31, 2007, 5.91% of the total ordinary income distributions paid by the Fund were considered qualified interest income.

For corporate shareholders, 100% of the total ordinary income distributions paid during the fiscal year ended December 31, 2007 qualify for the corporate dividends received deduction.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 1-800-228-1872 and (ii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30th is available (i) without charge, upon request, by calling 1-800-228-1872 and (ii) on the Commission’s website at http://www.sec.gov.

The Fund files complete Schedules of Portfolio Holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available without charge on the Commission’s website at http://www.sec.gov, or may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

16

Board Consideration of Advisory and Sub-Advisory Agreements

(Unaudited)

The Board of Trustees, at a meeting held on August 28, 2007, formally considered the continuance of the Trust’s investment advisory agreement (the “Advisory Agreement”) with BB&T Asset Management, Inc. (“BB&T AM” or the “Adviser”) with respect to the Equity Index Fund of the Trust (the “Fund”).

The Trustees reviewed extensive material in connection with their consideration of the Advisory Agreement, including data from an independent provider of mutual fund data (as assembled by the Fund’s administrator), which included comparisons with industry averages for comparable funds for advisory fees, Rule 12b-1 fees, and total fund expenses. The data reflected BB&T AM fee waivers in place, as well as BB&T AM’s contractual investment advisory fee levels. The Board was assisted in its review by independent legal counsel, who provided a memorandum detailing the legal standards for review of the Advisory Agreement. The Board received a detailed presentation by BB&T AM, which included an analysis of performance and investment process. The Board also received profitability information from the Adviser. The Board also deliberated outside the presence of management and the Advisers.

In their deliberations, each Trustee attributed different weights to various factors involved in an analysis of the Advisory Agreement, and no factor alone was considered determinative. The Trustees determined that the overall arrangements between the Trust and the Adviser, as provided in the Advisory Agreement, were fair and reasonable and that the continuance of the Advisory Agreement was in the best interests of the Fund and its shareholders.

The matters addressed below were considered and discussed by the Trustees in reaching their conclusions.

Nature, Extent and Quality of Services Provided by the Adviser

The Trustees received and considered information regarding the nature, extent, and quality of the services provided to the Fund under the Advisory Agreement. The Trustees took into account information furnished throughout the year at Trustee meetings, as well as materials furnished specifically in connection with the annual review process. The Trustees considered the background and experience of the Adviser’s senior management and the expertise of investment personnel responsible for the day-to-day oversight of the Fund. The Trustees considered the overall reputation, and the capabilities and commitment of the Adviser to provide high-quality service to the Trust, and the Trustees’ overall confidence in the Adviser’s integrity.

The Trustees received information concerning the investment philosophy and investment processes applied by the Adviser in managing the Fund as well as the Adviser’s Form ADV. The Trustees also considered information regarding regulatory compliance and compliance with the investment policies of the Fund. The Trustees evaluated the procedures of the Adviser designed to fulfill the Adviser’s fiduciary duty to the Fund with respect to possible conflicts of interest, including the Adviser’s code of ethics (regulating the personal trading of its officers and employees).

Based on their review, the Trustees concluded that, with respect to the quality and nature of services to be provided by the Adviser, the scope of responsibilities was consistent with mutual fund industry norms, and that the quality of the services was very satisfactory.

Investment Performance

The Trustees considered performance results of the Fund relative to both its benchmark index and its peer group. It was noted that, on a year-to-date basis, the Fund had achieved its investment goal of closely tracking the performance of the S&P 500 Index.

After reviewing the Fund’s performance, and taking into consideration the management style, investment strategies, and prevailing market conditions during the prior year and for longer periods, the Trustees concluded that the performance of the Fund was generally strong.

Cost of Services, Including the Profits Realized by the Advisers and Affiliates

The Trustees considered peer group comparable information with respect to the advisory fees charged by BB&T AM, taking into consideration both contractual and actual (i.e., after waiver) fee levels. The Trustees particularly noted that the Adviser was not currently charging an advisory fee since Fund assets were invested entirely in an underlying portfolio. The Trustees concluded that the investment advisory fee was acceptable as compared to peer groups.

Continued

17

Board Consideration of Advisory and Sub-Advisory Agreements, Continued

(Unaudited)

As part of their review, the Trustees considered benefits to the Adviser aside from investment advisory fees. The Trustees reviewed administration fees received by BB&T AM and considered the fallout benefits to BB&T AM.

Consideration of the reasonableness of advisory fees also took into account, where relevant, the profitability of the Adviser. The Trustees reviewed profitability information provided by the Adviser with respect to investment advisory services. With respect to such information, the Trustees recognized that such profitability data was generally unaudited and represented an Adviser’s own determination of its and its affiliates’ revenues from the contractual services provided to the Fund, less expenses of providing such services. Expenses include direct and indirect costs and were calculated using an allocation methodology developed by the Adviser. The Trustees also recognized that it is difficult to make comparisons of profitability from fund investment advisory contracts, because comparative information is not generally publicly available and is affected by numerous factors. Based on their review, the Trustees concluded that the profitability to BB&T AM and its affiliates as a result of their relationships with the Fund was acceptable. The Board also concluded that the fees under the Advisory Agreement were fair and reasonable, in light of the services and benefits provided to the Fund.

Economies of Scale

The Trustees also considered whether fee levels reflect economies of scale and whether economies of scale would be produced by the growth of the Fund’s assets. Given that no investment advisory fee was currently being charged by BB&T AM, the Trustees determined that the growth of the Fund would not result in greater economies of scale.

18

Information about Trustees and Officers (Unaudited)

The Fund is managed under the direction of the Board of Trustees. Subject to the provisions of the Declaration of Trust, By-laws and Massachusetts law, the Trustees have all powers necessary and convenient to carry out this responsibility, including the election and removal of Fund officers.

The Trustees and officers of the Fund, their ages, the position they hold with the Fund, their term of office and length of time served, a description of their principal occupations during the past five years, the number of portfolios in the fund complex that the Trustee oversees and any other directorships held by the Trustee are listed in the two tables immediately following. The business address of the persons listed below is 434 Fayetteville Street Mall, Raleigh, North Carolina 27601.

INDEPENDENT TRUSTEES

| | | | | | | | | | |

(1) Name and Age | | (2) Position(s) Held With The Funds | | (3) Term of Office and Length of Time Served | | (4) Principal Occupation During the Last 5 Years | | (5)

Number of

Portfolios in Fund

Complex Overseen

by Trustee | | (6)

Other

Directorships

Held by Trustee |

| | | | | |

Thomas W. Lambeth Birthdate: 1/35 | | Trustee Chairman of the Board of Trustees | | Indefinite, 8/92 — Present | | From January 2001 to present, Senior Fellow, Z. Smith Reynolds Foundation; from 1978 to January 2001, Executive Director, Z. Smith Reynolds Foundation. | | 30 | | None |

| | | | | |

Drew T. Kagan Birthdate: 2/48 | | Trustee | | Indefinite, 8/00 — Present | | From December 2003 to present, President and Director, Montecito Advisors, Inc.; from March 1996 to December 2003, President, Investment Affiliate, Inc. | | 30 | | None |

| | | | | |

Laura C. Bingham Birthdate: 11/56 | | Trustee | | Indefinite, 2/01 — Present | | From July 1998 to present, President of Peace College. | | 30 | | None |

| | | | | |

Douglas R. Van Scoy Birthdate: 11/43 | | Trustee | | Indefinite 5/04 — present | | Retired; from November 1974 to July 2001, employee of Smith Barney (investment banking), most recently as the Director of Private Client Group and Senior Executive Vice President | | 30 | | None |

| | | | | |

James L. Roberts Birthdate: 11/42 | | Trustee | | Indefinite 11/04 — present | | Retired; from November 2006 to present, Director, Grand Mountain Bancshares, Inc.; from January 1999 to December 2003, President, CEO and Director, Covest Bancshares, Inc. | | 30 | | None |

INTERESTED TRUSTEE

| | | | | | | | | | |

(1) Name and Age | | (2) Position(s) Held With The Funds | | (3) Term of Office and Length of Time Served | | (4) Principal Occupation During the Last 5 Years | | (5)

Number of

Portfolios in Fund

Complex Overseen

by Trustee | | (6)

Other

Directorships

Held by Trustee |

| | | | | |

*Keith F. Karlawish Birthdate: 8/64 | | Trustee | | Indefinite, 6/06 — Present | | From May 2002 to present, President, BB&T Asset Management, Inc.; from 1996 to 2002, Senior Vice President and Director of Fixed Income, BB&T Asset Management, Inc. | | 30 | | N/A |

| * | Mr. Karlawish is treated by the Funds as an “interested person” (as defined in Section 2(a)(19) of the 1940 Act) of the Funds. Mr. Karlawish is an “interested person” because he owns shares of BB&T Corporation and is the President of BB&T Asset Management, Inc., the Adviser. |

Continued

19

Information about Trustees and Officers (Unaudited)

OFFICERS

| | | | | | | | | | |

(1) Name And Age | | (2) Position(s) Held With The Funds | | (3) Term Of Office And Length Of Time Served | | (4) Principal Occupation During the Last 5 Years | | (5)

Number of

Portfolios

in Fund

Complex

Overseen

by Trustee | | (6)

Other

Directorships

Held by

Trustee |

Keith F. Karlawish Birthdate: 8/64 | | President | | Indefinite, 2/05 — Present | | From May 2002 to present, President, BB&T Asset Management, Inc.; from 1996 to 2002, Senior Vice President and Director of Fixed Income, BB&T Asset Management, Inc. | | N/A | | N/A |

| | | | | |

James T. Gillespie Birthdate: 11/66 | | Vice President, Secretary | | Indefinite, 5/02 — Present, 8/06 —Present | | From February 2005 to present, Vice President and Manager of Mutual Fund Administration, BB&T Asset Management, Inc.; from February 1992 to 2005, employee of BISYS Fund Services | | N/A | | N/A |

| | | | | |

E.G. Purcell, III Birthdate: 1/55 | | Vice President | | Indefinite, 11/00 — Present | | From 1995 to present, Senior Vice President, BB&T Asset Management, Inc. and its predecessors | | N/A | | N/A |

| | | | | |

Todd M. Miller Birthdate: 9/71 | | Vice President | | Indefinite, 8/05 — Present | | From June 2005 to present, Mutual Fund Administrator, BB&T Asset Management, Inc.; from May 2001 to May 2005, Manager, BISYS Fund Services | | N/A | | N/A |

| | | | | |

Diana Hanlin Birthdate: 5/67 | | Vice President | | Indefinite, 8/07 — Present | | From April 2007 to present, Compliance Officer, BB&T Asset Management, Inc.; from May 2004 to March 2007, Director of Compliance, BISYS Fund Services; from October 2000 to May 2004, Senior Compliance Analyst, BISYS Fund Services | | N/A | | N/A |

| | | | | |

Clinton L. Ward Birthdate: 11/69 | | Chief Compliance and Anti-Money Laundering Officer | | Indefinite, 4/07 — Present | | From July 2004 to present, Chief Compliance Officer and Secretary, BB&T Asset Management, Inc.; from January 2002 to July 2004, Compliance Analyst, Wachovia Bank, N.A.; from November 1999 to January 2002, Compliance Manager – Mutual Fund Compliance, Banc of America Capital Management, LLC | | N/A | | N/A |

| | | | | |

Andrew J. McNally Birthdate: 12/70 | | Treasurer | | Indefinite, 4/07 — Present | | From December 2000 to present, Vice President and Senior Director, Fund Accounting and Administration Department, PFPC Inc. | | N/A | | N/A |

| | | | | |

Avery Maher Birthdate: 2/45 | | Assistant Secretary | | Indefinite 4/07 — Present | | From March 2006 to present, Vice President and Counsel, Regulatory Administration Department, PFPC Inc.; from October 2004 to August 2005, Vice President and Assistant General Counsel, JPMorgan Asset Management; from 1992 to 2004, Second Vice President and Assistant Secretary, John Hancock Advisers, LLC | | N/A | | N/A |

The Fund’s Statement of Additional Information includes additional information about the Fund’s Trustees. To receive your copy of the Statement of Additional Information, call toll free 1-800-453-7348.

20

| | |

| S&P 500 Index Master Portfolio | | Schedule of Investments December 31, 2007 |

| | | | | |

| Common Stocks 95.80% | | | | |

Security | | Shares | | Value |

Advertising (0.14%): | | | | | |

Interpublic Group of Companies Inc. (The)(a)(b) | | 101,318 | | $ | 821,689 |

Omnicom Group Inc. | | 71,357 | | | 3,391,598 |

| | | | | |

| | | | | 4,213,287 |

| | | | | |

Aerospace & Defense (2.25%): | | | | | |

Boeing Co. (The) | | 169,302 | | | 14,807,153 |

General Dynamics Corp. | | 87,566 | | | 7,792,498 |

Goodrich Corp. | | 26,892 | | | 1,898,844 |

L-3 Communications Holdings Inc.(b) | | 27,125 | | | 2,873,622 |

Lockheed Martin Corp. | | 74,951 | | | 7,889,342 |

Northrop Grumman Corp. | | 74,138 | | | 5,830,212 |

Raytheon Co.(b) | | 94,337 | | | 5,726,256 |

Rockwell Collins Inc. | | 35,843 | | | 2,579,621 |

United Technologies Corp. | | 214,258 | | | 16,399,307 |

| | | | | |

| | | | | 65,796,855 |

| | | | | |

Agriculture (2.00%): | | | | | |

Altria Group Inc. | | 456,190 | | | 34,478,840 |

Archer-Daniels-Midland Co. | | 138,764 | | | 6,442,813 |

Monsanto Co. | | 117,787 | | | 13,155,630 |

Reynolds American Inc. | | 36,780 | | | 2,426,009 |

UST Inc.(b) | | 34,206 | | | 1,874,489 |

| | | | | |

| | | | | 58,377,781 |

| | | | | |

Airlines (0.07%): | | | | | |

Southwest Airlines Co.(b) | | 165,279 | | | 2,016,404 |

| | | | | |

| | | | | 2,016,404 |

| | | | | |

Apparel (0.37%): | | | | | |

Coach Inc.(a) | | 80,281 | | | 2,454,993 |

Jones Apparel Group Inc. | | 23,176 | | | 370,584 |

Liz Claiborne Inc.(b) | | 21,450 | | | 436,507 |

Nike Inc. Class B(b) | | 83,378 | | | 5,356,203 |

Polo Ralph Lauren Corp.(b) | | 12,742 | | | 787,328 |

VF Corp.(b) | | 19,030 | | | 1,306,600 |

| | | | | |

| | | | | 10,712,215 |

| | | | | |

Auto Manufacturers (0.36%): | | | | | |

Ford Motor Co.(a)(b) | | 452,029 | | | 3,042,153 |

General Motors Corp. | | 121,838 | | | 3,032,548 |

PACCAR Inc.(b) | | 80,339 | | | 4,376,869 |

| | | | | |

| | | | | 10,451,570 |

| | | | | |

Auto Parts & Equipment (0.20%): | | | |

Goodyear Tire & Rubber Co. (The)(a)(b) | | 47,167 | | | 1,331,053 |

Johnson Controls Inc.(b) | | 128,054 | | | 4,615,066 |

| | | | | |

| | | | | 5,946,119 |

| | | | | |

Banks (5.05%): | | | | | |

Bank of America Corp. | | 961,733 | | | 39,681,104 |

Bank of New York Mellon Corp. (The) | | 245,723 | | | 11,981,453 |

BB&T Corp.(b) | | 118,932 | | | 3,647,644 |

Comerica Inc. | | 33,352 | | | 1,451,813 |

Commerce Bancorp Inc. | | 41,275 | | | 1,574,228 |

Discover Financial Services LLC | | 107,447 | | | 1,620,301 |

Fifth Third Bancorp(b) | | 116,567 | | | 2,929,329 |

First Horizon National Corp.(b) | | 26,140 | | | 474,441 |

Huntington Bancshares Inc.(b) | | 78,890 | | | 1,164,416 |

KeyCorp | | 83,864 | | | 1,966,611 |

M&T Bank Corp.(b) | | 16,166 | | | 1,318,661 |

Marshall & Ilsley Corp.(b) | | 57,217 | | | 1,515,106 |

| | | | | |

| Common Stocks, continued | | | | |

Security | | Shares | | Value |

Banks, continued | | | | | |

National City Corp.(b) | | 136,212 | | $ | 2,242,050 |

Northern Trust Corp. | | 41,221 | | | 3,156,704 |

PNC Financial Services Group Inc. (The)(b) | | 74,134 | | | 4,866,897 |

Regions Financial Corp.(b) | | 152,282 | | | 3,601,469 |

State Street Corp. | | 84,153 | | | 6,833,224 |

SunTrust Banks Inc.(b) | | 75,269 | | | 4,703,560 |

Synovus Financial Corp.(b) | | 70,296 | | | 1,692,728 |

U.S. Bancorp (b) | | 372,849 | | | 11,834,227 |

Wachovia Corp.(b) | | 425,986 | | | 16,200,248 |

Wells Fargo & Co. | | 729,199 | | | 22,014,518 |

Zions Bancorporation(b) | | 23,135 | | | 1,080,173 |

| | | | | |

| | | | | 147,550,905 |

| | | | | |

Beverages (2.33%): | | | | | |

Anheuser-Busch Companies Inc. | | 161,796 | | | 8,468,403 |

Brown-Forman Corp. Class B | | 18,568 | | | 1,376,074 |

Coca-Cola Co. (The) | | 429,992 | | | 26,388,609 |

Coca-Cola Enterprises Inc. | | 61,213 | | | 1,593,374 |

Constellation Brands Inc. Class A(a)(b) | | 43,465 | | | 1,027,513 |

Molson Coors Brewing Co. Class B | | 29,267 | | | 1,510,763 |

Pepsi Bottling Group Inc. | | 30,076 | | | 1,186,799 |

PepsiCo Inc. | | 349,188 | | | 26,503,369 |

| | | | | |

| | | | | 68,054,904 |

| | | | | |

Biotechnology (0.80%): | | | | | |

Amgen Inc.(a) | | 234,720 | | | 10,900,397 |

Biogen Idec Inc.(a) | | 62,055 | | | 3,532,171 |

Celgene Corp.(a) | | 82,531 | | | 3,813,758 |