UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-06719

BB&T Funds

(Exact name of registrant as specified in charter)

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Address of principal executive offices) (Zip code)

E.G. Purcell, III, President

BB&T Funds

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

BB&T Funds

Notice of Privacy Policy & Practices

BB&T Funds recognizes and respects the privacy expectations of our customers.1 We provide this notice to you so that you will know what kinds of information we collect about our customers and the circumstances in which that information may be disclosed to third parties who are not affiliated with the BB&T Funds.

Collection of Customer Information

We collect nonpublic personal information about our customers from the following sources:

| • | | Account Applications and other forms, which may include a customer’s name, address, social security number, and information about a customer’s investment goals and risk tolerance; |

| • | | Account History, including information about the transactions and balances in a customer’s accounts; and |

| • | | Correspondence, written, telephonic or electronic between a customer and the BB&T Funds or service providers to the BB&T Funds. |

Disclosure of Customer Information

We many disclose all of the consumer information outlined above to third parties who are not affiliated with the BB&T Funds:

| • | | as permitted by law — for example with service providers who maintain or service shareholder accounts for the BB&T Funds or to a shareholder’s broker or agent; and |

| • | | to perform marketing services on our behalf or pursuant to a joint marketing agreement with another financial institutional. |

Security of Customer Information

We require service providers to the BB&T Funds:

| • | | to maintain policies and procedures designed to assure only appropriate access to, and use of information about customers of the BB&T Funds; and |

| • | | to maintain physical, electronic and procedural safeguards that comply with applicable legal standards to guard nonpublic personal information of customers of the BB&T Funds. |

We will adhere to the policies and practices described in this notice regardless of whether you are a current or former customer of the BB&T Funds.

1 For purposes of this notice, the terms “customer” or “customers” includes both individual shareholders of the BB&T Funds and individuals who provide nonpublic personal information to the BB&T Funds, but do not invest in BB&T Funds shares.

Table of Contents

Letter from the President and the Investment Advisor

Dear Shareholders:

We are pleased to present this annual report for the 12-month period ended September 30, 2009. The economy suffered through a severe recession during this fiscal year, but during the second half of the period a number of leading economic indicators improved, suggesting that the economy may have begun to mend. In fact, just-released for third quarter of 2009, GDP was 3.5%. Financial markets exhibited tremendous volatility. Stocks generated losses for the period, while bonds posted strong gains. During the 12-month period ended September 30, 2009, the S&P 500 returned -6.91%; the Russell 2000 Index returned -9.55%; the MSCI All CountryWorld Index Ex-U.S. returned 2.75%; and the Barclays Capital U.S. Aggregate Bond Index returned 10.56%.

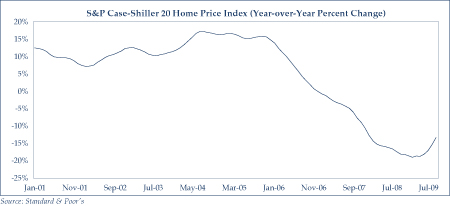

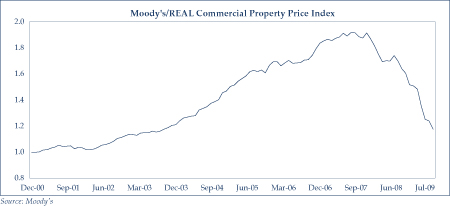

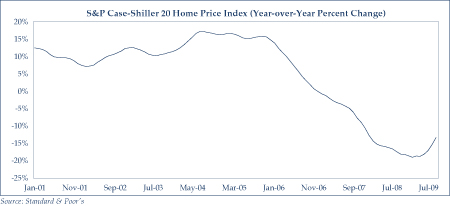

A challenging economic environment

The U.S. economy faced a number of challenges during the period, from a steady rise in unemployment to weak business and consumer spending and a steep wave of home foreclosures. These issues were compounded by continued fallout from the financial crisis and the high-profile bailouts of large portions of the auto and banking industries. In hopes of boosting liquidity and jumpstarting the economy, the Federal Reserve early in the period lowered its target federal funds rate from 2.00% to a range between 0% and 0.25%.

The economy began to stabilize mid-way through the period. Consumer spending started to rise from very low levels, aided by affordable gas prices, large tax refunds and lower payroll taxes. Nevertheless, the strength and sustainability of the recovery remained uncertain as the period ended.

Stocks fall, then rebound

Equities posted large losses in the first several months of the period, as investors displayed extreme aversion to risk. The market then rallied off its March 9th low point, as credit markets improved and the economy proved more resilient than many investors expected. Information technology stocks led the market for the fiscal year, while the worst-performing sector was financial services.

Foreign stocks fell farther than U.S. stocks early in the period as investors fled assets perceived to be risky, but then recovered more quickly and posted only a slight loss for the period as a whole.

Investors flee to bonds

The financial crisis early in the period drove investors to the relative safety of Treasury securities and other bonds backed by the U.S. government. As investors sought out Treasuries, they virtually ignored higher-risk fixed-income securities such as corporate bonds. That trend, started in the first quarter of 2009, reversed itself as the financial system recovered during the second half of the period. The shift led to strong performance among riskier securities, such as high-yield bonds, and relatively weak performance from Treasury securities. Ultimately, higher-risk holdings generated stronger returns for the period as a whole.

Our perspective

We expect the U.S. economy to grow in the coming months, although long-term growth likely will be

below historical averages due to the combined effects of deleveraging, higher taxes, increased regulation and the continued aftermath of the housing crisis. We believe that consumer spending is likely to remain weak, making higher export levels, as well as government and business spending, imperative to the recovery. We believe that foreign economies are likely to recover more quickly than the United States.

In our view, subdued inflation and the Fed’s extremely accommodative monetary policy remain encouraging for stocks. We expect equities to outperform fixed income as the economy improves in the coming months.

Thank you for your confidence in the BB&T Funds. We encourage you to call us at 1-800-228-1872 with any questions.

|

| Sincerely, |

|

|

| E.G. Purcell, III |

| President |

| BB&T Funds |

|

|

| Jeffrey J. Schappe, CFA |

| Chief Investment Officer |

| BB&T Asset Management, Inc. |

Past performance does not guarantee future results.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. BB&T Asset Management, Inc., a wholly owned subsidiary of BB&T Corporation, serves as investment adviser to the BB&T Funds and is paid a fee for its services. Shares of the BB&T Funds (each a “Fund” and collectively, the “Funds”) are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by BB&T AM Distributors, Inc. (the “Distributor”). The Distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. BB&T Asset Management, Inc. does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or offering individual or personalized investment advice.

BB&T Large Cap Fund

Portfolio Manager

Ronald T. Rimkus, CFA

The BB&T Large Cap Fund is managed by Ronald T. Rimkus, a chartered financial analyst and Director of Core Equity at BB&T Asset Management, Inc. Mr. Rimkus has more than 16 years of investment experience, including hands-on management of both growth and value equity portfolios. Most recently, he spent seven years overseeing large-company core equity portfolios. Mr. Rimkus holds a BA from Brown University and an MBA from UCLA. He is supported by the BB&T Large Cap Core Equity Portfolio Management Team.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund returned -9.40% (Institutional Shares). That compared to a -6.91% return for its benchmark, the S&P 500 Index.

Q. What factors affected the Fund’s performance?

A. The 12-month period ended September 30, 2009 was an historic period in the markets, punctuated by two distinct sub-periods. In the first half of the fiscal year, investors largely shunned perceived investment risk, which led to widespread losses in the equity markets. Certain areas such as shares of financial firms were especially hard hit during the financial crisis in late 2008 and early 2009. However, as the financial markets began to improve in the early months of 2009, investors moved back into the equity markets, fueling a sharp rally among equities in the last half of the period.1

The rally benefited low-quality stocks, including a wide variety of companies that were on the brink of bankruptcy in March. These stocks benefited from improvements in the credit markets, and rallied much more strongly than higher-quality issues in the latter half of the period.1

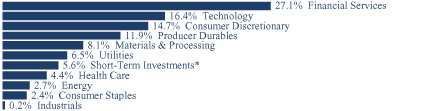

Sector selection was a main contributor to the Fund’s performance relative to its benchmark. At the start of the fiscal year, the Fund held an overweight in the consumer staples sector and an underweight in energy

and industrials. That positioning helped buoy performance during the worst of the financial crisis. But the Fund’s relative performance suffered when commodities, including energy, performed well in early 2009 prior to the improvement in the credit markets. Once we believed that the recovery in the financial markets was sustainable, we began increasing the Fund’s industrial, commodity and non-dollar exposure. That strategy, however, dragged on the Fund’s returns between March and June. By July, the Fund’s positioning and performance were much more in line with the economic rebound, and our positioning reflects this today.1

Moreover, the Fund during the second half of the period held overweight positions in financial, energy, industrial and material stocks. We believe that a global economic rebound will benefit such holdings, but those overweight positions detracted slightly from relative performance during recent months.1

The Fund generally benefited from its stock selections, which focused on undervalued shares of companies with sustainable competitive advantages, good management and strong returns on invested capital. That said, certain names in the financial sector contributed negatively to overall performance as that sector performed poorly in the wake of the troubles in the financial markets.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Years | | 10 Years |

Class A Shares* | | 10/9/92 | | -14.86% | | -2.40% | | -0.10% |

Class B Shares** | | 1/1/96 | | -13.87% | | -2.10% | | -0.11% |

Class C Shares*** | | 2/1/011 | | -10.43% | | -1.99% | | -0.17% |

Institutional Shares | | 10/9/92 | | -9.40% | | -0.98% | | 0.75% |

S&P 500 Index | | N/A | | -6.91% | | 1.02% | | -0.15% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

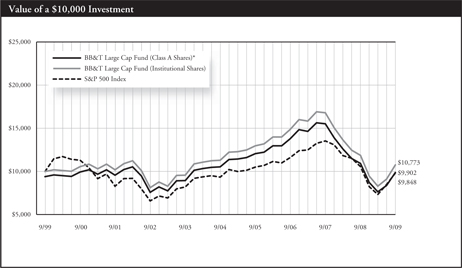

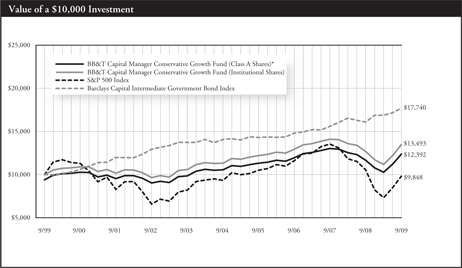

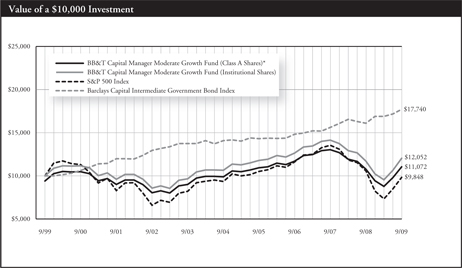

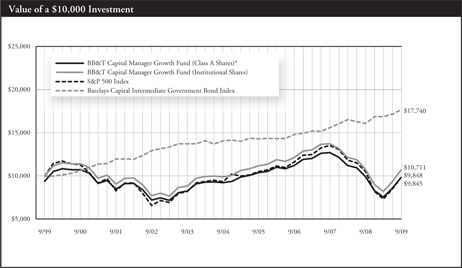

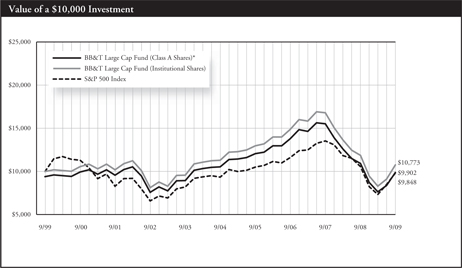

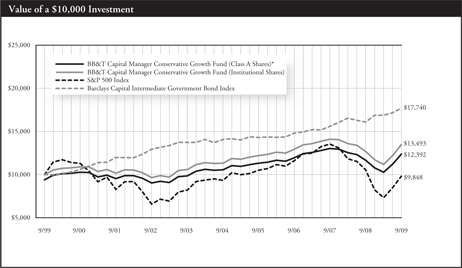

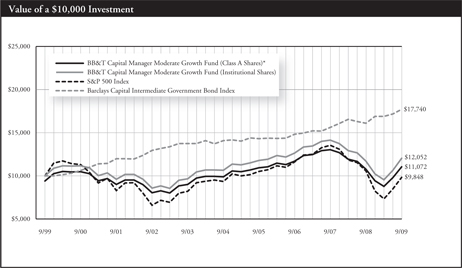

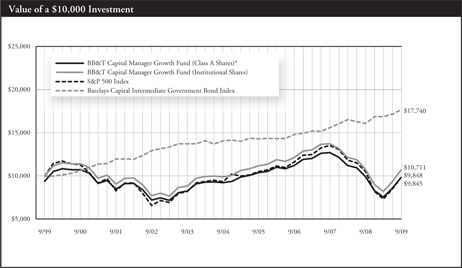

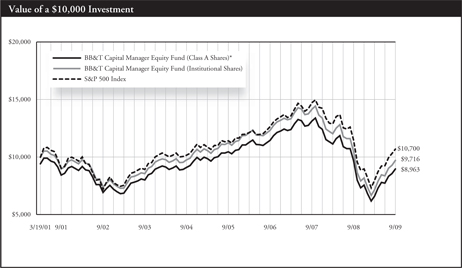

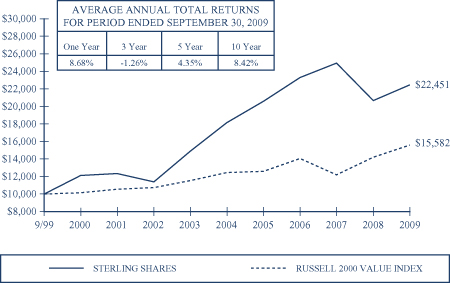

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares, but does not include the Class C Shares 12b-1 fees, which, if reflected, would have caused performance to be lower. |

The S&P 500 Index is generally considered to be representative of the performance of the stock market as a whole. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

BB&T Mid Cap Value Fund

Portfolio Manager

Timothy P. Beyer, CFA

The BB&T Mid Cap Value Fund is managed by Timothy P. Beyer, CFA, portfolio manager for Sterling Capital Management LLC (“Sterling”), sub-adviser to the Fund. Mr. Beyer, who joined Sterling in 2004, is a graduate of East Carolina University, where he received his BSBA in Finance, and has 20 years of investment management experience. Mr. Beyer is supported by Eduardo Brea, CFA; Robert Bridges, CFA; Lee D. Houser, CFA; Patrick W. Rau, CFA; and Brian Walton, CFA.

Investment Concerns

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund posted a return of 3.21% (Institutional Shares). That compared to a -7.12% return for its benchmark, the Russell Midcap® Value Index.

Q. What factors affected the Fund’s performance?

A. Financial markets experienced a drop of historic proportions in the first half of the fiscal year. While the general market decline affected the Fund’s performance, we were able to produce a positive return for our fiscal year. In particular, our technology and consumer cyclical stocks produced notable gains as the economic environment improved in the second half of the year.1

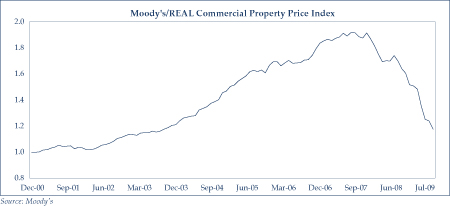

While we didn’t completely avoid problems in the financial services sector, we had relatively low exposure to the banking industry. At fiscal year end, we owned only two bank stocks, and had very little exposure to real estate investment trusts. The outperformance of our financial stocks significantly boosted the Fund’s performance relative to the benchmark index, which was weighed down by the credit crisis and declining property values.1

The Fund’s health care holdings reduced returns relative to the benchmark, as concerns about potential health care reform weighed on these shares’ performance. However, we continued to believe that the stocks’ valuations are attractive, even under bearish reform scenarios.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Years | | 10 Years |

Class A Shares* | | 8/1/961 | | -2.69% | | 3.87% | | 5.18% |

Class B Shares** | | 7/25/011 | | -1.83% | | 4.15% | | 5.13% |

Class C Shares*** | | 7/25/011 | | 2.08% | | 4.25% | | 5.09% |

Institutional Shares | | 8/1/961 | | 3.21% | | 5.30% | | 6.04% |

Russell Midcap® Value Index | | N/A | | -7.12% | | 3.53% | | 7.43% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

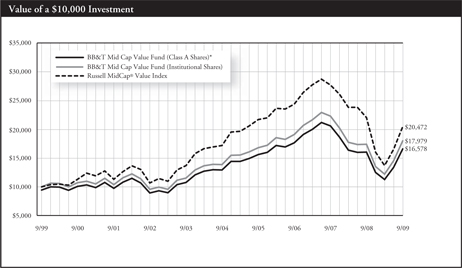

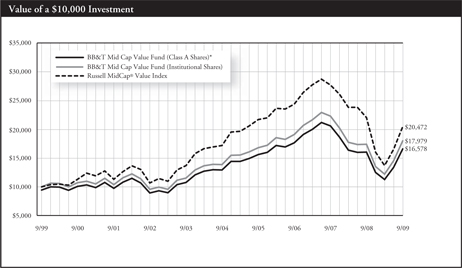

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Performance shown for Class A and Institutional Shares includes the performance of the OVB Equity Income Portfolio for the periods prior to its consolidation with the BB&T Mid Cap Value Fund on 7/23/01. The performance shown reflects reinvestment of all dividend and capital gains distributions. Class B and C Shares were not in existence prior to 7/25/01. Performance for periods prior to 7/25/01 is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class B and C Shares, respectively, but such performance does not reflect Class B and C Shares’ 12b-1 fees and expenses. Those adjustments would have caused the Funds’s total return to be lower. |

The Fund is measured against the Russell Midcap® Value Index, an unmanaged index which measures the performance of those securities in the Russell 1000 with lower price-to-book ratios or lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If fees had not been waived, the Fund’s total return for the periods would have been lower.

BB&T Mid Cap Growth Fund

Portfolio Manager

David P. Nolan

The BB&T Mid Cap Growth Fund is managed by David P. Nolan. A graduate of Wake Forest University, where he received a BS in Business, Mr. Nolan managed common and collective trust funds from 1985 to 1993 and has managed the Mid Cap Growth Fund since its inception in 1993.

Investment Concerns

Mid-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund returned -15.04% (Institutional Shares). That compared to a -0.40% return for its benchmark, the Russell Midcap® Growth Index.

Q. What factors affected the Fund’s performance?

A. Medium-sized growth stocks were extremely volatile during the period under review, contributing to the Fund’s negative returns. Poor returns from the high-growth, high price-to-earnings multiple firms in which the Fund invested contributed to much of the Fund’s underperformance.1

The Fund generally holds stocks of firms that the portfolio manager determines have higher projected growth rates than the benchmark index average. As the financial crisis deepened, investors lost confidence in the potential growth of such firms. In addition, the market recovery

that began March 10, 2009, was led by low-growth firms, which the Fund tends to avoid. As a result, the Fund did not fully participate in the market’s rally.1

Stock selection in industrials, health care and technology also dragged on returns during the period under review. Detractors to performance included a global semiconductor firm, a provider of detention and corrections services operating in the United States and a global provider of mining equipment.1

Top contributors to performance included a Canadian coal mining and copper producing company, a global copper and gold producer, and a digital entertainment technology firm. Stock selection in consumer staples and energy also contributed to the Fund’s performance relative to its benchmark index. The Fund’s overweight position in health care also boosted its performance relative to the benchmark.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | |

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | | 1 Year | | 5 Years | | 10 Years |

Class A Shares* | | 12/30/93 | 1 | | -20.06% | | -0.05% | | -0.85% |

Class B Shares** | | 7/25/01 | 1 | | -19.03% | | 0.24% | | -0.85% |

Class C Shares*** | | 7/25/01 | 1 | | -15.85% | | 0.40% | | -0.86% |

Institutional Shares | | 12/1/93 | 1 | | -15.04% | | 1.38% | | -0.02% |

Russell Midcap® Growth Index | | N/A | | | -0.40% | | 3.75% | | 2.18% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

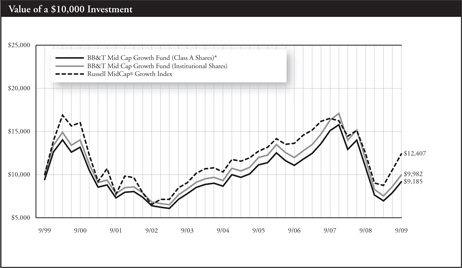

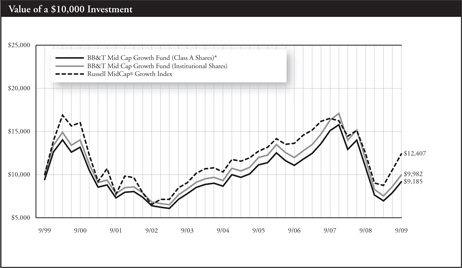

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Fund performance as shown for Class A and Institutional Shares includes the performance of the OVB Capital Appreciation Portfolio for the periods prior to its consolidation with the BB&T Mid Cap Growth Fund on 7/23/01. The performance shown reflects reinvestment of all dividend and capital gains distributions. The Class B and C Shares were not in existence prior to 7/25/01. Performance for periods prior to 7/25/01 is based on the historical performance of the Class A Shares and has been adjusted for the maximum CDSC applicable to Class B and C Shares, respectively, but such performance does not reflect Class B and C Shares’ 12b-1 fees and expenses. Those adjustments would have caused the Fund’s total return to be lower. |

The Fund is measured against the Russell Midcap® Growth Index, an unmanaged index which measures the performance of those securities in the Russell 1000® Index with higher price-to-book ratios and lower forecasted growth values. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total returns for the periods would have been lower.

BB&T Small Cap Fund

Portfolio Manager

David P. Nolan

The BB&T Small Cap Fund is managed by David P. Nolan. A graduate of Wake Forest University, where he received a BS in Business, Mr. Nolan managed common and collective trust funds from 1985 to 1993. He is supported by the BB&T Small Cap Portfolio Management Team, which includes Brian Baker.

Investment Concerns

Small-capitalization funds typically carry additional risks since smaller companies generally have a higher risk of failure, and historically, their stocks have experienced a greater degree of market volatility than stocks on average.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

Diversification does not guarantee a profit nor protect against a loss.

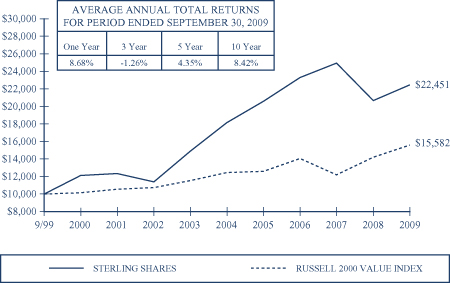

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund returned -19.70% (Institutional Shares). That compared to a -9.55% return for its benchmark, the Russell 2000® Index of small-cap stocks.

Q. What factors affected the Fund’s performance?

A. The generally poor environment for small-cap stocks contributed to the Fund’s negative returns during the period. In addition, the Fund’s long-term commitment to shares of high-quality companies in the small cap sector played a key role in determining its relative returns.1

The Fund typically invests in shares of companies the portfolio manager believes are financially stable with strong fundamentals and solid defensive characteristics. Such stocks helped the portfolio to outperform the benchmark index by almost two percentage points for the first six months of the fiscal year, when the market declined sharply. But shares

of companies the portfolio manager believes are less financially stable led the market rally that occurred during the second half of the fiscal year. As a result, the Fund trailed the benchmark by a wide margin.1

Some individual stock selections suffered significant declines due to industry-wide or company-specific problems. They included stocks of a global semiconductor firm, a small oil firm and a health care services firm.1

Some stock selections boosted the Fund’s relative performance. They included shares of a digital entertainment technology firm, a marine infrastructure services company and a provider of information technology services. Stock selection in consumer staples also contributed to the Fund’s performance relative to its benchmark. And the Fund’s overweight positions in health care and technology helped bolster its performance, as did its underweight position in financials.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Year | | Since

Inception |

Class A Shares* | | 5/19/03 | | -24.50% | | -3.32% | | 3.09% |

Class B Shares** | | 5/19/03 | | -23.71% | | -3.02% | | 3.26% |

Class C Shares*** | | 5/19/03 | | -20.57% | | -2.91% | | 3.24% |

Institutional Shares | | 5/19/03 | | -19.70% | | -1.90% | | 4.30% |

Russell 2000® Index | | 5/31/03 | | -9.55% | | 2.41% | | 6.45% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

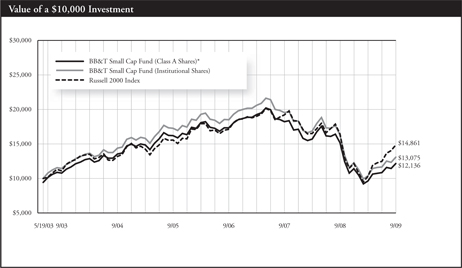

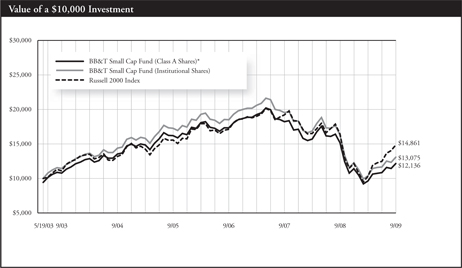

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Russell 2000® Index is a widely recognized index of common stocks that measures the performance of small- to mid-sized companies. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

BB&T International Equity Fund

Portfolio Managers

Rudolph-Riad Younes, CFA

Richard Pell

The BB&T International Equity Fund is managed by Rudolph-Riad Younes, CFA, Director and Head of International Equity at Artio Global Management LLC (“Artio Global”) (previously known as Julius Baer Investment Management LLC ), subadvisor to the Fund, since August 2000, and with the predecessor organization Julius Baer Group since September 1993, and Richard Pell, Chairman, Chief Executive Officer and Chief Investment Officer with Artio Global since August 2000, and with the predecessor organization Julius Baer Group since January 1995.

Investment Concerns

There are risks associated with investing in foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency and exchange rates.

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund returned -3.42% (Institutional Shares). That compared to a 2.75% return for its benchmark, the MSCI All Country World Index Ex-U.S(net).

Q. What factors affected the Fund’s performance?

A. The portfolio’s absolute return was negatively affected by the decline in the global equity markets, a seizure of the credit markets, and the general negative economic outlook during the period of October 1, 2008 through March 9, 2009. The portfolio and equity markets recovered in a rally that began in the U.S. financial sector at the beginning of March 2009 and has continued through the end of September. This rally quickly expanded to other sectors as investors’ appetite for risk, which had been constrained, increased substantially. Parts of the market that had been areas for concern, such as financial companies and emerging markets, performed well as risk aversion retreated.1

Prior to the market rally in March, the portfolio benefited from a defensive sector posture in sectors such as consumer staples, healthcare, telecommunications and utilities. Underweight allocations to higher-risk areas such as consumer discretionary stocks and emerging markets boosted relative performance during this time. Additionally, higher-than average cash levels over this time frame mitigated some of the downward influence of the global stock markets. Defensive hedges, particularly hedges into the yen, also added to relative performance, as did an underweight position in the Japanese equity market. Following the market reversal, an overweight stake in the materials sector and stock selection within the sector boosted relative performance.1

Three primary factors drove the portfolio’s relative underperformance for the fiscal year as a whole: an underweight to emerging markets, an underweight to global financials, and a bias toward higher-quality companies. The majority of the relative underperformance occurred within an eight-week timeframe following the market reversal in March — prior to that point, relative performance benefited from these positions.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

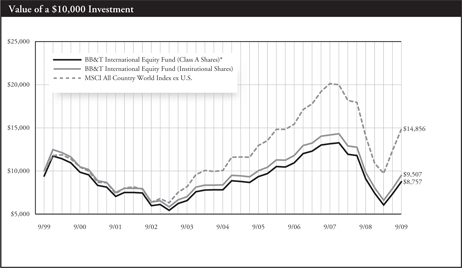

| Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Years | | 10 Years |

Class A Shares* | | 1/2/97 | | -9.25% | | 1.04% | | -1.32% |

Class B Shares** | | 1/2/97 | | -8.14% | | 1.39% | | -1.34% |

Class C Shares*** | | 2/1/011 | | -4.66% | | 1.46% | | -1.49% |

Institutional Shares | | 1/2/97 | | -3.42% | | 2.51% | | -0.50% |

MSCI All Country World Index Ex-U.S.(net) | | 12/31/96 | | 2.75% | | 5.42% | | 1.81% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

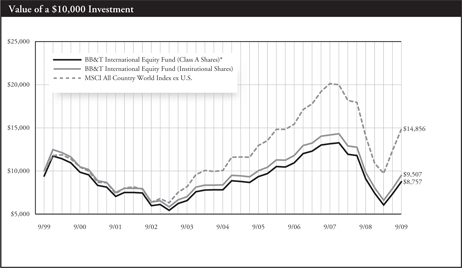

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class B Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares. |

The MSCI All Country World Index Ex-U.S. Index(net) is a unmanaged market capitalization-weighted index that is designed to represent the performance of equity markets in the global developed and emerging markets, excluding the United States. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

BB&T Special Opportunities Equity Fund

Portfolio Manager

George F. Shipp, CFA

The BB&T Special Opportunities Equity Fund is managed by George F. Shipp, CFA, chief investment officer of Scott & Stringfellow, LLC (���Scott & Stringfellow”), subadvisor to the Fund. Mr. Shipp, who joined Scott & Stringfellow in 1982, holds a BA from the University of Virginia and an MBA from the Darden Graduate School of Business at the University of Virginia. Mr. Shipp is supported by an investment management team from Scott & Stringfellow, which includes Meghann A. Cohen; Joshua L. Haggarty, CFA; R. Griffith Jones, Jr.; and Farley C. Shiner, CPA. The team brings to the Fund more than four decades of combined investment management experience, along with a broad range of investing skills.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. A concentrated portfolio may add a measure of volatility to performance, as major fluctuations in any one holding will likely affect the fund more than a fund with greater diversification.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund returned 1.91% (Institutional Shares). That compared to a -6.91.% return for its benchmark, the S&P 500 Index.

Q. What factors affected the Fund’s performance?

A. Stocks as measured by the S&P 500 generated losses for the fiscal year due to investors’ concerns about the global economic slowdown, as well as the collapse of credit markets and the ensuing financial panic. While the Fund was not immune to these factors, it produced a modest positive return for the period under review.1

The Fund’s return relative to its benchmark index benefited from sector selection. Information technology and healthcare firms were both among the benchmark index’s three best-performing sectors. The Fund’s overweight positions in these sectors improved performance relative to the index. The Fund’s underweight position in financials also boosted relative performance.1

Meanwhile, a leading provider of cable TV and Internet services, a defense contractor, and a global oil and gas exploration company weighed on returns relative to the benchmark index. Certain characteristics of these firms — underlying earnings and/or long-term asset values — grew during the period, leading us to increase our positions when prices were low.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

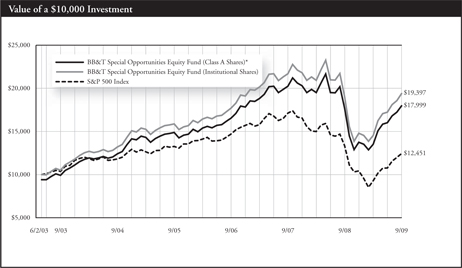

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Year | | Since

Inception |

Class A Shares* | | 6/2/03 | | -4.14% | | 6.45% | | 9.73% |

Class B Shares** | | 6/2/03 | | -2.75% | | 6.76% | | 9.94% |

Class C Shares*** | | 6/2/03 | | 0.97% | | 6.91% | | 9.94% |

Institutional Shares | | 6/2/03 | | 1.91% | | 7.99% | | 11.04% |

S&P 500 Index | | 5/31/03 | | -6.91% | | 1.02% | | 3.52% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

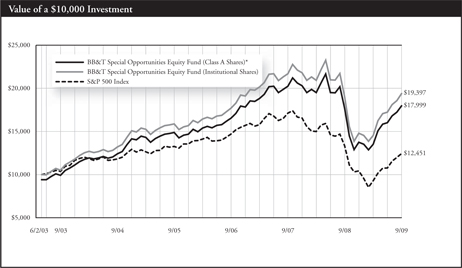

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

The Fund is measured against the S&P 500 Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

BB&T Equity Income Fund

Portfolio Manager

George F. Shipp, CFA

The BB&T Equity Income Fund is managed by George F. Shipp, CFA, Chief Investment Officer of Scott & Stringfellow, LLC (“Scott & Stringfellow”), subadvisor to the Fund. Mr. Shipp, who joined Scott & Stringfellow in 1982, holds a BA from the University of Virginia and an MBA from the Darden Graduate School of Business at the University of Virginia. Mr. Shipp is supported by an investment management team from Scott & Stringfellow, which includes Meghann A. Cohen; Joshua L. Haggarty, CFA; R. Griffith Jones, Jr.; and Farley C. Shiner, CPA. The team brings to the Fund more than four decades of combined investment management experience, along with a broad range of investing skills.

Investment Concerns

Equity securities (stocks) are more volatile and carry more risk than other forms of investments, including investments in high-grade fixed income securities. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. A concentrated portfolio may add a measure of volatility to performance, as major fluctuations in any one holding will likely affect the fund more than a fund with greater diversification.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund returned -5.18% (Institutional Shares). That compared to a -6.91% return for its benchmark, the S&P 500 Index.

Q. What factors affected the Fund’s performance?

A. Stocks as measured by the S&P 500 generated losses for the fiscal year due to investors’ concerns about the global economic slowdown, as well as the collapse of credit markets and the ensuing financial panic. We believe that these factors caused the Fund to generate a negative return for the period under review.1

The Fund’s return relative to its benchmark index benefited from sector selection. The Fund held an underweight position in financials, the worst-performing sector in the S&P 500 for the fiscal year. The Fund’s underweight position boosted relative performance. The Fund also began the period holding more cash than many of its peers, which allowed managers to take advantage of the price weaknesses that emerged.1

This Fund invests in stocks that offer above average and growing dividends. Although stocks exhibiting those criteria historically have tended to out-perform more speculative no-yield companies, following the stock market’s bottom on March 9, 2009, dividend-payers have dramatically lagged. In the nine months ended September 30, dividend-paying stocks in the S&P 500 gained 17.5% on average, while non-dividend paying stocks have surged 56.7%. These factors were largely responsible for the Fund’s performance relative to its benchmark index. The Fund’s overweight position in energy also dragged on relative performance, as energy shares were the market’s second-worst performer for the fiscal year.1

During a period when record numbers of companies slashed dividends, the Fund saw dividends maintained or increased at the vast majority of its holdings, which we believe is a testament to the high-quality holdings within our portfolio.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

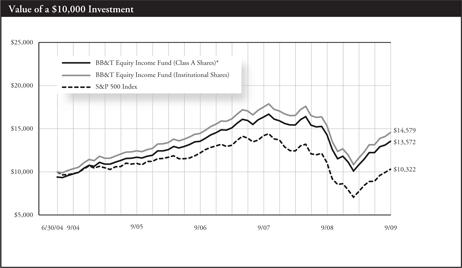

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Years | | Since

Inception |

Class A Shares* | | 6/30/04 | | -10.75% | | 5.49% | | 5.99% |

Class B Shares** | | 6/30/04 | | -9.76% | | 5.80% | | 6.24% |

Class C Shares*** | | 6/30/04 | | -6.10% | | 5.95% | | 6.38% |

Institutional Shares | | 6/30/04 | | -5.18% | | 7.00% | | 7.44% |

S&P 500 Index | | 6/30/04 | | -6.91% | | 1.02% | | 0.61% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

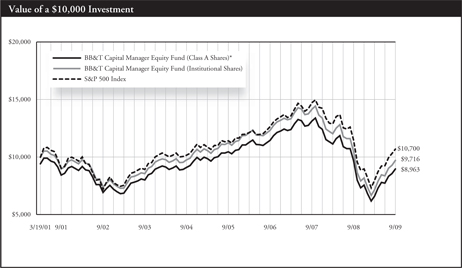

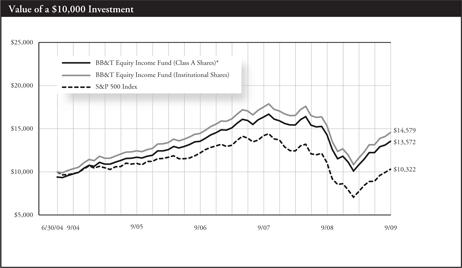

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the S&P 500 Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

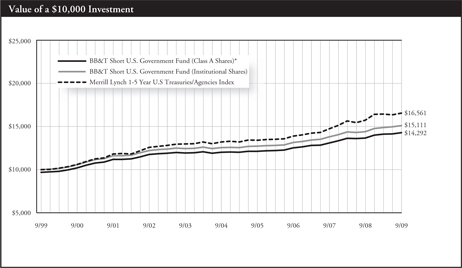

BB&T Short U.S. Government Fund

Portfolio Manager

Kevin E. McNair, CFA

The BB&T Short U.S. Government Fund is managed by Kevin E. McNair, CFA. Mr. McNair received a BA in Economics from the University of North Carolina-Chapel Hill and a Master’s of Economics from North Carolina State University, and has been managing investors’ money since 1994. Mr. McNair is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; Brad D. Eppard, CFA; David T. Johnson; Robert F. Millikan, CFA; and Justin B. Nicholson. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

Investment Concerns

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund gained 4.94% (Institutional Shares). That compared to a 5.27% return for its benchmark, the Merrill Lynch 1-5 Year U.S. Treasuries/Agencies Index.

Q. What factors affected the Fund’s performance?

A. The financial markets experienced two distinct environments during the 12-month period ended September 30, 2009. The first half of the period was marked by a worsening of the recent financial crisis, which fueled a widespread flight to quality among investors. Treasury securities were the main beneficiaries during that period because of their relative safety. But as the financial markets improved, investors’ appetite for risk increased and securities such as corporate bonds and agency issues performed well.1

Yields fell on short-term bonds early in the period as investor demand grew for short-term securities. Since bond prices rise when yields fall, that demand contributed to the fund’s absolute performance during the period. In relative terms, however, the Fund lagged its benchmark early

in the period due to an underweight position in Treasury securities, which performed very well during the first few months of the period.1

That performance reversed as the period continued thanks to the Fund’s overweight positions relative to its benchmark in corporate bonds and agency securities. We believed that though these securities carried more risk than Treasury securities, they offered more return potential. Indeed, rising investor demand for these securities midway through the period resulted in strong gains, which benefited the Fund. Those overweight positions were largely responsible for the Fund’s outperformance of its benchmark during the period.1

We anticipated that interest rates would rise during the period as the financial markets recovered. That led us to position the Fund with an average duration shorter than that of its benchmark. A shorter duration makes a portfolio less sensitive to interest rate movements. Interest rates, however, continued to fall during the period. That shorter average duration had a slight negative impact on the Fund’s performance relative to the benchmark.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 3.00% maximum sales charge. |

| | | | | | | | |

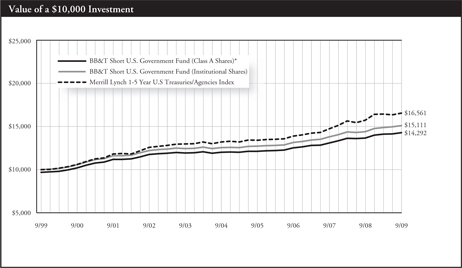

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Years | | 10 Years |

Class A Shares* | | 11/30/92 | | 1.38% | | 2.87% | | 3.64% |

Institutional Shares | | 11/30/92 | | 4.94% | | 3.76% | | 4.21% |

Merrill Lynch 1-5 Year U.S. Treasuries/Agencies Index | | N/A | | 5.27% | | 5.42% | | 5.12% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Merrill Lynch 1-5 Year U.S. Treasuries/Agencies Index, an unmanaged index which includes U.S. government and agency bonds that have a minimum issue size of $150 million and is a widely-recognized, capitalization weighted (companies with larger market capitalizations have more influence than those with smaller market capitalizations) index of U.S. Treasury securities with maturities of 1 year or greater and no more than 5 years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

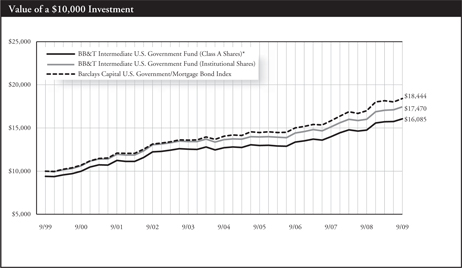

BB&T Intermediate U.S. Government Fund

Portfolio Manager

Brad D. Eppard, CFA

The BB&T Intermediate U.S. Government Fund is managed by Brad D. Eppard, CFA. Mr. Eppard received a BS in Business Administration/ Accounting from Radford University and has been managing investors’ money since 1986. Mr. Eppard is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; David T. Johnson; Kevin E. McNair, CFA; Robert F. Millikan, CFA; and Justin B. Nicholson. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

Investment Concerns

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund gained 9.06% (Institutional Shares). That compared to a 8.31% return for its benchmark, the Barclays Capital U.S. Government/Mortgage Bond Index.

Q. What factors affected the Fund’s performance?

A. Bonds posted strong returns throughout the period. A deepening financial crisis led investors to seek the relative safety of fixed-income securities — especially Treasuries — early in the period. Falling interest rates also helped push bond prices higher. Bonds continued to perform well during the second half of the period, but Treasuries lost ground relative to other issues as investors grew more optimistic about a market recovery and shifted money into corporate and agency-backed securities.1

The Fund maintained an underweight position in Treasuries relative to

its benchmark, and held a significant overweight in agency debt. That strategy initially dragged on relative returns as Treasuries performed well early in the period. But intervention by the federal government to shore up the finances of agencies including Fannie Mae and Freddie Mac led to a rally in such securities during the second half of the period.1

We also found opportunities in the corporate bond sector around the mid-point of the fiscal year; investors had largely shunned such securities early in the period. A 10% exposure to high-quality corporate bonds helped boost relative performance through the period.1

The Fund’s duration began the period slightly longer than that of its benchmark index. That helped performance early in the period as interest rates fell. However, we anticipated that interest rates would begin to climb as the period wore on, and adopted a relatively short duration. That strategy hurt relative performance as interest rates continued to fall through the period. 1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2009 | | Inception

Date | | 1 Year | | 5 Years | | 10 Years |

Class A Shares* | | 10/9/92 | | 2.66% | | 3.56% | | 4.87% |

Class B Shares** | | 1/1/96 | | 4.01% | | 3.84% | | 4.86% |

Class C Shares*** | | 2/1/011 | | 8.00% | | 4.03% | | 4.86% |

Institutional Shares | | 10/9/92 | | 9.06% | | 5.04% | | 5.74% |

Barclays Capital U.S. Government/Mortgage Bond Index | | N/A | | 8.31% | | 5.54% | | 6.31% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

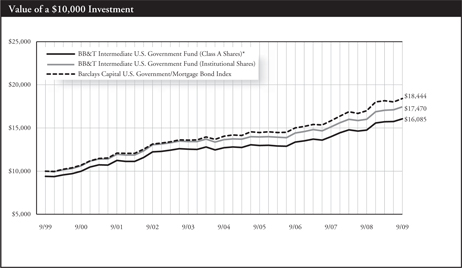

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class A Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares, but does not include the Class C Shares 12b-1 fees, which, if reflected, would have caused performance to be lower. |

The Fund is measured by the Barclays Capital U.S. Government/Mortgage Bond Index, an unmanaged index which is widely used as a broad measure of the performance of U.S. Government bonds with maturities of less than 10 years, and agency mortgage backed securities. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

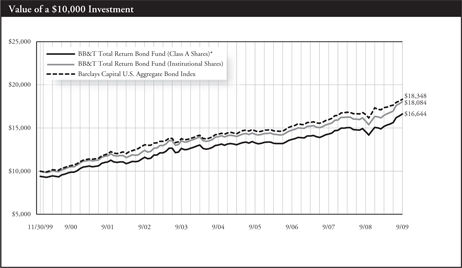

BB&T Total Return Bond Fund

Portfolio Manager

Mark Montgomery, CFA

The BB&T Total Return Bond Fund is managed by Mark Montgomery, CFA, Managing director, Fixed Income Portfolio Manager and head of Sterling Capital Management’s fixed income team. Mr. Montgomery is supported by Richard LaCoff; Howard Buznitsky, CFA; Neil Grant, CFA; Peter Brown, CFA and Michael Mc Vicker.

Investment Concerns

Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return.

The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund gained 14.16% (Institutional Shares). That compared to a 10.56% return for its benchmark, the Barclays Capital U.S. Aggregate Bond Index.

Q. What factors affected the Fund’s performance?

A. The financial crisis early in the period drove investors to the relative safety of Treasury securities, which are backed by the U.S. government. As investors sought out Treasuries, they virtually ignored higher-risk fixed-income securities such as corporate bonds. However, that trend reversed itself as the financial markets began to recover midway through the period. The shift led to strong performance among more risky securities, and relatively weak performance from Treasury securities. Ultimately, higher-risk holdings generated stronger returns for the period as a whole.1

The Fund performed well relative to its benchmark, in large part due to its exposure to corporate bonds and commercial mortgage-backed

securities. The Fund held an overweight position relative to its benchmark in those securities, which contributed to outperformance during the period.1

The Fund was underweighted in Treasuries relative to its benchmark. We correctly anticipated that the strong demand for these securities early in the period would wane as investors saw improvements in the financial markets. We also anticipated an influx in supply of Treasury bonds due to the government’s fiscal and monetary efforts to stimulate the sagging economy. While our strategy hurt performance slightly early in the period, it added considerably to performance as the period wore on.1

Interest rates were volatile during the period, but ultimately ended the fiscal year lower than at the beginning of the period. We did not choose to take a strong position on the direction of interest rates in this environment, and the Fund’s duration was neutral relative to its benchmark. That neutral position did not significantly affect its relative performance.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2009 | | Inception Date | | 1 Year | | 5 Years | | Since Inception |

Class A Shares* | | 12/2/99 | | 7.37% | | 3.72% | | 5.32% |

Class B Shares** | | 12/2/99 | | 9.03% | | 4.03% | | 5.32% |

Class C Shares*** | | 2/1/011 | | 13.14% | | 4.22% | | 5.20% |

Institutional Shares | | 12/2/99 | | 14.16% | | 5.24% | | 6.21% |

Barclays Capital U.S. Aggregate Bond Index | | 11/30/99 | | 10.56% | | 5.13% | | 6.37% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

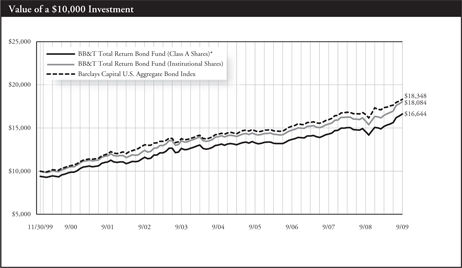

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/01. Performance for periods prior to that is based on the historical performance of the Class B Shares, and has been adjusted for the maximum CDSC applicable to Class C Shares, but does not include the Class C Shares 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against the Barclays Capital U.S. Aggregate Bond Index, an unmanaged index which is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

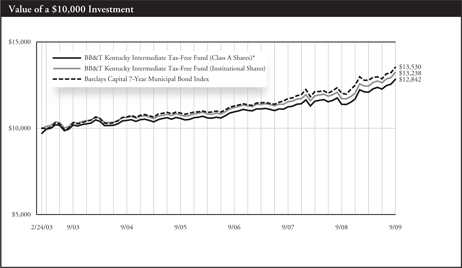

BB&T Kentucky Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

The BB&T Kentucky Intermediate Tax-Free Fund is managed by Robert F. Millikan, CFA, Director of Fixed Income Management for BB&T Asset Management, Inc. Mr. Millikan received a BA in Economics from Wake Forest University, and is a past president of the North Carolina Society of Financial Analysts and chairman of the board of directors of the Carolinas Municipal Advisory Council. Mr. Millikan has been managing investors’ money since 1990. He is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; Brad D. Eppard, CFA; David T. Johnson; Kevin E. McNair, CFA; and Justin B. Nicholson. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

Investment Concerns

Because the Fund is non-diversified and invests primarily in Kentucky municipal securities, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of Kentucky municipal securities. Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return. The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal. The Fund’s income may be subject to certain state and local taxes and, depending on a investors tax status, to the Federal alternative minimum tax.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund gained 13.00% (Institutional Shares). That compared to a 12.52% return for the Barclays Capital 7-Year Municipal Bond Index.

Q. What factors affected the Fund’s performance?

A. The municipal bond market produced very volatile returns during this period. The financial crisis led to a number of developments that hurt municipal securities in the period’s first several months, including forced selling by institutional investors and the failure of bond insurers. Those conditions led to much higher yields and considerably lower prices on municipal securities. The municipal markets then rallied powerfully between March and September, helping the Fund post strong gains for the fiscal year as a whole.1

We believe that the high quality of the Fund’s portfolio boosted returns relative to the benchmark. We invested opportunistically early in the period to take advantage of the extremely high yields available, and also extended the Fund’s duration in order to capture greater yield. In particular, we purchased some bonds with 20-year maturities, which offered premium yields. Such bonds produced some of the municipal market’s best returns during the summer rally, helping the Fund outperform its index. 1

We allowed the Fund’s duration to shorten as the market surged during the second half of the period. That strategy, which we employed to manage risk, reduced the Fund’s relative performance as longer-term bonds continued to post strong gains.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 3.00% maximum sales charge. |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2009 | | Inception Date | | 1 Year | | 5 Year | | Since Inception |

Class A Shares* | | 2/24/03 | | 9.28% | | 3.56% | | 3.86% |

Institutional Shares | | 2/24/03 | | 13.00% | | 4.48% | | 4.34% |

Barclays Capital 7-Year Municipal Bond Index | | 2/28/03 | | 12.52% | | 4.88% | | 4.70% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

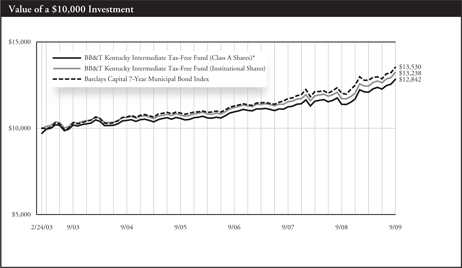

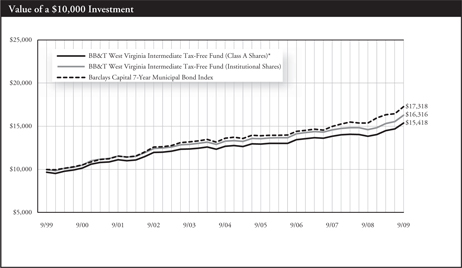

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of 6-8 years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

BB&T Maryland Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

The BB&T Maryland Intermediate Tax-Free Fund is managed by Robert F. Millikan, CFA, Director of Fixed Income Management for BB&T Asset Management, Inc. Mr. Millikan received a BA in Economics from Wake Forest University, and is a past president of the North Carolina Society of Financial Analysts and chairman of the board of directors of the Carolinas Municipal Advisory Council. Mr. Millikan has been managing investors’ money since 1990. He is supported by the BB&T Fixed Income Portfolio Management Team, which includes Carrie R. Breswitz; Brad D. Eppard, CFA; David T. Johnson; Kevin E. McNair, CFA; and Justin B. Nicholson. The team brings to the Fund six decades of combined investment management experience, along with a broad range of specialized skills encompassing a cross-section of fixed-income sectors.

Investment Concerns

Because the Fund is non-diversified and invests primarily in Maryland municipal securities, the Fund is particularly susceptible to any economic, political, or regulatory developments affecting a particular issuer of Maryland municipal securities. Bonds offer a relatively stable level of income, although bond prices will fluctuate providing the potential for principal gain or loss. Intermediate-term, higher-quality bonds generally offer less risk than longer-term bonds and a lower rate of return. The Fund is subject to the risk that principal value reacts in opposition to the movement of interests rates and that a rising interest rate environment increases the risk of loss of principal. The Fund’s income may be subject to certain state and local taxes and, depending on a investors tax status, to the Federal alternative minimum tax.

Q. How did the Fund perform during the 12-month period between October 1, 2008 and September 30, 2009?

A. The Fund gained 13.70% (Institutional Shares). That compared to a 12.52% return for the Barclays Capital 7-Year Municipal Bond Index.

Q. What factors affected the Fund’s performance?

A. The municipal bond market produced very volatile returns during this period. The financial crisis led to a number of developments that hurt municipal securities in the period’s first several months, including forced selling by institutional investors and the failure of bond insurers. Those conditions led to much higher yields and considerably lower prices on municipal securities. The municipal markets then rallied powerfully between March and September, helping the Fund post strong gains for the fiscal year as a whole.1

We believe that the high quality of the Fund’s portfolio boosted returns relative to the benchmark. Maryland’s state credit ratings are some of the highest in the nation, so quality-conscious investors prized the state’s municipal bonds. We invested opportunistically early in the period to take advantage of the extremely high yields available, and also extended the Fund’s duration in order to capture greater yield. In particular, we purchased some bonds with 20-year maturities, which offered premium yields. Such bonds produced some of the municipal market’s best returns during the summer rally, helping the Fund outperform its index.1

We allowed the Fund’s duration to shorten as the market surged during the second half of the period. That strategy, which we employed to manage risk, reduced the Fund’s relative performance as longer-term bonds continued to post strong gains.1

| 1 | Portfolio composition is as of September 30, 2009 and is subject to change. |

| * | Reflects 3.00% maximum sales charge. |

| | | | | | | | |

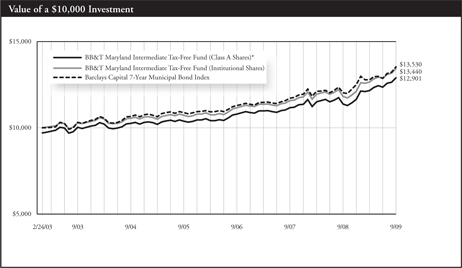

Average Annual Total Returns |

As of September 30, 2009 | | Inception Date | | 1 Year | | 5 Year | | Since Inception |

Class A Shares* | | 2/24/03 | | 10.04% | | 4.06% | | 3.94% |

Institutional Shares | | 2/24/03 | | 13.70% | | 4.96% | | 4.58% |

Barclays Capital 7-Year Municipal Bond Index | | 2/28/03 | | 12.52% | | 4.88% | | 4.70% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.bbtfunds.com.

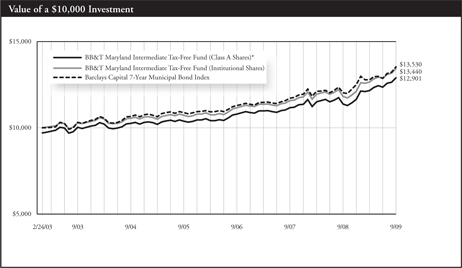

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of 6-8 years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

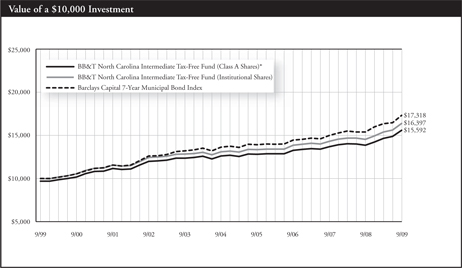

BB&T North Carolina Intermediate Tax-Free Fund

Portfolio Manager

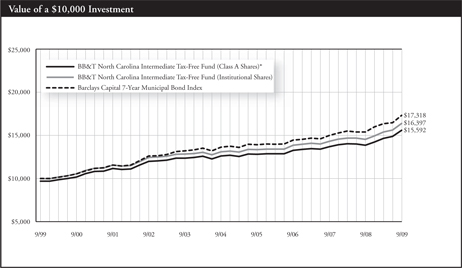

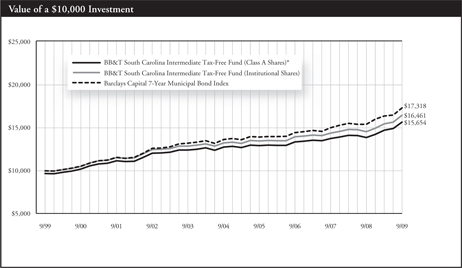

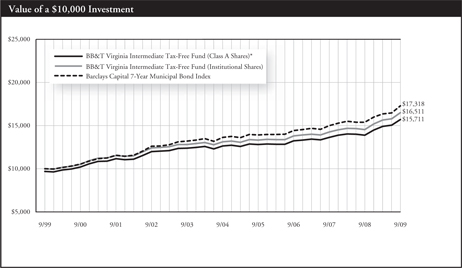

Robert F. Millikan, CFA