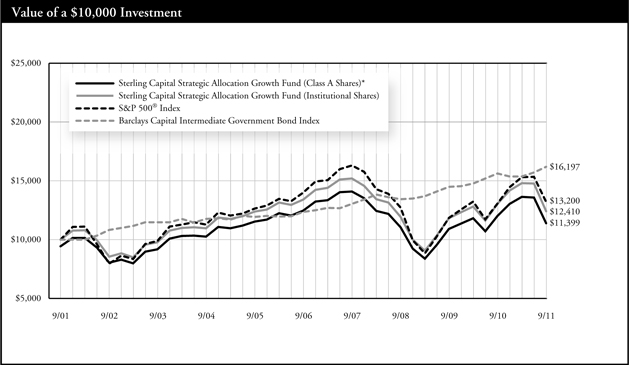

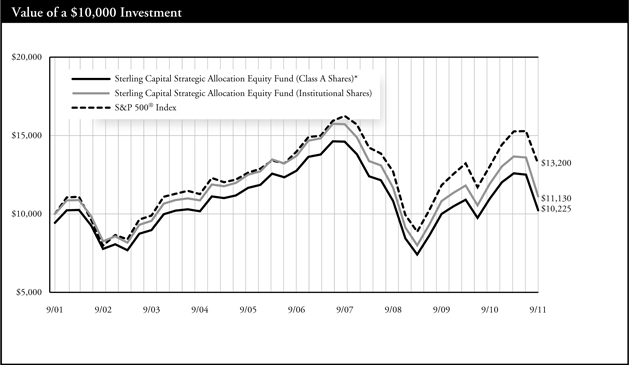

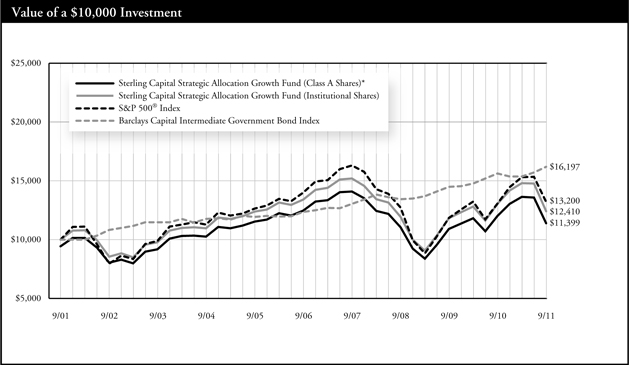

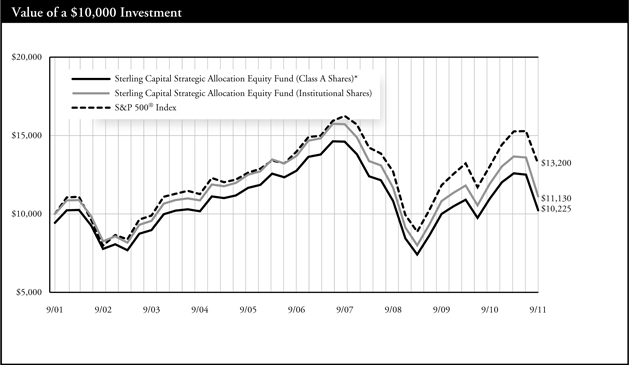

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06719

Sterling Capital Funds

(Exact name of registrant as specified in charter)

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Address of principal executive offices) (Zip code)

E.G. Purcell, III, President

Sterling Capital Funds

434 Fayetteville Street Mall, 5th Floor

Raleigh, NC 27601-0575

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Notice of Privacy Policy & Practices

Sterling Capital Funds recognizes and respects the privacy expectations of our customers.1 We provide this notice to you so that you will know what kinds of information we collect about our customers and the circumstances in which that information may be disclosed to third parties who are not affiliated with the Sterling Capital Funds.

Collection of Customer Information

We collect nonpublic personal information about our customers from the following sources:

| | • | | Account Applications and other forms, which may include a customer’s name, address, social security number, and information about a customer’s investment goals and risk tolerance; |

| | • | | Account History, including information about the transactions and balances in a customer’s accounts; and |

| | • | | Correspondence, written, telephonic or electronic between a customer and the Sterling Capital Funds or service providers to the Sterling Capital Funds. |

Disclosure of Customer Information

We many disclose all of the consumer information outlined above to third parties who are not affiliated with the Sterling Capital Funds:

| | • | | as permitted by law — for example with service providers who maintain or service shareholder accounts for the Sterling Capital Funds or to a shareholder’s broker or agent; and |

| | • | | to perform marketing services on our behalf or pursuant to a joint marketing agreement with another financial institution. |

Security of Customer Information

We require service providers to the Sterling Capital Funds:

| | • | | to maintain policies and procedures designed to assure only appropriate access to, and use of information about customers of the Sterling Capital Funds; and |

| | • | | to maintain physical, electronic and procedural safeguards that comply with applicable legal standards to guard nonpublic personal information of customers of the Sterling Capital Funds. |

We will adhere to the policies and practices described in this notice regardless of whether you are a current or former customer of the Sterling Capital Funds.

1 For purposes of this notice, the terms “customer” or “customers” includes both individual shareholders of the Sterling Capital Funds and individuals who provide nonpublic personal information to the Sterling Capital Funds, but do not invest in Sterling Capital Funds shares.

(This page has been left blank intentionally.)

Letter from the President and the Investment Advisor

Dear Shareholders:

We are pleased to present this annual report for the 12-month period ended September 30, 2011. The economy during this time continued its slow recovery from the severe recession of 2008. A number of leading economic indicators pointed to slow growth, though many quickly deteriorated in early 2011. Downward revisions to GDP numbers indicated the economy’s expansion had nearly stalled. The resulting blow to investor confidence sent financial markets into a period of tremendous volatility, which erased much of the gains made during the first three quarters of the fiscal year. Overall, the S&P 500 returned 1.1%; the Russell 2000 Index of small-capitalization stocks returned -3.53%; the MSCI EAFE Index of international stocks returned -12.02%; and the Barclays Capital U.S. Aggregate Bond Index returned 5.26%.

A stalling economy

Entering 2011, a second round of quantitative easing by the Federal Reserve, along with strengthened corporate balance sheets and improved earnings reports, led to general sentiment that the economy was on a path to recovery. But while our projections for the first half of the fiscal year accurately predicted soft patches and a faltering expansion, they over estimated economic growth. Several factors continued to drag on the recovery, including continued weakness in the housing market and stubbornly high unemployment figures. Additionally, supply chain disruptions resulting from the March 2011 tsunami in Japan dealt a setback to manufacturing activity and the deteriorated fiscal positions of Greece, Ireland, Portugal and other peripheral members of the euro zone tempered any optimism.

Those negatives, along with concerns that domestic political bickering would limit opportunities for policies that could support a near-term recovery, boosted concerns about a double-dip recession. A few positives remained by September 2011, in particular robust manufacturing activity and an expanded service sector. Nevertheless, it appeared that the recession was much more severe than initially reported and that the U.S. economic recovery to this point has been much flatter.

A volatile period for stocks

Equity markets ended the period down slightly. Market gains through the first three quarters of the fiscal year gave way to high market volatility and steep losses in the final quarter. The market’s volatility was the result of several factors, including concern over the slowing pace of the U.S. economy, Greek sovereign debt challenges and partisan gridlock in Washington. A second round of quantitative easing by the Federal Reserve and strengthening corporate balance sheets helped the market perform well early in the period. Attractive valuations and dividend yields (which in many cases were higher than yields offered by domestic fixed-income securities) helped drive up investor confidence, fueling increasing demand for equities. Investors who until this point had traded largely based on their appetite for risk began paying more attention to industry and company fundamentals.

Equities stumbled at the end of the second quarter of 2011, as concerns about European sovereign debt, most notably in Greece, raised fears of financial system contagion and a second global recession. Additionally, unrest in the Middle East contributed to worries about the global oil supply, sending prices higher. After steadying briefly in July, the markets gave back their gains for the year in August. High market volatility continued through the remainder of the period as confidence swung wildly and investors returned to trading based on their degree of willingness to assume risk.

Consumer staples, which tends to hold up well in slowing economies, was one of the best-performing sectors during the 12-month period. Financial services and basic materials stocks were among the period’s worst performers. Emerging markets suffered from efforts by China and others to cool mounting inflation, while European stock markets were hurt by concerns about sovereign debt problems in countries such as Greece. Many of our Sterling Capital funds lagged their benchmarks slightly during this fiscal year due to the challenging economic and investing climate.

Strong performance from Treasuries

The fixed-income market performed well during the first half of the period. The Federal Reserve’s policies to provide quantitative easing and to

keep the federal funds rate low provided support for many kinds of bonds. The Treasury yield curve remained steep through the first quarter of 2011: Short-term yields remained anchored by the low federal funds rate, while long-term rates reflected the expectation for higher inflation brought about by strengthening economic growth.

Concerns about European sovereign debt near the end of the third fiscal quarter drove investors to the perceived safety of the U.S. dollar and Treasuries, pushing down yields. Lower GDP numbers further contributed to the flight from risk, causing a downward shift in yields. In an ironic twist, Standard & Poor’s August downgrade of the U.S. long-term credit rating sparked a bond market rally that drove the 10-year Treasury yield close at its all-time low. Investors continued to view Treasuries as safe havens as they cut risk amid uncertainty.

Our perspective

Challenges to the recovery remain, as high unemployment and uncertain fiscal policy produce headwinds. We believe unemployment is unlikely to improve in 2011. Still, we believe that the Federal Reserve’s policies will continue to be accommodative although it is unlikely to be enough without fiscal expansion to boost economic growth and we see a likely chance of recession here and in Europe.

Thank you for your confidence in the Sterling Capital Funds. We encourage you to call us with any questions at 1-800-228-1872.

Sincerely,

E.G. Purcell, III

President

Sterling Capital Funds

Jeffrey J. Schappe, CFA

Managing Director-Chief Investment Officer

Sterling Capital Management LLC

Past performance does not guarantee future results.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Sterling Capital Management LLC (“Sterling Capital”) serves as investment advisor to the Sterling Capital Funds and is paid a fee for its services. Shares of the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”) are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by Sterling Capital Distributors, Inc. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. Sterling Capital does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or as offering individual or personalized investment advice.

Sterling Capital Select Equity Fund

Portfolio Manager

Stephen L. Morgan

Sterling Capital Select Equity Fund (formerly known as BB&T Select Equity Fund) (the “Fund”) is managed by Stephen L. Morgan, portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Stephen joined Sterling Capital in 1999. He has investment experience since 1980. Stephen is a graduate of American University where he received his BS in Finance and Accounting. He received his MBA from Virginia Tech. The Investment Team supporting the Fund has more than 65 combined years of investment experience and includes:

| • | | Greg Towner, CFA, CMT, Director |

| • | | J. Blake Guyler, CFA, Director |

| • | | James M. Walden, CFA, Director |

Investment Concerns

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value. Equity securities (stocks) are more volatile and carry more risk. The net asset value per share of this Fund will fluctuate as the value of the securities in the portfolio changes. The Fund may invest in foreign securities which involve certain risks such as currency volatility and political, social and economic instability.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

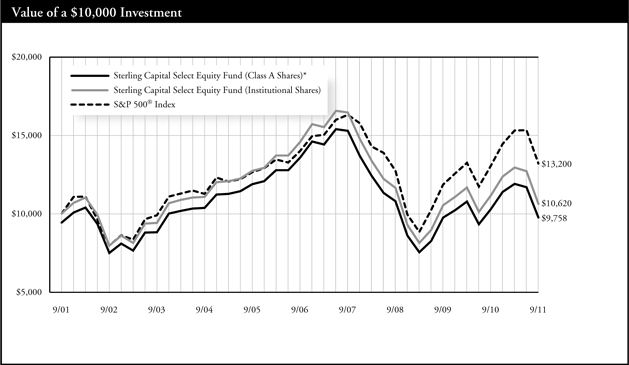

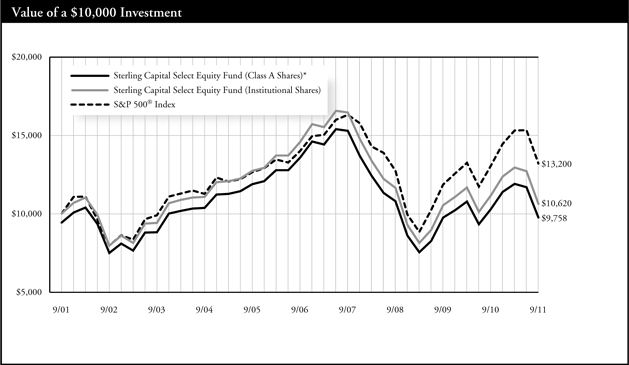

A. The Fund posted a return of -4.74% (Institutional Shares). That compared to a 1.14% return for its benchmark, S&P 500® Index.

Q. What factors affected the Fund’s performance?

A. The Fund’s return relative to its benchmark benefited from its overweight position in the energy and technology sectors, both of which performed relatively well during the period. Investors favored technology stocks, for example, for their perceived attractive valuations

and strong balance sheets. The Fund’s underweight position in financial services stocks also benefited relative performance, as those stocks underperformed other sectors of the market.1

The Fund’s underperformance relative to its benchmark resulted in part from the fact that growth stocks outperformed value stocks during the period, and the Fund was underweight growth stocks. The Fund’s underweight positions in consumer staples and utilities — defensive sectors which performed relatively well during the period — also dampened the Fund’s relative performance.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | | | | | |

As of September 30, 2011 | |

| Inception

Date |

| | | 1 Year | | | | 5 Years | | | | 10 Years | |

Class A Shares* | | | 10/9/92 | | | | -10.45% | | | | -7.50% | | | | -0.24% | |

Class B Shares** | | | 1/1/96 | | | | -9.44% | | | | -7.22% | | | | -0.26% | |

Class C Shares*** | | | 2/1/01 | | | | -5.72% | | | | -7.10% | | | | -0.41% | |

Institutional Shares | | | 10/9/92 | | | | -4.74% | | | | -6.15% | | | | 0.60% | |

S&P 500® Index | | | N/A | | | | 1.14% | | | | -1.18% | | | | 2.82% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital Mid Value Fund

Portfolio Manager

Timothy P. Beyer, CFA

Sterling Capital Mid Value Fund (formerly known as BB&T Mid Cap Value Fund) (the “Fund”) is managed by Timothy P. Beyer, CFA, portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Timothy joined Sterling Capital in 2004. He has investment experience since 1989. Timothy is a graduate of East Carolina University where he received his BSBA in Finance. The Investment Team supporting the Fund has more than 97 combined years of investment experience and includes:

| • | | Eduardo A. Brea, CFA, Managing Director |

| • | | Robert W. Bridges, CFA, Director |

| • | | Lee D. Houser, CFA, Director |

| • | | Patrick W. Rau, CFA, Executive Director |

| • | | Brian R. Walton, CFA, Managing Director |

Investment Concerns

The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation and political, social and economic instability.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

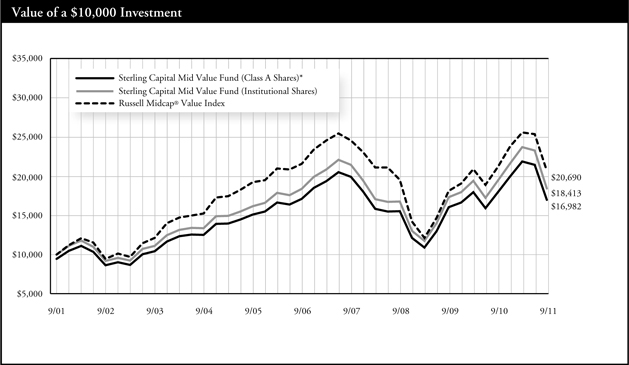

A. The Fund posted a return of -5.29% (Institutional Shares). That compared to a -2.36% return for its benchmark, Russell Midcap® Value Index.

Q. What factors affected the Fund’s performance?

A. In a market environment that continued to exhibit signs of economic stress, cyclical stocks led the market lower. Weakening energy prices hurt energy stocks, and technology stocks performed poorly.

Meanwhile, defensive stocks, such as utilities and consumer staples, performed well. Health care stocks contributed positively to the Fund’s

absolute return due to their attractive valuations and defensive nature in a weakening economy.1

Much of the Fund’s underperformance relative to its benchmark can be attributed to underweight positions in utilities and consumer staples.1

Overweight positions in the health care, financials and consumer discretionary sectors benefited the Fund’s relative performance. Stock selection in health care, including new investments in a biotech-related health care company, also benefited the Fund. Additionally, holdings of a dominant online retailer as well as a specialty mattress firm helped the Fund’s relative performance.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | | | | | | | | | |

As of September 30, 2011 | | Inception

Date | | | 1 Year | | | 5 Years | | | 10 Years | |

Class A Shares* | | | 8/1/96 | | | | -10.96% | | | | -1.30% | | | | 5.44% | |

Class B Shares** | | | 7/25/01 | | | | -10.00% | | | | -1.11% | | | | 5.41% | |

Class C Shares*** | | | 7/25/01 | | | | -6.26% | | | | -0.96% | | | | 5.24% | |

Institutional Shares | | | 8/1/96 | | | | -5.29% | | | | 0.04% | | | | 6.29% | |

Class R Shares | | | 2/1/101 | | | | -5.71% | | | | -0.06% | | | | 6.24% | |

Russell Midcap® Value Index | | | N/A | | | | -2.36% | | | | -0.84% | | | | 7.54% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

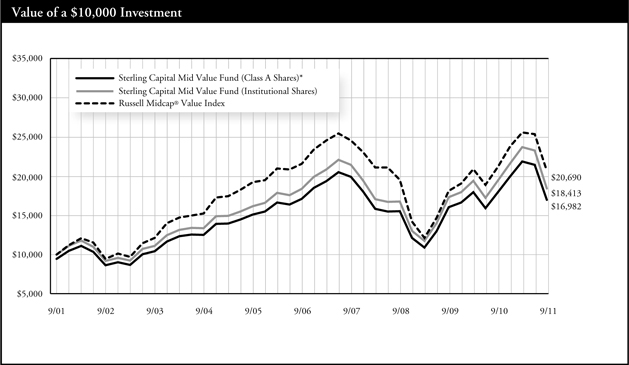

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of the Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against Russell Midcap® Value Index, an unmanaged index which measures the performance of those securities in the Russell 1000 with lower price-to-book ratios or lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital Small Value Fund

Portfolio Manager

Eduardo Brea, CFA

Sterling Capital Small Value Fund (formerly known as Sterling Capital Small Cap Value Fund) (the “Fund”) is managed by Eduardo Brea, CFA, Managing Director and Equity Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Eduardo joined Sterling Capital in 1995. He has investment experience since 1989. Mr. Brea is a graduate of the University of Florida where he received his BS in Finance. He received his MBA from University of South Florida. The Investment Team supporting the Fund has more than 97 combined years of investment experience and includes:

| • | | Timothy P. Beyer, CFA, Managing Director |

| • | | Brian R. Walton, CFA, Managing Director |

| • | | Patrick W. Rau, CFA, Executive Director |

| • | | Robert W. Bridges, CFA, Director |

| • | | Lee D. Houser, CFA, Director |

Investment Concerns

The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuation and political, social and economic instability.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

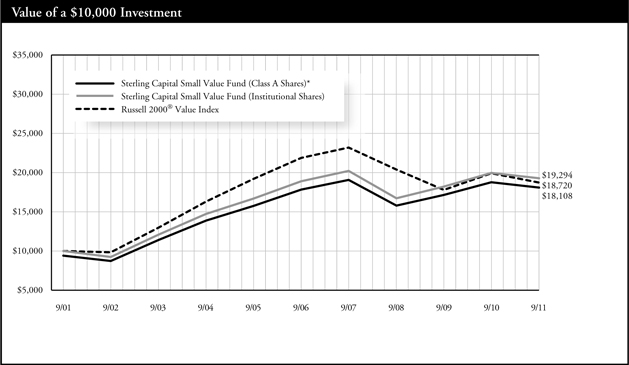

A. The Fund returned -3.31% (Institutional Shares). That compared to a -5.99% return for its benchmark, Russell 2000® Value Index (the “Index”) of small-cap stocks.

Q. What factors affected the Fund’s performance?

A. While the Fund’s performance was slightly negative for fiscal year 2011, we performed better than the Russell 2000® Value Index. The recent decline in the equity markets reflects investor concerns regarding budgetary imbalances and the inexorable growth in debt financed government spending, both in the U.S. and Europe. These concerns were manifest in significant declines in economically sensitive companies in the consumer, financial, technology, and producer durables sectors. Defensive sectors such as utilities and consumer staples outperformed.1

For the Fund, we outperformed the Index in 7 out of 10 sectors, largely through stock selection. The impact of sector selection was marginally negative. As a bottom-up value manager, we expect the vast majority of our value–added attribution to reside in stock selection. In 2011, our portfolio also benefited from the announced acquisition of two portfolio holdings - National Semiconductor (acquired by Texas Instruments) and Graham Packaging (acquired by Reynolds Group) at significant premiums to our purchase price.1

We are using the weak equity markets to establish positions in businesses with significant upside and economic sensitivity. This is where the best risk/reward valuations lead us. While our sector weightings are not dramatically different from the benchmark, we do have overweights in technology, consumer discretionary and producer durables. We have meaningful underweights in utilities and REITs.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

As of September 30, 2011 | |

| Inception

Date |

| | | 1 Year | | | | 5 Years | | | | 10 Years | |

Class A Shares* | | | 2/1/101 | | | | -9.10% | | | | -0.87% | | | | 6.12% | |

Class B Shares** | | | 2/1/101 | | | | -9.08% | | | | -0.18% | | | | 6.62% | |

Class C Shares*** | | | 2/1/101 | | | | -4.30% | | | | 0.08% | | | | 6.62% | |

Institutional Shares | | | 1/2/971 | | | | -3.31% | | | | 0.40% | | | | 6.79% | |

Class R Shares | | | 2/1/101 | | | | -3.49% | | | | 0.34% | | | | 6.76% | |

Russell 2000® Value Index | | | N/A | | | | -5.99% | | | | -3.08% | | | | 6.47% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

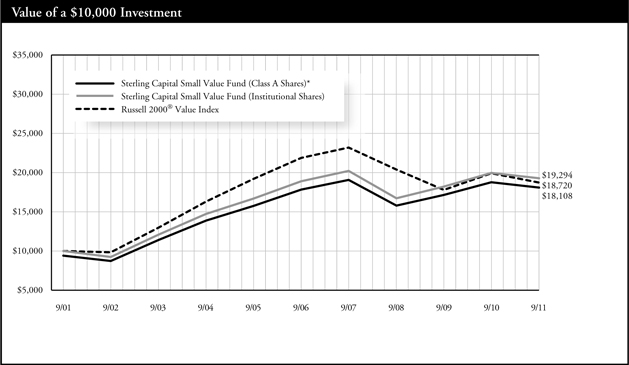

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class A, B, C and R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares and has been adjusted for maximum CDSC to the class applicable but does not include 12b-1 fees, which if reflected, would have caused performance of Class A, B C and R Shares to be lower. The performance information for Institutional Shares (formerly known as Sterling Shares) prior to 12/18/06 is based on the performance of the Institutional Shares of the Fund’s Predecessor, Sterling Capital Small Cap Value Fund, a series of The Advisors’ Inner Circle Fund (the “Predecessor Fund”), which transferred all of its assets and liabilities to the Fund pursuant to a reorganization. Information prior to 3/16/01 relates to the UAM Fund Inc.’s Sterling Partners’ Small Cap Value Portfolio, the assets of which were acquired by the Predecessor Fund. The performance of the Fund’s Institutional Shares would have been different because the Fund’s Institutional Shares have different expenses than the Predecessor’s Institutional Shares. |

Russell 2000® Value Index is a widely recognized index of common stocks that measures the performance of small- to mid-sized companies. The Index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital International Fund

Portfolio Managers

Richard Pell, Chief Investment Officer

Artio Global Management LLC (subadviser)

Sterling Capital International Fund (formerly known as BB&T International Equity Fund) (the “Fund”) is managed by Richard Pell, Chief Investment Officer, at Ario Global Management LLC (“Artio Global”), subadvisor to the Fund. Richard has managed the Fund since 2007. He received his BA from the University of California at Berkeley and an MBA from New York University. Richard has investment experience since 1983.

Investment Concerns

The Fund invests in the securities of foreign and emerging markets which involve certain risks such as currency fluctuation and political, social and economic instability. The Fund may invest in derivatives (futures, options, swaps) and exchange traded funds which may incur additional costs. Derivatives may be more sensitive to changes in market conditions and may amplify risks. The Fund may engage in writing covered call options. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

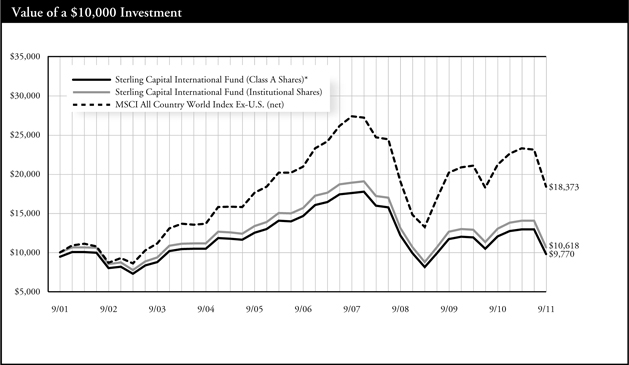

A. The Fund returned -18.50% (Institutional Shares). That compared to a -13.24% return for its benchmark, MSCI All Country World Index Ex-US. (net).

Q. What factors affected the Fund’s performance?

A. Volatility was the overriding trend of the 12-month period, as investor sentiment rose and fell amid bouts of extreme optimism and pessimism. The global economy worked through a long list of challenges. Meanwhile, governmental policy actions to prop up weaker segments of the market rendered traditional fundamental analysis less effective at determining market direction. Ultimately, investor concerns outweighed optimism and absolute returns were in negative territory for the period.1

The single largest drag on the Fund’s relative performance was its overweight position in emerging markets. An overweight position in China and India and stock selection in those countries and Russia also were notable detractors for the period.1

Stock and sector selection in certain areas of the developed markets, most notably in the financial and consumer staples sectors, also hurt the Fund’s relative performance. While an underweight position in the financials sector helped mitigate some of the poor relative performance, stock selection offset any benefits.1

The Fund’s relative performance benefited from stock selection in the developed markets portion of the portfolio. In particular, the industrials and information technology sectors added value. Stock selection in the emerging markets of Korea and Taiwan also boosted relative performance.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

As of September 30, 2011 | | Inception

Date | | | 1 Year | | | | 5 Years | | | | 10 Years | |

Class A Shares* | | 1/2/97 | | | -23.64% | | | | -8.84% | | | | -0.23% | |

Class B Shares** | | 1/2/97 | | | -22.42% | | | | -8.50% | | | | -0.23% | |

Class C Shares*** | | 2/1/01 | | | -19.23% | | | | -8.41% | | | | -0.38% | |

Institutional Shares | | 1/2/97 | | | -18.50% | | | | -7.49% | | | | 0.60% | |

MSCI All Country World Index Ex-U.S. (net) | | N/A | | | -13.24% | | | | -4.13% | | | | 4.28% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

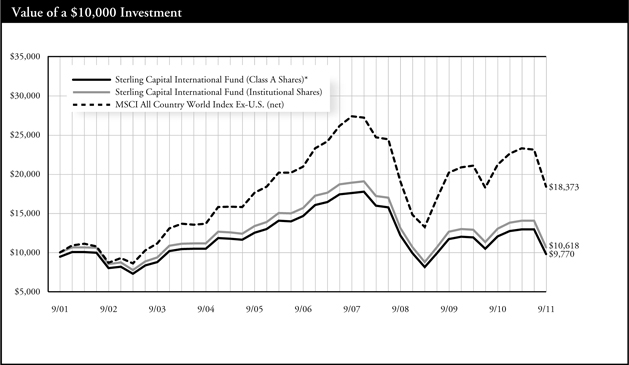

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

MSCI All Country World Index Ex-U.S. (net) is a unmanaged market capitalization-weighted index that is designed to represent the performance of equity markets in the global developed and emerging markets, excluding the United States. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital Special Opportunities Fund

Portfolio Manager

George F. Shipp, CFA

Chief Investment Officer

Scott & Stringfellow, LLC (subadviser)

Sterling Capital Special Opportunities Fund (formerly known as BB&T Special Opportunities Fund) (the “Fund”) is managed by George F. Shipp, CFA, Chief Investment Officer of Scott & Stringfellow, LLC (“Scott & Stringfellow”), subadvisor to the Fund. George has been the Fund’s manager since 2003 and also manages the Sterling Capital Equity Income Fund. He has investment experience since 1982. George is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business. The Investment Team supporting the Fund has more than 123 combined years of investment experience and includes:

| • | | Joshua L. Haggerty, CFA |

| • | | Michael S. Peasley, CFA |

Investment Concerns

The Fund is subject to investment style risk which depends on the market segment in which the Fund is primarily invested. An investment in growth stocks may be particularly sensitive to market conditions while value stocks may be undervalued for longer than anticipated. The Fund may invest in foreign securities subject to risks such as currency volatility and political and social instability or small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines. The Fund may engage in writing covered call options. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund returned -3.46% (Institutional Shares). That compared to a 1.14% return for its benchmark, S&P 500® Index.

Q. What factors affected the Fund’s performance?

A. Easy monetary policy and strong corporate earnings helped buoy investors’ appetite for stocks early in the 12-month period. Midway through 2011, however, investor optimism gave way to increasing uncertainty as a result of ongoing European sovereign credit concerns and evidence of macroeconomic deceleration. The end of the 12-month period was marked by increasing volatility.1

The Fund’s relative performance suffered from an overweight position in small- and mid-cap stocks, which experienced considerable volatility

during the period. By comparison, the benchmark has a bias toward larger-cap shares, which weathered the volatility better than the smaller cap stocks. Stock selection within the technology and energy sectors also detracted from performance. An underweight position in the market’s top performing sectors, utilities and consumer staples, further contributed to the Fund’s relative underperformance.1

The Fund benefited from overweight positions in the technology and health care sectors, both of which performed well during the period under review. Stock selection in the health care sector also contributed to the Fund’s relative performance. In particular, double-digit percentage gains in a diversified health insurer and a large drug distributor helped relative performance. The Fund’s lone holding in basic materials was also a solid contributor.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2011 | | Inception

Date | | 1 Year | | 5 Years | | Since Inception |

Class A Shares* | | 6/2/03 | | -9.25% | | 1.39% | | 7.90% |

Class B Shares** | | 6/2/03 | | -8.23% | | 1.67% | | 7.87% |

Class C Shares*** | | 6/2/03 | | -4.43% | | 1.83% | | 7.86% |

Institutional Shares | | 6/2/03 | | -3.46% | | 2.85% | | 8.93% |

Class R Shares | | 2/1/101 | | -3.95% | | 2.77% | | 8.88% |

S&P 500® Index | | 5/31/03 | | 1.14% | | -1.18% | | 4.01% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

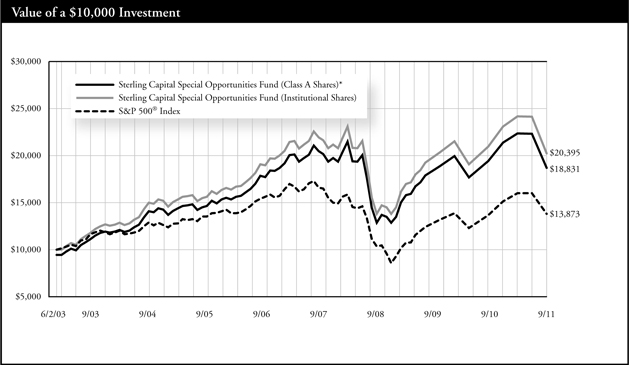

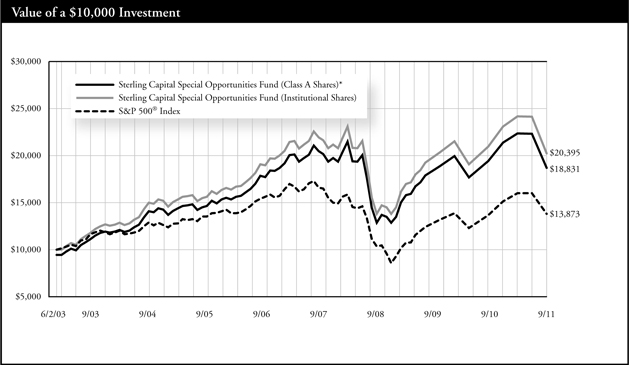

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against S&P 500® Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital Equity Income Fund

Portfolio Manager

George F. Shipp, CFA

Chief Investment Officer

Scott & Stringfellow, LLC (subadviser)

Sterling Capital Equity Income Fund (formerly known as BB&T Equity Income Fund) (the “Fund”) is managed by George F. Shipp, CFA, Chief Investment Officer of Scott & Stringfellow, LLC (“Scott & Stringfellow”), subadvisor to the Fund. George has been the Fund’s manager since 2004 and also manages the Sterling Capital Special Opportunities Fund. He has investment experience since 1982. George is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business. The Investment Team supporting the Fund has more than 123 combined years of investment experience and includes:

| • | | Joshua L. Haggerty, CFA |

| • | | Michael S. Peasley, CFA |

Investment Concerns

The Fund invests primarily in dividend-paying securities but also in convertible securities in search of yield. These securities may be undervalued and their value could be negatively affected by a rise in interest rates. The Fund may engage in writing covered call options. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund returned 3.17% (Institutional Shares). That compared to a 1.14% return for its benchmark, S&P 500® Index.

Q. What factors affected the Fund’s performance?

A. Easy monetary policy and strong corporate earnings helped buoy investors’ appetite for stocks in the first half of 2011. But this positive performance gave way to increasing volatility in the final quarter of the fiscal year, as ongoing sovereign credit concerns and evidence of macroeconomic deceleration dominated investor sentiment.1

The Fund’s positioning in large cap, dividend-paying securities served it well during the period of market volatility. The Fund surpassed its benchmark in part due to an overweight position in the consumer

staples sector. Stock selection in this sector also benefited the Fund, with strong performance coming from shares of a global foods company and a global personal care business. The Fund sold both holdings during the year. Underweight positions in the financials and basic materials sectors, the market’s worst performing sectors, also contributed to relative performance.1

The Fund’s relative performance suffered in part due to underperformance from its health care holdings. Weak returns from shares of a European capital goods company and a domestic thrift also contributed negatively to the Fund’s performance relative to the benchmark. The Fund’s cash holdings were an additional drag on performance due to the Federal Reserve’s decision to keep interest rates near zero.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00% |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | |

Average Annual Total Returns | |

As of September 30, 2011 | | Inception

Date | | 1 Year | | | 5 Years | | | Since Inception | |

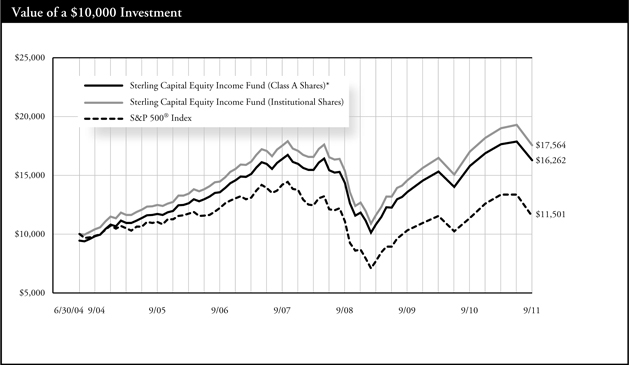

Class A Shares* | | 6/30/04 | | | -3.02% | | | | 2.48% | | | | 6.94% | |

Class B Shares** | | 6/30/04 | | | -1.88% | | | | 2.76% | | | | 7.01% | |

Class C Shares*** | | 6/30/04 | | | 2.13% | | | | 2.94% | | | | 7.01% | |

Institutional Shares | | 6/30/04 | | | 3.17% | | | | 3.97% | | | | 8.08% | |

Class R Shares | | 2/1/101 | | | 2.74% | | | | 3.82% | | | | 7.97% | |

S&P 500® Index | | 6/30/04 | | | 1.14% | | | | -1.18% | | | | 1.95% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

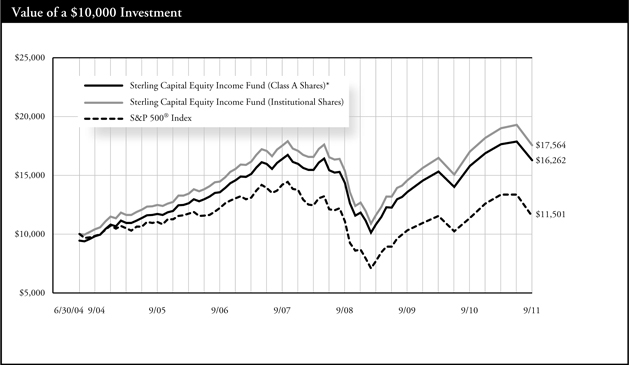

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against S&P 500® Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital Short-Term Bond Fund

Portfolio Managers

Sterling Capital Short-Term Bond Fund (formerly known as BB&T Short U.S. Government Fund) (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997. He has co-managed the Fund since 2008 and also co-manages the Sterling Capital Total Return Bond Fund. He received his BS from West Chester University and an MBA from Drexel University. Mark has investment experience since 1990.

Richard D. LaCoff

Richard joined Sterling Capital in 2007. He has co-managed the Fund since 2010 and also co-manages the Sterling Capital Total Return Bond Fund. He received his BS from Villanova University and an MBA from Drexel University. Richard has investment experience since 1991.

The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; derivatives (futures and swaps); mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify risks.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund gained 0.05% (Institutional Shares). That compared to a 1.23% return for its benchmark, Barclays Capital 1-3 Year Government Index.

Q. What factors affected the Fund’s performance?

A. Investors engaged in a flight-to-quality during the period, selecting U.S. Treasuries and municipal bonds in the face of sluggish U.S. economic growth and the uncertainty generated by Europe’s sovereign

debt woes. The Fund benefited from an overweight exposure to taxable municipal bonds. However, the Fund’s allocation to commercial mortgage-backed securities was a drag on absolute performance, as spreads widened due to concerns about a slowdown in the U.S. economy.1

The Fund’s position in long-duration bonds, which rose in value as rates fell, boosted relative performance. Exposure to corporate bonds weighed on relative performance, as investors reacted to a slowing global economy and Greece’s ongoing debt crisis.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 2.50% maximum sales charge. |

| | | | | | | | | | | | | | |

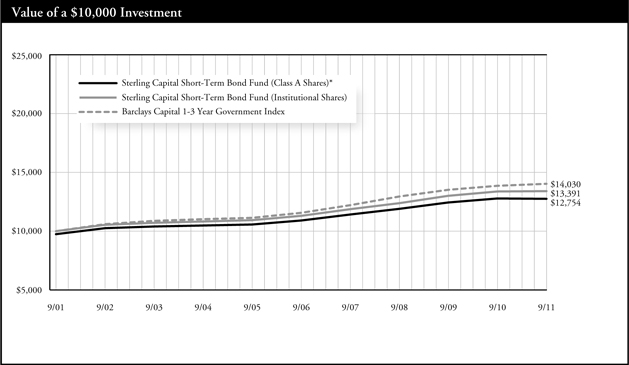

| Average Annual Total Returns | |

As of September 30, 2011 | | Inception

Date | | 1 Year | | | 5 Years | | | 10 Years | |

Class A Shares* | | 11/30/92 | | | -2.72% | | | | 2.67% | | | | 2.46% | |

Institutional Shares | | 11/30/92 | | | 0.05% | | | | 3.42% | | | | 2.96% | |

Barclays Capital 1-3 Year

Government Index | | 11/30/92 | | | 1.23% | | | | 3.96% | | | | 3.44% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

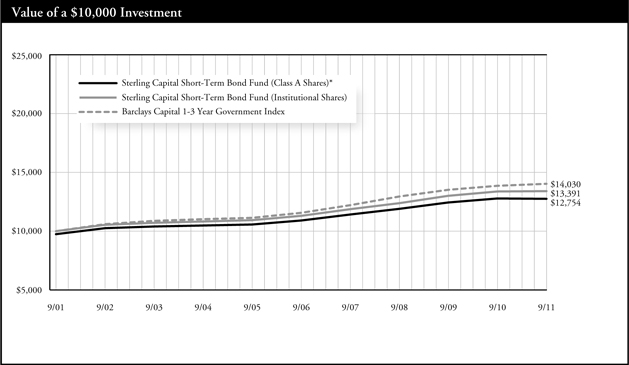

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 1-3 Year Government Index which consists of securities in Barclays Capital U.S. Government Index with a maturity from one up to three years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital Intermediate U.S. Government Fund

Portfolio Manager

Brad D. Eppard, CFA

Sterling Capital Intermediate U.S. Government Fund (formerly known as BB&T Intermediate U.S. Government Fund) (the “Fund”) is managed by Brad D. Eppard, CFA, Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Brad joined Sterling Capital in 2003. He has investment experience since 1985. He has been the portfolio manager for the Fund since 2003. Brad is a graduate of Radford University where he received his BS in Business Administration/Accounting. He is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in mortgage-backed securities which tend to be more sensitive to changes in interest rates. The Fund invests in securities issued or guaranteed by the U.S. government or its agencies (such as Fannie Mae or Freddie Mac). Although U.S. government securities issued directly by the U.S. government are guaranteed by the U.S. Treasury, other U.S. government securities issued by an agency or instrumentality of the U.S. government may not be. No assurance can be given that the U.S. government would provide financial support to its agencies and instrumentalities if not required to do so by law.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund gained 3.02% (Institutional Shares). That compared to a 3.40% return for its benchmark, Barclays Capital Intermediate Government Index.

Q. What factors affected the Fund’s performance?

A. The Fund’s coupon income remained low during the period as the Federal Reserve’s concerns about the U.S. economy weighed upon interest rates. The yield for the 10-year Treasury, for instance, dropped from 2.51% to 1.92% over the course of the period. At the same time, the Fund’s absolute return was boosted by higher bond prices, as

investors sought shelter from continued fiscal problems in peripheral European countries.1

The Fund’s performance lagged the benchmark in part because of its stake in high-grade paper issued by financial corporations. The industry’s struggles dragged on bond prices during the period under review.1

At the same time, the Fund’s relative performance benefited from maintaining a longer average duration than the benchmark index. The strategy allowed the portfolio to benefit from an overall drop in interest rates.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | |

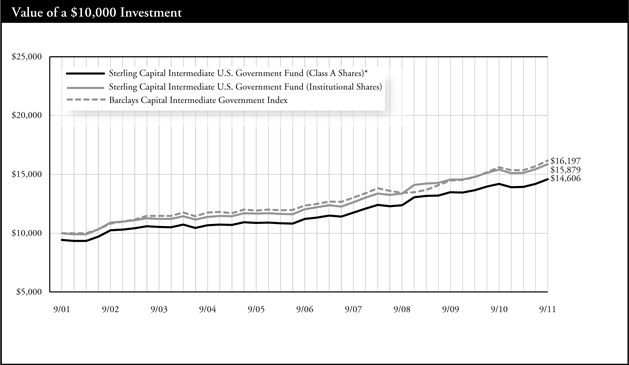

Average Annual Total Returns | | | | | |

As of September 30, 2011 | | Inception Date | | 1 Year | | | 5 Years | | | 10 Years | |

Class A Shares* | | 10/9/92 | | | -3.07% | | | | 4.19% | | | | 3.86% | |

Class B Shares** | | 1/1/96 | | | -2.00% | | | | 4.46% | | | | 3.85% | |

Class C Shares*** | | 2/1/01 | | | 1.99% | | | | 4.67% | | | | 3.71% | |

Institutional Shares | | 10/9/92 | | | 3.02% | | | | 5.69% | | | | 4.73% | |

Barclays Capital Intermediate Government Index | | 9/30/92 | | | 3.40% | | | | 5.92% | | | | 5.12% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

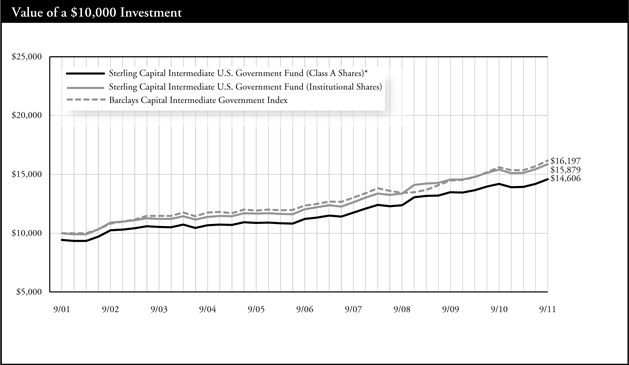

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.

The Fund is measured by Barclays Capital Intermediate Government Bond Index, an unmanaged index comprised of all publicly issued non-convertible domestic debt of the U.S. government or any agency there of, or corporate debt guaranteed by the U.S. government all with outstanding principal of $1 million and maturity between one and ten years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

Sterling Capital Total Return Bond Fund

Portfolio Managers

Sterling Capital Total Return Bond Fund (formerly known as BB&T Total Return Bond Fund) (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mark joined Sterling Capital in 1997. He has co-managed the Fund since 2008 and also co-manages the Sterling Capital Short-Term Bond Fund. He received his BS from West Chester University and an MBA from Drexel University. Mark has investment experience since 1990.

Richard D. LaCoff

Richard joined Sterling Capital in 2007. He has co-managed the Fund since 2010 and also co-manages the Sterling Capital Short-Term Bond Fund. He received his BS from Villanova University and an MBA from Drexel University. Richard has investment experience since 1991. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments such as foreign securities which may expose the fund to currency and exchange rate fluctuations; derivatives (futures and swaps); mortgage-backed securities sensitive to interest rates and high yield debt (also known as junk bonds) all of which may cause greater volatility and less liquidity. Derivatives may be more sensitive to changes in market conditions and may amplify risks.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund gained 3.94% (Institutional Shares). That compared to a 5.26% return for its benchmark, Barclays Capital U.S. Aggregate Bond Index.

Q. What factors affected the Fund’s performance?

A. Concerns about sovereign debt risk in Europe — particularly in Greece — and its potential to weigh on the U.S. economy’s growth rate created uncertainty during the period. Nervous investors flocked to U.S. Treasury securities with extremely high levels of liquidity and safety — pushing bond prices higher and yields lower. The Fund’s absolute return benefited in that environment.1

The Fund’s relative return benefited from the Fund’s overweight position in mortgage-backed securities, which offered higher yields than

Treasury securities along with strong credit ratings. Also, the Fund’s duration was longer than that of its benchmark index, which helped relative returns as prices of longer-term securities rose more than prices on shorter-term issues in the declining rate environment.1

The Fund’s relative return was dampened by the Fund’s overweight position in corporate bonds, which lagged Treasuries during the period. Investors feared that the U.S. economy would slow significantly and corporate profits would suffer as a result. Combined, those forces pushed down prices on corporate bonds. In particular, the Fund’s overweight position in corporate bonds from the financials sector was a drag on relative performance. Investors worried about global financial institutions’ exposure to Greece, which was in danger of defaulting on its debt during the period.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 5.75% maximum sales charge. |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | |

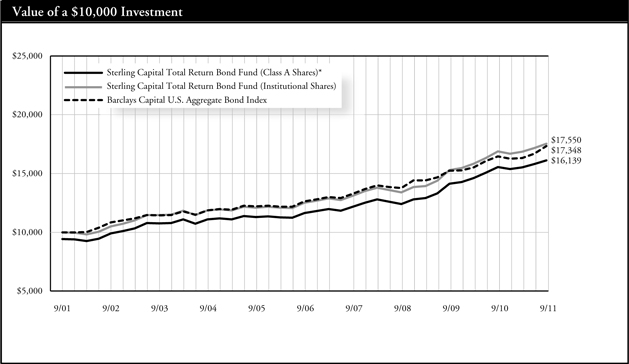

Average Annual Total Returns | | | | | |

As of September 30, 2011 | | Inception

Date | | 1 Year | | | 5 Years | | | 10 Years | |

Class A Shares* | | 12/2/99 | | | -2.28% | | | | 5.48% | | | | 4.90% | |

Class B Shares** | | 12/2/99 | | | -1.00% | | | | 5.78% | | | | 4.89% | |

Class C Shares*** | | 2/1/01 | | | 2.91% | | | | 5.96% | | | | 4.77% | |

Institutional Shares | | 12/2/99 | | | 3.94% | | | | 7.00% | | | | 5.79% | |

Class R Shares | | 2/1/101 | | | 3.24% | | | | 6.77% | | | | 5.67% | |

Barclays Capital U.S. Aggregate Bond Index | | N/A | | | 5.26% | | | | 6.53% | | | | 5.66% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

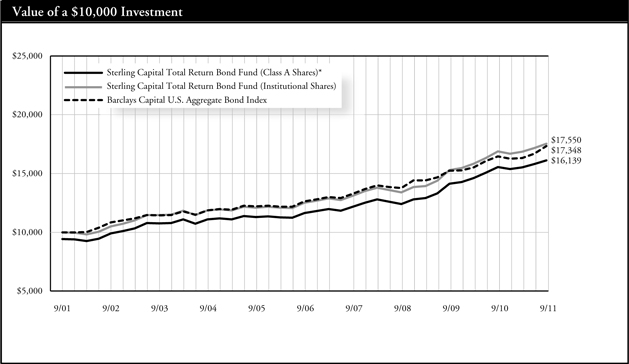

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against Barclays Capital U.S. Aggregate Bond Index, an unmanaged index which is a market value-weighted performance benchmark for investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

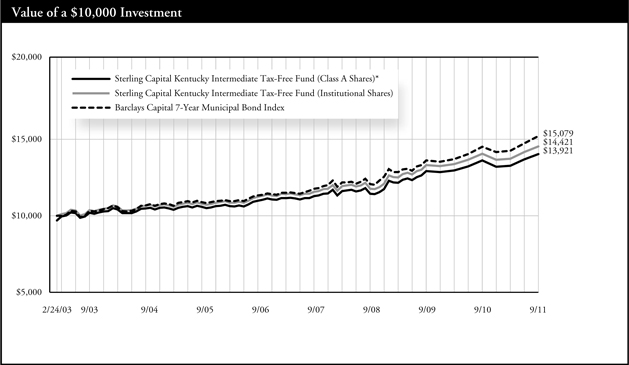

Sterling Capital Kentucky Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Kentucky Intermediate Tax-Free Fund (formerly known as BB&T Kentucky Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Kentucky and its political subdivisions and therefore will be affected by economic, political or other events affecting Kentucky.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund gained 3.34% (Institutional Shares). That compared to a 4.65% return for Barclays Capital 7-Year Municipal Bond Index.

Q. What factors affected the Fund’s performance?

A. Municipal bond markets generated strong absolute returns during the period. Several factors sparked a rally in Treasuries, which also prompted a muni bond rally. The threat of default by the Greek government and its reverberations through Europe in addition to Japan’s economic woes combined to drive Treasury and muni prices higher. Soft domestic economic growth and the Federal Reserve’s decision to keep short-term rates low buoyed the Fund’s returns as well. Issues with longer maturities — 7 to 10 years — were the bond market’s biggest performers.1

The Fund’s exposure to shorter-term bonds than the benchmark index dragged on relative returns. The Fund’s relative performance benefited from exposure to hospital, education and transportation bonds, which outperformed general obligation issues.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 3.00% maximum sales charge. |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2011 | | Inception

Date | | 1 Year | | 5 Years | | Since Inception |

Class A Shares* | | 2/24/03 | | -0.06% | | 4.28% | | 3.92% |

Institutional Shares | | 2/24/03 | | 3.34% | | 5.18% | | 4.35% |

Barclays Capital 7-Year Municipal Bond Index | | 2/28/03 | | 4.65% | | 5.95% | | 4.90% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

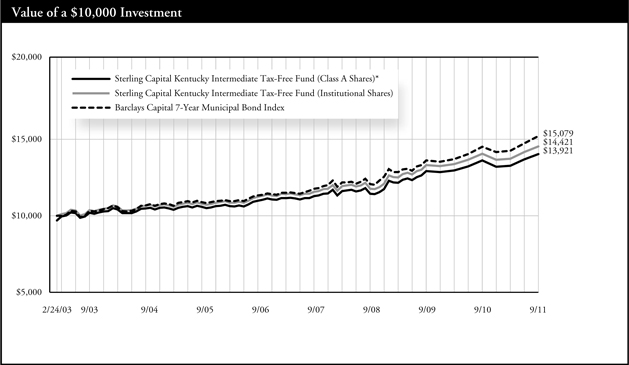

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

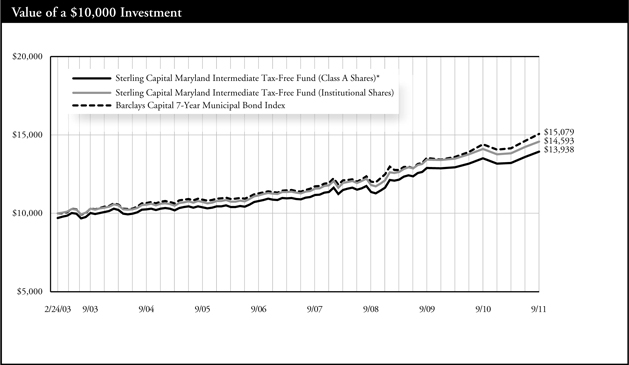

Sterling Capital Maryland Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital Maryland Intermediate Tax-Free Fund (formerly known as BB&T Maryland Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by Maryland and its political subdivisions and therefore will be affected by economic, political or other events affecting Maryland.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund gained 3.44% (Institutional Shares). That compared to a 4.65% return for Barclays Capital 7-Year Municipal Bond Index.

Q. What factors affected the Fund’s performance?

A. Investors bid up U.S. Treasuries and municipal bonds as market participants sought shelter from a global economy slowdown and the worries triggered by the euro zone’s ongoing debt crisis. Falling interest rates also helped longer-duration municipal bonds generate strong absolute returns.1

The Fund’s exposure to bonds shorter than five years dragged on returns relative to the benchmark. Meanwhile, holdings in high-quality states such as Maryland lagged those of bonds in more economically challenged jurisdictions, such as California, Illinois and New Jersey, which outperformed as spreads narrowed. Exposure to general obligation bonds weighed on relative returns, while the Fund’s positions in health care and education revenue bonds buoyed relative performance.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 3.00% maximum sales charge. |

| | | | | | | | |

Average Annual Total Returns |

As of September 30, 2011 | | Inception

Date | | 1 Year | | 5 Years | | Since

Inception |

Class A Shares* | | 2/24/03 | | -0.04% | | 4.60% | | 3.94% |

Institutional Shares | | 2/24/03 | | 3.44% | | 5.51% | | 4.49% |

Barclays Capital 7-Year Municipal Bond Index | | 2/28/03 | | 4.65% | | 5.95% | | 4.90% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

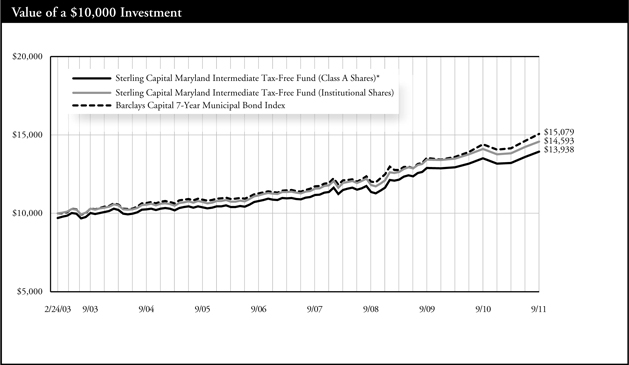

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

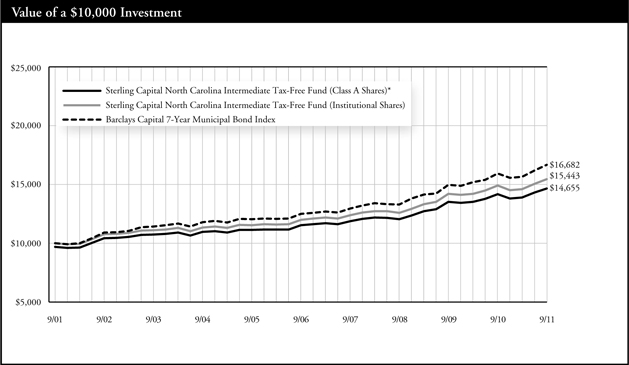

Sterling Capital North Carolina Intermediate Tax-Free Fund

Portfolio Manager

Robert F. Millikan, CFA

Sterling Capital North Carolina Intermediate Tax-Free Fund (formerly known as BB&T North Carolina Intermediate Tax-Free Fund) (the “Fund”) is managed by Robert F. Millikan, CFA, Executive Director and Portfolio Manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Robert joined Sterling Capital in 2000. He manages the state-specific municipal bond fund portfolios and has investment experience since 1990. Bob is a graduate of Wake Forest University where he received his BA in Economics and is a CFA Charterholder. The Investment Team supporting the Fund includes 18 investment professionals with an average of more than 16 years industry experience.

Investment Concerns

The Fund is subject to the same risks as the underlying bonds in the portfolios such as credit, prepayment and interest rate risk. As interest rates rise the value of bond prices will decline and an investor may lose money. The Fund is non-diversified and may invest a greater percentage of its assets in a single issuer than funds that are more diversified. Furthermore, the Fund invests primarily in municipal obligations issued by North Carolina and its political subdivisions and therefore will be affected by economic, political or other events affecting North Carolina.

Q. How did the Fund perform during the 12-month period between October 1, 2010 and September 30, 2011?

A. The Fund gained 3.60% (Institutional Shares). That compared to a 4.65% return for Barclays Capital 7-Year Municipal Bond Index.

Q. What factors affected the Fund’s performance?

A. Investors bid up U.S. Treasuries and municipal bonds as market participants sought shelter from a global economy slowdown and the worries triggered by the euro zone’s ongoing debt crisis. Falling interest rates also helped longer-duration municipal bonds generate strong absolute returns.1

The Fund’s exposure to bonds shorter than five years dragged on returns relative to the benchmark. Meanwhile, holdings in high-quality states such as North Carolina lagged those of bonds in more economically challenged jurisdictions, such as California, Illinois and New Jersey, which outperformed as spreads narrowed. Exposure to general obligation bonds weighed on relative returns, while the Fund’s positions in health care and education revenue bonds buoyed relative performance.1

| 1 | Portfolio composition is as of September 30, 2011 and is subject to change. |

| * | Reflects 3.00% maximum sales charge. |

| | | | | | | | | | | | | | | | |

Average Annual Total Returns | |

As of September 30, 2011 | |

| Inception

Date |

| | | 1 Year | | | | 5 Years | | | | 10 Years | |

Class A Shares* | | | 10/16/92 | | | | 0.25% | | | | 4.29% | | | | 3.90% | |

Institutional Shares | | | 10/16/92 | | | | 3.60% | | | | 5.19% | | | | 4.44% | |

Barclays Capital 7-Year Municipal Bond Index | | | N/A | | | | 4.65% | | | | 5.95% | | | | 5.25% | |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

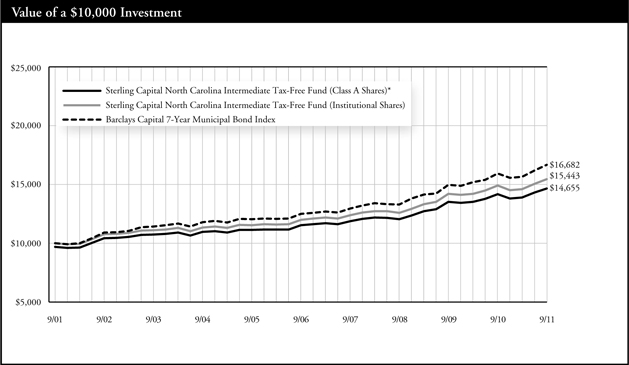

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against Barclays Capital 7-Year Municipal Bond Index, an unmanaged index which is representative of municipal bonds with a minimum credit rating of at least Baa, have a maturity value of at least $5 million and a maturity range of six to eight years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

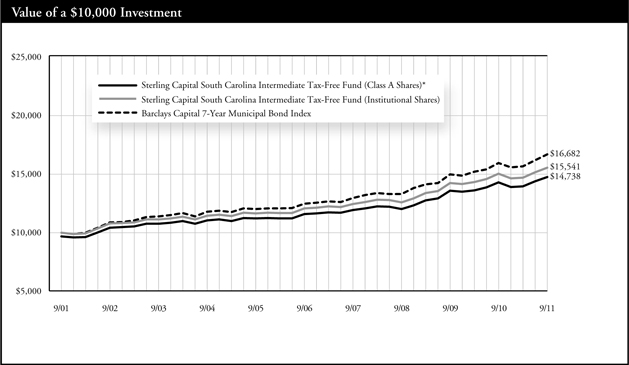

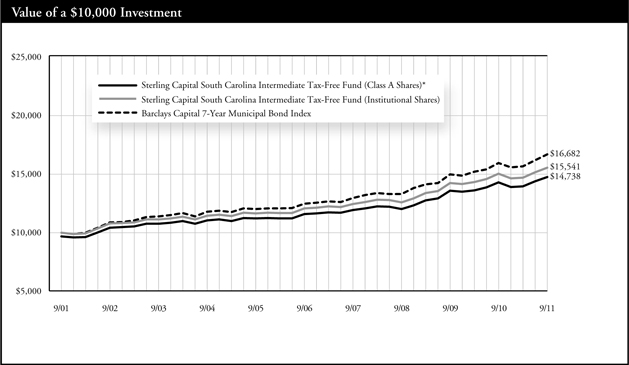

Sterling Capital South Carolina Intermediate Tax-Free Fund

Portfolio Manager

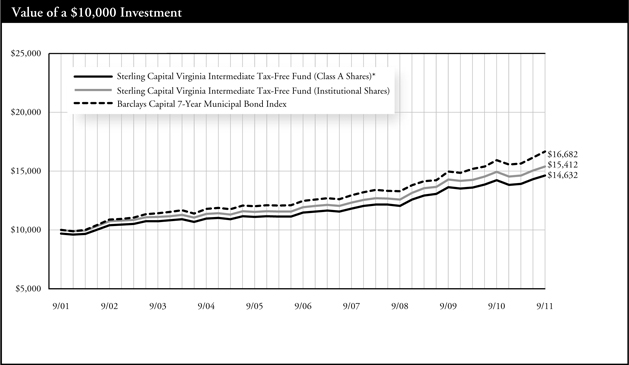

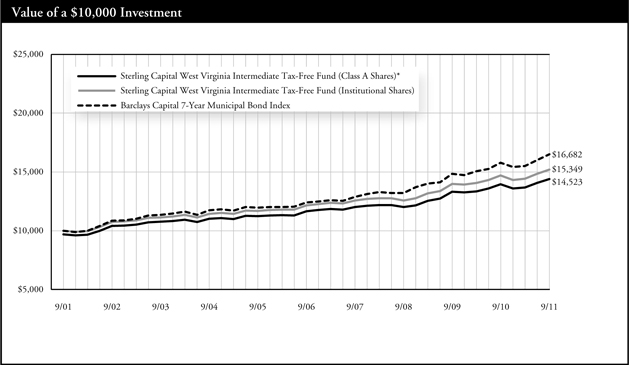

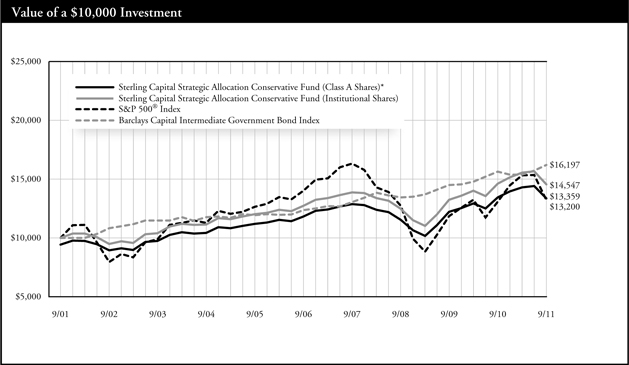

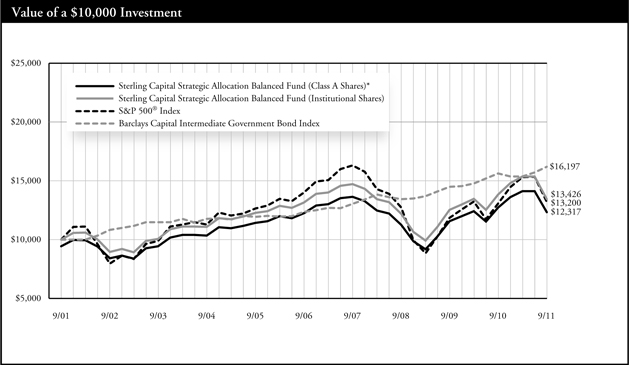

Robert F. Millikan, CFA