UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06719

| | | | |

| | Sterling Capital Funds | | |

| | (Exact name of registrant as specified in charter) | | |

434 Fayetteville Street, 5th Floor

| | | | |

| | Raleigh, NC 27601-0575 | | |

| | (Address of principal executive offices) (Zip code) | | |

James T. Gillespie, President

Sterling Capital Funds

434 Fayetteville Street, 5th Floor

| | | | |

| | Raleigh, NC 27601-0575 | | |

| | (Name and address of agent for service) | | |

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

ANNUAL REPORT

STERLING CAPITAL EQUITY INDEX FUND

Class A Shares

Class B Shares

Class C Shares

Institutional Shares

DECEMBER 31, 2012

Notice of Privacy Policy & Practices

Sterling Capital Funds recognizes and respects the privacy expectations of our customers.1 We provide this notice to you so that you will know what kinds of information we collect about our customers and the circumstances in which that information may be disclosed to third parties who are not affiliated with the Sterling Capital Funds.

Collection of Customer Information

We collect nonpublic personal information about our customers from the following sources:

| | • | | Account Applications and other forms, which may include a customer’s name, address, social security number and information about a customer’s investment goals and risk tolerance; |

| | • | | Account History, including information about the transactions and balances in a customer’s accounts; and |

| | • | | Correspondence, written, telephonic or electronic between a customer and the Sterling Capital Funds or service providers to the Sterling Capital Funds. |

Disclosure of Customer Information

We may disclose all of the consumer information outlined above to third parties who are not affiliated with the Sterling Capital Funds:

| | • | | as permitted by law — for example, with service providers who maintain or service shareholder accounts for the Sterling Capital Funds or to a shareholder’s broker or agent; and |

| | • | | to perform marketing services on our behalf or pursuant to a joint marketing agreement with another financial institution. |

Security of Customer Information

We require service providers to the Sterling Capital Funds:

| | • | | to maintain policies and procedures designed to assure only appropriate access to, and use of information about customers of the Sterling Capital Funds; and |

| | • | | to maintain physical, electronic and procedural safeguards that comply with applicable legal standards to guard nonpublic personal information of customers of the Sterling Capital Funds. |

We will adhere to the policies and practices described in this notice regardless of whether you are a current or former customer of the Sterling Capital Funds.

1 For purposes of this notice, the terms “customer” or “customers” includes both individual shareholders of the Sterling Capital Funds and individuals who provide nonpublic personal information to the Sterling Capital Funds, but do not invest in Sterling Capital Funds shares.

Letter from the Investment Advisor

Dear Shareholders,

We are pleased to present this annual report for the Sterling Capital Equity Index Fund covering the 12-month period through December 31, 2012.

U.S. equities made strong gains this year despite significant economic headwinds in the U.S. and abroad. Concerns about the ongoing eurozone debt crisis, an economic slowdown in China and the political face-off over the “fiscal cliff ” in the U.S. weighed on investors throughout the period. However, the U.S. economy continued its gradual recovery, supported by accommodative monetary policy and a recovering housing market. The S&P 500® Index1 (S&P) returned 16.00% for the year.

Early in the year, a nearly two-month stock rally was sustained by positive economic indicators and improving conditions in Europe due to the European Central Bank’s (ECB) long-term refinancing operations. Much of the gains made during that rally were lost by Summer, however. Disappointing job growth in the U.S. and a slowdown in China cast a pall over markets. Conditions in Europe deteriorated in the Spring as political instability in Greece deepened and Spain struggled to cope with a severe deficit.

Stocks made strong gains throughout the Summer as European leaders made significant progress toward fiscal integration in the euro currency bloc and the ECB president announced a commitment to doing “whatever it takes” to hold the eurozone together. In September, the ECB took significant measures to reduce peripheral countries’ interest costs while the U.S. Federal Reserve announced additional quantitative easing measures intended to improve employment and boost core inflation expectations.

Signs of vulnerability in the global economy dragged stocks down in the Fall. Slowing economic growth in China, and a rare leadership change in that country, threatened to undermine one of the world’s major drivers of growth. Disappointing economic data in the U.S. showed that another recession remained possible due to ongoing weakness, including declining exports and weak consumer income and savings.

Stocks picked up pace during the final months of the year as investors responded to a low interest rate environment by taking on more risk to achieve greater returns. Meanwhile, political leaders in the U.S. struggled to confront the looming fiscal cliff, which was scheduled to bring about automatic tax increases and spending cuts. Uncertainty regarding the fiscal cliff negotiations fueled high volatility in markets during the final days of 2012, and stocks pulled back slightly as the year ended without a last-minute deal.

For the year, international markets slightly outperformed U.S. stocks, with the MSCI EAFE Index showing a return of (+17.32%) during the period. In domestic markets, financials (+28.82%) and consumer discretionary (+23.89%) led among sectors in the S&P for 2012. Telecommunication services (+18.31%) and health care stocks (+17.70%) performed well after valuations in these sectors were pushed down by regulatory uncertainty. Every sector of the S&P moved higher in 2012, but energy stocks (+4.58%) lagged behind due to declining oil prices in the second half of the year, while utilities (+1.31%) lost favor with investors seeking higher risk investments.

Thank you for selecting the Sterling Capital Equity Index Fund. We look forward to serving your investment needs during the months and years ahead.

Sincerely,

Jeffrey J. Schappe, CFA

Managing Director-Chief Market Strategist

Sterling Capital Management LLC

| | 1 | “S&P 500®” is a registered service mark of Standard & Poor’s Corporation, which does not sponsor and is in no way affiliated with the Fund or Master Portfolio. The S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

Past performance does not guarantee future results. Mutual fund investing involves risk including the possible loss of principal.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Sterling Capital Management LLC (“Sterling Capital”) serves as investment advisor to the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”) and is paid a fee for its services. Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by Sterling Capital Distributors, LLC. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. Sterling Capital does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or as offering individual or personalized investment advice.

Sterling Capital Equity Index Fund

Investment Advisors

BlackRock Fund Advisors, a subsidiary of BlackRock, Inc. (S&P 500® Stock Master Portfolio), Sterling Capital Management LLC (Sterling Capital Equity Index Fund).

Unlike many traditional, actively managed investment funds, there is no single portfolio manager who makes investment decisions for the Sterling Capital Equity Index Fund (the “Fund”). Instead, the Fund invests substantially all of its assets in the S&P 500® Stock Master Portfolio (the “Master Portfolio”), which is managed by a team of investment professionals from BlackRock Fund Advisors, who use a specially designed software program to maintain a close match to the characteristics of the S&P 500® Index.

Investment Concerns

Equity securities (stocks) are more volatile. The net asset value per share of this Fund will fluctuate as the value of the securities held by the Master Portfolio changes. Common stocks, and funds investing in common stocks, generally provide greater return potential when compared with other types of investments.

The performance of the Fund is expected to be lower than that of the S&P 500® Index because of Fund fees and expenses.

Portfolio Manager’s Perspective

“Investing in an index fund such as ours is based on the belief that it’s very difficult to ‘beat the market’ on a consistent basis. Our approach, then, is to take advantage of the stock market’s long-term growth potential, while managing costs, to help shareholders potentially build wealth over time. We believe the Fund is an excellent tool for novice and experienced investors alike, and can serve as the foundation of most equity investors’ asset allocation strategies.”

Q. How did the Fund perform during the 12-month period between January 1, 2012 and December 31, 2012?

A. The Fund’s Class A Shares underperformed its benchmark, the S&P 500® Index.

Q. What factors affected the Fund’s performance?

A. The Fund seeks to approximate, as closely as possible, the performance of the capitalization-weighted S&P 500® Index.

Stocks began the year with a strong rally amid low volatility. The debt situation in Europe stabilized and global liquidity conditions improved as the European Central Bank (ECB) implemented its long-term refinancing operations. Positive economic indicators in the U.S. brightened the outlook for the world economy and equities moved boldly higher through the first two months of 2012.

A flare-up in the European debt crisis halted the rally in the Spring. Political instability in Greece caused anxiety about whether the country would continue its membership in the eurozone. Spain faced severe deficit issues, policymaking issues and a liquidity crisis in the nation’s banks. Many European countries fell into recession. Alongside the drama in Europe, investors became discouraged by gloomy economic reports from various parts of the world. A slowdown in China, a key powerhouse for global growth, was of particular concern. In the U.S., disappointing jobs reports signaled that the recovery was losing steam. U.S. equities lost half of their year-to-date gains by the end of May.

As the global economic picture dimmed, investors grew increasingly optimistic that the world’s central banks would intervene to stimulate growth. European leaders took meaningful steps toward fiscal integration in the euro currency bloc, helping to fuel a powerful equity rebound in June. A month later, ECB president Mario Draghi boosted

investor confidence by stating that his organization would do “whatever it takes” to hold the eurozone together. This assurance, along with growing hopes for additional central bank stimulus, overshadowed concerns about the dreary economic landscape. U.S. stocks continued their advance through the third quarter. In September, the ECB announced its decision to backstop eurozone governments with unlimited purchases of short-term sovereign debt. Days later, the U.S. Federal Reserve announced an aggressive stimulus program involving purchases of agency mortgage-backed securities.

Concerns about the world economy resurfaced in the Fall amid political uncertainty in key nations. Global trade slowed as Europe’s recession deepened, U.S. growth remained lackluster and growth continued to decelerate in China, where leadership change compounded uncertainty. In the U.S., the “fiscal cliff” threatened to push the nation into recession unless politicians could agree upon alternate measures to reduce the deficit before the end of 2012. Worries that political gridlock would preclude a budget deal prior to the deadline drove high levels of volatility in equity markets around the world in the months leading up to the last day of the year.

Despite a downtrodden economic environment and a suspenseful lead-up to the fiscal cliff deadline, U.S. stock prices moved higher through the final months of 2012 as investors took on more risk to achieve meaningful returns in the low interest rate environment.

The consumer discretionary and financials sectors saw the largest gains in 2012 among the S&P 500® Index sectors. Global central bank stimulus helped drive financials up 28.82%. Telecommunications services and health care stocks also performed well. All of the sectors moved higher during 2012, but energy stocks gained only 4.58% due to declining oil prices in the latter part of the year and utilities gained just 1.31% as investors sought riskier investments.

| | * | Reflects 5.75% maximum sales charge. |

| | ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

| | *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

| | | | | | | | | | | | | | |

| Average Annual Total Returns | | | | | | |

As of December 31, 2012 | | Inception

Date | | | 1 Year | | | 5 Years | | | 10 Years |

Class A Shares* | | | 9/11/00 | | | | 8.28 | % | | | -0.39% | | | 5.75% |

Class B Shares** | | | 9/11/00 | | | | 9.99 | % | | | -0.15% | | | 5.57% |

Class C Shares*** | | | 5/11/01 | | | | 13.90 | % | | | 0.04% | | | 5.58% |

Institutional Shares | | | 5/1/071 | | | | 15.01 | % | | | 1.10% | | | 6.52% |

S&P 500® Index | | | N/A | | | | 16.00 | % | | | 1.66% | | | 7.10% |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

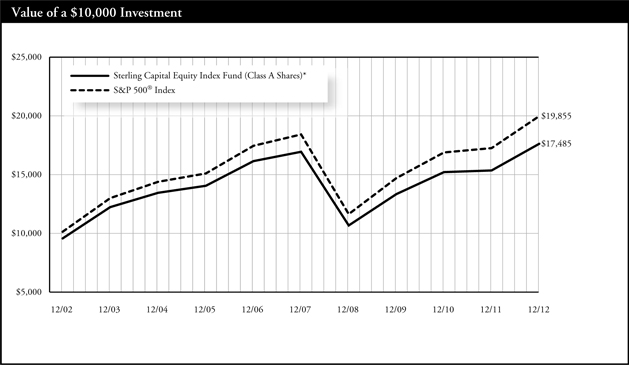

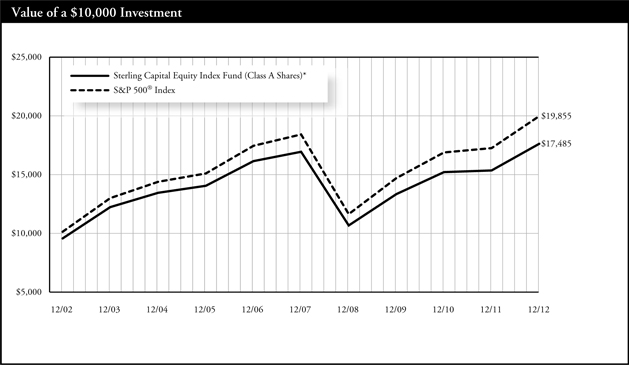

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Performance for Institutional Shares were not in existence prior to 5/1/07. Performance for periods prior to 5/1/07 is based on the performance of Class A Shares. Such performance would differ only to the extent that the Classes have different expenses. |

The Fund is measured against the S&P 500® Index, an unmanaged index which is generally considered to be representative of the performance of the stock market as a whole. Performance data for the S&P 500® Index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees had been contractually waived prior to 5/1/12. Fund performance for certain time periods would have been lower without fee waivers in effect. There are currently no agreements in effect.

Portfolio Holdings Summary

(Unaudited)

| | |

Investment Types | | % of Investments |

| |

S&P 500 Stock Master Portfolio | | 100.00% |

For a summary of the S&P 500 Stock Master Portfolio’s holdings, please see the accompanying financial statements of the S&P 500 Stock Master Portfolio.

Expense Example (Unaudited)

As a shareholder of the Sterling Capital Equity Index Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses.

These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2012 through December 31, 2012.

Actual Example

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | |

| | | Beginning

Account Value

7/1/12 | | Ending

Account Value

12/31/12 | | Expenses Paid

During Period*

7/1/12 - 12/31/12 | | Annualized

Expense Ratio**

During Period

7/1/12 - 12/31/12 |

Sterling Capital Equity Index Fund | | | | | | | | |

Class A Shares | | $1,000.00 | | $1,054.30 | | $5.58 | | 1.08% |

Class B Shares | | 1,000.00 | | 1,050.80 | | 9.43 | | 1.83% |

Class C Shares | | 1,000.00 | | 1,049.90 | | 9.43 | | 1.83% |

Institutional Shares | | 1,000.00 | | 1,055.80 | | 4.29 | | 0.83% |

| | * | Expenses are equal to the average account value over the period multiplied by the Fund’s annualized expense ratio, multiplied by 184 days divided by 366 (to reflect the six month period). |

| | ** | The annual expense ratio includes expenses allocated from the S&P 500 Stock Master Portfolio. |

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | |

| | | Beginning

Account Value

7/1/12 | | Ending

Account Value

12/31/12 | | Expenses Paid

During Period*

7/1/12 - 12/31/12 | | Annualized

Expense Ratio**

During Period

7/1/12 - 12/31/12 |

Sterling Capital Equity Index Fund | | | | | | | | |

Class A Shares | | $1,000.00 | | $1,019.71 | | $5.48 | | 1.08% |

Class B Shares | | 1,000.00 | | 1,015.94 | | 9.27 | | 1.83% |

Class C Shares | | 1,000.00 | | 1,015.94 | | 9.27 | | 1.83% |

Institutional Shares | | 1,000.00 | | 1,020.96 | | 4.22 | | 0.83% |

| | * | Expenses are equal to the average account value over the period multiplied by the Fund’s annualized expense ratio, multiplied by 184 days divided by 366 (to reflect the six month period). |

| | ** | The annual expense ratio includes expenses allocated from the S&P 500 Stock Master Portfolio. |

4

|

Sterling Capital Equity Index Fund |

Statement of Assets and Liabilities

December 31, 2012

| | | | |

Assets: | | | | |

Investment in S&P 500 Stock Master Portfolio, at value (See Note 1) | | $ | 20,474,148 | |

Receivable for capital shares issued | | | 11,276 | |

Prepaid expenses | | | 4,306 | |

| | | | |

Total Assets | | | 20,489,730 | |

| | | | |

Liabilities: | | | | |

Distributions payable | | | 85 | |

Payable for capital shares redeemed | | | 11,275 | |

Accrued expenses and other payables: | | | | |

Administration fees | | | 1,697 | |

Compliance service fees | | | 36 | |

Distribution fees | | | 4,328 | |

Trustee fees | | | 18 | |

Fund accounting fees | | | 8,531 | |

Printing fees | | | 10,730 | |

Professional fees | | | 18,510 | |

Other | | | 816 | |

| | | | |

Total Liabilities | | | 56,026 | |

| | | | |

Net Assets | | $ | 20,433,704 | |

| | | | |

Net Assets Consist of: | | | | |

Capital | | $ | 28,793,579 | |

Accumulated undistributed net investment income | | | 10,796 | |

Accumulated realized loss | | | (16,519,911 | ) |

Net unrealized appreciation (depreciation) | | | 8,149,240 | |

| | | | |

Net Assets | | $ | 20,433,704 | |

| | | | |

Net Assets | | | | |

Class A Shares | | $ | 13,898,676 | |

Class B Shares | | | 1,280,153 | |

Class C Shares | | | 338,136 | |

Institutional Shares | | | 4,916,739 | |

| | | | |

Total | | $ | 20,433,704 | |

| | | | |

| |

Shares of Beneficial Interest Outstanding (Unlimited number of shares authorized, no par value): | | | | |

Class A Shares | | | 1,452,798 | |

Class B Shares | | | 135,934 | |

Class C Shares | | | 35,672 | |

Institutional Shares | | | 514,797 | |

| | | | |

Total | | | 2,139,201 | |

| | | | |

Net Asset Value | | | | |

Class A Shares - redemption price per share | | $ | 9.57 | |

| | | | |

Class B Shares - offering price per share* | | $ | 9.42 | |

| | | | |

Class C Shares - offering price per share* | | $ | 9.48 | |

| | | | |

Institutional Shares - offering and redemption price per share | | $ | 9.55 | |

| | | | |

Maximum Sales Charge - Class A Shares | | | 5.75 | % |

| | | | |

Maximum Offering Price (100%/(100% - Maximum Sales Charge)) of net asset value adjusted to the nearest cent per share - Class A Shares | | $ | 10.15 | |

| | | | |

| * | Redemption price per share varies by length of time shares are held. |

See accompanying notes to the financial statements.

5

|

Sterling Capital Equity Index Fund |

Statement of Operations

For the Year Ended December 31, 2012

| | | | |

Net Investment Income Allocated from Master Portfolio: | | | | |

Dividend income | | $ | 465,477 | |

Foreign tax withholding | | | (255 | ) |

Interest Income | | | 875 | |

Securities lending income | | | 5,013 | |

Expenses(a) | | | (10,142 | ) |

| | | | |

Net Investment Income Allocated from Master Portfolio | | | 460,968 | |

| | | | |

Expenses: | | | | |

Distribution fees - Class A Shares | | | 45,247 | |

Distribution fees - Class B Shares | | | 16,335 | |

Distribution fees - Class C Shares | | | 2,769 | |

Administration fees (See Note 3) | | | 20,176 | |

Fund accounting fees | | | 45,337 | |

Compliance service fees (See Note 3) | | | 213 | |

Custodian fees | | | 957 | |

Printing fees | | | 32,801 | |

Professional fees | | | 29,178 | |

Registration fees | | | 13,864 | |

Transfer agent fees (See Note 3) | | | 11,991 | |

Trustees fees | | | 1,810 | |

Other | | | 8,076 | |

| | | | |

Gross expenses | | | 228,754 | |

Less expenses waived by the Distributor (See Note 3) | | | (11,379 | ) |

| | | | |

Net Expenses | | | 217,375 | |

| | | | |

Net Investment Income | | | 243,593 | |

| | | | |

Realized and Unrealized Gain (Loss) Allocated from Master Portfolio: | | | | |

Net realized gain from: | | | | |

Investments | | | 6,282,242 | |

Futures contracts | | | 31,648 | |

Change in unrealized appreciation/depreciation on: | | | | |

Investments | | | (3,719,312 | ) |

Futures contracts | | | 9,403 | |

| | | | |

Net realized/unrealized gains allocated from Master Portfolio | | | 2,603,981 | |

| | | | |

Change in net assets from operations | | $ | 2,847,574 | |

| | | | |

| (a) | Expenses allocated from the S&P 500 Stock Master Portfolio are shown net of any fee reductions. |

See accompanying notes to the financial statements.

6

|

Sterling Capital Equity Index Fund |

Statements of Changes in Net Assets

| | | | | | | | |

| | | For the

Year Ended

December 31,

2012 | | | For the

Year Ended

December 31,

2011 | |

From Investment Activities: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 243,593 | | | $ | 226,747 | |

Net realized gain (loss) | | | 6,313,890 | | | | (1,517,723 | ) |

Change in unrealized appreciation/depreciation | | | (3,709,909 | ) | | | 1,636,552 | |

| | | | | | | | |

Change in net assets from operations | | | 2,847,574 | | | | 345,576 | |

| | | | | | | | |

Distributions to Class A Shareholders: | | | | | | | | |

Net investment income | | | (154,294 | ) | | | (152,667 | ) |

Return of Capital | | | — | | | | (4,792 | ) |

Distributions to Class B Shareholders: | | | | | | | | |

Net investment income | | | (4,354 | ) | | | (5,564 | ) |

Return of Capital | | | — | | | | (175 | ) |

Distributions to Class C Shareholders: | | | | | | | | |

Net investment income | | | (1,369 | ) | | | (578 | ) |

Return of Capital | | | — | | | | (18 | ) |

Distributions to Institutional Shareholders: | | | | | | | | |

Net investment income | | | (66,914 | ) | | | (60,392 | ) |

Return of Capital | | | — | | | | (1,895 | ) |

| | | | | | | | |

Change in net assets from shareholder distributions | | | (226,931 | ) | | | (226,081 | ) |

| | | | | | | | |

Capital Transactions: | | | | | | | | |

Class A Shares: | | | | | | | | |

Proceeds from shares issued | | | 2,496,732 | | | | 2,350,164 | |

Distributions reinvested | | | 152,830 | | | | 156,426 | |

Value of shares redeemed | | | (4,418,884 | ) | | | (7,695,209 | ) |

| | | | | | | | |

Change in net assets from Class A Share transactions | | | (1,769,322 | ) | | | (5,188,619 | ) |

Class B Shares: | | | | | | | | |

Proceeds from shares issued | | | 14,035 | | | | — | |

Distributions reinvested | | | 4,138 | | | | 5,588 | |

Value of shares redeemed | | | (984,289 | ) | | | (1,599,125 | ) |

| | | | | | | | |

Change in net assets from Class B Share transactions | | | (966,116 | ) | | | (1,593,537 | ) |

Class C Shares: | | | | | | | | |

Proceeds from shares issued | | | 115,956 | | | | 163,007 | |

Distributions reinvested | | | 1,369 | | | | 596 | |

Value of shares redeemed | | | (33,577 | ) | | | (105,847 | ) |

| | | | | | | | |

Change in net assets from Class C Share transactions | | | 83,748 | | | | 57,756 | |

Institutional Shares: | | | | | | | | |

Distributions reinvested | | | 60,723 | | | | 61,282 | |

Value of shares redeemed | | | (46,246 | ) | | | (965,485 | ) |

| | | | | | | | |

Change in net assets from Institutional Share transactions | | | 14,477 | | | | (904,203 | ) |

| | | | | | | | |

Change in net assets from capital transactions | | | (2,637,213 | ) | | | (7,628,603 | ) |

| | | | | | | | |

Change in Net Assets | | | (16,570 | ) | | | (7,509,108 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 20,450,274 | | | | 27,959,382 | |

| | | | | | | | |

End of year | | $ | 20,433,704 | | | $ | 20,450,274 | |

| | | | | | | | |

Accumulated undistributed net investment income | | $ | 10,796 | | | $ | — | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Class A Shares: | | | | | | | | |

Issued | | | 270,316 | | | | 274,089 | |

Reinvested | | | 16,292 | | | | 18,445 | |

Redeemed | | | (482,400 | ) | | | (895,791 | ) |

| | | | | | | | |

Change in Class A Shares | | | (195,792 | ) | | | (603,257 | ) |

Class B Shares: | | | | | | | | |

Issued | | | 1,512 | | | | — | |

Reinvested | | | 444 | | | | 665 | |

Redeemed | | | (108,943 | ) | | | (190,362 | ) |

| | | | | | | | |

Change in Class B Shares | | | (106,987 | ) | | | (189,697 | ) |

Class C Shares: | | | | | | | | |

Issued | | | 12,822 | | | | 18,806 | |

Reinvested | | | 147 | | | | 71 | |

Redeemed | | | (3,608 | ) | | | (13,914 | ) |

| | | | | | | | |

Change in Class C Shares | | | 9,361 | | | | 4,963 | |

Institutional Shares: | | | | | | | | |

Reinvested | | | 6,487 | | | | 7,224 | |

Redeemed | | | (5,130 | ) | | | (109,587 | ) |

| | | | | | | | |

Change in Institutional Shares | | | 1,357 | | | | (102,363 | ) |

| | | | | | | | |

Change in Shares | | | (292,061 | ) | | | (890,354 | ) |

| | | | | | | | |

See accompanying notes to the financial statements.

7

|

Sterling Capital Equity Index Fund |

Financial Highlights, Class A Shares

The financial highlights table is intended to help you understand the Fund’s financial performance for the past 5 years. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended

December 31, 2012 | | For the Year Ended

December 31, 2011 | | For the Year Ended

December 31, 2010 | | For the Year Ended

December 31, 2009 | | For the

Year Ended

December 31, 2008 |

Net Asset Value, Beginning of Year | | | | $ | 8.43 | | | | | | | $ | 8.44 | | | | | | | $ | 7.49 | | | | | | | $ | 6.05 | | | | | | | $ | 9.85 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(a)(b) | | | | | 0.11 | | | | | | | | 0.09 | | | | | | | | 0.09 | | | | | | | | 0.08 | | | | | | | | 0.15 | | | |

Net realized and unrealized gain (loss) from investments(b) | | | | | 1.14 | | | | | | | | (0.01 | )(c) | | | | | | | 0.96 | | | | | | | | 1.45 | | | | | | | | (3.80 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from Investment Activities | | | | | 1.25 | | | | | | | | 0.08 | | | | | | | | 1.05 | | | | | | | | 1.53 | | | | | | | | (3.65 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.11 | ) | | | | | | | (0.09 | ) | | | | | | | (0.10 | ) | | | | | | | (0.08 | ) | | | | | | | (0.15 | ) | | |

Return of capital | | | | | — | | | | | | | | (0.00 | )(d) | | | | | | | — | | | | | | | | (0.01 | ) | | | | | | | (0.00 | )(d) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | | | (0.11 | ) | | | | | | | (0.09 | ) | | | | | | | (0.10 | ) | | | | | | | (0.09 | ) | | | | | | | (0.15 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value — End of Year | | | | $ | 9.57 | | | | | | | $ | 8.43 | | | | | | | $ | 8.44 | | | | | | | $ | 7.49 | | | | | | | $ | 6.05 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (excludes sales charge) | | | | | 14.83 | % | | | | | | | 0.94 | % | | | | | | | 14.09 | % | | | | | | | 25.60 | % | | | | | | | (37.35 | )% | | |

| | | | | | | | | | | | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (000’s) | | | | $ | 13,899 | | | | | | | $ | 13,896 | | | | | | | $ | 19,004 | | | | | | | $ | 19,191 | | | | | | | $ | 15,795 | | | |

Ratio of net expenses to average net assets(b) | | | | | 1.12 | % | | | | | | | 1.10 | % | | | | | | | 0.93 | % | | | | | | | 1.00 | % | | | | | | | 0.54 | % | | |

Ratio of net investment income to average net assets(b) | | | | | 1.22 | % | | | | | | | 1.02 | % | | | | | | | 1.20 | % | | | | | | | 1.27 | % | | | | | | | 1.79 | % | | |

Ratio of expenses to average net assets*(b) | | | | | 1.20 | % | | | | | | | 1.36 | % | | | | | | | 1.18 | % | | | | | | | 1.25 | % | | | | | | | 0.79 | % | | |

Portfolio turnover rate(e) | | | | | 10 | % | | | | | | | 5 | % | | | | | | | 9 | % | | | | | | | 5 | % | | | | | | | 8 | % | | |

| * | During the periods, certain fees were contractually waived (See Note 3 in the Notes to the Financial Statements). If such reductions had not occurred, the ratios would have been as indicated. |

| (a) | Per share net investment income has been calculated using the average daily shares method. |

| (b) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Stock Master Portfolio. |

| (c) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of Fund shares in relation to fluctuating market values during the period. |

| (d) | Less than (0.01) per share. |

| (e) | This rate represents the portfolio turnover rate of the S&P 500 Stock Master Portfolio. |

See accompanying notes to the financial statements.

8

|

Sterling Capital Equity Index Fund |

Financial Highlights, Class B Shares

The financial highlights table is intended to help you understand the Fund’s financial performance for the past 5 years. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

December 31, 2012 | | For the

Year Ended

December 31, 2011 | | For the

Year Ended

December 31, 2010 | | For the

Year Ended

December 31, 2009 | | For the

Year Ended

December 31, 2008 |

Net Asset Value, Beginning of Year | | | | $ | 8.29 | | | | | | | $ | 8.29 | | | | | | | $ | 7.35 | | | | | | | $ | 5.94 | | | | | | | $ | 9.67 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(a)(b) | | | | | 0.04 | | | | | | | | 0.02 | | | | | | | | 0.03 | | | | | | | | 0.03 | | | | | | | | 0.09 | | | |

Net realized and unrealized gain (loss) from investments(b) | | | | | 1.12 | | | | | | | | — | | | | | | | | 0.94 | | | | | | | | 1.42 | | | | | | | | (3.73 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from Investment Activities | | | | | 1.16 | | | | | | | | 0.02 | | | | | | | | 0.97 | | | | | | | | 1.45 | | | | | | | | (3.64 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.03 | ) | | | | | | | (0.02 | ) | | | | | | | (0.03 | ) | | | | | | | (0.04 | ) | | | | | | | (0.09 | ) | | |

Return of capital | | | | | — | | | | | | | | (0.00 | )(c) | | | | | | | — | | | | | | | | (0.00 | )(c) | | | | | | | (0.00 | )(c) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | | | (0.03 | ) | | | | | | | (0.02 | ) | | | | | | | (0.03 | ) | | | | | | | (0.04 | ) | | | | | | | (0.09 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value — End of Year | | | | $ | 9.42 | | | | | | | $ | 8.29 | | | | | | | $ | 8.29 | | | | | | | $ | 7.35 | | | | | | | $ | 5.94 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (excludes sales charge) | | | | | 13.99 | % | | | | | | | 0.23 | % | | | | | | | 13.30 | % | | | | | | | 24.58 | % | | | | | | | (37.83 | )% | | |

| | | | | | | | | | | | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (000’s) | | | | $ | 1,280 | | | | | | | $ | 2,014 | | | | | | | $ | 3,588 | | | | | | | $ | 5,298 | | | | | | | $ | 6,432 | | | |

Ratio of net expenses to average net assets(b) | | | | | 1.87 | % | | | | | | | 1.84 | % | | | | | | | 1.67 | % | | | | | | | 1.76 | % | | | | | | | 1.30 | % | | |

Ratio of net investment income to average net assets(b) | | | | | 0.41 | % | | | | | | | 0.26 | % | | | | | | | 0.42 | % | | | | | | | 0.55 | % | | | | | | | 1.05 | % | | |

Ratio of expenses to average net assets*(b) | | | | | 1.87 | % | | | | | | | 1.85 | % | | | | | | | 1.68 | % | | | | | | | 1.76 | % | | | | | | | 1.30 | % | | |

Portfolio turnover rate(d) | | | | | 10 | % | | | | | | | 5 | % | | | | | | | 9 | % | | | | | | | 5 | % | | | | | | | 8 | % | | |

| * | During the periods, certain fees were contractually waived (See Note 3 in the Notes to the Financial Statements). If such reductions had not occurred, the ratios would have been as indicated. |

| (a) | Per share net investment income has been calculated using the average daily shares method. |

| (b) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Stock Master Portfolio. |

| (c) | Less than (0.01) per share. |

| (d) | This rate represents the portfolio turnover rate of the S&P 500 Stock Master Portfolio. |

See accompanying notes to the financial statements.

9

|

Sterling Capital Equity Index Fund |

Financial Highlights, Class C Shares

The financial highlights table is intended to help you understand the Fund’s financial performance for the past 5 years. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

December 31, 2012 | | For the

Year Ended

December 31, 2011 | | For the

Year Ended

December 31, 2010 | | For the

Year Ended

December 31, 2009 | | For the

Year Ended

December 31, 2008 |

Net Asset Value, Beginning of Year | | | | $ | 8.36 | | | | | | | $ | 8.36 | | | | | | | $ | 7.42 | | | | | | | $ | 6.00 | | | | | | | $ | 9.76 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(a)(b) | | | | | 0.05 | | | | | | | | 0.02 | | | | | | | | 0.04 | | | | | | | | 0.03 | | | | | | | | 0.08 | | | |

Net realized and unrealized gain (loss) from investments(b) | | | | | 1.11 | | | | | | | | — | | | | | | | | 0.94 | | | | | | | | 1.44 | | | | | | | | (3.76 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from Investment Activities | | | | | 1.16 | | | | | | | | 0.02 | | | | | | | | 0.98 | | | | | | | | 1.47 | | | | | | | | (3.68 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.04 | ) | | | | | | | (0.02 | ) | | | | | | | (0.04 | ) | | | | | | | (0.04 | ) | | | | | | | (0.08 | ) | | |

Return of capital | | | | | — | | | | | | | | (0.00 | )(c) | | | | | | | — | | | | | | | | (0.01 | ) | | | | | | | (0.00 | )(c) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | | | (0.04 | ) | | | | | | | (0.02 | ) | | | | | | | (0.04 | ) | | | | | | | (0.05 | ) | | | | | | | (0.08 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value — End of Year | | | | $ | 9.48 | | | | | | | $ | 8.36 | | | | | | | $ | 8.36 | | | | | | | $ | 7.42 | | | | | | | $ | 6.00 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (excludes sales charge) | | | | | 13.90 | % | | | | | | | 0.29 | % | | | | | | | 13.28 | % | | | | | | | 24.60 | % | | | | | | | (37.84 | )% | | |

| | | | | | | | | | | | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (000’s) | | | | $ | 338 | | | | | | | $ | 220 | | | | | | | $ | 179 | | | | | | | $ | 123 | | | | | | | $ | 89 | | | |

Ratio of net expenses to average net assets(b) | | | | | 1.86 | % | | | | | | | 1.87 | % | | | | | | | 1.68 | % | | | | | | | 1.74 | % | | | | | | | 1.30 | % | | |

Ratio of net investment income to average net assets(b) | | | | | 0.51 | % | | | | | | | 0.26 | % | | | | | | | 0.46 | % | | | | | | | 0.52 | % | | | | | | | 0.95 | % | | |

Ratio of expenses to average net assets*(b) | | | | | 1.86 | % | | | | | | | 1.87 | % | | | | | | | 1.69 | % | | | | | | | 1.74 | % | | | | | | | 1.30 | % | | |

Portfolio turnover rate(d) | | | | | 10 | % | | | | | | | 5 | % | | | | | | | 9 | % | | | | | | | 5 | % | | | | | | | 8 | % | | |

| * | During the periods, certain fees were contractually waived (See Note 3 in the Notes to the Financial Statements). If such reductions had not occurred, the ratios would have been as indicated. |

| (a) | Per share net investment income has been calculated using the average daily shares method. |

| (b) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Stock Master Portfolio. |

| (c) | Less than (0.01) per share. |

| (d) | This rate represents the portfolio turnover rate of the S&P 500 Stock Master Portfolio. |

See accompanying notes to the financial statements.

10

|

Sterling Capital Equity Index Fund |

Financial Highlights, Institutional Shares

The financial highlights table is intended to help you understand the Fund’s financial performance for the past 5 years. Certain information reflects financial results for a single Fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the Fund (assuming reinvestment of all dividends and distributions).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

December 31, 2012 | | For the

Year Ended

December 31, 2011 | | For the

Year Ended

December 31, 2010 | | For the

Year Ended

December 31, 2009 | | For the

Year Ended

December 31, 2008 |

Net Asset Value, Beginning of Year | | | | $ | 8.42 | | | | | | | $ | 8.43 | | | | | | | $ | 7.48 | | | | | | | $ | 6.02 | | | | | | | $ | 9.81 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Activities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(a)(b) | | | | | 0.14 | | | | | | | | 0.11 | | | | | | | | 0.11 | | | | | | | | 0.10 | | | | | | | | 0.17 | | | |

Net realized and unrealized gain (loss) from investments(b) | | | | | 1.12 | | | | | | | | (0.01 | )(c) | | | | | | | 0.96 | | | | | | | | 1.47 | | | | | | | | (3.79 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total from Investment Activities | | | | | 1.26 | | | | | | | | 0.10 | | | | | | | | 1.07 | | | | | | | | 1.57 | | | | | | | | (3.62 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | | (0.13 | ) | | | | | | | (0.11 | ) | | | | | | | (0.12 | ) | | | | | | | (0.10 | ) | | | | | | | (0.17 | ) | | |

Return of capital | | | | | — | | | | | | | | (0.00 | )(d) | | | | | | | — | | | | | | | | (0.01 | ) | | | | | | | (0.00 | )(d) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | | | (0.13 | ) | | | | | | | (0.11 | ) | | | | | | | (0.12 | ) | | | | | | | (0.11 | ) | | | | | | | (0.17 | ) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value — End of Year | | | | $ | 9.55 | | | | | | | $ | 8.42 | | | | | | | $ | 8.43 | | | | | | | $ | 7.48 | | | | | | | $ | 6.02 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Return (excludes sales charge) | | | | | 15.01 | % | | | | | | | 1.21 | % | | | | | | | 14.41 | % | | | | | | | 26.36 | % | | | | | | | (37.24 | )% | | |

| | | | | | | | | | | | | | | |

Ratios/Supplementary Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Year (000’s) | | | | $ | 4,917 | | | | | | | $ | 4,321 | | | | | | | $ | 5,189 | | | | | | | $ | 3,343 | | | | | | | $ | 47,259 | | | |

Ratio of net expenses to average net assets(b) | | | | | 0.87 | % | | | | | | | 0.85 | % | | | | | | | 0.68 | % | | | | | | | 0.72 | % | | | | | | | 0.30 | % | | |

Ratio of net investment income to average net assets(b) | | | | | 1.47 | % | | | | | | | 1.27 | % | | | | | | | 1.46 | % | | | | | | | 1.66 | % | | | | | | | 2.08 | % | | |

Ratio of expenses to average net assets*(b) | | | | | 0.87 | % | | | | | | | 0.86 | % | | | | | | | 0.69 | % | | | | | | | 0.72 | % | | | | | | | 0.30 | % | | |

Portfolio turnover rate(e) | | | | | 10 | % | | | | | | | 5 | % | | | | | | | 9 | % | | | | | | | 5 | % | | | | | | | 8 | % | | |

| * | During the periods, certain fees were contractually waived (See Note 3 in the Notes to the Financial Statements). If such reductions had not occurred, the ratios would have been as indicated. |

| (a) | Per share net investment income has been calculated using the average daily shares method. |

| (b) | The per share amounts and percentages reflect income and expenses assuming inclusion of the Fund’s proportionate share of the income and expenses of the S&P 500 Stock Master Portfolio. |

| (c) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of Fund shares in relation to fluctuating market values during the period. |

| (d) | Less than (0.01) per share. |

| (e) | This rate represents the portfolio turnover rate of the S&P 500 Stock Master Portfolio. |

See accompanying notes to the financial statements.

11

|

Sterling Capital Equity Index Fund |

Notes to the Financial Statements

December 31, 2012

The Sterling Capital Equity Index Fund (the “Fund”) commenced operations on September 11, 2000 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified open-end investment company. The Fund is a separate series of the Sterling Capital Funds (the “Trust”), a Massachusetts business trust organized in 1992. The Fund invests all of its investable assets in the S&P 500 Stock Master Portfolio (the “Master Portfolio”) of the Master Investment Portfolio (“MIP”), a diversified open-end management investment company registered under the 1940 Act, rather than in a portfolio of securities. The Master Portfolio has substantially the same investment objective as the Fund. BlackRock Fund Advisors serves as investment advisor for the Master Portfolio. The financial statements of the Master Portfolio, including the schedule of investments in securities, are contained elsewhere in this report and should be read in conjunction with the Fund’s financial statements. The value of the Fund’s investment in the Master Portfolio reflects the Fund’s interest of 1.19% in the net assets of the Master Portfolio at December 31, 2012.

The Fund is authorized to issue an unlimited number of shares. The Fund offers four classes of shares: Class A Shares, Class B Shares, Class C Shares and Institutional Shares. Class B Shares of the Fund are closed to new accounts and additional purchases by existing shareholders. Class B Shares automatically convert to Class A Shares after eight years. Class A Shares of the Fund have a maximum sales charge of 5.75% as a percentage of the original purchase price. Purchases of $1 million or more of Class A Shares are not subject to a front-end sales charge, but will be subject to a contingent deferred sales charge (“CDSC”) of up to 1.00% of the purchase price as described below. A CDSC of up to 1.00% of the purchase price of Class A Shares will be charged to the following shareholders who received a sales charge waiver, and then redeem their shares within two years after purchase: (i) shareholders who purchased $1 million or more and (ii) employees of the Trust, BB&T Corporation and its affiliates for shares purchased prior 2/17/2012. The CDSC is based on the lower of the cost for the shares or their net asset value at the time of redemption. Class B Shares of the Fund are offered without any front-end sales charge but will be subject to a CDSC ranging from a maximum of 5.00% if redeemed less than one year after purchase to 0.00% if redeemed more than six years after purchase. Class C Shares of the Fund are offered without any front-end sales charge but will be subject to a maximum CDSC of 1.00% if redeemed less than one year after purchase. Institutional Shares of the Fund are offered without any front-end sales charge and without any CDSC.

Each class of shares has identical rights and privileges except with respect to the fees paid under the distribution plan, voting rights on matters affecting a single class of shares and the exchange privilege of each class of shares.

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Fund may enter into contracts with their vendors and others that provide for general indemnifications.The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

| | 2. | Significant Accounting Policies: |

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.The policies are in conformity with United States generally accepted accounting principles (“U.S. GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the reporting period. Actual results could differ from those estimates.

Securities Valuation — The Fund records its investment in the Master Portfolio at fair value. Valuation of securities held by the Master Portfolio is discussed in Note 1 of the Master Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

Fair Value Measurements — The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

• Level 1 – quoted prices in active markets for identical securities

12

|

Sterling Capital Equity Index Fund |

Notes to the Financial Statements — (continued)

December 31, 2012

• Level 2 – based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – based on significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. During the fiscal year ended December 31, 2012, there were no significant changes to the valuation policies and procedures.

The summary of inputs used to determine the fair value of the Fund’s investment as of December 31, 2012 is as follows:

| | | | | | | | |

| | | Level 1–

Quoted Inputs | | Level 2–

Other Significant

Observable Inputs | | Level 3–

Other

Significant

Unobservable Inputs | | Total Fair Value |

| | | | |

Investment in Master Portfolio | | $20,474,148 | | $— | | $— | | $20,474,148 |

There were no transfers between Level 1 and Level 2 for the fiscal year ended December 31, 2012. The Fund’s policy is to recognize transfers in and transfers out as of the beginning of the reporting period.

Distributions to Shareholders — Distributions from net investment income are declared and paid quarterly by the Fund. Distributable net realized gains, if any, are declared and distributed at least annually. The character of income and gains distributed are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., redemptions in-kind, wash sales, expiration of capital loss carryforwards, investments in real estate investment trusts (REITs), gains and losses from contributed securities, and return of capital distribution received from securities held), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. These reclassifications have no effect on net assets or net asset values per share. Distributions to shareholders which exceed net investment income and net realized gains for tax purposes are reported as distributions of capital.

As of December 31, 2012, these reclassifications were as follows:

| | | | | | |

| | | Undistributed Net

Investment Income | | Accumulated

Realized Gains | | Paid-in-Capital |

| | $(5,866) | | $(7,845,122) | | $7,850,988 |

Expenses and Allocation Methodology — Expenses directly attributable to a class of shares are charged to that class. Expenses directly attributable to the Fund are charged to the Fund. Expenses not directly attributable to the Fund are allocated proportionately among the Trust daily in relation to the net assets of each series of the Trust or on another reasonable basis. Each class of shares bears its pro-rata portion of expenses attributable to its series, except that each class separately bears expenses related specifically to that class, such as distribution fees. Expenses that are attributable to both the Trust and Sterling Capital Variable Insurance Funds are allocated across the Trust and Sterling Capital Variable Insurance Funds, based upon relative net assets or on another reasonable basis. Income and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Securities Transactions and Income Recognition — The Fund records daily its proportionate interest in the net investment income and realized/unrealized capital gains and losses of the Master Portfolio. The performance of the Fund is directly affected by the performance of the Master Portfolio.

Federal Income Taxes — It is the policy of the Fund to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code of 1986, as amended, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income tax is required.

13

|

Sterling Capital Equity Index Fund |

Notes to the Financial Statements — (continued)

December 31, 2012

| | 3. | Related Party Transactions: |

Under its Investment Advisory Agreement with respect to the Fund, Sterling Capital Management LLC (“Sterling Capital” or the “Advisor”) exercises general oversight over the investment performance of the Fund. Sterling Capital will advise the Board of Trustees (the “Board”) if investment of all of the Fund’s assets in the Master Portfolio is no longer an appropriate means of achieving the Fund’s investment objective. For periods in which all of the Fund’s assets are not invested in the Master Portfolio, Sterling Capital may receive an investment advisory fee from the Fund. For the fiscal year ended December 31, 2012, all of the Fund’s investable assets were invested in the Master Portfolio and Sterling Capital received no advisory fees.

Sterling Capital serves as the administrator to the Fund pursuant to an administration agreement. The Fund pays its portion of a fee to Sterling Capital for providing administration services based on the aggregate assets of the Trust (except Sterling Capital Strategic Allocation Conservative Fund, Sterling Capital Strategic Allocation Balanced Fund, Sterling Capital Strategic Allocation Growth Fund and Sterling Capital Strategic Allocation Equity Fund) and the Sterling Capital Variable Insurance Funds (except Sterling Capital Strategic Allocation Equity VIF) at a rate of 0.1075% on the first $3.5 billion of average net assets; 0.075% on the next $1 billion of average net assets; 0.06% on the next $1.5 billion of average net assets; and 0.04% of average net assets over $6 billion. Prior to July 1, 2012, the administration fee with respect to the first $3.5 billion of average net assets was 0.11%. This fee is accrued daily and payable on a monthly basis. Expenses incurred are reflected on the Statement of Operations as “Administration fees.” Pursuant to a Sub-Administration Agreement with Sterling Capital, BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon” or the “Sub-Administrator”), serves as sub-administrator to the Fund subject to the general supervision of the Board and Sterling Capital. For these services, BNY Mellon is entitled to a fee payable by Sterling Capital.

BNY Mellon serves as the Fund’s transfer agent and receives compensation by the Fund for these services. Expenses incurred are reflected on the Statement of Operations as “Transfer agent fees.”

Sterling Capital’s Chief Compliance Officer (“CCO”) serves as the Fund’s CCO. The CCO’s compensation is reviewed and approved by the Fund’s Board and paid by Sterling Capital. However, the Fund reimburses Sterling Capital for its allocable portion of the CCO’s salary. Expenses incurred for the Fund are reflected on the Statement of Operations as “Compliance service fees.”

The Fund has adopted a Distribution and Shareholder Services Plan (the “Plan”) in accordance with Rule 12b-1 under the 1940 Act. Sterling Capital Distributors, LLC (formerly known as Sterling Capital Distributors, Inc.) (the “Distributor”) serves as distributor to the Fund pursuant to an Underwriting Agreement. As of May 1, 2012, the Plan provides for payments to the Distributor of up to 0.25%, 1.00% and 1.00% of the average daily net assets of the Class A Shares, Class B Shares and Class C Shares, respectively. Prior to May 1, 2012, the Plan provided for payments to the distributor of up to 0.50%, 1.00% and 1.00% of the average daily net assets of the Class A Shares, Class B Shares and Class C Shares, respectively. The Distributor had contractually agreed to limit the distribution and service (12b-1) fees for Class A Shares of the Fund to 0.25% through April 30, 2012. Distribution fees totaling $11,379 were waived for the fiscal year ended December 31, 2012. Distribution fee waivers are included in the Statement of Operations as “Less expenses waived by the Distributor” and these waivers are not subject to recoupment in subsequent fiscal periods. The Distributor is entitled to receive commissions on sales of shares of the Fund. For the fiscal year ended December 31, 2012, the Distributor received $1,263 from commissions earned on sales of shares of the Fund. Commissions paid to affiliated broker-dealers during the fiscal year ended December 31, 2012 were $548. The fees may be used by the Distributor to pay banks, broker-dealers and other institutions, including affiliates of the Advisor.

Sterling Capital and/or its affiliates may pay out of their own bona fide profits compensation to broker-dealers and other persons for the sale and distribution of the shares and/or for the servicing of the shares. These are additional payments over and above the sales charge (including Rule 12b-1 fees) and service fees paid by the Fund. The payments, which may be different for different financial institutions, will not change the price an investor will pay for shares or the amount that a Fund will receive for the sale of the shares.

Certain Officers and a Trustee of the Trust are affiliated with Sterling Capital or the Sub-Administrator. Such Officers and Trustee receive no compensation from the Trust for serving in their respective roles. Each of the Trustees who are not interested persons (as defined in the 1940 Act) of the Trust who serve on the Board are compensated at the annual rate of $40,000 plus $5,000 for each regularly scheduled quarterly meeting attended, $4,000 for each special meeting attended in person and $3,000

14

|

Sterling Capital Equity Index Fund |

Notes to the Financial Statements — (continued)

December 31, 2012

for each special meeting attended by telephone, plus reimbursement for certain out of pocket expenses. The Trustee who is an interested person as defined in the 1940 Act of the Trust, but not affiliated with Sterling Capital is compensated at the annual rate of $40,000 plus $4,000 for each regularly scheduled quarterly meeting attended, $3,200 for each special meeting attended in person and $2,400 for each special meeting attended by telephone, plus reimbursement for certain out of pocket expenses. Each Trustee serving on a Committee of the Board receives a fee of $4,000 for each Committee meeting attended in person and $3,000 for each Committee meeting attended by telephone, plus reimbursement for certain out of pocket expenses. Committee meeting fees are only paid when such Committee meetings are not held in conjunction with a regular board meeting. Additionally, the Chairman of the Board and the Audit Committee Chairman each receive an annual retainer of $15,000, and the Chairman of the Nominations Committee receives additional compensation at the rate of $1,000 for each meeting over which he or she presides as Chairman. The fees are allocated across the Trust and the Sterling Capital Variable Insurance Funds based upon relative net assets. During the year ended December 31, 2012, actual Trustee compensation was $394,400 in total from the Trust, of which $1,638 was allocated to the Fund.

| | 4. | Federal Tax Information: |

Management evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax liabilities in the financial statements. Recognition of tax benefits of an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the year ended December 31, 2012, the Fund did not incur any interest or penalties.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (current and prior three tax years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Under the Regulated Investment Company Modernization Act of 2010, capital losses originating in taxable years beginning after December 22, 2010 (“post-enactment capital losses”) are carried forward indefinitely. Furthermore, post-enactment capital losses will retain their character as either short-term or long-term capital losses rather than being considered all short-term capital losses as under previous law.

At December 31, 2012, the Fund had net capital loss carryforwards available to offset future net capital gains, if any, to the extent provided by the Treasury regulations.

| | | | |

Amount | | | Expires |

| $ | 519,736 | | | 2013 |

| | 612,669 | | | 2014 |

| | 3,549,980 | | | 2016 |

| | 1,338,848 | | | 2017 |

| | 2,743,646 | | | 2018 |

| | 206 | | | Short-term Losses* |

| | 942,969 | | | Long-term Losses* |

| | | | |

| $ | 9,708,054 | | | |

| | | | |

| | * | Post-Enactment Losses: Must be utilized prior to losses subject to expiration. |

Capital loss carryforwards that expired in the current fiscal year was $175,416.

Under current tax law, capital losses realized after October 31 and ordinary losses realized after December 31 of a Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund had $1,479,810 of deferred qualified late-year losses, which will be treated as arising on the first business day of the fiscal year ending December 31, 2013.

15

|

Sterling Capital Equity Index Fund |

Notes to the Financial Statements — (continued)

December 31, 2012

The tax character of distributions paid to shareholders of the Fund during the fiscal year ended December 31, 2012 , were as follows:

| | | | | | | | | | |

| | | Distributions paid from | | | | | | |

| | | Ordinary

Income | | Total

Taxable

Distributions | | Total

Distributions

Paid* | | | | |

| | $226,931 | | $226,931 | | $226,931 | | | |

The tax character of distributions paid to shareholders of the Fund during the fiscal year ended December 31, 2011, were as follows: |

| | | Distributions paid from | | | | | | |

| | | Ordinary

Income | | Return

of

Capital | | Total

Distributions

Paid* | | | | |

| | $219,201 | | $6,880 | | $226,081 | | | |

| | * | Total Distributions Paid may differ from the Statement of Changes in Net Assets due to differences in the tax rules governing the timing of recognition. |

At December 31, 2012, the components of accumulated deficit on a tax basis were as follows:

| | | | | | | | | | | | | | | | |

| | | Undistributed Ordinary Income | | | | Accumulated

Capital and

Other Losses | | | | Unrealized

Appreciation | | | | Total

Accumulated

Deficit | | |

| | $10,796 | | | | $(11,187,864) | | | | $2,817,193 | | | | $(8,359,875) | |

Management has evaluated the need for the disclosure and/or adjustments resulting from subsequent events through the date the financial statements were issued, and has noted no events that require recognition or disclosure in the financial statements.

16

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of

Sterling Capital Funds:

We have audited the accompanying statement of assets and liabilities of the Sterling Capital Equity Index Fund (the “Fund”), one of the funds constituting Sterling Capital Funds, as of December 31, 2012, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the years in the two-period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of the Fund’s investment at December 31, 2012, by correspondence with the master portfolio’s fund accounting agent. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and the financial highlights referred to above present fairly, in all material respects, the financial position of the Sterling Capital Equity Index Fund as of December 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

February 26, 2013

17

BOARD CONSIDERATION OF ADVISORY AGREEMENT (UNAUDITED)

The Board of Trustees, at a meeting held on August 15-16, 2012, approved the continuance of the investment advisory agreement (the “Advisory Agreement”) between Sterling Capital Funds (the “Trust”) and Sterling Capital Management LLC (“Sterling Capital”), which serves as investment adviser to the Sterling Capital Equity Index Fund (the “Fund”) of the Trust for a new term running through January 31, 2013. At a meeting held on November 14, 2012, the Board of Trustees approved the further continuance of the Advisory Agreement between the Trust and Sterling Capital for a new term running through January 31, 2014. The Board approved the continuation of the Advisory Agreement two times in 2012 in order to adjust the Board’s contract review schedule for future years. As a result of this schedule change, the Board will have additional time for its review and deliberations in future years.

The Trustees reviewed extensive material in connection with their consideration of the Advisory Agreement, including data from an independent provider of mutual fund data (as assembled by the Trust’s administrator), which included comparisons with industry averages for comparable funds for advisory fees, 12b-1 fees, and total fund expenses. The data reflected Sterling Capital fee waivers in place, as well as Sterling Capital’s contractual investment advisory fee levels. The Board was assisted in its review by independent legal counsel, who provided memoranda detailing the legal standards for review of the Advisory Agreement. To facilitate its review, the Board received a detailed presentation by Sterling Capital, which included an analysis of investment processes and performance. The Board also received and considered fund-specific profitability information from the Adviser. The Independent Trustees met outside the presence of management and the Adviser with their independent legal counsel as part of their deliberations.

In their deliberations regarding the Advisory Agreement, each Trustee attributed different weights to various factors involved in an analysis of the Advisory Agreement, and in each case no factor alone was considered determinative. The Trustees determined that the overall arrangements between the Trust and Sterling Capital, as provided in the Advisory Agreement, were fair and reasonable and that the continuance of the Advisory Agreement was in the best interests of the Fund and its shareholders.

The matters addressed below were considered by the Trustees in reaching their conclusions.

Nature, Extent and Quality of Services Provided by the Adviser — The Trustees received and considered information regarding the nature, extent, and quality of the services provided to the Fund under the Advisory Agreement. The Trustees took into account information furnished throughout the year at Trustee meetings, as well as materials furnished specifically in connection with the annual review process. The Trustees considered the background and experience of the Adviser’s senior management and the expertise of investment personnel of the Adviser responsible for oversight of the Fund. The Trustees considered the overall reputation and the capabilities and commitment of the Adviser to provide high quality service to the Fund.