UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06719

Sterling Capital Funds

(Exact name of registrant as specified in charter)

434 Fayetteville Street, 5th Floor

Raleigh, NC 27601-0575

(Address of principal executive offices) (Zip code)

James T. Gillespie, President

Sterling Capital Funds

434 Fayetteville Street, 5th Floor

Raleigh, NC 27601-0575

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 228-1872

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Notice of Privacy Policy & Practices

Sterling Capital Funds recognizes and respects the privacy expectations of our customers.1 We provide this notice to you so that you will know what kinds of information we collect about our customers and the circumstances in which that information may be disclosed to third parties who are not affiliated with the Sterling Capital Funds.

Collection of Customer Information

We collect nonpublic personal information about our customers from the following sources:

| ● | Account Applications and other forms, which may include a customer’s name, address, social security number, and information about a customer’s investment goals and risk tolerance; |

| ● | Account History, including information about the transactions and balances in a customer’s accounts; and |

| ● | Correspondence, written, telephonic or electronic between a customer and the Sterling Capital Funds or service providers to the Sterling Capital Funds. |

Disclosure of Customer Information

We may disclose all of the consumer information outlined above to third parties who are not affiliated with the Sterling Capital Funds:

| ● | as permitted by law — for example with service providers who maintain or service shareholder accounts for the Sterling Capital Funds or to a shareholder’s broker or agent; and |

| ● | to perform marketing services on our behalf or pursuant to a joint marketing agreement with another financial institution. |

Security of Customer Information

We require service providers to the Sterling Capital Funds:

| ● | to maintain policies and procedures designed to assure only appropriate access to, and use of information about customers of the Sterling Capital Funds; and |

| ● | to maintain physical, electronic and procedural safeguards that comply with applicable legal standards to guard nonpublic personal information of customers of the Sterling Capital Funds. |

We will adhere to the policies and practices described in this notice regardless of whether you are a current or former customer of the Sterling Capital Funds.

1 For purposes of this notice, the terms “customer” or “customers” includes both individual shareholders of the Sterling Capital Funds and individuals who provide nonpublic personal information to the Sterling Capital Funds, but do not invest in Sterling Capital Funds shares.

|

Table of Contents

Management Discussion of Performance | ||||

| 1 | ||||

Fund Summary | ||||

| 2 | ||||

| 4 | ||||

| 6 | ||||

| 8 | ||||

| 10 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 18 | ||||

| 20 | ||||

| 22 | ||||

| 24 | ||||

| 26 | ||||

| 28 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| 45 | ||||

| 47 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 63 | ||||

| 65 | ||||

| 68 | ||||

| 72 | ||||

| 74 | ||||

| 81 | ||||

| 84 | ||||

| 87 | ||||

| 88 | ||||

| 90 | ||||

| 93 | ||||

| 95 | ||||

| 98 | ||||

| 101 | ||||

| 102 | ||||

| 103 | ||||

| 104 | ||||

| 166 | ||||

| 182 | ||||

| 184 | ||||

| 185 | ||||

(This page has been left blank intentionally.)

Letter from the President and the Investment Advisor

Dear Shareholders:

We are pleased to present this Sterling Capital Funds’ annual report covering the 12 months between October 1, 2014 and September 30, 2015. U.S. equities performed well early in the period under review, but a sharp sell-off in August undid most of the earlier gains, leaving stocks to post modest losses for the fiscal year. Slowing economic growth in international markets, especially China, was a major factor dragging on stock returns. The concern over global growth also drove down commodity prices, including the price of oil. Corporate profits were weaker than levels seen in recent years and the U.S. Federal Reserve’s decision to keep interest rates at a near-zero target sustained investor uncertainty and concerns. Fixed income securities posted modest gains during the period.

A Mixed Economic Picture

The U.S. economy continued to grow during the period under review, but at a slower rate than during the previous year and with a great deal of uncertainty. The domestic economy grew at an annualized rate of 2.1% during the fourth quarter of 2014, followed by a 0.6% rate in the first quarter of 2015 as record cold weather hindered consumption and a dock workers’ strike in the Pacific Northwest stalled trade. The economy rebounded in the second quarter of 2015, however, posting a GDP growth rate of 3.9% despite persistent economic headwinds both domestically and abroad.

Several key areas of the U.S. economy continued to show progress toward a recovery. The unemployment rate fell to 5.1% in August and there was a decline in the initial jobless claims. Yet job growth itself slowed somewhat towards the end of the period, dropping below market expectations in August and September even as the unemployment level remained low.

There were also signs of recovery in consumer-related sectors. The housing market continued to recover during the period, albeit at a gradual pace, with an increase in building permits and robust home sales. Consumer confidence hit multi-year highs during the period and consumer spending climbed steadily. Retail sales were more mixed throughout the period, however. They declined sharply during the winter and remained essentially flat during the fall.

Industrial production and manufacturing declined during the period, however, while business confidence also fell. Low energy and commodity prices dragged on oil and gas production as well as mining production, yet the same low oil costs also contributed to a sharp uptick in auto sales.

International trade was a clear area of weakness in the U.S. economy during the 12-month period. The U.S. dollar strengthened rapidly early in the period and remained strong throughout the end of the fiscal year. The stronger dollar encouraged imports and discouraged exports. Weaker overseas economies also dragged on

U.S. exports as they led to weaker global demand for U.S. commodities and other goods.

Inflation remained low during the period, by historical standards, and gas and oil prices fell sharply.

Uncertainty Lingers

The Fed’s decision to postpone a much anticipated increase in short-term interest rates added to the uncertainty investors were already feeling from mixed economic indicators. The Fed was widely expected to raise rates at its September meeting, but concerns about weak growth abroad, particularly in China, as well as the negative impact on exports of a stronger dollar, led to the decision to delay any rate hike.

The ongoing slowdown in China had a profound impact on economies throughout the world, weakening commodity prices and diminishing demand for many exports. The debt crisis in Greece added to the global economic uncertainty, as did further turmoil in Ukraine and halting efforts to negotiate a historic trade agreement among nations of the Pacific Rim. In particular, the Russian economy continued to suffer from the impacts of international sanctions and low oil prices.

Despite the Greek crisis, the economy of the eurozone managed to post stronger growth. Improvements in European labor markets and industrial output helped to buoy investor hopes that the eurozone was finally on firm economic footing.

Stocks End Down, Bonds Slightly Up

The stock market began the 12-month period with a sharp sell-off driven by several factors, including the winding down of the Fed’s long-running bond buying program and ongoing economic weakness in many global economies. The decline was offset in subsequent weeks by a rally fueled in part by a spike in mergers and acquisitions in a few sectors, including the health care sector. Tumbling oil prices and healthy earnings also buoyed stock prices. U.S. stocks made modest gains through the middle of the period before taking another steep dive in August 2015. That sell-off was triggered in part by dramatic market losses in China and signs of weakness in other overseas economies. Ultimately, equities made no significant gains during the period, and some sectors saw significant losses. The energy sector posted the largest losses, while the utilities and materials sectors also fared poorly.

The S&P 500® Index1(S&P 500) fell 0.61% during the 12 months under review. Small-cap stocks outperformed larger companies, with the Russell 2000® Index of small-cap stocks gaining 1.25% while the Russell 1000® Index fell 0.61%. International stocks, as measured by the MSCI EAFE Index, returned -8.66% for the period.

Fixed income markets made modest gains during the period. Slowing growth overseas made the U.S. economy more attractive to investors, helping push up bond prices in the U.S. and strengthening the dollar. Investors favored relatively safe areas of the bond market, resulting in

widening yield spreads for riskier bonds such as high-yield securities. Interest rates decreased in late 2014 and early 2015, boosting the performance of U.S. Treasuries and many other categories of bonds. Rates rose over the next several months in anticipation of a rate hike, only to decline as the Fed chose to postpone any increase. The Barclay’s U.S. Aggregate Bond Index returned 2.94% during the period.

Our perspective

The U.S. economy improved in many areas this year, but GDP growth has remained slow, and we believe there are signs it will continue to remain slow into 2016. U.S. economic growth has followed the same start-and-stop pattern since the current recovery began in 2009. Weakness has remained in the domestic economy, while slowing growth overseas is likely to pose its own set of challenges in our view. Despite these hurdles, however, we are optimistic for modest economic growth in the U.S., driven in part by improvements in employment and the service sector, which is slowing but should remain positive, in our estimation.

Given the current economic environment, we have continued to recommend downside protection and a well-diversified portfolio. Stocks with strong financials and attractive valuations are likely to outperform, in our estimation. Overall, we believe that the stock market can be expected to present better relative value than the fixed income market, which continues to offer low yields. We will continue to monitor the evolving economic and market climate, and will seek to manage the Sterling Capital Funds accordingly.

Thank you for your confidence in Sterling Capital Management. We look forward to serving your investment needs during the months and years ahead, and we encourage you to call us at 1-800-228-1872 with any questions.

Sincerely,

James T. Gillespie

President

Sterling Capital Funds

Jeffrey J. Schappe, CFA

Managing Director-Chief Market Strategist

Sterling Capital Management LLC

| 1 | “S&P 500®” is a registered service mark of Standard & Poor’s Corporation, which does not sponsor and is in no way affiliated with the Sterling Capital Funds. The S&P 500® Index is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. A Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities. |

Past performance does not guarantee future results. Mutual fund investing involves risk including the possible loss of principal.

This report is authorized for distribution only when preceded or accompanied by a prospectus. Please read the prospectus carefully before investing or sending money. Sterling Capital Management LLC (“Sterling Capital”) serves as investment advisor to the Sterling Capital Funds (each a “Fund” and collectively, the “Funds”) and is paid a fee for its services. Shares of the Funds are not deposits or obligations of, or guaranteed or endorsed by, Branch Banking and Trust Company or its affiliates. The Funds are not insured by the FDIC or any other government agency. The Funds currently are distributed by Sterling Capital Distributors, LLC. The distributor is not affiliated with Branch Banking and Trust Company or its affiliates.

The foregoing information and opinions are for general information only. Sterling Capital does not guarantee their accuracy or completeness, nor assume liability for any loss, which may result from the reliance by any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information only and are not intended as an offer or solicitation with respect to the purchase or sale of any security or as offering individual or personalized investment advice.

| 1 | ||||

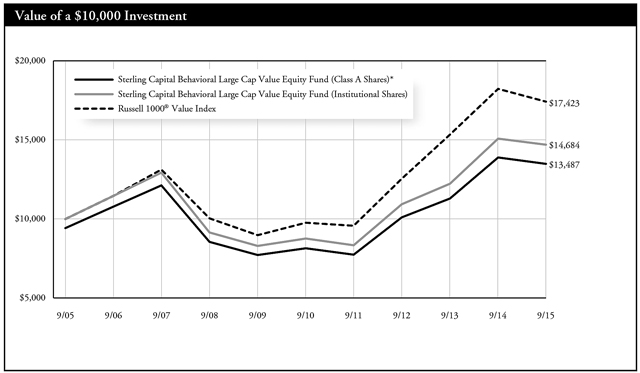

Sterling Capital Behavioral Large Cap Value Equity Fund

Portfolio Managers

Sterling Capital Behavioral Large Cap Value Equity Fund (formerly known as Sterling Capital Large Cap Value Diversified Fund) (the “Fund”) is managed by Robert W. Bridges and Robert O. Weller, Executive Directors and portfolio managers for Sterling Capital Management LLC (“Sterling Capital”).

Robert W. Bridges, CFA

Mr. Bridges, CFA, Executive Director joined Sterling Capital in 1996 and has been a portfolio manager of the Fund since 2013. He has investment experience since 1991. He is a graduate of Wake Forest University where he received his BS in Business.

Robert O. Weller, CFA

Mr. Weller, CFA, Executive Director joined Sterling Capital in 2012 and has been a portfolio manager of the Fund since 2013. He has investment experience since 1996. He is a graduate of Loyola University Maryland where he received his BBA in Finance.

Investment Considerations

The Fund may invest in undervalued securities which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in large- to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory as well as more sensitivity to adverse conditions. The Fund may invest in foreign securities which may be more volatile and less liquid due to currency fluctuations, political instability, social and economic risks. There is no guarantee that the strategy used by the portfolio managers will produce the desired results.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares outperformed its benchmark, the Russell 1000 ® Value Index, during the period.

Q. What factors affected the Fund performance?

A. The Fund changed its name in February 2015. The Fund was formerly the Sterling Capital Large Cap Value Diversified Fund. The new name is a reflection of the Fund’s strategy, which employs an investment process rooted in principles of behavioral finance. This process is specifically designed to capitalize upon known investor biases and heuristics (mental shortcuts) by taking into account the impact on markets of behavioral factors such as greed, fear and ego.

The U.S. stock market climbed sharply during the first two-thirds of the period. Those gains were largely reversed later in the period, during the late summer and early fall, as an economic slowdown in China and other emerging markets dragged on stock returns. Ongoing weakness in commodity markets and uncertainty stemming from the U.S. Federal

Reserve’s decision to postpone raising interest rates also acted as a drag on investor confidence and detracted from absolute results.

The Fund’s Institutional Shares outperformed its benchmark during this period primarily due to its exposure to behaviorally-based momentum factors designed to capture greed and ego. Its exposure to behaviorally-based value factors that seek to capture investors’ fears also contributed modestly to relative performance. These behavioral factors led the Fund to take on a greater-than-benchmark level of exposure to the health care equipment and services sector. In particular, two energy companies and two health care companies performed well during the period and added to relative results.

The Fund took an overweight stake in two insurance companies that dragged on its performance relative to the benchmark. Overweight positions in diversified financials, particularly two investment banks, also hurt relative performance as those companies underperformed. Stock selection in the utilities and food and staples areas detracted modestly from relative performance.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 2 | ||||

| * | Reflects 5.75% maximum sales charge.

| |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%.

| |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

Average Annual Total Returns

| ||||||||

As of September 30, 2015 | Inception Date | 1 Year | 5 Years | 10 Years | ||||

Class A Shares* | 10/9/92 | -8.40% | 9.31% | 3.04% | ||||

Class B Shares** | 1/1/96 | -7.35% | 9.65% | 3.03% | ||||

Class C Shares*** | 2/1/01 | -3.52% | 9.78% | 2.87% | ||||

Institutional Shares | 10/9/92 | -2.55% | 10.89% | 3.92% | ||||

Russell 1000® Value Index |

N/A |

-4.42% |

12.29% |

5.71% | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

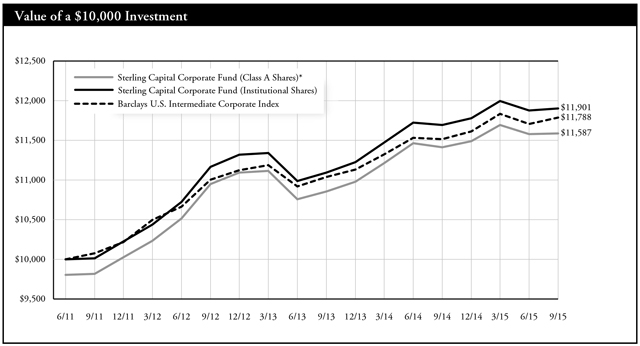

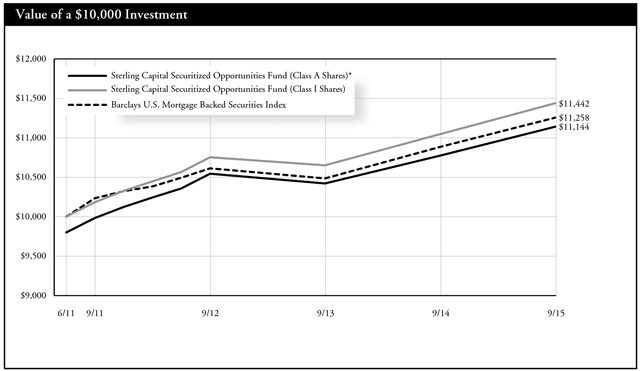

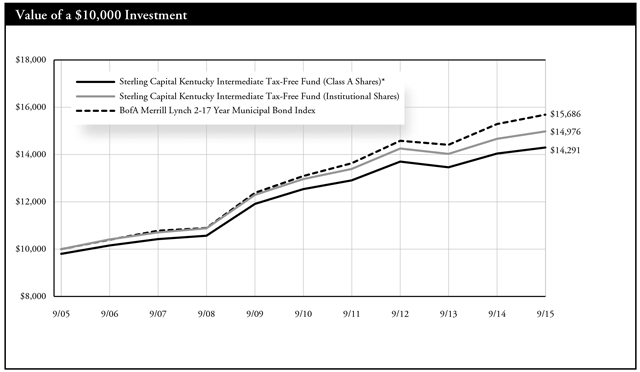

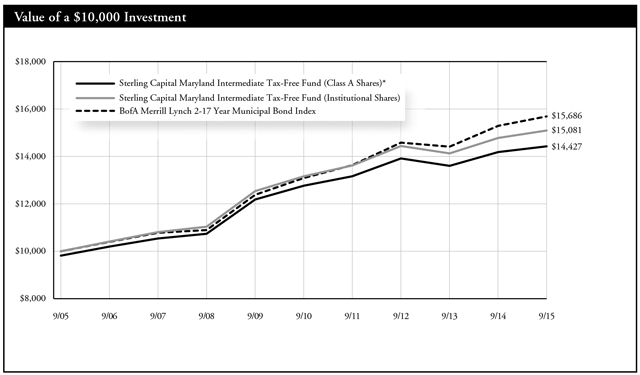

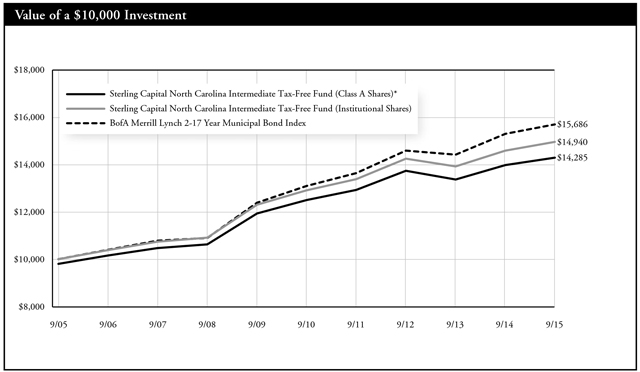

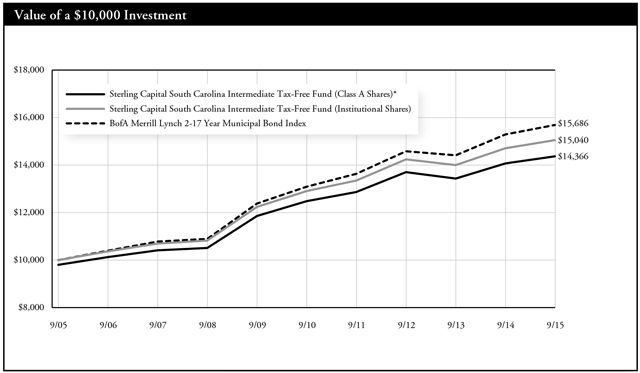

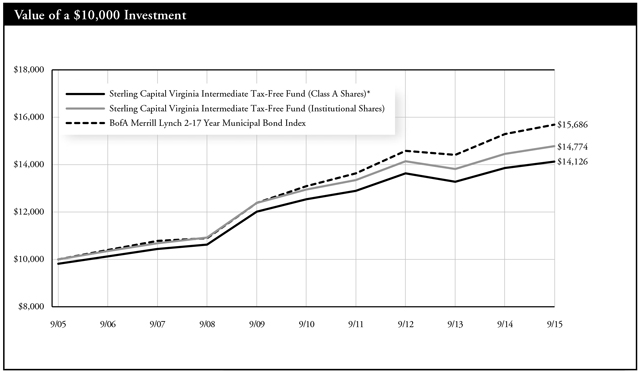

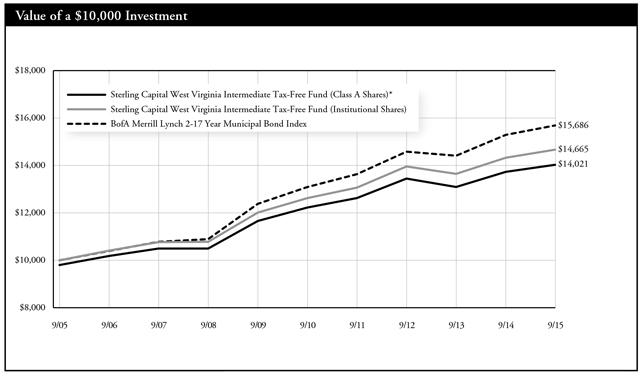

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Russell 1000® Value Index is a widely recognized index of common stocks that measures the performance of the large-cap value sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 3 | ||||

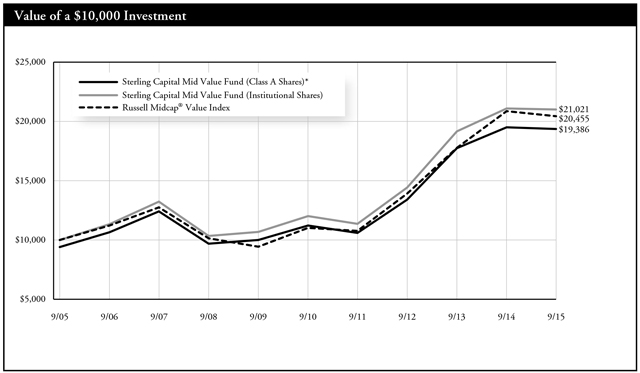

Sterling Capital Mid Value Fund

Portfolio Manager

Timothy P. Beyer, CFA

Sterling Capital Mid Value Fund is managed by Timothy P. Beyer, CFA, Managing Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Mr. Beyer joined Sterling Capital in 2004 and has been a portfolio manager of the Fund since 2005. He has investment experience since 1989. Mr. Beyer is a graduate of East Carolina University where he received his BSBA in Finance.

Investment Considerations

The Fund may invest in undervalued securities that may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities, which may be more volatile and less liquid due to currency fluctuation, political instability, social and economic risks.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares outperformed its benchmark, the Russell Midcap® Value Index.

Q. What factors affected the Fund’s performance?

A. The equity markets rallied in the first part of the 12-month period, and then gave back much of those gains in August and September. As a result, the Fund’s absolute performance was nearly flat for the year ending September 30th. The Federal Reserve’s September decision to keep interest rates at near-zero levels contributed to investor concerns late in the period, as did further signs of slowing economic growth in China. Yet strong performance in a number of sectors, including the health care and financial sectors, helped boost the Fund’s absolute performance. A benign hurricane season had a positive impact on the insurance industry, which also added to results.

The Fund’s Institutional Shares outperformed its benchmark for the

period. A large overweight position in financial services, as well as stock selection within that sector, added to relative results. Specifically, the Fund benefited from strong performance from a debit and credit card payment processer as well as big gains from a leading insurer, and was one of the Fund’s largest holdings. The Fund’s underweight allocation to the energy sector also helped its performance relative to its benchmark, given that the energy sector suffered large declines due to the steep drop in the price of oil.

The Fund’s large overweight position in consumer discretionary stocks, particularly retailers and media companies, negatively impacted its relative performance. Apparel retailers have been struggling for several years with declining mall traffic and a shift in consumer spending from clothing to more home- and auto-related purchases. That trend remained in place for the period. In addition, traditional television media companies have witnessed a decline in advertising sales as viewers seek more on-demand offerings and streaming of their favorite shows.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 4 | ||||

| * | Reflects 5.75% maximum sales charge.

| |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%.

| |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

Average Annual Total Returns

| ||||||||||

As of September 30, 2015 | Inception Date | 1 Year | 5 Years | 10 Years | ||||||

Class A Shares* | 8/1/96 | -6.40% | 10.24% | 6.84% | ||||||

Class B Shares** | 7/25/01 | -5.14% | 10.59% | 6.81% | ||||||

Class C Shares*** | 7/25/01 | -1.43% | 10.73% | 6.64% | ||||||

Institutional Shares | 8/1/96 | -0.43% | 11.84% | 7.71% | ||||||

Class R Shares | 2/1/101 | -0.89% | 11.06% | 7.33% | ||||||

Russell Midcap® Value Index |

N/A |

-2.07% |

13.15% |

7.42% | ||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of the Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against the Russell Midcap® Value Index, an unmanaged index, which measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

| 5 | ||||

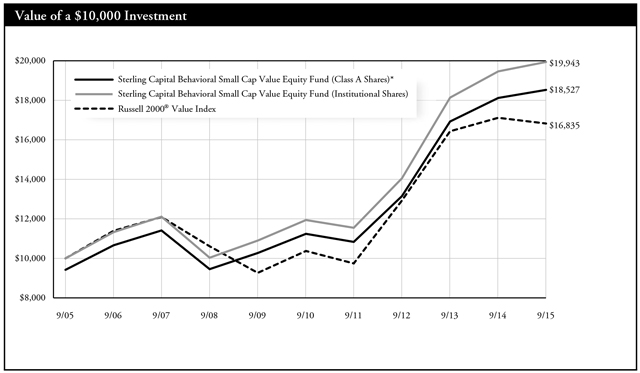

Sterling Capital Behavioral Small Cap Value Equity Fund

Portfolio Managers

Sterling Capital Behavioral Small Cap Value Equity Fund (formerly known as Sterling Capital Small Cap Value Diversified Fund) (the “Fund”) is managed by Robert W. Bridges and Robert O. Weller, Executive Directors and portfolio managers for Sterling Capital Management LLC (“Sterling Capital”).

Robert W. Bridges, CFA

Mr. Bridges, CFA, Executive Director joined Sterling Capital in 1996 and has been a portfolio manager of the Fund since 2013. He has investment experience since 1991. He is a graduate of Wake Forest University where he received his BS in Business.

Robert O. Weller, CFA

Mr. Weller, CFA, Executive Director joined Sterling Capital in 2012 and has been a portfolio manager of the Fund since 2013. He has investment experience since 1996. He is a graduate of Loyola University Maryland where he received his BBA in Finance.

Investment Considerations

The Fund may invest in undervalued securities, which may not appreciate in value as anticipated or remain undervalued for longer than anticipated. Investments made in small to mid-capitalization companies are subject to greater risks than large company stocks due to limited resources and inventory and are more sensitive to adverse conditions. The Fund may invest in foreign securities, which may be more volatile and less liquid due to currency fluctuations and political, social and economic instability. There is no guarantee that the strategy used by the portfolio managers will produce the desired results.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares outperformed its benchmark, the Russell 2000® Value Index.

Q. What factors affected the Fund’s performance?

A. The Fund changed its name in February 2015. The Fund was formerly the Sterling Capital Small Cap Value Diversified Fund. The new name is a reflection of the Fund’s strategy, which employs an investment process rooted in principles of behavioral finance. This process is specifically designed to capitalize upon known investor biases and heuristics (mental shortcuts) by taking into account the impact on markets of behavioral factors such as greed, fear and ego.

The U.S. stock market climbed sharply during the first two-thirds of the period. Those gains were largely reversed later in the period, however, as an economic slowdown in China and other emerging markets dragged on stock returns during the late summer and early fall. Other factors affecting the Fund’s absolute performance included ongoing weakness in commodity markets and uncertainty stemming

from the U.S. Federal Reserve’s decision to postpone raising interest rates. This uncertainty also acted as a drag on investor confidence and detracted from absolute results. Small-cap stocks in particular suffered from the impacts of this uncertainty, which led investors to seek the relative safety of larger-cap companies.

The Fund’s Institutional Shares outperformed its benchmark during this period primarily due to its exposure to behaviorally-based momentum factors designed to capture greed and ego. Its exposure to behaviorally-based value factors that captured investors’ fears also contributed more modestly to relative performance. Exposure to these behavioral factors involved an overweight position in the financials and transportation sectors. Significant stakes in two insurance companies and two airline companies played a particularly notable role in the Fund’s strong performance relative to its benchmark.

Much of the Fund’s underperformance can be attributed to an overweight allocation to commercial and professional services companies. Overweight positions in the retail sector, particularly in two apparel retailers, also hurt relative performance.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 6 | ||||

| * | Reflects 5.75% maximum sales charge.

| |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%.

| |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

Average Annual Total Returns

| ||||||||

As of September 30, 2015 | Inception Date | 1 Year | 5 Years | 10 Years | ||||

Class A Shares* | 2/1/101 | -3.64% | 9.21% | 6.36% | ||||

Class B Shares** | 2/1/101 | -3.56% | 9.39% | 6.54% | ||||

Class C Shares*** | 2/1/101 | 1.37% | 9.67% | 6.54% | ||||

Institutional Shares | 1/2/97 | 2.42% | 10.79% | 7.15% | ||||

Class R Shares | 2/1/101 | 1.84% | 10.42% | 6.96% | ||||

Russell 2000® Value Index |

N/A |

-1.60% |

10.17% |

5.35% | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class A, B, C and R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares and have been adjusted for maximum CDSC to the applicable class but does not include 12b-1 fees, which if reflected, would have caused performance of Class A, B C and R Shares to be lower. The performance information for Institutional Shares (formerly known as Sterling Shares) prior to 12/18/06 is based on the performance of the Institutional Shares of the Fund’s predecessor, Sterling Capital Small Cap Value Fund, a series of The Advisors’ Inner Circle Fund (the “Predecessor Fund”), which transferred all of its assets and liabilities to the Fund pursuant to a reorganization. The performance of the Fund’s Institutional Shares would have been different because the Fund’s Institutional Shares have different expenses than the Predecessor’s Institutional Shares. |

The Russell 2000® Value Index is a widely recognized index of common stocks that measures the performance of the small-cap value sector of the U.S. equity market. The index is unmanaged and does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

| 7 | ||||

Sterling Capital Special Opportunities Fund

Portfolio Manager

George F. Shipp, CFA

Sterling Capital Special Opportunities Fund (the “Fund”) is managed by George F. Shipp, CFA, Senior Managing Director and portfolio manager for Sterling Capital Management LLC. Mr. Shipp has been the Fund’s manager since 2003 and also manages the Sterling Capital Equity Income Fund. He has investment experience since 1982. Mr. Shipp is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business.

Investment Considerations

The Fund is subject to investment style risk, which depends on the market segment in which the Fund is primarily invested. An investment in growth stocks may be particularly sensitive to market conditions while value stocks may be undervalued for longer than anticipated. The Fund may invest in foreign securities subject to risks such as currency volatility and political and social instability or small capitalization companies subject to greater volatility and less liquidity due to limited resources or product lines. The Fund may engage in writing covered call options on securities. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares outperformed its benchmarks, the S&P 500® Index and the Russell 3000® Index.

Q. What factors affected the Fund’s performance?

A. Stocks performed well for the first two-thirds of the fiscal year, as the strengthening U.S. economy helped the Russell 3000® post a 9% total return through mid-May. Those gains had disappeared by fiscal year end, however. A combination of a persistently strong U.S. dollar, a slowdown in China and other emerging markets, weakness in commodity markets including energy, and a perception that the Federal Reserve missed an opportunity to step back from its zero interest rate policy all pressured corporate profits. These factors also added to investor uncertainty and thus to volatility. The resulting drop in overall investor confidence ultimately helped lead investors to shift their preference from a “growth at any price” mentality, to one preferring “quality” businesses that we believe should favor our investing style.

The Fund’s Institutional Shares outperformed its benchmarks. Overweight positions in the technology and health care sectors helped the Fund’s relative returns, as did stock selection within those sectors — particularly among companies with strong domestic exposure. The Fund’s technology holdings included the world’s leading internet search

and digital advertising company, a leading developer of online games, a leading internet security company, and the leading provider of “content delivery services,” which help make online experiences faster and safer. Among health care stocks, the Fund’s shares of the nation’s leading hospital chain, a physician services operation, a diagnostic laboratory testing company and the nation’s largest health insurer outperformed shares of multinational companies, which faced greater challenges due to the strong U.S. dollar. Though the Fund’s energy holdings hurt the fund’s absolute returns, a sale of three positions during the fiscal year’s first half mitigated potential losses and improved relative performance. The Fund also benefited from an underweight allocation in the materials and energy sectors, two of the market’s worst-performing sectors during the period.

Two well-established media companies dragged on the Fund’s performance, as ratings for traditional TV declined, losing share to newer online and mobile viewing platforms. The Fund suffered a loss in a leading credit card and banking company, appearing to coincide with the Fed’s reluctance to raise interest rates. The Fund’s selection of the nation’s leading organic foods grocer so far has proven to be a poor investment, offsetting better performance elsewhere in consumer staples. Finally, the Fund did not own any utility companies, a relatively strong-performing sector during the 12-month period.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 8 | ||||

| * | Reflects 5.75% maximum sales charge.

| |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%.

| |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

Average Annual Total Returns

| ||||||||

As of September 30, 2015 | Inception Date | 1 Year | 5 Years | 10 Years | ||||

Class A Shares* | 6/2/03 | -2.20% | 11.50% | 8.50% | ||||

Class B Shares** | 6/2/03 | -0.89% | 11.85% | 8.49% | ||||

Class C Shares*** | 6/2/03 | 2.99% | 11.98% | 8.33% | ||||

Institutional Shares | 6/2/03 | 4.02% | 13.11% | 9.43% | ||||

Class R Shares | 2/1/101 | 3.51% | 12.55% | 9.17% | ||||

S&P 500® Index | N/A | -0.61% | 13.34% | 6.80% | ||||

Russell 3000® Index |

N/A |

-0.49% |

13.28% |

6.92% | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

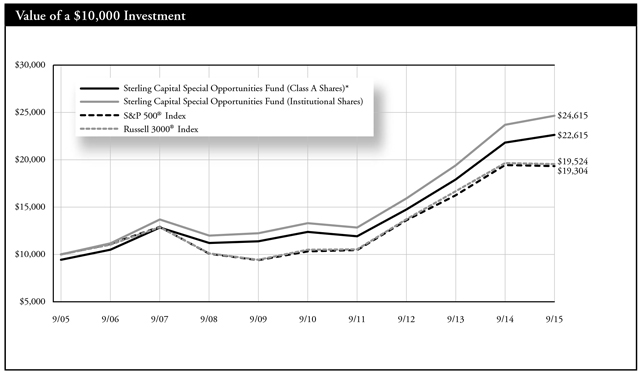

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against the S&P 500® Index and the Russell 3000® Index, unmanaged indices that are generally considered to be representative of the performance of the stock market as a whole. The indices do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

| 9 | ||||

Sterling Capital Equity Income Fund

Portfolio Manager

George F. Shipp, CFA

Sterling Capital Equity Income Fund (the “Fund”) is managed by George F. Shipp, CFA, Senior Managing Director and portfolio manager for Sterling Capital Management LLC, advisor to the Fund. Mr. Shipp has been the Fund’s manager since 2004 and also manages the Sterling Capital Special Opportunities Fund. He has investment experience since 1982. Mr. Shipp is a graduate of the University of Virginia and received his MBA at the Darden Graduate School of Business.

Investment Considerations

The Fund invests primarily in dividend-paying securities. These securities may be undervalued and their value could be negatively affected by a rise in interest rates. The Fund may engage in writing covered call options on securities. By writing covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying stock above the premium and the strike price, but continues to bear the risk of a decline in the stock price. While the Fund receives premiums for writing covered call options, the price it realizes from the exercise of an option could be substantially below a stock’s current market price.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares outperformed its primary benchmark, the Russell 1000® Value Index, although it underperformed the S&P 500® Index.

Q. What factors affected the Fund’s performance?

A. The Fund’s absolute performance initially benefitted from a strengthening U.S. economy, which boosted stock performance in the first two-thirds of the period. However, those market gains had disappeared by fiscal year’s end, due in large part to the pressure on corporate profits arising from the economic slowdown in China and other emerging markets, as well as the continued weakness in commodity sectors such as energy. The U.S. Federal Reserve’s decision to keep interest rates at near-zero levels caused further investor uncertainty. These developments detracted from the Fund’s absolute performance.

The Fund’s Institutional Shares outperformed one of its benchmarks, the Russell 1000® Value Index, during the period. Overweight positions in consumer discretionary and technology stocks helped that relative performance, as did favorable stock selection within those sectors. Healthcare was the best-performing of the ten major sectors, so the Fund’s overweight position was helpful, even though our stock selection was not. In addition, an underweight position in the materials

sector as well as stock selection also boosted the Fund’s relative performance. The Fund’s relative returns benefited from individual holdings including a leading home garden and lawn care supplier, a national coffee and donut chain, a biotech company, a large managed care insurer, and two multi-national pharmaceutical companies. The Fund’s holding of a cable TV and broadband Internet provider, which received a takeover offer during the period, also boosted relative performance.

The Fund’s underweight allocation to the financial sector was the largest detractor from relative performance. The banks and insurers the Fund did own struggled to gain traction as the long-anticipated Fed interest rate hike was delayed. Many of the fund’s holdings are larger, well-established multi-national corporations. As the period developed, however, exposure to slowing emerging markets was viewed negatively by the market. The Fund’s energy holdings, including two pipeline companies, which were deemed less sensitive to commodity prices, were not spared from the sharp sell-off in crude oil and natural gas. Holdings of the world’s leading toy company, despite being held for only part of the period under review, detracted from relative results and partially offset the positive contributions elsewhere in the consumer discretionary sector. Finally, the Fund did not own any utility companies, a relatively strong-performing sector for the period.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 10 | ||||

| * | Reflects 5.75% maximum sales charge.

| |

| ** | Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%.

| |

| *** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

Average Annual Total Returns

| ||||||||

As of September 30, 2015 | Inception Date | 1 Year | 5 Years | 10 Years | ||||

Class A Shares* | 6/30/04 | -9.69% | 7.71% | 6.94% | ||||

Class B Shares** | 6/30/04 | -8.60% | 8.03% | 6.93% | ||||

Class C Shares*** | 6/30/04 | -4.92% | 8.18% | 6.77% | ||||

Institutional Shares | 6/30/04 | -3.90% | 9.27% | 7.85% | ||||

Class R Shares | 2/1/101 | -4.40% | 8.74% | 7.55% | ||||

S&P 500® Index | N/A | -0.61% | 13.34% | 6.80% | ||||

Russell 1000® Value Index |

N/A |

-4.42% |

12.29% |

5.71% | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

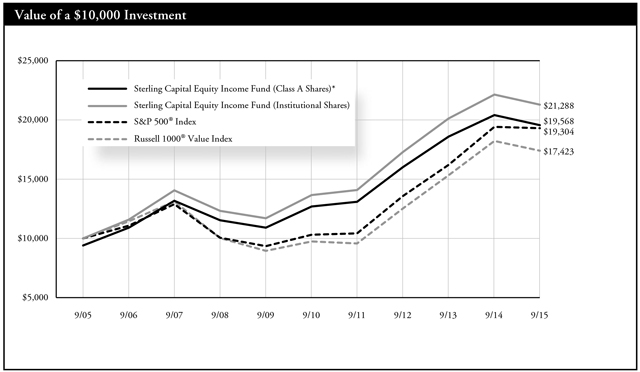

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmarks, and represents the reinvestment of dividends and capital gains.

| 1 | Class R Shares were not in existence prior to 2/1/10. Performance for periods prior to 2/1/10 is based on the performance of Institutional Shares, but such performance does not reflect Class R Shares’ 12b-1 fees, which if reflected, would have caused performance to be lower. |

The Fund is measured against the S&P 500® Index and the Russell 1000® Value Index, unmanaged indices that are generally considered to be representative of the performance of the stock market as a whole. The indices do not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

| 11 | ||||

Sterling Capital Long/Short Equity Fund

Portfolio Managers

Sterling Capital Long/Short Equity Fund (the “Fund”) is managed by L. Joshua Wein, CAIA and Executive Director and James C. Willis, CFA and Executive Director, portfolio managers for Sterling Capital Management LLC (“Sterling Capital”).

L. Joshua Wein, CAIA

Mr. Wein, Executive Director joined Sterling Capital in 2008 and has been a portfolio manager of the Fund since its inception. He has investment experience since 1995. He is a graduate of Emory University where he received his BBA in Finance and an MBA from Vanderbilt University.

James C. Willis, CFA

Mr. Willis, Executive Director joined Sterling Capital in 2003 and has been a portfolio manager of the Fund since its inception. He has investment experience since 1996. He is a graduate of Rice University where he received his BA in Economics and Political Science and an MBA from Georgetown University.

The Sub-Advisers and Sub-Adviser Portfolio Managers of the Fund for the fiscal year ended September 30, 2015 are the following:

● Lucas Capital Management (Red Bank, NJ)

Portfolio Managers: Russell Lucas, Ashton Lee | ● Highland Capital Healthcare Advisors, L.P. (Dallas, Texas)

Portfolio Managers: Michael Gregory | |

| ● Emancipation Capital, LLC (New York, NY) | ● Gator Capital Management (Tampa, FL) | |

| Portfolio Managers: Charles Frumberg | Portfolio Managers: Derek Pilecki | |

Investment Considerations

All investments carry a certain amount of risk and the Fund cannot guarantee that it will achieve its investment objective. The portfolio managers’ judgments about the capabilities of each Sub Adviser and the impact of each Sub Adviser’s investment techniques on the Fund’s overall investment exposures may prove incorrect, and the Fund may fail to produce the intended results. Unlike most traditional long only equity funds, the Fund will engage in short selling and derivative trading activities as a way of mitigating risk and/or enhancing return. Short sales by a fund theoretically involve unlimited loss potential since the market price of securities sold short may continuously increase. These strategies may involve significant transaction costs and may amplify risk.

Q. How did the Fund perform during the period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares underperformed its benchmark, the HFRX Equity Hedge Index.

Q. What factors affected the Fund’s performance?

A. Equity markets performed relatively well early in the 12-month period, but suffered a sharp-sell-off in August. Slowing economic growth in global markets such as China and Europe dragged on stock returns. Meanwhile, commodity prices remained weak and the U.S. Federal Reserve in September decided to keep interest rates at near-zero levels. Both of these factors added to investors’ uncertainty about the health of global markets. Overall, equities’ absolute returns suffered in this environment.

The Fund’s long exposure to the energy sector dragged on absolute returns as energy stocks fell sharply during the 12-month period. Fears of an economic slowdown in China, which could dampen demand for

crude oil, combined with the potential for increased Middle East production contributed to a large decline in oil prices during the period. Meanwhile, long exposure to financial stocks also detracted from the Fund’s absolute returns.

The Fund underperformed its benchmark, which is an index of long/ short equity funds, for the 12-month period. Making comparisons to an index of hedge funds can be challenging, however, so the Fund’s holdings will be discussed relative to its peer group, as represented by the Morningstar Long/Short Equity category. The Fund’s overweight position in the energy sector hurt returns relative to the benchmark.

The Fund benefited from an overweight exposure to the health care sector, with biotechnology and specialty pharmaceuticals holdings leading the way. In addition, the Fund’s short exposure to energy names, particularly oilfield services companies, contributed to returns versus the benchmark, though not enough to offset weakness on the long side of the portfolio.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 12 | ||||

| * | Reflects 5.75% maximum sales charge.

| |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

Average Annual Total Returns

| ||||||||

As of September 30, 2015 | Inception Date | 1 Year | Since Inception | |||||

Class A Shares* | 12/13/13 | -20.94% | -7.97% | |||||

Class C Shares** | 12/13/13 | -16.80% | -5.53% | |||||

Institutional Shares | 12/13/13 | -15.92% | -4.59% | |||||

HFRX Equity Hedge Index |

11/30/13 |

-2.95% |

-0.29% | |||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

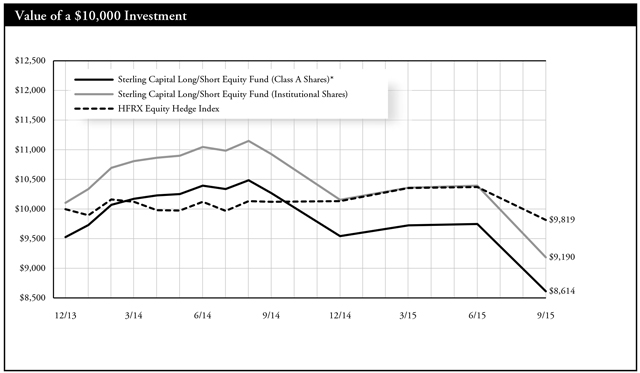

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the HFRX Equity Hedge Index, an unmanaged index that is generally considered to be representative of the performance of the stock market as a whole. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

| 13 | ||||

Sterling Capital Behavioral International Equity Fund

Portfolio Managers

Sterling Capital Behavioral International Equity Fund (the “Fund”) is managed by Robert W. Bridges and Robert O. Weller, Executive Directors and portfolio managers for Sterling Capital Management LLC (“Sterling Capital”).

Robert W. Bridges, CFA

Mr. Bridges, CFA, Executive Director joined Sterling Capital in 1996 and has been a portfolio manager of the Fund since inception. He has investment experience since 1991. He is a graduate of Wake Forest University where he received his BS in Business.

Robert O. Weller, CFA

Mr. Weller, CFA, Executive Director joined Sterling Capital in 2012 and has been a portfolio manager of the Fund since inception. He has investment experience since 1996. He is a graduate of Loyola University Maryland where he received his BBA in Finance.

Investment Considerations

The overall results of the Fund will be dependent on the process and ability of the Adviser to apply “behavioral finance” principles to recognize a company’s value, earnings revisions and market momentum. The Fund will invest in foreign securities which may be more volatile and less liquid due to currency fluctuation, political instability, and social and economic risks. The Fund may invest in REITs (Real Estate Investment Trusts), the value of which will be affected by conditions of the real estate industry, and exchange-traded funds (ETFs). Investing in ETFs may cause shareholders to bear additional costs, and an ETF may not exactly replicate the performance it seeks to track.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares outperformed its benchmark, the MSCI EAFE® Net Index.

Q. What factors affected the Fund’s performance?

A. The Fund was launched on November 28, 2014 with a focus on developed markets outside the United States and Canada. The Fund employs an investment process rooted in principles of behavioral finance. This process is specifically designed to capitalize upon known investor biases and heuristics (mental shortcuts) by taking into account the impact on markets of behavioral factors such as greed, fear and ego.

Equities in many developing nations and emerging markets declined during the period due in large part to flagging economic growth, geopolitical instability and weak commodity prices. An economic slowdown in China had a particularly profound impact on economies throughout the world, weakening commodity prices and a diminishing demand for many exports. A steep dive in Chinese markets in August triggered declines in equities throughout the globe.

The Fund’s Institutional Shares outperformed its benchmark during this period primarily due to its exposure to behaviorally-based momentum factors designed to capture greed and ego. Its exposure to behaviorally-based value factors that capture investors’ fears also contributed modestly to relative performance. These behavioral factors led the Fund to hold an overweight allocation to the materials and consumer discretionary sectors. The Fund’s performance relative to its benchmark was boosted by significant stakes in a chemical company and a mining company, which both outperformed despite a challenging environment for the broader sector. Overweight positions in a retailer and a homebuilder also added to relative results.

Stock selection in the biotech and pharmaceuticals sectors dragged on the Fund’s performance relative to its benchmark. An overweight position in two pharmaceutical companies dragged on returns. Lower-than-benchmark exposure to two household and personal products companies also hurt the Fund’s performance relative to its benchmark as this sector outperformed for the period.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 14 | ||||

| * | Reflects 5.75% maximum sales charge. | |

| ** | Reflects the applicable maximum CDSC of 1.00%. |

Average Annual Total Returns

| ||||||||||

As of September 30, 2015 | Inception Date | Since Inception | ||||||||

Class A Shares* |

11/28/14 |

|

-12.88% |

| ||||||

Class C Shares** |

11/28/14 |

|

-8.95% |

| ||||||

Institutional Shares |

11/28/14 |

|

-7.36% |

| ||||||

MSCI EAFE® Net Index |

11/30/14 |

|

-8.56% |

| ||||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

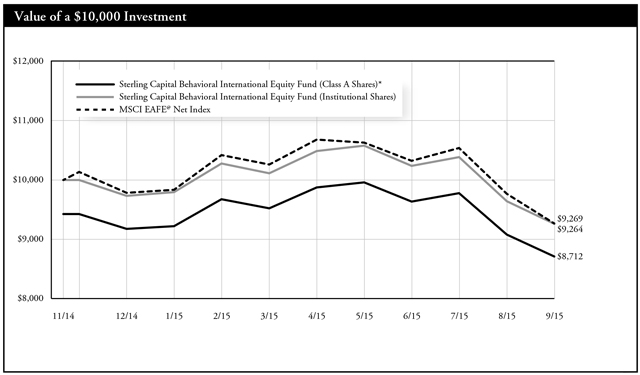

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

Fund is measured against the MSCI EAFE® Net Index, an unmanaged Index which is generally representative of large- and mid-cap equity across Developed Markets countries around the world, excluding the U.S. and Canada. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 15 | ||||

Sterling Capital Ultra Short Bond Fund

Portfolio Managers

Sterling Capital Ultra Short Bond Fund (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, Senior Managing Directors and portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mr. Montgomery, Senior Managing Director joined Sterling Capital in 1997 and has been a portfolio manager of the Fund since 2012. He is head of Sterling Capital’s Fixed Income Portfolio Management. He has investment experience since 1990 and is a graduate of West Chester University where he received his BS in Marketing and a Minor in Public Administration and an MBA from Drexel University. He is a CFA Charterholder.

Richard T. LaCoff

Mr. LaCoff, Senior Managing Director joined Sterling Capital in 2007 and has been a portfolio manager of the Fund since 2012. He has investment experience since 1991 and is a graduate of Villanova University where he received his BS in Business Administration and a MS in Finance from Drexel University.

Investment Considerations

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments, such as foreign securities, which may expose the Fund to currency and exchange rate fluctuations; mortgage-backed securities sensitive to interest rates; and high yield debt (also known as junk bonds), all of which may cause greater volatility and less liquidity.

Q. How did the Fund perform during the period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares outperformed its benchmark, the Citi 6-Month Treasury Bill Index.

Q. What factors affected the Fund’s performance?

A. Interest rates fluctuated throughout the 12-month period as investors anticipated a Federal Reserve decision to raise the target for the federal funds rate — a key short-term interest rate. These expectations peaked in mid-August, driving rates higher at the very short end of the yield curve. Short-term rates subsequently declined when concerns about overseas markets and the strength of the global economy reduced the chances of a rate increase, but rates remained higher relative to the start of the period. When interest rates rise, bond prices fall, and the overall increase in rates over the 12-month period dragged on the Fund’s absolute returns. The Fund’s allocation to asset-backed securities and commercial mortgage-backed securities contributed positively to the Fund’s absolute return.

The Fund’s Institutional Shares underperformed its benchmark for the period. Security selection within the Fund’s corporate allocation was the primary driver of the Fund’s relative

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

underperformance. In particular, debt securities issued by companies in the energy and metals and mining sectors underperformed as those sectors were hit hard by a decline in commodity prices. A modest overweight exposure to duration (a measure of interest-rate sensitivity) also dragged on results given that rates rose for the period. However, the extra income generated from the longer duration holdings helped offset some of the negative impacts of the increase in rates.

Relative results also benefited from the Fund’s allocation to securitized products. In particular, a significant allocation to asset-backed securities helped boost returns as these securities outperformed both U.S. Treasuries and other risk products. Higher quality asset-backed securities generally offer investors an alternative to Treasuries without sacrificing safety. These holdings underperformed as companies issued more debt in anticipation of a rise in interest rates, thus leading to an oversupply. Exposure to commercial mortgage-backed securities also contributed, as the Fund’s holdings of these securities are focused on more stable securities that exhibited less volatility than the broader asset class. The Fund’s holdings generated more income than did the benchmark, which also helped boost relative returns.

| 16 | ||||

| * | Reflects 0.50% maximum sales charge. |

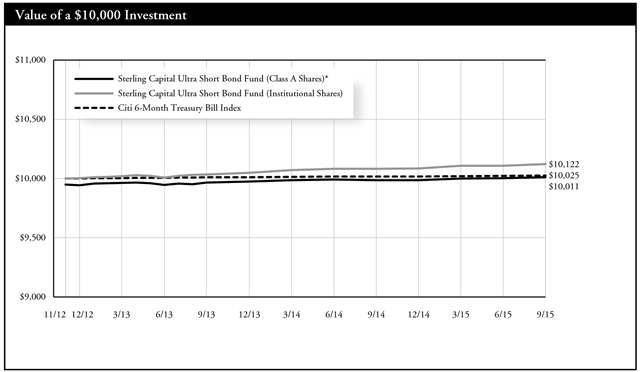

Average Annual Total Returns

| ||||||||

As of September 30, 2015 | Inception Date | 1 Year | Since Inception | |||||

Class A Shares* | 11/30/12 | | -0.26% | | 0.04% | |||

Institutional Shares | 11/30/12 | | 0.40% | | 0.43% | |||

Citi 6-Month Treasury Bill Index | 11/30/12 | | 0.08% | | 0.08% | |||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

The Fund is measured against the Citi 6-Month Treasury Bill Index, which measures the performance of Treasury bills with a maturity of six months or less. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

| 17 | ||||

Sterling Capital Short Duration Bond Fund

Portfolio Managers

Sterling Capital Short Duration Bond Fund (the “Fund”) is managed by Mark Montgomery, CFA and Richard LaCoff, Senior Managing Directors and portfolio managers for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund.

Mark Montgomery, CFA

Mr. Montgomery, Senior Managing Director joined Sterling Capital in 1997. He has been a portfolio manager of the Fund since 2011. He is head of Sterling Capital’s Fixed Income Portfolio Management. He has investment experience since 1990 and is a graduate of West Chester University where he received his BS in Marketing and a Minor in Public Administration and an MBA from Drexel University. He is a CFA Charterholder.

Richard T. LaCoff

Mr. LaCoff, Senior Managing Director joined Sterling Capital in 2007. He has been a portfolio manager of the Fund since 2011. He has investment experience since 1991 and is a graduate of Villanova University where he received his BS in Business Administration and an MS in Finance from Drexel University.

Investment Considerations

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund may invest in more aggressive investments, such as foreign securities, which may expose the Fund to currency and exchange rate fluctuations; mortgage-backed securities sensitive to interest rates; and high yield debt (also known as junk bonds), all of which may cause greater volatility and less liquidity.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares underperformed its benchmark, the BofA Merrill Lynch 1-3 Year U.S. Corporate Government Index.

Q. What factors affected the Fund’s performance?

A. Short-term interest rates increased during the period in anticipation of the Federal Reserve’s decision to raise its target on the federal funds rate. As bond prices fall when interest rates rise, the increase in short-term rates hurt the Fund’s absolute performance. The negative impact of falling rates on the prices of the securities held by the Fund was partially offset by the income generated by those securities. Exposure to asset-backed securities and commercial mortgage-backed securities also contributed positively to absolute results.

The Fund’s Institutional Shares underperformed its benchmark for the period, primarily as a result of its sector allocation strategy. The Fund

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

held more exposure to risk assets, such as corporate bonds, than did the benchmark. These holdings underperformed as companies issued more debt in anticipation of a rise in interest rates, thus leading to an oversupply.

The Fund’s exposure to securitized products helped offset some of these losses, however. In particular, the Fund’s large allocation to asset-backed securities boosted relative results, as did exposure to commercial mortgage-backed securities. Higher quality asset-backed securities generally offer investors an alternative to Treasuries without sacrificing safety. These securities held on to their value relative to other credit sectors, as investors avoided risk. The Fund’s exposure to relatively longer-dated maturities also contributed, as long-term rates declined in a flattening of the yield curve. Income generated by holdings of preferred securities also boosted relative performance, as did the Fund’s overall income advantage relative to the benchmark.

| 18 | ||||

*

| Reflects 2.00% maximum sales charge.

| |

| ** | Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

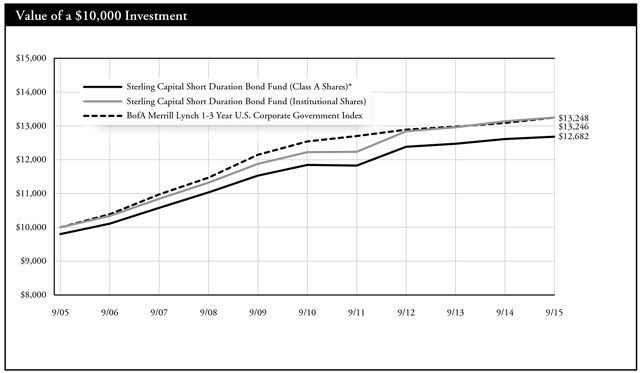

Average Annual Total Returns

| ||||||||

As of September 30, 2015 | Inception Date | 1 Year | 5 Years | 10 Years | ||||

Class A Shares* |

11/30/92 |

-1.50% |

0.95% |

2.40% | ||||

Class C Shares** |

2/1/121 |

-0.29% |

0.79% |

2.32% | ||||

Institutional Shares |

11/30/92 |

0.82% |

1.62% |

2.85% | ||||

BofA Merrill Lynch 1-3 Year U.S. Corporate Government Index | N/A | 1.16% | 1.10% | 2.85% | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark, and represents the reinvestment of dividends and capital gains.

| 1 | Class C Shares were not in existence prior to 2/1/12. Performance for periods prior to 2/1/12 is based on the performance of Class A Shares. Such performance could differ only to the extent that the Classes have different expenses. |

The Fund is measured against the BofA Merrill Lynch 1-3 Year U.S. Corporate Government Index, which consists of securities with a maturity from one to three years. The index does not reflect the deduction of expenses associated with a mutual fund, such as investment management and fund accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index, although they can invest in its underlying securities.

A portion of the Fund’s fees has been waived. If the fees had not been waived, the Fund’s total return for the periods would have been lower.

| 19 | ||||

Sterling Capital Intermediate U.S. Government Fund

Portfolio Manager

Brad D. Eppard, CFA

Sterling Capital Intermediate U.S. Government Fund (the “Fund”) is managed by Brad D. Eppard, CFA, Director and portfolio manager for Sterling Capital Management LLC (“Sterling Capital”), advisor to the Fund. Mr. Eppard joined Sterling Capital in 2003. He has investment experience since 1985. Mr. Eppard is a graduate of Radford University where he received his BS in Business Administration/Accounting. He is a CFA Charterholder.

Investment Considerations

The Fund is subject to the same risks as the underlying bonds in the portfolio such as credit, prepayment, call and interest rate risk. As interest rates rise, the value of bond prices will decline and an investor may lose money. The Fund may invest in mortgage-backed securities, which tend to be more sensitive to changes in interest rates. The Fund invests in securities issued or guaranteed by the U.S. government or its agencies (such as Fannie Mae or Freddie Mac). Although U.S. government securities issued directly by the U.S. government are guaranteed by the U.S. Treasury, other U.S. government securities issued by an agency or instrumentality of the U.S. government may not be. No assurance can be given that the U.S. government would provide financial support to its agencies and instrumentalities if not required to do so by law.

Q. How did the Fund perform during the 12-month period between October 1, 2014 and September 30, 2015?

A. The Fund’s Institutional Shares underperformed its benchmark, the Barclays Intermediate Government Index.

Q. What factors affected the Fund’s performance?

A. The Fund invests primarily in government securities and maintains an average portfolio duration of between two and half years and seven years. Yields on these securities remained low during the period, generating modest amounts of income. However, interest rates fell during the period, which led to an increase in debt security prices. This price appreciation made a significant contribution to absolute returns.

Several factors contributed to the Fund underperforming its benchmark, including an underweight position in bonds with maturities of five to seven years. Our expectation was that an interest rate hike by the Federal Reserve would lead to higher yields and lower

prices for these securities. However, the Fed in September decided to keep interest rates at historically low levels.

The Fund’s performance relative to its benchmark also was hurt by exposure to agency and securitized products with negative convexity, which means they typically lag in price when interest rates fall.

The Fund’s position in Treasury Inflation-Protected Securities (TIPS) also dragged on relative performance. TIPS lagged traditional Treasuries during the last part of the fiscal year due in large part to a drop in inflation expectations as slower growth in China led to lower commodity prices.

The Fund’s relative performance was boosted by a historically high spread between municipal bond yields and Treasury yields. The Fund’s managers purchased municipal bonds at a low cost relative to Treasuries, benefitting the portfolio as that yield spread contracted during the period to more typical levels.

Portfolio composition is as of September 30, 2015 and is subject to change and risk.

| 20 | ||||

| * | Reflects 2.00% maximum sales charge. | |

** |

Reflects the applicable contingent deferred sales charge (CDSC), maximum of 5.00%. |

***Reflects the applicable maximum CDSC of 1.00% (applicable only to redemptions within one year of purchase, and as such, are not reflected in the Average Annual Total Returns table since the periods reflected are for a year or longer). |

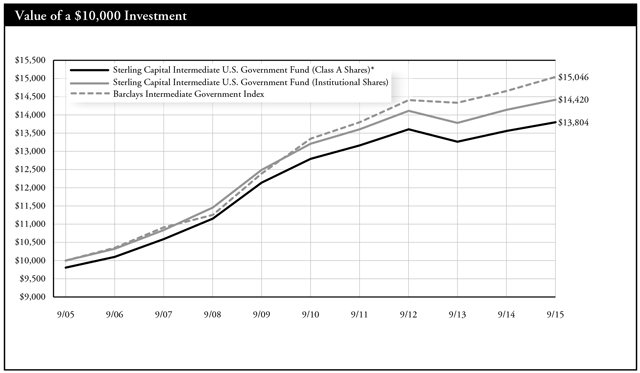

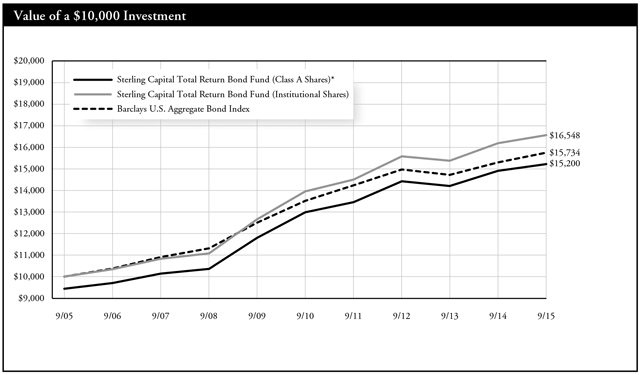

Average Annual Total Returns

| ||||||||

As of September 30, 2015 |

Inception | 1 Year | 5 Years | 10 Years | ||||

Class A Shares* | 10/9/92 | -0.24% | 1.12% | 3.28% | ||||

Class B Shares** | 1/1/96 | -2.94% | 0.58% | 2.86% | ||||

Class C Shares*** | 2/1/01 | 1.06% | 0.77% | 2.73% | ||||

Institutional Shares | 10/9/92 | 1.98% | 1.76% | 3.73% | ||||

Barclays Intermediate Government Index | N/A | 2.68% | 2.42% | 4.17% | ||||

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains, and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.sterlingcapitalfunds.com.

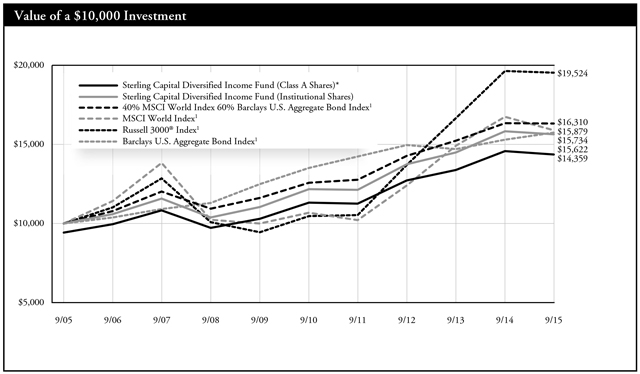

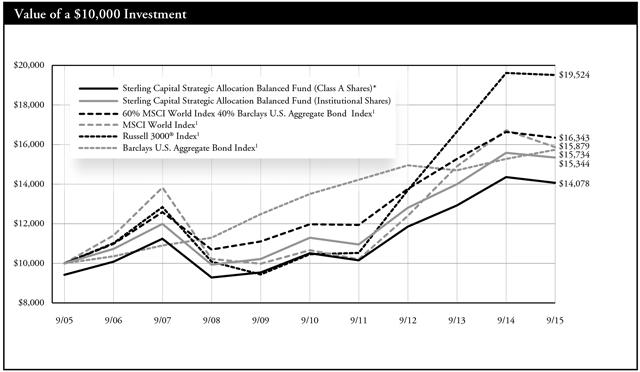

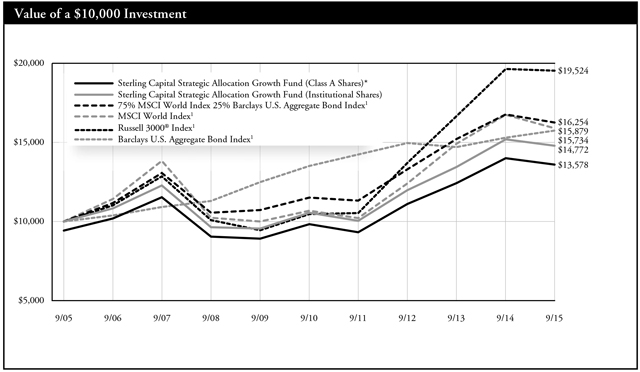

The chart above represents a comparison of a hypothetical $10,000 investment in the indicated share class versus a similar investment in the Fund’s benchmark and represents the reinvestment of dividends and capital gains.