UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File No. 1-11530

TAUBMAN CENTERS, INC.

(Exact name of registrant as specified in its charter)

| Michigan | 38-2033632 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

| 200 East Long Lake Road, | Suite 300, | |||

| Bloomfield Hills, | Michigan | USA | 48304-2324 | |

| (Address of principal executive offices) | (Zip code) | |||

| Registrant's telephone number, including area code: | (248) 258-6800 |

Securities registered pursuant to Section 12(b) of the Act:

| Trading | Name of each exchange | |

| Title of each class | Symbol | on which registered |

Common Stock, $0.01 Par Value | TCO | New York Stock Exchange |

6.5% Series J Cumulative Redeemable Preferred Stock, No Par Value | TCO PR J | New York Stock Exchange |

6.25% Series K Cumulative Redeemable Preferred Stock, No Par Value | TCO PR K | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x Accelerated Filer o Non-Accelerated Filer o Smaller reporting company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

The aggregate market value of the 59,434,600 shares of Common Stock held by non-affiliates of the registrant as of June 28, 2019 was $2.4 billion, based upon the closing price of $40.83 per share on the New York Stock Exchange composite tape on June 28, 2019. (For this computation, the registrant has excluded the market value of all shares of its Common Stock held by directors of the registrant and certain other shareholders; such exclusion shall not be deemed to constitute an admission that any such person is an "affiliate" of the registrant.) As of February 26, 2020, there were outstanding 61,238,366 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the annual meeting of shareholders to be held in 2020 are incorporated by reference into Part III, which we will file within 120 days after December 31, 2019, or if such proxy statement is not filed within such 120-day period, Part III will be filed as part of an amendment to this Form 10-K no later than the end of the 120-day period.

TAUBMAN CENTERS, INC.

CONTENTS

| PART I | ||

| PART II | ||

| PART III | ||

| PART IV | ||

1

PART I

Item 1. BUSINESS.

The following discussion of our business contains various "forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent our expectations or beliefs concerning future events and performance. We caution that although forward-looking statements reflect our good faith beliefs and reasonable judgment based upon current information, these statements are qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements, including those risks, uncertainties, and factors detailed from time to time in reports filed with the Securities and Exchange Commission (SEC), and in particular those set forth under Risk Factors in this Annual Report on Form 10-K. The forward-looking statements included in this report are made as of the date hereof or the date specified herein. Except as required by law, we assume no obligation to update these forward-looking statements, even if new information becomes available in the future.

The Company

Taubman Centers, Inc. (TCO) is a Michigan corporation (incorporated in 1973) that operates as a self-administered and self-managed real estate investment trust (REIT). TCO's sole asset is an approximate 70% general partnership interest in The Taubman Realty Group Limited Partnership (TRG), which owns direct or indirect interests in all of our real estate properties. In this report, the terms "we", "us", and "our" refer to TCO, TRG, and/or TRG's subsidiaries as the context may require. See "Our UPREIT Structure" for additional information about our structure.

We own, manage, lease, acquire, dispose of, develop, and expand shopping centers and interests therein. Our owned portfolio of operating centers as of December 31, 2019 consisted of 24 urban and suburban shopping centers operating in 11 U.S. states, Puerto Rico, South Korea, and China. The Taubman Company LLC (the Manager) provides certain management and administrative services for us and for our U.S. properties. See "Personnel" below for more information about the Manager.

The Consolidated Businesses consist of shopping centers and entities that are controlled, through ownership or contractual agreements, by TRG, the Manager, or Taubman Properties Asia LLC and its subsidiaries and affiliates (Taubman Asia). Shopping centers owned through joint ventures that are not controlled by us but over which we have significant influence (Unconsolidated Joint Ventures or UJVs) are accounted for under the equity method. See "Item 2. Properties" for information regarding the shopping centers.

On February 9, 2020, TCO, TRG, Simon Property Group, Inc., a Delaware corporation (Simon), Simon Property Group, L.P., a Delaware limited partnership (the Simon Operating Partnership), Silver Merger Sub 1, LLC, a Delaware limited liability company and wholly owned subsidiary of the Simon Operating Partnership (Merger Sub 1), and Silver Merger Sub 2, LLC, a Delaware limited liability company and wholly owned subsidiary of Merger Sub 1 (Merger Sub 2) (Merger Sub 2, Simon, the Simon Operating Partnership, and Merger Sub 1, referenced collectively as the Simon Parties), entered into an Agreement and Plan of Merger (the Merger Agreement) pursuant to which, on the terms and subject to the conditions set forth therein, Merger Sub 2 will be merged with and into TRG (the Partnership Merger), and TCO will be merged with and into Merger Sub 1 (the REIT Merger) (the REIT Merger and the Partnership Merger, referenced collectively as the Mergers). Upon completion of the Partnership Merger, TRG will survive and the separate existence of Merger Sub 2 will cease. On completion of the REIT Merger, Merger Sub 1 will survive and the separate corporate existence of TCO will cease. Immediately following the Partnership Merger, TRG will be converted into a Delaware limited liability company. On the terms and subject to the conditions set forth in the Merger Agreement, at the effective time of the REIT Merger each share of our common stock then issued and outstanding, other than certain shares of excluded common stock (as set forth in the Merger Agreement), will be converted into the right to receive $52.50 in cash.

We expect to continue paying regular cash dividends on shares of our common and preferred stock until the completion of the Mergers (see "Management's Discussion and Analysis of Financial Condition and Results of Operations (MD&A) - Liquidity and Capital Resources - Dividends" for further information).

We expect the Mergers to close in mid-2020. Completion of the Mergers is, however, subject to various conditions, and it is possible that events or other circumstances could result in the Mergers being completed at a later time or not at all. In addition, the announcement of the proposed transaction may materially impact our ongoing relationships with our tenants, operating results, and business generally, and the proposed transaction may disrupt management’s attention from our ongoing business operations. For additional information regarding the Mergers or the Merger Agreement, see our other filings made with the SEC, including our Current Report on Form 8-K filed with the SEC on February 11, 2020; in addition, see Part I - Item 1A - Risk Factors and Item 15 - Exhibits and Financial Statement Schedules - Notes to Consolidated Financial Statements - Note 22 - Subsequent Event.

2

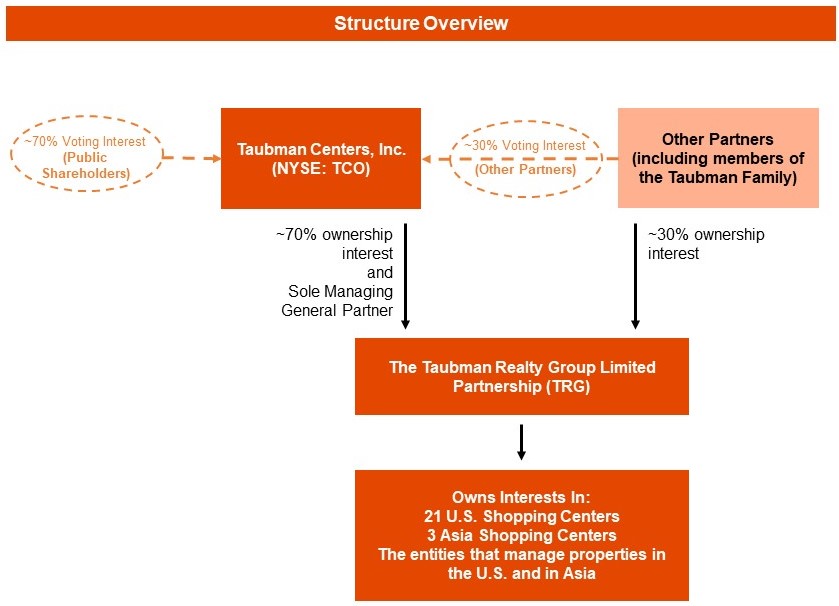

Our UPREIT Structure

We are structured as an umbrella partnership real estate investment trust, referred to as an UPREIT. In our UPREIT structure, TCO, which is a publicly-traded REIT, is the sole managing general partner of TRG. TCO's sole asset is its ownership of partnership interests in TRG (TRG Units), which constitute an approximate 70% economic interest in TRG as of December 31, 2019. The remaining approximate 30% of TRG Units are owned by TRG's partners other than TCO (Other Partners), including Robert S. Taubman, William S. Taubman, Gayle Taubman Kalisman, and the A. Alfred Taubman Restated Revocable Trust (Taubman Family). TRG owns direct or indirect interests in our real estate properties and in the companies that provide management services to us and our real estate properties, including in our UJVs and the Manager.

The following chart illustrates TCO's and TRG's structure:

Since TCO manages TRG as the sole managing general partner, the Other Partners have limited control rights in TRG in which they hold an economic interest. To provide the Other Partners with voting rights in TCO corresponding with their economic interests in TRG, in 1998, TCO issued, and made available for the Other Partners to purchase, Series B Non-Participating Convertible Preferred Stock (Series B Preferred Shares). The holders of the Series B Preferred Shares vote together with the holders of our common stock on all matters on which the common shareholders vote. Holders of our common stock and the Series B Preferred Shares are each entitled to one vote per share.

Shares of TCO's common stock are held by TCO's public shareholders and represent, as of December 31, 2019, an approximate 70% voting interest in TCO, which corresponds with TCO's economic ownership of TRG. The Series B Preferred Shares represent, as of December 31, 2019, an approximate 30% voting interest in TCO, which corresponds with the Series B Preferred shareholders’ economic ownership in TRG. As of December 31, 2019, based on information contained in filings made with the SEC by members of the Taubman Family, members of the Taubman Family collectively held 92% of the outstanding Series B Preferred Shares, and collectively held an approximate 30% voting interest in TCO based on their ownership of TCO common stock and Series B Preferred Shares. For further information regarding the control rights of members of the Taubman Family, see "Risk Factors - Risks Related to Our Business and Industry - Members of the Taubman Family have the power to vote a significant number of the shares of Capital Stock entitled to vote and have contractual rights."

3

We operate as a REIT under the Internal Revenue Code of 1986, as amended (the Code). In order to satisfy the provisions of the Code applicable to REITs, we must distribute to our shareholders at least 90% of our REIT taxable income prior to net capital gains and meet certain other requirements. TRG's partnership agreement provides that TRG will distribute, at a minimum, sufficient amounts to its partners such that our pro rata share will enable us to pay shareholder dividends (including capital gains dividends that may be required upon TRG's sale of an asset) that will satisfy the REIT provisions of the Code.

In 2017, the U.S. Congress passed the Tax Cuts and Jobs Act of 2017 (2017 Tax Act), which made significant changes to both corporate and individual tax rates and the resulting calculation of taxes, as well as international tax rules for U.S. domestic corporations. As a REIT, this legislation minimally changed the taxes we pay. However, it could impact the way in which our dividends are taxed on the holders of our stock.

Recent Developments

For a discussion of business developments that occurred in 2019, see "MD&A."

Business of TCO

We are engaged in the ownership, management, leasing, acquisition, disposition, development, and expansion of shopping centers and interests therein. We owned interests in 24 operating centers as of December 31, 2019. In the following discussion, the term "GLA" refers to gross retail space, including anchors and mall tenant areas, and the term "Mall GLA" refers to gross retail space, excluding anchors. The term "anchor" refers to a department store or other large retail store. The term "mall tenants" refers to stores (other than anchors) that lease space in shopping centers, including temporary tenants and specialty retailers.

As of December 31, 2019, the shopping centers:

| • | are strategically located in major metropolitan areas, many in communities that are among the most affluent in the U.S. or Asia, including Denver, Detroit, Honolulu, Kansas City, Los Angeles, Miami, Naples, Nashville, New York City, Orlando, Salt Lake City, San Francisco, San Juan, Sarasota, Tampa, Washington, D.C., West Palm Beach, Hanam (South Korea), Xi'an (China), and Zhengzhou (China); |

| • | range in size between 238,000 and 1.7 million square feet of GLA and between 187,000 and 1.0 million square feet of Mall GLA, with an average of 1.0 million and 0.5 million square feet, respectively. The smallest center has approximately 60 stores, and the largest has over 300 stores with an average of approximately 150 stores per shopping center. |

| • | have approximately 3,400 stores operated by their mall tenants; |

| • | have 59 anchors, operating under 17 trade names; |

| • | primarily lease to national chains (U.S. centers only), including subsidiaries or divisions of H&M, The Gap (Gap, Gap Kids, Baby Gap, Banana Republic, Janie and Jack, Old Navy, Athleta, and others), Forever 21 (Forever 21 and XXI Forever), and Limited Brands (Bath & Body Works/White Barn Candle, Pink, Victoria's Secret, and others); and |

| • | are among the highest quality centers in the U.S. public regional mall industry as measured by our high portfolio average of mall tenants' sales per square foot. In 2019, our mall tenants at U.S. comparable centers reported average sales per square foot of $972. |

The most important factor affecting the revenues generated by the centers is leasing to mall tenants (including temporary tenants and specialty retailers), which represents approximately 90% of revenues. Anchors account for less than 10% of revenues because many own their stores and, in general, those that lease their stores do so at rates substantially lower than those in effect for mall tenants.

4

Our portfolio is concentrated in highly productive shopping centers. All of our 24 owned centers have annualized rent rolls at December 31, 2019 of over $10 million. We believe that this level of productivity is indicative of the centers' strong competitive positions and is, in significant part, attributable to our business strategy and philosophy. We believe that our high-quality shopping centers are among the least susceptible to direct competition because, among other reasons, anchors and specialty retail stores do not find it economically attractive to open additional stores in the immediate vicinity of an existing location for fear of competing with themselves. We also believe that our centers' success can be attributed in part to their other characteristics, such as being well-designed with effective layouts, natural light, good physical condition, strong and evolving retail programming, state-of-the-art technology infrastructure, and other amenities. Many of our shopping centers are also strategically located in high-quality markets, with convenient access to a high density of customers, including significant tourist traffic.

Business Strategy and Philosophy

We believe that the shopping center business is not simply a real estate development business, but rather an operating business in which a retailing approach to the ongoing management and leasing of the centers is essential. Thus we:

| • | offer retailers a location where they can have strong profitability. We believe leading retailers and emerging concepts choose to showcase their brand in the best markets and highest quality assets; |

| • | offer a large, diverse selection of retail stores and dining in each center to give customers a broad selection of consumer goods, food, and entertainment and a variety of price ranges; |

| • | endeavor to increase overall mall tenants' sales by leasing space to a regularly changing mix of tenants, thereby increasing rents over time; |

| • | seek to anticipate trends in our industry and emphasize ongoing introductions of new concepts into our centers. Due in part to this strategy, a number of successful retail trade names have opened their first mall stores in our centers. In addition, we have brought to the centers "new to the market" retailers and other retailers that previously served customers through online presences. We believe that the execution of this leasing strategy is an important element in building and maintaining customer loyalty and increasing mall productivity; and |

| • | provide innovative initiatives, including those that utilize technology and the internet, to increase revenues, enhance the shopping experience, personalize our relationship with shoppers, build customer loyalty, and increase mall tenant sales, with the following as examples: |

| • | we are continuing to invest in other synergistic digital capabilities and are a developer of the "Smart Mall" concept. Of the 24 shopping centers in our portfolio, 18 are considered to be "Smart Malls." This technology includes an upgraded fiber optic network throughout the centers, free shopper Wi-Fi, navigation and directory technology, advanced energy management, high-speed networking options for our tenants, new digital, mobile shopper engagement, and advanced shopper analytics; |

| • | our Taubman website program connects shoppers to each of our individual center brands through the internet. In 2019, we transitioned to a new, more efficient and scalable back end content management system that powers content on our websites, directories, and applications; |

| • | we have a robust email program reaching our most loyal customers weekly and our social media sites offer retailers and customers an immediate geo-targeted communication vehicle; |

| • | we actively manage a comprehensive social media program at 18 centers, delivering authentic local content which gained over 537 million social content impressions in 2019, an increase of nearly 20% year-over-year; |

| • | we deploy highly targeted digital media programs that leverage geographic and behavioral targeting to drive incremental visits from local and tourist customers; |

| • | we continue to install "smart parking" systems at some of our shopping centers, providing customers real-time information about parking availability, most convenient spots, and directions to their parked cars; |

| • | we have implemented rewards, loyalty, VIP, and incentive programs that provide exclusive benefits to designated shoppers leveraging a variety of technologies ranging from dedicated applications for VIPs to customer relationship management database marketing efforts; and |

5

| • | we have added digital sponsorship screens within a number of centers, including high impact large screen LEDs at The Mall at Short Hills and at Beverly Center. |

Our leasing strategy involves assembling a diverse and unique mix of mall tenants in each of the centers in order to attract customers, thereby generating higher sales by mall tenants. High sales by mall tenants make the centers attractive to prospective renewal and new tenants, thereby increasing the rental rates that current and prospective tenants are willing to pay. We have implemented an active leasing strategy to increase the centers' productivity and to set minimum rents at higher levels. Elements of this strategy include renegotiating existing leases and leasing space to prospective tenants that would enhance a center's retail mix.

The shopping centers compete for retail consumer spending through diverse, in-depth presentations of predominantly fashion merchandise in an environment intended to facilitate customer shopping. Many of our centers include stores that target high-end customers, and such stores may also attract other retailers to come to the center. Each center is always individually merchandised in light of the demographics of its potential customers within convenient driving distance. When necessary, we consider rebranding existing shopping centers in order to maximize customer loyalty, maintain and increase mall tenant sales, and achieve greater profitability.

As our tenant mix continues to evolve to include tenants such as digitally native concepts and emerging brands, luxury, entertainment, restaurants, and fast fashion, increased tenant allowances have been, and may continue to be, provided to attract the best tenants to our centers. We believe bringing in great retailers will drive traffic and productivity to our centers, enhancing the long-term strategic position of each center.

Recent Trends in Retail

The U.S. shopping center industry has been challenged in recent years and is currently facing turbulence as it continues to evolve rapidly. Across the industry, department store sales have weakened and their ability to drive traffic has substantially decreased, resulting in increased store closures, with mature mall tenants and anchors rationalizing square footage and being highly selective in opening new stores. Bankruptcy filings by our mall tenants have recently been elevated, and included Forever 21, one of our largest mall tenants during the year ended December 31, 2019.

There has been some stabilization of the retail landscape recently; however, the retail headwinds still have the potential to be prolonged and ultimately may still result in many centers incurring lost or reduced rent, paying higher tenant allowances, and/or experiencing unscheduled terminations.

The impact of e-commerce on shopping center retail has been steadily increasing. There have been secular changes in shopper behavior affecting how, where, and what consumers shop for. In addition, technology has intervened in the direct relationship between shoppers and the mall by enabling them to research, compare, and purchase products online easily, challenging our unique position as the main shopping portal within a trade area.

While challenging traditional retail in the shorter-term, e-commerce is also making high-quality brick-and-mortar assets more valuable, as retailers focus their real estate investments on the strongest assets. Successful retailers understand that a combination of both physical and digital channels is likely to best meet their customer needs. Physical locations are an important distribution channel that reduce order fulfillment and customer acquisition costs, while improving website traffic and brand recognition. Physical locations also allow for tenants to most successfully express their full brand statement, creating emotional connections to customers. We strive to position our assets to be desirable platforms for omni-channel retailers, believing technology improves the customer experience and will continue to do so, from the front of the house, logistics, efficiency, pricing, customer acquisition, customer knowledge and service.

Over time we believe high-quality mall portfolios such as ours will continue to gain market share of mall tenant sales and rents. We expect to achieve this because brick-and-mortar remains the heart of omni-channel retailing. Our high-quality portfolio of shopping centers complements retailers' strategies by positioning their brands among high-end, productive retailers in the best markets. As an upscale, niche player in our industry, most of our assets have a unique value proposition in their respective markets for tenants and consumers - it's estimated that nearly 80% of our malls are ranked number one or two in their markets. They remain critical brick-and-mortar locations for retail brands and important destinations for shoppers. This is a strength of our assets that represents a key advantage against our larger competitors in our industry.

6

Apparel retailers, traditionally a dominant category for malls, had been facing particularly challenging times in recent years, however there has been recent momentum in the category, and apparel retail sales have increased in both 2018 and 2019. While it is prudent to continuously adjust the use of space in order to broaden the mall experience, we believe that the rebound of apparel is further evidence that the dramatic reallocation of in-line space to other tenants across the board for the sake of reducing exposure to apparel is neither economically sustainable nor strategically necessary. However, we have seen the emergence of a new tenant pool offering additional entertainment and coworking alternatives within the mall. We continue to expect that additional dining, entertainment, digitally native concepts, grocery, fitness, events, coworking and other new uses over time will gain a larger allocation of space alongside a significant presence of apparel, encouraging more shopping destination trips and strengthening high-quality malls as social hubs in their communities.

Throughout the industry, traditional department stores have been experiencing declining sales and market shares. As a result, some department stores have been pursuing strategies of consolidation and/or closure of under-performing locations. Given the overall quality of our real estate, however, many of our department stores have been performing comparatively well. As a result, we do not expect that we will have as many opportunities as others in our industry to reacquire and re-purpose anchor locations, with department stores often being reluctant to exit our malls. However, in the event of anchor closures, we generally expect re-purposing of anchors to add value strategically and be accretive financially.

Potential For Growth

Our principal objective is to enhance shareholder value. We seek to maximize the financial results of our core assets, while also pursuing a growth strategy that includes redevelopment of existing centers as well as a new center development program. With limited opportunities for new development in the U.S., our emphasis will now be on strengthening and growing our core assets and executing our redevelopments. We continue to invest for the future and are creating value in our centers that is intended to lead to sustained growth for our shareholders. Our internally generated funds and distributions from operating centers and other investing activities (including strategic dispositions of centers or a portion of our interests therein), augmented by use of our existing revolving lines of credit, provide resources to maintain our current operations and assets, pay dividends, and fund a portion of our major capital investments. We pursue an overall strategy of creating value and recycling capital using long-term fixed rate financing on the centers upon stabilization. Excess proceeds from refinancings, if any, typically are used to reinvest in our business. Generally, our need to access the capital markets is limited to refinancing debt obligations at or near maturity and funding major capital investments. From time to time, we also may sell interests in shopping centers or, in limited circumstances, access the equity markets, to raise additional funds or refinance existing obligations on a strategic basis, including using excess proceeds therefrom.

Internal Growth

As noted in "Business Strategy and Philosophy" above in detail, our core business strategy is to maintain a portfolio of properties that deliver above-market profitable growth by providing targeted retailers with the best opportunity to do business in each market and targeted shoppers with the best local shopping experience for their needs.

We continue to expect that over time a significant portion of our future growth will come from our existing core portfolio and business. We have always had and will continue to have a culture of intensively managing our assets and maximizing the rents from mall tenants over the long term as this is a key growth driver going forward.

Another element of our internal growth over time is the strategic expansion and redevelopment of existing properties to update and enhance their market positions by adding, replacing, re-tenanting, or otherwise re-merchandising the use of anchor space, increasing mall tenant space, or rebranding centers. Most of the centers have been designed to accommodate expansions. Expansion projects can be as significant as new shopping center construction in terms of scope and cost, requiring governmental and existing anchor store approvals, design and engineering activities, including rerouting utilities, providing additional parking areas or decking, acquiring additional land, and relocating anchors and mall tenants (all of which must take place with minimum disruption to existing tenants and customers).

We substantially completed our redevelopment project at Beverly Center in November 2018, which included a complete renovation and significant re-merchandising, including transformation of food offerings. We also substantially completed our redevelopment project at The Mall at Green Hills in 2019, which will ultimately add approximately 170,000 square feet of incremental GLA to the center.

7

We also look to monetize our common areas through robust specialty leasing and sponsorship programs. About 8% of our 2019 comparable center Net Operating Income (NOI) was generated from such programs. In the past five years, comparable center NOI from leasing and sponsorship programs has ranged from 8% to 9%. Examples found in our centers include destination holiday experiences, customer service programs, sponsored children's play areas, and turnkey attractions. In addition, we monetize our common areas through static and digital media that comes in a variety of formats.

External Growth

We pursue various areas of external growth, including traditional center development in the U.S., new opportunities in Asia, and acquisitions in both the U.S. and Asia. We have invested in a development project, Starfield Anseong, in South Korea for which we have formed an additional joint venture with Shinsegae Group (Shinsegae). Additionally, we opened CityOn.Zhengzhou in China in 2017. We continue to evaluate various development and acquisition possibilities for additional new centers.

Development of New U.S. Centers

Throughout our history, a critical element of our success has been the ground-up development of new shopping centers. Given the over saturation of suburban retail in the U.S., almost no new supply of suburban malls is expected within the foreseeable future. Current trends suggest that any future new supply of malls will likely be limited and in the format of mixed-use or destination projects. We do expect expansions of high-quality malls will continue as lower quality centers atrophy, and we will pro-actively pursue the re-purposing of anchors where appropriate (see "Internal Growth" above). We do not anticipate significant new ground-up developments.

While we will continue to evaluate potential future U.S. development projects using criteria, including financial criteria for rates of return, similar to those employed in the past, no assurances can be given that the adherence to these criteria will produce comparable or projected results in the future. In addition, the costs of shopping center development opportunities that are explored but ultimately abandoned will, to some extent, diminish the overall return on development projects taken as a whole. See "MD&A – Liquidity and Capital Resources – Capital Spending" for further discussion of our development activities.

Miami Worldcenter is a large, mixed-use, urban development currently under construction in Miami, Florida. Miami Worldcenter's master developer, Miami Worldcenter Associates, is pursuing a high street retail plan as a part of their master development of the site. We have agreed with Miami Worldcenter Associates on terms for a co-leasing services agreement with The Forbes Company for the retail portion of the street level project, with an option to purchase the retail component at a favorable price once it opens.

Asia

We are pursuing a development strategy in Asia to:

| • | provide additional growth through exposure to countries that have more rapidly growing gross domestic products; |

| • | utilize our expertise, including leasing/retailer relationships, design/development expertise, and operational/marketing skills; and |

| • | take advantage of a generational opportunity, as the demand for high-quality retail is early to mid-cycle, there is significant deal flow, and it diversifies longer-term growth investment opportunities. |

Taubman Asia is responsible for our operations and development in the Asia-Pacific region, focusing on China and South Korea. We have pursued a strategy of seeking strategic partners to jointly develop high-quality malls in our areas of focus. Taubman Asia is engaged in projects that leverage our strong retail planning, design, and operational capabilities with our strategic partners being responsible for acquiring and entitling the land and leading construction.

We envision that the Asia business will be a smaller but complementary and important part of our overall business. We have built three high-quality shopping centers and a fully integrated development and management platform with strategic, local partners. Our goal is to create a platform that finances itself by bringing in new capital partners, and potentially adding additional operating partners where appropriate, to create a less capital-intensive business that can grow the asset base with improved returns on equity, which is evidenced by our agreement in February 2019 with The Blackstone Group L.P. (Blackstone) to sell 50% of our interests in Starfield Hanam, CityOn.Xi'an, and CityOn.Zhengzhou described below.

8

As part of our Asia strategy, we look to mitigate our operating costs through property management fees and third party service contracts when possible. We currently provide some management and advisory services to third parties in Asia. We also attempt to manage risks and financial returns for our Asia developments through actively managing and limiting pre-construction costs, ensuring there is adequate anchor and tenant interest in the project prior to construction, and pursuing initial projects that are already fully entitled with partners having appropriate expertise in land acquisition and local regulatory issues. Developments in China and South Korea are subject to income taxes and taxes upon repatriation of earnings that also must be planned for and managed.

We have a joint venture with Shinsegae, one of South Korea's largest retailers, to build, lease, own, and manage Starfield Anseong, an approximately 1.1 million square foot shopping center, in Anseong, Gyeonggi Province, South Korea. We own a 49% interest in the project, which is scheduled to open in late 2020. We also have an additional joint venture with Shinsegae that owns and manages an approximately 1.7 million square foot shopping center, Starfield Hanam, in Hanam, South Korea. Additionally, we have two joint ventures with Wangfujing Group Co., Ltd (Wangfujing), one of China's largest department store chains, that own CityOn.Xi'an and CityOn.Zhengzhou in China.

In February 2019, we announced agreements to sell 50% of our interests in Starfield Hanam, CityOn.Xi’an, and CityOn.Zhengzhou to funds managed by Blackstone (Blackstone Transactions). In September 2019, we completed the sale of 50% of our interest in Starfield Hanam and now own 17.15% of the center. Additionally, in December 2019, we completed the sale of 50% of our interest in CityOn.Zhengzhou and now own 24.5% of the center. We expect to close on the sale of 50% of our interest in CityOn.Xi'an in the first quarter of 2020, and following the sale of 50% of our interest, we will own 25% of CityOn.Xi'an. We remain the partner responsible for the joint management of the three shopping centers, with Blackstone paying a property service fee.

See "MD&A - Results of Operations - Taubman Asia" for further details regarding the Blackstone Transactions and our activities in Asia.

Strategic Acquisitions

We expect attractive opportunities to acquire existing centers, or interests in existing centers, from other companies may be scarce and expensive. However, we continue to look for assets in both the U.S. and Asia where we can add significant value or that would be strategic to the rest of our portfolio. Our objective is to acquire existing centers only when they are compatible with the quality of our portfolio, or can be redeveloped to that level. We also may acquire additional interests in centers currently in our portfolio.

In April 2019, we acquired a 48.5% interest in The Gardens Mall in Palm Beach Gardens, Florida in exchange for 1.5 million newly issued TRG Units. The Forbes Company, our partner in The Mall at Millenia and Waterside Shops, also owns a 48.5% interest and manages and leases the center. This purchase is consistent with our strategy to own high-quality, dominant assets in great markets. See "MD&A - Results of Operations - The Gardens Mall Acquisition" for additional information regarding the acquisition.

Redevelopment Agreement for Taubman Prestige Outlets Chesterfield

In May 2018, we entered into a redevelopment agreement for Taubman Prestige Outlets Chesterfield, and all operations at the center, as well as the building and improvements, were transferred to The Staenberg Group (TSG). TSG leases the land from us through a long-term, participating ground lease and we receive ground lease payments and a share of the property’s revenues above a specified level. TSG is planning a significant redevelopment of the property, which will transform it into a unique entertainment, shopping and dining destination. We have the right to terminate the ground lease in the event that the redevelopment has not begun within five years, with the buildings and improvements reverting to us upon termination. We have deferred recognition of a sale until our termination right is no longer available, with the right ceasing upon TSG commencing construction of a redevelopment. TSG has made significant progress on its redevelopment plans and the commencement of construction is probable within the year, leading to an expected sale of the property in 2020. Accordingly, the center was classified as held for sale as of December 31, 2019 and an impairment charge of $72.2 million was recognized in the fourth quarter, which reduced the book value of the buildings, improvements, and equipment that were transferred to zero. See "MD&A - Results of Operations - Redevelopment Agreement for Taubman Prestige Outlets Chesterfield" for further details regarding the redevelopment agreement and impairment charge.

9

Rental Rates

As leases have expired in the centers, we have generally been able to rent the available space, either to the existing tenant or a new tenant, at rental rates that are higher than those of the expired leases. Generally, center revenues have increased as older leases rolled over or were terminated early and replaced with new leases negotiated at current rental rates that were usually higher than the average rates for existing leases. In periods of increasing sales, rents on new leases will generally tend to rise. In periods of slower growth or declining sales, rents on new leases will generally grow more slowly or will decline, as occurred in 2019, or we may execute shorter lease terms, as tenants' expectations of future growth become less optimistic. Where appropriate, we are making decisions as we re-tenant space to use some shorter term leases in order to maintain occupancy, merchandising, and preserve cash flow; this activity can have a material impact on our releasing spread for an applicable period. See "Risk Factors" for further information.

The following table contains certain information regarding average rent per square foot of our Consolidated Businesses and UJVs at the comparable centers (centers that had been owned and open for the current and preceding year, excluding centers impacted by significant redevelopment activity, as well as The Mall of San Juan due to the impact of Hurricane Maria). Comparable center statistics for 2019 and 2018 exclude Beverly Center, The Gardens Mall, The Mall of San Juan, and Taubman Prestige Outlets Chesterfield. Average rent per square foot statistics are computed using contractual rentals per the tenant lease agreements (excluding lease cancellation income, expense recoveries, and uncollectible tenant revenues), which reflect any lease modifications, including those for rental concessions.

| 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||

| Average rent per square foot: | |||||||||||||||||||

| Consolidated Businesses | $ | 70.69 | $ | 71.24 | $ | 69.25 | $ | 63.83 | $ | 61.37 | |||||||||

| Unconsolidated Joint Ventures | 47.29 | 46.27 | 47.02 | 58.10 | 57.28 | ||||||||||||||

| Combined | 56.12 | 55.24 | 55.36 | 61.07 | 59.41 | ||||||||||||||

See "MD&A – Rental Rates and Occupancy" for information regarding opening and closing rents per square foot for our centers.

10

Lease Expirations

The following table shows scheduled lease expirations for mall tenants based on information available as of December 31, 2019 for the next ten years for all owned centers in operation at that date.

Tenants 10,000 square feet or less (1) | Total (1)(2) | ||||||||||||||||||||||

Lease Expiration Year | Number of Leases Expiring | Leased Area in Square Footage | Annualized Base Rent Under Expiring Leases Per Square Foot (3) | Percent of Total Leased Square Footage Represented by Expiring Leases | Number of Leases Expiring | Leased Area in Square Footage | Annualized Base Rent Under Expiring Leases Per Square Foot (3) | Percent of Total Leased Square Footage Represented by Expiring Leases | |||||||||||||||

2020 (4) | 368 | 719 | $ | 44.75 | 8.8 | % | 380 | 928 | $ | 43.54 | 5.9 | % | |||||||||||

| 2021 | 591 | 1,332 | 58.88 | 16.2 | 617 | 1,993 | 47.45 | 12.7 | |||||||||||||||

| 2022 | 525 | 1,199 | 57.62 | 14.6 | 557 | 2,062 | 42.53 | 13.2 | |||||||||||||||

| 2023 | 303 | 903 | 60.41 | 11.0 | 315 | 1,132 | 55.50 | 7.2 | |||||||||||||||

| 2024 | 298 | 862 | 61.24 | 10.5 | 320 | 1,270 | 50.34 | 8.1 | |||||||||||||||

| 2025 | 259 | 875 | 65.39 | 10.7 | 290 | 1,505 | 53.83 | 9.6 | |||||||||||||||

| 2026 | 202 | 565 | 77.98 | 6.9 | 220 | 952 | 64.39 | 6.1 | |||||||||||||||

| 2027 | 149 | 462 | 72.47 | 5.6 | 164 | 875 | 47.72 | 5.6 | |||||||||||||||

| 2028 | 136 | 405 | 67.66 | 4.9 | 160 | 1,619 | 28.20 | 10.4 | |||||||||||||||

| 2029 | 159 | 494 | 57.55 | 6.0 | 171 | 760 | 50.41 | 4.9 | |||||||||||||||

| (1) | Excludes rents from temporary in-line tenants and centers not open and operating at December 31, 2019. |

| (2) | In addition to tenants with spaces 10,000 square feet or less, includes tenants with spaces over 10,000 square feet and value and outlet center anchors. Excludes rents from mall anchors and temporary in-line tenants. |

| (3) | Weighted average of the annualized contractual rent per square foot as of the end of the reporting period. |

| (4) | Excludes leases that expire in 2020 for which renewal leases or leases with replacement tenants have been executed as of December 31, 2019. |

We believe that the information in the table is not necessarily indicative of what will occur in the future, partially due to early lease terminations at the centers. The average remaining term of the leases that were terminated during the last five years was approximately 1.5 years. The average term of leases signed was approximately six and seven years during 2019 and 2018, respectively, excluding temporary in-line tenants (TILs).

In addition, mall tenants at the centers may seek the protection of the bankruptcy laws, which could result in the termination of such tenants' leases and thus cause a reduction in cash flow. In 2019, tenants representing 2.7% of the total number of tenant leases filed for bankruptcy during the year compared to 1.6% in 2018. In 2019, bankruptcy filings included Forever 21, one of our largest mall tenants during the year ended December 31, 2019. This statistic has ranged from 0.8% to 3.1% of leases per year over the last five years. However, many bankruptcies do not ultimately impact our occupancy because historically less than half of our tenants who file for bankruptcy actually close.

11

Occupancy

Occupancy and leased space statistics include TILs and value and outlet center anchors (Dolphin Mall, Great Lakes Crossing Outlets, and Taubman Prestige Outlets Chesterfield). The following table shows ending occupancy and leased space for the past five years:

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||

| All Centers: | ||||||||||||||

| Ending occupancy | 93.9 | % | 94.6 | % | 94.8 | % | 93.9 | % | 94.2 | % | ||||

| Leased space | 95.2 | 96.2 | 95.9 | 95.6 | 96.1 | |||||||||

| Comparable Centers: | ||||||||||||||

| Ending occupancy | 94.3 | % | 94.9 | % | ||||||||||

| Leased space | 95.7 | 96.4 | ||||||||||||

Major Tenants

No single retail company represented 4% or more of our Mall GLA as of December 31, 2019 or 2019 Rental Revenues. The combined operations of H&M accounted for 3.8% of Mall GLA as of December 31, 2019 and less than 2% of 2019 Rental Revenues.

The following table shows the ten mall tenants who occupy the most Mall GLA at our centers and their square footage as of December 31, 2019:

| Tenant | # of Stores | Square Footage | % of Mall GLA | |||

| H&M | 22 | 466,549 | 3.8% | |||

| The Gap (Gap, Gap Kids, Baby Gap, Banana Republic, Janie and Jack, Old Navy, Athleta, and others) | 61 | 450,693 | 3.6 | |||

| Forever 21 (Forever 21, XXI Forever) | 16 | 448,690 | 3.6 | |||

| Limited Brands (Bath & Body Works/White Barn Candle, Pink, Victoria's Secret, and others) | 41 | 290,131 | 2.3 | |||

| Inditex (Zara, Zara Home, Massimo Dutti, Bershka, and others) | 20 | 235,063 | 1.9 | |||

| Williams-Sonoma (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, and others) | 28 | 230,966 | 1.9 | |||

| Urban Outfitters (Anthropologie, Free People, Urban Outfitters) | 29 | 230,863 | 1.9 | |||

| Abercrombie & Fitch (Abercrombie & Fitch, Hollister, and others) | 32 | 214,876 | 1.7 | |||

| Ascena Retail Group (Ann Taylor, Ann Taylor Loft, Justice, and others) | 40 | 198,245 | 1.6 | |||

| Restoration Hardware | 6 | 197,754 | 1.6 | |||

12

Competition

There are numerous shopping facilities that compete with our properties in attracting retailers to lease space. We compete with other major real estate investors with significant capital for attractive investment opportunities. We also compete with online retailers as they draw sales away from our tenants or reduce sales attributed to their stores in our centers, which impacts rental rates. See "Risk Factors" for further details of our competitive business.

Seasonality

The shopping center industry in the U.S. is seasonal in nature, with mall tenant sales highest in the fourth quarter due to the Christmas season, and with lesser, though still significant, sales fluctuations associated with the Easter holiday and back-to-school period. See "MD&A – Seasonality" for further discussion.

Environmental Matters

See "Risk Factors" regarding discussion of environmental matters.

Personnel

The Manager provides real estate management, acquisition, development, leasing, and administrative services required by us and our properties in the United States, and employs all of our U.S. employees, including our executive officers. Taubman Asia Management Limited (TAM) and certain other affiliates provide similar services for third parties in China and South Korea as well as Taubman Asia. The Manager is 99.8% beneficially owned by TRG and 0.2% owned by Taub-Co Holdings LLC (Taub-Co), which is 100% owned by members of the Taubman Family. The Manager receives fees from the shopping centers, TCO, TRG, and their respective affiliates and third parties in exchange for the performance of its services. Since TRG has an approximate 99.8% beneficial interest in the Manager, substantially all of these fees accrue to TRG, with a de minimis portion of the fees accruing to the benefit of Taub-Co through its 0.2% beneficial interest in the Manager. For more information about the Manager, see "Risk Factors - Risks Related to Our Business and Industry - Members of the Taubman Family have the power to vote a significant number of the shares of Capital Stock entitled to vote and have contractual rights."

As of December 31, 2019, the Manager, TAM, and certain other affiliates had 420 full time employees.

Available Information

TCO makes available free of charge through its website at www.taubman.com all reports it electronically files with, or furnishes to, the SEC, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, as well as any amendments to those reports, as soon as reasonably practicable after those documents are filed with, or furnished to, the SEC. These filings are also accessible on the SEC’s website at www.sec.gov.

13

Item 1A. RISK FACTORS.

The following factors and other factors discussed in this Annual Report on Form 10-K could cause our actual results to differ materially from those contained in forward-looking statements made in this Annual Report on Form 10-K or presented elsewhere in future Securities and Exchange Commission (SEC) reports or statements made by our management from time to time. These factors may have a material adverse effect on our business, financial condition, operating results and cash flows, and should be carefully considered. We may update these factors in our future periodic reports.

Risks Related to the Merger

The Mergers are subject to receipt of approval from our shareholders as well as the satisfaction of other closing conditions in the Merger Agreement.

The Merger Agreement contains a number of conditions to completion of the Mergers, including the adoption of the Merger Agreement by: (1) the holders of at least two-thirds of the outstanding shares of our common stock and the Series B Preferred Shares (voting together as a single class); (2) the holders of at least a majority of the Series B Preferred Shares; and (3) the holders of at least a majority of the outstanding shares of our common stock and the Series B Preferred Shares (voting together as a single class), excluding the outstanding shares of our common stock and the Series B Preferred Shares owned of record or beneficially by certain members of the Taubman family. In addition, the consummation of the Mergers is subject to certain other customary closing conditions, including, among others, the approval of the Partnership Merger by the partners holding at least a majority of the aggregate percentage interests in TRG other than those held by TCO (which approval has been obtained), the absence of certain legal impediments to the consummation of the Mergers, the absence of a Material Adverse Effect (as defined in the Merger Agreement) with respect to TCO, and the performance in all material respects by each of the parties to the Merger Agreement of their respective obligations under the Merger Agreement. The obligations of the parties to consummate the Mergers are not subject to any financing condition or the receipt of any financing by the Simon Parties. We can provide no assurance that all required approvals will be obtained or that all closing conditions will otherwise be satisfied (or waived, if applicable), or as to the timing of such approvals or the satisfaction (or waiver, if applicable) of such conditions. Certain of the conditions to completion of the Mergers are not within either our or the Simon Parties’ control, and neither we nor the Simon Parties can predict when or if these conditions will be satisfied (or waived, if applicable). Any delay in completing the Mergers could cause us not to realize some or all of the benefits that we expect to achieve if the Mergers are successfully completed within their expected timeframe.

Failure to complete the Mergers could materially adversely affect our stock price, future business operations and financial results.

If the Mergers are not completed for any reason, our common shareholders will not receive the Common Stock Merger Consideration (as defined in the Merger Agreement). Instead, TCO will remain an independent public company, and the shares of our common stock will continue to be traded on the NYSE. Moreover, our ongoing business may be materially adversely affected, and we would be subject to a number of risks, including the following:

| • | we may experience negative reactions from the financial markets, including potentially significant negative impacts on our stock price (which as of February 26, 2020, reflected a 70.9% premium compared to our closing stock price of $31.09 on December 31, 2019), and it is uncertain when, if ever, the price of the shares would return to the prices at which the shares currently trade; |

| • | we may experience negative publicity, which could have an adverse effect on our ongoing operations including, but not limited to, retaining and attracting employees, tenants, partners, customers, and others with whom we do business; |

| • | in recent years, we have incurred significant expense related to shareholder activism, and our failure to complete the Mergers could result in continued or increasing shareholder activism and further significant expense; |

| • | we will still be required to pay certain significant costs relating to the Mergers, such as legal, accounting, financial advisor, printing, and other professional services fees, which may relate to activities that we would not have undertaken other than in connection with the Mergers; |

| • | we may be required to pay a cash termination fee as required under the Merger Agreement; |

| • | the Merger Agreement places certain restrictions on the conduct of our business, which may have delayed or prevented us from undertaking business opportunities that, absent the Merger Agreement, we may have pursued; |

14

| • | matters relating to the Mergers require substantial commitments of time and resources by our management, which may have resulted and could continue to result in the distraction of management from ongoing business operations and pursuing other opportunities that could have been beneficial to us; and |

| • | we may be required to commit time and resources to defending against enforcement proceedings commenced against us related to the Mergers. |

If the Mergers are not consummated, the risks described above may materialize, and they may have a material adverse effect on our business operations, financial results, and stock price, especially to the extent that the current market price of our common stock reflects an assumption that the Mergers will be completed.

Shareholder litigation challenging the proposed Mergers may prevent the Mergers from being completed within the anticipated timeframe.

Shareholder litigation challenging the proposed Mergers may be commenced against us and may delay completion of the Mergers in the expected timeframe or altogether. If the plaintiffs in any such litigation are successful in obtaining an injunction prohibiting the parties from consummating the Mergers on the terms contemplated by the Merger Agreement, the injunction may prevent the completion of the Mergers in the expected timeframe or altogether. In addition, litigation challenging the Mergers may result in significant defense costs and serve as a distraction to management and directors.

We are subject to certain restrictions in the Merger Agreement that may hinder operations pending the consummation of the Mergers.

Whether or not they are completed, the pending Mergers may disrupt our current plans and operations, which could have an adverse effect on our business and financial results. The Merger Agreement generally requires us to operate our business in the ordinary course of business consistent with past practice pending completion of the Mergers, and it also restricts us from taking certain actions with respect to our business and financial affairs, subject to certain exceptions. These restrictions could be in place for an extended period of time, including if the consummation of the Mergers is delayed more than expected, which may delay or prevent us from undertaking business opportunities that, absent the Merger Agreement, we might have pursued, or from effectively responding to competitive pressures or industry developments. For these and other reasons, the pendency of the Mergers could adversely affect our business and financial results.

If the Merger Agreement is terminated, we may, under certain circumstances, be obligated to pay a termination fee to Simon. These costs could require us to use cash that would have otherwise been available for other uses.

If the Mergers are not completed, in certain circumstances, we could be required to pay Simon a termination fee of $111.9 million if such termination occurs after the conclusion of the first 45 days following the signing of the Merger Agreement (the Go-Shop Period), or $46.6 million if such termination occurs during the Go-Shop Period (and for a limited period beyond the Go-Shop Period in certain cases, as described in the Merger Agreement). The termination fee is payable if the Merger Agreement is terminated by TCO prior to the approval of the Merger Agreement by TCO’s shareholders to accept a Superior Proposal (as defined in the Merger Agreement). If the Merger Agreement is terminated, any termination fee we may be required to pay under the Merger Agreement may require us to use available cash that would have otherwise been available for general corporate purposes or other uses. For these and other reasons, termination of the Merger Agreement could materially adversely affect our business operations and financial results, which in turn would materially and adversely affect the price of our common stock.

15

Risks Related to Our Business and Industry

The economic performance and value of our shopping centers are dependent on many factors.

The economic performance and value of our shopping centers are dependent on various factors. Additionally, these same factors will influence our decision on whether to go forward on the development of new shopping centers, acquisitions and dispositions, and have affected and may continue to affect the ultimate economic performance and value of projects under construction and acquired shopping centers. Adverse changes in the economic performance and value of our shopping centers would also adversely affect our income and cash available to pay dividends.

Such factors include:

| • | changes in the global, national, regional, and/or local economic and geopolitical climates. Changes such as a global economic and financial market downturn may cause, among other things, a significant tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, lower consumer and business spending, and lower consumer confidence and net worth; |

| • | changes in specific local economies, decreases in tourism, and/or other real estate conditions. These changes may have a more significant impact on our financial performance due to the geographic concentration of some of our shopping centers; |

| • | changes in mall tenant sales performance of our shopping centers, which over the long term are the single most important determinant of revenues of the shopping centers because mall tenants (including temporary tenants and specialty retailers), provide approximately 90% of these revenues and because mall tenant sales determine the amount of rent, overage rent, and recoverable expenses, excluding utilities (together, total occupancy costs) that mall tenants can afford to pay. In times of stagnant or depressed sales, mall tenants may become less willing to pay traditional levels of rent; |

| • | changes in business strategies of anchors and key tenants. Anchors and key tenants may adopt new or modify existing strategies in order to adapt to new challenges and shifts in the economic environment. Such strategies could include improving the overall in-store customer experience and creating a desired destination, which could impact the type of space anchors and key tenants desire in our shopping centers. Beyond changing the existing experience, other strategies could include consolidation, contraction, renegotiation of business arrangements, or closing; |

| • | changes in consumer shopping behavior. Certain merchandise categories have been experiencing lower growth in traditional shopping centers and technology has significantly impacted consumer spending habits; |

| • | availability and cost of financing. While current interest rates continue to be low, it is uncertain how long such rates will continue; |

| • | changes in the attractiveness of our shopping centers due to the public perception of the safety, convenience, and supply of shopping centers in the market; |

| • | changes in property tax assessments of our shopping centers which, if increased, may adversely affect our tenants' ability to pay under the terms of their existing leases, reduce our ability to release space at accretive rates, and/or lessen attractiveness of the shopping center for future prospective tenants; |

| • | consequences of unexpected natural disasters, climate change, epidemics and pandemics, outbreaks and the fear of spread of contagious diseases (such as coronavirus), or acts of war or terrorism; |

| • | changes in government regulations, global geopolitics, and international trade policies due to economic tensions between governments, especially between the U.S. and China, which could adversely impact the supply chains of our tenants; |

| • | legal liabilities; and |

| • | changes in real estate zoning and tax laws in the U.S., South Korea, or China. |

These factors can impact the valuation of certain long-lived or intangible assets that are subject to impairment testing, which has resulted in and may in the future result in impairment charges that are material to our financial condition or results of operations. See "MD&A - Application of Critical Accounting Policies and New Accounting Pronouncements - Valuation of Shopping Centers" for additional information regarding impairment testing and "MD&A - Results of Operations - Impairment Charges" for details of the impairment charges recognized during 2019.

16

In addition, the value and performance of our shopping centers have been and may continue to be adversely affected by certain other factors discussed below including the state of the capital markets, expansion in Asia, unscheduled closings or bankruptcies of our anchors and tenants, competition, uninsured losses, the impact of technology on consumer spending, and environmental liabilities.

We are in a competitive business.

There are numerous shopping facilities that compete with our properties in attracting retailers to lease space. Our ability to attract tenants to our shopping centers and lease space is important to our success, and difficulties in doing so can materially impact our shopping centers' performance. The existence of competing shopping centers have had, and could have in the future a material adverse impact on our ability to develop or operate shopping centers, lease space to desirable anchors and tenants, and on the level of rents that can be achieved. In addition, retailers at our properties face continued competition from shopping through various means and channels, including via the internet, lifestyle centers, value and outlet malls, wholesale and discount shopping clubs, and television shopping networks. Competition of this type has had, and could continue to have in the future, an adverse effect on our revenues and cash available for distribution to shareholders.

As new technologies emerge, the relationship among customers, retailers, and shopping centers are evolving on a rapid basis and we may not be able to adapt to such new technologies and relationships on a timely basis. Our relative size may limit the capital and resources we are willing to allocate to invest in strategic technology to enhance the mall experience, which may make our shopping centers relatively less desirable to anchors, mall tenants, and consumers. Additionally, a small but increasing number of tenants utilize our shopping centers as showrooms or as part of an omni-channel strategy (allowing customers to shop seamlessly through various sales channels). As a result, with respect to customers that make purchases through other sales channels during or immediately after visiting our shopping centers, such sales are not being captured currently in our tenant sales figures or monetized in our rental revenues or overage rents.

We compete with other major real estate investors with significant capital for attractive investment opportunities. These competitors include other REITs, investment banking firms, and private and institutional investors, some of whom have greater financial resources or have different investment criteria than we do. In particular, there is competition to acquire, develop, or redevelop highly productive retail properties. This could become even more severe as competitors gain size and economies of scale as a result of merger and consolidation activity. This competition has impaired and may continue to impair our ability to acquire, develop, or redevelop suitable properties, and to attract key retailers, on favorable terms in the future.

Our real estate investments are relatively illiquid.

We are limited in our ability to vary our portfolio in response to changes in economic, market, or other conditions by certain restrictions on transfer imposed by our partners or lenders. If we were unable to refinance our debt at a shopping center, we may be required to contribute capital to repay debt, fund capital spending, or other cash requirements. In addition, under TRG’s partnership agreement, upon the sale of a center or TRG’s interest in a center, TRG may be required to distribute to its partners all or a portion of the cash proceeds received by TRG from such sale (a special distribution). If TRG made such a distribution, the sale proceeds would not be available to finance TRG’s activities, and the sale of a center may result in a decrease in funds generated by operations and in distributions to TRG’s partners, including us. Further, pursuant to TRG’s partnership agreement, TRG cannot dispose or encumber certain of its shopping centers or its interest in such shopping centers, specifically Beverly Center, Cherry Creek Shopping Center, Twelve Oaks Mall, The Mall at Short Hills, or Stamford Town Center, without the consent of a majority-in-interest of its partners other than TCO, which is currently held by members of the Taubman Family.

We acquire and develop new properties and/or redevelop and expand our existing properties, and these activities are subject to various risks.

We pursue development, redevelopment, expansion, and acquisition activities as opportunities arise, and these activities are subject to the following risks, one or more of which typically occur in a given project or transaction:

| • | the pre-construction phase for a new project often extends over several years, and the time to obtain landowner, anchor, and tenant commitments, zoning and regulatory approvals, and financing can vary significantly from project to project; |

| • | we may not be able to obtain the necessary zoning, governmental and other approvals, or anchor or tenant commitments for a project, or we may determine that the expected return on a project is not sufficient; if we abandon our development activities with respect to a particular project, we may incur a loss on our investment; |

17

| • | construction and other project costs may exceed our original estimates because of increases in material and labor costs, delays, nonperformance of services by our contractors, increases in tenant allowances, costs to obtain anchor and tenant commitments, and other reasons; |

| • | we may not be able to obtain financing or to refinance construction loans at desired loan-to-value ratios or at all, which are generally recourse to TRG; |

| • | we may be obligated to contribute funding for development, redevelopment, or expansion projects in excess of our ownership requirements if our partners are unable or are not required to fund their ownership share; |

| • | we may be required to initiate redevelopments at potentially significant costs for tenant or anchor spaces that are returned to us upon termination of their lease; |

| • | equity issuances as a source of funds, directly as consideration for acquisitions or indirectly through capital market transactions, may become less financially favorable as affected by our stock price as well as general market conditions; |

| • | occupancy rates and rents, as well as occupancy costs and operating expenses, at a completed project or an acquired property may not meet our projections at opening or stabilization; |

| • | the costs of development activities that we explore but ultimately abandon will, to some extent, diminish the overall return on our completed development projects; and |

| • | competitive pressures in our targeted markets may negatively impact our ability to meet our leasing objectives. |

Certain of our projects represent the retail portion of larger mixed-use projects. As a result, there have been and may continue to be certain additional risks associated with such projects, including:

| • | increased time to obtain necessary permits and approvals; |

| • | increased uncertainty regarding shared infrastructure and common area costs; and |

| • | impact on sales and performance of the retail center from delays in opening of other uses and or/the performance of such uses, or the inability to open or finance such other uses. |

In addition, economic, market, and other conditions may reduce viable development and acquisition opportunities in the U.S. that meet our unlevered return requirements in the short to intermediate horizon. As a result, we anticipate focusing on strategic repurposing of shopping centers (including potential repurposing of certain anchor stores).

Clauses in leases with certain tenants of our development or redevelopment properties include inducements, such as reduced rent and tenant allowance payments, that can reduce our rental revenues, Funds from Operations (FFO), and/or returns achieved. The leases for a number of the tenants that have opened stores at properties we have developed or redeveloped have reduced rent from co-tenancy clauses that allow those tenants to pay reduced rent until occupancy at the respective property reaches certain thresholds and/or certain named co-tenants open stores at the respective property. Additionally, some tenants have rent abatement clauses that delay rent commencement for a prolonged period of time after initial occupancy. The effect of these clauses reduces our rents and FFO while they are applicable. We expect to continue to offer co-tenancy and rent abatement clauses in the future to attract tenants to our development and redevelopment properties. As a result, our current and future development and redevelopment properties are more likely to achieve lower returns during their stabilization periods than other projects of this nature historically have, which adversely impact our investment returns in such developments, and may adversely impact our financial condition and results of operations.

Dispositions may not achieve anticipated results.

We actively maintain a strategy of recycling capital to achieve growth over time. At times this strategy may include strategically disposing of assets, or partial interests in assets, to improve our liquidity and the overall performance of our core mall portfolio, measured by:

| • | achieving improved portfolio metrics, demographics, and operating statistics, such as higher sales productivity and occupancy rates; |

| • | accelerating future growth targets in our operating results and FFO; |

| • | strengthening of our balance sheet; and |

| • | creating increased net asset value for our shareholders over time. |

18

However, we may not achieve some or all of the targeted results we originally anticipated at the time of disposition. If we are not successful at achieving the anticipated results from any disposition, there is potential for a significant adverse impact on our returns and our overall profitability. We may not be able to achieve certain desired cap rates related to dispositions of assets, or partial interests in assets, due to general economic reasons or, in cases of lower productivity malls, the perception of over-capacity of such malls in the U.S.

We hold investments in joint ventures in which we do not control all decisions. As a result, we may have material conflicts with our joint venture partners, who may make decisions that are not in our best interests.

Many of our shopping centers and shopping center projects are partially owned by non-affiliated partners through joint venture arrangements. As a result, we do not control all decisions regarding certain of those shopping centers and may be required to take actions that are in the interest of the joint venture partners but not our best interests. Accordingly, we may not be able to favorably resolve any issues that arise with respect to such decisions, or we may have to provide financial or other inducements to our joint venture partners to obtain such resolution.

For some of our UJVs, we do not control decisions as to the design or operation of internal controls over accounting and financial reporting, including those relating to maintenance of accounting records, authorization of receipts and disbursements, selection and application of accounting policies, reviews of period-end financial reporting, and safeguarding of assets. Some of such joint venture partners do not have similar expertise or experience that we do regarding internal controls, and therefore we are exposed to increased risk that such controls may not be designed or operating effectively, which could ultimately affect the accuracy of financial information related to these joint ventures as prepared by our joint venture partners.

Various restrictive provisions and rights govern sales or transfers of interests in our joint ventures. These may work to our disadvantage because, among other things, we may be required to make decisions as to the purchase or sale of interests in our joint ventures at a time that is disadvantageous to us.

In our joint ventures, we have and may continue to partner with entities with whom we do not have a historical business relationship and therefore there is additional risk in working through operational, financial, and other issues.

Investors are cautioned that deriving our beneficial interest in a joint venture as our ownership interest in individual financial statement items of that joint venture may not accurately depict the legal and economic implications of holding a noncontrolling interest in it.

Our business activities and pursuit of new opportunities in Asia pose unique risks.

We have offices in Hong Kong, Seoul, and Shanghai and we are pursuing and evaluating investment opportunities in various locations in China and South Korea. We have invested in four joint ventures to develop and operate shopping centers in China and South Korea and may invest in other shopping centers in China and South Korea in the future. In addition, we provide management and advisory services for third parties for other shopping centers in Asia. In addition to the general risks described in this report, our international activities are subject to unique risks, including:

| • | adverse effects of changes in exchange rates for foreign currencies and the risks of hedging related thereto; |

| • | changes in and/or difficulties in operating in foreign political environments; |

| • | difficulties in attracting new capital partners at existing projects due to risks specific to foreign investment; |