UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K/A

Amendment No. 1

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File No. 1-11530

TAUBMAN CENTERS, INC.

(Exact name of registrant as specified in its charter)

| Michigan | 38-2033632 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

200 East Long Lake Road, | Suite 300, | |||

| Bloomfield Hills, | Michigan | USA | 48304-2324 | |

| (Address of principal executive offices) | (Zip code) | |||

| Registrant's telephone number, including area code: | (248) 258-6800 |

Securities registered pursuant to Section 12(b) of the Act:

| Trading | Name of each exchange | |

| Title of each class | Symbol | on which registered |

Common Stock, $0.01 Par Value | TCO | New York Stock Exchange |

6.5% Series J Cumulative Redeemable Preferred Stock, No Par Value | TCO PR J | New York Stock Exchange |

6.25% Series K Cumulative Redeemable Preferred Stock, No Par Value | TCO PR K | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x Accelerated Filer o Non-Accelerated Filer o Smaller reporting company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

The aggregate market value of the 59,434,600 shares of Common Stock held by non-affiliates of the registrant as of June 28, 2019 was $2.4 billion, based upon the closing price of $40.83 per share on the New York Stock Exchange composite tape on June 29, 2019. (For this computation, the registrant has excluded the market value of all shares of its Common Stock held by directors of the registrant and certain other shareholders; such exclusion shall not be deemed to constitute an admission that any such person is an “affiliate” of the registrant.) As of April 28, 2020, there were outstanding 61,608,379 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

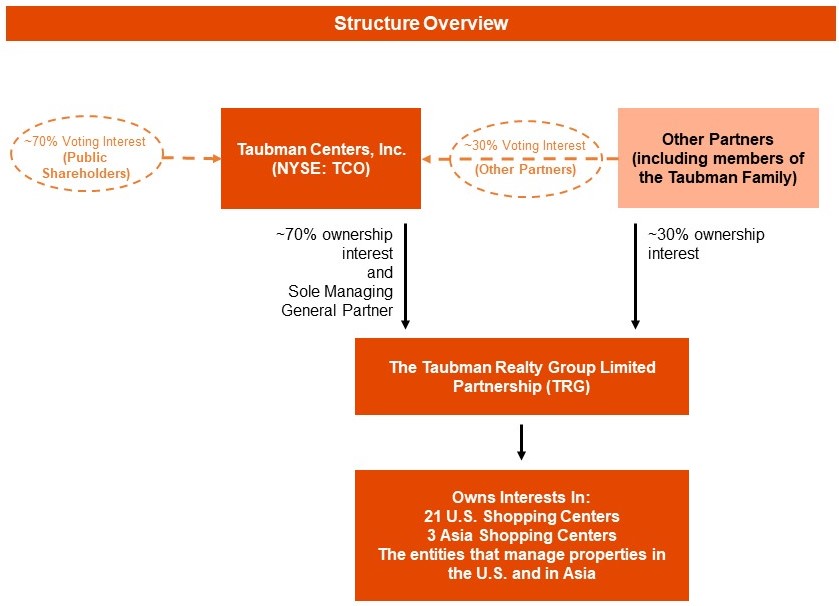

Taubman Centers, Inc. (TCO, Taubman or the Company) is a Michigan corporation (incorporated in 1973) that operates as a self-administered and self-managed real estate investment trust (REIT). TCO's sole asset is an approximate 70% general partnership interest in The Taubman Realty Group Limited Partnership (TRG), which owns direct or indirect interests in all of our real estate properties. In this report, the terms “we”, “us”, and “our” refer to TCO, TRG, and/or TRG's subsidiaries as the context may require. We own, manage, lease, acquire, dispose of, develop, and expand shopping centers and interests therein. Our owned portfolio of operating centers as of December 31, 2019 consisted of 24 urban and suburban shopping centers operating in 11 U.S. states, Puerto Rico, South Korea, and China. The Taubman Company LLC (the Manager) provides certain management and administrative services for us and for our U.S. properties.

This Amendment No. 1 to Form 10-K (this Amendment) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2019, originally filed on February 27, 2020 (the Original Filing) by the Company. This Amendment amends and restates in its entirety Part III, Items 10 - 14 of the Original Filing to include information previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K. The information included on the cover page of the Original Filing under “Documents Incorporated By Reference” is hereby deleted. In addition, as required under the Securities and Exchange Act of 1934, as amended (the Exchange Act), certifications by the Company's principal executive officer and principal financial officer are filed as exhibits to this Amendment under Part IV, Item 15 hereof. We are amending Part IV solely to add those certifications.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

1

INDEX

| ITEM | PAGE | ||||

| PART III | |||||

| PART IV | |||||

2

PART III

Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

Directors

Our directors are set forth below.

Name | Age | Title | Term Ending | |||

| Mayree C. Clark | 63 | Director | 2020 | |||

| Michael J. Embler | 56 | Director | 2020 | |||

| Janice L. Fields | 64 | Director | 2020 | |||

| Michelle J. Goldberg | 51 | Director | 2020 | |||

| Nancy Killefer | 66 | Director | 2020 | |||

| Cia Buckley Marakovits | 55 | Director | 2020 | |||

| Robert S. Taubman | 66 | Chairman of the Board, President and Chief Executive Officer | 2020 | |||

| Ronald W. Tysoe | 67 | Director | 2020 | |||

| Myron E. Ullman, III | 73 | Lead Director | 2020 | |||

Director Background and Qualifications

The following biographies set forth the business experience during at least the past five years of each director. In addition, the following includes, for each director, a brief discussion of the specific experiences, qualifications, attributes and skills that led to the conclusion that each director should serve on the Board of Directors of TCO (the Board) at this time in light of the goals set forth above.

Mayree C. Clark Director since: 2018 Age: 63 | Qualifications, Attributes, Skills and Experience: » Brings significant investor stewardship and extensive business leadership experience as CEO of an investment management firm and as an executive of a major public financial services company » Possesses experience in real estate, investment banking and capital markets, asset management, strategic planning, governance, and risk management, as well as extensive global exposure through her prior professional positions and service on other boards and professional organizations » Appointed by the Council of Institutional Investors to serve on the 2019 Corporate Governance Advisory Council » Served on the board of directors of the Stanford Management Company, which is responsible for Stanford University's endowment (2007-2015) and Commonfund (1992-2004) | |||||

Current Occupation(s): » Founding partner of Eachwin Capital, an investment management organization, which she led from 2011 to late 2016 for the benefit of third party investors and now oversees her family's investments | ||||||

Prior Occupation(s): » Independent director of Regulatory Data Corp. (RDC), owned by Vista Equity Partners, until 2020 » Partner and member of the executive committee of AEA Holdings, and a Senior Advisor to its real estate affiliate, Aetos Capital Asia from 2006 to 2010 » Held a variety of executive positions at Morgan Stanley over a span of 24 years from 1981 to 2005, serving as Head of Real Estate Capital Markets, Global Research Director, Director of Global Private Wealth Management, deputy to the Chairman, President and Chief Executive Officer, and non-executive Chairman of MSCI | ||||||

Other Public Company Board(s): » Director of Ally Financial Inc. (since 2009) (including service on the Audit and Risk Committees) (past Chair of the Risk Committee) » Member of the Supervisory Board of Deutsche Bank (since 2018) (including service as Chair of the Risk Committee and a member of the Strategy Committee and Nomination Committee) | ||||||

Michael J. Embler Director since: 2018 Age: 56 | Qualifications, Attributes, Skills and Experience: » Brings investor perspective and experience in finance, asset management and restructurings, capital markets and capital management » Possesses experience as a senior executive, perspective as an institutional investor and service as a public company director » Serves as a director of Mohonk Preserve, a non-profit land trust in New York State, where he serves as Treasurer and Chair of the Finance Committee » As a result of the foregoing expertise and experience, Mr. Embler qualifies as a financial expert under SEC rules » Possesses a Certificate in Cybersecurity Oversight from the National Association of Corporate Directors | |||||

Current Occupation(s): » Private investor | ||||||

Prior Occupation(s): » Chief Investment Officer of Franklin Mutual Advisers LLC, an asset management subsidiary of Franklin Resources, Inc. from 2005 to 2009. Head of its Distressed Investment Group from 2001 to 2005 » From 1992 until 2001, he worked at Nomura Holdings America in positions of increasing responsibility culminating in the position of Managing Director co-heading Nomura's Proprietary Distressed Debt/Special Situations Group | Other Public Company Board(s): » Director of NMI Holdings, Inc. (since 2012) (including service as Chair of the Audit Committee and a member of the Compensation Committee) » Director of American Airlines Group, Inc. (since 2013) (including service as Chair of the Finance Committee and a member of the Audit Committee) » Previously served as director of CIT Group Inc. from 2009 to 2016 (most recently served as a member of the Audit Committee and Nominating and Governance Committee), Abovenet, Inc. from 2003 to 2012 (most recently served as a member of the Audit Committee and Governance and Nominating Committee), Dynegy Inc. from 2011 to 2012 (most recently served as Chair of the Compensation and Human Resources Committee) and Kindred Healthcare from 2001 to 2008 (most recently served as a member of the Quality and Compliance Committee) | |||||

Janice L. Fields Director since: 2019 Age: 64 | Qualifications, Attributes, Skills and Experience: » Seasoned retail- and consumer-oriented executive with strong operational and corporate governance experience » Possesses a diversity of experience, including brand marketing, finance, supply chain, human relations, real estate, sustainability, communications, investor relations, risk management, strategic planning and global experience » Extensive public company board and board committee experience » Has served on the Global Board of Trustees for the Ronald McDonald House Charities since 2012 | |||||

Current Occupation(s): » Professional Director of Public Company Boards as set forth below: » Welbilt, Inc. since 2018 (member of the Compensation Committee and Corporate Governance Committee) » Chico’s FAS, Inc. since 2013 (Chair of the Corporate Governance and Nominating Committee and a member of the Executive Committee) | ||||||

Prior Occupation(s): » President, McDonald’s USA, LLC, a subsidiary of McDonald’s Corporation, from 2010 to 2012; U.S. Division President for the Central Division from 2003 to 2006; Executive Vice President and Chief Operating Officer from 2006 to 2010; served in numerous other roles in her 35 years at McDonald’s | Other Public Company Board(s): » Previously served as director of Monsanto Company from 2008 to 2018 (most recently served as Chair of the Sustainability and Corporate Responsibility Committee) and Buffalo Wild Wings, Inc. from 2017 to 2018 (most recently served as Chair of the Board) | |||||

4

Michelle J. Goldberg Director since: 2019 Age: 51 | Qualifications, Attributes, Skills and Experience: » As a venture capital investor and advisor to firms, Ms. Goldberg specializes in eCommerce and digital media, internet analytics, mobile and enterprise software » Provides a deep understanding of enterprise technology, including cloud computing, big data, scalability and SaaS » Possesses substantial public company board and corporate governance experience » Conversant in Mandarin » Possesses a B.A. in Asian Studies from Columbia College, where she is now a member of the Board of Visitors, and an M.A. in East Asian Studies from Harvard University | |||||

Current Occupation(s): » Partner at Ignition Partners, an early stage, technology venture capital firm, since 2000 » Venture Partner at SoGal Ventures, investing in how the next generation lives, works and stays healthy, since 2017 | ||||||

Prior Occupation(s): » Consultant in Microsoft's Developer Division, from 1999 to 2000 » Investment Banker working in middle market mergers and acquisitions at Olympic Capital Partners, from 1997 to 2000 » Associate, Management Consulting in the financial institutions group at A.T. Kearney, Inc., from 1994 to 1997 » Project Coordinator for the China External Trade Development Council in Taiwan, from 1991 to 1992 | ||||||

Other Public Company Board(s): » Director of Legg Mason, Inc. (since 2017) (including service as Chair of the Risk Committee and a member of the Special M&A and Audit Committees) » Previously served on the board of Plum Creek Timber Company, Inc. from 2015 to 2016 (including service as a member of the Compensation Committee) | ||||||

5

Nancy Killefer Director since: 2019 Age: 66 | Qualifications, Attributes, Skills and Experience: » Experienced senior executive and director. Ms. Killefer worked for McKinsey & Company, Inc. for 31 years in a variety of leadership roles, where she served a multitude of consumer, retail, restaurant, technology and other companies » Possesses a diversity of experience across a number of sectors combined with significant leadership experience, strategic depth and global experience » Provides significant governance, compensation and human resources expertise resulting from her board experience » Brings substantial experience in the areas of strategic planning and finance » As a result of the foregoing expertise and experience, Ms. Killefer qualifies as a financial expert under SEC rules » Extensive experience serving on U.S. government and other boards. From 2000 to 2005, she served on the IRS Oversight Board (Chair of the Board from 2002 to 2005). From 2014 to 2018, she served on the Defense Business Board, an advisory board to the U.S. Secretary of Defense (Vice Chair) » Served as a director of The Advisory Board Company from 2013 to 2017 (including service as a member of the Audit Committee) | |||||

Current Occupation(s): » Professional Director of Public Company Boards as set forth below: » Facebook, Inc. since 2020 » Natura & Co. since 2020 » Cardinal Health Inc. since 2015 (member of the Human Resources and Compensation Committee) | ||||||

Prior Occupation(s): » Senior Partner, McKinsey & Company, Inc.’s Public Sector practice (which she founded), from 2007 to 2013; Managing Partner of McKinsey’s Washington D.C. office, from 2000 to 2007; served in various other leadership positions at McKinsey, including director, from 1979 to 1997 » Served in various roles at the U.S. Department of the Treasury, including as Assistant Secretary for Management, Chief Financial Officer and Chief Operating Officer, from 1997 to 2000 | ||||||

Other Public Company Board(s): » Previously served as director of Avon Products, Inc. from 2013 to 2020 (including service as Chair of the Nominating and Corporate Governance Committee and a member of the Compensation and Management Development Committee), CSRA Inc. from 2015 to 2018 (including service as Chair of the Board and Chair of the Executive Committee) and Computer Sciences Corporation from 2013 to 2015 (including service as Chair of the Compensation Committee) | ||||||

6

Cia Buckley Marakovits Director since: 2016 Age: 55 | Qualifications, Attributes, Skills and Experience: » In-depth expertise and knowledge of real estate (domestic and globally), private investing, fiduciary responsibility with institutional investors, capital markets, finance, risk assessment, compliance and executive management throughout her professional experiences and service with real estate industry associations and in academia » Extensive experience with real estate investing in diverse asset classes on behalf of numerous, varied institutional investors, which provides her with significant and valuable insight into our strategic planning and valuation analysis and, especially, our investors’ views regarding those items » Possesses an in-depth knowledge of accounting and finance from her executive and private director positions, which included serving as President and Chief Financial Officer » As a result of the foregoing expertise and experience, Ms. Buckley Marakovits qualifies as a financial expert under SEC rules | |||||

Current Occupation(s): » President (since 2020), Chief Investment Officer (since 2012), Partner, Managing Director and Member of the Investment Committee (since 2007) of Dune Real Estate Partners LP (which evolved from Dune Capital Management LP) Prior Occupation(s): » From 1997 to 2007, held a variety of positions at JER Partners (an affiliate of the J.E. Robert Companies), including Chief Financial Officer, Head of Asset Management, Head of Acquisitions and, most recently, President of the U.S. Fund Business; also served on various investment committees of JER Partners » Spent nine years in the Real Estate Investment Banking Group of Bankers Trust managing investments in a variety of asset classes | ||||||

Other: » Full Member of the Urban Land Institute » Former Chair of the Investment Committee for ULI and ULIF » Trustee of ULI, active in the Women’s Leadership Initiative » Member of the Pension Real Estate Association » Member of Columbia Business School’s MBA Real Estate Program Advisory Board » Member of the Executive Committee of the Samuel Zell and Robert Lurie Real Estate Center at the Wharton School of Business » Member of WX, Women Executives in Real Estate » Treasurer and Member of the Board of Trustees and Chair of the Finance Committee, Collegiate School » Trustee of Phillips Exeter Academy | Other Public Company Board(s): » None | |||||

7

Robert S. Taubman Director since: 1992 Age: 66 | Qualifications, Attributes, Skills and Experience: » Has led TCO as a principal executive officer for over 36 years, as a director for 28 years and as Chairman of the Board for 19 years. He is a recognized leader in the REIT and regional mall industries » Under his leadership, our total shareholder return over the last 21 years has been 823% » Unique perspective and understanding of our business, culture and history, having led us through many economic cycles, internal and external growth and curtailment, global expansion and other key operational and strategic initiatives. His day-to-day leadership of TCO gives him critical insights into our operations, strategy and competition, and allows him to facilitate the Board's ability to perform its critical oversight function » Through his work at TCO and his leadership roles in numerous real estate and shopping center industry associations in Michigan and nationally, he possesses an in-depth knowledge of the REIT industry and regional malls, outlet centers and mixed-use centers on a global basis, and has significant relationships with key developers, potential and current joint venture partners, and tenants » Extensive board and board committee experience at other public companies, including through his current and long-standing service as a director of Comerica Bank and prior long-term service as a director of Sotheby's Holdings, also provides him significant insight as to governance and compliance-related matters of public companies | |||||

Current Occupation(s): » Chairman of the Board, and President and Chief Executive Officer of TCO and the Manager, which is a subsidiary of TRG. He has been Chairman since December 2001 and President and CEO since 1990 | ||||||

Other: » Past Chairman of the board and a director of the Real Estate Roundtable » Member and former Trustee of the Urban Land Institute » Advisory Board of Governors, National Association of Real Estate Investment Trusts » Member and past trustee of the International Council of Shopping Centers » Member of the University of Michigan Investment Advisory Committee for its endowment and is involved in a number of other community and philanthropic organizations » Brother of William Taubman | ||||||

Other Public Company Board(s): » Comerica Bank and related predecessor boards since 1987 (currently, a member of the Enterprise Risk Committee) » Previously served as director of Sotheby's Holdings, Inc., the international art auction house, from 2000 through his retirement from the board in May 2016 (most recently served as Chair of the Finance Committee) | ||||||

8

Ronald W. Tysoe Director since: 2007 Age: 67 | Qualifications, Attributes, Skills and Experience: » Long-standing service as a senior executive and a director of a company in the retail industry has provided him with extensive knowledge and experience in transactional, brand marketing, strategic planning, governance and international business matters » Such experience enables Mr. Tysoe to provide unique insight into tenant and development matters and the retail industry generally » Possesses an in-depth knowledge of accounting and finance from his executive and director positions, which included serving as a chief financial officer » Extensive board and board committee experience at other public companies across many industries, including through his current service to three other public companies, which enables him to provide significant insight as to governance and compliance-related matters and in particular accounting and finance matters » As a result of the foregoing expertise and experience, Mr. Tysoe qualifies as a financial expert under SEC rules | |||||

Current Occupation(s): » Director of Hauser Private Equity since 2008 » Professional Director of Public Company Boards as set forth below: » Cintas Corporation, since January 2008 (Chair of the Audit Committee and a member of the Nominating and Corporate Governance Committee) » J. C. Penney Company, Inc., since August 2013 (Chairman of the Board, Chair of the Corporate Governance Committee and a member of the Human Resources and Compensation Committee) | ||||||

Prior Occupation(s): » Senior Advisor at Perella Weinberg Partners LP, a boutique investment banking firm in New York from October 2006 through September 2007 » Vice Chairman, Finance and Real Estate, of Federated Department Stores, Inc. (now Macy's, Inc.), from April 1990 to 2006, including as Chief Financial Officer of Federated from 1990 to 1997. Served on the Federated board of directors from 1988 until 2005 | Other Public Company Board(s): » Previously served as director of Canadian Imperial Bank of Commerce from February 2004 to April 2019 (including service as a member of the Risk Management Committee) and Scripps Networks Interactive, Inc. (spun off from E.W. Scripps Company), a media and broadcasting enterprise, from July 2008 to March 2018 (most recently served as Chair of the Audit Committee and a member of the Compensation Committee and Pricing Committee) | |||||

9

Myron E. Ullman, III Director since: 2016 (appointed Lead Director in 2016); and served 2003-04 Age: 73 | Qualifications, Attributes, Skills and Experience: » Through his senior leadership and public company board experience with U.S. and international retailers, he brings to the Board extensive knowledge in critical areas, including leadership of global businesses, finance, executive compensation, governance, risk assessment and compliance » Possesses brand marketing experience and international distribution and operations experience from his roles at major U.S. and international retailers, as well as constructive insights and perspectives from positions he has held in the technology and real estate industries and the public sector » Experiences as chairman and chief executive officer of various entities during his career provide the Board with insight into the challenges inherent in managing a complex organization | |||||

Prior Occupation(s): » Served as Executive Chairman of J.C. Penney Company, Inc., from August 2015 to August 2016, and previously from November 2011 to January 2012. From April 2013 to August 2015, served as Chief Executive Officer and a member of the board of directors of J.C. Penney Company, Inc. Previously served as the Chairman of the board of directors and Chief Executive Officer from December 2004 to November 2011 » Served as Directeur General, Group Managing Director of LVMH Möet Hennessy Louis Vuitton, a luxury goods manufacturer and retailer, from July 1999 to January 2002 » From January 1995 to June 1999, he served as Chairman and Chief Executive Officer of DFS Group Limited, a retailer of luxury branded merchandise » From 1992 to 1995, he served as Chairman and Chief Executive Officer of R.H. Macy & Co., Inc. » Served as the Chairman of the National Retail Federation from 2006 to 2008 » Served as the Chairman of the Federal Reserve Bank of Dallas from 2008 to 2015 | ||||||

Other Public Company Board(s): » Serves as Lead Independent Director and Chairman of the board of directors of Starbucks Corporation (including service as a member of the Nominating and Corporate Governance Committee) » Has served on the board of directors for 11 U.S. and international public companies, including Starbucks, J.C. Penney Company, Inc., Ralph Lauren Corporation (most recently served as a member of the Audit Committee and Nominating and Corporate Governance Committee), Taubman Centers, Inc., Saks, Inc., R.H. Macy Corporation (most recently served as Chairman of the board of directors), LVMH Möet Hennessy Louis Vuitton, and Federated Department Stores, Inc. (most recently served as Deputy Chairman of the board of directors) | ||||||

Executive Officers

The executive officers of TCO serve at the pleasure of the Board. As of April 22, 2020, the executive officers of TCO are as follows:

Name | Age | Title | ||

| Robert S. Taubman | 66 | Chairman of the Board, President and Chief Executive Officer | ||

| William S. Taubman | 61 | Chief Operating Officer | ||

| Simon J. Leopold | 52 | Executive Vice President, Chief Financial Officer and Treasurer | ||

| Paul A. Wright | 49 | President, Taubman Asia Management Limited | ||

See “Item 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE — Director Background and Qualifications” for biographical and other information regarding Robert S. Taubman.

William S. Taubman is Chief Operating Officer of TCO, a position he has held since 2005. Mr. Taubman is also the Executive Vice President of the Manager, a position he has held since 1994. Mr. Taubman served as Executive Vice President of TCO from 1994 to 2005 and held various other positions with the Manager prior to 1994. Mr. Taubman served as a director of TCO from 2000 to 2018. He joined TCO in 1986 from Oppenheimer & Co., Inc. in New York, where he was a financial analyst specializing in mergers and acquisitions. His responsibilities include the overall management of the development, leasing and center operations functions.

Mr. Taubman also is a member of the International Council of Shopping Centers, where he previously served as Chairman of the Board. He is a member of the Urban Land Institute and the National Association of Real Estate Investment Trusts (NAREIT) and is involved in a number of other community and philanthropic organizations. He is also the brother of Robert S. Taubman.

10

Simon J. Leopold is Executive Vice President, Chief Financial Officer and Treasurer of TCO and the Manager. Mr. Leopold has been Executive Vice President and Chief Financial Officer since January 2016 and Treasurer since September 2012. Mr. Leopold joined us in September 2012 as Senior Vice President, Capital Markets and Treasurer, and he became Executive Vice President, Capital Markets and Treasurer in March 2015. Previously, Mr. Leopold spent approximately 13 years as an investment banker, where he served as the managing director in the real estate banking groups at Deutsche Bank (1999 to 2011), KBW (2011 to 2012) and UBS in 2012. Earlier in his career, Mr. Leopold worked in New York City government in a variety of urban planning and economic development positions in the Office of the Mayor, Department of City Planning and the city’s Economic Development Corporation. He is a member of the NAREIT, the International Council of Shopping Centers and the Urban Land Institute. He also has served as a director on the Board of Directors of Agree Realty Corporation since July 2019.

Paul A. Wright is President, Taubman Asia, a position he has held since January 1, 2020. Mr. Wright previously served as Executive Vice President, Global Head of Leasing of the Manager, a position he held from April 2017 to December 2019. Mr. Wright previously served in various other senior leasing roles for Taubman Asia Management Limited from mid-2006 to March 2017, most recently as Group Vice President of Leasing. Prior to joining the Company, Mr. Wright held senior-level positions with Citta Management Limited and Lendlease.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics (the Code), which sets out basic principles to guide the actions and decisions of all of our employees, officers (including our principal executive officer, principal financial officer and principal accounting officer) and directors. The Code covers numerous topics including honesty, integrity, raising concerns, conflicts of interest, compliance with laws and internal policies, corporate opportunities and confidentiality. Waivers of the Code are discouraged, but any waiver or material amendment that relates to our executive officers or directors may only be made by the Board or a Board committee and will be publicly disclosed on our website, www.taubman.com, under the Investors — Corporate Governance tab within four business days of such waiver or amendment. See “Related Person Transactions” for additional information on the Board's policies and procedures regarding related person transactions.

Audit Committee

The Audit Committee members are Michael J. Embler, Michelle J. Goldberg, Nancy Killefer and Ronald W. Tysoe (Chair). The Audit Committee is responsible for providing independent, objective oversight and review of our auditing, accounting and financial reporting processes, including by: reviewing the audit results and monitoring the effectiveness of our internal control over financial reporting, disclosure controls and internal audit function; reviewing our reports filed with or furnished to the U.S. Securities and Exchange Commission (the SEC) that include financial statements or results; and providing oversight of legal, ethical and regulatory compliance functions (including key compliance policies, such as the Code, Conflict of Interest and Related Person Transactions policies). In addition, the Audit Committee engages the independent registered public accounting firm and approves its work plan and fees. The Audit Committee may form and delegate authority to subcommittees as appropriate. See “Audit Committee Matters,” “Report of the Audit Committee” and the Audit Committee's charter for additional information on the responsibilities and activities of the Audit Committee.

The Board has determined that each Audit Committee member has sufficient knowledge in reading and understanding financial statements to serve thereon and is otherwise financially literate. The Board has further determined that three Audit Committee members, Mr. Embler, Ms. Killefer and Mr. Tysoe, qualify as “audit committee financial experts” within the meaning of SEC regulations and that each of them has the accounting and related financial management expertise required by the New York Stock Exchange (NYSE) listing standards. The designation of an “audit committee financial expert” does not impose upon such person any duties, obligations or liabilities that are greater than those generally imposed on such person as a member of the Audit Committee and the Board, and such designation does not affect the duties, obligations or liabilities of any other member of the Audit Committee or the Board.

11

Item 11. EXECUTIVE COMPENSATION.

Director Compensation

Non-employee director compensation consists of a mix of cash and equity, with such directors retaining the option to defer such compensation under the Non-Employee Directors' Deferred Compensation Plan. The combination of cash and equity compensation is intended to provide incentives for non-employee directors to continue to serve on the Board, to further align the interests of the Board and shareholders and to attract new non-employee directors with outstanding qualifications. Directors who are employees or officers of TCO or any of our subsidiaries do not receive any compensation for serving on the Board and therefore are excluded from the director compensation table below. We reimburse all directors for expenses incurred in attending meetings or performing their duties as directors.

The Compensation Committee reviews the non-employee director compensation program approximately every other year and makes recommendations to the Board as appropriate. The Compensation Committee did not review the non-employee director compensation program in 2019 and no changes were made from the 2018 program.

2019 Compensation Program

The following table sets forth the compensation program for non-employee directors in 2019:

| 2019 ($) | ||

| Annual cash retainer: | ||

| Board | 70,000 | |

| Additional annual cash retainer for Lead Director | 25,000 | |

| Additional annual cash retainer for Committees: | ||

| Audit Committee chair | 20,000 | |

| Audit Committee member | 12,000 | |

| Compensation Committee chair | 15,000 | |

| Compensation Committee member | 6,000 | |

| Nominating and Corporate Governance Committee chair | 12,500 | |

| Nominating and Corporate Governance Committee member | 4,500 | |

| Annual equity retainer (fair market value) | 125,000 | |

Annual Cash Retainer. The annual cash retainer was paid in installments each quarter (in advance).

Annual Equity Retainer. In 2019, each non-employee director received shares of common stock each quarter (in advance) having a fair market value of $31,250. The number of shares received is determined by dividing such amount by the closing price of the common stock as of the last business day of the preceding quarter. The 2019 awards were made pursuant to the 2018 Omnibus Long-Term Incentive Plan (the 2018 Omnibus Plan). We do not coordinate the timing of share grants with the release of material non-public information, as the grant date is always the first business day of each quarter.

Non-Employee Directors' Deferred Compensation Plan. Non-employee directors may defer the receipt of all or a portion of their cash retainer and equity retainer fee until the earlier of the termination of Board service or a change of control. The deferred amount is denominated in restricted share units (RSUs), and the number of RSUs received equals the amount of the deferred retainer fee divided by the fair market value of our common stock on the business day immediately before the date the director would have been otherwise entitled to receive the retainer fee. During the deferral period, the non-employee directors' notional deferral accounts are credited with dividend equivalents on their deferred RSUs (corresponding to cash dividends paid on our common stock), payable in additional RSUs based on the fair market value of our common stock on the business day immediately before the record date of the applicable dividend payment. Each non-employee director's notional deferral account is 100% vested. The restricted share units are converted into our common stock at the end of the deferral period for distribution. See “Security Ownership of Certain Beneficial Owners and Management - Ownership Table” beginning on page 45 for the amount of deferred shares held by non-employee directors.

Perquisites. We do not provide any perquisites to directors.

12

2019 Compensation Table

The table below sets forth the compensation of each non-employee director in 2019. Mr. Jerome Chazen and Mr. Craig Hatkoff resigned from the Board effective January 15, 2019 and did not earn any compensation in 2019.

Name | Fees Earned or Paid in Cash ($) (1)(4) | Stock Awards ($) (2)(4) | Total ($) | ||||||

| Mayree C. Clark | 96,750 | 124,875 | 221,625 | ||||||

| Michael J. Embler | 87,625 | 125,000 | 212,625 | ||||||

| Janice Fields | 76,000 | 125,000 | 201,000 | ||||||

| Nancy Killefer | 82,000 | 125,000 | 207,000 | ||||||

Michelle Goldberg(3) | 41,000 | 62,500 | 103,500 | ||||||

Jonathan Litt(3) | 41,000 | 62,500 | 103,500 | ||||||

| Cia Buckley Marakovits | 80,500 | 125,000 | 205,500 | ||||||

| Ronald W. Tysoe | 108,000 | 125,000 | 233,000 | ||||||

| Myron E. Ullman, III | 112,000 | 125,000 | 237,000 | ||||||

| Total | 724,875 | 999,875 | 1,724,750 | ||||||

| (1) | Represents primarily amounts earned in cash in 2019 with respect to the annual cash retainers, as well as cash paid for fractional shares awarded under the 2018 Omnibus Plan. |

| (2) | Reflects shares of common stock granted under the 2018 Omnibus Plan in 2019. The amounts reported reflect the grant-date fair value of each award, which equals the corresponding cash value of the award. |

| (3) | Mr. Litt's service on the Board ended on May 31, 2019. Ms. Goldberg's service on the Board began on May 31, 2019. |

| (4) | In 2019, the following directors elected to defer the receipt of all or a portion of their cash retainers and/or equity retainers under the Non-Employee Directors' Deferred Compensation Plan. The restricted share units were fully vested on the grant date. |

Name | 2019 Cash Deferrals ($) | 2019 Stock Deferrals ($) | Restricted Share Units Credited (excl. dividend equivalents) (#) | |||||

Michael J. Embler(1) | — | 125,000 | 2,809 | |||||

| Janice Fields | 76,000 | 125,000 | 4,409 | |||||

| Nancy Killefer | 82,000 | 125,000 | 4,541 | |||||

Michelle Goldberg(2) | 41,000 | 62,500 | 2,535 | |||||

Jonathan Litt(2) | 41,000 | 62,500 | 2,116 | |||||

| Cia Buckley Marakovits | 80,500 | 125,000 | 4,617 | |||||

Ronald W. Tysoe(1) | — | 125,000 | 2,809 | |||||

| Myron E. Ullman, III | 112,000 | 125,000 | 5,325 | |||||

| (1) | Mr. Embler and Mr. Tysoe elected to defer 0% of their cash compensation in 2019. |

| (2) | Mr. Litt's service on the Board ended on May 31, 2019. Ms. Goldberg's service on the Board began on May 31, 2019. |

Director Stock Ownership Guidelines

The Board has adopted stock ownership guidelines for the non-employee directors of TCO to further align the interests of shareholders and directors. The current guidelines are available on our website, www.taubman.com, under the Investors - Corporate Governance tab.

Under the current guidelines, non-employee directors are required to maintain shares having a value of $350,000 (five times the annual cash retainer and excluding the additional cash retainer for Lead Director, committee chairs and members). Until the requirement is satisfied, a non-employee director must retain at least 50% of the net shares that vest. However, once the requirement is satisfied initially, a non-employee director will not be subject to such retention requirement if the total value of the shares falls

13

below the requirement solely due to a decline in the price of our common stock. As of February 1, 2020, all non-employee directors in service were in compliance with the accumulation, or ownership, requirements under such guidelines.

Compensation Discussion and Analysis (CD&A)

The Compensation Discussion and Analysis (CD&A) describes and analyzes our executive compensation philosophy and program in the context of the compensation paid during the last fiscal year to our Named Executive Officers (NEOs). Our NEOs in 2019 are:

| Name | Title |

| Robert S. Taubman | Chairman of the Board, President and Chief Executive Officer |

| Simon J. Leopold | EVP, Chief Financial Officer and Treasurer |

| William S. Taubman | Chief Operating Officer |

| Paul A. Wright (1) | EVP, Global Head of Leasing |

| Peter J. Sharp (1) | Former President, Taubman Asia Management Limited |

(1) Peter Sharp resigned as President, Taubman Asia Management Limited effective October 9, 2019. Mr. Wright was promoted to President, Taubman Asia Management Limited effective January 1, 2020.

The following chart highlights the key considerations behind the development, review and approval of our NEOs' compensation in 2019:

| Objectives | Our NEO compensation program is designed to: • Align executives' long-term interests with those of our shareholders • Reward superior individual and Company performance • Attract, retain and motivate key executives who are critical to our operations |

| Philosophy | Our NEO compensation philosophy is built on the following principles: • Provide total compensation that is fair and competitively positioned in the marketplace • Reward results linked to short-term and long-term performance (pay for performance) • Drive a focus on increasing long-term shareholder value • Ensure incentives do not encourage inappropriate risk-taking |

Executive Summary

The following summary shows our continued commitment to align our compensation policies and practices with our performance while maintaining appropriate compensation governance. Also included below is a summary of the 2019 compensation related actions we believe will best position us to deliver long-term shareholder value.

14

| What We Do: | |

| • | Pay for Performance |

| • | Balance long-term and short-term incentives through a mix of metrics and performance periods |

| • | Benchmark compensation against an appropriate peer group |

| • | Independent committee administrates our equity plans |

| • | Use an industry specific index peer group as a long-term performance metric |

| • | Maintain a Clawback Policy |

| • | Maintain robust stock ownership requirements and monitor potential risks in our incentive plans |

| • | Engage an independent compensation consultant |

| What We Don't Do: | |

| • | Permit excise tax gross ups |

| • | Allow for equity vesting of less than one year or “single trigger” Change in Control vesting under the 2018 Omnibus Plan |

| • | Provide tenure-based benefits for executives, such as pension plans and retiree medical benefits |

| • | Pay dividends or dividend equivalent rights prior to vesting of equity award |

| • | Reprice, discount or reload stock options |

| • | Provide guaranteed bonuses |

2019 Company Performance Highlights

Our key financial results for 2019 included the following:

| • | Net income attributable to common shareholders of $3.32 per diluted common share, compared to $0.95 per diluted common share in 2018 |

| • | Adjusted funds from operations (AFFO) per diluted common share of $3.71(1) compared to AFFO per diluted share of $3.83 in 2018(2) (for additional information on funds from operations (FFO) and AFFO, see “Use of Non-GAAP Measures” below) |

| • | Comparable Center Net Operating Income (NOI) in 2019 compared to 2018: |

| • | Decreased by 2.6% - including lease cancellation income |

| • | Decreased by 1.3% - excluding lease cancellation income |

The Compensation Committee (the Committee) believes that AFFO and Comparable Center NOI are important supplemental measures of operating performance for REITs. Consequently, these measures are used as performance metrics in our incentive programs, creating an important link between pay and operating performance.

________________________________

(1) AFFO in 2019 excludes costs associated with shareholder activism, the fluctuation in the fair value of equity securities, restructuring charges, a charge recognized in connection with the write-off of deferred financing costs related to the early payoff of our $475 million unsecured term loan, costs related to Blackstone transactions, Taubman Asia President transition costs, and a promote fee, net of tax, related to Starfield Hanam

(2) AFFO in 2018 excludes costs associated with shareholder activism, the fluctuation in the fair value of equity securities, restructuring charges, and a charge recognized in connection with the write-off of deferred financing costs related to the early payoff of our $475 million unsecured term loan

Aligning Pay with Performance

To ensure that we are adhering to our pay for performance principles, a significant portion of the NEOs' compensation is at-risk based on the extent to which the following target performance measures are achieved:

| • | AFFO, |

| • | Growth in Comparable Center NOI, excluding lease cancellation income, |

| • | Asia goals related to combined center NOI and operating performance, and |

| • | Absolute and relative total shareholder return (TSR). |

15

Our incentive compensation programs for NEOs are designed to link compensation performance with our business goals, some of which are short-term, while others take several years to achieve. To the extent target performance measures are not achieved, or they are exceeded, the NEOs generally will earn compensation below or above the target total direct compensation, respectively, supporting our pay-for-performance objectives. Achievement of the short and long-term performance goals at target are reasonably possible but challenging based on historical comparisons and internal budgets which are reviewed by the Committee when establishing performance goals.

For 2019, our pay for performance philosophy was demonstrated through both our short and long-term programs with our annual bonus plan being funded slightly above target due to AFFO performance of $3.71, which exceeded the mid-point of our initial 2019 FFO/share guidance of $3.68, as discussed further on page 19. In contrast, the performance-based long-term incentive awards made in 2017, which vested in early 2020, resulted in 0.52x target payout for the relative TSR performance metric and no payout for the Comparable Center NOI performance metric as described further on page 20 and 21.

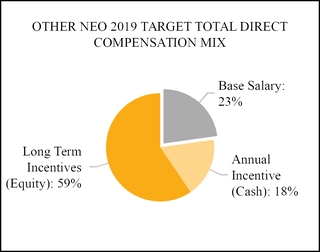

CEO / Other NEO Target Total Direct Compensation Mix

The charts below illustrate the mix of target total direct compensation (consisting of target base salary, target annual cash incentive, and target long-term equity incentive, including without any forfeitures for the CEO (as discussed further below) and COO) in support of our pay for performance philosophy for the NEOs:

Voluntary Forfeiture of Compensation by CEO

| • | Similar to 2017 and 2018, Mr. R. Taubman volunteered, with the approval of the Committee, to forfeit all of his annual equity awards and the majority of his base salary as detailed further on pages 22 and 23. |

| • | Similar to 2017 and 2018, the Committee adopted a tiered bonus funding approach that would begin funding the individual target cash bonus for Mr. R. Taubman only in the event our FFO/share exceeded $3.70. Based on our performance results (which exceeded the $3.70), Mr. R. Taubman received 2019 total direct pay of $1.4 million compared to his target total direct compensation of approximately $5 million. |

| • | These forfeiture actions were initiated by Mr. R. Taubman and supported by the Committee and the Board, given the collective focus on the long-term health of the business and advancing long-term value creation for shareholders. |

Shareholder “Say-on-Pay” Votes

In evaluating the design of our executive compensation programs and the specific compensation decisions for each of our NEOs, the Committee considers shareholder input, including the advisory “say-on-pay” vote at our annual meeting. At the 2019 annual meeting, we received significant shareholder support for compensation programs for NEOs with 95% of the outstanding votes cast approving the proposal (compared to 97% in 2018).

16

Elements of the Executive Compensation Program

The following table describes how elements of compensation are intended to satisfy the Committee's compensation objectives.

| Link to Program Objectives | Type of Compensation | Important Features | |

| Base Salary | • Fixed level of cash compensation to attract and retain key executives in a competitive marketplace | Cash | • Determined based on evaluation of individual’s experience, current performance, and internal pay equity and a comparison to the executive compensation peer group |

| Annual Cash Bonus | • Target cash incentive opportunity (set as a percentage of base salary) that encourages executives to achieve annual Company financial goals, and for Taubman Asia, certain operating goals • Assists in retaining, attracting and motivating employees in the near term | Cash | • U.S. funding based on the performance measures of FFO per diluted common share, as adjusted for extraordinary and/or unusual items, and growth in Comparable Center NOI • Payouts generally are based on individual performance |

Long-Term Incentives Program: RSUs* | • Focuses executives on achievement of long-term Company financial and strategic goals especially with respect to PSUs in creating long-term shareholder value (pay-for-performance) by using TSR (relative and absolute) and Comparable Center NOI performance metrics • Assists in maintaining a stable, continuous management team in a competitive market • Maintains shareholder-management alignment • Easy to understand and track performance • Limits dilution to existing shareholders relative to utilizing stock options | Long-Term Equity | • Funding based on the performance measures of FFO per diluted common share, as adjusted for extraordinary and/or unusual items, and growth in Comparable Center NOI • Payouts are based on individual performance • Senior management can elect to receive their award as Profits Units although no executives elected to receive Profits Units in 2019. |

| Long-Term Incentives Program: PSUs* | Long-Term Equity | • 50-60% of annual long-term incentive award in 2019 (half based on relative TSR and half based on Comparable Center NOI & Absolute TSR) with a three-year performance period • Three-year cliff-vest with actual payout of units at 0% to 300% of the target grant amount • Provides some upside in up- or down-market based on relative performance • Senior management can elect to receive their award as Profits Units although no executives elected to receive Profits Units in 2019. | |

| Retirement Benefits | • Helps attract and retain executive talent | Benefit | • NEOs receive retirement benefits through the 401(k) Plan |

| Perquisites | • Assists in attracting and retaining employees in competitive marketplace | Benefit | • Limited in amount and the Committee maintains a strict policy regarding eligibility and use • Messrs. Wright and Sharp's employment agreements permit certain expatriate benefits |

17

| Change of Control Agreements | • Attracts and retains employees in a competitive market • Ensures continued dedication of employees in case of personal uncertainties or risk of job loss • Attracts highly skilled employees in a competitive environment • Provides confidentiality and non-compete protections | Benefit | • The Severance Plan terminated in accordance with its terms on December 11, 2019 and was approved on February 9, 2020 • "Double trigger" protections (meaning an individual must experience a qualifying terminatin in connection with a change of control in order to receive any benefits)apply to all benefits, except for equity awards granted under the 2008 Omnibus Plan. The 2018 Omnibus Plan and Severance Plan both contain double-trigger protections • Messrs. R. and W. Taubman are not party to either the Severance Plan or a change in control agreement |

| Severance Plan Benefits | Benefit | ||

| Employment Agreements | Benefit | • Specific for the individual - only applies to Messrs. P. Sharp (who resigned in October 2019) and P. Wright | |

* The long-term incentive program permits U.S. based senior management an annual election to receive Profits Units of TRG (Profits Units) in place of annual performance-based share units (PSUs) and time-based RSUs of TCO. No NEOs elected Profits Units in 2019.

Description of Base Salary

The base salaries of NEOs are reviewed on an annual basis, as well as at the time of a promotion or other material change in responsibilities. Base salary adjustments are based on an evaluation of the individual’s experience, current performance, internal pay equity and a comparison to the executive compensation peer group.

When establishing base salaries for NEOs, the Committee considers a target at the 50th percentile of the executive compensation peer group data for comparable roles depending on experience and performance. As described below, none of the NEOs' base salaries were increased in 2019.

Description of Incentive Compensation Programs

Our incentive compensation programs for NEOs are designed to link compensation to performance of our business goals, some of which are short-term, while others take several years to achieve. To the extent target performance measures are not achieved, or they are exceeded, the NEOs generally will earn compensation below or above the target total direct compensation, respectively, supporting our pay-for-performance objectives.

When establishing short-term and long-term incentive targets for NEOs, the Committee considers a target at the 75th percentile of the executive compensation peer group data for comparable roles depending on experience and performance.

Short-Term (Cash) Annual Bonus Program | Long-Term (Equity) PSUs - TSR | Long-Term (Equity) PSUs - NOI | Long-Term (Equity) RSUs | |

| Objective | Short-term operational business priorities | Long-term shareholder value creation | ||

| Time Horizon | 1 Year | 3 Years with Cliff Vest | ||

| Metrics | FFO with a Comparable Center NOI growth modifier * | Relative TSR with 0-3x payout ** | Comparable Center NOI growth and Absolute TSR modifier with 0-3x payout | Time Vested |

* Prior to Mr. P. Sharp's resignation, his annual bonus opportunity also included specific metrics relating to Asia developments NOI and expense management

18

** Relative performance is measured against a comparator group of companies in the FTSE NAREIT All REITs Index (Property Sector: Retail) as discussed further on pages 20-21.

Description of 2019 Annual Cash Bonus Program

At the beginning of each year, target performance measures are established based upon our operating budget and competitive pressures, the anticipated economic climate (including interest rates) and other budgetary risks and opportunities.

The Committee continues to believe that FFO is a useful measure of operating performance for REITs when combined with a Comparable Center NOI growth qualifier as an additional measure to evaluate the operating performance of centers and to ensure the quality of earnings. The Committee retains the authority to adjust reported financial measures for unusual or nonrecurring items that impact the results in a given year and/or that were not contemplated when the original targets were set. These adjustments, if any, do not necessarily correspond to adjustments made for financial reporting purposes; the Committee customarily utilizes this discretion as appropriate.

In 2019, the Committee approved the following performance metrics for the U.S. and Asia (the U.S. metrics apply to all NEOs except Mr. Sharp, who was subject to Asia-specific metrics):

| U.S. | Asia | |||||

| Performance Metric | Weighting | Performance Metric | Weighting | |||

| FFO/share and Comparable Center NOI | 100 | % | FFO/share and Comparable Center NOI | 50 | % | |

| Asia Net Incremental Expense Performance | 25 | % | ||||

| Asia Combined Center NOI | 25 | % | ||||

If predetermined Comparable Center NOI growth levels were not achieved, the bonus pool funding could have been reduced. The performance goal and qualifier at target were reasonably possible but challenging based on historical comparisons (including prior development periods, adjusted for the current challenges of mall development) and our budget.

The Committee retained discretion to establish the earned cash bonus pool as it deemed appropriate so long as performance was above the threshold goal, although it established a guideline for the earned cash bonus pool if performance was between 50% to 150% of the target.

Following the approach outlined above, the Committee established a target objective of $3.68 FFO/share within a range of $3.62 (50% minimum payout) and $3.80 (150% maximum payout) for the entire U.S. bonus pool and 50% for the Asia bonus pool.

In addition, a tiered bonus funding approach was adopted by the Committee whereby the achievement of certain FFO/share thresholds would result in target cash bonus payouts for the CEO and COO. The tiered funding approach would fund above the CEO and COO's target bonus, along with the other participants (including the other NEOs), if FFO performance exceeded $3.70 FFO. We reported 2019 AFFO per diluted common share of $3.71 which was further adjusted to $3.73 for bonus pool funding purposes only to reflect unique expenses deemed by the Committee to be outside of the control of management. As a result, U.S. bonus funding (including the CEO and COO) was slightly above target level.

The Asia Net Incremental Expense Performance metric (25% of the Asia bonus pool funding) and Combined Center NOI metric (25% of the Asia bonus pool funding) use a payout formula for performance between 50% to 150% of the total Asia target bonuses. For 2019, the Asia expense metric was exceeded and the Combined Center NOI metric was not achieved, and combined with the FFO/share metric resulted in target level payouts in aggregate.

19

Description of Annual Long-Term Incentive Program

The Committee administers the long-term incentive program. 2019 awards under the long-term incentive program were made in accordance with the 2018 Omnibus Plan made in the following forms: - Restricted Share Units (RSUs) - Performance Share Units (PSUs) | Driving Shareholder Return Long-term incentive grants are intended to balance our short-term operating focus and align the long-term financial interests of senior management with those of our shareholders. | |

RSUs and PSUs:

Annual long-term equity award value has generally been allocated as follows:

| • | 40% RSUs and 60% PSUs (30% relative TSR and 30% Comparable Center NOI with Absolute TSR Modifier) (1) |

| (1) | With the exception of Mr. Wright due to the nature of his two-year assignment as described on page 25 |

Dividend Equivalent Rights (DERS) are included for both RSUs and PSUs. DERS are subject to the same time and performance vesting conditions as the underlying RSUs and PSUs.

The annual RSUs are a time-based award with a three-year cliff vesting period.

The annual PSUs represent a contingent number of units of stock granted at the beginning of a specified performance cycle, with the actual payout of units at 0 to 3x of the target grant amount. The PSU award value is divided equally into two awards with the following performance conditions:

Relative TSR PSUs:

Our relative performance with respect to shareholder return over a three-year period is measured against a comparison group consisting of companies in the FTSE NAREIT All REITs Index (Property Sector: Retail) as of the grant date (NAREIT Index). The Company has utilized the full NAREIT Index for the past 10 years to ensure the perception of objectivity in setting such performance measures.

The actual payout multiples are shown in the chart below, with interpolation between such performance levels.

| Relative Total Shareholder Return | |||||

Less than 25th percentile | 25th percentile | 50th percentile | 75th percentile | 100th percentile | |

| Multiple of Target Award upon Vesting | 0x | 0.5x | 1x | 2x | 3x |

20

| Companies Comprising the FTSE NAREIT All REITs Index (Property Sector: Retail) - PSU Peer Group | ||

| Acadia Realty Trust | Kite Realty Group Trust | Simon Property Group Inc. |

| Agree Realty Corporation | Macerich Company | SITE Centers Corp |

| Brixmor Property Group, Inc. | National Retail Properties, Inc. | Spirit MTA REIT |

| Brookfield Property REIT Inc. Class A | Pennsylvania Real Estate Investment Trust | Spirit Realty Capital, Inc. |

| CBL & Associates Properties, Inc. | Realty Income Corporation | STORE Capital Corporation |

| Cedar Realty Trust | Regency Centers Corp. | Tanger Factory Outlet Centers Inc. |

| Essential Properties Realty Trust, Inc. | Retail Opportunity Investments Corp. | Urban Edge Properties |

| Federal Realty Investment Trust | Retail Properties of America, Inc., Class A | Urstadt Biddle Properties Inc. Class A |

| Four Corners Property Trust, Inc. | Retail Value, Inc. | Urstadt Biddle Properties Inc. |

| Getty Realty Corp. | RPT Realty | Washington Prime Group Inc. |

| Kimco Realty Corp. | Saul Centers, Inc. | Weingarten Realty Investors |

| Seritage Growth Properties Class A | Wheeler Real Estate Investment Trust, Inc. | |

NOI Growth with Absolute TSR Modifier PSUs:

The Committee uses the three-year simple average for Comparable Center NOI growth with additional growth targets (set by the Committee at the time of grant). These targets are believed to be reasonably possible to achieve but challenging based on historical comparisons and our budget. Payout multiples above target require Comparable Center NOI performance in excess of our guidance. These PSUs have a zero to 3x payout with an absolute TSR modifier which limits the payout to 1x (target) if absolute TSR is not positive for the three-year period.

The actual payout multiples are shown in the chart below, with interpolation between such performance levels.

| Average Comparable Center NOI Growth | |||||

| Less than 67% of Target | 67% of Target | Target | 117% of Target | 133% of Target | |

| Multiple of Target Award upon Vesting | 0x | 0.5x | 1x | 2x | 3x |

Compensation Review Process

In determining compensation changes for NEOs from year to year, the Committee generally focuses on target total direct compensation, which consists of base salary, a target annual cash bonus and target long-term incentive awards. The Committee also reviews and proposes changes to post-termination benefits, perquisites and other compensation matters as it deems appropriate.

| Factors Guiding Decisions | |

| • | Compensation program objectives and philosophy (greater emphasis on variable pay - primarily long-term incentives) |

| • | Company financial performance |

| • | Individual executive performance |

| • | Recommendations of the CEO for other NEOs |

| • | Market pay practices |

| • | Assessment of risk management, including avoidance of unnecessary or excessive risk taking to ensure long-term shareholder value |

| • | Shareholder input including “say-on-pay” vote |

| • | Advice of independent outside compensation consultant |

21

Inputs to Compensation Decisions

Role of the Compensation Committee

Pursuant to its charter, the Committee, as a committee or together with the Board, has the overall responsibility to review, approve and evaluate our compensation plans, policies and programs. The Committee reviews and approves the compensation for senior management and determines all pay aspects for the Chief Executive Officer.

Role of Management in Compensation Decisions

Mr. R. Taubman, the CEO, provides the Committee with recommendations regarding the compensation for senior management, including each of the other NEOs, as well as the design and implementation of the compensation programs for senior management.

The CEO develops recommendations using assessments of executives' personal performance and achievement of their goals and objectives, and input from our human resources department on various factors (e.g., compensation history, tenure, responsibilities, market data, and executive compensation peer group proxy data). The Committee considers this input together with the input of our independent compensation consultant.

Role of the Compensation Consultant

The Committee engaged Willis Towers Watson as its compensation consultant for 2019 with respect to our senior management compensation program.

The Committee works with management to determine the consultant's responsibilities and direct its work product. The Committee is responsible for the formal approval of the annual work plan. Willis Towers Watson's responsibilities in 2019 with respect to executive compensation included, among other things: (A) presentation and discussion of 'best practices' and market trends in compensation; (B) advising management and the Committee, as requested, on executive compensation matters and participation in all Committee meetings; (C) review of the CD&A in the 2019 Proxy Statement; (D) peer group review; and (E) review of the appropriateness of the LTI performance metrics in light of the 2019 retail environment.

The Committee has the sole authority to approve the independent compensation consultant’s fees and terms of the engagement. Thus, the Committee annually reviews its relationship with Willis Towers Watson to ensure executive compensation consulting independence.

In addition to engaging Willis Towers Watson in 2019, the Committee also engaged FPL Associates to conduct a compensation study in order to ensure our pay practices were competitive when compared to private real estate companies for which we often compete for executive talent. The study, which focused on all the NEOs and three other executives, was used to provide additional market information for the Committee to consider when determining target total direct compensation for such executives.

2019 Peer Group

The Committee approved an industry peer group initially in 2014, and has ratified it on an annual basis, to use as an input to consider when assessing and determining pay levels for senior management. The details of this peer group, as modified to reflect extraordinary transactions, such as mergers and acquisitions since the group was approved, are included in the table below. The peer group is based on industry sector and market capitalization. The data from this executive compensation peer group was considered generally when making target pay decisions in addition to country-specific market trends and internal considerations.

| Executive Compensation Peer Group - 2019 | ||

| CBL & Associates Properties, Inc. | Kimco Realty Corporation | Site Centers Corp |

| Federal Realty Investment Trust | The Macerich Company | Tanger Factory Outlet Centers, Inc. |

| Forest City Enterprises, Inc. | Pennsylvania Real Estate Investment Trust | Vornado Realty Trust |

| GGP, Inc. | Washington Prime Group | |

| Howard Hughes Corp. | Simon Property Group, Inc. | |

Compensation Decisions

At the beginning of 2019, the Committee performed its annual NEO target pay review against the peer group data, position specific general industry data, if available, as well as the FPL Associates compensation study results. No changes in target total direct compensation were made for Messrs. R. Taubman, W. Taubman, S. Leopold or P. Wright. Mr. Sharp's target cash bonus and target long-term incentive were increased based on the annual NEO target pay review.

Base Salary

The Committee made no annual base salary changes for the NEOs for 2019. As described above, Messrs. R. Taubman and W. Taubman's forfeited 87% of their 2019 target base salary (the 13% paid represents the compensation needed to cover benefit

22

contributions). Mr. Sharp's 2019 paid base salary represents the amount paid prior to his resignation in October 2019. The following table sets forth the base salaries approved for the NEOs for 2019.

2019 Target ($) | 2019 Paid ($) | 2019 Paid vs 2019 Target (%) | |

| Robert S. Taubman | 928,818 | 120,010 | 13% |

| Simon J. Leopold | 525,000 | 525,000 | 100% |

| William S. Taubman | 750,000 | 98,978 | 13% |

| Paul A. Wright | 835,000 | 835,000 | 100% |

| Peter J. Sharp | 500,000 | 375,000 | 75% |

Annual Bonus Payouts

The target bonus of each NEO is reviewed on an annual basis, as well as at the time of a promotion or other material change in responsibilities. Target bonus adjustments are based on an evaluation of the individual’s experience, current performance, internal pay equity and a comparison to the executive compensation peer group (targeting the 75th percentile) and private company information from the FPL Associates compensation study (also targeting the 75th percentile). The Committee uses the sum of the target bonuses of each NEO to establish the target cash bonus pool based on the achievement of the performance metrics as described above.

Overall, the 2019 bonus expense for senior management was approximately $3.7 million, compared to a target bonus pool of $3.4 million (excluding Mr. Sharp who did not receive a bonus for 2019). This compares to a $4.6 million bonus expense against a target bonus pool of $3.6 million in 2018. Based on the tiered FFO/share thresholds established by the Committee, Messrs. R. Taubman and W. Taubman's target cash bonuses were fully funded and, along with the other NEOs, bonus awards were funded slightly above target. The Committee determined the U.S. bonus pool funding, and a portion of the Asia bonus pool funding, by slightly increasing the publicly reported AFFO of $3.71 to $3.73 to reflect unique expenses deemed by the Committee to be outside of the control of management. The payouts approved by the Committee for the CEO, and for the U.S. based senior management (except Mr. Wright), were based on individual achievements and progress against their individual performance goals.

Mr. Wright's target base salary consists of $425,000 base salary and an additional salary supplement of $410,000. Mr. Wright's 2019 target bonus as a percentage of base salary represents the full year bonus target opportunity ($212,500) consistent with his U.S. counterparts plus his additional full year bonus opportunity ($250,000) as part of his international assignment package payable on a biweekly basis with a clawback provision determined against his annual performance.

The following table sets forth each NEO's base salary, target cash bonus percentage of base salary and the approved annual cash bonus earned for 2019.

| 2019 Target Base Salary* ($) | 2019 Target Bonus Percentage of Base Salary | 2019 Actual Bonus ($) | |

| Robert S. Taubman | 928,818 | 125% | 1,200,000 |

| Simon J. Leopold | 525,000 | 100% | 600,000 |

| William S. Taubman | 750,000 | 100% | 775,000 |

| Paul A. Wright | 835,000 | 55% | 440,000 |

| Peter J. Sharp | 500,000 | 55% | — |

* The base salary amounts listed for Messrs. R. Taubman and W. Taubman represent their target base salary prior to forfeiting a portion of their 2019 base salary.

Long-Term Incentive Awards

For 2019, the number of RSUs and PSUs were determined by dividing the dollar award by the closing price of the common stock on the grant date.

The annual long-term incentive (LTIP) grants for the 2019 compensation program were as follows (Messrs. R. Taubman and W. Taubman forfeited their 2019 LTIP awards prior to them being granted):

23

2019 LTIP Award ($) (1) | Number of Time-based Units | Number of Target PSUs | |||||||

| TSR | NOI | ||||||||

| Robert S. Taubman | $ | — | — | — | — | ||||

| Simon J. Leopold | $ | 1,050,000 | 8,123 | 6,092 | 6,092 | ||||

| William S. Taubman | $ | — | — | — | — | ||||

| Paul A. Wright | $ | 675,000 | 6,576 | 3,240 | 3,240 | ||||

| Peter J. Sharp | $ | 500,000 | 3,868 | 2,901 | 2,901 | ||||

| (1) | The amounts reflect each NEO's LTIP target. These amounts differ from the grant-date fair value amounts reflected in the Summary Compensation Table-Stock Awards column, which are based on various valuation assumptions described in note 13 of our audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2019. |

Pay for Performance in Practice

The table below details the actual payout of the 2017 annual PSU awards based on performance achievement resulting in a 0.52x target payout for the relative TSR award and a 0x target payout for the Comparable Center NOI award. The estimated payouts for the remaining unvested PSU grants are also shown in the tables below as of December 31, 2019.

| Performance Period | Relative TSR Percentile Ranking During Performance Period (Estimates as of December 31, 2019) | Estimated/Actual Payout of Target PSUs (Estimates as of December 31, 2019) | |

| 2019 Award | March 12, 2019 - March 1, 2022 | 3% | Estimated 0x payout |

| 2018 Award | March 7, 2018 - March 1, 2021 | 8% | Estimated 0x payout |

| 2017 Award | February 20, 2017 - March 1, 2020 | 26% | Actual 0.52x payout |

| Performance Period | Comparable Center NOI During Performance Period with Absolute TSR Modifier (as of December 31, 2019) | Estimated/Actual Payout of Target PSUs (as of December 31, 2019) | ||

| 2019 Award | Jan 1, 2019 - Dec 31, 2021 | 0.2% | Estimated 0x payout 1 | |

| 2018 Award | Jan 1, 2018 - Dec 31, 2020 | 2% | Estimated .5x payout 1 | |

| 2017 Award | Jan 1, 2017 - Dec 31, 2019 | 1.6% | Actual 0x payout | |

1. Estimates represent a simple average of actual Comparable Center NOI during completed annual periods. Estimates of future Comparable Center NOI are excluded from the calculations.

Other Benefits

Our executive officers, including all of the NEOs, are eligible to participate in a number of broad-based benefit programs, including health, disability, life insurance and retirement programs.

Perquisites

The Committee historically has approved perquisites that provide an indirect benefit to us and do not provide excessive value to employees. The available perquisites in 2019 were primarily additional benefits related to health programs and plans and expatriate assignments as well as financial planning assistance. Mr. Wright’s and Mr. Sharp's 2019 perquisites were in-line with customary expatriate benefits and are noted on pages 39 and 40.

We own a corporate plane for business use which is available to executives and certain other individuals affiliated with TRG. Such persons are required to reimburse the Company for any personal use of the aircraft, as was the case for Messrs. R. Taubman and W. Taubman. The reimbursement includes total pilot and crew expenses (lodging, meals and transportation), fuel costs and landing fees. In 2019, reimbursements for personal use of the aircraft were well in excess of the IRS Standard Industry Fare Level formula.

Deferred Compensation Arrangements

The Committee believes non-qualified deferred compensation arrangements are a useful tool to assist in tax planning and ensure retirement income for its NEOs. Existing deferred compensation arrangements do not provide for above-market or preferential

24

earnings as defined under SEC regulations. In October 2016, pursuant to The Taubman Realty Group Limited Partnership and The Taubman Company LLC Election and Option Deferral Agreement, Mr. R. Taubman elected, effective December 1, 2017, to defer an option gain from December 2017 to December 2022. See “Non-qualified Deferred Compensation in 2019” for information regarding deferred compensation arrangements, as well as contributions, earnings, and withdrawals in 2019 and aggregate balances as of December 31, 2019.

Change of Control and Employment Agreements

See “Potential Payments Upon Termination or Change-in-Control” for a description of potential payments and benefits to the NEOs under our compensation plans and arrangements upon termination of employment or a change of control of TCO as of December 31, 2019.