UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01976

Sequoia Fund, Inc.

(Exact name of registrant as specified in charter)

9 West 57th Street, Suite 5000

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert D. Goldfarb

Ruane, Cunniff & Goldfarb Inc.

9 West 57th Street

Suite 5000

New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 686-6884

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Item 1. Reports to Stockholders.

Report to Shareholders is attached herewith.

Sequoia Fund, Inc.

Table of Contents

Sequoia Fund, Inc.

Illustration of An Assumed Investment of $10,000

(Unaudited)

The table below covers the period from July 15, 1970 (the date Sequoia Fund, Inc. (the “Fund”) shares were first offered to the public) to December 31, 2014. This period was one of widely fluctuating common stock prices. The results shown, which assume reinvestment of distributions, represent past performance and do not guarantee future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance shown. Investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

| | | | | | | | | | | | |

Period Ended | | Total Value

of Shares | | | | | Period Ended | | Total Value

of Shares | |

July 15, 1970 | | $ | 10,000 | | | | Dec. 31, 1992 | | $ | 343,863 | |

May 31, 1971 | | | 11,934 | | | | Dec. 31, 1993 | | | 380,919 | |

May 31, 1972 | | | 13,507 | | | | Dec. 31, 1994 | | | 393,633 | |

May 31, 1973 | | | 11,242 | | | | Dec. 31, 1995 | | | 556,525 | |

May 31, 1974 | | | 10,013 | | | | Dec. 31, 1996 | | | 677,506 | |

May 31, 1975 | | | 13,325 | | | | Dec. 31, 1997 | | | 970,200 | |

May 31, 1976 | | | 17,393 | | | | Dec. 31, 1998 | | | 1,312,197 | |

May 31, 1977 | | | 22,826 | | | | Dec. 31, 1999 | | | 1,095,125 | |

Dec. 31, 1977 | | | 28,057 | | | | Dec. 31, 2000 | | | 1,314,850 | |

Dec. 31, 1978 | | | 34,771 | | | | Dec. 31, 2001 | | | 1,453,175 | |

Dec. 31, 1979 | | | 38,961 | | | | Dec. 31, 2002 | | | 1,414,776 | |

Dec. 31, 1980 | | | 43,894 | | | | Dec. 31, 2003 | | | 1,656,923 | |

Dec. 31, 1981 | | | 53,329 | | | | Dec. 31, 2004 | | | 1,734,116 | |

Dec. 31, 1982 | | | 69,920 | | | | Dec. 31, 2005 | | | 1,869,038 | |

Dec. 31, 1983 | | | 89,015 | | | | Dec. 31, 2006 | | | 2,024,960 | |

Dec. 31, 1984 | | | 105,481 | | | | Dec. 31, 2007 | | | 2,195,146 | |

Dec. 31, 1985 | | | 134,975 | | | | Dec. 31, 2008 | | | 1,601,905 | |

Dec. 31, 1986 | | | 153,027 | | | | Dec. 31, 2009 | | | 1,848,293 | |

Dec. 31, 1987 | | | 164,361 | | | | Dec. 31, 2010 | | | 2,208,627 | |

Dec. 31, 1988 | | | 182,516 | | | | Dec. 31, 2011 | | | 2,499,935 | |

Dec. 31, 1989 | | | 233,453 | | | | Dec. 31, 2012 | | | 2,891,849 | |

Dec. 31, 1990 | | | 224,586 | | | | Dec. 31, 2013 | | | 3,891,835 | |

Dec. 31, 1991 | | | 314,426 | | | | Dec. 31, 2014 | | | 4,185,695 | |

|

Please consider the investment objectives, risks and charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other information about the Fund. You may obtain year to date performance as of the most recent month end, and a copy of the prospectus by calling 1-800-686-6884, or on the Fund’s website at www.sequoiafund.com. Please read the prospectus carefully before investing. Shares of the Fund are offered through the Fund’s distributor, Ruane, Cunniff & Goldfarb LLC. Ruane, Cunniff & Goldfarb LLC is an affiliate of Ruane, Cunniff & Goldfarb Inc. and is a member of FINRA. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

3

Sequoia Fund, Inc.

Annual Fund Operating Expenses

(Unaudited)

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder fees (fees paid directly from your investment)

The Fund does not impose any sales charges, exchange fees or redemption fees.

Annual Fund Operating Expenses (expenses that are deducted from Fund assets)

| | | | | | |

Management Fees | | | 1.00% | | | |

Other Expenses | | | 0.02% | | | |

| | | | | | |

Total Annual Fund Operating Expenses* | | | 1.02% | | | |

| | | | | | |

*Does not reflect Ruane, Cunniff & Goldfarb Inc.’s (‘‘Ruane, Cunniff & Goldfarb’’) contractual reimbursement of a portion of the Fund’s operating expenses. This reimbursement is a provision of Ruane, Cunniff & Goldfarb’s investment advisory agreement with the Fund and the reimbursement will be in effect only so long as that investment advisory agreement is in effect. The expense ratio presented is from the Prospectus dated May 1, 2014. For the year ended December 31, 2014, the Fund’s annual operating expenses and investment advisory fee, net of such reimbursement, were 1.00% and 0.97%, respectively.

4

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc.

Dear Shareholder:

Sequoia Fund’s results for the quarter and year ended December 31, 2014 appear below with comparable results for the S&P 500 Index:

| | | | | | |

To December 31, 2014 | | Sequoia Fund | | S&P 500 Index* | | |

Fourth Quarter | | 7.28% | | 4.93% | | |

1 Year | | 7.56% | | 13.69% | | |

5 Years (Annualized) | | 17.76% | | 15.45% | | |

10 Years (Annualized) | | 9.21% | | 7.67% | | |

The numbers shown above represent past performance and do not guarantee future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Future performance may be lower or higher than the performance information shown.

*The S&P 500 Index is an unmanaged capitalization-weighted index of the common stocks of 500 major US corporations. The performance data quoted represents past performance and assumes reinvestment of distributions.

The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Year to date performance as of the most recent month end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

The Fund outperformed the S&P 500 Index in the fourth quarter while underperforming the Index for the year. While we know a concentrated portfolio of stocks frequently will perform out of sync to the broader basket of stocks that constitute the Index, we nevertheless were disappointed with our performance in 2014.

We would attribute our underperformance to two factors, with a third issue that bears watching. First, the Fund held, on average, approximately 15% of its assets in cash during the year. This ranged between 20% cash at the start of the year and 12% in the fall. With cash generating negative returns, net of our fees, and the Index returning 13.7%, our cash position accounted for more than one-third of our 614 basis points of underperformance.

Second, our European holdings turned in mostly disappointing performance. About a decade ago we began trying to identify great businesses in Europe that source a growing percentage of their earnings from the emerging world. In 2004, many US businesses were still quite dependent on the domestic market while European companies tended to be more global, or so we felt. At the same time, we felt Europe shared similar standards of corporate governance with the U.S. We started 2014 with 7.1% of the Fund’s assets invested in UK-headquartered companies and 4.1% in two companies on the Continent, for a total of 11.2% invested overseas.

The UK Index, known as FTSE 100, rose 0.7% for the year, far below the S&P 500. On the Continent, our largest holding was Pirelli, the Italian maker of performance tires. Pirelli was down about 11% in dollars in March when we sold it, but had been a solid performer previously. We didn’t sell because of short-term price gyrations but because of concerns over corporate governance. The family that controls Pirelli had decided to sell a significant ownership stake to Rosneft, the Russian oil company that is aligned with President Vladimir Putin. We opted to exit immediately.

5

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

If Pirelli was a disappointment, the performance of our UK holdings in 2014 was a horror show. Rolls-Royce, our largest UK position, seems willing to destroy shareholder value in the name of diversification. Rolls-Royce has a world class business making engines for wide body jets. These engines are often sold at breakeven prices, or even a loss, but come with long-term Total Care service contracts that are quite profitable. Rolls shares a duopoly with General Electric in wide body engines and the barriers to entry for any newcomer would be formidable. Not only is the business intensely regulated, but a new player selling jet engines without an installed base of profitable service contracts likely would lose billions of dollars to capture market share from GE and Rolls. Not surprisingly, Rolls earns more than a 20% return on invested capital in civil aviation and its installed base of service contracts and strong backlog suggest Rolls should grow profitably for years to come.

And yet Rolls’ board of directors decided that it wanted to diversify deeper into the marine engine and power generation businesses, competitive sectors that are being encroached by low cost Asian players. To pursue this strategy, the board appears to have pushed out a sitting CEO who had crafted the successful Total Care service contract selling model, and replaced him with John Rishton, a board member who, in our meetings with him, has shown minimal awareness of the returns on capital his acquisitions have generated.

Rolls’ stock declined more than 30% in sterling during the year as investors lost confidence in management. We held our shares in the belief that Rolls’ wounds are self-inflicted and reversible. The recent share price does not properly value the civil aviation business even if we ascribe little value to the marine and energy businesses. However, management and the board seem stubborn and entrenched, and it may take a tough-minded activist to force strategic change.

Yet another British company in our portfolio, IMI, chose to force a successful CEO into early retirement and replace him with a newcomer because the board of directors wished to change strategy and pursue more acquisitions. Never mind that the existing management had been enormously successful. IMI shares declined 14% during the year in sterling (adjusting for a return of capital during the year). In fairness, we believe the new CEO is quite capable. Other UK holdings like Croda, Hiscox and Qinetiq were flat or down for the year, with the roughly 5% decline in GBP/USD exchange rate a further headwind.

The British take pride in their system of independent board chairmen, but the chair is often a retired CEO from an outside industry rather than an owners’ representative who knows the business. These gray alpha males frequently seem determined to inflict their will on the management teams they oversee. The U.S. system, in which one person often controls both management and the board, can be problematic when the leader is mediocre. But in the UK system it sometimes feels like the boards can’t bear to let management lead. Perhaps that helps explain why the FTSE 100 has lagged the S&P 500 by wide margins over the past five-, ten- and thirty-year periods.

In case it’s not clear, we are disappointed with our track record in Europe. Unfortunately, we’re slow learners. We bought two new positions in Europe during the year, one of which already has been sold at a loss. The other, Richemont, ranks among the great luxury houses globally: we believe Cartier is the strongest jewelry brand in the world and is flanked by a stellar portfolio of Swiss watch brands. As the emerging world grows wealthier, we believe the newly affluent will seek ways to project status and enjoy their wealth, benefiting Richemont and our long-time holding Tiffany. The chairman of Richemont is also an owner whose family built the company over decades. We’re hopeful that will make a difference.

6

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

A third issue we’ve been thinking about is the trend to passive investing. We are believers in the “fairly efficient market theory” and understand that it is difficult to outperform the S&P Index. But neither is it impossible, as reflected by the fact that a meaningful number of active investors beat the Index consistently over long time periods. But individual investors increasingly seem persuaded that it is so difficult to outperform that they are better off in low-cost Index funds.

The mutual fund ratings service Morningstar estimates that $98.4 billion exited actively-managed US equity mutual funds in 2014, while $166.6 billion flowed into passively-managed strategies such as Index funds. The market cap of the S&P 500 is about $19 trillion at this writing, so this movement may not have an observable impact on stock prices. Still, the net effect is stocks in the Index get bought and stocks outside the Index get sold without consideration of the merits of the decision. In turn, this means the Index will outperform the rest of the universe of US stocks.

We can’t say with any confidence that the trend to indexation hurt our returns in 2014. Our holdings Valeant, Idexx Labs and Sirona are not in the S&P 500 and each turned in outstanding share price performance. But the S&P 500, the largest and most important benchmark for most investors, rose 13.7% during the year, while the Russell 2000, a broader Index that includes smaller companies, rose 4.9%.

Vanguard says active managers control substantially more assets than passive managers, meaning the rotation to Index funds could continue for years. Indexation derives from a valid premise that active managers have created an efficiently priced market and, because they charge high fees, will underperform that market. Academic studies show passive strategies tend to outperform active managers in bull markets, perhaps for the simple reason that it works to be 100% invested in stocks when markets are rising. But studies also show passive strategies tend to underperform in bear markets, as it can hurt to be fully invested when stocks are dropping. If the trend to indexation continues, underperforming active managers will either slash their fees, disappear, or some of both.

One reason we think the trend could have legs is that markets continue to grow more efficient. Our colleague Greg Alexander likes to say “the Index is a lot better than it used to be.” U.S. corporate managements are generally competent and focused on creating shareholder value. There are not a lot of mutts left in the kennel, so to speak, so winning the dog show is harder. Over the past 10 years the Fund has outperformed the Index by about 150 basis points per year, or 9.2% vs. 7.7% annualized. This is well below our 45-year track record of 14.5% annualized vs. 11.0% for the Index. Yet it still ranks us in the upper tier of large US mutual funds over the past decade, per Morningstar.

We always aspire to improve, but the limitations imposed by our large size, the quality of the Index, the greater flow of information into the marketplace and the sheer number of smart people picking stocks for a living make it challenging to outperform. We haven’t helped ourselves with our foray into Europe.

A topic many shareholders and clients wanted to discuss with us in 2014 was Valeant. It is the largest holding in Sequoia by far. One could argue Valeant wasted much of the year on a quixotic effort to buy Allergan, maker of Botox. Allergan had no interest in being acquired and fought a vicious and savvy public relations campaign to portray Valeant as unworthy of marriage to such a prized catch. In the end, Allergan found a suitor more to its liking in Actavis, and Actavis agreed to pay a substantially higher price than Valeant had offered.

7

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

In our opinion, much of what Allergan said was wrong but Valeant seemed unprepared for what it should have known would be an aggressive counterattack. The defenses available to the targets of hostile takeovers are considerable and Valeant has now lost three hostile bids for public companies since 2011. Meanwhile, Allergan’s stock price nearly doubled over the past year without so much as a thank you note sent to Valeant CEO J. Michael Pearson.

Some good came out of this defeat. As it fought for Allergan, Valeant stopped making other acquisitions and so stopped taking one-time charges for restructuring and integrating its serial acquisitions. This made its financial reports easier to follow, and more investors came to see Valeant has a fine business. Most of its product categories show strong organic growth, despite claims to the contrary by Allergan. Valeant throws off sizable cash flows. It has very few products vulnerable to patent expirations in coming years. Management has done an excellent job of picking its spots, both geographically and by product category, while avoiding dependence upon a single drug. It integrated the large Bausch & Lomb acquisition flawlessly. And it proved itself capable of launching a new prescription drug, Jublia, with a highly-successful direct-to-consumer ad campaign.

In short, Valeant lost the battle for Allergan but we believe it is winning the war to establish itself among the first rank of global pharmaceutical companies. The stock suffered for much of the year from Allergan’s broadsides, but performed better once the takeover battled ended. We think Valeant is poised for more growth, both organic and acquired. We think it is brilliantly managed by Mike Pearson and his team. And yes, we are comfortable with the size of our holding.

Over the past five years, stock prices have doubled. Sequoia has done a bit better than that. The forward PE for the Index is now 17x, while the consensus estimate for S&P earnings growth is about 3% as of this writing, and has been trending lower. The price-to-earnings ratio does not feel inflated relative to the minuscule returns on Treasuries, but it does feel high relative to earnings growth. US companies have benefited enormously over the past few years from low borrowing costs, inversions/shrinking tax rates, lack of wage inflation and overcapacity in China, which keeps production costs low for all manner of goods. Yet earnings are expected to grow in mid-single digits. What happens when some or all of these tailwinds dissipate? What if some or all of them turn into headwinds? We think investors should be prepared to earn modest returns from stocks over the decade ahead.

The Fund is closed to new investment and partially as a result we had a net outflow during 2014 of $539 million, or 6% of assets. We lagged the Index for most of the year, and we saw redemptions increase over the summer and fall. A lot of the outflows came from financial advisors who manage their businesses on the Schwab, E*Trade and Ameritrade platforms, and who bought into Sequoia fairly recently. Given the instability of this client base, we continue to prefer direct relationships with like-minded shareholders to shelf space in a financial supermarket.

At year-end, the 10 largest stocks in the Fund constituted 63.8% of our net assets and 73% of our investment in stocks. We are comfortable with this level of concentration but would note that in seven of the past 15 years, Sequoia’s return has been at least 10 percentage points different than the S&P 500 Index return. Five times we’ve outperformed by at least 10 percentage points and twice we’ve underperformed by at least that much.

As for the year ahead, we’re skeptical anyone can predict the short-term direction of the market, and certainly we have a proven inability to do so. We believe we best serve Sequoia shareholders by endeavoring to own a

8

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

concentrated portfolio of stocks that has been intensively researched and carefully purchased, in the belief that such a portfolio will generate higher returns over time with less risk than a diversified basket of stocks chosen with less care.

Beginning this year, we are making a change to our communications with shareholders. Henceforth we will send an annual report that includes a letter from the co-managers and a discussion of our larger holdings, and a semi-annual report that includes the transcript of our May investor day meeting. We will stop sending reports after the first and third quarters. Few mutual funds send out reports after all four quarters and regulators do not require it. We believe our investor day meeting transcript provides a level of disclosure well beyond that provided by most other funds. The first and third quarter reports, by comparison, had become a chore for us to prepare and not especially useful for investors.

We are pleased to report that Vinod Ahooja has rejoined the Sequoia board. Vinny previously served 12 years on the board before retiring two years ago. We’re delighted to once again enjoy the benefit of his wise counsel.

Finally, we suffered a loss in 2014 when our co-founder Richard T. Cunniff passed away in March at the age of 91. Rick fought courageously in World War II and was both a gentleman of the old school and a fine stock analyst. He loved this firm and was greatly admired by all who worked here. Bill Ruane often said that he wouldn’t have had the nerve to start his own firm had Rick not been beside him. We are proud to have known Rick.

Sincerely,

| | |

| |  |

| Robert D. Goldfarb | | David M. Poppe |

| President | | Executive Vice President |

February 12, 2015

|

THE RUANE, CUNNIFF & GOLDFARB INC./SEQUOIA FUND, INC. ANNUAL INVESTOR DAY WILL BE HELD AT 10 A.M., NEW YORK CITY TIME, ON FRIDAY, MAY 15, 2015 AT THE ST. REGIS HOTEL, TWO EAST 55TH STREET, NEW YORK, NEW YORK 10022 |

9

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance

(Unaudited)

The total return for the Sequoia Fund was 7.6% in 2014. This compares with the 13.7% return of the S&P 500 Index. Our preference is to make concentrated commitments of capital in a limited number of companies that have superior long-term economic prospects and that sell at what we believe are attractive prices. Because Sequoia is deliberately not representative of the overall market, in any given year the performance of the Fund may vary significantly from that of the broad market indices.

The table below shows the 12-month stock total return for all positions that constituted at least 3% of the Fund’s assets at the end of 2014.

| | | | | | | | | | | | |

Position | | % of assets

12/31/14 | | | Total return | | | % of assets

12/31/13 | |

Valeant Pharmaceuticals | | | 20.0% | | | | 21.9% | | | | 16.5% | |

Berkshire Hathaway | | | 12.9% | | | | 27.0% | | | | 10.5% | |

TJX | | | 8.3% | | | | 8.7% | | | | 8.1% | |

Fastenal | | | 5.1% | | | | 2.2% | | | | 4.1% | |

O’Reilly Automotive | | | 3.9% | | | | 49.7% | | | | 2.7% | |

Mastercard | | | 3.2% | | | | 3.7% | | | | 3.1% | |

Idexx Labs | | | 3.1% | | | | 39.4% | | | | 2.6% | |

The underperformance of the portfolio vs. the S&P 500 in 2014 was driven in large part by the performance of the Fund’s European equity holdings, as well as the minimal return on its cash and Treasury Bills. The seven holdings listed above constituted nearly 57% of the Fund’s assets under management on December 31, 2014. At year-end, the Fund was 87.0% invested in common stocks and 13.0% invested in cash and Treasury Bills.

Valeant made headlines in 2014 as a result of its proposal to acquire Allergan, announced in late April. We were supportive of the transaction and believe that the combination would have resulted in a stronger and more profitable specialty pharmaceutical company with powerful franchises in dermatology, ophthalmology, aesthetics and consumer products. Unfortunately, Allergan had no interest in combining with Valeant and opposed the transaction vigorously. When Actavis announced a merger agreement to acquire Allergan

in mid-November for approximately $219 per share, Valeant chose to drop its acquisition proposal and move on. While we were disappointed that Valeant was not successful in its attempt to acquire Allergan, we felt the price ultimately paid for Allergan was high and were happy that Valeant remained financially disciplined, especially given that a significant portion of the deal would have been financed with equity.

Valeant generates substantial free cash flow and in 2014 it used those funds to reduce debt and make relatively small acquisitions. We estimate that in 2014 Valeant reduced its net debt from $16.8 billion to $14.6 billion and that the ratio of net debt to adjusted pro forma EBITA declined from above 4.5x to around 3.7x. In addition, the company spent another $1.3 billion on over 25 acquisitions. The two most significant deals completed during the year were Solta Medical for $293 million and PreCision Dermatology for $455 million.

Excluding the divestiture of the facial aesthetics business to Galderma, Valeant showed strong organic growth in 2014 with most business units likely increasing at a high single-digit or low double-digit rate for the year. Valeant’s growth was helped by a double-digit increase in sales from Bausch & Lomb, which Valeant acquired in the summer of 2013. Bausch & Lomb launched a number of new products in 2014 that helped drive growth. Overall, the acquisition is off to a strong start.

Prescription growth has also been very good to date, led by Jublia, a newly launched treatment for toenail fungus that has been backed by a successful direct-to-consumer television advertising campaign. Jublia has the potential to become one of Valeant’s largest drugs. The company has set a goal of realizing $300-400 million in sales for Jublia in 2015 as compared to $65 million in 2014.

Fourth quarter results have not been reported yet, but Valeant likely earned at least $8.30 of cash earnings per share in 2014, an increase of roughly 33% over

10

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

the prior year. The company has a number of drug launches scheduled for 2015, which should fuel double-digit organic sales growth. As we have mentioned in the past, we like Valeant’s approach to the pharmaceutical business and view the company as a value investor in health care products. We believe that it has pieced together a diversified and stable portfolio of products across areas such as dermatology, ophthalmology, branded generics, OTC drugs and medical devices like contact lenses.

Berkshire shares generated a gain of 27% last year. Although full year 2014 results are not yet available, we expect Berkshire to report a solid increase in earnings - though not as strong as the last two years when earnings growth exceeded 20% annually. In 2014 Berkshire benefited from strength in its insurance operations (including the near absence of large catastrophe losses), acquisitions announced or completed the previous year, and a modest rebound by some of its economically sensitive divisions. Book value growth during the year was aided by continued gains from the derivatives book— formerly an object of some derision— as well as by an obscure strategy to dispose of three stock positions without paying capital gain tax.

Less positively, Berkshire’s largest single business unit, the BNSF railroad, experienced serious service problems that, in our view, were partly self-inflicted. Several of the company’s larger equity holdings, including IBM, Tesco, Coca-Cola, Exxon, Bank of America and Sanofi, reported disappointing 2014 results.

Although high valuations for almost all asset classes made it difficult for Berkshire to make sensible acquisitions or investments in 2014, Berkshire managed to announce a few small-to-midsized purchases including a Canadian electricity transmission business, the Duracell battery operation, (acquired in exchange for P & G shares), the Van Tuyl car dealer group, a drilling fluid company sold by Weatherford, and $3 billion worth of preferred stock and warrants in Burger King. Cumulatively, the

benefit from these acquisitions will be enjoyed in 2015, while a return to form for the railroad could also propel Berkshire towards better core earnings gains.

TJX continues to report good results under the leadership of CEO Carol Meyrowitz, but 2014 was a bit below the company’s lofty standard. While full year results had not been announced as of this writing, we expect TJX generated revenue growth of about 4% and EPS growth of about 10% for the year. As TJX generates roughly one-quarter of its sales outside the US, a strong dollar may have depressed holiday sales and earnings, and may reduce expectations for 2015.

Though TJX is ostensibly a buyer of last resort for apparel vendors, in fact we believe it has become the largest customer for many brands across apparel, home décor, footwear and accessories. Its scale gives it great buying leverage, but the company is also viewed as a trusted partner. We think management is doing a nice job expanding into new categories including jewelry, outdoor and pet, that should provide avenues of future growth. We also believe TJX is making steady progress on an E-Commerce offering that will be differentiated both from Amazon and from its own retail stores. However, the decline of US shopping centers may mean TJX has less room to open new stores than we once believed, and makes critical the successful expansion of the E-Commerce and European businesses.

Long-term, we believe TJX can open more stores, although the opportunity may be greater in Europe than North America. We think sales can grow at mid-single digit rates, margins can move up modestly, and thanks to a consistent stock repurchase program EPS can grow at low double-digit rates.

After a difficult 2013, Fastenal largely returned to form in 2014. Fastenal’s performance in the 2012-2013 period was characterized by tight cost controls, high operating margins, and declining revenue growth. The middle of 2013 marked a temporary plateau in the

11

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

number of salesmen employed in Fastenal’s branch network. This pause in investment prevented Fastenal from growing revenue at its characteristic double digit rate. Fastenal’s leadership responded with typical aggression, expanding the number of district managers from 220 to 270 and investing heavily in the sales force over the ensuing twelve months. As a consequence, sales growth doubled from 6% in 2013 to 12% in 2014. The company grew earnings by 10% in 2014 and hopes to improve on this result in 2015 as it continues to reap the benefits of its investment in human capital. In the final quarter of the year, earnings improved by 19%.

The past year also marked the passing of the baton from Will Oberton to Leland Hein, in a well telegraphed and orderly leadership transition. Lee joined Fastenal in 1985, and like many of Fastenal’s senior managers he proved his mettle by starting at the bottom of the sales organization and working his way up. We have spent many hours with Lee during our 14 years as Fastenal shareholders and believe he is an excellent choice to succeed Mr. Oberton, who will continue with Fastenal as non-executive Chairman of the Board.

O’Reilly had another strong year. Sales grew 9% for the year, driven by an industry-leading 6% growth in comparable store sales. Operating income grew by 15% and, after share repurchase, O’Reilly earned $7.34 per share, up 22% from 2013. O’Reilly’s significant cash flow generation allowed the company to repurchase 5.7 million shares for $866 million during the year even after adding 200 net new stores. We have always liked O’Reilly for its industry-leading distribution network, which allows for superior inventory availability and prompt delivery times to commercial garages. Over the past year O’Reilly has added to that network with new distribution centers in Chicago, Illinois; Boston, Massachusetts and Lakeland, Florida to strengthen its market position in those regions. The Boston and Lakeland DCs will be particularly interesting to follow in 2015, as O’Reilly has a relatively small presence in the Northeast and Florida with aggressive expansion plans.

Mastercard had an excellent year in 2014, with earnings per share up 21% and underlying business trends strong across the board. The intermediate-term future may be slightly less bright for the business. Dollar strength will probably restrain revenue growth by several percentage points this year, and dilutive recent acquisitions will add a slight additional drag. More generally, we worry that what feels like a weakening global economy may weigh on cross-border transaction trends that have been astonishingly strong of late. We also will be closely watching the widely anticipated rollout of MCX, a new merchant-funded competitor that aims to take share from Mastercard and Visa in the domestic debit market. MCX has some major hurdles to overcome, and the Visa-Mastercard duopoly has proven durable over time, but there is also reason to believe that this new entrant may succeed where others have failed. Even if it does, we suspect the impact on Mastercard’s growth rate will be manageable. Currency headwinds will not last forever, and Mastercard remains a deeply advantaged business with phenomenal economics and years of expansion ahead of it as electronic payment transactions continue to grow at the expense of cash and checks.

In 2014, Idexx took the bold but correct decision to terminate its distributors after determining it could grow faster by selling direct. The benefits of this shift led to a strong year with sales up 8%. Excluding exceptional charges from the shift to hiring a direct sales force, earnings per share grew 15%. As for the stock, it easily outperformed the market. The company expects another good year in 2015 with organic revenue growth of about 14% and EPS growth of more than 20% as the margin benefits of selling directly begin to flow through. Idexx also continued to distance itself from competition last year with the introduction of promising diagnostics tests. Confident about the prospects in veterinary diagnostics – growth that Idexx itself is driving through innovation - it intends to continue using free cash flow for share repurchase.

12

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

Shares in Precision Castparts underperformed in 2014 as growth slowed and then took another leg down in January following weak reported results for the quarter ended in December. Precision attributed the weakness to a few specific short-term actions by aerospace customers and said commercial aircraft production rates should drive steady demand for airframe and engine components. Over the past 12 months, sales grew 7% and EPS advanced 13%. Precision should experience top-line growth of about 5% again this year - roughly in line with the growth of commercial aircraft builds. Sales of forged products to the oil & gas industry will be weak but oil & gas accounts for a small percentage of the company’s sales and earnings. Precision has historically been an aggressive acquirer but it made no purchases in 2014 and instead bought back stock as attractively priced M&A opportunities proved elusive. Mindful of shareholder value, management says it will remain patient until the right deal comes along.

Our worst performing large holding in 2014 was Rolls-Royce. We have been disappointed in some of its strategic decisions, particularly regarding its intentions to diversify away from its core aerospace business. During the year, the stock price suffered as it expressed interest in buying the Finnish medium-speed engine manufacturer Wartsila even as its Tognum diesel engine business sputtered to a weak performance. The company’s expected results in 2014 (it reports in mid-February) further support our feeling that Rolls-Royce needs to focus on its aerospace businesses. The company is guiding for its civil aerospace profits to grow 15%-20% in 2014 versus a double-digit decline in the non-aerospace businesses. Unfortunately, this is not an anomaly. Rolls-Royce’s aerospace businesses grew profits at a 21%+ annual rate from 2010 to 2013 versus a high single digit decline in the non-aerospace businesses over the same period. In years past, the non-aerospace businesses had a smaller dilutive impact on Rolls-Royce’s results. But with the non-aerospace businesses now larger thanks to the acquisition of Tognum, Rolls-Royce’s

overall figures are seeing a meaningful negative impact. We expect Rolls will report an overall revenue decline of 3% for 2014, with profit growth of perhaps 1%. The company’s slowing growth and management’s poor communications with the market on a variety of issues throughout the year led to a negative total return of more than 34% in U.S. dollars. This is a company sorely in need of new strategic direction.

The Fund made several new investments in 2014, including Richemont, Cabela’s and Constellation Software.

Richemont ranks among the world’s best luxury houses. Its Cartier jewelry brand arguably has no peer and drives a majority of the company’s profit. There is also a remarkable stable of Swiss watch brands that compete mostly at the very high-end of the business. Richemont was a pioneer in Asia and today derives more than 40% of sales there. Recently, sales of luxury watches in Greater China have slowed, but we believe Richemont’s future is bright. Branded jewelry continues to take market share globally from unbranded jewelry, and Cartier and our holding Tiffany are the two strongest brands in most of the world, in our opinion.

Cabela’s sells hunting and fishing goods both directly and through a growing chain of 60 retail stores. The outdoor industry is highly fragmented with independent operators controlling 60% of the business. Cabela’s has strong name recognition and a rabid following, allowing it to aggressively open new stores and take share from the independents. Another competitive advantage is its in-house bank, which helps drive same-store sales through its generous rewards program. Cabela’s is now suffering from a significant decline in gun sales following a surge in sales that followed the Newtown tragedy. But gun sales appear to be stabilizing, which should put Cabela’s back on a growth course.

Constellation Software specializes in acquiring and running vertical market software companies. These software companies help their customers do everything

13

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

from taxi dispatch to utility billing. The common thread is that they are essential to their customers’ operations. Constellation has mastered the art of purchasing these assets at attractive prices and then improving their operations to increase cash flow. By doing this, the company has managed to realize exceptional returns over time and we believe there’s more to come.

During 2014 the Fund sold its investments in Advance Auto Parts, Pirelli and Ritchie Bros. and trimmed its investments in Qinetiq, Rolls Royce and TJX.

* * * * *

14

Sequoia Fund, Inc.

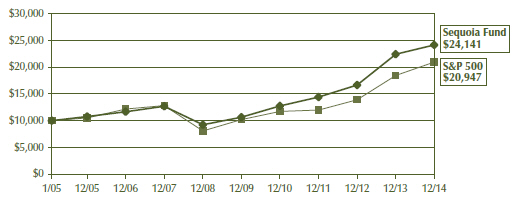

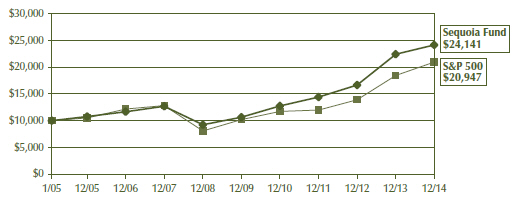

Growth of $10,000 Investment in the Fund

(Unaudited)

Sequoia Fund’s results as of December 31, 2014 appear below with comparable results for the S&P 500 Index:

| | | | | | |

To December 31, 2014 | | Sequoia Fund | | S&P 500 Index* | | |

1 Year | | 7.56% | | 13.69% | | |

5 Years (Annualized) | | 17.76% | | 15.45% | | |

10 Years (Annualized) | | 9.21% | | 7.67% | | |

The performance shown above represents past performance, assumes reinvestment of distributions, and does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance information shown. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Year to date performance as of the most recent month end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

*The S&P 500 Index is an unmanaged, capitalization-weighted index of the common stocks of 500 major U.S. corporations.

15

Sequoia Fund, Inc.

Sector Breakdown

(Unaudited)

| | | | | |

As of December 31, 2014 | | % of net

assets |

| |

Healthcare | | | | 21.4% | |

| |

U.S. Government Obligations | | | | 19.3% | |

| |

Diversified Companies | | | | 12.9% | |

| |

Retailing | | | | 10.5% | |

| |

Aerospace/Defense | | | | 5.3% | |

| |

Industrial & Construction Supplies | | | | 5.1% | |

| |

Auto Parts | | | | 3.9% | |

| |

Information Processing | | | | 3.2% | |

| |

Veterinary Diagnostics | | | | 3.2% | |

| |

Flooring Products | | | | 2.2% | |

| |

Internet Software Services | | | | 2.1% | |

| |

Dental Equipment | | | | 1.4% | |

| |

Transportation Services | | | | 1.3% | |

| |

Precision Instruments | | | | 1.2% | |

| |

Industrial Gases | | | | 1.1% | |

| |

Biotechnology | | | | 1.1% | |

| |

Investment Banking & Brokerage | | | | 1.0% | |

| |

Other | | | | 3.8% | |

| | | | | |

| | | | 100.0% | |

| | | | | |

16

Sequoia Fund, Inc.

Fees And Expenses of The Fund

(Unaudited)

Shareholder Expense Example

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2014 to December 31, 2014).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The

hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | | | | | |

| | | Beginning

Account

Value July 1,

2014 | | Ending Account

Value

December 31,

2014 | | Expenses

Paid During

Period*

July 1, 2014 to

December 31,

2014 |

Actual | | $1,000 | | $1,066.00 | | $5.21 |

Hypothetical (5% return per year before expenses) | | $1,000 | | $1,020.16 | | $5.09 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

17

Sequoia Fund, Inc.

Schedule of Investments

December 31, 2014

Common Stocks (86.9%)

| | | | | | |

Shares | | | | Value

(Note 1) | |

| | Advertising (0.9%) | | | | |

929,021 | | Omnicom Group Inc. | | $ | 71,971,257 | |

| | | | | | |

| | |

| | Aerospace/Defense (5.3%) | | | | |

942,616 | | Precision Castparts Corp. | | | 227,057,342 | |

13,028,708 | | Qinetiq Group plc (United Kingdom) | | | 38,156,082 | |

12,089,546 | | Rolls-Royce Holdings plc (United Kingdom) | | | 163,932,435 | |

| | | | | | |

| | | | | 429,145,859 | |

| | | | | | |

| | |

| | Apparel, Accessories & Luxury Goods (1.0%) | | | | |

872,753 | | Compagnie Financiere Richemont SA (Switzerland) | | | 77,952,591 | |

| | | | | | |

| | |

| | Application Software (0.9%) | | | | |

257,100 | | Constellation Software, Inc. (Canada) | | | 76,443,987 | |

| | | | | | |

| | |

| | Auto Parts (3.9%) | | | | |

1,650,465 | | O’Reilly Automotive, Inc. (a) | | | 317,912,568 | |

| | | | | | |

| | |

| | Biotechnology (1.1%) | | | | |

2,065,604 | | Novozymes A/S - B Shares (Denmark) | | | 87,196,081 | |

| | | | | | |

| | |

| | Construction & Engineering (0.8%) | | | | |

1,455,996 | | Jacobs Engineering Group Inc. (a) | | | 65,068,461 | |

| | | | | | |

| | |

| | Crude Oil & Gas Production (0.1%) | | | | |

178,601 | | Canadian Natural Resources Limited (Canada) | | | 5,515,199 | |

| | | | | | |

| | |

| | Dental Equipment (1.4%) | | | | |

1,250,644 | | Sirona Dental Systems, Inc. (a) | | | 109,268,766 | |

| | | | | | |

| | |

| | Diversified Companies (12.9%) | | | | |

2,938 | | Berkshire Hathaway, Inc.-Class A (a) | | | 663,988,000 | |

2,504,304 | | Berkshire Hathaway, Inc.-Class B (a) | | | 376,021,246 | |

| | | | | | |

| | | | | 1,040,009,246 | |

| | | | | | |

| | |

| | Diversified Manufacturing (0.8%) | | | | |

761,792 | | Danaher Corporation | | | 65,293,192 | |

| | | | | | |

| | |

| | Electrical & Mechanical Systems (0.4%) | | | | |

771,799 | | EMCOR Group, Inc. | | | 34,337,337 | |

| | | | | | |

| | |

| | Electronic Manufacturing Services (0.4%) | | | | |

1,270,244 | | Trimble Navigation Limited (a) | | | 33,712,276 | |

| | | | | | |

| | |

| | Flooring Products (2.2%) | | | | |

1,140,877 | | Mohawk Industries, Inc. (a) | | | 177,246,651 | |

| | | | | | |

| | |

| | Freight Transportation (0.0%) | | | | |

62,653 | | Expeditors International, Inc. | | | 2,794,950 | |

| | | | | | |

18

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2014

| | | | | | |

Shares | | | | Value

(Note 1) | |

| | Healthcare (21.4%) | | | | |

527,122 | | Perrigo Company plc (Ireland) | | $ | 88,113,713 | |

11,281,224 | | Valeant Pharmaceuticals International, Inc. (Canada) (a) | | | 1,614,455,967 | |

430,615 | | West Pharmaceutical Services, Inc. | | | 22,925,943 | |

19,932 | | Zoetis, Inc. | | | 857,674 | |

| | | | | | |

| | | | | 1,726,353,297 | |

| | | | | | |

| | |

| | Industrial & Construction Supplies (5.1%) | | | | |

8,712,162 | | Fastenal Company | | | 414,350,425 | |

| | | | | | |

| | |

| | Industrial Gases (1.1%) | | | | |

685,180 | | Praxair, Inc. | | | 88,771,921 | |

| | | | | | |

| | |

| | Industrial Machinery (0.9%) | | | | |

3,500,367 | | IMI plc (United Kingdom) | | | 68,905,292 | |

| | | | | | |

| | |

| | Information Processing (3.2%) | | | | |

2,974,345 | | MasterCard, Inc.-Class A | | | 256,269,565 | |

| | | | | | |

| | |

| | Insurance Brokers (0.5%) | | | | |

1,119,143 | | Brown & Brown, Inc. | | | 36,830,996 | |

| | | | | | |

| | |

| | Internet Software & Services (2.1%) | | | | |

161,452 | | Google, Inc.-Class A (a) | | | 85,676,118 | |

161,452 | | Google, Inc.-Class C (a) | | | 84,988,333 | |

| | | | | | |

| | | | | 170,664,451 | |

| | | | | | |

| | |

| | Investment Banking & Brokerage (1.0%) | | | | |

432,800 | | The Goldman Sachs Group, Incorporated | | | 83,889,624 | |

| | | | | | |

| | |

| | IT Consulting & Other Services (0.9%) | | | | |

464,967 | | International Business Machines Corp. | | | 74,599,305 | |

| | | | | | |

| | |

| | Precision Instruments (1.2%) | | | | |

837,443 | | Waters Corp. (a) | | | 94,396,575 | |

| | | | | | |

| | |

| | Property and Casualty Insurance (0.7%) | | | | |

31,041 | | Admiral Group plc (United Kingdom) | | | 639,592 | |

4,915,535 | | Hiscox Ltd. (Bermuda) | | | 55,200,171 | |

20,894 | | Verisk Analytics, Inc.-Class A (a) | | | 1,338,261 | |

| | | | | | |

| | | | | 57,178,024 | |

| | | | | | |

| | |

| | Retailing (10.5%) | | | | |

39,465 | | Costco Wholesale Corp. | | | 5,594,164 | |

848,687 | | Tiffany & Co. | | | 90,690,693 | |

9,807,086 | | TJX Companies, Inc. | | | 672,569,958 | |

890,120 | | Wal-Mart Stores, Inc. | | | 76,443,506 | |

| | | | | | |

| | | | | 845,298,321 | |

| | | | | | |

19

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2014

| | | | | | |

Shares | | | | Value

(Note 1) | |

| | Specialty Chemicals (0.8%) | | | | |

1,527,051 | | Croda International plc (United Kingdom) | | $ | 63,357,384 | |

| | | | | | |

| | |

| | Specialty Retailers (0.8%) | | | | |

1,285,581 | | Cabela’s, Inc. (a) | | | 67,762,974 | |

| | | | | | |

| | |

| | Transportation Services (1.3%) | | | | |

2,237,617 | | World Fuel Services Corp | | | 105,011,366 | |

| | | | | | |

| | |

| | Veterinary Diagnostics (3.2%) | | | | |

1,713,799 | | Idexx Laboratories, Inc. (a) | | | 254,104,978 | |

| | | | | | |

| | |

| | Miscellaneous Securities (0.1%)(b) | | | 11,122,013 | |

| | | | | | |

| | Total Common Stocks (Cost $2,335,930,482) | | | 7,012,734,932 | |

| | | | | | |

| | |

Principal Amount | | | | | |

| Corporate Bond (0.1%) | | | | |

| | Miscellaneous Securities (b) | | | 3,091,216 | |

| | | | | | |

| | Total Corporate Bond (Cost $3,032,693) | | | 3,091,216 | |

| | | | | | |

| |

| U.S. Treasury Obligations (19.3%) | | | | |

$1,557,000,000 | | U.S. Treasury Bills, 0.015% - 0.040% due 1/2/2015 through 1/29/2015 | | | 1,556,994,617 | |

| | | | | | |

| | Total U.S. Government Obligations (Cost $1,556,994,617) | | | 1,556,994,617 | |

| | | | | | |

| | |

| | Total Investments (106.3%) (Cost $3,895,957,792) (c) | | | 8,572,820,765 | |

| | |

| | Liabilities, Net of Other Assets (6.3)% | | | (504,790,050 | ) |

| | | | | | |

| | Net Assets (100.0%) | | $ | 8,068,030,715 | |

| | | | | | |

| (a) | Non-income producing security. |

| (b) | “Miscellaneous Securities” include holdings that are not restricted, have been held for not more than one year prior to December 31, 2014, and have not previously been publicly disclosed. |

| (c) | The cost for federal income tax purposes is identical. |

20

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2014

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | |

Level 1 – | | quoted prices in active markets for identical securities |

| |

Level 2 – | | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| |

Level 3 – | | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. During the period ended December 31, 2014, there were no transfers into and out of Level 1 and 2 measurements in the fair value hierarchy. There were no level 3 securities held in the Fund during the year ended December 31, 2014.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of December 31, 2014:

| | | | | | | | | | | | | | | | |

| | | Common Stocks | | | Corporate Bond | | | U.S.

Government

Obligations | | | Total | |

Level 1 - Quoted Prices | | $ | 7,012,734,932 | | | $ | — | | | $ | — | | | $ | 7,012,734,932 | |

Level 2 - Other Significant Observable Inputs | | | — | | | | 3,091,216 | | | | 1,556,994,617 | | | | 1,560,085,833 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 7,012,734,932 | | | $ | 3,091,216 | | | $ | 1,556,994,617 | | | $ | 8,572,820,765 | |

| | | | | | | | | | | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

21

Sequoia Fund, Inc.

Statement of Assets and Liabilities

December 31, 2014

| | | | |

Assets | | | | |

Investments in securities, at value (cost $3,895,957,792) (Note 1) | | $ | 8,572,820,765 | |

Cash on deposit | | | 9,923,880 | |

Receivable for investments sold | | | 16,849,166 | |

Receivable for capital stock sold | | | 1,060,491 | |

Dividends and interest receivable | | | 1,675,734 | |

| | | | |

Total assets | | | 8,602,330,036 | |

| | | | |

Liabilities | | | | |

Payable for investments purchased | | | 524,996,063 | |

Payable for capital stock repurchased | | | 2,498,858 | |

Accrued investment advisory fee | | | 6,556,699 | |

Accrued other expenses | | | 247,701 | |

| | | | |

Total liabilities | | | 534,299,321 | |

| | | | |

Net Assets | | $ | 8,068,030,715 | |

| | | | |

| |

Net Assets Consist of | | | | |

Capital (par value and paid in surplus) $.10 par value capital stock, 100,000,000 shares authorized, 34,331,726 shares outstanding | | $ | 3,305,355,129 | |

Accumulated net realized gains on investments (Note 4) | | | 85,845,138 | |

Unrealized appreciation on investments and foreign currency transactions | | | 4,676,830,448 | |

| | | | |

Net Assets | | $ | 8,068,030,715 | |

| | | | |

| |

Net asset value per share | | $ | 235.00 | |

| | | | |

The accompanying notes form an integral part of these Financial Statements.

22

Sequoia Fund, Inc.

Statement of Operations

Year Ended December 31, 2014

| | | | |

Investment Income | | | | |

Income | | | | |

Dividends, net of $291,080 foreign tax withheld | | $ | 58,706,238 | |

Interest | | | 244,422 | |

| | | | |

Total investment income | | | 58,950,660 | |

| | | | |

Expenses | | | | |

Investment advisory fee (Note 2) | | | 79,857,902 | |

Transfer agent fees | | | 929,480 | |

Independent Directors fees and expenses | | | 328,799 | |

Professional fees | | | 254,783 | |

Custodian fees. | | | 125,000 | |

Other | | | 382,996 | |

| | | | |

Total expenses | | | 81,878,960 | |

Less expenses reimbursed by Investment Adviser (Note 2) | | | 1,870,975 | |

| | | | |

Net expenses | | | 80,007,985 | |

| | | | |

Net investment loss | | | (21,057,325 | ) |

| | | | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions | | | | |

Realized gain (loss) on | | | | |

Investments (Note 3) | | | 280,283,086 | |

Foreign currency transactions | | | (118,995 | ) |

| | | | |

Net realized gain on investments and foreign currency transactions | | | 280,164,091 | |

Net increase in unrealized appreciation on investments and foreign currency translations . | | | 309,150,144 | |

| | | | |

Net realized and unrealized gain on investments and foreign currency transactions and translations | | | 589,314,235 | |

| | | | |

Net increase in net assets from operations | | $ | 568,256,910 | |

| | | | |

The accompanying notes form an integral part of these Financial Statements.

23

Sequoia Fund, Inc.

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | |

Increase (Decrease) in Net Assets | | | | | | | | |

From operations | | | | | | | | |

Net investment loss | | $ | (21,057,325 | ) | | $ | (25,955,496 | ) |

Net realized gain on investments and foreign currency transactions | | | 280,164,091 | | | | 230,849,682 | |

Net increase in unrealized appreciation on investments and foreign currency translations | | | 309,150,144 | | | | 1,844,931,680 | |

| | | | | | | | |

Net increase in net assets from operations | | | 568,256,910 | | | | 2,049,825,866 | |

| | | | | | | | |

Distributions to shareholders from

Net realized gains | | | (160,411,851 | ) | | | (120,895,246 | ) |

| | | | | | | | |

Capital share transactions | | | | | | | | |

Shares sold | | | 407,033,294 | | | | 611,624,071 | |

Shares issued to shareholders on reinvestment of net realized gain distributions. | | | 142,551,694 | | | | 107,075,851 | |

Shares repurchased | | | (928,561,658 | ) | | | (445,091,824 | ) |

| | | | | | | | |

Net increase (decrease) from capital share transactions | | | (378,976,670 | ) | | | 273,608,098 | |

| | | | | | | | |

Total increase in net assets | | | 28,868,389 | | | | 2,202,538,718 | |

Net Assets | | | | | | | | |

Beginning of period | | | 8,039,162,326 | | | | 5,836,623,608 | |

| | | | | | | | |

End of period (including undistributed net investment income of $0 and $0, respectively) | | $ | 8,068,030,715 | | | $ | 8,039,162,326 | |

| | | | | | | | |

| | |

Share transactions | | | | | | | | |

Shares sold | | | 1,811,779 | | | | 3,153,816 | |

Shares issued to shareholders on reinvestment of net realized gain distributions | | | 632,137 | | | | 506,868 | |

Shares repurchased | | | (4,175,480 | ) | | | (2,275,012 | ) |

| | | | | | | | |

Net increase (decrease) from capital share transactions | | | (1,731,564 | ) | | | 1,385,672 | |

| | | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

24

Sequoia Fund, Inc.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per Share Operating Performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 222.92 | | | $ | 168.31 | | | $ | 145.50 | | | $ | 129.29 | | | $ | 109.90 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment (loss) | | | (0.61 | ) | | | (0.72 | ) | | | (0.41 | ) | | | (0.42 | ) | | | (0.00 | )(a) |

Net realized and unrealized gains on investments | | | 17.23 | | | | 58.73 | | | | 23.22 | | | | 17.45 | | | | 21.35 | |

| | | | | | | | | | | | | | | | | | | | |

Net increase in net asset value from operations | | | 16.62 | | | | 58.01 | | | | 22.81 | | | | 17.03 | | | | 21.35 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions | | | | | | | | | | | | | | | | | | | | |

Distributions from net realized gains | | | (4.54 | ) | | | (3.40 | ) | | | — | | | | (0.82 | ) | | | (1.65 | ) |

Return of capital | | | — | | | | — | | | | — | | | | — | | | | (0.31 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (4.54 | ) | | | (3.40 | ) | | | — | | | | (0.82 | ) | | | (1.96 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 235.00 | | | $ | 222.92 | | | $ | 168.31 | | | $ | 145.50 | | | $ | 129.29 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return | | | 7.56 | % | | | 34.58 | % | | | 15.68 | % | | | 13.19 | % | | | 19.50 | % |

| | | | | |

Ratios/Supplementary data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in millions) | | $ | 8,068.0 | | | $ | 8,039.2 | | | $ | 5,836.6 | | | $ | 4,914.0 | | | $ | 3,487.7 | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement | | | 1.03 | % | | | 1.02 | % | | | 1.03 | % | | | 1.03 | % | | | 1.04 | % |

After expense reimbursement | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Ratio of net investment (loss) to average net assets | | | (0.26 | )% | | | (0.37 | )% | | | (0.26 | )% | | | (0.34 | )% | | | (0.00 | )%(b) |

Portfolio turnover rate | | | 8 | % | | | 2 | % | | | 5 | % | | | 3 | % | | | 23 | % |

(a) Represents less than ($0.005) per share.

(b) Represents less than (0.005)%.

The accompanying notes form an integral part of these Financial Statements.

25

Sequoia Fund, Inc.

Notes to Financial Statements

Note 1— Significant Accounting Policies

Sequoia Fund, Inc. (the ‘‘Fund’’) is registered under the Investment Company Act of 1940, as amended, as a non-diversified, open-end management investment company. The investment objective of the Fund is long-term growth of capital. The following is a summary of significant accounting policies, consistently followed by the Fund in the preparation of its financial statements.

| A. | Valuation of investments: Investments are carried at market value or at fair value as determined under the supervision of the Fund’s Board of Directors. Securities traded on a national securities exchange are valued at the last reported sales price on the principal exchange on which the security is listed; securities traded in the NASDAQ Stock Market (“NASDAQ”) are valued in accordance with the NASDAQ Official Closing Price. Securities for which there is no sale or Official Closing Price are valued at the mean between the last reported bid and asked prices. |

Securities traded on a foreign exchange are valued at the Official Closing Price on the last business day of the period on the principal exchange on which the security is primarily traded. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the New York Stock Exchange on the date of valuation.

U.S. Treasury Bills with remaining maturities of 60 days or less are valued at their amortized cost. U.S. Treasury Bills that when purchased have a remaining maturity in excess of sixty days are stated at their discounted value based upon the mean between the bid and asked discount rates until the sixtieth day prior to maturity, at which point they are valued at amortized cost.

When reliable market quotations are insufficient or not readily available at time of valuation or when the Investment Adviser determines that the prices or values available do not represent the fair value of a security, such security is valued as determined in good faith by the Investment Adviser, in conformity with guidelines adopted by and subject to review by the Board of Directors.

Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of foreign securities are translated into U.S. dollars at the rates of exchange prevailing when such securities are acquired or sold. Income and expenses are translated into U.S. dollars at the rates of exchange prevailing when accrued. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments. Reported net realized foreign exchange gains or losses arise from the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

| B. | Accounting for investments: Investment transactions are accounted for on the trade date and dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Premiums and discounts on fixed income securities are amortized over the life of the respective security. The net realized gain or loss on security transactions is determined for accounting and tax purposes on the specific identification basis. |

26

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

| C. | Federal income taxes: The Fund complies with the requirements of the Internal Revenue Code applicable to regulated investment companies and distributes all of its taxable income to its stockholders. Therefore, no federal income tax provision is required. |

| D. | Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| E. | General: Dividends and distributions are recorded by the Fund on the ex-dividend date. |

| F. | Indemnification: The Fund’s officers, directors and agents are indemnified against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss thereunder to be remote. |

Note 2— Investment Advisory Contract and Payments to Interested Persons

Ruane, Cunniff & Goldfarb Inc. (the ‘‘Investment Adviser’’) provides the Fund with investment advice and administrative services.

Under the terms of the Advisory Agreement, the Investment Adviser receives a management fee equal to 1% per annum of the Fund’s average daily net asset value. This percentage will not increase or decrease in relation to increases or decreases in the net asset value of the Fund. Under the Advisory Agreement, the Investment Adviser is contractually obligated to reimburse the Fund for the amount, if any, by which the operating expenses of the Fund (including the investment advisory fee) in any year exceed the sum of 1 1/2% of the average daily net asset value of the Fund for such year up to a maximum of $30,000,000, plus 1% of the average daily net asset value in excess of $30,000,000. The expenses incurred by the Fund exceeded the limitation for the year ended December 31, 2014 and the Investment Adviser reimbursed the Fund $1,870,975. Such reimbursement is not subject to recoupment by the Investment Adviser.

For the year ended December 31, 2014, advisory fees of $79,857,902 were earned by the Investment Adviser and brokerage commissions of $226,976, and foreign security transaction fees of $131,342 were earned by Ruane, Cunniff & Goldfarb LLC, the Fund’s distributor and a wholly-owned subsidiary of the Investment Adviser. Certain officers of the Fund are also officers of the Investment Adviser and the Fund’s distributor. Ruane, Cunniff & Goldfarb LLC received no compensation from the Fund on the sale of the Fund’s capital shares for the year ended December 31, 2014. There were no other amounts accrued or paid to interested persons, including officers and directors.

27

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Note 3— Portfolio Transactions

The aggregate cost of purchases and the proceeds from the sales of securities, excluding U.S. government obligations, for the year ended December 31, 2014 were $526,718,632 and $669,597,415, respectively. Included in proceeds of sales is $153,966,931 representing the value of securities disposed of in payment of redemptions in-kind, resulting in realized gains of $125,675,610.

At December 31, 2014 the aggregate gross tax basis unrealized appreciation and depreciation of securities were $4,711,331,469 and $34,468,496, respectively.

Note 4— Federal Income Transactions

Distributions to shareholders are determined in accordance with Federal income tax regulations and may differ from those determined for financial statement purposes. To the extent these differences are permanent such amounts are reclassified within the capital accounts. For the year ended December 31, 2014 permanent differences primarily due to realized gains on redemptions in-kind not recognized for tax purposes, net operating loss and different book and tax treatment of net realized gains on foreign currency transactions resulted in a net decrease in accumulated net realized gains of $125,556,615 with a corresponding increase in capital of $104,499,290, and a decrease to accumulated net investment loss of $21,057,325. These reclassifications had no effect on net assets.

The tax character of distributions paid for the years ended December 31, 2014 and 2013 was as follows:

| | | | | | | | |

| | | 2014 | | | 2013 | |

Distributions paid from | | | | | | | | |

Long-term capital gains | | $ | 160,411,851 | | | $ | 120,895,246 | |

| | | | | | | | |

As of December 31, 2014 and 2013 the components of distributable earnings on a tax basis were as follows:

| | | | | | | | |

| | | 2014 | | | 2013 | |

Undistributed long-term gains | | $ | 85,845,138 | | | $ | 91,649,513 | |

Unrealized appreciation | | | 4,676,830,448 | | | | 4,367,680,304 | |

| | | | | | | | |

| | $ | 4,762,675,586 | | | $ | 4,459,329,817 | |

| | | | | | | | |

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the positions are ‘‘more likely than not’’ to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions taken on federal income tax returns for all open years (tax years ended December 31, 2011 through December 31, 2014) and has concluded that no provision for unrecognized benefits or expenses is required in these financial statements.

28

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Note 5— Subsequent Events

Accounting principles generally accepted in the United States of America require the Fund to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

29

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of Sequoia Fund, Inc.

We have audited the accompanying statement of assets and liabilities of Sequoia Fund, Inc. (the ‘‘Fund’’), including the schedule of investments, as of December 31, 2014, the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2014 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Sequoia Fund, Inc. as of December 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and its financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

February 19, 2015

30

Sequoia Fund, Inc.

Approval of Advisory Agreement

(Unaudited)

At a meeting held on December 8, 2014, the Board of Directors of Sequoia Fund, Inc. (the “Fund”), including a majority of the independent Directors, evaluated and approved the renewal of the advisory contract (the “Advisory Agreement”) between the Fund and Ruane, Cunniff & Goldfarb Inc. (the “Investment Adviser”). In approving the renewal of the Advisory Agreement, the Directors considered all information they deemed reasonably necessary to evaluate the terms of the Advisory Agreement.

Nature, Extent and Quality of Services. The Directors considered information concerning the nature, extent and quality of the services provided by the Investment Adviser to the Fund under the Advisory Agreement. They considered information describing the personnel responsible for the day-to-day management of the Fund, the Investment Adviser’s existing and planned staffing levels and changes to the staffing levels that had occurred since the last contract renewal. The Directors also considered the Investment Adviser’s research capability and the number of individuals devoted to investment research and portfolio management. They considered the overall reputation of the Investment Adviser and the Investment Adviser’s representation that it had no current plans to change the nature of services provided to the Fund. They considered information regarding the compensation arrangements of the portfolio managers. They considered information concerning the Investment Adviser’s compliance policies and procedures, which are reasonably designed to, among other things, address the Investment Adviser’s conflicts of interest in providing services to the Fund and its other advisory clients. Based on these factors, the Directors concluded that they were satisfied with the nature, extent and quality of services provided to the Fund by the Investment Adviser under the Advisory Agreement.