UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01976

Sequoia Fund, Inc.

(Exact name of registrant as specified in charter)

9 West 57th Street, Suite 5000

New York, NY 10019

(Address of principal executive offices) (Zip code)

Robert D. Goldfarb

Ruane, Cunniff & Goldfarb Inc.

9 West 57th Street

Suite 5000

New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 686-6884

Date of fiscal year end: December 31, 2015

Date of reporting period: December 31, 2015

Item 1. Reports to Stockholders.

Report to Shareholders is attached herewith.

Sequoia Fund, Inc.

Table of Contents

Sequoia Fund, Inc.

Illustration of An Assumed Investment of $10,000

(Unaudited)

The table below covers the period from July 15, 1970 (the date Sequoia Fund, Inc. (the “Fund”) shares were first offered to the public) to December 31, 2015. This period was one of widely fluctuating common stock prices. The results shown, which assume reinvestment of distributions, represent past performance and do not guarantee future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance shown. Investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

| | | | |

Period Ended | | Total Value

of Shares | |

| |

July 15, 1970 | | $ | 10,000 | |

May 31, 1971 | | | 11,934 | |

May 31, 1972 | | | 13,507 | |

May 31, 1973 | | | 11,242 | |

May 31, 1974 | | | 10,013 | |

May 31, 1975 | | | 13,325 | |

May 31, 1976 | | | 17,393 | |

May 31, 1977 | | | 22,826 | |

Dec. 31, 1977 | | | 28,057 | |

Dec. 31, 1978 | | | 34,771 | |

Dec. 31, 1979 | | | 38,961 | |

Dec. 31, 1980 | | | 43,894 | |

Dec. 31, 1981 | | | 53,329 | |

Dec. 31, 1982 | | | 69,920 | |

Dec. 31, 1983 | | | 89,015 | |

Dec. 31, 1984 | | | 105,481 | |

Dec. 31, 1985 | | | 134,975 | |

Dec. 31, 1986 | | | 153,027 | |

Dec. 31, 1987 | | | 164,361 | |

Dec. 31, 1988 | | | 182,516 | |

Dec. 31, 1989 | | | 233,453 | |

Dec. 31, 1990 | | | 224,586 | |

Dec. 31, 1991 | | | 314,426 | |

Dec. 31, 1992 | | | 343,863 | |

| | | | |

Period Ended | | Total Value

of Shares | |

| |

Dec. 31, 1993 | | $ | 380,919 | |

Dec. 31, 1994 | | | 393,633 | |

Dec. 31, 1995 | | | 556,525 | |

Dec. 31, 1996 | | | 677,506 | |

Dec. 31, 1997 | | | 970,200 | |

Dec. 31, 1998 | | | 1,312,197 | |

Dec. 31, 1999 | | | 1,095,125 | |

Dec. 31, 2000 | | | 1,314,850 | |

Dec. 31, 2001 | | | 1,453,175 | |

Dec. 31, 2002 | | | 1,414,776 | |

Dec. 31, 2003 | | | 1,656,923 | |

Dec. 31, 2004 | | | 1,734,116 | |

Dec. 31, 2005 | | | 1,869,038 | |

Dec. 31, 2006 | | | 2,024,960 | |

Dec. 31, 2007 | | | 2,195,146 | |

Dec. 31, 2008 | | | 1,601,905 | |

Dec. 31, 2009 | | | 1,848,293 | |

Dec. 31, 2010 | | | 2,208,627 | |

Dec. 31, 2011 | | | 2,499,935 | |

Dec. 31, 2012 | | | 2,891,849 | |

Dec. 31, 2013 | | | 3,891,835 | |

Dec. 31, 2014 | | | 4,185,695 | |

Dec. 31, 2015 | | | 3,880,364 | |

| | | | |

|

Please consider the investment objectives, risks and charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other information about the Fund. You may obtain year to date performance as of the most recent month end, and a copy of the prospectus by calling 1-800-686-6884, or on the Fund’s website at www.sequoiafund.com. Please read the prospectus carefully before investing. Shares of the Fund are offered through the Fund’s distributor, Ruane, Cunniff & Goldfarb LLC. Ruane, Cunniff & Goldfarb LLC is an affiliate of Ruane, Cunniff & Goldfarb Inc. and is a member of FINRA. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

3

Sequoia Fund, Inc.

Annual Fund Operating Expenses

(Unaudited)

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder fees (fees paid directly from your investment)

The Fund does not impose any sales charges, exchange fees or redemption fees.

Annual Fund Operating Expenses (expenses that are deducted from Fund assets)

| | | | | | |

Management Fees | | | 1.00% | | | |

Other Expenses | | | 0.03% | | | |

| | | | | | |

Total Annual Fund Operating Expenses* | | | 1.03% | | | |

*Does not reflect Ruane, Cunniff & Goldfarb Inc.’s (‘‘Ruane, Cunniff & Goldfarb’’) contractual reimbursement of a portion of the Fund’s operating expenses. This reimbursement is a provision of Ruane, Cunniff & Goldfarb’s investment advisory agreement with the Fund and the reimbursement will be in effect only so long as that investment advisory agreement is in effect. The expense ratio presented is from the Prospectus dated May 1, 2015. For the year ended December 31, 2015, the Fund’s annual operating expenses and investment advisory fee, net of such reimbursement, were 1.00% and 0.97%, respectively.

4

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc.

Dear Shareholder:

Sequoia Fund’s results for the quarter and year ended December 31, 2015 appear below with comparable results for the S&P 500 Index:

| | | | | | | | | | | | | | |

To December 31, 2015 | | Sequoia Fund | | | | S&P 500 Index* | | |

Fourth quarter | | | | -9.10 | % | | | | | | 7.04 | % | | |

1 Year | | | | -7.31 | % | | | | | | 1.38 | % | | |

5 Years (Annualized) | | | | 11.93 | % | | | | | | 12.57 | % | | |

10 Years (Annualized) | | | | 7.58 | % | | | | | | 7.31 | % | | |

The numbers shown above represent past performance and do not guarantee future results. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Future performance may be lower or higher than the performance information shown. The performance data quoted represents past performance and assumes reinvestment of distributions.

The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Year to date performance as of the most recent month end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

*The S&P 500 Index is an unmanaged capitalization-weighted index of the common stocks of 500 major US corporations.

• • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • • •

• •

Sequoia turned in its second straight year of poor results in 2015.Teasing out the source of our underperformance doesn’t take much work. We began the year with a 20% weighting in Valeant Pharmaceuticals. Valeant rose by more than 80% through the summer, driving very strong gains for the Fund. But the price collapsed in the fall amid revelations and allegations about the company’s business practices. Ultimately, Valeant declined 29% for the year and by more than 70% from its 52-week high to its low. We bought more shares in October, and we calculate that Valeant contributed -6.3% to Sequoia’s return of -7.3% for the year.

At its peak price, Valeant constituted more than 30% of the Fund’s assets. We’ve been criticized for allowing the holding to grow so large, but our feeling before the crisis erupted was that Valeant was executing well on its business model. Earnings were growing rapidly and we believed the company was making intelligent acquisitions that were creating shareholder value. Valeant was taking outsized price increases on a portion of its drug portfolio, but the entire branded pharmaceutical industry routinely has taken substantial annual price increases on drugs for more than a decade.

As you are no doubt aware, Valeant was rocked in the fall by the closure of an affiliated specialty pharmacy, Philidor, after health care payers said they would not reimburse Philidor for claims it submitted. It has been further buffeted by subpoenas from Congress over its pricing strategies and by regulatory and law enforcement scrutiny over practices at Philidor. A committee of Valeant’s board of directors is investigating the relationship with Philidor. Valeant recently said it would restate prior earnings as it improperly accounted for sales to Philidor in late 2014.

5

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

As these inquiries continue and Valeant remains a subject of intense scrutiny, the share price is very unstable. For the stock to regain credibility with long-term investors, Valeant will need to generate strong earnings and cash flow this year, make progress in paying down some of its debt, demonstrate that it can launch new drugs from its own development pipeline and avoid provoking health care payers and the government. The company has committed to doing all of these things and we are confident interim CEO Howard Schiller and interim board chairman Robert Ingram are focused on the right metrics. Before CEO J. Michael Pearson went out on an extended medical leave, he also seemed committed to this path.

In the end, Valeant’s ability to grow earnings over a period of years will determine the stock price. A few months ago, the consensus cash earnings estimate from Wall Street analysts for Valeant in 2016 was about $16 per share. Today, estimates are closer to $13.50. This represents material deterioration, but still good growth over 2015 results. And with strong performance from its gastrointestinal drug Xifaxan and a slate of new product releases in 2016, Valeant has the potential to grow earnings for several years driven more by organic volume increases than price hikes.

As the largest shareholder of Valeant, our own credibility as investors has been damaged by this saga. We’ve seen higher-than-normal redemptions in the Fund, had two of our five independent directors resign in October and been sued by two Sequoia shareholders over our concentration in Valeant. We do not believe the lawsuit has merit and intend to defend ourselves vigorously in court.

Moving along, Valeant was not the only problem with our portfolio last year. The non-Valeant portion of Sequoia modestly underperformed the Index.

Berkshire Hathaway, our second largest holding, declined by 12.5% during the year. Berkshire now trades at less than 12 times our estimate of 2016 earnings. We think Berkshire grew its earnings at a high-single digit rate in 2015 but many of its individual operating companies face challenges. Railroad volumes declined abruptly at year-end and the outlook for 2016 volume is poor. GEICO’s auto insurance profit was off and many of Berkshire’s other service and manufacturing businesses were soft. Berkshire committed over $40 billion to acquisitions in 2015, the bulk of it to buy Precision Castparts.

Our European holdings continued to turn in poor performance. Rolls-Royce fired its CEO John Rishton and replaced him with a board member, Warren East, who had great success leading the semiconductor company ARM Holdings. Mr. East knows what he is doing but he’s got his work cut out for him as he tries to improve operating discipline at this inefficient manufacturer. Rolls and our UK holding IMI plc were the two worst-performing stocks in Sequoia, each declining about 35% in dollars.

A striking fact about 2015 is that the Index rose 1.4% for the year, but the so-called FANG stocks – Facebook, Amazon, Netflix and Google – accounted for more than 100% of the S&P’s total gain, meaning the other 496 stocks cumulatively declined. The securities firm Jefferies provides more detail about the dispersion of returns: as of late January, about one-fifth the stocks in the S&P 500 were at least 40% below their 52-week highs. Essentially, we are in a bear market for stocks (and most other asset classes) mitigated by extreme strength in a small number of businesses, mostly in technology.

Sequoia reflected this bifurcation. Though the Index moved up by a modest 1.4% for the year, only eight of our 38 stocks rose or declined by a single digit percentage in 2015. Thirty stocks moved by double digits, either up or down. Among our top eight holdings: Valeant declined 29%, Berkshire declined 12%, TJX rose 5%, O’Reilly rose 32%, Fastenal declined 12% and MasterCard rose 14%. Precision Castparts declined by 4%, aided by the decision to sell to Berkshire. Our eighth largest position, Alphabet (nee Google), rose by 47%.

6

Sequoia Fund, Inc.

To the Shareholders of

Sequoia Fund, Inc. (Continued)

This is not mentioned to rationalize our weak overall performance. In fact, the market‘s logic was clear. The few companies showing good growth were rewarded with sharp increases in their stock prices. The preponderance of large US businesses that showed little or no growth got punished. Our portfolio was no different, with the notable exception of Valeant, which grew earnings but saw its stock value plummet.

Every year in this letter we remind Sequoia shareholders that we have a distinct investing philosophy. For 46 years we have endeavored to concentrate our investments in a relatively small number of companies that we have studied intensively and purchased carefully, in the belief that such a portfolio will generate higher returns over time with less risk than a diversified basket of stocks chosen with less care. Our results over the past two years are very disappointing, but our commitment to this process has not changed.

We also communicate clearly that a concentrated portfolio of stocks will not perform in line with the S&P 500 Index from year to year. It is common for Sequoia to generate returns far out of line with the Index. In seven of the past 16 years Sequoia’s results differed from the Index return by at least 10 percentage points. Five times we outperformed by more than 10 percentage points and twice we’ve underperformed. We underperformed by about 8.7 percentage points in 2015.

As of this writing, our top 10 holdings make up about 70% of Sequoia’s portfolio. Given this, you should expect performance variance from the Index from year to year. Valeant continues to be our largest holding and if it does not recover our future performance may lag the Index.

We have changed the venue for our annual meeting with Sequoia shareholders and other clients. We will meet with you on Friday, May 20 at 10 am in the Grand Ballroom of the Plaza Hotel in New York City. We’re moving the meeting to the Plaza as it is a large venue and we expect attendance to be high this year. Please make note of the change.

Sincerely,

| | | | | | | | |

| |  | | | |  | | |

| | | | |

| | Robert D. Goldfarb | | | | David M. Poppe | | |

| | President | | | | Executive Vice President | | |

February 22, 2016

7

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance

(Unaudited)

The total return for the Sequoia Fund was -7.3% in 2015. This compares with the 1.4% return of the S&P 500 Index. Our preference is to make concentrated commitments of capital in a limited number of companies that have superior long-term economic prospects and that sell at what we believe are attractive prices. Because Sequoia is deliberately not representative of the overall market, in any given year the performance of the Fund may vary significantly from that of the broad market indices.

The table below shows the 12-month stock total return for all positions that constituted at least 3% of the Fund’s assets at the end of 2015.

| | | | | | | | | | | | |

Company | | % of assets

12/31/15 | | | Total return | | | % of assets

12/31/14 | |

Valeant Pharmaceuticals | | | 19.3% | | | | -29.0% | | | | 20.0% | |

Berkshire Hathaway | | | 13.2% | | | | -12.5% | | | | 12.9% | |

TJX | | | 6.9% | | | | 4.6% | | | | 8.3% | |

O’Reilly Automotive | | | 6.2% | | | | 31.6% | | | | 3.9% | |

Fastenal | | | 5.3% | | | | -11.8% | | | | 5.1% | |

Mastercard | | | 4.3% | | | | 13.7% | | | | 3.2% | |

Precision Castparts | | | 4.1% | | | | -3.6% | | | | 2.8% | |

Alphabet | | | 3.7% | | | | 46.6% | | | | 2.1% | |

Idexx Labs | | | 3.4% | | | | -1.6% | | | | 3.2% | |

Mohawk | | | 3.2% | | | | 21.9% | | | | 2.2% | |

The underperformance of the portfolio vs. the S&P 500 in 2015 was driven in large part by the negative return from Valeant, the Fund’s largest holding. The ten holdings listed above constituted nearly 70% of the Fund’s assets under management on December 31, 2015. At year-end, the Fund was 94% invested in common stocks, 1% invested in corporate bonds and 5% invested in cash and Treasury Bills.

Valeant experienced considerable earnings growth in 2015, but also found its business model and corporate ethics under severe criticism. Organic growth should be about 10% for the full year despite substantial disruption in the dermatology business during the fourth quarter as an affiliated specialty pharmacy, Philidor, closed after health care payers stopped reimbursing it

for prescriptions. Adjusted EPS should be up more than 20%, to around $10.25 before any unusual charges.

The closure of Philidor will significantly impact Valeant’s business in the short term, but we are optimistic that the transition of Philidor’s dermatology program to the more ubiquitous and respected Walgreen’s will be successful. Our conversations with dermatologists indicate that they want to prescribe Valeant’s brands and intend to direct their patients to Walgreen’s.

Valeant closed several acquisitions during the year, of which Salix was the most notable. That $15 billion purchase was Valeant’s largest to date. The acquisition was unusual as the portfolio is concentrated in drugs with limited patent lives, a departure from Valeant’s strategy of acquiring longer duration assets. Salix has a strong niche in gastroenterology, a market-leading sales force and opportunities for bolt-on acquisitions. We are encouraged by the growth of Salix’s brands, especially Xifaxan.

Looking forward, growth will be driven by prescription drugs such as Salix’s Xifaxan (hepatic encephalopathy, diarrhea and irritable bowel syndrome) and Jublia (toenail fungus); new treatments for acne, psoriasis, glaucoma and constipation; over-the-counter products such as contact lens solutions and moisturizing creams; and a strong emerging markets business. Valeant’s business is currently well diversified both geographically and by therapeutic category. U.S. government reimbursement is limited to around 15% of total sales.

Valeant’s $31 billion debt remains high, but we believe Valeant could pay back about $3 billion of debt in 2016 while also making contingent payments of $925 million tied to prior acquisitions. Cash available for debt repayment should grow in 2017 as the business grows and contingent payments decline. In the absence of large acquisitions or other uses of cash such as to pay fines or penalties, we estimate Valeant could pay back its debt in six years. We expect Valeant will adopt a more conservative financial position but after two or three years of paying down debt may be in position to make major acquisitions again.

8

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

Berkshire Hathaway’s stock performed poorly in 2015 and now trades at a multiple of less than 12 times earnings, the cheapest it has been in some time. Look-through earnings most likely increased about 9%, but the year could fairly be described as challenging. The company’s largest unit, the Burlington Northern Santa Fe railroad, ended the year on a sour note as the industry faced several weak end markets simultaneously, with coal and petroleum the most notable examples. On the plus side, service metrics improved markedly from 2014 levels and earnings growth likely exceeded 12% for the year. Volumes were basically flat for the year, outperforming its number one competitor in the West by 5.8 percentage points. However, excluding coal, Burlington’s volumes were no better than the industry in 2015, and it seems less certain that BNSF’s coal business will outperform in 2016. Moreover, a portion of the earnings gain in 2015 was attributable to a lag in the re-pricing of fuel surcharges as the price of diesel fuel declined, a benefit that cannot be counted on to recur this year.

The insurance business was a mixed bag. GEICO continues to grow rapidly in a stagnant industry, but profits were lower as accident frequency and severity picked up - most likely because lower gas prices led to an increase in the number of miles driven. GEICO is raising prices in response to higher claims experience. Reinsurance profits were down as a result of intense price pressure amid a lower-than-usual level of catastrophes the last couple of years. Berkshire chose to write less business for super catastrophes because it thought rates were inadequate. The growth of BH Specialty, essentially a startup primary commercial unit staffed with hires from industry competitors, was a bright spot.

The manufacturing and service businesses started the year strongly but comparisons deteriorated during the year as demand from markets reliant on higher

commodity prices weakened and the translation of profits in foreign markets was hurt by the stronger dollar. Among the major investees, American Express’s earnings were hurt by the loss of a contract with co-brand partner Costco and IBM’s results suffered from the strong dollar and the fact that corporate buyers are increasingly turning to lower cost hardware and “cloud” storage solutions.

In 2016, Berkshire committed over $40 billion to acquisitions. The purchase of Precision Castparts is, by one measure, the largest acquisition in Berkshire’s history at $37 billion - including debt assumed. The deal value of the Precision acquisition was struck at a historically high multiple of 15 times trailing operating income. Berkshire will fund about 30% of the deal costs with low-cost borrowed money but, even with leverage, Precision’s earnings will need to grow relatively rapidly for the acquisition to work out well. Berkshire also injected over $5 billion into Heinz to help facilitate Heinz’s merger with Kraft to form a larger food company.

TJX generated excellent results through the first three quarters of 2015 in what was a difficult period for most soft goods retailers. US department and specialty stores are struggling, making TJX an increasingly important customer for apparel, accessories, footwear and home décor vendors. In fact, we believe TJX has become the largest customer for many well-known brands, giving it great buying leverage and access to product. This is reflected in merchandise margins that have risen sharply in recent years.

TJX faced some headwinds in 2015, notably around higher entry-level wages and poor currency translation of sales in Canada and Europe into US dollars. Both reported revenue and EPS grew below the rate of recent years and we sold about one-third of our position during the year. At year-end, TJX remained the third-largest position in the Fund and while the outlook for most bricks-and-mortar retailers is poor, TJX has a value proposition and business model that has proven very hard to replicate online. TJX continues to open successful stores in North America and Europe.

9

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

Early in 2016, CEO Carol Meyrowitz transitioned to a new role as executive chairman of the board and her long-time deputy Ernie Herrman was promoted to CEO. Carol’s decade as CEO was marked by one success after another. Ernie has played an important role in these results and he takes over a far stronger company than existed 10 years ago.

O’Reilly Automotive had another excellent year against very strong 2014 comparisons. Despite operating at industry leading levels the past few years, the company managed to increase its outperformance over the competition in 2015. While full year results are not in as we write this, O’Reilly will likely increase sales by close to 10% to $7.9 billion on the back of 7% growth in comparable same store sales. That growth should drive an increase in operating income of over 17% and, with the aid of share repurchase, diluted EPS should be up over 20% to near $9.00 per share. While competitors such as Advance and AutoZone have recently made greater investments to improve their position in the commercial space, we believe O’Reilly has a superior distribution network that allows the company to provide greater inventory availability and faster delivery times than the competition. On the Do-It-Yourself side, O’Reilly has very successfully rolled out its O’Rewards loyalty card program that at last count numbered 18 million members. The O’Rewards program, along with increased labor hours on nights and weekends and improved store services such as battery and window wiper blade installations, have helped the company drive strong growth in the DIY business the past few years. O’Reilly has also been helped by favorable industry tailwinds, including lower gas prices and the continued growth of miles driven.

Fastenal faced multiple headwinds in 2015, including: a weak industrial economy, particularly in the oil and gas sector; a strong and rising US dollar, which impacts Fastenal’s many export focused customers;

and low inflation accompanied by falling metal prices, which reduces Fastenal’s pricing power. Though our Fastenal stake has performed well for shareholders since its inception in 2001, the last few years have been difficult. The business has become increasingly vulnerable to cyclical factors as it has matured and new store openings have slowed to a trickle. Revenue grew a mere 3.6% in 2015, the second worst showing of the past 25 years. Strong cost controls and an increase in share repurchases pushed EPS growth to 6.2% for the year and, while that performance exceeded the results of Fastenal’s broad-line industrial distribution peers, it was not the performance we have come to expect from the company.

With typical alacrity, Fastenal’s board moved to replace CEO Lee Hein after just seven months at the helm, installing longtime CFO Dan Florness in his place. Rather than nurse its wounds, the company doubled down on its growth drivers in 2015. It increased the number of salesmen employed by more than 15% over the course of the year, and it increased the number of industrial vending machines installed with customers by 18.5%. These machines make the sales process more efficient and save money for Fastenal’s customers by reducing waste at the point of sale. From a standing start in 2009, the company has installed 55,510 vending devices through the end of fiscal 2015. Fastenal also plans to expand its store footprint in 2016 for the first time in three years, with a goal of 60-75 new openings. These steps position the company for healthy growth if and when economic headwinds abate. In the meantime, Fastenal investors enjoy a dividend yield exceeding 3% and the company continues to repurchase shares.

10

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

In terms of reported financial results, MasterCard had its worst year since its IPO in 2006. Earnings per share, excluding unusual expenses, rose 11%, but an unsustainable drop in the company’s tax rate accounted for roughly half of the increase. Looking below the surface, core business trends were actually quite robust, but masked by massive foreign exchange headwinds and the impact of dilutive bolt-on acquisitions. We thus expect an improved result this year. MasterCard’s virtues are well-appreciated by the stock market but the evolution of mobile payment habits and the rise of blockchain ledger technology could pose longer term challenges to the company’s wildly profitable business model. We have owned MasterCard for nearly a decade and it has been one of the best performers in the history of our firm, but we expect future returns will be more modest.

Berkshire Hathaway agreed to buy Precision Castparts in August for $235 a share. The deal closed in January. Berkshire already owned a small stake in Precision when it agreed to the purchase. It was attracted by the company’s strong competitive position and the quality of its hard-driving management. The stock price fell following the collapse of the oil & gas market and a lull in aerospace builds, and gave Berkshire the opportunity to buy Precision at what seemed like a fair price. End markets have continued to weaken since then and it is clear that Berkshire did not get the “bottom tick” in the stock price. But Berkshire invests for the long-haul and Precision should do well if the aerospace market continues to grow.

Operating performance at Alphabet (formerly Google) in 2015 was nothing short of remarkable for a company of its size. Revenue rose 17.8% in 2015 despite the fact that more than 50% of Alphabet’s sales are international, and the strength of the dollar created significant currency-based headwinds. On a constant currency basis, revenue grew 20.3%, with growth accelerating as the year progressed. Concerns over Alphabet’s ability to navigate the ongoing shift from desktop to mobile search eased in the third quarter, after changes in the company’s mobile ad formats led to a surge in ad click rates. Whether on the desktop or on the phone, there is no substitute for search. Meanwhile, the number of hours people spent watching YouTube rose more than 60% year over year, and YouTube

solidified its position as the premier video site on the internet, with more than 1 billion users. Investors recognized Alphabet’s continuing strong performance by driving the stock up. Today, Alphabet is jockeying with Apple for the title of world’s most valuable company by market capitalization.

In 2015, Alphabet management disclosed segmented financial results for the first time, separately reporting the profits attributable to Google and the losses attributable to Alphabet’s early stage investments in a number of other areas, including venture capital investments, Nest smart thermostats, Google Fiber, Google X, Calico (a biotechnology research company), Verily (a life sciences company), and Sidewalk Labs, an incubator for urban technology such as high-speed WiFi kiosks. The new disclosures show that Google’s operating income rose 23.5% in 2015 to more than $28 billion, while segment operating margin increased by 2.5% to 31.4%, even as Google invested heavily in its continued growth. Those financial results put Google in exceedingly rare company. Meanwhile, Alphabet’s Other Bets showed operating losses of $3.6 billion, a reflection of the company’s heavy investment in a number of early stage endeavors. Undoubtedly, some of these Other Bets will fail to pay off. However, the company is leveraging its unparalleled engineering expertise to pursue clever approaches to solving universal problems, and taken together, Other Bets may create substantial long term value for the company. It is too early to make predictions, but Alphabet’s management team has proven to be very far-sighted so far.

Idexx Labs had another good year in 2015, benefiting from a strengthening pet healthcare market in the US. The company reported healthy double digit revenue and mid-teens earnings growth in 2015, driven by the launch of its new Catalyst One in-clinic blood chemistry analyzer and continued growth in its reference labs and instrument consumables businesses. During the year, Idexx completed its transition to a direct sales model for its North American companion animal business. Despite a small hiccup within its legacy rapid assay business, the transition appears to have gone smoothly. With a strong line-up of new products coming to market over the next year we expect Idexx will generate high-single digit or low-double digit revenue growth in 2016 barring a slowdown in end markets.

11

Sequoia Fund, Inc.

Management’s Discussion of Fund Performance (Continued)

(Unaudited)

Mohawk performed well in a recovering US housing market despite lackluster demand for flooring in Europe and unfavorable trends in currency exchange rates. Increased sales volume, lower input costs and improved productivity helped boost sales and profits to the highest levels in the company’s history. Management also laid the groundwork for future growth, investing heavily in its legacy property, plant & equipment and deploying more than $1.5 billion in acquisitions of businesses in Belgium, Bulgaria, Ireland, and Mexico, increasing the company’s production capacity in ceramic tile, insulation panels, laminate, and vinyl. Current conditions for the flooring market in the US are more unsettled than a year ago and Europe remains mired in a slump. Mohawk’s growing business in Russia will continue to wrestle with a widely fluctuating ruble. But Mohawk’s management, the best in the business in our opinion, remains confident in the long-term prospects of the world’s largest floor covering company.

During 2015 the Fund established new investments in Allergan and Monsanto, while adding to existing investments in Constellation Software, Jacobs Engineering, Precision Castparts, Rolls-Royce and Valeant. The Fund sold its investments in Brown & Brown, Goldman Sachs, Novozymes, Qinetiq, Serco and World Fuel and trimmed its investments in Idexx Labs., Perrigo and TJX.

* * * * *

12

Sequoia Fund, Inc.

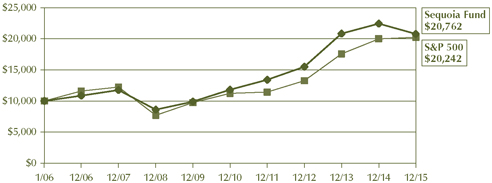

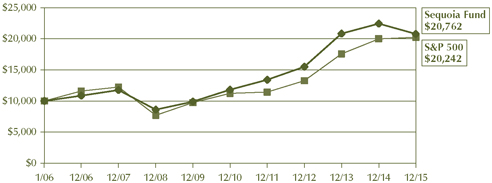

Growth of $10,000 Investment in the Fund

(Unaudited)

Sequoia Fund’s results as of December 31, 2015 appear below with comparable results for the S&P 500 Index:

| | | | | | | | | | |

| | | To December 31, 2015 | | Sequoia Fund | | | | S&P 500 Index* | | |

| | 1 Year | | -7.31% | | | | 1.38% | | |

| | 5 Years (Annualized) | | 11.93% | | | | 12.57% | | |

| | 10 Years (Annualized) | | 7.58% | | | | 7.31% | | |

The performance shown above represents past performance, assumes reinvestment of distributions, and does not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance information shown.

The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Year to date performance as of the most recent month end can be obtained by calling DST Systems, Inc. at (800) 686-6884.

*The S&P 500 Index is an unmanaged, capitalization-weighted index of the common stocks of 500 major U.S. corporations.

13

Sequoia Fund, Inc.

Sector Breakdown

(Unaudited)

| | | | | |

As of December 31, 2015 | | % of

net assets |

| |

Healthcare | | | | 20.7% | |

| |

Diversified Companies | | | | 13.2% | |

| |

Retailing | | | | 8.8% | |

| |

Aerospace/Defense | | | | 6.5% | |

| |

Auto Parts | | | | 6.2% | |

| |

Industrial & Construction Supplies | | | | 5.3% | |

| |

U.S. Government Obligations | | | | 5.1% | |

| |

Information Processing | | | | 4.3% | |

| |

Internet Software & Services | | | | 3.7% | |

| |

Veterinary Diagnostics | | | | 3.4% | |

| |

Flooring Products | | | | 3.2% | |

| |

Application Software | | | | 2.6% | |

| |

Dental Equipment | | | | 2.0% | |

| |

Precision Instruments | | | | 1.7% | |

| |

Construction & Engineering | | | | 1.4% | |

| |

Miscellaneous Securities | | | | 1.3% | |

| |

Diversified Manufacturing | | | | 1.1% | |

| |

Advertising | | | | 1.0% | |

| |

Industrial Gases | | | | 1.0% | |

| |

Property and Casualty Insurance | | | | 1.0% | |

| |

Specialty Chemicals | | | | 1.0% | |

| |

Other | | | | 5.5% | |

| |

| | | | 100.0% | |

14

Sequoia Fund, Inc.

Fees And Expenses of The Fund

(Unaudited)

Shareholder Expense Example

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2015 to December 31, 2015).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The

hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | |

| | | Beginning

Account

Value

July 1,

2015 | | | | Ending

Account

Value

December 31,

2015 | | | | Expenses

Paid During

Period*

July 1, 2015

to December 31,

2015 |

Actual | | $1,000 | | | | $ 844.40 | | | | $4.65 |

Hypothetical (5% return per year before expenses) | | $1,000 | | | | $1,020.16 | | | | $5.09 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

15

Sequoia Fund, Inc.

Schedule of Investments

December 31, 2015

(Percentages are of the Fund’s Net Assets)

Common Stocks (93.9%)

| | | | | | | |

Shares | | | | Value (Note 1) |

| | |

| | Advertising (1.0%) | | | | | |

| 928,976 | | Omnicom Group Inc | | | $ | 70,286,324 | |

| | | | | | | |

| | |

| | Aerospace/Defense (6.5%) | | | | | |

| 1,199,942 | | Precision Castparts Corp | | | | 278,398,543 | |

| 18,684,157 | | Rolls-Royce Holdings plc (United Kingdom) | | | | 158,379,996 | |

| | | | | | | |

| | | | | | 436,778,539 | |

| | | | | | | |

| | |

| | Apparel, Accessories & Luxury Goods (0.9%) | | | | | |

| 872,711 | | Compagnie Financiere Richemont SA (Switzerland) | | | | 62,821,948 | |

| | | | | | | |

| | |

| | Application Software (2.6%) | | | | | |

| 422,445 | | Constellation Software, Inc. (Canada) | | | | 176,122,043 | |

| | | | | | | |

| | |

| | Auto Parts (6.2%) | | | | | |

| 1,650,386 | | O’Reilly Automotive, Inc. (a) | | | | 418,240,820 | |

| | | | | | | |

| | |

| | Construction & Engineering (1.4%) | | | | | |

| 2,220,000 | | Jacobs Engineering Group Inc. (a) | | | | 93,129,000 | |

| | | | | | | |

| | |

| | Crude Oil & Gas Production (0.1%) | | | | | |

| 178,592 | | Canadian Natural Resources Limited (Canada) | | | | 3,898,663 | |

| | | | | | | |

| | |

| | Dental Equipment (2.0%) | | | | | |

| 1,250,584 | | Sirona Dental Systems, Inc. (a) | | | | 137,026,489 | |

| | | | | | | |

| | |

| | Diversified Companies (13.2%) | | | | | |

| 2,838 | | Berkshire Hathaway, Inc.-Class A (a) | | | | 561,356,400 | |

| 2,509,777 | | Berkshire Hathaway, Inc.-Class B (a) | | | | 331,390,955 | |

| | | | | | | |

| | | | | | 892,747,355 | |

| | | | | | | |

| | |

| | Diversified Manufacturing (1.1%) | | | | | |

| 761,755 | | Danaher Corporation | | | | 70,751,804 | |

| | | | | | | |

| | |

| | Electrical & Mechanical Systems (0.6%) | | | | | |

| 771,762 | | EMCOR Group, Inc. | | | | 37,075,446 | |

| | | | | | | |

| | |

| | Electronic Manufacturing Services (0.4%) | | | | | |

| 1,270,183 | | Trimble Navigation Limited (a) | | | | 27,245,425 | |

| | | | | | | |

| | |

| | Flooring Products (3.2%) | | | | | |

| 1,140,822 | | Mohawk Industries, Inc. (a) | | | | 216,060,279 | |

| | | | | | | |

| | |

| | Freight Transportation (0.0%) | | | | | |

| 49,650 | | Expeditors International, Inc. | | | | 2,239,215 | |

| | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

16

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2015

| | | | | | | |

Shares | | | | Value

(Note 1) |

| | |

| | Healthcare (20.7%) | | | | | |

| 459,618 | | Perrigo Company plc (Ireland) | | | $ | 66,506,725 | |

| 12,803,392 | | Valeant Pharmaceuticals International, Inc. (Canada) (a) | | | | 1,301,464,797 | |

| 430,594 | | West Pharmaceutical Services, Inc. | | | | 25,930,371 | |

| 19,931 | | Zoetis, Inc. | | | | 955,094 | |

| | | | | | | |

| | | | | | 1,394,856,987 | |

| | | | | | | |

| | |

| | Industrial & Construction Supplies (5.3%) | | | | | |

| 8,711,743 | | Fastenal Company | | | | 355,613,349 | |

| | | | | | | |

| | |

| | Industrial Gases (1.0%) | | | | | |

| 685,147 | | Praxair, Inc. | | | | 70,159,053 | |

| | | | | | | |

| | |

| | Industrial Machinery (0.7%) | | | | | |

| 3,500,199 | | IMI plc (United Kingdom) | | | | 44,453,606 | |

| | | | | | | |

| | |

| | Information Processing (4.3%) | | | | | |

| 2,974,202 | | MasterCard, Inc.-Class A | | | | 289,568,307 | |

| | | | | | | |

| | |

| | Internet Software & Services (3.7%) | | | | | |

| 161,444 | | Alphabet, Inc.-Class A (a) | | | | 125,605,046 | |

| 161,887 | | Alphabet, Inc.-Class C (a) | | | | 122,852,807 | |

| | | | | | | |

| | | | | | 248,457,853 | |

| | | | | | | |

| | |

| | IT Consulting & Other Services (0.9%) | | | | | |

| 464,945 | | International Business Machines Corp. | | | | 63,985,731 | |

| | | | | | | |

| | |

| | Precision Instruments (1.7%) | | | | | |

| 837,403 | | Waters Corp. (a) | | | | 112,697,696 | |

| | | | | | | |

| | |

| | Property and Casualty Insurance (1.0%) | | | | | |

| 31,040 | | Admiral Group plc (United Kingdom) | | | | 759,149 | |

| 4,325,462 | | Hiscox Ltd. (Bermuda) | | | | 67,209,720 | |

| 20,893 | | Verisk Analytics, Inc.-Class A (a) | | | | 1,606,254 | |

| | | | | | | |

| | | | | | 69,575,123 | |

| | | | | | | |

| | |

| | Retailing (8.8%) | | | | | |

| 39,463 | | Costco Wholesale Corp | | | | 6,373,275 | |

| 848,646 | | Tiffany & Co. | | | | 64,743,203 | |

| 6,579,883 | | TJX Companies, Inc. | | | | 466,579,503 | |

| 890,077 | | Wal-Mart Stores, Inc. | | | | 54,561,720 | |

| | | | | | | |

| | | | | | 592,257,701 | |

| | | | | | | |

| | |

| | Specialty Chemicals (1.0%) | | | | | |

| 1,526,978 | | Croda International plc (United Kingdom) | | | | 68,477,984 | |

| | | | | | | |

| | |

| | Specialty Retailers (0.9%) | | | | | |

| 1,285,519 | | Cabela’s, Inc. (a) | | | | 60,072,303 | |

| | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

17

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2015

| | | | | | | |

Shares | | | | Value

(Note 1) |

| | |

| | Veterinary Diagnostics (3.4%) | | | | | |

| 3,140,671 | | Idexx Laboratories, Inc. (a) | | | $ | 229,017,729 | |

| | | | | | | |

| | |

| | Miscellaneous Securities (1.3%)(b) | | | | 87,288,644 | |

| | | | | | | |

| | |

| | Total Common Stocks (Cost $2,609,958,307) | | | | 6,330,905,416 | |

| | | | | | | |

| | |

Principal Amount | | | | |

Corporate Bond (0.9%) | | | | | |

| 76,460,100 | | Constellation Software, Inc. (Canada) | | | | | |

| | 8.50%,3/31/2040 | | | | 59,954,621 | |

| | | | | | | |

| | |

| | Total Corporate Bond (Cost $67,793,304) | | | | 59,954,621 | |

| | | | | | | |

| |

U.S. Government Obligations (5.1%) | | | | | |

| $341,000,000 | | United States Treasury Bill, 0.00% due 01/07/2016 | | | | 340,990,907 | |

| | | | | | | |

| | |

| | Total U.S. Government Obligations (Cost $340,990,907) | | | | 340,990,907 | |

| | | | | | | |

| | |

| | Total Investments (99.9%) (Cost $3,018,742,518) (c) | | | | 6,731,850,944 | |

| | |

| | Other Assets Less Liabilities (0.1%) | | | | 9,030,378 | |

| | | | | | | |

| | Net Assets (100.0%) | | | $ | 6,740,881,322 | |

| | | | | | | |

| (a) | Non-income producing security. |

| (b) | “Miscellaneous Securities” include holdings that are not restricted, have been held for not more than one year prior to December 31, 2015, and have not previously been publicly disclosed. |

| (c) | The cost for federal income tax purposes is identical. |

The accompanying notes form an integral part of these Financial Statements.

18

Sequoia Fund, Inc.

Schedule of Investments (Continued)

December 31, 2015

Generally accepted accounting principles establish a disclosure hierarchy that categorizes the inputs to valuation techniques used to value the investments at measurement date. These inputs are summarized in the three levels listed below:

| | | | |

| Level 1 | | – | | unadjusted quoted prices in active markets for identical securities |

| | |

| Level 2 | | – | | other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds and credit risk.) |

| | |

| Level 3 | | – | | unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers between levels are recognized at the end of the reporting period. During the year ended December 31, 2015, there were no transfers into or out of Level 1 or 2 measurements in the fair value hierarchy. There were no Level 3 securities held in the Fund during the year ended December 31, 2015.

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of December 31, 2015:

| | | | | | | | | | | | | | | | |

| | | Common Stocks | | | Corporate Bond | | | U.S.

Government

Obligations | | | Total | |

Level 1 - Quoted Prices | | $ | 6,330,905,416 | | | $ | — | | | $ | — | | | $ | 6,330,905,416 | |

Level 2 - Other Significant Observable Inputs | | | — | | | | 59,954,621 | | | | 340,990,907 | | | | 400,945,528 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 6,330,905,416 | | | $ | 59,954,621 | | | $ | 340,990,907 | | | $ | 6,731,850,944 | |

| | | | | | | | | | | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

19

Sequoia Fund, Inc.

Statement of Assets and Liabilities

December 31, 2015

| | | | |

Assets | | | | |

Investments in securities, at value (cost $3,018,742,518) (Note 1) | | $ | 6,731,850,944 | |

Cash on deposit | | | 8,906,345 | |

Foreign currency (cost $1,170,083) | | | 1,174,226 | |

Receivable for investments sold | | | 5,467,043 | |

Receivable for capital stock sold | | | 841,499 | |

Dividends and interest receivable | | | 1,971,796 | |

Other assets | | | 59,196 | |

| | | | |

Total assets | | | 6,750,271,049 | |

| | | | |

Liabilities | | | | |

Payable for investments purchased | | | 348,015 | |

Payable for capital stock repurchased | | | 3,366,589 | |

Accrued investment advisory fee | | | 5,383,896 | |

Accrued other expenses | | | 291,227 | |

| | | | |

Total liabilities | | | 9,389,727 | |

| | | | |

Net Assets | | $ | 6,740,881,322 | |

| | | | |

| |

Net Assets Consist of | | | | |

Capital (par value and paid in surplus) $.10 par value capital stock, 100,000,000 shares authorized, 32,523,440 shares outstanding | | $ | 2,989,321,878 | |

Accumulated net realized gains on investments (Note 4) | | | 38,617,309 | |

Unrealized appreciation on investments and foreign currency transactions | | | 3,712,942,135 | |

| | | | |

Net Assets | | $ | 6,740,881,322 | |

| | | | |

| |

Net asset value per share | | $ | 207.26 | |

| | | | |

The accompanying notes form an integral part of these Financial Statements.

20

Sequoia Fund, Inc.

Statement of Operations

Year Ended December 31, 2015

| | | | |

Investment Income | | | | |

Income | | | | |

Dividends, net of $592,534 foreign tax withheld | | $ | 47,489,809 | |

Interest | | | 966,848 | |

| | | | |

Total investment income | | | 48,456,657 | |

| | | | |

Expenses | | | | |

Investment advisory fee (Note 2) | | | 83,374,569 | |

Transfer agent fees | | | 888,070 | |

Professional fees | | | 561,264 | |

Independent Directors fees and expenses | | | 368,181 | |

Custodian fees | | | 125,000 | |

Other | | | 422,759 | |

| | | | |

Total expenses | | | 85,739,843 | |

Less expenses reimbursed by Investment Adviser (Note 2) | | | 2,215,274 | |

| | | | |

Net expenses | | | 83,524,569 | |

| | | | |

Net investment loss | | | (35,067,912 | ) |

| | | | |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions | | | | |

Realized gain (loss) on | | | | |

Investments (Note 3) | | | 418,415,843 | |

Foreign currency transactions | | | (158,568 | ) |

| | | | |

Net realized gain on investments and foreign currency transactions | | | 418,257,275 | |

Net decrease in unrealized appreciation on investments and foreign currency translations | | | (963,888,313 | ) |

| | | | |

Net realized and unrealized (loss) on investments and foreign currency transactions and translations | | | (545,631,038 | ) |

| | | | |

Net decrease in net assets from operations | | $ | (580,698,950 | ) |

| | | | |

The accompanying notes form an integral part of these Financial Statements.

21

Sequoia Fund, Inc.

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

December, 31, | |

| | | 2015 | | | 2014 | |

Increase (Decrease) in Net Assets | | | | | | | | |

From operations | | | | | | | | |

Net investment loss | | $ | (35,067,912 | ) | | $ | (21,057,325 | ) |

Net realized gain on investments and foreign currency transactions | | | 418,257,275 | | | | 280,164,091 | |

Net increase (decrease) in unrealized appreciation on investments and foreign currency translations | | | (963,888,313 | ) | | | 309,150,144 | |

| | | | | | | | |

Net increase (decrease) in net assets from operations | | | (580,698,950 | ) | | | 568,256,910 | |

| | | | | | | | |

Distributions to shareholders from | | | | | | | | |

Net realized gains | | | (345,179,339 | ) | | | (160,411,851 | ) |

| | | | | | | | |

Capital share transactions | | | | | | | | |

Shares sold | | | 389,567,801 | | | | 407,033,294 | |

Shares issued to shareholders on reinvestment of net realized gain distributions | | | 306,531,556 | | | | 142,551,694 | |

Shares repurchased | | | (1,097,370,461 | ) | | | (928,561,658 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (401,271,104 | ) | | | (378,976,670 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | (1,327,149,393 | ) | | | 28,868,389 | |

Net Assets | | | | | | | | |

Beginning of period | | | 8,068,030,715 | | | | 8,039,162,326 | |

| | | | | | | | |

End of period (including accumulated net investment loss of $0 and $0, respectively) | | $ | 6,740,881,322 | | | $ | 8,068,030,715 | |

| | | | | | | | |

| | |

Share transactions Shares sold | | | 1,585,069 | | | | 1,811,779 | |

Shares issued to shareholders on reinvestment of net realized gain distributions | | | 1,476,907 | | | | 632,137 | |

Shares repurchased | | | (4,870,262 | ) | | | (4,175,480 | ) |

| | | | | | | | |

Net decrease from capital share transactions | | | (1,808,286 | ) | | | (1,731,564 | ) |

| | | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

22

Sequoia Fund, Inc.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Per Share Operating Performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 235.00 | | | $ | 222.92 | | | $ | 168.31 | | | $ | 145.50 | | | $ | 129.29 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment (loss) | | | (1.08 | ) | | | (0.61 | ) | | | (0.72 | ) | | | (0.41 | ) | | | (0.42 | ) |

Net realized and unrealized gains (losses) on investments | | | (16.15 | ) | | | 17.23 | | | | 58.73 | | | | 23.22 | | | | 17.45 | |

| | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in net asset value from operations | | | (17.23 | ) | | | 16.62 | | | | 58.01 | | | | 22.81 | | | | 17.03 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions from Net realized gains | | | (10.51 | ) | | | (4.54 | ) | | | (3.40 | ) | | | — | | | | (0.82 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 207.26 | | | $ | 235.00 | | | $ | 222.92 | | | $ | 168.31 | | | $ | 145.50 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return | | | (7.31 | )% | | | 7.56 | % | | | 34.58 | % | | | 15.68 | % | | | 13.19 | % |

| | | | | |

Ratios/Supplementary data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in millions) | | $ | 6,741 | | | $ | 8,068 | | | $ | 8,039 | | | $ | 5,837 | | | $ | 4,914 | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | |

Before expense reimbursement | | | 1.03 | % | | | 1.03 | % | | | 1.02 | % | | | 1.03 | % | | | 1.03 | % |

After expense reimbursement | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Ratio of net investment (loss) to average net assets | | | (0.42 | )% | | | (0.26 | )% | | | (0.37 | )% | | | (0.26 | )% | | | (0.34 | )% |

Portfolio turnover rate | | | 10 | % | | | 8 | % | | | 2 | % | | | 5 | % | | | 3 | % |

The accompanying notes form an integral part of these Financial Statements.

23

Sequoia Fund, Inc.

Notes to Financial Statements

Note 1— Significant Accounting Policies

Sequoia Fund, Inc. (the ‘‘Fund’’) is registered under the Investment Company Act of 1940, as amended, as a non-diversified, open-end management investment company. The investment objective of the Fund is long-term growth of capital. The Fund is an investment company under U.S. generally accepted accounting principles and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies, consistently followed by the Fund in the preparation of its financial statements.

| A. | Valuation of investments: Investments are carried at fair value as determined under the supervision of the Fund’s Board of Directors. Securities traded on a national securities exchange are valued at the last reported sales price on the principal exchange on which the security is listed; securities traded in the NASDAQ Stock Market (“NASDAQ”) are valued in accordance with the NASDAQ Official Closing Price. Securities for which there is no sale or Official Closing Price are valued at the mean between the last reported bid and asked prices. |

Securities traded on a foreign exchange are valued at the closing price on the last business day of the period on the principal exchange on which the security is primarily traded. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the New York Stock Exchange on the date of valuation.

U.S. Treasury Bills with remaining maturities of 60 days or less are valued at their amortized cost. U.S. Treasury Bills that when purchased have a remaining maturity in excess of sixty days are valued on the basis of market quotations and estimates until the sixtieth day prior to maturity, at which point they are valued at amortized cost. Fixed-income securities, other than U.S. Treasury Bills, are valued at the last quoted bid price.

When reliable market quotations are insufficient or not readily available at time of valuation or when the Investment Adviser determines that the prices or values available do not represent the fair value of a security, such security is valued as determined in good faith by the Investment Adviser, in conformity with guidelines adopted by and subject to review by the Fund’s Board of Directors.

| B. | Foreign currency translations: Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of foreign securities are translated into U.S. dollars at the rates of exchange prevailing when such securities are acquired or sold. Income and expenses are translated into U.S. dollars at the rates of exchange prevailing when accrued. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments. Reported net realized gains or losses on foreign currency transactions arise from the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized gains and losses on foreign currency transactions and translations arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |

24

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

| C. | Investment transactions and investment income: Investment transactions are accounted for on the trade date and dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Premiums and discounts on fixed income securities are amortized over the life of the respective security. The net realized gain or loss on security transactions is determined for accounting and tax purposes on the specific identification basis. |

| D. | Federal income taxes: The Fund’s policy is to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and distributes all of its taxable income to its stockholders. Therefore, no federal income tax provision is required. |

| E. | Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| F. | Dividends and distributions: Dividends and distributions are recorded by the Fund on the ex-dividend date. |

Note 2— Investment Advisory Contract and Payments to Affiliates

Ruane, Cunniff & Goldfarb Inc. (the ‘‘InvestmentAdviser’’) provides the Fund with investment advice and administrative services.

Under the terms of the Advisory Agreement, the Investment Adviser receives an investment advisory fee equal to 1% per annum of the Fund’s average daily net asset value. Under the Advisory Agreement, the Investment Adviser is contractually obligated to reimburse the Fund for the amount, if any, by which the operating expenses of the Fund (including the investment advisory fee) in any year exceed the sum of 1 1⁄2% of the average daily net asset value of the Fund for such year up to a maximum of $30,000,000 of net assets, plus 1% of the average daily net asset value in excess of $30,000,000. The expenses incurred by the Fund exceeded the limitation for the year ended December 31, 2015 and the InvestmentAdviser reimbursed the Fund $2,215,274. Such reimbursement is not subject to recoupment by the Investment Adviser.

For the year ended December 31, 2015, advisory fees of $83,374,569 were earned by the Investment Adviser and brokerage commissions of $394,404 were earned by Ruane, Cunniff & Goldfarb LLC, the Fund’s distributor and a wholly-owned subsidiary of the Investment Adviser. Certain officers of the Fund are also officers of the Investment Adviser and the Fund’s distributor. Ruane, Cunniff & Goldfarb LLC received no compensation from the Fund on the sale of the Fund’s capital shares for the year ended December 31, 2015. There were no other amounts accrued or paid to interested persons, including officers and directors.

25

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Note 3— Investment Transactions

The aggregate cost of purchases and the proceeds from the sales of securities, excluding short-term securities, for the year ended December 31, 2015 were $693,656,001 and $777,928,564, respectively. Included in proceeds of sales is $154,004,110 representing the value of securities disposed of in payment of redemptions in-kind, resulting in realized gains of $120,464,333.

Note 4— Federal Income Tax Information

Distributions to shareholders are determined in accordance with Federal income tax regulations and may differ from those determined for financial statement purposes. To the extent these differences are permanent such amounts are reclassified within the capital accounts. During the year ended December 31, 2015, permanent differences primarily due to realized gains on redemptions in-kind not recognized for tax purposes, net operating loss and different book and tax treatment of net realized gains on foreign currency transactions resulted in a net decrease in accumulated net realized gains of $120,305,765 with a corresponding increase in capital of $85,237,853, and a decrease to accumulated net investment loss of $35,067,912. These reclassifications had no effect on net assets.

At December 31, 2015 the aggregate gross unrealized appreciation and depreciation of securities for federal income tax purposes were $3,818,955,682, and $105,847,256, respectively.

The tax character of distributions paid for the years ended December 31, 2015 and 2014 was as follows:

| | | | | | | | | | |

| | | 2015 | | | | | 2014 | |

Distributions paid from | | | | | | | | | | |

Long-term capital gains | | $ | 345,179,339 | | | | | $ | 160,411,851 | |

| | | | | | | | | | |

| | | | | | | | | | |

As of December 31, 2015 and December 31, 2014 the components of distributable earnings on a tax basis were as follows: | |

| | | 2015 | | | | | 2014 | |

Undistributed long-term gains | | $ | 38,617,309 | | | | | $ | 85,845,138 | |

Unrealized appreciation | | | 3,712,942,135 | | | | | | 4,676,830,448 | |

| | | | | | | | | | |

| | $ | 3,751,559,444 | | | | | $ | 4,762,675,586 | |

| | | | | | | | | | |

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the positions are ‘‘more likely than not’’ to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions taken on federal income tax returns for all open years (tax years ended December 31, 2012 through December 31, 2015) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

26

Sequoia Fund, Inc.

Notes to Financial Statements (Continued)

Note 5— Indemnification

The Fund’s officers, directors and agents are indemnified against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss thereunder to be remote.

Note 6— Subsequent Events

Accounting principles generally accepted in the United States of America require the Fund to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

27

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders of

Sequoia Fund, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Sequoia Fund, Inc. (the “Fund”), as of December 31, 2015, and the related statements of operations and changes in net assets, and the financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. The statement of changes in net assets for the year ended and the financial highlights for the four-year period ending December 31, 2014 were audited by other auditors, whose report thereon dated February 19, 2015, expressed an unqualified opinion on those statements.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2015, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of December 31, 2015, the results of its operations, changes in its net assets, and the financial highlights for the year then ended in conformity with U.S. generally accepted accounting principles.

| | |

New York, New York February 23, 2016 | |  |

| |

28

Sequoia Fund, Inc.

Approval of Advisory Agreement

(Unaudited)

At a meeting held on December 7, 2015, the Board of Directors of Sequoia Fund, Inc. (the “Fund”), including a majority of the Independent Directors, evaluated and approved the renewal of the advisory contract (the “Advisory Agreement”) between the Fund and Ruane, Cunniff & Goldfarb Inc. (the “Investment Adviser”). In approving the renewal of the Advisory Agreement, the Directors considered all information they deemed reasonably necessary to evaluate the terms of the Advisory Agreement.

Nature, Extent and Quality of Services. The Directors considered information concerning the nature, extent and quality of the services provided by the Investment Adviser to the Fund under the Advisory Agreement. They considered information describing the personnel responsible for the day-to-day management of the Fund, the Investment Adviser’s existing and planned staffing levels and changes to the staffing levels that had occurred since the last contract renewal. The Directors also considered the Investment Adviser’s research capability and the number of individuals devoted to investment research and portfolio management. They considered the overall reputation of the Investment Adviser and the Investment Adviser’s representation that it had no current plans to change the nature of services provided to the Fund. They considered information regarding the compensation arrangements of the portfolio managers. They considered information concerning the Investment Adviser’s compliance policies and procedures. Based on these and other factors concerning the advisory services provided by Ruane, the Directors concluded that they were satisfied with the nature, extent and quality of services provided to the Fund by the Investment Adviser under the Advisory Agreement.

Investment Performance. The Directors reviewed information regarding the Fund’s performance under the Investment Adviser’s management. They considered information reflecting the Fund’s performance and the performance of the S&P 500 Index for the 11-month period ended November 30, 2015.They reviewed information concerning those portfolio holdings that contributed to the Fund’s performance during that period, as well as holdings that detracted from such performance during that period. They considered information about the Fund’s purchases and sales during the period. They also considered the Fund’s annualized performance compared to the annualized performance of peer-group funds and the S&P 500 Index for the 1-year, 3-year, 5-year and 10-year periods ended November 30, 2015.They considered that the performance information was compiled by the Investment Adviser from information made publicly available by Morningstar and discussed the performance of the S&P 500 Index relative to the Fund’s performance. The Directors considered the Fund’s performance in light of information provided by the InvestmentAdviser concerning the performance of other advisory clients managed by the Investment Adviser for various periods through November 30, 2015. The Directors considered management’s view of a reasonable performance objective for the Fund and how the Fund evaluates its performance and the causes of the Fund’s underperformance. In determining whether to approve the advisory contract, the Board concluded that, despite the acknowledged disappointing results during the prior year, the Fund’s overall long-term performance is satisfactory.

Fees. Next, the Directors examined the fee paid to the Investment Adviser under the Advisory Agreement and the Fund’s overall expense ratio. They reviewed information provided by the Investment Adviser comparing the Fund’s advisory fee and expense ratio to the advisory fees charged to, and the expense ratios of, the peer-group funds. They reviewed information showing that the Fund’s expense ratio was 1.00% (after expense reimbursements) and that the average expense ratio for funds in the Fund’s Morningstar category was 1.23%. They considered the Investment Adviser’s obligation under the Advisory Agreement to reimburse the Fund for the excess, if any, in any year of the Fund’s operating expenses over 1 1⁄2% of the Fund’s average daily net asset values up to a maximum of $30 million, plus 1% of the Fund’s average daily net asset values in excess of $30 million. They reviewed information showing that the Investment Adviser received net advisory fees of 0.98% and that this was within the range of advisory fees for the peer-group funds. The Directors also considered information regarding the fees charged by the Investment Adviser to its other advisory clients. Based on these and other factors, the Directors determined that the fees charged by the Investment Adviser to the Fund under the Advisory Agreement were reasonable in light of the services provided by the Investment Adviser and the fees charged by other advisers to similar funds.

29

Sequoia Fund, Inc.

Approval of Advisory Agreement (Continued)

(Unaudited)

Profitability and Other Benefits to the Investment Adviser. The Directors considered information highlighting the profitability of the Fund to the Investment Adviser. They also considered other benefits to the Investment Adviser and its affiliates as a result of their relationship with the Fund, including a written analysis of the amounts and rates of brokerage commissions paid by the Fund to Ruane, Cunniff & Goldfarb LLC, a registered broker-dealer that is an affiliate of the Investment Adviser. Based on these factors, the Directors concluded that the Investment Adviser’s profitability would not prevent them from approving the renewal of the Advisory Agreement.

Economies of Scale. The Directors considered information concerning economies of scale and whether the existing advisory fee paid by the Fund to the Investment Adviser might require adjustment in light of any economies of scale. The Directors determined that no such modification of the existing advisory fee was necessary.

In light of the Fund’s long-term performance, the Investment Adviser’s provision of advisory and other services, the comparison of the Fund’s advisory fee to the advisory fees of peer-group funds and other factors, the Directors concluded that the renewal of the Advisory Agreement and retention of the Investment Adviser under the terms of the Advisory Agreement (including at the advisory fee rate set forth in the Advisory Agreement) were in the best interests of the Fund and its stockholders. This conclusion was not based on any single factor, but on an evaluation of the totality of factors and information reviewed and evaluated by the Directors. Based upon such conclusions, the Directors, including a majority of the Independent Directors, approved the renewal of the Advisory Agreement.

30

Sequoia Fund, Inc.

Directors and Officers

(Unaudited)

The Statement of Additional Information (“SAI”) includes additional information about Fund Directors and is available, without charge, upon request. You may call toll-free 1-800-686-6884 to request the SAI.

| | | | | | | | |

Name, Age, and Address | | Position Held with Fund(1) | | Length of Time

Served(2) | | Principal Occupation during Past 5 Years | | Other Directorships Held by Director |

Interested Directors and Officers(3) | | | | | | |

Robert D. Goldfarb, 71 9 West 57th Street New York, NY 10019 | | President & Director | | 37 Years | | Chairman & Director of Ruane, Cunniff & Goldfarb Inc. | | None |

David M. Poppe, 51 9 West 57th Street New York, NY 10019 | | Executive Vice President & Director | | 12 Years | | President & Director of Ruane, Cunniff & Goldfarb Inc. | | None |

| | | | |

| Independent Directors | | | | | | | | |

| | | | |

Edward Lazarus, 55 9 West 57th Street New York, NY 10019 | | Director | | 1 Year | | Executive Vice President and General Counsel of Tribune Media Co., and former Chief of Staff to the Chairman of the Federal Communications Commission | | None |

| | | | |

Roger Lowenstein, 61 9 West 57th Street New York, NY 10019 | | Director(4) | | 17 Years | | Writer for Major Financial and News Publications | | None |

| | | | |

Robert L. Swiggett, 93 9 West 57th Street New York, NY 10019 | | Director | | 45 Years | | Retired | | None |

31

Sequoia Fund, Inc.

Directors and Officers (Continued)

(Unaudited)

| | | | | | | | |

Name, Age, and Address | | Position Held with Fund(1) | | Length of Time

Served(2) | | Principal Occupation during Past 5 Years | | Other Directorships Held by Director |

Additional Officers | | | | | | | | |