UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01976

Sequoia Fund, Inc.

(Exact name of registrant as specified in charter)

9 West 57th Street, Suite 5000

New York, NY 10019

(Address of principal executive offices) (Zip code)

John B. Harris

Ruane, Cunniff & Goldfarb L.P.

9 West 57th Street

Suite 5000

New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)686-6884

Date of fiscal year end: December 31, 2018

Date of reporting period: December 31, 2018

Item 1. Reports to Stockholders.

Report to Stockholders.

ANNUAL REPORT

DECEMBER 31, 2018

Beginning on February 12, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.sequoiafund.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically through your financial intermediary, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically at any time by contacting your financial intermediary.

You may elect to receive all future reports in paper form free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue to receive paper copies of your shareholder reports by calling1-800-686-6884.

| | |

Sequoia Fund | | December 31, 2018 |

Table of Contents

|

| |

Please consider the investment objectives, risks and charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other information about the Fund. You may obtain year to date performance as of the most recent quarter end, and a copy of the prospectus, by calling1-800-686-6884, or on the Fund’s website at www.sequoiafund.com. Please read the prospectus carefully before investing. Shares of the Fund are offered through the Fund’s distributor, Ruane, Cunniff & Goldfarb LLC. Ruane, Cunniff & Goldfarb LLC is an affiliate of Ruane, Cunniff & Goldfarb L.P. (the “Investment Adviser”) and is a member of FINRA. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

[THIS PAGE INTENTIONALLY LEFT BLANK.]

| | |

Sequoia Fund | | December 31, 2018 |

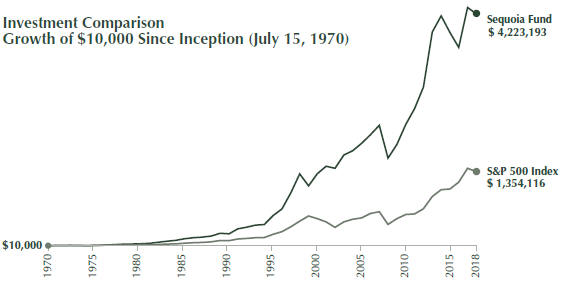

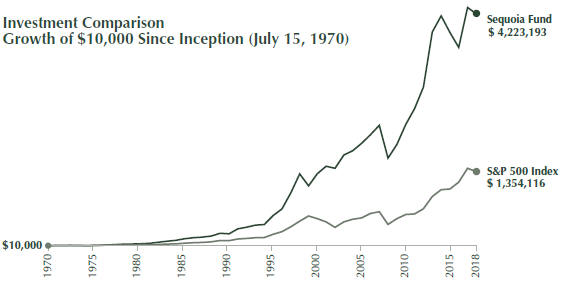

Illustration of an Assumed Investment of $10,000 (Unaudited)

The graph below covers the period from July 15, 1970 (the date Sequoia Fund, Inc. (the “Fund”) shares were first offered to the public) through December 31, 2018.

Sequoia Fund’s results as of December 31, 2018 appear below with comparable results for the S&P 500 Index:

| | | | | | | | |

| | | Year ended December 31, 2018 | | Sequoia Fund | | | | S&P 500 Index* |

| | 1 Year | | -2.62% | | | | -4.38% |

| | 5 Years (Annualized) | | 1.65% | | | | 8.49% |

| | 10 Years (Annualized) | | 10.18% | | | | 13.12% |

| | Since inception (Annualized)** | | 13.29% | | | | 10.66% |

The results shown in the graph and table, which assume reinvestment of distributions, represent past performance and do not guarantee future results. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance shown. Investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

*The S&P 500 Index is an unmanaged, capitalization-weighted index of the common stocks of 500 major U.S. corporations.

**Inception Date: July 15, 1970.

3

| | |

Sequoia Fund | | December 31, 2018 |

Shareholder Letter

Dear Shareholder:

We are happy to report that despite a slight decline, Sequoia Fund beat the market by two percentage points in 2018. As for the longer-term performance of the team presently managing the Fund, over the two and a half years since June 2016, Sequoia has tracked the S&P 500 Index almost precisely, appreciating a cumulative 25.4%, versus 25.6% for the Index.

Our portfolio contains 23 stocks, ten of which account for 62% of Fund assets. The Index includes 500 stocks, the ten largest of which account for just over 20% of total value. None of us went far enough in mathematics to calculate the odds of two such remarkably different animals running at such a similar pace for such a long period, but we’re quite certain that they’re low. At some point in the future, Sequoia’s path is bound to diverge markedly from that of the Index. With the quality and growth potential of our holdings relative to their valuations more appealing to us than at any point since we assumed management of the Fund, our expectation is that the lead we opened in 2018 will continue to expand in coming years.

In the meantime, we remain pleased that we have kept pace with a liquidity-driven market of haves and have-nots that has proven challenging for active managers in general and value-oriented investors in particular. Though the S&P 500 Index has gained 26% since June 2016, the roughly 300 Index constituents classified as “growth” stocks have returned 34%, while the roughly 200 constituents classified as “value” stocks have returned only 16%. Peering one layer deeper, “new economy” Indexsub-groups such as Internet, Application Software, Systems Software and Data Processing have gained70-100%, while “old economy”sub-groups such as Home Furnishings, Industrial Conglomerates, Oil & Gas and Household Appliances have declined33-45%. No wonder Wall Street is rife with talk of a possible recession. Parts of the stock market are acting like one has already happened.

Come what may, we continue to believe that Sequoia owns a carefully selected collection of businesses whose aggregate quality, growth prospects and valuation make them a much more appealing investment than the crowd of 500 companies that comprise the Index. Sequoia’s portfolio trades for eighteen times the earnings we think our companies will produce in 2019.1 That represents a modest premium to the price-earnings ratio of the Index, but the premium is well deserved: Sequoia’s combined earnings per share grew 29% last year, versus 18% for the S&P Index, and looking forward, we expect our EPS to grow 15% in 2019 and 13% in 2020, versus 9% and 9% for the Index.2 By our estimates, the aggregate return on equity of our portfolio vastly exceeds that of the S&P Index, and we believe the earnings of our companies are more resilient to the vagaries of the economic cycle than those of the Index.

One reason why we think our holdings have fared relatively well amidst a treacherous environment for value investing is that they reflect the open-minded approach to value that has long been our hallmark. Our interests as investors have always ranged widely, and the companies that have driven our outperformance over time have been eclectic. They have included well-understood behemoths like Johnson & Johnson, Freddie Mac and Cap Cities/ABC, as well as lesser-known compounders like Progressive, Fifth Third Bank and P.H. Glatfelter; fast-growing franchises with high price-earnings ratios, like Fastenal, Mastercard, Expeditors International and Idexx Labs, as well as slower-growing enterprises with lower statistical valuations like TJX and O’Reilly Automotive. The common thread that weaves through this quirky quilt of past performers is a culture that has always encouraged creative thinking, prized painstaking research and cultivated an intellectual climate in which talented people can enjoy the luxury of thinking like owners of businesses rather than holders of stocks.

When we look at it through this lens, our current portfolio feels familiar and comfortable, leaving us excited about the Fund’s future prospects. It includes large, dominant franchises like Google, Berkshire, Mastercard and Amazon;“off-the-run” gems like Credit Acceptance, Constellation Software, Melrose, Formula One and Hiscox; long-duration growers such as Electronic Arts, Booking Holdings, Naspers and a2 Milk; and steady, high-quality market share gainers like Carmax, Liberty/Charter and Charles Schwab. Almost without exception, our companies enjoy deep and durable competitive advantages that allow them to outgrow both their peers and the broader economy while producing prodigious excess cash flows that can fund strategic investments or distributions to shareholders. Only five of them, accounting for roughly a quarter of Fund assets, have net debts of serious consequence relative to their earnings. In aggregate, they trade for what we believe to be a substantial discount to the intrinsic value of their likely future profits. All of these virtues should redound to Sequoia’s benefit in the less liquidity-powered and more earnings-driven stock market that we expect over the years to come.

1 As referenced, this is based on our internal estimates and not the consensus of Wall Street analysts. Our internal estimates reflect how we think a sensible owner would calculate the earnings of a business, and they can deviate significantly from GAAP or “consensus” earnings. Thus when we compare the P/E ratio of our portfolio based on our estimates to the P/E ratio of the Index based on Wall Street consensus, we are to some extent comparing apples and oranges. We consider the comparison a relevant one nonetheless, because while our internal estimates do attribute more earning power than the Wall Street consensus to companies like Amazon that charge many of their growth investments against current earnings (more later), our estimates are often more conservative than Wall Street numbers that exclude costs like stock-based compensation and “extraordinary” restructuring charges, which to us are very real business expenses.

2 S&P 500 earnings data is based on consensus analyst estimates aggregated by CapitalIQ.

4

| | |

Sequoia Fund | | December 31, 2018 |

Shareholder Letter (Continued)

• • • • • • • • • •

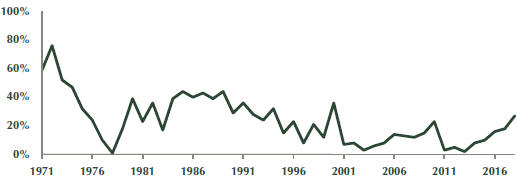

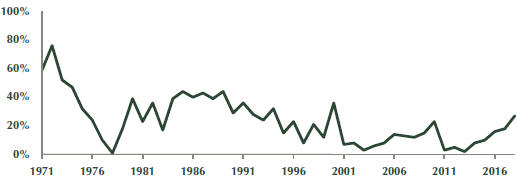

As significant Fund shareholders, we are all acutely aware that constructing the portfolio we have today has entailed three consecutive years of large realized gains. Paying the associated taxes is no fun, but like the composition of our current holdings, lumpy episodes of portfolio turnover are also very much in keeping with our historical pattern. As shown below, Sequoia experienced similar periods of transformation in the late 2000s and the late 1990s. We expect this one, just like those of the past, to be followed by a spell of reduced activity. A mindset of long-term business ownership remains a defining and essential characteristic of our culture, and as already mentioned, we like what we own.

Sequoia Fund Annual Turnover

By industry convention, turnover is expressed as either total purchases or total sales— whichever is lower— divided by average portfolio investments

Though periodic reconstitutions have been a regular feature of Sequoia’s history, selling successful long-term holdings is never easy. That’s partially because doing so involves crystallizing large tax liabilities, but investments that span decades rather than years— likeTJX, O’Reilly and other recent sales— are by definition extraordinarilytax-efficient. The more agonizing aspect of these divorces, as we have learned from years of humbling experience, is that it’s incredibly difficult to buy great companies at great prices in the first place, and even harder to know when to sell them. Most seasoned investors will tell you that their greatest regrets are not the duds they dumped at losses, but rather the gems that they sold too soon. We’re certainly no exception to that rule. Though our willingness to stick with outstanding companies longer than many peers has been a big contributor to our success over time, we can think of past holdings that we wish we had kept longer.

Clients may justifiably wonder, then: Why would we ever sell wonderful companies, especially while their results continue to impress? Doesn’t our history demonstrate that when you find franchises this special, you should keep them forever? Isn’t that lesson only reinforced by the fact that some of the big winners we’ve recently either exited or trimmed have continued appreciating after our sales?

We sympathize with these sentiments, which is why we very often spend more time debating decisions to sell than decisions to buy. Indeed, we cannot emphasize enough just how agonizing these choices can be. That is largely why we tend to move more quickly into investments than we move out of them. In a world where stocks go up more often than they go down, and where the surprises with great businesses tend to be more good than bad, the only thing we’re certain of when we decide to part ways with a special company is that we’re never going to pick the perfect day. By spreading out our sales, we at least reduce the stakes associated with any given decision on any given day and ensure that we will be “less wrong” than we might have been otherwise.

Our lives would be immeasurably easier were this not the case, but the unfortunate reality is that a great business can become something other than a great stock. It’s especially vexing that this transition can take place even in the context of outstanding financial performance. That might be because the price of the stock rises to a level that bears no reasonable proportion to even our most optimistic assessment of future profits. Or it might be because a more subtle combination of changed business fundamentals and increased valuation leads us to conclude that the balance of risks and rewards has become demonstrably less appealing than what we see in the other opportunities available to us.

We find that decisions driven purely by valuation tend to be the easier ones to make. For example, we sold our last shares of Idexx for over thirty times our estimate of near-future earnings, even as we struggled to see how those earnings could grow more than 15% per annum for any extended period. Granted, the stock subsequently rose to a head-scratching level of more than fifty times earnings at one point, but from our perspective, that’s someone else’s money to make. Hot Potato is not our game.

By contrast, we have a harder time wrestling with situations where we see a healthy valuation intersecting with a maturing business profile and the potential for unfavorable changes in industry dynamics. As an example, when we first purchased shares in O’Reilly Automotive, it was a regional retailer with 1,500 stores, a pretax profit margin of about 12% and a return on equity in themid-teens. We saw room

5

| | |

Sequoia Fund | | December 31, 2018 |

Shareholder Letter (Continued)

for all of these metrics to increase materially, and the idea of serious online competition in the auto parts industry seemed as realistic to us as the idea of a Paypal executive building a $60 billion electric car company. In other words, the possibilities looked plentiful and the risks seemed minimal.

A little over a decade later, by the time we sold, O’Reilly had become a hugely profitable national juggernaut, with 5,000 stores, a 20% pretax profit margin and a stunning return on equity of more than 50%. We have nothing but the highest admiration for the skill with which CEO Greg Henslee and his team engineered this remarkable transformation, but our job as investors is to look forward rather than backward, and while the price-earnings ratio of the stock had not changed meaningfully since our purchase, we had a hard time seeing how the company’s future could be nearly as bright as its past. We worried that it would be harder to continue taking market share from a base of 5,000 stores than from a base of 1,500. We worried about the sustainability of selling commodity packaged goods for a 20% profit margin in the age of Amazon— a company whose founder once famously quipped that “your margin is my opportunity.” We worried that eventually, life could become challenging for an auto parts retailer in a world of electric drivetrains with few moving parts and increasingly intelligent vehicles that get into fewer accidents. In other words, though current business performance looked as strong as it ever had, more risk and less potential return.

There is unfortunately no way to know when your worries about a company’s fundamental prospects will start to weigh on its stock price— or even if they’re valid in the first place. Amidst this frustrating fog, we depend for direction on the deep research and deliberative process that— exclusively— drive our business judgments. If they lead us to conclude that the balance of risk and return is tilting in the wrong direction, then if we can find other companies of similar quality where that balance tilts more favorably, we act. In some cases, as with our exit from Dentsply Sirona early last year or our recent sales of TJX, subsequent shifts in stock prices over months and quarters will vindicate our decisions. In other cases, they won’t. Far more important is whether new investments outperform the ones they replace over years and decades.

Even by that yardstick, the only thing we know with certainty is that we will never get these decisions completely right, and we will get a few of them embarrassingly wrong. We are confident, however, that if we curate a carefully-researched portfolio of high-quality companies, encourage a thoughtful debate about their long-term risks and opportunities and maintain a healthy respect for both the difficulty of making good judgments and the ease of underestimating the value of special companies, we will produce results after all taxes and fees that meet our very high expectations.

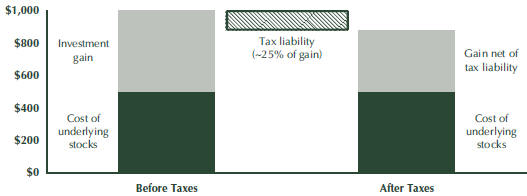

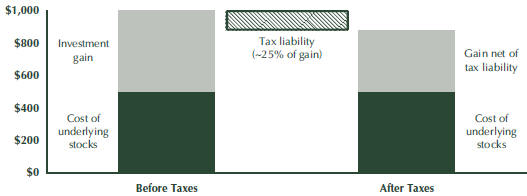

As we continue pushing toward that goal, we think it worth noting that portfolio turnover and the realized gains that accompany it do have an upside: they reduce the invisible tax liability associated with your investment. As shown below, if your holdings reside in a taxable account with a market value of $1,000, it likely does not represent $1,000 of “free and clear” savings. It is some combination of the money spent to purchase your investments and any profit earned on them, and unless you have a Swiss passport, a portion of that profit isn’t really yours. It’s Uncle Sam’s, and eventually you have to transfer it to him. When your investment includes large unrealized gains, that liability to the government gets big. When sales of profitable investments reduce your unrealized gains, your liability gets smaller.

Illustrative Example of the Tax Liability Embedded in a Hypothetical Fund Investment

Assumes that the Fund’s cost to purchase underlying stocks equals 50% of net asset value and that investment gains on the Fund’s underlying stocks = 50% of net asset value.

Because Sequoia invests for the long term, the Fund’s net asset value (NAV) has almost always included a large embedded gain. Over the last fifteen years, such gains have averaged almost exactly 50% ofyear-end NAV. As ofyear-end 2018, recent tax distributions had reduced them to just under 32% of NAV— unusually low in the context of the Fund’s recent history.

6

| | |

Sequoia Fund | | December 31, 2018 |

Shareholder Letter (Continued)

While fluctuations in the size of the Fund’s embedded gain are inevitable over time, the frustrating byproduct of this ebb and flow is that it can impact the timing of tax payments in ways that benefit some shareholders over others— even in a case where two shareholders earn the same total profit on their investment from beginning to end. This is because the tax rules relating to mutual funds can create temporary mismatches between the profits you earn on your Fund investment and the tax liabilities that arise when the Fund pays out capital gain distributions. Importantly, though, capital gain distributions serve to increase your tax basis, effectively shielding youdollar-for-dollar from future tax liability and ensuring that in the fullness of time, you only pay taxes on gains in which you participate.

To make this dynamic clearer, consider the hypothetical example of two Fund shareholders: one who invested at the beginning of 2018 and one who invests today. Conveniently for our purposes, performance is roughly flat since the beginning of 2018, so we can assume for the sake of simplicity that our two hypothetical U.S. individual investors pay the same amount for their shares. Now imagine— and again, this is an example, not a prediction— that Sequoia’s value increases in the future by $100 per share without any further tax distributions, and that both investors subsequently sell their shares. Very importantly, they will both have made the same $100 profit, and assuming they’re subject to the same tax rates, they will both have paid the same amount of tax from beginning to end. They will not, however, pay it at the same time. Because the Fund made a $34 capital gain distribution during 2018, the early investor will have paid roughly 34% of her total tax bill during 2018 and the other 66% in the year she sells. By contrast, the more recent investor will pay 100% of her tax bill in the year she exits the Fund. Again, both investors pay the same amount of tax, but one pays some of her bill sooner than the other.3

This potential for shareholders who earn similar profits to pay their associated taxes on different time schedules is an unfortunately unavoidable aspect of the mutual fund construct, but it’s largely irrelevant for a shareholder with a long-term mindset. If you think about your investment in Sequoia in terms of years and even decades— as we do, and as so many of our clients have historically— the good news is that you can probably ignore the last few paragraphs, because it’s a mathematical fact that your long-term,after-tax return is very likely to depend almost entirely on the stocks we pick and the prices we pay, as opposed to the timing of your tax payments.

• • • • • • • • • •

Notable positive contributors for the Fund in 2018 included Mastercard (up 25%), Amazon (up 28%) and TJX (up 20%). We sold all but a sliver of our remaining position in TJX during the fourth quarter at an average price of $110 (or $55 after the recent stock split), for many of the same reasons why we sold the last of our O’Reilly shares earlier in the year. Financial performance at TJX remains excellent, but with the company far larger and more mature than when we bought into it nearly twenty years ago, and with the price-earnings ratio roughly double what we originally paid, the future for both the business and the stock looks much less exciting than it once did.

Meaningful detractors for the year included Mohawk (down 58%), Naspers (down 28%) and Charles Schwab (down 18%). In terms of our other large positions, Alphabet, Berkshire and Constellation Software were all flattish.

In any given year, business results matter much more to us than stock prices, and on this front, the news was mostly good. Growth at Google, Amazon, Mastercard, Naspers and Vivendi’s key Universal Music operation remains very pleasing, while Carmax, Credit Acceptance, Booking, Schwab, Charter and Hiscox continue to gobble up market share in their respective industries. Berkshire and Constellation completed several sensible acquisitions and investments, albeit perhaps not as many as they would have liked, while Rolls-Royce and Formula One made progress on important strategic and operational initiatives that should make them better businesses in the future than they’ve been in the recent past. Finally, Jacobs Engineering announced a big divestiture that will focus the company on its two most profitable and least cyclical segments while wiping all of the debt off of its balance sheet.

On the other side of the ledger, a slowing housing market combined with a shift in consumer tastes led to a disappointing year at Mohawk, where earnings for 2018 are likely to come in around 10% below the company’s record result in 2017. We trimmed our position in Mohawk twice in the past two years, at significantly higher prices than where the stock trades today. These actions reduced the impact of Mohawk’s subsequent steep descent, but the events of 2018 suggest that we should have been even more aggressive exiting the position when Mohawk remained in Mr. Market’s good graces.

Most of the decline in Mohawk’s stock price came from a large contraction in its price-earnings multiple. The problem is that we believe part of this contraction was justified. Mohawk earns its highest and most defensible profit margins producing carpet, wood and ceramic tile. Unfortunately, consumers are increasingly turning away from these surfaces in favor of cheaper, more versatile and more durable vinyl products, where lower shipping costs reduce Mohawk’s advantages as a local producer, and where flexible, smaller-scale producers have the ability to gain share with innovation. The silver lining is that these challenges are reflected in the company’s valuation— and then some. Mohawk now trades for less than ten times its likely earnings for the coming year, which strikes us as too cheap for a clear market leader run by an exceptional owner-manager.

3 The above is just an example and is based on certain assumptions. The actual timing and amount of any taxes due by an investor depend upon a variety of factors, including the amount, timing and character of dividends paid by the Fund, whether such dividends are reinvested in the Fund by an investor, the investor’s status and circumstances that are unique to such investor.Each investor is encouraged to consult her own tax adviser regarding the taxationof an investment in the Fund in her particular circumstances.

7

| | |

Sequoia Fund | | December 31, 2018 |

Shareholder Letter (Continued)

In contrast to Mohawk, Charles Schwab continues to perform admirably and we detect no deterioration in its strategic position. Brokerage firms are cyclical businesses whose stock prices tend to follow the trend of the market in exaggerated fashion. This has been the case with Schwab since we invested, and we expect it to remain the case in the future. Importantly, beyond this cyclical turbulence, a favorable structural tailwind remains intact, as Schwab’s large cost advantages and powerful brand continue to pull client assets away from banks and traditional brokerages. We think the company will extend its long history of market share gain, attractive organic revenue growth and high profitability for years to come.

While we have similar expectations for Naspers, its stock swooned last year on account of a slowing Chinese economy and negative regulatory developments affecting the video game and payments businesses at Tencent, the company’s key holding. A moratorium on new product approvals that stunted Tencent’s gaming growth last year has since been lifted, and while disappointing recent changes in China’s mobile payments ecosystem will not reverse, we continue to judge Tencent’s prospects in that area favorably. More broadly, we remain confident in our original thesis that a hugely advantaged and under-monetized parcel of online real estate in one of the world’s largest economies should continue to grow its profits at very rapid rates for a very long time. In retrospect, we could have timed our purchase here better, but business performance has met our expectations thus far, and if that continues in coming years, the investment should produce a good result from beginning to end.

Conversely, 2018 was yet another year of disappointment at Wells Fargo, where we were reminded for what seems like the 100th time that with great management teams, the surprises tend to be good ones, and with lesser managements, they tend to be bad ones. Exasperated with the degree to which we misjudged business quality here and presented with more attractive uses of our capital, we sold our shares and moved on. Importantly, the Fund actually made a small profit on Wells in the end, which validates one aspect of our original analysis: the price we paid for our shares incorporated a substantial margin of safety. There’s a reason why those three words are the most important in all of investing: predicting the future is hard, even when you work as diligently at it as we do. If you can be right more often than you’re wrong, and if you can avoid big losses when you’re wrong and occasionally hit it big when you’re right, you’ll get a good result in the end, even while amassing an inevitable litany of regrets. Wells can officially be added to that list.

• • • • • • • • • •

We initiated three new investments during the fourth quarter: a2 Milk, Electronic Arts and Melrose. a2 is a New Zealand-based producer of premium milk and baby formula with an unusually long story behind it. Sometime around five to ten thousand years ago, scientists believe that a genetic mutation began to proliferate throughout certain global populations of cows, changing the protein content of the milk they produced. Originally, cow’s milk, like mother’s milk today, contained a protein with the exciting and original moniker A2. Cows that inherited the mutation, by contrast, started to produce milk containing a second protein labeled— you guessed it— A1. While this is far from settled science, some researchers and nutritionists believe that because people have only been drinkingA1-bearing milk for a relatively short period by evolutionary standards, our bodies have a harder time digesting it than “pure” A2 milk.

A good analogy here is Greek yogurt, which is believed in some quarters to confer health benefits you can’t get from regular yogurt. While Greek yogurt, like A2 milk, is a commodity product, companies like Fage and Chobani have built big businesses by wrapping compelling brands around it. a2 Milk is attempting to do the same thing, to great effect thus far. Riding powerful consumer trends favoring products perceived to be healthy and natural, a2 has become the leading premium milk brand in Australia while making rapid inroads into the massive and quality-obsessed infant formula market in China. An effort to penetrate the U.S. milk market is also showing early promise. Notwithstanding its remarkable success to date, a2 remains a young company, and much will depend on whether management can navigate a thorny distribution landscape in China, solidify the positioning of an embryonic brand and exploit growth opportunities in new geographies and product lines. With good execution, particularly in China, we think a2 could become a much larger business than it is today, more than justifying the statistically high price-earnings ratio we paid for our shares.

Though much more established and mature than a2, Electronic Arts is another global franchise that we expect to grow substantially. EA is one of the world’s largest producers of video games, and a business we have admired for years. After missing an opportunity to purchase its shares following an extensive research project a few years ago, we were pleased to get another chance to invest following a recent tumble in the company’s stock price. Video games are a comparatively cheap form of entertainment where both the quality and accessibility of the product have increased dramatically over time. As a result, more and more people are spending more and more time playing them. At the same time, the cost of producing the world’s leading game franchises has exploded, tilting the competitive scales in favor of deep-pocketed leaders like EA. Though we suspect that secular usage growth and a profit-enhancing mix shift toward digital game delivery andin-game purchases will benefit all of the industry’s largest players, we have always been attracted to the durability of EA’s sports franchises— especially FIFA soccer— which make its earnings lesshit-driven and thus more dependable than those of its peers.

Melrose is another business we have followed and admired for years, though for very different reasons than EA. With EA (and a2, for that matter), we are betting on talented horses that we think can run for years. With Melrose, the bet is on the jockey. Melrose is essentially a publicly-traded private equity firm, but with some very unusual twists. It mostly avoids borrowed money, focuses on only a small handful of investments at any given time and eschews dedicated funds that create a compulsion to invest without regard for the quality of the opportunities on offer. As with Berkshire and Constellation Software, the combination of a differentiated approach and a talented team has enabled Melrose to compile a hugely impressive long-term record of value creation. The company has never lost money on any of its realized investments, and in aggregate, it has produced an IRR of 24% per annum. At present, the company owns a collection of manufacturing businesses in the U.S. and Europe that span the aerospace, automotive and HVAC industries. In aggregate, they’re unlikely to grow any faster than the overall economy, but we think Melrose can make them substantially more profitable, and we ultimately expect management to sell them at attractive prices, freeing up time and capital for new opportunities.

8

| | |

Sequoia Fund | | December 31, 2018 |

Shareholder Letter (Continued)

Melrose is one of several Fund holdings trading at alow-teens multiple of their likely earnings for 2019, a valuation that assumes scant future profit growth. Others include Carmax, Jacobs, Mohawk and Credit Acceptance, with Schwab not far behind. We also see a noteworthy disconnect between market prices and our assessments of higher-growth holdings such as Alphabet, Booking, Constellation, EA and Naspers, which by our estimates all trade for price-earnings ratios in the high teens— a modest premium to the valuation of the Index for companies whose quality, economics and prospects we consider vastly superior to those of the average business. It could take months or years, but eventually we are confident that the discrepancies between price and value that we increasingly see throughout our portfolio will resolve themselves, to the benefit of Fund performance.

• • • • • • • • • •

More than two years into our extensive renovation and modernization project, we are happy to report that the business infrastructure at Ruane Cunniff has never been stronger. During 2018, we implemented new order management and trade reconciliation systems, began an overhaul of our client reporting templates and introduced online account access. We also made important hires in account administration and compliance while welcoming two talented new investment analysts, with a third set to join this spring. In total, our business team now numbers 39, while our investment team has grown to 27.

Our modernization push will continue apace in 2019, with more improvements to client reporting and the closure of our affiliated broker-dealer. Like our conversion to a limited partnership structure last year, the closure of the broker-dealer will bring us into alignment with standard industry practice. In the early days of professional money management, many investment firms grew out of brokerage businesses. Most have long since shuttered their affiliated brokerage operations to reduce costs and risks associated with regulatory compliance. We will now follow suit. To complete this transition, clients will have to fill out a few short forms that will be distributed in the coming weeks.

While preparations for the broker-dealer closure along with the new systems implementations put our business team to the test during 2018, we doubt anyone outside our offices noticed. The four of us spent an unusual amount of time with clients last year, and we’re not sure any of us left a meeting without hearing a gratifying story about the regularity with which our colleagues go above and beyond the call of duty to provide the world’s best service to the world’s best clients. We would not be able to invest the way we do if we didn’t have the clients we have, and based on the astoundingly consistent feedback we received last year, we are quite certain that we would not have the clients we have without the very special team and culture with which we have been blessed.

Ruane Cunniff is a much larger and more sophisticated place today than it was when the longest-tenured of us first arrived here a little over fifteen years ago, but it still feels every bit as much like a family. Ironically, we were eloquently reminded of the reasons why while reading an old annual report of a company we have long admired. It describes a “restless and inquisitive” culture built on “everyday small gestures” and “the care that [we] have for one another,” explaining that the combination of these attributes “creates a unique, driven and quirky environment that we believe results in people feeling there’s no place they’d rather be.” We can’t say it any better than that.

Few if any members of our team personify the Firm’s culture better than our longtime colleague Greg Steinmetz, who was recently elected to serve on the Sequoia Fund Board, joining John as one of two Ruane Cunniff-affiliated directors. Greg came to us nearly twenty years ago from the world of journalism, where he once served as the Wall Street Journal’s European bureau chief, and is a senior partner of the Firm. Greg’s unemotional,low-key demeanor and his dogged commitment to the core of our investment process— intensive primary research— have made him an example for our growing team of younger analysts to emulate and should make him a valuable example for the Board of the temperament and tasks that drive Ruane Cunniff day to day.

Our annual Investor Day, during which we can usually rely on Greg for a dryone-liner or two, will take place on Friday, May 17, 2019 in the Grand Ballroom of the Plaza Hotel in New York City, the same venue as last year. We look forward to seeing many of you there, and in the meantime, we send our warmest wishes for a happy, healthy and successful new year.

Sincerely,

The Ruane, Cunniff & Goldfarb Investment Committee,

| | | | | | |

| |  | |  | |  |

| Arman Gokgol-Kline | | John B. Harris | | Trevor Magyar | | D. Chase Sheridan |

January 28, 2019

9

| | |

Sequoia Fund | | December 31, 2018 |

Management’s Discussion of Fund Performance (Unaudited)

The table below shows the12-month stock total return for the top ten equity positions at the end of 2018.

| | | | | | | | | | | | |

Company | | % of

Net

Assets

12/31/18 | | Total

Return | | | % of

Net

Assets

12/31/17 |

Alphabet, Inc. | | | 12.1 | % | | | -1.03 | % | | | 10.2 | % |

Berkshire Hathaway, Inc. | | | 10.0 | % | | | 2.82 | % | | | 12.5 | % |

CarMax, Inc. | | | 8.0 | % | | | -2.18 | % | | | 3.9 | % |

Mastercard, Inc. | | | 6.1 | % | | | 25.32 | % | | | 8.1 | % |

Constellation Software, Inc. | | | 5.3 | % | | | 6.03 | % | | | 5.6 | % |

Credit Acceptance Corp. | | | 4.6 | % | | | 18.02 | % | | | 3.2 | % |

Liberty Media Corporation1 | | | 4.1 | % | | | -10.13 | % | | | 3.8 | % |

Rolls-Royce Holdings plc, Inc. | | | 4.1 | % | | | -6.37 | % | | | 4.6 | % |

Amazon, Inc. | | | 4.0 | % | | | 28.43 | % | | | 3.6 | % |

The Charles Schwab Corp. | | | 3.8 | % | | | -18.43 | % | | | 3.9 | % |

| | | | | | | | | | | | |

1 We acquired Liberty Media shares in a private placement at a discount to prevailing market prices in January 2017.

The total return for the Sequoia Fund in 2018 was-2.62%. This compares with the-4.38% return of the S&P 500 Index.

Our preference is to make concentrated commitments of capital in a limited number of companies that have superior long-term economic prospects and that sell at what we believe are attractive prices. Because Sequoia is deliberately not representative of the overall market, in any given year the performance of the Fund may vary significantly from that of the broad market indices.

The ten equity positions constituted approximately 62% of Sequoia’s net assets on December 31, 2018. Atyear-end, the Fund was approximately 96% invested in common stocks and approximately 4% invested in US Treasury Bills and cash.

Alphabet once again grew its top line at ferocious pace for a company of its size, with revenues increasing 23% in 2018 to $136.8 billion. The drivers of Alphabet’s growth have remained intact for several years now, with growth in mobile search, YouTube and Google Cloud Services leading the charge. Generally speaking, Alphabet’s fast-growing businesses generate lower margins than its more mature desktop search business. Thanks to this shifting mix, operating income usually grows at a slower pace than revenue- though still at a healthy clip. 2018 was no exception, with operating income growing 8.7%, excluding the impact of a $5.1 billion fine levied in the second quarter by the European Commission on Competition (“ECC”).

2018 marked the second consecutive year that Alphabet faced a multibillion euro fine by the ECC, underlining the idea that government intervention rather than private competition presents

the greatest risk to Alphabet’s continued prosperity in the coming years. Government interest in a business naturally rises in concert with that business’s power, and Alphabet operates one of the world’s most powerful platforms. The political environment is particularly challenging in Europe, where privacy concerns and consumer discomfort over the power exercised by American technology companies has emboldened regulators and politicians to pursue an activist agenda targeting Alphabet and its ilk. It is incumbent upon Alphabet and its large technology peers to engage with regulators, build (or in some cases rebuild) consumer trust, and embrace transparent and consumer-friendly policies in all aspects of their businesses. To be sure, model citizenship will not be enough to calm the regulatory headwinds Alphabet faces over the next few years- but it may help.

Alphabet continues to invest enormous sums in computing infrastructure and R&D, deepening the moats of its advertising businesses while positioning it as a leader in important developing technologies, notably machine learning and the more general field of artificial intelligence. Some of the benefits of Alphabet’s global leadership in artificial intelligence are largely invisible to consumers, including improved search results and better ranking algorithms, which in turn drives higher revenue. Other uses of AI are already providing highly visible benefits to consumers in areas such as natural language processing, image recognition and autonomous driving. For example, in December Alphabet’s Waymo subsidiary officially launched a limited rollout of Waymo One, a commercial self-driving car service serving select neighborhoods in Phoenix Arizona. This enormous technical achievement cements Waymo’s position as the world leader in autonomous driving. A larger geographical rollout is in the works, although we expect Waymo to proceed slowly while exercising the utmost caution. When it comes to autonomous driving, it doesn’t pay to move fast and break things.

Alphabet currently trades for roughly twenty times our estimate of its intrinsic earnings power in 2019. That represents a material premium to the S&P 500, but one we believe is warranted by the company’s rapid growth, large moat, and fortress balance sheet. It remains Sequoia’s largest position.

Berkshire’s look-through earnings per share are expected to increase close to 50% in 2018 due to five main factors: a positive swing in insurance profits due to fewer catastrophe claims and reserve releases from prior years’ estimates; improved demand for Berkshire’s industrial products; higher interest income on cash due to higher short-term interest rates; the purchase of an estimated $50 billion of common stocks during 2018 (including repurchases of Berkshire’s own shares); and a sharp decline in the corporate tax rate. At the current price, Berkshire is trading for a very reasonable low double-digit multiple of our estimate of normalized (with respect to both

10

| | |

Sequoia Fund | | December 31, 2018 |

Management’s Discussion of Fund Performance (Unaudited) (Continued)

the macroeconomy and the insurance market) look-through earnings. This estimate assumes the company is unable to deploy much of its cash hoard in a productive fashion, which could prove conservative.

Carmax, the country’s largest retailer of used cars, had a mixed year. While diluted earnings per share rose 15% with help from a lower tax rate and share buybacks, sales only grew 5.4%, much of which came from new store openings. The source of the comparable store sales softness is hard to pinpoint, but we know the unusually narrow gap between new and used car prices did not help. Margins fell slightly as Carmax pumped money into its omni-channel initiative to sell cars online. Online sales are a tiny but growing part of the market and Carmax is currently testing its omni-channel model in Atlanta, with plans for a national rollout. Carmax earns the highest margins of any car dealer and has considerable competitive advantages. We believe these advantages position it to succeed, over time, with its omni-channel offering.

Mastercard turned in another strong set of financial results in 2018. Diluted earnings per share increased 41%, thanks in part to a lower tax rate and buybacks. Revenues grew 20%, while operating earnings paced slightly ahead. The longstanding secular trend towards plastic remains intact. We continue to monitor potential technological threats as well as regulatory and legal developments in various geographies. Taken altogether, the company’s valuation feels both full and fair. As such, we trimmed our position during the year.

Constellation Software notched an impressive 24% increase in revenue through the first nine months of the year, which drove 27% growth in adjusted net income. Organic growth was anemic, but it was a good year for acquisitions. The team continued executing on its playbook in 2018, deepening its presence in existing verticals like healthcare and opening up new ones like software for nurseries. Through the first nine months, the company deployed nearly all its incoming cash flow into acquisitions. Constellation is essentially a team of software value investors, and we believe they are making smart investments that will yield good returns for shareholders.

Credit Acceptance, the leader in deep subprime auto lending, had an excellent year. Adjusted earnings per share rose 38.9% to $28.39, driven primarily by growth in the company’s loan portfolio, a lower federal tax rate, and collections that roughly matched expectations. Growth in the company’s loan portfolio is partly attributable to the recent expansion of its salesforce, which helped propel consumer loan unit volume growth of 13.6% in 2018.With the salesforce expansion largely complete, the company plans to focus on raising salesforce productivity (rather than headcount) over the next couple of years. The stock currently trades for 13.3run-rate earnings (that is, the

most recent quarterly adjusted EPS, annualized). This strikes us as a reasonable price for a differentiated, growing lender with a proven, shareholder-friendly management team.

Formula One continued its efforts to improve the world’s leading motorsport in 2018. The company invested in core functions, continued negotiating with teams towards a new “Concord Agreement” that should lead to greater parity at the racetrack level, attracted new sponsors (in Amazon Web Services and Interregional Sports Group), and signed up a new race (Vietnam). At the same time, there were bumps in the road this year. Negotiations with the leading Formula One teams were undoubtedly affected by the untimely passing of Ferrari CEO Sergio Marchionne. Also, the sport’s incumbent engine manufacturers successfully delayed a move to a cheaper engine that Formula One (and we) hoped might attract more engine manufacturers to the sport. Stepping back, we continue to believe the vision laid out by CEO Chase Carey and Managing Director of Motorsport Ross Brawn is in the long-term interests of FormulaOne-the sport as well as all its stakeholders.

Formula One’s reported results should benefit in the coming year from the just-mentioned recent investments in the business as well as a new and very large broadcast contract in the UK. However, the real action this year will likely take place away from the company’s reported financials. The Concord Agreement expires at the end of 2020, and the practical realities of the sport are such that there needs to be agreement on a new deal, or at least the key elements of one, roughly 18 months in advance. We will be monitoring the situation closely.

Rolls-Royce continues to prove that the business of designing, manufacturing and supporting aerospace engines is not easy. While Rolls made very good progress this year on its corporate cost cutting program, further focused on its core aerospace businesses (it sold its struggling commercial marine business) and continued to ramp up production in its civil aerospace business while reducing new engine losses, the company also hit a big speedbump. More specifically, issues emerged with the company’s Trent 1000 engine, which powers the Boeing 787. This plane pushed engine technology to its limits, as evidenced by issues with GE’s GEnX engine and now by the just-mentioned issues with Rolls’ Trent 1000 engine. These sorts of issues are not unheard of in this industry, but they’re never welcome and they’re sometimes costly. In this case, Rolls expects to spend £1.4 billion over the five years through 2022 on customer assistance, redesign and remanufacture. The silver lining is that, thanks to hard-earned operational improvements within the business and the growing installed base of engines, Rolls was able to absorb this hit without changing its guidance for cash earnings and free cash flow.

11

| | |

Sequoia Fund | | December 31, 2018 |

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Rolls does not report its full year results until the end of February, but we expect the company to report good growth in revenues and cash profits, driven by strong growth in the civil aerospace business and good growth in the power systems business. As a reminder, new accounting rules call for the delayed recognition of aftermarket revenue and profit, which means Rolls’ reported accounting results will understate its cash profitability over the medium term.

Amazon had another very impressive year. The ecommerce platform for which the company is best known maintained its dominant position, with roughly half of all US ecommerce activity going through it. Total paid unit growth, perhaps the simplest disclosed measure of system throughput, was in the high teens for the year. This represents a deceleration versus prior years, which is perhaps not surprising given the size of the business at this point, and in any case remains robust by just about any other standard. Amazon offers an ever-evolving value proposition that is, for a very broad swath of ecommerce purchase scenarios, unrivaled. We believe the company delivers on this value proposition in a way that generates real earnings power if not much in the way of reported GAAP earnings. We expect ecommerce generally and Amazon specifically to take share from brick and mortar retail for years to come.

Amazon’s other main business is public cloud, which the company brands Amazon Web Services (AWS). Growth here bordered on the breathtaking, with revenues up 47% for the year and exiting the year at arun-rate of almost $30 billion. Notably, AWS is highly profitable. While AWS does have competition, from Microsoft Azure and to a lesser extent Google Cloud, it remains the market leader by a wide margin. We believe we are still in the very early innings of the development of the public cloud market.

Charles Schwab had another strong year. The company’s diluted earnings per share rose 52%. Tax reform was obviously helpful, but Schwab’s fundamentals were also healthy. Revenues increased 18%, boosted primarily by “bulk transfers” of client cash to the company’s internal bank and a modest increase in interest rates (which favorably impacted the spread the company earns on client cash at this bank), and tamped down by a modest market-driven decline in client assets. Significantly, Schwab’s asset gathering machine continued to hum, with the company taking in $228 billion in net new client assets during the year. This was worth seven points of growth in total client assets.

Schwab’s investor-friendly strategy positions it well to continue gathering assets from the traditional wirehouses that still hold client assets on the order of $10 trillion. Moreover, the trend towards passive investment products and automated advice represents more opportunity than risk for the company. We believe that Schwab has a powerful value proposition that is supported by long-term secular trends and that the stock should generate, from here, a good through-cycle return.

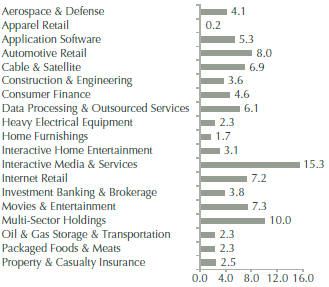

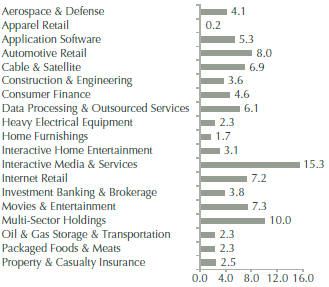

Sector Breakdown as of December 31, 2018 (% of net assets)

12

| | |

Sequoia Fund | | December 31, 2018 |

Annual Fund Operating Expenses (Unaudited)

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Shareholder Fees(fees paid directly from your investment)

The Fund does not impose any sales charges, exchange fees or redemption fees.

Annual Fund Operating Expenses(expenses that are deducted from Fund assets)

| | | | |

| | Management Fees | | 1.00% |

| | Other Expenses | | 0.07% |

| | | | |

| | Total Annual Fund Operating Expenses* | | 1.07% |

| | Expense Reimbursement by Investment Adviser* | | -0.07% |

| | | | |

| | Net Annual Fund Operating Expenses* | | 1.00% |

| | | | | |

*It is the intention of the Investment Adviser to ensure the Fund does not pay in excess of 1.00% in Net Annual Fund Operating Expenses. This reimbursement is a provision of the Investment Adviser’s investment advisory contract with the Fund and the reimbursement will be in effect only so long as that investment advisory contract is in effect.

Fees and Expenses of The Fund (Unaudited)

Shareholder Expense Example

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2018 through December 31, 2018).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ‘‘Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | | | | | | |

| | | Beginning

Account

Value

July 1,

2018 | | | Ending

Account

Value

December 31,

2018 | | | Expenses

Paid During

Period*

July 1, 2018

through

December 31,

2018 | |

Actual | | | $1,000 | | | | $ 908.70 | | | | $4.81 | |

Hypothetical (5% return per year before expenses) | | | $1,000 | | | | $1,020.16 | | | | $5.09 | |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and will not help you determine the relative total costs of owning different funds.

13

| | |

Sequoia Fund | | December 31, 2018 |

Schedule of Investments

December 31, 2018

(Percentages are of the Fund’s Net Assets)

Common Stocks (96.4%)

| | | | | | | | |

| Shares | | | | | Value

(Note 1) | |

| | |

| | | | Aerospace & Defense (4.1%) | | | | |

| | 13,231,748 | | | Rolls-Royce Holdings plc (United Kingdom) | | $ | 139,981,019 | |

| | | | | | | | |

| | |

| | | | Apparel Retail (0.2%) | | | | |

| | 119,499 | | | TJX Companies, Inc. | | | 5,346,385 | |

| | | | | | | | |

| | |

| | | | Application Software (5.3%) | | | | |

| | 282,811 | | | Constellation Software, Inc. (Canada) | | | 181,026,385 | |

| | | | | | | | |

| | |

| | | | Automotive Retail (8.0%) | | | | |

| | 4,393,852 | | | CarMax, Inc. (a) | | | 275,626,336 | |

| | | | | | | | |

| | |

| | | | Cable & Satellite (6.9%) | | | | |

| | 480,106 | | | Liberty Broadband Corp.-Class A (a) | | | 34,476,412 | |

| | 1,238,458 | | | Liberty Broadband Corp.-Class C (a) | | | 89,206,130 | |

| | 571,639 | | | Naspers Ltd.-Class N (South Africa) | | | 114,914,636 | |

| | | | | | | | |

| | | | | | | 238,597,178 | |

| | | | | | | | |

| | |

| | | | Construction & Engineering (3.6%) | | | | |

| | 2,121,601 | | | Jacobs Engineering Group Inc. | | | 124,028,795 | |

| | | | | | | | |

| | |

| | | | Consumer Finance (4.6%) | | | | |

| | 410,229 | | | Credit Acceptance Corp. (a) | | | 156,609,023 | |

| | | | | | | | |

| | |

| | | | Data Processing & Outsourced Services (6.1%) | | | | |

| | 1,104,810 | | | Mastercard, Inc.-Class A | | | 208,422,407 | |

| | | | | | | | |

| | |

| | | | Heavy Electrical Equipment (2.3%) | | | | |

| | 37,857,351 | | | Melrose Industries plc (United Kingdom) | | | 79,062,493 | |

| | | | | | | | |

| | |

| | | | Home Furnishings (1.7%) | | | | |

| | 512,559 | | | Mohawk Industries, Inc. (a) | | | 59,948,901 | |

| | | | | | | | |

| | |

| | | | Interactive Home Entertainment (3.0%) | | | | |

| | 1,328,304 | | | Electronic Arts, Inc. (a) | | | 104,816,469 | |

| | | | | | | | |

| | |

| | | | Interactive Media & Services (15.2%) | | | | |

| | 143,715 | | | Alphabet, Inc.-Class A (a) | | | 150,176,426 | |

| | 254,912 | | | Alphabet, Inc.-Class C (a) | | | 263,989,416 | |

| | 837,473 | | | Facebook, Inc.-Class A (a) | | | 109,784,336 | |

| | | | | | | | |

| | | | | | | 523,950,178 | |

| | | | | | | | |

| | |

| | | | Internet Retail (7.2%) | | | | |

| | 90,927 | | | Amazon.com, Inc. (a) | | | 136,569,626 | |

| | 63,908 | | | Booking Holdings, Inc. (a) | | | 110,076,417 | |

| | | | | | | | |

| | | | | | | 246,646,043 | |

| | | | | | | | |

| | |

| | | | Investment Banking & Brokerage (3.8%) | | | | |

| | 3,143,365 | | | The Charles Schwab Corp. | | | 130,543,948 | |

| | | | | | | | |

| | |

| | | | Movies & Entertainment (7.3%) | | | | |

| | 49,478 | | | Liberty Media Corporation-Liberty Formula One - Series A (a) | | | 1,470,486 | |

| | 4,551,721 | | | Liberty Media Corporation-Liberty Formula One - Series C (a) | | | 139,737,835 | |

| | 4,473,446 | | | Vivendi SA (France) | | | 109,069,686 | |

| | | | | | | | |

| | | | | | | 250,278,007 | |

| | | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

14

| | |

Sequoia Fund | | December 31, 2018 |

Schedule of Investments (Continued)

December 31, 2018

| | | | | | | | |

| Shares | | | | | Value

(Note 1) | |

| | |

| | | | Multi-Sector Holdings (10.0%) | | | | |

| | 755 | | | Berkshire Hathaway, Inc.-Class A (a) | | $ | 231,030,000 | |

| | 547,008 | | | Berkshire Hathaway, Inc.-Class B (a) | | | 111,688,093 | |

| | | | | | | | |

| | | | | | | 342,718,093 | |

| | | | | | | | |

| | |

| | | | Oil & Gas Storage & Transportation (2.3%) | | | | |

| | 1,712,746 | | | Koninklijke Vopak NV (Netherlands) | | | 77,867,255 | |

| | | | | | | | |

| | |

| | | | Packaged Foods & Meats (2.3%) | | | | |

| | 10,957,493 | | | a2 Milk Co. Ltd. (New Zealand) (a) | | | 79,648,761 | |

| | | | | | | | |

| | |

| | | | Property & Casualty Insurance (2.5%) | | | | |

| | 4,168,266 | | | Hiscox Ltd. (Bermuda) | | | 86,121,637 | |

| | | | | | | | |

| | | | Total Common Stocks(Cost $2,230,006,573) | | | 3,311,239,313 | |

| | | | | | | | |

| | |

Principal

Amount | | | | | | |

| |

| | U.S. Government Obligations (1.4%) | | | | |

| | $50,000,000 | | | United States Treasury Bills, 2.31% due 02/05/2019 | | | 49,887,708 | |

| | | | | | | | |

| | |

| | | | Total U.S. Government Obligations

(Cost $49,887,708) | | | 49,887,708 | |

| | | | | | | | |

| | |

| | | | Total Investments (97.8%)

(Cost $2,279,894,281) (b) | | | 3,361,127,021 | |

| | |

| | | | Other Assets Less Liabilities (2.2%) | | | 74,380,512 | |

| | | | | | | | |

| | | | Net Assets (100.0%) | | $ | 3,435,507,533 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | The cost for federal income tax purposes is identical. |

Generally accepted accounting principles establish a disclosure hierarchy that categorizes the inputs to valuation techniques used to value the investments at measurement date. These inputs are summarized in the three levels listed below:

| | |

Level 1 – | | unadjusted quoted prices in active markets for identical securities. |

| |

Level 2 – | | other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds and credit risk) |

| |

Level 3 – | | unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers between levels are recognized at the end of the reporting period. For the year ended December 31, 2018, there were no transfers between Levels. There were no Level 3 securities held by the Fund during the year ended December 31, 2018.

The accompanying notes form an integral part of these Financial Statements.

15

| | |

Sequoia Fund | | December 31, 2018 |

Schedule of Investments (Continued)

December 31, 2018

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of December 31, 2018:

| | | | | | | | | | | | | | | |

| | | Common Stocks | | U.S.

Government

Obligations | | Total |

Level 1 - Quoted Prices | | | $ | 3,311,239,313 | | | | $ | — | | | | $ | 3,311,239,313 | |

Level 2 - Other Significant Observable Inputs | | | | — | | | | | 49,887,708 | | | | | 49,887,708 | |

| | | | | | | | | | | | | | | |

Total | | | $ | 3,311,239,313 | | | | $ | 49,887,708 | | | | $ | 3,361,127,021 | |

| | | | | | | | | | | | | | | |

The accompanying notes form an integral part of these Financial Statements.

16

| | |

Sequoia Fund | | December 31, 2018 |

Statement of Assets and Liabilities

December 31, 2018

| | | | |

| Assets | | | | |

| |

Investments in securities, at value (cost $2,279,894,281) (Note 1) | | $ | 3,361,127,021 | |

Cash on deposit | | | 82,475,622 | |

Receivable for investments sold | | | 41,491,093 | |

Receivable for capital stock sold | | | 2,468,592 | |

Dividends and interest receivable | | | 423,491 | |

Other assets | | | 168,659 | |

| | | | |

| |

Total assets | | | 3,488,154,478 | |

| | | | |

| |

| Liabilities | | | | |

| |

Payable for capital stock repurchased | | | 49,304,494 | |

Accrued investment advisory fee | | | 2,878,191 | |

Accrued professional fees | | | 257,117 | |

Accrued other expenses | | | 207,143 | |

| | | | |

| |

Total liabilities | | | 52,646,945 | |

| | | | |

| |

| Net Assets | | $ | 3,435,507,533 | |

| | | | |

| |

Net Assets Consist of | | | | |

Capital (par value and paid in surplus) $.10 par value capital stock, 100,000,000 shares authorized, 25,987,544 shares outstanding | | $ | 2,228,718,096 | |

Total distributable earnings (loss) | | | 1,206,789,437 | |

| | | | |

| |

Net Assets | | $ | 3,435,507,533 | |

| | | | |

| |

Net asset value per share | | $ | 132.20 | |

| | | | |

The accompanying notes form an integral part of these Financial Statements.

17

| | |

Sequoia Fund | | December 31, 2018 |

Statement of Operations

Year Ended December 31, 2018

| | | | |

| Investment Income | | | | |

| |

Income | | | | |

Dividends, net of $1,000,171 foreign tax withheld | | $ | 20,182,695 | |

Interest | | | 4,701,243 | |

| | | | |

| |

Total investment income | | | 24,883,938 | |

| | | | |

| |

Expenses | | | | |

Investment advisory fee (Note 2) | | | 42,580,000 | |

Professional fees | | | 2,499,223 | |

Transfer agent fees | | | 901,582 | |

Independent Directors fees and expenses | | | 473,270 | |

Custodian fees | | | 125,000 | |

Other | | | 800,917 | |

| | | | |

| |

Total expenses | | | 47,379,992 | |

Less professional fees reimbursed by insurance company (Note 5) | | | 2,200,000 | |

| | | | |

| |

Expenses before reimbursement by Investment Adviser | | | 45,179,992 | |

Less expenses reimbursed by Investment Adviser (Note 2) | | | 2,449,992 | |

| | | | |

| |

Net expenses | | | 42,730,000 | |

| | | | |

| |

Net investment loss | | | (17,846,062 | ) |

| | | | |

| |

| Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions | | | | |

Realized gain (loss) on | | | | |

Investments (Note 3) | | | 1,008,579,756 | |

Foreign currency transactions | | | (74,179 | ) |

| | | | |

| |

Net realized gain on investments and foreign currency transactions | | | 1,008,505,577 | |

Net change in unrealized appreciation/(depreciation) on

Investments | | | (1,071,309,643 | ) |

Foreign currency translations | | | (52,546 | ) |

| | | | |

| |

Net decrease in unrealized appreciation/(depreciation) on investments and foreign currency translations | | | (1,071,362,189 | ) |

| | | | |

| |

Net realized and unrealized loss on investments and foreign currency transactions and translations | | | (62,856,612 | ) |

| | | | |

| |

Net decrease in net assets from operations | | $ | (80,702,674 | ) |

| | | | |

The accompanying notes form an integral part of these Financial Statements.

18

| | |

Sequoia Fund | | December 31, 2018 |

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

December 31, | |

| | |

| Increase (Decrease) in Net Assets | | 2018 | | | 2017 | |

| | |

From operations | | | | | | | | |

Net investment loss | | $ | (17,846,062 | ) | | $ | (14,882,317 | ) |

Net realized gain on investments and foreign currency transactions | | | 1,008,505,577 | | | | 604,396,107 | |

Net increase (decrease) in unrealized appreciation/(depreciation) on investments and foreign currency translations | | | (1,071,362,189 | ) | | | 177,852,405 | |

| | | | | | | | |

| | |

Net increase (decrease) in net assets from operations | | | (80,702,674 | ) | | | 767,366,195 | |

| | | | | | | | |

| | |

Distributions to shareholders from: | | | | | | | | |

Total distributable earnings(1) | | | (790,789,876 | ) | | | (537,585,896 | ) |

| | | | | | | | |

| | |

Capital share transactions | | | | | | | | |

Shares sold | | | 133,367,761 | | | | 117,034,879 | |

Shares issued to shareholders on reinvestment of net realized gain distributions | | | 656,695,555 | | | | 451,584,683 | |

Shares repurchased | | | (728,875,560 | ) | | | (649,001,366 | ) |

| | | | | | | | |

| | |

Net increase (decrease) from capital share transactions | | | 61,187,756 | | | | (80,381,804 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | (810,304,794 | ) | | | 149,398,495 | |

| | |

| Net Assets | | | | | | | | |

Beginning of year | | | 4,245,812,327 | | | | 4,096,413,832 | |

| | | | | | | | |

| | |

End of year(2) | | $ | 3,435,507,533 | | | $ | 4,245,812,327 | |

| | | | | | | | |

| | |

Share transactions | | | | | | | | |

Shares sold | | | 784,118 | | | | 679,161 | |

Shares issued to shareholders on reinvestment of net realized gain distributions | | | 4,783,658 | | | | 2,749,684 | |

Shares repurchased | | | (4,621,843 | ) | | | (3,786,278 | ) |

| | | | | | | | |

| | |

Net increase (decrease) from capital share transactions | | | 945,933 | | | | (357,433 | ) |

| | | | | | | | |

| (1) | Distributions from net investment income and from realized gains are no longer required to be separately disclosed. See Note 6. For the year ended December 31, 2017, distributions from net investment income and net realized gains were $0 and $537,585,896, respectively. |

| (2) | Parenthetical disclosure of accumulated net investment income or loss is no longer required. See Note 6. As of December 31, 2017, end of year net assets included accumulated net investment loss of $0. |

The accompanying notes form an integral part of these Financial Statements.

19

| | |

Sequoia Fund | | December 31, 2018 |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Per Share Operating Performance (for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 169.55 | | | $ | 161.28 | | | $ | 207.26 | | | $ | 235.00 | | | $ | 222.92 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.69 | ) | | | (0.59 | ) | | | (0.43 | ) | | | (1.08 | ) | | | (0.61 | ) |

Net realized and unrealized gains

(losses) on investments | | | (2.67 | ) | | | 32.12 | | | | (15.16 | ) | | | (16.15 | ) | | | 17.23 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net increase (decrease) in net asset value from operations | | | (3.36 | ) | | | 31.53 | | | | (15.59 | ) | | | (17.23 | ) | | | 16.62 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Less distributions from | | | | | | | | | | | | | | | | | | | | |

Net realized gains | | | (33.99 | ) | | | (23.26 | ) | | | (30.39 | ) | | | (10.51 | ) | | | (4.54 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, end of year | | $ | 132.20 | | | $ | 169.55 | | | $ | 161.28 | | | $ | 207.26 | | | $ | 235.00 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return | | | (2.62 | )% | | | 20.07 | %(a) | | | (6.90 | )% | | | (7.31 | )% | | | 7.56 | % |

| | | | | |

Ratios/Supplementary data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in millions) | | $ | 3,436 | | | $ | 4,246 | | | $ | 4,096 | | | $ | 6,741 | | | $ | 8,068 | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | |

Before expenses reimbursed by Investment Adviser(b) | | | 1.06 | % | | | 1.07 | % | | | 1.07 | % | | | 1.03 | % | | | 1.03 | % |

After expenses reimbursed by Investment Adviser | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Ratio of net investment loss to average net assets | | | (0.42 | )% | | | (0.35 | )% | | | (0.22 | )% | | | (0.42 | )% | | | (0.26 | )% |

Portfolio turnover rate | | | 27 | % | | | 18 | % | | | 16 | % | | | 10 | % | | | 8 | % |

| (a) | Includes the impact of proceeds received and credited to the Fund resulting from a class action settlement, which enhanced the Fund’s performance for the year ended December 31, 2017 by 0.05%. |

| (b) | Reflects reductions of 0.05%, 0.02% and 0.02% for expenses reimbursed by insurance company for the years ended December 31, 2018, 2017 and 2016, respectively. |

The accompanying notes form an integral part of these Financial Statements.

20

| | |

Sequoia Fund | | December 31, 2018 |

Notes to Financial Statements

Note 1— Significant Accounting Policies

Sequoia Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as anon-diversified,open-end management investment company. The investment objective of the Fund is long-term growth of capital. The Fund follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services— Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles (“GAAP”). The Fund consistently follows such policies in the preparation of its financial statements.

| A. | Valuation of investments: Investments are carried at fair value as determined under the supervision of the Fund’s Boardof Directors. Securities traded on a national securities exchange are valued at the last reported sales price on the principal exchange on which the security is listed; securities traded in the NASDAQ Stock Market (“NASDAQ”) are valued in accordance with the NASDAQ Official Closing Price. Securities for which there is no sale or Official Closing Price are valued at the mean of the last reported bid and asked prices. |

Securities traded on a foreign exchange are valued at the closing price on the last business day of the period on the principal exchange on which the security is primarily traded. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the New York Stock Exchange on the date of valuation.

U.S. Treasury Bills with remaining maturities of 60 days or less are valued at their amortized cost. U.S. Treasury Bills that when purchased have a remaining maturity in excess of 60 days are valued on the basis of market quotations and estimates until the sixtieth day prior to maturity, at which point they are valued at amortized cost. Fixed-income securities, other than U.S. Treasury Bills, are valued at the last quoted sales price or, if adequate trading volume is not present, at the mean of the last bid and asked prices.

When reliable market quotations are insufficient or not readily available at the time of valuation or when Ruane, Cunniff & Goldfarb L.P. (the “Investment Adviser”) determines that the prices or values available do not represent the fair value of a security, such security is valued as determined in good faith by the Investment Adviser, in conformity with procedures adopted by and subject to review by the Fund’s Board of Directors.

| B. | Foreign currency translations: Investment securities and other assets and liabilities denominated in foreign currenciesare translated into U.S. dollar amounts at the date of valuation. Purchases and sales of foreign securities are translated into U.S. dollars at the rates of exchange prevailing when such securities are acquired or sold. Income and expenses are translated into U.S. dollars at the rates of exchange prevailing when accrued. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments. Reported net realized gains or losses on foreign currency transactions arise from the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized gains and losses on foreign currency transactions and translations arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates. |