UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Long Form of Press Release

Commission File Number 1-11414

BANCO LATINOAMERICANO DE COMERCIO EXTERIOR, S.A.

(Exact name of Registrant as specified in its Charter)

FOREIGN TRADE BANK OF LATIN AMERICA, INC.

(Translation of Registrant’s name into English)

Business Park Torre V, Ave. La Rotonda, Costa del Este

P.O. Box 0819-08730

Panama City, Republic of Panama

(Address of Registrant’s Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes o No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes o No x

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| Date: May 6, 2022 | |

| | FOREIGN TRADE BANK OF LATIN AMERICA, INC. |

| | (Registrant) |

| | |

| | By: | /s/ Ana Graciela de Mndez |

| | | | | | | | |

| | Name: | Ana Graciela de Mndez |

| | Title: | CFO |

BLADEX ANNOUNCES PROFIT FOR THE FIRST QUARTER 2022 OF $11.1 MILLION, OR $0.31 PER SHARE; ON HIGHER CREDIT PROVISIONS ASSOCIATED TO SOLID PORTFOLIO GROWTH

PANAMA CITY, REPUBLIC OF PANAMA, May 4, 2022

Banco Latinoamericano de Comercio Exterior, S.A. (NYSE: BLX, “Bladex”, or “the Bank”), a Panama-based multinational bank originally established by the central banks of 23 Latin-American and Caribbean countries to promote foreign trade and economic integration in the Region, today announced its results for the First Quarter (“1Q22”) ended March 31, 2022.

The consolidated financial information in this document has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

FINANCIAL SNAPSHOT

| | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million, except percentages and per share amounts) | | 1Q22 | | 4Q21 | | 1Q21 | | | | |

| Key Income Statement Highlights | | | | | | | | | | |

| Net Interest Income ("NII") | | $ | 25.7 | | | $ | 24.8 | | | $ | 18.9 | | | | | |

| Fees and commissions, net | | $ | 3.9 | | | $ | 6.2 | | | $ | 3.0 | | | | | |

| Gain (loss) on financial instruments, net | | $ | 0.6 | | | $ | (1.3) | | | $ | (0.1) | | | | | |

| Other income, net | | $ | 0.0 | | | $ | 0.1 | | | $ | 0.1 | | | | | |

| Total revenues | | $ | 30.2 | | | $ | 29.8 | | | $ | 22.0 | | | | | |

| Provision for credit losses | | $ | (8.1) | | | $ | (0.2) | | | $ | 0.0 | | | | | |

| Gain on non-financial assets, net | | $ | 0.0 | | | $ | 0.7 | | | $ | 0.0 | | | | | |

| Operating expenses | | $ | (11.0) | | | $ | (10.3) | | | $ | (9.1) | | | | | |

| Profit for the period | | $ | 11.1 | | | $ | 20.1 | | | $ | 12.8 | | | | | |

| Profitability Ratios | | | | | | | | | | |

Earnings per Share ("EPS") (1) | | $ | 0.31 | | | $ | 0.54 | | | $ | 0.32 | | | | | |

Return on Average Equity (“ROAE”) (2) | | 4.5 | % | | 7.9 | % | | 5.0 | % | | | | |

| Return on Average Assets (ROAA) | | 0.6 | % | | 1.1 | % | | 0.8 | % | | | | |

Net Interest Margin ("NIM") (3) | | 1.32 | % | | 1.42 | % | | 1.24 | % | | | | |

Net Interest Spread ("NIS") (4) | | 1.15 | % | | 1.26 | % | | 1.04 | % | | | | |

Efficiency Ratio (5) | | 36.4 | % | | 34.6 | % | | 41.6 | % | | | | |

| Assets, Capital, Liquidity & Credit Quality | | | | | | | | | | |

Credit Portfolio (6) | | $ | 8,412 | | | $ | 7,365 | | | $ | 6,097 | | | | | |

Commercial Portfolio (7) | | $ | 7,321 | | | $ | 6,540 | | | $ | 5,708 | | | | | |

| Investment Portfolio | | $ | 1,091 | | | $ | 825 | | | $ | 389 | | | | | |

| Total assets | | $ | 8,458 | | | $ | 8,038 | | | $ | 6,375 | | | | | |

| Total equity | | $ | 1,005 | | | $ | 992 | | | $ | 1,037 | | | | | |

Market capitalization (8) | | $ | 565 | | | $ | 601 | | | $ | 601 | | | | | |

Tier 1 Capital to risk-weighted assets (Basel III – IRB)(9) | | 16.2 | % | | 19.1 | % | | 26.3 | % | | | | |

Capital Adequacy Ratio (Regulatory) (10) | | 13.4 | % | | 15.6 | % | | 19.4 | % | | | | |

| Total assets / Total equity (times) | | 8.4 | | 8.1 | | 6.1 | | | | |

Liquid Assets / Total Assets (11) | | 9.2 | % | | 17.5 | % | | 15.6 | % | | | | |

Credit-impaired loans to Loan Portfolio (12) | | 0.2 | % | | 0.2 | % | | 0.2 | % | | | | |

Total allowance for losses to Credit Portfolio (13) | | 0.7 | % | | 0.6 | % | | 0.7 | % | | | | |

Total allowance for losses to credit-impaired loans (times) (13) | | 5.2 | | 4.4 | | 4.2 | | | | |

BUSINESS HIGHLIGHTS

•The Bank’s Credit Portfolio increased 38% YoY and 14% QoQ, to reach record levels of $8.4 billion as of March 31, 2022. This growth was driven by Commercial Portfolio reaching $7.3 billion (+28% YoY; +12% QoQ) along with increased credit investment securities to $0.9 billion, aimed to diversify exposures and complement the Bank’s commercial activities.

•The Commercial Portfolio’s growth trend of seven consecutive quarters is propelled by stronger demand from the Bank’s traditional client base, mainly top tier corporations, boosted by higher commodity prices and trade flows in the Region. The Bank continued to focus its origination on portfolio diversification, preserving the high quality of its borrowers, as evidenced by the successful collection of all scheduled loan maturities, as well as by the short-term nature of its business (74% maturing in less than a year).

•Bladex´s liquidity position, consisting of cash and due from banks and highly rated corporate debt securities (‘A-‘ or above), stood at $0.8 billion, or 9% of total assets as of March 31, 2022. The Bank relies on sustained deposit levels and well diversified funding sources with ample access to global debt and capital markets, such as the re-opening of a debt placement in the Mexican market for an amount equivalent of $150 million, and a $300 million global syndicated transaction, during 1Q22.

•Alongside Bladex’s portfolio growth is its asset quality preservation, as credit-impaired loans (“NPLs”) remained unchanged at $11 million or 0.2% of total Loan Portfolio as of March 31, 2022. Credits categorized as Stage 2 under IFRS 9 (with increased risk since origination) represented 2% of total credits, unchanged QoQ and down from 5% a year ago, with the remaining 98% categorized as Stage 1 or low-risk credits.

•As of March 31, 2022, the total allowance for credit losses increased 24% YoY and 17% QoQ to reach $55.2 million, representing 0.7% of total Credit Portfolio, and 5.2 times NPL balances. The $8.1 million provision for credit losses in 1Q22 was closely tied to the Bank’s Credit Portfolio growth.

•Bladex’s Profit for 1Q22 totaled $11.1 million (-13% YoY; -45% QoQ), as the increase in top-line revenues (+38% YoY; +1% QoQ) was mainly offset by the aforementioned credit provision charges.

•NII continued its quarterly growth trend since a year ago, up 36% YoY and 4% QoQ, to $25.7 million for 1Q22, mainly resulting from the effect of higher average net lending rates and volumes.

•Fees and Commissions, net, totaled $3.9 million in 1Q22 (+30% YoY; -37% QoQ). Fees from the Bank’s letters credit business sustained its growth trend performance (+31% YoY; +6% QoQ), although impacted by the uneven nature of the transaction-based syndication business when compared to the 4Q21.

•As of March 31, 2022, the Bank´s Tier 1 Basel III Capital and Regulatory Capital Adequacy Ratios stood at 16.2% and 13.4%, respectively, due to higher risk-weighted assets on increased Loan and Investment Portfolios, while equity levels remained relatively stable at over $1 billion.

CEO’s Comments

Mr. Jorge Salas, Bladex’s Chief Executive Officer said: “This quarter was record-breaking in terms of asset growth, reaching USD8.5 billion in total assets on the back of a strong Commercial Portfolio performance. This is now the seventh consecutive quarter of continued growth, as we have been actively taking advantage from increased demand in countries and sectors benefiting from the positive trend in trade volumes, as the increase in commodity prices are a favorable development for net commodity exporters in Latin America.”

Mr. Salas added: “To support this growth, Bladex continues to rely on its resilient level of deposits and ample access to debt and capital markets. During the quarter, Bladex successfully reopened a debt placement in the Mexican capital market for 3 billion Mexican Pesos or approximately USD 150 million, and entered into a USD 300 million global syndicated transaction. These new resources allow us to keep funding our commercial growth while maintaining a cost-efficient, diversified and resilient funding base.”

Mr. Salas also indicated: “Interest income does not reflect the full impact of the increased volume of commercial assets observed during the quarter, as most of the growth took place during the last weeks of the quarter and the Bank maintained

higher liquidity levels at the onset of the year, in anticipation of the expected increase of its credit portfolio. The robust asset growth should provide a strong basis for a sustained improvement of the Bank’s revenue flows in the coming months.”

Mr. Salas concluded: “Even though growth forecasts for the Region have been revised down slightly, while inflation continues to rise strongly, with official interest rates expected to move further into restrictive territory, we are confident in our ability to increase the profitability of our credit portfolio given its high turnover and the favorable market dynamics that benefit our business model, which, coupled with our expertise in the Region, allows us to continue to serve our clients’ increasing financing needs.”

RESULTS BY BUSINESS SEGMENT

The Bank’s activities are managed and executed through two business segments, Commercial and Treasury. Information related to each reportable segment is set out below. Business segment results are based on the Bank’s managerial accounting process, which assigns assets, liabilities, revenue, and expense items to each business segment on a systemic basis.

COMMERCIAL BUSINESS SEGMENT

The Commercial Business Segment encompasses the Bank’s core business of financial intermediation and fee generation activities developed to cater to corporations, financial institutions, and investors in Latin America. These activities include the origination of bilateral short-term and medium-term loans, structured and syndicated credits, loan commitments, and financial guarantee contracts such as issued and confirmed letters of credit, stand-by letters of credit, guarantees covering commercial risk, and other assets consisting of customers’ liabilities under acceptances.

Profits from the Commercial Business Segment include (i) net interest income from loans; (ii) fees and commissions from the issuance, confirmation and negotiation of letters of credit, guarantees and loan commitments, as well as through loan structuring and syndication activities; (iii) gain on sale of loans generated through loan intermediation activities, such as sales and distribution in the primary market; (iv) gain (loss) on sale of financial instruments measured at FVTPL; (v) reversal (provision) for credit losses, (vi) gain (loss) on non-financial assets; and (vii) direct and allocated operating expenses.

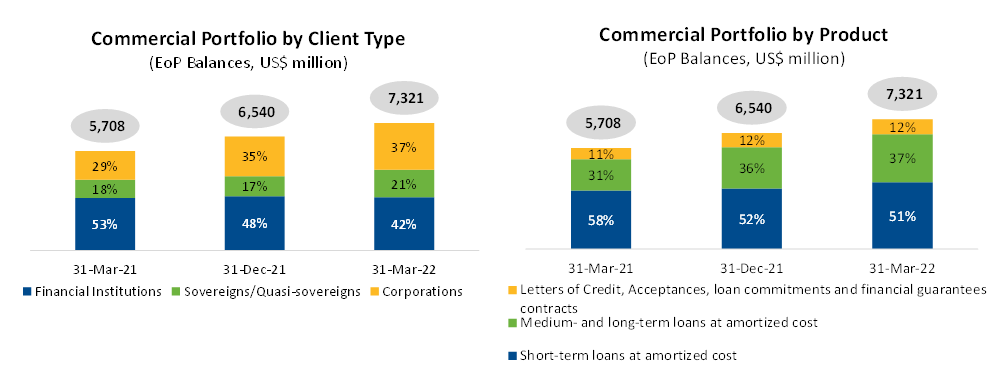

Bladex’s Commercial Portfolio maintained its sequential quarterly growth trend, reaching $7.3 billion at the end of 1Q22, a 28% YoY increase compared to $5.7 billion a year ago, and a 12% QoQ increase compared to $6.5 billion a quarter ago.

On an average basis, Commercial Portfolio balances reached $6.7 billion for the 1Q22 (+25% YoY; +8% QoQ). The quarterly increased levels of EoP balances and average volumes were driven by stronger demand from the Bank’s traditional client base of top tier corporations, boosted by higher commodity prices and trade flows in the Region, while exposure to Financial Institutions remained relatively stable on a nominal basis. In addition, the Bank continued collecting all scheduled loan maturities, evidencing the high quality of the Bank’s borrower base and short-term nature of its business.

As of March 31, 2022, 74% of the Commercial Portfolio was scheduled to mature within a year, down 3 pp from a year ago, and down 1 pp compared from the previous quarter. Trade finance transactions represented 67% of the short-term origination, up 10 pp compared to a year ago, and up 3 pp compared to a quarter ago.

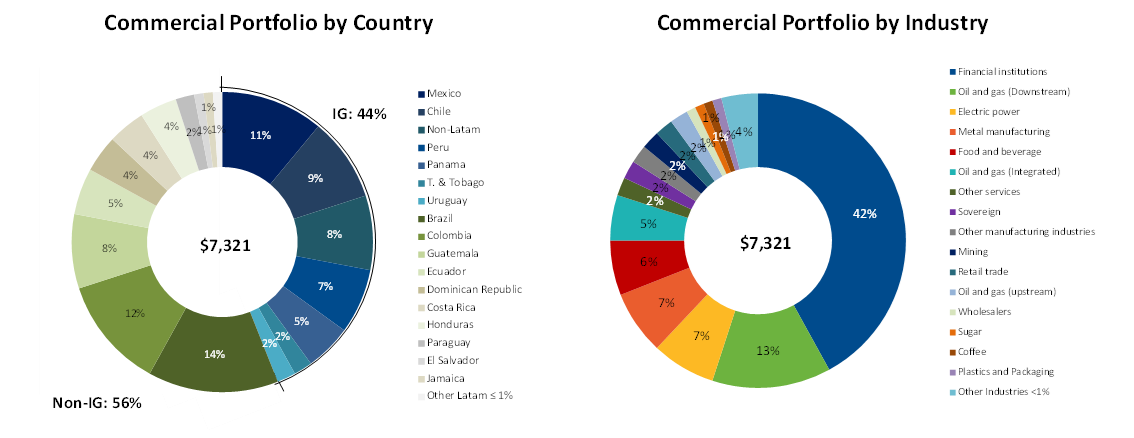

The following graphs illustrate the geographic distribution of the Bank’s Commercial Portfolio, highlighting the portfolio´s risk diversification by country and across industry segments, as of March 31, 2022:

Bladex’s credit quality remains sound with a well-diversified exposure across countries. As of March 31, 2022, 44% of the Commercial Portfolio was geographically distributed in investment grade countries, up 1 pp from the previous quarter, still centered on preserving credit quality through well diversified exposures with top-tier clients across the Region, and down 13 pp from a year ago, which is mostly explained by the Bank´s classification of Colombia as non-investment grade following downgrades by two main credit rating agencies back in May and July of 2021. Brazil continues to represent the largest country-risk exposure at 14% of the total Commercial Portfolio, of which 70% was with financial institutions. Other relevant country-risk exposures were Colombia at 12% and investment grade countries such as Mexico at 11%, Chile at 9% and top-rated countries outside of Latin America (which relates to transactions carried out in Latin America) at 8% of the total portfolio.

The Commercial Portfolio by industries also remained well-diversified and focused on high quality borrowers, as exposure to the Bank’s traditional client base of financial institutions represented 42% of the total Commercial Portfolio, and exposure to sovereign and state-owned corporations accounted for 21% of the total portfolio at the end of 1Q22. The remaining exposure comprises top tier corporates throughout the Region, well diversified across sectors, in which most industries represented 5% or less of the total Commercial Portfolio, except for certain sectors, strategic to the Bank, benefiting from by higher commodity prices and LatAm trade flows, such as Oil & Gas (Downstream) at 13%, Electric power and Metal manufacturing, each at 7%, and Food and beverage, at 6% of the Commercial Portfolio at the end of 1Q22.

Refer to Exhibit VII for additional information related to the Bank’s Commercial Portfolio distribution by country, and Exhibit IX for the Bank’s distribution of loan disbursements by country.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million) | | 1Q22 | | 4Q21 | | 1Q21 | | QoQ (%) | | YoY (%) | | | | | | |

| Commercial Business Segment: | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 25.3 | | | $ | 23.3 | | | $ | 18.7 | | | 8 | % | | 35 | % | | | | | | |

| Other income | | 4.1 | | 6.5 | | 3.3 | | -37 | % | | 27 | % | | | | | | |

| Total revenues | | 29.4 | | 29.8 | | 22.0 | | -1 | % | | 34 | % | | | | | | |

| Provision for credit losses | | (7.4) | | (0.2) | | 0.0 | | -4501 | % | | n.m. | | | | | | |

| Gain on non-financial assets, net | | 0.0 | | 0.7 | | 0.0 | | -100 | % | | n.m. | | | | | | |

| Operating expenses | | (8.8) | | (7.8) | | (7.1) | | -12 | % | | -23 | % | | | | | | |

| Profit for the segment | | $ | 13.2 | | | $ | 22.5 | | | $ | 14.9 | | | -41 | % | | -11 | % | | | | | | |

| "n.m." means not meaningful. | | | | | | | | | | | | | | | | |

The Commercial Business Segment’s Profit was $13.2 million for 1Q22 (-11% YoY; -41% QoQ), as higher NII (+35% YoY; +8% QoQ) resulting from the effect of higher average lending rates and volumes, and the sustained growth trend performance in fees from the letters of credit business (+31% YoY; +6% QoQ), were offset by the $7.4 million in provision for credit losses closely tied to higher Commercial Portfolio balances (+28% YoY; +12% QoQ), coupled with lower QoQ syndications fees due to the uneven nature of this transaction-based business, and increased operating expenses, mainly personnel related, as the Bank has strengthen its work force through new hires in order to capture increased business activity.

TREASURY BUSINESS SEGMENT

The Treasury Business Segment focuses on managing the Bank’s investment portfolio and the overall structure of its assets and liabilities to achieve more efficient funding and liquidity positions for the Bank, mitigating the traditional financial risks associated with the balance sheet, such as interest rate, liquidity, price and currency risks. Interest-earning assets managed by the Treasury Business Segment include liquidity positions in cash and cash equivalents, as well as highly liquid corporate debt securities rated ‘A-‘ or above, and financial instruments related to the investment management activities, consisting of securities at fair value through other comprehensive income (“FVOCI”) and securities at amortized cost (the “Investment Portfolio”). The Treasury Business Segment also manages the Bank’s interest-bearing liabilities, which constitute its funding sources, mainly deposits, short- and long-term borrowings and debt.

Profits from the Treasury Business Segment include net interest income derived from the above-mentioned Treasury assets and liabilities, and related net other income (net results from derivative financial instruments and foreign currency exchange, gain (loss) per financial instruments at fair value through profit or loss (“FVTPL”), gain (loss) on sale of securities at FVOCI, and other income), recovery or impairment loss on financial instruments, and direct and allocated operating expenses.

The Bank’s liquid assets, mostly consisting of cash and due from banks, as well as highly rated corporate debt securities (‘A-‘ or above) aimed to enhance liquidity yields, totaled $0.8 billion at the end of 1Q22, down from $1.0 billion a year ago, and $1.4 billion a quarter ago, as the Bank was able to invest it having experienced strong credit growth, while maintaining liquidity levels in line with regulatory requirements. As of March 31, 2022, $585 million, or 75% of total liquid assets represented deposits placed with the Federal Reserve Bank of New York, while $172 million, or 22% of total liquid assets represented corporate debt securities classified as high quality liquid assets (“HQLA”) in accordance with the specifications of the Basel Committee. As of the end of 1Q22, 4Q21, and 1Q21, liquidity balances to total assets represented 9%, 17% and 16%, respectively, while the liquidity balances to total deposits ratio was 24%, 46% and 31%, respectively.

The credit investment portfolio, related to the Treasury’s investment management activities aimed to diversify exposures and complement the Bank’s Commercial Portfolio, increased to $919 million at the end of 1Q22, almost five times higher compared to $188 million a year ago, and a 46% increase compared to $631 million a quarter ago. Consequently, the Bank’s total Investment Portfolio amounted to $1,091 million as of March 31, 2022, mostly consisting of readily-quoted

U.S., Latin American and Multilateral securities. Refer to Exhibit VIII for a per-country risk distribution of the Investment Portfolio.

On the funding side, deposit balances above $3.3 billion at the end of 1Q22, were up 2% YoY and 7% QoQ. The sustained and relevant level of the Bank’s deposit base is enhanced by its Yankee CD program, which complements the short-term funding structure, combined with the steady support from the Bank’s Class A shareholders (i.e.: central banks and their designees), which represented 49% of total deposits at the end of 1Q22, up 3 pp from 46% a year ago and unchanged from the previous quarter. As of March 31, 2022, total deposits represented 45% of total funding sources, unchanged compared to the previous quarter, but down 16 pp compared to 61% a year ago, as the Bank relies on its well diversified funding sources, most recently favoring its ample access to global debt and capital markets, such as the re-opening of a debt placement in the Mexican market for $3 billion Mexican Pesos or its equivalent of approximately $150 million U.S. dollars, and a $300 million global syndicated transaction. In turn, funding through securities sold under repurchase agreements (“Repos”) decreased to $346 million at the end of 1Q22 (+121% YoY; -19% QoQ), while short- and medium-term borrowings and debt totaled $3.6 billion at the end of 1Q22 (+92% YoY; +8% QoQ). Weighted average funding costs resulted in 1.12% for 1Q22 (+2 bps YoY; +17 bps QoQ), mostly reflecting increased market base rates.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million) | | 1Q22 | | 4Q21 | | 1Q21 | | QoQ (%) | | YoY (%) | | | | | | |

| Treasury Business Segment: | | | | | | | | | | | | | | | | |

| Net interest income | | $ | 0.5 | | | $ | 1.5 | | | $ | 0.2 | | | -69 | % | | 187 | % | | | | | | |

| Other income (expense) | | 0.4 | | (1.5) | | (0.2) | | 127 | % | | 309 | % | | | | | | |

| Total revenues | | 0.9 | | 0.0 | | 0.0 | | n.m. | | n.m. | | | | | | |

| Provision for credit losses | | (0.8) | | (0.0) | | (0.0) | | n.m. | | n.m. | | | | | | |

| Operating expenses | | (2.2) | | (2.5) | | (2.0) | | 10 | % | | -11 | % | | | | | | |

| Loss for the segment | | $ | (2.1) | | | $ | (2.5) | | | $ | (2.1) | | | 15 | % | | -2 | % | | | | | | |

| "n.m." means not meaningful. | | | | | | | | | | | | | | | | |

The Treasury Business Segment recorded a $2.1 million loss for 1Q22 (-2% YoY; +15% QoQ). The 1Q22 loss was mainly impacted by lower net interest income on increased average liquidity during the quarter, as the Bank secured funding in anticipation of strong credit origination which materialized toward the end of the quarter. Treasury results were also impacted by the $0.8 million provision for credit losses closely tied to the increase in the credit investment portfolio.

NET INTEREST INCOME AND MARGINS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million, except percentages) | | 1Q22 | | 4Q21 | | 1Q21 | | QoQ (%) | | YoY (%) | | | | | | |

| Net Interest Income | | | | | | | | | | | | | | | | |

| Interest income | | $ | 45.0 | | | $ | 39.0 | | | $ | 32.9 | | | 15 | % | | 37 | % | | | | | | |

| Interest expense | | (19.3) | | | (14.2) | | | (14.0) | | | -36 | % | | -38 | % | | | | | | |

| Net Interest Income ("NII") | | $ | 25.7 | | | $ | 24.8 | | | $ | 18.9 | | | 4 | % | | 36 | % | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Interest Spread ("NIS") | | 1.15 | % | | 1.26 | % | | 1.04 | % | | -8 | % | | 11 | % | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net Interest Margin ("NIM") | | 1.32 | % | | 1.42 | % | | 1.24 | % | | -7 | % | | 6 | % | | | | | | |

NII totaled $25.7 million for 1Q22 (+36% YoY; +4% QoQ), resulting from the effect of higher average loan volumes (+24% YoY; +9% QoQ) and net lending rates (+13 bps YoY; +20 bps QoQ), partially offset by temporarily increased liquidity levels on securing funding to support strong credit origination.

FEES AND COMMISSIONS

Fees and Commissions, net, includes the fee income associated with letters of credit and the fee income derived from loan structuring and syndication activities, together with loan intermediation and distribution activities in the primary market, and other commissions, mostly from other contingent credits, such as guarantees and credit commitments, net of fee expenses.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million) | | 1Q22 | | 4Q21 | | 1Q21 | | QoQ (%) | | YoY (%) | | | | | | |

| Letters of credit fees | | 3.3 | | 3.1 | | 2.5 | | 6 | % | | 31 | % | | | | | | |

| Loan syndication fees | | 0.4 | | 2.4 | | 0.1 | | -82 | % | | 328 | % | | | | | | |

| Other commissions, net | | 0.2 | | 0.7 | | 0.4 | | -71 | % | | -52 | % | | | | | | |

| Fees and Commissions, net | | $ | 3.9 | | | $ | 6.2 | | | $ | 3.0 | | | -37 | % | | 30 | % | | | | | | |

Fees and Commissions, net, totaled $3.9 million in 1Q22 (+30% YoY; -37% QoQ), mostly driven by the sustained growth trend performance in fees from the letters of credit business (+31% YoY; +6% QoQ). Compared to the 4Q21, the positive trend in letters of credit was offset by the uneven nature of the Bank’s transaction-based syndication business.

PORTFOLIO QUALITY AND TOTAL ALLOWANCE FOR CREDIT LOSSES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million, except percentages) | | 31-Mar-22 | | 31-Dec-21 | | 30-Sep-21 | | 30-Jun-21 | | 31-Mar-21 |

| Allowance for loan losses | | | | | | | | | | |

| Balance at beginning of the period | | $ | 41.5 | | | $ | 41.4 | | | $ | 41.4 | | | $ | 41.1 | | | $ | 41.2 | |

| Provisions (reversals) | | $ | 7.7 | | | $ | 0.1 | | | $ | 0.0 | | | $ | 0.1 | | | $ | (0.1) | |

| Write-offs, net of recoveries | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.2 | | | $ | 0.0 | |

| End of period balance | | $ | 49.2 | | | $ | 41.5 | | | $ | 41.4 | | | $ | 41.4 | | | $ | 41.1 | |

| | | | | | | | | | | |

| Allowance for loan commitments and financial guarantee contract losses | | | | | | | | | | |

| Balance at beginning of the period | | $ | 3.8 | | | $ | 3.7 | | | $ | 3.8 | | | $ | 2.9 | | | $ | 2.9 | |

| (Reversals) provisions | | $ | (0.3) | | | $ | 0.1 | | | $ | (0.1) | | | $ | 0.9 | | | $ | 0.0 | |

| End of period balance | | $ | 3.5 | | | $ | 3.8 | | | $ | 3.7 | | | $ | 3.8 | | | $ | 2.9 | |

| | | | | | | | | | | |

| Allowance for Investment Portfolio losses | | | | | | | | | | |

| Balance at beginning of the period | | $ | 1.8 | | | $ | 1.8 | | | $ | 0.9 | | | $ | 0.6 | | | $ | 0.5 | |

| Provisions (reversals) | | $ | 0.7 | | | $ | 0.0 | | | $ | 0.9 | | | $ | 0.3 | | | $ | 0.1 | |

| End of period balance | | $ | 2.6 | | | $ | 1.8 | | | $ | 1.8 | | | $ | 0.9 | | | $ | 0.6 | |

| | | | | | | | | | | |

| Total allowance for losses | | $ | 55.2 | | | $ | 47.1 | | | $ | 46.9 | | | $ | 46.1 | | | $ | 44.6 | |

| | | | | | | | | | | |

| Total allowance for losses to Credit Portfolio | | 0.7 | % | | 0.6 | % | | 0.7 | % | | 0.7 | % | | 0.7 | % |

| Credit-impaired loans to Loan Portfolio | | 0.2 | % | | 0.2 | % | | 0.2 | % | | 0.2 | % | | 0.2 | % |

| Total allowance for losses to credit-impaired loans (times) | | 5.2 | | 4.4 | | 4.4 | | 4.4 | | 4.2 |

| | | | | | | | | | | |

| Stage 1 (low risk) to Total Credit Portfolio | | 98 | % | | 98 | % | | 97 | % | | 96 | % | | 95 | % |

| Stage 2 (increased risk) to Total Credit Portfolio | | 2 | % | | 2 | % | | 3 | % | | 4 | % | | 5 | % |

| Stage 3 (credit impaired) to Total Credit Portfolio | | 0 | % | | 0 | % | | 0 | % | | 0 | % | | 0 | % |

As of March 31, 2022, the total allowance for credit losses increased to $55.2 million, representing a coverage ratio to the Credit Portfolio of 0.7%, compared to $44.6 million, or 0.7%, at the end of 1Q21, and compared to $47.1 million, or 0.6%, at the end of 4Q21. Higher allowance during the quarter was closely tied to provisions for credit losses driven by the Bank’s Credit Portfolio growth, as balances were up by 38% YoY and 14% QoQ at the end of 1Q22.

The Bank maintained its sound asset quality, with credit-impaired loans (“NPL”) unchanged at $11 million, or 0.2% of the total Loan Portfolio as of March 31, 2022. Credits categorized as Stage 2 under IFRS 9 (with increased risk since origination) represented 2% of total credits, down from 5% a year ago and unchanged QoQ, with the remaining 98% categorized as Stage 1 or low-risk credits.

OPERATING EXPENSES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million, except percentages) | | 1Q22 | | 4Q21 | | 1Q21 | | QoQ (%) | | YoY (%) | | | | | | |

| Operating expenses | | | | | | | | | | | | | | | | |

| Salaries and other employee expenses | | 7.4 | | | 4.9 | | | 5.4 | | | 52 | % | | 37 | % | | | | | | |

| Depreciation of investment property, equipment and improvements | | 0.5 | | | 0.6 | | | 0.8 | | | -14 | % | | -35 | % | | | | | | |

| Amortization of intangible assets | | 0.1 | | | 0.1 | | | 0.3 | | | 4 | % | | -54 | % | | | | | | |

| Other expenses | | 2.9 | | | 4.7 | | | 2.6 | | | -38 | % | | 12 | % | | | | | | |

| Total Operating Expenses | | $ | 11.0 | | | $ | 10.3 | | | $ | 9.1 | | | 7 | % | | 21 | % | | | | | | |

| Efficiency Ratio | | 36.4 | % | | 34.6 | % | | 41.6 | % | | | | | | | | | | |

The Bank’s 1Q22 operating expenses totaled $11.0 million (+21% YoY; +7 QoQ). These quarterly increases were mostly related to higher salaries and other employee expenses, as the Bank has been strengthening its work force through new hires in order to capture increased business activity. In addition, when compared to the previous quarter, expense variation is also impacted by a non-recurring salary-related expense reduction during the 4Q21.

The Bank’s Efficiency Ratio stood at 36.4% in 1Q22, compared to 41.6% a year ago and compared to 34.6% a quarter ago, as the 38% YoY and 1% QoQ improvements in total revenues were partly offset by the aforementioned increase in operating expenses.

CAPITAL RATIOS AND CAPITAL MANAGEMENT

The following table shows capital amounts and ratios as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (US$ million, except percentages and shares outstanding) | | 31-Mar-22 | | 31-Dec-21 | | 31-Mar-21 | | QoQ (%) | | YoY (%) |

| Total equity | | $ | 1,005 | | | $ | 992 | | | $ | 1,037 | | | 1 | % | | -3 | % |

Tier 1 capital to risk weighted assets (Basel III – IRB)(9) | | 16.2 | % | | 19.1 | % | | 26.3 | % | | -15 | % | | -39 | % |

Risk-Weighted Assets (Basel III – IRB)(9) | | $ | 6,224 | | | $ | 5,189 | | | $ | 3,935 | | | 20 | % | | 58 | % |

Capital Adequacy Ratio (Regulatory) (10) | | 13.4 | % | | 15.6 | % | | 19.4 | % | | -14 | % | | -31 | % |

Risk-Weighted Assets (Regulatory) (10) | | $ | 7,555 | | | $ | 6,513 | | | $ | 5,431 | | | 16 | % | | 39 | % |

| Total assets / Total equity (times) | | 8.4 | | 8.1 | | 6.1 | | 4 | % | | 37 | % |

| Shares outstanding (in thousand) | | 36,268 | | 36,231 | | 39,703 | | 0 | % | | -9 | % |

The Bank’s equity consists entirely of issued and fully paid ordinary common stock, with 36.3 million common shares outstanding as of March 31, 2022. At the same date, the Bank’s ratio of total assets to total equity stood at 8.4 times, and the Bank’s Tier 1 Basel III Capital Ratio, in which risk-weighted assets are calculated under the advanced internal ratings-based approach (IRB) for credit risk, decreased to 16.2% due to higher risk-weighted assets, impacted by increased Loan and Investment Portfolios, while equity levels remained relatively stable at over $1 billion. Similarly, the Bank’s Capital Adequacy Ratio, as defined by Panama’s banking regulator, was 13.4% as of March 31, 2022, well above the required minimum of 8%. Under this methodology, credit risk-weighted assets are calculated under Basel’s standardized approach.

RECENT EVENTS

•Quarterly dividend payment: The Board approved a quarterly common dividend of $0.25 per share corresponding to the first quarter 2022. The cash dividend will be paid on June 1, 2022, to shareholders registered as of May 16, 2022.

•Annual Shareholders’ Meeting Results: At the Annual Shareholders’ Meeting held on April 27, 2022, in Panama City, Panama, shareholders:

–Elected Mr. Fausto de Andrade Ribeiro as Director representing Class “A” shares of the Bank’s common stock.

–Elected Mrs. Lorenza Martinez, Mr. Ricardo Manuel Arango and Mr. Roland Holst as Directors representing Class “E” shares of the Bank’s common stock.

–Approved the Bank’s audited consolidated financial statements for the fiscal year ended December 31, 2021.

–Ratified KPMG as the Bank’s independent registered public accounting firm for the fiscal year ending December 31, 2022.

–Approved, on an advisory basis, the compensation of the Bank’s executive officers.

Notes:

–Numbers and percentages set forth in this earnings release have been rounded and accordingly may not total exactly.

–QoQ and YoY refer to quarter-on-quarter and year-on-year variations, respectively.

Footnotes:

(1)Earnings per Share ("EPS") calculation is based on the average number of shares outstanding during each period.

(2)ROAE refers to return on average stockholders' equity which is calculated on the basis of unaudited daily average balances.

(3)NIM refers to net interest margin which constitutes to Net Interest Income (NII) divided by the average balance of interest-earning assets.

(4)NIS refers to net interest spread which constitutes the average yield earned on interest-earning assets, less the average yield paid on interest-bearing liabilities.

(5)Efficiency Ratio refers to consolidated operating expenses as a percentage of total revenues.

(6)The Bank's Credit Portfolio includes gross loans at amortized cost (or the Loan Portfolio), securities at FVOCI and at amortized cost, gross of interest receivable and the allowance for expected credit losses, loan commitments and financial guarantee contracts, such as confirmed and stand-by letters of credit, and guarantees covering commercial risk; and other assets consisting of customers' liabilities under acceptances.

(7)The Bank's Commercial Portfolio includes gross loans at amortized cost (or the Loan Portfolio), loan commitments and financial guarantee contracts, such as issued and confirmed letters of credit, stand-by letters of credit, guarantees covering commercial risk and other assets consisting of customers' liabilities under acceptances.

(8)Market capitalization corresponds to total outstanding common shares multiplied by market close price at the end of each corresponding period.

(9)Tier 1 Capital ratio is calculated according to Basel III capital adequacy guidelines, and as a percentage of risk-weighted assets. Risk-weighted assets are estimated based on Basel III capital adequacy guidelines, utilizing internal-ratings based approach or IRB for credit risk and standardized approach for operational risk.

(10)As defined by the Superintendency of Banks of Panama through Rules No. 01-2015 and 03-2016, based on Basel III standardized approach. The capital adequacy ratio is defined as the ratio of capital funds to risk-weighted assets, rated according to the asset's categories for credit risk. In addition, risk-weighted assets consider calculations for market risk and operating risk.

(11)Liquid assets refer to total cash and cash equivalents, consisting of cash and due from banks and interest-bearing deposits in banks, excluding pledged deposits and margin calls; as well as highly rated corporate debt securities (above 'A-'). Liquidity ratio refers to liquid assets as a percentage of total assets.

(12)Loan Portfolio refers to gross loans at amortized cost, excluding interest receivable, the allowance for loan losses, and unearned interest and deferred fees. Credit-impaired loans are also commonly referred to as Non-Performing Loans or NPLs.

(13)Total allowance for losses refers to allowance for loan losses plus allowance for loan commitments and financial guarantee contract losses and allowance for investment securities losses.

SAFE HARBOR STATEMENT

This press release contains forward-looking statements of expected future developments within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by words such as: “anticipate”, “intend”, “plan”, “goal”, “seek”, “believe”, “project”, “estimate”, “expect”, “strategy”, “future”, “likely”, “may”, “should”, “will” and similar references to future periods. The forward-looking statements in this press release include the Bank’s financial position, asset quality and profitability, among others. These forward-looking statements reflect the expectations of the Bank’s management and are based on currently available data; however, actual performance and results are subject to future events and uncertainties, which could materially impact the Bank’s expectations. Among the factors that can cause actual performance and results to differ materially are as follows: the coronavirus (COVID-19) pandemic and government actions intended to limit its spread; the anticipated changes in the Bank’s credit portfolio; the continuation of the Bank’s preferred creditor status; the impact of increasing/decreasing interest rates and of the macroeconomic environment in the Region on the Bank’s financial condition; the execution of the Bank’s strategies and initiatives, including its revenue diversification strategy; the adequacy of the Bank’s allowance for expected credit losses; the need for additional allowance for expected credit losses; the Bank’s ability to achieve future growth, to reduce its liquidity levels and increase its leverage; the Bank’s ability to maintain its investment-grade credit ratings; the availability and mix of future sources of funding for the Bank’s lending operations; potential trading losses; the possibility of fraud; and the adequacy of the Bank’s sources of liquidity to replace deposit withdrawals. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

ABOUT BLADEX

Bladex, a multinational bank originally established by the central banks of Latin-American and Caribbean countries, began operations in 1979 to promote foreign trade and economic integration in the Region. The Bank, headquartered in Panama, also has offices in Argentina, Brazil, Colombia, Mexico, and the United States of America, and a Representative License in Peru, supporting the regional expansion and servicing its customer base, which includes financial institutions and corporations.

Bladex is listed on the NYSE in the United States of America (NYSE: BLX), since 1992, and its shareholders include: central banks and state-owned banks and entities representing 23 Latin American countries; commercial banks and financial institutions; and institutional and retail investors through its public listing.

CONFERENCE CALL INFORMATION

There will be a conference call to discuss the Bank’s quarterly results on Wednesday, May 4, 2022 at 11:00 a.m. New York City time (Eastern Time). For those interested in participating, please dial (800) 420-1271 in the United States or, if outside the United States, (785) 424-1205. Participants should use conference passcode 47922, and dial in five minutes before the call is set to begin. There will also be a live audio webcast of the conference at http://www.bladex.com. The webcast presentation will be available for viewing and downloads on http://www.bladex.com.

The conference call will become available for review on Conference Replay one hour after its conclusion and will remain available for 30 days. Please dial (888) 219-1264 and follow the instructions. The replay passcode is: 47922.

For more information, please access http://www.bladex.com or contact:

Mrs. Ana Graciela de Méndez

Chief Financial Officer

Tel: +507 210-8563

E-mail address: amendez@bladex.com

EXHIBIT I

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | AT THE END OF, | | | | | | | | |

| | (A) | | (B) | | (C) | | (A) - (B) | | | | (A) - (C) | | |

| | March 31, 2022 | | December 31, 2021 | | March 31, 2021 | | CHANGE | | % | | CHANGE | | % |

| | | | | | | | | | | | | | |

| | (In US$ thousand) | | | | | | | | |

| Assets | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Cash and due from banks | $ | 653,789 | | | $ | 1,253,052 | | | $ | 819,514 | | | $ | (599,263) | | | (48) | % | | $ | (165,725) | | | (20) | % |

| | | | | | | | | | | | | | |

| Securities and other financial assets, net | $ | 1,099,189 | | | $ | 831,913 | | | $ | 391,401 | | | $ | 267,276 | | | 32 | | 707,788 | | 181 |

| | | | | | | | | | | | | | |

| Loans, net | $ | 6,449,282 | | | $ | 5,713,022 | | | $ | 5,042,467 | | | $ | 736,260 | | | 13 | | 1,406,815 | | 28 |

| | | | | | | | | | | | | | |

| Customers' liabilities under acceptances | $ | 193,119 | | | $ | 201,515 | | | $ | 78,164 | | | $ | (8,396) | | | (4) | | 114,955 | | 147 |

| Derivative financial instruments - assets | $ | 34,725 | | | $ | 10,805 | | | $ | 16,340 | | | $ | 23,920 | | | 221 | | 18,385 | | 113 |

| Equipment and leasehold improvements, net | $ | 17,329 | | | $ | 17,779 | | | $ | 15,361 | | | $ | (450) | | | (3) | | 1,968 | | 13 |

| Intangibles, net | $ | 1,690 | | | $ | 1,595 | | | $ | 1,712 | | | $ | 95 | | | 6 | | (22) | | (1) |

| Investment properties | $ | 0 | | | $ | 0 | | | $ | 3,145 | | | $ | 0 | | | n.m. | | (3,145) | | (100) |

| Other assets | $ | 9,260 | | | $ | 8,430 | | | $ | 6,742 | | | $ | 830 | | | 10 | | 2,518 | | 37 |

| | | | | | | | | | | | | | |

| Total assets | $ | 8,458,383 | | | $ | 8,038,111 | | | $ | 6,374,846 | | | $ | 420,272 | | | 5 | % | | $ | 2,083,537 | | | 33 | % |

| | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Demand deposits | $ | 436,137 | | | $ | 362,356 | | | $ | 355,301 | | | $ | 73,781 | | | 20 | % | | $ | 80,836 | | | 23 | % |

| Time deposits | $ | 2,819,731 | | | $ | 2,673,872 | | | $ | 2,830,446 | | | $ | 145,859 | | | 5 | | (10,715) | | (0) |

| | $ | 3,255,868 | | | $ | 3,036,228 | | | $ | 3,185,747 | | | $ | 219,640 | | | 7 | | 70,121 | | | 2 |

| Interest payable | $ | 2,165 | | | $ | 1,229 | | | $ | 2,853 | | | $ | 936 | | | 76 | | (688) | | (24) |

| Total deposits | $ | 3,258,033 | | | $ | 3,037,457 | | | $ | 3,188,600 | | | $ | 220,576 | | | 7 | | 69,433 | | | 2 |

| | | | | | | | | | | | | | |

| Securities sold under repurchase agreements | 345,848 | | | 427,497 | | | 156,690 | | | (81,649) | | | (19) | | 189,158 | | 121 |

| Borrowings and debt, net | 3,580,687 | | | 3,321,911 | | | 1,869,304 | | | 258,776 | | | 8 | | 1,711,383 | | 92 |

| Interest payable | 15,020 | | | 11,322 | | | 9,248 | | | 3,698 | | | 33 | | 5,772 | | 62 |

| | | | | | | | | | | | | | |

| Acceptance outstanding | 193,119 | | | 201,515 | | | 78,164 | | | (8,396) | | | (4) | | 114,955 | | 147 |

| Derivative financial instruments - liabilities | 29,672 | | | 28,455 | | | 19,449 | | | 1,217 | | | 4 | | 10,223 | | 53 |

| Allowance for loan commitments and financial guarantee contract losses | 3,455 | | | 3,803 | | | 2,936 | | | (348) | | | (9) | | 519 | | 18 |

| Other liabilities | 27,993 | | | 14,361 | | | 13,780 | | | 13,632 | | | 95 | | 14,213 | | 103 |

| | | | | | | | | | | | | | |

| Total liabilities | $ | 7,453,827 | | | $ | 7,046,321 | | | $ | 5,338,171 | | | $ | 407,506 | | | 6 | % | | $ | 2,115,656 | | | 40 | % |

| | | | | | | | | | | | | | |

| Equity | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Common stock | $ | 279,980 | | | $ | 279,980 | | | $ | 279,980 | | | $ | 0 | | | 0 | % | | $ | 0 | | | 0 | % |

| Treasury stock | (115,135) | | | (115,799) | | | (57,452) | | | 664 | | | 1 | | (57,683) | | (100) |

| Additional paid-in capital in excess of value assigned of common stock | 119,797 | | | 120,043 | | | 120,305 | | | (246) | | | (0) | | (508) | | (0) |

| Capital reserves | 95,210 | | | 95,210 | | | 95,210 | | | 0 | | | 0 | | 0 | | 0 |

| Regulatory reserves | 136,019 | | | 136,019 | | | 136,019 | | | 0 | | | 0 | | 0 | | 0 |

| Retained earnings | 489,936 | | | 487,885 | | | 466,978 | | | 2,051 | | | 0 | | 22,958 | | 5 |

| Other comprehensive income (loss) | (1,251) | | | (11,548) | | | (4,365) | | | 10,297 | | | 89 | | 3,114 | | 71 |

| | | | | | | | | | | | | | |

| Total equity | $ | 1,004,556 | | | $ | 991,790 | | | $ | 1,036,675 | | | $ | 12,766 | | | 1 | % | | $ | (32,119) | | | (3) | % |

| | | | | | | | | | | | | | |

| Total liabilities and equity | $ | 8,458,383 | | | $ | 8,038,111 | | | $ | 6,374,846 | | | $ | 420,272 | | | 5 | % | | $ | 2,083,537 | | | 33 | % |

EXHIBIT II

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

(In US$ thousand, except per share amounts and ratios)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOR THE THREE MONTHS ENDED | | | | | | | | |

| | (A) | | (B) | | (C) | | (A) - (B) | | | | (A) - (C) | | |

| | March 31, 2022 | | December 31, 2021 | | March 31, 2021 | | CHANGE | | % | | CHANGE | | % |

| Net Interest Income: | | | | | | | | | | | | | |

| Interest income | $ | 45,004 | | | $ | 39,031 | | | $ | 32,918 | | | $ | 5,973 | | | 15 | % | | $ | 12,086 | | | 37 | % |

| Interest expense | (19,283) | | | (14,221) | | | (14,023) | | | (5,062) | | | (36) | | (5,260) | | | (38) |

| | | | | | | | | | | | | | |

| Net Interest Income | 25,721 | | | 24,810 | | | 18,895 | | | 911 | | | 4 | | 6,826 | | | 36 |

| | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | |

| Fees and commissions, net | 3,949 | | | 6,235 | | | 3,040 | | | (2,286) | | | (37) | | 909 | | | 30 |

| Gain (loss) on financial instruments, net | 566 | | | (1,347) | | | (71) | | | 1,913 | | | 142 | | 637 | | | 897 |

| Other income, net | 16 | | | 127 | | | 97 | | | (111) | | | (87) | | (81) | | | (84) |

| Total other income, net | 4,531 | | | 5,015 | | | 3,066 | | | (484) | | | (10) | | 1,465 | | | 48 |

| | | | | | | | | | | | | | |

| Total revenues | 30,252 | | | 29,825 | | | 21,961 | | | 427 | | | 1 | | 8,291 | | | 38 |

| | | | | | | | | | | | | | |

| Provision for credit losses | (8,111) | | | (173) | | | 0 | | | (7,938) | | | (4,588) | | (8,111) | | | n.m. |

| Gain on non-financial assets, net | 0 | | | 742 | | | 0 | | | (742) | | | (100) | | 0 | | | n.m. |

| | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | |

| Salaries and other employee expenses | (7,445) | | | (4,888) | | | (5,448) | | | (2,557) | | | (52) | | (1,997) | | | (37) |

| Depreciation of investment properties, equipment and improvements | (533) | | | (617) | | | (819) | | | 84 | | | 14 | | 286 | | | 35 |

| Amortization of intangible assets | (124) | | | (119) | | | (271) | | | (5) | | | (4) | | 147 | | | 54 |

| Other expenses | (2,920) | | | (4,704) | | | (2,607) | | | 1,784 | | | 38 | | (313) | | | (12) |

| Total operating expenses | (11,022) | | | (10,328) | | | (9,145) | | | (694) | | | (7) | | (1,877) | | | (21) |

| | | | | | | | | | | | | | |

| Profit for the period | $ | 11,119 | | | $ | 20,066 | | | $ | 12,816 | | | $ | (8,947) | | | (45) | % | | $ | (1,697) | | | (13) | % |

| | | | | | | | | | | | | | |

| PER COMMON SHARE DATA: | | | | | | | | | | | | | |

| Basic earnings per share | $ | 0.31 | | | $ | 0.54 | | | $ | 0.32 | | | | | | | | | |

| Diluted earnings per share | $ | 0.31 | | | $ | 0.54 | | | $ | 0.32 | | | | | | | | | |

| Book value (period average) | $ | 27.72 | | | $ | 27.05 | | | $ | 26.26 | | | | | | | | | |

| Book value (period end) | $ | 27.70 | | | $ | 27.37 | | | $ | 26.11 | | | | | | | | | |

| | | | | | | | | | | | | | |

| Weighted average basic shares | 36,249 | | | 37,073 | | | 39,693 | | | | | | | | | |

| Weighted average diluted shares | 36,249 | | | 37,073 | | | 39,693 | | | | | | | | | |

| Basic shares period end | 36,268 | | | 36,231 | | | 39,703 | | | | | | | | | |

| | | | | | | | | | | | | | |

| PERFORMANCE RATIOS: | | | | | | | | | | | | | |

| Return on average assets | 0.6 | % | | 1.1 | % | | 0.8 | % | | | | | | | | |

| Return on average equity | 4.5 | % | | 7.9 | % | | 5.0 | % | | | | | | | | |

| Net interest margin | 1.32 | % | | 1.42 | % | | 1.24 | % | | | | | | | | |

| Net interest spread | 1.15 | % | | 1.26 | % | | 1.04 | % | | | | | | | | |

| Efficiency Ratio | 36.4 | % | | 34.6 | % | | 41.6 | % | | | | | | | | |

| Operating expenses to total average assets | 0.55 | % | | 0.58 | % | | 0.59 | % | | | | | | | | |

| | |

(*)"n.m." means not meaningful. |

EXHIBIT III

CONSOLIDATED NET INTEREST INCOME AND AVERAGE BALANCES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOR THE THREE MONTHS ENDED |

| | March 31, 2022 | | December 31, 2021 | | March 31, 2021 |

| | AVERAGE BALANCE | | INTEREST | | AVG. RATE | | AVERAGE BALANCE | | INTEREST | | AVG. RATE | | AVERAGE BALANCE | | INTEREST | | AVG. RATE |

| | (In US$ thousand) |

| INTEREST EARNING ASSETS | | | | | | | | | | | | | | | | | |

| Cash and due from banks | $ | 1,104,575 | | | $ | 503 | | | 0.18 | % | | $ | 726,519 | | | $ | 282 | | | 0.15 | % | | $ | 1,005,121 | | | $ | 361 | | | 0.14 | % |

| Securities at fair value through OCI | 182,403 | | | 156 | | | 0.34 | | 194,099 | | | 176 | | | 0.35 | | 230,765 | | | 239 | | | 0.41 |

Securities at amortized cost (1) | 737,931 | | | 4,137 | | | 2.24 | | 595,935 | | | 3,634 | | | 2.39 | | 168,756 | | | 1,398 | | | 3.31 |

| Loans, net of unearned interest | 5,887,768 | | | 40,208 | | | 2.73 | | 5,396,919 | | | 34,939 | | | 2.53 | | 4,755,822 | | | 30,921 | | | 2.60 |

| | | | | | | | | | | | | | | | | | |

| TOTAL INTEREST EARNING ASSETS | $ | 7,912,677 | | | $ | 45,004 | | | 2.28 | % | | $ | 6,913,473 | | | $ | 39,031 | | | 2.21 | % | | $ | 6,160,464 | | | $ | 32,918 | | | 2.14 | % |

| | | | | | | | | | | | | | | | | | |

| Allowance for loan losses | (43,559) | | | | | | (42,056) | | | | | | (40,254) | | | | |

| Non interest earning assets | 263,036 | | | | | | 212,698 | | | | | | 142,182 | | | | |

| | | | | | | | | | | | | | | | | | |

| TOTAL ASSETS | $ | 8,132,154 | | | | | | | $ | 7,084,115 | | | | | | | $ | 6,262,393 | | | | | |

| | | | | | | | | | | | | | | | | | |

| INTEREST BEARING LIABILITIES | | | | | | | | | | | | | | | | | |

| Deposits | 3,155,179 | | $ | 3,540 | | | 0.45 | % | | 3,167,728 | | $ | 2,812 | | | 0.35 | % | | $ | 3,254,281 | | | $ | 3,472 | | | 0.43 | % |

| Securities sold under repurchase agreement and short-term borrowings and debt | 1,865,683 | | 4,393 | | | 0.94 | | 1,118,020 | | 2,148 | | | 0.75 | | 368,291 | | 1,785 | | | 1.94 |

Long-term borrowings and debt, net (2) | 1,863,515 | | 11,350 | | | 2.44 | | 1,586,340 | | 9,261 | | | 2.28 | | 1,494,923 | | 8,766 | | | 2.35 |

| | | | | | | | | | | | | | | | | | |

| TOTAL INTEREST BEARING LIABILITIES | $ | 6,884,376 | | | $ | 19,283 | | | 1.12 | % | | $ | 5,872,087 | | | $ | 14,221 | | | 0.95 | % | | $ | 5,117,495 | | | $ | 14,023 | | | 1.10 | % |

| | | | | | | | | | | | | | | | | | |

| Non interest bearing liabilities and other liabilities | $ | 243,072 | | | | | | | $ | 209,344 | | | | | | | $ | 102,420 | | | | | |

| | | | | | | | | | | | | | | | | | |

| TOTAL LIABILITIES | 7,127,448 | | | | | | | 6,081,431 | | | | | | | 5,219,916 | | | | | |

| | | | | | | | | | | | | | | | | | |

| EQUITY | 1,004,705 | | | | | | | 1,002,683 | | | | | | | 1,042,477 | | | | | |

| | | | | | | | | | | | | | | | | | |

| TOTAL LIABILITIES AND EQUITY | $ | 8,132,154 | | | | | | | $ | 7,084,115 | | | | | | | $ | 6,262,393 | | | | | |

| | | | | | | | | | | | | | | | | | |

| NET INTEREST SPREAD | | | | | 1.15 | % | | | | | | 1.26 | % | | | | | | 1.04 | % |

| | | | | | | | | | | | | | | | | | |

| NET INTEREST INCOME AND NET INTEREST MARGIN | | | $ | 25,721 | | | 1.32 | % | | | | $ | 24,811 | | | 1.42 | % | | | | $ | 18,895 | | | 1.24 | % |

(1)Gross of the allowance for losses relating to securities at amortized cost.

(2)Includes lease liabilities, net of prepaid commissions.

Note: Interest income and/or expense includes the effect of derivative financial instruments used for hedging.

EXHIBIT IV

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

(In US$ thousand, except per share amounts and ratios)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | FOR THE THREE MONTHS ENDED | | |

| | | | MAR 31/22 | | DEC 31/21 | | SEP 30/21 | | JUN 30/21 | | MAR 31/21 | | |

| Net Interest Income: | | | | | | | | | | | | | |

| Interest income | | | $ | 45,004 | | $ | 39,031 | | $ | 34,770 | | $ | 34,164 | | $ | 32,918 | | |

| Interest expense | | | (19,283) | | (14,221) | | (12,691) | | (13,166) | | (14,023) | | |

| Net Interest Income | | | 25,721 | | 24,810 | | 22,079 | | 20,998 | | 18,895 | | |

| | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | |

| Fees and commissions, net | | | 3,949 | | 6,235 | | 4,752 | | 4,271 | | 3,040 | | |

| Gain (loss) on financial instruments, net | | | 566 | | (1,347) | | (112) | | 234 | | (71) | | |

| Other income, net | | | 16 | | 127 | | 111 | | 87 | | 97 | | |

| Total other income, net | | | 4,531 | | 5,015 | | 4,751 | | 4,592 | | 3,066 | | |

| | | | | | | | | | | | | | |

| Total revenues | | | 30,252 | | 29,825 | | 26,830 | | 25,590 | | 21,961 | | |

| | | | | | | | | | | | | | |

| (Provision for) reversal of credit losses | | | (8,111) | | (173) | | (771) | | (1,384) | | 0 | | |

| Gain on non-financial assets, net | | | 0 | | 742 | | 0 | | 0 | | 0 | | |

| Total operating expenses | | | (11,022) | | (10,328) | | (10,328) | | (10,122) | | (9,145) | | |

| | | | | | | | | | | | | | |

| Profit for the period | | | $ | 11,119 | | $ | 20,066 | | $ | 15,731 | | $ | 14,084 | | $ | 12,816 | | |

| | | | | | | | | | | | | | |

| SELECTED FINANCIAL DATA | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| PER COMMON SHARE DATA | | | | | | | | | | | | | |

| Basic earnings per share | | | $ | 0.31 | | | $ | 0.54 | | | $ | 0.41 | | | $ | 0.36 | | | $ | 0.32 | | | |

| | | | | | | | | | | | | | |

| PERFORMANCE RATIOS | | | | | | | | | | | | | |

| Return on average assets | | | 0.6 | % | | 1.1 | % | | 0.9 | % | | 0.8 | % | | 0.8 | % | | |

| Return on average equity | | | 4.5 | % | | 7.9 | % | | 6.1 | % | | 5.4 | % | | 5.0 | % | | |

| Net interest margin | | | 1.32 | % | | 1.42 | % | | 1.33 | % | | 1.27 | % | | 1.24 | % | | |

| Net interest spread | | | 1.15 | % | | 1.26 | % | | 1.17 | % | | 1.11 | % | | 1.04 | % | | |

| Efficiency Ratio | | | 36.4 | % | | 34.6 | % | | 38.5 | % | | 39.6 | % | | 41.6 | % | | |

| Operating expenses to total average assets | | | 0.55 | % | | 0.58 | % | | 0.61 | % | | 0.60 | % | | 0.59 | % | | |

EXHIBIT V

BUSINESS SEGMENT ANALYSIS

(In US$ thousand)

| | | | | | | | | | | | | | | | | | | | | |

| | | | FOR THE THREE MONTHS ENDED |

| | | | | | MAR 31/22 | | DEC 31/21 | | MAR 31/21 |

| COMMERCIAL BUSINESS SEGMENT: | | | | | | | | | |

| | | | | | | | | | |

| Net interest income | | | | | $ | 25,254 | | | $ | 23,295 | | | $ | 18,732 | |

| Other income | | | | | 4,132 | | | 6,512 | | | 3,257 | |

| Total revenues | | | | | 29,386 | | | 29,807 | | | 21,989 | |

| (Provision for) reversal of credit losses | | | | | (7,361) | | | (160) | | | 37 | |

| Gain on non-financial assets, net | | | | | 0 | | | 742 | | | 0 | |

| Operating expenses | | | | | (8,800) | | (7,849) | | (7,148) |

| | | | | | | | | | |

| Profit for the segment | | | | | $ | 13,225 | | | $ | 22,540 | | | $ | 14,878 | |

| | | | | | | | | | |

| Segment assets | | | | | 6,658,539 | | | 5,931,201 | | | 5,137,623 | |

| | | | | | | | | | |

| TREASURY BUSINESS SEGMENT: | | | | | | | | | |

| | | | | | | | | | |

| Net interest income | | | | | $ | 467 | | | $ | 1515 | | | $ | 163 | |

| Other income (expense) | | | | | 399 | | | (1,497) | | | (191) | |

| Total revenues | | | | | 866 | | | 18 | | | (28) | |

| Provision for credit losses | | | | | (750) | | | (13) | | | (37) | |

| Operating expenses | | | | | (2,222) | | | (2,479) | | | (1,997) | |

| | | | | | | | | | |

| Loss for the segment | | | | | $ | (2,106) | | | $ | (2,474) | | | $ | (2,062) | |

| | | | | | | | | | |

| Segment assets | | | | | 1,790,642 | | | 2,098,492 | | | 1,230,515 | |

| | | | | | | | | | |

| TOTAL: | | | | | | | | | |

| | | | | | | | | | |

| Net interest income | | | | | $ | 25,721 | | | $ | 24,810 | | | $ | 18,895 | |

| Other income | | | | | 4,531 | | | 5,015 | | | 3,066 | |

| Total revenues | | | | | 30,252 | | | 29,825 | | | 21,961 | |

| (Provision for) reversal of credit losses | | | | | (8,111) | | | (173) | | | 0 | |

| Gain on non-financial assets, net | | | | | 0 | | | 742 | | | 0 | |

| Operating expenses | | | | | (11,022) | | | (10,328) | | | (9,145) | |

| Profit for the period | | | | | $ | 11,119 | | | $ | 20,066 | | | $ | 12,816 | |

| Total segment assets | | | | | 8,449,181 | | | 8,029,693 | | | 6,368,138 | |

| Unallocated assets | | | | | 9,202 | | | 8,418 | | | 6,708 | |

| Total assets | | | | | 8,458,383 | | | 8,038,111 | | | 6,374,846 | |

EXHIBIT VI

CREDIT PORTFOLIO

DISTRIBUTION BY COUNTRY

(In US$ million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | AT THE END OF, |

| | | (A) | | (B) | | (C) | | | | |

| | | March 31, 2022 | | December 31, 2021 | | March 31, 2021 | | Change in Amount |

| COUNTRY | | Amount | | % of Total

Outstanding | | Amount | | % of Total

Outstanding | | Amount | | % of Total

Outstanding | | (A) - (B) | | (A) - (C) |

| ARGENTINA | | $ | 66 | | | 1 | | $ | 74 | | | 1 | | $ | 108 | | | 2 | | $ | (8) | | | $ | (42) | |

| BOLIVIA | | 3 | | | 0 | | 6 | | | 0 | | 15 | | | 0 | | (3) | | | (12) | |

| BRAZIL | | 1,119 | | | 13 | | 1,201 | | | 16 | | 1,220 | | | 20 | | (82) | | | (101) | |

| CHILE | | 771 | | | 9 | | 773 | | | 10 | | 645 | | | 11 | | (2) | | | 126 | |

| COLOMBIA | | 904 | | | 11 | | 884 | | | 12 | | 719 | | | 12 | | 20 | | | 185 | |

| COSTA RICA | | 305 | | | 4 | | 272 | | | 4 | | 191 | | | 3 | | 33 | | | 114 | |

| DOMINICAN REPUBLIC | | 322 | | | 4 | | 297 | | | 4 | | 205 | | | 3 | | 25 | | | 117 | |

| ECUADOR | | 367 | | | 4 | | 319 | | | 4 | | 212 | | | 3 | | 48 | | | 155 | |

| EL SALVADOR | | 97 | | | 1 | | 80 | | | 1 | | 31 | | | 1 | | 17 | | | 66 | |

| GUATEMALA | | 577 | | | 7 | | 493 | | | 7 | | 338 | | | 6 | | 84 | | | 239 | |

| HONDURAS | | 258 | | | 3 | | 50 | | | 1 | | 20 | | | 0 | | 208 | | | 238 | |

| JAMAICA | | 83 | | | 1 | | 5 | | | 0 | | 46 | | | 1 | | 78 | | | 37 | |

| MEXICO | | 934 | | | 11 | | 787 | | | 11 | | 593 | | | 10 | | 147 | | | 341 | |

| PANAMA | | 411 | | | 5 | | 293 | | | 4 | | 324 | | | 5 | | 118 | | | 87 | |

| PARAGUAY | | 122 | | | 1 | | 108 | | | 1 | | 128 | | | 2 | | 14 | | | (6) | |

| PERU | | 626 | | | 7 | | 473 | | | 6 | | 386 | | | 6 | | 153 | | | 240 | |

| TRINIDAD & TOBAGO | | 134 | | | 2 | | 141 | | | 2 | | 152 | | | 2 | | (7) | | | (18) | |

| UNITED STATES OF AMERICA | | 539 | | | 6 | | 314 | | | 4 | | 0 | | | 0 | | 225 | | | 539 | |

| URUGUAY | | 127 | | | 2 | | 149 | | | 2 | | 97 | | | 2 | | (22) | | | 30 | |

| MULTILATERAL ORGANIZATIONS | | 84 | | | 1 | | 105 | | | 1 | | 112 | | | 2 | | (21) | | | (28) | |

OTHER NON-LATAM (1) | | 563 | | | 7 | | 541 | | | 7 | | 555 | | | 9 | | 22 | | | 8 | |

| | | | | | | | | | | | | | | | | |

TOTAL CREDIT PORTFOLIO (2) | | $ | 8,412 | | | 100 | % | | $ | 7,365 | | | 100 | % | | $ | 6,097 | | | 100 | % | | $ | 1,047 | | | $ | 2,315 | |

| | | | | | | | | | | | | | | | | |

| UNEARNED INTEREST AND DEFERRED FEES | | (10) | | | | | (9) | | | | | (6) | | | | | (1) | | | (4) | |

| | | | | | | | | | | | | | | | |

| TOTAL CREDIT PORTFOLIO, NET OF UNEARNED INTEREST & DEFERRED FEES | | $ | 8,402 | | | | | $ | 7,356 | | | | | $ | 6,091 | | | | | $ | 1,046 | | | $ | 2,311 | |

(1)Risk in highly rated countries outside the Region related to transactions carried out in the Region.

(2)Includes gross loans (or the Loan Portfolio), securities at FVOCI and at amortized cost, gross of interest receivable and the allowance for expected credit losses, loan commitments and financial guarantee contracts, such as confirmed and stand-by letters of credit, and guarantees covering commercial risk; and other assets consisting of customers liabilities under acceptances.

EXHIBIT VII

COMMERCIAL PORTFOLIO

DISTRIBUTION BY COUNTRY

(In US$ million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | AT THE END OF, |

| | | (A) | | (B) | | (C) | | | | |

| | | March 31, 2022 | | December 31, 2021 | | March 31, 2021 | | Change in Amount |

| COUNTRY | | Amount | | % of Total

Outstanding | | Amount | | % of Total

Outstanding | | Amount | | % of Total

Outstanding | | (A) - (B) | | (A) - (C) |

| ARGENTINA | | $ | 66 | | | 1 | | $ | 74 | | | 1 | | $ | 108 | | | 2 | | $ | (8) | | | $ | (42) | |

| BOLIVIA | | 3 | | | 0 | | 6 | | | 0 | | 15 | | | 0 | | (3) | | | (12) | |

| BRAZIL | | 1,017 | | | 14 | | 1,102 | | | 17 | | 1,159 | | | 20 | | (85) | | | (142) | |

| CHILE | | 661 | | | 9 | | 667 | | | 10 | | 604 | | | 11 | | (6) | | | 57 | |

| COLOMBIA | | 859 | | | 12 | | 846 | | | 13 | | 704 | | | 12 | | 13 | | | 155 | |

| COSTA RICA | | 303 | | | 4 | | 270 | | | 4 | | 191 | | | 3 | | 33 | | | 112 | |

| DOMINICAN REPUBLIC | | 317 | | | 4 | | 292 | | | 4 | | 205 | | | 4 | | 25 | | | 112 | |

| ECUADOR | | 367 | | | 5 | | 319 | | | 5 | | 212 | | | 4 | | 48 | | | 155 | |

| EL SALVADOR | | 97 | | | 1 | | 80 | | | 1 | | 31 | | | 1 | | 17 | | | 66 | |

| GUATEMALA | | 572 | | | 8 | | 490 | | | 7 | | 338 | | | 6 | | 82 | | | 234 | |

| HONDURAS | | 258 | | | 4 | | 50 | | | 1 | | 20 | | | 0 | | 208 | | | 238 | |

| JAMAICA | | 83 | | | 1 | | 5 | | | 0 | | 46 | | | 1 | | 78 | | | 37 | |

| MEXICO | | 837 | | | 11 | | 731 | | | 11 | | 549 | | | 10 | | 106 | | | 288 | |

| PANAMA | | 387 | | | 5 | | 270 | | | 4 | | 314 | | | 6 | | 117 | | | 73 | |

| PARAGUAY | | 122 | | | 2 | | 108 | | | 2 | | 128 | | | 2 | | 14 | | | (6) | |

| PERU | | 539 | | | 7 | | 409 | | | 6 | | 369 | | | 6 | | 130 | | | 170 | |

| TRINIDAD & TOBAGO | | 134 | | | 2 | | 141 | | | 2 | | 152 | | | 3 | | (7) | | | (18) | |

| URUGUAY | | 127 | | | 2 | | 149 | | | 2 | | 97 | | | 2 | | (22) | | | 30 | |

OTHER NON-LATAM (1) | | 572 | | | 8 | | 531 | | | 8 | | 466 | | | 8 | | 41 | | | 106 | |

| | | | | | | | | | | | | | | | | |

TOTAL COMMERCIAL PORTFOLIO (2) | | $ | 7,321 | | | 100 | % | | $ | 6,540 | | | 100 | % | | $ | 5,708 | | | 100 | % | | $ | 781 | | | $ | 1,613 | |

| | | | | | | | | | | | | | | | | |

| UNEARNED INTEREST AND DEFERRED FEES | | (10) | | | | | (9) | | | | | (6) | | | | | (1) | | | (4) | |

| | | | | | | | | | | | | | | | |

| TOTAL COMMERCIAL PORTFOLIO, NET OF UNEARNED INTEREST & DEFERRED FEES | | $ | 7,311 | | | | | $ | 6,531 | | | | | $ | 5,702 | | | | | $ | 780 | | | $ | 1,609 | |

(1)Risk in highly rated countries outside the Region related to transactions carried out in the Region. As of March 31, 2022, Other Non-Latam was comprised of United States of America ($38 million), European countries ($341 million) and Asian countries ($193 million).

(2)Includes gross loans (or the Loan Portfolio), loan commitments and financial guarantee contracts, such as confirmed and stand-by letters of credit, and guarantees covering commercial risk; and other assets consisting of customers liabilities under acceptances.

EXHIBIT VIII

INVESTMENT PORTFOLIO

DISTRIBUTION BY COUNTRY

(In US$ million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | AT THE END OF, |

| | | (A) | | (B) | | (C) | | | | |

| | | March 31, 2022 | | December 31, 2021 | | March 31, 2021 | | Change in Amount |

| COUNTRY | | Amount | | % of Total

Outstanding | | Amount | | % of Total

Outstanding | | Amount | | % of Total

Outstanding | | (A) - (B) | | (A) - (C) |

| BRAZIL | | $ | 102 | | | 9 | | $ | 99 | | | 12 | | $ | 61 | | | 16 | | $ | 3 | | | $ | 41 | |

| CHILE | | 110 | | 10 | | 106 | | | 13 | | 41 | | | 10 | | 4 | | | 69 | |

| COLOMBIA | | 45 | | | 4 | | 38 | | | 5 | | 15 | | | 4 | | 7 | | | 30 | |

| COSTA RICA | | 2 | | | 0 | | 2 | | | 0 | | 0 | | | 0 | | 0 | | | 2 | |

| DOMINICAN REPUBLIC | | 5 | | | 0 | | 5 | | | 1 | | 0 | | | 0 | | 0 | | | 5 | |

| GUATEMALA | | 5 | | | 0 | | 3 | | | 0 | | 0 | | | 0 | | 2 | | | 5 | |

| MEXICO | | 97 | | | 9 | | 56 | | | 7 | | 44 | | | 11 | | 41 | | | 53 | |

| PANAMA | | 24 | | | 2 | | 23 | | | 3 | | 10 | | | 3 | | 1 | | | 14 | |

| PERU | | 87 | | | 8 | | 64 | | | 8 | | 17 | | | 4 | | 23 | | | 70 | |

| UNITED STATES OF AMERICA | | 501 | | | 46 | | 295 | | | 36 | | 112 | | | 29 | | 206 | | | 389 | |

| MULTILATERAL ORGANIZATIONS | | 84 | | | 8 | | 105 | | | 13 | | 89 | | | 23 | | (21) | | | (5) | |

OTHER NON-LATAM (1) | | 29 | | | 3 | | 29 | | | 3 | | 0 | | | 0 | | 0 | | | 29 | |

| | | | | | | | | | | | | | | | | |

TOTAL INVESTMENT PORTFOLIO (2) | | $ | 1,091 | | | 100 | % | | $ | 825 | | | 100 | % | | $ | 389 | | | 100 | % | | $ | 266 | | | $ | 702 | |

(1)Risk in highly rated countries outside the Region

(2)Includes securities at FVOCI and at amortized cost, gross of interest receivable and the allowance for losses.

EXHIBIT IX

LOAN DISBURSEMENTS

DISTRIBUTION BY COUNTRY

(In US$ million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | QUARTERLY | | | Change in Amount |

| | | | | | | (A) | | (B) | | (C) | | | | | | |

| COUNTRY | | | | | | 1Q22 | | 4Q21 | | 1Q21 | | | | (A) - (B) | | (A) - (C) |

| ARGENTINA | | | | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | | | $ | 0 | | | $ | 0 | |

| BOLIVIA | | | | | | 0 | | | 0 | | | 5 | | | | | 0 | | | (5) | |

| BRAZIL | | | | | | 464 | | | 630 | | | 287 | | | | | (166) | | | 177 | |

| CHILE | | | | | | 332 | | | 289 | | | 347 | | | | | 43 | | | (15) | |

| COLOMBIA | | | | | | 284 | | | 532 | | | 340 | | | | | (248) | | | (56) | |

| COSTA RICA | | | | | | 159 | | | 97 | | | 23 | | | | | 62 | | | 136 | |

| DOMINICAN REPUBLIC | | | | | | 157 | | | 321 | | | 183 | | | | | (164) | | | (26) | |

| ECUADOR | | | | | | 45 | | | 12 | | | 5 | | | | | 33 | | | 40 | |

| EL SALVADOR | | | | | | 56 | | | 10 | | | 30 | | | | | 46 | | | 26 | |

| GUATEMALA | | | | | | 169 | | | 187 | | | 99 | | | | | (18) | | | 70 | |

| HONDURAS | | | | | | 222 | | | 30 | | | 10 | | | | | 192 | | | 212 | |

| JAMAICA | | | | | | 198 | | | 40 | | | 63 | | | | | 158 | | | 135 | |

| MEXICO | | | | | | 567 | | | 909 | | | 508 | | | | | (342) | | | 59 | |

| PANAMA | | | | | | 153 | | | 64 | | | 106 | | | | | 89 | | | 47 | |

| PARAGUAY | | | | | | 58 | | | 70 | | | 63 | | | | | (12) | | | (5) | |

| PERU | | | | | | 189 | | | 260 | | | 106 | | | | | (71) | | | 83 | |

| TRINIDAD & TOBAGO | | | | | | 0 | | | 20 | | | 0 | | | | | (20) | | | 0 | |

| UNITED STATES | | | | | | 20 | | | 39 | | | 0 | | | | | (19) | | | 20 | |

| URUGUAY | | | | | | 197 | | | 171 | | | 86 | | | | | 26 | | | 111 | |

OTHER NON-LATAM (1) | | | | | | 191 | | | 272 | | | 131 | | | | | (81) | | | 60 | |

| | | | | | | | | | | | | | | | | |

TOTAL LOAN DISBURSED (2) | | | | | | $ | 3,461 | | | $ | 3,953 | | | $ | 2,392 | | | | | $ | (492) | | | $ | 1,069 | |

(1)Origination in highly rated countries outside the Region, mostly in Europe and North America, related to transactions carried out in the Region.

(2)Total loan disbursed does not include loan commitments and financial guarantee contracts, nor other interest-earning assets such as investment securities.