| | EXHIBIT 99.1 |

| | News |

| For Immediate Release | |

| July 23, 2009 | Contact: |

| | | Rick B. Honey |

| | | (212) 878-1831 |

MINERALS TECHNOLOGIES INC. ANNOUNCES RESTRUCTURING OF REFRACTORIES SEGMENT TO STEM LOSSES

----------

Company Records Pre-Tax Restructuring and Impairment Charges of $55 million

----------

Earnings per Share Were $0.15, Excluding Special Items;

Second Quarter Loss per Share was $2.18

----------

Board Declares Regular Quarterly Dividend of $0.05 per Share

----------

Highlights:

| • | Company anticipates annual savings of $16 million to $20 million upon completion of restructuring program. |

| • | Restructuring consolidates manufacturing operations, improves efficiencies and provides better strategic positioning for improved profitability. |

| • | Charges relate primarily to realignment of Refractories business as a result of continued weakness in the steel industry. |

| • | Approximately 200 employees, or 10 percent of the workforce, affected by these changes. |

| • | Specialty Minerals segment showed sequential improvement in sales and profitability. |

| • | Strong Cash Flow from Operations in excess of $39 million for the quarter. |

NEW YORK, July 23 - Minerals Technologies Inc. (NYSE: MTX) announced today a restructuring program that will focus on its Refractories business but also includes other select operations. As a result, the company will curtail significant losses in the business segment most deeply affected by the ongoing worldwide economic recession and improve near-term performance. This restructuring program reflects the company's on-going strategy to be optimally positioned for profitability in changing economic conditions. The company will take special charges of $55 million in the second quarter, the majority of which relate to the Refractories business, which has been hard hit by the downturn in the worldwide steel industry,

-2-

resulting in a loss of $2.18 per share for the second quarter. Excluding these special items, diluted earnings per share were $0.15 per share.

"The downturn in the worldwide steel industry, which has resulted in nearly a 50-percent reduction in demand in the United States, our largest market, has had a severe impact on our Refractories operations," said Joseph C. Muscari, chairman and chief executive officer. "We will consolidate operations and reduce our workforce in the Refractories business to meet this reduction in demand. We have also, however, taken restructuring charges in our other businesses and support functions, which will allow us to operate more effectively at these lower levels of demand and will position Minerals Technologies to achieve greater profitability as the economic environment improves."

RESTRUCTURING

The major components of the restructuring program include consolidation of operations, rationalization of some product lines, and streamlining management structures for a more cost-effective business model.

In the Refractories segment, the company will consolidate North American refractory operations in Old Bridge, New Jersey, into Bryan, Ohio, and Baton Rouge, Louisiana, improving manufacturing efficiencies and reducing transportation costs. The company will also rationalize its North American specialty shapes product line and European refractory operations. In Asia, Minerals Technologies will consolidate refractory operations and actively seek a regional alliance to aid in the marketing of its high value products there as a result of difficulties penetrating that market.

In the Paper PCC business, the company recorded an impairment charge at its satellite PCC facility in Millinocket, Maine, which has been idle since September of 2008 and where the start-up of the company's satellite facility has become unlikely.

The company recorded a restructuring charge to reflect severance and other costs related to plant consolidations as well as streamlining the management structure to operate more efficiently in the current economic environment. In discontinued operations, the company recorded

-3-

impairment charges to recognize the lower market value of its Mt. Vernon, Indiana, operations, which have been held for sale since October of 2007.

The company anticipates annualized savings from the restructuring actions to be between $16 million and $20 million upon completion of the program in the second quarter of 2010.

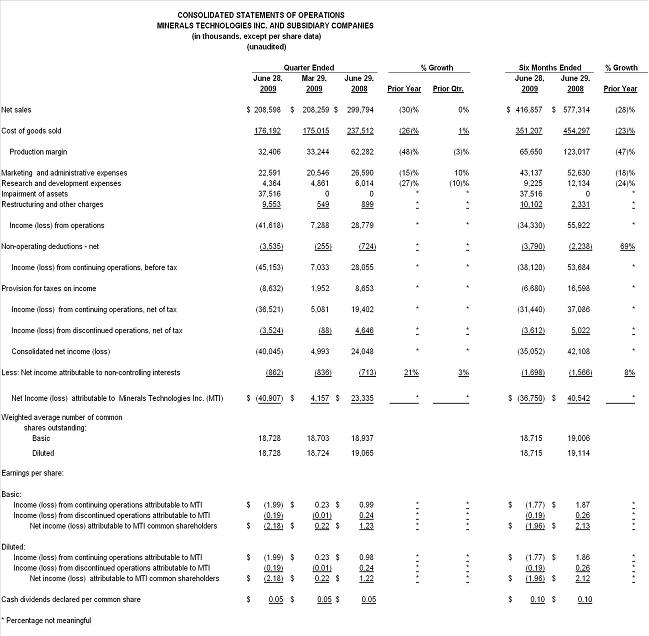

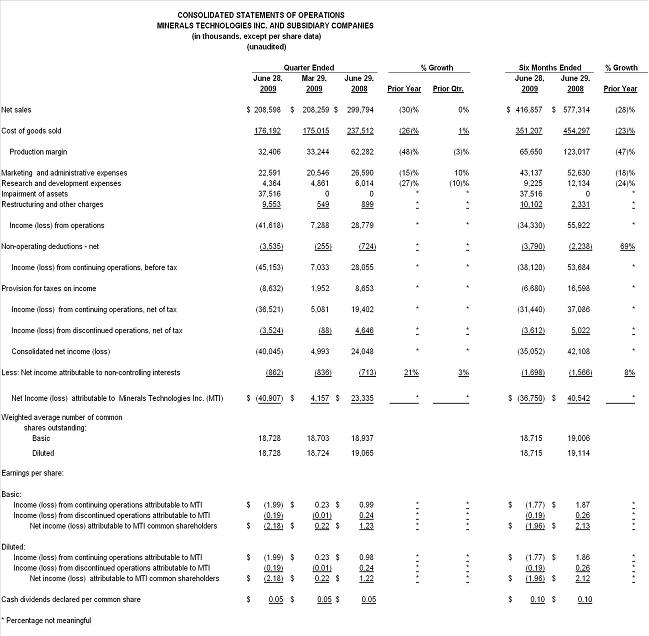

SECOND QUARTER EARNINGS

Comparisons to First Quarter 2009

Due to the restructuring activities, the company reported a second quarter net loss of $40.9 million ($2.18 per share), compared to net income of $4.2 million or $0.22 per share in the first quarter of 2009. Excluding special items, net income for the second quarter was $2.9 million or $0.15 per share, a 40-percent decrease from the $0.25 per share in the first quarter of 2009.

The company's worldwide sales in the second quarter were $208.6 million, a slight increase over the $208.3 million reported in the first quarter of 2009, of which foreign exchange had a favorable impact on sales of approximately $2.5 million or 1 percentage point of growth. Operating income, excluding special items, was $5.5 million, a 29-percent decrease from the $7.8 million reported in the first quarter of 2009.

For the second quarter, worldwide sales in the company's Specialty Minerals segment, which consists of precipitated calcium carbonate (PCC) and Processed Minerals, were $152.0 million compared with $143.6 million in the first quarter of 2009, a 6-percent increase, which was primarily the result of volume increases for both product lines. Foreign exchange had a favorable impact on sequential sales growth for the quarter of approximately 1 percentage point. Income from operations for the Specialty Minerals segment, excluding special items, was $13.2 million, a 32-percent increase over the $10.0 million recorded in the previous quarter.

Worldwide sales of PCC, which is used mainly in the manufacturing processes of the paper industry, were $127.7 million, a 4-percent increase over the $123.1 million recorded in the first quarter of 2009. This increase was associated primarily with higher PCC volumes, reflecting a slight increase in North American paper shipments.

Sales of Processed Minerals products were $24.3 million, up 19 percent over the $20.5 million recorded in the previous quarter. This increase was primarily due to seasonal demand in

-4-

this product line during the second quarter. Processed Minerals products, which include ground calcium carbonate and talc, are used in the building materials, polymers, ceramics, paints and coatings, glass and other manufacturing industries.

"The performance improvement in the Specialty Minerals segment was due not only to the volume increases in both the PCC and Processed Minerals products lines," said Mr. Muscari, "but also to a 12-percent improvement in productivity in our Specialty PCC, ground calcium carbonate and talc operations, as our Operational Excellence initiatives are beginning to show results."

In the company's Refractories segment, sales in the second quarter of 2009 were $56.6 million, a 13-percent decline from the $64.7 million recorded in the first quarter of 2009. This decline was primarily related to volume decreases of approximately 9 percent. The Refractory segment, which provides products and services primarily to the worldwide steel industry, recorded an operating loss of $7.1 million, excluding special items, compared with a loss of $1.9 million for the first quarter. The increase in operating loss was primarily due to sales volume declines, to consumption of higher-cost magnesium oxide, the primary raw material for refractories products, and to manufacturing inefficiencies caused by low utilization rates in the refractory manufacturing facilities.

Year-Over-Year Comparisons

Second Quarter

The company's second quarter net loss of $40.9 million ($2.18 per share) compares with a net income of $23.3 million, or $1.22 per share in the second quarter of 2008. Excluding special items, earnings were $0.15 per share as compared with $1.01 per share in the prior year.

Second quarter worldwide sales declined 30 percent from the $299.8 million recorded in the same period in 2008. Foreign exchange had an unfavorable impact on sales of approximately $16.2 million or 5 percentage points. Operating income, excluding special items, declined 81 percent from the $29.7 million recorded in the second quarter of 2008.

Second quarter worldwide sales for the Specialty Minerals segment declined 20 percent from the $189.1 million recorded in the second quarter of 2008. Foreign exchange had an unfavorable

-5-

impact on sales of approximately $11.2 million, or 6 percentage points. Income from operations, excluding special items, declined 35 percent from the $20.3 million recorded in the same period in 2008.

PCC sales declined 19 percent from the $158.0 million recorded in the second quarter of 2008 on a volume decline of 16 percent. Processed Minerals products second quarter sales were down 22 percent from the $31.1 million in the same period last year, as volumes declined 25 percent.

Refractories segment sales in the second quarter of 2009 were 49 percent down from the $110.7 million recorded in the same period in 2008. Foreign exchange had an unfavorable impact on sales of approximately $5.0 million or 5 percentage points. Refractory volumes declined dramatically from the second quarter of 2008 and were in line with the reduction in steel production. The Refractory segment recorded an operating loss of $7.1 million, excluding special items, compared to operating income of $9.6 million in the second quarter of 2008.

Six Months

The net loss for the six months was $36.8 million, or $1.96 per share. In the same period in 2008, the company recorded net income of $40.5 million, or $2.12 per share. Excluding special items, earnings were $0.40 per share as compared with $1.94 per share in the prior year.

Minerals Technologies' worldwide sales for the first six months of 2009 decreased 28 percent to $416.9 million from $577.3 million in the same period last year. Foreign exchange had an unfavorable impact on sales of 5 percentage points of growth. Operating loss for the six months was $34.3 million compared to operating income of $55.9 million reported for the first six months of 2008. Included in the loss from operations in 2009 were an impairment of assets charge of $37.5 million and restructuring costs of $10.1 million. Excluding special items, operating income for the first six months of 2009 was $13.3 million.

The Specialty Minerals segment's worldwide sales for the first six months of 2009 decreased 20 percent to $295.7 million from $369.9 million for the same period in 2008. Specialty Minerals recorded income from operations, excluding special items, of $23.2 million for the first six months of 2009, a 42-percent decrease from the $39.8 million recorded for the same period in

-6-

2008.

The Refractories segment's sales for the first six months of 2009 were $121.2 million, a 42-percent decrease from the $207.4 million in the previous year. For the six months, Refractories operating loss, excluding special items, was $9.0 million compared to operating income of $18.8 million for the comparable period in 2008.

"We have taken additional significant steps to stem the losses in the refractories segment and to position the company for higher profitability," said Mr. Muscari. "Our Specialty Minerals segment has stabilized and we continue to generate strong operating cash flow - $39 million in the second quarter - under these difficult business conditions. Our strong cash position and solid balance sheet differentiates MTI from many other companies and provides us with additional opportunities for future growth."

----------

The company also declared a regular quarterly dividend of $0.05 per share on its common stock. The dividend is payable on September 17, 2009 to shareholders of record on September 2, 2009.

----------

Minerals Technologies will sponsor a conference call tomorrow, July 24, at 11 a.m. The conference call will be broadcast live on the company web site, which can be found at www.mineralstech.com.

####

This press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, which describe or are based on current expectations. Actual results may differ materially from these expectations. In addition, any statements that are not historical fact (including statements containing the words "believes," "plans," "anticipates," "expects," "estimates," and similar expressions) should also be considered to be forward-looking statements. The company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. Forward-looking statements in this document should be evaluated together with the many uncertainties that affect our businesses, particularly those mentioned in the risk factors and other cautionary statements in our 2008 Annual Report on Form 10-K and in our other reports filed with the Securities and Exchange Commission.

----------------

For further information about Minerals Technologies Inc. look on the internet at http://www.mineralstech.com.

####