UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F /A

Amendment No. 1

| [ ] | | REGISTRATION STATEMENT PURSUANT TO SECTION 12 (b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| [X] | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the 12-month period ended June 30, 2002

or

| [ ] | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period ended June 30, 2002

Commission file number # 0-20588

NEWMONT YANDAL OPERATIONS LIMITED (A.C.N. 007 066 766)

(Exact Name of Registrant as Specified in its Charter)

(Translation of Registrant’s Name Into English)

STATE OF VICTORIA, AUSTRALIA

(Jurisdiction of Incorporation or Organisation)

100 Hutt Street, Adelaide, South Australia, 5000, Australia

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12 (b) of the Act:

TITLE OF EACH CLASS

| | NAME OF EACH EXCHANGE-

ON WHICH REGISTERED

|

NONE | | NONE |

| |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Fully Paid Ordinary Shares: | | |

at June 30, 2002 | | 308,960,662 |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark which financial statement item the registrant has elected to follow.

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12,13 or 15 (d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

YES | | [ ] | | NO | | [ ] | | NOT APPLICABLE |

EXPLANATORY NOTE

Subsequent to filing, on 10 April 2003, its Annual Report on Form 20-F for the period ending 30 June 2002 (the "Report"), it has come to the attention of Newmont Yandal Operations Limited (the "Company") that the Report contains certain contradictory information in relation to ore reserves and resources.

The Company hereby amends the Report by replacing Item 4D of the Report with the following Item 4D.

2

4D. Property, plant and equipment

The Group’s main property consists of the plant and infrastructure at Bronzewing, Jundee-Nimary and Wiluna mines as well as its rights to explore and mine land in Western Australia as granted under the Mining Act. In addition, NYOL has a number of significant joint venture agreements under which it is able to obtain an interest in the rights to explore or mine land.

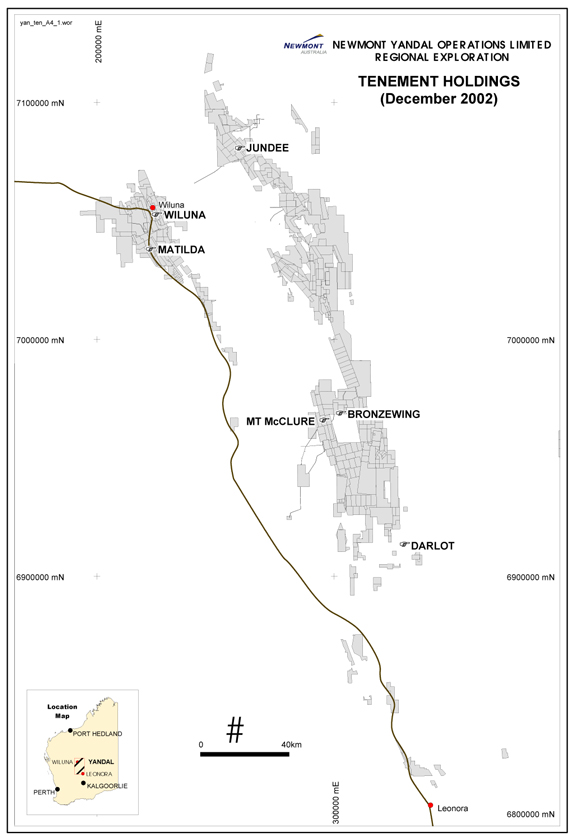

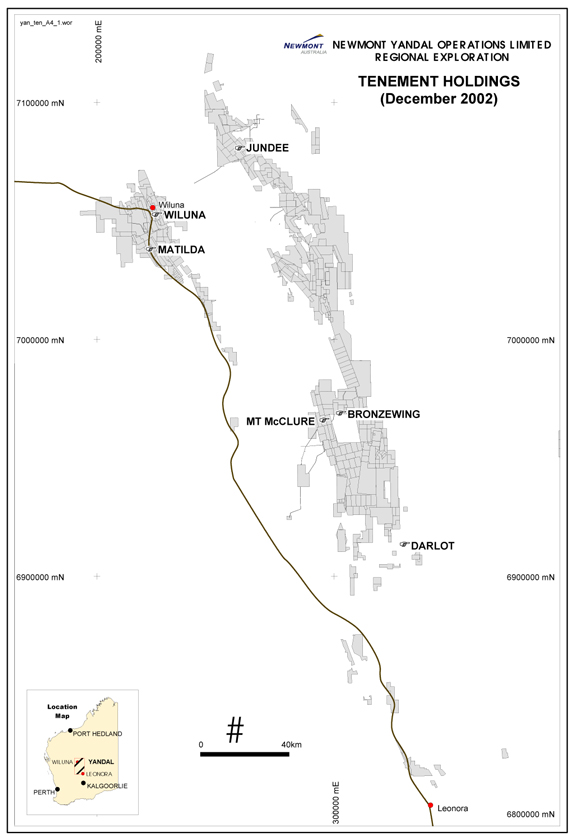

NYOL’s exploration activities encompass 3,150 square kilometres of exploration tenements located in the Yandal region. A map showing the location of NYOL’s land holdings is set out on the following page.

3

4

Operating Mines

Bronzewing

Background. NYOL’s Bronzewing Gold Operations are in the central Yandal greenstone belt and are located approximately 68 kilometres from Leinster township and 360 kilometres from Kalgoorlie in Western Australia. Access to Bronzewing is by air charter flight to its airstrip or by road. The Bronzewing gold deposits were discovered by NYOL in 1993 on tenements, which were subject to a purchase agreement with Mr. Mark Creasy. In May 1994, NYOL entered into a purchase agreement with Mr. Creasy to acquire the balance of his interest in the Bronzewing and Jundee-Nimary tenements for A$122 million and the issuance of 1,000,000 of Newmont Yandal Operations’ ordinary shares. The acquisition closed in 1995.

Mining. Open pit mining commenced in June 1994 in three pits known as Laterite, Central and Discovery. In February 1995 the development of underground mining commenced. Open pit mining operations concluded at the Laterite pit in February 1995 at a planned depth of 20 metres and at the Central pit at a planned depth of 130 metres. Open pit mining operations concluded at the Discovery pit in August 1996 at a planned depth of 235 metres. Since August 1996 all mining operations at Bronzewing have been conducted from underground. The adjacent dormant McClure property was acquired in September 1999 and integrated with the Bronzewing operation.

During the year ended June 30, 2002, pre-feasibility work was undertaken on Lotus Deeps orebody extensions and the Cockburn pit cutback and underground plan.

The mining operations are carried out by a combination of NYOL employees and contract miners. The mining contractor invoices NYOL at rates defined in the mining contract under which the contractor provides substantially all mining and associated equipment to conduct mining, including drilling and blasting where necessary. NYOL’s employees (rather than contract employees) carry out the stope drill and blast work. A separate contract exists for the haulage of the ore to the ore stockpiled prior to treatment. A full description of the contracts is set out in “Item 4B: Business Overview”.

During the year ended June 30, 2002, mine production totalled 1,703,434 tonnes of ore at an average grade of 4.70 grams of gold per tonne. The ore was sourced from Bronzewing and McClure (Lotus Deeps).

Processing. Bronzewing’s gold processing plant is a conventional carbon-in-pulp/carbon-in-leach gold treatment plant. Due to the course nature of the Bronzewing gold mineralisation, approximately 60% of the gold is extracted through the gravity portion of the processing plant thereby reducing costs and increasing recovery rates. Plant construction was completed in November 1994 for a total cost of A$36 million.

The plant was upgraded to a capacity of 2.0 million tonnes per annum during 1997/98 with construction of a new primary and secondary crushing circuit, the installation of new cyclones and the addition of a third Knelson concentrator. A thickener and INCO detoxification unit was also constructed during 1997/98. These additions reduce water consumption by 30-35 percent and eliminate cyanide in the water tailings dam, thereby lowering rehabilitation costs.

For the year ended June 30, 2002, total production was 8.46 tonnes of gold from 1,865,282 tonnes of ore at a headfeed grade of 4.69 grams of gold per tonne and plant recovery of 96.7%. For the year ended June 30, 2001, total production was 8.10 tonnes of gold from 1,801,126 tonnes of ore at a headfeed grade of 4.63 grams of gold per tonne and plant recovery of 97.22%.

Capital expenditure for the year ended June 30, 2002 was A$16 million. Capital expenditure was A$6.3 million for the six months ended December 31, 2002, and is budgeted to be A$1.7 million for the year ended December 31, 2003.

The total cost of Property, Plant and Equipment as at June 30, 2002 was A$351.2 million, (June 30, 2001: A$338.2 million)

5

At June 30, 2002 there were 193 persons employed at the Bronzewing Gold Operations.

The Bronzewing mine is expected to cease operations in late 2003 or early 2004, when NYOL’s reserves at Bronzewing are exhausted. If no additional reserves are discovered and no agreements for toll treating ore are entered into, the likelihood of which cannot be reasonably predicted, the Bronzewing processing plant could be dismantled and the site reclaimed.

Jundee-Nimary

Background. NYOL’s Jundee-Nimary Gold Operations are located in the northern part of the Yandal region and are the consolidation of two separate mines (Jundee-Nimary and Nimary) with contiguous boundaries which Newmont Yandal Operations and Eagle mined separately prior to the acquisition of Eagle by Newmont Yandal Operations. Jundee-Nimary is located approximately 45 kilometres north-east of Wiluna which is the nearest township. Access to Jundee-Nimary is by air charter flight to the Jundee-Nimary mine airstrip or by road from Wiluna township.

Like the Bronzewing mine, the deposit forming the Jundee-Nimary mine was discovered by NYOL on tenements acquired from Mr. Creasy in May 1994. By a separate agreement, NYOL paid Mr. Creasy a non-refundable deposit of A$1.0 million to acquire an option to obtain a 100% interest in Plover Bore, a tenement adjacent to the Jundee-Nimary mine site. A payment of A$40 million by NYOL on November 1, 2001 was required if NYOL wanted to purchase the tenement. That payment was not made, however, it is anticipated that Mr. Creasy will extend the November 1, 2001 date for payment to November 1, 2003, and that further extensions will be granted from year to year. NYOL also has an access deed with Mr. Creasy that gives it the right to construct and operate the Jundee-Nimary gold processing plant on this tenement.

Mining. NYOL and Eagle Mining Corporation commenced open pit mining at Jundee-Nimary and Nimary in late 1995. At that time Nimary and Jundee-Nimary merged along a common border and shared some common pits. Consolidation and integration of the Jundee-Nimary operation is now complete, resulting in an overall reduction in staffing levels and costs.

Underground mine production was mostly sourced from the Barton Deeps orebody, but there was increased production from Hughes and Nim 3 developments. Level 17S from Barton Deeps was extended to intercept the Westside ore shoots and development of this new mineralised system has commenced. Open pit production continued to decline until all open pits were exhausted in late 2002.

Contractors carry out all of the mining operations at Jundee-Nimary under the management of the Group’s senior operations staff. A full description of the contracts is set out in “Item 4B: Business Overview”.

During the year ended June 30, 2002, mine production totalled 3,185,244 tonnes of ore at an average grade of 3.91 grams of gold per tonne.

Processing. Ore is treated at one of two conventional carbon-in-pulp/carbon-in-leach gold processing plants. A number of improvements have been made to the processing operations since start-up in late November 1995 with the aim of improving recoveries. These include installation of two additional leach tanks and a regrind ball mill at Nimary, and installation of oxygen generation and Filblast air injection plants at both mills. Improvements to the Nimary mill during the year ended June 30, 2000 increased capacity to 1.2 million tonnes per annum. The plants now have a combined processing capacity of 3.0 million tonnes per annum, depending on the hardness of the ore being mined.

During the year ended June 30, 2002, treatment plant throughput declined, reflecting an increasing proportion of harder ore from the deepening open pits and underground. Ore was processed through the Nimary and Jundee plants.

For the year ended June 30, 2002, total production was 11.10 tonnes of gold from 2,158,757 tonnes of ore at a headfeed grade of 5.47 grams of gold per tonne and plant recovery of 93.96%. For the year ended June 30, 2001, total production was 12.79 tonnes of gold from 2,457,454 tonnes of ore at a headfeed grade of 5.51 grams of gold per tonne and plant recovery of 94.3%.

6

Capital expenditure for the year ended June 30, 2002 was A$24.2 million. Capital expenditure was A$9.5 million for the six months ended December 31, 2002, and is budgeted to be A$33.9 million for the year ended December 31, 2003.

The total cost of Property, Plant and Equipment as at June 30, 2002 was A$308.4 million, (June 30, 2001: A$284.2 million)

At June 30, 2002 there were 135 persons employed at the Jundee-Nimary Gold Operations.

Wiluna

Background. The Wiluna mine is located just south of the township of Wiluna and is approximately 45 kilometres south-west of the Jundee-Nimary operation. Access to the Wiluna mine is by air charter flight to the Wiluna mine airstrip or by road from Wiluna township. Mining has been intermittently carried in the Wiluna mine region for over 100 years.

Asarco Inc. (“Asarco”) commenced exploration activity in the Wiluna region in 1982. Construction of an oxide gold processing plant began in 1986 with the first gold production occurring in 1987. Oxide ores were mined from several open pits in the Wiluna and surrounding regions between 1987 and 1994. Commencing in 1993 several of the open pits were deepened to provide access to sulphide ores. Generally, the Wiluna primary sulphide ore is refractory and requires pre-treatment to release gold bound up in sulphide prior to processing in a traditional carbon-in-pulp or carbon-in-leach circuit. Asarco sold its interests in its Australian operations to Wiluna Mines Limited (“Wiluna Mines”) in 1994 and in the same year commenced underground sulphide mining operations. The Wiluna Gold Operations were integrated into NYOL’s operations from January 1, 1998, following the takeover of Wiluna Mines.

Mining. Mining at Wiluna is mainly underground and refractory, sulphide ore from the Bulletin, Woodley and Creek Shear deposits. The Golden Age underground, quartz vein hosted gold mineralisation is non-refractory and the East and West Lode Open pits also provided mill feed during the year. Stoping of the upper levels of the Woodley orebody commenced in 2001-2002. Studies to redevelop the East and West Lode underground resources advanced from conceptual to feasibility status but a decision on the future development of this resource was deferred.

Contractors carry out all of the mining operations at Wiluna under the management of the Group’s senior operations staff. A full description of the contracts is set out in “Item 4B: Business Overview”.

For the year ended June 30, 2002, mine production was 869,709 tonnes of ore at an average grade of 5.39 grams of gold per tonne.

Processing. With the exception of the Golden Age underground quartz vein hosted gold mineralisation, most of the ore produced by the Wiluna mine is now refractory sulphide ore. The sulphide ore must be treated prior to cyanide leaching to reduce the sulphide content using bacterial oxidation (otherwise known as the BIOX process). BIOX is a patented process technology owned by Goldfields of South Africa. Micro-organisms are used to oxidise certain gold-bearing sulphide ores in order to facilitate gold recovery. Following consideration of the available options and environmental waste concerns, Wiluna Mines chose the BIOX bacterial oxidation process because of the lower operating and capital costs involved. The Wiluna BIOX gold processing plant, completed in 1993, was originally designed to treat sulphide flotation concentrate and had a designed processing capacity of 420,000 tonnes per annum of ore. The initial BIOX gold processing plant consisted of six 450 cubic metre reactors, three primary reactors in parallel followed by three secondary reactors in series. An expansion in the BIOX gold processing plant was completed during 1996, resulting in an increased designed processing capacity of 600,000 tonnes per annum. The BIOX expansion project enabled the plant to treat higher grade sulphide ore produced from the underground mines and included an upgrade of the BIOX circuit’s cooling water and air reticulation systems. Following the BIOX process, the oxidised product is treated in a standard carbon-in-leach gold processing circuit similar to that used at Bronzewing and Jundee-Nimary mines. Currently the BIOX plant is running in excess of designed processing capacity of 600,000 tonnes per annum.

7

The commissioning of the gas fired power plant in 1997/98 and 1998/99 and ongoing research into improving metallurgical and throughput recoveries has led to an overall decrease in mining and processing costs and an increase in recoveries over recent years.

For the year ended June 30, 2002, total production was 3.68 tonnes of gold from 789,720 tonnes of ore at a headfeed grade of 5.66 grams of gold per tonne and plant recovery of 82.22%. For the year ended June 30, 2001, total production was 3.6 tonnes of gold from 808,275 tonnes of ore at a headfeed grade of 5.41 grams of gold per tonne and plant recovery of 82.44%.

On September 11, 2002, NYOL entered into an agreement to sell the Wiluna mine and surrounding exploration acreage to Agincourt Resources Limited, a company controlled by members of the Wiluna mine management group and an independent contractor. Completion of the sales transaction was originally anticipated to occur in October 2002 subject to receipt of necessary third party consents and approvals. As of the date of this report, the Company had not received all the necessary third party consents and approvals and, as a result, the agreement has expired without the sale having been completed. As of the date of this report, the agreement had not been extended nor had any new agreement been concluded.

Based on current mine plans production at the Wiluna operation is expected to cease by December 2003.

Capital expenditure for the year ended June 30,2002 was A$6.2 million. Capital expenditure was A$ 4.1 million for the six months ended December 31, 2002 and is budgeted to be A$1.1 million for the year ended June 30, 2003.

The total cost of Property, Plant and Equipment as at June 30, 2002 was A$193.2 million, (June 30,2001: A$189.0 million)

At June 30, 2002 there were 96 persons employed at the Wiluna Gold Operations.

8

Reserves

NYOL’s consolidated reserves included the proven and probable reserves at Bronzewing, Jundee-Nimary and Wiluna totaling 55.28 tonnes of gold, comprising 13.60 million tonnes of ore at an average grade of 4.10 grams of gold per tonne. During the year ended June 30, 2002, the Group produced 23.31 tonnes of gold depleting the reserve by 4.81 million tonnes of ore containing an average grade of 5.20 grams of gold per tonne, or 25.02 tonnes of gold (average recovery 93%).

The table below is a summary of the Group’s ore reserves at June 30, 2002:

9

Ore reserves as at June 30, 2002

| | | | Proven

| | Probable

| | Total

|

Bronzewing | | | | | | | | |

Mine | | Mt | | 3.17 | | 1.10 | | 4.27 |

| | G/t | | 3.5 | | 4.6 | | 3.8 |

| | Tonnes Au | | 11.16 | | 5.07 | | 16.23 |

Mt McClure | | Mt | | | | 0.14 | | 0.14 |

| | G/t | | | | 10.2 | | 10.2 |

| | Tonnes Au | | | | 1.49 | | 1.49 |

Stockpiles | | Mt | | 0.09 | | | | 0.09 |

| | G/t | | 2.0 | | | | 2.0 |

| | Tonnes Au | | 0.19 | | | | 0.19 |

Total Bronzewing | | Mt | | 3.26 | | 1.24 | | 4.49 |

| | G/t | | 3.5 | | 5.3 | | 4.0 |

| | Tonnes Au | | 11.35 | | 6.56 | | 17.91 |

| | | |

| |

| |

|

Jundee-Nimary | | | | | | | | |

Barton Deeps | | Mt | | 1.56 | | 1.43 | | 2.99 |

| | G/t | | 5.7 | | 6.01 | | 5.9 |

| | Tonnes Au | | 8.93 | | 8.61 | | 17.54 |

Other Deeps | | Mt | | | | 1.71 | | 1.71 |

| | G/t | | | | 6.3 | | 6.3 |

| | Tonnes Au | | | | 10.79 | | 10.79 |

Open pits | | Mt | | 0.05 | | | | 0.05 |

| | G/t | | 1.7 | | | | 1.7 |

| | Tonnes Au | | 0.09 | | | | 0.09 |

Stockpiles | | Mt | | 3.44 | | | | 3.44 |

| | G/t | | 1.1 | | | | 1.1 |

| | Tonnes Au | | 3.7 | | | | 3.7 |

Total Jundee-Nimary | | Mt | | 5.05 | | 3.14 | | 8.19 |

| | G/t | | 2.5 | | 6.2 | | 3.9 |

| | Tonnes Au | | 12.75 | | 19.41 | | 32.16 |

| | | |

| |

| |

|

Wiluna | | | | | | | | |

Sulphides | | Mt | | 0.18 | | .26 | | .44 |

| | G/t | | 8.42 | | 7.96 | | 8.15 |

| | Tonnes Au | | 1.52 | | 2.08 | | 3.61 |

Stockpiles | | Mt | | .37 | | .09 | | .46 |

| | G/t | | 2.25 | | 8.68 | | 3.56 |

| | Tonnes Au | | 0.84 | | 0.81 | | 1.65 |

Total Wiluna | | Mt | | .55 | | .36 | | .91 |

| | G/t | | 4.29 | | 8.15 | | 5.8 |

| | Tonnes Au | | 2.36 | | 2.89 | | 5.26 |

| | | |

| |

| |

|

Total | | Mt | | 8.9 | | 4.7 | | 13.6 |

| | G/t | | 3.0 | | 6.1 | | 4.1 |

| | Tonnes Au | | 26.43 | | 28.85 | | 55.28 |

| | | |

| |

| |

|

Mt = million tonnes, G/t = grams per tonne, t = tonnes contained in gold.

10

It should be noted that contained ounces do not take into account recovery factors.

Figures do not in some instances exactly match tonnage, grade and ounce totals due to rounding.

Notes to accompany ore reserves table above

Most reserve estimates were made at a gold price of A$545 per ounce.

Bronzewing

The Bronzewing reserve declined as a result of mining depletion. The removal of the blanket 20% reconciliation factor on the grade in June 2001 was supported by the reconciliation between the revised reserve and production in the January-June 2002 period. The Bronzewing reserve estimates are based on designed stopes and development planned to economically extract the resource. The reserves are being continually evaluated in response to production information and new drilling data.

Jundee-Nimary

Barton Deeps/Other Deeps

The Barton Deeps Reserve has declined as a result of

| • | | increased data density (particularly to a depth of 400m from surface), which has refined ore zone shapes and better defined post mineral lamprophyre dykes, which stope out the ore zone. |

All underground reserves are reported above a block grade of 3.5 grams of gold per tonne.

The Other Deeps reserves include Hughes Deeps and Nim 3 Deeps.

Underground sill development, has commenced on the 17 South level into the Westside Deposit. Drilling on 40X40m centres closing down to 20x20m has started at Westside and a reserve estimate is expected in early 2003.

Open Pits

Surface reserves are reported within a A$545 pit shell above a cutoff of 0.5 grams of gold per tonne for oxide material, 0.7 grams of gold per tonne for transition and 0.8 grams of gold per tonne for sulphide or fresh ore. Mill recoveries of 96% for oxide, 92% for transition and 90% for fresh material were used to assess the viability of the mineralised material.

Wiluna

Reserves totaling 5.26 tonnes were compiled from multiple sources, five of which were underground and an array of stockpiles including for the first time the Biox Residue Dam. The underground Woodley deposit has the largest single source. reserve at 39% of total. Ore reserves have declined by 35% (2.79 tonnes) from the June 2001 figure to 5.26 tonnes net of depletion from mine production and resource model reviews. Mine production (excluding 860oz from low-grade stockpiles) totals, 4.61 tonnes with 56% from underground and 44% from the East/West pits. Recovery of the contained gold mined from the June 2001 ore reserve to the crusher is 100%. Recovery from the main underground sources Woodley and Golden Age is again significantly positive at 133%. The pits show negative recovery at 92% of reserves.

Underground Sulphide

Development of the lenses of the Woodley underground orebody confirmed the complex grade distribution and irregular geological controls. Reserve reconciliation of 0.87 tonnes depleted from reserves for 1.05 tonnes or 120% in the crusher. Block modeling methods continue to be refined. A minor 0.096 tonne ore remnant remains to be recovered from the Bulletin orebody. Extensions in Creek Shear on 6 and 7 levels delineated during the year add 0.46 tonnes to the reserves. Golden Age reserves have increased by 0.08 tonnes net of depletion by mine production. Mining has reached 23 Level and deeper drilling supports continuity of the vein at a shallowing dip to 37 Level at 891RL (610m below surface). Reserves are to 30 Level at 926 RL.A review of the underground orebodies has shown no material difference between reserves estimated at A$500 and A$575/oz.

Open Pit (Sulphide Reserves)

11

East and West pit reserves have been depleted by mining during 2001/02. Reserve recovery in the crusher from the open pits has been generally negative at 92% of ounces. Problems persisted with erratic grades, mining dilution and operational difficulties mining around old open stopes.

General Summary

| • | | Reserves are nominally estimated at A$545/ounce . The style of these mineralised systems mean they are relatively insensitive to gold price. |

| • | | Metallurgical recovery based on test work and plant performance has not been applied to Reserve estimates although they are used in establishing the viability of the estimates. Reserves reported are contained gold. |

| • | | Proved and probable reserves include dilution. |

| • | | Reserves for all mines include stockpiles. |

| • | | Analytical results have been verified by quality control and quality assurance procedures including screen fire assays, duplicates assays and assay of standards at various independent laboratories. |

| • | | Specific gravity is based on test work on core and mine operational experience. |

12

Reserves as at December 31, 2002

NYOL’s consolidated reserves include the proved and probable reserves at Bronzewing, Jundee – Nimary and Wiluna totalling 65.77 tonnes of gold; compromising 14.52 million tonnes of ore at an average grade of 4.53 grams of gold per tonne. During the six months from June 30, 2002 to December 31, 2002 the group produced 10.36 tonnes of gold depleting the reserve by 2.6 million tonnes of ore

The table below is a summary of the Group’s ore reserves at December 31, 2002.

All ore reserve estimates have been undertaken at a gold price A$530 per ounce.

13

Ore Reserves as at December 31, 2002

| | | | Proven

| | Probable

| | Total

|

Bronzewing | | | | | | | | |

Mine | | Mt | | 0.91 | | 2.30 | | 3.21 |

| | g/t | | 4.55 | | 2.70 | | 3.25 |

| | Tonnes Au | | 4.14 | | 6.20 | | 10.34 |

Mt McClure | | Mt | | 0.04 | | — | | 0.04 |

| | g/t | | 5.20 | | — | | 5.20 |

| | Tonnes Au | | 0.20 | | — | | 0.20 |

Stockpiles | | Mt | | 0.074 | | — | | 0.074 |

| | g/t | | 1.82 | | — | | 1.82 |

| | Tonnes Au | | 0.13 | | — | | 0.13 |

Total Bronzewing | | Mt | | 1.02 | | 2.30 | | 3.32 |

| | g/t | | 4.37 | | 2.70 | | 3.21 |

| | Tonnes Au | | 4.47 | | 6.20 | | 10.68 |

| | | |

| |

| |

|

Jundee – Nimary | | | | | | | | |

Barton Deeps | | Mt | | 0.36 | | 1.33 | | 1.69 |

| | g/t | | 8.10 | | 6.79 | | 7.07 |

| | Tonnes Au | | 2.87 | | 8.99 | | 11.86 |

Other Deeps | | Mt | | 0.11 | | 3.76 | | 3.87 |

| | g/t | | 7.43 | | 8.54 | | 8.30 |

| | Tonnes Au | | 0.79 | | 32.11 | | 32.91 |

Open Pits | | Mt | | — | | 1.22 | | 1.22 |

| | g/t | | — | | 1.61 | | 1.61 |

| | Tonnes Au | | — | | 1.96 | | 1.96 |

Stockpiles | | Mt | | 3.38 | | — | | 3.38 |

| | g/t | | 0.94 | | — | | 0.94 |

| | Tonnes Au | | 3.17 | | — | | 3.17 |

Total Jundee – Nimary | | | | | | | | |

| | Mt | | 3.84 | | 6.31 | | 10.15 |

| | g/t | | 1.78 | | 6.83 | | 4.92 |

| | Tonnes Au | | 6.83 | | 43.09 | | 49.88 |

| | | |

| |

| |

|

Wiluna | | | | | | | | |

Sulphides | | Mt | | 0.13 | | 0.34 | | 0.47 |

| | g/t | | 9.16 | | 7.39 | | 7.88 |

| | Tonnes Au | | 1.18 | | 2.52 | | 3.70 |

Stockpiles | | Mt | | 0.27 | | 0.30 | | 0.57 |

| | g/t | | 1.91 | | 3.22 | | 2.60 |

| | Tonnes Au | | 0.51 | | 0.98 | | 1.48 |

Total Wiluna | | Mt | | 0.40 | | 0.65 | | 1.04 |

| | g/t | | 4.27 | | 5.42 | | 4.98 |

| | Tonnes Au | | 1.70 | | 3.48 | | 5.18 |

| | | |

| |

| |

|

Total | | Mt | | 5.27 | | 9.25 | | 14.52 |

| | g/t | | 2.47 | | 5.71 | | 4.53 |

| | Tonnes Au | | 13.0 | | 52.78 | | 65.77 |

| | | |

| |

| |

|

14

Mt = million tonnes of ore, g/t = grams of gold per tonne contained in ore, t = tonnes of contained gold. It should be noted that contained tonnes of gold do not take into account recovery factors. Figures do not in some instances exactly match tonnage, grade and gold totals due to rounding.

Notes to accompany Ore Reserves table above

Ore reserve estimates were made at a gold price assumption of A$530 per ounce.

Bronzewing

During the period June 30, 2002 to December 31, 2002 total contained gold within Ore Reserves at Bronzewing declined from 17.91 tonnes to 10.68 tonnes of gold, a net reduction of 7.23 tonnes. Of this decline 4.53 tonnes or 63% is directly attributable to production during the six month period. Other changes principally related to;

| • | | Removal of some resource blocks within the Bronzewing mine (2.22 tonnes) due to improved geological modelling and refined economic criteria. |

| • | | Reduction in underground reserve at Lotus (1.18 tonnes) as a result of more stringent economic constraints. |

| • | | Re-evaluation of the expanded Central Pit (0.73 tonnes), which is not considered economic at US$300 per ounce gold. |

Jundee – Nimary

Significant changes in the gold inventory attributable to Ore Reserves at Jundee – Nimary occurred during the six month period from June 30, to December 31, 2002. Total contained gold in reserves increased by 17.72 tonnes from 32.16 tonnes on June 30, to 49.88 tonnes at December 31, 2002. This increase has been achieved after allowance for production during the period of 4.86 tonnes of gold. Principal changes include;

| • | | The addition to the Open Pits reserve of 1.96 tonnes of gold from new deposits at Gourdis, Vause and Area 7. |

| • | | An addition to reserves from the Westside deposit of 19.06 tonnes. Drilling to define further additions to this new ore position will be ongoing throughout 2003 – 2004. |

| • | | A revised feasibility study into underground mining at the Invicta deposit. |

These additions to the Ore Reserves have been partially offset by re-modelling of the lower levels at the Barton Deeps, which highlighted the more discontinuous nature of this orebody at depth. This has resulted in a reduction in available reserves in this area.

Wiluna

Ore reserves at Wiluna have been generally maintained at constant levels after allowance for production of 1.78 tonnes during the period from June 30, 2002 to December 31, 2002. The very modest net reduction of 0.08 tonnes has been achieved after changes in reserves principally due to;

| • | | depletion of the intermediate stockpiles being partially offset by the inclusion of the low grade stockpiles (0.36 tonnes) into the reserves. |

| • | | Underground depletion due to production during the period has been more than matched by new additions to reserves based on additional data, in the Woodley Orebodies. |

15

Exploration

The Eastern Goldfields in Western Australia is one of the major gold producing regions in the world, currently accounting for approximately 8% of worldwide production NYOL believes the Yandal and Wiluna greenstone belts, located at the northern end of the Eastern Goldfields, to be among the most prospective regions for mineral exploration in Western Australia. At June 30, 2002 NYOL had reserves of 55.28 tonnes within the Yandal and Wiluna greenstone belts.

NYOL has discovered and developed two major gold deposits in the Yandal Belt: Bronzewing and Jundee. Recent research by the University of Western Australia has shown the Yandal Belt to be the northern extension of the Kalgoorlie Terrain. NYOL operates two other mines: Wiluna in the Wiluna Belt and McClure in the Yandal Belt. The Group has a total of 3,150 square kilometres secured under 387 granted tenements and 1,560 square kilometres held under 182 license applications. The total tenement area is reduced from previous years as NYOL has reviewed and prioritised targets and relinquished tenements over un-prospective or completely explored ground.

The Group has a commitment to the discovery of extensions and repetitions of known deposits. The potential was highlighted by the discovery of the new Westside ore position at Jundee.

District-scale exploration also has the potential to add value to existing operations because all exploration is conducted within 60km (trucking distance) of an existing NYOL mill.

NYOL has discovered 311 tonnes of gold (current deposits plus past production) in the Yandal greenstone belt since 1992. The primary goals of the current exploration program are:

| • | | Within Mine: to explore the extensions of known mineralised systems and to evaluate potential repetitions of those systems. |

| • | | Near Mine: Within the immediate mine environs look for repetitions or extensions either at depth, along strike or in parallel structures. |

| • | | District-scale: to grow production through the discovery of new Reserves that are within trucking distance of one of the Yandal mills, and discover new Reserves in excess of 100 tonnes of gold that can be developed as stand-alone mining operations; |

NYOL spent A$15.5 million on exploration in the year ended June 30, 2002, of which A$7.2 million was on mine sites. For the six months ended December 31, 2002 a total of A$6.7 million was budgeted for exploration, which included A$2.4 million for mine-site and near mine exploration and A$4.3 million for district-scale exploration. The company also recently moved to a calendar year budget. For the year ending December 31, 2003, a total of A$13.1 million has been budgeted for exploration, which includes A$4.1 million for mine-site and near mine exploration and A$9.0 million for district scale exploration. The Group’s exploration expenditures include all of the costs associated with exploration activities such as contract drilling, personnel, geochemical testing and tenement statutory fees.

NYOL’s focus is on gold, but it also holds tenements prospective for nickel and copper-lead-zinc-silver. Exploration partnerships are being considered with companies interested in pursuing this non-gold potential. NYOL is placing greater emphasis on exploration in the Yandal Belt as more land becomes accessible through the grant of exploration title in important target areas and the development of heritage protection protocols with a number of indigenous groups permitting on-ground access to granted exploration tenements. Exploration consists of a rigorous process of historical data analysis and evaluation, geophysical surveying and interpretation, geological mapping and surface sampling, and drilling. Improved data processing techniques and the refinement of geological models for the Yandal Belt continue to expose untested exploration opportunities. It is estimated that 65% of the Yandal Belt controlled by NYOL remains either under-explored or unexplored.

Plainting against NYOL by other parties for statutory conditions non-compliance is becoming more of an issue, as it is for all exploration and mining companies in Western Australia. NYOL has 15 Plaints to defend, none of which impacts on critical land holdings. It is anticipated that all tenements affected will be successfully retained by NYOL.

16

Opportunities to grow the Group’s portfolio of prospective and strategic landholdings are rigorously pursued. Land acquisition is pursued through pegging of vacant tenements over areas of prospective geology through the vigilant monitoring of tenement situations, and through commercial joint venture agreement with other companies or individuals.

Bronzewing

In Mine Exploration

With a declining reserve base an aggressive in mine and near mine exploration program was undertaken during 2001-2002 with the objective of extending mine life.

The in mine program involved drill testing immediate extensions to known mineralization. The Winged Keel, Avacado, Shoot 39 and Carrot targets at Bronzewing and Lotus North at McClure fall into this category.

The Bronzewing Deeps and Eastern Zone were conceptual targets with the potential for repetition of the Discovery or Central orebodies.

The Eastern Zone was a potential repetition of the Bronzewing system east of the Discovery Granodiorite and the Bronzewing Deeps target was a potential depth repetition of the mineralised systems.

The resource extension programs at Winged Keel (13.2m @ 14.4g/t Au; 7.8m @ 6.2 g/t Au; 5m @ 6.9g/t Au), Avacodo (10 Level, 30.6m @ 12.3 g/t Au from 72m and 8.2m @ 4.1 from 106.9m ; 8.4m @ 4.7 g/t Au from 26.0m; 3.9m. @ 13.2 g/t Au from 49.1m ; 4.2m @ 35.8 g/t Au from 8.2m) and Shoot 39 (9.8m @ 8.8g/t, 6.5m @ 8.0g/t and 5.7m @ 6.4g/t) were successful, but only resulted in an incremental increase in the mineralised material. Most successful were extensions to the Winged Keel position, with the known lode now extended to the 17 and potentially 18 levels.

The programs to test the Eastern Zone and Discovery Deeps commenced in 2000 and the final holes were completed in July and August 2001.

BWRCD3179 intersected 1m @ 6.6g/t Au from 511m in the Eastern Zone, immediately east of the Discovery Granodiorite

BWRCD3181 drilled to further test the Discovery Deeps target intersected a 30m wide shear zone with 11m of quartz veining and intense biotite-carbonate alteration. An anomalous zone of 10m @ 0.7g/t Au (inc 2m @ 2.3g/t Au) was outlined.

These two deep diamond holes completed the Eastern Zone and Discovery Deeps programs. This work showed that although alteration zones and anomalous gold mineralisation extended beyond the Discovery and Central Deposits, no economically significant gold mineralisation was intersected.

McClure

At Lotus both surface RC and Diamond drilling was used to explore the northern extension of the Lotus mineralisation. Only one hole intersected economically significant mineralisation 3m (TW 1.5m) @ 70.0 g/t Au approximately 80m north of current resource limits.

For the year ended June 30, 2002, A$0.14 million was spent on in mine exploration at Bronzewing. For the six months ended December 31, 2002, A$0.03 million was spent on mine exploration at Bronzewing and for the year ending December 31, 2003, no mine exploration has been budgeted.

Near Mine Exploration

Sparrow Hawk, Parthfinder, Voyager and Old Sundowner are prospects associated with NNE trending structures from 2–6 kms NE of Bronzewing. Cockburn, Goldwing, Grand Union and Anomaly 45 are associated with the NNW trending McClure Trend

17

Sparrow Hawk

Several diamond holes were drilled to test this target and zones of anomalous gold mineralisation were intersected. eg, 8m @ 2.0 g/t Au from 36m; 3m @ 10.6 g/t Au from 109m; 8m @ 0.8gt/t Au from 99m; 4m @ 3.7 g/t Au from 108m; and 12m @ 0.5 g/t Au from 96m.

However, considering the lack of continuity of the mineralisation and the depth of the intersections no further work is planned.

At Pathfinder ((NDYBWRCD3182 4m @ 0.4 g/t Au from 208m) and Voyager (DYBWRCD 3185 12m @ 0.33 g/t au from 236m) diamond drilling intersected at best anomalous gold mineralisation.

Old Sundowner

Near mine drilling at Sundowner North (10m @ 0.9g/t Au from 8m; 1m @ 4.4 g/t Au from 38m; 1m @ 4.0 g/t Au from 119m and 4m @ 4.9 g/t Au from 168m) and BWRCD3199 1m @ 1.4 g/t, 1.7m @ 2.2 g/t and 2.1m @ 1.6 g/t (all below 176m), produced broadly anomalous zones, but no economically significant mineralisation.

In summary the near mine programs on the NE prospects intersected the target structures and alteration, but the extent and quality of the gold mineralisation was not sufficient to warrant further work.

McClure Trend

Cockburn

As a prelude to evaluating the Cockburn resource, all old surface holes drilled by previous owners were gyroscopically surveyed. A revised geological and mineralisation interpretation was undertaken. Reverse circulation drilling was undertaken at Goldwing and Anomaly 45 without improving the prospectivity of the targets. At Grand Union follow up to a previous intersection of 4m @ 4.0g/t (MCRC28 from 264m) intersected 12m @ 2.8 g/t Au (MCRC44).

For the year ended June 30, 2002, A$2.89 million was spent on near mine exploration at Bronzewing. For the six months ended December 31, 2002, A$1.0 million was budgeted for near mine exploration at Bronzewing and for the year ending December 31, 2003, A$1.0 million has been budgeted, subject to favourable drilling results on near mine leases and/or at McClure.

Jundee-Nimary

In Mine Exploration

In mine exploration focused on the Westside mineralised system, discovered during 2000. Westside began the year as a promising narrow, high grade target close to the Barton Deeps underground development and by June 2002 had emerged as a probable new, future reserve. After initial surface holes it was possible to drill the Upper Panel of Westside (200-460m below surface) from Barton Deeps with a drill spacing of approximately 40x40m. This program was well advanced by June 2002 and added reserves at year ended December 31, 2002.

In addition to the Main and Hangingwall veins defined by surface drilling the more closely spaced underground holes showed the continuity of splays and linking structures between the major veins.

For logistical reasons it was not possible to drill the Lower Westside Panel (460- 700m) from underground. As of the date of this report, approximately 80 x80m spaced surface holes have tested the Lower Panel.

In the process of testing Westside the hangingwall Lyons Dolerite with shear hosted gold mineralisation similar to Westside was intersected. The Lyons target has emerged as having significant additional exploration potential for mineralisation similar to Westside.

19

Westside

Upper Panel

The table below contains a sample of the economically significant results from drill testing the Westside Upper Panel. The mineralisation is restricted to discrete structures with very little leakage into a halo around the structures.

Westside Upper Panel Surface and Underground Diamond Drill Results

Hole No

| | From

| | To

| | Width

| | Au

| | Comments

|

| | m. | | m. | | m. | | g/t | | |

WSXP521 | | 128.8 228.0 | | 129.5 229.0 | | 0.7 1.0 | | 1,470 49.2 | | |

BDXP0500 | | 73.0 | | 74.0 | | 1.0 | | 63.2 | | Upper Panel Westside |

BDXP0501 | | 101.0 | | 105.0 | | 4.0 | | 16.8 | | Upper Panel Westside |

HDXPO488 | | 137.5 249.9 | | 141.2 251.0 | | 3.7 1.1 | | 32.7 110 | | |

HDXPO489 | | 149.6 219.6 227.8 277.4 | | 151.0 220.0 229.0 279.0 | | 1.4 0.4 1.2 1.6 | | 148 26.2 16.4 17.0 | | |

HDXPO490 | | 103.0 | | 104.0 | | 1.0 | | 50.9 | | |

BDXPO420 | | 294.0 | | 299.0 | | 5.0 | | 3,288 | | |

HDX04161 | | 58.1 | | 59.2 | | 1.1 | | 96.3 | | |

JRCD8859 | | 361.8 398.0 | | 362.45 399.0 | | 0.65 1.0 | | 96.2 21.1 | | Surface Hole |

BDXP0502 | | 71.0 120.0 165.9 183.0 222.4 | | 75.0 125.6 170.0 184.0 223.4 | | 4.0 5.6 4.1 1.0 0.9 | | 8.3 5.3 46.2 59.1

122.4 | | Upper Panel Westside Upper Panel Westside Upper Panel Westside Upper Panel Westside Upper Panel Westside |

N.B. all grades are uncut

These holes demonstrate the narrow width of the multiple vein system (eg BDXP0502) and the very high gold grades that are possible. The mineralised system has been outlined over a strikelength of approximately 400m. The gold mineralisation is often visible and associated with chlorite and biotite, quartz and carbonate veining within shear zones sometimes with breccia.

Lower Panel

The bulk of the Lower Panel (460-700m from surface) has been drilled from surface on approximately 80m centres . The table below contains a selection of drill results from the 2001-2002 program.

Westside Lower Panel Surface and Underground Diamond Drill results

Hole No

| | From

| | To

| | Width

| | Au

| | Comments

|

| | m. | | m. | | m. | | g/t | | |

BDXP0497 | | 168.0 351.0 | | 170.0 353.9 | | 2.0 2.9 | | 5.6 6.1 | | Lyons Dolerite Lower Panel Westside |

JRCD9050 | | 664.0 | | 664.5 | | 0.5 | | 8,970 | | |

JRCD8926 | | 482.2 | | 484.2 | | 2.0 | | 8.6 | | Westside |

JRCD8951 | | 646.1 | | 647.8 | | 1.7 | | 115 | | Westside HW |

JRCD8952 | | 366.8 | | 367.5 | | 0.7 | | 18.7 | | Lyons Dolerite |

| | 532.0 | | 535.2 | | 3.2 | | 9.1 | | Westside |

JRCD8953 | | 166.2 | | 166.6 | | 0.4 | | 122 | | Lyons Dolerite |

| | 451.1 | | 451.8 | | 0.7 | | 40.7 | | Westside HW |

20

| | 463.3 | | 463.7 | | 0.4 | | 49.8 | | Westside |

BDXP0419 | | 89.2 | | 90.9 | | 1.7 | | 20.8 | | Westside HW |

HDXP0493 | | 98.1 | | 98.7 | | 0.6 | | 119 | | Westside HW |

| | 84.7 | | 85.2 | | 0.5 | | 767 | | Westside |

N.B. all grades are uncut

The Lower Panel is an immediate extension of the Upper Westside Panel. Gold grades, widths of structures and the host alteration are similar.

Lyons Dolerite

At Jundee there are three dolerites separated by narrow bands of sediments. The eastern most dolerite, the Barton Dolorite hosts the Barton and Barton Deeps orebodies, which will produce approximately 47 tonnes of gold.

In the hanging wall to the Barton’s Dolerite is the Hughes Dolerite, which hosts the Westside mineralisation. The third and most western dolerite is the Lyons Dolerite. Surface drilling, targeting Westside Lower Panel has intersected narrow zones of high grade gold mineralisation in the Lyons Dolerite. The table below summarizes some of the more economically significant drill results.

Lyons Dolerite Diamond Drill results

Hole No

| | From

| | To

| | Width

| | Au

| | Comments

|

| | m. | | m. | | m. | | g/t | | |

BDXP0497 | | 168.0 351.0 | | 170.0 353.9 | | 2.0 2.9 | | 5.6 6.1 | | Lyons Dolerite Lower Panel Westside |

BDXP0494 | | 173.0 | | 177.0 | | 4.0 | | 5.0 | | Lyons Dolerite |

| | 227.0 | | 227.4 | | 0.4 | | 34.2 | | Westside HW |

BXD0509 | | | | | | 1.8 | | 58.7 | | Lyons Dolerite |

JRCD 8925 | | | | | | 0.3 | | 2,910 | | Surface Hole – Lyons Dolerite |

JRCD8952 | | | | | | 0.7 | | 18.7 | | Surface Hole – Lyons dolerite |

It should be noted that all grades are uncut.

Exploration of the Lyons Dolerite hosted mineralised system is at an early stage, but results to date have been encouraging.

For the year ended June 30, 2002, A$2,4 million was spent on in mine exploration at Jundee-Nimary. For the six months ended December 31, 2002, A$0.8 million was budgeted for in mine exploration at Jundee-Nimary and for the year ending December 31, 2003, A$2.6 million has been budgeted.

Near Mine Exploration

Near mine exploration has targeted the Gateway Prospect mineralised system and a group of low grade potentially open pitable deposits located up to 50 kms south of Jundee. Minor work was done at Cork Bore north of Jundee.

Gateway

The Gateway prospect is located approximately 2 kms SW of Barton and has the Nexis structural orientation. Several surface diamond holes were drilled during the year with variable results.

JRCD8873 returned 3m @ 5.0 g/t Au from 542m, and JRCD8842 intersected a zone of visible gold mineralised dacite which assayed 57.4 g/t Au over 2.3m from 551m.

In March 2002 3.9m @ 6.0g/t Au, 100m downdip from the base of the current interpretation was intersected, but a second hole JRCD9017 intersected similar alteration, but no economically significant Au mineralisation.

21

Open Pits

South of Jundee, broad zones of low grade mineralisation, Winter (61m @ 0.81g/t Au from 8m.) and Strickland Prospects ( 48m @ 0.91 g/t Au from 20m.) were intersected, but the area does not appear to have reserve potential.

At Area 7 West, 15 kms south of Jundee carbonate-chlorite-silica alteration and disseminated pyrite was intersected in dolerite. The interval returned 29m @ 1.2 g/t Au (inc 10m @ 2.3 g/tAu) from 297m.

At Cork Bore 10 kms north of Jundee there was some encouragement from testing NS and NE trending limonitic quartz veining in Mg basalt and felsic porphyry. Initial result included 20m @ 1.1 g/t Au from 51m and follow up drilling continued to expand the zone eg JRC8881 8m @ 0.5 g/t Au from 44m; JRC8882 16m @ 0.23 g/t Au from 48m and 4m @ 0.8 g/t Au from 108m. However, there was no indication of the extent or grade of mineralisation necessary for economic exploitation.

For the year ended June 30, 2002, A$3.26 million was spent on near mine exploration at Jundee-Nimary. For the six months ended December 31, 2002, A$0.4 million was spent on near mine exploration at Jundee-Nimary and for the year ending December 31, 2003, A$0.4 million has been budgeted (not including expenditure on resource to reserve conversion).

Wiluna

In Mine Exploration

Exploration at Wiluna focused on immediate extensions to known mineralised systems to increase reserves in the short term and expand mine life. In Mine drilling was undertaken at Happy Jack, East and West Lodes and Calvert, Golden Age and Woodley.

At Happy Jack drilling intersected a lens (7.63m @ 15.4g/t Au; 2.9m @ 16.6 g/t Au and 1m @ 9.1 g/t Au), 30m south of the old workings and 80m from the nearest development.

In the East/West Lodes and Calvert reverse circulation and diamond drilling was undertaken to extend the East/West Lode open pit potential and to add to the underground resource potential associated with the old East and West Lode underground workings. At Calvert-West Lode WD545B intersected 16m @ 12.2 g/t Au from 520m and WD547 10.2m @ 4.7g/t Au from 585.3m. At East Lode Sth WR2690A intersected 8m @ 7.7 g/t Au, WR2681 9m @ 10.5 g/t Au from 241m and WR2682 4m @ 5.1 g/t Au from 251m. However, additional holes drilled down plunge failed to intersect economic grades and widths of gold mineralisation

GDH272 intersected 4.1m @ 24.8g/t Au from 433.7m and GDH273 intersected 0.61m at 11.3 g/t Au from 505.4m at Golden Age and these results should extend the reef 250m south and 150m below the current workings on the 21 Level.

At Wiluna Queen and Magazine south-east of East Lode reverse circulation drilling intersected relatively narrow zones of moderate grade gold mineralisation. (WR2652; 2.0m @ 4.1g/t Au from 222m: WR2671; 2.0m @ 3.6g/t Au from 260m; WR2672; 4.0m @ 6.2g/t Au from 106m;WR2672; 1.0m @ 3.2g/t from 218m)

At Woodley results include WDH124 4.8m @ 16.0 g/t Au, WDH128 1.1m @ 33.6 g/t Au and WDH130 4.0m @ 6.1 g/t Au testing lens 80/200 below the 965RL.

WD496B was drilled to test Woodley Deeps downdip from the Woodley and Bulletin Sth mineralised zones. The hole intersected 4.7m @ 17.9 g/t Au from 934.3m in sheared dolerite and 14.7m @ 2.7 g/t in the interpreted Woodley position.

Other prospects tested with reverse circulation or diamond drilling in the near mine area included Squib Nth,East Lode South, Lake Reef North, Lone Hand Fault, Moonlight/Adelaide (2m @ 3.0 g/t Au from 640m), Dolerite Zone (WD544A – 10.9m @ 4 g/t Au), Golden Bracelet (WR2689A 4m @ 0.35 g/t Au

22

from 199m and 1m @ 2.15 g/t Au from 181m), Quartz Scheelite, North Lode and Stonehaven.

There was no expenditure on in mine exploration at Wiluna for the year ended June 30, 2002, the six months ended December 31, 2002, and none has been budgeted for the year ending December 31, 2003.

Near Mine Exploration

Outside the mine area, exploration was undertaken at Galaxy, 12 kms to the north and Williamson on Lake Way to the south.

Galaxy

Sixteen RC holes were drilled to test oxide pit potential at Galaxy. Results include WR2709 13m @ 3.3 g/t Au from 33m, WR2714 2m @ 11.6 g/t Au from 36m and WR2718 4m @ 11.4 g/t Au from 54m.

Williamson

A 43 hole Aircore programme was completed to depths of 33-119m over 500m strikelength at the Williamson Prospect on Lake Way. Eighteen holes reported intervals with grades exceeding 1 g/t Au and these are summarised in the table below. All holes were drilled at 60 degrees to the west.

| | Co ordinates

| | Interval

| | | | |

Hole No

| | North

| | East

| | From

| | To

| | Width

| | Au

|

| | m. | | m. | | m. | | m. | | m. | | g/t |

WA01716 | | 7035580 | | 233180 | | 9.0 16.0 | | 11.0 24.0 | | 2.0 8.0 | | 4.3 1.3 |

|

WA01717 | | | | 233195 | | 18.0 | | 31.0 | | 13.0 | | 3.3 |

|

WA01718 | | | | 233210 | | 21.0 33.0 42.0 | | 30.0 37.0 47.0 | | 9.0 4.0 5.0 | | 1.3 1.1 2.5 |

|

WA01720 | | 7035640 | | 233165 | | 5.0 | | 10.0 | | 5.0 | | 1.2 |

|

WA01721 | | | | 233179 | | 28.0 37.0 | | 30.0 41.0 | | 2.0 4.0 | | 4.7 2.7 |

|

WA01722 | | | | 233195 | | 15.0 36.0 | | 22.0 40.0 | | 7.0 4.0 | | 9.1 1.4 |

|

WA01723 | | | | 233210 | | 34.0 41.0 75.0 90.0 | | 36.0 71.0 77.0 92.0 | | 2.0 30.0 2.0 2.0 | | 4.4 7.3 3.3 3.9 |

|

WA01728 | | 7035670 | | 233205 | | 20.0 67.0 | | 24.0 70.0 | | 4.0 3.0 | | 2.7 3.2 |

|

WA01731 | | 7035740 | | 233176 | | 9.0 | | 12.0 | | 3.0 | | 3.9 |

|

WA01732 | | | | 233190 | | 26.0 | | 32.0 | | 6.0 | | 4.1 |

|

WA01733 | | | | 233205 | | 27.0 | | 43.0 | | 16.0 | | 4.6 |

|

WA01737 | | 7035820 | | 233210 | | 31.0 60.0 | | 53.0 70.0 | | 22.0 10.0 | | 2.8 5.6 |

|

WA01738 | | | | 233224 | | 88.0 | | 93.0 | | 5.0 | | 5.3 |

|

WA01742 | | 7036020 | | 233211 | | 81.0 | | 88.0 | | 7.0 | | 1.5 |

|

WA01745 | | 7036060 | | 233209 | | 54.0 | | 64.0 | | 10.0 | | 2.4 |

|

WA01747 | | 7035390 | | 233201 | | 38.0 | | 43.0 | | 5.0 | | 3.0 |

|

WA01748 | | | | 233222 | | 42.0 | | 52.0 | | 10.0 | | 4.7 |

|

WA01756 | | 7035550 | | 233209 | | 6.0 | | 39.0 | | 33.0 | | 3.4 |

For the year ended June 30, 2002, A$1.1 million was spent on near mine exploration at Wiluna. For the six months ended December 31, 2002, A$0.5 million was spent on near mine exploration at Wiluna and for the year ending December 31, 2003, no near mine exploration has been budgeted.

23

District-Scale Exploration

Newmont Yandal Operations Limited (NYOL) and wholly owned entities (principally Newmont Wiluna Gold Pty Ltd) hold 411km2

of granted exploration and mining tenure, and 187km2 of tenure under application in the Wiluna Belt. Holding costs for all granted tenure amount to A$170,808 per annum in Rates and A$477,324 per annum in rent. The aggregate statutory expenditure commitment on granted tenure only is A$4.3 million. Despite statutory expenditure commitments having not been met on many tenements for a number of years, tenure is relatively secure because the Project Status granted by the Department of Industry and Resources (DoIR) permits the redistribution of aggregated mining and exploration costs across all tenements.

The Wiluna gold deposits were discovered in outcrop over 100 years ago in 1896. Areas of outcrop were easily prospected at low cost using loaming and dry blowing techniques, and more recently by systematic soil sampling and assaying using analytical techniques with detection limits that only in the early 1980’s surpassed the effectiveness of the gold pan.

The Wiluna ore bodies lie along north-trending faults in the Wiluna Mine Sequence. These structures are easily identifiable in the high-resolution aeromagnetic data. The same data also highlights similar structures within sections of the 80% of the Wiluna Mine Sequence concealed beneath transported cover. This transported cover masks the geochemical response of the buried mineralisation and consequently, these areas are not amenable to traditional surface prospecting techniques. These concealed conceptual targets have been systematically drilled and tested with 20,800 holes for 864,350 metres.

The last of the priority targets was tested in 2000 & 2001 with comprehensive drilling on Lake Way. The northern shore of the lake is located approximately 10km south of the Wiluna Mine and the drilling was permitted only with the development of new lake drilling technology. The Williamson gold system was discovered by this work, but gold grades in the discontinuous mineralisation were generally low. Potential remains for the discovery of small oxide deposits beneath Lake Way Structural sites and host rocks with characteristics similar to those that control other types or Archaean lode gold deposits in the Eastern Goldfields have also been tested in the Wiluna area. However, initial indications of gold anomalism and mineralisation failed to develop into tangible resource potential when followed up with systematic drill testing. The risk profile of future exploration, should it be undertaken, will increase substantially as lower order opportunities are targeted beneath increasingly thicker transported cover.

The Wiluna Belt is recognized more for its nickel rather than its gold endowment. Several nickel sulphide deposits, some in production (Agnew, Mt Keith and Cosmos), have been discovered in the southern half of the Wiluna Belt. No nickel sulphide deposits have been discovered within NYOL land holdings in the northern Wiluna Belt although favourable host rocks are present and a contemporary reassessment of historical nickel exploration could reveal untested nickel potential. A lateritic nickel deposit of approximately 100 million tonnes grading 1% nickel equivalent has been outlined on NYOL tenure, although this resource is relatively small by lateritic nickel deposit standards and is unlikely to be of economic value in the foreseeable future.

24

Yandal Belt

Bronzewing Area (South Yandal)

Exploration priority was given to targets that fell within a 30km radius of Bronzewing Mine because of the mine’s pending closure due to reserve depletion. Although all high priority district-scale targets, with the exception of the Katherine Well prospect, had been tested, lower priority targets which could have possibly represented incremental mill feed for Bronzewing were also assessed. In September 2002 the Bronzewing Mine geologists and Yandal Regional geologists formed a task force to systematically work through and audit all exploration that had been conducted within a 30km radius of Bronzewing Mine and identify the residual exploration opportunities that either remained untested or partially tested. As a results of this audit a further 10 lower priority district-scale targets were evaluated, but no significant mineralisation was discovered.

The Katherine Well prospect, located 30km southeast of Bronzewing Mine, was discovered in mid-2002 and was the last of the higher priority district-scale exploration targets to be tested near Bronzewing. Initial drilling of this new discovery, which is concealed beneath transported cover, intersected mineralisation assaying >1g/t Au over a strike of 1,200 metres in broad-spaced (400m) drill traversed. Better results include 4m @ 6.7g/t Au from 68m and 8m @ 2.0g/t Au from 60m.Subsequent follow-up drilling along lines 200 metres apart was unsuccessful in delineating coherent, ore-grade mineralisation and no further work is planned following the downgrading of the resource potential.

Other district-scale exploration that could have had a positive impact on Bronzewing was undertaken in the Newton project area—an area considered prospective because of the coincidence of favourable structure, lithologies and broad-scale alteration. As part of the follow-up of a conceptual targets in mid-2002, an outcropping, gold-bearing quartz vein that assay up to 1,470g/t Au in rock-chip samples was discovered 45km north of Bronzewing. Follow-up drilling of this mineralized vein returned a best result of 4m @ 2.3g/t Au. Since the drilling was conducted, intensive geological mapping has documented three principal vein arrays that are known to contain gold. Further drilling is planned in 2003.

Exploration beneath Lake Darlot located 50km southeast of Bronzewing Mine has been delayed due to aboriginal heritage issue. Although the tenure has been granted, three separate heritage surveys are required with three indigenous groups before drilling on the surface of the ephemeral salt lake can commence The project area is located 15km northwest of Barrick’s 2 million ounce Darlot gold mine. The principal controlling structure at the Darlot Gold Mine strikes north into NYOL’s ground and converges with a number of other region structures to form an interpreted zone of dilation and focus for mineralisation beneath Lake Darlot. It is anticipated that all three heritage surveys will be completed during the first half of 2003 and drilling on the lake will commence in the second half of 2003.

Jundee Area (North Yandal)

The northern section of the Yandal Belt, in particular the 200km2 Red Lake project area located 50km southeast of Jundee mine, holds some of the best remaining conceptual exploration potential in the Yandal Belt. Granting of tenure at Red Lake is expected in the first half of 2003 once a heritage protocol and land access agreement has been negotiated with the Wiluna Native Title Claimants and the Tjupan People (heritage survey scheduled for April 2003).

Exploration during 2002 focussed on the Tipperary Well prospect – a large (2 km2), gold anomalous (+0.2g/t Au), pervasive haematite-epidote alteration system located 60km south of Jundee. Exploration drilling was unsuccessful in delineating a focus for the metal-rich mineralizing fluids beyond a few, narrow, high-grade quartz veins which returned a best intercept of 1m @ 11g/t Au.

25

Signatures

The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F/A and that it has duly caused and authorised the undersigned to sign this Amendment No. 1 to Anual Report on its behalf.

Newmont Yandal Operations Limited

By:

/s/ John Dow

John Dow

Chief Executive Officer

Date: May 29, 2003

26

CERTIFICATION OF CHIEF EXECUTIVE OFFICER

(SECTION 302 CERTIFICATION OF THE SARBANES OXLEY ACT OF 2002)

I, John Dow, certify that:

| 1. | | I have reviewed this Amendment No. 1 to Annual Report on Form 20-F/A of Newmont Yandal Operations Limited; |

| 2. | | Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report. |

Date: May 29, 2003

/s/ John Dow

John Dow

Chief Executive Officer

27

CERTIFICATION OF CHIEF FINANCIAL OFFICER

(SECTION 302 CERTIFICATION OF THE SARBANES OXLEY ACT OF 2002)

I, Gary Farmar, certify that:

| 1. | | I have reviewed this Amendment No. 1 to Annual Report on Form 20-F/A of Newmont Yandal Operations Ltd. |

| 2. | | Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this annual report; |

Date: May 29, 2003

/s/ Gary Farmar

Gary Farmar

Chief Financial Officer

28