UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

| ¨ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12 (b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the 12-month period ended June 30, 2002

or

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period ended June 30, 2002

Commission file number # 0-20588

NEWMONT YANDAL OPERATIONS LIMITED (A.C.N. 007 066 766)

(Exact Name of Registrant as Specified in its Charter)

(Translation of Registrant’s Name Into English)

STATE OF VICTORIA, AUSTRALIA

(Jurisdiction of Incorporation or Organisation)

100 Hutt Street, Adelaide, South Australia, 5000, Australia

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12 (b) of the Act:

TITLE OF EACH CLASS

| | NAME OF EACH EXCHANGE-

ON WHICH REGISTERED

|

NONE | | NONE |

| |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Fully Paid Ordinary Shares: | | |

at June 30, 2002 | | 308,960,662 |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark which financial statement item the registrant has elected to follow.

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12,13 or 15 (d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

YES | | ¨ | | NO | | ¨ | | NOT APPLICABLE |

2

TABLE OF CONTENTS

3

4

Newmont Yandal Operations Limited

In this Annual Report on Form 20-F, references to Newmont Yandal Operations, NYOL or the Group are references to the Newmont Yandal Operations consolidated group of companies. Reference to Newmont Yandal Operations Limited or the Company is to the company “Newmont Yandal Operations Limited”.

Change of Name

On April 23, 2002, the Company changed its name from Normandy Yandal Operations Limited to Newmont Yandal Operations Limited. NYOL’s Annual Report for the eighteen months ended December 31, 2002 is expected to be published in May 2003.

Change of Financial Year

For the purpose of synchronising the Company’s financial year with that of its ultimate parent entity, Newmont Mining Corporation, NYOL has changed its financial year to a calendar basis. Under Australian Corporations Law, NYOL will prepare audited financial statements for the eighteen months ended December 31, 2002.

This Report as of and for the twelve months ended June 30, 2002 is being filed voluntarily by the Company.

Accounting principles

NYOL’s general purpose financial report for the twelve months ended June 30, 2002 has been prepared in accordance with applicable Australian Accounting Standards, Urgent Issues Group Consensus Views and the Australian Corporations Act 2001. These accounting principles are referred to within this annual report on Form 20-F as A-GAAP (Australian generally accepted accounting principles).

Currency

NYOL’s general purpose financial report is in Australian dollars (“A$”). In this annual report, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in A$. References made to US$ is the lawful currency of the United States.

5

Change in functional currency for US GAAP

NYOL first prepared a US GAAP reconciliation in connection with the issue of its US$300,000,000 8 7/8% Senior Notes due April 1998. At that time, the Group was an Australia public company with a predominantly Australian shareholder base, and used Australian dollars (“A$”) as the reporting currency for A-GAAP. Consequently, A$ was adopted as the functional currency for US GAAP.

On February 15, 2002, the Group’s parent entity, Newmont Australia Limited (formerly Normandy Mining Limited) was acquired by Newmont Mining Corporation (“Newmont”), a US public gold mining company with a majority of US shareholders. Newmont adopts the US dollars as the functional currency for each of its international subsidiaries.

With the Group’s sales price for gold moving in direct correlation with the US dollar gold price, and a combination of US dollars and A$ costs, necessitated a change in functional currency for the Group to the US dollars.

As the A$ is still used as the reporting currency for A GAAP, the reconciling adjustment to US GAAP reflects the impact of recording transactions denominated in A$ or other currencies in US dollars at the prevailing exchange rate at the time they occur.

6

Certain forward-looking statements

This annual report includes “forward-looking information” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended is intended to be covered by the safe harbor provided for under these sections. Certain statements contained in this annual report, including without limitation, those concerning the economic outlook for the gold mining industry; estimates of future costs and other liabilities, and estimates of future hedge liabilities expectations regarding gold prices, sales and production; the timing, scope and cost of drilling and other exploration activities, potential changes in NYOL’s gold production and reserves, and NYOL’s liquidity and capital resources, contain certain forward-looking statements regarding the Group’s operations.

NYOL believes that the expectations expressed in these forward looking statements are reasonable, however, no assurance can be given that such expectations will prove to be accurate or correct.

Accordingly, results could differ materially from those set out in the forward-looking statements. Factors that could cause actual results to differ materially include, among others, changes in gold prices, interest rates and exchange rates, unanticipated grade, geological, metallurgical processing or other problems, results of current exploration activities, results of pending and future feasibility studies, changes in project parameters as plans continue to be refined, availability of materials and equipment, the timing of receipt of governmental permits, force majeure events, the failure of plant, equipment or processes to operate in accordance with specifications or expectations, accidents, labour relations, delays in start-up dates, environmental costs and risks, the outcome of acquisition negotiations and general domestic and international economic and political conditions. Refer to item 3D “Risk factors” for a more in depth discussion of factors that could materially adversely affect the Group.

7

Part I

Item 1: Identity of directors, senior management and advisers

Not applicable.

Item 2: Offer statistics and expected timetable

Not applicable.

Item 3: Key information

| 3A. | | Selected financial data |

Exchange rates

The following table sets forth for the periods indicated, the average, high, low and period-end Noon Buying Rates in the City of New York for Australian dollars into United States dollars as certified for customs purposes by the Federal Reserve Bank of New York, rounded to two decimal places.

Twelve months ended: | | Average | | High | | Low | | Period end |

June 30, 1998 – A$1.00 = | | US$ | 0.68 | | US$ | 0.75 | | US$ | 0.59 | | US$ | 0.62 |

June 30, 1999 – A$1.00 = | | US$ | 0.63 | | US$ | 0.67 | | US$ | 0.56 | | US$ | 0.66 |

June 30, 2000 – A$1.00 = | | US$ | 0.62 | | US$ | 0.67 | | US$ | 0.57 | | US$ | 0.60 |

June 30, 2001 – A$1.00 = | | US$ | 0.54 | | US$ | 0.60 | | US$ | 0.48 | | US$ | 0.51 |

June 30, 2002 – A$1.00 = | | US$ | 0.52 | | US$ | 0.57 | | US$ | 0.48 | | US$ | 0.56 |

The high and low exchange rates for the previous six complete months, rounded to two decimal places are:

Months | | High | | Low |

October 2002 – A$1.00 = | | US$ | 0.56 | | US$ | 0.54 |

November 2002 – A$1.00 = | | US$ | 0.56 | | US$ | 0.55 |

December 2002 – A$1.00 = | | US$ | 0.56 | | US$ | 0.56 |

January 2003 – A$1.00 = | | US$ | 0.59 | | US$ | 0.58 |

February 2003 – A$1.00 = | | US$ | 0.61 | | US$ | 0.60 |

March 2003 – A$1.00 = | | US$ | 0.61 | | US$ | 0.59 |

The exchange rate for Australian dollars into United States dollars on April, 7, 2003, rounded to two decimal places, was A$1.00 equal US$0.59.

Gold Prices

The following table sets forth for the dates indicated, the average spot price for the twelve months ending on the following specified dates for gold as displayed on Bloomberg Financial Markets Commodities News.

| | | A$ per ounce

| | US$ per ounce

|

June 30, 1998 | | 477.73 | | 306.43 |

June 30, 1999 | | 456.50 | | 286.36 |

June 30, 2000 | | 447.63 | | 281.05 |

June 30, 2001 | | 501.83 | | 269.53 |

June 30, 2002 | | 550.67 | | 288.93 |

8

Selected Financial Data

The selected financial data set forth below has been derived from NYOL’s respective audited consolidated financial statements. NYOL’s audited consolidated financial statements as of June 30, 2002 and for each of the three years in the period ended June 30, 2002 are included elsewhere herein.

Such audited consolidated financial statements are prepared in accordance with A-GAAP, which differ in certain significant respects from accounting principles generally accepted in the United States of America (“US GAAP”). Note 37 of the audited consolidated financial statements provides a description of the material differences between A-GAAP and US GAAP as they affect NYOL and a reconciliation to US GAAP of the net profit/(loss) and total equity for the periods and as of the dates presented therein.

Subsequent to the issuance of the Group’s 2001 audited consolidated financial statements and the filing of its 2001 Annual Report on Form 20-F with the Securities and Exchange Commission (the “SEC”), management determined that certain errors had been made in the reconciliation to US GAAP (Note 37) in the prior year. As a result, the reconciliation to US GAAP as of June 30, 2001 and for the year ended June 30, 2001 and related narrative have been restated. Thus, for the year ended June 30, 2001, NYOL’s net loss in accordance with US GAAP was reduced from A$240.5 million to A$213.0 million and NYOL’s total deficit in accordance with US GAAP was reduced from A$290.8 million to A$263.2 million. Refer to Note 38 to the audited consolidated financial statements for a discussion and quantification of the restatements.

The following selected financial data should be read in conjunction with, and are qualified in their entirety by reference to, the audited consolidated financial statements, including the notes thereto. The selected financial data should also be read in conjunction with Item 5 – “Operating and financial review and prospects”.

| | | As Of and For the Year Ended June 30,

| |

| | | 2002 | | | 2001 | | | 2000 | | | 1999 | | | 1998(1) | |

| | | A$

| | | A$

| | | A$

| | | A$

| | | A$

| |

| | | (in thousands, except share data) | |

Statement of Financial Performance Data: | | | | | | | | | | | | | | | |

A-GAAP: | | | | | | | | | | | | | | | |

Sales revenue | | 404,226 | | | 416,481 | | | 395,805 | | | 440,160 | | | 376,061 | |

Cost of sales | | (390,985 | ) | | (376,227 | ) | | (308,935 | ) | | (326,032 | ) | | (194,163 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Gross profit | | 13,241 | | | 40,254 | | | 86,870 | | | 114,128 | | | 181,898 | |

Other expenses from ordinary activities, net (2) | | (494,820 | ) | | (139,537 | ) | | (407,432 | ) | | (84,542 | ) | | (115,481 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

(Loss)/profit from ordinary activities | | (481,579 | ) | | (99,283 | ) | | (320,562 | ) | | 29,586 | | | 66,417 | |

Income tax benefit/(expense) relating to ordinary activities | | (6,539 | ) | | 23,141 | | | 66,763 | | | (17,165 | ) | | (28,681 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Net (loss)/profit | | (488,118 | ) | | (76,142 | ) | | (253,799 | ) | | 12,421 | | | 37,736 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

(Loss)/profit per share: | | | | | | | | | | | | | | | |

– Basic (cents per share) (3) | | (158.0 | ) | | (24.6 | ) | | (82.1 | ) | | 4.0 | | | 13.3 | |

US GAAP:(4) | | | | | As Restated

| | | | | | | | | | |

Sales revenue | | 402,121 | | | 415,390 | | | 395,805 | | | 440,160 | | | N/A | |

Net (loss)/profit | | (439,737 | ) | | (212,973 | ) | | (219,049 | ) | | 19,176 | | | N/A | |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

9

| | | As Of and For the Year Ended June 30,

|

| | | 2002 | | | 2001 | | | 2000 | | | 1999 | | 1998(1) |

| | | A$

| | | A$

| | | A$

| | | A$

| | A$

|

| | | (in thousands, except share data) |

Statement of Financial Position Data: | | | | | | | | | | | | | |

A-GAAP | | | | | | | | | | | | | |

Cash and cash equivalents | | 106,478 | | | 104,672 | | | 9,506 | | | 41,941 | | 27,183 |

Total assets | | 464,701 | | | 747,714 | | | 756,022 | | | 1,102,015 | | 1,094,449 |

Total interest bearing liabilities, including current maturities | | 533,652 | | | 511,270 | | | 476,510 | | | 509,558 | | 522,130 |

Total liabilities | | 864,214 | | | 659,109 | | | 591,275 | | | 675,210 | | 675,354 |

Net (liabilities) / assets | | (399,513 | ) | | 88,605 | | | 164,747 | | | 426,805 | | 419,095 |

Contributed equity | | — 358,533 | | | 358,533 | | | 358,533 | | | 358,533 | | 354,839 |

Retained earnings(deficit) | | (758,046 | ) | | (269,928 | ) | | (193,786 | ) | | 68,272 | | 64,256 |

| | |

|

| |

|

| |

|

| |

| |

|

US GAAP: (4) | | | | | As Restated

| | | | | | | | |

Total (deficit)/equity | | (559,901 | ) | | (263,321 | ) | | 148,411 | | | N/A | | N/A |

| | |

|

| |

|

| |

|

| |

| |

|

Other Data: | | | | | | | | | | | | | |

Dividends: | | | | | | | | | | | | | |

Dividends per ordinary share: | | | | | | | | | | | | | |

– Dividend (A$) | | — | | | — | | | 0.03 | | | 0.03 | | 0.06 |

– Dividend (US$) (5) | | — | | | — | | | 0.02 | | | 0.02 | | 0.03 |

| (1) | | Includes the results of Eagle Mining Limited from October 1, 1997 and the results of Wiluna Mines Limited from November 1, 1997. |

| (2) | | “Other expenses from ordinary activities, net” includes exploration and evaluation expenditure, administration expenses, borrowing costs, write downs and other income and expense items and derivative losses. |

| (3) | | The weighted average number of ordinary shares on issue used to calculate basic and diluted earnings per share was as follows: 2002 – 308,960,662, 2001 – 308,960,662, 2000 – 308,960,662, 1999 – 308,147,621, and 1998 – 282,657,701. |

| (4) | | For a description of the differences between A-GAAP and US GAAP as they relate to NYOL, see Note 37 to the audited consolidated financial statements of the Group included elsewhere herein. |

| (5) | | A convenience translation has been made to determine the US$ value of the dividends at an exchange rate of A$1.00 = US$0.51. |

| 3B. | | Capitalisation and indebtedness |

Not applicable.

| 3C. | | Reasons for the offer and use of proceeds |

Not applicable.

10

A substantial or extended rise in gold prices may adversely effect NYOL’s financial position

Gold prices are subject to volatile movements over short periods of time and are influenced by numerous factors beyond NYOL’s control. Movement in the market price of gold has an effect on the mark to mark value of financial instruments entered into by NYOL. NYOL entered into hedging transactions with a view to reducing the adverse effects of gold price fluctuations, however as at June 30, 2002 hedge positions exceed sales forecasts, resulting in recognition of the mark to market deficit of excess positions as a A$222.8 million liability on the Company’s audited consolidated financial statements.

In addition, gold interest rate swap arrangements include gold indexation structures with various hedge counter-parties. The effect of these gold indexation structures is that the Company is obliged to pay the counter-parties certain amounts of gold if the gold price is above A$540 per ounce at the end of March and September in the years 2003 through to 2008. The ounce liability under these indexation structures increases on a linear basis between the floor price of A$540, where the liability is zero ounces and a capped price of A$627, where the liability is 42,224 ounces for each semi annual period. Given these matters a substantial or extended rise in gold prices may adversely effect NYOL’s financial position. Refer to Item 11 “Quantitative and qualitative disclosures about market risk” and Note 28 “Financial Instruments” to the audited consolidated financial statements for a description of the Group’s hedging activities.

Exercise of rights to break under hedging contracts may result in cash settlements to hedge counter-parties in excess of funds available to the Group

A number of NYOL’s hedging positions are governed by agreements that confer to the relevant hedge counter-party a right to terminate prior to their agreed scheduled maturity dates. Such a termination would result in an immediate cash settlement of those contracts based on the market value on the date of termination. Exercise of rights to break may result in cash settlements to hedge counter-parties in excess of funds available to the Group. Refer to Item 5B “Liquidity and capital resources”, Item 11 “Quantitative and qualitative disclosures about market risk” and Note 28 “Financial Instruments” to the audited consolidated financial statements for a description of the Group’s hedging activities.

NYOL’s level of indebtedness may adversely affect its business

NYOL’s capital structure is highly leveraged. As at June 30, 2002 the consolidated financial statements reflect negative shareholders funds of A$399.5 million. Moreover, at June 30, 2002, in addition to A$222.8 million of liabilities in respect of the Company’s hedge positions included on the Company’s Statement of financial position, the mark to market value of NYOL’s effective hedges not recorded on the Statement of Financial Position totalled A$241.7 million. Its existing obligations and credit ratings (Moody’s Investors Service “Ba2” and Standard & Poor’s “B-”) and its high leverage may limit its ability to raise capital at commercially reasonable cost and terms in the future.

On March 3, 2003 Standard and Poor’s announced that it had lowered NYOL’s corporate credit rating and the rating on NYOL’s US$300,000,000 8 7/8% Senior Notes due April 2008 from BBB to BB- Standard and Poor’s also announced that it had revised its outlook on the Company from stable to negative. On April 1, 2003, Standard & Poor’s lowered it’s long-term rating on the Company from BB- to B- and affirmed its continued outlook on the Company. According to Standard & Poor’s: “An obligation rated ‘B’ is more vulnerable to nonpayment than obligations rated BB-, but the obligor currently has the capacity to meet its financial commitment on the obligation. Adverse business, financial, or economic conditions will likely impair the obligor’s capacity or willingness to meet its financial commitment on the obligation.” In addition, according to Standard & Poor’s, a minus or “-” shows relative standing within a ratings category and a negative outlook means that the current rating may be lowered. Standard & Poor’s indicated that its action was based on concern over the Company’s future liquidity position in June 2004 if hedge counter parties exercise their rights to break existing contracts. The Company’s US$300, 000,000 8 7/8% Senior Notes due April 2008 and hedge book obligations rankpari passu in liquidation and are nonrecourse to the Company’s ultimate parent entity, Newmont Mining Corporation.

On March 28, 2003, Moody’s Investor Services revised its review direction for the Company to a review for a possible downgrade. Moody’s indicated that the change to review for possible downgrade reflected

11

Moody’s concern that the Senior Notes will remain an unsupported legal obligation of the Company, dependent upon its financial strength and cash flow generating ability. Additionally, Moody’s indicated that it was concerned with the Company’s limited proven reserve position relative to its debt maturities and hedge book position. Further factors of concern identified by Moody’s included the degree of the Company’s leverage, the negative mark to market position of the hedge book and the early termination dates under various hedge contracts, giving counter parties the right to break.

Refer to Item 5B “Liquidity and capital resources” for further information.

NYOL’s exploration activities may not be successful

Exploration activities are highly speculative and often unproductive. Once gold mineralisation is discovered, it can take several years until the actual production of gold is possible. During this development period, the economic feasibility of production may change significantly. In addition, as part of the development period, substantial expenditures need to be made to establish confidence that the area under development contains probable gold reserves exploitable through mining. As a result, there can be no assurance that the Group’s exploration program will result in the expansion or replacement of current production with new reserves or operations. The discovery and production of additional reserves is an important factor in addressing the Company’s ability to meet its financial obligations.

Increased production costs could affect profitability

Changes in costs have a major impact on NYOL’s profitability. NYOL’s main costs are salaries and wages, energy, transport, materials, and amortisation of property, plant and equipment. In addition, industrial disruptions, work stoppages, refurbishments, installation of new plants, accidents or bad weather at the Group’s operations can result in production losses and delays in delivery of products, which may adversely affect profitability. Certain costs are also affected by government imposts and regulations. NYOL’s costs depend upon the efficient design and construction of mining and processing facilities and competent operation of those facilities. Changes in cost of mining and processing operations can occur as a result of unforeseen events or change in reserve estimates.

Estimates of reserves are uncertain

NYOL prepares its figures for gold reserves in conformity with the SEC Industry Guide 7; Description Of Property By Issuers Engaged Or To Be Engaged In Significant Mining Operations. However, such figures are estimates and there can be no assurance that the reserves will be recovered. Additionally, estimates may change substantially if new information subsequently becomes available. Fluctuations in the price of gold, a variation in production costs or different recovery rates may ultimately result in NYOL’s estimated reserves being restated. The Bronzewing and Wiluna gold operations are anticipated to process all currently known reserves by the end of 2003 or early 2004. In the absence of a new discovery that could promptly be put into production to sustain the operations, NYOL’s gold production commencing in calender year 2004 will be substantially reduced. Refer to Item 5D “Trend information” for further information.

Foreign exchange risk

In April 1998, Newmont Yandal Operations Limited issued US$300 million of ten year senior unsecured notes (“Notes”) pursuant to an Indenture entered into with The Bank of New York, as trustee for the noteholders (the “Indenture”). Of the total, US $183.6 million has been swapped into a gold commodity obligation. The Company has an exposure to the US$/A$ exchange rate on the remaining US $116.4 million of Notes. Adverse movements in the US$/A$ exchange rate will result in an increase in obligations of the Company. The impact of adverse exchange rate movements in a financial year will be recorded in the Statement of Financial Performance. Any adverse movement in the exchange rate over the ten-year life of the Notes will result in additional cash outflow on the Notes’ redemption. Assuming a constant USD gold price a fall in the AUD/USD exchange rate will have an adverse effect on hedge book obligations.

12

Regulatory and court action risk

The Group’s operations could be affected by government actions, such as controls on imports, exports and prices, variations in taxation laws (including royalties), government directions, guidelines and regulations particularly in relation to the environment and mine operations, and court decisions, particularly those that impact on land access and freedom to conduct mining operations. Refer to Item 4B “Business Overview – Description of material effects of government regulations on the Group’s business activities”. Any such government action or court decisions may require increased capital or operating expenditures or both.

Title to some of our properties may be challenged

Plainting against NYOL by other parties for statutory conditions non-compliance is becoming more of an issue, as it is for other exploration and mining companies in Western Australia. NYOL has approximately 15 Plaints to defend, none of which impacts on critical land holdings. There can be no assurance that NYOL can successfully defend against such claims. In addition certain mining titles are subject to native title claims, but such claims are not anticipated to impact existing titles. Refer to Item 4D “Property, plant, equipment – Exploration”.

13

Item 4: Information on the Company

| 4A. | | History and development of the Company |

NYOL is a gold producer, with three producing gold mines in the Yandal and Wiluna greenstone belts of Western Australia, producing 750,202 ounces of gold in the year ended June 30, 2002.

Newmont Yandal Operations Limited (ABN 30 007 066 766) was incorporated as Great Central Mines N.L. under the laws of Western Australia on February 12, 1985. At the Company’s request and following the conclusion of the ASIC litigation discussed below, its ordinary shares were removed from the official list of the Australian Stock Exchange (ASX) on February 28, 2003. In November 1996, the Company changed its name to Great Central Mines Limited. Following the 100% acquisition of the Company by Normandy Mining Limited, (Normandy) in April, 2000 the name was changed to Normandy Yandal Operations Limited. On April 23, 2002, the Company changed its name to Newmont Yandal Operations Limited, following the takeover of its parent entity, Normandy by Newmont Mining Corporation. Its principal registered and administration office is located at 100 Hutt Street, Adelaide, South Australia, Australia, 5000 (Telephone +61 8 8303 1700). The Company’s agent in the United States of America is: CT Corporation System, 111 Eighth Avenue, 13th Floor, New York, NY 10011, United States of America.

In late 1988, NYOL discovered the Plutonic gold deposit near Meekatharra in Western Australia, which is located approximately 120 kilometres from Jundee-Nimary. It subsequently sold this deposit to Pioneer Minerals Australia Limited in 1989. NYOL sold the Plutonic gold deposit because it did not at the time have sufficient cash resources to conduct the additional exploration to complete a bankable feasibility study.

The Group utilised part of the proceeds from the sale of the Plutonic gold deposit to acquire tenement interests at Nabberu which were located approximately 20 kilometres north-east of the Plutonic gold deposit. NYOL conducted gold, base metals and subsequently diamond exploration on the tenements at Nabberu until early 1994 when it decided to focus its exploration program solely on the Yandal region following the discovery of Bronzewing and Jundee-Nimary. As a result, NYOL entered into an agreement to sell its diamond interests to Astro Mining N.L. (“Astro”), formerly an affiliated company.

In 1989, NYOL acquired a tenement known as Great Lady, located approximately 50 kilometres northwest of Kalgoorlie in Western Australia and approximately 300 kilometres south of Bronzewing. Great Lady was located adjacent to the Lady Bountiful Extended gold operations of Centaur Mining & Exploration Limited (“Centaur”), formerly an affiliated company, and was developed in conjunction with that operation. Great Lady was a small, open pit mining operation managed by Centaur on behalf of NYOL. Production ceased in 1995 when reserves were depleted. In 1997, Great Lady was sold to Centaur for A$0.3 million (based on an independent valuation) as there was no ongoing production, no reserves and the Group wished to concentrate its focus on the Yandal region.

In late 1991, NYOL entered into a purchase agreement with Mr. Mark Creasy, an Australian prospector, to acquire tenements for the purpose of conducting exploration for gold in the Yandal region of Western Australia. Pursuant to the purchase agreement, the Group acquired a 51% interest in the tenements, which now contain the Jundee-Nimary Gold Operations and a 70% interest in a number of other tenements, some of which now contain the Bronzewing Gold Operations. NYOL paid Mr. Creasy A$3.2 million and issued 20,000 Newmont Yandal Operations Limited ordinary shares for these interests. NYOL discovered the Bronzewing deposit in 1993 and the Jundee-Nimary deposit in 1994. Subsequently, the Group entered into further agreements with Mr. Creasy to acquire the remaining 49% of the Jundee-Nimary tenements and 30% of the Bronzewing tenements it did not own at a cost of A$122 million plus the issuance of 1,000,000 Newmont Yandal Operations Limited ordinary shares to Mr. Creasy. NYOL funded the cash payment with part of the proceeds of private equity placements.

14

The Group acquired control of Eagle Mining Corporation Limited and Wiluna Mines Limited in October and November 1997, respectively. The acquisitions allowed NYOL to: consolidate exploration and mining rights covering approximately 80% of the mineral rich Yandal belt; increase NYOL’s contiguous tenements in this region; and gain important tenements in the neighbouring Wiluna and Millrose greenstone belts. These acquisitions were partly funded through equity issues to and loans from Normandy.

In April 1998, the Company issued US$300 million 8 7/8% Senior Notes due 2008 (the “Senior Notes”). The Senior Notes are guaranteed by the Company’s subsidiaries. Refer to Item 5B “Liquidity and capital resources – Liquidity”. In connection with the issue of Senior Notes, the Company entered into a gold interest rate swap arrangement to partially reduce the interest rate risk exposure associated with the Senior Notes. Of the total US$300 million, US$183.6 million was swapped into a gold commodity contract, of which half was fixed at 3.87% and half was floating and subject to an indexation component. The mark to market value of the principal component of the gold commodity obligation was negative A$53.9 million as at June 30, 2002 and negative A$53.4 million as at December 31, 2002. Refer to Item 11 “Quantitative and Qualitative disclosures about market risk -Gold price risk management activities” The mark to market value of the interest rate component of the gold commodity obligation and indexation arrangement was negative A$ 48.0 million as at June 30, 2002 and negative A$ 100.9 million as at December 31, 2002. Refer to item 11 “Quantitative and Qualitative disclosures about market risk – Interest rate risk management.

In September 1999, NYOL acquired the Mt McClure mine, infrastructure and surrounding tenement interests from the Receivers and Managers of Arimco Mining N.L., a non-associated company, for A$8.3 million. The Mt McClure Gold Mine is located approximately 10 kilometres from NYOL’s Bronzewing Mine and ore from Mt McClure was processed through the Bronzewing gold processing plant.

In January 1999, Yandal Gold, a company owned 100% by Yandal Gold Holdings Pty Ltd, which in turn was owned 50.1% by Edensor Nominees Pty Ltd (“Edensor”) and 49.9% by Normandy, announced a takeover bid of A$1.50 per ordinary share of Great Central Mines Limited. Compulsory acquisition procedures had commenced in April 1999 but had been discontinued whilst the legal proceedings referred to below were pending. In June 1999 Yandal Gold continued compulsory acquisition procedures in respect of those shareholders who had not accepted its takeover bid under the Australian Corporations Act. Following the conclusion of the compulsory acquisition procedures Yandal Gold had acquired 174,434,858 ordinary shares with the remaining shares being held by Edensor as to 38,796,340 ordinary shares, Normandy as to 85,912,369 ordinary shares and ANZ Nominees Limited as to 9,817,093 ordinary shares. In April 2000, Normandy acquired all of Edensor’s shares in the Company and in Yandal Gold Holdings, resulting in Normandy holding 100% of the Company.

In a Federal Court action brought by the Australian Securities and Investment Commission (“ASIC”) against Yandal Gold and others, the Federal Court found the defendants to have committed various breaches of the Corporation Law, now referred to as the Corporations Act 2001 and ordered payment by Edensor to ASIC of A$28.5 million for distribution to former Newmont Yandal Operations Limited shareholders. An appeal by Edensor to the Full Court of the Federal Court, to which Normandy became a party on the application of ASIC, was allowed on the basis that the Federal Court lacked jurisdiction to make the order. This decision was appealed to the High Court, which overturned the Full Federal Court decision. The High Court held that the Federal Court did have jurisdiction to hear and determine the matter and make orders under the Corporation Law now referred to as the Corporations Act 2001. The High Court sent the matter back to the Full Federal Court to determine Edensor’s appeal on the merits. In early 2002 the Full Federal Court affirmed the Federal Court decision and leave to appeal to the High Court was denied in September 2002. On January 6, 2003, NAL paid an amount of approximately of A$33.7 million to ASIC who distributed it to the former shareholders of NYOL, representing funds (with interest) that the Federal Court ordered certain respondents in the proceeding to pay for distribution to former NYOL shareholders. In addition to the payment order, the Federal Court also entered an order allowing former NYOL shareholders to reacquire their NYOL, (formerly GCM) shares upon returning the consideration paid by Yandal Gold Pty Ltd in the takeover. Newmont Australia Limited, a party to the proceedings, applied to the Federal Court to remove this portion of its order. Newmont Australia’s application was

15

granted by the Federal Court on February 18, 2003. Following that court decision and ASIC’s confirmation that it had no objection to the Company de-listing from the ASX, at the Company’s request, its ordinary shares were removed from the official list of the ASX on February 28, 2003.

NYOL’s capital expenditure for the last three years has been as follows:

| • | | Year ended June 30, 2002: A$46.4 million |

| • | | Year ended June 30, 2001: A$40.7 million |

| • | | Year ended June 30, 2000: A$65.4 million |

For the six months ended December 31, 2002, capital expenditures were A$19.9 million, including capital expenditures of A$6.3 million at the Bronzewing Gold Operations, A$9.5 million at the Jundee-Nimary Gold Operations and A$4.1 million at the Wiluna Gold Operations. For the year ended December 31, 2003, capital expenditure of A$36.7 million has been budgeted, including capital expenditures for 2003 of A$1.7 million at the Bronzewing Gold Operations, A$33.9 million at the Jundee-Nimary Gold Operations and A$1.1 million at the Wiluna Gold Operations.

Capital expenditures for the year ended June 30, 2002 and the six months ended December 31, 2002, and the budgeted capital expenditure for the year ended December 31, 2003 has been or is expected to be financed internally from funds within the Group and the cash generated from its operations.

16

Description of the nature of operations and principal activities

NYOL currently operates three producing gold mines within the Yandal and Wiluna greenstone belts, known as Bronzewing, Jundee-Nimary and Wiluna. Jundee-Nimary is the combination of the former Jundee-Nimary operations of Great Central Mines and the Nimary operations of Eagle Mining Corporation acquired in the financial year ended June 30, 1998. The operations are located immediately adjacent to each other at the northern end of the Yandal greenstone belt.

Sales revenue for the years ended June 30, 2002, 2001and 2000 were A$404.2 million, A$416.5 million and A$395.8 million, respectively. All sales revenue is derived from the sale of gold produced at the Group’s Western Australian operations.

NYOL has an extensive gold price hedging program which effectively fixed the realisable gold price for all sales. Following the acquisition of NYOL’s parent entity, Newmont Australia Limited (formerly Normandy Mining Limited) by Newmont Mining Corporation in February 2002, revised life of mine plans have been developed by management which revised the forecasts of the amount and timing of future production. As a result of adoption of the revised plans, certain derivative contracts held by the Group were considered excess to the requirement to hedge future production. Accordingly, unrealised losses on these contracts in the amount of A$222.8 million has been recorded as an expense, in the statement of financial performance during the period, as deferred foreign exchange losses on derivative contracts and as a liability in the statement of financial position.

Refer to Item 11: “Quantitative and qualitative disclosures about market risk” and Note 28 “Financial Instruments”.

On September 11, 2002, NYOL entered into an agreement to sell the Wiluna mine and surrounding exploration acreage to Agincourt Resources Limited, a company controlled by members of the Wiluna mine management group and an independent contractor. Completion of the sales transaction was originally anticipated to occur in October 2002 subject to receipt of necessary third party consents and approvals. As of the date of this report, the Company had not received all the necessary third party consents and approvals and, as a result, the agreement has expired without the sale having been completed. As of the date of this report, the agreement had not been extended nor had any new agreement been concluded.

The operation and assets of NYOL’s business are further described in Item 4D “Property, Plant and Equipment”.

Description of the sources and availability of gold reserves

Ore reserves referred to in this Annual Report are reported in accordance with the SEC Industry Guide 7; Description of Property By Issuers Engaged Or To Be Engaged In Significant Mining Operations.

Ore reserve estimates are stated in terms of tonnage, ore grade and either contained metal or recoverable metal. Contained metal represents the total amount of metal contained within the reserves. Recoverable metal represents that portion of the contained metal that can be extracted from the ore and recovered in the processing plant as a saleable product.

In this report all reserves estimates are reported as contained metal.

17

Ore reserves

The term “reserve” means that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination.

The term “economically”, as used in the definition of reserve implies that profitable extraction or production has been established or analytically demonstrated, in a full feasibility study, to be viable and justifiable under reasonable investment and market assumptions.

The term “legally”, as used in the definition of reserve does not imply that all permits needed for mining and processing have been obtained or that other legal issues have been completely resolved. However, for a reserve to exist the Company must have a justifiable expectation, based on applicable laws and regulations, that issuance of permits or resolution of legal issues necessary for mining and processing at a particular deposit will be accomplished in the ordinary course and in a timeframe consistent with the Company’s current mine plans.

The term “proven reserves” means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; (b) grade and/or quality are computed from the result of detailed sampling and (c) the sites for inspection, sampling and measurements are spaced so closely and the geologic character is sufficiently defined that size, shape, depth and mineral content of reserves are well established.

The term “probable reserves” means reserves for which quantity and grade are computed from information similar to that used for proven reserves but the sites for sampling are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

Proven and probable reserves were calculated using different cutoff grades depending on each deposit’s properties. The term “cut-off grade” means the lowest grade of mineralized rock that can be included in the reserves in a given deposit. Cut-off grades vary between deposits depending upon prevailing economic conditions, mineability of the deposit, amenability of the ore to gold extraction, and milling or leaching facilities available.

Ore reserve estimates in this Annual Report have been adjusted for dilution during the mining process. Reserves and grade figures are not adjusted for metallurgical recovery; they are contained grade and metal.

| | | RESERVES

|

| | | (at June 30, 2002)

|

| | | Proven

| | Probable

| | Total

| | Gold Tonnes

|

| | | (Mt) | | (g/t) | | (Mt) | | (g/t) | | (Mt) | | (g/t) | | |

Bronzewing | | 3.26 | | 3.5 | | 1.24 | | 5.30 | | 4.49 | | 4.0 | | 17.91 |

Jundee-Nimary | | 5.05 | | 2.5 | | 3.14 | | 6.20 | | 8.19 | | 3.9 | | 32.16 |

Wiluna | | 0.55 | | 4.3 | | 0.36 | | 8.15 | | 0.91 | | 5.8 | | 5.25 |

TOTAL | | 8.90 | | 3.0 | | 4.70 | | 6.10 | | 13.6 | | 4.1 | | 55.28 |

| | | RESERVES

|

| | | (at December 31, 2002)

|

| | | Proven

| | Probable

| | Total

| | Gold Tonnes

|

| | | (Mt) | | (g/t) | | (Mt) | | (g/t) | | (Mt) | | (g/t) | | |

Bronzewing | | 1.02 | | 4.37 | | 2.30 | | 2.70 | | 3.32 | | 3.21 | | 10.68 |

Jundee-Nimary | | 3.84 | | 1.78 | | 6.31 | | 6.83 | | 10.15 | | 4.92 | | 49.88 |

Wiluna | | 0.40 | | 4.27 | | 0.65 | | 5.42 | | 1.04 | | 4.98 | | 5.18 |

TOTAL | | 5.27 | | 2.47 | | 9.25 | | 5.71 | | 14.52 | | 4.53 | | 65.77 |

18

Information in this report relating to ore reserves, conforms to the reporting requirements of “ SEC Industry Guide 7, Description Of Property By Issuers Engaged Or To Be Engaged In Significant Mining Operations.” It is based on, and accurately reflects, information complied by M Hatcher, Chief Operations Geologist, Newmont Australia, a Member of the AusIMM. It is included in this report with his consent.

Description of the sources and availability of raw materials

NYOL’s gold processing plants use various supplies in the production of gold, with major items including cyanide, lime, steel balls, diesel oil and natural gas which are purchased from various sources. NYOL has long-term contracts with certain suppliers, which include suppliers of cyanide, natural gas and natural gas transportation. Diesel oil and natural gas, the primary energy sources for ore processing are in adequate supply.

In January 1998, NYOL entered into a six year take-or-pay natural gas supply agreement (with certain rights to extend for a further eight years) under which NYOL was obligated to pay for 80% of its agreed supply until December 31, 2001. Under the terms of the agreement, NYOL may source additional gas from alternative markets, unless the sellers can provide such additional gas on no less favourable terms.

On September 1, 1998, NYOL entered into a gas transportation agreement with Newmont Pipelines Pty. Ltd. (“NPPL”) effective as from that date. The agreement lasts until September 13, 2016, but may be terminated by either party on 60 days notice from May 1, 2003. The agreement allows NYOL to avail itself of part of the reserved capacity of NPPL in the GGT Pipeline. The agreement was subsequently novated to Southern Cross Pipelines (NPL) Pty Ltd effective from April 1, 1999.

Mining Contracts

The Group is currently party to a number of mining contracts that are detailed below.

With respect to the Bronzewing Gold Operations, NYOL has an agreement with Brandrill Ltd to perform all mining activities at Bronzewing and Mt McClure until January 2003. This agreement is extended on a monthly basis as required.

At the Jundee-Nimary Gold Operations, Byrnecut Pty Ltd (“Byrnecut”) provides the excavation of declines, underground production and other underground development services at Barton Deeps. A new two-year contract was awarded to Byrnecut in September 2001. A tender is currently out for the mining and haulage from several satellite pits, this contract is expected to run for no longer than 14 months.

At Wiluna Operations Barminco Pty Ltd provides underground development, hand held mining, production drilling, bogging and haulage services. The contract will continue until NYOL deems, in its’ reasonable opinion the continuation of mining of ore and waste is not viable for any reason. The contract for open pit mining services (including the provision of mining of ore and waste, drilling and blasting services) and rehabilitation at Wiluna, was awarded to Roche Mining (a division of Downer EDI Limited) for two years from March 2001. This contract was cancelled when open pit mining ceased in June 2002.

Under each of the mining contracts, the contract employees are covered by the mining contractors’ workers’ compensation liability policy and also is responsible for all other insurance matters. In each case NYOL pays mobilisation and demobilisation to the mining contractor and during the term of the contract, the mining contractor invoices NYOL at rates for the particular services defined in the respective mining contract. Furthermore, at each of its mine sites, NYOL has an experienced mining team on-site which is responsible for the mine planning, ore scheduling and pit design, grade control drilling, definition and marking of ore zones and reconciliation of ore produced and the supervision of the contract employees.

19

Competition

Because mines have limited lives based on proved and probable reserves, NYOL is continually seeking to replace and expand its reserves. The Group encounters competition from other mining companies in connection with the acquisition of properties producing or capable of producing gold and in the recruitment and retention of qualified labour. As a result of this competition, some of which is with companies having significantly greater financial resources, the Group may be unable to acquire attractive mining properties on terms it considers acceptable. In addition, there are a number of uncertainties inherent in any program relating to the location of economic reserves, the development of appropriate metallurgical processes, the receipt of necessary governmental approvals, licenses and permits, the construction of mining and processing facilities and the appropriate financing thereof.

Description of material effects of government regulations on the Group’s business activities

Newmont Yandal Operations Limited is subject to and complies with the following material governmental regulations:

Australian Corporations and Securities Legislation

Australian Corporations and Securities Legislation is the main body of law governing companies incorporated in Australia. The Legislation is administered and enforced by the Australian Securities and Investment Commission (ASIC), which is an Australian Government instrumentality.

The legislation covers matters such as:

| • | | Directors’ duties and responsibilities. |

| • | | Preparation of financial statements. |

| • | | Control of auditors who have to be registered and approved by ASIC. |

| • | | Issue and transfer of shares. |

| • | | Rights of minority interests. |

| • | | Amendments to capital structures. |

| • | | Preparation and filing of public documents such as returns relating to change in Directors, details of changes to capital and annual reports. |

| • | | Insolvency of a corporation. |

20

ASX Listing Rules

ASX Listing Rules are imposed on all listed companies.

The ASX Listing Rules cover such things as ASX prior approval of certain documentation to be forwarded to shareholders, immediate notification to the market of price sensitive and other relevant information and periodic financial reporting.

At the Company’s request, its ordinary shares were removed from the official list of the ASX on February 28, 2003. Refer to Item 4A “History and development of the Company”. Accordingly, the Company is no longer subject to the ASX Listing Rules.

Mining Law

In Australia, legislation regulating the exploration for and the production of minerals is enacted by the individual States and Territories. At common law there is a presumption that the owner of land owns everything on or below the surface of that land to an indefinite extent. However, this principle has virtually been abolished by statute in Australia so that, with limited exceptions, minerals are the property of the States or Territories of Australia. Under the relevant legislation, exploration and mining titles are available for grant and the grant is a prerequisite to the conduct of exploration or mining operations (as the case may be). There are a number of procedural steps, which must be followed before a title is granted, including the right to negotiate procedure under the Native Title Act.

The process of application for and the granting of rights to use land for exploration and mining is governed by State Legislation. The Group’s current mining operations are located in the State of Western Australia. Under the Mining Act 1978 (Western Australia) and Regulations, as amended (the “Mining Act”), there are several categories of exploration, mining and ancillary titles. The principal of these are as follows:

Prospecting License | A Prospecting License authorises the holder to enter the land to prospect for all minerals (except iron ore unless expressly authorised by the Minister of Mines). The maximum area of a Prospecting License is 200 hectares and the term is four years (if granted after July 1, 1994) with no right of renewal. The holder of a Prospecting License has a priority right during its term to apply for Mining Leases over the whole or part of the area of the Prospecting License. Pending determination of the application, the Prospecting License remains in force notwithstanding the expiry, in the interim, of its four-year term. |

Exploration License | The rights conferred by an Exploration License are materially the same as by a Prospecting License. The maximum area of an Exploration License is 70 graticular blocks. A graticular block is an area of one square kilometre. The term is five years with annual renewal permitted in exceptional circumstances. There is a requirement for progressive surrender during its term of parts of an Exploration License. The holder of an Exploration License has a priority right, during its term, to apply for Mining Leases over the whole or part of the area of the Exploration License. Pending determination of the application the Exploration License remains in force notwithstanding the expiration of its term. |

Retention License | A Retention License may be granted in respect of the whole or any part of the land formerly within a Prospecting License, Exploration License or Mining Lease. The purpose of a Retention Lease is to permit the holder to retain title to an identified but marginal mineralised deposit and the area of the Retention License varies with the area of such deposit. The term is five years with a right of renewal for up to a further five years. |

21

Mining Lease | A Mining Lease authorises the holder to mine for and dispose of any minerals on the land in respect of which the Mining Lease is granted. In contrast to other States in Australia, in Western Australia the holder of an Exploration or Prospecting licence need not establish indications of an economic mineralised deposit before applying for a Mining Lease. A Mining Lease may be applied for provided that the holder has expended a minimum level of investment. The lessee is entitled to use, occupy and enjoy the land for mining purposes and owns all minerals lawfully mined. The rights conferred are exclusive rights for mining purposes in relation to the land in respect of which the Mining Lease was granted. No other mining tenement (except a Miscellaneous License) may be granted over the land. The State of Western Australia may grant or refuse a Mining Lease at its discretion. However if the applicant is the holder of a valid Exploration or Prospecting Licence and the holder has complied with the conditions of the licence the Mining Lease application, generally, will be granted. The area of a Mining Lease may not exceed 10 square kilometres. The term of a Mining Lease is 21 years with a right of renewal for a further 21 years. Subsequent renewals are at the discretion of the Minister for Mines for terms of up to 21 years. |

General Purpose Lease | A General Purpose Lease is fundamentally a surface lease aimed at acquiring large areas of land for purposes incidental to mining without attracting requirements to commit to certain levels of mining or exploration expenditure which are a feature of Mining Leases or Exploration Licenses. It entitles the lessee to erect, place and operate machinery in connection with mining operations, to deposit or treat minerals or tailing obtained from the land and to use the land for any other specified purpose directly connected with mining operations. |

Miscellaneous License | A Miscellaneous License may be granted over any land, including any land the subject of an existing mining title, whether held by the applicant or by another person. A Miscellaneous License authorises the construction and operation of specified facilities in connection with a mining operation, which may include roads, tramways, aerial ropeways, water pipelines, powerlines, conveyor systems, tunnels, bridges or a license for any prescribed purpose. |

Pastoral Lease | Leasehold title in respect of areas up to 500,000 hectares granted by the Department of Land Administration in Western Australia over Crown land (being land vested in the State) for the purposes of grazing livestock. This grant is made by the Government pursuant to TheLand Act 1933 (WA) (the “Land Act”) and is subject to a number of terms relating to improvements (e.g., fences and dams), stocking levels and environmental requirements. The Lease has a fixed term and all Pastoral Leases have a common expiry date of June 30, 2015. The Pastoral Lease may be transferred by the lessee provided that the Minister of Lands gives his consent. A Pastoral Lease may exist over land, subject to a mining tenement. Provision is made in the Land Act and the Mining Act to control this interaction. |

The terms and conditions under which NYOL has title to its various mining Tenements oblige it to meet Tenement rentals and minimum levels of exploration expenditure as gazetted by the Western Australian Department of Minerals and Energy as well as Local Government rates and taxes.

22

Native Title

The legal framework concerning native title issues in Australia is as follows:

Common Law.In 1992, the High Court of Australia, inMabo v. State of Queensland, recognised that a form of native title existed on a small island in the Torres Strait. Subsequently in November 1998, the Federal Court held, inWard v Western Australia, that the Mirriuwung Gajerrong people held native title in respect of an area of Western Australia and the Northern Territory. This decision followed on from Mabo by confirming that native title can exist on the mainland of Australia. In its time, Mabo introduced a degree of uncertainty over the tenure to land in Australia because the High Court did not define exhaustively all of the circumstances in which native title might continue to exist.

Subsequent legislation (discussed below) and court decisions have provided further guidance in respect of native title. In the appeal of theWard v Western Australiacase to the High Court, the court determined that native title does not extend to minerals in Western Australia and that, while mining lease may not entirely extinguish native title, any native title right to control access to land that may have existed would not survive the grant of a mining lease because such a native title right would be inconsistent with the rights conferred by the mining lease.

The Native Title Act 1993 (the “Native Title Act”). The Australian Parliament enacted the Native Title Act in 1993. In enacting the Native Title Act, the Parliament recognised that native title rights needed to be supplemented. It achieved this by a package of related measures, the underlying principle of which is the recognition of native title and its protection from the effects of future acts, including the grant of various mining tenement types which at common law would lessen or extinguish it. To provide this protection the Native Title Act provided for, amongst other things, the validation of existing exploration and mining tenements where such tenements were granted before January 1, 1994. Where exploration and mining tenements were applied for after January 1, 1994, the Native Title Act established a procedure, known as the “right to negotiate” procedure, whereby Australian Aboriginal claimants to native title may participate in the process of deciding whether the tenement applications should be granted. Basically both Australian Aboriginals and non-Aboriginals could seek a ruling from the National Native Title Tribunal (“NNTT”) or the Federal Court of Australia for a determination as to whether native title exists on a specified piece of land and/or whether mining activities can be undertaken. Although native title may continue to exist over land subject to valid mining tenements, the rights and interests incidental to that native title have no effect to the extent they are inconsistent with such tenements. Upon the expiration of any such tenement, native title rights and interests may revive. Importantly, the Native Title Act provided certainty in relation to past acts confirming for instance, that the grant of a tenement prior to 1994 was not invalid due to the existence of native title.

The Native Title Amendment Act 1998 (the “Native Title Amendment Act”). The Native Title Amendment Act was proclaimed, and became operational, on September 30, 1998. The Native Title Amendment Act provides for the implementation of the strengthened claimant registration test (registration being a precondition for Aboriginal claimants to obtain the “right to negotiate”) as well as improvements to procedures related to mining tenement renewals, infrastructure projects and negotiation timeframes.

The Native Title Amendment Act also provided for the validation of tenements and other titles issued by State and Territory Governments without subjecting them to the “right to negotiate” provisions between January 1, 1994 and the“Wik” decision on December 24, 1996, as well as allowing States and Territories to establish their own right to negotiate regimes as an alternative to the right to negotiate provisions in the Native Title Act.

The Native Title Amendment Act sets out how the right to negotiate may not apply to some proposed developments, introducing instead a right to be consulted, which in some cases replaces the “right to negotiate”. Some types of proposed developments where the “right to negotiate” no longer applies include amongst others certain mineral exploration tenements, renewal of some mineral tenements, and the grant of mining infrastructure tenements. In these cases registered native title applicants or holders have a right to be consulted.

23

State/Territory legislation complementary to amended Commonwealth Native Title Act. Each State and Territory in Australia is now in the process of or has passed legislation complementary to the Native Title Amendment Act. The extent of the response in each state and territory to date has differed. Some states are establishing more comprehensive regimes (as provided for in section 43A of the Native Title Act), whilst others are relying upon the Commonwealth to continue administering native title through the NNTT.

The WA Government has enacted legislation (Native Title (State Provisions) Act 1999) establishing alternative provisions under section 43A of the Native Title Act. There has since been a change of government in WA and the new government has not yet proceeded with the implementation of this legislation.

All current and future tenement and title applications (including any change of status of any existing tenement from an Exploration License to a Mining Lease) will require processing through the provisions of the Native Title Act, as amended.

Impact on the Group’s Mining Tenements.NYOL believes that none of its gold mining operations or projects is jeopardised by any native title issues. NYOL’s gold mining tenements were either issued prior to January 1, 1994 (in which case they are either valid as not having been affected by the existence of native title or validated by Western Australian state legislation passed in conformity with the Native Title Act), granted pursuant to the “right to negotiate” procedures set down in the Native Title Act, or were validated by the Native Title Amendment Act and the Titles (Validation) and Native Title (Effect of Past Acts) Act 1995.

Applications for a range of further tenements have been lodged with the Western Australian Government, which is processing the tenements through the relevant native title provisions. Negotiations with the relevant native title claimants have been proceeding in accordance with the Native Title Act. Further tenements required for the purposes of the NYOL’s operations, and/or renewals of existing tenements, will be required to go through the relevant transitional and/or future act provisions of the Native Title Amendment Act. NYOL actively seeks negotiated outcomes with registered native title claimants. The negotiation process can lead to delays in the grant of new tenements and claimants actively seek some form of compensation in agreeing to the grant of a mining lease.

Eleven native title claims now affect the Group’s operations and surrounding areas. Five of these have been registered and six remain unregistered. The reduction over the past twelve months is due principally to the consolidation of claims. The registered native title claims are ‘WC99/24 Wiluna, WC95/01 Koara, WC95/042 Koara 6, WC99/10 Wutha and WC99/01 Wongatha’. The unregistered native title claims are ‘WC95/58 Sir Samuel, WC95/82 Sir Samuel 2, WC01/14 Ngalia Kutjungkatja, WC02/02 Ngalia Kutjungkatja 2, WC96/20 Mantjintjarra Ngalia and WC99/05 Koara (Registration set aside)’. Claims WC95/58 Sir Samuel and WC95/82 Sir Samuel 2 are currently being amended and are entering the registration process.

Australian Aboriginal Cultural Heritage Legislation

The Commonwealth of Australia and Western Australia have passed legislation governing the preservation of the heritage of Aboriginals.

The Commonwealth legislation provides for declarations of preservation to be made in relation to any region by the Commonwealth Minister for Aboriginal Affairs. Usually such a declaration would be made on the application by interested groups of Australian Aborigines seeking preservation of a place of particular significance to them. The terms of a declaration of preservation are for the Minister to decide, but may include prohibiting access to or disturbance of the region concerned, or allowing such access or disturbance on certain conditions. It is an offence to contravene such a declaration. The Western Australian legislation has particular application to the discovery and preservation of Australian Aboriginal sites, relics and artifacts, and provides for the state Minister to make declarations relating to the protection of Australian Aboriginal sites (for example by requiring the consent of the Aboriginal groups concerned) in certain circumstances. It also requires a mining company, which discovers any Aboriginal relics or artifacts to report the matter to the state government.

24

NYOL maintains a good working relationship with Aboriginal communities. Some Australian Aboriginal sites may be located in regions, which are likely to be affected by the Group’s mining. Applications to disturb in accordance with these agreements have been made by NYOL and granted in accordance with the relevant Aboriginal heritage legislation. If additional archaeological and anthropological evidence of an Aboriginal site is revealed at any stage, NYOL is required to report this evidence to the Aboriginal Affairs Department and to the native title claimants concerned under the terms of their agreements with NYOL. In addition, NYOL routinely conducts heritage surveys of mining tenements, in conjunction with Aboriginals, to determine if heritage sites might exist in areas where NYOL intends to conduct exploration and other activities.

Western Australia Gold Royalty

Since July 1, 1998, the Mining Act has imposed a royalty on gold. The royalty from July 1, 1998 to June 30, 2000 was 1.25% of the realised value of gold produced (calculated monthly based on the average gold spot prices in the relevant month). From July 1, 2000 the royalty has been 2.5%, however, in the period from July 1, 2000 to June 30, 2005 only, the royalty will be 1.25% if the average gold spot price for a quarter is less than A$450 per ounce. After 2005, the royalty rate will be fixed at 2.5%. The first 2,500 ounces produced during a financial year from gold bearing material produced or obtained from the same “gold royalty project” (being either a mining treatment plant or tenements from which anyone produces or obtains gold bearing material that is treated or processed at a common treatment facility or combination of treatment facilities, or as is approved as such by the Minister of the Director General of Mines) will be exempt from royalty payment.

Environmental Matters

NYOL complies with legislation in relation to the environment in the conduct of its affairs. This legislation covers such areas as pollution control, safety and rehabilitation. Failure to comply with applicable laws and regulations may result in orders being sought that may cause operations to cease or be curtailed or may require installation of additional equipment. Violators may be required to compensate those suffering loss or damage by reason of violations and may be fined if convicted of an offence under such legislation.

Legislation such as the Mining Act, the Land Act, theEnvironmental Protection Act 1986 (WA), the Soil and Land Conservation Act 1945 (WA), the Health Act 1911 (WA), the Water Boards Act 1904 (WA), the Rights in Water and Irrigation Act 1914 (WA), the Explosives and Dangerous Goods Act 1961 (WA), Conservation and Land Management Act 1984 (WA), Aboriginal Affairs Planning Authority Act 1972 (WA), Aboriginal Heritage Act 1972 (WA), Country Areas Water Supply Act 1947 (WA), Local Government Act 1960 (WA) andTown Planning and Development Act 1928 (WA), regulate or control noise, air and water pollution and soil erosion and protect State forests, timber reserves, Aboriginal reserves, Aboriginal sacred sites and national parks. These Acts, as amended, and the regulations made under them must be complied with, to the extent that they are applicable, in the conduct of various mining activities conducted by the Group. In particular, emissions from processing plants are controlled under theEnvironmental Protection Act 1986 (WA) and are monitored by local environmental officials.

The Western Australian government currently has a bill, theContaminated Sites Bill 2002, before Parliament dealing with the identification of contaminated sites. The objective of the Bill is to protect human health, the environment and environmental values by providing for the identification, recording, management and remediation of contaminated sites in Western Australia.

Water used in production and in dust abatement around mining sites in Western Australia is largely derived from ground water. Access to and use of the available ground water resource is regulated by the Mining Act and theRights in Water and Irrigation Act 1914 (WA). Licences are required to be obtained under the Mining Act to search for water and install and operate bore fields and associated pipelines.

Under applicable law and the terms of licenses under which NYOL operates, it is required to reclaim and rehabilitate land disturbed by its operations to certain environmentally acceptable conditions. NYOL’s

25

policy is to conduct reclamation concurrently with mining operations where feasible, although NYOL is currently behind schedule in reclaiming disturbed exploration areas.

The Group must complete the remainder of reclamation activities, which include the closure and dismantling of mining and processing facilities upon cessation of mining activities. In addition, NYOL is required under the Mining Act, to secure performance bonds in the form of bank guarantees to ensure its performance of the various environmental conditions imposed in the tenements it holds which relate to the conduct of mining operations.

NYOL has made, and expects to make in the future, expenditures to comply with such laws and licenses, but cannot predict the amount of such future expenditures. Estimated future reclamation costs are based principally on legal and regulatory requirements. At June 30, 2002, approximately A$55.7 million was accrued for reclamation costs relating to currently producing mines.

Australian Corporate Tax

Australian income tax is a tax imposed and payable to the Federal Government of Australia. Individual States of Australia currently do not impose income tax though they have the power to do so.

In Australia, the taxable income of a resident company is subject to corporate income tax at the rate of 36% for the 2000 tax year, 34% for the 2001 tax year and 30% for the 2002 and subsequent tax years. A company is resident in Australia if it is incorporated in Australia or, not being so incorporated, if it carries on business in Australia and has either its central management and control in Australia or its voting power controlled by Australian resident shareholders. The Company is resident in Australia for income tax purposes.

The taxable income of a company is calculated as the difference between the company’s assessable income and its allowable deductions. Assessable income includes income as it is traditionally understood including sales income, interest, hedging profits, rent and royalties as well as capital gains derived from the disposal of assets.

All losses or outgoings to the extent to which they are incurred in producing such assessable income or in carrying on of a business are allowable deductions except where they are capital or private in nature. Separate capital allowances are available in respect of capital expenditure including depreciation and amortisation of mine development costs. Exploration expenditure is deductible in the year that it is incurred.

Plant and equipment is depreciable with depreciation rates determined by reference to the plant’s effective life. Subject to certain limited exceptions, mine development expenditure that is not plant and equipment is amortised on a straight-line basis over ten years or life of mine, whichever is less. From July 1, 2001, mine development is required to be amortised over the life of mine.

Tax losses incurred in 1989-90 and later years are available to be carried forward indefinitely and set off against future taxable income, provided that the company satisfies certain continuity of ownership and same business tests. Carry-backs are not permitted.

From July 1, 2000, a goods and services tax (“GST”) of 10% applies on the supply of most goods; services and anything else consumed in Australia. GST is a transaction-based tax imposed on the supply of most goods and services at virtually all stages of production and distribution. Businesses generally charge GST in the price of goods, services and anything else they supply. To the extent that supplies are used in business activities, registered persons are then generally entitled to claim an input tax credit for GST paid on their purchases. All relevant subsidiaries in the Group are registered for GST purposes.

Since June 30, 2002 the Australian Government has enacted legislation that will allow 100 per cent commonly owned Australian resident company groups to form a single consolidated group for income tax purposes. The new rules apply, at the group’s election, on a date any time after June 30, 2002. The first two

26

tranches of legislation became substantively enacted on October 21, 2002 when the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Bill 2002 was passed by the Senate.

The consequences of forming a tax-consolidated group are many. Formation of a consolidated group for tax purposes will require the tax basis of assets to be re-set pursuant to complex transition rules. Furthermore future utilisation of tax losses that transition to a consolidated group will become subject to loss factors that will limit in any one year the amount of transitional losses that can be offset against taxable income of the tax consolidated group.

The financial effect of the legislation has not been recognised in this financial report in accordance with the UIG 39 “Effect of Proposed Tax Consolidation on Deferred Tax Balances” as it cannot yet be reliably estimated. NYOL has not determined whether to adopt the legislation.

27

| 4C. | | Organisational Structure |

All Newmont Yandal Operations Limited controlled entities are 100% owned and are incorporated in Australia. The entities in the Group are listed below, indicating those with mine ownership rights:

Parent entity | | Mine ownership |

Newmont Yandal Operations Limited | | 100% Bronzewing mine, 100% Jundee mine |

|

Subsidiaries | | |

Clynton Court Pty Limited | | |

Great Central Holdings Pty Limited | | |

Eagle Mining Pty Limited | | 51% Nimary mine |

Hunter Resources Pty Limited | | 29% Nimary mine |

Quotidian No. 117 Pty Limited | | |

Matlock Mining Pty Limited | | |

Matlock Castellano Pty Limited | | |

Great Central Mines Pty Limited | | |

Australian Metals Corp. Pty Limited | | 20% Nimary mine |

Great Central Investments Pty Limited | | |

Newmont Wiluna Mines Pty Limited | | |

Newmont Wiluna Gold Pty Limited | | 100% Wiluna mine, 100% Mt McClure mine |

Newmont Wiluna Metals Pty Limited | | |

28

4D. Property, plant and equipment

The Group’s main property consists of the plant and infrastructure at Bronzewing, Jundee-Nimary and Wiluna mines as well as its rights to explore and mine land in Western Australia as granted under the Mining Act. In addition, NYOL has a number of significant joint venture agreements under which it is able to obtain an interest in the rights to explore or mine land.

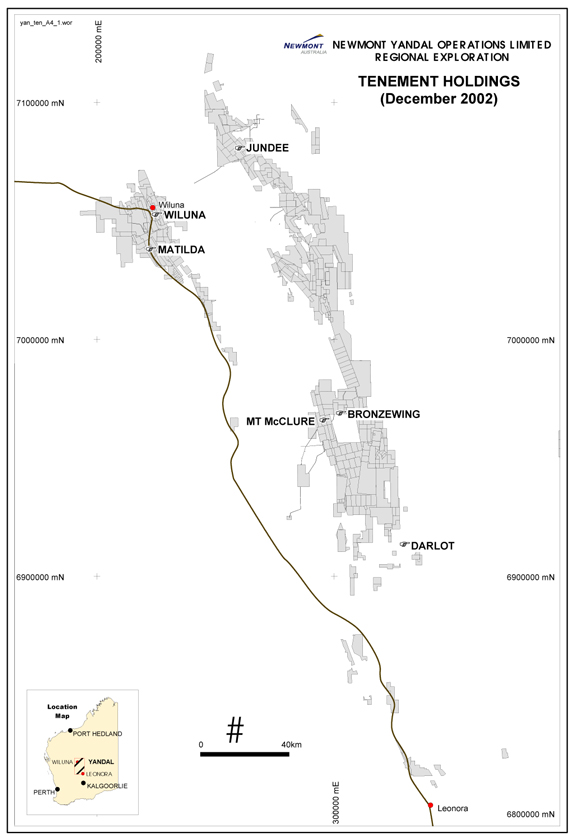

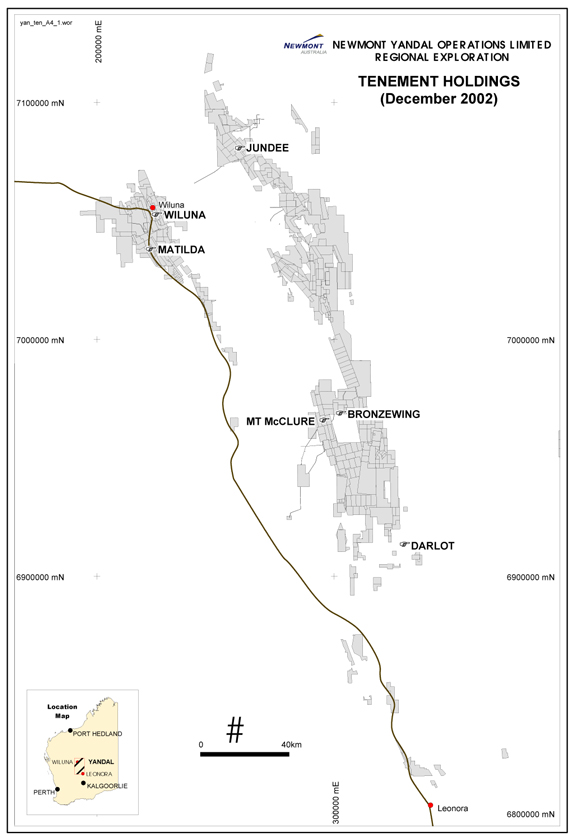

NYOL’s exploration activities encompass 3,150 square kilometres of exploration tenements located in the Yandal region. A map showing the location of NYOL’s land holdings is set out on the following page.

29

30

Operating Mines

Bronzewing

Background. NYOL’s Bronzewing Gold Operations are in the central Yandal greenstone belt and are located approximately 68 kilometres from Leinster township and 360 kilometres from Kalgoorlie in Western Australia. Access to Bronzewing is by air charter flight to its airstrip or by road. The Bronzewing gold deposits were discovered by NYOL in 1993 on tenements, which were subject to a purchase agreement with Mr. Mark Creasy. In May 1994, NYOL entered into a purchase agreement with Mr. Creasy to acquire the balance of his interest in the Bronzewing and Jundee-Nimary tenements for A$122 million and the issuance of 1,000,000 of Newmont Yandal Operations’ ordinary shares. The acquisition closed in 1995.