- UVE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Universal Insurance (UVE) DEF 14ADefinitive proxy

Filed: 27 Apr 18, 4:16pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| ☒ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| Check the appropriate box: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to§240.14a-12 | |

UNIVERSAL INSURANCE HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i) (1) and0-11. | |

(1) Title of each class of securities to which transaction applies: | ||

(2) Aggregate number of securities to which transaction applies: | ||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

(4) Proposed maximum aggregate value of transaction: | ||

(5) Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) Amount Previously Paid: | ||

(2) Form, Schedule or Registration Statement No.: | ||

(3) Filing Party: | ||

(4) Date Filed: | ||

1110 West Commercial Boulevard, Fort Lauderdale, Florida 33309

(954) 958-1200

April 27, 2018

Dear Shareholder:

You are cordially invited to attend the 2018 Annual Meeting of Shareholders of Universal Insurance Holdings, Inc. We will hold the meeting at 9:00 a.m., Eastern Time, on June 13, 2018 at the Biltmore, 1 Lodge Street, Asheville, North Carolina 28803.

Enclosed you will find a notice setting forth the business expected to come before the meeting, the Proxy Statement, a proxy card and a copy of our Annual Report on Form10-K for the fiscal year ended December 31, 2017. Your vote is very important to us. We encourage you to vote, regardless of the number of shares you own. Whether or not you plan to attend the meeting in person, please submit your proxy by mail, internet or telephone to ensure that your shares are represented and voted at the meeting. The methods available to vote your shares are described in the Proxy Statement and on your proxy card.

Our 2017 financial results were very strong, highlighted by continued organic growth from both our home state of Florida and our expansion efforts into other states, solid underwriting profitability and meaningful growth in both net income and book value per share. We achieved these excellent results despite the occurrence of Hurricane Irma, which made landfall in Florida on September 10, 2017 as a Category 4 storm on the Saffir-Simpson Hurricane Scale, and caused a wide swath of damage across the entire Florida Peninsula and throughout the Southeastern United States. We demonstrated the true value of our business model in the wake of Hurricane Irma’s landfall, and we are proud of how well the entire Universal team responded to this devastating event. Our comprehensive reinsurance program performed as expected, limiting net losses incurred from one of Florida’s largest hurricanes in over a decade, while our vertically integrated structure produced various income streams in the months following the storm, and our superior claims handling and catastrophe response teams delivered excellent service to our policyholders, closing claims in a timely and orderly manner. We believe that Universal emerged from this event as a stronger company, and we remain well-positioned to deliver outstanding value to shareholders throughout 2018 and beyond.

I would like to thank you for your continued confidence in our company.

| Sincerely, |

|

| Sean P. Downes |

| Chairman and Chief Executive Officer |

UNIVERSAL INSURANCE HOLDINGS, INC.

1110 West Commercial Boulevard

Fort Lauderdale, Florida 33309

(954) 958-1200

www.universalinsuranceholdings.com

NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS

Items of Business

| ||||||||

| Date and Time | Wednesday, June 13, 2018 9:00 a.m., Eastern Time

| ◾ Election of ten director nominees named in the Proxy Statement to our Board of Directors for a one-year term

◾ Advisory vote to approve the compensation paid to our Named Executive Officers

◾ Ratification of the appointment of Plante & Moran, PLLC as our independent registered public accounting firm for the 2018 fiscal year

◾ Transaction of such other business as may properly come before the meeting or any adjournment thereof

| ||||||

| Place | Biltmore 1 Lodge Street Asheville, North Carolina 28803

| |||||||

| Record Date | Only shareholders of record at the close of business on April 16, 2018 are entitled to receive notice of, and to vote at, the meeting. | |||||||

Proxy Voting

Please vote promptly. You can vote your shares via the internet, by telephone or by signing, dating and returning the enclosed proxy card in the enclosed postage-paid envelope. Submitting your proxy now will not prevent you from voting your shares at the meeting, as your proxy is revocable at your option.

|

BY ORDER OF THE BOARD OF DIRECTORS

Stephen J. Donaghy,

Secretary

Fort Lauderdale, Florida

April 27, 2018

| TABLE OF CONTENTS |

| PROXY SUMMARY |

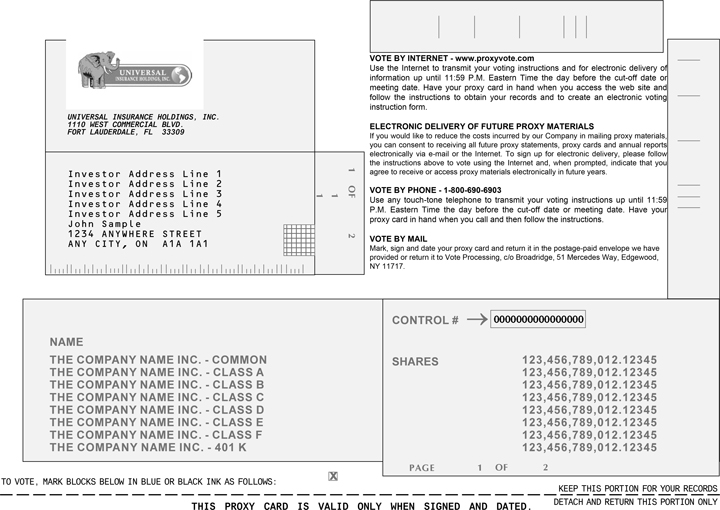

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Universal Insurance Holdings, Inc., a Delaware corporation (“Company”, “Universal” or “UVE”), of proxies to be voted at the 2018 Annual Meeting of Shareholders, to be held at the Biltmore, 1 Lodge Street, Asheville, North Carolina 28803, on Wednesday, June 13, 2018, at 9:00 a.m., Eastern Time, and at any and all postponements or adjournments thereof, for the items of business set forth in the accompanying Notice of 2018 Annual Meeting of Shareholders. This Proxy Statement, Notice of 2018 Annual Meeting of Shareholders, accompanying proxy card and our Annual Report on Form10-K for the fiscal year ended December 31, 2017 are available athttp://www.proxyvote.com.

To reduce our costs and decrease the environmental impact of our proxy materials, in lieu of mailing our proxy materials, we will send a Notice of Internet Availability of Proxy Materials (the “Notice”) to certain of our shareholders containing instructions on how to access our proxy materials online. If you receive a Notice, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review the proxy materials online and on how to submit your proxy online. If you received a Notice and would like to receive a copy of our proxy materials, follow the instructions contained in the Notice to request a copy electronically or in paper form. The Notice and printed copies of our proxy materials, as applicable, are expected to be mailed to shareholders on or about April 27, 2018.

Meeting Agenda and Board Vote Recommendations

Item Number | Meeting Agenda Item | Board Vote Recommendation | Page Reference | |||

| 1 | Election of ten directors named in this Proxy Statement for an annual term ending in 2019 | FOR EACH NOMINEE | 5 – 7 | |||

| 2 | Advisory vote to approve the compensation paid to the Company’s Named Executive Officers | FOR | 14 – 25 | |||

| 3 | Ratification of the appointment of Plante & Moran, PLLC as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018 | FOR | 26 | |||

Company Overview and Business Strategy

Universal is a Fort Lauderdale, Florida-based insurance holding company that operates through a vertically integrated structure and performs all aspects of insurance underwriting, distribution and claims. Universal has two insurance company subsidiaries:

| • | Universal Property & Casualty Insurance Company (UPCIC) is one of the leading writers of homeowners insurance in Florida and is fully licensed and has commenced operations in 17 states (Alabama, Delaware, Florida, Georgia, Hawaii, Indiana, Maryland, Massachusetts, Michigan, Minnesota, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, South Carolina and Virginia). UPCIC has also received a Certificate of Authority in Illinois, Iowa and West Virginia. |

| • | American Platinum Property and Casualty Insurance Company (APPCIC) currently writes homeowners multi-peril insurance on Florida homes valued in excess of $1 million and is licensed to write Fire, Commercial Multi-Peril, and Other Liability (collectively, “Commercial Residential”) lines of business in Florida. |

The key tenets of our business strategy include:

| • | Pursue Profitable Growth with a Focus on Organic Development We continue to pursue profitable growth both within Florida and through expansion into other states, while continuing to expand Universal DirectSM and adding new products when prudent (such as the Commercial Residential line of business that we introduced in Florida in late 2016). |

| • | Optimize our Reinsurance Program as our Risk Profile Changes We expect to continue to obtain what we believe to be appropriate reinsurance limits, coverage and terms so that our policyholders and shareholders are adequately protected in the event of an active hurricane season. |

| • | Continue to Build and Enhance Our Claims Operations We plan to continue to enhance our superior claims division, highlighted by our proprietary claims administration system, which we developed over the last decade and allows us to efficiently process nearly all aspects of claims resolution for our policyholders, as well as by our Fast Track initiative, which expedites the claims settlement process to close certain types of claims in as little as 24 hours. |

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 1 |

| PROXY SUMMARY—CONTINUED |

| • | Maintain an Emphasis on Underwriting Discipline We seek to generate a consistent underwriting profit on the business we write in hard and soft markets through carefully developed underwriting guidelines informed by our experience in evaluating risks and in handling and processing claims. |

| • | Provide High Quality Service to our Policyholders We strive to provide excellent customer service to each of our policyholders |

throughout every aspect of our business. We believe our vertically integrated business model provides a superior level of customer service for our policyholders, enhancing our reputation and increasing the likelihood that our policyholders will renew their policies with us. |

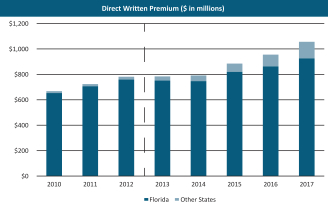

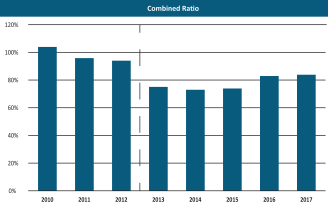

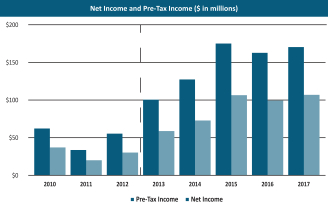

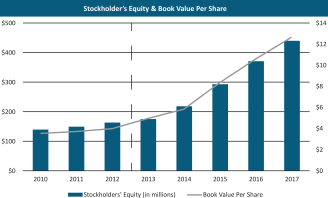

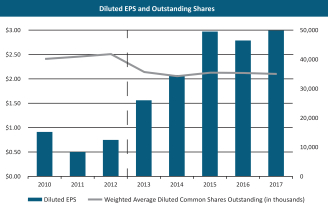

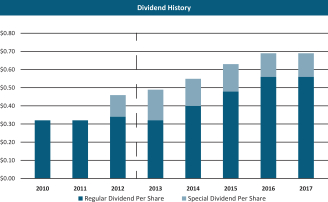

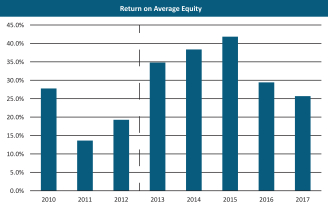

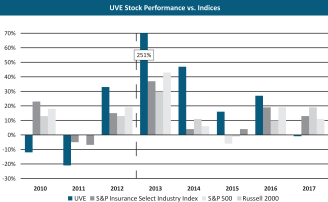

Performance Highlights

Key financial achievements for 2017 include:

| • | Direct premiums written overall grew by $101.3 million, or 10.6%, to $1,055.9 million compared to 2016. In Florida, direct premiums written grew by $63.3 million, or 7.4%, to $924.0 million. Outside of Florida, direct premiums written grew by $38.0 million, or 40.4%, to $131.9 million. |

| • | Net premiums earned grew by $56.4 million, or 8.9%, to $688.8 million compared to 2016. |

| • | Total revenues increased by $66.6 million, or 9.7%, to $751.9 million compared to 2016. |

| • | Net income increased by $7.5 million, or 7.6%, to $106.9 million compared to 2016. |

| • | Diluted earnings per share increased by $0.20, or 7.1%, to $2.99 per common share compared to 2016. |

| • | Declared and paid dividends per common share of $0.69, including a $0.13 special dividend in December. |

| • | Repurchased approximately 771,000 shares in 2017 at an aggregate cost of $18.1 million. |

| • | Generated a Return on Average Equity of 25.7% for 2017. |

Although Hurricane Irma caused substantial losses, our vertically integrated structure and comprehensive reinsurance program substantially limited the overall financial impact from this damaging storm.

For further details about our 2017 performance, please see our Annual Report on Form10-K for the fiscal year ended December 31, 2017.

Key operational achievements and milestones for 2017 include:

| • | Our Florida business continued to grow in 2017. We received regulatory approval for an overall 3.4% average statewide rate increase in Florida during 2017, which we began using on December 7, 2017 for new business and on January 26, 2018 for renewal business. |

| • | We also continued to make progress on our geographic expansion initiative, as we commenced writing homeowners policies in New Jersey and New York, and we received Certificates of Authority from Illinois and Iowa. |

| • | We offered Universal DirectSM in all 16 states in which we wrote policies as of December 31, 2017. |

| • | Our comprehensive reinsurance program performed as designed and as expected during Hurricane Irma, limiting our exposure to the largest hurricane to make landfall in Florida in the past decade, and enabling us to report an underwriting profit during both the third quarter of 2017 and the full year 2017. |

| • | We experienced a meaningful increase in headcount during the year (from 483 full-time employees as of February 14, 2017 to 558 full-time employees at February 9, 2018), with the majority of those increases coming within our claims department. In particular, we added significant headcount in connection with ourbuild-out of the subrogation and litigation teams within our claims department. |

The following charts demonstrate the achievements of our executive team since Sean P. Downes, Chairman and Chief Executive Officer, and Jon W. Springer, President, Chief Risk Officer, and Director assumed leadership in February 2013.

| 2 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| PROXY SUMMARY—CONTINUED |

|  | |

|  | |

|  | |

|  |

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 3 |

| PROXY SUMMARY—CONTINUED |

Director Nominees

We strive to maintain a committed, engaged Board with the diverse, independent skill set demanded by its oversight role.

Committee Membership | ||||||||||||||||

| Name | Age | Director Since | Principal Occupation | Nominating & Governance | Compensation | Audit | Investment | Risk | ||||||||

Sean P. Downes (Chairman and CEO) | 48 | 2005 | Chairman and Chief Executive Officer, Universal Insurance Holdings, Inc. | X | ||||||||||||

Scott P. Callahan | 64 | 2013 | President and Managing Member of SPC Global RE Advisors, LLC; Former EVP of Everest Reinsurance Holdings | X | X | |||||||||||

Kimberly D. Cooper | 40 | 2017 | Chief Information Officer and Chief Administration Officer, Universal Insurance Holdings, Inc. | X | ||||||||||||

Darryl L. Lewis | 53 | 2013 | Trial Attorney with Searcy Denney Scarola Barnhart & Shipley, P.A. | Chair | X | Chair | ||||||||||

Ralph J. Palmieri | 70 | 2014 | Retired Insurance Company Executive from The Hartford Insurance Group | Chair | ||||||||||||

Richard D. Peterson | 50 | 2014 | CFO of Dermavant Sciences, Inc.; Former CFO of Sienna Biopharmaceuticals, Inc. | X | Chair | |||||||||||

Michael A. Pietrangelo (Lead Independent Director) | 75 | 2010 | Lawyer with Pietrangelo Cook, PLC | X | Chair | |||||||||||

Ozzie A. Schindler | 49 | 2007 | Lawyer with Greenberg Traurig LLP | X | ||||||||||||

Jon W. Springer | 48 | 2013 | President and Chief Risk Officer, Universal Insurance Holdings, Inc. | X | X | |||||||||||

Joel M. Wilentz, M.D. | 83 | 1997 | Founding Member of Dermatology Associates and the Centers for Cosmetic Enhancement in Florida | X | X | |||||||||||

| Denotes Board members added since our current management team assumed leadership in 2013. |

Governance Highlights

| • | Seven of our ten director nominees are independent. |

| • | We added six new directors to the Board since 2013. |

| • | Our independent directors elect our lead independent director, who chairs regularly-scheduled executive sessions at which our independent directors discuss matters without management present, including management’s performance, succession planning and Board effectiveness. |

| • | We have five Board committees: Audit Committee, Compensation Committee, Nominating and Governance Committee, Investment Committee and Risk Committee, with Audit Committee, Compensation Committee and Nominating and Governance Committee comprised exclusively of independent directors. |

| • | Our directors are elected annually. |

| • | We have outreach and engagement with our largest shareholders and have established a telephone hotline to allow shareholders to communicate any concerns to our independent directors on an anonymous basis. |

| • | The Board routinely focuses on continuing director education for all directors and Board orientation for new directors. |

| • | The Board and each committee conduct an annual evaluation of its performance. |

| • | Senior management succession planning is a top Board priority. The Board devotes significant attention to identifying and developing talented senior leaders. |

| 4 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| CORPORATE GOVERNANCE |

The Board is responsible for overseeing management and providing sound governance on behalf of our shareholders. The Board selects our executive officers, delegates responsibilities for the conduct ofday-to-day operations to such officers and monitors the performance of our officers.

Board Membership Criteria and Nominations

In selecting candidates for director, the Nominating and Governance Committee of the Board looks for individuals with strong personal attributes including:

| • | Integrity: Directors should demonstrate high ethical standards and integrity in their personal and professional dealings. |

| • | Accountability: Directors should be willing to be accountable for their decisions as directors. |

| • | Judgment: Directors should possess the ability to provide wise and thoughtful counsel on a broad range of issues. |

| • | Responsibility: Directors should interact with each other in a manner that encourages responsible, open, challenging and inspired discussion. |

| • | High Performance Standards: Directors should have a history of achievements that reflects high standards for themselves and others. |

| • | Commitment and Enthusiasm: Directors should be committed to, and enthusiastic about, their service on the Board. |

| • | Courage: Directors should possess the courage to express views openly, even in the face of opposition. |

The Board maintains no formal policy regarding Board membership diversity. In nominating directors, the Board considers, among other things, functional areas of experience, educational background, employment experience and leadership performance.

The Board generally believes that the Nominating and Governance Committee and the Board are best situated to identify candidates with appropriate industry and related expertise to meet the Company’s needs; however, we will carefully consider any director nominees recommended by shareholders. If a shareholder desires to formally propose a director nominee at the annual meeting, or to put a proposal on the agenda for the annual meeting, our bylaws establish an advance notice procedure that must be complied with in order to do so.

The current directors of the Company are set forth below, each of whom is also a director nominee. If elected, each nominee is expected to serve until the 2019 Annual Meeting of Shareholders or until his or her successor is duly elected and qualified.

| Name | Age | Position | Date of Joining the Board | |||

Scott P. Callahan | 64 | Director | 2013 | |||

Kimberly D. Cooper | 40 | Director, Chief Information Officer and Chief Administrative Officer | 2017 | |||

Sean P. Downes | 48 | Chairman and Chief Executive Officer | 2005 | |||

Darryl L. Lewis | 53 | Director | 2013 | |||

Ralph J. Palmieri | 70 | Director | 2014 | |||

Richard D. Peterson | 50 | Director | 2014 | |||

Michael A. Pietrangelo | 75 | Director | 2010 | |||

Ozzie A. Schindler | 49 | Director | 2007 | |||

Jon W. Springer | 48 | Director, President and Chief Risk Officer | 2013 | |||

Joel M. Wilentz, M.D. | 83 | Director | 1997 |

Scott P. Callahan became a director of the Company in 2013. Mr. Callahan has more than thirty years’ experience in the property and casualty reinsurance industry. Mr. Callahan currently serves as President and Managing Member of SPC Global RE Advisors LLC, a consulting firm specializing in reinsurance matters, a position he has held since 2013. Until 2011, Mr. Callahan served as Executive Vice President of Everest Reinsurance Holdings, Inc. and Everest

Reinsurance Company since 2002. Mr. Callahan also served as a director of Everest Reinsurance Company from 2001 to 2011, a director of Everest International Reinsurance, Ltd. from 2003 to 2007, and director of Everest Reinsurance (Bermuda), Ltd. from 2001 to 2007. His broad knowledge of the reinsurance industry allows Mr. Callahan to provide valuable perspective to the Board, particularly on matters related to the Company’s reinsurance program.

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 5 |

| CORPORATE GOVERNANCE—CONTINUED |

Kimberly D. Cooper became a director of the Company in 2017. Ms. Cooper joined the Company in 2007 and became Chief Administrative Officer in June 2015 and Chief Information Officer in February 2015. Prior to assuming these roles, Ms. Cooper spent eight years in the Company’s internal audit department, serving as both IT Manager and then IT Audit Director. She managed IT general controls reviews and new application deployment and performed ongoing security and risk awareness training to improve operational efficiencies and ensure ongoing compliance with regulatory requirements. Ms. Cooper brings to the Board significant experience in information technology, risk management, regulatory compliance and operational efficiency practices.

Sean P. Downes became Chairman and Chief Executive Officer of the Company in 2013. Mr. Downes also served as President of the Company from 2013 to March 10, 2016. Prior to becoming President and Chief Executive Officer, Mr. Downes served as Senior Vice President and Chief Operating Officer of the Company since 2005 and Chief Operating Officer of UPCIC, a wholly-owned subsidiary of the Company, since 2003. Mr. Downes has served as a director of the Company since 2005 and as a director of UPCIC since 2003. Prior to joining UPCIC, Mr. Downes was Chief Operating Officer of Universal Adjusting Corporation, a wholly-owned subsidiary of the Company, from 1999 to 2003. As an experienced financial and operational leader within the insurance industry, Mr. Downes brings to the Board a broad understanding of the strategic priorities and operational demands facing the Company.

Darryl L. Lewis became a director of the Company in 2013. Mr. Lewis is an established trial attorney in Florida and throughout the southeast region of the United States. Mr. Lewis has been a shareholder with the law firm of Searcy Denney Scarola Barnhart & Shipley, P.A. since 2003. Mr. Lewis has been named in theBest Lawyers in America publication in connection with his litigation practice since 2007 and in theSouth Florida Legal Guide as one of Florida’s top trial lawyers. Mr. Lewis’s extensive knowledge of the Florida business and legal markets makes him a valuable member of the Board.

Ralph J. Palmieri became a director of the Company in 2014. Mr. Palmieri has more than 40 years of experience in the insurance and reinsurance industries. Mr. Palmieri served in various capacities with The Hartford Insurance Group and its subsidiaries from 1976 until his retirement in 2007, including Senior Vice President, Specialty Lines, for The Hartford and President and Chief Operating Officer of The Hartford’s surplus lines subsidiary, First State Management Group (formerly known as Cameron and Colby Co.), from 1988 to 2007. Mr. Palmieri brings an acute understanding of the insurance and reinsurance industries and executive leadership experience to the Board.

Richard D. Peterson became a director of the Company in 2014. Mr. Peterson has over 20 years of experience in the areas of executive management, finance and accounting. Mr. Peterson is currently the Chief Financial Officer of Dermavant Sciences, Inc., a position he has held since 2018. From 2017 to 2018, Mr. Peterson was the Chief Financial Officer of Sienna Biopharmaceuticals, Inc., a public pharmaceutical company. Mr. Peterson also served as Chief Financial Officer of Novan, Inc., a public pharmaceutical company,

from 2015 to 2017. Mr. Peterson served in various executive roles at Medicis Pharmaceutical Corporation from 1995 to 2012, including as Executive Vice President, Chief Financial Officer and Treasurer from 2008 to 2012. Mr. Peterson has an understanding of corporate governance matters and experience with financial reporting and executive leadership that make him a valued member of our Board.

Michael A. Pietrangelo became a director of the Company in 2010. Since 1998, Mr. Pietrangelo has practiced law and has been of counsel to the firm of Pietrangelo Cook, PLC. Mr. Pietrangelo is admitted to the bars of the states of New York and Tennessee and the District of Columbia. He served on the board of directors of MRI Interventions Inc., a publicly traded research and development company, from 2010 to 2014, and he currently serves on the board of directors of the American Parkinson Disease Association, anot-for-profit organization focused on serving the Parkinson’s community. Mr. Pietrangelo also serves as the managing partner of The Theraplex Company, LLC, a privately held skin care company. He brings valuable experience to the Board in corporate governance, legal and financial matters as a result of his positions as a lawyer, executive and director of privately held and public companies, as well as nonprofit organizations.

Ozzie A. Schindler became a director of the Company in 2007. Mr. Schindler has been a shareholder with the law firm of Greenberg Traurig LLP since 2005, specializing in all aspects of international tax planning. He is admitted to both the Florida and New York bars. Mr. Schindler provides strong regulatory, accounting, financial, risk analysis, internal audit, compliance, corporate governance and administrative skills and experience to the Board.

Jon W. Springer became a director of the Company in 2013. Mr. Springer became President and Chief Risk Officer of the Company as of March 10, 2016. Prior to taking on such role, he served as an Executive Vice President and Chief Operating Officer of the Company since 2013. Mr. Springer was an Executive Vice President of Universal Risk Advisors, Inc., a wholly-owned subsidiary of the Company, from 2006 through 2008, and an Executive Vice President of Blue Atlantic Reinsurance Corporation (“Blue Atlantic”), a wholly-owned subsidiary of the Company, from 2008 to 2013. Before joining Universal Risk Advisors, Inc. in 2006, Mr. Springer was an Executive Vice President of Willis Re, Inc. and was responsible for managing property and casualty operations in its Minneapolis office. Mr. Springer brings to the Board extensive experience in the property and casualty insurance industry, including with respect to reinsurance arrangements.

Joel M. Wilentz, M.D. became a director of the Company in 1997. Dr. Wilentz is one of the founding members of Dermatology Associates, founded in 1970, and of the Centers for Cosmetic Enhancement in Florida. He is a former member of the Board of Directors of the Neurological Injury Compensation Association for the State of Florida. Dr. Wilentz is, at present, a member of the Board of Governors of Nova Southeastern University. Dr. Wilentz’s general business acumen and deep understanding of the Florida business, professional and regulatory environment allow him to provide independent guidance to the Board on a wide variety of general corporate and strategic matters.

| 6 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| CORPORATE GOVERNANCE—CONTINUED |

The Board, upon the recommendation of the Nominating and Governance Committee, has nominated incumbent directors Scott P. Callahan, Kimberly D. Cooper, Sean P. Downes, Darryl L. Lewis, Ralph J. Palmieri, Richard D. Peterson, Michael A. Pietrangelo, Ozzie A. Schindler, Jon W. Springer and Joel M. Wilentz, M.D. for election to the Board to serve as directors until the 2019 Annual Meeting of Shareholders or until each nominee’s successor is duly elected and qualified or until such director’s earlier death, resignation or removal. The Board has fixed the number of director seats on the Board at ten.

The nominees have consented to be named in this Proxy Statement as director nominees and have indicated their intent to serve if elected. If any nominee becomes unavailable for any reason, or if any vacancy in the slate of directors to be elected at the meeting should occur before the election, the shares represented by the proxy will be

voted for the person, if any, who is designated by the Board to replace the nominee or to fill such vacancy on the Board.

A director nominee must receive the affirmative vote of the majority of votes cast at the annual meeting in order to be elected. If elected, each nominee is expected to serve until the 2019 Annual Meeting of Shareholders or until his or her successor is duly elected and qualified. Otherwise, if a director nominee fails to receive the affirmative vote of the majority of votes cast, then he or she shall promptly tender his or her resignation to the Board, and the Board, taking into account the recommendation of the Nominating and Governance Committee, shall subsequently determine whether to accept or reject the resignation, or whether other action should be taken.

THE BOARD RECOMMENDS A VOTEFOR EACH OF ITS NOMINEES FOR ELECTION AS DIRECTORS.

Corporate Governance Framework

The Board’s leadership structure is designed to ensure that authority and responsibility are effectively allocated between the Board and management. In addition to our strong corporate governance practices and the key oversight roles of our lead independent director and committee chairs, each as described below, all directors share equally in their responsibilities as members of the Board and take seriously the charge of leading the Company on behalf of our shareholders. Our corporate governance framework reflects our commitment to independence and corporate responsibility and to promote achievement of our financial goals through responsible development and execution of corporate strategy. Our governance framework enables independent and skilled directors to provide

oversight, advice and counsel to promote the interests of the Company and our shareholders. Our governance framework is established and evidenced by our Corporate Governance Guidelines (“Governance Guidelines”), Code of Business Conduct and Ethics (“Code of Conduct”), our risk management program and our commitment to transparent financial reporting. Our Governance Guidelines, Code of Conduct and the charters of each Board committee are available at www.universalinsuranceholdings.com. The Board, along with management, regularly reviews our policies and procedures, charters and practices to ensure that they are appropriate and reflect desired standards of corporate governance.

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 7 |

| CORPORATE GOVERNANCE—CONTINUED |

Governance Highlights

The following chart highlights our corporate governance practices and principles.

| Board Independence | • | Seven of our ten director nominees are independent. | ||

| • | Messrs. Downes and Springer and Ms. Cooper are the members of management who serve as directors. | |||

| Board Composition | • | The Nominating and Governance Committee regularly reviews Board performance, assesses gaps in skills or experience on the Board and periodically recommends new directors to add a fresh perspective to the Board while maintaining continuity and valuable historic knowledge. | ||

| • | We have added six new directors to the Board since 2013. | |||

| Lead Independent Director | • | Our independent directors elect our lead independent director. | ||

| • | Our lead independent director chairs regularly-scheduled executive sessions at which our independent directors discuss matters without management present, including management’s performance, succession planning and Board effectiveness. | |||

| Board Committees | • | We have five Board committees: Audit Committee, Compensation Committee, Nominating and Governance Committee, Investment Committee and Risk Committee. | ||

| • | Our Compensation Committee, Audit Committee and Nominating and Governance Committee are each comprised exclusively of independent directors. | |||

| • | Chairs of the Board committees shape the agenda and information presented to their committees. | |||

| Board Oversight of Risk Management | • | The Board seeks to ensure that material risks are identified and managed appropriately, and the Board and its committees regularly review material operational, financial, compensation and compliance risks with senior management. | ||

| • | Our Audit Committee oversees the integrity of our financial reporting process, financial statements and related legal and regulatory compliance. | |||

| • | Our Compensation Committee considers risk in connection with its design of the compensation program for our executives. | |||

| • | Our Nominating and Governance Committee assists in managing risk by regularly reviewing the Company’s governance practices and the composition of the Board and its committees, including with regard to director independence. | |||

| • | Our Investment Committee considers risks related to the investment of the Company’s securities portfolio and the Company’s investment strategy. | |||

| • | Our Risk Committee assists in managing risk by developing and overseeing risk management process and systems of internal controls intended to provide assurance that the Company has identified and evaluated key enterprise risks and implemented mitigating controls. | |||

| • | The Board and management also focus on privacy protection, cybersecurity and information security in an effort to mitigate the risk of cyber-attacks and to protect the Company’s information and that of our customers. | |||

| Accountability | • | Our directors are elected annually. | ||

| • | We have outreach and engagement with our largest shareholders and have established a mechanism to allow shareholders to communicate anonymously any concerns to our independent directors. | |||

| Open Communications | • | Our committees report to the Board regularly. | ||

| • | The Board promotes open and frank discussions with management. | |||

| • | Our directors have free access to members of management and other employees and are authorized to hire outside consultants or experts at the Company’s expense. | |||

| Director Education | • | The Board routinely focuses on continuing director education for all directors and Board orientation for new directors. | ||

| Self-Evaluations | • | The Board and each committee conduct annual evaluations of their performance. | ||

| Succession Planning | • | Senior management succession planning is a top Board priority. The Board devotes significant attention to identifying and developing talented senior leaders. | ||

| Director Stock Ownership | • | Within two years of joining the Board, each director is expected to hold shares of our common stock having a value of at least $25,000. | ||

Clawback Policy; No Hedging or Pledging | • | We have a compensation clawback policy designed to mitigate risk in connection with executive compensation. | ||

| • | Our directors, executive officers and senior accounting and finance personnel may not hedge or short shares of our common stock, engage in options trading, trade on margin or pledge shares of our common stock as collateral. |

| 8 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| CORPORATE GOVERNANCE—CONTINUED |

Board and Committee Meetings

Meetings of the Board are held regularly each quarter and as may otherwise be required. The Board held four meetings during 2017. We encourage directors to attend the annual meeting of shareholders and expect that they will attend. All of our directors were present at the 2017 Annual Meeting of Shareholders. Other than Mr. Callahan, all of our directors attended at least 75% of the meetings of the Board and the committees on which they served during 2017. Mr. Callahan attended 73% of the Board and Board committee meetings on which he serves during 2017. The meetings he missed were all held on the same day; he could not attend these meetings due to illness in his family.

Board Leadership Structure

The Board believes that it is important to retain flexibility in determining the best leadership structure for the Company as our needs may change over time. The roles of Board Chairman and Chief Executive Officer may be filled by the same or different individuals, which provides the Board the flexibility to determine whether these roles should be combined or separated based on the Company’s circumstances and needs at any given time. The roles of Chairman and Chief Executive Officer of the Company are currently held by the same person, Sean P. Downes. The Board believes that our shareholders are best served at this time by having Mr. Downes fill both positions. Mr. Downes’s tenure and experience with the Company make him the most familiar with the business and challenges the Company faces in the current business environment. His experience and expertise make him the most appropriate person to set agendas for, and lead discussions of, strategic matters affecting our business at this time. Moreover, this structure enables Mr. Downes to act as a bridge between management and the Board and helps to promote unified leadership and direction. The Board believes this structure, together with a strong lead independent director, currently provides appropriate leadership for the Company and facilitates effective communications between the Board and management. Our Chairman is appointed annually by all the directors. The Chairman’s responsibilities, in addition to providing general leadership to the Board, include calling and presiding at Board and shareholder meetings and preparing meeting schedules, agendas and materials.

Independence of Our Directors

NYSE rules require that at least a majority of our directors be independent of the Company and management. The Board has determined that each of our directors, other than Messrs. Downes and Springer and Ms. Cooper, is an “independent director,” as such term is defined by NYSE rules. In making such independence determination with regard to Mr. Ralph Palmieri, the Board considered that Mr. Palmieri’s son, Matthew J. Palmieri, is employed as President of Blue Atlantic, a wholly-owned subsidiary of the Company, and has been with the Company since June 2006. Matthew Palmieri is not an executive officer of the Company. See “Certain Relationships and Related-Party Transactions” for additional details regarding Matthew Palmieri’s employment with Blue Atlantic.

Lead Independent Director; Meetings of Independent Directors

Our independent directors chose Michael A. Pietrangelo to serve as the lead independent director in 2014, and Mr. Pietrangelo continues to serve in this role. Our independent directors met four times in executive session in 2017. Our lead independent director presides over all executive sessions of our independent directors, facilitates communication between management and our independent directors and is available for consultation with major shareholders and other constituencies, as appropriate. Interested parties may anonymously communicate any concerns to our independent directors, including our lead independent director, by calling(877) 778-5463, which is the same number that employees may use to anonymously report complaints to the Audit Committee concerning accounting or auditing matters.

Board and Committee Annual Evaluations

At the direction of the Nominating and Governance Committee, the Board annually conducts a self-evaluation aimed at enhancing effectiveness. The annual assessment process is a key governance tool used by the Nominating and Governance Committee to solicit feedback in a number of areas, including overall effectiveness, communications with management and committee structures. Each committee also performs an annual self-evaluation, which includes an assessment of its effectiveness and a review of the committee charter and other relevant governance practices and procedures. The Nominating and Governance Committee periodically reviews and assesses the evaluation process as well.

The Board’s Role in Risk Oversight

Risk is an inherent part of our business, and effective risk management is a top Board priority. Risk management and key risks identified by management are overseen by the Board and its committees. These include material operational, financial, compensation and compliance risks. The Board and management also focus on privacy protection, cybersecurity and information security in an effort to mitigate the risk of cyber-attacks and to protect the Company’s information and that of our customers.

Our Board committees also help manage risk. The Audit Committee performs a central oversight role with respect to financial and compliance risks. As part of its responsibilities, the Audit Committee discusses with management the Company’s policies and guidelines governing the process by which risk assessment and risk management are undertaken by management, including guidelines and policies to identify major financial risk exposures and the steps management has taken to monitor and control such exposures. The Compensation Committee considers risk in connection with its design of compensation programs for our executives, including confirming that the compensation program does not encourage unnecessary risk taking, as more fully discussed in the Compensation Discussion and Analysis section of this Proxy Statement. The Nominating and Governance Committee assists in managing risk by annually reviewing the composition of the Board and its committees,

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 9 |

| CORPORATE GOVERNANCE—CONTINUED |

including with regard to director independence, by assessing the adequacy of our corporate governance policies and procedures and by making recommendations to the Board, as appropriate, regarding modifications to such policies and procedures. The Investment Committee considers risks related to the investment of the Company’s securities portfolio and reviews the performance of the portfolio, compliance with applicable state investment codes and regulations and adherence to the Company’s investment strategy. The Risk Committee is responsible for the development and oversight of risk management processes and systems of internal controls intended to provide assurances to management and the Board that the Company has identified and evaluated key enterprise risks and implemented mitigating controls.

Code of Business Conduct and Ethics

Our Code of Conduct is a critical component in helping us maintain high professional standards. We also provide an internal reporting hotline, through which employees can anonymously report suspected violations of the Code of Conduct or other policies. Suspected violations of the Code of Conduct are investigated by the Company and may result in disciplinary action. The Code of Conduct is publicly available on our website at www.universalinsuranceholdings.com. The Audit Committee annually reviews our Code of Conduct for changes, as appropriate. In the event of an amendment to the Code of Ethics, or a waiver from a provision of the Code of Ethics granted to a senior executive officer, the Company intends to post such information on its website.

Governance Guidelines

Our Governance Guidelines address director independence standards, conflicts of interest, meeting and committee procedures, Board membership criteria, director qualifications and duties and succession planning, among other pertinent governance matters. Our Governance Guidelines are publicly available on our website at www.universalinsuranceholdings.com. The Nominating and Governance Committee annually reviews the Governance Guidelines for changes, as appropriate.

Shareholder Communications

We have established a process for shareholders to send communications to the Board. Shareholders may anonymously communicate any concerns regarding the Company to our independent directors by calling(877) 778-5463, which is the same number that employees may use to anonymously report complaints to the Audit Committee concerning accounting or auditing matters. Upon receipt of any shareholder concerns, our independent directors have discretion whether to convey any such information to our full Board. Shareholders may send other general communications to our Company by mail to our Secretary, Stephen J. Donaghy, at Universal Insurance Holdings, Inc., 1110 West Commercial Boulevard, Fort Lauderdale, Florida 33309.

We proactively engage with our shareholders on a variety of topics, including governance and executive compensation matters, throughout the year.

Committees and Committee Chairs

The Board has appointed strong committee chairs to lead each Board committee in its respective area. All committee chairs are independent and appointed annually by the Board. Committee chairs are responsible for setting meeting agendas, presiding at committee meetings, facilitating open communications with the Board and management and working directly with management in connection with committee matters. Our committees have the authority and the

resources to seek legal or other expert advice from independent sources. Each committee reports its actions and recommendations to the full Board on a regular basis.

The following table sets forth the current committee membership, chairpersons and “audit committee financial experts” for our Company:

| Nominating & Governance Committee | Investment Committee | Compensation Committee | Audit Committee | Risk Committee | Audit Committee Financial Expert | |||||||||

| Scott P. Callahan | I | Member | Member | |||||||||||

| Kimberly D. Cooper | Member | |||||||||||||

| Sean P. Downes | C | Member | ||||||||||||

| Darryl L. Lewis | I | Chairperson | Member | Chairperson | ||||||||||

| Ralph J. Palmieri | I | Chairperson | ||||||||||||

| Richard D. Peterson | I | Member | Chairperson | Expert | ||||||||||

| Michael A. Pietrangelo | I, LD | Member | Chairperson | |||||||||||

| Ozzie A. Schindler | I | Member | Expert | |||||||||||

| Jon W. Springer | Member | Member | ||||||||||||

| Joel M. Wilentz, M.D. | I | Member | Member |

I - Independent director; C - Chairman of the Board; LD - Lead Director

| 10 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| CORPORATE GOVERNANCE—CONTINUED |

Audit Committee

The Audit Committee provides oversight of the Company’s financial management, internal audit department and independent auditor. The Audit Committee oversees the quality and effectiveness of the Company’s internal controls, which provide reasonable assurance that assets are safeguarded and that financial reports are properly prepared. The Audit Committee also reviews and monitors the Company’s financial reporting procedures, compliance and disclosure. In performing these functions, the Audit Committee meets periodically with the independent auditor, management and internal auditors (including in private sessions) to review their work and confirm that they are properly discharging their respective responsibilities. In addition, the Audit Committee appoints and evaluates the performance of the independent auditor.

The Audit Committee held six meetings in 2017.

The Board has determined that Messrs. Peterson and Schindler are each an “audit committee financial expert” as defined by Item 407(d)(5) of RegulationS-K promulgated by the SEC.

The Audit Committee’s charter is publicly available on our website at www.universalinsuranceholdings.com. The Audit Committee annually reviews its charter to determine whether any changes are appropriate.

Compensation Committee

The Compensation Committee is responsible for establishing and overseeing the Company’s executive compensation philosophy and principles, reviewing and recommending for approval by the independent directors the compensation for and employment agreement with our Chief Executive Officer, approving the compensation for and employment agreements with certain other executive officers, establishing and evaluating performance-based goals related to compensation, overseeing the design and administration of the 2009 Omnibus Incentive Plan, as amended from time to time (“Omnibus Plan”), and reviewing, and recommending for approval by the full Board, the compensation for our independent directors.

The Compensation Committee held eight meetings in 2017.

The Compensation Committee’s charter is publicly available on our website at www.universalinsuranceholdings.com. The Compensation Committee annually reviews its charter to determine whether any changes are appropriate.

Nominating and Governance Committee

The Nominating and Governance Committee exercises general oversight with respect to the governance of the Board. It assists the Board by identifying individuals qualified to become directors and recommends to the Board nominees for the next annual meeting of shareholders and to fill vacancies in membership of the Board as they occur; recommends to the Board nominees for each committee of the Board; and considers matters relating to corporate governance

generally, including assessing the adequacy of our corporate governance policies and procedures and making recommendations to the Board, as appropriate, regarding modifications to such policies and procedures, including our Governance Guidelines and our certificate of incorporation and bylaws. The Nominating and Governance Committee also oversees the director self-evaluation process and is responsible for maintaining orientation and continuing education programs for all directors.

The Nominating and Governance Committee held three meetings in 2017.

The Nominating and Governance Committee’s charter is publicly available on our website at www.universalinsuranceholdings.com. The Nominating and Governance Committee annually reviews its charter to determine whether any changes are appropriate.

Investment Committee

The Investment Committee’s responsibilities include monitoring whether the Company has adopted and adheres to a rational and prudent investment strategy; monitoring whether investment actions are consistent with the Company’s investment strategy, financial objectives and business goals; compliance with legal and regulatory requirements pertaining to investment and capital management and assessing the competence and performance of the Company’s third-party investment advisers. The Investment Committee does not make operating decisions about market timing, sector rotation or security selection, which are the responsibilities of management and the Company’s third-party investment advisers.

The Investment Committee held four meetings in 2017.

The Investment Committee’s charter is publicly available on our website at www.universalinsuranceholdings.com. The Investment Committee annually reviews its charter to determine whether any changes are appropriate.

Risk Committee

The Risk Committee’s responsibilities include designing, implementing and maintaining an effective risk management framework; evaluating and addressing risk management and capital management matters affecting the Company related to the design and implementation of the Company’s risk management framework; assessing the Company’s enterprise risk management capabilities; maintaining a risk-aware corporate culture; and developing risk tolerance protocols and procedures. The Risk Committee annually reviews the Company’s risk tolerance levels, risk appetite statements and risk management policy.

The Risk Committee held two meetings in 2017.

The Risk Committee’s charter is publicly available on our website at www.universalinsuranceholdings.com. The Risk Committee annually reviews its charter to determine whether any changes are appropriate.

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 11 |

| CORPORATE GOVERNANCE—CONTINUED |

Compensation Committee Interlocks and Insider Participation

Richard D. Peterson, Michael A. Pietrangelo and Joel M. Wilentz, M.D. served as members of the Compensation Committee during 2017. There are no Compensation Committee interlocks, meaning that none of our executive officers served on the compensation committee (or its equivalent) or board of directors of another entity for

which any of our directors served as an executive officer at any time during 2017.

No compensation committee member is or was an employee or officer of the Company or has any relationship with the Company requiring disclosure as a related party transaction.

Each independent director currently receives an annual cash retainer of $85,000. In light of the workload and broad responsibilities of their positions, the Chairs of our Board committees each receive an additional annual cash retainer of $15,000. The independent directors are also entitled to receive discretionary grants ofnon-qualified stock options under our Omnibus Plan.

Messrs. Downes and Springer and Ms. Cooper are employees of the Company and do not receive additional compensation for their Board service.

Director Summary Compensation Table

The table below summarizes the compensation paid to our independent directors for the fiscal year ended December 31, 2017.

| Name | Fees Paid in Cash ($) | Stock Awards (1) ($) | Total ($) | |||||||||

Scott P. Callahan | $ | 85,000 | — | $ | 85,000 | |||||||

Darryl L. Lewis | $ | 100,000 | — | $ | 100,000 | |||||||

Ralph J. Palmieri | $ | 100,000 | — | $ | 100,000 | |||||||

Richard D. Peterson | $ | 100,000 | — | $ | 100,000 | |||||||

Michael A. Pietrangelo | $ | 100,000 | $ | 634,054 | $ | 734,054 | ||||||

Ozzie A. Schindler | $ | 85,000 | — | $ | 85,000 | |||||||

Joel M. Wilentz, M.D. | $ | 85,000 | — | $ | 85,000 | |||||||

| 1 | On July 10, 2017, the Company granted Mr. Pietrangelo 25,413 shares of common stock to replace the value of a stock option award that had terminated in 2016 without being exercised. The grant date fair value of the stock issued was $634,054, based on the $24.05 per share closing price on such date, with one-half of these shares subject to transfer restrictions that lapse over two years. As of December 31, 2017, the number of equity awards (in the form of stock options) that were outstanding for each independent director was as follows: Mr. Callahan 40,000, Mr. Lewis 40,000, Mr. Palmieri 50,000, Mr. Peterson 50,000, Mr. Pietrangelo 85,000, Mr. Schindler 40,000 and Mr. Wilentz 40,000. |

Stock Ownership Guidelines; No Hedging or Pledging Shares

We believe that our directors should be personally invested in the Company alongside our shareholders. It is expected that, within two years of joining the Board, each director will own shares of our common stock having a value of at least $25,000. Additionally, our

directors may not hedge or short shares of our common stock, engage in options trading, trade on margin or pledge shares of our common stock as collateral.

Each director is currently in compliance with these guidelines.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires our directors, executive officers and persons who own more than 10% of the Company’s common stock (collectively, “Reporting Persons”) to file initial reports of ownership and reports of changes in ownership with the SEC. Reporting Persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on a review of copies of Forms 3, 4 and 5 provided to us and written representations by the Reporting Persons, we believe that, for the year ended December 31, 2017, all of the Reporting Persons timely filed their Section 16 reports.

| 12 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| CORPORATE GOVERNANCE—CONTINUED |

Our executive officers are elected annually by the Board and serve at the discretion of the Board. The current executive officers of the Company are as follows:

| Name | Age | Position | ||||

Sean P. Downes | 48 | Chairman and Chief Executive Officer | ||||

Jon W. Springer | 48 | President, Chief Risk Officer and Director | ||||

Stephen J. Donaghy | 53 | Chief Operating Officer and Secretary | ||||

Frank C. Wilcox | 52 | Chief Financial Officer | ||||

Kimberly D. Cooper | 40 | Chief Administrative Officer, Chief Information Officer and Director | ||||

Our executive officers are collectively referred to in this Proxy Statement as our “Named Executive Officers” or “NEOs.” Biographical information about our Named Executive Officers is as follows.

Sean P. Downes. For biographical information on Sean P. Downes, see “Director Nominees.”

Jon W. Springer. For biographical information on Jon W. Springer, see “Director Nominees.”

Stephen J. Donaghy became the Chief Operating Officer of the Company as of March 10, 2016, and Secretary in February 2013. He also served as our Chief Marketing Officer from January 2015 to March 2016, Chief Administrative Officer from February 2013 to June 2015, Chief Information Officer from 2009 to February 2015 and Executive Vice President since 2006. Before joining the Company, Mr. Donaghy held various executive positions at JM Family Enterprises, a private company, including Vice President of Strategic Initiatives, Vice President of Sales and Marketing and Senior Information Officer.

Frank C. Wilcox became the Chief Financial Officer and Principal Accounting Officer of the Company and Chief Financial Officer and Treasurer of the Company’s wholly-owned insurance subsidiaries in 2013. Mr. Wilcox served as the Company’s Vice President – Finance from 2011 to 2013. Prior to joining the Company, Mr. Wilcox held senior corporate accounting positions with Burger King Corporation (2006 to 2011) and BankUnited (2000 to 2006), as well as various auditing, finance, accounting and SEC reporting positions from 1989 to 2000 at Coopers & Lybrand, Blackstone, Dean Witter, CSFB and American Express. Mr. Wilcox has been licensed as a certified public accountant in New York since 1996.

Kimberly D. Cooper. For biographical information on Kimberly D. Cooper, see “Director Nominees.”

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 13 |

| EXECUTIVE COMPENSATION |

Compensation Discussion and Analysis

We believe that the compensation provided to the Named Executive Officers for 2017 is aligned with ourpay-for-performance philosophy and our overall business performance as evidenced by the key

financial and operational milestones presented on pages 2-3 of this Proxy Statement.

2017 Named Executive Officers

| Name | Age | Position | ||||

Sean P. Downes | 48 | Chairman and Chief Executive Officer | ||||

Jon W. Springer | 48 | President, Chief Risk Officer and Director | ||||

Stephen J. Donaghy | 53 | Chief Operating Officer and Secretary | ||||

Frank C. Wilcox | 52 | Chief Financial Officer | ||||

Kimberly D. Cooper | 40 | Chief Administrative Officer, Chief Information Officer and Director | ||||

This Compensation Discussion and Analysis (the “CD&A”) provides an overview of the Company’s executive compensation program and executive compensation philosophies and objectives. The Compensation Committee oversees our compensation program for our Named Executive Officers and the equity compensation program for the Company’s employees generally.

The Compensation Committee designs our executive compensation program to:

| • | attract, retain and reward high-performing executive officers who will drive Company growth and profitability; |

| • | increase long-term value for shareholders; |

| • | manage the Company in a prudent and responsible manner; and |

| • | maintain and enhance the Company’s reputation for operational excellence. |

In making its decisions, the Compensation Committee takes into account, among other things:

| • | the Company’s performance; |

| • | shareholder alignment; |

| • | individual employee performance; |

| • | the Company’s executive retention needs; |

| • | the recommendations of the Chief Executive Officer; |

| • | the terms of applicable employment agreements with the Named Executive Officers; and |

| • | the advice of the Compensation Committee’s independent compensation consultant and outside legal counsel. |

| 14 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| EXECUTIVE COMPENSATION—CONTINUED |

Recent Developments

Response to 2017 Say-on-Pay Shareholder Vote

At the 2017 Annual Meeting of Shareholders, the Company’s shareholders did not approve, on an advisory basis, the compensation paid to the Company’s Named Executive Officers for the year ended December 31, 2016. Of the votes cast, the say-on-pay resolution received 47%.

After this meeting, the Compensation Committee and senior management evaluated how to be responsive to the concerns of shareholders as reflected in this vote, particularly in view of the fact that Mr. Downes’s 2016 Employment Agreement does not expire until December 31, 2018, and Mr. Springer’s 2016 Employment Agreement expired on December 31, 2017.

Mr. Downes proposed an arrangement pursuant to which he would surrender the $4.4 million of stock options and $3.0 million of Performance Stock Units (“PSUs”) he received for 2017 pursuant to the terms of his 2016 Employment Agreement and forgo the $4.4 million and $3.0 million of stock options and PSUs, respectively, that he is entitled to for 2018.

In consultation with the Compensation Committee, the Company evaluated the financial accounting and tax implications of any such surrender, and determined that any such action would be negative for the Company.

From a financial accounting standpoint, any such surrender would accelerate the compensation expense attributable to the stock options and PSUs. From a tax standpoint, as this evaluation was undertaken after the enactment of P.L. 115-97, commonly referred to as the Tax Cuts and Jobs Act (“Tax Act”) on December 22, 2017, the Company was concerned that any such surrender would be viewed as a material modification to Mr. Downes’s 2016 Employment Agreement, thereby jeopardizing the Company’s grandfathered tax deductibility for amounts paid pursuant to certain written binding contracts in place on November 2, 2017. See the discussion at “—Tax Considerations” below.

The Company was similarly concerned that not complying with the terms of Mr. Downes’s 2016 Employment Agreement—i.e., by not granting the $4.4 million in stock options and $3.0 million of PSUs to Mr. Downes in 2018—would also effectively be viewed as a material modification to his 2016 Employment Agreement, thereby also jeopardizing the Company’s grandfathered tax deductibility.

In view of the negative consequences to the Company from a financial accounting standpoint and a tax standpoint, the Compensation Committee determined that it was not advisable to alter the terms of Mr. Downes’s compensation arrangements. Instead, the Compensation Committee negotiated Mr. Springer’s 2018 Employment Agreement, as described below, with a view to similarly modifying Mr. Downes’s future employment agreement, which will likely be in effect as of January 1, 2019, and set the duration of Mr. Springer’s agreement to one year, so that the Compensation Committee will negotiate Mr. Downes’s and Mr. Springer’s employment agreements for 2019 and beyond at the same time.

2018 Employment Agreements

On February 22, 2018, the Company entered into new two-year employment agreements with Messrs. Donaghy and Wilcox and Ms. Cooper, and on April 11, 2018, the Company entered into a new one year employment agreement with Mr. Springer (collectively, the “2018 Employment Agreements”). Messrs. Donaghy’s and Wilcox’s 2018 Employment Agreements are not materially different than their prior agreements, other than a restricted stock grant of 50,000 shares to Mr. Wilcox in 2018, which vests over three years. Ms. Cooper did not have an employment agreement before 2018.

Mr. Springer’s new agreement contains a materially different incentive compensation program, as set forth below, which the Compensation Committee developed in response to the negative say-on-pay vote at the 2017 annual shareholder meeting and in consultation with Pay Governance LLC (“Pay Governance”), an independent adviser to the Compensation Committee.

2018Annual IncentiveCompensation for Mr. Springer

Pursuant to his 2018 Employment Agreement, for 2018, Mr. Springer is entitled to receive an annual incentive award equal to a percentage of his target bonus of $4.5 million (the “Target”) only if the Company’s return on average equity, calculated on a basis that does not reflect the accrual of the annual incentive awards to Messrs. Downes, Springer and Donaghy (“CROAE”, as defined in Mr. Springer’s 2018 Employment Agreement), is at least 10%, as follows:

| CROAE | % of Target | |||

10% | 25.0% | |||

15% | 50.0% | |||

20% | 75.0% | |||

25% | 85.0% | |||

30% | 100.0% | |||

35% | 110.0% | |||

40% | 120.0% | |||

For CROAE between two thresholds, the applicable percentage of the Target will be determined by straight-line interpolation between the applicable thresholds. CROAE is being used to determine annual incentive compensation for Mr. Springer because management must focus on this performance measure to manage and operate the Company profitably and to grow the Company’s business. This award will be subject to the maximum shareholder-approved amount for an annual incentive award under the Omnibus Plan.

In contrast, for 2017, Mr. Springer was entitled to receive an annual incentive award if the Company’s pre-tax income before the calculation of annual incentive awards paid to Messrs. Downes, Springer and Donaghy (as calculated, the “Compensation Pre-Tax Income”) exceeded $113.5 million. If this threshold was met, Mr. Springer’s annual incentive would equal 1.875% of Compensation Pre-Tax Income if it is less than or equal to $125 million, or 2.5% if it is greater than $125 million. For 2017, Compensation Pre-Tax Income was $184.0 million, and Mr. Springer’s annual incentive award was $4,601,177.

| UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement | 15 |

| EXECUTIVE COMPENSATION—CONTINUED |

2018Equity Incentive Compensationfor Mr. Springer

Similar to his prior employment agreement, under his 2018 Employment Agreement, Mr. Springer is entitled to receive PSUs with an annual grant date target value of $1 million. The PSUs are subject to both performance vesting and time vesting conditions, similar to prior PSU grants. However, Mr. Springer is no longer entitled to receive stock options with a grant date fair value of $1.5 million.

Rather, the amount of his annual stock option grant, if any, shall be at the discretion of the Compensation Committee, which gives the Committee flexibility to exercise its judgment in view of facts and circumstances at the time of grant.

Tax Considerations

Prior to the December 22, 2017 enactment of the Tax Act, Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”) provided that no U.S. income tax deduction was allowable to

a publicly held corporation for non-performance-based compensation in excess of $1 million paid to a “covered employee” (generally, the NEOs other than the CFO).

The Tax Act includes numerous changes to existing law, including (1) eliminating the exclusions for commissions or performance-based compensation paid to “covered employees” under Code Section 162(m), (2) expanding the definition of “covered employee” to include anyone serving as CEO or CFO at any point during the year, as well as the three most highly compensated officers as shown in SEC disclosures, and (3) providing that status as a covered employee continues to apply if the person was ever a covered employee for years ending after December 31, 2016. The Tax Act is effective for tax years beginning after 2017, though it includes a transition rule for compensation paid pursuant to certain written binding contracts (such as Mr. Downes’s employment agreement) in place on November 2, 2017 which are not materially modified.

2017 Compensation Components

Other than for Ms. Cooper, who did not have an employment agreement during 2017, the compensation for the Named Executive Officers in 2017 was determined by the terms of the 2016 Employment Agreements, as defined below, in place for each such officer as well as by the Compensation Committee’s discretionary decisions to grant certain equity awards to the Named Executive Officers. For Mr. Wilcox, his 2016 Employment Agreement expired on October 1, 2017 and his compensation from October 1, 2017 to December 31, 2017 was determined by the terms of his 2018 Employment Agreement, as defined below.

Base Salary

For Messrs. Downes, Springer and Donaghy, base salaries were established in their 2016 Employment Agreements. For Mr. Wilcox, his salary before October 1, 2017 was established in his 2016 Employment Agreement and, after October 1, 2017, in his 2018 Employment Agreement. Messrs. Downes’s and Springer’s base salaries will not be increased or decreased during the term of their 2016 Employment Agreements. Base salaries for Messrs. Donaghy and Wilcox and Ms. Cooper may be adjusted by the Compensation Committee at its discretion. In general, base salaries for our NEOs depend on a number of factors, including the size, scope and impact of their role, the market value associated with their role, leadership skills and values, length of service, and individual performance and contributions.

Annual Incentive Compensation

Pursuant to their 2016 Employment Agreements, Messrs. Downes and Springer are entitled to receive an annual incentive award only if the Company’s CompensationPre-Tax Income exceeds $113.5 million for 2017. If this threshold is met, for Mr. Downes, his annual incentive will equal 3% of CompensationPre-Tax Income if it is less than or equal to $125 million, or 4% of CompensationPre-Tax Income if it is greater than $125 million. For Mr. Springer, his annual incentive will equal 1.875% of CompensationPre-Tax Income if it is

less than or equal to $125 million, or 2.5% if it is greater than $125 million. Under his 2016 Employment Agreement, Mr. Donaghy is entitled to an annual incentive award equal to 1.5% of the Company’s net income, which includes the effects of Messrs. Downes’s and Springer’s annual incentive awards and estimated tax payments using the Company’s statutory rate, but not Mr. Donaghy’s annual incentive award (as calculated, the “Compensation Net Income”). CompensationPre-Tax Income and Compensation Net Income are used to determine annual incentive compensation for these individuals because management must focus on these performance measures to manage and operate the Company profitably and to grow the Company’s business. This approach to annual incentives recognizes the central roles of Messrs. Downes, Springer and Donaghy within the Company. In each case, these awards will be subject to the maximum shareholder-approved amount for an annual incentive award under the Omnibus Plan.

For 2017, the Company’s CompensationPre-Tax Income was $184.0 million and Compensation Net Income was $106.7 million. The Compensation Committee therefore approved annual incentive awards for 2017 of $7,361,883 for Mr. Downes, $4,601,177 for Mr. Springer and $1,600,381 for Mr. Donaghy.

Mr. Wilcox and Ms. Cooper were not subject to a formulaic annual compensation program in 2017. Based on the recommendation of Mr. Downes, the Compensation Committee awarded discretionary bonuses in the amounts of $275,000 for Mr. Wilcox and $100,000 for Ms. Cooper. Mr. Downes’s recommendation to the Compensation Committee for such discretionary bonuses was based primarily on Mr. Wilcox’s leadership of the Company’s finance and accounting functions and Ms. Cooper’s leadership in the areas of information technology and risk management. In approving the bonus for Mr. Wilcox, the Compensation Committee also took into account input from Mr. Peterson, the Chair of the Audit Committee.

Equity Incentive Compensation

Pursuant to their 2016 Employment Agreements, Messrs. Downes and Springer each received grants of PSUs and stock options in 2017. The PSUs are subject to both performance vesting and time

| 16 | UNIVERSAL INSURANCE HOLDINGS, INC. | Proxy Statement |

| EXECUTIVE COMPENSATION—CONTINUED |

vesting conditions. For each annual period, the Compensation Committee establishes a performance objective that is set at a target level intended to be challenging yet attainable. No portion of a PSU award shall be earned, and the entire amount will be forfeited, if the target level is not met. In the event the target level is met at the end of the year,two-thirds of the PSU grant will be vested, and the remainingone-third will vest ratably over the following two years. The unvested PSUs will be entitled to receive dividend equivalents, which amounts will be subject to the same time-vesting conditions as the PSUs.

For 2017, the performance objective and target level was to increase the aggregate amount ofin-force rate adequate premiums from states other than Florida by at least 25% as compared to 2016. The Company met and exceeded this target level, increasingin-force rate adequate premiums from states other than Florida by 40.4% as compared to 2016. Growth innon-Florida premiums is used to incentivize Messrs. Downes and Springer to execute on the Company’s strategy to increase the Company’s policiesin-force outside of Florida in order to grow profitability and diversify revenue and risk.

Under their 2016 Employment Agreements, Messrs. Downes and Springer are entitled to receive PSUs with an annual grant date target value of $3 million and $1 million, respectively (the number of PSUs is based on the applicable dollar value divided by the closing sale price of the Company’s common stock on the date of grant) and stock options with a grant date fair value of $4.4 million and $1.5 million, respectively, as calculated in accordance with the Black-Scholes pricing model used by the Company for financial accounting purposes. The stock options vest ratably over a three-year period.

In general, the Company uses grants of stock options to focus executives on delivering long-term value to shareholders because options have value only to the extent that the price of Company stock on the date of exercise exceeds the stock price on the grant date, as well as to retain executives. The Company did not grant equity awards to the other NEOs in 2017.

Perquisites and Other Benefits

In 2017, the Company provided the following benefits to each of Messrs. Downes, Springer and Donaghy: (1) executive-only Company-paid medical and dental and disability insurance premiums; (2) annual automobile allowance; and (3) executive-only Company-paid premiums for each executive’s term life insurance policy with a death benefit in the amount of $1 million. Mr. Wilcox and Ms. Cooper each also received an annual automobile allowance.

Other than as discussed herein, our Named Executive Officers participate in our corporate-wide benefit programs, which includes participation in the Company’s 401(k) plan. In addition, the Company believes that executives should be able to provide for their retirement needs from the total annual compensation and thus the Company

does not provide its Named Executive Officers with anytax-qualified or nonqualified defined benefit pension plans, supplemental executive retirement plans, deferred compensation plans or other forms of compensation for retirement.

Compensation Clawback Policy

Our clawback policy is designed to mitigate risk in connection with executive compensation. The clawback policy seeks to recover certain compensation awarded under our Omnibus Plan. Specifically, the clawback policy provides that if the Board determines that:

| • | we are required to restate our financial statements due to material noncompliance with any financial reporting requirement under the law, whether or not such noncompliance is the result of misconduct, and |

| • | the prior determination of the level of achievement of any performance goal used under the Omnibus Plan is materially incorrect and that such determination caused the award of cash or shares in an amount greater than what should have been paid or delivered had such determination been correct, then |