FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 For the month of July, 2022 Commission File Number: 001-12518 Banco Santander, S.A. (Exact name of registrant as specified in its charter) Ciudad Grupo Santander 28660 Boadilla del Monte (Madrid) Spain (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S- T Rule 101(b)(1): Yes ☐ No ☒ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S- T Rule 101(b)(7): Yes ☐ No ☒

BANCO SANTANDER, S.A. ________________________ TABLE OF CONTENTS Item 1. Press Release regarding January - June 2022 Results

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 1 Santander reports underlying attributable profit of €4,894 million, up 16% for the first half of 2022 The group added more than seven million customers, with capital and asset quality remaining robust, and costs growing below inflation Return on tangible equity (RoTE) was 13.7% for the period, while earnings per share increased by 38% and TNAV + cash dividend per share increased by 9% year-on-year Madrid, 28 July 2022 - PRESS RELEASE • The group has remained focused on supporting customers throughout the first six months of 2022, with loans and deposits growing by 6% and 5% respectively in constant euros (i.e. excluding FX movements), and total revenue increasing by 4% on the same basis. • Santander’s diversification continued to deliver consistent, profitable growth, with South and North America generating an adjusted RoTE1 of over 27% and 23%, respectively, and Europe 12%. Together North and South America generated 59% of group profit, with Europe contributing 31%, including Spain, which generated 11%. • Connectivity across the group continued to drive both revenue growth and cost efficiency, with the group’s global businesses performing well, particularly CIB. • Digital adoption continued to increase, with 56% of sales now through online or mobile channels. The number of customers using digital channels increasing by 10% to 50 million. • Inflationary effects led to an overall increase in costs (+5% in constant euros), however, in real terms, costs fell by 4% as the bank continued to improve productivity across markets. The cost to income ratio was 45.5%, placing Santander among the most efficient banks in its peer group. • Cost of risk was 0.83%, remaining below ‘through-the-cycle’ average. Loan-loss provisions increased by 18% in constant euros, due in part to the release of provisions in the second quarter of 2021, as well as the expected normalization in provisions in the US. • Attributable profit for the first half of the year was €4,894 million, up 33% year-on-year (+21% in constant euros) after the previous year was impacted by restructuring charges. In the second quarter alone, attributable profit was €2,351, up 14% year-on-year (+2% in constant euros). • Santander’s balance sheet remained robust and the group’s fully-loaded CET1 capital ratio stood at 12.05% at the end of June 2022. • Santander is on track to meet the 2022 targets outlined in February (mid-single digit revenue growth, underlying RoTE of above 13%, cost-to-income ratio of 45%, fully-loaded CET1 of 12%), and the board remains committed to its 2022 remuneration policy to distribute 40% of underlying profit to shareholders, split between cash dividend and share buybacks2. Note: Reconciliation of underlying results to statutory results, available in the Alternative Performance Measures section of the financial report. 1 Adjusted based on group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 20.8% for South America, 12.2% for North America and 8.8% for Europe. 2 The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

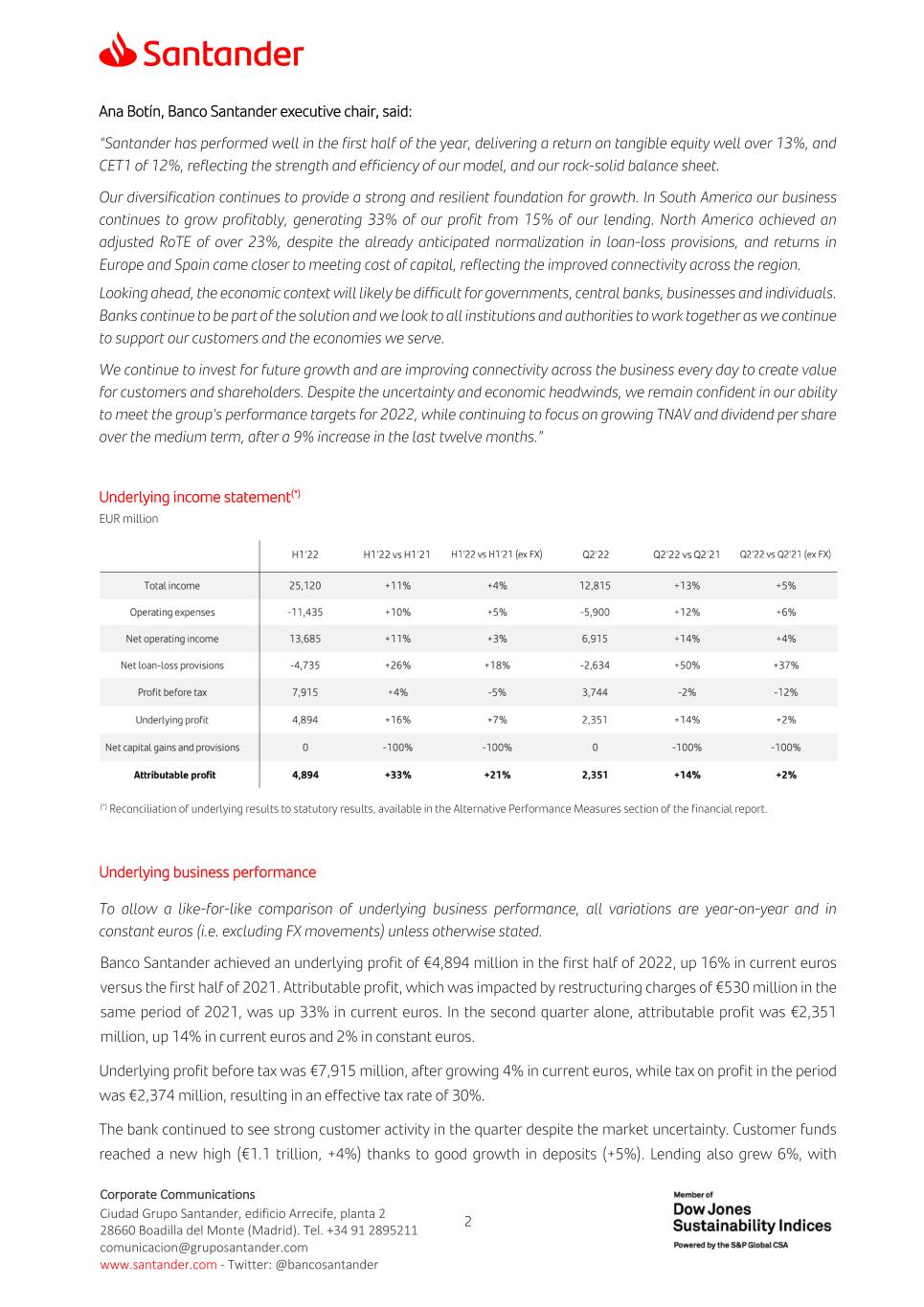

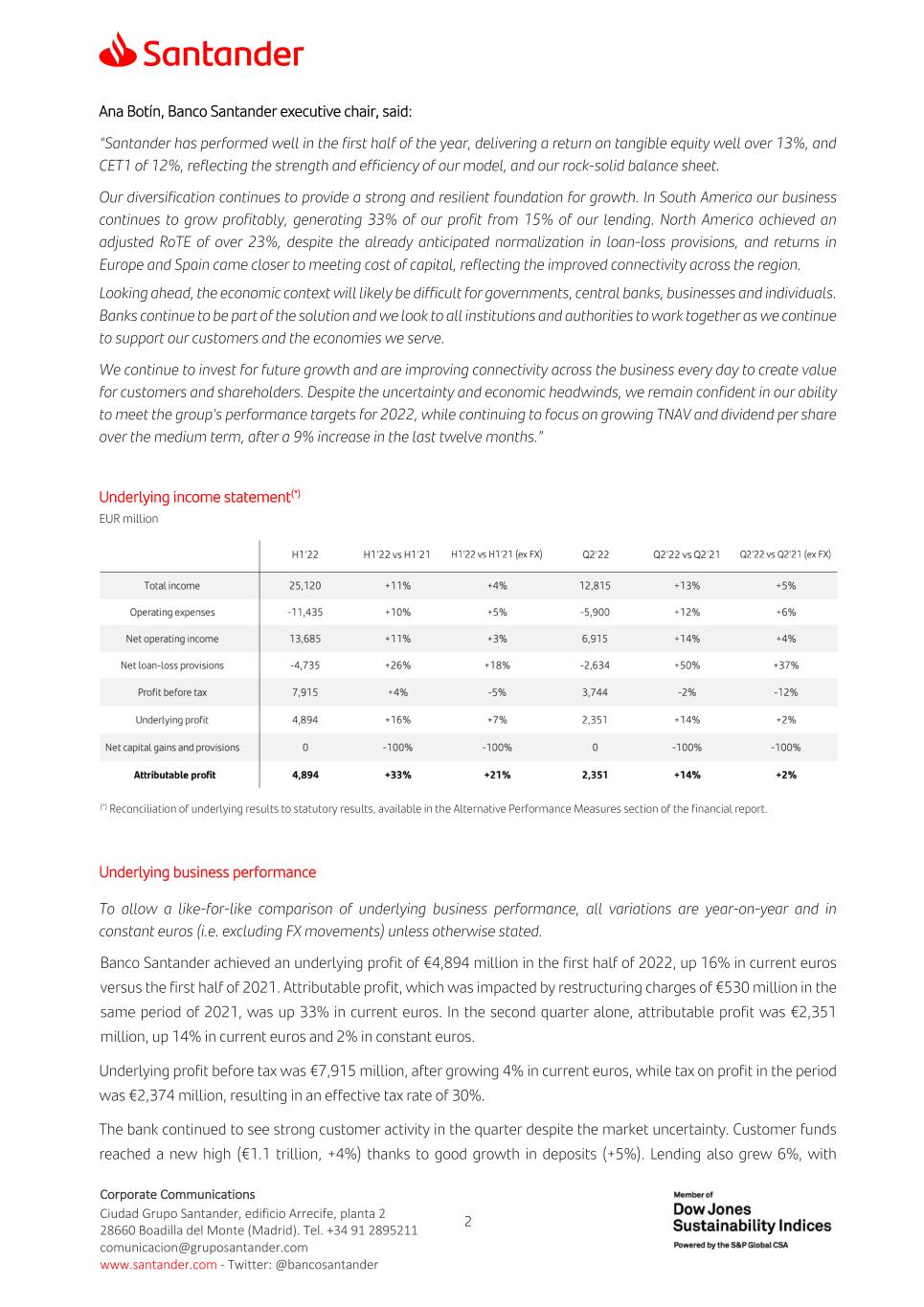

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 2 Ana Botín, Banco Santander executive chair, said: “Santander has performed well in the first half of the year, delivering a return on tangible equity well over 13%, and CET1 of 12%, reflecting the strength and efficiency of our model, and our rock-solid balance sheet. Our diversification continues to provide a strong and resilient foundation for growth. In South America our business continues to grow profitably, generating 33% of our profit from 15% of our lending. North America achieved an adjusted RoTE of over 23%, despite the already anticipated normalization in loan-loss provisions, and returns in Europe and Spain came closer to meeting cost of capital, reflecting the improved connectivity across the region. Looking ahead, the economic context will likely be difficult for governments, central banks, businesses and individuals. Banks continue to be part of the solution and we look to all institutions and authorities to work together as we continue to support our customers and the economies we serve. We continue to invest for future growth and are improving connectivity across the business every day to create value for customers and shareholders. Despite the uncertainty and economic headwinds, we remain confident in our ability to meet the group’s performance targets for 2022, while continuing to focus on growing TNAV and dividend per share over the medium term, after a 9% increase in the last twelve months.” Underlying income statement(*) EUR million (*) Reconciliation of underlying results to statutory results, available in the Alternative Performance Measures section of the financial report. Underlying business performance To allow a like-for-like comparison of underlying business performance, all variations are year-on-year and in constant euros (i.e. excluding FX movements) unless otherwise stated. Banco Santander achieved an underlying profit of €4,894 million in the first half of 2022, up 16% in current euros versus the first half of 2021. Attributable profit, which was impacted by restructuring charges of €530 million in the same period of 2021, was up 33% in current euros. In the second quarter alone, attributable profit was €2,351 million, up 14% in current euros and 2% in constant euros. Underlying profit before tax was €7,915 million, after growing 4% in current euros, while tax on profit in the period was €2,374 million, resulting in an effective tax rate of 30%. The bank continued to see strong customer activity in the quarter despite the market uncertainty. Customer funds reached a new high (€1.1 trillion, +4%) thanks to good growth in deposits (+5%). Lending also grew 6%, with

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 3 mortgages up 7%, consumer lending up 6%, and lending to companies up 4%. The bank’s loan book remains well diversified across both businesses lines and geographies, with 65% of total lending secured. The group continued to grow its customer base, adding more than seven million customers in the last twelve months, taking the total to 157 million. The strong increase in digital adoption continued, with 56% of sales now through online or mobile channels, compared to 52% in the same period last year. The total number of customers using digital channels grew by more than four million to 50 million. The strong activity, as well as an increase in central bank interest rates in the UK, Poland and elsewhere, supported a 7% increase in net interest income, with particularly strong growth in the UK (+13%), Poland (+92%), Mexico (+9%), Chile (+7%), and Argentina (+93%). Net fee income also increased 7% thanks to higher volumes and improved activity. For example, card and points of sale turnover increased by 20% and 30%, respectively. Wealth Management & Insurance and Santander Corporate & Investment Banking (Santander CIB) also recorded significant growth. As a result, total revenue grew 4% (+11% in current euros due to a strengthening in most currencies) to €25,120 million, with net interest income and net fee income accounting for 97% of the group’s revenue, reflecting the quality of the group’s earnings. Inflationary effects led to an overall increase in costs (+5% in constant euros), however, in real terms costs fell by 4% as the bank continued to improve productivity and connectivity across markets. As a result, the cost-to-income ratio was 45.5% in the first half of 2022 (improving 0.7 percentage points versus full year 2021), placing Santander among the most efficient banks in its peer group. For full year 2022, Santander’s cost-to-income ratio target is to be 45%. The group’s diversification continues to provide a strong foundation for growth. Underlying profit for the first half grew 38% in Europe to €1,839 million and 7% in South America to €1,946 million, while it decreased 10% in North America to €1,578 million due to the expected normalization in loan-loss provisions. Digital Consumer Bank’s underlying profits also grew strongly (+16%) to €572 million. Connectivity across the group continued to drive both revenue growth and cost efficiency. PagoNxt, for example, has increased revenues by 87% year-on-year in constant euros, while the group’s global businesses continued to perform well, with particularly strong performance in Corporate & Investment Banking: its underlying profit grew 28% to €1,531 million. The results led to a strong improvement across the key profitability metrics, with a return on tangible equity (RoTE) of 13.7%, well above cost of capital for the group, and an earnings per share (EPS) of €0.272, up 38% (+19% compared to first half 2021 underlying EPS). For full year 2022, Santander’s underlying RoTE target is to be above 13%. The tangible net asset value (TNAV) per share in June 2022 was €4.24. TNAV per share plus cash dividends per share paid in May 2022 and November 2021 (value creation) grew 9% in the last twelve months. The bank’s balance sheet remains robust, with the non-performing loan ratio standing at 3.05%, down 17 basis points year-on-year thanks to the positive performance in Europe and North America, while the coverage ratio stood at 71%. Cost of risk increased 6 basis points in the quarter to 0.83% due to the increase in provisions. In line with the bank’s strategy to deploy capital to the most profitable businesses, in the first half of 2022 Santander completed the acquisition of Santander Consumer USA minority interests in the US and Amherst Pierpont, the US market-leading independent fixed-income broker dealer.

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 4 Santander maintained a strong net organic capital generation in the quarter, adding 18 basis points. The bank’s fully- loaded CET1 capital ratio stood at 12.05% and the group aims to maintain a fully-loaded CET1 of 12% going forward. In applying the shareholder remuneration policy for 2021, Santander paid a second interim cash dividend of €5.15 cents per share in May, and completed a second share buyback programme of €865 million. As a result, the total amount allocated to shareholders from 2021 results was around €3.4 billion, representing a yield of approximately 7%3. The board remains committed to generating returns for shareholders, including its 4 million retail shareholders in Spain, the UK and elsewhere. It also remains committed to its stated policy for 2022 under which it intends to pay out approximately 40% of underlying profit, split evenly between cash dividends and share buybacks4. Santander has been active in supporting the response to the humanitarian crisis resulting from the war in Ukraine. In Poland, the bank worked with the UN Refugee Agency to utilize technology that has allowed refugees to withdraw funds raised by the charity for humanitarian aid from most ATMs without the need for a bank card or account. Furthermore, the bank helped several hundred refugees to reach Spain and Portugal safely, offered temporary accommodation and removed fees on all permitted transfers to Ukraine from Europe and the US. It also has helped raise nearly €18 million to aid the response; and has suspended account and card fees for Ukrainian customers in Poland as well as providing charge-free use of ATMs and ongoing access to cash in branches and via ATMs. Santander is committed to supporting the transition to a green economy and recently announced its ambition to be net zero by 2050, and to align its power generation portfolio to the Paris Agreement by 2030. The bank was once again the leading provider of renewable energy project finance globally in 2021 by number of deals, according to Bloomberg Clean Energy index. In the first half of 2022, it raised or facilitated the mobilization of nearly €9 billion in green finance, bringing the total to €74 billion since 2019. Santander is committed to raising or facilitating €120 billion in green finance by 2025. Market summary (H1 2022 vs H1 2021) To better reflect the local performance of each market, the year-on-year percentage changes provided below are presented in constant euros unless stated otherwise. Variations in current euros are available in the financial report. The group’s geographic and business diversification continues to support consistent, profitable growth, with Europe contributing 31% of underlying profit, South America contributing 33%, North America 26%, and Digital Consumer Bank 10%. The group’s global businesses, Santander CIB and Wealth Management & Insurance, also continued to deliver solid growth. Europe. Underlying profit jumped 38% to €1,839 million in the first half of 2022 thanks to good cost optimization (costs were down 7% in real terms), while loan-loss provisions dropped 4%. The bank continued to accelerate its business transformation to achieve superior growth and a more efficient operating model. The bank continues to support more customers in more ways, as loans and deposits grew 5% each and the number of digital customers increased by 7% to 16.8 million. 3 As % of H1'22 average share price. 4 The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 5 In Spain, underlying profit in the first half of 2022 was €652 million, a recovery (+86%) driven by a reduction in loan-loss provisions and lower costs (-4% or -11% in real terms) despite the impact of inflation, reflecting the progress in the transformation of the operating model. Revenues increased 1% as strong growth in net fee income growth (+7%) offset a reduction in net interest income of 6% due in part to a change of mix towards mortgages. Santander Spain has increased its customer base every month in 2022, reflected in individuals’ business (loans, deposits and insurance up). The NPL ratio further improved (3.83%; -133 basis points, partly backed by portfolio sales), driving the six-month annualized cost of risk down to 0.61%. In the UK, underlying profit was €736 million, up 6%, reflecting good margin management after recent changes in interest rates and a resilient mortgage market, which supported a 13% increase in net interest income. Operating expenses grew slightly due to technology investments and inflationary pressures, however in real terms, costs were down 5% due to savings generated from the bank’s ongoing transformation programme. Loan-loss provisions rose to €125 million (after €68 million of provisions were released in the first half last year). However, cost of risk remained very low. North America. Underlying profit in North America reached €1,578 million, remaining broadly stable in current euros. In constant euros, profit was down 10% impacted by loan-loss provisions normalization and lower lease income in the US, primarily due to an increase in the share of lease-end vehicles repurchased at the dealership. Across the region the group continued to leverage local strengths and capabilities in Mexico and the US, while capitalizing on group’s scale and connectivity to improve service and efficiency. US. Underlying profit in the US was €1,090 million, down 21% after an exceptional year in 2021, but still well above pre-pandemic levels. Overall, profitability remained strong, despite the aforementioned normalization in credit quality, competitive pricing and lower ‘end-of-lease’ income. Loans (auto, consumer and CIB) and deposits increased in a highly competitive market. In Mexico, underlying profit in the period was €546 million, up 32%. Total income rose 10% supported by higher volumes (+10% in loyal customers) and the rise in interest rates. The bank has gained market share in individual loans for 26 consecutive months. The bank also saw positive net fee income performance (+16%) mainly from insurance, credit cards and account management, and lower loan-loss provisions, which improved profitability. Note: YoY changes in constant euros. Loans and advances to customers excluding reverse repos. Customer deposits excluding repos. (1) Adjusted RoTEs: adjusted based on group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 8.8% for Europe, 12.2% for North America, 20.8% for South America and 12.0% for DCB.

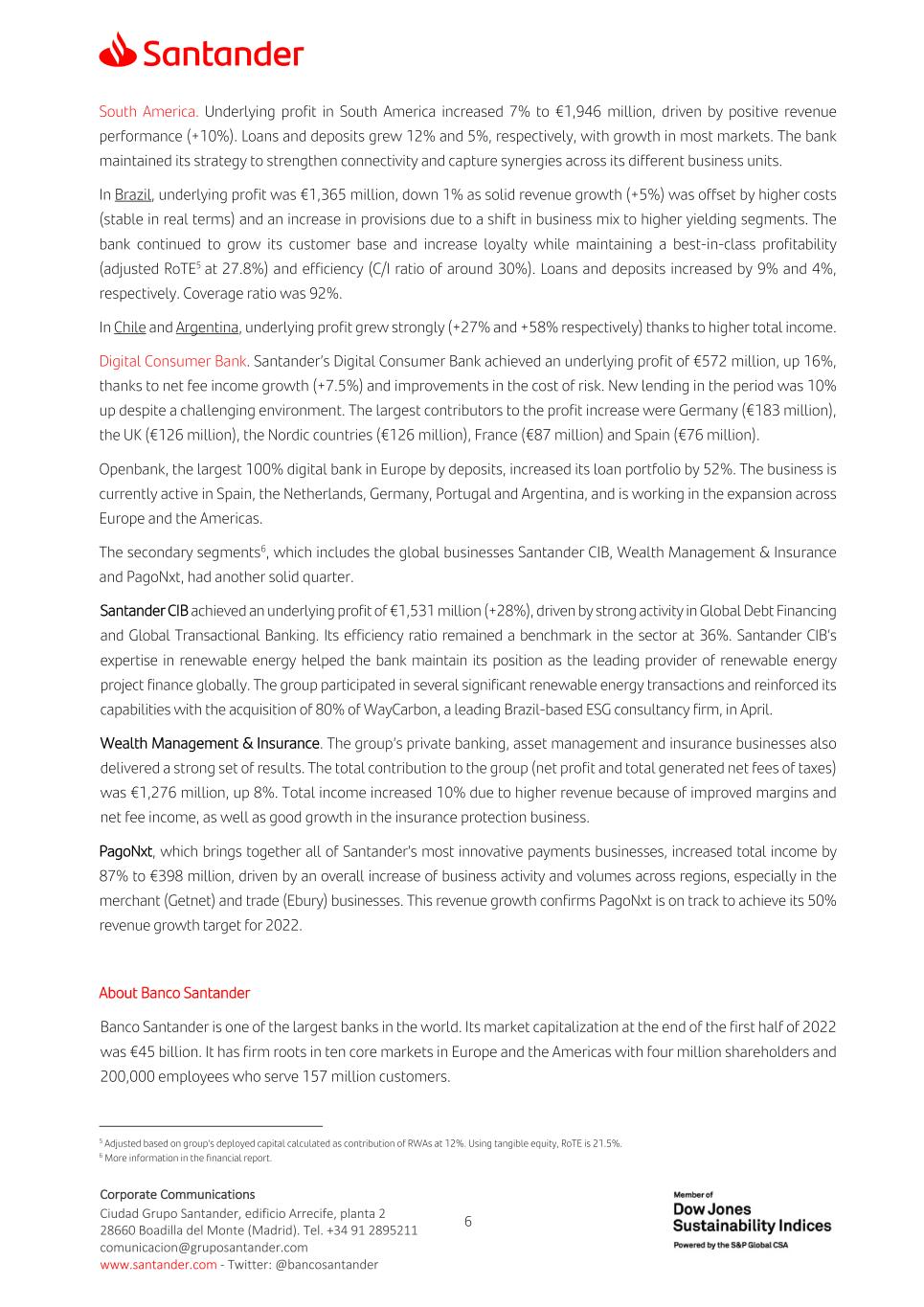

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 6 South America. Underlying profit in South America increased 7% to €1,946 million, driven by positive revenue performance (+10%). Loans and deposits grew 12% and 5%, respectively, with growth in most markets. The bank maintained its strategy to strengthen connectivity and capture synergies across its different business units. In Brazil, underlying profit was €1,365 million, down 1% as solid revenue growth (+5%) was offset by higher costs (stable in real terms) and an increase in provisions due to a shift in business mix to higher yielding segments. The bank continued to grow its customer base and increase loyalty while maintaining a best-in-class profitability (adjusted RoTE5 at 27.8%) and efficiency (C/I ratio of around 30%). Loans and deposits increased by 9% and 4%, respectively. Coverage ratio was 92%. In Chile and Argentina, underlying profit grew strongly (+27% and +58% respectively) thanks to higher total income. Digital Consumer Bank. Santander’s Digital Consumer Bank achieved an underlying profit of €572 million, up 16%, thanks to net fee income growth (+7.5%) and improvements in the cost of risk. New lending in the period was 10% up despite a challenging environment. The largest contributors to the profit increase were Germany (€183 million), the UK (€126 million), the Nordic countries (€126 million), France (€87 million) and Spain (€76 million). Openbank, the largest 100% digital bank in Europe by deposits, increased its loan portfolio by 52%. The business is currently active in Spain, the Netherlands, Germany, Portugal and Argentina, and is working in the expansion across Europe and the Americas. The secondary segments6, which includes the global businesses Santander CIB, Wealth Management & Insurance and PagoNxt, had another solid quarter. Santander CIB achieved an underlying profit of €1,531 million (+28%), driven by strong activity in Global Debt Financing and Global Transactional Banking. Its efficiency ratio remained a benchmark in the sector at 36%. Santander CIB’s expertise in renewable energy helped the bank maintain its position as the leading provider of renewable energy project finance globally. The group participated in several significant renewable energy transactions and reinforced its capabilities with the acquisition of 80% of WayCarbon, a leading Brazil-based ESG consultancy firm, in April. Wealth Management & Insurance. The group’s private banking, asset management and insurance businesses also delivered a strong set of results. The total contribution to the group (net profit and total generated net fees of taxes) was €1,276 million, up 8%. Total income increased 10% due to higher revenue because of improved margins and net fee income, as well as good growth in the insurance protection business. PagoNxt, which brings together all of Santander’s most innovative payments businesses, increased total income by 87% to €398 million, driven by an overall increase of business activity and volumes across regions, especially in the merchant (Getnet) and trade (Ebury) businesses. This revenue growth confirms PagoNxt is on track to achieve its 50% revenue growth target for 2022. About Banco Santander Banco Santander is one of the largest banks in the world. Its market capitalization at the end of the first half of 2022 was €45 billion. It has firm roots in ten core markets in Europe and the Americas with four million shareholders and 200,000 employees who serve 157 million customers. 5 Adjusted based on group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 21.5%. 6 More information in the financial report.

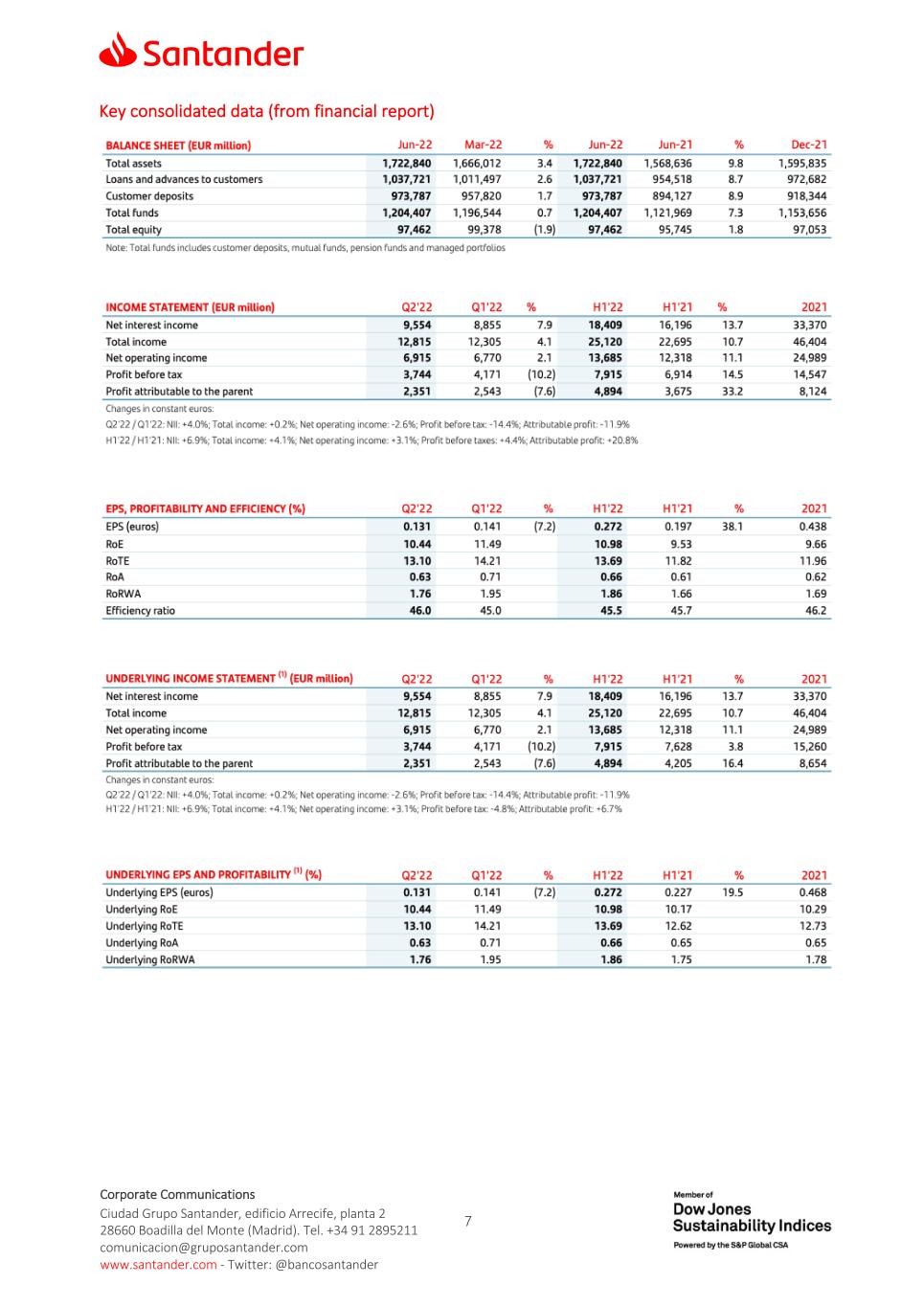

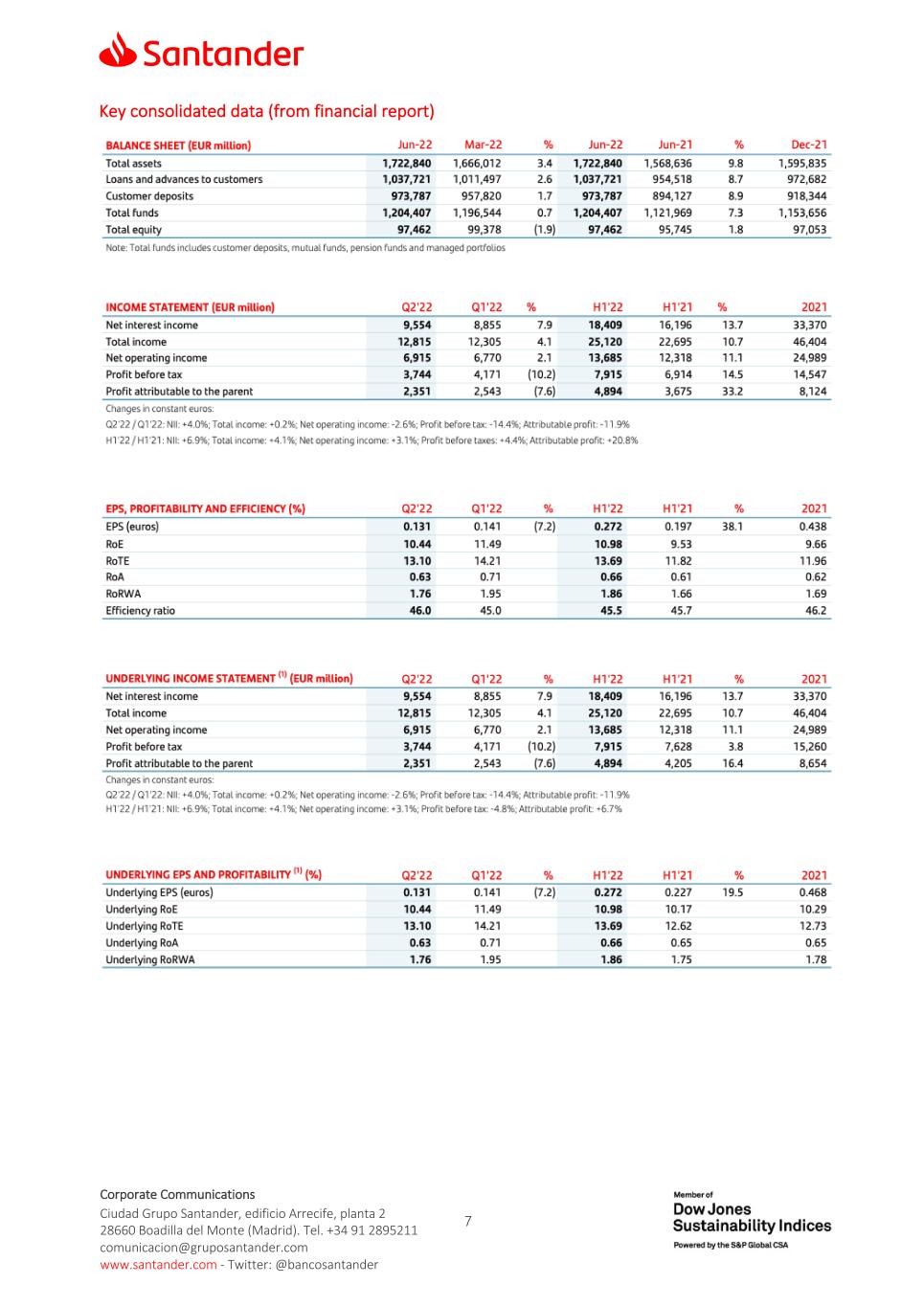

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 7 Key consolidated data (from financial report)

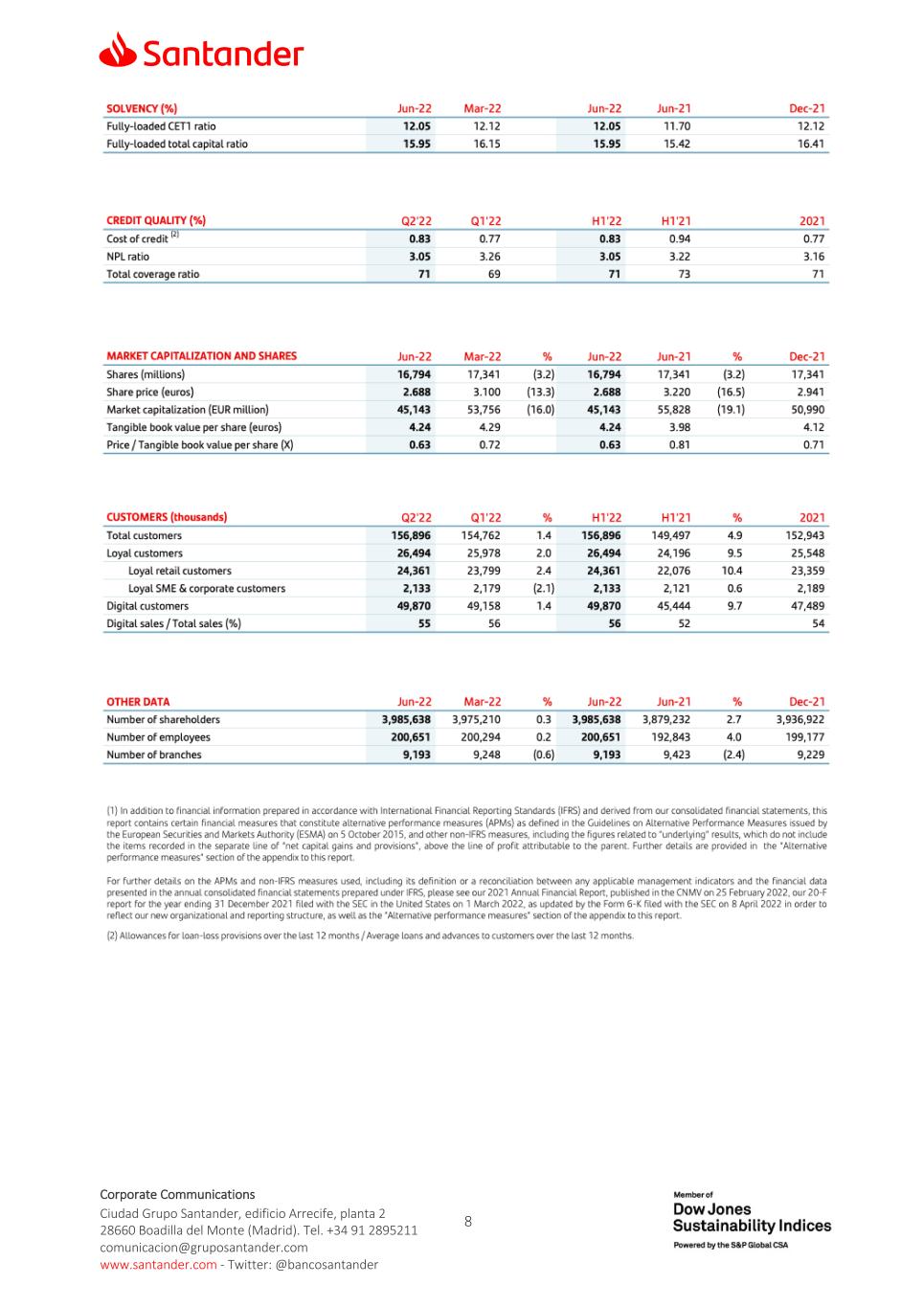

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 8

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 9 Important information Non-IFRS and alternative performance measures This document contains, in addition to the financial information prepared in accordance with International Financial Reporting Standards (“IFRS”) and derived from our financial statements, alternative performance measures (“APMs”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 (ESMA/2015/1415en) and other non-IFRS measures (“Non-IFRS Measures”). These financial measures that qualify as APMs and non-IFRS measures have been calculated with information from Santander Group; however those financial measures are not defined or detailed in the applicable financial reporting framework nor have been audited or reviewed by our auditors. We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider these APMs and non-IFRS measures to be useful metrics for our management and investors to compare operating performance between accounting periods, as these measures exclude items outside the ordinary course performance of our business, which are grouped in the “management adjustment” line and are further detailed in Section 3.2 of the Economic and Financial Review in our Directors’ Report included in our Annual Report on Form 20-F for the year ended 31 December 2021. Nonetheless, these APMs and non-IFRS measures should be considered supplemental information to, and are not meant to substitute IFRS measures. Furthermore, companies in our industry and others may calculate or use APMs and non-IFRS measures differently, thus making them less useful for comparison purposes. For further details on APMs and Non-IFRS Measures, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2021 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) on 1 March 2022, as updated by the Form 6-K filed with the SEC on 8 April 2022 in order to reflect our new organizational and reporting structure, as well as the section “Alternative performance measures” of the annex to this Banco Santander, S.A. (“Santander”) Q2 2022 Financial Report, published as Inside Information on 28 July 2022. These documents are available on Santander’s website (www.santander.com). Underlying measures, which are included in this document, are non-IFRS measures. The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the included businesses and local applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries. Forward-looking statements Banco Santander, S.A. (“Santander”) advises that this document contains “forward-looking statements” as per the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words like “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”, “future” and similar expressions. Found throughout this document, they include (but are not limited to) statements on our future business development, economic performance and shareholder remuneration policy. However, a number of risks, uncertainties and other important factors may cause actual developments and results to differ materially from our expectations. The following important factors, in addition to others discussed elsewhere in this document, could affect our future results and could cause materially different outcomes from those anticipated in forward-looking statements: (1) general economic or industry conditions of areas where we have significant operations or investments (such as a worse economic environment; higher volatility in the capital markets; inflation or deflation; changes in demographics, consumer spending, investment or saving habits; and the effects of the war in Ukraine or the COVID-19 pandemic in the global economy); (2) exposure to various market risks (particularly interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices); (3) potential losses from early repayments on our loan and investment portfolio, declines in value of collateral securing our loan portfolio, and counterparty risk; (4) political stability in Spain, the United Kingdom, other European countries, Latin America and the US (5) changes in legislation, regulations, taxes, including regulatory capital and liquidity requirements, especially in view of the UK exit of the European Union and increased regulation in response to financial crises; (6) our ability to integrate successfully our acquisitions and related challenges that result from the inherent diversion of management’s focus and resources from other strategic opportunities and operational matters; and (7) changes in our access to liquidity and funding on acceptable terms, in particular if resulting from credit spreads shifts or downgrade in credit ratings for the entire Group or significant subsidiaries. Numerous factors could affect our future results and could cause those results deviating from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Forward-looking statements speak only as of the date of this document and are informed by the knowledge, information and views available on such date. Santander is not required to update or revise any forward-looking statements, regardless of new information, future events or otherwise.

Corporate Communications Ciudad Grupo Santander, edificio Arrecife, planta 2 28660 Boadilla del Monte (Madrid). Tel. +34 91 2895211 comunicacion@gruposantander.com www.santander.com - Twitter: @bancosantander 10 No offer The information contained in this document is subject to, and must be read in conjunction with, all other publicly available information, including, where relevant any fuller disclosure document published by Santander. Any person at any time acquiring securities must do so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in this document. No investment activity should be undertaken on the basis of the information contained in this document. In making this document available Santander gives no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this document nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this document is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Historical performance is not indicative of future results Statements about historical performance or accretion must not be construed to indicate that future performance, share price or results (including earnings per share) in any future period will necessarily match or exceed those of any prior period. Nothing in this document should be taken as a profit forecast. Third Party Information In particular, regarding the data provided by third parties, neither Santander, nor any of its administrators, directors or employees, either explicitly or implicitly, guarantees that these contents are exact, accurate, comprehensive or complete, nor are they obliged to keep them updated, nor to correct them in the case that any deficiency, error or omission were to be detected. Moreover, in reproducing these contents in by any means, Santander may introduce any changes it deems suitable, may omit partially or completely any of the elements of this document, and in case of any deviation between such a version and this one, Santander assumes no liability for any discrepancy.

SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Banco Santander, S.A. Date: 28 July 2022 By: /s/ José García Cantera Name: José García Cantera Title: Chief Financial Officer