FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October, 2022

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

BANCO SANTANDER, S.A.

________________________

TABLE OF CONTENTS

| | | | | |

|

|

| |

| Item 1. January - September 2022 Financial Report | |

Index

This report was approved by the board of directors on 25 October 2022, following a favourable report from the audit committee. Important information regarding this report can be found on pages 88 and 89.

Key consolidated data

| | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE SHEET (EUR million) | Sep-22 | Jun-22 | % | Sep-22 | Sep-21 | % | Dec-21 |

| Total assets | 1,815,792 | | 1,722,840 | | 5.4 | | 1,815,792 | | 1,578,295 | | 15.0 | | 1,595,835 | |

| Loans and advances to customers | 1,067,466 | | 1,037,721 | | 2.9 | | 1,067,466 | | 958,311 | | 11.4 | | 972,682 | |

| Customer deposits | 1,008,800 | | 973,787 | | 3.6 | | 1,008,800 | | 909,034 | | 11.0 | | 918,344 | |

| Total funds | 1,241,548 | | 1,204,407 | | 3.1 | | 1,241,548 | | 1,140,322 | | 8.9 | | 1,153,656 | |

| Total equity | 99,312 | | 97,462 | | 1.9 | | 99,312 | | 95,624 | | 3.9 | | 97,053 | |

| Note: Total funds includes customer deposits, mutual funds, pension funds and managed portfolios. |

| | | | | | | | | | | | | | | | | | | | | | | |

| INCOME STATEMENT (EUR million) | Q3'22 | Q2'22 | % | 9M'22 | 9M'21 | % | 2021 |

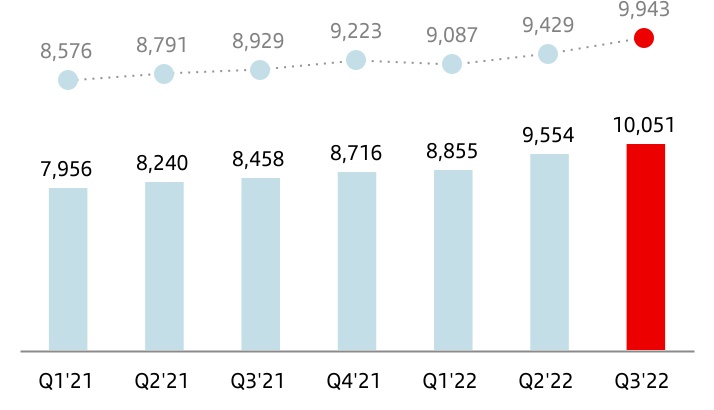

| Net interest income | 10,051 | | 9,554 | | 5.2 | | 28,460 | | 24,654 | | 15.4 | | 33,370 | |

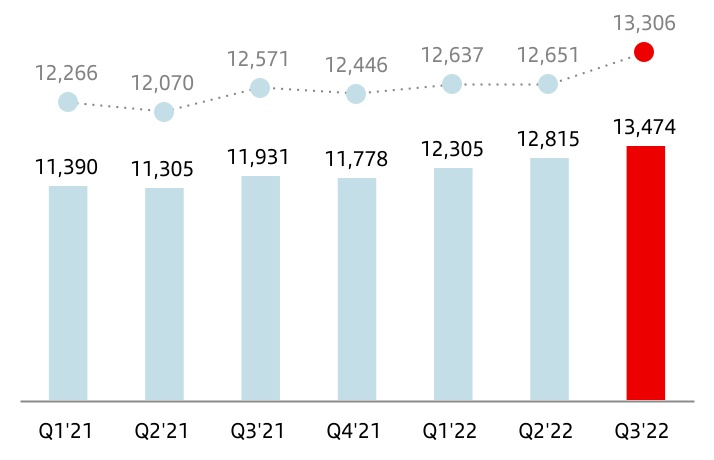

| Total income | 13,474 | | 12,815 | | 5.1 | | 38,594 | | 34,626 | | 11.5 | | 46,404 | |

| | | | | | | |

| Net operating income | 7,314 | | 6,915 | | 5.8 | | 20,999 | | 18,848 | | 11.4 | | 24,989 | |

| | | | | | | |

| Profit before tax | 3,846 | | 3,744 | | 2.7 | | 11,761 | | 10,716 | | 9.8 | | 14,547 | |

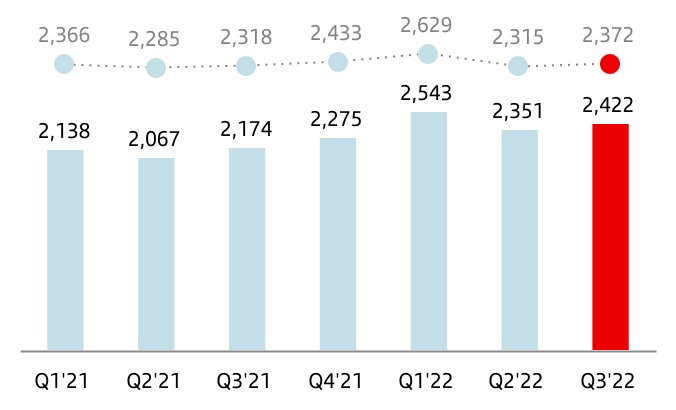

| Profit attributable to the parent | 2,422 | | 2,351 | | 3.0 | | 7,316 | | 5,849 | | 25.1 | | 8,124 | |

| Changes in constant euros: | | | | | | | |

| Q3'22 / Q2'22: NII: +5.4%; Total income: +5.2%; Net operating income: +5.7%; Profit before tax: +2.5%; Attributable profit: +2.5%. |

| 9M'22 / 9M'21: NII: +8.2%; Total income: +4.6%; Net operating income: +3.2%; Profit before tax: +0.1%; Attributable profit: +13.7%. |

| | | | | | | | | | | | | | | | | | | | | | | |

| EPS, PROFITABILITY AND EFFICIENCY (%) | Q3'22 | Q2'22 | % | 9M'22 | 9M'21 | % | 2021 |

| EPS (euros) | 0.137 | | 0.131 | | 4.9 | | 0.409 | | 0.313 | | 30.5 | | 0.438 | |

| RoE | 10.64 | | 10.44 | | | 10.86 | | 9.54 | | | 9.66 | |

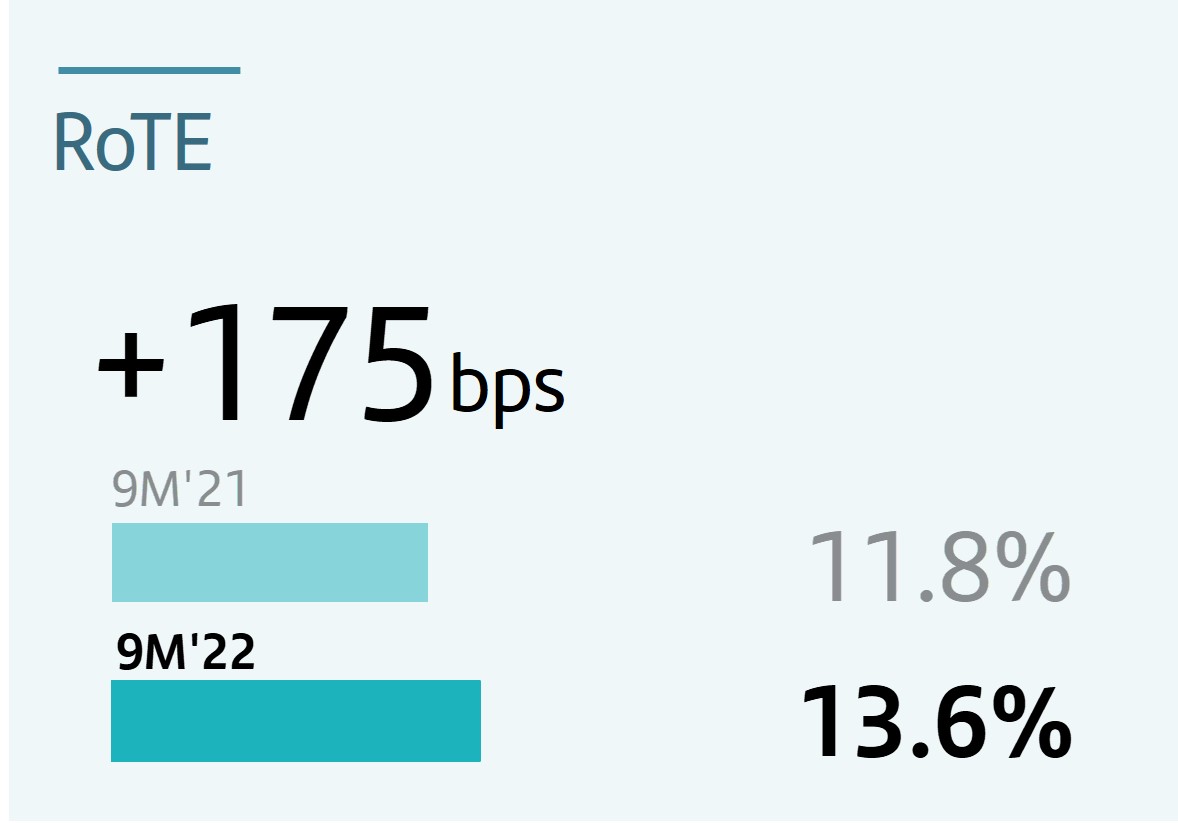

| RoTE | 13.38 | | 13.10 | | | 13.57 | | 11.82 | | | 11.96 | |

| RoA | 0.61 | | 0.63 | | | 0.64 | | 0.61 | | | 0.62 | |

| RoRWA | 1.75 | | 1.76 | | | 1.82 | | 1.66 | | | 1.69 | |

| Efficiency ratio | 45.6 | | 46.0 | | | 45.5 | | 45.6 | | | 46.2 | |

| | | | | | | | | | | | | | | | | | | | | | | |

UNDERLYING INCOME STATEMENT (1) (EUR million) | Q3'22 | Q2'22 | % | 9M'22 | 9M'21 | % | 2021 |

| Net interest income | 10,051 | | 9,554 | | 5.2 | | 28,460 | | 24,654 | | 15.4 | | 33,370 | |

| Total income | 13,509 | | 12,815 | | 5.4 | | 38,629 | | 34,626 | | 11.6 | | 46,404 | |

| | | | | | | |

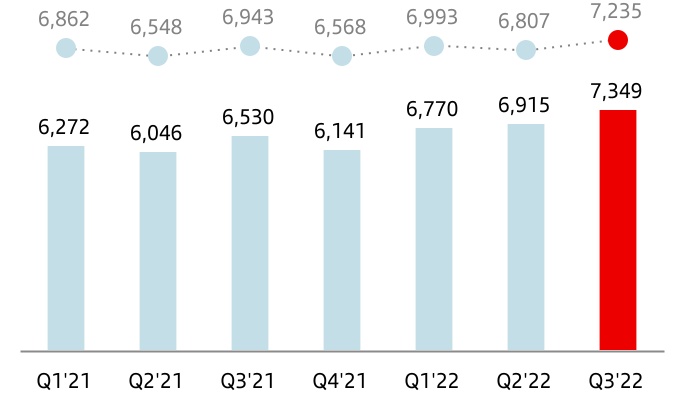

| Net operating income | 7,349 | | 6,915 | | 6.3 | | 21,034 | | 18,848 | | 11.6 | | 24,989 | |

| | | | | | | |

| Profit before tax | 3,846 | | 3,744 | | 2.7 | | 11,761 | | 11,432 | | 2.9 | | 15,260 | |

| Profit attributable to the parent | 2,422 | | 2,351 | | 3.0 | | 7,316 | | 6,379 | | 14.7 | | 8,654 | |

| Changes in constant euros: | | | | | |

| Q3'22 / Q2'22: NII: +5.4%; Total income: +5.5%; Net operating income: +6.3%; Profit before tax: +2.5%; Attributable profit: +2.5%. |

| 9M'22 / 9M'21: NII: +8.2%; Total income: +4.7%; Net operating income: +3.3%; Profit before tax: -5.7%; Attributable profit: +5.0%. |

| | | | | | | | | | | | | | | | | | | | | | | |

UNDERLYING EPS AND PROFITABILITY (1) (%) | Q3'22 | Q2'22 | % | 9M'22 | 9M'21 | % | 2021 |

| Underlying EPS (euros) | 0.137 | | 0.131 | | 4.9 | | 0.409 | | 0.344 | | 18.9 | | 0.468 | |

| Underlying RoE | 10.64 | | 10.44 | | | 10.86 | | 10.18 | | | 10.29 | |

| Underlying RoTE | 13.38 | | 13.10 | | | 13.57 | | 12.61 | | | 12.73 | |

| Underlying RoA | 0.61 | | 0.63 | | | 0.64 | | 0.65 | | | 0.65 | |

| Underlying RoRWA | 1.75 | | 1.76 | | | 1.82 | | 1.76 | | | 1.78 | |

| | | | | | | | |

January - September 2022 | | 3 |

| | | | | | | | | | | | | | | | | | | | | | | |

| SOLVENCY (%) | Sep-22 | Jun-22 | | Sep-22 | Sep-21 | | Dec-21 |

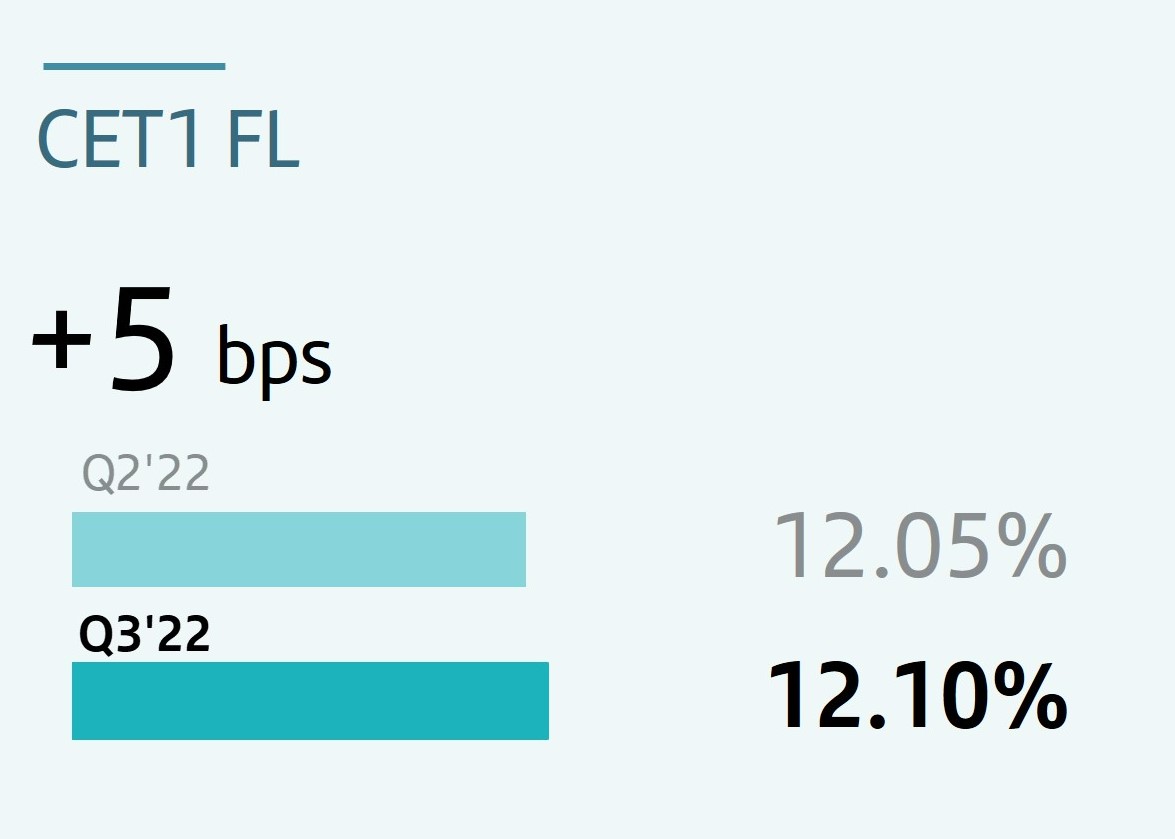

| Fully-loaded CET1 ratio | 12.10 | | 12.05 | | | 12.10 | | 11.85 | | | 12.12 | |

| Fully-loaded total capital ratio | 16.00 | | 15.95 | | | 16.00 | | 15.82 | | | 16.41 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| CREDIT QUALITY (%) | Q3'22 | Q2'22 | | 9M'22 | 9M'21 | | 2021 |

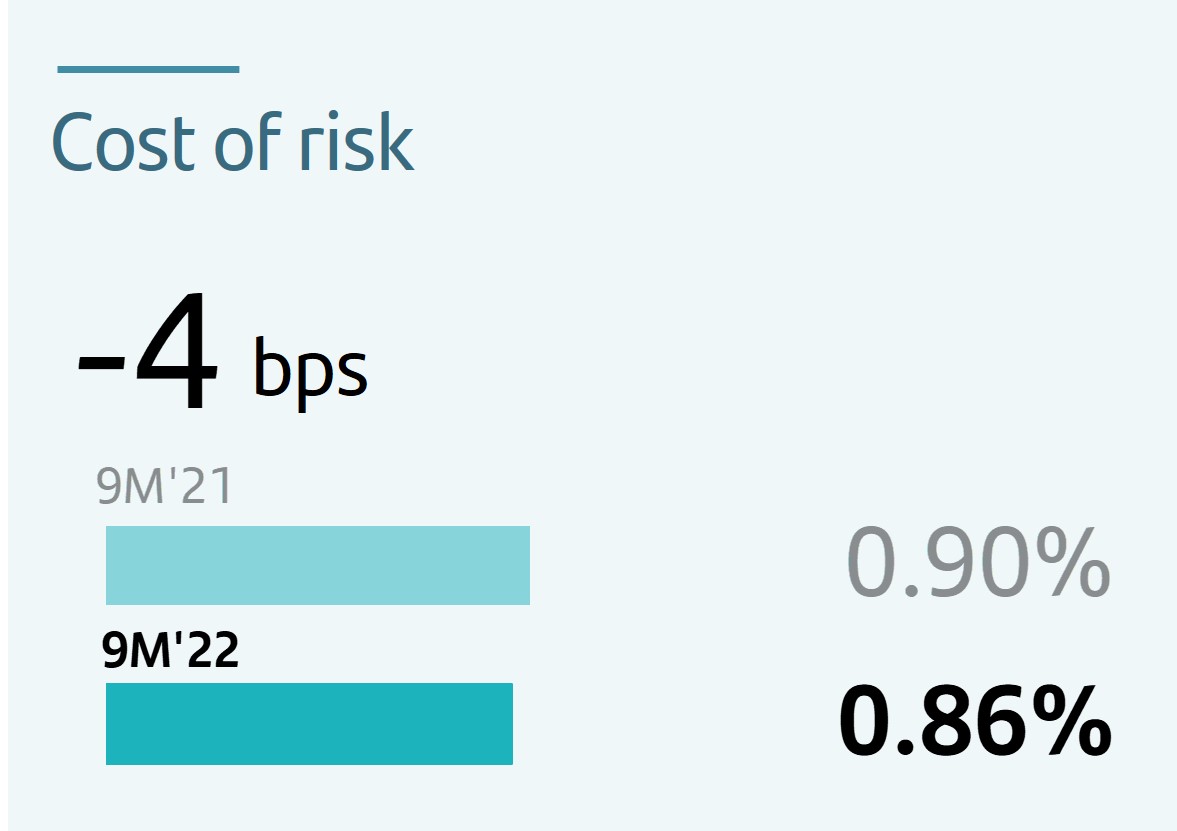

Cost of risk2 | 0.86 | | 0.83 | | | 0.86 | | 0.90 | | | 0.77 | |

| NPL ratio | 3.08 | | 3.05 | | | 3.08 | | 3.18 | | | 3.16 | |

| Total coverage ratio | 70 | | 71 | | | 70 | | 74 | | | 71 | |

| | | | | | | | | | | | | | | | | | | | | | | |

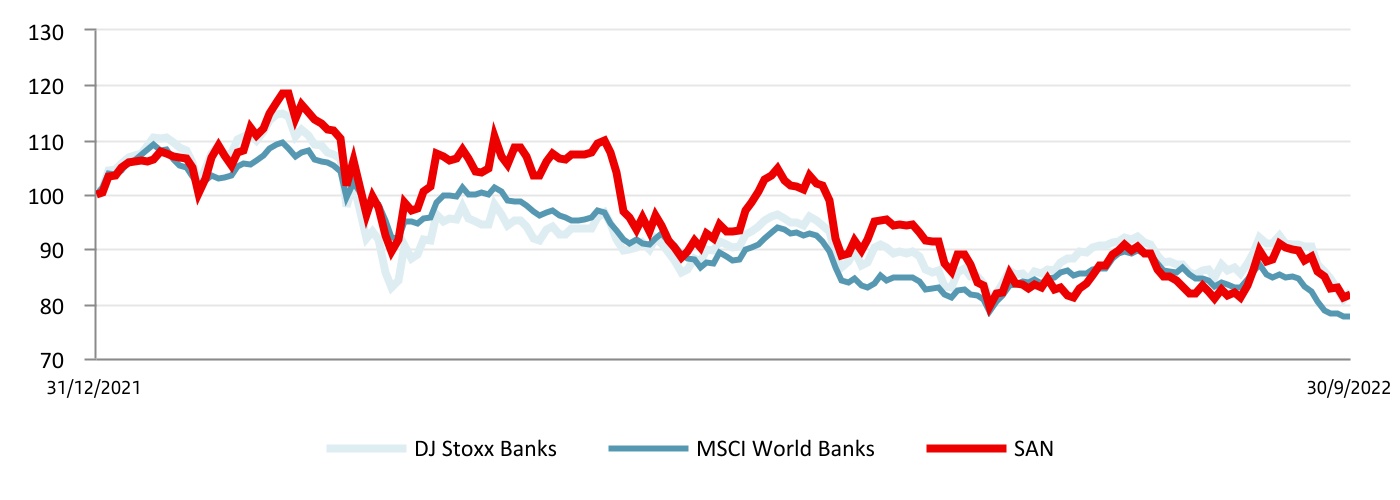

| MARKET CAPITALIZATION AND SHARES | Sep-22 | Jun-22 | % | Sep-22 | Sep-21 | % | Dec-21 |

| Shares (millions) | 16,794 | | 16,794 | | 0.0 | | 16,794 | | 17,341 | | (3.2) | | 17,341 | |

| Share price (euros) | 2.398 | | 2.688 | | (10.8) | | 2.398 | | 3.137 | | (23.6) | | 2.941 | |

| Market capitalization (EUR million) | 40,265 | | 45,143 | | (10.8) | | 40,265 | | 54,389 | | (26.0) | | 50,990 | |

| Tangible book value per share (euros) | 4.31 | | 4.24 | | | 4.31 | | 3.99 | | | 4.12 | |

| Price / Tangible book value per share (X) | 0.56 | | 0.63 | | | 0.56 | | 0.79 | | | 0.71 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| CUSTOMERS (thousands) | Q3'22 | Q2'22 | % | 9M'22 | 9M'21 | % | 2021 |

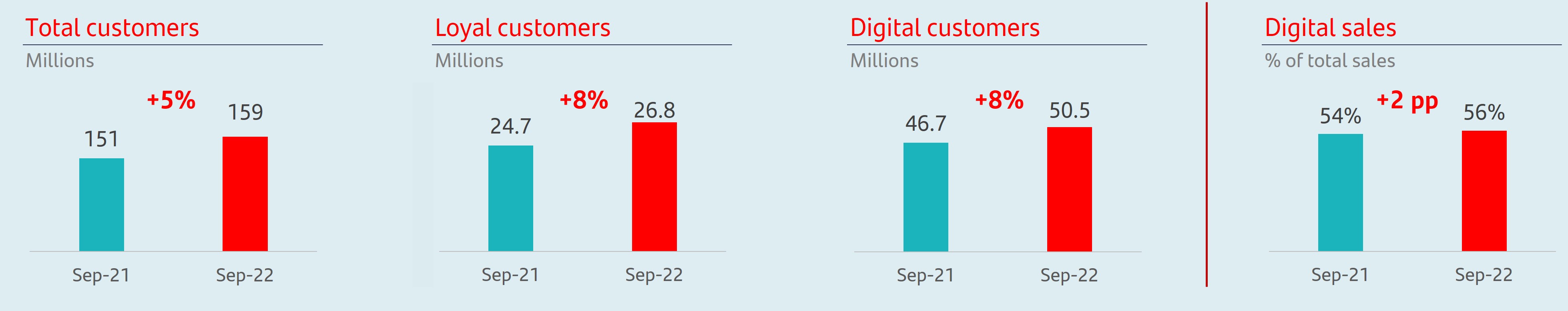

| Total customers | 159,384 | | 156,896 | | 1.6 | | 159,384 | | 151,433 | | 5.3 | 152,943 | |

| Loyal customers | 26,841 | | 26,494 | | 1.3 | | 26,841 | | 24,742 | | 8.5 | 25,548 | |

| Loyal retail customers | 24,674 | | 24,361 | | 1.3 | | 24,674 | | 22,588 | | 9.2 | 23,359 | |

| Loyal SME & corporate customers | 2,167 | | 2,133 | | 1.6 | | 2,167 | | 2,154 | | 0.6 | 2,189 | |

| Digital customers | 50,451 | | 49,870 | | 1.2 | | 50,451 | | 46,693 | | 8.0 | 47,489 | |

| Digital sales / Total sales (%) | 55.5 | | 54.6 | | | 55.5 | | 54.0 | | | 54.4 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| OTHER DATA | Sep-22 | Jun-22 | % | Sep-22 | Sep-21 | % | Dec-21 |

| Number of shareholders | 3,928,568 | | 3,985,638 | | (1.4) | | 3,928,568 | | 3,817,454 | | 2.9 | | 3,936,922 | |

| Number of employees | 203,376 | | 200,651 | | 1.4 | | 203,376 | | 195,264 | | 4.2 | | 199,177 | |

| Number of branches | 9,134 | | 9,193 | | (0.6) | | 9,134 | | 9,254 | | (1.3) | | 9,229 | |

| | |

(1) In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015, and other non-IFRS measures, including the figures related to “underlying” results, which do not include the items recorded in the separate line of “net capital gains and provisions”, above the line of profit attributable to the parent. Further details are provided in the “Alternative performance measures” section of the appendix to this report.

For further details on the APMs and non-IFRS measures used, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the annual consolidated financial statements prepared under IFRS, please see our 2021 Annual Financial Report, published in the CNMV on 25 February 2022, our 20-F report for the year ending 31 December 2021 filed with the SEC in the United States on 1 March 2022, as updated by the Form 6-K filed with the SEC on 8 April 2022 in order to reflect our new organizational and reporting structure, as well as the “Alternative performance measures” section of the appendix to this report.

|

|

|

| (2) Allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months. |

| | | | | | | | |

| 4 | | January - September 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | | Group financial information | | Financial information by segment | | Responsible banking

Corporate governance

Santander share | | Appendix |

| | | | | | | | |

Our business model is based on three pillars

| | | | | | | | | | | | | | | | | | | | | | | |

| 01. Customer focus | | | 02. Our scale | | | 03. Diversification |

Deepening the relationships

with our customers | | |

Local scale and global reach | | |

Geographic and business diversification |

| | | | | | | |

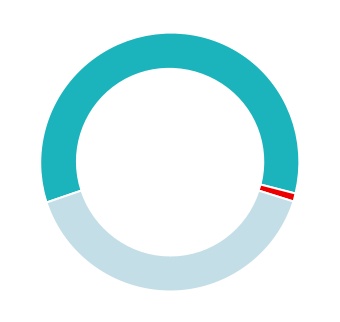

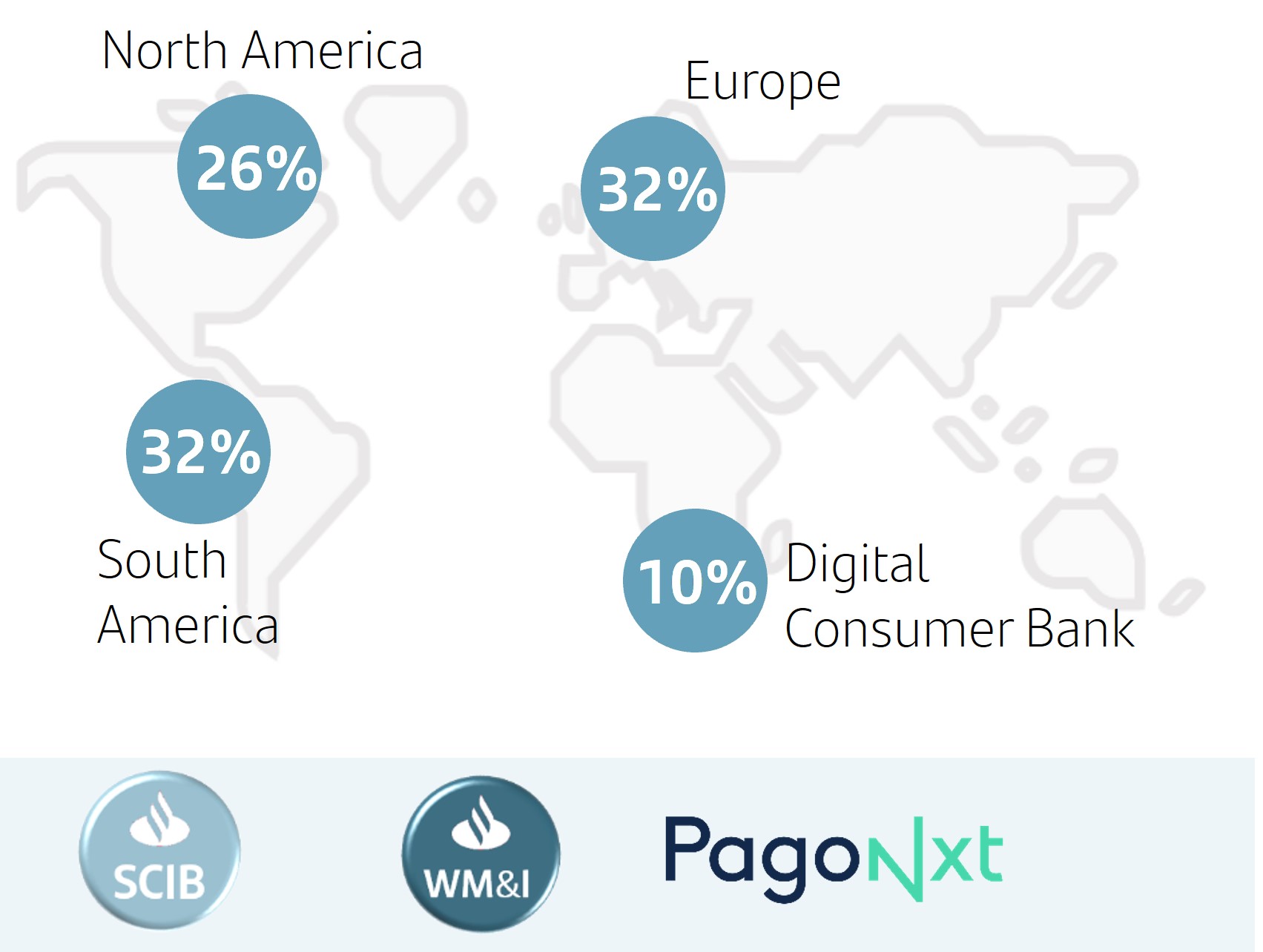

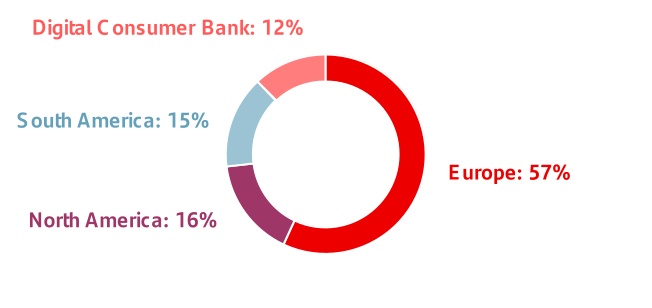

| Top 3 NPS1 in 6 out of 9 markets | | | Top 3 in lending2 in 10 of our markets | | | Balanced profit distribution3 |

| | | | |

| | | | | | |

| 159 mn total customers | | | | | |

| | | |

| | | | | | | |

| (1) NPS – internal benchmark of individual customers' satisfaction audited by Stiga / Deloitte in H1'22. | | | (2) Market share in lending as of June 2022 including only privately-owned banks. UK benchmark refers to the mortgage market. Digital Consumer Bank (DCB) refers to auto in Europe. | | | (3) 9M'22 underlying attributable profit by region. Operating areas excluding Corporate Centre. |

| Our business model remains a source of great strength and resilience |

Our corporate culture

The Santander Way remains unchanged to continue to deliver for all our stakeholders

| | | | | | | | | | | |

| Our purpose To help people and businesses prosper. | | |

| | |

| Our aim To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities. | |

| | |

| Our how Everything we do should be Simple, Personal and Fair. | |

| | |

| | | | | | | | |

January - September 2022 | | 5 |

| | | | | | | | | | | |

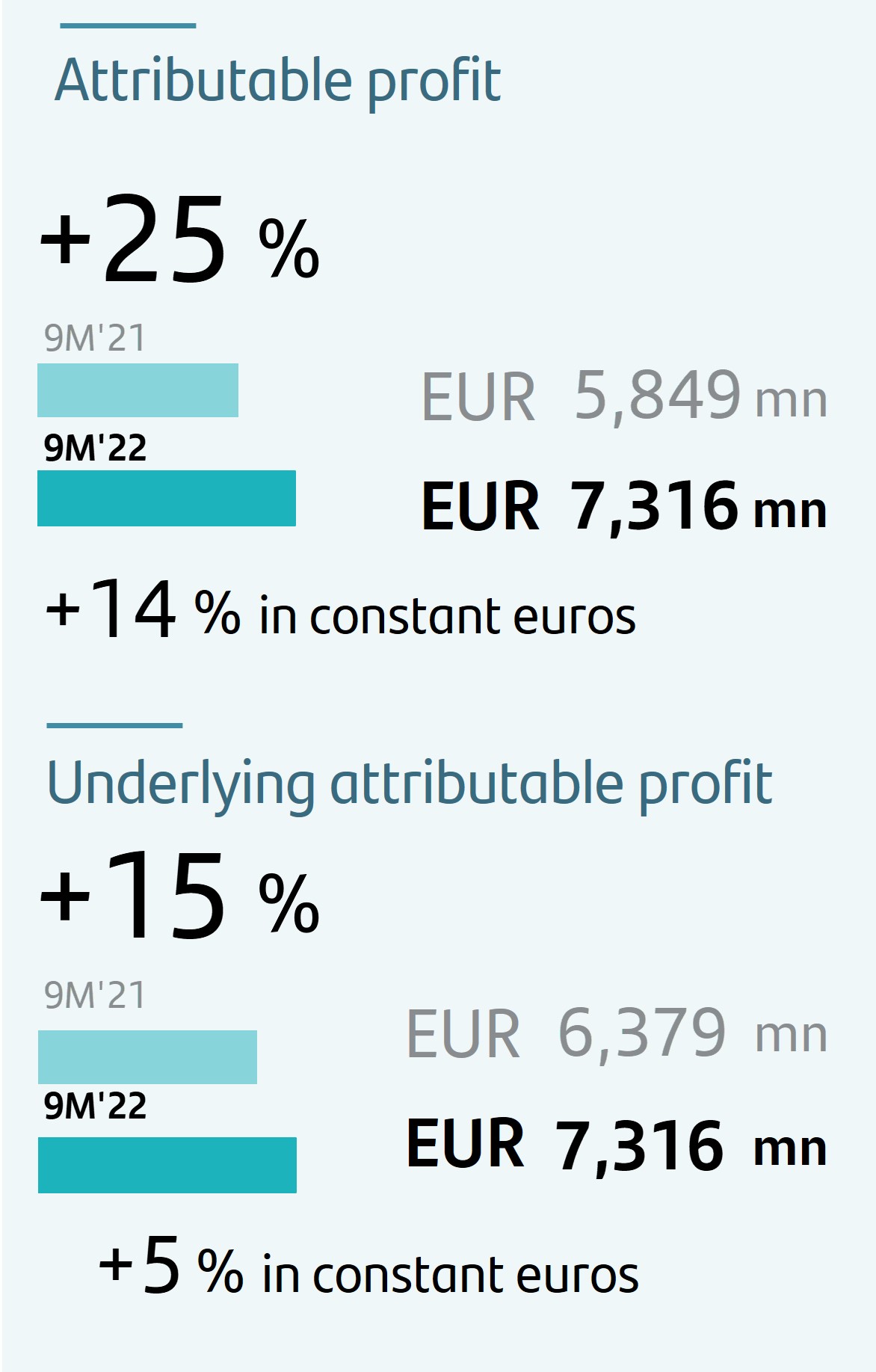

| | u | In Q3'22, attributable profit amounted to EUR 2,422 million, including a charge of EUR 181 million (net of tax) as a result of the Polish mortgage payment holiday regulations. Profit was 3% higher than the second quarter (+11% excluding the aforementioned charge). |

| | |

| u | In the first nine months of 2022, attributable profit rose to EUR 7,316 million, 25% more than in the same period of 2021 (+14% in constant euros). Underlying profit also amounted to EUR 7,316 million, 15% higher (+5% in constant euros) than the first nine months of 2021 (excluding a net charge for restructuring costs of EUR 530 million). |

| | |

| u | Our geographic and business diversification to some extent protects us from adverse circumstances and enables us to resiliently face the indirect impacts arising from the Russia-Ukraine conflict. Santander's presence in and exposure to Russia and Ukraine is negligible. |

| | |

| | |

| | | |

| | | |

| | u | In applying the shareholder remuneration policy for 2022, the board of directors approved an interim distribution against 2022 results, which will be made in two parts: |

| | |

| | •A cash dividend of EUR 5.83 cents per share (pre-tax) which is expected to be paid from 2 November 2022 (20% higher than the equivalent in 2021). |

| | |

| | •A share repurchase programme of up to EUR 979 million is expected to start once the applicable regulatory approval has been obtained, as announced in the Inside Information disclosed on 27 September 2022. As a result, the total remuneration of this interim distribution will exceed EUR 1.9 billion (+16% compared to its equivalent in 2021) and represents approximately 40% of H1 2022 profit (c. 20% dividend payment and c. 20% share repurchase).

|

| | |

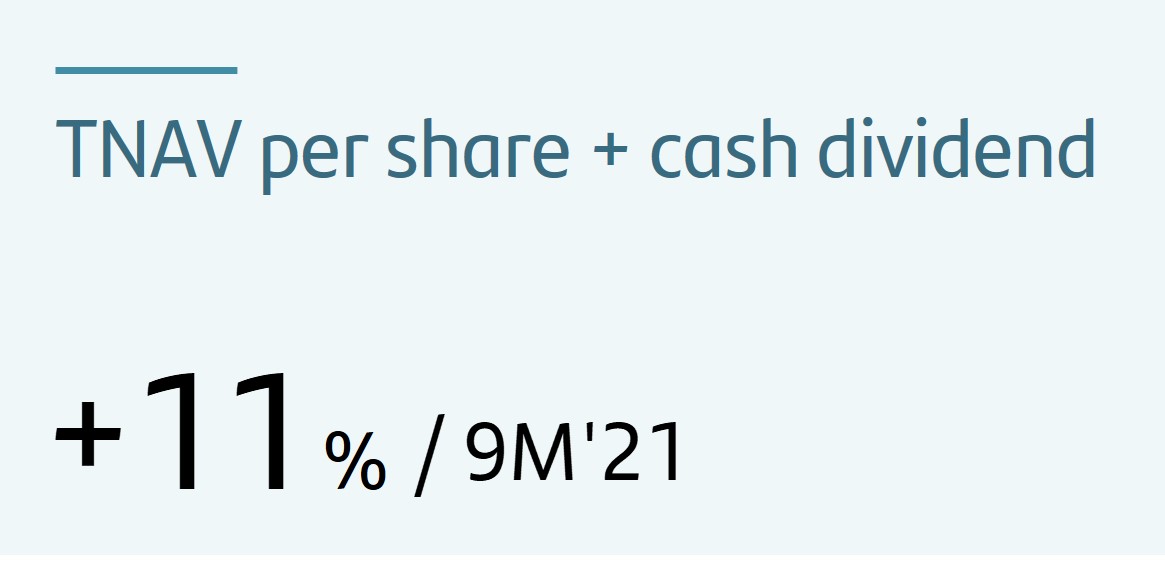

| | u | TNAV per share was EUR 4.31, with 11% growth year-on-year including the cash dividends per share paid in May 2022 and the one already announced for November 2022. In the quarter, TNAV per share plus dividend increased 3%. |

| |

| |

| | | |

| | | |

| | u | Santander is the leader in renewable energy financing and mobilized close to EUR 78.7 billion between 2019 and the end of Q3'22. The Group's target is to mobilize EUR 220 billion in green finance by 2030. |

| | |

| u | We continued to help our customers in their green transition with, for example, the financing of fully-electric vehicles. |

| | |

| u | In 2022, we granted EUR 677 million in loans through our microfinance programmes to 1.1 million micro-entrepreneurs in 8 countries. |

| | |

| u | We were named Best Global Bank for Financial Inclusion by Euromoney, highlighting our programmes in South America and Mexico, and Best Bank for Corporate Responsibility in Central and Eastern Europe for our support to refugees from the Russia-Ukraine conflict. |

| | | | | | | | |

| 6 | | January - September 2022 |

| | | | | | | | | | | |

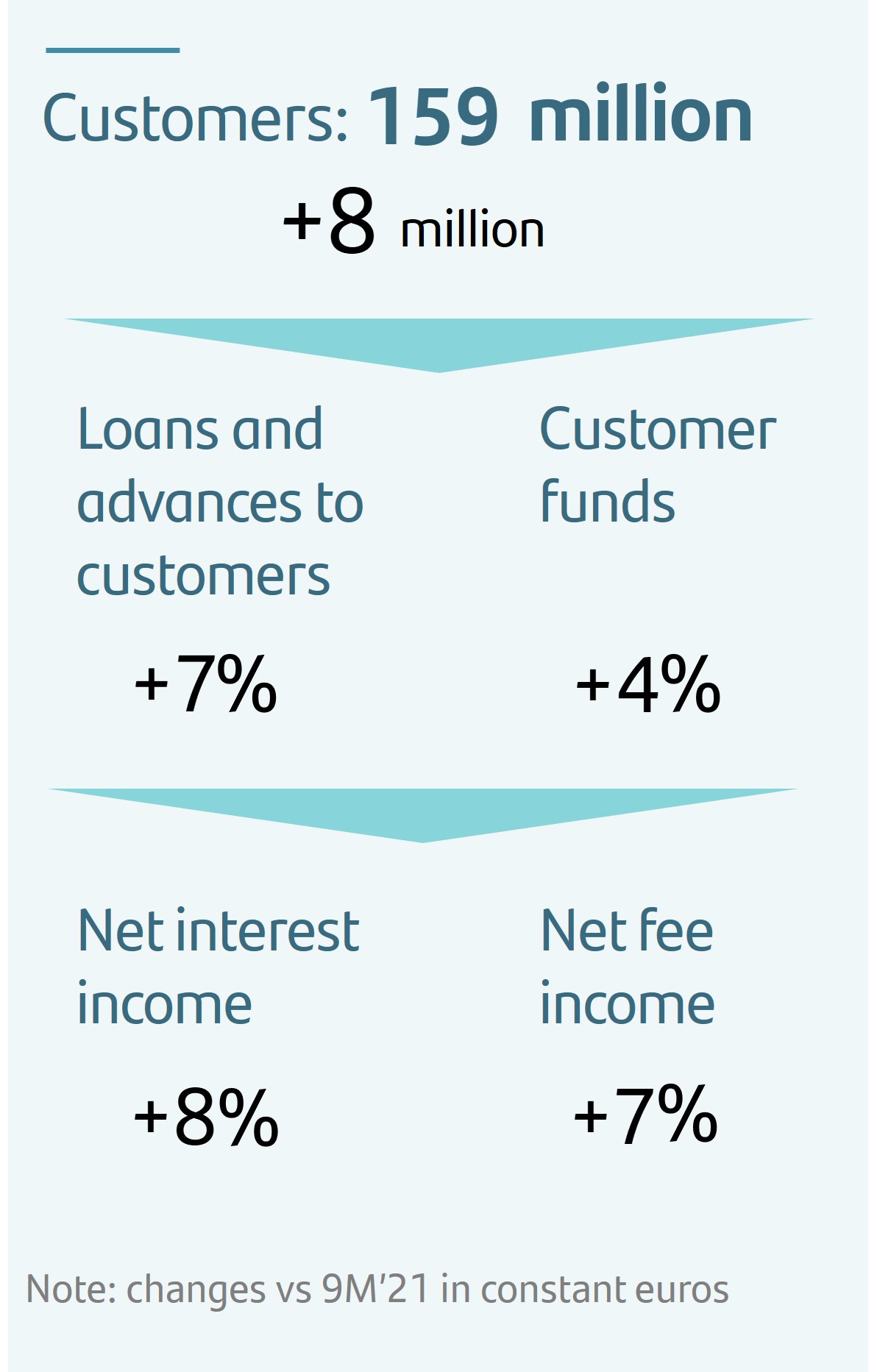

| | u | Total customers amounted to 159 million, +8 million compared to September 2021 (+2.5 million in the third quarter). Loyal customers reached 26.8 million, 8% higher year-on-year. |

| | |

| u | Digital adoption continued to be key, as we now have 50 million digital customers, an increase of 3.8 million since September 2021. In the first nine months of 2022, 56% of sales were made through digital channels. |

| | |

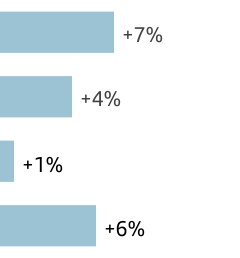

| u | Business volumes continued to grow in a context of uncertainty. In this environment, loans and advances to customers increased 2% in the quarter and 10% year-on-year (+7% in constant euros). Customer funds rose 3% in the quarter (+2% in constant euros) and +8% year-on-year (+4% in constant euros). |

| | |

| u | Greater activity, together with higher interest rates and margin management, was reflected in the 15% rise in net interest income and a 14% increase in net fee income (+8% and +7%, respectively, in constant euros). |

| | | | | | | | | | | |

| | u | The increase in profit, underpinned by the positive performance across regions, Digital Consumer Bank (DCB) and the global businesses, was reflected in higher profitability. |

| | |

| u | Sustained earnings per share growth, which rose +31% year-on-year to EUR 40.9 cents in the first nine months of 2022 (underlying EPS +19%). |

| | |

| u | RoTE of 13.6%, RoRWA was 1.82%, both clearly exceeding figures from the first nine months of 2021. |

| | | | | | | | | | | |

| | u | Regarding credit quality, the cost of risk stood at 0.86% (0.90% in September 2021). |

| | |

| u | The NPL ratio was 3.08%, 3 bps higher quarter-on-quarter and 10 bps lower year-on-year, mainly due to the good performance in Europe and Digital Consumer Bank. |

| | |

| u | Total loan-loss reserves reached EUR 24,813 million, with a coverage of 70% (-1 pp vs. Q2'22). |

| | | |

| | u | The fully-loaded CET1 ratio was 12.10%. In the quarter, net organic generation of 26 bps, resulting from gross organic generation of 34 bps from Q3'22 profit and an 8 bp charge for a future cash dividend payment1. In addition there were negative impacts, mainly from market performance and models. |

(1) Implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

| | | | | | | | |

January - September 2022 | | 7 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Grupo Santander. Summarized income statement |

| EUR million | | | | | | | | |

| | | Change | | | Change |

| Q3'22 | Q2'22 | % | % excl. FX | 9M'22 | 9M'21 | % | % excl. FX |

| Net interest income | 10,051 | | 9,554 | | 5.2 | | 5.4 | | 28,460 | | 24,654 | | 15.4 | | 8.2 | |

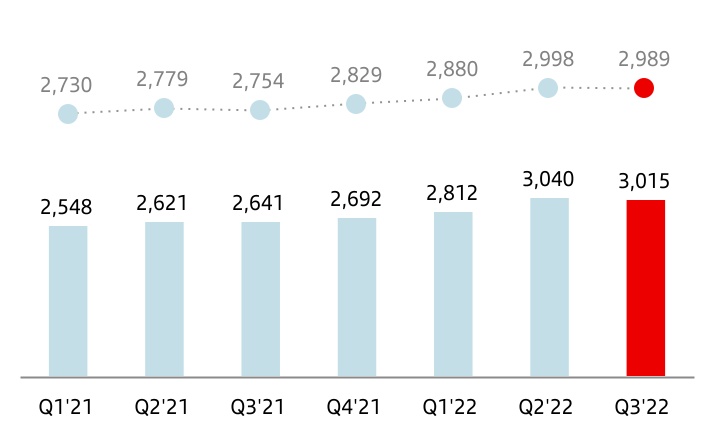

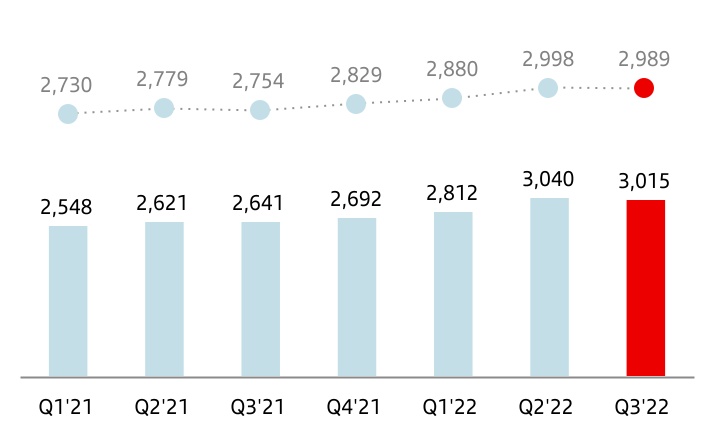

| Net fee income (commission income minus commission expense) | 3,015 | | 3,040 | | (0.8) | | (0.3) | | 8,867 | | 7,810 | | 13.5 | | 7.3 | |

| Gains or losses on financial assets and liabilities and exchange differences (net) | 372 | | 356 | | 4.5 | | 7.6 | | 1,115 | | 1,220 | | (8.6) | | (13.1) | |

| Dividend income | 87 | | 267 | | (67.4) | | (67.5) | | 422 | | 404 | | 4.5 | | 4.4 | |

| Share of results of entities accounted for using the equity method | 189 | | 179 | | 5.6 | | 5.6 | | 501 | | 295 | | 69.8 | | 61.9 | |

| Other operating income / expenses | (240) | | (581) | | (58.7) | | (51.7) | | (771) | | 243 | | — | | — | |

| Total income | 13,474 | | 12,815 | | 5.1 | | 5.2 | | 38,594 | | 34,626 | | 11.5 | | 4.6 | |

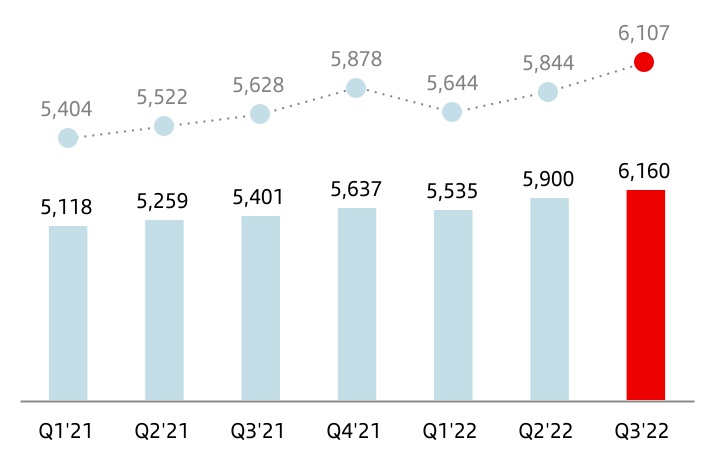

| Operating expenses | (6,160) | | (5,900) | | 4.4 | | 4.5 | | (17,595) | | (15,778) | | 11.5 | | 6.3 | |

| Administrative expenses | (5,367) | | (5,162) | | 4.0 | | 4.0 | | (15,360) | | (13,714) | | 12.0 | | 6.7 | |

| Staff costs | (3,177) | | (3,085) | | 3.0 | | 2.8 | | (9,125) | | (8,205) | | 11.2 | | 6.3 | |

| Other general administrative expenses | (2,190) | | (2,077) | | 5.4 | | 5.7 | | (6,235) | | (5,509) | | 13.2 | | 7.2 | |

| Depreciation and amortization | (793) | | (738) | | 7.5 | | 7.8 | | (2,235) | | (2,064) | | 8.3 | | 3.8 | |

| Provisions or reversal of provisions | (370) | | (480) | | (22.9) | | (18.6) | | (1,305) | | (2,006) | | (34.9) | | (35.7) | |

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) | (3,073) | | (2,640) | | 16.4 | | 16.0 | | (7,836) | | (6,000) | | 30.6 | | 21.5 | |

| | | | | | | | |

| Impairment on other assets (net) | (25) | | (26) | | (3.8) | | (6.1) | | (86) | | (134) | | (35.8) | | (37.7) | |

| Gains or losses on non-financial assets and investments, net | 6 | | (6) | | — | | — | | 2 | | 43 | | (95.3) | | (96.3) | |

| Negative goodwill recognized in results | — | | — | | — | | — | | — | | — | | — | | — | |

| Gains or losses on non-current assets held for sale not classified as discontinued operations | (6) | | (19) | | (68.4) | | (67.1) | | (13) | | (35) | | (62.9) | | (66.9) | |

| Profit or loss before tax from continuing operations | 3,846 | | 3,744 | | 2.7 | | 2.5 | | 11,761 | | 10,716 | | 9.8 | | 0.1 | |

| Tax expense or income from continuing operations | (1,164) | | (1,072) | | 8.6 | | 8.8 | | (3,538) | | (3,725) | | (5.0) | | (13.6) | |

| Profit from the period from continuing operations | 2,682 | | 2,672 | | 0.4 | | 0.0 | | 8,223 | | 6,991 | | 17.6 | | 7.4 | |

| Profit or loss after tax from discontinued operations | — | | — | | — | | — | | — | | — | | — | | — | |

| Profit for the period | 2,682 | | 2,672 | | 0.4 | | 0.0 | | 8,223 | | 6,991 | | 17.6 | | 7.4 | |

| Profit attributable to non-controlling interests | (260) | | (321) | | (19.0) | | (18.0) | | (907) | | (1,142) | | (20.6) | | (25.7) | |

| Profit attributable to the parent | 2,422 | | 2,351 | | 3.0 | | 2.5 | | 7,316 | | 5,849 | | 25.1 | | 13.7 | |

| | | | | | | | |

| EPS (euros) | 0.137 | | 0.131 | | 4.9 | | | 0.409 | | 0.313 | | 30.5 | | |

| Diluted EPS (euros) | 0.137 | | 0.130 | | 4.9 | | | 0.408 | | 0.312 | | 30.5 | | |

| | | | | | | | |

| Memorandum items: | | | | | | | | |

| Average total assets | 1,769,904 | | 1,707,903 | | 3.6 | | | 1,702,210 | | 1,550,943 | | 9.8 | | |

| Average stockholders' equity | 91,044 | | 90,035 | | 1.1 | | | 89,854 | | 83,574 | | 7.5 | | |

| | | | | | | | |

| 8 | | January - September 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Executive summary | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Profit. In constant euros | | | | | | Performance. In constant euros | | |

| | | | | | | | | | | |

| | Strong profit growth underpinned by our geographic and business diversification | | | | | Revenue growth accelerated, costs under control and LLP growth slowed | | |

| | Attributable profit | | | | | Total income | Costs | Provisions | | |

| | EUR 7,316 mn | | +14% vs 9M'21 | | | | | +4.7% | +6.3% | +16.7% | | |

| | | +5% vs 9M'21 underlying att. profit | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Efficiency | | | | | | | | | | | Profitability | | |

| | | | | | | | | | | | | | | | |

| | The Group's efficiency ratio improved, mainly driven by Europe | | | | Strong improvement in our profitability ratios | | |

| | Group | | Europe | | | | | RoTE | RoRWA | | |

| | 45.5% | | 47.4% | | | | | 13.6% | 1.82% | | |

| | -0.1 pp | | -4.1 pp | | | | | +1.8 pp | +1.0 pp | 1 | +0.2 pp | +0.1 pp | 2 | | |

| | Changes vs 9M'21. | | | | | | | | | | | | | Changes vs 9M'21. | 1. vs underlying RoTE. | | 2. vs under. RoRWA | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

è Results performance compared to 9M'21

The Group presents, both at the total level and for each of the business units, the changes in euros produced in the income statement, as well as variations excluding the exchange rate effect (FX), on the understanding that the latter provide a better analysis of the Group’s management of the country units. For the Group as a whole, exchange rates had an impact of +7 pp in revenue and +5 pp in costs.

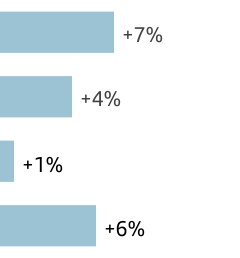

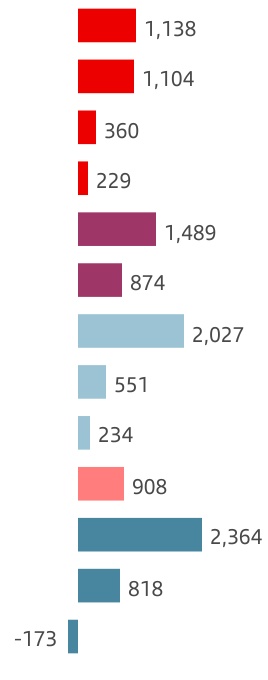

u Total income

Total income in the first nine months of 2022 was EUR 38,594 million, up 11% compared to the same period in 2021. Excluding the exchange rate impact, total income increased 5%. Net interest income and net fee income accounted for 97% of total income. By line:

•Net interest income amounted to EUR 28,460 million, 15% higher compared to 9M 2021. Stripping out the exchange rate impact, growth was 8%, mainly due to greater volumes and higher interest rates.

By country, and at constant exchange rates, there were increases in the UK (+12%), Poland (+104%), the US (+2%, +4% without the Bluestem portfolio disposal in 2021), Mexico (+12%), Chile (+1%) and Argentina (+142%).

| | | | | |

| Net interest income |

| EUR million |

| constant euros |

On the other hand, Spain remained flat due to lower ALCO portfolio volumes, lower TLTRO contribution and a change of mix towards mortgages. Brazil fell (-1%) due to its negative sensitivity to interest rate hikes and Portugal fell 6% impacted by lower ALCO portfolio and TLTRO contributions. All three improved their trend in the third quarter, with Spain and Portugal rising compared to the second quarter, and Brazil remained stable.

•Net fee income was EUR 8,867 million, up 14% compared to the first nine months of 2021. Excluding the exchange rate impact, net fee income increased 7%, driven by higher volumes and improved activity.

There was strong growth in high value-added products and services, as card and point of sale turnover increased 16% and 29%, respectively, and card transactions were 14% higher. Transactional fees rose 9%.

In Wealth Management & Insurance (WM&I), net fee income from mutual funds and pensions grew 3% and insurance premiums rose 24%.

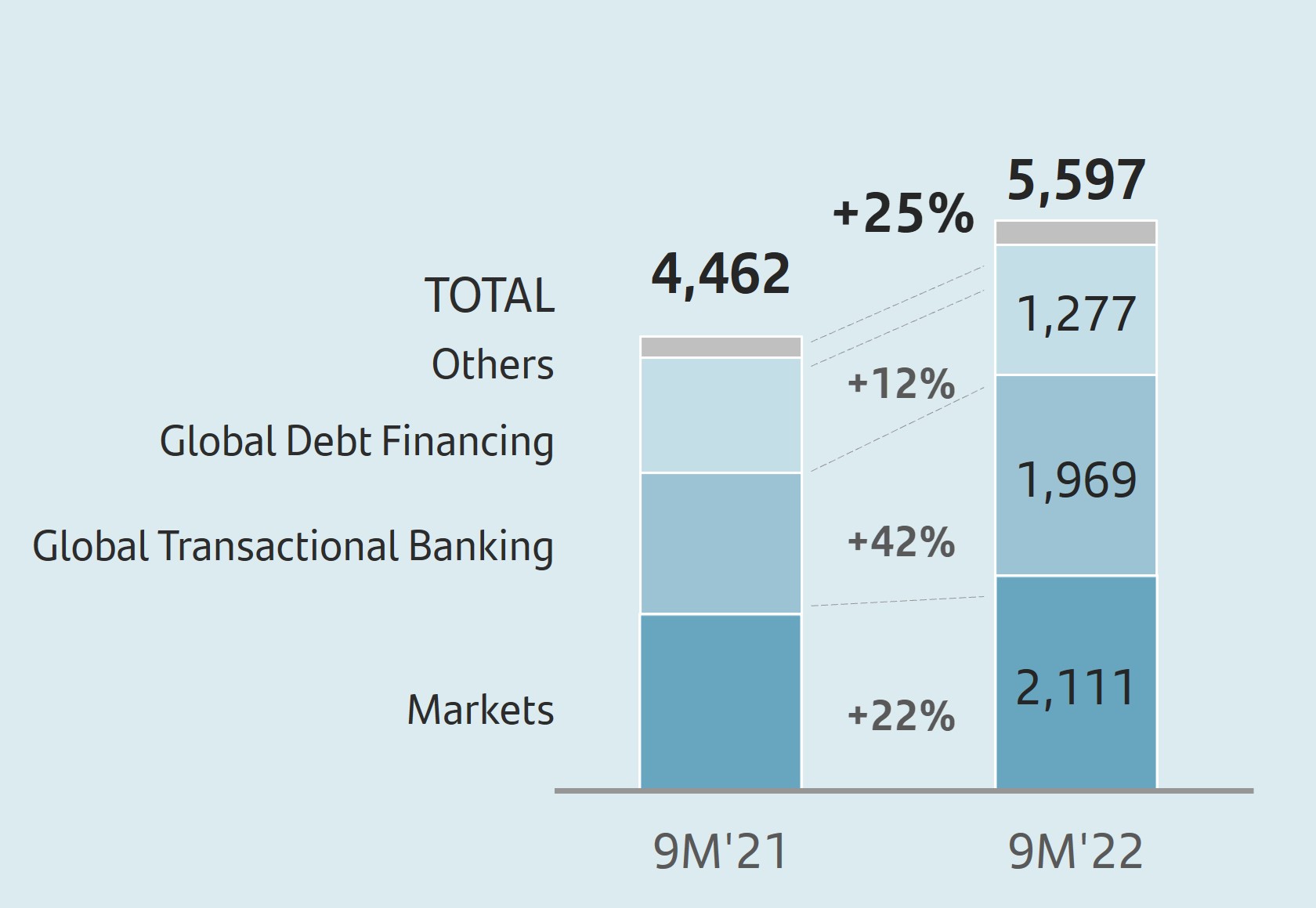

In Santander Corporate & Investment Banking (SCIB), net fee income increased 9%, with double-digit growth in its core businesses.

| | | | | |

| Net fee income |

| EUR million |

| constant euros |

| | | | | | | | |

January - September 2022 | | 9 |

Together, the two businesses accounted for close to 50% of the Group’s total fee income (SCIB: 17%; WM&I: 31%).

By region, net fee income in Europe was up 6%, supported by growth in all countries except the UK (transfer of its SCIB business in Q4 2021). There was a 4% increase in North America, as the US was dampened by the Bluestem portfolio disposal in 2021. Excluding it, net fee income would have increased 7% in the region. The 20% increase in Mexico was driven by net fee income from payments, insurance and mutual funds. South America was up 11% driven by greater transactionality, with growth in all main countries and Digital Consumer Bank rose 2% driven by greater new lending.

•Gains on financial transactions, accounted for 3% of total income and were 9% lower year-on-year at EUR 1,115 million (-13% excluding the exchange rate impact), due to the negative impact of FX hedges at the Corporate Centre which offset the positive impact of exchange rates in the countries' results. In addition, there were decreases in Portugal and Mexico, due to ALCO portfolio sales recorded in 9M'21, and the US backed by lower capital market activity.

•Dividend income was EUR 422 million in the first nine months of 2022, increasing 4% in both euros and constant euros.

•The results of entities accounted for using the equity method rose 70% (62% excluding the exchange rate impact) to EUR 501 million, due to the greater contribution from Group entities in Spain and Brazil.

•Other operating income stood at -EUR 771 million compared to EUR 243 million in the first nine months of 2021.

Several effects justify this movement: lower leasing income in North America, greater contribution to the SRF, the creation of an Institutional Protection Scheme in Poland in Q2'22, and finally, the impact of high inflation in Argentina.

| | | | | |

| Total income |

| EUR million |

| constant euros |

u Costs

Operating costs amounted to EUR 17,595 million, 12% higher than in the first nine months of 2021 (+6% excluding the exchange rate impact), due to the sharp increase in inflation. In real terms (excluding the rise in average inflation), costs fell 5% in constant euros.

Our disciplined cost management enabled us to maintain one of the best efficiency ratios in the sector, which stood at 45.5%, a 0.1 pp improvement on the first nine months of 2021. Our transformation plan continued to progress across countries towards a more integrated and digital operating model, with better business dynamics and improved customer service and satisfaction.

The year-on-year trends in costs in constant euros were as follows:

•In Europe, costs rose 1%, which translates into a 7% drop in real terms, on the back of our transformation process and operational improvements. In real terms, there were falls across the region: -11% in Spain, -6% in the UK, -18% in Portugal and -4% in Poland. The region's efficiency ratio was 47.4% (-4.1 pp compared to the first nine months of 2021), improving in all countries.

•In North America, costs increased 5%. In real terms, they were down 3%. They remained flat in the US (-8% in real terms) while Mexico recorded an increase due to wage increases, digitalization and technology, and by the increase in supply costs affected by inflation at 8%. The efficiency ratio stood at 47.0% (+2.7 pp compared to the first nine months of 2021).

•In South America, the rise in costs (+17%) was significantly distorted by soaring average inflation in the region (+19%, due to +61% in Argentina) which was reflected in salary increases in Brazil and Argentina. In real terms, costs in Brazil fell 2%, -3% in Chile and they rose 24% in Argentina. The efficiency ratio was 36.3% (+1.6 pp compared to the first nine months of 2021).

•In Digital Consumer Bank, cots rose 2% affected by inflation, strategic investments, transformational costs and business growth. In real terms, costs fell 5%. The efficiency ratio stood at 47.7% (+0.1 pp compared to the first nine months of 2021).

| | | | | |

| Operating expenses |

| EUR million |

| constant euros |

| | | | | | | | |

| 10 | | January - September 2022 |

u Provisions or reversal of provisions

Provisions (net of provisions reversals) amounted to EUR 1,305 million (EUR 2,006 million in in the first nine months of 2021). This item includes the charges for restructuring costs recorded in 2021 (EUR 530 million net of tax).

u Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net)

Impairment or reversal of impairment on financial assets not measured at fair value through profit or loss (net) amounted to EUR 7,836 million, 31% higher than in the first nine months of 2021 (+22% in constant euros). This comparison was affected by the releases recorded in the UK and the US in Q2 2021, macro provisions in 2022 (mainly in Spain, the UK and the US) resulting from a potential macroeconomic slowdown, the charges in Poland and DCB for CHF mortgages and the new mortgage payment holiday regulations in Poland (EUR 287 million). Lastly, there was a year-on-year rise in Brazil, driven by individuals, although they showed a decline in the third quarter.

u Impairment on other assets (net)

The impairment on other assets (net) stood at EUR 86 million, down from EUR 134 million in the first nine months of 2021.

u Gains or losses on non-financial assets and investments (net)

EUR 2 million was recorded in this line in the first nine months of 2022 (EUR 43 million in the first nine months of 2021).

| | | | | |

| Net loan-loss provisions |

| EUR million |

| constant euros |

u Negative goodwill recognized in results

No negative goodwill was recorded in the first nine months of 2022 or in the same period of 2021.

u Gains or losses on non-current assets held for sale not classified as discontinued operations

This item, which mainly includes impairment of foreclosed assets recorded and the sale of properties acquired upon foreclosure, totalled -EUR 13 million in the first nine months of 2022, compared to -EUR 35 million in the first nine months of 2021.

u Profit before tax

Profit before tax was EUR 11,761 million in the first nine months of 2022, 10% higher compared to the first nine months of 2021 (practically stable in constant euros).

u Income tax

Total corporate income tax was EUR 3,538 million (EUR 3,725 million in the first nine months of 2021).

u Profit attributable to non-controlling interests

Profit attributable to non-controlling interests amounted to EUR 907 million, down 21% year-on-year (-26% excluding the exchange rate impact), mainly due to the buyback of minority interests of SC USA in the US.

u Profit attributable to the parent

Profit attributable to the parent amounted to EUR 7,316 million in the first nine months of 2022, compared to EUR 5,849 million in the same period of 2021. The evolution of the aforementioned income statement items is reflected in a profit growth of 25% in euros and 14% in constant euros.

RoTE stood at 13.57%, RoRWA at 1.82% and earnings per share at EUR 0.409 (11.82%, 1.66% and EUR 0.313, respectively, in the first nine months of 2021).

| | | | | | | | |

January - September 2022 | | 11 |

u Underlying profit attributable to the parent

Underlying profit attributable to the parent recorded the same amount as profit attributable to the parent in 9M'22, as profit was not affected by the recording of results that are outside the ordinary course of our business. As such, attributable profit and underlying profit attributable to the parent in 9M'22 both amounted to EUR 7,316 million.

In 9M'21, profit attributable to the parent was affected by restructuring costs, mainly in the UK and Portugal. Excluding these charges from the line where they were recorded, and including them separately in the net capital gains and provisions line, adjusted profit or underlying profit attributable to the parent in 9M'21 stood at EUR 6,379 million.

As a result, profit in 9M'22 was 15% higher in euros and +5% in constant euros compared to the adjusted or underlying profit in the same period of 2021.

The Group’s cost of risk (considering the last 12 months) stood at 0.86%, (0.90% in September 2021).

Before recording loan-loss provisions, Grupo Santander's underlying net operating income (total income less operating expenses) was EUR 21,034 million, 12% higher year-on-year in euros, +3% excluding the FX impact. This is the highest net operating income ever recorded in the first nine months of a year. The performance in constant euros is detailed below.

By line:

•Total income increased mainly due to net interest income (+8%), continuing with its quarter-after-quarter improvement, and net fee income (+7%), which recovered further given the greater commercial activity.

•Costs were driven up by soaring inflation.

By region:

•In Europe, net operating income increased 19% underscored by higher total income and costs stability.

•In North America, net operating income fell 7%, -5% excluding the impact from the sale of the Bluestem portfolio in 2021, dampened by lower net fee income and leasing income in the US. Growth in Mexico was 12%.

•In South America, net operating income growth was 5% with rises in all countries, with the exception of Brazil which remained flat.

•In Digital Consumer Bank, net operating income increased 2%.

In the first nine months of 2022, Grupo Santander’s underlying RoTE was 13.57%, underlying RoRWA was 1.82% and underlying earnings per share was EUR 0.409 (12.61%, 1.76% and EUR 0.344, respectively, in the first nine months of 2021).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summarized underlying income statement |

| EUR million | | | Change | | | Change |

| Q3'22 | Q2'22 | % | % excl. FX | 9M'22 | 9M'21 | % | % excl. FX |

| Net interest income | 10,051 | | 9,554 | | 5.2 | 5.4 | 28,460 | | 24,654 | | 15.4 | 8.2 |

| Net fee income | 3,015 | | 3,040 | | (0.8) | (0.3) | 8,867 | | 7,810 | | 13.5 | 7.3 |

Gains (losses) on financial transactions (1) | 372 | | 356 | | 4.5 | 7.6 | 1,115 | | 1,220 | | (8.6) | (13.1) |

| Other operating income | 71 | | (135) | | — | — | 187 | | 942 | | (80.1) | (82.4) |

| Total income | 13,509 | | 12,815 | | 5.4 | 5.5 | 38,629 | | 34,626 | | 11.6 | 4.7 |

| Administrative expenses and amortizations | (6,160) | | (5,900) | | 4.4 | 4.5 | (17,595) | | (15,778) | | 11.5 | 6.3 |

| Net operating income | 7,349 | | 6,915 | | 6.3 | 6.3 | 21,034 | | 18,848 | | 11.6 | 3.3 |

| Net loan-loss provisions | (2,756) | | (2,634) | | 4.6 | 4.1 | (7,491) | | (5,973) | | 25.4 | 16.7 |

| Other gains (losses) and provisions | (747) | | (537) | | 39.1 | 43.5 | (1,782) | | (1,443) | | 23.5 | 22.2 |

| Profit before tax | 3,846 | | 3,744 | | 2.7 | 2.5 | 11,761 | | 11,432 | | 2.9 | (5.7) |

| Tax on profit | (1,164) | | (1,072) | | 8.6 | 8.8 | (3,538) | | (3,911) | | (9.5) | (17.4) |

| Profit from continuing operations | 2,682 | | 2,672 | | 0.4 | — | 8,223 | | 7,521 | | 9.3 | 0.4 |

| Net profit from discontinued operations | — | | — | | — | | — | | — | | — | | — | | (100.0) | |

| Consolidated profit | 2,682 | | 2,672 | | 0.4 | — | 8,223 | | 7,521 | | 9.3 | 0.4 |

| Non-controlling interests | (260) | | (321) | | (19.0) | (18.0) | (907) | | (1,142) | | (20.6) | (25.7) |

| Net capital gains and provisions | — | | — | | — | — | — | | (530) | | (100.0) | (100.0) |

| Profit attributable to the parent | 2,422 | | 2,351 | | 3.0 | 2.5 | 7,316 | | 5,849 | | 25.1 | 13.7 |

Underlying profit attributable to the parent (2) | 2,422 | | 2,351 | | 3.0 | 2.5 | 7,316 | | 6,379 | | 14.7 | 5.0 |

| | | | | | | | |

(1) Includes exchange differences.

(2) Excludes net capital gains and provisions.

| | | | | | | | |

| 12 | | January - September 2022 |

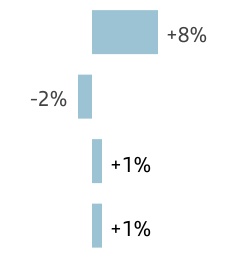

è Results performance compared to the previous quarter

Underlying profit attributable to the parent and profit attributable to the parent recorded the same amount in Q3'22 as profit was not affected by results outside the ordinary course of our business.

Q2'22 was also not affected by results outside the ordinary course of our business and as such underlying profit attributable to the parent and profit attributable to the parent were the same.

Profit in the third quarter amounted to EUR 2,422 million, including a EUR 181 million (net of tax) charge mainly as a result of the Polish mortgage payment holiday regulations. Profit was 3% higher than second quarter (+2% in constant euros) and +11% excluding the aforementioned charge (+10% in constant euros).

The performance of the main lines of the income statement in constant euros was as follows:

•Total income increased significantly in the quarter (+5%) with overall improvement in all regions, DCB, SCIB and WM&I, partially favoured by the contributions made to the SRF and BFG in the second quarter.

•Of note was the net interest income increase, up 5% due to higher interest rates and volumes. By region, 7% rise in Europe, driven by all countries. In North America, net interest income growth was 6%, with a positive performance both in the US and Mexico. South America rose 5%, as the decline in Chile compared to an exceptionally high second quarter and stability in Brazil (due to the negative sensitivity to interest rate hikes and growth in less profitable and lower-risk products) were offset by the rise in Argentina.

• | | | | | |

| Net operating income |

| EUR million |

| constant euros |

•Net fee income remained flat in Europe (seasonality, lower deposit earnings in SCIB and a one-off in cards in the second quarter in the UK), and North America (due to lower net fee income from global businesses in the US). On the other hand, South America increased 5%.

•Gains on financial transactions increased 8%, due to CIB performance in Spain and Argentina.

•Costs rose 4% affected by the overall increase in inflation and labour agreements in Mexico, Brazil and Argentina.

•Net loan-loss provisions increased 4% mainly due to the US, where it is normalizing from historical lows. On the other hand, decreases in some units, such as Brazil, Chile and Mexico.

•Other losses and provisions rose 44%, negatively affected by the aforementioned charge related to mortgage payment holidays.

| | | | | |

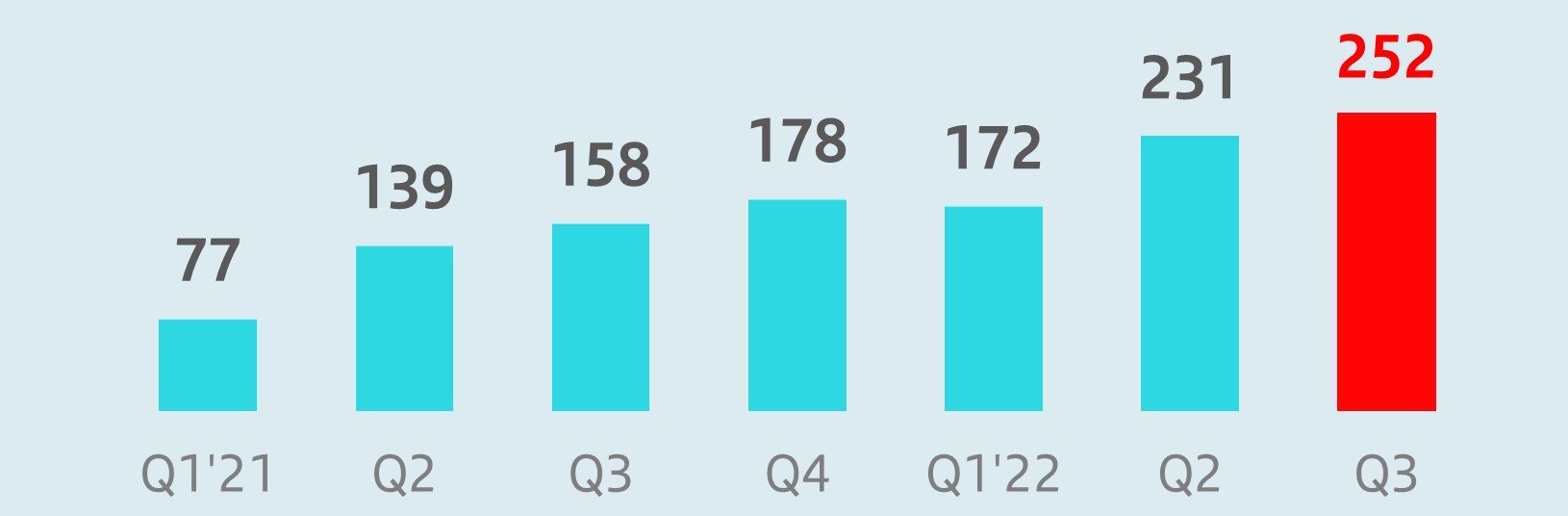

Underlying profit attributable to the parent1 |

| EUR million |

| constant euros |

(1) Excluding net capital gains and provisions.

| | | | | | | | |

January - September 2022 | | 13 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | |

| |

| | | |

|

| | Balance sheet | | | | | | |

| | | | | | | | | | | | | | | | | |

| Grupo Santander. Condensed balance sheet |

| EUR million | | | | | |

| | | Change | |

| Assets | Sep-22 | Sep-21 | Absolute | % | Dec-21 |

| Cash, cash balances at central banks and other demand deposits | 246,533 | | 191,035 | | 55,498 | | 29.1 | | 210,689 | |

| Financial assets held for trading | 179,775 | | 122,967 | | 56,808 | | 46.2 | | 116,953 | |

| Debt securities | 37,655 | | 30,834 | | 6,821 | | 22.1 | | 26,750 | |

| Equity instruments | 9,271 | | 14,586 | | (5,315) | | (36.4) | | 15,077 | |

| Loans and advances to customers | 14,131 | | 3,651 | | 10,480 | | 287.0 | | 6,829 | |

| Loans and advances to central banks and credit institutions | 35,480 | | 17,246 | | 18,234 | | 105.7 | | 14,005 | |

| Derivatives | 83,238 | | 56,650 | | 26,588 | | 46.9 | | 54,292 | |

| Financial assets designated at fair value through profit or loss | 15,462 | | 42,126 | | (26,664) | | (63.3) | | 21,493 | |

| Loans and advances to customers | 7,306 | | 22,930 | | (15,624) | | (68.1) | | 10,826 | |

| Loans and advances to central banks and credit institutions | 618 | | 11,876 | | (11,258) | | (94.8) | | 3,152 | |

| Other (debt securities an equity instruments) | 7,538 | | 7,320 | | 218 | | 3.0 | | 7,515 | |

| Financial assets at fair value through other comprehensive income | 87,915 | | 109,570 | | (21,655) | | (19.8) | | 108,038 | |

| Debt securities | 78,117 | | 98,016 | | (19,899) | | (20.3) | | 97,922 | |

| Equity instruments | 2,030 | | 2,690 | | (660) | | (24.5) | | 2,453 | |

| Loans and advances to customers | 7,768 | | 8,864 | | (1,096) | | (12.4) | | 7,663 | |

| Loans and advances to central banks and credit institutions | — | | — | | — | | — | | — | |

| Financial assets measured at amortized cost | 1,173,274 | | 1,011,994 | | 161,280 | | 15.9 | | 1,037,898 | |

| Debt securities | 68,727 | | 34,079 | | 34,648 | | 101.7 | | 35,708 | |

| Loans and advances to customers | 1,038,261 | | 922,867 | | 115,394 | | 12.5 | | 947,364 | |

| Loans and advances to central banks and credit institutions | 66,286 | | 55,048 | | 11,238 | | 20.4 | | 54,826 | |

| Investments in subsidiaries, joint ventures and associates | 7,805 | | 7,684 | | 121 | | 1.6 | | 7,525 | |

| Tangible assets | 35,662 | | 32,446 | | 3,216 | | 9.9 | | 33,321 | |

| Intangible assets | 18,789 | | 16,246 | | 2,543 | | 15.7 | | 16,584 | |

| Goodwill | 14,138 | | 12,645 | | 1,493 | | 11.8 | | 12,713 | |

| Other intangible assets | 4,651 | | 3,601 | | 1,050 | | 29.2 | | 3,871 | |

| Other assets | 50,577 | | 44,227 | | 6,350 | | 14.4 | | 43,334 | |

| Total assets | 1,815,792 | | 1,578,295 | | 237,497 | | 15.0 | | 1,595,835 | |

| | | | | |

| Liabilities and shareholders' equity | | | | | |

| Financial liabilities held for trading | 132,563 | | 80,147 | | 52,416 | | 65.4 | | 79,469 | |

| Customer deposits | 12,451 | | 4,809 | | 7,642 | | 158.9 | | 6,141 | |

| Debt securities issued | — | | — | | — | | — | | — | |

| Deposits by central banks and credit institutions | 18,792 | | 5,350 | | 13,442 | | 251.3 | | 7,526 | |

| Derivatives | 82,505 | | 55,086 | | 27,419 | | 49.8 | | 53,566 | |

| Other | 18,815 | | 14,902 | | 3,913 | | 26.3 | | 12,236 | |

| Financial liabilities designated at fair value through profit or loss | 44,599 | | 47,900 | | (3,301) | | (6.9) | | 32,733 | |

| Customer deposits | 35,994 | | 36,694 | | (700) | | (1.9) | | 25,608 | |

| Debt securities issued | 5,442 | | 5,401 | | 41 | | 0.8 | | 5,454 | |

| Deposits by central banks and credit institutions | 3,163 | | 5,805 | | (2,642) | | (45.5) | | 1,671 | |

| Other | — | | — | | — | | — | | — | |

| Financial liabilities measured at amortized cost | 1,493,298 | | 1,317,759 | | 175,539 | | 13.3 | | 1,349,169 | |

| Customer deposits | 960,355 | | 867,531 | | 92,824 | | 10.7 | | 886,595 | |

| Debt securities issued | 279,591 | | 238,882 | | 40,709 | | 17.0 | | 240,709 | |

| Deposits by central banks and credit institutions | 214,164 | | 180,221 | | 33,943 | | 18.8 | | 191,992 | |

| Other | 39,188 | | 31,125 | | 8,063 | | 25.9 | | 29,873 | |

| Liabilities under insurance contracts | 777 | | 779 | | (2) | | (0.3) | | 770 | |

| Provisions | 8,341 | | 9,815 | | (1,474) | | (15.0) | | 9,583 | |

| Other liabilities | 36,902 | | 26,271 | | 10,631 | | 40.5 | | 27,058 | |

| Total liabilities | 1,716,480 | | 1,482,671 | | 233,809 | | 15.8 | | 1,498,782 | |

| Shareholders' equity | 123,340 | | 118,380 | | 4,960 | | 4.2 | | 119,649 | |

| Capital stock | 8,397 | | 8,670 | | (273) | | (3.1) | | 8,670 | |

| Reserves (including treasury stock) | 108,606 | | 104,702 | | 3,904 | | 3.7 | | 103,691 | |

| Profit attributable to the Group | 7,316 | | 5,849 | | 1,467 | | 25.1 | | 8,124 | |

| Less: dividends | (979) | | (841) | | (138) | | 16.4 | | (836) | |

| Other comprehensive income | (32,316) | | (32,992) | | 676 | | (2.0) | | (32,719) | |

| Minority interests | 8,288 | | 10,236 | | (1,948) | | (19.0) | | 10,123 | |

| Total equity | 99,312 | | 95,624 | | 3,688 | | 3.9 | | 97,053 | |

| Total liabilities and equity | 1,815,792 | | 1,578,295 | | 237,497 | | 15.0 | | 1,595,835 | |

| | | | | | | | |

| 14 | | January - September 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | |

| |

| | | |

|

| | Balance sheet | | | | | | |

| | | | | | | | |

| GRUPO SANTANDER BALANCE SHEET |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Executive summary 1 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Loans and advances to customers (excl. reverse repos) | | | | | | | Customer funds (deposits excl. repos + mutual funds) | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Positive trend in loans and advances to customers continued, increasing both QoQ and YoY | | | | | Customer funds continued to grow, mainly backed by customer deposits | | |

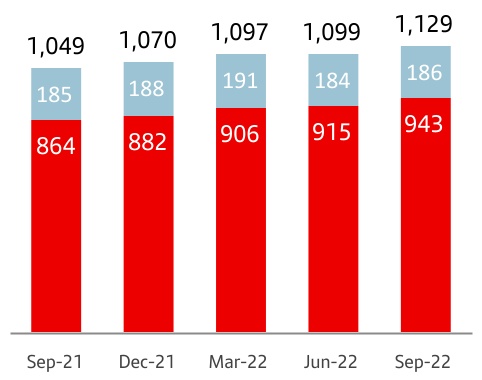

| | 1,040 | +2% QoQ | +7% YoY | | | | | 1,129 | +2% QoQ | +4% YoY | | |

| | EUR billion | | | | | EUR billion | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | è By segment (YoY changes): | | | | | | | | | | | | è By product (YoY changes): | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Growth backed by individuals and large corporates | | | | Demand deposits accounted for 64% of customer funds. Increase in time deposits due to higher interest rates and mutual funds were impacted by market performance | | |

| | | | | | |

| | Individuals | SMEs and corporates | CIB | | | | Demand | Time | Mutual funds | | |

| | +7% | +2% | +14% | | | | +1% | +27% | -5% | | |

| | | | | | | | | | | | |

| | | | | (1) Changes in constant euros. | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

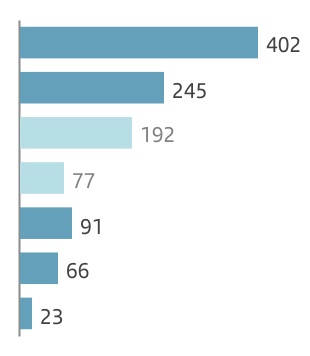

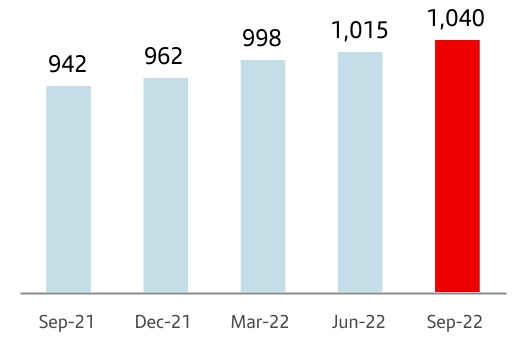

è Loans and advances to customers

Loans and advances to customers stood at EUR 1,067,466 million at 30 September, +3% quarter-on-quarter and +11% year-on-year.

For the purpose of analysing traditional commercial banking loans, the Group uses gross loans and advances to customers excluding reverse repos, which exceeded EUR 1 trillion (EUR 1,040,457 million). In order to facilitate the analysis of the Group's management, the comments below do not include the exchange rate impact.

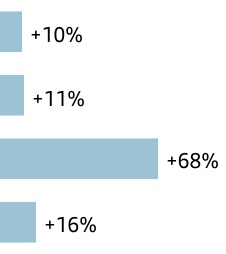

In the quarter, gross loans and advances to customers, excluding reverse repos, rose 2%, as follows:

•Europe rose 1% with increases in the UK and Spain, while Portugal and Poland remained flat.

•North America rose 2% with equal growth both in Mexico and the US.

•In South America, loans increased 4%, with Brazil increasing 4%, Chile +3%, Argentina +14% and Uruguay +5%.

•Digital Consumer Bank (DCB) rose 2%, with Openbank also growing 2%.

| | | | | |

| Gross loans and advances to customers (excl. reverse repos) |

| EUR billion |

(1) In constant EUR: +7%.

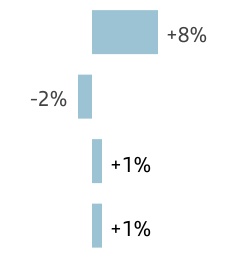

Compared to September 2021, gross loans and advances to customers (excluding reverse repos and the FX impact) grew 7%, with broad-based growth across countries, as follows:

•In Europe, growth was 5%. Spain rose 7% (individuals and private banking), Poland rose 6% (corporates, institutions and CIB), the UK rose 4% (mortgages) and Portugal was up 1% (mortgages).

•+9% in North America as the US grew 8% propelled by auto financing, CIB and CRE (commercial real estate), while Mexico was up 13% with rises in most segments, except SMEs.

•Growth in South America was 13%, with Chile +11% backed by individuals, Brazil increased +10% owing to individuals and corporates, Argentina rose +68% driven by auto, SMEs and corporates and Uruguay recorded a 15% increase.

•DCB increased 6%, receiving an uplift from new lending, which rose 10% year-on-year, and increased in most countries. Openbank increased 42%.

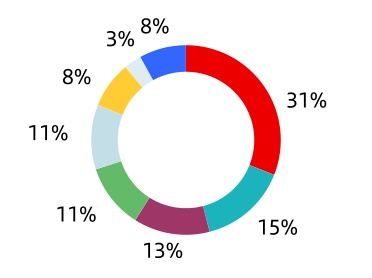

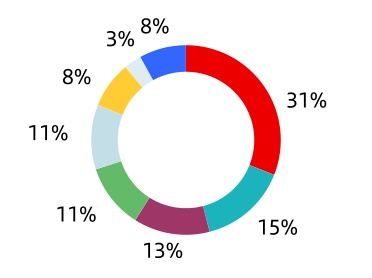

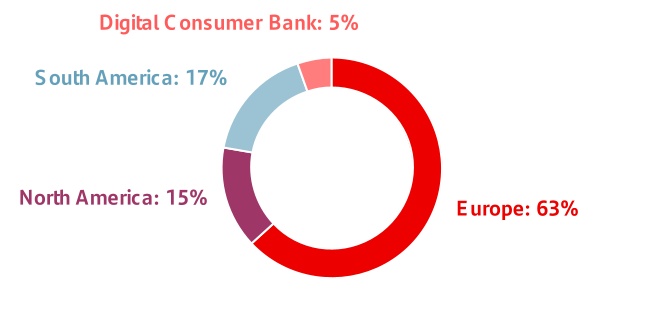

As of September 2022, gross loans and advances to customers excluding reverse repos maintained a balanced structure: individuals (61%), SMEs and corporates (24%) and SCIB (15%).

| | |

| Gross loans and advances to customers (excl. reverse repos) |

| % operating areas. September 2022 |

| | | | | | | | |

January - September 2022 | | 15 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Business model | |

| |

| | | |

|

| | Balance sheet | | | | | | |

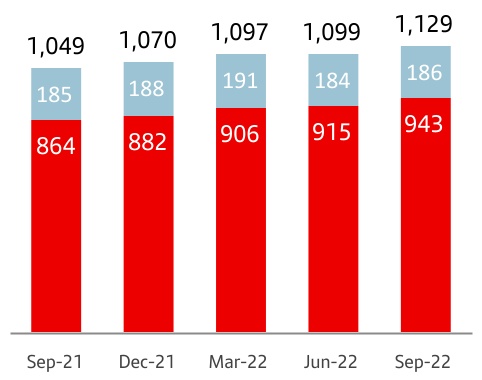

è Customer funds

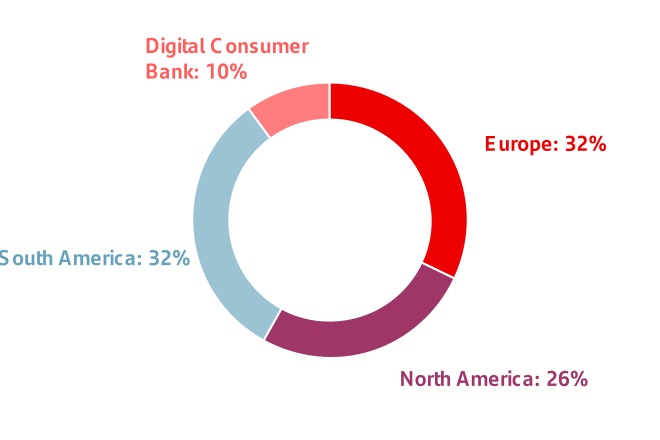

Customer deposits amounted to EUR 1,008,800 million in September 2022, increasing 4% quarter-on-quarter and 11% year-on-year.

The Group uses customer funds (customer deposits excluding repos, plus mutual funds) for the purpose of analysing traditional retail banking funds, which amounted to EUR 1,129,020 million in September 2022. Just as for loans and advances to customers, the comments below do not include the exchange rate impact.

•In the third quarter, customer funds grew 2%, as follows:

–By product, customer deposits excluding repos increased 2% and mutual funds fell 1%.

–By primary segment, customer funds rose in the three regions while DCB remained stable. By country, customer funds increased 4% in Spain, 3% in Poland and the US, +5% in Chile and +15% in Argentina. In Portugal and Mexico customer funds decreased 2%, while Brazil was practically unchanged.

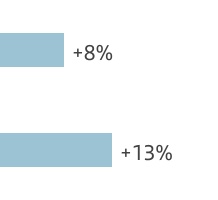

•Compared to September 2021, customer funds were up 4%, excluding the exchange rate impact:

–By product, deposits excluding repos rose 6%. Demand deposits grew 1% (with rises Europe and falls in North and South America) and time deposits were 27% higher driven by Europe and North America. Mutual funds dropped 5% with widespread falls across most countries due to the impact from markets and the rising interest rate environment.

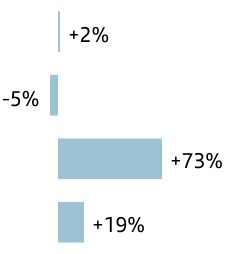

–By region, customer funds increased 4% in Europe, with rises in Spain (+8%), Portugal (+1%) and Poland (+1%), while the UK decreased 2%. There was a 2% rise in North America (the US: +4%; Mexico: -0.4%) and +5% South America (Brazil: +2%; Chile: -5%; Argentina: +73%; Uruguay: +17%).

–6% rise in DCB, where Openbank increased 9%.

With this performance, the weight of demand deposits as a percentage of total customer funds was 64%, time deposits accounted for 20% of the total and mutual funds 16%.

| | |

| Customer funds |

| EUR billion |

| | | | | | | | |

| | |

| +8 | % | 1a | |

| | |

| +1 | % | | |

| | |

| +9 | % | | |

| | |

| | |

•Total |

•Mutual funds |

•Deposits exc. repos |

| | |

| Sep-22 / Sep-21 |

| | |

(1) In constant EUR: +4%.

In addition to capturing customer deposits, the Group, for strategic reasons, maintains a selective policy of issuing securities in the international fixed income markets and strives to adapt the frequency and volume of its market operations to the structural liquidity needs of each unit, as well as to the receptiveness of each market.

In the first nine months of 2022, the Group issued:

•Medium- and long-term covered bonds amounting to EUR 9,041 million and EUR 16,170 million of senior debt placed in the market.

•There were EUR 13,751 million of securitizations placed in the market. Additionally, we extended the maturity of an additional EUR 158 million.

•In order to strengthen the Group’s situation, issuances to meet the TLAC requirement amounted to EUR 9,716 million (EUR 9,594 million of senior non-preferred debt and EUR 122 million of subordinated debt).

•Maturities of medium- and long-term debt totalled EUR 21,622 million.

The net loan-to-deposit ratio was 106% (105% in September 2021). The ratio of deposits plus medium- and long-term funding to the Group’s loans was 118%, underscoring the comfortable funding structure.

The Group's access to wholesale funding markets as well as the cost of issuances depends, in part, on the ratings of the rating agencies.

The ratings of Banco Santander, S.A. by the main rating agencies were: Fitch A- senior non-preferred debt, A senior long-term and F2/F1 senior short-term; Moody's A2 long-term and P-1 short-term; and DBRS A High and R-1 Medium short-term. In December 2021, Standard & Poor's (S&P) raised its long-term rating to A+ (from A) and maintained its short-term rating at A-1. Moody's, DBRS and Fitch maintained their stable outlooks. In March 2022, S&P upgraded it to stable as a result of the sovereign's outlook upgrade.

Sometimes the methodology applied by the agencies limits a bank's rating to the sovereign rating of the country where it is headquartered. Banco Santander, S.A. is still rated above the sovereign debt rating of the Kingdom of Spain by Moody’s, DBRS and S&P and at the same level by Fitch, which demonstrates our financial strength and diversification.

| | |

| Customer funds |

| % operating areas. September 2022 |

| | | | | | | | |

| 16 | | January - September 2022 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Executive summary | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Fully-loaded capital ratio | | | | | | | | Fully-loaded CET1 ratio | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Fully-loaded CET1 ratio exceeded 12% at the end of September 2022 | | | | | We continued to generate capital organically in the quarter, backed by profit and RWA management | | |

| | | | | | | | | | Gross organic generation | +26 bps | | | | +34 bps | | | | |

| | | | | | | | | Cash dividend accrual1 | -8 bps | | | | -8 bps | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | TNAV per share | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | TNAV per share was EUR 4.31, +3% quarter-on-quarter and 11% higher year-on-year including cash dividends | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

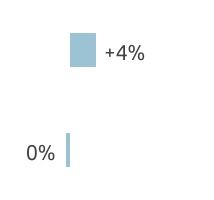

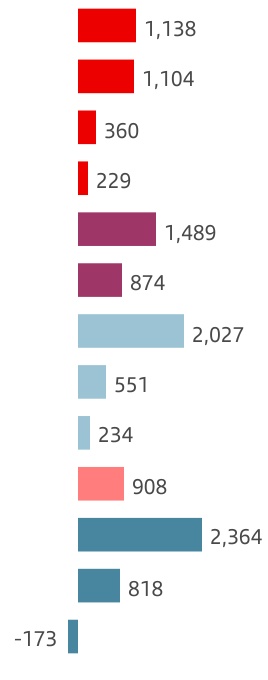

At the end of September 2022, the total phased-in capital ratio (applying the IFRS 9 transitional arrangements) stood at 16.18% and the phased-in CET1 ratio at 12.24%. We comfortably meet the levels required by the European Central Bank on a consolidated basis (13.01% for the total capital ratio and 8.86% for the CET1 ratio). This results in a distance to the maximum distributable amount (MDA) of 307 bps and a CET1 management buffer of 338 bps.

The total fully-loaded capital ratio stood at 16.00% and the fully-loaded CET1 ratio at 12.10%.

We maintained strong net organic generation in the quarter, 26 bps, resulting from gross organic generation of 34 bps (from Q2'22 profit and RWA management), and the 8 bp accrual for the future cash dividend payment1.

Additionally, in the quarter there was a 15 bp negative impact from markets (mainly from portfolio valuations) and -6 bps from models.

The fully-loaded leverage ratio stood at 4.59%, and the phased-in at 4.63%.

Lastly, the TNAV per share ended September 2022 at EUR 4.31, +3% quarter-on-quarter including the EUR 5.83 cents cash dividend to be paid in November, but which has already been deducted from shareholder's equity. Compared to the same period last year, TNAV per share increased 11%, including the previously mentioned dividend, and EUR 5.15 cent cash dividend paid in May 2022.

| | | | | | | | |

| Eligible capital. September 2022 |

| EUR million | | |

| Fully-loaded | Phased-in* |

| CET1 | 74,653 | | 75,499 | |

| Basic capital | 83,667 | | 84,513 | |

| Eligible capital | 98,724 | | 99,773 | |

| Risk-weighted assets | 617,116 | | 616,738 | |

| | |

| CET1 capital ratio | 12.10 | | 12.24 | |

| Tier 1 capital ratio | 13.56 | | 13.70 | |

| Total capital ratio | 16.00 | | 16.18 | |

| | |

| Fully-loaded CET1 ratio performance |

| % |

(1) Cash dividend accrual corresponding to 20% of Q3'22 profit. The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

(*) The phased-in ratio includes the transitory treatment of IFRS 9, calculated in accordance with article 473 bis of the Capital Requirements Regulation (CRR2) and subsequent modifications introduced by Regulation 2020/873 of the European Union. Total phased-in capital ratios include the transitory treatment according to chapter 4, title 1, part 10 of the CRR2.

| | | | | | | | |

January - September 2022 | | 17 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Executive summary | | | | | | | | |

| | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Credit risk | | Market risk | | |

| | | | | | | |

| | | Credit quality indicators increased slightly in response to macro economic uncertainty, inflationary pressure and the resulting reaction of the central banks | | Our risk profile remains stable with just a slight rise in the VaR levels, despite the current uncertainty | | |

| | | Cost of risk2 | NPL ratio | Coverage ratio | | Q3'22 | Average

VaR | EUR 15 million | | |

| | | 0.86% | 3.08% | 70% | | | |

| | | +3 bps vs Q2'22 | +3 bps vs Q2'22 | -1 pp vs Q2'22 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | Structural and liquidity risk | | Operational risk | | |

| | | | | | | | | |

| | | Robust and diversified liquidity buffer, with ratios well above regulatory requirements | | Losses, by Basel categories, were lower than the previous quarter | | |

| | | Liquidity Coverage Ratio (LCR)3 | | | |

| | | 169% +4 pp vs Q2'22 | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

u Monitoring of Russia-Ukraine conflict effects

The Russia-Ukraine conflict is having a significant impact on the global economy, with rising commodity prices, supply chain disruptions and rapidly rising inflation.

The impacts of the rising inflation will depend on the intensity and duration of the measures taken by the different central banks, who currently face the challenge of balancing economic growth and inflation.

Our diversification across countries, together with our proactive risk management, is helping us to maintain our medium-low risk profile despite the current economic environment.

u Credit risk management

Total risk exposure increased slightly to EUR 1,156,548 million, +2% in comparison to the second quarter and +8% year-on-year, both in constant euros.

Credit impaired loans: stood at EUR 35,600 million, 2% higher in constant euros compared to the previous quarter, in line with the aforementioned portfolio growth.

The NPL ratio rose slightly in the quarter (+3 bps) and stood at 3.08%, explained by the performance in North and South America, partially offset by the positive trend in Europe and Digital Consumer Bank. In the year-on-year comparison, the NPL ratio was 10 bps lower.

Loan-loss provisions amounted to EUR 2,756 million in the third quarter, 4% higher compared to the previous quarter in constant euros. Considering the first nine months of the year, loan-loss provisions amounted to EUR 7,491 million (+17% year-on-year in constant euros), driven mainly by a potential economic slowdown and the provisions releases in 2021. As a consequence, the cost of risk stood at 0.86% (+3 bps compared to Q2'22, although at lower levels than the previous year).

This loan-loss provisions performance brought the total loan-loss reserves to EUR 24,813 million, a 2% decrease year to date in constant euros.

Total coverage of credit impaired loans remained stable at 70% compared to the previous quarter. It should be noted that a significant part of our portfolios in Spain and the UK has real estate collateral, which requires lower coverage levels.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key metrics performance by geographic area | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | |

| | Loan-loss provisions1 | | Cost of risk (%)2 | | NPL ratio (%) | | Total coverage ratio (%) |

| | 9M'22 | Chg (%)

/ 9M'21 | | 9M'22 | Chg (bps)

/ 9M'21 | | 9M'22 | Chg (bps)

/ 9M'21 | | 9M'22 | Chg (pp)

/ Q1'21 |

| Europe | 1,760 | | (6.0) | | | 0.36 | | (12) | | | 2.58 | | (57) | | | 49.7 | | (1.4) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| North America | 1,666 | | 35.6 | | | 1.12 | | (34) | | | 2.79 | | 23 | | | 102.7 | | (36.6) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| South America | 3,633 | | 34.5 | | | 3.11 | | 58 | | | 5.54 | | 116 | | | 84.7 | | (14.0) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Digital Consumer Bank | 429 | | (4.7) | | | 0.43 | | (14) | | | 2.20 | | 5 | | | 95.6 | | (17.2) | |

| | | | | | | | | | | | |

| TOTAL GROUP | 7,491 | | 16.7 | | | 0.86 | | (4) | | | 3.08 | | (10) | | | 69.7 | | (4.3) | |

| | | | | | | | | | | | |

| (1) EUR million and % change in constant euros. |

| (2) Allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months. |

| (3) Provisional data. |

| |

| | | | | | | | |

| 18 | | January - September 2022 |

The Group closely monitors the performance of government liquidity programmes, mainly concentrated in Spain, as the payment holiday periods are reaching their end, with no signs of deterioration.

IFRS 9 stages evolution: the distribution of the portfolio remained stable in the quarter.

| | | | | | | | | | | | | | | | | | | | | | | |

| Coverage ratio by stage | |

| EUR billion |

| Exposure1 | | Coverage |

| Sep-22 | Jun-22 | Sep-21 | | Sep-22 | Jun-22 | Sep-21 |

| Stage 1 | 1,030 | 998 | 912 | | 0.5 | % | 0.5 | % | 0.5 | % |

| Stage 2 | 70 | 66 | 67 | | 7.7 | % | 8.5 | % | 8.6 | % |

| Stage 3 | 36 | 34 | 33 | | 41.0 | % | 40.1 | % | 43.0 | % |

1. Exposure subject to impairment. Additionally, in September 2022 there was EUR 21 billion in loans and advances to customers not subject to impairment recorded at mark to market with changes through P&L (EUR 23 billion in June 2022 and EUR 27 billion in September 2021).

Stage 1: financial instruments for which no significant increase in credit risk is identified since its initial recognition.

Stage 2: if there has been a significant increase in credit risk since the date of initial recognition but the impairment event has not materialized, the financial instrument is classified in Stage 2.

Stage 3: a financial instrument is catalogued in this stage when it shows effective signs of impairment as a result of one or more events that have already occurred resulting in a loss.

| | | | | | | | | | | |

| Credit impaired loans and loan-loss allowances |

| EUR million | | |

| | Change (%) |

| Q3'22 | QoQ | YoY |

| Balance at beginning of period | 34,259 | | (4.0) | | 3.0 | |

| Net additions | 3,703 | | 75.1 | | 69.2 | |

| Increase in scope of consolidation | — | | — | | — | |

| Exchange rate differences and other | 496 | | — | | — | |

| Write-offs | (2,858) | | (12.8) | | 40.1 | |

| Balance at period-end | 35,600 | | 3.9 | | 7.7 | |

| | | |

| Loan-loss allowances | 24,813 | | 2.6 | | 1.4 | |

| For impaired assets | 14,603 | | 6.3 | | 2.8 | |

| For other assets | 10,210 | | (2.4) | | (0.5) | |

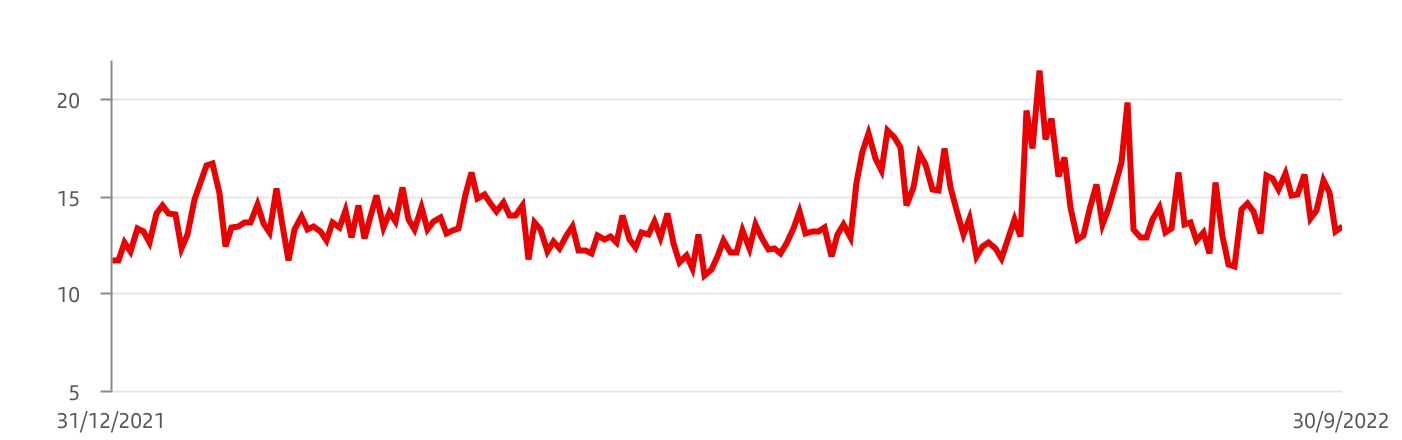

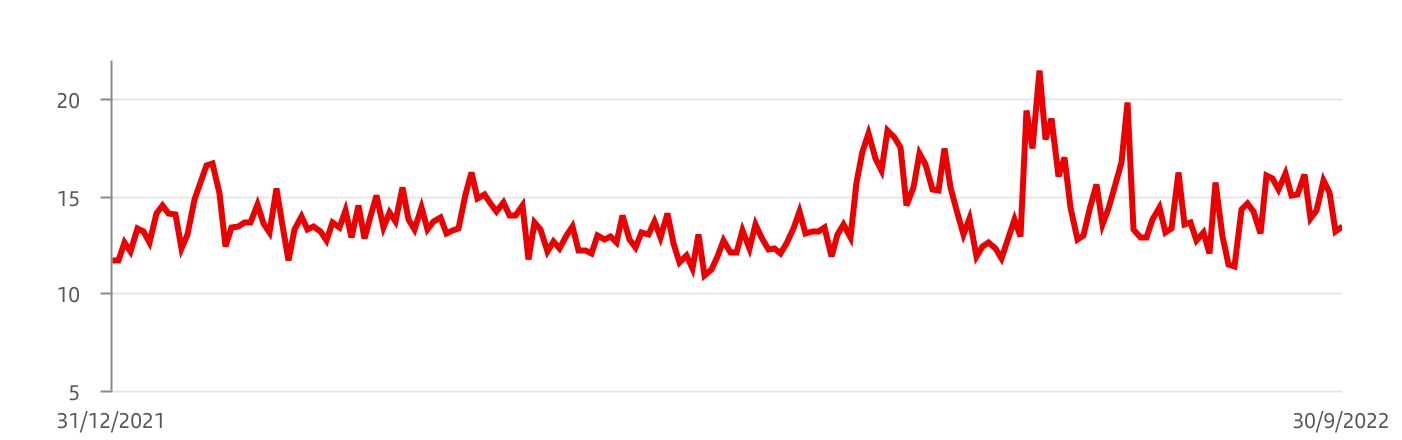

u Market risk

The risk associated with global corporate banking trading activity is mainly interest rate driven, focused on servicing our customers' needs and measured in daily VaR terms at 99%.

In the third quarter of 2022, the VaR fluctuated around an average value of EUR 15 million, reflecting our low market risk profile in a context that remains highly volatile, as a result of the impact of the Russia-Ukraine conflict on energy prices and its effect on inflation, increasing the pressure on central banks. By the end of the quarter, VaR was EUR 13 million. These figures remain low compared to the size of the Group’s balance sheet and activity.

| | | | | | | | | | | | | | |

Trading portfolios.(1) VaR by geographic region |

| EUR million | | | | |

| 2022 | | 2021 |

| Third quarter | Average | Latest | | Average |

| | | | |

| Total | 14.6 | | 13.4 | | | 10.6 | |

| Europe | 14.1 | | 13.7 | | | 9.9 | |

| North America | 2.0 | | 1.7 | | | 2.6 | |

| South America | 7.7 | | 6.0 | | | 5.9 | |

1. Activity performance in Santander Corporate & Investment Banking markets.

| | | | | | | | | | | | | | |

Trading portfolios.(1) VaR by market factor |

| EUR million | | | | |

| Third quarter 2022 | Min. | Avg. | Max. | Last |

| VaR total | 11.3 | | 14.6 | | 21.5 | | 13.4 | |

| Diversification effect | (8.4) | | (13.3) | | (22.3) | | (14.9) | |

| Interest rate VaR | 9.7 | | 12.8 | | 19.3 | | 13.2 | |

| Equity VaR | 2.5 | | 3.3 | | 5.1 | | 3.3 | |

| FX VaR | 2.7 | | 4.4 | | 7.2 | | 3.6 | |

| Credit spreads VaR | 3.6 | | 5.0 | | 7.8 | | 7.0 | |

| Commodities VaR | 1.3 | | 2.4 | | 4.4 | | 1.3 | |

1.Activity performance in Santander Corporate & Investment Banking markets.

Note: In the North America, South America and Asia portfolios, VaR corresponding to the credit spreads factor other than sovereign risk is not relevant and is included in the interest rate factor.

| | | | | | | | |

January - September 2022 | | 19 |

| | |

Trading portfolios1. VaR performance

|

| EUR million |

1. Corporate & Investment Banking performance in financial markets.

1. Corporate & Investment Banking performance in financial markets.

u Structural and liquidity risk

Structural exchange rate risk: mainly driven by transactions in foreign currencies related to permanent financial investments, their results and related hedges. Our dynamic management of this risk seeks to limit the impact of foreign exchange rate movements on the Group's core capital ratio. In the third quarter, currency hedging impacting this ratio remained close to 100%.

Structural interest rate risk: the persistence of high levels of inflation caused significant adjustments in the monetary policies of some central banks such as the ECB or the Fed, with interest rate markets reflecting these movements. In this context, our structural debt portfolios continued to be negatively impacted. Despite the volatility of the markets during the quarter, the risk remained at comfortable levels.

Liquidity risk: the Group maintained a comfortable liquidity risk position, supported by a robust and diversified liquidity buffer, with ratios well above regulatory limits. During the third quarter, the Group issued a mortgage covered bond of EUR 3,500 million in a multi-tranche operation to obtain liquidity. This kind of operation has been reactivated within the Eurozone as a result of the current economic conjuncture.

u Operational risk

In general, our operational risk profile remained stable in the third quarter of 2022, after a moderate increase in the beginning of the year. The following aspects were closely monitored during this period:

•IT risks arising from transformation plans related to business strategy and development of digital capabilities, as well as proactive management of obsolete technology and IT services provided by third parties, in order to ensure availability of services and operations.

•Regulatory compliance, due to increasing regulatory requirements (such as ESG, operational resilience, data management regulations, among others) across the Group.

•New types of fraud, mainly in online banking transactions (e.g. customer fraud) and in the loan admission processes (e.g. identity theft).

•We continued to focus on consumer protection and Financial Crime Compliance monitoring, and compliance with international financial measures and sanctions due to the Russia-Ukraine conflict.

•Cyber threats across the financial industry, focused on alerts derived from the Russia-Ukraine conflict, strengthening the bank's monitoring and control environment mechanisms.

•Third party risk exposure, maintaining close oversight of critical providers, focusing on their control environment including business continuity capabilities, supply chains, cyber risk management and compliance with service level agreements.

Regarding the third quarter performance, losses (by Basel categories) were lower than the previous quarter.

| | | | | | | | |

| 20 | | January - September 2022 |

Grupo Santander conducted its business in the third quarter of 2022 in an environment marked by market volatility, uncertainty stemming from the Russia-Ukraine conflict, and its impact on gas supply in Europe, in addition to other factors, such as China's zero-covid strategy and consequent impacts on global production chains. This has exacerbated the already high pricing pressures, accelerating inflation globally and for longer than expected. Against this backdrop, central banks in mature and developing countries moved ahead with monetary policy normalization, which will likely lead to a slowdown in the global economy in the coming quarters due to rising interest rates.

| | | | | | | | | | | |

| Country | GDP Change1 | Economic performance |

| Eurozone | +1.4% | GDP showed solid growth during Q2'22, driven by the services sector, with the unemployment rate falling to historic lows (6.6% in August). Inflation surprised on the upside (9.9% in September), with a rise in core inflation. In this context, the ECB raised its interest rates twice, from -0.50% before the first increase (July) to 0.75% today. |

| Spain | +1.3% | In Q2'22, the reopening after covid-19 restrictions (which allowed tourism to recover) offset the uncertainty stemming from the Russia-Ukraine conflict. The labour market remained dynamic, although recent data indicates a slowdown. Although inflation eased in September (8.9%), it remains high and core inflation, at 6.2% is particularly concerning. |

| United Kingdom | +0.9% | The recovery ran out of steam and the economy faced adverse circumstances such as rising inflation (10.1% in September) and higher interest rates (2.25%) to contain it. Both measures reduced household purchasing power. The result was a slowdown, that will get worse in the coming quarters However, the labour market remained strong (3.5% unemployment rate). |

| Portugal | +2.5% | The strong performance in exports offset the worse domestic demand, as GDP remained broadly flat in Q2. High inflation (9.3% in September) affected activity in Q3, although demand should remain stable due to accumulated household savings. The Q2'22 unemployment rate fell to 5.7%. Public accounts continued to improve. |

| Poland | +0.3% | Economic growth continued to lose momentum in Q2'22 due to the consequences of the Russia-Ukraine conflict. Government measures to support households in the face of sharp price increases (CPI was 17.2% in September) and supply cuts, as well as the strong labour market (unemployment rate at 2.6%) should mean economic growth will slow gradually. The official interest rate was raised to 6.5%. |

| United States | -0.6% | Inflation remained high (8.2% in September) and core inflation rose to 6.6%. Employment continued to grow at a healthy pace and unemployment remained at historically low levels. To contain inflation, the Fed increased rates aggressively (300 bps in 7 months) and expects further hikes this year, increasing fears of recession. |

| Mexico | +2.1% | The economy continued to grow at the beginning of Q3'22 supported by expansion in industry and service sector. However, greater global uncertainty and high inflation (8.7% in September) could result in a slowdown. The central bank reaffirmed its commitment to price stability and accelerated interest rate hikes (150 bps in Q3'22 to 9.25%), suggesting higher rates in the coming months. |

| Brazil | +2.4% | After the solid growth in the first half of the year, economic growth remained dynamic, supported by industry and service sector expansion, and the lowest unemployment rate since 2015 (8.9%). Inflation subsided (7.2% in September) and expectations started to ease. The central bank, raised the official rate in August (50 bps to 13.75%), but left it stable in September, though maintained its restrictive tone. |

| Chile | -0.6% | Following strong growth in 2021, the economy began an adjustment process in 2022, as fiscal and monetary stimulus effects from the previous year faded. Inflation remained high (13.7% in September) and the central bank continued to raise the official rate (+175 bps in Q3'22 to 10.75%) with an additional hike in October to 11.25%, but suggested stability in the future. |

| Argentina | +2.2% | The IMF approved the second review of Argentina's programme, allowing it to refinance its debt maturities with the organization until the end of the year. The economy grew 1% quarter-on-quarter in Q2'22 and inflation remained high (6.8% monthly average in Q3'22). The central bank continued to raise the official rate to 75% in Q3'22 (vs. 52% in Q2'22). |

(1) Year-on-year change for H1'22.

| | | | | | | | |

January - September 2022 | | 21 |

We base segment reporting on financial information presented to the chief operating decision maker, which excludes certain statutory results items that distort year-on-year comparisons and are not considered for management reporting. This financial information (underlying basis) is computed by adjusting reported results for the effects of certain gains and losses (e.g. capital gains, write-downs, impairment of goodwill, etc.). These gains and losses are items that management and investors ordinarily identify and consider separately to better understand the underlying trends in the business.

Santander has aligned the information in this chapter with the underlying information used internally for management reporting and with that presented in the Group's other public documents.

Santander's executive committee has been selected to be its chief operating decision maker. The Group's operating segments reflect its organizational and managerial structures. The executive committee reviews internal reporting based on these segments to assess performance and allocate resources.

The segments are split by geographic area in which profits are earned and type of business. We prepare the information by aggregating the figures for Santander’s various geographic areas and business units, relating it to both the accounting data of the business units integrated in each segment and that provided by management information systems. The same general principles as those used in the Group are applied.

With the aim of increasing transparency and improving capital allocation to continue enhancing our profitability, on 4 April 2022, we announced that, starting and effective with the financial information for the first quarter of 2022, inclusive, we would carry out the following modifications to our reporting:

a. Main changes in the composition of Grupo Santander's segments announced in April 2022

The main changes, which have been applied to management information for all periods included in the consolidated financial statements, are the following:

1.Reallocation of certain financial costs from the Corporate Centre to the country units:

•Further clarity in the MREL/TLAC regulation makes it possible to better allocate the cost of eligible debt issuances to the country units.

•Other financial costs, primarily associated with the cost of funding the excess capital held by the country units above the Group's CET1 ratio, have been reassigned accordingly.

2.Downsizing of Other Europe:

•The Corporate & Investment Banking branches of Banco Santander, S.A. in Europe and other business lines previously reported under 'Other Europe' have been now integrated into the Spain unit to reflect how the business will be managed and supervised, in line with other regions.

The Group recast the corresponding information of earlier periods considering the changes included in this section to facilitate a homogeneous comparison.

In addition to these changes, we completed the usual annual adjustment of the perimeter of the Global Customer Relationship Model between Retail Banking and Santander Corporate & Investment Banking and between Retail Banking and Wealth Management & Insurance.