FORM 6-K SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 For the month of October, 2022 Commission File Number: 001-12518 Banco Santander, S.A. (Exact name of registrant as specified in its charter) Ciudad Grupo Santander 28660 Boadilla del Monte (Madrid) Spain (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ☐ No ☒ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ☐ No ☒

BANCO SANTANDER, S.A. ________________________ TABLE OF CONTENTS Item 1. January - September 2022 Earnings presentation

Earnings Presentation — 9M’22 26 October 2022

2 Important information Non-IFRS and alternative performance measures This presentation contains, in addition to the financial information prepared in accordance with International Financial Reporting Standards (“IFRS”) and derived from our financial statements, alternative performance measures (“APMs”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 (ESMA/2015/1415en) and other non-IFRS measures (“Non-IFRS Measures”). These financial measures that qualify as APMs and non-IFRS measures have been calculated with information from the Banco Santander Group; however those financial measures are not defined or detailed in the applicable financial reporting framework nor have been audited or reviewed by our auditors. We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider these APMs and non-IFRS measures to be useful metrics for our management and investors to compare operating performance between accounting periods, as these measures exclude items outside the ordinary course performance of our business, which are grouped in the “management adjustment” line and are further detailed in Section 3.2 of the Economic and Financial Review in our Directors’ Report included in our Annual Report on Form 20-F for the year ended 31 December 2021. Nonetheless, these APMs and non-IFRS measures should be considered supplemental information to, and are not meant to substitute IFRS measures. Furthermore, companies in our industry and others may calculate or use APMs and non-IFRS measures differently, thus making them less useful for comparison purposes. For further details on APMs and Non-IFRS Measures, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2021 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the “SEC”) on 1 March 2022, as updated by the Form 6-K filed with the SEC on 8 April 2022 in order to reflect our new organizational and reporting structure, as well as the section “Alternative performance measures” of the annex to the Banco Santander, S.A. (“Santander”) Q3 2022 Financial Report, published as Inside Information on 26 October 2022. These documents are available on Santander’s website (www.santander.com). Underlying measures, which are included in this presentation, are non-IFRS measures. This presentation also contains statements on emissions and other climate-related performance data, statistics, metrics and/or targets (the “ESG Data”). The ESG Data are not financial data and are non-IFRS data. Such ESG Data are non-audited estimates, continue to evolve and may be based on assumptions believed to be reasonable at the time of preparation, but should not be considered guarantees. The ESG Data is for informational purposes only, is not intended to be comprehensive and does not constitute investment, legal or tax advice. The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the included businesses and local applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries. Forward-looking statements Santander advises that this presentation contains “forward-looking statements” as per the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words like “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”, “future”, “commitment”, “commit”, “focus”, “pledge” and similar expressions. Found throughout this presentation, they include (but are not limited to) statements on our future business development, performance, shareholder remuneration policy and ESG Data. However, a number of risks, uncertainties and other important factors may cause actual developments and results to differ materially from those anticipated, expected, projected or assumed in forward-looking statements. The following important factors, in addition to other factors discussed elsewhere in this presentation and other risk factors, uncertainties or contingencies detailed in our most recent Form 20-F and subsequent 6-Ks filed with, or furnished to, the SEC, as well as other unknown or unpredictable factors, could affect our future development and results and could cause materially different outcomes from those anticipated, expected, projected or assumed in forward- looking statements: (1) general economic or industry conditions of areas where we have significant operations or investments (such as a worse economic environment; higher volatility in the capital markets; inflation or deflation; changes in demographics, consumer spending, investment or saving habits; energy prices; and the effects of the war in Ukraine or the COVID-19 pandemic in the global economy); (2) climate-related conditions, regulations, targets and weather events; (3) exposure to various market risks (particularly interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices); (4) potential losses from early repayments on our loan and investment portfolio, declines in value of collateral securing our loan portfolio, and counterparty risk; (5) political stability in Spain, the United Kingdom, other European countries, Latin America and the United States; (6) changes in legislation, regulations, taxes, including regulatory capital and liquidity requirements, especially in view of the United Kingdom exit from the European Union and increased regulation in response to financial crises; (7) our ability to integrate successfully our acquisitions and related challenges that result from the inherent diversion of management’s focus and resources from other strategic opportunities and operational matters; and (8) changes in our access to liquidity and funding on acceptable terms, in particular if resulting from credit spreads shifts or downgrade in credit ratings for the entire Santander, the Banco Santander Group or significant subsidiaries.

3 Important information Forward looking statements are based on current expectations and future estimates about Santander’s and third-parties’ operations and businesses and address matters that are uncertain to varying degrees, including, but not limited to developing standards that may change in the future; plans, projections, expectations, targets, objectives, strategies and goals relating to environmental, social, safety and governance performance, including expectations regarding future execution of Santander’s and third-parties’ energy and climate strategies, and the underlying assumptions and estimated impacts on Santander’s and third-parties’ businesses related thereto; Santander’s and third-parties’ approach, plans and expectations in relation to carbon use and targeted reductions of emissions; changes in operations or investments under existing or future environmental laws and regulations; and changes in government regulations and regulatory requirements, including those related to climate-related initiatives. Forward-looking statements are aspirational, should be regarded as indicative, preliminary and for illustrative purposes only, speak only as of the date of this presentation, are informed by the knowledge, information and views available on such date and are subject to change without notice. Santander is not required to update or revise any forward-looking statements, regardless of new information, future events or otherwise, except as required by applicable law. No offer The information contained in this presentation is subject to, and must be read in conjunction with, all other publicly available information, including, where relevant any fuller disclosure document published by Santander. Any person at any time acquiring securities must do so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in this presentation. No investment activity should be undertaken on the basis of the information contained in this presentation. In making this presentation available Santander gives no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever. Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities. No offering of securities shall be made in the United States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000. Historical performance is not indicative of future results Statements about historical performance must not be construed to indicate that future performance, share price or results (including earnings per share) in any future period will necessarily match or exceed those of any prior period. Nothing in this presentation should be taken as a profit forecast. Third Party Information In this presentation, Santander relies on and refers to certain information and statistics obtained from publicly-available information and third-party sources, which it believes to be reliable. Neither Santander nor its directors, officers and employees have independently verified the accuracy or completeness of any such publicly-available and third-party information, make any representation or warranty as to the quality, fitness for a particular purpose, non-infringement, accuracy or completeness of such information or undertake any obligation to update such information after the date of this presentation. In no event shall Santander be liable for any use by any party of, for any decision made or action taken by any party in reliance upon, or for inaccuracies or errors in, or omission from, such publicly-available and third-party information contained herein. Any sources of publicly-available information and third-party information referred or contained herein retain all rights with respect to such information and use of such information herein shall not be deemed to grant a license to any third party.

4 Index 1 Appendix 3 Group and Business areas review Final remarks 2 4 9M'22 Highlights

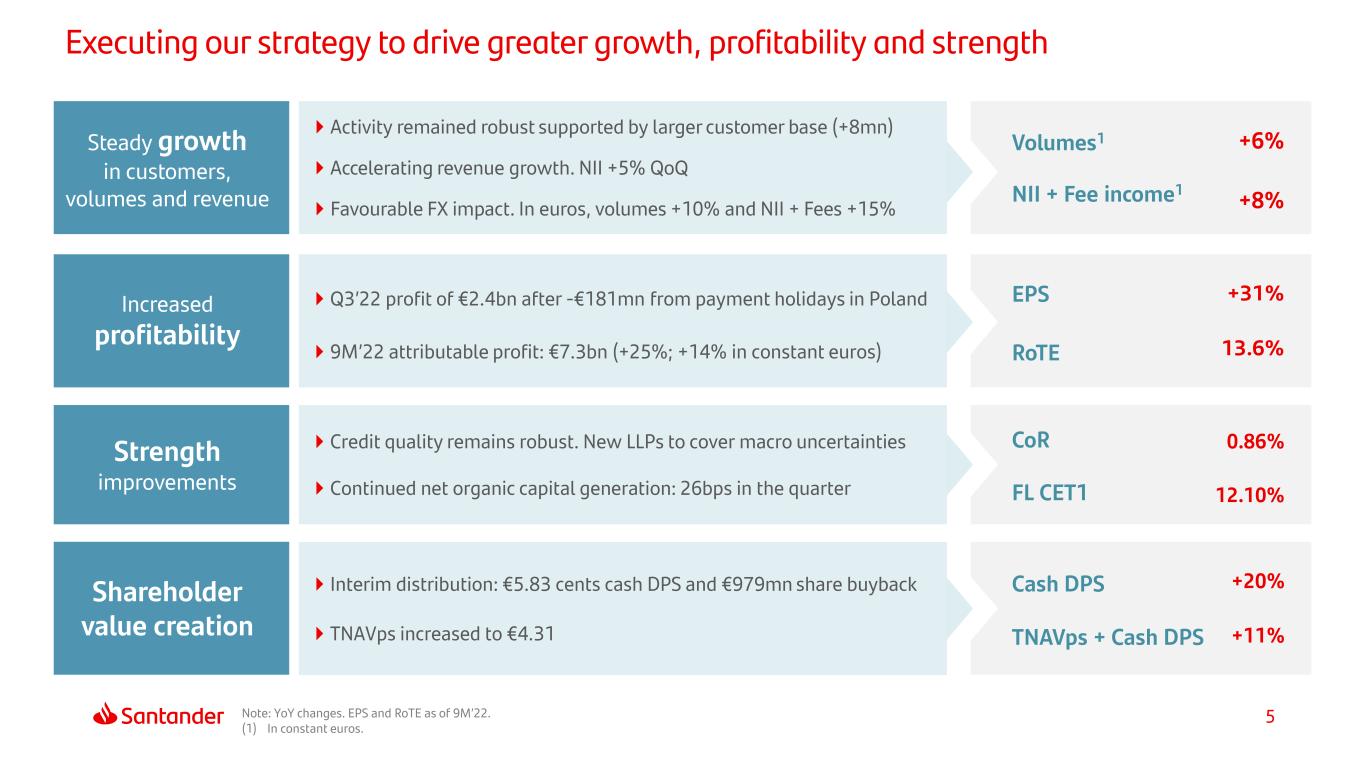

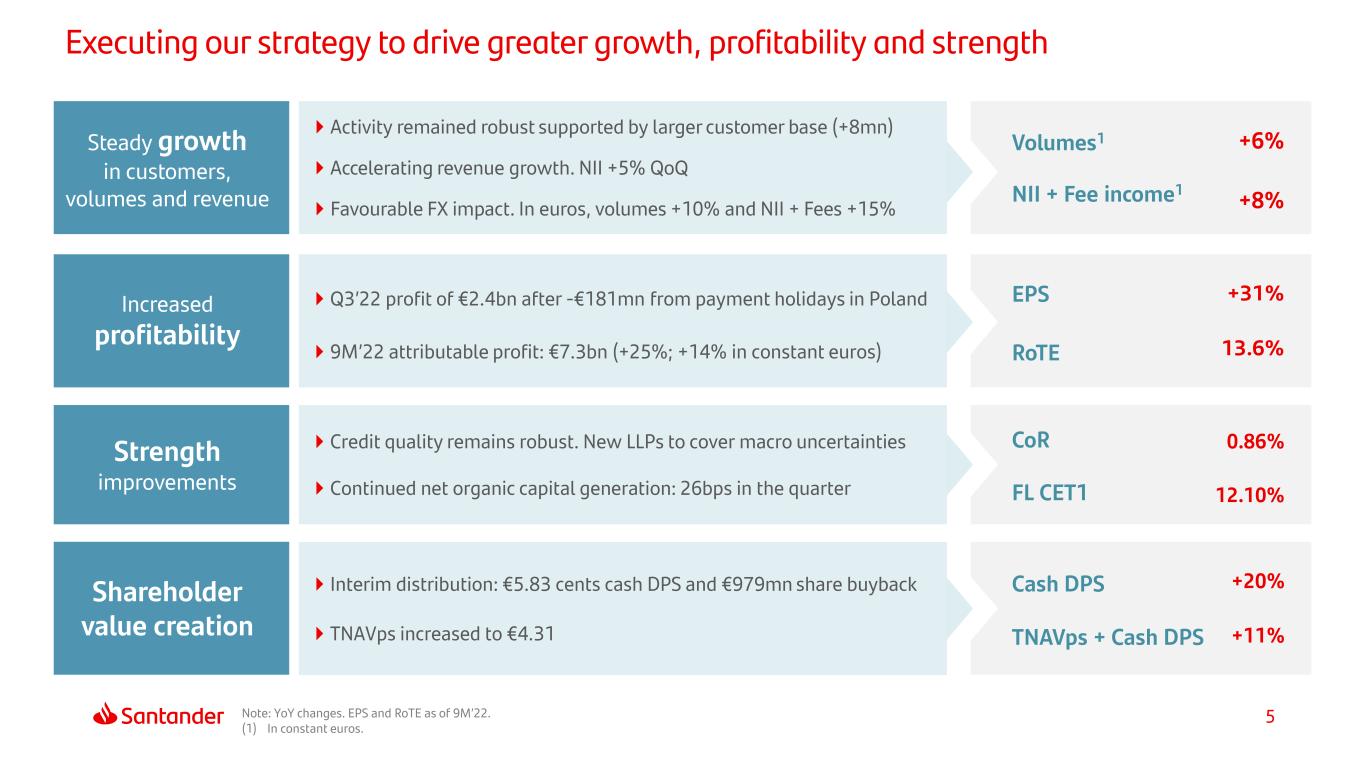

5 Executing our strategy to drive greater growth, profitability and strength Note: YoY changes. EPS and RoTE as of 9M’22. (1) In constant euros. Activity remained robust supported by larger customer base (+8mn) Accelerating revenue growth. NII +5% QoQ Favourable FX impact. In euros, volumes +10% and NII + Fees +15% Q3’22 profit of €2.4bn after -€181mn from payment holidays in Poland 9M’22 attributable profit: €7.3bn (+25%; +14% in constant euros) Credit quality remains robust. New LLPs to cover macro uncertainties Continued net organic capital generation: 26bps in the quarter Interim distribution: €5.83 cents cash DPS and €979mn share buyback TNAVps increased to €4.31 Steady growth in customers, volumes and revenue Volumes1 NII + Fee income1 Increased profitability EPS RoTE Strength improvements CoR FL CET1 Shareholder value creation TNAVps + Cash DPS Cash DPS +6% +8% +31% 13.6% 0.86% 12.10% +20% +11%

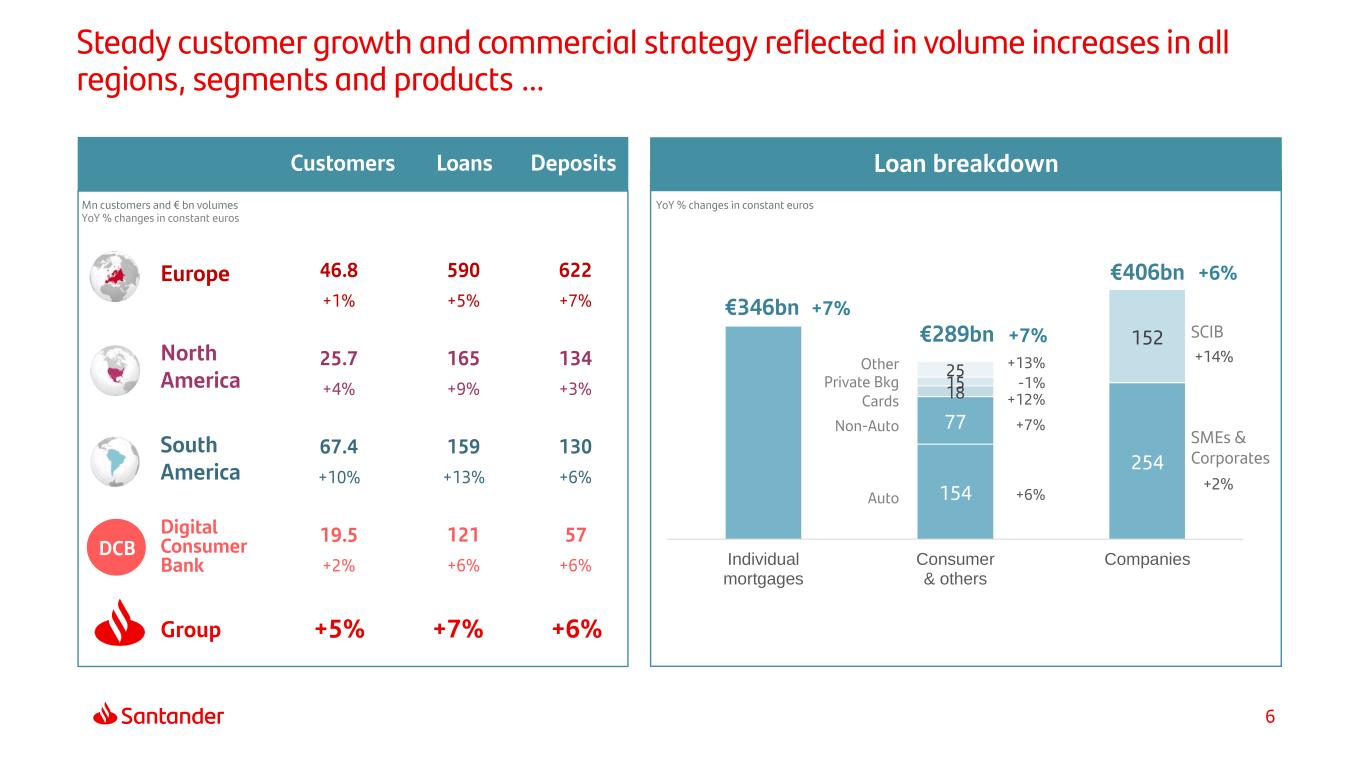

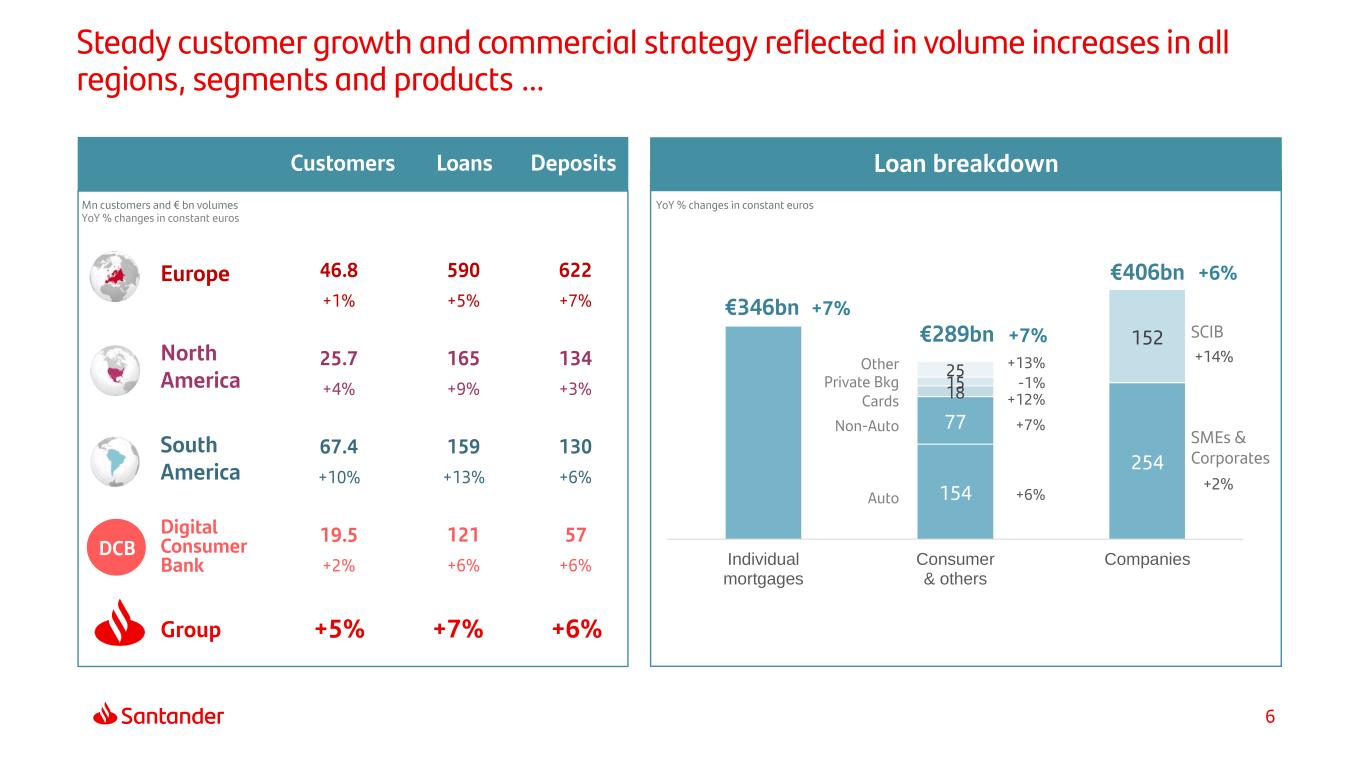

6 Steady customer growth and commercial strategy reflected in volume increases in all regions, segments and products … Europe South America North America DCB DepositsLoans Digital Consumer Bank SMEs & Corporates 154 254 77 152 18 15 25 €346bn €289bn €406bn Individual mortgages Consumer & others Companies Loan breakdown SCIB Auto Non-Auto Cards Private Bkg Other +7% +6% +7% +12% -1% +13% +7% +6% +2% Customers 622 +7% 134 +3% 130 +6% 57 +6% 590 +5% 165 +9% 159 +13% 121 +6% 46.8 +1% 25.7 +4% 67.4 +10% 19.5 +2% Mn customers and € bn volumes YoY % changes in constant euros YoY % changes in constant euros Group +5% +7% +6% +14%

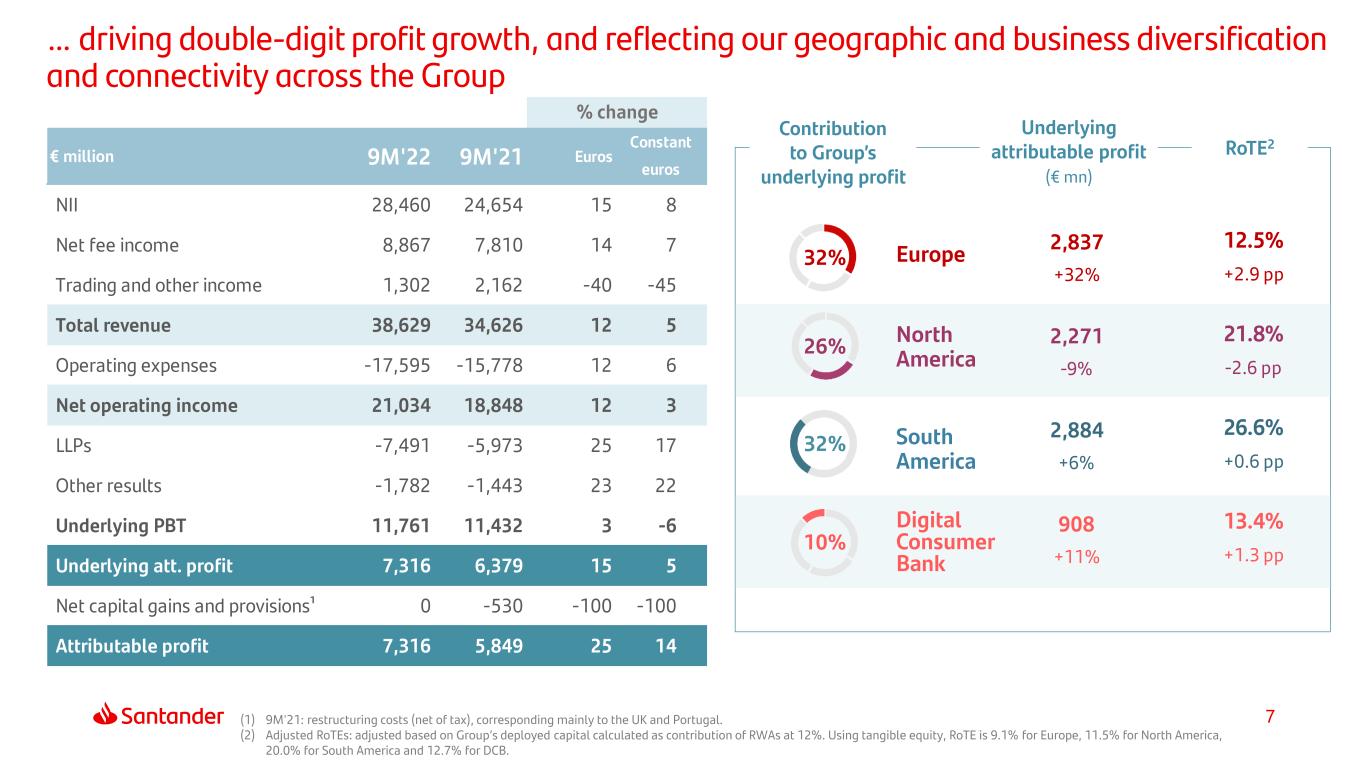

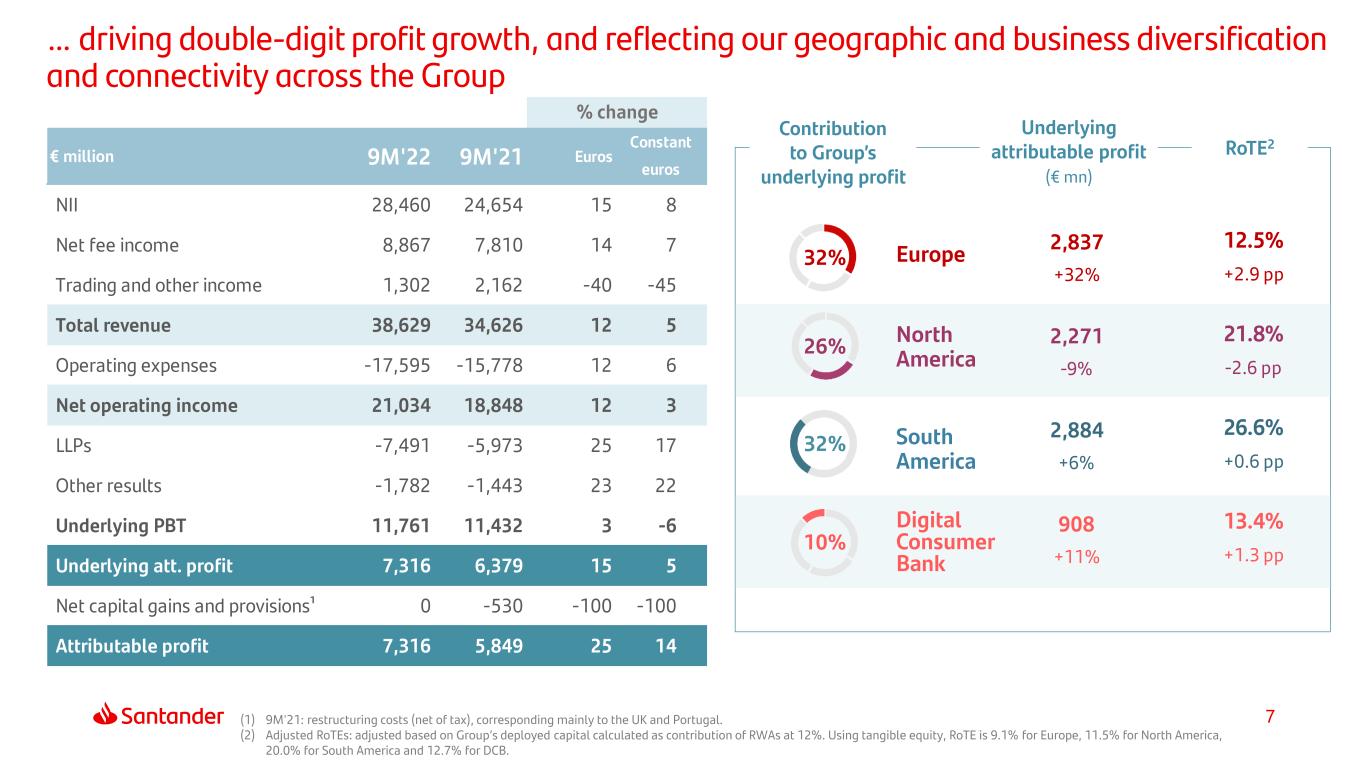

7(1) 9M'21: restructuring costs (net of tax), corresponding mainly to the UK and Portugal. (2) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 9.1% for Europe, 11.5% for North America, 20.0% for South America and 12.7% for DCB. … driving double-digit profit growth, and reflecting our geographic and business diversification and connectivity across the Group € million 9M'22 9M'21 Euros NII 28,460 24,654 15 8 Net fee income 8,867 7,810 14 7 Trading and other income 1,302 2,162 -40 -45 Total revenue 38,629 34,626 12 5 Operating expenses -17,595 -15,778 12 6 Net operating income 21,034 18,848 12 3 LLPs -7,491 -5,973 25 17 Other results -1,782 -1,443 23 22 Underlying PBT 11,761 11,432 3 -6 Underlying att. profit 7,316 6,379 15 5 Net capital gains and provisions¹ 0 -530 -100 -100 Attributable profit 7,316 5,849 25 14 % change Constant euros Europe South America North America Digital Consumer Bank Underlying attributable profit (€ mn) Contribution to Group’s underlying profit 32% 26% 32% 10% RoTE2 12.5% +2.9 pp 21.8% -2.6 pp 26.6% +0.6 pp 13.4% +1.3 pp 2,837 +32% 2,271 -9% 2,884 +6% 908 +11%

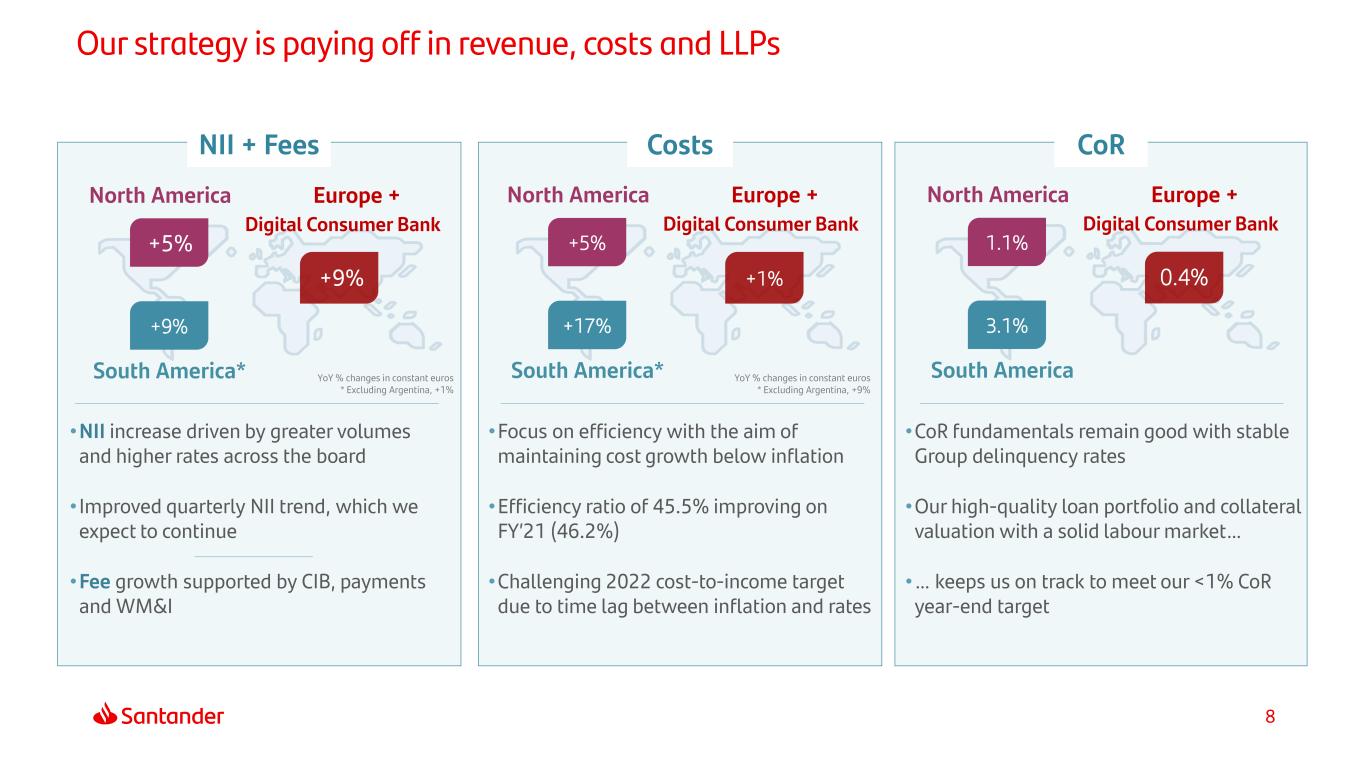

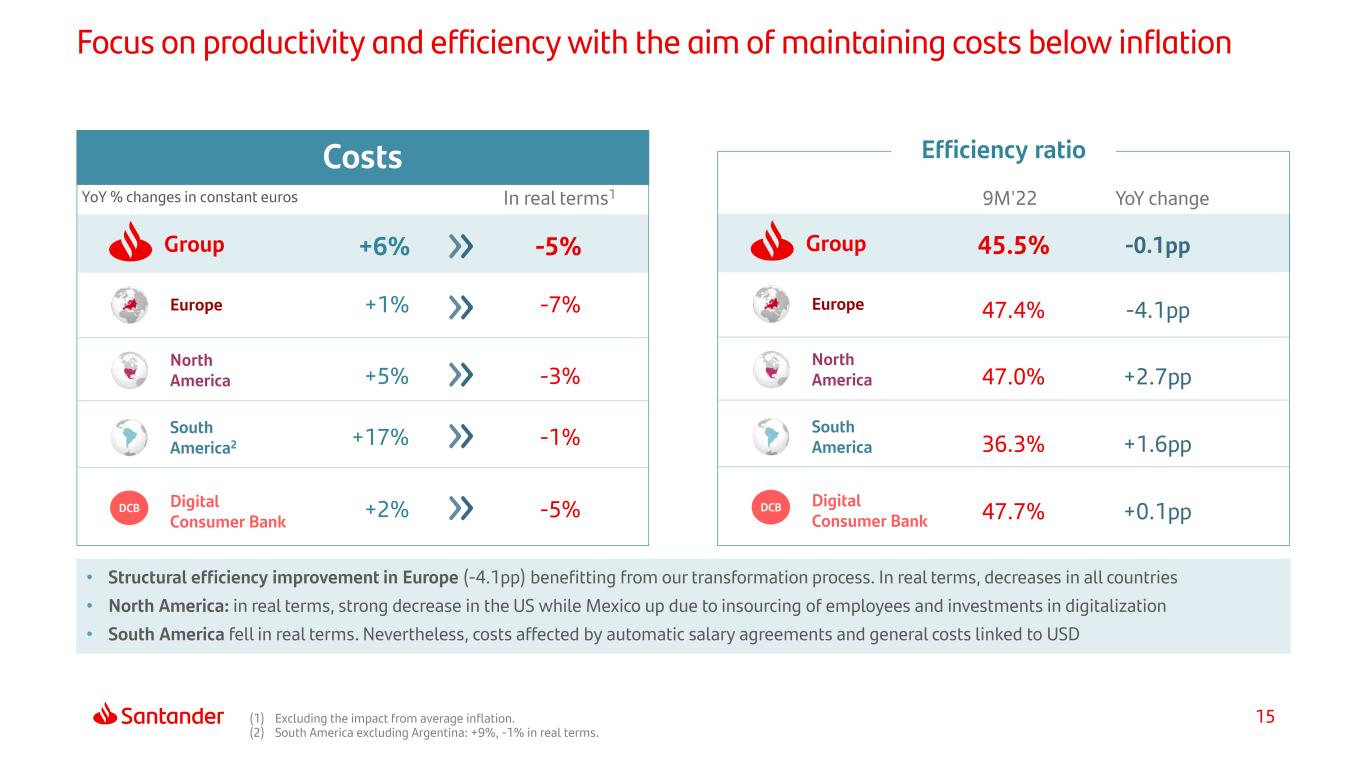

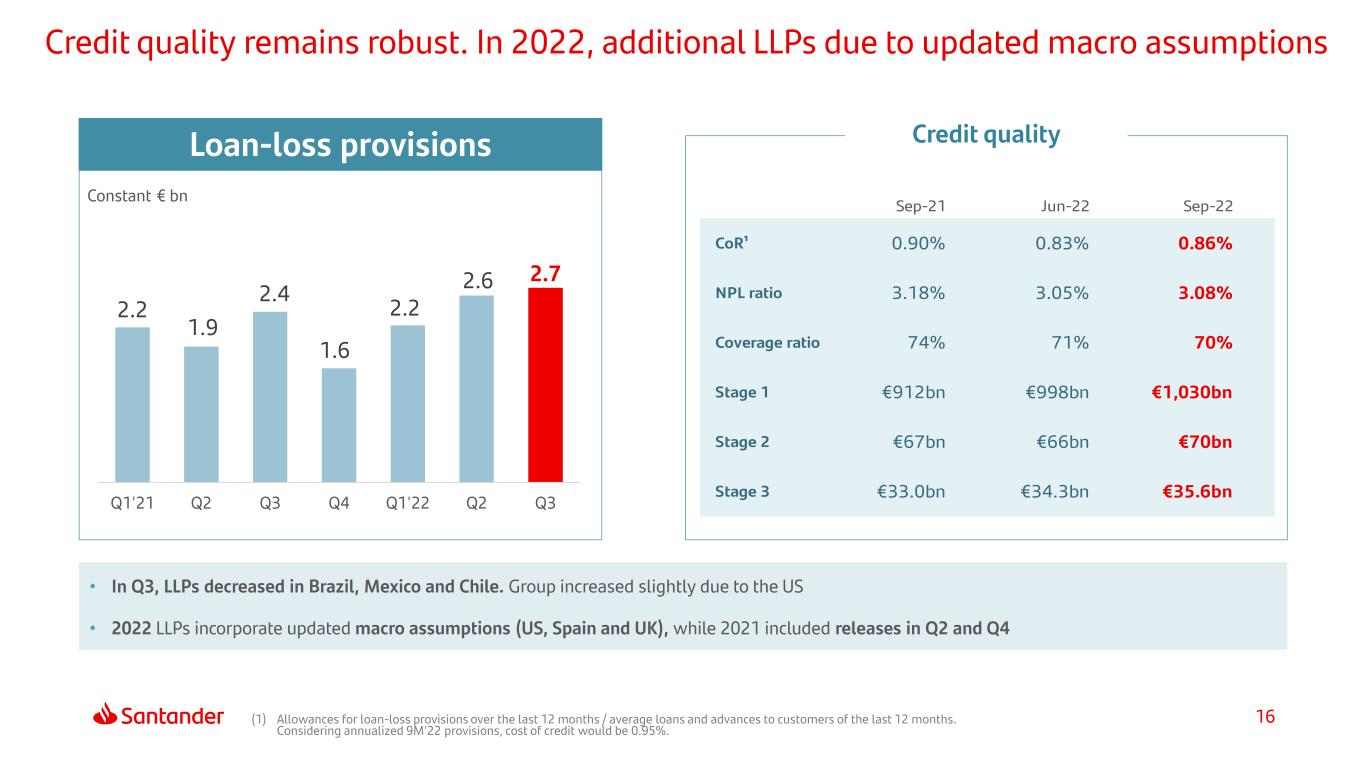

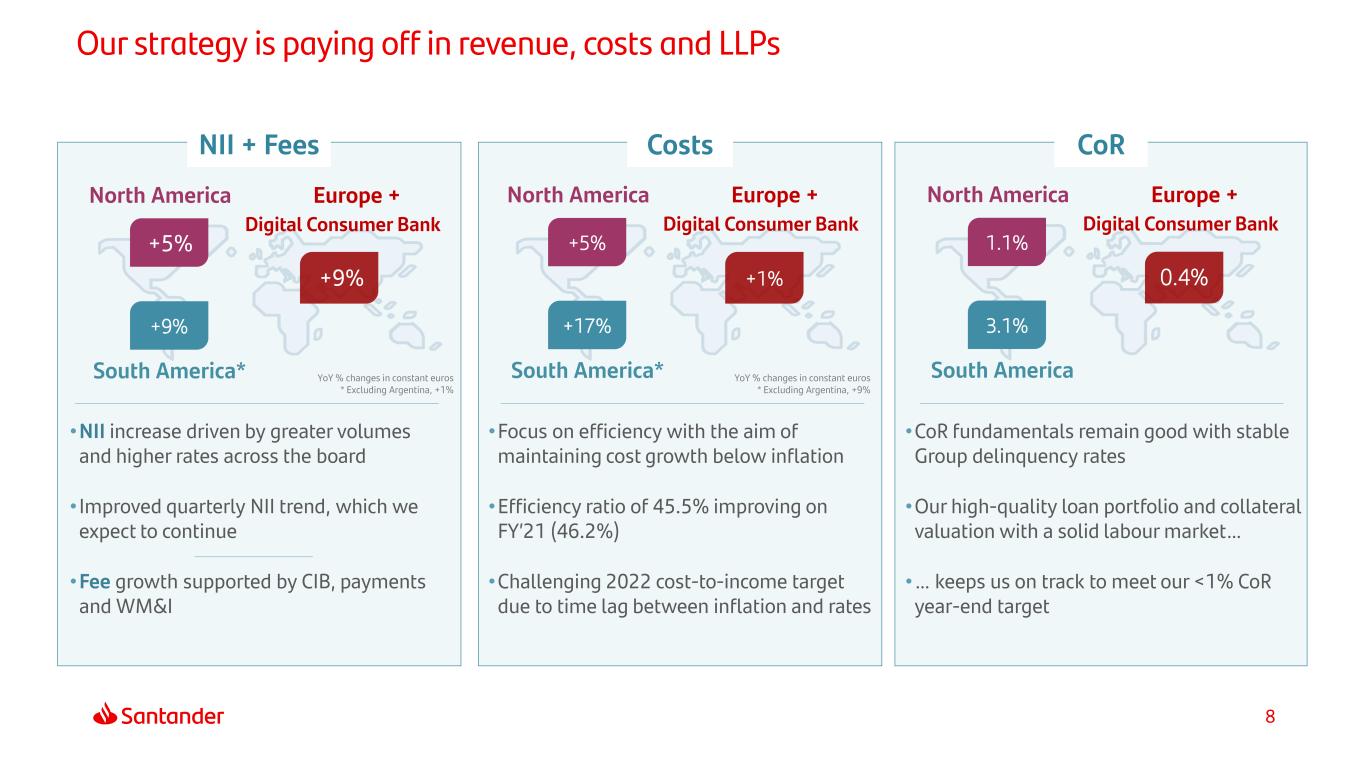

8 Our strategy is paying off in revenue, costs and LLPs CostsNII + Fees CoR •NII increase driven by greater volumes and higher rates across the board • Improved quarterly NII trend, which we expect to continue •Fee growth supported by CIB, payments and WM&I •Focus on efficiency with the aim of maintaining cost growth below inflation •Efficiency ratio of 45.5% improving on FY’21 (46.2%) •Challenging 2022 cost-to-income target due to time lag between inflation and rates •CoR fundamentals remain good with stable Group delinquency rates •Our high-quality loan portfolio and collateral valuation with a solid labour market… •… keeps us on track to meet our <1% CoR year-end target North America South America* Europe + Digital Consumer Bank +9% North America South America* Europe + Digital Consumer Bank +5% +1% +17% North America South America Europe + Digital Consumer Bank 1.1% 0.4% 3.1% YoY % changes in constant euros * Excluding Argentina, +1% +5% +9% YoY % changes in constant euros * Excluding Argentina, +9%

9 11.8% 13.6% 9M'21 9M'22 3.99 4.31 Sep-21 Sep-22 Delivering shareholder value: enhanced profitability, TNAVps and dividend per share … (1) The board of directors has approved the payment of the first interim cash dividend against H1’22 results from 2 November and the repurchase programme is expected to commence once the applicable regulatory approval has been obtained. (2) % change versus 2021 first interim dividend. RoTE € TNAV per share TNAV + Dividend per share: +3% QoQ +11% YoY 31.3 40.9 9M'21 9M'22 EPS € cents Cash dividend per share: €5.83 cents (+20%2) Share buyback programme: €979mn Interim distribution1 in Nov-22 Total value c.€2.0bn 40% of H1’22 underlying profit

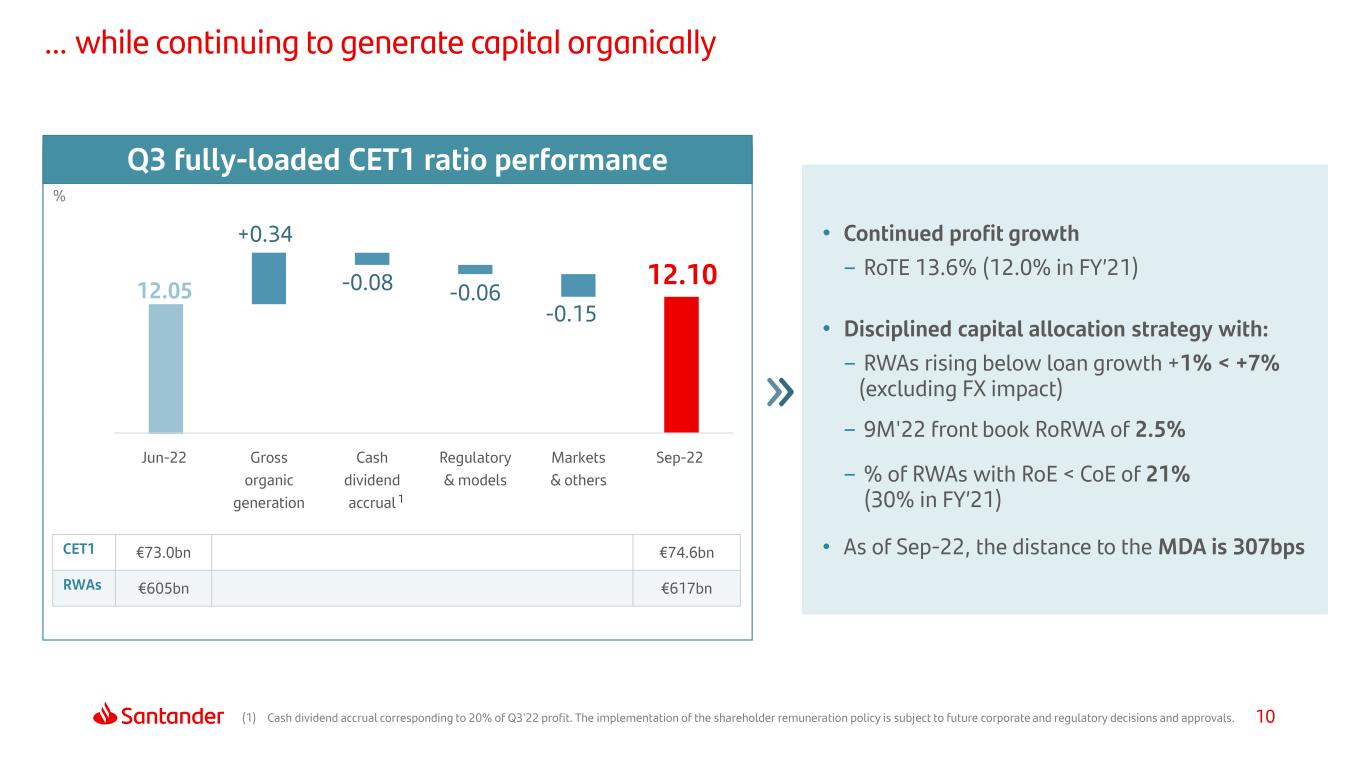

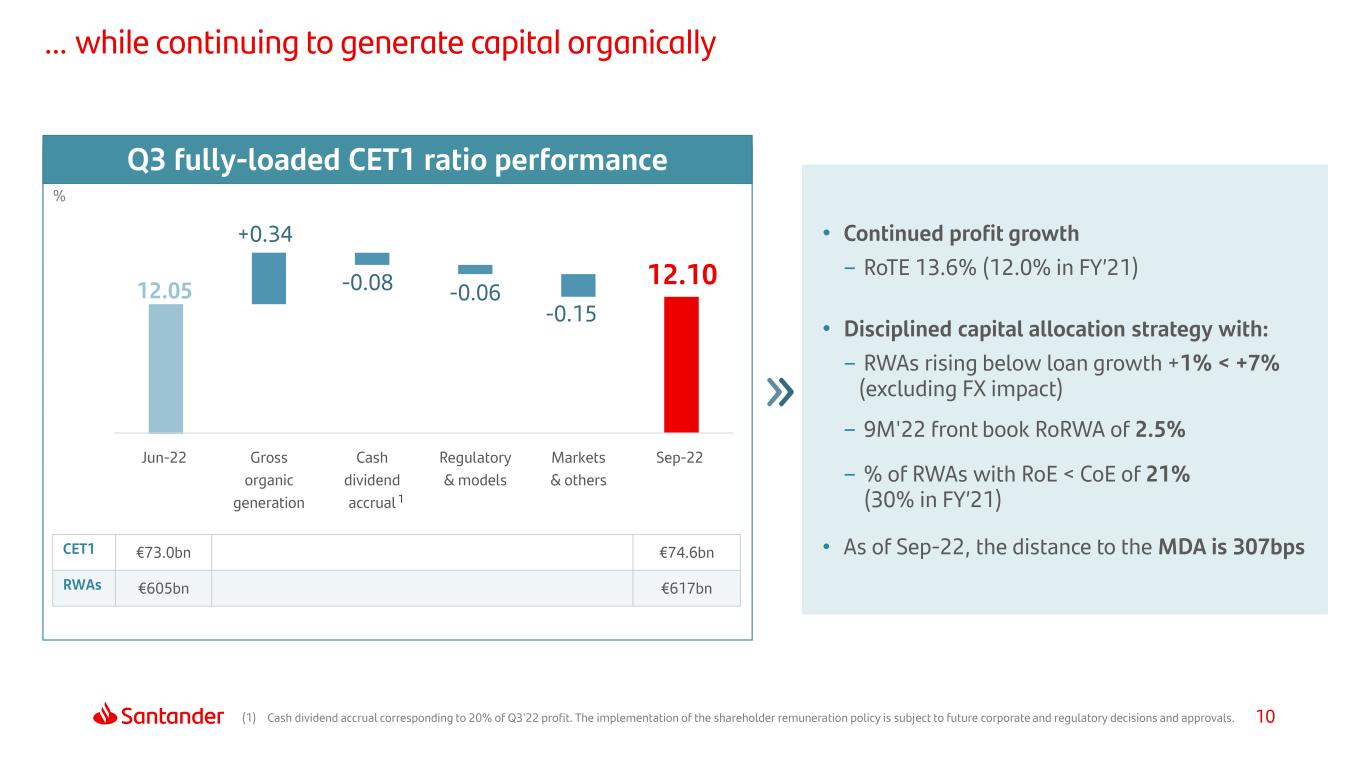

10 … while continuing to generate capital organically (1) Cash dividend accrual corresponding to 20% of Q3'22 profit. The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals. 12.10-0.08 -0.06 -0.15 12.05 +0.34 Jun-22 Gross organic generation Cash dividend accrual Regulatory & models Markets & others Sep-22 1 • Continued profit growth – RoTE 13.6% (12.0% in FY’21) • Disciplined capital allocation strategy with: – RWAs rising below loan growth +1% < +7% (excluding FX impact) – 9M'22 front book RoRWA of 2.5% – % of RWAs with RoE < CoE of 21% (30% in FY’21) • As of Sep-22, the distance to the MDA is 307bps % Q3 fully-loaded CET1 ratio performance CET1 €73.0bn €74.6bn RWAs €605bn €617bn

11 Index 1 Appendix 3 Group and Business areas review Final remarks 2 4 9M'22 Highlights

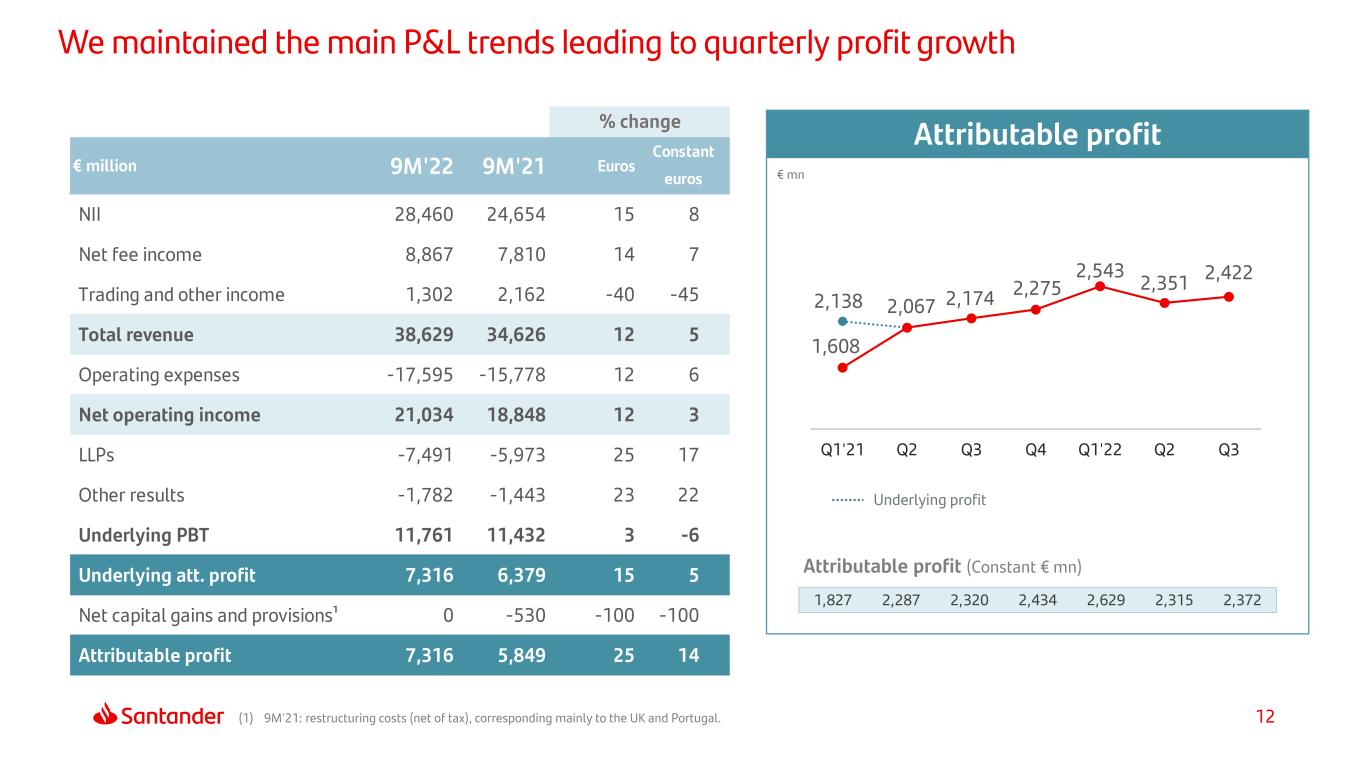

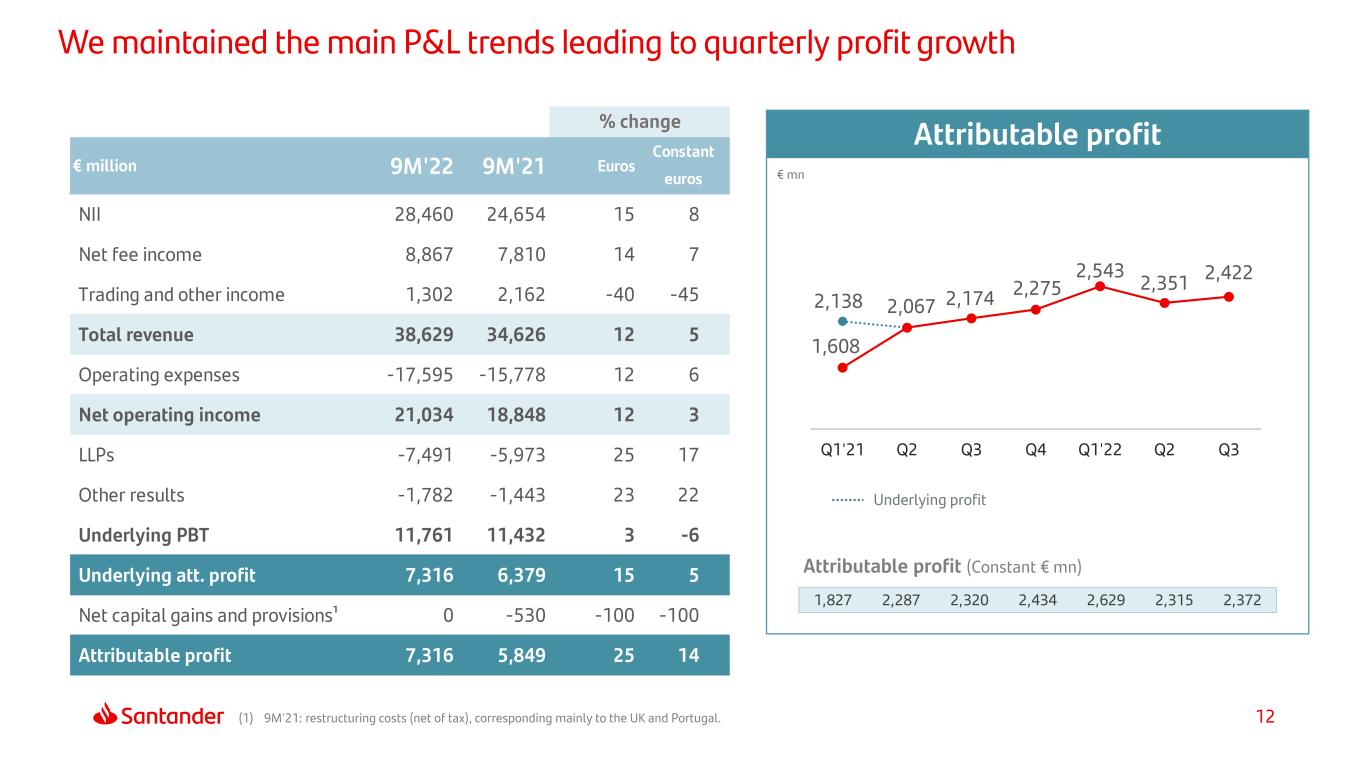

12(1) 9M'21: restructuring costs (net of tax), corresponding mainly to the UK and Portugal. We maintained the main P&L trends leading to quarterly profit growth 1,608 2,067 2,174 2,275 2,543 2,351 2,422 2,138 Q1'21 Q2 Q3 Q4 Q1'22 Q2 Q3 Attributable profit (Constant € mn) € mn Attributable profit Underlying profit € million 9M'22 9M'21 Euros NII 28,460 24,654 15 8 Net fee income 8,867 7,810 14 7 Trading and other income 1,302 2,162 -40 -45 Total revenue 38,629 34,626 12 5 Operating expenses -17,595 -15,778 12 6 Net operating income 21,034 18,848 12 3 LLPs -7,491 -5,973 25 17 Other results -1,782 -1,443 23 22 Underlying PBT 11,761 11,432 3 -6 Underlying att. profit 7,316 6,379 15 5 Net capital gains and provisions¹ 0 -530 -100 -100 Attributable profit 7,316 5,849 25 14 % change Constant euros 1,827 2,287 2,320 2,434 2,629 2,315 2,372

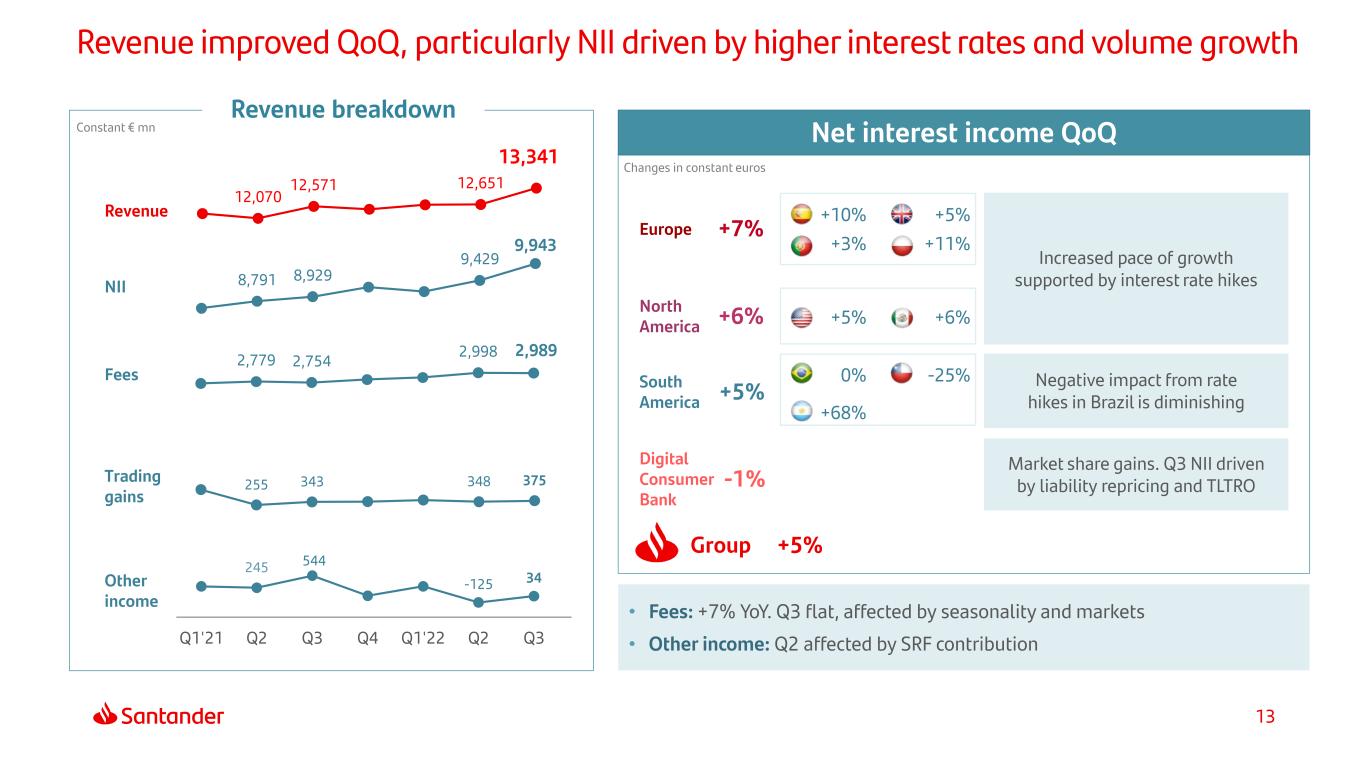

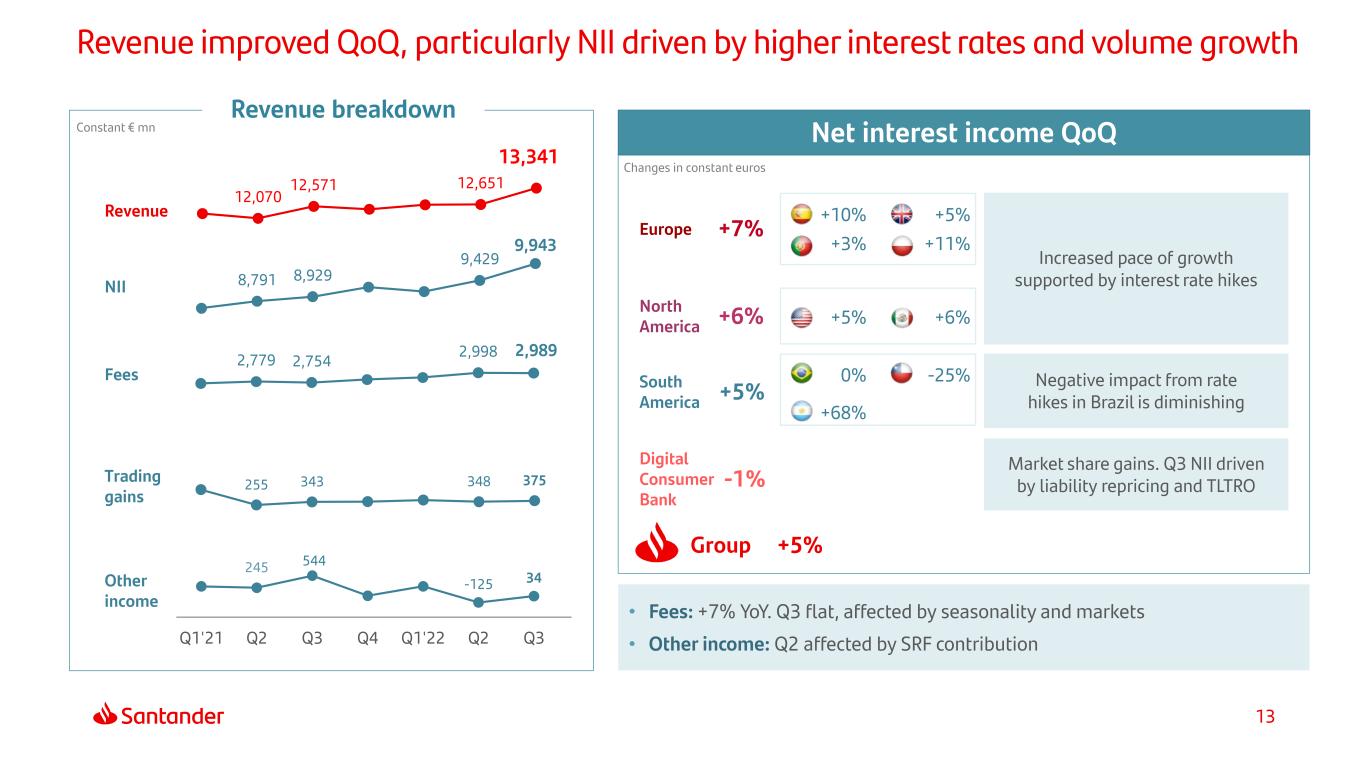

13 +10% +5% +3% +11% 0% -25% +68% 12,070 12,571 12,651 13,341 Revenue improved QoQ, particularly NII driven by higher interest rates and volume growth Fees NII Revenue breakdown Constant € mn 255 343 348 375Trading gains Other income Revenue 245 544 -125 34 Q1'21 Q2 Q3 Q4 Q1'22 Q2 Q3 2,779 2,754 2,998 2,989 Europe North America South America Digital Consumer Bank Net interest income QoQ • Fees: +7% YoY. Q3 flat, affected by seasonality and markets • Other income: Q2 affected by SRF contribution Increased pace of growth supported by interest rate hikes Negative impact from rate hikes in Brazil is diminishing Market share gains. Q3 NII driven by liability repricing and TLTRO Group 8,791 8,929 9,429 9,943 +7% +6% +5% +5% +6% -1% +5% Changes in constant euros

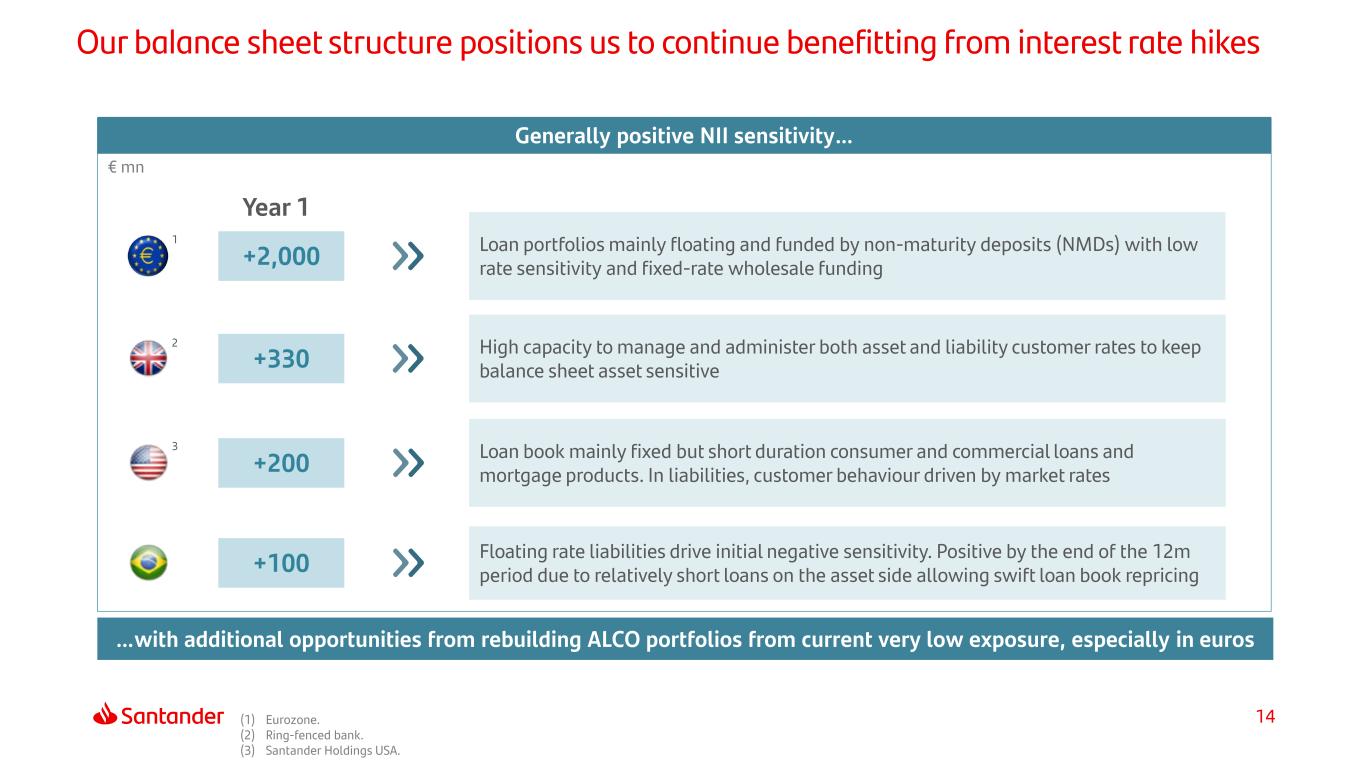

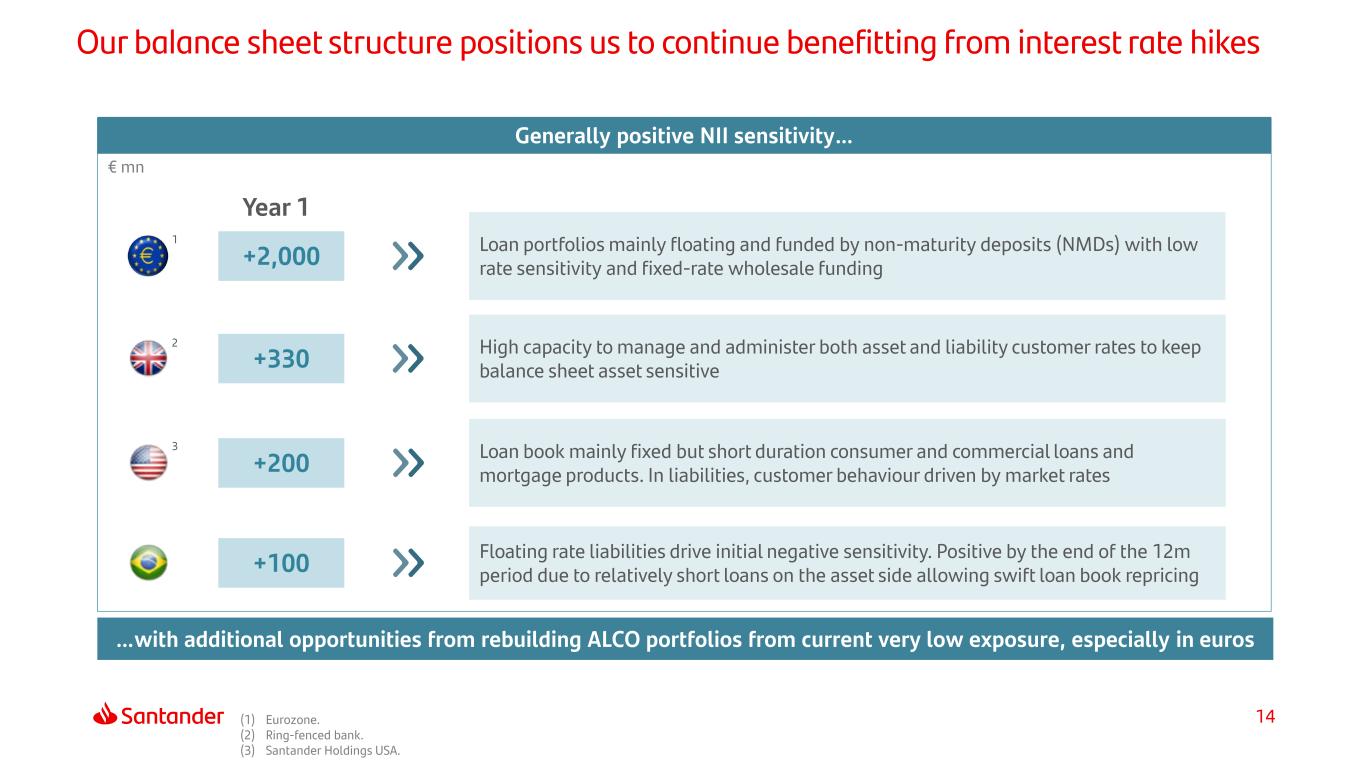

14 Our balance sheet structure positions us to continue benefitting from interest rate hikes Generally positive NII sensitivity… € mn High capacity to manage and administer both asset and liability customer rates to keep balance sheet asset sensitive Loan book mainly fixed but short duration consumer and commercial loans and mortgage products. In liabilities, customer behaviour driven by market rates Floating rate liabilities drive initial negative sensitivity. Positive by the end of the 12m period due to relatively short loans on the asset side allowing swift loan book repricing Loan portfolios mainly floating and funded by non-maturity deposits (NMDs) with low rate sensitivity and fixed-rate wholesale funding 1 2 3 …with additional opportunities from rebuilding ALCO portfolios from current very low exposure, especially in euros +2,000 +330 +200 +100 Year 1 (1) Eurozone. (2) Ring-fenced bank. (3) Santander Holdings USA.

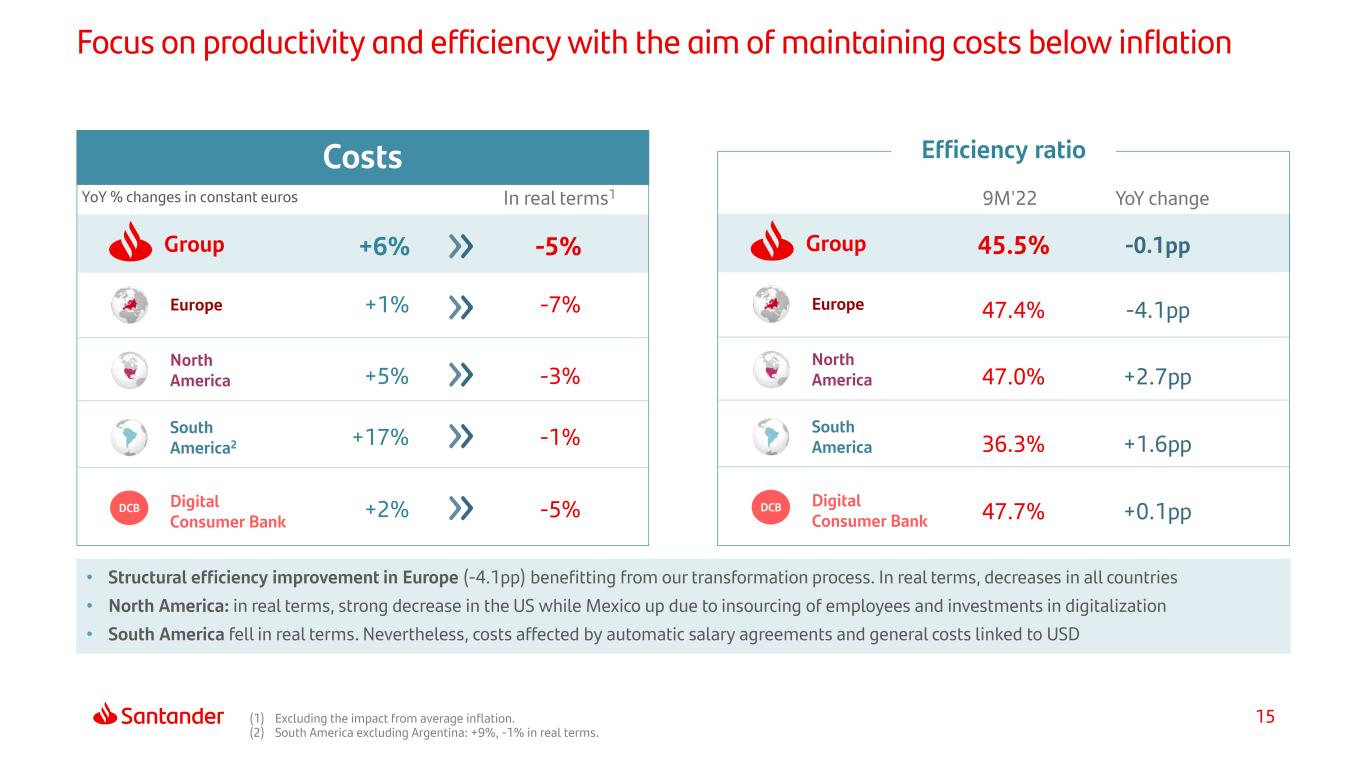

15 Focus on productivity and efficiency with the aim of maintaining costs below inflation In real terms1YoY % changes in constant euros DCB Europe North America South America Digital Consumer Bank Group 9M'22 YoY change 45.5% -0.1pp 47.4% -4.1pp 47.0% +2.7pp 36.3% +1.6pp 47.7% +0.1ppDCB Europe North America South America2 Digital Consumer Bank Group +1% -7% +5% -3% +17% -1% +2% -5% +6% -5% • Structural efficiency improvement in Europe (-4.1pp) benefitting from our transformation process. In real terms, decreases in all countries • North America: in real terms, strong decrease in the US while Mexico up due to insourcing of employees and investments in digitalization • South America fell in real terms. Nevertheless, costs affected by automatic salary agreements and general costs linked to USD Costs Efficiency ratio (1) Excluding the impact from average inflation. (2) South America excluding Argentina: +9%, -1% in real terms.

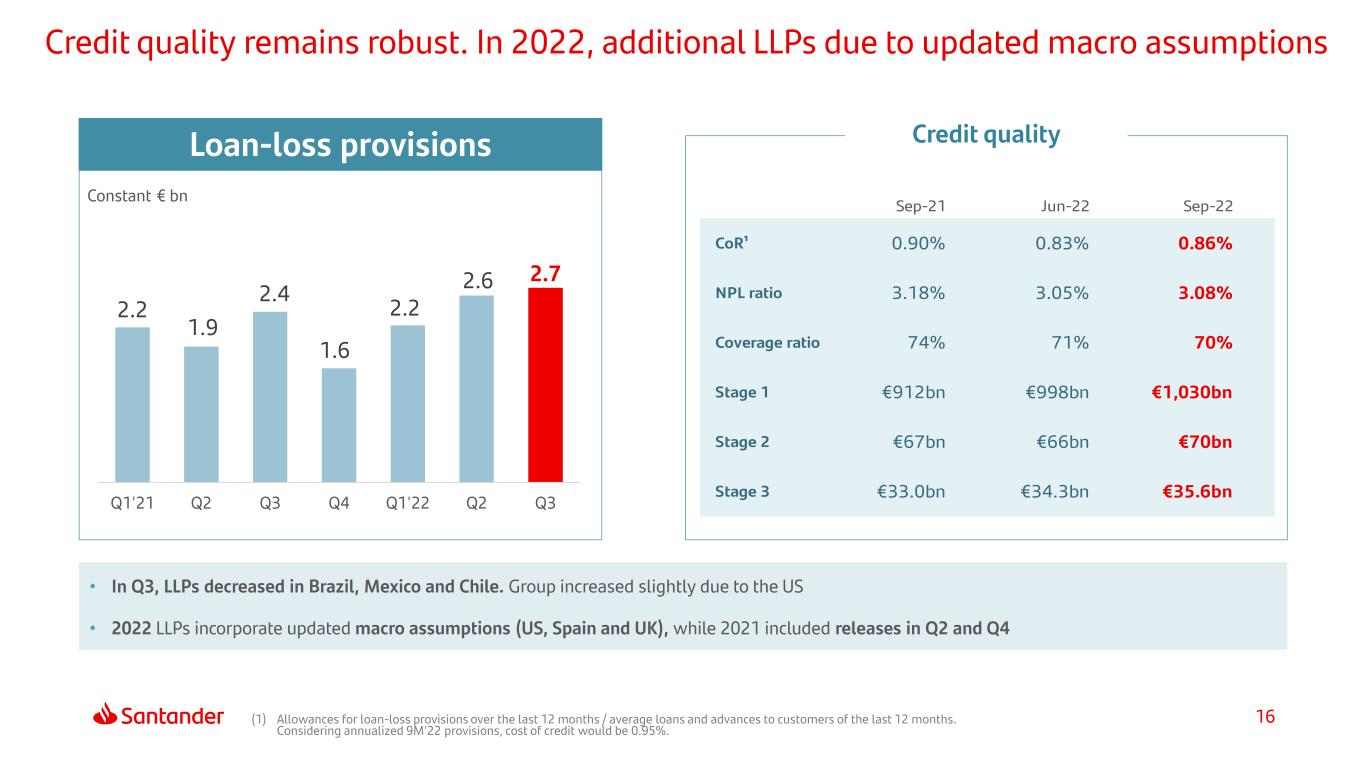

16 Sep-21 Jun-22 Sep-22 CoR¹ 0.90% 0.83% 0.86% NPL ratio 3.18% 3.05% 3.08% Coverage ratio 74% 71% 70% Stage 1 €912bn €998bn €1,030bn Stage 2 €67bn €66bn €70bn Stage 3 €33.0bn €34.3bn €35.6bn 2.2 1.9 2.4 1.6 2.2 2.6 2.7 Q1'21 Q2 Q3 Q4 Q1'22 Q2 Q3 Constant € bn Credit quality remains robust. In 2022, additional LLPs due to updated macro assumptions Loan-loss provisions Credit quality • In Q3, LLPs decreased in Brazil, Mexico and Chile. Group increased slightly due to the US • 2022 LLPs incorporate updated macro assumptions (US, Spain and UK), while 2021 included releases in Q2 and Q4 (1) Allowances for loan-loss provisions over the last 12 months / average loans and advances to customers of the last 12 months. Considering annualized 9M'22 provisions, cost of credit would be 0.95%.

17 Spain Highly-collateralized and diversified loan portfolio whose key macro drivers are expected to remain resilient • Average mortgage portfolio LTV of 62%. Average house prices 30% lower than 2008 (in real terms) • 75% of the mortgage portfolio at variable rate • Corporates improved avg. rating in the last 12M and ICO portfolio performed better than expected • Below historical average unemployment rate, improved to 34% of housing affordability1 (53% in 2008) • Simple average mortgage LTV of 40%. 12% of portfolio at variable rate • Less than 5% of the mortgage book has LTV over 80% (12% in 2015) • Unemployment rate at low levels; affordability rate2 at 34% (vs 44% in 2008) • High quality portfolio: as of today c.80% of the total portfolio in the US is prime • Historically low unemployment rate • Used car prices above historical average (Manheim index: 200 currently vs 137 on average over the last 15 years) • CoR of 4.5% increased due to unsecured lending to individuals (20% of total portfolio) • Focus on strengthening portfolio through growth in secured individuals, corporates and CIB • Positive macro outlook: 2023 GDP growth and low unemployment is expected Low-mid credit risk profile in all countries (1) Source: annual theorical affordability rate from Banco de España. (2) Source: Nationwide affordability indicators. Spain 25% UK 24% Portugal 4%Poland 3% Other Europe 1% US 12% Mexico 4% Brazil 9% Chile 4% Other South Am. 2% DCB 12% Loan portfolio breakdown Sep-22 €1,040bn High quality portfolio (82% concentrated in mature markets and 65% secured) UK USA Brazil

18 Detail by country and business

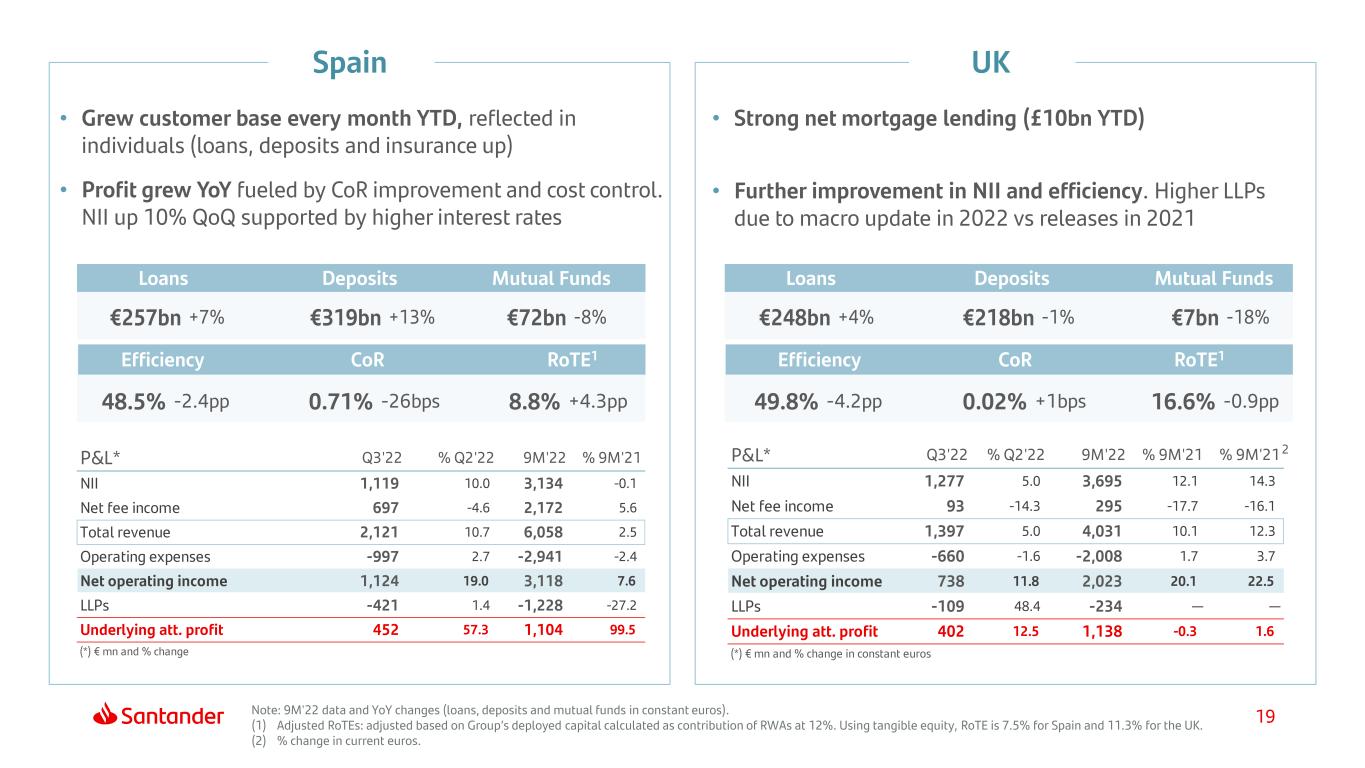

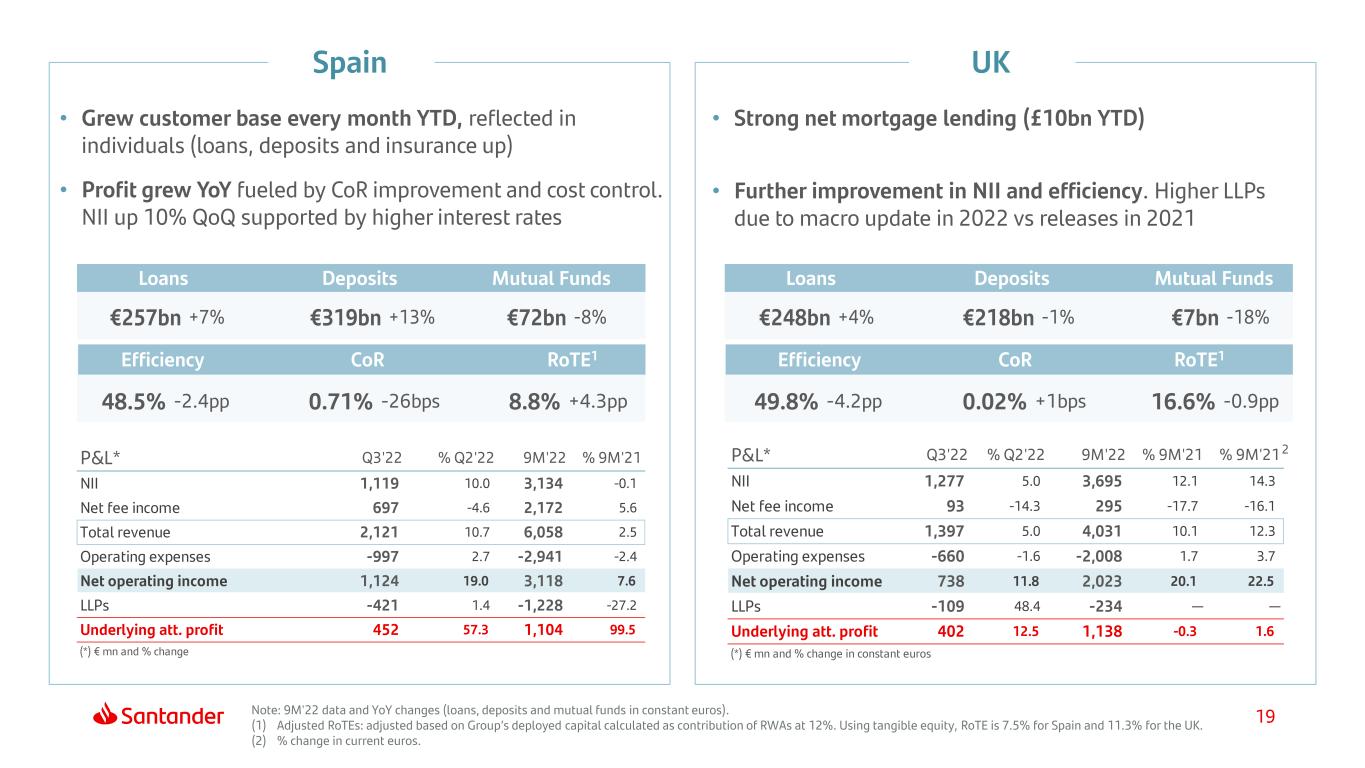

19 España and UK Spain UK Efficiency CoR RoTE1 P&L* Q3'22 % Q2'22 9M'22 % 9M'21 NII 1,119 10.0 3,134 -0.1 Net fee income 697 -4.6 2,172 5.6 Total revenue 2,121 10.7 6,058 2.5 Operating expenses -997 2.7 -2,941 -2.4 Net operating income 1,124 19.0 3,118 7.6 LLPs -421 1.4 -1,228 -27.2 Underlying att. profit 452 57.3 1,104 99.5 (*) € mn and % change €257bn +7% €319bn +13% €72bn -8% Loans Deposits Mutual Funds 48.5% -2.4pp 0.71% -26bps 8.8% +4.3pp Efficiency CoR RoTE1 Loans Deposits Mutual Funds €248bn +4% €218bn -1% €7bn -18% 49.8% -4.2pp 0.02% +1bps 16.6% -0.9pp Note: 9M'22 data and YoY changes (loans, deposits and mutual funds in constant euros). (1) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 7.5% for Spain and 11.3% for the UK. (2) % change in current euros. P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 1,277 5.0 3,695 12.1 14.3 Net fee income 93 -14.3 295 -17.7 -16.1 Total revenue 1,397 5.0 4,031 10.1 12.3 Operating expenses -660 -1.6 -2,008 1.7 3.7 Net operating income 738 11.8 2,023 20.1 22.5 LLPs -109 48.4 -234 — — Underlying att. profit 402 12.5 1,138 -0.3 1.6 (*) € mn and % change in constant euros 2 • Grew customer base every month YTD, reflected in individuals (loans, deposits and insurance up) • Profit grew YoY fueled by CoR improvement and cost control. NII up 10% QoQ supported by higher interest rates • Strong net mortgage lending (£10bn YTD) • Further improvement in NII and efficiency. Higher LLPs due to macro update in 2022 vs releases in 2021

20 US Mexico • Loans (CIB, CRE and Auto) and deposits increased while maintaining deposit costs relatively stable • High profit (c.€1.5bn) favoured by improved NII trend, despite LLP normalization and lower end of lease income • Successful customer attraction strategy (+1.3mn total customers YoY) reflected in loan volumes • Outstanding results and improved profitability driven by greater customer revenue and better credit quality USA and Mexico €121bn +8% €97bn +6% €15bn -10% 46.5% +3.9pp 0.87% -19bps 18.8% -6.1pp €43bn +13% €37bn -4% €15bn +8% 44.3% -0.2pp 1.86% -83bps 34.7% +7.1pp Note: 9M'22 data and YoY changes (loans, deposits and mutual funds in constant euros). (1) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 10.3% for the US and 16.6% for Mexico. (2) % change in current euros Efficiency CoR RoTE1 Loans Deposits Mutual Funds Efficiency CoR RoTE1 Loans Deposits Mutual Funds P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 1,669 5.4 4,546 2.4 15.3 Net fee income 194 -7.9 588 -13.9 -3.0 Total revenue 2,001 2.1 5,667 -8.6 2.9 Operating expenses -953 2.0 -2,635 -0.3 12.3 Net operating income 1,048 2.1 3,032 -14.8 -4.0 LLPs -513 45.6 -1,107 118.3 145.9 Underlying att. profit 399 -27.2 1,489 -23.7 -14.0 (*) € mn and % change in constant euros P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 950 6.4 2,556 11.8 25.1 Net fee income 303 1.8 831 20.3 34.7 Total revenue 1,216 4.1 3,312 12.0 25.3 Operating expenses -537 3.0 -1,467 11.4 24.7 Net operating income 679 5.0 1,845 12.5 25.9 LLPs -188 -2.6 -555 -23.0 -13.8 Underlying att. profit 328 5.5 874 32.8 48.6 (*) € mn and % change in constant euros 2 2

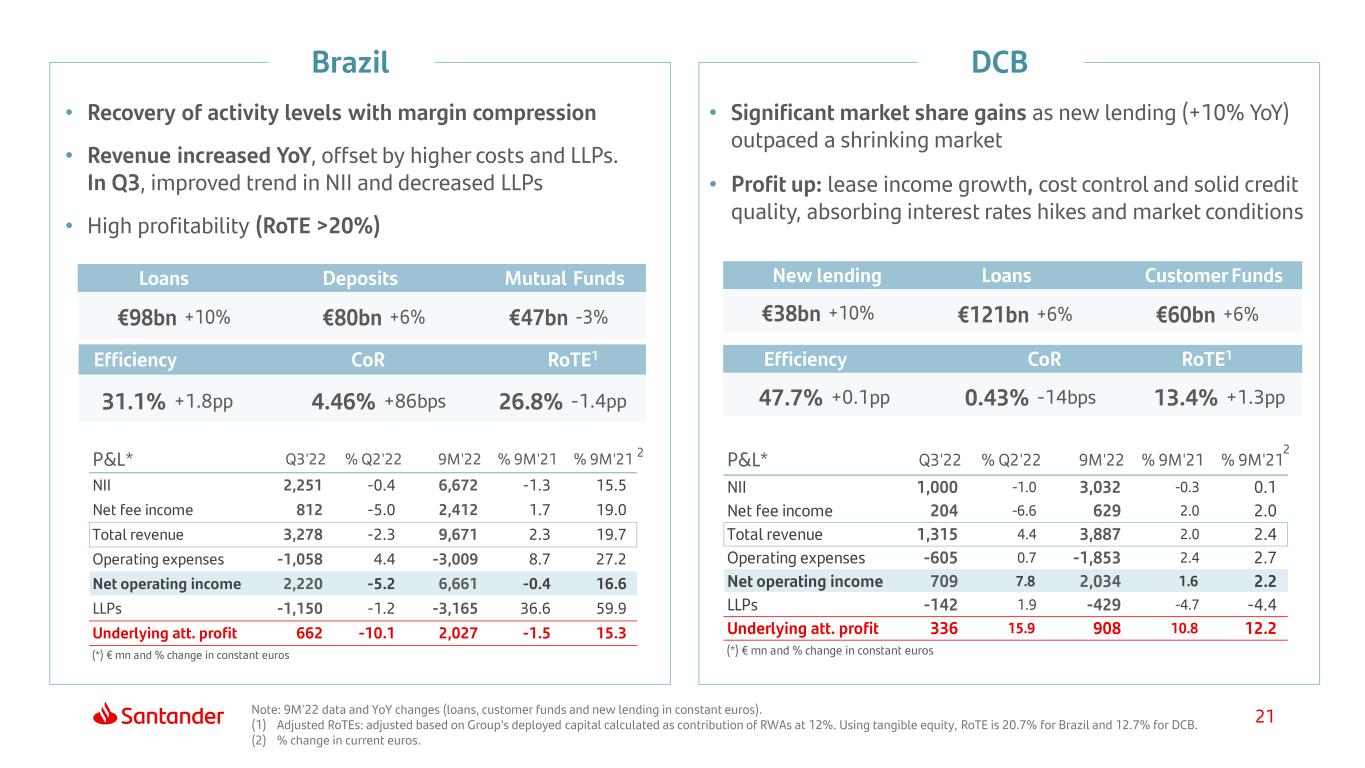

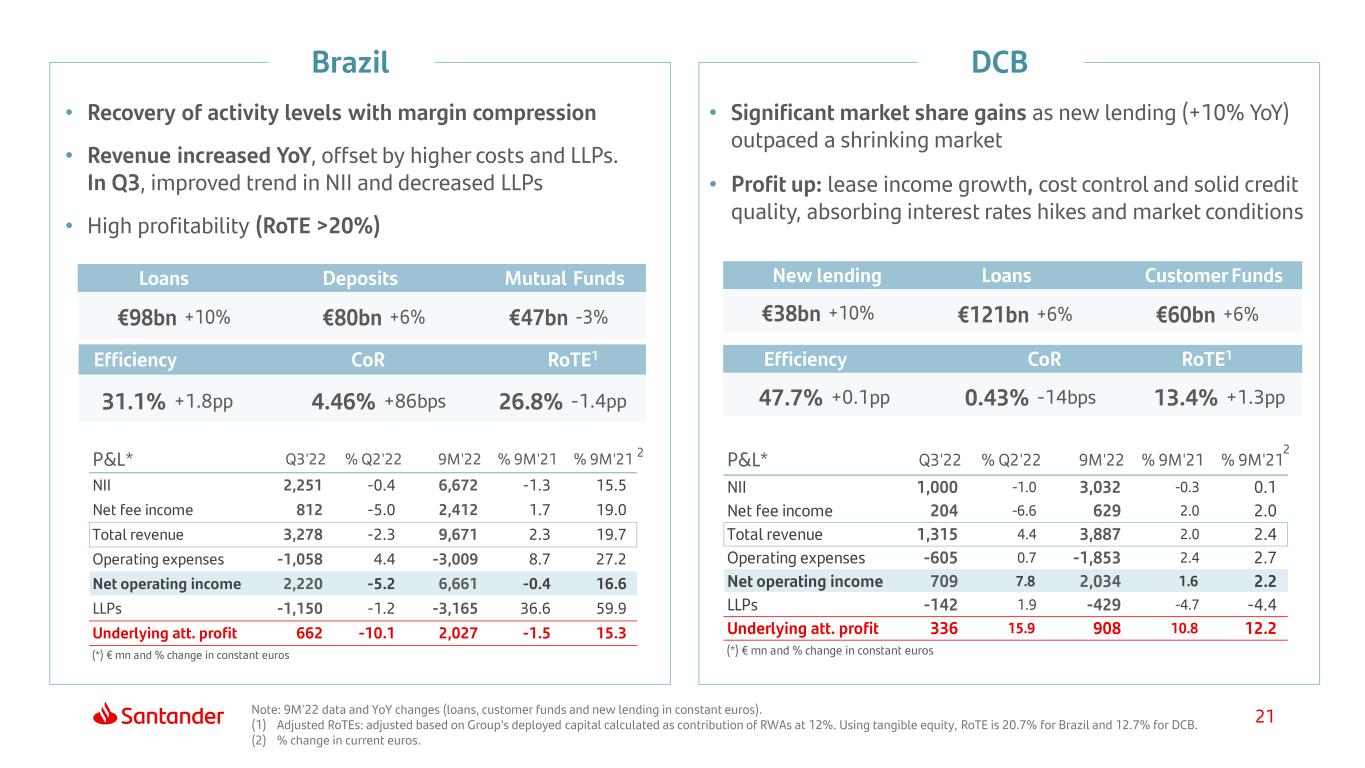

21 €98bn +10% €80bn +6% €47bn -3% 31.1% +1.8pp 4.46% +86bps 26.8% -1.4pp Note: 9M'22 data and YoY changes (loans, customer funds and new lending in constant euros). (1) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 20.7% for Brazil and 12.7% for DCB. (2) % change in current euros. Efficiency CoR RoTE1 Loans Deposits Mutual Funds Brazil • Recovery of activity levels with margin compression • Revenue increased YoY, offset by higher costs and LLPs. In Q3, improved trend in NII and decreased LLPs • High profitability (RoTE >20%) Brasil and DCB DCB New lending Loans Customer Funds Efficiency CoR RoTE1 €121bn +6% €60bn +6% 47.7% +0.1pp 0.43% -14bps 13.4% +1.3pp €38bn +10% P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 2,251 -0.4 6,672 -1.3 15.5 Net fee income 812 -5.0 2,412 1.7 19.0 Total revenue 3,278 -2.3 9,671 2.3 19.7 Operating expenses -1,058 4.4 -3,009 8.7 27.2 Net operating income 2,220 -5.2 6,661 -0.4 16.6 LLPs -1,150 -1.2 -3,165 36.6 59.9 Underlying att. profit 662 -10.1 2,027 -1.5 15.3 (*) € mn and % change in constant euros P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 1,000 -1.0 3,032 -0.3 0.1 Net fee income 204 -6.6 629 2.0 2.0 Total revenue 1,315 4.4 3,887 2.0 2.4 Operating expenses -605 0.7 -1,853 2.4 2.7 Net operating income 709 7.8 2,034 1.6 2.2 LLPs -142 1.9 -429 -4.7 -4.4 Underlying att. profit 336 15.9 908 10.8 12.2 (*) € mn and % change in constant euros 2 2 • Significant market share gains as new lending (+10% YoY) outpaced a shrinking market • Profit up: lease income growth, cost control and solid credit quality, absorbing interest rates hikes and market conditions

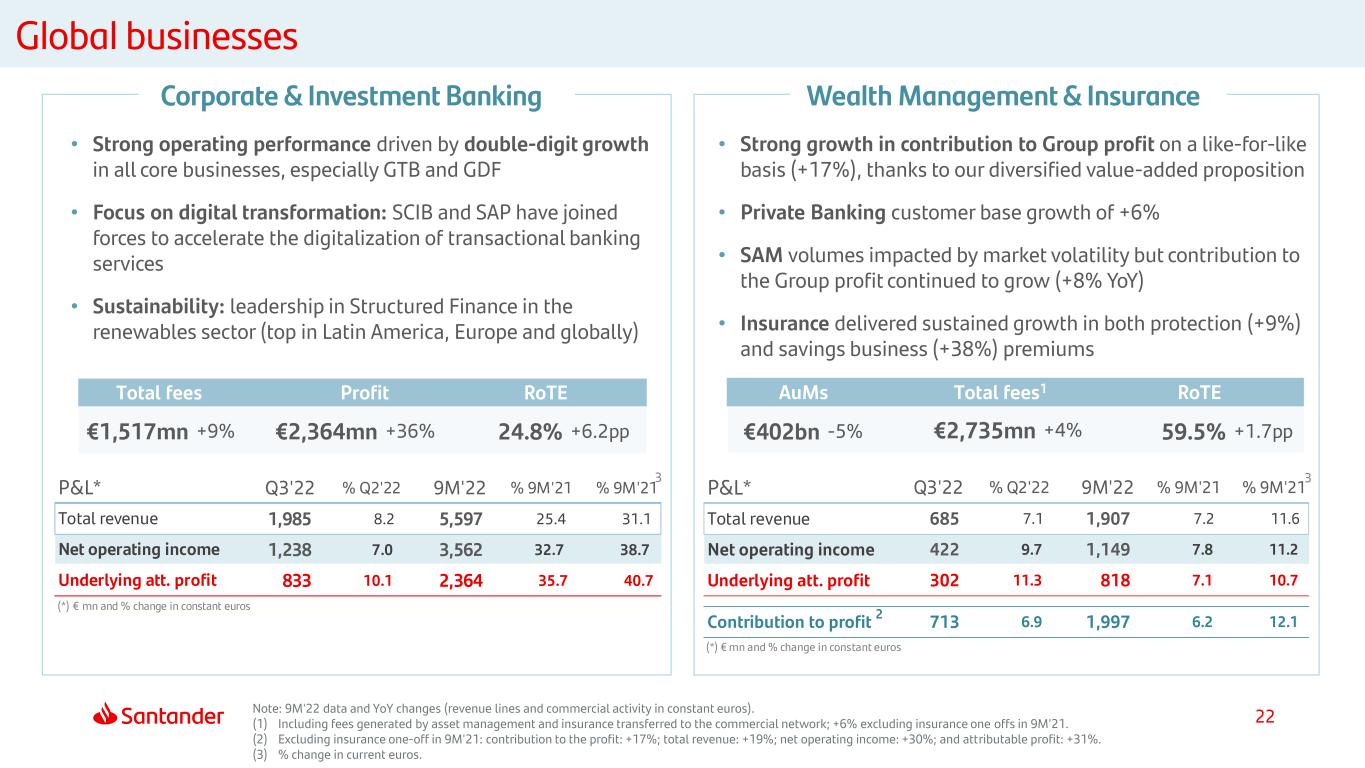

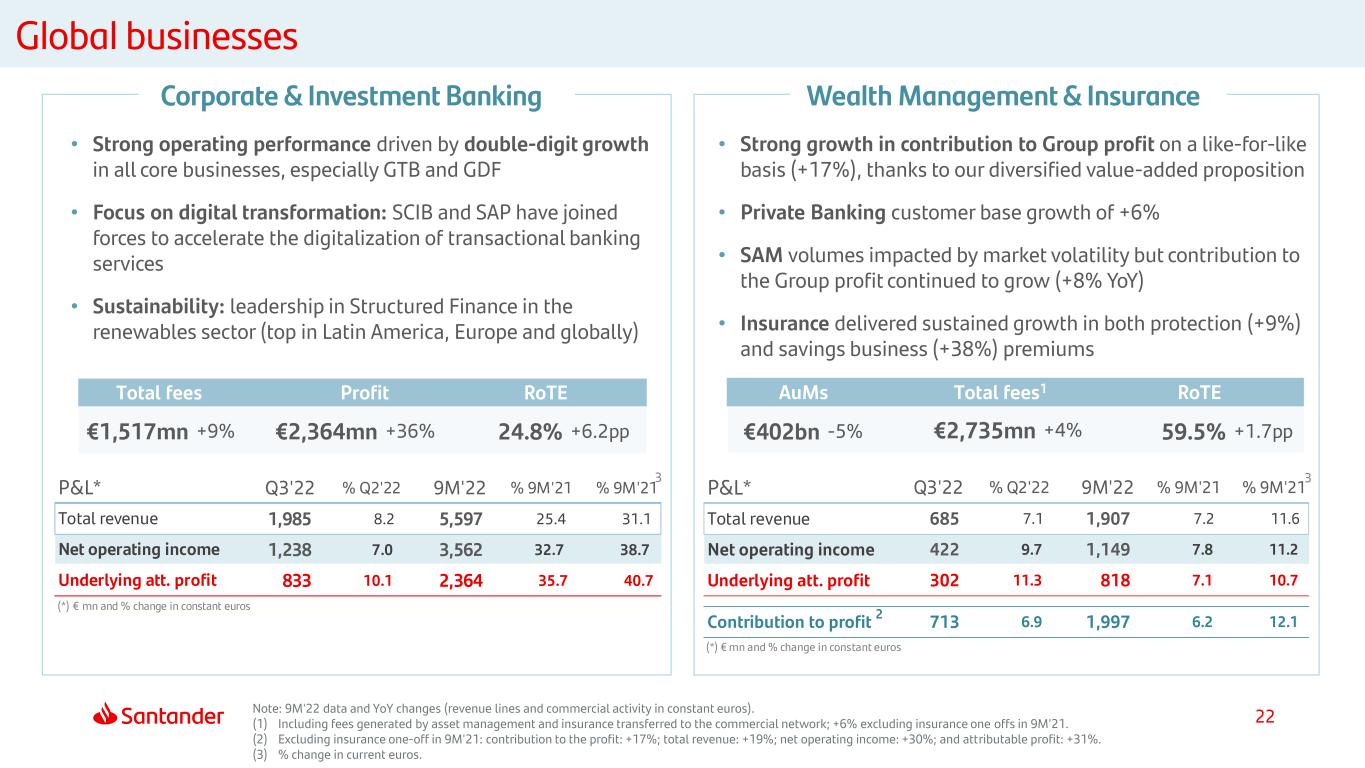

22 Total fees Profit RoTE AuMs Total fees1 RoTE • Strong growth in contribution to Group profit on a like-for-like basis (+17%), thanks to our diversified value-added proposition • Private Banking customer base growth of +6% • SAM volumes impacted by market volatility but contribution to the Group profit continued to grow (+8% YoY) • Insurance delivered sustained growth in both protection (+9%) and savings business (+38%) premiums Global businesses Corporate & Investment Banking Wealth Management & Insurance €1,517mn +9% 24.8% +6.2pp €402bn -5% €2,735mn +4% • Strong operating performance driven by double-digit growth in all core businesses, especially GTB and GDF • Focus on digital transformation: SCIB and SAP have joined forces to accelerate the digitalization of transactional banking services • Sustainability: leadership in Structured Finance in the renewables sector (top in Latin America, Europe and globally) €2,364mn +36% 2 Note: 9M'22 data and YoY changes (revenue lines and commercial activity in constant euros). (1) Including fees generated by asset management and insurance transferred to the commercial network; +6% excluding insurance one offs in 9M'21. (2) Excluding insurance one-off in 9M'21: contribution to the profit: +17%; total revenue: +19%; net operating income: +30%; and attributable profit: +31%. (3) % change in current euros. 59.5% +1.7pp P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 Total revenue 1,985 8.2 5,597 25.4 31.1 Net operating income 1,238 7.0 3,562 32.7 38.7 Underlying att. profit 833 10.1 2,364 35.7 40.7 (*) € mn and % change in constant euros P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 Total revenue 685 7.1 1,907 7.2 11.6 Net operating income 422 9.7 1,149 7.8 11.2 Underlying att. profit 302 11.3 818 7.1 10.7 Contribution to profit 713 6.9 1,997 6.2 12.1 (*) € mn and % change in constant euros 33

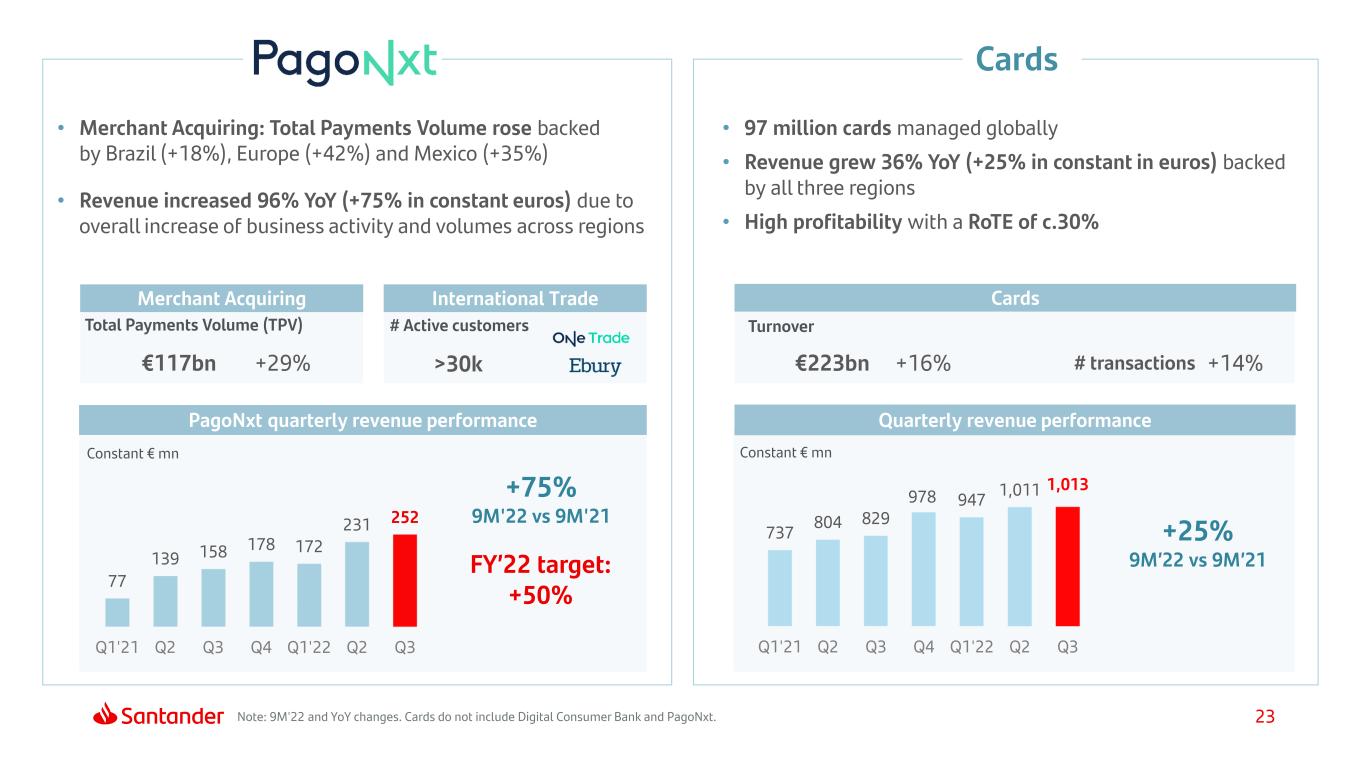

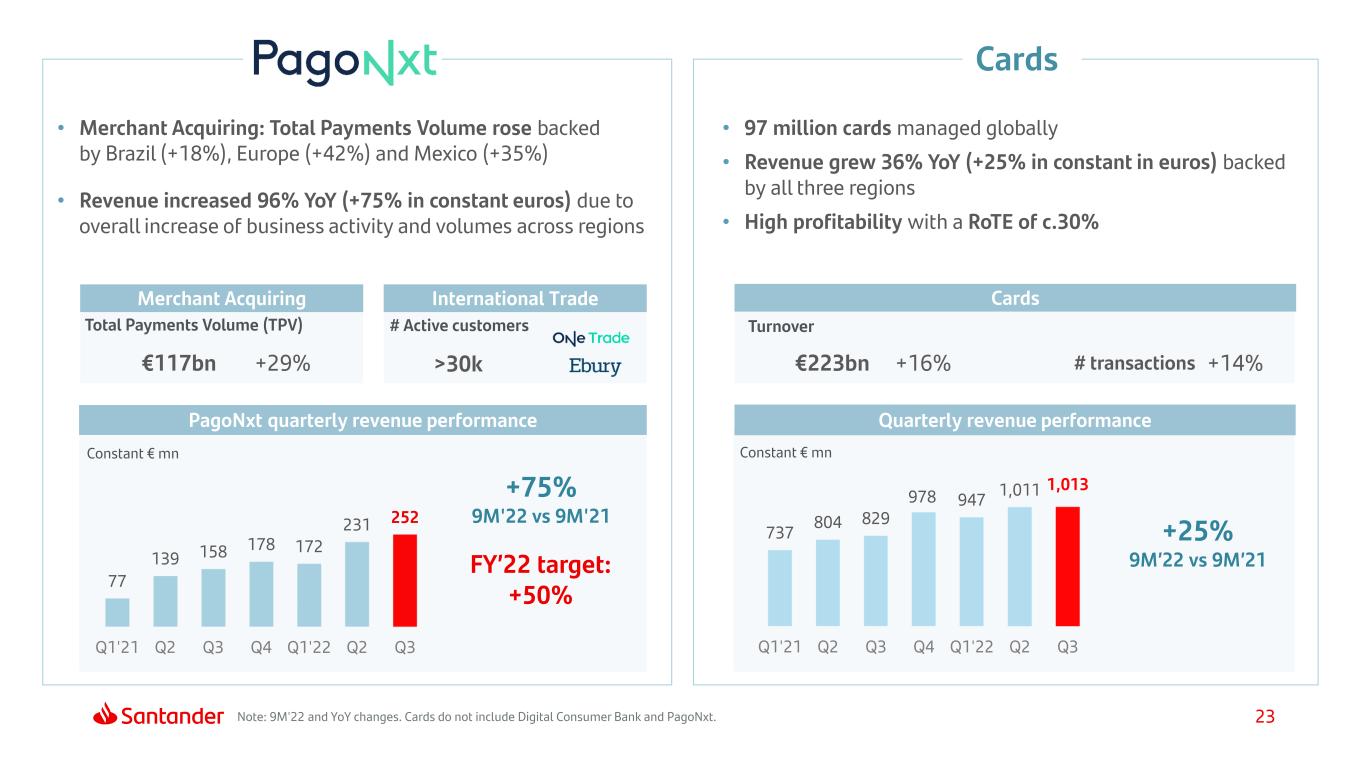

23Note: 9M'22 and YoY changes. Cards do not include Digital Consumer Bank and PagoNxt. PagoNxt quarterly revenue performance +75% 9M'22 vs 9M'21 Merchant Acquiring €117bn +29% International Trade 77 139 158 178 172 231 252 Q1'21 Q2 Q3 Q4 Q1'22 Q2 Q3 • Merchant Acquiring: Total Payments Volume rose backed by Brazil (+18%), Europe (+42%) and Mexico (+35%) • Revenue increased 96% YoY (+75% in constant euros) due to overall increase of business activity and volumes across regions >30k Total Payments Volume (TPV) # Active customers Constant € mn FY’22 target: +50% PagoNxt Cards Cards €223bn +16% # transactions +14% • 97 million cards managed globally • Revenue grew 36% YoY (+25% in constant in euros) backed by all three regions • High profitability with a RoTE of c.30% Turnover Quarterly revenue performance +25% 9M’22 vs 9M’21 737 804 829 978 947 1,011 1,013 Q1'21 Q2 Q3 Q4 Q1'22 Q2 Q3 Constant € mn

24 Index 1 Appendix 3 Group and Business areas review Final remarks 2 4 9M'22 Highlights

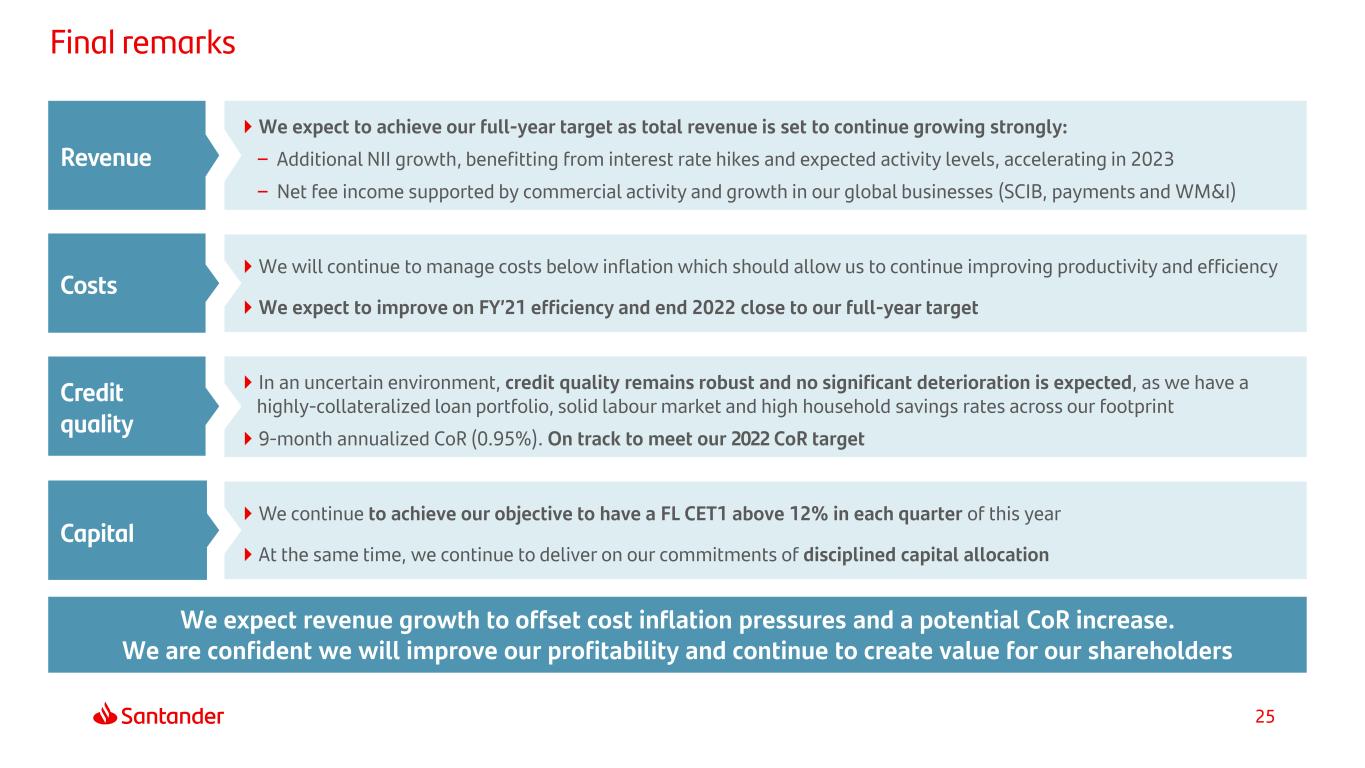

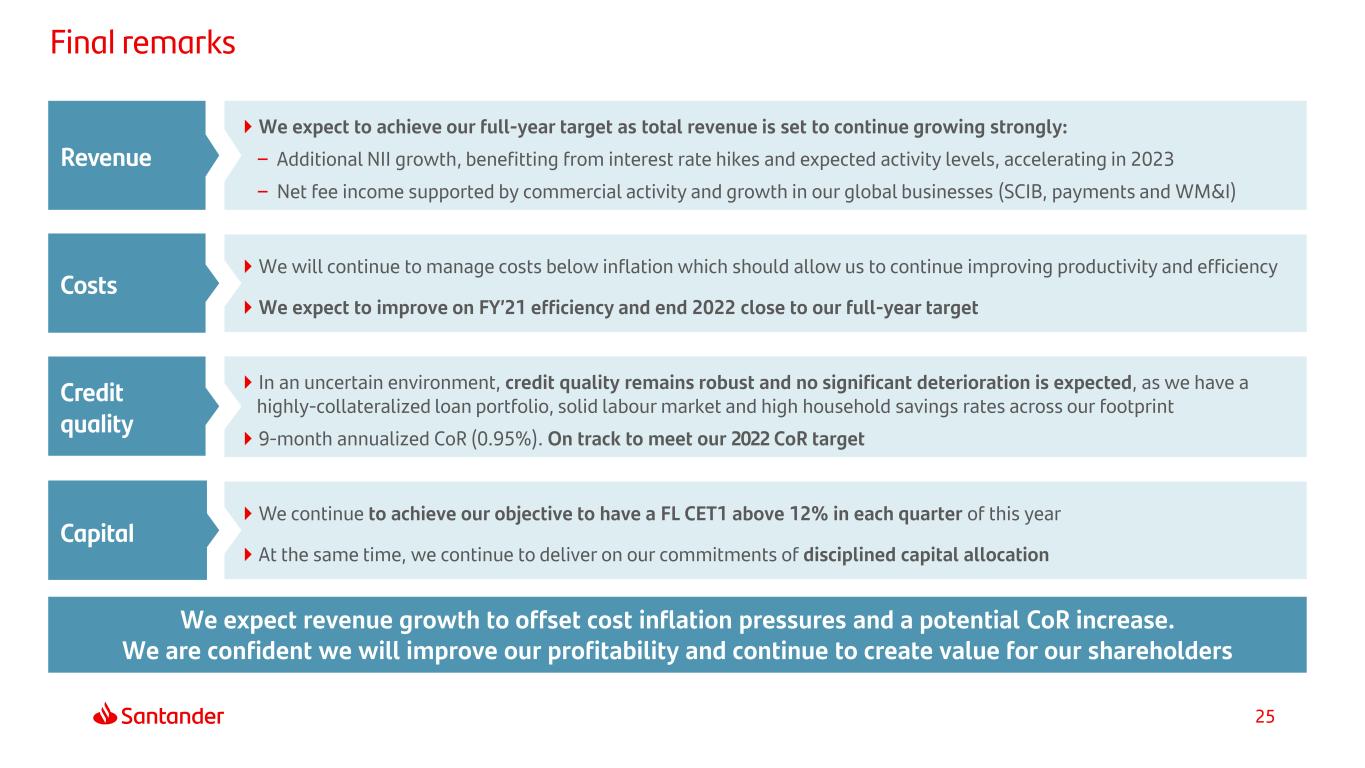

25 Final remarks We expect to achieve our full-year target as total revenue is set to continue growing strongly: – Additional NII growth, benefitting from interest rate hikes and expected activity levels, accelerating in 2023 – Net fee income supported by commercial activity and growth in our global businesses (SCIB, payments and WM&I) Revenue We will continue to manage costs below inflation which should allow us to continue improving productivity and efficiency We expect to improve on FY’21 efficiency and end 2022 close to our full-year target Costs In an uncertain environment, credit quality remains robust and no significant deterioration is expected, as we have a highly-collateralized loan portfolio, solid labour market and high household savings rates across our footprint 9-month annualized CoR (0.95%). On track to meet our 2022 CoR target Credit quality We continue to achieve our objective to have a FL CET1 above 12% in each quarter of this year At the same time, we continue to deliver on our commitments of disciplined capital allocation Capital We expect revenue growth to offset cost inflation pressures and a potential CoR increase. We are confident we will improve our profitability and continue to create value for our shareholders

27 Index 1 Appendix 3 Business areas review Final remarks 2 4 Highlights and Group performance

28 Appendix NII and CoR details by country Primary segments Responsible Banking Glossary The other information in the Appendix regularly provided each quarter can be found in the document entitled "Supplementary Information", published together with this presentation on the Group's corporate website.

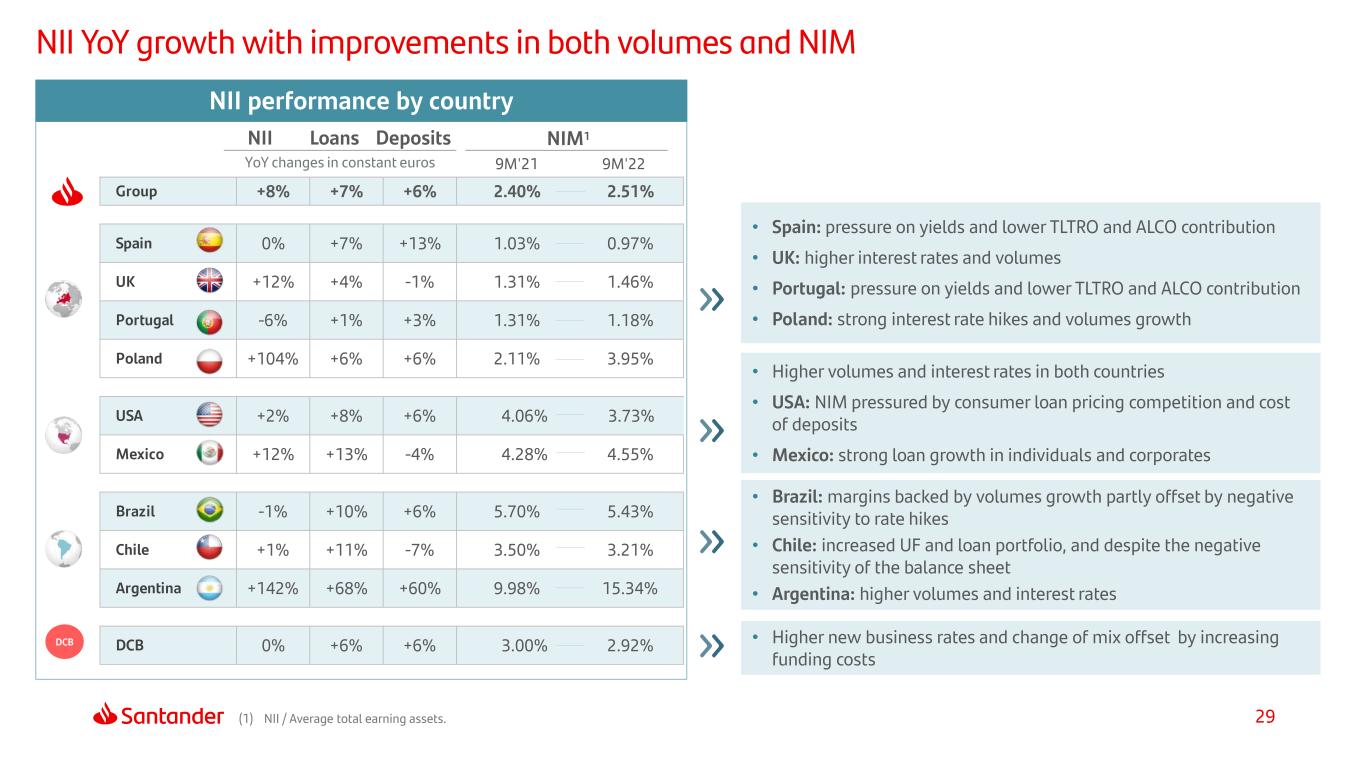

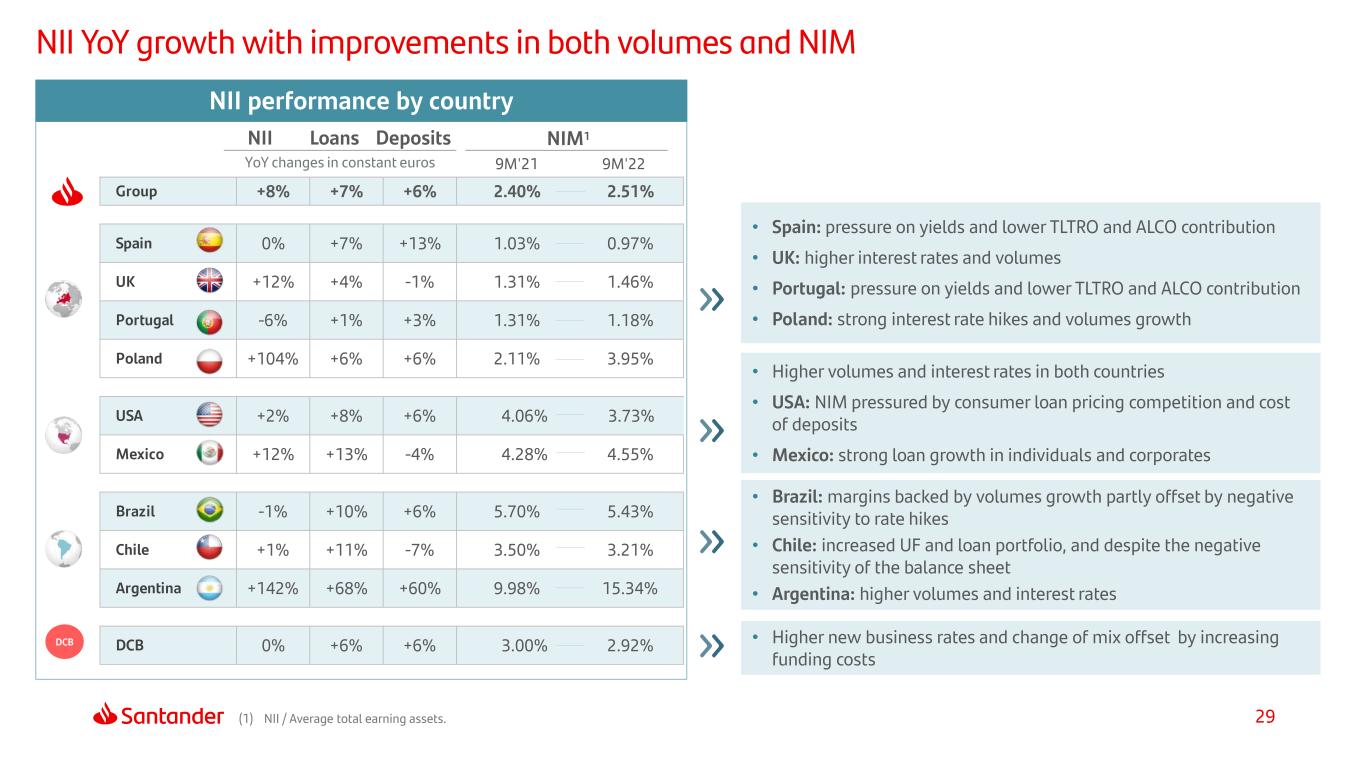

29 Group +8% +7% +6% 2.40% 2.51% Spain 0% +7% +13% 1.03% 0.97% UK +12% +4% -1% 1.31% 1.46% Portugal -6% +1% +3% 1.31% 1.18% Poland +104% +6% +6% 2.11% 3.95% USA +2% +8% +6% 4.06% 3.73% Mexico +12% +13% -4% 4.28% 4.55% Brazil -1% +10% +6% 5.70% 5.43% Chile +1% +11% -7% 3.50% 3.21% Argentina +142% +68% +60% 9.98% 15.34% DCB 0% +6% +6% 3.00% 2.92% NII YoY growth with improvements in both volumes and NIM DCB Loans NIM1 9M'21 9M'22 Deposits YoY changes in constant euros NII performance by country NII (1) NII / Average total earning assets. • Spain: pressure on yields and lower TLTRO and ALCO contribution • UK: higher interest rates and volumes • Portugal: pressure on yields and lower TLTRO and ALCO contribution • Poland: strong interest rate hikes and volumes growth • Higher volumes and interest rates in both countries • USA: NIM pressured by consumer loan pricing competition and cost of deposits • Mexico: strong loan growth in individuals and corporates • Brazil: margins backed by volumes growth partly offset by negative sensitivity to rate hikes • Chile: increased UF and loan portfolio, and despite the negative sensitivity of the balance sheet • Argentina: higher volumes and interest rates • Higher new business rates and change of mix offset by increasing funding costs

30 Group 0.77% 0.86% Spain 0.92% 0.71% UK -0.09% 0.02% Portugal 0.09% -0.12% Poland 0.67% 1.07% USA 0.43% 0.87% Mexico 2.44% 1.86% Brazil 3.73% 4.46% Chile 0.85% 0.87% Argentina 3.01% 2.88% DCB 0.46% 0.43% Cost of risk remained at low levels in most countries (1) Allowances for loan-loss provisions over the last 12 months / average loans and advances to customers of the last 12 months. DCB Dec-21 Sep-22 CoR1 performance by country • Spain: lower LLPs with improved credit quality • UK: gradual normalization after releases in Q2 and Q4’21 • Portugal: LLP releases in Q4’21 and low cost of credit in 2022 • Poland: higher LLPs impacted by CHF mortgage related charges while BAU provisions improve • USA: LLP releases in 2021 and progressive macro normalization in 2022, with cost of risk still well below pre-pandemic levels • Mexico: good performance of loan portfolio (mainly cards, CIB) • CoR remains low for the consumer business • Brazil: CoR up mainly in unsecured individuals; solid portfolio mix • Chile and Argentina: CoR remains at low levels

31 Appendix NII and CoR details by country Primary segments Responsible Banking Glossary

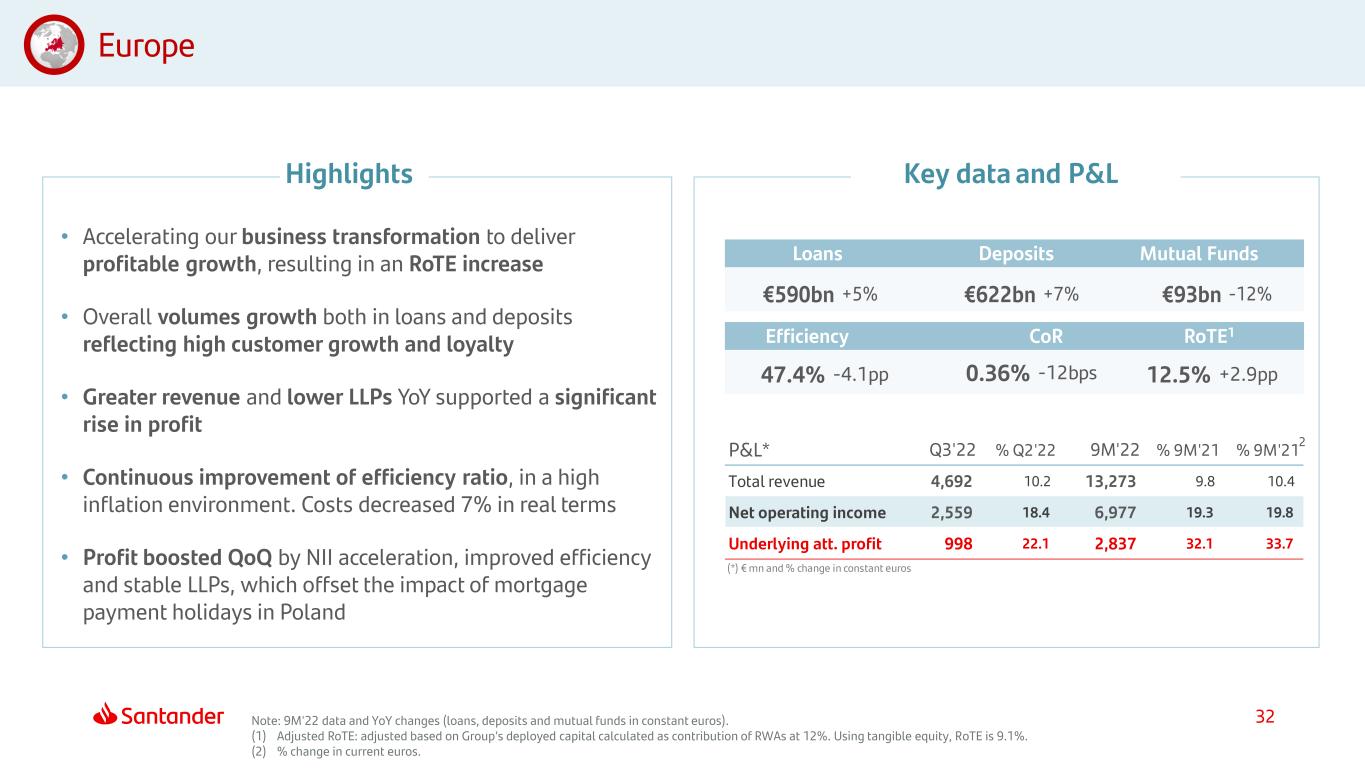

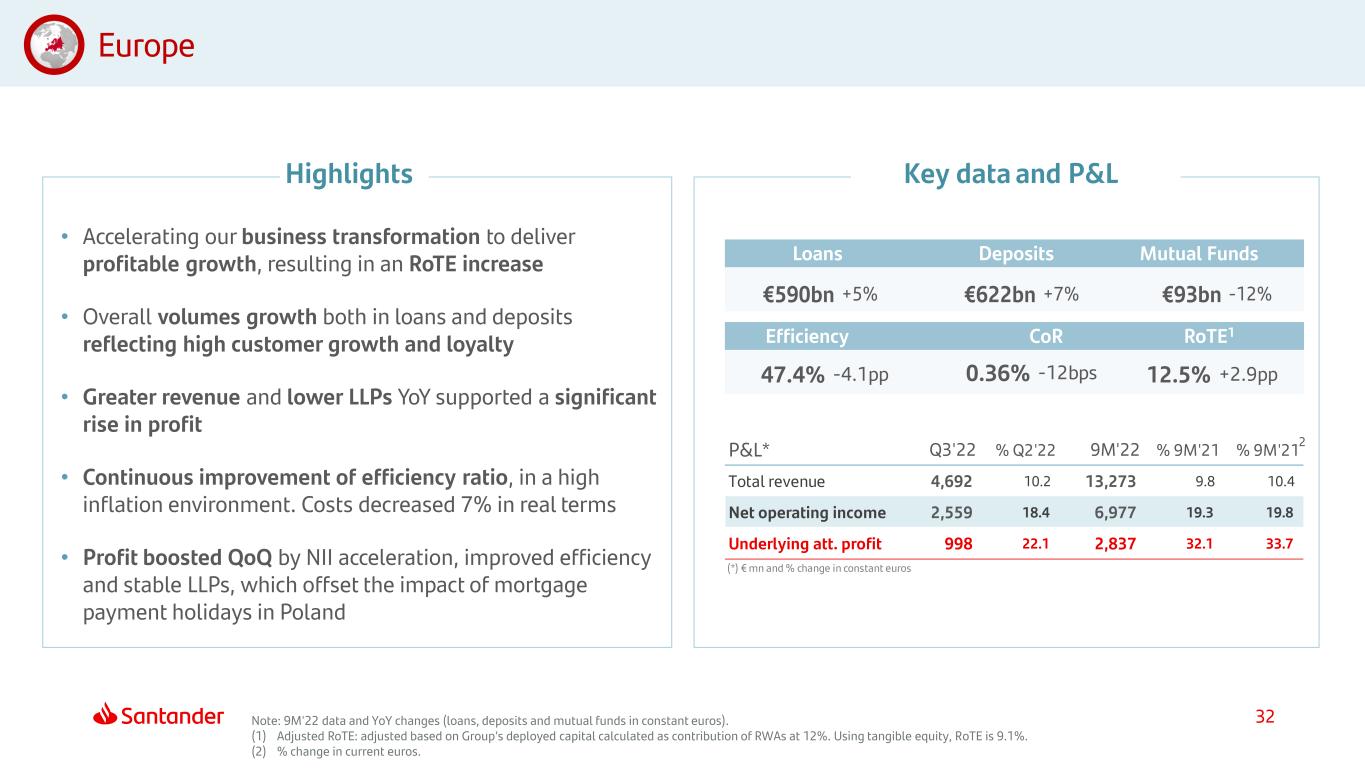

32 Europe Highlights Key data and P&L Loans Deposits Mutual Funds Efficiency CoR RoTE1 €590bn +5% €622bn +7% €93bn -12% 47.4% -4.1pp 0.36% -12bps 12.5% +2.9pp Note: 9M'22 data and YoY changes (loans, deposits and mutual funds in constant euros). (1) Adjusted RoTE: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 9.1%. (2) % change in current euros. • Accelerating our business transformation to deliver profitable growth, resulting in an RoTE increase • Overall volumes growth both in loans and deposits reflecting high customer growth and loyalty • Greater revenue and lower LLPs YoY supported a significant rise in profit • Continuous improvement of efficiency ratio, in a high inflation environment. Costs decreased 7% in real terms • Profit boosted QoQ by NII acceleration, improved efficiency and stable LLPs, which offset the impact of mortgage payment holidays in Poland P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 Total revenue 4,692 10.2 13,273 9.8 10.4 Net operating income 2,559 18.4 6,977 19.3 19.8 Underlying att. profit 998 22.1 2,837 32.1 33.7 (*) € mn and % change in constant euros 2

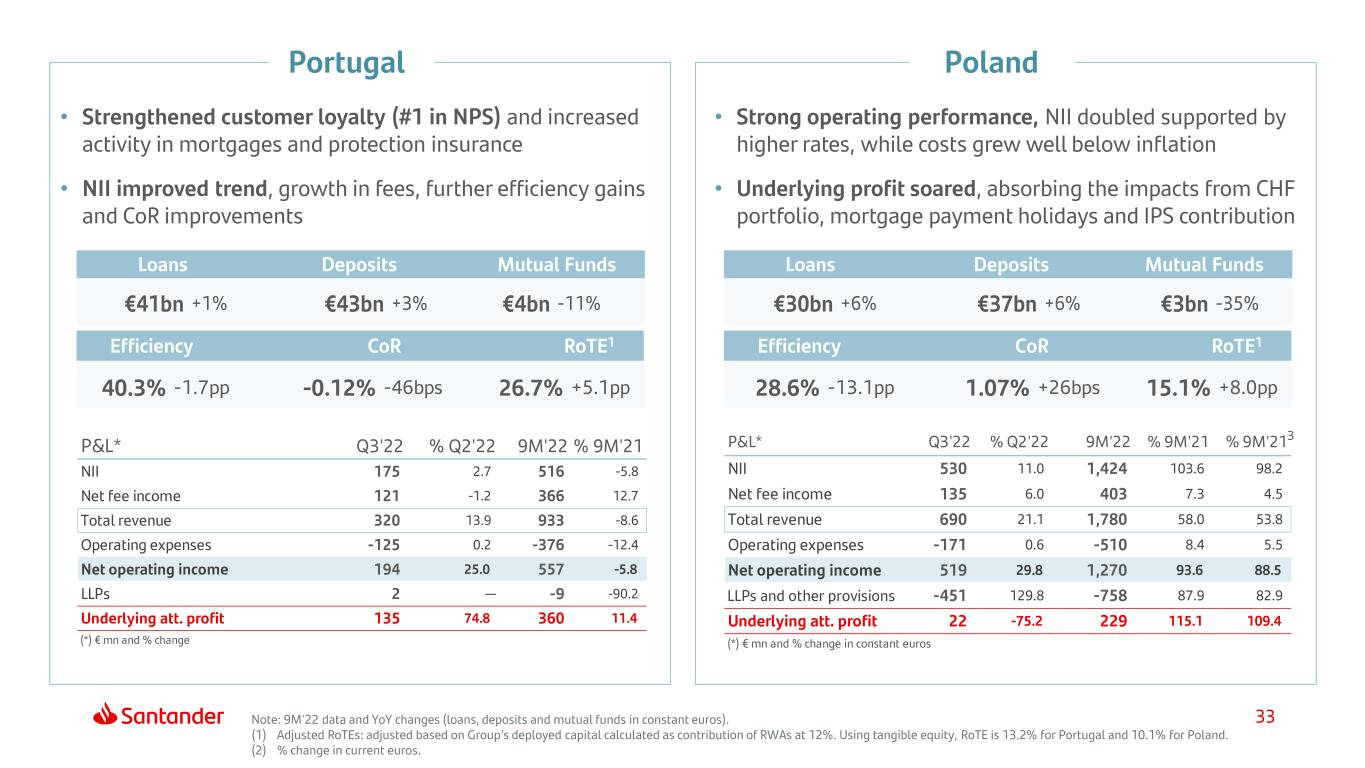

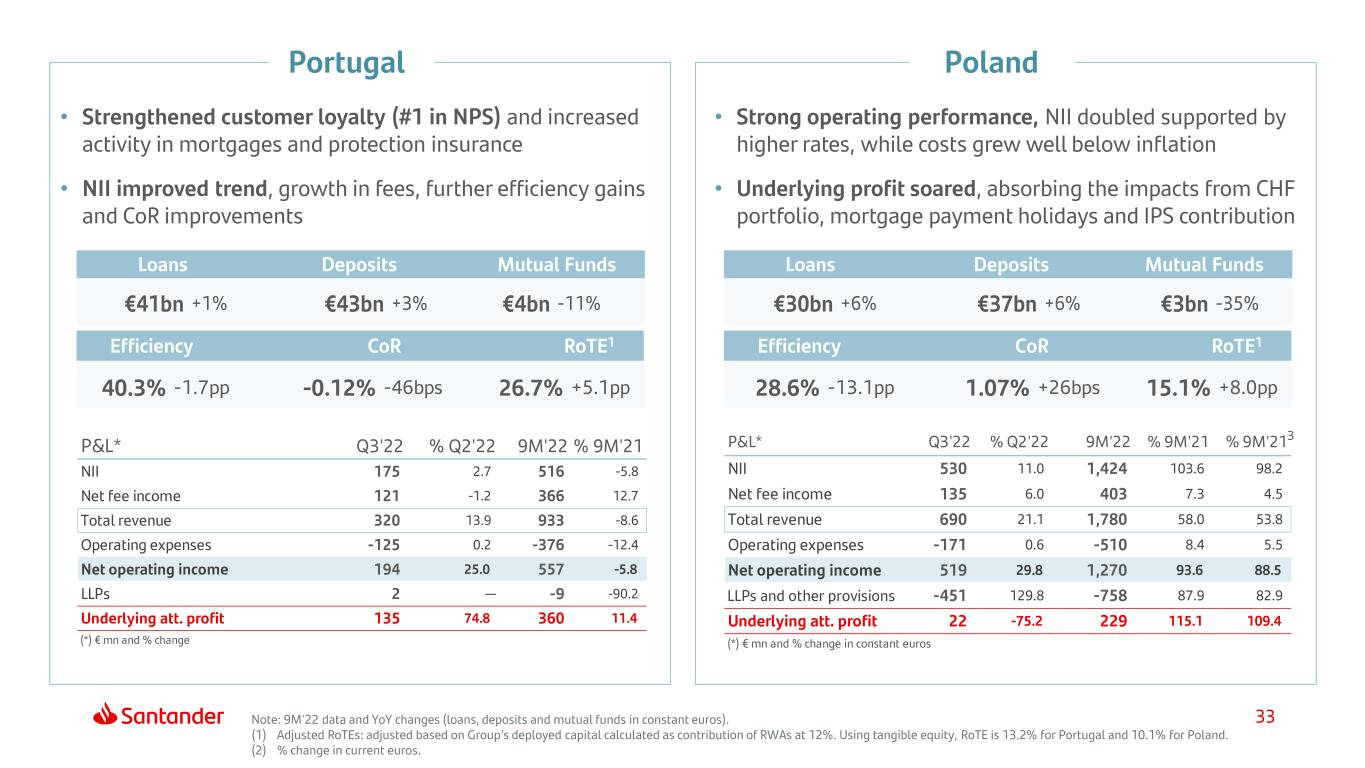

33 Efficiency CoR RoTE1 Loans Deposits Mutual Funds Efficiency CoR RoTE1 Loans Deposits Mutual Funds €41bn +1% €43bn +3% €4bn -11% 40.3% -1.7pp -0.12% -46bps 26.7% +5.1pp €30bn +6% €37bn +6% €3bn -35% 28.6% -13.1pp 1.07% +26bps 15.1% +8.0pp Note: 9M'22 data and YoY changes (loans, deposits and mutual funds in constant euros). (1) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 13.2% for Portugal and 10.1% for Poland. (2) % change in current euros. • Strengthened customer loyalty (#1 in NPS) and increased activity in mortgages and protection insurance • NII improved trend, growth in fees, further efficiency gains and CoR improvements • Strong operating performance, NII doubled supported by higher rates, while costs grew well below inflation • Underlying profit soared, absorbing the impacts from CHF portfolio, mortgage payment holidays and IPS contribution Portugal Poland P&L* Q3'22 % Q2'22 9M'22 % 9M'21 NII 175 2.7 516 -5.8 Net fee income 121 -1.2 366 12.7 Total revenue 320 13.9 933 -8.6 Operating expenses -125 0.2 -376 -12.4 Net operating income 194 25.0 557 -5.8 LLPs 2 — -9 -90.2 Underlying att. profit 135 74.8 360 11.4 (*) € mn and % change Portugal and Polonia P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 530 11.0 1,424 103.6 98.2 Net fee income 135 6.0 403 7.3 4.5 Total revenue 690 21.1 1,780 58.0 53.8 Operating expenses -171 0.6 -510 8.4 5.5 Net operating income 519 29.8 1,270 93.6 88.5 LLPs and other provisions -451 129.8 -758 87.9 82.9 Underlying att. profit 22 -75.2 229 115.1 109.4 (*) € mn and % change in constant euros 3

34 North America Note: 9M'22 data and YoY changes (loans, deposits and mutual funds in constant euros). (1) Adjusted RoTE: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 11.5%. (2) % change in current euros. Key data and P&L Loans Deposits Mutual Funds Efficiency CoR RoTE1 €165bn +9% €134bn +3% €30bn -2% 47.0% +2.7pp 1.12% -34bps 21.8% -2.6pp Highlights • Greater customer base and enhanced customer experience through tailored products and services • Overall volumes growth QoQ and YoY, driven by most segments in Mexico and in CIB, CRE and Auto in the US • Profitability remained high driven by outstanding results in Mexico and high profit in the US • In Q3, NII continued to show signs of recovery and cost control. LLPs increased as CoR continues to normalize P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 Total revenue 3,240 3.0 9,021 -1.7 10.5 Net operating income 1,694 3.4 4,782 -6.7 5.1 Underlying att. profit 693 -16.0 2,271 -9.3 2.4 (*) € mn and % change in constant euros 2

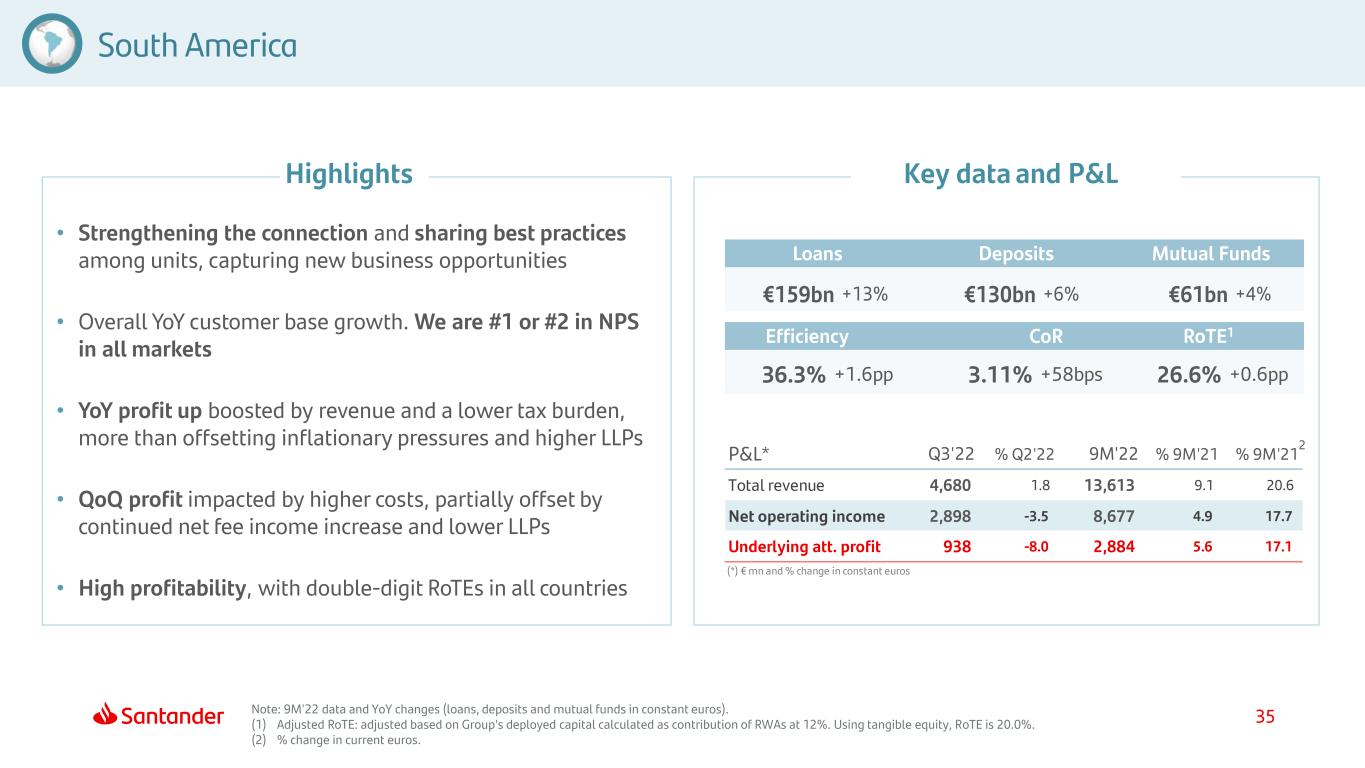

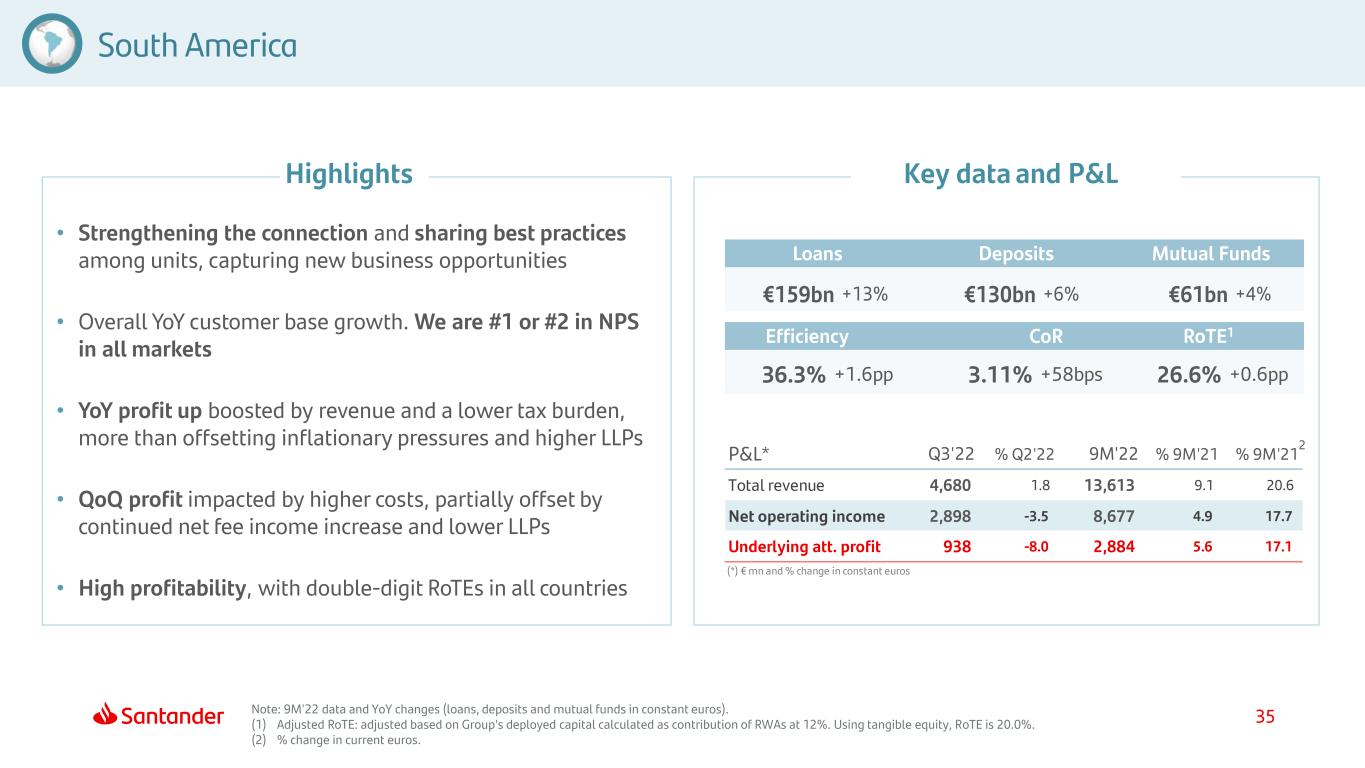

35 South America Note: 9M'22 data and YoY changes (loans, deposits and mutual funds in constant euros). (1) Adjusted RoTE: adjusted based on Group��s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 20.0%. (2) % change in current euros. Highlights Key data and P&L Loans Deposits Mutual Funds Efficiency CoR RoTE1 €159bn +13% €130bn +6% €61bn +4% 36.3% +1.6pp 3.11% +58bps 26.6% +0.6pp • Strengthening the connection and sharing best practices among units, capturing new business opportunities • Overall YoY customer base growth. We are #1 or #2 in NPS in all markets • YoY profit up boosted by revenue and a lower tax burden, more than offsetting inflationary pressures and higher LLPs • QoQ profit impacted by higher costs, partially offset by continued net fee income increase and lower LLPs • High profitability, with double-digit RoTEs in all countries P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 Total revenue 4,680 1.8 13,613 9.1 20.6 Net operating income 2,898 -3.5 8,677 4.9 17.7 Underlying att. profit 938 -8.0 2,884 5.6 17.1 (*) € mn and % change in constant euros 2

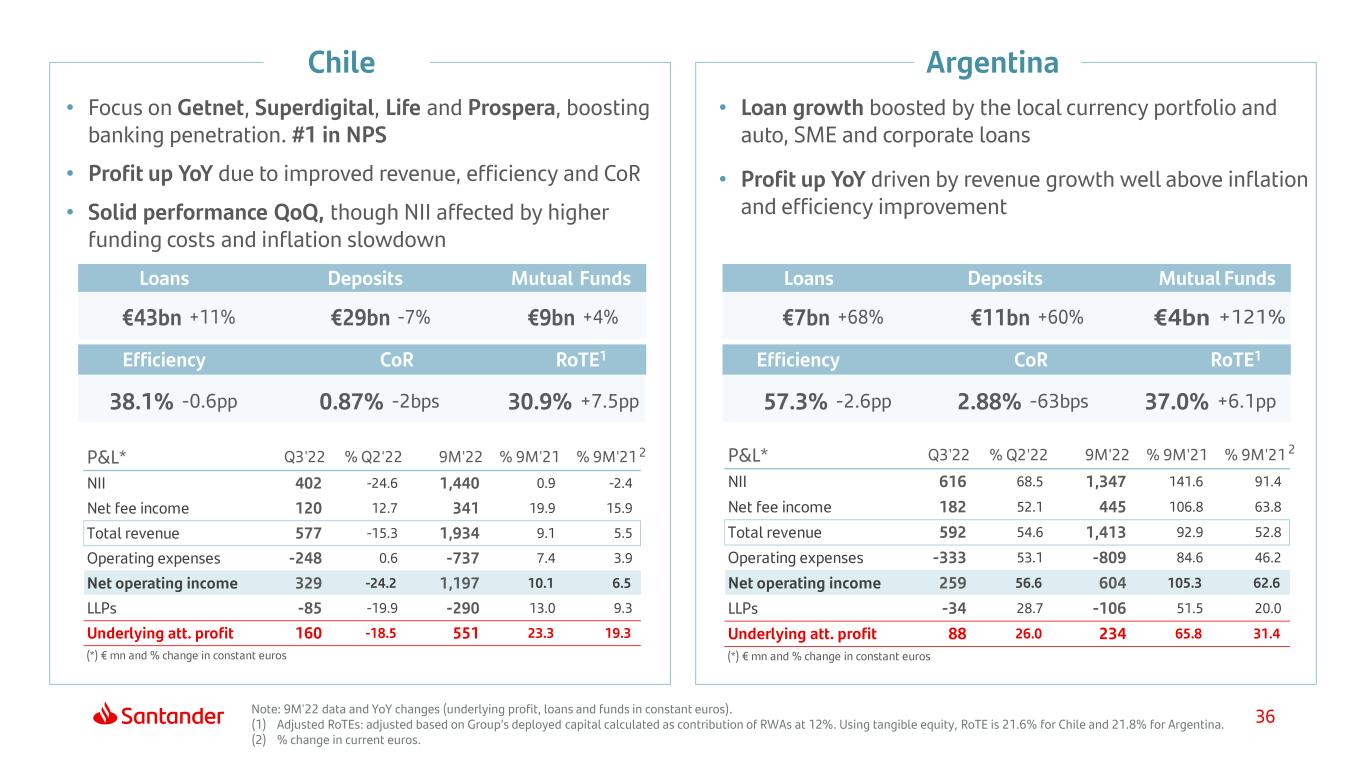

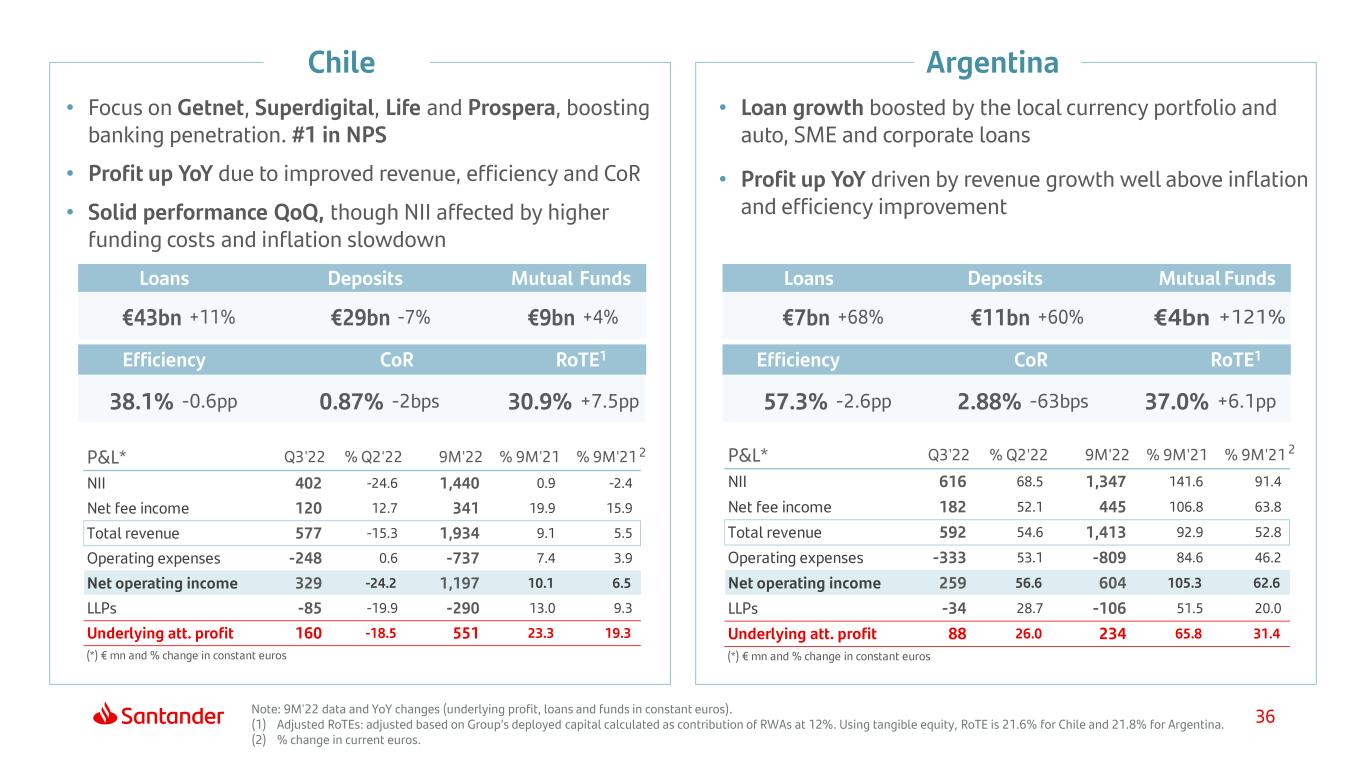

36 Efficiency CoR RoTE1 Loans Deposits Mutual Funds €7bn +68% €11bn +60% €4bn +121% 57.3% -2.6pp 2.88% -63bps 37.0% +6.1pp Note: 9M'22 data and YoY changes (underlying profit, loans and funds in constant euros). (1) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 21.6% for Chile and 21.8% for Argentina. (2) % change in current euros. Argentina • Loan growth boosted by the local currency portfolio and auto, SME and corporate loans • Profit up YoY driven by revenue growth well above inflation and efficiency improvement Chile y Argentina €43bn +11% €29bn -7% €9bn +4% 38.1% -0.6pp 0.87% -2bps 30.9% +7.5pp Efficiency CoR RoTE1 Loans Deposits Mutual Funds Chile • Focus on Getnet, Superdigital, Life and Prospera, boosting banking penetration. #1 in NPS • Profit up YoY due to improved revenue, efficiency and CoR • Solid performance QoQ, though NII affected by higher funding costs and inflation slowdown P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 402 -24.6 1,440 0.9 -2.4 Net fee income 120 12.7 341 19.9 15.9 Total revenue 577 -15.3 1,934 9.1 5.5 Operating expenses -248 0.6 -737 7.4 3.9 Net operating income 329 -24.2 1,197 10.1 6.5 LLPs -85 -19.9 -290 13.0 9.3 Underlying att. profit 160 -18.5 551 23.3 19.3 (*) € mn and % change in constant euros P&L* Q3'22 % Q2'22 9M'22 % 9M'21 % 9M'21 NII 616 68.5 1,347 141.6 91.4 Net fee income 182 52.1 445 106.8 63.8 Total revenue 592 54.6 1,413 92.9 52.8 Operating expenses -333 53.1 -809 84.6 46.2 Net operating income 259 56.6 604 105.3 62.6 LLPs -34 28.7 -106 51.5 20.0 Underlying att. profit 88 26.0 234 65.8 31.4 (*) € mn and % change in constant euros 2 2

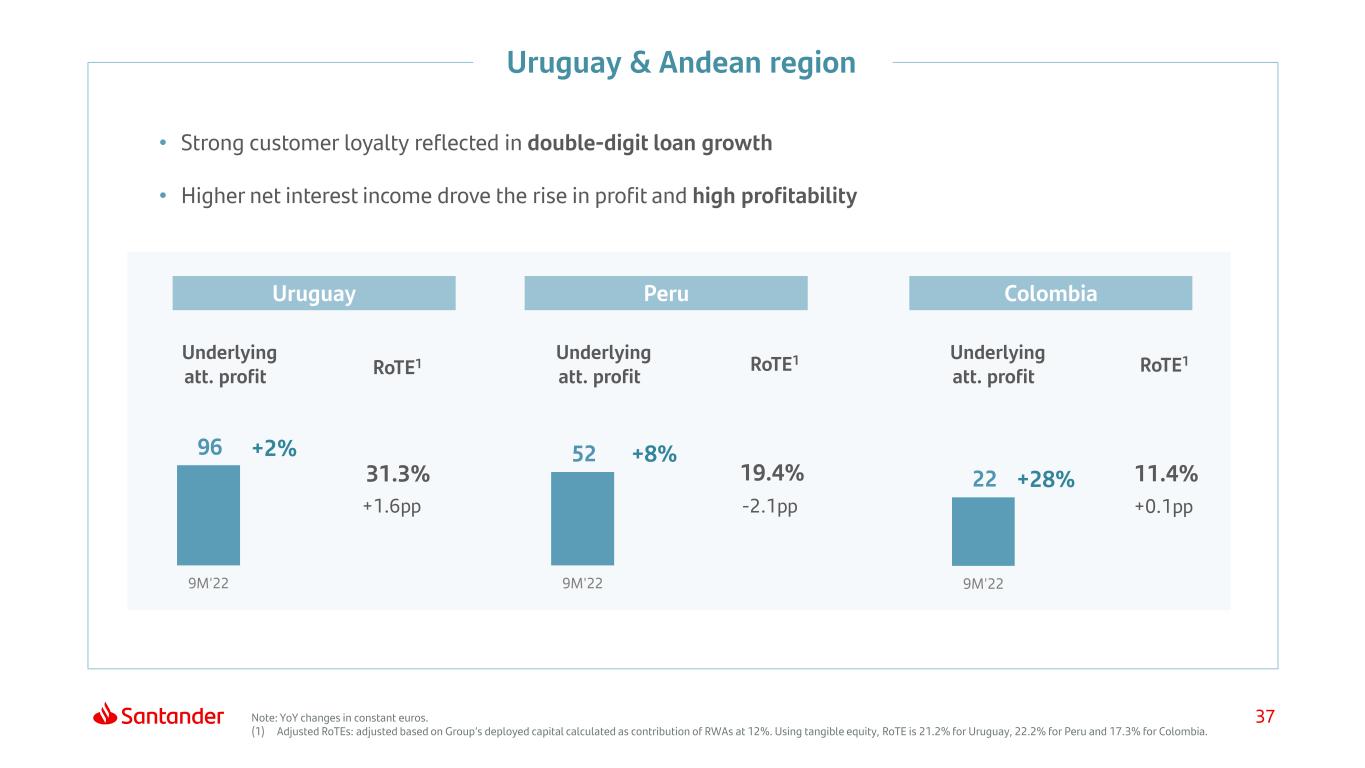

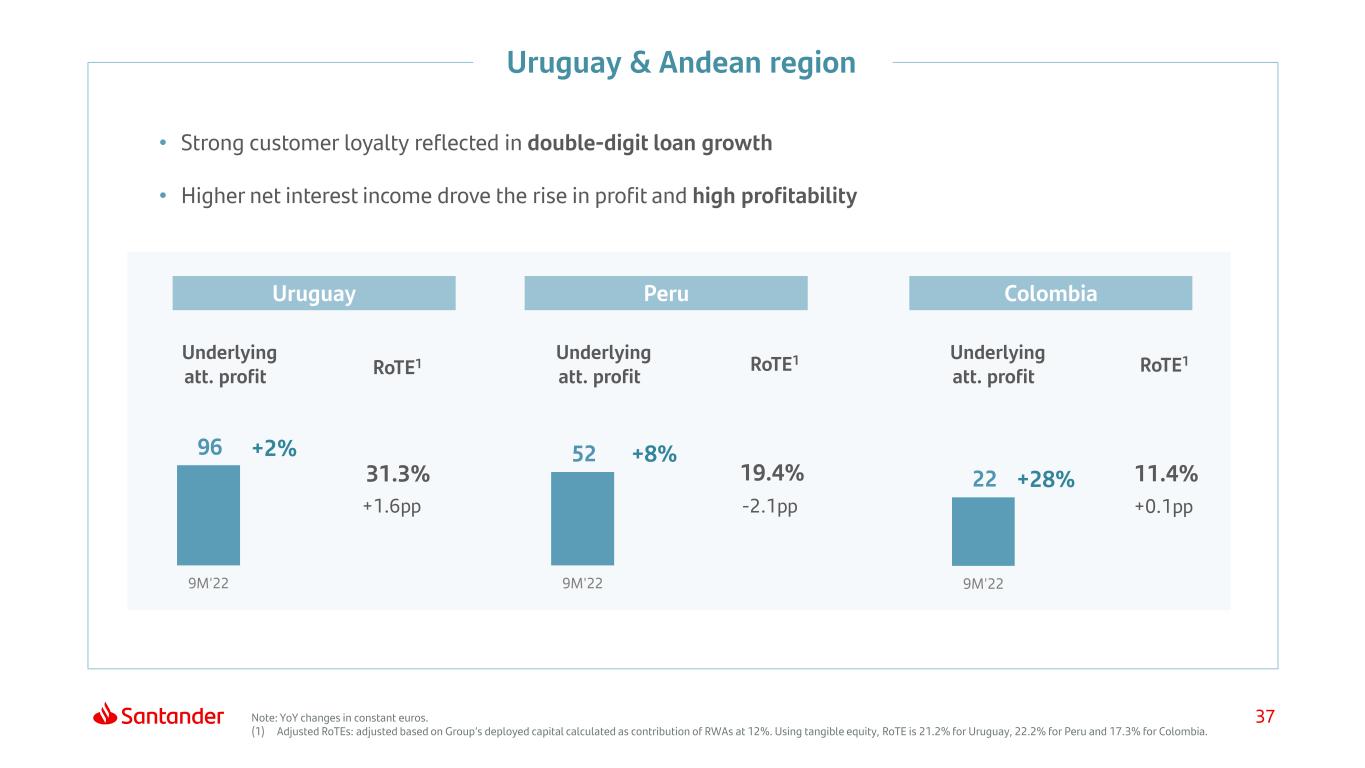

37Note: YoY changes in constant euros. (1) Adjusted RoTEs: adjusted based on Group’s deployed capital calculated as contribution of RWAs at 12%. Using tangible equity, RoTE is 21.2% for Uruguay, 22.2% for Peru and 17.3% for Colombia. Uruguay and Andean region 22 9M'22 52 9M'22 96 9M'22 • Strong customer loyalty reflected in double-digit loan growth • Higher net interest income drove the rise in profit and high profitability Uruguay & Andean region RoTE1 Underlying att. profit +2% Underlying att. profit Underlying att. profit +8% +28% RoTE1 RoTE1 Uruguay Peru Colombia 31.3% +1.6pp 19.4% -2.1pp 11.4% +0.1pp

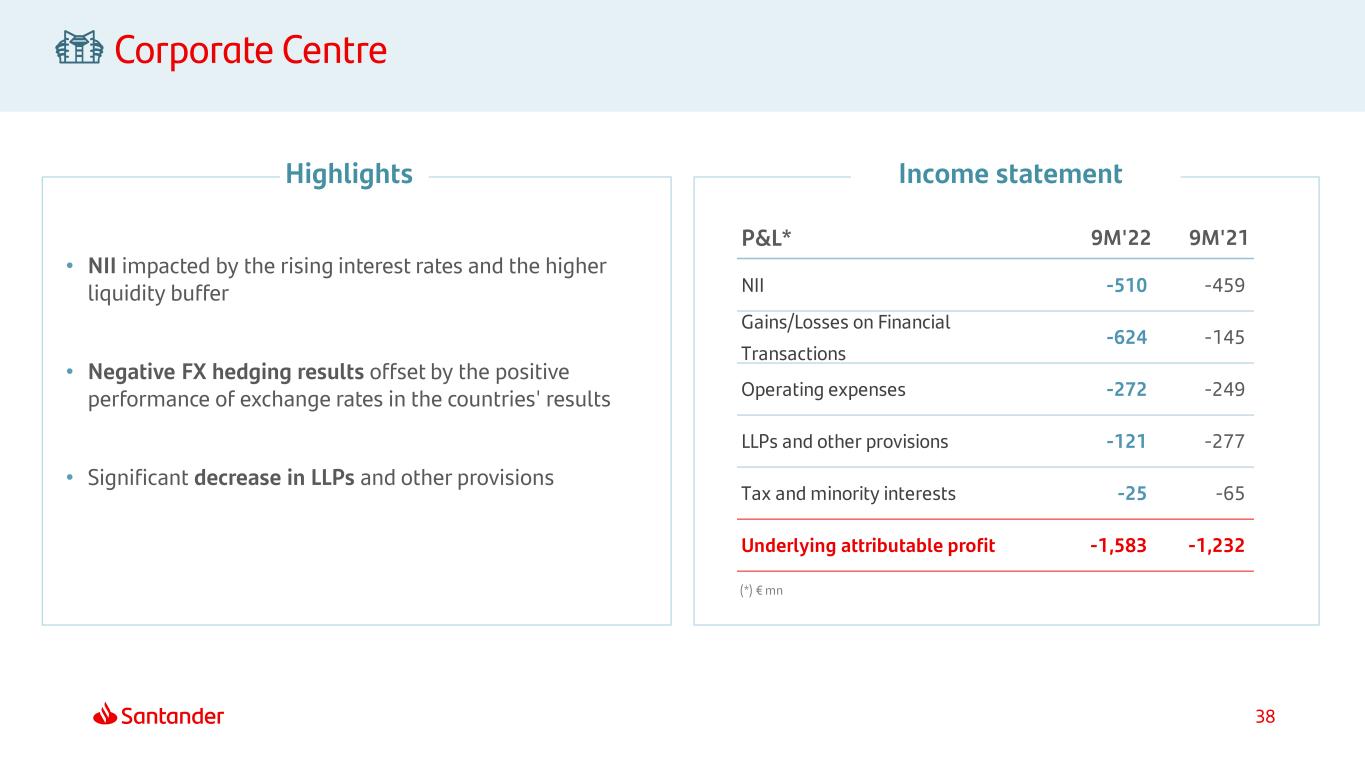

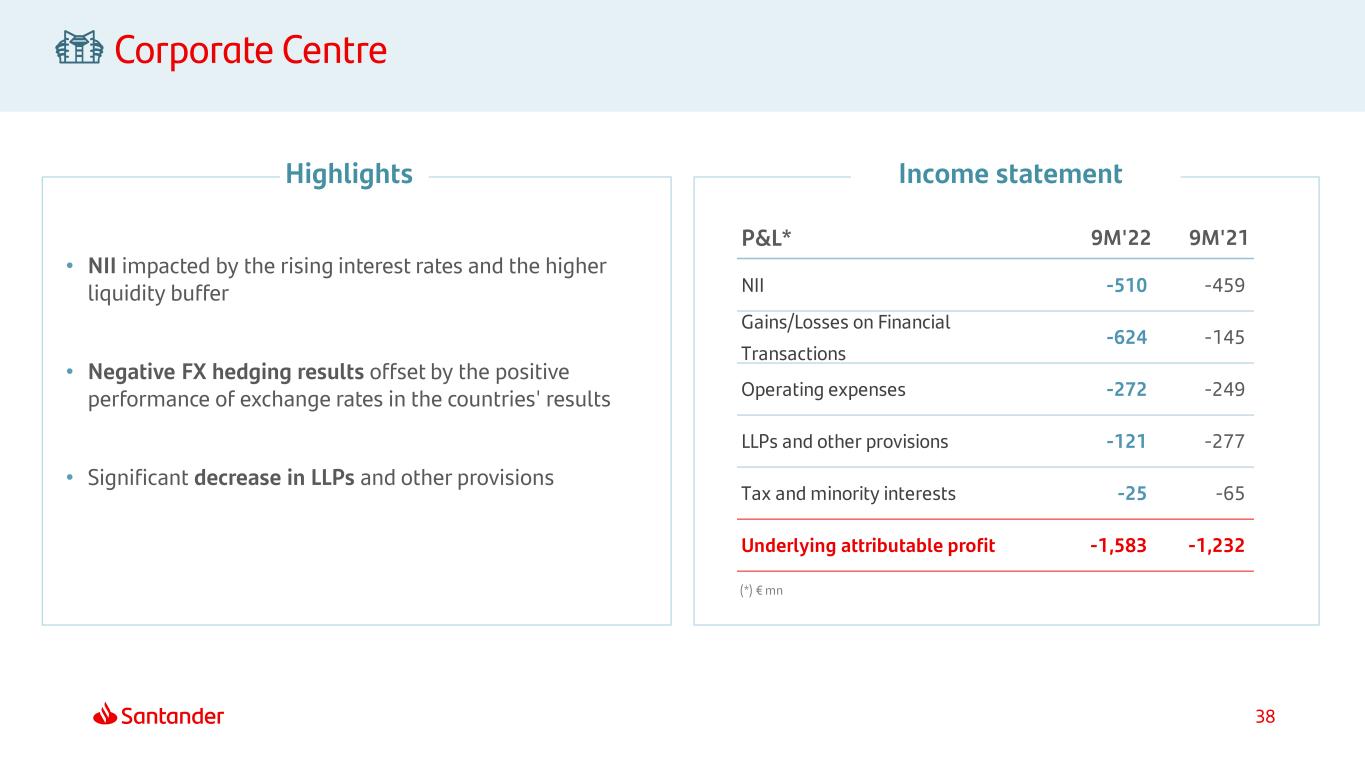

38 Corporate Centre Highlights Income statement • NII impacted by the rising interest rates and the higher liquidity buffer • Negative FX hedging results offset by the positive performance of exchange rates in the countries' results • Significant decrease in LLPs and other provisions P&L* 9M'22 9M'21 NII -510 -459 Gains/Losses on Financial Transactions -624 -145 Operating expenses -272 -249 LLPs and other provisions -121 -277 Tax and minority interests -25 -65 Underlying attributable profit -1,583 -1,232 (*) € mn

39 Appendix NII and CoR details by country Primary segments Responsible Banking Glossary

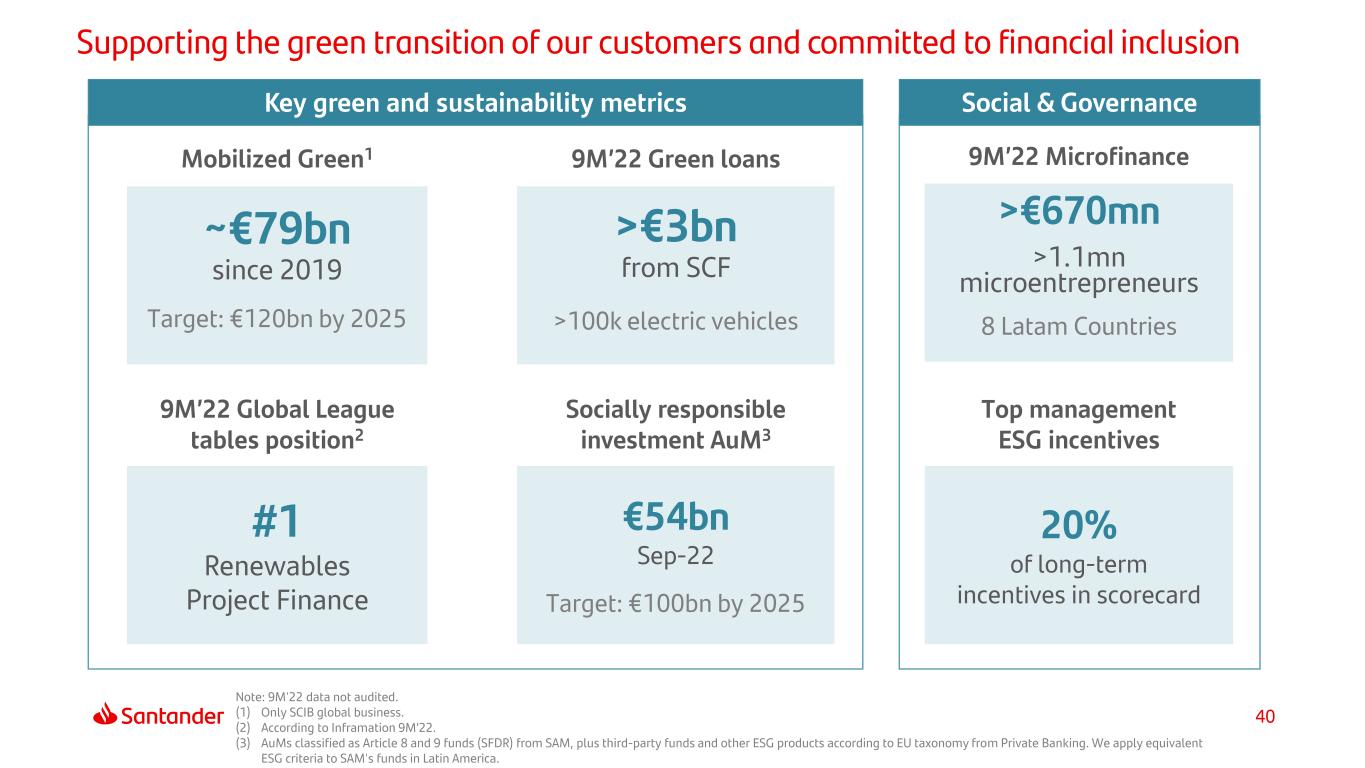

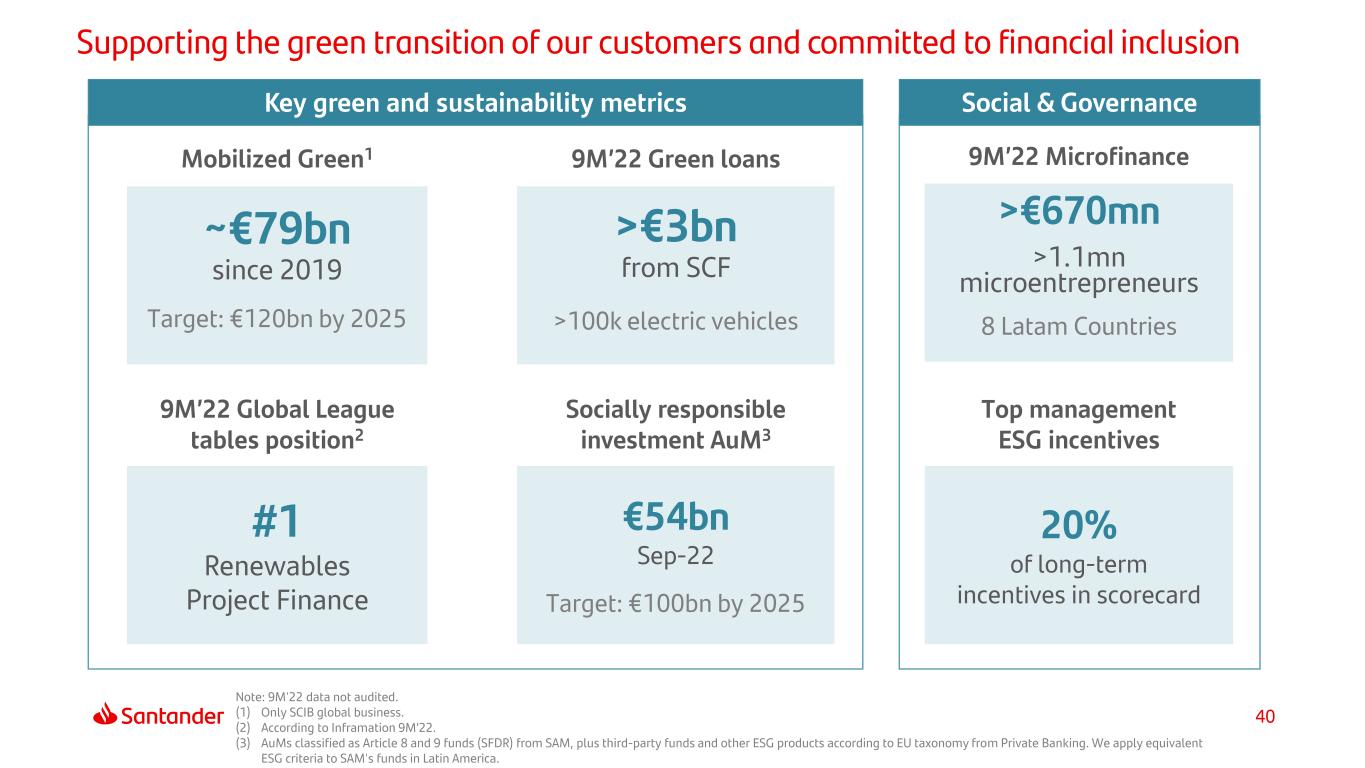

40 Supporting the green transition of our customers and committed to financial inclusion ~€79bn since 2019 Target: €120bn by 2025 Socially responsible investment AuM3 9M’22 Microfinance 20% of long-term incentives in scorecard >€670mn >1.1mn microentrepreneurs 8 Latam Countries Top management ESG incentives >€3bn from SCF >100k electric vehicles €54bn Sep-22 Target: €100bn by 2025 Mobilized Green1 9M’22 Global League tables position2 #1 Renewables Project Finance 9M’22 Green loans Note: 9M'22 data not audited. (1) Only SCIB global business. (2) According to Inframation 9M’22. (3) AuMs classified as Article 8 and 9 funds (SFDR) from SAM, plus third-party funds and other ESG products according to EU taxonomy from Private Banking. We apply equivalent ESG criteria to SAM's funds in Latin America. Social & GovernanceKey green and sustainability metrics

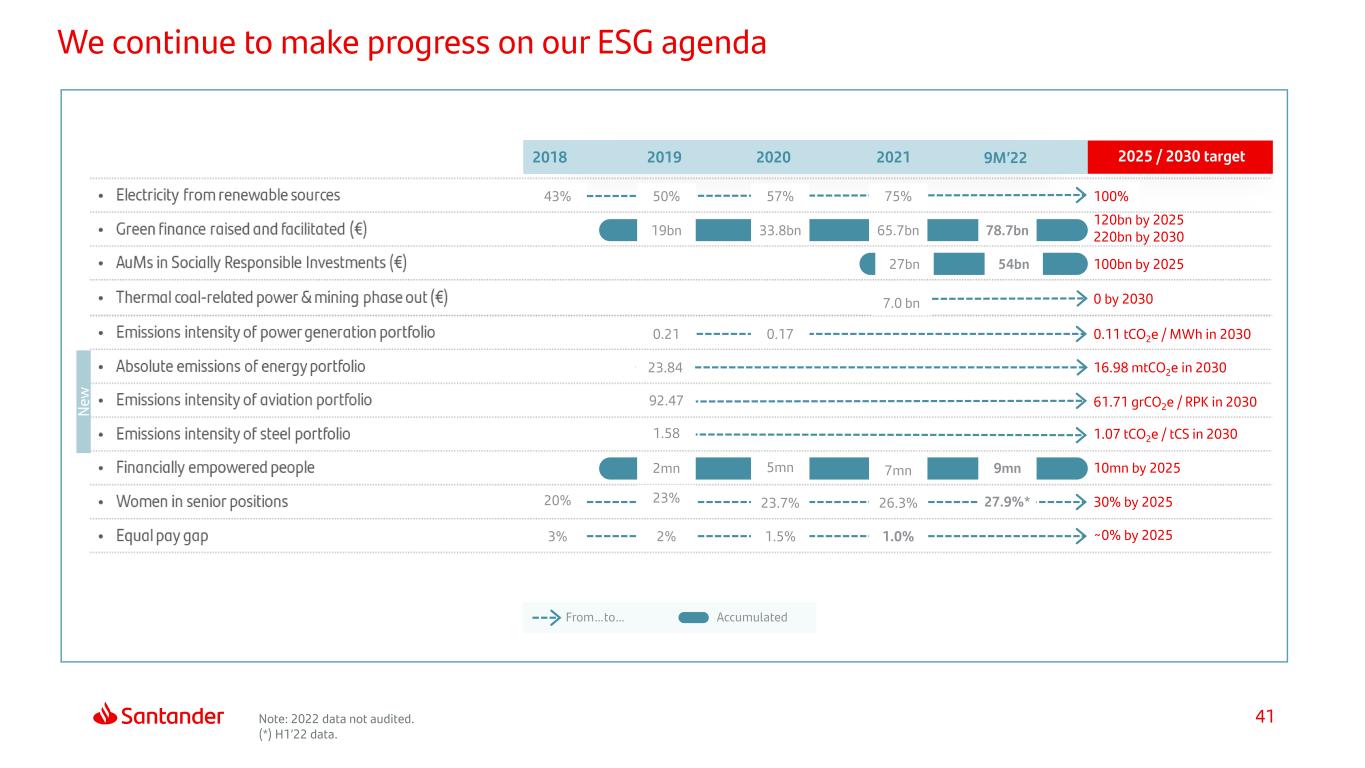

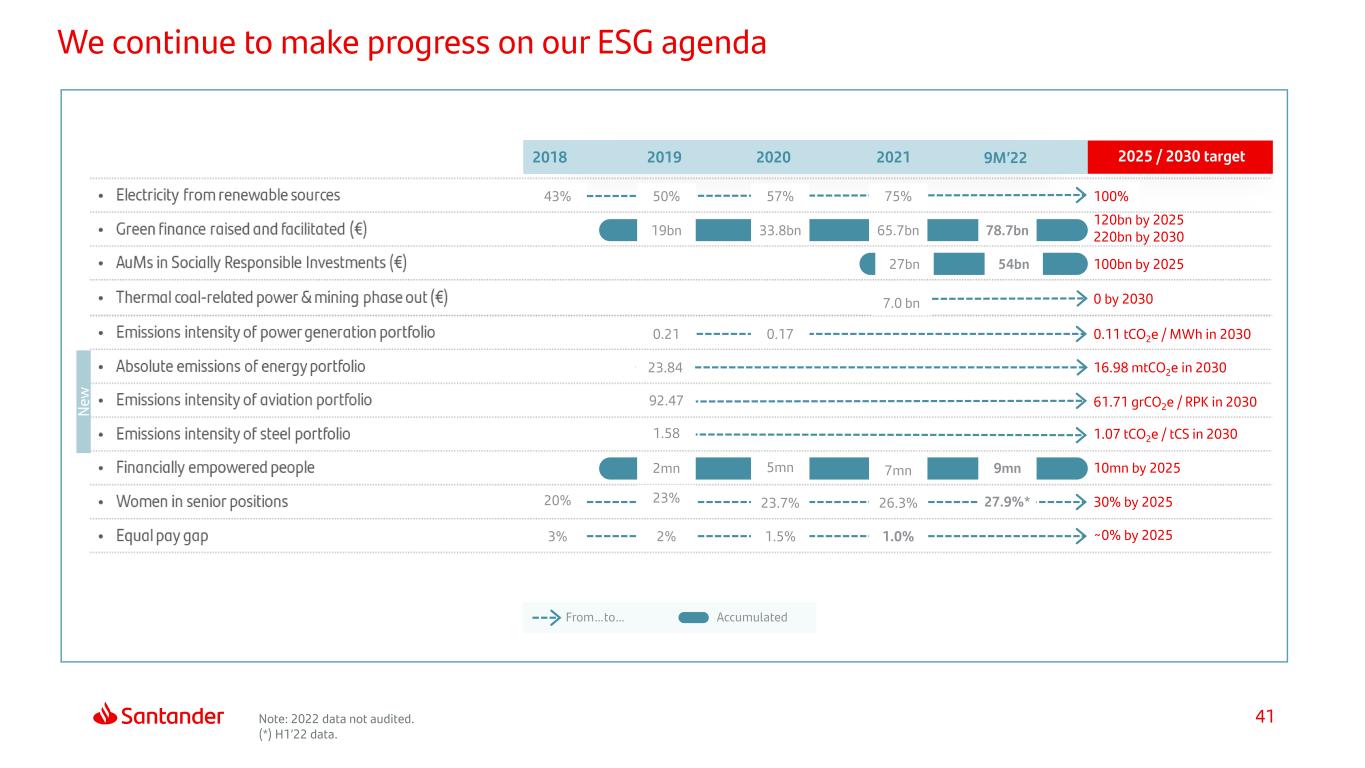

41 We continue to make progress on our ESG agenda 2025 / 2030 target2020 20% 3% 23% 23.7% 30% by 2025 ~0% by 2025 5mn 10mn by 20257mn 26.3% 2018 2019 2021 100bn by 202527bn 0.11 tCO2e / MWh in 2030 0 by 2030 0.21 7.0 bn 43% 100% 19bn 33.8bn 120bn by 2025 220bn by 203065.7bn From…to… Accumulated 9M’22 N ew 16.98 mtCO2e in 203023.84 61.71 grCO2e / RPK in 203092.47 1.07 tCO2e / tCS in 20301.58 54bn 0.17 78.7bn 50% 57% 75% 9mn 2% 1.5% 1.0% 2mn 27.9%* Note: 2022 data not audited. (*) H1’22 data.

42 Appendix NII and CoR details by country Primary segments Responsible Banking Glossary

43 Glossary - Acronyms ▪ ALCO: Assets and Liabilities Committee ▪ AT1: Additional Tier 1 ▪ AuMs: Assets under Management ▪ BFG: Deposit Guarantee Fund in Poland ▪ bn: Billion ▪ Bps: basis points ▪ CET1: Common equity tier 1 ▪ CIB: Corporate & Investment Bank ▪ CoE: Cost of equity ▪ CoR: Cost of risk ▪ Covid-19: Coronavirus Disease 19 ▪ DGF: Deposit guarantee fund ▪ DPS: Dividend per share ▪ GTB: Global Transaction Banking ▪ GDF: Global Debt Finance ▪ HQLA: High quality liquid asset ▪ FL: Fully-loaded ▪ FX: Foreign exchange ▪ EPS: Earning per share ▪ ESG: Environmental, social and governance ▪ FY: Full year ▪ HTC&S: Held to collect and sell ▪ IFRS 9: International Financial Reporting Standard 9, regarding financial instruments ▪ IPS: Institutional Protection Scheme ▪ LLPs: Loan-loss provisions ▪ M/LT: Medium- and long-term ▪ mn: million ▪ MREL: Minimum requirement for eligible liabilities ▪ NII: Net interest income ▪ NIM: Net interest margin ▪ NPL: Non-performing loans ▪ NPS: Net promoter score ▪ PBT: Profit before tax ▪ P&L: Profit and loss ▪ PoS: Point of Sale ▪ Pp: percentage points ▪ QoQ: Quarter-on-Quarter ▪ Repos: Repurchase agreements ▪ RoE: Return on equity ▪ RoRWA: Return on risk-weighted assets ▪ RoTE: Return on tangible equity ▪ RWA: Risk-weighted assets ▪ SAM: Santander Asset Management ▪ SCIB: Santander Corporate & Investment Banking ▪ SME: Small and Medium Enterprises ▪ SRF: Single Resolution Fund ▪ ST: Short term ▪ T1/T2: Tier 1 / Tier 2 ▪ TLAC: Total loss absorbing capacity ▪ TLTRO: Targeted longer-term refinancing operations ▪ TNAV: Tangible net asset value ▪ TPV: Total Payments Volume ▪ YoY: Year-on-Year ▪ YTD: Year to date ▪ WM&I: Wealth Management & Insurance

44 Glossary - Definitions Notes: The averages for the RoTE and RoRWA denominators are calculated using 10 months from December to September. For periods less than one year, and if there are results in the net capital gains and provisions line, the profit used to calculate RoE and RoTE is the annualized underlying attributable profit to which said results are added without annualizing. For periods less than one year, and if there are results in the net capital gains and provisions line, the profit used to calculate RoA and RoRWA is the annualized underlying consolidated profit, to which said results are added without annualizing. The risk-weighted assets included in the denominator of the RoRWA metric are calculated in line with the criteria laid out in the CRR (Capital Requirements Regulation). PROFITABILITY AND EFFICIENCY ✓ RoTE: Return on tangible capital: Group attributable profit / average of: net equity (excluding minority interests) – intangible assets (including goodwill) ✓ RoRWA: Return on risk-weighted assets: consolidated profit / average risk-weighted assets ✓ Efficiency: Operating expenses / total income. Operating expenses defined as general administrative expenses + amortizations VOLUMES ✓ Loans: Gross loans and advances to customers (excl. reverse repos) ✓ Customer funds: Customer deposits excluding repos + marketed mutual funds CREDIT RISK ✓ NPL ratio: Credit impaired loans and advances to customers, customer guarantees and customer commitments granted / Total risk. Total risk is defined as: Total loans and advances and guarantees to customers (including credit impaired assets) + contingent liabilities granted that are credit impaired ✓ Total coverage ratio: Total allowances to cover impairment losses on loans and advances to customers, customer guarantees and customer commitments granted / Credit impaired loans and advances to customers, customer guarantees and customer commitments granted ✓ Cost of risk: Allowances for loan-loss provisions over the last 12 months / average loans and advances to customers of the last 12 months CAPITALIZATION ✓ Tangible net asset value per share – TNAVps: Tangible stockholders' equity / number of shares (excluding treasury shares). Tangible stockholders' equity calculated as shareholders equity + accumulated other comprehensive income - intangible assets

Thank You. Our purpose is to help people and businesses prosper. Our culture is based on believing that everything we do should be:

SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Banco Santander, S.A. Date: 26 October 2022 By: /s/ José García Cantera Name: José García Cantera Title: Chief Financial Officer