Banco Santander (SAN) 6-KCurrent report (foreign)

Filed: 17 Mar 20, 11:28am

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of March, 2020

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No | X |

Banco Santander, S.A.

TABLE OF CONTENTS

Item | |

| 1 | Presentation to European Financials Conference |

Item 1

| 1 Confidential European Financials 17 th March 2020 Ana Botín Group Executive Chairman C on f e r en c e Morgan Stanley

Confidential Important Information Non - IFRS and alternative performance measures In addition to the financial information prepared in accordance with International Financial Reporting Standards (“IFRS”) and derived from our financial statements, this presentation contains certain financial measures that constitute alternative performance measures (“APMs”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015 (ESMA/ 2015 / 1415 en) and other non - IFRS measures (“Non - IFRS Measures”) . The financial measures contained in this presentation that qualify as APMs and non - IFRS measures have been calculated using the financial information from Santander Group but are not defined or detailed in the applicable financial reporting framework and have neither been audited nor reviewed by our auditors . We use these APMs and non - IFRS measures when planning, monitoring and evaluating our performance . We consider these APMs and non - IFRS measures to be useful metrics for management and investors to facilitate operating performance comparisons from period to period . While we believe that these APMs and non - IFRS measures are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute of IFRS measures . In addition, other companies, including companies in our industry, may calculate or use such measures differently, which reduces their usefulness as comparative measures . For further details of the APMs and Non - IFRS Measures used, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the consolidated financial statements prepared under IFRS, please see the 2019 Annual Financial Report, filed with the Comisión Nacional del Mercado de Valores of Spain (CNMV) as Other Relevant Information on 28 February 2020 . This document is available on Santander’s website ( www . santander . com ) . The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the included businesses and local applicable accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such subsidiaries Forward - looking statements Santander cautions that this presentation contains statements that constitute “forward - looking statements” within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by words such as “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”, “future” and similar expressions . These forward - looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business development and economic performance and our shareholder remuneration policy . While these forward - looking statements represent our judgment and future expectations concerning the development of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations . The following important factors, in addition to those discussed elsewhere in this presentation, could affect our future results and could cause outcomes to differ materially from those anticipated in any forward - looking statement : ( 1 ) general economic or industry conditions in areas in which we have significant business activities or investments, including a worsening of the economic environment, increasing in the volatility of the capital markets, inflation or deflation, and changes in demographics, consumer spending, investment or saving habits ; ( 2 ) exposure to various types of market risks, principally including interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices ; ( 3 ) potential losses associated with prepayment of our loan and investment portfolio, declines in the value of collateral securing our loan portfolio, and counterparty risk ; ( 4 ) political stability in Spain, the UK, other European countries, Latin America and the US ( 5 ) changes in laws, regulations or taxes, including changes in regulatory capital and liquidity requirements, including as a result of the UK exiting the European Union and increased regulation in light of the global financial crisis ; ( 6 ) our ability to integrate successfully our acquisitions and the challenges inherent in diverting management’s focus and resources from other strategic opportunities and from operational matters while we integrate these acquisitions ; and ( 7 ) changes in our ability to access liquidity and funding on acceptable terms, including as a result of changes in our credit spreads or a downgrade in our credit ratings or those of our more significant subsidiaries . Numerous factors could affect the future results of Santander and could result in those results deviating materially from those anticipated in the forward - looking statements . Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward - looking statements . Forward - looking statements speak only as of the date of this presentation and are based on the knowledge, information available and views taken on such date; such knowledge, information and views may change at any time. Santander does not undertake any obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise. No offer The information contained in this presentation is subject to, and must be read in conjunction with, all other publicly available information, including, where relevant any fuller disclosure document published by Santander . Any person at any time acquiring securities must do so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only on such information as is contained in such public information having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the information contained in this presentation . No investment activity should be undertaken on the basis of the information contained in this presentation . In making this presentation available Santander gives no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever . Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities . No offering of securities shall be made in the United States except pursuant to registration under the U . S . Securities Act of 1933 , as amended, or an exemption therefrom . Nothing contained in this presentation is intended to constitute an invitation or inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U . K . Financial Services and Markets Act 2000 . Historical performance is not indicative of future results Statements as to historical performance or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily match or exceed those of any prior period. Nothing in this presentation should be construed as a profit forecast. Third Party Information In particular, regarding the data provided by third parties, neither Santander, nor any of its administrators, directors or employees, either explicitly or implicitly, guarantees that these contents are exact, accurate, comprehensive or complete, nor are they obliged to keep them updated, nor to correct them in the case that any deficiency, error or omission were to be detected. Moreover, in reproducing these contents in by any means, Santander may introduce any changes it deems suitable, may omit partially or completely any of the elements of this presentation, and in case of any deviation between such a version and this one, Santander assumes no liability for any discrepancy. | 2

| 3 Confidential COVID - 19 Update Impact of Covid - 19 on the business • Santander has taken action to protect the wellbeing of our employees, customers and shareholders while ensuring that we continue to meet our obligations to all stakeholders − Employees in large centres working from home where possible − Shareholders to participate remotely in the AGM instead of attending in person − Access to liquidity provided for customers where required • Santander has in place the necessary contingency plans to ensure business continuity • We have not yet seen any relevant impact on business activity; do not expect any material impact in Q1 • Expect underlying earnings in Q1 broadly in line with previous quarters as well as organic capital generation in line with guidance offset by one - off impacts of Allianz acquisition ( - 10bps) and IFRS9 ( - 5bps) • Looking ahead, at this stage it is too soon to predict the impact and will depend on how the situation evolves. In a V - shape impact scenario, negative impact of c.5% for 2020 full - year earnings without including mitigating measures • Our strong pre - provision profit (c.€26 billion in 2019, 3x cost of risk) means that we are well positioned to withstand even a severe stress scenario • Based on current outlook we still target to be at the top end of our CET1 FL guidance range by the end of 2020

| 4 Co n f id e ntial Ind e x Achievements & delivery Santander for the future 1 2

| 5 Confidential In 2015 we set a strategy focused on customer loyalty… Our purpose To help people and businesses prosper Our aim as a bank To be the best open financial services platform , by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities Our how Everything we do should be Simple, Personal and Fair

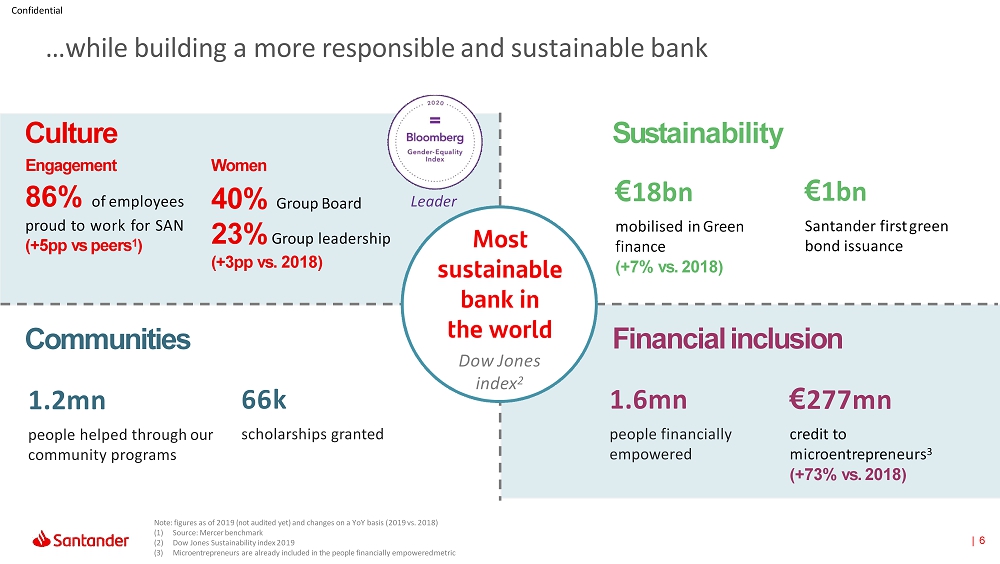

| 6 Confidential …while building a more responsible and sustainable bank Note: figures as of 2019 (not audited yet) and changes on a YoY basis (2019 vs. 2018) (1) Source: Mercer benchmark (2) Dow Jones Sustainability index 2019 (3) Microentrepreneurs are already included in the people financially empowered metric Financial inclusion 1.6mn people financially empowered 66k scholarships granted Communities 1.2mn people helped through our community programs Women 40% Group Board 23% Group leadership (+3pp vs. 2018) € 277mn credit to m i c r oent r ep r e neurs 3 (+73% vs. 2018) € 1bn Santander first green bond issuance Culture Engagement 86 % of employees proud to work for SAN (+ 5 pp vs peers 1 ) Sus t ainabil i ty € 18bn mobilised in Green finance (+7% vs. 2018) Dow Jones index 2 L ead er

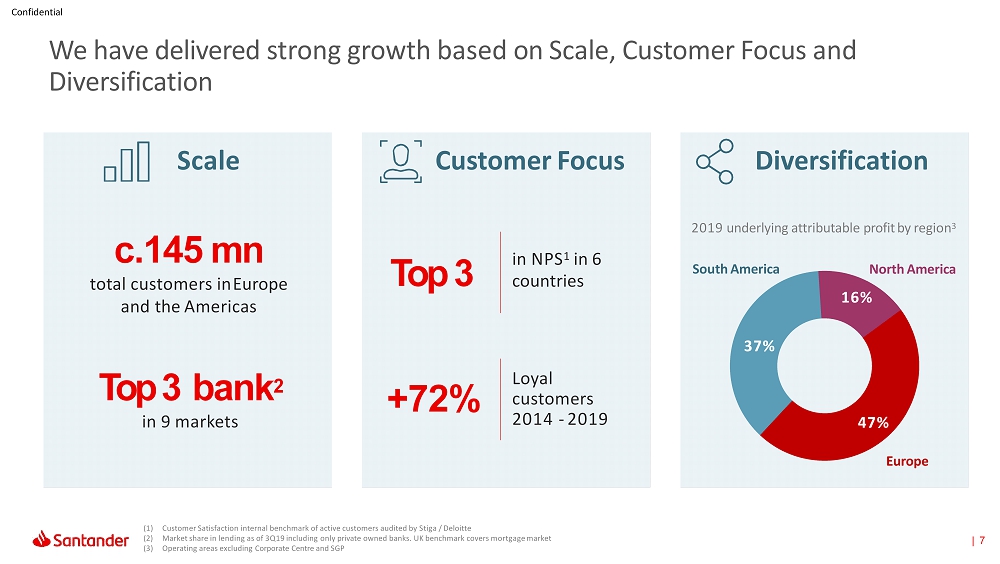

| 7 Confidential We have delivered strong growth based on Scale, Customer Focus and Diversification (1) Customer Satisfaction internal benchmark of active customers audited by Stiga / Deloitte (2) Market share in lending as of 3Q19 including only private owned banks. UK benchmark covers mortgage market (3) Operating areas excluding Corporate Centre and SGP 37% South America 47% Europe North America 16% Diversification 2019 underlying attributable profit by region 3 Scale c.145 mn total customers in Europe and the Americas Top 3 bank 2 in 9 markets Customer Focus Top 3 in NPS 1 in 6 countries +72% Loyal customers 2014 - 2019

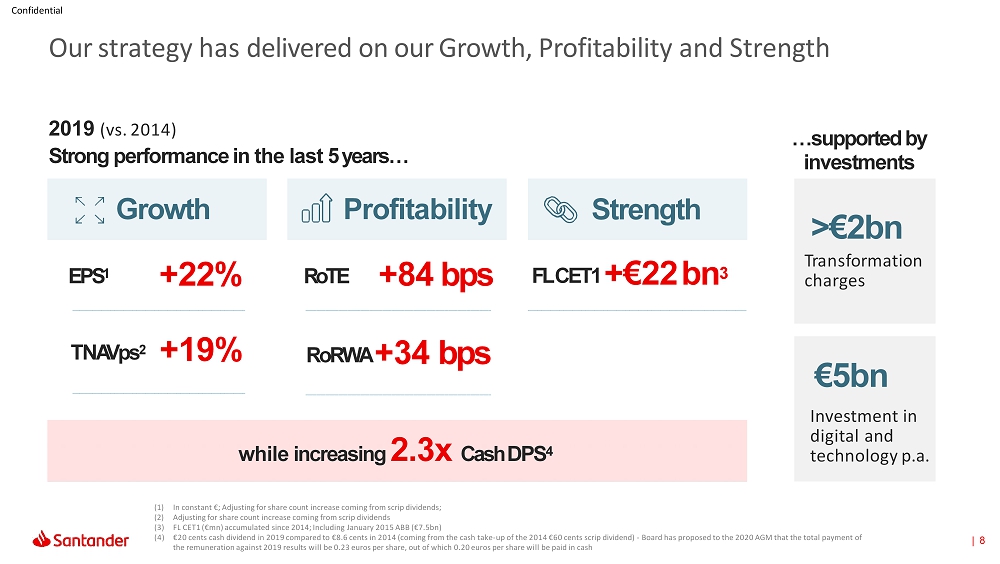

| 8 Confidential Our strategy has delivered on our Growth, Profitability and Strength €5bn Investment in digital and technology p.a. >€2bn T r ans f or mat i o n charges (1) In constant €; Adjusting for share count increase coming from scrip dividends; (2) Adjusting for share count increase coming from scrip dividends (3) FL CET1 (€mn) accumulated since 2014; Including January 2015 ABB (€7.5bn) (4) €20 cents cash dividend in 2019 compared to €8.6 cents in 2014 (coming from the cash take - up of the 2014 €60 cents scrip dividend) - Board has proposed to the 2020 AGM that the total payment of the remuneration against 2019 results will be 0.23 euros per share, out of which 0.20 euros per share will be paid in cash E P S 1 T N A V ps 2 +19% …supported by investments R o TE +22% +84 bps RoRWA +34 bps 2019 (vs. 2014) Strong performance in the last 5 years… Growth Profitability FL CET1 +€22 bn 3 Strength while increasing 2.3x Cash DPS 4

| 9 Confidential (1) Statutory attributable profit to the Group. (2) Source Bloomberg average Euribor 12 month per year. (3) For comparison purposes, capital ratio is calculated by applying Basel III (BIS II 11.71%). (4) Data calculated using the IFRS 9 transitional arrangements Since 2014 Underlying profit (€ Mn) Attributable profit 1 (€ Mn) 8 , 0 6 4 8 , 2 52 Underlying RoTE Avg. Euribor 12M 2 CET1 FL - 0. 2 1% 0. 4 8 % - 0. 1 7% 11.3% 4 7.8% 3 11.65% 4 8.3% +42% - 69bps Profitability 4,175 5,816 7,810 6,515 +12% 9.6% 12.1% 11.8% +84bps 0. 5 4 % 2013 2014 2018 2019 CET1 FL + € 22Bn (+47%) CET1 FL % +338 bps Doubled profits and increasing CET1 since 2013

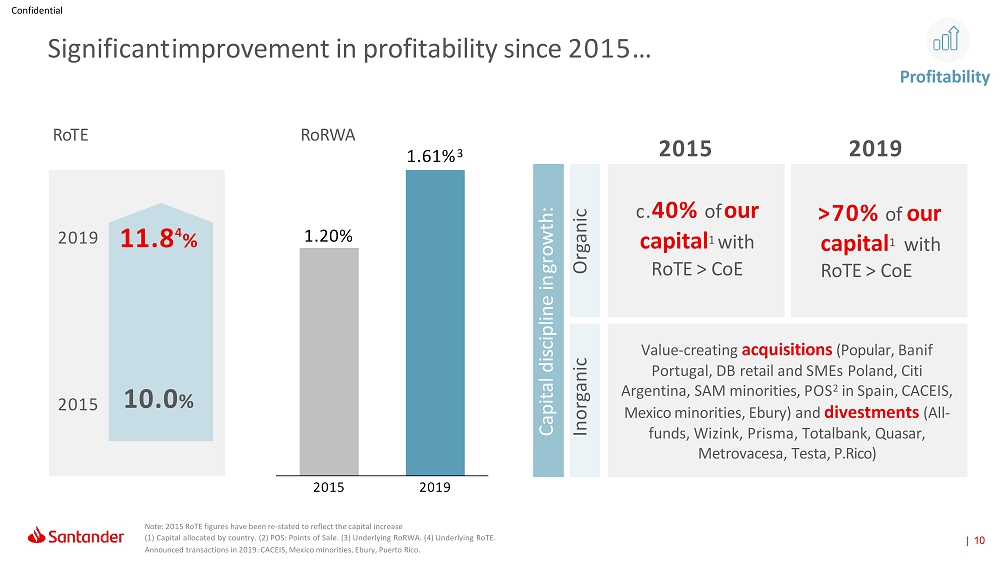

| 10 Confidential Significant improvement in profitability since 2015… 2015 2019 R o TE Ro R W A 10.0 % 11.8 4 % 2019 2015 Capital discipline in growth: Organic c. 40% of our capital 1 with RoTE > CoE > 70 % of our capital 1 with RoTE > CoE Inorganic Value - creating acquisitions (Popular, Banif Portugal, DB retail and SMEs Poland, Citi Argentina, SAM minorities, POS 2 in Spain, CACEIS, Mexico minorities, Ebury) and divestments (All - funds, Wizink, Prisma, Totalbank, Quasar, Metrovacesa, Testa, P.Rico) Profitability 1 .2 0 % 2015 2019 Note: 2015 RoTE figures have been re - stated to reflect the capital increase (1) Capital allocated by country. (2) POS: Points of Sale. (3) Underlying RoRWA. (4) Underlying RoTE. Announced transactions in 2019: CACEIS, Mexico minorities, Ebury, Puerto Rico. 1 .6 1 % 3

| 11 Confidential This strong profitability has led to a significant and increasing capital accumulation S t r ength +40bps per annum 5 Year run - r a t e c.12% 5 Yr net capital accumulation J a n - 15 2019 2020 net capital accumulation 2020 9.65% +200 bps 11.65% c.+40 bps FL CET1 Jan 2015 - 2020

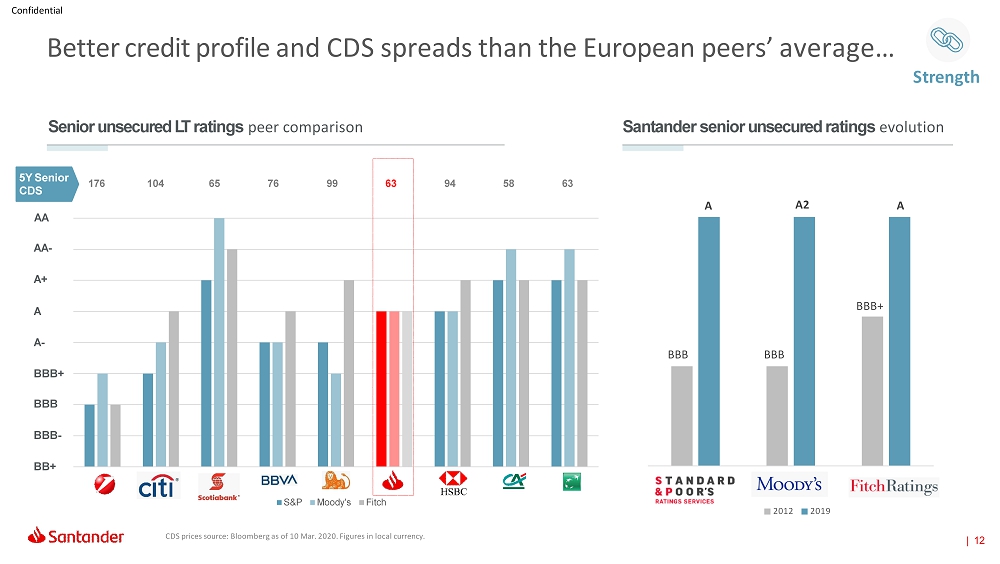

| 12 Confidential S& P M ood y ' s F i t c h 2 0 1 2 2 0 1 9 CDS prices source: Bloomberg as of 10 Mar. 2020. Figures in local currency. 9 10 11 12 13 14 15 16 17 S& P M ood y ' s F i t c h 176 104 65 76 99 63 94 58 63 BBB+ BBB BBB - BB+ A - A Senior unsecured LT ratings peer comparison Santander senior unsecured ratings evolution 5Y Senior CDS Better credit profile and CDS spreads than the European peers’ average… S t r ength BBB BBB BBB+ A A2 A AA AA - A+

| 13 Confidential …being the strongest European bank under the 2018 EBA stress test adverse scenario 694 657 625 576 533 437 381 363 341 334 288 265 219 193 141 FL CET1 erosion under the adverse scenario (bps) 395 bps SYSTEM AVERAGE 403 bps PEER AVERAGE Source 2018 EBA stress test S t r ength

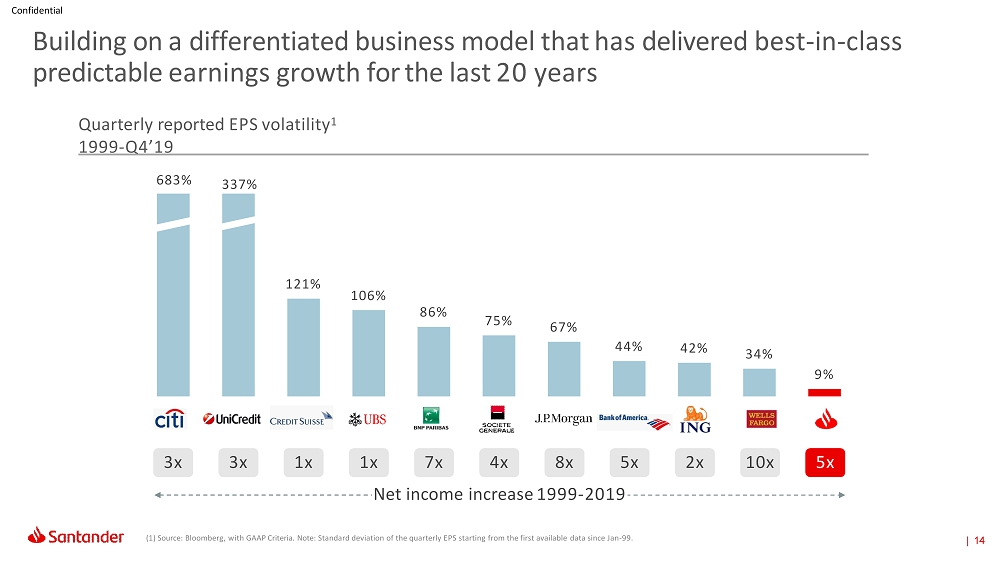

| 14 Confidential 121% 106% 86% 75% 67% 44% 42% 34% 9% Building on a differentiated business model that has delivered best - in - class predictable earnings growth for the last 20 years (1) Source: Bloomberg, with GAAP Criteria. Note: Standard deviation of the quarterly EPS starting from the first available data since Jan - 99. Quarterly reported EPS volatility 1 1999 - Q4’19 5x 10x 2x 1x 3x 3x 1 x 7 x 4 x 8 x 5x Net income increase 1999 - 2019 683% 337%

| 15 Co n f id e ntial Ind e x Achievements & delivery Santander for the future 1 2

| 16 Confidential Execution of our three - pillar plan to drive profitable growth in a responsible way Improve operating performance Accelerate digitalisation through Santander Global Platform Optimise capital allocation Continue building a more Responsible Bank

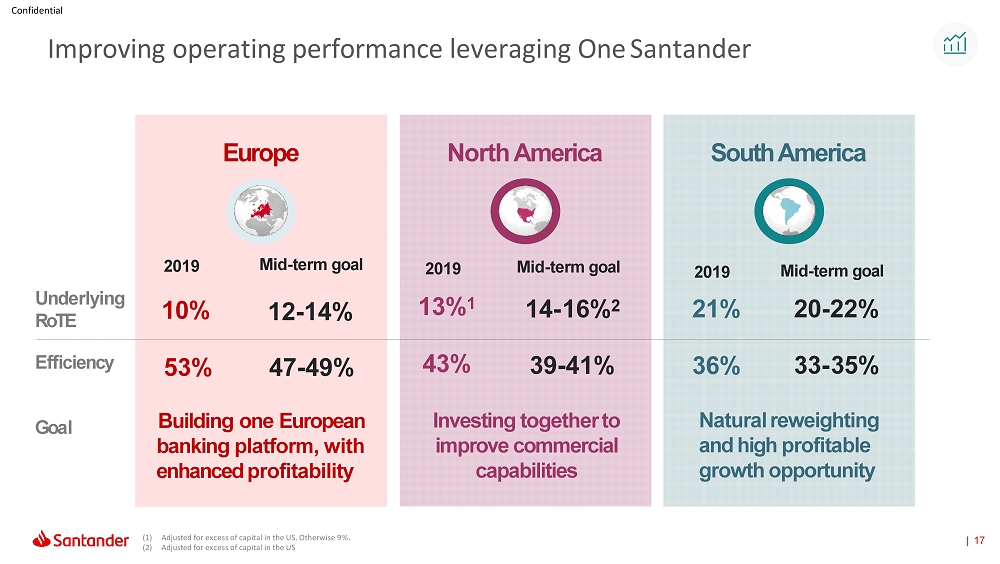

| 17 Confidential Improving operating performance leveraging One Santander (1) Adjusted for excess of capital in the US. Otherwise 9%. (2) Adjusted for excess of capital in the US South America North America Investing together to improve commercial capabilities Und er l y i ng RoTE Ef f icie n cy 36 % 33 - 35% Natural reweighting and high profitable growth opportunity 2019 Mid - term goal 21% 20 - 22% 39 - 41% 43% Mid - term goal 14 - 16 % 2 2019 13 % 1 Eu r o p e 53% 47 - 49% Building one European banking platform, with enhanced profitability Mid - term goal 12 - 14% 2019 10% G o al

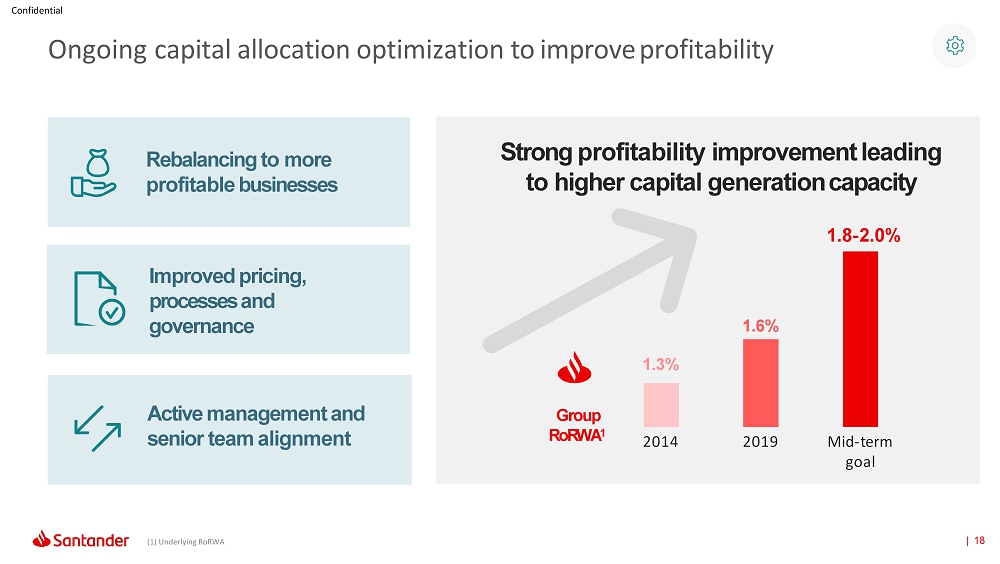

| 18 Confidential Ongoing capital allocation optimization to improve profitability Rebalancing to more profitable businesses Improved pricing, processes and governance Active management and senior team alignment Group Ro R W A 1 1.3% 1.6% Strong profitability improvement leading to higher capital generation capacity 1 .8 - 2 . 0 % 2014 2019 Mid - t e r m goal (1) Underlying RoRWA

| 19 Confidential Accelerating digitalisation and building Santander Global Platform Accelerate the t r a n s f ormation of our ‘core Banks’ Moving towards ONE SANTANDER to build simpler, faster and better services Provide faster and better global payments and solutions

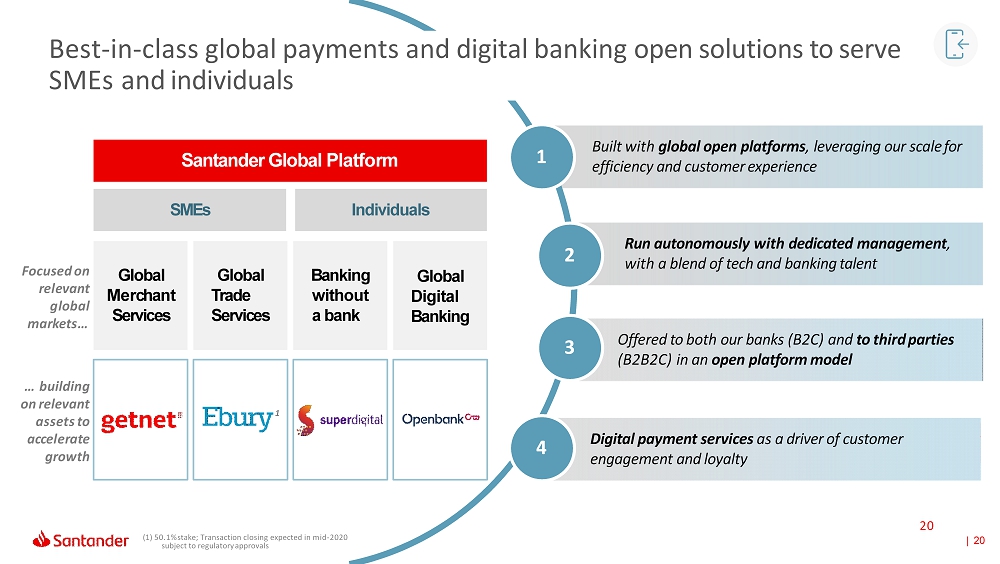

| 20 20 Built with global open platforms , leveraging our scale for efficiency and customer experience Run autonomously with dedicated management , with a blend of tech and banking talent Confidential Accelerate digitisation Best - in - class global payments and digital banking open solutions to serve SMEs and individuals SMEs Individuals Santander Global Platform Global Me r c h a nt Services Global Trade Servi c e s B a nking without a bank Focused on r e l e v a nt g lo bal m a r k e t s … … building on relevant assets to a cc e l e r a t e g r o w th Global Digital B a nking Digital payment services as a driver of customer engagement and loyalty 1 Offered to both our banks (B2C) and to third parties (B2B2C) in an open platform model 3 4 (1) 50.1% stake; Transaction closing expected in mid - 2020 subject to regulatory approvals 1 2

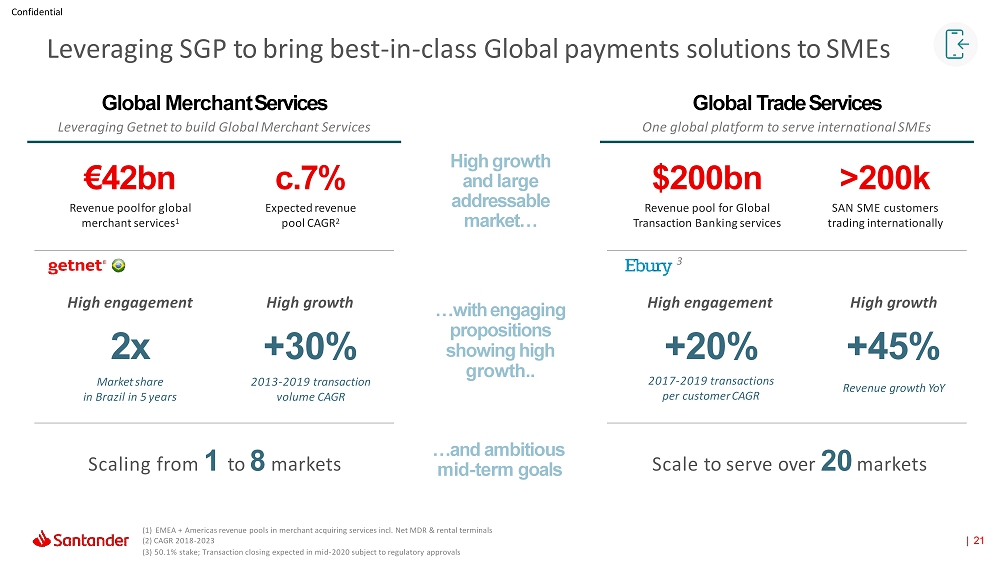

| 21 High growth and large addressable market… …with engaging propositions showing high growth.. … and ambitious mid - term goals Global Merchant Services Leveraging Getnet to build Global Merchant Services Scaling from 1 to 8 markets Global Trade Services One global platform to serve international SMEs Confidential Leveraging SGP to bring best - in - class Global payments solutions to SMEs >200k SAN SME customers trading internationally $200bn Revenue pool for Global Transaction Banking services 3 High engagement 2x Market share in Brazil in 5 years High growth +30% 2013 - 2019 transaction volume CAGR High engagement +20% 2017 - 2019 transactions per customer CAGR High growth +45% Revenue growth YoY c.7% Expected revenue pool CAGR 2 €42bn Revenue pool for global merchant services 1 (1) EMEA + Americas revenue pools in merchant acquiring services incl. Net MDR & rental terminals (2) CAGR 2018 - 2023 (3) 50.1% stake; Transaction closing expected in mid - 2020 subject to regulatory approvals Scale to serve over 20 markets

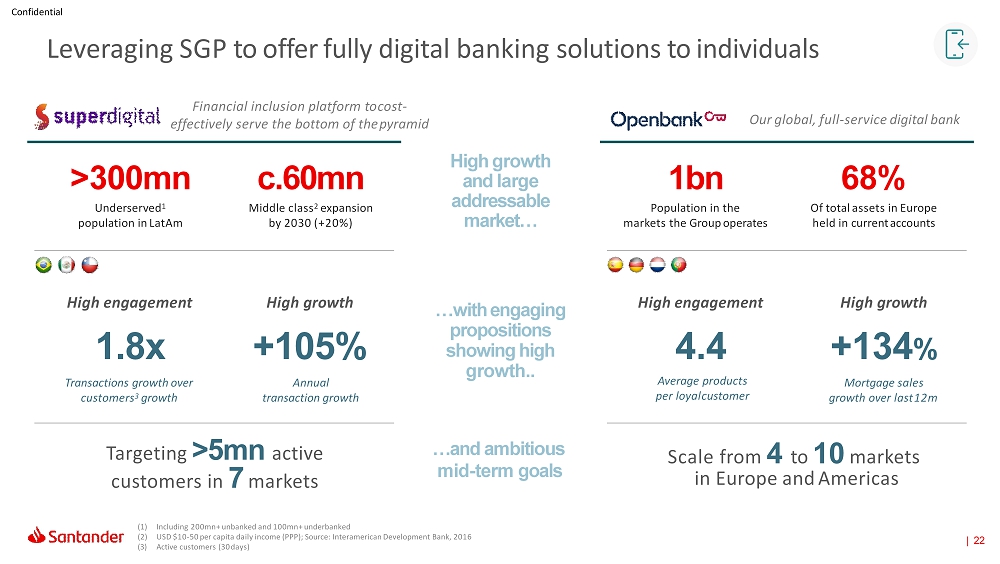

| 22 High growth and large addressable market… …with engaging propositions showing high growth.. … and ambitious mid - term goals Financial inclusion platform to cost - effectively serve the bottom of the pyramid Targeting >5mn active customers in 7 markets Our global, full - service digital bank Confidential Leveraging SGP to offer fully digital banking solutions to individuals c.60mn Middle class 2 expansion by 2030 (+20%) 68% Of total assets in Europe held in current accounts >300 m n Underserved 1 population in LatAm 1bn Population in the markets the Group operates High engagement 1.8x Transactions growth over customers 3 growth High growth +105% Annual transaction growth High engagement 4.4 Average products per loyal customer High growth +134 % Mortgage sales growth over last 12m (1) Including 200mn+ unbanked and 100mn+ underbanked (2) USD $10 - 50 per capita daily income (PPP); Source: Interamerican Development Bank, 2016 (3) Active customers (30 days) Scale from 4 to 10 markets in Europe and Americas

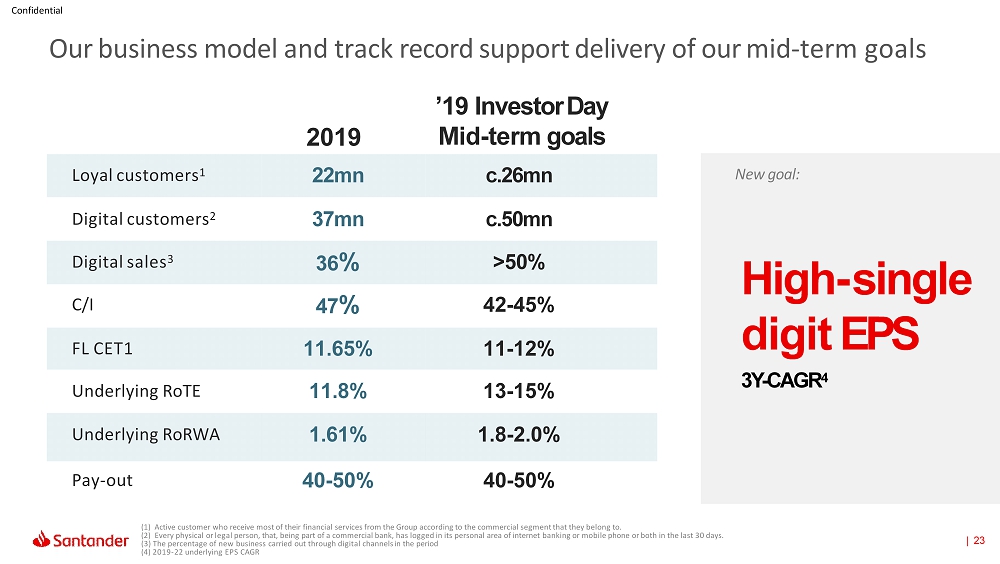

| 23 Confidential Our business model and track record support delivery of our mid - term goals ’19 Investor Day Mid - term goals 2019 (1) Active customer who receive most of their financial services from the Group according to the commercial segment that they belong to. (2) Every physical or legal person, that, being part of a commercial bank, has logged in its personal area of internet banking or mobile phone or both in the last 30 days. (3) The percentage of new business carried out through digital channels in the period (4) 2019 - 22 underlying EPS CAGR Loyal customers 1 22mn c.26mn Digital customers 2 37mn c.50mn Digital sales 3 36 % >50% C/I 47 % 42 - 45% FL CET1 11.65% 11 - 12% Underlying RoTE 11.8% 13 - 15% Underlying RoRWA 1.61% 1.8 - 2.0% Pay - out 40 - 50% 40 - 50% High - sing l e digit EPS 3Y - CAGR 4 New goal:

| 24 Confidential Our purpose is to help people and businesses prosper. Our culture is based on believing that everything we do should be: Thank You.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Banco Santander, S.A. | |||||

| Date: | March 17, 2020 | By: | /s/ José García Cantera | ||

| Name: | José García Cantera | ||||

| Title: | Chief Financial Officer | ||||