I can hardly believe that we have been navigating through one of the worst pandemics in modern history for more than a year. From the start, our thoughts have been with those affected by COVID-19 and with our frontline healthcare and essential workers. We are encouraged by the rapid rollout of vaccines and the continued reopening of the economy, and we hope this signals a turning point.

This is the first time in over 20 years in this business that I have witnessed volatility as extreme as the volatility that has rocked the financial markets and the economy over the past year. Both the pace of change and the magnitude of change have been staggering. As I reflect on this, I am reminded of a scientific concept called “punctuated equilibrium.” Biologist Stephen Jay Gould revolutionized evolutionary thinking with this theory, which challenged the prevailing belief that biological change happens slowly, consistently, and methodically over time. His theory instead proposed that change happens abruptly and dramatically and that new species pop up and others vanish rapidly, sometimes caused by catastrophic events. In between these explosive periods are much longer intervals of relative stability.

The dramatic market downdraft brought on by the pandemic, followed by the equally dramatic recovery, have been jarring. We witnessed an explosion of IPOs, a plethora of bankruptcies, and a dramatic change in market leadership. Yet unlike in the biological world, we are able to respond to stock market crises and try to dampen their negative impact. There have been numerous and unprecedented fiscal and monetary responses from the Federal Reserve and the U.S. government, and in many ways these measures may have spurred the economic recovery.

For the first six months of our fiscal year through April 30, 2021, the market appeared to be on a relentless march higher, with the S&P 500® Index rising 28.85% on a total return basis, setting new all-time highs 35 times in 124 trading days and closing at its then-highest level ever on April 29, 2021. We saw a dramatic shift back toward value investing, and many of the sectors and individual stocks that had underperformed for most of last year soared. Value outperformed growth, small-caps beat mid-caps, and mid-caps beat large-caps. The Energy and Financials sectors skyrocketed, as evidenced by the S&P 500® Energy Index’s total return of 75.94% and the Russell 1000® Index Financials’ total return of 52.00% during the six-month period. As we begin to move beyond the chaos caused by the pandemic, solid market fundamentals are reappearing, which we believe underscores the health and strength of our economy.

We are pleased with the performance of our mutual funds during the first half of our fiscal year. On an absolute basis, each of our 16 Funds achieved positive performance, and 11 of our 16 funds outperformed their primary benchmark. Ten of our 11 domestic equity-only Funds outperformed the S&P 500® Index, and three of our sector Funds posted total returns of over 50%, due primarily to their focus on the Energy and Financials sectors. We believe this was a favorable period for both our style of high-conviction investing as well as the areas and sectors of the market in which our Funds focus. While performance may wax and wane over a complete market cycle, we remain committed to managing our portfolios for long-term performance, ever mindful of downside risk.

Circling back to Gould’s theory of punctuated equilibrium, we are left with the question, “Where do we go from here?” Are we entering a more stable period in the economy and the market, similar to the periods of relative stasis in the geological record? We are optimistic that this may in fact be the case and that the markets will return to a less volatile part of the cycle. But, with history as our guide, we know that even the greatest bull markets have experienced corrections along the way. While certain individual stock or sector valuations might look stretched, we believe the market as a whole has more room to run. Strong GDP growth and increasing earnings expectations for this year, a potentially lower-for-longer interest rate environment, accommodative fiscal and monetary policies, a healthy and robust financial system, low unemployment and solid wage growth, and a measured reopening of certain parts of the economy all support the market moving higher from here.

We remain committed to our shareholders as we thoughtfully navigate these unprecedented times. We know that you have a multitude of investment options to choose from, and we are grateful for the trust you put in us and your continued interest and investment in our family of Funds. Should you have any questions or would like to speak with us, please don’t hesitate to call us directly at (800) 966-4354.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Ryan C. Kelley and are subject to change, are not guaranteed, and should not be considered investment advice.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com. Performance shown for periods including or prior to October 26, 2012, is that of the FBR Balanced Fund.

The 60/40 Blended Balanced Index consists of 60% common stocks represented by the S&P 500® Index and 40% bonds represented by the Bloomberg Barclays Intermediate U.S. Government/Credit Index. The 70/30 Blended Balanced Index consists of 70% common stocks represented by the S&P 500® Index and 30% bonds represented by the Bloomberg Barclays Intermediate U.S. Government/Credit Index. The Bloomberg Barclays Intermediate U.S. Government/Credit Index measures the performance of U.S. dollar-denominated Treasury securities and government-related and investment-grade corporate securities that have $250 million or more of outstanding face value, are fixed rate and non-convertible, and have remaining maturities of greater than or equal to one year and less than 10 years. The S&P 500® Index is a capitalization-weighted index that is designed to represent the broad domestic economy through changes in the aggregate market value of 500 stocks across all major industries. One cannot invest directly in an index. These indices are used herein for comparative purposes in accordance with Securities and Exchange Commission regulations.

The expense ratios presented are from the most recent prospectus. The expense ratios for the current reporting period are available in the Financial Highlights section of this report.

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

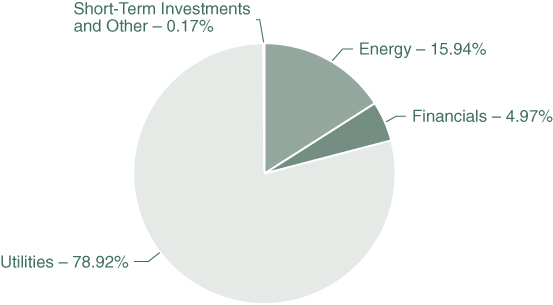

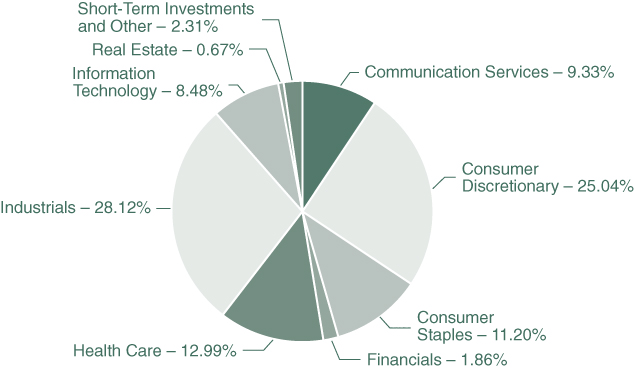

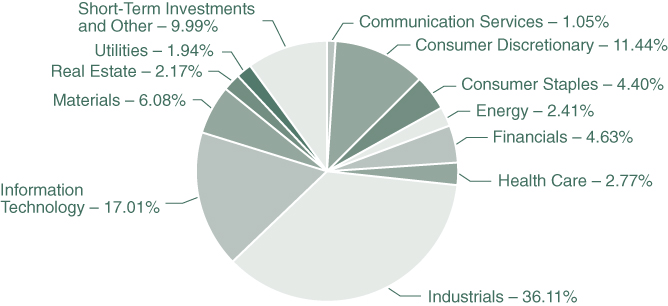

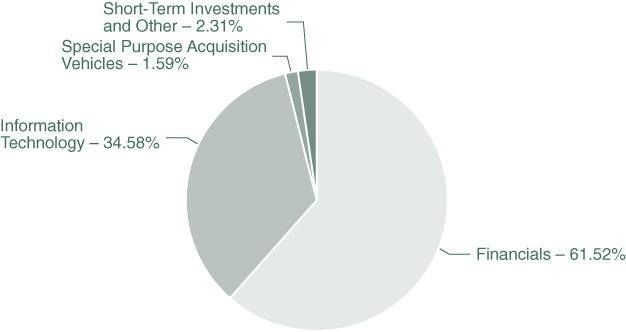

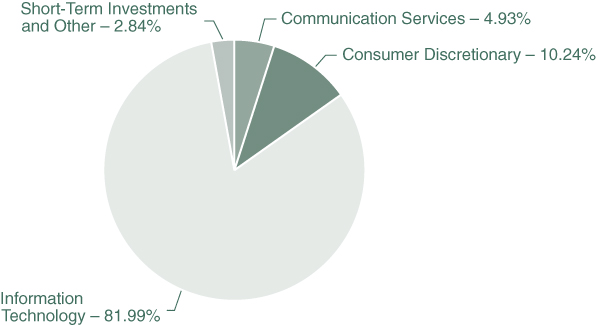

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2021 (see Note 3 in the accompanying Notes to the Financial Statements):

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The Hennessy Equity and Income Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is long-term capital growth and current income. The Fund is a diversified fund.

The Fund offers Investor Class and Institutional Class shares. Each class of shares differs principally in its respective 12b-1 distribution and service, shareholder servicing, and sub-transfer agent expenses. There are no sales charges. Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only one class.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles (“GAAP”).

The Fund follows its valuation policies and procedures in determining its net asset value and, in preparing these financial statements, the fair value accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

The following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities on a recurring basis:

The Board of Trustees of the Fund (the “Board”) has adopted fair value pricing procedures that are followed when a price for a security is not readily available or if a significant event has occurred that indicates the closing price of a security no longer represents the true value of that security. Fair value pricing determinations are made in good faith in accordance with these procedures. There are numerous criteria considered in determining a fair value of a security, such as the trading volume of a security and markets, the values of other similar securities, and news events with direct bearing on a security or markets. Fair value pricing results in an estimated price for a security that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The fair value of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of relevant American Depositary Receipts or futures contracts. Using fair value pricing means that the Fund’s NAV reflects the affected portfolio securities’ values as determined by the Board or its designee, pursuant to the fair value pricing procedures adopted by the Board, instead of being determined by the market. Using a fair value pricing methodology to price a foreign security may result in a value that is different from such foreign security’s most recent closing price and from the value used by other investment companies to calculate their NAVs. Such securities are generally classified in Level 2 of the fair value hierarchy. Because the Fund may invest in foreign securities, the value of the Fund’s portfolio securities may change on days when a shareholder is unable to purchase or redeem Fund shares.

The Board has delegated day-to-day valuation matters to the Valuation and Liquidity Committee comprising representatives from Hennessy Advisors, Inc., the Fund’s investment advisor (the “Advisor”). The function of the Valuation and Liquidity Committee, among other things, is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation and Liquidity Committee are reviewed by the Board.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determinations. Various inputs are used to determine the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair value hierarchy of the Fund’s securities as of April 30, 2021, are included in the Schedule of Investments.

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the six months ended April 30, 2021, were $15,076,921 and $21,930,339, respectively.

Purchases and sales/maturities of long-term U.S. government securities for the Fund during the six months ended April 30, 2021, were $0 and $1,952,386, respectively.

The Advisor provides the Fund with investment advisory services under an Investment Advisory Agreement. The Advisor oversees the provision of investment advice and furnishes office space, facilities, and most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based on the average daily net assets of the Fund at an annual rate of 0.80%. The net investment advisory fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

The Advisor has delegated the day-to-day management of the equity allocation of the Fund to a sub-advisor, The London Company of Virginia, LLC, and has delegated the day-to-day management of the fixed income allocation of the Fund to a sub-advisor, FCI Advisors. The Advisor pays the sub-advisory fees from its own assets, and these fees are not an additional expense of the Fund. During the six months ended April 30, 2021, the Advisor (not the Fund) paid a sub-advisory fee at the rate of 0.33% of the daily net assets of the equity allocation of the Fund and 0.27% of the daily net assets of the fixed income allocation of the Fund.

The Board has approved a Shareholder Servicing Agreement for Investor Class shares of the Fund, which compensates the Advisor for the non-investment advisory services it

provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund attributable to Investor Class shares. The shareholder service fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the distribution of Fund shares at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to Investor Class shares. Even though the authorized rate is up to 0.25%, the Fund is currently only using up to 0.15% of its average daily net assets attributable to Investor Class shares for such purpose. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not limited to, advertising, shareholder account servicing, printing and mailing of prospectuses to other than current shareholders, printing and mailing of sales literature, and compensation for sales and marketing activities or to financial institutions and others, such as dealers and distributors. The distribution fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of Fund shares. The agreements provide for periodic payments of sub-transfer agent expenses by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services. These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. The sub-transfer agent fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”) provides the Fund with administrative, accounting, and transfer agent services. As administrator, Fund Services is responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s custodian, transfer agent, and accountants, and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. The servicing agreements between the Trust, Fund Services, and U.S. Bank N.A. contain a fee schedule that is inclusive of administrative, accounting, custody, and transfer agent fees. The administrative, accounting, custody, and transfer agent fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

Quasar Distributors, LLC (“Quasar”), a wholly owned broker-dealer subsidiary of Foreside Financial Group, LLC, acts as the Fund’s principal underwriter in a continuous public offering of Fund shares.

The officers of the Fund are affiliated with the Advisor. With the exception of the Chief Compliance Officer and the Senior Compliance Officer, such officers receive no compensation from the Fund for serving in their respective roles. The Fund, along with the other funds in the Hennessy Funds family (collectively, the “Hennessy Funds”), makes reimbursement payments on an equal basis to the Advisor for a portion of the salary and benefits associated with the office of the Chief Compliance Officer and for all of the salary and benefits associated with the office of the Senior Compliance Officer. The compliance fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

Under the Hennessy Funds’ organizational documents, their officers and trustees are indemnified by the Hennessy Funds against certain liabilities arising out of the performance of their duties to the Hennessy Funds. Additionally, in the normal course of business, the Hennessy Funds enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

The Fund has an uncommitted line of credit with the other Hennessy Funds in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Fund and 10% for the Hennessy Balanced Fund. The line of credit is intended to provide any necessary short-term financing in connection with shareholder redemptions, subject to certain restrictions. The credit facility is with the Hennessy Funds’ custodian bank, U.S. Bank N.A. Borrowings under this arrangement bear interest at the bank’s prime rate and are secured by all of the Fund’s assets (as to its own borrowings only). During the six months ended April 30, 2021, the Fund did not have any borrowings outstanding under the line of credit.

As of October 31, 2020, the Fund’s most recent fiscal year end, the components of accumulated earnings (losses) for income tax purposes were as follows:

The difference between book-basis unrealized appreciation/depreciation and tax-basis unrealized appreciation/depreciation (as shown above) is attributable primarily to wash sales.

As of October 31, 2020, the Fund had no tax-basis capital losses to offset future capital gains.

As of October 31, 2020, the Fund did not defer, on a tax basis, any late-year ordinary losses. Late-year ordinary losses are net ordinary losses incurred after December 31, 2019, but within the taxable year, that are deemed to arise on the first day of the Fund’s next taxable year.

During fiscal year 2021 (year to date) and fiscal year 2020, the tax character of distributions paid by the Fund was as follows:

The Fund invests in financial instruments with payment obligations, financing terms, hedging strategies, or investment values based on, among other floating rates, the London Interbank Offered Rate (“LIBOR”). LIBOR is the offered rate for short-term Eurodollar deposits between major international banks. On July 27, 2017, the UK Financial Conduct Authority, which regulates LIBOR, announced that it would no longer persuade or compel banks to submit rates for the calculation of LIBOR after 2021, meaning that LIBOR cannot continue on its current basis and will not be guaranteed after 2021. Regulators and industry working groups have suggested alternative reference rates, but global consensus is lacking, and the process for amending existing contracts or instruments to transition away from LIBOR remains unclear. The transition away from LIBOR may lead to increased volatility and illiquidity in markets tied to LIBOR, reduce the value of LIBOR-related instruments, and reduce the effectiveness of hedging strategies, which could adversely affect the Fund’s performance. Additionally, any alternative reference rate may be an ineffective substitute, resulting in prolonged adverse market conditions for the Fund’s investments.

Management has evaluated the Fund’s related events and transactions that occurred subsequent to April 30, 2021, through the date of issuance of the Fund’s financial statements. Management has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

As a shareholder of the Fund, you incur ongoing costs, including management fees, service fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2020, through April 30, 2021.

In the table below, the first line under each of the “Investor Class” and “Institutional Class” headings provides information about actual account values and actual expenses for each share class. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bank Global Fund Services, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, the Fund’s transfer agent charges a $15 fee. IRAs are charged a $15 annual maintenance fee (up to $30 maximum per shareholder for shareholders with multiple IRAs). The examples below include, but are not limited to, management, shareholder servicing, accounting, custody, and transfer agent fees. However, the examples below do not include portfolio trading commissions and related expenses.

In the table below, the second line under each of the “Investor Class” and “Institutional Class” headings provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each share class and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return for such share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second lines under “Investor Class” and “Institutional Class” headings are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge (1) by calling 1-800-966-4354, (2) on the Hennessy Funds’ website at www.hennessyfunds.com/proxy-voting/voting-policy, or (3) on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. The Fund’s proxy voting record is available without charge on both the Hennessy Funds’ website at www.hennessyfunds.com/proxy-voting/voting-record and the SEC’s website at www.sec.gov no later than August 31 for the prior 12 months ending June 30.

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov or on request by calling 1-800-966-4354.

For fiscal year 2020, certain dividends paid by the Fund may be subject to a maximum tax rate of 23.8%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00%.

For corporate shareholders, the percent of ordinary income distributions that qualified for the corporate dividends received deduction for fiscal year 2020 was 100.00%.

The percentage of taxable ordinary income distributions that were designated as short-term capital gain distributions under Section 871(k)(2)(C) of the Internal Revenue Code of 1986, as amended, for the Fund was 0.00%.

To help keep the Fund’s costs as low as possible, we generally deliver a single copy of notices, shareholder reports, proxy statements, and prospectuses to shareholders who share an address and have the same last name. This process does not apply to account statements. You may request an individual copy of a shareholder document at any time. If you would like to receive separate mailings of shareholder documents, please call U.S. Bank Global Fund Services at 1-800-261-6950 or 1-414-765-4124, and individual delivery will begin within 30 days of your request. If your account is held through a financial institution or other intermediary, please contact such intermediary directly to request individual delivery.

As permitted by SEC regulations, the Fund’s shareholder reports are made available on a website, and unless you sign up for eDelivery or elect to receive paper copies as detailed below, you will be notified by mail each time a report is posted and provided with a website link to access the report.

The Fund also offers shareholders the option to receive all notices, account statements, prospectuses, tax forms, and shareholder reports online. To sign up for eDelivery or change your delivery preference, please visit www.hennessyfunds.com/account.

To elect to receive paper copies of all future reports free of charge, please call U.S. Bank Global Fund Services at 1-800-261-6950 or 1-414-765-4124.

Subscribe to receive our team’s unique market and sector insights delivered to your inbox

At its meeting on March 10, 2021, the Board of Trustees of the Fund (the “Board,” and the members thereof, the “Trustees”) unanimously approved the continuation of the investment advisory agreement of the Fund with Hennessy Advisors, Inc. (the “Advisor”) and the sub-advisory agreement for the equity allocation of the Fund between the Advisor and The London Company, LLC, and the sub-advisory agreement for the fixed income allocation of the Fund between the Advisor and Financial Counselors, Inc. (with The London Company, LLC and Financial Counselors, Inc., each herein referred to individually as a “Sub-Advisor” and together as the “Sub-Advisors”). As part of the process, the Trustees reviewed their fiduciary duties and the relevant factors for them to consider with respect to approving the advisory and sub-advisory agreements. In addition, the Trustees who are not deemed “interested persons” (as defined by the Investment Company Act of 1940, as amended) of the Fund (the “Independent Trustees”) met in executive session to discuss the approval of the advisory and sub-advisory agreements.

In advance of the meeting, the Advisor sent detailed information to the Trustees to assist them in their evaluation of the advisory and sub-advisory agreements. This information included, but was not limited to, the following:

All of the factors discussed were considered as a whole by the Trustees and by the Independent Trustees meeting in executive session. The factors were viewed in their totality by the Trustees, with no single factor being the principal or determinative factor in the Trustees’ determination of whether to approve the continuation of the advisory and sub-advisory agreements. The Trustees recognized that the management and fee

arrangements for the Fund are the result of years of review and discussion between the Independent Trustees and the Advisor, that certain aspects of such arrangements may receive greater scrutiny in some years than in others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements and information received during the course of the year and in prior years.

Prior to approving the continuation of the advisory and sub-advisory agreements, the Trustees, including the Independent Trustees in executive session, considered, among other items:

The material considerations and determinations of the Trustees, including the Independent Trustees, were as follows:

After reviewing the materials and information provided at the meeting, as well as other information regularly provided at the Board’s quarterly meetings throughout the year regarding the quality of services provided by the Advisor and the Sub-Advisors, the performance of the Fund, expense information, brokerage commissions information, the adequacy and efficacy of the Advisor’s and the Sub-Advisors’ written policies and procedures, other regulatory compliance issues, trading information and related matters, and other factors that the Trustees deemed relevant, the Trustees, including the Independent Trustees, approved the continuation of the advisory and sub-advisory agreements.

Hennessy Advisors, Inc.

U.S. Bancorp Fund Services, LLC

d/b/a U.S. Bank Global Fund Services

P.O. Box 701

U.S. Bank N.A.

Neil J. Hennessy

Robert T. Doyle

J. Dennis DeSousa

Gerald P. Richardson

others only if preceded or accompanied by a current prospectus.

SEMI-ANNUAL REPORT

APRIL 30, 2021

HENNESSY BALANCED FUND

Investor Class HBFBX

www.hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to Shareholders | 2 |

| Performance Overview | 4 |

| Financial Statements | |

| Schedule of Investments | 5 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statements of Changes in Net Assets | 11 |

| Financial Highlights | 12 |

| Notes to the Financial Statements | 14 |

| Expense Example | 21 |

| Proxy Voting Policy and Proxy Voting Records | 22 |

| Availability of Quarterly Portfolio Schedule | 22 |

| Federal Tax Distribution Information | 22 |

| Important Notice Regarding Delivery of Shareholder Documents | 22 |

| Electronic Delivery | 22 |

| Board Approval of Investment Advisory Agreement | 23 |

| HENNESSY FUNDS | 1-800-966-4354 | |

May 2021

Dear Hennessy Funds Shareholder:

I can hardly believe that we have been navigating through one of the worst pandemics in modern history for more than a year. From the start, our thoughts have been with those affected by COVID-19 and with our frontline healthcare and essential workers. We are encouraged by the rapid rollout of vaccines and the continued reopening of the economy, and we hope this signals a turning point.

This is the first time in over 20 years in this business that I have witnessed volatility as extreme as the volatility that has rocked the financial markets and the economy over the past year. Both the pace of change and the magnitude of change have been staggering. As I reflect on this, I am reminded of a scientific concept called “punctuated equilibrium.” Biologist Stephen Jay Gould revolutionized evolutionary thinking with this theory, which challenged the prevailing belief that biological change happens slowly, consistently, and methodically over time. His theory instead proposed that change happens abruptly and dramatically and that new species pop up and others vanish rapidly, sometimes caused by catastrophic events. In between these explosive periods are much longer intervals of relative stability.

The dramatic market downdraft brought on by the pandemic, followed by the equally dramatic recovery, have been jarring. We witnessed an explosion of IPOs, a plethora of bankruptcies, and a dramatic change in market leadership. Yet unlike in the biological world, we are able to respond to stock market crises and try to dampen their negative impact. There have been numerous and unprecedented fiscal and monetary responses from the Federal Reserve and the U.S. government, and in many ways these measures may have spurred the economic recovery.

For the first six months of our fiscal year through April 30, 2021, the market appeared to be on a relentless march higher, with the S&P 500® Index rising 28.85% on a total return basis, setting new all-time highs 35 times in 124 trading days and closing at its then-highest level ever on April 29, 2021. We saw a dramatic shift back toward value investing, and many of the sectors and individual stocks that had underperformed for most of last year soared. Value outperformed growth, small-caps beat mid-caps, and mid-caps beat large-caps. The Energy and Financials sectors skyrocketed, as evidenced by the S&P 500® Energy Index’s total return of 75.94% and the Russell 1000® Index Financials’ total return of 52.00% during the six-month period. As we begin to move beyond the chaos caused by the pandemic, solid market fundamentals are reappearing, which we believe underscores the health and strength of our economy.

We are pleased with the performance of our mutual funds during the first half of our fiscal year. On an absolute basis, each of our 16 Funds achieved positive performance, and 11 of our 16 funds outperformed their primary benchmark. Ten of our 11 domestic equity-only Funds outperformed the S&P 500® Index, and three of our sector Funds posted total returns of over 50%, due primarily to their focus on the Energy and Financials sectors. We believe this was a favorable period for both our style of high-conviction investing as well as the areas and sectors of the market in which our Funds focus. While performance may wax and wane over a complete market cycle, we remain committed to managing our portfolios for long-term performance, ever mindful of downside risk.

Circling back to Gould’s theory of punctuated equilibrium, we are left with the question, “Where do we go from here?” Are we entering a more stable period in the economy and the market, similar to the periods of relative stasis in the geological record? We are optimistic that this may in fact be the case and that the markets will return to a less volatile part of the cycle. But, with history as our guide, we know that even the greatest bull markets have experienced corrections along the way. While certain individual stock or sector valuations might look stretched, we believe the market as a whole has more room to run. Strong GDP growth and increasing earnings expectations for this year, a potentially lower-for-longer interest rate environment, accommodative fiscal and monetary policies, a healthy and robust financial system, low unemployment and solid wage growth, and a measured reopening of certain parts of the economy all support the market moving higher from here.

We remain committed to our shareholders as we thoughtfully navigate these unprecedented times. We know that you have a multitude of investment options to choose from, and we are grateful for the trust you put in us and your continued interest and investment in our family of Funds. Should you have any questions or would like to speak with us, please don’t hesitate to call us directly at (800) 966-4354.

Best regards,

| |

| |

| |

| |

|

| Ryan C. Kelley |

| Chief Investment Officer |

Past performance does not guarantee future results. To obtain current standardized performance for the Hennessy Funds, visit https://www.hennessyfunds.com/funds/price-performance.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Ryan C. Kelley and are subject to change, are not guaranteed, and should not be considered investment advice.

The S&P 500® Index is a capitalization-weighted index that is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks across all major industries. The S&P 500® Energy Index comprises those companies included in the S&P 500® Index that are classified in the Energy sector. The Russell 1000® Index Financials is a subset of the Russell 1000® Index that measures the performance of securities classified in the Financials sector of the large-capitalization U.S. equity market. The indices are used herein for comparative purposes in accordance with SEC regulations. One cannot invest directly in an index. All returns are shown on a total return basis.

| HENNESSY FUNDS | 1-800-966-4354 | |

Performance Overview (Unaudited)

AVERAGE ANNUAL TOTAL RETURN FOR PERIODS ENDED APRIL 30, 2021

| | Six | One | Five | Ten |

| | Months(1) | Year

| Years

| Years

|

| Hennessy Balanced Fund (HBFBX) | 15.16% | 12.94% | 5.37% | 4.98% |

| 50/50 Blended DJIA/Treasury Index | 13.99% | 19.84% | 9.10% | 7.03% |

| Dow Jones Industrial Average | 29.07% | 42.12% | 16.48% | 12.95% |

Expense ratio: 1.89%

(1) | Periods of less than one year are not annualized. |

_______________

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.hennessyfunds.com.

The 50/50 Blended DJIA/Treasury Index consists of 50% common stocks represented by the Dow Jones Industrial Average and 50% short-duration Treasury securities represented by the ICE BofAML 1-Year U.S. Treasury Note Index, which comprises U.S. Treasury securities maturing in approximately one year. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange or The NASDAQ Stock Market. One cannot invest directly in an index. These indices are used herein for comparative purposes in accordance with Securities and Exchange Commission regulations.

The expense ratio presented is from the most recent prospectus. The expense ratio for the current reporting period is available in the Financial Highlights section of this report.

| PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS |

Financial Statements

Schedule of Investments as of April 30, 2021 (Unaudited) |

HENNESSY BALANCED FUND

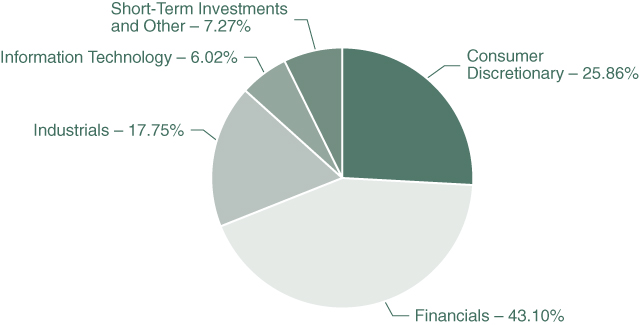

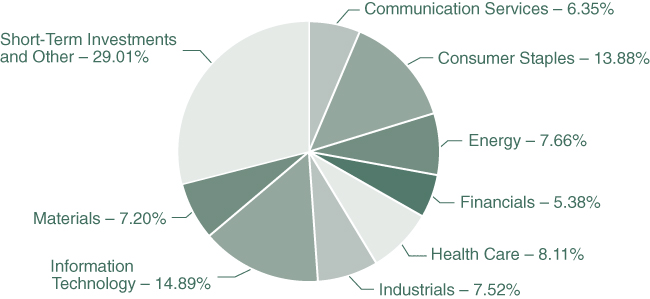

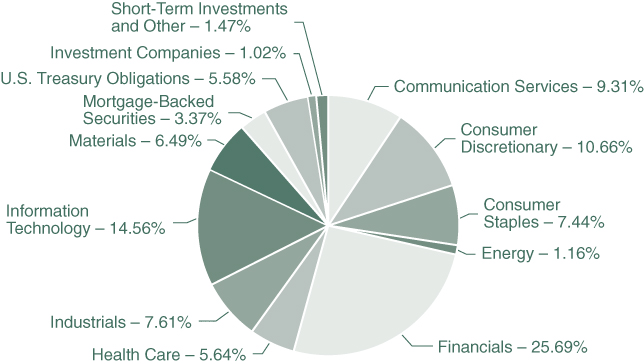

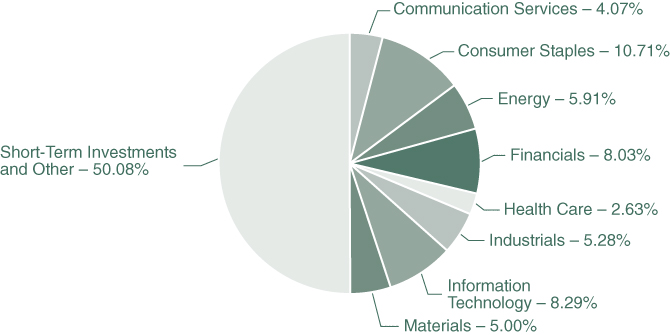

(% of Net Assets)

| TOP TEN HOLDINGS (EXCLUDING MONEY MARKET FUNDS) | % NET ASSETS |

| U.S. Treasury Bill, 0.090%, 01/27/2022 | 19.35% |

| U.S. Treasury Bill, 0.010%, 06/17/2021 | 8.19% |

| U.S. Treasury Bill, 0.110%, 12/02/2021 | 7.44% |

| Walgreens Boots Alliance, Inc. | 5.69% |

| JPMorgan Chase & Co. | 5.32% |

| Chevron Corp. | 5.29% |

| 3M Co. | 5.28% |

| U.S. Treasury Bill, 0.035%, 11/04/2021 | 5.21% |

| The Coca-Cola Co. | 5.02% |

| International Business Machines Corp. | 5.01% |

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property and a service mark of MSCI, Inc. and Standard & Poor’s Financial Services LLC. It has been licensed for use by the Hennessy Funds.

| HENNESSY FUNDS | 1-800-966-4354 | |

| COMMON STOCKS – 49.92% | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Communication Services – 4.07% | | | | | | | | | |

| Verizon Communications, Inc. | | | 9,450 | | | $ | 546,116 | | | | 4.07 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 10.71% | | | | | | | | | | | | |

| The Coca-Cola Co. | | | 12,500 | | | | 674,750 | | | | 5.02 | % |

| Walgreens Boots Alliance, Inc. | | | 14,400 | | | | 764,640 | | | | 5.69 | % |

| | | | | | | | 1,439,390 | | | | 10.71 | % |

| | | | | | | | | | | | | |

| Energy – 5.91% | | | | | | | | | | | | |

| Chevron Corp. | | | 6,900 | | | | 711,183 | | | | 5.29 | % |

| Exxon Mobil Corp. | | | 1,450 | | | | 82,998 | | | | 0.62 | % |

| | | | | | | | 794,181 | | | | 5.91 | % |

| | | | | | | | | | | | | |

| Financials – 8.03% | | | | | | | | | | | | |

| JPMorgan Chase & Co. | | | 4,650 | | | | 715,217 | | | | 5.32 | % |

| Travelers Companies, Inc. | | | 2,350 | | | | 363,451 | | | | 2.71 | % |

| | | | | | | | 1,078,668 | | | | 8.03 | % |

| | | | | | | | | | | | | |

| Health Care – 2.63% | | | | | | | | | | | | |

| Amgen, Inc. | | | 350 | | | | 83,874 | | | | 0.62 | % |

| Merck & Co., Inc. | | | 1,100 | | | | 81,950 | | | | 0.61 | % |

| Pfizer, Inc. | | | 4,850 | | | | 187,452 | | | | 1.40 | % |

| | | | | | | | 353,276 | | | | 2.63 | % |

| | | | | | | | | | | | | |

| Industrials – 5.28% | | | | | | | | | | | | |

| 3M Co. | | | 3,600 | | | | 709,704 | | | | 5.28 | % |

| | | | | | | | | | | | | |

| Information Technology – 8.29% | | | | | | | | | | | | |

| Cisco Systems, Inc. | | | 8,650 | | | | 440,371 | | | | 3.28 | % |

| International Business Machines Corp. | | | 4,750 | | | | 673,930 | | | | 5.01 | % |

| | | | | | | | 1,114,301 | | | | 8.29 | % |

| | | | | | | | | | | | | |

| Materials – 5.00% | | | | | | | | | | | | |

| Dow, Inc. | | | 10,750 | | | | 671,875 | | | | 5.00 | % |

| | | | | | | | | | | | | |

| Total Common Stocks | | | | | | | | | | | | |

| (Cost $5,491,084) | | | | | | | 6,707,511 | | | | 49.92 | % |

The accompanying notes are an integral part of these financial statements.

| SHORT-TERM INVESTMENTS – 50.19% | | Number of Shares/ | | | | | | % of | |

| | | Par Amount | | | Value | | | Net Assets | |

| Money Market Funds – 4.05% | | | | | | | | | |

| First American Government Obligations | | | | | | | | | |

| Fund, Institutional Class, 0.03% (a) | | | 543,965 | | | $ | 543,965 | | | | 4.05 | % |

| | | | | | | | | | | | | |

| U.S. Treasury Bills – 46.14% | | | | | | | | | | | | |

| 0.020%, 05/20/2021 (b) | | | 300,000 | | | | 299,977 | | | | 2.23 | % |

| 0.010%, 06/17/2021 (b) | | | 1,100,000 | | | | 1,099,756 | | | | 8.19 | % |

| 0.020%, 07/15/2021 (b) | | | 500,000 | | | | 499,992 | | | | 3.72 | % |

| 0.035%, 11/04/2021 (b) | | | 700,000 | | | | 699,900 | | | | 5.21 | % |

| 0.110%, 12/02/2021 (b) | | | 1,000,000 | | | | 999,852 | | | | 7.44 | % |

| 0.090%, 01/27/2022 (b) | | | 2,600,000 | | | | 2,599,408 | | | | 19.35 | % |

| | | | | | | | 6,198,885 | | | | 46.14 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $6,740,995) | | | | | | | 6,742,850 | | | | 50.19 | % |

| | | | | | | | | | | | | |

| Total Investments | | | | | | | | | | | | |

| (Cost $12,232,079) – 100.11% | | | | | | | 13,450,361 | | | | 100.11 | % |

| Liabilities in Excess of Other Assets – (0.11)% | | | | | | | (14,571 | ) | | | (0.11 | )% |

| | | | | | | | | | | | | |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 13,435,790 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

| (a) | The rate listed is the fund’s seven-day yield as of April 30, 2021. |

| (b) | The rate listed is the discount rate at issue. |

Summary of Fair Value Exposure as of April 30, 2021

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2021 (see Note 3 in the accompanying Notes to the Financial Statements):

| Common Stocks | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Communication Services | | $ | 546,116 | | | $ | — | | | $ | — | | | $ | 546,116 | |

| Consumer Staples | | | 1,439,390 | | | | — | | | | — | | | | 1,439,390 | |

| Energy | | | 794,181 | | | | — | | | | — | | | | 794,181 | |

| Financials | | | 1,078,668 | | | | — | | | | — | | | | 1,078,668 | |

| Health Care | | | 353,276 | | | | — | | | | — | | | | 353,276 | |

| Industrials | | | 709,704 | | | | — | | | | — | | | | 709,704 | |

| Information Technology | | | 1,114,301 | | | | — | | | | — | | | | 1,114,301 | |

| Materials | | | 671,875 | | | | — | | | | — | | | | 671,875 | |

| Total Common Stocks | | $ | 6,707,511 | | | $ | — | | | $ | — | | | $ | 6,707,511 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Money Market Funds | | $ | 543,965 | | | $ | — | | | $ | — | | | $ | 543,965 | |

| U.S. Treasury Bills | | | — | | | | 6,198,885 | | | | — | | | | 6,198,885 | |

| Total Short-Term Investments | | $ | 543,965 | | | $ | 6,198,885 | | | $ | — | | | $ | 6,742,850 | |

| Total Investments | | $ | 7,251,476 | | | $ | 6,198,885 | | | $ | — | | | $ | 13,450,361 | |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Statement of Assets and Liabilities as of April 30, 2021 (Unaudited) |

| ASSETS: | | | |

| Investments in securities, at value (cost $12,232,079) | | $ | 13,450,361 | |

| Dividends and interest receivable | | | 5,943 | |

| Prepaid expenses and other assets | | | 13,964 | |

| Total assets | | | 13,470,268 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable to advisor | | | 6,586 | |

| Payable to administrator | | | 4,154 | |

| Payable to auditor | | | 11,227 | |

| Accrued distribution fees | | | 2,222 | |

| Accrued service fees | | | 1,097 | |

| Accrued trustees fees | | | 5,212 | |

| Accrued expenses and other payables | | | 3,980 | |

| Total liabilities | | | 34,478 | |

| NET ASSETS | | $ | 13,435,790 | |

| | | | | |

| NET ASSETS CONSISTS OF: | | | | |

| Capital stock | | $ | 12,166,047 | |

| Total distributable earnings | | | 1,269,743 | |

| Total net assets | | $ | 13,435,790 | |

| | | | | |

| NET ASSETS: | | | | |

| Investor Class | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding shares | | $ | 13,435,790 | |

| Shares issued and outstanding | | | 1,078,754 | |

| Net asset value, offering price, and redemption price per share | | $ | 12.45 | |

The accompanying notes are an integral part of these financial statements.

| STATEMENT OF ASSETS AND LIABILITIES/STATEMENT OF OPERATIONS |

Financial Statements

Statement of Operations for the six months ended April 30, 2021 (Unaudited) |

| INVESTMENT INCOME: | | | |

| Dividend income | | $ | 131,027 | |

| Interest income | | | 13,114 | |

| Total investment income | | | 144,141 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (See Note 5) | | | 38,484 | |

| Compliance expense (See Note 5) | | | 13,844 | |

| Administration, accounting, custody, and transfer agent fees (See Note 5) | | | 13,061 | |

| Audit fees | | | 11,227 | |

| Federal and state registration fees | | | 10,136 | |

| Distribution fees – Investor Class (See Note 5) | | | 9,621 | |

| Trustees’ fees and expenses | | | 9,231 | |

| Service fees – Investor Class (See Note 5) | | | 6,414 | |

| Sub-transfer agent expenses – Investor Class (See Note 5) | | | 3,384 | |

| Reports to shareholders | | | 2,720 | |

| Legal fees | | | 88 | |

| Interest expense (See Note 7) | | | 29 | |

| Other expenses | | | 2,167 | |

| Total expenses | | | 120,406 | |

| NET INVESTMENT INCOME | | $ | 23,735 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | |

| Net realized gain on investments | | $ | 105,022 | |

| Net change in unrealized appreciation/depreciation on investments | | | 1,664,733 | |

| Net gain on investments | | | 1,769,755 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,793,490 | |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

(This Page Intentionally Left Blank.)

| STATEMENTS OF CHANGES IN NET ASSETS |

Financial Statements

| Statements of Changes in Net Assets |

| | | Six Months Ended | | | | |

| | | April 30, 2021 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2020 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 23,735 | | | $ | 128,595 | |

| Net realized gain (loss) on investments | | | 105,022 | | | | (37,345 | ) |

| Net change in unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | 1,664,733 | | | | (1,068,334 | ) |

| Net increase (decrease) in net | | | | | | | | |

| assets resulting from operations | | | 1,793,490 | | | | (977,084 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributable earnings – Investor Class | | | (33,666 | ) | | | (623,540 | ) |

| Total distributions | | | (33,666 | ) | | | (623,540 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Investor Class | | | 513,268 | | | | 1,953,092 | |

| Dividends reinvested – Investor Class | | | 33,139 | | | | 613,858 | |

| Cost of shares redeemed – Investor Class | | | (858,648 | ) | | | (1,281,653 | ) |

| Net increase (decrease) in net assets derived | | | | | | | | |

| from capital share transactions | | | (312,241 | ) | | | 1,285,297 | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 1,447,583 | | | | (315,327 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 11,988,207 | | | | 12,303,534 | |

| End of period | | $ | 13,435,790 | | | $ | 11,988,207 | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Investor Class | | | 42,502 | | | | 173,324 | |

| Shares issued to holders as reinvestment | | | | | | | | |

| of dividends – Investor Class | | | 2,814 | | | | 51,675 | |

| Shares redeemed – Investor Class | | | (72,705 | ) | | | (112,932 | ) |

| Net increase (decrease) in shares outstanding | | | (27,389 | ) | | | 112,067 | |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

For an Investor Class share outstanding throughout each period

| | | Six Months Ended | |

| | | April 30, 2021 | |

| | | (Unaudited) | |

| PER SHARE DATA: | | | |

| Net asset value, beginning of period | | $ | 10.84 | |

| | | | | |

| Income from investment operations: | | | | |

| Net investment income | | | 0.02 | (1) |

| Net realized and unrealized gains (losses) on investments | | | 1.62 | |

| Total from investment operations | | | 1.64 | |

| | | | | |

| Less distributions: | | | | |

| Dividends from net investment income | | | (0.03 | ) |

| Dividends from net realized gains | | | — | |

| Total distributions | | | (0.03 | ) |

| Net asset value, end of period | | $ | 12.45 | |

| | | | | |

| TOTAL RETURN | | | 15.16 | %(2) |

| | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | |

| Net assets, end of period (millions) | | $ | 13.44 | |

| Ratio of expenses to average net assets | | | 1.88 | %(3) |

| Ratio of net investment income to average net assets | | | 0.37 | %(3) |

| Portfolio turnover rate | | | 3 | %(2) |

(1) | Calculated using the average shares outstanding method. |

(2) | Not annualized. |

(3) | Annualized. |

The accompanying notes are an integral part of these financial statements.

| FINANCIAL HIGHLIGHTS — INVESTOR CLASS |

| Year Ended October 31, | |

| 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | | | | | | | | | | | | |

| $ | 12.38 | | | $ | 12.34 | | | $ | 12.88 | | | $ | 12.68 | | | $ | 12.37 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.12 | (1) | | | 0.13 | (1) | | | 0.09 | | | | 0.06 | | | | 0.04 | |

| | (1.04 | ) | | | 0.59 | | | | 0.33 | | | | 1.09 | | | | 0.58 | |

| | (0.92 | ) | | | 0.72 | | | | 0.42 | | | | 1.15 | | | | 0.62 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.12 | ) | | | (0.13 | ) | | | (0.08 | ) | | | (0.05 | ) | | | (0.04 | ) |

| | (0.50 | ) | | | (0.55 | ) | | | (0.88 | ) | | | (0.90 | ) | | | (0.27 | ) |

| | (0.62 | ) | | | (0.68 | ) | | | (0.96 | ) | | | (0.95 | ) | | | (0.31 | ) |

| $ | 10.84 | | | $ | 12.38 | | | $ | 12.34 | | | $ | 12.88 | | | $ | 12.68 | |

| | | | | | | | | | | | | | | | | | | |

| | -7.84 | % | | | 6.05 | % | | | 3.46 | % | | | 9.56 | % | | | 5.20 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 11.99 | | | $ | 12.30 | | | $ | 11.62 | | | $ | 12.24 | | | $ | 12.08 | |

| | 1.89 | % | | | 1.88 | % | | | 1.84 | % | | | 1.82 | % | | | 1.68 | % |

| | 1.05 | % | | | 1.04 | % | | | 0.70 | % | | | 0.45 | % | | | 0.33 | % |

| | 42 | % | | | 52 | % | | | 21 | % | | | 31 | % | | | 51 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Notes to the Financial Statements April 30, 2021 (Unaudited) |

1). ORGANIZATION

The Hennessy Balanced Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is a combination of capital appreciation and current income. The Fund is a non-diversified fund and offers Investor Class shares.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

2). SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles (“GAAP”).

| a). | Securities Valuation – All investments in securities are valued in accordance with the Fund’s valuation policies and procedures, as described in Note 3. |

| | |

| b). | Federal Income Taxes – The Fund has elected to be taxed as a regulated investment company and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. As a result, the Fund has made no provision for federal income taxes or excise taxes. Net investment income/loss and realized gains/losses for federal income tax purposes may differ from those reported in the financial statements because of temporary book-basis and tax-basis differences. Temporary differences are primarily the result of the treatment of wash sales for tax reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the Statement of Operations as an income tax expense. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes. The Fund may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders on redemption of shares, as part of the dividends paid deduction for income tax purposes. |

| | |

| c). | Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for the prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major tax jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware. |

| | |

| d). | Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount, is recognized on an accrual basis. |

| NOTES TO THE FINANCIAL STATEMENTS |

| | Market discounts, original issue discounts, and market premiums on debt securities are accreted or amortized to interest income over the life of a security with a corresponding increase or decrease, as applicable, in the cost basis of such security using the yield-to-maturity method or, where applicable, the first call date of the security. Other non-cash dividends are recognized as investment income at the fair value of the property received. The Fund is charged for those expenses that are directly attributable to its portfolio, such as advisory, administration, and certain shareholder service fees. |

| | |

| e). | Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid at the end of each calendar quarter. Distributions of net realized capital gains, if any, are declared and paid annually, usually in December. |

| | |

| f). | Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the realized gain/loss from an investment transaction by comparing the original cost of the security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted or amortized, respectively, over the life of each such security. |

| | |

| g). | Use of Estimates – Preparing financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported change in net assets during the reporting period. Actual results could differ from those estimates. |

| | |

| h). | Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing (i) the total value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by (ii) the total number of Fund shares outstanding, rounded to the nearest $0.01. Fund shares are not priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share. |

| | |

| i). | New Accounting Pronouncements – In August 2018, the FASB issued Accounting Standards Update No. 2018-13 “Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”). ASU 2018-13 eliminates the requirement to disclose the amount of and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, the timing of transfers between levels of the fair value hierarchy, and the valuation processes for Level 3 fair value measurements. ASU 2018-13 does not eliminate the requirement to disclose the range and weighted average used to develop significant unobservable inputs for Level 3 fair value measurements or the requirement to disclose the changes in unrealized gains and losses for recurring Level 3 fair value measurements. ASU 2018-13 requires that information is provided about the measurement uncertainty of Level 3 fair value measurements as of the reporting date. The guidance is effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Management evaluated the impact of this change in guidance and, due to the permissibility of early adoption, modified the Fund’s fair value disclosures beginning with its fiscal year 2019. |

3). SECURITIES VALUATION

The Fund follows its valuation policies and procedures in determining its net asset value and, in preparing these financial statements, the fair value accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and

| HENNESSY FUNDS | 1-800-966-4354 | |

valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement. |

| | | |

| | Level 2 – | Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets, such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data). |

| | | |

| | Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are unavailable. |

The following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities on a recurring basis:

| | Equity Securities – Equity securities, including common stocks, preferred stocks, exchange-traded funds, closed-end mutual funds, partnerships, rights, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available generally are valued at the last sales price as reported by the primary exchange on which the securities are listed. Securities listed on The NASDAQ Stock Market (“NASDAQ”) generally are valued at the NASDAQ Official Closing Price, which may differ from the last sales price reported. Securities traded on a securities exchange for which a last-quoted sales price is not readily available generally are valued at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy. |

| | |

| | Registered Investment Companies – Investments in open-end registered investment companies, commonly referred to as mutual funds, generally are priced at the ending NAV provided by the applicable mutual fund’s service agent and are classified in Level 1 of the fair value hierarchy. |

| | |

| | Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate observable market data, such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. These securities are generally classified in Level 2 of the fair value hierarchy. |

| | |

| | Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above for equity securities. Short-term debt investments with an original term to maturity of 60 days or less are valued at amortized cost, which approximates fair market value. If the original term to maturity of a short-term debt investment exceeds 60 days, then the values as of the |

| NOTES TO THE FINANCIAL STATEMENTS |

| | 61st day prior to maturity are amortized. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined as described below. Short-term securities are generally classified in Level 1 or Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities. |

The Board of Trustees of the Fund (the “Board”) has adopted fair value pricing procedures that are followed when a price for a security is not readily available or if a significant event has occurred that indicates the closing price of a security no longer represents the true value of that security. Fair value pricing determinations are made in good faith in accordance with these procedures. There are numerous criteria considered in determining a fair value of a security, such as the trading volume of a security and markets, the values of other similar securities, and news events with direct bearing on a security or markets. Fair value pricing results in an estimated price for a security that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The Board has delegated day-to-day valuation matters to the Valuation and Liquidity Committee comprising representatives from Hennessy Advisors, Inc., the Fund’s investment advisor (the “Advisor”). The function of the Valuation and Liquidity Committee, among other things, is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation and Liquidity Committee are reviewed by the Board.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determinations. Various inputs are used to determine the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair value hierarchy of the Fund’s securities as of April 30, 2021, are included in the Schedule of Investments.

4). INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the six months ended April 30, 2021, were $175,602 and $884,364, respectively.

There were no purchases or sales/maturities of long-term U.S. government securities for the Fund during the six months ended April 30, 2021.

5). INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Advisor provides the Fund with investment advisory services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities and most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based on the average daily net assets of the Fund at an annual rate of 0.60%. The net investment advisory fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

The Board has approved a Shareholder Servicing Agreement for the Fund, which compensates the Advisor for the non-investment advisory services it provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund. The shareholder service fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

| HENNESSY FUNDS | 1-800-966-4354 | |

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the distribution of Fund shares at an annual rate of up to 0.25% of the Fund’s average daily net assets. Even though the authorized rate is up to 0.25%, the Fund is currently only using up to 0.15% of its average daily net assets for such purpose. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not limited to, advertising, shareholder account servicing, printing and mailing of prospectuses to other than current shareholders, printing and mailing of sales literature, and compensation for sales and marketing activities or to financial institutions and others, such as dealers and distributors. The distribution fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of Fund shares. The agreements provide for periodic payments of sub-transfer agent expenses by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services. These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. The sub-transfer agent fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services (“Fund Services”) provides the Fund with administrative, accounting, and transfer agent services. As administrator, Fund Services is responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s custodian, transfer agent, and accountants, and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. U.S. Bank N.A., an affiliate of Fund Services, serves as the Fund’s custodian. The servicing agreements between the Trust, Fund Services, and U.S. Bank N.A. contain a fee schedule that is inclusive of administrative, accounting, custody, and transfer agent fees. The administrative, accounting, custody, and transfer agent fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

Quasar Distributors, LLC (“Quasar”), a wholly owned broker-dealer subsidiary of Foreside Financial Group, LLC, acts as the Fund’s principal underwriter in a continuous public offering of Fund shares.

The officers of the Fund are affiliated with the Advisor. With the exception of the Chief Compliance Officer and the Senior Compliance Officer, such officers receive no compensation from the Fund for serving in their respective roles. The Fund, along with the other funds in the Hennessy Funds family (collectively, the “Hennessy Funds”), makes reimbursement payments on an equal basis to the Advisor for a portion of the salary and benefits associated with the office of the Chief Compliance Officer and for all of the salary and benefits associated with the office of the Senior Compliance Officer. The compliance fees expensed by the Fund during the six months ended April 30, 2021, are included in the Statement of Operations.

6). GUARANTEES AND INDEMNIFICATIONS

Under the Hennessy Funds’ organizational documents, their officers and trustees are indemnified by the Hennessy Funds against certain liabilities arising out of the performance of their duties to the Hennessy Funds. Additionally, in the normal course of

| NOTES TO THE FINANCIAL STATEMENTS |

business, the Hennessy Funds enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

7). LINE OF CREDIT

The Fund has an uncommitted line of credit with the other Hennessy Funds in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Fund and 10% for the Fund. The line of credit is intended to provide any necessary short-term financing in connection with shareholder redemptions, subject to certain restrictions. The credit facility is with the Hennessy Funds’ custodian bank, U.S. Bank N.A. Borrowings under this arrangement bear interest at the bank’s prime rate and are secured by all of the Fund’s assets (as to its own borrowings only). During the six months ended April 30, 2021, the Fund had an outstanding average daily balance and a weighted average interest rate of $1,751 and 3.25%, respectively. The interest expensed by the Fund during the six months ended April 30, 2021, is included in the Statement of Operations. The maximum amount outstanding for the Fund during the period was $53,000. As of April 30, 2021, the Fund did not have any borrowings outstanding under the line of credit.

8). FEDERAL TAX INFORMATION

As of October 31, 2020, the Fund’s most recent fiscal year end, the components of accumulated earnings (losses) for income tax purposes were as follows:

| | | Investments | |

| Cost of investments for tax purposes | | $ | 12,539,947 | |

| Gross tax unrealized appreciation | | $ | 274,863 | |

| Gross tax unrealized depreciation | | | (739,994 | ) |

| Net tax unrealized appreciation/(depreciation) | | $ | (465,131 | ) |

| Undistributed ordinary income | | $ | 2,835 | |

| Undistributed long-term capital gains | | | — | |

| Total distributable earnings | | $ | 2,835 | |

| Other accumulated gain/(loss) | | $ | (27,785 | ) |

| Total accumulated gain/(loss) | | $ | (490,081 | ) |

The difference between book-basis unrealized appreciation/depreciation and tax-basis unrealized appreciation/depreciation (as shown above) is attributable primarily to wash sales.

As of October 31, 2020, the Fund had $27,785 in unlimited short-term capital loss carryforwards.