As filed with the Securities and Exchange Commission on July 6, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2018

Date of reporting period: April 30, 2018

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT

APRIL 30, 2018

HENNESSY CORNERSTONE

GROWTH FUND

Investor Class HFCGX

Institutional Class HICGX

hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to Shareholders | | | 2 |

| Performance Overview | | | 4 |

| Financial Statements | | | |

| Schedule of Investments | | | 5 |

| Statement of Assets and Liabilities | | | 10 |

| Statement of Operations | | | 11 |

| Statements of Changes in Net Assets | | | 13 |

| Financial Highlights | | | 14 |

| Notes to the Financial Statements | | | 18 |

| Expense Example | | | 26 |

| Proxy Voting Policy and Proxy Voting Records | | | 28 |

| Quarterly Schedule of Investments | | | 28 |

| Important Notice Regarding Delivery of Shareholder Documents | | | 28 |

| Board Approval of Investment Advisory Agreement | | | 29 |

| HENNESSY FUNDS | 1-800-966-4354 | |

May 2018

Dear Hennessy Funds Shareholder:

Investors in the United States and abroad experienced the return of volatility in the six months ended April 30, 2018, especially during the second half of the period. Equities rallied sharply during the first half of the period and fell back during the second half, but nevertheless ended the period with solid gains, with the Dow Jones Industrial Average posting a total return of 4.5% and the S&P 500 Index up 3.8%. Over the past year, I have repeatedly shared my belief that the stock market was due for a correction, but that it would bounce back, as it has so many times during the current bull market.

In the closing months of 2017 and into January 2018, U.S. equities rallied in response to the enactment of the Tax Cuts and Jobs Act of 2017, which significantly lowered corporate tax rates. Investors were also encouraged by two quarters of real GDP growth of 3.2% and 2.9%. However, equity prices quickly lost ground in reaction to the imposition of trade tariffs on steel and aluminum, and fears that additional proposed tariffs could provoke a trade war with China. Signals from the Federal Reserve that the pace of interest rate increases would move slightly higher also weighed on investors. During the period, the federal funds rate was raised twice, by a quarter point each time, in December 2017 and March 2018.

The current bull market in U.S. equities is now entering its 10th year, and we remain optimistic about the outlook for stock prices. In our opinion, economic fundamentals look positive. The U.S. economy is growing at a solid pace of 2 – 3% annually, inflation is low, and high employment levels are supporting healthy growth in consumption. Wages are rising, but the rate of increase has remained steady at around 2.6% per year since mid-2016. While it appears that the Federal Reserve will continue to raise the federal funds rate and normalize monetary policy, we believe it will be able to do so gradually, avoiding a severe jolt to either financial markets or the economy. Meanwhile, companies continue to report robust earnings growth, boosted this year by lower tax rates.

We believe U.S. equities remain attractively valued. U.S. long bond yields are hovering near 3%, having risen over the period in response to strong economic activity. Prospective PE multiples, however, have dropped significantly since the end of 2017, the result of a combination of lower taxes, higher operating earnings, and lower stock prices. The Dow Jones Industrial Average and the S&P 500 Index are trading at about 17x forward earnings, down from approximately 20x at the beginning of the calendar year, valuations we believe to be very reasonable.

We are not overly concerned about recent protectionist actions by the U.S. administration. We consider the announcements and ongoing discussions regarding import tariffs and NAFTA to be representative of standard Trump deal-making tactics – make far-reaching demands and then negotiate a reasonable outcome that is beneficial to both sides. We expect continued pro-business policies and regulatory relief to be enacted by our leaders in Washington.

Finally, as noted many times in past letters during this bull market, the euphoria that has historically accompanied a peak in the market continues to be absent. Investors today are worried about many things, including higher interest rates, larger budget deficits, higher import tariffs, and political distractions. But they are definitely not euphoric. In the past, I have likened the current bull market to the 1982-2000 bull market, and I continue

HENNESSYFUNDS.COM

to believe the comparison is a good one. We remain confident that the market will be able to weather the current period of volatility and that the economy, despite higher interest rates and possible trade disruptions, is resilient enough to continue its steady growth into the coming year.

Thank you for your continued confidence and investment in the Hennessy Funds. If you have any questions or would like to speak with us directly, please don’t hesitate to call us at (800) 966-4354.

Best regards,

Neil J. Hennessy

President and Chief Investment Officer

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed, and should not be considered investment advice.

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. One cannot invest directly in an index.

Price to earnings (PE) is calculated by dividing a company’s market price per share by its earnings per share. Earnings growth is not a measure of a fund’s future performance.

| HENNESSY FUNDS | 1-800-966-4354 | |

Performance Overview (Unaudited)

AVERAGE ANNUAL TOTAL RETURN FOR PERIODS ENDED APRIL 30, 2018

| | Six | One | Five | Ten |

| | Months(1) | Year | Years | Years |

| Hennessy Cornerstone Growth Fund – | | | | |

| Investor Class (HFCGX) | -2.69% | 13.80% | 11.19% | 5.88% |

| Hennessy Cornerstone Growth Fund – | | | | |

| Institutional Class (HICGX) | -2.54% | 14.14% | 11.51% | 6.20% |

Russell 2000® Index | 3.27% | 11.54% | 11.74% | 9.49% |

| S&P 500 Index | 3.82% | 13.27% | 12.96% | 9.02% |

Expense ratios: 1.30% (Investor Class); 0.97% (Institutional Class)

(1) | Periods less than one year are not annualized. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The Russell 2000® Index is an index commonly used to measure the performance of U.S. small-capitalization stocks. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. One cannot invest directly in an index.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes or Russell ratings or underlying data and no party may rely on any Russell Indexes or Russell ratings or underlying data contained in this communication. No further distribution of Russell data is permitted without Russell’s express written consent. Russell does not promote, sponsor, or endorse the content of this communication.

The expense ratios presented are from the most recent prospectus. The expense ratios for the current reporting period are available in the Financial Highlights section of this report.

HENNESSYFUNDS.COM

| PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS |

Financial Statements

Schedule of Investments as of April 30, 2018 (Unaudited) |

HENNESSY CORNERSTONE GROWTH FUND

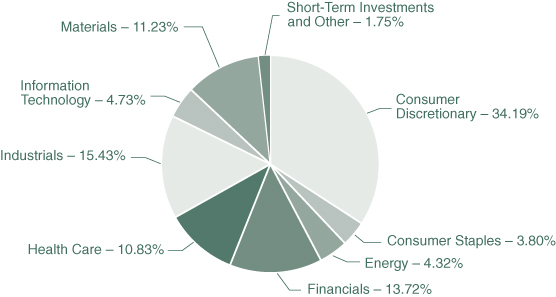

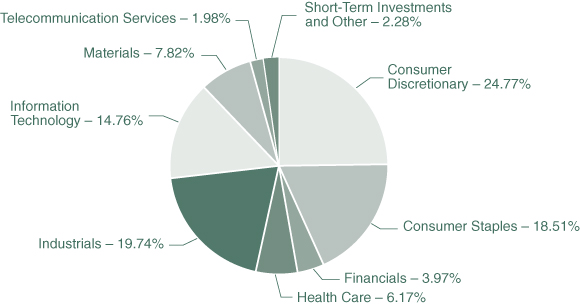

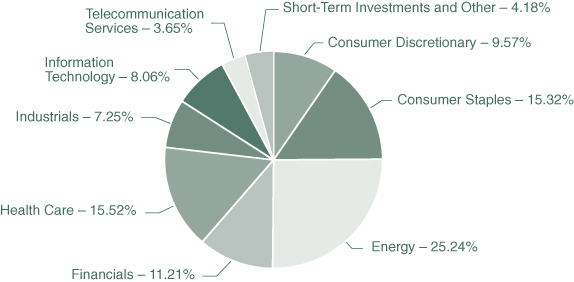

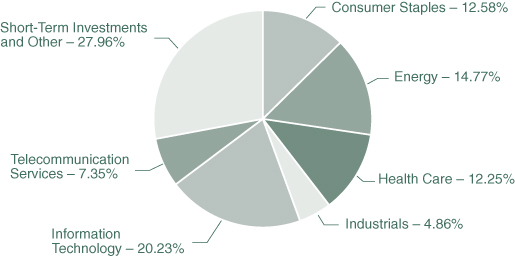

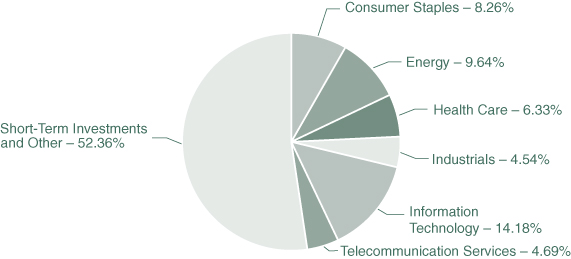

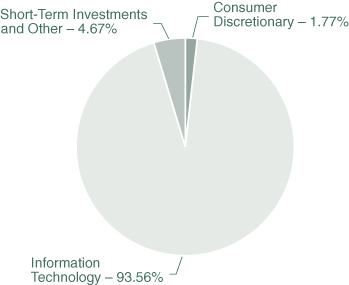

(% of Net Assets)

| TOP TEN HOLDINGS (EXCLUDING CASH/CASH EQUIVALENTS) | % NET ASSETS |

| Enova International, Inc. | 2.57% |

| Comtech Telecommunications Corp. | 2.57% |

| Insperity, Inc. | 2.42% |

| Providence Service Corp. | 2.34% |

| AMN Healthcare Services, Inc. | 2.30% |

| Crocs, Inc. | 2.30% |

| Boot Barn Holdings, Inc. | 2.26% |

| Marathon Petroleum Corp. | 2.22% |

| Burlington Stores, Inc. | 2.21% |

| Penn National Gaming, Inc. | 2.19% |

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property and a service mark of MSCI, Inc. and Standard & Poor Financial Services LLC. It has been licensed for use by the Hennessy Funds.

| HENNESSY FUNDS | 1-800-966-4354 | |

| COMMON STOCKS – 98.25% | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Consumer Discretionary – 34.19% | | | | | | | | | |

| Best Buy Co., Inc. | | | 56,000 | | | $ | 4,285,680 | | | | 2.12 | % |

| Boot Barn Holdings, Inc. (a) | | | 233,600 | | | | 4,571,552 | | | | 2.26 | % |

| Burlington Stores, Inc. (a) | | | 32,800 | | | | 4,455,880 | | | | 2.21 | % |

| Callaway Golf Co. | | | 253,900 | | | | 4,382,314 | | | | 2.17 | % |

| Conn’s, Inc. (a) | | | 127,700 | | | | 3,256,350 | | | | 1.61 | % |

| Crocs, Inc. (a) | | | 294,900 | | | | 4,659,420 | | | | 2.30 | % |

| Dollar Tree, Inc. (a) | | | 37,500 | | | | 3,595,875 | | | | 1.78 | % |

| Fiat Chrysler Automobiles N.V. (a)(b) | | | 180,300 | | | | 3,935,949 | | | | 1.95 | % |

| KB Home | | | 129,700 | | | | 3,443,535 | | | | 1.70 | % |

| Kohl’s Corp. | | | 62,500 | | | | 3,882,500 | | | | 1.92 | % |

| Lear Corp. | | | 20,700 | | | | 3,870,279 | | | | 1.92 | % |

| Live Nation Entertainment, Inc. (a) | | | 83,700 | | | | 3,303,639 | | | | 1.64 | % |

| Penn National Gaming, Inc. (a) | | | 146,000 | | | | 4,425,260 | | | | 2.19 | % |

| Qurate Retail, Inc. QVC Group (a) | | | 140,800 | | | | 3,296,128 | | | | 1.63 | % |

| Regis Corp. (a) | | | 241,300 | | | | 3,769,106 | | | | 1.87 | % |

| Sleep Number Corp. (a) | | | 109,900 | | | | 3,114,566 | | | | 1.54 | % |

| The Children’s Place, Inc. | | | 27,400 | | | | 3,494,870 | | | | 1.73 | % |

| Vipshop Holdings Ltd. – ADR (a)(b) | | | 215,700 | | | | 3,339,036 | | | | 1.65 | % |

| | | | | | | | 69,081,939 | | | | 34.19 | % |

| | | | | | | | | | | | | |

| Consumer Staples – 3.80% | | | | | | | | | | | | |

| Nomad Foods Ltd. (a)(b) | | | 235,200 | | | | 3,878,448 | | | | 1.92 | % |

| Sprouts Farmers Market, Inc. (a) | | | 151,800 | | | | 3,799,554 | | | | 1.88 | % |

| | | | | | | | 7,678,002 | | | | 3.80 | % |

| | | | | | | | | | | | | |

| Energy – 4.32% | | | | | | | | | | | | |

| CVR Energy, Inc. | | | 122,700 | | | | 4,233,150 | | | | 2.10 | % |

| Marathon Petroleum Corp. | | | 59,900 | | | | 4,487,109 | | | | 2.22 | % |

| | | | | | | | 8,720,259 | | | | 4.32 | % |

| | | | | | | | | | | | | |

| Financials – 13.72% | | | | | | | | | | | | |

| Enova International, Inc. (a) | | | 177,500 | | | | 5,200,750 | | | | 2.57 | % |

| EZCORP, Inc., Class A (a) | | | 300,500 | | | | 4,116,850 | | | | 2.04 | % |

| First American Financial Corp. | | | 69,400 | | | | 3,547,034 | | | | 1.76 | % |

| LPL Financial Holdings, Inc. | | | 62,700 | | | | 3,797,739 | | | | 1.88 | % |

| PennyMac Financial Services, Inc., Class A (a) | | | 161,900 | | | | 3,335,140 | | | | 1.65 | % |

| Progressive Corp. | | | 69,400 | | | | 4,184,126 | | | | 2.07 | % |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

| COMMON STOCKS | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Financials (Continued) | | | | | | | | | |

| The Carlyle Group LP | | | 172,400 | | | $ | 3,534,200 | | | | 1.75 | % |

| | | | | | | | 27,715,839 | | | | 13.72 | % |

| | | | | | | | | | | | | |

| Health Care – 10.83% | | | | | | | | | | | | |

| AMN Healthcare Services, Inc. (a) | | | 69,700 | | | | 4,659,445 | | | | 2.30 | % |

| Anthem, Inc. | | | 17,100 | | | | 4,035,429 | | | | 2.00 | % |

| Centene Corp. (a) | | | 39,600 | | | | 4,299,768 | | | | 2.13 | % |

| Providence Service Corp. (a) | | | 62,300 | | | | 4,727,324 | | | | 2.34 | % |

| UnitedHealth Group, Inc. | | | 17,600 | | | | 4,160,640 | | | | 2.06 | % |

| | | | | | | | 21,882,606 | | | | 10.83 | % |

| | | | | | | | | | | | | |

| Industrials – 15.43% | | | | | | | | | | | | |

| CBIZ, Inc. (a) | | | 221,000 | | | | 4,110,600 | | | | 2.03 | % |

| CNH Industrial N.V. (b) | | | 281,100 | | | | 3,443,475 | | | | 1.70 | % |

| Insperity, Inc. | | | 60,800 | | | | 4,879,200 | | | | 2.42 | % |

| MasTec, Inc. (a) | | | 78,300 | | | | 3,445,200 | | | | 1.71 | % |

| Saia, Inc. (a) | | | 54,400 | | | | 3,593,120 | | | | 1.78 | % |

| SPX FLOW, Inc. (a) | | | 83,700 | | | | 3,766,500 | | | | 1.86 | % |

| Titan Machinery, Inc. (a) | | | 198,700 | | | | 3,838,884 | | | | 1.90 | % |

| XPO Logistics, Inc. (a) | | | 42,200 | | | | 4,100,152 | | | | 2.03 | % |

| | | | | | | | 31,177,131 | | | | 15.43 | % |

| | | | | | | | | | | | | |

| Information Technology – 4.73% | | | | | | | | | | | | |

| Comtech Telecommunications Corp. | | | 169,600 | | | | 5,188,064 | | | | 2.57 | % |

| Mantech International Corp., Class A | | | 74,000 | | | | 4,372,660 | | | | 2.16 | % |

| | | | | | | | 9,560,724 | | | | 4.73 | % |

| | | | | | | | | | | | | |

| Materials – 11.23% | | | | | | | | | | | | |

| Alcoa Corp. (a) | | | 83,400 | | | | 4,270,080 | | | | 2.11 | % |

| Boise Cascade Co. | | | 91,300 | | | | 3,798,080 | | | | 1.88 | % |

| Constellium N.V., Class A (a)(b) | | | 325,100 | | | | 3,689,885 | | | | 1.83 | % |

| Huntsman Corp. | | | 118,100 | | | | 3,515,837 | | | | 1.74 | % |

| Schnitzer Steel Industries, Inc., Class A | | | 113,200 | | | | 3,333,740 | | | | 1.65 | % |

| Verso Corp. (a) | | | 226,300 | | | | 4,086,978 | | | | 2.02 | % |

| | | | | | | | 22,694,600 | | | | 11.23 | % |

| | | | | | | | | | | | | |

| Total Common Stocks | | | | | | | | | | | | |

| (Cost $197,555,038) | | | | | | | 198,511,100 | | | | 98.25 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

| RIGHTS – 0.00% | | Number | | | | | | % of | |

| | | of Shares | | | Value | | | Net Assets | |

| Health Care – 0.00% | | | | | | | | | |

| Forest Laboratories, Inc. (a)(c) | | | 5,500 | | | $ | 55 | | | | 0.00 | % |

| | | | | | | | | | | | | |

| Total Rights | | | | | | | | | | | | |

| (Cost $0) | | | | | | | 55 | | | | 0.00 | % |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS – 1.96% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Money Market Funds – 1.96% | | | | | | | | | | | | |

| Fidelity Government Portfolio, Institutional Class, 1.58% (d) | | | 3,966,017 | | | | 3,966,017 | | | | 1.96 | % |

| | | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $3,966,017) | | | | | | | 3,966,017 | | | | 1.96 | % |

| | | | | | | | | | | | | |

| Total Investments | | | | | | | | | | | | |

| (Cost $201,521,055) – 100.21% | | | | | | | 202,477,172 | | | | 100.21 | % |

| Liabilities in Excess of Other Assets – (0.21)% | | | | | | | (433,284 | ) | | | (0.21 | )% |

| | | | | | | | | | | | | |

TOTAL NET ASSETS – 100.00% | | | | | | $ | 202,043,888 | | | | 100.00 | % |

Percentages are stated as a percent of net assets.

ADR – American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | U.S. traded security of a foreign corporation |

| (c) | Security is fair valued in good faith and is deemed a Level 3 investment because it is valued using significant unobservable inputs.. |

| (d) | The rate listed is the fund’s seven-day yield as of April 30, 2018. |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

Summary of Fair Value Exposure at April 30, 2018

The following is a summary of the inputs used to value the Fund’s net assets as of April 30, 2018 (See Note 3 in the accompanying notes to the financial statements):

| Common Stocks | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Consumer Discretionary | | $ | 69,081,939 | | | $ | — | | | $ | — | | | $ | 69,081,939 | |

| Consumer Staples | | | 7,678,002 | | | | — | | | | — | | | | 7,678,002 | |

| Energy | | | 8,720,259 | | | | — | | | | — | | | | 8,720,259 | |

| Financials | | | 27,715,839 | | | | — | | | | — | | | | 27,715,839 | |

| Health Care | | | 21,882,606 | | | | — | | | | — | | | | 21,882,606 | |

| Industrials | | | 31,177,131 | | | | — | | | | — | | | | 31,177,131 | |

| Information Technology | | | 9,560,724 | | | | — | | | | — | | | | 9,560,724 | |

| Materials | | | 22,694,600 | | | | — | | | | — | | | | 22,694,600 | |

| Total Common Stocks | | $ | 198,511,100 | | | $ | — | | | $ | — | | | $ | 198,511,100 | |

| Rights | | | | | | | | | | | | | | | | |

| Health Care | | $ | — | | | $ | — | | | $ | 55 | * | | $ | 55 | |

| Total Rights | | $ | — | | | $ | — | | | $ | 55 | | | $ | 55 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Money Market Funds | | $ | 3,966,017 | | | $ | — | | | $ | — | | | $ | 3,966,017 | |

| Total Short-Term Investments | | $ | 3,966,017 | | | $ | — | | | $ | — | | | $ | 3,966,017 | |

| Total Investments | | $ | 202,477,117 | | | $ | — | | | $ | 55 | | | $ | 202,477,172 | |

* Acquired in merger.

Transfers between levels are recognized at the end of the reporting period. During the six-month period ended April 30, 2018, the Fund recognized no transfers between levels.

Level 3 Reconciliation Disclosure

Following is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| | | Rights | |

| Balance as of October 31, 2017 | | $ | 55 | |

| Accrued discounts/premiums | | | — | |

| Realized gain (loss) | | | — | |

| Change in unrealized appreciation (depreciation) | | | — | |

| Purchases | | | — | |

| (Sales) | | | — | |

| Transfer in and/or out of Level 3 | | | — | |

| Balance as of April 30, 2018 | | $ | 55 | |

| | | | | |

| Change in unrealized appreciation/depreciation during the period for | | | | |

| Level 3 investments held at April 30, 2018 | | $ | — | |

The Level 3 investments as of April 30, 2018, represented 0.00% of net assets and did not warrant a disclosure of significant unobservable inputs.

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Statement of Assets and Liabilities as of April 30, 2018 (Unaudited) |

| ASSETS: | | | |

| Investments in securities, at value (cost $201,521,055) | | $ | 202,477,172 | |

| Dividends and interest receivable | | | 63,509 | |

| Receivable for fund shares sold | | | 4,825 | |

| Prepaid expenses and other assets | | | 31,433 | |

| Total Assets | | | 202,576,939 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for fund shares redeemed | | | 175,438 | |

| Payable to advisor | | | 123,561 | |

| Payable to administrator | | | 32,915 | |

| Payable to auditor | | | 9,721 | |

| Accrued distribution fees | | | 126,138 | |

| Accrued service fees | | | 14,770 | |

| Accrued trustees fees | | | 5,070 | |

| Accrued expenses and other payables | | | 45,438 | |

| Total Liabilities | | | 533,051 | |

| NET ASSETS | | $ | 202,043,888 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 175,246,176 | |

| Accumulated net investment loss | | | (1,542,624 | ) |

| Accumulated net realized gain on investments | | | 27,384,911 | |

| Unrealized net appreciation on investments | | | 955,425 | |

| Total Net Assets | | $ | 202,043,888 | |

| | | | | |

| NET ASSETS | | | | |

| Investor Class: | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding Investor Class shares | | $ | 178,711,891 | |

| Shares issued and outstanding | | | 7,604,472 | |

| Net asset value, offering price and redemption price per share | | $ | 23.50 | |

| | | | | |

| Institutional Class: | | | | |

| Shares authorized (no par value) | | Unlimited | |

| Net assets applicable to outstanding Institutional Class shares | | $ | 23,331,997 | |

| Shares issued and outstanding | | | 963,653 | |

| Net asset value, offering price and redemption price per share | | $ | 24.21 | |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

| STATEMENT OF ASSETS AND LIABILITIES/STATEMENT OF OPERATIONS |

Financial Statements

Statement of Operations for the six months ended April 30, 2018 (Unaudited) |

| INVESTMENT INCOME: | | | |

Dividend income(1) | | $ | 569,749 | |

| Interest income | | | 26,769 | |

| Total investment income | | | 596,518 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (See Note 5) | | | 788,303 | |

| Sub-transfer agent expenses – Investor Class (See Note 5) | | | 139,929 | |

| Sub-transfer agent expenses – Institutional Class (See Note 5) | | | 7,945 | |

| Distribution fees – Investor Class (See Note 5) | | | 139,929 | |

| Administration, fund accounting, custody and transfer agent fees (See Note 5) | | | 100,198 | |

| Service fees – Investor Class (See Note 5) | | | 93,286 | |

| Federal and state registration fees | | | 16,990 | |

| Compliance expense (See Note 5) | | | 14,628 | |

| Reports to shareholders | | | 12,447 | |

| Audit fees | | | 10,969 | |

| Trustees’ fees and expenses | | | 9,377 | |

| Interest expense (See Note 7) | | | 355 | |

| Other expenses | | | 7,937 | |

| Total expenses | | | 1,342,293 | |

| NET INVESTMENT LOSS | | $ | (745,775 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS: | | | | |

| Net realized gain on investments | | $ | 27,387,007 | |

| Net change in unrealized appreciation on investments | | | (32,414,086 | ) |

| Net loss on investments | | | (5,027,079 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (5,772,854 | ) |

(1) | Net of foreign taxes withheld and issuance fees of $11,564. |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

(This Page Intentionally Left Blank.)

HENNESSYFUNDS.COM

| STATEMENTS OF CHANGES IN NET ASSETS |

Financial Statements

| Statements of Changes in Net Assets |

| | | Six Months Ended | | | | |

| | | April 30, 2018 | | | Year Ended | |

| | | (Unaudited) | | | October 31, 2017 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (745,775 | ) | | $ | (615,891 | ) |

| Net realized gain on investments | | | 27,387,007 | | | | 25,408,962 | |

| Net change in unrealized appreciation on investments | | | (32,414,086 | ) | | | 26,412,588 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (5,772,854 | ) | | | 51,205,659 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares subscribed – Investor Class | | | 2,087,487 | | | | 5,154,765 | |

| Proceeds from shares subscribed – Institutional Class | | | 817,261 | | | | 6,572,602 | |

| Cost of shares redeemed – Investor Class | | | (15,462,705 | ) | | | (37,414,723 | ) |

| Cost of shares redeemed – Institutional Class | | | (8,486,489 | ) | | | (7,012,794 | ) |

| Net decrease in net assets derived | | | | | | | | |

| from capital share transactions | | | (21,044,446 | ) | | | (32,700,150 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (26,817,300 | ) | | | 18,505,509 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 228,861,188 | | | | 210,355,679 | |

| End of period | | $ | 202,043,888 | | | $ | 228,861,188 | |

| Undistributed net investment loss, end of period | | $ | (1,542,624 | ) | | $ | (796,849 | ) |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold – Investor Class | | | 87,289 | | | | 233,860 | |

| Shares sold – Institutional Class | | | 32,627 | | | | 279,691 | |

| Shares redeemed – Investor Class | | | (646,541 | ) | | | (1,795,884 | ) |

| Shares redeemed – Institutional Class | | | (342,548 | ) | | | (328,917 | ) |

| Net decrease in shares outstanding | | | (869,173 | ) | | | (1,611,250 | ) |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

For an Investor Class share outstanding throughout each period

| | Six Months Ended | |

| | April 30, 2018 | |

| | (Unaudited) | |

| PER SHARE DATA: | | | | |

| Net asset value, beginning of period | | $ | 24.16 | | |

| | | | | | |

| Income from investment operations: | | | | | |

| Net investment income (loss) | | | (0.10 | ) | |

| Net realized and unrealized gains (losses) on investments | | | (0.56 | ) | |

| Total from investment operations | | | (0.66 | ) | |

| | | | | | |

| Less distributions: | | | | | |

| Dividends from net investment income | | | — | | |

| Total distributions | | | — | | |

| Net asset value, end of period | | $ | 23.50 | | |

| | | | | | |

| TOTAL RETURN | | | (2.69 | )%(1) | |

| | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | |

| Net assets, end of period (millions) | | $ | 178.71 | | |

| Ratio of expenses to average net assets | | | 1.30 | %(2) | |

| Ratio of net investment income (loss) to average net assets | | | (0.74 | )%(2) | |

Portfolio turnover rate(3) | | | 93 | %(1) | |

(1) | Not annualized. |

(2) | Annualized. |

(3) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

| FINANCIAL HIGHLIGHTS — INVESTOR CLASS |

| Year Ended October 31, | |

| 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | | | | | | | | | | |

| $ | 18.98 | | | $ | 20.00 | | | $ | 18.68 | | | $ | 15.65 | | | $ | 12.38 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.09 | ) | | | (0.02 | ) | | | 0.06 | | | | (0.04 | ) | | | (0.11 | ) |

| | 5.27 | | | | (0.98 | ) | | | 1.26 | | | | 3.07 | | | | 3.38 | |

| | 5.18 | | | | (1.00 | ) | | | 1.32 | | | | 3.03 | | | | 3.27 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | (0.02 | ) | | | — | | | | — | | | | — | |

| | — | | | | (0.02 | ) | | | — | | | | — | | | | — | |

| $ | 24.16 | | | $ | 18.98 | | | $ | 20.00 | | | $ | 18.68 | | | $ | 15.65 | |

| | | | | | | | | | | | | | | | | | | |

| | 27.29 | % | | | (5.00 | )% | | | 7.07 | % | | | 19.36 | % | | | 26.41 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 197.22 | | | $ | 184.61 | | | $ | 248.74 | | | $ | 227.68 | | | $ | 220.83 | |

| | 1.30 | % | | | 1.32 | % | | | 1.15 | % | | | 1.23 | % | | | 1.29 | % |

| | (0.33 | )% | | | (0.18 | )% | | | 0.30 | % | | | (0.17 | )% | | | (0.26 | )% |

| | 98 | % | | | 97 | % | | | 102 | % | | | 84 | % | | | 105 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

For an Institutional Class share outstanding throughout each period

| | Six Months Ended | |

| | April 30, 2018 | |

| | (Unaudited) | |

| PER SHARE DATA: | | | | |

| Net asset value, beginning of period | | $ | 24.85 | | |

| | | | | | |

| Income from investment operations: | | | | | |

| Net investment income (loss) | | | 0.08 | | |

| Net realized and unrealized gains (losses) on investments | | | (0.72 | ) | |

| Total from investment operations | | | (0.64 | ) | |

| | | | | | |

| Less distributions: | | | | | |

| Dividends from net investment income | | | — | | |

| Total distributions | | | — | | |

| Net asset value, end of period | | $ | 24.21 | | |

| | | | | | |

| TOTAL RETURN | | | (2.54 | )%(1) | |

| | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | |

| Net assets, end of period (millions) | | $ | 23.33 | | |

| Ratio of expenses to average net assets: | | | | | |

| Before expense reimbursement | | | 0.96 | %(2) | |

| After expense reimbursement | | | 0.96 | %(2) | |

| Ratio of net investment loss to average net assets: | | | | | |

| Before expense reimbursement | | | (0.41 | )%(2) | |

| After expense reimbursement | | | (0.41 | )%(2) | |

Portfolio turnover rate(3) | | | 93 | %(1) | |

(1) | Not annualized. |

(2) | Annualized. |

(3) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

| FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS |

| Year Ended October 31, | |

| 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| | | | | | | | | | | | | | |

| $ | 19.46 | | | $ | 20.47 | | | $ | 19.08 | | | $ | 15.94 | | | $ | 12.57 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.01 | | | | 0.17 | | | | 0.03 | | | | 0.06 | | | | 0.01 | |

| | 5.38 | | | | (1.13 | ) | | | 1.36 | | | | 3.08 | | | | 3.36 | |

| | 5.39 | | | | (0.96 | ) | | | 1.39 | | | | 3.14 | | | | 3.37 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | (0.05 | ) | | | — | | | | — | | | | — | |

| | — | | | | (0.05 | ) | | | — | | | | — | | | | — | |

| $ | 24.85 | | | $ | 19.46 | | | $ | 20.47 | | | $ | 19.08 | | | $ | 15.94 | |

| | | | | | | | | | | | | | | | | | | |

| | 27.70 | % | | | (4.69 | )% | | | 7.29 | % | | | 19.70 | % | | | 26.81 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 31.65 | | | $ | 25.74 | | | $ | 38.96 | | | $ | 25.54 | | | $ | 26.23 | |

| | | | | | | | | | | | | | | | | | | |

| | 0.97 | % | | | 0.98 | % | | | 0.99 | % | | | 1.03 | % | | | 1.11 | % |

| | 0.97 | % | | | 0.98 | % | | | 0.99 | % | | | 0.98 | % | | | 0.98 | % |

| | | | | | | | | | | | | | | | | | | |

| | (0.00 | )% | | | 0.14 | % | | | 0.51 | % | | | 0.03 | % | | | (0.01 | )% |

| | (0.00 | )% | | | 0.14 | % | | | 0.51 | % | | | 0.08 | % | | | 0.12 | % |

| | 98 | % | | | 97 | % | | | 102 | % | | | 84 | % | | | 105 | % |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 | |

Financial Statements

Notes to the Financial Statements April 30, 2018 (Unaudited) |

1). ORGANIZATION

The Hennessy Cornerstone Growth Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The investment objective of the Fund is long-term growth of capital. The Fund is a diversified fund.

The Fund offers Investor Class and Institutional Class shares. Each class of shares differs principally in its respective 12b-1 distribution and service, shareholder servicing, and sub-transfer agent expenses. There are no sales charges. Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only an individual class.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

2). SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform to U.S. generally accepted accounting principles (“GAAP”).

| a). | Investment Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3. |

| | |

| b). | Federal Income Taxes – No provision for federal income taxes or excise taxes has been made because the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Net investment income/loss and realized gains/losses for federal income tax purposes may differ from those reported in the financial statements because of temporary book and tax basis differences. Temporary differences are primarily the result of the treatment of wash sales for tax reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the Statement of Operations as an income tax expense. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes. The Fund may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders on redemption of shares, as part of the dividends paid deduction for income tax purposes. |

| | |

| c). | Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for the prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware. |

HENNESSYFUNDS.COM

| NOTES TO THE FINANCIAL STATEMENTS |

| d). | Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount, is recognized on an accrual basis. The Fund is charged for those expenses that are directly attributable to the portfolio, such as advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains/losses on investments are allocated to each class of shares based on such class’s net assets. |

| | |

| e). | Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid annually, usually in December. Distributions of net realized capital gains, if any, are declared and paid annually, usually in December. |

| | |

| f). | Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the realized gain/loss from an investment transaction by comparing the original cost of the security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted or amortized, respectively, over the life of each such security. |

| | |

| g). | Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported change in net assets during the reporting period. Actual results could differ from those estimates. |

| | |

| h). | Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing (i) the total value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by (ii) the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share. |

3). SECURITIES VALUATION

The Fund follows fair valuation accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | Level 1 – | Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement. |

| | | |

| | Level 2 – | Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets (such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data)). |

| | | |

| | Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are unavailable. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

| HENNESSY FUNDS | 1-800-966-4354 | |

| | Equity Securities – Equity securities, including common stocks, preferred stocks, foreign-issued common stocks, exchange-traded funds, closed-end mutual funds, partnerships, rights, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available will generally be valued at the last sales price as reported by the primary exchange on which the securities are listed. Securities listed on The NASDAQ Stock Market (“NASDAQ”) will generally be valued at the NASDAQ Official Closing Price, which may differ from the last sales price reported. Securities traded on a securities exchange for which a last-quoted sales price is not readily available will generally be valued at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy. Securities traded on foreign exchanges generally are not valued at the same time the Fund calculates its NAV because most foreign markets close well before such time. The earlier close of most foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim. In certain circumstances, it may be determined that a security needs to be fair valued because it appears that the value of the security might have been materially affected by events occurring after the close of the market in which the security is principally traded, but before the time the Fund calculates its NAV, such as by a development that affects an entire market or region (e.g., a weather-related event) or a potentially global development (e.g., a terrorist attack that may be expected to have an effect on investor expectations worldwide). |

| | |

| | Registered Investment Companies – Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV provided by the applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy. |

| | |

| | Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate observable market data, such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. These securities are generally classified in Level 2 of the fair value hierarchy. |

| | |

| | Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above. Short-term debt investments with an original term to maturity of 60 days or less are valued at amortized cost, which approximates fair market value. If the original term to maturity of a short-term debt investment exceeded 60 days, then the values as of the 61st day prior to maturity are amortized. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined, as described below. Short-term securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs used and market activity levels for specific securities. |

The Board of Trustees of the Fund (the “Board”) has adopted fair value pricing procedures that are followed when a price for a security is not readily available or if a significant event has occurred that indicates the closing price of a security no longer

HENNESSYFUNDS.COM

| NOTES TO THE FINANCIAL STATEMENTS |

represents the true value of that security. Fair value pricing determinations are made in good faith in accordance with these procedures. There are numerous criteria that will be given consideration in determining a fair value of a security, such as the trading volume of a security and markets, the values of other similar securities, and news events with direct bearing on a security or markets. Fair value pricing results in an estimated price for a security that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The fair valuation of foreign securities may be determined with the assistance of a pricing service using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of relevant American Depositary Receipts or futures contracts. The effect of using fair value pricing is that the Fund’s NAV will reflect the affected portfolio securities’ values as determined by the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to price a foreign security may result in a value that is different from such foreign security’s most recent closing price and from the value used by other investment companies to calculate their NAVs. Such securities are generally classified in Level 2 of the fair valuation hierarchy. Because the Fund may invest in foreign securities, the value of the Fund’s portfolio securities may change on days when you will not be able to purchase or redeem your shares.

The Board has delegated day-to-day valuation matters to a Valuation Committee comprised of one or more representatives from Hennessy Advisors, Inc., the Fund’s investment advisor (the “Advisor”). The function of the Valuation Committee is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation Committee are reviewed by the Board.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determinations. Various inputs are used to determine the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair valuation hierarchy of the Fund’s securities as of April 30, 2018, are included in the Schedule of Investments.

4). INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the six months ended April 30, 2018, were $195,462,565 and $212,458,167, respectively.

There were no purchases or sales/maturities of long-term U.S. government securities for the Fund during the six months ended April 30, 2018.

The Fund is permitted to purchase or sell securities from or to another fund in the Hennessy Funds family of funds (the “Hennessy Funds”) under specified conditions outlined in procedures adopted by the Board. The procedures have been designed to ensure that any purchase or sale of securities by the Fund from or to another Hennessy Fund complies with Rule 17a-7 of the Investment Company Act of 1940, as amended. During the six months ended April 30, 2018, the Fund did not engage in purchases or sales of securities pursuant to Rule 17a-7 of the Investment Company Act of 1940, as amended.

5). INVESTMENT MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES

The Advisor provides the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, and facilities, as well as most of the personnel needed by the Fund. As

| HENNESSY FUNDS | 1-800-966-4354 | |

compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based upon the average daily net assets of the Fund at an annual rate of 0.74%. The net investment advisory fees expensed by the Fund during the six months ended April 30, 2018, are included in the Statement of Operations.

In the past, the Advisor had contractually agreed to waive its fees and absorb expenses to the extent that total annual operating expenses exceeded 0.98% of the Fund’s net assets for Institutional Class shares of the Fund (excluding all federal, state and local taxes, interest, brokerage commissions, acquired fund fees and expenses and other costs incurred in connection with the purchase and sale of securities, and extraordinary items). The expense limitation agreement was terminated by the Board as of February 28, 2015.

For a period of three years after the year in which the Advisor waived or reimbursed expenses, the Advisor may seek reimbursement from the Fund to the extent that total annual fund operating expenses are less than the expense limitation that was in effect at the time the Advisor waived or reimbursed expenses. As of April 30, 2018, cumulative expenses subject to potential recovery under the aforementioned conditions were $1,023 for Institutional Class shares, which will expire on October 31, 2018.

The Board has approved a Shareholder Servicing Agreement for Investor Class shares of the Fund, which was instituted to compensate the Advisor for the non-investment management services it provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund attributable to Investor Class shares. The shareholder service fees expensed by the Fund during the six months ended April 30, 2018, are included in the Statement of Operations.

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the distribution of the Fund’s shares at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to Investor Class shares. Even though the authorized rate is up to 0.25%, the Fund is currently only using up to 0.15% of its average daily net assets attributable to Investor Class shares for such purpose. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not limited to, advertising, shareholder account servicing, the printing and mailing of prospectuses to other than current shareholders, the printing and mailing of sales literature, and compensation for sales and marketing activities or to financial institutions and others, such as dealers and distributors. The distribution fees expensed by the Fund during the six months ended April 30, 2018, are included in the Statement of Operations.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of shares of the Fund. The agreements provide for periodic payments by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services (sub-transfer agent expenses). These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. The sub-transfer agent fees expensed by the Fund during the six months ended April 30, 2018, are included in the Statement of Operations.

U.S. Bancorp Fund Services, LLC (“USBFS”) provides the Fund with administrative, fund accounting, and transfer agent services. As administrator, USBFS is responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s custodian, transfer agent, and accountants,

HENNESSYFUNDS.COM

| NOTES TO THE FINANCIAL STATEMENTS |

and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. U.S. Bank N.A., an affiliate of USBFS, serves as the Fund’s custodian. The servicing agreements between the Trust and USBFS and U.S. Bank N.A. contain a fee schedule that is inclusive of administrative, fund accounting, custody, and transfer agent fees. The administrative, fund accounting, custody, and transfer agent fees expensed by the Fund during the six months ended April 30, 2018, are included in the Statement of Operations.

Quasar Distributors, LLC acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. Quasar Distributors, LLC is an affiliate of USBFS and U.S. Bank N.A.

The officers of the Fund are affiliated with the Advisor. Such officers, with the exception of the Chief Compliance Officer and the Senior Compliance Officer, receive no compensation from the Fund for serving in their respective roles. The Fund, along with the other Hennessy Funds, makes reimbursement payments, on an equal basis, to the Advisor for a portion of the salary and benefits associated with the office of the Chief Compliance Officer and for all of the salary and benefits associated with the office of the Senior Compliance Officer. The compliance fees expensed by the Fund during the six months ended April 30, 2018, are included in the Statement of Operations.

6). GUARANTEES AND INDEMNIFICATIONS

Under the Hennessy Funds’ organizational documents, their officers and trustees are indemnified by the Hennessy Funds against certain liabilities arising out of the performance of their duties to the Hennessy Funds. Additionally, in the normal course of business, the Hennessy Funds enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

7). LINE OF CREDIT

The Fund has an uncommitted line of credit with the other Hennessy Funds in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Fund and 10% for the Hennessy Balanced Fund, intended to provide short-term financing, if necessary, subject to certain restrictions, in connection with shareholder redemptions. The credit facility is with the Hennessy Funds’ custodian bank, U.S. Bank N.A. Borrowings under this arrangement bear interest at the bank’s prime rate and are secured by all of the Fund’s assets (as to its own borrowings only). During the six months ended April 30, 2018, the Fund had an outstanding average daily balance and a weighted average interest rate of $15,691 and 4.50%, respectively. The interest expensed by the Fund during the six months ended April 30, 2018, is included in the Statement of Operations. The maximum amount outstanding for the Fund during the period was $838,000. As of April 30, 2018, the Fund did not have any borrowings outstanding under the line of credit.

| HENNESSY FUNDS | 1-800-966-4354 | |

8). FEDERAL TAX INFORMATION

As of October 31, 2017, the Fund’s most recent fiscal year end, the components of accumulated earnings (losses) for income tax purposes were as follows:

| | | | Investments | |

| | Cost of investments for tax purposes | | $ | 195,261,730 | |

| | Gross tax unrealized appreciation | | $ | 47,139,153 | |

| | Gross tax unrealized depreciation | | | (13,771,738 | ) |

| | Net tax unrealized appreciation | | $ | 33,367,415 | |

| | Undistributed ordinary income | | $ | — | |

| | Undistributed long-term capital gains | | | — | |

| | Total distributable earnings | | $ | — | |

| | Other accumulated loss | | $ | (796,849 | ) |

| | Total accumulated gain | | $ | 32,570,566 | |

The difference between book-basis unrealized appreciation/depreciation (as shown in the Statement of Assets and Liabilities) and tax-basis unrealized appreciation/depreciation (as shown above) is attributable primarily to partnership adjustments.

As of October 31, 2017, the Fund’s most recent fiscal year end, the Fund had no tax basis capital losses to offset future capital gains.

During fiscal year 2017, the Fund’s most recent fiscal year, the capital losses utilized by the Fund were $25,411,058 and capital losses expired were $81,285,880.

Capital losses sustained in fiscal year 2012 and in future taxable years will not expire and may be carried over by the Fund without limitation; however, they will retain the character of the original loss. Furthermore, any loss incurred during those taxable years will be required to be utilized prior to the losses incurred in taxable years prior to 2012. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss.

As of October 31, 2017, the Fund’s most recent fiscal year end, the Fund deferred, on a tax basis, a late-year ordinary loss of $796,849. Late-year ordinary losses are net ordinary losses incurred after December 31, 2016, but within the taxable year, that are deemed to arise on the first day of the Fund’s next taxable year.

During fiscal year 2018 (year to date) and fiscal year 2017, the Fund did not pay any distributions.

9). EVENTS SUBSEQUENT TO PERIOD END

Management has evaluated the Fund’s related events and transactions that occurred subsequent to April 30, 2018, through the date of issuance of the Fund’s financial statements. Management has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

HENNESSYFUNDS.COM

| NOTES TO THE FINANCIAL STATEMENTS |

(This Page Intentionally Left Blank.)

| HENNESSY FUNDS | 1-800-966-4354 | |

Expense Example (Unaudited)

April 30, 2018

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2017, through April 30, 2018.

Actual Expenses

The first line of the table below under the “Investor Class” and “Institutional Class” headings provides information about actual account values and actual expenses. Although the Fund charges no sales loads or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15 fee is charged by the Fund’s transfer agent. IRA accounts will be charged a $15 annual maintenance fee. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody, and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line of the table under the “Investor Class” or “Institutional Class” headings in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below under the “Investor Class” and “Institutional Class” headings provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return.] The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or exchange fees. Therefore, the second line of the table under the “Investor Class” and “Institutional Class” headings is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

HENNESSYFUNDS.COM

| | | | Expenses Paid |

| | Beginning | Ending | During Period(1) |

| | Account Value | Account Value | November 1, 2017 – |

| | November 1, 2017 | April 30, 2018 | April 30, 2018 |

| Investor Class | | | |

| Actual | $1,000.00 | $ 973.10 | $6.36 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.35 | $6.51 |

| | | | |

| Institutional Class | | | |

| Actual | $1,000.00 | $ 974.60 | $4.70 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.03 | $4.81 |

(1) | Expenses are equal to the Fund’s expense ratio of 1.30% for Investor Class shares or 0.96% for Institutional Class shares, as applicable, multiplied by the average account value over the period, multiplied by 181/365 days (to reflect one-half year period). |

| HENNESSY FUNDS | 1-800-966-4354 | |

How to Obtain a Copy of the Fund’s

Proxy Voting Policy and Proxy Voting Records

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge (1) by calling 1-800-966-4354, (2) on the Hennessy Funds’ website at hennessyfunds.com/proxy-voting/voting-policy, or (3) on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. The Fund’s proxy voting record is available without charge on both the Hennessy Funds’ website at hennessyfunds.com/proxy-voting/voting-record and the SEC’s website at www.sec.gov no later than August 31 for the prior 12 months ending June 30.

Quarterly Filings on Form N-Q

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. Information included in the Fund’s Forms N-Q will also be available upon request by calling 1-800-966-4354.

Important Notice Regarding Delivery of

Shareholder Documents

To help keep the Fund’s costs as low as possible, we generally deliver a single copy of shareholder reports, proxy statements, and prospectuses to shareholders who share an address and have the same last name. This process does not apply to account statements. You may request an individual copy of a shareholder document at any time. If you would like to receive separate mailings of shareholder documents, please call U.S. Bancorp Fund Services, LLC at 1-800-261-6950 or 1-414-765-4124, and individual delivery will begin within 30 days of your request. If your account is held through a financial institution or other intermediary, please contact such intermediary directly to request individual delivery.

HENNESSYFUNDS.COM

| PROXY VOTING — BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT |

Board Approval of Investment Advisory

Agreement

At its meeting on March 7, 2018, the Board of Trustees of the Fund (the “Board,” and the members thereof, the “Trustees”) unanimously approved the continuation of the investment advisory agreement of the Fund with Hennessy Advisors, Inc. (the “Advisor”). As part of the process of approving the continuation of the advisory agreement, the Trustees reviewed their fiduciary duties with respect to approving the advisory agreement and the relevant factors for them to consider. In addition, the Trustees who are not deemed “interested persons” (as defined by the Investment Company Act of 1940, as amended) of the Fund (the “Independent Trustees”) met in executive session to discuss the approval of the advisory agreement.

In advance of the meeting, the Advisor sent detailed information to the Trustees to assist them in their evaluation of the advisory agreement. This information included, but was not limited to, the following:

| | (1) | A memorandum from outside legal counsel that described the fiduciary duties of the Board with respect to approving the continuation of the advisory agreement and the relevant factors for consideration; |

| | | |

| | (2) | A memorandum from the Advisor that listed the factors relevant to the Board’s approval of the continuation of the advisory agreement and also referenced the documents that had been provided to help the Board assess each such factor; |

| | | |

| | (3) | An inventory of the range of services provided by the Advisor to the Fund; |

| | | |

| | (4) | A written discussion of economies of scale; |

| | | |

| | (5) | The advisory agreement; |

| | | |

| | (6) | A recent Fund fact sheet, which included, among other things, performance information over various periods; |

| | | |

| | (7) | A peer expense comparison of both the net expense ratio and investment advisory fee of the Fund; |

| | | |

| | (8) | The Advisor’s most recent Form 10-K and Form 10-Q, which includes information about the Advisor’s profitability; |

| | | |

| | (9) | Information about brokerage commissions; |

| | | |

| | (10) | Information about the Fund’s compliance program; and |

| | | |

| | (11) | The Advisor’s current Form ADV Part I. |

All of the factors discussed were considered as a whole by the Trustees, and also by the Independent Trustees meeting in executive session. The factors were viewed in their totality by the Trustees, with no single factor being the principal or determinative factor in the Trustees’ determination of whether to approve the continuation of the advisory agreement. The Trustees recognized that the management and fee arrangements for the Fund are the result of years of review and discussion between the Independent Trustees and the Advisor, that certain aspects of such arrangements may receive greater scrutiny in some years than in others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements and information received during the course of the year and in prior years.

| HENNESSY FUNDS | 1-800-966-4354 | |

Prior to approving the continuation of the advisory agreement, the Trustees, including the Independent Trustees in executive session, considered, among other items:

| | (1) | The nature and quality of the advisory services provided by the Advisor; |

| | | |

| | (2) | A comparison of the fees and expenses of the Fund to other similar funds; |

| | | |

| | (3) | Whether economies of scale are recognized by the Fund; |

| | | |

| | (4) | The costs and profitability of the Fund to the Advisor; |

| | | |

| | (5) | The performance of the Fund; and |

| | | |

| | (6) | Any benefits to the Advisor from serving as an investment advisor to the Fund (other than the advisory fee). |

The material considerations and determinations of the Trustees, including the Independent Trustees, were as follows:

| | (1) | The Trustees considered the services identified below that are provided by the Advisor. Based on this review, the Trustees concluded that the Advisor provides high-quality services to the Fund, and they noted that their overall confidence in the Advisor is high. The Trustees also concluded that they were satisfied with the nature, extent, and quality of the advisory services provided to the Fund by the Advisor, and that the nature and extent of the services provided by the Advisor are appropriate to assure that the Fund’s operations are conducted in compliance with applicable laws, rules, and regulations. |

| | | (a) | The Advisor acts as the portfolio manager for the Fund. In this capacity, the Advisor does the following: |

| | | | (i) | manages the composition of the Fund’s portfolio, including the purchase, retention, and disposition of portfolio securities in accordance with the Fund’s investment objectives, policies, and restrictions; |

| | | | | |

| | | | (ii) | ensures compliance with “best execution” for the Fund’s portfolio; |

| | | | | |

| | | | (iii) | manages the use of soft dollars for the Fund; and |

| | | | | |

| | | | (iv) | manages proxy voting for the Fund. |

| | | (b) | The Advisor performs a daily reconciliation of portfolio positions and cash for the Fund. |

| | | | |

| | | (c) | The Advisor monitors the Fund’s compliance with its investment objectives and restrictions. |

| | | | |

| | | (d) | The Advisor monitors compliance with federal securities laws and performs activities such as maintaining a compliance program, conducting ongoing reviews of the compliance programs of the Fund’s service providers, conducting on-site visits to the Fund’s service providers, monitoring incidents of abusive trading practices, reviewing Fund expense accruals, payments, and fixed expense ratios, evaluating insurance providers for fidelity bond coverage and D&O/E&O insurance coverage, conducting employee compliance training, reviewing reports provided by service providers, maintaining books and records, and preparing an annual compliance report for the Board. |

| | | | |

| | | (e) | The Advisor oversees service providers that provide accounting, administration, distribution, transfer agency, custodial, sales, marketing, public relations, audit, information technology, and legal services to the Fund. |

HENNESSYFUNDS.COM

| BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT |

| | | (f) | The Advisor maintains in-house marketing and distribution departments on behalf of the Fund. |

| | | | |

| | | (g) | The Advisor is actively involved with preparing regulatory filings for the Fund, including writing and annually updating the Fund’s prospectus and related documents. |

| | | | |

| | | (h) | The Advisor prepares a written summary of the Fund’s performance for the most recent 12-month period for each annual report of the Fund. |

| | | | |

| | | (i) | The Advisor oversees distribution of the Fund through third-party broker/dealers and independent financial institutions such as Charles Schwab, Inc., Fidelity, TD Waterhouse, and Pershing. The Advisor participates in “no transaction fee” (“NTF”) programs with these companies on behalf of the Fund, which allow customers to purchase the Fund through third-party distribution channels without paying a transaction fee. The Advisor compensates, in part, a number of these third-party providers of NTF programs out of its own revenues. |

| | | | |

| | | (j) | The Advisor pays the incentive compensation of the Fund’s compliance officers and employs other staff, such as legal, marketing, national accounts, distribution, sales, administrative, and trading oversight personnel, as well as management executives. |

| | | | |

| | | (k) | The Advisor provides a quarterly compliance certification to the Board. |

| | | | |

| | | (l) | The Advisor prepares or reviews Board materials, frequently presents to the Board or leads Board discussions, prepares or reviews meeting minutes, and arranges for Board training and education. |

| | (2) | The Trustees compared the performance of the Fund to benchmark indices over various time periods and also noted that the Trustees review and discuss reports comparing the investment performance of the Fund to various indices at each quarterly Board meeting. Based on all such information, the Trustees believe that the Advisor manages the Fund in a manner that is materially consistent with its stated investment objective and style. The Trustees concluded that the performance of the Fund over various time periods warranted the continuation of the advisory agreement. |

| | | |

| | (3) | The Trustees reviewed the advisory fees and overall expense ratios of the Fund compared to other funds similar in asset size and investment objective to the Fund using data from Morningstar. As part of the discussion with management, the Trustees ensured that they understood and were comfortable with the criteria used to determine the mutual funds included in the Morningstar categories for purposes of the materials considered at the meeting. The Trustees determined that the advisory fee and overall expense ratio of the Fund falls within the range of the advisory fees and overall expense ratios of other comparable funds and concluded that they are reasonable and warranted continuation of the advisory agreement. |

| | | |

| | (4) | The Trustees also considered whether economies of scale were being realized by the Advisor that should be shared with the Fund’s shareholders. The Trustees noted that many of the expenses incurred to manage the Fund are asset-based fees and thus do not result in material economies of scale being realized as the assets of the Fund increase. For example, mutual fund platform fees increase as the Fund’s assets grow. The Trustees also considered the Advisor’s efforts to |

| HENNESSY FUNDS | 1-800-966-4354 | |

| | | contain expenses, the Advisor’s significant marketing efforts to promote the Funds, and the Advisor’s agreement to waive fees or lower its management fees in certain circumstances. The Trustees noted that at current asset levels it did not appear that there were economies of scale being realized by the Advisor and concluded that it would continue to monitor economies of scale in the future as circumstances changed. |

| | | |

| | (5) | The Trustees considered the profitability of the Advisor, including the impact of mutual fund platform fees on the Advisor’s profitability, and also considered the resources and revenues that the Advisor has put into managing and distributing the Fund. The Trustees then concluded that the profits of the Advisor are reasonable and not excessive when compared to profitability guidelines set forth in relevant court cases. |

| | | |

| | (6) | The Trustees considered the high level of professionalism and knowledge of the Advisor’s employees, along with a very low level of turnover, and concluded that this was beneficial to the Fund and its shareholders. |

| | | |

| | (7) | The Trustees considered any benefits to the Advisor from serving as an advisor to the Fund (other than the advisory fee). The Trustees noted that the Advisor may derive ancillary benefits from, by way of example, its association with the Fund in the form of proprietary and third-party research products and services received from broker-dealers that execute portfolio trades for the Fund. The Trustees determined that any such products and services have been used for legitimate purposes relating to the Fund by providing assistance in the investment decision-making process. The Trustees concluded that any additional benefits realized by the Advisor its relationship with the Fund were reasonable. |

After reviewing the materials provided at the meeting and management’s presentation, as well as other information regularly provided at the Board’s quarterly meetings throughout the year regarding the quality of services provided by the Advisor, the performance of the Fund, expense information, regulatory compliance issues, trading information and related matters, and other factors that the Trustees deemed relevant, the Trustees, including the Independent Trustees, approved the continuation of the advisory agreement.

HENNESSYFUNDS.COM

| BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT |

(This Page Intentionally Left Blank.)

For information, questions or assistance, please call

The Hennessy Funds

1-800-966-4354 or 1-415-899-1555

INVESTMENT ADVISOR

Hennessy Advisors, Inc.

7250 Redwood Boulevard, Suite 200

Novato, California 94945

ADMINISTRATOR,

TRANSFER AGENT,

DIVIDEND PAYING AGENT &

SHAREHOLDER SERVICING AGENT

U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

CUSTODIAN

U.S. Bank N.A.

Custody Operations

1555 North River Center Drive, Suite 302

Milwaukee, Wisconsin 53212

TRUSTEES

Neil J. Hennessy

Robert T. Doyle

J. Dennis DeSousa

Gerald P. Richardson

COUNSEL

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202-5306