As filed with the Securities and Exchange Commission on _____ __, 2006

Registration No. 033-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

¨ Pre-Effective Amendment No. ___ ¨ Post-Effective Amendment No. ___

(Check appropriate box or boxes)

| | |

Exact Name of Registrant as Specified in Charter: TCW Funds, Inc. | | Area Code and Telephone Number: (213) 244-0000 |

|

Address of Principal Executive Offices: (Number, Street, City, State, Zip Code) 865 South Figueroa Street, Suite 1800, Los Angeles, California 90017 |

| |

Name and Address of Agent for Service: Philip K. Holl, Secretary 865 South Figueroa Street, Suite 1800 Los Angeles, California 90017 With copies to: Douglas P. Dick, Esquire, Dechert LLP 4675 MacArthur Court, Suite 1400 Newport Beach, California 92660 | | Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement goes effective |

| (Number and Street) (City) (State) (Zip Code) | | |

Calculation of Registration Fee under the Securities Act of 1933:

No filing fee is due because an indefinite number of shares have been deemed to be registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

It is proposed that this filing will become effective on the thirtieth day after the date upon which it is filed, pursuant to Rule 488 under the Securities Act of 1933.

TCW Aggressive Growth Equities Fund

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

1-800-FUND-TCW

, 2006

Dear Shareholder:

Your Board of Directors has called a Special Meeting of Shareholders of the TCW Aggressive Growth Equities Fund (the “Aggressive Growth Equities Fund”) scheduled to be held at 9:00 a.m., local time, on June 30, 2006 at 865 South Figueroa Street, Suite 1800, Los Angeles, California 90017.

The Board of Directors of TCW Funds, Inc. (the “Company”), on behalf of the Aggressive Growth Equities Fund, has approved a reorganization of the Aggressive Growth Equities Fund into the TCW Growth Equities Fund (the “Growth Equities Fund”), each a series of the Company managed by TCW Investment Management Company (the “Reorganization”). If the Reorganization is approved by shareholders, you will become a shareholder of the Growth Equities Fund on the date that the Reorganization occurs. The Growth Equities Fund has investment objectives that are identical and investment policies that are similar in many respects to those of the Aggressive Growth Equities Fund. The Reorganization is expected to result in a reduction of the total gross operating expenses and no increase in the total net operating expenses for holders of Class N shares of the Aggressive Growth Equities Fund and a reduction in the total gross operating expenses and net operating expenses for holders of Class I shares of the Aggressive Growth Equities Fund.

You are being asked to vote to approve an Agreement and Plan of Reorganization. The accompanying document describes the proposed transaction and compares the policies and expenses of each of the funds for your evaluation.

After careful consideration, the Board of Directors of the Company unanimously approved this proposal and recommended that shareholders vote “FOR” the proposal.

A Prospectus/Proxy Statement that describes the Reorganization is enclosed. We urge you to vote your shares by completing and returning the enclosed proxy card in the envelope provided at your earliest convenience. If you prefer, you may vote by telephone by calling the 1-800 number that appears on the enclosed proxy card. Voting by telephone will reduce the time and costs associated with the proxy solicitation. When the Aggressive Growth Equities Fund records proxies by telephone it will use procedures designed to: (i) authenticate shareholders’ identities, (ii) allow shareholders to authorize the voting of their shares in accordance with their instructions, and (iii) confirm that their instructions have been properly recorded.

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Prospectus/Proxy Statement and cast your vote. It is important that your vote be received no later than June 29, 2006.

Proxy solicitations will be made by mail, and may also be made by personal interview, telephone, and facsimile transmission on behalf of the Aggressive Growth Equities Fund by the Company’s directors and officers.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

|

Sincerely, |

|

| |

Alvin R. Albe, Jr. |

President |

TCW Funds, Inc. |

TCW Aggressive Growth Equities Fund

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

1-800-FUND-TCW

Notice of Special Meeting of Shareholders of

TCW Aggressive Growth Equities Fund

Scheduled For June 30, 2006

To the Shareholders:

A Special Meeting of Shareholders (“Special Meeting”) of the TCW Aggressive Growth Equities Fund (the “Aggressive Growth Equities Fund”) is scheduled for Friday, June 30, 2006 at 9:00 a.m. local time, at 865 South Figueroa Street, Suite 1800, Los Angeles, CA 90017.

The purposes of the Special Meeting of the Aggressive Growth Equities Fund are as follows:

| | 1. | To approve an Agreement and Plan of Reorganization providing for: (i) the transfer of all of the assets and liabilities of the Aggressive Growth Equities Fund to the TCW Growth Equities Fund (the “Growth Equities Fund”); (ii) an amendment to the Articles of Incorporation of TCW Funds, Inc. reclassifying the Class I and Class N shares of the Aggressive Growth Equities Fund into Class I and Class N shares, respectively, of the Growth Equities Fund; (iii) the issuance of Class I and Class N shares, as applicable, of the Growth Equities Fund to holders of the Class I and Class N shares, respectively, of the Aggressive Growth Equities Fund; and (iv) the subsequent complete liquidation of the Aggressive Growth Equities Fund. |

| | 2. | To transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

Shareholders of record at the close of business on April 28, 2006 are entitled to notice of, and to vote at, the meeting. Your attention is called to the accompanying Prospectus/Proxy Statement. Regardless of whether you plan to attend the meeting, please complete, sign and promptly return the enclosed proxy card or promptly cast your vote by telephone so that a quorum will be present and a maximum number of shares may be voted. If you are present at the meeting, you may change your vote, if desired, at that time.

| | |

By Order of the Board of Directors of |

TCW Funds, Inc. |

| |

| | | |

Philip K. Holl |

Secretary |

[DATE]

PROSPECTUS/PROXY STATEMENT

TCW Aggressive Growth Equities Fund

865 South Figueroa Street

Suite 1800

Los Angeles, CA 90017

1-800-FUND-TCW

Special Meeting of Shareholders Scheduled for

June 30, 2006

Aggressive Growth Equities Fund

(a series of TCW Funds, Inc.)

Relating to the Reorganization into

Growth Equities Fund

(a series of TCW Funds, Inc.)

(collectively, the “Funds” and each, a “Fund”)

INTRODUCTION

This Prospectus/Proxy Statement provides you with information about a proposed transaction between the TCW Aggressive Growth Equities Fund (the “Aggressive Growth Equities Fund”) and the TCW Growth Equities Fund (the “Growth Equities Fund”), both series of TCW Funds, Inc. (the “Company”), a Maryland corporation which is an open-end investment company registered under the Investment Company Act of 1940. If approved, this transaction (the “Reorganization”) will involve: (i) the transfer of all of the assets and liabilities of the Aggressive Growth Equities Fund to the Growth Equities Fund, (ii) an amendment to the Articles of Incorporation of the Company reclassifying the Class I and Class N shares of the Aggressive Growth Equities Fund into Class I and Class N shares, respectively, of the Growth Equities Fund, (iii) the issuance of Class I and Class N shares, as applicable, of the Growth Equities Fund to holders of the Class I and Class N shares, respectively, of the Aggressive Growth Equities Fund, and (iv) the complete liquidation of the Aggressive Growth Equities Fund. As a result of the Reorganization, you will receive shares of the Growth Equities Fund having an aggregate net asset value equal to the aggregate net asset value of the shares you held of the Aggressive Growth Equities Fund as of the close of business on the day of the Reorganization. You are being asked to vote on the Agreement and Plan of Reorganization through which these transactions will be accomplished.

Because you, as a shareholder of the Aggressive Growth Equities Fund, are being asked to approve a transaction that will result in you holding shares of the Growth Equities Fund, this Proxy Statement also serves as a Prospectus for the Growth Equities Fund.

This Prospectus/Proxy Statement, which you should retain for future reference, concisely sets forth important information about the Growth Equities Fund that you should know before investing. A Statement of Additional Information dated , 2006 related to this Prospectus/Proxy Statement and the Reorganization (the “Reorganization SAI”) has been filed with the Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Prospectus/Proxy Statement. A copy of the Reorganization SAI is available upon request and without charge by calling 1-800-FUND-TCW.

The Company is subject to the informational requirements of the Securities Exchange Act of 1934 and in accordance therewith files reports and other information with the SEC. The following documents have been filed

with the SEC and are incorporated herein by reference: (i) the Prospectus of the Aggressive Growth Equities Fund and the Growth Equities Fund (Class I shares) dated February 27, 2006; (ii) the Prospectus of the Aggressive Growth Equities Fund and the Growth Equities Fund (Class N shares) dated February 27, 2006; (iii) the Statement of Additional Information of the Aggressive Growth Equities Fund and the Growth Equities Fund dated February 27, 2006 (the “SAI”); and (iv) the Annual Report of the Aggressive Growth Equities Fund and the Growth Equities Fund for the period ended October 31, 2005 (the “Annual Report”). Copies of any of these documents and any subsequently released annual or semi-annual reports for either of the Funds may be obtained, without charge, by calling 1-800-FUND-TCW.

You can copy and review information about each Fund (including the SAI) at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 942-8090. Proxy materials, reports and other information about each Fund are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following E-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, D.C. 20549-0102.

The Securities and Exchange Commission has not approved or disapproved these securities, or determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

SUMMARY

You should read this entire Prospectus/Proxy Statement carefully. For additional information, you should consult the Growth Equities Fund Prospectus and the Aggressive Growth Equities Fund Prospectus, which are incorporated herein by reference, and the Agreement and Plan of Reorganization, which is attached hereto as Appendix A.

On February 23, 2006, the Board of Directors of the Company, on behalf of the Aggressive Growth Equities Fund, approved an Agreement and Plan of Reorganization with respect to the Aggressive Growth Equities Fund (the “Reorganization Agreement”). Subject to shareholder approval, the Reorganization Agreement provides for:

| | • | | the transfer of all of the assets of the Aggressive Growth Equities Fund to the Growth Equities Fund; |

| | • | | the assumption by the Growth Equities Fund of all of the liabilities of the Aggressive Growth Equities Fund; |

| | • | | an amendment to the Company’s Articles of Incorporation reclassifying the Class I and Class N shares of the Aggressive Growth Equities Fund into Class I and Class N shares, respectively, of the Growth Equities Fund; |

| | • | | the issuance of Class I and Class N shares, as applicable, of the Growth Equities Fund to holders of the Class I and Class N shares, respectively, of the Aggressive Growth Equities Fund; and |

| | • | | the complete liquidation of the Aggressive Growth Equities Fund. |

The Reorganization is expected to be effective upon the close of business on August 31, 2006, or on such other date as the parties may agree (the “Closing”). As a result of the Reorganization, each shareholder of Class I shares of the Aggressive Growth Equities Fund will become a shareholder of Class I shares of the Growth Equities Fund and each shareholder of Class N shares of the Aggressive Growth Equities Fund will become a shareholder of Class N shares of the Growth Equities Fund.

Each shareholder will hold, immediately after the Closing, Class I shares or Class N shares of the Growth Equities Fund having an aggregate value equal to the aggregate value of the Class I shares or Class N shares, respectively, of the Aggressive Growth Equities Fund held by that shareholder as of the close of business on the business day of the Closing.

The primary purposes of the proposed Reorganization are to seek potential economies of scale and to eliminate certain costs associated with operating the Aggressive Growth Equities Fund and the Growth Equities Fund separately. The proposed Reorganization is designed to provide investors with the ability to invest in a fund with an identical investment objective, long-term capital appreciation, and very similar investment policies to that of the Aggressive Growth Equities Fund, but with a significantly larger asset base than that of the Aggressive Growth Equities Fund. In addition, there is currently substantial overlap in the manner in which the Funds are managed, which would be eliminated if the Funds were reorganized as discussed herein.

Prior to January 1, 2006, the portfolio managers of the Aggressive Growth Equities Fund were Douglas S. Foreman, Christopher J. Ainley, Husam H. Nazer and R. Brendt Stallings. The strategy implemented by the Aggressive Growth Equities Fund was primarily designed by Mr. Foreman. Prior to January 1, 2006, the portfolio managers of the Growth Equities Fund were R. Brendt Stallings, Christopher J. Ainley and Douglas S. Foreman. The strategy implemented by the Growth Equities Fund was primarily designed by Mr. Stallings. As of December 31, 2005, Mr. Ainley resigned from his position at the Advisor and Mr. Foreman is no longer involved with the portfolio management of the Funds. Upon the termination of Mr. Foreman as a portfolio manager, Mr. Stallings, the portfolio manager of the Growth Equities Fund, also assumed portfolio management responsibilities for the Aggressive Growth Equities Fund. Although the investment objectives of both Funds are identical and the investment policies are similar, in managing the Growth Equities Fund, Mr. Stallings employs a different investment management style from the style employed previously by Mr. Foreman and his team with respect to the Aggressive Growth Equities Fund. Since Mr. Stallings has assumed responsibility for the portfolio

1

management of the Aggressive Growth Equities Fund, he has employed a very similar style to that he has designed for the portfolio management of the Growth Equities Fund, such that both Funds are currently being managed by Mr. Stallings in a substantially similar style.

Management has determined that rather than operating two separate funds with identical investment objectives managed in a substantially similar style by Mr. Stallings, that it is in the best interests of the shareholders of the Aggressive Growth Equities Fund (as well as shareholders of the Growth Equities Fund) to consolidate the assets of both Funds into one fund, the Growth Equities Fund (which has been managed under the strategy designed by Mr. Stallings since inception), with a larger combined asset base. Management has also determined that the Reorganization is in the best interests of shareholders of the Aggressive Growth Equities Fund (as well as shareholders of the Growth Equities Fund) because since January 1, 2006, when Mr. Foreman’s and Mr. Ainley’s involvement in the management of the Aggressive Growth Equities Fund ceased, the Aggressive Growth Equities Fund began to experience a decline in assets which could prevent it from becoming a viable mutual fund. During the same period, however, under the management of Mr. Stallings, the assets of the Growth Equities Fund have steadily increased.

Combining the assets of the Funds is intended to provide various benefits to shareholders of the Aggressive Growth Equities Fund who become shareholders of the Growth Equities Fund (as well as to existing and future investors in the Growth Equities Fund). For example, the proposed Reorganization will allow shareholders of the Aggressive Growth Equities Fund to enjoy the benefits of investing in a fund that has higher asset levels, which will result in the fixed and relatively fixed costs associated with operating the Fund being spread over a larger asset base, thereby reducing gross expenses of Class N and Class I shares of the Fund and reducing net per share expenses indirectly borne by holders of Class I shares of the Fund.1 In addition, it is anticipated that the current shareholders of the Growth Equities Fund will benefit from the Reorganization because the additional assets from the Aggressive Growth Equities Fund that will be aggregated with those of the Growth Equities Fund will help the Growth Equities Fund achieve certain additional economies of scale. The proposed Reorganization will, in management’s view, also allow the more viable surviving Fund with a greater asset base to participate in greater investment opportunities and to potentially take larger portfolio positions.

Further, the Reorganization will allow the Aggressive Growth Equities Fund’s shareholders to continue to participate in a professionally-managed portfolio which seeks to achieve long-term capital appreciation through investments in equity securities and equity equivalents of growth companies. Subject to the restrictions of each of the various funds in the TCW Funds group, shareholders of the Growth Equities Fund, including former shareholders of the Aggressive Growth Equities Fund, will be able to exchange their shares of the Growth Equities Fund for the same class of shares of other mutual funds in the TCW Funds group.

The Reorganization is intended to qualify for Federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Aggressive Growth Equities Fund nor its shareholders nor the Growth Equities Fund is expected to recognize any gain or loss from the Reorganization for Federal income tax purposes. Immediately prior to the Reorganization, the Aggressive Growth Equities Fund will pay a dividend or dividends which, together with all previous dividends, will have the effect of distributing to its shareholders all of the Aggressive Growth Equities Fund’s investment company taxable income for taxable years ending on or prior to the Reorganization (computed without regard to any deduction for dividends paid) and all of its net capital gain, if any, realized in taxable years ending on or prior to the Reorganization (including any gains from sales of holdings prior to the Reorganization), after reduction by any available capital loss carryovers. Such dividends will be included in the taxable income of the Aggressive Growth Equities Fund’s shareholders.

In considering whether to approve the Reorganization, you should note that:

| | • | | The Funds have identical investment objectives and similar investment policies, however, certain important differences are highlighted below. |

| 1 | Net per share expenses paid by holders of Class N shares of the Fund will not increase. |

2

| | • | | Both Funds invest principally in equity securities of mid-cap “growth” companies. |

| | • | | The Aggressive Growth Equities Fund focuses on “emerging growth” companies, which are companies that are likely to show high growth through reinventing an existing industry or pioneering a new industry. The Growth Equities Fund focuses on “growth” companies, which are companies expected to exhibit faster than average gains in earnings and which are expected to continue to show a high level of growth gain. |

| | • | | The Aggressive Growth Equities Fund may invest without limit as to issuer or sector. At December 31, 2005, the Aggressive Growth Equities Fund had approximately 40.4% of its assets invested in the information technology sector. |

| | • | | The Growth Equities Fund may not invest more than 7% of its net assets in any one issuer, measured at the time of investment, and it may not invest more than the greater of 25% of the Fund’s net assets or the Russell Mid-Cap Index weighting, determined monthly, in any particular sector. |

| | • | | The investment policies of the Aggressive Growth Equities Fund do not allow the Fund to utilize options, futures, foreign currency futures and forward contracts. |

| | • | | The Growth Equities Fund may use options, futures, foreign currency futures and forward contracts to protect against uncertainty in the level of future foreign currency exchange rates. |

| | • | | TCW Investment Management Company, 865 South Figueroa Street, Suite 1800, Los Angeles, California 90017 is the investment advisor to both Funds (the “Advisor”). R. Brendt Stallings is a portfolio manager of both Funds. Mr. Stallings began the growth equities strategy currently employed by both Funds in 1999. |

| | • | | The Reorganization is expected to result in no increase in the total operating expenses for holders of Class N shares of the Aggressive Growth Equities Fund and a reduction in the total operating expenses for holders of Class I shares of the Aggressive Growth Equities Fund. For example, the operating expenses, expressed as a percentage of net asset value per share of Class I shares and Class N shares, are as follows: |

| | | | | | |

| | | Class I | | | Class N | |

• Expenses of the Growth Equities Fund before a voluntary reduction of the management fee and assumption of certain fund expenses by the Advisor (based on the fiscal year ended October 31, 2005). | | 1.62 | % | | 5,104.46 | %1 |

| | |

• Expenses of the Growth Equities Fund after a voluntary reduction of the management fee and assumption of certain fund expenses by the Advisor (based on the fiscal year ended October 31, 2005). | | 1.62 | % | | 1.67 | % |

| | |

• Expenses of the Aggressive Growth Equities Fund before a voluntary reduction of the management fee and assumption of certain fund expenses by the Advisor (based on the fiscal year ended October 31, 2005). | | 1.35 | % | | 1.86 | % |

| | |

• Expenses of the Aggressive Growth Equities Fund after a voluntary reduction of the management fee and assumption of certain fund expenses by the Advisor (based on the fiscal year ended October 31, 2005): | | 1.35 | % | | 1.67 | % |

| | |

• Projected expenses of the Growth Equities Fund after the Reorganization (Pro Forma): | | 1.31 | % | | 1.85 | % |

| | |

• Projected expenses of the Growth Equities Fund after the Reorganization after a voluntary reduction of the management fee and certain fund expenses by the Advisor (Pro Forma): | | 1.31 | % | | 1.67 | % |

| 1 | The high expense ratio is a result of the low net asset level, less than $1,000, of the Class N shares. |

3

| | • | | The distribution, purchase and redemption procedures, and the exchange rights and voting rights of the Funds are identical and the Reorganization will not change these procedures and rights. |

| | • | | Approval of the Reorganization Agreement requires the affirmative vote of the holders of a majority of the Aggressive Growth Equities Fund’s shares outstanding and entitled to vote on the matter as of April 28, 2006 (the “Record Date”). |

After careful consideration, the Board of Directors of the Company, on behalf of the Aggressive Growth Equities Fund, unanimously approved the proposed Reorganization. The Board recommends that you vote “FOR” the proposed Reorganization.

4

COMPARISON OF THE INVESTMENT OBJECTIVES AND POLICIES OF THE FUNDS

Comparison of Investment Objectives, Strategies, Processes and Risks

| | | | |

| | | Aggressive Growth Equities Fund | | Growth Equities Fund |

| Investment Objective | | The Fund seeks long-term capital appreciation. | | The Fund seeks long-term capital appreciation. |

| | | |

| Principal Investment Strategies | | The Fund invests in equity securities of companies that appear to offer above average growth prospects. The Fund normally invests at least 80% of its assets in equity securities (including amounts borrowed for investment purposes). Equity securities include common and preferred stock; rights or warrants to purchase common or preferred stock; securities convertible into common or preferred stock; and other securities with equity characteristics. Normally the Fund primarily invests in issuers which are characterized as “emerging growth” companies according to criteria established by the Advisor. The fund defines emerging growth companies as companies that are likely to show high growth through reinventing an existing industry or pioneering a new industry. In managing the Fund’s investments, the Advisor focuses on emerging companies that exhibit this characteristic. The Fund may acquire convertible securities and warrants. The Fund may use convertible debt securities which are rated below investment grade. The Fund may make short sales of securities that it owns or has the right to acquire through conversion or exchange of other securities that it owns. | | The Fund invests in equity securities of emerging growth companies. The Fund normally invests at least 80% of its assets in equity securities (including amounts borrowed for investment purposes). Equity securities include common and preferred stock; rights or warrants to purchase common or preferred stock; securities convertible into common or preferred stock; and other securities with equity characteristics. Normally at the time that a new position is initially purchased into the Fund, the issue will be within the capitalization range of the companies comprising the Russell MidCap Growth Index. As of December 31, 2005, the market capitalization range of the Russell MidCap Growth Index was between $996 million and $18.438 billion. Normally the Fund primarily invests in issuers which are characterized as “growth” companies according to criteria established by the Advisor. The Fund defines growth companies as companies that are expected to exhibit faster than average gains in earnings and which are expected to continue to show a high level of growth gain. The Fund may use options, futures, foreign currency futures and forward contracts. The Fund may acquire convertible securities and warrants. The Fund may use convertible debt securities which are rated below investment grade. The Fund may make short sales of securities that it owns or has the right to acquire through conversion or exchange of other securities that it owns. |

5

| | | | |

| | | Aggressive Growth Equities Fund | | Growth Equities Fund |

| Investment Process | | The Advisor utilizes a “bottom-up” approach to identify securities for investment. First, the Advisor uses quantitative and qualitative criteria to screen companies. The Advisor then subjects companies that make it through this screening process to fundamental analysis, which generally looks for at least one or more of the following factors: • a demonstrated record of consistent earnings growth or the potential to grow earnings • an ability to earn an attractive return on equity • a price/earnings ratio which is less than the Advisor’s internally estimated three-year earnings growth rate • a large and growing market share • a strong balance sheet • significant ownership interest by management and a strong management team. Typically, the Fund sells an individual security when the company fails to meet expectations, there is a deterioration of underlying fundamentals, the intermediate and long-term prospects for the company are poor, the price/earnings ratio rises above the Advisor’s internally estimated three-year growth rate or the Advisor determines to take advantage of a better investment opportunity. | | The Advisor utilizes a “bottom-up” approach to identify securities for investment. First, the Advisor uses quantitative and qualitative criteria to screen companies. The Advisor then subjects companies that make it through this screening process to fundamental analysis, which generally looks for at least one or more of the following factors: • a demonstrated record of consistent earnings growth or the potential to grow earnings • an ability to earn an attractive return on equity • a price/earnings ratio which is less than the Advisor’s internally estimated three-year earnings growth rate • a large and growing market share • a strong balance sheet • significant ownership interest by management and a strong management team. The Fund seeks to achieve diversification by limiting the weighting in any one security or any one sector. Typically, the Fund sells an individual security when the company fails to meet expectations, there is a deterioration of underlying fundamentals, the intermediate and long-term prospects for the company are poor or the Advisor determines to take advantage of a better investment opportunity. The Fund will also sell if an individual security weighting or sector weighting is too large. |

| Main Risks | | The Fund holds primarily stocks, which may go up or down in value, sometimes rapidly and unpredictably. Although stocks offer the potential for greater long-term growth than most debt securities, stocks generally have higher short-term volatility. The Fund is designed for long-term investors | | The Fund holds primarily stocks, which may go up or down in value, sometimes rapidly and unpredictably. Although stocks offer the potential for greater long-term growth than most debt securities, stocks generally have higher short-term volatility. In addition, the Fund may hold convertible debt |

6

| | | | |

| | | Aggressive Growth Equities Fund | | Growth Equities Fund |

| Main Risks (cont’d) | | interested in an equity portfolio, including common stocks. In addition, the Fund may hold convertible debt securities. Many convertible debt securities are rated below investment grade and are considered speculative by rating agencies as to repayment of principal and interest. The primary risks affecting this Fund are “price volatility”, “liquidity risk” and “equity risk.” Price volatility refers to the possibility that the value of the Fund’s portfolio will change as the prices of its investments go up or down. This Fund may be subject to greater price volatility than funds that invest in the securities of larger companies. The Fund’s returns may vary, and you could lose money. Liquidity risk refers to the possibility that the Fund may lose money or be prevented from earning capital gains if it cannot sell securities at the time and price that is most beneficial to the Fund. Because the securities of medium-sized companies may be less liquid than the securities of large-sized companies, the Fund may be susceptible to liquidity risk more than funds that invest in the securities of large-sized companies. In addition, the Fund may be subject to liquidity risk because it may invest in debt instruments rated below investment grade. Equity risk is the risk that stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of stocks and other equity securities will change based on changes in a company’s financial condition and in overall market and economic conditions. The Fund may also be subject to “investment style risk.” The Advisor primarily uses a particular style or set of styles—in this case “growth” styles—to select investments for the Fund. Those styles may be out of favor or may not produce the best results over short or longer time periods and may increase the volatility of the Fund’s share price. | | securities. Many convertible debt securities are rated below investment grade and are considered speculative by rating agencies as to repayment of principal and interest. The primary risks affecting this Fund are “price volatility”, “liquidity risk” and “equity risk.” Price volatility refers to the possibility that the value of the Fund’s portfolio will change as the prices of its investments go up or down. This Fund may be subject to greater price volatility than funds that invest in the securities of larger companies. The Fund’s returns may vary, and you could lose money. Liquidity risk refers to the possibility that the Fund may lose money or be prevented from earning capital gains if it cannot sell securities at the time and price that is most beneficial to the Fund. Because the securities of medium-sized companies may be less liquid than the securities of large-sized companies, the Fund may be susceptible to liquidity risk more than funds that invest in the securities of large-sized companies. In addition, the Fund may be subject to liquidity risk because it may invest in debt instruments rated below investment grade. Equity risk is the risk that stocks and other equity securities generally fluctuate in value more than bonds and may decline in value over short or extended periods. The value of stocks and other equity securities will change based on changes in a company’s financial condition and in overall market and economic conditions. The Fund may also be subject to “investment style risk.” The Advisor primarily uses a particular style or set of styles—in this case “growth” styles—to select investments for the Fund. Those styles may be out of favor or may not produce the best results over short or longer time periods, and may increase the volatility of the Fund’s share price. |

7

| | | | |

| | | Aggressive Growth Equities Fund | | Growth Equities Fund |

| Investment Advisor | | TCW Investment Management Company | | TCW Investment Management Company |

| Portfolio Managers | | R. Brendt Stallings and Husam H. Nazer | | R. Brendt Stallings |

Comparison of Portfolio Characteristics1

The following table compares certain characteristics of the portfolios of the Funds as of the end of their last fiscal year, October 31, 2005:

| | | | |

| | | Aggressive Growth Equities Fund | | Growth Equities Fund |

| Net Assets2 | | $42,035,906 | | $24,924,738 |

| Number of Holdings | | 95 | | 60 |

| | | |

| Portfolio Turnover Rate | | 57.17% | | 57.18% |

| (as a % of net assets) | | | | |

Equity Securities (as a % of net assets) | | 99.9% | | 99.0% |

Debt Securities (as a % of net assets) | | 0.5%3 | | 0.6% |

| | | |

| Top 6 Industries | | Computer Services—19.6% | | Commercial Services—18.0% |

| (as a % of net assets) | | Commercial Services—16.2% | | Computer Services—15.9% |

| | | Retail—11.9% | | Retail—10% |

| | | Telecommunications—7.7% | | Healthcare—8.6% |

| | | Oil & Gas—6.9% | | Oil & Gas—7.1% |

| | | Foods, Hotels & Restaurants—6.9% | | Banking & Financial Services—7.1% |

| | | |

| Top 10 equity holdings | | Yahoo! Inc.—7.9% | | Yahoo! Inc.—6.3% |

| (as a % of net assets) | | eBay Inc.—6.8% | | eBay Inc.—4.6% |

| | | Research in Motion Limited—4.4% | | Robert Half International Inc.—3.8% |

| | | Genentech, Inc.—3.6% | | Genentech, Inc.—3.6% |

| | | Juniper Networks, Inc.—3.3% | | Express Scripts, Inc.—3.4% |

| | | Amazon.com, Inc.—2.8% | | Corporate Executive Board Co.—3.2% |

| | | National Oilwell Varco, Inc.—2.5% Robert Half International Inc.—2.4% Corporate Executive Board Co.—2.3% Resources Connection, Inc.—2.3% | | Cognizant Technology Solutions

Corp.— 3.1% |

| | | | Amazon.com, Inc.—3.1% |

| | | | Smith International, Inc.—3.1% |

| | | | Resources Connection, Inc.—2.7% |

| 1 | The numbers in this table are for comparison purposes only and have not been audited. |

| 2 | As of March 31, 2006, the Aggressive Growth Equities Fund and the Growth Equities Fund had net assets of $34.1 million and $29.9 million, respectively. |

| 3 | The Aggressive Growth Equities Fund also holds other short-term investments representing investment of security lending collateral. |

8

Comparison of Distribution, Purchase and Redemption Procedures and Exchange Rights

The distribution, purchase and redemption procedures of both Funds are identical, as are the exchange rights granted to shareholders of both Funds. The Shareholder Guide attached as Exhibit D to this registration statement contains a more detailed description of the distribution, purchase and redemption procedures and exchange rights applicable to both Funds.

Tax Consequences

The Reorganization is intended to qualify for Federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Aggressive Growth Equities Fund nor its shareholders nor the Growth Equities Fund is expected to recognize any gain or loss from the Reorganization for Federal income tax purposes. For a more detailed discussion of the tax consequences of the Reorganization see “INFORMATION ABOUT THE REORGANIZATION—Tax Considerations.”

9

RISKS OF INVESTING IN THE FUNDS

Because the Funds have investment objectives that are identical and policies that are similar in many respects, many of the risks of investing in the Growth Equities Fund are similar to the risks of investing in the Aggressive Growth Equities Fund. The following risks should be considered before investing in either Fund.

Market Risk

There is the possibility that the returns from the types of securities in which either Fund invests will underperform returns from the various general securities markets or different asset classes. Different types of securities tend to go through cycles of outperformance and underperformance in comparison to the general securities markets.

Investment Style/Securities Selection Risk

Both Funds may also be subject to investment style risk. The Advisor primarily uses a particular style or set of styles—in both cases “growth” styles—to select investments for the Funds. Those styles may be out of favor or may not produce the best results over short or longer time periods, and may increase the volatility of the Funds’ share prices. There is also the possibility that the specific securities held in each of the Fund’s portfolios will underperform other funds in the same asset class or benchmarks that are representative of the general performance of the asset class because of the portfolio managers’ choice of securities.

Price Volatility

There is the possibility that the value of each of the Fund’s portfolios will change as the prices of their investments go up or down. Both Funds hold primarily stocks, which may go up or down in value, sometimes rapidly and unpredictably. Although stocks offer the potential for greater long-term growth than most fixed income securities, stocks generally have higher short-term volatility. Both Funds are subject to greater price volatility than other funds because they invest primarily in securities of small or medium sized companies.

Small and Medium Capitalization Company Risk

Both Funds invest most of their assets in the equity securities of companies with small and medium capitalizations which are subject to certain risks. Companies with small and medium size market capitalization often have narrower markets, fewer products or services to offer and more limited managerial and financial resources than do larger more established companies. As a result, their performance can be more volatile, and they face a greater risk of business failure, which could increase the volatility and risk of loss of a Fund’s assets.

Liquidity Risk

There is the possibility that both Funds may lose money or be prevented from earning capital gains if they cannot sell a security at the time and price that is most beneficial to the applicable Fund. Because the securities of medium-sized companies may be less liquid than the securities of large-sized companies, both Funds may be susceptible to liquidity risk more than funds that invest in the securities of large-sized companies. In addition, both Funds may be subject to liquidity risk because they may invest in debt instruments rated below investment grade.

Credit Risk

Credit Risk refers to the likelihood that an issuer will default in the payment of principal and/or interest on a security. Because convertible securities may be rated below investment grade, they are subject to greater credit risk. Both Funds may invest in convertible securities rated below investment grade. Debt securities that are rated

10

below investment grade are considered to be speculative. Those debt securities rated below investment grade are also commonly known as “junk bonds.” These securities are regarded as bonds predominately speculative with respect to the issuer’s continuing ability to meet principal and interest payments. Because investment in lower quality securities involves greater investment risk, achievement of the Funds’ investment objective will be more dependent on the Advisor’s analysis than would be the case if the Funds were investing in higher quality debt securities. In addition, lower quality securities may be more susceptible to real or perceived adverse economic and individual corporate developments than would investment grade debt securities. Also, the secondary trading market for lower quality securities may be less liquid than the market for investment grade securities. This potential lack of liquidity may make it more difficult for the Advisor to accurately value certain portfolio securities.

Non-Diversified Status

Each Fund is non-diversified for the purposes of the Investment Company Act of 1940 (“1940 Act”), and as such may invest a larger percentage of its assets in individual issuers than a diversified investment company. In this regard, the Funds are not subject to the general limitation that they not invest more than 5% of their total assets in the securities of any one issuer.

To the extent that the Funds make investments in excess of 5% of their assets in a particular issuer, their exposure to credit and market risks associated with that issuer is increased. However, the Funds’ investments will be limited so as to qualify for the special tax treatment afforded “regulated investment companies” under the Internal Revenue Code of 1986, as amended.

Because a relatively high percentage of each Fund’s assets may be invested in the securities of a limited number of issuers, both Funds may be more susceptible to any single economic, political or regulatory occurrence than a diversified fund.

As an operating policy, however, the Growth Equities Fund invests no more than 7% of its net assets in any one issuer measured at the time of investment.

Temporary Defensive Strategies

For both Funds, when the Advisor anticipates unusual market or other conditions, the Funds may temporarily depart from their principal investment strategies as a defensive measure. The Advisor may temporarily invest up to 100% of the Fund’s assets in high quality short- term money market instruments if it believes adverse economic conditions such as excessive volatility or sharp market declines, justify taking a defensive posture. To the extent a Fund is engaged in temporary defensive investments, it will not be pursuing its investment objective.

Sale of Securities

Following the Reorganization and in the ordinary course of business as a mutual fund, certain holdings of the Aggressive Growth Equities Fund that are transferred to the Growth Equities Fund in connection with the Reorganization may be sold. Such sales may result in increased transaction costs for the Growth Equities Fund, and the realization of taxable gains and losses for the Growth Equities Fund which would result in taxable distributions to shareholders. Any sales by the Aggressive Growth Equities Fund prior to the Reorganization may result in taxable distributions to shareholders of the Aggressive Growth Equities Fund.

11

COMPARISON OF FEES AND EXPENSES OF THE FUNDS

The following discussion describes and compares the fees and expenses of the Aggressive Growth Equities Fund with the Growth Equities Fund.

Annual Fund Operating Expenses

The operating expenses of the Class I and Class N shares of the Aggressive Growth Equities Fund, expressed as a ratio of expenses to average daily net assets (“expense ratio”) are 0.27% and 5102.6% lower than those of the corresponding shares of the Growth Equities Fund, which were 1.62% and 5104.46%1, respectively, before any expense limitations, for the fiscal year ended October 31, 2005. For the fiscal year ended October 31, 2005, the operating expenses for Class I and Class N shares of the Aggressive Growth Equities Fund were 1.35% and 1.86%, respectively.

The Advisor voluntarily paid certain of the operating expenses for the Class N shares of the Growth Equities Fund and the Aggressive Growth Equities Fund so that the ordinary operating expenses for the Class N shares of both Funds did not exceed the trailing monthly expense ratio for comparable funds as reported by Lipper, Inc. During the fiscal year ended October 31, 2005, shareholders of the Class N shares of the Growth Equities Fund and the Aggressive Growth Equities Fund paid operating expenses of 1.67% and 1.67%, respectively, as a result of these waivers and assumptions of expenses. The expense limitations for the Funds are voluntary and are terminable on six months notice.

Management Fee

The Aggressive Growth Equities Fund and the Growth Equities Fund have the same annual management fee of 1.00% of the Fund’s average daily net assets.

Distribution and Service Fees

Both Funds charge a distribution (12b-1) fee for their Class N shares of .25% of the average daily net assets of the Fund attributable to the Fund’s Class N shares. Neither Fund charges a distribution (12b-1) fee or a service fee for their Class I shares. Neither Fund charges a contingent deferred sales load for Class N or Class I shares.

| 1 | The high expense ratio is a result of the low net asset level, less than $1,000, of the Class N shares of the Growth Equities Fund. |

12

Expense Table

The current expenses of each of the Funds and estimated pro forma expenses after giving effect to the proposed Reorganization are shown in the following table. Expenses for the Funds are annualized based upon the operating expenses incurred by Class I and Class N shares of the Aggressive Growth Equities Fund, and Growth Equities Fund for the fiscal year ended October 31, 2005. Pro forma fees show estimated fees of the Class I and Class N shares of the Growth Equities Fund after giving effect to the proposed Reorganization. Pro forma numbers are estimated in good faith and are hypothetical.

| | | | | | | | | | | | | | | | | | |

| | | Class I | | | Class N | |

| | | Aggressive

Growth

Equities

Fund | | | Growth

Equities

Fund | | | Growth

Equities Fund

after

Reorganization

(Pro Forma) (1) | | | Aggressive

Growth

Equities

Fund | | | Growth

Equities

Fund | | | Growth

Equities Fund

after

Reorganization

(Pro Forma) (1) | |

Shareholder Transaction Fees (fees paid directly from your investment) | | | | | | | | | | | | | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases | | None | | | None | | | None | | | None | | | None | | | None | |

Maximum Deferred Sales Charge (Load) | | None | | | None | | | None | | | None | | | None | | | None | |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends | | None | | | None | | | None | | | None | | | None | | | None | |

Redemption Fee | | None | | | None | | | None | | | None | | | None | | | None | |

Exchange Fee | | None | | | None | | | None | | | None | | | None | | | None | |

| | | | | | |

| Annual Fund Operating Expenses (expenses that are deducted from the Funds’ assets) | | | | | | | | | | | | | | | | | | |

Management Fees | | 1.00 | % | | 1.00 | % | | 1.00 | % | | 1.00 | % | | 1.00 | % | | 1.00 | % |

Distribution (12b-1) Fees | | None | | | None | | | None | | | 0.25 | % | | 0.25 | % | | 0.25 | % |

Other Expenses | | 0.35 | % | | 0.62 | % | | 0.31 | % | | 0.61 | % | | 5,103.21 | % | | 0.60 | % |

Total Annual Fund Operating Expenses | | 1.35 | % | | 1.62 | % | | 1.31 | % | | 1.86 | %(2) | | 5,104.46 | %(3) | | 1.85 | % |

Fee Waiver/Expense Reimbursement | | None | | | None | | | None | | | 0.19 | % | | 5,102.79 | % | | 0.18 | % |

Net Expenses | | 1.35 | % | | 1.62 | % | | 1.31 | % | | 1.67 | % | | 1.67 | % | | 1.67 | %(4) |

| (1) | Pro forma expenses are estimated. |

| (2) | For the fiscal year ended October 31, 2005, the Advisor voluntarily reduced its fee and paid operating expenses of the Class N shares of the Aggressive Growth Equities Fund, so that the total operating expenses for the Fund’s Class N shares were 1.67%. |

| (3) | For the fiscal year ended October 31, 2005, the Advisor voluntarily reduced its fee and paid operating expenses of the Class N shares of the Aggressive Growth Equities Fund, so that the total operating expenses for the Fund’s Class N shares were 1.67%. |

| (4) | Reflects continuation of the voluntary fee reduction for the Fund’s Class N shares. The expense limitation is expected to be continued indefinitely and may only be terminated upon six (6) months notice. |

Expense Examples

The examples are intended to help you compare the cost of investing in each of the Funds with the costs of investing in other mutual funds. The examples assume that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The examples also assume that your

13

investment has a 5% return each year and that each Fund’s operating expenses remain the same. The 5% return is an assumption and is not intended to portray past or future investment results. The figures shown are the same whether or not you sold your shares at the end of the period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Aggressive Growth Equities Fund | | Growth Equities Fund | | | Growth Equities Fund after

Reorganization (Pro Forma) (1) | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

Class I | | $ | 137 | | $ | 428 | | $ | 739 | | $ | 1,624 | | $ | 165 | | | $ | 511 | | | $ | 881 | | | $ | 1,922 | | | $ | 133 | | | $ | 415 | | | $ | 718 | | | $ | 1,579 | |

Class N | | $ | 189 | | $ | 585 | | $ | 1,006 | | $ | 2,180 | | | N/A | (2) | | | N/A | (2) | | | N/A | (2) | | | N/A | (2) | | $ | 188 | (3) | | $ | 582 | (3) | | $ | 1,001 | (3) | | $ | 2,169 | (3) |

| (1) | Pro forma figures are estimated. |

| (2) | Based on the net expenses of the Class N shares of the Growth Equities Fund after reimbursement, the Expense Example would be: |

| | | | | | |

1

Year | | 3

Years | | 5

Years | | 10

Years |

| $170 | | $526 | | $907 | | $1,976 |

| (3) | Based on the net expenses of the Class N shares of the Growth Equities Fund after reimbursement, the Expense Example after the Reorganization (Pro Forma) would be: |

| | | | | | |

1

Year | | 3

Years | | 5

Years | | 10

Years |

| $170 | | $526 | | $907 | | $1,976 |

14

INFORMATION ABOUT THE REORGANIZATION

The Agreement and Plan of Reorganization

The Reorganization Agreement provides for: (i) the transfer of all of the assets and liabilities of the Aggressive Growth Equities Fund to the Growth Equities Fund; (ii) an amendment to the Articles of Incorporation of the Company reclassifying the Class I and Class N shares of the Aggressive Growth Equities Fund into Class I and Class N shares, respectively, of the Growth Equities Fund; (iii) the issuance of Class I and Class N shares, as applicable, of the Growth Equities Fund to holders of the Class I and Class N shares, respectively, of the Aggressive Growth Equities Fund; and (iv) the subsequent complete liquidation of the Aggressive Growth Equities Fund.

After the Reorganization, each shareholder of the Aggressive Growth Equities Fund will own shares in the Growth Equities Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of the Aggressive Growth Equities Fund held by that shareholder as of the close of business on the day of the Closing. Shareholders of Class I shares of the Aggressive Growth Equities Fund will receive Class I shares of the Growth Equities Fund and shareholders of Class N shares of the Aggressive Growth Equities Fund will receive Class N shares of the Growth Equities Fund.

In the interest of economy and convenience, shares of the Growth Equities Fund generally will not be represented by physical certificates, unless requested in writing.

Until the Closing, shareholders of the Aggressive Growth Equities Fund will continue to be able to redeem their shares. Redemption requests received after the Closing will be treated as requests received by the Growth Equities Fund for the redemption of its shares.

The obligations of the Funds under the Reorganization Agreement are subject to various conditions, including approval of the shareholders of the Aggressive Growth Equities Fund. The Reorganization Agreement also requires that each of the Funds take, or cause to be taken, all action, and do or cause to be done, all things reasonably necessary, proper or advisable to consummate and make effective the transactions contemplated by the Reorganization Agreement. The Reorganization Agreement may be terminated by mutual agreement of the parties or on certain other grounds. Please refer to Appendix A to review the terms and conditions of the Reorganization Agreement.

Reasons for the Reorganization

The primary purposes of the proposed Reorganization are to seek potential economies of scale and to eliminate certain costs associated with operating the Aggressive Growth Equities Fund and the Growth Equities Fund separately. The proposed Reorganization is designed to provide investors with the ability to invest in a fund with an identical investment objective, long-term capital appreciation, and very similar investment policies to that of the Aggressive Growth Equities Fund, but with a significantly larger asset base than that of the Aggressive Growth Equities Fund. In addition, there is currently substantial overlap in the manner in which the Funds are managed, which would be eliminated if the Funds were reorganized as discussed herein.

Prior to January 1, 2006, the portfolio managers of the Aggressive Growth Equities Fund were Douglas S. Foreman, Christopher J. Ainley, Husam H. Nazer and R. Brendt Stallings. The strategy implemented by the Aggressive Growth Equities Fund was primarily designed by Mr. Foreman. Prior to January 1, 2006, the portfolio managers of the Growth Equities Fund were R. Brendt Stallings, Christopher J. Ainley and Douglas S. Foreman. The strategy implemented by the Growth Equities Fund was primarily designed by Mr. Stallings. As of December 31, 2005, Mr. Ainley resigned from his position at the Advisor and Mr. Foreman is no longer involved with the portfolio management of the Funds. Upon the termination of Mr. Foreman as a portfolio manager, Mr. Stallings, the portfolio manager of the Growth Equities Fund, also assumed portfolio management

15

responsibilities for the Aggressive Growth Equities Fund. Although the investment objectives of both Funds are identical and the investment policies are similar, in managing the Growth Equities Fund, Mr. Stallings employs a different investment management style from the style employed previously by Mr. Foreman and his team with respect to the Aggressive Growth Equities Fund. Since Mr. Stallings has assumed responsibility for the portfolio management of the Aggressive Growth Equities Fund, he has employed a very similar style to that he has designed for the portfolio management of the Growth Equities Fund, such that both Funds are currently being managed by Mr. Stallings in a substantially similar style.

Management has determined that rather than operating two separate funds with identical investment objectives managed in a substantially similar style by Mr. Stallings, that it is in the best interests of the shareholders of the Aggressive Growth Equities Fund (as well as shareholders of the Growth Equities Fund) to consolidate the assets of both Funds into one fund, the Growth Equities Fund (which has been managed under the strategy designed by Mr. Stallings since inception), with a larger combined asset base. Management has also determined that the Reorganization is in the best interests of shareholders of the Aggressive Growth Equities Fund (as well as shareholders of the Growth Equities Fund) because since January 1, 2006, when Mr. Foreman’s and Mr. Ainley’s involvement in the management of the Aggressive Growth Equities Fund ceased, the Aggressive Growth Equities Fund began to experience a decline in assets which could prevent it from becoming a viable mutual fund. During the same period, however, under the management of Mr. Stallings, the assets of the Growth Equities Fund have steadily increased.

Combining the assets of the Funds is intended to provide various benefits to shareholders of the Aggressive Growth Equities Fund who become shareholders of the Growth Equities Fund (as well as to existing and future investors of the Growth Equities Fund). For example, the proposed Reorganization will allow shareholders of the Aggressive Growth Equities Fund to enjoy the benefits of investing in a fund that has higher asset levels, which will result in the fixed and relatively fixed costs associated with operating the Aggressive Growth Equities Fund being spread over a larger asset base, thereby reducing gross expenses of Class N and Class I shares of the Fund and reducing net per share expenses indirectly borne by holders of Class I shares of the Fund.1 In addition, it is anticipated that the current shareholders of the Growth Equities Fund will benefit from the Reorganization because the additional assets from the Aggressive Growth Equities Fund that will be aggregated with those of the Growth Equities Fund will help the Growth Equities Fund achieve certain additional economies of scale. The proposed Reorganization will, in management’s view, also allow the more viable surviving Fund with a greater asset base to participate in greater investment opportunities and to potentially take larger portfolio positions.

Further, the Reorganization will allow the Aggressive Growth Equities Fund’s shareholders to continue to participate in a professionally-managed portfolio which seeks to achieve long-term capital appreciation through investments in equity securities and equity equivalents of growth companies. Subject to the restrictions of each of the various funds in the TCW Funds group, shareholders of the Growth Equities Fund, including former shareholders of the Aggressive Growth Equities Fund, will be able to exchange their shares of the Growth Equities Fund for the same class of shares of other mutual funds in the TCW Funds group.

Expenses of the Reorganization

The Advisor will bear half the cost of the Reorganization, including, but not limited to, the costs of solicitation of voting instructions and any necessary filings with the SEC. Both Funds will each bear a quarter of the expenses related to the proposed Reorganization. The costs of the Reorganization shall not include any brokerage or other transaction fees or costs incurred as a result of the purchase or sale of portfolio securities by either Fund.

The Reorganization may result in limitations in the use of capital loss carryovers of the Aggressive Growth Equities Fund after the Reorganization. See “INFORMATION ABOUT THE REORGANIZATION—Tax Considerations.”

| 1 | Net per share expenses indirectly borne by holders of Class N shares of the Fund will not increase. |

16

Board Considerations

The proposed Reorganization was initially presented to the Board of Directors of the Company for consideration at a meeting held on October 28, 2005. Additional information regarding the Reorganization was provided to the Board of Directors and the Reorganization was approved by the Directors on behalf of the Aggressive Growth Equities Fund at a meeting held on February 23, 2006. For the reasons discussed below, the Directors, including all of the Directors who are not “interested persons” (as defined in the 1940 Act) and who are advised by their own counsel, determined that the interests of the shareholders of the Aggressive Growth Equities Fund will not be diluted as a result of the proposed Reorganization, and that the proposed Reorganization is in the best interests of the Aggressive Growth Equities Fund and its shareholders.

The Board of Directors, on behalf of the Aggressive Growth Equities Fund, in recommending the proposed transaction, considered a number of factors, including the following:

| | (1) | expense ratios and information regarding fees and expenses of the Aggressive Growth Equities Fund and the Growth Equities Fund; |

| | (2) | the ability of the shareholders of the Aggressive Growth Equities Fund to continue to participate in a fund that invests with an objective of long-term capital appreciation; |

| | (3) | that the Reorganization would not dilute the interests of the Aggressive Growth Equities Fund’s current shareholders; |

| | (4) | the similarity of the investment objectives, policies and restrictions of the Growth Equities Fund with those of the Aggressive Growth Equities Fund; |

| | (5) | the relative size of the Funds and whether performance and investment flexibility have the potential to be enhanced if the assets of each of the Funds are combined; |

| | (6) | the costs borne by the Growth Equities Fund, its shareholders and the Aggressive Growth Equities Fund and its shareholders; and |

| | (7) | the possible limitations on the use of the capital loss carryovers of the Aggressive Growth Equities Fund after the Reorganization. |

The Directors of the Company, on behalf of the Aggressive Growth Equities Fund, recommend that shareholders approve the Reorganization with the Growth Equities Fund.

Tax Considerations

The Reorganization is intended to qualify for Federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Aggressive Growth Equities Fund or its shareholders nor the Growth Equities Fund is expected to recognize any gain or loss from the Reorganization for Federal income tax purposes. As a condition to the Closing of the Reorganization, the Funds will receive an opinion from the law firm of Dechert LLP to the effect that the Reorganization will qualify as a tax-free reorganization for Federal income tax purposes. That opinion will be based in part upon certain assumptions and upon certain representations made by the Growth Equities Fund, the Aggressive Growth Equities Fund and the Company in the Reorganization Agreement.

Immediately prior to the Reorganization, the Aggressive Growth Equities Fund will pay a dividend or dividends which, together with all previous dividends, will have the effect of distributing to its shareholders all of the Aggressive Growth Equities Fund’s investment company taxable income for taxable years ending on or prior to the Reorganization (computed without regard to any deduction for dividends paid) and all of its net capital gain, if any, realized in taxable years ending on or prior to the Reorganization (including any gains from sales of holdings prior to the Reorganization), after reduction by any available capital loss carryovers. Such dividends will be included in the taxable income of the Aggressive Growth Equities Fund’s shareholders.

17

As of October 31, 2005, the Aggressive Growth Equities Fund had capital loss carryovers from prior taxable years of approximately $38 million. To the extent that such capital loss carryovers can be offset against future capital gains recognized by the Fund, it would not be necessary for the Fund to distribute such gains (although such undistributed gains would be reflected in amounts received on redemptions and would therefore affect the amount of gain or loss on redemptions). Capital loss carryovers generally expire after a period of eight years. Approximately $32 million of capital loss carryovers are currently scheduled to expire in 2010 and approximately $6 million of capital loss carryovers are scheduled to expire in 2011. It is possible that the Reorganization may limit the use of these capital loss carryovers and it may also result in the loss of the ability to use a portion of such capital loss carryovers. Whether these limitations apply would depend, in part, on the comparative size of each Fund at the time of the Reorganization. If the limitations apply, the combined fund would have an annual limitation on the use of the capital loss carryovers of the Aggressive Growth Equities Fund, that, based on current values, could be approximately $1.5 million per year and, in such an event, the major portion of the current capital loss carryovers would expire before they are used. It should also be noted, however, that there is no assurance that the Aggressive Growth Equities Fund could use a substantial portion of its capital loss carryovers even in the absence of the Reorganization since the use of such loss carryovers would depend on the recognition of substantial future gains by the Aggressive Growth Equities Fund before the expiration of the loss carryovers.

Capitalization

The following table shows on an unaudited basis the capitalization of each of the Funds as of the Record Date and on a pro forma basis as of the Record Date after giving effect to the Reorganization:

| | | | | | | | |

| | | Net Assets | | Net Asset

Value Per

Share | | Shares Outstanding |

Aggressive Growth Equities Fund | | | | | | | | |

Class I | | $ | | | $ | | | |

Class N | | $ | | | $ | | | |

| | | |

Growth Equities Fund | | | | | | | | |

Class I | | $ | | | $ | | | |

Class N | | $ | | | $ | | | |

| | | |

Pro Forma—Growth Equities Fund (including Aggressive Growth Equities Fund) | | | | | | | | |

Class I | | $ | | | $ | | | |

Class N | | $ | | | $ | | | |

18

ADDITIONAL INFORMATION ABOUT THE AGGRESSIVE GROWTH EQUITIES FUND

Investment Personnel

The Aggressive Growth Equities Fund is managed by R. Brendt Stallings, Managing Director, the Advisor, TCW Asset Management Company and Trust Company of the West, and Husam H. Nazer, Managing Director, the Advisor, TCW Asset Management Company and Trust Company of the West.

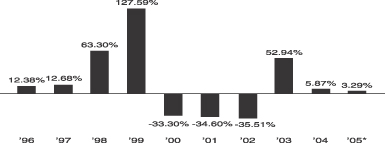

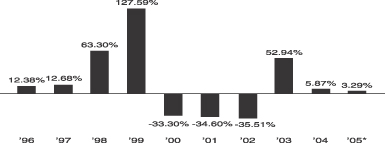

Performance of the Aggressive Growth Equities Fund

The bar chart and table below show the Fund’s annual and after-tax returns and its long-term performance with respect to its Class I shares. The bar chart shows some indications of the risks of investing in the Fund by showing how the Fund’s performance has varied from year to year. The bar chart includes the performance of the predecessor limited partnership of the Aggressive Growth Equities Fund which was managed by an affiliate of the Advisor, using the same investment strategy as the Aggressive Growth Equities Fund. The table provides some indication of the risks of investing in the Fund by showing how the Fund’s before and after-tax returns over time compare to that of a broad-based securities market index for the past ten calendar years. Both the bar chart and the table assume reinvestment of dividends and distributions.

The performance of the partnership was calculated using performance standards applicable to private investment partnerships, which take into account all elements of total return and reflect the deduction of fees and expenses of operation. The predecessor limited partnership was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions imposed by the 1940 Act and Subchapter M of the Internal Revenue Code of 1986, as amended. If the limited partnership had been registered under the 1940 Act, it’s performance could have been adversely affected.

As with all mutual funds, past performance, both before and after taxes, is not a prediction of future results.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown, and after-tax returns shown are not relevant if you hold shares of the Aggressive Growth Equities Fund through a tax-deferred arrangement, such as an individual retirement account. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

Year by year total return (%)

as of December 31 each year (1)

Aggressive Growth Equities Fund—Class I Shares

| (1) | During the period shown in the chart, the Fund’s best quarterly performance was 65.37% for the quarter ended December 31, 1999, and the Fund’s worst quarterly performance was -39.89% for the quarter ended September 30, 2001. |

| * | The Fund’s total return for the period November 1, 2005 to December 31, 2005 was 6.05%. |

19

The table below shows what the average annual total returns of the Aggressive Growth Equities Fund would equal if you averaged out actual performance over various lengths of time, compared to the Russell Mid Cap Growth Index. The Russell Mid Cap Growth Index is an unmanaged group of securities and assumes no reduction for fees and expenses in measuring returns. The securities in the Russell Mid Cap Growth Index are substantially different from those in the Aggressive Growth Equities Fund. An investor cannot invest directly in an index.

Average Annual Total Returns

| | | | | | | | | |

| (For the periods ended December 31, 2005) | | 1 Year | | | 5 Years | | | From Inception/

Registration or 10 Years | |

Return Before Taxes | | | | | | | | | |

Aggressive Growth Equities Fund—Class N | | 3.13 | % | | -6.93 | % | | -0.77 | % |

| | | |

Return Before Taxes from Registration Date (6/3/96) | | | | | | | | | |

Aggressive Growth Equities Fund—Class I | | 3.29 | % | | -6.59 | % | | 6.07 | % |

| | | |

Return After Taxes on Distributions from Registration Date (1) | | | | | | | | | |

Aggressive Growth Equities Fund—Class I | | 3.29 | % | | -6.59 | % | | 5.46 | % |

| | | |

Return After Taxes on Distributions and Sales of Fund Shares from Registration Date (1) | | | | | | | | | |

Aggressive Growth Equities Fund—Class I | | 2.14 | % | | -5.48 | % | | 5.24 | % |

| | | |

Russell Mid Cap Growth Index from Registration Date | | 12.56 | % | | 8.60 | % | | 8.21 | % |

(reflects no deduction for fees, expenses or taxes) | | | | | | | | | |

| | | |

Return Before Taxes Including Limited Partnership Performance | | | | | | | | | |

Aggressive Growth Equities Fund—Class I | | 3.29 | % | | -6.59 | % | | 8.36 | % |

| (1) | After-tax returns are shown only for Class I shares, after-tax returns for Class N shares will vary. |

For a discussion by the Advisor regarding the performance of the Aggressive Growth Equities Fund for the fiscal year ended October 31, 2005, see Appendix B to this Prospectus/Proxy Statement. Additional information regarding the Aggressive Growth Equities Fund is included in the Shareholder Guide attached as Appendix D to this Prospectus/Proxy Statement.

20

ADDITIONAL INFORMATION ABOUT THE GROWTH EQUITIES FUND

Investment Personnel

The Growth Equities Fund is managed by R. Brendt Stallings, Managing Director, the Advisor, TCW Asset Management Company and Trust Company of the West.

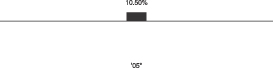

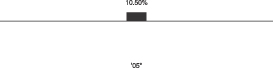

Performance of the Growth Equities Fund

The bar chart and table below show the Fund’s annual and after-tax returns and its performance since inception with respect to its Class I shares. The table provides some indication of the risks of investing in the Fund by showing how the Fund’s before and after-tax returns over time compare to that of a broad-based securities market index for the period of time the Fund has been registered with the SEC under the 1940 Act. Both the bar chart and the table assume reinvestment of dividends and distributions.

As with all mutual funds, past performance (before and after taxes) is not a prediction of future results.

Year by year total return (%)

as of December 31 each year (1)

Growth Equities Fund—Class I Shares

| (1) | During the period shown in the chart, the Fund’s best quarterly performance was 9.44% for the quarter ended September 30, 2005, and the Fund’s worst quarterly performance was -9.54% for the quarter ended March 31, 2005. |

| * | The Fund’s total return for the period November 1, 2005 to December 31, 2005 was 6.54%. |

21

The table below shows what the average annual total returns of the Growth Equities Fund would equal if you averaged out actual performance over various lengths of time, compared to the Russell Mid Cap Growth Index. The Russell Mid Cap Growth Index is an unmanaged group of securities and assumes no reduction for fees and expenses in measuring returns. The securities in the Russell Mid Cap Growth Index are substantially different from those in the Growth Equities Fund. An investor cannot invest directly in an index.

Average Annual Total Returns

| | | | | | | | |

| (For the periods ended December 31, 2005) | | 1 Year | | | 5 Years | | From Inception/

Registration | |

Return Before Taxes | | | | | | | | |

Growth Equities Fund—Class N | | 10.81 | % | | N/A | | 11.42 | % |

| | | |

Return Before Taxes from Registration Date (3/1/04) | | | | | | | | |

Growth Equities Fund—Class I | | 10.90 | % | | N/A | | 11.47 | % |

| | | |

Return After Taxes on Distributions from Registration Date (1) | | | | | | | | |

Growth Equities Fund—Class I | | 10.90 | % | | N/A | | 11.47 | % |

| | | |

Return After Taxes on Distributions and Sales of Fund Shares from Registration Date (1) | | | | | | | | |

Growth Equities Fund—Class I | | 7.09 | % | | N/A | | 9.82 | % |

| | | |

Russell Mid Cap Growth Index | | 12.10 | % | | N/A | | 12.08 | % |

(reflects no deduction for fees, expenses or taxes) | | | | | | | | |

| (1) | After-tax returns are shown only for Class I shares, after-tax returns for Class N shares will vary. |

For a discussion by the Advisor regarding the performance of the Growth Equities Fund for the fiscal year ended October 31, 2005, see Appendix C to this Prospectus/Proxy Statement. Additional information regarding the Growth Equities Fund is included in the Shareholder Guide attached as Appendix D to this Prospectus/Proxy Statement.

22

GENERAL INFORMATION ABOUT THE PROXY STATEMENT

Solicitation of Proxies

Solicitation of proxies is being made primarily by the mailing of this Notice and Proxy Statement with its enclosures on or about May 19, 2006. Shareholders of the Aggressive Growth Equities Fund whose shares are held by nominees, such as brokers, can vote their proxies by contacting their respective nominee. In addition to the solicitation of proxies by mail, employees of the Company and its affiliates, without additional compensation, may solicit proxies in person or by telephone, telegraph, facsimile, or oral communication.

A shareholder may revoke the accompanying proxy at any time prior to its use by filing with the Aggressive Growth Equities Fund, a written revocation or duly executed proxy bearing a later date. In addition, any shareholder who attends the Special Meeting in person may vote by ballot at the Special Meeting, thereby canceling any proxy previously given. The persons named in the accompanying proxy will vote as directed by the proxy card, but in the absence of voting directions in any proxy card that is signed and returned, they intend to vote “FOR” the Reorganization proposal and may vote in their discretion with respect to other matters not now known to the Board of Directors of the Company that may be presented at the Special Meeting.

Voting Rights

Shareholders of the Aggressive Growth Equities Fund are entitled to one vote for each share held as to any matter on which they are entitled to vote and each fractional share shall be entitled to a proportionate fractional vote. Shares have no preemptive or subscription rights.