Table of Contents

As filed with the Securities and Exchange Commission on July 15, 2008

Registration No. 333-151313

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| x Pre-Effective Amendment No. 2 | ¨ Post-Effective Amendment No. |

(Check appropriate box or boxes)

Exact Name of Registrant as Specified in Charter:

TCW Funds, Inc. | Area Code and Telephone Number:

(213) 244-0000 | |

Address of Principal Executive Offices: (Number, Street, City, State, Zip Code)

865 South Figueroa Street, Suite 1800, Los Angeles, California 90017 | ||

Name and Address of Agent for Service:

Philip K. Holl, Secretary 865 South Figueroa Street, Suite 1800 Los Angeles, California 90017

With copies to:

Douglas P. Dick, Esquire, Dechert LLP 4675 MacArthur Court, Suite 1400 Newport Beach, California 92660 (Number and Street) (City) (State) (Zip Code) | Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement goes effective under the Securities Act of 1933, as amended.

The Registrant hereby amends this Registration under the Securities Act of 1933 on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine. | |

Calculation of Registration Fee under the Securities Act of 1933:

No filing fee is due because an indefinite number of shares have been deemed to be registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

Table of Contents

TCW Equities Fund

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

1-800-FUND-TCW

July 15, 2008

Dear TCW Equities Fund Shareholder:

The Board of Directors has called a Special Meeting of Shareholders of the TCW Equities Fund (the “Equities Fund”) scheduled to be held at 9:00 a.m., local time, on Monday, August 18, 2008 at 865 South Figueroa Street, Suite 1800, Los Angeles, California 90017.

The Board of Directors of TCW Funds, Inc. (the “Company”), on behalf of the Equities Fund, has approved a reorganization of the Equities Fund into the TCW Focused Equities Fund (the “Focused Equities Fund”), each a series of the Company managed by TCW Investment Management Company (the “Reorganization”). If the Reorganization is approved by shareholders, you will become a shareholder of the Focused Equities Fund on the date that the Reorganization occurs. The Focused Equities Fund has an investment objective that is identical and investment policies that are similar in many respects to those of the Equities Fund.

While the Reorganization will result in some changes, we expect the Reorganization will offer shareholders the following advantages:

Anticipated reduction in total gross and net operating expenses. The Reorganization is expected to result in a reduction in the total gross and net operating expenses for holders of Class N shares of the Equities Fund. In addition, management has contractually agreed to cap the expenses for the Focused Equities Fund at the lower, pre-merger expense ratio of the Class I shares of the Equities Fund for a period of one year after the Reorganization.

Larger asset base. Shareholders are expected to benefit from combining the funds because, among other things, the Focused Equities Fund would have a larger asset base, which may provide greater investment opportunities and economies of scale over the long term.

No change in fund management. Both the Equities Fund and the Focused Equities Fund are managed by TCW Investment Management Company. Both Funds also have the same portfolio managers.

You are being asked to vote to approve an Agreement and Plan of Reorganization. The accompanying Prospectus/Proxy Statement describes the Reorganization and compares the policies and expenses of each of the funds for your evaluation.

After careful consideration, the Board of Directors of the Company unanimously approved this proposal and recommended that shareholders vote “FOR” the proposal.

Table of Contents

We urge you to vote your shares:

| • | By completing and returning the enclosed proxy card in the envelope provided at your earliest convenience, or |

| • | In person at the Special Meeting. |

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Prospectus/Proxy Statement and cast your vote. It is important that your vote be received no later than August 15, 2008.

Proxy solicitations will be made by mail, and may also be made by personal interview, telephone, and facsimile transmission on behalf of the Equities Fund by the Company’s directors and officers. In addition, The Altman Group, the Equities Fund’s proxy solicitor, may make proxy solicitations.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

| Sincerely, |

| William C. Sonneborn |

| President |

| TCW Funds, Inc. |

Table of Contents

TCW Equities Fund

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

1-800-FUND-TCW

Notice of Special Meeting of Shareholders of

TCW Equities Fund

Scheduled For August 18, 2008

To the TCW Equities Fund Shareholders:

A Special Meeting of Shareholders (“Special Meeting”) of the TCW Equities Fund (the “Equities Fund”) is scheduled for Monday, August 18, 2008 at 9:00 a.m. local time, at 865 South Figueroa Street, Suite 1800, Los Angeles, CA 90017.

The purposes of the Special Meeting of the Equities Fund are as follows:

| 1. | To approve an Agreement and Plan of Reorganization providing for: (i) the transfer of all of the assets and liabilities of the Equities Fund to the TCW Focused Equities Fund (the “Focused Equities Fund”); (ii) the issuance of Class I and Class N shares, as applicable, of the Focused Equities Fund to holders of the Class I and Class N shares, respectively, of the Equities Fund on a pro rata basis; (iii) the subsequent complete liquidation of the Equities Fund; and (iv) an amendment to the Articles of Incorporation of TCW Funds, Inc. reclassifying the Class I and Class N shares of the Equities Fund into Class I and Class N shares, respectively, of the Focused Equities Fund to become effective after the closing. |

| 2. | To transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

Shareholders of record at the close of business on May 31, 2008 are entitled to notice of, and to vote at, the meeting. Your attention is called to the accompanying Prospectus/Proxy Statement. Regardless of whether you plan to attend the meeting, please complete, sign and promptly return the enclosed proxy card so that a quorum will be present and a maximum number of shares may be voted. If you are present at the meeting, you may change your vote, if desired, at that time.

By Order of the Board of Directors of TCW Funds, Inc. |

| Philip K. Holl |

| Secretary |

July 15, 2008

Table of Contents

PROSPECTUS/PROXY STATEMENT

TCW Equities Fund

865 South Figueroa Street

Suite 1800

Los Angeles, CA 90017

1-800-FUND-TCW

Special Meeting of Shareholders Scheduled for

August 18, 2008

Relating to the Reorganization of

TCW Equities Fund

(a series of the TCW Funds, Inc.)

into TCW Focused Equities Fund

(a series of the TCW Funds, Inc.)

(collectively, the “Funds” and each, a “Fund”)

INTRODUCTION

This Prospectus/Proxy Statement provides you with information about a proposed transaction between the TCW Equities Fund (the “Equities Fund”) and the TCW Focused Equities Fund (the “Focused Equities Fund”), both series of TCW Funds, Inc. (the “Company”), a Maryland corporation which is an open-end investment company registered under the Investment Company Act of 1940. If approved, this transaction (the “Reorganization”) will involve:

| • | the transfer of all of the assets and liabilities of the Equities Fund to the Focused Equities Fund; |

| • | the issuance of Class I and Class N shares, as applicable, of the Focused Equities Fund to holders of the Class I and Class N shares, respectively, of the Equities Fund on a pro rata basis; |

| • | the subsequent complete liquidation of the Equities Fund; and |

| • | an amendment to the Articles of Incorporation of the Company reclassifying the Class I and Class N shares of the Equities Fund into Class I and Class N shares, respectively, of the Focused Equities Fund to become effective after the closing. |

As a result of the Reorganization, you will receive shares of the Focused Equities Fund having an aggregate net asset value equal to the aggregate net asset value of the shares you held of the Equities Fund as of the close of business on the day of the Reorganization.

Table of Contents

You are being asked to vote on the Agreement and Plan of Reorganization through which these transactions will be accomplished.

Because you, as a shareholder of the Equities Fund, are being asked to approve a transaction that will result in you holding shares of the Focused Equities Fund, this Proxy Statement also serves as a Prospectus for the Focused Equities Fund.

This Prospectus/Proxy Statement, which you should retain for future reference, concisely sets forth important information about the Focused Equities Fund that you should know before investing. A Statement of Additional Information dated July 15, 2008 related to this Prospectus/Proxy Statement and the Reorganization (the “Reorganization SAI”) has been filed with the Securities and Exchange Commission (the “SEC”) and is incorporated by reference into this Prospectus/Proxy Statement. A copy of the Reorganization SAI is available upon request and without charge by calling 1-800-FUND-TCW.

The Company is subject to the informational requirements of the Securities Exchange Act of 1934 and in accordance therewith files reports and other information with the SEC. The following documents have been filed with the SEC and are incorporated by reference (i) the Prospectus of the Equities Fund and the Focused Equities Fund (Class I shares) dated February 29, 2008; (ii) the Prospectus of the Equities Fund and the Focused Equities Fund (Class N shares) dated February 29, 2008; (iii) the Statement of Additional Information of the Equities Fund and the Focused Equities Fund dated February 29, 2008 (the “SAI”); and (iv) the Annual Report of the Equities Fund and the Focused Equities Fund for the period ended October 31, 2007 (the “Annual Report”). Copies of any of these documents and any subsequently released annual or semi-annual reports for either of the Funds may be obtained, without charge, by calling 1-800-FUND-TCW or on the Internet at www.tcwfunds.com.

You can copy and review information about each Fund (including the SAI) at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 942-8090. Proxy materials, reports and other information about each Fund are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following E-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, D.C. 20549-0102.

The Securities and Exchange Commission has not approved or disapproved these securities, or determined that this Prospectus/Proxy Statement is truthful or complete. Any representation to the contrary is a criminal offense.

Table of Contents

| Page | ||

| 1 | ||

COMPARISON OF INVESTMENT OBJECTIVES AND POLICIES OF THE FUNDS | 4 | |

| 9 | ||

| 11 | ||

| 15 | ||

| 19 | ||

| 22 | ||

| 24 | ||

| A-1 | ||

| B-1 | ||

APPENDIX C—EXCERPT FROM ANNUAL REPORT OF THE FOCUSED EQUITIES FUND | C-1 | |

| D-1 | ||

Table of Contents

You should read this entire Prospectus/Proxy Statement carefully. For additional information, you should consult the Focused Equities Fund Prospectus and the Equities Fund Prospectus, which are incorporated herein by reference and the Agreement and Plan of Reorganization, which is attached hereto as Appendix A.

On February 20, 2008, the Board of Directors of the Company, on behalf of the Equities Fund, approved an Agreement and Plan of Reorganization with respect to the Equities Fund (the “Reorganization Agreement”). Subject to shareholder approval, the Reorganization Agreement provides for:

| • | the transfer of all of the assets of the Equities Fund to the Focused Equities Fund; |

| • | the assumption by the Focused Equities Fund of all of the liabilities of the Equities Fund; |

| • | the issuance of Class I and Class N shares, as applicable, of the Focused Equities Fund to holders of the Class I and Class N shares, respectively, of the Equities Fund on a pro rata basis; |

| • | the complete liquidation of the Equities Fund; and |

| • | an amendment to the Company’s Articles of Incorporation reclassifying the Class I and Class N shares of the Equities Fund into Class I and Class N shares, respectively, of the Focused Equities Fund to become effective after the closing. |

The Reorganization is expected to be effective upon the close of business on September 30, 2008, or on such other date as the parties may agree (the “Closing”). As a result of the Reorganization, each shareholder of Class I shares of the Equities Fund will become a shareholder of Class I shares of the Focused Equities Fund and each shareholder of Class N shares of the Equities Fund will become a shareholder of Class N shares of the Focused Equities Fund.

Each shareholder will hold, immediately after the Closing, Class I shares or Class N shares of the Focused Equities Fund having an aggregate value equal to the aggregate value of the Class I shares or Class N shares, respectively, of the Equities Fund held by that shareholder as of the close of business on the business day of the Closing.

The primary purposes of the proposed Reorganization are to seek potential economies of scale and to eliminate certain costs associated with operating the Equities Fund and the Focused Equities Fund separately. The proposed Reorganization is designed to provide investors in the Equities Fund with the ability to invest in a fund with an identical investment objective, long-term capital appreciation, and very similar investment policies to the Equities Fund, but with a larger combined asset base than the Equities Fund.

1

Table of Contents

The portfolio managers of the Focused Equities Fund and the Equities Fund are Thomas K. McKissick and N. John Snider. The investment objectives of both Funds are identical and the investment policies and investment strategies are similar. However, there are some differences. In managing the Focused Equities Fund Messrs. McKissick and Snider typically invest in a portfolio of 25 to 40 issues while the Equities Fund typically holds securities in a larger number of issues.

Management has determined that rather than operating two separate funds with identical investment objectives managed in a substantially similar style by Messrs. McKissick and Snider, that it is in the best interests of the shareholders of the Equities Fund (as well as shareholders of the Focused Equities Fund) to consolidate the assets of both Funds into one fund, the Focused Equities Fund, with a larger combined asset base. Combining the assets of the Funds is intended to provide various benefits to shareholders of the Equities Fund who become shareholders of the Focused Equities Fund (as well as to existing and future investors in the Focused Equities Fund). For example, management believes that the shareholders of the Equities Fund may benefit from the participation in a fund that has had greater overall investment returns than those achieved by the Equities Fund. Management also believes that the Reorganization may benefit the existing and future shareholders of the Focused Equities Fund and the shareholders of the Equities Fund by resulting in a surviving fund with a larger asset base. A larger asset base is expected to provide greater investment opportunities for the surviving portfolio and the potential to take larger portfolio positions, as well as the potential for lower total annual portfolio operating expenses through economies of scale. Based on these factors, Management has determined that the Reorganization is in the best interests of shareholders of each Fund.

Further, the Reorganization will allow the Equities Fund’s shareholders to continue to participate in a professionally-managed portfolio which seeks to achieve long-term capital appreciation through investments in equity securities and equity equivalents of large capitalization companies. Subject to the restrictions of each of the various funds in the TCW Funds group, shareholders of the Focused Equities Fund, including former shareholders of the Equities Fund, will continue to be able to exchange their shares of the Focused Equities Fund for the same class of shares of other mutual funds in the TCW Funds group.

The Reorganization is intended to qualify for Federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Equities Fund nor its shareholders nor the Focused Equities Fund is expected to recognize any gain or loss from the Reorganization for Federal income tax purposes. Immediately prior to the Reorganization, the Equities Fund will pay a dividend or dividends which, together with all previous dividends, will have the effect of distributing to its shareholders all of the Equities Fund’s investment company taxable income for taxable years ending on or prior to the Reorganization (computed without regard to any deduction for dividends paid) and all of its net capital gain, if any, realized in taxable years ending on or prior to the Reorganization (including any gains from sales of holdings prior to the

2

Table of Contents

Reorganization), after reduction by any available capital loss carry forward. Such dividends will be included in the taxable income of the Equities Fund’s shareholders.

In considering whether to approve the Reorganization, you should note that:

| • | The Funds have identical investment objectives and similar investment policies, however, certain important differences are highlighted below. |

| • | Both Funds invest principally in equity securities of large capitalization companies. |

| • | While there are no restrictions on the number of issues portfolio managers for the Equities Fund may select for investment, the Focused Equities Fund typically invests in a more concentrated portfolio of 25 to 40 issues. |

| • | TCW Investment Management Company, 865 South Figueroa Street, Suite 1800, Los Angeles, California 90017 is the investment advisor to both Funds (the “Advisor”). Thomas K. McKissick and N. John Snider are the portfolio managers of both Funds. |

| • | The Reorganization is expected to result in a reduction in the total gross and net operating expenses for holders of Class N shares of the Equities Fund. In addition, management has contractually agreed to cap the expenses for the Focused Equities Fund at the lower, pre-merger expense ratio of the Class I shares of the Equities Fund and the Class N shares of the Focused Equities Fund for a period of one year after the Reorganization. |

| • | The distribution, purchase and redemption procedures, and the exchange rights and voting rights of the Funds are identical and the Reorganization will not change these procedures and rights. |

| • | Approval of the Reorganization Agreement requires the affirmative vote of the holders of a majority of the Equities Fund’s shares outstanding and entitled to vote on the matter as of May 31, 2008 (the “Record Date”). |

After careful consideration, the Board of Directors of the Company, on behalf of the Equities Fund, unanimously approved the proposed Reorganization. The Board recommends that you vote “FOR” the proposed Reorganization.

3

Table of Contents

COMPARISON OF THE INVESTMENT OBJECTIVES AND POLICIES OF THE FUNDS

Comparison of Investment Objectives, Strategies, Processes and Risks

Equities Fund

|

Focused Equities Fund

| |||||

Investment Objective

| The Fund seeks long-term capital appreciation.

| The Fund seeks long-term capital appreciation.

| ||||

| Principal Investment Strategies | The Fund invests primarily in equity securities of large capitalization companies.

These equity securities include common and preferred stock; rights or warrants to purchase common or preferred stock; securities convertible into common or preferred stock; and other securities with equity characteristics.

The Fund invests (except when maintaining a temporary defensive position) at least 80% of the value of its net assets (plus amounts borrowed for investment purposes) in publicly traded equity securities of companies with a market capitalization of greater than $3 billion at the time of purchase. The Fund invests in companies trading below their (long-term) intrinsic value in the opinion of the Advisor.

The Fund typically invests in a portfolio of 45 to 75 issues.

| The Fund invests primarily in equity securities of large capitalization companies.

These equity securities include common and preferred stock; rights or warrants to purchase common or preferred stock; securities convertible into common or preferred stock; and other securities with equity characteristics.

The Fund invests (except when maintaining a temporary defensive position) at least 80% of the value of its net assets (plus amounts borrowed for investment purposes) in publicly traded equity securities of companies with a market capitalization of greater than $3 billion dollars at the time of purchase. The Fund invests in companies trading below their (long-term) intrinsic value.

The Fund typically invests in a portfolio of 25 to 40 issues.

| ||||

4

Table of Contents

Equities Fund

|

Focused Equities Fund

| |||||

| Investment Process | The Advisor seeks to invest in attractively valued equity securities of companies where the return on invested capital is improving. The Advisor utilizes bottom-up fundamental research to identify these companies. | The Advisor seeks to invest in attractively valued equity securities where the return on invested capital is improving. The Advisor utilizes bottom-up fundamental research to identify these companies.

| ||||

The Advisor performs fundamental research by using techniques such as: • making company visits • financial screening to identify companies • maintaining a disciplined approach to stock selection and portfolio construction

The Advisor will use both quantitative and qualitative screening criteria to supplement the scope of its fundamental research.

Typically, the Fund sells an individual security when the company fails to meet expectations, there is a deterioration of underlying fundamentals, the intermediate and long-term prospects for the company are poor or the Advisor determines to take advantage of a better investment opportunity. | The application of the Advisor’s quantitative screening focuses on companies that have a disciplined approach to investing capital and favors companies with increasing return on invested capital. The Advisor performs fundamental research by using techniques such as: • making company visits • telephone contract with senior management • industry conferences • financial projections

Typically, the Fund sells an individual security when the company fails to meet expectations, there is a deterioration of underlying fundamentals, the intermediate and long-term prospects for the company are poor or the Advisor determines to take advantage of a better investment opportunity.

|

5

Table of Contents

Equities Fund

|

Focused Equities Fund

| |||||

Main Risks | The primary risks affecting this Fund are: • price volatility risk • liquidity risk • equity risk • investment style risk • portfolio management risk • securities selection risk • market risk • securities lending risk • non-diversification risk

| The primary risks affecting this Fund are: • price volatility risk • liquidity risk • equity risk • investment style risk • portfolio management risk • securities selection risk • market risk • securities lending risk • non-diversification risk

| ||||

Investment Advisor | TCW Investment Management Company

| TCW Investment Management Company

| ||||

Portfolio Managers

| Thomas K. McKissick and N. John Snider

| Thomas K. McKissick and N. John Snider

| ||||

Comparison of Portfolio Characteristics1

The following table compares certain characteristics of the portfolios of the Funds as of April 30, 2008.

Equities Fund | Focused Equities Fund | |||||||

Net Assets | $57,088,336 | $44,529,783 | ||||||

Number of Holdings | 54 | 34 | ||||||

Portfolio Turnover Rate | 52%* | 65%* | ||||||

Equity Securities | 99.6% | 99.2% | ||||||

Cash | 0.4% | 0.8% | ||||||

6

Table of Contents

Equities Fund | Focused Equities Fund | |||||||||

Top 6 Industries | ||||||||||

(as a % of net assets) | Oil & Gas | 19.97 | % | Oil & Gas | 23.72 | % | ||||

| Banking | 8.55 | % | Banking | 9.44 | % | |||||

| Aerospace & Defense | 7.88 | % | Aerospace & Defense | 8.64 | % | |||||

| Cosmetics & Personal Care | 6.52 | % | Cosmetics & Personal Care | 8.49 | % | |||||

| Pharmaceuticals | 6.40 | % | Pharmaceuticals | 8.15 | % | |||||

| Financial Services | 6.24 | % | Electronics | 6.53 | % | |||||

Top 10 equity holdings | ||||||||||

(as a % of net assets) | Exxon Mobil Corp. | 5.0 | % | Procter & Gamble Co. | 4.9 | % | ||||

| Procter & Gamble Co. | 4.2 | % | JPMorgan Chase & Co. | 4.6 | % | |||||

| JPMorgan Chase & Co. | 4.1 | % | Schlumberger Ltd. | 4.6 | % | |||||

| Halliburton Co. | 3.2 | % | Flowserve | 4.4 | % | |||||

| Wells Fargo & Co. | 3.1 | % | Halliburton Co. | 4.4 | % | |||||

| Danaher Corp. | 3.1 | % | Lockheed Martin Corp. | 4.2 | % | |||||

| Schlumberger Ltd. | 3.0 | % | Weatherford International | 3.8 | % | |||||

| Flowserve | 2.8 | % | Exxon Mobil Corp. | 3.7 | % | |||||

| Lockheed Martin Corp. | 2.8 | % | Johnson & Johnson | 3.6 | % | |||||

| Honeywell International Inc. | 2.8 | % | Microchip Technology Inc. | 3.5 | % | |||||

* Trailing 12 months. |

1 The numbers in this table are for comparison purposes only and have not been audited. |

Comparison of Distribution, Purchase and Redemption Procedures and Exchange Rights

The distribution, purchase and redemption procedures of both Funds are identical, as are the exchange rights granted to shareholders of both Funds. The Shareholder Guide attached as Exhibit D to this registration statement contains a more detailed description of the distribution, purchase and redemption procedures and exchange rights applicable to both Funds.

7

Table of Contents

Tax Consequences

The Reorganization is intended to qualify for Federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Equities Fund nor its shareholders nor the Focused Equities Fund is expected to recognize any gain or loss from the Reorganization for Federal income tax purposes. For a more detailed discussion of the tax consequences of the Reorganization see “INFORMATION ABOUT THE REORGANIZATION—Tax Considerations.”

8

Table of Contents

RISKS OF INVESTING IN THE FUNDS

Because the Funds have investment objectives that are identical and policies that are similar in many respects, many of the risks of investing in the Focused Equities Fund are similar to the risks of investing in the Equities Fund. The following risks should be considered before investing in either Fund.

Equity Risk

Equity Risk is the risk that stocks and other equity securities generally fluctuate more than bonds and can decline in value over short or extended periods. The value of stocks and other equity securities will be affected as a result of changes in a company’s financial condition and in overall market and economic conditions.

Market Risk

There is the possibility that the returns from the types of securities in which either Fund invests will underperform returns from the various general securities markets or different asset classes. Different types of securities tend to go through cycles of outperformance and underperformance in comparison to the general securities markets.

Investment Style/Securities Selection Risk

Both Funds may also be subject to investment style risk. The Advisor primarily uses a particular style or set of styles—in both cases “value” styles—to select investments for the Funds. Those styles may be out of favor or may not produce the best results over short or longer time periods, and may increase the volatility of the Funds’ share prices. There is also the possibility that the specific securities held in each of the Fund’s portfolios will underperform other funds in the same asset class or benchmarks that are representative of the general performance of the asset class because of the portfolio managers’ choice of securities.

Price Volatility

There is the possibility that the value of each of the Fund’s portfolios will change as the prices of their investments go up or down. Both Funds hold primarily stocks, which may go up or down in value, sometimes rapidly and unpredictably. Although stocks offer the potential for greater long-term growth than most fixed income securities, stocks generally have higher short-term volatility.

Non-Diversified Status

Each Fund is non-diversified for the purposes of the Investment Company Act of 1940 (“1940 Act”), and as such may invest a larger percentage of its assets in individual issuers than a diversified investment company. In this regard, the Funds are not subject to the general limitation that they not invest more than 5% of their total assets in the securities of any one issuer.

9

Table of Contents

To the extent that the Funds make investments in excess of 5% of their assets in a particular issuer, their exposure to credit and market risks associated with that issuer is increased. However, the Funds’ investments will be limited so as to qualify for the special tax treatment afforded “regulated investment companies” under the Internal Revenue Code of 1986, as amended.

Because a relatively high percentage of each Fund’s assets may be invested in the securities of a limited number of issuers, both Funds may be more susceptible to any single economic, political or regulatory occurrence than a diversified fund. This risk is greater with respect to the Focused Equities Fund because the Fund typically limits its investments to a portfolio of 25 to 40 issues.

Liquidity Risk

There is the possibility that both Funds may lose money or be prevented from earning capital gains if they cannot sell a security at the time and price that is most beneficial to the applicable Fund. If that happens, a Fund may have to lower the selling price, sell other securities instead, or forego an investment opportunity, any of which could have a negative effect on the Fund’s performance.

Securities Lending Risk

Each Fund may lend portfolio securities with a value up to 25% of its total assets, including collateral received for securities lent. If a Fund lends securities, there is a risk that the securities will not be available to the Fund on a timely basis, and the Fund, therefore, may lose the opportunity to sell the securities at a desirable price. In addition, as with other extensions of credit, there is the risk of possible delay in receiving additional collateral or in the recovery of the securities or possible loss of rights in the collateral should the borrower fail financially. Also, there is the risk that the value of the investment of the collateral could decline causing a Fund to lose money.

Portfolio Management Risk

Both Funds may be subject to Portfolio Management Risk. The Advisor’s judgments about the attractiveness, value and potential appreciation of particular companies’ stocks may prove to be incorrect and may not anticipate actual market movements or the impact of economic conditions generally. No matter how well the Advisor evaluates market conditions, the securities the Advisor chooses may fail to produce the intended result, and investors could lose money on their investment in the Funds.

Temporary Defensive Strategies

For both Funds, when the Advisor anticipates unusual market or other conditions, the Funds may temporarily depart from their principal investment strategies as a

10

Table of Contents

defensive measure. The Advisor may temporarily invest up to 100% of the assets in high quality short- term money market instruments if it believes adverse economic conditions such as excessive volatility or sharp market declines, justify taking a defensive posture. To the extent a Fund is engaged in temporary defensive investments, it will not be pursuing its investment objective.

Sale of Securities

Following the Reorganization and in the ordinary course of business as a mutual fund, certain holdings of the Equities Fund that are transferred to the Focused Equities Fund in connection with the Reorganization may be sold. Such sales may result in increased transaction costs for the Focused Equities Fund, and the realization of taxable gains and losses for the Focused Equities Fund which would result in taxable distributions to shareholders. Any sales by the Equities Fund prior to the Reorganization may result in taxable distributions to shareholders of the Equities Fund.

COMPARISON OF FEES AND EXPENSES OF THE FUNDS

The following discussion describes and compares the fees and expenses of the Equities Fund with the Focused Equities Fund.

Annual Fund Operating Expenses

As of April 30, 2008, the operating expenses of the Class I and Class N shares of the Equities Fund, expressed as a ratio of expenses to average daily net assets (“expense ratio”) were 0.82% and 1.77%, respectively before any expense limitations in place for the Class N shares. As of April 30, 2008, the operating expenses of the corresponding Class I and Class N shares of the Focused Equities Fund were 1.25% and 1.25%, respectively.

The Advisor voluntarily paid certain of the operating expenses for the Class N shares of the Equities Fund so that the ordinary operating expenses for the Class N shares of this Fund did not exceed the trailing monthly expense ratio for comparable funds as reported by Lipper, Inc. During the fiscal year ended October 31, 2007, shareholders of the Class N shares of the Equities Fund paid operating expenses of 1.33%, as a result of these waivers and assumptions of expenses. The expense limitations for the Funds are voluntary and are terminable on six months notice.

Management Fee

The Equities Fund has an investment advisory fee of 0.55% of the Fund’s average daily net assets and the Focused Equities Fund has an annual management fee of 0.65% of the Fund’s average daily net assets.

11

Table of Contents

Distribution and Service Fees

Each Fund charges a distribution (12b-1) fee for its Class N shares of 0.25% of the average daily net assets of the Fund attributable to the Fund’s Class N shares. Neither Fund charges a distribution (12b-1) fee or a service fee for its Class I shares. Neither Fund charges a contingent deferred sales load for Class N or Class I shares.

Expense Table

The current expenses of each of the Funds and estimated pro forma expenses after giving effect to the proposed Reorganization are shown in the following table. Expenses for the Funds are based upon the operating expenses incurred by Class I and Class N shares of the Equities Fund and Focused Equities Fund for the period ended April 30, 2008, which are based upon unaudited financial statements for the period. Pro forma fees show estimated fees of the Class I and Class N shares of the Focused Equities Fund after giving effect to the proposed Reorganization. Pro forma numbers are estimated in good faith and are hypothetical.

| Class I | Class N | |||||||||||||||||

| Equities Fund | Focused Equities Fund | Focused Equities Fund after Reorganization (Pro Forma)(1) | Equities Fund | Focused Equities Fund | Focused Equities Fund after Reorganization (Pro Forma)(1) | |||||||||||||

Shareholder Transaction Fees (fees paid directly from your investment) | ||||||||||||||||||

Maximum Sales Charge (Load) Imposed on Purchases | None | None | None | None | None | None | ||||||||||||

Maximum Deferred Sales Charge (Load) | None | None | None | None | None | None | ||||||||||||

Maximum Sales Charge (Load) Imposed on Reinvested Dividends | None | None | None | None | None | None | ||||||||||||

Redemption Fee | None | None | None | None | None | None | ||||||||||||

Exchange Fee | None | None | None | None | None | None | ||||||||||||

Annual Fund Operating Expenses (expenses that are deducted from the | ||||||||||||||||||

Management Fees | 0.55 | % | 0.65 | % | 0.65 | % | 0.55 | % | 0.65 | % | 0.65 | % | ||||||

12

Table of Contents

| Class I | Class N | |||||||||||||||||

| Equities Fund | Focused Equities Fund | Focused Equities Fund after Reorganization (Pro Forma)(1) | Equities Fund | Focused Equities Fund | Focused Equities Fund after Reorganization (Pro Forma)(1) | |||||||||||||

Distribution (12b-1) Fees | None | None | None | 0.25 | % | 0.25 | % | 0.25 | % | |||||||||

Other Expenses | 0.27 | % | 0.60 | % | 0.23 | % | 0.97 | % | 0.35 | % | 0.29 | % | ||||||

Total Annual Fund Operating Expenses | 0.82 | % | 1.25 | % | 0.88 | %(2) | 1.77 | %(3) | 1.25 | % | 1.19 | % | ||||||

| (1) | Pro forma expenses are estimated. |

| (2) | The Advisor will contractually limit the operating expenses at the lower, pre-merger expense ratios for each class. Therefore Class I shares will be limited to 0.82% of net assets. The expense limitation will continue for one year from the date of the Reorganization. The expenses may increase after the expiration of the contractual expense cap ends on or after September 30, 2009 unless the Advisor chooses to extend the term of the cap. If the term of the cap is not extended, the Advisor has agreed to reduce its investment advisory fee or to pay the operating expenses of the Fund to the extent necessary to limit the Fund’s operating expenses to an amount not to exceed the trailing monthly expense ratio average for comparable funds as calculated by Lipper Inc. |

| (3) | For the period ended April 30, 2008, the Advisor voluntarily reduced its fee and paid operating expenses of the Class N shares of the Equities Fund, so that the total operating expenses for the Fund’s Class N shares were 1.29%. |

As shown in the table above, the operating expenses, expressed as a percentage of net asset value per share of Class I shares and Class N shares, are as follows:

| Class I | Class N | |||||

• Expenses of the Focused Equities Fund (based on the period ended April 30, 2008). | 1.25 | % | 1.25 | % | ||

• Expenses of the Equities Fund (based on the period ended April 30, 2008). | 0.82 | % | 1.77 | % | ||

• Expenses of the Equities Fund after a voluntary reduction of the management fee and assumption of certain fund expenses by the Advisor (based on the period ended April 30, 2008). | 0.82 | % | 1.29 | % | ||

• Projected expenses of the Focused Equities Fund after the Reorganization (Pro Forma). | 0.88 | % | 1.19 | % | ||

13

Table of Contents

| Class I | Class N | |||||

• Projected expenses of the Focused Equities Fund after the Reorganization and a contractual cap of the management fee and certain fund expenses by the Advisor (Pro Forma). | 0.82 | %1 | 1.19 | % | ||

1 | The Advisor has contractually agreed to cap the expenses for the combined fund at the lower, pre-merger expense ratios for each class for one year after the Reorganization. |

Expense Examples

The examples are intended to help you compare the cost of investing in each of the Funds with the costs of investing in other mutual funds. The examples assume that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. The 5% return is an assumption and is not intended to portray past or future investment results. The figures shown are the same whether or not you sold your shares at the end of the period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| Equities Fund | Focused Equities Fund | Focused Equities Fund after Reorganization (Pro Forma)(1) | ||||||||||||||||||||||||||||||||||

| 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||||||||||

Class I | $ | 84 | $ | 262 | $ | 455 | $ | 1,014 | $ | 127 | $ | 397 | $ | 686 | $ | 1,511 | $ | 90 | $ | 281 | $ | 488 | $ | 1,084 | ||||||||||||

Class N | $ | 180 | $ | 557 | $ | 959 | $ | 2,084 | $ | 127 | $ | 397 | $ | 686 | $ | 1,511 | $ | 121 | $ | 378 | $ | 654 | $ | 1,443 | ||||||||||||

| (1) | Pro forma figures are estimated. |

14

Table of Contents

INFORMATION ABOUT THE REORGANIZATION

The Agreement and Plan of Reorganization

The Reorganization Agreement provides for: (i) the transfer of all of the assets and liabilities of the Equities Fund to the Focused Equities Fund; (ii) the issuance of Class I and Class N shares, as applicable, of the Focused Equities Fund to holders of the Class I and Class N shares, respectively, of the Equities Fund on a pro rata basis; (iii) the subsequent complete liquidation of the Equities Fund; and (iv) an amendment to the Articles of Incorporation of the Company reclassifying the Class I and Class N shares of the Equities Fund into Class I and Class N shares, respectively, of the Focused Equities Fund to become effective after the Closing.

The distribution of Focused Equities Fund shares to Equities Fund Shareholders will be accomplished by opening new accounts on the books of the Focused Equities Fund in the names of the Equities Fund Shareholders and transferring to those shareholder accounts the shares of the Focused Equities Fund. Such newly opened accounts on the books of Focused Equities Fund will represent the respective pro rata number of shares of the same class of the Focused Equities Fund that the Equities Fund receives under the terms of the Reorganization Agreement.

After the Reorganization, each shareholder of the Equities Fund will own shares in the Focused Equities Fund having an aggregate net asset value equal to the aggregate net asset value of the shares of the Equities Fund held by that shareholder as of the close of business on the day of the Closing. Shareholders of Class I shares of the Equities Fund will receive Class I shares of the Focused Equities Fund and shareholders of Class N shares of the Equities Fund will receive Class N shares of the Focused Equities Fund. As a result of the Reorganization, a shareholder of the Equities Fund will hold a smaller voting percentage of the combined fund than the shareholder did in the Equities Fund prior to the Reorganization.

In the interest of economy and convenience, shares of the Focused Equities Fund generally will not be represented by physical certificates, unless requested in writing.

Until the Closing, shareholders of the Equities Fund will continue to be able to redeem their shares. Redemption requests received after the Closing will be treated as requests received by the Focused Equities Fund for the redemption of its shares.

The obligations of the Funds under the Reorganization Agreement are subject to various conditions, including approval of the shareholders of the Equities Fund. The Reorganization Agreement also requires that each of the Funds take, or cause to be taken, all action, and do or cause to be done, all things reasonably necessary, proper or advisable to consummate and make effective the transactions contemplated by the Reorganization Agreement. The Reorganization Agreement may be terminated by mutual agreement of the parties or on certain other grounds. Please refer to Appendix A to review the terms and conditions of the Reorganization Agreement.

15

Table of Contents

Reasons for the Reorganization

The primary purposes of the proposed Reorganization are to seek potential economies of scale and to eliminate certain costs associated with operating the Equities Fund and the Focused Equities Fund separately. The proposed Reorganization is designed to provide Equities Fund investors with the ability to invest in a fund with an identical investment objective, long-term capital appreciation, and very similar investment policies to those of the Equities Fund, but with a larger combined asset base than the Equities Fund.

The portfolio managers of the Focused Equities Fund and the Equities Fund are Thomas K. McKissick and N. John Snider. The investment objectives of both Funds are identical and the investment policies and investment strategies are similar. However, there is one material difference. In managing the Focused Equities Fund Messrs. McKissick and Snider invest in a portfolio of 25 to 40 issues while the Equities Fund typically holds securities in a larger number of issues (typically 45 to 75 issues).

Management has determined that rather than operating two separate funds with identical investment objectives managed in a substantially similar style by Messrs. McKissick and Snider, it is in the best interests of the shareholders of the Equities Fund (as well as shareholders of the Focused Equities Fund) to consolidate the assets of both Funds into one fund, the Focused Equities Fund, with a larger combined asset base. Combining the assets of the Funds is intended to provide various benefits to shareholders of the Equities Fund who become shareholders of the Focused Equities Fund (as well as to existing and future investors in the Focused Equities Fund). For example, management believes that the shareholders of the Equities Fund may benefit from the participation in a fund that has had greater overall investment returns than those achieved by the Equities Fund. Management also believes that the Reorganization may benefit the existing and future shareholders of the Focused Equities Fund and the shareholders of the Equities Fund by resulting in a surviving fund with a larger asset base. A larger asset base is expected to provide greater investment opportunities for the surviving portfolio and the potential to take larger portfolio positions, as well as the potential for lower total annual portfolio operating expenses through economies of scale. Based on these factors, Management has determined that the Reorganization is in the best interests of shareholders of each Fund.

Further, the Reorganization will allow the Equities Fund’s shareholders to continue to participate in a professionally-managed portfolio which seeks to achieve long-term capital appreciation through investments in equity securities and equity equivalents of large capitalization companies. Subject to the restrictions of each of the various funds in the TCW Funds group, shareholders of the Focused Equities Fund, including former shareholders of the Equities Fund, will continue to be able to exchange their shares of the Focused Equities Fund for the same class of shares of other mutual funds in the TCW Funds group.

16

Table of Contents

Expenses of the Reorganization

The Advisor will bear half the cost of the Reorganization, including, but not limited to, the costs of solicitation of voting instructions and any necessary filings with the SEC. Each Fund will bear one quarter of the expenses related to the proposed Reorganization. Each Fund’s estimated cost for the proposed Reorganization is $25,000. The costs of the Reorganization will not include any brokerage or other transaction fees or costs incurred as a result of the purchase or sale of portfolio securities by either Fund. The Advisor will bear the costs of the Reorganization if it is not approved by shareholders.

The Reorganization will result in limitations in the use of capital loss carry forwards, if any, of the Equities Fund after the Reorganization.

Board Considerations

The proposed Reorganization was presented to the Board of Directors of the Company for consideration at a meeting held on February 20, 2008 and the Reorganization was approved by the Directors on behalf of the Equities Fund at that meeting. For the reasons discussed below, the Directors, including all of the Directors who are not “interested persons” of the Fund (as defined in the 1940 Act) and who are advised by their own counsel, determined that the interests of the shareholders of the Equities Fund will not be diluted as a result of the proposed Reorganization, and that the proposed Reorganization is in the best interests of the Equities Fund and its shareholders.

The Board of Directors, on behalf of the Equities Fund, in recommending the proposed transaction, considered a number of factors, including the following:

| (1) | expense ratios and information regarding fees and expenses of the Equities Fund and the Focused Equities Fund; |

| (2) | the ability of the shareholders of the Equities Fund to continue to participate in a fund that invests with an objective of long-term capital appreciation; |

| (3) | that the Reorganization would not dilute the interests of the Equities Fund’s current shareholders; |

| (4) | the similarity of the investment objectives, policies and restrictions of the Focused Equities Fund with those of the Equities Fund; |

| (5) | the relative sizes of the Funds and whether performance and investment flexibility have the potential to be enhanced if the assets of each of the Funds are combined; |

| (6) | the costs borne by the Focused Equities Fund, its shareholders and the Equities Fund and its shareholders; and |

| (7) | the possible limitations on the use of the capital loss carry forwards of the Equities Fund after the Reorganization. |

The Directors of the Company, on behalf of the Equities Fund, recommend that shareholders approve the Reorganization with the Focused Equities Fund.

17

Table of Contents

Tax Considerations

The Reorganization is intended to qualify for Federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Equities Fund nor its shareholders nor the Focused Equities Fund is expected to recognize any gain or loss from the Reorganization for Federal income tax purposes. As a condition to the Closing of the Reorganization, the Funds will receive an opinion from the law firm of Dechert LLP to the effect that the Reorganization will qualify as a tax-free reorganization for Federal income tax purposes. That opinion will be based in part upon certain assumptions and upon certain representations made by the Focused Equities Fund, the Equities Fund and the Company in the Reorganization Agreement.

Immediately prior to the Reorganization, the Equities Fund will pay a dividend or dividends which, together with all previous dividends, will have the effect of distributing to its shareholders all of the Equities Fund’s investment company taxable income for taxable years ending on or prior to the Reorganization (computed without regard to any deduction for dividends paid) and all of its net capital gain, if any, realized in taxable years ending on or prior to the Reorganization (including any gains from sales of holdings prior to the Reorganization), after reduction by any available capital loss carry forward. Such dividends will be included in the taxable income of the Equities Fund’s shareholders.

Capitalization

The following table shows on an unaudited basis the capitalization of each of the Funds as of the Record Date and on a pro forma basis as of the Record Date after giving effect to the Reorganization:

| TCW EQUITIES FUND | TCW FOCUSED EQUITIES FUND | PRO FORMA ADJUSTMENT | PRO FORMA COMBINED(1) | ||||||||||

NET ASSETS | |||||||||||||

I Class | $ | 50,591,542 | $ | 7,257,884 | $ | (28,745 | ) | $ | 57,820,681 | ||||

N Class | $ | 1,775,821 | $ | 32,248,221 | $ | (21,255 | ) | $ | 34,002,787 | ||||

SHARES OUTSTANDING | |||||||||||||

I Class | 3,484,266 | 473,443 | (184,100 | ) | 3,773,609 | ||||||||

N Class | 122,134 | 2,110,486 | (5,915 | ) | 2,226,705 | ||||||||

NET ASSET VALUE PER SHARE | |||||||||||||

I Class | $ | 14.52 | $ | 15.33 | $ | (0.01 | ) | $ | 15.32 | ||||

N Class | $ | 14.54 | $ | 15.28 | $ | (0.01 | ) | $ | 15.27 | ||||

| (1) | The pro forma data reflects the combined assets after the merger of the TCW Equities Fund into the TCW Focused Equities Fund. The pro forma data also reflects adjustments to account for the costs of the Merger to be borne by each Fund, which are estimated to be $25,000 per fund. |

18

Table of Contents

ADDITIONAL INFORMATION ABOUT THE EQUITIES FUND

Investment Personnel

The Equities Fund is managed by Thomas K. McKissick , Group Managing Director of the Advisor, TCW Asset Management Company and Trust Company of the West, and N. John Snider, Group Managing Director of the Advisor, TCW Asset Management Company and Trust Company of the West.

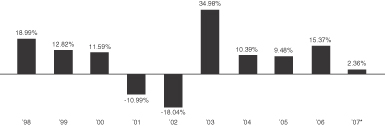

Performance of the Equities Fund

The bar chart and table below show the Equities Fund’s annual and after-tax returns and its long-term performance with respect to its Class I shares. The bar chart provides some indication of the risks of investing in the Fund by showing how the Fund’s performance has varied from year to year. The bar chart includes the performance of the predecessor entity of the Equities Fund which was managed by an affiliate of the Advisor using the same investment strategy as the Equities Fund. The table provides some indication of the risks of investing in the Fund by showing how the Fund’s before and after-tax returns over time compare to that of a broad-based securities market index for the past ten calendar years. Both the bar chart and the table assume reinvestment of dividends and distributions.

The performance of the predecessor entity was calculated using performance standards applicable to private investment partnerships, which take into account all elements of total return and reflect the deduction of fees and expenses of operation. The predecessor account was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions imposed by the 1940 Act and Subchapter M of the Internal Revenue Code of 1986, as amended. If the account had been registered under the 1940 Act, its performance could have been adversely affected.

As with all mutual funds, past performance, both before and after taxes, is not a prediction of future results.

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown, and after-tax returns shown are not relevant if a shareholder holds shares of the Equities Fund through a tax-deferred arrangement, such as an individual retirement account. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

19

Table of Contents

Year by year total return (%)

as of December 31 each year(1)

Equities Fund—Class I Shares

| (1) | During the period shown in the chart, the Fund’s best quarterly performance was 20.89% for the quarter ended December 31, 1998, and the Fund’s worst quarterly performance was -20.98% for the quarter ended September 30, 2002. |

| * | The Fund’s total return for the period November 1, 2007 to March 31, 2008 was -10.76%. |

The table below shows what the average annual total returns of the Equities Fund would equal if a shareholder averaged out actual performance over various lengths of time, compared to the S&P 500 Index. The S&P 500 Index is an unmanaged group of securities and assumes no reduction for fees and expenses in measuring returns. The securities in the S&P 500 Index are substantially different from those in the Equities Fund. An investor cannot invest directly in an index.

Average Annual Total Returns

| (For the periods ended December 31, 2007) | 1 Year | 5 Years | From Inception/ Registration or 10 Years | ||||||

Return Before Taxes | |||||||||

Equities Fund—Class N | 1.80 | % | 13.43 | % | 5.96 | % | |||

Return Before Taxes from Registration Date (6/3/98) | |||||||||

Equities Fund—Class I | 2.36 | % | 14.13 | % | 7.23 | % | |||

Return After Taxes on Distributions from Registration Date(1) | |||||||||

Equities Fund—Class I | 0.32 | % | 13.33 | % | 6.67 | % | |||

Return After Taxes on Distributions and Sales of Fund Shares from Registration Date(1) | |||||||||

Equities Fund—Class I | 4.28 | % | 12.40 | % | 6.25 | % | |||

20

Table of Contents

| (For the periods ended December 31, 2007) | 1 Year | 5 Years | From Inception/ Registration or 10 Years | ||||||

S&P 500 Index from Registration Date | 5.49 | % | 12.83 | % | 4.82 | % | |||

(reflects no deduction for fees, expenses or taxes) | |||||||||

Return Before Taxes Including Predecessor Account Performance | |||||||||

Equities Fund—Class I | 2.36 | % | 14.13 | % | 7.82 | % | |||

| (1) | After-tax returns are shown only for Class I shares, after-tax returns for Class N shares will vary. |

For a discussion by the Advisor regarding the performance of the Equities Fund for the fiscal year ended October 31, 2007, see Appendix B to this Prospectus/Proxy Statement.

21

Table of Contents

ADDITIONAL INFORMATION ABOUT THE FOCUSED EQUITIES FUND

Investment Personnel

The Equities Fund is managed by Thomas K. McKissick , Group Managing Director of the Advisor, TCW Asset Management Company and Trust Company of the West, and N. John Snider, Group Managing Director of the Advisor, TCW Asset Management Company and Trust Company of the West.

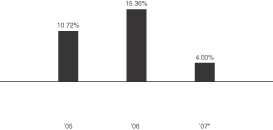

Performance of the Focused Equities Fund

The bar chart and table below show the Focused Equities Fund’s annual and after-tax returns and its performance since inception with respect to its Class I shares. The table provides some indication of the risks of investing in the Fund by showing how the Fund’s before and after-tax returns over time compare to that of a broad-based securities market index for the period of time the Fund has been registered with the SEC under the 1940 Act. Both the bar chart and the table assume reinvestment of dividends and distributions.

As with all mutual funds, past performance (before and after taxes) is not a prediction of future results.

Year by year total return (%)

as of December 31 each year(1)

Focused Equities Fund—Class I Shares

| (1) | During the period shown in the chart, the Fund’s best quarterly performance was 7.76% for the quarter ended December 31, 2006, and the Fund’s worst quarterly performance was -1.88% for the quarter ended December 31, 2007. |

| * | The Fund’s total return for the period November 1, 2007 to March 31, 2008 was -9.41%. |

22

Table of Contents

After-tax returns are calculated using the highest historical individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown, and after-tax returns shown are not relevant if a shareholder holds shares of the Equities Fund through a tax-deferred arrangement, such as an individual retirement account. In some cases the return after taxes may exceed the return before taxes due to an assumed tax benefit from any losses on a sale of Fund shares at the end of the measurement period.

The table below shows what the average annual total returns of the Focused Equities Fund would equal if a shareholder averaged out actual performance over various lengths of time, compared to the S&P 500 Index. The S&P 500 Index is an unmanaged group of securities and assumes no reduction for fees and expenses in measuring returns. The securities in the S&P 500 Index are substantially different from those in the Focused Equities Fund. An investor cannot invest directly in an index.

Average Annual Total Returns

| (For the periods ended December 31, 2007) | 1 Year | 5 Years | From Inception/ Registration | ||||||

Return Before Taxes | |||||||||

Focused Equities Fund—Class N | 3.95 | % | 15.48 | % | 7.54 | % | |||

Return Before Taxes from Registration Date (11/1/04) | |||||||||

Focused Equities Fund—Class I | 4.00 | % | N/A | 11.51 | % | ||||

Return After Taxes on Distributions from Registration Date(1) | |||||||||

Focused Equities Fund—Class I | 3.95 | % | N/A | 11.48 | % | ||||

Return After Taxes on Distributions and Sales of Fund Shares from Registration Date(1) | |||||||||

Focused Equities Fund—Class I | 2.68 | % | N/A | 9.94 | % | ||||

S&P 500 Index | 5.49 | % | N/A | 10.68 | % | ||||

(reflects no deduction for fees, expenses or taxes) | |||||||||

| (1) | After-tax returns are shown only for Class I shares, after-tax returns for Class N shares will vary. |

For a discussion by the Advisor regarding the performance of the Focused Equities Fund for the fiscal year ended October 31, 2007, see Appendix C to this Prospectus/Proxy Statement.

23

Table of Contents

GENERAL INFORMATION ABOUT THE PROXY STATEMENT

Solicitation of Proxies

Solicitation of proxies is being made primarily by the mailing of this Notice and Prospectus/Proxy Statement with its enclosures on or about July 17, 2008. Shareholders of the Equities Fund whose shares are held by nominees, such as brokers, can vote their proxies by contacting their respective nominee. In addition to the solicitation of proxies by mail, employees of the Company and its affiliates, without additional compensation, may solicit proxies in person or by telephone, telegraph, facsimile, or oral communication. The Equities Fund has retained The Altman Group to act as its proxy solicitor and will receive approximately $3000 as compensation for seeking shareholder votes.

A shareholder may revoke the accompanying proxy at any time prior to its use by filing with the Equities Fund, a written revocation or duly executed proxy bearing a later date. In addition, any shareholder who attends the Special Meeting in person may vote by ballot at the Special Meeting, thereby canceling any proxy previously given. The persons named in the accompanying proxy will vote as directed by the proxy card, but in the absence of voting directions in any proxy card that is signed and returned, they intend to vote “FOR” the Reorganization proposal and may vote in their discretion with respect to other matters not now known to the Board of Directors of the Company that may be presented at the Special Meeting.

Voting Rights

Shareholders of the Equities Fund are entitled to one vote for each share held as to any matter on which they are entitled to vote and each fractional share shall be entitled to a proportionate fractional vote. Shares have no preemptive or subscription rights.

Shareholders of the Equities Fund at the close of business on the Record Date, May 31, 2008, will be entitled to be present at the Special Meeting and to give voting instructions with respect to their shares owned as of the Record Date. As of the Record Date, 3,606,399.53 shares of the Equities Fund were outstanding and entitled to vote.

Approval of the Reorganization requires the affirmative vote of the holders of a majority of the Equities Fund’s shares outstanding and entitled to vote on the matter. The holders of one-third of the outstanding shares will constitute a quorum.

If a shareholder abstains from voting as to any matter, or if a broker returns a “non-vote” proxy, indicating a lack of authority to vote on a matter, the shares represented by the abstention or non-vote will be deemed present at the Special Meeting for purposes of determining a quorum. However, abstentions and broker non-votes will not be deemed represented at the Special Meeting for purposes of calculating the vote on any matter. As a result, an abstention or broker non-vote will have the same effect as a vote against the Reorganization.

24

Table of Contents

The Equities Fund expects that, before the Special Meeting, broker-dealer firms holding shares of the Fund in “street name” for their customers will request voting instructions from their customers and beneficial owners.

To the knowledge of the Company, as of the Record Date, each of the directors and executive officers owned individually, and collectively as a group, 2.34% of the outstanding shares of the Equities Fund Class I shares and less than 1% of the Class N shares and 1.03% of the outstanding shares of the Focused Equities Fund Class N shares and less than 1% of the Class I shares.

Appendix D lists the persons that as of the Record Date owned beneficially or of record 5% or more of the outstanding shares of any Class of the Equities Fund and/or the Focused Equities Fund.

Adjournment

The vote required to adjourn the Special Meeting is a majority of all the votes cast on the matter by stockholders entitled to vote at the Special Meeting who are present in person or by proxy. If a quorum is not present in person or by proxy at the time the Special Meeting is called to order, the chairman of the Special Meeting or the stockholders may adjourn the Special Meeting. In such a case, the persons named as proxy holders will vote all proxies in favor of the adjournment. If a quorum is present but there are not sufficient votes to approve the proposal, the chairman of the Special Meeting may, with respect to that proposal, adjourn the Special Meeting or the persons named as proxy holders may propose one or more adjournments of the Meeting to permit further solicitation of proxies. In such a case, the persons named as proxy holders will vote those proxies which they are entitled to vote in favor of the proposal “FOR” the adjournment, and will vote those proxies required to be voted against the proposal “AGAINST” the adjournment as to that proposal, and broker non-votes and abstentions will not be voted either for or against the adjournment.

Other Matters to Come Before the Special Meeting

The Company does not know of any matters to be presented at the Special Meeting other than those described in this Prospectus/Proxy Statement. If other business should properly come before the Special Meeting, the proxyholders will vote thereon in accordance with their best judgment.

Shareholder Proposals

The Company is not required to hold regular annual meetings and, in order to minimize its costs, does not intend to hold meetings of shareholders unless so required by applicable law, regulation, regulatory policy or if otherwise deemed advisable by the Company’s management. Therefore it is not practicable to specify a date by which shareholder proposals must be received in order to be incorporated in an upcoming proxy statement for an annual meeting.

25

Table of Contents

Reports to Shareholders

The Company will furnish, without charge, a copy of the Annual Report and the most recent semi-annual report succeeding the Annual Report, if any, on request. Requests for such reports should be directed to the Company at 865 South Figueroa Street, Suite 1800, Los Angeles, California 90017 or by calling 1-800-FUND-TCW. Such reports may also be found on the Internet at www.tcwfunds.com.

In order that the presence of a quorum at the meeting may be assured, prompt execution and return of the enclosed proxy card is requested. A self-addressed, postage-paid envelope is enclosed for your convenience.

| Philip K. Holl |

| Secretary |

July 15, 2008

26

Table of Contents

FORM OF AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the “Agreement”) is made as of this day of , 2008, by and between TCW Funds, Inc., a Maryland corporation (the “Company”) with its principal place of business at 865 South Figueroa Street, Los Angeles, California 90017, on behalf of itself and its series, the TCW Focused Equities Fund (the “Acquiring Fund”), and the TCW Equities Fund (the “Acquired Fund”).

This Agreement is intended to be and is adopted as a plan of reorganization and liquidation within the meaning of Section 368(a)(1) of the United States Internal Revenue Code of 1986, as amended (the “Code”). Upon the terms and conditions set forth in this Agreement, the reorganization (the “Reorganization”) will consist of: (i) the transfer of all of the assets of the Acquired Fund to the Acquiring Fund; (ii) the assumption by the Acquiring Fund of all liabilities of the Acquired Fund; (iii) the issuance of the Acquiring Fund Shares (as defined below) to the shareholders of the Acquired Fund on a pro rata basis; (iv) the complete liquidation of the Acquired Fund as provided herein; and (v) an amendment to the Company’s Articles of Incorporation (effective after the Closing (as defined below)) reclassifying the Class I shares of common stock ($0.001 par value) of the Acquired Fund (“Acquired Fund Class I Shares”) into Class I shares of common stock ($0.001 par value) of the Acquiring Fund (the “Acquiring Fund Class I Shares”), reclassifying the Class N shares of common stock ($0.001 par value) of the Acquired Fund (the “Acquired Fund Class N Shares” and together with the Acquired Fund Class I Shares, the “Acquired Fund Shares”) into Class N shares of common stock ($0.001 par value) of the Acquiring Fund (the “Acquiring Fund Class N Shares” and together with the Acquiring Fund Class I Shares, the “Acquiring Fund Shares”) and eliminating the authorized Class K shares of common stock ($0.001 par value) of the Acquired Fund (the “Acquired Fund Class K Shares”).

WHEREAS, the Acquired Fund and the Acquiring Fund are series of an open-end, registered investment company of the management type and the Acquired Fund owns securities which generally are assets of the character in which the Acquiring Fund is permitted to invest;

WHEREAS, the Directors of the Company have determined that the exchange of all of the assets of the Acquired Fund for Acquiring Fund Shares and the assumption of all liabilities of the Acquired Fund by the Acquiring Fund is in the best interests of the Acquiring Fund and its shareholders and that the interests of the existing shareholders of the Acquiring Fund would not be diluted as a result of this transaction; and

WHEREAS, the Directors of the Company, have determined that the exchange of all of the assets of the Acquired Fund for Acquiring Fund Shares and the assumption of all liabilities of the Acquired Fund by the Acquiring Fund is in the best interests of the

A-1

Table of Contents

Acquired Fund and its shareholders and that the interests of the existing shareholders of the Acquired Fund would not be diluted as a result of this transaction;

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements hereinafter set forth, the parties hereto covenant and agree as follows:

| 1. | FILING OF ARTICLES OF AMENDMENT, TRANSFER OF ASSETS OF THE ACQUIRED FUND TO THE ACQUIRING FUND IN EXCHANGE FOR THE ACQUIRING FUND SHARES, THE ASSUMPTION OF ALL ACQUIRED FUND LIABILITIES AND THE LIQUIDATION OF THE ACQUIRED FUND |

1.1. Subject to the requisite approval of the Acquired Fund shareholders and the other terms and conditions herein set forth and on the basis of the representations and warranties contained herein, the Company agrees that after the Closing Date (as defined below), the Company will execute and file Articles of Amendment to the Company’s Articles of Incorporation with the Maryland State Department of Assessments and Taxation in substantially the form attached hereto as Exhibit A (the “Articles of Amendment”). The Articles of Amendment will, effective after the Closing Date: (i) reclassify all of the issued and outstanding Acquired Fund Class I Shares into Acquiring Fund Class I Shares of equal aggregate value; (ii) reclassify all of the issued and outstanding Acquired Fund Class N Shares into Acquiring Fund Class N Shares of equal aggregate value; (iii) reclassify all of the authorized and unissued Acquired Fund Class I Shares into Acquiring Fund Class I Shares; (iv) reclassify all of the authorized and unissued Acquired Fund Class N Shares into Acquiring Fund Class N Shares; and (v) eliminate the authorized and unissued Acquired Fund Class K Shares.

1.2. Subject to the requisite approval of the Acquired Fund shareholders and the other terms and conditions herein set forth and on the basis of the representations and warranties contained herein, the Acquired Fund agrees to transfer all of the Acquired Fund’s assets, as set forth in Section 1.3, to the Acquiring Fund, and the Acquiring Fund agrees in exchange therefor: (i) to deliver to the Acquired Fund the number of full and fractional Acquiring Fund Class I Shares determined by dividing the aggregate net asset value of the Acquired Fund Class I Shares, computed in the manner and as of the time and date set forth in Section 2, by the net asset value of one Acquiring Fund Class I Share, computed in the manner and as of the time and date set forth in Section 2.2; (ii) to deliver to the Acquired Fund the number of full and fractional Acquiring Fund Class N Shares determined by dividing the aggregate net asset value of the Acquired Fund Class N Shares, computed in the manner and as of the time and date set forth in Section 2, by the net asset value of one Acquiring Fund Class N Share, computed in the manner and as of the time and date set forth in Section 2.2; and (iii) to assume all liabilities of the Acquired Fund, as set forth in Section 1.4. Such transactions shall take place at the closing provided for in Section 3.1 (the “Closing”).

1.3. The assets of the Acquired Fund to be acquired by the Acquiring Fund shall consist of all assets and property, including, without limitation, all cash, securities,

A-2

Table of Contents

commodities and futures interests and dividends or interests receivable, that are owned by the Acquired Fund, and any deferred or prepaid expenses shown as an asset on the books of the Acquired Fund on the closing date provided for in Section 3.1 (the “Closing Date”) (collectively, the “Assets”).

1.4. The Acquired Fund will endeavor to discharge all of its known liabilities and obligations prior to the Closing Date. The Acquiring Fund shall also assume all of the liabilities of the Acquired Fund, whether accrued or contingent, known or unknown, existing at the Valuation Date, as defined below (collectively, the “Liabilities”). On or as soon as practicable prior to the Closing Date, the Acquired Fund will declare and pay to its shareholders of record one or more dividends and/or other distributions so that it will have distributed substantially all (and in no event less than 98%) of its investment company taxable income (computed without regard to any deduction for dividends paid) and realized net capital gain, if any, for the current taxable year through the Closing Date.