UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12

Ribozyme Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| | (1) Title | | of each class of securities to which transaction applies: |

| | (2) Aggregate | | number of securities to which transaction applies: |

| | (3) Per | | unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) Proposed | | maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | (1) Amount | | Previously Paid: |

| | (2) Form, | | Schedule or Registration Statement No.: |

Notes:

Reg. (S) 240.14a-101.

SEC 1913 (3-99)

1

RIBOZYME PHARMACEUTICALS, INC.

2950 Wilderness Place

Boulder, Colorado 80301

To our Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Ribozyme Pharmaceuticals, Inc. (the “Company”) to be held on Friday, the 24th day of May, 2002, at 10:00 a.m., local time, at the principal offices of the Company, 2950 Wilderness Place, Boulder, Colorado, 80301. Your Notice of Annual Meeting, Proxy Statement and Proxy are enclosed, as is the Company’s 2001 Annual Report which includes the Company’s financial statements.

At the Annual Meeting, you will be asked to (1) elect five directors; (2) to approve an increase in the number of shares subject to options which may be granted under the Company’s 2001 Stock Option Plan by 2,000,000 from 1,000,000 to 3,000,000; and (3) ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for 2002. The Board of Directors has approved the proposals described in the Proxy Statement and recommends that you vote “FOR” each proposal.

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, we ask that you return your completed Proxy, using the envelope provided, as soon as possible and in any case no later than 3:00 p.m. on Thursday, May 23, 2002.

Thank you for your continued support.

| | RIB | OZYME PHARMACEUTICALS, INC. |

| | Ch | ief Executive Officer and President |

Date: April 24, 2002

1

RIBOZYME PHARMACEUTICALS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held May 24, 2002

TO OUR SHAREHOLDERS:

Notice is hereby given that pursuant to the call of its Board of Directors, the Annual Meeting of Shareholders of Ribozyme Pharmaceuticals, Inc., a Delaware corporation (the “Company”), will be held on Friday, May 24, 2002, at 10:00 a.m., local time, at 2950 Wilderness Place, Boulder, Colorado, 80301, for the following purposes:

(1) To elect five (5) directors of the Company to hold office until the next Annual Meeting of Shareholders or until their respective successors shall be elected and qualified.

(2) To approve an increase in the number of shares subject to options which may be granted under the Company’s 2001 Stock Option Plan by 2,000,000 from 1,000,000 to 3,000,000.

(3) To ratify the selection of Ernst & Young LLP as the Company’s independent auditors for 2002.

(4) To transact such other business as may be properly presented at the meeting.

The names of the Board of Directors’ nominees for directors of the Company and descriptions of the other matters to be voted upon are set forth in the accompanying Proxy Statement.

Only shareholders of record at the close of business on April 5, 2002, will be entitled to vote at the meeting. To be sure that your shares are represented at the meeting, you are urged to vote, sign, date and promptly return the enclosed Proxy in the envelope provided. You may revoke your Proxy at any time prior to the time it is voted.

| | By | Order of the Board of Directors |

Date: April 24, 2002

Boulder, Colorado

IMPORTANT—PLEASE MAIL YOUR PROXY PROMPTLY. In order that there may be proper representation at the meeting, you are urged to sign and return the enclosed Proxy in the envelope provided as soon as possible so that it will be received no later than 3:00 p.m., May 23, 2002. Shares of common stock represented by Proxies which are returned unmarked will be voted in favor of (i) the Board nominees, (ii) the increase in shares which may be granted under the Company’s 2001 Stock Option Plan, (iii) the ratification of Ernst & Young LLP as the independent auditors, and (iv) in the discretion of management, upon such other business as may properly be presented at the meeting.

2

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 24, 2002

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of Proxies by management under the direction of the Board of Directors of the Company for use at the Annual Meeting of Shareholders of the Company to be held on May 24, 2002. Only shareholders of record as of April 5, 2002, will be entitled to notice of, and to vote at, the Annual Meeting. Each share is entitled to one vote on the matters to be voted on at the Annual Meeting. As of April 5, 2002, 20,016,808 shares of the Company’s common stock were outstanding held of record by approximately 210 shareholders.

The cost of soliciting Proxies will be borne by the Company. In addition to use of the mail, Proxies may be solicited personally or by telephone or facsimile by directors and officers who will not be specially compensated for such solicitation. The Company has engaged American Stock Transfer & Trust Company, the Company’s transfer agent, to solicit Proxies held by brokers and nominees. Brokerage firms and other custodians, nominees and fiduciaries will be requested to forward these soliciting materials to their principals and the Company will, upon request, reimburse them for the reasonable expenses of doing so. The Company’s transfer books will remain open between the record date and meeting date.

This Proxy Statement and enclosed Proxy were first mailed to the Company’s shareholders on or about April 24, 2002.

Your Proxy is important in helping to achieve good representation at the meeting. Any shareholder giving a Proxy has the right to revoke it at any time before it is exercised; therefore, execution of the Proxy will not in any way affect the shareholder’s right to attend the meeting in person. Revocation may be made prior to the meeting by written revocation or duly executed Proxy bearing a later date sent to the Company, Attention: Lawrence E. Bullock, Secretary, 2950 Wilderness Place, Boulder, Colorado 80301; or a Proxy may be revoked personally at the Annual Meeting by written notice to the Secretary at the Annual Meeting prior to the voting of the Proxy.

In the absence of specific instructions to the contrary, shares represented by properly executed Proxies received by management, including unmarked Proxies, will be voted to (i) elect the five nominees to the Board described herein; (ii) to approve an increase in the number of shares subject to options which may be granted under the Company’s 2001 Stock Option Plan by 2,000,000 from 1,000,000 to 3,000,000; thus increasing the total number of shares subject to options under the 2001 Stock Option Plan, together with the Company’s 1996 Stock Option Plan, to 5,767,154; and (iii) ratify the selection of Ernst & Young LLP as the Company’s independent auditors for 2002.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of the Company’s common stock is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions and broker non-votes are counted as present or represented at the meeting for purposes of determining whether a quorum exists. Cumulative voting is not permitted. The nominees for election as directors at the Annual Meeting will be elected by a plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting. Withholding authority to vote for a nominee for director will have no effect on the outcome of the vote. For the proposals (1) to increase by 2,000,000 shares of the Company’s common stock for which stock options may be granted under the Company’s 2001 Stock Option Plan, and (2) to ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for the fiscal year ending December 31, 2002, the affirmative vote of a majority of shares of common stock present or represented by proxy at the Annual Meeting is necessary for approval. Because abstentions are treated as shares present or represented and entitled to vote at the Annual Meeting, abstentions with respect to either of these proposals will have the same effect as a vote against the proposal.

3

If a broker, bank or other representative holds shares of common stock for a shareholder, generally the broker, bank or other representative may only vote the common stock that it holds in accordance with the instructions of the shareholder. However, if it has not timely received instructions from the shareholder, the broker, bank or representative may vote on certain matters for which it has discretionary voting authority. If it cannot vote on a particular matter because it does not have discretionary voting authority, that is a “broker non-vote” on that matter. Broker non-votes are not considered for a particular matter and have the practical effect of reducing the number of affirmative votes required to achieve a majority for such matter by reducing the total number of votes from which the majority is calculated. The Company does not expect any broker non-votes on any of the matters to come before the Annual Meeting because they are considered routine matters.

4

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of April 5, 2002, there were 20,016,808 shares of Company Stock outstanding, par value $0.01, held of record by approximately 210 shareholders. The following table summarizes information regarding the beneficial ownership of the Company’s outstanding securities as of April 5, 2002 (which includes shares that may be acquired on the exercise of stock options vested or warrants exercisable through June 4, 2002), by:

| | • | | each person or group that the Company knows owns more than 5% of the outstanding shares of common stock; |

| | • | | each of the Company’s directors and nominees for directors; |

| | • | | each executive officer listed in the Summary Compensation Table on page 11; and |

| | • | | all of the Company’s current directors and executive officers as a group. |

Beneficial ownership is determined in accordance with rules of the SEC and includes shares over which the indicated beneficial owner exercises voting and/or investment power. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days are deemed outstanding for computing the percentage ownership of the person holding the options but are not deemed outstanding for computing the percentage ownership of any other person. Except as otherwise indicated in the footnotes to this table, the Company believes that each shareholder identified in the table has sole voting and investment power with respect to all shares listed opposite their names. Unless otherwise indicated, the following officers, directors and shareholders can be reached at the Company’s principal offices.

Name and Address

| | Number of Shares Beneficially Owned(1)

| | | Percentage of Shares Outstanding(2)

| |

Elan Corporation plc Lincoln House, Lincoln Place Dublin 2, Ireland | | 4,108,847 | (3) | | 18.5 | % |

|

Schering Berlin Venture Corporation 3400 Changebridge Road Monteville, New Jersey 07045 | | 1,274,809 | (4) | | 6.0 | % |

|

Chiron Corporation 4560 Horton Street Emeryville, California 94608 | | 1,102,788 | (5) | | 5.4 | % |

|

| Ralph E. Christoffersen, Ph.D. | | 311,450 | (6) | | 1.5 | % |

| Howard W. Robin | | 80,000 | (7) | | * | |

| Jeremy L. Curnock Cook | | 30,000 | (8) | | * | |

| John Groom | | 4,137,847 | (3)(9) | | 14.6 | % |

| David T. Morgenthaler | | 65,503 | (10) | | * | |

| Samuel R. Saks, M.D. | | 15,000 | (11) | | * | |

| Anders P. Wiklund | | 34,444 | (12) | | * | |

| Lawrence Blatt, Dr. P.H. | | 60,196 | (13) | | * | |

| Lawrence E. Bullock | | 148,911 | (14) | | * | |

| Alene Campbell | | 95,479 | (15) | | * | |

| Marvin Tancer, CPA | | 5,000 | | | * | |

| Nassim Usman, Ph.D. | | 125,874 | (16) | | * | |

| Executive officers and directors as a group | | | | | | |

| (12 persons) | | 4,284,704 | (17) | | 18.7 | % |

| (1) | | This table is based upon information supplied by officers, directors and principal stockholders and |

5

| | Schedules 13D and 13G filed with the Securities and Exchange Commission (the “SEC”). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. |

| (2) | | Applicable percentages are based on 20,016,808 shares of Common Stock outstanding on April 5, 2002, adjusted as required by SEC rules. |

| (3) | | Includes 641,026 shares and 300,000 shares issuable upon exercise of warrants at $20.00 per share owned by Elan Pharmaceutical Investments II, Ltd. (“EPIL II”). Also includes 1,250,500 shares of common stock owned; 1,159,334 shares convertible from the Company’s Series A convertible preferred stock assuming a conversion price of $12.00 per share; 682,987 shares convertible from the Company’s convertible promissory notes assuming conversion prices ranging from $8.15 to $38.31, and 75,000 shares issuable upon exercise of warrants at $5.00 per share held by Elan International Services Ltd. (“EIS”). EPIL II and EIS are indirectly wholly-owned subsidiaries of Elan Corporation, plc, an Irish public limited company. Mr. Groom is a director of Elan but disclaims beneficial ownership of these shares. |

| (4) | | Total amount includes shares convertible from outstanding debt assuming a conversion price of $2.62 per share. |

| (5) | | Includes 444,444 shares issuable upon exercise of warrants at $22.50 per share. |

| (6) | | Includes options to purchase 199,654 shares and 3,762 shares held by Dr. Christoffersen under the Company’s 401(k) Plan. |

| (7) | | Includes options to purchase 75,000 shares. |

| (8) | | Includes options to purchase 30,000 shares. |

| (9) | | Includes options to purchase 15,000 shares. |

| (10) | | Includes options to purchase 30,000 shares, 15,101 shares held by Morgenthaler Family Partnership and 19,646 shares held by Edgewater Lakewood, L.P. Mr. Morgenthaler is a general partner of both partnerships and disclaims beneficial ownership of these shares except to the extent of his general partnership interests. |

| (11) | | Includes options to purchase 15,000 shares. |

| (12) | | Includes options to purchase 34,444 shares. |

| (13) | | Includes options to purchase 49,555 shares and 2,526 shares held by Dr. Blatt under the Company’s 401(k) Plan. |

| (14) | | Includes options to purchase 120,886 shares and 3,762 shares held by Mr. Bullock under the Company’s 401(k) Plan. |

| (15) | | Includes options to purchase 78,818 shares and 3,611 shares held by Ms. Campbell under the Company’s 401(k) Plan. |

| (16) | | Includes options to purchase 120,112 shares and 3,762 shares held by Dr. Usman under the Company’s 401(k) Plan. |

| (17) | | Includes options to purchase 768,469 shares by all current directors and officers as a group that are exercisable on or before June 4, 2002. |

6

PROPOSAL 1—ELECTION OF DIRECTORS

Directors and Nominees

In accordance with the Company’s Bylaws, five directors will be elected to the Board of Directors to serve until the 2003 Annual Meeting of Shareholders or until their successor has been duly elected and qualified. The Proxies will be voted, unless authority to do so is withheld, in favor of the five nominees recommended by the Board. The Board of Directors currently consists of seven directors. Dr. Christoffersen and Mr. Morgenthaler have informed the Company that they do not wish to stand for reelection at the Annual Meeting. The Board of Directors has determined to reduce the number of directors from seven to five. Our five remaining current directors are all standing for reelection at the Annual Meeting. The Board has no reason to anticipate that any nominee will decline or be unable to serve as a director. In the event any nominee does decline or is unable to serve, Proxies may be voted for the election of a substitute nominee or the Board may reduce the number of directors to be elected. Certain information regarding each nominee is set forth below.

Name

| | Age

| | Position

|

| Ralph E. Christoffersen, Ph.D. (1) (4) | | 64 | | Chairman of the Board |

| Howard W. Robin (1) | | 49 | | Chief Executive Officer, President and Director |

| Jeremy L. Curnock Cook (1) (2) (3) | | 52 | | Director |

| John Groom (1) (2) | | 63 | | Director |

| David Ichikawa (5) | | 49 | | Director |

| David T. Morgenthaler (1) (2) (4) | | 82 | | Director |

| Samuel R. Saks, M.D. (3) | | 47 | | Director |

| Anders P. Wiklund (2) (3) | | 61 | | Director |

| (1) | | Member of the Executive Committee. |

| (2) | | Member of the Compensation Committee. |

| (3) | | Member of the Audit Committee. |

| (4) | | This Board member will not be standing for reelection |

| (5) | | Mr. Ichikawa resigned from the Board in November 2001. |

Howard W. Robin has served as Chief Executive Officer, President and Director since July 2001. From January 2001 to June 2001, Mr. Robin was Chief Operating Officer, President and Director. From 1991 to 2001 Mr. Robin was Corporate Vice President and General Manager at Berlex Laboratories, Inc. and from 1987 to 1991 he served as Vice President of Finance and Business Development and Chief Financial Officer. From 1984 to 1987 Mr. Robin was Director of Business Planning & Development at Berlex. He was a Senior Associate with Arthur Anderson & Company prior to joining Berlex. He received his B.S. in Accounting & Finance from Farleigh Dickinson University in 1974.

Jeremy L. Curnock Cook has served as a director since July 1995. Mr. Cook was a director of Rothschild Asset Management, an investment management company, where he was responsible for the Rothschild Bioscience Unit from 1987 until his retirement in 2000. Mr. Cook founded the International Biochemicals Group in 1975, which he subsequently sold to Royal Dutch Shell in 1985, remaining as Managing Director until 1987. He is Executive Chairman of Bioscience Managers Ltd., a corporate advisory company, and Non-Executive Chairman of Targeted Genetics Inc. He is also a director of Virogen Ltd., AMRAD Corporation, GlycoDesign, Inc., Valigen, N.V., Inflazyme Pharmaceuticals, Inc. and Biocompatibles International plc. Mr. Cook received an M.A. in Natural Sciences from Trinity College Dublin.

John Groom has served as a director since April 2000. Mr. Groom served as President and Chief Operating Officer of Elan Corporation plc from 1996 until his retirement in 2001. Mr. Groom continues as a director of Elan Corporation plc. He served as President and Chief Executive Officer of Athena Neurosceiences, Inc. from 1987 to 1996. Mr. Groom is also a director of Ligand Pharmaceuticals, Inc., CV Therapeutics Inc. and Amarin Corporation Inc. Mr. Groom is a Fellow of the Association of Certified Accountants (UK).

Samuel R. Saks, M.D. has served as a director since April 2000. Dr. Saks is Company Group Chairman, ALZA Corporation, an operating company of Johnson & Johnson. In 1992, Dr. Saks joined ALZA as the Vice President for Medical Affairs and subsequently served as Senior Vice President, Medical Affairs and Group Vice

7

President, ALZA Pharmaceuticals. Prior to joining ALZA, Dr. Saks was Vice President of Clinical Research at XOMA Corporation and also worked in the clinical research departments of Schering-Plough and Genentech. Dr. Saks received his M.D. with honors from the University of Illinois and completed his residency in Internal Medicine at the University of Texas Southwestern Medical Center at Dallas and his fellowship in oncology at the University of California, San Francisco. Dr. Saks is board certified in oncology and is a diplomat of the American Board of Internal Medicine.

Anders P. Wiklund has served as a director since August 1994. Since January 1997, Mr. Wiklund has been the principal of Wiklund International, an advisory firm to the biotechnology and pharmaceutical industries. From 1967 through 1996, Mr. Wiklund served in numerous executive positions for the Kabi and Pharmacia group of companies, including President and CEO of Kabi Vitrum Inc. and Kabi Pharmacia, Incorporated. Mr. Wiklund is also a director of Glyco Design, Inc., Medivir, A.B. and InSite Vision, Inc., as well as serving on private company boards. Mr. Wiklund received a Master of Pharmacy degree from the Pharmaceutical Institute in Stockholm.

The Board of Directors recommends a vote FOR THE ELECTION OF THE FIVE NOMINEES FOR DIRECTOR NAMED ABOVE.

The officers of the Company hold office until their successors are appointed by the Board of Directors (see “Executives and Executive Compensation”). There are no arrangements or understandings between any of the directors or nominees listed above or the officers, or any other persons, pursuant to which any of the above directors have been selected as directors, or officers have been selected as officers.

Board Committees and Meetings

The Board has established an Audit Committee, a Compensation Committee, and an Executive Committee. In addition, in March 2002, the Board formed a Nominating Committee. In 2001 there were four meetings of the Board of Directors of the Company. All directors attended 75 percent or more of the Company’s Board meetings and meetings of Board committees on which they served.

The Executive Committee, last year consisting of Mr. Morgenthaler (Chairman), Mr. Cook, Dr. Christoffersen, Mr. Groom and Mr. Robin, oversees the management and operation of the Company’s business. The Executive Committee met six times in 2001.

The Compensation Committee, last year consisting of Mr. Cook (Chairman), Mr. Groom, Mr. Morgenthaler and Mr. Wiklund:

| | • | | reviews and recommends for Board approval grants of options pursuant to the Company’s Stock Option Plans; |

| | • | | decides salaries and incentive compensation for the Company’s employees and consultants; and |

| | • | | recommends compensation for executive officers (see “Report by the Compensation Committee on Executive Compensation”) for approval by the board. |

The Compensation Committee met once in 2001.

The Audit Committee, last year consisted of Mr. Ichikawa (Chairman until November 2001), Dr. Saks (Chairman since March 2002), and Mr. Wiklund. In addition to Dr. Saks and Mr. Wiklund, the Audit Committee in 2002 also includes Mr. Cook. The Audit Committee:

| | • | | recommends to the Board the selection of independent auditors; |

| | • | | reviews the results and scope of the audit and other services provided by the Company’s independent auditors; and |

| | • | | reviews and evaluates the Company’s audit and control functions. |

The Board of Directors adopted a written Audit Committee charter in 2001. A copy of this charter was included as an appendix to the Proxy Statement for the Annual Meeting of Stockholders held in 2001.

The Company believes that all of the members of the Audit Committee are independent within the meaning

8

of the Nasdaq Listing Standards.

The Audit Committee met four times in 2001.

Prior to March 2002, the Board of Directors had no standing nominating committee. The nominees for the Board of Directors to be voted upon at the upcoming Annual Meeting were determined by the entire Board. In March 2002, a Nominating Committee was organized for the purpose of identifying, reviewing and recommending qualified director candidates to the Board, to review qualifications of such candidates and to recommend to the Board for consideration such candidates for membership as a director or to fill vacancies that may arise from time to time The Nominating Committee consists of Mr. Cook (Chairman), Mr. Groom, Dr. Saks and Mr. Wiklund.

Director Compensation

Fees. All non-employee directors are entitled to receive a fee of:

| | • | | $10,000 annual retainer; |

| | • | | $1,000 per day for each Board or Committee meeting attended in person; and |

| | • | | $500 per day for participating telephonically in a Board or Committee meeting. |

Stock Options. Under the Company’s Stock Option Plan, non-employee directors receive:

| | • | | an initial stock option grant of 20,000 shares of common stock that vest over four years; and |

| | • | | an annual grant of stock options for 10,000 shares of common stock that vest after one year of service. |

Executives and Executive Compensation

Information regarding the Company’s executive officers is set forth below.

Name

| | Age

| | Position

|

| Howard W. Robin (1) | | 49 | | Chief Executive Officer, President and Director |

| Marvin Tancer, CPA | | 51 | | Chief Financial Officer and Vice President of Operations |

| Nassim Usman, Ph.D. | | 42 | | Chief Scientific Officer and Vice President of Research and Development |

| Lawrence E. Bullock | | 46 | | Vice President of Administration and Finance and Secretary |

| Lawrence Blatt, Dr. P.H. | | 40 | | Vice President of Research |

| Alene A. Campbell | | 45 | | Vice President of Corporate Development |

| (1) | | Howard Robin is discussed under “Directors and Nominees.” |

Marvin Tancer, CPAhas served as Chief Financial Officer and Vice President of Operations since June 2001. Prior to joining the Company in 2001, Mr. Tancer served as National Sales Director of Oncology and Area Sales Director for the Western United States for Berlex Labs, Inc. from 1999 to 2000. From 1992 to 1998 he held the position of Director of Finance and Administration and Chief Financial Officer at Berlex Biosciences. From 1986 to 1992 he held the position of Corporate Controller for Berlex Labs, Inc. and from 1982 to 1986 was Pharmaceutical Division Controller and Director of Financial Analysis. He earned his BS in Business Administration from the Wharton School of Business.

9

Nassim Usman, Ph.D.,has served as Chief Scientific Officer since February 2002 and Vice President of Research and Development since August 2000. From December 1999 to July 2000, Dr. Usman served as Senior Vice President of Research. From May 1996 to December 1999, Dr. Usman served as Vice President of Research at Ribozyme Pharmaceuticals. From April 1994 until May 1996, Dr. Usman served as Director of Chemistry and Biochemistry Research and from September 1992 until April 1994 Dr. Usman served as Senior Scientist in Chemistry and Biochemistry. Prior to joining the Company, Dr. Usman was a Postdoctoral Fellow and Scientist in the Departments of Biology and Chemistry at the Massachusetts Institute of Technology. Dr. Usman received his Ph.D. in chemistry from McGill University.

Lawrence E. Bullockhas served as Vice President of Administration and Finance and Secretary since January 1996. From December 1990 to January 1996, Mr. Bullock was Chief Financial Officer, Director of Finance and Administration and Secretary of La Jolla Pharmaceutical Company, a biopharmaceutical company. Mr. Bullock received his MBA from the University of Utah.

Lawrence M. Blatt, Dr. P.H.,has served as Vice President of Research since August 2000. From January 1999 to July 2000, Dr. Blatt served as Research Vice President, BioPharmacology and Preclinical Research. From January 1998 until January 1999, Dr. Blatt served as Senior Director of Preclinical and Clinical Development. Prior to joining the Company, Dr. Blatt served as Vice President of Product Development for the National Genetics Institute, a molecular diagnostic company, from August 1996 to January 1998. From August 1984 to January 1996, Dr. Blatt served in various managerial and scientific positions at Amgen Inc., a bio-pharmaceutical company. He received his Doctorate in Public Health Administration from the University of La Verne in 1996 and his MBA degree from California Sate University, Northridge in 1988.

Alene A. Campbellhas served as Vice President of Corporate Development since December 1999. Ms. Campbell served as Vice President of Business Development and General Manager of Target Validation and Discovery Business from April 1997 to December 1999. From January 1990 to March 1997, Ms. Campbell was Vice President of ChemTrak Corporation, a medical technology firm, where she was responsible for finance, business development and marketing and sales. From 1987 to 1990, she was Vice President of CytoSciences, Inc., a biomedical company, and from 1981 to 1987 she was Vice President of Marketing and Sales for Hana Biologics, Inc., a biotechnology firm. Ms. Campbell received her MBA from the University of California at Berkeley.

In addition to the officers listed above, Ralph E. Christoffersen, Ph.D. served as the Chief Executive Officer of the Company from June 1992 through June 2001, at which time he retired as Chief Executive Officer. Dr. Christoffersen also served as a Director of the Company from June 1992 through the present time. In addition, Dr. Christoffersen entered into a consulting agreement with the Company, effective January 2002 (see “Employment Agreements”). He is not seeking reelection to the Board of Directors and, accordingly, has not been nominated.

10

The following table summarizes the compensation paid to or earned by the Company’s Chief Executive Officer and the other five most highly compensated executive officers whose annual compensation exceeded $100,000 in 2001 (“Named Executive Officers”).

Summary Compensation Table

| | | Annual Compensation

| | | Long-term Compensation

|

Name and Principal Position

| | Year

| | Salary($)

| | | Bonus($)

| | Other Annual Comp.($)

| | | Shares Underlying Options Granted(#)

| | All Other Comp.($) (1)

|

| Howard W. Robin | | 2001 | | 309,231 | | | 124,313 | | 678,273 | (3) | | 385,000 | | — |

| Chief Executive Officer and President(2) | | | | | | | | | | | | | | |

|

| Ralph E. Christoffersen, Ph.D.(4) | | 2001 | | 243,750 | | | 75,000 | | — | | | — | | 5,249 |

| | | 2000 | | 309,000 | | | 72,000 | | — | | | 30,000 | | 5,238 |

| | | 1999 | | 297,000 | | | 68,000 | | — | | | 37,000 | | 4,993 |

|

| Marvin Tancer, CPA(5) | | 2001 | | 135,417 | | | 59,500 | | 480,447 | (6) | | 195,000 | | — |

| Chief Financial Officer and | | | | | | | | | | | | | | |

| Vice President of Operations | | | | | | | | | | | | | | |

|

| Nassim Usman, Ph.D. | | 2001 | | 240,000 | | | 50,907 | | 43,958 | (7) | | 20,000 | | 5,249 |

| Chief Scientific Officer, | | 2000 | | 218,330 | | | 38,200 | | 43,958 | (7) | | 35,000 | | 5,238 |

| Vice President of Research and Development | | 1999 | | 177,925 | | | 32,000 | | 42,669 | (7) | | 42,000 | | 4,993 |

|

| Lawrence E. Bullock | | 2001 | | 180,000 | | | 11,340 | | 25,797 | (8) | | 10,000 | | 5,249 |

| Vice President of Administration | | 2000 | | 166,275 | | | 29,925 | | 25,797 | (8) | | 30,000 | | 5,238 |

| and Finance and Secretary | | 1999 | | 158,350 | | | 25,350 | | 25,797 | (8) | | 24,000 | | 4,993 |

|

| Lawrence Blatt, Dr. P.H. | | 2001 | | 181,000 | | | 40,725 | | 25,797 | (9) | | 35,000 | | 5,249 |

| Vice President of Research | | 2000 | | 164,813 | | | 29,600 | | 25,756 | (9) | | 57,500 | | 4,938 |

| | | 1999 | | 149,350 | | | 21,150 | | 12,842 | (9) | | 32,760 | | 4,993 |

|

| Alene A. Campbell | | 2001 | | 194,625 | | | 12,261 | | 3,000 | (10) | | 10,000 | | 5,249 |

| Vice President of Corporate | | 2000 | | 179,625 | | | 26,950 | | 28,000 | (10) | | 20,000 | | 5,238 |

| Development | | 1999 | | 166,325 | | | 30,000 | | 28,000 | (10) | | 42,000 | | 4,993 |

|

| J. Wayne Cowens, M.D. (11) | | 2001 | | 288,275 | (12) | | — | | 180,668 | (13) | | — | | — |

| Vice President of Clinical Affairs | | 2000 | | 230,616 | | | 36,900 | | 48,979 | (13) | | 12,500 | | 5,238 |

| | | 1999 | | 112,500 | | | 42,750 | | 110,269 | (13) | | 122,000 | | — |

| (1) | | The “All Other Compensation” column shows matching contributions in common stock made by the Company under the 401(k) Salary Reduction Plan. |

| (2) | | Mr. Robin joined the Company on January 4, 2001. |

| (3) | | Includes (a) reimbursement of relocation expenses of $323,829; (b) $266,675 for taxes related to relocation; (c) imputed interest of $48,000 on a five year $400,000 forgivable loan; and (d) $39,559 for taxes related to the imputed interest on the loan. |

| (4) | | Dr. Christoffersen retired from his position as Chief Executive Officer effective July 1, 2001. He continued in a consulting capacity and was paid at 50% of his 2001 salary, which was $325,000, through December 31, 2001. |

| (5) | | Mr. Tancer joined the Company on June 18, 2001. |

| (6) | | Includes (a) reimbursement of relocation expenses of $232,485; (b) $191,453 for taxes related to relocation; (c) imputed interest of $30,897 on a five year $200,000 forgivable loan; and (d) $25,463 for taxes related to the |

11

| | imputed | | interest on the loan. |

| (7) | | Includes (a) $27,000 in each of 2001 and 2000, and $15,000 in 1999 for partial forgiveness of a loan; (b) $14,000 in each of 2001 and 2000, and approximately $7,800 in 1999 for taxes related to partial forgiveness of the loan; (c) in 1999, $11,102 representing imputed interest related to an interest-free loan and $5,770 for taxes relating to the imputed interest for the loan; and (d) approximately $3,000 in each of 2001, 2000 and 1999 for dependent daycare expenses. |

| (8) | | Includes (a) $15,000 in each of 2001, 2000 and 1999 for partial forgiveness of a loan; (b) approximately $7,800 in each of 2001, 2000 and 1999 for taxes relating to the loan; and (c) $3,000 in each of 2001, 2000 and 1999 as reimbursements for dependent daycare expenses. |

| (9) | | Includes (a) $15,000 in 2001 and 2000 for partial forgiveness of a loan; (b) imputed interest of $6,476 in 1999 for the loan; (c) $7,797 in each of 2001 and 2000, and $3,366 in 1999 for taxes relating to the loans; and (d) approximately $3,000 in 2001, 2000 and 1999 as reimbursements of dependent daycare expenses. |

| (10) | | Includes (a) $25,000 in each of 2000 and 2001 for partial forgiveness of a loan; and (b) $3,000 in each of 2001, 2000 and 1999 as reimbursements for dependent daycare expenses. |

| (11) | | Dr. Cowens joined the Company on July 1, 1999 and resigned on September 28, 2001. |

| (12) | | Includes severance pay of $115,313. |

| (13) | | Includes (a) $120,000 and $30,000 in 2001 and 2000, respectively, for forgiveness of a loan; (b) $60,668, $15,510 and $14,426 in 2001, 2000 and 1999, respectively, for taxes related to the loan; (c) $27,755 in 1999 representing imputed interest relating to an interest-free loan; (d) $44,802 to reimburse Dr. Cowens for relocation expenses in 1999; and (e) $23,286 for taxes relating to relocation in 1999. |

Stock Option Plans

In May 2001 shareholders approved the Company’s 2001 Stock Option Plan (“2001 Plan”) which provides for the issuance of options for up to 1,000,000 shares of the Company’s common stock. In addition, in March 1996 the Company amended, restated and merged its stock option plans and named the resulting plan the 1996 Stock Option Plan (“1996 Plan”) which provides for the issuance of options for up to 2,767,154 shares of the Company’s common stock. As of April 5, 2002, 2,824,945 shares of common stock are outstanding and reserved for issuance under the 1996 Plan and the 2001 Plan (collectively, the “Plans”). As of April 5, 2002, 485,945 options remain available for grant under the Plans. Shareholders are being asked to approve an increase in the number of shares subject to options which may be granted pursuant to the 2001 Plan (see “Proposal 2”). The 1996 Plan terminates in January 2006, unless earlier terminated by the Board of Directors. The purposes of the stock option plans are to:

| | • | | attract and retain qualified personnel; |

| | • | | provide additional incentives to the Company’s employees, officers, directors and consultants; and |

| | • | | promote the success of the Company’s business. |

Under the stock option plans, the Company may grant or issue incentive stock options and supplemental (non-qualified) stock options to its consultants, employees, officers and directors.

Administration. The Board has delegated administration of the Plans to a Compensation Committee comprised of three independent directors (see “Board Committees and Meetings”). Subject to the limitations set forth in the Plans, the Board or the Compensation Committee has the authority to:

| | • | | select the persons to whom grants are to be made; |

| | • | | designate the number of shares to be covered by each option; |

| | • | | determine whether an option is an incentive stock option or a non-statutory stock option; |

| | • | | establish vesting schedules; and |

| | • | | subject to restrictions, specify the type of consideration to be paid upon exercise and to specify other terms of the options. |

Terms. The maximum term of options granted under the Plans is ten years, however, the maximum term is five years for incentive options granted to a person who at that time owns 10% of the total combined voting power of all classes of stock. The aggregate fair market value of the stock with respect to which incentive stock options are first exercisable in any calendar year may not exceed $100,000 per optionee. Any portion in excess of $100,000 shall be treated as non-statutory stock options. Options granted under the Plans are non-transferable and generally expire upon the earlier of the stated expiration date or three months after the termination of an optionee’s service. However,

12

the expiration date would be 18 months in the event the optionee’s employment terminates by reason of death or 12 months in the event the optionee’s employment terminates due to disability, or a longer or shorter period as may be specified in the option agreement.

The Board has discretion in connection with a merger, consolidation, reorganization or similar corporate event where the Company is the surviving corporation to prescribe the terms and conditions for the modifications of the options granted under the Plans. If the Company is not the surviving corporation in the event of its dissolution or liquidation, or its merger or consolidation, all outstanding options will terminate unless assumed by another corporation.

No specific vesting schedule is required under the Plans. The exercise price of incentive stock options must equal at least the fair market value of the common stock on the date of grant, except that the exercise price of incentive stock options granted to any person who at the time of grant owns stock possessing more than 10% of the combined voting power of all classes of stock must be at least 110% of the fair market value of the stock on the date of grant. The exercise price on non-statutory stock options under the Plan may be no less than 85% of the fair market value of the common stock on the date of grant.

The following table contains information about stock options granted to each of the executive officers named in the Summary Compensation Table during 2001 under the Plans. All options granted in 2001 vest in increments of 25% over a four-year period and become exercisable on the first anniversary of the grant date. The exercise price of each option was equal to the fair market value of the common stock on the date of the option grant as determined by the Board of Directors. The options are granted for a term of ten years, subject to earlier termination if employment is terminated. In 2001, the Company granted options representing an aggregate of 978,800 shares of the Company’s common stock to employees and directors, including the named executive officers.

13

Option Grants in 2001

| | | Individual Grants

| | | | | | |

| | | Number of Shares Underlying Options Granted (#)

| | % of Total Options Granted to Employees in 2001

| | | Exercise Price ($/Share)

| | Potential Realizable Value at Annual Rate of Stock Price Appreciation Expiration for Option Term(1)

|

| | | | | | Date

| | 5%($)

| | 10%($)

|

| Howard W. Robin | | 275,000 | | 28.1 | % | | $ | 9.94 | | 01-04-11 | | 1,719,083 | | 4,356,495 |

| | | 5,000 | | 0.5 | % | | | 9.94 | | 02-01-11 | | 31,256 | | 79,209 |

| | | 5,000 | | 0.5 | % | | | 7.50 | | 03-01-11 | | 23,584 | | 59,765 |

| | | 5,000 | | 0.5 | % | | | 6.19 | | 03-30-11 | | 19,464 | | 49,326 |

| | | 5,000 | | 0.5 | % | | | 8.90 | | 05-01-11 | | 27,986 | | 70,922 |

| | | 5,000 | | 0.5 | % | | | 9.24 | | 06-01-11 | | 29,055 | | 73,631 |

| | | 85,000 | | 8.7 | % | | | 4.00 | | 12-14-11 | | 213,824 | | 541,872 |

| | |

| |

|

| | | | | | | | | |

| | | 385,000 | | 39.3 | % | | | | | | | | | |

|

| Marvin Tancer, CPA | | 175,000 | | 17.9 | % | | | 8.38 | | 06-18-11 | | 922,274 | | 2,337,223 |

| | | 20,000 | | 2.0 | % | | | 4.00 | | 12-14-11 | | 50,312 | | 127,499 |

| | |

| |

|

| | | | | | | | | |

| | | 195,000 | | 19.9 | % | | | | | | | | | |

|

| Nassim Usman, Ph.D. | | 20,000 | | 2.4 | % | | | 4.00 | | 12-14-11 | | 50,312 | | 127,499 |

| Lawrence E. Bullock | | 10,000 | | 1.0 | % | | | 4.00 | | 12-14-11 | | 25,156 | | 63,750 |

| Lawrence Blatt, Dr. P.H. | | 35,000 | | 3.6 | % | | | 4.00 | | 12-14-11 | | 88,045 | | 223,124 |

| Alene A. Campbell | | 10,000 | | 1.0 | % | | | 4.00 | | 12-14-11 | | 25,156 | | 63,750 |

| Ralph E. Christoffersen, Ph.D. (2) | | — | | — | | | | — | | — | | — | | — |

| (1) | | Amounts reported in these columns show hypothetical gains that may be realized upon exercise of the options, assuming the market price of common stock appreciates at the specified annual rates of appreciation, compounded annually over the term of the options. These numbers are calculated based upon rules promulgated by the SEC. Actual gains, if any, depend on the future performance of common stock and overall market conditions. |

| (2) | | Dr. Christoffersen resigned his position as Chief Executive Officer effective July 1, 2001. |

14

The following table contains information about the stock options exercised in 2001 and the number and value of stock options held by each named executive officer as of December 31, 2001. A stock option is “in-the-money” if the closing market price of common stock exceeds the exercise price of the stock option. The value of “in-the-money” unexercised stock options set forth in the table represents the difference between the exercise price of these options and the closing sales price of the common stock on December 31, 2001, as reported by the Nasdaq National Market ($4.57 per share).

Aggregated Option Exercises in 2001 and

2001 Year-End Option Values

Name

| | Shares Acquired On Exercise (#)

| | Value Realized ($)(1)

| | Number of Securities Underlying Unexercised Options at December 31, 2001(#) Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at December 31, 2001($) Exercisable/Unexercisable

|

| Howard W. Robin | | — | | — | | 0/385,000 | | 0/48,450 |

| Ralph E. Christoffersen | | 29,778 | | 258,473 | | 199,654/73,648 | | 222,196/48,274 |

| Marvin Tancer | | — | | — | | 0/195,000 | | 0/11,400 |

| Nassim Usman | | — | | — | | 119,112/89,038 | | 115,665/39,366 |

| Lawrence E. Bullock | | — | | — | | 120,886/50,355 | | 111,049/30,435 |

| Lawrence Blatt | | — | | — | | 47,555/100,305 | | 15,700/35,650 |

| Alene A. Campbell | | 3,000 | | 10,890 | | 75,818/65,400 | | 47,100/24,540 |

| | |

| |

| |

| |

|

| (1) | | Value realized is the difference between the exercise price and the closing market price of the common stock on the day of exercise. |

Employment Agreements

Howard W. Robin. In January 2001, the Company entered into an employment agreement with Howard W. Robin, Chief Executive Officer and President, which, as amended, currently provides for:

| | • | | an annual salary of $344,500; |

| | • | | an annual performance-based cash bonus of up to 45% of his current salary; |

| | • | | stock options for common stock as reflected in the tables in this “Executive Compensation” section; |

| | • | | an interest-free loan of $400,000 made in January 2001 and forgivable in five equal annual installments, grossed –up for taxes, as long as Mr. Robin remains employed by the Company; and |

| | • | | all reasonable relocation expenses, grossed-up for taxes, for Mr. Robin’s move from California to Colorado. |

If the Company terminates Mr. Robin’s employment without cause or for good reason, he is entitled up to eighteen months of severance payment at his then current salary and estimated bonus.

Marvin Tancer, CPA. In June 2001, the Company entered into an employment agreement with Marvin Tancer, Chief Financial Officer and Vice President of Operations, which, as amended, currently provides for:

| | • | | an annual salary of $266,000; |

| | • | | an annual performance-based cash bonus of up to 30% of his current salary; |

| | • | | stock options for common stock as reflected in the tables in this “Executive Compensation” section; |

| | • | | an interest-free loan of $200,000 made in June 2001 and forgivable in five equal annual installments, grossed –up for taxes, as long as Mr. Tancer remains employed by the Company; and |

| | • | | all reasonable relocation expenses, grossed-up for taxes, for Mr. Tancer’s move from California to Colorado. |

If the Company terminates Mr. Tancer’s employment without cause or for good reason, he is entitled up to nine months of severance payment at his then current salary and estimated bonus.

Nassim Usman, Ph.D. In 1996, the Company entered into an employment agreement with Nassim Usman, Chief Scientific Officer and Vice President of Research and Development, which, as amended, currently provides for:

15

| | • | | an annual salary of $254,000; |

| | • | | an annual performance-based cash bonus of up to 30% of his current salary; |

| | • | | stock options for common stock as reflected in the tables in this “Executive Compensation” section; and |

| | • | | an interest-free loan of $75,000 made in 1996 and an additional interest-free loan of $60,000 made in 1999, both of which are forgivable in five equal installments, grossed-up for taxes, as long as Dr. Usman remains employed by the Company. |

If the Company terminates Dr. Usman’s employment without cause, he will be entitled to six months’ severance pay at his then current salary.

Lawrence E. Bullock. In 1996, the Company entered into an employment agreement with Lawrence E. Bullock, Vice President of Finance and Administration and Secretary, which, as amended, currently provides for:

| | • | | an annual salary of $185,400; |

| | • | | an annual performance-based cash bonus of up to 25% of his current salary; and |

| | • | | stock options for common stock as reflected in the tables in this “Executive Compensation” section. |

If the Company terminates Mr. Bullock’s employment without cause, he is entitled to six months’ severance pay at his then current salary.

Lawrence Blatt, Dr. P.H. In 1998, the Company entered into an employment agreement with Lawrence Blatt, Vice President of Research, which, as amended, currently provides for:

| | • | | an annual salary of $203,000, |

| | • | | an annual performance-based cash bonus of up to 30% of his current salary, |

| | • | | stock options for common stock as reflected in the tables in this “Executive Compensation” section, and |

| | • | | an interest-free loan of $75,000 made in 1999 and forgivable in five equal annual installments, grossed-up for taxes, as long as Dr. Blatt remains employed by the Company. |

If the Company terminates Dr. Blatt’s employment without cause, he is entitled to six months’ severance pay at his then current salary.

Alene A. Campbell. In 1997, the Company entered into an employment agreement with Alene A. Campbell, Vice President of Corporate Development, which, as amended, currently provides for:

| | • | | an annual salary of $202,410; |

| | • | | an annual performance-based cash bonus of up to 25% of her current salary; and |

| | • | | stock options for common stock as reflected in the tables in this “Executive Compensation” section. |

If the Company terminates Ms. Campbell’s employment without cause, she is entitled to six months’ severance pay at her then current salary.

Ralph E. Christoffersen, Ph.D. Dr. Christoffersen retired as Chief Executive Officer effective July 1, 2001. Pursuant to an agreement with Dr. Christoffersen, the Company continued to pay him 50% of his then current salary set forth in his employment agreement through December 31, 2001 in exchange for his part-time consulting. This amount totaled $81,250. Pursuant to this agreement, Dr. Christoffersen continued to receive certain benefits, in addition to 31,174 stock options which vested between the time of his retirement and December 31, 2001. In January 2002, the Company entered into a consulting agreement with Dr. Christoffersen pursuant to which Dr. Christoffersen will serve as a consultant to the Company until December 31, 2002, unless either party terminates earlier upon thirty days notice. The consulting agreement provides that Dr. Christoffersen will receive:

| | • | | compensation at the rate of $350 per hour of services performed, with a minimum monthly compensation of $3,000; and |

| | • | | reimbursement for all reasonable out-of-pocket expenses. |

In addition, Dr. Christoffersen continues to serve as a Director of the Company from his retirement until the present

16

time. He is not seeking reelection to the Board of Directors and, accordingly, has not been nominated by the Board.

Employee Benefits

Executive Bonus Plan. The Company adopted an Executive Bonus Plan in March 1999. This Bonus Plan provides the Company’s executive officers with the opportunity to earn an annual bonus contingent upon their fulfillment of annual goals as determined by the Compensation Committee comprised of three independent directors. The Compensation Committee has complete authority to establish the goals for each executive officer, to interpret all provisions of the Bonus Plan and to make all other determinations necessary or advisable for the administration of the Bonus Plan. The Compensation Committee may award each executive officer with an annual bonus comprised of one or more of the following:

| | • | | stock options pursuant to the Company’s stock option plan; or |

| | • | | forgiveness of any portion of the principal of interest-free loans provided to the executive officer. |

Section 401(k) Plan. As part of its effort to attract and maintain high quality staff, the Company adopted a 401(k) Salary Reduction Plan and Trust on June 1, 1992. The Company’s employees may make pre-tax elective contributions of up to 20% of their salary, subject to limitations prescribed by law. All contributions are paid to a trustee who invests for the benefit of members of the 401(k) Plan. In March 1997, the 401(k) Plan was amended to provide that the Company may match the employee’s contributions with common stock. The Company may amend or terminate the 401(k) Plan at any time, subject to legal restrictions.

Employee Stock Purchase Plan. In March 1996, the Company adopted an Employee Stock Purchase Plan (the “Purchase Plan”), which authorizes the issuance of up to 600,000 shares of the Company’s common stock to eligible employees. Generally, each offering may last up to twenty-four months, and purchases are made on each October 31 and April 30 during each offering. For example, the initial offering began on April 11, 1996, and terminated on April 30, 1999. Common stock is purchased for accounts of employees participating in the Purchase Plan at a price per share equal to the lower of:

| | • | | 85% of the fair market value of a share of common stock on the date of commencement of participation in the offering, or |

| | • | | 85% of the fair market value of a share of common stock on the date of purchase. |

Generally, all regular employees, including executive officers, may participate in the Purchase Plan and may authorize payroll deductions of up to 15% of their base compensation for the purchase of common stock under the Purchase Plan. The Company’s Board of Directors has the authority to terminate the Purchase Plan at its discretion. As of April 5, 2002, 305,671 shares had been issued pursuant to the Purchase Plan.

Compensation Committee Interlocks

The members of the Company’s Compensation Committee have no interlocking relationships as defined under SEC regulations.

17

Report by the Compensation Committee on Executive Compensation

Responsibilities and Objectives. The Committee establishes and administers the general compensation policies and plans for the Company and the specific compensation levels for the executive officers and other key employees. The Committee is responsible for conducting, at a minimum, annual reviews of executive compensation and for taking certain actions regarding the compensation of senior executives of the Company. The Committee determines the salary levels for senior executives, and other key employees, and the types and amounts of cash and other bonuses to be distributed to these individuals in accordance with Bonus Plan. The Committee also determines grants of stock options pursuant to the stock option plans.

This report is submitted by members of the Committee summarizing their involvement in the compensation decisions and policies adopted by the Company for the Company’s executive officers.

General Policy. The Company’s executive compensation practices are designed to reward and provide an incentive for executives based on the achievements of annual and long-term corporate and individual performance goals. Compensation levels for executives are established after giving consideration to a variety of quantitative measures including, but not limited to, Company financial and operating performance, peer group comparisons and labor market conditions. Before making decisions, the Committee elicits the recommendations and advice of the CEO regarding appropriate or desired levels of compensation for management personnel generally. The Committee has complete access to all necessary Company personnel records, financial reports and other data, and may seek the advice of experts and analysts.

The ultimate purpose of the Company’s compensation structure is to attract and retain executives of the highest caliber and to motivate these executives to put forth maximum effort toward the achievement of Company goals identified through the strategic planning process of the Board and management. Also, the compensation design emphasizes long-term incentives in the form of stock options that will encourage these individuals to maintain their focus on the paramount importance of long-term shareholder interests.

Components of Compensation. In evaluating executive compensation, the Committee focuses upon several fundamental components: salary, annual bonus and long-term incentive compensation consisting of stock options. The Committee’s recommendations are offered to the full Board of Directors and are ultimately ratified, changed or rejected by the full Board.

Salary levels for senior executives and other officers are reviewed by the Committee annually. The Company has entered into employment agreements with its executive officers, as amended from time to time, which set forth the salary level for each executive (see “Executive Compensation—Employment Agreements”). In establishing salary levels, the Committee has relied upon salary survey data and other publicly available information. The Committee also considers the experience of each executive officer as well as his or her past performance and expected future performance.

The annual bonus component of executive compensation has historically been provided to an executive, if and as appropriate, for obtaining pre-determined corporate and individual goals. The Committee typically determines whether annual bonuses will be awarded to executives for attainment of these goals at the end of each year. Pursuant to the Bonus Plan, the Committee may award bonuses comprised of cash, stock options and loan forgiveness based on the executive officer’s fulfillment of annual goals previously established by the Committee. At that time, the Committee also sets the performance goals for the upcoming year.

The third component of the Company’s executive compensation strategy is long-term incentive compensation pursuant to which executives receive stock options pursuant to the Plan which are tied to the long-term appreciation of the value of the Company Stock. The Plan offers executives the possibility of future gains depending upon the executives’ continued employment by, and contributions to, the Company. The Committee believes that a portion of the total compensation of senior executives over a period of years should consist of such long-term incentive awards (see “Executive Compensation—Stock Option Plan”).

Executive officers of the Company also are permitted to participate in the Purchase Plan which is open to all of the Company’s full-time employees.(See “Executive Compensation-Employee Stock Purchase Plan”). The Purchase Plan enables the Company’s employees, including officers, to acquire Company Stock at a

18

discount to the market price by allocating up to 15% of their base salary (subject to certain limits) to the acquisition of such stock.

Review of Executive Compensation. The Committee, in making its recommendations and determinations at year end 2001 regarding executive compensation, was influenced by numerous positive considerations, including achievement of all 2001 corporate goals as set forth in the 2001 budget and planning process.

In light of the results in 2001, the Committee determined that increases in executive compensation were justifiable, both to reward management for accomplishments to date and to encourage future achievement of both short- and long-term objectives. Accordingly, the Committee approved salary increases and bonuses that it believes reflected appropriate rewards for management’s performance in 2001. The Committee also granted stock options to the executive officers (see “Executive Compensation”).

Compensation of Chief Executive Officer. In assessing appropriate types and amounts of compensation for the Chief Executive Officer, the Committee evaluates both corporate and individual performance. Corporate factors included in the evaluation are (i) progress and number of products in clinical and preclinical development, (ii) levels and quality of research, and (iii) current and potential funds raised in equity offerings and collaborations. Individual factors include initiation and implementation of successful business strategic partnerships, maintenance of an effective management team and various personal qualities, including leadership, commitment and professional standing.

Conclusion. For these and other reasons, the Committee recommended an increase in salary for Mr. Robin from $325,000 in 2001 to $344,500 in 2002. In addition, the Committee approved and recommended payment of a $124,313 cash bonus to Mr. Robin after January 1, 2002. The Committee also granted stock options for 385,000 shares of common stock under the Plan to Mr. Robin in 2001 (see “Executive Compensation”). The Committee believes that these compensation amounts and awards reflect appropriate levels given the Company’s performance in 2001 and the individual performance of management. The Committee also believes that these awards evidence the Committee’s philosophy to emphasize long-term incentive rewards tied to the Company’s performance.

Submitted by the Compensation Committee:

Jeremy Curnock Cook (Chairman)

John Groom

David T. Morgenthaler

Anders P. Wiklund

19

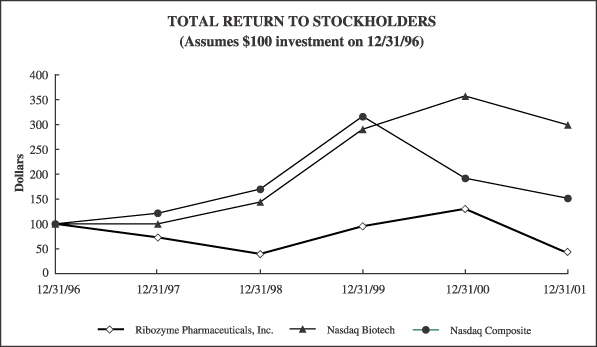

Company Performance

The following line graph presents the cumulative total shareholder return for the Company Stock since December 31, 1996, compared with the Nasdaq Composite (US) index and Nasdaq Biotech index. Trade prices are not always disclosed to management. The graph assumes that $100 was invested on December 31, 1996 and that dividends were reinvested.

| | | 12/31/96

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

|

| Ribozyme Pharmaceuticals, Inc. | | $ | 100.00 | | $ | 72.73 | | $ | 39.77 | | $ | 95.45 | | $ | 130.11 | | $ | 41.54 |

| Nasdaq Biotech | | $ | 100.00 | | $ | 99.93 | | $ | 144.18 | | $ | 290.56 | | $ | 357.36 | | $ | 299.45 |

| Nasdaq Composite | | $ | 100.00 | | $ | 121.64 | | $ | 169.84 | | $ | 316.10 | | $ | 191.91 | | $ | 151.51 |

Certain Relationships and Related Transactions

The Company believes that the following transactions were in its best interests. As a matter of policy, these transactions were, and all future transactions between the Company and any of its officers, directors or principal shareholders will be:

| | • | | approved by a majority of the independent members of the Board of Directors, |

| | • | | entered into on terms no less favorable to the Company than could be obtained from unaffiliated third parties, and |

| | • | | entered into in connection with bona fide business purposes. |

20

Executive Loans. The Company made interest-free loans to its executive officers. The Company has forgiven all or a portion of the outstanding principal amount of each loan under the terms of each officer’s employment agreement. See “Management—Employment Agreements.”

Name

| | Loan Amount

| | | Balance as of April 5, 2002

|

| Howard W. Robin | | $ | 400,000 | (1) | | $ | 320,000 |

| Marvin Tancer, CPA | | | 200,000 | | | | 200,000 |

| Nassim Usman, Ph.D. | | | 135,000 | (2) | | | 36,000 |

| Lawrence Blatt, Dr. P.H. | | | 75,000 | (3) | | | 30,000 |

| (1) | | $80,000 forgiven in January 2002. |

| (2) | | $15,000 forgiven in each of June 1997, May 1998, May 1999, May 2000 and May 2001, and $12,000 forgiven in each of October 2000 and October 2001. |

| (3) | | $15,000 forgiven in each of February 2000, February 2001 and February 2002. |

Chiron Transactions. Chiron and the Company granted each other licenses to technologies and agreed to undertake research activities pursuant to a collaboration agreement. Chiron purchased:

| | • | | 100,000 shares of the Company’s common stock for a purchase price of $3.60 per share, |

| | • | | 107,095 shares of the Company’s Series E Preferred Stock for a purchase price of $37.35 per share, and |

| | • | | a warrant at a price of $4.50 per warrant share, exercisable for 444,444 shares of common stock at an exercise price of $40.50 per share. |

In March 2001, the Company and Chiron amended the collaboration agreement to grant the Company the sole right to develop any product targeting human immunodeficiency virus (HIV) using the licensed technology and granting the Company rights in jointly developed technology related to that target. In exchange for these rights, the Company issued Chiron 38,920 shares of its common stock and agreed to pay Chiron royalties on sales of products targeting HIV.

In 1996 the Company amended the warrant issuable to Chiron to reduce the exercise price from $40.50 per share to $22.50 per share. When the Company closed its initial public offering in April 1996, Chiron:

| | • | | purchased 377,202 shares of common stock for $3.6 million at the initial public offering price less one-half of the underwriting discount, |

| | • | | paid the Company $1.8 million to complete the purchase of its warrant, and |

| | • | | received 35,127 additional shares of common stock pursuant to anti-dilutive provisions. |

In 1996 the Company entered into a second collaboration with Chiron for the use of ribozymes to characterize gene function. The collaborations give Chiron the right to develop and commercialize products that result from the collaboration, and entitle the Company to receive product development milestone payments and royalties on sales of commercial products. Chiron and the Company each pay a portion of the research and development expenses of the collaboration, and the Company agreed to provide Chiron $1.8 million, which was paid in 1996 to fund cell culture assays of potential targets and research related to potential target identification, development of delivery systems for ribozyme drugs and other matters related to the Company’s collaborations with Chiron.

Schering AG Transaction. In April 1997 the Company entered into a collaboration agreement, subsequently amended, with Schering AG and Schering Berlin Venture Corporation, or SBVC, an affiliate of Schering AG as part of the Company’s target discovery and validation program. SBVC made a $2.5 million equity investment in the Company in April 1997 in exchange for 212,766 shares of the Company’s common stock and made an additional equity investment of $2.5 million for 465,117 shares of the Company’s common stock in April 1998. Separately, Schering AG provided loans of $2.0 million in each of 1997, 1998, 1999, 2000 and 2001. The Company received the final draw-down of $1.0 million from Schering AG in April 2001. The loans, which carry an interest rate of 8.0% per annum, are immediately convertible into equity at the option of Schering AG. Additionally, 50.0% of any borrowings made on

21

the line of credit is collateralized by equipment purchases. In April 2000, after the completion of the Company’s public offering, the Company repaid $6.9 million of the outstanding borrowings to Schering AG. In June 2000, Schering AG converted $997,000 of the loan balance into 42,435 shares of the Company’s common stock at a conversion price of $23.50. At December 31, 2001, the Company had $3.2 million in outstanding loans and accrued interest from Schering AG, which was convertible into approximately 705,000 shares of the Company’s common stock. Principal and interest payments are deferred until maturity of the loans in April 2004. As a result of the Atugen formation in 1998, the Company subcontracts all of its existing target discovery and validation programs to Atugen, which does not effect the terms of the Company’s loan agreement with Schering AG.

Atugen Transaction. In 1998 the Company and other investors formed Atugen AG in Germany. Financing for Atugen was accomplished through a combination of venture capital, an investment by the Company and German government grants and loans. The Company contributed $2.0 million in cash to Atugen. The Company currently owns a 31.6% equity interest in Atugen. Certain of the Company’s executive officers and employees received shares of Atugen’s common stock in the formation at no cost to them, for which the Company recorded a one-time compensation expense of approximately $81,000. During 1999, Atugen granted one of the Company’s executives an additional 25 shares of previously unissued Atugen stock.

As part of the formation, Atugen received exclusive royalty-free licenses to the Company’s extensive patents and technologies for target validation and discovery. The Company received a one-time $2.0 million up-front license payment in 1999. The Company currently is compensated for providing management and other services to Atugen under the terms of a service agreement.

Eli Lilly Transaction. In March 1999, the Company entered into a collaboration with Eli Lilly to conduct research, development and commercialization of HEPTAZYME™, the Company’s anti-HCV ribozyme for the treatment of Hepatitis C virus infection. The Company granted Lilly the exclusive worldwide right to develop and commercialize HEPTAZYME™ in return for funding all research, development and commercialization costs for the drug. Under the terms of the agreement, the Company received approximately $9.2 million during 1999, which included $1.7 million of funding for research and clinical trial expenses and a $7.5 million equity investment. In April 1999, Lilly purchased five shares of the Company’s Series L Convertible Preferred Stock for $7.5 million. Subsequently, in September 2000, the Company entered into an agreement with Lilly to repurchase all rights to HEPTAZYME™. Lilly had directed the clinical trials for HEPTAZYME™ to date under the licensing agreement; however, according to the repurchase agreement, the Company renegotiated the global rights to HEPTAZYME™ and will direct all subsequent clinical trials. Pursuant to the repurchase agreement, Lilly converted the outstanding five shares of the Series L Convertible Preferred Stock into 636,640 shares of the Company’s common stock in December 2000. In addition, the Company issued to Lilly $3,000,000 of the Company’s common stock, which resulted in 252,632 shares, as payment for Lilly efforts in generating and providing clinical trial data. In return, Lilly paid the Company a termination fee of $2.8 million in December 2000.

Elan Transaction. In January 2000, the Company formed a joint venture with Elan Corporation, plc (Elan) for the development and commercialization of HERZYME™, the Company’s product to treat breast and other cancers. As part of this arrangement, the Company licensed HERZYME™ and Elan licensed its MEDIPAD® drug delivery technology to the joint venture, Medizyme Pharmaceuticals, Ltd. (Medizyme). The MEDIPAD® system is a disposable continuous subcutaneous drug delivery system that allows a patient to administer the drug at home.

Initial funding of Medizyme included $12.0 million from the Company and $3.0 million from Elan. The Company’s $12.0 million capital contribution was funded by the sale to Elan of (i) 12,015 shares of the Company’s Series A Convertible Exchangeable Preferred Stock (the Series A Preferred Stock), (ii) a warrant to purchase up to 200,000 shares of the Company’s common stock at an exercise price of $15.00 per share with a term of two years, and (iii) a warrant to purchase up to 300,000 shares of the Company’s common stock at an exercise price of $20.00 per share with a term of seven years. The Series A Preferred Stock has a stated dividend rate of 6.0% which is payable semi-annually through the issuance of additional shares of Series A Preferred Stock at a nominal value of $1,000 per share. The Series A Preferred Stock has a liquidation preference of $12,015,000. As of December 31, 2001, the Company had recorded $1,491,802 as an accreted dividend related to this preferred stock arrangement.

As a result of Medizyme’s initial capitalization, the Company owns 80.1% of the outstanding capital stock of Medizyme and Elan owns 19.9%. However, Elan can exchange, at its option, all of its shares of the Company’s Series A Preferred Stock for 30.1% of RPI’s interest in Medizyme. After such redemption, Elan would own 50% of the then

22

outstanding capital stock of Medizyme. Elan also has the option of converting its shares of the Company’s Series A Preferred Stock into approximately 1,200,000 shares of RPI’s common stock. As of December 31, 2001, the Series A Preferred Stock was convertible into 1,125,567 shares of the Company’s common stock.

Medizyme paid Elan in cash a $15.0 million non-refundable license fee for the MEDIPAD® drug delivery technology. As a result of this licensing transaction, Medizyme capitalized the entire license fee and is amortizing the balance over the three-year term of the agreement. The Company estimates that funding for Medizyme will require approximately $15.0 million in additional operating and development costs. In connection with expected funding requirements, Elan has agreed to provide the Company with a $12.0 million credit facility to fund the Company’s pro rata portion of Medizyme’s operating costs over the development period, which is expected to be 42 months. The debt has a 12% interest rate and may be converted at any time into shares of the Company’s Series B Convertible Preferred Stock (the Series B Preferred Stock), which ultimately is convertible into shares of the Company’s common stock at a 50% premium to the average price of its common stock for the 60 days prior to the time of the applicable draw down on the credit facility. The Series B Preferred Stock has a stated dividend rate of 12%, which is payable semi-annually through the issuance of additional shares of Series B Preferred Stock at a nominal value of $1,000 per share. As of December 31, 2001 the Company borrowed $8.2 million on the credit facility. If converted at December 31, 2001, the outstanding borrowings would be convertible into 644,095 shares of the Company’s common stock. For the year ended December 31, 2001, the Company recorded $4.0 million in revenue from Medizyme, of the total $5.4 million of research and development expenses recorded by Medizyme, and recorded $8.3 million as equity in the net loss of Medizyme.

Also in connection with the Medizyme joint venture, Elan purchased 641,026 shares of the Company’s common stock for a purchase price of $5.0 million in 2000. In addition, Elan purchased 500,500 shares of the Company’s common stock for $5.0 million in May 2001 at a premium to the average closing price for the 45 trading days preceding the purchase. Elan also purchased 750,000 shares of the Company’s common stock and a warrant to purchase 75,000 shares of common stock in December 2001 for $3.0 million.

In January 2002, the Company expanded its collaboration with Elan. Under the terms of the amended agreement, for no cost Medizyme will license Elan’s liposome technology for the development of HERZYME™. The purpose of the amendment is to assess tumor localization and pharmacokinetics with several liposome formulations in conjunction with HERZYME™.

Archemix Transaction. In May 2001, the Company announced the formation of a strategic alliance with Archemix Corporation, a Massachusetts privately held biotechnology company, that will allow both companies to capitalize on reciprocal intellectual property in the field of proteomics and molecular diagnostics. Under the terms of the agreement, Archemix received exclusive licenses and sublicenses to the Company’s intellectual property covering the allosteric ribozyme technology for use in detecting proteins in connection with drug development and in a wide range of molecular detection applications. In addition, the Company received a license to Archemix’s intellectual property covering allosteric ribozymes for use in molecular diagnostic applications. In exchange for the licenses, the Company received an equity position in Archemix, a seat on Archemix’s Board of Directors and a seat on the Scientific Advisory Board. Currently, Dr. Usman serves as a Director on Archemix’s Board of Directors and Dr. Blatt serves as a member on the Scientific Advisory Board. Dr. Usman receives cash compensation and stock options from Archemix for his services on their Board of Directors. Dr. Blatt does not receive compensation, either in cash or stock options, for his services on Archemix’s Scientific Advisory Board.

23

PROPOSAL 2—APPROVAL OF AN INCREASE IN THE NUMBER

OF OPTIONS WHICH MAY BE GRANTED UNDER THE

COMPANY’S 2001 STOCK OPTION PLAN

In May 2001, shareholders approved the Company’s 2001 Stock Option Plan (“2001 Plan”) which provides for the issuance of options for up to 1,000,000 shares of the Company’s common stock. In addition, in March 1996 the Company amended, restated and merged its then existing stock option plans and named the resulting plan the 1996 Stock Option Plan (“1996 Plan”). The 1996 Plan currently provides for the issuance of options for up to 2,767,154 shares of the Company’s common stock. The 1996 Plan and the 2001 Plan (collectively the “Plans”) currently authorize the grant of options to purchase up to 3,767,154 shares of the Company’s common stock. As of April 5, 2002, options to purchase 2,824,945 shares were outstanding and 485,945 options remain available for grant under the Plans. The 1996 Plan will terminate in January 2006, unless earlier terminated by the Board of Directors. For a detailed description of the Plan see “PROPOSAL 1—ELECTION OF DIRECTORS—Stock Option Plan.”