- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

KT (KT) 6-KCurrent report (foreign)

Filed: 6 May 11, 12:00am

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2011

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

206 Jungja-dong

Bundang-gu, Sungnam

Kyunggi-do

463-711

Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ü Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No ü

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: May 6, 2011 | ||

| KT Corporation | ||

| By: | /s/ Thomas Bum Joon Kim | |

| Name: | Thomas Bum Joon Kim |

| Title: | Managing Director |

| By: | /s/ Young Jin Kim | |

| Name: | Young Jin Kim |

| Title: | Director |

KT

2011 1Q Earnings Release

Investor Relations May 6, 2011

Disclaimer

1 |

This presentation has been prepared by KT Corp. (“the Company”). This presentation contains forward-looking statements, which are subject to risks, uncertainties, and assumptions. This presentation is being presented solely for your information and is subject to change without notice. No representation or warranty, expressed or implied, is made and no reliance should be placed on the accuracy, actuality, fairness, or completeness of the information presented.

The Company, its affiliates or representatives accept no liability whatsoever for any losses arising from any information contained in the presentation. This presentation does not constitute an offer or invitation to purchase or subscribe for any shares of the Company, and no part of this presentation shall form the Basis of or be relied upon in connection with any contract or commitment.

Any decision to purchase shares of the Company should be made solely on the Basis of information, which has been publicly filed with the Securities and Exchange Commission or the Korea Stock Exchange and distributed to all investors.

The contents of this presentation may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, in whole or in part, for any purpose.

Financial Highlights

I.Financial Highlights (Consolidated)

1.Consolidated Income Statement

2.Consolidated Statement of Financial Position

3.CAPEX(KT Separate)

2 |

3 |

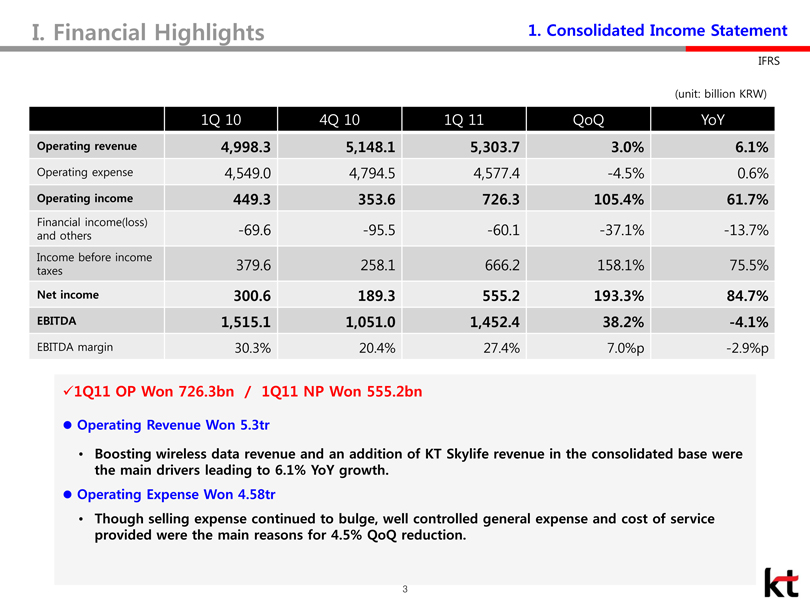

I. Financial Highlights1. Consolidated Income Statement

ü1Q11 OP Won 726.3bn/ 1Q11 NP Won 555.2bn

Operating Revenue Won 5.3tr

•Boosting wireless data revenue and an addition of KT Skyliferevenue in the consolidated base were the main drivers leading to 6.1% YoYgrowth.

Operating Expense Won 4.58tr

•Though selling expense continued to bulge, well controlled general expense and cost of service provided were the main reasons for 4.5% QoQreduction.

1Q 10 4Q 10 1Q 11 QoQ YoY

Operating revenue 4,998.3 5,148.1 5,303.7 3.0% 6.1%

Operating expense 4,549.0 4,794.5 4,577.4 -4.5% 0.6%

Operating income 449.3 353.6 726.3 105.4% 61.7%

Financial income(loss)and others -69.6 -95.5 -60.1 -37.1% -13.7%

Income before income taxes 379.6 258.1 666.2 158.1% 75.5%

Net income 300.6 189.3 555.2 193.3% 84.7%

EBITDA 1,515.1 1,051.0 1,452.4 38.2% -4.1%

EBITDA margin 30.3% 20.4% 27.4% 7.0%p -2.9%p

(unit: billion KRW)

IFRS

4 |

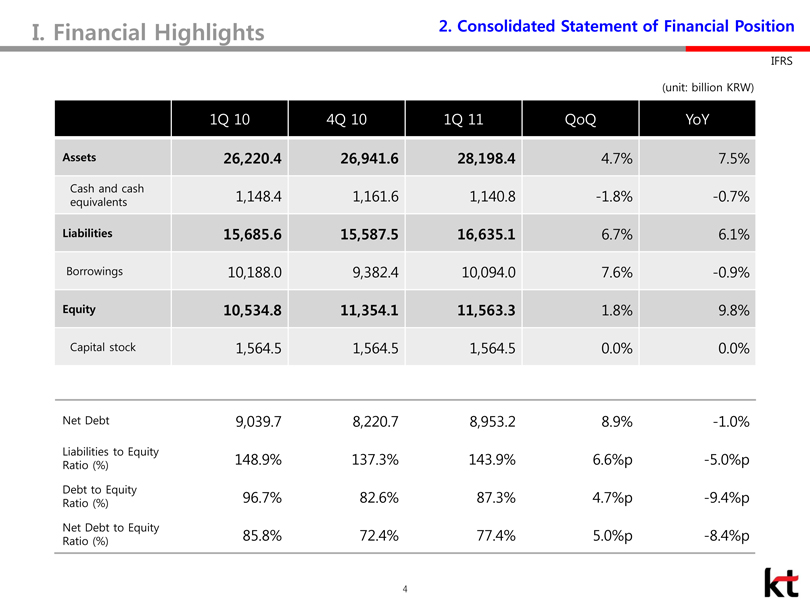

I. Financial Highlights

IFRS

1Q 10 4Q 10 1Q 11 QoQ YoY

Assets 26,220.4 26,941.6 28,198.4 4.7% 7.5%

Cash and cashequivalents 1,148.4 1,161.6 1,140.8 -1.8% -0.7%

Liabilities 15,685.6 15,587.5 16,635.1 6.7% 6.1%

Borrowings 10,188.0 9,382.4 10,094.0 7.6% -0.9%

Equity 10,534.8 11,354.1 11,563.3 1.8% 9.8%

Capitalstock 1,564.5 1,564.5 1,564.5 0.0% 0.0%

Net Debt 9,039.7 8,220.7 8,953.2 8.9% -1.0%

Liabilities to Equity Ratio(%) 148.9% 137.3% 143.9% 6.6%p -5.0%p

Debt toEquity Ratio (%) 96.7% 82.6% 87.3% 4.7%p -9.4%p

Net Debt toEquity Ratio (%) 85.8% 72.4% 77.4% 5.0%p -8.4%p

2. Consolidated Statement of Financial Position

(unit: billion KRW)

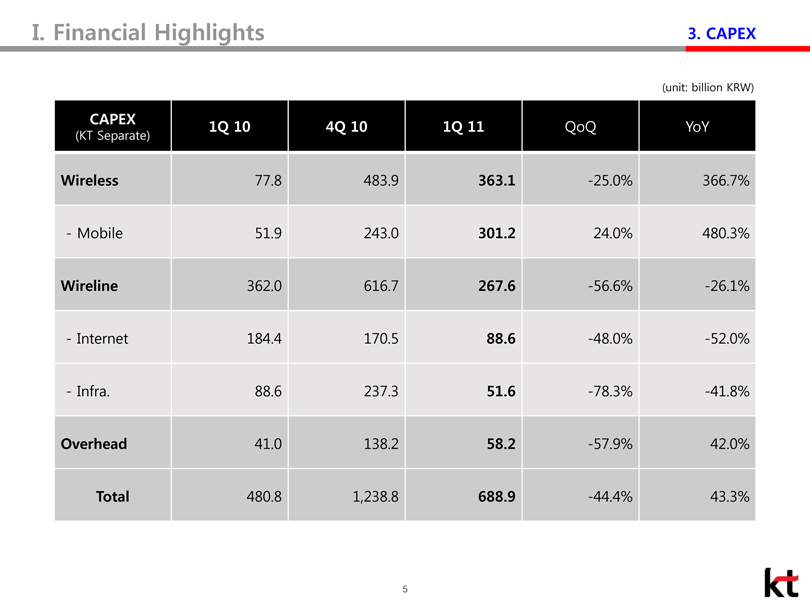

5I. Financial Highlights

CAPEX

(KTSeparate) 1Q 10 4Q 10 1Q 11 QoQ YoY

Wireless 77.8 483.9 363.1 -25.0% 366.7%

-Mobile 51.9 243.0 301.2 24.0% 480.3%

Wireline 362.0 616.7 267.6 -56.6% -26.1%

-Internet 184.4 170.5 88.6 -48.0% -52.0%

-Infra. 88.6 237.3 51.6 -78.3% -41.8%

Overhead 41.0 138.2 58.2 -57.9% 42.0%

Total 480.8 1,238.8 688.9 -44.4% 43.3%

3. CAPEX

(unit: billion KRW)

Business Overview

II. Business Overview (Consolidated)

1.Wireless Service

2.Telephone Service

3.Internet Service

4.Other Services

5.Operating Expense

6 |

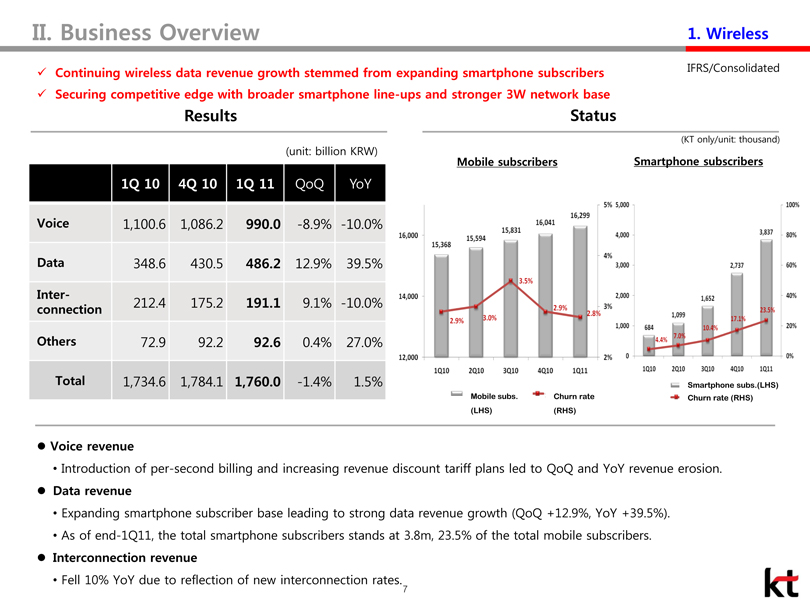

7II. Business Overview

Mobile subscribers

Smartphone subscribers

1Q 10 4Q 10 1Q 11 QoQ YoY

Voice 1,100.6 1,086.2 990.0 -8.9% -10.0%

Data 348.6 430.5 486.2 12.9% 39.5%

Inter-connection 212.4 175.2 191.1 9.1% -10.0%

Others 72.9 92.2 92.6 0.4% 27.0%

Total 1,734.6 1,784.1 1,760.0 -1.4% 1.5%

Results

Status

(KT only/unit: thousand)

1. Wireless

üContinuing wireless data revenue growth stemmed from expanding smartphonesubscribers

üSecuring competitive edge with broader smartphoneline-ups and stronger 3W network base

?Voice revenue

•Introduction of per-second billing and increasing revenue discount tariff plans led to QoQand YoYrevenue erosion.

?Data revenue

•Expanding smartphonesubscriber base leading to strong data revenue growth(QoQ+12.9%, YoY+39.5%).

•As of end-1Q11, the total smartphonesubscribers stands at 3.8m, 23.5% of the total mobile subscribers.

?Interconnection revenue

•Fell 10% YoYdue to reflection of new interconnection rates.

IFRS/Consolidated

(unit: billion KRW)Mobile subs.(LHS)Churn rate(RHS)

Churn rate (RHS)

Smartphone subs.(LHS)

8 |

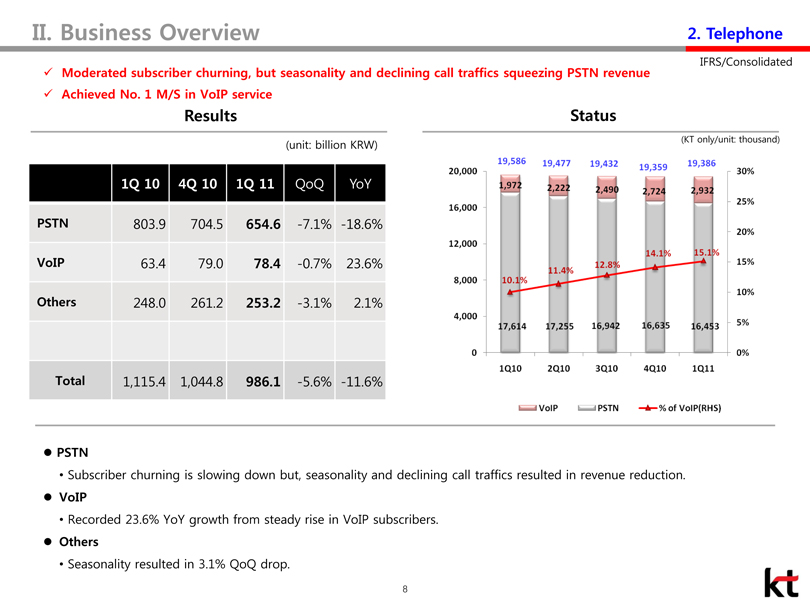

II. Business Overview

Results

Status

üModerated subscriber churning, but seasonality and declining call traffics squeezing PSTN revenue

üAchieved No. 1 M/S in VoIP service

1Q 10 4Q 10 1Q 11 QoQ YoY

PSTN 803.9 704.5 654.6 -7.1% -18.6%

VoIP 63.4 79.0 78.4 -0.7% 23.6%

Others 248.0 261.2 253.2 -3.1% 2.1%

Total 1,115.4 1,044.8 986.1 -5.6% -11.6%

2. Telephone

?PSTN

•Subscriber churning is slowing down but, seasonality and declining call traffics resulted in revenue reduction.

?VoIP

•Recorded 23.6% YoYgrowth from steady rise in VoIP subscribers.

?Others

•Seasonality resulted in 3.1% QoQdrop.

(unit: billion KRW)

(KT only/unit: thousand)

IFRS/Consolidated

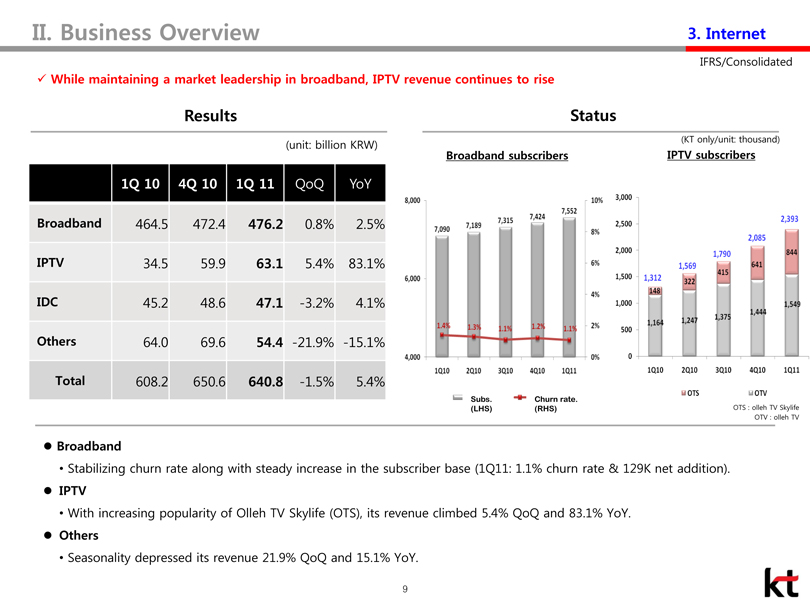

9II. Business OverviewBroadband subscribers

Results

Status

IPTV subscribers

1Q 10 4Q 10 1Q 11 QoQ YoY

Broadband 464.5 472.4 476.2 0.8% 2.5%

IPTV 34.5 59.9 63.1 5.4% 83.1%

IDC 45.2 48.6 47.1 -3.2% 4.1%

Others 64.0 69.6 54.4 -21.9% -15.1%

Total 608.2 650.6 640.8 -1.5% 5.4%

OTS : ollehTV Skylife

OTV : ollehTV

3. Internet

üWhile maintaining a market leadership in broadband, IPTV revenue continues to rise

?Broadband

•Stabilizing churn rate along with steady increase in the subscriber base (1Q11: 1.1% churn rate & 129K net addition).

?IPTV

•With increasing popularity of OllehTV Skylife(OTS), its revenue climbed 5.4% QoQand 83.1% YoY.

?Others

•Seasonality depressed its revenue 21.9% QoQand 15.1% YoY.

IFRS/Consolidated(KT only/unit: thousand)

(unit: billion KRW)

Subs.(LHS)

Churn rate.(RHS)

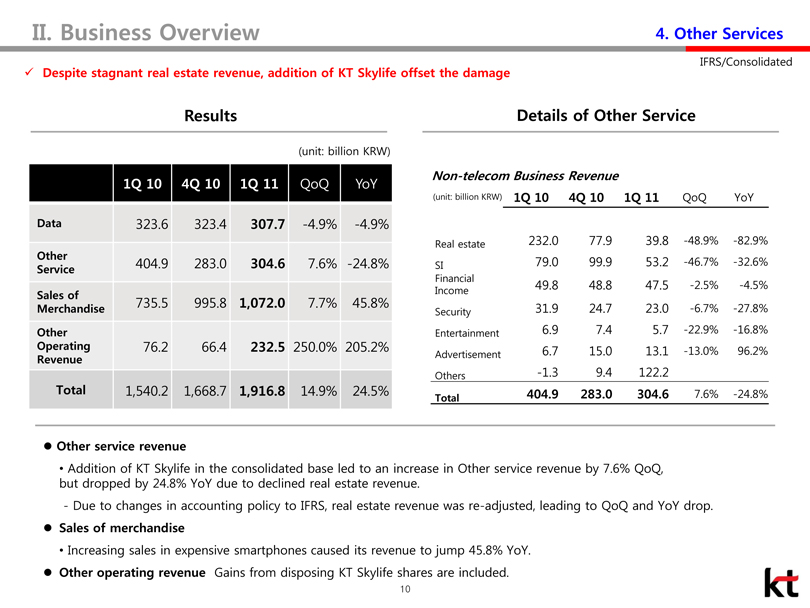

10II. Business Overview

1Q 10 4Q 10 1Q 11 QoQ YoY

Data 323.6 323.4 307.7 -4.9% -4.9%

Other Service 404.9 283.0 304.6 7.6% -24.8%

Sales of Merchandise 735.5 995.8 1,072.0 7.7% 45.8%

Other OperatingRevenue 76.2 66.4 232.5 250.0% 205.2%

Total 1,540.2 1,668.7 1,916.8 14.9% 24.5%

Results

Details of Other Service

Non-telecom Business Revenue

(unit: billion KRW) 1Q 10 4Q 10 1Q 11 QoQ YoY

Realestate 232.0 77.9 39.8 -48.9% -82.9%

SI 79.0 99.9 53.2 -46.7% -32.6%

Financial

Income 49.8 48.8 47.5 -2.5% -4.5%

Security 31.9 24.7 23.0 -6.7% -27.8%

Entertainment 6.9 7.4 5.7 -22.9% -16.8%

Advertisement 6.7 15.0 13.1 -13.0% 96.2%

Others -1.3 9.4 122.2

Total 404.9 283.0 304.6 7.6% -24.8%

4. Other Services

üDespite stagnant real estate revenue, addition of KT Skylifeoffset the damage

?Other service revenue

•Addition of KT Skylifein the consolidated base led to an increase in Other service revenue by 7.6% QoQ, but dropped by 24.8% YoYdue to declined real estate revenue.-Due to changes in accounting policy to IFRS, real estate revenue was re-adjusted, leading to QoQand YoYdrop.

?Sales of merchandise

•Increasing sales in expensive smartphonescaused its revenue to jump45.8% YoY.

?Other operating revenue Gains from disposing KT Skylifeshares are included.

(unit: billion KRW)IFRS/Consolidated

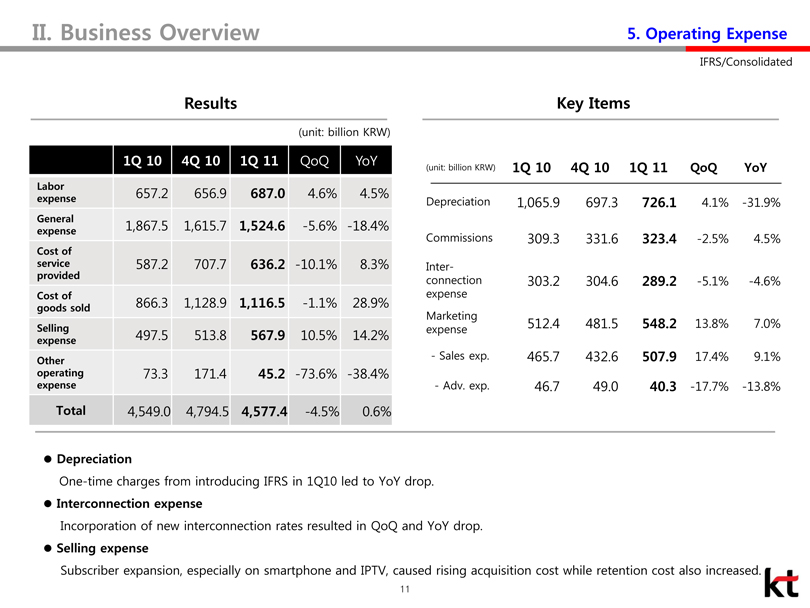

11II. Business Overview

1Q 10 4Q 10 1Q 11 QoQ YoY

Laborexpense 657.2 656.9 687.0 4.6% 4.5%

General expense 1,867.5 1,615.7 1,524.6 -5.6% -18.4%

Cost of serviceprovided 587.2 707.7 636.2 -10.1% 8.3%

Cost of goods sold 866.3 1,128.9 1,116.5 -1.1% 28.9%

Selling expense 497.5 513.8 567.9 10.5% 14.2%

Other operatingexpense 73.3 171.4 45.2 -73.6% -38.4%

Total 4,549.0 4,794.5 4,577.4 -4.5% 0.6%

(unit: billion KRW) 1Q 10 4Q 10 1Q 11 QoQ YoY

Depreciation 1,065.9 697.3 726.1 4.1% -31.9%

Commissions 309.3 331.6 323.4 -2.5% 4.5%

Inter-connection expense 303.2 304.6 289.2 -5.1% -4.6%

Marketingexpense 512.4 481.5 548.2 13.8% 7.0%

-Sales exp.

465.7 | 432.6 507.9 17.4% 9.1% |

-Adv. exp. 46.7 49.0 40.3 -17.7% -13.8%

Results

Key Items

5. Operating Expense

?DepreciationOne-time charges from introducing IFRS in 1Q10 led to YoYdrop.

?Interconnection expenseIncorporation of new interconnection rates resulted in QoQand YoYdrop.

?Selling expenseSubscriber expansion, especially on smartphoneand IPTV, caused rising acquisition cost while retention cost also increased.

(unit: billion KRW)

IFRS/Consolidated

Appendix

III.Appendix

1.Income Statement (Consolidated/Separate)

2.Statement of Financial Position(Consolidated/Separate)

3.Factsheet (Separate)

12

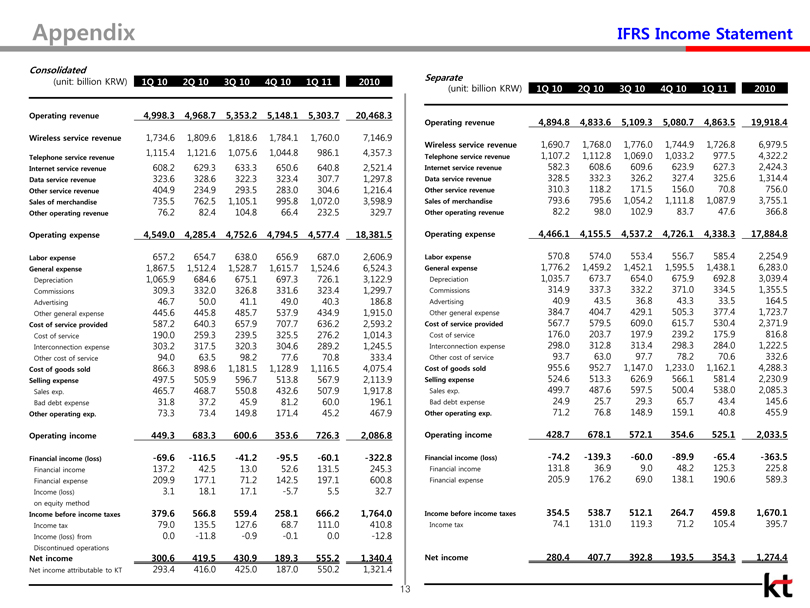

13AppendixIFRS Income Statement

Consolidated

(unit: billion KRW) 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2010

Operatingrevenue 4,998.3 4,968.7 5,353.2 5,148.1 5,303.7 20,468.3

Wireless service revenue 1,734.6 1,809.6 1,818.6 1,784.1 1,760.0 7,146.9

Telephoneservice revenue 1,115.4 1,121.6 1,075.6 1,044.8 986.1 4,357.3

Internetservice revenue 608.2 629.3 633.3 650.6 640.8 2,521.4

Dataservice revenue 323.6 328.6 322.3 323.4 307.7 1,297.8

Other service revenue 404.9 234.9 293.5 283.0 304.6 1,216.4

Sales of merchandise 735.5 762.5 1,105.1 995.8 1,072.0 3,598.9

Other operating revenue 76.2 82.4 104.8 66.4 232.5 329.7

Operating expense 4,549.0 4,285.4 4,752.6 4,794.5 4,577.4 18,381.5

Labor expense 657.2 654.7 638.0 656.9 687.0 2,606.9

Generalexpense 1,867.5 1,512.4 1,528.7 1,615.7 1,524.6 6,524.3

Depreciation 1,065.9 684.6 675.1 697.3 726.1 3,122.9

Commissions 309.3 332.0 326.8 331.6 323.4 1,299.7

Advertising 46.7 50.0 41.1 49.0 40.3 186.8

Othergeneral expense 445.6 445.8 485.7 537.9 434.9 1,915.0

Cost of serviceprovided 587.2 640.3 657.9 707.7 636.2 2,593.2

Cost of service 190.0 259.3 239.5 325.5 276.2 1,014.3

Interconnection expense 303.2 317.5 320.3 304.6 289.2 1,245.5

Other cost of service 94.0 63.5 98.2 77.6 70.8 333.4

Cost of goods sold 866.3 898.6 1,181.5 1,128.9 1,116.5 4,075.4

Selling expense 497.5 505.9 596.7 513.8 567.9 2,113.9

Sales exp. 465.7 468.7 550.8 432.6 507.9 1,917.8

Bad debt expense 31.8 37.2 45.9 81.2 60.0 196.1

Other operating exp. 73.3 73.4 149.8 171.4 45.2 467.9

Operating income 449.3 683.3 600.6 353.6 726.3 2,086.8

Financial income (loss) -69.6 -116.5 -41.2 -95.5 -60.1 -322.8

Financial income 137.2 42.5 13.0 52.6 131.5 245.3

Financial expense 209.9 177.1 71.2 142.5 197.1 600.8

Income (loss) 3.1 18.1 17.1 -5.7 5.5 32.7

on equity method

Income before income taxes 379.6 566.8 559.4 258.1 666.2 1,764.0

Income tax 79.0 135.5 127.6 68.7 111.0 410.8

Income (loss) from 0.0 -11.8 -0.9 -0.1 0.0 -12.8

Discontinued operations

Net income 300.6 419.5 430.9 189.3 555.2 1,340.4

Net income attributable to KT 293.4 416.0 425.0 187.0 550.2 1,321.4

Separate

(unit: billion KRW) 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2010

Operatingrevenue 4,894.8 4,833.6 5,109.3 5,080.7 4,863.5 19,918.4

Wireless service revenue 1,690.7 1,768.0 1,776.0 1,744.9 1,726.8 6,979.5

Telephoneservice revenue 1,107.2 1,112.8 1,069.0 1,033.2 977.5 4,322.2

Internetservice revenue 582.3 608.6 609.6 623.9 627.3 2,424.3

Dataservice revenue 328.5 332.3 326.2 327.4 325.6 1,314.4

Other service revenue 310.3 118.2 171.5 156.0 70.8 756.0

Sales of merchandise 793.6 795.6 1,054.2 1,111.8 1,087.9 3,755.1

Other operating revenue 82.2 98.0 102.9 83.7 47.6 366.8

Operating expense 4,466.1 4,155.5 4,537.2 4,726.1 4,338.3 17,884.8

Labor expense 570.8 574.0 553.4 556.7 585.4 2,254.9

Generalexpense 1,776.2 1,459.2 1,452.1 1,595.5 1,438.1 6,283.0

Depreciation 1,035.7 673.7 654.0 675.9 692.8 3,039.4

Commissions 314.9 337.3 332.2 371.0 334.5 1,355.5

Advertising 40.9 43.5 36.8 43.3 33.5 164.5

Othergeneral expense 384.7 404.7 429.1 505.3 377.4 1,723.7

Cost of serviceprovided 567.7 579.5 609.0 615.7 530.4 2,371.9

Cost of service 176.0 203.7 197.9 239.2 175.9 816.8

Interconnection expense 298.0 312.8 313.4 298.3 284.0 1,222.5

Other cost of service 93.7 63.0 97.7 78.2 70.6 332.6

Cost of goods sold 955.6 952.7 1,147.0 1,233.0 1,162.1 4,288.3

Selling expense 524.6 513.3 626.9 566.1 581.4 2,230.9

Sales exp. 499.7 487.6 597.5 500.4 538.0 2,085.3

Bad debt expense 24.9 25.7 29.3 65.7 43.4 145.6

Other operating exp. 71.2 76.8 148.9 159.1 40.8 455.9

Operating income 428.7 678.1 572.1 354.6 525.1 2,033.5

Financial income (loss) -74.2 -139.3 -60.0 -89.9 -65.4 -363.5

Financial income 131.8 36.9 9.0 48.2 125.3 225.8

Financial expense 205.9 176.2 69.0 138.1 190.6 589.3

Income before income taxes 354.5 538.7 512.1 264.7 459.8 1,670.1

Income tax 74.1 131.0 119.3 71.2 105.4 395.7

Net income 280.4 407.7 392.8 193.5 354.3 1,274.4

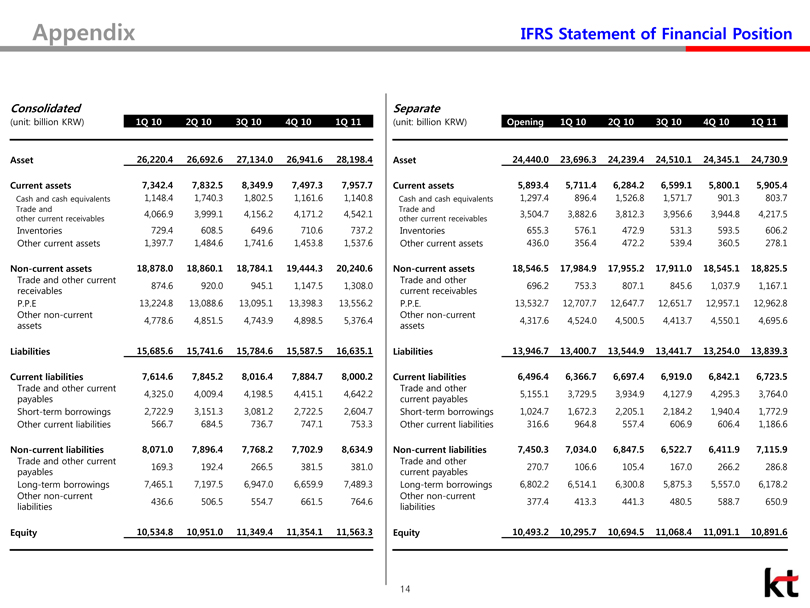

14AppendixIFRS Statement of Financial Position

Consolidated

(unit: billion KRW) 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11

Asset 26,220.4 26,692.6 27,134.0 26,941.6 28,198.4

Current assets 7,342.4 7,832.5 8,349.9 7,497.3 7,957.7

Cash and cash equivalents 1,148.4 1,740.3 1,802.5 1,161.6 1,140.8

Trade and other current receivables 4,066.9 3,999.1 4,156.2 4,171.2 4,542.1

Inventories 729.4 608.5 649.6 710.6 737.2

Other current assets 1,397.7 1,484.6 1,741.6 1,453.8 1,537.6

Non-current assets 18,878.0 18,860.1 18,784.1 19,444.3 20,240.6

Trade and other current receivables 874.6 920.0 945.1 1,147.5 1,308.0

P.P.E 13,224.8 13,088.6 13,095.1 13,398.3 13,556.2

Other non-current assets 4,778.6 4,851.5 4,743.9 4,898.5 5,376.4

Liabilities 15,685.6 15,741.6 15,784.6 15,587.5 16,635.1

Current liabilities 7,614.6 7,845.2 8,016.4 7,884.7 8,000.2

Trade and other current payables 4,325.0 4,009.4 4,198.5 4,415.1 4,642.2

Short-term borrowings 2,722.9 3,151.3 3,081.2 2,722.5 2,604.7

Other current liabilities 566.7 684.5 736.7 747.1 753.3

Non-current liabilities 8,071.0 7,896.4 7,768.2 7,702.9 8,634.9

Trade and other current payables 169.3 192.4 266.5 381.5 381.0

Long-term borrowings 7,465.1 7,197.5 6,947.0 6,659.9 7,489.3

Other non-current liabilities 436.6 506.5 554.7 661.5 764.6

Equity 10,534.8 10,951.0 11,349.4 11,354.1 11,563.3

Separate

(unit: billion KRW) Opening 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11

Asset 24,440.0 23,696.3 24,239.4 24,510.1 24,345.1 24,730.9

Current assets 5,893.4 5,711.4 6,284.2 6,599.1 5,800.1 5,905.4

Cash and cash equivalents 1,297.4 896.4 1,526.8 1,571.7 901.3 803.7

Trade and other current receivables 3,504.7 3,882.6 3,812.3 3,956.6 3,944.8 4,217.5

Inventories 655.3 576.1 472.9 531.3 593.5 606.2

Other current assets 436.0 356.4 472.2 539.4 360.5 278.1

Non-current assets 18,546.5 17,984.9 17,955.2 17,911.0 18,545.1 18,825.5

Trade and other current receivables 696.2 753.3 807.1 845.6 1,037.9 1,167.1

P.P.E. 13,532.7 12,707.7 12,647.7 12,651.7 12,957.1 12,962.8

Other non-current assets 4,317.6 4,524.0 4,500.5 4,413.7 4,550.1 4,695.6

Liabilities 13,946.7 13,400.7 13,544.9 13,441.7 13,254.0 13,839.3

Current liabilities 6,496.4 6,366.7 6,697.4 6,919.0 6,842.1 6,723.5

Trade and other current payables 5,155.1 3,729.5 3,934.9 4,127.9 4,295.3 3,764.0

Short-term borrowings 1,024.7 1,672.3 2,205.1 2,184.2 1,940.4 1,772.9

Other current liabilities 316.6 964.8 557.4 606.9 606.4 1,186.6

Non-current liabilities 7,450.3 7,034.0 6,847.5 6,522.7 6,411.9 7,115.9

Trade and other current payables 270.7 106.6 105.4 167.0 266.2 286.8

Long-term borrowings 6,802.2 6,514.1 6,300.8 5,875.3 5,557.0 6,178.2

Other non-current liabilities 377.4 413.3 441.3 480.5 588.7 650.9

Equity 10,493.2 10,295.7 10,694.5 11,068.4 11,091.1 10,891.6

15

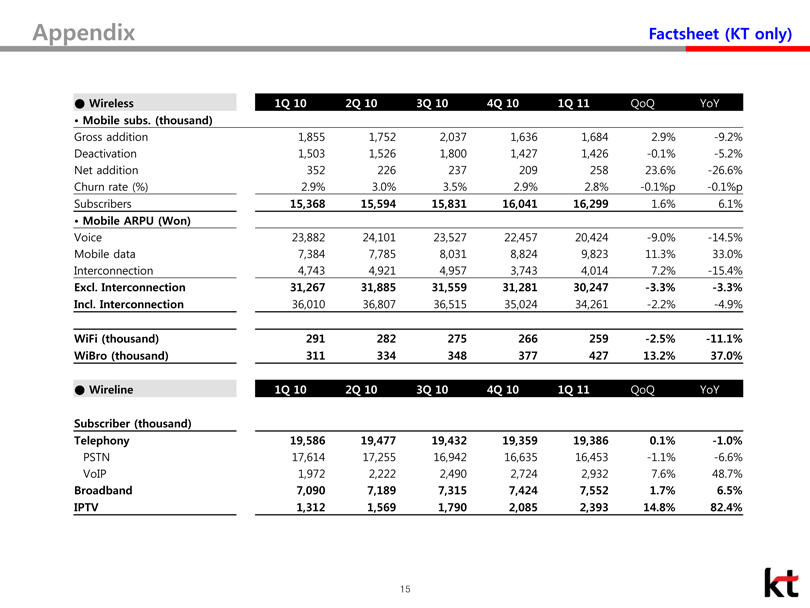

AppendixFactsheet (KT only)

•Wireless 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 QoQ YoY

• Mobilesubs. (thousand)

Grossaddition 1,855 1,752 2,037 1,636 1,684 2.9% -9.2%

Deactivation 1,503 1,526 1,800 1,427 1,426 -0.1% -5.2%

Netaddition 352 226 237 209 258 23.6% -26.6%

Churnrate(%) 2.9% 3.0% 3.5% 2.9% 2.8% -0.1%p -0.1%p

Subscribers 15,368 15,594 15,831 16,041 16,299 1.6% 6.1%

• MobileARPU (Won)

Voice 23,882 24,101 23,527 22,457 20,424 -9.0% -14.5%

Mobile data 7,384 7,785 8,031 8,824 9,823 11.3% 33.0%

Interconnection 4,743 4,921 4,957 3,743 4,014 7.2% -15.4%

Excl. Interconnection 31,267 31,885 31,559 31,281 30,247 -3.3% -3.3%

Incl. Interconnection 36,010 36,807 36,515 35,024 34,261 -2.2% -4.9%

WiFi(thousand) 291 282 275 266 259 -2.5% -11.1%

WiBro(thousand) 311 334 348 377 427 13.2% 37.0%

•Wireline 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 QoQ YoY

Subscriber(thousand)

Telephony 19,586 19,477 19,432 19,359 19,386 0.1% -1.0%

PSTN 17,614 17,255 16,942 16,635 16,453 -1.1% -6.6%

VoIP 1,972 2,222 2,490 2,724 2,932 7.6% 48.7%

Broadband 7,090 7,189 7,315 7,424 7,552 1.7% 6.5%

IPTV 1,312 1,569 1,790 2,085 2,393 14.8% 82.4%