- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K/A Filing

KT (KT) 6-K/ACurrent report (foreign) (amended)

Filed: 27 Mar 23, 1:53pm

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2023

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

90, Buljeong-ro,

Bundang-gu, Seongnam-si,

Gyeonggi-do,

Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☑

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _______________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: March 27, 2023 | ||

| KT Corporation | ||

| By: | /s/ Seunghoon Chi | |

| Name: Seunghoon Chi | ||

| Title: Vice President | ||

| By: | /s/ Sanghyun Cho | |

| Name: Sanghyun Cho | ||

| Title: Director | ||

Explanatory Note

This Form 6-K/A is being filed to amend KT Corporation’s amended filing of Form 6-K/A on March 10, 2023 related to its Notice of the 41st Annual General Meeting of Shareholders. KT Corporation is further amending its Agenda No. 1 (Election of Representative Director) to delete election of Mr. Yun since he resigned as a candidate for personal reason on March 27, 2023. Pursuant to Articles of Incorporation of the company, Agenda No. 4-1 (Election of Inside Director Candidate) and 4-2 (Election of Inside Director Candidate) will be discarded due to invalidation of the recommendation of the candidacy for inside director. Additionally, Agenda 7 (Employment Contract for the Representative Director) will be discarded due to the resignation of the Representative Director Candidate.

Notice of the 41st Annual General Meeting of Shareholders

| * | To be presented at the meeting |

2

Notice of the Annual General Meeting of Shareholders

March 8, 2023

To our Shareholders,

KT Corporation will be holding the 41st Annual General Meeting of Shareholders (“the Meeting”) on March 31st, 2023.

At the Meeting, “Matters to be Report” will present information on the Company’s performance as well as material issues worth noting for FY2022. Agenda items including the election of Executive directors will be submitted for shareholders’ approval.

Holders of KT Corporation’s common stock as of the close of business on December 31, 2022 will be entitled to exercise voting rights at the Meeting. Each common stock is entitled to one vote for the election of each director position and one vote for each of the other agendas.

KT Corporation would like to thank our shareholders for their continued investment and support. The Company understands that shareholders consider a range of matters before submitting their vote. We hope that our shareholders will find the information in the Convocation Notice helpful to make an informed voting decision.

We invite you to attend our upcoming Annual General Meeting on Friday March 31st, 2023. We wish you good health and look forward to your participation.

Hyeon-Mo Ku

Chief Executive Officer

| • | Date and Time: Friday, March 31st 2023 at 9:00 a.m. (local time) |

| • | Place: Lecture Hall (2F) of KT Corporation’s R&D Center located at 151 Taebong-ro, Seocho-gu, Seoul, Korea |

| • | Record Date: December 31, 2022 |

3

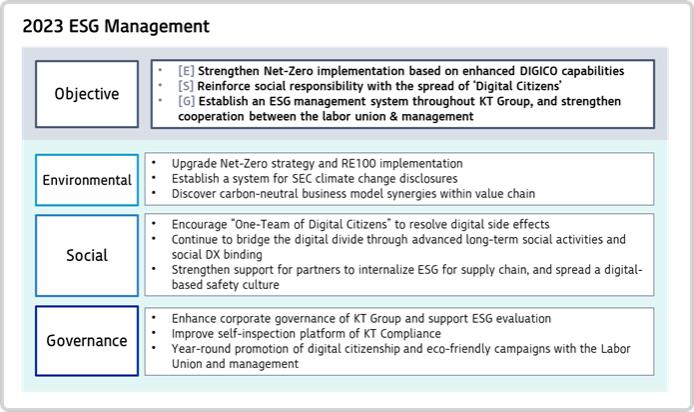

[2023 ESG(Environmental)]

Strengthen Net-Zero implementation based on enhanced DIGICO capabilities

| 1. | Upgrade Net-Zero strategy and RE100 implementation |

| • | Reestablish mid to long-term carbon neutral strategy |

| • | Reinforce execution to achieve RE100 |

| • | Establish a system for climate change disclosures |

| 2. | Reinforcing partners for the internalization of ESG supply chain |

| • | Expand recycle business for rental mobiles |

| • | Establish a network cable/device renewing cycle |

| • | Operate a customer-oriented carbon-neutral platform |

4

[2023 ESG(Social)]

Strengthening social responsibility by spreading digital citizenship

| 1. | Activation of One-Team digital citizenship |

| • | Establishment of the education infrastructure and expansion of education opportunities |

| • | Finding and expansion of the Digital Clean Tech |

| • | Support digital victims for the recovery of daily lives |

| 2. | Reinforcing partners for the internalization of ESG supply chain |

| • | Support overall partners for the evaluation of ESG |

| • | Intensive ESG consulting to be conducted for major 20 partners and minor 20 partners |

| 3. | Continuous resolution of the digital gap through DX linkage |

| • | Advancement of the longterm social contributoin activities incorporating DIGICO technology |

| • | Bolster accompanying with the socially disabled, utilizing govermental·municipal public budgets |

| • | Promotion of nationwide sharing activities using APP developed by KT |

| 4. | Digital based safety management and spread of the safety culture |

| • | Establish a safety first culture among KT, subsidiaries, and partners |

| • | Systemize safety management system for the potential risk of serious disasters |

| • | Introduce smart safety equipements and strengthen safety education |

[2023 ESG(Governance)]

Establishment of the KT Group ESG management system and reinforcement of the cooperation between the labor union and the management

| 1. | Enhancement KT group’s governance and compliance |

| • | Upgrade of KT compliance self-inspection platform |

| • | Conduct dedicated compliance diagnosis for the domestic and global subsidiary companies |

| • | Improve governance of the listed group companies and support external ESG assessments |

| 2. | Joint ESG management of the labor union and the management, and inspiration of the employees’ pride |

| • | Environmental campaign by the labor union and the management |

| • | ESG activities using GenieVerse(KT metaverse) |

| • | Campaign to spread digital citizenship |

5

[Enhancement of Compliance System]

<System>

| • | Established the Compliance Committee and recruited outside expert as Chair of Compliance(April 2020) |

| • | Created compliance supporting group and regional HQs’ compliance teams |

| • | Revised operating standards for the expenses, strengthened internal control including improvement of the security management system, and enacted a code of conduct to prevent corruption |

<Infra>

| • | Established the Compliance Platform to systemize compliance-related management such as self-inspection, and awareness enhancement(March 2020) |

| • | Expanded the Compliance Platform to the Group level |

<Education>

| • | CEO’s continuous message of compliance control fostered the consensus to establish a compliance culture |

| • | 290 times training session conducted for 317k employees in KT group for the past 3 years |

| • | Quarterly Compliance Day Education conducted via Compliance Platform |

6

Business Report for the 41st Fiscal Year

Pursuant to Article 447-2(Preparation of Business Report) and Article 449 of the Commercial Act (Approval and Public Notice of Financial statements, etc.), KT’s 41st annual business report is as follows:

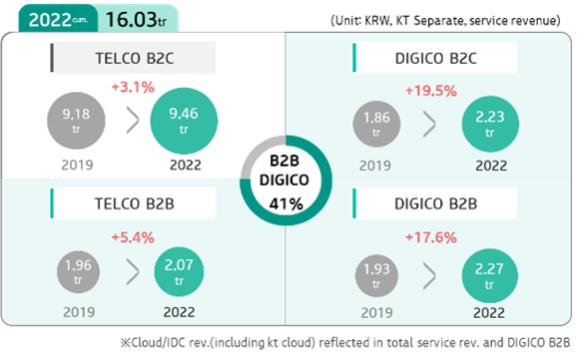

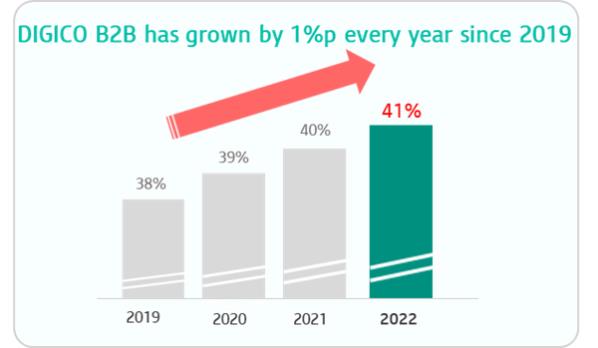

The year 2022 marked the 3rd year since declaring transformation into a digital platform company (DIGICO), expanding business playgrounds and building a foundation for structural growth.

The telco business continued to show robust growth, and the DIGICO/B2B businesses showed accelerated growth. Moreover, KT Corporation (“the Company”) has firmly established a Group business portfolio around finance, media and contents, and real estate. (B2B+DIGICO portion accounts for 41 % of KT’s separate service revenue in FY22.)

In the B2B sector, revenue uptrend in Corp. line continued, and AI/DX businesses such as AICC began to see increases in the top-line. For Cloud/IDC business, the Company established a special entity ‘kt cloud’ on April 1st to strengthen the competitiveness. In media and contents business, following the success of our original content <Extraordinary Attorney Woo>, in December, KT and CJ ENM merged their respective OTT businesses, Seezn and Tving. Consequently, the Company rapidly secured the competitiveness for becoming a local top-tier OTT player. In finance, the business performance of BC Card has improved, following the recovery of domestic consumption from COVID-19 peak-out. K bank has also seen all indicators uptrend including loans/deposits/subscribers widening its profit since it began to make profits in the second quarter of 2021.

As of the end of 2022, the number of 5G subscribers reached 8.45 million, which is about 62% of total handset subscribers. Due to the increased demand for high quality of internet service, the sales portion of GiGA internet has been expanded, and IPTV business has initiated “home media era” reinventing its brand as ‘Genie TV’ from “olleh TV” and introducing AI-based media portal service.

KT Corporation has prepared its financial statements in accordance with K-IFRS. On a separate basis, the Company recorded a total operating revenue of KRW 18,289.3 billion, operating income of KRW 1,168.1 billion and net income of KRW 763.8 billion in FY2022.

8

9

Report on Evaluation Results of Management Performance for the 41st Fiscal Year

Pursuant to Article 34 (Execution of Employment Contract with the Representative Director), evaluations results for Representative Directors performance shall be reported at the Meeting as described below.

The Evaluation and Compensation Committee has reviewed management’s performance for FY2022. The following table summarizes annual KPI and evaluation results for the Representative Director’s short-term performance.

Annual KPI | Weight | Score | ||||||||

Quantitative KPI | - Service Revenue of KT Corporation - Revenue Generated from DIGICO/B2B Business - Operating Income of KT Corporation | 65 | % | 64.87 | ||||||

Qualitative KPI | - Accelerating Growth with ‘DIGICO’ - Enhancing Group Value and - Strengthening Customer Trust in KT | 35 | % | 34.50 | ||||||

|

|

|

| |||||||

Total | 100 | % | 99.37 | |||||||

|

|

|

| |||||||

10

Report on Standards and Method of Payment for Remuneration of Directors

Pursuant to Article 31 (Remuneration and Severance Allowance for Directors) of the KT’s Articles of Incorporation, the criteria in place to determine the remuneration for executive directors and the method of payment are reported as follows:

For clarification, executive director refers to an inside director, whereas non-executive director represents an outside director.

| • | Summary of Executive Compensation Program |

The Company’s Executive Compensation program is designed to reward both short-term and long-term performances of management. The Company believes it is critical to maintain a well-balanced incentive program that encourages the management not only to achieve short-term performance, but also to strive for the Company’s long-term value enhancement. The Company operates the Evaluation and Compensation Committee, which dictates annual goals and conducts performance evaluation of the management on an annual basis. The Evaluation and Compensation Committee is also comprised of only outside directors in order to maintain objectivity and fairness of the program. Despite the existing norm among Korean companies do not disclose such standards and methods, the Company not only discloses but also reports such information to the AGM in order to guarantee transparency in executive compensation.

| • | Components of Executive Compensation |

The remuneration for executive officers consists of annual salary, short-term performance based incentives, long-term performance based incentives, severance package.

The annual salary is further separated into two major factors — base salary and payment for the responsibility of office. Compensation shall be made on a monthly basis at an amount equivalent to one-twelfth of the annual salary.

Short-term performance based incentives are paid in cash. The amount varies in accordance with each director’s result of performance evaluation by the Evaluation and Compensation Committee. Specific payment schemes related to short-term incentives are as follows:

| • | Representative Director : 0~180% of base salary |

| • | Other Inside Directors : 0~140% of base salary |

11

Long-term performance based incentives are paid in the form of a stock grant with a lock-up period of three years. The amount is determined based on TSR (Total Shareholder’s Return), Group EBITDA and Group Revenue. Specific payment schemes related to long-term incentives are as follows:

| • | Representative Director : 0~140% of base salary |

| • | Other Inside Directors : 0~95% of base salary |

Severance payment is calculated using the following formulas:

| • | Representative Director : |

(Average monthly salary) x (number of years in service) x (5)

| • | Other Inside Directors : |

(Average monthly salary) x (number of years in service) x (3)

Fringe benefits are paid in accordance with relevant standards.

| • | Criteria for Evaluation |

The Company’s performance evaluation process begins with the setting up of annual goals by the Evaluation and Compensation Committee. Annual goals are established in alignment with the Company’s overall operational and financial goals and the ultimate goal of improving shareholders’ value.

Short-term Performance

Short-term performance is comprised of quantitative and qualitative factors. Typically, quantitative goals are related to financial and operational performances, whereas qualitative goals are focused on achieving operational and strategic goals to further enhance long-term competitiveness. Weighted Key Performance Index (KPI) is in place to assess annual short-term performance. Please refer to “Report on Evaluation Results of Management Performance for the 41th Fiscal Year” for results of the Representative Director’s short-term performance for FY2022.

Long-term Performance

Long-term performance incentives are provided to reward management’s contribution to long-term financial and operational competitiveness. Incentive are offered in accordance with TSR (Total Shareholder Return), Group EBITDA and Group Revenue; each factor has a weight of 20%, 40% and 40% respectively. TSR is computed by the relative performance of the Company’s TSR against the TSR of KOSPI and other domestic telecommunication service providers. The following illustrates the formulas for TSR, Group EBITDA and Group Revenue:

| • | TSR : Share Price Return + Shareholders Return (Dividend and Share Retirement) |

| • | TSR Result : 100% + {KT’s TSR – (Domestic Telco’s TSR x 80% + KOSPI TSR x 20%)} |

| • | Group EBITDA : Operating profit + Depreciation & Amortization |

| • | Group Revenue : Consolidated revenue |

12

| • | Compensation for Outside Directors |

Until February 2010, the Company had no incentive based compensation program for outside directors. Instead, fixed amounts of compensation were paid to outside directors as allowances to execute their respective duties. However, the BoD introduced a new compensation program for outside directors in March 2010. The program consists of cash and stock grant in which stock grant requires a one year of lock-up period. The total remuneration for outside directors for FY2022 was recorded at KRW million. The stock grant will be offered in FY2023

| • | Summary of Total Compensation |

1) Compensation Paid to Directors

(KRW millions)

Year | Inside Directors | Outside Directors | Total | |||||||||||||||||

| Total | Average | Total | Average | |||||||||||||||||

2020 | 6,680 | 2,227 | 764 | 96 | 7,444 | |||||||||||||||

2021 | 4,979 | 1,660 | 827 | 103 | 5,806 | |||||||||||||||

2021 excl. severance pay | 3,439 | 1,146 | 827 | 103 | 4,266 | |||||||||||||||

2022 | 2,994 | 1,497 | 786 | 98 | 3,780 | |||||||||||||||

| * | The amount above represents actual cash payments executed each FY. |

| * | The amount includes severance pay for former-inside directors following the Severance Pay Regulations for Executives. |

| * | FY2021 severance pay for former-inside director Mr. Yoon-Young Park (13.32 years of service) was KRW 1,540 million |

| * | From FY2020 to FY2021, the compensation was paid to three inside directors and eight outside directors; In FY2022, the compensation was paid to two inside directors and eight outside directors. |

2) Comparison between total compensation paid and ceiling amounts on remuneration approved at the Annual General Meeting of Shareholders.

(KRW millions)

Year | Total Compensation(A) | Ceiling Amount on Remuneration(B)* | Payment Ratio(A/B) | |||||||||

2020 | 7,444 | 5,800 | 128.3 | % | ||||||||

2021 | 5,806 | 5,800 | 100.1 | % | ||||||||

2021 excl. severance pay | 4,266 | 5,800 | 73.6 | % | ||||||||

2022 | 3,780 | 5,800 | 65.2 | % | ||||||||

| * | Maximum amounts of remuneration allowed per accrual basis |

13

Ceiling amount on remuneration for Directors for the year 2023 is proposed at the BoD meeting on March 8, 2023. Following the board’s resolution, proposed cap will be voted at the upcoming AGM. For further details, please refer to the Agenda No.6 – Approval of Ceiling Amount on Remuneration for Directors.

| • | Share Ownership of Directors |

Inside directors can make personal decisions to purchase KT shares from the market. In addition, inside directors are also rewarded with stock grants as long-term performance incentives based on the TSR, Group EBITDA and Group Revenue formulas described above. Such grants are subject to a lock-up period of three years.

The following table represents current inside directors’ ownership of KT shares as of December 31, 2022.

Full Name | Number of Shares | |||

Hyeon-Mo Ku | 36,571 | |||

Kyung-Lim Yun | 1,100 | |||

Outside directors are also rewarded with stock grant with a lock-up period of one year. The following table represents current outside directors’ ownership of KT shares as of December 31, 2022.

Full Name | Number of Shares | |||

Dae-You Kim | 1,979 | |||

Gang-Cheol Lee | 1,892 | |||

Hee-Yol Yu | 1,421 | |||

Chung-Gu Kang | 949 | |||

Eun-Jung Yeo | 949 | |||

Hyun-Myung Pyo | 11,633 | |||

Yong-Hun Kim | — | |||

Benjamin Hong | — | |||

| * | Mr. Gang-Cheol Lee resigned from the outside director as of 12 January 2023. |

| * | Mr. Benjamin Hong resigned from the outside director as of 6 March 2023. |

14

General Information for Voting

| • | Number and Classification of Voting Shares |

The record date to exercise voting rights at the AGM is December 31, 2022. As of the record date, the total number of KT shares issued was 261,111,808. The number of common shares, excluding treasury shares, entitled to exercise voting rights was 256,042,678 shares.

| • | Method of Resolution |

Pursuant to the provisions of the Commercial Act, Agenda No. 1, 2, 4, 5, 6, 7, and 8 shall be passed by a majority of the votes cast by the shareholders present at the meeting and at least one-fourth of the total shares that are entitled to vote. However, in which voting rights can be exercised electronically, Agenda No. 5 shall be passed with the approval of a majority vote of the shareholders present at the meeting is obtained. Agenda No. 3 shall be passed by at least two-thirds of the votes cast by the shareholders present at the meeting and at least one-third of total shares entitled to vote.

| • | Limit on Exercising Voting Rights for Election of the Members of the Audit Committee |

The Article 409 of the Commercial Act stipulates that any shareholder who holds more than 3% of the total issued shares with voting rights may not exercise his or her vote in respect of such excess shares beyond the “3% limit” when exercising voting rights with respect to election of Member of the Audit Committee(Agenda No. 5). Please note that the shareholders who own more than 3% of KT’s voting shares, equivalent to 7,681,280 shares, are not entitled to exercise any voting rights exceeding the “3% limit”.

15

Report on Transaction with Major Stakeholders

Pursuant to Article 542-9 of the Commercial Code (Transaction with the stakeholders, including major shareholders, etc.), such transaction for the period shall be reported at the Meeting as described below.

Background Information

The following transaction involves an outsourcing contract with an affiliated subsidiary specialized in the IT field.

Summary of Transaction

| 1. | Purpose: |

| • | To secure provision of high-quality IT related services from KT ds |

| • | To achieve cost efficiency by leveraging core competency of KT ds |

| 2. | Counterparty: KT ds |

| 3. | Contract Amount |

| • | Fixed(Flat) Amount : KRW 6,576 billion |

| • | Variable Amount : KRW 1,773 billion (ITO increase expected by the establishment of new technology fields and the development of new services) |

| 4. | Contract Period |

| • | January 2023 ~ December 2025 (3 Years) |

16

Approval of Financial Statements for the 41st Fiscal Year

Pursuant to Article 449 of the Commercial Act (Approval and Public Notice of Financial Statements), approval of the financial statements for the 41th fiscal year is hereby requested.

Background Information

Subsequent pages include only financial statements for both consolidated and separate bases. The financial statements have been audited by an independent auditor. On March 8, 2023, a full copy of the Independent Auditor’s Report, including opinion pages and a report on ICOFR*, was uploaded to KT’s website(https://corp.kt.com/eng/html/investors/financial/audit_01.html , IR Audit Report), and will be filed with SEC as a Form 6-K on March 9, 2023. Financial notes is also included in the Independent Auditor’s Report and should be read in conjunction with financial statements.

* ICOFR : Internal Controls over Financial Reporting

19

KT Corporation and Subsidiaries

Consolidated Statements of Financial Position

Years Ended December 31, 2022 and 2021

| (in millions of Korean won) | Notes | December 31, 2022 | December 31, 2021 | |||||||||

Assets | ||||||||||||

Current assets | ||||||||||||

Cash and cash equivalents | 4,5,38 | |||||||||||

Trade and other receivables, net | 4,6,38 | 6,098,072 | 5,087,490 | |||||||||

Other financial assets | 4,7,38 | 1,322,452 | 1,185,659 | |||||||||

Current income tax assets | 1,543 | 5,954 | ||||||||||

Inventories, net | 8 | 709,191 | 514,145 | |||||||||

Current assets held-for-sale | 10 | — | 1,187 | |||||||||

Other current assets | 9 | 2,101,212 | 2,044,323 | |||||||||

|

|

|

| |||||||||

Total current assets | 12,681,532 | 11,858,350 | ||||||||||

|

|

|

| |||||||||

Non-current assets | ||||||||||||

Trade and other receivables, net | 4,6,38 | 1,491,046 | 1,091,326 | |||||||||

Other financial assets | 4,7,38 | 2,501,484 | 822,379 | |||||||||

Property and equipment, net | 11 | 14,772,179 | 14,464,886 | |||||||||

Right-of-use assets | 21 | 1,280,334 | 1,248,308 | |||||||||

Investment properties, net | 12,38 | 1,933,358 | 1,720,654 | |||||||||

Intangible assets, net | 13 | 3,129,833 | 3,447,333 | |||||||||

Investments in associates and joint ventures | 14 | 1,480,722 | 1,288,429 | |||||||||

Deferred income tax assets | 30 | 578,443 | 423,728 | |||||||||

Net defined benefit assets | 18 | 311,142 | 17,585 | |||||||||

Other non-current assets | 9 | 820,608 | 776,363 | |||||||||

|

|

|

| |||||||||

Total non-current assets | 28,299,149 | 25,300,991 | ||||||||||

|

|

|

| |||||||||

Total assets | ||||||||||||

|

|

|

| |||||||||

20

KT Corporation and Subsidiaries

Consolidated Statements of Financial Position

Years Ended December 31, 2022 and 2021

| (in millions of Korean won) | Notes | December 31, 2022 | December 31, 2021 | |||||||||

Liabilities | ||||||||||||

Current liabilities | ||||||||||||

Trade and other payables | 4,15,38 | |||||||||||

Borrowings | 4,16,38 | 1,827,042 | 1,731,422 | |||||||||

Other financial liabilities | 4,7,38 | 8,791 | 72,807 | |||||||||

Current income tax liabilities | 232,382 | 266,430 | ||||||||||

Other provisions | 17 | 109,133 | 171,316 | |||||||||

Deferred income | 26 | 55,737 | 64,742 | |||||||||

Other current liabilities | 9 | 1,133,018 | 1,124,293 | |||||||||

|

|

|

| |||||||||

Total current liabilities | 10,699,268 | 10,072,432 | ||||||||||

|

|

|

| |||||||||

Non-current liabilities | ||||||||||||

Trade and other payables | 4,15,38 | 1,064,099 | 1,338,781 | |||||||||

Borrowings | 4,16,38 | 8,179,643 | 6,706,281 | |||||||||

Other financial liabilities | 4,7,38 | 412,650 | 424,859 | |||||||||

Net defined benefit liabilities | 18 | 51,654 | 197,883 | |||||||||

Other provisions | 17 | 91,233 | 86,081 | |||||||||

Deferred income | 26 | 165,186 | 194,309 | |||||||||

Deferred income tax liabilities | 30 | 967,650 | 643,958 | |||||||||

Other non-current liabilities | 9 | 934,575 | 927,596 | |||||||||

|

|

|

| |||||||||

Total non-current liabilities | 11,866,690 | 10,519,748 | ||||||||||

|

|

|

| |||||||||

Total liabilities | 22,565,958 | 20,592,180 | ||||||||||

|

|

|

| |||||||||

Equity attribute to owners of the Controlling Company | ||||||||||||

Share capital | 22 | 1,564,499 | 1,564,499 | |||||||||

Share premium | 1,440,258 | 1,440,258 | ||||||||||

Retained earnings | 23 | 14,257,343 | 13,287,390 | |||||||||

Accumulated other comprehensive income | 24 | (77,776 | ) | 117,469 | ||||||||

Other components of equity | 24 | (572,152 | ) | (1,433,080 | ) | |||||||

|

|

|

| |||||||||

| 16,612,172 | 14,976,536 | |||||||||||

Non-controlling interest | 1,802,551 | 1,590,625 | ||||||||||

|

|

|

| |||||||||

Total equity | 18,414,723 | 16,567,161 | ||||||||||

|

|

|

| |||||||||

Total liabilities and equity | ||||||||||||

|

|

|

| |||||||||

The above consolidated statements of financial position should be read in conjunction with the accompanying notes.

21

KT Corporation and Subsidiaries

Consolidated Statements of Profit or Loss

Years Ended December 31, 2022 and 2021

| (in millions of Korean won, except per share amounts) | Notes | 2022 | 2021 | |||||||||

Operating revenue | 26 | |||||||||||

Operating expenses | 27 | 23,959,923 | 23,226,181 | |||||||||

|

|

|

| |||||||||

Operating profit | 1,690,088 | 1,671,824 | ||||||||||

Other income | 28 | 595,351 | 307,654 | |||||||||

Other expenses | 28 | 314,607 | 280,081 | |||||||||

Finance income | 29 | 690,428 | 726,283 | |||||||||

Finance costs | 29 | 749,908 | 563,330 | |||||||||

Share of net losses of associates and joint ventures | 14 | (17,285 | ) | 116,061 | ||||||||

|

|

|

| |||||||||

Profit before income tax expense | 1,894,067 | 1,978,411 | ||||||||||

Income tax expense | 30 | 506,404 | 519,016 | |||||||||

|

|

|

| |||||||||

Profit for the year | ||||||||||||

|

|

|

| |||||||||

Profit for the year attributable to: | ||||||||||||

Owners of the Controlling Company: | ||||||||||||

Non-controlling interest: | 125,165 | 102,517 | ||||||||||

Earnings per share attributable to the equity holders of the Controlling Company during the year (in Korean won): | 31 | |||||||||||

Basic earnings per share | ||||||||||||

Diluted earnings per share | 5,205 | 5,747 | ||||||||||

The above consolidated statements of profit or loss should be read in conjunction with the accompanying notes.

22

KT Corporation and Subsidiaries

Consolidated Statements of Comprehensive Income

Years Ended December 31, 2022 and 2021

| (in millions of Korean won) | Notes | 2022 | 2021 | |||||||||

Profit for the year | ||||||||||||

|

|

|

| |||||||||

Other comprehensive income | ||||||||||||

Items that will not be reclassified to profit or loss: | ||||||||||||

Remeasurements of net defined benefit liabilities | 18 | 181,429 | 55,822 | |||||||||

Share of remeasurement loss of associates and joint ventures | (332 | ) | (1,596 | ) | ||||||||

Gain (loss) on valuation of equity instruments | (141,944 | ) | 144,890 | |||||||||

at fair value through other comprehensive income | ||||||||||||

Items that may be subsequently reclassified to profit or loss: | ||||||||||||

Loss on valuation of debt instruments at fair value through other comprehensive income | (16,630 | ) | (15,110 | ) | ||||||||

Valuation gain on cash flow hedge | 64,091 | 141,855 | ||||||||||

Other comprehensive loss from cash flow hedges reclassified to profit or loss | (95,421 | ) | (136,583 | ) | ||||||||

Share of other comprehensive loss from associates and joint ventures | (10,851 | ) | (24,216 | ) | ||||||||

Exchange differences on translation of foreign operations | 17,464 | 505 | ||||||||||

|

|

|

| |||||||||

Total comprehensive income for the year | ||||||||||||

|

|

|

| |||||||||

Total comprehensive income for the year attributable to: | ||||||||||||

Owners of the Controlling Company | ||||||||||||

Non-controlling interest | 148,790 | 114,589 | ||||||||||

The above consolidated statements of comprehensive income should be read in conjunction with the accompanying notes.

23

KT Corporation and Subsidiaries

Consolidated Statements of Changes in Equity

Years Ended December 31, 2022 and 2021

| Attributable to owners of the Controlling Company | ||||||||||||||||||||||||||||||||||||

| (in millions of Korean won) | Notes | Share capital | Share premium | Retained earnings | Accumulated other comprehensive income | Other components of equity | Total | Non-controlling interest | Total equity | |||||||||||||||||||||||||||

Balance as at January 1, 2021 | ||||||||||||||||||||||||||||||||||||

Comprehensive income | ||||||||||||||||||||||||||||||||||||

Profit for the year | — | — | 1,356,878 | — | — | 1,356,878 | 102,517 | 1,459,395 | ||||||||||||||||||||||||||||

Remeasurements of net defined benefit liabilities | 18 | — | — | 47,348 | — | — | 47,348 | 8,474 | 55,822 | |||||||||||||||||||||||||||

Share of gain on remeasurements of associates | — | — | (1,559 | ) | — | — | (1,559 | ) | (37 | ) | (1,596 | ) | ||||||||||||||||||||||||

Share of other comprehensive loss of associates | — | — | — | (19,718 | ) | — | (19,718 | ) | (4,498 | ) | (24,216 | ) | ||||||||||||||||||||||||

Valuation gain on cash flow hedge | 4,7 | — | — | — | 5,222 | — | 5,222 | 50 | 5,272 | |||||||||||||||||||||||||||

Gain on valuation of financial instruments at fair value | 4,7 | — | — | 76,288 | 47,247 | — | 123,535 | 6,245 | 129,780 | |||||||||||||||||||||||||||

Exchange differences on translation of foreign operations | — | — | — | (1,333 | ) | — | (1,333 | ) | 1,838 | 505 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total comprehensive income for the year | — | — | 1,478,955 | 31,418 | — | 1,510,373 | 114,589 | 1,624,962 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Transactions with owners | ||||||||||||||||||||||||||||||||||||

Dividends paid by the Controlling Company | — | — | (326,487 | ) | — | — | (326,487 | ) | — | (326,487 | ) | |||||||||||||||||||||||||

Dividends paid to non-controlling interest of subsidiaries | — | — | — | — | — | — | (23,762 | ) | (23,762 | ) | ||||||||||||||||||||||||||

Effect of change in connection range | — | — | — | — | — | — | (17,566 | ) | (17,566 | ) | ||||||||||||||||||||||||||

Change in ownership interest in subsidiaries | — | — | — | — | 15,797 | 15,797 | (22,620 | ) | (6,823 | ) | ||||||||||||||||||||||||||

Appropriations of loss on disposal of treasury stock | — | — | (20,498 | ) | — | 20,498 | — | — | — | |||||||||||||||||||||||||||

Acquisition of treasury stock | — | — | — | — | (190,105 | ) | (190,105 | ) | — | (190,105 | ) | |||||||||||||||||||||||||

Disposal of treasury stock | — | — | — | — | 50,954 | 50,954 | — | 50,954 | ||||||||||||||||||||||||||||

Recognition of the obligation to purchase its own equity | — | — | — | — | (101,829 | ) | (101,829 | ) | — | (101,829 | ) | |||||||||||||||||||||||||

Others | — | — | — | — | 6,389 | 6,389 | (5 | ) | 6,384 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Subtotal | — | — | (346,985 | ) | — | (198,296 | ) | (545,281 | ) | (63,953 | ) | (609,234 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Balance as at December 31, 2021 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

24

KT Corporation and Subsidiaries

Consolidated Statements of Changes in Equity

Years Ended December 31, 2022 and 2021

| Attributable to owners of the Controlling Company | ||||||||||||||||||||||||||||||||||||

| (in millions of Korean won) | Notes | Share capital | Share premium | Retained earnings | Accumulated other comprehensive income | Other components of equity | Total | Non-controlling interest | Total equity | |||||||||||||||||||||||||||

Balance as at January 1, 2022 | ||||||||||||||||||||||||||||||||||||

Comprehensive income | ||||||||||||||||||||||||||||||||||||

Profit for the year | — | — | 1,262,498 | — | — | 1,262,498 | 125,165 | 1,387,663 | ||||||||||||||||||||||||||||

Remeasurements of net defined benefit liabilities | 18 | — | — | 165,524 | — | — | 165,524 | 15,905 | 181,429 | |||||||||||||||||||||||||||

Share of gain on remeasurements of associates | — | — | (189 | ) | — | — | (189 | ) | (143 | ) | (332 | ) | ||||||||||||||||||||||||

Share of other comprehensive loss of associates | — | — | — | (8,291 | ) | — | (8,291 | ) | (2,560 | ) | (10,851 | ) | ||||||||||||||||||||||||

Valuation loss on cash flow hedge | 4,7 | — | — | — | (32,140 | ) | — | (32,140 | ) | 810 | (31,330 | ) | ||||||||||||||||||||||||

Loss on valuation of financial instruments at fair value | 4,7 | — | — | 4,091 | (160,785 | ) | — | (156,694 | ) | (1,880 | ) | (158,574 | ) | |||||||||||||||||||||||

Exchange differences on translation of foreign operations | — | — | — | 5,971 | — | 5,971 | 11,493 | 17,464 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total comprehensive income for the year | — | — | 1,431,924 | (195,245 | ) | — | 1,236,679 | 148,790 | 1,385,469 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Transactions with owners | ||||||||||||||||||||||||||||||||||||

Dividends paid by the Controlling Company | — | — | (450,394 | ) | — | — | (450,394 | ) | — | (450,394 | ) | |||||||||||||||||||||||||

Dividends paid to non-controlling interest of subsidiaries | — | — | — | — | — | — | (26,407 | ) | (26,407 | ) | ||||||||||||||||||||||||||

Effect of change in connection range | — | — | — | — | — | — | 3,152 | 3,152 | ||||||||||||||||||||||||||||

Change in ownership interest in subsidiaries | — | — | — | — | 88,924 | 88,924 | 32,695 | 121,619 | ||||||||||||||||||||||||||||

Appropriations of loss on disposal of treasury stock | — | — | (11,577 | ) | — | 11,577 | — | — | — | |||||||||||||||||||||||||||

Acquisition of treasury stock | — | — | — | — | 763,081 | 763,081 | — | 763,081 | ||||||||||||||||||||||||||||

Conversion of redeemable convertible preferred shares of subsidiaries to common shares | — | — | — | — | — | — | 51,476 | 51,476 | ||||||||||||||||||||||||||||

Others | — | — | — | — | (2,654 | ) | (2,654 | ) | 2,220 | (434 | ) | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Subtotal | — | — | (461,971 | ) | — | 860,928 | 398,957 | 63,136 | 462,093 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Balance as at December 31, 2022 | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

The above consolidated statements of changes in equity should be read in conjunction with the accompanying notes.

25

KT Corporation and Subsidiaries

Consolidated Statements of Cash Flows

Years Ended December 31, 2022 and 2021

| (in millions of Korean won) | Notes | 2022 | 2021 | |||||||||

Cash flows from operating activities | ||||||||||||

Cash generated from operations | 33 | |||||||||||

Interest paid | (263,520 | ) | (257,809 | ) | ||||||||

Interest received | 307,091 | 272,061 | ||||||||||

Dividends received | 68,827 | 74,441 | ||||||||||

Income tax paid | (351,212 | ) | (356,466 | ) | ||||||||

|

|

|

| |||||||||

Net cash inflow from operating activities | 3,597,065 | 5,561,834 | ||||||||||

|

|

|

| |||||||||

Cash flows from investing activities | ||||||||||||

Collection of loans | 44,287 | 54,934 | ||||||||||

Disposal of financial assets at fair value through profit or loss | 1,298,621 | 609,849 | ||||||||||

Disposal of financial assets at amortized cost | 1,046,115 | 690,457 | ||||||||||

Disposal of financial assets at fair value through other comprehensive income | 97,932 | 244,994 | ||||||||||

Disposal of investments in associates and joint ventures | 34,828 | 10,880 | ||||||||||

Disposal of assets held-for-sale | 4,600 | — | ||||||||||

Disposal of property and equipment and investment properties | 178,063 | 174,413 | ||||||||||

Disposal of intangible assets | 20,088 | 11,624 | ||||||||||

Disposal of right-of-use assets | 97 | 318 | ||||||||||

Increase in cash due to changes in scope of consolidation and others | 6,754 | 39,340 | ||||||||||

Loans granted | (43,694 | ) | (54,128 | ) | ||||||||

Acquisition of financial assets at fair value through profit or loss | (1,317,175 | ) | (753,907 | ) | ||||||||

Acquisition of financial assets at amortized cost | (1,450,442 | ) | (623,924 | ) | ||||||||

Acquisition of financial assets at fair value through other comprehensive income | (449,504 | ) | (131,674 | ) | ||||||||

Acquisition of investments in associates and joint ventures | (280,988 | ) | (487,828 | ) | ||||||||

Acquisition of property and equipment and investment properties | (3,439,857 | ) | (3,495,021 | ) | ||||||||

Acquisition of intangible assets | (545,190 | ) | (752,181 | ) | ||||||||

Acquisition of right-of-use assets | (2,090 | ) | (4,261 | ) | ||||||||

Decrease in cash due to changes in scope of consolidation and others | (41,088 | ) | (671,359 | ) | ||||||||

|

|

|

| |||||||||

Net cash outflow from investing activities | (4,838,643 | ) | (5,137,474 | ) | ||||||||

|

|

|

| |||||||||

26

December 31, 2022 and 2021

Separate Statements of Financial Position

December 31, 2022 and 2021

| (in millions of Korean won) | Notes | December 31, 2022 | December 31, 2021 | |||||||||

Assets | ||||||||||||

Current assets | ||||||||||||

Cash and cash equivalents | 4,5,36 | |||||||||||

Trade and other receivables, net | 4,6,36 | 3,055,649 | 3,092,397 | |||||||||

Other financial assets | 4,7,36 | 232,837 | 104,062 | |||||||||

Inventories, net | 8 | 349,870 | 289,345 | |||||||||

Other current assets | 9 | 1,998,825 | 1,972,529 | |||||||||

|

|

|

| |||||||||

Total current assets | 6,603,488 | 7,167,047 | ||||||||||

|

|

|

| |||||||||

Non-current assets | ||||||||||||

Trade and other receivables, net | 4,6,36 | 526,988 | 750,820 | |||||||||

Other financial assets | 4,7,36 | 1,993,893 | 591,201 | |||||||||

Property and equipment, net | 10 | 11,540,162 | 12,021,117 | |||||||||

Right-of-use assets | 20 | 983,049 | 1,078,129 | |||||||||

Investment properties, net | 11,36 | 1,137,489 | 997,344 | |||||||||

Intangible assets, net | 12 | 1,855,679 | 2,236,564 | |||||||||

Investments in subsidiaries, associates and joint ventures | 13 | 4,879,219 | 3,816,915 | |||||||||

Net defined benefit assets | 17 | 180,689 | — | |||||||||

Other non-current assets | 9 | 717,118 | 703,232 | |||||||||

|

|

|

| |||||||||

Total non-current assets | 23,814,286 | 22,195,322 | ||||||||||

|

|

|

| |||||||||

Total assets | ||||||||||||

|

|

|

| |||||||||

27

KT Corporation

Separate Statements of Financial Position

December 31, 2022 and 2021

| (in millions of Korean won) | December 31, 2022 | December 31, 2021 | ||||||||||

Liabilities | ||||||||||||

Current liabilities | ||||||||||||

Trade and other payables | 4,14,36 | |||||||||||

Borrowings | 4,15,36 | 984,720 | 1,338,207 | |||||||||

Other financial liabilities | 4,7,36 | — | 17,807 | |||||||||

Current income tax liabilities | 29 | 127,944 | 104,481 | |||||||||

Provisions | 16 | 87,720 | 155,660 | |||||||||

Deferred income | 25 | 44,042 | 48,977 | |||||||||

Other current liabilities | 9 | 665,968 | 779,967 | |||||||||

|

|

|

| |||||||||

Total current liabilities | 6,321,450 | 6,968,720 | ||||||||||

|

|

|

| |||||||||

Non-current liabilities | ||||||||||||

Trade and other payables | 4,14,36 | 979,050 | 1,259,709 | |||||||||

Borrowings | 4,15,36 | 6,510,841 | 5,611,447 | |||||||||

Other financial liabilities | 4,7,36 | 37,566 | 5,572 | |||||||||

Net defined benefit liabilities | 17 | — | 116,456 | |||||||||

Provisions | 16 | 79,374 | 77,284 | |||||||||

Deferred income | 25 | 158,161 | 187,309 | |||||||||

Deferred income tax liabilities | 29 | 763,113 | 487,107 | |||||||||

Other non-current liabilities | 9 | 710,139 | 783,871 | |||||||||

|

|

|

| |||||||||

Total non-current liabilities | 9,238,244 | 8,528,755 | ||||||||||

|

|

|

| |||||||||

Total liabilities | 15,559,694 | 15,497,475 | ||||||||||

|

|

|

| |||||||||

Equity | ||||||||||||

Share capital | 21 | 1,564,499 | 1,564,499 | |||||||||

Share premium | 1,440,258 | 1,440,258 | ||||||||||

Retained earnings | 22 | 12,347,403 | 11,931,481 | |||||||||

Accumulated other comprehensive income | 23 | (72,672 | ) | 125,610 | ||||||||

Other components of equity | 23 | (421,408 | ) | (1,196,954 | ) | |||||||

|

|

|

| |||||||||

Total equity | 14,858,080 | 13,864,894 | ||||||||||

|

|

|

| |||||||||

Total liabilities and equity | ||||||||||||

|

|

|

| |||||||||

The above separate statements of financial position should be read in conjunction with the accompanying notes.

28

KT Corporation

Separate Statements of Profit or Loss

Years Ended December 31, 2022 and 2021

| (in millions of Korean won, except per share amounts) | Notes | 2022 | 2021 | |||||||

Operating revenue | 25 | |||||||||

Operating expenses | 26 | 17,121,140 | 17,319,161 | |||||||

|

|

|

| |||||||

Operating profit | 1,168,103 | 1,068,273 | ||||||||

Other income | 27 | 408,025 | 346,907 | |||||||

Other expenses | 27 | 228,723 | 244,261 | |||||||

Finance income | 28 | 577,334 | 638,931 | |||||||

Finance costs | 28 | 653,996 | 488,533 | |||||||

|

|

|

| |||||||

Profit before income tax | 1,270,743 | 1,321,317 | ||||||||

Income tax expense | 29 | 506,993 | 330,826 | |||||||

|

|

|

| |||||||

Profit for the year | ||||||||||

|

|

|

| |||||||

Earnings per share | ||||||||||

Basic earnings per share | 30 | |||||||||

Diluted earnings per share | 30 | 3,152 | 4,203 | |||||||

The above separate statements of profit or loss should be read in conjunction with the accompanying notes.

29

KT Corporation

Separate Statements of Comprehensive Income

Years Ended December 31, 2022 and 2021

| (in millions of Korean won) | Notes | 2022 | 2021 | |||||||||

Profit for the year | ||||||||||||

|

|

|

| |||||||||

Other comprehensive income (loss) | ||||||||||||

Items that will not be reclassified to profit or loss: | ||||||||||||

Remeasurements of net defined benefit liabilities | 17 | 114,154 | 31,025 | |||||||||

Gain (loss) on valuation of equity instruments at fair value through other comprehensive income | (149,638 | ) | 116,913 | |||||||||

Items that may be subsequently reclassified to profit or loss: | ||||||||||||

Loss on valuation of debt instruments at fair value through other comprehensive income | 4 | (13,902 | ) | (15,110 | ) | |||||||

Valuation gain on cash flow hedges | 4,7 | 56,259 | 137,865 | |||||||||

Other comprehensive loss from cash flow hedges reclassified to profit or loss | 4 | (91,012 | ) | (133,728 | ) | |||||||

|

|

|

| |||||||||

Total other comprehensive income (loss) | ||||||||||||

|

|

|

| |||||||||

Total comprehensive income for the year | ||||||||||||

|

|

|

| |||||||||

The above separate statements of comprehensive income should be read in conjunction with the accompanying notes.

30

KT Corporation

Separate Statements of Changes in Equity

Years Ended December 31, 2022 and 2021

| (in millions of Korean won) | Notes | Share capital | Share premium | Retained earnings | Accumulated other comprehensive income | Other components of equity | Total | |||||||||||||||||||||

Balance at January 1, 2021 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Comprehensive income | ||||||||||||||||||||||||||||

Profit for the year | — | — | 990,491 | — | — | 990,491 | ||||||||||||||||||||||

Gain on valuation of financial assets at fair value through other comprehensive income | 4,29 | — | — | 23,236 | 78,567 | — | 101,803 | |||||||||||||||||||||

Remeasurements of net defined benefit liabilities | 17,29 | — | — | 31,025 | — | — | 31,025 | |||||||||||||||||||||

Valuation gain on cash flow hedge | 4,29 | — | — | — | 4,137 | — | 4,137 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income for the year | — | — | 1,044,752 | 82,704 | — | 1,127,456 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Transactions with equity holders | ||||||||||||||||||||||||||||

Dividends paid | 31 | — | — | (326,487 | ) | — | — | (326,487 | ) | |||||||||||||||||||

Appropriation of retained earnings related to loss on disposal of treasury stock | 22 | — | — | (20,498 | ) | — | 20,498 | — | ||||||||||||||||||||

Acquisition of treasury stock | 23 | — | — | — | — | (190,105 | ) | (190,105 | ) | |||||||||||||||||||

Disposal of treasury stock | 23 | — | — | — | — | 50,954 | 50,954 | |||||||||||||||||||||

Others | — | — | — | — | (481 | ) | (481 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Balance at December 31, 2021 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Balance at January 1, 2022 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Comprehensive income | ||||||||||||||||||||||||||||

Profit for the year | — | — | 763,750 | — | — | 763,750 | ||||||||||||||||||||||

Loss on valuation of financial assets at fair value through other comprehensive income | 4,29 | — | — | (11 | ) | (163,529 | ) | — | (163,540 | ) | ||||||||||||||||||

Remeasurements of net defined benefit liabilities | 17,29 | — | — | 114,154 | — | — | 114,154 | |||||||||||||||||||||

Valuation loss on cash flow hedge | 4,29 | — | — | — | (34,753 | ) | — | (34,753 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income for the year | — | — | 877,893 | (198,282 | ) | — | 679,611 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Transactions with equity holders | ||||||||||||||||||||||||||||

Dividends paid | 31 | — | — | (450,394 | ) | — | — | (450,394 | ) | |||||||||||||||||||

Appropriation of retained earnings related to loss on disposal of treasury stock | 22 | — | — | (11,577 | ) | — | 11,577 | — | ||||||||||||||||||||

Disposal of treasury stock | 23 | — | — | — | — | 763,081 | 763,081 | |||||||||||||||||||||

Others | — | — | — | — | 888 | 888 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Balance at December 31, 2022 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

31

KT Corporation

Separate Statements of Cash Flows

Years Ended December 31, 2022 and 2021

| (in millions of Korean won) | Notes | 2022 | 2021 | |||||||||

Cash flows from operating activities | ||||||||||||

Cash generated from operations | 32 | |||||||||||

Interest paid | (202,579 | ) | (228,368 | ) | ||||||||

Interest received | 211,170 | 230,509 | ||||||||||

Dividends received | 98,874 | 76,629 | ||||||||||

Income tax paid | (173,297 | ) | (117,810 | ) | ||||||||

|

|

|

| |||||||||

Net cash inflow from operating activities | 4,062,353 | 4,959,328 | ||||||||||

|

|

|

| |||||||||

Cash flows from investing activities | ||||||||||||

Collection of loans | 133,864 | 47,254 | ||||||||||

Disposal of current financial instruments at amortized cost | 900 | 189,976 | ||||||||||

Disposal of financial assets at fair value through profit or loss | 1,695 | 33,651 | ||||||||||

Disposal of financial assets at fair value through other comprehensive income | — | 36,749 | ||||||||||

Disposal of investments in subsidiaries, associates and joint ventures | 36,028 | 70,785 | ||||||||||

Disposal of property and equipment | 60,619 | 40,722 | ||||||||||

Disposal of intangible assets | 17,047 | 6,036 | ||||||||||

Disposal of right-of-use assets | 96 | 110 | ||||||||||

Loans granted | (125,146 | ) | (42,815 | ) | ||||||||

Acquisition of current financial instruments at amortized cost | (117,764 | ) | — | |||||||||

Acquisition of non-current financial instruments at amortized cost | (226,030 | ) | — | |||||||||

Acquisition of financial assets at fair value through profit or loss | (115,415 | ) | (71,899 | ) | ||||||||

Acquisition of financial assets at fair value through other comprehensive income | (442,176 | ) | (40,182 | ) | ||||||||

Acquisition of investments in subsidiaries, associates and joint ventures | (348,607 | ) | (383,221 | ) | ||||||||

Acquisition of property and equipment | (2,980,008 | ) | (2,946,975 | ) | ||||||||

Acquisition of intangible assets | (307,689 | ) | (633,847 | ) | ||||||||

Acquisition of right-of-use assets | (1,984 | ) | (3,330 | ) | ||||||||

|

|

|

| |||||||||

Net cash outflow from in investing activities | (4,414,570 | ) | (3,696,986 | ) | ||||||||

|

|

|

| |||||||||

Cash flows from financing activities | ||||||||||||

Proceeds from borrowings and bonds | 1,741,962 | 1,038,456 | ||||||||||

Settlement of derivative instruments (inflow) | 76,280 | 216 | ||||||||||

Dividend paid | (450,394 | ) | (326,487 | ) | ||||||||

Repayments of borrowings and debentures | (1,359,117 | ) | (1,223,841 | ) | ||||||||

Settlement of derivative instruments (outflow) | (41,197 | ) | — | |||||||||

Acquisition of treasury stock | — | (190,105 | ) | |||||||||

Decrease in lease liabilities | (357,337 | ) | (393,634 | ) | ||||||||

|

|

|

| |||||||||

Net cash outflow from financing activities | 33 | (389,803 | ) | (1,095,395 | ) | |||||||

|

|

|

| |||||||||

Effect of exchange rate change on cash and cash equivalents | (387 | ) | 557 | |||||||||

|

|

|

| |||||||||

Net increase (decrease) in cash and cash equivalents | (742,407 | ) | 167,504 | |||||||||

Cash and cash equivalents | ||||||||||||

Beginning of the year | 5 | 1,708,714 | 1,541,210 | |||||||||

|

|

|

| |||||||||

End of the year | 5 | |||||||||||

|

|

|

| |||||||||

32

Amendment to the Articles of Incorporation

In order to expand subscriber base and to strengthen communication with shareholders regarding treasury stocks matter, approval of the following changes to the Articles of Incorporation is requested. .

Background Information

Proposed changes to the Articles of Incorporation have been drafted following a resolution by the Board of Directors. The amendment includes –

| 1) | Adding items in Business Purposes in the Article of Incorporation in order to expand subscriber base of DIGICO B2C to initiate rental service |

| 2) | Strengthening communication with Shareholders regarding treasury stock matters |

Background information is drafted to improve shareholder’s understanding. For more accurate excerpts, please refer to the subsequent pages. If any potential conflicts exist, the following information shall prevail.

33

<Agenda No. 3-1, Amendment to add items in Business Purposes>

Before Amendment | After Amendment | Purpose | ||

Article 2. (Purpose) The objective of KT is to engage in the following business activities:

35. Any and all other activities or businesses incidental to or necessary for attainment of the foregoing. | Article 2. (Purpose) The objective of KT is to engage in the following business activities:

35. Facility rental business

36. Any and all other activities or businesses incidental to or necessary for attainment of the foregoing. | Added a business purpose to promote rental business to expand DIGICO B2C customer base | ||

34

<Agenda No. 3-2, Duty to report purpose of holding treasury stocks and plans for cancellation and disposal >

Before Amendment | After Amendment | Purpose | ||

| <New> | Article 48-2 (Treasury Stock Report)

KT shall report the purpose, plans for retirement and disposal of the treasury stock held at the annual general shareholder’s meetings. | Strengthening communication with Shareholders regarding treasury stock matters | ||

35

<Agenda No. 3-3, Shareholders approval required in case of acquisition of stock of other companies for cross shareholding through treasury stocks>

Before Amendment | After Amendment | Purpose | ||

| <New> | Article 48-3 (Acquisition of Stock of Other Companies for Cross Shareholding)

When KT acquires the stocks of other companies for cross shareholding by way of selling or exchanging treasury stocks, it shall be approved by the General Meeting of Shareholders. | Strengthening communication with Shareholders regarding treasury stock matters | ||

36

Addendum

Addendum

Before Amendment | After Amendment | Purpose | ||

ADDENDUM (March 31, 2023)

Article 1. (Enforcement Date)

These Articles of Incorporation shall become effective from the date on which a resolution on the foregoing amendments is adopted at the General Meeting of Shareholders. | Amended to add effective date of amended Articles of Incorporation as of date of the resolution at the Annual General Meeting of Shareholders | |||

37

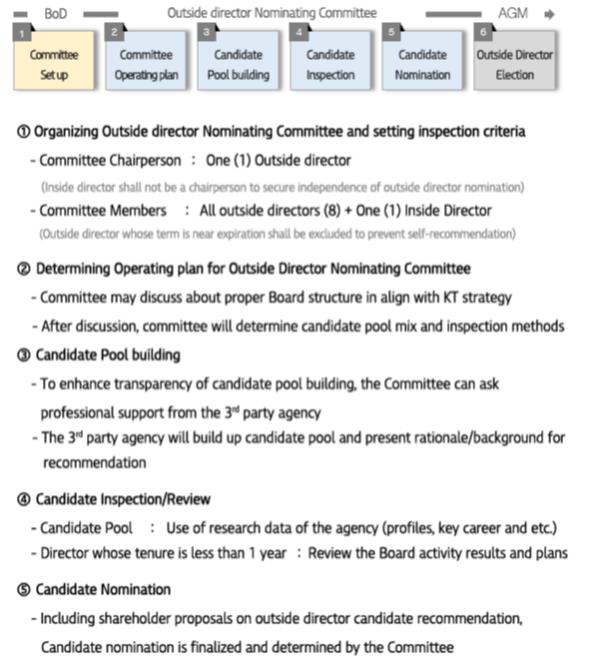

Election of Directors

Pursuant to Article 382(Appointment of Directors, Relationship with Company and Outside Directors) and Article 542-8(Appointment of Outside Directors) of the Commercial Act, Article 25(Election of the Representative Director and Directors) and Article 42(Outside Director Candidates Recommendation Committee) of the Articles of Incorporation, approval of the election of directors is hereby requested.

At the 41th Annual General Meeting of Shareholders, a total of 3 directors shall be elected – three outside directors. The Outside Director Nominating Committee has nominated three outside director candidates.

[Board Composition and Election Process]

Our board of directors has the ultimate responsibility for the administration of our affairs. Our articles of incorporation provide for a board of directors consisting of:

| • | up to three inside directors, including the Representative Director; and |

| • | up to eight outside directors. |

All of our directors are elected at the general shareholders’ meeting. Under our articles of incorporation, the term of office for an inside director is up to three years. Pursuant to an amendment to our articles of incorporation in March 2020, the term of office for an outside director changed from up to ten years to up to six years, which change was made to reflect an amendment to the enforcement decree of the Commercial Code of Korea.

According to our articles of incorporation, Outside Director Nominating Committee must consist of one inside director and all of our outside directors, other than for election of an outside director resulting from the expiration of the term of the office, in which case such outside director whose term is expiring may not be a member of the committee. Our Outside Director Candidate Nominating Committee nominates outside director candidates for appointment at the general shareholders’ meeting.

Representative Director recommends Inside Director candidates with the consent of the Board of Directors and candidates are elected at the general shareholders’ meeting. And in accordance with the company’s Articles of Incorporation, one person recommended by the CEO among the inside directors can be additionally appointed as a representative director by a resolution of the Board of Directors.

38

▣ Nomination and Election Process for Outside Director

Biographies of candidates are disclosed in the subsequent pages.

39

• Educational Background

| • 1993 | Ph.D. in Electrical and Computer Engineering, University of California at Irvine | |

| • 1989 | Master’s in Electrical and Computer Engineering, University of California at Irvine | |

| • 1987 | Bachelor’s in Electrical Engineering, University of California at San Diego | |

• Professional Associations

| ||

| • 1994 – Present | Full Professor, School of Electrical Engineering, Korea University | |

| • 2020 – Present | Chair, Executive Committee, SatCom Forum | |

| • 2020 – Present | Member, The National Academy of Engineering of Korea | |

| • 2019 – 2020 | Chair, Consultative Committee for Radio Policy, Ministry of Science and ICT | |

| • 2018 – Present | Honorary President at Korea Institute of Communication and Information Sciences | |

| • 2015 – 2018 | Chair at Technology Development & Standardization Subcommittee, 5G Strategic Planning Committee, Ministry of Science and ICT | |

42

• Rationale for Recommendation

Mr. Kang, as an expert in ICT industry, currently serves as a professor at Korea University School of Electrical Engineering, and during the past three years of working as an outsider director, he has presented the company’s development direction based on strategic decisions related to telecommunications technology and future businesses.

In 2022, as a Chairperson of the Board of Directors, including delivering various opinions from internal and external stakeholders’ of a company to the management, he made efforts to ensure a balanced board operation. In particular, as the Chair of Representative Director Candidate Examination Committee (the “RDCEC”), he contributed greatly to the selection of the best CEO candidate to lead the KT Group, operating the committee fairly and transparently.

Based on the professionalism and balanced perspectives that the candidate has demonstrated through board activities, He is recommend as an outside director since he is expected to decide company’s management goals and management policies for the benefit of the company and shareholders, and to contribute to enhancing the corporate value to the next level, supervising management activities for the transparent management.

• Candidate’s Plan as Outside Director

Mr. Kang will continue to monitor and support activities to ensure proper investment, stability in the network, and basic infrastructure so that the management can go back to basics and prevent potential risks. As an ICT expert, through preemptively establishing a 6G vision, he will support future standardization led by operators, and will also review frequency·technology strategies as well as mid-to long-term investment plans.

As a member of the board of directors, Mr. Kang will support KT’s business portfolio strengthening for its sustainable growth, and contribute to the company’s growth as a digital platform company through systematic review of performance. In particular, Mr. Kang will strive to introduce sustainable evaluation index necessary for technology accumulation and human resource management for the internalization of basic technologies. Mr. Kang will improve communication with stakeholders to strengthen the independence of the board of directors and the stability of governance structure. Moreover, Mr. Kang will support to become a company that meets market expectations and become a trusted company through continuously monitoring compliance performance at the board level.

43

• Educational Background

| • 2006 | Ph.D. in Economics, University of Michigan | |

| • 1998 | Master’s in Chemical Engineering, Seoul National University | |

| • 1996 | Bachelor’s in Chemical Engineering, Seoul National University | |

• Professional Associations

| ||

| • 2009 – Present | Professor at College of Business, Chung-Ang University | |

| • 2022 – Present | Member of Advisory Committee, Korea Deposit Insurance Corporation | |

| • 2021 – Present | Non-Executive Officer, KOMSCO(Korea Minting & Security Printing & ID Card Operating Corporation) | |

| • 2020 – Present | Auditor, Financial Information Society of Korea | |

| • 2019 – Present | Director in MBA Program, School of Business Administration, Chung-Ang University | |

| • 2018 – Present | Member of Asset Management Committee for Employment Insurance / Industrial Insurance Fund, Ministry of Employment and Labor | |

| • 2018 – Present | Risk Management Committee, Deposit Insurance Fund, Korea Deposit Insurance Corporation | |

| • 2015 – Present | Member of Evaluation Committee for Public Funds, Ministry of Strategy and Finance | |

44

• Rationale for Recommendation

Mrs. Eun-Jung Yeo, a candidate for outside director, is an engineering graduate with a Ph.D. in economics. She is a financial expert, actively engaged with many different positions, serving as a professor of College of Business at Chung-Ang University, a Chair of Financial Innovation Committee at the Korea Securities Association, and a non-executive officer at the KOMSCO(Korea Minting & Security Printing & ID Card Operating Corporation)Korea Minting and Security Printing Corporation). The candidate has the financial/accounting expert qualifications required by Article 37 (Audit Committee) of the Enforcement Decree of the Commercial Act. During her tenure as an outside director at KT, she made efforts to strengthen the compliance system as the chair of the Audit Committee, thereby improving management supervision based on his financial expertise and through this, contributed to the improvement of the management supervision function based on financial expertise.

Her knowledge and experience related to financial accounting that the candidate has demonstrated through her board activities will continue to be a great help to the interests of company as well as shareholders. Through transparent management supervision, Mrs. Yeo can contribute to enhancing long-term corporate value by reconciling conflicting interests between company’s management and shareholders including supervising the adequacy and effectiveness of the internal control system.

• Candidate’s Plan as an Outside Director

KT’s corporate value and shareholder value enhancement are the top priorities, and Mrs. Yeo plans to continue to strive for the independent and effective functioning of the Board of Directors and Audit Committee. Mrs. Yeo will provide a wide range of advice on valuation and financial risk factors according to the company’s new business in the future, take a close look at internal control as well as related tasks to ensure that the agreement with the U.S. Securities and Exchange Commission is fully implemented, and will supervise the company to thoroughly implement preparations in response to the introduction of the consolidated internal accounting management system.

45

• Educational Background

| • 1998 | Ph.D. in Telecommunication Engineering, Korea University | |

| • 1983 | Master’s in Telecommunication Engineering, Korea University | |

| • 1977 | Bachelor’s in Electronic Engineering, Korea University | |

• Professional Associations

| ||

| • 2021 – Present | Outside Director at Hankook Tire & Technology | |

| • 2019 – 2020 | Outside Director at JB Financial Group Co., Ltd. | |

| • 2015 – 2018 | CEO at Lotte Rental Co., Ltd. | |

| • 2014 – 2015 | CEO at KT Rental Co., Ltd. | |

| • 2010 – 2014 | President at KT Corporation, KT | |

47

• Rationale for Recommendation

Mr. Pyo is a well-respected expert both in the ICT sector with a Ph.D. in telecommunication Engineering and in corporate management with myriad experiences including his former position as CEO of Lotte Rental. As an outside director of KT for the past three years, the candidate spared no advice for the Company’s advancement based on his past experience as a successful CEO.

During his tenure as the Company’s outside director, Mr. Pyo presented the Company with the direction for sustainable management as the Chairman of the Sustainable Management Committee and contributed to the declaration of KT’s ESG management by advising the Company to prepare a differentiated ESG roadmap. Furthermore, he proposed the path for the Company’s advancement such as strengthening the competitiveness of major businesses and revamping the portfolio, and contributed to enhancing the corporate value through requesting a stronger alignment between management goals and executive evaluations for a robust growth of KT Group.

Based on the expertise shown by the Candidate through Board activities and diverse corporate experiences, Mr. Pyo is expected to contribute significantly to positioning the Company as an exemplary company in terms of governance through with practical advice on digital-based eco-friendly policies and solutions to social issues.

• Candidate’s Plan as Outside Director

Mr. Pyo plans to encourage an active Board so that the Company’s governance structure can be reach a top-tier level on a global standard. In particular, he will upgrade the CEO succession process to a global level. Mr. Pyo will strive to implement ESG management throughout the entire KT Group, to internalize the company’s compliance system, and to publicize it. In addition, he will fully support an upgrade to the communication network and IT infrastructure to a level will satisfy customers by providing advice on ways to strengthen the Group’s IT capabilities such as fostering and securing IT personnel and internalizing core technologies.

Mr. Pyo will advocate an innovation to the business portfolio to enhance long-term shareholder values and will also spare no advice on ways to strengthen the competitiveness of the Company’s Mobility business with specific action plans based on management experience in the mobility business. Furthermore, to achieve a global standard Group management scheme, Mr. Pyo will advocate upgrading the authority delegation system so that CEOs of subsidiaries can fully execute responsible management, and as a result increase the portion of subsidiaries’ revenue.

48

Board of Directors - Activity & Tenure Status

1) Summary of the BoD Meeting Attendance

Outside Directors | Percentage of Attendance* | The Number of Meetings | The Number of Attendance | |||

| • Outside Directors | ||||||

| Dae-You Kim | 100% | 23 | 23 | |||

| Gang-Cheol Lee | 100% | 23 | 23 | |||

| Hee-Yol Yu | 100% | 23 | 23 | |||

| Hyun-Myung Pyo | 100% | 23 | 23 | |||

| Chung-Gu Kang | 100% | 23 | 23 | |||

| Eun-Jung Yeo | 95.7% | 23 | 22 | |||

| Yong-Hun Kim | 100% | 16 | 16 | |||

| Benjamin Hong | 100% | 16 | 16 | |||

| * | Percentage of attendance is calculated over FY 2022 |

2) Comparison of the BoD Members

In 2023, as an outside director Benjamin Hong resigned just before the notice of the 41st AGM, there was a limit to nominate new outside director candidate.

( ) Gender in parenthesis, Represents directors who are candidates for KT Board of Directors

Represents directors who are candidates for KT Board of Directors

Before AGM | After AGM | |

| • Inside Directors | ||

| Hyeon-Mo Ku (M) | ||

| Kyoung-Lim Yun (M) | ||

| • Outside Directors | ||

| Dae-You Kim* (M) | Dae-You Kim* (M) | |

| Gang-Cheol Lee (M) | Hee-Yol Yu (M) | |

| Hee-Yol Yu (M) | Yong-Hun Kim* (M) | |

| Eun-Jung Yeo* (F) | Chung-Gu Kang* (M) | |

| Chung-Gu Kang* (M) | Eun-Jung Yeo* (F) | |

| Hyun-Myung Pyo (M) | Hyun-Myung Pyo (M) | |

| Yong-Hun Kim* (M) | ||

| Benjamin Hong (M) | ||

| * | Members of the Audit Committee |

| Gang-Cheol Lee voluntarily resigned on January 12, 2023 |

| Benjamin Hong voluntarily resigned on March 6, 2023 |

| Seung-Tae Lim voluntarily resigned on March 10, 2023 |

| Kyoung-Lim Yun voluntarily resigned on March 27, 2023 |

| Pursuant to Articles of Incorporation of the company, the candidacy for Chang-Seok Seo and Kyung-Min Song is no longer available due to the invalidation of recommendation of the candidacy by Representative Director Candidate. |

49

3) Tenure Status of the BoD Members

Refers to directors who are candidates for KT Board of Directors

Refers to directors who are candidates for KT Board of Directors

Name | Initial Appointment | Recent Appointment | End of Tenure | |||||

Outside Directors | Dae-You Kim | March 2018 | March 2021 | AGM 2024 | ||||

| Hee-Yol Yu | March 2019 | March 2022 | AGM 2025 | |||||

| Yong-Hun Kim | March 2022 | March 2022 | AGM 2025 | |||||

| Chung-Gu Kang | March 2020 | March 2023* | AGM 2024* | |||||

| Eun-Jung Yeo | March 2020 | March 2023* | AGM 2024* | |||||

| Hyun-Myung Pyo | March 2020 | March 2023* | AGM 2024* |

| * | implies the date under the assumption of approval of election at the 41st AGM. |

4) Committees of the BOD

Corporate | Audit Committee | Evaluation | Related- | Sustainability | Outside Director | Management | ||||||||

Hyeon-Mo Ku |  | |||||||||||||

Kyoung-Lim Yun |  |  |  |  | ||||||||||

Dae-Yoo Kim |  |  |  | |||||||||||

Gang-Cheol Lee |  |  |  |  | ||||||||||

Hee-Yol Yu |  |  |  |  | ||||||||||

Eun-Jung Yeo |  |  | ||||||||||||

Chung-Gu Kang |  |  | ||||||||||||

Hyun-Myung Pyo |  |  |  | |||||||||||

Yong-Hun Kim |  |  |  | |||||||||||

Benjamin Hong |  |  |  |  | ||||||||||

chairperson

chairperson

| * | In 2023, Inside Director Kyoung-Lim Yun did not attend Outside Director Candidate Nominating Committee meetings for Outside Director candidate examination and recommendation |

50

Election of Members of Audit Committee

Pursuant to the Article 542-11(Audit Committee) and Article 542-12(Composition of Audit Committee) of Commercial Code, approval of the election of the members of the Audit Committee is hereby requested.

At this Annual General Meeting of Shareholders, an outside director who will serve as Members of the Audit Committee will be elected

Limit on Exercising Voting Rights for Election of the Members of the Audit Committee

Limit on Exercising Voting Rights for Election of the Members of the Audit Committee

The Article 409 of the Korean Commercial Code stipulates that any shareholder who holds more than 3% of the total issued shares with voting rights may not exercise his or her vote in respect of such excess shares beyond the “3% limit” when exercising voting rights with respect to election of members of the audit committee (Agenda No. 5). Please note that the shareholders who own more than 3% of KT’s voting shares, equivalent to 7,681,280 shares, are not entitled to exercise any voting rights exceeding the “3% limit”.

51

<Agenda No. 5-1, Election of Members of Audit Committee>

Full Name: Mr. Chung-Gu Kang

Current Occupation: Professor, College of Engineering, Korea University

Date of Birth | December 12, 1962 | |

Recommended by | Outside Director Nominating Committee | |

Relation to the Largest Shareholder | None | |

Transactions with the Company (recent three years) | None | |

Taxes in Arrears / Management of any Insolvent Companies / Statutory Reasons for Disqualification (recent five years) | None | |

Other Board Service | None | |

Service Term | March 31, 2023 to the 2024 AGM (one-year term) |

• Educational Background

| • 1993 | Ph.D. in Electrical and Computer Engineering, University of California at Irvine | |

| • 1989 | Master’s in Electrical and Computer Engineering, University of California at Irvine | |

| • 1987 | Bachelor’s in Electrical Engineering, University of California at San Diego | |

• Professional Associations

| • 1994 – Present | Full Professor, School of Electrical Engineering, Korea University | |

| • 2020 – Present | Chair, Executive Committee, SatCom Forum | |

| • 2020 – Present | Member, The National Academy of Engineering of Korea | |

| • 2019 – 2020 | Chair, Consultative Committee for Radio Policy, Ministry of Science and ICT | |

| • 2018 – Present | Honorary President at Korea Institute of Communication and Information Sciences | |

| • 2015 – 2018 | Chair at Technology Development & Standardization Subcommittee, 5G Strategic Planning Committee, Ministry of Science and ICT | |

52