- KT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

KT (KT) 6-KCurrent report (foreign)

Filed: 24 Apr 23, 12:07pm

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2023

Commission File Number 1-14926

KT Corporation

(Translation of registrant’s name into English)

90, Buljeong-ro,

Bundang-gu, Seongnam-si,

Gyeonggi-do,

Korea

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- _______________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: April 24, 2023 | ||

| KT Corporation | ||

| By: | /s/ Seunghoon Chi | |

| Name: | Seunghoon Chi | |

| Title: | Vice President | |

| By: | /s/ Sanghyun Cho | |

| Name: | Sanghyun Cho | |

| Title: | Director | |

ANNUAL FINANCIAL REPORT

OF

KT CORPORATION

(From January 1, 2022 to December 31, 2022)

(Translation of the Annual Report filed in Korean with the Financial Supervisory Service of Korea)

I. | 2 | |||||

II. | 7 | |||||

III. | 34 | |||||

IV. | 36 | |||||

V. | 40 | |||||

VI. | 80 |

1

| I. | Corporate purpose of KT Corporation |

Business Objectives

| 1. | Information and communications business; |

| 2. | New media business and internet multimedia broadcasting business |

| 3. | Development and sale of software and contents; |

| 4. | Sale and distribution of information communication equipment; |

| 5. | Testing and inspection of information communication equipment, device or facilities; |

| 6. | Advertisement business; |

| 7. | Retail business via telephone, mail order or online; |

| 8. | IT facility construction business, electrical construction business and fire protection facility business |

| 9. | Real estate and housing business |

| 9(1). | Business facilities management and business support service industry |

| 10. | Electronic banking and finance business; |

| 11. | Education and learning service business; |

| 12. | Security service business (Machinery system surveillance service, Facilities security service, etc); |

| 13. | Research and technical development, education, training and promotion, overseas businesses, and export and import, manufacture and distribution related to activities mentioned in Subparagraphs 1 through 12 |

| 14. | Frequency-based telecommunications services and other telecommunications services |

| 15. | Value-added telecommunications business |

| 16. | Manufacture, provision (screening) and distribution of contents such as musical records, music videos, movies, videos and games |

| 17. | Issuance and management of pre-paid electronic payment instruments, and businesses related to electronic finance such as payment gateway services |

| 18. | Sales and leasing of equipment and facilities related to the activities mentioned in Subparagraphs 14 through 17 |

| 19. | Any overseas business or export and import business related to activities mentioned in Subparagraphs 14 through 18 |

| 20. | Tourism |

| 21. | (Deleted) |

2

| 22. | New and renewable energy, energy generation business, electrical system design business and electrical safety management agent business |

| 23. | Health Informatics business |

| 24. | Manufacture of communication equipment, device or facilities for military purpose |

| 25. | Energy diagnostics business, professional business relating to energy conservation, and any and all other business in the field of energy use rationalization |

| 26. | Information securities, any and all other business in the field of identification service |

| 27. | Activities of management consultancy |

| 28. | Warehousing and storage |

| 29. | Total construction business |

| 30. | Specialized design services |

| 31. | Freight Transportation Business, Cargo Transportation Intermediation Business |

| 32. | Manufacturing and sales of medical device |

| 33. | Any and all other activities or businesses incidental to or necessary for attainment of the foregoing |

| 34. | Personal information management business and ancillary work |

| 35 | Any and all other activities or businesses incidental to or necessary for attainment of the foregoing. |

| 2. | History |

| A. | Changes since Incorporation |

| (1) | Date of Incorporation: December 10, 1981 |

| (2) | Location of Headquarters: |

90 Bulljeong-ro

Bundang-gu, Seongnam-city

Gyeonggi-do 13606

Korea

| (3) | Major Changes in KT Corporation |

| • | On March 27, 2009, KT Corporation (“KT”) signed a merger agreement with its mobile subsidiary KTF, in which KT held a 54.25% interest, and on June 1, 2009, the merger was completed. |

3

| • | At the annual general shareholders’ meeting held on March 11, 2011, KT’s shareholders approved the addition of the health bioinformatics business to KT’s business objectives, which is a new emerging industry that integrates IT with genetic data information sequencing, computation, accumulation, and application. The shareholders also approved the addition of military communication equipment, devices and facility manufacturing to its business objectives. |

| • | Mr. Suk Chae Lee was reelected as the Chief Executive Officer (“CEO”) and President of KT at the annual general shareholders’ meeting held on March 16, 2012. |

| • | At the annual general shareholders’ meeting held on March 15, 2013, KT’s shareholders approved the addition of energy inspection, energy conservation, and the energy use rationalization business to KT’s business objectives. |

| • | Mr. Chang-Gyu Hwang was elected as the CEO and President of KT at the extraordinary general shareholders’ meeting held on January 27, 2014. |

| • | At the annual general shareholders’ meeting held on March 25, 2016, KT’s shareholders approved the addition of Information securities, any and all other business in the field of identification service. |

| • | Mr. Chang-Gyu Hwang was re-elected as the CEO and President of KT at the annual general shareholders’ meeting held on March 24, 2017. KT’s shareholders approved the addition of fire protection facility business, electrical system design business, activities of management consultancy, and warehousing & storage |

| • | At the annual general shareholders’ meeting held on March 23, 2018, KT’s shareholders approved the addition of electrical safety management agent business. They also approved the Total construction business for Clarification of Business Purpose and Specialized design services for Business Area Expansion. |

| • | Mr. Hyeon-Mo Ku was elected as the Representative Director of KT at the annual general shareholders’ meeting held on March 30, 2020. |

| • | At the annual general shareholders’ meeting held on March 31, 2021, KT’s shareholders approved the addition of “My data” business on the Article of Incorporation. They also approved change in notification and diversification of shareholders return method. |

| 3. | Total Number of Shares and Related Matters |

| A. | Status of Capital Increase/Decrease (As of December 31, 2022) (Unit: KRW million, Shares) |

There has been no change in capital stock for the past 5 business years.

Type of Stock | Category | 41th (The end of 2022) | 40th (The end of 2021) | 39th (The end of 2020) | ||||||||||

Common Stock | Current Number of Issued Shares | 261,111,808 | 261,111,808 | 261,111,808 | ||||||||||

| Par value | 0.005 | 0.005 | 0.005 | |||||||||||

| Capital Stock | 1,564,499 | 1,564,499 | 1,564,499 | |||||||||||

Preferred Stock | Current Number of Issued Shares | |||||||||||||

| Par value | ||||||||||||||

| Capital Stock | ||||||||||||||

Others | Current Number of Issued Shares | |||||||||||||

| Par value | ||||||||||||||

| Capital Stock | ||||||||||||||

Total | Capital Stock | 1,564,499 | 1,564,499 | 1,564,499 | ||||||||||

4

Date of Shares Issued | Type of Shares Issued (Retired) | Details of Issued (Retired) Shares | ||||||||||

Type | Number of Issued | Par Value per Share | Par Value of | Note | ||||||||

| — | — | — | — | — | — | — | ||||||

| B. | Total Number of Shares (As of December 31, 2022) (Unit: Shares) |

Category | Type of Shares | Total | ||||||||||||

| Common shares | Preferred shares | |||||||||||||

I. Total Number of Authorized Shares | 1,000,000,000 | — | 1,000,000,000 | |||||||||||

II. Total Number of Issued Shares | 312,899,767 | — | 312,899,767 | |||||||||||

III. Total Number of Reduced Shares | 51,787,959 | — | 51,787,959 | |||||||||||

Details of Reduced Shares | 1. Reduction of Capital | — | — | — | ||||||||||

| 2. Share Retirement | 51,787,959 | — | 51,787,959 | |||||||||||

| 3. Redemption of Redeemable Shares | — | — | — | |||||||||||

| 4. Other | — | — | — | |||||||||||

IV. Current Number of Issued Shares (II – III) | 261,111,808 | — | 261,111,808 | |||||||||||

V. Number of Treasury Shares | 5,069,130 | — | 5,069,130 | |||||||||||

VI. Current Number of Issued and Outstanding Shares | 256,042,678 | — | 256,042,678 | |||||||||||

C. Acquisition and Disposal of Treasury Shares (As of December 31, 2022) (Unit: Shares)

Method of Acquisition | Type of Shares | Beginning of Term | Acquisition (+) | Disposition (-) | Retirement (-) | End of Term | ||||||||||||||||||||

Direct Acquisition | | Over-the- Counter |

| Common shares | 25,303,662 | — | 20,234,532 | — | 5,069,130 | |||||||||||||||||

| Preferred shares | — | — | — | — | — | |||||||||||||||||||||

| | Exchange- Traded | Common shares | — | — | — | — | — | |||||||||||||||||||

| Preferred shares | — | — | — | — | — | |||||||||||||||||||||

Indirect Acquisition (e.g. Trust Contract) | Common shares | — | — | |||||||||||||||||||||||

| Preferred shares | — | — | — | — | — | |||||||||||||||||||||

Total | Common shares | 25,303,662 | 20,234,532 | — | 5,069,130 | |||||||||||||||||||||

| Preferred shares | — | — | — | — | — | |||||||||||||||||||||

5

| • | The above “Beginning of Term” means as of January 1, 2022 and “End of Term” means as of December 31, 2022, which is the most recent date of shareholder registry. |

| • | Details of trust agreement of treasury shares after the base date (From January 1, 2022 to December 31, 2022) are as follows : |

- To enhance shareholder’s value, KT decided to enter into a trust agreement for the acquisition of treasury Shares

[Treasury shares acquisition through a trust agreement with Shinhan Securities Co., Ltd.]

- Contract Amount : KRW 300 billion

- Contract Period : From February 10, 2023 to August 9, 2023

- Decision to Retire Treasury Shares : A total of KRW 100 billion out of KRW 300 billion worth of treasury shares to be purchased through a trust contract will be retired

- Expected date of retirement : August 10, 2023

6

| 1. | (Manufacturing Service) Business Overview |

Each division of KT is distinguished by a separate legal entity that provides independent services and products, and the business of each affiliated company is categorized into (1) ICT that provides wireless and wired communication/convergence services, (2) Finance business that provides credit card services, (3) Satellite broadcasting services, (4) Real estate business utilizing KT’s assets, and (5) Other businesses carried out by subsidiaries including content, information technology, global business, and others.

Revenue by division (Unit: KRW million)

Revenue by division (Unit: KRW million)

Division | FY2022 | FY2021 | FY2020 | |||||||||||||||||||||

| Revenue | Proportion | Revenue | Proportion | Revenue | Proportion | |||||||||||||||||||

ICT | 18,289,243 | 59.4 | % | 18,387,434 | 63.0 | % | 17,879,281 | 64.0 | % | |||||||||||||||

Finance | 3,613,981 | 11.7 | % | 3,525,211 | 12.1 | % | 3,343,010 | 12.0 | % | |||||||||||||||

Satellite Broadcasting | 704,928 | 2.3 | % | 655,354 | 2.2 | % | 660,404 | 2.4 | % | |||||||||||||||

Real Estate | 485,056 | 1.6 | % | 335,373 | 1.1 | % | 359,954 | 1.3 | % | |||||||||||||||

Other | 7,708,737 | 25.0 | % | 6,283,023 | 21.5 | % | 5,700,724 | 20.4 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Sum | 30,801,945 | 100.0 | % | 29,186,395 | 100.0 | % | 27,943,373 | 100.0 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Cons’ Adjustment | (5,151,934 | ) | — | (4,288,390 | ) | — | (4,026,706 | ) | — | |||||||||||||||

Total | 25,650,011 | — | 24,898,005 | — | 23,916,667 | — | ||||||||||||||||||

Financial statements for the 41st, 40th, and 39th fiscal years are in accordance with K-IFRS No. 1116

Financial statements for the 41st, 40th, and 39th fiscal years are in accordance with K-IFRS No. 1116

| A. | ICT : KT |

KT operates wireless communications services for individual and corporate customers such as wireless communications, high-speed Internet, and corporate lines, pay TV services such as IPTV, and platform-based B2B businesses such as IDC, Cloud, and AI/DX. KT declared its change into a digital platform company (DIGICO) in 2020 and is accelerating innovation from various businesses such as media, finance, and B2B to customer-centered platforms. Based on the solid performance growth of Telco business in 2021, we are striving for the growth of B2B+DIGICO business.

| B. | Satellite TV : Skylife |

KT Skylife is leading the domestic HD broadcasting service market by commercializing H.264 based multi-channel HD for the first time in Korea. It is launching Korea’s largest UHD multi-channel service and reflecting customer trends that aim for rational consumption with ‘30% discount home combination’ products. In October 2020, it launched ‘SkyLife Mobile’, an affordable phone service, and started selling three types of combined products (TPS) including affordable phones, satellite broadcasting, and the Internet.

On September 30, 2021, KT completed the acquisition of Hyundai HCN, a comprehensive wired broadcasting operator, and expanded its wired subscriber base. Skylife TV, a subsidiary of KT Skylife, is a broadcasting channel user operator and has 12 channels including the representative channel ENA.

| C. | Real Estate: KT Estate |

In 2022, the real estate business achieved KRW 485.1 billion, an increase of KRW 149.7 billion (44.6%) from the previous year. The performance of Novotel, Ibis, and Sofitel hotels grew significantly compared to the previous year, affected by the endemic, and the opening of Le Meridien in Myeongdong and Moxy in November contributed to sales and profit growth. Profit recorded KRW 1.19 trillion, an increase of KRW 776 billion (188.7%) compared to the previous year.

7

KT Group’s real estate business continues to pursue stable growth through an asset-focused business strategy and periodic portfolio strategy updates that reflect real estate market fluctuations, product selection, maximizing asset value and creating new spaces that reflect innovative ICT technology.

| D. | Other Businesses (Commerce, Advertisements, etc.) |

| • | Genie Music, through the music platform ‘Genie’, provides customers with high quality music service. It also provides differentiated services by applying AI curation technology based on music listening history, for the first among domestic music streaming platforms, and provides various and wide content services through the original audio and live performance platform ‘STAYG’. |

| • | KT SAT’s satellite service business is a business that secures satellites and provides services to generate revenue by using orbit and frequency allocated by the government. It provides satellite services using a total of four self-owned satellites and overseas satellite relay services. |

| • | KT Alpha (formerly KT HiTel) is expanding the foundation of its commerce business from TV to mobile and creating synergy through the merger (merger date: July 1, 2021) with KT M-house, which has mobile coupon business capabilities. KT Alpha sold all shares of Alpha DX Solution, which it 100% owned, to KTDS (sale date: October 7, 2022). |

| • | Nasmedia is mainly engaged in internet and mobile, IPTV, and digital out-of-home advertising media sales centered on display advertising. It launched K-Deal, a CPS advertising product based on text, in 2021. |

| • | KT Studio Genie was established on January 28, 2021, to oversee and lead the group’s media/content business (content production/planning/investment/distribution, etc.), and it has established itself as a studio business operator by broadcasting original content in 2022. |

| • | kt cloud, which was launched on April 1, 2022, aims to become the best DX specialist company in Korea by strengthening its core competitiveness in IDC and cloud, which is inevitable in the digital era and for KT’s DIGICO strategy. |

8

| 2. | (Manufacturing Service) Main Products and Services |

| A. | ICT : KT |

Price fluctuations of KT’s mobile plans, IPTV, broad band, fixed-line phones, and combined products are as follows. For more information, please refer to the product service contents on our website(https://product.kt.com). Prices below do not reflect additional discounts.

| • | Mobile (Unit : KRW, VAT included) |

Plan | Monthly Rate | |||||

5G Super Plan Choice | Premium Choice | 130,000 | ||||

| Special Choice | 110,000 | |||||

| Basic Choice | 90,000 | |||||

5G Simple | 69,000 | |||||

5G Simple Plus | 61,000 | |||||

5G Slim | 55,000 | |||||

5G Save | 45,000 | |||||

| On September 25th, 2020, KT released the 5G Super Plan Choice, followed by 5G Simple and Save on October 5th, Netflix content on October 28th, a Hyundai Card partnership benefit on June 2nd, 2021, Disney+ content on November 12th, 2021, Samsung Electronics and Woori Card partnership benefits on February 14th, 2022, YouTube Premium content on May 2nd, 2022, and Tving/Genie content on July 1st, 2022. On August 23rd, 2022, KT launched the 5G Slim Plus plan. |

| • | IPTV(Unit : KRW, VAT included) |

| - | Revised TV subscription plans to “Choice” plans (June 2nd, 2022) |

| - | Released new subscription plans: OTV Muse Choice, OTV CEO Choice (June 2nd, 2022) |

| - | Rebranded to Genie TV (October 4th, 2022) |

Plan | Monthly Rate | |||||||||||||||||||

| No Contract | 1 Year Contract | 2 Year Contract | 3 Year Contract | Broadband bundle | ||||||||||||||||

OTV Slim | 16,500 | 15,675 | 14,850 | 13,200 | 11,000 | |||||||||||||||

OTV Basic | 18,150 | 17,270 | 16,390 | 14,740 | 12,100 | |||||||||||||||

OTV Lite | 19,800 | 18,810 | 17,820 | 15,840 | 13,200 | |||||||||||||||

OTV Essence | 25,300 | 24,035 | 22,770 | 20,240 | 16,500 | |||||||||||||||

OTV Essence Plus | 28,160 | 26,730 | 25,300 | 22,484 | 18,700 | |||||||||||||||

OTV VOD Choice | 31,020 | 29,469 | 27,918 | 24,816 | 20,900 | |||||||||||||||

OTV Kids Land Pack Choice | 31,020 | 29,469 | 27,918 | 24,816 | 20,900 | |||||||||||||||

OTV Muse Choice | 34,540 | 32,175 | 29,810 | 25,080 | 20,900 | |||||||||||||||

OTV Super Pack Choice | 36,300 | 34,540 | 32,890 | 29,480 | 25,300 | |||||||||||||||

OTV CEO Choice | 47,300 | 43,450 | 39,600 | 31,900 | 25,300 | |||||||||||||||

OTV Netflix Choice HD | 37,300 | 35,265 | 33,450 | 29,680 | 25,500 | |||||||||||||||

OTV Netflix Choice UHD | 39,800 | 37,325 | 35,840 | 31,680 | 27,500 | |||||||||||||||

| Above prices do not include additional costs such as call-out fees. |

9

| • | Broadband(Unit : KRW, VAT included) |

The following prices do not include additional costs such as equipment (modem) rental fees, call-out fees, etc.

- Prices of new plans in 2022 are as follows.

Plan | Monthly Rate | |||||||||||||||||||||

| No Contract | 1 Year Contract | 2 Year Contract | 3 Year Contract | T/M bundle | Launch | |||||||||||||||||

Secure Internet Premium | 64,900 | 58,300 | 52,250 | 45,650 | 40,150 | 7th Jan. 2022 | ||||||||||||||||

Secure Internet Essence | 59,400 | 52,800 | 46,750 | 40,150 | 34,650 | 7th Jan. 2022 | ||||||||||||||||

Secure Internet Basic | 50,600 | 45,100 | 40,150 | 34,650 | 29,150 | 7th Jan. 2022 | ||||||||||||||||

Secure Internet Slim | 44,000 | 37,950 | 32,450 | 23,650 | 23,650 | 7th Jan. 2022 | ||||||||||||||||

Secure Internet Premium Wifi | 73,700 | 65,450 | 57,750 | 45,650 | 40,150 | 7th Jan. 2022 | ||||||||||||||||

Secure Internet Essence Wifi | 68,200 | 59,950 | 52,250 | 40,150 | 34,650 | 7th Jan. 2022 | ||||||||||||||||

Secure Internet Basic Wifi | 59,400 | 52,250 | 45,650 | 35,750 | 30,250 | 7th Jan. 2022 | ||||||||||||||||

Secure Internet Slim Wifi | 52,800 | 45,100 | 37,950 | 24,750 | 24,750 | 7th Jan. 2022 | ||||||||||||||||

Secure Payment Internet Essence | 67,100 | 59,950 | 52,800 | 41,800 | 36,300 | 2nd Jun. 2022 | ||||||||||||||||

Secure Payment Internet Basic | 58,300 | 52,250 | 46,200 | 36,300 | 30,800 | 2nd Jun. 2022 | ||||||||||||||||

Secure Payment Internet Slim | 51,700 | 45,100 | 38,500 | 25,300 | 25,300 | 2nd Jun. 2022 | ||||||||||||||||

Secure Payment Internet Essence Wifi | 75,900 | 67,100 | 58,300 | 42,900 | 37,400 | 2nd Jun. 2022 | ||||||||||||||||

Secure Payment Internet Basic Wifi | 67,100 | 59,400 | 51,700 | 37,400 | 31,900 | 2nd Jun. 2022 | ||||||||||||||||

Secure Payment Internet Slim Wifi | 60,500 | 52,250 | 44,000 | 26,400 | 26,400 | 2nd Jun. 2022 | ||||||||||||||||

- Prices of new plans in 2021 are as follows.

Plan | Monthly Rate | |||||||||||||||||||||||||||||

| No Contract | 1 Year Contract | 2 Year Contract | 3 Year Contract | 4 Year Contract | 5 Year Contract | T/M bundle | Launch | |||||||||||||||||||||||

GiGA Wi Internet Max 2.5G(ax) | 78,100 | 69,300 | 60,500 | 45,650 | (*) | — | — | 40,150 | (*) | 5th Mar. 21 | ||||||||||||||||||||

GiGA Wi Internet Max 1G(ax) | 72,600 | 63,800 | 55,000 | 40,150 | (*) | — | — | 34,650 | (*) | 5th Mar. 21 | ||||||||||||||||||||

GiGA Wi Internet Max 500M(ax) | 63,800 | 56,100 | 48,400 | 35,750 | (*) | — | — | 30,250 | (*) | 5th Mar. 21 | ||||||||||||||||||||

GiGA Wi Internet Max 100M(ax) | 57,200 | 48,950 | 40,700 | 24,750 | (*) | — | — | 24,750 | (*) | 5th Mar. 21 | ||||||||||||||||||||

Multinet Essence | 60,500 | 53,900 | 48,400 | 44,000 | (*) | 41,250 | 38,500 | 38,500 | (*) | 4th Nov. 21 | ||||||||||||||||||||

Multinet Basic | 51,700 | 46,200 | 41,800 | 38,500 | (*) | 35,750 | 33,000 | 33,000 | (*) | 4th Nov. 21 | ||||||||||||||||||||

Multinet Slim | 45,100 | 39,600 | 34,100 | 27,500 | (*) | 25,850 | 24,200 | 27,500 | (*) | 4th Nov. 21 | ||||||||||||||||||||

| (*) | Based on a 3-year contract for GiGA Wi internet plans with maximum speeds of 2.5G/1G/500M, and a TV/Mobile bundle. Based on a 3-year contract for Multi-Net Essence/Basic/Slim plans, and a Multi-Net (TV) bundle. |

| - | Prices of new plans in 2020 are as follows. |

10

Plan | Monthly Rate | Rate with 1 year term | Rate with 2 year term | Rate with 3 year term | Rate with 3 year term when IPTV, mobile and Broadband are bundled | Launch Date | ||||||||||||||||||

GiGA Wi Max 2.5G(ac) | 78,100 | 69,300 | 60,500 | 45,100 | (*) | 39,600 | (*) | 23th June 20 | ||||||||||||||||

GiGA Wi Max 1G(ac) | 72,600 | 63,800 | 55,000 | 39,600 | (*) | 34,100 | (*) | 23th June 20 | ||||||||||||||||

GiGA Wi Max 500M(ac) | 63,800 | 56,100 | 48,400 | 35,200 | (*) | 29,700 | (*) | 23th June 20 | ||||||||||||||||

GiGA Wi Max 100M(ac) | 57,200 | 48,950 | 40,700 | 24,200 | (*) | 24,200 | (*) | 23th June 20 | ||||||||||||||||

| (*) | The price for the 3-year contract and TV/Mobile combination of GiGA Wi internet with speeds of up to 2.5G/1G/500M is the price after applying the GiGA WiFi Buddy launch promotion. |

- Broadband plan names have been changed since September 25, 2021.

| Classification | AS-IS | TO-BE | ||

| Internet only | 10 GiGA MAX 10G | Internet Super Premium | ||

| 10 GiGA MAX 5G | Internet Premium Plus | |||

| 10 GiGA MAX 2.5G | Internet Premium | |||

| GiGA MAX 1G | Internet Essence | |||

| GiGA MAX 500M | Internet Basic | |||

| GiGA MAX 200M | Internet Slim Plus | |||

| GiGA MAX 100M | Internet Slim | |||

| WiFi Package | 10G MAX 2.5G Plus | Internet Premium WiFi | ||

| GiGA MAX 1G Plus | Internet Essence WiFi | |||

| GiGA MAX 500M Plus | Internet Basic WiFi | |||

| GiGA MAX 100M Plus | Internet Slim WiFi | |||

| GiGA Wi internet | GiGA Wi | Internet Wide | ||

| Family Secure Package | the Internet plus that reassures the family (10 GiGA Max 2.5G) | Internet Premium WiFi that reassures the family | ||

| the Internet plus that reassures the family (10 GiGA Max 1G) | Internet Essence WiFi that reassures the family | |||

| the Internet plus that reassures the family (10 GiGA Max 500M) | Internet Basic WiFi that reassures the family | |||

| the Internet plus that reassures the family (10 GiGA Max 100M) | Internet Slim WiFi that reassures the family | |||

| the Internet that reassures the family (10 GiGA Max 2.5G) | Internet Premium that reassures the family | |||

| the Internet that reassures the family (10 GiGA Max 1G) | Internet Essence that reassures the family | |||

| the Internet that reassures the family (10 GiGA Max 500M) | Internet Basic that reassures the family | |||

| the Internet that reassures the family (10 GiGA Max 100M) | Internet Slim that reassures the family |

| • | Fixed Line Telephone Services (Unit : KRW, VAT included) |

11

2020~2021 – No changes occurred.

| • | Bundled Rate Plans (Unit : KRW, VAT included) |

2022 | 2021 | 2020 | ||

<2022.02> ● Premium Single Combination Promotion normalized (02.24~) - Combining 500M or more speed with 5G mobile plans of KRW 80,000+ (LTE plans of KRW 65,890+) in a single line, 25% discount for monthly mobile fees

<2022.04> ● Newlywed combination Promotion normalized (04.01~) - For engaged or newlywed couples, mobile discounts for upto 6 months without internet ● System improvements for collective contract buildings, reducing return amount of discounts by 100% from requests made after April 2022 ● Additional Premium Single Bundle discounts for bundles within CEO Success Pack

<2022.05> ● 5G Premium Family Bundle Teen Discount Promotion (22.05.02~22.10.31) - If teenagers under 18 and legal guardian’s mobile plans meet all following conditions, teenager gets additional KRW 5,500 (including VAT) monthly discount. • Joining Premium Family Bundle Discount program • Using a 5G plan of KRW 80,000 or more ● New discount option for Base plan of Premium Family Bundle - Internet can be applied to mobile base plans instead

<2022.10> ● More plans to the multi-network Bundle discount program - Additional products: home phone, internet phone (home and Centrex) - Discounts are the same as CEO Success Pack Bundle discount.

<2022.11> ● 5G Premium Family Bundle Teen Discount Promotion normalized (11.1~) - If teenagers under 18 and legal guardian’s mobile plans meet all following conditions, teenager gets additional KRW 5,500 (including VAT) monthly discount. • Joining Premium Family Bundle Discount program • Using a 5G plan of KRW 80,000 or more

<2022.12> ● Premium family and single mobile plans will be unified based on a single standard (80,000 KRW+ 5G Plans/65,890KRW+ LTE plans g 77,000KRW+ 5G/LTE plans, including VAT) by unifying the mobile plans provided for Premium Family and Single plans | <2021.04> ● Mobile bundle promotion ‘between friends’ - Equivalent discount benefit as the ‘Mobile bundle pack for my family’ for foreigners of same nationality

<2021.05> ● Renewal of the CEO Success Pack - Added mobile bundle service - Integrated VAN billing and relaxation of the discount condition

<2021.08> ● Promotion of the Premium Single bundling package - 25% discount of the mobile tariff for the service usage of over 500Mbps internet and 5G mobile plan over 80k KRW (65,890 KRW for LTE subscriber)

<2021.10> ● Pre-marriage Bundle Promotion - Lump sum discount of mobile service for soon to be married or newly married couple for maximum 6 months | <2020.04> ● Renewal of the Internet Telephony Home bundle plan - Change of the discount amount from 2,200 won to 1,100 won of the Internet Telephony Home bundle plan if bundled with Home Telephony with 3 year term

<2020.06> ● Renewal of the Home Telephony TPS bundle plan within home bundle - Change of the discount amount from 4,620 won to 1,320 won for grade 8 or higher of the Home Telephony bundle plan if bundled with TPS with 3 year term including IPTV

<2020.07> ● CEO Success Pack launch |

12

| B. | Satellite TV – KT Skylife |

| • | TV (Unit : KRW, VAT Included) |

Service Type | 2022 | 2021 | 2020 | |||||||||||||||||

Satellite only | Android | sky UHD Family A+ | Receiving | 12,100 | 12,100 | 12,100 | ||||||||||||||

| Bundle | 8,800 | 8,800 | 8,800 | |||||||||||||||||

| sky UHD Blue A+ | Receiving | 14,300 | 14,300 | 14,300 | ||||||||||||||||

| Bundle | 11,000 | 11,000 | 11,000 | |||||||||||||||||

| sky UHD Green A+ | Receiving | 12,100 | 12,100 | 12,100 | ||||||||||||||||

| Bundle | 8,800 | 8,800 | 8,800 | |||||||||||||||||

| UHD | sky Family+ HD + sky UHD pack | Receiving | 12,100 | 12,100 | 12,100 | |||||||||||||||

| Bundle | 8,800 | 8,800 | 8,800 | |||||||||||||||||

| HD | Sky On+ HD | Receiving | 8,800 | 8,800 | 8,800 | |||||||||||||||

| Bundle | 8,250 | 7,700 | 7,700 | |||||||||||||||||

OTS | — | UHD OTS Prime Kids Land /Entertainment (19) | Receiving | 20,900 | 20,900 | 20,900 | ||||||||||||||

| UHD OTS Essence (15) | Receiving | 16,500 | 16,500 | 16,500 | ||||||||||||||||

| UHD OTS Light (12) | Receiving | 13,200 | 13,200 | 13,200 | ||||||||||||||||

| UHD OTS Slim (10) | Receiving | 11,000 | 11,000 | 11,000 | ||||||||||||||||

| OTS Prime Kids Land /Entertainment (19) | Receiving | 20,900 | 20,900 | 20,900 | ||||||||||||||||

| OTS Essence (15) | Receiving | 16,500 | 16,500 | 16,500 | ||||||||||||||||

| OTS Light (12) | Receiving | 13,200 | 13,200 | 13,200 | ||||||||||||||||

| OTS Slim (10) | Receiving | 11,000 | 11,000 | 11,000 | ||||||||||||||||

| OTS Basic (11) | Receiving | 12,100 | 12,100 | 12,100 | ||||||||||||||||

| Based on products available as of the end of December 2022 |

| - | Receiving: based on 3-year contract (VAT included) |

| - | Bundle: based on TV-Internet bundle (VAT included) |

| • | Broadband (Unit : KRW, VAT Included) |

Service Type | 2022 | 2021 | 2020 | |||||||||||||||

Internet | sky 100M | Price | 28,050 | 28,050 | 28,050 | |||||||||||||

| Bundle | 19,800 | 19,800 | 19,800 | |||||||||||||||

| sky GiGA 200M | Price | 30,250 | 30,250 | 30,250 | ||||||||||||||

| Bundle | 22,000 | 22,000 | 22,000 | |||||||||||||||

| sky GiGA 500M | Price | 33,000 | 33,000 | 33,000 | ||||||||||||||

| Bundle | 27,500 | 27,500 | 27,500 | |||||||||||||||

| sky GiGA 1G | Price | 38,500 | 38,500 | 38,500 | ||||||||||||||

| Bundle | 33,000 | 33,000 | 33,000 | |||||||||||||||

| Based on products available as of the end of December 2022 |

| - | Price : based on 3-year contract (VAT included), does not include rental fees, installation fees, etc. |

| - | Bundle price: based on TV-internet combination (VAT included) |

| - | AP rental fee discount promotion applied |

13

| - | Promotion for a 2,000KRW discount on bundle price for sky 100M and sky Giga 200M applied |

| - | Direct Secure discount promotion: Additional discount of 8,800 KRW per month for the sky Giga 500M/1G Safe combination product, only available through direct channels (customer center, online) |

| • | Mobile |

SKY Life’s mobile plans are divided into 10,000 KRW data plans, selectable plans, and unlimited plans.

| C. | Other Businesses |

| • | Genie Music |

| - | Price change of major services Prices of music streaming service products are as follows. (30-day subscription price, based on Web payment. Unit: KRW, VAT excluded) |

Service | Type | Product | 2022 | 2021 | 2020 | |||||||||||

Music Service | Unlimited Streaming | Data Safe Music Streaming | 10,900 | 10,900 | 10,900 | |||||||||||

| Music Streaming(PC+Mobile) | 8,400 | 8,400 | 8,400 | |||||||||||||

| Smart Music Streaming (Mobile only) | 7,400 | 7,400 | 7,400 | |||||||||||||

| MP3 Download + Unlimited Streaming | Streaming + 30 Downloads/month | N/A | N/A | 10,800 | ||||||||||||

| Streaming + 50 Downloads/month | N/A | N/A | 15,000 | |||||||||||||

| MP3 Download | 5 Downloads/month | 3,000 | 3,000 | 3,000 | ||||||||||||

| 10 Downloads/month | 5,500 | 5,500 | 5,500 | |||||||||||||

| 30 Downloads/month | N/A | N/A | 8,800 | |||||||||||||

| 50 Downloads/month | N/A | N/A | 12,500 | |||||||||||||

| Streaming by Play Count | 1,000 songs | N/A | 16,000 | 16,000 | ||||||||||||

| 300 songs | 4,800 | 4,800 | 4,800 | |||||||||||||

| 100songs | 1,600 | 1,600 | 1,600 | |||||||||||||

| 20 songs | 800 | 800 | 800 | |||||||||||||

Bundle Service | Unlimited Music + e-book | Smart Streaming + e-book (Genie + Millie’s library) | 13,000 | 13,000 | — | |||||||||||

| • | KT CS |

| (1) | Price change of major services (Unit: KRW) |

Item | 2022 | 2021 | 2019~2020 | |||

114 Directory assistance | 170 (190 won at Night/Holidays) * all-day surge on Saturday | 170 (190 won at Night/Holidays) * all-day surge on Saturday) | 120 (140 won at Night/Holidays) * all-day surge on Saturday | |||

Priority Number Assistance | Standard 40,000/month Budget 10,000/month (“Dong” standard) | 30,000/month (“Dong” standard) | 30,000/month (“Dong” standard) |

14

| “Dong” is Korea’s address classification system. |

| Quotation for contact center services may vary depending on the type of business (inbound, outbound) and industry (government agencies, general enterprises), and it cannot be considered as a single-task service due to the nature of the work. Therefore, the calculation of an average price would not be meaningful. For further detail, please refer to the following. |

| (2) | Reasons for Price Fluctuation |

| ① | Contact Center Outsourcing: |

The outsourcing cost includes direct and indirect labor costs, management costs, and profits. Among them, labor costs account for approximately 85-90% (depending on the client), the largest proportion. The quotation (price) is usually calculated based on the cost per person /month, and it may also be calculated based on PPC (Pay Per Call) depending on the number of responses or processed cases. Since contact centers cannot be regarded as a single-task service due to the nature of the work, the calculation of an average price would not be meaningful. For total outsourcing contact centers, the cost of supporting system management and operation for the leased facilities is added to the calculation. For leased facilities, the unit cost is calculated based on the depreciation expense under the fixed asset method.

| ② | 114 Directory Service: |

History of fee increases for 114 directory service is as follows (Unit: KRW)

2021.2.1 | 2016.12.01 | 2003.11.01 | 2002.05.01 | |||||

Price | Price increase (Daytime 170, Night/Holidays 190), Additional Service increase (Direct connection 110, indirect connection 80) | Saturday mornings: Weekday rates no longer apply | Price increase (Daytime 120, Night/Holidays 140), | Price increase (80g100, 3 free monthly calls terminated) |

| Free 114 Directory Assistance provided until 1996 has become paid service from 1997, as a cost recovery measure. |

| ③ | Priority Number Directory Assistance |

The following are the changes to the priority number directory assistance fees since March 1, 2022 (Unit: KRW)

Service | Details | Before | After 22.3.1 | |||||

Standard | Budget | |||||||

| Priority Number Guide Service for Dong (Eup, Myeon*) | Provides priority number guide service to registered district areas | 30,000/month | 40,000/month | 10,000/month | ||||

| Priority Number Guide Service for Gu (Gun*) | Provides priority number guide service to registered district areas | 40,000/month | 50,000/month | 15,000/month | ||||

| Priority Number Guide Service for Cities (Metropolitan/Non-metropolitan) | Provides priority number guide service to registered district areas | 50,000/month | 60,000/month | 20,000/month | ||||

| * | Dong, Gu, Eup, Myeon, and Gun and are types of Korea’s address classification system |

15

| Fee exceptions: Standard industry fees for customers with a membership history within one year of the fee change date (March 1, 2022) are based on the previous fees. However, if the service is re-subscribed after one year of termination, new fees will apply. |

| Budget industry: Designated and operated for unpopular industries with no membership history within one year of the fee change. |

| ④ | Distribution |

Telecommunications equipment follows pricing policy of the manufacturer. and major telecommunications services follows pricing policy of KT Corporation

| • | KT IS |

| (1) | 114 Directory Assistance Price: Daytime 170 KRW, Nighttime/holidays 190 KRW |

| As of February 1, 2021, the daytime/nighttime/holiday fee increased by 50KRW. |

| (2) | Priority Number Directory Assistance Price (Unit: KRW, VAT excluded) |

Item | 2022 | |||||||||||||||||||

| Monthly Fee | Group 1 | Group 2 | Group 3 | Group 4 | ||||||||||||||||

| City | 55,000 | 53,000 | 50,000 | 45,000 | ||||||||||||||||

| Gu | 44,000 | 42,000 | 40,000 | 36,000 | ||||||||||||||||

Priority Number Directory Assistance | Dong | 33,000 | 31,000 | 30,000 | 27,000 | |||||||||||||||

| The sign-up fee for the Priority Number Information Service is divided into groups based on the service area and industry. Each area is divided into “city”, “district”, and “neighborhood” units, and the industry groups are divided into 1st group (moving centers, rental cars, etc.), 2nd group (flower shops/delivery, water purifier sales, etc.), 3rd group (quick delivery, key repair, etc.), and 4th group (industries outside of the 1st to 3rd groups) in order of high usage rates. |

| The pricing of the Priority Number Directory Assistance has not undergone any price changes in the last 3 years. |

| (3) | Other contact center (outsourcing) businesses besides those mentioned above are difficult to view as single services due to their job characteristics, and pricing in the distribution business tends to be determined according to the policies of KT and terminal manufacturers, making it difficult to derive meaningful figures through average pricing calculations. |

| • | KT M Mobile |

KT M Mobile’s mobile plans are divided into device bundle plans of post-paid plans, SIM-only plans, and pre-paid plans.

16

| • | KT Cloud |

| 1) | Cloud |

Public | - On-demand service that provides Cloud-based IT infrastructure (computing/storage/NW, etc.) tailored to client needs, available whenever and as much as needed - Offers high performance and stability without concerns for IT procurement, operation, or management | |

CDN | - Contents Delivery service that delivers large-scale contents in real-time anywhere in the world - Supports 100+ countries and 200,000+ Edge services | |

Private | - Client-specific Cloud service independently built at client’s location - Provides tailored services optimized for client business environments with high stability and excellent security | |

Marketplace | - Digital catalog service that curates industry-leading 3rd party solutions to clients’ needs - Provides easy access to solutions that are optimized for clients’ business needs | |

| 2) | IDC |

Colocation | - Provides advanced computing infrastructure by directly accessing KT IDC Internet backbone network to improve internet connectivity speed and by providing power, air conditioning, and security infrastructure. | |

MSP | - Service where clients outsource the management of their IT systems and various computing infrastructure resources to KT. Includes leasing monitoring tools, IT infrastructure operation and maintenance, migration, consulting, and utilizing KT’s professional personnel, facilities, equipment, and network resources | |

DC/Infra | - Service that builds and provides customers with customized DC/DR. Formerly classified as On-demand IDC. | |

Connectivity | - Service that provides connectivity to all services (Neutral IDC/CSP) based on One IDC | |

3. (Manufacturing Service) Sales

| A. | ICT : KT |

(1) Performance in terms of revenue (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Service revenue | 15,766,188 | 86.2 | 15,501,216 | 84.3 | 15,086,246 | 84.4 | ||||||||||||||||||

Merchandise sales | 2,523,055 | 13.8 | 2,886,218 | 15.7 | 2,793,035 | 15.6 | ||||||||||||||||||

Total | 18,289.243 | 100.0 | 18,387,434 | 100.0 | 17,879,281 | 100.0 | ||||||||||||||||||

17

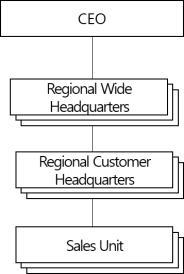

(2) Sales Organization and Channels

Sales organization

<B2C>

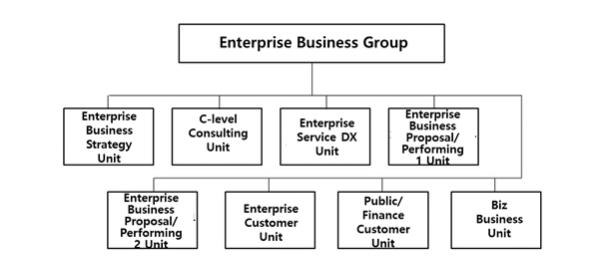

<B2B>

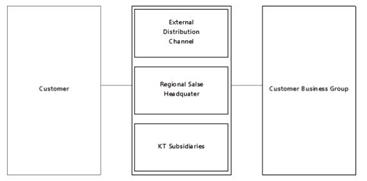

Sales Channels

<B2C>

18

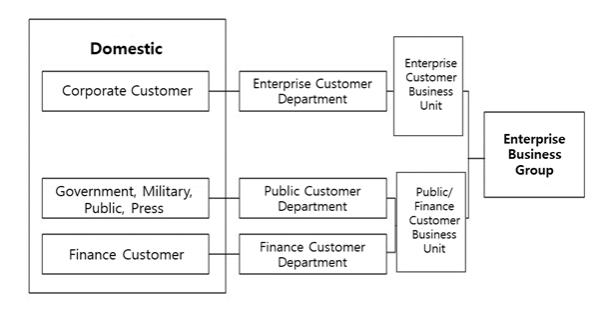

<B2B>

(3) Methods and Conditions of Sales

KT provides our products and services to customer through the sales organization and channel as above, basically, customers pay the service charges with cash, bank direct debit bill and credit card. In addition to monthly service fee, customers must pay the equipment rental fee and installment fee as well.

For the B2B business, the supply conditions and service fees are determined via a negotiation with enterprise customers.

(4) Sales Strategy

(a) Mobile Service

| • | Device leadership : Differentiate wireless experience with pre-emptive adoption of differentiated 5G/LTE smartphones and new forms of emerging devices. |

| • | Network quality differentiation : 5G first C-DRX Application and 5G network quality based on edge communication center, tight national network LTE-A Network. |

| • | Innovative rate plans : ‘5G Choice plan’ to offer unlimited data and worldwide data roaming, and LTE data ON providing unlimited data across all plans |

| • | Segment marketing : Introducing products exclusively for young customers such as Y super pan, Y24 and providing premium single bundled rate plan optimized for single-person households |

| • | Loyalty program : A variety of mobile phone replacement programs and installment plans, including industry-leading membership benefits, long-term customer special benefits, and rental services to reduce inconvenience in device replacement. |

| • | Differentiated service : The CS system optimized for smartphones, the benefits of reducing telecommunication charge through affiliated cards, differentiated mobile phone insurance products, and ‘Dual Number’ service to use 2 phone numbers in 1 phone. |

19

(b) Broadband Internet Service

| • | Lead the market with preemptive GiGA infrastructure investment and service quality enhancement |

| • | Expand sales synergy by bundling products between telco(5G, IPTV, etc.) and non-telco(CCTV, IoT, etc.) services |

| • | Broaden internet business coverage such as low cost market with skylife internet resale |

| • | Provide the optimized wireless internet environment through introducing advanced WiFi devices such as ‘GiGA WiFi home ax’, ‘GiGA WiFi Buddy ax’, ‘GiGA WiFi Premium 6E’, etc. |

| • | Offer the customized services for specific segments based on the customer behavior analysis to enhance customer convenience |

| • | Expand the product lineups including bundling, WiFi devices for small business owners |

| • | Acquire a number of broadband lines by winning the B2B/B2G orders e.g. mobile internet infrastructure installment business. |

(c) Telephone Service

| • | Preemptive care activities to minimize customer churn : |

| • | Uncombined customers using the Internet and TV products : Service bundling propulsion |

| • | Customers who need home telephony service : Promoting KT telephony 3000 price plan |

| • | Customers who did re-contract VoIP service : Promoting KT VoIP 3000 price plan |

| • | SOHO, small business customers : Pushing to sign up for converged products including Telephone manager, Ringo |

| • | Preventing from decreasing revenue by restructuring price plans : |

| • | Rolling out new VoIP price plan which is charging per second(February, 2020) |

(d) IPTV Service

| • | Improve the product’s marketability take into strategic partnerships considering the changes in the media environment |

| • | Increase IPTV sales by introducing new media devices |

| • | Based on AI, organizing personalized content and strengthening the recommendation |

B. Satellite Business (KT skylife)

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Service revenue | 399,555 | 56.7 | 364,983 | 55.7 | 349,277 | 52.9 | ||||||||||||||||||

Platform revenue | 217,167 | 30.8 | 219,218 | 33.5 | 216,968 | 32.9 | ||||||||||||||||||

Others | 88,205 | 12.5 | 71,153 | 14.3 | 94,159 | 14.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 704,927 | 100.0 | 655,354 | 100.0 | 660,404 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| The above numbers are written on a separate basis. |

20

| Platform revenue: Advertisement revenue + Home shopping transmission fee + T-commerce transmission fee |

| Service revenue: Broadcasting revenue + Internet revenue + Mobile revenue |

(2) Sales Organization and Channels

KT Skylife currently has various sales channels such as skylife head office, customer center, 196 sales offices which are further organized under 9 branches (three in Seoul, two in Busan and one each in Daejeon, Daegu, Gwangju and etc.) and 2 local office (one each in Jeonju, Daejeon), KT.

Sales offices perform sales and services through consignment contracts with KT Skylife, and 2 customer centers(Suwon, Gwangju) perform business activities such as customer counseling, as well as defending customer churn and attracting new subscribers.

The combined products are sold through KT’s in-house/outdoor sales channels and group companies, which are nationwide, and we are continuously sold on the headquarters’ website.

In addition, we have been continuously partnering with various on and off-line companies such as companies, government offices, and online markets to secure sales channels.

As of the end of December 2022, sales by route are as follows (Accumulated from January to December 2022)

Category | New Subscribers | % | ||||||

Sales office | 235,784 | 75.2 | ||||||

KT | 3,041 | 1.0 | ||||||

Headquarter, customer center | 74,588 | 23.8 | ||||||

|

|

|

| |||||

Total | 313,413 | 100. | ||||||

|

|

|

| |||||

C. Others Business

KT Estate

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Rental business | 175,167 | 35.9 | 160,212 | 47.8 | 156,784 | 43.6 | ||||||||||||||||||

Development business | 11,156 | 2.3 | — | — | 61,360 | 17.0 | ||||||||||||||||||

PM fee | 58,073 | 11.9 | 45,513 | 13.6 | 106,506 | 29.6 | ||||||||||||||||||

Real estate commission business | 140,098 | 28.7 | 99,424 | 29.6 | 7,753 | 2.2 | ||||||||||||||||||

Others | 103,257 | 21.2 | 30,224 | 9.0 | 27,551 | 7.6 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 487,751 | 100.0 | 335,373 | 100.0 | 359,954 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

21

KT Sat

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Gap filler rentals | 105,171 | 58.4 | 102,372 | 58.6 | 96,853 | 55.8 | ||||||||||||||||||

Data transmission | 17,990 | 10.0 | 24,565 | 14.1 | 20,778 | 12.0 | ||||||||||||||||||

Video transmission | 8,340 | 4.6 | 8,161 | 4.7 | 9,467 | 5.5 | ||||||||||||||||||

Mobile satellite service | 24,507 | 13.6 | 22,051 | 12.6 | 20,059 | 11.6 | ||||||||||||||||||

Others | 24,067 | 13.4 | 17,506 | 10.0 | 26,391 | 15.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 180,075 | 100.0 | 174,655 | 100.0 | 173,548 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Performances were written in accordance with K-IFRS |

(2) Sales Organization and Channels

KT SAT’s sales organization manages and operates customers by region. Due to the characteristics of the service, the company has a large number of corporate customers and is attracting new customers through sales of internal sales representatives and external distribution networks (partners).

2) Sales Organization and Channels

KT Estate’s main business is real estate leasing service and development. For this reason, this report does not disclose the sales organization and channels information.

KT alpha (Former KT Hitel)

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

T-Commerce(K Shopping) | 325,515 | 69.3 | 307,181 | 72.5 | 228,424 | 65.4 | ||||||||||||||||||

Mobile Gift Commerce | 96,067 | 20.5 | 61,886 | 14.6 | — | — | ||||||||||||||||||

Content Distribution | 47,992 | 10.2 | 54,598 | 12.9 | 37,486 | 10.7 | ||||||||||||||||||

ICT Platform | — | — | — | — | 83,404 | 23.9 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 469,574 | 100.0 | 423,664 | 100.0 | 349,314 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| The performance above was written in accordance with K-IFRS 1116 |

| The revenues of ICT business in 2021 and 2022 were classified as a discontinued operation since the shares of AlphaDXSolution(which was a subsidiary company) was sold in a carve-out(October, 2022) |

(2) Sales Organization and Channels

(a) Commerce

After the MD has signed a contract with the vendor to supply the product, the product information is provided directly to the general customer through platforms such as VOD, TV, Internet, and mobile. After receiving the customer’s order through TV remote control, internet, and mobile, if payment is made, we will ship the product through the delivery company.

22

(b) Mobile Gift Commerce

KT alpha divides its customers to B2B and B2C depending on the purchasing entities and provides its service. For the B2B customers, the company carries out the sales activities directly to enterprise customers who want to purchase in bulk. Also, the company provides the mobile gift certificate purchase online service (“Giftishow biz”) optimized for business purchase process indirectly such as promotion planning and managing the budget, etc. For B2C customers, the company service through its own web/app and also a variety of affiliate channel such as mobile commerce channel and online open market, etc.

(c) Content

The content supply and demand representative make copyright agreements with the content creator or distributor. And we provide content VOD or library services to 150 platform companies such as IPTV, OTT, and Internet web hard.

Genie Music

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

| 2022 | 2021 | 2020 | ||||||||||||||||||||||

Category | Amount | % | Amount | % | Amount | % | ||||||||||||||||||

Music business | 222,660 | 92.7 | 235,257 | 96.4 | 236,652 | 95.8 | ||||||||||||||||||

| Others | 17,610 | 7.3 | 8,696 | 3.6 | 10,316 | 4.2 | ||||||||||||||||||

Total | 240,270 | 100.0 | 243,954 | 100.0 | 246,968 | 100.0 | ||||||||||||||||||

| Music Business: Regular Music services and distribution of content |

| Others: Irregular music service development service and Artist-related MD sales |

| The numbers are on a separate basis and were written in accordance with K-IFRS 1115. |

(2) Sales Organization and Channels

Genie Music serves as a service provider and content distributor within the digital music industry.

(a) Music Business (Music Services and Content Distributor)

Genie Music provides music services directly to the domestic customers through its own music platform Genie such as website, mobile app and etc. Also, the company is providing music services through the value-added services which telecom companies roll out.

As a content distributor, Genie Music distributes a variety of content including music sources to the domestic and overseas business players.

(b) Others (Performance, MD and etc.)

Genie Music generates others revenue through performance business, MD products, etc.. For the performance business, it shares ticket sales from performances with production/planning companies. For the MD business, the company is selling the MD products (which are bought or imported from MD vendor) to the online and offline stores.

23

KT Telecop

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2021 | 2020 | 2019 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Security service | 510,384 | 98.8 | 502,075 | 98.3 | 380,575 | 97.5 | ||||||||||||||||||

Distribution | 5,403 | 1.1 | 8,318 | 1.6 | 9,098 | 2.3 | ||||||||||||||||||

Others | 647 | 0.1 | 608 | 0.1 | 660 | 0.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 516,434 | 100.0 | 511,001 | 100.0 | 390,333 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

(2) Sales Organization and Channels

KT Telecop operates the business department, regional headquarters strategic sales team, branch offices. And we provide dispatch security service and integrated security service.

Nasmedia

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Digital Advertising | 66,184 | 61.3 | 60,745 | 68.5 | 61,162 | 74.5 | ||||||||||||||||||

Platform | 41,794 | 38.7 | 27,98 | 31.5 | 20,896 | 25.5 | ||||||||||||||||||

Total | 107,977 | 100.0 | 88,726 | 100.0 | 82,058 | 100.0 | ||||||||||||||||||

| The above numbers are written on a separate basis. |

(2) Sales Organization and Channels

The online advertising industry can be divided into three areas: advertising companies, media reps, and media. Media reps generate revenue by selling media.

Nasmedia and its major subsidiaries generally deal with advertisers, advertising agencies, and media companies.

KT Studio Genie

(1) Performance in Terms of Revenue (Unit: millions of Korean won, %)

Category | 2022 | 2021 | ||||||||||||||

| Amount | % | Amount | % | |||||||||||||

Content Production | 95,083 | 93.7 | 10,578 | 89.5 | ||||||||||||

Distribution Agency | 3,096 | 3.0 | 293 | 2.5 | ||||||||||||

PR Agency | 2,442 | 2.4 | ||||||||||||||

Others | 833 | 0.9 | 952 | 8.0 | ||||||||||||

Total | 101,454 | 100.0 | 11,824 | 100.0 | ||||||||||||

2) Sales Organization and Channels

KT Studio Genie’s main business are producing and selling media content (drama). For this reason, this report does not disclose the sales organization and channels information.

24

kt cloud

4th Quarter 2022 | 3rd Quarter 2022 | 2nd Quarter 2022 | 1st Quarter 2022 | 2021 | ||||

156,700 | 144,100 | 129,700 | — | — |

| Revenues are disclosed after its establishment on 1st April in 2022. |

4. (Manufacturing Service) Other References

Matters related to the discharge of environmental substances or environmental protection

KT was designated as a company subject to the Greenhouse Gas Emissions Trading System, which has been in effect since 2015 under the ‘ Framework Act on Low Carbon Green Growth’ and ‘Act on Allocation and Transaction of Greenhouse Gas Emissions’.

In 2018, KT was allocated a greenhouse gas emission allowance from the government, and we continue to reduce Greenhouse Gas emissions.

KT’s greenhouse gas emissions are mainly due to the heating and cooling energy of office buildings nationwide and the use of electricity in telecommunication facilities, such as base stations, and repeaters. By 2050, we have set a goal to meet carbon neutrality.

5. (Finance) Business Overview

BC Card’s main business is issuing and managing credit cards, transaction processing of credit card and recruiting and managing of credit card merchants. Also, BC Card provides credit loans such as short-term card loans and long-term card loans to credit card members, while conducting supplementary businesses such as retail business via telephone, mail order or online, insurance, tourism service and loans.

Credit card companies are a typical domestic-based industry with a sensitive nature to changes in private consumption and overall domestic economic conditions, as they are based on the domestic market. Market entry requires approval from the Financial Services Commission, and considering the need for credit risk management for stable business operations, the entry barrier is high

BC Card is mainly engaged in credit card processing business, and has secured a stable revenue base for card issuers based on its position in the credit card processing market. Additionally, BC Card strives to provide customers with easy and convenient financial services through mobile platform ‘Paybook’ for simplified payments and various financial services.

Credit sales amounted to KRW 130.7968 trillion, long and short-term credit card loans to KRW 8.3931 trillion, financial lease to KRW 176 billion, factoring to KRW 197 billion, and other loans receivables to KRW 1.0582 trillion, resulting in operating revenue of KRW 3.8963 trillion related to those.

BC Card raises funds through the issuance of corporate bonds and CP, and the average balance of financing for the current year was KRW 1.468 trillion, with an average funding rate of 3.332%.

The adjusted capital adequacy ratio at the end of the current term was 27.34%, significantly exceeding the limit of 8% under the Regulation on Supervision of Credit-Specialized Financial Business. The delinquency ratio was 0.94%, and the KRW Liquidity Ratio was 123.01%.

25

6. (Finance) Business Status

A. Performance in Terms of Revenue (Unit: KRW million, %)

Category | 2021 | 2020 | 2019 | |||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||

Card processing revenue | 3,188,690 | 81.8 | 3,154,561 | 88.1 | 2,961,791 | 87.4 | ||||||||||||||||||

Service fee revenue | 169,694 | 4.4 | 176,610 | 4.9 | 199,934 | 5.9 | ||||||||||||||||||

Additional business fee revenue | 57,480 | 1.5 | 68,972 | 1.9 | 77,032 | 2.3 | ||||||||||||||||||

Member Service Fee revenue | 55,560 | 1.4 | 57,182 | 1.6 | 49,860 | 1.5 | ||||||||||||||||||

Private Label Credit Card revenue | 22,970 | 0.6 | 9,051 | 0.3 | 4,591 | 0.1 | ||||||||||||||||||

Financial revenue | 70,427 | 1.8 | 29,935 | 0.9 | 24,186 | 0.7 | ||||||||||||||||||

Foreign currency-related profit | 7,426 | 0.2 | 4,062 | 0.1 | 4,679 | 0.1 | ||||||||||||||||||

Other operating revenue | 324,038 | 8.3 | 79,065 | 2.2 | 67,986 | 2.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 3,896,285 | 100.0 | 3,579,438 | 100.0 | 3,390,059 | 100.0 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| The above numbers are written on a K-IFRS consolidated basis. |

B. Fundraising and Operation

(1) Fundraising

(Unit: KRW million, %)

| 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||

Category | Average Balance | amount of payments | Interest rate | % | Average Balance | amount of payments | Interest rate | % | Average Balance | amount of payments | Interest rate | % | ||||||||||||||||||||||||||||||||||||||

| Short-term debt | CP | 65,076 | 2,723 | 4.18 | 6.24 | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| General debt | 39,274 | 1,445 | 3.68 | 3.77 | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Other debt | 3,287 | 123 | 3.74 | 0.32 | 247 | 8 | 3.24 | 0.08 | — | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Lomg-term debt | CP | 150,237 | 4,501 | 3.00 | 14.41 | 6,270 | 138 | 2.20 | 2.03 | — | — | — | — | |||||||||||||||||||||||||||||||||||||

Corporate Bonds | 784,488 | 18,327 | 2.34 | 75.26 | 301,794 | 5,195 | 1.72 | 97.89 | 52,186 | 823 | 1.58 | 100.00 | ||||||||||||||||||||||||||||||||||||||

Total | 1,042,362 | 27,119 | 2.60 | 100.00 | 308,311 | 5,341 | 1.73 | 100.00 | 52,186 | 823 | 1.58 | 100.00 | ||||||||||||||||||||||||||||||||||||||

| Financial Supervisory Service’s business report standard |

| The other debt of short-term debt refer to borrowings under the credit line agreement |

| % represents the proportion to the Average Balance |

(2) Operation

(Unit: KRW million, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Profit amount | ROI | % | Average Balance | Profit amount | ROI | % | Average Balance | Profit amount | ROI | % | |||||||||||||||||||||||||||||||||||||

Credit Card assets | 110,064 | 20,582 | 18.70 | 13.13 | 30,676 | 9,889 | 32.24 | 3.66 | 12,749 | 4,042 | 31.70 | 1.52 | ||||||||||||||||||||||||||||||||||||

Lease assets | 14,634 | 525 | 3.59 | 1.75 | 2,979 | 82 | 2.75 | 0.36 | — | — | — | — | ||||||||||||||||||||||||||||||||||||

Factoring | 70,358 | 4,241 | 6.03 | 8.39 | 61,041 | 3,709 | 6.08 | 7.28 | 27,879 | 1,827 | 6.55 | 3.33 | ||||||||||||||||||||||||||||||||||||

General loan | 643,147 | 51,623 | 8.03 | 76.73 | 170,126 | 17,298 | 10.17 | 20.30 | 96,854 | 12,814 | 13.23 | 11.55 | ||||||||||||||||||||||||||||||||||||

Total | 838,203 | 76,971 | 9.18 | 100.00 | 264,822 | 30,978 | 11.70 | 31.59 | 137,482 | 18,683 | 13.59 | 16.40 | ||||||||||||||||||||||||||||||||||||

| Financial Supervisory Service’s business report standard |

| Lease assets are comprised of Financial lease bonds |

26

C. Status by Business areas

(1) Business performance by department

(Unit: KRW billion, %)

Category | 2022 | 2021 | 2020 | |||||||||||||||||||||||||

| Amount | % | Amount | % | Amount | % | |||||||||||||||||||||||

Card | Credit sales | Lump sum payment | 1,120,765 | 79.89 | 1,017,012 | 77.98 | 956,746 | 77.46 | ||||||||||||||||||||

| Installment | 187,203 | 13.34 | 206,810 | 15.86 | 198,477 | 16.07 | ||||||||||||||||||||||

Cash loan | Short-term card loan (cash advance) | 83,874 | 5.98 | 76,905 | 5.89 | 78,521 | 6.36 | |||||||||||||||||||||

| Long-term card loan (card loan) | 57 | 0.00 | 2 | 0.00 | — | — | ||||||||||||||||||||||

Lease | 176 | 0.01 | 111 | 0.01 | — | — | ||||||||||||||||||||||

Factoring | 197 | 0.01 | 413 | 0.03 | 387 | 0.03 | ||||||||||||||||||||||

Loan | 10,582 | 0.75 | 2,987 | 0.23 | 1,035 | 0.08 | ||||||||||||||||||||||

Total | 1,402,854 | 100.00 | 1,304,240 | 100.00 | 1,235,166 | 100.00 | ||||||||||||||||||||||

| Financial Supervisory Service’s business report standard |

| The amount of credit sales(Lump sum payment and Installment) and short-term card loans(cash advance) is the total performance of BC Card and its member companies |

(2) Member status

(Unit: thousand, thousand, %)

| 2022 | 2021 | 2020 | YoY | |||||||||||||||||||

Category | Change | % of Change | ||||||||||||||||||||

Individual | Number of cards | 39,904 | 40,807 | 43,713 | -903 | -2.21 | ||||||||||||||||

| Number of members | 33,963 | 30,154 | 31,732 | 3,809 | 12.63 | |||||||||||||||||

Corporate | Number of cards | 5,229 | 5,102 | 5,014 | 127 | 2.49 | ||||||||||||||||

| Number of members | 3,353 | 1,993 | 2,014 | 1,360 | 68.24 | |||||||||||||||||

Total | Number of cards | 45,134 | 45,909 | 48,728 | -775 | -1.69 | ||||||||||||||||

| Number of members | 37,316 | 32,146 | 33,746 | 5,170 | 16.08 | |||||||||||||||||

| Financial Supervisory Service’s business report standard |

27

(3) The number of affiliated merchants

(Unit : thousand, %)

Category | 2022 | 2021 | 2020 | YoY | ||||||||||||||||

| Change | % of Change | |||||||||||||||||||

Affiliated merchants | 3,455 | 3,333 | 3,119 | 122 | 3.66 | |||||||||||||||

| Financial Supervisory Service’s business report standard |

7. (Finance) Derivatives Transaction

A. The breakdown of derivatives currently held by BC Card for trading purposes or hedging purposes is as follows :

(1) Drag-along Right

BC card gave drag-along rights to financial investors participating in capital raise of K Bank. In case K Bank fails in IPO at an agreed conditions, financial investors can exercise drag-along rights.

(2) Interest rate Swap

This contract is aimed at avoiding cash flow fluctuation risks caused by changes in interest rates for BC Card’s held floating-rate KRW denominated bonds, and the major details are as follows

(Unit: KRW million)

Item | Counter Party | Contract Signing date | Contract expiration date | Contract amount | Interest rate | |||||||||||||||||

| Contract interest rate | Swap rate | |||||||||||||||||||||

Interest rate swap | Shinhan Bank | 2022-03-25 | 2025-03-25 | 60,000 | CMS | (5Y) | 2.70 | % | ||||||||||||||

| 2022-03-25 | 2032-03-25 | 40,000 | CMS | (10Y) | 2.64 | % | ||||||||||||||||

B. Derivative assets and liabilities as of the reference date are as follows :

(1) 4Q22

(Unit: KRW million)

Item | Trading purpose | Risk management purpose | ||||||||||||||

| Asset | Liability | Asset | Liability | |||||||||||||

Drag-along Right | — | 134,881 | — | — | ||||||||||||

Interest rate Swap | — | — | 3,123 | — | ||||||||||||

Total | — | 134,881 | 3,123 | — | ||||||||||||

28

(2) 4Q21

(Unit: KRW million)

Item | Trading purpose | Risk management purpose | ||||||||||||||

| Asset | Liability | Asset | Liability | |||||||||||||

Drag-along Right | — | 158,284 | — | — | ||||||||||||

(3) 4Q20

- None

C. The details of profits and losses related to derivatives during the disclosure period

(Unit: KRW million)

| 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||||||

Item | Gain/Loss On Valuation | Gain/Loss On Trading | Other comprehensive income | Gain/Loss On Valuation | Gain/Loss On Trading | Other comprehensive income | Gain/Loss On Valuation | Gain/Loss On Trading | Other comprehensive income | |||||||||||||||||||||||||||

Drag-along Right | 23,403 | — | — | 47,039 | — | — | — | — | ||||||||||||||||||||||||||||

Interest rate Swap | (418 | ) | — | 2,720 | — | — | — | — | — | |||||||||||||||||||||||||||

forward exchange rate | — | — | — | — | — | — | — | 1,175 | — | |||||||||||||||||||||||||||

Total | 22,985 | — | 2,720 | 47,039 | — | — | — | 1,175 | — | |||||||||||||||||||||||||||

8. (Finance) Business Facilities

A. Branch offices and other establishments (Reference date : 31 Dec. 2022)

(Unit: KRW million)

Region | Branch office | Sales office | Office | Sum | ||||||||||||

Gyeongsang-do | 2 | — | 1 | 3 | ||||||||||||

Jeolla-do | 1 | — | — | 1 | ||||||||||||

Jeju-do | — | — | 1 | 1 | ||||||||||||

Total | 3 | — | 2 | 5 | ||||||||||||

The head office is located in Seoul.

The head office is located in Seoul.

29

B. Equipment and other assets (Reference date : 31 Dec. 2022)

(Unit: KRW million)

Item | Property | Building | Total | |||||||||

Main office | 310,041 | 186,076 | 496,117 | |||||||||

Branch office | 465 | 2,989 | 3,454 | |||||||||

Sum | 310,506 | 189,065 | 499,571 | |||||||||

Main office includes real estate for investment (based on acquisition cost)

Main office includes real estate for investment (based on acquisition cost)

9. (Finance) Financial Stability

[Major Management Index]

Items | 2022 | 2021 | 2020 | Formula | ||||||||||||

Capital Adequacy | Adjusted Equity Ratio | 27.34 | 35.80 | 44.19 | Adjusted Equity/ Adjusted Total Assets x 100 | |||||||||||

| Tangible Common Equity Ratio | 25.78 | 35.44 | 41.43 | Equity/Total Assets x 100 | ||||||||||||

Asset Quality | Loss Risk Weighted Non-performing Loans Ratio | 0.29 | 0.08 | 0.12 | Weighted Non-performing Loans/ Total Loans x 100 | |||||||||||

| Substandard Loans Ratio | 0.41 | 0.11 | 0.15 | Substandard Loans/ Total Loans x 100 | ||||||||||||

| Loan Loss Provision Ratio | 139.41 | 171.83 | 158.34 | Loan Loss Provision Balance/ Required Provision Amount x 100 | ||||||||||||

Profitability | Return on Asset | 1.74 | 2.47 | 2.15 | Net profit / Total Assets x 100 | |||||||||||

| Return on Equity | 6.10 | 7.46 | 6.32 | Net profit/ Equity x 100 | ||||||||||||

| Expenses to Total Assets | 4.72 | 5.44 | 6.24 | Total expenses/ Total Assets x 100 | ||||||||||||

Liquidity | Liquidity Ratio | 123.01 | 114.90 | 112.27 | Current Asset/ Current Liability x 100 (Due in 90 days) | |||||||||||

| Operating Assets Ratio | 34.63 | 36.31 | 38.25 | Operating Asset/ Equity | ||||||||||||

A. Characteristics of the Industry

Credit card business involves issuing and managing credit cards, settling card balances derived from the usage of the card holders, and managing credit card member stores. Credit card business generates revenues through transaction fee, annual fees, financial loans, and others.

If a company desires to enter into the credit card business, government licensing is required. Also, government regulations are strict, so this industry has an extremely high barriers to entry.

30

B. Growth of the Industry

In early 2000, the credit card business grew exponentially with the supportive policies of the Korean government. However, since 2010, the industry is entering into the maturity stage. The growth in number of member stores is slowing down and Number of Credit Card Per Capital is decreasing.

C. Characteristics of Economic Cycle and Seasonality

The credit card industry is a typical domestic-oriented industry and has a sensitive nature to changes in consumer spending and overall domestic economic conditions due to fluctuations in the economy.

Furthermore, seasonal consumption patterns such as travel and leisure industries during vacation seasons, department stores and discount stores during major holidays such as Lunar New Year, Chuseok, and year-end season, and individual disposable income also have significant impact on the credit card industry.

D. Market Conditions

(1) Number of Credit Card and Member Merchant Store

Category | Population (in 10K) | Population Available for Economic Activity*1 (in 10K) | Credit Card (in 10K) | Number of Credit Card Per Capital | Number of Member Stores*2 (in 10K) | |||||||||||||||

2018 | 5,164 | 2,758 | 10,506 | 3.8 | 269 | |||||||||||||||

2019 | 5,171 | 2,819 | 11,098 | 3.9 | 281 | |||||||||||||||

2020 | 5,178 | 2,801 | 11,373 | 4.1 | 290 | |||||||||||||||

2021 | 5,174 | 2,831 | 11,769 | 4.2 | 299 | |||||||||||||||

2022.2Q | 5,163 | 2,923 | 12,084 | 4.1 | — | |||||||||||||||

| Source : Credit Finance Association, Korea |

| *1 | Age 15 or order and must be eligible for employment activity |

| *2 | At least one sales transaction incurred annually from a member store |

Accumulated number of credit card issuance is 120,840,000 as of 2Q22. Average credit card holdings of economically active population is 4.1 cards per person and the number of member merchant stores is 2.99 million as of the end of 2021

(2) Credit Card Usage in Korea (Unit : KRW billion)

| Credit Card Usage | Credit Card Usage over Private Consumption Expenditure* | |||||||||||||||||||

Category | Total | Lump-Sum Payment | Installment Payment | Card Loan (Short-term) | ||||||||||||||||

2018 | 724,781.5 | 539,284.6 | 124,728.6 | 60,768.3 | 68.4 | % | ||||||||||||||

2019 | 760,075.9 | 572,183.9 | 128,768.1 | 59,123.9 | 71.7 | % | ||||||||||||||

2020 | 759,330.1 | 572,943.2 | 132,303.3 | 54,083.6 | 75.2 | % | ||||||||||||||

2021 | 834,172.9 | 634,315.1 | 144,719.5 | 55,138.3 | 77.8 | % | ||||||||||||||

2022.2Q | 454,234.2 | 351,118.0 | 74,911.7 | 28,204.5 | 80.9 | % | ||||||||||||||

| Source : Credit Finance Association, Korea |

Credit card usage is in uptrend and the portion of credit card as a payment method is in very high level as the credit card usage over private consumption expenditure exceeds 70% as of 2Q22.

31

E. Competitiveness

In credit card business, solicitation of member merchant stores, development of products and services, customer segment focused marketing services and risk management capabilities for stable asset portfolio are key management factors. With the technological advancement, boundary of financial services has become more abstract, and digital payment market has grown bigger in which competition among financial service providers are increasing. BC Card continues its efforts to provide various digital financial services in response to evolving market.

BC Card has lower credit card industry specific risk like deterioration risk of asset soundness while BC card focuses on core business, credit card processing business, and most of its receivables are from high credit institutions like banks and credit card companies. Based on strong foothold in credit card transaction processing market, BC card has built stable revenue stream from middle and small card issuers, which are not available of economy of scale. Moreover,

F. Tools to remain competitive in the competition

BC Card focuses on credit card processing as its main business and secures a stable revenue base targeting card issuers based on its position in the credit card processing market. In addition, BC Card strives to provide customers with easy and convenient financial services through simple payment and various financial services based on the mobile platform ‘Paybook’

10. Research and Development Activities

A. R&D Costs—Consolidated Basis (Unit: millions of Korean won, %)

Category | 2022 | 2021 | 2020 | |||||||||

Raw Materials | — | — | — | |||||||||

Labor Costs | 91,785 | 83,774 | 82,225 | |||||||||

Depreciation | 28,541 | 22,685 | 20,732 | |||||||||

Commissions | — | — | — | |||||||||

Others | 110,295 | 107,511 | 127,516 | |||||||||

Total R&D Costs ( | 230,621 | 213,969 | 230,473 | |||||||||

(Subsidy from Government) | 8 | 8 | 211 | |||||||||

| Accounting costs Research and Ordinary Development Costs | 174,936 | 168,969 | 156,940 | |||||||||

treatment Development Costs (Intangible Assets) | 55,677 | 44,992 | 73,322 | |||||||||

Percentage of R&D Costs over Revenue ( | 0.90 | % | 0.86 | % | 0.96 | % | ||||||

1: 1: | Total costs before deducted the subsidy from government |

2: 2: | Rate of Total costs before deducted the subsidy from government and Total Revenue |

B. R&D Organization Structure (KT)

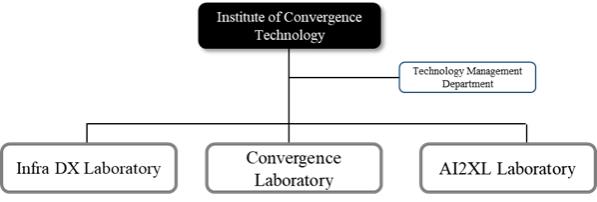

| • | Institute of Convergence Technology |

32

| ● | Main Mission |

| • | Securing core technologies to strengthen future business and business competitiveness |