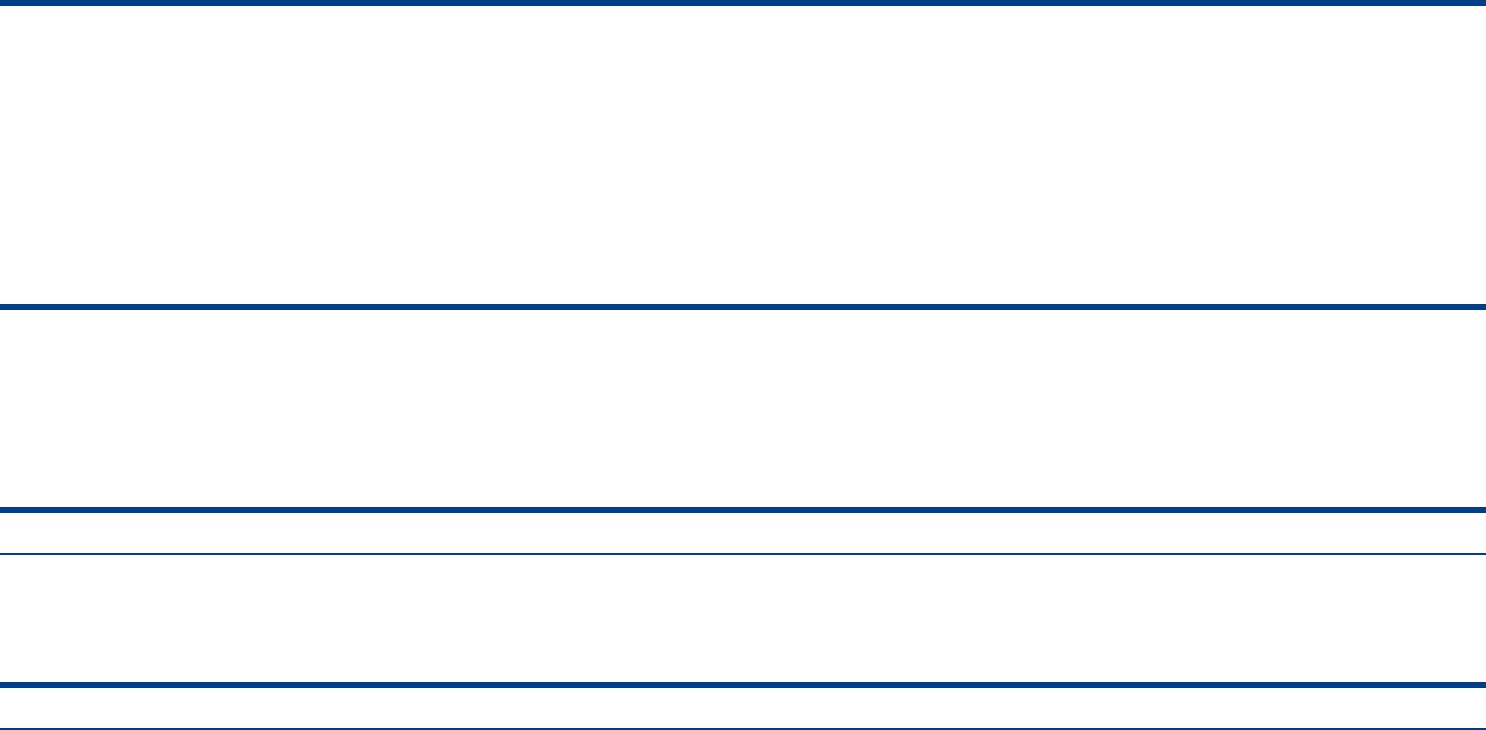

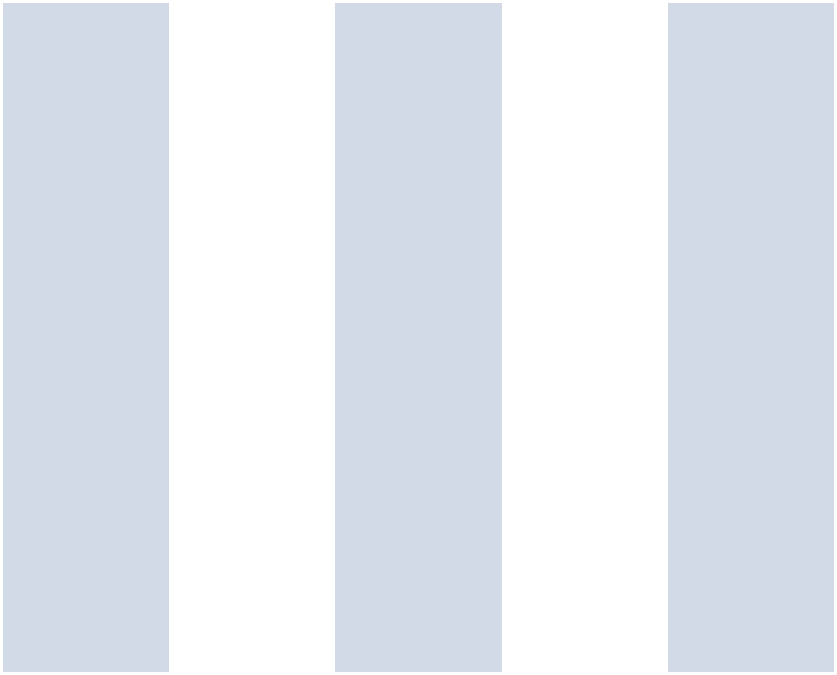

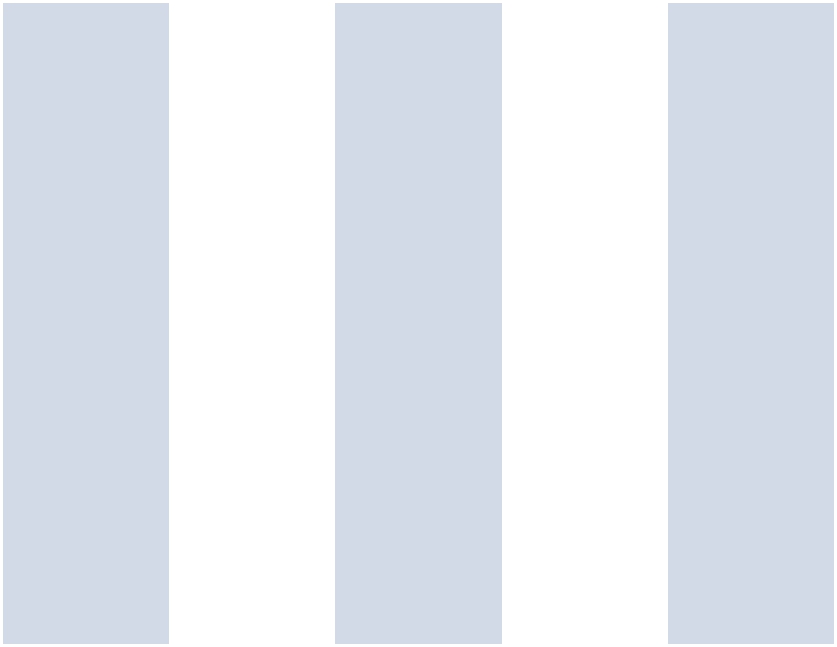

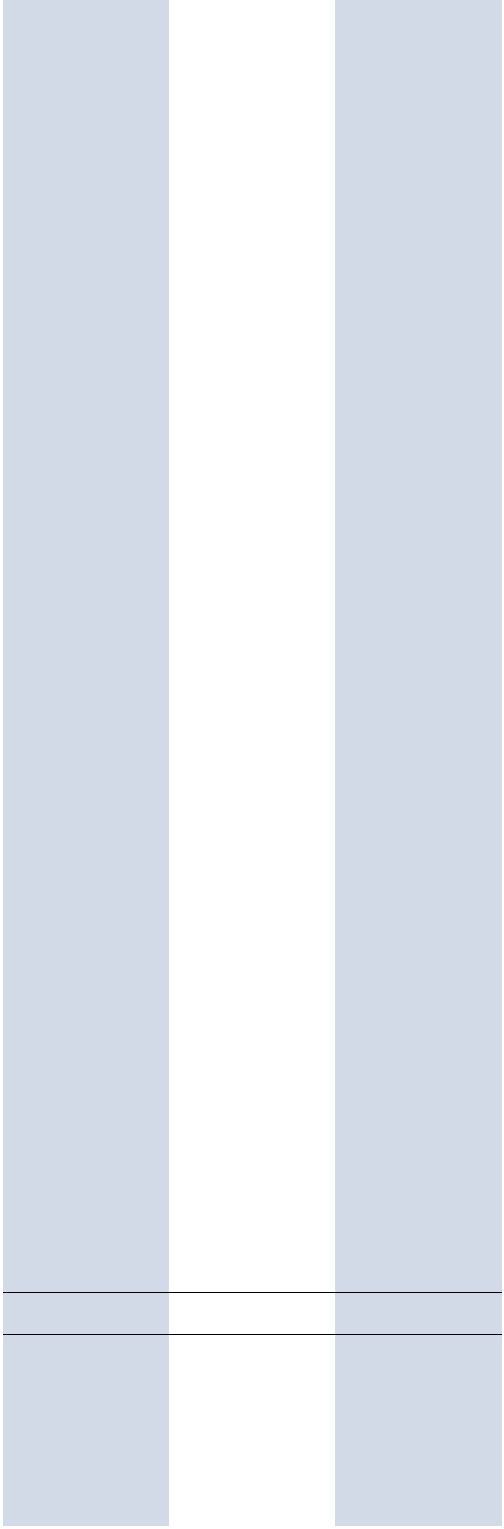

Bonds, notes & other debt instruments (continued) | Principal amount | Value |

(000) | (000) |

| | |

Asset-backed obligations (continued) | | |

| | |

Bankers Healthcare Group Securitization Trust, Series 2021-A, Class A, | | |

1.42% 11/17/20335,7 | USD282 | $ 270 |

BofA Auto Trust, Series 2024-1, Class A3, 5.35% 11/15/20285,7 | 2,756 | 2,766 |

CarMax Auto Owner Trust, Series 2024-2, Class A2A, 5.65% 5/17/20277 | 4,737 | 4,744 |

CarMax Select Receivables Trust, Series 2024-A, Class A2A, 5.78% 9/15/20277 | 1,259 | 1,259 |

Castlelake Aircraft Securitization Trust, Series 2021-1, Class A, 2.868% 5/11/20375,7 | 4,411 | 3,940 |

Castlelake Aircraft Securitization Trust, Series 2017-1R, Class A, 2.741% 8/15/20415,7 | 283 | 264 |

Cent CLO, Ltd., Series 2014-21A, Class AR, | | |

(3-month USD CME Term SOFR + 1.231%) 6.556% 7/27/20305,7,8 | 1,461 | 1,462 |

CF Hippolyta, LLC, Series 2020-1, Class A1, 1.69% 7/15/20605,7 | 5,140 | 4,873 |

CF Hippolyta, LLC, Series 2020-1, Class A2, 1.99% 7/15/20605,7 | 1,716 | 1,493 |

CF Hippolyta, LLC, Series 2021-1, Class A1, 1.53% 3/15/20615,7 | 6,034 | 5,531 |

Chase Auto Owner Trust, Series 2024-2, Class A2, 5.66% 5/26/20275,7 | 5,525 | 5,528 |

Chase Auto Owner Trust, Series 2024-3, Class A2, 5.53% 9/27/20275,7 | 5,646 | 5,653 |

Chase Auto Owner Trust, Series 2024-3, Class A3, 5.22% 7/25/20295,7 | 4,751 | 4,752 |

Chase Issuance Trust, Series 2024-A1, Class A, 4.60% 1/16/20297 | 10,475 | 10,387 |

Chase Issuance Trust, Series 2024-A2, Class A, 4.63% 1/15/20317 | 3,278 | 3,259 |

Citibank Credit Card Issuance Trust, Series 2023-A1, Class A1, 5.23% 12/8/20277 | 4,553 | 4,551 |

CLI Funding VI, LLC, Series 2020-2A, Class A, 2.03% 9/15/20455,7 | 1,159 | 1,046 |

CLI Funding VI, LLC, Series 2020-1A, Class A, 2.08% 9/18/20455,7 | 4,344 | 3,917 |

CLI Funding VI, LLC, Series 2020-3A, Class A, 2.07% 10/18/20455,7 | 926 | 838 |

CLI Funding VIII, LLC, Series 2021-1A, Class A, 1.64% 2/18/20465,7 | 1,286 | 1,144 |

CNH Equipment Trust, Series 2024-B, Class A2A, 5.42% 10/15/20277 | 4,015 | 4,018 |

CPS Auto Trust, Series 2024-C, Class A, 5.88% 2/15/20285,7 | 2,347 | 2,350 |

Credit Acceptance Auto Loan Trust, Series 2023-3, Class A, 6.39% 8/15/20335,7 | 1,958 | 1,983 |

Daimler Trucks Retail Trust, Series 2024-1, Class A2, 5.60% 4/15/20267 | 4,594 | 4,595 |

Daimler Trucks Retail Trust, Series 2024-1, Class A3, 5.49% 12/15/20277 | 3,457 | 3,470 |

DriveTime Auto Owner Trust, Series 2022-3, Class A, 6.05% 10/15/20265,7 | 716 | 716 |

DriveTime Auto Owner Trust, Series 2023-2, Class A, 5.88% 4/15/20275,7 | 1,279 | 1,279 |

Dryden Senior Loan Fund, CLO, Series 2017-47A, Class A1R, | | |

(3-month USD CME Term SOFR + 1.242%) 6.57% 4/15/20285,7,8 | 1,871 | 1,873 |

EDvestinU Private Education Loan, LLC, Series 2021-A, Class A, 1.80% 11/25/20455,7 | 273 | 244 |

Enterprise Fleet Financing, LLC, Series 2024-2, Class A2, 5.74% 12/20/20265,7 | 960 | 963 |

Enterprise Fleet Financing, LLC, Series 2022-1, Class A2, 3.03% 1/20/20285,7 | 2,073 | 2,053 |

Enterprise Fleet Financing, LLC, Series 2022-3, Class A2, 4.38% 7/20/20295,7 | 1,856 | 1,838 |

Enterprise Fleet Financing, LLC, Series 2022-4, Class A2, 5.76% 10/22/20295,7 | 3,404 | 3,407 |

First National Master Note Trust, Series 2024-1, Class A, 5.34% 5/15/20307 | 4,430 | 4,452 |

FirstKey Homes Trust, Series 2020-SFR2, Class A, 1.266% 10/19/20375,7 | 5,699 | 5,399 |

Flagship Credit Auto Trust, Series 2022-4, Class A2, 6.15% 9/15/20265,7 | 648 | 649 |

Ford Credit Auto Owner Trust, Series 2018-1, Class A, 3.19% 7/15/20315,7 | 9,605 | 9,477 |

Ford Credit Auto Owner Trust, Series 2020-1, Class A, 2.04% 8/15/20315,7 | 8,861 | 8,665 |

Ford Credit Auto Owner Trust, Series 2023-2, Class A, 5.28% 2/15/20365,7 | 6,693 | 6,751 |

Ford Credit Auto Owner Trust, Series 2024-1, Class A, 4.87% 8/15/20365,7,8 | 15,000 | 14,898 |

GCI Funding I, LLC, Series 2020-1, Class A, 2.82% 10/18/20455,7 | 535 | 487 |

GCI Funding I, LLC, Series 2020-1, Class B, 3.81% 10/18/20455,7 | 215 | 193 |

Global SC Finance V SRL, Series 2019-1A, Class B, 4.81% 9/17/20395,7 | 1,894 | 1,793 |

Global SC Finance V SRL, Series 2020-1A, Class A, 2.17% 10/17/20405,7 | 7,977 | 7,394 |

Global SC Finance VII SRL, Series 2020-2A, Class A, 2.26% 11/19/20405,7 | 10,020 | 9,290 |

Global SC Finance VII SRL, Series 2021-1A, Class A, 1.86% 4/17/20415,7 | 3,284 | 2,945 |

Global SC Finance VII SRL, Series 2021-2A, Class A, 1.95% 8/17/20415,7 | 4,871 | 4,399 |

Global SC Finance VII SRL, Series 2021-2A, Class B, 2.49% 8/17/20415,7 | 385 | 342 |

GM Financial Automobile Leasing Trust, Series 2023-3, Class A3, 5.38% 11/20/20267 | 1,774 | 1,773 |

GM Financial Revolving Receivables Trust, Series 2023-2, Class A, 5.77% 8/11/20365,7 | 9,657 | 9,927 |

GM Financial Securitized Term Auto Receivables Trust, Series 2024-1, Class A3, | | |

4.85% 12/18/20287 | 2,372 | 2,359 |

Hertz Vehicle Financing III, LLC, Series 2021-A, Class B, 9.44% 6/25/20252,5,7 | 5,930 | 5,930 |

Hertz Vehicle Financing III, LLC, Series 2021-1A, Class A, 1.21% 12/26/20255,7 | 8,452 | 8,341 |

Hertz Vehicle Financing III, LLC, Series 2021-1A, Class B, 1.56% 12/26/20255,7 | 634 | 625 |

Hertz Vehicle Financing III, LLC, Series 2021-1A, Class C, 2.05% 12/26/20255,7 | 405 | 399 |

Hertz Vehicle Financing III, LLC, Series 2022-1A, Class A, 1.99% 6/25/20265,7 | 8,089 | 7,861 |

Hertz Vehicle Financing III, LLC, Series 2022-4A, Class A, 3.73% 9/25/20265,7 | 8,390 | 8,214 |