Chart Industries, Inc. Investor Update - August 2019 Exhibit 99.1

Forward Looking Statements Certain statements made in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning the Company’s business plans, including statements regarding completed acquisitions, including the recent acquisition of Harsco’s Industrial Air-X-Changers Business (“AXC”), cost synergies and efficiency savings, objectives, future orders, revenues, margins, earnings or performance, liquidity and cash flow, capital expenditures, business trends, governmental initiatives, including executive orders and other information that is not historical in nature. Forward-looking statements may be identified by terminology such as "may," "will," "should," "could," "expects," "anticipates," "believes," "projects," "forecasts," “outlook,” “guidance,” "continue," or the negative of such terms or comparable terminology. Forward-looking statements contained in this presentation or in other statements made by the Company are made based on management's expectations and beliefs concerning future events impacting the Company and are subject to uncertainties and factors relating to the Company's operations and business environment, all of which are difficult to predict and many of which are beyond the Company's control, that could cause the Company's actual results to differ materially from those matters expressed or implied by forward-looking statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements include: the Company’s ability to successful integrate recent acquisitions, including the AXC acquisition, and achieve the anticipated revenue, earnings, accretion and other benefits from these acquisitions; and the other factors discussed in Item 1A (Risk Factors) in the Company’s most recent Annual Report on Form 10-K filed with the SEC, which should be reviewed carefully. The Company undertakes no obligation to update or revise any forward-looking statement. This presentation contains non-GAAP financial information, including EBITDA. For additional information regarding the Company's use of non-GAAP financial information, as well as reconciliations of non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the United States ("GAAP"), please see slides titled "Non-GAAP Financial Measures" included in the appendix at the end of this presentation. Chart is a leading diversified global manufacturer of highly engineered equipment servicing multiple market applications in Energy and Industrial Gas. The majority of Chart's products are used throughout the liquid gas supply chain for purification, liquefaction, distribution, storage and end-use applications, a large portion of which are energy-related. Chart has domestic operations located across the United States and an international presence in Asia, Australia, Europe and the Americas. For more information, visit: http://www.chartindustries.com.

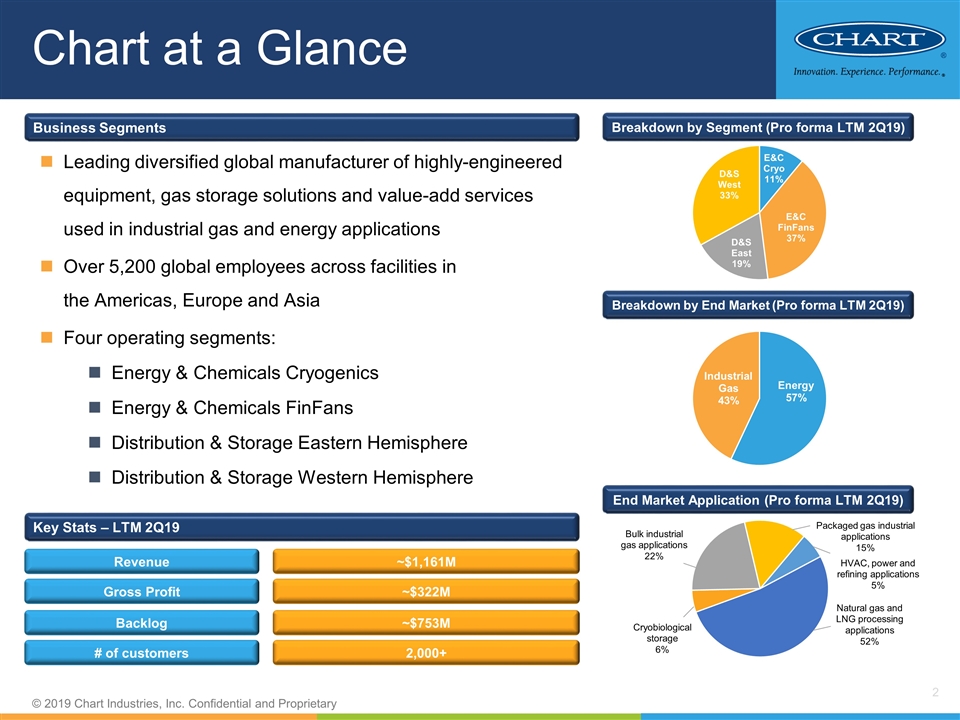

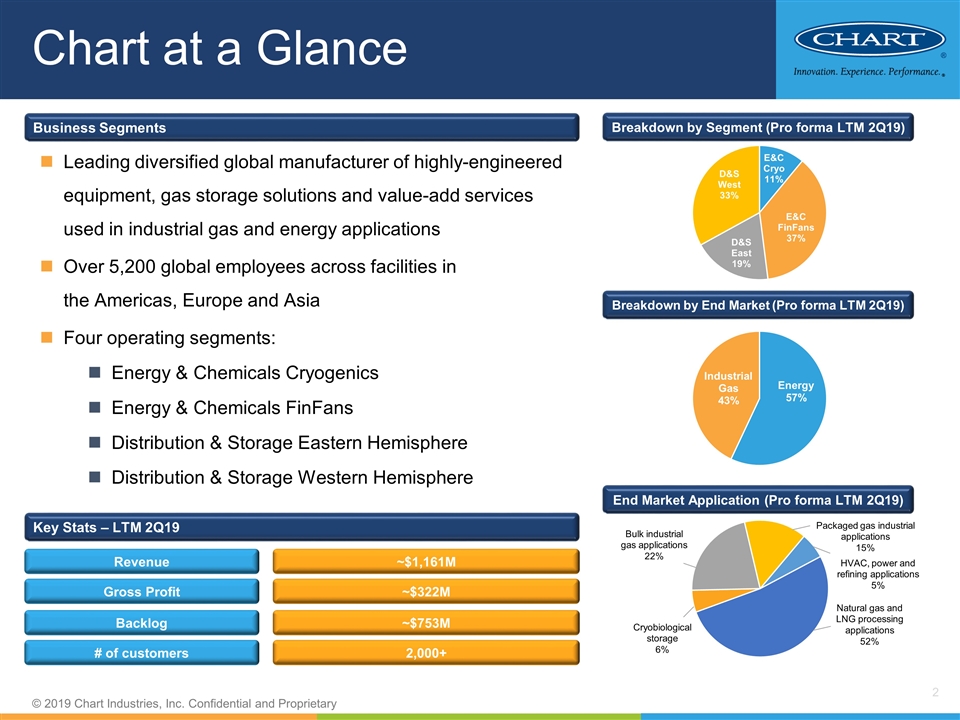

HVAC, power and refining applications 5% Natural gas and LNG processing applications 52% Cryobiological storage 6% Bulk industrial gas applications 22% Packaged gas industrial applications 15% Breakdown by Segment (Pro forma LTM 2Q19) Breakdown by End Market (Pro forma LTM 2Q19) End Market Application (Pro forma LTM 2Q19) Leading diversified global manufacturer of highly-engineered equipment, gas storage solutions and value-add services used in industrial gas and energy applications Over 5,200 global employees across facilities in the Americas, Europe and Asia Four operating segments: Energy & Chemicals Cryogenics Energy & Chemicals FinFans Distribution & Storage Eastern Hemisphere Distribution & Storage Western Hemisphere Business Segments Chart at a Glance Navy blue = 157.195.53 Light blue = 51.163.221 Green = 157.195.53 Orange = 253.164.30 Key Stats – LTM 2Q19 Revenue ~$1,161M Backlog ~$753M # of customers 2,000+ Gross Profit ~$322M

Staying Focused on Our Strategy Acquisition of Hudson Products Acquisition of Skaff Resegmentation and Leadership Changes Acquisition of VRV Sale of CAIRE Medical September 2017 January 2018 September 2018 November 2018 December 2018 July 1, 2019 Acquired Harsco’s Air-X-Changers Business Staying Focused on Our Strategy Broadest product offering for the markets we serve including repair and service Engineering capabilities with product and solution innovation Reduce costs through operational excellence Offer highly responsive, economical service solutions to our customers Take Advantage of Favorable Market Trends Deliver Profitable Growth Through Strategic Initiatives Achieve Financial Targets Being A Responsible Company: Focusing on Environmental, Social and Governance

Chart Solutions & Products Cold Boxes Specialty Pressure & Heat Transfer Equipment Brazed Aluminum Heat Exchangers Air Cooled Heat Exchangers Cryogenic Distribution & Storage Lifecycle Services LNG Virtual Pipeline Solutions Integrated Energy Systems

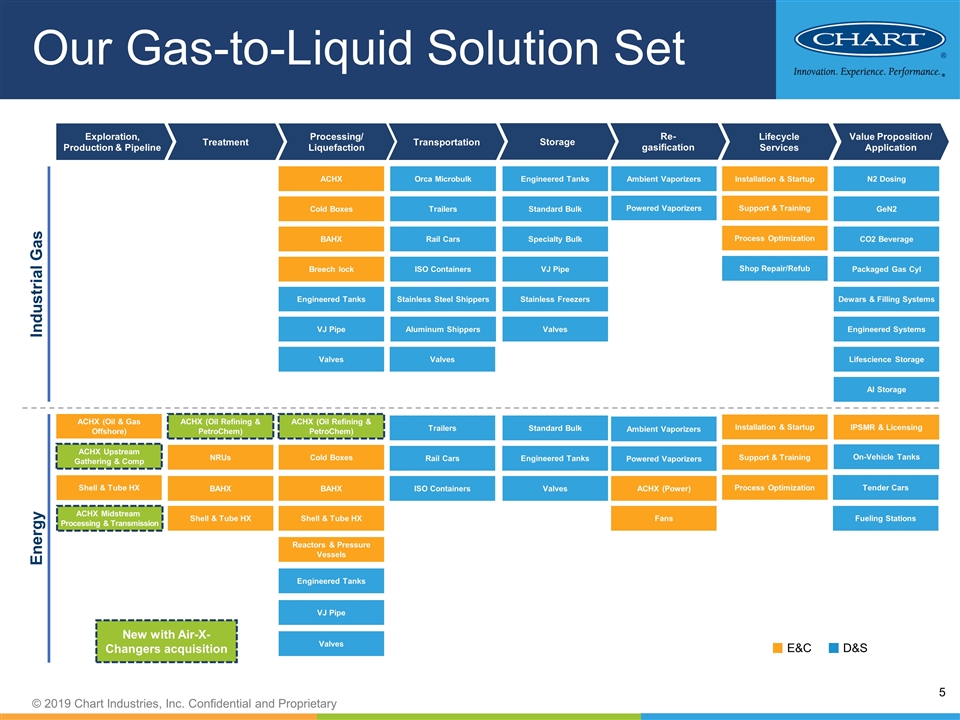

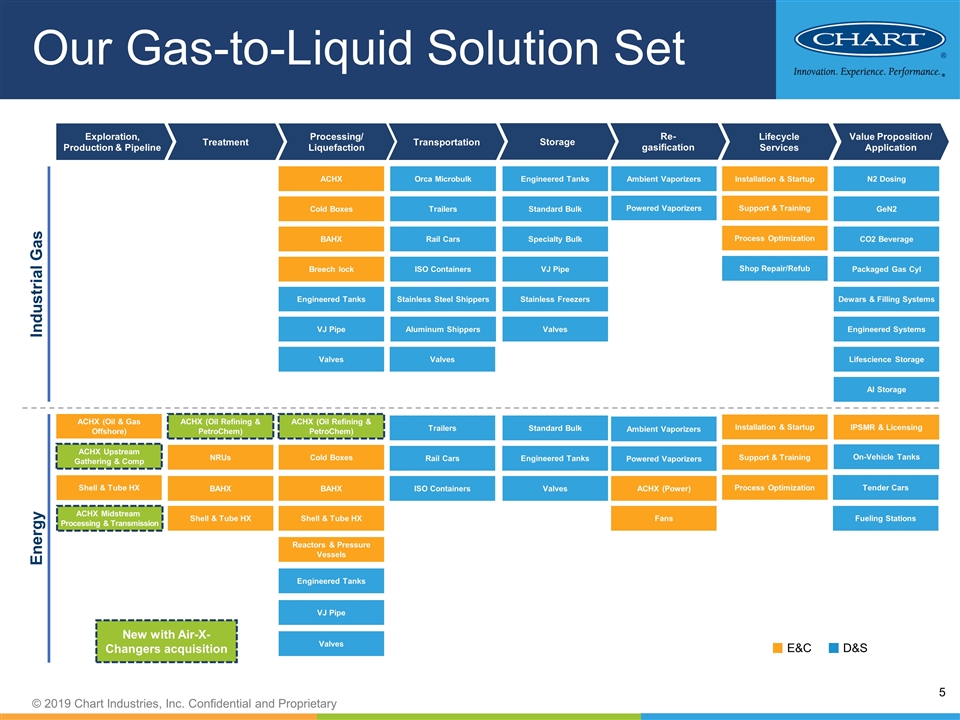

E&C D&S Exploration, Production & Pipeline Processing/ Liquefaction Treatment Transportation Storage Lifecycle Services Value Proposition/ Application Re- gasification New with Air-X-Changers acquisition Engineered Tanks Engineered Tanks VJ Pipe Engineered Tanks VJ Pipe Trailers Shop Repair/Refub Rail Cars Standard Bulk Specialty Bulk ISO Containers Trailers Rail Cars ISO Containers Ambient Vaporizers Powered Vaporizers Ambient Vaporizers Powered Vaporizers VJ Pipe Orca Microbulk Standard Bulk Engineered Tanks Fueling Stations On-Vehicle Tanks Tender Cars N2 Dosing GeN2 CO2 Beverage Packaged Gas Cyl Dewars & Filling Systems Engineered Systems ACHX (Oil & Gas Offshore) ACHX (Oil Refining & PetroChem) NRUs ACHX (Oil Refining & PetroChem) ACHX Cold Boxes BAHX Installation & Startup Support & Training Process Optimization Installation & Startup Support & Training Process Optimization Cold Boxes BAHX IPSMR & Licensing ACHX (Power) Fans Stainless Freezers Stainless Steel Shippers Aluminum Shippers Lifescience Storage AI Storage Breech lock Shell & Tube HX Valves Valves Valves Valves Valves BAHX ACHX Upstream Gathering & Comp Reactors & Pressure Vessels Shell & Tube HX Shell & Tube HX ACHX Midstream Processing & Transmission Industrial Gas Energy Navy blue = 32.64.110 Light blue = 51.163.221 Green = 157.195.53 Orange = 253.164.30 Our Gas-to-Liquid Solution Set

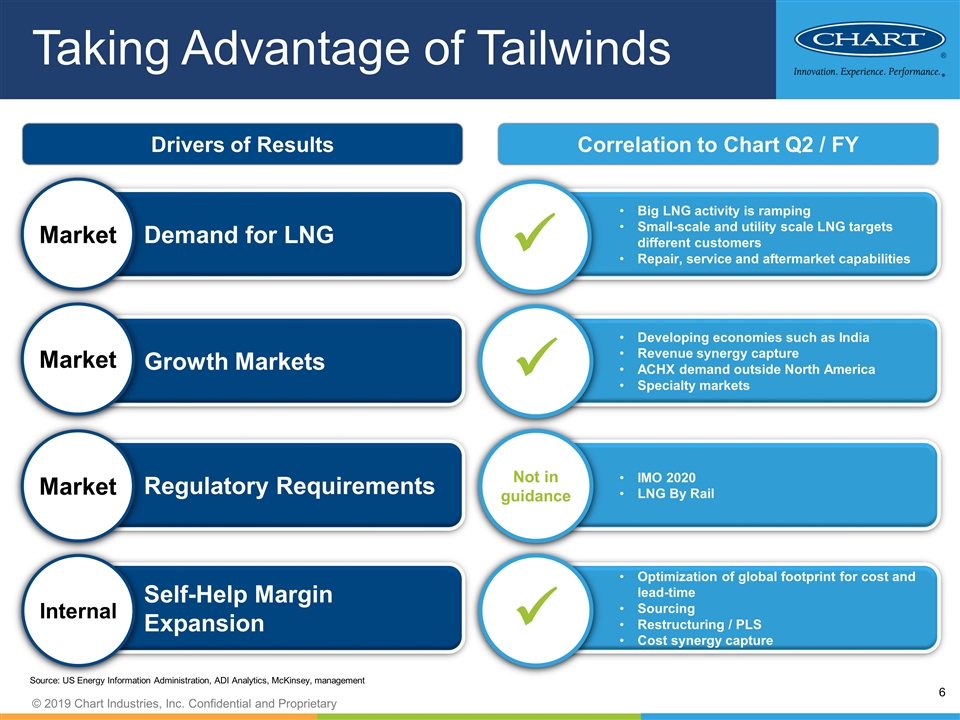

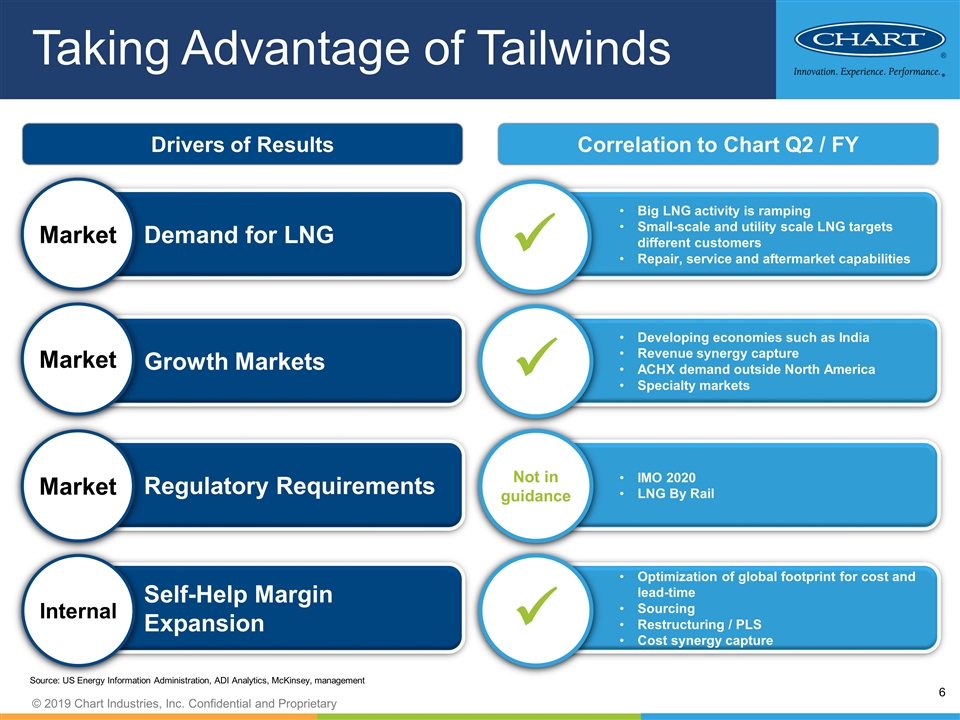

Navy blue = 32.64.110 Light blue = 51.163.221 Green = 157.195.53 Orange = 253.164.30 Taking Advantage of Tailwinds Drivers of Results Correlation to Chart Q2 / FY Source: US Energy Information Administration, ADI Analytics, McKinsey, management Demand for LNG Market Growth Markets Regulatory Requirements Self-Help Margin Expansion Big LNG activity is ramping Small-scale and utility scale LNG targets different customers Repair, service and aftermarket capabilities ü Developing economies such as India Revenue synergy capture ACHX demand outside North America Specialty markets IMO 2020 LNG By Rail Optimization of global footprint for cost and lead-time Sourcing Restructuring / PLS Cost synergy capture Not in guidance ü ü Market Market Internal

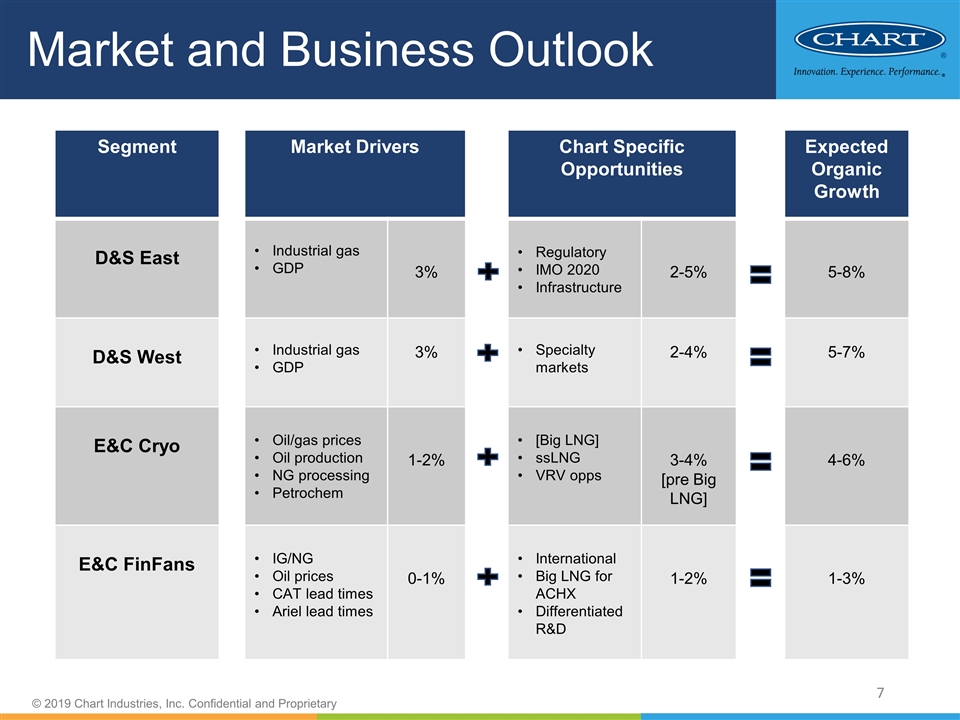

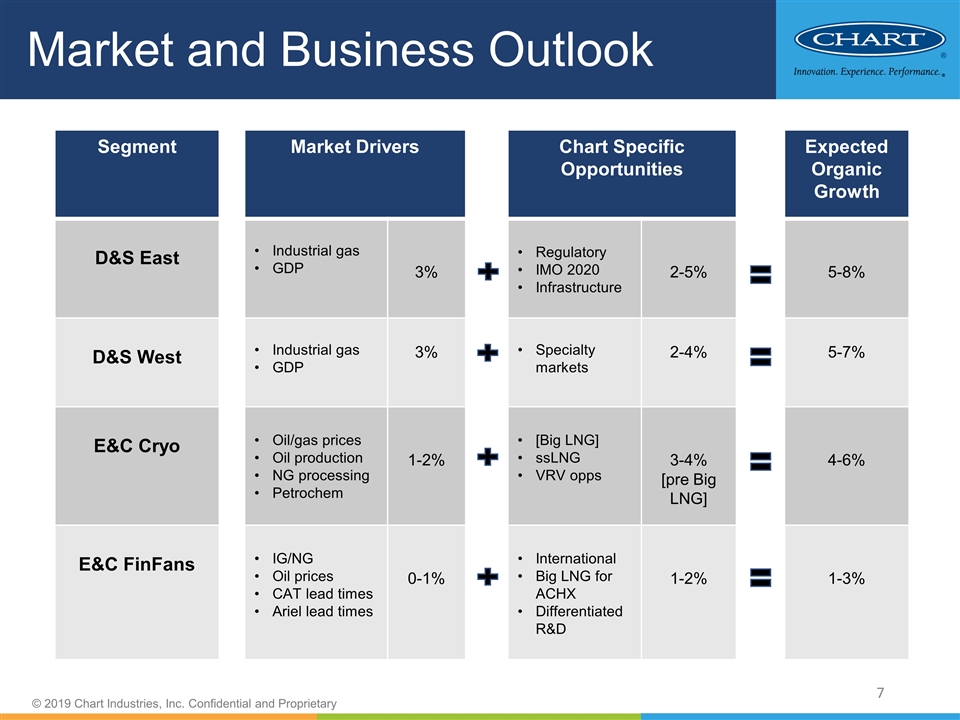

Market and Business Outlook Segment Market Drivers Chart Specific Opportunities Expected Organic Growth D&S East Industrial gas GDP 3% Regulatory IMO 2020 Infrastructure 2-5% 5-8% D&S West Industrial gas GDP 3% Specialty markets 2-4% 5-7% E&C Cryo Oil/gas prices Oil production NG processing Petrochem 1-2% [Big LNG] ssLNG VRV opps 3-4% [pre Big LNG] 4-6% E&C FinFans IG/NG Oil prices CAT lead times Ariel lead times 0-1% International Big LNG for ACHX Differentiated R&D 1-2% 1-3%

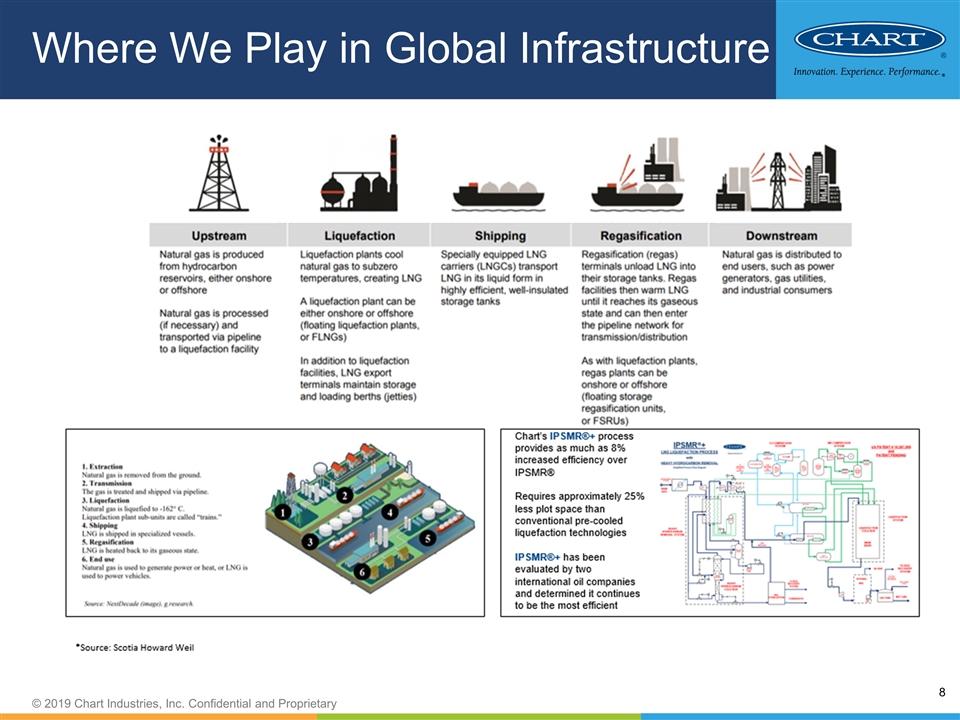

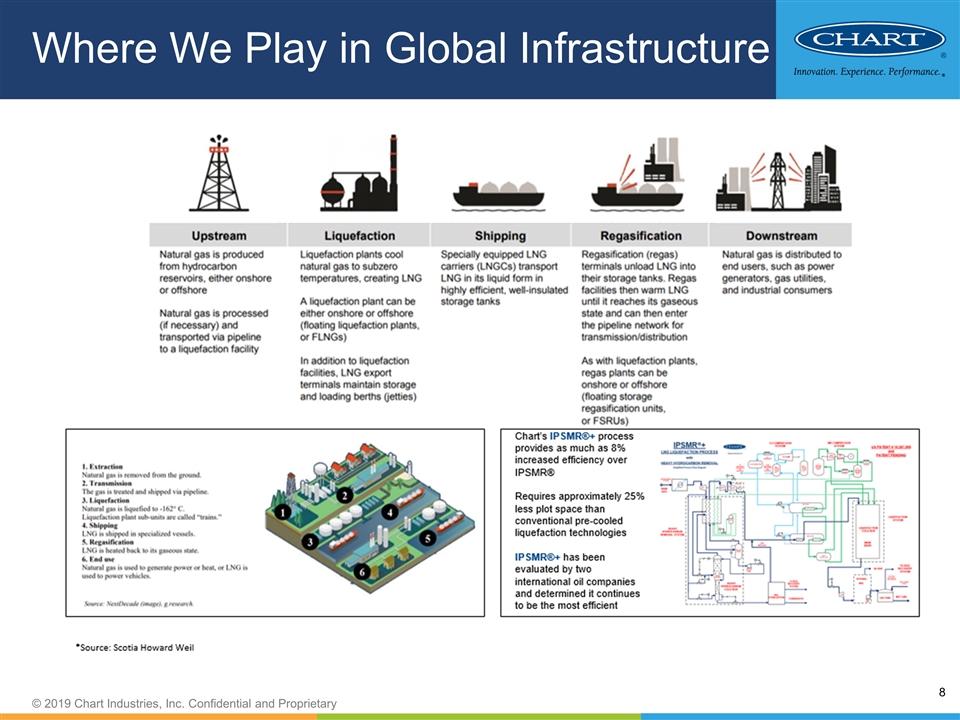

Where We Play in Global Infrastructure

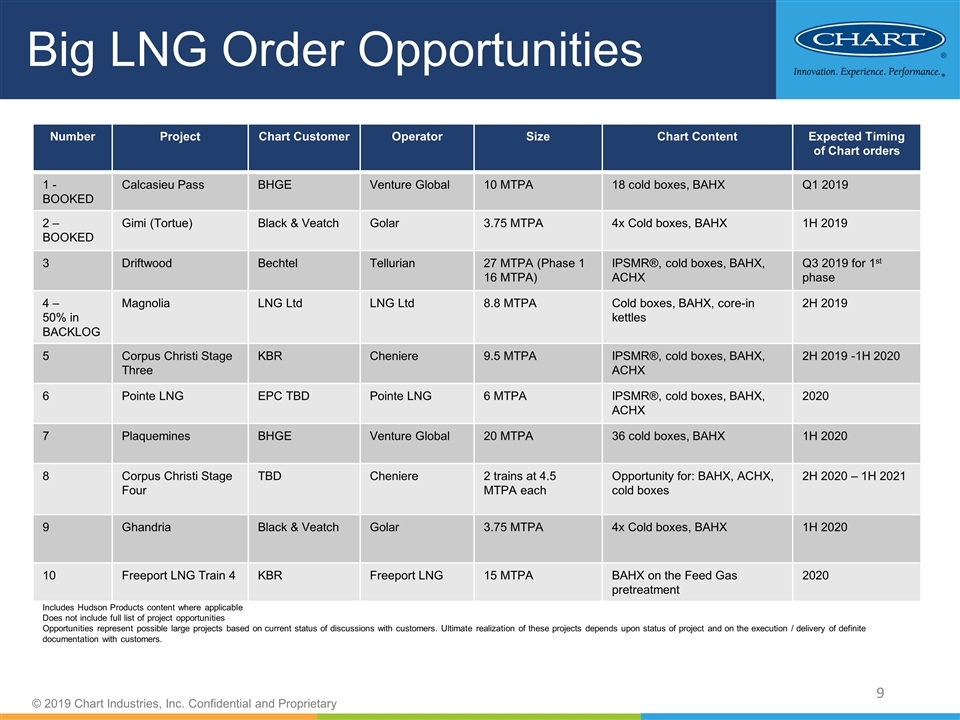

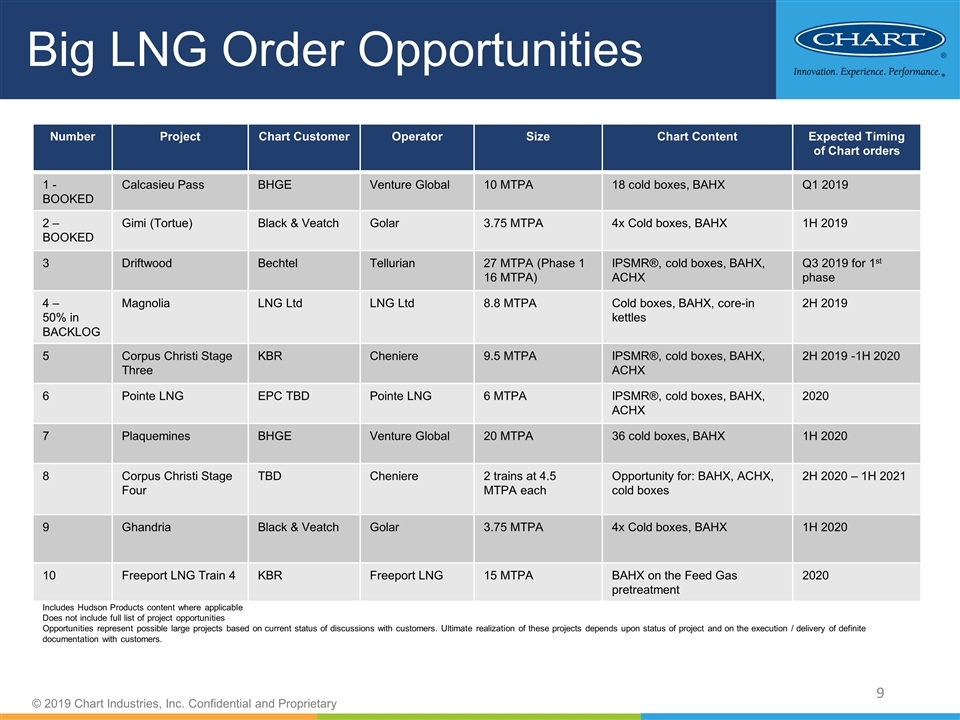

Big LNG Order Opportunities Number Project Chart Customer Operator Size Chart Content Expected Timing of Chart orders 1 - BOOKED Calcasieu Pass BHGE Venture Global 10 MTPA 18 cold boxes, BAHX Q1 2019 2 – BOOKED Gimi (Tortue) Black & Veatch Golar 3.75 MTPA 4x Cold boxes, BAHX 1H 2019 3 Driftwood Bechtel Tellurian 27 MTPA (Phase 1 16 MTPA) IPSMR®, cold boxes, BAHX, ACHX Q3 2019 for 1st phase 4 – 50% in BACKLOG Magnolia LNG Ltd LNG Ltd 8.8 MTPA Cold boxes, BAHX, core-in kettles 2H 2019 5 Corpus Christi Stage Three KBR Cheniere 9.5 MTPA IPSMR®, cold boxes, BAHX, ACHX 2H 2019 -1H 2020 6 Pointe LNG EPC TBD Pointe LNG 6 MTPA IPSMR®, cold boxes, BAHX, ACHX 2020 7 Plaquemines BHGE Venture Global 20 MTPA 36 cold boxes, BAHX 1H 2020 8 Corpus Christi Stage Four TBD Cheniere 2 trains at 4.5 MTPA each Opportunity for: BAHX, ACHX, cold boxes 2H 2020 – 1H 2021 9 Ghandria Black & Veatch Golar 3.75 MTPA 4x Cold boxes, BAHX 1H 2020 10 Freeport LNG Train 4 KBR Freeport LNG 15 MTPA BAHX on the Feed Gas pretreatment 2020 Includes Hudson Products content where applicable Does not include full list of project opportunities Opportunities represent possible large projects based on current status of discussions with customers. Ultimate realization of these projects depends upon status of project and on the execution / delivery of definite documentation with customers.

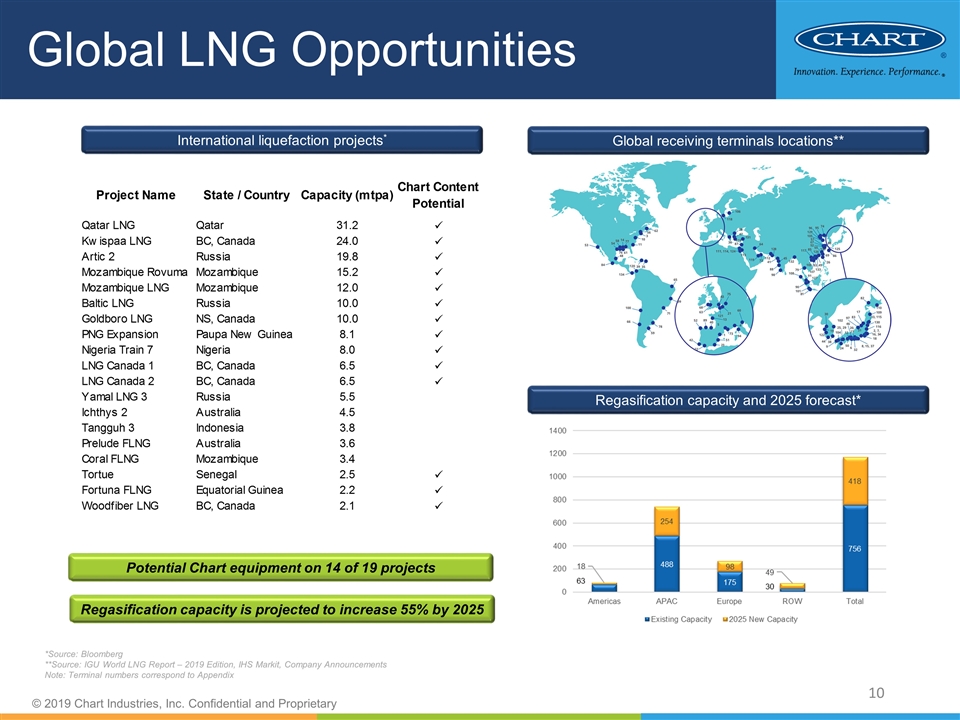

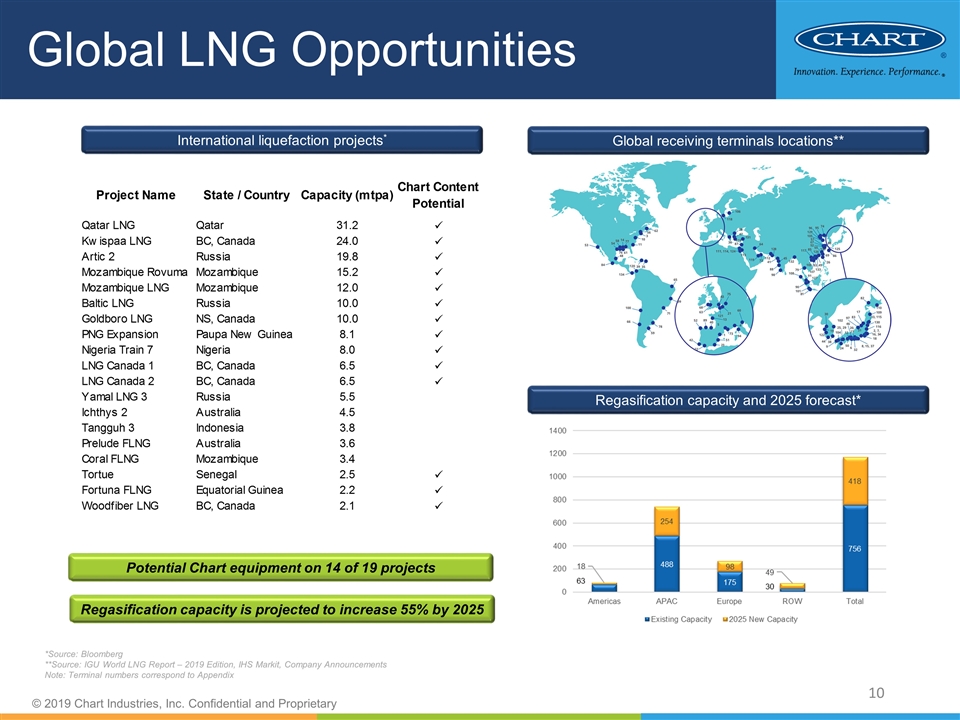

Global LNG Opportunities *Source: Bloomberg **Source: IGU World LNG Report – 2019 Edition, IHS Markit, Company Announcements Note: Terminal numbers correspond to Appendix International liquefaction projects* Global receiving terminals locations** Regasification capacity and 2025 forecast* Potential Chart equipment on 14 of 19 projects Regasification capacity is projected to increase 55% by 2025

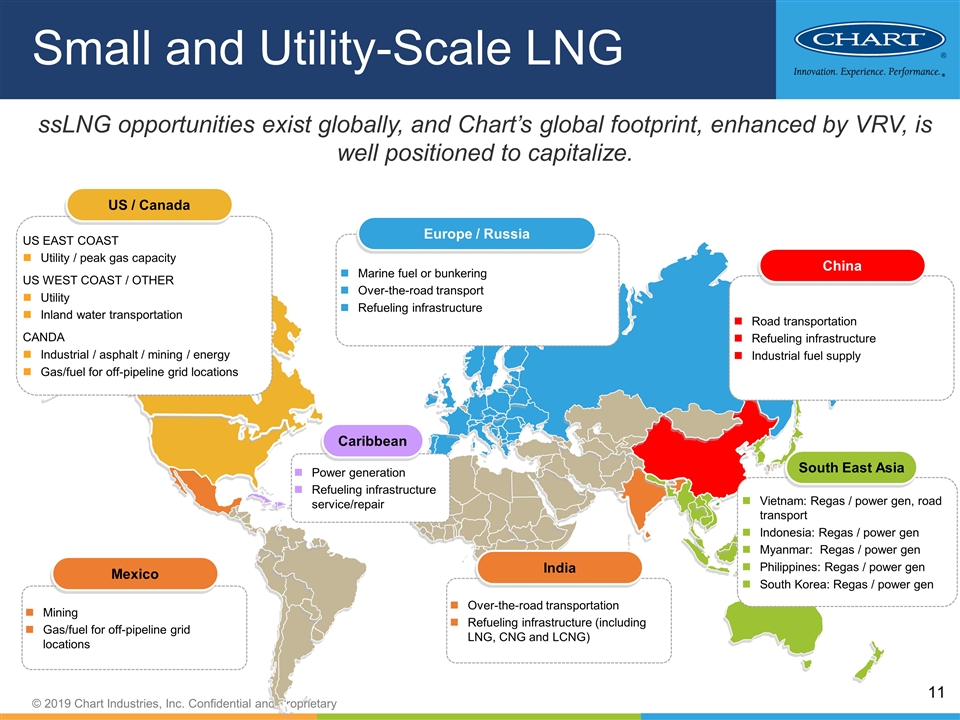

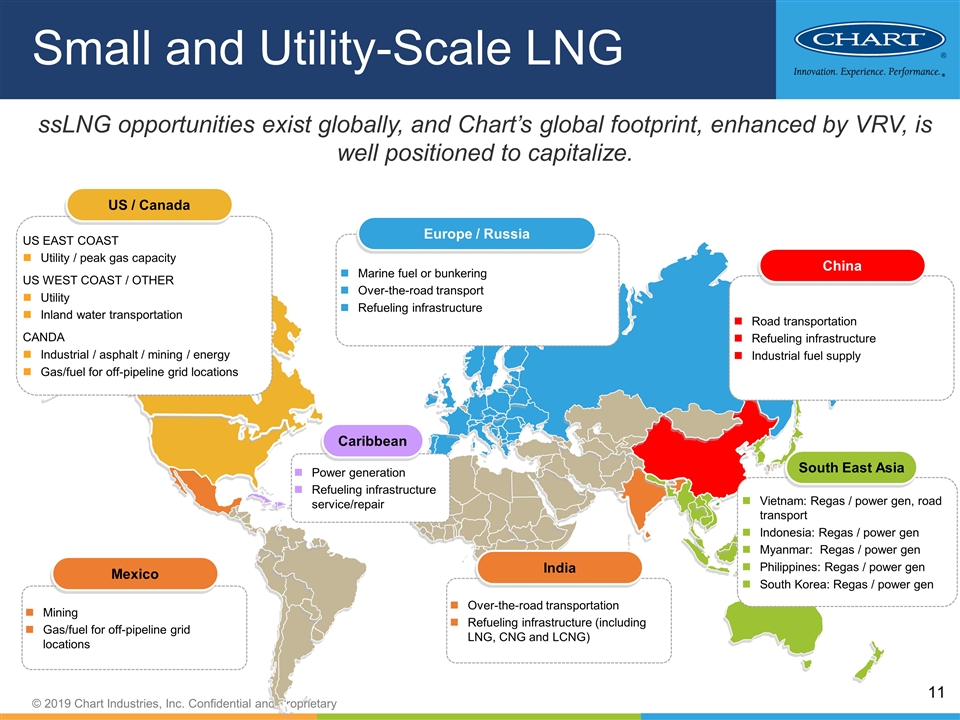

Small and Utility-Scale LNG Road transportation Refueling infrastructure Industrial fuel supply China Over-the-road transportation Refueling infrastructure (including LNG, CNG and LCNG) India Mining Gas/fuel for off-pipeline grid locations Mexico Power generation Refueling infrastructure service/repair Caribbean US EAST COAST Utility / peak gas capacity US WEST COAST / OTHER Utility Inland water transportation CANDA Industrial / asphalt / mining / energy Gas/fuel for off-pipeline grid locations US / Canada Marine fuel or bunkering Over-the-road transport Refueling infrastructure Europe / Russia Vietnam: Regas / power gen, road transport Indonesia: Regas / power gen Myanmar: Regas / power gen Philippines: Regas / power gen South Korea: Regas / power gen South East Asia ssLNG opportunities exist globally, and Chart’s global footprint, enhanced by VRV, is well positioned to capitalize.

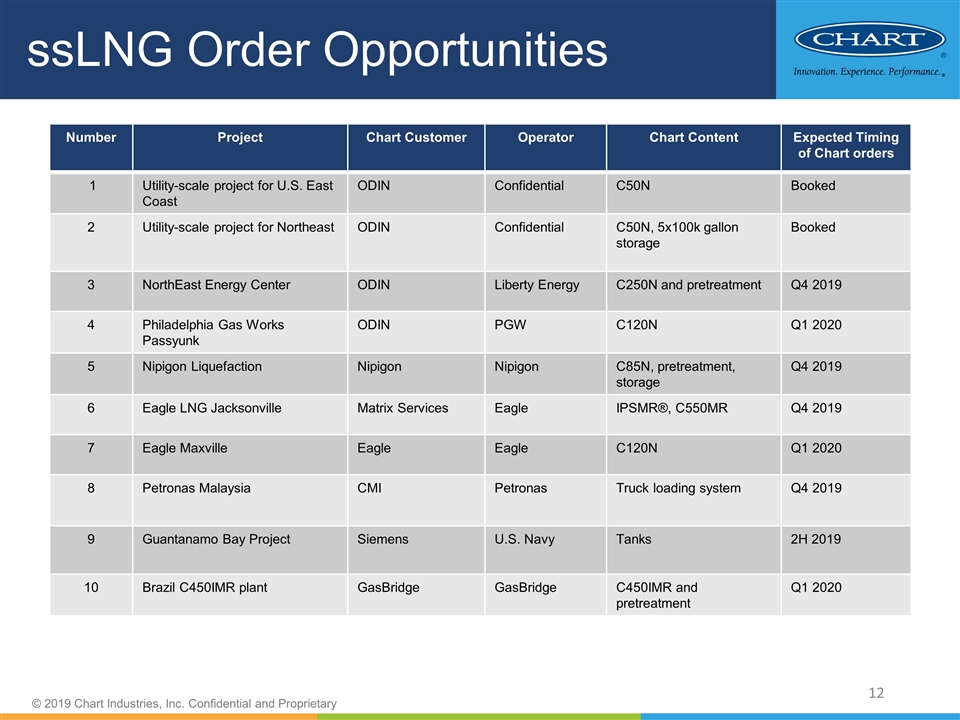

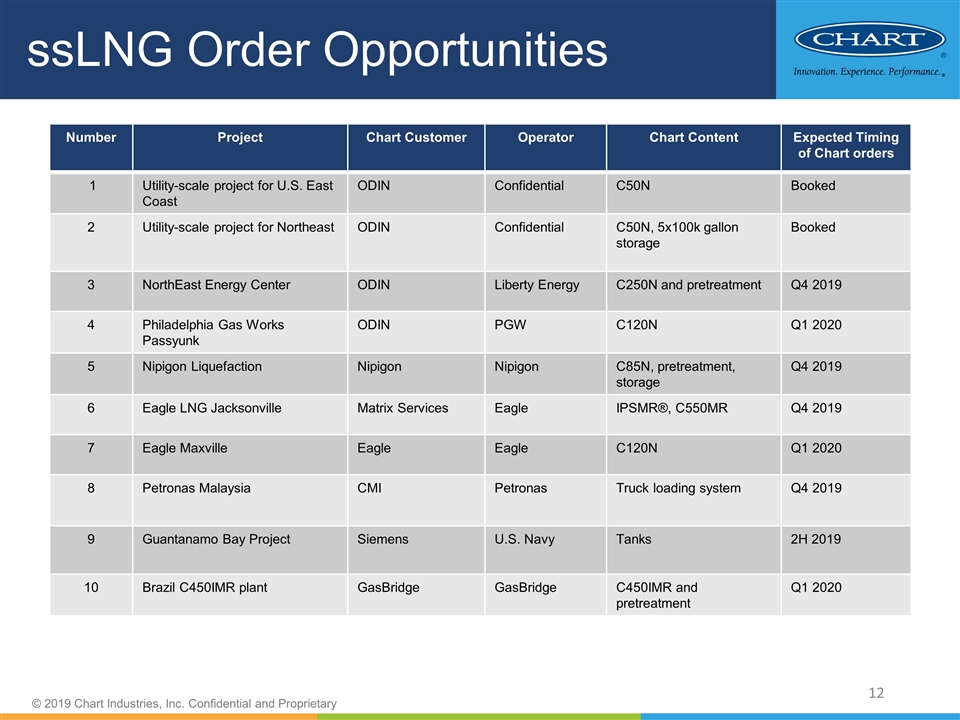

ssLNG Order Opportunities Number Project Chart Customer Operator Chart Content Expected Timing of Chart orders 1 Utility-scale project for U.S. East Coast ODIN Confidential C50N Booked 2 Utility-scale project for Northeast ODIN Confidential C50N, 5x100k gallon storage Booked 3 NorthEast Energy Center ODIN Liberty Energy C250N and pretreatment Q4 2019 4 Philadelphia Gas Works Passyunk ODIN PGW C120N Q1 2020 5 Nipigon Liquefaction Nipigon Nipigon C85N, pretreatment, storage Q4 2019 6 Eagle LNG Jacksonville Matrix Services Eagle IPSMR®, C550MR Q4 2019 7 Eagle Maxville Eagle Eagle C120N Q1 2020 8 Petronas Malaysia CMI Petronas Truck loading system Q4 2019 9 Guantanamo Bay Project Siemens U.S. Navy Tanks 2H 2019 10 Brazil C450IMR plant GasBridge GasBridge C450IMR and pretreatment Q1 2020

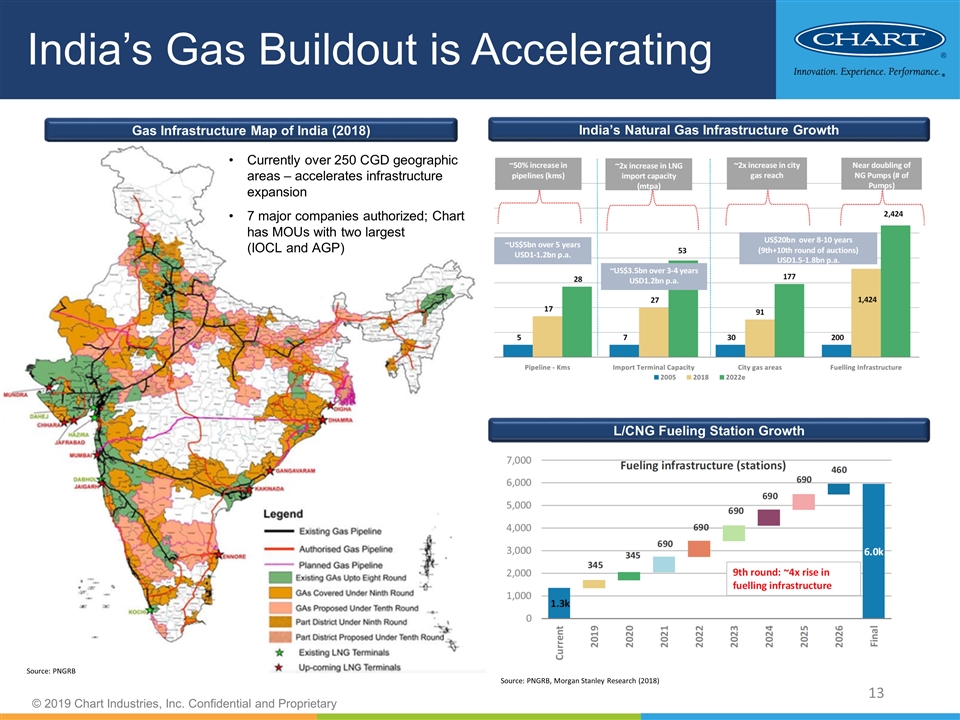

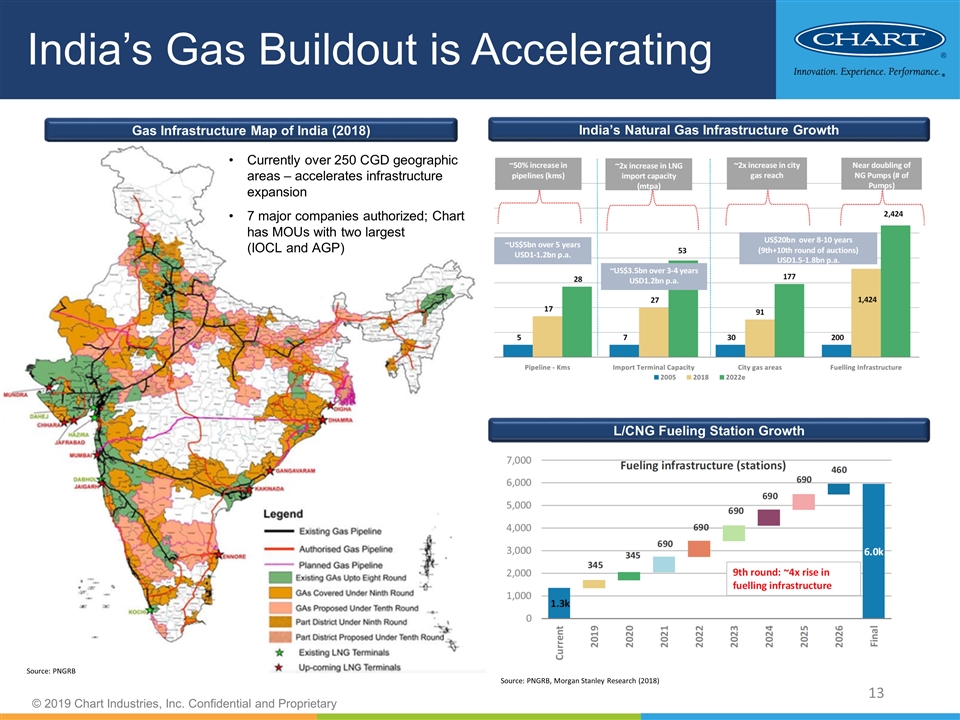

India’s Gas Buildout is Accelerating Gas Infrastructure Map of India (2018) India’s Natural Gas Infrastructure Growth L/CNG Fueling Station Growth Currently over 250 CGD geographic areas – accelerates infrastructure expansion 7 major companies authorized; Chart has MOUs with two largest (IOCL and AGP) Source: PNGRB, Morgan Stanley Research (2018) Source: PNGRB

Specialty Markets Also Driving Growth Food & Beverage Cannabis Lasers Hydrogen Water Treatment -80 Degrees Freezers Supplying big food & beverage companies Nitrogen dosing and food preservation equipment Use of CO2 in grow houses to increase grow yields Super-critical CO2 in extraction process High purity nitrogen provides a superior edge, free of any impurities Leads to cost savings for plant operators on secondary operations H2 vehicle fueling stations and mobile equipment for delivery and hauling Liquefaction storage at H2 production sites Broad-based end market applications at medium temperatures Mechanical freezers providing enhanced efficiency and reduced energy consumption Improving potable water quality and the reuse of wastewater Storage systems and vaporizers for liquid oxygen and CO2 used in purification

Leveraging Our Global Operations Europe D&S West D&S East D&S East Asia-Pacific Americas Corporate Headquarters Ball Ground, GA E&C E&C Navy blue = 157.195.53 Light blue = 51.163.221 Green = 157.195.53 Orange = 253.164.30 Ferox – Decin, CR GOFA –Germany Flow – Germany VCT Vogel – Germany Germany (CryoBio) VRV – Italy VRV/Cryo Diffusion – France VRV – Italy IMB – Italy Hudson/Cofimco – Italy Changzhou, China Chengdu, China (CryoBio) VRV – India Australia (CryoBio) Ball Ground, GA New Prague, MN Fremont, CA McCarran, NV (Repairs) Houston, TX (Repairs) Skaff – Brentwood, NH (Repairs) Thermax – Dartmouth, MA New Iberia, LA Tulsa, OK La Crosse, WI The Woodlands, TX Hudson/Cofimco – Beasley, TX Franklin, IN (Repairs) Benefits: 27 out of 44 D&S product lines have reduced lead times since beginning of 2019 Margin improvements

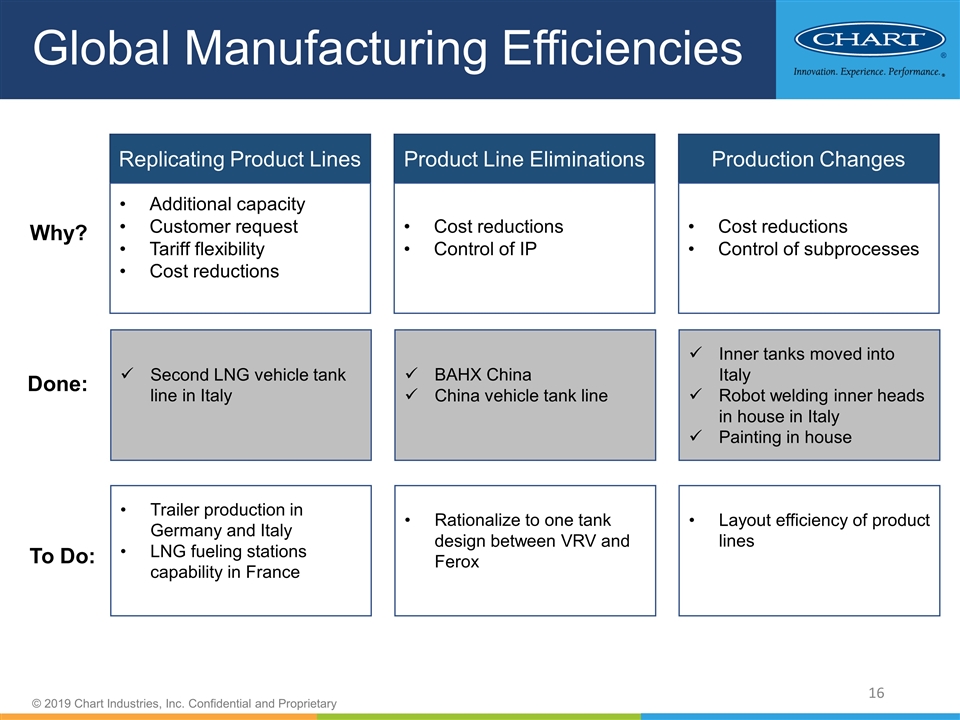

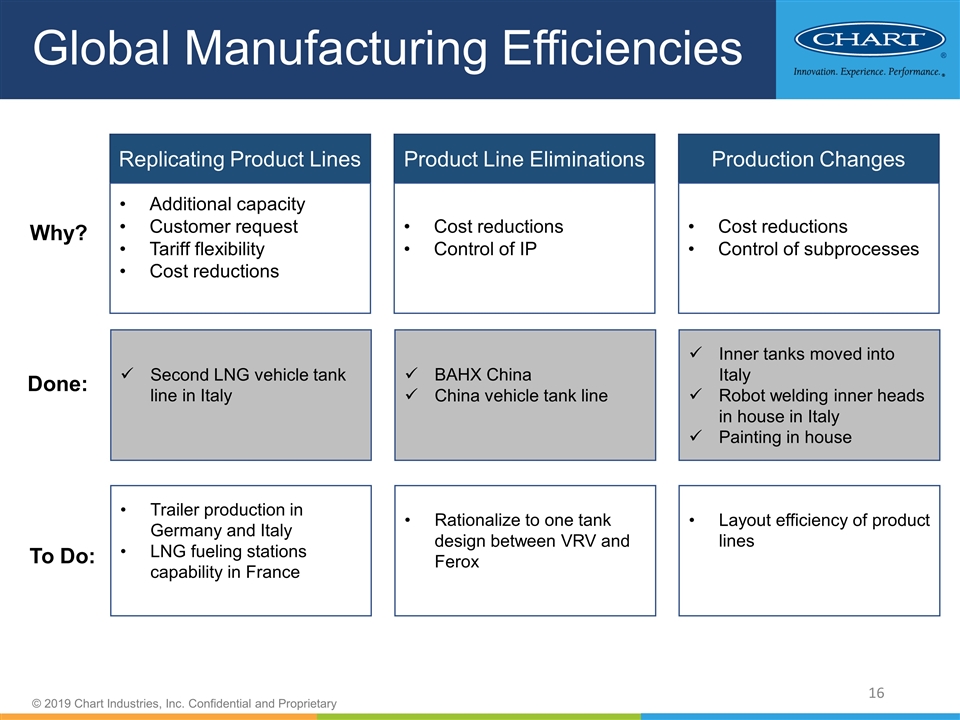

Global Manufacturing Efficiencies Replicating Product Lines Product Line Eliminations Production Changes Additional capacity Customer request Tariff flexibility Cost reductions Cost reductions Control of IP Cost reductions Control of subprocesses Why? Done: To Do: Second LNG vehicle tank line in Italy BAHX China China vehicle tank line Inner tanks moved into Italy Robot welding inner heads in house in Italy Painting in house Trailer production in Germany and Italy LNG fueling stations capability in France Rationalize to one tank design between VRV and Ferox Layout efficiency of product lines

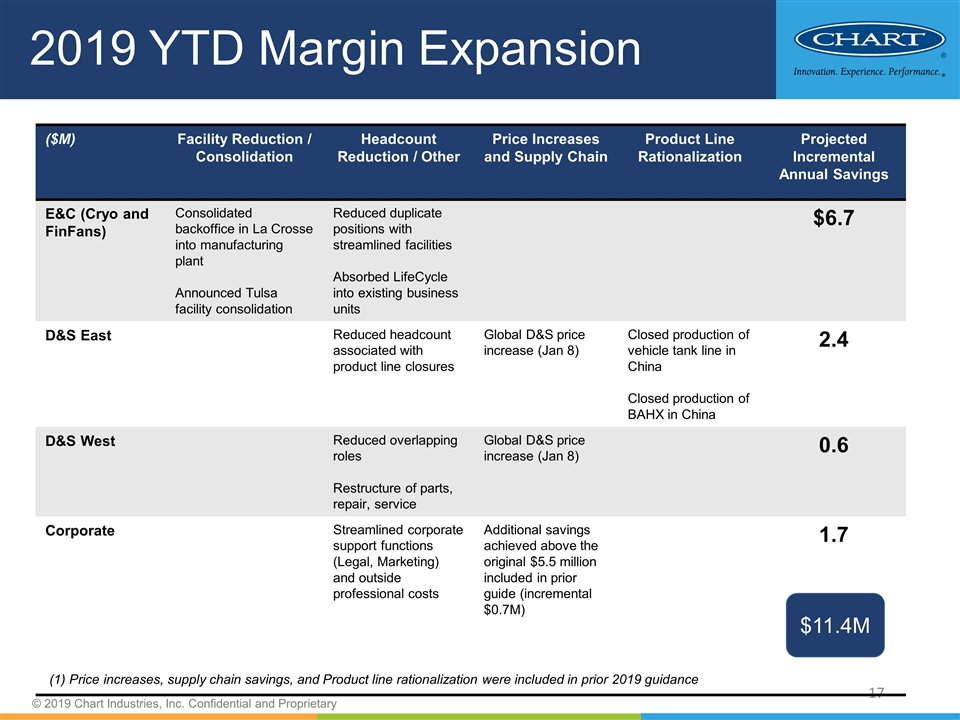

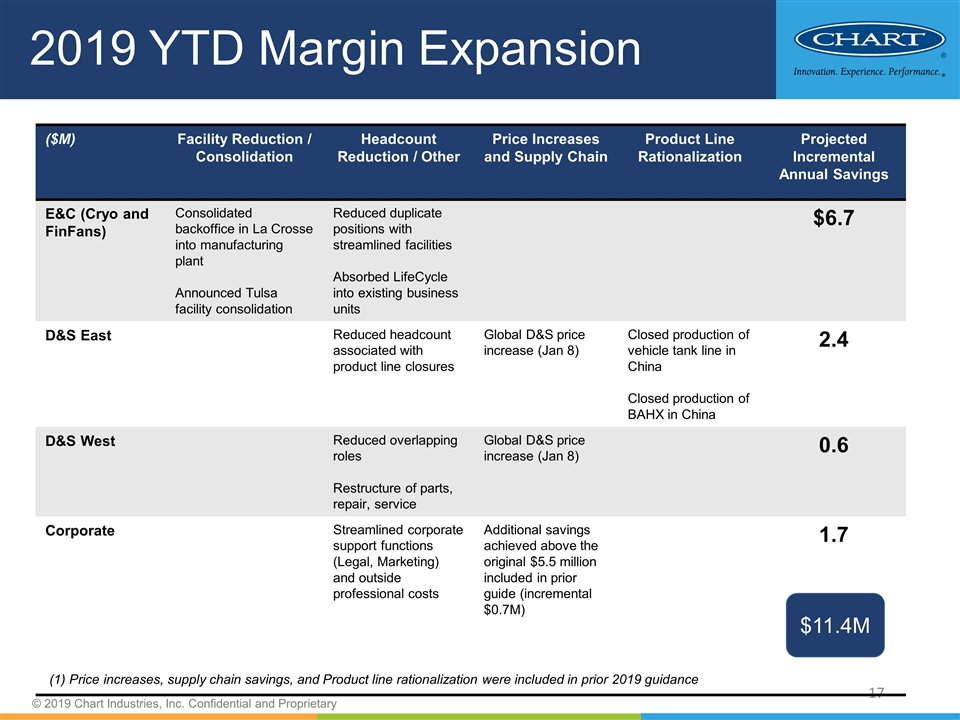

2019 YTD Margin Expansion ($M) Facility Reduction / Consolidation Headcount Reduction / Other Price Increases and Supply Chain Product Line Rationalization Projected Incremental Annual Savings E&C (Cryo and FinFans) Consolidated backoffice in La Crosse into manufacturing plant Announced Tulsa facility consolidation Reduced duplicate positions with streamlined facilities Absorbed LifeCycle into existing business units $6.7 D&S East Reduced headcount associated with product line closures Global D&S price increase (Jan 8) Closed production of vehicle tank line in China Closed production of BAHX in China 2.4 D&S West Reduced overlapping roles Restructure of parts, repair, service Global D&S price increase (Jan 8) 0.6 Corporate Streamlined corporate support functions (Legal, Marketing) and outside professional costs Additional savings achieved above the original $5.5 million included in prior guide (incremental $0.7M) 1.7 (1) Price increases, supply chain savings, and Product line rationalization were included in prior 2019 guidance $11.4M

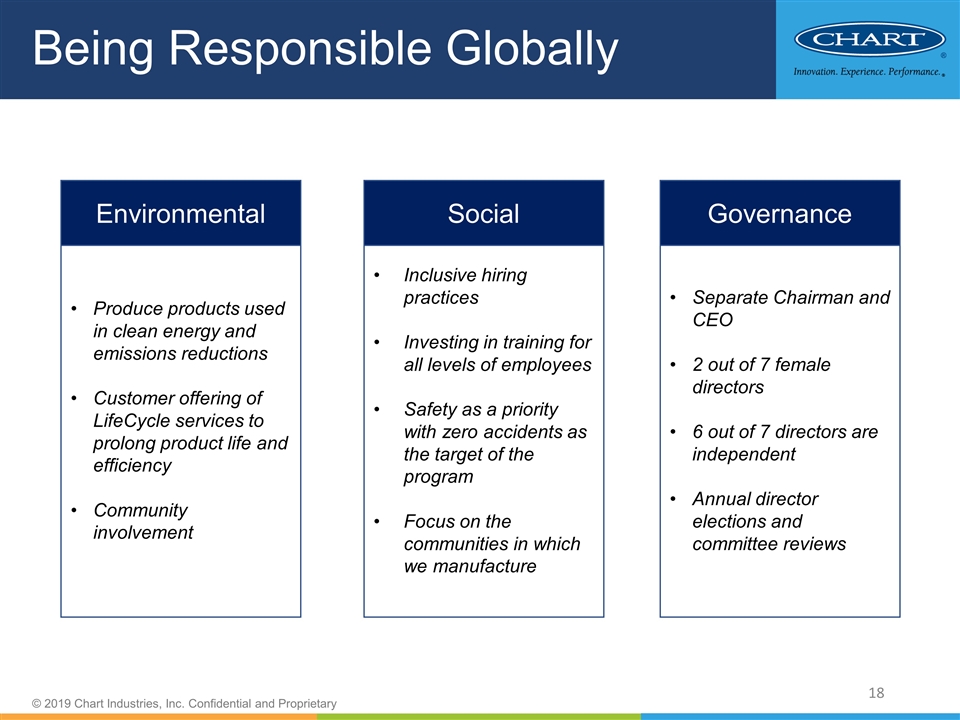

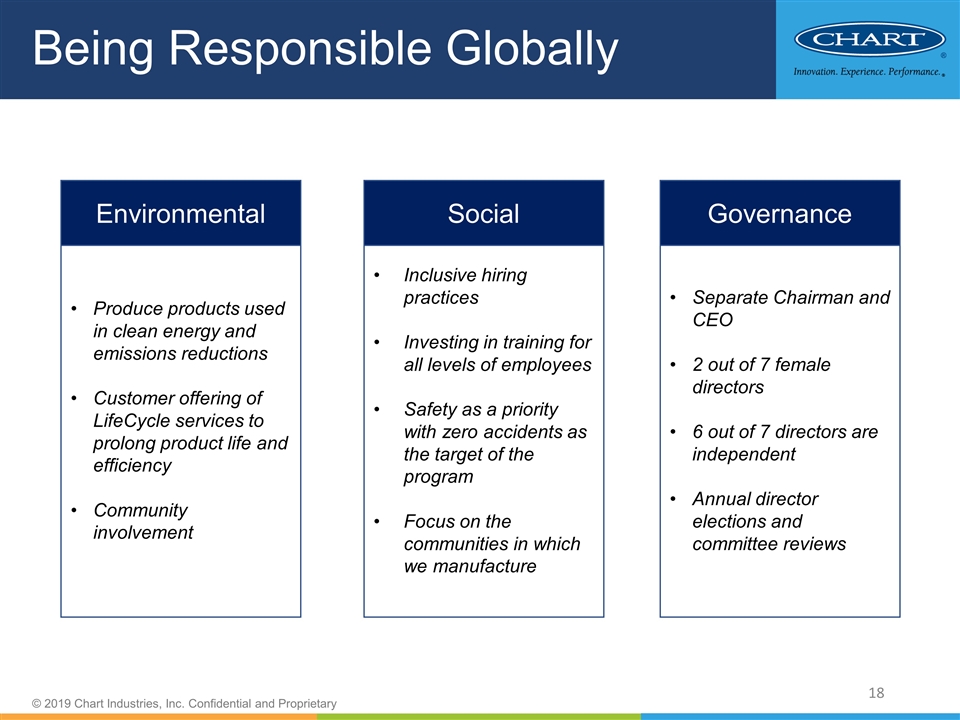

Being Responsible Globally Environmental Social Governance Produce products used in clean energy and emissions reductions Customer offering of LifeCycle services to prolong product life and efficiency Community involvement Inclusive hiring practices Investing in training for all levels of employees Safety as a priority with zero accidents as the target of the program Focus on the communities in which we manufacture Separate Chairman and CEO 2 out of 7 female directors 6 out of 7 directors are independent Annual director elections and committee reviews

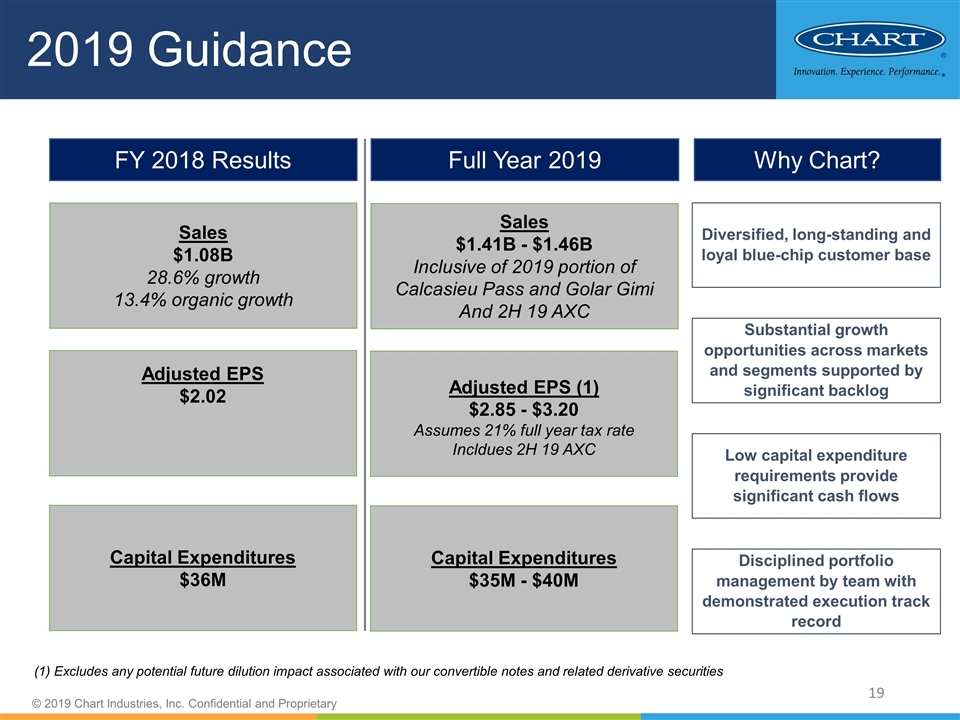

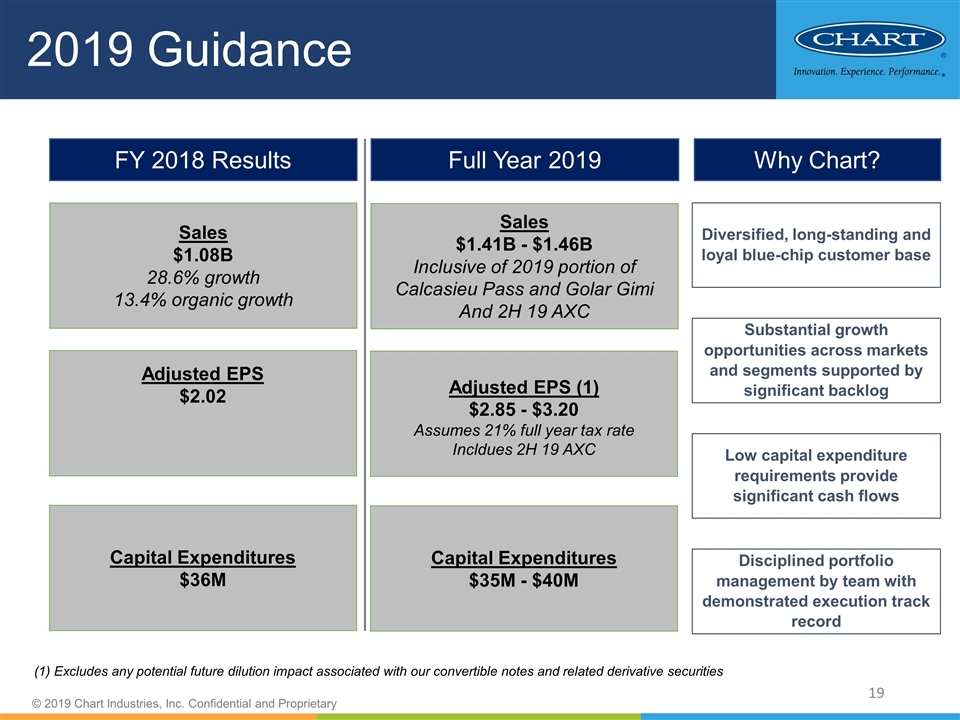

2019 Guidance Full Year 2019 FY 2018 Results Sales $1.08B 28.6% growth 13.4% organic growth Adjusted EPS $2.02 Capital Expenditures $36M Sales $1.41B - $1.46B Inclusive of 2019 portion of Calcasieu Pass and Golar Gimi And 2H 19 AXC Adjusted EPS (1) $2.85 - $3.20 Assumes 21% full year tax rate Incldues 2H 19 AXC Capital Expenditures $35M - $40M (1) Excludes any potential future dilution impact associated with our convertible notes and related derivative securities Diversified, long-standing and loyal blue-chip customer base Substantial growth opportunities across markets and segments supported by significant backlog Low capital expenditure requirements provide significant cash flows Disciplined portfolio management by team with demonstrated execution track record Why Chart?

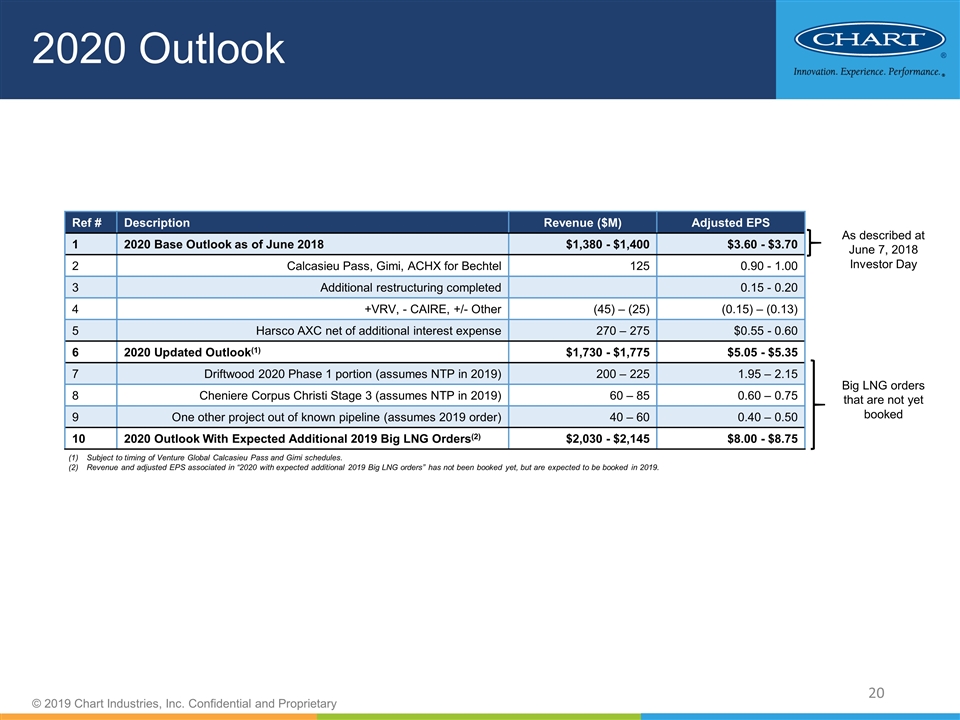

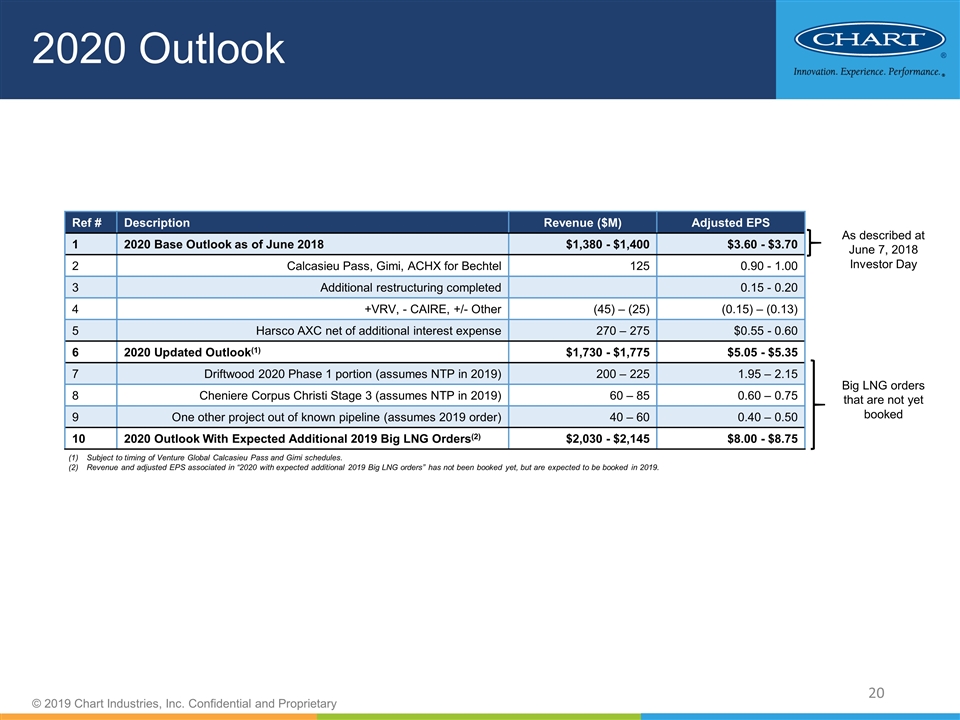

2020 Outlook Ref # Description Revenue ($M) Adjusted EPS 1 2020 Base Outlook as of June 2018 $1,380 - $1,400 $3.60 - $3.70 2 Calcasieu Pass, Gimi, ACHX for Bechtel 125 0.90 - 1.00 3 Additional restructuring completed 0.15 - 0.20 4 +VRV, - CAIRE, +/- Other (45) – (25) (0.15) – (0.13) 5 Harsco AXC net of additional interest expense 270 – 275 $0.55 - 0.60 6 2020 Updated Outlook(1) $1,730 - $1,775 $5.05 - $5.35 7 Driftwood 2020 Phase 1 portion (assumes NTP in 2019) 200 – 225 1.95 – 2.15 8 Cheniere Corpus Christi Stage 3 (assumes NTP in 2019) 60 – 85 0.60 – 0.75 9 One other project out of known pipeline (assumes 2019 order) 40 – 60 0.40 – 0.50 10 2020 Outlook With Expected Additional 2019 Big LNG Orders(2) $2,030 - $2,145 $8.00 - $8.75 Big LNG orders that are not yet booked Subject to timing of Venture Global Calcasieu Pass and Gimi schedules. Revenue and adjusted EPS associated in “2020 with expected additional 2019 Big LNG orders” has not been booked yet, but are expected to be booked in 2019. As described at June 7, 2018 Investor Day

Appendix

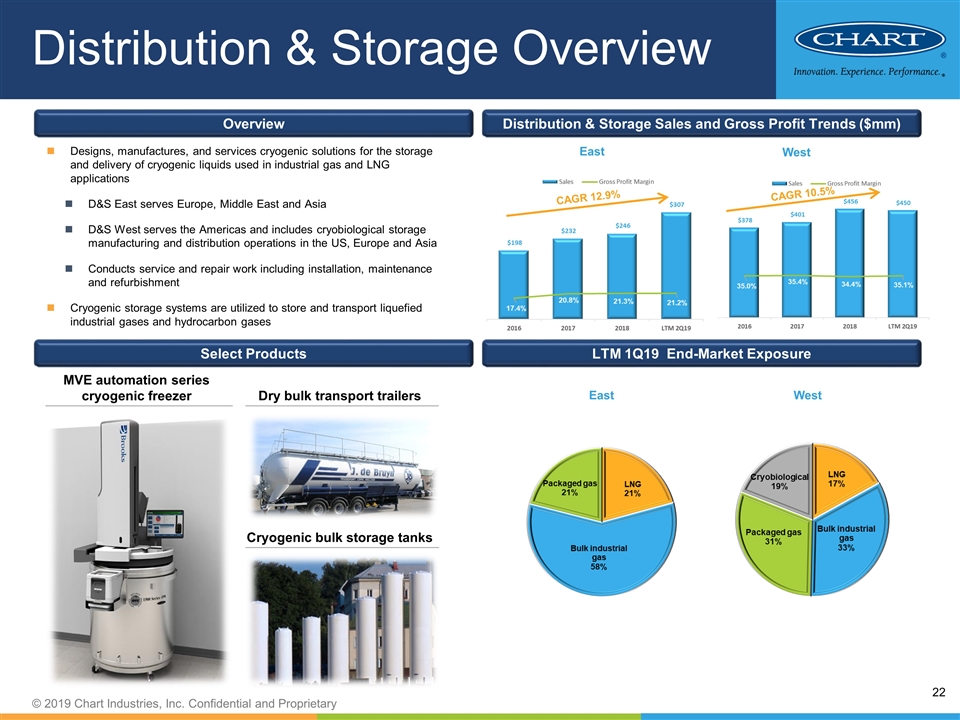

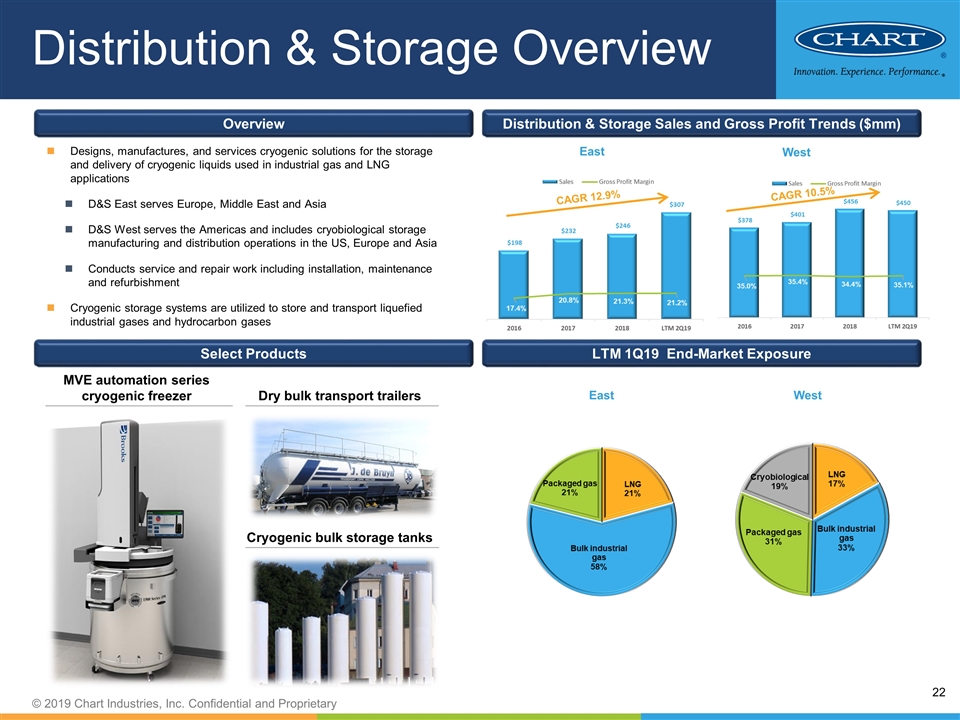

CAGR 10.5% Energy and Chemicals Sales and Gross Profit Trends ($mm) Distribution & Storage Sales and Gross Profit Trends ($mm) LTM 1Q19 End-Market Exposure Overview Designs, manufactures, and services cryogenic solutions for the storage and delivery of cryogenic liquids used in industrial gas and LNG applications D&S East serves Europe, Middle East and Asia D&S West serves the Americas and includes cryobiological storage manufacturing and distribution operations in the US, Europe and Asia Conducts service and repair work including installation, maintenance and refurbishment Cryogenic storage systems are utilized to store and transport liquefied industrial gases and hydrocarbon gases West East West East Cryogenic bulk storage tanks Dry bulk transport trailers MVE automation series cryogenic freezer Select Products Distribution & Storage Overview CAGR 12.9%

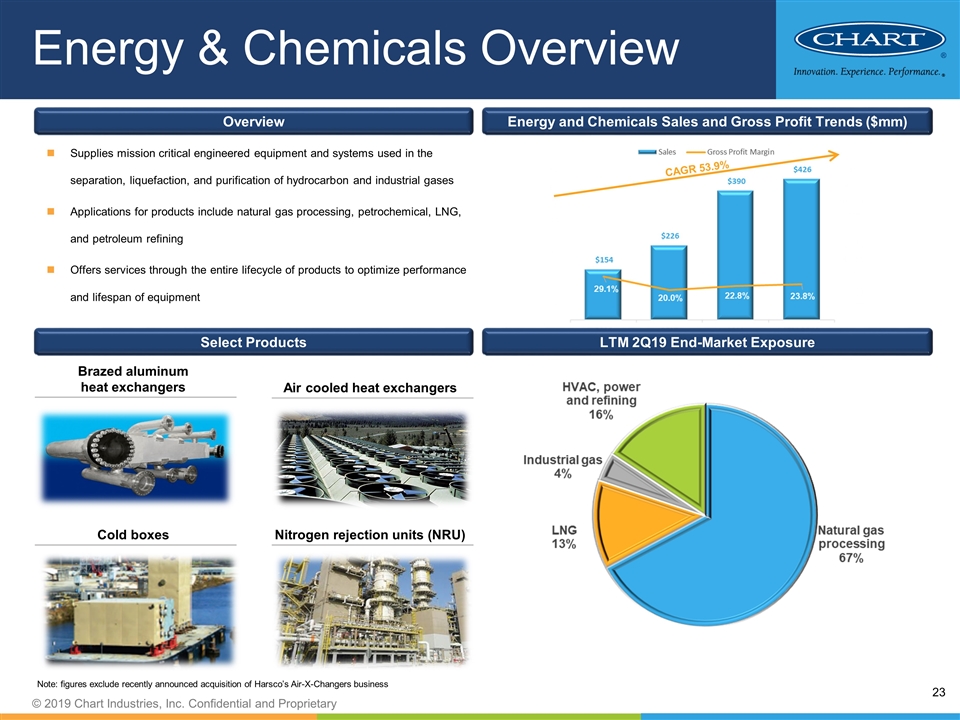

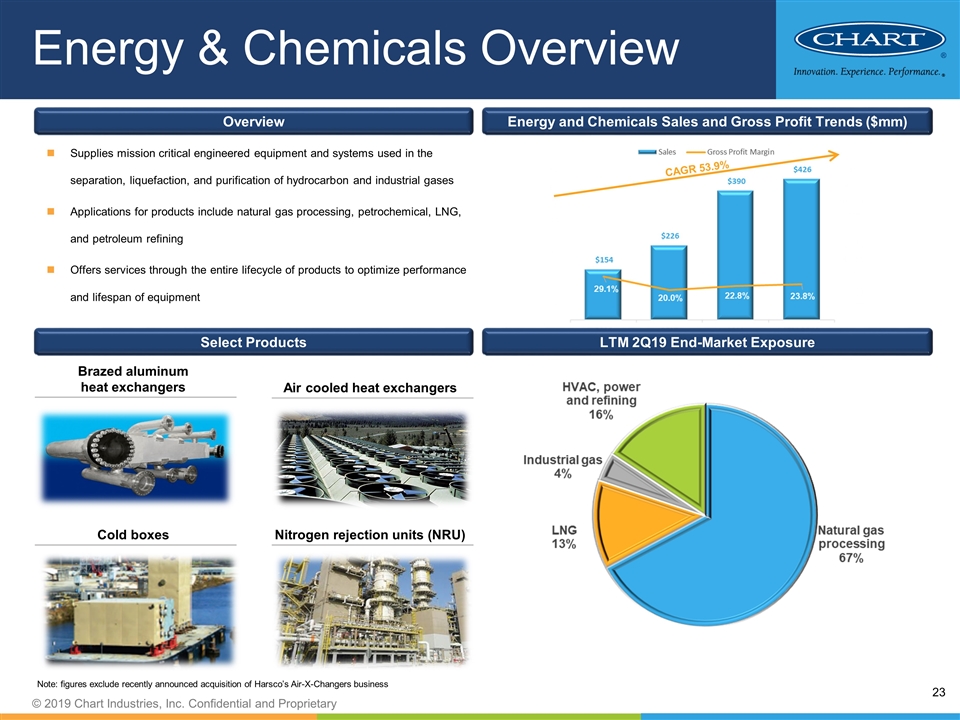

Energy and Chemicals Sales and Gross Profit Trends ($mm) Energy and Chemicals Sales and Gross Profit Trends ($mm) LTM 2Q19 End-Market Exposure Overview Supplies mission critical engineered equipment and systems used in the separation, liquefaction, and purification of hydrocarbon and industrial gases Applications for products include natural gas processing, petrochemical, LNG, and petroleum refining Offers services through the entire lifecycle of products to optimize performance and lifespan of equipment Cold boxes Brazed aluminum heat exchangers Select Products Air cooled heat exchangers Nitrogen rejection units (NRU) Energy & Chemicals Overview Note: figures exclude recently announced acquisition of Harsco’s Air-X-Changers business CAGR 53.9%