| OMB APPROVAL |

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response: 20.6

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07242 | |

| The Cutler Trust |

| (Exact name of registrant as specified in charter) |

| 525 Bigham Knoll Jacksonville, Oregon | 97530 |

| (Address of principal executive offices) | (Zip code) |

Matthew C. Patten

| Cutler Investment Counsel, LLC 525 Bigham Knoll Jacksonville, Oregon 97530 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (541) 770-9000 | |

| Date of fiscal year end: | June 30 | |

| | | |

| Date of reporting period: | June 30, 2018 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| The Cutler Trust |

CUTLER EQUITY FUND

CUTLER FIXED INCOME FUND

CUTLER EMERGING MARKETS FUND

ANNUAL REPORT

June 30, 2018

THE CUTLER TRUST

TABLE OF CONTENTS

| | Page |

Letter to Shareholders | 2 |

Management Discussion of Fund Performance | 3 |

Performance Information | 9 |

Portfolio Information | 12 |

Schedules of Investments | 15 |

Statements of Assets and Liabilities | 27 |

Statements of Operations | 28 |

Statements of Changes in Net Assets | 29 |

Financial Highlights | 32 |

Notes to Financial Statements | 35 |

Report of Independent Registered Public Accounting Firm | 47 |

About Your Fund’s Expenses | 48 |

Federal Tax Information | 50 |

Trustees and Officers of the Trust | 51 |

Additional Information | 53 |

Approval of Investment Advisory Agreement | 54 |

1

THE CUTLER TRUST

LETTER TO SHAREHOLDERS

To The Cutler Funds Shareholders:

The enclosure represents the annual report to shareholders for the Cutler Trust for the fiscal year ended June 30, 2018. Should you have questions about any of the Cutler Funds after reading this report, we invite you to reach out and discuss your investments at your convenience.

This fiscal year can be conveniently separated into two-distinct halves. The first half was the continuation of an unprecedented bull market that began in 2009. Stocks rallied relentlessly throughout 2017, peaking in January of 2018. While the second half of the fiscal year was not a “bear market,” both Domestic Large Cap and Emerging Markets stocks experienced a correction of over 10% from the market peak. This is not surprising, given the normal ebb and flow of equities and the strength of the preceding rally.

While there may be continued market volatility, Cutler believes that equities are fairly valued today. Corporate earnings growth has been phenomenal, which we believe will ultimately guide equities higher. Investors, as always, need to remain focused on the long-term value of their portfolio holdings, and not the mid-cycle gyrations that often get the headlines.

For fixed income investors, this past year had slightly negative results. The Federal Reserve has continued to raise rates, and we have seen long-rates rise mildly. Rising rates represent a headwind for returns from bond portfolios. Cutler continues to navigate this trend with an eye toward income generation within our fixed income portfolio. We believe that inflation expectations remain anchored, providing some opportunities for investors to selectively extend maturities. Bonds remain the best “safe haven” investment for diversifying equity investor risks.

Thank you for your continued trust in Cutler.

Sincerely,

|

|

Matthew C. Patten | Erich M. Patten |

Chairman | Chief Investment Officer |

The Cutler Trust | Cutler Investment Counsel, LLC |

Before investing you should carefully consider the Cutler Funds’ investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by calling 1-800-228-8537. Please read the prospectus carefully before you invest.

The views in this report were those of the Cutler Funds’ investment adviser as of June 30, 2018 and may not reflect its views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Cutler Funds and do not constitute investment advice.

2

CUTLER EQUITY FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

1) | How did the Equity Fund perform last year? |

The Cutler Equity Fund has a net return of 10.63% for the fiscal year ended June 30, 2018.

2) | What were the most significant market factors affecting the Fund’s performance during the past year? |

Market factors included:

| | 1) | Continued low interest rate environment |

| | 2) | Strong performance of growth stocks |

3) | Why did the Fund underperform relative to the benchmark? |

The market continues to favor growth stocks versus value stocks, and Cutler’s investment strategy is biased toward value. The S&P 500 TR had a return of 14.37% (net) during the fiscal year. Cutler outperformed the Russell 1000 Value TR, which returned 6.77% (net) during the year. The Russell 1000 Value represents an appropriate benchmark for the Fund during times of extreme market bi-furcation.

4) | What strategies did you use to manage the Fund? |

Cutler’s investment process focuses on dividends as the primary driver of investment returns. The strategy was unchanged in the previous year, and the management of the Equity Fund was consistent with previous years. We look for holdings in the portfolio that maintain a 10-year record of consistent dividend payments and typically have a total market capitalization of at least $10 billion. We seek relative value as compared to other companies in similar industries. The strategy is further detailed in the Equity Fund’s prospectus.

5) | What were the primary strategic factors that guided your management of the Fund? |

Cutler’s dividend criteria have been the primary strategic factors used in managing the Equity Fund this past year. For example, Cutler looks for companies that have at least a 10-year history of maintaining or increasing dividend. We believe this criterion results in a portfolio of companies with stable earnings and sound business models. In addition, the Equity Fund’s portfolio managers continue to focus on companies they believe offer attractive current yields and the potential for total return.

Portfolio turnover of the Fund remained low this past year at 10%. We have remained patient with our current holdings in a sustained bull market but are monitoring market developments closely that may necessitate a change in positioning.

3

CUTLER EQUITY FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

(Continued)

6) | What were some of the key trends in each of the regions/significant industries in which the Fund invests? |

The Equity Fund’s holdings remain 100% domiciled in the U.S., and the strategies employed do not have any additional regional bias. In certain cases, holdings may have legal registration outside of the U.S. but are considered domestic due to the locality of their operations.

The U.S. markets continued the bull market that was born from the financial crisis. As has been the trend, growth stocks had a very strong 12 months, with large cap growth being a notable asset class for investment.

Tax reform had a significant impact on corporate earnings as of January 1, 2018. Much of the late 2017 rally can be attributed to anticipated earnings growth through this change in corporate cost structure.

7) | Which securities helped the Fund’s performance? |

8) | Did any securities hurt the Fund’s performance? |

4

CUTLER FIXED INCOME FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

1) | How did the Fixed Income Fund perform last year? |

The Fixed Income Fund returned -0.59% for the fiscal year ended June 30, 2018.

2) | What were the most significant market factors affecting the Fixed Income Fund’s performance during the past year? |

Market factors included:

| | 2) | Fed funds rate increase by the Federal Reserve Board |

| | 3) | Continued compression of credit spreads |

3) | Explain the Fixed Income Fund’s performance relative to the benchmark. |

The Bloomberg Barclays Intermediate U.S. Government/Credit Index was down -0.58% during the fiscal year, materially performing in line with the Fund’s net return of -0.59%.

4) | What strategies did you use to manage the Fixed Income Fund? |

The Fixed Income Fund has been significantly underweight Corporates, with Agency holdings comprising the bulk of the market overweight at 44% of the total portfolio. This past year, we systematically reduced the CMBS exposure within the portfolio, which as of June 30th represents 17.9% of the portfolio. The CMBS proceeds were primarily allocated into select investment-grade corporate holdings, as well as the portfolio cash overweight.

The portfolio managers continue to recognize that spreads are very tight and want to manage the sector weighting with this bias in mind. Therefore, Agency and Treasury overweights are likely to continue, although the degree of the overweight may be subject to change.

5) | What were the primary strategic factors that guided your management of the Fixed Income Fund? |

Cutler continues to anticipate the Fed will raise rates, albeit the strength of rate rises should abate as the yield curve continues to flatten. The yield curve has been flattening since the end of 2013, not unusual when the Fed is in the midst of a tightening cycle and short-term rates are driven higher. As measured by the spread between the 2-year and 30-year U.S. Treasury, the yield curve was just 46 basis points at the end of the fiscal year, which is about 112 basis points flatter than where it stood twelve months earlier. This flattening has many investors concerned that the curve may eventually invert portending economic conditions more reflective of a recession.

5

CUTLER FIXED INCOME FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

(Continued)

Barring a change in economic conditions we expect to see the upward trend in short to medium term rates. This could flatten the curve even more unless something is to impact the long end, i.e., increased inflation expectations. This trend leaves the yield curve on the brink of an inversion. While not all inversions precede recessions, all recessions have had inverted yield curves precede them.

With this backdrop, our bias is to remain in quality and overweight the short-end of the curve. While this outlook is bullish for long-term Treasuries, we do not feel the risk vs. reward is attractive at the long end of the curve.

6) | What were some of the key trends in each of the regions/significant industries in which the Fixed Income Fund invests? |

The Fixed Income Fund is 100% domestic and does not invest into securities domiciled outside the U.S. While the Fund increased corporate holdings during the period, specific industry fundamentals do not have a meaningful role in the total positioning of the Fund. Instead, with a corporate underweight, the Fund’s positioning is largely influenced by the underlying economic fundamental. In this sense, the Fund is likely to underperform the benchmark during “risk on” economic environments, as lower quality credit positions continue to tighten vs. government bonds. The strong growth of the U.S. economy continues to support the corporate sector, as well as lower quality credit, which is a headwind for our preferred positioning. However, these sectors are also more susceptible to volatility or economic recession and investing at these levels must be done selectively.

7) | Which securities helped the Fixed Income Fund’s performance? |

| | a) | FNA 2013-M4 X1 3.912% 3/1/18 |

| | b) | FNA 2010-M3 X 0.464% 3/25/20 |

| | c) | FNMA Remic Trust 2015-M1 0.563% 9/25/24 |

8) | Did any securities hurt the Fixed Income Fund’s performance? |

| | a) | Bear Stearns CMBS 2005-Top 20 6.024% 10/12/42 |

| | b) | Federal Farm Credit 2.24% Due 7/6/27 |

| | c) | Federal Home Loan Banks 2.57% Due 10/6/31 |

6

CUTLER EMERGING MARKETS FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

1) | How did the Emerging Markets Fund perform last year? |

The Emerging Markets Fund returned 2.95% for the fiscal year ended June 30, 2018.

2) | What were the most significant market factors affecting the Emerging Markets Fund’s performance during the past year? |

The U.S. Federal Reserve has contributed to a dollar strengthening rally, which has a negative contribution to securities in foreign currency. In addition, market dynamics globally have mimicked the U.S.’ outperformance of growth and technology versus value.

3) | Explain the Emerging Markets Fund’s performance relative to the benchmark. |

The MSCI Emerging Markets Index returned 8.20% during the period. Given the large number of securities globally, we anticipate the portfolio will not closely track the index returns. However, the primary contributing factor to performance versus the benchmark is the underweight of Technology, with the Fund holding about 12% less in this strongly performing sector.

4) | What strategies did you use to manage the Emerging Markets Fund? |

Cutler utilizes a universe which we refer to as “The 15DU.” The 15DU consists of companies in the emerging markets index that have paid dividends for at least 14 of the last 15 years. The bulk of the portfolio is comprised of these securities. Additionally, Cutler uses ETFs to gain exposure to markets with less liquidity or as a way to provide trading liquidity for shareholder transactions. Further details on strategies are outlined in the Fund Prospectus.

5) | What were the primary strategic factors that guided your management of the Emerging Markets Fund? |

In combination with our economic outlook, Cutler considers geo-political risk when assessing our country weightings. In general, Cutler is biased against less stable political environments. Instead, we prefer to invest into faster growing economies with favorable demographic trends. Cutler believes that emerging markets investing should primarily be focused on consumer-based investment themes, not commodities. When possible, but not exclusively, we will look for 15DU securities that are exposed to a growing middle-class in countries and regions.

6) | What were some of the key trends in each of the regions/significant industries in which the Emerging Markets Fund invests? |

Emerging markets are diverse, yet global correlations exist that impact total portfolio performance. The most significant trend of the past year impacting Emerging Markets has been the strengthening U.S. dollar, which became especially prescient after the market peaked in

7

CUTLER EMERGING MARKETS FUND

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

(Continued)

January. The strengthening dollar also impacts global commodity trends, which impact many emerging market economies that may be more dependent on commodity production for economic growth.

While the global economy continues to grow, 2018 has experience increased tensions, particularly with regards to trade. Emerging economies are particularly susceptible to trade impacts, as their dependency on developed countries is evident.

7) | Which securities helped the Emerging Markets Fund’s performance? |

| | b) | Tingyi (Cayman Islands) Holdings |

8) | Did any securities hurt the Emerging Markets Fund’s performance? |

| | c) | Coca-Cola Femsa S.A.B. de C.V. |

8

CUTLER EQUITY FUND

PERFORMANCE INFORMATION

June 30, 2018 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Cutler Equity Fund and S&P 500 Total Return Index

Average Annual Total Returns

(for periods ended June 30, 2018) |

| | 1 Year | 5 Years | 10 Years | |

Cutler Equity Fund(a) | 10.63% | 9.39% | 8.99% | |

S&P 500 Total Return Index(b) | 14.37% | 13.42% | 10.17% | |

| | | | | | |

(a) | Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. | |

(b) | The S&P 500 Total Return Index is a market capitalization weighted index that is widely used as a barometer of U.S. stock market performance. The index is unmanaged and shown for illustration purposes only. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. | |

9

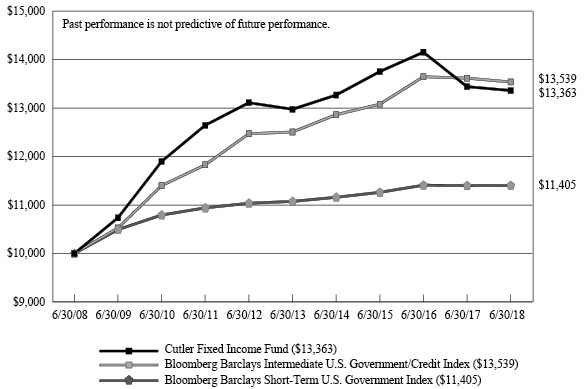

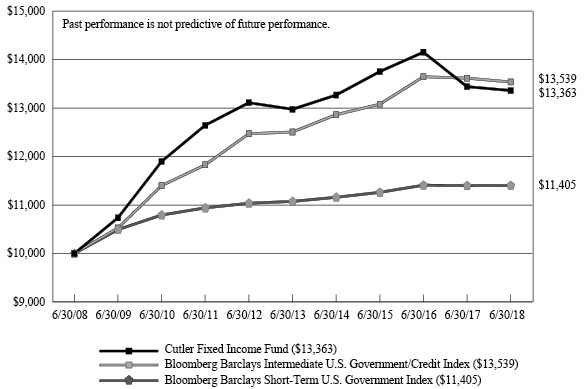

CUTLER FIXED INCOME FUND

PERFORMANCE INFORMATION

June 30, 2018 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Cutler Fixed Income Fund, Bloomberg Barclays Intermediate U.S. Government/Credit Index

and Bloomberg Barclays Short-Term U.S. Government Index

Average Annual Total Returns

(for periods ended June 30, 2018) |

| | 1 Year | 5 Years | 10 Years | |

Cutler Fixed Income Fund(a) | (0.59%) | 0.59% | 2.94% | |

Bloomberg Barclays Intermediate U.S. Government/Credit Index(b) | (0.58%) | 1.60% | 3.08% | |

Bloomberg Barclays Short-Term U.S. Government Index(b) | 0.03% | 0.59% | 1.32% | |

| | | | | | |

(a) | Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. | |

(b) | The Bloomberg Barclays Intermediate U.S. Government/Credit Index and the Bloomberg Barclays Short-Term U.S. Government Index cover intermediate and short-term, respectively, fixed income securities of the U.S government and publicly-issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity, and quality requirements. The indices are unmanaged and shown for illustration purposes only. An investor cannot invest in an index and its returns are not indicative of the performance or any specific investment. | |

10

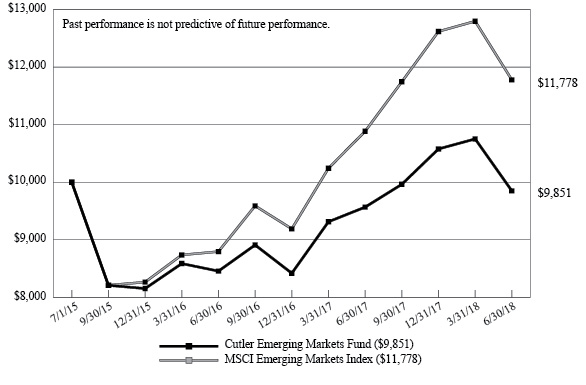

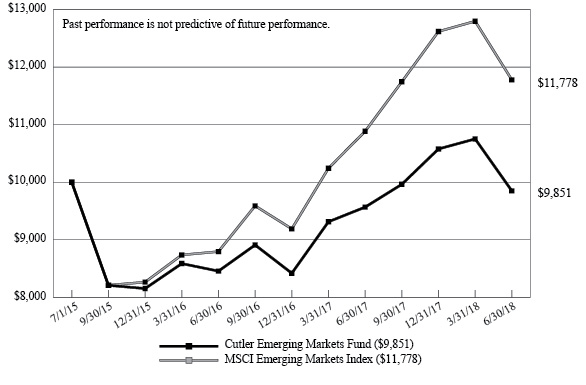

CUTLER EMERGING MARKETS FUND

PERFORMANCE INFORMATION

June 30, 2018 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in

Cutler Emerging Markets Fund and MSCI Emerging Markets Index

Average Annual Total Returns

(for periods ended June 30, 2018) |

| | | 1 Year | Since

Inception(b) | |

Cutler Emerging Markets Fund(a) | | 2.95% | (0.50%) | |

MSCI Emerging Markets Index(c) | | 8.20% | 5.61% | |

| | | | | | |

(a) | Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. | |

(b) | The Fund commenced operations on July 1, 2015. | |

(c) | The MSCI Emerging Markets Index captures large and mid cap representation across 24 emerging markets: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. The index is unmanaged and shown for illustration purposes only. An investor cannot invest in an index and its returns are not indicative of the performance of any specific investment. | |

11

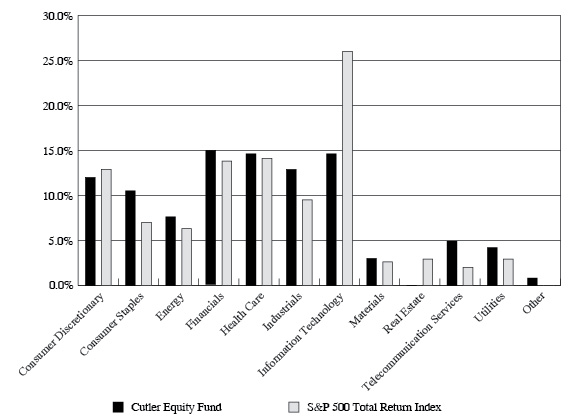

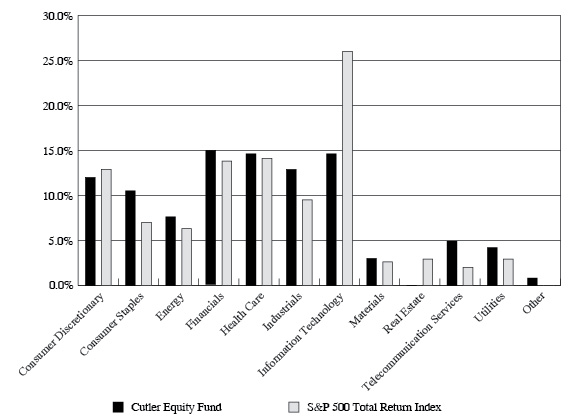

CUTLER EQUITY FUND

PORTFOLIO INFORMATION

June 30, 2018 (Unaudited)

Sector Allocation (% of Net Assets)

12

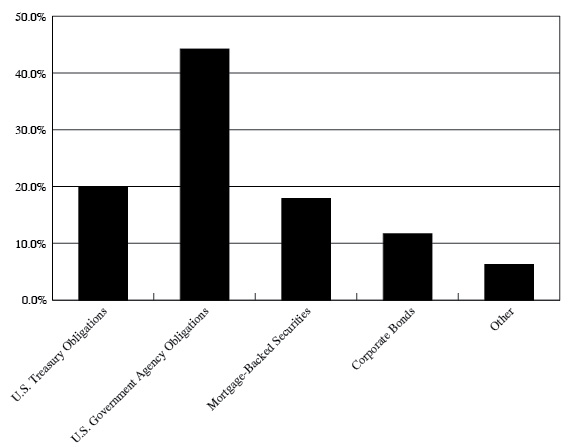

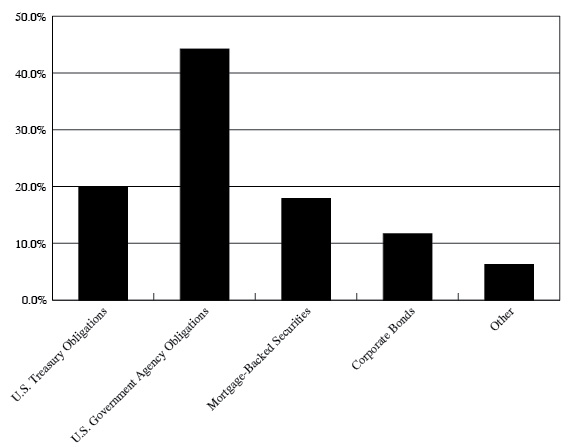

CUTLER FIXED INCOME FUND

PORTFOLIO INFORMATION

June 30, 2018 (Unaudited)

Asset Allocation (% of Net Assets)

13

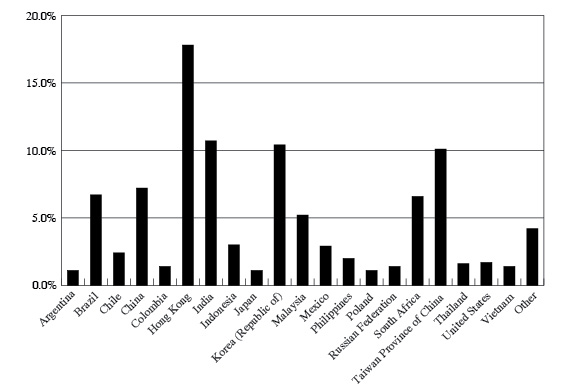

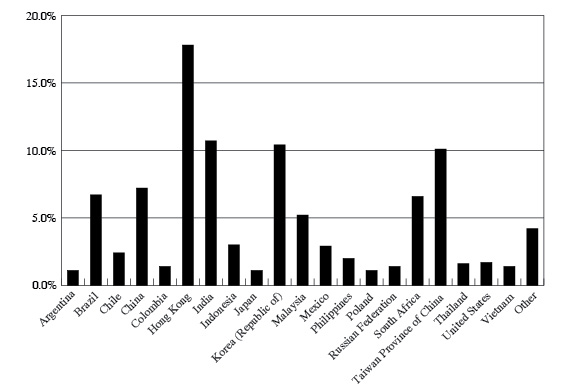

CUTLER EMERGING MARKETS FUND

PORTFOLIO INFORMATION

June 30, 2018 (Unaudited)

Country Allocation (% of Net Assets)

14

CUTLER EQUITY FUND

SCHEDULE OF INVESTMENTS

June 30, 2018 |

| COMMON STOCKS — 99.2% | | Shares | | | Value | |

| Consumer Discretionary — 12.0% | | | | | | |

| Hotels, Restaurants & Leisure — 4.1% | | | | | | |

| McDonald's Corporation | | | 39,655 | | | $ | 6,213,542 | |

| | | | | | | | | |

| Media — 3.4% | | | | | | | | |

| Walt Disney Company (The) | | | 48,992 | | | | 5,134,852 | |

| | | | | | | | | |

| Specialty Retail — 4.5% | | | | | | | | |

| Home Depot, Inc. (The) | | | 34,575 | | | | 6,745,582 | |

| | | | | | | | | |

| Consumer Staples — 10.5% | | | | | | | | |

| Beverages — 2.8% | | | | | | | | |

| PepsiCo, Inc. | | | 37,995 | | | | 4,136,516 | |

| | | | | | | | | |

| Food & Staples Retailing — 5.4% | | | | | | | | |

| Kroger Company (The) | | | 122,971 | | | | 3,498,525 | |

| Walmart, Inc. | | | 53,677 | | | | 4,597,435 | |

| | | | | | | | 8,095,960 | |

| Household Products — 2.3% | | | | | | | | |

| Procter & Gamble Company (The) | | | 45,130 | | | | 3,522,848 | |

| | | | | | | | | |

| Energy — 7.6% | | | | | | | | |

| Energy Equipment & Services — 1.2% | | | | | | | | |

| Schlumberger Ltd. | | | 27,000 | | | | 1,809,810 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels — 6.4% | | | | | | | | |

| Chevron Corporation | | | 43,820 | | | | 5,540,163 | |

| Exxon Mobil Corporation | | | 49,563 | | | | 4,100,347 | |

| | | | | | | | 9,640,510 | |

| Financials — 14.9% | | | | | | | | |

| Banks — 3.2% | | | | | | | | |

| M&T Bank Corporation | | | 28,340 | | | | 4,822,051 | |

| | | | | | | | | |

| Capital Markets — 7.1% | | | | | | | | |

| BlackRock, Inc. | | | 13,284 | | | | 6,629,247 | |

| Northern Trust Corporation | | | 39,000 | | | | 4,012,710 | |

| | | | | | | | 10,641,957 | |

| Insurance — 4.6% | | | | | | | | |

| Marsh & McLennan Companies, Inc. | | | 44,000 | | | | 3,606,680 | |

| Prudential Financial, Inc. | | | 35,500 | | | | 3,319,605 | |

| | | | | | | | 6,926,285 | |

15

CUTLER EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 99.2% (Continued) | | Shares | | | Value | |

| Health Care — 14.6% | | | | | | |

| Health Care Equipment & Supplies — 6.7% | | | | | | |

| Becton, Dickinson and Company | | | 27,525 | | | $ | 6,593,889 | |

| Medtronic plc | | | 41,000 | | | | 3,510,010 | |

| | | | | | | | 10,103,899 | |

| Pharmaceuticals — 7.9% | | | | | | | | |

| Bristol-Myers Squibb Company | | | 71,490 | | | | 3,956,256 | |

| Johnson & Johnson | | | 34,670 | | | | 4,206,858 | |

| Merck & Company, Inc. | | | 62,790 | | | | 3,811,353 | |

| | | | | | | | 11,974,467 | |

| Industrials — 12.9% | | | | | | | | |

| Aerospace & Defense — 2.7% | | | | | | | | |

| United Technologies Corporation | | | 32,010 | | | | 4,002,210 | |

| | | | | | | | | |

| Machinery — 8.2% | | | | | | | | |

| Caterpillar, Inc. | | | 44,280 | | | | 6,007,468 | |

| Deere & Company | | | 45,944 | | | | 6,422,971 | |

| | | | | | | | 12,430,439 | |

| Road & Rail — 2.0% | | | | | | | | |

| Union Pacific Corporation | | | 21,000 | | | | 2,975,280 | |

| | | | | | | | | |

| Information Technology — 14.6% | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 9.8% | | | | | | | | |

| Intel Corporation | | | 104,965 | | | | 5,217,810 | |

| QUALCOMM, Inc. | | | 64,464 | | | | 3,617,720 | |

| Texas Instruments, Inc. | | | 53,365 | | | | 5,883,491 | |

| | | | | | | | 14,719,021 | |

| Software — 4.8% | | | | | | | | |

| Microsoft Corporation | | | 73,425 | | | | 7,240,439 | |

| | | | | | | | | |

| Materials — 3.0% | | | | | | | | |

| Chemicals — 3.0% | | | | | | | | |

| DowDuPont, Inc. | | | 69,875 | | | | 4,606,160 | |

| | | | | | | | | |

| Telecommunication Services — 4.9% | | | | | | | | |

| Diversified Telecommunication Services — 4.9% | | | | | | | | |

| AT&T, Inc. | | | 109,403 | | | | 3,512,930 | |

| Verizon Communications, Inc. | | | 75,786 | | | | 3,812,794 | |

| | | | | | | | 7,325,724 | |

16

CUTLER EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 99.2% (Continued) | | Shares | | | Value | |

| Utilities — 4.2% | | | | | | |

| Gas Utilities — 1.8% | | | | | | |

| National Fuel Gas Company | | | 52,145 | | | $ | 2,761,599 | |

| | | | | | | | | |

| Multi-Utilities — 2.4% | | | | | | | | |

| Dominion Energy, Inc. | | | 53,243 | | | | 3,630,108 | |

| | | | | | | | | |

Total Common Stocks (Cost $96,789,579) | | | | | | $ | 149,459,259 | |

| |

| MONEY MARKET FUNDS — 0.9% | | Shares | | | Value | |

Invesco STIT Government & Agency Portfolio - Institutional Class, 1.80% (a) (Cost $1,351,153) | | | 1,351,153 | | | $ | 1,351,153 | |

| | | | | | | | | |

Total Investments at Value — 100.1% (Cost $98,140,732) | | | | | | $ | 150,810,412 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.1%) | | | | | | | (213,082 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 150,597,330 | |

(a) | The rate shown is the 7-day effective yield as of June 30, 2018. |

See accompanying notes to financial statements. |

17

CUTLER FIXED INCOME FUND

SCHEDULE OF INVESTMENTS

June 30, 2018 |

| U.S. TREASURY OBLIGATIONS — 19.9% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| U.S. Treasury Notes | | | 1.750 | % | | | 11/30/19 | | | $ | 250,000 | | | $ | 247,481 | |

| U.S. Treasury Notes | | | 1.875 | % | | | 12/15/20 | | | | 250,000 | | | | 245,801 | |

| U.S. Treasury Notes | | | 2.375 | % | | | 03/15/21 | | | | 250,000 | | | | 248,486 | |

| U.S. Treasury Notes | | | 1.625 | % | | | 02/15/26 | | | | 700,000 | | | | 642,195 | |

| U.S. Treasury Notes | | | 1.625 | % | | | 05/15/26 | | | | 650,000 | | | | 594,572 | |

| U.S. Treasury Notes | | | 2.000 | % | | | 11/15/26 | | | | 500,000 | | | | 468,574 | |

Total U.S. Treasury Obligations (Cost $2,540,315) | | | | | | | | | | | | | | $ | 2,447,109 | |

| |

| U.S. GOVERNMENT AGENCY OBLIGATIONS — 44.2% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Federal Farm Credit Bank — 20.0% | | | | | | | | | | | | | | | | |

| Federal Farm Credit Bank | | | 2.750 | % | | | 06/26/23 | | | $ | 500,000 | | | $ | 497,668 | |

| Federal Farm Credit Bank | | | 2.040 | % | | | 02/10/25 | | | | 100,000 | | | | 93,023 | |

| Federal Farm Credit Bank | | | 2.370 | % | | | 05/01/25 | | | | 300,000 | | | | 287,889 | |

| Federal Farm Credit Bank | | | 2.360 | % | | | 06/16/25 | | | | 310,000 | | | | 292,992 | |

| Federal Farm Credit Bank | | | 2.240 | % | | | 07/06/27 | | | | 1,150,000 | | | | 1,057,371 | |

| Federal Farm Credit Bank | | | 2.500 | % | | | 07/12/27 | | | | 250,000 | | | | 233,162 | |

| | | | | | | | | | | | | | | | 2,462,105 | |

| Federal Home Loan Bank — 18.8% | | | | | | | | | | | | | | | | |

| Federal Home Loan Bank | | | 1.500 | % | | | 03/29/22 | | | | 250,000 | | | | 244,156 | |

| Federal Home Loan Bank | | | 1.500 | % | | | 10/27/22 | | | | 500,000 | | | | 489,498 | |

| Federal Home Loan Bank | | | 2.125 | % | | | 03/10/23 | | | | 350,000 | | | | 339,823 | |

| Federal Home Loan Bank | | | 1.500 | % | | | 07/27/28 | | | | 1,000,000 | | | | 931,665 | |

| Federal Home Loan Bank | | | 2.570 | % | | | 10/06/31 | | | | 345,000 | | | | 310,828 | |

| | | | | | | | | | | | | | | | 2,315,970 | |

| Federal Home Loan Mortgage Corporation — 1.2% | | | | | | | | | | | | | | | | |

| Federal Home Loan Mortgage Corporation | | | 1.500 | % | | | 10/27/23 | | | | 150,000 | | | | 144,173 | |

| | | | | | | | | | | | | | | | | |

| Private Export Funding Corporation — 3.0% | | | | | | | | | | | | | | | | |

| Private Export Funding Corporation | | | 4.300 | % | | | 12/15/21 | | | | 350,000 | | | | 365,941 | |

| | | | | | | | | | | | | | | | | |

| U.S. Department of Housing and Urban Development — 1.2% | | | | | | | | | | | | | | |

| U.S. Department of Housing and Urban Development | | | 4.130 | % | | | 08/01/25 | | | | 150,000 | | | | 154,616 | |

Total U.S. Government Agency Obligations (Cost $5,626,751) | | | | | | | | | | | | | $ | 5,442,805 | |

18

CUTLER FIXED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| MORTGAGE-BACKED SECURITIES — 17.9% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Commercial — 1.5% | | | | | | | | | | | | |

| Banc of America Commercial Mortgage Trust, IO, Series 2004-4 | | | 0.062 | %(a) | | | 07/01/42 | | | $ | 1,567,909 | | | $ | 227 | |

| Bear Stearns Commercial Mortgage Securities Trust, Series 2005-T20 | | | 6.024 | %(a) | | | 10/12/42 | | | | 200,000 | | | | 44,086 | |

| Credit Suisse First Boston Mortgage Securities, IO, Series 2004-C1, 144A | | | 0.842 | %(a) | | | 01/15/37 | | | | 3,740,588 | | | | 69,037 | |

| GMAC Commercial Mortgage Securities, Inc. Trust, IO, Series 1997-C1 | | | 1.526 | %(a) | | | 07/15/29 | | | | 3,895,841 | | | | 66,820 | |

| Morgan Stanley Capital I Trust, IO, Series 1998-HF2 | | | 1.069 | %(a) | | | 11/01/30 | | | | 379,666 | | | | 19 | |

| Wachovia Bank Commercial Mortgage Trust, IO, Series 2005-C21 | | | 0.000 | %(a) | | | 10/01/44 | | | | 123,409,088 | | | | 5,418 | |

| | | | | | | | | | | | | | | | 185,607 | |

| Federal Home Loan Mortgage Corporation — 0.3% | | | | | | | | | | | | | | | | |

| FHLMC, Pool #J13584 | | | 3.500 | % | | | 11/01/25 | | | | 24,619 | | | | 24,928 | |

| FHLMC, Series 1963 | | | 7.500 | % | | | 01/01/27 | | | | 14,360 | | | | 15,989 | |

| | | | | | | | | | | | | | | | 40,917 | |

| Federal National Mortgage Association — 10.8% | | | | | | | | | | | | | | | | |

| FANNIEMAE-ACES, IO, Series 2012-M4 | | | 0.564 | %(a) | | | 04/25/22 | | | | 10,198,814 | | | | 175,545 | |

| FANNIEMAE-ACES, IO, Series 2015-M4 | | | 0.487 | %(a) | | | 07/25/22 | | | | 13,573,006 | | | | 218,520 | |

| FANNIEMAE-ACES, IO, Series 2014-M13 | | | 0.124 | %(a) | | | 08/25/24 | | | | 12,098,075 | | | | 89,890 | |

| FANNIEMAE-ACES, IO, Series 2015-M1 | | | 0.546 | %(a) | | | 09/25/24 | | | | 28,810,721 | | | | 826,165 | |

| FNMA, Pool #899237 | | | 5.000 | % | | | 03/01/22 | | | | 2,835 | | | | 2,941 | |

| FNMA, Series 2002-93 | | | 6.500 | % | | | 03/01/32 | | | | 16,961 | | | | 18,072 | |

| | | | | | | | | | | | | | | | 1,331,133 | |

| Government National Mortgage Association — 5.3% | | | | | | | | | | | | | | | | |

| GNMA, IO, Series 2011-121 (-1*1MO LIBOR + 610) | | | 4.099 | %(a) | | | 03/16/43 | | | | 989,751 | | | | 119,569 | |

| GNMA, IO, Series 2012-4 | | | 0.199 | %(a) | | | 05/16/52 | | | | 2,400,773 | | | | 31,844 | |

| GNMA, IO, Series 2013-35 | | | 0.483 | %(a) | | | 01/16/53 | | | | 9,743,077 | | | | 312,904 | |

| GNMA, IO, Series 2012-114 | | | 0.803 | %(a) | | | 01/16/53 | | | | 3,554,712 | | | | 190,106 | |

| | | | | | | | | | | | | | | | 654,423 | |

| | | | | | | | | | | | | | | | | |

Total Mortgage-Backed Securities (Cost $2,731,186) | | | | | | | | | | | | | | $ | 2,212,080 | |

19

CUTLER FIXED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| CORPORATE BONDS — 11.7% | | Coupon | | | Maturity | | | Par Value | | | Value | |

| Consumer Discretionary — 1.2% | | | | | | | | | | | | | | | | |

| NVR, Inc. | | | 3.950 | % | | | 09/15/22 | | | $ | 150,000 | | | $ | 150,969 | |

| | | | | | | | | | | | | | | | | |

| Consumer Staples — 1.2% | | | | | | | | | | | | | | | | |

| Dollar Tree, Inc. | | | 4.000 | % | | | 05/15/25 | | | | 150,000 | | | | 146,595 | |

| | | | | | | | | | | | | | | | | |

| Financials — 4.5% | | | | | | | | | | | | | | | | |

| Citigroup, Inc. | | | 2.700 | % | | | 10/27/22 | | | | 150,000 | | | | 144,048 | |

| Finial Holdings, Inc. | | | 7.125 | % | | | 10/15/23 | | | | 250,000 | | | | 282,758 | |

| First American Financial Advisors, Inc. | | | 4.300 | % | | | 02/01/23 | | | | 125,000 | | | | 124,625 | |

| | | | | | | | | | | | | | | | 551,431 | |

| Health Care — 1.3% | | | | | | | | | | | | | | | | |

| S&P Global, Inc. | | | 4.400 | % | | | 02/15/26 | | | | 150,000 | | | | 153,795 | |

| | | | | | | | | | | | | | | | | |

| Industrials — 2.4% | | | | | | | | | | | | | | | | |

| Mosaic Company | | | 3.250 | % | | | 11/15/22 | | | | 150,000 | | | | 145,710 | |

| Mueller Industries, Inc. | | | 6.000 | % | | | 03/01/27 | | | | 150,000 | | | | 147,000 | |

| | | | | | | | | | | | | | | | 292,710 | |

| Information Technology — 1.1% | | | | | | | | | | | | | | | | |

| Cigna Corporation | | | 3.250 | % | | | 04/15/25 | | | | 150,000 | | | | 141,046 | |

| | | | | | | | | | | | | | | | | |

Total Corporate Bonds (Cost $1,471,559) | | | | | | | | | | | | | | $ | 1,436,546 | |

20

CUTLER FIXED INCOME FUND

SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 5.8% | | Shares | | | Value | |

Invesco STIT Government & Agency Portfolio - Institutional Class, 1.80% (b) (Cost $708,416) | | | 708,416 | | | $ | 708,416 | |

| | | | | | | | | |

Total Investments at Value — 99.5% (Cost $13,078,227) | | | | | | $ | 12,246,956 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.5% | | | | | | | 67,535 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 12,314,491 | |

IO – Interest only strip. Par value shown is the notional value, not a true par value (Note 7). |

144A – Security was purchased in a transaction exempt from registration in compliance with Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. The total value of such securities is $69,037 as of June 30, 2018, representing 0.6% of net assets. |

LIBOR – London Interbank Offered Rate. |

(a) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of June 30, 2018. For securities based on a published reference rate and spread, the reference rate and spread (in basis points) are indicated parenthetically. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities, therefore, do not indicate a reference rate and spread. |

(b) | The rate shown is the 7-day effective yield as of June 30, 2018. |

See accompanying notes to financial statements. |

21

CUTLER EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS

June 30, 2018 |

| COMMON STOCKS — 72.5% | | Shares | | | Value | |

| Brazil — 3.6% | | | | | | |

| Ambev S.A. - ADR | | | 32,010 | | | $ | 148,206 | |

| Banco Bradesco S.A. - ADR | | | 17,319 | | | | 118,808 | |

| Telefonica Brasil S.A. - ADR | | | 8,850 | | | | 105,049 | |

| TIM Participacoes S.A. - ADR | | | 7,700 | | | | 129,822 | |

| | | | | | | | 501,885 | |

| Chile — 2.3% | | | | | | | | |

| Empresa Nacional de Telecomunicaciones S.A. | | | 17,614 | | | | 161,760 | |

| Viña Concha y Toro S.A. | | | 79,500 | | | | 163,661 | |

| | | | | | | | 325,421 | |

| China — 4.9% | | | | | | | | |

| China Petroleum & Chemical Corporation - ADR | | | 1,600 | | | | 143,744 | |

| PetroChina Company Ltd. - ADR | | | 4,176 | | | | 318,504 | |

| Sinopec Shanghai Petrochemical Company Ltd. - ADR | | | 3,704 | | | | 222,166 | |

| | | | | | | | 684,414 | |

| Colombia — 1.4% | | | | | | | | |

| Grupo de Inversiones Suramericana S.A. | | | 14,983 | | | | 193,181 | |

| | | | | | | | | |

| Hong Kong — 17.8% | | | | | | | | |

Beijing Enterprises Holdings Ltd. (a) | | | 41,000 | | | | 199,067 | |

China Overseas Land & Investment Ltd. (a) | | | 59,000 | | | | 193,649 | |

China Overseas Property Holdings Ltd. (a) | | | 15,666 | | | | 5,166 | |

China Resources Beer Holdings Company Ltd. (a) | | | 104,000 | | | | 503,613 | |

China Resources Land Ltd. (a) | | | 68,000 | | | | 228,415 | |

CITIC Ltd. (a) | | | 107,000 | | | | 150,521 | |

COSCO SHIPPING Ports Ltd. (a) | | | 12,250 | | | | 10,189 | |

Hengan International Group Company Ltd. (a) | | | 39,000 | | | | 374,080 | |

| Lenovo Group Ltd. - ADR | | | 8,206 | | | | 88,748 | |

Shanghai Industrial Holdings Ltd. (a) | | | 69,000 | | | | 160,307 | |

Sino Biopharmaceutical Ltd. (a) | | | 148,500 | | | | 226,789 | |

| Tingyi (Cayman Islands) Holding Corporation | | | 148,000 | | | | 343,325 | |

| | | | | | | | 2,483,869 | |

| Indonesia — 3.1% | | | | | | | | |

Indofood Sukses Makmur Tbk. (a) | | | 277,700 | | | | 129,397 | |

Semen Indonesia Persero Tbk. (a) | | | 263,100 | | | | 131,358 | |

| Telekomunikasi Indonesia Persero Tbk. - ADR | | | 6,514 | | | | 169,429 | |

| | | | | | | | 430,184 | |

22

CUTLER EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 72.5% (Continued) | | Shares | | | Value | |

| Korea (Republic of) — 10.5% | | | | | | |

AmorePacific Group (a) | | | 710 | | | $ | 78,756 | |

Dongbu Insurance Company Ltd. (a) | | | 2,159 | | | | 114,412 | |

Korea Gas Corporation (a)(b) | | | 3,880 | | | | 223,171 | |

| KT Corporation - ADR | | | 11,956 | | | | 158,776 | |

LG Corporation (a) | | | 3,275 | | | | 211,866 | |

| POSCO - ADR | | | 2,676 | | | | 198,345 | |

Samsung Electronics Company Ltd. (a) | | | 9,400 | | | | 394,020 | |

Samsung Fire & Marine Insurance Company Ltd. (a) | | | 370 | | | | 87,725 | |

| | | | | | | | 1,467,071 | |

| Malaysia — 5.3% | | | | | | | | |

CIMB Group Holdings Berhad (a) | | | 227,693 | | | | 307,212 | |

Genting Berhad (a) | | | 84,200 | | | | 175,298 | |

Malayan Banking Berhad (a) | | | 115,860 | | | | 258,236 | |

| | | | | | | | 740,746 | |

| Mexico — 2.9% | | | | | | | | |

| América Móvil S.A.B. de C.V. - Series L - ADR | | | 15,817 | | | | 263,511 | |

| Coca-Cola Femsa S.A.B. de C.V. - Series L | | | 23,837 | | | | 134,427 | |

| | | | | | | | 397,938 | |

| Philippines — 2.0% | | | | | | | | |

Aboitiz Equity Ventures, Inc. (a) | | | 87,350 | | | | 89,311 | |

Robinsons Land Corporation (a) | | | 228,364 | | | | 79,612 | |

Universal Robina Corporation (a) | | | 45,370 | | | | 102,692 | |

| | | | | | | | 271,615 | |

| South Africa — 6.6% | | | | | | | | |

| Liberty Holdings Ltd. | | | 16,865 | | | | 143,015 | |

| Naspers Ltd. - Class N - ADR | | | 6,285 | | | | 315,004 | |

| Sasol Ltd. - ADR | | | 4,502 | | | | 164,503 | |

Shoprite Holdings Ltd. (a) | | | 10,000 | | | | 160,293 | |

| Shoprite Holdings Ltd. - ADR | | | 8,803 | | | | 140,892 | |

| | | | | | | | 923,707 | |

| Taiwan Province of China — 8.9% | | | | | | | | |

Cheng Shin Rubber Industry Company Ltd. (a) | | | 54,000 | | | | 81,279 | |

Compal Electronics, Inc. (a) | | | 238,000 | | | | 149,850 | |

CTCI Corporation (a) | | | 156,000 | | | | 249,726 | |

Delta Electronics, Inc. (a) | | | 39,100 | | | | 140,247 | |

Giant Manufacturing Company Ltd. (a) | | | 21,000 | | | | 88,779 | |

President Chain Store Corporation (a) | | | 29,000 | | | | 328,843 | |

| Taiwan Semiconductor Manufacturing Company Ltd. - ADR | | | 5,575 | | | | 203,822 | |

| | | | | | | | 1,242,546 | |

23

CUTLER EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued) |

| COMMON STOCKS — 72.5% (Continued) | | Shares | | | Value | |

| Thailand — 1.6% | | | | | | |

Charoen Pokphand Foods plc (a) | | | 309,000 | | | $ | 226,451 | |

| | | | | | | | | |

| United States — 1.6% | | | | | | | | |

| Southern Copper Corporation | | | 4,890 | | | | 229,194 | |

| | | | | | | | | |

Total Common Stocks (Cost $8,819,721) | | | | | | $ | 10,118,222 | |

| |

| PREFERRED STOCKS — 4.5% | | Shares | | | Value | |

| Brazil — 3.1% | | | | | | |

Companhia Brasileira de Distribuição - ADR (c) | | | 7,000 | | | $ | 139,860 | |

Companhia Paranaense de Energia-Copel - ADR (c) | | | 15,000 | | | | 83,700 | |

Itau Unibanco Holding S.A. - ADR (c) | | | 19,270 | | | | 200,023 | |

| | | | | | | | 423,583 | |

Colombia — 0.0% (d) | | | | | | | | |

Grupo de Inversiones Suramericana S.A. (c) | | | 183 | | | | 2,215 | |

| | | | | | | | | |

| Russian Federation — 1.4% | | | | | | | | |

Surgutneftegaz OJSC - ADR (c) | | | 39,980 | | | | 197,101 | |

| | | | | | | | | |

Total Preferred Stocks (Cost $618,461) | | | | | | $ | 622,899 | |

| |

| EXCHANGE-TRADED FUNDS — 18.8% | | Shares | | | Value | |

| Columbia India Consumer ETF | | | 11,000 | | | $ | 504,240 | |

| Global X MSCI Argentina ETF | | | 5,650 | | | | 152,381 | |

| iShares China Large-Cap ETF | | | 7,500 | | | | 322,275 | |

| iShares MSCI India ETF | | | 26,800 | | | | 892,172 | |

| iShares MSCI Japan ETF | | | 2,750 | | | | 159,252 | |

| iShares MSCI Taiwan ETF | | | 4,429 | | | | 159,444 | |

| VanEck Vectors India Small-Cap Index ETF | | | 1,890 | | | | 91,986 | |

| VanEck Vectors Poland ETF | | | 9,326 | | | | 148,344 | |

| VanEck Vectors Vietnam ETF | | | 12,400 | | | | 198,028 | |

Total Exchange-Traded Funds (Cost $2,478,651) | | | | | | $ | 2,628,122 | |

24

CUTLER EMERGING MARKETS FUND

SCHEDULE OF INVESTMENTS (Continued) |

| MONEY MARKET FUNDS — 3.7% | | Shares | | | Value | |

Invesco STIT Government & Agency Portfolio - Institutional Class, 1.80% (e) (Cost $516,877) | | | 516,877 | | | $ | 516,877 | |

| | | | | | | | | |

Total Investments at Value — 99.5% (Cost $12,433,710) | | | | | | $ | 13,886,120 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.5% | | | | | | | 67,254 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 13,953,374 | |

ADR - American Depositary Receipt. |

(a) | Level 2 security (Note 2) |

(b) | Non-income producing security. |

(c) | Security has a perpetual maturity date. |

(d) | Percentage rounds to less than 0.1%. |

(e) | The rate shown is the 7-day effective yield as of June 30, 2018. |

See accompanying notes to financial statements. |

25

CUTLER EMERGING MARKETS FUND

SUMMARY OF COMMON STOCKS & PREFERRED STOCKS

BY SECTOR AND INDUSTRY

June 30, 2018 |

Sector/Industry | % of Net Assets |

Consumer Discretionary — 4.7% | |

Auto Components | 0.6% |

Hotels, Restaurants & Leisure | 1.2% |

Leisure Products | 0.6% |

Media | 2.3% |

Consumer Staples — 21.3% | |

Beverages | 3.2% |

Food & Staples Retailing | 9.1% |

Food Products | 5.8% |

Personal Products | 3.2% |

Energy — 5.9% | |

Oil, Gas & Consumable Fuels | 5.9% |

Financials — 10.3% | |

Banks | 6.4% |

Diversified Financial Services | 1.4% |

Insurance | 2.5% |

Health Care — 1.6% | |

Pharmaceuticals | 1.6% |

Industrials — 7.7% | |

Construction & Engineering | 1.8% |

Industrial Conglomerates | 5.8% |

Transportation Infrastructure | 0.1% |

Information Technology — 7.0% | |

Electronic Equipment, Instruments & Components | 1.0% |

Semiconductors & Semiconductor Equipment | 1.5% |

Technology Hardware, Storage & Peripherals | 4.5% |

Materials — 5.6% | |

Chemicals | 1.6% |

Construction Materials | 0.9% |

Metals & Mining | 3.1% |

Real Estate — 3.6% | |

Real Estate Management & Development | 3.6% |

Telecommunication Services — 7.1% | |

Diversified Telecommunication Services | 3.1% |

Wireless Telecommunication Services | 4.0% |

Utilities — 2.2% | |

Electric Utilities | 0.6% |

Gas Utilities | 1.6% |

| | 77.0% |

See accompanying notes to financial statements. |

26

THE CUTLER TRUST

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2018 |

| | | Cutler

Equity Fund | | | Cutler Fixed

Income Fund | | | Cutler

Emerging

Markets Fund | |

| ASSETS | | | | | | | | | |

| Investments in securities: | | | | | | | | | | | | |

| At cost | | $ | 98,140,732 | | | $ | 13,078,227 | | | $ | 12,433,710 | |

| At value (Note 2) | | $ | 150,810,412 | | | $ | 12,246,956 | | | $ | 13,886,120 | |

| Cash | | | — | | | | — | | | | 30 | |

| Cash denominated in foreign currency (Cost $25,548) | | | — | | | | — | | | | 25,361 | |

| Receivable for capital shares sold | | | 88,700 | | | | 712 | | | | 1,371 | |

| Dividends and interest receivable | | | 114,529 | | | | 103,994 | | | | 73,212 | |

| Other assets | | | 8,725 | | | | 5,564 | | | | 4,203 | |

| Total assets | | | 151,022,366 | | | | 12,357,226 | | | | 13,990,297 | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Distributions payable | | | 5,745 | | | | — | | | | — | |

| Payable for capital shares redeemed | | | 278,194 | | | | 7,536 | | | | 102 | |

| Payable to Adviser (Note 3) | | | 82,307 | | | | 4,846 | | | | 4,829 | |

| Payable to administrator (Note 3) | | | 19,000 | | | | 6,000 | | | | 6,500 | |

| Other accrued expenses | | | 39,790 | | | | 24,353 | | | | 25,492 | |

| Total liabilities | | | 425,036 | | | | 42,735 | | | | 36,923 | |

| | | | | | | | | | | | | |

| NET ASSETS | | $ | 150,597,330 | | | $ | 12,314,491 | | | $ | 13,953,374 | |

| | | | | | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | |

| Paid-in capital | | $ | 95,492,374 | | | $ | 15,315,822 | | | $ | 12,687,192 | |

| Undistributed net investment income (loss) | | | 34,512 | | | | (140,288 | ) | | | 21,783 | |

| Accumulated net realized gains (losses) from investment transactions | | | 2,400,764 | | | | (2,029,772 | ) | | | (207,683 | ) |

| Net unrealized appreciation (depreciation) on investments | | | 52,669,680 | | | | (831,271 | ) | | | 1,452,410 | |

| Net unrealized depreciation on translation of assets and liabilities in foreign currencies | | | — | | | | — | | | | (328 | ) |

| NET ASSETS | | $ | 150,597,330 | | | $ | 12,314,491 | | | $ | 13,953,374 | |

| | | | | | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | 7,597,991 | | | | 1,451,947 | | | | 1,449,871 | |

| | | | | | | | | | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 19.82 | | | $ | 8.48 | | | $ | 9.62 | |

See accompanying notes to financial statements. |

27

THE CUTLER TRUST

STATEMENTS OF OPERATIONS

For the Year Ended June 30, 2018 |

| | | Cutler

Equity Fund | | | Cutler Fixed

Income Fund | | | Cutler

Emerging

Markets Fund | |

| INVESTMENT INCOME | | | | | | | | | |

| Dividend income | | $ | 3,898,241 | | | $ | 10,563 | | | $ | 380,953 | |

| Interest income | | | — | | | | 73,705 | (a) | | | — | |

| Foreign withholding taxes on dividends | | | — | | | | — | | | | (46,021 | ) |

| Total investment income | | | 3,898,241 | | | | 84,268 | | | | 334,932 | |

| | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | |

| Investment advisory fees (Note 3) | | | 1,140,322 | | | | 69,126 | | | | 122,276 | |

| Administration fees (Note 3) | | | 228,184 | | | | 72,000 | | | | 78,000 | |

| Shareholder servicing fees (Note 4) | | | 223,947 | | | | 16 | | | | — | |

| Professional fees | | | 50,470 | | | | 28,181 | | | | 23,789 | |

| Registration and filing fees | | | 22,084 | | | | 14,564 | | | | 9,470 | |

| Custody and bank service fees | | | 16,036 | | | | 5,316 | | | | 22,125 | |

| Trustees’ fees and expenses (Note 3) | | | 32,791 | | | | 4,289 | | | | 4,142 | |

| Pricing costs | | | 1,127 | | | | 15,673 | | | | 14,806 | |

| Postage and supplies | | | 11,045 | | | | 3,973 | | | | 8,044 | |

| Insurance expense | | | 16,594 | | | | 2,189 | | | | 1,908 | |

| Printing of shareholder reports | | | 6,552 | | | | 3,882 | | | | 3,253 | |

| Other expenses | | | 11,497 | | | | 9,146 | | | | 9,561 | |

| Total expenses | | | 1,760,649 | | | | 228,355 | | | | 297,374 | |

| Less fee reductions by the Adviser (Note 3) | | | (12,154 | ) | | | — | | | | (74,399 | ) |

| Fees voluntarily waived by the Adviser (Note 3) | | | — | | | | (240 | ) | | | — | |

| Net expenses | | | 1,748,495 | | | | 228,115 | | | | 222,975 | |

| | | | | | | | | | | | | |

| NET INVESTMENT INCOME (LOSS) | | | 2,149,746 | | | | (143,847 | ) | | | 111,957 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCIES | | | | | | | | | | | | |

| Net realized gains (losses) from: | | | | | | | | | | | | |

| Investment transactions | | | 3,144,331 | | | | (1,056,814 | ) | | | (57,515 | ) |

| Foreign currency transactions | | | — | | | | — | | | | (1,155 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

| Investments | | | 9,752,282 | | | | 1,111,041 | | | | 302,541 | |

| Foreign currency translation | | | — | | | | — | | | | (197 | ) |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS AND FOREIGN CURRENCIES | | | 12,896,613 | | | | 54,227 | | | | 243,674 | |

| | | | | | | | | | | | | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | | $ | 15,046,359 | | | $ | (89,620 | ) | | $ | 355,631 | |

(a) | Includes income received from prepayment penalties for IO securities (Note 7). |

See accompanying notes to financial statements. |

28

CUTLER EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year

Ended

June 30,

2018 | | | Year

Ended

June 30,

2017 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 2,149,746 | | | $ | 2,116,103 | |

| Net realized gains from investment transactions | | | 3,144,331 | | | | 3,216,953 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 9,752,282 | | | | 7,680,452 | |

| Net increase in net assets from operations | | | 15,046,359 | | | | 13,013,508 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (2,123,002 | ) | | | (2,190,013 | ) |

| From net realized gains | | | (1,915,091 | ) | | | (1,318,085 | ) |

| Decrease in net assets from distributions to shareholders | | | (4,038,093 | ) | | | (3,508,098 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 13,365,712 | | | | 14,631,254 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 4,010,459 | | | | 3,470,999 | |

| Payments for shares redeemed | | | (19,372,054 | ) | | | (18,158,476 | ) |

| Net decrease from capital share transactions | | | (1,995,883 | ) | | | (56,223 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 9,012,383 | | | | 9,449,187 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 141,584,947 | | | | 132,135,760 | |

| End of year | | $ | 150,597,330 | | | $ | 141,584,947 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 34,512 | | | $ | 7,768 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 670,098 | | | | 819,672 | |

| Shares reinvested | | | 199,637 | | | | 192,278 | |

| Shares redeemed | | | (972,289 | ) | | | (1,016,163 | ) |

| Net decrease in shares outstanding | | | (102,554 | ) | | | (4,213 | ) |

| Shares outstanding at beginning of year | | | 7,700,545 | | | | 7,704,758 | |

| Shares outstanding at end of year | | | 7,597,991 | | | | 7,700,545 | |

See accompanying notes to financial statements. |

29

CUTLER FIXED INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year

Ended

June 30,

2018 | | | Year

Ended

June 30,

2017 | |

| FROM OPERATIONS | | | | | | |

| Net investment income (loss) | | $ | (143,847 | ) | | $ | 506,502 | |

| Net realized losses from investment transactions | | | (1,056,814 | ) | | | (876,752 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 1,111,041 | | | | (559,697 | ) |

| Net decrease in net assets from operations | | | (89,620 | ) | | | (929,947 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | — | | | | (1,341,500 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 820,313 | | | | 1,722,438 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 1,322,778 | |

| Payments for shares redeemed | | | (3,486,876 | ) | | | (3,991,945 | ) |

| Net decrease from capital share transactions | | | (2,666,563 | ) | | | (946,729 | ) |

| | | | | | | | | |

| TOTAL DECREASE IN NET ASSETS | | | (2,756,183 | ) | | | (3,218,176 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 15,070,674 | | | | 18,288,850 | |

| End of year | | $ | 12,314,491 | | | $ | 15,070,674 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT LOSS | | $ | (140,288 | ) | | $ | (58,036 | ) |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 95,575 | | | | 189,121 | |

| Shares reinvested | | | — | | | | 148,472 | |

| Shares redeemed | | | (409,663 | ) | | | (458,319 | ) |

| Net decrease in shares outstanding | | | (314,088 | ) | | | (120,726 | ) |

| Shares outstanding at beginning of year | | | 1,766,035 | | | | 1,886,761 | |

| Shares outstanding at end of year | | | 1,451,947 | | | | 1,766,035 | |

See accompanying notes to financial statements. |

30

CUTLER EMERGING MARKETS FUND

STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year

Ended

June 30,

2018 | | | Year

Ended

June 30,

2017 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 111,957 | | | $ | 69,892 | |

| Net realized losses from: | | | | | | | | |

| Investment transactions | | | (57,515 | ) | | | (77,335 | ) |

| Foreign currency transactions | | | (1,155 | ) | | | (1,786 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 302,541 | | | | 1,161,934 | |

| Foreign currency translation | | | (197 | ) | | | (167 | ) |

| Net increase in net assets from operations | | | 355,631 | | | | 1,152,538 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (116,500 | ) | | | (56,835 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 3,604,397 | | | | 4,612,140 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 116,500 | | | | 56,835 | |

| Payments for shares redeemed | | | (2,118,397 | ) | | | (1,781,382 | ) |

| Net increase from capital share transactions | | | 1,602,500 | | | | 2,887,593 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,841,631 | | | | 3,983,296 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 12,111,743 | | | | 8,128,447 | |

| End of year | | $ | 13,953,374 | | | $ | 12,111,743 | |

| | | | | | | | | |

| UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 21,783 | | | $ | 27,481 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 355,893 | | | | 511,702 | |

| Shares reinvested | | | 11,708 | | | | 6,831 | |

| Shares redeemed | | | (203,910 | ) | | | (202,148 | ) |

| Net increase in shares outstanding | | | 163,691 | | | | 316,385 | |

| Shares outstanding at beginning of year | | | 1,286,180 | | | | 969,795 | |

| Shares outstanding at end of year | | | 1,449,871 | | | | 1,286,180 | |

See accompanying notes to financial statements. |

31

CUTLER EQUITY FUND

FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| | | Years Ended June 30, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Net asset value at beginning of year | | $ | 18.39 | | | $ | 17.15 | | | $ | 17.06 | | | $ | 17.33 | | | $ | 14.94 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.28 | | | | 0.28 | | | | 0.30 | | | | 0.25 | | | | 0.22 | |

| Net realized and unrealized gains on investments | | | 1.68 | | | | 1.42 | | | | 0.88 | | | | 0.02 | | | | 2.47 | |

| Total from investment operations | | | 1.96 | | | | 1.70 | | | | 1.18 | | | | 0.27 | | | | 2.69 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.28 | ) | | | (0.29 | ) | | | (0.28 | ) | | | (0.25 | ) | | | (0.22 | ) |

| Net realized gains | | | (0.25 | ) | | | (0.17 | ) | | | (0.81 | ) | | | (0.29 | ) | | | (0.08 | ) |

| Total distributions | | | (0.53 | ) | | | (0.46 | ) | | | (1.09 | ) | | | (0.54 | ) | | | (0.30 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 19.82 | | | $ | 18.39 | | | $ | 17.15 | | | $ | 17.06 | | | $ | 17.33 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (a) | | | 10.63 | % | | | 9.97 | % | | | 7.40 | % | | | 1.49 | % | | | 18.13 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 150,597 | | | $ | 141,585 | | | $ | 132,136 | | | $ | 122,739 | | | $ | 122,230 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | 1.15 | %(b) | | | 1.14 | % | | | 1.15 | % | | | 1.15 | % | | | 1.15 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 1.41 | % | | | 1.54 | % | | | 1.79 | % | | | 1.42 | % | | | 1.37 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 10 | % | | | 5 | % | | | 11 | % | | | 14 | % | | | 8 | % |

(a) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) | Absent advisory fee reductions, the ratio of expenses to net assets would have been 1.16% (Note 3). |

See accompanying notes to financial statements. |

32

CUTLER FIXED INCOME FUND

FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Year |

| | | Years Ended June 30, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Net asset value at beginning of year | | $ | 8.53 | | | $ | 9.69 | | | $ | 10.18 | | | $ | 10.01 | | | $ | 9.98 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.11 | ) | | | 0.25 | | | | 0.79 | | | | 0.49 | | | | 0.05 | |

| Net realized and unrealized gains (losses) on investments | | | 0.06 | (a) | | | (0.72 | ) | | | (0.50 | ) | | | (0.12 | ) | | | 0.17 | |

| Total from investment operations | | | (0.05 | ) | | | (0.47 | ) | | | 0.29 | | | | 0.37 | | | | 0.22 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.69 | ) | | | (0.78 | ) | | | (0.20 | ) | | | (0.14 | ) |

| Net realized gains | | | — | | | | — | | | | — | | | | — | | | | (0.05 | ) |

| Total distributions | | | — | | | | (0.69 | ) | | | (0.78 | ) | | | (0.20 | ) | | | (0.19 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 8.48 | | | $ | 8.53 | | | $ | 9.69 | | | $ | 10.18 | | | $ | 10.01 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return(b) | | | (0.59 | %) | | | (5.02 | %) | | | 2.91 | % | | | 3.65 | % | | | 2.26 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 12,314 | | | $ | 15,071 | | | $ | 18,289 | | | $ | 17,431 | | | $ | 14,941 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/supplementary data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net expenses to average net assets | | | 1.65 | %(c) | | | 1.46 | % | | | 1.36 | % | | | 1.41 | % | | | 1.52 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets | | | (1.04 | %)(d) | | | 2.91 | %(d) | | | 8.42 | %(d) | | | 4.95 | %(d) | | | 0.61 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 36 | % | | | 24 | % | | | 71 | % | | | 85 | % | | | 55 | % |

(a) | Realized and unrealized gains per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains (losses) in the Fund’s Statement of Operations due to share transactions for the period. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(c) | Ratio was determined after voluntary advisory fee waivers by the Adviser. If such fee waivers had not occurred, the ratio would have been 1.65% (Note 3). |

(d) | Ratio includes income from prepayment penalties received for IO securities of 3.75%, 11.29%, 6.90% and 4.57% of average daily net assets for the years ended June 30, 2018, 2017, 2016 and 2015, respectively (Note 7). |

See accompanying notes to financial statements. |

33

CUTLER EMERGING MARKETS FUND

FINANCIAL HIGHLIGHTS |

| Per Share Data for a Share Outstanding Throughout Each Period |

| | | Year

Ended

June 30,

2018 | | | Year

Ended

June 30,

2017 | | | Period

Ended

June 30,

2016(a) | |

| Net asset value at beginning of period | | $ | 9.42 | | | $ | 8.38 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | |

| Net investment income | | | 0.07 | | | | 0.06 | | | | 0.10 | |

| Net realized and unrealized gains (losses) on investments | | | 0.21 | | | | 1.03 | | | | (1.65 | ) |

| Total from investment operations | | | 0.28 | | | | 1.09 | | | | (1.55 | ) |

| | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | |

| Net investment income | | | (0.08 | ) | | | (0.05 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 9.62 | | | $ | 9.42 | | | $ | 8.38 | |

| | | | | | | | | | | | | |

Total return (b) | | | 2.95 | % | | | 13.14 | % | | | (15.43 | %)(c) |

| | | | | | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 13,953 | | | $ | 12,112 | | | $ | 8,128 | |

| | | | | | | | | | | | | |

| Ratios/supplementary data: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 2.07 | % | | | 2.60 | % | | | 3.85 | %(e) |

| | | | | | | | | | | | | |

Ratio of net expenses to average net assets (d) | | | 1.55 | % | | | 1.56 | %(f) | | | 1.55 | %(e) |

| | | | | | | | | | | | | |

Ratio of net investment income to average net assets (d) | | | 0.78 | % | | | 0.72 | % | | | 1.56 | %(e) |

| | | | | | | | | | | | | |

| Portfolio turnover rate | | | 2 | % | | | 15 | % | | | 10 | %(c) |

(a) | Represents the period from the commencement of operations (July 2, 2015) through June 30, 2016. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(c) | Not annualized. |

(d) | Ratio was determined after advisory fee reductions and expense reimbursements (Note 3). |

(e) | Annualized. |

(f) | Includes federal excise taxes of 0.01% of average net assets with respect to the year ended June 30, 2017. |

See accompanying notes to financial statements. |

34

THE CUTLER TRUST

NOTES TO FINANCIAL STATEMENTS

June 30, 2018

1. Organization

Cutler Equity Fund, Cutler Fixed Income Fund and Cutler Emerging Markets Fund (individually, a “Fund” and collectively, the “Funds”) are each a diversified series of The Cutler Trust (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of Fund shares of beneficial interest without par value.

Cutler Equity Fund seeks current income and long-term capital appreciation.

Cutler Fixed Income Fund seeks to achieve high income over the long-term.

Cutler Emerging Markets Fund seeks current income and long-term capital appreciation.

2. Significant Accounting Policies

The following summarizes the significant accounting policies of the Funds. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). Each Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

New Accounting Pronouncement — In March, 2017, FASB issued Accounting Standards Update No. 2017-08 - Receivables – Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities (the “ASU”). The ASU shortens the amortization period for certain callable debt securities, held at a premium, to be amortized to the earliest call date. The ASU does not require an accounting change for securities held at a discount, which continue to be amortized to maturity. The ASU is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018. Management is currently evaluating the impact, if any, of applying the ASU.

Securities Valuation — Portfolio securities are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 p.m., Eastern time) on each day the NYSE is open. Exchange traded securities are valued using the last reported sales price on the exchanges on which they are primarily traded. When using the last sales price and when the market is considered to be active, the security will be classified within Level 1 of the fair value hierarchy (see below). In the absence of a sale, such securities are valued at the mean of the last bid and asked price. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities principally traded in non-U.S. markets that may close at different times than U.S. markets are typically fair valued by an independent pricing service and translated from the local currency into U.S. dollars using currency exchange rates supplied by an independent pricing quotation service. Non-exchange traded securities for which over-the-counter quotations

35

THE CUTLER TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

are available are generally valued at the closing bid price. Fixed income securities are generally valued using prices provided by an independent pricing service. The independent pricing service uses information with respect to transactions in bonds, quotations from bond dealers, market transactions in comparable securities, and various relationships between securities in determining the prices. Investments in shares of other open-end investment companies are valued at their net asset value (“NAV”) as reported by such companies.

The Funds value securities at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the “Board”) if (1) market quotations are insufficient or not readily available or (2) the Funds’ investment adviser believes that the prices or values available are unreliable due to, among other things, the occurrence of events after the close of the securities markets on which the Funds’ securities primarily trade but before the time as of which the Funds calculate their NAVs. In instances where the investment adviser believes that the prices received from the independent pricing service are unreliable, proprietary valuation models may be used that consider benchmark yield curves, estimated default rates, coupon rates, anticipated timing of principal repayments and other unique security features to estimate the relevant cash flows, which are discounted to calculate the fair values. Fair valued securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

The Board approves the independent pricing services used by the Funds.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires disclosures about fair value measurements.

Various inputs are used in determining the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | ● | Level 1 – quoted unadjusted prices for identical instruments in active markets to which the Fund has access at the date of measurement. |

| | ● | Level 2 – quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model derived valuations in which all significant inputs and significant value drivers are observable. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little public information exists or instances where prices vary substantially over time or among brokered market makers. |

| | ● | Level 3 – model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information. |

36

THE CUTLER TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

Fixed income securities held by Cutler Fixed Income Fund are classified as Level 2 because the values for the fixed income securities are based on prices that utilize various “other significant observable inputs” including bid and ask quotations, prices of similar securities and interest rates, among other factors.

Securities of Cutler Emerging Markets Fund traded in foreign markets may be classified as Level 2 despite the availability of closing prices because such securities are typically fair valued by an independent pricing service approved by the Board. These foreign securities may be priced at their fair value because the value of the securities may be materially affected by events occurring before the Fund’s pricing time but after the close of the primary markets or exchanges on which such foreign securities are traded. These intervening events might be country-specific (e.g., natural disaster, economic or political developments, interest rate change); issuer-specific (e.g., earnings report, merger announcement); or U.S. markets-specific (such as a significant movement in the U.S. markets that is deemed to affect the value of foreign securities). The pricing service uses an automated system incorporating a model based on multiple parameters, including a security’s local closing price, relevant general and sector indices, currency fluctuations, trading in depositary receipts and futures, if applicable, and/or research valuations by its staff, in determining what it believes is the fair value of the securities.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value each Fund’s investments as of June 30, 2018 by security type:

| Cutler Equity Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 149,459,259 | | | $ | — | | | $ | — | | | $ | 149,459,259 | |

| Money Market Funds | | | 1,351,153 | | | | — | | | | — | | | | 1,351,153 | |

| Total | | $ | 150,810,412 | | | $ | — | | | $ | — | | | $ | 150,810,412 | |

37

THE CUTLER TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

| Cutler Fixed Income Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| U.S. Treasury Obligations | | $ | — | | | $ | 2,447,109 | | | $ | — | | | $ | 2,447,109 | |

| U.S. Government Agency Obligations | | | — | | | | 5,442,805 | | | | — | | | | 5,442,805 | |

| Mortgage-Backed Securities | | | — | | | | 2,212,080 | | | | — | | | | 2,212,080 | |

| Corporate Bonds | | | — | | | | 1,436,546 | | | | — | | | | 1,436,546 | |

| Money Market Funds | | | 708,416 | | | | — | | | | — | | | | 708,416 | |

| Total | | $ | 708,416 | | | $ | 11,538,540 | | | $ | — | | | $ | 12,246,956 | |

| Cutler Emerging Markets Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 4,257,892 | | | $ | 5,860,330 | | | $ | — | | | $ | 10,118,222 | |

| Preferred Stocks | | | 622,899 | | | | — | | | | — | | | | 622,899 | |

| Exchange-Traded Funds | | | 2,628,122 | | | | — | | | | — | | | | 2,628,122 | |

| Money Market Funds | | | 516,877 | | | | — | | | | — | | | | 516,877 | |

| Total | | $ | 8,025,790 | | | $ | 5,860,330 | | | $ | — | | | $ | 13,886,120 | |

Refer to each Fund’s Schedule of Investments for a listing of the securities by security type and sector or industry type. It is the Funds’ policy to recognize transfers into or out of any Level at the end of the reporting period. As of June 30, 2018, Cutler Equity Fund and Cutler Emerging Markets Fund did not have any transfers into or out of any Level. There were no Level 3 securities held by the Funds as of June 30, 2018.

The following is a reconciliation of Level 3 investments of Cutler Fixed Income Fund for which significant unobservable inputs were used to determine fair value between June 30, 2017 and June 30, 2018:

| | | Cutler Fixed

Income Fund | |

| Balance as of June 30, 2017 | | $ | 574,169 | |

| Transfers out of Level 3* | | | (5,418 | ) |

| Sales | | | (442,797 | ) |

| Realized losses | | | (159,479 | ) |

| Amortization | | | (113,533 | ) |

| Net change in unrealized appreciation (depreciation) | | | 147,058 | |

| Balance as of June 30, 2018 | | $ | — | |

* | Transfers out of Level 3 occurred due to the availability of a vendor price during the year. |

38

THE CUTLER TRUST

NOTES TO FINANCIAL STATEMENTS (Continued)

There were no derivative instruments held by the Funds during the year ended or as of June 30, 2018.

Share valuation — The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to its NAV per share.