UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07324 |

| Chesapeake Investment Trust |

| (Exact name of registrant as specified in charter) |

| 285 Wilmington-West Chester Pike Chadds Ford, Pensylvania | 19317 |

| (Address of principal executive offices) | (Zip code) |

| Capital Services Inc. 1675 S State Street, Suite B, Dover, DE 19901 |

| (Name and address of agent for service) |

With a copy to:

Jesse D. Hallee, Esq.

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

and

John H. Lively, Esq.

Practus, LLP

11300 Tomahawk Creek Parkway, Suite 310

Leawood, KS 66211

| Registrant’s telephone number, including area code: | (610) 558-2800 |

| Date of fiscal year end: | October 31 |

| | |

| Date of reporting period: | October 31, 2024 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Chesapeake Growth Fund

Annual Shareholder Report - October 31, 2024

This annual shareholder report contains important information about The Chesapeake Growth Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://funddocs.filepoint.com/chesapeake/. You can also request this information by contacting us at (800) 430-3863.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Chesapeake Growth Fund (The) | $193 | 1.74% |

How did the Fund perform during the reporting period?

During the past fiscal year, the Fund delivered a positive return of 21.60% compared to 38.02% for the S&P 500 Index ("S&P 500").

The Fund's return was positively influenced by our strategic allocation to the Information Technology, Consumer Discretionary, and Communication Services sectors of the S&P 500, while at the same time hindered by our exposure to the Health Care, Consumer Staples, and Energy sectors. Top performing individual holdings included TransDigm Group, Inc. (TOG), Toll Brothers, Inc. (TOL), and Apple, Inc. (AAPL), whereas performance was most negatively impacted by Humana, Inc. (HUM), Boeing Company (The) (BA), and lululemon athletica, inc. (LULU).

While the Fund and the S&P 500 experienced periods of turbulence during the year resulting from interest rate volatility, geopolitical conflicts, tense trade relations, and political uncertainty, both were able to produce positive returns each individual quarter. We remain committed to our disciplined, bottom-up, fundamental approach to investing, focusing solely on those companies that possess meaningful competitive advantages, best in class management teams, positive catalysts for growth, and that are priced attractively.

We believe the Fund is well positioned to continue generating positive returns going forward and look forward to updating shareholders at the end of fiscal year 2025.

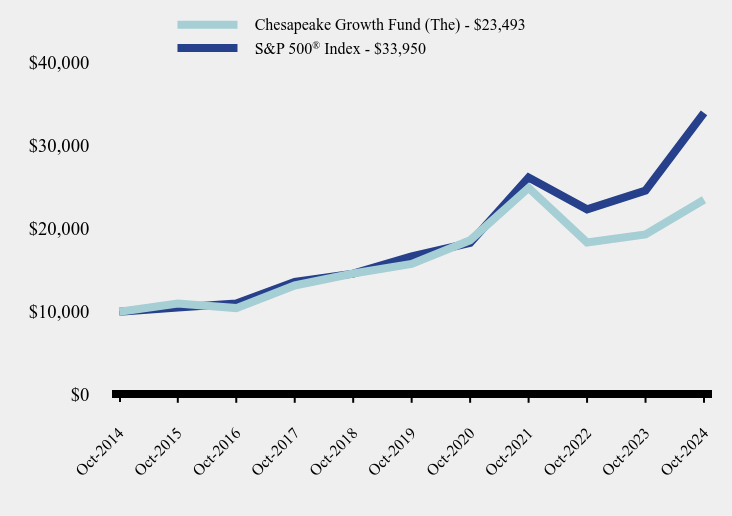

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Chesapeake Growth Fund (The) | S&P 500® Index |

|---|

| Oct-2014 | $10,000 | $10,000 |

| Oct-2015 | $11,000 | $10,520 |

| Oct-2016 | $10,438 | $10,994 |

| Oct-2017 | $13,166 | $13,593 |

| Oct-2018 | $14,607 | $14,591 |

| Oct-2019 | $15,757 | $16,681 |

| Oct-2020 | $18,610 | $18,301 |

| Oct-2021 | $24,916 | $26,155 |

| Oct-2022 | $18,341 | $22,334 |

| Oct-2023 | $19,320 | $24,599 |

| Oct-2024 | $23,493 | $33,950 |

Average Annual Total Returns

| 1 Year | 5 Years | 10 Years |

|---|

| Chesapeake Growth Fund (The) | 21.60% | 8.32% | 8.92% |

S&P 500® Index | 38.02% | 15.27% | 13.00% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

Fund Statistics

(as of October 31, 2024)

| Net Assets | $42,547,386 |

| Number of Portfolio Holdings | 35 |

| Advisory Fee | $413,934 |

| Portfolio Turnover | 45% |

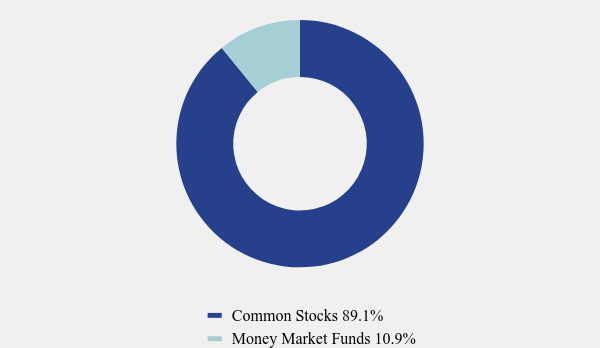

Asset Weighting (% of total investments)

(as of October 31, 2024)

| Value | Value |

|---|

| Common Stocks | 89.1% |

| Money Market Funds | 10.9% |

What did the Fund invest in?

Top 10 Holdings (% of net assets)

(as of October 31, 2024)

| Holding Name | % of Net Assets |

| Apple, Inc. | 6.6% |

| Microsoft Corporation | 6.1% |

| Mastercard, Inc. - Class A | 6.0% |

| Alphabet, Inc. - Class C | 5.6% |

| Amazon.com, Inc. | 5.6% |

| TransDigm Group, Inc. | 4.9% |

| UBS Group AG | 4.9% |

| NVIDIA Corporation | 4.8% |

| Exxon Mobil Corporation | 4.1% |

| Toll Brothers, Inc. | 3.8% |

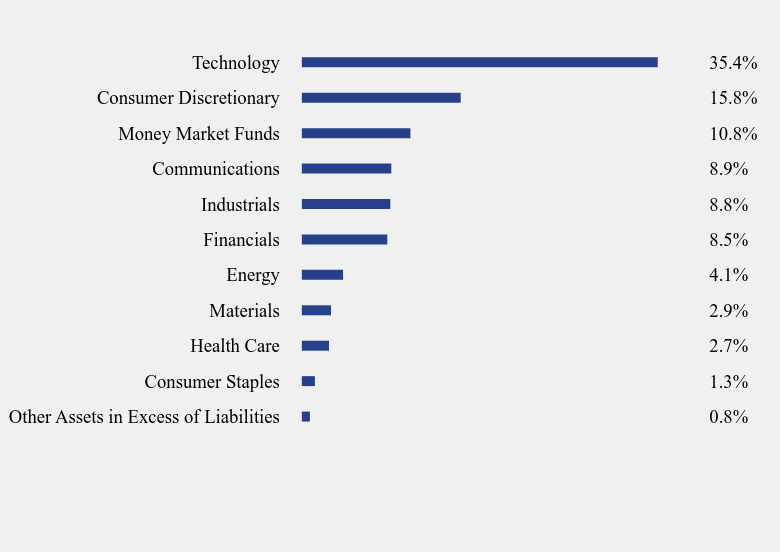

Sector Weighting (% of net assets)

(as of October 31, 2024)

| Value | Value |

|---|

| Other Assets in Excess of Liabilities | 0.8% |

| Consumer Staples | 1.3% |

| Health Care | 2.7% |

| Materials | 2.9% |

| Energy | 4.1% |

| Financials | 8.5% |

| Industrials | 8.8% |

| Communications | 8.9% |

| Money Market Funds | 10.8% |

| Consumer Discretionary | 15.8% |

| Technology | 35.4% |

No material changes occurred during the year ended October 31, 2024.

The Chesapeake Growth Fund (CHCGX)

Annual Shareholder Report - October 31, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website (https://funddocs.filepoint.com/chesapeake/), including its:

Prospectus

Financial information

Holdings

Proxy voting information

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. Pursuant to Item 13(a)(1), a copy of registrant’s code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by this report, the code of ethics has not been amended, and the registrant has not granted any waivers, including implicit waivers, from the provisions of the code of ethics.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that the registrant does not have an audit committee financial expert serving on its audit committee. The audit committee determined that, although none of its members meet the technical definition of an audit committee financial expert, the members have sufficient financial expertise to address any issues that are likely to come before the committee. After evaluation of the accounting environment within which the registrant operates, it was the consensus of the audit committee members that it is not necessary at the present time for the committee to seek to recruit an additional trustee who would qualify as an audit committee financial expert. It was the view of the committee that, if novel issues ever arise, it will hire an expert to assist it as needed.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees. The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $14,500 and $14,500 with respect to the registrant’s fiscal years ended October 31, 2024 and 2023, respectively. |

| (b) | Audit-Related Fees. No fees were billed during the fiscal years ended October 31, 2024 and 2023 for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. |

| (c) | Tax Fees. The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $3,000 and $3,000 with respect to the registrant’s fiscal years ended October 31, 2024 and 2023, respectively. The services comprising these fees include the preparation of the registrant’s federal income and excise tax returns. |

| (d) | All Other Fees. No fees were billed in either of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. |

| (e)(1) | The audit committee approves all audit and non-audit related services and, therefore, has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

| (e)(2) | None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Less than 50% of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees. |

| (g) | With respect to the fiscal years ended October 31, 2024 and October 31, 2023, aggregate non-audit fees of $3,000 and $3,000, respectively, were billed by the registrant’s accountant for services rendered to the registrant. No non-audit fees were billed in either of the last two fiscal years by the registrant’s accountant for services rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant |

| (h) | The principal accountant has not provided any non-audit services to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant. |

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

(a) The Registrant(s) schedule(s) of investments is included in the Financial Statements under Item 7 of this form.

(b) Not applicable

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

(a)

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | The Chesapeake Growth Fund | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | Financial Statements Report | | | |

| | | | | | | | |

| | | | October 31, 2024 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | Investment Advisor | Administrator | | | |

| | | | Gardner Lewis Asset Management, L.P. | Ultimus Fund Solutions, LLC | | | |

| | | | 285 Wilmington-West Chester Pike | P.O. Box 46707 | | | |

| | | | Chadds Ford, Pennsylvania 19317 | Cincinnati, Ohio 45246-0707 | | | |

| | | | www.chesapeakefunds.com | 1-800-430-3863 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| The Chesapeake Growth Fund |

| Schedule of Investments |

| October 31, 2024 |

| Common Stocks — 88.4% | | Shares | | | Value | |

| Communications — 8.9% | | | | | | | | |

| Internet Media & Services — 8.9% | | | | | | | | |

| Alphabet, Inc. - Class C | | | 13,743 | | | $ | 2,373,279 | |

| Meta Platforms, Inc. - Class A | | | 230 | | | | 130,543 | |

| Netflix, Inc. * | | | 1,720 | | | | 1,300,372 | |

| | | | | | | | 3,804,194 | |

| Consumer Discretionary — 15.8% | | | | | | | | |

| Automotive — 1.0% | | | | | | | | |

| Ferrari N.V. | | | 885 | | | | 421,154 | |

| | | | | | | | | |

| E-Commerce Discretionary — 7.0% | | | | | | | | |

| Alibaba Group Holding Ltd. - ADR | | | 6,385 | | | | 625,602 | |

| Amazon.com, Inc. * | | | 12,695 | | | | 2,366,348 | |

| | | | | | | | 2,991,950 | |

| Home Construction — 3.8% | | | | | | | | |

| Toll Brothers, Inc. | | | 11,135 | | | | 1,630,609 | |

| | | | | | | | | |

| Retail — Discretionary — 4.0% | | | | | | | | |

| lululemon athletica, inc. * | | | 359 | | | | 106,946 | |

| TJX Companies, Inc. (The) | | | 13,917 | | | | 1,573,039 | |

| | | | | | | | 1,679,985 | |

| Consumer Staples — 1.3% | | | | | | | | |

| Beverages — 0.8% | | | | | | | | |

| Monster Beverage Corporation * | | | 5,980 | | | | 315,027 | |

| | | | | | | | | |

| Retail — Consumer Staples — 0.5% | | | | | | | | |

| Murphy USA, Inc. | | | 445 | | | | 217,360 | |

| | | | | | | | | |

| Energy — 4.1% | | | | | | | | |

| Oil & Gas Producers — 4.1% | | | | | | | | |

| Exxon Mobil Corporation | | | 14,971 | | | | 1,748,313 | |

| | | | | | | | | |

| Financials — 8.5% | | | | | | | | |

| Asset Management — 6.0% | | | | | | | | |

| Ares Management Corporation - Class A | | | 2,605 | | | | 436,806 | |

| UBS Group AG | | | 68,175 | | | | 2,091,609 | |

| | | | | | | | 2,528,415 | |

| Banking — 2.5% | | | | | | | | |

| Citigroup, Inc. | | | 16,785 | | | | 1,077,094 | |

| | | | | | | | | |

| Health Care — 2.7% | | | | | | | | |

| Biotech & Pharma — 1.1% | | | | | | | | |

| Eli Lilly & Company | | | 570 | | | | 472,952 | |

| The Chesapeake Growth Fund |

| Schedule of Investments (Continued) |

| Common Stocks — 88.4% (Continued) | | Shares | | | Value | |

| Health Care — 2.7% (Continued) | | | | | | | | |

| Health Care Facilities & Services — 0.3% | | | | | | | | |

| Humana, Inc. | | | 459 | | | $ | 118,344 | |

| | | | | | | | | |

| Medical Equipment & Devices — 1.3% | | | | | | | | |

| Danaher Corporation | | | 2,315 | | | | 568,703 | |

| | | | | | | | | |

| Industrials — 8.8% | | | | | | | | |

| Aerospace & Defense — 8.3% | | | | | | | | |

| Boeing Company (The) * | | | 1,625 | | | | 242,629 | |

| L3Harris Technologies, Inc. | | | 1,150 | | | | 284,590 | |

| Spirit AeroSystems Holdings, Inc. - Class A * | | | 28,100 | | | | 909,597 | |

| TransDigm Group, Inc. | | | 1,617 | | | | 2,105,819 | |

| | | | | | | | 3,542,635 | |

| Electrical Equipment — 0.5% | | | | | | | | |

| Amphenol Corporation - Class A | | | 3,135 | | | | 210,108 | |

| | | | | | | | | |

| Materials — 2.9% | | | | | | | | |

| Construction Materials — 2.9% | | | | | | | | |

| Vulcan Materials Company | | | 4,540 | | | | 1,243,642 | |

| | | | | | | | | |

| Technology — 35.4% | | | | | | | | |

| Semiconductors — 8.7% | | | | | | | | |

| Broadcom, Inc. | | | 5,220 | | | | 886,199 | |

| NVIDIA Corporation | | | 15,510 | | | | 2,059,108 | |

| NXP Semiconductors N.V. | | | 3,161 | | | | 741,254 | |

| | | | | | | | 3,686,561 | |

| Software — 11.1% | | | | | | | | |

| Microsoft Corporation | | | 6,368 | | | | 2,587,637 | |

| ServiceNow, Inc. * | | | 955 | | | | 891,005 | |

| Synopsys, Inc. * | | | 2,385 | | | | 1,224,960 | |

| | | | | | | | 4,703,602 | |

| Technology Hardware — 6.6% | | | | | | | | |

| Apple, Inc. | | | 12,389 | | | | 2,798,799 | |

| | | | | | | | | |

| Technology Services — 9.0% | | | | | | | | |

| Gartner, Inc. * | | | 2,140 | | | | 1,075,350 | |

| Mastercard, Inc. - Class A | | | 5,120 | | | | 2,557,901 | |

| Verisk Analytics, Inc. | | | 790 | | | | 217,029 | |

| | | | | | | | 3,850,280 | |

| | | | | | | | | |

| Total Common Stocks (Cost $23,972,245) | | | | | | $ | 37,609,727 | |

| The Chesapeake Growth Fund |

| Schedule of Investments (Continued) |

| Money Market Funds — 10.8% | | Shares | | | Value | |

| Fidelity Investments Money Market Government Portfolio - Class I, 4.70% (a) (Cost $4,612,784) | | | 4,612,784 | | | $ | 4,612,784 | |

| | | | | | | | | |

| Total Investments at Value — 99.2% (Cost $28,585,029) | | | | | | $ | 42,222,511 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 0.8% | | | | | | | 324,875 | |

| | | | | | | | | |

| Total Net Assets — 100.0% | | | | | | $ | 42,547,386 | |

ADR - American Depositary Receipt.

| * | Non-income producing security. |

| (a) | The rate shown is the 7-day effective yield as of October 31, 2024. |

See accompanying notes to financial statements.

| The Chesapeake Growth Fund |

| Statement of Assets and Liabilities |

| October 31, 2024 |

| ASSETS | | | | |

| Investments in securities: | | | | |

| At cost | | $ | 28,585,029 | |

| At value (Note 2) | | $ | 42,222,511 | |

| Receivable for investment securities sold | | | 1,587,573 | |

| Dividends receivable | | | 14,949 | |

| Tax reclaims receivable | | | 5,592 | |

| Other assets | | | 12,403 | |

| TOTAL ASSETS | | | 43,843,028 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investment securities purchased | | | 1,223,227 | |

| Payable to Advisor (Note 5) | | | 36,598 | |

| Accrued Trustees’ fees (Note 4) | | | 9,135 | |

| Payable to administrator (Note 5) | | | 5,000 | |

| Accrued distribution and service plan fees (Note 5) | | | 3,200 | |

| Accrued audit fees | | | 17,500 | |

| Other accrued expenses | | | 982 | |

| TOTAL LIABILITIES | | | 1,295,642 | |

| | | | | |

| NET ASSETS | | $ | 42,547,386 | |

| | | | | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 28,440,714 | |

| Distributable earnings | | | 14,106,672 | |

| NET ASSETS | | $ | 42,547,386 | |

| | | | | |

| Shares of beneficial interest outstanding | | | | |

| (unlimited number of shares authorized, no par value) | | | 820,540 | |

| | | | | |

| Net asset value, offering price and redemption price per share (Note 2) | | $ | 51.85 | |

See accompanying notes to financial statements.

| The Chesapeake Growth Fund |

| Statement of Operations |

| For the Year Ended October 31, 2024 |

| INVESTMENT INCOME | | | | |

| Dividends (net of foreign withholding taxes of $7,397) | | $ | 693,279 | |

| | | | | |

| EXPENSES | | | | |

| Management fees (Note 5) | | | 413,934 | |

| Administration fees (Note 5) | | | 61,646 | |

| Compliance service fees (Note 5) | | | 60,000 | |

| Distribution and service plan fees (Note 5) | | | 35,265 | |

| Trustees’ fees and expenses (Note 4) | | | 25,471 | |

| Registration and filing fees | | | 25,224 | |

| Legal fees | | | 23,660 | |

| Audit and tax services fees | | | 18,432 | |

| Shareholder account maintenance fees | | | 11,418 | |

| Shareholder reporting expenses | | | 10,441 | |

| Insurance expense | | | 8,157 | |

| Custodian and bank service fees | | | 7,419 | |

| Postage and supplies | | | 5,297 | |

| Other expenses | | | 11,960 | |

| TOTAL EXPENSES | | | 718,324 | |

| | | | | |

| NET INVESTMENT LOSS | | | (25,045 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | | |

| Net realized gains from investment transactions | | | 853,294 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 6,945,227 | |

| NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 7,798,521 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 7,773,476 | |

See accompanying notes to financial statements.

| The Chesapeake Growth Fund |

| Statements of Changes in Net Assets |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | October 31, | | | October 31, | |

| | | 2024 | | | 2023 | |

| FROM OPERATIONS | | | | | | | | |

| Net investment loss | | $ | (25,045 | ) | | $ | (93,124 | ) |

| Net realized gains (losses) from investment transactions | | | 853,294 | | | | (3,477 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 6,945,227 | | | | 1,976,234 | |

| Net increase in net assets resulting fom operations | | | 7,773,476 | | | | 1,879,633 | |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 33,920 | | | | 93,627 | |

| Payments for shares redeemed | | | (1,739,440 | ) | | | (974,033 | ) |

| Net decrease in net assets from capital share transactions | | | (1,705,520 | ) | | | (880,406 | ) |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 6,067,956 | | | | 999,227 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 36,479,430 | | | | 35,480,203 | |

| End of year | | $ | 42,547,386 | | | $ | 36,479,430 | |

| | | | | | | | | |

| SUMMARY OF CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 697 | | | | 2,243 | |

| Shares redeemed | | | (35,580 | ) | | | (23,355 | ) |

| Net decrease in shares outstanding | | | (34,883 | ) | | | (21,112 | ) |

| Shares outstanding, beginning of year | | | 855,423 | | | | 876,535 | |

| Shares outstanding, end of year | | | 820,540 | | | | 855,423 | |

See accompanying notes to financial statements.

| The Chesapeake Growth Fund |

| Financial Highlights |

Per share data for a share outstanding throughout each year:

| | | For the Years Ended October 31, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | |

| Net asset value at beginning of year | | $ | 42.64 | | | $ | 40.48 | | | $ | 58.08 | | | $ | 43.38 | | | $ | 36.73 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.04 | ) | | | (0.11 | ) | | | (0.28 | ) | | | (0.61 | ) | | | (0.51 | ) |

| Net realized and unrealized gains (losses) on investments | | | 9.25 | | | | 2.27 | | | | (14.39 | ) | | | 15.31 | | | | 7.16 | |

| Total from investment operations | | | 9.21 | | | | 2.16 | | | | (14.67 | ) | | | 14.70 | | | | 6.65 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net realized capital gains | | | — | | | | — | | | | (2.93 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of year | | $ | 51.85 | | | $ | 42.64 | | | $ | 40.48 | | | $ | 58.08 | | | $ | 43.38 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return (a) | | | 21.60 | % | | | 5.34 | % | | | (26.39 | %) | | | 33.89 | % | | | 18.11 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of year (000’s) | | $ | 42,547 | | | $ | 36,479 | | | $ | 35,480 | | | $ | 50,690 | | | $ | 39,796 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of total expenses to average net assets | | | 1.74 | % | | | 1.86 | % | | | 1.75 | % | | | 1.66 | % | | | 1.82 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment loss to average net assets | | | (0.06 | %) | | | (0.26 | %) | | | (0.59 | %) | | | (1.10 | %) | | | (1.16 | %) |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 45 | % | | | 80 | % | | | 55 | % | | | 42 | % | | | 42 | % |

| (a) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

See accompanying notes to financial statements.

| The Chesapeake Growth Fund |

| Notes to Financial Statements |

| October 31, 2024 |

1. Organization

The Chesapeake Growth Fund (the “Fund”) is a diversified series of The Chesapeake Investment Trust (the “Trust”), an open-end management investment company organized as a Delaware statutory trust and registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The investment objective of the Fund is to seek capital appreciation.

2. Significant Accounting Policies

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Regulatory update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – Effective January 24, 2023, the Securities and Exchange Commission (the “SEC”) adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments had a compliance date of July 24, 2024. The Fund has implemented the rule and form requirements, as applicable, and is currently adhering to the requirements.

Securities valuation – Securities that are traded on any stock exchange, including common stocks, are generally valued at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded on NASDAQ are valued at the NASDAQ Official Closing Price. Investments representing shares of money market funds and other open-end investment companies are valued at their net asset value (“NAV”) as reported by such companies.

When using a quoted price and when the market for the security is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). Securities and assets for which representative market quotations are not readily available or which cannot be accurately valued using the Fund’s normal pricing procedures are valued at fair value as determined by Gardner Lewis Asset Management, L.P. (the “Advisor”), as the Fund’s valuation designee, in accordance with procedures

| The Chesapeake Growth Fund |

| Notes to Financial Statements (Continued) |

adopted by the Board of Trustees (the ‘Board’) pursuant to Rule 2a-5 under the 1940 Act. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Fair value pricing may be used, for example, in situations where (i) a portfolio security is so thinly traded that there have been no transactions for that security over an extended period of time; (ii) the exchange on which the portfolio security is principally traded closes early; or (iii) trading of the portfolio security is halted during the day and does not resume prior to the Fund’s NAV calculation. A portfolio security’s “fair value” price may differ from the price next available for that portfolio security using the Fund’s normal pricing procedures.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities |

| ● | Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the assets or liability, either directly or indirectly; these inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment seeds, credit risks, yield curves, default rates and similar data |

| ● | Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing a Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and based on the best information available |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the Fund’s investments based on the inputs used to value the investments as of October 31, 2024:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 37,609,727 | | | $ | — | | | $ | — | | | $ | 37,609,727 | |

| Money Market Funds | | | 4,612,784 | | | | — | | | | — | | | | 4,612,784 | |

| Total | | $ | 42,222,511 | | | $ | — | | | $ | — | | | $ | 42,222,511 | |

| | | | | | | | | | | | | | | | | |

| The Chesapeake Growth Fund |

| Notes to Financial Statements (Continued) |

Refer to the Fund’s Schedule of Investments for a listing of the securities by sector and industry type. The Fund did not hold derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended October 31, 2024.

Share valuation – The NAV per share of the Fund is calculated as of the close of trading on the New York Stock Exchange (the “Exchange”) (normally 4:00 p.m., Eastern Time) on each day that the Exchange is open for business. The NAV per share of the Fund is calculated by dividing the total value of the Fund’s assets, minus liabilities, by the number of shares outstanding. The offering price and redemption price per share is equal to the NAV per share.

Investment transactions and investment income – Investment transactions are accounted for on trade date. Cost of investments sold is determined on a specific identification basis. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the security received. Interest income, if any, is accrued as earned and includes amortization of discounts and premiums. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

Distributions to shareholders – Distributions arising from net investment income and net realized capital gains, if any, are declared and paid at least annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with income tax regulations, which may differ from GAAP, and are recorded on the ex-dividend date. There were no distributions paid to shareholders during the years ended October 31, 2024, and 2023.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increase (decrease) in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

| The Chesapeake Growth Fund |

| Notes to Financial Statements (Continued) |

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of October 31, 2024:

| Tax cost of investments | | $ | 28,662,172 | |

| Gross unrealized appreciation | | $ | 13,650,785 | |

| Gross unrealized depreciation | | | (90,446 | ) |

| Net unrealized appreciation | | | 13,560,339 | |

| Undistributed long-term capital gains | | | 638,714 | |

| Accumulated capital and other losses | | | (92,381 | ) |

| Distributable earnings | | $ | 14,106,672 | |

| | | | | |

The difference between the federal income tax cost of investments and the financial statement cost of investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due to the tax deferral of losses on wash sales.

Net qualified late year losses, incurred after December 31, 2023 and within the taxable year, are deemed to arise on the first day of the Fund’s next taxable year. For the year ended October 31, 2024, the Fund deferred $92,381 of late year ordinary losses to November 1, 2024 for federal tax purposes.

During the year ended October 31, 2024 the Fund utilized $196,171 of short-term capital loss carryforwards against current year gains.

For the year ended October 31, 2024, the Fund reclassified $28,613 of net investment loss against paid-in capital on the Statement of Assets and Liabilities. Such reclassification, the result of permanent differences between the financial statement and income tax reporting requirements, had no effect on the Fund’s net assets or NAV per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more-likely-than-not” to be sustained assuming examination by tax authorities. Management has reviewed the tax positions taken on federal income tax returns for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund identifies its major tax jurisdiction as U.S. Federal.

| The Chesapeake Growth Fund |

| Notes to Financial Statements (Continued) |

The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations. During the year ended October 31, 2024, the Fund did not incur any interest or penalties.

3. Investment Transactions

During the year ended October 31, 2024, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $16,564,635 and $17,879,549, respectively.

4. Trustees and Officers

A Trustee and certain officers of the Trust are affiliated with the Advisor, the investment advisor to the Fund, and certain officers are affiliated with Ultimus Fund Solutions, LLC (“Ultimus”), the Fund’s administrator, transfer agent and fund accounting agent, and Ultimus Fund Distributors, LLC (“UFD”), the Fund’s principal underwriter.

Each Trustee of the Trust who is not affiliated with the Advisor (“Independent Trustee”) receives an annual retainer of $10,000. In addition, the Fund pays each Independent Trustee $600 for attendance at each Board meeting, either in person or by telephone, plus reimbursement of any travel and other expenses incurred in attending meetings.

5. Transactions with Related Parties

Investment Advisory Agreement

Under the terms of the Investment Advisory Agreement between the Trust and the Advisor, the Advisor serves as the investment advisor to the Fund. For its services, the Fund pays the Advisor a management fee, which is computed and accrued daily and paid monthly, at the annual rate of 1.00% of the Fund’s average daily net assets.

The Chief Compliance Officer of the Trust is an employee of the Advisor. The Fund reimburses the Advisor $60,000 annually for the services provided by the Chief Compliance Officer to the Trust.

Administrator

Pursuant to servicing agreements between the Trust and Ultimus, Ultimus provides administrative, pricing, accounting, dividend disbursing, shareholder servicing and transfer agent services for the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Fund’s portfolio securities.

| The Chesapeake Growth Fund |

| Notes to Financial Statements (Continued) |

Distribution And Service Fees

The Trust has adopted a distribution plan, pursuant to Rule 12b-1 under the 1940 Act (the “Rule 12b-1 Plan”), pursuant to which the Fund may incur certain costs for distribution and/or shareholder servicing expenses not to exceed 0.25% per annum of the Fund’s average daily net assets. During the year ended October 31, 2024, the Fund incurred $35,265 in distribution and service plan fees under the Rule 12b-1 Plan.

Distribution Agreement

Under the terms of a Distribution Agreement with the Trust, UFD provides distribution services to the Trust and serves as principal underwriter to the Fund. UFD is a wholly-owned subsidiary of Ultimus. UFD receives compensation from the Fund for such services, which is paid pursuant to the Rule 12b-1 Plan discussed above.

Principal Holder Of Fund Shares

As of October 31, 2024, the following shareholder owned of record 25% or more of the outstanding shares of the Fund:

| Name of Record Owner | % Ownership |

| J.P. Morgan Securities, LLC (for the benefit of its customers) | 48% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

6. Sector Risk

If the Fund has significant investments in the securities of issuers in industries within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss of an investment in the Fund and increase the volatility of the Fund’s net asset value per share. From time to time, a particular set of circumstances may affect this sector or companies within the sector. For instance, economic or market factors, regulation or deregulation, or other developments may negatively impact all companies in a particular sector and therefore the value of the Fund’s portfolio will be adversely affected. As of October 31, 2024, the Fund had 35.4% of the value of its net assets invested in stocks within the Technology sector.

| The Chesapeake Growth Fund |

| Notes to Financial Statements (Continued) |

7. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

8. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

| The Chesapeake Growth Fund |

| Report of Independent Registered Public Accounting Firm |

To the Shareholders of The Chesapeake Growth Fund

and Board of Trustees of Chesapeake Investment Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Chesapeake Growth Fund (the “Fund”), a series of The Chesapeake Investment Trust, as of October 31, 2024, the related statement of operations for the year then ended, the statements of changes in net assets and the financial highlights for each of the two years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2024, the results of its operations for the year then ended, and the changes in net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial highlights for the years ended October 31, 2022, and prior, were audited by other auditors whose report dated December 21, 2022, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2024, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting

| The Chesapeake Growth Fund |

| Report of Independent Registered Public Accounting Firm (Continued) |

principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2023.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

December 19, 2024

| The Chesapeake Growth Fund |

| Other Information (Unaudited) |

The Trust files a complete listing of the Fund’s portfolio holdings with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The filings are available free of charge, upon request, by calling the Trust toll-free at 1-800-430-3863. Furthermore, you may obtain a copy of these filings on the SEC’s website at www.sec.gov and the Fund’s website www.chesapeakefunds.com.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling the Trust toll-free at 1-800-430-3863, or on the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling the Trust toll-free at 1-800-430-3863, or on the SEC’s website at www.sec.gov.

| The Chesapeake Growth Fund |

| Renewal of the Investment Advisory Agreement (Unaudited) |

The Adviser supervises the investments of the Fund pursuant to an Investment Advisory Agreement (the “Advisory Agreement”) between the Adviser and the Trust. At the quarterly meeting of the Board of Trustees of the Trust that was held on September 12, 2024, the Trustees unanimously approved the continuance of the Advisory Agreement for an additional annual term. In considering whether to approve the renewal of the Advisory Agreement, the Trustees reviewed and considered such information as they deemed reasonably necessary, including the following material factors: (1) the nature, extent and quality of the services provided by the Adviser; (2) the investment performance of the Fund and the Adviser; (3) the costs of the services provided and profits realized by the Adviser from its relationship with the Fund; (4) the extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; (5) the Adviser’s practices regarding brokerage and portfolio transactions; and (6) the Adviser’s practices regarding possible conflicts of interest.

The Trustees reviewed various informational materials including, without limitation: (1) the Advisory Agreement; (2) financial statements of the Adviser; (3) a description of the Adviser’s key personnel and the services provided by the Adviser to the Fund; (4) information regarding the Adviser’s investment approach and investment performance and comparative performance information for other mutual funds with strategies similar to the Fund; (5) information regarding the Adviser’s brokerage practices, compliance program and affiliations, including potential conflicts of interest; (6) analyses of Fund expenses and comparative expense information for other mutual funds with strategies similar to the Fund; and (7) a memorandum from the Trust’s outside legal counsel that summarized the fiduciary duties and responsibilities of the Board of Trustees in reviewing and approving the Advisory Agreement, including the material factors set forth above and the types of information included in each factor that should be considered by the Board of Trustees in order to make an informed decision.

1. Nature, Extent, and Quality of the Services Provided by the Adviser

In considering the nature, extent, and quality of the services provided by the Adviser, the Trustees reviewed the responsibilities of the Adviser under the Advisory Agreement. The Trustees reviewed the services being provided by the Adviser to the Fund including, without limitation: the quality of its investment advisory services since the Fund’s commencement of operations (including research and recommendations with respect to portfolio securities); its process for formulating investment decisions and assuring compliance with the Fund’s investment objectives and limitations; its efforts to negotiate arrangements with other service providers for the benefit of shareholders; and its efforts to promote and market the Fund and grow the Fund’s assets. The Trustees also evaluated the Adviser’s personnel, including their education and experience. The Trustees noted

| The Chesapeake Growth Fund |

| Renewal of the Investment Advisory Agreement (Unaudited) (Continued) |

that the principal executive officer and president of the Trust is an employee of the Adviser and serves the Trust without additional compensation. After reviewing the information in the materials provided by the Adviser, the Board concluded, in light of all the facts and circumstances, that the nature, extent, and quality of the services provided by the Adviser to the Fund were satisfactory and adequate.

2. Investment Performance of the Fund and the Adviser

In considering the investment performance of the Fund and the Adviser, the Trustees compared the short-term and long-term performance of the Fund with the historical returns of comparable funds with similar structures, investment objectives, and strategies (i.e., the Morningstar peer group data). The Trustees also considered the consistency of the Adviser’s management of the Fund with its investment objective and policies. The Trustees reviewed the Fund’s performance over the one-, three-, five-, and ten-year periods ended August 30, 2024, and further noted that the Fund underperformed the S&P 500 Index for each of these periods. The Trustees observed that the Fund underperformed the median of the Morningstar US Fund Large Cap Growth Category and the Morningstar peer group of large cap growth funds with assets under $50 million for the one-, three-, five-, and ten-year periods ended August 30, 2024. The Trustees considered the Adviser’s representation that the performance of the Fund in comparison to other advisory accounts managed by the Adviser that use investment objectives similar to that of the Fund are not significantly different. After reviewing and discussing the short-term and long-term investment performance of the Fund, the Adviser’s experience managing the Fund and other advisory accounts, the Adviser’s historical investment performance, the Fund’s investment strategy, the differences between the Fund’s investment strategy and the strategies of the funds in its peer group, and other factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Fund and the Adviser was satisfactory.

3. Costs of the Services Provided and Profits Realized by the Adviser

In considering the costs of the services provided and profits realized by the Adviser from its relationship with the Fund, the Trustees considered, among other things: (i) the Adviser’s financial condition and the level of commitment to the Fund; (ii) the asset levels of the Fund; (iii) the overall expenses of the Fund; (iv) the nature and frequency of advisory fee payments; (v) the Adviser’s staffing, personnel, and methods of operating; and (vi) the Adviser’s compliance policies and procedures. The Trustees reviewed financial statements and other information communicated by the Adviser regarding its profits associated with managing the Fund. The Trustees also considered potential benefits for the Adviser in managing the Fund, including

| The Chesapeake Growth Fund |

| Renewal of the Investment Advisory Agreement (Unaudited) (Continued) |

the ability for the Adviser to place small accounts into the Fund and the potential for the Adviser to generate “soft dollar” research from certain of the Fund’s trades that may also benefit the Adviser’s other clients.

The Trustees then compared the fees and expenses of the Fund (including the management fee) to other specifically identifiable funds with similar investment objectives managed by other investment advisers. The Trustees considered the Adviser’s representation that a comparison of fees the Adviser charges its separately managed accounts vis-à-vis the Fund are not necessarily an appropriate comparison because the services rendered to the two types of accounts are sufficiently different with, in the Adviser’s view, the Fund requiring more man-hours of servicing than separate accounts, and the management of the Fund involving higher levels of risk and administration in fund management. The Trustees noted that the Fund’s management fee is higher than the average and median of comparable funds in the Fund’s Morningstar category and peer group of large cap growth funds with assets under $50 million, and that the Fund’s management fee is within the range of management fees of other funds with a similar investment strategy identified by the Adviser. Further, the Trustees noted that the Fund’s net expense ratio was higher than the average and median in its Morningstar category and peer group. After discussion, the Board concluded that the fees paid to the Adviser by the Fund, in light of all the facts and circumstances, were fair, reasonable, and consistent with terms under an arm’s length negotiation.

4. Economies of Scale

In considering the extent to which the Fund would realize economies of scale as the assets increase and whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors, the Trustees determined that while the management fee for the Fund is the same at all asset levels, the Fund’s shareholders would benefit from economies of scale under the Fund’s agreements with service providers other than the Adviser. The Trustees agreed that it was not appropriate to introduce fee breakpoints at present. The Trustees noted, however, that if the Fund grows significantly in assets, it may become necessary for the Adviser to consider adding breakpoints to the management fees. Following further discussion of the Fund’s asset levels, expectations for growth, and fee levels, the Board determined that the Fund’s fee arrangements, in light of all the facts and circumstances, were fair, reasonable, and consistent with the nature and quality of the services provided by the Adviser.

| The Chesapeake Growth Fund |

| Renewal of the Investment Advisory Agreement (Unaudited) (Continued) |

5. The Adviser’s Practices Regarding Brokerage and Portfolio Transactions

In considering the Adviser’s practices regarding brokerage and portfolio transactions, the Trustees reviewed the Adviser’s practices for seeking best execution for the Fund’s portfolio transactions. The Trustees also considered the extent to which the Fund allocates portfolio business to broker-dealers who provide research, statistical, or other services, and whether the higher rates are reasonable given the services provided to the Adviser and the Fund. The Trustees considered the process by which the Adviser evaluates its best execution duties. The Trustees noted that in selecting broker-dealers to execute portfolio transactions, the Adviser considers a variety of factors including, among others: order flow, liquidity of the security traded, ability of a broker-dealer to maintain the confidentiality of trading intentions, ability of a broker-dealer to place trades in difficult market environments, research services provided, execution facilitation services provided, timeliness of execution, timeliness and accuracy of trade confirmations, willingness to commit capital, allocation of limited investment opportunities, client direction, record-keeping services provided, custody services provided, frequency and correction of trading errors, ability to access a variety of market venues, expertise as it relates to specific securities, intermediary compensation (commissions and spreads), financial condition, and business reputation. The Trustees also considered the process for aggregating or “blocking” trades for client accounts, including the Fund. After further review and discussion, the Board determined that the Adviser’s practices regarding brokerage and portfolio transactions were satisfactory.

6. The Adviser’s Practices Regarding Possible Conflicts of Interest

In considering the Adviser’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis for “soft dollar” arrangements with broker-dealers; the basis of decisions to buy or sell securities for the Fund and/or the Adviser’s other accounts; the method for bunching of portfolio securities transactions; the substance and administration of the Adviser’s code of ethics; and the compensation paid to the chief compliance officer by the Fund. Following further consideration and discussion, the Board indicated that the Adviser’s standards and practices relating to the identification and mitigation of possible conflicts of interest were satisfactory.

Based upon all of the foregoing considerations, the Board of Trustees, including a majority of the Trustees who are not parties to the Advisory Agreement or “interested persons” of any such party (as such term is defined by the Investment Company Act of 1940), approved the renewal of the Advisory Agreement.

The Chesapeake Growth Fund

is a series of

Chesapeake Investment Trust

| For Shareholder Service Inquiries: | For Investment Advisor Inquiries: |

| | |

| The Chesapeake Growth Fund | Gardner Lewis Asset Management |

| c/o Ultimus Fund Solutions, LLC | 285 Wilmington-West Chester Pike |

| P.O. Box 46707 | Chadds Ford, Pennsylvania 19317 |

| Cincinnati, Ohio 45246-0707 | |

Toll-Free Telephone:

1-800-430-3863

World Wide Web @:

www.chesapeakefunds.com

(b) Included in (a)

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Included under Item 7

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Included under Item 7

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable

Item 15. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 16. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable

Item 18. Recovery of Erroneously Awarded Compensation.

(a) Not applicable

(b) Not applicable

Item 19. Exhibits.

File the exhibits listed below as part of this Form. Letter or number the exhibits in the sequence indicated.

(a)(1) Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit: Attached hereto

(a)(2) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)): Attached hereto

(1) Not applicable

(2) Change in the registrant’s independent public accountant: Not applicable

(b) Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)): Attached hereto

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Chesapeake Investment Trust | |

| | | |

| By (Signature and Title)* | /s/ W. Whitfield Gardner |

| | | W. Whitfield Gardner, Chairman and Chief Executive Officer (Principal Executive Officer) |

| Date | January 6, 2025 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ W. Whitfield Gardner |

| | | W. Whitfield Gardner, Chairman and Chief Executive Officer (Principal Executive Officer) |

| | | |

| Date | January 6, 2025 | |

| | | |

| By (Signature and Title)* | /s/ Angela A. Simmons |

| | | Angela A. Simmons, Treasurer (Principal Financial Officer) |

| | | |

| Date | January 6, 2025 | |

| * | Print the name and title of each signing officer under his or her signature. |