May 9, 2016

Dear Fellow Cogentix Shareholder,

You may have received the most recent letter from Mr. Pell. In light of the numerous false and misleading assertions made in Mr. Pell’s letter, we feel it is important to provide our shareholders with the facts. We believe Mr. Pell’s campaign is misguided and not in the best interests of shareholders. In fact, the two largest independent proxy advisory services agree with us, too. We ask that you do not return any proxy cards sent to you by Mr. Pell. Please sign and return management’s WHITE proxy card.

Here are the summary points that we ask you to consider:

| · | Prior to the merger, under the leadership of Mr. Pell, Vision‐Sciences was a company that produced consistently dismal results and created no shareholder value since its inception in 1992. |

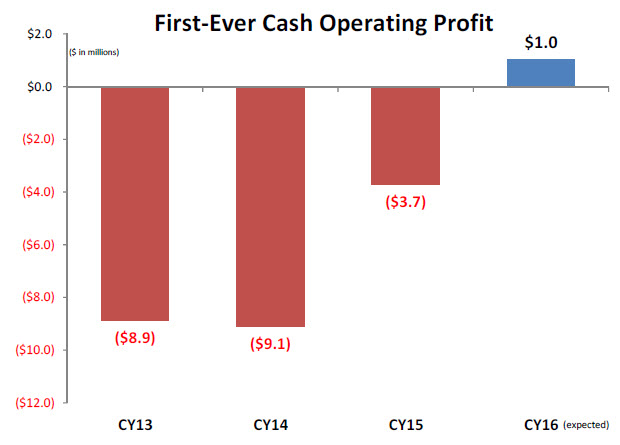

| · | After the merger, your Board and management team have delivered record results, including two consecutive quarters of cash operating profit, a milestone that neither company had achieved in their long histories. The path to shareholder value creation is finally visible. |

| · | As the largest debt holder of Cogentix Medical, Mr. Pell’s interests are not aligned with those of all shareholders. Mr. Pell has vowed to “protect at all costs” his $28.5 million in debt regardless of what that might mean for our shareholders. |

| · | Your Board and management team have attempted to avoid a proxy contest. However, Mr. Pell rebuffed our numerous reasonable requests to do so and is now causing us to wastefully spend shareholder money defending you from Mr. Pell’s self‐serving campaign to control the Company. |

| · | Your Board believes Mr. Pell’s actions are not in the best interests of all shareholders. In fact, ISS (the largest independent proxy advisory firm) wrote in a report published May 7, 2016* that Mr. Pell’s “own soliciting materials unnecessarily raise questions about his understanding of a director's role at a public company.” |

| · | In the same report published May 7, 2016, ISS recommended shareholders vote the WHITE proxy card in support of the Board’s proposals while also stating, “Pell is not the most compelling candidate to advance the interests of all shareholders. Shareholders, accordingly, should use the WHITE management card to WITHHOLD votes from dual dissident/management nominee Pell.” Additionally, ISS recommended that shareholders DO NOT VOTE Mr. Pell’s proxy card. |

*Permission neither sought nor obtained for ISS quotations used in this letter.

cogentixmedical.com

MANAGEMENT HAS DELIVERED RECORD RESULTS AND PROFITABILTY FOLLOWING THE MERGER

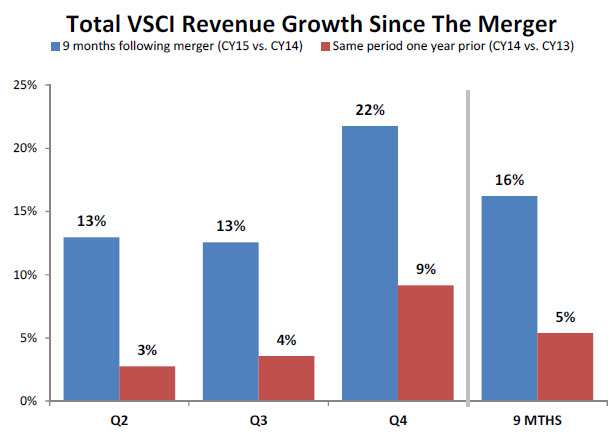

Mr. Pell’s continued statements about the “Company’s dismal performance” are more than puzzling. We believe they are a blatant misrepresentation of the facts. As promised at the time of the merger, revenue growth has accelerated, and we achieved the first‐ever cash operating profit in the history of either company within nine months of the merger. The following charts clearly demonstrate the superior performance under the leadership of your management team (blue bars) as compared to the underwhelming performance of Vision‐Sciences under the leadership of Mr. Pell and Mr. Zauberman, the former CEO of Vision‐Sciences (red bars).

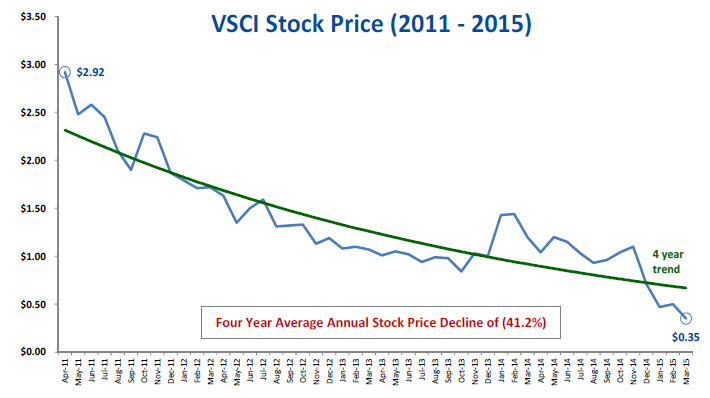

IN THE ONE YEAR PERIOD FOLLOWING THE MERGER, THE SHARE PRICE OF COGENTIX MEDICAL HAS OUTPERFORMED ITS PEER GROUP

While we are not satisfied with the decline in our share price in the time since the merger, we have outperformed our peer group. The following comment is from the May 7, 2016 ISS proxy analysis report. “ISS compared the company's performance to the performance of other microcap medical device companies with market caps between $20 and $30 million – the company is approximately the midpoint of that range – as well as the Russell Microcap Health Care Index. Performance was measured from the date Cogentix first began trading through Feb. 16, 2016, the last trading day before the dissident began to make its concerns public. Over that brief period, the company's shares declined 28 percentage points. This was 5.3 percentage points better than the index, and 37.3 points better than peers over the same period. Extending the analysis through May 6, 2016, the company's shares were down 39.1 percent – now 10.4 points below the index, but still a sizeable 28.4 points better than the median of the other microcap medical device makers.”

Mr. Pell should be well aware of this sector performance as he is the Chairman of PhotoMedex, another microcap medical technology company. In the past year, Mr. Pell oversaw a 72% decline in the PhotoMedex share price. Clearly, his comments about the Cogentix Medical share price are self‐serving in his attempts to gain control of your Board, especially when one considers the consistent dismal stockholder returns during Mr. Pell’s reign as the Chairman of Vision‐Sciences.

MR. PELL’S FALSE AND MISLEADING STATEMENTS

Mr. Pell’s statement that “no independent consultant was used to evaluate the fairness or effectiveness of Mr. Kill’s compensation package” is simply not true. In 2014, the Uroplasty Board of Directors engaged Frederic W. Cook & Company, a nationally recognized compensation consulting firm. Frederic W. Cook, using their professional judgment, selected the peer group for Uroplasty. Mr. Kill’s compensation was set within the peer group range by the Compensation Committee and approved by the full Board, utilizing the compensation report provided by Frederic W. Cook. Mr. Kill’s cash compensation was set in 2014 and, pursuant to Mr. Kill’s request, has not increased since that date.

Mr. Pell also makes misleading statements about the 2014 Uroplasty “Say on Pay” Proposal. The negative recommendation of ISS was not based on the level of Mr. Kill’s pay as Mr. Pell suggests. Their negative recommendation was due to an excise tax gross‐up provision in Mr. Kill’s employment agreement. That provision expired at the end of 2014. In last year’s proxy analysis report published July 17, 2015, ISS wrote, “given that the problematic excise tax gross‐up provision has expired (and no new gross‐up provisions were entered into), there are no adverse vote recommendations.” In their May 7, 2016 proxy analysis report, ISS wrote, “Despite having cited it extensively on one page of its investor presentation, the dissident (Pell) – or perhaps the dissident's advisors – appear to not have read, to have misread, or perhaps just to have willfully misrepresented the ISS analysis they cite from Uroplasty's 2014 annual meeting.”

MR. PELL MISREPRESENTS MR. KILL’S COMPENSATION INFORMATION

Mr. Pell also misrepresents other key facts about Mr. Kill’s compensation. Mr. Pell states that Mr. Kill has total annualized compensation of $1.7 million, which is misleading to investors. Mr. Kill’s compensation is not paid entirely in cash as Mr. Pell would like investors to believe. For example, in the last fiscal year, thirty‐five percent (35%) of Mr. Kill’s compensation was provided in equity, which aligns his interests with shareholders. While this equity is reported as compensation in the year the award is made, it is important to understand that this equity vests over a three‐year period, and the value of that equity is dependent on the share price. For example, the total value of the options granted to Mr. Kill in 2015 is currently $0 due to the recent decline in the share price and the fact that two‐thirds of those options have not yet vested. Despite this fact, these options were reported as $160,073 in compensation to Mr. Kill in 2015. Finally, Mr. Kill’s cash compensation in his three years as CEO has been well within the range of his peer group identified in the Frederic W. Cook report.

Mr. Pell also claims that Mr. Kill’s pay reflects approximately 3.7% of Cogentix total revenue since the merger. Once again, this is not accurate and is a misleading statement. Mr. Kill’s calendar year 2015 compensation is 2.8% of Cogentix 2015 total revenue, or 24% less than what Mr. Pell claims. If one were to exclude the non‐cash equity component, which should not be used when calculating compensation as a percentage of cash revenue, the percentage is actually 1.8%, or 51% less than what Mr. Pell claims.

MR. PELL APPROVES EXCESSIVE COMPENSATION PRACTICES AT PHOTOMEDEX

Additionally, you should be aware that Mr. Pell is a member of the Compensation Committee at PhotoMedex, the company mentioned earlier in this letter that experienced the 72% decline in their share price in the past year under the leadership of Mr. Pell as Chairman. In a proxy analysis report on PhotoMedex that was published on October 8, 2015, the independent proxy advisory firm recommended a WITHHOLD vote for Mr. Pell as a nominee for Director. Why? Mr. Pell serves on the PhotoMedex Compensation Committee, and the proxy advisory firm reported “a high level of concern due to total CEO pay over the last three years.” In fact, Mr. Pell approved cash compensation of approximately $1.8 million and $2.6 million for the CEO of PhotoMedex in their last two fiscal years despite the fact that the company reported a loss of over $100 million from continuing operations during that time period. Mr. Pell also approved a “minimum guaranteed bonus of at least $300,000 a quarter for three years” for the PhotoMedex CEO, a bonus which is also uncapped.

In comparison, forty‐five percent (45%) of Mr. Kill’s cash compensation is at risk annually. His bonus opportunity is capped and is not guaranteed, which means Mr. Kill could be paid $0 of his bonus if he does not meet the aggressive performance targets established by the Cogentix Medical Board. Clearly, Mr. Pell’s campaign about Mr. Kill’s compensation is driven by his desire to have a CEO and a Board whom he can control, which is what he had at Vision‐Sciences prior to the merger, and has very little to do with the performance of the company, which has exceeded all expectations.

In their May 7, 2016 proxy analysis report on Cogentix Medical, ISS recommended that “shareholders vote FOR ratification of the company's compensation structure.”

PELL’S INTERESTS ARE NOT ALIGNED WITH ALL SHAREHOLDERS

As you can see, we believe Mr. Pell has consistently misrepresented information to suit his own misguided purposes. Additional numerous false and misleading statements made by Mr. Pell can be found at this link – www.cogentixmedical/pellrebuttal. Mr. Pell is clearly not credible, and we believe his self‐interested intentions are apparent.

Mr. Pell is not an activist investor agitating for change on behalf of all shareholders. This is a former minority but controlling shareholder in a predecessor company who:

| · | Willingly merged “his” company (Vision‐Sciences) with Uroplasty, |

| · | Almost immediately after the merger decided that he did not like having a CEO or Board that he could not control, |

| · | Has engaged in a vindictive campaign to have the CEO removed and the Board changed so that he can control both the CEO and the Board, and has waged his campaign without any regard for the Corporate Governance Guidelines and Policies that he himself approved at the time of the merger, |

| · | Has not identified any shortcoming of the current CEO who has led the company to exceed all objectives established at the time of the merger, |

| · | Has neglected his fiduciary duties to all shareholders by seeking to “protect at all costs” his $28.5 million in debt with the company. |

Returning control of the company to Mr. Pell would mean a return to the historical dismal performance of Vision‐Sciences in which shareholders were never rewarded. The likely ensuing loss of talent would destabilize the company and lead to a dramatic decline in revenue and perhaps bankruptcy, Mr. Pell’s oft stated objective. Clearly, we believe that allowing Mr. Pell to gain control of the Board is not in the best interests of all shareholders.

VOTE THE WHITE PROXY CARD TO SUPPORT OUR BRIGHT FUTURE

We are excited about our future as we build upon the benefits of last year’s merger. We ask that you ignore any proxy material that you may receive from Mr. Pell. Please sign, date and return management’s WHITE PROXY CARD with a vote FOR these proposals. Thank you for your support.

Sincerely,

Kevin H. Roche

Chairman, Governance & Nominating Committee

Non-GAAP Financial Measures:

The tables set forth below titled “Pro forma Combined Revenue (Unaudited)” provides the non-GAAP, pro forma combined revenue as if Vision-Sciences, Inc. and Uroplasty, Inc. had merged as of the earliest reported date and is the sum of the historical results of each predecessor company. This non-GAAP, pro forma information does not take into account any purchase price adjustments. The row labeled “Former UPI Revenue” within such tables reflects the GAAP revenue of the Company for the quarter and nine months ended December 31, 2014.

The tables set forth below entitled “Pro forma Combined Statements of Operations (Unaudited)” provides the non-GAAP, pro forma combined statement of operations of Vision-Sciences and Uroplasty as if they had merged as of the earliest reported date and is the sum of the historical results of each predecessor company. Such tables reconcile the Company’s net loss calculated in accordance with GAAP to non-GAAP financial measures that exclude non-cash charges for share-based compensation, long-term incentive plan, depreciation and amortization as well as merger-related costs.

The non- GAAP, pro forma combined financial information used by management and disclosed by us is not a substitute for, nor superior to, financial information and consolidated financial results calculated in accordance with GAAP, and you should carefully evaluate our reconciliations to non-GAAP. We may calculate our non-GAAP, pro forma combined financial information differently from similarly titled measures used by other companies. Therefore, our non-GAAP, pro forma combined financial information may not be comparable to those used by other companies. We have described the reconciliations of each of our non-GAAP, pro forma combined financial information described above to the most directly comparable GAAP financial measures.

We use this non-GAAP financial information, and in particular non-GAAP net loss, for internal managerial purposes because we believe such measures are one important indicator of the strength and the operating performance of our business. Analysts and investors frequently ask us for this information. We believe that they use this information to evaluate the overall operating performance of companies in our industry, including as a means of comparing period-to-period results and as a means of evaluating our results with those of other companies.

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED REVENUE (UNAUDITED) (NON-GAAP)

THIRD QUARTER ENDED December 31,

| (dollars in thousands) | | | | | | | | | | | | |

| Market/Product | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Urology | | | 3,511 | | | $ | 2,746 | | | $ | 765 | | | | 27.9 | % |

| Airway Management | | | 1,068 | | | | 1,107 | | | | (39 | ) | | | (3.5 | %) |

| Industrial | | | 1,411 | | | | 1,067 | | | | 344 | | | | 32.2 | % |

| Former VSCI Revenue | | | 5,990 | | | | 4,920 | | | | 1,070 | | | | 21.7 | % |

| | | | | | | | | | | | | | | | | |

| UPC | | | 5,628 | | | | 4,416 | | | | 1,212 | | | | 27.4 | % |

| MPQ | | | 1,749 | | | | 1,975 | | | | (229 | ) | | | (11.6 | %) |

| Other | | | 271 | | | | 276 | | | | (5 | ) | | | (1.8 | %) |

| Former UPI Revenue | | | 7,648 | | | | 6,667 | | | | 978 | | | | 14.7 | % |

| | | | | | | | | | | | | | | | | |

| Combined Revenue | | | 13,638 | | | $ | 11,587 | | | $ | 2,051 | | | | 17.7 | % |

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED STATEMENT OF OPERATIONS (UNAUDITED)

(NON-GAAP)

THIRD QUARTER ENDED December 31,

| (dollars in thousands) | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Revenue | | $ | 13,638 | | | $ | 11,587 | | | $ | 2,048 | | | | 17.7 | % |

| Gross profit | | | 8,725 | | | | 7,793 | | | | 932 | | | | 12.0 | % |

| | | | 64.0 | % | | | 67.3 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating costs | | | 8,760 | | | | 10,030 | | | | (1,270 | ) | | | 12.7 | % |

| Amortization of intangibles | | | 634 | | | | 8 | | | | 626 | | | | n/m | |

| Merger-related costs | | | 45 | | | | 1,282 | | | | (1,237 | ) | | | n/m | |

| Operating loss | | | (714 | ) | | | (3,527 | ) | | | 2,813 | | | | 79.8 | % |

| | | | | | | | | | | | | | | | | |

| Non cash operating costs | | | 1,232 | | | | 1,021 | | | | 211 | | | | 20.7 | % |

| Merger-related costs | | | 45 | | | | 1,282 | | | | (1,237 | ) | | | n/m | |

| Cash net income (loss), excluding merger-related costs | | $ | 563 | | | $ | (1,224 | ) | | $ | 1,787 | | | | 146.0 | % |

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED REVENUE (UNAUDITED) (NON-GAAP)

NINE MONTHS ENDED December 31,

| (dollars in thousands) | | | | | | | | | | | | |

| Market/Product | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Urology | | $ | 9,294 | | | $ | 7,015 | | | $ | 2,279 | | | | 32.5 | % |

| Airway Management | | | 2,721 | | | | 3,167 | | | | (446 | ) | | | (14.1 | %) |

| Industrial | | | 2,840 | | | | 2,600 | | | | 240 | | | | 9.2 | % |

| Former VSCI Revenue | | | 14,855 | | | | 12,782 | | | | 2,073 | | | | 16.2 | % |

| | | | | | | | | | | | | | | | | |

| UPC | | | 15,372 | | | | 12,721 | | | | 2,651 | | | | 20.8 | % |

| MPQ | | | 5,571 | | | | 5,982 | | | | (411 | ) | | | (6.9 | %) |

| Other | | | 824 | | | | 803 | | | | 21 | | | | 2.6 | % |

| Former UPI Revenue | | | 21,767 | | | | 19,506 | | | | 2,261 | | | | 11.6 | % |

| | | | | | | | | | | | | | | | | |

| Combined Revenue | | $ | 36,622 | | | $ | 32,288 | | | $ | 4,334 | | | | 13.4 | % |

COGENTIX MEDICAL, INC. AND SUBSIDIARIES

PRO FORMA COMBINED STATEMENT OF OPERATIONS (UNAUDITED)

(NON-GAAP)

NINE MONTHS ENDED December 31,

| (dollars in thousands) | | 2015 | | | 2014 | | | $ Change | | | % Change | |

| Revenue | | $ | 36,622 | | | $ | 32,288 | | | $ | 4,334 | | | | 13.4 | % |

| Gross profit | | | 24,103 | | | | 21,493 | | | | 2,610 | | | | 12.1 | % |

| | | | 65.8 | % | | | 66.6 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating costs | | | 27,183 | | | | 30,274 | | | | (3,091 | ) | | | (10.2 | %) |

| Amortization of intangibles | | | 1,903 | | | | 24 | | | | 1,879 | | | | n/ | m |

| Merger-related costs | | | 950 | | | | 1,282 | | | | (332 | ) | | | n/ | m |

| Operating loss | | | (5,933 | ) | | | (10,087 | ) | | | 4,154 | | | | (41.2 | %) |

| | | | | | | | | | | | | | | | | |

| Non cash operating costs | | | 3,476 | | | | 2,553 | | | | 923 | | | | 36.2 | % |

| Merger-related costs | | | 950 | | | | 1,282 | | | | (332 | ) | | | n/ | m |

| Cash net loss, excluding merger-related costs | | $ | (1,507 | ) | | $ | (6,252 | ) | | $ | 4,745 | | | | (75.9 | %) |

If you have any questions on how to vote your shares, please call: Banks and Brokerage Firms Call: (203) 658-9400 Shareholders Call Toll Free: (800) 662-5200 E-mail: cgnt@morrowco.com |