UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-07358 |

Duff & Phelps Utility and Corporate Bond Trust Inc.

|

| (Exact name of registrant as specified in charter) |

| | |

| 55 East Monroe Street, Suite 3600, Chicago, Illinois | | 60603 |

| (Address of principal executive offices) | | (Zip code) |

| | |

| Alan M. Meder | | John R. Sagan |

| Duff & Phelps Utility and Corporate Bond Trust Inc. | | Mayer, Brown, Rowe & Maw LLP |

| 55 East Monroe Street, Suite 3600 | | 71 South Wacker Drive |

| Chicago, Illinois 60603 | | Chicago, Illinois 60606 |

|

| (Name and address of agents for service) |

Registrant’s telephone number, including area code: (312) 541-5555

Date of fiscal year end: December 31

Date of reporting period: June 30, 2007

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders follows.

Dear Fellow Shareholders:

YOUR FUND’S PERFORMANCE

During the first half of 2007, the performance of leveraged bond funds, including Duff & Phelps Utility and Corporate Bond Trust Inc. (the “DUC Fund”), was hampered by both a rise in interest rates and increased levels of uncertainty in the credit markets. The rise in interest rates was associated with the markets anticipation of stronger U.S. economic growth and the potential for higher inflation in the second half of the year. Uncertainty in the credit markets was fueled by speculation surrounding potential leveraged buyout (“LBO”) activity and concerns regarding the sub-prime lending markets. Increased global liquidity and the resultant increase in demand for U.S. corporate securities by foreign investors offset some of the uncertainty. As a result, the DUC Fund, similar to the broader fixed-income market, posted modest returns, while the traditional equity markets enjoyed higher returns, boosted by solid corporate fundamentals and robust profitability. The following table compares the performance of the DUC Fund to various market benchmarks.

| | | | | | | | | | | | | | | |

For the period

indicated

through

June 30, 2007 | | DUC Fund (Per share

performance

with dividends

reinvested in

Fund plan) | | | DUC Fund (NAV-based

performance) | | | Lehman

Aggregate Bond

Index | | | Dow Jones

Industrial

Index (dividends

reinvested) | | | S&P 500 Index (dividends

reinvested) | |

| Six Months | | (1.63 | %) | | .86 | % | | .98 | % | | 8.76 | % | | 6.68 | % |

| One Year | | 4.78 | % | | 5.34 | % | | 6.12 | % | | 23.04 | % | | 19.89 | % |

| 5 Years (annualized) | | 3.77 | % | | 6.61 | % | | 4.48 | % | | 10.19 | % | | 10.11 | % |

Performance returns for the Dow Jones Industrial Index, the S&P 500 Index and the Lehman Aggregate Bond Index were obtained from Confluence Technologies Inc. DUC Fund per share-based returns and DUC Fund NAV-based returns were obtained from the Administrator of the DUC Fund. Past performance is not indicative of future results.

Based on the mid-year closing price of $11.05 and a monthly dividend of $0.065 per share, the DUC Fund common stock had an annualized dividend yield of 7.06%. The DUC Fund’s yield compares favorably with the 1.74% dividend yield of the S&P 500 Index and the 5.67% yield of the Lehman Aggregate Bond Index.

MARKET OVERVIEW AND OUTLOOK

In the first quarter of 2007, U.S. economic growth slowed to an annualized rate of 0.7%, as businesses liquidated inventories while domestic demand remained soft. Consumer spending was restrained, due in part to higher energy costs and higher interest rates. Declines in housing market activity were compounded by problems in the sub-prime lending industry. After delinquency rates on sub-prime loans surged to alarmingly high levels and sub-prime lenders began to experience difficulties, investors started to conclude that lending standards on lower quality loans had been compromised and pulled back from investments in sub-prime lending companies as delinquencies continued to mount. The DUC Fund has no direct exposure to sub-prime loans or institutions that exclusively focus on the sub-prime market. In contrast to the U.S. economy, global growth accelerated nicely, led by the Chinese economy that continued to surge.

Several other factors contributed to uncertainty in the U.S. equity and credit markets. Event risk remained high, as much of corporate America continued to come under pressure from shareholders to generate higher returns,

1

thus stimulating an increase in merger and acquisition activity. LBO transactions, which are corporate takeovers in which the buyer borrows money to buy a controlling interest in a company, cause volatility to increase for both the equity and debt of the target company. Markets were also influenced by ongoing geopolitical turmoil and by elevated levels of foreign investment in the U.S., much of which is believed to have flowed into the more volatile areas of the financial markets, such as private equity funds and high yield bonds. In the case of the equity markets, positive corporate fundamentals and robust global growth generally allowed equity investors to look beyond the uncertainties, resulting in solid returns for the equity markets.

From mid-year 2004 to mid-year 2006, the Federal Open Market Committee (the “FOMC”) raised the target federal funds rate at seventeen consecutive meetings in 25 basis point increments. The last move, which took place on June 29, 2006, brought the federal funds target rate from a multi-decade low of 1.00% in 2004 to its current level of 5.25%. Since that time, a stable monetary policy by the Federal Reserve, along with an anticipated re-acceleration in the pace of U.S. economic growth, has created an environment in which short-term interest rates held steady and long-term interest rates moved higher. Over the first half of 2007, while the federal funds target rate remained at 5.25%, the U.S. Treasury yield curve shifted upward and became more positively sloped (i.e., long rates higher than short rates). Yields increased by 5 basis points on two-year maturities, by 32 basis points on ten-year maturities and by 31 basis points on thirty-year maturities. As a result, the broad fixed-income markets posted only modest returns for the first half of 2007.

Looking ahead to the second half of 2007, the U.S. economy is expected to rebound from a meager 0.7% first quarter rate of growth. At the most recent meeting of the FOMC, the Federal Reserve commented that the U.S. economy is likely to continue to expand at a moderate pace over coming quarters and that measures of core inflation have improved modestly in recent months. However, the Federal Reserve also commented that a sustained moderation in inflation pressures has yet to be convincingly demonstrated and, therefore, the committee’s predominant concern remains the risk that inflation will fail to moderate as expected. Given a solid economic outlook and the potential for core inflation to remain above the Federal Reserve’s comfort zone, market participants are expecting the Federal Reserve to hold rates steady in the near term, while closely monitoring economic conditions. Consumer spending may be dampened, as the potential exists for lower home prices to reduce the net worth of American households, though a still respectable employment market may limit the downside.

Business is expected to remain the primary driver of U.S. economic growth, although increasing levels of global competition suggest that U.S. corporate profitability may flatten following several consecutive years of double-digit growth. While corporate fundamentals in the U.S. remain solid, pressure on companies to return capital to shareholders in the form of stock buybacks and special dividends is likely to continue. Moreover, businesses with healthy balance sheets may become takeover targets if they exhibit weak equity performance. In this regard, a further increase in LBO activity could put bondholders at a disadvantage, as credit statistics of the target company often deteriorate as a result of such transactions. At the same time, strong demand for corporate bonds from both domestic and foreign investors has driven up valuations in the corporate bond markets to potentially unsustainable levels. Therefore volatility in the corporate bond market is expected to increase. In addition, an environment of sustained U.S. economic growth and heightened uncertainty about inflation could set the stage for continued upward pressure on interest rates. Under this scenario, the returns of leveraged bond funds would be restrained, both by the impact of high short-term interest rates on the cost of leverage and by negative pressure on bond valuations due to increased volatility and the potential for rising long-term interest rates.

2

ABOUT YOUR FUND

At its regular meeting on May 10, 2007, the Board of Directors of the DUC Fund voted to revise one of the non-fundamental investment policies of the DUC Fund. As you know, all of the DUC Fund’s investments must be, at the time of investment, (i) rated investment grade or (ii) with respect to no more than 10% of the DUC Fund’s total assets, unrated but determined by management to be of comparable quality to investment grade rated obligations. The foregoing policies with respect to credit quality apply only at the time of initial investment, and the DUC Fund is not required to dispose of securities in the event of a rating downgrade below investment grade or, in the case of unrated obligations, in the event that management reassesses its view with respect to the credit quality of the issuer thereof. However, the DUC Fund has historically also had a policy that management would seek to engage in an orderly disposition of such downgraded securities to the extent necessary, except in unusual market conditions, to limit the DUC Fund’s holdings of securities rated below investment grade, or deemed by management to be of comparable quality, to not more than 5% of the DUC Fund’s total assets. At the May 10, 2007 meeting, the Board of Directors reexamined this 5% holding limitation in light of the significant increase in the frequency of corporate restructurings since the DUC Fund’s inception, including various merger and acquisition activities such as leveraged buyouts. Such market activities can potentially result in the downgrading of investment grade securities to non-investment grade levels. The Board of Directors concluded that it was in the best interest of shareholders to remove the 5% holding limitation. The revision provides the flexibility to more efficiently manage such situations, thus limiting potential forced divestitures at times when trading liquidity could be severely restricted. In addition, the revision gives management the ability to avoid forced divestitures that could result in the untimely recognition of capital gains and/or losses. Nevertheless, it is important to note that the requirement that all securities be investment grade at the time of purchase remains fully in effect. Therefore, it is expected that the composition of the DUC Fund will not deviate significantly from its historical credit rating posture.

The use of leverage enables the DUC Fund to borrow at short-term rates and invest at long-term rates. As of September 30, 2006, the DUC Fund’s leverage consisted of $138 million of outstanding commercial paper notes (“CP Notes”). Toward the end of October, the DUC Fund completed an offering of Auction Market Preferred Shares (“AMPS”) in the amount of $190 million. The DUC Fund used this offering of AMPS to retire the outstanding CP Notes and to reconfigure and expand its use of leverage. The net proceeds of the offering were invested in accordance with the DUC Fund’s investment objective and policies. As of June 30, 2007, the amount of leverage represented by the AMPS constituted approximately 37% of total assets. The amount and type of leverage used by the DUC Fund is determined by the Board of Directors based on the expected earnings relative to the anticipated costs (including fees and expenses) associated with the leverage. In addition, the longer-term expected benefits of leverage are carefully weighed against the potential effect of increasing the volatility of both the DUC Fund’s net asset value and the market value of its common stock. Since the costs associated with discontinuing or initiating a leverage program based on short-term trends can be substantial, the Board takes a longer-term view when evaluating the merits of using leverage. Historically, the tendency of the U.S. yield curve to exhibit a positive slope (i.e., long rates higher than short rates) fosters an environment in which leverage can add incremental value. Over the last few years, the DUC Fund’s cost of leverage has steadily increased from historically low levels, partly as a result of the series of increases in the federal funds target rate discussed above. However, the use of leverage is still beneficial, although at a reduced rate because of the narrower spread between the rate at which the DUC Fund is able to borrow and the rate at which it is able to invest the borrowed funds.

The DUC Fund seeks to provide investors with a stable monthly dividend that is primarily derived from current fiscal year net investment income. At times, a portion of the monthly distribution could be derived from realized

3

capital gains and, to the extent necessary, paid-in-capital, in which case the DUC Fund is required to inform shareholders of the sources of the distribution based on U.S. generally accepted accounting principles (“GAAP”). A return of capital distribution does not necessarily reflect the DUC Fund’s investment performance and should not be confused with “yield” or “income”. For the six month period ended June 30, 2007, under GAAP, 83% of the total distributions were attributable to current year net investment income and 17% was in excess of current year net investment income and was therefore attributable to paid-in-capital. The characterization of the distributions for GAAP purposes and federal income tax purposes may differ, primarily because of a difference in the tax and GAAP accounting treatment of amortization for premiums on fixed income securities. As of the date of this letter, the Fund estimates that its current year distributions will be derived entirely from net investment income. In January 2008, a Form 1099-DIV will be sent to shareholders, which will state the amount and tax characterization of the DUC Fund’s 2007 distributions.

DIVIDEND REINVESTMENTAND CASH PURCHASE PLANAND DIRECT DEPOSIT

To those of you receiving dividends in cash, you may want to consider taking advantage of the dividend reinvestment and cash purchase plan (the “Plan”) available to all registered shareholders of the DUC Fund. Under the Plan, the DUC Fund absorbs all administrative costs (except brokerage commissions, if any) so that the total amount of your dividends and other distributions may be reinvested in additional shares of the DUC Fund. Also, the cash purchase option permits participants to purchase shares in the open market through the Plan Agent. Additional information about the Plan is available from the Plan Agent, The Bank of New York, at (800) 524-4458, or for more details, please refer to page 17.

For those shareholders receiving dividend checks, you may want to consider having your monthly dividends deposited, free of charge, directly into your bank account through electronic funds transfer. Direct deposit provides the convenience of automatic and immediate access to your funds, while eliminating the possibility of mail delays and lost, stolen or destroyed checks. Additional information about direct deposit is available from The Bank of New York, at (800) 432-8224.

For more information about the DUC Fund, shareholders can access www.phoenixwm.com.

We appreciate your investment in Duff & Phelps Utility and Corporate Bond Trust Inc. and look forward to continuing our service to you.

Sincerely,

| | |

| |  |

| Francis E. Jeffries, CFA | | Nathan I. Partain, CFA |

| Chairman of the Board | | Director, President & CEO |

4

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Portfolio of Investments

June 30, 2007

(Unaudited)

| | | | | | |

Principal

Amount

(000)

| | Description

| | Value

(Note 1)

|

| | | | | |

| | | | LONG-TERM INVESTMENTS—155.2% |

| | | | U.S. Government and Agency Obligations—13.5% | | | |

| | | | Federal National Mortgage Association, | | | |

| $ | 339 | | 8.00%, 10/01/30 | | $ | 356,838 |

| | 1,178 | | 7.00%, 12/01/31 | | | 1,221,628 |

| | | | Government National Mortgage Association

Pass-Through Certificates, | | | |

| | 15 | | 7.00%, 3/15/26 | | | 16,097 |

| | 106 | | 7.50%, 5/15/26 | | | 110,761 |

| | 94 | | 8.00%, 11/15/30 | | | 100,382 |

| | 103 | | 8.00%, 2/15/31 | | | 108,958 |

| | | | U.S. Treasury Bonds | | | |

| | 40,000 | | 10.375%, 11/15/12 | | | 40,775,040 |

| | | | | |

|

|

| | | | Total U.S. Government and Agency Obligations

(Cost $47,107,261) | | | 42,689,704 |

| | | | | |

|

|

| |

| | | | Corporate Bonds—135.5% |

| | | | Auto & Truck—3.3% | | | |

| | | | DaimlerChrysler NA Holdings, | | | |

| | 10,000 | | 7.20%, 9/01/09 | | | 10,326,060 |

| | | | | |

|

|

| | |

| | | | Financial—38.8% | | | |

| | | | Aegon NV, | | | |

| | 4,000 | | 9.375%, 3/01/08 | | | 4,074,700 |

| | | | Bank United, | | | |

| | 4,910 | | 8.00%, 3/15/09 | | | 5,087,722 |

| | | | Bear Stearns & Co. Inc., | | | |

| | 7,000 | | 7.625%, 12/07/09 | | | 7,322,672 |

| | | | Boeing Capital Corp., | | | |

| | 5,000 | | 6.50%, 2/15/12 | | | 5,217,510 |

| | | | Duke Realty Corp, L.P., | | | |

| | 6,000 | | 6.80%, 2/12/09 | | | 6,129,108 |

| | | | ERP Operating Limited Partnership, | | | |

| | 5,000 | | 6.625%, 3/15/12 | | | 5,195,255 |

| | | | Firstar Bank, N.A., | | | |

| | 7,000 | | 7.125%, 12/01/09 | | | 7,278,138 |

| | | | | | |

Principal

Amount

(000)

| | Description

| | Value

(Note 1)

|

| | | | | |

| | | | Financial (Continued) | | | |

| | | | General Electric Capital Corporation, | | | |

| $ | 7,565 | | 8.625%, 6/15/08 | | $ | 7,769,520 |

| | | | Household Finance Corp., | | | |

| | 10,000 | | 8.00%, 7/15/10 | | | 10,687,600 |

| | | | JPMorgan Chase & Co., | | | |

| | 10,000 | | 7.875%, 6/15/10 | | | 10,650,040 |

| | | | Mack-Cali Realty L.P., | | | |

| | 7,000 | | 7.75%, 2/15/11 | | | 7,453,411 |

| | | | Merrill Lynch & Co., | | | |

| | 5,000 | | 6.50%, 7/15/18 | | | 5,229,330 |

| | 5,000 | | 6.875%, 11/15/18 | | | 5,337,420 |

| | | | NationsBank Capital Trust IV, | | | |

| | 10,000 | | 8.25%, 4/15/27 | | | 10,403,230 |

| | | | PNC Funding Corp., | | | |

| | 6,000 | | 7.50%, 11/01/09 | | | 6,273,216 |

| | | | Simon Property Group, L.P., | | | |

| | 5,000 | | 7.125%, 2/09/09 | | | 5,117,620 |

| | 5,000 | | 7.00%, 7/15/09 | | | 5,141,375 |

| | | | Verizon Global Funding Corp., | | | |

| | 7,500 | | 7.375%, 9/01/12 | | | 8,086,500 |

| | | | | |

|

|

| | | | | | | 122,454,367 |

| | | | | |

|

|

| | |

| | | | Industrial—22.0% | | | |

| | | | Dow Chemical Company, | | | |

| | 7,000 | | 9.00%, 4/01/21 | | | 8,377,201 |

| | | | Sun Company, Inc., | | | |

| | 5,000 | | 9.00%, 11/01/24 | | | 6,223,965 |

| | | | Tele-Communications, Inc., | | | |

| | 5,275 | | 10.125%, 4/15/22 | | | 6,872,523 |

| | 3,200 | | 9.875%, 6/15/22 | | | 4,115,872 |

| | | | Time Warner Entertainment Company, L.P., | | | |

| | 5,000 | | 8.875%, 10/01/12 | | | 5,657,655 |

| | | | Time Warner, Inc., | | | |

| | 5,000 | | 9.15%, 2/01/23 | | | 6,058,690 |

| | | | Trans-Canada Pipelines Limited, | | | |

| | 10,000 | | 9.875%, 1/01/21 | | | 13,183,920 |

| | | | Union Pacific Corp., | | | |

| | 7,000 | | 7.375%, 9/15/09 | | | 7,308,301 |

See Notes to Financial Statements.

5

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Portfolio of Investments—(Continued)

June 30, 2007

(Unaudited)

| | | | | | |

Principal

Amount

(000)

| | Description

| | Value

(Note 1)

|

| | | | | |

| | | | Industrial (Continued) | | | |

| | | | USX Corporation, | | | |

| $ | 10,000 | | 9.125%, 1/15/13 | | $ | 11,653,710 |

| | | | | |

|

|

| | | | | | | 69,451,837 |

| | | | | |

|

|

| | | | Retail—1.6% | | | |

| | | | Wal-Mart Stores, Inc., | | | |

| | 5,000 | | 6.875%, 8/10/09 | | | 5,158,835 |

| | | | | |

|

|

| | |

| | | | Telephone—18.4% | | | |

| | | | British Telecommunications PLC, | | | |

| | 7,000 | | 8.625%, 12/15/10 | | | 7,655,102 |

| | | | Deutsche Telekom International Finance, | | | |

| | 12,000 | | 8.00%, 6/15/10 | | | 12,798,684 |

| | | | France Telecom SA, | | | |

| | 5,000 | | 7.75%, 3/01/11 | | | 5,346,125 |

| | | | Koninklijke (Royal) KPN NV, | | | |

| | 5,000 | | 8.00%, 10/01/10 | | | 5,355,190 |

| | | | New Cingular Wireless Services Inc., | | | |

| | 9,000 | | 8.125%, 5/01/12 | | | 9,905,832 |

| | | | New York Telephone Co., | | | |

| | 5,000 | | 8.625%, 11/15/10 | | | 5,390,725 |

| | | | Sprint Corp., | | | |

| | 10,125 | | 9.25%, 4/15/22 | | | 11,674,894 |

| | | | | |

|

|

| | | | | | | 58,126,552 |

| | | | | |

|

|

| | |

| | | | Utilities-Electric—51.4% | | | |

| | | | AGL Capital Corp., | | | |

| | 10,000 | | 7.125%, 1/14/11 | | | 10,456,580 |

| | | | Alabama Power Co., | | | |

| | 2,750 | | 7.125%, 10/01/07 | | | 2,759,576 |

| | | | CalEnergy Company, Inc., | | | |

| | 10,000 | | 8.48%, 9/15/28 | | | 12,382,520 |

| | | | CenterPoint Energy Resources Corp., | | | |

| | 10,000 | | 7.75%, 2/15/11 | | | 10,674,780 |

| | | | ComEd Financing II, | | | |

| | 17,438 | | 8.50%, 1/15/27 | | | 18,119,181 |

| | | | Dominion Resources, Inc., | | | |

| | 10,000 | | 8.125%, 6/15/10 | | | 10,775,020 |

| | | | | | |

Principal

Amount

(000)

| | Description

| | Value

(Note 1)

|

| | | | | |

| | | | Utilities-Electric (Continued) | | | |

| | | | Duke Energy Corporation, | | | |

| $ | 10,000 | | 7.375%, 3/01/10 | | $ | 10,464,410 |

| | | | Hydro-Quebec, | | | |

| | 10,000 | | 7.50%, 4/01/16 | | | 11,342,060 |

| | | | Illinois Power Co., | | | |

| | 8,485 | | 7.50%, 6/15/09 | | | 8,658,060 |

| | | | KeySpan Gas East Corporation, | | | |

| | 10,088 | | 7.875%, 2/01/10 | | | 10,657,740 |

| | | | NSTAR, | | | |

| | 5,020 | | 8.00%, 2/15/10 | | | 5,324,950 |

| | | | Progress Energy, Inc., | | | |

| | 6,000 | | 7.10%, 3/01/11 | | | 6,292,182 |

| | | | PSE&G Power, LLC, | | | |

| | 5,000 | | 7.75%, 4/15/11 | | | 5,342,450 |

| | | | Sempra Energy, | | | |

| | 10,000 | | 7.95%, 3/01/10 | | | 10,579,370 |

| | | | Southern California Edison Company, | | | |

| | 5,512 | | 7.625%, 1/15/10 | | | 5,782,402 |

| | | | South Carolina Electric & Gas Co., | | | |

| | 6,000 | | 6.125%, 3/01/09 | | | 6,059,454 |

| | | | Wisconsin Energy Corp., | | | |

| | 6,000 | | 6.50%, 4/01/11 | | | 6,180,258 |

| | | | Xcel Energy, Inc., | | | |

| | 10,131 | | 7.00%, 12/01/10 | | | 10,572,478 |

| | | | | |

|

|

| | | | | | | 162,423,471 |

| | | | | |

|

|

| | | | Total Corporate Bonds

(Cost $426,341,597) | | | 427,941,122 |

| | | | | |

|

|

| |

| | | | Asset-Backed Securities—1.7% |

| | | | Detroit Edison Securitization Funding LLC 2001-1 A6, | | | |

| | 5,000 | | 6.62%, 3/01/16 | | | 5,297,605 |

| | | | | |

|

|

| | | | Total Asset-Backed Securities

(Cost $5,925,000) | | | 5,297,605 |

| | | | | |

|

|

See Notes to Financial Statements.

6

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Portfolio of Investments—(Continued)

June 30, 2007

(Unaudited)

| | | | | |

| | |

Shares

| | Description

| | Value

(Note 1)

|

| | | | | |

| | | Non-Convertible Preferred Stock—4.5% |

| | | Financial—4.5% | | | |

| | | Duke Realty Corp., Series M, | | | |

| 100,000 | | 6.95% | | $ | 2,525,000 |

| | | Duke Realty Corp., Series N, | | | |

| 100,000 | | 7.25% | | | 2,553,000 |

| | | Public Storage, Inc., Series I, | | | |

| 120,000 | | 7.25% | | | 3,066,000 |

| | | Realty Income Corp., Series D, | | | |

| 100,000 | | 7.375% | | | 2,545,000 |

| | | UDR, Inc., Series G, | | | |

| 100,000 | | 6.75% | | | 2,463,000 |

| | | Vornado Realty Trust I, Series I, | | | |

| 50,000 | | 6.625% | | | 1,190,000 |

| | | | |

|

|

| | | Total Non-Convertible Preferred Stock

(Cost $14,213,000) | | | 14,342,000 |

| | | | |

|

|

| | | Total Long-Term Investments

(Cost $493,586,858) | | | 490,270,431 |

| | | | |

|

|

| | | | | | | |

Principal

Amount

(000)

| | Description

| | Value

(Note 1)

| |

| | | | | | | | |

| | | | SHORT-TERM INVESTMENTS—0.6% | |

| | | | U.S. Treasury Bills, | | | | |

| $ | 1,800 | | 4.125%, 7/26/07

(Cost $1,794,200) | | $ | 1,794,200 | |

| | | | | |

|

|

|

| | | | Total Investments—155.8%

(Cost $495,381,058) | | | 492,064,631 | |

| | | | Other Assets in Excess of Liabilities—4.4% | | | 13,804,533 | |

| | | | Liquidation Value of Preferred

Shares—(60.2)% | | | (190,000,000 | ) |

| | | | | |

|

|

|

| | | | Net Assets Applicable to Common Stock—100% | | $ | 315,869,164 | |

| | | | | |

|

|

|

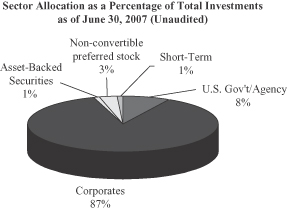

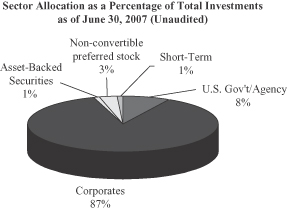

Summary of Ratings as a Percentage of Long-term Investments

as of June 30, 2007 (Unaudited)

| | |

Rating *

| | %

|

AAA | | 11.4 |

AA | | 6.9 |

A | | 33.3 |

BBB | | 44.7 |

B | | 3.7 |

| | |

|

| | | 100.0 |

| * | Based on the lowest rating of Standard & Poor’s Ratings Services or Moody’s Investors Service, Inc. |

See Notes to Financial Statements.

7

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Statement of Assets and Liabilities

June 30, 2007

(Unaudited)

| | | | |

Assets | | | | |

Investments, at value (cost $495,381,058) | | $ | 492,064,631 | |

Cash | | | 10,401,402 | |

Interest receivable | | | 9,211,112 | |

Dividends receivable | | | 36,068 | |

Other assets (Note 7) | | | 285,571 | |

| | |

|

|

|

Total assets | | | 511,998,784 | |

| | |

|

|

|

Liabilities | | | | |

Payable for securities purchased | | | 5,420,908 | |

Deferred compensation payable (Note 7) | | | 280,977 | |

Investment advisory fee payable (Note 2) | | | 249,263 | |

Dividends payable on Auction Market Preferred Shares | | | 85,011 | |

Administrative fee payable (Note 2) | | | 46,665 | |

Accrued expenses | | | 46,796 | |

| | |

|

|

|

Total liabilities | | | 6,129,620 | |

| | |

|

|

|

Auction Market Preferred Shares, 7,600 shares issued and outstanding, liquidation preference $25,000 per share (Note 6) | | | 190,000,000 | |

| | |

|

|

|

Net Assets Applicable to Common Stock | | $ | 315,869,164 | |

| | |

|

|

|

Capital | | | | |

Common stock, $.01 par value, 599,992,400 shares authorized, 27,076,161 shares issued and outstanding (Note 5) | | $ | 270,762 | |

Additional paid-in capital | | | 367,528,906 | |

Distributions in excess of net investment income | | | (21,810,911 | ) |

Accumulated net realized loss on investment transactions | | | (26,803,166 | ) |

Net unrealized depreciation on investments | | | (3,316,427 | ) |

| | |

|

|

|

Net Assets Applicable to Common Stock | | $ | 315,869,164 | |

| | |

|

|

|

Net asset value per share of common stock: ($315,869,164 ÷ 27,076,161 shares of common stock issued and outstanding) | | $ | 11.67 | |

| | |

|

|

|

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Statement of Operations

For the Six Months Ended June 30, 2007

(Unaudited)

| | | | |

Investment Income | | | | |

Interest income | | | $14,549,074 | |

Dividend income | | | 419,844 | |

| | |

|

|

|

Total Investment income | | | 14,968,918 | |

| | |

|

|

|

Expenses | | | | |

Investment advisory fees (Note 2) | | | 1,268,307 | |

Administrative fees (Note 2) | | | 239,166 | |

Commissions expense-Auction Market Preferred Shares (Note 6) | | | 238,914 | |

Directors’ fees and expenses | | | 113,310 | |

Professional fees | | | 61,899 | |

Reports to shareholders | | | 49,666 | |

Custodian fees and expenses | | | 25,836 | |

Transfer agent fees and expenses | | | 24,424 | |

Registration fees | | | 11,863 | |

Other | | | 44,623 | |

| | |

|

|

|

Total expenses | | | 2,078,008 | |

| | |

|

|

|

Net investment income | | | 12,890,910 | |

| | |

|

|

|

Realized and Unrealized Gain/(Loss) on Investments | | | | |

Net realized gain on investment transactions | | | 1,920,639 | |

Net change in unrealized appreciation/depreciation on investments | | | (7,544,334) | |

| | |

|

|

|

Net realized and unrealized loss on investments | | | (5,623,695 | ) |

| | |

|

|

|

Dividends and Distributions On Auction Market Preferred Shares from net investment income | | | (4,914,583 | ) |

| | |

|

|

|

Net Increase in Net Assets Applicable to Common Stock Resulting from Operations | | $ | 2,352,632 | |

| | |

|

|

|

See Notes to Financial Statements.

8

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Statements of Changes In Net Assets

| | | | | | |

| | | For the Six

Months Ended

June 30, 2007

(Unaudited)

| | For the

Year Ended

December 31,

2006

| |

Operations | | | | | | |

Net investment income | | $12,890,910 | | $ | 19,217,797 | |

Net realized gain/(loss) on investment transactions | | 1,920,639 | | | (2,925,199 | ) |

Net change in unrealized appreciation/depreciation on investments | | (7,544,334) | | | (4,044,896 | ) |

Dividends and distributions on Auction Market Preferred Shares from net investment income | | (4,914,583) | | | (1,853,221 | ) |

| | |

| |

|

|

|

Net increase in net assets resulting from operations | | 2,352,632 | | | 10,394,481 | |

| | |

| |

|

|

|

Dividends and Distributions on Common Stock | | | | | | |

From and in excess of net investment income | | (10,559,713) | | | (22,735,261 | ) |

| | |

| |

|

|

|

Capital Stock Transactions | | | | | | |

Reinvestment of dividends resulting in the issuance of 0 shares and 50,658 shares of common stock, respectively | | — | | | 644,890 | |

Offering costs-Auction Market Preferred Shares | | 20,620 | | | (2,200,000 | ) |

| | |

| |

|

|

|

Net increase/(decrease) in net assets resulting from capital stock transactions | | 20,620 | | | (1,555,110 | ) |

| | |

| |

|

|

|

Total decrease in net assets | | (8,186,461) | | | (13,895,890 | ) |

Net Assets Applicable to Common Stock | | | | | | |

Beginning of period | | 324,055,625 | | | 337,951,515 | |

| | |

| |

|

|

|

End of period (a) | | $315,869,164 | | $ | 324,055,625 | |

| | |

| |

|

|

|

(a) includes distributions in excess of net investment income of | | $(21,810,911) | | $ | (19,227,525 | ) |

| | |

| |

|

|

|

See Notes to Financial Statements.

9

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

PER SHARE OPERATING PERFORMANCE | | For the

Six Months

Ended

June 30, 2007

(Unaudited)

| | | For the Year Ended December 31,

| |

| | | 2006

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| |

Net asset value, beginning of year | | $ | 11.97 | | | $ | 12.50 | | | $ | 13.51 | | | $ | 13.85 | | | $ | 13.03 | | | $ | 13.23 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net investment income (1) | | | 0.48 | | | | 0.71 | | | | 0.73 | | | | 0.86 | | | | 0.93 | | | | 0.99 | |

Net realized and unrealized gain/(loss) on investments transactions | | | (0.21 | ) | | | (0.25 | ) | | | (0.72 | ) | | | (0.18 | ) | | | 0.91 | | | | (0.17 | ) |

Dividends and distributions on Auction Market Preferred Shares from net investment income | | | (0.18 | ) | | | (0.07 | ) | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net increase from investment operations | | | 0.09 | | | | 0.39 | | | | 0.01 | | | | 0.68 | | | | 1.84 | | | | 0.82 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Dividends and distributions on common stock from and in excess of net investment income | | | (0.39 | ) | | | (0.84 | ) | | | (1.02 | ) | | | (1.02 | ) | | | (1.02 | ) | | | (1.02 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Offering costs-Auction Market Preferred Shares | | | — | | | | (0.08 | ) | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net asset value, end of period | | $ | 11.67 | | | $ | 11.97 | | | $ | 12.50 | | | $ | 13.51 | | | $ | 13.85 | | | $ | 13.03 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Per share market value, end of period | | $ | 11.05 | | | $ | 11.62 | | | $ | 13.10 | | | $ | 14.69 | | | $ | 14.99 | | | $ | 13.16 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

TOTAL INVESTMENT RETURN ON COMMON STOCK (2) | | | (1.63 | )% | | | (4.82 | )% | | | (3.84 | )% | | | 5.55 | % | | | 22.64 | % | | | 7.91 | % |

RATIOS TO AVERAGE NET ASSETS APPLICABLE TO COMMON STOCK (3) | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.30 | %(6) | | | 2.98 | % | | | 2.55 | % | | | 1.78 | % | | | 1.79 | % | | | 2.16 | % |

Operating expenses (4) | | | 1.30 | %(6) | | | 1.12 | % | | | 1.05 | % | | | 1.06 | % | | | 1.08 | % | | | 1.04 | % |

Net investment income (5) | | | 8.09 | %(6) | | | 5.87 | % | | | 5.64 | % | | | 6.34 | % | | | 6.81 | % | | | 7.84 | % |

SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover | | | 10 | % | | | 15 | % | | | 15 | % | | | 17 | % | | | 10 | % | | | 27 | % |

Net assets applicable to common stock, end of period (000) | | $ | 315,869 | | | $ | 324,056 | | | $ | 337,952 | | | $ | 362,600 | | | $ | 369,624 | | | $ | 345,131 | |

Preferred stock outstanding (000) | | $ | 190,000 | | | $ | 190,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Asset coverage per share of preferred stock, end of the period | | $ | 66,652 | | | $ | 67,639 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

COMMERCIAL PAPER INFORMATION | | | | | | | | | | | | | | | | | | | | | | | | |

Aggregate amount outstanding at end of period (000) | | $ | — | | | $ | — | | | $ | 143,000 | | | $ | 143,000 | | | $ | 143,000 | | | $ | 140,500 | |

Average daily amortized cost of commercial paper outstanding (000) | | $ | — | | | $ | — | | | $ | 142,295 | | | $ | 142,557 | | | $ | 142,115 | | | $ | 141,657 | |

Asset coverage per $1,000 at end of period | | $ | — | | | $ | — | | | $ | 3,363 | | | $ | 3,537 | | | $ | 3,585 | | | $ | 3,455 | |

| (1) | Based on average shares outstanding. |

| (2) | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each year reported. Dividends and distributions are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Brokerage commissions are not reflected. |

| (3) | As a percentage of average weekly net assets which includes any liabilities or senior securities constituting indebtedness in connection with financial leverage. |

| (4) | Ratio from 2002 through 2006 excluded interest and other commercial paper expenses. Commercial paper program was terminated on October 25, 2006. Ratio at June 30, 2007 includes Commissions expense-Auction Market Preferred Shares. |

| (5) | Ratios do not reflect dividends paid on preferred stock. Accordingly, the ratio of net investment income after preferred stock dividends to average net assets to common stock is 5.00%, 5.31%, 5.64%, 6.34%, 6.81% and 7.84%, respectively. |

See Notes to Financial Statements.

10

DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC.

Notes to Financial Statements

June 30, 2007

(Unaudited)

Duff & Phelps Utility and Corporate Bond Trust Inc. (the “Fund”) was incorporated in Maryland on November 23, 1992 as a diversified, closed-end management investment company with operations commencing on January 29, 1993.

The Fund’s investment objective is to seek high current income consistent with investing in securities of investment-grade quality. The Fund seeks to achieve its investment objective by investing substantially all of its assets in a diversified portfolio of Utility Income Securities, Corporate Income Securities, Mortgage-Backed Securities and Asset-Backed Securities. The ability of the issuers of the securities held by the Fund to meet their obligations may be affected by economic developments in a specific state, industry or region.

Note 1. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuation: The Fund values its fixed income securities by using market quotations, prices provided by market makers or estimates of market values obtained from yield data relating to instruments or securities with similar characteristics in accordance with procedures established by the Board of Directors of the Fund. The relative liquidity of some securities in the Fund’s portfolio may adversely affect the ability of the Fund to accurately value such securities. Any securities or other assets for which such current market quotations are not readily available are valued at fair value as determined in good faith under procedures established by and under the general supervision and responsibility of the Fund’s Board of Directors.

Debt securities having a remaining maturity of 60 days or less when purchased and debt securities originally purchased with maturities in excess of 60 days but which currently have maturities of 60 days or less are valued at cost adjusted for amortization of premiums and accretion of discounts, which approximates market value.

Investments in mutual funds are valued at their net asset value as of the close of the New York Stock Exchange on the date of valuation.

Securities Transactions and Investment Income: Securities transactions are recorded on the trade date. Realized gains and losses on sales of securities are calculated on the identified cost basis. Interest income is recorded on the accrual basis. The Fund amortizes premiums and accretes discounts on securities using the effective interest method.

Federal Income Taxes: It is the Fund’s intention to meet the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute sufficient net income and capital gains to shareholders to qualify as a regulated investment company. Therefore, no provision for federal income or excise tax is required.

Dividends and Distributions: The Fund will declare and pay dividends on its common stock monthly from net investment income. Net long-term capital gains, if any, in excess of loss carryforwards are expected to be distributed annually. The Fund will make a determination at the end of its fiscal year as to whether to retain or distribute such gains. Dividends and distributions are recorded on the ex-dividend date. Dividends and distributions on preferred shares are accrued on a daily basis and are determined as described in Note 6.

Income distributions and capital gain distributions are determined in accordance with income tax regulations which may differ from investment income and capital gains recorded in accordance with U.S. generally accepted accounting principles.

11

Recent Accounting Pronouncements: Effective June 29, 2007, the Fund adopted FASB Interpretation No. 48 (“FIN 48”) “Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109.” FIN 48 prescribes the minimum recognition threshold a tax position must meet in connection with accounting for uncertainties in income tax positions taken or expected to be taken by an entity, including mutual funds, before being measured and recognized in the financial statements. Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements.

In addition, in September 2006, Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“SFAS 157”), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. The Fund will adopt SFAS 157 during the fiscal year ending December 31, 2008. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund’s financial statement disclosures.

Use of Estimates: The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Note 2. Agreements

The Fund has an Advisory Agreement with Duff & Phelps Investment Management Co. (the “Adviser”), a subsidiary of Phoenix Investment Partners, Ltd. (“Phoenix” or “PXP”), and an Administration Agreement with Princeton Administrators, LLC (“Princeton”).

The investment advisory fee paid to the Adviser is computed weekly and payable monthly at an annual rate of 0.50% of the Fund’s average weekly managed assets, which is defined as the average weekly value of the total assets of the Fund minus the sum of all accrued liabilities of the Fund (other than the aggregate amount of any outstanding borrowings or other indebtedness constituting financial leverage).

The administration fee paid to Princeton is computed weekly and payable monthly at an annual rate of 0.15% of the Fund’s average weekly net assets, which is defined as the average weekly value of the total assets of the Fund minus the sum of all accrued liabilities of the Fund (including the aggregate amount of any outstanding borrowings or other indebtedness constituting financial leverage), subject to a monthly minimum of $12,500.

Pursuant to the Advisory Agreement, the Adviser provides continuous supervision of the investment portfolio and pays the compensation of officers of the Fund who are affiliated persons of the Adviser. Pursuant to the Administration Agreement, Princeton provides administration services that include oversight of the Fund’s books and records and preparation of financial statements and other regulatory filings. The Fund bears all other costs and expenses.

Note 3. Portfolio Securities

Purchases and sales of investment securities, other than U.S. Government securities and short-term investments, for the six months ended June 30, 2007 aggregated $47,403,557 and $46,901,290, respectively.

The United States federal income tax basis of the Fund’s investments and the net unrealized depreciation as of June 30, 2007 was as follows:

| | | | | | | | | |

Tax Basis of

Investments

| | Appreciation

| | Depreciation

| | Net

Unrealized Depreciation

|

$517,498,661 | | $ | 4,115,464 | | $ | 29,549,494 | | $ | 25,434,030 |

12

Note 4. Distributions to Stockholders

The tax character of distributions to be paid for the year ending December 31, 2007 will be determined at the end of the current fiscal year. The tax character of distributions paid during the fiscal year ended December 31, 2006 was as follows:

| | | |

| | | 12/31/2006

|

| |

Distributions paid from: | | | |

Ordinary income | | $ | 24,588,482 |

| | |

|

|

Total taxable distributions* | | $ | 24,588,482 |

| | |

|

|

| * | The distributions presented above include distributions payable to preferred shareholders at December 31, 2006. |

As of December 31, 2006, the components of accumulated earnings on a tax basis were as follows:

| | | | |

Undistributed ordinary income-net | | $ | 2,168,553 | |

Undistributed long-term capital gains—net | | | 0 | |

| | |

|

|

|

Total undistributed earnings | | | 2,168,553 | |

Capital loss carryforward | | | (28,723,805 | )* |

Unrealized gains/(losses)—net | | | (17,168,171 | )** |

| | |

|

|

|

Total accumulated earnings/(losses) | | $ | (43,723,423 | ) |

| | |

|

|

|

| * | On December 31, 2006, the Fund had a net capital loss carryforward of $28,723,805 of which $17,513,106 expires in 2011, $3,731,126 expires in 2012, $3,265,594 expires in 2013 and $4,213,979 expires in 2014. This amount will be available to offset like amounts of any future taxable gains. |

| ** | The difference between book-basis and tax-basis unrealized gains / (losses) is attributable primarily to the difference between book and tax amortization methods for premiums and discounts on fixed income securities. The above amount also includes book-to-tax temporary differences, which primarily consists of deferred expenses related to the directors deferred compensation plan. |

Note 5. Capital

There are 600 million shares of stock, $0.01 par value per share, authorized. For the six months ended June 30, 2007 and the year ended December 31, 2006, the Fund issued 0 and 50,658 shares of common stock, respectively, in connection with the reinvestment of dividends.

Note 6. Auction Market Preferred Shares

The Fund’s Charter grants the authority to the Board of Directors to authorize the creation and issuance of one or more series of preferred stock out of the authorized and unissued stock of the Fund. Accordingly, on October 25, 2006, the Fund issued 7,600 shares of Auction Market Preferred Shares (“AMPS”) in two series of 3,800 shares each at a public offering price of $25,000 per share. The underwriting discount and other offering costs incurred in connection with the issuance of the AMPS were recorded as a reduction of paid-in capital on common stock. Dividends on shares of AMPS are cumulative from their date of original issue and payable on each dividend payment date. Dividend rates ranged from 4.95% to 5.35% for the six months ended June 30, 2007.

Under the Investment Company Act of 1940, the Fund may not declare dividends or make other distributions on shares of common stock or purchase any such shares if, at the time of the declaration, distribution or purchase, asset coverage with respect to the outstanding preferred stock would be less than 200%.

The AMPS are redeemable at the option of the Fund, in whole or in part, on any dividend payment date at $25,000 per share plus any accumulated or unpaid dividends, whether or not declared. The AMPS are also subject to a mandatory redemption at $25,000 per share plus any accumulated or unpaid dividends, whether or not declared, if certain requirements relating to the composition of the assets and liabilities of the Fund as set forth in the Fund’s Charter are not satisfied.

13

The holders of AMPS have voting rights equal to the holders of common stock (one vote per share) and will vote together with holders of common stock as a single class. However, holders of AMPS, voting separately as a class, are also entitled to elect two of the Fund’s directors. In addition, the Investment Company Act of 1940 requires that along with any approval by shareholders that might otherwise be required, the approval of the holders of a majority of any outstanding shares of preferred stock, voting separately as a class, would be required to (a) adopt any plan of reorganization that would adversely affect the preferred stock, and (b) take certain actions requiring a vote of security holders, including, among other things, changes in the Fund’s subclassification as a closed-end investment company or changes in its fundamental investment restrictions.

Note 7. Deferred Compensation Plan

Effective on January 1, 2000, the Fund established a deferred compensation program for its independent directors. Any director who was not an “interested person” of the Fund and who elected to participate in the program (a “participating director”) was eligible to defer receipt of all or a portion of his or her compensation from the Fund. Any amounts deferred by a participating director were credited to a deferred compensation ledger account (a “deferral account”) established for such director. From January 1, 2000 through December 31, 2004, the deferred compensation program was administered by the Fund’s transfer agent on behalf of the Fund, and all amounts credited to each participating director’s deferral account were deemed to be invested in common stock of the Fund. Participating directors do not have an ownership interest in those shares. Contributions to the deferral account and increases in value of the measuring shares caused the account balance to increase accordingly, while withdrawals from the deferral account and decreases in value of the measuring shares caused the account balance to decrease accordingly. When a participating director retires, the director may elect to receive payments under the plan in a lump sum or in equal installments over a period of up to ten years. If a participating director dies, any amount payable under the plan will be paid to the director’s beneficiaries. Effective on January 1, 2005, administration of new contributions under the deferred compensation program was transferred to Fidelity Investments, which administers similar programs for other investment companies advised by affiliates of Phoenix. The Fidelity Investments program gave participating directors the ability to allocate amounts in their deferral accounts among various investment options, one of which was common stock of the Fund. Although the acceptance of new contributions under the Fund’s deferred compensation program was discontinued, effective on December 31, 2006, the obligation to make payouts to directors with respect to compensation deferred between January 1, 2000 and December 31, 2006 remains a general obligation of the Fund. For this reason, the Fund’s Statement of Assets and Liabilities at June 30, 2007 includes “Deferred compensation payable” in the amount of $280,977, and the $280,977 in deferred compensation investments that support that obligation are included in “Other assets.”

Note 8. Indemnifications

Under the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that provide general indemnifications to other parties. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

Note 9. Other Matters

In June 2002, the Fund held certain securities issued by WorldCom Inc. (“WorldCom”) that declined in value after WorldCom announced that it

14

would restate its financial results and then filed for bankruptcy protection in July 2002. Several class action lawsuits were filed on behalf of investors in response to the WorldCom bankruptcy, in addition to litigation initiated by the SEC. Subsequent to the Fund’s fiscal year end, the Adviser discovered that clerical errors had been made while processing claims for the class action and SEC litigation settlements involving WorldCom. The Adviser has informed the Fund that the monies to which the Fund would have been entitled from the WorldCom settlements may be as much as $6.685 million. During 2007, the Fund submitted a claim to participate in the WorldCom class action settlement. The Fund intends to pursue this and other means, including any applicable insurance coverage and/or payments from its service providers, to recoup all of the monies to which it would have been entitled from the WorldCom settlements, including appropriate payment for related costs to the Fund. While management expects that the amounts collected from the WorldCom settlements and other sources will serve to increase the Fund’s net asset value, it is unable to reasonably estimate the total amounts the Fund will receive or when it is likely to receive them. Accordingly, the Fund’s financial statements do not reflect any adjustments for such amounts.

Note 10. Subsequent Events

Subsequent to June 30, 2007, dividends declared and paid on preferred stock totaled $1,147,334 through August 10, 2007. On July 2, 2007, the Board of Directors of the Fund declared a dividend of $0.065 per share of common stock payable on July 31, 2007 to shareholders of record on July 16, 2007. On August 1, 2007 the Board of Directors of the Fund declared a dividend of $0.065 per share of common stock payable on August 31, 2007 to shareholders of record on August 15, 2007.

15

REPORT ON ANNUAL MEETING OF SHAREHOLDERS (Unaudited)

The Annual Meeting of Shareholders of the Fund was held on May 10, 2007. The description of each matter voted upon and number of shares voted were as follows:

| | | | |

| | | Shares Voted

For

| | Shares Withheld

|

1. To elect four directors to serve until the Annual Meeting in the year indicated below or until their successors are duly elected and qualified: | | | | |

Philip R. McLoughlin (2010) | | 19,133,465 | | 186,262 |

Eileen A. Moran (2010) | | 19,169,477 | | 150,250 |

Nathan I. Partain (2010) | | 19,161,608 | | 158,119 |

Carl F. Pollard (2008)* | | 367 | | 80 |

| * | Elected by the holders of the Fund’s preferred stock voting as a separate class. |

Directors whose term of office continued beyond this meeting are as follows: Francis E. Jeffries, Nancy Lampton, Geraldine M. McNamara and David J. Vitale.

ADDITIONAL INFORMATION (Unaudited)

Notice is hereby given in accordance with Section 23(c) of the 1940 Act that the Fund may from time to time purchase its shares of common stock in the open market.

PROXY VOTING POLICY AND PROCEDURES (Unaudited)

Although the Fund does not typically hold voting securities, the Fund’s Board of Directors has adopted proxy voting procedures whereby Duff & Phelps Investment Management Co., the Fund’s investment adviser (the “Adviser”), would review any proxy solicitation materials on a case-by-case basis and would vote any such securities in accordance with the Adviser’s good faith belief as to the best interests of the Fund and its shareholders. These proxy voting procedures may be changed at any time or from time to time by the Fund’s Board of Directors. A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 are available without charge, upon request, by calling the Adviser toll-free at (800) 338-8214 and on the Securities Exchange Commission’s (“SEC”) website at http://www.sec.gov.

AVAILABILITY OF QUARTERLY PORTFOLIO OF INVESTMENTS (Unaudited)

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (202) 551-8090. The Fund’s Form N-Q is also available, without charge, upon request, by calling the Adviser toll-free at (800) 338-8214.

16

DIVIDEND REINVESTMENT AND CASH PURCHASE PLAN (Unaudited)

Common shareholders are automatically enrolled in the Fund’s Dividend Reinvestment and Cash Purchase Plan (the “Plan”). Under the Plan, all distributions to common shareholders of dividends and capital gains will automatically be reinvested by The Bank of New York (the “Plan Agent”) in additional shares of common stock of the Fund unless an election is made to receive distributions in cash. Shareholders who elect not to participate in the Plan will receive all distributions in cash via direct deposit or paid by check in U.S. dollars mailed directly to the shareholder of record (or if the shares are held in street or other nominee name, then to the nominee) by the Plan Agent.

The Plan Agent serves as agent for the common shareholders in administering the Plan. After the Fund declares a dividend or determines to make a capital gains distribution, if (1) the market price of shares on the valuation date equals or exceeds the net asset value of these shares, the Fund will issue new shares at net asset value, provided that the Fund will not issue new shares at a discount of more than 5% from the then current market price; or if (2) the market price is lower than the net asset value, or if dividends or capital gains distributions are declared and payable only in cash, then the Plan Agent will, as agent for the participants, receive the cash payment and use it to buy shares of common stock in the open market, on the New York Stock Exchange or elsewhere, for the participants’ accounts. If, before the Plan Agent has completed its purchases, the market price exceeds the net asset value per share of the common stock, the average per share purchase price paid by the Plan Agent may exceed the net asset value of the Fund’s common stock, resulting in the acquisition of fewer shares of common stock than if the dividend or distribution had been paid in common stock issued by the Fund. As described below, the Plan was amended, effective December 1, 1999, whereby the Fund will issue new shares in circumstances in which it will be beneficial to plan participants.

The Plan Agent’s fees for the handling of the reinvestment of dividends and distributions will be paid by the Fund. However, each participant will pay a pro rata share of brokerage commissions (or equivalent purchase costs) incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of dividends and distributions and with voluntary additional share investments. There are no other charges to participants for reinvesting dividends or capital gains distributions, except for certain brokerage commissions (or equivalent purchase costs) as described above.

The Plan also permits Plan participants to periodically purchase additional shares of common stock through the Plan by delivering to the Plan Agent a check for at least $100, but not more than $5,000 in any month. The Plan Agent will use the funds to purchase shares in the open market or in private transactions. The Fund will not issue any new shares in connection with voluntary additional share investments. Purchases made pursuant to the Plan will be made commencing at the time of the first dividend or distribution payment following the second business day after receipt of the funds for additional purchases, and may be aggregated with purchases of shares for reinvestment of the dividends and distributions. Shares will be allocated to the accounts of participants purchasing additional shares at the average price per share, plus a service charge imposed by the Plan Agent and brokerage commissions (or equivalent purchase costs) paid by the Plan Agent for all shares purchased by it, including for reinvestment of dividends and distributions. Checks drawn on a foreign bank are subject to collection and collection fees, and will be invested at the time of the next distribution after funds are collected by the Plan Agent.

The Plan Agent will make every effort to invest funds promptly, and in no event more than 30 days after the Plan Agent receives a dividend or distribution, except where postponement is deemed necessary to comply with applicable provisions of the federal securities laws.

17

Funds sent to the Plan Agent for voluntary additional share investment may be recalled by the participant by written notice received by the Plan Agent not later than two business days before the next distribution payment date. If for any reason a regular monthly distribution is not paid by the Fund, funds for voluntary additional share investment will be returned to the participant, unless the participant specifically directs that they continue to be held by the Plan Agent for subsequent investment.

Participants in the Plan may withdraw from the Plan upon written notice to the Plan Agent. When a participant withdraws from the Plan or upon termination of the Plan as provided below, certificates for whole shares credited to his or her account under the Plan will be issued and a cash payment will be made for any fraction of a share credited to such account. An election to withdraw from the Plan will, until such election is changed, be deemed to be an election by a common shareholder to take all subsequent dividends and distributions in cash. Elections will only be effective for dividends and distributions declared after, and with a record date of at least ten days after, such elections are received by the Plan Agent. There is no penalty for non-participation in or withdrawal from the Plan, and shareholders who have withdrawn from the Plan may rejoin it at any time. The Plan Agent imposes charges on participants for selling participants shares on termination of participation (currently a base fee of $5.00 plus $.04 per share). The Fund reserves the right to amend the Plan to institute a service charge to participants.

The Plan Agent maintains each shareholder’s account in the Plan and furnishes monthly written confirmations of all transactions in the accounts, including information needed by shareholders for personal and tax records. Shares in the account of each Plan participant will be held by the Plan Agent in non-certificated form in the name of the participant, and each shareholder’s proxy will include those shares purchased pursuant to the Plan.

Common shareholders whose common stock is held in the name of a broker or nominee should contact such broker or nominee to determine whether or how they may participate in the Plan.

In the case of shareholders, such as banks, brokers or nominees, that hold shares for others who are the beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares certified from time to time by the record shareholder as representing the total amount registered in the record shareholder’s name and held for the account of beneficial owners who are participants in the Plan.

The automatic reinvestment of dividends and distributions will not relieve participants of any federal income tax that may be payable or required to be withheld on such dividends or distributions.

The Fund reserves the right to amend or terminate the Plan as applied to any dividend or distribution paid subsequent to written notice of the change sent to all participants in the Plan at least 90 days before the record date for the dividend or distribution. The Plan may also be amended or terminated by the Plan Agent by at least 90 days’ written notice to all participants in the Plan. All questions concerning the Plan should be directed to the Plan Agent by calling (800) 524-4458.

18

Directors

Francis E. Jeffries, CFA, Chairman

Nancy Lampton, Vice Chairman

Philip R. McLoughlin

Geraldine M. McNamara

Eileen A. Moran

Nathan I. Partain, CFA

Carl F. Pollard

David J. Vitale

Officers

Nathan I. Partain, CFA

President & Chief Executive Officer

Daniel J. Petrisko, CFA

Vice President & Chief Investment Officer

T. Brooks Beittel, CFA

Secretary

Alan M. Meder, CFA

Treasurer & Assistant Secretary

Joyce B. Riegel,

Chief Compliance Officer

Investment Adviser

Duff & Phelps Investment Management Co.

55 East Monroe Street

Suite 3600

Chicago, IL 60603

(800) 338-8214

Administrator

Princeton Administrators, LLC

P.O. Box 9095

Princeton, NJ 08543-9095

Custodian and Transfer Agent

The Bank of New York

P.O. Box 11258

Church Street Station

New York, NY 10286

(800) 524-4458

Independent Registered Public Accounting Firm

Ernst & Young LLP

233 South Wacker Drive

Chicago, IL 60606

Legal Counsel

Mayer, Brown, Rowe & Maw LLP

71 South Wacker Drive

Chicago, IL 60606

This report is for stockholder information. This is not a prospectus intended for use in the purchase or sale of Fund shares. Information contained in this report is dated and subject to change. Past performance is no guarantee of future results.

Duff & Phelps

Utility and

Corporate

Bond Trust Inc.

SEMI-ANNUAL REPORT

JUNE 30, 2007

Not required as this is not an annual filing.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not required as this is not an annual filing.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not required as this is not an annual filing.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not required as this is not an annual filing.

| ITEM 6. | SCHEDULE OF INVESTMENTS |

Included as part of the report to shareholders filed under Item 1 of this Form.

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not required as this is not an annual filing.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not required as this is not an annual filing.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

During the period covered by this report, no purchases were made by or on behalf of the registrant or any “affiliated purchaser” (as defined in Rule 10b-18(a)(3) under the Securities Exchange Act of 1934 (the “Exchange Act”)) of shares or other units of any class of the registrant’s equity securities that is registered by the registrant pursuant to Section 12 of the Exchange Act.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

No changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors have been implemented after the registrant last provided disclosure in response to the requirements of Item 7(d)(2)(ii)(G) of Schedule 14A (i.e., in the registrant’s Proxy Statement dated April 12, 2007) or this Item.

| ITEM 11. | CONTROLS AND PROCEDURES. |

(a) The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “1940 Act”)) are effective, based on an evaluation of those controls and procedures made as of a date within 90 days of the filing date of this report as required by Rule 30a-3(b) under the 1940 Act and Rule 13a-15(b) under the Exchange Act.

(b) There has been no change in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the second fiscal quarter of the fiscal half-year covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

| | | | | | |

| | | (a) | | Exhibit 99.CERT | | Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| | | |

| | | (b) | | Exhibit 99.906CERT | | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| (Registrant) | | DUFF & PHELPS UTILITY AND CORPORATE BOND TRUST INC. |

| | |

| By (Signature and Title) | | /s/ Alan M. Meder | | |

| | Alan M. Meder | | |

| | Treasurer | | |

| | (Principal Financial and Accounting Officer) | | |

| | |

| Date | | September 4, 2007 | | |

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| | |

By (Signature and Title) | | /s/ Nathan I. Partain | | |

| | Nathan I. Partain | | |

| | President and Chief Executive Officer | | |

| | |

Date | | September 4, 2007 | | |

| | |

By (Signature and Title) | | /s/ Alan M. Meder | | |

| | Alan M. Meder | | |

| | Treasurer | | |

| | (Principal Financial and Accounting Officer) | | |

| | |

Date | | September 4, 2007 | | |