UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7362 |

|

Salomon Brothers Municipal Partners Fund Inc. |

(Exact name of registrant as specified in charter) |

|

125 Broad Street, New York, NY | | 10004 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq.

Salomon Brothers Asset Management Inc.

300 First Stamford Place

Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 725-6666 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2006 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

| | Salomon Brothers |

| | Municipal Partners |

| | Fund Inc. |

| | |

| | |

SEMI-ANNUAL | | |

REPORT | | |

| | |

JUNE 30, 2006 | | |

| | |

| | |

| | |

| | |

| | INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Salomon Brothers

Municipal Partners Fund Inc.

Semi-Annual Report • June 30, 2006

What’s Inside

Fund Objective

The Fund’s primary investment objective is to seek a high level of current income which is exempt from federal income taxes,* consistent with the preservation of capital.

* Certain investors may be subject to the Federal Alternative Minimum Tax, and state and local taxes may apply. Capital gains, if any, are fully taxable. Please consult your personal tax advisor.

Letter from the Chairman | I |

| |

Fund at a Glance | 1 |

| |

Schedule of Investments | 2 |

| |

Statement of Assets and Liabilities | 9 |

| |

Statement of Operations | 10 |

| |

Statements of Changes in Net Assets | 11 |

| |

Financial Highlights | 12 |

| |

Notes to Financial Statements | 13 |

| |

Board Approval of Management and Subadvisory Agreements | 19 |

| |

Additional Shareholder Information | 22 |

| |

Dividend Reinvestment Plan | 23 |

“Smith Barney”, “Salomon Brothers” and “Citi” are service marks of Citigroup, licensed for use by Legg Mason as the names of funds and investment managers. Legg Mason and its affiliates, as well as the Fund’s investment manager, are not affiliated with Citigroup.

Letter from the Chairman

R. JAY GERKEN, CFA

Chairman, President and Chief Executive Officer

Dear Shareholder,

The U.S. economy appeared to be on solid footing during the six-month reporting period. After gross domestic product (“GDP”)(i) rose 1.7% in the fourth quarter of 2005 — the first quarter in which GDP growth did not surpass 3.0% in nearly three years — the economy rebounded sharply in the first quarter of 2006. During this time, GDP rose 5.6%, its best showing since the third quarter of 2003. Both strong consumer and business spending prompted the economic turnaround. In the second quarter of 2006, GDP growth was a more modest 2.5%, according to the Commerce Department’s initial reading for the period. The decline was largely attributed to lower consumer spending, triggered by higher interest rates and oil prices, as well as a cooling housing market. In addition, business spending fell during the quarter.

The Federal Reserve Board (“Fed”)(ii) continued to raise interest rates during the reporting period. Despite the “changing of the guard” from Fed Chairman Alan Greenspan to Ben Bernanke in early 2006, it was “business as usual” for the Fed, as it raised short-term interest rates four times during the period. Since it began its tightening campaign in June 2004, the Fed has increased rates 17 consecutive times, bringing the federal funds rate(iii) from 1.00% to 5.25%. Coinciding with its latest rate hike in June 2006, the Fed said: “The extent and timing of any additional firming...will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.”

Both short- and long-term yields rose over the reporting period. During the six months ended June 30, 2006, two-year Treasury yields increased from 4.41% to 5.16%. Over the same period, 10-year Treasury yields moved from 4.39% to 5.15%. Short-term rates rose in concert with the Fed’s

Salomon Brothers Municipal Partners Fund Inc. I

repeated rate hikes, while long-term rates rose on fears of mounting inflationary pressures. Looking at the municipal market, yields of both 2- and 10-year securities also rose over the reporting period.

Performance Review

For the six months ended June 30, 2006, the Salomon Brothers Municipal Partners Fund Inc. returned –0.56%, based on its net asset value (“NAV”)(iv) and 1.59% based on its New York Stock Exchange (“NYSE”) market price per share. In comparison, the Fund’s unmanaged benchmark, the Lehman Brothers Municipal Bond Index(v), returned 0.28% for the same time frame. The Lipper General Municipal Debt (Leveraged) Closed-End Funds Category Average(vi) increased 0.48%. Please note that Lipper performance returns are based on each fund’s NAV per share.

During this six-month period, the Fund made distributions to common shareholders totaling $0.41 per share, (which may have included a return of capital). The performance table shows the Fund’s six-month total return based on its NAV and market price as of June 30, 2006. Past performance is no guarantee of future results.

Performance Snapshot as of June 30, 2006 (unaudited)

| Price Per Share | | Six-Month

Total Return | |

| $14.40 (NAV) | | -0.56 | % | |

| $13.42 (Market Price) | | 1.59 | % | |

All figures represent past performance and are not a guarantee of future results.

Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions, including returns of capital, if any, in additional shares.

II Salomon Brothers Municipal Partners Fund Inc.

Special Shareholder Notices

Following the purchase of substantially all of Citigroup Inc.’s (“Citigroup”) asset management business in December 2005, Legg Mason, Inc. (“Legg Mason”) undertook an internal reorganization to consolidate the advisory services provided to the legacy Citigroup funds through a more limited number of advisers. As part of this reorganization, at meetings held during June and July 2006, the Fund’s Board approved a new management agreement with Legg Mason Partners Fund Advisor, LLC (“LMPFA”), under which LMPFA will act as the investment adviser for the Fund effective August 1, 2006.

The Fund’s Board also approved a new sub-advisory agreement for the Fund between LMPFA and Western Asset Management Company (“Western Asset”). LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason. The portfolio managers who are responsible for the day-to-day management of the Fund remain the same immediately prior to and immediately after the date of these changes.

LMPFA will provide administrative and certain oversight services to the Fund. LMPFA will delegate to Western Asset, as applicable, the day-to-day portfolio management of the Fund. The management fees for the Fund will remain unchanged.

In addition to these advisory changes, it is expected that the Fund’s name will change to Western Asset Municipal Partners Fund Inc. in October 2006.

Information About Your Fund

As you may be aware, several issues in the mutual fund industry (not directly affecting closed-end investment companies, such as this Fund) have come under the scrutiny of federal and state regulators. Affiliates of the Fund’s Manager have, in recent years, received requests for information from various government regulators regarding market timing, late trading, fees, and other mutual fund issues in connection with various investigations. The regulators appear to be examining, among other things, the open-end funds’ response to market timing and shareholder exchange activity, including compliance with prospectus disclosure related to

Salomon Brothers Municipal Partners Fund Inc. III

these subjects. The Fund is not in a position to predict the outcome of these requests and investigations, or whether these may affect the Fund.

Important information with regard to recent regulatory developments that may affect the Fund is contained in the Notes to Financial Statements included in this report.

Looking for Additional Information?

The Fund is traded under the symbol “MNP” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under symbol XMNPX on most financial websites. Barron’s and The Wall Street Journal’s Monday editions carry closed-end fund tables that will provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.leggmason.com/InvestorServices.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 6:00 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

July 28, 2006

IV Salomon Brothers Municipal Partners Fund Inc.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: An investment in the Fund is subject to risk, including the possible loss of the principal amount that you invest in the Fund. Certain investors may be subject to the Federal Alternative Minimum Tax (AMT), and state and local taxes will apply. Capital gains, if any, are fully taxable. As interest rates rise, bond prices fall, reducing the value of the Fund’s fixed income securities. Lower-rated, higher-yielding bonds are subject to greater credit risk than higher-rated obligations.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

(i) | Gross domestic product is a market value of goods and services produced by labor and property in a given country. |

| |

(ii) | The Federal Reserve Board is responsible for the formulation of a policy designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| |

(iii) | The federal funds rate is the interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight loans. |

| |

(iv) | NAV is calculated by subtracting total liabilities and outstanding preferred stock from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is at the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

| |

(v) | The Lehman Brothers Municipal Bond Index is a broad measure of the municipal bond market with maturities of at least one year. |

| |

(vi) | Lipper, Inc. is a major independent mutual-fund tracking organization. Returns are based on the six-month period ended June 30, 2006, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 56 funds in the Fund’s Lipper category. |

Salomon Brothers Municipal Partners Fund Inc. V

(This page intentionally left blank.)

Fund at a Glance (unaudited)

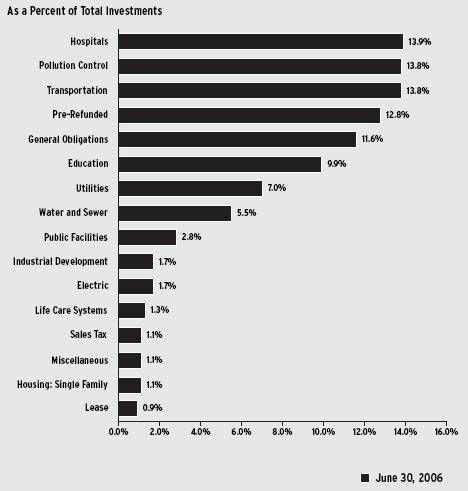

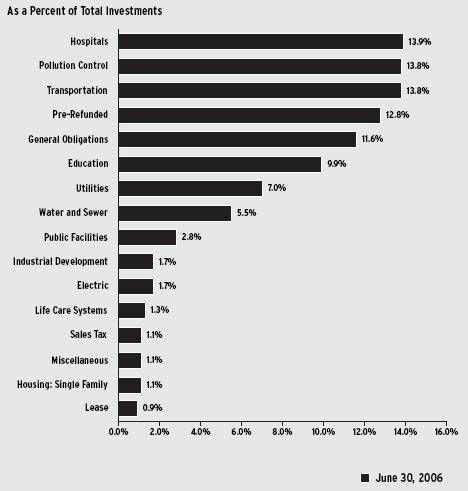

Investment Breakdown

As a Percent of Total Investments

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 1

Schedule of Investments (June 30, 2006) (unaudited)

SALOMON BROTHERS MUNICIPAL PARTNERS FUND INC.

Face

Amount | | Rating‡ | | Security | | Value | |

MUNICIPAL BONDS — 100.0% | | | |

California — 6.2% | | | | | |

$ | 1,000,000 | | A3(a) | | California Health Facilities Financing Authority Revenue, Cedars-Sinai

Medical Center, 5.000% due 11/15/34 | | $ | 998,590 | |

1,575,000 | | A+ | | California State, GO, 5.125% due 6/1/24 | | 1,608,894 | |

1,250,000 | | AAA | | Huntington Beach, CA, Union High School District, GO, Election 2004, FSA-Insured, 5.000% due 8/1/29 | | 1,277,463 | |

2,000,000 | | AAA | | Los Angeles, CA, Department of Water & Power Revenue, Power Systems, Subordinated Series A-1, FSA-Insured, 5.000% due 7/1/35 | | 2,042,160 | |

1,370,000 | | AAA | | Pleasant Valley, CA, GO, School District, Ventura County, Series A, MBIA-Insured, 5.850% due 2/1/17 | | 1,551,374 | |

| | | | Total California | | 7,478,481 | |

Colorado — 1.4% | | | | | |

600,000 | | BBB+ | | Colorado Health Facilities Authority Revenue, Poudre Valley Health Care, Series F, 5.000% due 3/1/25 | | 594,072 | |

| | | | Colorado Springs, CO, Hospital Revenue: | | | |

505,000 | | A- | | 6.375% due 12/15/30 | | 541,289 | |

495,000 | | A- | | 6.375% due 12/15/30 (b) | | 544,624 | |

| | | | Total Colorado | | 1,679,985 | |

District of Columbia — 1.7% | | | |

2,000,000 | | AAA | | District of Columbia Revenue, American University, AMBAC-Insured,

5.625% due 10/1/26 | | 2,026,720 | |

Hawaii — 1.8% | | | | | | | |

2,000,000 | | AAA | | Hawaii State Airport System Revenue, Series B, FGIC-Insured, 6.000% due 7/1/19 (c) | | 2,144,480 | |

Illinois — 15.2% | | | | | |

3,750,000 | | AAA | | Chicago, IL, Board of Education, GO, Chicago School Reform, AMBAC-Insured, 5.750% due 12/1/27 (b) | | 3,921,262 | |

| | | | Chicago, IL, GO, Series A, FSA-Insured: | | | |

145,000 | | AAA | | 5.250% due 1/1/16 | | 153,564 | |

355,000 | | AAA | | 5.250% due 1/1/16 (b) | | 381,139 | |

| | | | Chicago, IL, Midway Airport Revenue: | | | |

2,000,000 | | AAA | | Series A, MBIA-Insured, 5.500% due 1/1/29 | | 2,035,000 | |

2,000,000 | | AAA | | Series B, MBIA-Insured, 5.625% due 1/1/29 (c) | | 2,032,720 | |

2,000,000 | | AAA | | Chicago, IL, Park District, Refunding, Series D, FGIC-Insured, 5.000% due 1/1/29 | | 2,034,820 | |

1,250,000 | | AAA | | Chicago, IL, Sales Tax Revenue, FSA-Insured, 5.000% due 1/1/22 | | 1,285,587 | |

2,000,000 | | Aaa(a) | | Illinois DFA, Revolving Fund Revenue, 5.250% due 9/1/12 | | 2,120,780 | |

1,000,000 | | AA+ | | Illinois EFA Revenue, Northwestern University, 5.500% due 12/1/13 | | 1,065,100 | |

1,500,000 | | A+ | | Illinois Health Facilities Authority Revenue, Refunding, Lutheran General Health System, Series C, 7.000% due 4/1/14 | | 1,744,605 | |

1,500,000 | | AAA | | Illinois State, GO, First Series, FSA-Insured, 5.500% due 5/1/16 | | 1,633,365 | |

| | | | Total Illinois | | 18,407,942 | |

| | | | | | | | | |

See Notes to Financial Statements.

2 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (June 30, 2006) (unaudited) (continued)

Face

Amount | | Rating‡ | | Security | | Value | |

Indiana — 3.4% | | | |

| | | | | Indiana Bond Bank Revenue, Series B: | | | | |

$ | 1,125,000 | | AAA | | 5.000% due 8/1/23 | | $ | 1,143,630 | |

625,000 | | AAA | | 5.000% due 8/1/23 (b) | | 655,256 | |

1,195,000 | | AAA | | Indiana Health Facility Financing Authority, Hospital Revenue, Community Hospital Project, Series A, AMBAC-Insured, 5.000% due 5/1/35 | | 1,212,830 | |

1,000,000 | | BBB+ | | Indiana State DFA Environment Improvement Revenue, USX Corp. Project, 5.250% due 12/1/22 | | 1,055,640 | |

| | | | Total Indiana | | 4,067,356 | |

Iowa — 0.9% | | | | | |

1,000,000 | | Aa3(a) | | Iowa Finance Authority, Hospital Facility Revenue, 6.750% due 2/15/16 (b) | | 1,101,440 | |

Kansas — 1.3% | | | | | |

1,430,000 | | AA | | Kansas State Development Finance Authority, Health Facilities Revenue, Sisters of Charity, Series J, 6.250% due 12/1/28 | | 1,537,894 | |

Maryland — 5.7% | | | |

| | | | Maryland State Health & Higher Educational Facilities Authority Revenue: | | | |

1,500,000 | | Baa1(a) | | Carroll County General Hospital, 6.000% due 7/1/37 | | 1,571,025 | |

1,000,000 | | A | | Suburban Hospital, Series A, 5.500% due 7/1/16 | | 1,065,890 | |

| | | | University of Maryland Medical Systems: | | | |

1,000,000 | | A3(a) | | 6.750% due 7/1/30 (b) | | 1,110,500 | |

500,000 | | A+ | | 6.000% due 7/1/32 | | 534,195 | |

2,500,000 | | Aaa(a) | | Northeast Maryland Waste Disposal Authority, Solid Waste Revenue, AMBAC-Insured, 5.500% due 4/1/15 (c) | | 2,647,750 | |

| | | | Total Maryland | | 6,929,360 | |

Massachusetts — 5.0% | | | | | |

2,500,000 | | AA- | | Massachusetts State Health & EFA Revenue, Partners Healthcare System, Series C, 5.750% due 7/1/32 | | 2,669,575 | |

| | | | Massachusetts State Water Pollution Abatement Trust Revenue, MWRA Program, Series A: | | | |

2,540,000 | | AAA | | 5.750% due 8/1/29 | | 2,687,193 | |

630,000 | | AAA | | 5.750% due 8/1/29 (b) | | 669,280 | |

| | | | Total Massachusetts | | 6,026,048 | |

Michigan — 1.3% | | | | | |

1,500,000 | | AA- | | Michigan State, Hospital Finance Authority Revenue, Trinity Health, Series C, 5.375% due 12/1/30 | | 1,552,965 | |

Nevada — 0.7% | | | | | |

| | | | Nevada Housing Division Revenue, Single-Family Program, Series B-2: | | | |

845,000 | | Aa2(a) | | 6.400% due 10/1/25 (c) | | 848,828 | |

25,000 | | Aa2(a) | | 6.950% due 10/1/26 (c) | | 25,140 | |

| | | | Total Nevada | | 873,968 | |

See Notes to Financial Statements.

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 3

Schedule of Investments (June 30, 2006) (unaudited) (continued)

Face

Amount | | Rating‡ | | Security | | Value | |

New Hampshire — 0.1% | | | |

$ | 90,000 | | A+ | | New Hampshire State HFA, Single-Family Residential Revenue, Series A, 6.800% due 7/1/15 (c) | | $ | 90,434 | |

New Jersey — 10.3% | | | | | |

| | | | New Jersey EDA: | | | |

5,150,000 | | AAA | | PCR, Revenue, Public Service Electric and Gas Co. Project, Series A, MBIA-Insured, 6.400% due 5/1/32 (c) | | 5,197,946 | |

4,450,000 | | AAA | | Water Facilities Revenue, New Jersey American Water Co. Inc. Project, Series A, FGIC-Insured, 6.875% due 11/1/34 (c) | | 4,493,432 | |

1,000,000 | | A3(a) | | New Jersey Health Care Facilities Financing Authority Revenue, Hackensack University Medical Center, 6.000% due 1/1/25 | | 1,055,670 | |

1,695,000 | | AAA | | New Jersey State, EFA Revenue, Princeton University, Series A, 5.000% due 7/1/21 | | 1,768,648 | |

| | | | Total New Jersey | | 12,515,696 | |

New York — 11.8% | | | | | |

| | | | New York City, NY, GO: | | | |

| | | | Series A: | | | |

10,000 | | AA- | | 6.000% due 5/15/30 | | 10,693 | |

990,000 | | AA- | | 6.000% due 5/15/30 (b) | | 1,073,873 | |

500,000 | | AA- | | Series G, 5.000% due 12/1/33 | | 503,395 | |

| | | | New York City, NY, Municipal Water Finance Authority, Water & Sewer Systems Revenue: | | | |

| | | | Series B: | | | |

1,175,000 | | AA+ | | 5.750% due 6/15/29 (b) | | 1,208,487 | |

1,000,000 | | AA+ | | 5.125% due 6/15/31 | | 1,015,490 | |

2,000,000 | | AA+ | | Series D, 5.000% due 6/15/37 | | 2,026,760 | |

1,250,000 | | AAA | | New York City, NY, TFA Revenue, Series A, 5.500% due 11/15/17 | | 1,342,162 | |

| | | | New York State Dormitory Authority Revenue, Court Facilities Lease, NYC Issue, Non State Supported Debt, Series A, AMBAC-Insured: | | | |

1,000,000 | | AAA | | 5.500% due 5/15/28 | | 1,120,280 | |

5,365,000 | | AAA | | 5.500% due 5/15/30 | | 6,001,504 | |

| | | | Total New York | | 14,302,644 | |

Ohio — 7.3% | | | | | |

2,000,000 | | BBB+ | | Miami County, OH, Hospital Facilities Revenue, Upper Valley Medical Center, Series C, 6.250% due 5/15/13 | | 2,041,700 | |

6,700,000 | | A+ | | Ohio State Water Development Authority, Solid Waste Disposal Revenue, North Star BHP Steel, Cargill Inc., 6.300% due 9/1/20 (c) | | 6,798,557 | |

| | | | Total Ohio | | 8,840,257 | |

Pennsylvania — 0.2% | | | | | |

250,000 | | AAA | | Philadelphia, PA, School District GO, Series A, FSA-Insured, Call 2/1/12 @ 100, 5.500% due 2/1/31 (b) | | 268,818 | |

Puerto Rico — 2.8% | | | | | |

3,000,000 | | AAA | | Puerto Rico Commonwealth Infrastructure Financing Authority, Series C, AMBAC-Insured, 5.500% due 7/1/25 | | 3,335,580 | |

| | | | | | | | | |

See Notes to Financial Statements.

4 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Schedule of Investments (June 30, 2006) (unaudited) (continued)

Face

Amount | | Rating‡ | | Security | | Value | |

Tennessee — 3.3% | | | | | |

$3,500,000 | | AAA | | Memphis-Shelby County, TN, Airport Authority Revenue, Series D, AMBAC-Insured, 6.000% due 3/1/24 (c) | | $ | 3,725,995 | |

310,000 | | AA | | Tennessee Housing Development Agency Revenue, Homeownership Program, Series 2B, 6.350% due 1/1/31 (c) | | 315,936 | |

| | | | Total Tennessee | | 4,041,931 | |

Texas — 12.3% | | | | | |

2,500,000 | | AAA | | Aledo, TX, GO, ISD, School Building, Series A, PSF-Insured, 5.000% due 2/15/30 | | 2,536,600 | |

1,000,000 | | Aaa(a) | | Edgewood, TX, ISD, PSFG-Insured, 5.250% due 2/15/18 | | 1,058,940 | |

1,165,000 | | A | | Harris County, TX, Health Facilities Development Corp. Hospital Revenue, Memorial Hermann Healthcare System, Series A, 5.250% due 12/1/17 | | 1,205,076 | |

1,500,000 | | AAA | | Houston, TX, Utility System Revenue, Combined First Lien, FSA-Insured, 5.000% due 11/15/35 | | 1,517,835 | |

1,600,000 | | AAA | | Lake Dallas, TX, GO, ISD, School Building, PSF-Insured, 5.000% due 8/15/34 | | 1,618,016 | |

100,000 | | AAA | | North Harris Montgomery Community College District, TX, GO, FGIC-Insured, 5.375% due 2/15/16 | | 106,064 | |

1,000,000 | | BBB- | | Sabine River Authority, Texas Pollution Control, Refunding, Remarketed 11/29/05, 5.200% due 5/1/28 | | 1,012,470 | |

1,000,000 | | AAA | | Texas State Transportation Commission Revenue, First Tier, 5.000% due 4/1/13 | | 1,051,050 | |

3,500,000 | | AAA | | Texas State Turnpike Authority Revenue, First Tier, Series A, AMBAC-Insured, 5.500% due 8/15/39 | | 3,722,705 | |

1,000,000 | | AAA | | Williamson County, TX, GO, MBIA-Insured, 5.250% due 2/15/21 | | 1,062,740 | |

| | | | Total Texas | | 14,891,496 | |

Washington — 7.3% | | | | |

1,000,000 | | AAA | | Chelan County, WA, Public Utility District, Chelan Hydro System No.1, Construction Revenue, Series A, AMBAC-Insured, 5.450% due 7/1/37 (c) | | 1,035,460 | |

2,000,000 | | AAA | | Port of Seattle, WA, Revenue, Refunding, Intermediate Lien, Series A, MBIA-Insured, 5.000% due 3/1/30 | | 2,029,380 | |

4,250,000 | | AAA | | Seattle, WA, GO, Series B, FSA-Insured, 5.750% due 12/1/28 (b) | | 4,538,362 | |

1,200,000 | | AAA | | Washington State Public Power Supply System Revenue, Nuclear Project No. 1, Series A, MBIA-Insured, 5.125% due 7/1/17 | | 1,238,724 | |

| | | | Total Washington | | 8,841,926 | |

| | | | TOTAL INVESTMENTS — 100.0%

(Cost — $118,191,827#) | | $ | 120,955,421 | |

‡ All ratings are by Standard & Poor’s Ratings Service, unless otherwise noted.

(a) Rating by Moody’s Investors Service.

(b) Pre-Refunded bonds are escrowed with government obligations and/or government agency securities and are considered by the Manager to be triple-A rated even if issuer has not applied for new ratings.

(c) Income from this issue is considered a preference item for purposes of calculating the alternative minimum tax (“AMT”).

# Aggregate cost for federal income tax purposes is substantially the same.

See pages 7 and 8 for definitions of ratings.

See Notes to Financial Statements.

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 5

Schedule of Investments (June 30, 2006) (unaudited) (continued)

Abbreviations used in this schedule:

AMBAC | - | Ambac Assurance Corporation |

DFA | - | Development Finance Agency |

EDA | - | Economic Development Authority |

EFA | - | Educational Facilities Authority |

FGIC | - | Financial Guaranty Insurance Company |

FSA | - | Financial Security Assurance |

GO | - | General Obligation |

HFA | - | Housing Finance Authority |

ISD | - | Independent School District |

MBIA | - | Municipal Bond Investors Assurance Corporation |

MWRA | - | Massachusetts Water Resources Authority |

PCR | - | Pollution Control Revenue |

PSF | - | Permanent School Fund |

PSFG | - | Permanent School Fund Guaranty |

TFA | - | Transitional Finance Authority |

Summary of Investments by Industry* (unaudited)

Hospitals | | 13.9 | % |

Pollution Control | | 13.8 | |

Transportation | | 13.8 | |

Pre-Refunded | | 12.8 | |

General Obligations | | 11.6 | |

Education | | 9.9 | |

Utilities | | 7.0 | |

Water and Sewer | | 5.5 | |

Public Facilities | | 2.8 | |

Industrial Development | | 1.7 | |

Electric | | 1.7 | |

Life Care Systems | | 1.3 | |

Sales Tax | | 1.1 | |

Miscellaneous | | 1.1 | |

Housing: Single Family | | 1.1 | |

Lease | | 0.9 | |

| | 100.0 | % |

* As a percentage of total investments. Please note that Fund holdings are as of June 30, 2006 and are subject to change.

See Notes to Financial Statements.

6 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Bond Ratings (unaudited)

The definitions of the applicable rating symbols are set forth below:

Standard & Poor’s Ratings Service (“Standard & Poor’s”) — Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (-) sign to show relative standings within the major rating categories. |

| | |

AAA | — | Bonds rated “AAA” have the highest rating assigned by Standard & Poor’s. Capacity to pay interest and repay principal is extremely strong. |

AA | — | Bonds rated “AA” have a very strong capacity to pay interest and repay principal and differs from the highest rated issue only in a small degree. |

A | — | Bonds rated “A” have a strong capacity to pay interest and repay principal although it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher rated categories. |

BBB | — | Bonds rated “BBB” are regarded as having an adequate capacity to pay interest and repay principal. Whereas they normally exhibit adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for debt in this category than in higher rated categories. |

BB, B, CCC, CC and C | — | Bonds rated “BB” “B”, “CCC”, “CC” and “C” are regarded, on balance, as predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. “BB” represents the lowest degree of speculation and “C” the highest degree of speculation. While such bonds will likely have some quality and protective characteristics, these are outweighed by large uncertainties or major risk exposures to adverse conditions. |

D | — | Bonds rated “D” are in default and payment of interest and/or repayment of principal is in arrears. |

| | |

Moody’s Investors Service (“Moody’s”) — Numerical modifiers 1, 2 and 3 may be applied to each generic rating from “Aa” to “Caa,” where 1 is the highest and 3 the lowest ranking within its generic category. |

| | |

Aaa | — | Bonds rated “Aaa” are judged to be of the best quality. They carry the smallest degree of investment risk and are generally referred to as “gilt edge.” Interest payments are protected by a large or by an exceptionally stable margin and principal is secure. While the various protective elements are likely to change, such changes as can be visualized are most unlikely to impair the fundamentally strong position of such issues. |

Aa | — | Bonds rated “Aa” are judged to be of high quality by all standards. Together with the “Aaa” group they comprise what are generally known as high grade bonds. They are rated lower than the best bonds because margins of protection may not be as large in “Aaa” securities or fluctuation of protective elements may be of greater amplitude or there may be other elements present which make the long-term risks appear somewhat larger than in “Aaa” securities. |

A | — | Bonds rated “A” possess many favorable investment attributes and are to be considered as upper medium grade obligations. Factors giving security to principal and interest are considered adequate but elements may be present which suggest a susceptibility to impairment some time in the future. |

Baa | — | Bonds rated “Baa” are considered as medium grade obligations, i.e., they are neither highly protected nor poorly secured. Interest payments and principal security appear adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over any great length of time. Such bonds lack outstanding investment characteristics and in fact have speculative characteristics as well. |

Ba | — | Bonds rated “Ba” are judged to have speculative elements; their future cannot be considered as well assured. Often the protection of interest and principal payments may be very moderate and thereby not well safeguarded during both good and bad times over the future. Uncertainty of position characterizes bonds in this class. |

B | — | Bonds that are rated “B” generally lack characteristics of desirable investments. Assurance of interest and principal payments or of maintenance of other terms of the contract over any long period of time may be small. |

Caa | — | Bonds rated “Caa” are of poor standing. These issues may be in default or present elements of danger may exist with respect to principal or interest. |

Ca | — | Bonds rated “Ca” represent obligations which are speculative in a high degree. Such issues are often in default or have other marked short comings. |

C | — | Bonds rated “C” are the lowest class of bonds and issues so rated can be regarded as having extremely poor prospects of ever attaining any real investment standing. |

NR | — | Indicates that the bond is not rated by Standard & Poor’s or Moody’s. |

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 7

Short-Term Security Ratings (unaudited)

SP-1 | — | Standard & Poor’s highest rating indicating very strong or strong capacity to pay principal and interest; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign. |

A-1 | — | Standard & Poor’s highest commercial paper and variable-rate demand obligation (VRDO) rating indicating that the degree of safety regarding timely payment is either overwhelming or very strong; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign. |

VMIG 1 | — | Moody’s highest rating for issues having a demand feature — VRDO. |

P-1 | — | Moody’s highest rating for commercial paper and for VRDO prior to the advent of the VMIG 1 rating. |

8 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Statement of Assets and Liabilities (June 30, 2006) (unaudited)

ASSETS: | | | |

Investments, at value (Cost — $118,191,827) | | $ | 120,955,421 | |

Cash | | 63,946 | |

Interest receivable | | 1,868,520 | |

Receivable for securities sold | | 140,043 | |

Prepaid expenses | | 22,342 | |

Total Assets | | 123,050,272 | |

LIABILITIES: | | | |

Investment management fee payable | | 56,004 | |

Distributions payable to Auction Rate Cumulative Preferred Stockholders | | 19,726 | |

Directors’ fees payable | | 4,617 | |

Accrued expenses | | 47,925 | |

Total Liabilities | | 128,272 | |

Auction Rate Cumulative Preferred Stock (800 shares authorized and issued at $50,000 per share) (Note 4) | | 40,000,000 | |

Total Net Assets | | $ | 82,922,000 | |

| | | | |

NET ASSETS: | | | |

Par value ($0.001 par value; 5,757,094 shares issued and outstanding; 100,000,000 common shares authorized) | | $ | 5,757 | |

Paid-in capital in excess of par value | | 79,673,514 | |

Undistributed net investment income | | 435,692 | |

Accumulated net realized gain on investments | | 43,443 | |

Net unrealized appreciation on investments | | 2,763,594 | |

Total Net Assets | | $ | 82,922,000 | |

| | | | |

Shares Outstanding | | 5,757,094 | |

Net Asset Value | | $ | 14.40 | |

See Notes to Financial Statements.

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 9

Statement of Operations (For the six months ended June 30, 2006) (unaudited)

INVESTMENT INCOME: | | | |

Interest | | $ | 3,111,854 | |

EXPENSES: | | | |

Investment management fee (Note 2) | | 340,489 | |

Directors’ fees | | 56,035 | |

Auction agent fees (Note 4) | | 53,565 | |

Audit and tax | | 28,602 | |

Shareholder reports | | 25,688 | |

Legal fees | | 11,537 | |

Transfer agent fees | | 10,603 | |

Stock exchange listing fees | | 7,859 | |

Custody fees | | 522 | |

Insurance | | 513 | |

Miscellaneous expenses | | 8,160 | |

Total Expenses | | 543,573 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | (2,785 | ) |

Net Expenses | | 540,788 | |

Net Investment Income | | 2,571,066 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS (NOTES 1 AND 3): | | | |

Net Realized Gain From Investment Transactions | | 2,748 | |

Change in Net Unrealized Appreciation/Depreciation From Investments | | (2,358,635 | ) |

Net Loss on Investments | | (2,355,887 | ) |

Distributions Paid to Auction Rate Cumulative Preferred Stockholders From Net Investment Income | | (660,062 | ) |

Decrease in Net Assets From Operations | | $ | (444,883 | ) |

See Notes to Financial Statements.

10 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Statements of Changes in Net Assets

For the six months ended June 30, 2006 (unaudited)

and the year ended December 31, 2005

| | 2006 | | 2005 | |

OPERATIONS: | | | | | |

Net investment income | | $ | 2,571,066 | | $ | 5,283,965 | |

Net realized gain | | 2,748 | | 307,226 | |

Change in net unrealized appreciation/depreciation | | (2,358,635 | ) | (2,142,589 | ) |

Distributions paid to Auction Rate Cumulative Preferred Stockholders from:

Net investment income | | (660,062 | ) | (976,886 | ) |

Net realized gains | | — | | (26,248 | ) |

Increase (Decrease) in Net Assets From Operations | | (444,883 | ) | 2,445,468 | |

DISTRIBUTIONS TO COMMON STOCK SHAREHOLDERS FROM (NOTE 1): | | | | | |

Net investment income | | (2,360,409 | ) | (4,835,959 | ) |

Net realized gains | | — | | (143,927 | ) |

Decrease in Net Assets From Distributions to Common Stock Shareholders | | (2,360,409 | ) | (4,979,886 | ) |

Decrease in Net Assets | | (2,805,292 | ) | (2,534,418 | ) |

NET ASSETS: | | | | | |

Beginning of period | | 85,727,292 | | 88,261,710 | |

End of period* | | $82,922,000 | | $85,727,292 | |

| | | | | | | |

* Includes undistributed net investment income of: | | $435,692 | | $885,097 | |

See Notes to Financial Statements.

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 11

Financial Highlights

For a share of common stock outstanding throughout each year ended December 31, unless otherwise noted:

| | 2006(1) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

Net Asset Value, Beginning of Period | | $14.89 | | $15.33 | | $15.52 | | $15.35 | | $14.38 | | $14.25 | |

Income (Loss) From Operations: | | | | | | | | | | | | | |

Net investment income | | 0.45 | | 0.92 | | 0.93 | | 0.95 | | 1.00 | | 1.03 | |

Net realized and unrealized gain (loss) | | (0.42 | ) | (0.32 | ) | (0.12 | ) | 0.13 | | 0.86 | | 0.04 | |

Distributions paid to Auction Rate Cumulative Preferred Stockholders from: | | | | | | | | | | | | | |

Net investment income | | (0.11 | ) | (0.17 | ) | (0.08 | ) | (0.07 | ) | (0.10 | ) | (0.21 | ) |

Net realized gains | | — | | (0.00 | )(2) | (0.01 | ) | — | | — | | — | |

Total Income (Loss) From Operations | | (0.08 | ) | 0.43 | | 0.72 | | 1.01 | | 1.76 | | 0.86 | |

Less Distributions Paid to Common Stock Shareholders From: | | | | | | | | | | | | | |

Net investment income | | (0.41 | ) | (0.84 | ) | (0.84 | ) | (0.84 | ) | (0.79 | ) | (0.73 | ) |

Net realized gains | | — | | (0.03 | ) | (0.07 | ) | — | | — | | — | |

Total Distributions Paid to Common Stock Shareholders | | (0.41 | ) | (0.87 | ) | (0.91 | ) | (0.84 | ) | (0.79 | ) | (0.73 | ) |

Net Asset Value, End of Period | | $14.40 | | $14.89 | | $15.33 | | $15.52 | | $15.35 | | $14.38 | |

Market Price, End of Period | | $13.42 | | $13.60 | | $13.45 | | $14.00 | | $13.40 | | $12.59 | |

Total Return, Based on NAV(3) | | (0.56 | )% | 2.85 | % | 4.82 | % | 6.78 | % | 12.52 | % | 6.17 | % |

Total Return, Based on Market Price Per Share(4) | | 1.59 | % | 7.64 | % | 2.68 | % | 11.07 | % | 12.93 | % | 10.52 | % |

Net Assets, End of Period (000s) | | $82,922 | | $85,727 | | $88,262 | | $89,364 | | $88,382 | | $82,778 | |

Ratios to Average Net Assets:(5) | | | | | | | | | | | | | |

Gross expenses | | 1.29 | %(6) | 1.30 | % | 1.32 | % | 1.32 | % | 1.34 | % | 1.33 | % |

Net expenses | | 1.29 | (6)(7) | 1.30 | | 1.32 | | 1.32 | | 1.34 | | 1.33 | |

Net investment income | | 6.11 | (6) | 6.07 | | 6.05 | | 6.17 | | 6.70 | | 7.10 | |

Portfolio Turnover Rate | | 3 | % | 40 | % | 38 | % | 57 | % | 71 | % | 34 | % |

Auction Rate Cumulative Preferred Stock: | | | | | | | | | | | | | |

Total Amount Outstanding (000s) | | $40,000 | | $40,000 | | $40,000 | | $40,000 | | $40,000 | | $40,000 | |

Asset Coverage Per Share | | 155,653 | | 157,159 | | 160,328 | | 161,705 | | 160,478 | | 153,473 | |

Involuntary Liquidating Preference Per Share | | 50,000 | | 50,000 | | 50,000 | | 50,000 | | 50,000 | | 50,000 | |

Average Market Value Per Share | | 50,000 | | 50,000 | | 50,000 | | 50,000 | | 50,000 | | 50,000 | |

(1) For the six months ended June 30, 2006 (unaudited).

(2) Amount represents less than $0.01 per share.

(3) Performance figures may reflect fee waivers and/or expense reimbursements. Past performance is no guarantee of future results. In the absence of fee waivers and/or expense reimbursements, the total return would be lower.

(4) The total return calculation assumes that dividends are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized.

(5) Ratios calculated on the basis of income and expenses relative to the average net assets of common shares and excludes the effect of dividend payments to preferred stockholders.

(6) Annualized.

(7) Reflects fee waivers and/or expense reimbursements.

See Notes to Financial Statements.

12 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

Salomon Brothers Municipal Partners Fund Inc. (the “Fund”) was incorporated in Maryland on November 24, 1992 and is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors authorized 100 million shares of $0.001 par value common stock. The Fund’s primary investment objective is to seek a high level of current income which is exempt from federal income taxes, consistent with the preservation of capital.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment Valuation. Securities are valued at the mean between the bid and asked prices provided by an independent pricing service that are based on transactions in municipal obligations, quotations from municipal bond dealers, market transactions in comparable securities and various other relationships between securities. Securities for which market quotations are not readily available, or are determined not to reflect fair value, will be valued in good faith by or under the direction of the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates market value.

(b) Concentration of Credit Risk. Since the Fund invests a portion of its assets in issuers located in a single state, it may be affected by economic and political developments in a specific state or region. Certain debt obligations held by the Fund are entitled to the benefit of insurance, standby letters of credit or other guarantees of banks or other financial institutions.

(c) Security Transactions and Investment Income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

(d) Distributions to Shareholders. Distributions to common shareholders from net investment income for the Fund, if any, are declared and paid on a monthly basis. The Fund intends to satisfy conditions that will enable interest from municipal securities, which is exempt from federal and certain state income taxes, to retain such tax-exempt status when distributed to the shareholders of the Fund. Distributions of net realized gains, if any, are taxable and are declared at least annually. Distributions to common shareholders are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP. Distributions to preferred shareholders are accrued and paid on a weekly basis and are determined as described in Note 4.

(e) Federal and Other Taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its income and net realized gains on investments, if any, to shareholders

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 13

Notes to Financial Statements (unaudited) (continued)

each year. Therefore, no federal income tax provision is required in the Fund’s financial statements.

(f) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share.

2. Investment Management Agreement and Other Transactions with Affiliates

For the period of this report, Salomon Brothers Asset Management Inc. (“SBAM”), an indirect wholly-owned subsidiary of Legg Mason, Inc. (“Legg Mason”), acted as the investment manager of the Fund. Under the investment management agreement, the Fund paid an investment management fee calculated at an annual rate of 0.55% of the Fund’s weekly net assets. For purposes of calculating this fee, the liquidation value of any outstanding preferred stock of the Fund is not deducted in determining the Fund’s average weekly net assets. This fee is calculated daily and paid monthly.

During the six months ended June 30, 2006, SBAM waived a portion of its fees in the amount of $2,785.

Certain officers and one Director of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

3. Investments

During the six months ended June 30, 2006, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

Purchases | | $4,152,945 | |

Sales | | 3,647,045 | |

At June 30, 2006, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows:

Gross unrealized appreciation | | $ 4,186,981 | |

Gross unrealized depreciation | | (1,423,387 | ) |

Net unrealized appreciation | | $ 2,763,594 | |

4. Auction Rate Cumulative Preferred Stock

On April 2, 1993, the Fund closed its public offering of 800 shares of $0.001 par value Auction Rate Cumulative Preferred Stock (“Preferred Stock”) at an offering price of $50,000 per share. The Preferred Stock has a liquidation preference of $50,000 per share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) and subject to certain restrictions, are redeemable in whole or in part.

Dividend rates generally reset every 7 days and are determined by auction procedures. The dividend rates on the Preferred Stock during the six months ended June 30, 2006 ranged from 2.890% to 4.500%. The weighted average dividend rate for the six months ended June 30, 2006 was 3.328%.

14 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Notes to Financial Statements (unaudited) (continued)

The Fund is subject to certain restrictions relating to the Preferred Stock. The Fund may not declare dividends or make other distributions on shares of common stock or purchase any such shares if, at the time of the declaration, distribution or purchase, asset coverage with respect to the outstanding Preferred Stock would be less than 200%. The Preferred Stock is also subject to mandatory redemption at $50,000 per share plus any accumulated or unpaid dividends, whether or not declared, if certain requirements relating to the composition of the assets and liabilities of the Fund as set forth in its Articles Supplementary are not satisfied.

The Preferred Stock Shareholders are entitled to one vote per share and generally vote with the common stock shareholders but vote separately as a class to elect two directors and on certain matters affecting the rights of the Preferred Stock.

The issuance of preferred stock poses certain risks to holders of common stock, including, among others the possibility of greater market price volatility and in certain market conditions, the yield to holders of common stock may be adversely affected.

The Fund is required to maintain certain asset coverages with respect to the Preferred Stock. If the Fund fails to maintain these coverages and does not cure any such failure within the required time period, the Fund is required to redeem a requisite number of the Preferred Stock in order to meet the applicable requirement. Additionally, failure to meet the foregoing asset requirements would restrict the Fund’s ability to pay dividends to common shareholders.

5. Distributions Subsequent to June 30, 2006

Common Stock Distributions. On May 8, 2006, the Board of Directors of the Fund declared two common share distributions from net investment income, each in the amount of $0.06 per share, payable on July 28, 2006 and August 25, 2006 to shareholders of record on July 25, 2006 and August 22, 2006, respectively.

On July 25, 2006, the Board of Directors of the Fund declared three common share distributions from net investment income, each in the amount of $0.06 per share, payable on September 29, 2006, October 27, 2006 and November 24, 2006 to shareholders of record on September 22, 2006, October 20, 2006 and November 17, 2006, respectively.

Preferred Stock Distributions. The Board of Directors designated each of the following dividend periods as a Special Rate Period. With each auction date, the regular auction procedure resumes, subject to the Fund’s ability to designate any subsequent dividend period as a Special Rate Period.

Auction Date | | Commencement of

Rate Period | | Rate Effective

Through | | Preferred Rate | |

6/26/06 | | 6/27/06 | | 7/4/06 | | 4.500 | % | |

7/3/06 | | 7/5/06 | | 7/10/06 | | 3.750 | | |

7/10/06 | | 7/11/06 | | 7/17/06 | | 3.650 | | |

7/17/06 | | 7/18/06 | | 7/24/06 | | 3.650 | | |

7/24/06 | | 7/25/06 | | 7/31/06 | | 3.390 | | |

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 15

Notes to Financial Statements (unaudited) (continued)

6. Regulatory Matters

On May 31, 2005, the U.S. Securities and Exchange Commission (“SEC”) issued an order in connection with the settlement of an administrative proceeding against Smith Barney Fund Management LLC (“SBFM”) and Citigroup Global Markets Inc. (“CGM”) relating to the appointment of an affiliated transfer agent for the Smith Barney family of mutual funds (the “Affected Funds”).

The SEC order finds that SBFM and CGM willfully violated Section 206(1) of the Investment Advisers Act of 1940 (“Advisers Act”). Specifically, the order finds that SBFM and CGM knowingly or recklessly failed to disclose to the boards of the Affected Funds in 1999 when proposing a new transfer agent arrangement with an affiliated transfer agent that: First Data Investors Services Group (“First Data”), the Affected Funds’ then existing transfer agent, had offered to continue as transfer agent and do the same work for substantially less money than before; and that Citigroup Asset Management (“CAM”), the Citigroup business unit that, at the time, included the Affected Funds’ investment manager and other investment advisory companies, had entered into a side letter with First Data under which CAM agreed to recommend the appointment of First Data as sub-transfer agent to the affiliated transfer agent in exchange for, among other things, a guarantee by First Data of specified amounts of asset management and investment banking fees to CAM and CGM. The order also finds that SBFM and CGM willfully violated Section 206(2) of the Advisers Act by virtue of the omissions discussed above and other misrepresentations and omissions in the materials provided to the Affected Funds’ boards, including the failure to make clear that the affiliated transfer agent would earn a high profit for performing limited functions while First Data continued to perform almost all of the transfer agent functions, and the suggestion that the proposed arrangement was in the Affected Funds’ best interests and that no viable alternatives existed. SBFM and CGM do not admit or deny any wrongdoing or liability. The settlement does not establish wrongdoing or liability for purposes of any other proceeding.

The SEC censured SBFM and CGM and ordered them to cease and desist from violations of Sections 206(1) and 206(2) of the Advisers Act. The order requires Citigroup to pay $208.1 million, including $109 million in disgorgement of profits, $19.1 million in interest, and a civil money penalty of $80 million. Approximately $24.4 million has already been paid to the Affected Funds, primarily through fee waivers. The remaining $183.7 million, including the penalty, has been paid to the U.S. Treasury and will be distributed pursuant to a plan submitted for the approval of the SEC. At this time, there is no certainty as to how the above-described proceeds of the settlement will be distributed, to whom such distributions will be made, the methodology by which such distributions will be allocated, and when such distributions will be made.

The order also required that transfer agency fees received from the Affected Funds since December 1, 2004 less certain expenses be placed in escrow and provided that a portion of such fees might be subsequently distributed in accordance with the terms of the order.

On April 3, 2006, an aggregate amount of approximately $9 million was distributed to the Affected Funds.

The order required SBFM to recommend a new transfer agent contract to the Affected Funds boards within 180 days of the entry of the order; if a Citigroup affiliate submitted a

16 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Notes to Financial Statements (unaudited) (continued)

proposal to serve as transfer agent or sub-transfer agent, SBFM and CGM would have been required, at their expense, to engage an independent monitor to oversee a competitive bidding process. On November 21, 2005, and within the specified timeframe, the Fund’s Board selected a new transfer agent for the Fund. No Citigroup affiliate submitted a proposal to serve as transfer agent. Under the order, SBFM also must comply with an amended version of a vendor policy that Citigroup instituted in August 2004.

Although there can be no assurance, SBFM does not believe that this matter will have a material adverse effect on the Affected Funds.

This Fund is not one of the Affected Funds and therefore did not implement the transfer agent arrangement described above and therefore has not received and will not receive any portion of the distributions.

On December 1, 2005, Citigroup completed the sale of substantially all of its global asset management business, including SBFM, to Legg Mason.

7. Other Matters

On September 16, 2005, the staff of the SEC informed SBFM and SBAM that the staff is considering recommending that the SEC institute administrative proceedings against SBFM and SBAM for alleged violations of Section 19(a) and 34(b) of the 1940 Act (and related Rule 19a-1). The notification is a result of an industry wide inspection by the SEC and is based upon alleged deficiencies in disclosures regarding dividends and distributions paid to shareholders of certain funds. Section 19(a) and related Rule 19a-1 of the 1940 Act generally require funds that are making dividend and distribution payments to provide shareholders with a written statement disclosing the source of the dividends and distributions, and, in particular, the portion of the payments made from each of net investment income, undistributed net profits and/or paid-in capital. In connection with the contemplated proceedings, the staff may seek a cease and desist order and/or monetary damages from SBFM or SBAM.

Although there can be no assurance, SBAM believes that this matter is not likely to have a material adverse effect on the Fund.

8. Subsequent Events

The Fund’s Board has approved a new management agreement with Legg Mason Partners Fund Advisor, LLC (“LMPFA”), under which LMPFA will act as the investment adviser for the Fund effective August 1, 2006. The Fund’s Board has also approved a new sub-advisory agreement for the Fund between LMPFA and Western Asset Management Company (“Western Asset”). LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason. The portfolio managers who are responsible for the day-to-day management of the Fund remain the same immediately prior to and immediately after the date of these changes.

LMPFA will provide administrative and certain oversight services to the Fund. LMPFA will delegate to the subadviser, as applicable, the day-to-day portfolio management of the Fund. The management fees for the Fund will remain unchanged. For its services, LMPFA will pay Western Asset 70% of the net management fee that it receives from the Fund.

In addition to these advisory changes, it is expected that the Fund’s name will change to Western Asset Municipal Partners Fund in October 2006.

Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report 17

Notes to Financial Statements (unaudited) (continued)

On August 7, 2006, the Fund, in accordance with its tender offer for up to 575,710 of its issued and outstanding shares of common stock, accepted and made payment of these shares at $14.26 per share (98% of the net asset value per share of $14.55 on July 28, 2006). These shares represent 10% of the Fund’s outstanding shares.

9. Recent Accounting Pronouncement

During June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation 48 (“FIN 48” or the “Interpretation”), Accounting for Uncertainty in Income Taxes – an interpretation of FASB statement 109. FIN 48 supplements FASB Statement 109 by defining the confidence level that a tax position must meet in order to be recognized in the financial statements. FIN 48 prescribes a comprehensive model for how a fund should recognize, measure, present, and disclose in its financial statements uncertain tax positions that the fund has taken or expects to take on a tax return. FIN 48 requires that the tax effects of a position be recognized only if it is “more likely than not” to be sustained based solely on its technical merits. Management must be able to conclude that the tax law, regulations, case law, and other objective information regarding the technical merits sufficiently support the position’s sustainability with a likelihood of more than 50 percent. FIN 48 is effective for fiscal periods beginning after December 15, 2006, which for this Fund will be January 1, 2007. At adoption, the financial statements must be adjusted to reflect only those tax positions that are more likely than not to be sustained as of the adoption date. Management of the Fund is currently evaluating the impact that FIN 48 will have on the financial statements.

18 Salomon Brothers Municipal Partners Fund Inc. 2006 Semi-Annual Report

Board Approval of Management and Subadvisory Agreements (unaudited)

At a meeting held in person on June 26, 2006, the Fund’s Board, including a majority of the Board Members who are not “interested persons” of the Fund or Legg Mason Partners Fund Advisor, LLC (the “Manager”) or any sub-investment adviser or proposed sub-investment adviser as defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Board Members”), approved a new management agreement (the “New Management Agreement”) between the Fund and the Manager. The Fund’s Board, including a majority of the Independent Board Members, also approved one or more new subadvisory agreements between the Manager and Western Asset Management Company (the “Subadviser”) (the “New Subadvisory Agreement”). The New Management Agreement and the New Subadvisory Agreements replaced the Fund’s prior management agreement with Salomon Brothers Asset Management Inc. (“SBAM”) and were entered into in connection with an internal reorganization of the Manager’s and the prior manager’s parent organization, Legg Mason. In approving the New Management Agreement and New Subadvisory Agreement, the Board, including the Independent Board Members, considered the factors discussed below, among other things.

The Board noted that the Manager will provide administrative and certain oversight services to the Fund, and that the Manager will delegate to the Subadviser the day-to-day portfolio management of the Fund. The Board Members reviewed the qualifications, backgrounds and responsibilities of the senior personnel that will provide oversight and general management services and the portfolio management team that would be primarily responsible for the day-to-day management of the Fund. The Board Members noted that the portfolio management team was expected to be the same as then managing the Fund.

The Board Members received and considered information regarding the nature, extent and quality of services expected to be provided to the Fund by the Manager under the New Management Agreement and by the Subadviser under the New Subadvisory Agreement. The Board Members’ evaluation of the services expected to be provided by the Manager and the Subadviser took into account the Board Members’ knowledge and familiarity gained as Fund Board Members, including as to the scope and quality of Legg Mason’s investment management and other capabilities and the quality of its administrative and other services. The Board Members considered, among other things, information and assurances provided by Legg Mason as to the operations, facilities and organization of the Manager and the Subadviser and the qualifications, backgrounds and responsibilities of their senior personnel. The Board Members further considered the financial resources available to the Manager, the Subadviser and Legg Mason. The Board Members concluded that, overall, the nature, extent and quality of services expected to be provided under the New Management Agreement and the New Subadvisory Agreement were acceptable.

The Board Members also received and considered performance information for the Fund as well as comparative information with respect to a peer group of funds (the “Performance Universe”) selected by Lipper, Inc. (“Lipper”), an independent provider of investment company data. The Board Members were provided with a description of the methodology Lipper used to determine the similarity of the Fund to the funds included in the Performance Universe. The Board Members noted that they had received and discussed

Salomon Brothers Municipal Partners Fund Inc. 19

Board Approval of Management and Subadvisory Agreements (unaudited) (continued)

with management, at periodic intervals, information comparing the Fund’s performance against, among other things, its benchmark. Based on the Board Members’ review, which included careful consideration of the factors noted above, the Board Members concluded that the performance of the Fund, under the circumstances, supported approval of the New Management Agreement and New Subadvisory Agreement.

The Board Members reviewed and considered the management fee that would be payable by the Fund to the Manager in light of the nature, extent and quality of the management services expected to be provided by the Manager. Additionally, the Board Members received and considered information comparing the Fund’s management fee and overall expenses with those of comparable funds in both the relevant expense group and a broader group of funds, each selected and provided by Lipper. The Board Members also reviewed and considered the subadvisory fee that would be payable by the Manager to the Subadviser in light of the nature, extent and quality of the management services expected to be provided by the Subadviser. The Board Members noted that the Manager, and not the Fund, will pay the subadvisory fee to the Subadviser. The Board Members determined that the Fund’s management fee and the Fund’s subadvisory fee were reasonable in light of the nature, extent and quality of the services expected to be provided to the Fund under the New Management Agreement and the New Subadvisory Agreement.

The Board Members received and considered a pro-forma profitability analysis of Legg Mason and its affiliates in providing services to the Fund, including information with respect to the allocation methodologies used in preparing the profitability data. The Board Members recognized that Legg Mason may realize economies of scale based on its internal reorganization and synergies of operations. The Board Members noted that it was not possible to predict with a high degree of confidence how Legg Mason’s and its affiliates’ profitability would be affected by its internal reorganization and by other factors including potential economies of scale, but that based on their review of the pro forma profitability analysis, their most recent prior review of the profitability of the predecessor manager and its affiliates from their relationship with the Fund and other factors considered, they determined that the management fee was reasonable. The Board Members noted that they expect to receive profitability information on an annual basis.

In their deliberations, the Board Members also considered, and placed significant importance on, information that had been received and conclusions that had been reached by the Board in connection with the Board’s most recent approval of the Fund’s prior management agreement, in addition to information provided in connection with the Board’s evaluation of the terms and conditions of the New Management Agreement and the New Subadvisory Agreement.

The Board Members considered Legg Mason’s advice and the advice of its counsel that the New Management Agreement and the New Subadvisory Agreement were being entered into in connection with an internal reorganization within Legg Mason, that did not involve an actual change of control or management. The Board Members further noted that the terms and conditions of the New Management Agreement are substantially identical to those of the Fund’s previous management agreement except for the identity of

20 Salomon Brothers Municipal Partners Fund Inc.

Board Approval of Management and Subadvisory Agreements (unaudited) (continued)

the Manager, and that the initial term of the New Management Agreement (after which it will continue in effect only if such continuance is specifically approved at least annually by the Board, including a majority of the Independent Board Members) was the same as that under the prior management agreement.

In light of all of the foregoing, the Board, including the Independent Board Members, approved the New Management Agreement and the New Subadvisory Agreement. No single factor reviewed by the Board Members was identified as the principal factor in determining whether to approve the New Management Agreement and the New Subadvisory Agreement. The Independent Board Members were advised by separate independent legal counsel throughout the process. The Independent Board Members also discussed the proposed approval of the New Management Agreement and the New Subadvisory Agreement in private sessions with their independent legal counsel at which no representatives of the Manager or Subadviser were present.

Salomon Brothers Municipal Partners Fund Inc. 21

Additional Shareholder Information (unaudited)

Results of Annual Meeting of Stockholders

The Fund held its Annual Meeting of Stockholders on April 28, 2006, for the purpose of voting upon the election of Carol L. Colman, Leslie H. Gelb and Dr. Riordan Roett as Class I Directors of the Fund, to serve until the 2009 Annual Meeting of Stockholders. Under the terms of the Fund’s charter, the holders of preferred stock are entitled as a class, to the exclusion of the holders of common stock, to elect two Directors of the Fund and the Fund’s charter further sets forth that one of the two Preferred Share Directors shall be a Class I Director and the other shall be a Class II. The charter also provides that the remaining Directors shall be elected by holders of common stock and preferred stock voting together as a single class. The following table provides information concerning the matter voted upon at the Meeting.

Election of Directors

Nominees | | Common

Stock

Votes For | | Common

Stock

Votes

Withheld | | Preferred

Stock

Votes For | | Preferred

Stock

Votes

Withheld | |

Class I — to serve until the year 2009 | | | | | | | | | |

Carol L. Colman | | 4,731,577 | | 98,126 | | 620 | | 24 | |

Leslie H. Gelb | | 4,717,400 | | 112,303 | | 620 | | 24 | |

Dr. Riordan Roett | | N/A | | N/A | | 620 | | 24 | |

At June 30, 2006, in addition to Carol L. Colman, Leslie H. Gelb and Dr. Riordan Roett, the other Directors of the Fund were as follows:

Daniel P. Cronin

R. Jay Gerken

William R. Hutchinson

Jeswald W. Salacuse

22 Salomon Brothers Municipal Partners Fund Inc.

Dividend Reinvestment Plan (unaudited)

Pursuant to certain rules of the SEC, the following additional disclosure is provided.

Pursuant to the Fund’s Dividend Reinvestment Plan (“Plan”), holders of Common Stock whose shares of Common Stock are registered in their own names will be deemed to have elected to have all distributions automatically reinvested by American Stock Transfer & Trust Company (“Plan Agent”) in Fund shares pursuant to the Plan, unless they elect to receive distributions in cash. Holders of Common Stock who elect to receive distributions in cash will receive all distributions in cash by check in dollars mailed directly to the holder by the Plan Agent as dividend-paying agent. Holders of Common Stock who do not wish to have distributions automatically reinvested should notify the Plan Agent at the address below. Distributions with respect to Common Stock registered in the name of a bank, broker-dealer or other nominee (i.e., in “street name”) will be reinvested under the Plan unless the service is not provided by the bank, broker-dealer or other nominee or the holder elects to receive distributions in cash. Investors who own shares registered in the name of a bank, broker-dealer or other nominee should consult with such nominee as to participation in the Plan through such nominee, and may be required to have their shares registered in their own names in order to participate in the Plan.

The Plan Agent serves as agent for the holders of Common Stock in administering the Plan. After the Fund declares a distribution on the Common Stock or determines to make a capital gain distribution, the Plan Agent will, as agent for the participants, receive the cash payment and use it to buy the Fund’s Common Stock in the open market, on the NYSE or elsewhere, for the participants’ accounts. The Fund will not issue any new shares of Common Stock in connection with the Plan.

Participants have the option of making additional cash payments to the Plan Agent, monthly, in a minimum amount of $250, for investment in the Fund’s Common Stock. The Plan Agent will use all such funds received from participants to purchase shares of Common Stock in the open market on or about the first business day of each month. To avoid unnecessary cash accumulations, and also to allow ample time for receipt and processing by the Plan Agent, it is suggested that participants send in voluntary cash payments to be received by the Plan Agent approximately ten days before an applicable purchase date specified above. A participant may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than 48 hours before such payment is to be invested.

The Plan Agent maintains all shareholder accounts in the Plan and furnishes written confirmations of all transactions in an account, including information needed by shareholders for personal and tax records. Shares of Common Stock in the account of each Plan participant will be held by the Plan Agent in the name of the participant, and each shareholder’s proxy will include those shares purchased pursuant to the Plan.

In the case of holders of Common Stock, such as banks, broker-dealers or other nominees, who hold shares for others who are beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares of Common Stock certified from time to time by the holders as representing the total amount registered in such holders’ names and held for the account of beneficial owners that have not elected to receive distributions in cash.

Salomon Brothers Municipal Partners Fund Inc. 23

Dividend Reinvestment Plan (unaudited) (continued)

There is no charge to participants for reinvesting of distributions or voluntary cash payments. The Plan Agent’s fees for the reinvestment of distributions and voluntary cash payments will be paid by the Fund. However, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of distributions and voluntary cash payments made by the participant. The receipt of distributions under the Plan will not relieve participants of any income tax which may be payable on such distributions.

Participants may terminate their accounts under the Plan by notifying the Plan Agent in writing. Such termination will be effective immediately if notice in writing is received by the Plan Agent not less than ten days prior to any distribution record date. Upon termination, the Plan Agent will send the participant a certificate for the full shares held in the account and a cash adjustment for any fractional shares or, upon written instruction from the participant, the Plan Agent will sell part or all of the participant’s shares and remit the proceeds to the participant, less a $2.50 fee plus brokerage commission for the transaction.

Experience under the Plan may indicate that changes in the Plan are desirable. Accordingly, the Fund and the Plan Agent reserve the right to terminate the Plan as applied to any voluntary cash payments made and any distributions paid subsequent to notice of the termination sent to all participants in the Plan at least 30 days before the record date for the distribution. The Plan also may be amended by the Fund or the Plan Agent upon at least 30 days’ written notice to participants in the Plan.

All correspondence concerning the Plan should be directed to the Plan Agent at 59 Maiden Lane, New York, New York 10038.

24 Salomon Brothers Municipal Partners Fund Inc.

Salomon Brothers Municipal Partners Fund Inc.

DIRECTORS

Carol L. Colman

Daniel P. Cronin

Leslie H. Gelb

R. Jay Gerken, CFA

Chairman

William H. Hutchinson

Riordan Roett

Jeswald W. Salacuse

OFFICERS

R. Jay Gerken, CFA

President and Chief Executive Officer

Frances M. Guggino

Chief Financial Officer and Treasurer

Ted P. Becker

Chief Compliance Officer

Wendy S. Setnicka

Controller

Robert I. Frenkel

Secretary and Chief Legal Officer

SALOMON BROTHERS MUNICIPAL PARTNERS FUND INC.

125 Broad Street

10th Floor, MF-2

New York, New York 10004

INVESTMENT MANAGER

Legg Mason Partners Fund Advisor, LLC

SUBADVISER

Western Asset Management Company

AUCTION AGENT

Deutsche Bank

60 Wall Street

New York, New York 10005

CUSTODIAN

State Street Bank & Trust Company

225 Franklin Street

Boston, Massachusetts 02110

TRANSFER AGENT

American Stock Transfer & Trust Company

59 Maiden Lane

New York, New York 10038

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

KPMG LLP

345 Park Avenue

New York, New York 10154

LEGAL COUNSEL

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017

NEW YORK STOCK EXCHANGE SYMBOL

MNP

This report is transmitted to the shareholders of Salomon Brothers Municipal Partners Fund Inc. for their information. This is not a prospectus, circular or representation intended for use in the purchase of shares ofthe Fund or any securities mentioned in this report.

American Stock Transfer &

Trust Company

59 Maiden Lane

New York, New York 10038 | | Salomon Brothers Municipal Partners Fund Inc.

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that from time to time the Fund may purchase, at market prices, shares of its common stock in the open market.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Funds Forms N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington D.C., and information on the operation of the Public Reference Room may be obtained

|

SAM0895 6/06 | SR06-125 | | by calling 1-800-SEC-0330. To obtain information on Form N-Q from the Fund, shareholders can call1-800-446-1013. |

| | | |

| | | Information on how the Fund voted proxies relating to portfolio securities during the prior 12 month period ended June 30th of each year and a description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio transactions is available (1) without charge, upon request, by calling 1-800-446-1013, (2) on each Fund’s website at http://www.leggmason.com/InvestorServices and (3) on the SEC’s website at http://www.sec.gov. |

| | |

| | |

| | |

| |

| | | | |

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

Item 4. Principal Accountant Fees and Services

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS.

Included herein under Item 1.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Concerning Citigroup Asset Management (1)(CAM) Proxy Voting Policies and Procedures

The following is a brief overview of the Proxy Voting Policies and Procedures (the “Policies”) that CAM has adopted to seek to ensure that CAM votes proxies relating to equity securities in the best interest of clients.