UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7362 |

|

Western Asset Municipal Partners Fund Inc. |

(Exact name of registrant as specified in charter) |

|

55 Water Street, New York, NY | | 10041 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place,

Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (888) 777-0102 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2009 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

SEMI-ANNUAL REPORT / JUNE 30, 2009

Western Asset Municipal Partners Fund Inc.

(MNP)

Managed by WESTERN ASSET

INVESTMENT PRODUCTS: NOT FDIC INSURED · NO BANK GUARANTEE · MAY LOSE VALUE |

Fund objective

The Fund’s primary investment objective is to seek a high level of current income which is exempt from regular federal income taxes,* consistent with the preservation of capital. As a secondary investment objective, the Fund intends to enhance portfolio value by purchasing tax exempt securities that, in the opinion of the investment manager, may appreciate in value relative to other similar obligations in the marketplace.

* Certain investors may be subject to the federal alternative minimum tax (“AMT”), and state and local taxes will apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser.

What’s inside

Letter from the chairman | I |

| |

Fund at a glance | 1 |

| |

Schedule of investments | 2 |

| |

Statement of assets and liabilities | 11 |

| |

Statement of operations | 12 |

| |

Statements of changes in net assets | 13 |

| |

Financial highlights | 14 |

| |

Notes to financial statements | 16 |

| |

Additional shareholder information | 23 |

| |

Dividend reinvestment plan | 24 |

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and Western Asset Management Company (“Western Asset”) is the Fund’s subadviser. LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc.

Letter from the chairman

Dear Shareholder,

The U.S. economy remained weak during the six-month reporting period ended June 30, 2009. Looking back, the U.S. Department of Commerce reported that third and fourth quarter 2008 U.S. gross domestic product (“GDP”)i contracted 2.7% and 5.4%, respectively. Economic contraction has continued in 2009 as GDP fell 6.4% during the first quarter and the advance estimate for the second quarter is a 1.0% decline. The economy’s more modest contraction in the second quarter was due, in part, to smaller declines in exports and business spending.

The U.S. recession, which began in December 2007, now has the dubious distinction of being the lengthiest since the Great Depression. Contributing to the economy’s troubles has been extreme weakness in the labor market. Since December 2007, approximately six and a half million jobs have been shed and we have experienced eighteen consecutive months of job losses. In addition, the unemployment rate continued to move steadily higher, rising from 9.4% in May to 9.5% in June 2009, to reach its highest rate since August 1983.

Another strain on the economy, the housing market, may finally be getting closer to reaching a bottom. After plunging late in 2008, new single-family home starts have been fairly stable in recent months and, while home prices have continued to fall, the pace of the decline has moderated somewhat. Other recent economic news also seemed to be “less negative.” Inflation remained low, manufacturing contracted at a slower pace and inventory levels were drawn down.

Ongoing issues related to the housing and subprime mortgage markets and seizing credit markets prompted the Federal Reserve Board (“Fed”)ii to take aggressive and, in some cases, unprecedented actions. After reducing the federal funds rateiii from 5.25% in August 2007 to a range of 0 to 1/4 percent in December 2008—a historic low—the Fed has maintained this stance thus far in 2009. In conjunction with its June meeting, the Fed stated that it “will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period.”

Western Asset Municipal Partners Fund Inc. | I |

Letter from the chairman continued

In addition to maintaining extremely low short-term interest rates, the Fed took several actions to improve liquidity in the credit markets. Back in September 2008, it announced an $85 billion rescue plan for ailing AIG and pumped $70 billion into the financial system as Lehman Brothers’ bankruptcy and mounting troubles at other financial firms roiled the markets. More recently, the Fed has taken additional measures to thaw the frozen credit markets, including the purchase of debt issued by Fannie Mae and Freddie Mac, as well as introducing the Term Asset-Backed Securities Loan Facility (“TALF”). In March 2009, the Fed continued to pursue aggressive measures as it announced its intentions to:

· Purchase up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion in 2009.

· Increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion.

· Buy up to $300 billion of longer-term Treasury securities over the next six months.

The U.S. Department of the Treasury has also taken an active role in attempting to stabilize the financial system, as it orchestrated the government’s takeover of mortgage giants Fannie Mae and Freddie Mac in September 2008. In October, the Treasury’s $700 billion Troubled Asset Relief Program (“TARP”) was approved by Congress and signed into law by former President Bush. Then, in March 2009, Treasury Secretary Geithner introduced the Public-Private Partnership Investment Program (“PPIP”), which is intended to facilitate the purchase of troubled mortgage assets from bank balance sheets. President Obama has also made reviving the economy a priority in his administration, the cornerstone thus far being the $787 billion stimulus package that was signed into law in February 2009.

Both short- and long-term Treasury yields fluctuated during the reporting period. This was often prompted by changing perceptions regarding the economy, future Fed policy decisions and the government’s initiatives to stabilize the financial system. When the period began, Treasury yields were extremely low, given numerous “flights to quality” in 2008 that were triggered by the financial crisis. After starting the period at 0.76% and 2.25%, respectively, two- and ten-year Treasury yields drifted even lower (and their prices higher) in mid-January 2009. Yields then generally moved higher (and their prices lower) until early June. Two- and ten-year yields peaked at 1.42% and 3.98%, respectively, before falling and ending the reporting period at 1.11% and 3.53%. Over the six months ended June 30, 2009, longer-term yields moved higher than their shorter-term counterparts due to fears of future inflation given the government’s massive stimulus

II | Western Asset Municipal Partners Fund Inc. |

program. In a reversal from 2008, investor risk aversion faded as the six-month reporting period progressed, driving spread sector (non-Treasury) prices higher.

The municipal bond market outperformed its taxable bond counterpart over the six months ended June 30, 2009. Over that period, the Barclays Capital Municipal Bond Indexiv and the Barclays Capital U.S. Aggregate Indexv returned 6.43% and 1.90%, respectively. Municipal securities outperformed the taxable bond market during four of the six months of the reporting period, as risk aversion decreased and investors were drawn to the attractive yields and valuations in the tax-free market.

Performance review

For the six months ended June 30, 2009, Western Asset Municipal Partners Fund Inc. returned 17.79% based on its net asset value (“NAV”)vi and 27.90% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the Barclays Capital Municipal Bond Index, returned 6.43% over the same time frame. The Lipper General Municipal Debt (Leveraged) Closed-End Funds Category Averagevii returned 18.36% for the same period. Please note that Lipper performance returns are based on each fund’s NAV.

During this six-month period, the Fund made distributions to shareholders totaling $0.33 per share, which may have included a return of capital. The performance table shows the Fund’s six-month total return based on its NAV and market price as of June 30, 2009. Past performance is no guarantee of future results.

Certain investors may be subject to the federal alternative minimum tax, and state and local taxes will apply. Capital gains, if any, are fully taxable. Please consult your personal tax or legal adviser.

PERFORMANCE SNAPSHOT as of June 30, 2009 (unaudited)

PRICE PER SHARE | | 6-MONTH

TOTAL RETURN*

(not annualized) | |

$13.50 (NAV) | | 17.79% | |

$12.05 (Market Price) | | 27.90% | |

All figures represent past performance and are not a guarantee of future results.

*Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions, including returns of capital, if any, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Western Asset Municipal Partners Fund Inc. | III |

Letter from the chairman continued

A special note regarding increased market volatility

Dramatically higher volatility in the financial markets has been very challenging for many investors. Market movements have been rapid–sometimes in reaction to economic news, and sometimes creating the news. In the midst of this evolving market environment, we at Legg Mason want to do everything we can to help you reach your financial goals. Now, as always, we remain committed to providing you with excellent service and a full spectrum of investment choices. Rest assured, we will continue to work hard to ensure that our investment managers make every effort to deliver strong long-term results.

We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our enhanced website, www.leggmason.com/cef. Here you can gain immediate access to many special features to help guide you through difficult times, including:

· Fund prices and performance,

· Market insights and commentaries from our portfolio managers, and

· A host of educational resources.

During periods of market unrest, it is especially important to work closely with your financial advisor and remember that reaching one’s investment goals unfolds over time and through multiple market cycles. Time and again, history has shown that, over the long run, the markets have eventually recovered and grown.

Information about your fund

Important information with regard to certain regulatory developments that may affect the Fund is contained in the Notes to Financial Statements included in this report.

Looking for additional information?

The Fund is traded under the symbol “MNP” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XMNPX” on most financial websites. Barron’s and The Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites, as well as www.leggmason.com/cef.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Standard Time, for the Fund’s current NAV, market price and other information.

IV | Western Asset Municipal Partners Fund Inc. |

As always, thank you for your confidence in our stewardship of your assets. We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

July 31, 2009

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

RISKS: An investment in the Fund is subject to risk, including the possible loss of the principal amount that you invest in the Fund. Certain investors may be subject to the federal alterative minimum tax, and state and local taxes will apply. Capital gains, if any, are fully taxable. As interest rates rise, bond prices fall, reducing the value of the Fund’s fixed-income securities. Lower-rated, higher-yielding bonds are subject to greater credit risk than higher-rated obligations.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

i Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time.

ii The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments.

iii The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day.

iv The Barclays Capital (formerly Lehman Brothers) Municipal Bond Index is a market value weighted index of investment grade municipal bonds with maturities of one year or more.

v The Barclays Capital (formerly Lehman Brothers) U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity.

vi Net asset value (“NAV”) is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares.

vii Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the six-month period ended June 30, 2009, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 58 funds in the Fund’s Lipper category.

Western Asset Municipal Partners Fund Inc. | V |

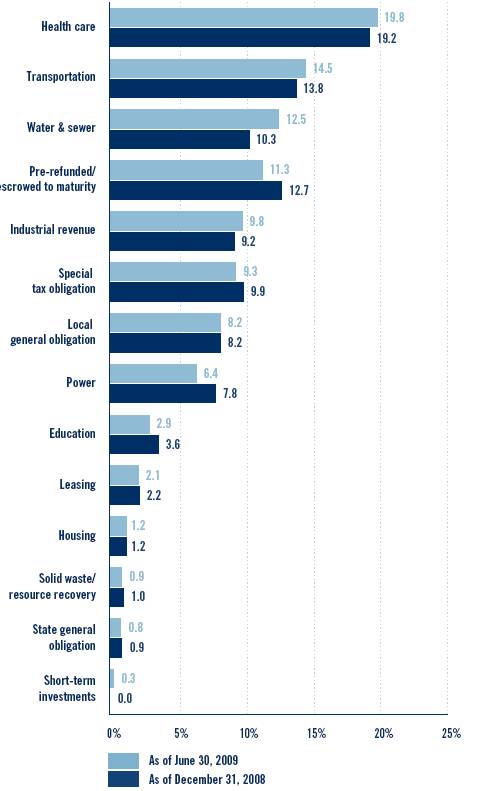

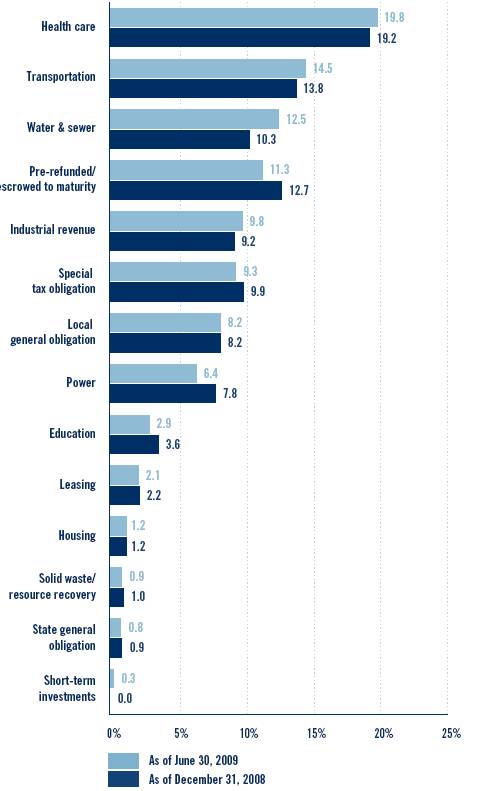

Fund at a glance (unaudited)

INVESTMENT BREAKDOWN (%) As a percent of total investments

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 1 |

Schedule of investments (unaudited)

June 30, 2009

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

FACE

AMOUNT | | SECURITY | | VALUE | |

MUNICIPAL BONDS† — 99.7% | | | |

| | Arizona — 1.8% | | | |

$ | 2,855,000 | | Glendale, AZ, Transportation Excise Tax Revenue, NATL, 5.000% due 7/1/28 | | $ | 2,894,370 | |

1,000,000 | | Phoenix, AZ, Civic Improvement Corp., Water System Revenue, 5.000% due 7/1/29 | | 1,026,090 | |

| | Total Arizona | | 3,920,460 | |

| | California — 9.0% | | | |

5,000,000 | | California Health Facilities Finance Authority Revenue, Catholic Healthcare West, 5.625% due 7/1/32 | | 4,719,400 | |

2,000,000 | | California Housing Finance Agency Revenue, Home Mortgage, 4.800% due 8/1/37(a) | | 1,493,960 | |

35,000 | | California State, GO, Unrefunded Balance, 5.125% due 6/1/24 | | 33,164 | |

1,500,000 | | California Statewide CDA Revenue, Insured Health Facility L.A., Jewish Home, CA Mortgage Insurance, 5.000% due 11/15/28 | | 1,365,285 | |

5,000,000 | | Los Angeles, CA, Department of Water & Power Revenue, Power Systems, Subordinated, FSA, 5.000% due 7/1/35 | | 4,776,050 | |

2,000,000 | | Southern California Public Power Authority, Project Number 1, 5.250% due 11/1/26 | | 1,727,460 | |

2,500,000 | | Turlock, CA, Public Financing Authority, Tax Allocation Revenue, FSA, 5.000% due 9/1/30 | | 2,543,450 | |

2,620,000 | | University of California Revenues, AMBAC, 5.000% due 5/15/36 | | 2,529,741 | |

| | Total California | | 19,188,510 | |

| | Colorado — 5.6% | | | |

| | Colorado Health Facilities Authority Revenue: | | | |

2,850,000 | | Poudre Valley Health Care, 5.000% due 3/1/25 | | 2,549,724 | |

5,000,000 | | Refunding Adventist Health, Sunbelt, 5.250% due 11/15/35(b) | | 4,525,600 | |

495,000 | | Colorado Springs, CO, Hospital Revenue, 6.375% due 12/15/30(c) | | 536,887 | |

| | Public Authority for Colorado Energy, Natural Gas Purchase Revenue: | | | |

500,000 | | 5.750% due 11/15/18 | | 476,995 | |

4,000,000 | | 6.500% due 11/15/38 | | 3,794,520 | |

| | Total Colorado | | 11,883,726 | |

| | Connecticut — 0.5% | | | |

1,000,000 | | Connecticut State HFA, Housing Mortgage Finance Program, 6.000% due 11/15/38 | | 1,034,630 | |

| | District of Columbia — 2.0% | | | |

4,600,000 | | District of Columbia, Hospital Revenue, Childrens Hospital Obligation Group, FSA, 5.250% due 7/15/45 | | 4,200,030 | |

| | Florida — 4.1% | | | |

2,000,000 | | Florida State Department of Environmental Protection, Preservation Revenue, Florida Forever, AMBAC, 5.000% due 7/1/21 | | 1,998,200 | |

4,950,000 | | Florida State Department of Transportation, Turnpike Revenue, FSA, 4.500% due 7/1/34 | | 4,397,135 | |

| | | | | | | |

See Notes to Financial Statements.

2 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

FACE

AMOUNT | | SECURITY | | VALUE | |

| | Florida — 4.1% continued | | | |

$ | 2,000,000 | | Miami-Dade County, FL, Aviation Revenue, Miami International Airport, FSA, 5.000% due 10/1/41 | | $ | 1,835,560 | |

500,000 | | Seminole Tribe Florida Special Obligation Revenue, 5.250% due 10/1/27(d) | | 413,275 | |

| | Total Florida | | 8,644,170 | |

| | Hawaii — 0.9% | | | |

2,000,000 | | Hawaii State Airport System Revenue, FGIC, 6.000% due 7/1/19(a) | | 2,007,380 | |

| | Illinois — 13.1% | | | |

| | Chicago, IL, Midway Airport Revenue, NATL: | | | |

2,000,000 | | 5.500% due 1/1/29 | | 2,000,240 | |

3,750,000 | | 5.625% due 1/1/29(a) | | 3,401,813 | |

5,000,000 | | Chicago, IL, Park District, GO, Refunding, FGIC, 5.000% due 1/1/29 | | 5,119,500 | |

1,000,000 | | Chicago, IL, Public Building Commission, Building Revenue, Chicago School Reform, FGIC, 5.250% due 12/1/18 | | 1,065,630 | |

1,500,000 | | Cook County, IL, Community College District No. 524 Moraine Valley, GO, NATL, 5.000% due 12/1/25 | | 1,524,630 | |

2,000,000 | | Illinois EFA Revenue, Northwestern University, 5.500% due 12/1/13 | | 2,234,840 | |

| | Illinois Health Facilities Authority Revenue: | | | |

| | Refunding: | | | |

1,475,000 | | Lutheran General Health System, 7.000% due 4/1/14 | | 1,636,232 | |

1,850,000 | | SSM Health Care, NATL, 6.550% due 6/1/13(e) | | 2,194,322 | |

2,000,000 | | Servantoor Project, FSA, 6.000% due 8/15/12(e) | | 2,172,340 | |

605,000 | | South Suburban Hospital Project, 7.000% due 2/15/18(e) | | 726,339 | |

4,145,000 | | Illinois Municipal Electric Agency Power Supply, FGIC, 5.250% due 2/1/28 | | 4,225,164 | |

1,500,000 | | Illinois State, GO, First Series, FSA, 5.500% due 5/1/16 | | 1,694,115 | |

| | Total Illinois | | 27,995,165 | |

| | Indiana — 1.8% | | | |

| | Indiana Bond Bank Revenue: | | | |

715,000 | | 5.000% due 8/1/23(c) | | 756,942 | |

1,285,000 | | Unrefunded Balance, 5.000% due 8/1/23 | | 1,314,002 | |

2,390,000 | | Indiana Health Facility Financing Authority, Hospital Revenue, Community Hospital Project, AMBAC, 5.000% due 5/1/35 | | 1,754,236 | |

| | Total Indiana | | 3,825,180 | |

| | Iowa — 0.5% | | | |

1,000,000 | | Iowa Finance Authority, Hospital Facility Revenue, 6.750% due 2/15/16(c) | | 1,045,470 | |

| | Kansas — 0.7% | | | |

1,430,000 | | Kansas State Development Finance Authority, Health Facilities Revenue, Sisters of Charity, 6.250% due 12/1/28 | | 1,465,936 | |

| | | | | | | |

See Notes to Financial Statements.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 3 |

Schedule of investments (unaudited) continued

June 30, 2009

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

FACE

AMOUNT | | SECURITY | | VALUE | |

| | Maryland — 5.8% | | | |

| | Maryland State Health & Higher EFA Revenue: | | | |

$ | 3,000,000 | | Carroll County General Hospital, 6.000% due 7/1/37 | | $ | 2,932,410 | |

2,500,000 | | Suburban Hospital, 5.500% due 7/1/16 | | 2,600,350 | |

| | University of Maryland Medical Systems: | | | |

1,000,000 | | 6.750% due 7/1/30(c) | | 1,069,490 | |

1,000,000 | | 6.000% due 7/1/32(c) | | 1,128,420 | |

| | Northeast Maryland Waste Disposal Authority, Solid Waste Revenue, AMBAC: | | | |

2,500,000 | | 5.500% due 4/1/15(a) | | 2,554,725 | |

2,000,000 | | 5.500% due 4/1/16(a) | | 2,031,480 | |

| | Total Maryland | | 12,316,875 | |

| | Massachusetts — 5.0% | | | |

1,000,000 | | Massachusetts Educational Financing Authority Education Loan Revenue, 6.125% due 1/1/22(a) | | 1,014,790 | |

| | Massachusetts State HEFA Revenue, Partners Health: | | | |

2,405,000 | | 5.750% due 7/1/32(c) | | 2,654,687 | |

95,000 | | Unrefunded Balance, 5.750% due 7/1/32 | | 96,532 | |

| | Massachusetts State Water Pollution Abatement Trust Revenue, MWRA Program: | | | |

1,155,000 | | 5.750% due 8/1/29(c) | | 1,170,870 | |

4,665,000 | | Unrefunded Balance, 5.750% due 8/1/29 | | 4,723,499 | |

1,000,000 | | Massachusetts State Water Resources Authority, NATL, 5.000% due 8/1/34 | | 1,003,260 | |

| | Total Massachusetts | | 10,663,638 | |

| | Michigan — 3.2% | | | |

| | Michigan State, Hospital Finance Authority Revenue: | | | |

2,000,000 | | McLaren Health Care Corp., 5.750% due 5/15/38 | | 1,836,940 | |

2,500,000 | | Refunding, Sparrow Hospital Obligated, 5.000% due 11/15/36 | | 1,959,275 | |

3,000,000 | | Trinity Health, 5.375% due 12/1/30 | | 2,949,300 | |

| | Total Michigan | | 6,745,515 | |

| | Missouri — 1.6% | | | |

2,000,000 | | Boone County, MO, Hospital Revenue, Boone Hospital Center, 5.375% due 8/1/38 | | 1,691,840 | |

1,500,000 | | Missouri State Highways & Transit Commission, State Road Revenue, Second Lien, 5.250% due 5/1/20 | | 1,670,535 | |

| | Total Missouri | | 3,362,375 | |

| | New Jersey — 7.1% | | | |

| | New Jersey EDA: | | | |

2,500,000 | | Motor Vehicle Surcharges Revenue, NATL, 5.250% due 7/1/16 | | 2,622,700 | |

5,150,000 | | PCR, Revenue, Public Service Electric and Gas Co. Project, NATL, 6.400% due 5/1/32(a) | | 5,156,489 | |

| | | | | | | |

See Notes to Financial Statements.

4 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

FACE

AMOUNT | | SECURITY | | VALUE | |

| | New Jersey — 7.1% continued | | | |

$ | 5,450,000 | | Water Facilities Revenue, New Jersey American Water Co. Inc. Project, FGIC, 6.875% due 11/1/34(a) | | $ | 5,450,272 | |

2,000,000 | | New Jersey State, Turnpike Authority Revenue, 5.250% due 1/1/40 | | 1,999,980 | |

| | Total New Jersey | | 15,229,441 | |

| | New York — 10.9% | | | |

2,000,000 | | Liberty, NY, Development Corporation Revenue, Goldman Sachs Headquarters, 5.250% due 10/1/35 | | 1,813,360 | |

500,000 | | Nassau County, NY, Industrial Development Agency Revenue, Continuing Care Retirement, Amsterdam at Harborside, 6.700% due 1/1/43 | | 378,090 | |

| | New York City, NY: | | | |

| | GO: | | | |

1,980,000 | | 6.000% due 5/15/30(c) | | 2,094,999 | |

20,000 | | Unrefunded Balance, 6.000% due 5/15/30 | | 20,446 | |

1,000,000 | | Municipal Water Finance Authority, Water & Sewer Systems Revenue, 5.125% due 6/15/31 | | 1,005,010 | |

4,115,000 | | TFA Revenue, Unrefunded Balance, Future Tax Secured, 5.500% due 11/15/17 | | 4,399,017 | |

3,365,000 | | New York State Dormitory Authority Revenue, Court Facilities Lease, NYC Issue, Non State Supported Debt, AMBAC, 5.500% due 5/15/30 | | 3,444,818 | |

4,700,000 | | New York State Thruway Authority, Second General Highway & Bridge Trust Fund, AMBAC, 5.000% due 4/1/26 | | 4,833,198 | |

5,000,000 | | New York State Urban Development Corp. Revenue, State Personal Income Tax, 5.000% due 3/15/26 | | 5,131,250 | |

| | Total New York | | 23,120,188 | |

| | North Carolina — 0.5% | | | |

1,200,000 | | North Carolina Medical Care Commission Health Care Facilities Revenue, Novant Health Obligation Group, 5.000% due 11/1/39 | | 1,138,080 | |

| | Oregon — 0.6% | | | |

1,250,000 | | Multnomah County, OR, Hospital Facilities Authority Revenue, Providence Health Systems, 5.250% due 10/1/18 | | 1,318,850 | |

| | Pennsylvania — 1.5% | | | |

| | Philadelphia, PA: | | | |

2,685,000 | | Gas Works Revenue, 7th General Ordinance, AMBAC, 5.000% due 10/1/17 | | 2,578,486 | |

500,000 | | School District, GO, FSA, 5.500% due 2/1/31(c) | | 553,160 | |

| | Total Pennsylvania | | 3,131,646 | |

| | Tennessee — 2.2% | | | |

4,700,000 | | Memphis-Shelby County, TN, Airport Authority Revenue, AMBAC, 6.000% due 3/1/24(a) | | 4,729,610 | |

| | | | | | | |

See Notes to Financial Statements.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 5 |

Schedule of investments (unaudited) continued

June 30, 2009

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

FACE

AMOUNT | | SECURITY | | VALUE | |

| | Texas — 15.5% | | | |

$ | 5,000,000 | | Aledo, TX, GO, ISD, School Building, PSF, 5.000% due 2/15/30 | | $ | 5,100,100 | |

| | Austin, TX, Water & Wastewater System Revenue: | | | |

2,500,000 | | 5.000% due 11/15/26 | | 2,602,450 | |

2,210,000 | | 5.125% due 11/15/28 | | 2,310,179 | |

1,100,000 | | Beaumont, TX, ISD, GO, School Building, PSF, 5.000% due 2/15/33 | | 1,109,636 | |

250,000 | | Brazos River Authority Texas PCR, TXU Co., 8.250% due 5/1/33(a)(d) | | 120,003 | |

4,750,000 | | Brazos River, TX, Harbor Navigation District, Brazoria County Environmental, Dow Chemical Co. Project, 5.950% due 5/15/33(a) | | 4,029,853 | |

3,125,000 | | Cypress-Fairbanks, TX, ISD, GO, School House, PSF, 5.000% due 2/15/30 | | 3,196,281 | |

2,960,000 | | Harris County, TX, Health Facilities Development Corp., Hospital Revenue, Memorial Hermann Healthcare Systems, 5.250% due 12/1/18 | | 2,918,856 | |

3,000,000 | | Houston, TX, Utility System Revenue, Refunding, Combined First Lien, FSA, 5.250% due 5/15/20 | | 3,161,220 | |

1,000,000 | | Mesquite, TX, ISD No. 1, GO, Capital Appreciation, PSFG, zero coupon bond to yield 5.169% due 8/15/27 | | 389,870 | |

2,500,000 | | North Texas Tollway Authority Revenue, 5.750% due 1/1/40 | | 2,450,675 | |

1,000,000 | | Spring, Tex, ISD, GO, SchoolHouse, PSF, 5.000% due 8/15/23 | | 1,073,300 | |

5,000,000 | | Texas State Turnpike Authority Revenue, First Tier, AMBAC, 5.500% due 8/15/39 | | 4,490,700 | |

| | Total Texas | | 32,953,123 | |

| | Virginia — 1.5% | | | |

2,915,000 | | Greater Richmond, VA, Convention Center Authority, Hotel Tax Revenue, Convention Center Expansion Project, 6.125% due 6/15/20(c) | | 3,099,869 | |

| | Washington — 4.3% | | | |

2,900,000 | | Chelan County, WA, Public Utility District, Chelan Hydro System No.1, Construction Revenue, AMBAC, 5.450% due 7/1/37(a) | | 2,475,295 | |

2,000,000 | | Port of Seattle, WA, Revenue, Refunding, Intermediate Lien, NATL, 5.000% due 3/1/30 | | 1,977,020 | |

4,650,000 | | Seattle, WA, GO, FSA, 5.750% due 12/1/28(c) | | 4,796,428 | |

| | Total Washington | | 9,248,743 | |

| | TOTAL INVESTMENTS BEFORE SHORT-TERM INVESTMENTS

(Cost — $216,532,182) | | 212,268,610 | |

SHORT-TERM INVESTMENTS† — 0.3% | | | |

| | Illinois — 0.2% | | | |

400,000 | | Illinois DFA, Chicago Educational Television Association, LOC-LaSalle Bank, 0.350%, 7/1/09(f) | | 400,000 | |

| | Michigan — 0.1% | | | |

100,000 | | University of Michigan Revenue, 0.280%, 7/1/09(f) | | 100,000 | |

| | Nebraska — 0.0% | | | |

100,000 | | Nebraska Educational Finance Authority Revenue, Creighton University Projects, LOC-JPMorgan Chase, 0.180%, 7/1/09(f) | | 100,000 | |

| | | | | | | |

See Notes to Financial Statements.

6 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

FACE

AMOUNT | | SECURITY | | VALUE | |

| | Virginia — 0.0% | | | |

$ | 100,000 | | Virginia Commonwealth University, VA, AMBAC, LOC-Wachovia Bank N.A., SPA-Wachovia Bank N.A., 0.300%, 7/1/09(f) | | $ | 100,000 | |

| | TOTAL SHORT-TERM INVESTMENTS (Cost — $700,000) | | 700,000 | |

| | TOTAL INVESTMENTS — 100.0% (Cost — $217,232,182#) | | $ | 212,968,610 | |

| | | | | | | |

† Under the Statement of Financial Accounting Standards No. 157, all securities are deemed Level 2. Please refer to Note 1 of the Notes to Financial Statements.

(a) Income from this issue is considered a preference item for purposes of calculating the alternative minimum tax (“AMT”).

(b) Variable rate security. Interest rate disclosed is that which is in effect at June 30, 2009.

(c) Pre-Refunded bonds are escrowed with U.S. government obligations and/or U.S. government agency securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings.

(d) Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted.

(e) Bonds are escrowed to maturity by government securities and/or U.S. government agency securities and are considered by the manager to be triple-A rated even if issuer has not applied for new ratings.

(f) Variable rate demand obligations have a demand feature under which the Fund can tender them back to the issuer or liquidity provider on no more than 7 days notice. Date shown is the date of the next interest rate change.

# Aggregate cost for federal income tax purposes is substantially the same.

Abbreviations used in this schedule: |

AMBAC | – American Municipal Bond Assurance Corporation - Insured Bonds |

CDA | – Community Development Authority |

DFA | – Development Finance Agency |

EDA | – Economic Development Authority |

EFA | – Educational Facilities Authority |

FGIC | – Financial Guaranty Insurance Company - Insured Bonds |

FSA | – Financial Security Assurance - Insured Bonds |

GO | – General Obligation |

HEFA | – Health & Educational Facilities Authority |

HFA | – Housing Finance Authority |

ISD | – Independent School District |

LOC | – Letter of Credit |

MWRA | – Massachusetts Water Resources Authority |

NATL | – National Public Finance Guarantee Corporation - Insured Bonds |

PCR | – Pollution Control Revenue |

PSF | – Permanent School Fund |

PSFG | – Permanent School Fund Guaranty |

SPA | – Standby Bond Purchase Agreement - Insured Bonds |

TFA | – Transitional Finance Authority |

See Notes to Financial Statements.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 7 |

Schedule of investments (unaudited) continued

June 30, 2009

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

SUMMARY OF INVESTMENTS BY INDUSTRY* | | | |

| | | |

Health care | | 19.8 | % |

Transportation | | 14.5 | |

Water & sewer | | 12.5 | |

Pre-refunded/escrowed to maturity | | 11.3 | |

Industrial revenue | | 9.8 | |

Special tax obligation | | 9.3 | |

Local general obligation | | 8.2 | |

Power | | 6.4 | |

Education | | 2.9 | |

Leasing | | 2.1 | |

Housing | | 1.2 | |

Solid waste/resource recovery | | 0.9 | |

State general obligation | | 0.8 | |

Short-term investments | | 0.3 | |

| | 100.0 | % |

* As a percentage of total investments. Please note that Fund holdings are as of June, 30, 2009 and are subject to change.

RATINGS TABLE† | | | |

| | | |

S&P/Moody’s‡ | | | |

AAA/Aaa | | 34.9 | % |

AA/Aa | | 26.9 | |

A | | 29.7 | |

BBB/Baa | | 3.5 | |

CCC/Caa | | 0.1 | |

A-1/VMIG1 | | 0.3 | |

NR | | 4.6 | |

| | 100.0 | % |

† As a percentage of total investments.

‡ In the event that a security is rated by multiple nationally recognized statistical rating organizations (“NRSROs”) and receives different ratings, the fund will treat the security as being rated in the highest rating category received from an NRSRO.

See pages 9 and 10 for definitions of ratings.

8 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

Bond ratings (unaudited)

The definitions of the applicable rating symbols are set forth below:

Standard & Poor’s Ratings Service (“Standard & Poor’s”) – Ratings from “AA” to “CCC” may be modified by the addition of a plus (+) or minus (-) sign to show relative standings within the major rating categories.

AAA | – | Bonds rated “AAA” have the highest rating assigned by Standard & Poor’s. Capacity to pay interest and repay principal is extremely strong. |

AA | – | Bonds rated “AA” have a very strong capacity to pay interest and repay principal and differ from the highest rated issues only in a small degree. |

A | – | Bonds rated “A” have a strong capacity to pay interest and repay principal although they are somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher rated categories. |

BBB | – | Bonds rated “BBB” are regarded as having an adequate capacity to pay interest and repay principal. Whereas they normally exhibit adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for bonds in this category than in higher rated categories. |

BB, B, CCC, CC and C | – | Bonds rated “BB”, “B”, “CCC”, “CC” and “C” are regarded, on balance, as predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation. “BB” represents the lowest degree of speculation and “C” the highest degree of speculation. While such bonds will likely have some quality and protective characteristics, these are outweighed by large uncertainties or major risk exposures to adverse conditions. |

D | – | Bonds rated “D” are in default and payment of interest and/or repayment of principal is in arrears. |

| | |

Moody's Investors Service (“Moody’s”) – Numerical modifiers 1, 2 and 3 may be applied to each generic rating from “Aa” to “Caa,” where 1 is the highest and 3 the lowest ranking within its generic category. |

Aaa | – | Bonds rated “Aaa” are judged to be of the best quality. They carry the smallest degree of investment risk and are generally referred to as “gilt edge.” Interest payments are protected by a large or by an exceptionally stable margin and principal is secure. While the various protective elements are likely to change, such changes can be visualized as most unlikely to impair the fundamentally strong position of such issues. |

Aa | – | Bonds rated “Aa” are judged to be of high quality by all standards. Together with the “Aaa” group they comprise what are generally known as high grade bonds. They are rated lower than the best bonds because margins of protection may not be as large as in “Aaa” securities or fluctuation of protective elements may be of greater amplitude or there may be other elements present which make the long-term risks appear somewhat larger than in “Aaa” securities. |

A | – | Bonds rated “A” possess many favorable investment attributes and are to be considered as upper medium grade obligations. Factors giving security to principal and interest are considered adequate but elements may be present which suggest a susceptibility to impairment some time in the future. |

Baa | – | Bonds rated “Baa” are considered as medium grade obligations, i.e., they are neither highly protected nor poorly secured. Interest payments and principal security appear adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over any great length of time. Such bonds lack outstanding investment characteristics and in fact have speculative characteristics as well. |

Ba | – | Bonds rated “Ba” are judged to have speculative elements; their future cannot be considered as well assured. Often the protection of interest and principal payments may be very moderate and therefore not well safeguarded during both good and bad times over the future. Uncertainty of position characterizes bonds in this class. |

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 9 |

Bond ratings (unaudited) continued

B | – | Bonds rated “B” generally lack characteristics of desirable investments. Assurance of interest and principal payments or of maintenance of other terms of the contract over any long period of time may be small. |

Caa | – | Bonds rated “Caa” are of poor standing. These may be in default, or present elements of danger may exist with respect to principal or interest. |

Ca | – | Bonds rated “Ca” represent obligations which are speculative in a high degree. Such issues are often in default or have other marked short-comings. |

C | – | Bonds rated “C” are the lowest class of bonds and issues so rated can be regarded as having extremely poor prospects of ever attaining any real investment standing. |

NR | – | Indicates that the bond is not rated by Standard & Poor’s or Moody’s. |

Short-term security ratings (unaudited)

SP-1 | – | Standard & Poor’s highest rating indicating very strong or strong capacity to pay principal and interest; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign. |

A-1 | – | Standard & Poor’s highest commercial paper and variable-rate demand obligation (VRDO) rating indicating that the degree of safety regarding timely payment is either overwhelming or very strong; those issues determined to possess overwhelming safety characteristics are denoted with a plus (+) sign. |

VMIG 1 | – | Moody’s highest rating for issues having a demand feature – VRDO. |

MIG1 | – | Moody’s highest rating for short-term municipal obligations. |

P-1 | – | Moody’s highest rating for commercial paper and for VRDO prior to the advent of the VMIG 1 rating. |

| | |

F1 | – | Fitch’s highest rating indicating the strongest capacity for timely payment of financial commitments; those issues determined to possess overwhelming strong credit feature are denoted with a plus (+) sign. |

10 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

Statement of assets and liabilities (unaudited)

June 30, 2009

ASSETS: | | | |

Investments, at value (Cost — $217,232,182) | | $212,968,610 | |

Cash | | 3,999 | |

Interest receivable | | 3,425,624 | |

Prepaid expenses | | 38,287 | |

Total Assets | | 216,436,520 | |

LIABILITIES: | | | |

Investment management fee payable | | 97,921 | |

Directors’ fees payable | | 3,397 | |

Accrued expenses | | 107,511 | |

Total Liabilities | | 208,829 | |

Auction Rate Cumulative Preferred Stock (1,700 shares authorized and issued at $50,000 per share) (Note 5) | | 85,000,000 | |

TOTAL NET ASSETS | | $131,227,691 | |

NET ASSETS: | | | |

Par value ($0.001 par value; 9,719,063 shares issued and outstanding; 100,000,000 shares authorized) | | $ 9,719 | |

Paid-in capital in excess of par value | | 135,567,168 | |

Undistributed net investment income | | 1,968,215 | |

Accumulated net realized loss on investments and futures contracts | | (2,053,839 | ) |

Net unrealized depreciation on investments | | (4,263,572 | ) |

TOTAL NET ASSETS | | $131,227,691 | |

Shares Outstanding | | 9,719,063 | |

Net Asset Value | | $13.50 | |

See Notes to Financial Statements.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 11 |

Statement of operations (unaudited)

For the Six Months Ended June 30, 2009

INVESTMENT INCOME: | | | |

Interest | | $ 5,612,519 | |

EXPENSES: | | | |

Investment management fee (Note 2) | | 575,791 | |

Auction participation fees (Note 5) | | 108,008 | |

Audit and tax | | 53,487 | |

Directors’ fees | | 34,472 | |

Legal fees | | 31,811 | |

Shareholder reports | | 25,186 | |

Transfer agent fees | | 12,281 | |

Stock exchange listing fees | | 11,526 | |

Insurance | | 2,492 | |

Custody fees | | 2,393 | |

Miscellaneous expenses | | 12,409 | |

Total Expenses | | 869,856 | |

NET INVESTMENT INCOME | | 4,742,663 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FUTURES CONTRACTS (NOTES 1, 3 AND 4): | | | |

Net Realized Loss From: | | | |

Investment transactions | | (596,618 | ) |

Futures contracts | | (518,078 | ) |

Net Realized Loss | | (1,114,696 | ) |

Change in Net Unrealized Appreciation/Depreciation From: | | | |

Investments | | 14,842,429 | |

Futures contracts | | 2,034,313 | |

Change in Net Unrealized Appreciation/Depreciation | | 16,876,742 | |

NET GAIN ON INVESTMENTS AND FUTURES CONTRACTS | | 15,762,046 | |

Distributions Paid to Auction Rate Cumulative Preferred Stockholders From Net Investment Income (Notes 1 and 5) | | (304,798 | ) |

INCREASE IN NET ASSETS FROM OPERATIONS | | $20,199,911 | |

See Notes to Financial Statements.

12 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

Statements of changes in net assets

FOR THE SIX MONTHS ENDED JUNE 30, 2009 (unaudited) AND THE YEAR ENDED DECEMBER 31, 2008 | | 2009 | | 2008 | |

OPERATIONS: | | | | | |

Net investment income | | $ 4,742,663 | | $ 9,186,427 | |

Net realized loss | | (1,114,696 | ) | (974,791 | ) |

Change in net unrealized appreciation/depreciation | | 16,876,742 | | (26,263,000 | ) |

Distributions Paid to Auction Rate Cumulative Preferred Stockholders From: | | | | | |

Net investment income | | (304,798 | ) | (2,779,113 | ) |

Net realized gains | | — | | (191,771 | ) |

Increase (Decrease) in Net Assets From Operations | | 20,199,911 | | (21,022,248 | ) |

DISTRIBUTIONS TO SHAREHOLDERS FROM (NOTE 1): | | | | | |

Net investment income | | (3,158,695 | ) | (6,037,394 | ) |

Net realized gains | | — | | (374,759 | ) |

Decrease in Net Assets From Distributions to Common Shareholders | | (3,158,695 | ) | (6,412,153 | ) |

FUND SHARE TRANSACTIONS: | | | | | |

Cost of tendered shares (0 and 1,049,983 tendered shares, respectively) (Note 7) | | — | | (15,048,949 | ) |

Decrease in Net Assets From Fund Share Transactions | | — | | (15,048,949 | ) |

INCREASE (DECREASE) IN NET ASSETS | | 17,041,216 | | (42,483,350 | ) |

NET ASSETS: | | | | | |

Beginning of period | | 114,186,475 | | 156,669,825 | |

End of period* | | $131,227,691 | | $114,186,475 | |

* Includes undistributed net investment income of: | | $1,968,215 | | $689,045 | |

See Notes to Financial Statements.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 13 |

Financial highlights

FOR A SHARE OF CAPITAL STOCK OUTSTANDING THROUGHOUT EACH YEAR ENDED DECEMBER 31, UNLESS OTHERWISE NOTED:

| | 20091,2 | | 20082 | | 20072 | | 20062 | | 2005 | | 2004 | |

NET ASSET VALUE, BEGINNING OF PERIOD | | $11.75 | | $14.55 | | $14.79 | | $14.89 | | $15.33 | | $15.52 | |

INCOME (LOSS) FROM OPERATIONS: | | | | | | | | | | | | | |

Net investment income | | 0.49 | | 0.93 | | 0.89 | | 0.90 | | 0.92 | | 0.93 | |

Net realized and unrealized gain (loss) | | 1.62 | | (2.81 | ) | (0.20 | ) | (0.01 | ) | (0.32 | ) | (0.12 | ) |

Distributions paid to auction rate cumulative preferred stockholders from: | | | | | | | | | | | | | |

Net investment income | | (0.03 | ) | (0.29 | ) | (0.31 | ) | (0.25 | ) | (0.17 | ) | (0.08 | ) |

Net realized gains | | — | | (0.02 | ) | (0.01 | ) | (0.00 | )3 | (0.00 | )3 | (0.01 | ) |

Total income (loss) from operations | | 2.08 | | (2.19 | ) | 0.37 | | 0.64 | | 0.43 | | 0.72 | |

DISTRIBUTIONS PAID TO COMMON STOCK SHAREHOLDERS FROM: | | | | | | | | | | | | | |

Net investment income | | (0.33 | ) | (0.60 | ) | (0.62 | ) | (0.77 | ) | (0.84 | ) | (0.84 | ) |

Net realized gains | | — | | (0.04 | ) | (0.01 | ) | (0.00 | )3 | (0.03 | ) | (0.07 | ) |

Total distributions paid to common stock shareholders | | (0.33 | ) | (0.64 | ) | (0.63 | ) | (0.77 | ) | (0.87 | ) | (0.91 | ) |

Increase in Net Asset Value due to shares repurchased in tender offer | | — | | 0.03 | | 0.02 | | 0.03 | | — | | — | |

NET ASSET VALUE, END OF PERIOD | | $13.50 | | $11.75 | | $14.55 | | $14.79 | | $14.89 | | $15.33 | |

MARKET PRICE, END OF PERIOD | | $12.05 | | $9.69 | | $13.24 | | $14.19 | | $13.60 | | $13.45 | |

Total return, based on NAV4,5 | | 17.79 | % | (15.35 | )% | 2.74 | % | 4.68 | % | 2.85 | % | 4.82 | % |

Total return, based on Market Price5 | | 27.90 | % | (22.67 | )% | (2.22 | )% | 10.22 | % | 7.64 | % | 2.68 | % |

NET ASSETS, END OF PERIOD (000s) | | $131,228 | | $114,186 | | $156,670 | | $76,629 | | $85,727 | | $88,262 | |

RATIOS TO AVERAGE NET ASSETS:6 | | | | | | | | | | | | | |

Gross expenses | | 1.39 | %7 | 1.48 | % | 1.48 | %8 | 1.41 | % | 1.30 | % | 1.32 | % |

Net expenses | | 1.39 | 7 | 1.48 | 9 | 1.48 | 8 | 1.41 | 10 | 1.30 | | 1.32 | |

Net investment income | | 7.58 | 7 | 6.67 | | 6.15 | | 6.09 | | 6.07 | | 6.05 | |

PORTFOLIO TURNOVER RATE | | 6 | % | 46 | % | 47 | % | 18 | % | 40 | % | 38 | % |

AUCTION RATE CUMULATIVE PREFERRED STOCK: | | | | | | | | | | | | | |

Total Amount Outstanding (000s) | | $85,000 | | $85,000 | | $85,000 | | $40,000 | | $40,000 | | $40,000 | |

Asset Coverage Per Share | | 127,193 | | 117,169 | | 142,159 | | 145,786 | | 157,159 | | 160,328 | |

Involuntary Liquidating Preference Per Share11 | | 50,000 | | 50,000 | | 50,000 | | 50,000 | | 50,000 | | 50,000 | |

See Notes to Financial Statements.

14 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

1 For the six months ended June 30, 2009 (unaudited).

2 Per share amounts have been calculated using the average shares method.

3 Amount represents less than $0.01 per share.

4 Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized.

5 The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized.

6 Ratios calculated on the basis of income and expenses relative to the average net assets of common shares and excludes the effect of dividend payments to preferred stockholders.

7 Annualized.

8 Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Fund during the period. Without these fees, the gross and net expense ratios would both have been 1.25%.

9 The impact to the expense ratio was less than 0.01% as a result of fees paid indirectly.

10 Reflects fee waivers and/or expense reimbursements.

11 Excludes accumulated and unpaid distributions.

See Notes to Financial Statements.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 15 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Western Asset Municipal Partners Fund Inc. (the “Fund”) was incorporated in Maryland on November 24, 1992 and is registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors authorized 100 million shares of $0.001 par value common stock. The Fund’s primary investment objective is to seek a high level of current income which is exempt from federal income taxes, consistent with the preservation of capital. As a secondary investment objective, the Fund intends to enhance portfolio value by purchasing tax exempt securities that, in the opinion of the investment manager, may appreciate in value relative to other similar obligations in the marketplace.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through August 24, 2009, the issuance date of the financial statements.

(a) Investment valuation. Securities are valued based on transactions in municipal obligations, quotations from municipal bond dealers, market transactions in comparable securities and various other relationships between securities. Futures contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. When prices are not readily available, or are determined not to reflect fair value, the Fund may value these securities at fair value as determined in accordance with the procedures approved by the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

The Fund adopted Statement of Financial Accounting Standards No. 157 (“FAS 157”). FAS 157 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Fund’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

· Level 1 — quoted prices in active markets for identical investments

· Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

· Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

16 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

DESCRIPTION | | QUOTED PRICES

(LEVEL 1) | | OTHER

SIGNIFICANT

OBSERVABLE

INPUTS

(LEVEL 2) | | SIGNIFICANT

UNOBSERVABLE

INPUTS

(LEVEL 3) | | TOTAL | |

Long-term securities:

Municipal bonds† | | — | | $212,268,610 | | | — | | $212,268,610 | |

Short-term securities | | — | | 700,000 | | | — | | 700,000 | |

Total investments | | — | | $212,968,610 | | | — | | $212,968,610 | |

† See Schedule of Investments for additional detailed categorizations.

(b) Futures contracts. The Fund may use futures contracts to gain exposure to, or hedge against, changes in the value of interest rates. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.

Upon entering into a futures contract, the Fund is required to deposit with a broker cash or cash equivalents in an amount equal to a certain percentage of the contract amount. This is known as the “initial margin.” Subsequent payments (“variation margin”) are made or received by the Fund each day, depending on the daily fluctuation in the value of the contract. The daily changes in contract value are recorded as unrealized gains or losses in the Statement of Operations and the Fund recognizes a realized gain or loss when the contract is closed.

Futures contracts involve, to varying degrees, risk of loss in excess of the amounts reflected in the financial statements. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

(c) Concentration of credit risk. Since the Fund invests a portion of its assets in obligations of issuers within a single state, it may be subject to possible concentration risks associated with economic, political, or legal developments or industrial or regional matters specifically affecting that state.

(d) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults on an expected interest payment, the Fund’s policy is to

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 17 |

Notes to financial statements (unaudited) continued

generally halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default.

(e) Distributions to shareholders. Distributions to common shareholders from net investment income for the Fund, if any, are generally declared quarterly and paid on a monthly basis. The Fund intends to satisfy conditions that will enable interest from municipal securities, which is exempt from federal and certain state income taxes, to retain such tax-exempt status when distributed to the shareholders of the Fund. Distributions of net realized gains, if any, are taxable and are declared at least annually. Distributions to common shareholders are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP. Distributions to preferred shareholders are accrued daily and paid on a weekly basis and are determined as described in Note 5.

(f) Fees paid indirectly. The Fund’s custody fees are reduced according to a fee arrangement, which provides for a reduction based on the level of cash deposited with the custodian by the Fund. The amount is shown as a reduction of expenses on the Statement of Operations. Interest expense, if any, paid to the custodian related to cash overdrafts is included in interest expense in the Statement of Operations.

(g) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income and net realized gains, if any, to shareholders each year. Therefore, no federal income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years and has concluded that as of June 30, 2009, no provision for income tax would be required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(h) Reclassification. GAAP requires that certain components of net assets be adjusted to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share.

18 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and Western Asset Management Company (“Western Asset”) is the Fund’s subadviser. LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

LMPFA provides administrative and certain oversight services to the Fund. The Fund pays LMPFA an investment management fee, calculated daily and paid monthly, at an annual rate of 0.55% of the Fund’s average weekly net assets. For purposes of calculating this fee, the liquidation value of any outstanding preferred stock of the Fund is not deducted in determining the Fund’s net assets.

LMPFA has delegated to Western Asset the day-to-day portfolio management of the Fund. For its services, LMPFA pays Western Asset 70% of the net management fee it receives from the Fund.

Certain officers and one Director of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

3. Investments

During the six months ended June 30, 2009, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

| | | |

Purchases | | $17,929,391 | |

Sales | | 11,519,118 | |

At June 30, 2009, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows:

Gross unrealized appreciation | | $ 4,416,628 | |

Gross unrealized depreciation | | (8,680,200 | ) |

Net unrealized depreciation | | $ (4,263,572 | ) |

4. Derivative instruments and hedging activities

Financial Accounting Standards Board Statement of Financial Accounting Standards No. 161, “Disclosures about Derivative Instruments and Hedging Activities,” requires enhanced disclosure about an entity’s derivative and hedging activities.

At June 30, 2009 the Fund did not hold any derivative instruments.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 19 |

Notes to financial statements (unaudited) continued

The following tables provide information about the effect of derivatives and hedging activities on the Fund’s Statement of Operations for the six months ended June 30, 2009. The first table provides additional detail about the amounts and sources of gains/(losses) realized on derivatives during the period. The second table provides additional information about the changes in unrealized appreciation/(depreciation) resulting from the Fund’s derivatives and hedging activities during the period.

AMOUNT OF REALIZED GAIN OR (LOSS)

ON DERIVATIVES RECOGNIZED |

| | INTEREST

RATE

CONTRACTS

RISK | | OTHER

CONTRACTS

RISK | | TOTAL | |

Futures contracts | | $(518,078) | | — | | $(518,078) | |

CHANGE IN UNREALIZED APPRECIATION/DEPRECIATION

ON DERIVATIVES RECOGNIZED |

| | INTEREST

RATE

CONTRACTS

RISK | | OTHER

CONTRACTS

RISK | | TOTAL | |

Futures contracts | | $2,034,313 | | — | �� | $2,034,313 | |

5. Auction rate preferred stock

On April 2, 1993, the Fund closed its public offering of 800 shares of $0.001 par value Auction Rate Cumulative Preferred Stock, Series M (“Preferred Stock”), at an offering price of $50,000 per share. On July 20, 2007, the Fund acquired the Preferred Stock of Western Asset Municipal Partners Fund II Inc. On October 1, 1993, Western Asset Municipal Partners Fund II Inc. closed its public offering of 900 shares of $0.001 par value Preferred Stock at an offering price of $50,000 per share. Thus, the Fund now has 1,700 shares of Preferred Stock outstanding. The Preferred Stock has a liquidation preference of $50,000 per share plus an amount equal to accumulated but unpaid dividends (whether or not earned or declared) and subject to certain restrictions, are redeemable in whole or in part.

Dividend rates generally reset every 7 days and are determined by auction procedures. The dividend rate cannot exceed a certain maximum rate, including in the event of a failed auction. The maximum rate is calculated using the higher of 110% of the taxable equivalent of the short-term municipal bond rate and 110% of the prevailing 30 day AA commercial paper rate. The Fund may pay higher maximum rates if the rating of the Fund’s Preferred Stock were to be lowered by the rating agencies. To the extent capital gains and other taxable income are allocated to holders of Preferred Shares for tax purposes, the Fund will likely have to pay higher dividends to holders of Preferred Shares to compensate them for the increased tax liability to them resulting from such allocation. Due to failed auctions experienced by the Fund’s Preferred Stock

20 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

starting on February 15, 2008, the Fund pays the applicable maximum rate. The dividend rates on the Preferred Stock during the six months ended June 30, 2009 ranged from 0.442% to 1.432%. The weighted average dividend rate for the six months ended June 30, 2009 was 0.723%. At June 30, 2009, the dividend rate was 0.442%.

After each auction, the auction agent will pay to each broker/dealer, from monies the Fund provides, a participation fee. For the period of the report and for all previous periods since the ARCPS have been outstanding, the participation fee has been paid at the annual rate of 0.25% of the purchase price of the ARCPS that the broker/dealer places at the auction. However, subsequent to the period of this report, effective on August 3, 2009, Citigroup Global Markets Inc. (“CGM”), reduced its participation fee to an annual rate of 0.05% of the purchase price of the ARCPS, in the case of a failed auction. For the six months ended June 30, 2009, the Fund paid $108,008 to participating broker/dealers.

The Fund is subject to certain restrictions relating to the Preferred Stock. The Fund may not declare dividends or make other distributions on shares of common stock or purchase any such shares if, at the time of the declaration, distribution or purchase, asset coverage with respect to the outstanding Preferred Stock would be less than 200%. The Preferred Stock is also subject to mandatory redemption at $50,000 per share plus any accumulated or unpaid dividends, whether or not declared, if certain requirements relating to the composition of the assets and liabilities of the Fund as set forth in its Articles Supplementary are not satisfied.

The Preferred Stock Shareholders are entitled to one vote per share and generally vote with the common shareholders but vote separately as a class to elect two directors and on certain matters affecting the rights of the Preferred Stock. The issuance of Preferred Stock poses certain risks to holders of common stock, including, among others, the possibility of greater market price volatility, and in certain market conditions, the yield to holders of common stock may be adversely affected. The Fund is required to maintain certain asset coverages with respect to the Preferred Stock. If the Fund fails to maintain these coverages and does not cure any such failure within the required time period, the Fund is required to redeem a requisite number of shares of the Preferred Stock in order to meet the applicable requirement. The Preferred Stock is otherwise not redeemable by holders of the shares. Additionally, failure to meet the foregoing asset coverage requirements would restrict the Fund’s ability to pay dividends to common shareholders.

6. Distributions subsequent to June 30, 2009

Common Stock Distributions. On May 26, 2009, the Board of Directors of the Fund declared common stock distributions from net investment income, each in the amount of $0.06 per share, payable on July 31, 2009 and August 28, 2009 to shareholders of record on July 24, 2009 and August 21, 2009, respectively.

Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report | 21 |

Notes to financial statements (unaudited) continued

On August 13, 2009, the Fund’s Board declared three dividends in the amount of $0.065 per share, payable September 25, 2009, October 30, 2009 and November 27, 2009 to shareholders of record on September 18, 2009, October 23, 2009 and November 20, 2009, respectively.

7. Tender offer

On January 15, 2008, the Fund, in accordance with its tender offer for up to 538,453 of its issued and outstanding shares of common stock, accepted and made payment of these shares at $14.62 per share (98% of the net asset value per share of $14.91). These shares represent 5% of the Fund’s then outstanding shares.

On July 15, 2008, the Fund, in accordance with its tender offer for up to 511,530 of its issued and outstanding shares of common stock, accepted and made payment of these shares at $14.03 per share (98% of the net asset value per share of $14.32). These shares represent 5% of the Fund’s then outstanding shares.

8. Capital loss carryforward

As of December 31, 2008, the Fund had a net capital loss carryforward of approximately $891,295, all of which expires in 2016. This amount will be available to offset any future taxable capital gains.

9. Subsequent event

At the May 2009 meeting, the Board approved a recommendation from LMPFA to change the fiscal year-end for the Fund from December 31st to November 30th. This change will result in a “stub period” annual report being produced for the eleven-month period ending November 30, 2009.

22 | Western Asset Municipal Partners Fund Inc. 2009 Semi-Annual Report |

Additional shareholder information (unaudited)

Result of annual meeting of shareholders

The Annual Meeting of Shareholders of Western Asset Municipal Partners Fund Inc. was held on April 28, 2009, for the purpose of considering and voting upon the election of Directors. The following table provides information concerning the matter voted upon at the meeting:

Election of directors

NOMINEES | | COMMON SHARES

VOTES FOR | | COMMON

SHARES

VOTES WITHHELD | | PREFERRED

SHARES

VOTES FOR | | PREFERRED

SHARES

VOTES

WITHHELD | |

Carol L. Colman | | 8,632,638.54 | | 375,468.80 | | 521 | | 0 | |

Leslie H. Gelb | | 8,615,773.03 | | 392,334.31 | | 521 | | 0 | |

Riordan Roett* | | — | | — | | 521 | | 0 | |

* Mr. Roett has been designated as a Preferred Stock Director.

At June 30, 2009, in addition to Carol L. Colman, Leslie H. Gelb and Riordan Roett, the other Directors of the Fund were as follows:

Daniel P. Cronin

Paolo M. Cucchi

William R. Hutchinson

Jeswald W. Salacuse

R. Jay Gerken

Western Asset Municipal Partners Fund Inc. | 23 |

Dividend reinvestment plan (unaudited)

Pursuant to certain rules of the SEC, the following additional disclosure is provided.

Pursuant to the Fund’s Dividend Reinvestment Plan (“Plan”), holders of Common Stock whose shares of Common Stock are registered in their own names will be deemed to have elected to have all distributions automatically reinvested by American Stock Transfer & Trust Company (“Plan Agent”) in Fund shares pursuant to the Plan, unless they elect to receive distributions in cash. Holders of Common Stock who elect to receive distributions in cash will receive all distributions in cash by check in dollars mailed directly to the holder by the Plan Agent as dividend-paying agent. Holders of Common Stock who do not wish to have distributions automatically reinvested should notify the Plan Agent at the address below. Distributions with respect to Common Stock registered in the name of a bank, broker-dealer or other nominee (i.e., in “street name”) will be reinvested under the Plan unless the service is not provided by the bank, broker-dealer or other nominee or the holder elects to receive distributions in cash. Investors who own shares registered in the name of a bank, broker-dealer or other nominee should consult with such nominee as to participation in the Plan through such nominee, and may be required to have their shares registered in their own names in order to participate in the Plan.

The Plan Agent serves as agent for the holders of Common Stock in administering the Plan. After the Fund declares a distribution on the Common Stock or determines to make a capital gain distribution, the Plan Agent will, as agent for the participants, receive the cash payment and use it to buy the Fund’s Common Stock in the open market, on the NYSE or elsewhere, for the participants’ accounts. The Fund will not issue any new shares of Common Stock in connection with the Plan.

Participants have the option of making additional cash payments to the Plan Agent, monthly, in a minimum amount of $250, for investment in the Fund’s Common Stock. The Plan Agent will use all such funds received from participants to purchase shares of Common Stock in the open market on or about the first business day of each month. To avoid unnecessary cash accumulations, and also to allow ample time for receipt and processing by the Plan Agent, it is suggested that participants send in voluntary cash payments to be received by the Plan Agent approximately ten days before an applicable purchase date specified above. A participant may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than 48 hours before such payment is to be invested.

The Plan Agent maintains all shareholder accounts in the Plan and furnishes written confirmations of all transactions in an account, including information needed by shareholders for personal and tax records. Shares of Common Stock in the account of each Plan participant will be held by the Plan Agent in the name of the participant, and each shareholder’s proxy will include those shares purchased pursuant to the Plan.

24 | Western Asset Municipal Partners Fund Inc. |

In the case of holders of Common Stock, such as banks, broker-dealers or other nominees, who hold shares for others who are beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares of Common Stock certified from time to time by the holders as representing the total amount registered in such holders’ names and held for the account of beneficial owners that have not elected to receive distributions in cash.

There is no charge to participants for reinvesting of distributions or voluntary cash payments. The Plan Agent’s fees for the reinvestment of distributions and voluntary cash payments will be paid by the Fund. However, each participant will pay a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of distributions and voluntary cash payments made by the participant. The receipt of distributions under the Plan will not relieve participants of any income tax which may be payable on such distributions.

Participants may terminate their accounts under the Plan by notifying the Plan Agent in writing. Such termination will be effective immediately if notice in writing is received by the Plan Agent not less than ten days prior to any distribution record date. Upon termination, the Plan Agent will send the participant a certificate for the full shares held in the account and a cash adjustment for any fractional shares or, upon written instruction from the participant, the Plan Agent will sell part or all of the participant’s shares and remit the proceeds to the participant, less a $2.50 fee plus brokerage commission for the transaction.

Experience under the Plan may indicate that changes in the Plan are desirable. Accordingly, the Fund and the Plan Agent reserve the right to terminate the Plan as applied to any voluntary cash payments made and any distributions paid subsequent to notice of the termination sent to all participants in the Plan at least 30 days before the record date for the distribution. The Plan also may be amended by the Fund or the Plan Agent upon at least 30 days’ written notice to participants in the Plan.

All correspondence concerning the Plan should be directed to the Plan Agent at 59 Maiden Lane, New York, New York 10038.

Western Asset Municipal Partners Fund Inc. | 25 |

Western Asset Municipal Partners Fund Inc. | |

| |

Directors | Investment manager |

Carol L. Colman | Legg Mason Partners Fund Advisor, LLC |

Daniel P. Cronin | |

Paolo M. Cucchi | Subadviser |

Leslie H. Gelb | Western Asset Management Company |

R. Jay Gerken, CFA | |

Chairman | Auction agent |

William R. Hutchinson | Deutsche Bank |

Riordan Roett | 60 Wall Street |

Jeswald W. Salacuse | New York, New York 10005 |

| |

| Custodian |

Officers | State Street Bank and Trust Company |

R. Jay Gerken, CFA | 1 Lincoln Street |

President and Chief Executive Officer | Boston, Massachusetts 02111 |

| |

Kaprel Ozsolak | Transfer agent |

Chief Financial Officer and Treasurer | American Stock Transfer & Trust Company |

| 59 Maiden Lane |

Ted P. Becker | New York, New York 10038 |

Chief Compliance Officer | |

| Independent registered public accounting firm |

Robert I. Frenkel | KPMG LLP |

Secretary and Chief Legal Officer | 345 Park Avenue |

| New York, New York 10154 |

Thomas C. Mandia | |

Assistant Secretary | Legal counsel |

| Simpson Thacher & Bartlett LLP |

Albert Laskaj | 425 Lexington Avenue |

Controller | New York, New York 10017 |

| |

Steven Frank | New York Stock Exchange Symbol |

Controller | MNP |

| |

Western Asset Municipal Partners Fund Inc. | |

55 Water Street | |

New York, New York 10041 | |

Western Asset Municipal Partners Fund Inc.

WESTERN ASSET MUNICIPAL PARTNERS FUND INC.

55 Water Street

New York, New York 10041

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that from time to time the Fund may purchase at market prices shares of its common stock in the open market.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Funds Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. To obtain information on Form N-Q from the Fund, shareholders can call 1-888-777-0102.

Information on how the Fund voted proxies relating to portfolio securities during the prior 12-month period ended June 30th of each year and a description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio transactions are available (1) without charge, upon request, by calling 1-888-777-0102, (2) on the Fund’s website at www.leggmason.com/cef and (3) on the SEC’s website at www.sec.gov.

This report is transmitted to the shareholders of Western Asset Municipal Partners Fund Inc. for their information. This is not a prospectus, circular or representation intended for use in the purchase of shares ofthe Fund or any securities mentioned in this report.

American Stock Transfer &

Trust Company

59 Maiden Lane

New York, New York 10038

WASX010083 8/09 SR09-876

ITEM 2. CODE OF ETHICS.

Not Applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not Applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not Applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not Applicable.

ITEM 6. SCHEDULE OF INVESTMENTS.

Included herein under Item 1.

ITEM 7. DISCLOSURE OF PROXY VOTING POLOCIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not Applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not Applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not Applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not Applicable.

ITEM 11. CONTROLS AND PROCEDURES.