Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

x Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2011

¨ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File No. 1-13726

Chesapeake Energy Corporation

(Exact name of registrant as specified in its charter)

| Oklahoma | 73-1395733 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 6100 North Western Avenue | ||

| Oklahoma City, Oklahoma | 73118 | |

| (Address of principal executive offices) | (Zip Code) | |

(405) 848-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |||

Common Stock, par value $0.01 | New York Stock Exchange | |||

7.625% Senior Notes due 2013 | New York Stock Exchange | |||

9.5% Senior Notes due 2015 | New York Stock Exchange | |||

6.25% Senior Notes due 2017 | New York Stock Exchange | |||

6.5% Senior Notes due 2017 | New York Stock Exchange | |||

6.875% Senior Notes due 2018 | New York Stock Exchange | |||

7.25% Senior Notes due 2018 | New York Stock Exchange | |||

6.775% Senior Notes due 2019 | New York Stock Exchange | |||

6.625% Senior Notes due 2020 | New York Stock Exchange | |||

6.875% Senior Notes due 2020 | New York Stock Exchange | |||

6.125% Senior Notes due 2021 | New York Stock Exchange | |||

2.75% Contingent Convertible Senior Notes due 2035 | New York Stock Exchange | |||

2.5% Contingent Convertible Senior Notes due 2037 | New York Stock Exchange | |||

2.25% Contingent Convertible Senior Notes due 2038 | New York Stock Exchange | |||

4.5% Cumulative Convertible Preferred Stock | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES x NO ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x | Accelerated Filer ¨ | Non-accelerated Filer ¨ | Smaller Reporting Company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO x

The aggregate market value of our common stock held by non-affiliates on June 30, 2011 was approximately $19.4 billion. At February 22, 2012, there were 662,498,825 shares of our $0.01 par value common stock outstanding.

Table of Contents

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES

2011 ANNUAL REPORT ON FORM 10-K/A

| Page | ||||||

| PART III | ||||||

Item 10. | Directors, Executive Officers and Corporate Governance | 3 | ||||

Item 11. | Executive Compensation | 13 | ||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 37 | ||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 39 | ||||

Item 14. | Principal Accounting Fees and Services | 42 | ||||

| PART IV | ||||||

Item 15. | Exhibits and Financial Statement Schedules | 43 | ||||

Table of Contents

EXPLANATORY NOTE

Chesapeake Energy Corporation filed its Form 10-K for the year ended December 31, 2011 (the “2011 Form 10-K”) with the Securities and Exchange Commission on February 29, 2012. Pursuant to General Instruction G(3) to Form 10-K, the Company incorporated by reference the information required by Part III of Form 10-K from our definitive proxy statement for the 2012 Annual Meeting of Stockholders (the “2012 Proxy Statement”) that we expected to file with the Commission not later than 120 days after the end of the fiscal year covered by the 2011 Form 10-K. Because the definitive 2012 Proxy Statement will not be filed with the Commission before such date, the Company is filing this Amendment No. 1 to the 2011 Form 10-K (the “Form 10-K/A”) to provide the additional information required by Part III of Form 10-K. This Form 10-K/A does not change the previously reported financial statements or any of the other disclosures contained in Part I, Part II or Part IV, other than to update information provided in the Exhibit List under Item 15(a)(3), of the 2011 Form 10-K. Some of the information provided in this Form 10-K/A may be superseded by the information provided in the definitive 2012 Proxy Statement to be filed with the Commission. References to “Chesapeake,” “us,” “we,” “Company” and “our” in this report refer to Chesapeake Energy Corporation, together with its subsidiaries.

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

Board of Directors

The Board is currently composed of eight independent directors and Aubrey K. McClendon, the Chairman of the Board and Chief Executive Officer. The Board is responsible for the oversight of the Company and recognizes the importance and necessity of effective corporate governance to enable the Board to adequately oversee, advise and monitor the management of the Company.

The Board held four meetings in person and eight meetings by telephone conference during 2011. Non-employee directors meet regularly in executive session, including after each scheduled quarterly Board meeting. Additionally, management frequently discusses matters with the directors on an informal basis. Each director attended, either in person or by telephone conference, at least 90% of the Board and committee meetings held while serving as a director or committee member in 2011. The Company expects the directors to attend annual meetings of shareholders. All of the Company’s directors attended the 2011 Annual Meeting of Shareholders.

Board Committees

The Board currently has a Compensation Committee, an Audit Committee and a Nominating and Corporate Governance Committee. Each committee has a written charter; all such charters, as well as the Company’s Corporate Governance Principles, are available on the Company’s website atwww.chk.com in the Corporate Governance sub-section of the section entitled “About”. The membership and primary responsibilities of the committees are described below.

| Name and Members(1) | Primary Responsibilities | Meetings | ||

Compensation Committee

Frank Keating (Chair)

Kathleen M. Eisbrenner

Charles T. Maxwell | • Establish compensation policies that effectively attract, retain and motivate executive officers • Establish goals and objectives relevant to CEO compensation, evaluate CEO performance and set CEO compensation levels • Periodically evaluate succession plans for executive officers • Evaluate and recommend to the Board compensation of directors and other executive officers • Oversee and administer the Company’s compensation plans • Establish and monitor compliance with stock ownership guidelines • Oversee Employee Compensation and Benefits Committee (the “ECBC”) regarding compensation of non-executive employees | 4 2 | ||

Audit Committee(2)

V. Burns Hargis (Chair)

Richard K. Davidson

Merrill A. (“Pete”) Miller | • Oversee the integrity of the Company’s financial statements and disclosure • Oversee the Company’s compliance with legal and regulatory requirements • Oversee the Company’s internal audit function • Appoint and oversee the independent auditor • Oversee the Company’s enterprise risk management (“ERM”) program • Oversee the Employee and Vendor Hotline for anonymous reporting of questionable activity | 4 6 | ||

Nominating and Corporate Governance Committee

Don Nickles (Chair)

Louis A. Simpson | • Establish criteria for Board and committee membership and selection of new directors • Evaluate and recommend nominees for Board service • Periodically assess and advise the Board on sufficiency of the size of the Board and the diversity of skills and experience represented on the Board • Establish and periodically evaluate corporate governance principles and make recommendations to the Board on corporate governance matters • Oversee and evaluate compliance by the Board and management with the Company’s corporate governance principles and its Code of Business Conduct and Ethics | 3 | ||

| (1) | All committee members are independent as determined by the Board in accordance with the NYSE corporate governance listing standards. |

| (2) | Messrs. Davidson, Hargis and Miller are all independent, as determined by the Board in accordance with Section 10A of the Securities Exchange Act of 1934 (the “Exchange Act”), and Messrs. Hargis and Miller are designated by the Board as “audit committee financial experts”, as defined in Item 407(d) of Regulation S-K. For the relevant experience of Messrs. Davidson, Hargis and Miller, please refer to their respective biographies on pages 5-7. |

3

Table of Contents

Code of Business Conduct and Ethics

In 2002, the Board adopted a Code of Business Conduct and Ethics applicable to all directors, officers and employees of the Company, including our principal executive officer, principal financial officer and principal accounting officer. The Code of Business Conduct and Ethics is posted on the Company’s website atwww.chk.com in the Corporate Governance sub-section of the section entitled “About”. Waivers of provisions of the Code as to any director or executive officer and amendments to the Code must be approved by the Audit Committee of the Board. We will post on our website required disclosure about any such waiver or amendment within four business days of Audit Committee approval.

Communications to the Board

Shareholders and other interested parties may communicate with the Board, either individually or as a group, through one of the processes outlined on the Company’s website atwww.chk.com in the Corporate Governance sub-section of the section entitled “About”.

Director Criteria, Qualifications and Experience

The Nominating and Corporate Governance Committee periodically assesses the skills and the experience needed to properly oversee the interests of the Company. The Committee then compares those skills to the skills of the current directors and potential director candidates. The Committee conducts targeted efforts to identify and recruit individuals who have the qualifications identified through this process. In the past, the Committee has considered and nominated appropriate director candidates recommended by shareholders in the foregoing process.

Chesapeake is a large, vertically integrated exploration and production company. As such, the Committee looks for its current and potential directors collectively to have a diverse mix of skills, qualifications and experience, some of which are described below:

- business leadership | - government/public policy | |

- corporate governance | - international | |

- energy consumption | - legal | |

- energy production/distribution | - risk management | |

- financial expertise | - technology |

The Committee seeks a mix of directors with the qualities that will achieve the ultimate goal of a well-rounded, diverse Board that thinks critically yet functions collegially.

Additionally, the Committee expects each of the Company’s directors to have proven leadership, sound judgment, integrity and a commitment to the success of the Company. Qualified candidates for nomination to the Board are considered without regard to race, color, religion, gender, ancestry or national origin.

In evaluating director candidates and considering incumbent directors for renomination to the Board, the Committee considers a variety of factors. These include each nominee’s independence, financial literacy, personal and professional accomplishments and experience in light of the needs of the Company. For incumbent directors, the factors include past performance on the Board and contributions to their respective committees.

Along with each director’s biography, we have included below an assessment of the skills and experience of such director.

4

Table of Contents

Directors

Richard K. Davidson,70, has been a member of our Board of Directors since 2006. Mr. Davidson served as Chairman of the Board of Directors of Union Pacific Corporation (NYSE:UNP) from 1997 until February 2007 and as its Chief Executive Officer from 1997 until 2006. He started his railroad career in 1960 with Missouri Pacific Railroad and held various positions of increasing authority before being named Vice President of Operations in 1976. In 1982, Union Pacific merged with the Missouri Pacific and Western Pacific railroads, and in 1986, Mr. Davidson was promoted to Vice President of Operations of the combined railroads. He was promoted to Executive Vice President in 1989 and became Chairman and Chief Executive Officer of Union Pacific Railroad in 1991. He was named Chairman and Chief Executive Officer of Union Pacific Corporation in 1997. Mr. Davidson is currently a director of Impala Asset Management, LLC, an investment fund headquartered in New Haven, Connecticut, and a member of the board of advisors of HCI Equity Partners, a private equity firm headquartered in Washington, D.C. He is a past member of the Horatio Alger Association of Distinguished Americans, and formerly served on the board of the Association of American Railroads, as chairman of the President’s National Infrastructure Advisory Council, and as a director and trustee of the Malcolm Baldridge National Quality Awards Foundation. Mr. Davidson graduated from Washburn University in 1966 and has completed the Program for Management Development at Harvard University.

Mr. Davidson’s career with Union Pacific, a large industrial company that consumes and transports energy (among many other commodities and goods), provides particularly valuable insight into the needs and concerns of large industrial energy consumers including their sensitivity to energy prices and the manner in which such consumers manage their exposure to volatility in energy prices. Additionally, due to Mr. Davidson’s experience as Chairman and Chief Executive Officer of Union Pacific and through his various other executive, financial and management positions, Mr. Davidson hasvaluable experience in managing many of the major issues, such as financial, business strategy, technology, compensation, management development, acquisitions, capital allocation, risk management, corporate governance and shareholder relations, that we deal with regularly.

V. Burns Hargis,66, has been a member of our Board of Directors since September 2008. Mr. Hargis has been the President of Oklahoma State University since March 2008. Before being named OSU President, Mr. Hargis was Vice Chairman of BOK Financial Corporation (NASDAQ:BOKF), a financial holding company based in Tulsa, Oklahoma, from 1997 to 2008 and is currently a director of BOKF. Before joining BOKF, he practiced law in Oklahoma City for 28 years, most recently with the firm of McAfee & Taft. In 1967, Mr. Hargis entered the United States Army as a Commissioned 2nd Lieutenant, Military Intelligence, and was honorably discharged as a Captain, U.S. Army Reserves, Finance Corps in 1977. Mr. Hargis is a former President of the Oklahoma County Bar Association, former President of the Oklahoma Bar Foundation and is a Fellow of the American Bar Foundation. Mr. Hargis previously served as Vice-Chairman of the Oklahoma State Election Board, the Oklahoma Constitutional Revision Commission, Chairman of the Oklahoma Commission for Human Services, Chairman of the Board of Regents for the Oklahoma Agricultural and Mechanical Colleges of Oklahoma State University and a member of the Commission of the North Central Association of Colleges and Schools. Mr. Hargis graduated from Oklahoma State University in 1967 with a degree in Accounting and from the University of Oklahoma College of Law in 1970.

Mr. Hargis’ extensive public service in Oklahoma and his expertise in corporate law and public policy are invaluable to our Board of Directors. Additionally, Mr. Hargis’ financial and banking experience is particularly relevant to his service on our Audit Committee and qualifies him as an Audit Committee financial expert. Under Mr. Hargis’ leadership, Oklahoma State University has developed many innovative ways to manage its system-wide energy consumption, including the conversion of its vehicle fleet to compressed natural gas (CNG) and is recognized as an “ENERGY STAR Partner” by ENERGY STAR, a joint program of the U.S. Environmental Protection Agency and the U.S. Department of Energy, for its strategic approach to energy management. In addition, Mr. Hargis’ career in the legal profession brings considerable benefit to the Company as it addresses the various legal proceedings that companies the size of Chesapeake routinely face.

Aubrey K. McClendon, 52, has served as Chairman of the Board and Chief Executive Officer since co-founding the Company in 1989. Mr. McClendon has also served as a director of the general partner of Chesapeake Midstream Partners, L.P. (NYSE:CHKM) since 2010. From 1982 to 1989, Mr. McClendon was an independent producer of natural gas and oil. Mr. McClendon graduated from Duke University in 1981.

As our co-founder, Chairman and CEO, Mr. McClendon sets the strategic direction of our Company with the guidance of the Board of Directors and serves as the Company’s spokesman to its shareholders and other constituencies. Mr. McClendon’s extensive knowledge of the Company and experience in the energy industry make him an invaluable asset to the Board.

5

Table of Contents

Don Nickles, 63, has been a member of our Board of Directors since 2005. Senator Nickles is the founder and President of The Nickles Group, a consulting and business venture firm in Washington, D.C. Senator Nickles was elected to represent Oklahoma in the United States Senate from 1980 to 2005 where he held numerous leadership positions, including Assistant Republican Leader from 1996 to 2003 and Chairman of the Senate Budget Committee from 2003 to 2005. Senator Nickles also served on the Senate Energy and Natural Resources Committee and the Senate Finance Committee. Prior to his service in the U.S. Senate, Senator Nickles served in the Oklahoma State Senate from 1979 to 1980 and worked for Nickles Machine Corporation in Ponca City, Oklahoma, becoming Vice President and General Manager. Senator Nickles is also a director of Valero Energy Corporation (NYSE:VLO), an independent oil refiner headquartered in San Antonio, Texas and Washington Mutual Investors Fund (WMIF). Senator Nickles served in the National Guard from 1970 to 1976 and graduated from Oklahoma State University in 1971.

Senator Nickles’ 24 years of service as a U.S. Senator, including his chairmanship of the Senate Budget Committee as well as service on the Senate Energy and Natural Resources Committee and the Senate Finance Committee, have given him valuable experience and perspective on many of the major issues we face as a publicly traded energy company and insight into past and potential international, national and state energy policy and other public policy and taxation issues. Additionally, his service on Valero’s board of directors has given him valuable exposure to the downstream energy sector and domestic energy supply and demand.

Kathleen M. Eisbrenner, 51, has been a member of our Board of Directors since December 2010. Ms. Eisbrenner is the founder and has been Chief Executive Officer of Next Decade since June 2010, a company that is creating new opportunities in the integrated international liquefied natural gas (LNG) industry. Prior to organizing Next Decade, she served as the head of Houston-based Poten & Partners’ Project Development Group from March 2010 to June 2010. Poten & Partners is a global broker and commercial advisor for the energy and ocean transportation industries and a recognized leader in the crude and petroleum products, LNG, liquefied petroleum gas (LPG), fuel oil, naphtha and asphalt market sectors. From September 2007 to December 2009, Ms. Eisbrenner was Executive Vice President responsible for Royal Dutch Shell plc’s Global LNG business. From 2003 to August 2007, she was founder, President and Chief Executive Officer of Excelerate Energy, a global importer and marketer of LNG. Ms. Eisbrenner also previously served in various senior leadership positions with other energy companies in the United States, including El Paso Corporation (NYSE:EP). Ms. Eisbrenner graduated from the University of Notre Dame in 1982.

Ms. Eisbrenner has nearly 30 years of experience in the energy industry. The executive and management experience she gained as President and Chief Executive Officer of Excelerate Energy, as well as that gained as an Executive Vice President with Royal Dutch Shell plc’s Global LNG business, give her experience and insight on many of the major issues we deal with regularly, such as finance, business strategy, technology, compensation, management development, acquisitions, capital allocation, risk management, corporate governance and shareholder relations. In addition, Ms. Eisbrenner’s extensive experience in the global LNG industry provides valuable expertise regarding world-wide markets for natural gas.

Louis A. Simpson, 75, has been a member of our Board of Directors since June 2011. He has been the Chairman of SQ Advisors, LLC since January 2011. Mr. Simpson served as President and Chief Executive Officer, Capital Operations, of GEICO Corporation (a subsidiary of Berkshire Hathaway Corporation) from 1993 until his retirement on December 31, 2010. From 1985 to 1993, he served as Vice Chairman of the Board of GEICO. Mr. Simpson joined GEICO in 1979 as Senior Vice President and Chief Investment Officer. Prior to joining GEICO, Mr. Simpson was President and Chief Executive Officer of Western Asset Management, a subsidiary of the Los Angeles, California-based Western Bancorporation. Previously, Mr. Simpson was a partner at Stein Roe and Farnham, a Chicago, Illinois investment firm, and an instructor of economics at Princeton University. Mr. Simpson has also served as a director of VeriSign, Inc. (NASDAQ:VRSN) since 2005 and as a director of SAIC, Inc. (NYSE:SAI) since 2006. He was previously a director of Western Asset Funds Inc. and Western Asset Income Fund and a trustee of Western Asset Premier Bond Fund until 2006. Mr. Simpson graduated from Ohio Wesleyan University in 1958 and from Princeton University in 1960.

6

Table of Contents

Mr. Simpson’s unique blend of professional experiences, accomplishments and skills is invaluable to the Company. Mr. Simpson has had a long and distinguished career as one of our nation’s most accomplished investors. His experience as Chief Executive Officer, Capital Operations, of GEICO is of substantial benefit to the Company and will help us continue to build significant intrinsic value per share. Mr. Simpson has also served as a director of numerous public companies, which allows him to bring insights into many of the major issues that we deal with regularly, such as finance, business strategy, technology, compensation, management development, acquisitions, capital allocation, risk management, corporate governance and shareholder relations.

Frank Keating, 68, has been a director of the Company since 2003. Governor Keating has been the President and Chief Executive Officer of the American Bankers Association, a large trade organization based in Washington, D.C., since January 2011. Governor Keating previously served as President and Chief Executive Officer of the American Council of Life Insurers from January 2003 to December 2010. Governor Keating became a special agent in the Federal Bureau of Investigation in 1969 and then served as Assistant District Attorney in Tulsa County, Oklahoma. In 1972, Governor Keating was elected to the Oklahoma State House of Representatives and two years later was elected to the Oklahoma State Senate. In 1981, Governor Keating was appointed as the U.S. Attorney for the Northern District of Oklahoma and in 1985, he began seven years of service in the Ronald Reagan and George H.W. Bush administrations, serving as Assistant Secretary of the Treasury, Associate Attorney General in the Justice Department and General Counsel and Acting Deputy Secretary of the Department of Housing and Urban Development. In 1994, Governor Keating was elected Oklahoma’s 25th Governor and served two consecutive four-year terms. He was chairman of the Interstate Oil and Gas Commerce Commission during his term as governor. Governor Keating is an advisory director of Stewart Information Services Corporation (NYSE:STC), a real estate information and transaction management company located in Houston, Texas. Governor Keating graduated from Georgetown University in 1966 and from the University of Oklahoma College of Law in 1969.

Through his service as Governor, Senator, a member of the House of Representatives of Oklahoma, senior-level U.S. government appointments, and other appointments and positions, Governor Keating has valuable experience and knowledge regarding many of the major issues we face as a publicly traded energy company. He has extensive experience with national and state energy policy and other public policy matters. Governor Keating’s other board and management positions have given him exposure to different industries, approaches to governance and other key issues. Additionally, Governor Keating gained specific, first-hand knowledge of the energy industry and management of energy assets through management of his family’s oil and gas interests.

Merrill A. (“Pete”) Miller, Jr., 61, has been a director of the Company since 2007 and our Lead Independent Director since March 2010. Mr. Miller is Chairman, President and Chief Executive Officer of National Oilwell Varco, Inc. (NYSE:NOV), a supplier of oilfield services, equipment and components to the worldwide oil and natural gas industry. Mr. Miller joined NOV in 1996 as Vice President of Marketing, Drilling Systems and was promoted in 1997 to President of the company’s products and technology group. In 2000, he was named President and Chief Operating Officer, in 2001 was elected President and Chief Executive Officer and in 2002 was also elected Chairman of the Board. Mr. Miller served as President of Anadarko Drilling Company from 1995 to 1996. Prior to his service at Anadarko, Mr. Miller spent fifteen years at Helmerich & Payne International Drilling Company (NYSE:HP) in Tulsa, Oklahoma, serving in various senior management positions, including Vice President, U.S. Operations. Mr. Miller graduated from the United States Military Academy, West Point, New York in 1972. Upon graduation, he served five years in the United States Army and received his MBA from Harvard Business School in 1980. Mr. Miller serves on the Board of Directors for the Offshore Energy Center, Petroleum Equipment Suppliers Association and Spindletop International, and is a member of the National Petroleum Council.

Mr. Miller has more than 30 years of management and executive experience in the oil and gas equipment and service industry. As a result of his positions as Chairman, President and Chief Executive Officer of NOV and various other executive, financial and management positions, Mr. Miller has valuable experience in managing many of the major issues that we deal with regularly, such as finance, business strategy, technology, compensation, management development, acquisitions, capital

7

Table of Contents

allocation, risk management, corporate governance and shareholder relations. Additionally, in Mr. Miller’s current position with NOV, he has particularly valuable insight into issues affecting the global energy environment, including global energy supply and demand and trends affecting oilfield service costs both globally and domestically. Mr. Miller also has extensive financial and accounting expertise and is one of our Audit Committee financial experts.

Charles T. Maxwell, 79, has been a director of the Company since 2002. Mr. Maxwell has been a Senior Energy Analyst with Weeden & Co., an institutional brokerage firm located in Greenwich, Connecticut, from 1999 to the present. Entering the oil and natural gas industry in 1957, Mr. Maxwell worked for what is now ExxonMobil for eleven years in the U.S., Europe, the Middle East and Africa. In 1968, Mr. Maxwell joined Cyrus J. Lawrence, an institutional research and brokerage firm, as an oil analyst. He was ranked byInstitutional Investor Magazine as No. 1 in his field in 1972, 1974, 1977, and 1981 through 1986. He rose to the position of Managing Director of Cyrus J. Lawrence/Morgan Grenfell and retired from the firm in 1997, several years after it was acquired by Deutsche Bank. Mr. Maxwell is a director of American DG Energy Inc. (NYSE:ADGE), a provider of on-site electric power and hot water co-generation, based in Waltham, Massachusetts. He is also a director of Daleco Resources Corporation (DLOV.OB), a minerals and oil and gas exploration and production company located in West Chester, Pennsylvania; and Lescarden, Inc. (LCAR.OB), a biomedical company in New York City. Mr. Maxwell graduated from Princeton University in 1953 and Oxford University in 1957.

Mr. Maxwell’s distinguished career in the energy industry and as an energy analyst provides the Board of Directors with very helpful perspectives on global energy markets, potential OPEC decisions and initiatives and macro-economic trends affecting the energy industry in general. Mr. Maxwell has long been considered one of the foremost energy experts in the industry, and the Company has benefited from his insights into Middle Eastern politics and socioeconomic trends over the years. In addition, Mr. Maxwell frequently provides information about the possible future direction of natural gas and oil prices, which has been useful to the Company in executing its highly successful natural gas and oil hedging program.

8

Table of Contents

Officers

Executive Officers

In addition to Mr. McClendon, the following are also executive officers of the Company:

Steven C. Dixon, 53, has served as Executive Vice President—Operations and Geosciences and Chief Operating Officer since February 2010. Mr. Dixon served as Executive Vice President—Operations and Chief Operating Officer from 2006 to February 2010 and as Senior Vice President—Production from 1995 to 2006. He also served as Vice President—Exploration from 1991 to 1995. Mr. Dixon was a self-employed geological consultant in Wichita, Kansas from 1983 through 1990. He was employed by Beren Corporation in Wichita, Kansas from 1980 to 1983 as a geologist. Mr. Dixon graduated from the University of Kansas in 1980.

Douglas J. Jacobson, 58, has served as Executive Vice President—Acquisitions and Divestitures since 2006. He served as Senior Vice President—Acquisitions and Divestitures from 1999 to 2006. Prior to joining the Company, Mr. Jacobson was employed by Samson Investment Company from 1980 until 1999, where he served as Senior Vice President—Project Development and Marketing from 1996 to 1999. Prior to joining Samson, Mr. Jacobson was employed by Peat, Marwick, Mitchell & Co. Mr. Jacobson has served on various Oklahoma legislative commissions which have addressed issues in the oil and gas industry, including the Commission of Oil and Gas Production Practices and the Natural Gas Policy Commission. Mr. Jacobson is a Certified Public Accountant and graduated from John Brown University in 1976 and from the University of Arkansas in 1977.

Domenic J. (“Nick”) Dell’Osso, Jr., 35, has served as Executive Vice President and Chief Financial Officer since November 2010. Mr. Dell’Osso has also served as a director of the general partner of Chesapeake Midstream Partners, L.P. (NYSE:CHKM) since June 2011. Mr. Dell’Osso served as Vice President—Finance of the Company and Chief Financial Officer of Chesapeake’s wholly owned midstream subsidiary, Chesapeake Midstream Development, L.P., from August 2008 to November 2010. Prior to joining Chesapeake, Mr. Dell’Osso was an energy investment banker with Jefferies & Co. from 2006 to August 2008 and Banc of America Securities from 2004 to 2006. Mr. Dell’Osso graduated from Boston College in 1998 and from the University of Texas at Austin in 2003.

Martha A. Burger, 59, has served as Senior Vice President—Human and Corporate Resources since 2007. She served as Treasurer from 1995 to 2007 and as Senior Vice President—Human Resources since 2000. She was the Company’s Vice President—Human Resources from 1998 until 2000, Human Resources Manager from 1996 to 1998 and Corporate Secretary from 1999 to 2000. From 1994 to 1995, she served in various accounting positions with the Company, including Assistant Controller—Operations. From 1989 to 1993, Ms. Burger was employed by Hadson Corporation as Assistant Treasurer and from 1993 to 1994 served as Vice President and Controller of Hadson Corporation. Prior to joining Hadson Corporation, Ms. Burger was employed by The Phoenix Resource Companies, Inc. as Assistant Treasurer and by Arthur Andersen & Co. Ms. Burger graduated from the University of Central Oklahoma in 1982 and from Oklahoma City University in 1992.

9

Table of Contents

Henry J. Hood, 51, was appointed General Counsel in 2006, and has served as Senior Vice President—Land and Legal since 1997. He served as Vice President—Land and Legal from 1995 to 1997. Mr. Hood was retained as a consultant to the Company during the two years prior to his joining the Company, and he was associated with the law firm of White, Coffey, Galt & Fite from 1992 to 1995. He was associated with or a partner of the law firm of Watson & McKenzie from 1987 to 1992. Mr. Hood is a member of the Oklahoma and Texas Bar Associations. Mr. Hood graduated from Duke University in 1982 and from the University of Oklahoma in 1985.

Jennifer M. Grigsby, 43, has served as Senior Vice President and Treasurer since 2007 and as Corporate Secretary since 2000. She served as Vice President from 2006 to 2007 and as Assistant Treasurer from 1998 to 2007. From 1995 to 1998, she served in various accounting positions with the Company. Ms. Grigsby was employed by Commander Aircraft Company as Supervisor of Finance and Human Resources from 1994 to 1995 and by Deloitte & Touche LLC from 1991 to 1994. Ms. Grigsby is a Certified Public Accountant and Certified Equity Professional. She graduated from Oklahoma State University in 1991 and from Oklahoma City University in 1999.

Michael A. Johnson, 46, has served as Senior Vice President—Accounting, Controller and Chief Accounting Officer since 2000. He served as Vice President of Accounting and Financial Reporting from 1998 to 2000 and as Assistant Controller from 1993 to 1998. From 1991 to 1993, Mr. Johnson served as Project Manager for Phibro Energy Production, Inc., a Russian joint venture. From 1987 to 1991, he was employed by Arthur Andersen & Co. Mr. Johnson is a Certified Public Accountant and graduated from the University of Texas at Austin in 1987.

Other Officers

Jeffrey A. Fisher, 52, has served as Senior Vice President—Production since 2006. He served as Vice President—Operations for the Company’s Southern Division from 2005 to 2006 and served as Operations Manager from 2003 to 2005. Prior to joining the Company, Mr. Fisher held the position of Asset Manager for British Petroleum plc (NYSE:BP) from 2000 to 2003. From 1993 to 2000, Mr. Fisher worked for Vastar Resources as Engineering Manager. Mr. Fisher began his professional career with ARCO in 1983 as an engineer and served in various technical and managerial positions in the exploration, production and midstream business segments of ARCO until 1993. Mr. Fisher serves on the Oklahoma State University Advisory Board for the College of Engineering, Architecture & Technology and is a member of the Society of Petroleum Engineers. Mr. Fisher graduated from Oklahoma State University in 1983.

James C. Johnson, 54, has served as President of Chesapeake Energy Marketing, Inc., a wholly-owned subsidiary of the Company, since 2000. He served as Vice President—Contract Administration for the Company from 1997 to 2000 and as Manager—Contract Administration from 1996 to 1997. From 1980 to 1996, Mr. Johnson held various gas marketing and land positions with Enogex, Inc., Delhi Gas Pipeline Corporation, TXO Production Corp. and Gulf Oil Corporation. Mr. Johnson is a member of the Natural Gas & Energy Association of Oklahoma and graduated from the University of Oklahoma in 1980.

10

Table of Contents

John M. Kapchinske, 61, has been Senior Vice President – Geoscience since June 2011. He served as Vice President – Geoscience from 2005 to May 2011 and Geoscience Manager from 2001 to 2004. Prior to joining Chesapeake, Mr. Kapchinske held the position of District Exploration Manager for HS Resources, Inc. from 1998 to 2001. Mr. Kapchinske held various positions in geology in the oil and gas industry from 1979 to 1998. Mr. Kapchinske graduated from Illinois State University in 1974 and 1977 and from Northern Illinois University in 1980.

Stephen W. Miller, 55, has served as Senior Vice President—Drilling since 2001. He served as Vice President—Drilling from 1996 to 2001 and as District Manager—College Station District from 1994 to 1996. Mr. Miller held various engineering positions in the oil and gas industry from 1980 to 1993. Mr. Miller is a registered Professional Engineer and a member of the Society of Petroleum Engineers. Mr. Miller graduated from Texas A & M University in 1980.

Jeffrey L. Mobley, 43, has served as Senior Vice President—Investor Relations and Research since 2006 and was Vice President—Investor Relations and Research from 2005 to 2006. From 2002 to 2005, Mr. Mobley was Vice President of Equity Research at Raymond James & Associates focusing on the exploration and production sector. From 1998 to 2002, Mr. Mobley worked in energy investment banking for Prudential Securities and ABN Amro Securities. Mr. Mobley also worked in the Principal Investments Group and Energy Finance Group at Enron Capital & Trade Resources from 1995 to 1998. Mr. Mobley is a CFA Charterholder and graduated from New Mexico State University in 1991 and the Wharton School of Business at the University of Pennsylvania in 1995.

Thomas S. Price, Jr., 60, has served as Senior Vice President—Corporate Development and Government Relations since March 2009. He served as Senior Vice President—Corporate Development from 2005 to March 2009 and as Senior Vice President—Investor and Government Relations from 2003 to 2005, Senior Vice President—Corporate Development from 2000 to 2003, Vice President—Corporate Development from 1992 to 2000 and a consultant to the Company during the three years prior. He was employed by Kerr-McGee Corporation, Oklahoma City, from 1988 to 1989 and by Flag-Redfern Oil Company from 1984 to 1988. Mr. Price is a board member of the Oklahoma Independent Petroleum Association, the Texas Oil and Gas Association, the Colorado Oil and Gas Association and the American Clean Skies Foundation. Mr. Price graduated from the University of Central Oklahoma in 1983, from the University of Oklahoma in 1989 and from the Thunderbird School of Global Management in 1992.

J. Mike Stice, 53, has served as Chief Executive Officer of the general partner of Chesapeake Midstream Partners, L.P. (NYSE:CHKM) since September 2009, and as Senior Vice President—Natural Gas Projects of the Company and President and

11

Table of Contents

Chief Operating Officer of Chesapeake Midstream Development, L.P., a wholly owned subsidiary of the Company, since November 2008. Prior to joining the Company, Mr. Stice spent 27 years with ConocoPhillips and its predecessor companies, where he most recently served as President of ConocoPhillips Qatar, responsible for the development, management and construction of natural gas liquefaction and regasification (LNG) projects. While at ConocoPhillips, he also served as Vice President of Global Gas LNG, as President of Gas and Power and as President of Energy Solutions in addition to other roles in ConocoPhillips’ midstream business units. Mr. Stice graduated from the University of Oklahoma in 1981, Stanford University in 1995 and George Washington University in 2011.

Cathlyn L. Tompkins, 51, has served as Senior Vice President—Information Technology and Chief Information Officer since 2006. Ms. Tompkins served as Vice President—Information Technology from 2005 to 2006. Prior to joining the Company in 2004 as Director—Applications and Programming, Ms. Tompkins spent 20 years in IT management and technical positions at various companies including Devon Energy Corporation, Ocean Energy, Inc., Cabot Oil and Gas Corporation, Price Waterhouse LLP and Shell Oil Company. Ms. Tompkins graduated from the University of Alabama in 1983.

Jerry Winchester, 52, has served as Chief Executive Officer of Chesapeake Oilfield Services, L.L.C., our oilfield services subsidiary, since September 2011 and as Senior Vice President—Oilfield Services of the Company since November 2011. From November 2010 to September 2011, Mr. Winchester served as the Vice President—Boots & Coots of Halliburton. From July 2002 to September 2010, Mr. Winchester served as the President and Chief Executive Officer of Boots & Coots International Well Control, Inc. (“Boots & Coots”), an NYSE-listed oilfield services company specializing in providing integrated pressure control and related services. In addition, from 1998 until September 2010, Mr. Winchester served as a director of Boots & Coots and from 1998 until May 2008, served as Chief Operating Officer of Boots & Coots. Mr. Winchester started his career with Halliburton in 1981 and received a Bachelor of Science degree from Oklahoma State University in 1983.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who beneficially own more than 10% of the Company’s common stock to file reports of ownership and subsequent changes with the Securities and Exchange Commission (the “SEC”). Based only on a review of copies of such reports and written representations delivered to the Company by such persons, the Company believes that there were no late filings under Section 16(a) by any such persons during 2011.

12

Table of Contents

| Item 11. | Executive Compensation |

Compensation Discussion and Analysis

In this section, we describe the material components of our executive compensation system for the “named executive officers” or “NEOs” listed below, whose compensation is set forth in the 2011 Summary Compensation Table and other compensation tables contained in this proxy statement.

| Aubrey K. McClendon | Chairman and Chief Executive Officer (“CEO”), co-founded the Company in 1989 and has been with the Company since its inception | |

| Domenic J. (“Nick”) Dell’Osso, Jr. | Executive Vice President and Chief Financial Officer (“CFO”), is in his fourth year with the Company | |

| Steven C. Dixon | Executive Vice President—Operations and Geosciences and Chief Operating Officer (“COO”), has been with the Company for 21 years | |

| Douglas J. Jacobson | Executive Vice President—Acquisition and Divestitures, has been with the Company for 13 years | |

| Martha A. Burger | Senior Vice President—Human and Corporate Resources, has been with the Company for 18 years | |

We also provide an overview of our executive compensation philosophy and of important changes the Compensation Committee of our Board recently implemented to our executive compensation system. In addition, we explain how and why the Compensation Committee arrives at specific compensation policies and decisions.

Response to 2011 Shareholder Advisory Vote on NEO Compensation

At our 2011 Annual Meeting of Shareholders, shareholders voted a majority (58%) of shares cast “for” our named executive officer compensation. Leading up to the meeting and throughout 2011 we engaged many of our largest shareholders to seek specific feedback on our executive compensation system. Through this process, it became clear many of our largest shareholders were concerned that (i) our executive compensation system did not clearly communicate our practice of paying for performance and (ii) Mr. McClendon’s compensation had been “too high” the past few years. As a result, our compensation committee set out to redesign our executive compensation system and retained Cogent Compensation Partners, an independent compensation consulting firm with extensive experience in the energy industry, to provide recommendations to the committee. In response to the 2011 say on pay vote and the feedback from our shareholders, the committee (i) approved our 2012 redesigned, performance-based executive compensation system and (ii) reduced Mr. McClendon’s 2011 total compensation by 15%, as reported in the summary compensation table.

Executive Compensation Highlights

Our 2012 redesigned, performance-based executive compensation system has the following attributes:

Compensation System Attributes | Description | |

| Objective long-term performance measures | 50% of long-term compensation will depend on achievement of objective pre-determined performance goals over the vesting period beginning in 2012 | |

| Annual incentive plan with pre-determined performance measures | Annual cash bonuses will be based on achievement of pre-determined performance goals beginning in 2012 | |

| 2011 CEO compensation benchmarked to peers | Reduced CEO 2011 total compensation by 15% | |

| No tax gross-ups for executive officers | Will not provide tax gross-ups for executive officers beginning in 2012 | |

| Use of tally sheets | Tally sheets allow the Compensation Committee to analyze both the individual elements of compensation (including the compensation mix) and the aggregate total amount of actual and projected compensation | |

| Minimum stock ownership guidelines | Maintained significant minimum stock ownership guidelines for all NEOs, including 5x base salary for our CEO | |

| Prohibits certain margining and speculative transactions | Prohibited margining, derivative or speculative transactions, such as hedges, pledges and margin accounts, by NEOs relating to shares necessary to satisfy their respective minimum stock ownership guidelines | |

| Incentive plans designed to qualify for Section 162(m) tax deductibility | Annual incentive plan awards and performance share unit awards are intended to qualify as performance-based under Section 162(m) | |

13

Table of Contents

2011 Corporate Performance Highlights

Key Achievements

In 2011, Chesapeake delivered the following major accomplishments:

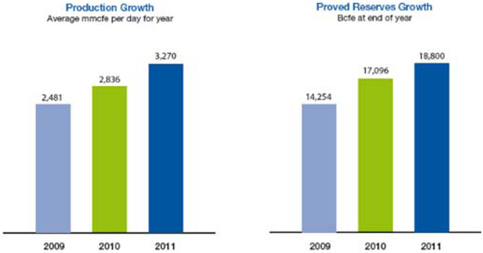

| • | We increased production by 15% (net of asset sales) to an average of 3.27 bcfe per day |

| • | We increased liquids production by 72% to approximately 110 mbbls per day (year-end exit rate) |

| • | We increased proved reserves by 10% to 18.8 tcfe, despite the sale of 2.8 tcfe |

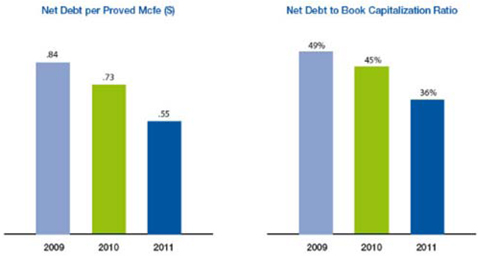

| • | We reduced our long-term net debt (long-term debt net of discounts, unrestricted cash and cash equivalents) by 25% per proved mcfe from $0.73 per mcfe to $0.55 per mcfe |

| • | We reduced our long-term net debt by $2.3 billion, or 18%, to $10.3 billion, thereby achieving more than 70% of our two-year 25% debt reduction goal |

| • | We increased revenues by 24% to $11.6 billion |

| • | We announced the discovery of the Utica Shale play in eastern Ohio |

| • | We increased fully diluted shares outstanding by only 0.6% (due to restricted stock awards made to the vast majority of our approximately 13,000 employees) |

| • | We made strategic investments in natural gas demand creation initiatives (Clean Energy Fuels Corp. convertible debt; Sundrop Fuels, Inc. preferred stock; and fleet vehicle, drilling rig and hydraulic fracturing equipment conversions to natural gas) |

We believe this is an excellent series of accomplishments in a very tough year for the industry as natural gas prices declined approximately 30%.

Leading positions in top plays

We have accumulated the largest inventory of U.S. natural gas shale play leasehold and own a leading position in 11 of what we believe are the top 15 unconventional liquids-rich plays in the U.S. World class energy companies, such as Total, CNOOC, BHP Billiton, Statoil, BP and Plains Exploration and Production, have validated the quality and value of our assets through joint venture partnerships and other transactions with Chesapeake.

Strong growth in production and proved reserves

The Company’s daily production continued to climb in 2011, averaging 3.3 bcfe per day, which is an increase of 15% over the 2010 full year. For the 2011 full year, our year-over-year growth rate of natural gas production was 9% and our year-over-year growth rate of liquids production was 72%, or approximately 36,000 barrels per day. In addition, we grew our proved reserves by 10% despite the sale of 2.8 tcfe.

Substantial debt reduction

In 2011, the Company reduced its long-term net debt by $2.3 billion, or 18%, to $10.3 billion, putting us more than 70% towards our two-year 25% debt reduction goal. We also continued our trend of significantly reducing our net debt per proved reserve metric and our net debt as a percent of total book capitalization, as illustrated below:

14

Table of Contents

Industry-leading asset monetizations

2011 was another year of superb value creation through industry-leading asset monetizations. These monetizations came in many forms, from traditional asset sales to innovative joint venture structures, where we identify new leasehold plays, acquire leasehold at wholesale prices and then sell off a minority portion of our leasehold at retail prices to reduce net leasehold acquisition costs to zero (or below) and accelerate the development of the play.

Some of our specific asset monetizations in 2011 include:

| • | Joint venture with CNOOC in the Denver-Julesburg and Powder River Basins for consideration of approximately $1.3 billion |

| • | Sale of Fayetteville Shale assets to BHP Billiton for approximately $4.7 billion |

| • | Initial public offering of Chesapeake Granite Wash Trust for net proceeds of approximately $410.0 million |

| • | Sale of preferred stock in CHK Utica, L.L.C. for approximately $1.3 billion |

| • | Joint venture with Total in the Utica Shale for consideration of approximately $2.0 billion |

| • | Sale of Marcellus Shale midstream assets to Chesapeake Midstream Partners, L.P. for consideration of approximately $880.0 million |

Awards and recognition

In recognition of the success achieved through the leadership of our named executive officers and commitment of all our employees, the Company has been acknowledged with prestigious awards, including the following:

|  |  | ||||||

Industry Leadership Award for efforts the Company has made to position itself to help lead the transition toward a greater use of natural gas as the fuel for motor vehicles. Deal of the Year Award for joint ventures in the Eagle Ford Shale and Denver-Julesberg and Powder River basins with a subsidiary of CNOOC Limited. | We are proud to have madeFORTUNE’s 100 Best Companies to Work For® list for the fifth consecutive year. Chesapeake ranked #18 (#1 in Oklahoma) for 2012 and #5 in the U.S. among companies with more than 10,000 employees on this prestigious list. Our employees’ dedication, work ethic and attitude allow us to stand among the elite of the nation’s finest companies to work for. | CEO 20- 20 Club In recognition of the tremendous value added to the Company by Mr. McClendon over his tenure as CEO, he was named to Forbes “CEO 20-20 Club” in 2011, an elite list of eight chief executives who have at least 20 years of service as chief executive and produced at least a 20% annual return to shareholders during their tenure, as calculated by Forbes. |

Philosophy and Objectives of our Executive Compensation System

Our compensation philosophy has developed over time and is founded on our belief that the creation of meaningful

15

Table of Contents

shareholder value is dependent on great people. Our philosophy is to provide an attractive, flexible and competitive compensation system tied to performance and aligned with the interests of our shareholders. Our primary objective is to attract, retain and motivate high performing executive officers with the competence, knowledge, leadership skills and experience to grow the profitability of the Company. Within this framework, we observe the following principles:

| • | Attract and retain high performing executives: our executive compensation system should be competitive relative to our peers and we should consider the qualifications and commitment of our named executive officers, including our CEO whose unique skills and energy have helped set the direction of the Company and its high levels of productivity and innovation since co-founding the Company in 1989; |

| • | Pay for performance: a significant portion of the compensation of our named executive officers should vary with business performance and each individual’s role and relative contribution to that performance; |

| • | Align compensation with shareholder interests: the interests of our named executive officers should be linked with those of our shareholders through the risks and rewards of compensation that is tied to the value of our common stock; |

| • | Reward long-term value creation: our compensation and performance review process should reward the named executive officers for successfully seizing opportunities to create long-term shareholder value; |

| • | Discourage excessive risk: our executive compensation system should be designed to reward short- and long-term performance, while discouraging excessive risk taking; |

| • | Maintain flexibility: our executive compensation system should allow for flexibility to better respond to our dynamic and cyclical industry and encourage responsiveness to opportunities and changing market conditions; and |

| • | Reinforce high ethical, environmental, health and safety standards: our executive compensation system should reflect that ethical behavior, protection of the environment, public health and safety are top priorities across our operations. |

2012 Performance-based Executive Compensation System

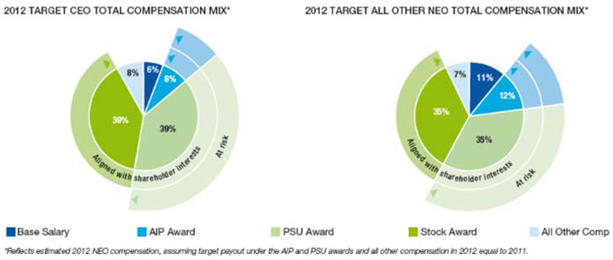

In December 2011, the Compensation Committee adopted substantial changes to our executive compensation system. As shown below, our redesigned compensation system continues to utilize base salary and restricted stock awards and also features the following new performance-based components: (1) annual incentive awards under our new Annual Incentive Plan (“AIP”) and (2) PSUs under our Long Term Incentive Plan.

The purpose and key characteristics of each element of our 2012 executive compensation system are summarized below:

| Element | Purpose | Key Characteristics | ||

Base Salary | Reflects each NEO’s base level of responsibility, leadership, tenure, qualifications and contribution to the success and profitability of the Company. | Fixed compensation that is reviewed semi-annually and adjusted, if and when appropriate. | ||

AIP Award | Motivates our NEOs to achieve our short-term (annual) business objectives that drive long-term performance while providing flexibility to respond to opportunities and changing market conditions. | New variable performance-based annual award. Amounts earned in cash will be based on the Compensation Committee’s evaluation of corporate performance compared to pre-established performance goals. |

16

Table of Contents

| PSU Award | Motivates our NEOs to achieve our business objectives by tying incentives to our financial and key operational metrics over the performance period while continuing to reinforce the link between the interests of our NEOs and our shareholders. | New variable performance-based long-term award. The ultimate number of units earned will be based on the achievement of relative and absolute total shareholder return and production and proved reserve growth performance goals. | ||

| Restricted Stock Award | Motivates our NEOs to achieve our business objectives by tying incentives to the performance of our common stock over the long term; reinforces the link between the interests of our NEOs and our shareholders; motivates our NEOs to remain with the company by mitigating swings in incentive values during periods of high commodity price volatility. | Long-term restricted stock award with a ratable vesting period over four years. The ultimate value realized will vary with our common stock price. | ||

| Other Compensation | Provides benefits that promote employee health and work-life balance, which assists in attracting and retaining our NEOs. | Indirect compensation element consisting of health and welfare plans and perquisites. | ||

It is important to note that these changes apply to compensation we will pay in 2012 and are therefore not reflected in the named executive officer compensation reported in the Summary Compensation Table in this proxy statement.

New Elements of our 2012 Executive Compensation System

Annual Incentive Plan. In December 2011, the Compensation Committee and the Board approved the Chesapeake Energy Corporation 2012 Annual Incentive Plan (the “AIP”), subject to shareholder approval at our 2012 Annual Meeting of Shareholders. The AIP is a cash-based incentive program utilizing pre-established performance goals. It is intended to motivate and reward named executive officers for achieving our short-term (annual) business objectives that we believe drive the overall performance of the Company over the long term. The following summary of certain material features of the AIP does not purport to be complete and is qualified in its entirety by reference to the specific language of the AIP, which is attached to this proxy statement as Exhibit B.

For the entire named executive officer team and any other participant in the AIP to be eligible for award payments under the AIP, the Company must first achieve one of the objective performance goals specified below. If none of these performance goals are met by the Company during the performance period, no cash bonus will be paid under the AIP for that performance period.

| Cash Flow: | at least 50% of operating cash flow for the corresponding performance period of the prior year | |

| Natural Gas and Oil Production: | at least 75% of production for the corresponding performance period of the prior year | |

| Debt Reduction: | long-term indebtedness per unit of proved reserves of less than $0.50/mcfe | |

The Compensation Committee may decrease (but not increase) the maximum amounts payable under the AIP to each named executive officer. The Compensation Committee may also establish additional performance goals prior to the start of, or during the initial quarter, of the applicable performance period. Assuming one of the above objective goals has been met, the additional performance goals serve as the framework for the Compensation Committee’s bonus decisions for each AIP participant during the performance period.

For 2012, the Compensation Committee established the following additional performance goals:

| Financial: | Progress toward the Company’s two-year goals of reducing long-term debt by at least 25% and increasing cumulative production volume by at least 25% | |||

| Combined 2011 - 2012 financial metrics (based on NYMEX oil/gas prices of $100.00/$5.00 per unit) consisting of the following: | ||||

| • | operating cash flow equal to $9.0 billion - $11.0 billion | |||

| • | adjusted EBITDA equal to $9.0 billion - $11.0 billion | |||

| • | adjusted net income equal to $3.5 billion - $4.5 billion | |||

| Operational: | Increase liquids production to at least 20% of the Company’s production mix | |||

| Proved reserves increase (before asset sales) of 3.0 - 4.0 tcfe | ||||

| Strategic: | Leading new discoveries, new technology, risk management and asset monetization | |||

The financial metrics applicable to the AIP described above are non-GAAP financial measures. We provide reconciliations to the most directly comparable financial measures calculated in accordance with generally accepted accounting principles in our quarterly earnings releases and post them on the Company’s website atwww.chk.com in the Reconciliation of Non-GAAP Financials sub-section of the section entitled “Investors”.

Operating cash flow represents net cash provided by operating activities before changes in assets and liabilities. For 2011, operating cash flow was $5.3 billion.

EBITDA represents net income before income tax expense, interest expense and depreciation, depletion and amortization expense. Adjusted EBITDA excludes certain items that management believes affect the comparability of operating results. For 2011, adjusted EBITDA was $5.4 billion.

Adjusted net income represents net income available to common stockholders, excluding certain items that management believes affect the comparability of operating results. For 2011, adjusted net income was $1.9 billion.

17

Table of Contents

Each June and December, the Compensation Committee will score the Company’s year-to-date performance relative to the pre-established performance goals and express the score as an adjustment factor based on a percentage of base salary. The adjustment factor for the plan ranges from 50% to 300% of base salary. The chart below shows the range of bonus opportunities expressed as a percentage of salary for the named executive officers by title.

Executive Level | Threshold | Target | Maximum | |||||||||

CEO | 75 | % | 150 | % | 300 | % | ||||||

EVP | 50 | % | 125 | % | 250 | % | ||||||

SVP | 50 | % | 100 | % | 200 | % | ||||||

The Compensation Committee established the above ranges to provide an annual incentive opportunity that is competitive with our peers. The AIP terms are subject to the limitations on annual incentives previously imposed under the executives’ employment agreements. This means, for example, that Mr. McClendon’s full-year 2012 bonus under the AIP could range from $0 – $2,925,000, depending on the Compensation Committee’s evaluation of the Company’s performance; however, the maximum payment would be limited to no more than $1,951,000 because of the limitation in his employment agreement described below. In 2012, mid-year bonuses will be determined by the Compensation Committee in June based on mid-year performance and may not exceed half of the expected full-year bonus based on the bonus opportunities described above. The 2012 end-of-year bonuses will be based on full-year performance, subject to adjustment to reflect the payment of the mid-year bonus.

The AIP is intended to comply with Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and comply with, or be exempt from, Section 409A of the Code.

Performance Share Unit Awards. The Compensation Committee and the Board also approved significant modifications to our long-term incentive compensation, which incorporates PSUs awarded under the Company’s Amended and Restated Long Term Incentive Plan (the “LTIP”). Since 2004, the Company has provided long-term compensation in the form of restricted stock granted under the LTIP. The Compensation Committee determined that long-term compensation that consists of 50% restricted stock and 50% performance-based cash incentives best meets our compensation objectives in 2012. This approach is intended to motivate our named executive officers to achieve our business objectives by tying incentives to our financial performance and key operational performance objectives over the performance period and continue to reinforce the link between the interests of our named executive officers and our shareholders.

In January 2012, the Compensation Committee granted each named executive officer an award of a number of PSUs. The number of PSUs underlying an award is subject to modification based on the Company’s performance relative to objective performance goals following the end of the performance period. The Compensation Committee will establish the performance goals prior to the start of, or during the initial 25% of, each performance period, based on any one performance goal or combination of performance goals enumerated in the LTIP. Each PSU ultimately awarded entitles a named executive officer to a cash payment based on the price per share of the Company’s common stock.

In redesigning our executive compensation program, the Compensation Committee engaged with several of the Company’s largest shareholders, who emphasized the importance of incorporating both total shareholder return (“TSR”) and operational performance goals in order to provide named executive officers with effective incentives associated with our Company’s long-term growth and performance. The Compensation Committee agreed and, as a direct result of shareholder feedback, granted 2012 PSU awards subject to a modifier comprised of two components:

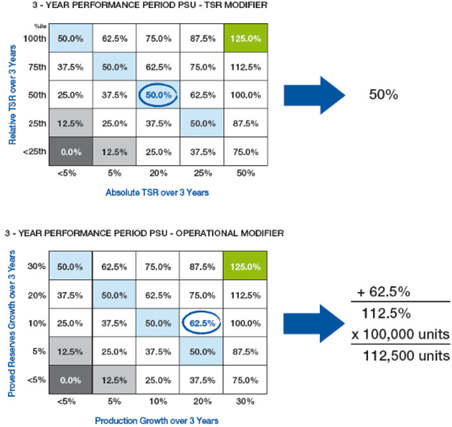

| • | TSR modifier: The TSR modifier is based on absolute and relative TSR goals. Absolute TSR measures the percentage change in the Company’s share price and dividends during the performance period. Relative TSR measures the performance of the Company’s share price and dividends compared to its peer group during the performance period. |

| • | Operational modifier: The operational modifier is based on proved reserves growth and production growth over the performance period (both as adjusted for asset purchases or dispositions). |

The Compensation Committee established an industry peer group to measure achievement of relative TSR goals consisting of Anadarko Petroleum Corporation, Apache Corporation, ConocoPhilips, Devon Energy Corporation, EOG Resources, Inc., Hess Corporation, Marathon Oil Corporation and Occidental Petroleum Corporation. Within the exploration and production industry, there are a very limited number of companies that closely resemble us in scale, scope and nature of business operations. Our self-selected industry peer group contains companies in our industry that are both larger and smaller in size and scope. We have included more companies in our performance peer group than we did in our compensation peer group described below under“—2011 Process for Determining Executive Compensation” on page 20 because we believe these companies are our chief competitors with respect to performance even though some are larger than we are.

The Compensation Committee will calculate the combined modifier, which is represented as a percentage ranging from

18

Table of Contents

0% to 250% of the initial PSU award and is the sum of the TSR modifier and the operational modifier, following the end of the performance period. The Compensation Committee has specified certain threshold, target and maximum modifiers to be applied to the initial 2012 PSU award which correspond to specified levels of performance relative to the 2012 performance goals discussed above. In no event will the Compensation Committee apply a combined modifier greater than 250% to the initial PSU award to a named executive officer.

At the end of each performance period, the Committee will multiply the initial PSU award by the combined modifier to determine the final number of PSUs resulting from a PSU award. The cash payment made to a named executive officer following the end of the performance period will be an amount equal to the final number of PSUs awarded multiplied by the average closing price per share of the Company’s common stock as reported on the New York Stock Exchange for the 20 trading days including and immediately preceding the last day of the performance period.

To illustrate (using the matrices below showing the three-year performance goals established in 2012 and an initial grant of 100,000 PSUs as an example), if after three years the Company’s absolute TSR is 20% and the Company’s relative TSR is at the 50th percentile among our peers, then the TSR modifier will be 50%. Likewise, if after three years the Company’s production growth is 20% and the Company’s proved reserves growth is 10%, the operational modifier will be 62.5%. The TSR modifier (50%) and the operational modifier (62.5%) will be added together for a combined modifier of 112.5%. The initial grant of 100,000 units will then be multiplied by the combined modifier (112.5%) for a total of 112,500 units. The ultimate cash earned will be determined by multiplying the number of units, as modified, by the average closing price per share of the Company’s common stock as reported on the New York Stock Exchange for the 20 trading days including and immediately preceding the last day of the performance period. Note that the Compensation Committee will calculate the applicable modifier at the end of each performance period based on actual levels of performance by interpolating between the specific modifiers shown in the matrices below. For example, if the Company achieves 15% proved reserves growth and 15% production growth over three years, the operational unit modifier percentage would be 62.5%.

The 2012 PSU awards consist of 12.5% one-year performance period PSUs, 21.875% two-year performance period PSUs and 65.625% three-year performance period PSUs. The mix of one-, two- and three-year performance goal PSUs provides a transition from a restricted stock program with consistent annual payouts to a hybrid program under which 50% of the long-term incentive does not pay out until the end of a three-year performance period. This transition mitigates what would otherwise be a significant decrease in payouts of long-term incentive compensation to the named executive officers in 2013, 2014 and 2015. We expect that beginning in 2014, every PSU award will have a three-year performance period.

19

Table of Contents

We believe the 2012 PSU awards granted by the Compensation Committee appropriately reflect our compensation principles by establishing a clear connection between the compensation of our named executive officers and the achievement of performance goals that are important for long-term value creation. We believe that our stock performance goals, by incorporating both absolute and relative TSR performance measures, correctly balance accountability to shareholders for absolute TSR with the need for compensation incentives that reward named executive officers for outstanding achievement relative to our peers even when low commodity prices weigh on our stock price. Similarly, we believe that our operational performance goals balance two of the most important factors that drive long-term value creation for our shareholders: production growth and proved reserves growth.

All PSU awards are intended to comply with Section 162(m) of the Code and comply with, or be exempt from, Section 409A of the Code.

2011 Process for Determining Executive Compensation

The Compensation Committee reviews each named executive officer’s performance twice each year in June and December. The Compensation Committee makes an overall assessment of the performance of the named executive officer team and the role and relative contribution of each of its members. In 2011, this approach consisted of a subjective consideration of each named executive officer’s overall role in the organization, rather than individual, predetermined metrics or data points. The Compensation Committee’s assessment also recognized the current value created from consistent effort in prior years and prospective value creation based on current efforts. In its assessment of the performance of each named executive officer in 2011, the Compensation Committee considered the following:

| Individual Performance | Company Performance | Intangibles | ||

• NEO’s contributions to the development and execution of the Company’s business plans and strategies (including contributions that are expected to provide substantial benefit to the Company in future periods) | • Overall performance of the Company, including progress made with respect to production, reserves, operating costs, drilling results, risk management activities, asset acquisitions and asset monetizations | • Leadership ability • Demonstrated commitment to the Company | ||

• Performance of the NEO’s department or functional unit • Level of responsibility • Longevity with the Company | • Financial performance as measured by cash flow, net income, cost of capital, general and administrative costs and common stock price performance

| • Motivational skills • Attitude • Work ethic |

2011 Benchmarking

In 2011, at the request of the Compensation Committee, Cogent conducted a peer group benchmarking analysis. The objective of this analysis was to understand the competitiveness of the named executive officers’ total direct compensation, consisting of base salary, annual cash bonus and the grant date fair value of restricted stock awards, relative to our compensation peer group companies. The peer group consisted of select exploration and production peer companies which are similar to the Company in size, scope and nature of business operations. Cogent collected and analyzed the benchmark data based on publicly disclosed information and presented its analysis to the Compensation Committee. The results informed the Compensation Committee’s decisions with respect to 2011 and 2012 executive compensation.

Our 2011 industry peer group consisted of the following companies: Anadarko Petroleum Corporation, Apache Corporation, Devon Energy Corporation, EOG Resources, Inc. and Occidental Petroleum Corporation. Within the exploration and production industry, there are a small number of companies that closely resemble us in size, scope and nature of business operations. Our self-selected industry peer group contains companies in our industry that are both larger and smaller in size and scope. All of the peer companies are independent exploration and production companies. We have not included companies in our peer group that compete in unrelated industries within the energy sector such as the refining, mining or coal industries. Also, we have excluded companies from our performance peer group that compete in our industry, but are larger than we are such as ConocoPhilips. We compete with the companies in our compensation peer group for talent and believe the selected companies are currently the most appropriate for use in executive compensation benchmarking. The differences and similarities between us and the companies in our industry peer group are taken into consideration when referencing benchmarks for named executive officer compensation decisions.

The Compensation Committee’s goal for 2011 was to ensure that our CEO’s compensation was reasonable in comparison to the compensation paid to the CEOs of our peer companies. Total direct compensation of our CEO and our named executive officers as a group in 2011 resulted in compensation paid between the median and the seventy-fifth percentile of benchmark data as compared to our peer group. The review also indicated that our executive compensation system for the CEO is more conservative in terms of fixed compensation (i.e., salary and bonus) than our peers.

In addition, our CEO, CFO, COO, and Senior Vice President, Treasurer and Corporate Secretary provided the Compensation Committee with detailed analyses and recommendations regarding each element of named executive officer compensation to facilitate the Compensation Committee’s semi-annual review of named executive officer compensation.

20

Table of Contents

The information provided to the Compensation Committee included tally sheets detailing for each named executive officer:

| • | the components of the named executive officer’s current compensation, including cash compensation (salary, bonus and restricted stock awards), equity compensation, accumulated 401(k) and deferred compensation balances and perquisites; |

| • | potential payouts under the termination of employment and change of control provisions under the named executive officer’s employment agreement and applicable equity compensation plans; and |

| • | projected wealth accumulation from the named executive officer’s outstanding equity compensation awards assuming 0%, 5% and 10% appreciation and depreciation in the price of the Company’s common stock over the next five years. |