Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Fiscal Year Ended December 31, 2012

[ ] Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File No. 1-13726

Chesapeake Energy Corporation

(Exact name of registrant as specified in its charter)

| Oklahoma | 73-1395733 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 6100 North Western Avenue | ||

| Oklahoma City, Oklahoma | 73118 | |

| (Address of principal executive offices) | (Zip Code) | |

(405) 848-8000

(Registrant’s telephone number, including area code)

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.01 | New York Stock Exchange | |

| 7.625% Senior Notes due 2013 | New York Stock Exchange | |

| 9.5% Senior Notes due 2015 | New York Stock Exchange | |

| 6.25% Senior Notes due 2017 | New York Stock Exchange | |

| 6.5% Senior Notes due 2017 | New York Stock Exchange | |

| 6.875% Senior Notes due 2018 | New York Stock Exchange | |

| 7.25% Senior Notes due 2018 | New York Stock Exchange | |

| 6.775% Senior Notes due 2019 | New York Stock Exchange | |

| 6.625% Senior Notes due 2020 | New York Stock Exchange | |

| 6.875% Senior Notes due 2020 | New York Stock Exchange | |

| 6.125% Senior Notes due 2021 | New York Stock Exchange | |

| 2.75% Contingent Convertible Senior Notes due 2035 | New York Stock Exchange | |

| 2.5% Contingent Convertible Senior Notes due 2037 | New York Stock Exchange | |

| 2.25% Contingent Convertible Senior Notes due 2038 | New York Stock Exchange | |

| 4.5% Cumulative Convertible Preferred Stock | New York Stock Exchange | |

| Securities registered pursuant to Section 12(g) of the Act: | ||

| None | ||

Table of Contents

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES [X] NO [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer [X] Accelerated Filer [ ] Non-accelerated Filer [ ] Smaller Reporting Company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

The aggregate market value of our common stock held by non-affiliates on June 30, 2012 was approximately $12.2 billion. At February 21, 2013, there were 667,567,791 shares of our $0.01 par value common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the 2013 Annual Meeting of Shareholders are incorporated by reference in Part III.

Table of Contents

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES

2012 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| PART I | |||

| Page | |||

| Item 1. | Business | ||

| Item 1A. | Risk Factors | ||

| Item 1B. | Unresolved Staff Comments | ||

| Item 2. | Properties | ||

| Item 3. | Legal Proceedings | ||

| Item 4. | Mine Safety Disclosures | ||

| PART II | |||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | ||

| Item 6. | Selected Financial Data | ||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | ||

| Item 8. | Financial Statements and Supplementary Data | ||

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | ||

| Item 9A. | Controls and Procedures | ||

| Item 9B. | Other Information | ||

| PART III | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | ||

| Item 11. | Executive Compensation | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||

| Item 13. | Certain Relationships and Related Transactions and Director Independence | ||

| Item 14. | Principal Accountant Fees and Services | ||

| PART IV | |||

| Item 15. | Exhibits and Financial Statement Schedules | ||

Table of Contents

Part I

ITEM 1. Business

Our Business

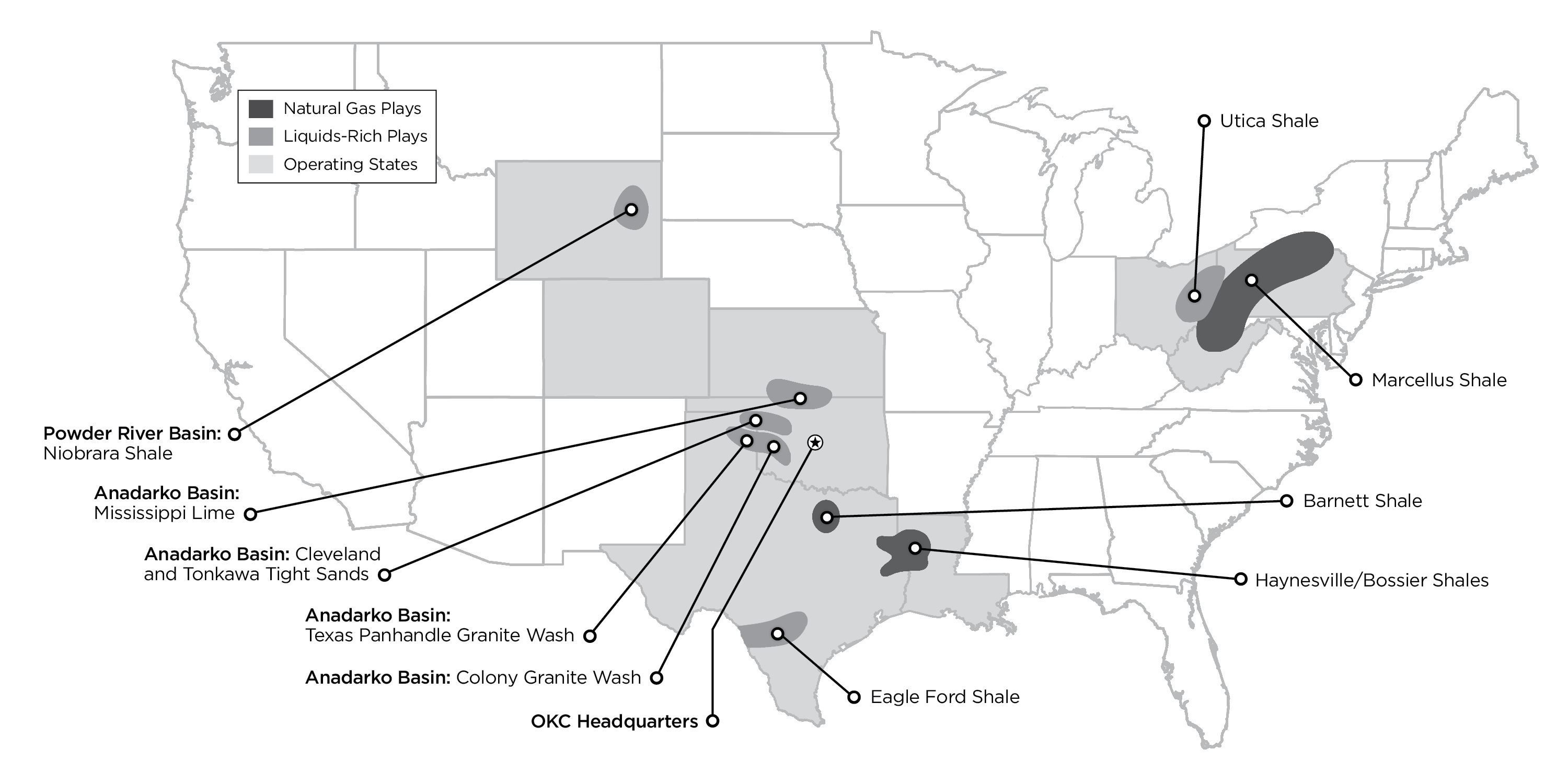

We are the second-largest producer of natural gas, a top 11 producer of liquids and the most active driller of wells in the U.S. We own interests in approximately 45,400 producing natural gas and oil wells that are currently producing approximately 3.9 bcfe per day, net to our interest. The Company has built a large resource base of onshore U.S. unconventional natural gas and liquids assets. Our core natural gas resource plays are the Haynesville/Bossier Shales in northwestern Louisiana and East Texas; the Marcellus Shale in the northern Appalachian Basin of West Virginia and Pennsylvania; and the Barnett Shale in the Fort Worth Basin of north-central Texas. In addition, we have built leading positions in the liquids-rich resource plays of the Eagle Ford Shale in South Texas; the Utica Shale in Ohio and Pennsylvania; the Granite Wash, Cleveland, Tonkawa and Mississippi Lime plays in the Anadarko Basin in northwestern Oklahoma, the Texas Panhandle and southern Kansas; and the Niobrara Shale in the Powder River Basin in Wyoming. We have also vertically integrated many of our operations and own substantial marketing, compression and oilfield services businesses.

The map below illustrates the locations of Chesapeake's natural gas and oil exploration and production operations.

The Company's December 31, 2012 estimated proved reserves were 15.690 tcfe, a decrease of 3.099 tcfe, or 17%, from 18.789 tcfe at year-end 2011. The decrease was primarily price related as natural gas prices in 2012 declined to the lowest levels in ten years. The 2012 proved reserve movement included 6.391 tcfe of extensions, downward revisions of 5.414 tcfe resulting from lower natural gas prices and downward revisions of 1.349 tcfe resulting from changes to previous estimates. In 2012, we produced 1.422 tcfe, acquired 42 bcfe and divested 1.347 tcfe of estimated proved reserves, including the disposition of 1.013 tcfe associated with the sale of our Permian Basin assets in September and October 2012.

Natural gas prices used in estimating proved reserves as of December 31, 2012 decreased by $1.36, or 33%, to $2.76 per mcf from $4.12 per mcf as of December 31, 2011 using the trailing 12-month average prices required by the Securities and Exchange Commission (SEC). The reserve reductions included the loss of significant proved undeveloped reserves, primarily in the Barnett Shale and the Haynesville Shale plays, for which future development is uneconomic at the natural gas prices used in the reserve estimates. As a result of lower natural gas prices leading to lower estimated reserves, we were required to impair the carrying value of our natural gas and oil properties in the 2012 third quarter. See Natural Gas and Oil Properties in Note 1 of the notes to our consolidated financial statements included in Item 8 of this report for further discussion of this impairment and its impact on the consolidated financial statements.

1

Table of Contents

Our daily production for 2012 averaged 3.886 bcfe, an increase of 614 mmcfe, or 19%, over the 3.272 bcfe of daily production for 2011, and consisted of 3.084 bcf (80% on a natural gas equivalent basis), approximately 85,420 bbls of oil (13% on a natural gas equivalent basis) and approximately 48,130 bbls of NGL (7% on a natural gas equivalent basis). Our natural gas production in 2012 grew by 12%, or 333 mmcf per day; our oil production increased by 84%, or approximately 38,950 bbls per day; and our NGL production increased by 19%, or approximately 7,820 bbls per day.

Information About Us

Our principal executive offices are located at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118 and our main telephone number at that location is (405) 848-8000. We make available free of charge on our website at www.chk.com our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. From time to time, we also post announcements, updates, events, investor information and presentations on our website in addition to copies of all recent news releases. References to "Chesapeake", the "Company", "us", "we" and "our" in this report are to Chesapeake Energy Corporation together with its subsidiaries, unless the context otherwise requires.

Business Strategy

Since our inception in 1989, Chesapeake's primary goal has been to create value for investors by building and developing one of the largest onshore natural gas and liquids-rich resource bases in the U.S. Key elements of this business strategy are further explained below.

Grow Through the Drillbit. We believe that our most distinctive characteristic is our commitment and ability to grow production and proved reserves organically through the drillbit at a low cost in areas with large unconventional accumulations of natural gas and liquids. We are currently utilizing 83 operated drilling rigs and 31 non-operated drilling rigs to conduct the most active drilling program in the U.S. We are active in most of the nation's major unconventional plays, where we drill more horizontal wells than any other company in the industry. For many years, we have invested large amounts of capital in undeveloped leasehold, three dimensional (3-D) seismic information and human resources to take full advantage of our capacity to grow through the drillbit. As a result of those investments, we have been able to increase production for 23 consecutive years. We believe the success of our drilling program is largely due to our recognition, earlier than most of our competitors, that advanced horizontal drilling and completion techniques would enable development of previously uneconomic natural gas and liquids-rich reservoirs and that, as a consequence, various unconventional formations could be recognized and developed as potentially prolific reservoirs. For 2013 and beyond, we anticipate spending significantly less than in previous years on undeveloped leasehold, oilfield service assets and other fixed assets, and at the same time benefiting from our past investment in non-drilling assets that facilitate our ability to drill the best wells in the most efficient manner.

Increase Liquids Production. In recognition of the value gap between liquids and natural gas prices that has widened to historic levels in the last five years, we have directed a significant portion of our technological and leasehold acquisition expertise to identify, secure and commercialize new unconventional liquids-rich plays. This planned transition will result in a more balanced and likely more profitable portfolio between natural gas and liquids. To date, we have established production in multiple liquids-rich plays on approximately 6.4 million net acres. Our production of liquids averaged approximately 133,550 bbls per day during 2012, a 54% increase over the average during 2011, as a result of the increased development of our unconventional liquids-rich plays. In 2012, approximately 85% of our drilling and completion expenditures were allocated to liquids-rich plays, compared to 50% in 2011 and 30% in 2010. We are projecting that 85% of our operated drilling and completion expenditures will be allocated to liquids development in 2013 as well, and we expect to increase our liquids production through our drilling activities by approximately 27% in 2013 compared to 2012, net of expected asset sales. We project that liquids will account for more than 25% of our 2013 production and approximately 60% of our natural gas, oil and NGL revenue, after differentials and realized hedging.

Control Substantial Land and Drilling Location Inventories. Recognizing that better horizontal drilling and completion technologies, when applied to various new unconventional reservoirs, would likely create a unique opportunity to capture many years worth of drilling opportunities, we aggressively acquired leases in natural gas shale plays from 2006 through 2008 and unconventional oil plays from 2009 through 2011. We believe our lease acquisition program has given us competitive advantages in some of the best unconventional resource plays in the U.S. As of December 31, 2012, we held approximately 15 million net acres of onshore leasehold in the U.S. We believe this extensive leasehold position provides substantial opportunities for future growth and offers valuable divestiture

2

Table of Contents

opportunities as we focus on developing the most promising of our plays. Our undeveloped leasehold acquisition phase is now substantially complete. We spent approximately 50% less on new leasehold in 2012 than in 2011 and are forecasting to spend approximately 75% less in 2013 than in 2012.

Focus our Operations in the "Core of the Core" of Our Leasehold. We have made significant acquisitions of leasehold inventory and necessary investments in infrastructure, oilfield services, seismic data and human resources that have allowed us to drill wells more successfully and at a lower cost. Recently, we have shifted our focus to the development of the 10 plays in which we have a #1 or #2 ownership position. In an effort to optimize our portfolio around our core natural gas and oil properties, during 2012 we completed sales of non-core natural gas and oil properties, midstream and other assets for proceeds of approximately $12 billion (including $1.25 billion from the sale of a preferred security in a subsidiary), and in 2013 we are planning to sell additional natural gas and oil properties as well as midstream, certain oilfield services and other assets that do not fit our long-term plans for expected additional proceeds of approximately $4 - $7 billion. We expect that a much higher percentage of our total expenditures in 2013 will be directed toward drilling and completion activities. By concentrating on the "core of the core" of our assets, we believe we can leverage our past investments to prioritize our drilling program around our highest-return assets and enhance returns on capital.

Improve Our Balance Sheet through Reduction of Debt. Our strategic and financial plan calls for reduced long-term debt along with continued growth in production. We believe that reduced debt and continued growth in our asset base will lead to investment grade metrics. We expect to reduce debt primarily with proceeds from asset sales. Among the several benefits of lower debt are lower borrowing costs, and we believe improved credit metrics will lead to more favorable debt ratings by the major ratings agencies over time.

Mitigate Natural Gas and Oil Price Risk. We have used and intend to continue using our hedging program to mitigate the risks inherent in developing and producing natural gas and liquids-rich resources and to provide a level of cash flow certainty. We intend to periodically use the volatility in natural gas and oil prices to our benefit by adjusting our hedge position when market prices reach levels that management believes are either unsustainable for the long term, have material risk in the short term or offer unusually high rates of return on our invested capital. We currently have downside hedge protection on approximately 85% of our expected 2013 oil production and 50% of our expected 2013 natural gas production, which equates to approximately 72% of our expected 2013 natural gas, oil and NGL revenue, after differentials. We have also hedged a significant portion of our projected 2014 oil production.

Focus on Low Costs and Vertical Integration. By minimizing lease operating expenses through focused activities, vertical integration and increased scale, we strive to deliver attractive profit margins and financial returns through all phases of the commodity price cycle. Our operational efficiencies are reflected in faster spud-to-spud cycle times, overall decreases in production costs per unit and economies of scale from pad drilling. We believe our low cost structure is the result of management's effective cost-control programs, a high-quality asset base and access to oilfield services, especially those we own through our wholly and non-wholly owned subsidiaries, and natural gas processing and transportation infrastructures that exist in our key operating areas. Our high level of drilling activity and production volumes create considerable value for our oilfield services and compression businesses. As of December 31, 2012, we operated approximately 27,200 of our 45,400 gross wells, which delivered approximately 85% of our daily production volume. This large percentage of operated properties provides us with a high degree of operational flexibility and cost control.

Maintain an Entrepreneurial Culture. As an employer of approximately 12,000 people and an indirect employer of tens of thousands more, we take pride in our innovative and aggressive implementation of our business strategy and strive to be as entrepreneurial today as we were when we were a much smaller company. We have maintained an unusually flat organizational structure as we have grown to help ensure that important information travels rapidly through the Company and decisions are made and implemented quickly. Our efforts in the development of our human resources have been recognized by many, most recently Fortune Magazine, which in January 2013 named Chesapeake the 26th best company to work for in the U.S., including the second highest ranked company within the U.S. oil and gas industry. This was the sixth year in a row that we have been named by Fortune as one of the 100 Best Companies to Work for in America.

3

Table of Contents

Operating Divisions

Chesapeake focuses its exploration, development, acquisition and production efforts in the four geographic operating divisions described below.

Southern Division. Primarily includes the Haynesville/Bossier Shales in northwestern Louisiana and East Texas and the Barnett Shale in the Fort Worth Basin of north-central Texas.

Northern Division. The Mid-Continent region, principally the Anadarko Basin in northwestern Oklahoma, the Texas Panhandle and southern Kansas, including the Mississippi Lime, Cleveland and Tonkawa tight sands and Granite Wash plays.

Eastern Division. Primarily includes the Marcellus Shale in the northern Appalachian Basin of West Virginia and Pennsylvania and the Utica Shale in Ohio and Pennsylvania.

Western Division. Primarily includes the Eagle Ford Shale in South Texas, the Niobrara Shale in the Powder River Basin in Wyoming and, prior to November 2012, the Permian and Delaware Basins of West Texas and southern New Mexico. In September and October 2012, we sold all of our producing properties, gathering business and substantially all of our leasehold in the Permian and Delaware Basins.

Well Data

At December 31, 2012, we had interests in approximately 45,400 gross (21,200 net) productive wells, including properties in which we held an overriding royalty interest, of which 37,300 gross (18,500 net) were classified as primarily natural gas productive wells and 8,100 gross (2,700 net) were classified as primarily oil productive wells. Chesapeake operates approximately 27,200 of its 45,400 productive wells. During 2012, we drilled 1,642 gross (1,111 net) wells and participated in another 959 gross (161 net) wells operated by other companies. We operate approximately 85% of our current daily production volumes.

4

Table of Contents

Drilling Activity

The following table sets forth the wells we drilled or participated in during the periods indicated. In the table, "gross" refers to the total wells in which we had a working interest and "net" refers to gross wells multiplied by our working interest.

| 2012 | 2011 | 2010 | ||||||||||||||||||||||||||||||||||

| Gross | % | Net | % | Gross | % | Net | % | Gross | % | Net | % | |||||||||||||||||||||||||

| Development: | ||||||||||||||||||||||||||||||||||||

| Productive | 2,075 | 99 | 956 | 99 | 2,536 | 99 | 1,077 | 99 | 2,721 | 99 | 1,031 | 99 | ||||||||||||||||||||||||

| Dry | 21 | 1 | 5 | 1 | 10 | 1 | 3 | 1 | 30 | 1 | 12 | 1 | ||||||||||||||||||||||||

| Total | 2,096 | 100 | 961 | 100 | 2,546 | 100 | 1,080 | 100 | 2,751 | 100 | 1,043 | 100 | ||||||||||||||||||||||||

| Exploratory: | ||||||||||||||||||||||||||||||||||||

| Productive | 495 | 98 | 305 | 98 | 430 | 99 | 201 | 99 | 265 | 95 | 99 | 93 | ||||||||||||||||||||||||

| Dry | 10 | 2 | 6 | 2 | 3 | 1 | 1 | 1 | 15 | 5 | 7 | 7 | ||||||||||||||||||||||||

| Total | 505 | 100 | 311 | 100 | 433 | 100 | 202 | 100 | 280 | 100 | 106 | 100 | ||||||||||||||||||||||||

The following table shows the wells we drilled or participated in by operating division:

| 2012 | 2011 | 2010 | ||||||||||||||||

| Gross Wells | Net Wells | Gross Wells | Net Wells | Gross Wells | Net Wells | |||||||||||||

| Southern | 363 | 183 | 1,104 | 550 | 1,023 | 495 | ||||||||||||

| Northern | 942 | 441 | 1,076 | 342 | 1,371 | 369 | ||||||||||||

| Eastern | 578 | 264 | 371 | 149 | 367 | 140 | ||||||||||||

| Western | 718 | 384 | 428 | 241 | 270 | 145 | ||||||||||||

| Total | 2,601 | 1,272 | 2,979 | 1,282 | 3,031 | 1,149 | ||||||||||||

At December 31, 2012, we had 1,033 (461 net) wells in drilling or completing status.

5

Table of Contents

Production, Sales, Prices and Expenses

The following table sets forth information regarding the production volumes, natural gas, oil and NGL sales, average sales prices received, other operating income and expenses for the periods indicated:

| Years Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Net Production: | ||||||||||||

| Natural gas (bcf) | 1,128.8 | 1,004.1 | 924.9 | |||||||||

| Oil (mmbbl) | 31.3 | 17.0 | 10.9 | |||||||||

| NGL (mmbbl) | 17.6 | 14.7 | 7.5 | |||||||||

Natural gas equivalent (bcfe)(a) | 1,422.1 | 1,194.2 | 1,035.2 | |||||||||

| Natural Gas, Oil and NGL Sales ($ in millions): | ||||||||||||

| Natural gas sales | $ | 2,004 | $ | 3,133 | $ | 3,169 | ||||||

| Natural gas derivatives – realized gains (losses) | 328 | 1,656 | 1,982 | |||||||||

| Natural gas derivatives – unrealized gains (losses) | (331 | ) | (669 | ) | 425 | |||||||

| Total natural gas sales | 2,001 | 4,120 | 5,576 | |||||||||

| Oil sales | 2,829 | 1,523 | 822 | |||||||||

| Oil derivatives – realized gains (losses) | 39 | (60 | ) | 74 | ||||||||

| Oil derivatives – unrealized gains (losses) | 857 | (128 | ) | (1,033 | ) | |||||||

| Total oil sales | 3,725 | 1,335 | (137 | ) | ||||||||

| NGL sales | 526 | 603 | 257 | |||||||||

| NGL derivatives – realized gains (losses) | (9 | ) | (42 | ) | — | |||||||

| NGL derivatives – unrealized gains (losses) | 35 | 8 | (49 | ) | ||||||||

| Total NGL sales | 552 | 569 | 208 | |||||||||

| Total natural gas, oil and NGL sales | $ | 6,278 | $ | 6,024 | $ | 5,647 | ||||||

| Average Sales Price (excluding gains (losses) on derivatives): | ||||||||||||

| Natural gas ($ per mcf) | $ | 1.77 | $ | 3.12 | $ | 3.43 | ||||||

| Oil ($ per bbl) | $ | 90.49 | $ | 89.80 | $ | 75.29 | ||||||

| NGL ($ per bbl) | $ | 29.89 | $ | 40.96 | $ | 34.38 | ||||||

| Natural gas equivalent ($ per mcfe) | $ | 3.77 | $ | 4.40 | $ | 4.10 | ||||||

| Average Sales Price (excluding unrealized gains (losses) on derivatives): | ||||||||||||

| Natural gas ($ per mcf) | $ | 2.07 | $ | 4.77 | $ | 5.57 | ||||||

| Oil ($ per bbl) | $ | 91.74 | $ | 86.25 | $ | 82.10 | ||||||

| NGL ($ per bbl) | $ | 29.37 | $ | 38.12 | $ | 34.38 | ||||||

| Natural gas equivalent ($ per mcfe) | $ | 4.02 | $ | 5.70 | $ | 6.09 | ||||||

Other Operating Income(b) ($ in millions): | ||||||||||||

| Marketing, gathering and compression net margin | $ | 119 | $ | 123 | $ | 127 | ||||||

| Oilfield services net margin | $ | 142 | $ | 119 | $ | 32 | ||||||

| Expenses ($ per mcfe): | ||||||||||||

| Natural gas, oil and NGL production | $ | 0.92 | $ | 0.90 | $ | 0.86 | ||||||

| Production taxes | $ | 0.13 | $ | 0.16 | $ | 0.15 | ||||||

| General and administrative expenses | $ | 0.38 | $ | 0.46 | $ | 0.44 | ||||||

| Natural gas, oil and NGL depreciation, depletion and amortization | $ | 1.76 | $ | 1.37 | $ | 1.35 | ||||||

| Depreciation and amortization of other assets | $ | 0.21 | $ | 0.24 | $ | 0.21 | ||||||

Interest expense(c) | $ | 0.06 | $ | 0.03 | $ | 0.08 | ||||||

6

Table of Contents

___________________________________________

| (a) | Natural gas equivalent is based on six mcf of natural gas to one barrel of oil or one barrel of NGL. This ratio reflects an energy content equivalency and not a price or revenue equivalency. Given recent natural gas, oil and NGL prices, the price for an mcfe of natural gas is significantly less than the price for an mcfe of oil or NGL. |

| (b) | Includes revenue and operating costs and excludes depreciation and amortization of other assets. See Depreciation and Amortization of Other Assets under Results of Operations in Item 7 of this report for details of the depreciation and amortization of other assets associated with our marketing, gathering and compression and oilfield services operating segments. |

| (c) | Includes the effects of realized (gains) losses from interest rate derivatives, but excludes the effects of unrealized (gains) losses and is net of amounts capitalized. |

Natural Gas, Oil and NGL Reserves

The tables below set forth information as of December 31, 2012 with respect to our estimated proved reserves, the associated estimated future net revenue and present value (discounted at an annual rate of 10%) of estimated future net revenue before and after future income taxes (standardized measure) at such date. Neither the pre-tax present value of estimated future net revenue nor the after-tax standardized measure is intended to represent the current market value of the estimated natural gas, oil and NGL reserves we own. All of our estimated natural gas and oil reserves are located within the U.S.

| December 31, 2012 | |||||||||||||||

| Natural Gas | Oil | NGL | Total | ||||||||||||

| (bcf) | (mmbbl) | (mmbbl) | (bcfe)(a) | ||||||||||||

| Proved developed | 7,174 | 162.9 | 132.1 | 8,944 | |||||||||||

| Proved undeveloped | 3,759 | 332.6 | 165.2 | 6,746 | |||||||||||

Total proved(b) | 10,933 | 495.5 | 297.3 | 15,690 | |||||||||||

Proved Developed | Proved Undeveloped | Total Proved | |||||||||||||

| ($ in millions) | |||||||||||||||

Estimated future net revenue(c) | $ | 20,510 | $ | 21,779 | $ | 42,289 | |||||||||

Present value of estimated future net revenue(c) | $ | 10,793 | $ | 6,980 | $ | 17,773 | |||||||||

Standardized measure(c)(d) | $ | 14,666 | |||||||||||||

| Operating Division | Natural Gas | Oil | NGL | Natural Gas Equivalent | Percent of Proved Reserves | Present Value | ||||||||||||||

| (bcf) | (mmbbl) | (mmbbl) | (bcfe)(a) | ($ millions) | ||||||||||||||||

| Southern | 3,532 | 11.7 | 23.4 | 3,742 | 24 | % | $ | 1,527 | ||||||||||||

| Northern | 2,680 | 153.5 | 130.8 | 4,385 | 28 | % | 5,834 | |||||||||||||

| Eastern | 3,891 | 9.5 | 34.3 | 4,155 | 26 | % | 2,901 | |||||||||||||

| Western | 830 | 320.8 | 108.8 | 3,408 | 22 | % | 7,511 | |||||||||||||

| Total | 10,933 | 495.5 | 297.3 | 15,690 | 100 | % | $ | 17,773 | (c) | |||||||||||

___________________________________________

| (a) | Natural gas equivalent based on six mcf of natural gas to one barrel of oil or NGL. |

| (b) | Includes 91 bcf of natural gas, 4 mmbbl of oil and 9 mmbbl of NGL reserves owned by the Chesapeake Granite Wash Trust, 45 bcf of natural gas, 2 mmbbl of oil and 4 mmbbl of NGL of which are attributable to the noncontrolling interest holders. |

| (c) | Estimated future net revenue represents the estimated future gross revenue to be generated from the production of proved reserves, net of estimated production and future development costs, using prices and costs under existing economic conditions as of December 31, 2012. For the purpose of determining "prices", we used the unweighted arithmetic average of the prices on the first day of each month within the 12-month period ended |

7

Table of Contents

December 31, 2012. The prices used in our reserve reports were $2.76 per mcf of natural gas and $94.84 per barrel of oil, before price differential adjustments. Including the effect of price differential adjustments, the prices used in our reserve reports were $1.75 per mcf of natural gas, $91.78 per barrel of oil and $30.81 per barrel of NGL. These prices should not be interpreted as a prediction of future prices, nor do they reflect the value of our commodity derivative instruments in place as of December 31, 2012. The amounts shown do not give effect to non-property related expenses, such as corporate general and administrative expenses and debt service, or to depreciation, depletion and amortization. The present value of estimated future net revenue differs from the standardized measure only because the former does not include the effects of estimated future income tax expenses ($3.1 billion as of December 31, 2012).

Management uses future net revenue, which is calculated without deducting estimated future income tax expenses, and the present value thereof, as one measure of the value of the Company's current proved reserves and to compare relative values among peer companies. We also understand that securities analysts and rating agencies use this measure in similar ways. While future net revenue and present value are based on prices, costs and discount factors which are consistent from company to company, the standardized measure of discounted future net cash flows is dependent on the unique tax situation of each individual company.

| (d) | Additional information on the standardized measure is presented in Note 10 of the notes to our consolidated financial statements included in Item 8 of this report. |

As of December 31, 2012, our reserve estimates included 6.746 tcfe of reserves classified as proved undeveloped (PUD), compared to 8.683 tcfe as of December 31, 2011. Presented below is a summary of changes in our proved undeveloped reserves for 2012.

| Total | |||

| (bcfe) | |||

| Proved undeveloped reserves, beginning of period | 8,683 | ||

| Extensions, discoveries and other additions | 4,161 | ||

Revisions of previous estimates(a) | (4,778 | ) | |

| Developed | (961 | ) | |

| Sale of reserves-in-place | (363 | ) | |

| Purchase of reserves-in-place | 4 | ||

| Proved undeveloped reserves, end of period | 6,746 | ||

_________________________________________

(a) Included in this amount are 4,009 bcfe of downward price-related revisions.

As of December 31, 2012, there were no PUDs that had remained undeveloped for five years or more. In 2012, we invested approximately $1.035 billion, net of drilling and completion cost carries of $86 million, to convert 961 bcfe of PUDs to proved developed reserves. In 2013, we estimate that we will invest approximately $2.4 billion, net of drilling and completion cost carries of $95 million, for PUD conversion.

The future net revenue attributable to our estimated proved undeveloped reserves of $21.779 billion as of December 31, 2012, and the $6.980 billion present value thereof, has been calculated assuming that we will expend approximately $12.0 billion to develop these reserves: $2.4 billion in 2013, $2.2 billion in 2014, $2.6 billion in 2015, $2.6 billion in 2016 and $2.2 billion in 2017, although the amount and timing of these expenditures will depend on a number of factors, including actual drilling results, service costs, commodity prices and the availability of capital. Chesapeake's developmental drilling schedules are subject to revision and reprioritization throughout the year resulting from unknowable factors such as the relative success in an individual developmental drilling prospect leading to an additional drilling opportunity, rig availability, title issues or delays, and the effect that acquisitions or dispositions may have on prioritizing developmental drilling plans.

The SEC's rules for reporting reserves allow the booking of proved undeveloped reserves at locations greater distances from producing wells than immediate offsets. All proved reserves are required to meet reasonable certainty standards; thus, locations more than direct offsets to producing wells must be shown to be underlain by the productive formation. Reasonable certainty also requires that the formation is continuous between the producing wells and the PUD locations and that the PUDs are economically viable.

8

Table of Contents

Our proved reserves as of December 31, 2012 included PUDs more than directly offsetting producing wells in two resource plays: the Marcellus Shale and the Eagle Ford Shale. In all other areas, we restricted PUD locations to immediate offsets to producing wells. Within the Marcellus and Eagle Ford Shale plays, we used both public and proprietary geologic data to establish continuity of the formation and its producing properties. This included seismic data and interpretations (2-D, 3-D and micro seismic); open hole log information (collected both vertically and horizontally) and petrophysical analysis of the log data; mud logs; gas sample analysis; drill cutting samples; measurements of total organic content; thermal maturity; sidewall cores; whole cores; and data measured in our internal core analysis facility. After the geologic area was shown to be continuous, statistical analysis of existing producing wells was conducted to generate an area of reasonable certainty at distances from established production. Undrilled locations within this proved area could be booked as PUDs. However, due to other factors and requirements of SEC reserves reporting rules, numerous locations within the proved area of these two statistically evaluated plays have not yet been booked as PUDs.

Our annual net decline rate on producing properties is projected to be 33% from 2013 to 2014, 22% from 2014 to 2015, 17% from 2015 to 2016, 14% from 2016 to 2017 and 12% from 2017 to 2018. Of our 8.9 tcfe of proved developed reserves as of December 31, 2012, 1.2 tcfe were non-producing.

Chesapeake's ownership interest used in calculating proved reserves and the associated estimated future net revenue was determined after giving effect to the assumed maximum participation by other parties to our farm-out and participation agreements. The prices used in calculating the estimated future net revenue attributable to proved reserves do not reflect market prices for natural gas and oil production sold subsequent to December 31, 2012. The estimated proved reserves may not be produced and sold at the assumed prices.

The Company's estimated proved reserves and the standardized measure of discounted future net cash flows of the proved reserves as of December 31, 2012, 2011 and 2010, and the changes in quantities and standardized measure of such reserves for each of the three years then ended, are shown in Note 10 of the notes to the consolidated financial statements included in Item 8 of this report. No estimates of proved reserves comparable to those included herein have been included in reports to any federal agency other than the SEC.

There are numerous uncertainties inherent in estimating quantities of proved reserves and in projecting future rates of production and timing of development expenditures, including many factors beyond our control. The reserve data represent only estimates. Reserve engineering is a subjective process of estimating underground accumulations of natural gas and oil that cannot be measured exactly, and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. As a result, estimates made by different engineers often vary. In addition, results of drilling, testing and production subsequent to the date of an estimate may justify revision of such estimates, and such revisions may be material. Accordingly, reserve estimates often differ from the actual quantities of natural gas, oil and NGL that are ultimately recovered. Furthermore, the estimated future net revenue from proved reserves and the associated present value are based upon certain assumptions, including prices, future production levels and costs that may not prove correct. Future prices and costs may be materially higher or lower than the prices and costs as of the date of any estimate.

Chesapeake's management uses forward-looking market-based data in developing its drilling plans, assessing its capital expenditure needs and projecting future cash flows. We believe that using the 10-year average future NYMEX strip prices yields a better indication of the likely economic producibility of proved reserves than the trailing average 12-month price required by the SEC's reserves reporting rules. Reserve volumes represent estimated production to be sold in the future. Futures prices, such as the 10-year average NYMEX strip prices, represent an unbiased consensus estimate by market participants about the likely prices to be received for future production. We hedge substantial amounts of future production based on futures prices. While historical data, such as the trailing 12-month average price required by the SEC's reporting rule, facilitate comparisons of proved reserves from company to company and may be helpful in discerning trends, such as price-related effects on end-user demand, the price at which we can sell our production in the future is by far the major determinant of the likely economic producibility of our reserves. A 12-month average price adjusts slowly to falling or rising prices, further detracting from its usefulness as a predictor of the prices at which future production will actually be sold.

9

Table of Contents

The table below compares our estimated proved reserves and associated present value (discounted at an annual rate of 10%) of estimated future revenue before income tax using the 2012 12-month average prices of $2.76 per mcf and $94.84 per bbl, before price differential adjustments, reflected in our reported reserve estimates and the 10-year average future NYMEX strip prices as of December 31, 2012, which were $4.85 per mcf and $87.90 per bbl, before price differential adjustments. Our cost and other assumptions are the same under the two pricing scenarios.

| December 31, 2012 | ||||||||||||||||

| Natural Gas | Oil | NGL | Total | Present Value | ||||||||||||

| (bcf) | (mmbbl) | (mmbbl) | (bcfe) | ($ in millions) | ||||||||||||

2012 12-month average prices (SEC)(a) | 10,933 | 495.5 | 297.3 | 15,690 | $ | 17,773 | ||||||||||

10-year average future NYMEX strip prices as of December 31, 2012(b) | 14,742 | 497.2 | 304.2 | 19,550 | $ | 27,927 | ||||||||||

___________________________________________

| (a) | Volumes represent proved reserves as defined in Rule 4-10(a)(22) of Regulation S-X. |

| (b) | Volumes do not represent proved reserves as defined in Rule 4-10(a)(22) of Regulation S-X. |

Reserves Estimation

Chesapeake's Reservoir Engineering Department prepared approximately 11% of the proved reserves estimates (by volume) disclosed in this report. Those estimates were based upon the best available production, engineering and geologic data.

Chesapeake's Vice President of Corporate Reserves is the technical person primarily responsible for overseeing the preparation of the Company's reserve estimates. His qualifications include the following:

| • | 37 years of practical experience in petroleum engineering, including 34 years of this experience in the estimation and evaluation of reserves; |

| • | registered professional engineer in the state of Oklahoma; |

| • | Bachelor of Science degree in Petroleum Engineering; and |

| • | member in good standing of the Society of Petroleum Engineers. |

We ensure that the key members of the Department have appropriate technical qualifications to oversee the preparation of reserves estimates, including, with respect to our engineers, a minimum of an undergraduate degree in petroleum, mechanical or chemical engineering or other applicable technical discipline. With respect to our engineering technicians, a minimum of a four-year degree in mathematics, economics, finance or other technical/business/science field is required. We maintain a continuous education program for our engineers and technicians on new technologies and industry advancements as well as refresher training on basic skills and analytical techniques.

We maintain internal controls such as the following to ensure the reliability of reserves estimations:

| • | We follow comprehensive SEC-compliant internal policies to determine and report proved reserves. Reserves estimates are made by experienced reservoir engineers or under their direct supervision. |

| • | The Reservoir Engineering Department reviews all of the Company's reported proved reserves at the close of each quarter. |

| • | Each quarter, Reservoir Engineering Department managers, the Vice President of Corporate Reserves, the Executive Vice President of Production and the Chief Operating Officer review all significant reserves changes and all new proved undeveloped reserves additions. |

| • | The Reservoir Engineering Department reports independently of any of our operating divisions. |

10

Table of Contents

We engaged three third-party engineering firms to prepare portions of our reserves estimates comprising approximately 89% of our estimated proved reserves (by volume) at year-end 2012. The portion of our estimated proved reserves prepared by each of our third-party engineering firms as of December 31, 2012 is presented below.

| % Prepared (by Volume) | Operating Division | ||||

| Ryder Scott Company, L.P. | 44% | Northern, Western | |||

PetroTechnical Services, Division of Schlumberger Technology Corporation | 24% | Eastern | |||

| Netherland, Sewell & Associates, Inc. | 21% | Southern | |||

Copies of the reports issued by the engineering firms are filed with this report as Exhibits 99.1 through 99.3. The qualifications of the technical person at each of these firms primarily responsible for overseeing his firm's preparation of the Company's reserve estimates are set forth below.

Ryder Scott Company, L.P.

| • | over 30 years of practical experience in the estimation and evaluation of reserves |

| • | registered professional engineer in the state of Texas |

| • | Bachelor of Science degree in Electrical Engineering |

| • | member in good standing of the Society of Petroleum Engineers and the Society of Petroleum Evaluation Engineers |

PetroTechnical Services, Division of Schlumberger Technology Corporation

| • | over 20 years of practical experience in petroleum geology and in the estimation and evaluation of reserves |

| • | registered professional geologist license in the Commonwealth of Pennsylvania |

| • | certified petroleum geologist of the American Association of Petroleum Geologists |

| • | Bachelor of Science degree in Petroleum and Natural Gas Engineering |

Netherland, Sewell & Associates, Inc.

| • | over 30 years of practical experience in petroleum engineering and in the estimation and evaluation of reserves |

| • | registered professional engineer in the state of Texas |

| • | Bachelor of Science degree in Petroleum Engineering |

11

Table of Contents

Costs Incurred in Natural Gas and Oil Property Acquisition, Exploration and Development

The following table sets forth historical costs incurred in natural gas and oil property acquisitions, exploration and development activities during the periods indicated:

| Years Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| ($ in millions) | ||||||||||||

| Acquisition of Properties: | ||||||||||||

| Proved properties | $ | 332 | $ | 48 | $ | 243 | ||||||

| Unproved properties | 2,981 | 4,736 | 6,953 | |||||||||

| Exploratory costs | 2,353 | 2,261 | 872 | |||||||||

| Development costs | 6,733 | 5,497 | 4,741 | |||||||||

Costs incurred(a)(b) | $ | 12,399 | $ | 12,542 | $ | 12,809 | ||||||

___________________________________________

| (a) | Exploratory and development costs are net of joint venture drilling and completion cost carries of $784 million, $2.570 billion and $1.151 billion in 2012, 2011 and 2010, respectively. |

| (b) | Includes capitalized interest and asset retirement cost as follows: |

| Capitalized interest | $ | 976 | $ | 727 | $ | 711 | ||||||

| Asset retirement obligations | $ | 32 | $ | 3 | $ | 2 | ||||||

As of December 31, 2012, there were no PUDs that had remained undeveloped for five years or more. In 2012, we invested approximately $1.035 billion, net of drilling and completion cost carries of $86 million, to convert 961 bcfe of PUDs to proved developed reserves.

A summary of our exploration and development, acquisition and divestiture activities in 2012 by operating division is as follows:

| Gross Wells Drilled | Net Wells Drilled | Exploration and Development | Acquisition of Unproved Properties | Acquisition of Proved Properties | Sales of Unproved Properties | Sales of Proved Properties | Total(a) | |||||||||||||||||||||||

| ($ in millions) | ||||||||||||||||||||||||||||||

| Southern | 363 | 183 | $ | 1,060 | $ | 181 | $ | 12 | $ | (50 | ) | $ | — | $ | 1,203 | |||||||||||||||

| Northern | 942 | 441 | 3,055 | 559 | 14 | (838 | ) | (1,098 | ) | 1,692 | ||||||||||||||||||||

| Eastern | 578 | 264 | 1,785 | 1,727 | — | (731 | ) | (7 | ) | 2,774 | ||||||||||||||||||||

| Western | 718 | 384 | 3,186 | 514 | 306 | (1,800 | ) | (1,356 | ) | 850 | ||||||||||||||||||||

| Total | 2,601 | 1,272 | $ | 9,086 | $ | 2,981 | $ | 332 | $ | (3,419 | ) | $ | (2,461 | ) | $ | 6,519 | ||||||||||||||

___________________________________________

| (a) | Includes capitalized internal costs of $410 million and related capitalized interest of $976 million. |

12

Table of Contents

Acreage

The following table sets forth as of December 31, 2012 the gross and net developed and undeveloped natural gas and oil leasehold and fee mineral acreage. "Gross" acres are the total number of acres in which we own a working interest. "Net" acres refer to gross acres multiplied by our fractional working interest. Acreage numbers do not include our unexercised options to acquire additional acreage.

| Developed Leasehold | Undeveloped Leasehold | Fee Minerals | Total | |||||||||||||||||||||

Gross Acres | Net Acres | Gross Acres | Net Acres | Gross Acres | Net Acres | Gross Acres | Net Acres | |||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Southern | 1,018 | 653 | 327 | 189 | 141 | 65 | 1,486 | 907 | ||||||||||||||||

| Northern | 4,606 | 2,458 | 4,242 | 2,863 | 1,056 | 178 | 9,904 | 5,499 | ||||||||||||||||

| Eastern | 1,972 | 1,497 | 5,913 | 3,413 | 706 | 508 | 8,591 | 5,418 | ||||||||||||||||

| Western | 625 | 355 | 4,941 | 2,822 | 350 | 31 | 5,916 | 3,208 | ||||||||||||||||

| Total | 8,221 | 4,963 | 15,423 | 9,287 | 2,253 | 782 | 25,897 | 15,032 | ||||||||||||||||

We actively acquire new leases, most of which have a three to five-year term. Managing lease expirations to ensure that we do not experience unintended material expirations is an important part of our business. Our leasehold management efforts include scheduling our drilling to establish production in paying quantities in order to hold leases by production, timely exercising our contractual rights to pay delay rentals to extend the terms of leases we value, planning leasehold asset sales and joint venture transactions to high-grade our lease inventory or to raise capital for additional development and letting some leases expire that are no longer part of our development plans.

The following table sets forth as of December 31, 2012, the expiration periods of gross and net undeveloped leasehold acres, unless production from the leasehold acreage is established prior to the expiration date, or we take action to extend the lease term.

| Acres Expiring | ||||||

Gross Acres | Net Acres | |||||

| (in thousands) | ||||||

| Years Ending December 31: | ||||||

| 2013 | 2,684 | 1,533 | ||||

| 2014 | 3,442 | 2,430 | ||||

| 2015 | 2,243 | 1,360 | ||||

| After 2015 and other | 7,054 | 3,964 | ||||

Total(a) | 15,423 | 9,287 | ||||

___________________________________________

| (a) | Includes held-by-production acreage that will remain in force as our production continues on the subject leases, and other leasehold acreage where management anticipates the lease to remain in effect past the primary term of the agreement due to our contractual option to extend the lease term. |

Marketing, Gathering and Compression

Marketing

Chesapeake Energy Marketing, Inc. (CEMI), one of our wholly owned subsidiaries, provides natural gas, oil and NGL marketing services, including commodity price structuring, contract administration and nomination services for Chesapeake, its joint working interest owners and other producers. We attempt to enhance the value of our natural gas and oil production by aggregating volumes to be sold to various intermediary markets, end markets and pipelines. This aggregation allows us to attract larger, more creditworthy customers that in turn assist in maximizing the prices received for our production.

Our oil and NGL production is generally sold under market sensitive short-term or spot price contracts. Our natural gas production is sold to purchasers under percentage-of-proceeds contracts, percentage-of-index contracts or spot

13

Table of Contents

price contracts. By the terms of the percentage-of-proceeds contracts, we receive a percentage of the resale price received by the purchaser after transportation and processing of our natural gas. Under percentage-of-index contracts, the price per mmbtu we receive for our natural gas is tied to indices published in Inside FERC or Gas Daily. Although exact percentages vary daily, as of February 2013, approximately 80% of our natural gas production was primarily sold under short-term contracts at market-sensitive prices. Sales to Plains Marketing, L.P. represented 11% of our total revenues (before the effects of hedging) for the year ended December 31, 2012. There were no sales to individual customers constituting 10% or more of total revenues (before the effects of hedging) for the years ended December 31, 2011 and 2010.

Midstream Gathering Operations

Historically, Chesapeake invested, directly and through affiliates, in gathering systems and processing facilities to complement our natural gas operations in regions where we had significant production and additional infrastructure was required. By doing so, we were better able to manage the value received for, and the costs of, gathering, treating and processing natural gas. These systems were designed primarily to gather the Company's production for delivery into major intrastate or interstate pipelines. In addition, our midstream business provided services to joint working interest owners and other third-party customers. Chesapeake generated revenues from its gathering, treating and compression activities through various gathering rate structures. The Company also processed a portion of its natural gas at various third-party plants.

In December 2012, we sold the majority of our midstream business for proceeds of $2.160 billion, subject to post-closing adjustments, to Access Midstream Partners, L.P. (NYSE: ACMP). ACMP, formerly Chesapeake Midstream Partners, L.P., was an affiliate of ours from 2010 until we sold our investment in it during June 2012 for proceeds of $2.0 billion. See Note 11 and Note 12 of the notes to the consolidated financial statements included in Item 8 of this report for further discussion of these transactions.

Compression Operations

Since 2003, Chesapeake has built its compression business through its wholly owned subsidiary, MidCon Compression, L.L.C. (MidCon). MidCon operates wellhead and system compressors, with over 1.0 million horsepower of compression, to facilitate the transportation of natural gas primarily produced from Chesapeake-operated wells. In a series of transactions since 2007, MidCon sold 2,322 compressors (net of 231 repurchased units), a significant portion of its compressor fleet, and entered into a master lease agreement. These transactions were recorded as sales and operating leasebacks.

Our marketing activities, along with our midstream gathering and compression operations, constitute a reportable segment under accounting guidance for disclosure about segments of an enterprise and related information. See Note 17 of the notes to our consolidated financial statements included in Item 8 of this report.

Oilfield Services

We formed Chesapeake Oilfield Services, L.L.C. (now COS Holdings, L.L.C.) (COS) in 2011 to own and operate our oilfield services assets. COS is a diversified oilfield services company that provides a wide range of well site services, primarily to Chesapeake and its working interest partners. COS focuses on providing services that are strategic to our operations, represent historical bottlenecks to our operations or that provide relatively high margins to the service provider. These services include contract drilling, hydraulic fracturing, oilfield rentals, rig relocation, fluid transportation and disposal and manufacturing of natural gas compressor packages. These services are fundamental to establishing and maintaining the flow of natural gas and oil throughout the productive life of a well. A source of liquidity for COS's business is the $500 million oilfield services revolving bank credit facility described under Liquidity and Capital Resources in Item 7 of this report. Additionally, in October 2011, Chesapeake Oilfield Operating, L.L.C. (COO), a wholly owned subsidiary of COS, issued $650 million principal amount of 6.625% Senior Notes due 2019 in a private placement. Proceeds from this placement were used to make a cash distribution to its direct parent, COS, to enable it to reduce indebtedness under an intercompany note with Chesapeake. See Note 3 of the notes to the consolidated financial statements included in Item 8 of the report for further discussion of the revolving bank credit facility and senior notes.

Our oilfield services operations constitute a reportable segment under accounting guidance for disclosure about segments of an enterprise and related information. See Note 17 of the notes to our consolidated financial statements included in Item 8 of this report. COS conducts operations through five lines of business, as described below.

14

Table of Contents

Contract Drilling

Securing available rigs is an integral part of the exploration process, and therefore, owning our own drilling company, Nomac Drilling, L.L.C., is a strategic advantage for us. As of December 31, 2012, we had invested approximately $1.4 billion to build or acquire 119 drilling rigs, which are utilized primarily to drill Chesapeake-operated wells. In a series of transactions since 2006, our drilling subsidiaries have sold 68 drilling rigs (net of 26 repurchased rigs) and related equipment and subsequently leased back the rigs through 2018. These transactions were recorded as sales and operating leasebacks. The drilling rigs have depth ratings between 3,000 and 25,000 feet and range in drilling horsepower from 500 to 2,000. These drilling rigs are currently operating in Louisiana, Montana, North Dakota, Ohio, Oklahoma, Pennsylvania, Texas, West Virginia and Wyoming. As of December 31, 2012, we had a fleet of 119 land drilling rigs and are the fifth largest land driller operating in the U.S.

Hydraulic Fracturing

In 2010, we began the process of building a hydraulic fracturing business under the name of Performance Technologies, L.L.C. (PTL). As part of that effort, we purchased two hydraulic fracturing fleets with an aggregate of 60,000 horsepower. As of December 31, 2012, we owned seven hydraulic fracturing fleets with an aggregate of 270,000 horsepower that provide hydraulic fracturing and other well stimulation services.

Oilfield Rentals

Our oilfield rentals business provides premium rental tools for land-based natural gas and oil drilling, completion and workover activities under the name Great Plains Oilfield Rental, L.L.C. We offer a full line of rental tools, including drill pipe, drill collars, tubing, blowout preventers, frac tanks and mud tanks and mud systems. We also provide air drilling and flowback services and services associated with the transfer of fresh water to the wellsite.

Oilfield Trucking

In 2006, we expanded our oilfield services by acquiring two privately owned oilfield trucking service companies. We now own one of the largest oilfield and heavy haul transportation companies in the industry under the names of Hodges Trucking Company, L.L.C. and Oilfield Trucking Solutions, L.L.C. Our trucks move drilling rigs, produced water, crude oil, other fluids and construction materials to and from the wellsite. As of December 31, 2012, we owned a fleet of 278 rig relocation trucks, 66 cranes and forklifts and 250 fluid service trucks.

Other Operations

Our other operations consist primarily of our natural gas compressor manufacturing business that operates under the name of Compass Manufacturing, L.L.C. in which we design, engineer, fabricate, install and sell natural gas compression units, accessories and equipment used in the production, treatment and processing of natural gas and oil. Once the compressors are complete, substantially all of the completed compressors are sold to MidCon.

Competition

We compete with both major integrated and other independent natural gas and oil companies in all aspects of our business to explore, develop and operate our properties and market our production. Some of our competitors may have larger financial and other resources than ours. Competitive conditions may be affected by future legislation and regulations as the U.S. develops new energy and climate-related policies. In addition, some of our larger competitors may have a competitive advantage when responding to factors that affect demand for natural gas and oil production, such as changing prices, domestic and foreign political conditions, weather conditions, the price and availability of alternative fuels, the proximity and capacity of natural gas pipelines and other transportation facilities, and overall economic conditions. We believe that our technological expertise, our exploration, land, drilling and production capabilities and the experience of our management generally enable us to compete effectively.

Hedging Activities

We utilize derivative strategies to manage the price of a portion of our future natural gas and oil production and to manage interest rate exposure. See Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

15

Table of Contents

Regulation

General

All of our operations are conducted onshore in the U.S. The U.S. natural gas and oil industry is regulated at the federal, state and local levels, and some of the laws, rules and regulations that govern our operations carry substantial administrative, civil and criminal penalties for non-compliance. Although we believe we are in substantial compliance with all applicable laws and regulations, and that remaining in substantial compliance with existing requirements will not have a material adverse effect on our financial position, cash flows or results of operations, such laws and regulations could be, and frequently are, amended or reinterpreted. Additionally, currently unforeseen environmental incidents may occur or past non-compliance with environmental laws or regulations may be discovered. Therefore, we are unable to predict the future costs or impacts of compliance or non-compliance. Additional proposals and proceedings that affect the natural gas and oil industry are regularly considered by Congress, the states, the local governments, the courts and federal agencies, such as the U.S. Environmental Protection Agency (EPA), the Federal Energy Regulatory Commission, the Department of Transportation, the Department of Interior and the Department of Energy. We actively monitor regulatory developments regarding our industry in order to anticipate and design required compliance activities and systems.

Exploration and Production Operations

The laws and regulations applicable to our exploration and production operations include requirements for permits to drill and to conduct other operations and for provision of financial assurances (such as bonds) covering drilling and well operations. Other activities subject to such laws and regulations include, but are not limited to:

| • | the location of wells; |

| • | the method of drilling and completing wells; |

| • | the surface use and restoration of properties upon which wells are drilled; |

| • | water withdrawal; |

| • | the plugging and abandoning of wells; |

| • | the recycling or disposal of fluids used or other substances handled in connection with operations; |

| • | the marketing, transportation and reporting of production; and |

| • | the valuation and payment of royalties. |

Our operations may require us to obtain permits for, among other things,

| • | air emissions; |

| • | construction activities, including in sensitive areas, such as wetlands, coastal regions or areas that contain endangered or threatened species or their habitats; |

| • | the construction and operation of underground injection wells to dispose of produced water and other non-hazardous oilfield wastes; and |

| • | the construction and operation of surface pits to contain drilling muds and other non-hazardous fluids associated with drilling operations. |

Delays in obtaining permits or an inability to obtain new permits or permit renewals could inhibit our ability to execute our drilling and production plans. Failure to comply with provisions of our permits could result in revocation of such permits and the imposition of fines and penalties.

Our exploration and production activities are also subject to various conservation regulations. These include the regulation of the size of drilling and spacing units (regarding the density of wells that may be drilled in a particular area) and the unitization or pooling of natural gas and oil properties. In this regard, some states, such as Oklahoma, allow the forced pooling or integration of tracts to facilitate exploration, while other states, such as Texas, Ohio, West Virginia and Pennsylvania, rely on voluntary pooling of lands and leases. In areas where pooling is voluntary, it may be more difficult to form units and therefore, more difficult to fully develop a project if the operator owns or controls less than 100% of the leasehold. In addition, state conservation laws establish maximum rates of production from natural gas and oil wells, generally limit the venting or flaring of natural gas and impose certain requirements regarding the ratability

16

Table of Contents

of production. The effect of these regulations is to limit the amount of natural gas and oil we can produce and to limit the number of wells and the locations at which we can drill.

Midstream Operations

Historically, Chesapeake invested, directly and through an affiliate, in gathering systems and processing facilities to complement our natural gas operations in regions where we had significant production and additional infrastructure was required. In December 2012, however, we sold substantially all of our midstream business, and we plan to sell most of our remaining midstream business in 2013. As a result, the impact on our business of compliance with the laws and regulations described below has decreased since the beginning of 2012 and will continue to diminish as we complete additional midstream sales.

In addition to the environmental, health and safety laws and regulations discussed below under Environmental, Health and Safety Matters, our midstream facilities are subject to regulation by the Pipeline and Hazardous Materials Safety Administration (PHMSA) of the U.S. Department of Transportation (DOT) pursuant to the Natural Gas Pipeline Safety Act of 1968 (NGPSA) and the Pipeline Safety Improvement Act of 2002 (PSIA) which was reauthorized and amended by the Pipeline Inspection, Protection, Enforcement and Safety Act of 2006. The NGPSA regulates safety requirements in the design, construction, operation and maintenance of gas pipeline facilities. The PSIA establishes mandatory inspections for all U.S. oil and natural gas transportation pipelines and some gathering lines in high-consequence areas. The PHMSA has developed regulations implementing the PSIA that require transportation pipeline operators to implement integrity management programs, including more frequent inspections and other measures to ensure pipeline safety in “high consequence areas,” such as high population areas, areas unusually sensitive to environmental damage and commercially navigable waterways.

We or the entities in which we own an interest inspect our pipelines regularly using equipment rented from third-party suppliers. Third parties also assist us in interpreting the results of the inspections.

States are largely preempted by federal law from regulating pipeline safety for interstate lines but most are certified by the DOT to assume responsibility for enforcing federal intrastate pipeline regulations and inspection of intrastate pipelines. In practice, because states can adopt stricter standards for intrastate pipelines than those imposed by the federal government for interstate lines, states vary considerably in their authority and capacity to address pipeline safety. We do not anticipate that complying with applicable state laws and regulations will have a material adverse effect on our financial position, cash flows or results of operations. Our natural gas pipelines have inspection and compliance programs designed to keep the facilities in compliance with pipeline safety and pollution control requirements.

Natural gas gathering and intrastate transportation facilities are exempt from the jurisdiction of the Federal Energy Regulatory Commission (FERC) under the Natural Gas Act. Although the FERC has not made any formal determinations with regard to any of our facilities, we believe that our natural gas pipelines and related facilities are engaged in exempt gathering and intrastate transportation and, therefore, are not subject to the FERC's jurisdiction.

FERC regulation affects our gathering and compression business generally. The FERC provides policies and practices across a range of natural gas regulatory activities, including, for example, its policies on open access transportation, market manipulation, ratemaking, capacity release and market transparency, and market center promotion, which indirectly affect our gathering business. In addition, the distinction between FERC-regulated transmission facilities and federally unregulated gathering and intrastate transportation facilities is a fact-based determination made by the FERC on a case-by-case basis; this distinction has also been the subject of regular litigation and change. The classification and regulation of our gathering and intrastate transportation facilities are subject to change based on future determinations by the FERC, the courts or Congress.

Our natural gas gathering operations are subject to ratable take and common purchaser statutes in most of the states in which we operate. These statutes generally require our gathering pipelines to take natural gas without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply. The regulations under these statutes can have the effect of imposing restrictions on our ability as an owner of gathering facilities to decide with whom we contract to gather natural gas. The states in which we operate typically have adopted a complaint-based regulation of natural gas gathering activities, which allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to gathering access and rate discrimination.

17

Table of Contents

Oilfield Services Operations

Our oilfield services business operates under the jurisdiction of a number of regulatory bodies that regulate worker safety standards, the handling of hazardous materials, the transportation of explosives, the protection of the environment and driving standards of operation. Regulations concerning equipment certification create an ongoing need for regular maintenance that is incorporated into our daily operating procedures.

In providing trucking services, we operate as a motor carrier and therefore are subject to regulation by the DOT and various state agencies. These regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations and regulatory safety, financial reporting and certain mergers, consolidations and acquisitions. Interstate motor carrier operations are subject to safety requirements prescribed by the DOT and, to a large degree, intrastate motor carrier operations are subject to safety regulations that mirror federal regulations. Such matters as weight and dimension of equipment are also subject to federal and state regulations, and DOT regulations mandate drug testing of drivers. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment and product handling requirements.

The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices or by changing the demand for common or contract carrier services or the cost of providing truckload services. Some of these possible changes include increasingly stringent environmental regulations, changes in the hours of service (HOS) regulations that govern the amount of time a driver may drive in any specific period, onboard black box recorder devices or limits on vehicle weight and size. From time to time, various legislative proposals are introduced, such as proposals to increase federal, state, or local taxes, including taxes on motor fuels, which may increase our costs or adversely impact the recruitment of drivers. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted.

Environmental, Health and Safety Matters

Our operations are subject to stringent and complex federal, state and local laws and regulations relating to the protection of human health and safety, the environment and natural resources. These laws and regulations can restrict or impact our business activities in many ways, such as:

| • | requiring the installation of pollution-control equipment or otherwise restricting the way we can handle or dispose of wastes and other substances connected with operations; |

| • | limiting or prohibiting construction activities in sensitive areas, such as wetlands, coastal regions or areas that contain endangered or threatened species or their habitats; |

| • | requiring investigatory and remedial actions to address pollution conditions caused by our operations or attributable to former operations; |

| • | requiring noise mitigation, setbacks, landscaping, fencing, and other measures; and |

| • | prohibiting the operations of facilities deemed to be in non-compliance with permits issued pursuant to such environmental laws and regulations. |

Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial or restoration obligations, and the issuance of orders enjoining future operations or imposing additional compliance requirements. Certain environmental statutes impose strict, joint and several liability for costs required to clean up and restore sites where hazardous substances, hydrocarbons or wastes have been disposed or otherwise released. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment.

The trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment. We monitor developments at the federal and state levels to anticipate future regulatory requirements that might be imposed to reduce the costs of compliance with any such requirements. We also actively participate in industry groups that help formulate recommendations for addressing existing or future regulations and that share best practices and lessons learned in relation to pollution prevention and incident investigations.

Below is a discussion of the material environmental, health and safety laws and regulations that relate to our business. We believe that we are in substantial compliance with these laws and regulations. We do not believe that compliance with existing environmental, health and safety laws or regulations will have a material adverse effect on our financial condition, results of operations or cash flow. At this point, however, we cannot reasonably predict what

18

Table of Contents

applicable laws, regulations or guidance may eventually be adopted with respect to our operations or the ultimate cost to comply with such requirements.

Hazardous Substances and Waste

Federal and state laws, in particular the Federal Resource Conservation and Recovery Act, or RCRA, regulate hazardous and non-hazardous solid wastes. In the course of our operations, we generate petroleum hydrocarbon wastes such as produced water and ordinary industrial wastes. Under a longstanding legal framework, certain of these wastes are not subject to federal regulations governing hazardous wastes, although they are regulated under other federal and state waste laws.

Federal, state and local laws may also require us to remove or remediate previously disposed wastes or hazardous substances otherwise released into the environment, including wastes or hazardous substances disposed of or released by us or prior owners or operators in accordance with current laws or otherwise, to suspend or cease operations at contaminated areas, or to perform remedial well plugging operations or response actions to reduce the risk of future contamination. Federal laws, including the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, and analogous state laws impose joint and several liability, without regard to fault or legality of the original conduct, on classes of persons who are considered responsible for releases of a hazardous substance into the environment. These persons include the owner or operator of the site where the release occurred and persons that disposed of or arranged for the disposal of hazardous substances at the site. CERCLA and analogous state laws also authorize the EPA, state environmental agencies and, in some cases, third parties to take action to prevent or respond to threats to human health or the environment and to seek to recover from responsible classes of persons the costs of such actions.

Air Emissions