O C T O B E R 3 1 , 2 0 2 2 WOLFSPEED CONFIDENTIAL &PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. Wolfspeed Investor Day 1

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. T Y L E R G R O N B A C H | V P O F I N V E S T O R R E L A T I O N S Welcome

FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES Note on Forward-Looking Statements This presentation contains forward-looking statements involving risks and uncertainties, both known and unknown, that may cause Wolfspeed’s actual results to differ materially from those indicated in the forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about Wolfspeed’s business outlook, future targets, product markets, plans and objectives for future operations, and product development programs and goals. Actual results could differ materially due to a number of factors, including but not limited to, ongoing uncertainty in global economic and geopolitical conditions, including the ongoing military conflict between Russia and Ukraine, infrastructure development or customer demand that could negatively affect product demand, collectability of receivables and other related matters as consumers and businesses may defer purchases or payments, or default on payments; risks related to international sales and purchases; risks associated with our factory optimization plan and construction of a new device fabrication facility and a new materials facility, including design and construction delays and cost overruns, issues in installing and qualifying new equipment and ramping production, poor production process yields and quality control, and potential increases to our restructuring costs; the risk that the markets for our products will not develop as we expect, including the adoption of our products by electrical vehicle (EV) manufacturers; the risk that adoption of EVs does not continue to grow at the rate anticipated; the risk that our opportunity pipeline will not convert into orders and revenue at the rates that we have assumed or historically experienced; the risk that we may experience production difficulties that preclude us from shipping sufficient quantities to meet customer orders or that result in higher production costs, lower yields and lower margins; our ability to lower costs; the risk that our results will suffer if we are unable to balance fluctuations in customer demand and capacity, including bringing on additional capacity on a timely basis to meet customer demand; the risk that longer manufacturing lead times may cause customers to fulfill their orders with a competitor's products instead; product mix; risks associated with the ramp-up of production of our new products, and our entry into new business channels different from those in which we have historically operated; our ability to convert customer design-ins to sales of significant volume and, if customer design-in activity does result in such sales, when such sales will ultimately occur and what the amount of such sales will be; the risk that the economic and political uncertainty caused by the tariffs imposed by the United States on Chinese goods, and corresponding Chinese tariffs and currency devaluation in response, may negatively impact demand for our products; the risk that we or our channel partners are not able to develop and expand customer bases and accurately anticipate demand from end customers, which can result in increased inventory and reduced orders as we experience wide fluctuations in supply and demand; risks resulting from the concentration of our business among few customers, including the risk that customers may reduce or cancel orders or fail to honor purchase commitments; the risk that our investments may experience periods of significant market value and interest rate volatility causing us to recognize fair value losses on our investment; the risk posed by managing an increasingly complex supply chain that has the ability to supply a sufficient quantity of raw materials, subsystems and finished products with the required specifications and quality; risks relating to the ongoing COVID-19 pandemic, including the risk of new and different government restrictions and regulations that limit our ability to do business, the risk of infection in our workforce and subsequent impact on our ability to conduct business, the risk that our supply chain, including our contract manufacturers, or customer demand may be negatively impacted, the risk posed by vaccine resistance and the emergence of fast-spreading variants, the risk that the COVID-19 pandemic will contribute to a global recession and the potential for costs associated with our operations during current and future years to be greater than we anticipate as a result of all of these factors; the risk we may be required to record a significant charge to earnings if our remaining goodwill or amortizable assets become impaired; risks relating to confidential information theft or misuse, including through cyber-attacks, cyber intrusion or ransomware; our ability to complete development and commercialization of products under development; the rapid development of new technology and competing products that may impair demand or render our products obsolete; the potential lack of customer acceptance for our products; risks associated with ongoing litigation; the risk that customers do not maintain their favorable perception of our brand and products, resulting in lower demand for our products; the risk that our products fail to perform or fail to meet customer requirements or expectations, resulting in significant additional costs; risks associated with strategic transactions; and other factors discussed in our filings with the Securities and Exchange Commission (SEC), including our report on Form 10-K for the fiscal year ended June 26, 2022, and subsequent reports filed with the SEC. The forward-looking statements in this presentation were based on management’s analysis of information available at the time the presentation was prepared and on assumptions deemed reasonable by management. Our industry and business is constantly evolving, and Wolfspeed undertakes no obligation to update such forward-looking statements to reflect new information, future events, subsequent developments or otherwise, except as may be required by applicable U.S. federal securities laws and regulations. Note on Non-GAAP Measures This presentation includes certain non-GAAP financial measures and targets. Wolfspeed’s management evaluates results and makes operating decisions using both GAAP and non-GAAP measures included in this presentation. Non-GAAP measures exclude certain costs, charges and expenses which are included in GAAP measures. By including these non-GAAP measures, management intends to provide investors with additional information to further analyze the Company’s performance, core results and underlying trends. Non-GAAP measures are not prepared in accordance with GAAP and non-GAAP measures should be considered a supplement to, and not a substitute for, financial measures prepared in accordance with GAAP. Investors and potential investors are encouraged to review the reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures attached to this presentation. Please see the Appendix at the end of this presentation. 3WOLFSPEED CONFIDENTIAL &PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc.

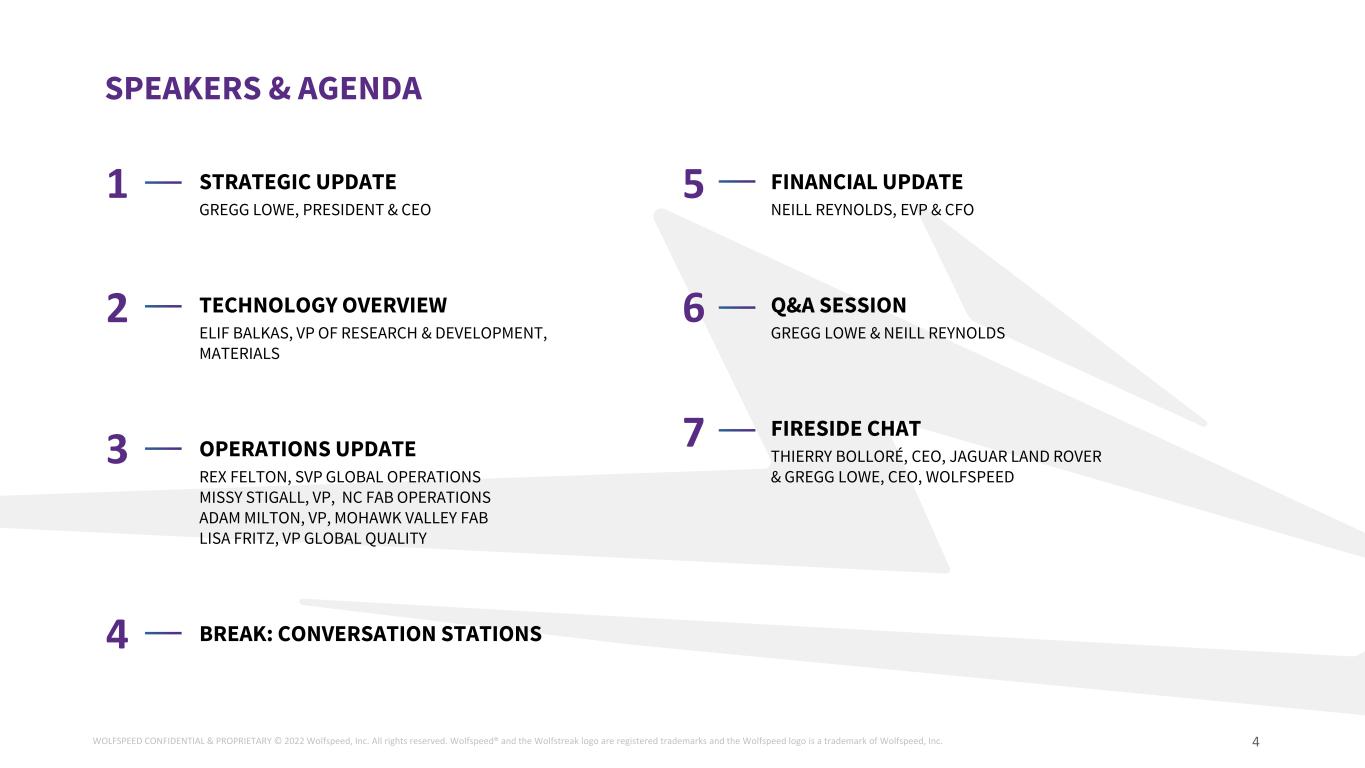

4 1 2 3 4 STRATEGIC UPDATE GREGG LOWE, PRESIDENT & CEO TECHNOLOGY OVERVIEW ELIF BALKAS, VP OF RESEARCH & DEVELOPMENT, MATERIALS OPERATIONS UPDATE REX FELTON, SVP GLOBAL OPERATIONS MISSY STIGALL, VP, NC FAB OPERATIONS ADAM MILTON, VP, MOHAWK VALLEY FAB LISA FRITZ, VP GLOBAL QUALITY BREAK: CONVERSATION STATIONS 5 6 7 FINANCIAL UPDATE NEILL REYNOLDS, EVP & CFO Q&A SESSION GREGG LOWE & NEILL REYNOLDS FIRESIDE CHAT THIERRY BOLLORÉ, CEO, JAGUAR LAND ROVER & GREGG LOWE, CEO, WOLFSPEED SPEAKERS & AGENDA WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc.

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. G R E G G L O W E | P R E S I D E N T & C E O Strategic Overview

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 6 JAGUAR LAND ROVER PARTNERS WITH WOLFSPEED FOR SILICON CARBIDE SEMICONDUCTOR TECHNOLOGY Gregg Lowe and Thierry Bolloré, CEO of JLR • Reimagine strategy transforming Jaguar Land Rover into an electric-first business • Wolfspeed enables a secure supply chain for Silicon Carbide devices for next generation vehicles • Wolfspeed’s Silicon Carbide devices have been used by Jaguar TCS Racing Formula E team since 2017 • Next generation Silicon Carbide devices to be produced at world’s largest, fully automated 200mm Silicon Carbide Mohawk Valley Fab Key Partnership Facts

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 7 …and spoke about the importance of Wolfspeed’s focus on where we’re going… LAST YEAR I TOOK A BIKE RIDE…

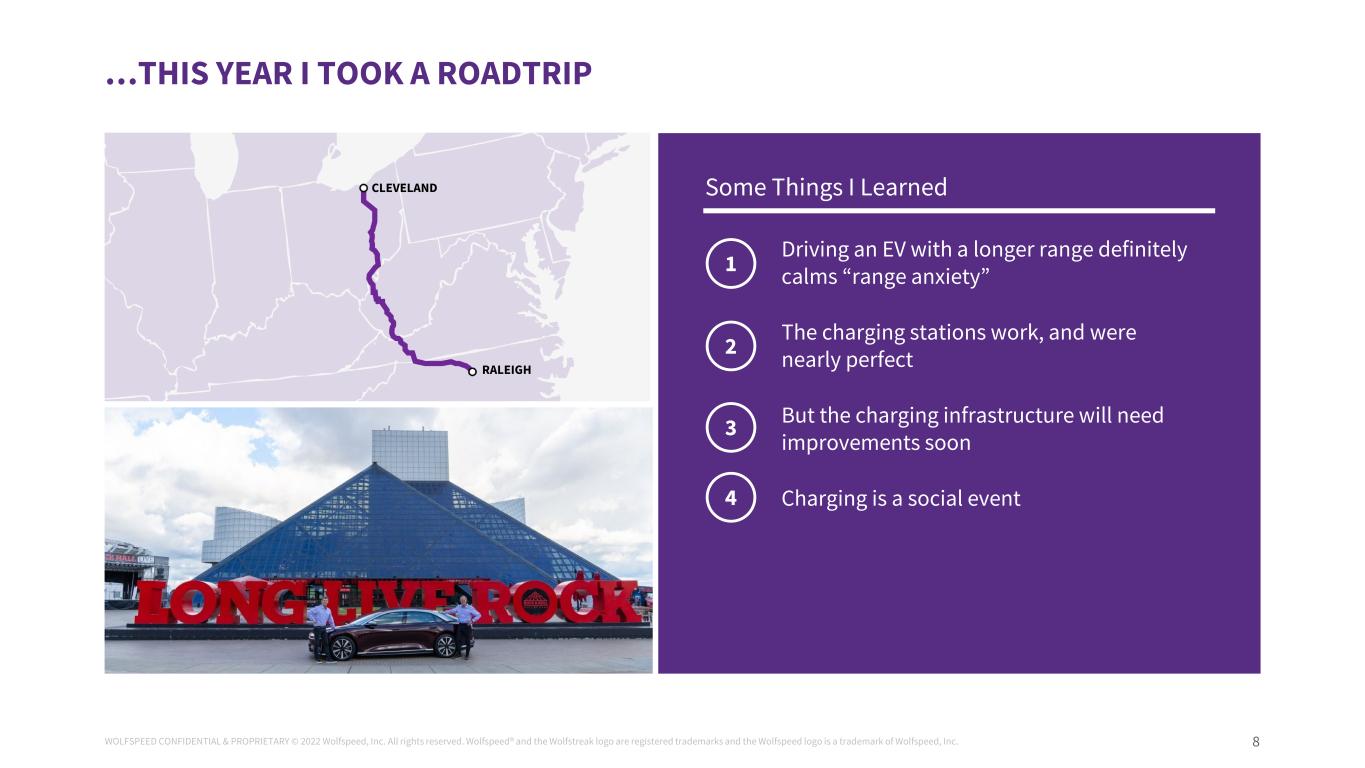

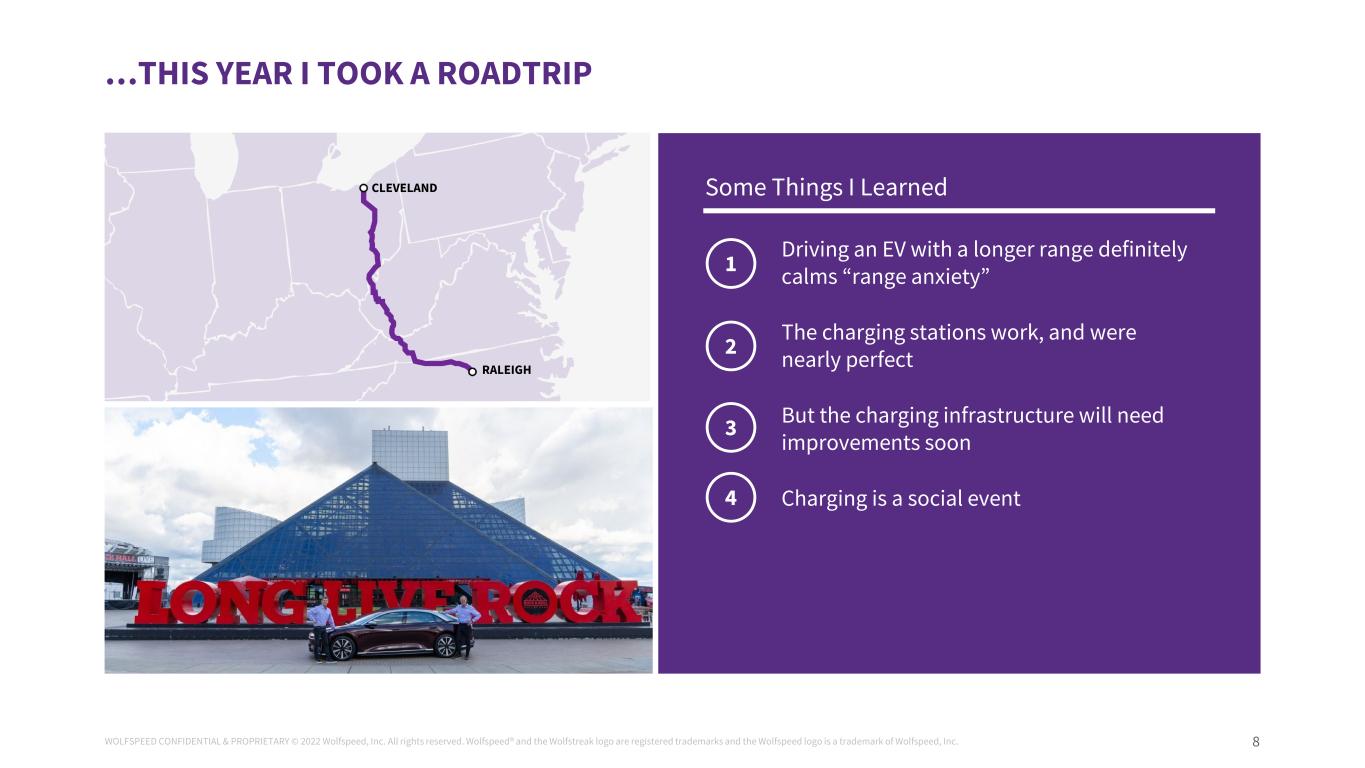

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 8 CLEVELAND RALEIGH 1 2 3 4 Driving an EV with a longer range definitely calms “range anxiety” The charging stations work, and were nearly perfect But the charging infrastructure will need improvements soon Charging is a social event Some Things I Learned …THIS YEAR I TOOK A ROADTRIP

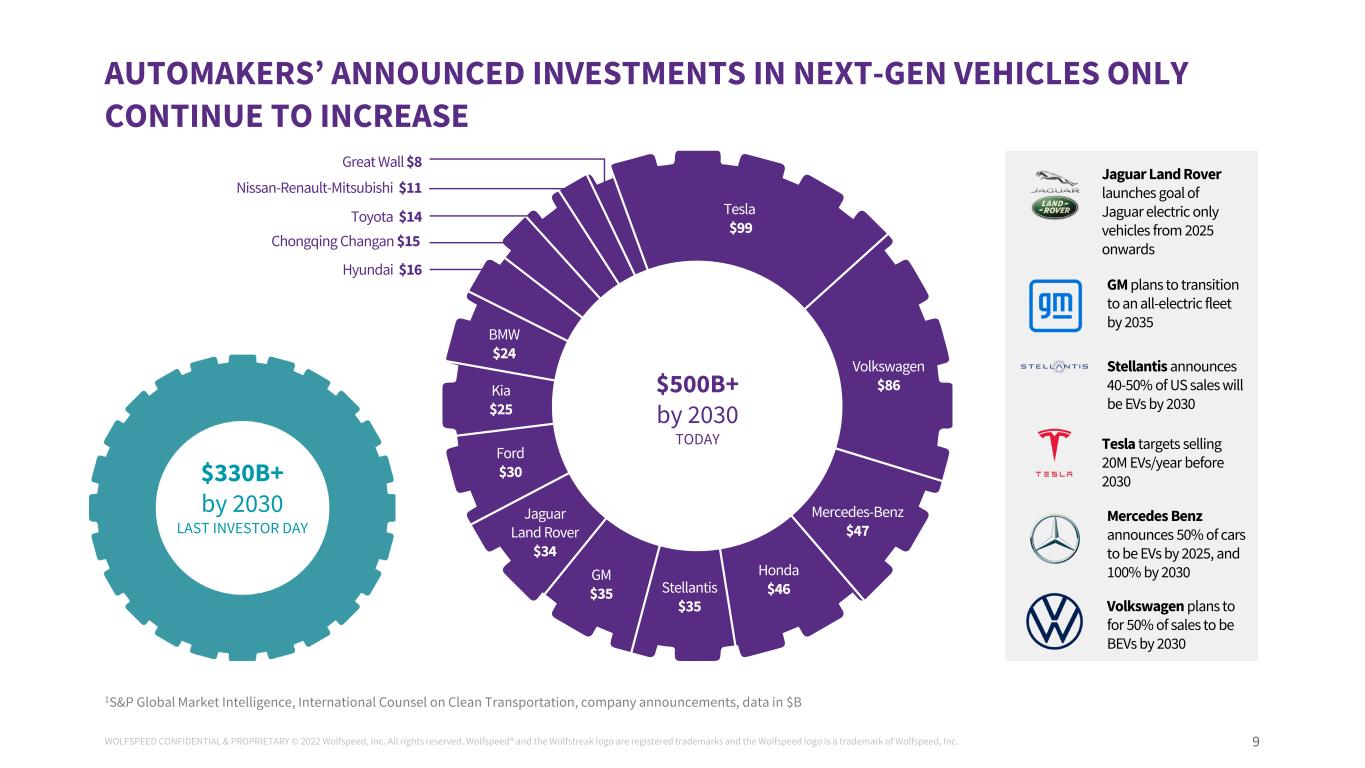

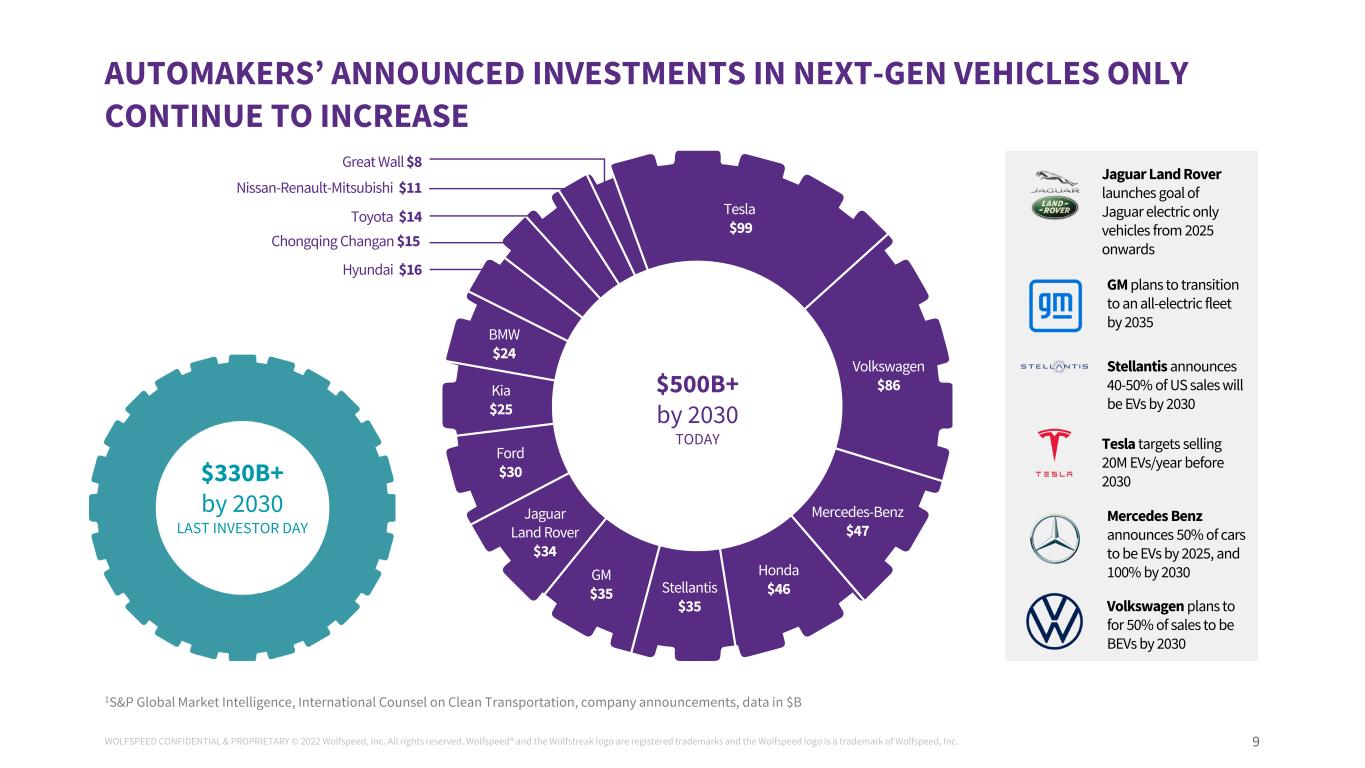

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 9 1S&P Global Market Intelligence, International Counsel on Clean Transportation, company announcements, data in $B AUTOMAKERS’ ANNOUNCED INVESTMENTS IN NEXT-GEN VEHICLES ONLY CONTINUE TO INCREASE $330B+ by 2030 LAST INVESTOR DAY Tesla $99 Volkswagen $86 GM $35 Kia $25 Stellantis $35 Ford $30 Honda $46 BMW $24 Jaguar Land Rover $34 Great Wall $8 Chongqing Changan $15 Nissan-Renault-Mitsubishi $11 Toyota $14 Hyundai $16 Tesla targets selling 20M EVs/year before 2030 Jaguar Land Rover launches goal of Jaguar electric only vehicles from 2025 onwards Stellantis announces 40-50% of US sales will be EVs by 2030 GM plans to transition to an all-electric fleet by 2035 Mercedes Benz announces 50% of cars to be EVs by 2025, and 100% by 2030 Volkswagen plans to for 50% of sales to be BEVs by 2030 $500B+ by 2030 TODAY Mercedes-Benz $47

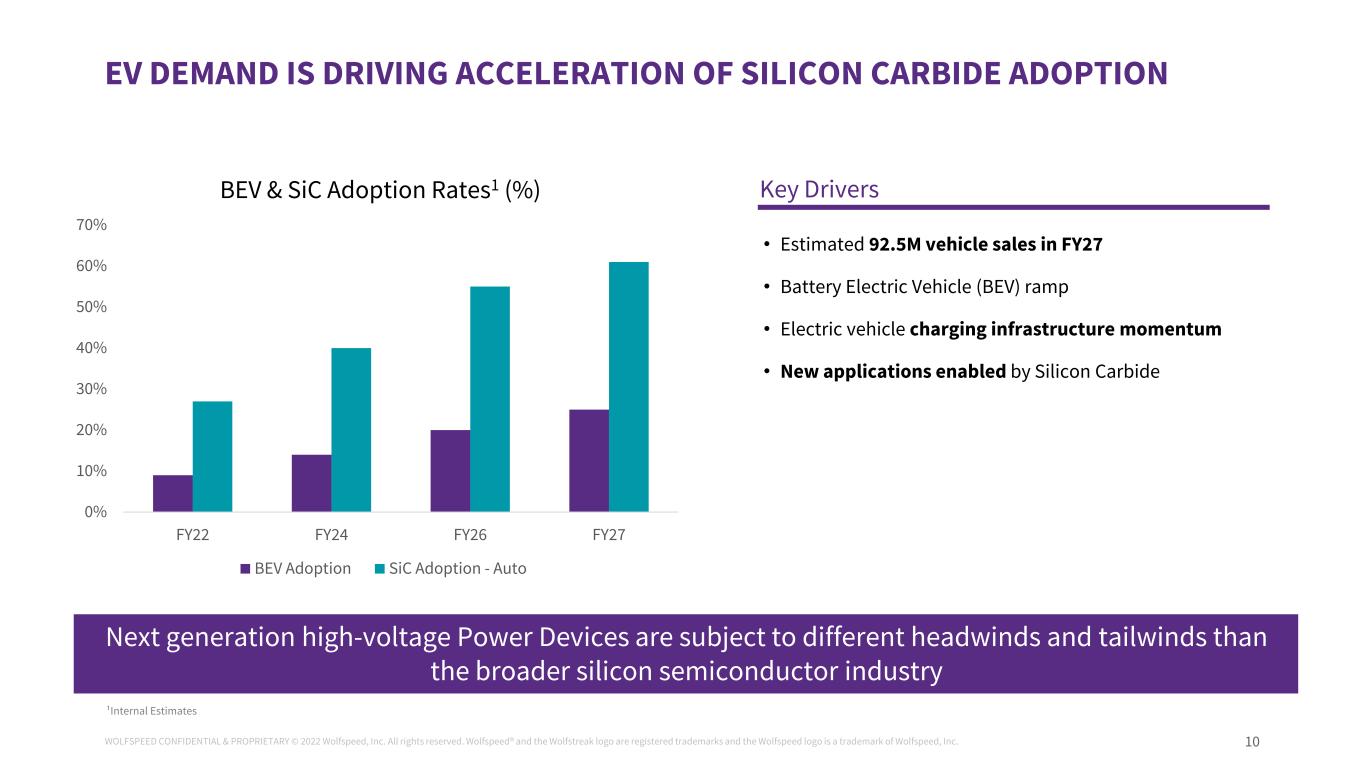

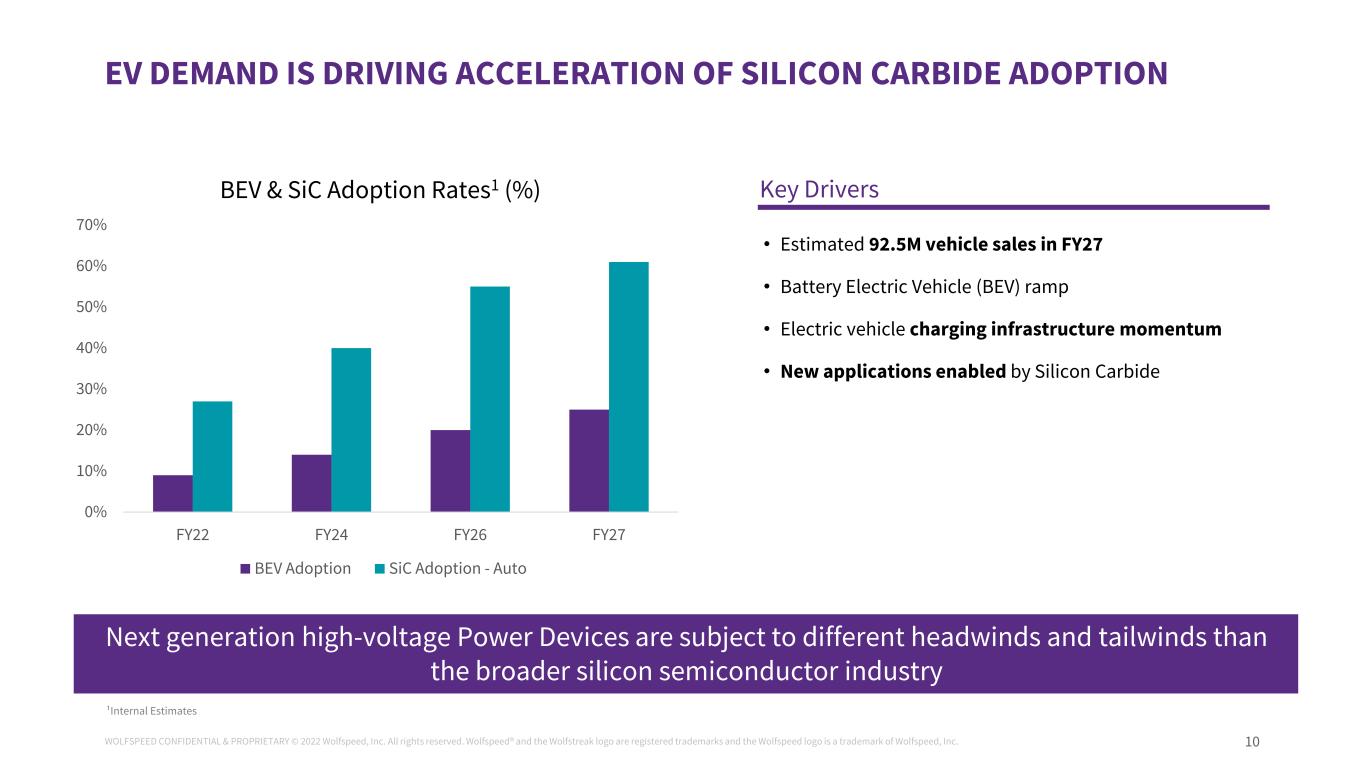

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 10 EV DEMAND IS DRIVING ACCELERATION OF SILICON CARBIDE ADOPTION • Estimated 92.5M vehicle sales in FY27 • Battery Electric Vehicle (BEV) ramp • Electric vehicle charging infrastructure momentum • New applications enabled by Silicon Carbide Key Drivers 0% 10% 20% 30% 40% 50% 60% 70% FY22 FY24 FY26 FY27 BEV & SiC Adoption Rates1 (%) BEV Adoption SiC Adoption - Auto Next generation high-voltage Power Devices are subject to different headwinds and tailwinds than the broader silicon semiconductor industry ¹Internal Estimates

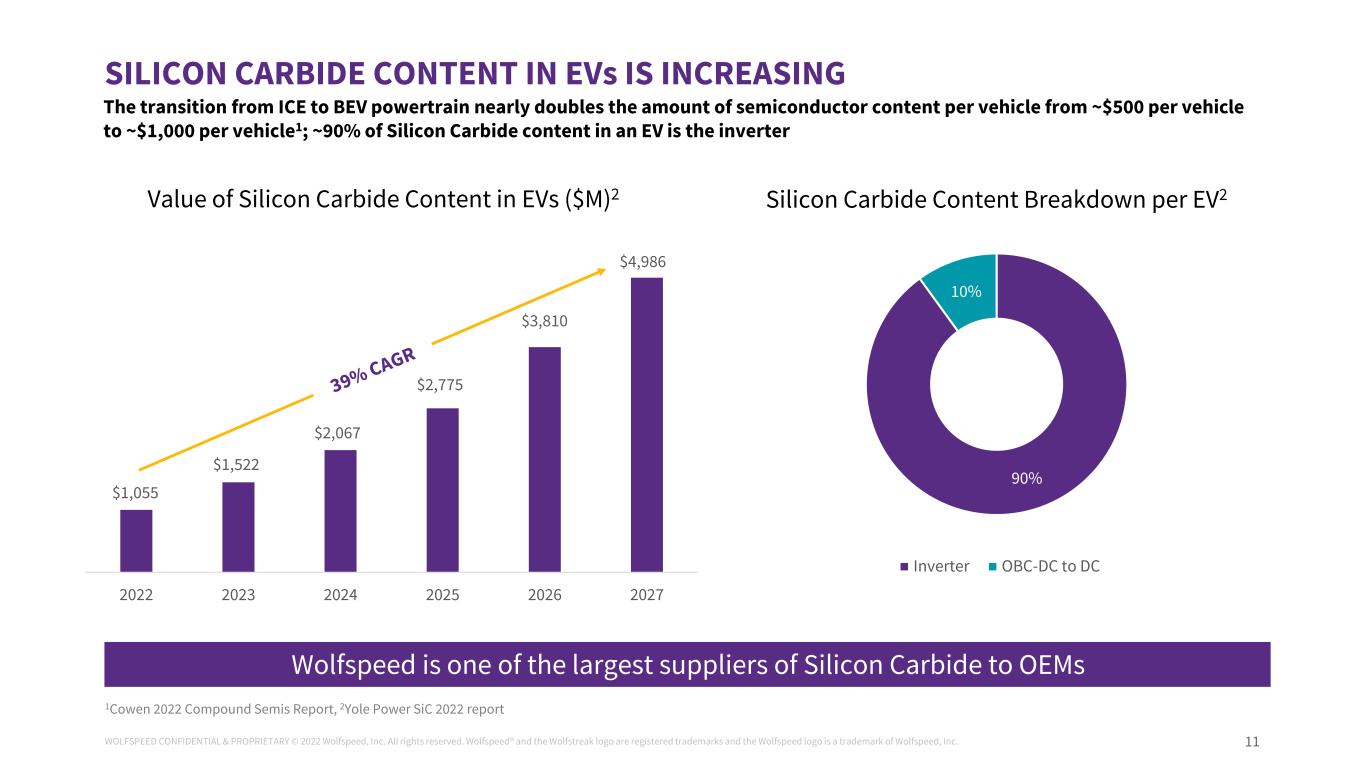

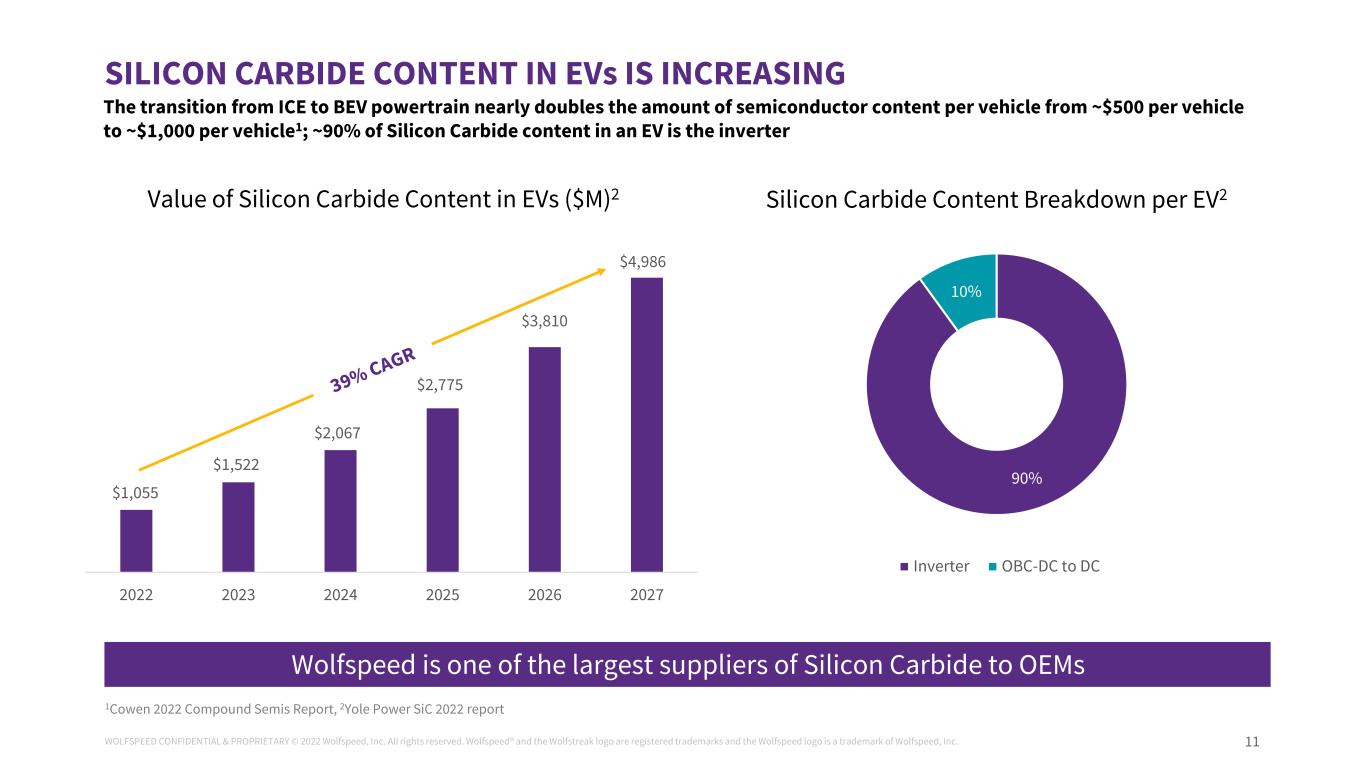

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 11 SILICON CARBIDE CONTENT IN EVs IS INCREASING 1Cowen 2022 Compound Semis Report, 2Yole Power SiC 2022 report The transition from ICE to BEV powertrain nearly doubles the amount of semiconductor content per vehicle from ~$500 per vehicle to ~$1,000 per vehicle1; ~90% of Silicon Carbide content in an EV is the inverter 90% 10% Silicon Carbide Content Breakdown per EV2 Inverter OBC-DC to DC 2022 2023 2024 2025 2026 2027 Value of Silicon Carbide Content in EVs ($M)2 $1,055 $1,522 $2,067 $2,775 $3,810 $4,986 Wolfspeed is one of the largest suppliers of Silicon Carbide to OEMs

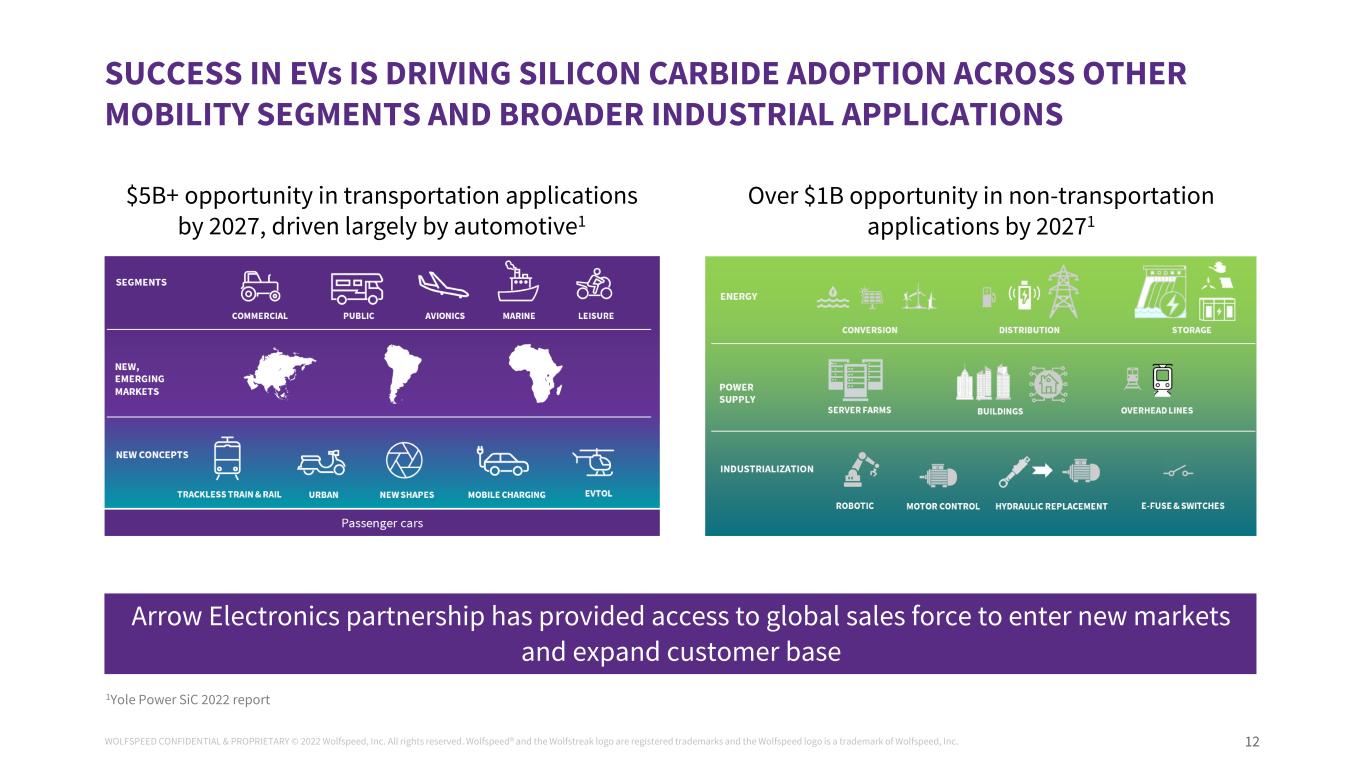

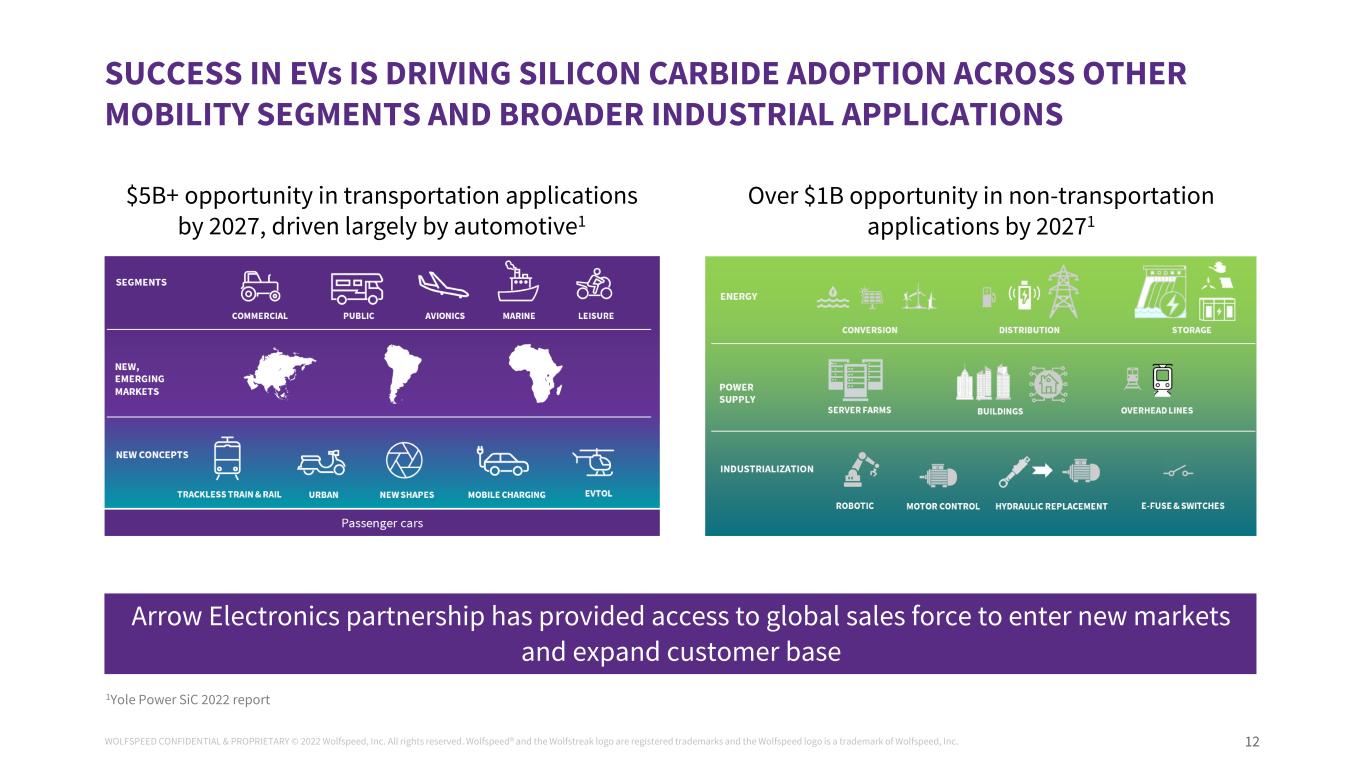

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 12 1Yole Power SiC 2022 report $5B+ opportunity in transportation applications by 2027, driven largely by automotive1 Over $1B opportunity in non-transportation applications by 20271 Arrow Electronics partnership has provided access to global sales force to enter new markets and expand customer base SUCCESS IN EVs IS DRIVING SILICON CARBIDE ADOPTION ACROSS OTHER MOBILITY SEGMENTS AND BROADER INDUSTRIAL APPLICATIONS

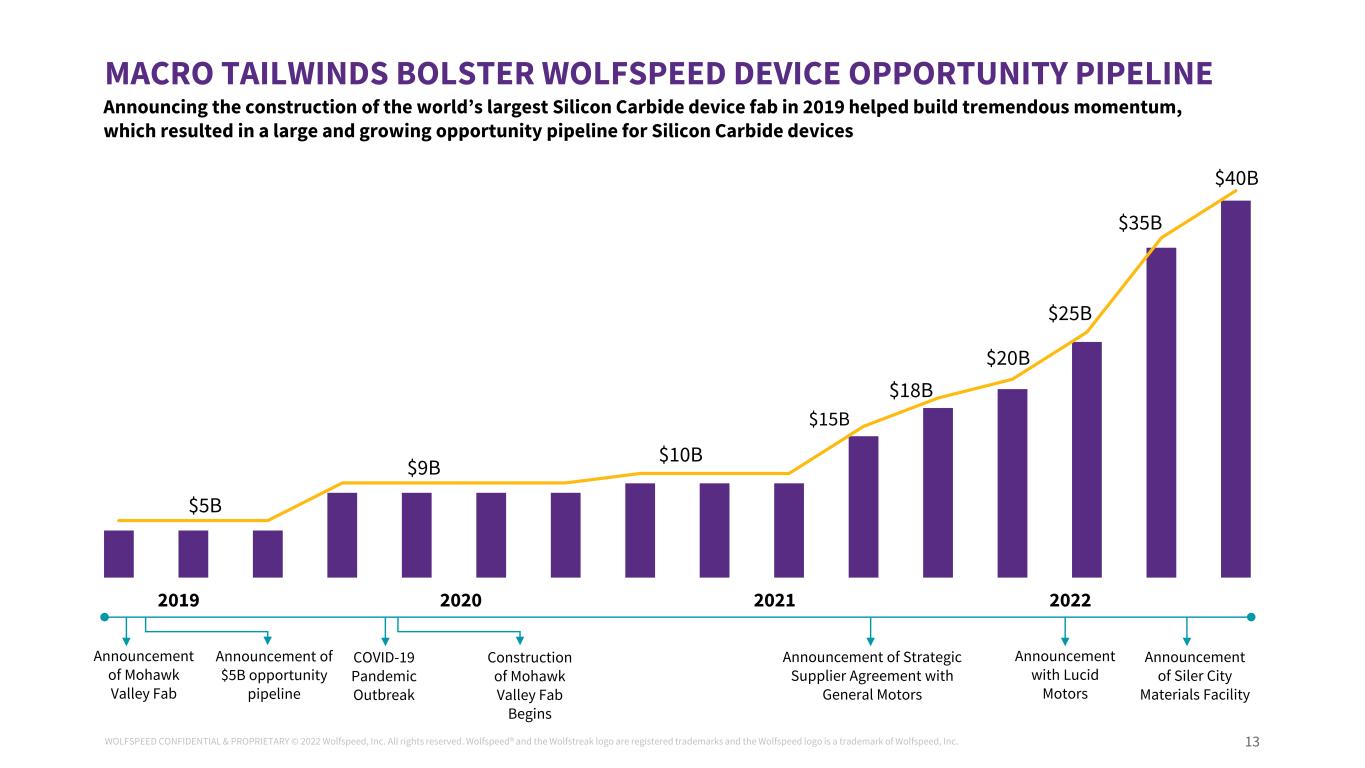

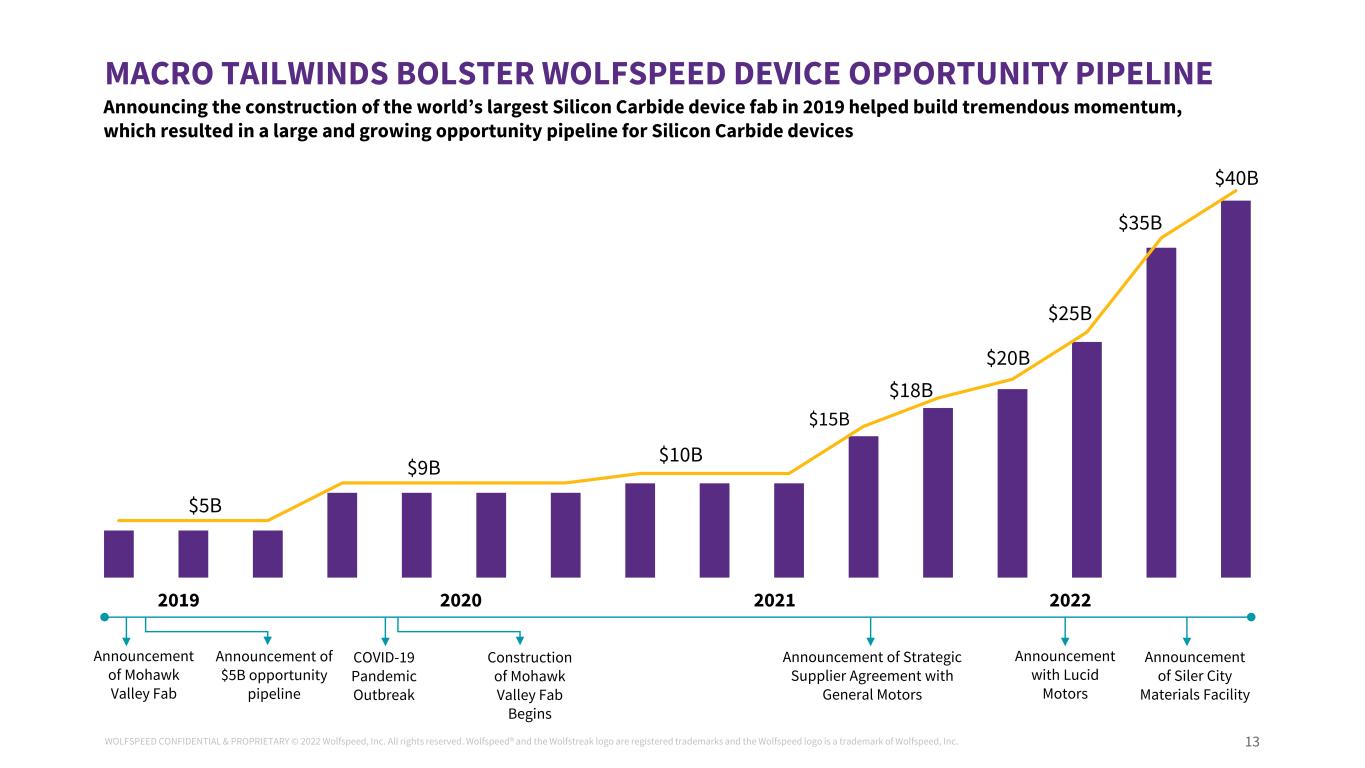

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 13 $5B $9B $10B $18B $20B $25B $35B $40B MACRO TAILWINDS BOLSTER WOLFSPEED DEVICE OPPORTUNITY PIPELINE COVID-19 Pandemic Outbreak Announcement of Mohawk Valley Fab Announcement of $5B opportunity pipeline 2019 2020 2021 2022 Construction of Mohawk Valley Fab Begins Announcement of Siler City Materials Facility Announcement with Lucid Motors Announcement of Strategic Supplier Agreement with General Motors Announcing the construction of the world’s largest Silicon Carbide device fab in 2019 helped build tremendous momentum, which resulted in a large and growing opportunity pipeline for Silicon Carbide devices $15B

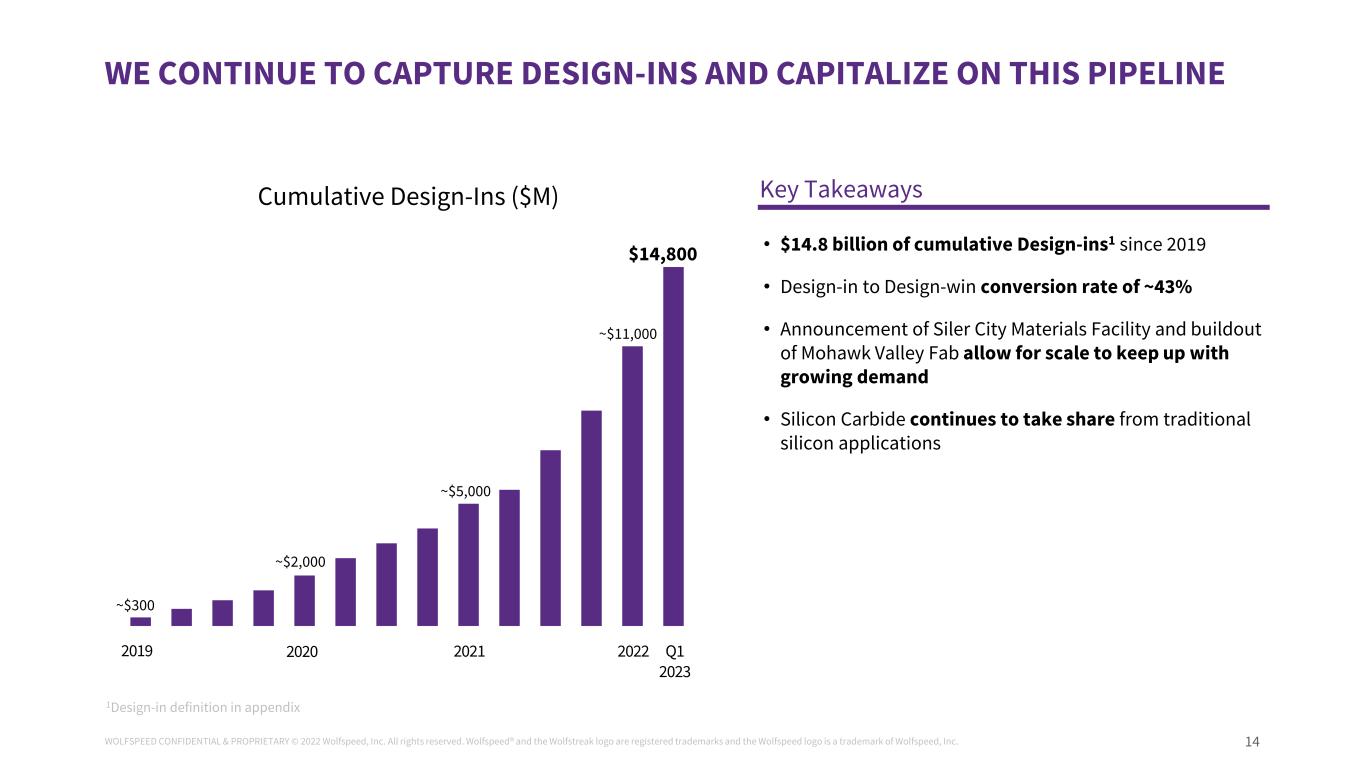

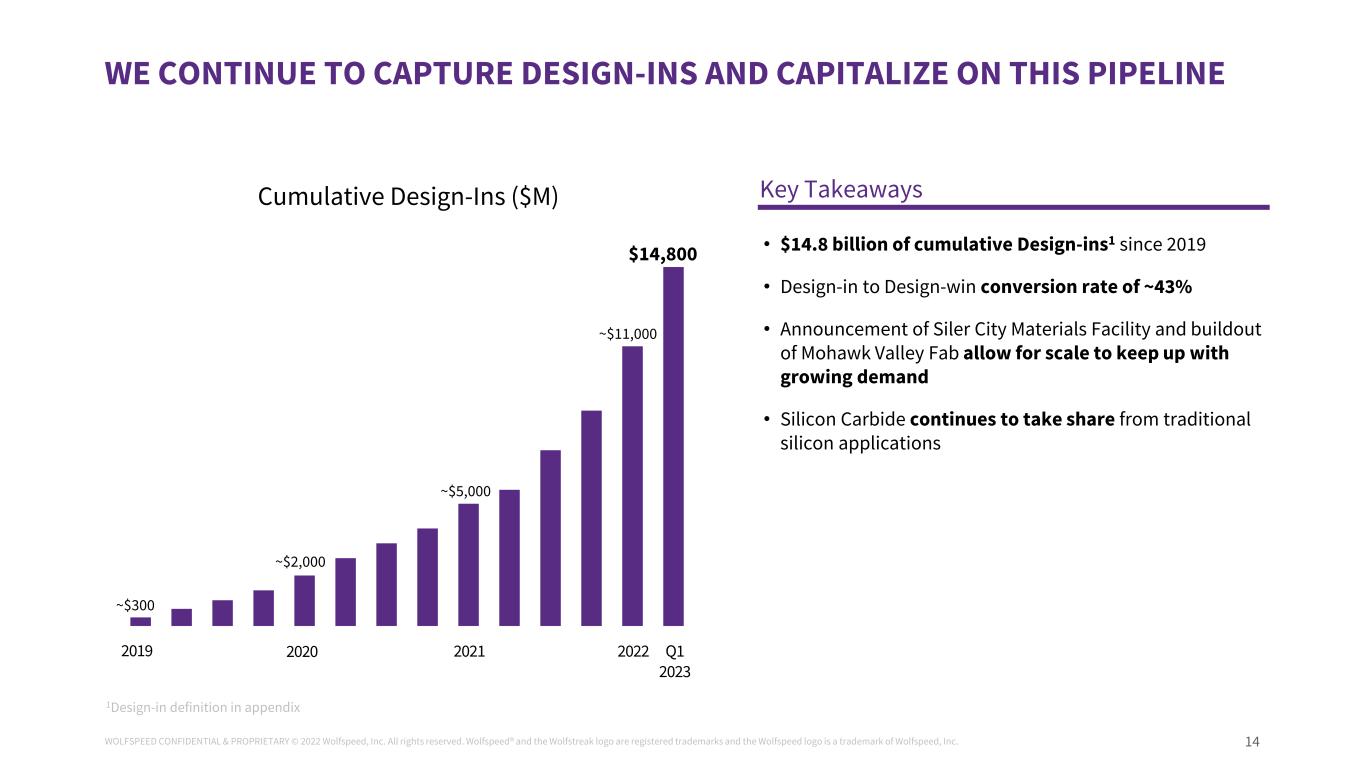

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 14 Cumulative Design-Ins ($M) 202120202019 2022 ~$300 ~$2,000 ~$5,000 ~$11,000 Q1 2023 $14,800 • $14.8 billion of cumulative Design-ins1 since 2019 • Design-in to Design-win conversion rate of ~43% • Announcement of Siler City Materials Facility and buildout of Mohawk Valley Fab allow for scale to keep up with growing demand • Silicon Carbide continues to take share from traditional silicon applications Key Takeaways WE CONTINUE TO CAPTURE DESIGN-INS AND CAPITALIZE ON THIS PIPELINE 1Design-in definition in appendix

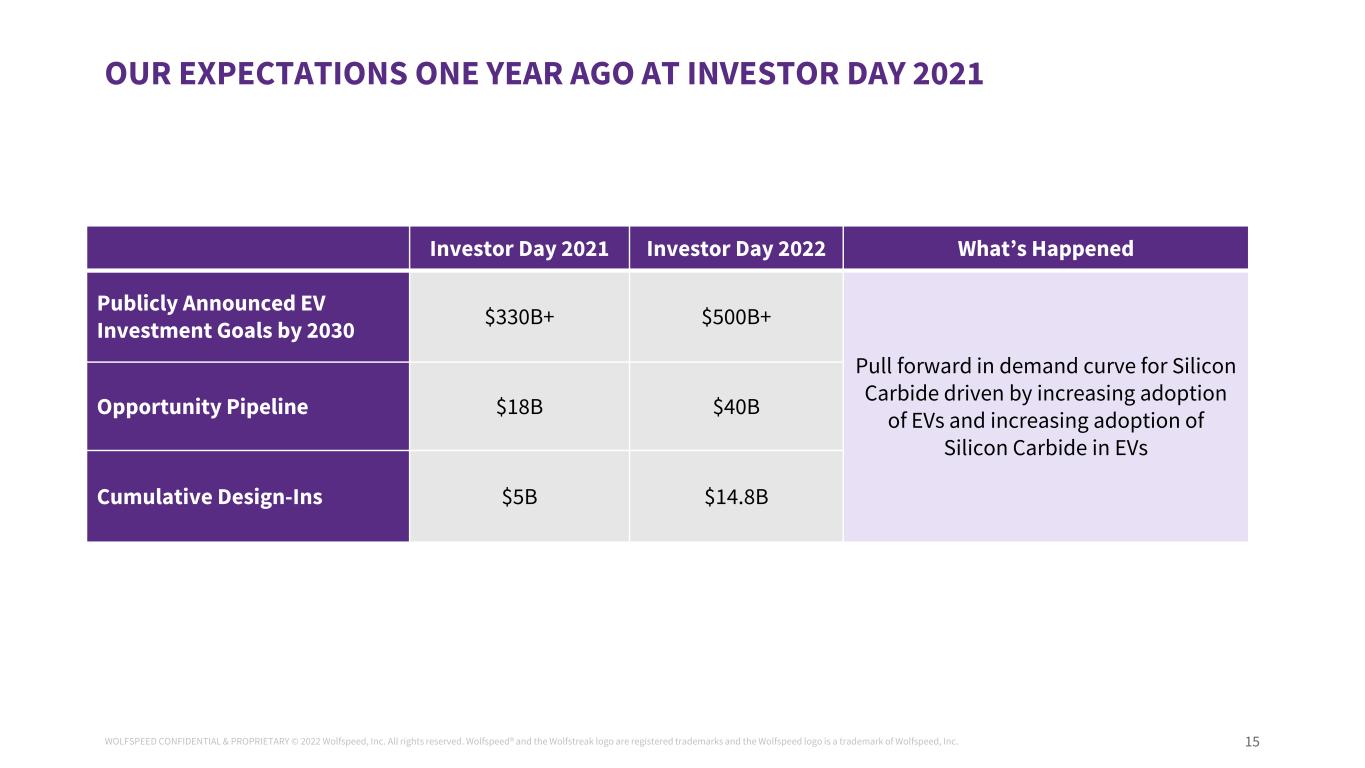

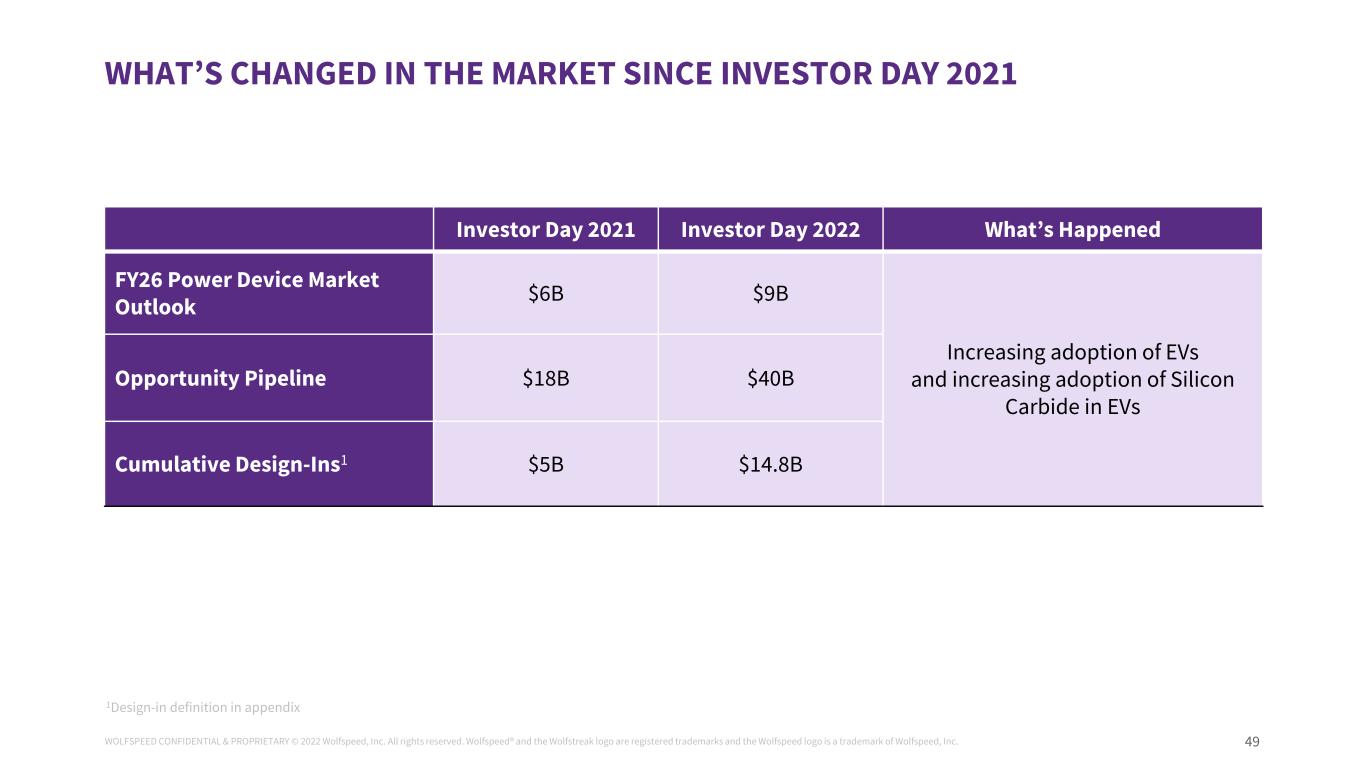

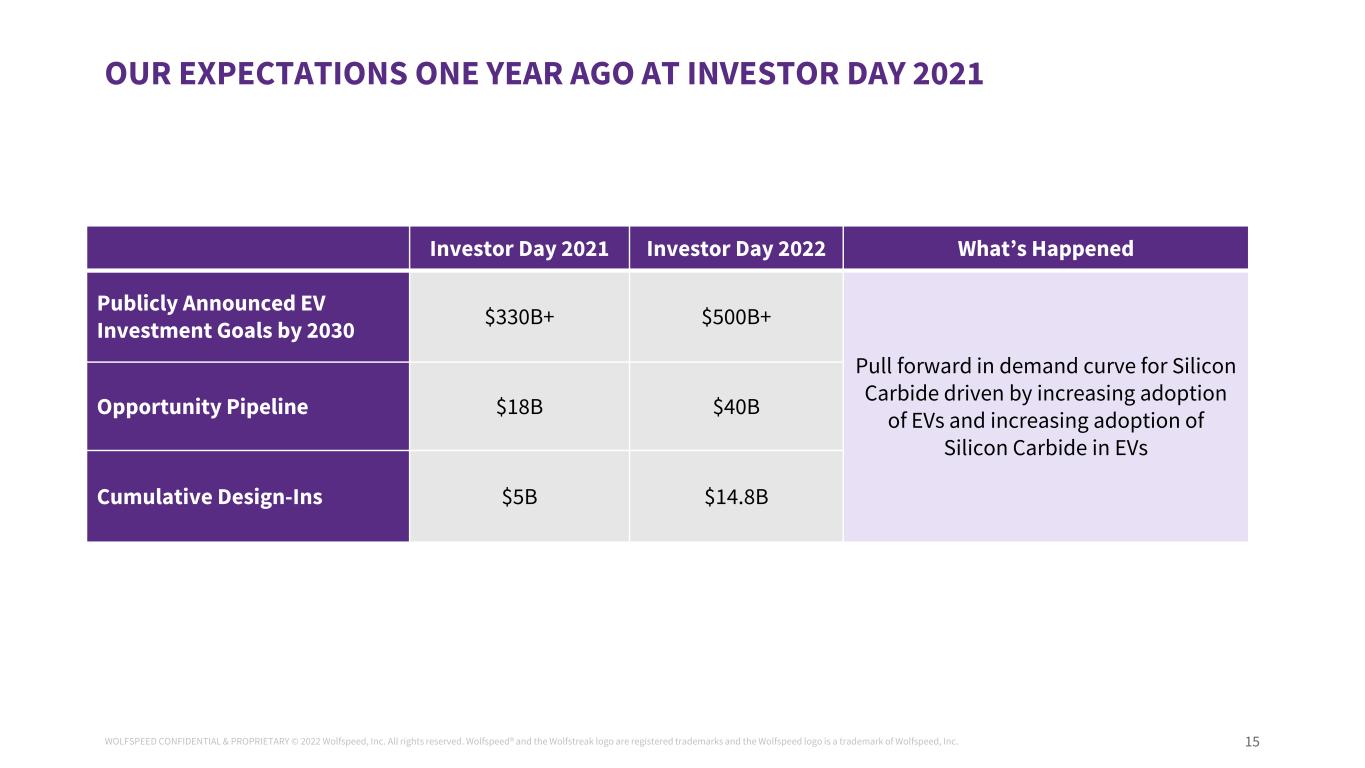

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 15 OUR EXPECTATIONS ONE YEAR AGO AT INVESTOR DAY 2021 Investor Day 2021 Investor Day 2022 What’s Happened Publicly Announced EV Investment Goals by 2030 $330B+ $500B+ Pull forward in demand curve for Silicon Carbide driven by increasing adoption of EVs and increasing adoption of Silicon Carbide in EVs Opportunity Pipeline $18B $40B Cumulative Design-Ins $5B $14.8B

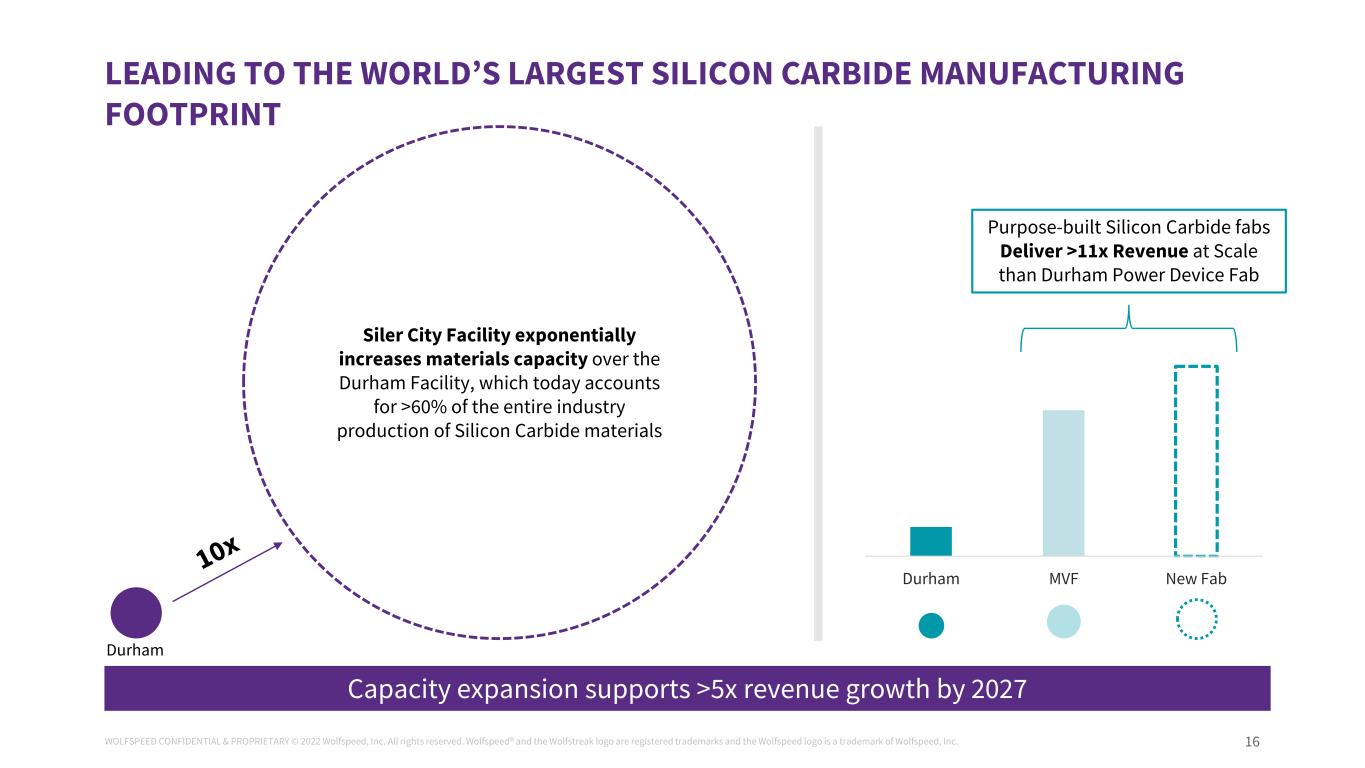

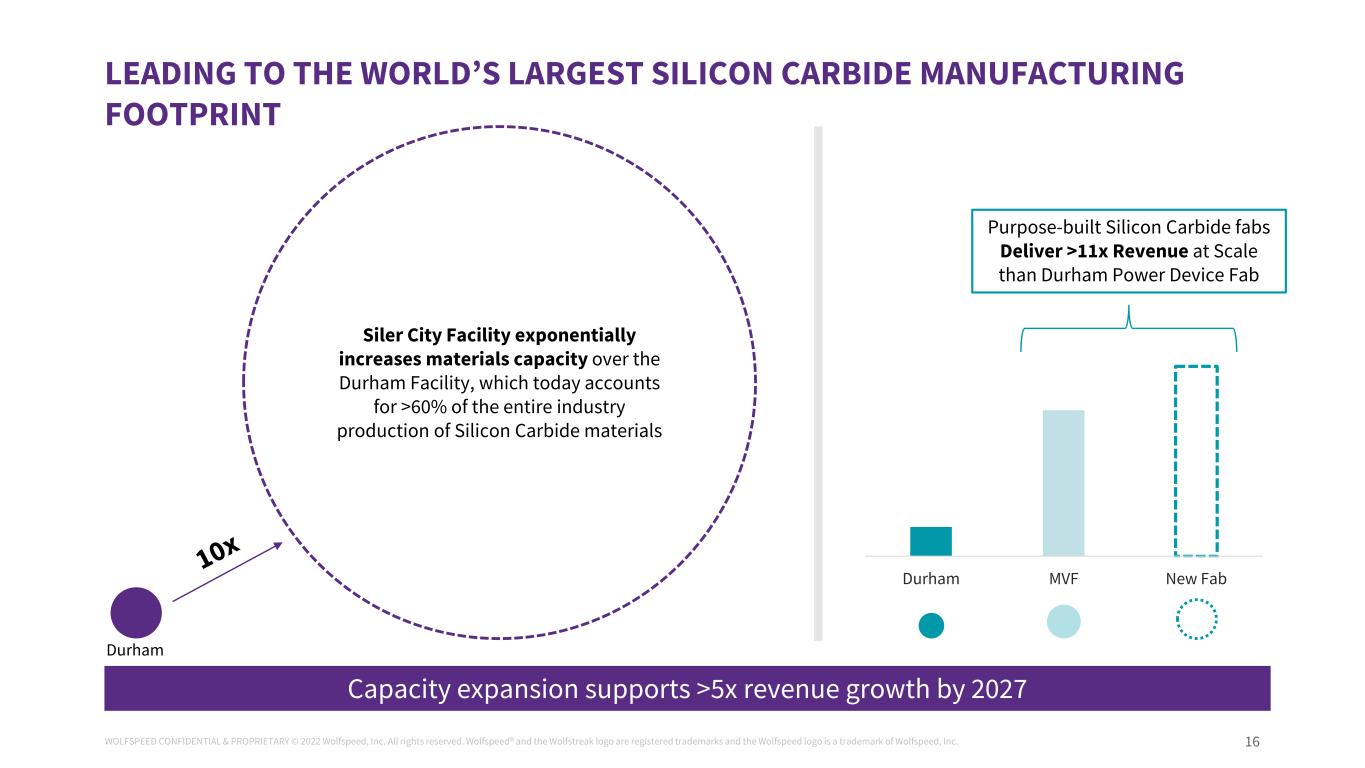

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 16 LEADING TO THE WORLD’S LARGEST SILICON CARBIDE MANUFACTURING FOOTPRINT Siler City Facility exponentially increases materials capacity over the Durham Facility, which today accounts for >60% of the entire industry production of Silicon Carbide materials Capacity expansion supports >5x revenue growth by 2027 Durham MVF New Fab Purpose-built Silicon Carbide fabs Deliver >11x Revenue at Scale than Durham Power Device Fab Durham

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. OUR FOCUS CAPITALIZES ON MASSIVE OPPORTUNITY $40 billion opportunity pipeline presents a window to expand our reach in the market We are exponentially increasing capacity with greenfield fabs and facilities to support $14.8 billion in Design-ins We are exploring new markets, and we are excited to see what Silicon Carbide will unlock next 1 2 3 17

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2021 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. LET’S REIMAGINE A MORE SUSTAINABLE WORLD. TOGETHER. WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® an the Wolfstreak logo are regist red tra emarks nd the Wolfspeed logo is a trademark of Wol speed, Inc.

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. E L I F B A L K A S | V P O F R E S E A R C H A N D D E V E L O P M E N T , M A T E R I A L S Technology Update

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 20 Invested leader in technology with the capacity to efficiently lead heterogeneous teams while respecting their uniqueness to collectively achieve what others say can’t be done INTRODUCTION – ELIF BALKAS I love technology in application and believe in continuous learning About Me VP of Research and Development Materials, Wolfspeed EXPERIENCE AND EDUCATION Silicon Carbide crystal growth Silicon Carbide and Gallium Nitride epitaxy The Wharton School Executive Education Product management and strategy, scaling a business and leadership development North Carolina State University Ph.D., Materials Science, minor in Electrical and Computer Engineering Gallium Nitride crystal growth via physical vapor transport

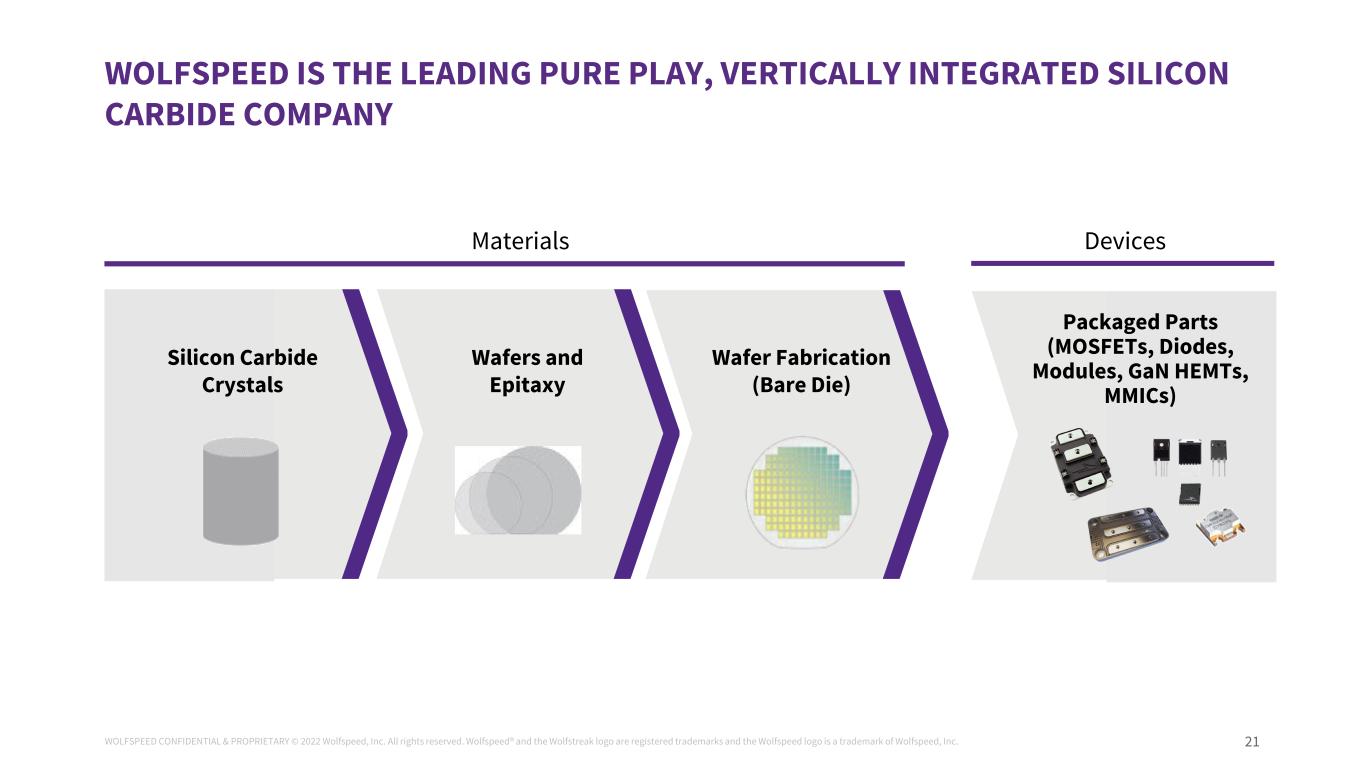

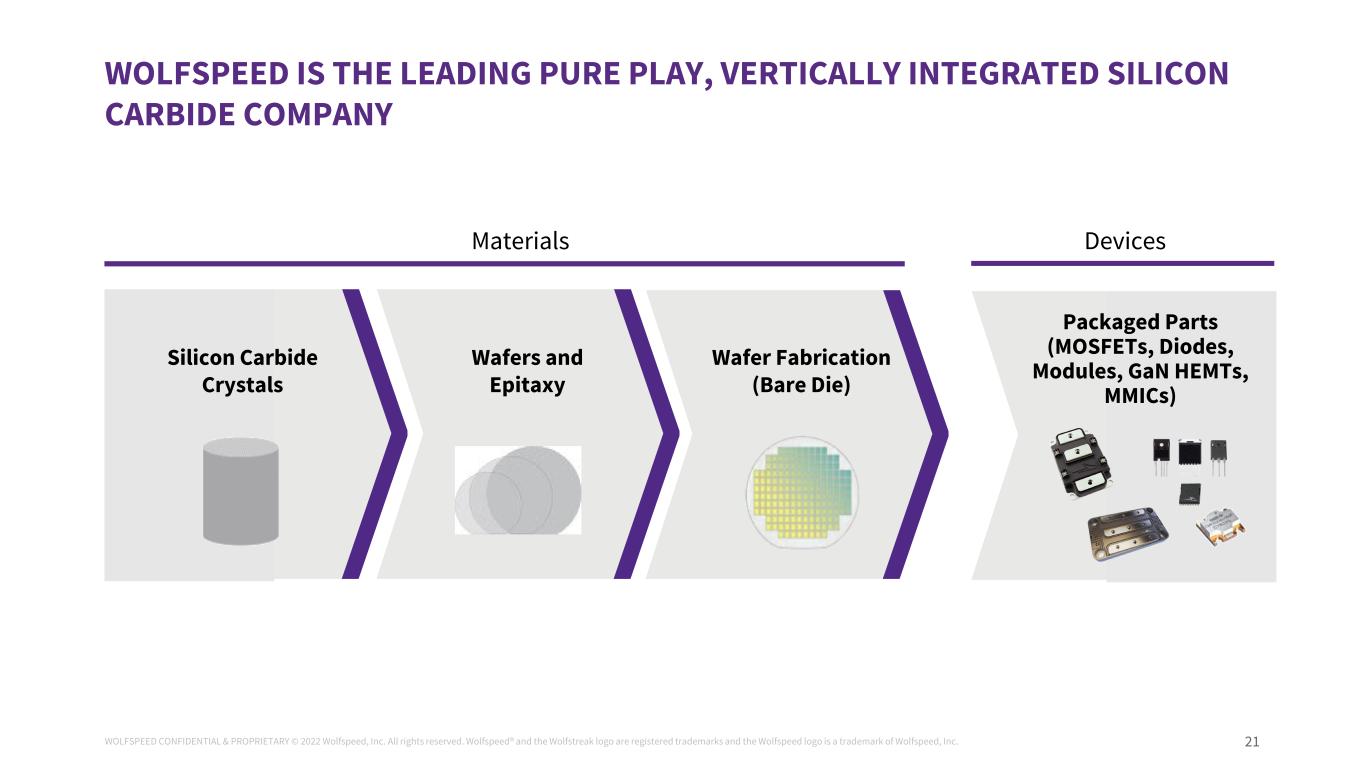

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 21 WOLFSPEED IS THE LEADING PURE PLAY, VERTICALLY INTEGRATED SILICON CARBIDE COMPANY Materials Silicon Carbide Crystals Wafers and Epitaxy Wafer Fabrication (Bare Die) Devices Packaged Parts (MOSFETs, Diodes, Modules, GaN HEMTs, MMICs)

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 22 WHAT IS SILICON CARBIDE? Combination of silicon and carbon in a crystalline structure Variety of applications including abrasive, ceramics, electronics and medical Crystalizes at very high temperature and can take many (>200) crystalline structures Superior mechanical, chemical and thermal properties, all combined Can be electrical insulator or conductor Ultimate material to design and build Power, RF and optical devices ¹Source: Wolfspeed website

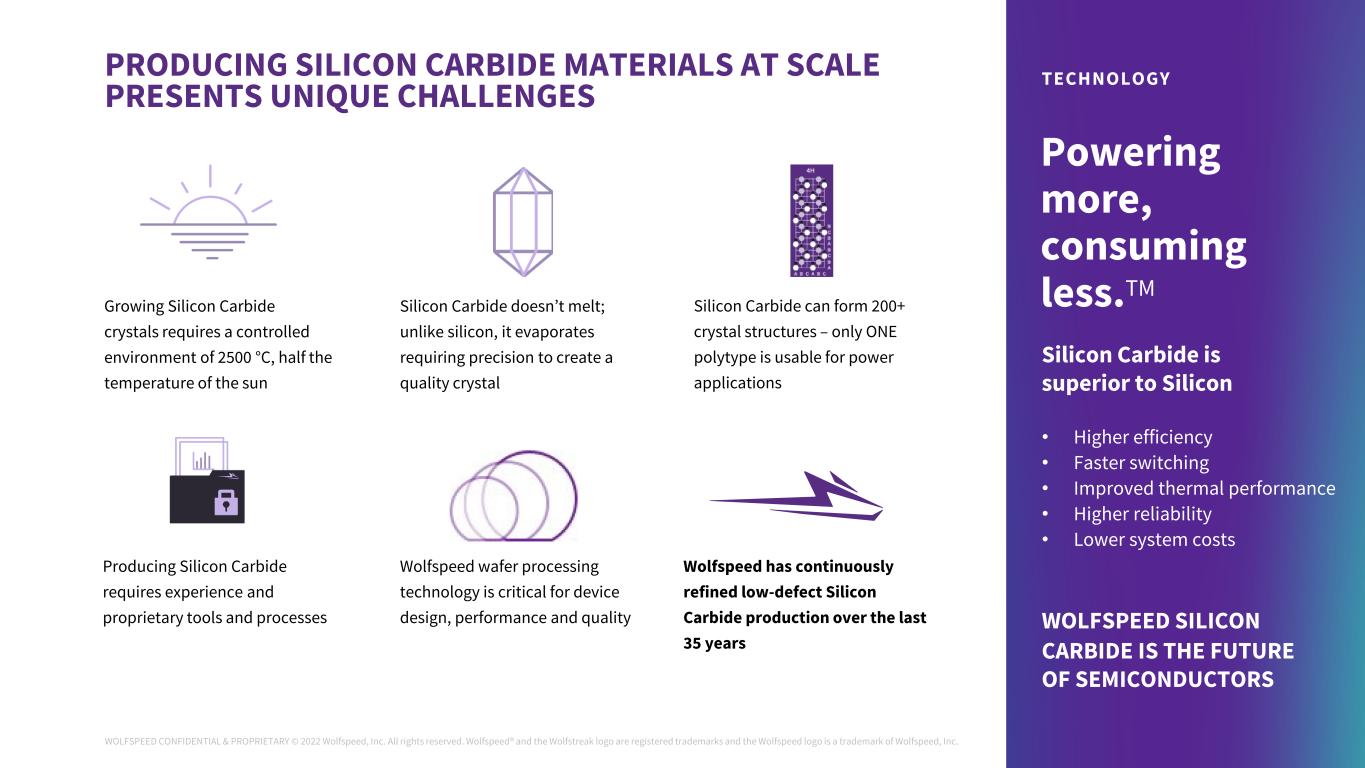

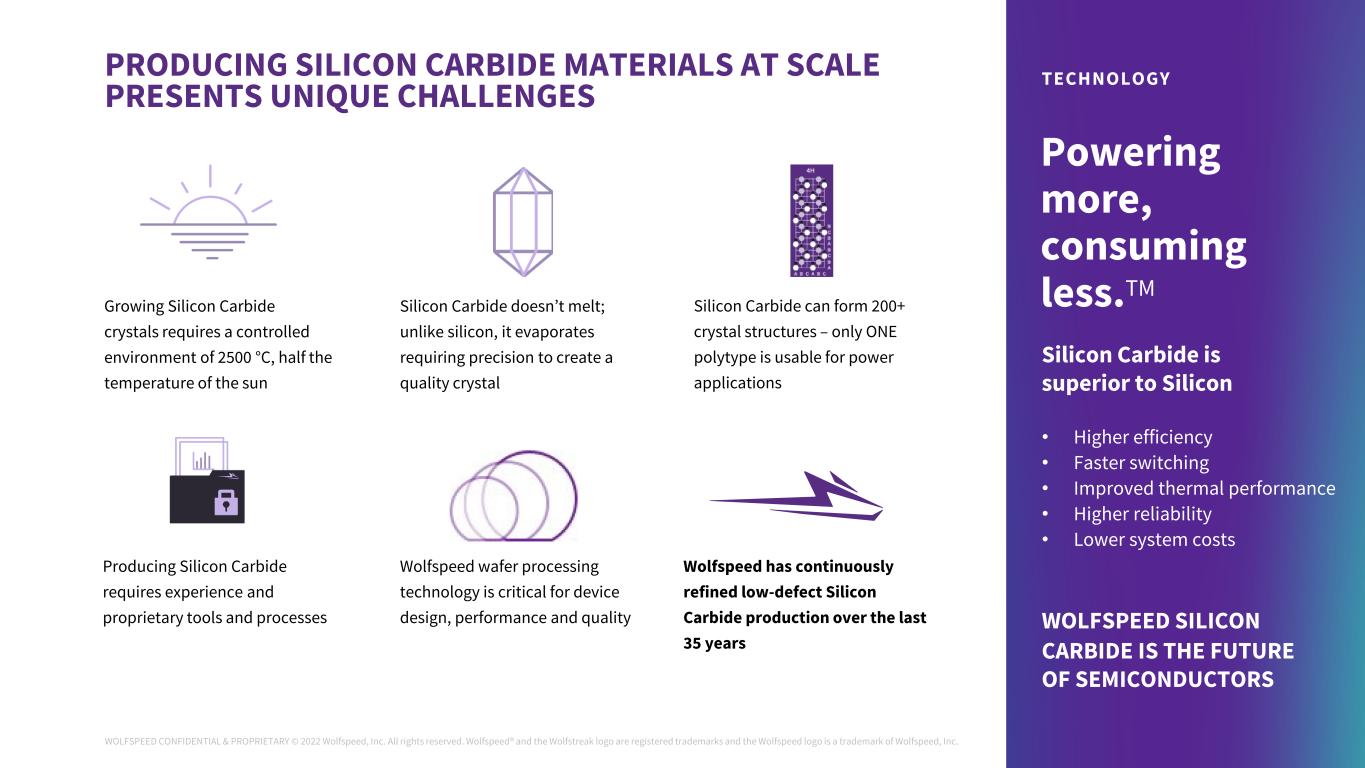

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 23 PRODUCING SILICON CARBIDE MATERIALS AT SCALE PRESENTS UNIQUE CHALLENGES Powering more, consuming less.TM TECHNOLOGY Silicon Carbide doesn’t melt; unlike silicon, it evaporates requiring precision to create a quality crystal Growing Silicon Carbide crystals requires a controlled environment of 2500 °C, half the temperature of the sun Wolfspeed wafer processing technology is critical for device design, performance and quality Wolfspeed has continuously refined low-defect Silicon Carbide production over the last 35 years Producing Silicon Carbide requires experience and proprietary tools and processes Silicon Carbide is superior to Silicon • Higher efficiency • Faster switching • Improved thermal performance • Higher reliability • Lower system costs WOLFSPEED SILICON CARBIDE IS THE FUTURE OF SEMICONDUCTORS Silicon Carbide can form 200+ crystal structures – only ONE polytype is usable for power applications

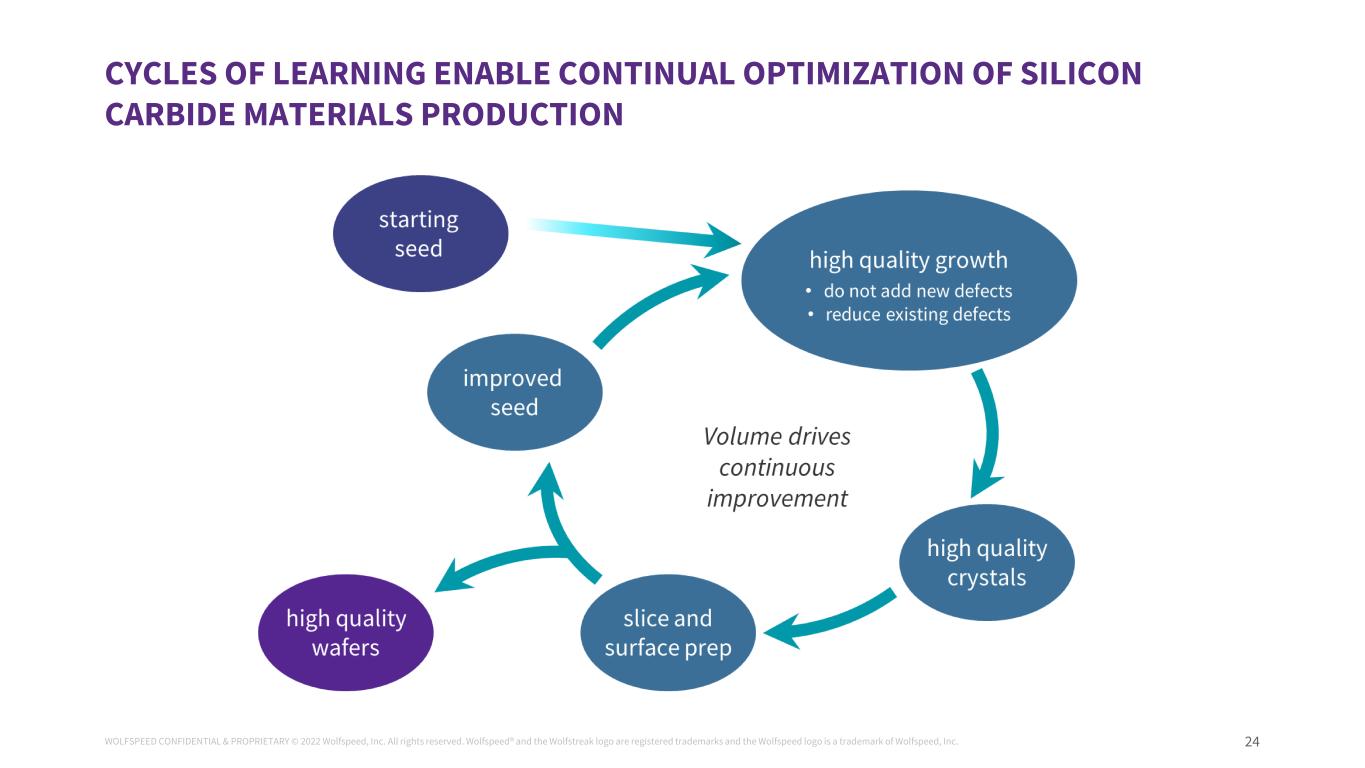

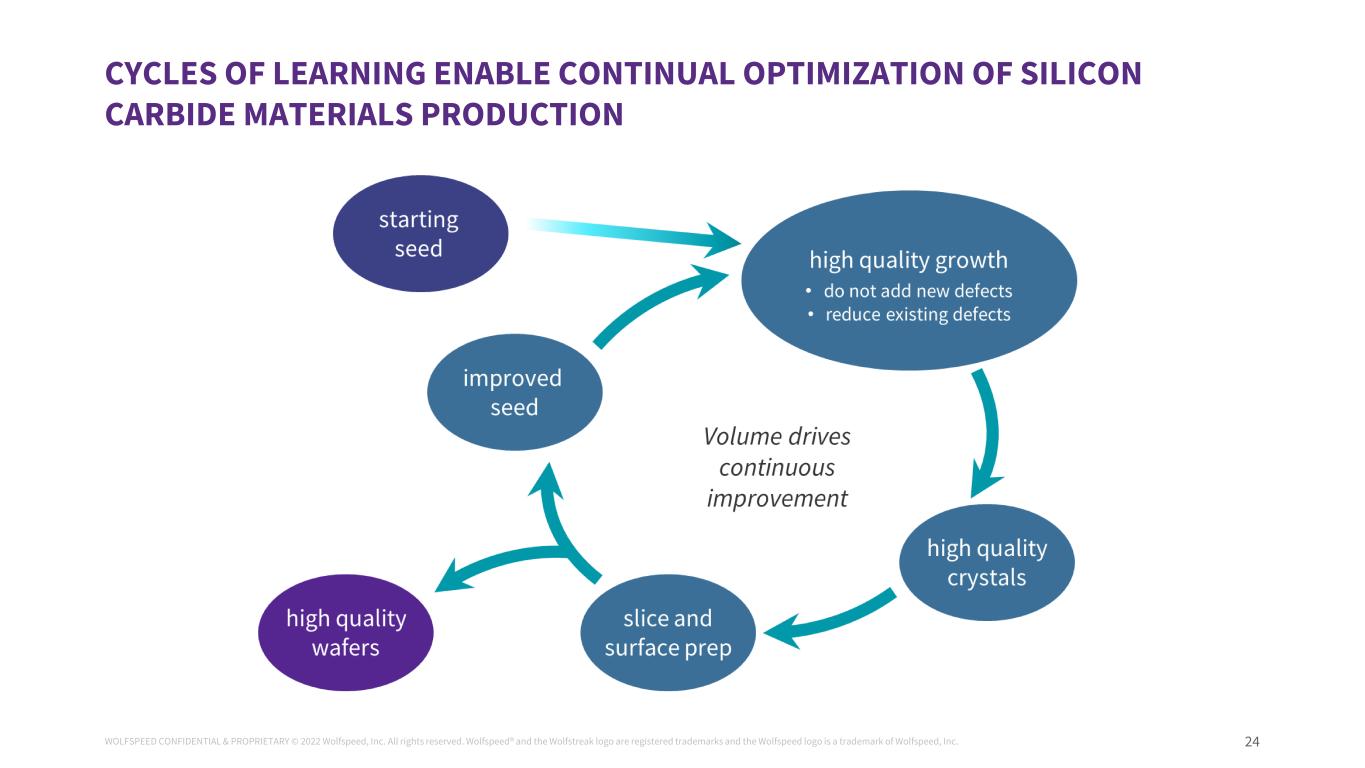

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 24 CYCLES OF LEARNING ENABLE CONTINUAL OPTIMIZATION OF SILICON CARBIDE MATERIALS PRODUCTION

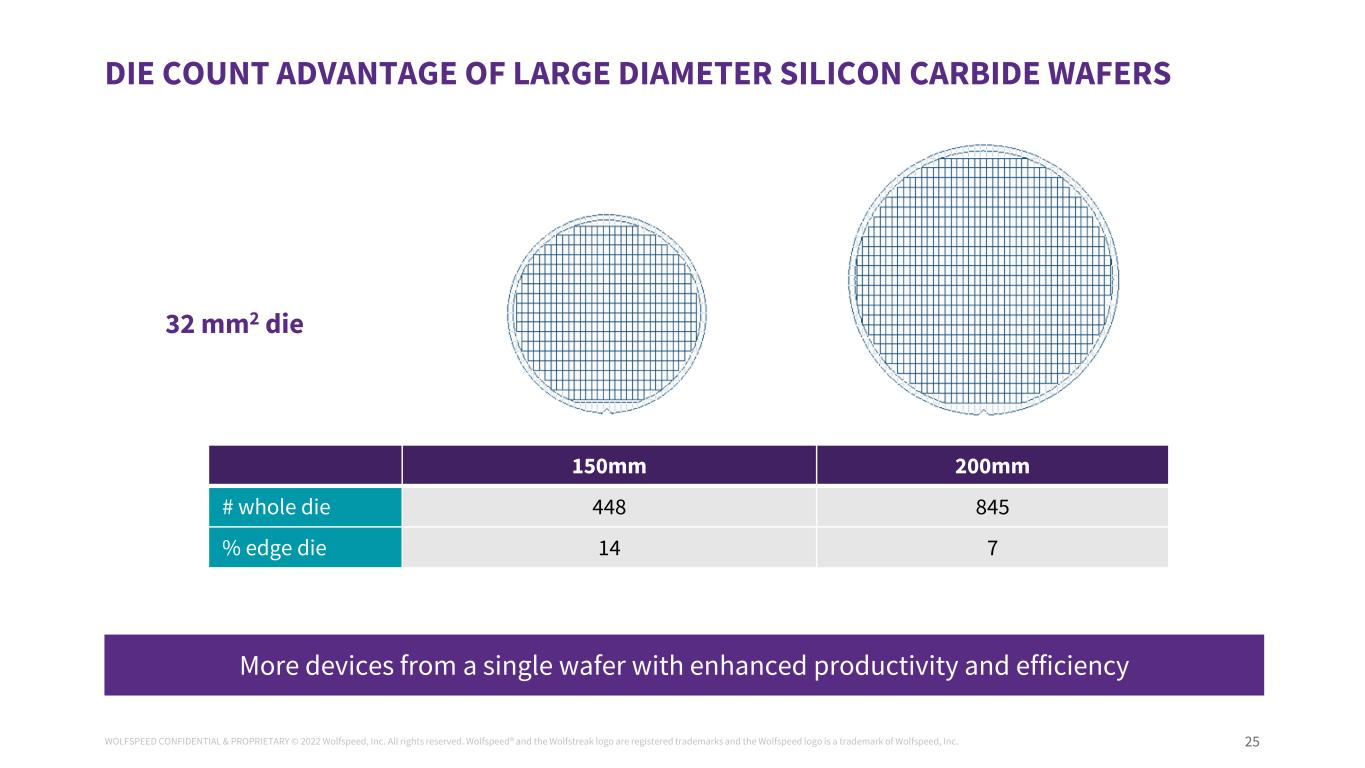

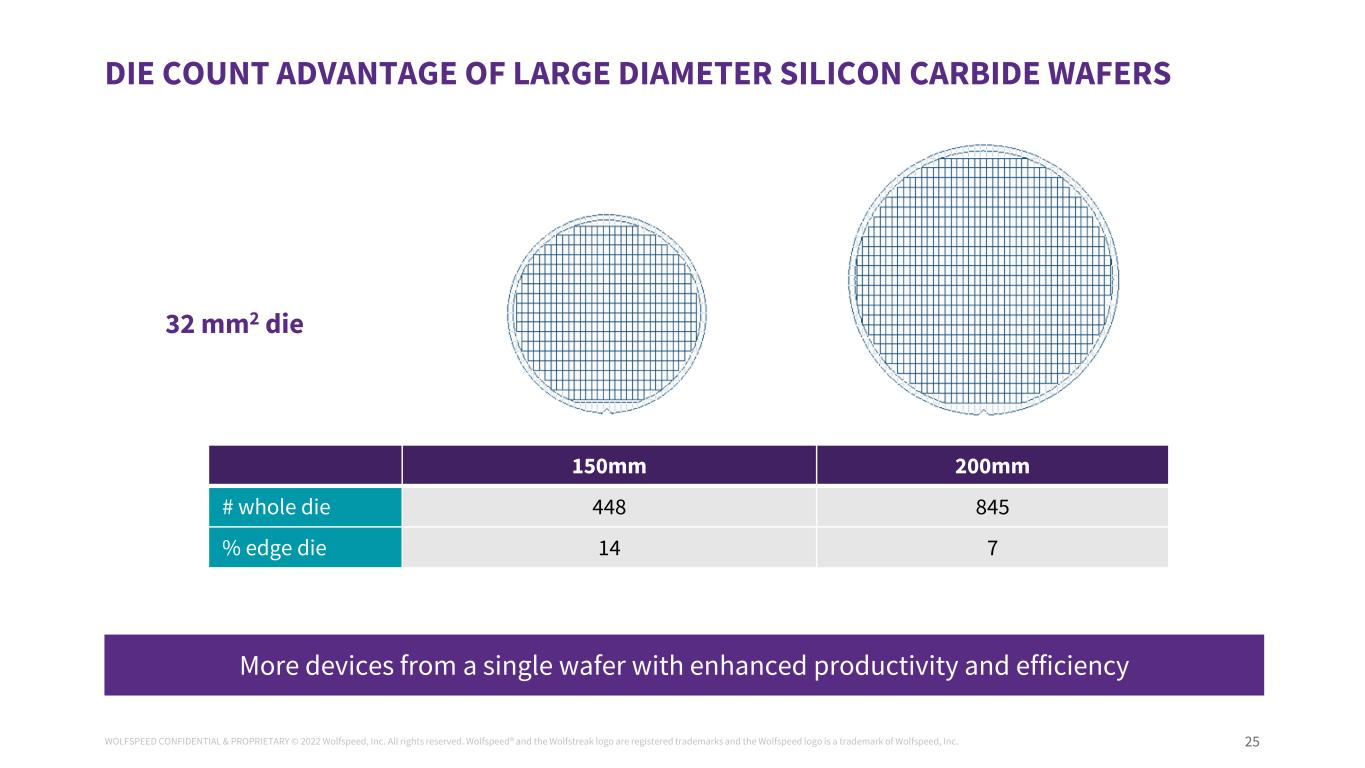

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 25 More devices from a single wafer with enhanced productivity and efficiency 32 mm2 die DIE COUNT ADVANTAGE OF LARGE DIAMETER SILICON CARBIDE WAFERS 150mm 200mm # whole die 448 845 % edge die 14 7

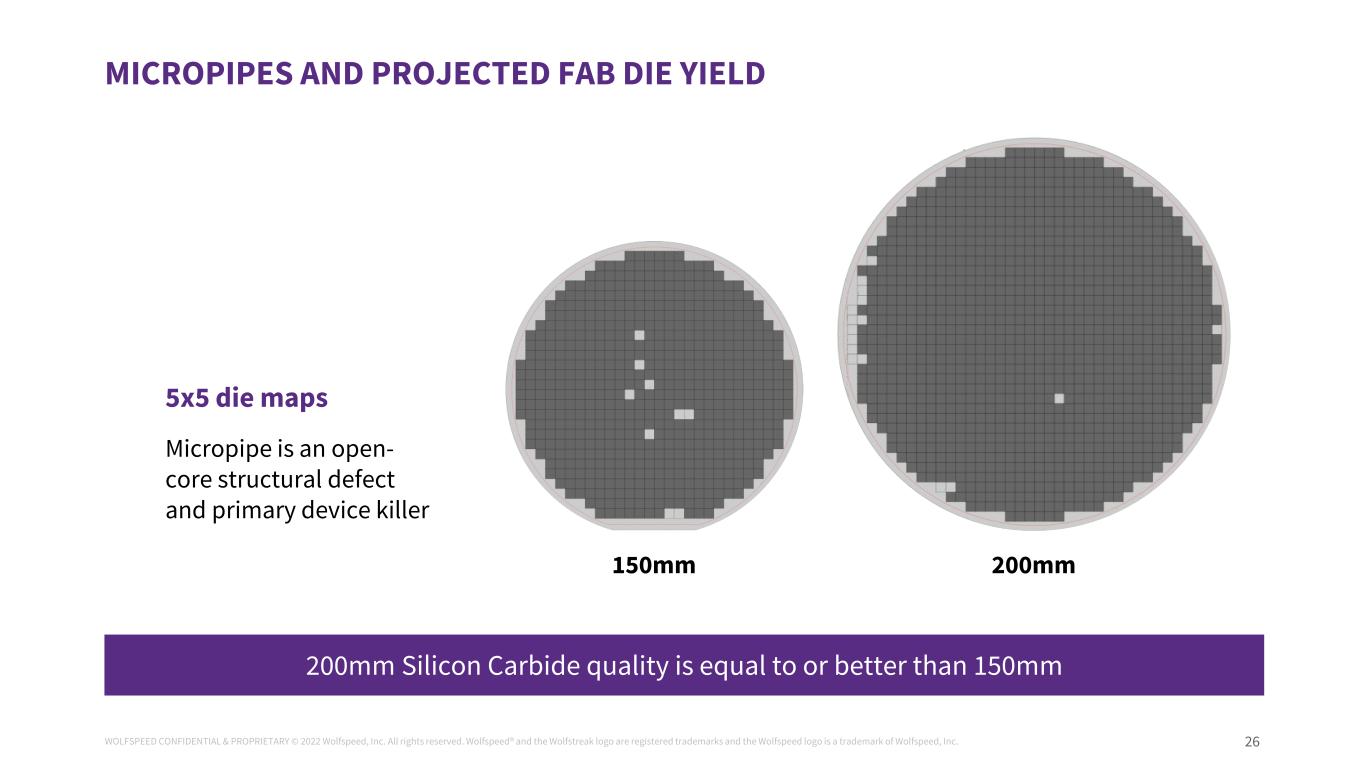

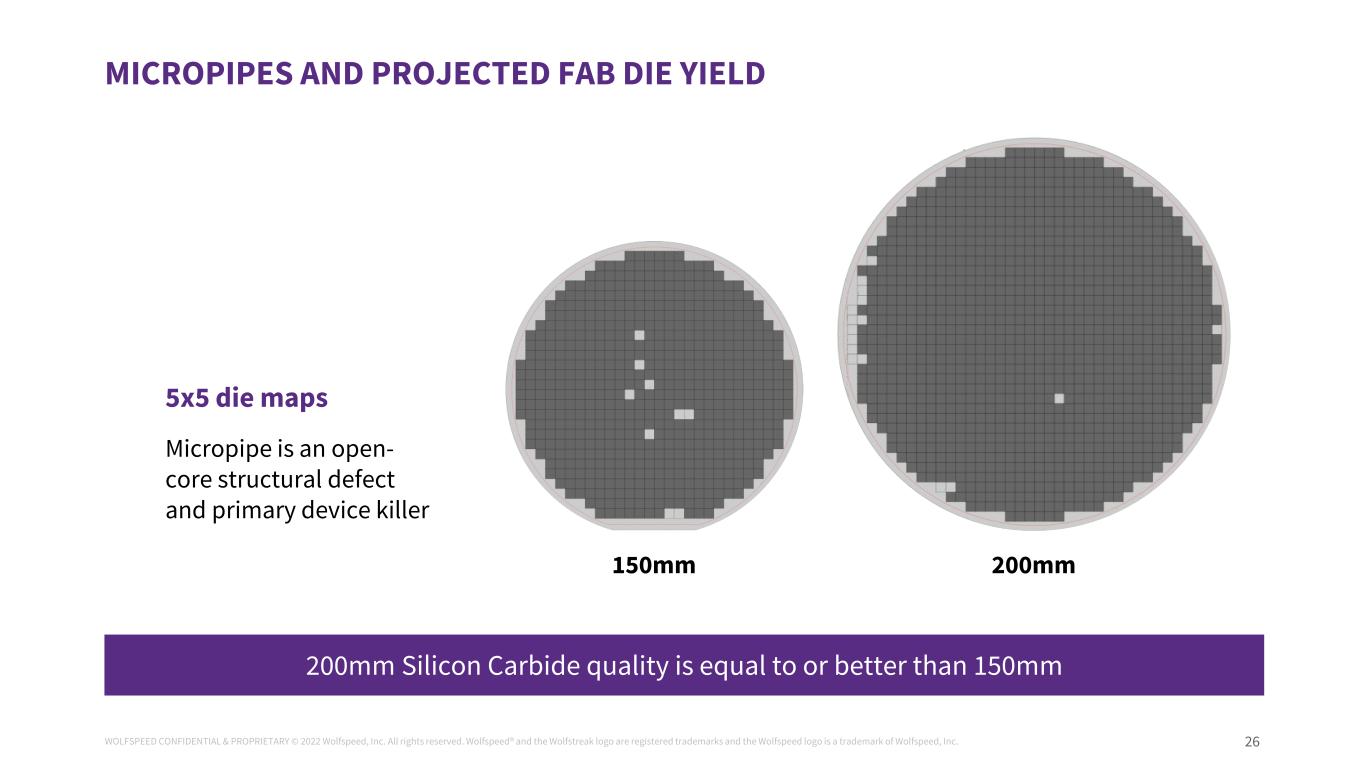

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 26 200mm Silicon Carbide quality is equal to or better than 150mm MICROPIPES AND PROJECTED FAB DIE YIELD Micropipe is an open- core structural defect and primary device killer 5x5 die maps 150mm 200mm

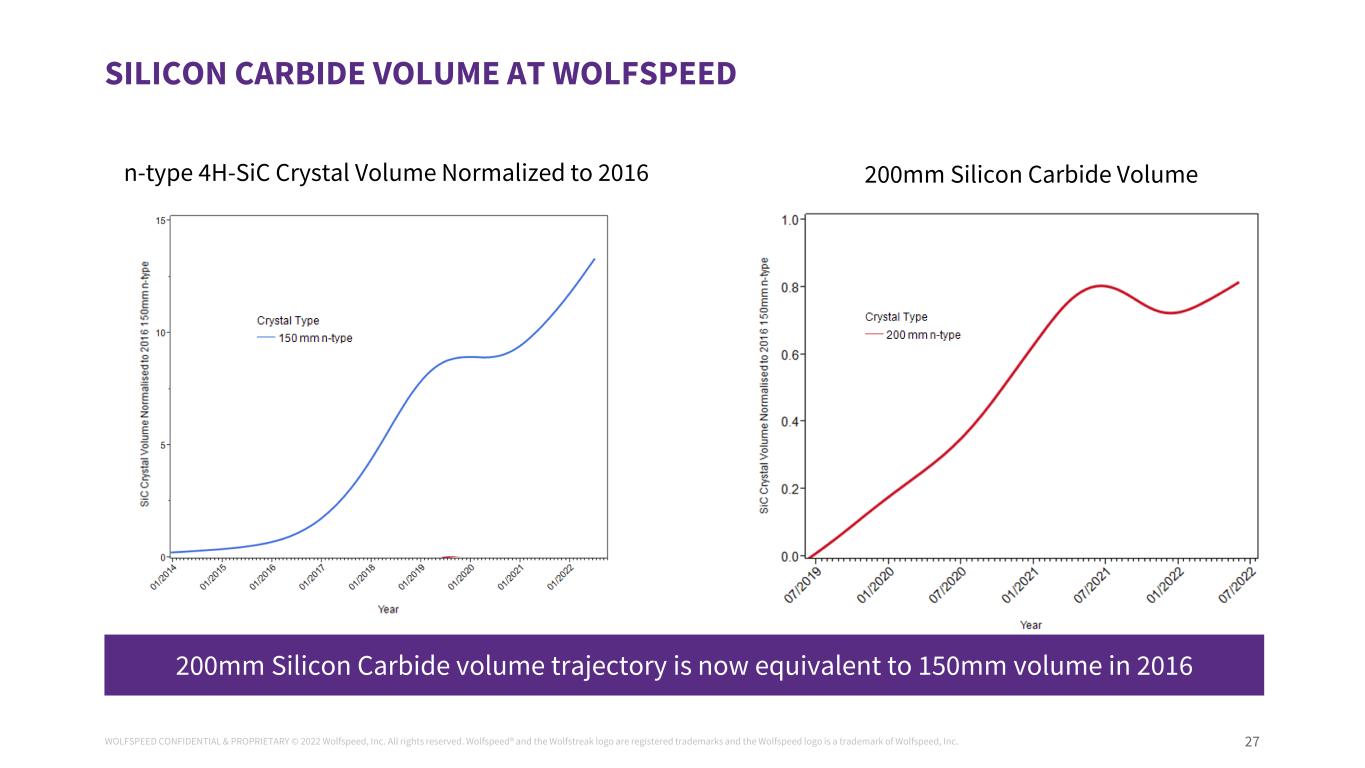

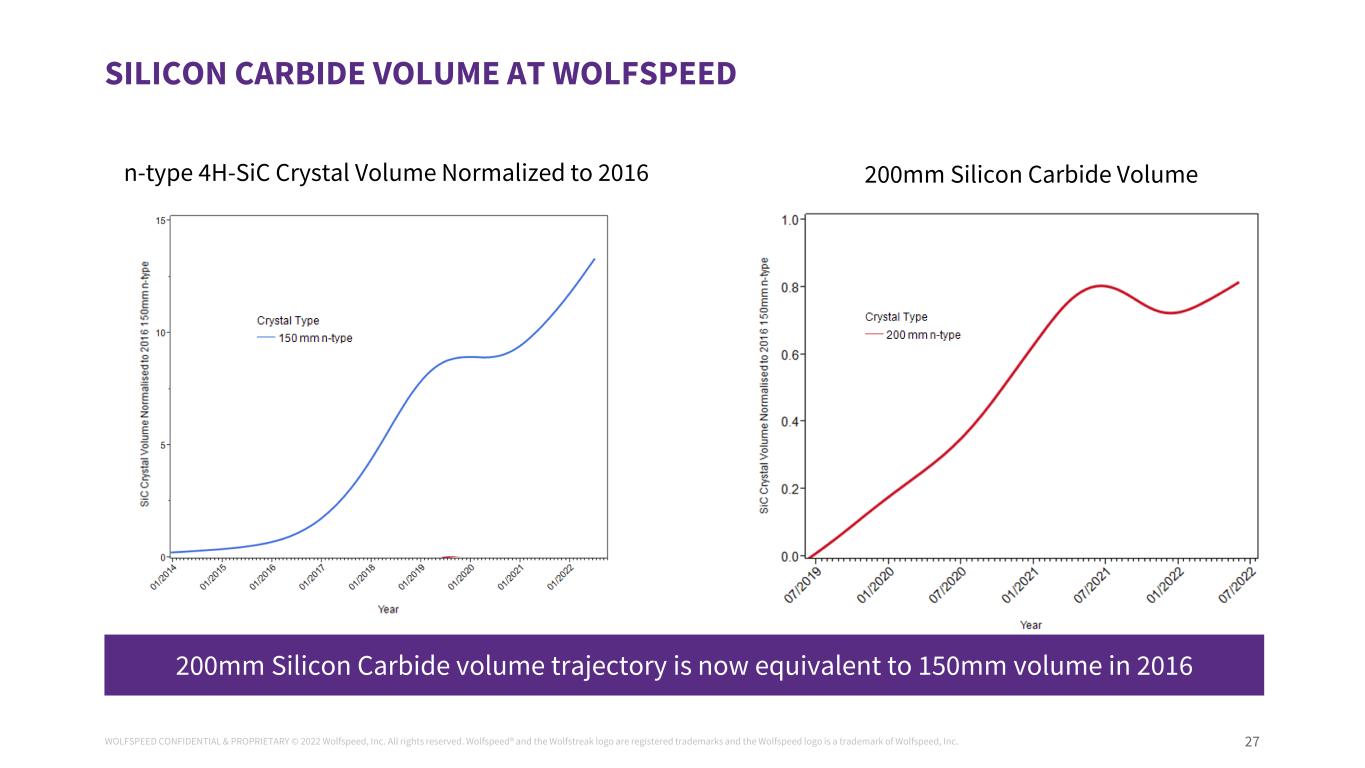

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 27 200mm Silicon Carbide volume trajectory is now equivalent to 150mm volume in 2016 SILICON CARBIDE VOLUME AT WOLFSPEED 200mm Silicon Carbide Volume n-type 4H-SiC Crystal Volume Normalized to 2016

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 28 LEVERAGING DEEP SILICON CARBIDE KNOWLEDGE AND TECHNICAL EXPERTISE AFTER 35 YEARS OF INDUSTRY LEADERSHIP Our combined Silicon Carbide expertise, technology and volume are unmatched in the industry 200mm Silicon Carbide quality equal to or better than 150mm enabling the die count advantage of larger diameter 200mm Silicon Carbide volume is increasing with strong technology performance Silicon Carbide is the new generation semiconductor creating many advantages and opportunities

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2021 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. LET’S REIMAGINE A MORE SUSTAINABLE WORLD. TOGETHER. WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® an the Wolfstreak logo are regist red tra emarks nd the Wolfspeed logo is a trademark of Wol speed, Inc.

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. R E X F E L T O N | S V P G L O B A L O P E R A T I O N S M I S S Y S T I G A L L | V P , N C F A B O P E R A T I O N S A D A M M I L T O N | V P , M O H A W K V A L L E Y F A B L I S A F R I T Z | V P , G L O B A L Q U A L I T Y Operations Update

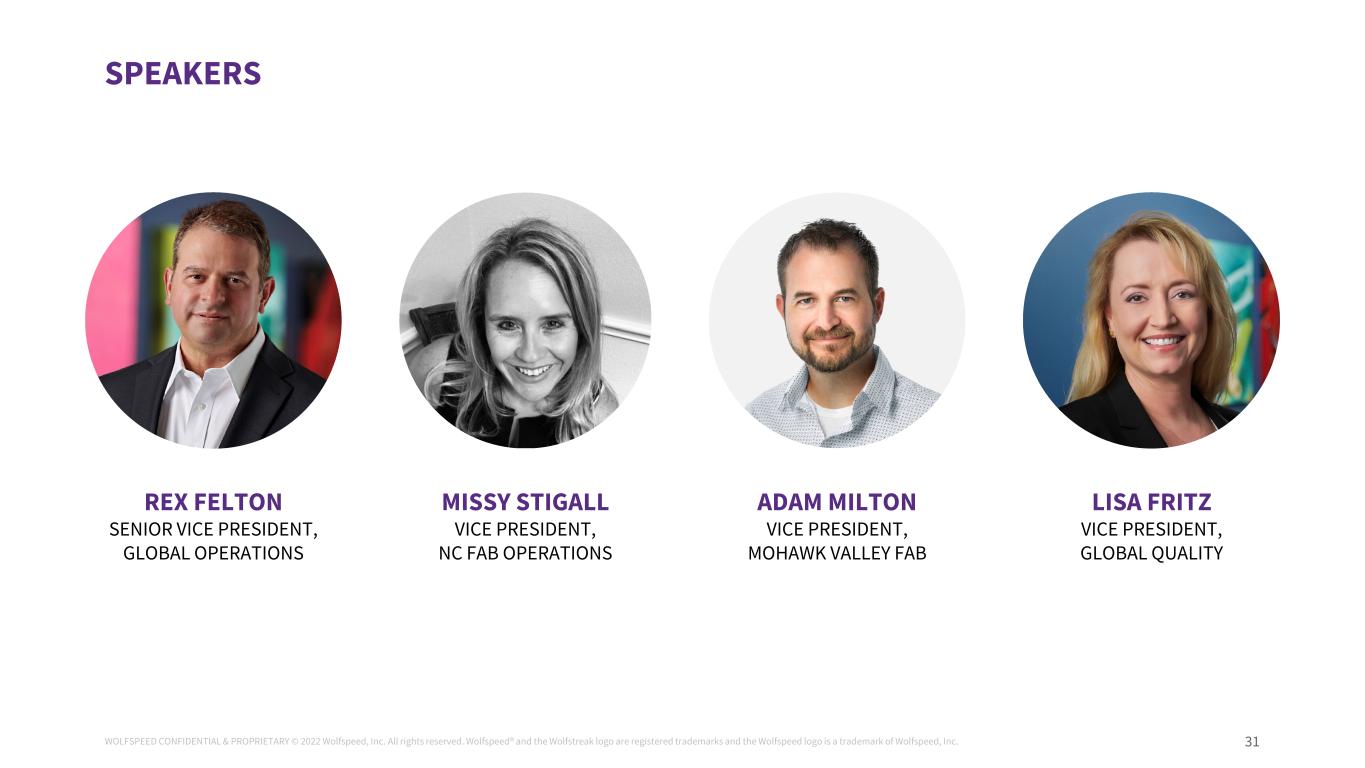

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 31 SPEAKERS REX FELTON SENIOR VICE PRESIDENT, GLOBAL OPERATIONS MISSY STIGALL VICE PRESIDENT, NC FAB OPERATIONS ADAM MILTON VICE PRESIDENT, MOHAWK VALLEY FAB LISA FRITZ VICE PRESIDENT, GLOBAL QUALITY

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 32 WE ARE WOLFSPEED, WE ARE ONEPACK • Safe, Right, Fast Mentality • Nimble and Agile • OnePack Culture: Make it Personal and Win • Reaching for Perfection and Catching Excellence Global Operations Vision

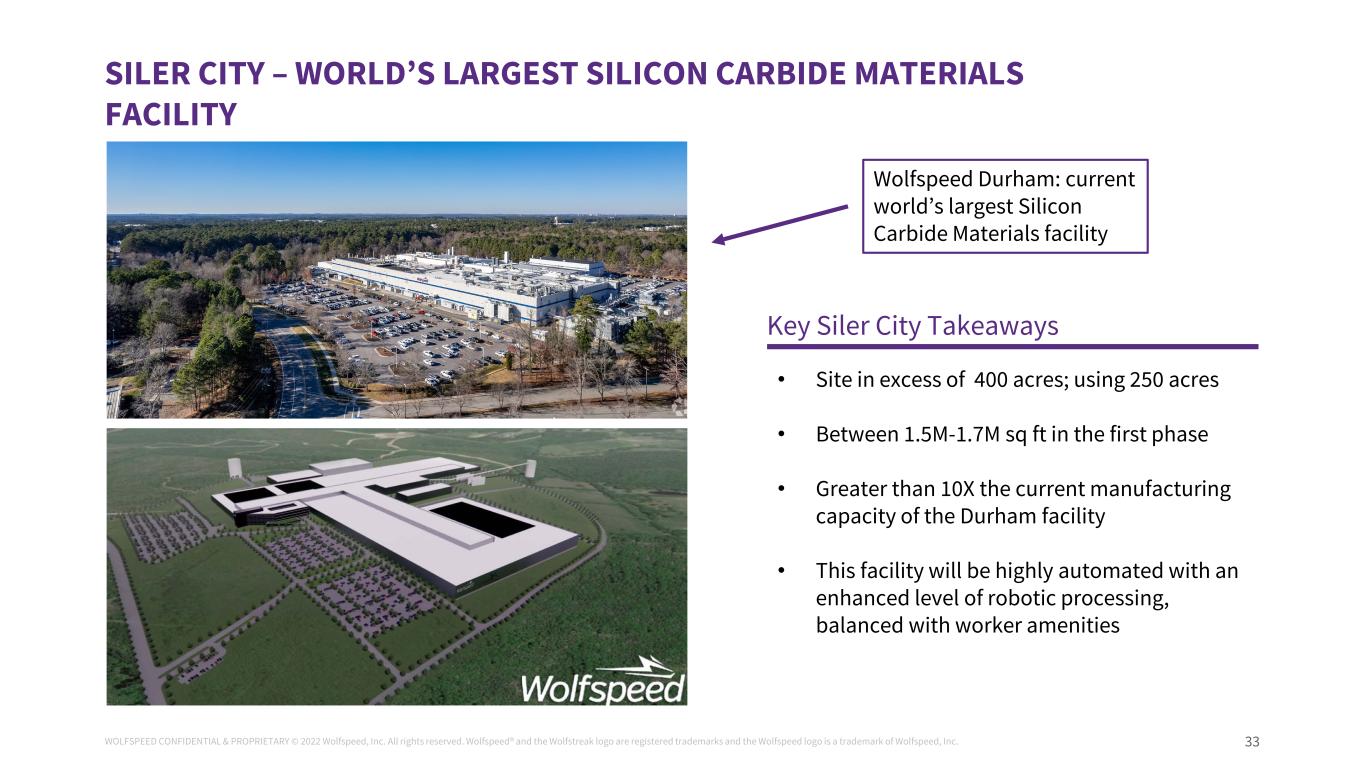

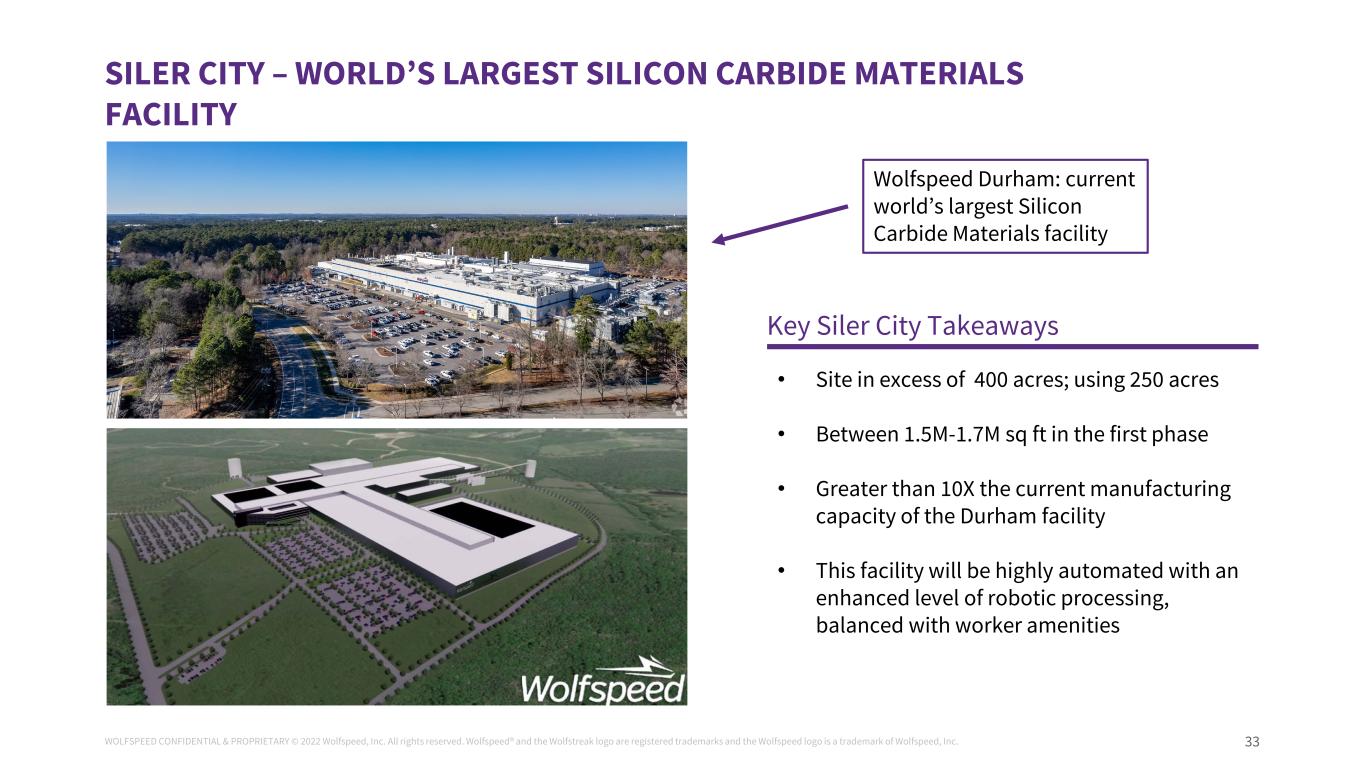

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 33 SILER CITY – WORLD’S LARGEST SILICON CARBIDE MATERIALS FACILITY • Site in excess of 400 acres; using 250 acres • Between 1.5M-1.7M sq ft in the first phase • Greater than 10X the current manufacturing capacity of the Durham facility • This facility will be highly automated with an enhanced level of robotic processing, balanced with worker amenities Key Siler City Takeaways Wolfspeed Durham: current world’s largest Silicon Carbide Materials facility

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 34 SILER CITY VS DURHAM – MATERIALS MANUFACTURING SPACE COMPARISON Current Durham Materials facility footprint overlaid on Siler City footprint

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 35 OnePack culture of operations excellence, automotive quality and productivity Manufacturing Execution – 10% reduction in Multi-Factory Flow through optimization in front end of the line – 9% reduction in non-value add steps, improved overall cycle time by 2.5 days – 550 trained on 5S fundamentals – 67% increase in output from Q1 to Q4FY22 Process and Equipment Stability – 60% hold rate and 45% rework rate reduction YoY – 16% reduction in long tool downs – Overdue workorders reduced by 50% Quality & Reliability – 2000+ parameters added to SPC system – 14% Improvement in overall Power yield WOLFSPEED WORLD CLASS MANUFACTURING Safety First, Quality Mindset, Relentless Execution, 5S Foundation Cost CPP, Productivity RTP Durham Transfers Durham MV Safety First Pause, 100% Accountability, Daily Safety Moment Operational Excellence 5S, Lot Location, WIP Transfer and Dispatch, Line Management, Manual Task Reduction Structured Problem Solving 4C, 3X5 Why, Engineering 5S Tool Stability Critical Tool Ao, % Charts OOC, Rework Reduction, Holds Reduction Target Zero Defects Dispo Guidelines, Detection Methods, Sampling and Inspection, Risk Reduction CT + OTD Moves, Turn Ratio, Prototype CT Quality Yield Top 10 by Tech Drive to Zero Actions Process Yield People Development & Career Roadmap DEI

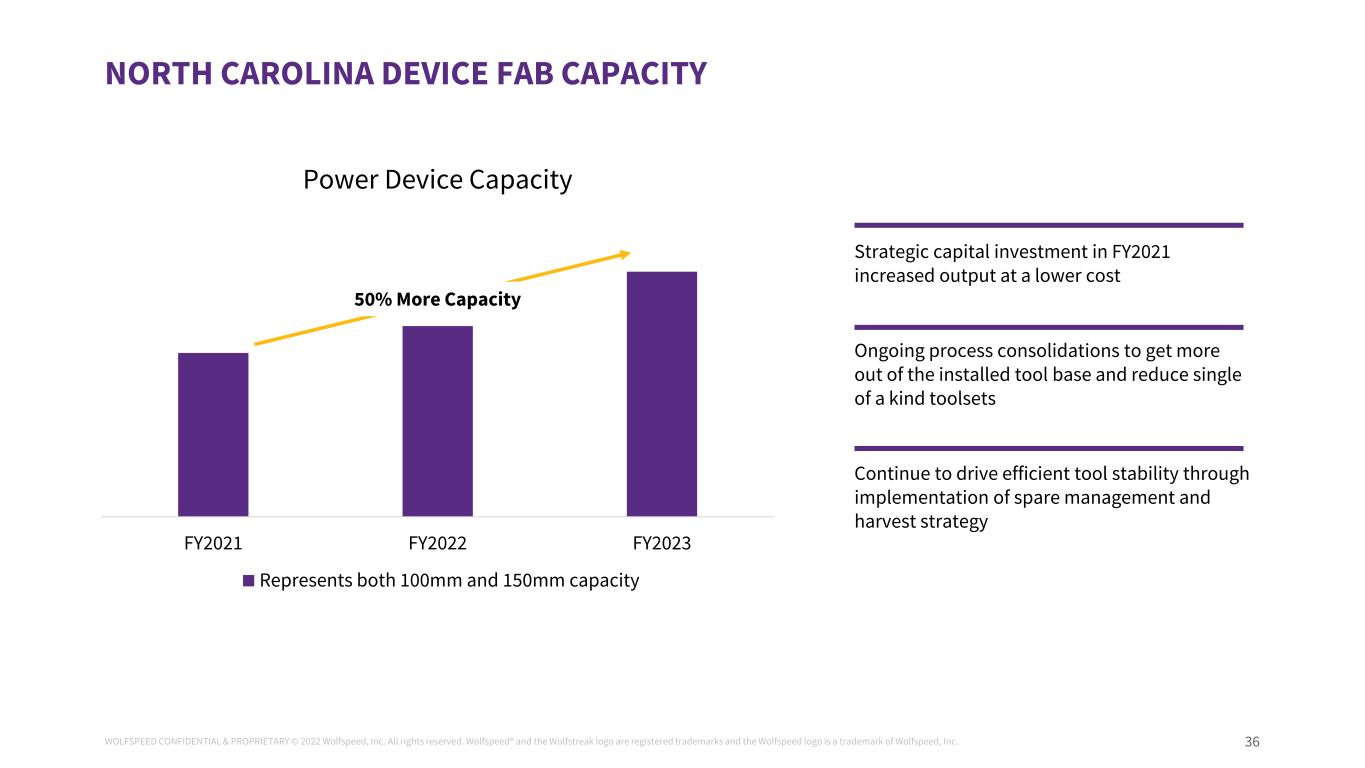

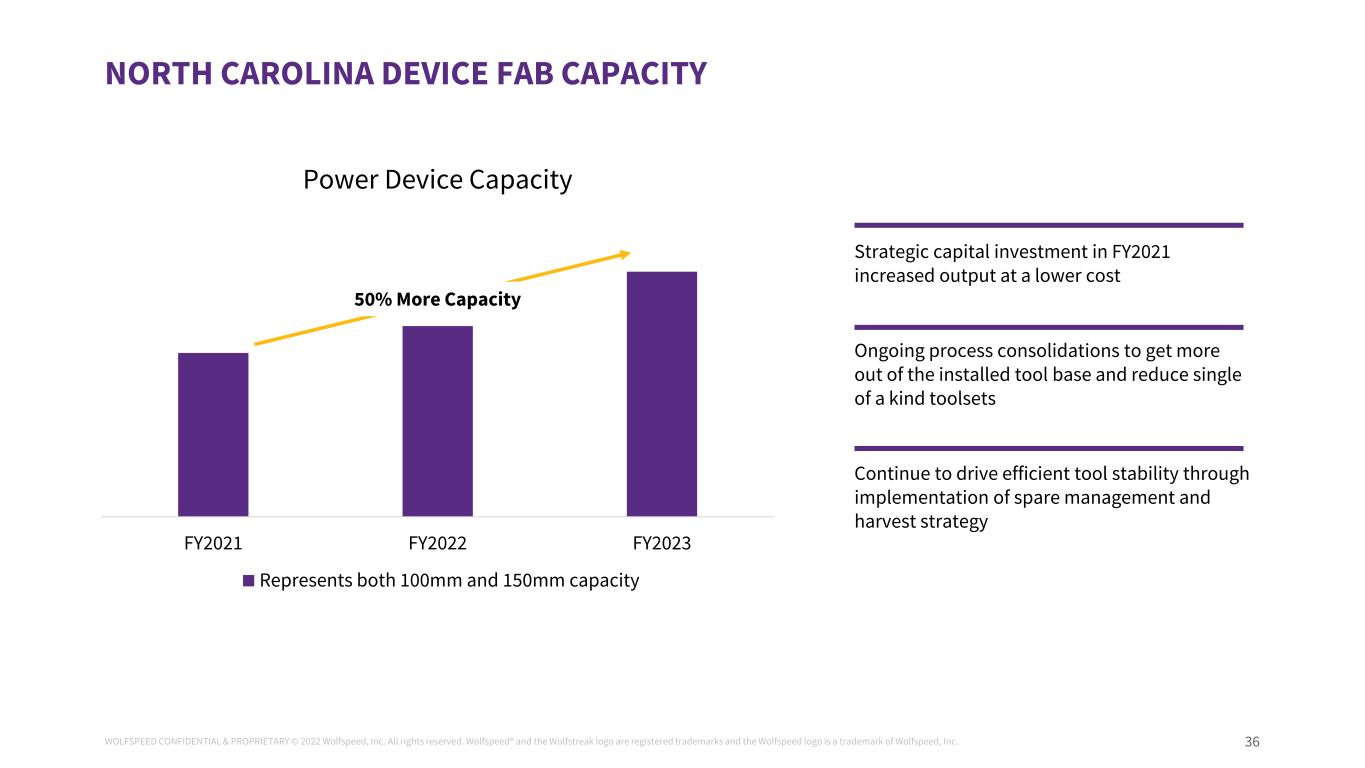

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 36 NORTH CAROLINA DEVICE FAB CAPACITY FY2021 FY2022 FY2023 Power Device Capacity Represents both 100mm and 150mm capacity Strategic capital investment in FY2021 increased output at a lower cost Ongoing process consolidations to get more out of the installed tool base and reduce single of a kind toolsets Continue to drive efficient tool stability through implementation of spare management and harvest strategy 50% More Capacity

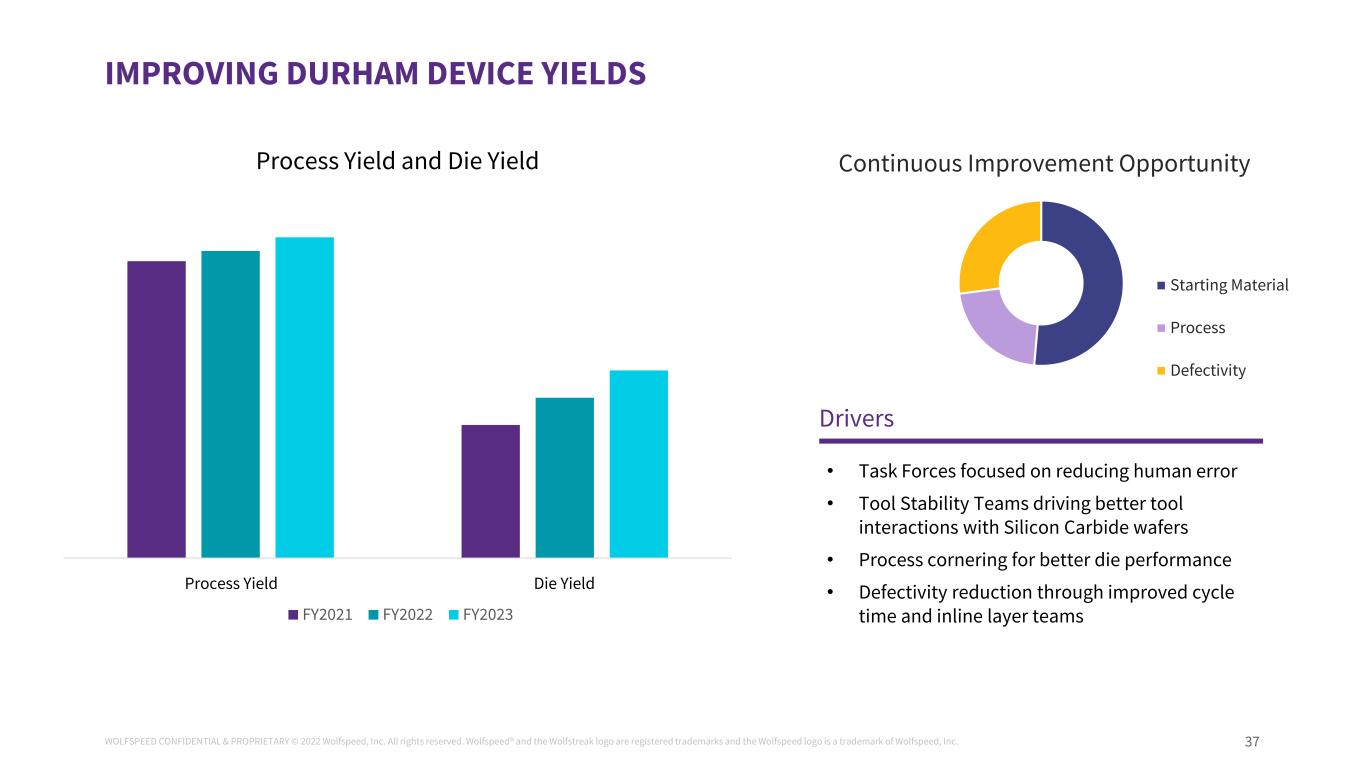

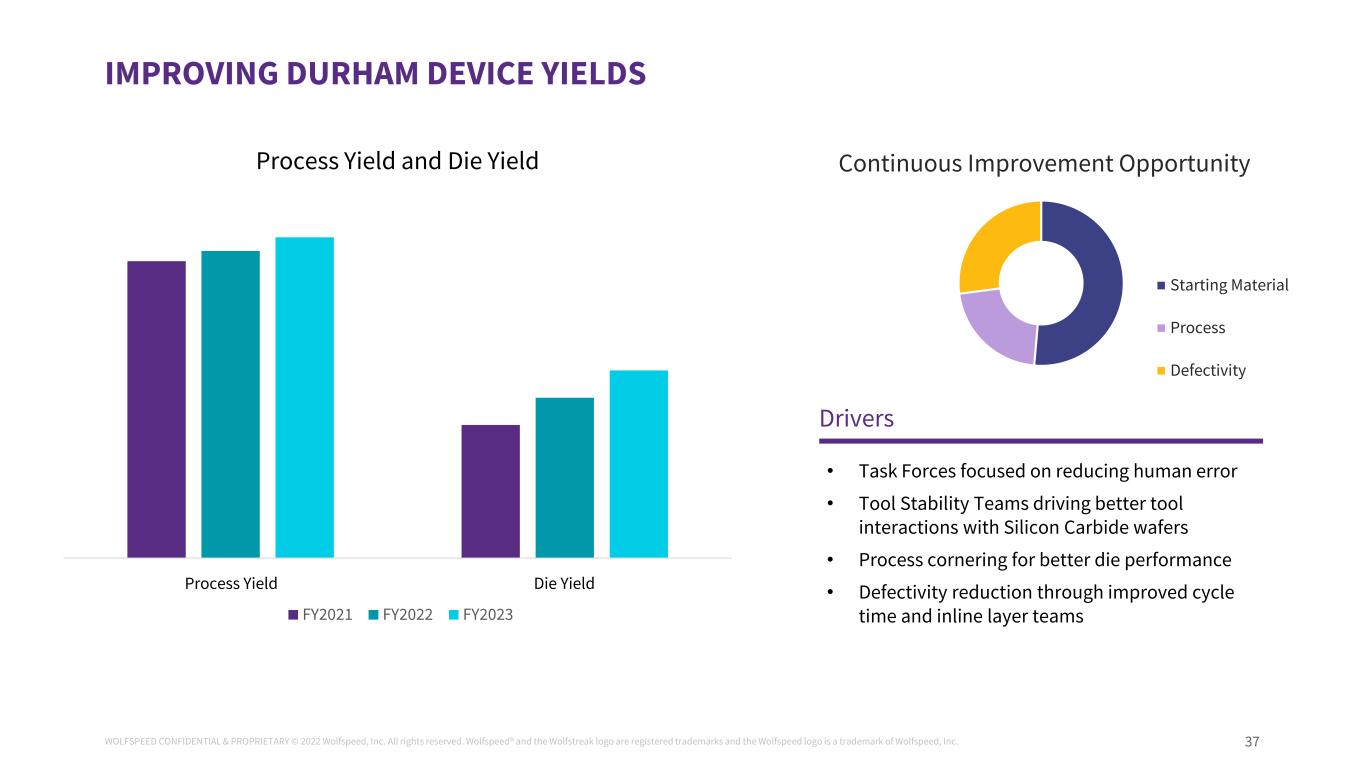

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 37 Continuous Improvement Opportunity Starting Material Process Defectivity IMPROVING DURHAM DEVICE YIELDS • Task Forces focused on reducing human error • Tool Stability Teams driving better tool interactions with Silicon Carbide wafers • Process cornering for better die performance • Defectivity reduction through improved cycle time and inline layer teams Drivers Wafer Die FY2021 FY2022 FY2023 Process Yield and Die Yield Process Yield Die Yield

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 38 Mohawk Valley Fab was designed from the ground up for world class 200mm Silicon Carbide devices MOHAWK VALLEY FAB – KEY DIFFERENTIATION • Automotive quality systems by design • IATF certified out of the gate Best Quality • World class team combining decades of experience with Silicon Carbide, silicon HVM, and automotive Best People • 300mm silicon-like automation retrofitted to work on 200mm Silicon Carbide • Manufacturing systems supporting “big data” environment Best Systems • Yield and reliability demonstrated in pilot line • Wafer handling expertise • Vertically integrated feedback loop Best Silicon Carbide

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 39 Mohawk Valley Fab was designed from the ground up for world-class 200mm SiC devices MOHAWK VALLEY FAB: KEY DIFFERENTIATION

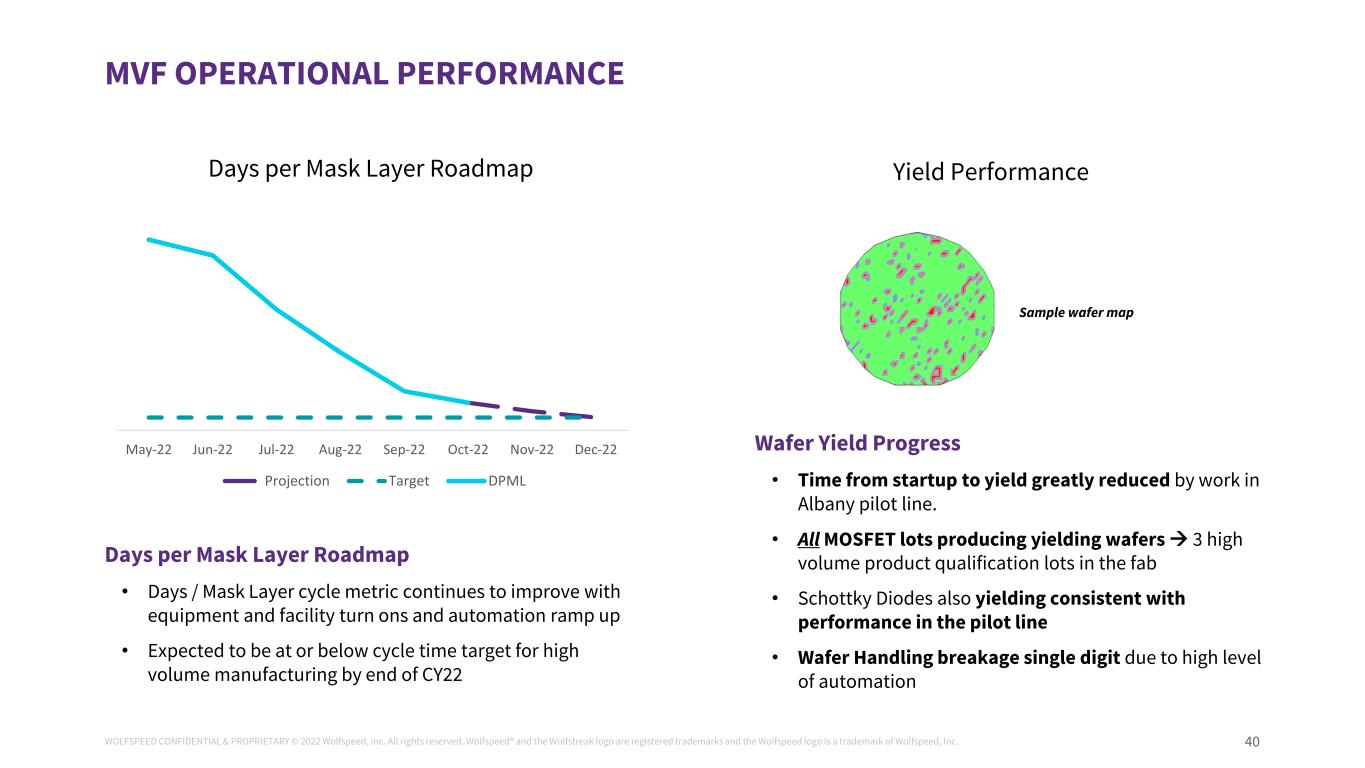

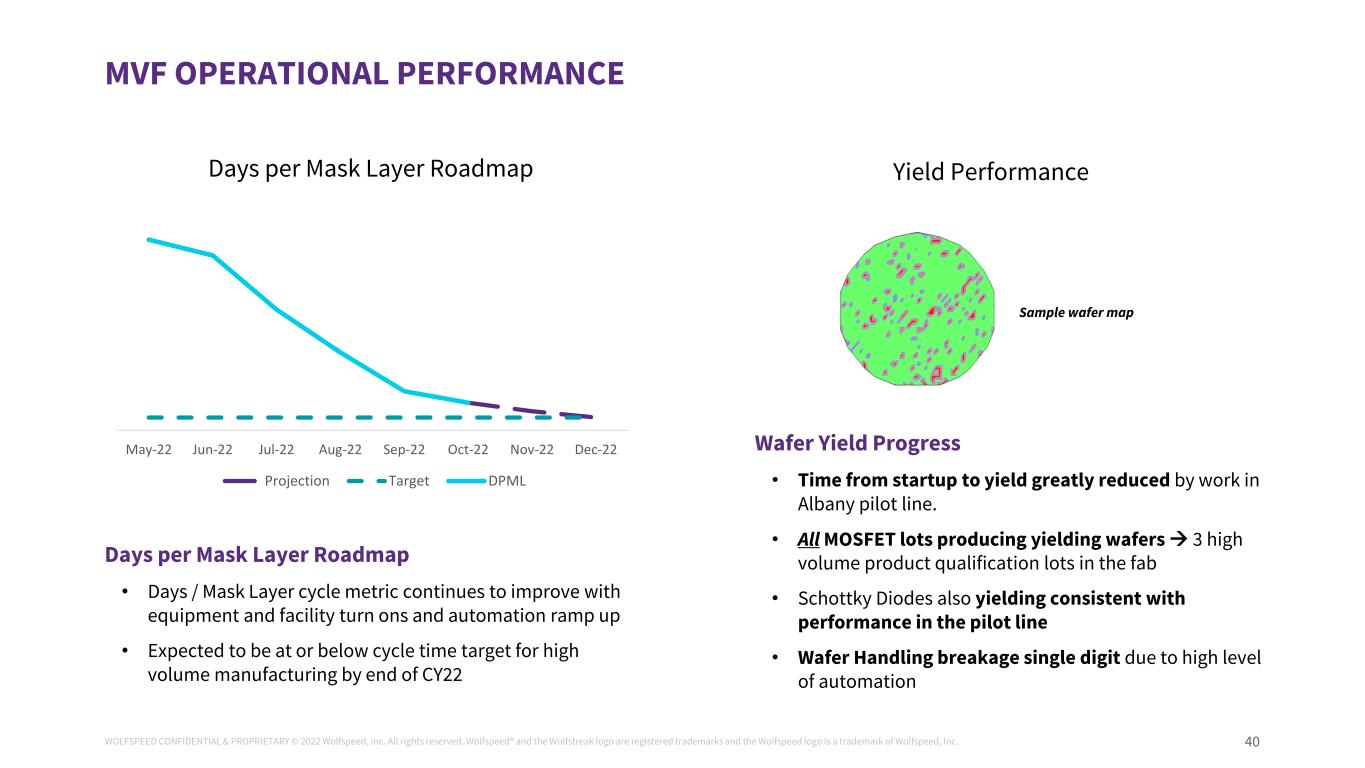

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 40 Days per Mask Layer Roadmap • Days / Mask Layer cycle metric continues to improve with equipment and facility turn ons and automation ramp up • Expected to be at or below cycle time target for high volume manufacturing by end of CY22 MVF OPERATIONAL PERFORMANCE Days per Mask Layer Roadmap Yield Performance Wafer Yield Progress • Time from startup to yield greatly reduced by work in Albany pilot line. • All MOSFET lots producing yielding wafers 3 high volume product qualification lots in the fab • Schottky Diodes also yielding consistent with performance in the pilot line • Wafer Handling breakage single digit due to high level of automation Sample wafer map May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Projection Target DPML

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 41 Wafer Ramp • Ramp continues to increase over coming months • Product qualification and proliferations to support ramp MVF RAMP PLAN 200mm Wafer Starts Ramp Plan Production Equipment Installed Production Equipment Installation • Equipment installed in MV Fab today to support qualification and ramp • Installs continue through current planning horizon to support long range growth plans 22-Oct 22-Nov 22-Dec 23-Jan 23-Feb 23-Mar 23-Apr 23-May 23-Jun Q4 CY2022 Q1 CY2023 Q2 CY2023 20 0m m W af er s S ta rt s/ W ee k Today Q4 CY2022 Q1 CY2023 Q2 CY2023 Q4 CY2023 To ol C ou nt

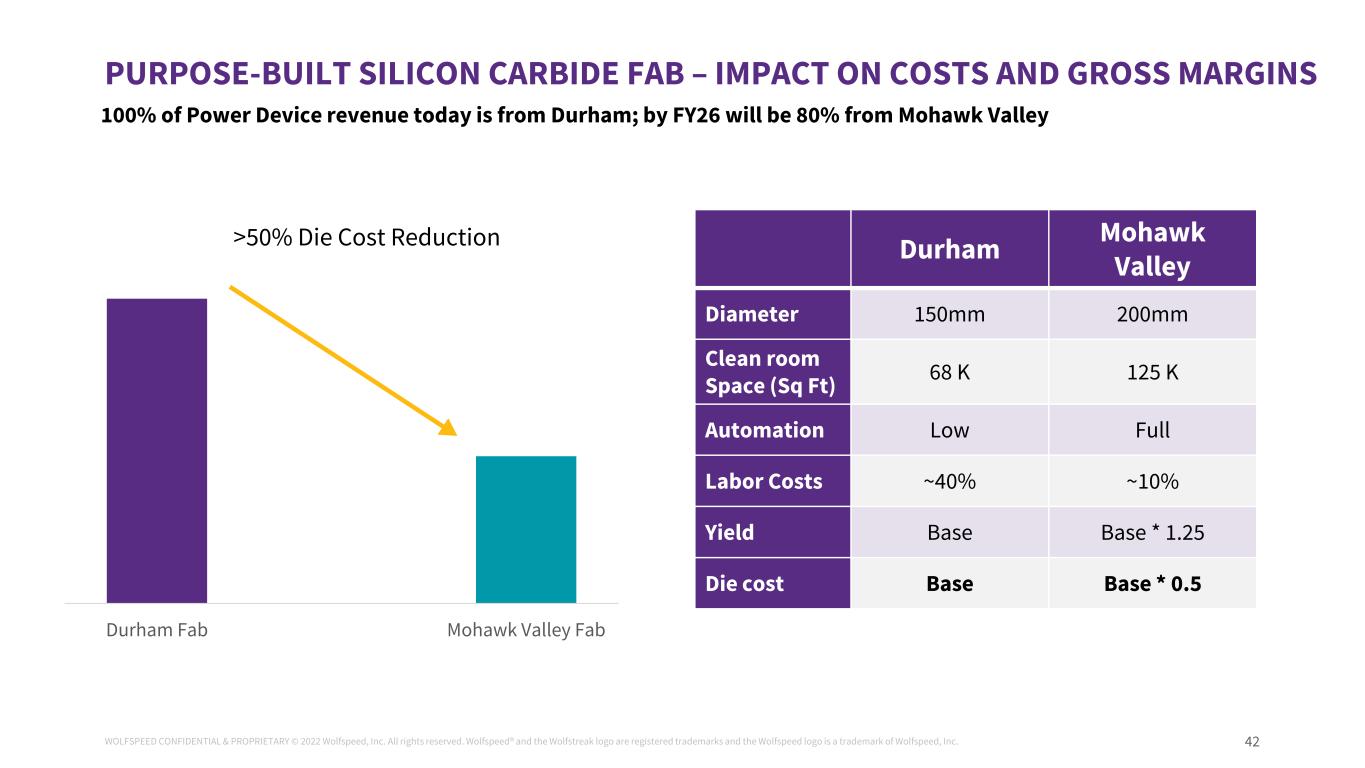

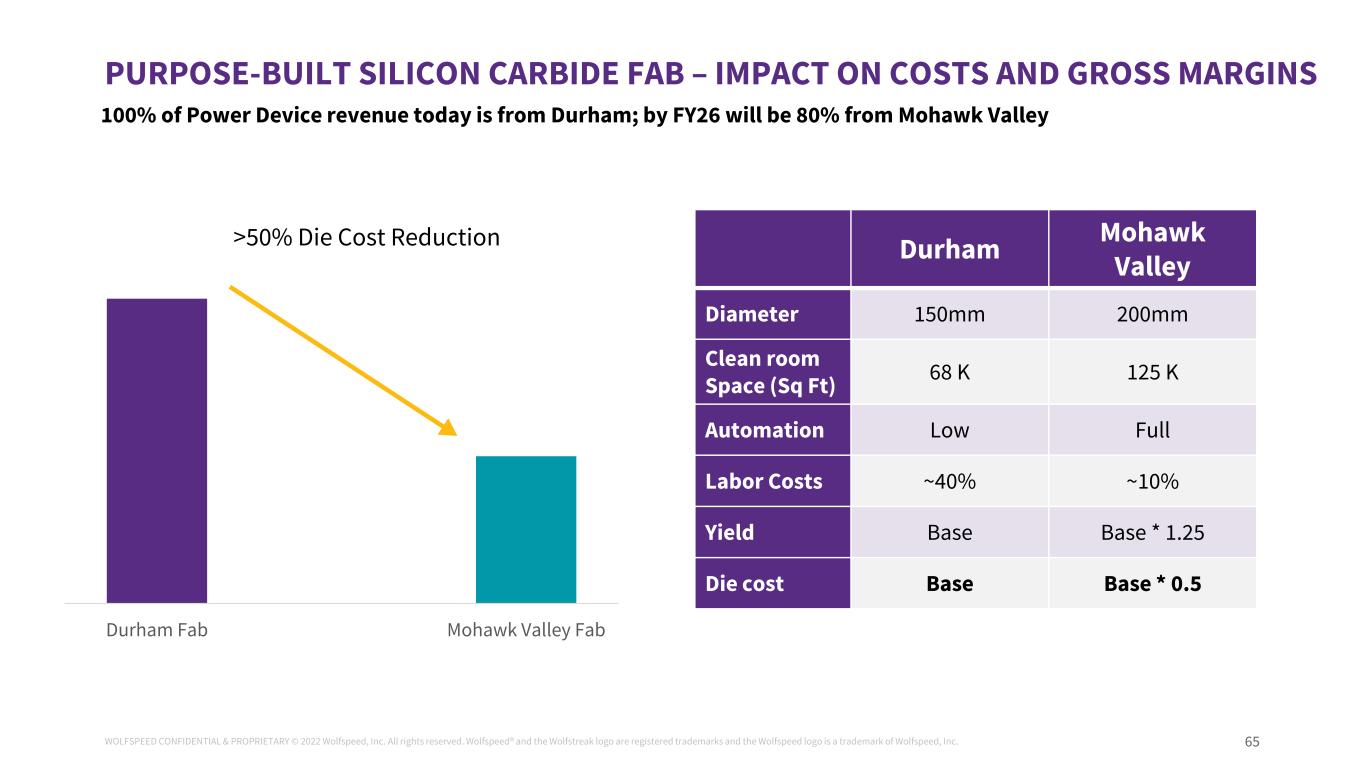

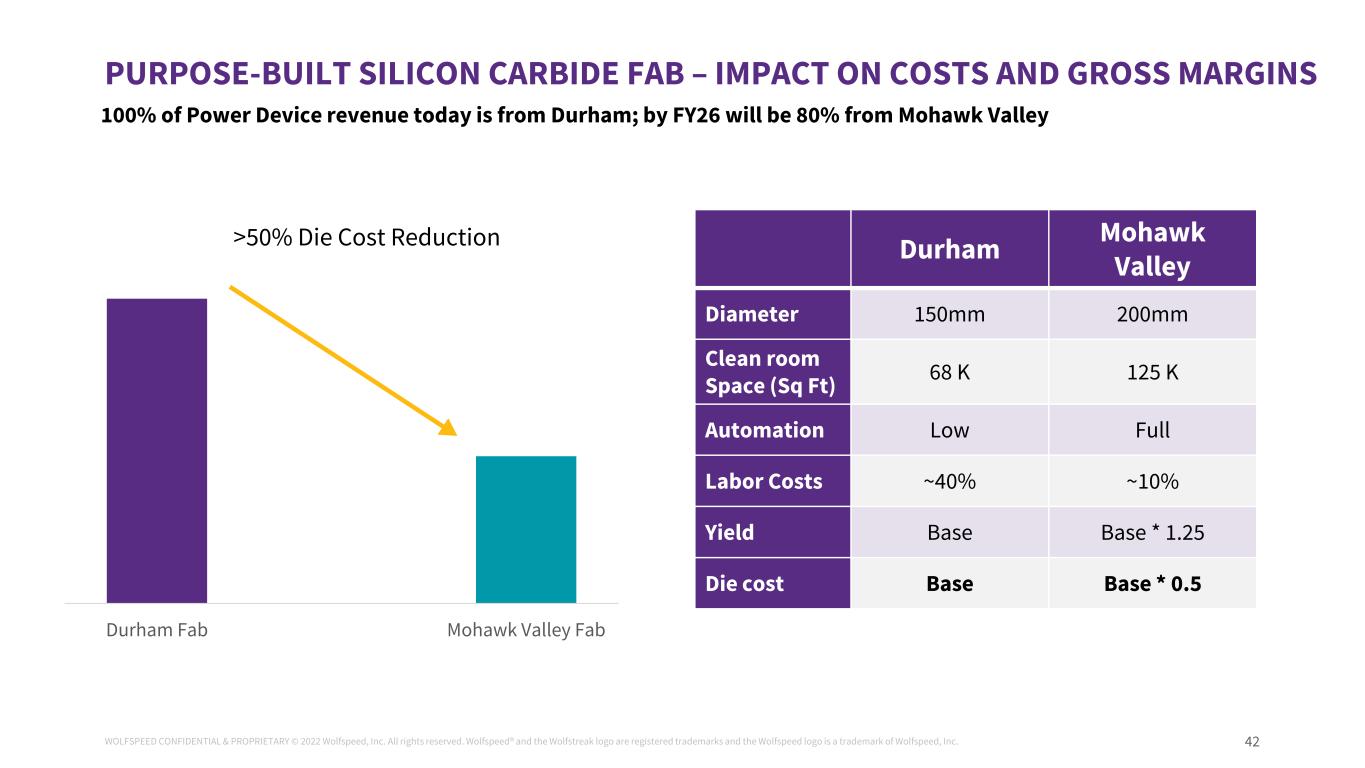

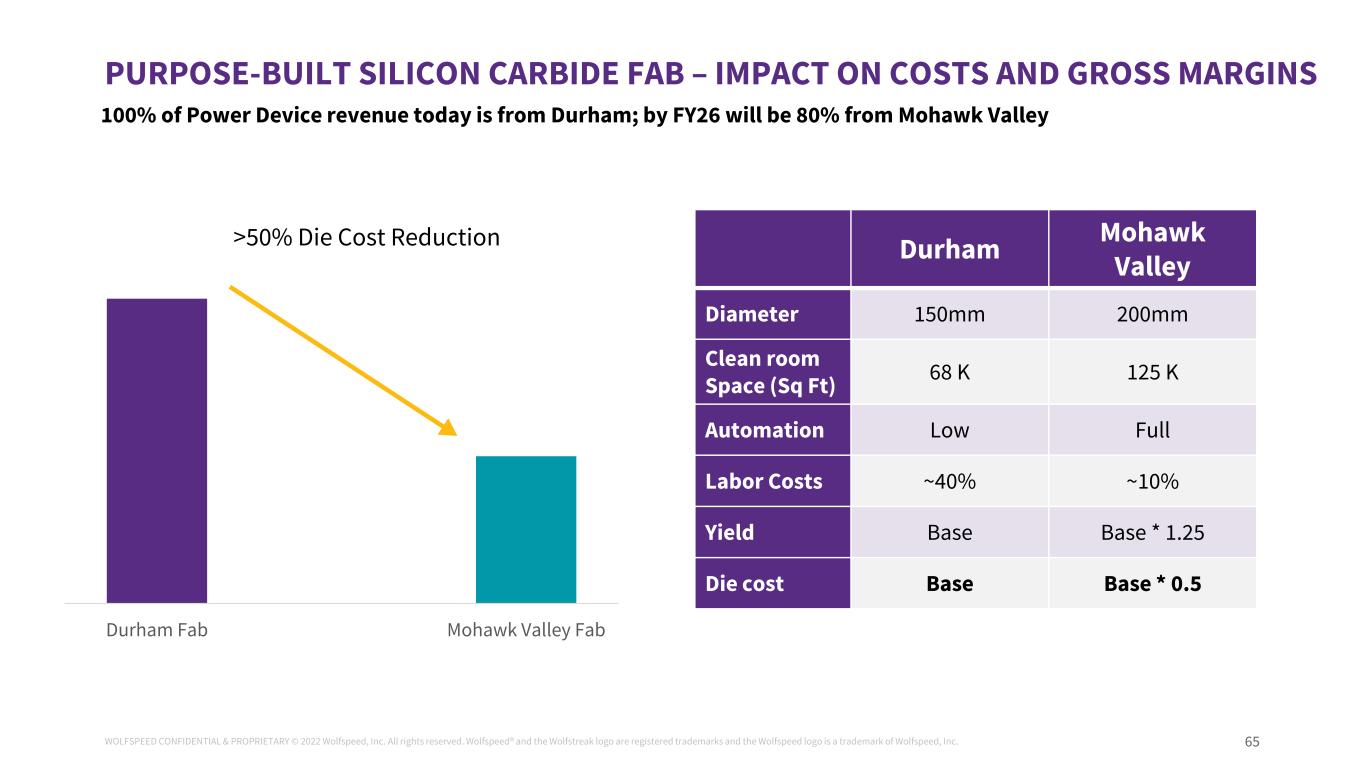

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 42 PURPOSE-BUILT SILICON CARBIDE FAB – IMPACT ON COSTS AND GROSS MARGINS Durham Fab Mohawk Valley Fab >50% Die Cost Reduction 100% of Power Device revenue today is from Durham; by FY26 will be 80% from Mohawk Valley Durham Mohawk Valley Diameter 150mm 200mm Clean room Space (Sq Ft) 68 K 125 K Automation Low Full Labor Costs ~40% ~10% Yield Base Base * 1.25 Die cost Base Base * 0.5

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 43 WOLFSPEED QUALITY FOCUS Build out experienced quality engineering teams Invest in scaling quality management systems and processes Advance automotive culture through key quality initiatives Our strategy to integrate our people, systems and culture is driving our competitive advantage

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 44 Advancing Industry Standards • Leading Silicon Carbide engagement in industry standards organizations [JEDEC, ECPE (including AQG), ZVEI, ICE, SEMI] Wolfspeed’s Commitment to Quality • Automotive certified business and factories • Global manufacturing, supplier, and customer quality teams • Industry standard qualifications and metrics • Compliance and continual improvement Implementing Key Quality Initiatives • Zero defect strategies • Auto-centric Quality Management System • Improved customer satisfaction Leading the industry transformation and defining the roadmap for Silicon Carbide quality SILICON CARBIDE AUTOMOTIVE QUALITY – A WOLFSPEED CULTURE

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 45 BUILDING OUR QUALITY CULTURE PROCESSES & SYSTEMS ONE PACK CULTURE • High quality product at optimized cost • Increased customer satisfaction • Enable zero defects ATTITUDE BEHAVIOR • Quality Management Systems, training, and factory automation • Proactive mindset • Active engagement in risk mitigation • Meet automotive expectations Delivering on customer expectations through key quality initiatives

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2021 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. LET’S REIMAGINE A MORE SUSTAINABLE WORLD. TOGETHER. WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® an the Wolfstreak logo are regist red tra emarks nd the Wolfspeed logo is a trademark of Wol speed, Inc.

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. N E I L L R E Y N O L D S | E V P & C F O Financial Overview

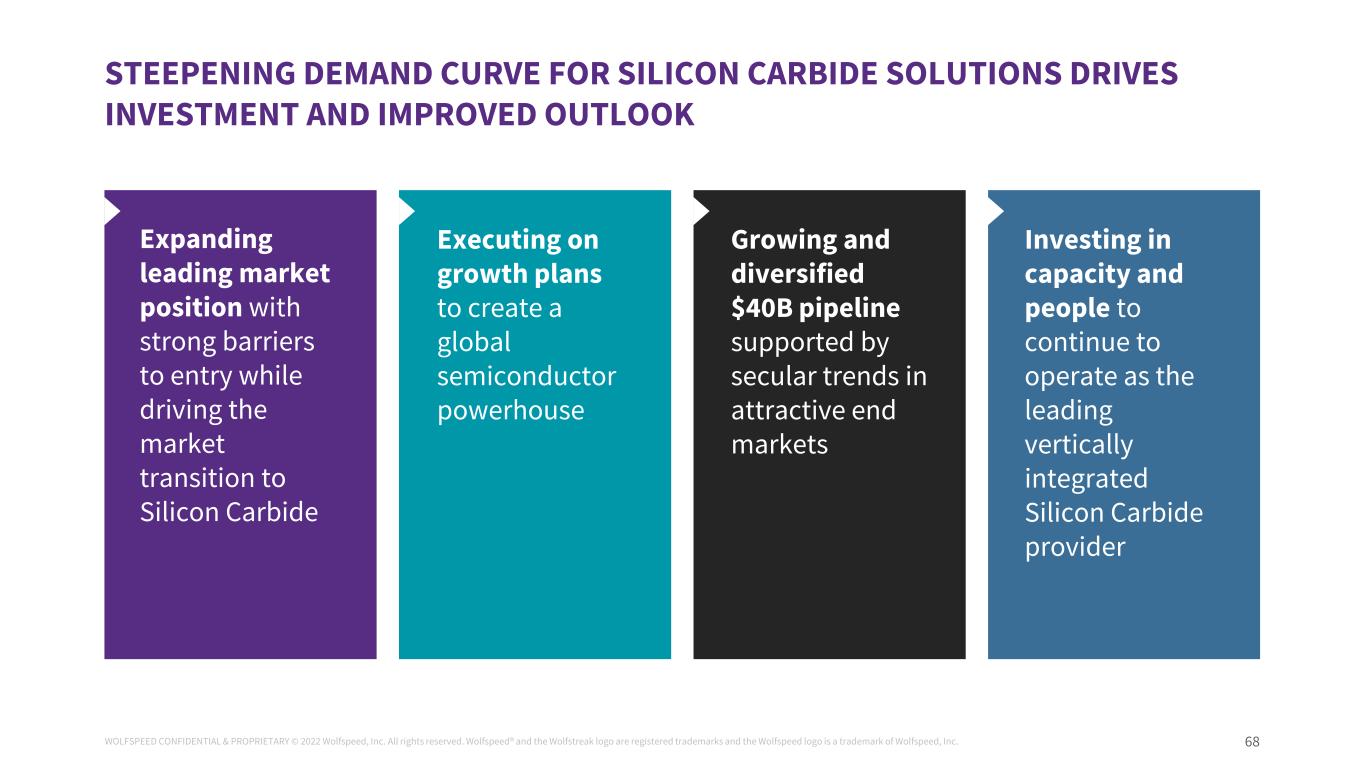

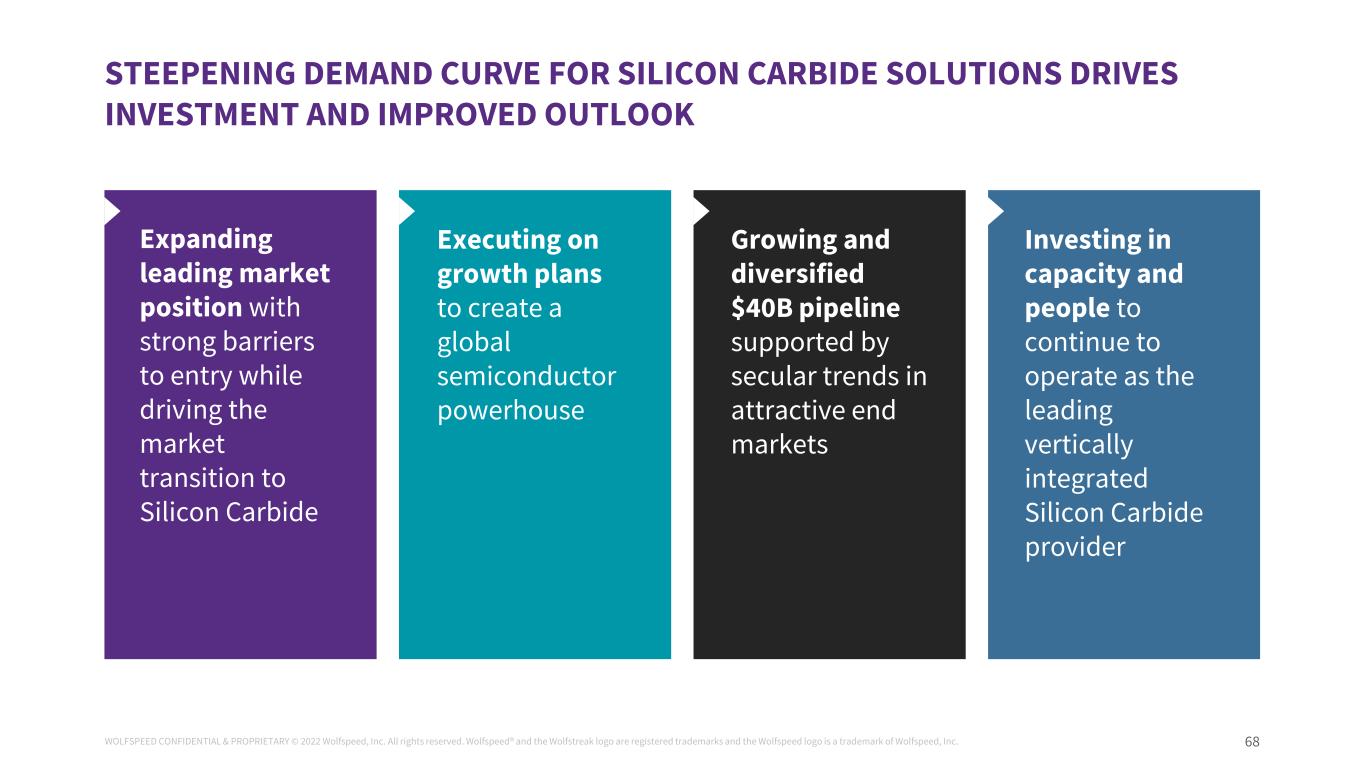

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 48 Expanding leading market position with strong barriers to entry while driving the market transition to Silicon Carbide Executing on growth plans to create a global semiconductor powerhouse Growing and diversified $40B pipeline supported by secular trends in attractive end markets Investing in capacity and people to continue to operate as the leading vertically integrated Silicon Carbide provider STEEPENING DEMAND CURVE FOR SILICON CARBIDE SOLUTIONS DRIVES INVESTMENT AND IMPROVED OUTLOOK

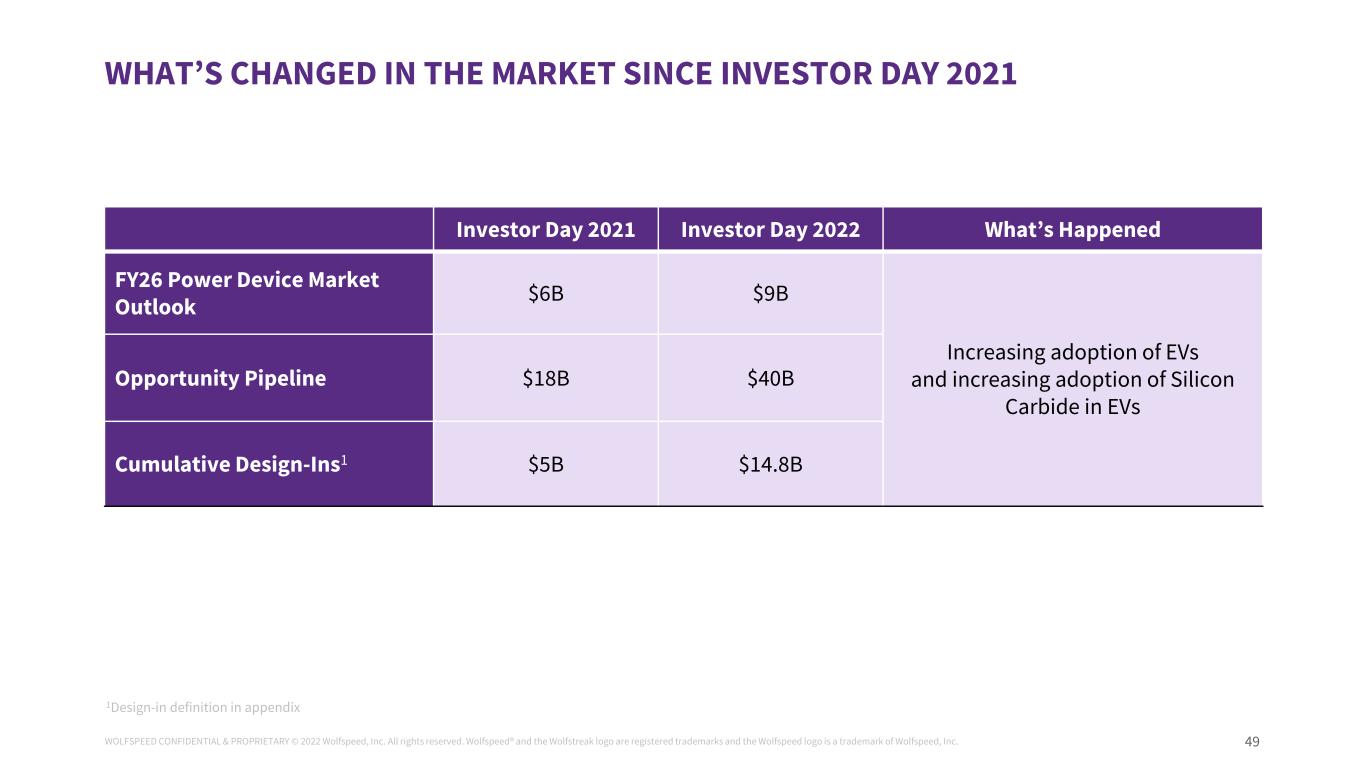

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 49 WHAT’S CHANGED IN THE MARKET SINCE INVESTOR DAY 2021 Investor Day 2021 Investor Day 2022 What’s Happened FY26 Power Device Market Outlook $6B $9B Increasing adoption of EVs and increasing adoption of Silicon Carbide in EVs Opportunity Pipeline $18B $40B Cumulative Design-Ins1 $5B $14.8B 1Design-in definition in appendix

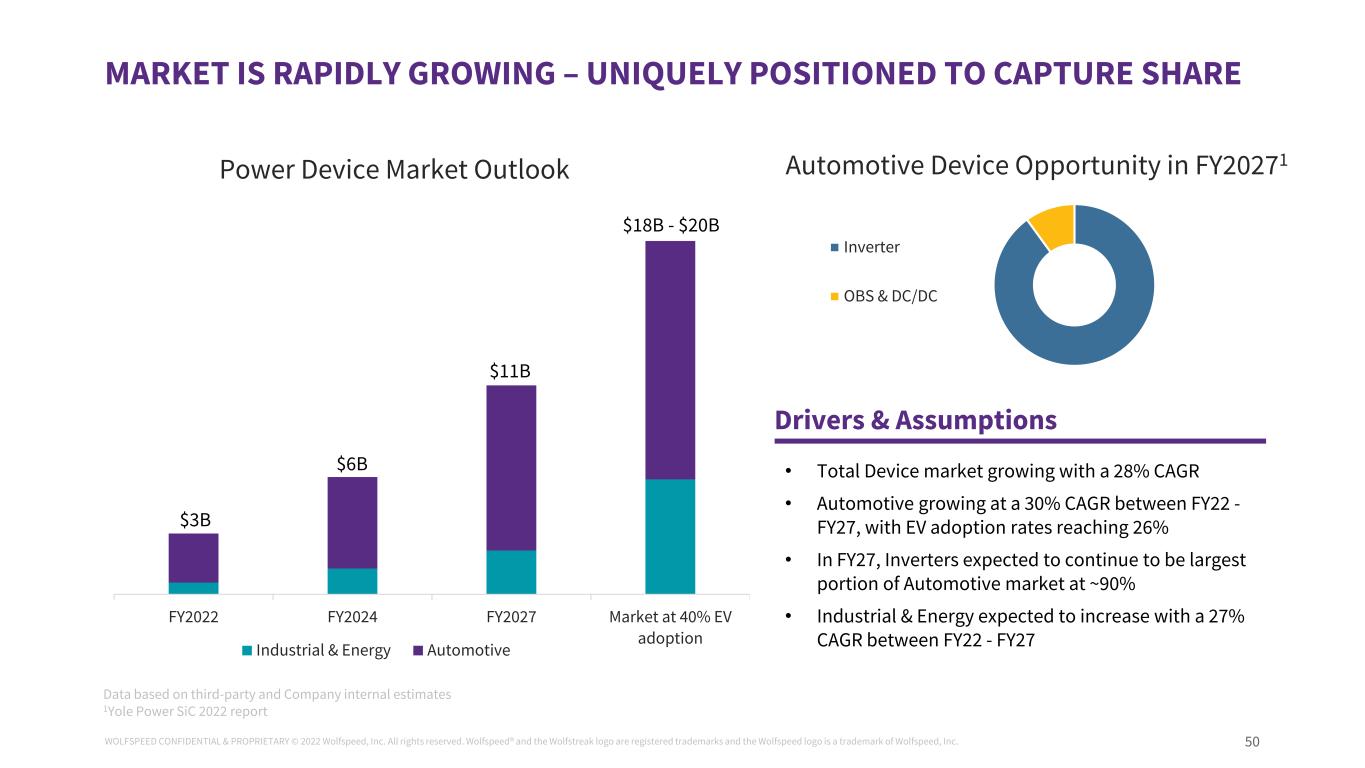

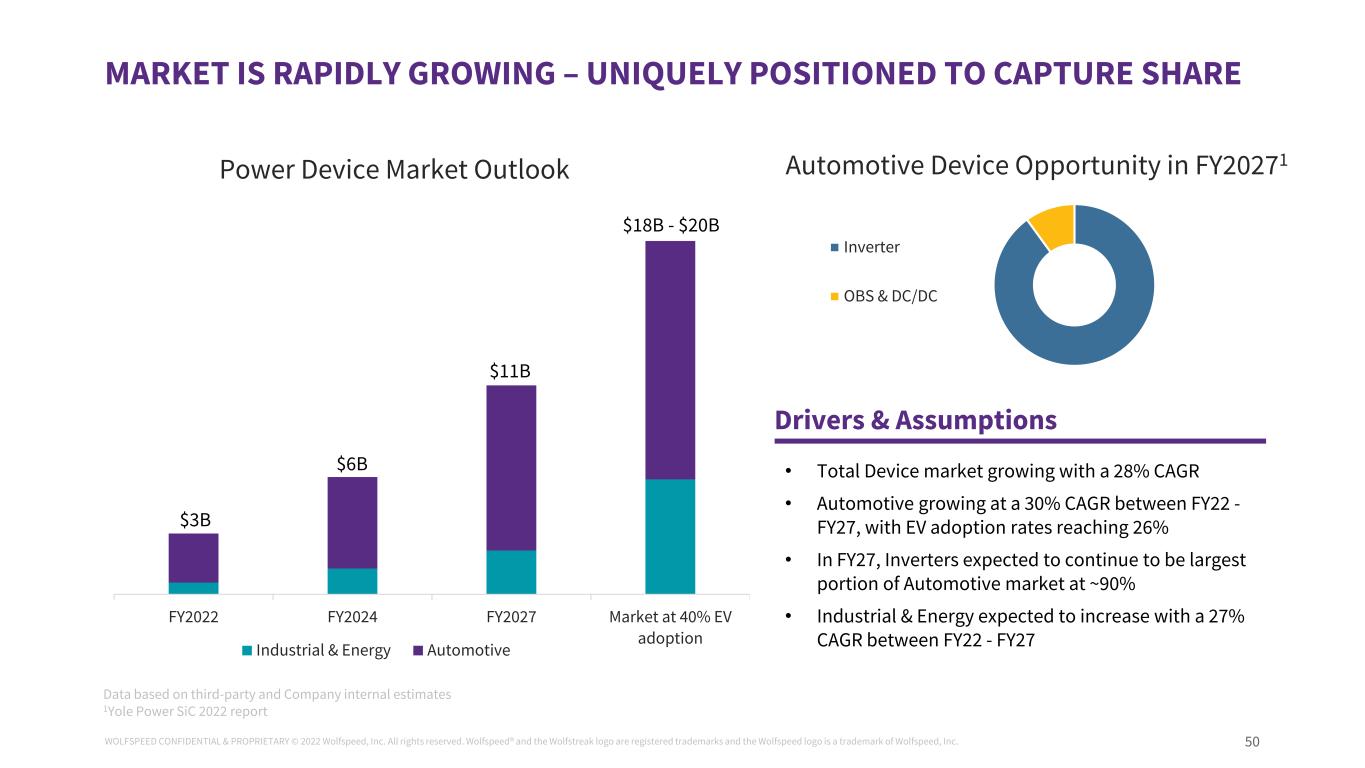

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 50 MARKET IS RAPIDLY GROWING – UNIQUELY POSITIONED TO CAPTURE SHARE Automotive Device Opportunity in FY20271 Inverter OBS & DC/DC FY2022 FY2024 FY2027 Market at 40% EV adoption Power Device Market Outlook Industrial & Energy Automotive $18B - $20B $6B $11B • Total Device market growing with a 28% CAGR • Automotive growing at a 30% CAGR between FY22 - FY27, with EV adoption rates reaching 26% • In FY27, Inverters expected to continue to be largest portion of Automotive market at ~90% • Industrial & Energy expected to increase with a 27% CAGR between FY22 - FY27 Drivers & Assumptions Data based on third-party and Company internal estimates 1Yole Power SiC 2022 report $3B

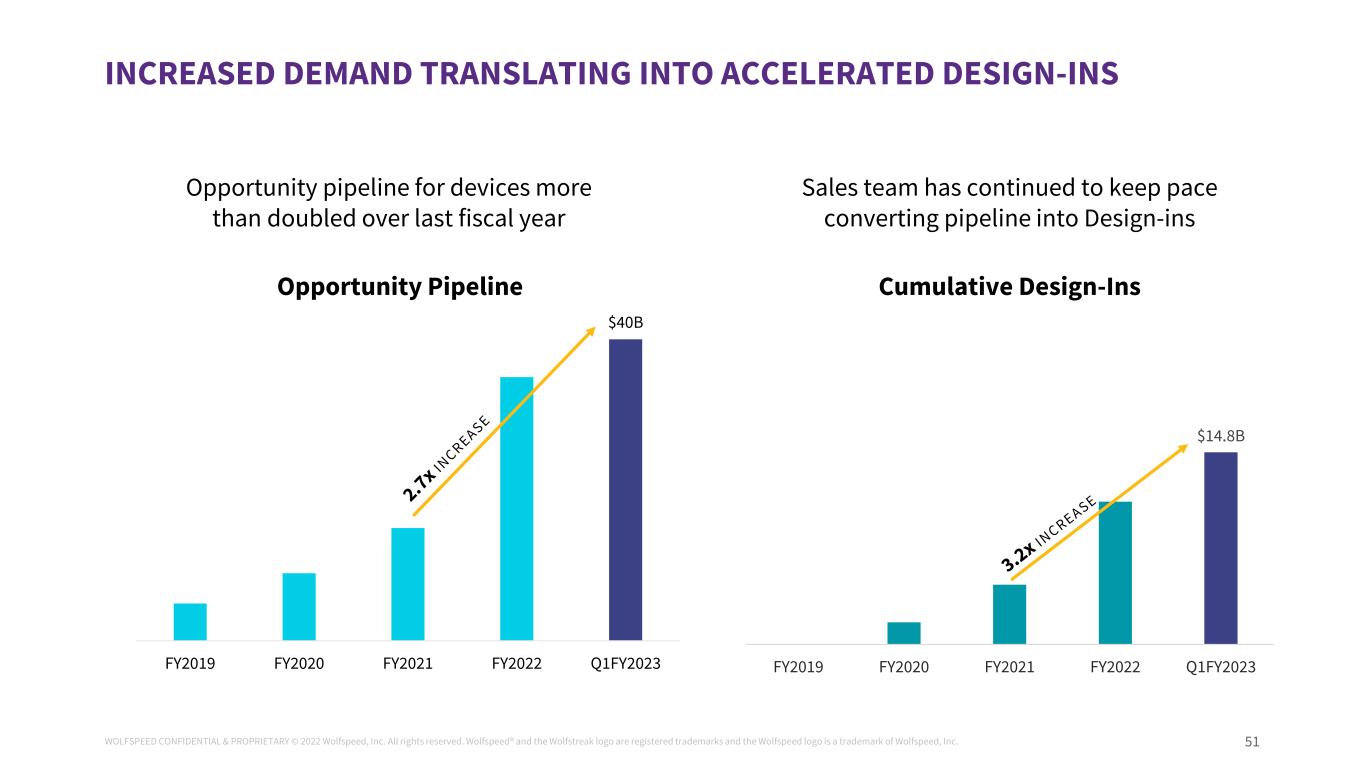

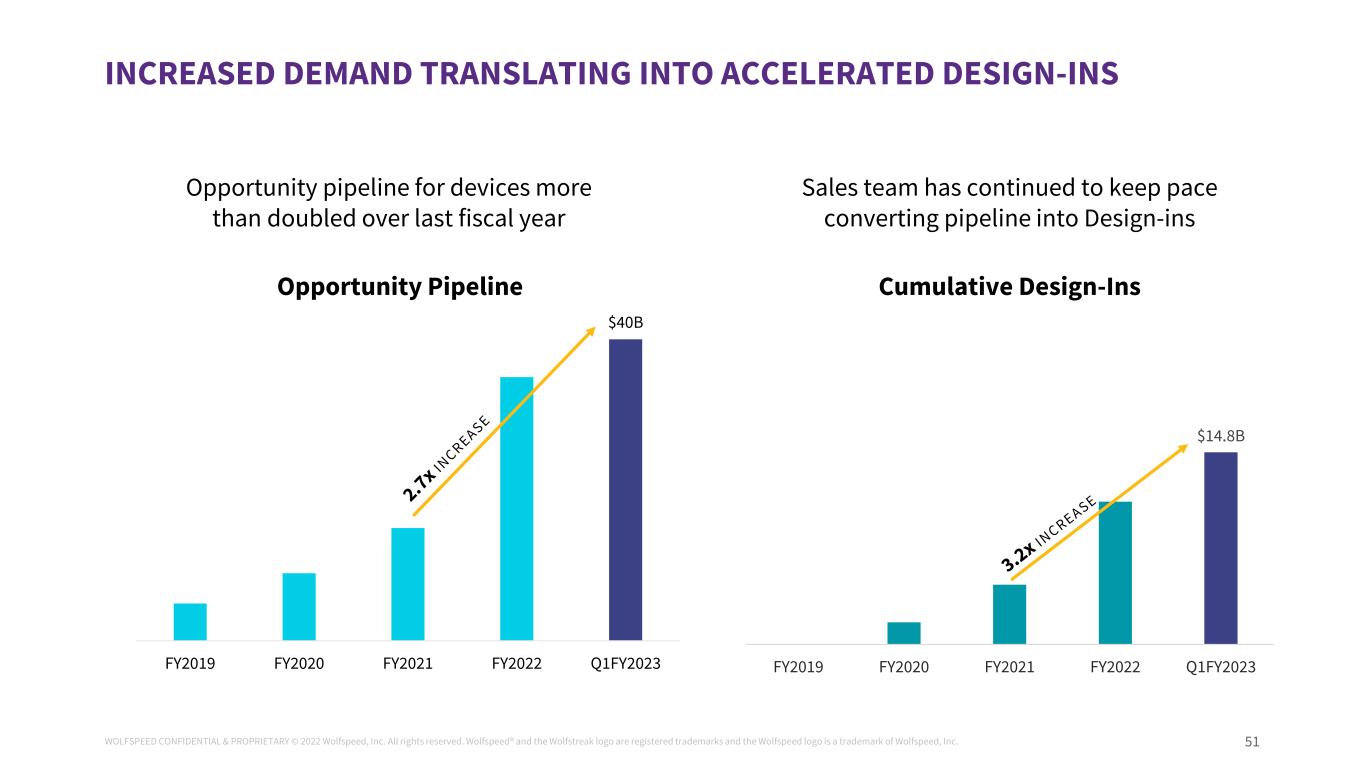

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 51 INCREASED DEMAND TRANSLATING INTO ACCELERATED DESIGN-INS $40B FY2019 FY2020 FY2021 FY2022 Q1FY2023 Opportunity Pipeline $14.8B FY2019 FY2020 FY2021 FY2022 Q1FY2023 Cumulative Design-Ins Sales team has continued to keep pace converting pipeline into Design-ins Opportunity pipeline for devices more than doubled over last fiscal year

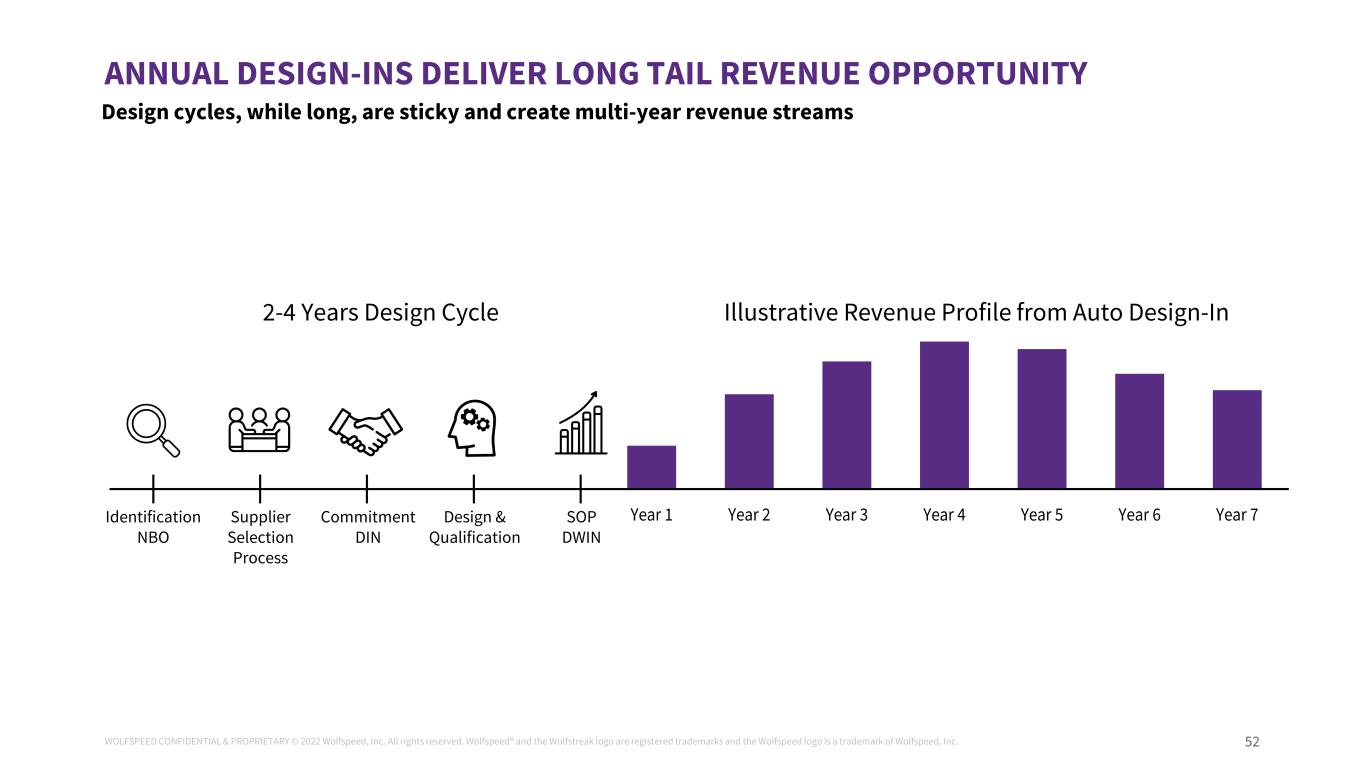

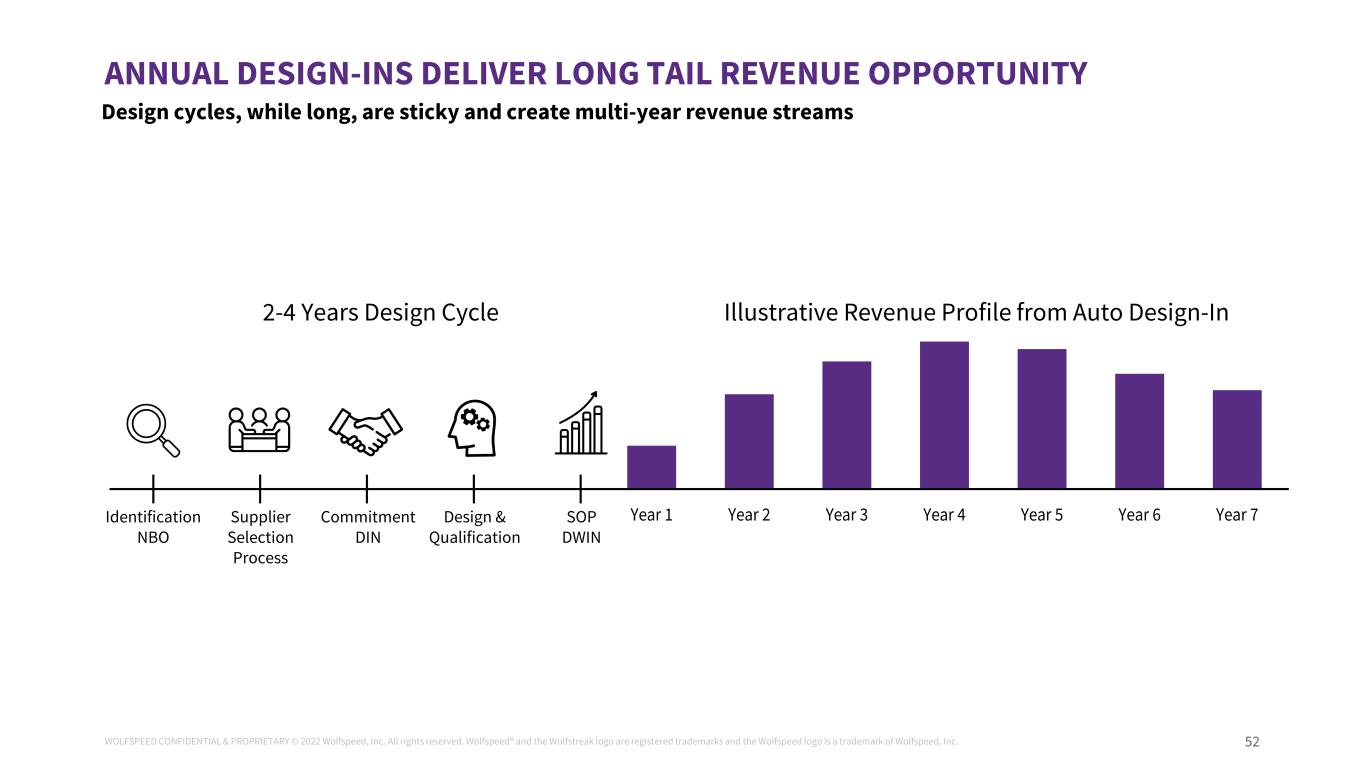

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 52 ANNUAL DESIGN-INS DELIVER LONG TAIL REVENUE OPPORTUNITY Design cycles, while long, are sticky and create multi-year revenue streams Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7Identification NBO Supplier Selection Process Commitment DIN Design & Qualification SOP DWIN 2-4 Years Design Cycle Illustrative Revenue Profile from Auto Design-In

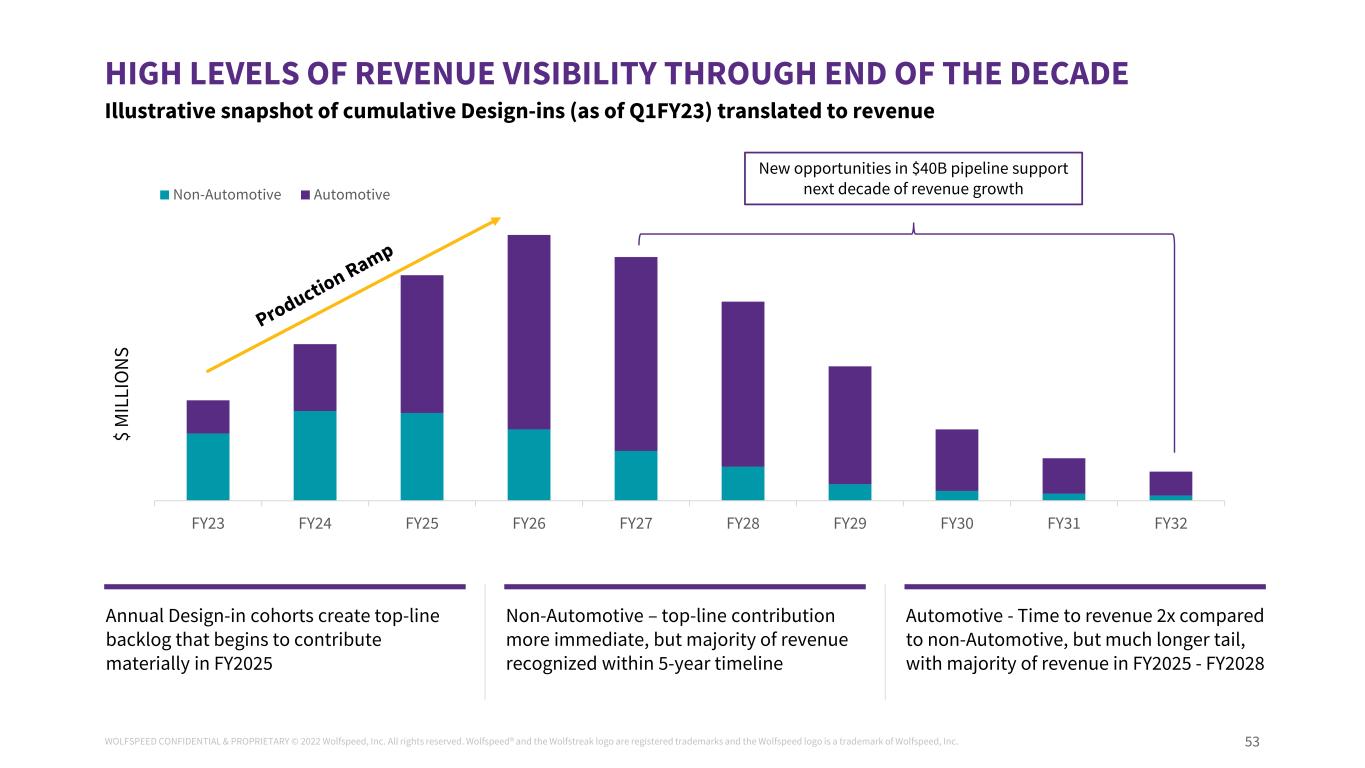

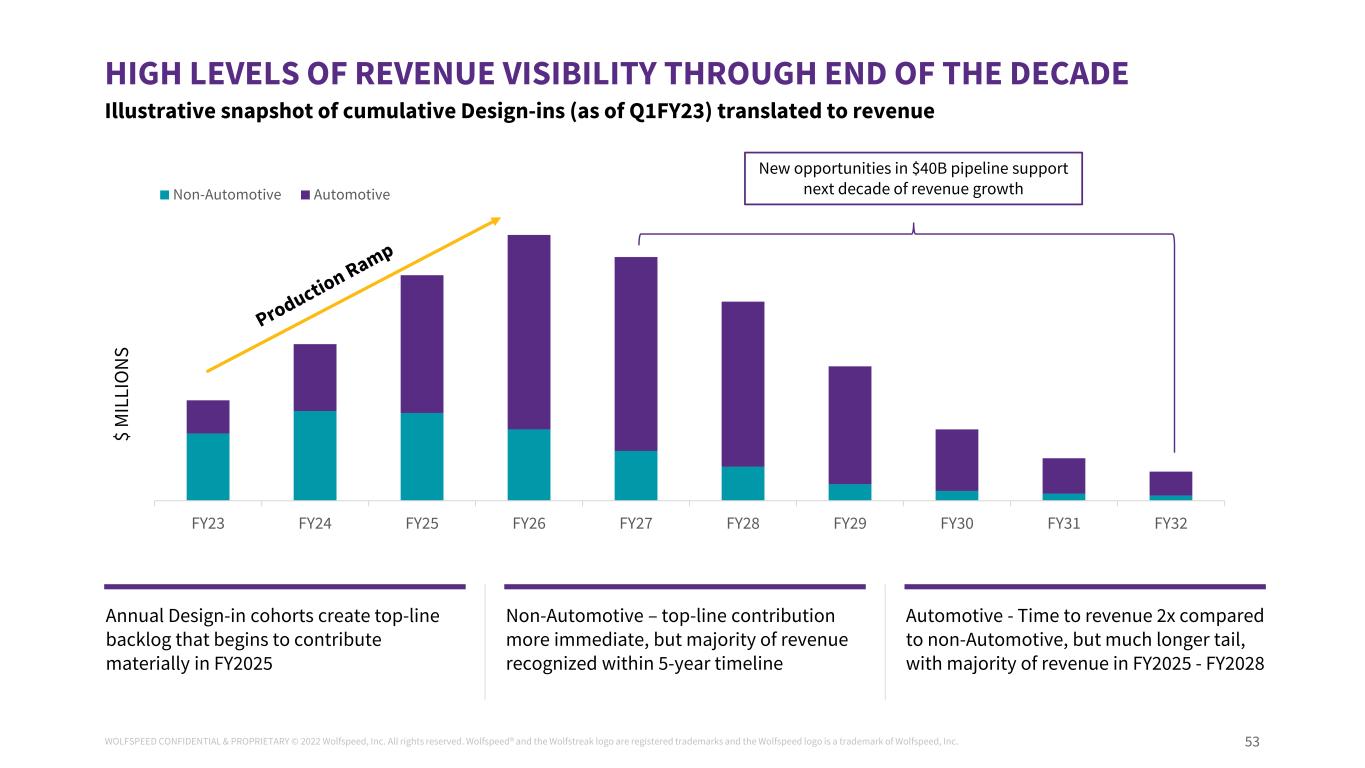

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 53 FY23 FY24 FY25 FY26 FY27 FY28 FY29 FY30 FY31 FY32 Non-Automotive Automotive HIGH LEVELS OF REVENUE VISIBILITY THROUGH END OF THE DECADE $ M IL LI O N S Automotive - Time to revenue 2x compared to non-Automotive, but much longer tail, with majority of revenue in FY2025 - FY2028 Annual Design-in cohorts create top-line backlog that begins to contribute materially in FY2025 Non-Automotive – top-line contribution more immediate, but majority of revenue recognized within 5-year timeline Illustrative snapshot of cumulative Design-ins (as of Q1FY23) translated to revenue New opportunities in $40B pipeline support next decade of revenue growth

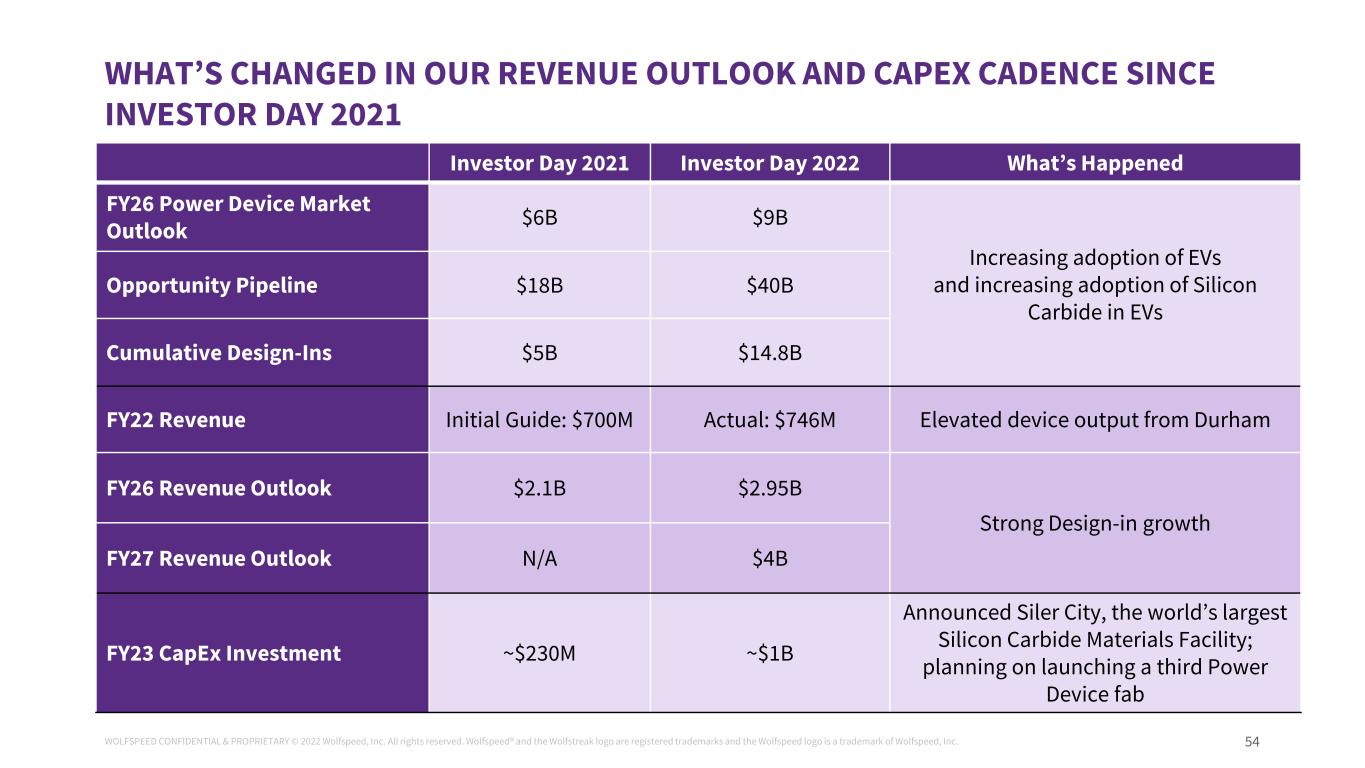

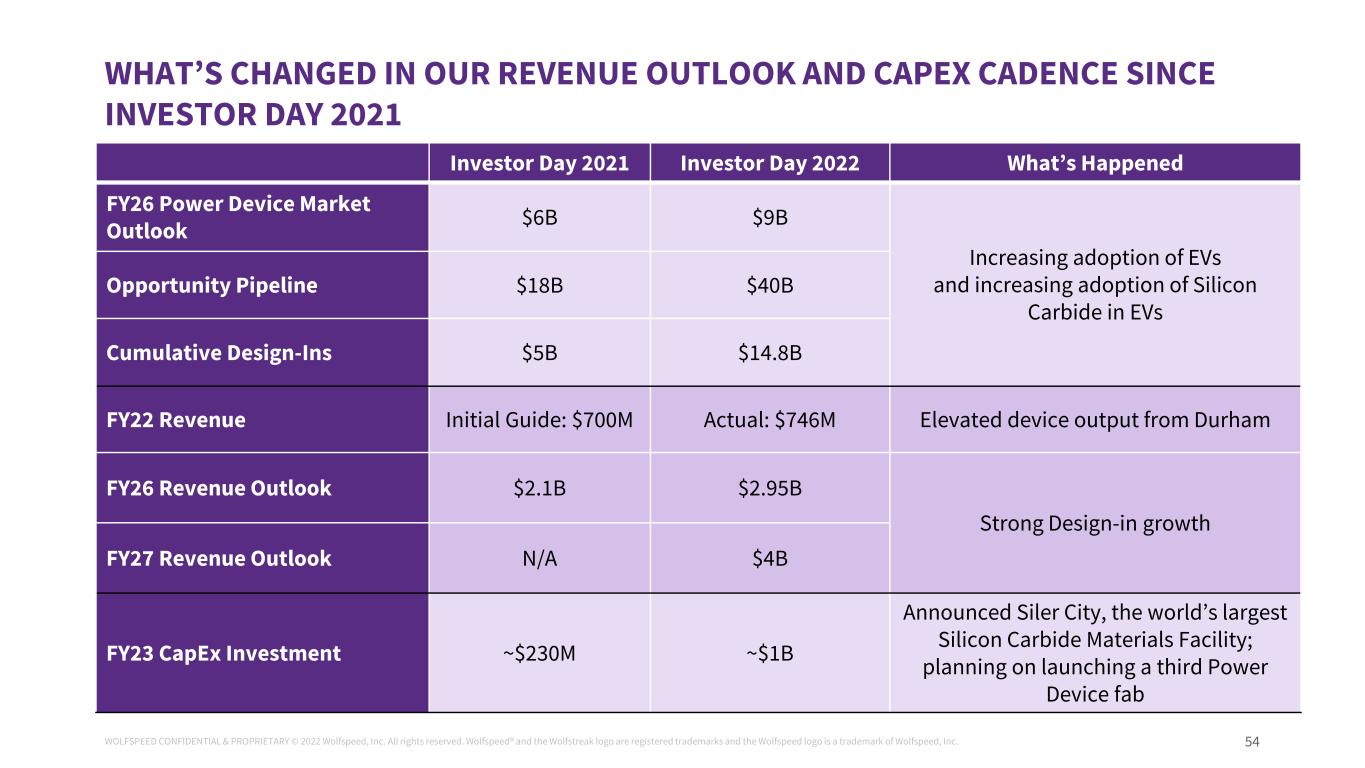

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 54 WHAT’S CHANGED IN OUR REVENUE OUTLOOK AND CAPEX CADENCE SINCE INVESTOR DAY 2021 Investor Day 2021 Investor Day 2022 What’s Happened FY26 Power Device Market Outlook $6B $9B Increasing adoption of EVs and increasing adoption of Silicon Carbide in EVs Opportunity Pipeline $18B $40B Cumulative Design-Ins $5B $14.8B FY22 Revenue Initial Guide: $700M Actual: $746M Elevated device output from Durham FY26 Revenue Outlook $2.1B $2.95B Strong Design-in growth FY27 Revenue Outlook N/A $4B FY23 CapEx Investment ~$230M ~$1B Announced Siler City, the world’s largest Silicon Carbide Materials Facility; planning on launching a third Power Device fab

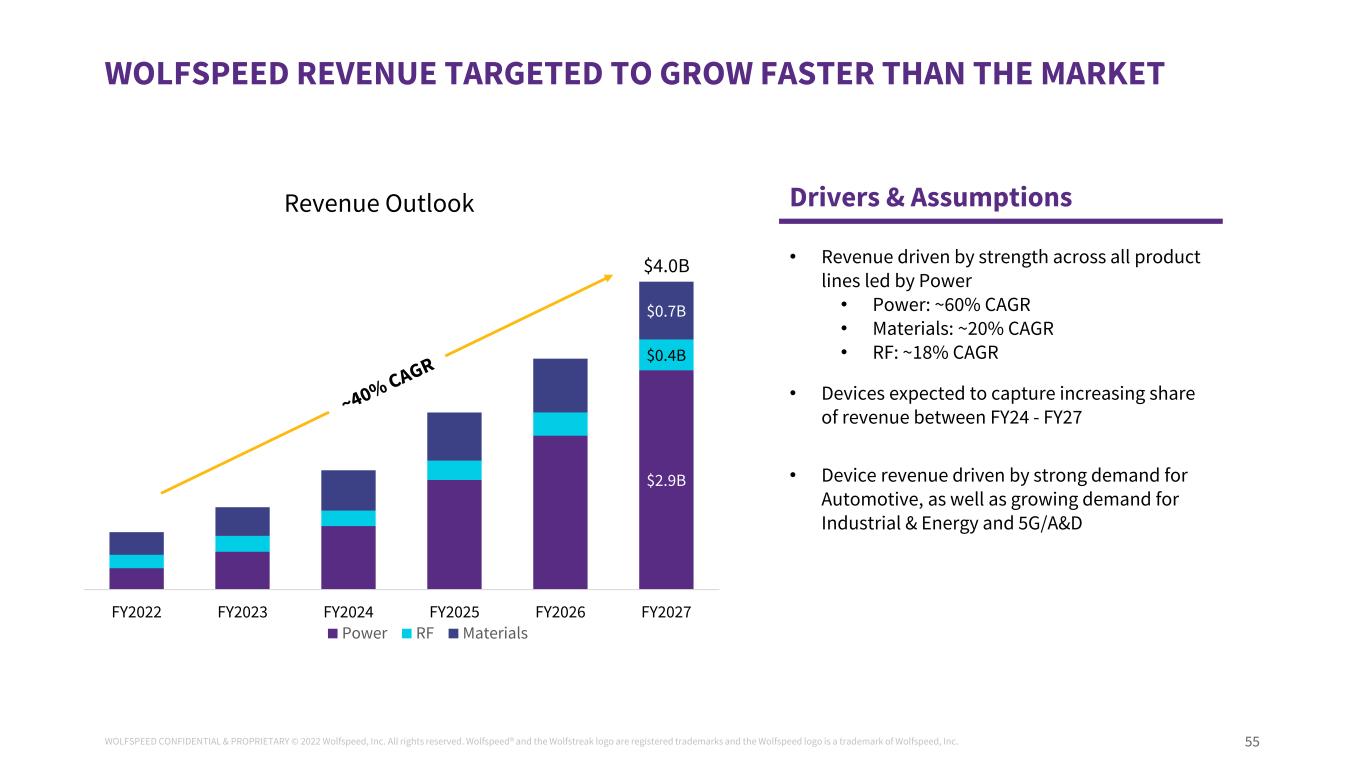

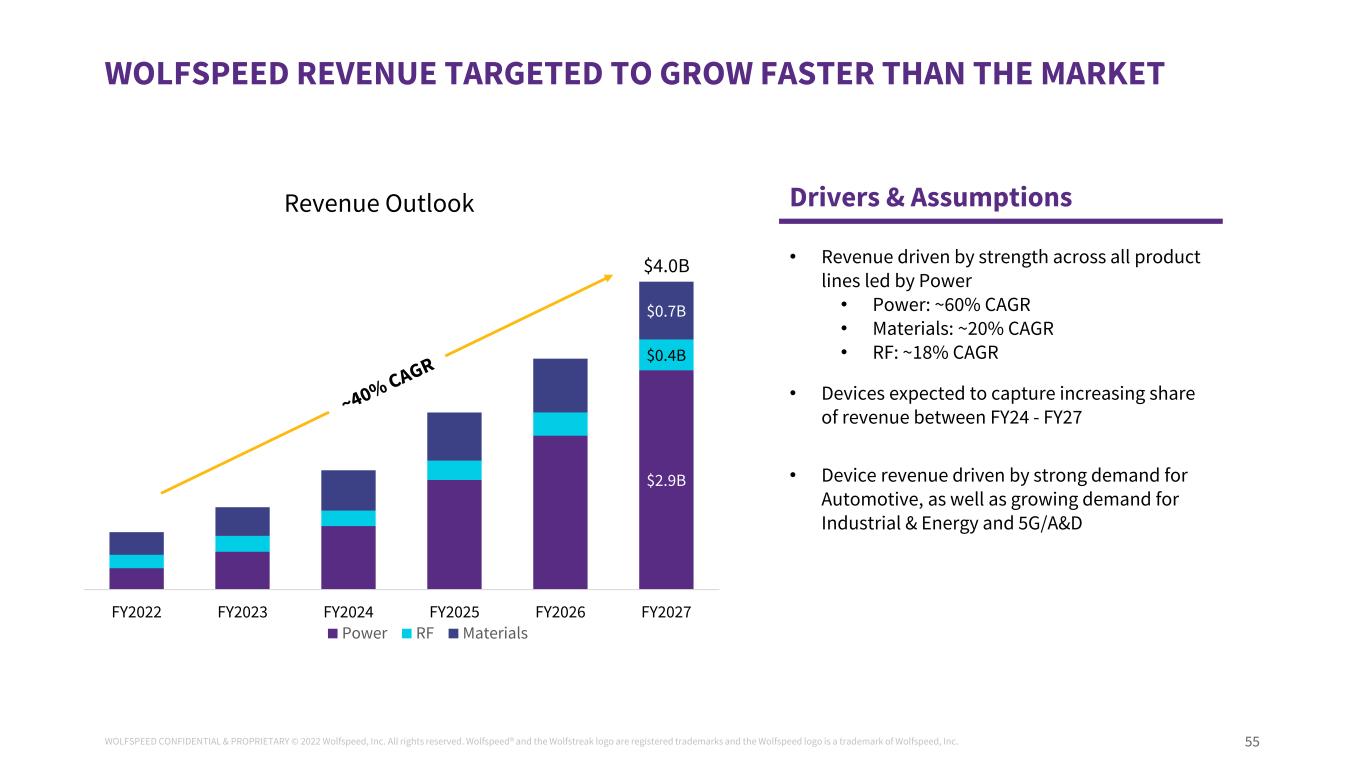

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 55 WOLFSPEED REVENUE TARGETED TO GROW FASTER THAN THE MARKET • Revenue driven by strength across all product lines led by Power • Power: ~60% CAGR • Materials: ~20% CAGR • RF: ~18% CAGR • Devices expected to capture increasing share of revenue between FY24 - FY27 • Device revenue driven by strong demand for Automotive, as well as growing demand for Industrial & Energy and 5G/A&D $2.9B $0.4B $0.7B FY2022 FY2023 FY2024 FY2025 FY2026 FY2027 Revenue Outlook Power RF Materials $4.0B Drivers & Assumptions

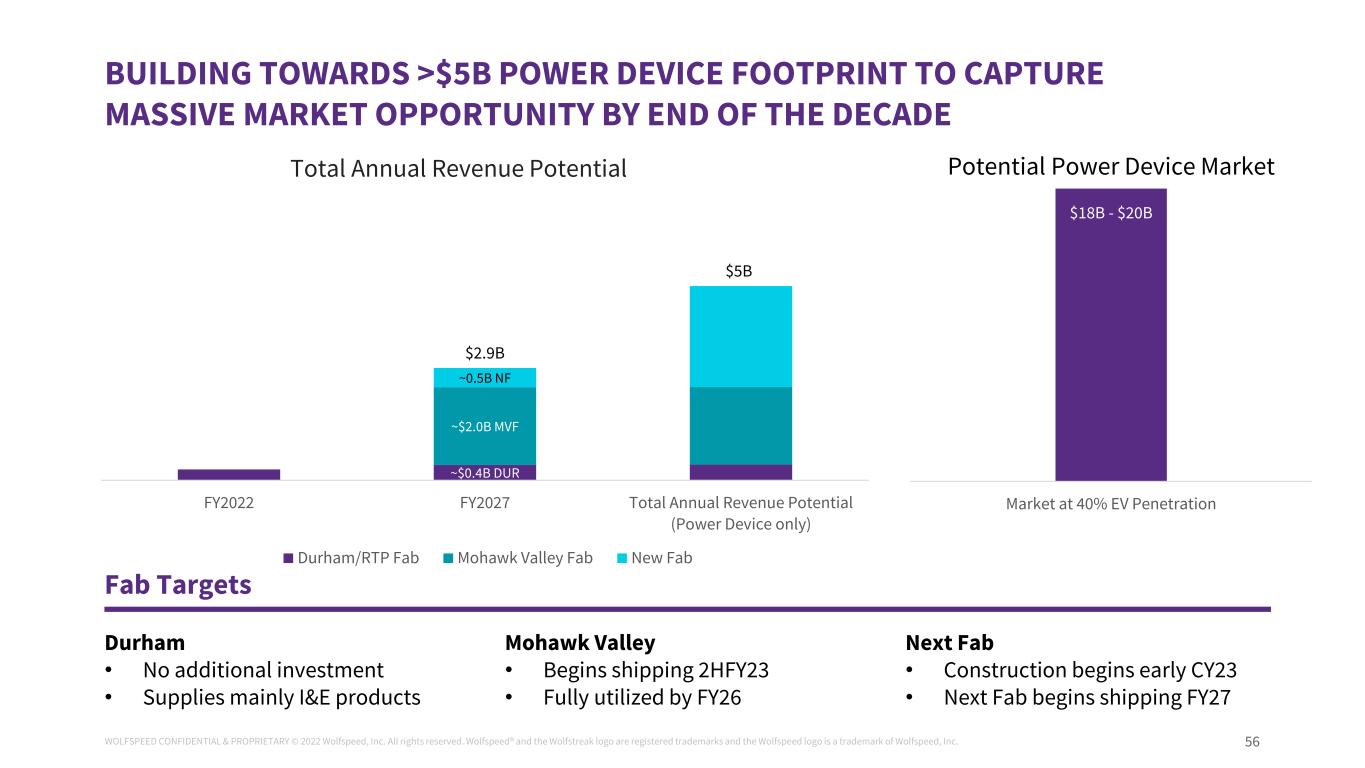

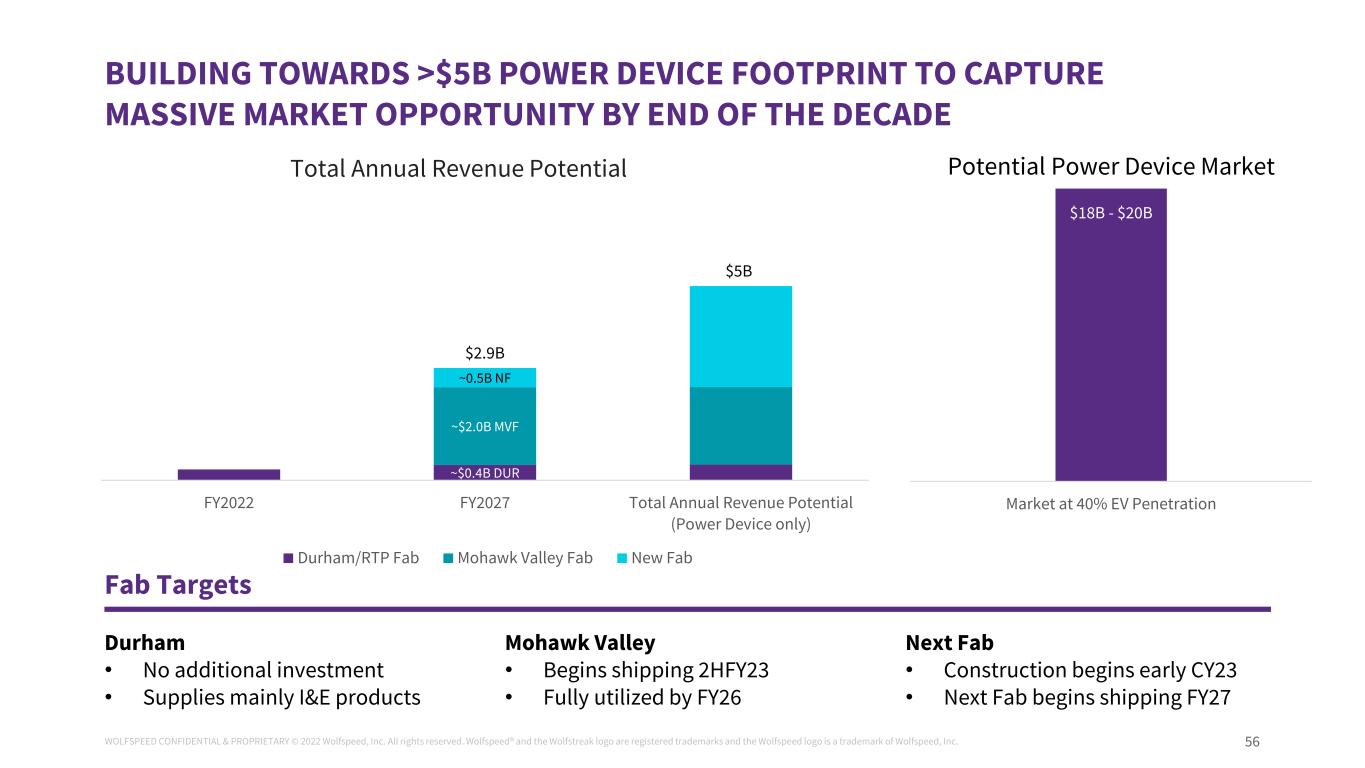

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 56 Market at 40% EV Penetration ~$0.4B DUR ~$2.0B MVF ~0.5B NF FY2022 FY2027 Total Annual Revenue Potential (Power Device only) Durham/RTP Fab Mohawk Valley Fab New Fab $2.9B BUILDING TOWARDS >$5B POWER DEVICE FOOTPRINT TO CAPTURE MASSIVE MARKET OPPORTUNITY BY END OF THE DECADE $5B Durham • No additional investment • Supplies mainly I&E products Mohawk Valley • Begins shipping 2HFY23 • Fully utilized by FY26 Next Fab • Construction begins early CY23 • Next Fab begins shipping FY27 Fab Targets Total Annual Revenue Potential $18B - $20B Potential Power Device Market

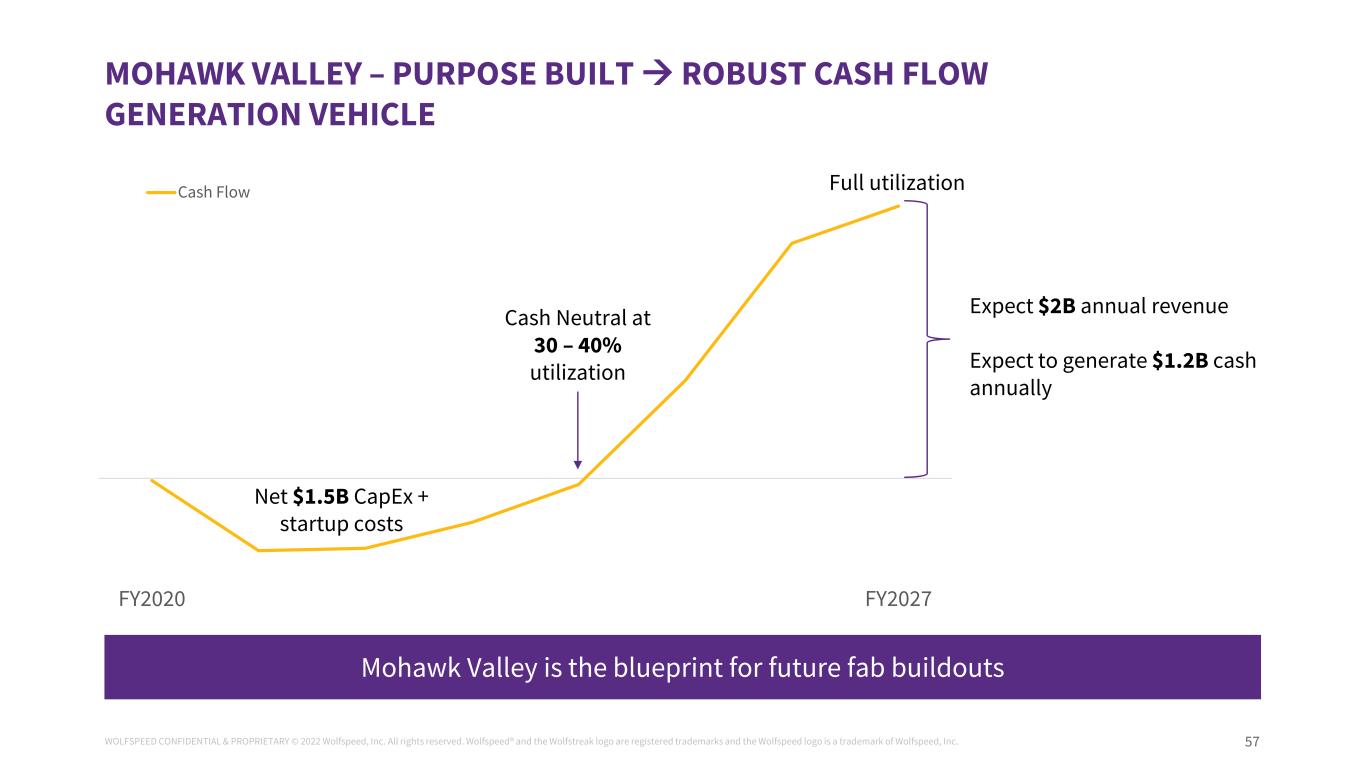

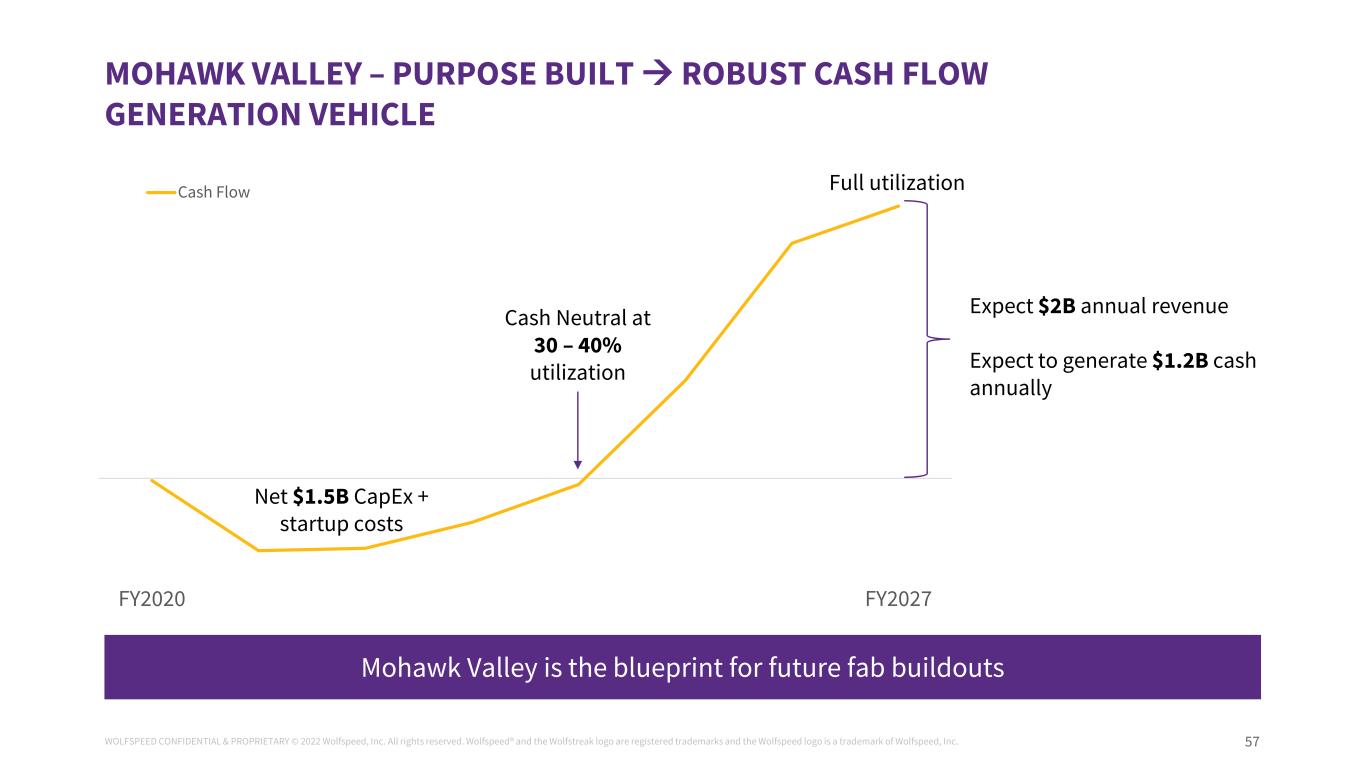

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 57 MOHAWK VALLEY – PURPOSE BUILT ROBUST CASH FLOW GENERATION VEHICLE FY2020 FY2027 Cash Flow Cash Neutral at 30 – 40% utilization Expect $2B annual revenue Expect to generate $1.2B cash annually Net $1.5B CapEx + startup costs Mohawk Valley is the blueprint for future fab buildouts Full utilization

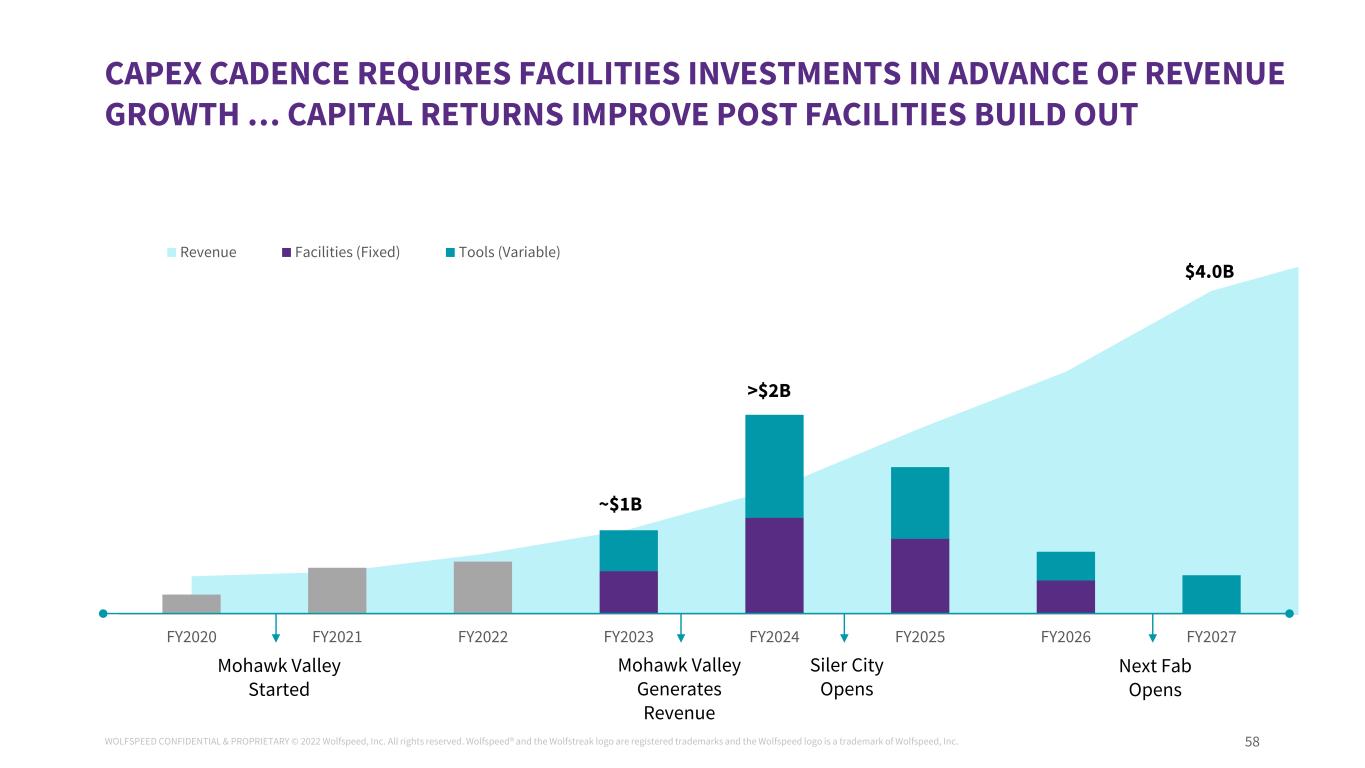

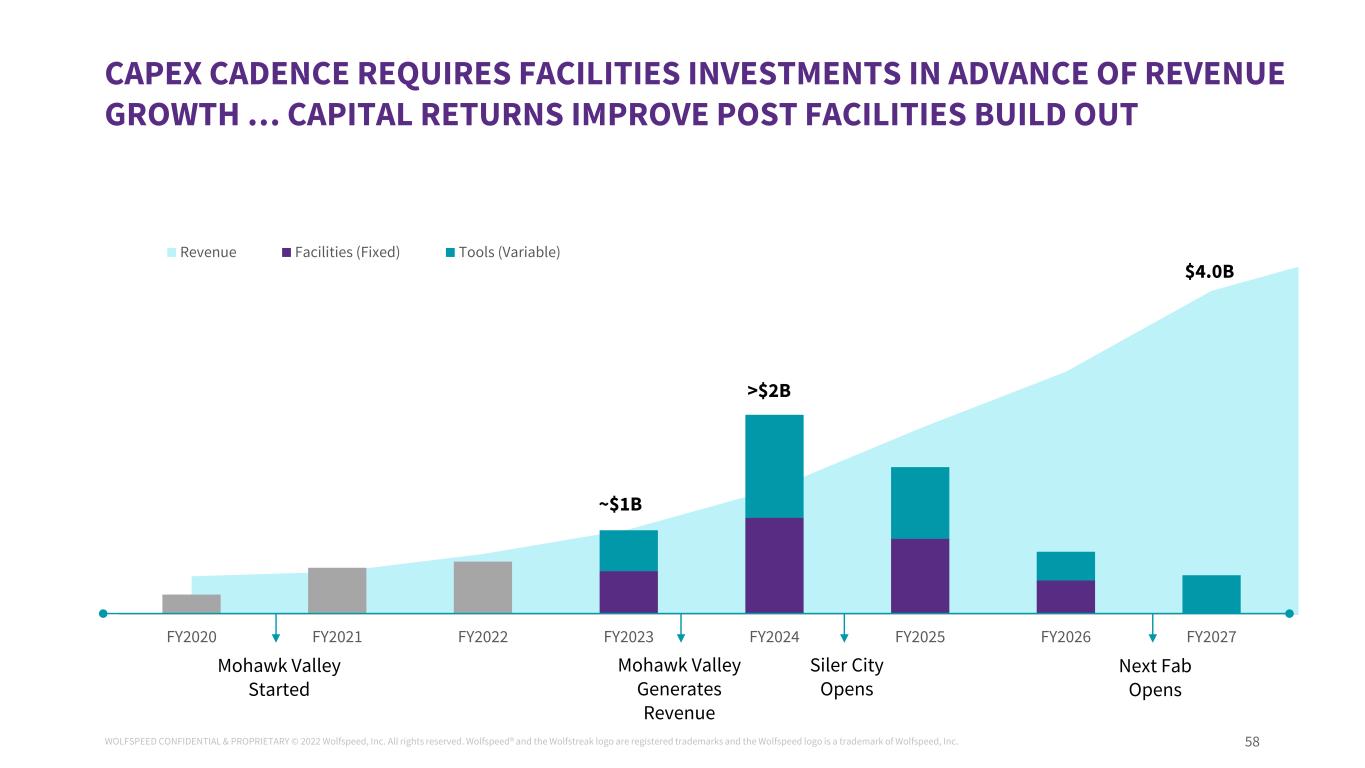

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 58 CAPEX CADENCE REQUIRES FACILITIES INVESTMENTS IN ADVANCE OF REVENUE GROWTH … CAPITAL RETURNS IMPROVE POST FACILITIES BUILD OUT FY2020 FY2021 FY2022 FY2023 FY2024 FY2025 FY2026 FY2027 Revenue Facilities (Fixed) Tools (Variable) $4.0B ~$1B >$2B Mohawk Valley Generates Revenue Siler City Opens Next Fab Opens Mohawk Valley Started

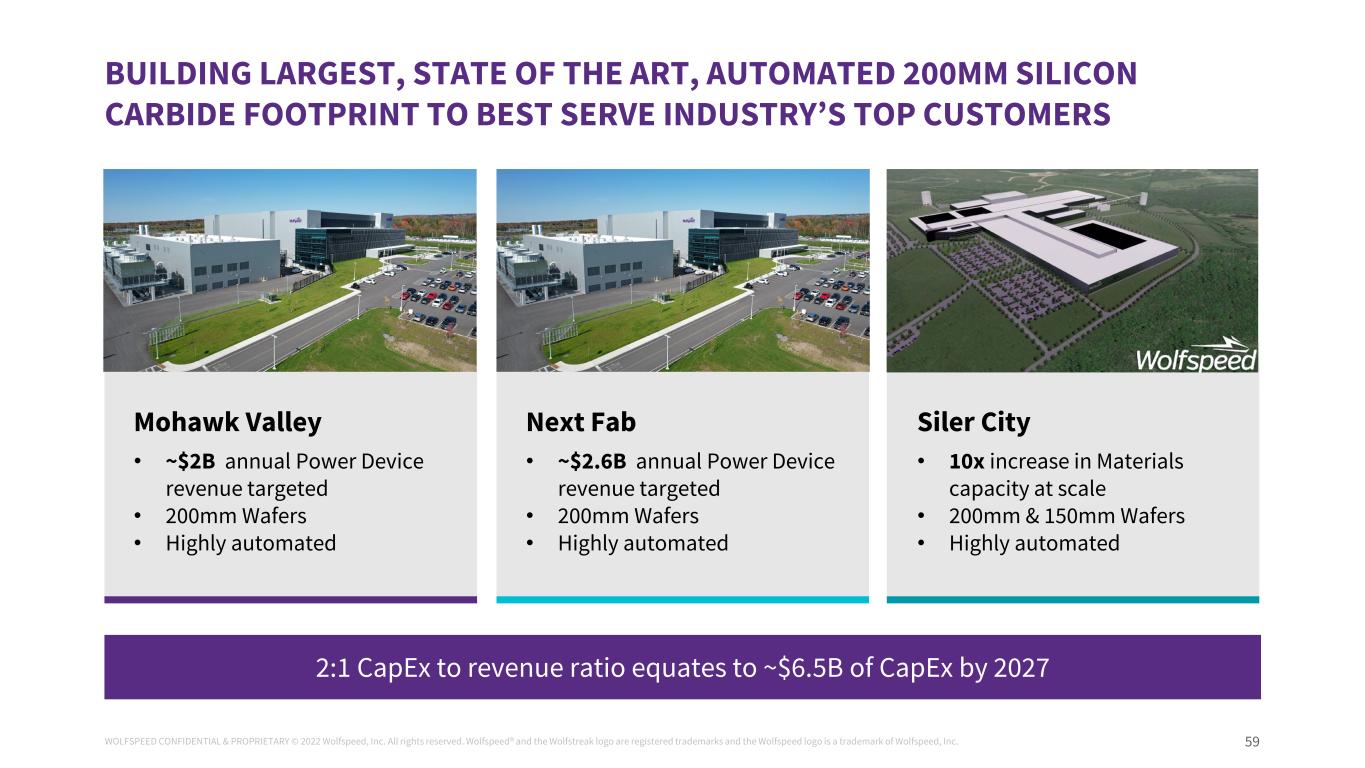

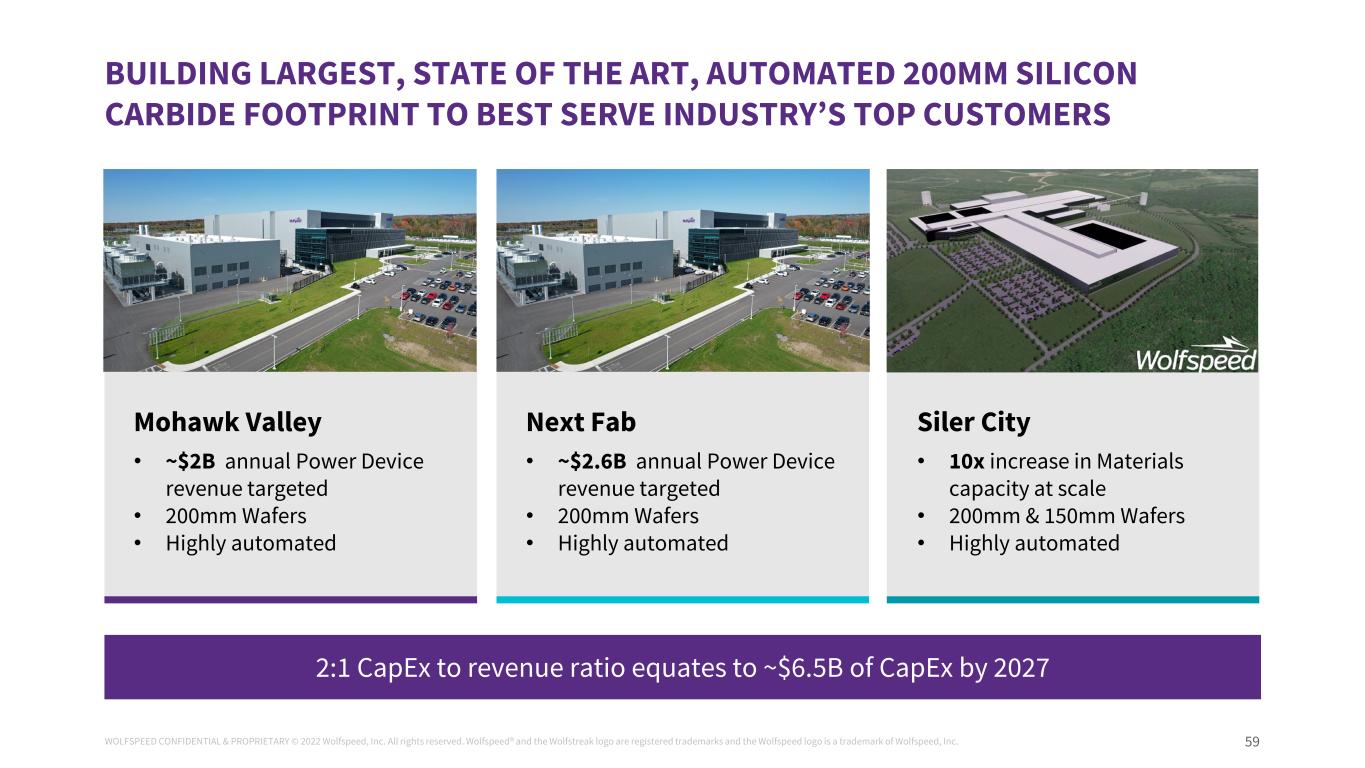

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 59 2:1 CapEx to revenue ratio equates to ~$6.5B of CapEx by 2027 BUILDING LARGEST, STATE OF THE ART, AUTOMATED 200MM SILICON CARBIDE FOOTPRINT TO BEST SERVE INDUSTRY’S TOP CUSTOMERS Mohawk Valley • ~$2B annual Power Device revenue targeted • 200mm Wafers • Highly automated Next Fab • ~$2.6B annual Power Device revenue targeted • 200mm Wafers • Highly automated Siler City • 10x increase in Materials capacity at scale • 200mm & 150mm Wafers • Highly automated

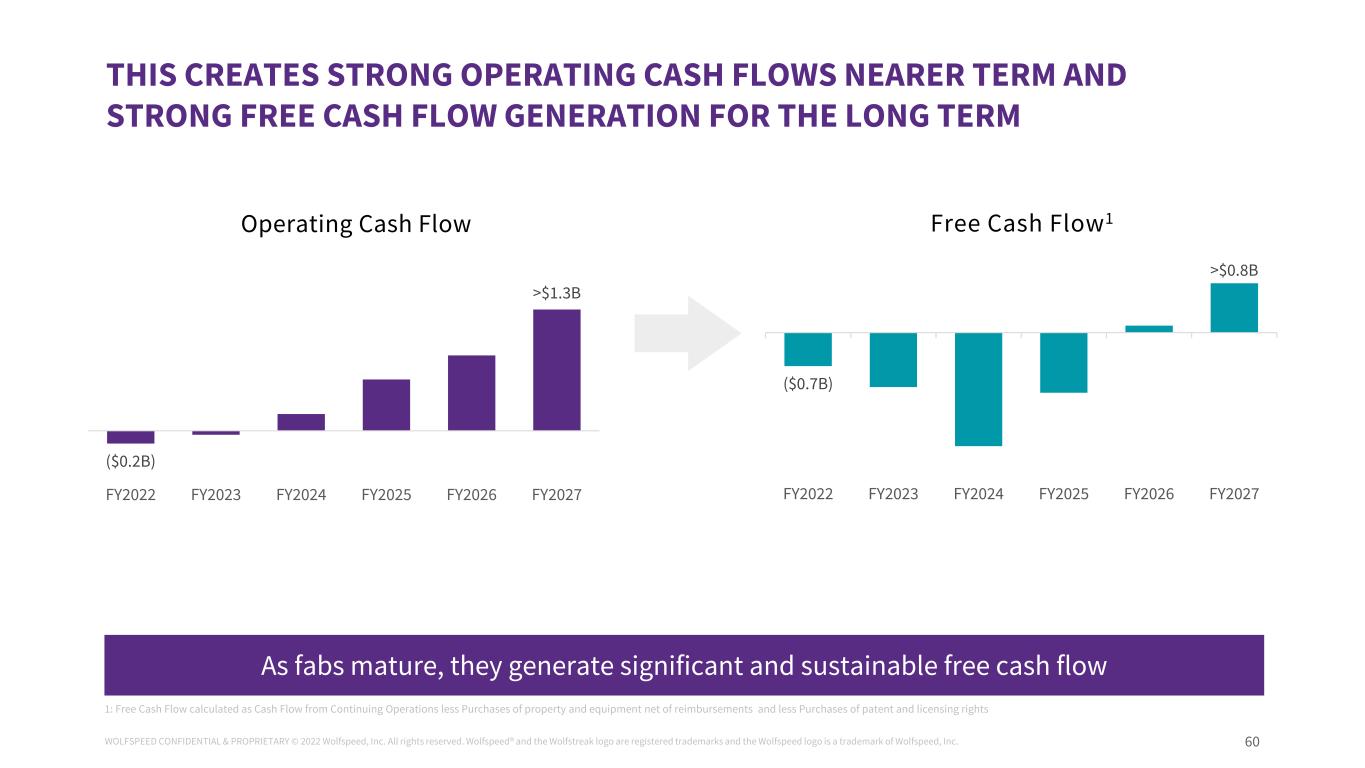

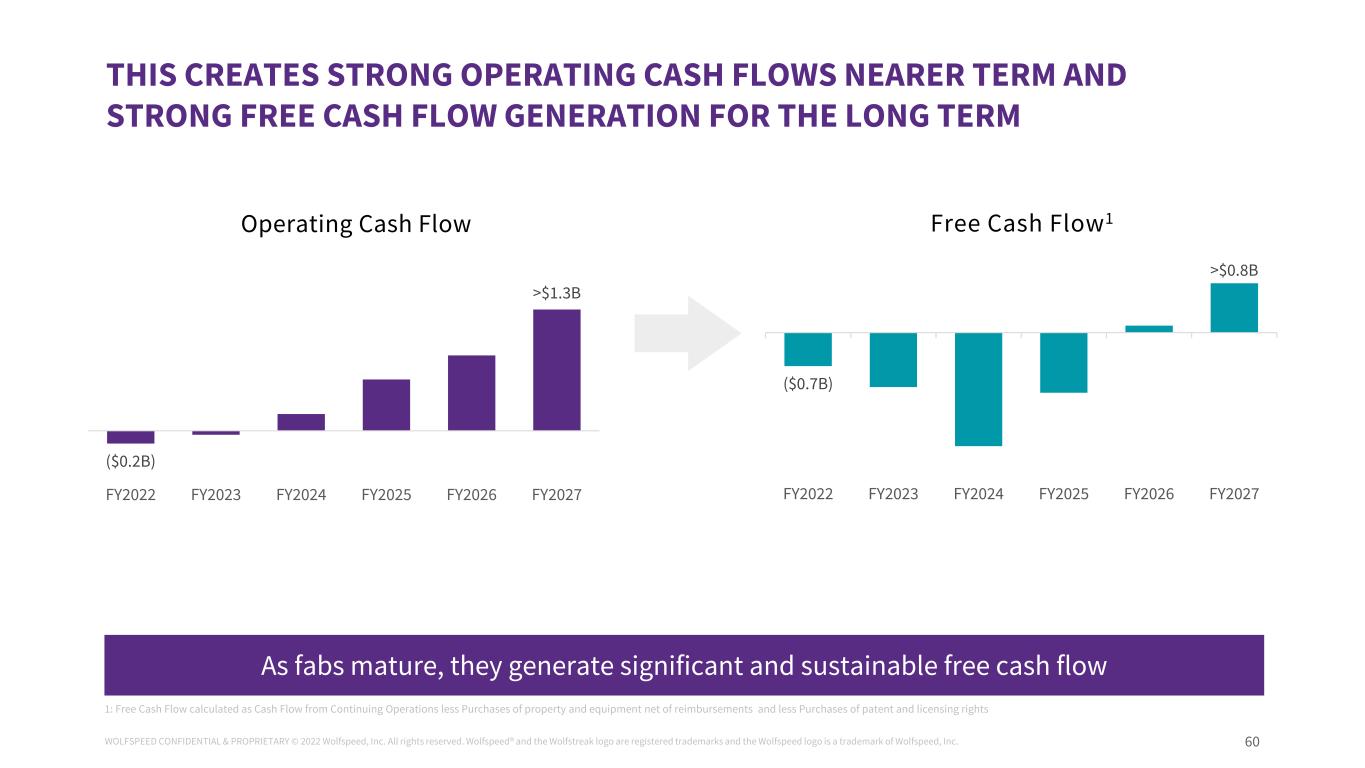

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 60 THIS CREATES STRONG OPERATING CASH FLOWS NEARER TERM AND STRONG FREE CASH FLOW GENERATION FOR THE LONG TERM Free Cash Flow1Operating Cash Flow ($0.7B) >$0.8B FY2022 FY2023 FY2024 FY2025 FY2026 FY2027 1: Free Cash Flow calculated as Cash Flow from Continuing Operations less Purchases of property and equipment net of reimbursements and less Purchases of patent and licensing rights ($0.2B) >$1.3B FY2022 FY2023 FY2024 FY2025 FY2026 FY2027 As fabs mature, they generate significant and sustainable free cash flow

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 61 FUNDING PLAN - THOUGHTFULLY MANAGING DILUTION IS TOP OF MIND Private / Project Financing Private market & asset backed financing to reduce dilution Government Incentives Range of options from various government subsides and bills $ Public Markets Public equity and debt markets Customer Funding Expressed interest in funding to accelerate capacity expansion Many funding options at our disposal, most of which have little or no dilution impact

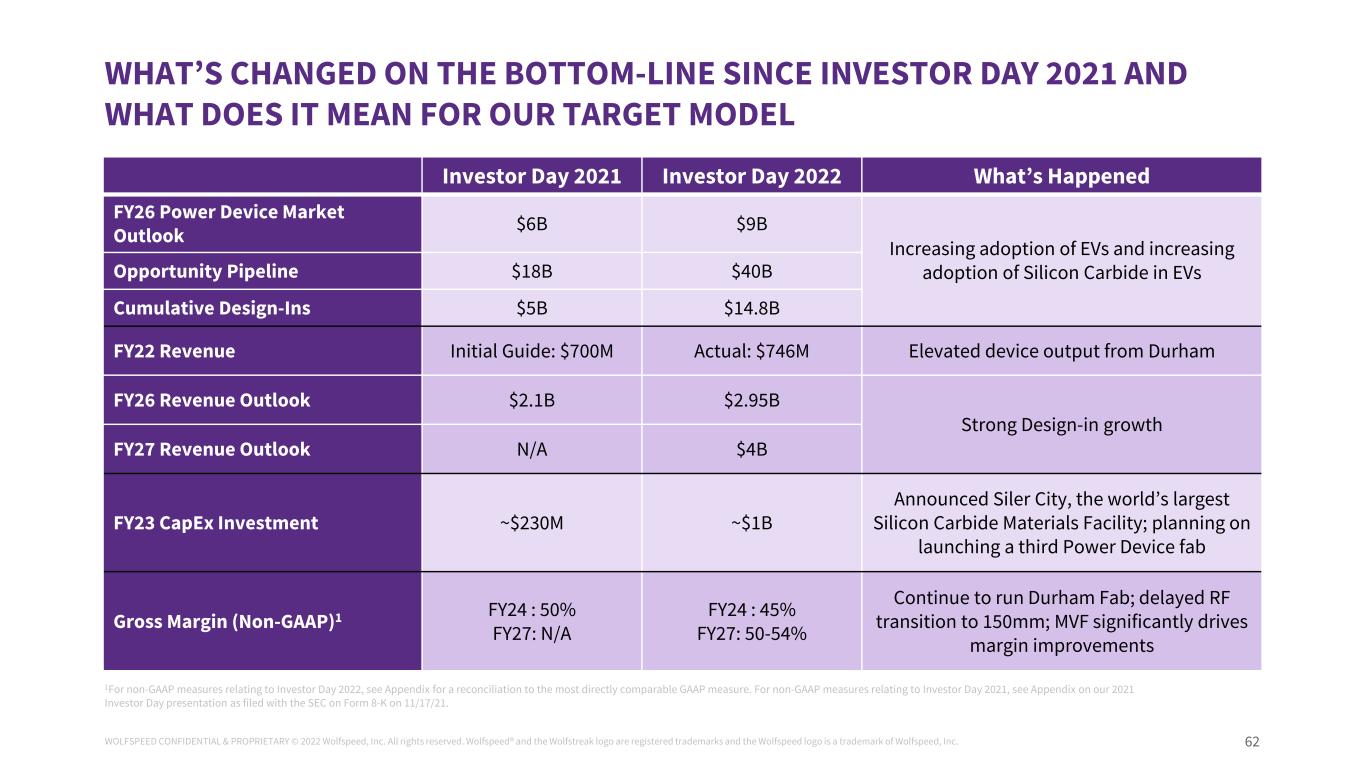

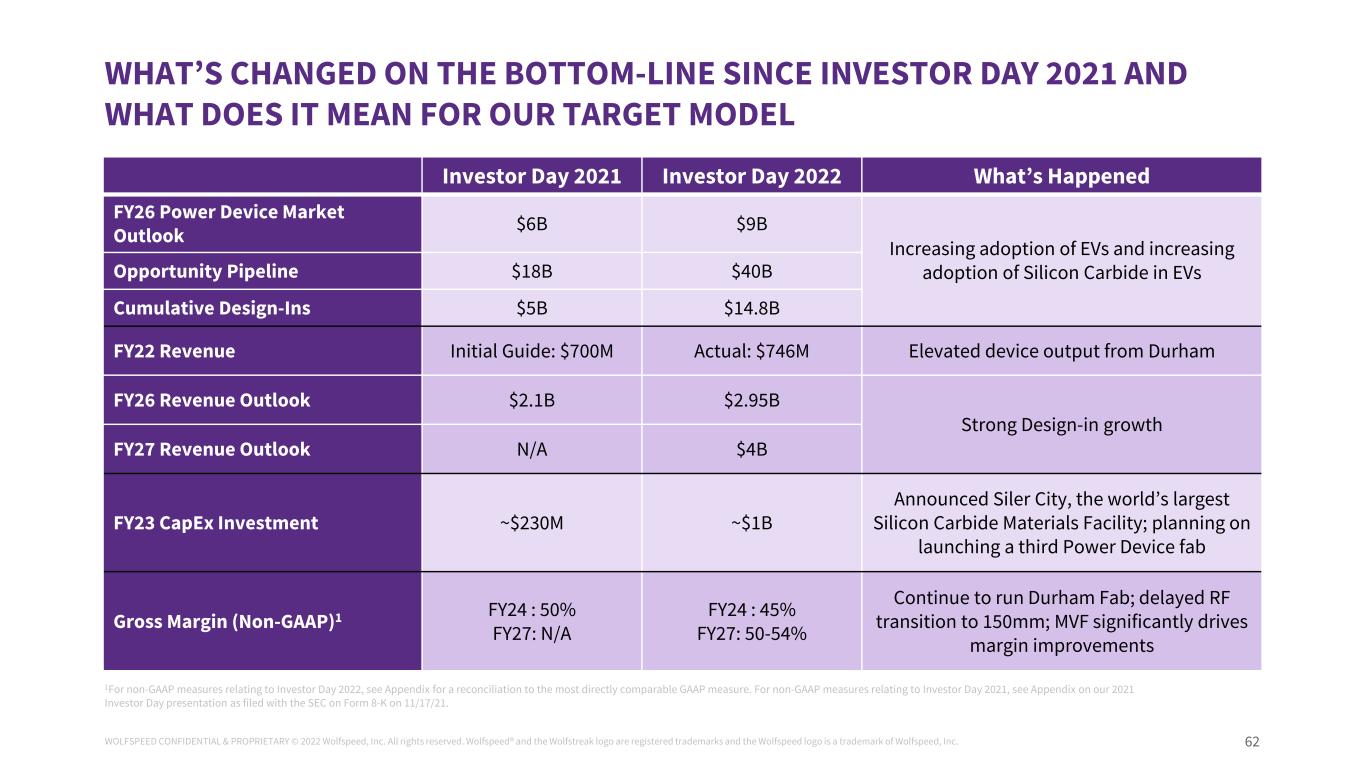

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 62 WHAT’S CHANGED ON THE BOTTOM-LINE SINCE INVESTOR DAY 2021 AND WHAT DOES IT MEAN FOR OUR TARGET MODEL Investor Day 2021 Investor Day 2022 What’s Happened FY26 Power Device Market Outlook $6B $9B Increasing adoption of EVs and increasing adoption of Silicon Carbide in EVsOpportunity Pipeline $18B $40B Cumulative Design-Ins $5B $14.8B FY22 Revenue Initial Guide: $700M Actual: $746M Elevated device output from Durham FY26 Revenue Outlook $2.1B $2.95B Strong Design-in growth FY27 Revenue Outlook N/A $4B FY23 CapEx Investment ~$230M ~$1B Announced Siler City, the world’s largest Silicon Carbide Materials Facility; planning on launching a third Power Device fab Gross Margin (Non-GAAP)1 FY24 : 50% FY27: N/A FY24 : 45% FY27: 50-54% Continue to run Durham Fab; delayed RF transition to 150mm; MVF significantly drives margin improvements 1For non-GAAP measures relating to Investor Day 2022, see Appendix for a reconciliation to the most directly comparable GAAP measure. For non-GAAP measures relating to Investor Day 2021, see Appendix on our 2021 Investor Day presentation as filed with the SEC on Form 8-K on 11/17/21.

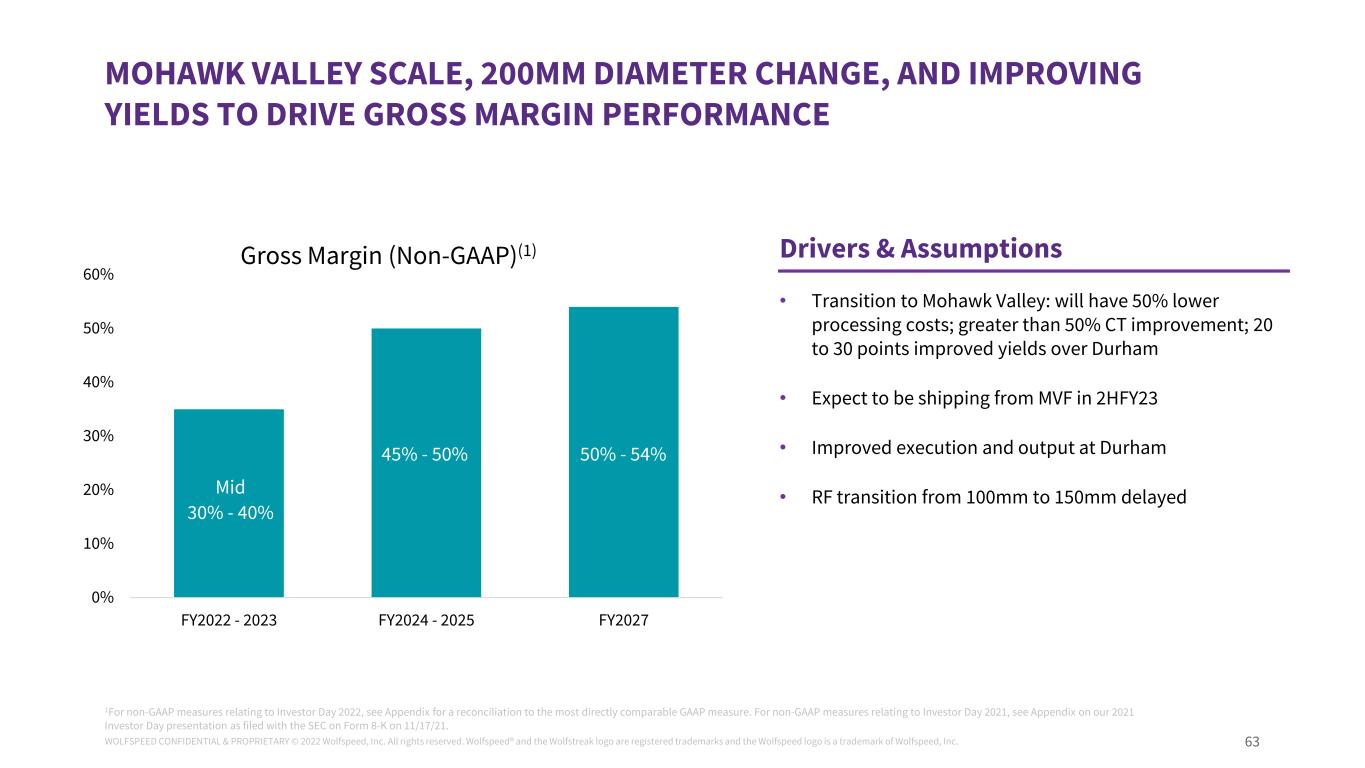

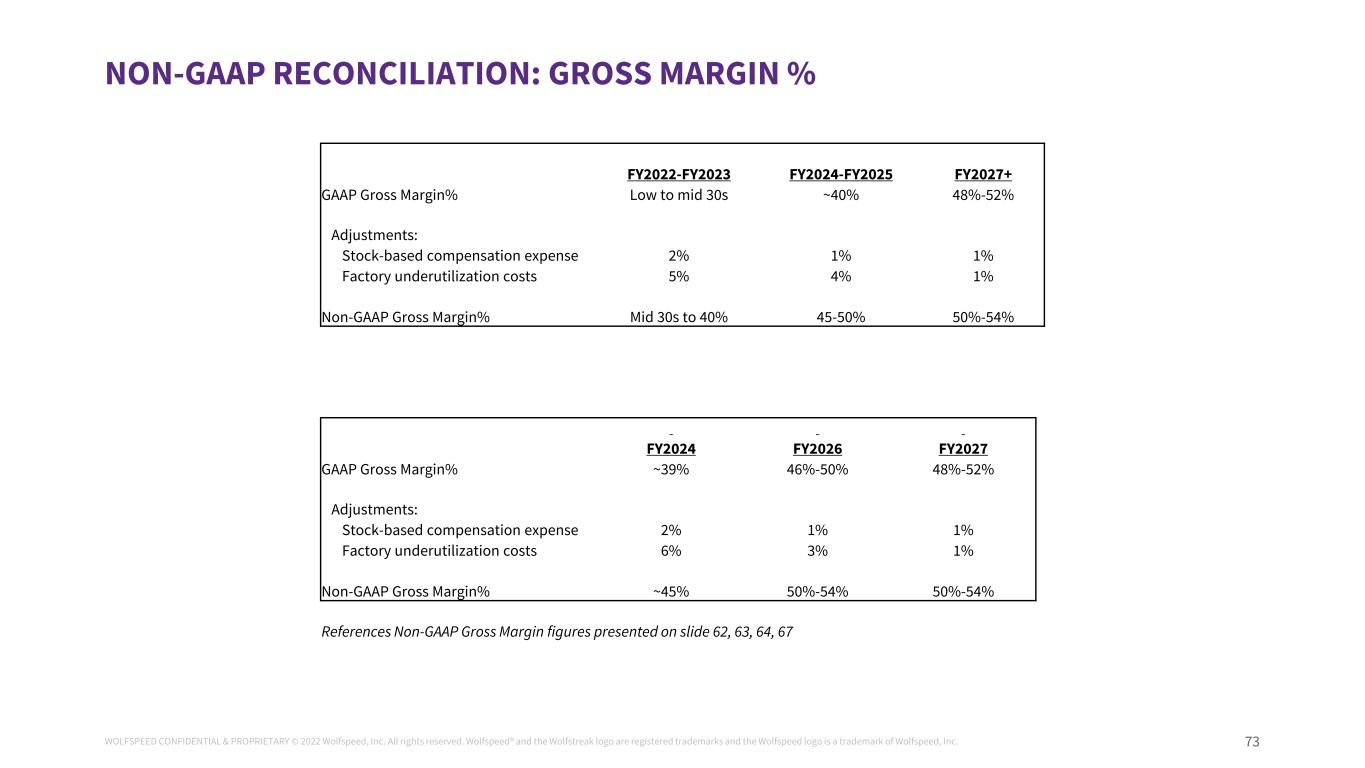

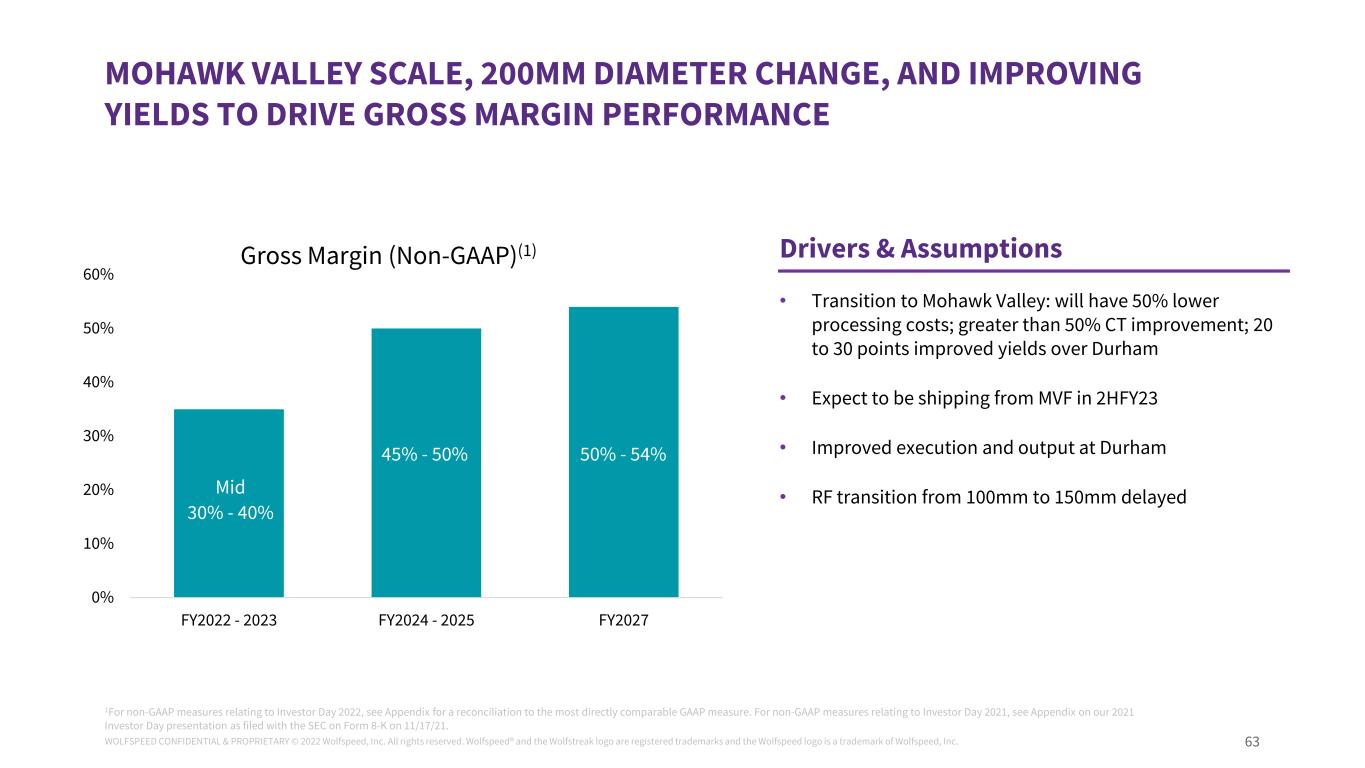

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 63 Gross Margin (Non-GAAP)(1) • Transition to Mohawk Valley: will have 50% lower processing costs; greater than 50% CT improvement; 20 to 30 points improved yields over Durham • Expect to be shipping from MVF in 2HFY23 • Improved execution and output at Durham • RF transition from 100mm to 150mm delayed Drivers & Assumptions MOHAWK VALLEY SCALE, 200MM DIAMETER CHANGE, AND IMPROVING YIELDS TO DRIVE GROSS MARGIN PERFORMANCE 0% 10% 20% 30% 40% 50% 60% FY2022 - 2023 FY2024 - 2025 FY2027 45% - 50% 50% - 54% Mid 30% - 40% 1For non-GAAP measures relating to Investor Day 2022, see Appendix for a reconciliation to the most directly comparable GAAP measure. For non-GAAP measures relating to Investor Day 2021, see Appendix on our 2021 Investor Day presentation as filed with the SEC on Form 8-K on 11/17/21.

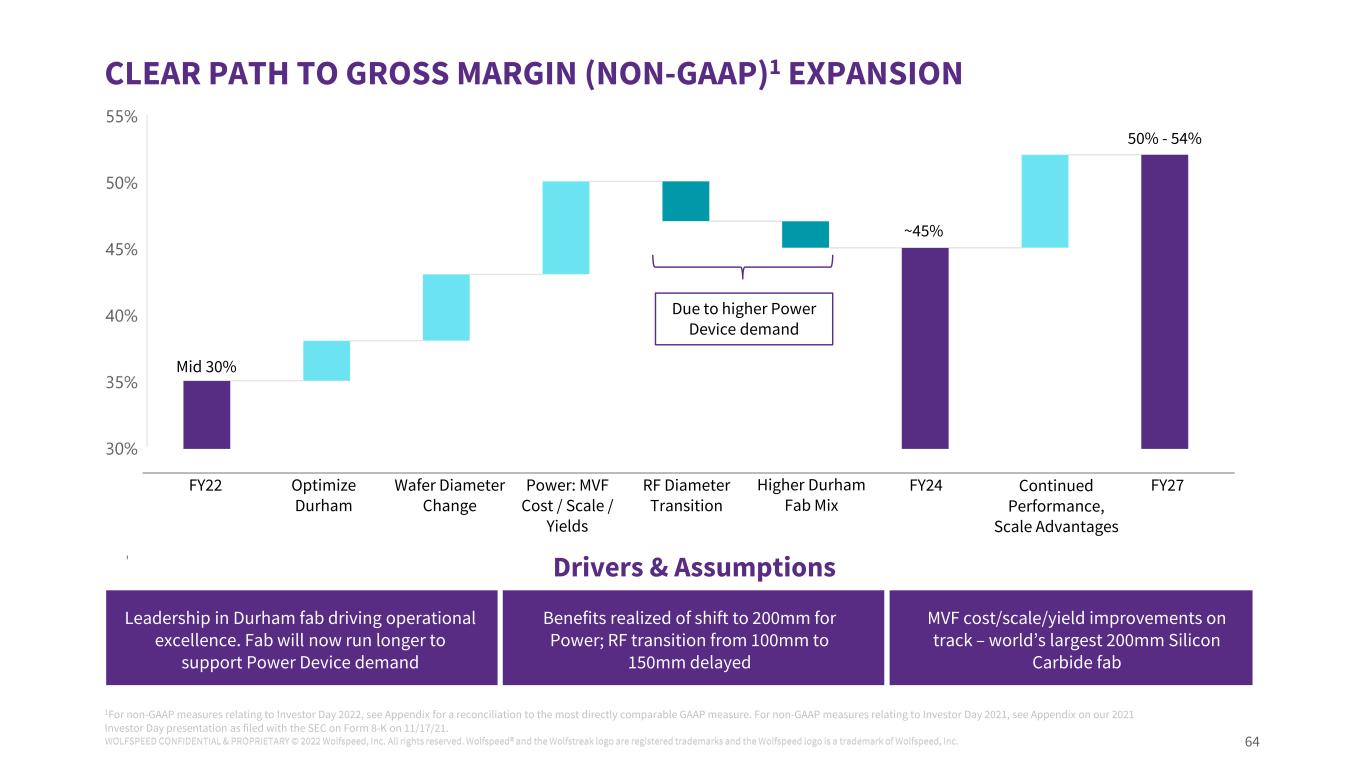

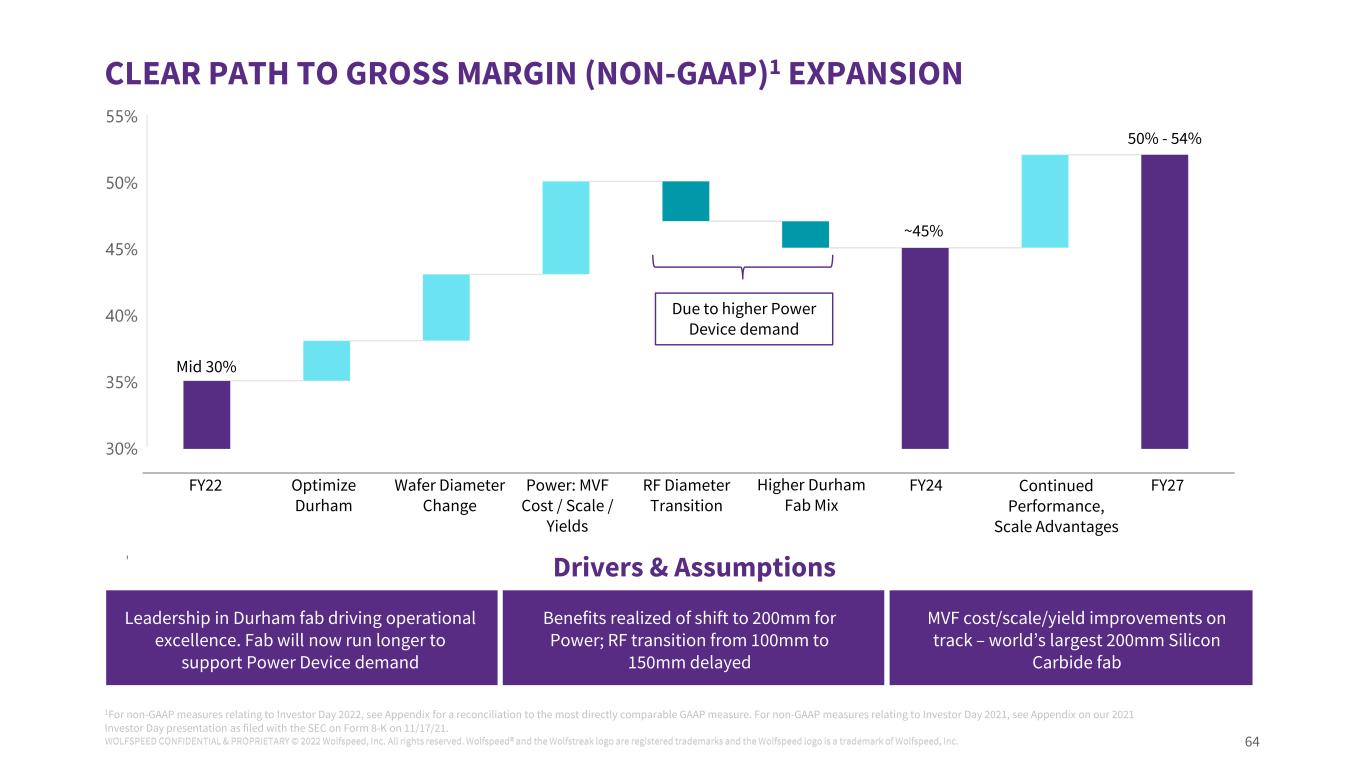

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 64 CLEAR PATH TO GROSS MARGIN (NON-GAAP)1 EXPANSION FY22 Optimize Durham Wafer Diameter Change Power: MVF Cost / Scale / Yields FY24 Continued Performance, Scale Advantages FY27 Mid 30% 50% - 54% ~45% RF Diameter Transition 1For non-GAAP measures relating to Investor Day 2022, see Appendix for a reconciliation to the most directly comparable GAAP measure. For non-GAAP measures relating to Investor Day 2021, see Appendix on our 2021 Investor Day presentation as filed with the SEC on Form 8-K on 11/17/21. Higher Durham Fab Mix Drivers & Assumptions Leadership in Durham fab driving operational excellence. Fab will now run longer to support Power Device demand Benefits realized of shift to 200mm for Power; RF transition from 100mm to 150mm delayed MVF cost/scale/yield improvements on track – world’s largest 200mm Silicon Carbide fab Due to higher Power Device demand

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 65 PURPOSE-BUILT SILICON CARBIDE FAB – IMPACT ON COSTS AND GROSS MARGINS Durham Fab Mohawk Valley Fab >50% Die Cost Reduction 100% of Power Device revenue today is from Durham; by FY26 will be 80% from Mohawk Valley Durham Mohawk Valley Diameter 150mm 200mm Clean room Space (Sq Ft) 68 K 125 K Automation Low Full Labor Costs ~40% ~10% Yield Base Base * 1.25 Die cost Base Base * 0.5

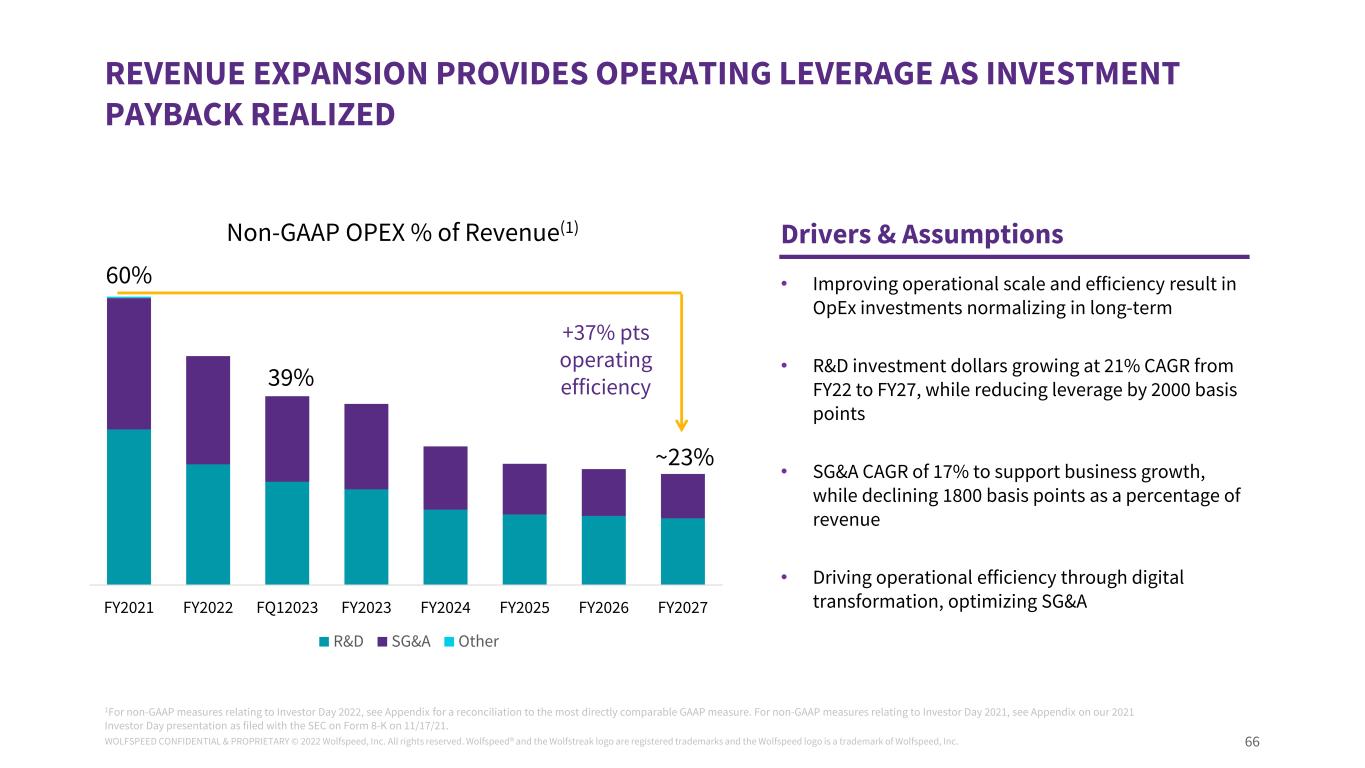

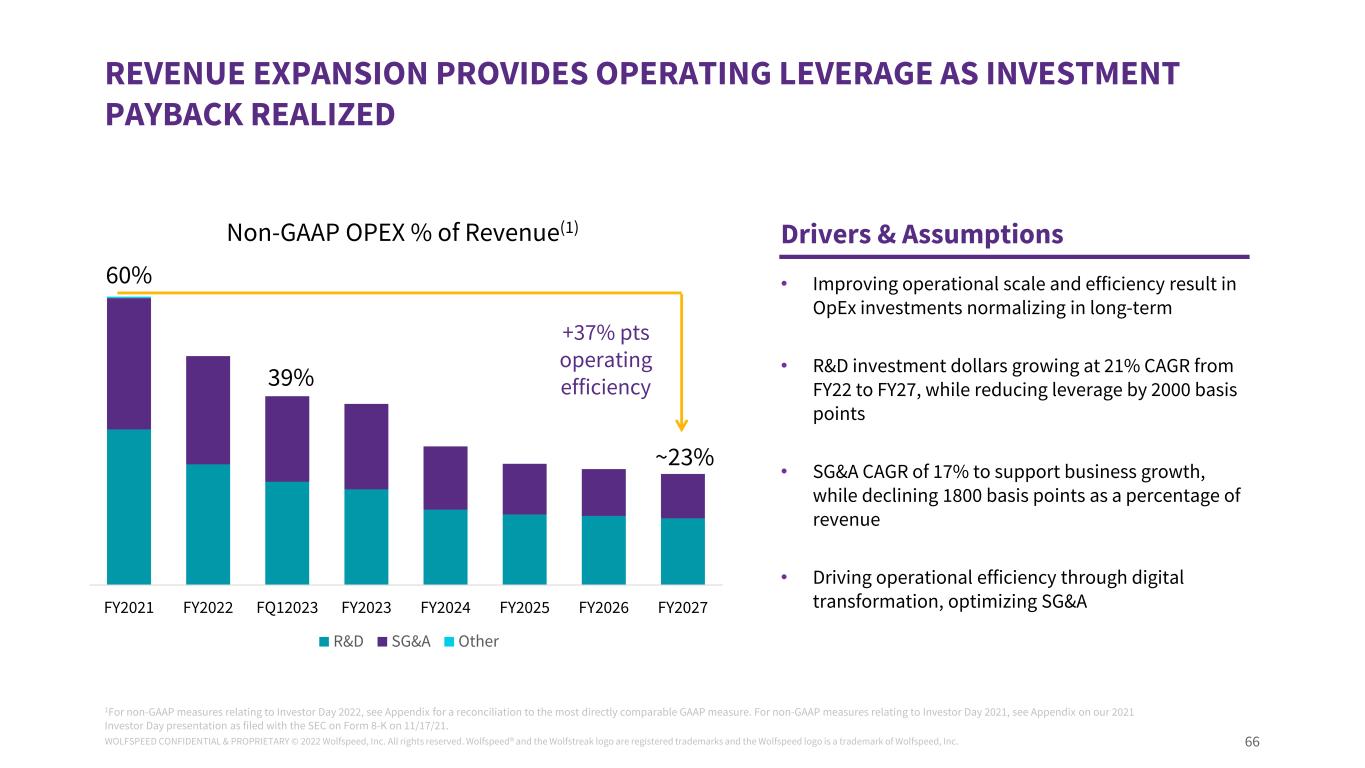

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 66 FY2021 FY2022 FQ12023 FY2023 FY2024 FY2025 FY2026 FY2027 R&D SG&A Other REVENUE EXPANSION PROVIDES OPERATING LEVERAGE AS INVESTMENT PAYBACK REALIZED Drivers & AssumptionsNon-GAAP OPEX % of Revenue(1) 60% ~23% +37% pts operating efficiency39% • Improving operational scale and efficiency result in OpEx investments normalizing in long-term • R&D investment dollars growing at 21% CAGR from FY22 to FY27, while reducing leverage by 2000 basis points • SG&A CAGR of 17% to support business growth, while declining 1800 basis points as a percentage of revenue • Driving operational efficiency through digital transformation, optimizing SG&A 1For non-GAAP measures relating to Investor Day 2022, see Appendix for a reconciliation to the most directly comparable GAAP measure. For non-GAAP measures relating to Investor Day 2021, see Appendix on our 2021 Investor Day presentation as filed with the SEC on Form 8-K on 11/17/21.

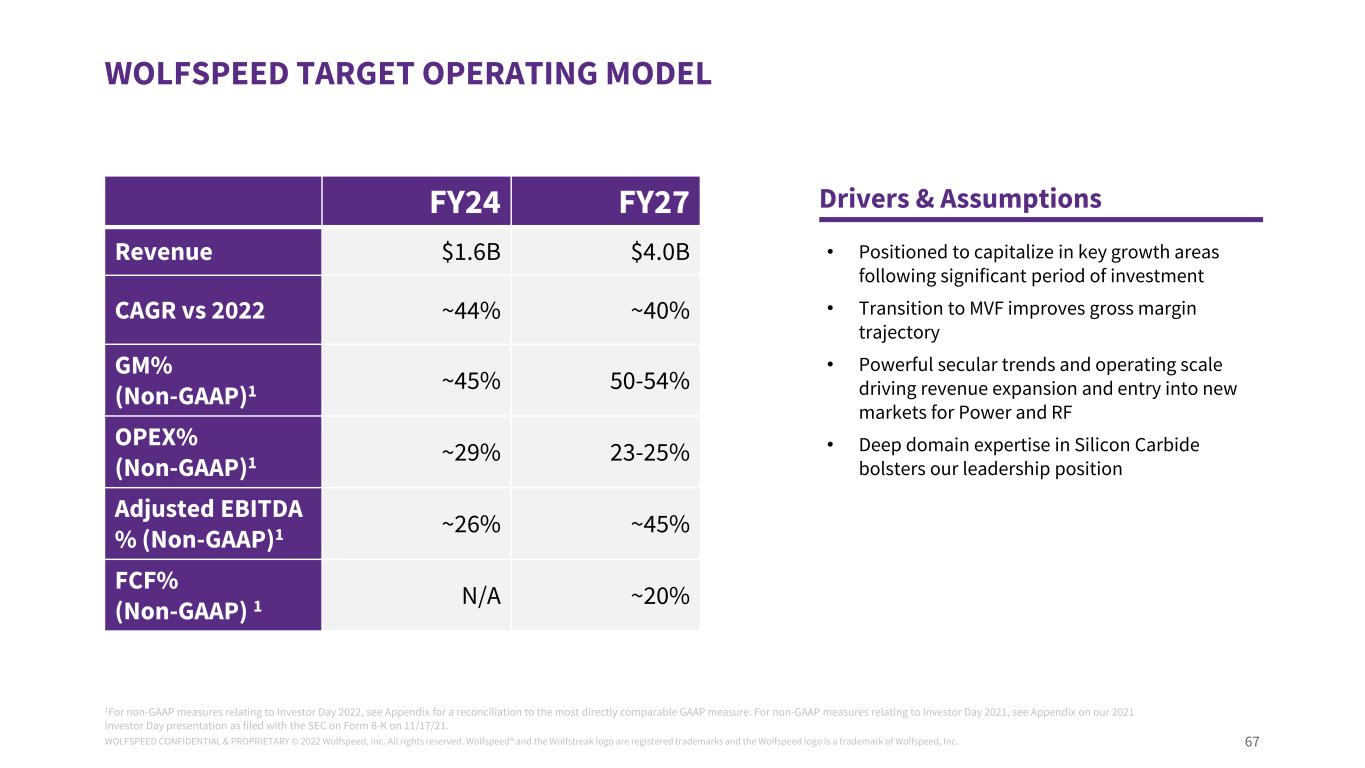

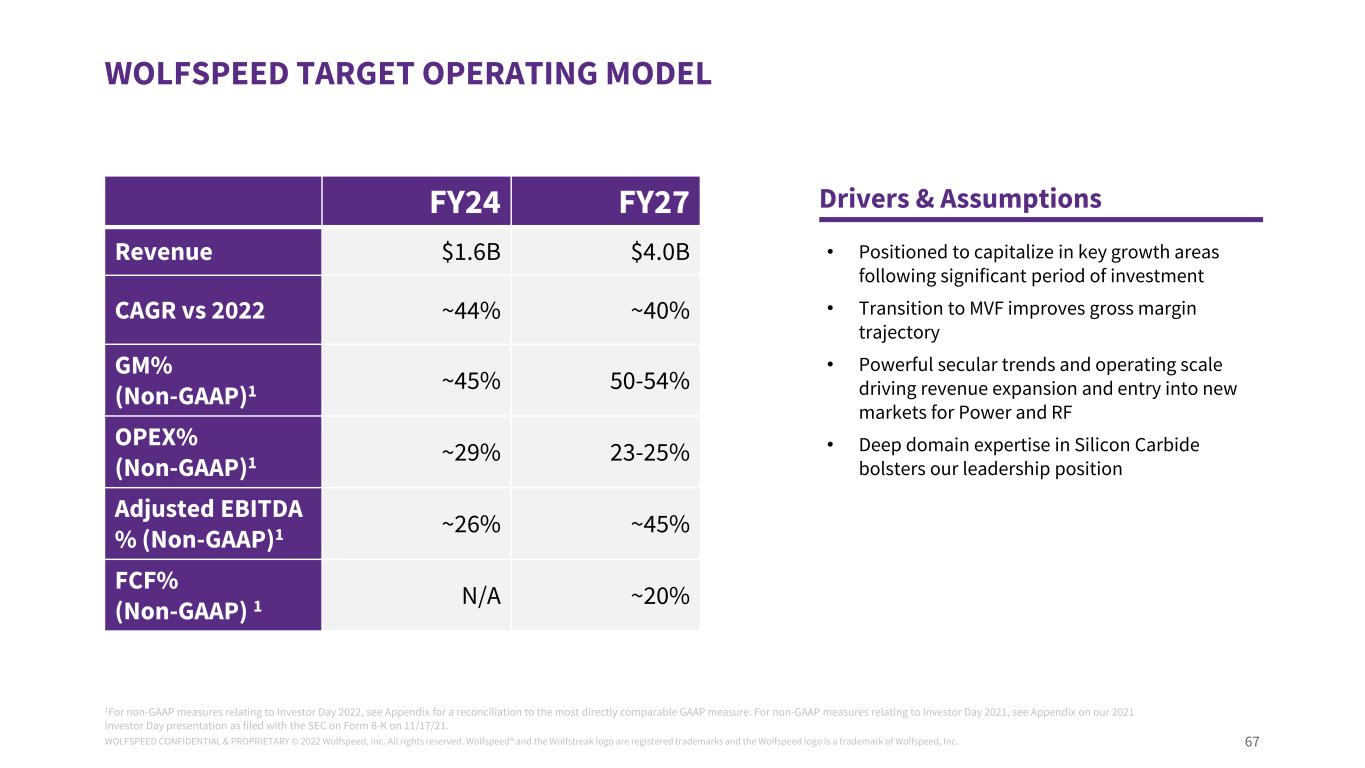

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 67 FY24 FY27 Revenue $1.6B $4.0B CAGR vs 2022 ~44% ~40% GM% (Non-GAAP)1 ~45% 50-54% OPEX% (Non-GAAP)1 ~29% 23-25% Adjusted EBITDA % (Non-GAAP)1 ~26% ~45% FCF% (Non-GAAP) 1 N/A ~20% WOLFSPEED TARGET OPERATING MODEL Drivers & Assumptions • Positioned to capitalize in key growth areas following significant period of investment • Transition to MVF improves gross margin trajectory • Powerful secular trends and operating scale driving revenue expansion and entry into new markets for Power and RF • Deep domain expertise in Silicon Carbide bolsters our leadership position 1For non-GAAP measures relating to Investor Day 2022, see Appendix for a reconciliation to the most directly comparable GAAP measure. For non-GAAP measures relating to Investor Day 2021, see Appendix on our 2021 Investor Day presentation as filed with the SEC on Form 8-K on 11/17/21.

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 68 Expanding leading market position with strong barriers to entry while driving the market transition to Silicon Carbide Executing on growth plans to create a global semiconductor powerhouse Growing and diversified $40B pipeline supported by secular trends in attractive end markets Investing in capacity and people to continue to operate as the leading vertically integrated Silicon Carbide provider STEEPENING DEMAND CURVE FOR SILICON CARBIDE SOLUTIONS DRIVES INVESTMENT AND IMPROVED OUTLOOK

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. Fireside Chat G R E G G L O W E | C E O , W O L F S P E E D T H I E R R Y B O L L O R É | C E O , J A G U A R L A N D R O V E R

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. Audience Q&A G R E G G L O W E | P R E S I D E N T & C E O N E I L L R E Y N O L D S | E V P & C F O

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. Appendix

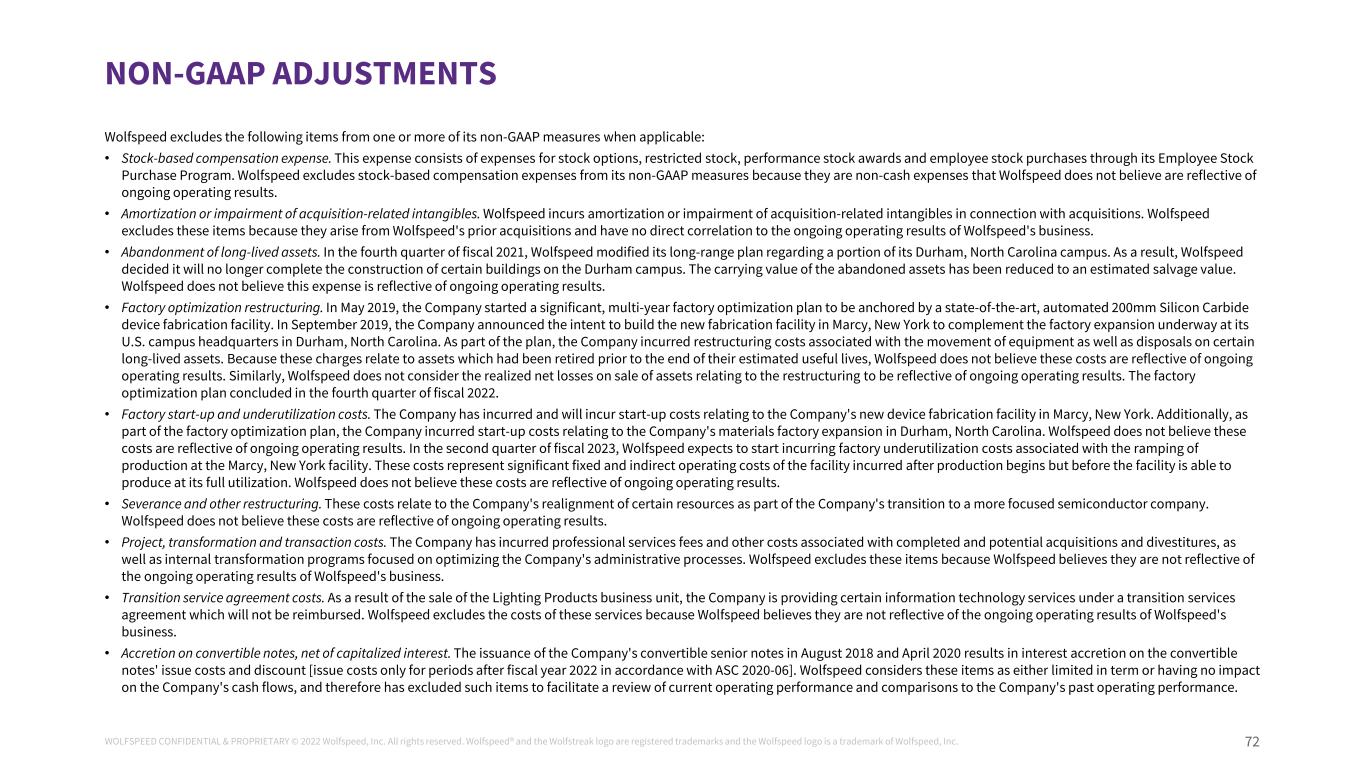

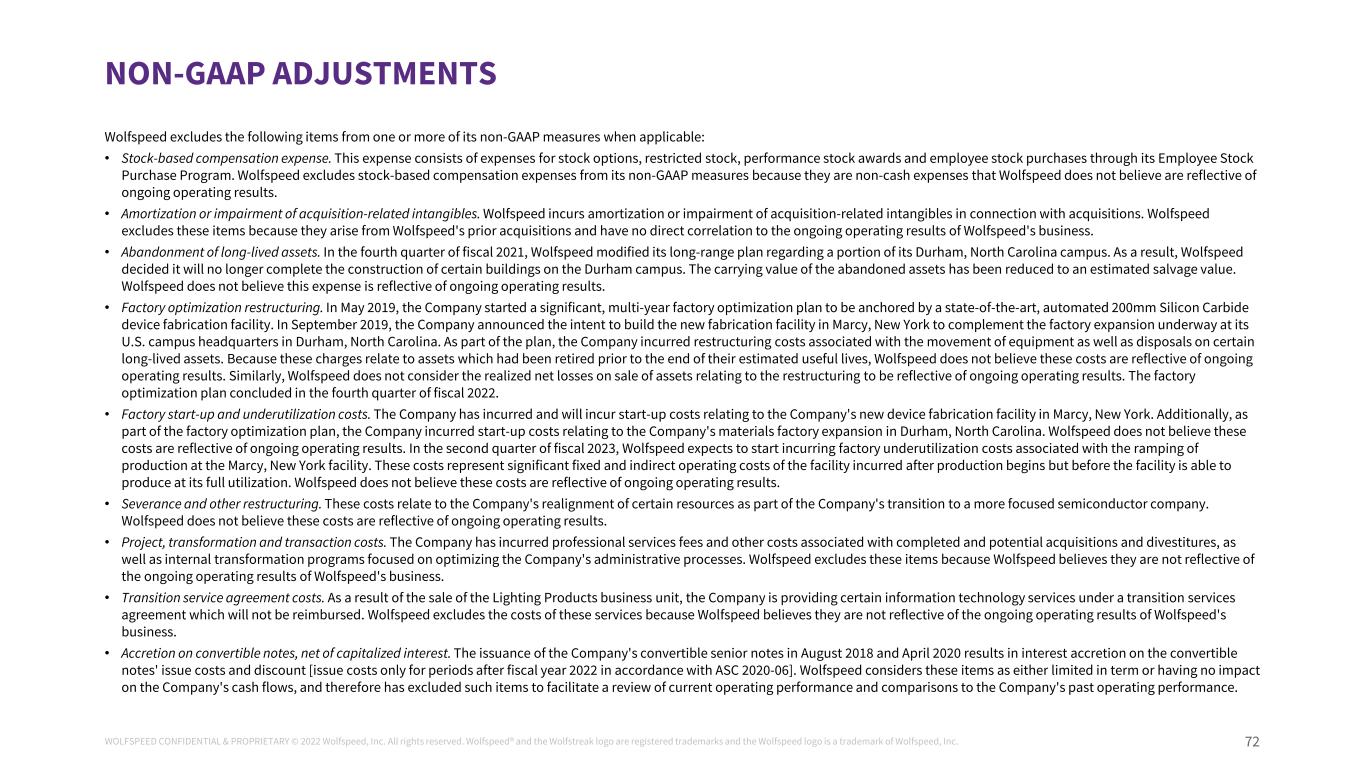

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 72 Wolfspeed excludes the following items from one or more of its non-GAAP measures when applicable: • Stock-based compensation expense. This expense consists of expenses for stock options, restricted stock, performance stock awards and employee stock purchases through its Employee Stock Purchase Program. Wolfspeed excludes stock-based compensation expenses from its non-GAAP measures because they are non-cash expenses that Wolfspeed does not believe are reflective of ongoing operating results. • Amortization or impairment of acquisition-related intangibles. Wolfspeed incurs amortization or impairment of acquisition-related intangibles in connection with acquisitions. Wolfspeed excludes these items because they arise from Wolfspeed's prior acquisitions and have no direct correlation to the ongoing operating results of Wolfspeed's business. • Abandonment of long-lived assets. In the fourth quarter of fiscal 2021, Wolfspeed modified its long-range plan regarding a portion of its Durham, North Carolina campus. As a result, Wolfspeed decided it will no longer complete the construction of certain buildings on the Durham campus. The carrying value of the abandoned assets has been reduced to an estimated salvage value. Wolfspeed does not believe this expense is reflective of ongoing operating results. • Factory optimization restructuring. In May 2019, the Company started a significant, multi-year factory optimization plan to be anchored by a state-of-the-art, automated 200mm Silicon Carbide device fabrication facility. In September 2019, the Company announced the intent to build the new fabrication facility in Marcy, New York to complement the factory expansion underway at its U.S. campus headquarters in Durham, North Carolina. As part of the plan, the Company incurred restructuring costs associated with the movement of equipment as well as disposals on certain long-lived assets. Because these charges relate to assets which had been retired prior to the end of their estimated useful lives, Wolfspeed does not believe these costs are reflective of ongoing operating results. Similarly, Wolfspeed does not consider the realized net losses on sale of assets relating to the restructuring to be reflective of ongoing operating results. The factory optimization plan concluded in the fourth quarter of fiscal 2022. • Factory start-up and underutilization costs. The Company has incurred and will incur start-up costs relating to the Company's new device fabrication facility in Marcy, New York. Additionally, as part of the factory optimization plan, the Company incurred start-up costs relating to the Company's materials factory expansion in Durham, North Carolina. Wolfspeed does not believe these costs are reflective of ongoing operating results. In the second quarter of fiscal 2023, Wolfspeed expects to start incurring factory underutilization costs associated with the ramping of production at the Marcy, New York facility. These costs represent significant fixed and indirect operating costs of the facility incurred after production begins but before the facility is able to produce at its full utilization. Wolfspeed does not believe these costs are reflective of ongoing operating results. • Severance and other restructuring. These costs relate to the Company's realignment of certain resources as part of the Company's transition to a more focused semiconductor company. Wolfspeed does not believe these costs are reflective of ongoing operating results. • Project, transformation and transaction costs. The Company has incurred professional services fees and other costs associated with completed and potential acquisitions and divestitures, as well as internal transformation programs focused on optimizing the Company's administrative processes. Wolfspeed excludes these items because Wolfspeed believes they are not reflective of the ongoing operating results of Wolfspeed's business. • Transition service agreement costs. As a result of the sale of the Lighting Products business unit, the Company is providing certain information technology services under a transition services agreement which will not be reimbursed. Wolfspeed excludes the costs of these services because Wolfspeed believes they are not reflective of the ongoing operating results of Wolfspeed's business. • Accretion on convertible notes, net of capitalized interest. The issuance of the Company's convertible senior notes in August 2018 and April 2020 results in interest accretion on the convertible notes' issue costs and discount [issue costs only for periods after fiscal year 2022 in accordance with ASC 2020-06]. Wolfspeed considers these items as either limited in term or having no impact on the Company's cash flows, and therefore has excluded such items to facilitate a review of current operating performance and comparisons to the Company's past operating performance. NON-GAAP ADJUSTMENTS

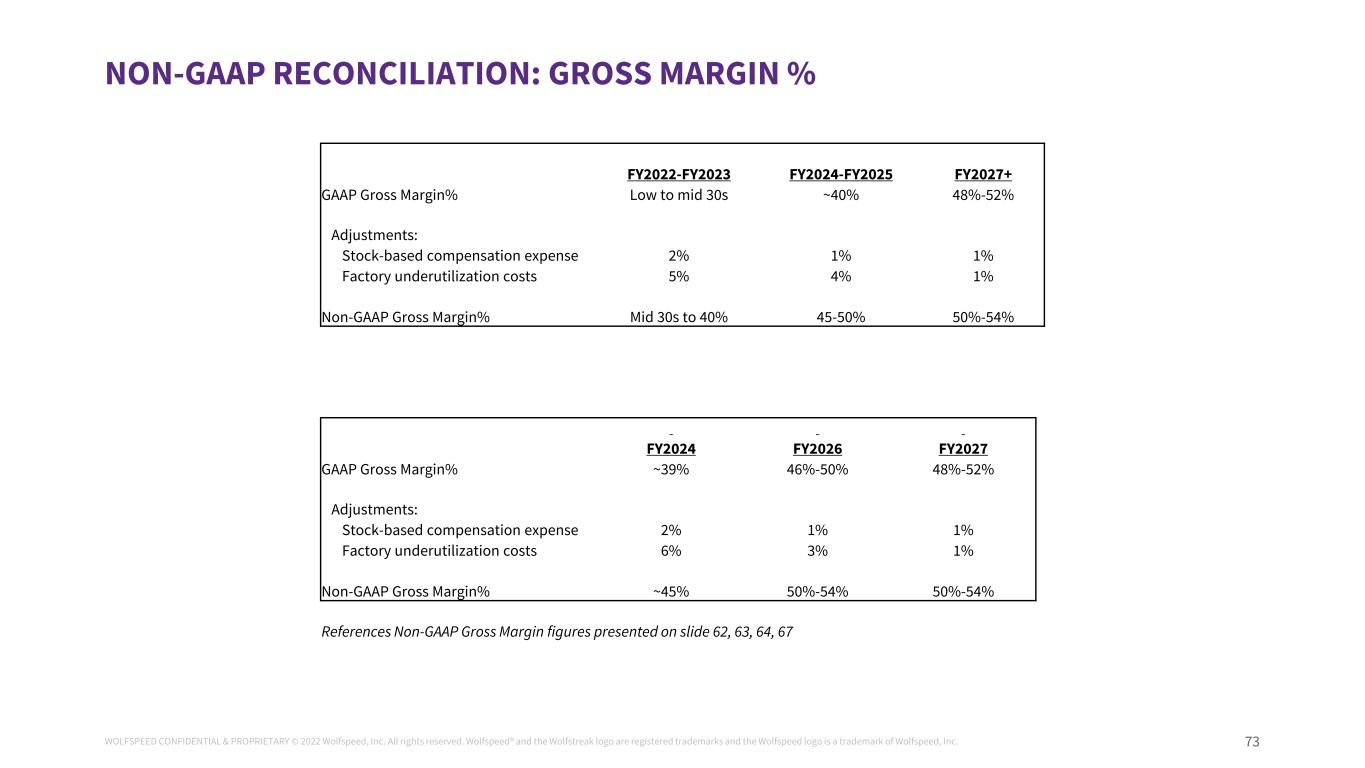

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 73 NON-GAAP RECONCILIATION: GROSS MARGIN % FY2022-FY2023 FY2024-FY2025 FY2027+ GAAP Gross Margin% Low to mid 30s ~40% 48%-52% Adjustments: Stock-based compensation expense 2% 1% 1% Factory underutilization costs 5% 4% 1% Non-GAAP Gross Margin% Mid 30s to 40% 45-50% 50%-54% FY2024 FY2026 FY2027 GAAP Gross Margin% ~39% 46%-50% 48%-52% Adjustments: Stock-based compensation expense 2% 1% 1% Factory underutilization costs 6% 3% 1% Non-GAAP Gross Margin% ~45% 50%-54% 50%-54% References Non-GAAP Gross Margin figures presented on slide 62, 63, 64, 67

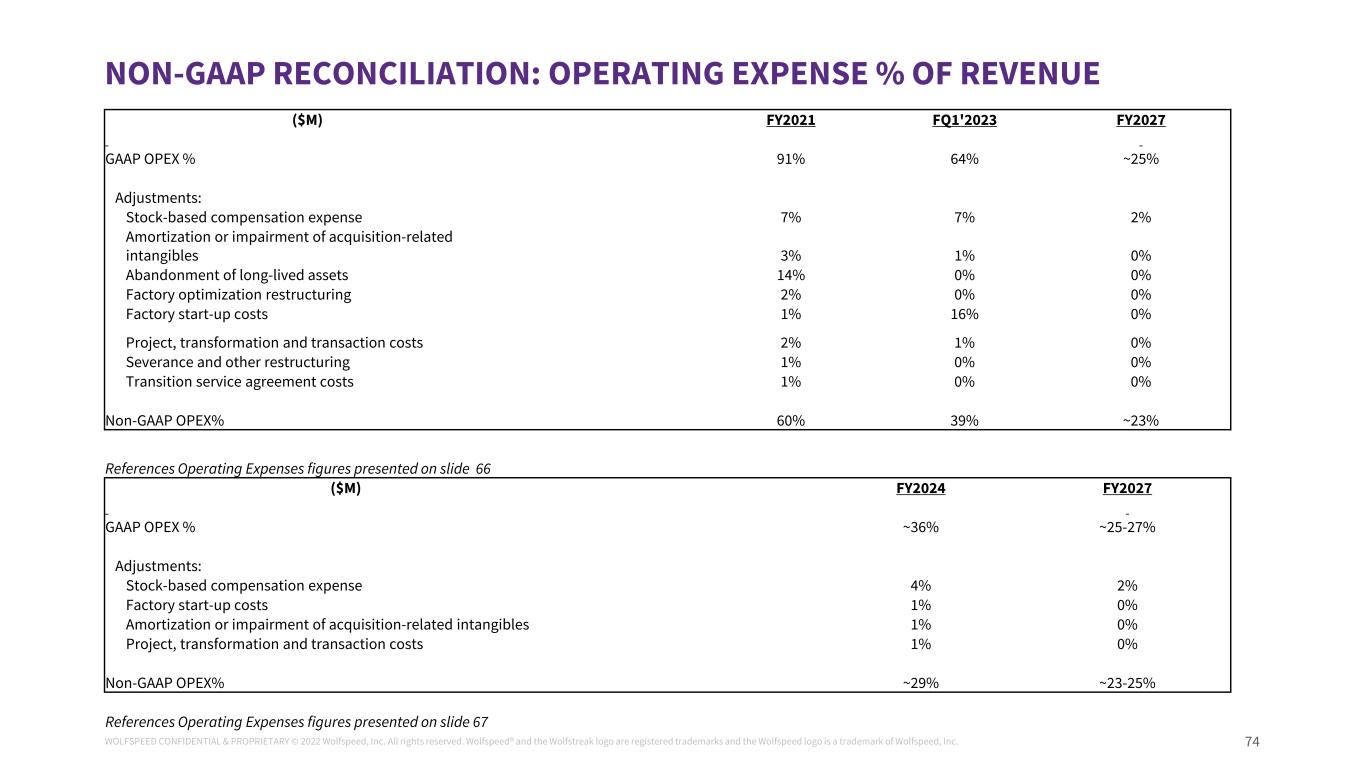

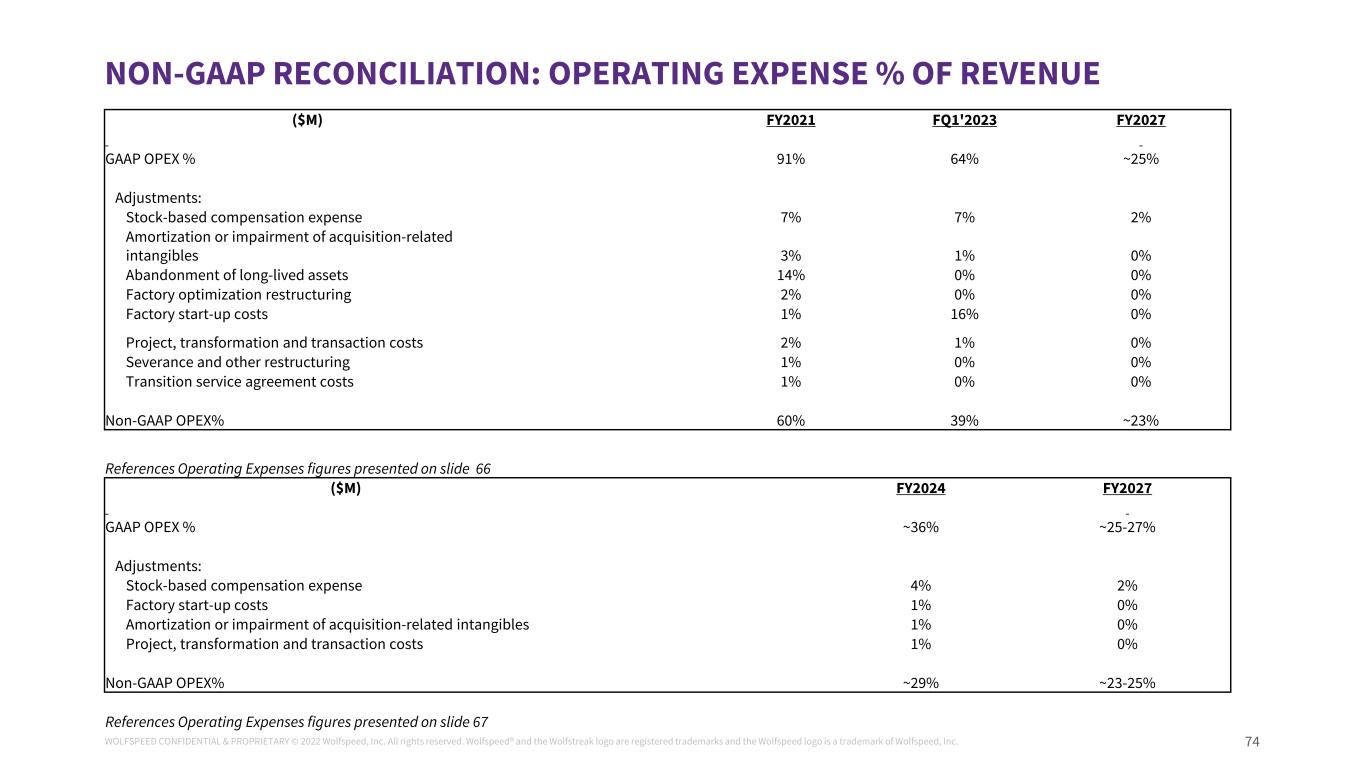

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 74 NON-GAAP RECONCILIATION: OPERATING EXPENSE % OF REVENUE ($M) FY2021 FQ1'2023 FY2027 GAAP OPEX % 91% 64% ~25% Adjustments: Stock-based compensation expense 7% 7% 2% Amortization or impairment of acquisition-related intangibles 3% 1% 0% Abandonment of long-lived assets 14% 0% 0% Factory optimization restructuring 2% 0% 0% Factory start-up costs 1% 16% 0% Project, transformation and transaction costs 2% 1% 0% Severance and other restructuring 1% 0% 0% Transition service agreement costs 1% 0% 0% Non-GAAP OPEX% 60% 39% ~23% References Operating Expenses figures presented on slide 66 ($M) FY2024 FY2027 GAAP OPEX % ~36% ~25-27% Adjustments: Stock-based compensation expense 4% 2% Factory start-up costs 1% 0% Amortization or impairment of acquisition-related intangibles 1% 0% Project, transformation and transaction costs 1% 0% Non-GAAP OPEX% ~29% ~23-25% References Operating Expenses figures presented on slide 67

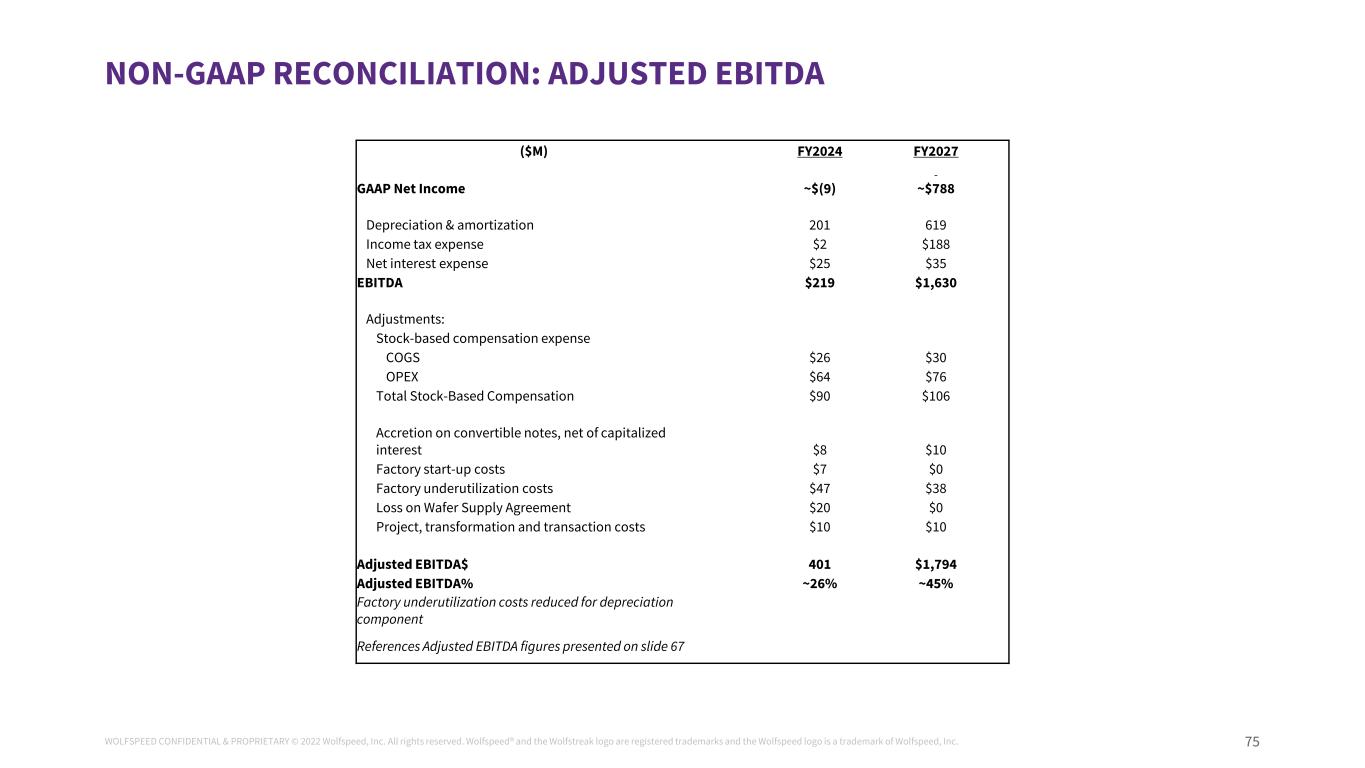

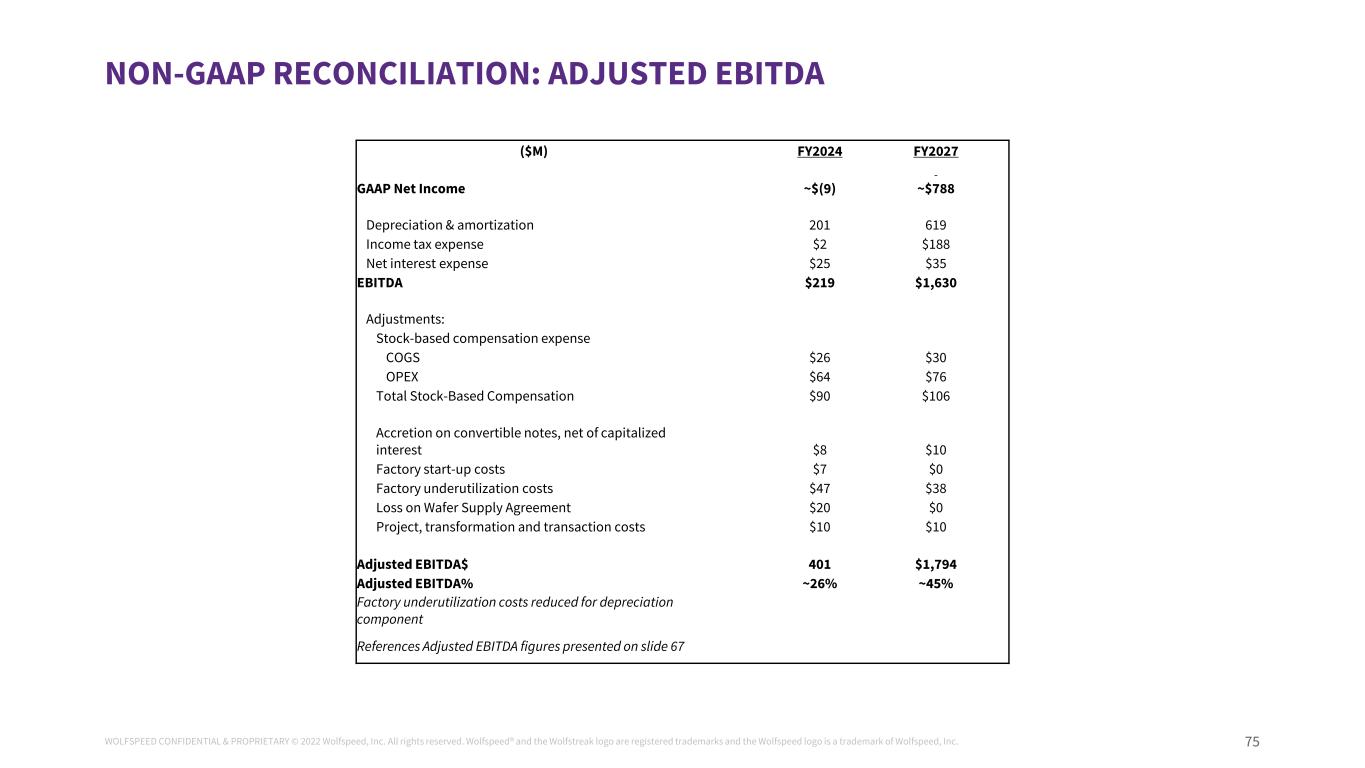

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 75 NON-GAAP RECONCILIATION: ADJUSTED EBITDA ($M) FY2024 FY2027 GAAP Net Income ~$(9) ~$788 Depreciation & amortization 201 619 Income tax expense $2 $188 Net interest expense $25 $35 EBITDA $219 $1,630 Adjustments: Stock-based compensation expense COGS $26 $30 OPEX $64 $76 Total Stock-Based Compensation $90 $106 Accretion on convertible notes, net of capitalized interest $8 $10 Factory start-up costs $7 $0 Factory underutilization costs $47 $38 Loss on Wafer Supply Agreement $20 $0 Project, transformation and transaction costs $10 $10 Adjusted EBITDA$ 401 $1,794 Adjusted EBITDA% ~26% ~45% Factory underutilization costs reduced for depreciation component References Adjusted EBITDA figures presented on slide 67

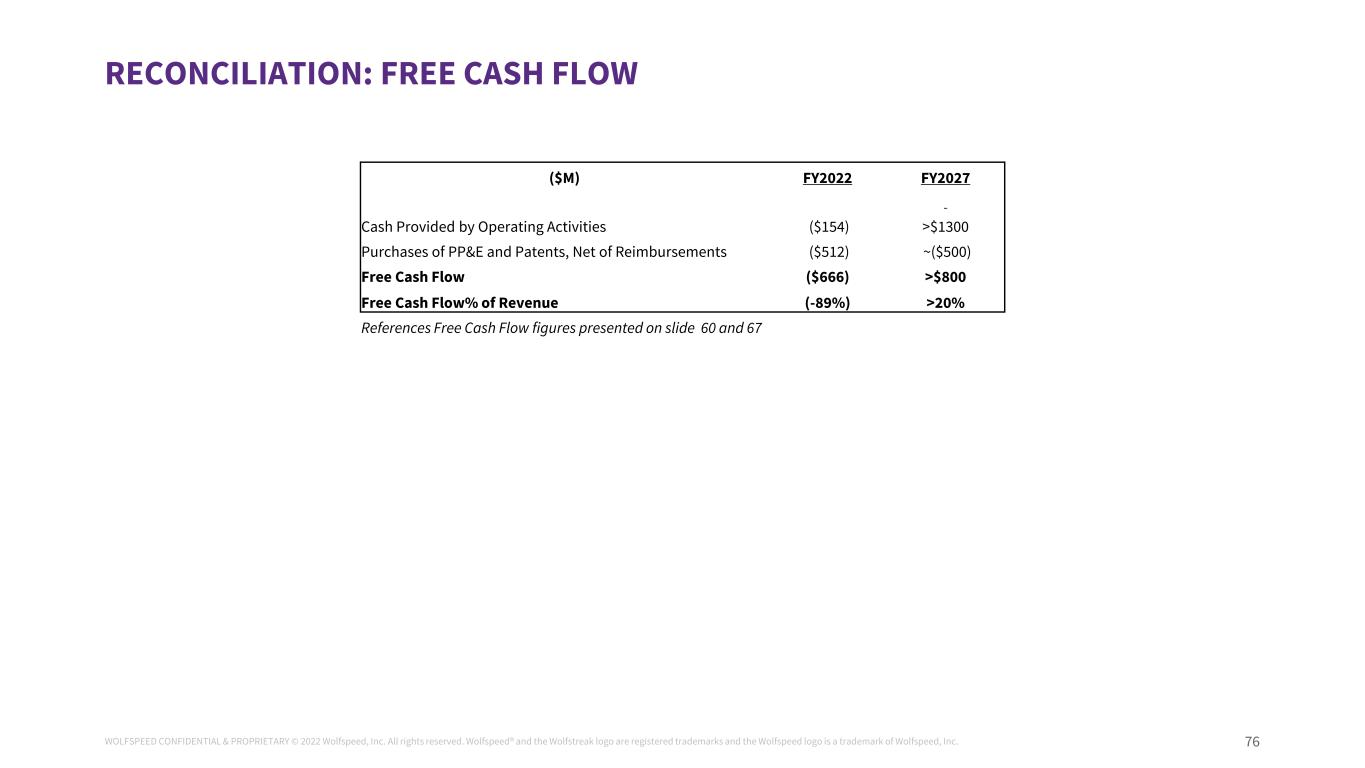

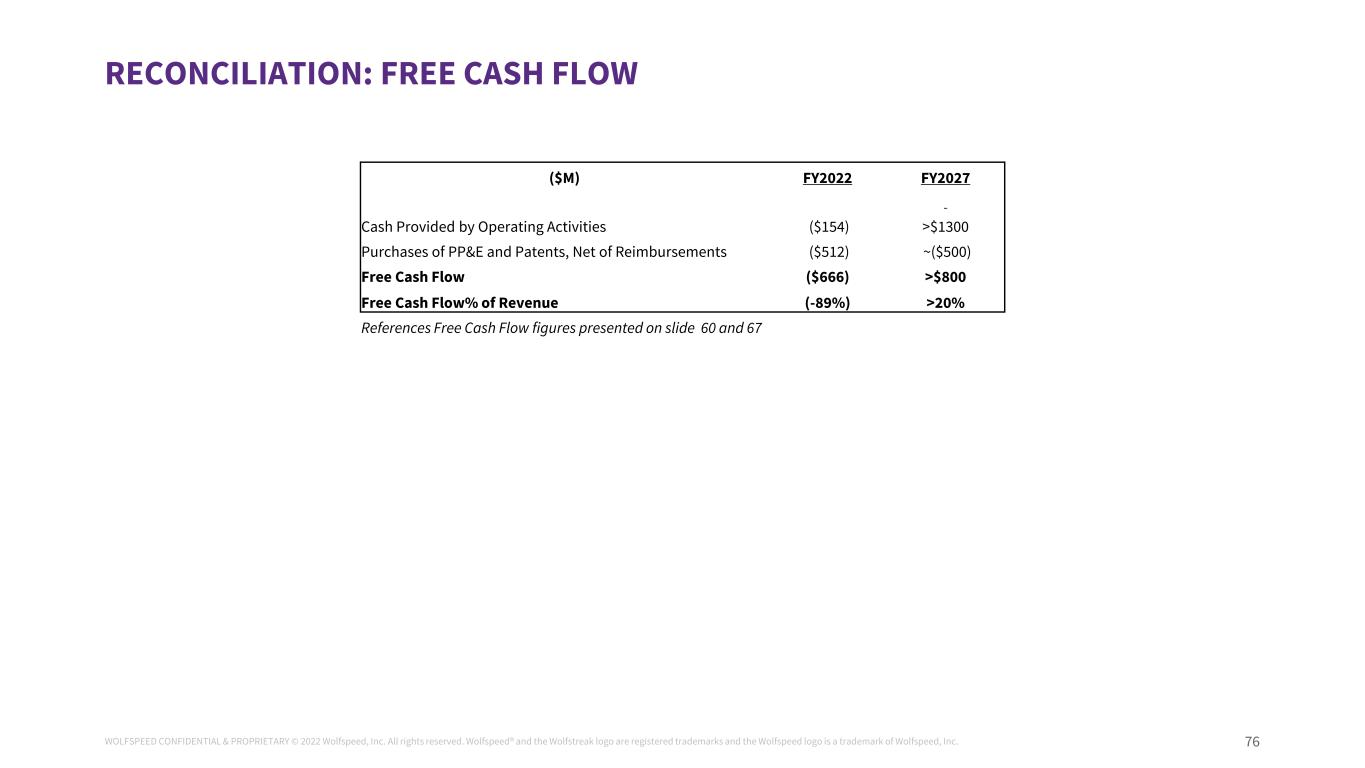

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 76 RECONCILIATION: FREE CASH FLOW ($M) FY2022 FY2027 Cash Provided by Operating Activities ($154) >$1300 Purchases of PP&E and Patents, Net of Reimbursements ($512) ~($500) Free Cash Flow ($666) >$800 Free Cash Flow% of Revenue (-89%) >20% References Free Cash Flow figures presented on slide 60 and 67

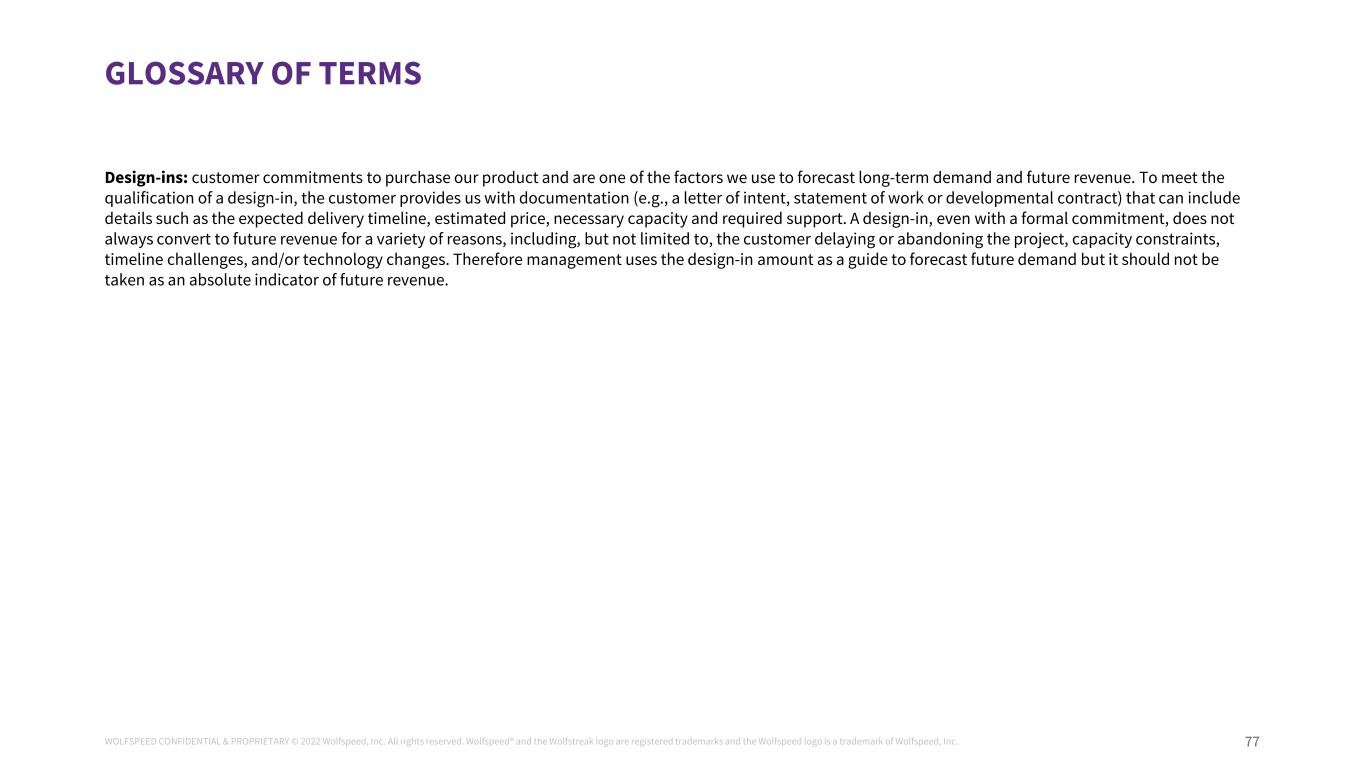

WOLFSPEED CONFIDENTIAL & PROPRIETARY © 2022 Wolfspeed, Inc. All rights reserved. Wolfspeed® and the Wolfstreak logo are registered trademarks and the Wolfspeed logo is a trademark of Wolfspeed, Inc. 77 Design-ins: customer commitments to purchase our product and are one of the factors we use to forecast long-term demand and future revenue. To meet the qualification of a design-in, the customer provides us with documentation (e.g., a letter of intent, statement of work or developmental contract) that can include details such as the expected delivery timeline, estimated price, necessary capacity and required support. A design-in, even with a formal commitment, does not always convert to future revenue for a variety of reasons, including, but not limited to, the customer delaying or abandoning the project, capacity constraints, timeline challenges, and/or technology changes. Therefore management uses the design-in amount as a guide to forecast future demand but it should not be taken as an absolute indicator of future revenue. GLOSSARY OF TERMS